SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December, 2017

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

Rua Coronel Dulcídio, 800

80420-170 Curitiba, Paraná

Federative Republic of Brazil

(5541) 3222-2027

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

Sanepar's Public Offer of Units–Bookbuilding

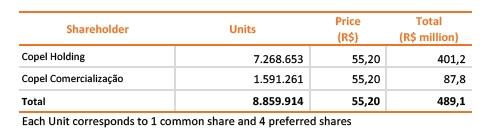

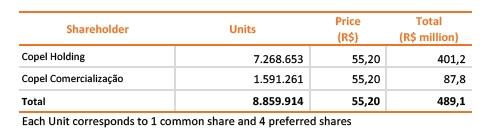

Companhia Paranaense de Energia–COPEL, a company that generates, transmits, distributes and sells power, with shares listed on the Brasil, Bolsa, Balcão–B3 (CPLE3, CPLE5, CPLE6), the NYSE (ELPVY, ELP) and the LATIBEX (XCOP), hereby informs its shareholders and the market in general, in addition to the material fact disclosed on November 29, 2017, that on December 12, 2017, the Bookbuilding process was concluded in the scope of the public offering with restricted efforts of secondary distribution of deposit certificates of shares ("Units"), representing each of one common share and four preferred shares issued by Companhia de Saneamento do Paraná - SANEPAR, with the establishment of the price of R $ 55.20 per Unit.

Copel participated as a seller and sold 8,859,914 Units, which represents all of its Units issued by Sanepar, of which 7,268,653 Units were held by Copel Holding and 1,591,261 Units held by Copel Comercialização.

The effective settlement of the Restricted Offer will be on December 18, 2017.

The following table summarizes the operation.

On September 30, 2017, the Company has R$470.7 million in its assets, in the account "other temporary investments" related to COPEL's interest in SANEPAR.

Curitiba, December 13, 2017

Adriano Rudek de Moura

Chief Financial and Investor Relations Officer

For further information, please contact our Investor Relations team:

ri@copel.com or (41) 3222-2027

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| COMPANHIA PARANAENSE DE ENERGIA – COPEL |

| | |

| By: | /S/ Antonio Sergio de Souza Guetter

| |

| | Antonio Sergio de Souza Guetter

Chief Executive Officer | |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.