As filed with the Securities and Exchange Commission on April 18, 2018

File No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

☐ Pre-Effective Amendment No.

☐ Post-Effective Amendment No.

NUVEEN INVESTMENT TRUST II

(Exact Name of Registrant as Specified in Charter)

333 West Wacker Drive

Chicago, Illinois 60606

(Address of Principal Executive Offices: Number, Street, City, State, Zip Code)

(800) 257-8787

(Area Code and Telephone Number)

Christopher M. Rohrbacher

Vice President and Secretary

333 West Wacker Drive

Chicago, Illinois 60606

(Name and Address of Agent for Service)

Copy to:

| | |

Deborah Bielicke Eades

Vedder Price P.C.

222 North LaSalle Street

Chicago, Illinois 60601 | | Eric F. Fess

Chapman and Cutler LLP

111 West Monroe Street

Chicago, Illinois 60603 |

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

Title of securities being registered: Shares of beneficial interest, par value $0.01 per share, of the Registrant.

It is proposed that this filing will become effective on May 18, 2018 pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is required because of reliance on Section 24(f) and an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

IMPORTANT INFORMATION FOR SHAREHOLDERS OF

NUVEEN SYMPHONY LOW VOLATILITY EQUITY FUND

At a special meeting of shareholders of Nuveen Symphony Low Volatility Equity Fund (the “Target Fund”), a series of Nuveen Investment Trust II (the “Trust”), you will be asked to vote on the reorganization of your fund into Nuveen Santa Barbara Dividend Growth Fund (the “Acquiring Fund”), also a series of the Trust (the “Reorganization”). The Target Fund and the Acquiring Fund are collectively referred to herein as the “Funds” and individually as a “Fund.”

The Board of Trustees of the Trust (the “Board”), including the independent board members, unanimously recommends that you vote FOR the proposal.

Although we recommend that you read the complete Proxy Statement/Prospectus, for your convenience we have provided the following brief overview of the matter to be voted on.

| Q. | Why is the Reorganization being proposed? |

| A. | Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors” or the “Adviser”) serves as each Fund’s investment adviser. The Adviser proposed the Reorganization as part of a strategic decision to end its support of the retail equity fund line of business of Symphony Asset Management LLC (“Symphony”), the Target Fund’s sub-adviser. The proposed Reorganization will allow Target Fund shareholders to continue their investment in an equity fund with a similar performance and risk profile as the Target Fund. In addition, the Adviser and the Board believe that Target Fund shareholders (as shareholders of the Acquiring Fund following the Reorganization) will recognize operating cost savings and operational efficiencies because the fixed costs involved with operating a fund will be spread across a larger asset base following the Reorganization, and the need for certain duplicative services for separate stand-alone funds will be eliminated. This is expected to result in a decrease in total annual fund operating expenses for shareholders of the Target Fund following the Reorganization. In addition to considering the benefits to shareholders expected to result from the Reorganization, the Board considered that the Adviser may realize certain efficiencies by no longer providing certain services to separate stand-alone funds. See “Reorganization of the Target Fund into the Acquiring Fund—Approval of the Proposed Reorganization by the Board of Trustees” at page 23 of the Proxy Statement/Prospectus. |

| Q. | How will the Reorganization affect my shares? |

| A. | Upon the closing of the Reorganization, each Target Fund shareholder will receive shares of the Acquiring Fund in an amount equal in total net asset value to the total net asset value of the Target Fund shares surrendered by such shareholder. Holders of Class A shares, Class C shares, Class R6 shares and Class I shares of the Target Fund will receive the same class of shares of the Acquiring Fund. |

| Q. | Will Target Fund shareholders incur sales loads or contingent deferred sales charges on Acquiring Fund shares received in the Reorganization? |

| A. | The front-end sales load on Class A shares received in the Reorganization will be waived. If your Target Fund shares are subject to a contingent deferred sales charge (“CDSC”), which may be the case for either Class A share purchases of $1 million or more that were not subject to a front-end sales load or Class C shares, the Acquiring Fund shares that you receive in the Reorganization will be subject to a CDSC if they are redeemed within 18 months of the date you purchased your Target Fund Class A shares subject to a CDSC and within 12 months of the date you purchased your Target Fund Class C shares. |

| Q. | Are the Funds managed by the same sub-adviser? |

| A. | The Target Fund is sub-advised by Symphony and is managed by Gunther Stein, Ross Sakamoto, CFA, and Marc Snyder. The Acquiring Fund is sub-advised by Santa Barbara Asset Management, LLC (“Santa Barbara”) and is managed by James R. Boothe, CFA. Santa Barbara will continue to serve as sub-adviser to the Acquiring Fund, and Mr. Boothe will continue to serve as the portfolio manager for the Acquiring Fund, following the Reorganization. |

| Q. | How do the Funds’ investment objectives, principal investment strategies and principal risks compare? |

| A. | Although both Funds invest significantly in dividend-paying common stocks, the Funds’ investment objectives, principal investment strategies and principal risks differ in certain respects, as summarized below. |

| | The investment objective of the Target Fund is to seek long-term capital appreciation with lower absolute volatility than the broad equity market. The investment objective of the Acquiring Fund is to seek an attractive total return comprised of income from dividends and long-term capital appreciation. |

| | Under normal market conditions, the Target Fund invests at least 80% of the sum of its net assets and the amount of any borrowings for investment purposes in equity securities (which are defined to include, among other things, common stocks and preferred securities). The goal of the Target Fund’s portfolio construction process is to produce long-term returns superior to the broad equity market with lower absolute volatility. The Target Fund’s sub-adviser seeks a “beta” (i.e., a measure of a portfolio’s sensitivity to market movements) that is approximately 90% of the beta of the Russell 1000® Index, the Target Fund’s primary benchmark index, although there is no guarantee that this can be achieved. In seeking to lower absolute volatility, the Target Fund historically has invested a high percentage of its assets (approximately 77% of net assets as of February 28, 2018) in dividend-paying common stocks. |

| | Under normal market conditions, the Acquiring Fund invests at least 80% of its net assets in dividend-paying common stocks and preferred securities. Historically, the Acquiring Fund has invested substantially all of its net assets in dividend-paying common stocks. Unlike the Target Fund, as a principal investment strategy, the Acquiring Fund may invest up to 25% of its net assets in non-U.S. equity securities that are U.S. dollar-denominated. |

ii

| | Although an investment in each Fund is subject to substantially similar risks (i.e., active management risk, equity security risk and small- and mid-cap stock risk), an investment in the Acquiring Fund is subject to certain additional principal risks (i.e., currency risk and non-U.S. investment risk) related to investments in non-U.S. equity securities, which is not a principal investment strategy of the Target Fund. See the section of the Proxy Statement/Prospectus entitled “Risk Factors” for a comparison of and additional information regarding each Fund’s principal investment risks. |

| | A more detailed comparison of the investment objectives, strategies and risks of the Funds is contained in the Proxy Statement/Prospectus. |

| Q. | Will the portfolio of the Target Fund be repositioned prior to the Reorganization? |

| A. | Yes. If the Reorganization had occurred as of February 28, 2018, it is estimated that approximately 78% (or $105.4 million) of the Target Fund’s investment portfolio would have been sold. If such sales had occurred as of February 28, 2018, it is estimated that such portfolio repositioning would have resulted in brokerage commissions or other transaction costs for the Target Fund of approximately $47,900 (0.04% of the Target Fund’s net assets), based on average commission rates normally paid by the Target Fund. These transaction costs represent expenses of the Target Fund that will not be subject to the Target Fund’s expense cap and will be borne by the Target Fund and indirectly borne by the Target Fund’s shareholders. Capital gains from such portfolio sales may result in increased distributions of net capital gain and net investment income. If such sales had occurred as of February 28, 2018, the sales would have resulted in realized gains of approximately $24.2 million (approximately $5.75 per share or 18% of the Target Fund’s net assets). |

| | Taking into account the repositioning of the Target Fund, the Acquiring Fund is not expected to sell a material portion (i.e., 5% or more of net assets) of the Target Fund’s assets received in the Reorganization in order to meet its investment policies and restrictions. |

| Q. | How will the Reorganization impact fees and expenses? |

| A. | If the Reorganization had taken place as of January 31, 2018, the date in the Fees and Expenses table in the Proxy Statement/Prospectus, the pro forma total net and gross operating expenses of the Acquiring Fund following the Reorganization would have been lower than the total net and gross operating expenses of the Target Fund for all share classes. Pro forma amounts are estimated; actual operating expenses will vary based on asset size and other factors. See the section entitled “Further Comparison of the Funds—Fees and Expenses” in the Proxy Statement/Prospectus for additional information. |

| Q. | Will the Reorganization create a taxable event for me? |

| A. | No. The Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. It is expected that you will recognize no gain or loss for federal income tax purposes as a direct result of the Reorganization. Prior to the closing of the Reorganization, the Target Fund expects to distribute all of its net investment income and net capital gains, if any. All or a portion of such a distribution may be taxable to Target Fund shareholders and will generally be taxed as ordinary income or capital gains for federal income tax purposes, unless |

iii

| | you are investing through a tax-advantaged account such as an IRA or 401(k) plan (in which case you may be taxed upon withdrawal of your investment from such account). These distributions will be reinvested in additional shares of the Target Fund unless a shareholder has made an election to receive distributions in cash. The tax character of such distributions will be the same regardless of whether they are paid in cash or reinvested in additional shares. In addition, the Target Fund may recognize gains or losses as a result of portfolio sales effected prior to the Reorganization, including sales anticipated in connection with the repositioning described above. Such gains or losses may increase or decrease the net capital gains or net investment income to be distributed by the Target Fund to its shareholders, and may increase or decrease the Target Fund’s capital loss carryforwards, if any. |

| Q. | Who will bear the costs of the Reorganization? |

| A. | Nuveen Fund Advisors or its affiliates (collectively, “Nuveen”) will absorb the costs of the Reorganization, which are estimated to be approximately $230,000. |

| Q. | What is the timetable for the Reorganization? |

| A. | If approved by the Target Fund’s shareholders at the special meeting of shareholders on July 16, 2018, the Reorganization of the Target Fund is expected to occur at the close of business on August 24, 2018 or as soon as practicable thereafter. |

General

| Q. | Whom do I call if I have questions? |

| A. | If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call Computershare Fund Services, the proxy solicitor hired by the Target Fund, at [•] weekdays during its business hours of 9:00 a.m. to 11:00 p.m. and Saturdays 12:00 p.m. to 6:00 p.m. Eastern time. Please have your proxy materials available when you call. |

| Q. | How do I vote my shares? |

| A. | You may vote in person, by mail, by telephone or over the Internet: |

| | • | | To vote in person, please attend the special meeting of shareholders and bring your photographic identification. If you hold your Target Fund shares through a bank, broker or other nominee, you must also bring satisfactory proof of ownership of those shares and a “legal proxy” from the nominee. |

| | • | | To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. |

| | • | | To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. |

| | • | | To vote over the Internet, go to the Internet address provided on your proxy card and follow the instructions, using your proxy card as a guide. |

iv

| Q. | Will anyone contact me? |

| A. | You may receive a call from Computershare Fund Services, the proxy solicitor hired by the Target Fund, to verify that you received your proxy materials, to answer any questions you may have about the proposals and to encourage you to vote your proxy. |

| | We recognize the inconvenience of the proxy solicitation process and would not impose on you if we did not believe that the matters being proposed were important. Once your vote has been registered with the proxy solicitor, your name will be removed from the solicitor’s follow-up contact list. |

| Q. | How does the Board suggest that I vote? |

| A. | After careful consideration, the Board has agreed unanimously that the proposed Reorganization is in the best interests of the Target Fund and recommends that you vote “FOR” the proposal. If shareholders do not approve the Reorganization, the Board will take such action as it deems to be in the best interests of the Target Fund, including continuing to operate the Target Fund as a stand-alone fund, liquidating the Target Fund, or such other options the Board may consider. |

| | Your vote is very important. We encourage you as a shareholder to participate in your Fund’s governance by returning your vote as soon as possible. If enough shareholders fail to cast their votes, your Fund may not be able to hold its shareholder meeting or the vote on the issue, and your Fund will be required to incur additional solicitation costs in order to obtain sufficient shareholder participation. |

v

[•], 2018

Dear Shareholders:

We are pleased to invite you to the special meeting of shareholders of Nuveen Symphony Low Volatility Equity Fund (the “Target Fund”) (the “Special Meeting”). The Special Meeting is scheduled for July 16, 2018, at 2:00 p.m., Central time, at the offices of Nuveen, LLC, 333 West Wacker Drive, Chicago, Illinois 60606.

At the Special Meeting, you will be asked to consider and approve a very important proposal for your fund. You are being asked to consider the reorganization of your fund into Nuveen Santa Barbara Dividend Growth Fund (the “Acquiring Fund” and together with the Target Fund, the “Funds” and each a “Fund”) (the “Reorganization”). The Funds are each a series of Nuveen Investment Trust II (the “Trust”).

Nuveen Fund Advisors, LLC (the “Adviser”) serves as each Fund’s investment adviser. The Adviser proposed the Reorganization as part of a strategic decision to end its support of the equity fund line of business of Symphony Asset Management LLC, the Target Fund’s sub-adviser. The proposed Reorganization will allow Target Fund shareholders to continue their investment in an equity fund with a similar performance and risk profile as the Target Fund. In addition, the Adviser and the Board of Trustees of the Trust (the “Board”) believe that Target Fund shareholders (as shareholders of the Acquiring Fund following the Reorganization) will recognize operating cost savings and operational efficiencies because the fixed costs involved with operating a fund will be spread across a larger asset base following the Reorganization, and the need for certain duplicative services for separate stand-alone funds will be eliminated. This is expected to result in a decrease in total annual fund operating expenses for shareholders of the Target Fund following the Reorganization. The Board believes the Reorganization is in the best interests of the Target Fund and recommends that you vote “FOR” the proposed Reorganization.

The attached Proxy Statement/Prospectus has been prepared to give you information about the proposal.

All shareholders are cordially invited to attend the Special Meeting. In order to avoid delay and additional expense and to assure that your shares are represented, please vote as promptly as possible, whether or not you plan to attend the Special Meeting. You may vote by mail, by telephone or over the Internet. To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. To vote over the Internet, go to the Internet address provided on your proxy card and follow the instructions, using your proxy card as a guide.

If you intend to attend the Special Meeting in person and you are a record holder of the Target Fund’s shares, in order to gain admission you must show photographic identification, such as your driver’s license. If you intend to attend the Special Meeting in person and you hold your shares through a bank, broker or other nominee, in order to gain admission you must show photographic identification, such as your driver’s license, and satisfactory proof of ownership of shares of the Target Fund, such as your voting instruction form (or a copy thereof) or broker’s statement indicating ownership as of a

1

recent date. If you hold your shares in a brokerage account or through a bank or other nominee, you will not be able to vote in person at the Special Meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other nominee and present it at the Special Meeting.

We appreciate your continued support and confidence in Nuveen and our family of funds.

Very truly yours,

Christopher M. Rohrbacher

Vice President and Secretary

2

[•], 2018

NUVEEN SYMPHONY LOW VOLATILITY EQUITY FUND

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JULY 16, 2018

To the Shareholders:

Notice is hereby given that a special meeting of shareholders of Nuveen Symphony Low Volatility Equity Fund (the “Target Fund”), a series of Nuveen Investment Trust II (the “Trust”), a Massachusetts business trust, will be held at the offices of Nuveen, LLC, 333 West Wacker Drive, Chicago, Illinois 60606, on July 16, 2018 at 2:00 p.m., Central time (the “Special Meeting”), for the purposes described below.

| | 1. | To approve an Agreement and Plan of Reorganization (and the related transactions), which provides for (i) the transfer of all the assets of the Target Fund to Nuveen Santa Barbara Dividend Growth Fund (the “Acquiring Fund”) in exchange solely for Class A, Class C, Class R6 and Class I shares of beneficial interest of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and (ii) the pro rata distribution of Class A, Class C, Class R6 and Class I shares of the Acquiring Fund to the holders of Class A, Class C, Class R6 and Class I shares of the Target Fund, respectively, in complete liquidation and termination of the Target Fund (the “Reorganization”). |

| | 2. | To transact such other business as may properly come before the Special Meeting. |

Only shareholders of record as of the close of business on May 11, 2018 are entitled to vote at the Special Meeting or any adjournments or postponements thereof.

All shareholders are cordially invited to attend the Special Meeting. In order to avoid delay and additional expense and to assure that your shares are represented, please vote as promptly as possible, whether or not you plan to attend the Special Meeting. You may vote by mail, by telephone or over the Internet. To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. To vote over the Internet, go to the Internet address provided on your proxy card and follow the instructions, using your proxy card as a guide.

If you intend to attend the Special Meeting in person and you are a record holder of the Target Fund’s shares, in order to gain admission you must show photographic identification, such as your driver’s license. If you intend to attend the Special Meeting in person and you hold your shares through a bank, broker or other nominee, in order to gain admission you must show photographic identification, such as your driver’s license, and satisfactory proof of ownership of shares of the Target Fund, such as your voting instruction form (or a copy thereof) or broker’s statement indicating ownership as of a recent date. If you hold your shares in a brokerage account or through a bank or other nominee, you will not be able to vote in person at the Special Meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other nominee and present it at the Special Meeting.

Very truly yours,

Christopher M. Rohrbacher

Vice President and Secretary

The information contained in this Proxy Statement/Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Proxy Statement/Prospectus is not an offer to sell these securities, and it is not a solicitation of an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION,

DATED APRIL 18, 2018

PROXY STATEMENT/PROSPECTUS

DATED [•], 2018

Relating to the Acquisition of the Assets and Liabilities of

NUVEEN SYMPHONY LOW VOLATILITY EQUITY FUND

by

NUVEEN SANTA BARBARA DIVIDEND GROWTH FUND

This Proxy Statement/Prospectus is being furnished to shareholders of Nuveen Symphony Low Volatility Fund (the “Target Fund”), a series of Nuveen Investment Trust II, a Massachusetts business trust (the “Trust”) and an open-end investment company registered under the Investment Company Act of 1940 Act, as amended (the “1940 Act”), and relates to the special meeting of shareholders of the Target Fund to be held at the offices of Nuveen, LLC, 333 West Wacker Drive, Chicago, Illinois 60606, on July 16, 2018 at 2:00 p.m., Central time, and at any and all adjournments and postponements thereof (the “Special Meeting”). This Proxy Statement/Prospectus is provided in connection with the solicitation by the Board of Trustees of the Trust (the “Board of Trustees” or the “Trustees”) of proxies to be voted at the Special Meeting. The purpose of the Special Meeting is to allow the shareholders of the Target Fund to consider and vote on the proposed reorganization (the “Reorganization”) of the Target Fund into Nuveen Santa Barbara Dividend Growth Fund (the “Acquiring Fund”), also a series of the Trust. The Target Fund and the Acquiring Fund are collectively referred to herein as the “Funds” and individually as a “Fund.”

If shareholders approve the Reorganization and it is completed, each Target Fund shareholder will receive shares of the Acquiring Fund in an amount equal in total net asset value to the total net asset value of the Target Fund shares surrendered by such shareholder. Holders of shares of the Target Fund will receive the same class of shares of the Acquiring Fund as they currently hold. The Board of Trustees has determined that the Reorganization is in the best interests of the Target Fund. The address and telephone number of the principal executive office of the Funds and the Trust is 333 West Wacker Drive, Chicago, Illinois 60606, (800) 257-8787.

The enclosed proxy and this Proxy Statement/Prospectus are first being sent to shareholders of the Target Fund on or about [•], 2018. Shareholders of record as of the close of business on May 11, 2018 are entitled to vote at the Special Meeting.

The Securities and Exchange Commission has not approved or disapproved these securities or determined whether the information in this Proxy Statement/Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This Proxy Statement/Prospectus concisely sets forth the information shareholders of the Target Fund should know before voting on the Reorganization (in effect, investing in Class A, Class C, Class R6 and Class I shares of the Acquiring Fund, as applicable) and constitutes an offering of Class A, Class C, Class R6 and Class I shares of beneficial interest, par value $0.01 per share, of the Acquiring Fund. Please read it carefully and retain it for future reference.

The following documents have been filed with the Securities and Exchange Commission (“SEC”) and are incorporated into this Proxy Statement/Prospectus by reference and also accompany this Proxy Statement/Prospectus:

| | (i) | the Acquiring Fund’s prospectus dated November 30, 2017, as supplemented through the date of this Proxy Statement/Prospectus, only insofar as it relates to the Acquiring Fund (File Nos. 333-33607 and 811-08333); and |

| | (ii) | the unaudited financial statements contained in the Acquiring Fund’s Semi-Annual Report, only insofar as they relate to the Acquiring Fund, for the six months ended January 31, 2018 (File No. 811-08333). |

The following documents contain additional information about the Funds and have been filed with the SEC and are incorporated into this Proxy Statement/Prospectus by reference:

| | (i) | the Statement of Additional Information relating to the Reorganization, dated [•], 2018 (the “Reorganization SAI”); |

| | (ii) | the Target Fund’s prospectus dated January 31, 2018, as supplemented through the date of this Proxy Statement/Prospectus, only insofar as it relates to the Target Fund (File Nos. 333-33607 and 811-08333); |

| | (iii) | The Target Fund’s statement of additional information dated January 31, 2018, as supplemented through the date of this Proxy Statement/Prospectus, only insofar as it relates to the Target Fund (File Nos. 333-33607 and 811-08333); |

| | (iv) | the audited financial statements contained in the Target Fund’s Annual Report, only insofar as they relate to the Target Fund, for the fiscal year ended September 30, 2017 (File No. 811-08333); |

| | (v) | the Acquiring Fund’s statement of additional information dated November 30, 2017, as supplemented through the date of this Proxy Statement/Prospectus, only insofar as it relates to the Acquiring Fund (File Nos. 333-33607 and 811-08333); and |

| | (vi) | the audited financial statements contained in the Acquiring Fund’s Annual Report, only insofar as they relate to the Acquiring Fund, for the fiscal year ended July 31, 2017 (File No. 811-08333). |

No other parts of the Funds’ Annual Reports or Semi-Annual Reports are incorporated by reference herein.

Copies of the foregoing may be obtained without charge by calling or writing the Funds at the telephone number or address shown above. If you wish to request the Reorganization SAI, please ask for the “Santa Barbara Dividend Growth Fund Reorganization SAI.” In addition, the Acquiring Fund will furnish, without charge, a copy of its most recent annual report and subsequent semi-annual report to a shareholder upon request. Any such request should be directed to the Acquiring Fund by calling (800) 257-8787 or by writing the Acquiring Fund at 333 West Wacker Drive, Chicago, Illinois 60606.

ii

The Trust is subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the 1940 Act, and in accordance therewith files reports and other information with the SEC. Reports, proxy statements, registration statements and other information filed by the Trust (including the Registration Statement relating to the Acquiring Fund on Form N-14 of which this Proxy Statement/Prospectus is a part) may be inspected without charge and copied (for a duplication fee at prescribed rates) at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 or at the SEC’s Northeast Regional Office (3 World Financial Center, New York, New York 10281) or Midwest Regional Office (175 W. Jackson Boulevard, Suite 900, Chicago, Illinois 60604). You may call the SEC at (202) 551-8090 for information about the operation of the Public Reference Room. You may obtain copies of this information, with payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. You may also access reports and other information about the Funds on the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

iii

TABLE OF CONTENTS

iv

REORGANIZATION OF THE TARGET FUND INTO THE ACQUIRING FUND

Summary

The following is a summary of, and should be read in conjunction with, the more complete information contained in this Proxy Statement/Prospectus and the information attached hereto or incorporated herein by reference, including the form of Agreement and Plan of Reorganization. As discussed more fully below and elsewhere in this Proxy Statement/Prospectus, the Board of Trustees believes the proposed Reorganization is in the best interests of the Target Fund and that the interests of the Target Fund’s existing shareholders would not be diluted as a result of the Reorganization. If shareholders of the Target Fund approve the Reorganization and it is completed, the Target Fund shareholders will become shareholders of the Acquiring Fund and will cease to be shareholders of the Target Fund.

Shareholders should read the entire Proxy Statement/Prospectus carefully together with the Acquiring Fund’s prospectus that accompanies this Proxy Statement/Prospectus, which is incorporated herein by reference. See the section entitled “Further Comparison of the Funds” below for a comparison of investment policies, fees and expenses, and other matters. This Proxy Statement/Prospectus constitutes an offering of Class A, Class C, Class R6 and Class I shares of the Acquiring Fund.

Background

Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors” or the “Adviser”) serves as each Fund’s investment adviser. The Adviser proposed the Reorganization of the Target Fund into the Acquiring Fund as part of a strategic decision to end its support of the retail equity fund line of business of Symphony Asset Management LLC (“Symphony”), the Target Fund’s sub-adviser. The proposed Reorganization will allow Target Fund shareholders to continue their investment in an equity fund with a similar performance and risk profile as the Target Fund. In addition, the Adviser and the Board of Trustees believe that Target Fund shareholders (as shareholders of the Acquiring Fund following the Reorganization) will recognize operating cost savings and operational efficiencies because the fixed costs involved with operating a fund will be spread across a larger asset base following the Reorganization, and the need for certain duplicative services for separate stand-alone funds will be eliminated. This is expected to result in a decrease in total annual fund operating expenses for shareholders of the Target Fund following the Reorganization.

The Reorganization

This Proxy Statement/Prospectus is being furnished to shareholders of the Target Fund in connection with the proposed combination of the Target Fund into the Acquiring Fund pursuant to the terms and conditions of the Agreement and Plan of Reorganization entered into by (i) the Trust, on behalf of each Fund, and (ii) the Adviser (the “Agreement”).

The Agreement provides for (i) the transfer of all the assets of the Target Fund to the Acquiring Fund in exchange solely for Class A, Class C, Class R6 and Class I shares of beneficial interest, par value $0.01 per share, of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and (ii) the pro rata distribution of Class A, Class C, Class R6 and Class I shares of the Acquiring Fund to the holders of Class A, Class C, Class R6 and Class I shares of the Target Fund, respectively, in complete liquidation and termination of the Target Fund.

If shareholders of the Target Fund approve the Reorganization and it is completed, Target Fund shareholders will become shareholders of the Acquiring Fund. The Board of Trustees has determined that the Reorganization is in the best interests of the Target Fund and that the interests of existing Target Fund shareholders would not be diluted as a result of the Reorganization. The Board of Trustees unanimously approved the Reorganization and the Agreement at a meeting held on April 10–11, 2018. The Board of Trustees recommends a vote “FOR” the Reorganization.

Nuveen Fund Advisors or its affiliates (collectively, “Nuveen”) will absorb the costs of the Reorganization, which are estimated to be approximately $230,000.

The Board of Trustees is asking shareholders of the Target Fund to approve the Reorganization at the Special Meeting to be held on July 16, 2018. Approval of the Reorganization requires the affirmative vote of the holders of a majority of the total number of the Target Fund’s shares outstanding and entitled to vote, voting as a single class. See “Voting Information and Requirements” below.

If shareholders of the Target Fund approve the Reorganization, it is expected that the Reorganization will occur at the close of business on August 24, 2018 or such other date as agreed to by the parties (the “Closing Date”). If the Reorganization is not approved, the Board of Trustees will take such action as it deems to be in the best interests of the Target Fund, including continuing to operate the Target Fund as a stand-alone fund, liquidating the Target Fund, or other options the Board of Trustees may consider. The Closing Date may be delayed and the Reorganization may be abandoned at any time by the mutual agreement of the parties. In addition, either Fund may at its option terminate the Agreement at or before the closing of the Reorganization due to (i) a breach by the other Fund of any representation, warranty or agreement contained in the Agreement to be performed at or before the closing, if not cured within 30 days of notification to the breaching party and prior to the closing, (ii) a condition precedent to the obligations of the terminating party that has not been met and it reasonably appears that it will not or cannot be met or (iii) a determination by the Board of Trustees that the consummation of the transactions contemplated by the Agreement is not in the best interests of such Fund.

Comparison of Investment Objectives and Principal Investment Strategies

Although both Funds invest significantly in dividend-paying common stocks, the Funds’ investment objectives and principal investment strategies differ in certain respects, as summarized below.

The investment objective of the Target Fund is to seek long-term capital appreciation with lower absolute volatility than the broad equity market. The investment objective of the Acquiring Fund is to seek an attractive total return comprised of income from dividends and long-term capital appreciation.

Under normal market conditions, the Target Fund invests at least 80% of the sum of its net assets and the amount of any borrowings for investment purposes in equity securities (which are defined to include, among other things, common stocks and preferred securities). The goal of the Target Fund’s portfolio construction process is to produce long-term returns superior to the broad equity market with lower absolute volatility. The Target Fund’s sub-adviser seeks a “beta” (i.e., a measure of a portfolio’s sensitivity to market movements) that is approximately 90% of the beta of the Russell 1000® Index, the Target Fund’s primary benchmark index, although there is no guarantee that

2

this can be achieved. In seeking to lower absolute volatility, the Target Fund historically has invested a high percentage of its assets (approximately 77% of net assets as of February 28, 2018) in dividend-paying common stocks.

Under normal market conditions, the Acquiring Fund invests at least 80% of its net assets in dividend-paying common stocks and preferred securities. Historically, the Acquiring Fund has invested substantially all of its net assets in dividend-paying common stocks. Unlike the Target Fund, as a principal investment strategy, the Acquiring Fund may invest up to 25% of its net assets in non-U.S. equity securities that are U.S. dollar-denominated.

Each Fund may invest in companies of any size, including small-, mid- and large-cap companies.

Distribution, Purchase, Redemption, Exchange of Shares and Dividends

The Funds have identical procedures for purchasing, exchanging and redeeming shares for each share class except Class R3 shares, which are offered by the Acquiring Fund but not by the Target Fund. The Target Fund offers four classes of shares: Class A, Class C, Class R6 and Class I shares. The Acquiring Fund offers five classes of shares: Class A, Class C, Class R3, Class R6 and Class I shares. Each Fund has also established and designated (but is not currently offering) Class T shares. The Adviser is currently the sole holder of all outstanding Class T shares of the Acquiring Fund; the Adviser has not yet seeded Class T shares of the Target Fund. The corresponding classes of each Fund have the same investment eligibility criteria. The Target Fund normally pays dividends from net investment income annually, and the Acquiring Fund normally pays dividends from net investment income quarterly. For each Fund, any net capital gains are normally distributed at least once a year. See “Further Comparison of the Funds—Distribution, Purchase, Redemption, Exchange of Shares and Dividends” below for a more detailed discussion.

Material Federal Income Tax Consequences of the Reorganization

As a condition to closing the Reorganization, the Target Fund and the Acquiring Fund will receive an opinion from Vedder Price P.C., subject to certain representations, assumptions and conditions, substantially to the effect that the Reorganization will qualify as a tax-free reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is expected that neither Fund will recognize any gain or loss for federal income tax purposes as a direct result of the Reorganization. Prior to the close of regular trading on the New York Stock Exchange on the Closing Date, the Target Fund will declare a distribution of all of its net investment income and net capital gains, if any. All or a portion of such a distribution may be taxable to the Target Fund’s shareholders for federal income tax purposes.

If the Reorganization had occurred as of February 28, 2018, it is estimated that approximately 78% (or $105.4 million) of the Target Fund’s portfolio would have been sold. It is estimated that such portfolio repositioning would have resulted in brokerage commissions or other transaction costs for the Target Fund of approximately $47,900 (0.04% of the Target Fund’s net assets), based on average commission rates normally paid by the Target Fund. These transaction costs represent expenses of the Target Fund that will not be subject to the Target Fund’s expense cap and will be borne by the Target Fund and indirectly borne by the Target Fund’s shareholders. Capital gains from such portfolio sales may result in increased distributions of net capital gain and net investment income. If such sales had occurred as of February 28, 2018, the sales would have resulted in realized gains of approximately $24.2 million (approximately $5.75 per share or 18% of the Target Fund’s net assets).

3

Taking into account the repositioning of the Target Fund, the Acquiring Fund is not expected to sell a material portion (i.e., 5% or more of net assets) of the Target Fund’s assets received in the Reorganization in order to meet its investment policies and restrictions.

For a more detailed discussion of the federal income tax consequences of the Reorganization, please see “The Proposed Reorganization—Material Federal Income Tax Consequences” below.

Risk Factors

In evaluating the Reorganization, you should consider carefully the risks of the Acquiring Fund to which you will be subject if the Reorganization is approved and completed. Investing in a mutual fund involves risk, including the risk that you may receive little or no return on your investment or even that you may lose part or all of your investment. Because of these and other risks, you should consider an investment in the Acquiring Fund to be a long-term investment. An investment in the Acquiring Fund may not be appropriate for all shareholders. For a complete description of the risks of an investment in the Acquiring Fund, see the section in the Acquiring Fund’s prospectus entitled “Principal Risks.”

Although an investment in each Fund is subject to substantially similar risks (i.e., Active Management Risk, Equity Security Risk and Small- and Mid-Cap Stock Risk), an investment in the Acquiring Fund is subject to certain additional principal risks (i.e., Currency Risk and Non-U.S. Investment Risk) related to investments in non-U.S. equity securities, which is not a principal investment strategy of the Target Fund.

The following table provides a comparison of the types of investment risks associated with an investment in each Fund.

| | | | |

Principal Investment Risks | | Target Fund | | Acquiring Fund |

Active Management Risk | | X | | X |

Currency Risk | | — | | X |

Cybersecurity Risk | | X | | X |

Dividend-Paying Security Risk | | — | | X |

Equity Security Risk | | X | | X |

Low Volatility Investment Strategy Risk | | X | | — |

Non-U.S. Investment Risk | | — | | X |

Preferred Security Risk(1) | | — | | X |

Smaller Company Risk(2) | | X | | X |

| (1) | Both Funds are subject to Preferred Security Risk, however, it is a principal risk for the Acquiring Fund. |

| (2) | The Target Fund’s prospectus identifies this risk as Small- and Mid-Cap Stock Risk. Each Fund may invest in companies of any size, meaning an investment in each Fund is subject to the risks of small- and mid-cap stocks. |

A description of these principal investment risks is also provided below.

Active Management Risk—The Fund’s sub-adviser actively manages the Fund’s investments. Consequently, the Fund is subject to the risk that the investment techniques and risk analyses employed by the Fund’s sub-adviser may not produce the desired results. This could cause the Fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

Currency Risk—Even though the non-U.S. securities held by the Fund are traded in U.S. dollars, their prices are typically indirectly influenced by currency fluctuations. Changes in currency

4

exchange rates may affect the Fund’s net asset value, the value of dividends and interest earned, and gains or losses realized on the sale of securities.

Cybersecurity Risk—Cybersecurity risk is the risk of an unauthorized breach and access to Fund assets, customer data (including private shareholder information), or proprietary information, or the risk of an incident occurring that causes the Fund, its investment adviser or sub-adviser, custodian, transfer agent, distributor or other service provider or a financial intermediary to suffer a data breach, data corruption or lose operational functionality. Successful cyber-attacks or other cyber-failures or events affecting the Fund or its service providers may adversely impact the Fund or its shareholders. Additionally, a cybersecurity breach could affect the issuers in which the Fund invests, which may cause the Fund’s investments to lose value.

Dividend-Paying Security Risk—The Fund’s investment in dividend-paying stocks could cause the Fund to underperform similar funds that invest without consideration of a company’s track record of paying dividends. Stocks of companies with a history of paying dividends may not participate in a broad market advance to the same degree as most other stocks, and a sharp rise in interest rates or economic downturn could cause a company to unexpectedly reduce or eliminate its dividend.

Equity Security Risk—Equity securities in the Fund’s portfolio may decline significantly in price over short or extended periods of time, and such declines may occur because of declines in the equity market as a whole, or because of declines in only a particular country, company, industry, or sector of the market. Holders of common stock generally are subject to more risks than holders of preferred securities because the status of common stockholders upon the bankruptcy of the issuer is subordinated to that of preferred security holders. From time to time, the Fund may invest a significant portion of its assets in companies in one or more related sectors or industries which would make the Fund more vulnerable to adverse developments affecting such sectors or industries.

Low Volatility Investment Strategy Risk—In an attempt to construct a portfolio with lower absolute volatility than the broad equity market, historical data is used to produce a portfolio expected to have a defined level of market risk and the highest projected return for the risk taken. However, individual stock behavior may change in the future, and therefore there is no guarantee that this strategy will be successful.

Non-U.S. Investment Risk—Non-U.S. issuers or U.S. issuers with significant non-U.S. operations may be subject to risks in addition to those of issuers located in or that principally operate in the United States as a result of, among other things, political, social and economic developments abroad and different legal, regulatory and tax environments.

Preferred Security Risk—Preferred securities generally are subordinated to bonds and other debt instruments in a company’s capital structure and therefore will be subject to greater credit risk than those debt instruments. In addition, preferred securities are subject to other risks, such as having no or limited voting rights, being subject to special redemption rights, having distributions deferred or skipped, having floating interest rates or dividends, which may result in a decline in value in a falling interest rate environment, having limited liquidity, changing or unfavorable tax treatments and possibly being issued by companies in heavily regulated industries.

Smaller Company Risk—Small-cap stocks involve substantial risk. Prices of small-cap stocks may be subject to more abrupt or erratic movements, and to wider fluctuations, than stock prices of

5

larger, more established companies or the market averages in general. It may be difficult to sell small-cap stocks at the desired time and price. While mid-cap stocks may be slightly less volatile than small-cap stocks, they still involve similar risks.

Further Comparison of the Funds

Investment Objectives

The investment objective of the Target Fund is to seek long-term capital appreciation with lower absolute volatility than the broad equity market. The investment objective of the Acquiring Fund is to seek an attractive total return comprised of income from dividends and long-term capital appreciation.

Principal Investment Strategies

Although both Funds invest significantly in dividend-paying common stocks, the Funds’ principal investment strategies differ in certain respects, as summarized below.

Under normal market conditions, the Target Fund invests at least 80% of the sum of its net assets and the amount of any borrowings for investment purposes in equity securities (which are defined to include, among other things, common stocks and preferred securities). The goal of the Target Fund’s portfolio construction process is to produce long-term returns superior to the broad equity market with lower absolute volatility. The Target Fund’s sub-adviser seeks a “beta” (i.e., a measure of a portfolio’s sensitivity to market movements) that is approximately 90% of the beta of the Russell 1000® Index, the Target Fund’s primary benchmark index, although there is no guarantee that this can be achieved. In seeking to lower absolute volatility, the Target Fund historically has invested a high percentage of its assets (approximately 77% of net assets as of February 28, 2018) in dividend-paying common stocks.

Under normal market conditions, the Acquiring Fund invests at least 80% of its net assets in dividend-paying common stocks and preferred securities. Historically, the Acquiring Fund has invested substantially all of its net assets in dividend-paying common stocks. Unlike the Target Fund, as a principal investment strategy, the Acquiring Fund may invest up to 25% of its net assets in non-U.S. equity securities that are U.S. dollar-denominated.

6

The table below summarizes each Fund’s principal investment strategies and highlights relevant differences.

| | | | |

Target Fund | | Acquiring Fund | | Differences |

Principal Strategy: | | Principal Strategy: | | |

| | |

Under normal market conditions, the Target Fund invests at least 80% of the sum of its net assets and the amount of any borrowings for investment purposes in equity securities. The Target Fund seeks to limit its volatility by limiting its portfolio’s sensitivity to market movements, sometimes referred to as “beta.” The Target Fund’s sub-adviser targets a beta that is approximately 90% of the beta of the Russell 1000® Index, the Target Fund’s primary benchmark index, although there is no guarantee that this can be achieved. | | Under normal market conditions, the Acquiring Fund invests at least 80% of its net assets in dividend-paying common stocks and preferred securities. | | The Funds have different sub-advisers that employ principal investment strategies that differ in certain respects. |

| | |

Capitalization: | | Capitalization: | | |

| | |

| The Target Fund may invest in companies of any size. | | The Acquiring Fund may invest in small-, mid- and large-cap companies. | | Substantially the same. |

| | |

Non-U.S. Investments: | | Non-U.S. Investments: | | |

| | |

| Not a principal investment strategy. | | The Acquiring Fund may invest up to 25% of its net assets in non-U.S. equity securities that are U.S. dollar-denominated. | | Unlike the Target Fund, the Acquiring Fund may invest in non-U.S. equity securities as a principal investment strategy. |

| | |

Diversification: | | Diversification: | | |

| | |

| The Target Fund is a diversified company under the 1940 Act. | | The Acquiring Fund is a diversified company under the 1940 Act. | | No differences. |

In evaluating the Reorganization, Target Fund shareholders should consider the risks of investing in the Acquiring Fund. The principal risks of investing in the Acquiring Fund are described in the section above entitled “Risk Factors.”

Additional Information Regarding the Funds’ Portfolio Management Styles

Target Fund: The goal of the portfolio construction process is to produce long-term returns superior to the broad equity market with lower absolute volatility. Through security selection and the use of risk controls, and by maintaining a broadly diversified portfolio, the Target Fund’s sub-adviser believes it can reduce volatility while preserving the Target Fund’s potential to generate returns in excess of the market over the long term.

7

The Target Fund’s sub-adviser utilizes a multi-faceted investment process that incorporates fundamental research, comprehensive market views and proactive risk management. Industry-focused analysts draw upon a broad range of resources to identify potential investments, including a top down macro-framework, fundamental bottom-up insights, quantitative analysis, valuation assessment and catalyst identification. Through this stock selection process, the Target Fund’s portfolio management team seeks to identify equity ideas with a favorable risk-adjusted return potential across diverse sectors of the market. With the assistance of quantitative tools, the Target Fund’s sub-adviser monitors the levels and types of risks in the portfolio and positions the portfolio based on its macroeconomic and market outlook.

Acquiring Fund: Companies in certain economic sectors of the market have historically provided higher dividend yields than companies in other sectors and industries. As a result, given the Acquiring Fund’s focus on dividend-paying securities, the Acquiring Fund may, from time to time, have a greater exposure to higher dividend-yield sectors and industries than the broad equity market.

Fees and Expenses

The tables below provide information about the fees and expenses attributable to each class of shares of the Funds and the pro forma fees and expenses of the Acquiring Fund following the Reorganization. Shareholder fees reflect the fees currently in effect for each Fund. Annual fund operating expenses reflect the actual expenses of the Target Fund for its fiscal year ended September 30, 2017 and the actual expenses of the Acquiring Fund for the six months ended January 31, 2018, annualized. The Acquiring Fund Pro Forma fees and expenses are based on the amounts shown in the table for each Fund, assuming the Reorganization occurred as of January 31, 2018.

Shareholder Fees

(fees paid directly from your investment)

| | | | | | | | | | | | |

| | | Target Fund | | | Acquiring Fund | | | Acquiring Fund

Pro Forma | |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of Offering Price) | | | | | | | | | | | | |

Class A(1) | | | 5.75 | % | | | 5.75 | % | | | 5.75 | % |

Class C | | | None | | | | None | | | | None | |

Class R6 | | | None | | | | None | | | | None | |

Class I | | | None | | | | None | | | | None | |

Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of purchase price or redemption proceeds)(2) | | | | | | | | | | | | |

Class A | | | None | | | | None | | | | None | |

Class C | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

Class R6 | | | None | | | | None | | | | None | |

Class I | | | None | | | | None | | | | None | |

Maximum Sales Charge (Load) Imposed on Reinvested Dividends | | | | | | | | | | | | |

Class A | | | None | | | | None | | | | None | |

Class C | | | None | | | | None | | | | None | |

Class R6 | | | None | | | | None | | | | None | |

Class I | | | None | | | | None | | | | None | |

8

| | | | | | | | | | | | |

| | | Target Fund | | | Acquiring Fund | | | Acquiring Fund

Pro Forma | |

Exchange Fee | | | | | | | | | | | | |

Class A | | | None | | | | None | | | | None | |

Class C | | | None | | | | None | | | | None | |

Class R6 | | | None | | | | None | | | | None | |

Class I | | | None | | | | None | | | | None | |

Annual Low Balance Account Fee (for accounts under $1,000)(3) | | | | | | | | | | | | |

Class A | | | $15 | | | | $15 | | | | $15 | |

Class C | | | $15 | | | | $15 | | | | $15 | |

Class R6 | | | None | | | | None | | | | None | |

Class I | | | $15 | | | | $15 | | | | $15 | |

| (1) | No front-end sales charge will be imposed on the Class A shares of the Acquiring Fund received in connection with the Reorganization. Additional information regarding sales load waivers for Class A shares can be found in the Acquiring Fund’s prospectus under “How to Reduce Your Sales Charge—Class A Sales Charge Waivers.” |

| (2) | Class C shares are subject to a contingent deferred sales charge if redeemed within 12 months of purchase. Class A share purchases of $1 million or more that were not subject to a front-end sales load are subject to a contingent deferred sales charge if redeemed within 18 months of purchase. For shares received in the Reorganization, such charge will be applied to Class C and Class A shares redeemed within 12 months and 18 months, respectively, of purchase of your Target Fund shares. |

| (3) | Fee applies to the following types of accounts under $1,000 held directly with a Fund: individual retirement accounts (IRAs), Coverdell Education Savings Accounts, and accounts established pursuant to the Uniform Transfers to Minors Act (UTMA) or the Uniform Gifts to Minors Act (UGMA). |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | | | | | | | | | |

| | | Target Fund | | | Acquiring Fund | | | Acquiring Fund

Pro Forma | |

Management Fees | | | | | | | | | | | | |

Class A | | | 0.68 | % | | | 0.61 | % | | | 0.61 | % |

Class C | | | 0.68 | % | | | 0.61 | % | | | 0.61 | % |

Class R6 | | | 0.68 | % | | | 0.61 | % | | | 0.61 | % |

Class I | | | 0.68 | % | | | 0.61 | % | | | 0.61 | % |

Distribution and Service (12b-1) Fees | | | | | | | | | | | | |

Class A | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % |

Class C | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

Class R6 | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

Class I | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

Other Expenses | | | | | | | | | | | | |

Class A | | | 0.29 | % | | | 0.10 | % | | | 0.10 | % |

Class C | | | 0.29 | % | | | 0.10 | % | | | 0.10 | % |

Class R6 | | | 0.19 | % | | | 0.03 | % | | | 0.03 | % |

Class I | | | 0.29 | % | | | 0.10 | % | | | 0.10 | % |

Total Annual Fund Operating Expenses | | | | | | | | | | | | |

Class A | | | 1.22 | % | | | 0.96 | % | | | 0.96 | % |

Class C | | | 1.97 | % | | | 1.71 | % | | | 1.71 | % |

Class R6 | | | 0.87 | % | | | 0.64 | % | | | 0.64 | % |

Class I | | | 0.97 | % | | | 0.71 | % | | | 0.71 | % |

Fee Waivers and/or Expense Reimbursements | | | | | | | | | | | | |

Class A | | | (0.21 | )%(1) | | | — | (2) | | | — | (2) |

Class C | | | (0.21 | )%(1) | | | — | (2) | | | — | (2) |

Class R6 | | | (0.21 | )%(1) | | | — | (2) | | | — | (2) |

Class I | | | (0.21 | )%(1) | | | — | (2) | | | — | (2) |

9

| | | | | | | | | | | | |

| | | Target Fund | | | Acquiring Fund | | | Acquiring Fund

Pro Forma | |

Total Annual Fund Operating Expenses – After Fee Waivers and/or Expense Reimbursements | | | | | | | | | | | | |

Class A | | | 1.01 | % | | | 0.96 | % | | | 0.96 | % |

Class C | | | 1.76 | % | | | 1.71 | % | | | 1.71 | % |

Class R6 | | | 0.66 | % | | | 0.64 | % | | | 0.64 | % |

Class I | | | 0.76 | % | | | 0.71 | % | | | 0.71 | % |

| (1) | Nuveen Fund Advisors has agreed to waive fees and/or reimburse expenses through July 31, 2019 so that the total annual fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 0.78% (1.45% after July 31, 2019) of the average daily net assets of any class of Target Fund shares. However, because Class R6 shares are not subject to sub-transfer agent and similar fees, the total annual fund operating expenses for the Class R6 shares will be less than the expense limitation. The expense limitation that expires on July 31, 2019 may be terminated or modified prior to that date only with the approval of the Board of Trustees. The permanent expense limitation in effect thereafter may be terminated or modified only with the approval of shareholders of the Target Fund. |

| (2) | Nuveen Fund Advisors has agreed to waive fees and/or reimburse expenses so that the total annual fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 1.25% of the average daily net assets of any class of Acquiring Fund shares. However, because Class R6 shares are not subject to sub-transfer agent and similar fees, the total annual fund operating expenses for the Class R6 shares will be less than the expense limitation. This permanent expense limitation may be terminated or modified only with the approval of shareholders of the Acquiring Fund. |

Examples

The examples below are intended to help you compare the cost of investing in each Fund and the pro forma cost of investing in the Acquiring Fund following the Reorganization. The examples assume you invest $10,000 in a Fund for the time periods indicated (based on information in the tables above) and then either redeem or do not redeem your shares at the end of a period. The examples assume that your investment has a 5% return each year and that a Fund’s expenses remain at the level shown in the table above. For presentation purposes, the examples below assume the Reorganization is effective as of September 1, 2018, the first day of the month following the actual expected closing of the Reorganization. These amounts are estimated; actual operating expenses will vary based on asset size and other factors.

The examples below assume that you sell your shares at the end of a period, but the estimated costs are the same if you do not sell your shares at the end of a period. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | | | | | |

| | | Target Fund | | | Acquiring Fund | | | Acquiring Fund

Pro Forma | |

1 Year | | | | | | | | | | | | |

Class A | | $ | 674 | | | $ | 667 | | | $ | 667 | |

Class C | | $ | 181 | | | $ | 174 | | | $ | 174 | |

Class R6 | | $ | 69 | | | $ | 65 | | | $ | 65 | |

Class I | | $ | 79 | | | $ | 73 | | | $ | 73 | |

3 Years | | | | | | | | | | | | |

Class A | | $ | 922 | | | $ | 863 | | | $ | 863 | |

Class C | | $ | 600 | | | $ | 539 | | | $ | 539 | |

Class R6 | | $ | 258 | | | $ | 205 | | | $ | 205 | |

Class I | | $ | 290 | | | $ | 227 | | | $ | 227 | |

10

| | | | | | | | | | | | |

| | | Target Fund | | | Acquiring Fund | | | Acquiring Fund

Pro Forma | |

5 Years | | | | | | | | | | | | |

Class A | | $ | 1,189 | | | $ | 1,075 | | | $ | 1,075 | |

Class C | | $ | 1,045 | | | $ | 928 | | | $ | 928 | |

Class R6 | | $ | 463 | | | $ | 357 | | | $ | 357 | |

Class I | | $ | 518 | | | $ | 395 | | | $ | 395 | |

10 Years | | | | | | | | | | | | |

Class A | | $ | 1,951 | | | $ | 1,685 | | | $ | 1,685 | |

Class C | | $ | 2,280 | | | $ | 2,019 | | | $ | 2,019 | |

Class R6 | | $ | 1,055 | | | $ | 798 | | | $ | 798 | |

Class I | | $ | 1,172 | | | $ | 883 | | | $ | 883 | |

The expense example figures above reflect the imposition of the maximum sales charge (load) imposed on purchases of Class A shares, and these figures are applicable to purchases of Acquiring Fund shares made after completion of the Reorganization. However, no sales charge will be imposed on Class A shares of the Acquiring Fund that are received in connection with the Reorganization. Based on the assumptions described above, and removing the effect of the sales charge, your costs of investing in Class A shares received in connection with the Reorganization would be:

| | | | |

Class A Shares | | Acquiring Fund Pro Forma | |

1 Year | | $ | 98 | |

3 Years | | $ | 306 | |

5 Years | | $ | 531 | |

10 Years | | $ | 1,178 | |

Performance Information

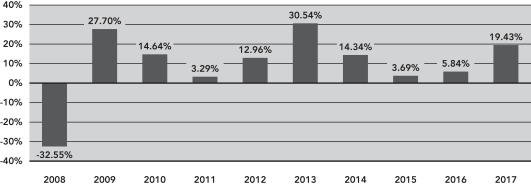

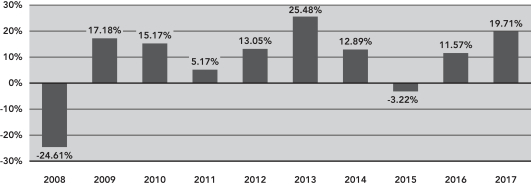

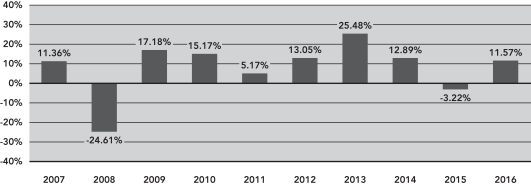

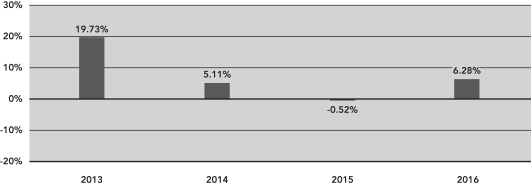

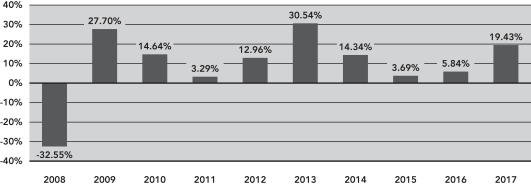

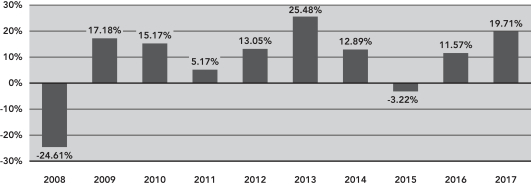

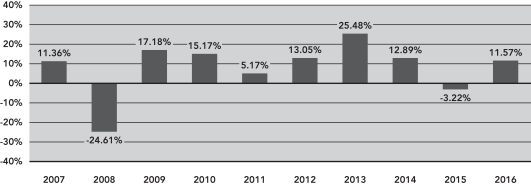

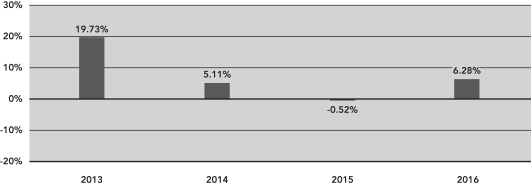

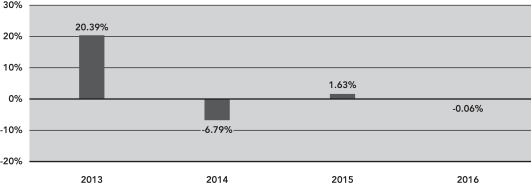

The total returns of each Fund for the periods ended December 31, 2017, based on historical fees and expenses for each period, are set forth in the bar charts and tables below.

The bar charts below illustrate calendar year returns for each Fund’s Class A shares. The performance of the other share classes will differ due to their different expense structures. The bar charts and the highest/lowest quarterly return information that follow do not reflect sales charges, and if these charges were reflected, the returns would be less than those shown.

The tables below illustrate average annual total returns for the one-year, five-year and ten-year periods ended December 31, 2017 for Class A, Class C and Class I shares of each Fund and for the one-year and since inception periods ended December 31, 2017 for Class R6 shares of each Fund. The tables also show how each Fund’s performance compares with the returns of a broad measure of market performance and an index of funds with similar investment objectives. This information is intended to help you assess the variability of Fund returns (and, consequently, the potential risks of a Fund investment).

All after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. After-tax returns are shown for Class A shares only; after-tax returns for other share classes will vary. Returns for market indices do not include operating expenses, which are deducted from Fund returns, or taxes. Your own actual after-tax returns will depend on your specific tax situation and may differ from what is shown here. After-tax returns are not relevant to investors who hold Fund shares in tax-advantaged accounts, such as IRAs or employer-sponsored retirement plans; but such investors generally are subject to tax on withdrawals from such accounts.

11

Both the bar charts and the tables assume that all distributions have been reinvested. Performance reflects fee waivers and operating expense limitations, if any, in effect during the periods presented. If any such fee waivers and expense limitations were not in place, performance would be reduced. A Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Current performance information for the Funds is available at www.nuveen.com/performance or by calling (800) 257-8787.

Target Fund—Class A Annual Total Return*

| * | Class A year-to-date total return as of March 31, 2018 was 0.63%. The performance of the other share classes will differ due to their different expense structures. |

During the ten-year period ended December 31, 2017, the Target Fund’s Class A highest and lowest quarterly returns were 12.19% and -20.65%, respectively, for the quarters ended June 30, 2009 and December 31, 2008.

Acquiring Fund—Class A Annual Total Return*

| * | Class A year-to-date total return as of March 31, 2018 was -2.27%. The performance of the other share classes will differ due to their different expense structures. |

During the ten-year period ended December 31, 2017, the Acquiring Fund’s Class A highest and lowest quarterly returns were 14.44% and -13.94%, respectively, for the quarters ended September 30, 2010 and December 31, 2008.

12

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns for the Periods

Ended December 31, 2017 | |

Target Fund | | Inception

Date | | | 1 Year | | | 5 Years | | | 10 Years | | | Since

Inception

(Class R6) | |

Class A (return before taxes) | | | 9/28/07 | | | | 12.58 | % | | | 13.01 | % | | | 7.82 | % | | | N/A | |

Class A (return after taxes on distributions) | | | | | | | 11.31 | % | | | 11.19 | % | | | 6.86 | % | | | N/A | |

Class A (return after taxes on distributions and sale of Fund shares) | | | | | | | 8.17 | % | | | 9.82 | % | | | 6.07 | % | | | N/A | |

Class C (return before taxes) | | | 9/28/07 | | | | 18.51 | % | | | 13.51 | % | | | 7.65 | % | | | N/A | |

Class R6 (return before taxes) | | | 6/30/16 | | | | 19.83 | % | | | N/A | | | | N/A | | | | 14.92 | % |

Class I (return before taxes) | | | 9/28/07 | | | | 19.72 | % | | | 14.65 | % | | | 8.73 | % | | | N/A | |

Russell 1000® Index(1) (reflects no deduction for fees, expenses or taxes) | | | | | | | 21.69 | % | | | 15.71 | % | | | 8.59 | % | | | 20.99 | % |

S&P 500® Index(2) (reflects no deduction for fees, expenses or taxes) | | | | | | | 21.83 | % | | | 15.79 | % | | | 8.50 | % | | | 20.94 | % |

Lipper Multi-Cap Core Funds Category Average (reflects no deduction for taxes or sales loads)(3) | | | | | | | 19.47 | % | | | 13.74 | % | | | 7.13 | % | | | 20.95 | % |

| (1) | An index that measures the performance of the large-cap segment of the U.S. equity universe which includes approximately 1,000 of the largest securities based on a contribution of their market cap and current index measurement. |

| (2) | An unmanaged index generally considered representative of the U.S. stock market. |

| (3) | Represents the average annualized returns for all reporting funds in the Lipper Multi-Cap Core Funds Category. |

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns for the Periods

Ended December 31, 2017 | |

Acquiring Fund | | Inception

Date | | | 1 Year | | | 5 Years | | | 10 Years | | | Since

Inception

(Class R6) | |

Class A (return before taxes) | | | 3/28/06 | | | | 12.82 | % | | | 11.53 | % | | | 7.64 | % | | | N/A | |

Class A (return after taxes on distributions) | | | | | | | 11.67 | % | | | 10.56 | % | | | 7.02 | % | | | N/A | |

Class A (return after taxes on distributions and sale of Fund shares) | | | | | | | 8.16 | % | | | 9.03 | % | | | 6.11 | % | | | N/A | |

Class C (return before taxes) | | | 3/28/06 | | | | 18.83 | % | | | 12.02 | % | | | 7.47 | % | | | N/A | |

Class R6 (return before taxes) | | | 3/25/13 | | | | 20.08 | % | | | N/A | | | | N/A | | | | 12.11 | % |

Class I (return before taxes) | | | 3/28/06 | | | | 20.03 | % | | | 13.14 | % | | | 8.55 | % | | | N/A | |

S&P 500® Index(1) (reflects no deduction for fees, expenses or taxes) | | | | | | | 21.83 | % | | | 15.79 | % | | | 8.50 | % | | | 14.36 | % |

Lipper Equity Income Funds Category Average(2) (reflects no deduction for taxes or sales loads) | | | | | | | 15.45 | % | | | 12.31 | % | | | 6.99 | % | | | 10.76 | % |

| (1) | An unmanaged index generally considered representative of the U.S. stock market. |

| (2) | Represents the average annualized returns for all reporting funds in the Lipper Equity Income Funds Category. |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect a Fund’s performance. During their most recent fiscal years, the Funds had the following portfolio turnover rates:

| | | | | | | | |

Fund | | Fiscal Year Ended | | | Rate | |

Target Fund | | | 9/30/17 | | | | 67 | % |

Acquiring Fund | | | 7/31/17 | | | | 22 | % |

13

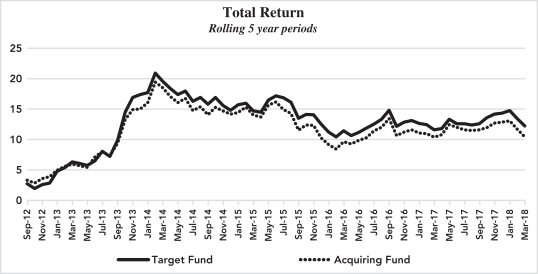

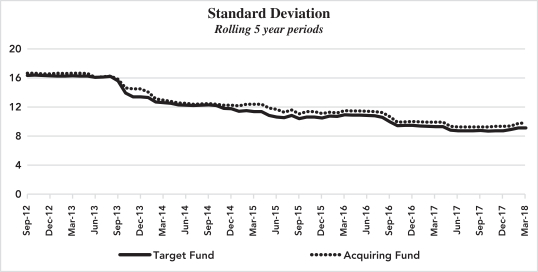

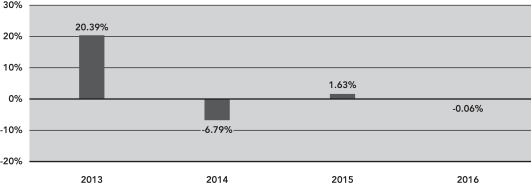

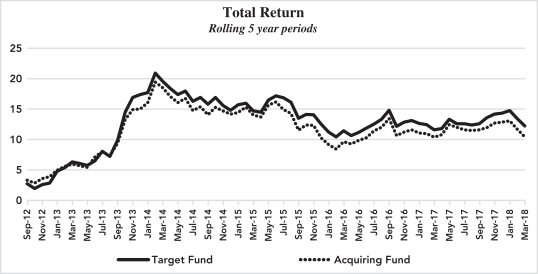

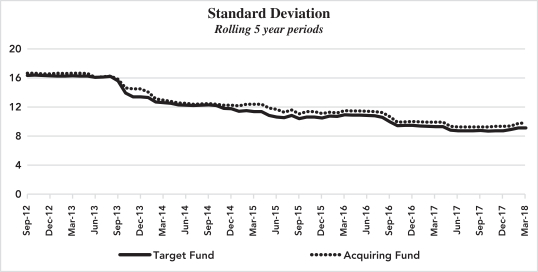

The charts below compare the performance (measured as total return) and risk (measured as standard deviation) of the Funds’ Class A shares on a three-month rolling basis for the five-year period ended January 31, 2018. As reflected in the charts, the Funds have similar performance and risk profiles over this period.

14

Fundamental Investment Restrictions

The Funds have fundamental investment restrictions, set forth below, that are identical. These fundamental investment restrictions, together with the investment objective of each of the Funds, may not be changed for a Fund without the approval of the holders of a majority of the Fund’s outstanding voting shares. For this purpose, a majority of a Fund’s outstanding voting shares means the vote of (1) 67% or more of the Fund’s shares, voting as a single class, present at a meeting, if the holders of more than 50% of the Fund’s outstanding shares are present or represented by proxy; or (2) more than 50% of the Fund’s shares, voting as a single class, whichever is less.

As a fundamental policy, each Fund is diversified, as set forth in number (1) below. Each Fund has adopted a policy of not concentrating its investments in any industry, as set forth in number (8) below.

Fundamental Investment Restrictions (Both Funds)

Each of the Funds, as a fundamental policy, may not, without the approval of the holders of a majority of the Fund’s outstanding voting shares:

(1) With respect to 75% of the total assets of the Fund, individually, purchase the securities of any issuer (except securities issued or guaranteed by the United States government or any agency or instrumentality thereof) if, as a result, (i) more than 5% of the Fund’s total assets would be invested in securities of that issuer, or (ii) the Fund would hold more than 10% of the outstanding voting securities of that issuer.

(2) Borrow money, except as permitted by the 1940 Act and exemptive orders granted under the 1940 Act.

(3) Act as an underwriter of another issuer’s securities, except to the extent that the Fund may be deemed to be an underwriter within the meaning of the Securities Act of 1933 in connection with the purchase and sale of portfolio securities.

(4) Make loans, except as permitted by the 1940 Act and exemptive orders granted under the 1940 Act.

(5) Purchase or sell physical commodities, unless acquired as a result of ownership of securities or other instruments; but this restriction shall not prohibit the Fund from investing in options on commodity indices, commodity futures contracts and options thereon, commodity-related swap agreements, other commodity-related derivative instruments, and investment companies that provide exposure to commodities.

(6) Purchase or sell real estate unless acquired as a result of ownership of securities or other instruments (but this shall not prohibit the Fund from purchasing or selling securities or other instruments backed by real estate or of issuers engaged in real estate activities).

(7) Issue senior securities, except as permitted under the 1940 Act.

(8) Purchase the securities of any issuer if, as a result, 25% or more of the Fund’s total assets would be invested in the securities of issuers whose principal business activities are in the same industry; except that this restriction shall not be applicable to securities issued or guaranteed by the U.S. government or any agency or instrumentality thereof.

15

For each Fund, except with respect to the limitation set forth in number (2) above, the foregoing restrictions and limitations will apply only at the time of purchase of securities, and the percentage limitations will not be considered violated unless an excess or deficiency occurs or exists immediately after and as a result of an acquisition of securities, unless otherwise indicated.

For each Fund, for purposes of applying the limitations set forth in numbers (2) and (7) above, under the 1940 Act as currently in effect, a Fund is not permitted to issue senior securities, except that the Fund may borrow from any bank if immediately after such borrowing the value of the Fund’s total assets is at least 300% of the principal amount of all of the Fund’s borrowings (i.e., the principal amount of the borrowings may not exceed 33 1/3% of the Fund’s total assets). In the event that such asset coverage shall at any time fall below 300%, the Fund shall, within three calendar days thereafter (not including Sundays and holidays), reduce the amount of its borrowings to an extent that the asset coverage of such borrowing shall be at least 300%. No exemptive orders have been issued with respect to the limitation set forth in number (2).

For each Fund, for purposes of applying the limitation set forth in number (4) above, there are no limitations with respect to unsecured loans made by a Fund to an unaffiliated party. However, if the Fund loans its portfolio securities, the obligation on the part of the Fund to return collateral upon termination of the loan could be deemed to involve the issuance of a senior security within the meaning of Section 18(f) of the 1940 Act. In order to avoid violation of Section 18(f), the Fund may not make a loan of portfolio securities if, as a result, more than one-third of its total asset value (at market value computed at the time of making a loan) would be on loan. No exemptive orders have been issued with respect to the limitation set forth in number (4).