Financial presentation to accompany management transcript Q1 FY20

Safe harbor and non-GAAP measures This presentation and the accompanying management commentary contains statements Walmart believes are "forward-looking statements" as defined in, and are intended to enjoy the protection of the safe harbor for forward-looking statements within the meaning of, Section 21E of the Securities Exchange Act of 1934, as amended. Assumptions on which such forward-looking statements are based are also forward-looking statements. Walmart's actual results may differ materially from the guidance provided as a result of changes in circumstances, assumptions not being realized or other risks, uncertainties and factors including: • economic, geo-political, capital markets and business conditions, trends and events around the world and in the markets in which Walmart operates; • currency exchange rate fluctuations, changes in market interest rates and commodity prices; • unemployment levels; competitive pressures; inflation or deflation, generally and in particular product categories; • consumer confidence, disposable income, credit availability, spending levels, shopping patterns, debt levels and demand for certain merchandise; • consumer enrollment in health and drug insurance programs and such programs' reimbursement rates; • the amount of Walmart's net sales denominated in the U.S. dollar and various foreign currencies; • the impact of acquisitions, investments, divestitures, store or club closures, and other strategic decisions; • Walmart's ability to successfully integrate acquired businesses, including within the eCommerce space; • Walmart's effective tax rate and the factors affecting Walmart's effective tax rate, including assessments of certain tax contingencies, valuation allowances, changes in law, administrative audit outcomes, impact of discrete items and the mix of earnings between the U.S. and Walmart's international operations; • changes in existing tax, labor and other laws and changes in tax rates; • the imposition of new taxes on imports and new tariffs and changes in tariff rates; • changes in existing trade restrictions and new trade restrictions; • customer traffic and average ticket in Walmart's stores and clubs and on its eCommerce websites; • the mix of merchandise Walmart sells, the cost of goods it sells and the shrinkage it experiences; • the amount of Walmart's total sales and operating expenses in the various markets in which it operates; • transportation, energy and utility costs and the selling prices of gasoline and diesel fuel • supply chain disruptions and disruptions in seasonal buying patterns; • consumer acceptance of and response to Walmart's stores, clubs, digital platforms, programs, merchandise offerings and delivery methods; • cyber security events affecting Walmart and related costs; • developments in, outcomes of, and costs incurred in legal or regulatory proceedings to which Walmart is a party; • casualty and accident-related costs and insurance costs; • the turnover in Walmart's workforce and labor costs, including healthcare and other benefit costs; • changes in accounting estimates or judgments; • the level and consistent availability of public assistance payments; and • natural disasters, public health emergencies, civil disturbances, and terrorist attacks; and Such risks, uncertainties and factors also include the risks relating to Walmart’s strategy, operations and performance and the financial, legal, tax, regulatory, compliance, reputational and other risks discussed in Walmart’s most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q filed with the SEC. Walmart urges you to consider all of the risks, uncertainties and factors identified above or discussed in such reports carefully in evaluating the forward-looking statements in this release. Walmart cannot assure you that the results reflected or implied by any forward-looking statement will be realized or, even if substantially realized, that those results will have the forecasted or expected consequences and effects for or on Walmart’s operations or financial performance. The forward-looking statements made in this release are as of the date of this release. Walmart undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances. This presentation includes certain non-GAAP measures as defined under SEC rules, including net sales, revenue, and operating income on a constant currency basis, adjusted EPS, comp sales excluding fuel, free cash flow and return on investment. Refer to information about the non-GAAP measures contained in this presentation. Additional information as required by Regulation G and Item 10(e) of Regulation S-K regarding non GAAP measures can be found in our most recent Form 10-K and our Form 8-K furnished as of the date of this presentation with the SEC, which are available at www.stock.walmart.com. 2

Walmart Inc. 1 1 (Amounts in millions, except per share data) Q1 $ Δ % Δ Total revenue $ 123,925 $ 1,235 1.0 % Total revenue, constant currency2 125,778 3,088 2.5 % Net sales 122,949 1,319 1.1 % Net sales, constant currency2 124,787 3,157 2.6 % Membership & other income 976 (84) (7.9)% Operating income 4,945 (209) (4.1)% Operating income, constant currency2 4,997 (157) (3.0)% Interest expense, net 625 138 28.3 % Other (gains) and losses (837) (2,682) (145.4)% Consolidated net income attributable to Walmart 3,842 1,708 80.0 % EPS 1.33 0.61 84.7 % Adjusted EPS2 1.13 (0.01) (0.9)% 1 Change versus prior year comparable period. 2 See press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non-GAAP financial measures. 3

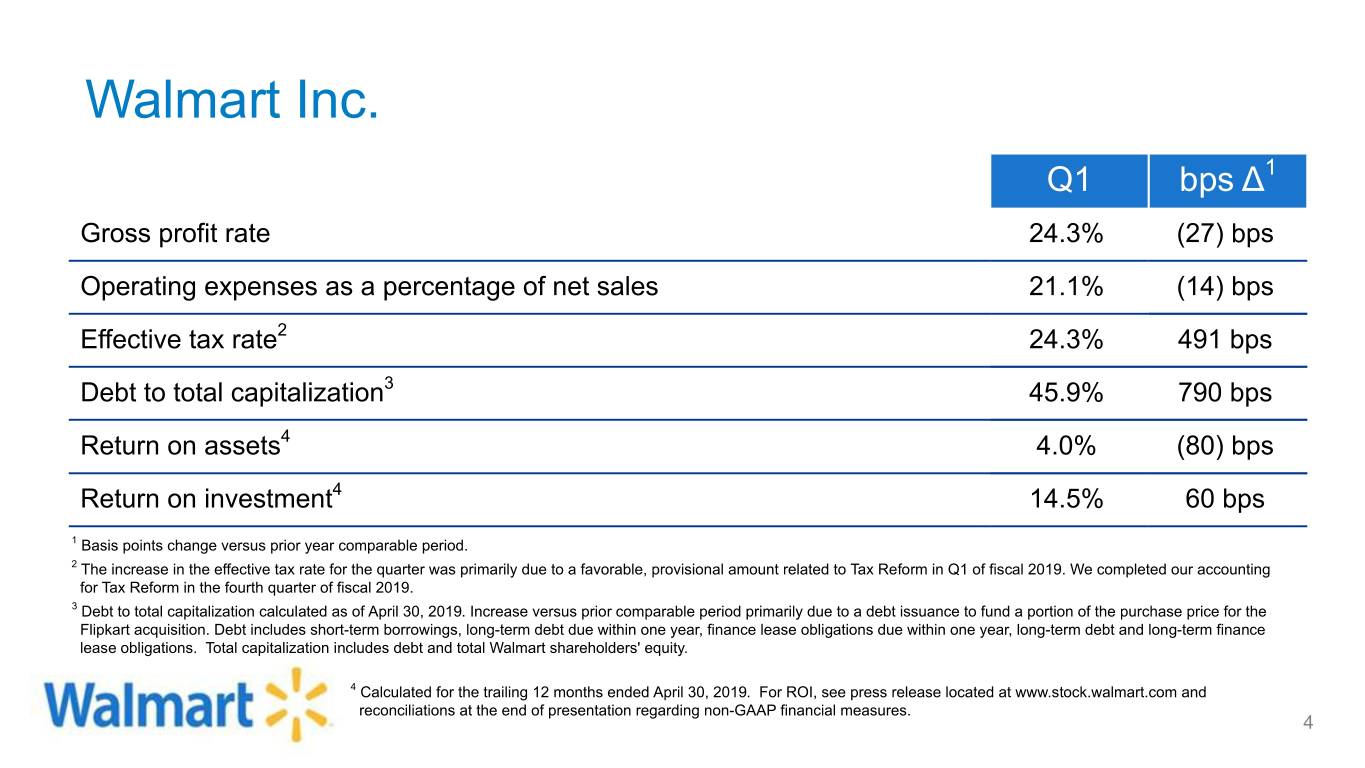

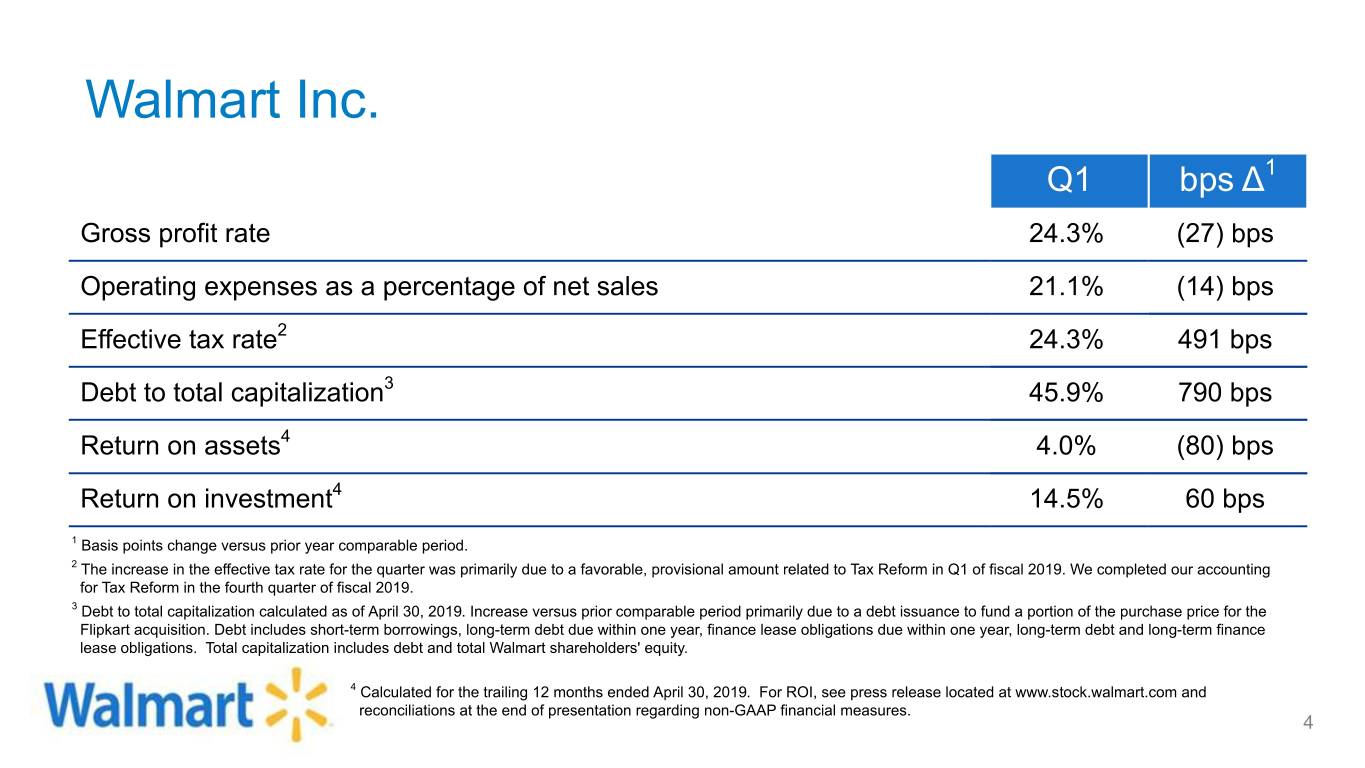

Walmart Inc. Q1 bps Δ1 Gross profit rate 24.3% (27) bps Operating expenses as a percentage of net sales 21.1% (14) bps Effective tax rate2 24.3% 491 bps Debt to total capitalization3 45.9% 790 bps Return on assets4 4.0% (80) bps Return on investment4 14.5% 60 bps 1 Basis points change versus prior year comparable period. 2 The increase in the effective tax rate for the quarter was primarily due to a favorable, provisional amount related to Tax Reform in Q1 of fiscal 2019. We completed our accounting for Tax Reform in the fourth quarter of fiscal 2019. 3 Debt to total capitalization calculated as of April 30, 2019. Increase versus prior comparable period primarily due to a debt issuance to fund a portion of the purchase price for the Flipkart acquisition. Debt includes short-term borrowings, long-term debt due within one year, finance lease obligations due within one year, long-term debt and long-term finance lease obligations. Total capitalization includes debt and total Walmart shareholders' equity. 4 Calculated for the trailing 12 months ended April 30, 2019. For ROI, see press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non-GAAP financial measures. 4

Walmart Inc. 1 1 (Amounts in millions) Q1 $ Δ % Δ Receivables, net $ 5,342 $ 774 16.9% Inventories 44,751 1,448 3.3% Accounts payable 45,110 498 1.1% 1 Change versus prior year comparable period. 5

Walmart Inc. 1 (Amounts in millions) Q1 $ Δ Operating cash flow $ 3,563 $ (1,598) Capital expenditures 2,205 387 Free cash flow2 $ 1,358 (1,985) 1 (Amounts in millions) Q1 % Δ Dividends $ 1,520 (0.8)% Share repurchases3 2,135 296.1% Total $ 3,655 76.4% 1 Change versus prior year comparable period. 2 See press release located at www.stock.walmart.com and reconciliations at the end of this presentation regarding non- GAAP financial measures. 3 $9.2 billion remains of the $20 billion authorization approved in October 2017. The company repurchased approximately 6 22 million shares in the first quarter of fiscal 2020.

Walmart U.S. (Amounts in millions) Q1 Δ1 Net sales $80,344 3.3% Comparable sales2,3 3.4% 130 bps • Comp transactions4 1.1% (30) bps • Comp ticket 2.3% 160 bps eCommerce impact3 ~140 bps ~40 bps Gross profit rate Increase 6 bps Operating expense rate Decrease (10) bps Operating income $4,142 5.5% 1 Change versus prior year comparable period. 2 Comp sales for the 13-week ended April 26, 2019, excluding fuel. 3 The results of new acquisitions are included in our comp sales metrics in the 13th month after acquisition. 4 In the first quarter of FY20, we updated our definition of traffic as a component of comparable sales to be all sales transactions in our stores as well as for eCommerce. Traffic will now be called transactions. For comparability, we revised this metric for FY19 and have provided a quarterly summary on our website at http://www.stock.walmart.com. 7

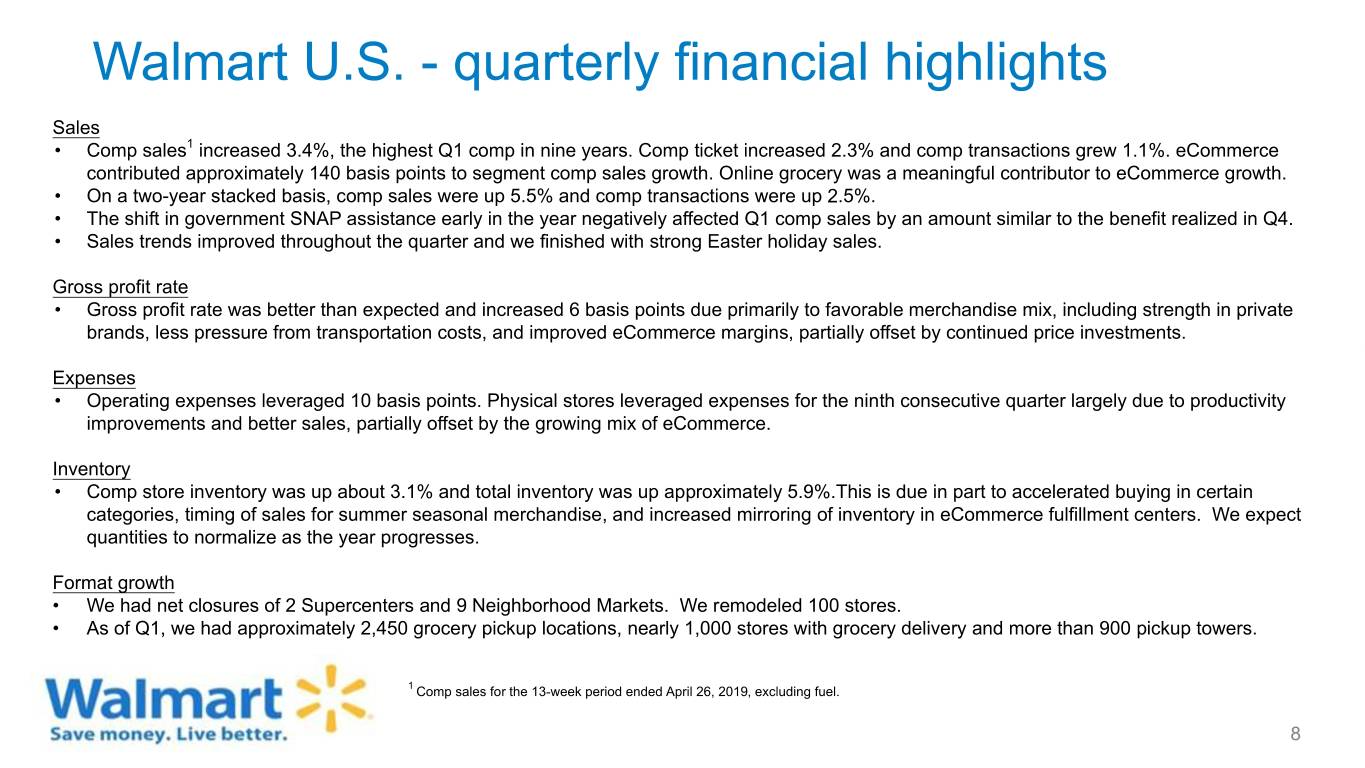

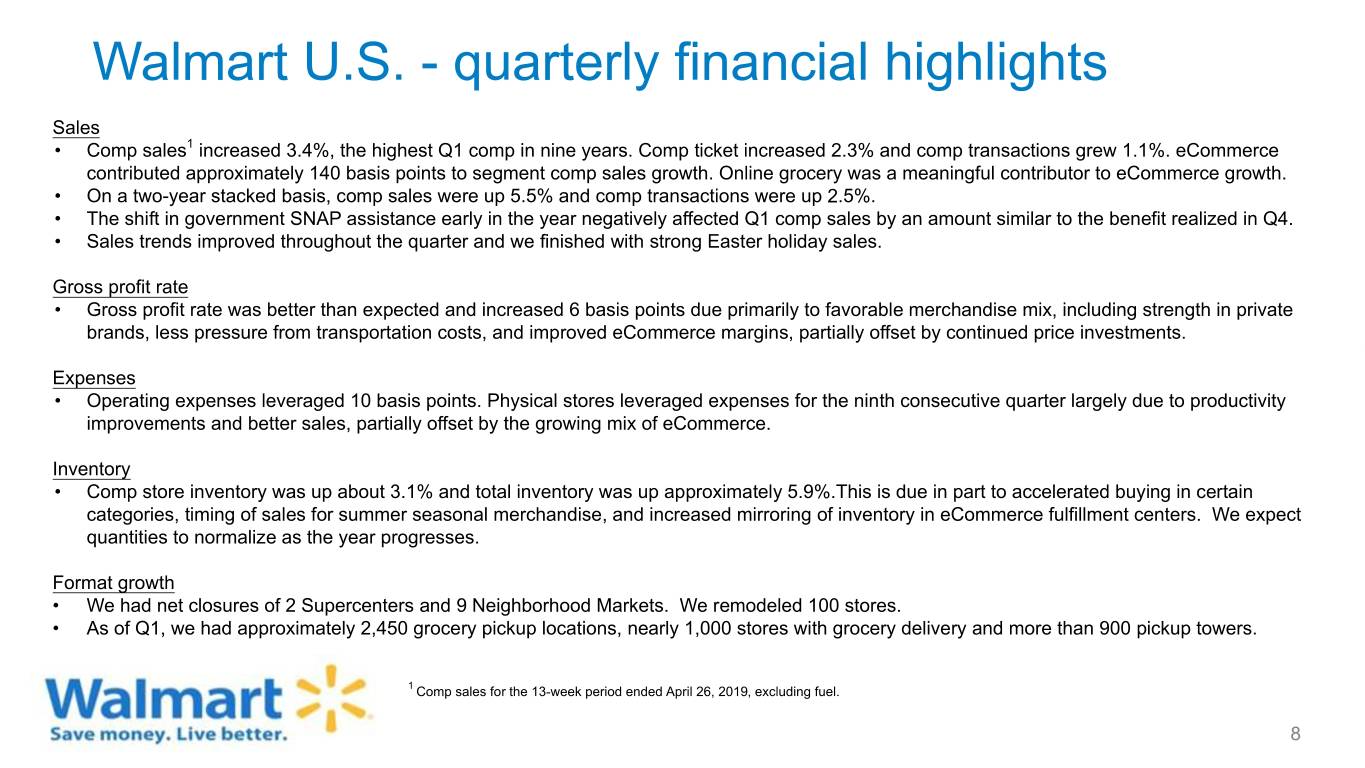

Walmart U.S. - quarterly financial highlights Sales • Comp sales1 increased 3.4%, the highest Q1 comp in nine years. Comp ticket increased 2.3% and comp transactions grew 1.1%. eCommerce contributed approximately 140 basis points to segment comp sales growth. Online grocery was a meaningful contributor to eCommerce growth. • On a two-year stacked basis, comp sales were up 5.5% and comp transactions were up 2.5%. • The shift in government SNAP assistance early in the year negatively affected Q1 comp sales by an amount similar to the benefit realized in Q4. • Sales trends improved throughout the quarter and we finished with strong Easter holiday sales. Gross profit rate • Gross profit rate was better than expected and increased 6 basis points due primarily to favorable merchandise mix, including strength in private brands, less pressure from transportation costs, and improved eCommerce margins, partially offset by continued price investments. Expenses • Operating expenses leveraged 10 basis points. Physical stores leveraged expenses for the ninth consecutive quarter largely due to productivity improvements and better sales, partially offset by the growing mix of eCommerce. Inventory • Comp store inventory was up about 3.1% and total inventory was up approximately 5.9%.This is due in part to accelerated buying in certain categories, timing of sales for summer seasonal merchandise, and increased mirroring of inventory in eCommerce fulfillment centers. We expect quantities to normalize as the year progresses. Format growth • We had net closures of 2 Supercenters and 9 Neighborhood Markets. We remodeled 100 stores. • As of Q1, we had approximately 2,450 grocery pickup locations, nearly 1,000 stores with grocery delivery and more than 900 pickup towers. 1 Comp sales for the 13-week period ended April 26, 2019, excluding fuel. 8

Walmart U.S. - quarterly merchandise highlights Category Comp Comments Momentum continued in food and consumables with strong comp sales despite the pull-forward of SNAP funding into Q4. Snack & 1 beverages and pet categories were particularly strong. Customers are Grocery + mid single-digit responding favorably to our pricing strategy, omni-channel offer and enhanced private brands. Food inflation was negligible, but we saw a modest increase in consumables inflation. Pharmacy comp sales benefited from branded drug inflation. In Health & wellness + mid single-digit addition, 90-day script counts increased due to a later cold, cough and flu season versus last year. General We delivered solid results across key categories due in part to strong merchandise2 + low single-digit Easter holiday sales. Home, lawn & garden, toys and wireless categories were the strongest performers during the quarter. 1 Includes food and consumables. 2 General merchandise includes entertainment, toys, hardlines, apparel, home and seasonal. 9

Walmart International Constant 1 (Amounts in millions) Reported currency 1Q1 Δ2 Q1 Δ2 Net sales $28,775 (4.9)% $30,613 1.2% Gross profit rate Decrease (172) bps NP NP Operating expense rate Decrease (30) bps Decrease (19) bps Operating income $738 (41.7)% $790 (37.5)% 1 See press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non-GAAP financial measures. 2 Change versus prior year comparable period. NP - Not provided 10

Walmart International - quarterly financial highlights Sales • Positive comp sales in three of our four largest markets - Mexico, China and Canada. In the U.K., comps were negative as a result of the timing of Easter. • The deconsolidation of Brazil was a headwind in the quarter but was partially offset by sales from Flipkart. • Currency negatively affected net sales by $1.8 billion. Gross profit • Gross profit rate declined 172 basis points on a reported basis, primarily due to Flipkart. A change in mix towards lower margin categories and price investments were also contributing factors in certain other markets. Expenses • Operating expenses leveraged 30 basis points on a reported basis and 19 basis points in constant currency. Lapping discrete charges from the prior year as well as positive comp sales and cost discipline across multiple markets contributed to the performance. Operating income • Operating income in the quarter declined 41.7% on a reported basis and declined 37.5% in constant currency, primarily due to Flipkart. ◦ Timing of the Easter holiday negatively affected operating income in certain markets. • Changes in currency rates resulted in a $52 million headwind to operating income. Inventory • During the quarter, inventory outpaced sales on a reported basis as planning for the shift in the timing of Easter affected certain markets. 11

Walmart International - key market quarterly results Comp3 Gross 1,2 Net Operating Country 3 profit sales income3 Sales Transactions Ticket rate3 Walmex4 3.6% (0.5)% 4.1% 5.0% Decrease Increase China 0.4% (0.3)% 0.7% 1.4% Decrease Decrease Canada 1.2% (0.5)% 1.7% 1.3% Decrease Decrease United Kingdom5 (1.1)% 0.5% (1.6)% 0.6% Decrease Decrease 1 Results are presented on a constant currency basis here and for all key market highlights. Net sales and comp sales are presented on a nominal, calendar basis. 2 eCommerce results are included for each of the markets listed in the table. 3 Change versus prior year comparable period. 4 Walmex includes the consolidated results of Mexico and Central America. 5 Comp sales for the United Kingdom are presented excluding fuel. 12

Walmart International - key market highlights Walmex • Net sales increased 5.0% and comp sales increased 3.6%, led by strength in Mexico. ◦ In Mexico, comp sales increased 4.7% or 14.7% on a two-year stacked basis. ◦ Added 41 stores in Mexico that offer online grocery bringing the total number of stores with this service to 236. ◦ Continued expansion with the opening of 12 new stores (9 new stores in Mexico and 3 new locations in Central America). • Comp sales growth continued to outpace ANTAD1 self-service and clubs; Walmex has now outperformed the market for 17 consecutive quarters. ◦ Increased eCommerce sales in Mexico by 49%. • Gross profit rate declined primarily as a result of a higher level of markdowns as well as additional costs associated with a border disruption for apparel imports. • Operating income increased slightly as lower gross margins pressured results. China • Net sales increased 1.4% and comp sales increased 0.4%. • Sales were affected by certain factors, including soft sales in the hypermarket format. • Gross profit rate declined as a result of a greater mix of lower margin Sam's Club sales as well as additional markdowns in general merchandise categories. • Operating expense leverage is primarily due to store cost controls resulting from our “operate for less” program, which included lower supplies, labor and utility costs. • Operating income declined primarily as a result of gross margin pressures. 1 ANTAD - Asociación Nacional de Tiendas de Autoservicio y Departamentales; The National Association of Supermarkets and Department Stores 13

Walmart International - key market highlights Canada • Net sales increased 1.3%, with comp sales growth of 1.2%. ◦ Comp sales growth benefited from strength in grocery and fresh, partially offset by softer sales in general merchandise and apparel. • Gross profit rate declined primarily due to the change in mix to lower margin grocery categories as well as a greater level of markdowns in apparel. • Operating expense leverage is primarily due to lapping a charge from the prior year related to the sale of Walmart Canada bank. • Operating income declined primarily as a result of increases to minimum wages and the decline in gross profit. U.K. • Net sales increased by 0.6%, as comp sales declined 1.1%. ◦ The timing of Easter negatively affected net sales and resulted in negative comp sales. ◦ Sales of private label products and growth in online grocery each outpaced the market. ◦ Customer experience improved through a better price position and shelf availability. • Gross profit rate declined primarily as a result of increased fuel sales with lower margins. • Operating expenses deleveraged, as planned, primarily due to cost inflationary pressures, omnichannel expansion and costs associated with the proposed merger. • Operating income declined, as planned, as a result of the decline in gross profit margin and expense deleverage. 14

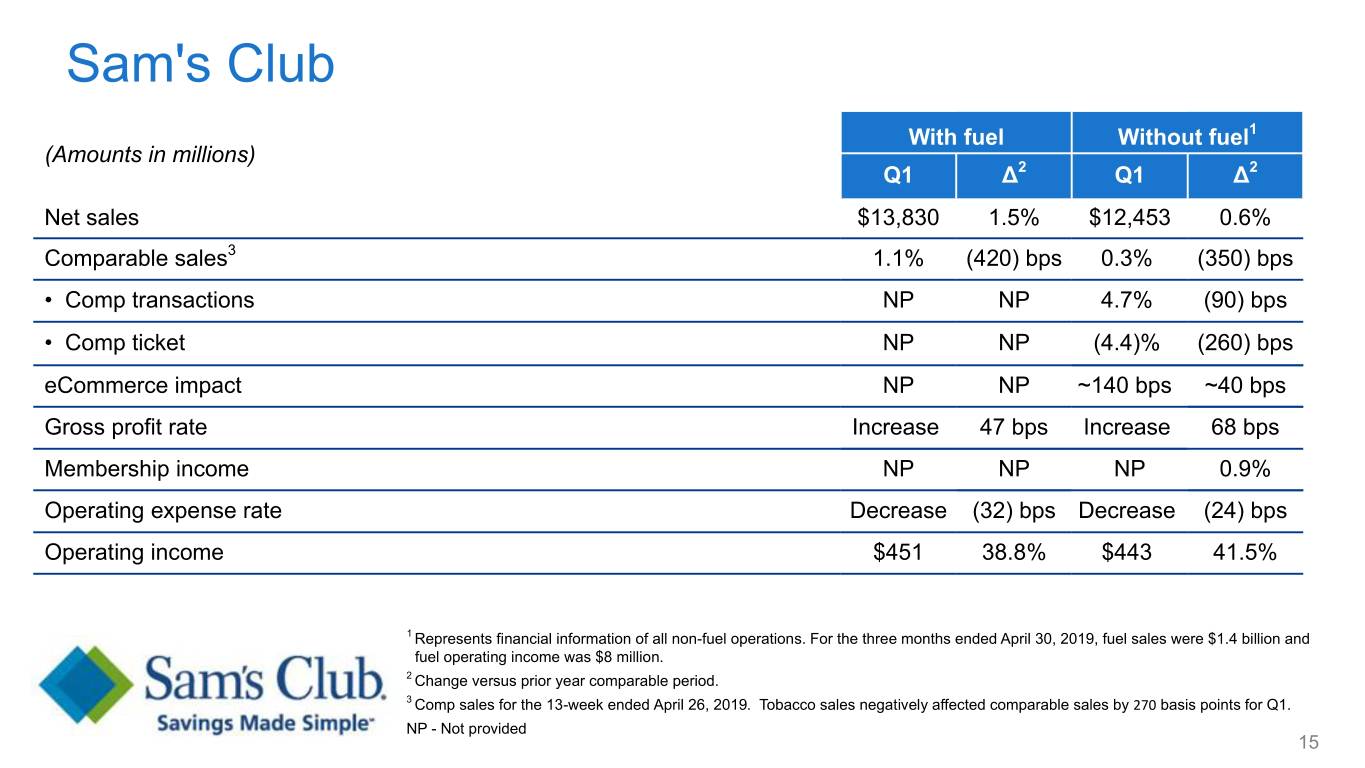

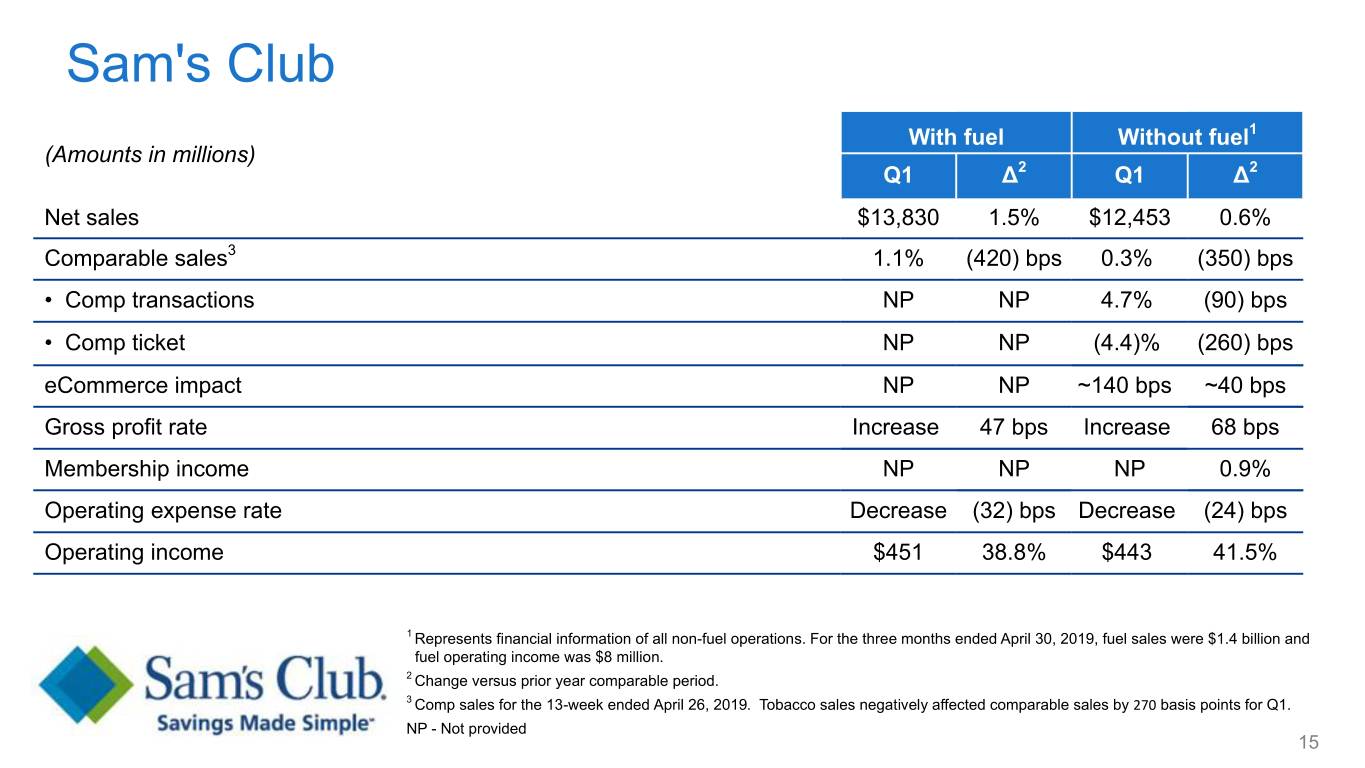

Sam's Club With fuel Without fuel1 (Amounts in millions) Q1 Δ2 Q1 Δ2 Net sales $13,830 1.5% $12,453 0.6% Comparable sales3 1.1% (420) bps 0.3% (350) bps • Comp transactions NP NP 4.7% (90) bps • Comp ticket NP NP (4.4)% (260) bps eCommerce impact NP NP ~140 bps ~40 bps Gross profit rate Increase 47 bps Increase 68 bps Membership income NP NP NP 0.9% Operating expense rate Decrease (32) bps Decrease (24) bps Operating income $451 38.8% $443 41.5% 1 Represents financial information of all non-fuel operations. For the three months ended April 30, 2019, fuel sales were $1.4 billion and fuel operating income was $8 million. 2 Change versus prior year comparable period. 3 Comp sales for the 13-week ended April 26, 2019. Tobacco sales negatively affected comparable sales by 270 basis points for Q1. NP - Not provided 15

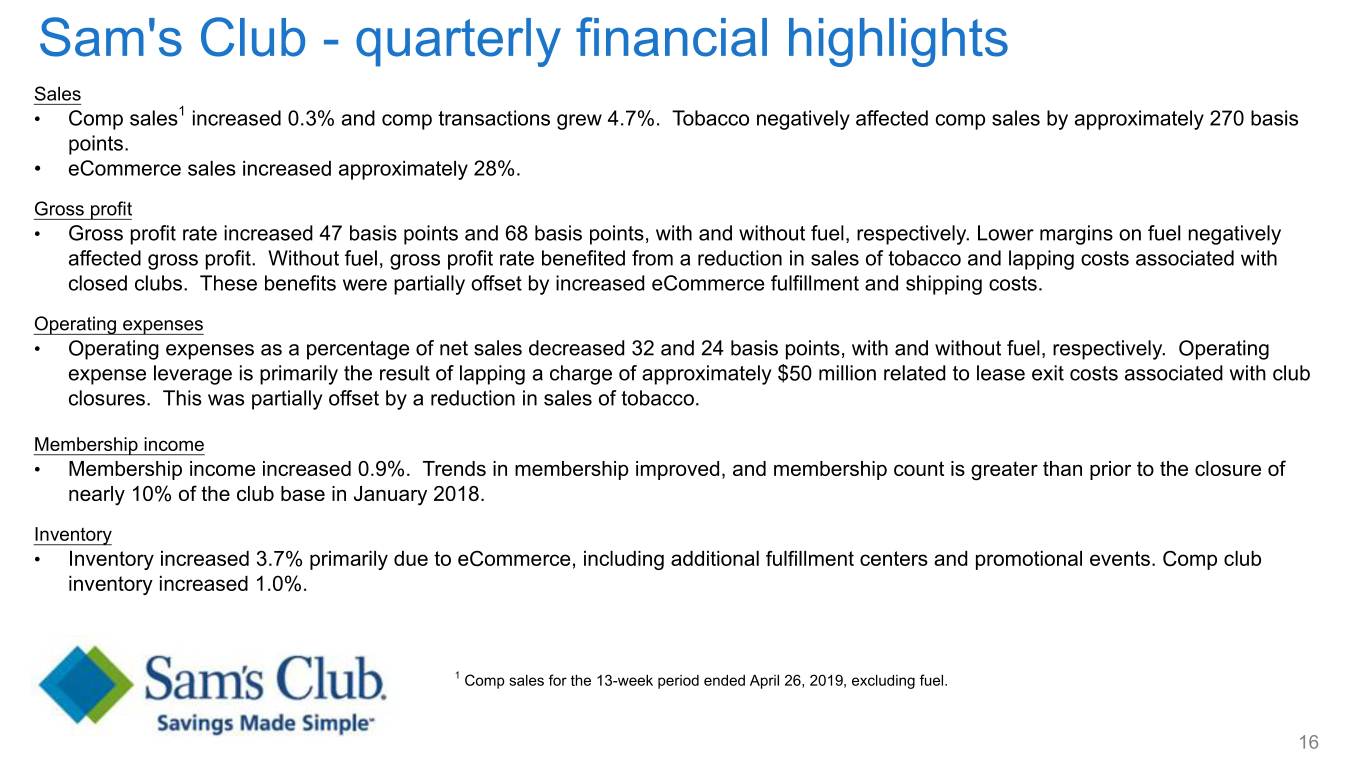

Sam's Club - quarterly financial highlights Sales • Comp sales1 increased 0.3% and comp transactions grew 4.7%. Tobacco negatively affected comp sales by approximately 270 basis points. • eCommerce sales increased approximately 28%. Gross profit • Gross profit rate increased 47 basis points and 68 basis points, with and without fuel, respectively. Lower margins on fuel negatively affected gross profit. Without fuel, gross profit rate benefited from a reduction in sales of tobacco and lapping costs associated with closed clubs. These benefits were partially offset by increased eCommerce fulfillment and shipping costs. Operating expenses • Operating expenses as a percentage of net sales decreased 32 and 24 basis points, with and without fuel, respectively. Operating expense leverage is primarily the result of lapping a charge of approximately $50 million related to lease exit costs associated with club closures. This was partially offset by a reduction in sales of tobacco. Membership income • Membership income increased 0.9%. Trends in membership improved, and membership count is greater than prior to the closure of nearly 10% of the club base in January 2018. Inventory • Inventory increased 3.7% primarily due to eCommerce, including additional fulfillment centers and promotional events. Comp club inventory increased 1.0%. 1 Comp sales for the 13-week period ended April 26, 2019, excluding fuel. 16

Sam's Club - quarterly category highlights Category Comp Comments Fresh / Freezer / Cooler + low single-digit Prepared meals, deli and frozen performed well. Grocery and beverage + mid single-digit Snacks, soda, spirits and candy performed well. Consumables + high single-digit Experienced broad-based strength, including paper goods, baby care and pet supplies. Home and apparel + low single-digit Apparel performed well. Technology, office and entertainment + low single-digit Mobile and gift cards performed well. Health and wellness + low single-digit OTC performed well. 17

Non-GAAP measures - ROI We include Return on Assets ("ROA"), which is calculated in accordance with U.S. generally accepted accounting principles ("GAAP") as well as Return on Investment ("ROI") as measures to assess returns on assets. Management believes ROI is a meaningful measure to share with investors because it helps investors assess how effectively Walmart is deploying its assets. Trends in ROI can fluctuate over time as management balances long-term strategic initiatives with possible short-term impacts. We consider ROA to be the financial measure computed in accordance with GAAP that is the most directly comparable financial measure to our calculation of ROI. ROA was 4.0 percent and 4.8 percent for the trailing twelve months ended April 30, 2019 and 2018, respectively. The decline in ROA was primarily due to the decrease in consolidated net income over the trailing twelve months, primarily resulting from the $4.5 billion net loss in fiscal 2019 related to the sale of the majority stake in Walmart Brazil and net unrealized loss on our JD.com investment. ROI was 14.5 percent and 13.9 percent for the trailing twelve months ended April 30, 2019 and 2018, respectively. The increase in ROI was due to the increase in operating income over the trailing twelve months primarily as a result of lapping the restructuring and impairment charges in the fourth quarter of fiscal 2018. The denominator remained relatively flat as the increase in average total assets due to the Flipkart Acquisition was largely offset by the decrease in average invested capital resulting from the removal of the eight times rent factor upon adoption of ASU 2016-02, Leases ("ASU 2016-02") as operating lease right of use assets are now included in total assets. We define ROI as adjusted operating income (operating income plus interest income, depreciation and amortization, and rent expense) for the trailing 12 months divided by average invested capital during that period. We consider average invested capital to be the average of our beginning and ending total assets, plus average accumulated depreciation and average amortization, less average accounts payable and average accrued liabilities for that period. Upon adoption of ASU 2016-02, rent for the trailing 12 months multiplied by a factor of 8 is no longer included in the calculation of ROI on a prospective basis as operating lease assets are now capitalized. For fiscal 2020, lease related assets and associated accumulated amortization are included in the denominator at their carrying amount as of the current balance sheet date, rather than averaged, because they are no longer directly comparable to the prior year calculation which included rent for the trailing 12 months multiplied by a factor of 8. A two-point average will be used for leased assets beginning in fiscal 2021, after one full year from the date of adoption of the new lease standard. Further, beginning prospectively in fiscal 2020, rent expense in the numerator excludes short-term and variable lease costs as these costs are not included in the operating lease right of use asset balance. 18

Non-GAAP measures - ROI cont. Prior to adoption of ASU 2016-02, we defined ROI as adjusted operating income (operating income plus interest income, depreciation and amortization, and rent expense) for the trailing 12 months divided by average invested capital during that period. We considered average invested capital to be the average of our beginning and ending total assets, plus average accumulated depreciation and average amortization, less average accounts payable and average accrued liabilities for that period, plus a rent factor equal to the rent for the fiscal year or trailing 12 months multiplied by a factor of 8, which estimated the hypothetical capitalization of our operating leases. Because the new lease standard was adopted prospectively as of February 1, 2019, our calculation of ROI for the comparable fiscal 2019 period was not recast. Our calculation of ROI is considered a non-GAAP financial measure because we calculate ROI using financial measures that exclude and include amounts that are included and excluded in the most directly comparable GAAP financial measure. For example, we exclude the impact of depreciation and amortization from our reported operating income in calculating the numerator of our calculation of ROI. As mentioned above, we consider ROA to be the financial measure computed in accordance with generally accepted accounting principles most directly comparable to our calculation of ROI. ROI differs from ROA (which is consolidated net income for the period divided by average total assets for the period) because ROI: adjusts operating income to exclude certain expense items and adds interest income; adjusts total assets for the impact of accumulated depreciation and amortization, accounts payable and accrued liabilities to arrive at total invested capital. Because of the adjustments mentioned above, we believe ROI more accurately measures how we are deploying our key assets and is more meaningful to investors than ROA. Although ROI is a standard financial measure, numerous methods exist for calculating a company's ROI. As a result, the method used by management to calculate our ROI may differ from the methods used by other companies to calculate their ROI. 19

Non-GAAP measures - ROI cont. The calculation of ROA and ROI, along with a reconciliation of ROI to the calculation of ROA, is as follows: CALCULATION OF RETURN ON ASSETS CALCULATION OF RETURN ON INVESTMENT Trailing Twelve Months Trailing Twelve Months Ended April 30, Ended April 30, (Dollars in millions) 2019 2018 (Dollars in millions) 2019 2018 Numerator Numerator Consolidated net income $ 8,809 $ 9,647 Operating income $ 21,748 $ 20,354 Denominator + Interest income 222 160 Average total assets1 $ 219,736 $ 202,323 + Depreciation and amortization 10,714 10,656 Return on assets (ROA) 4.0% 4.8% + Rent 2,866 3,036 Adjusted operating income $ 35,550 $ 34,206 April 30, Denominator Certain Balance Sheet Data 2019 2018 2017 Average total assets1,2 $ 226,465 $ 202,323 + Average accumulated depreciation Total assets $ 234,544 $ 204,927 $ 199,718 and amortization1,2 84,960 81,862 Leased assets, net 20,637 7,178 NP - Average accounts payable1 44,861 42,990 Total assets without leased assets, net 213,907 197,749 NP - Average accrued liabilities1 20,903 20,245 Accumulated depreciation and amortization 87,426 84,964 78,760 + Rent x 8 N/A 24,288 Accumulated amortization on leased assets 3,085 5,556 NP Average invested capital $ 245,661 $ 245,238 Accumulated depreciation and amortization, without leased assets 84,341 79,408 NP Return on investment (ROI) 14.5% 13.9% Accounts payable 45,110 44,612 41,367 Accrued liabilities 21,023 20,782 19,708 1 The average is based on the addition of the account balance at the end of the current period to the account balance at the end of the prior period and dividing by 2. Average total assets as used in ROA includes the average impact of the adoption of ASU 2016-02. 2 For the twelve months ended April 30, 2019, as a result of adopting ASU 2016-02, average total assets is based on the average of 'total assets without leased assets, net' plus 'leased assets, net' as of April 30, 2019. Average accumulated depreciation and amortization is based on the average of 'accumulated depreciation and amortization, without leased assets' plus 'accumulated amortization on leased assets' as of April 30, 2019. 20 NP = not provided 3 Upon adoption of ASU 2016-02, Leases, a factor of eight times rent is no longer included in the calculation of ROI on a prospective basis as operating lease assets are now recorded on the Consolidated Balance Sheet. 1 The average is based on the addition of the account balance at the end of the current period to the account balance at the end of the prior period and dividing by 2. 2 The average is based on the addition of 'total assets without leased assets, net' at the end of the current period to 'total assets without leased assets, net' at the end of the prior period and dividing by 2, plus 'leased assets, net' at the end of the current period. 3 The average is based on the addition of 'accumulated depreciation and amortization, without leased assets' at the end of the current period to 'accumulated depreciation and amortization, without leased assets' at the end of the prior period and dividing by 2, plus 'accumulated amortization on leased assets' at the end of the current period. NP = not provided

Non-GAAP measures - free cash flow We define free cash flow as net cash provided by operating activities in a period minus payments for property and equipment made in that period. We had net cash provided by operating activities of $3.6 billion for the three months ended April 30, 2019, which declined when compared to $5.2 billion for the three months ended April 30, 2018 primarily due to an increase in inventory related to accelerated buying in certain categories, the timing of sell through for summer seasonal merchandise, increased eCommerce fulfillment center mirroring, and the timing of payments. We generated free cash flow of $1.4 billion for the three months ended April 30, 2019, which declined when compared to $3.3 billion for the twelve months ended April 30, 2018 due to the same reasons as the decline in net cash provided by operating activities, as well as $0.4 billion in increased capital expenditures. Free cash flow is considered a non-GAAP financial measure. Management believes, however, that free cash flow, which measures our ability to generate additional cash from our business operations, is an important financial measure for use in evaluating the company's financial performance. Free cash flow should be considered in addition to, rather than as a substitute for, consolidated net income as a measure of our performance and net cash provided by operating activities as a measure of our liquidity. Additionally, Walmart's definition of free cash flow is limited, in that it does not represent residual cash flows available for discretionary expenditures, due to the fact that the measure does not deduct the payments required for debt service and other contractual obligations or payments made for business acquisitions. Therefore, we believe it is important to view free cash flow as a measure that provides supplemental information to our Consolidated Statements of Cash Flows. Although other companies report their free cash flow, numerous methods may exist for calculating a company's free cash flow. As a result, the method used by Walmart's management to calculate our free cash flow may differ from the methods used by other companies to calculate their free cash flow. The following table sets forth a reconciliation of free cash flow, a non-GAAP financial measure, to net cash provided by operating activities, which we believe to be the GAAP financial measure most directly comparable to free cash flow, as well as information regarding net cash used in investing activities and net cash used in financing activities. Fiscal Years Ended April 30, (Dollars in millions) 2019 2018 Net cash provided by operating activities $ 3,563 $ 5,161 Payments for property and equipment (capital expenditures) (2,205) (1,818) Free cash flow $ 1,358 $ 3,343 Net cash used in investing activities1 $ (1,135) $ (1,682) Net cash used in financing activities (846) (2,486) 1 "Net cash used in investing activities" includes payments for property and equipment, which is also included in our computation of free cash flow. 21

Non-GAAP measures - constant currency In discussing our operating results, the term currency exchange rates refers to the currency exchange rates we use to convert the operating results for countries where the functional currency is not the U.S. dollar into U.S. dollars or for countries experiencing hyperinflation. We calculate the effect of changes in currency exchange rates as the difference between current period activity translated using the current period's currency exchange rates and the comparable prior year period's currency exchange rates. Additionally, no currency exchange rate fluctuations are calculated for non-USD acquisitions until owned for 12 months. Throughout our discussion, we refer to the results of this calculation as the impact of currency exchange rate fluctuations. When we refer to constant currency operating results, this means operating results without the impact of the currency exchange rate fluctuations. The disclosure of constant currency amounts or results permits investors to better understand Walmart's underlying performance without the effects of currency exchange rate fluctuations. The table below reflects the calculation of constant currency for total revenues, net sales and operating income for the three months ended April 30, 2019. Three Months Ended April 30, Percent Percent 2019 Change1 2019 Change1 (Dollars in millions) Walmart International Consolidated Total revenues: As reported $ 29,073 -5.1% $ 123,925 1.0% Currency exchange rate fluctuations 1,853 N/A 1,853 N/A Constant currency total revenues $ 30,926 1.0% $ 125,778 2.5% Net sales: As reported $ 28,775 -4.9% $ 122,949 1.1% Currency exchange rate fluctuations 1,838 N/A 1,838 N/A Constant currency net sales $ 30,613 1.2% $ 124,787 2.6% Operating income: As reported $ 738 -41.7% $ 4,945 -4.1% Currency exchange rate fluctuations 52 N/A 52 N/A Constant currency operating income $ 790 -37.5% $ 4,997 -3.0% 1 Change versus prior year comparable period. 22

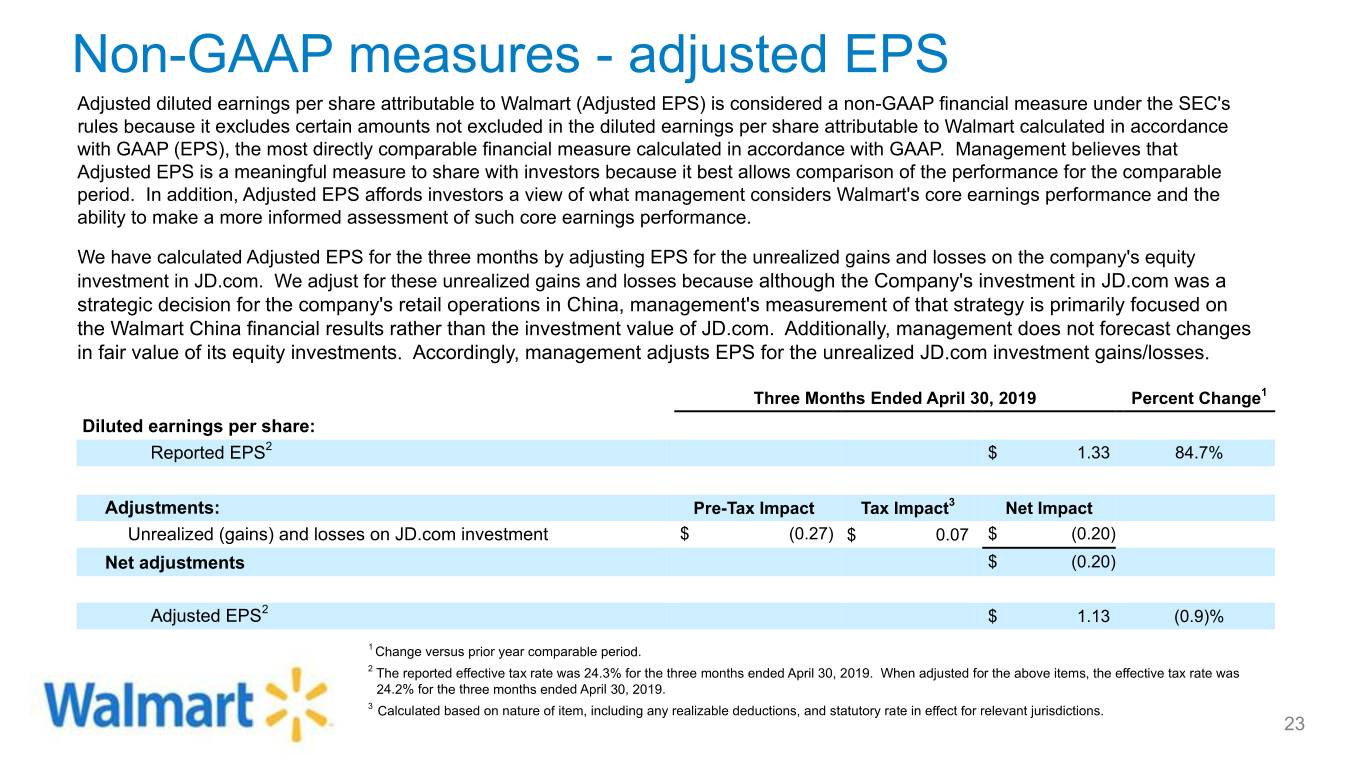

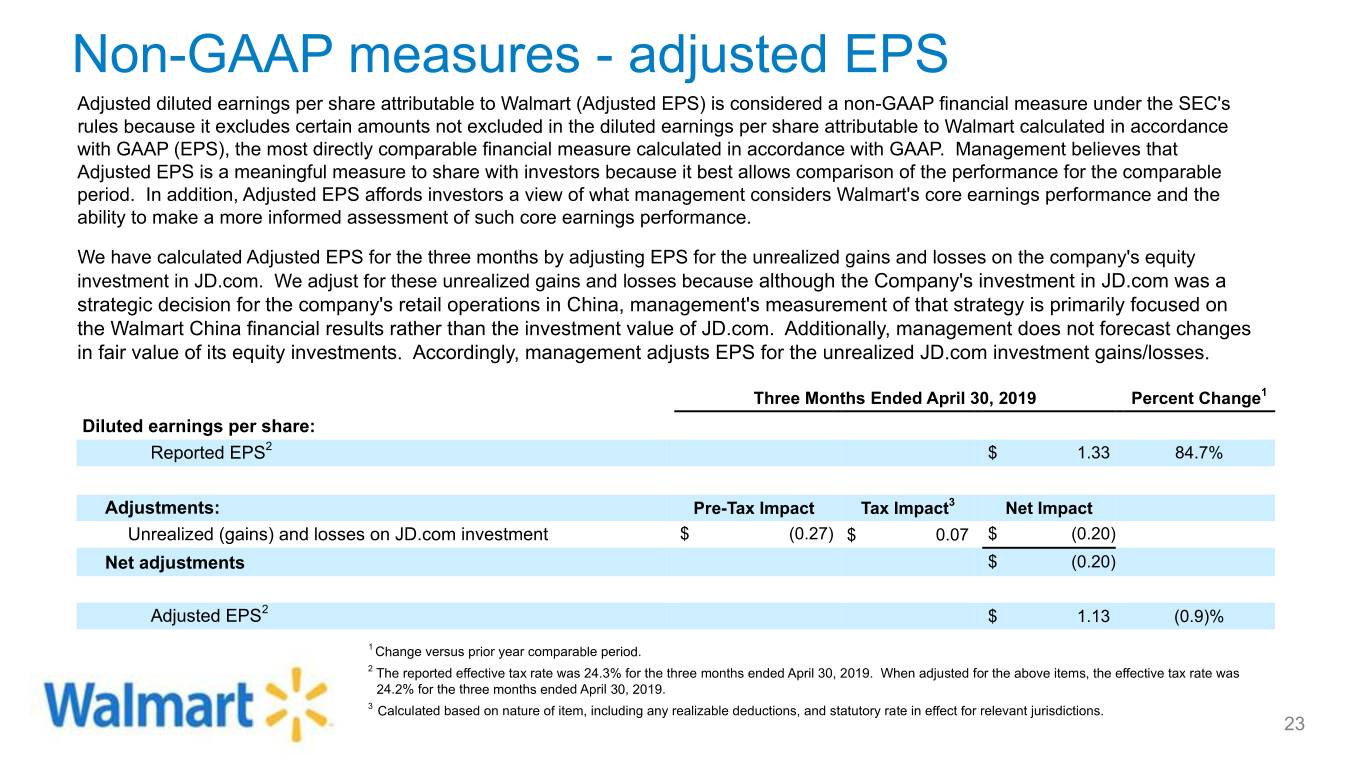

Non-GAAP measures - adjusted EPS Adjusted diluted earnings per share attributable to Walmart (Adjusted EPS) is considered a non-GAAP financial measure under the SEC's rules because it excludes certain amounts not excluded in the diluted earnings per share attributable to Walmart calculated in accordance with GAAP (EPS), the most directly comparable financial measure calculated in accordance with GAAP. Management believes that Adjusted EPS is a meaningful measure to share with investors because it best allows comparison of the performance for the comparable period. In addition, Adjusted EPS affords investors a view of what management considers Walmart's core earnings performance and the ability to make a more informed assessment of such core earnings performance. We have calculated Adjusted EPS for the three months by adjusting EPS for the unrealized gains and losses on the company's equity investment in JD.com. We adjust for these unrealized gains and losses because although the Company's investment in JD.com was a strategic decision for the company's retail operations in China, management's measurement of that strategy is primarily focused on the Walmart China financial results rather than the investment value of JD.com. Additionally, management does not forecast changes in fair value of its equity investments. Accordingly, management adjusts EPS for the unrealized JD.com investment gains/losses. Three Months Ended April 30, 2019 Percent Change1 Diluted earnings per share: Reported EPS2 $ 1.33 84.7% Adjustments: Pre-Tax Impact Tax Impact3 Net Impact Unrealized (gains) and losses on JD.com investment $ (0.27) $ 0.07 $ (0.20) Net adjustments $ (0.20) Adjusted EPS2 $ 1.13 (0.9)% 1 Change versus prior year comparable period. 2 The reported effective tax rate was 24.3% for the three months ended April 30, 2019. When adjusted for the above items, the effective tax rate was 24.2% for the three months ended April 30, 2019. 3 Calculated based on nature of item, including any realizable deductions, and statutory rate in effect for relevant jurisdictions. 23

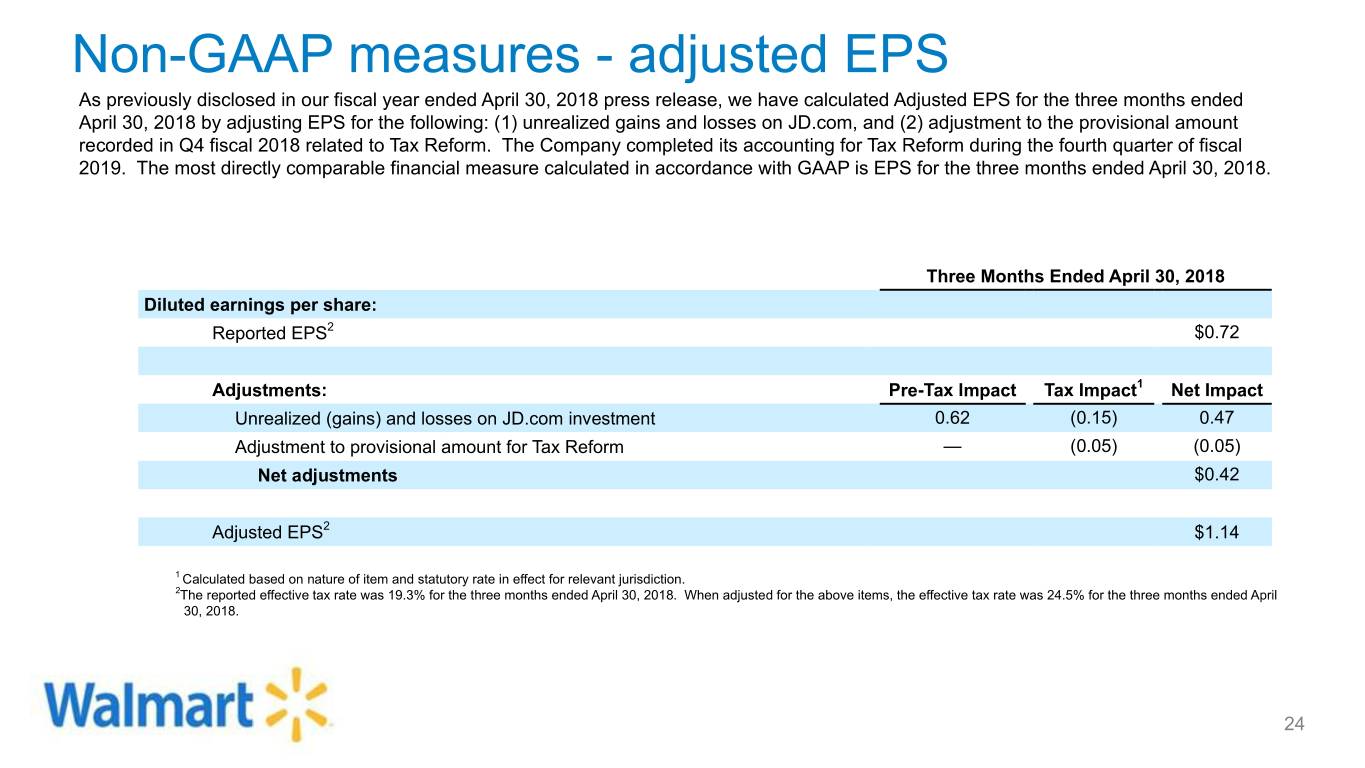

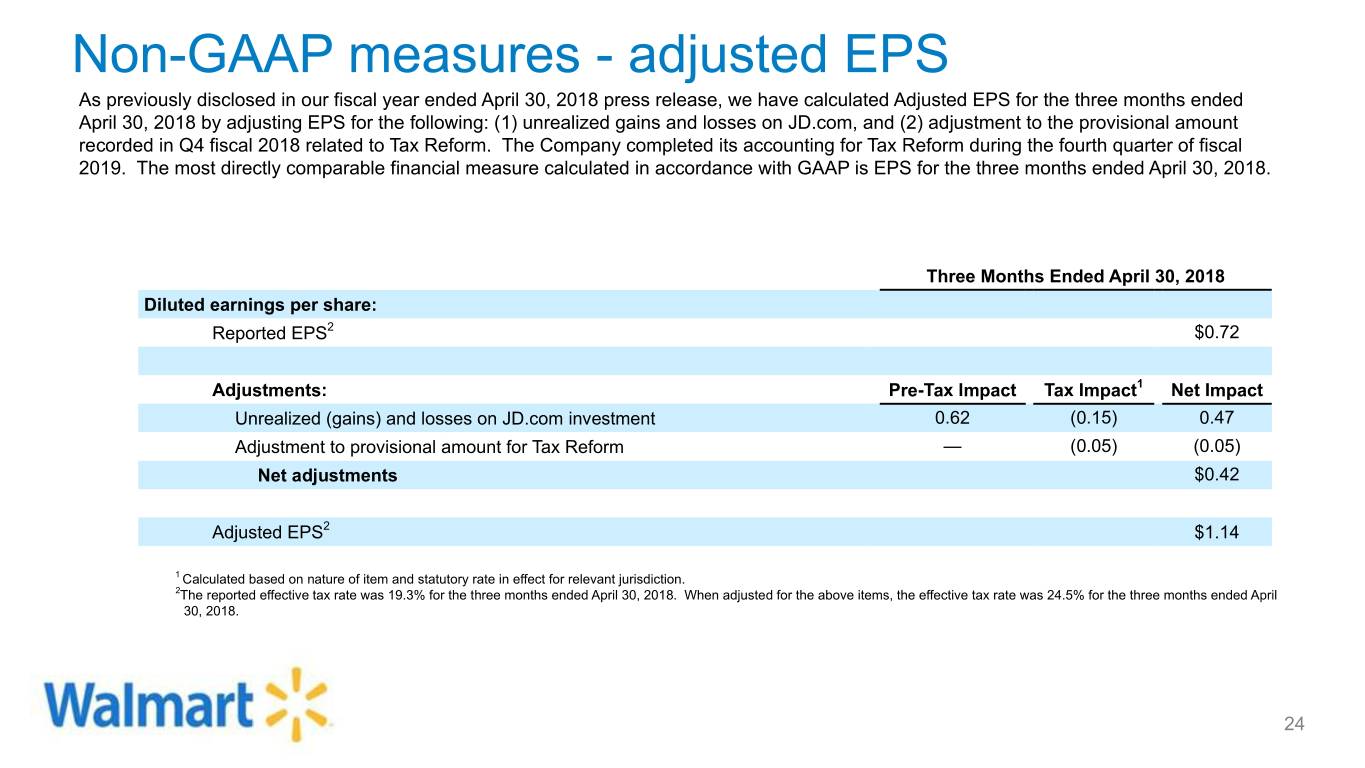

Non-GAAP measures - adjusted EPS As previously disclosed in our fiscal year ended April 30, 2018 press release, we have calculated Adjusted EPS for the three months ended April 30, 2018 by adjusting EPS for the following: (1) unrealized gains and losses on JD.com, and (2) adjustment to the provisional amount recorded in Q4 fiscal 2018 related to Tax Reform. The Company completed its accounting for Tax Reform during the fourth quarter of fiscal 2019. The most directly comparable financial measure calculated in accordance with GAAP is EPS for the three months ended April 30, 2018. Three Months Ended April 30, 2018 Diluted earnings per share: Reported EPS2 $0.72 Adjustments: Pre-Tax Impact Tax Impact1 Net Impact Unrealized (gains) and losses on JD.com investment 0.62 (0.15) 0.47 Adjustment to provisional amount for Tax Reform — (0.05) (0.05) Net adjustments $0.42 Adjusted EPS2 $1.14 1 Calculated based on nature of item and statutory rate in effect for relevant jurisdiction. 2The reported effective tax rate was 19.3% for the three months ended April 30, 2018. When adjusted for the above items, the effective tax rate was 24.5% for the three months ended April 30, 2018. 24

Additional resources at stock.walmart.com • Unit counts & square footage • Comparable store sales, including and excluding fuel • Revised fiscal 2019 quarterly comp transactions • Terminology 25