SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of June, 2018

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

Rua Coronel Dulcídio, 800

80420-170 Curitiba, Paraná

Federative Republic of Brazil

(5541) 3222-2027

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

PROPOSAL FOR AMENDMENT OF THE BYLAWS

COMPANHIA PARANAENSE DE ENERGIA - COPEL

The Government of the State of Paraná published, in January 2015, the State Decree no. 34/2015 (revoked by Decree no. 6.262/2017) and State Law no. 18.875/2016, which established the Control Council for State-Owned Companies of the State of Paraná - CCEE, directly subordinated to the State Finance Secretary, with the duty of advising the Governor in the creation, sale, merge, spin-off, liquidation and extinction of companies directly or indirectly controlled by the State.

On September 21, 2015, CCEE published the Normative Deliberation no. 001/2015, which provides for general rules to be observed by companies in which the State of Paraná is a controlling shareholder in matters related to the Executive Board, Board of Directors, Fiscal Council, among others. In addition, CCEE sent the companies a "model" of corporate bylaws, recommending the adequacy to it. Copel (Holding), its wholly-owned subsidiaries and controlled companies are among the ones included in this resolution.

In view of the scenario that was unfolding in the electricity sector, within the state government and the legislative field, regarding integrity, compliance and good governance practices, Copel (Holding), in September 2015, established a working group with the goal of promoting studies and assessments aiming at adapting to the new laws, as well as verifying possible synergy gains, cost reduction, among other improvements.

While Copel (Holding) carried out these studies, on April 15, 2016, CCEE revoked Normative Deliberation no. 001/2015 with the publication of Normative Deliberation no. 001/2016 (revoked by Normative Deliberation no. 001/2018) on the regulation of certain topics that should be present in the bylaws of companies controlled by the State of Paraná.

Thus, in addition to the legislative changes at the federal and state levels, changes in the governance programs of state companies, changes in the organizational structure and reorganization of corporate duties of Copel (Holding), in order to improve its performance in the market, Copel (Holding) was obliged to carry out an evaluation of the impacts and effects of these changes for a reformulation of its bylaws.

While this evaluation was carried out, on June 30, 2016, Federal Law no. 13,303, publicly known as the State-Owned Company Responsibility Law, was promulgated, which established new standards of governance, control and transparency for companies under state control, resulting in a new challenge for the Company's technical team to organize its activities.

The scenario described above, together with the expansion and diversification of Copel (Holding) and its wholly-owned subsidiaries' businesses, the increase in control by oversight and regulatory bodies, the need to improve corporate governance best practices to safeguard the interests of the shareholders, justified the need for Copel (Holding) to propose new statutory changes.

Copel (Holding) also considered the rules defined by the Brazilian Securities and Exchange Commission - CVM in the preparation of the proposal for the adequacy of the bylaws, as of the publication of CVM Instruction no. 586/2017. The main change brought by CVM Instruction no. 586 is related to the incorporation in CVM Instruction no. 480/2009 of the companies' duty to disclose information on the application of the governance practices set forth in the Brazilian Corporate Governance Code. The rule applies to issuers registered in category A, whose shares or share certificates are admitted to trading on stock exchanges.

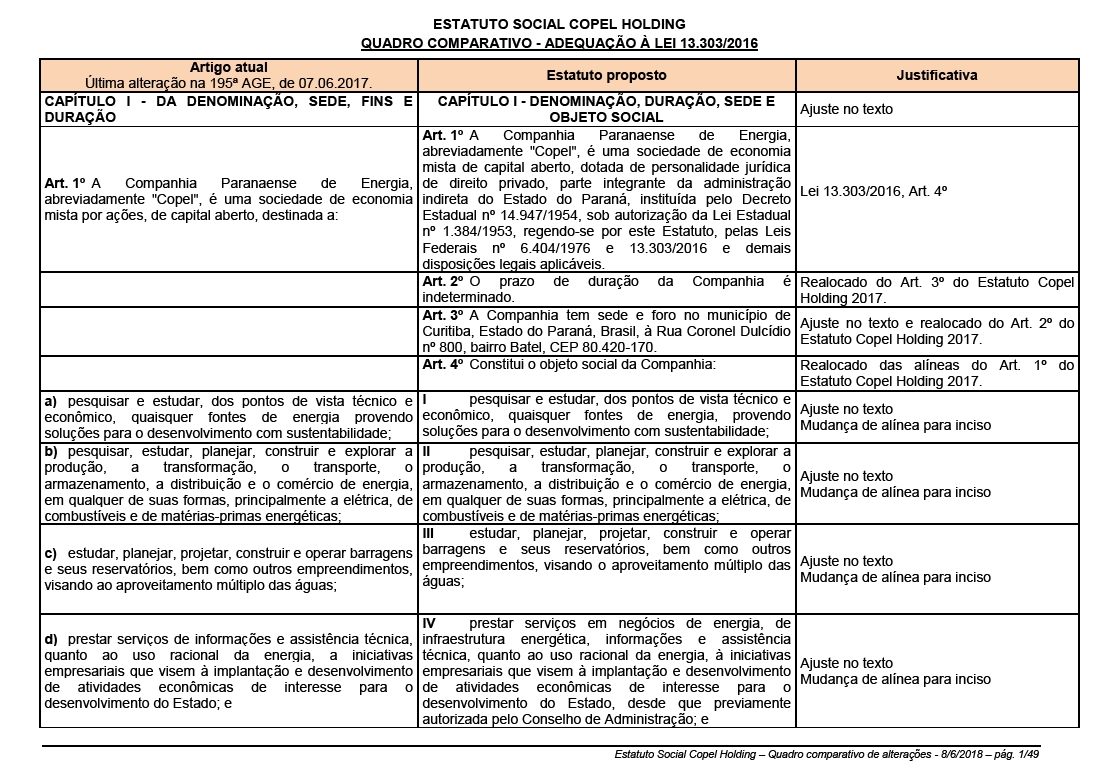

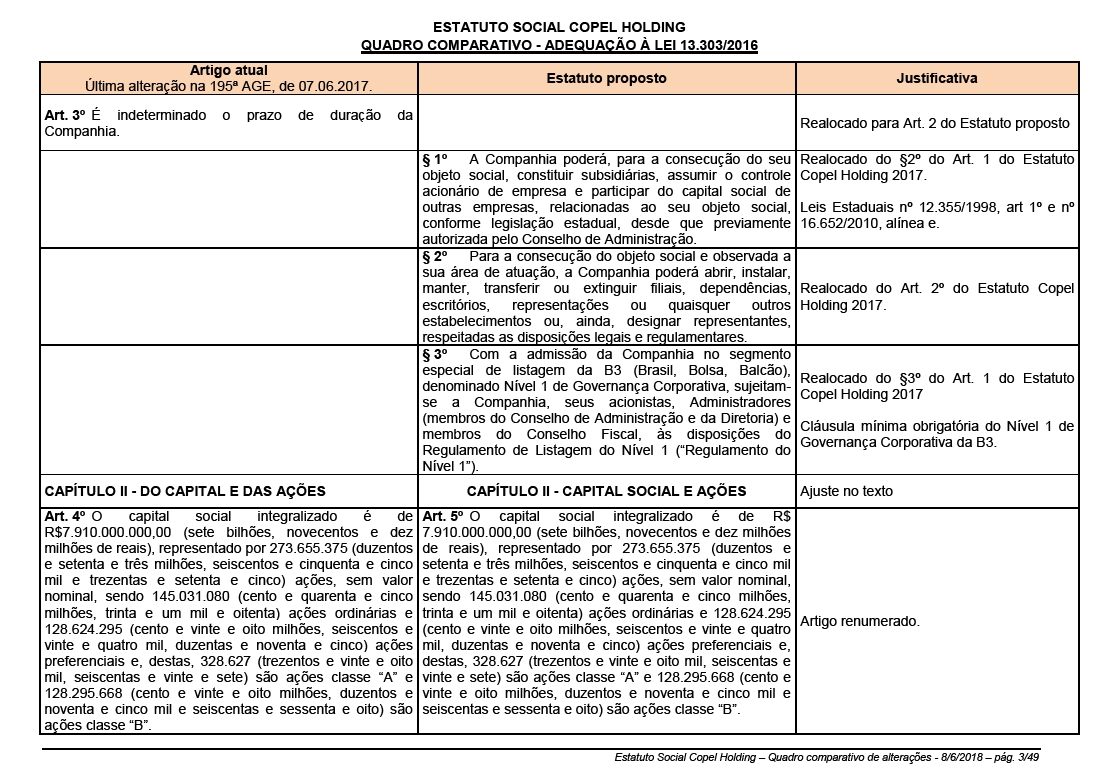

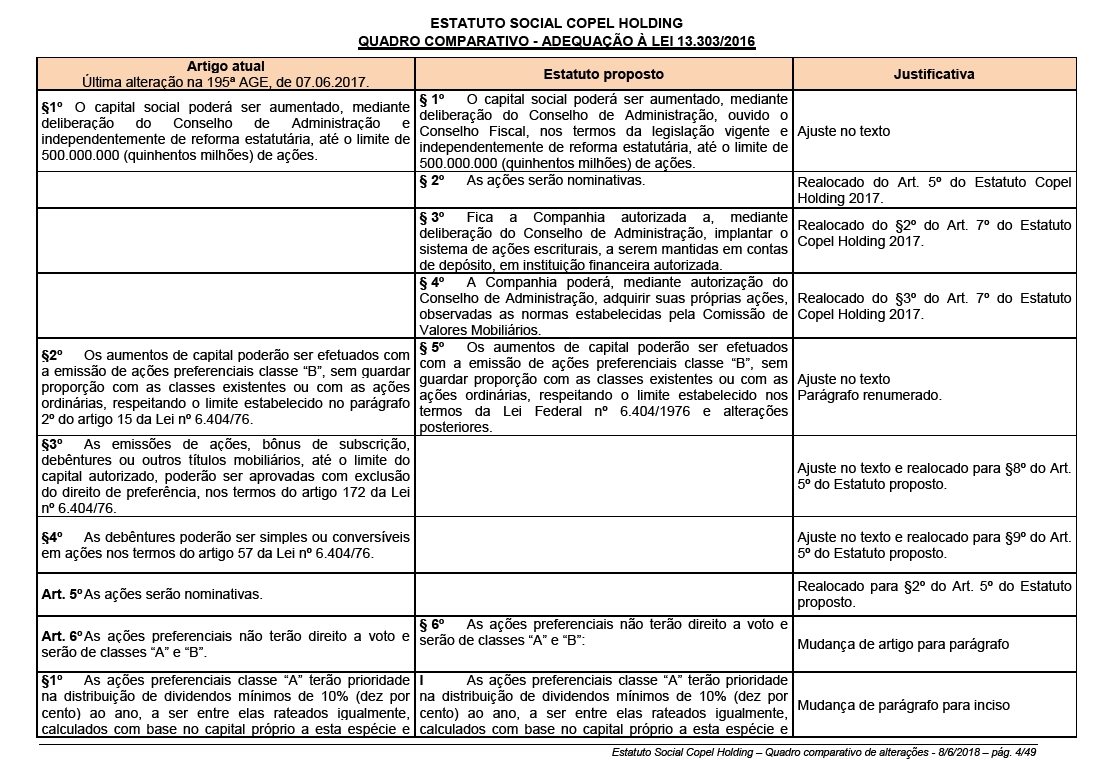

Accordingly, in order to adapt Copel's bylaws to the objectives set forth in Federal Law no. 13,303/2016, CVM Instruction no. 586/2017, B3's State-Owned Enterprises Governance Program and other necessary adjustments, and based on the model of bylaws proposed by CCEE and good corporate governance practices, Copel proposed a version of its bylaws comprising the changes that seek to broaden transparency and compliance, strengthening the Company's corporate governance.

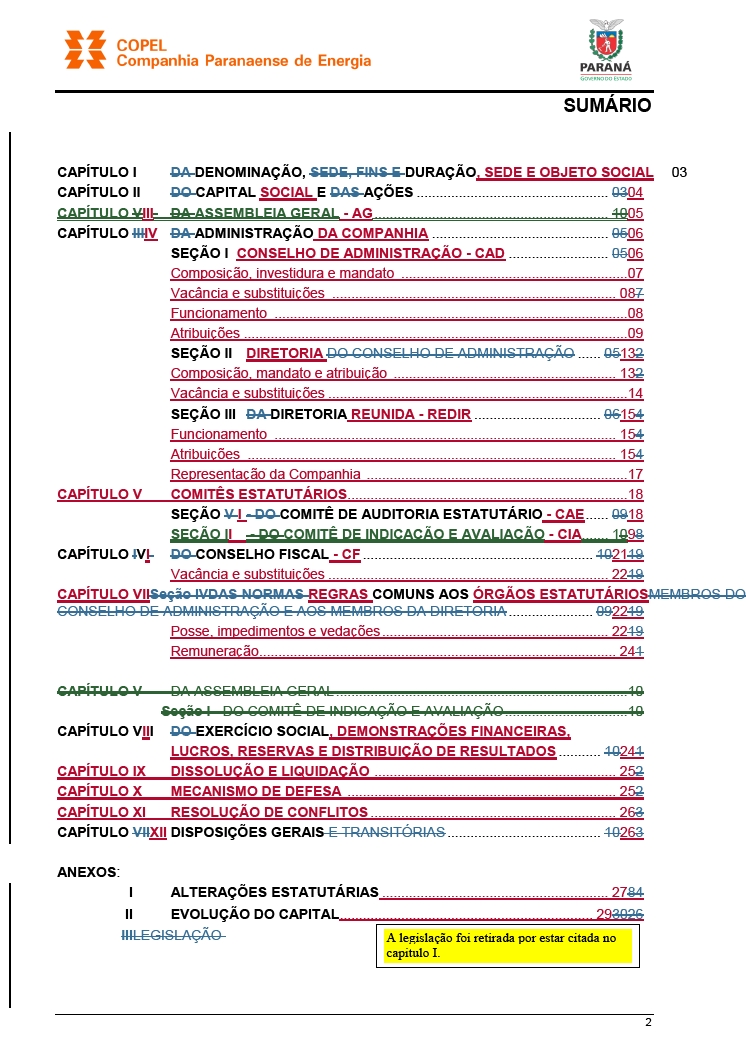

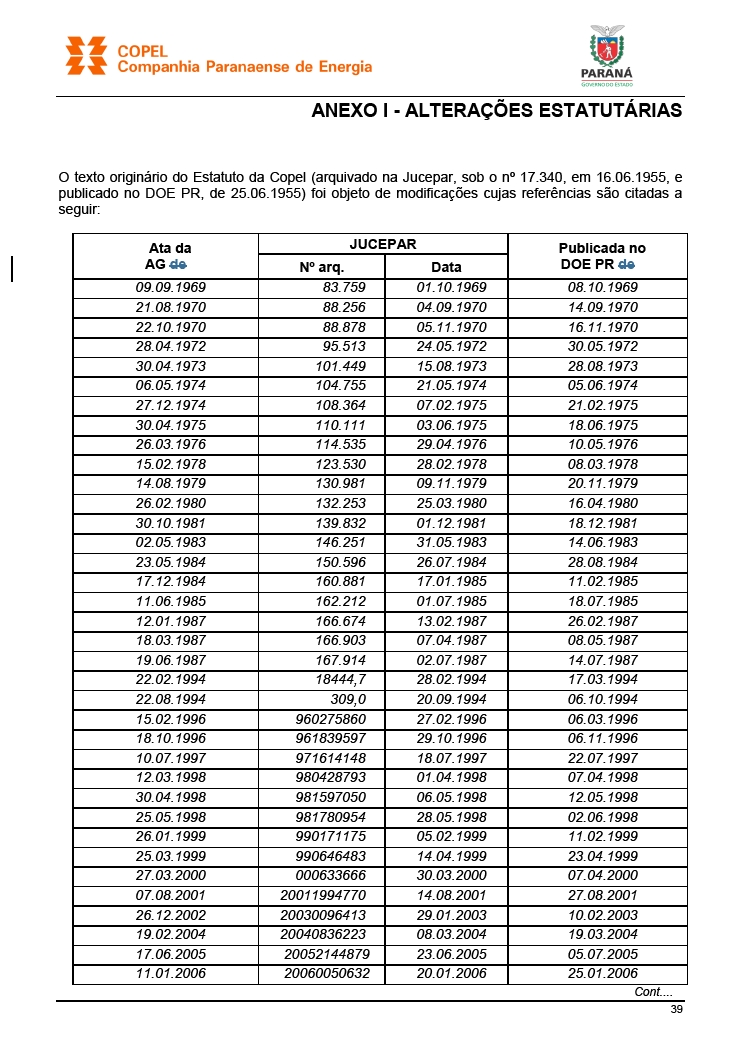

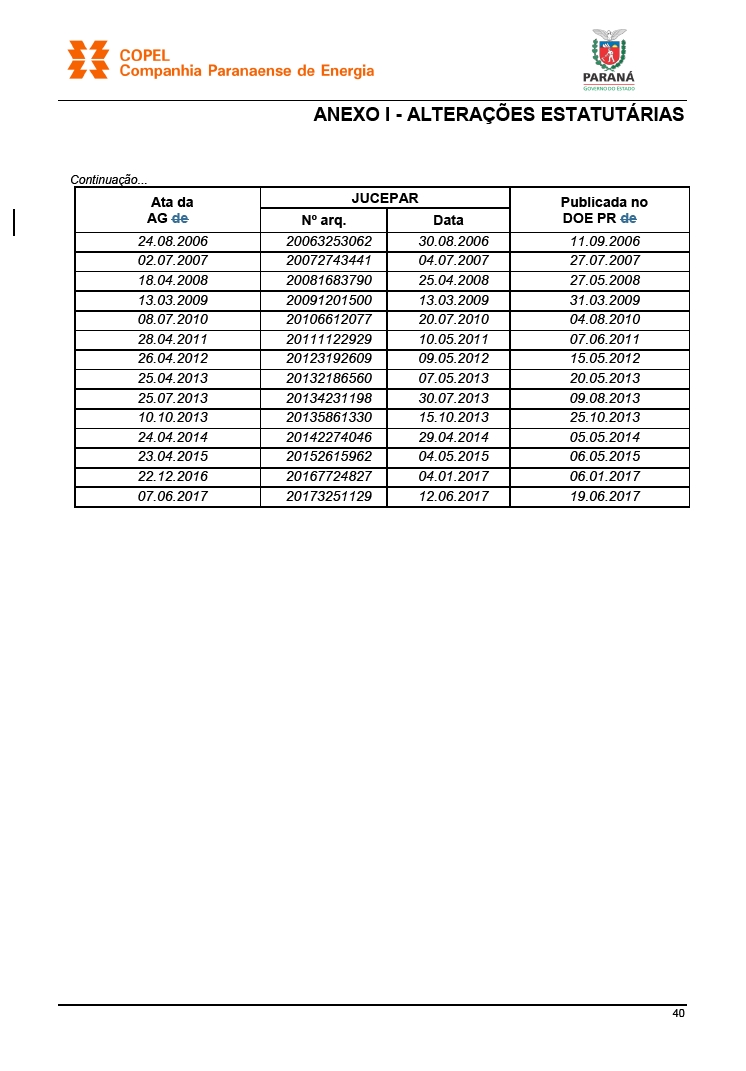

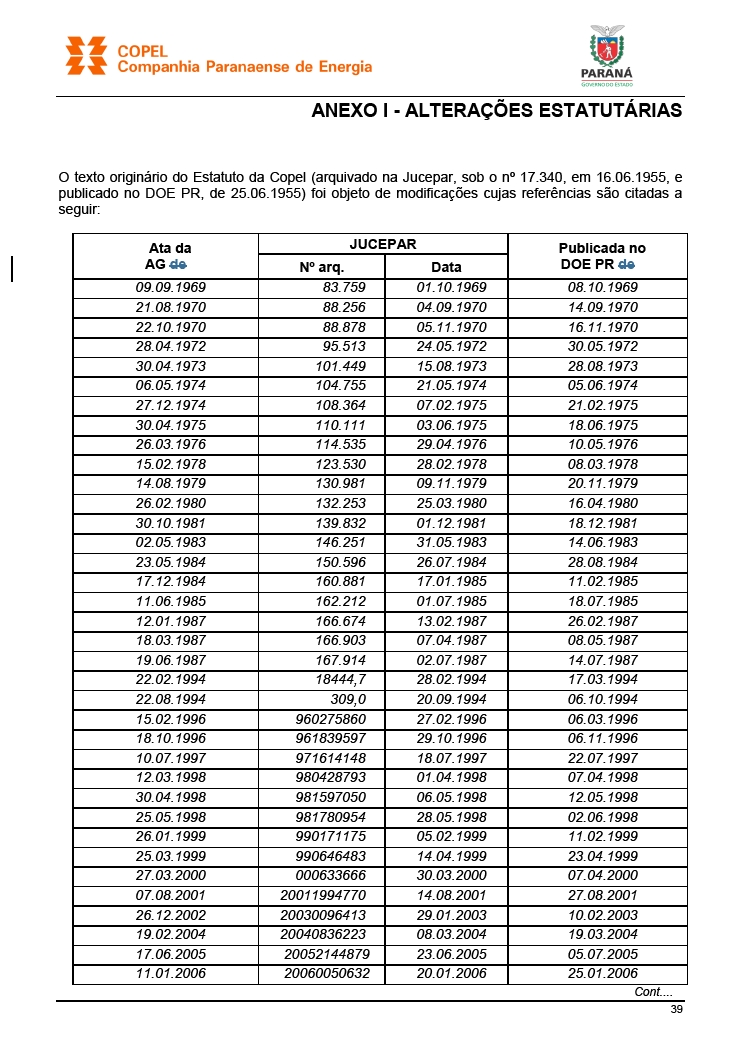

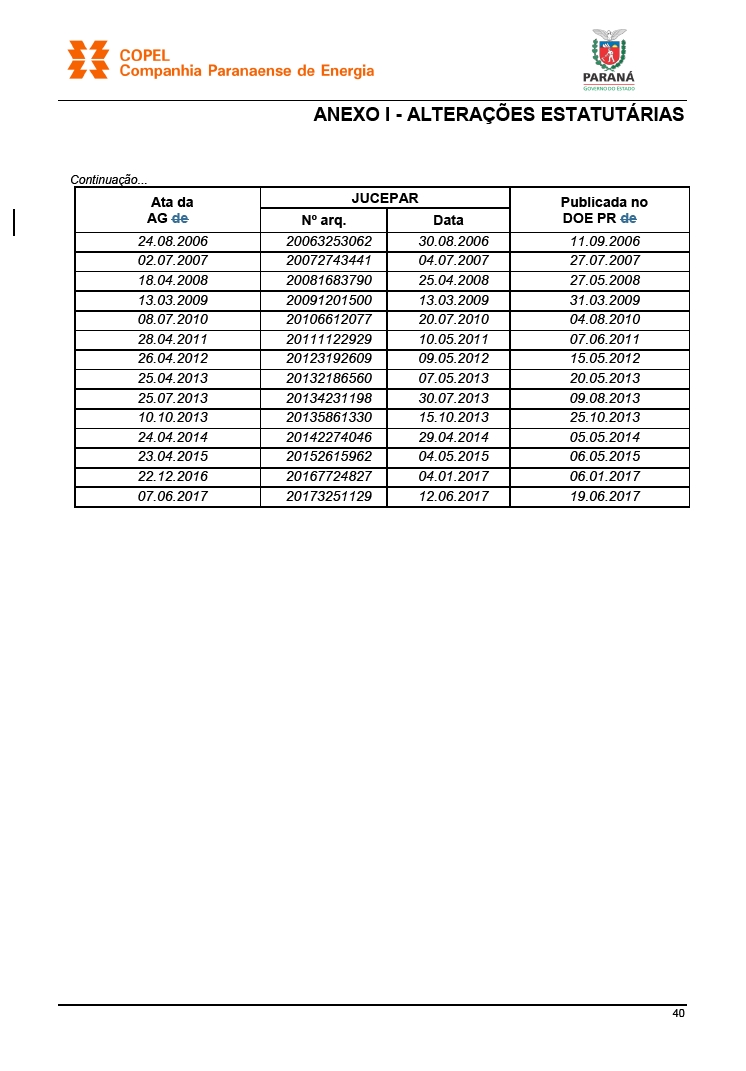

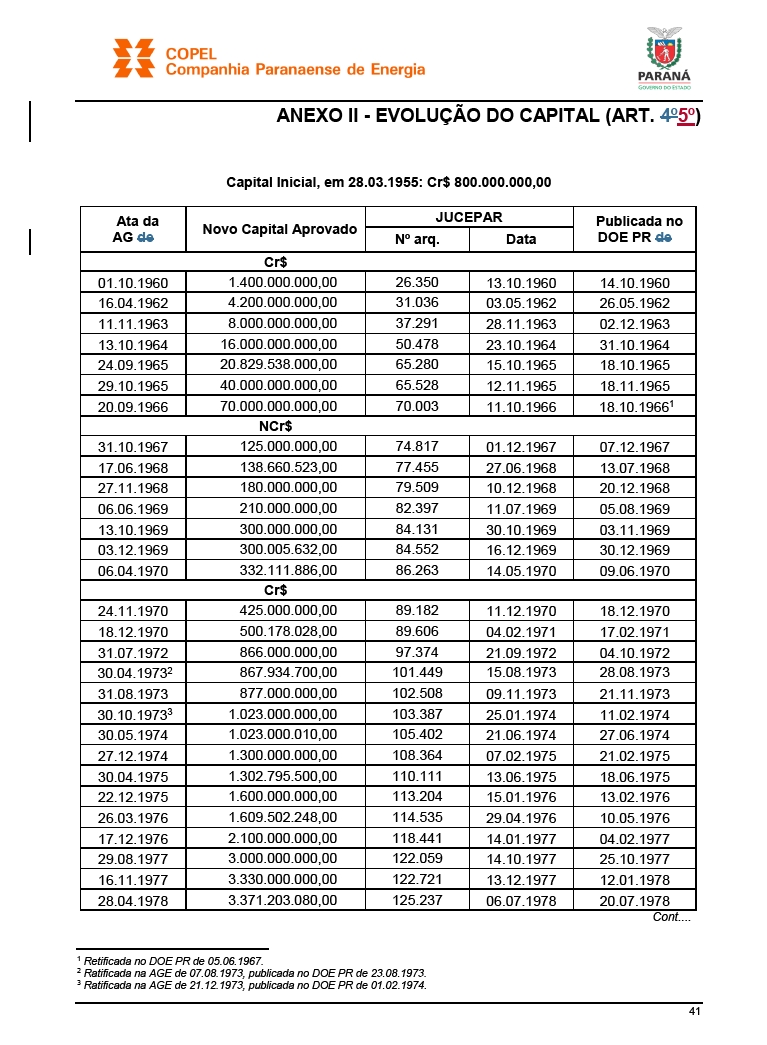

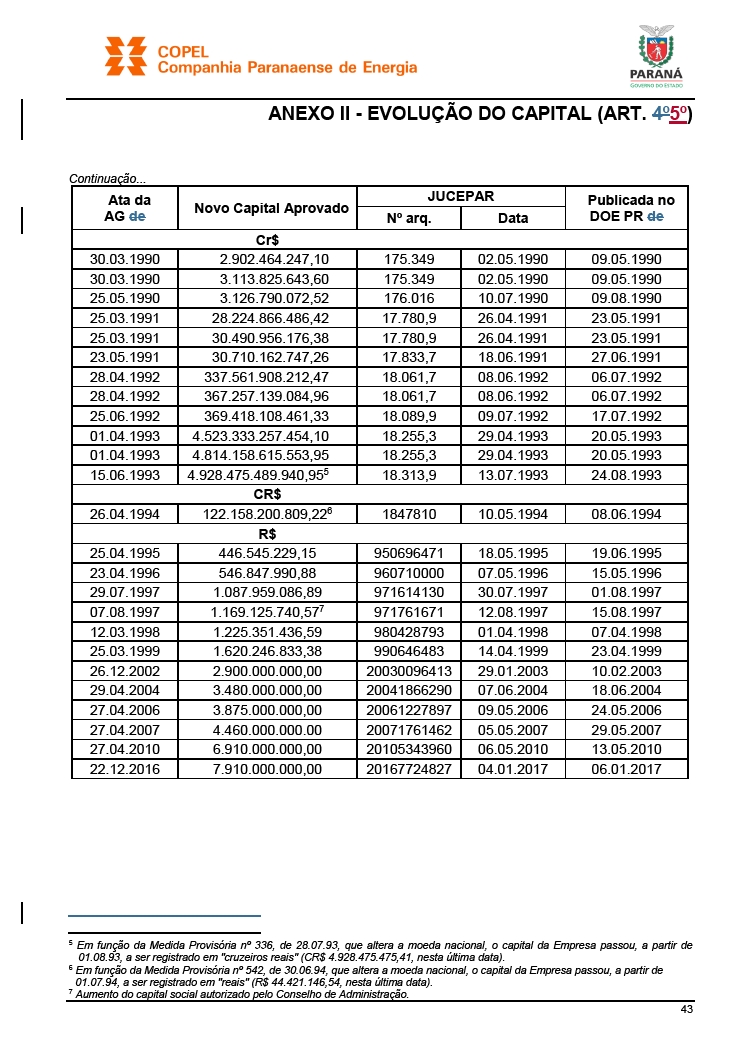

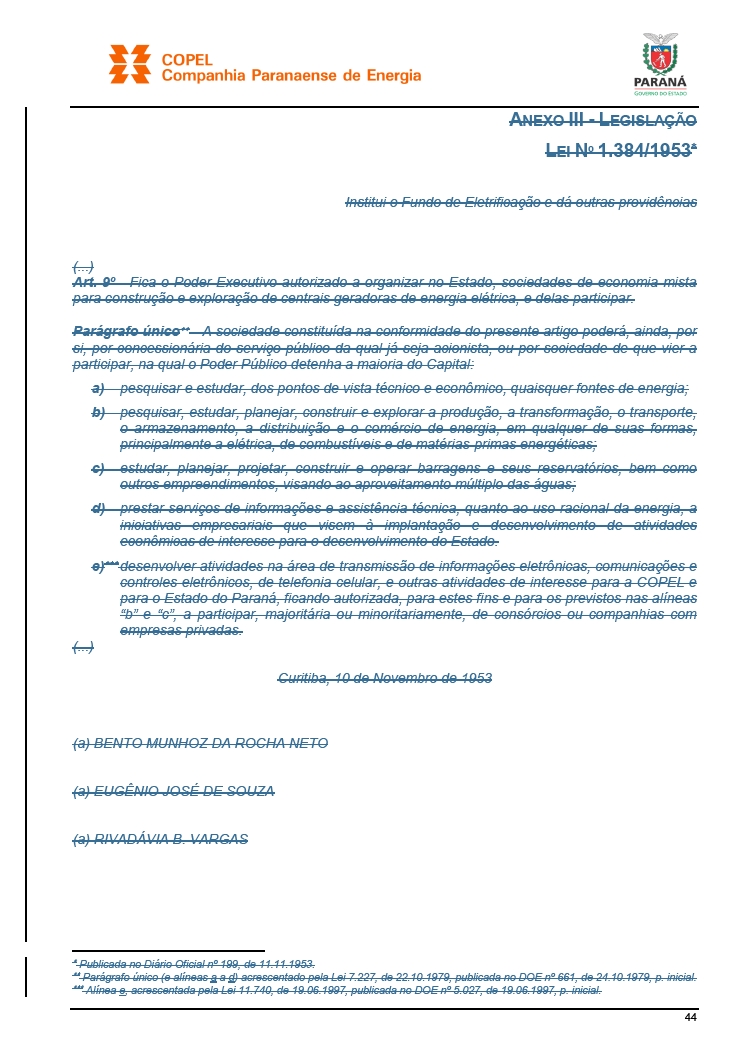

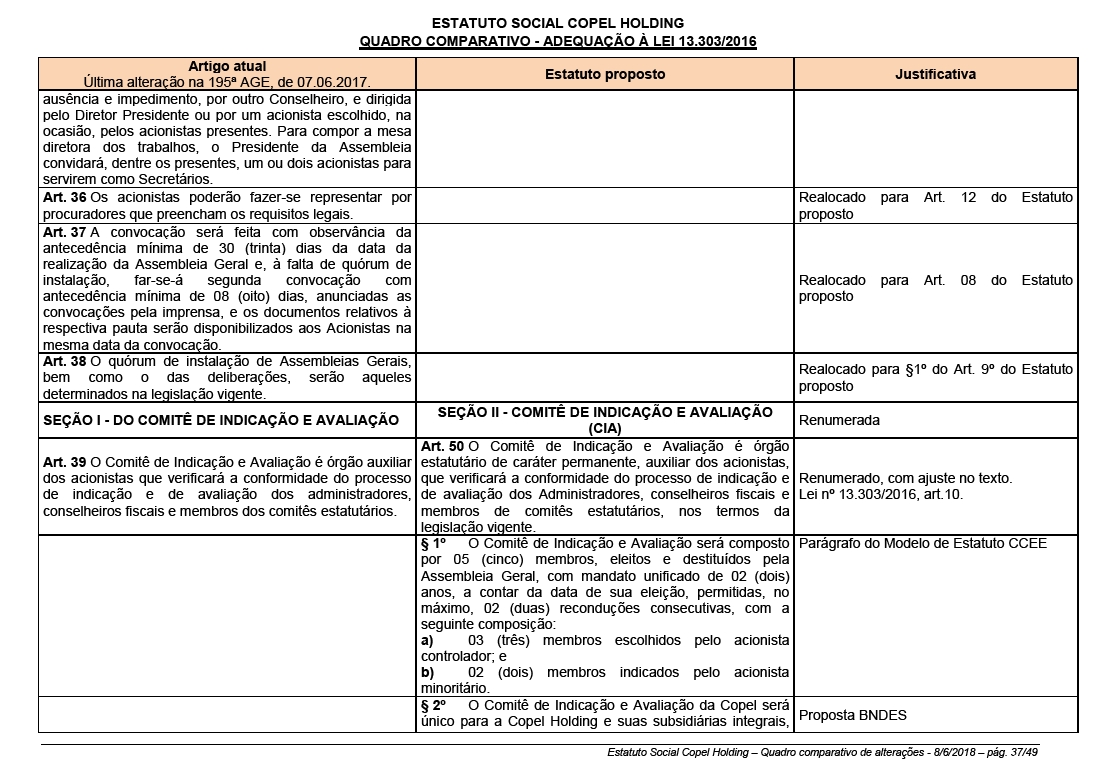

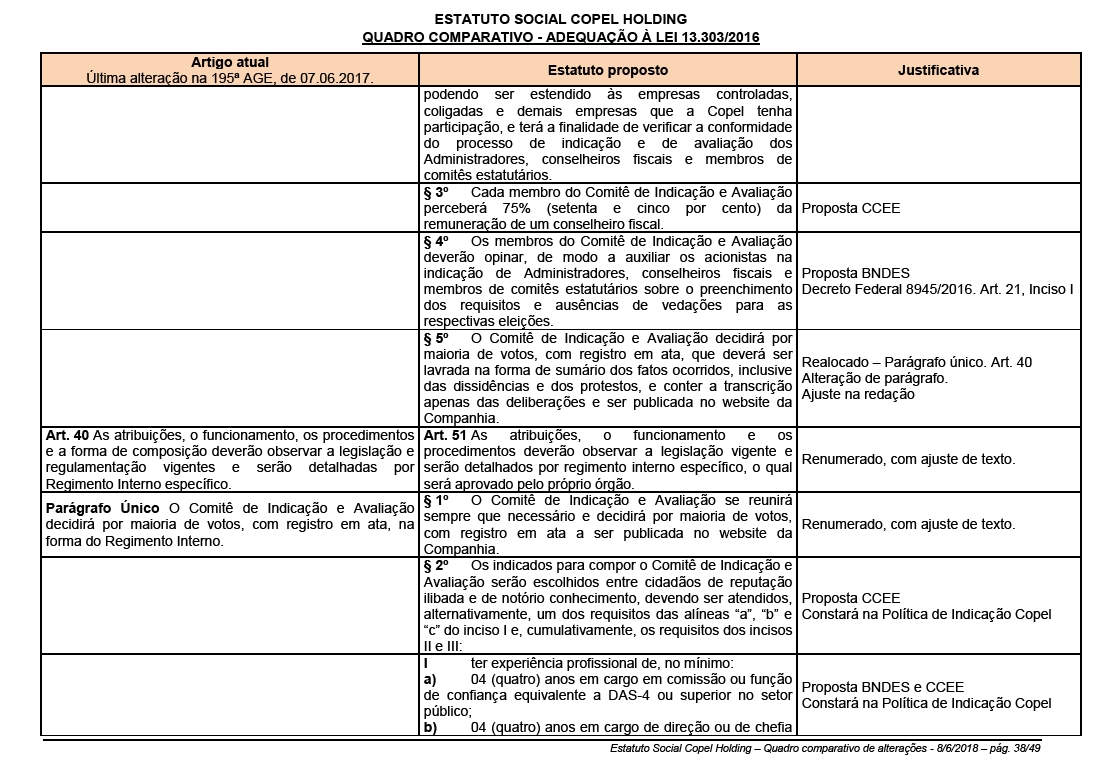

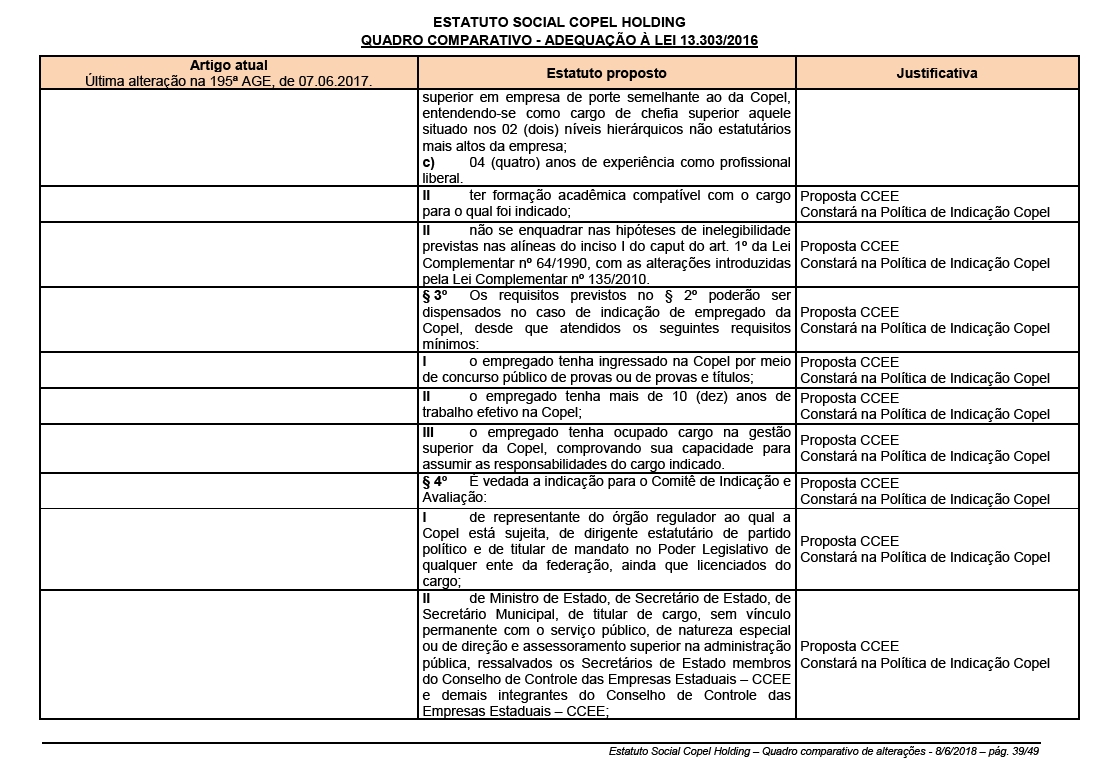

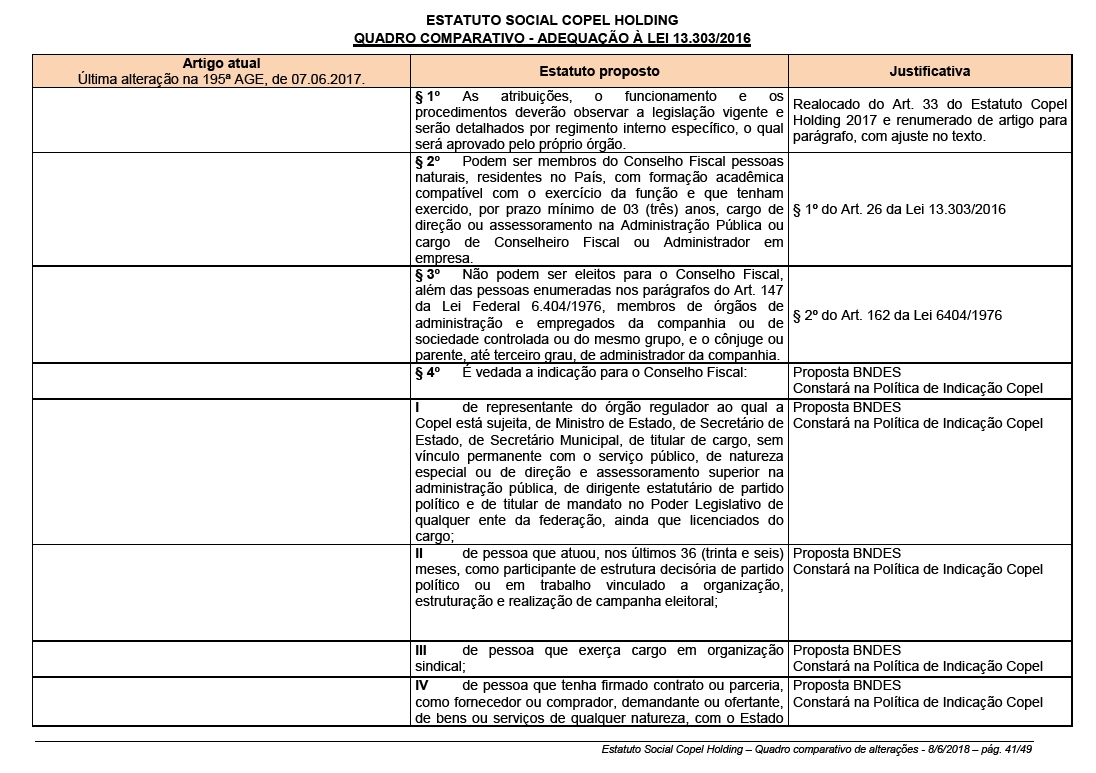

Considering the conclusion of the adjustments in the text by the parties, in order to improve theircontent, the resubmission of this Manual presentsthe proposal for alteration of the Company’s Bylaws, specially concerning the adjustments to the dispositions of Federal Law no. 13,303/2016, to CVM Rule no. 586/2017, as well as the compliance and validation of governance and integrity programs and sustainability platforms incorporated and required by national and international bodies and institutions such asAgência Nacional de Energia Elétrica - Aneel, ISE-BOVESPA,Câmara de Comercialização de Energia Elétrica - CCEE, Dow Jones Sustainability Index - DJSI, The Committee of Sponsoring Organizations of the Treadway Commission - COSO, Sustainability Disclosure Search - CERES-SEC, State Owned Enterprises Governance Program from B3 S.A. - Brasil, Bolsa, Balcão, Securities and Exchange Comission of Brazil - CVM, Control Council for State-Owned Companies of the State of Paraná - CCEE of the Secretariat of Finance of the State of Paraná, among others, as well as its compatibility with current national and state regulations, in accordance withAnnex I a.

The current proposal, which replaces the one previously filed at CVM on May 29, 2018, provides on itsAnnex I ba comparative chart containing all the justifications, item by item, to the presented propositions.

PROPOSAL FOR SUBSTITUTION OF MEMBER IN THE COMPANY’S BOARD OF DIRECTORS

Copel’s Board of Directors is a decision-making body, composed of 9 (nine) members, Brazilian, shareholders, residing in the country and elected by the General Assembly, pursuant to the Brazilian Corporation Law (Law no. 6,404/1976).

The Board of Directos has as its main duty the laying down of the overall strategy for the Company business.

In accordance with Law no. 6,404/1976 (Brazilian Corporation Law), in order to take office, all Board members shall sign a clearance certificate declaring that they are not impeded by any crimes provided for by law from performing business activities, and they shall also execute the Investiture Instrument and the Instruments of Adhesion to the Policies for Disclosure of Material Information and Maintenance of Confidentiality and for Trading of Securities issued by Copel itself, set forth by CVM Rule no. 358/2002, through which they undertake to comply with the rules therein.

Additionally, the members of the Board of Directors, in order to take office, shall sign a Management Consent Form as referred in the Corporate Governance Practices of Level 1 Regulation ("Level 1 Regulation") ofB3 S.A. - Brasil, Bolsa, Balcão, and in compliance with article 25 of the Company’s Bylaws.

Voting right

Copel’sBoardofDirectorsis currentlycomposed of9(nine)members and the board vacancies are filled as follows:

a) five are appointed by the State of Paraná, the Company’s main shareholder (only holders of common shares have voting rights);

b) two are appointed by BNDES Participações S.A. - BNDESPAR, as established in the Shareholders’ Agreement signed with the State of Paraná (only holders of common shares have voting rights);

c) one is appointed by the Company’s employees as established in State Law no. 8,096/1985, regulated by the Decree no. 6,343/1985 and by the State Law no. 8,681/1987 (only holders of common shares have voting rights); and

d) one is appointed by the minority of shareholders in compliance with article 239 of Law no. 6,404/1976 (Brazilian Corporation Law), being the election held separately(the controlling shareholders are not entitled to vote).Only holders of common and preferred shares have voting rights. The candidate elected is the one that obtains the highest representation percentage of the Company’s capital stock, with no minimum limit.

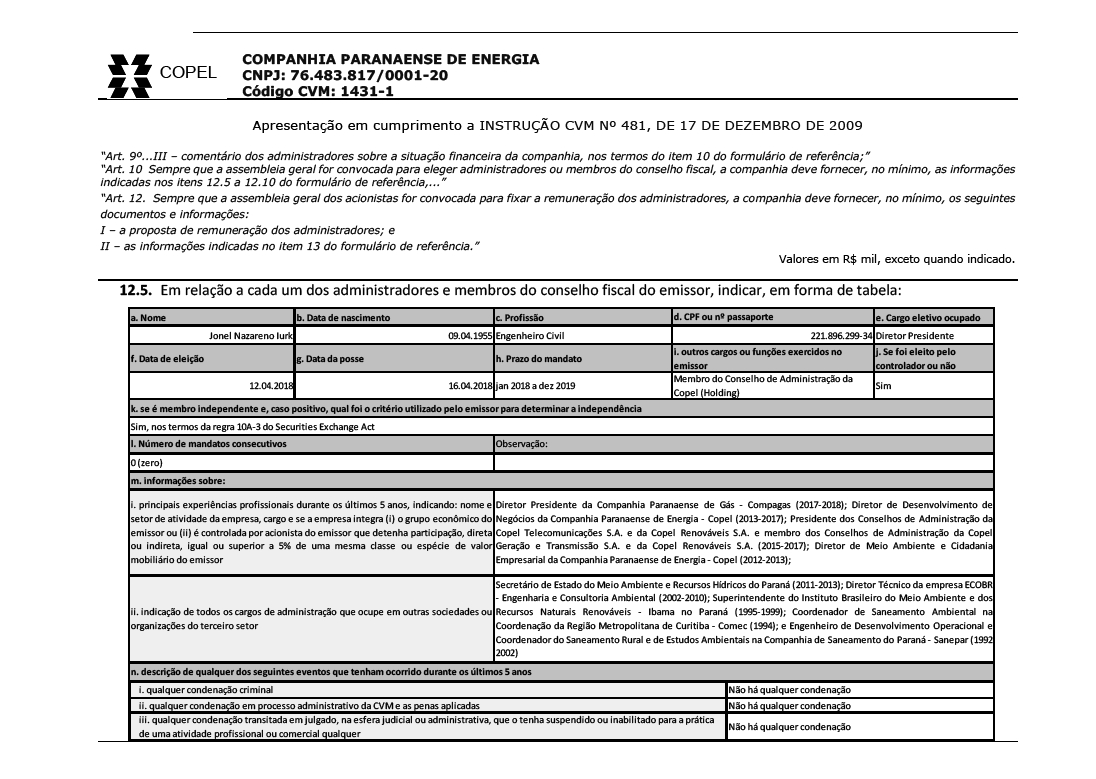

Nomination

Thus, considering the recent substitution of the Company’s Chief Executive Office, which is a statutory member of the Board of Directors (on vacancies provided on item “a)” above), the Company presents for consideration and vote of Shareholders, to fill the vacant position of the Board of Directors, to complete the 2017-2019 term of office:

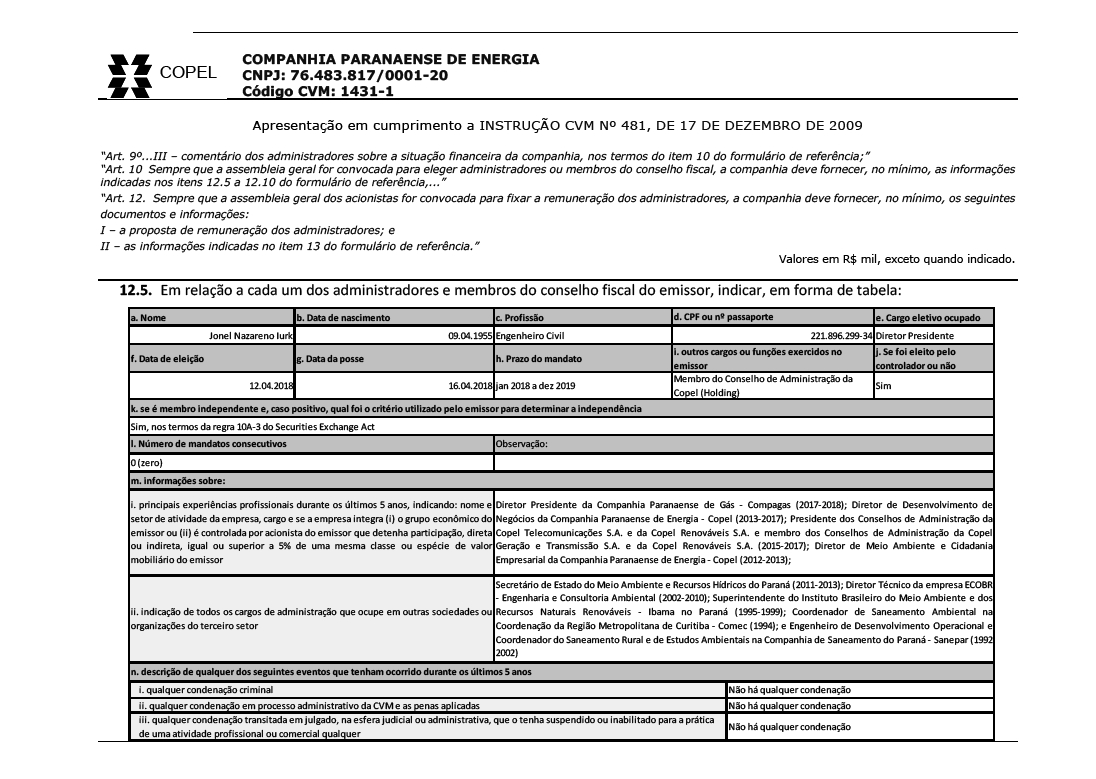

· JONEL NAZARENO IURK - to fill the vacant position due to substitution of the member Antonio Sergio de Souza Guetter, according to OF CEE/G 108/18, of April 16, 2018.

MANUAL FOR PARTICIPATION

IN GENERAL MEETINGS

197th Extraordinary General Meeting

June 28, 2018

| TABLE OF CONTENTS |

| | | |

| I | Message from the Chairman of the Board of Directors | 3 |

| | | |

| II | Guidance for Participation in the General Shareholders’ Meeting | 4 |

| | | |

| Attending Shareholder | 4 |

| | | |

| Shareholder Represented by Proxy | 4 |

| | | |

| Holders of ADRs | 4 |

| | | |

| III | Call Notice | 5 |

| | | |

| IV | Information on the matters to be examined and discussed at the 197thExtraordinary General Meeting | 7 |

| | | |

| Analysis, discussion and voting on the proposal for alteration of the Company’s Bylaws, in order to adjust it to the dispositions of the Federal Law no. 13,303/2016, to CVM Rule no. 586/2017, to B3’s State Owned Enterprises Governance Program and other necessary adjustments considering the format proposed by the Control Council for State-Owned Companies of the State of Paraná - CCEE, according to good practices of corporate governance | 7 |

| | | |

| Analysis, discussion and voting on the proposal for substitution of member in the Company’s Board of Directors | 9 |

| | | |

| Annexes (Only in Portuguese) | |

| | | |

| I a. | THE COMPANY’S BYLAWS HIGHLIGHTING THE ALTERATION PROPOSALS, IN COMPLIANCE WITH ARTICLE 11 OF CVM RULE NO. 481/09 |

| | | |

| I b. | THE COMPANY’S BYLAWS ALTERATION PROPOSALS WITH DESCRIPTION OF THE CURRENT ARTICLES AND THE NEW PROPOSED ARTICLES AND THE DUE JUSTIFICATIONS FOR THE ALTERATIONS, IN COMPLIANCE WITH ARTICLE 11 OF CVM RULE NO. 481/09 | |

| | |

| II. | ITEMS 12.5 TO 12.10 OF THE REFERENCE FORM |

2/10

I. Message from the Chairman of the Board of Directors

Dear Shareholder:

ItiswithimmensepleasurethatIpresenttoyouthisManualforParticipation inthe General Shareholders’MeetingoftheCompanhiaParanaensedeEnergia -Copel,with generalguidanceforaneffectiveparticipationandexerciseofthevote.

ThismanualhasbeenpreparedbasedonCopel'sCorporateGovernancepolicy, whichisfoundedontransparencyandequity.

Themanualaimstopresent,inaclearandbriefway,theinformation relatedtothe Company’s General Shareholders’Meeting,seekingtherebytocontributeforthe understandingoftheproposalsforresolutionandtoencouragetheparticipationof shareholdersintheeventsoftheannualcorporateagendaoftheCompany.

Copel’s 197thExtraordinary General Meeting was called for June 28, 2018, at 9h30 a.m., at the Company’s headquarters located at Rua Coronel Dulcídio nº 800, in the city of Curitiba.

ThematterstobepresentedintheExtraordinary General Meeting for theresolutionof theshareholders aredescribed intheCallNoticeandinthismanual as well as thetypes ofsharesgrantingtherighttovoteontheitemoftheagenda.Giventhecurrent numberofCompanyshareholders, thismanualseekstoencourageandenable participationintheGeneralMeeting.

Yourparticipation isveryimportant,considering thatissuesrelevanttotheCompany and its shareholders aredealtwithinthe General Shareholders’ Meetings.

Yours sincerely,

Mauricio Schulman

Chairman of the Board of Directors

3/10

II. Guidance for Participation in the General Shareholders’ Meeting

Copel’sshareholdersmaytakepartintheGeneralMeetingbyattendingthemeeting attheCompany’sheadquartersandvoting orby appointing a proxy with powers to represent him/her,asdescribedbelow.

Attending Shareholder

Theshareholder wishingtotakepartin the Extraordinary General Meeting shallarrivea few minutesbeforethetimeindicated intheCallNoticeandbearthefollowing documents:

· Identity card (RG), Alien’s Identity Card (RNE), Brazilian Driver’s License (CNH) or an accreditation card issued by an official professional organization; and

· Proof as Company shareholder issued by a depositary financial institution or a custodian agent or through the shareholding position issued by Copel.

Shareholder Represented by Proxy

Theshareholderwhoisnotabletoattendthemeetingandwishestotakepartin the Extraordinary General Meetingmayappointaproxywithpowerstorepresenthim/her.

Pursuant toArticle126,paragraph1,oftheBrazilianCorporationLaw no.6,404/1976, theproxyshallbeashareholder,lawyerormanageroftheCompanyorofa financialinstitution/investmentfund.Theproxyshallhavebeenappointednot morethanoneyearbeforethedateofthe Annual General Meeting.

The documents required are the following:

· Power of attorney with special powers for representation at Copel’s General Meeting, bearing a notarized signature of the grantee (shareholder);

· Bylaws or Article of Incorporation and the instrument of election/appointment of the managers in the event of the grantee being a legal entity; and

· Proof of ownership of the shares issued by the Company, conferred by the depositary financial institution and/or custodian.

Note:thedocumentsmentionedaboveshallbe forwardedtoCopel’sheadquarters,DiretoriadeFinanças e deRelaçõescom Investidores,Departamento de Acionistas e Custódia,atRuaCoronelDulcídionº800 -3º andar,preferably48hourspriortotheMeeting.

Holders of ADRs

ThefinancialdepositaryinstitutionofAmericanDepositaryReceipts(ADRs)in theUnitedStates,TheBankof NewYorkMellon,willsendthepowersof attorney totheholders ofADRs,sothattheyexercise theirvotingrightatthe Extraordinary General Meeting.

TheparticipationshalltakeplacethroughBancoItaú,representativeofThe BankofNewYorkMelloninBrazil.

Shouldtherebeanydoubtconcerning the Extraordinary General Meeting procedures anddeadlines, pleasecontacttheShareholdersandCustodyDepartment(Departamento de AcionistaseCustódia)atthetelephonenumber(5541)3331-4269orthrough thee-mailaddressacionistas@copel.com.

III. Call Notice

The present Call Notice replaces the former one, which was filed, on May 29, 2018, on the proper websites both ofComissão de Valores Mobiliários - CVM and B3 S.A. -Brasil, Bolsa, Balcão, and published, in accordance with article 289 of Brazilian Corporation Law (no. 6,404/1976), on the Official Gazette of the State of Paraná (DIOE-PR), on May 30 and June 04 and 05, 2018, and on the newspaper Folha de Londrina - PR, on May 30 and 31 and June 01, 2018, as a result of agreements between the shareholders State of Paraná and BNDES Participações S.A. - BNDESPAR, which led to the replacement of the proposal for alteration of the Company’s Bylaws to be examined at the 197th Extraordinary General Meeting.

EXTRAORDINARY GENERAL MEETING

CALL NOTICE

The Shareholders of Companhia Paranaense de Energia - Copel are invited to attend the Extraordinary General Meeting to be held onJune 28, 2018, at9h30 a.m.at the Company’s head office located at Rua Coronel Dulcídio nº 800, Curitiba, to decide on the following agenda:

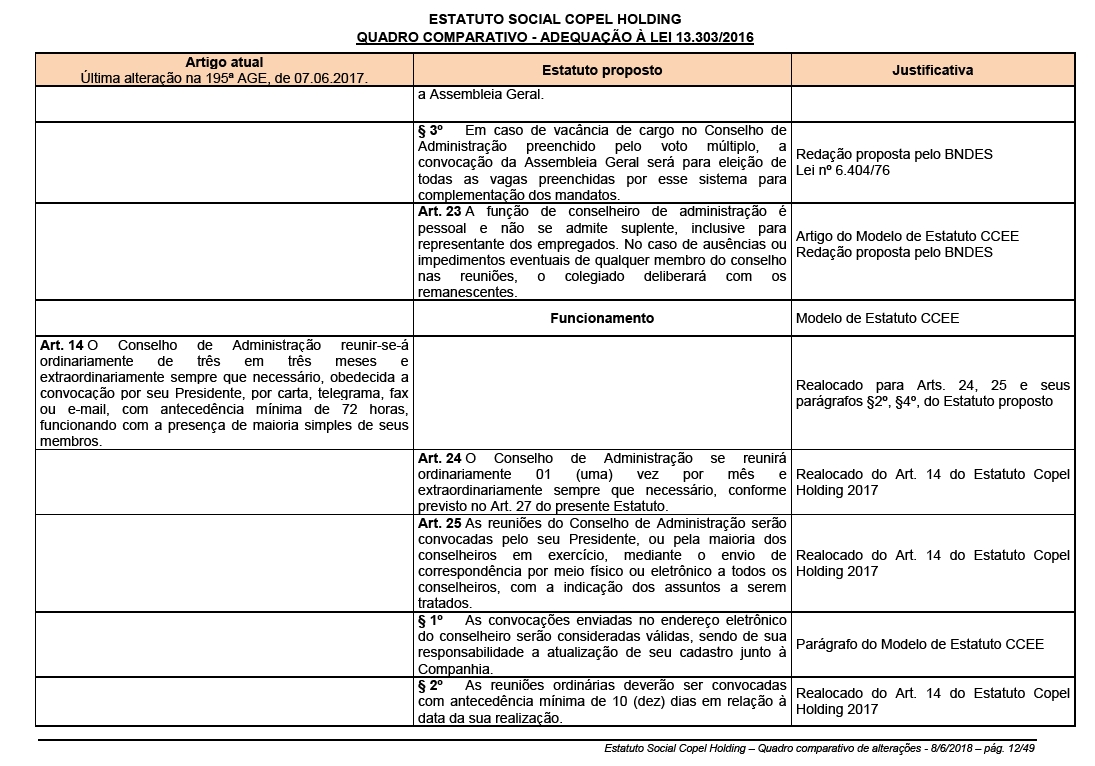

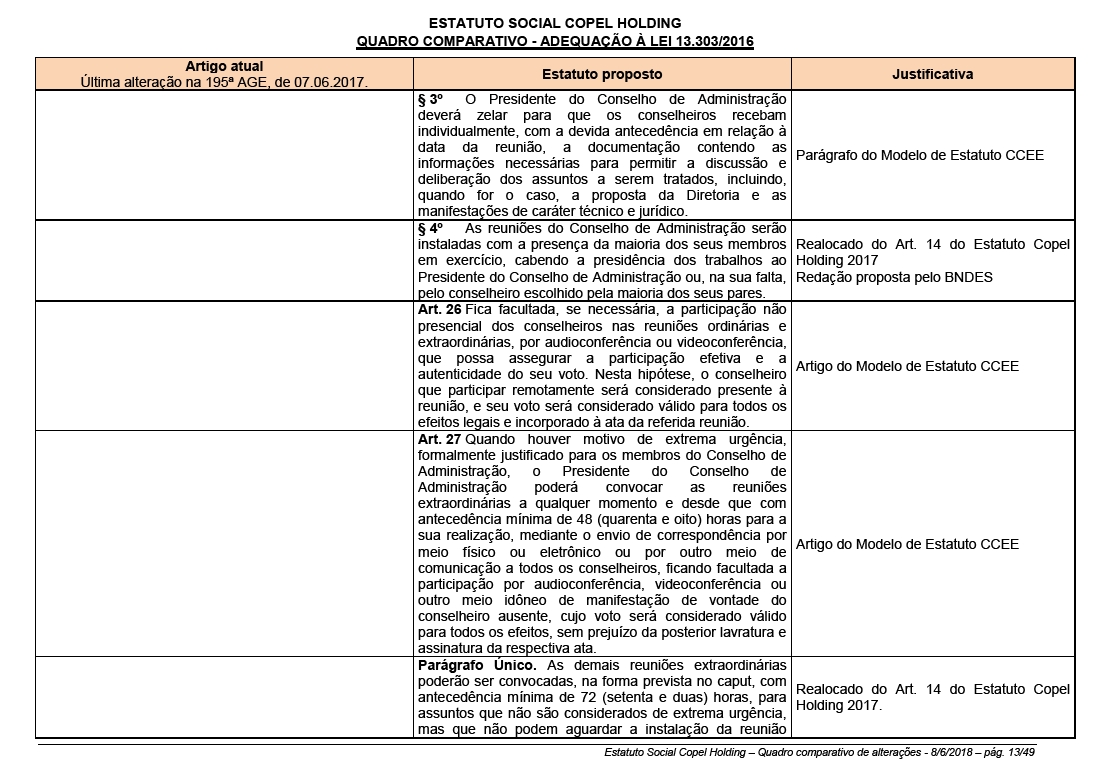

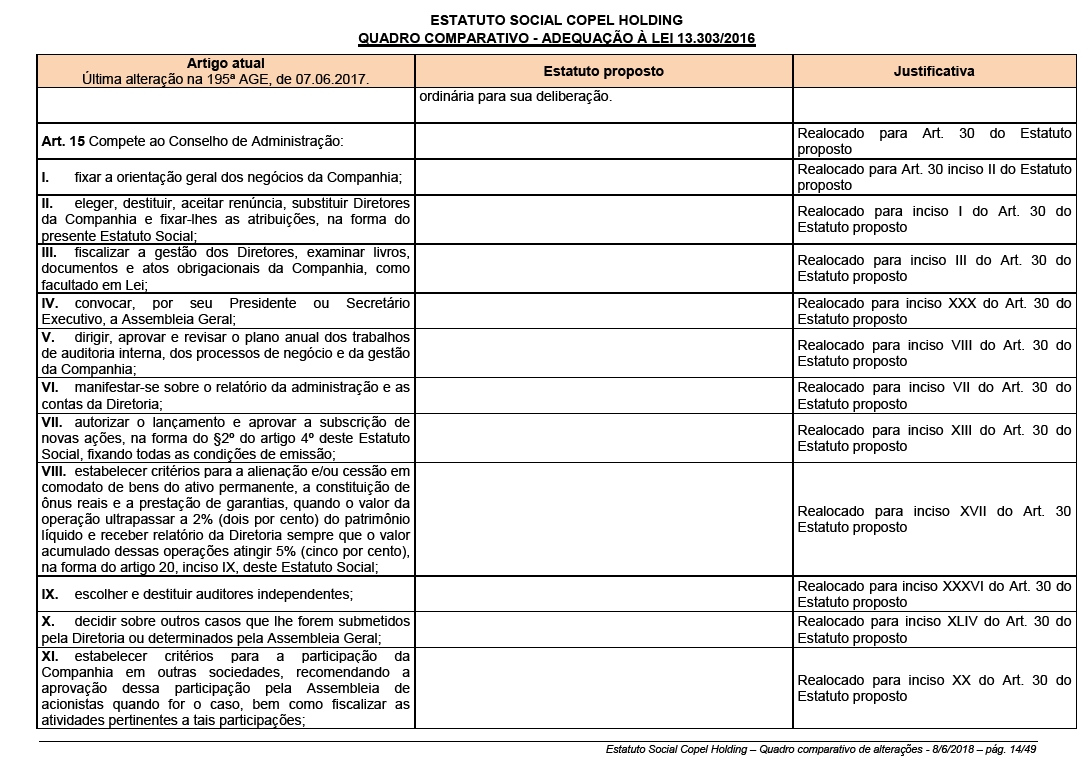

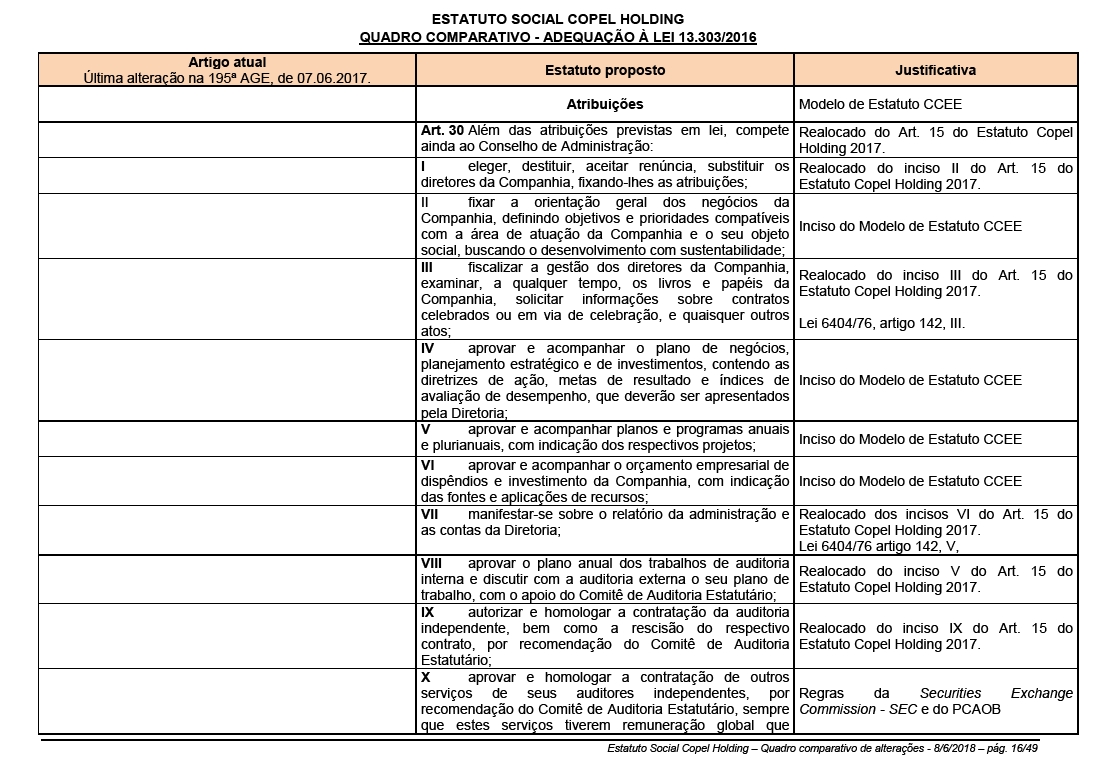

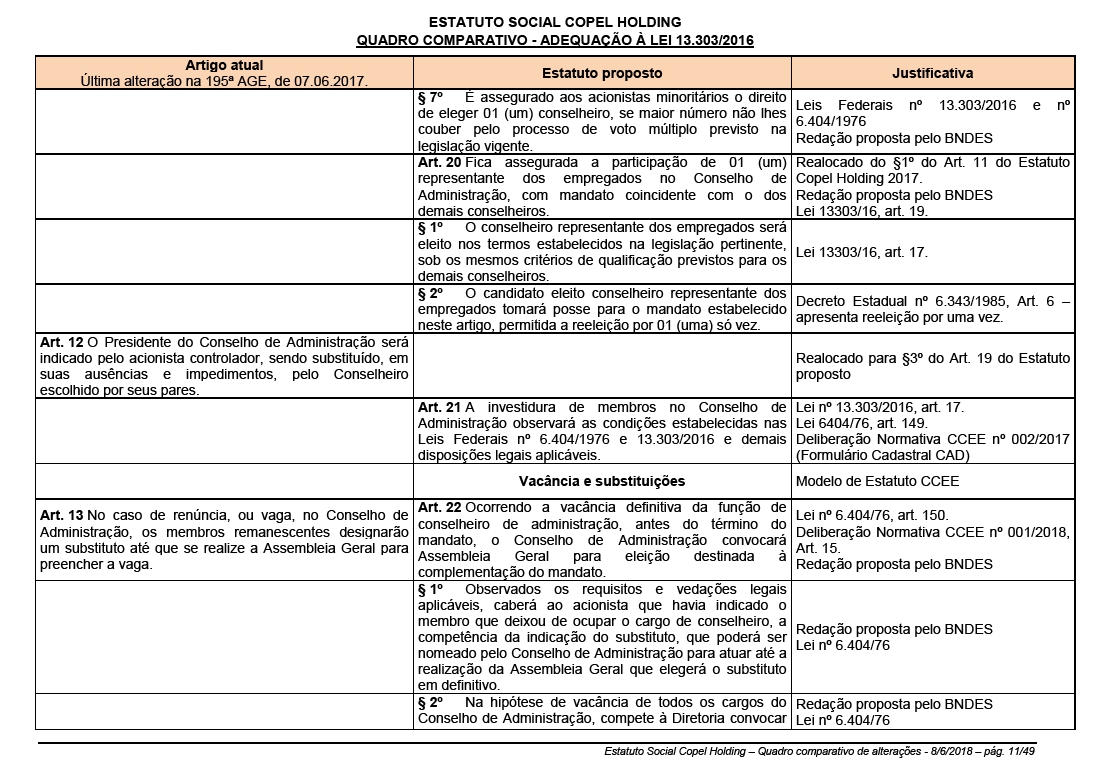

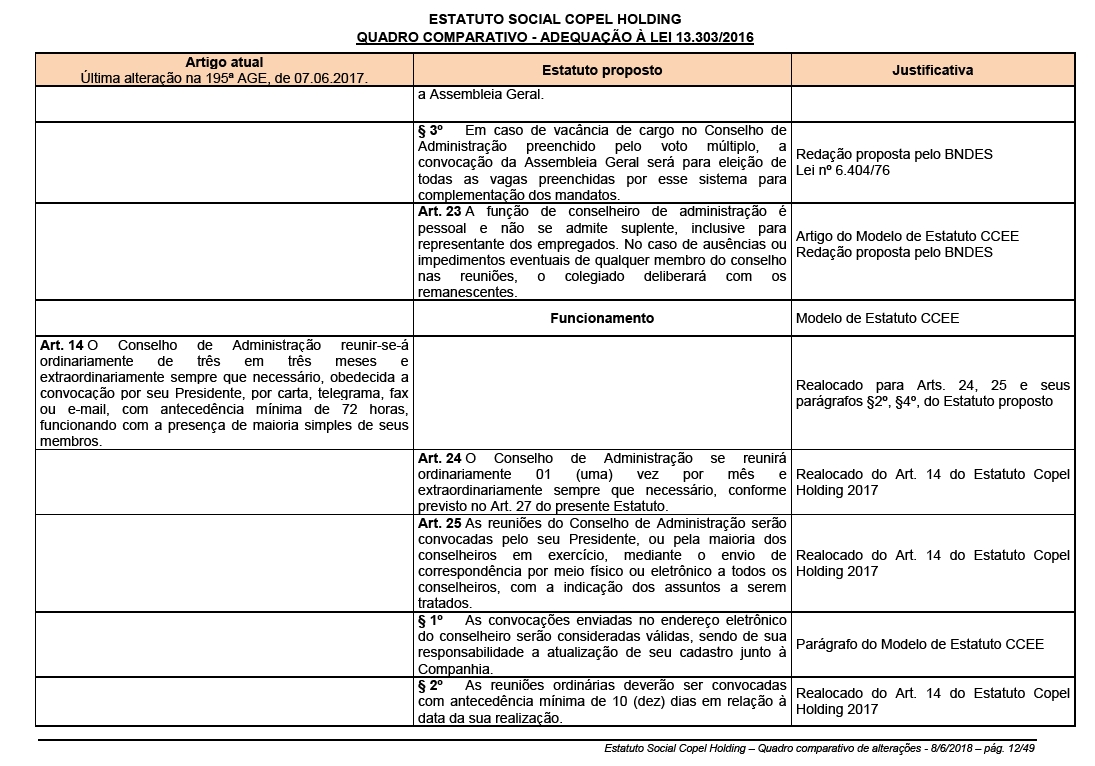

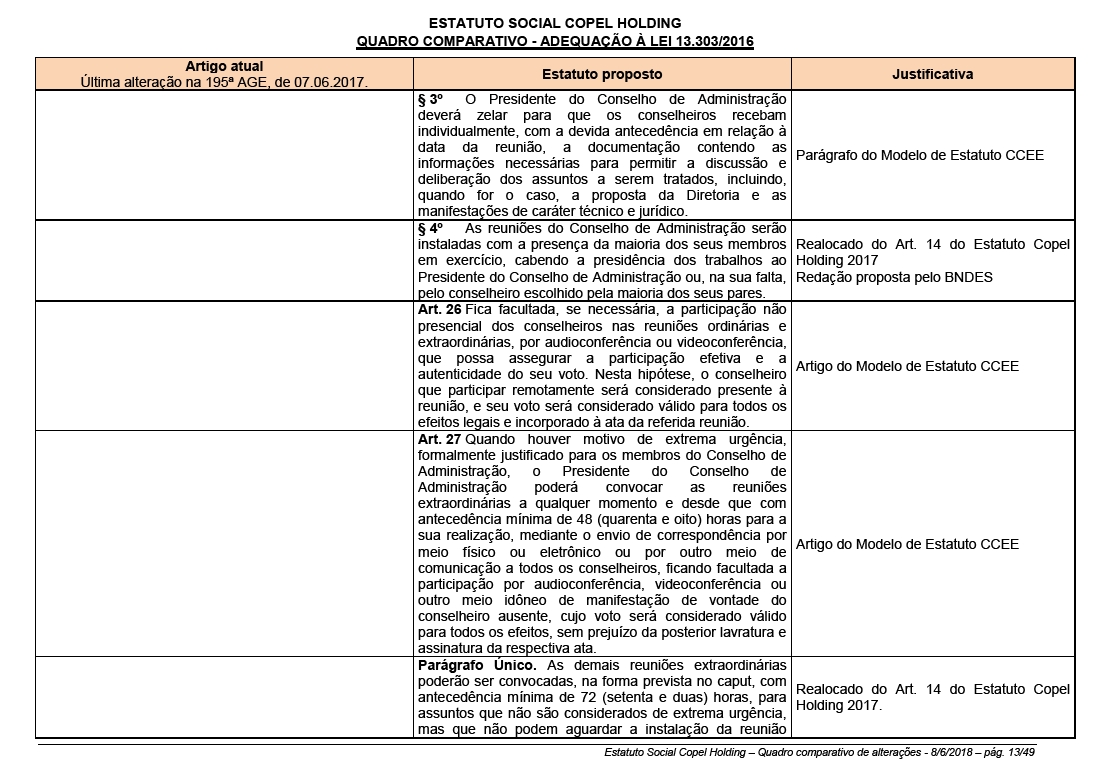

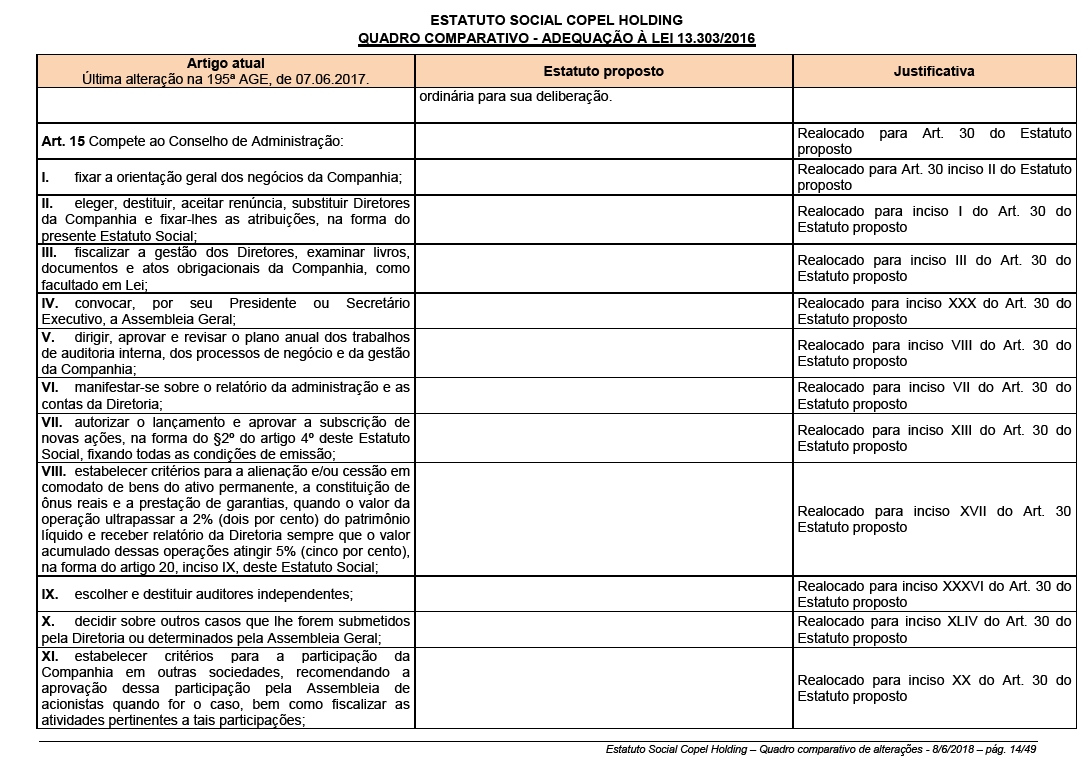

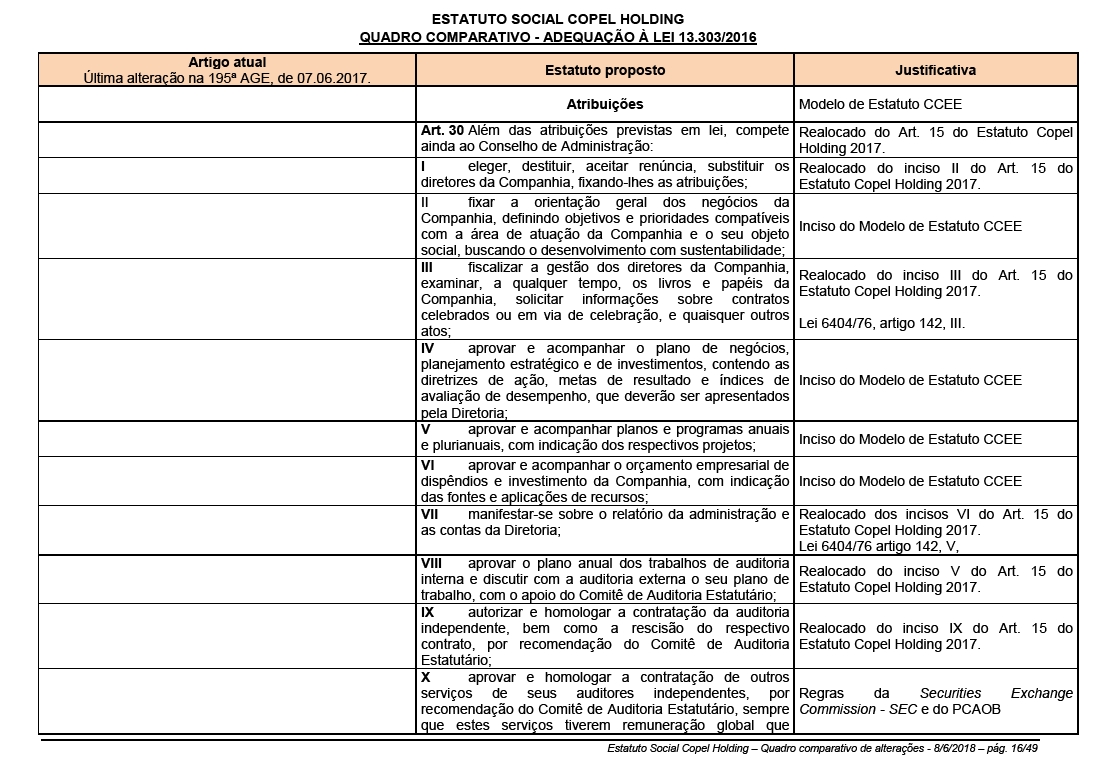

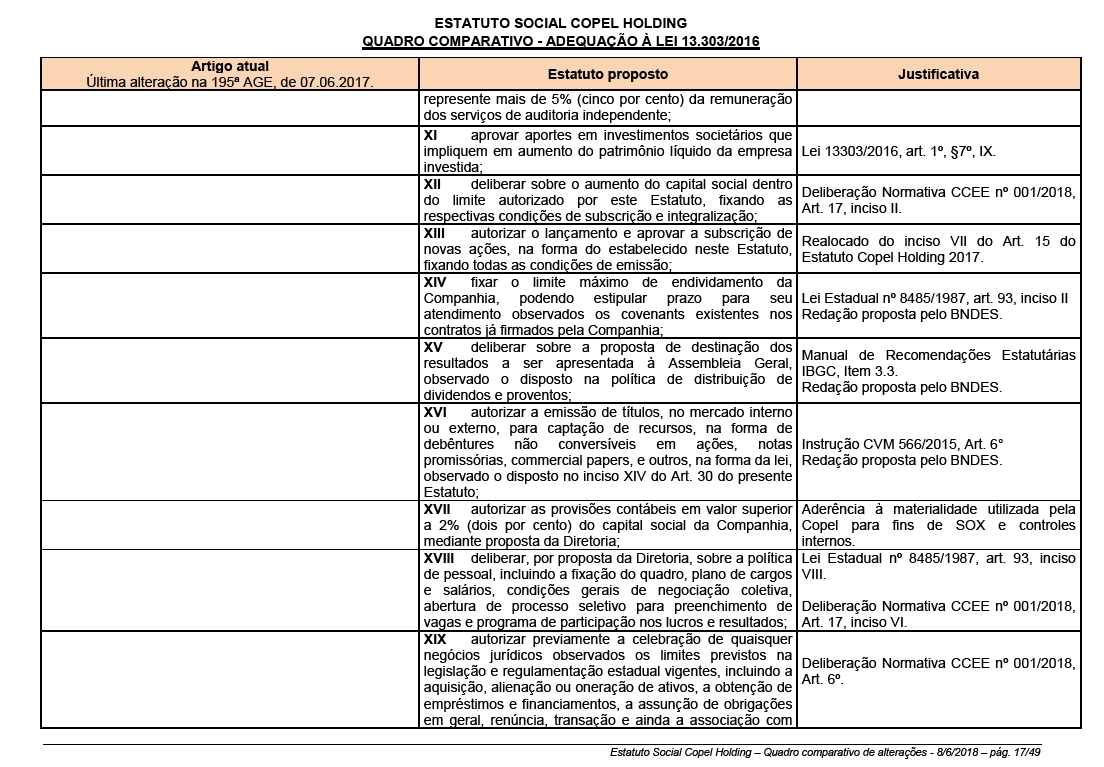

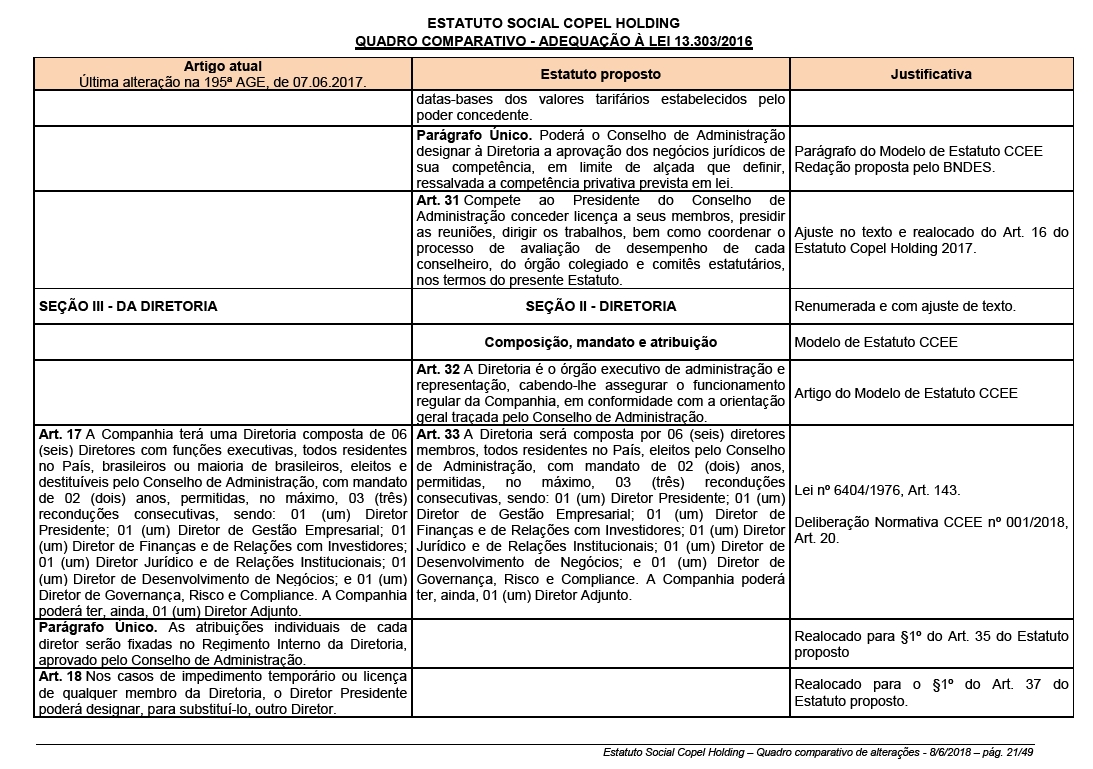

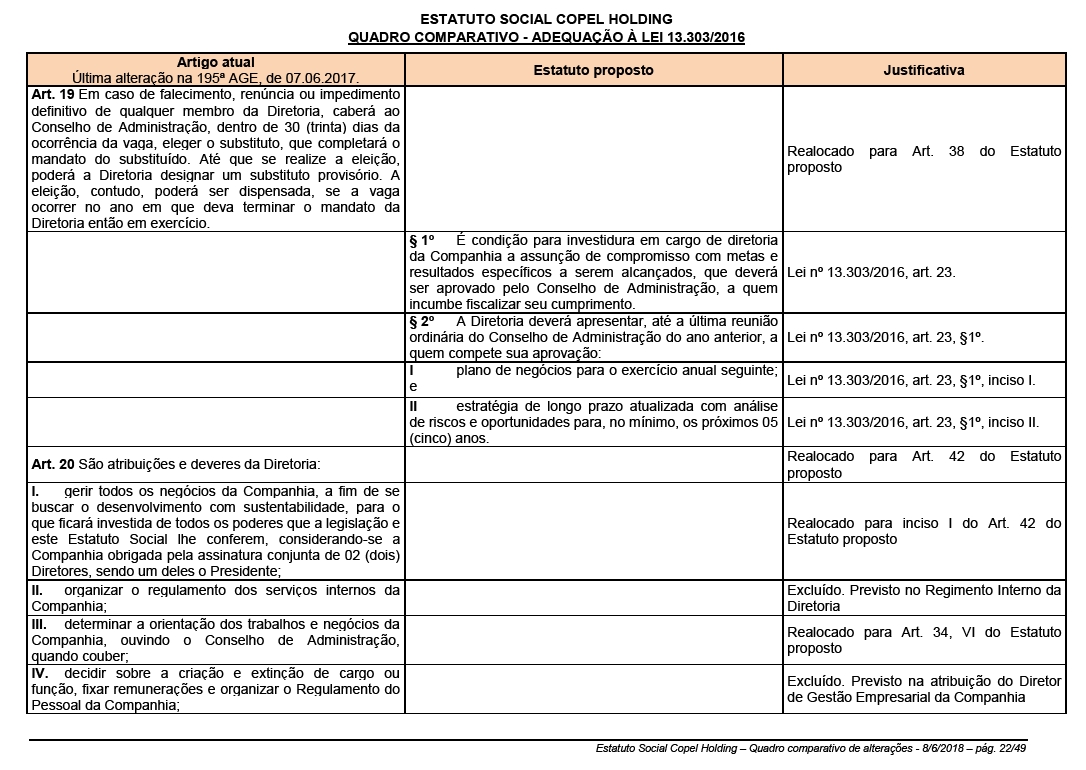

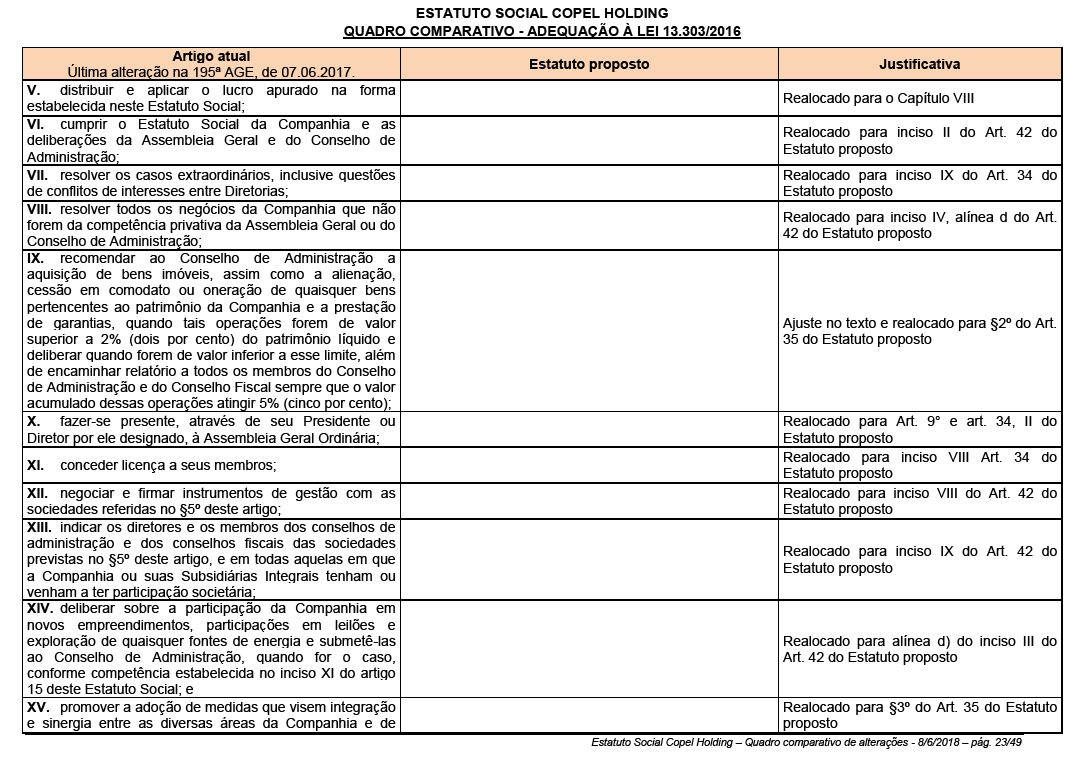

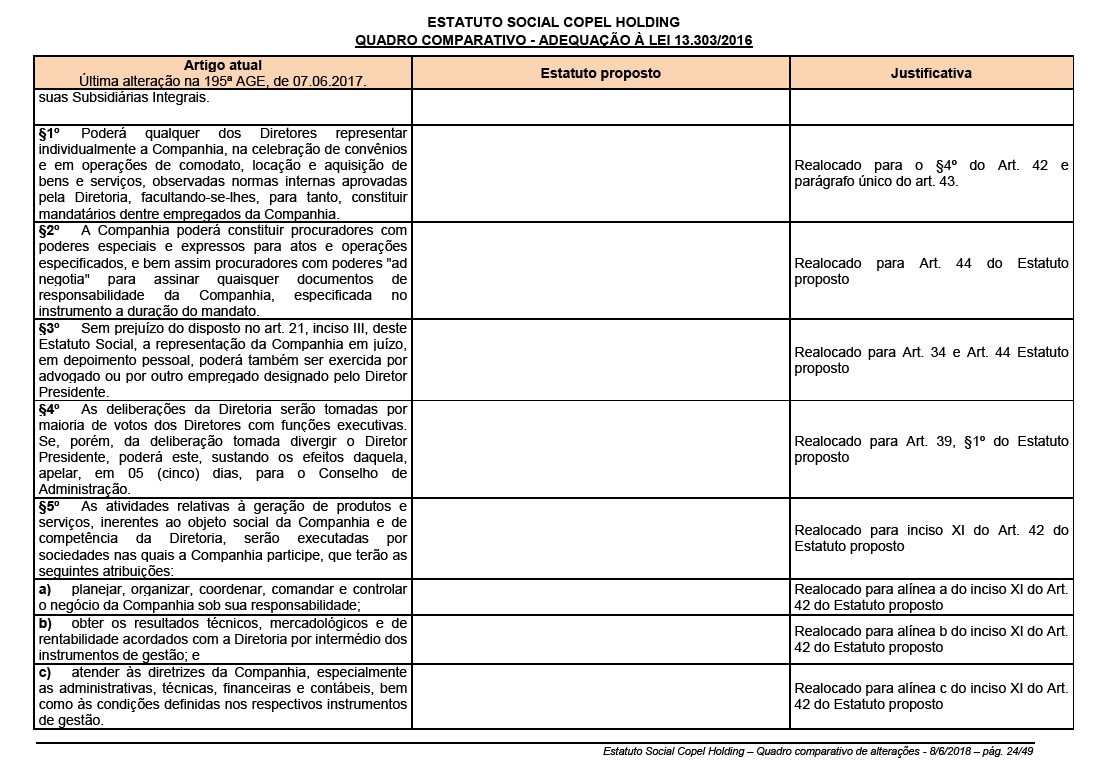

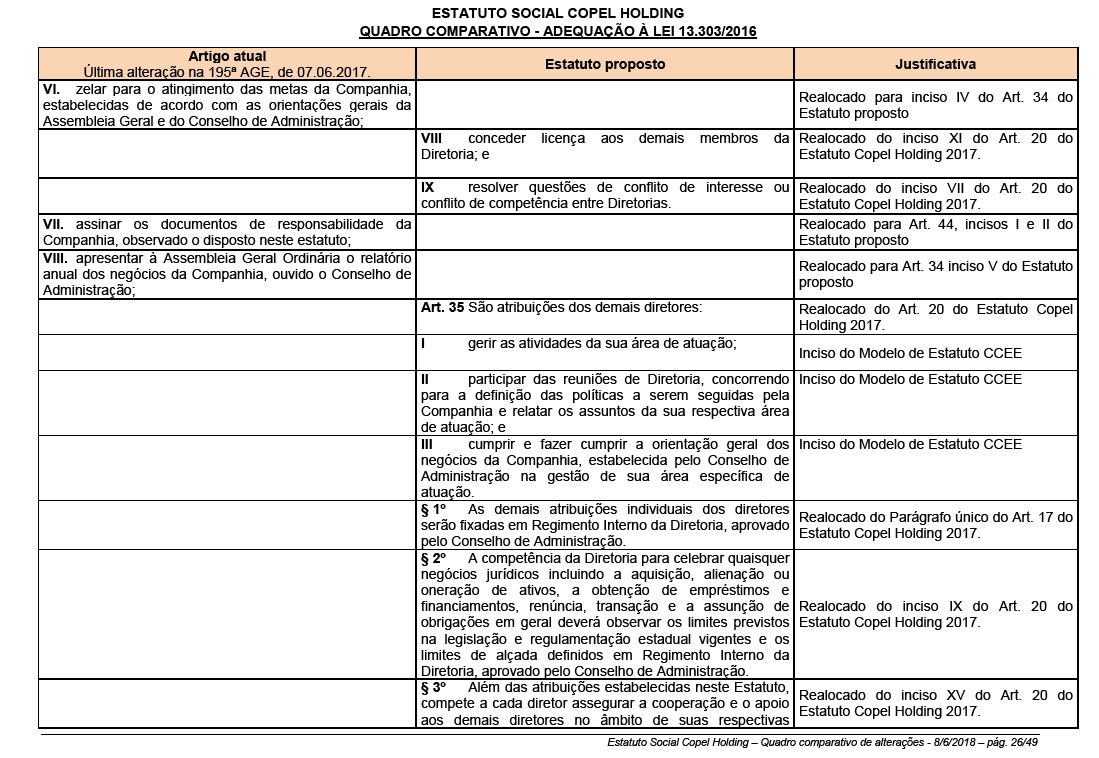

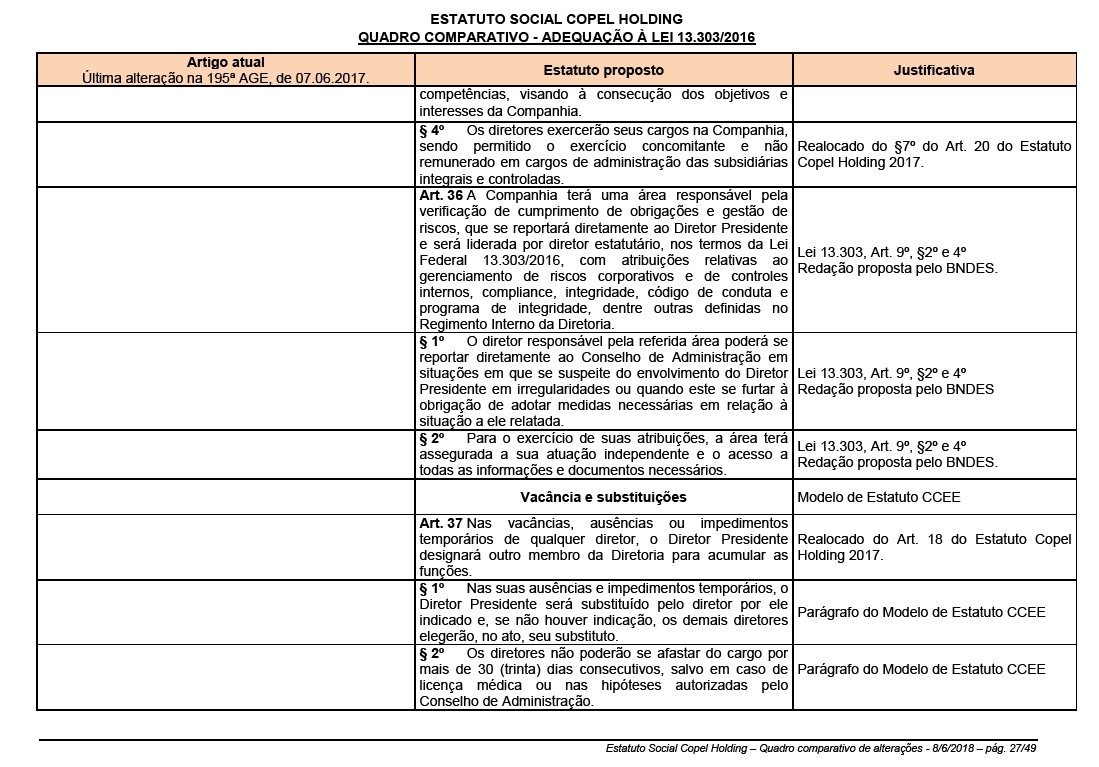

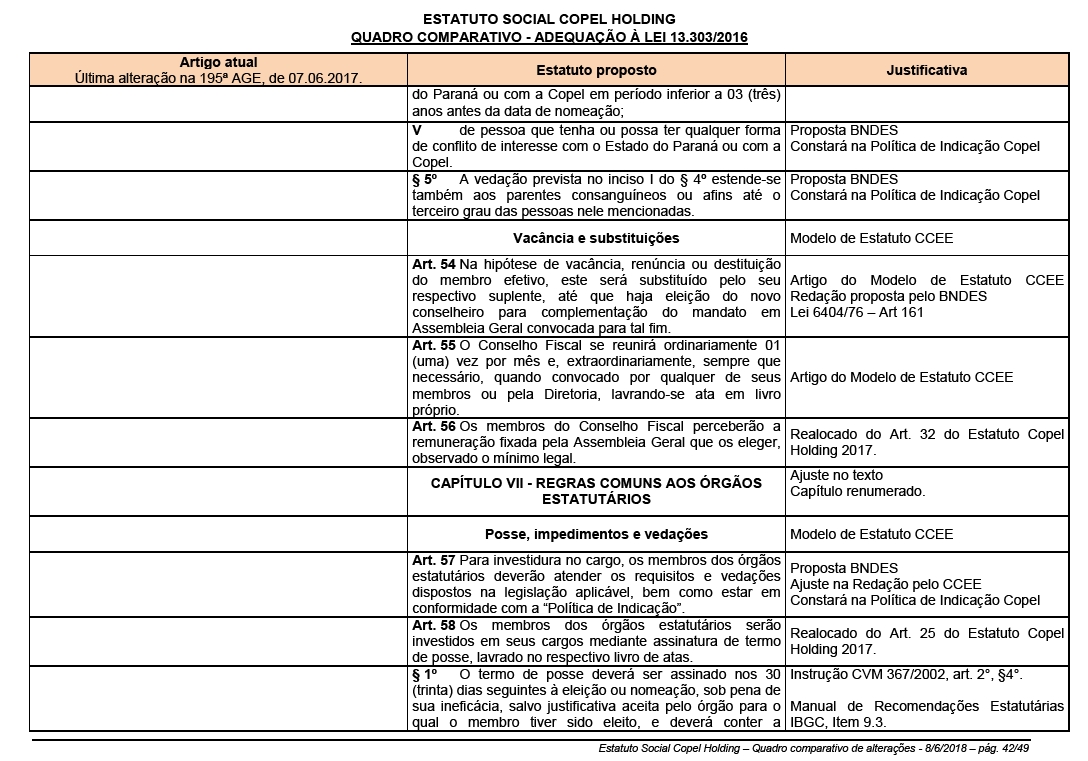

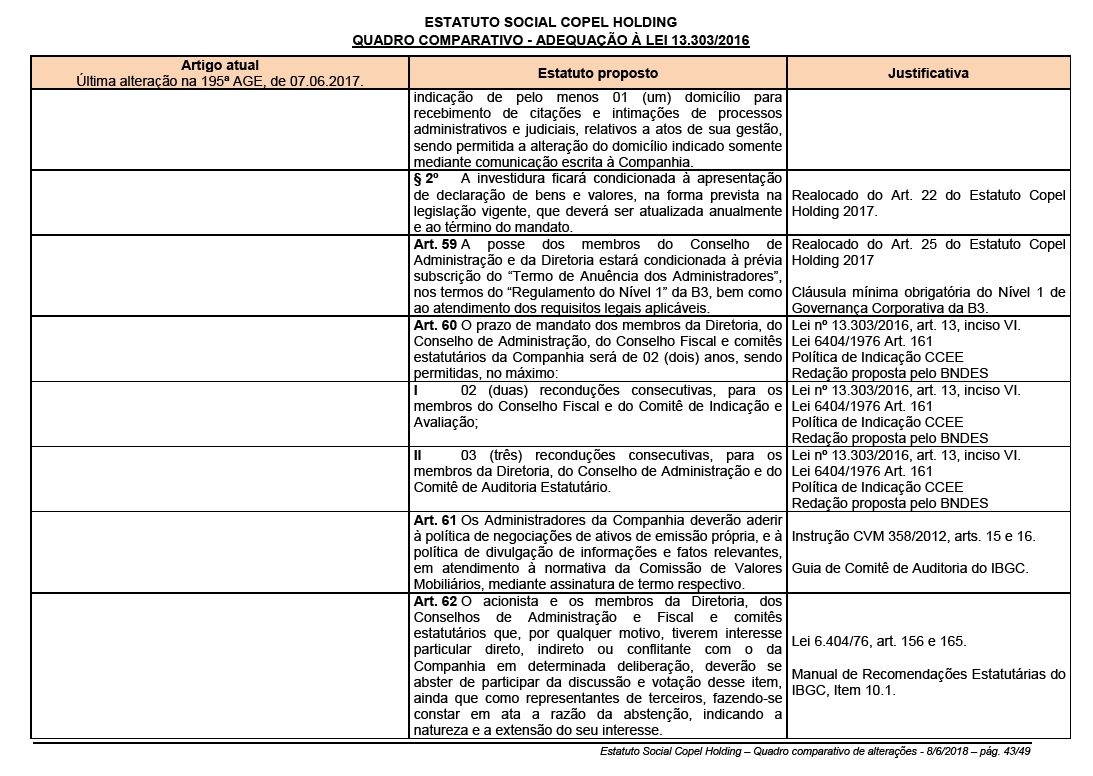

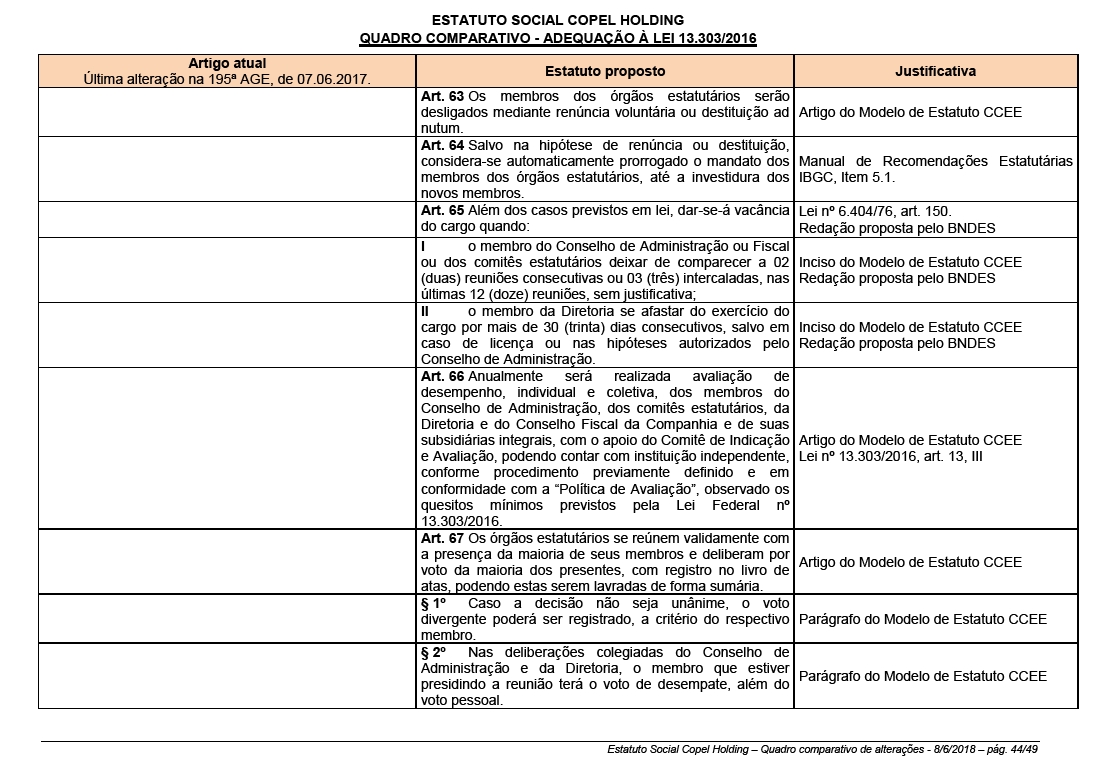

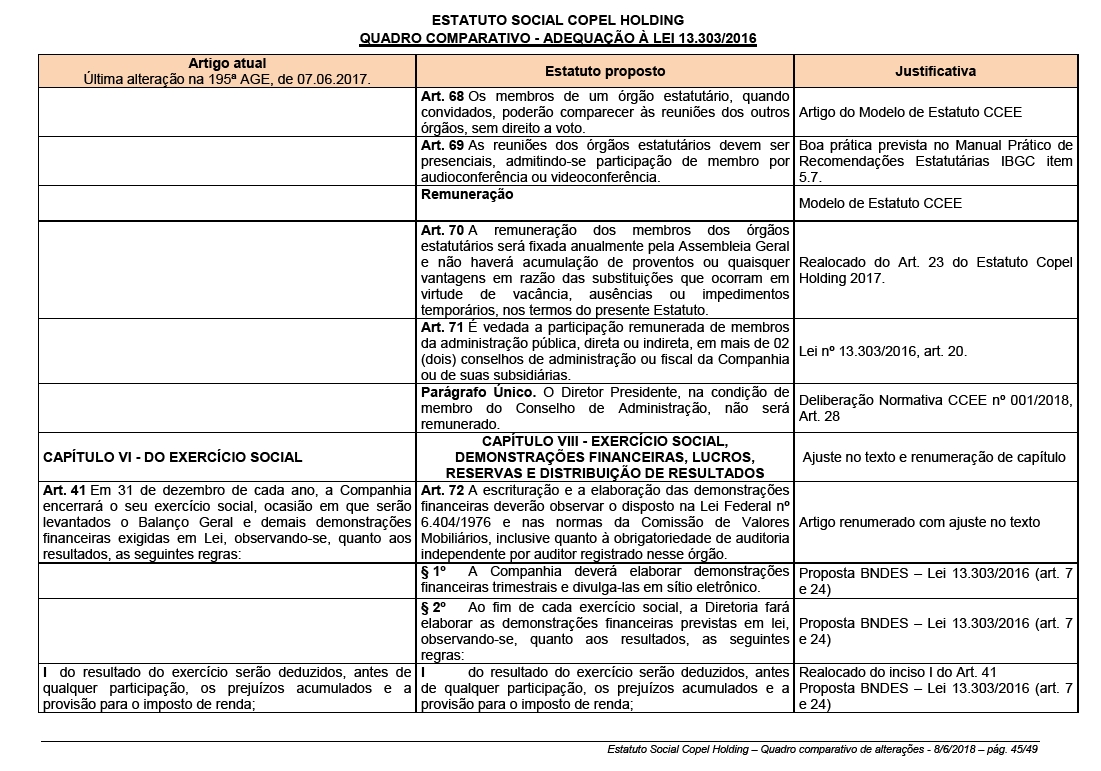

EXTRAORDINARY GENERAL MEETING

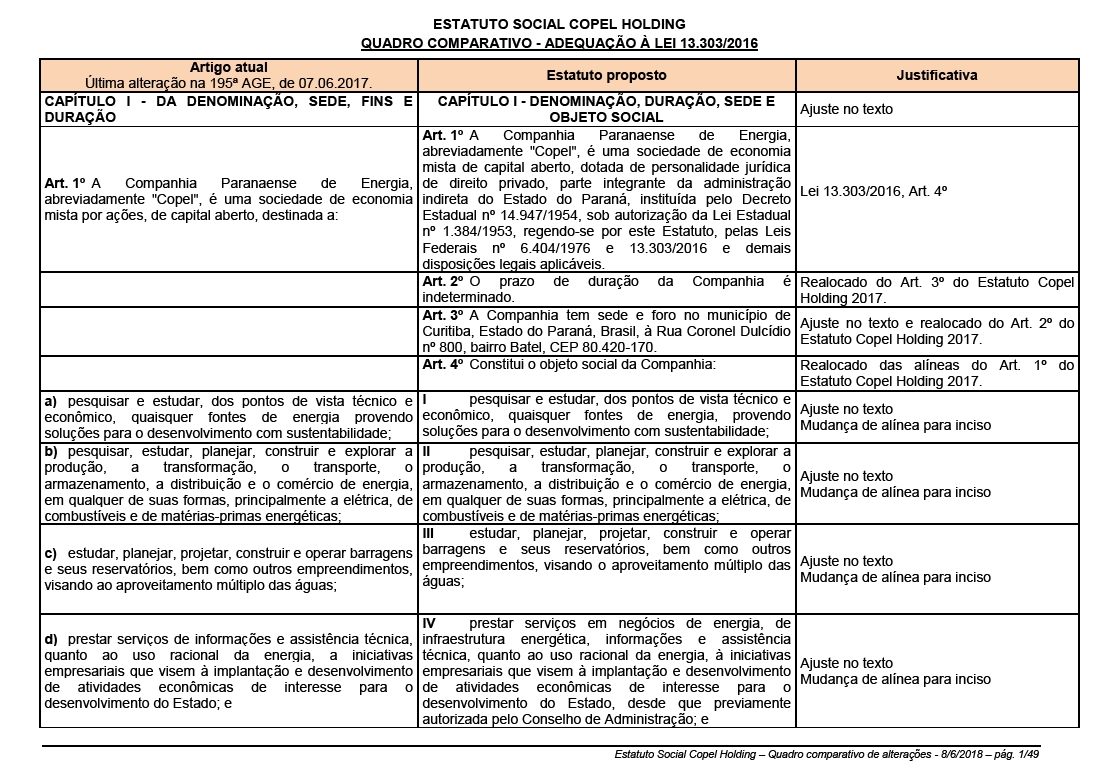

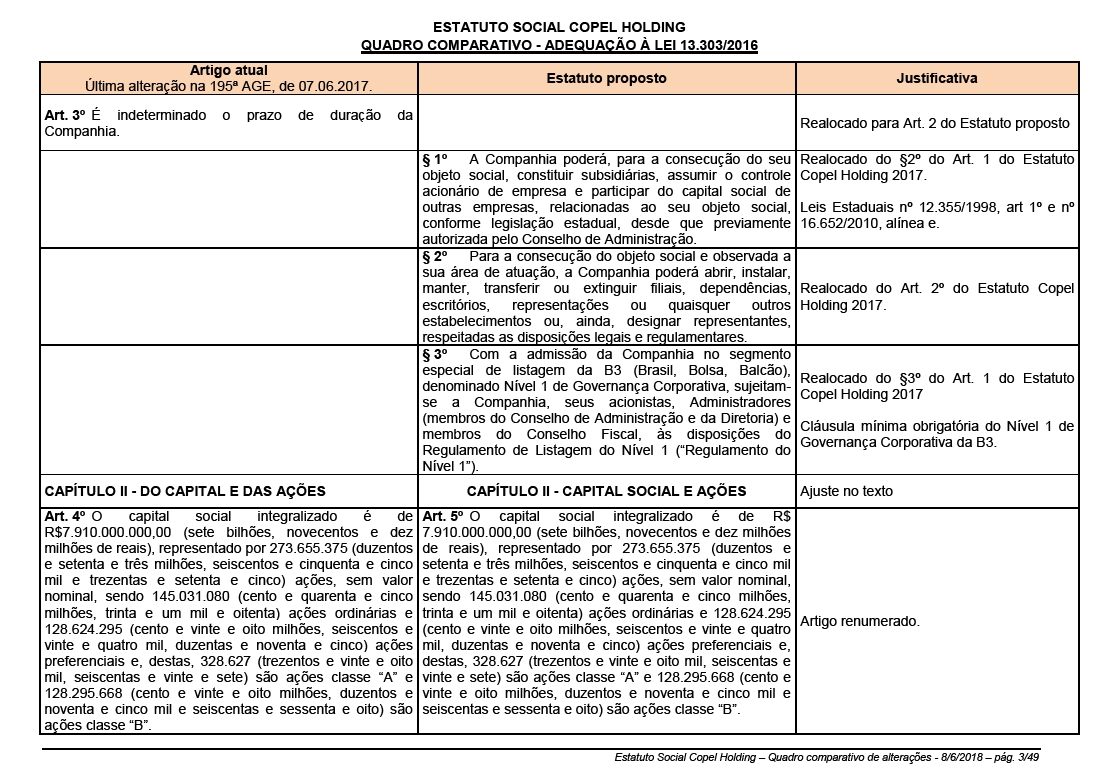

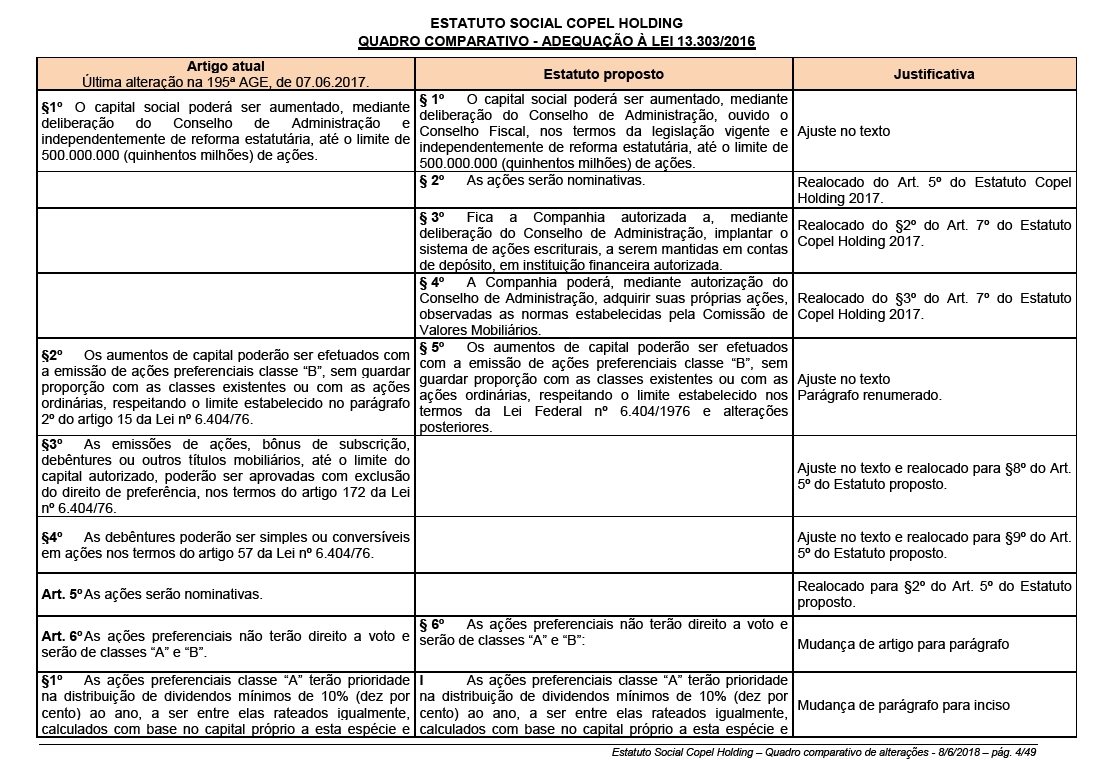

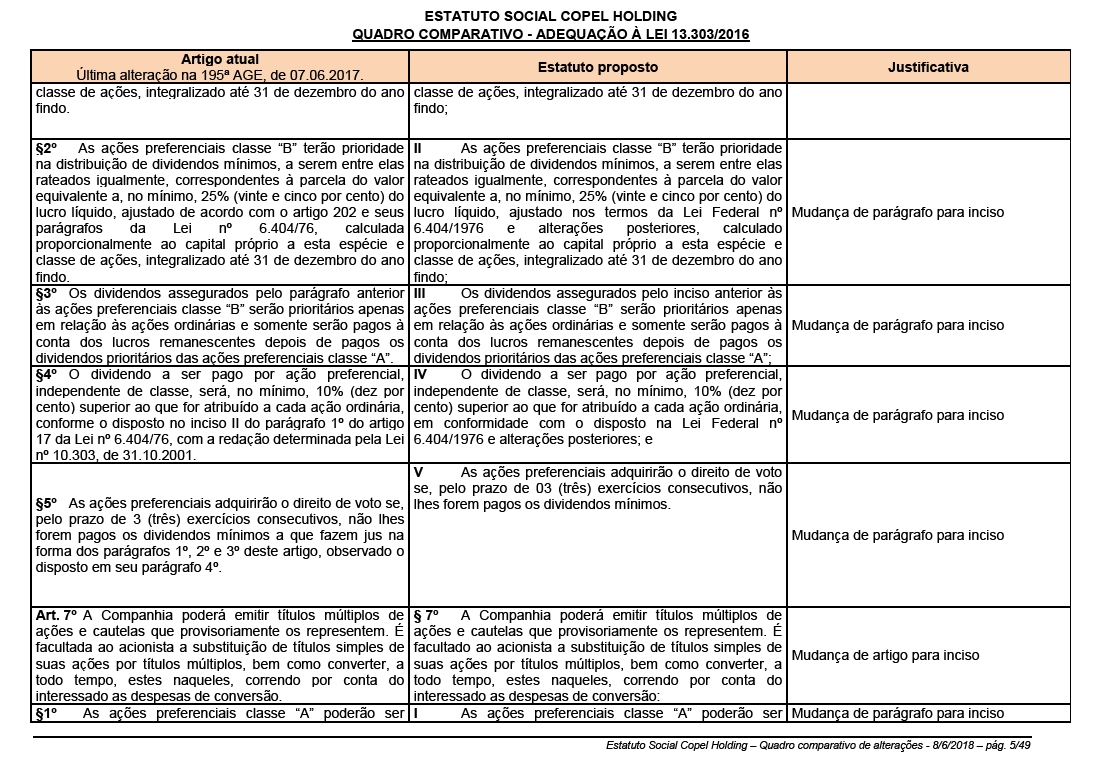

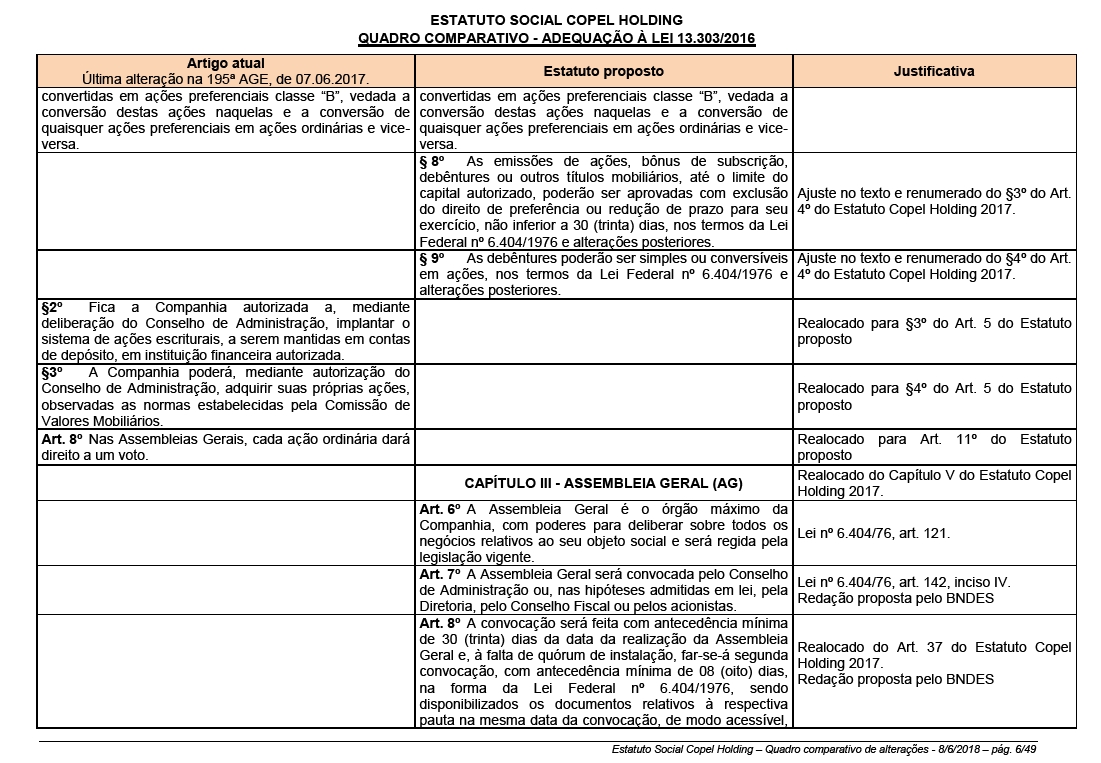

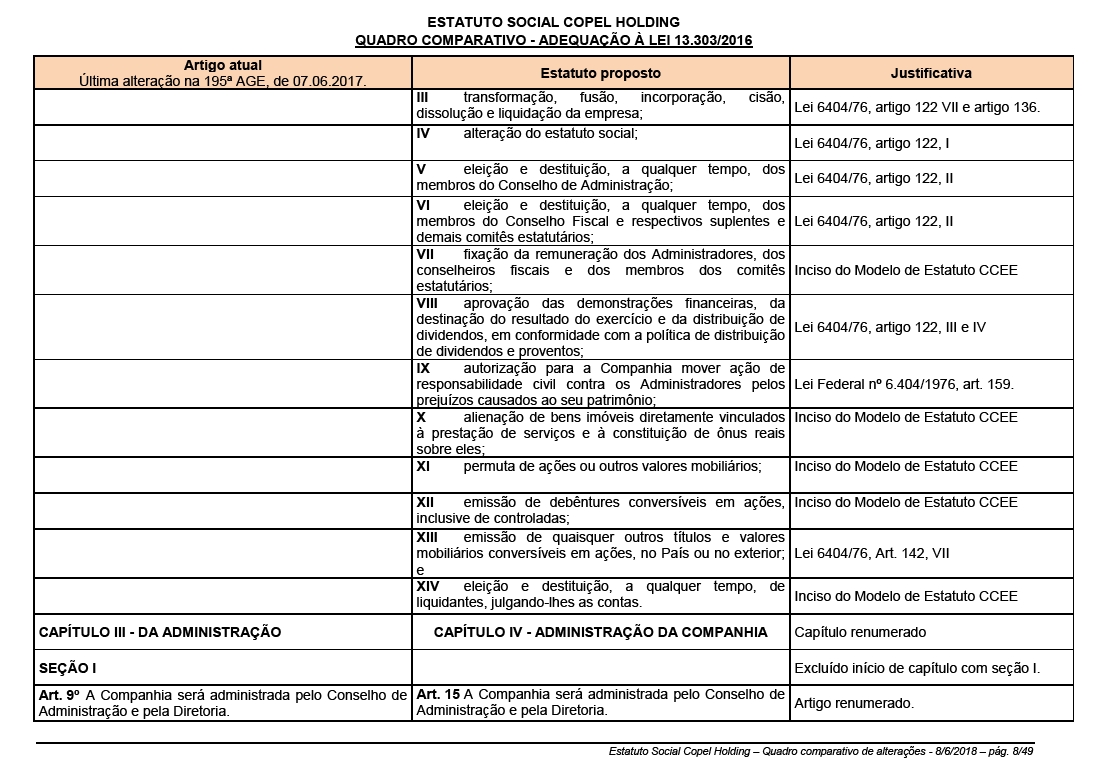

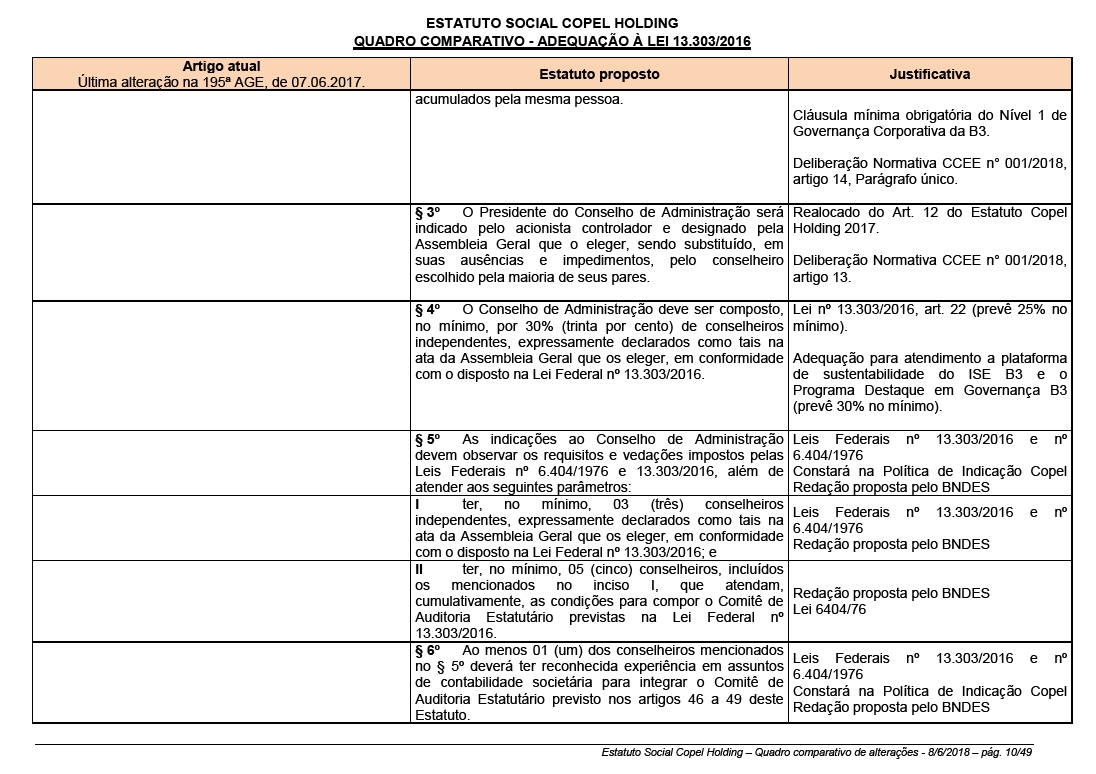

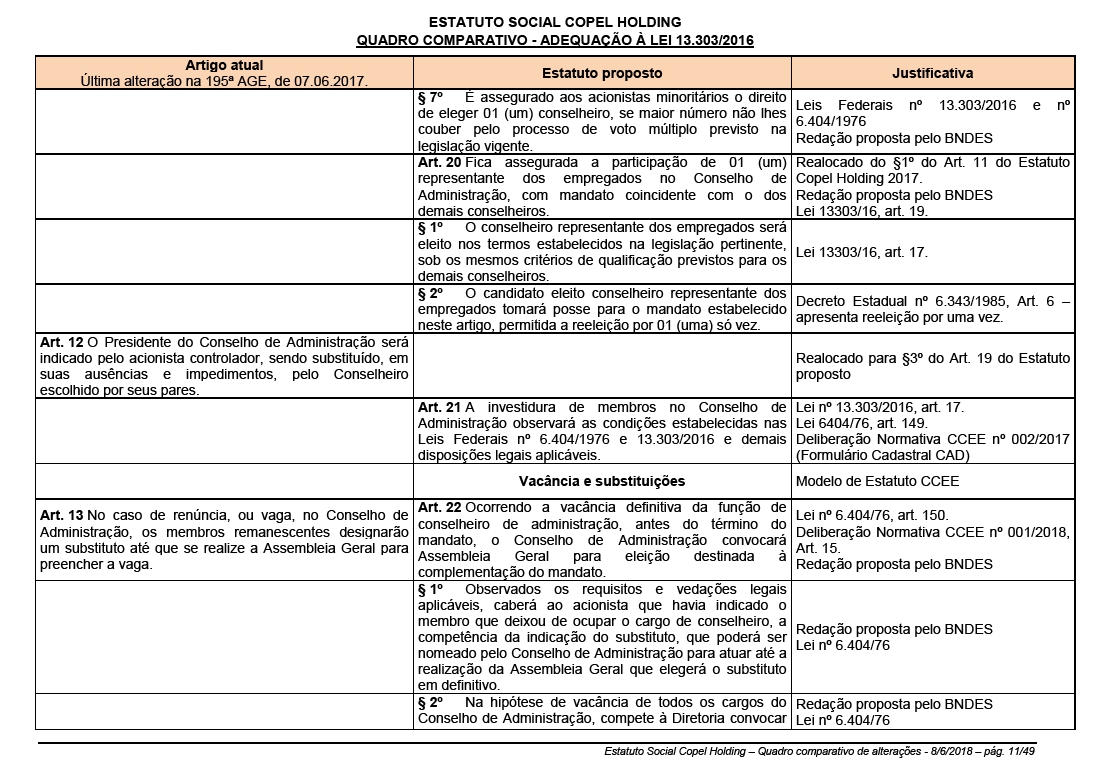

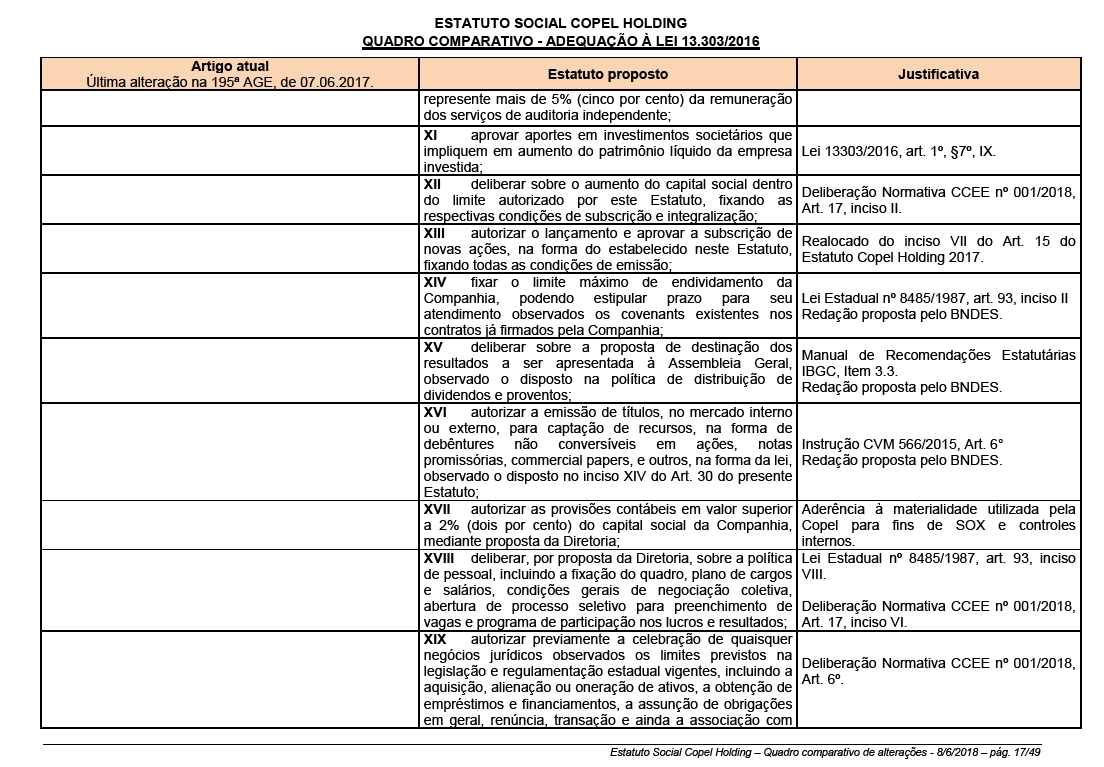

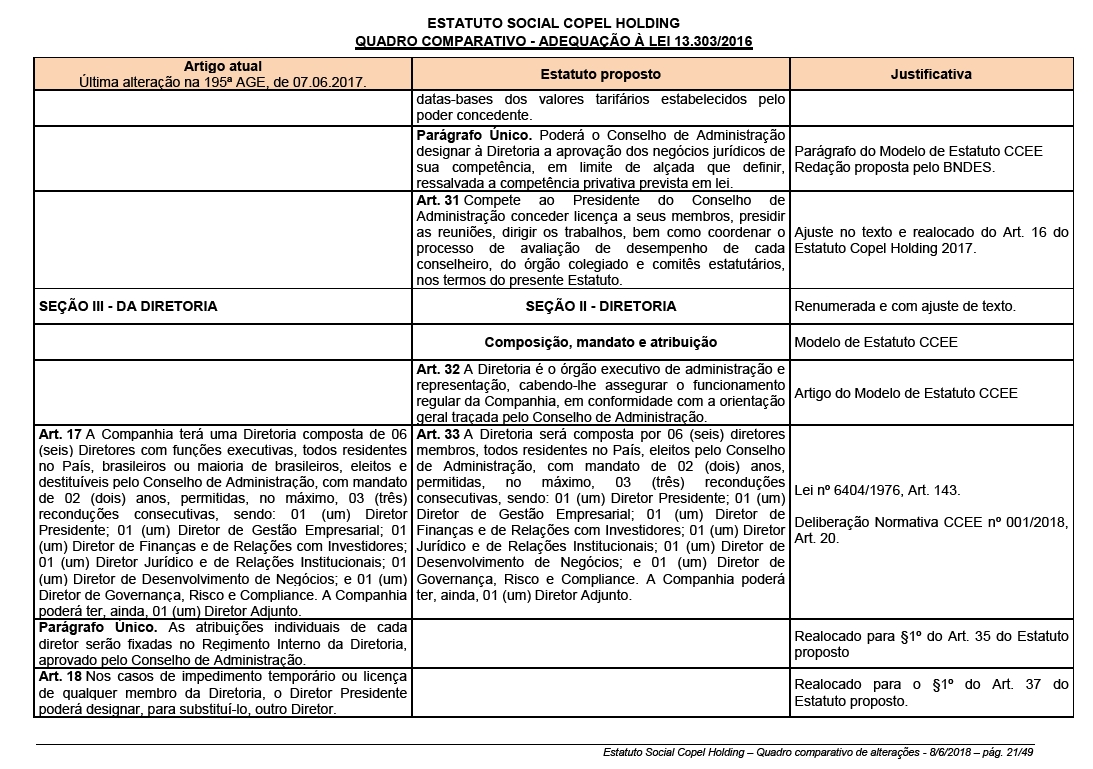

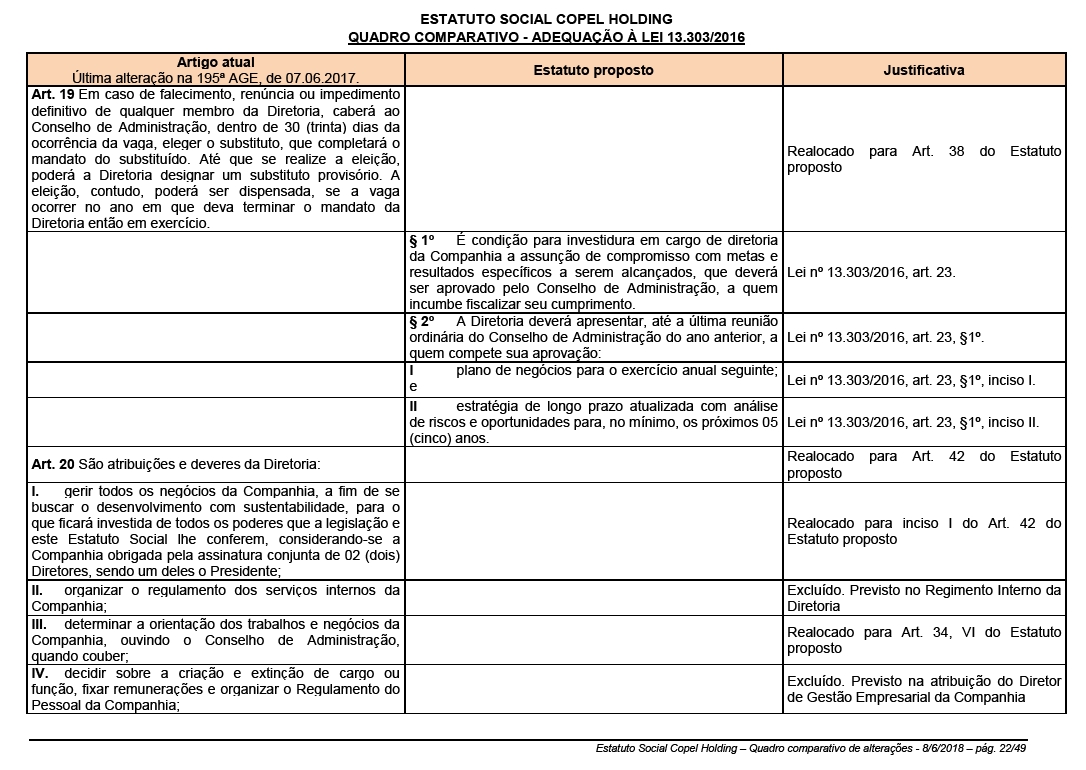

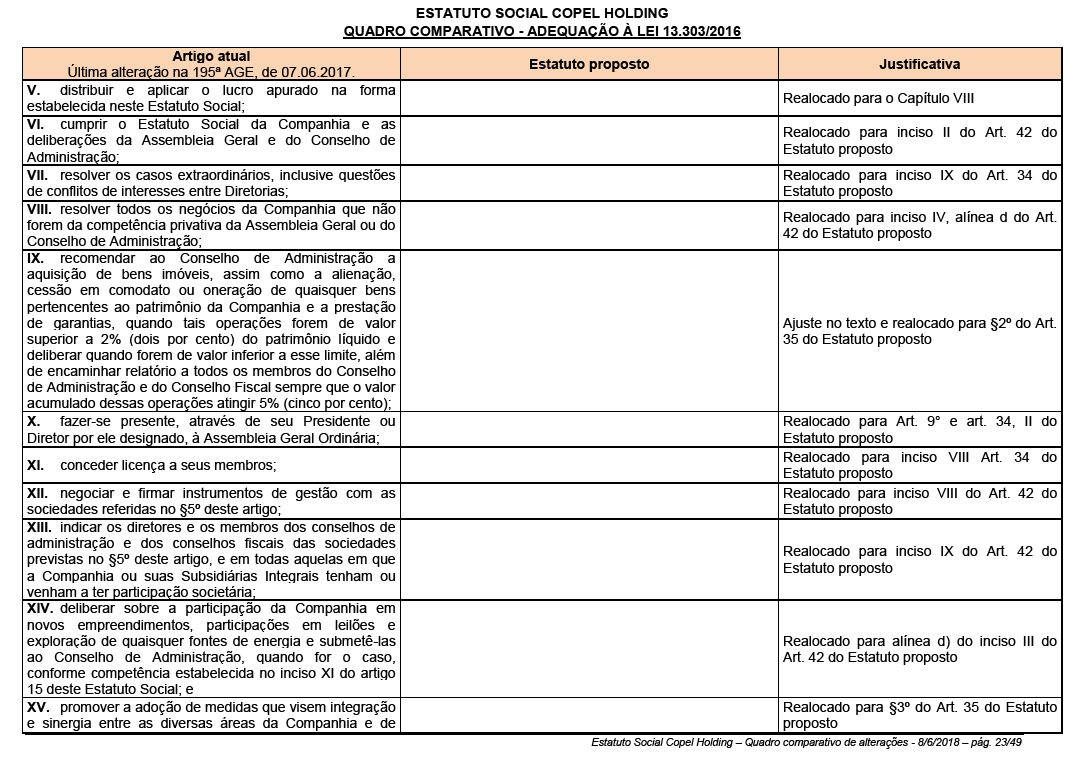

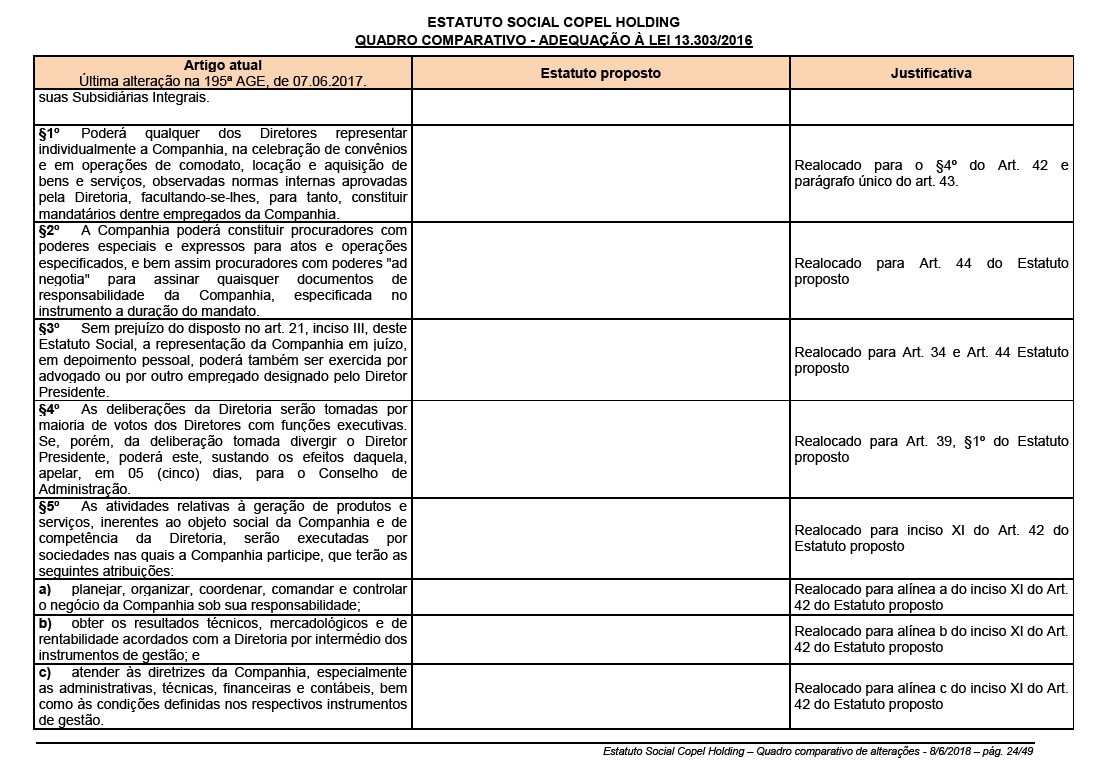

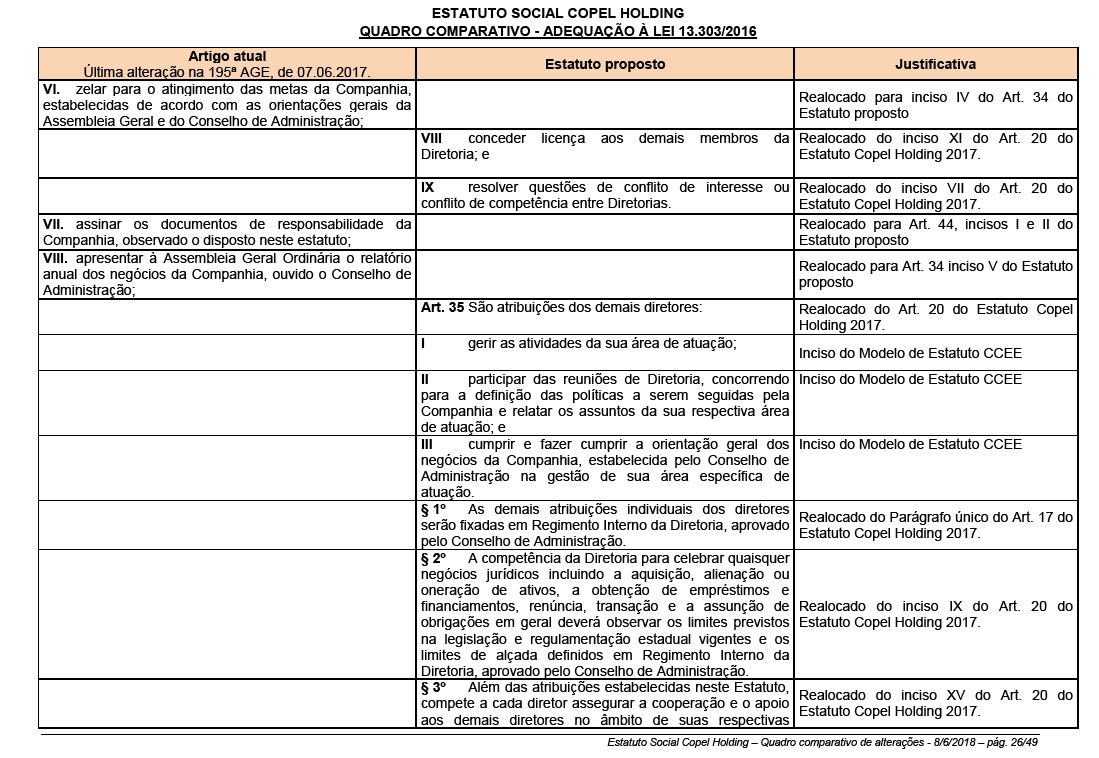

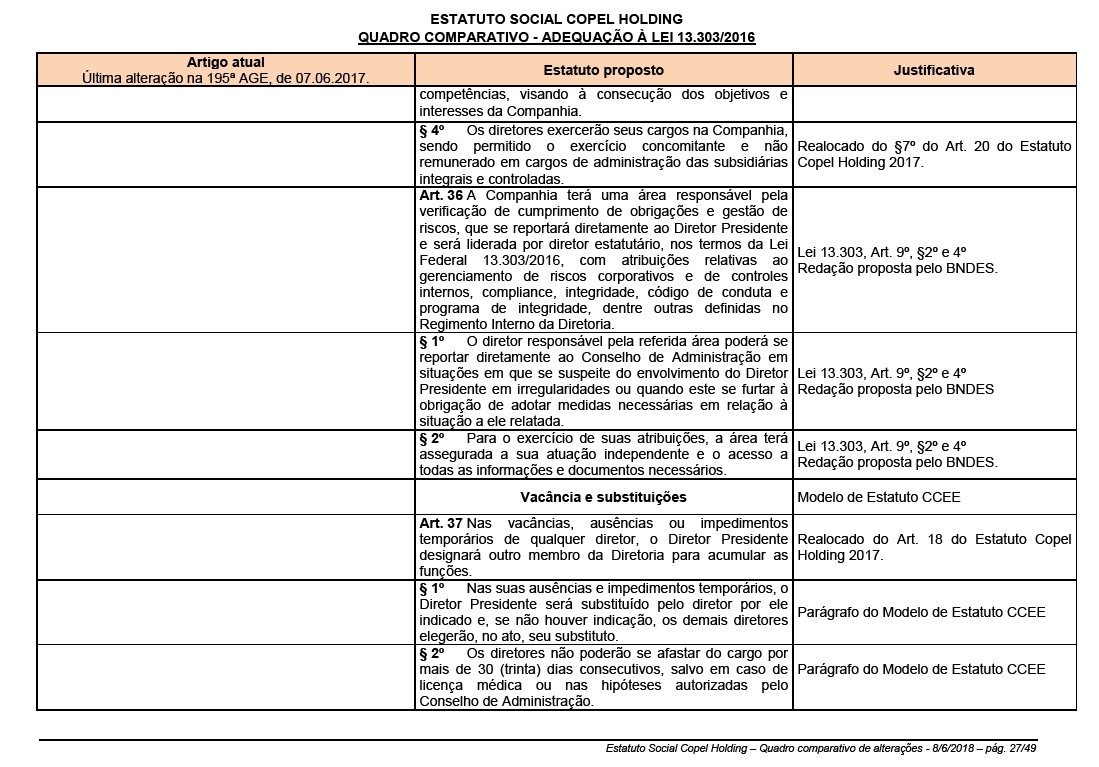

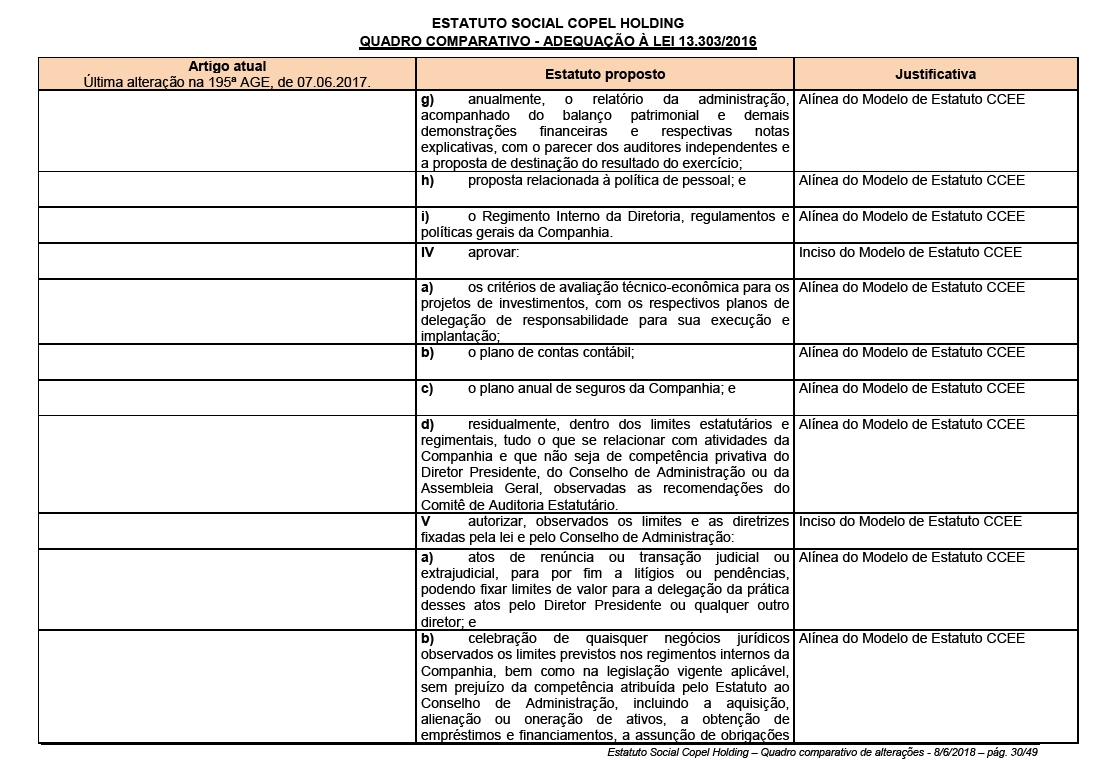

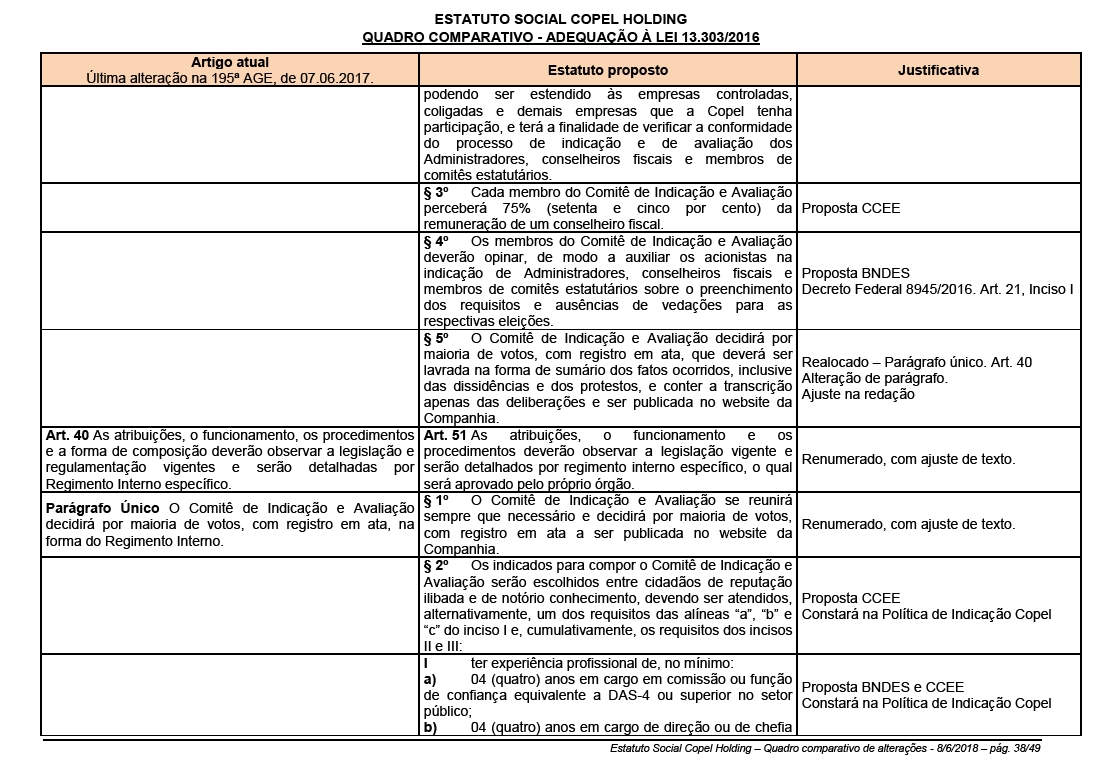

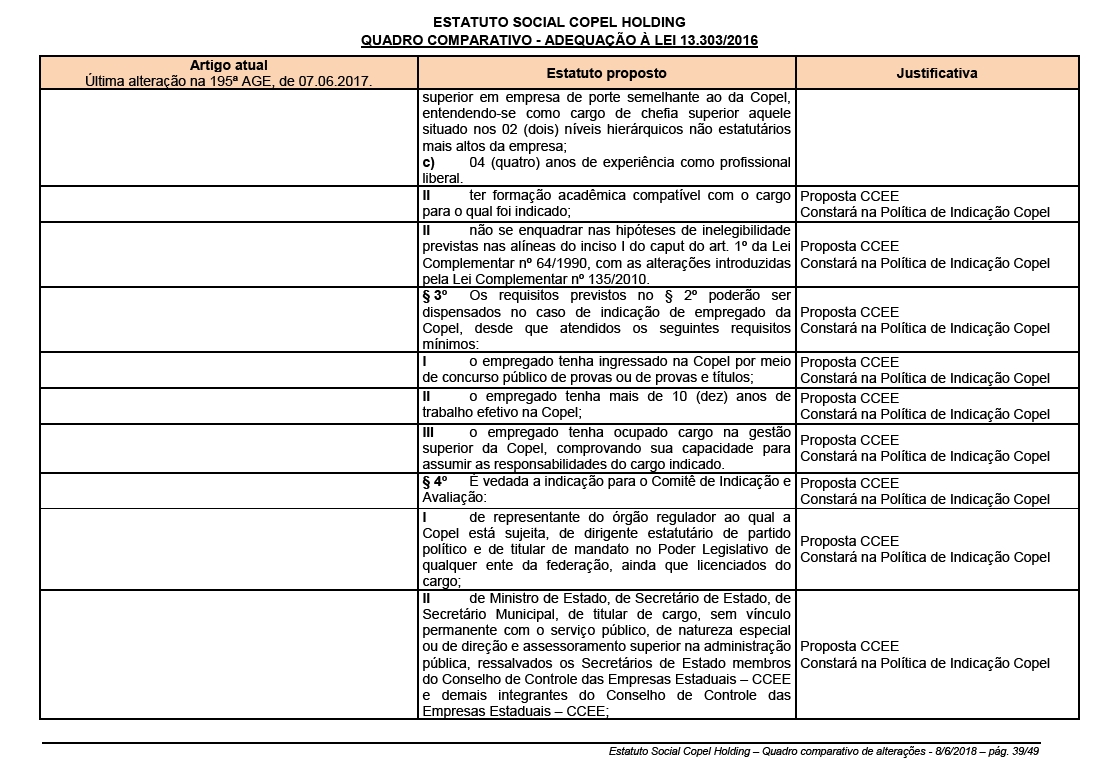

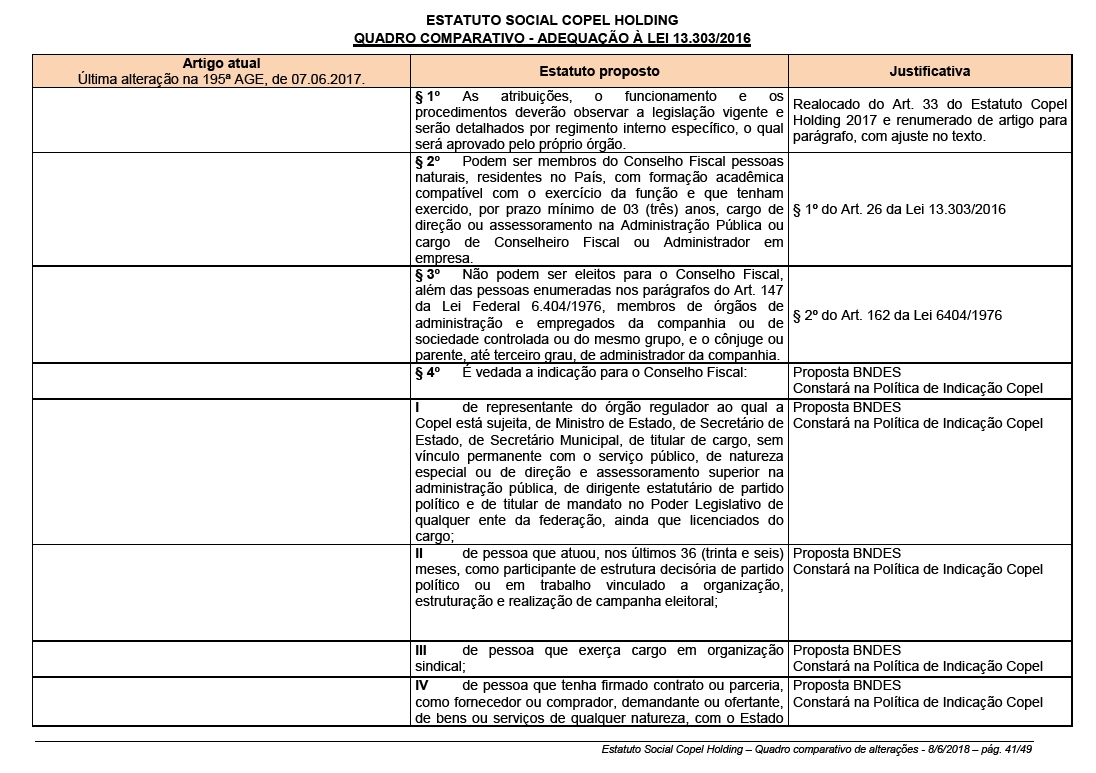

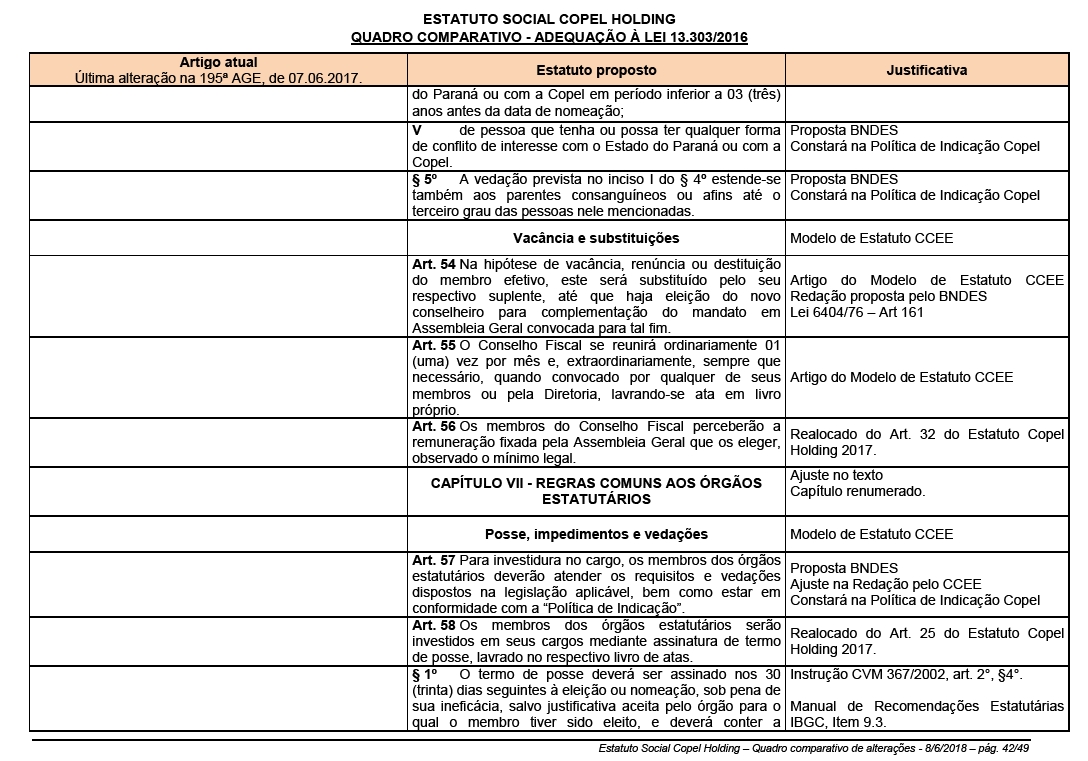

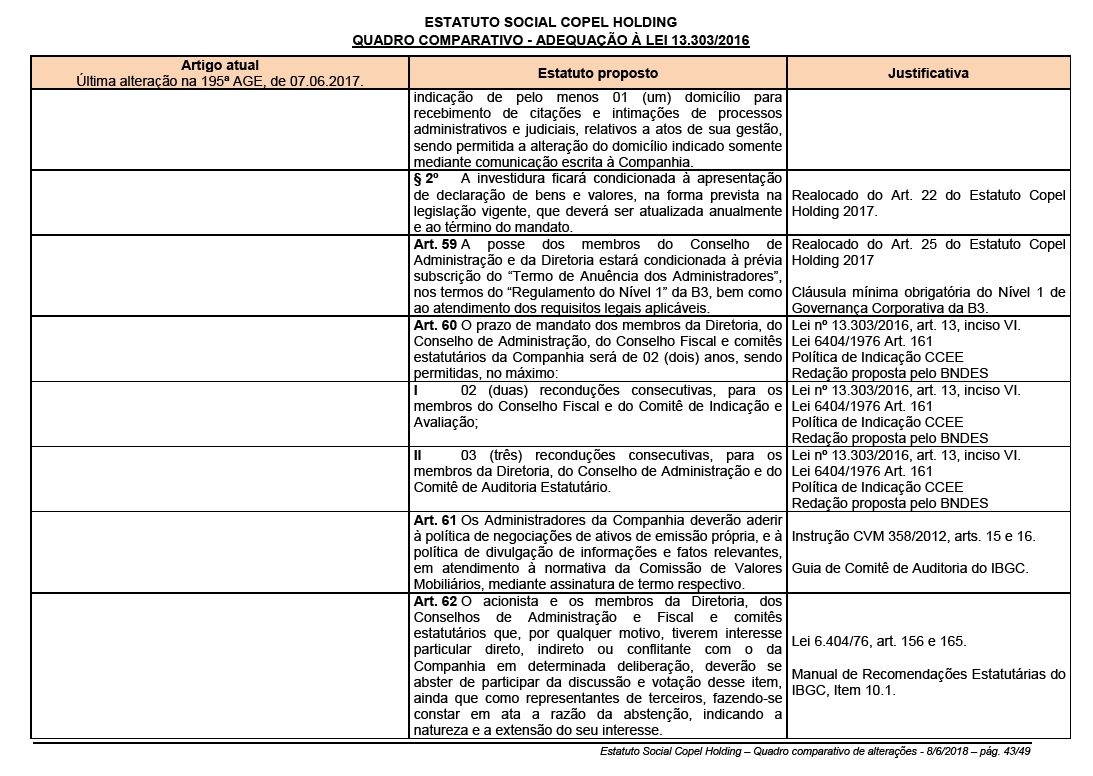

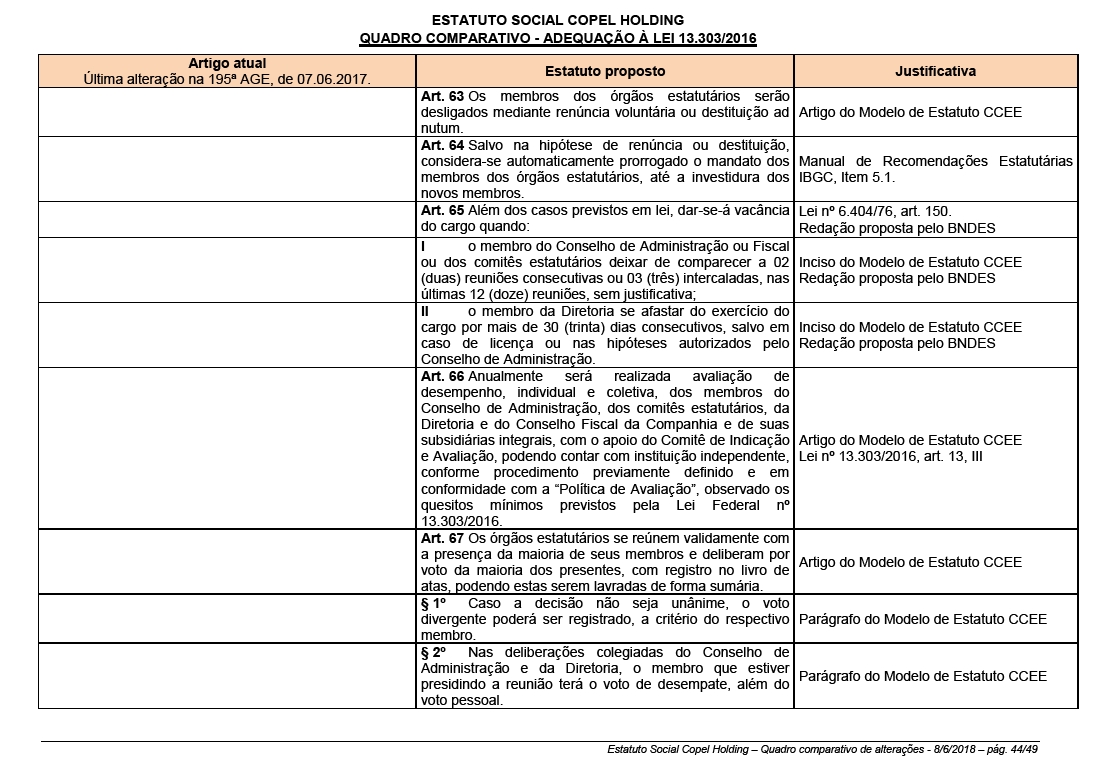

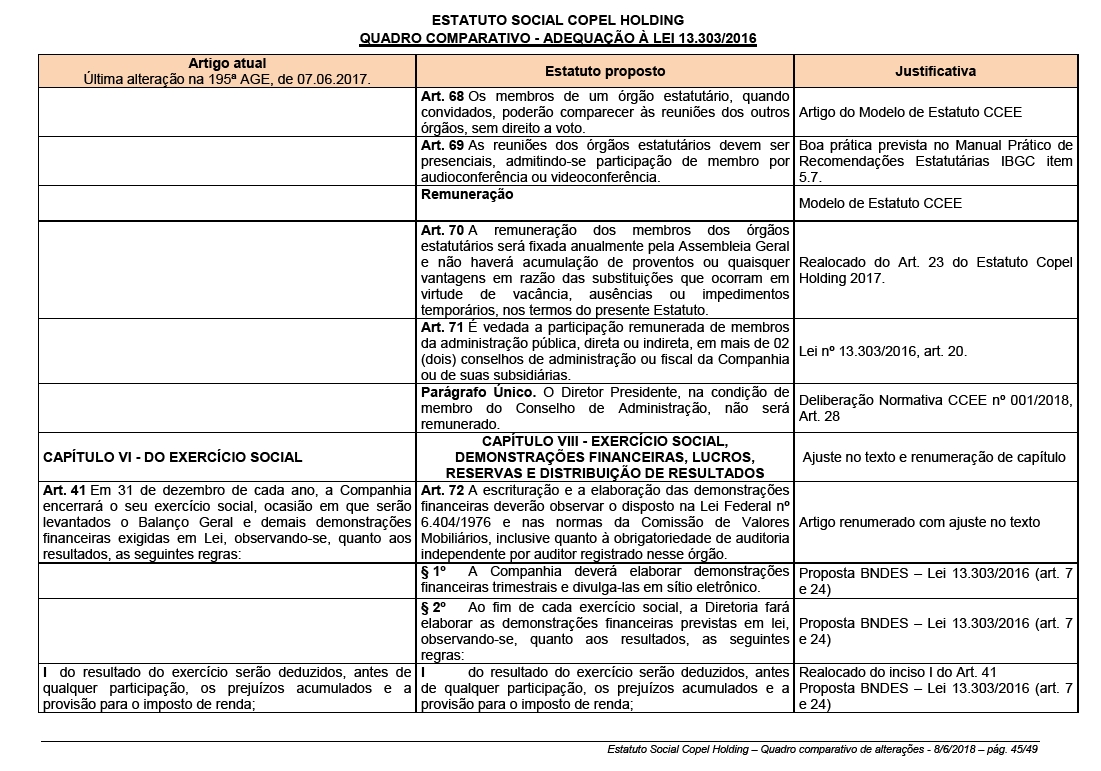

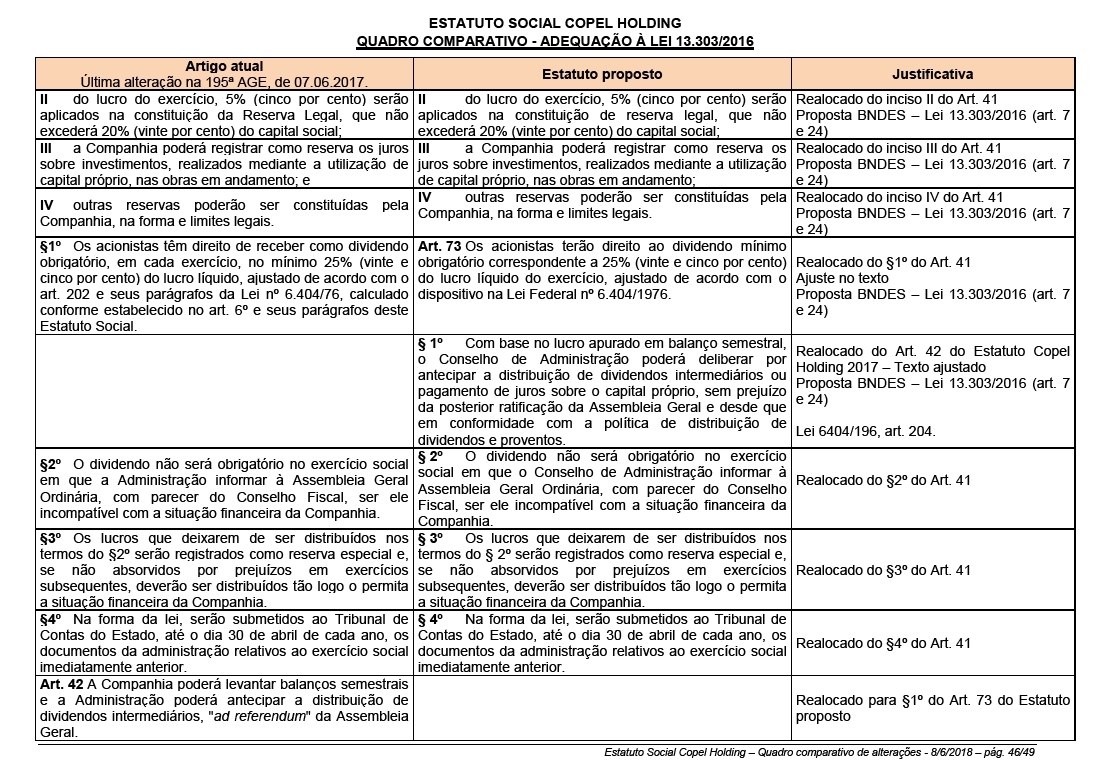

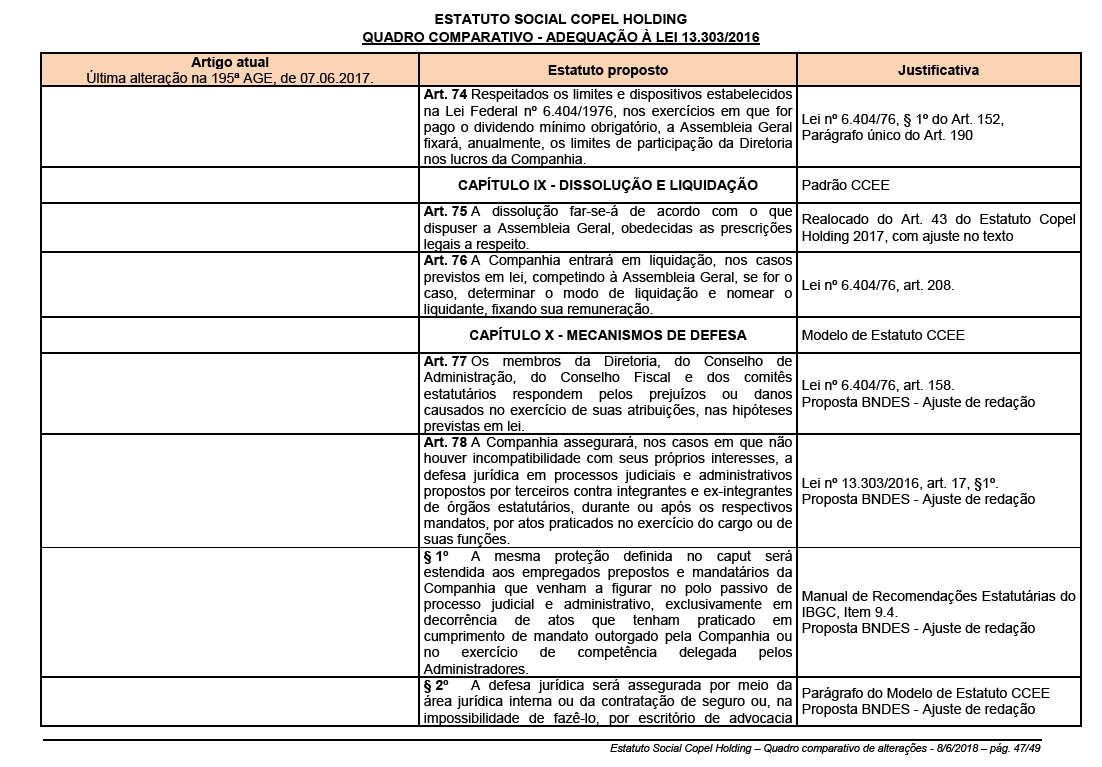

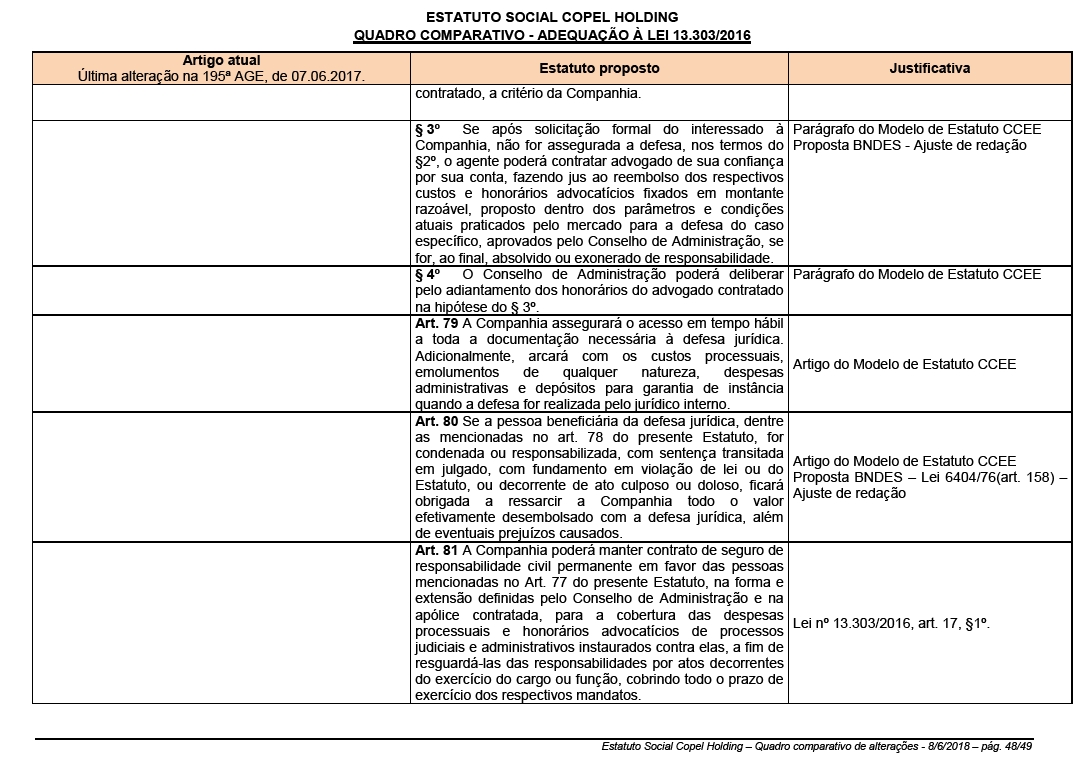

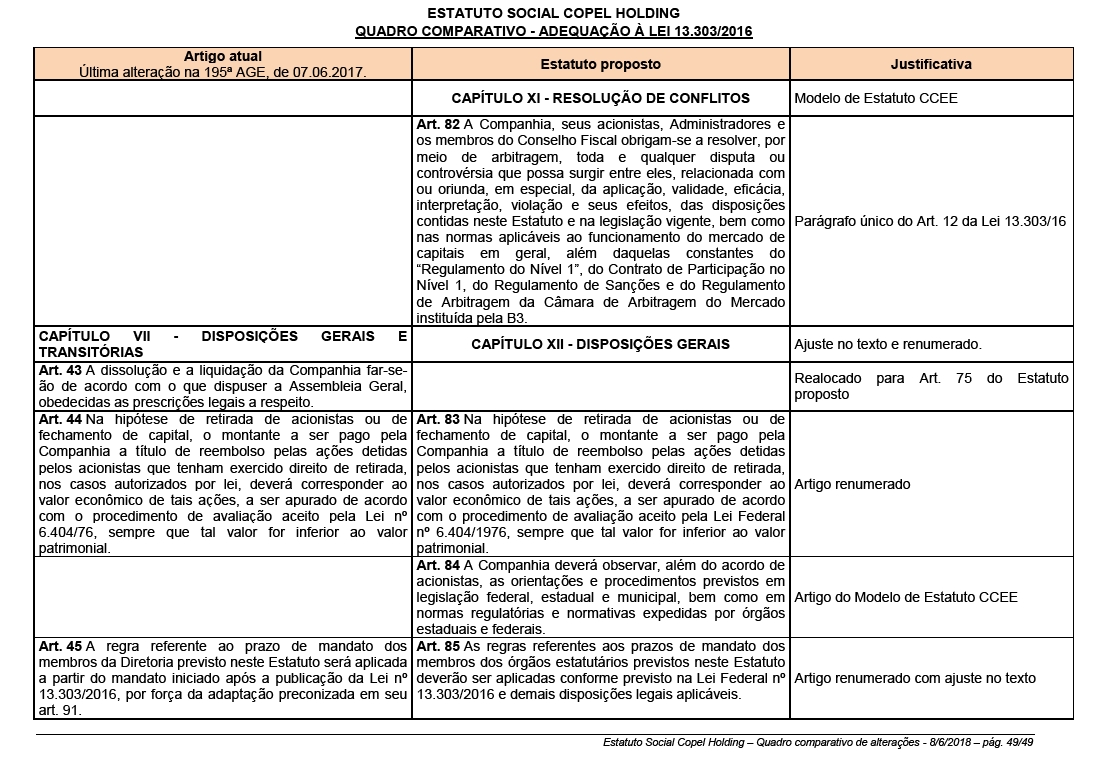

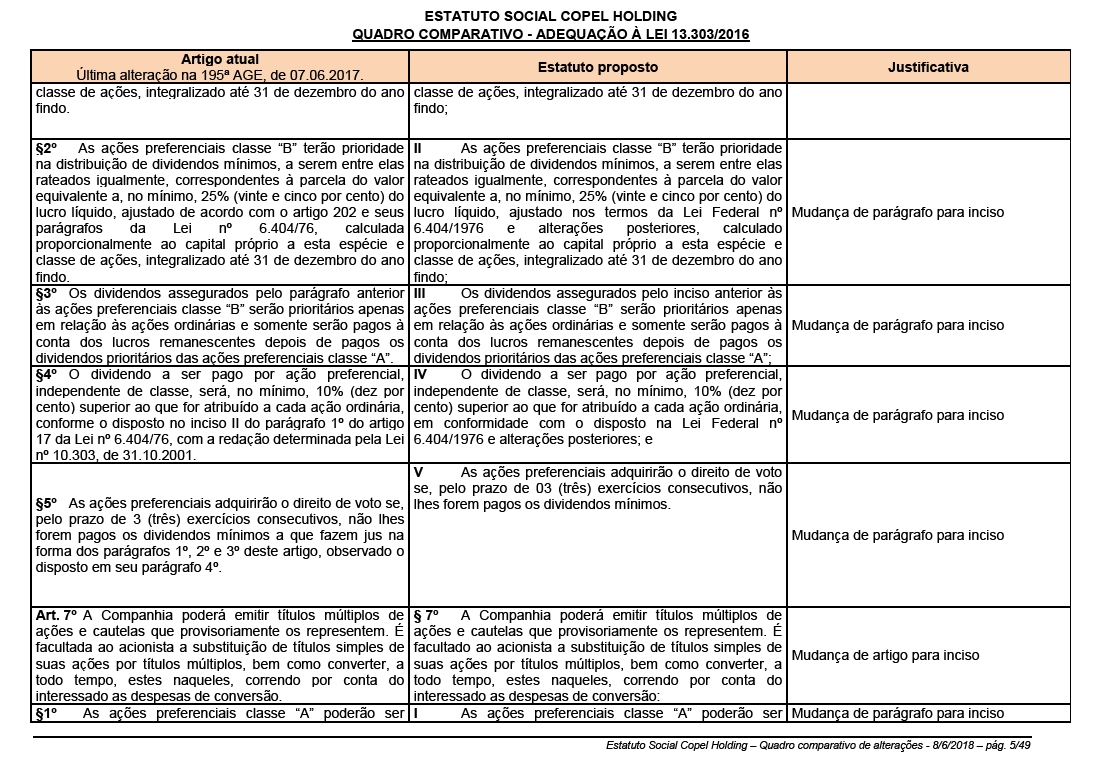

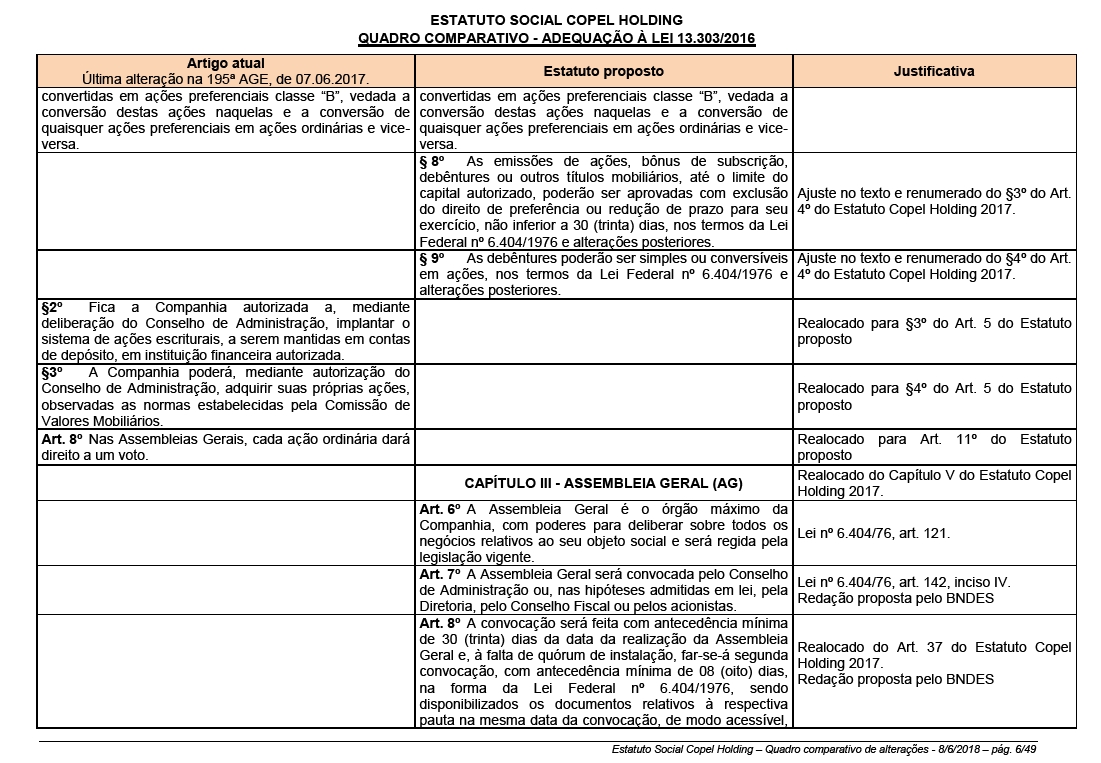

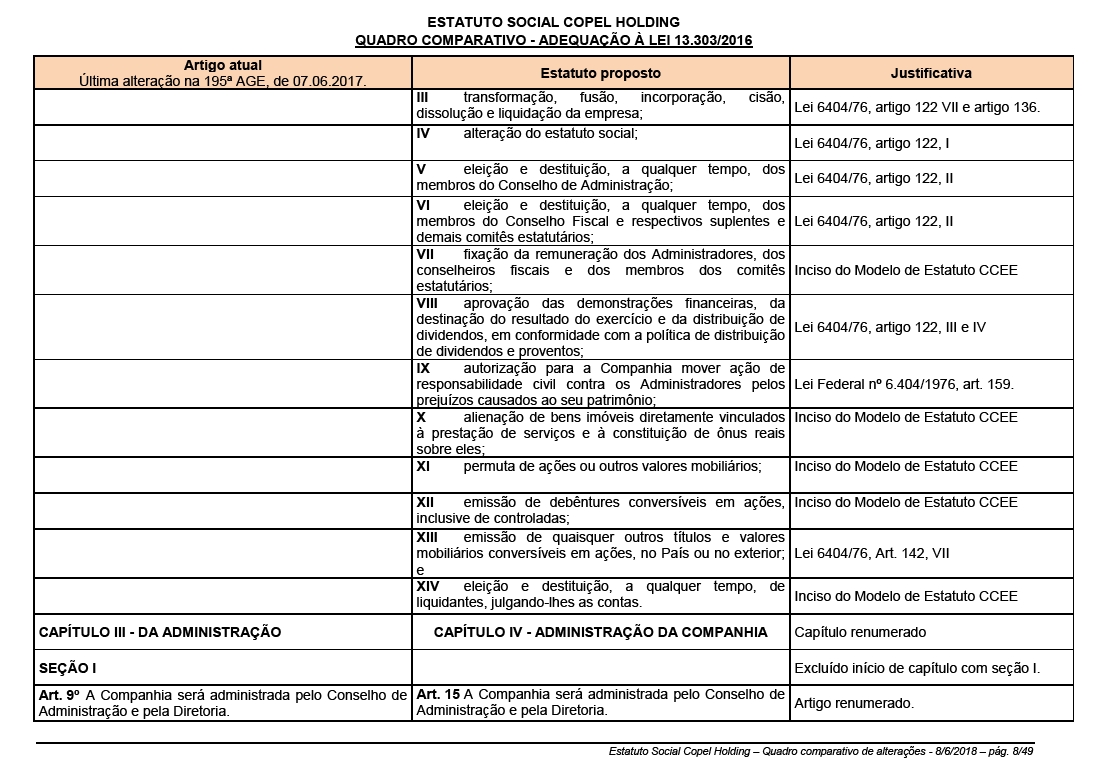

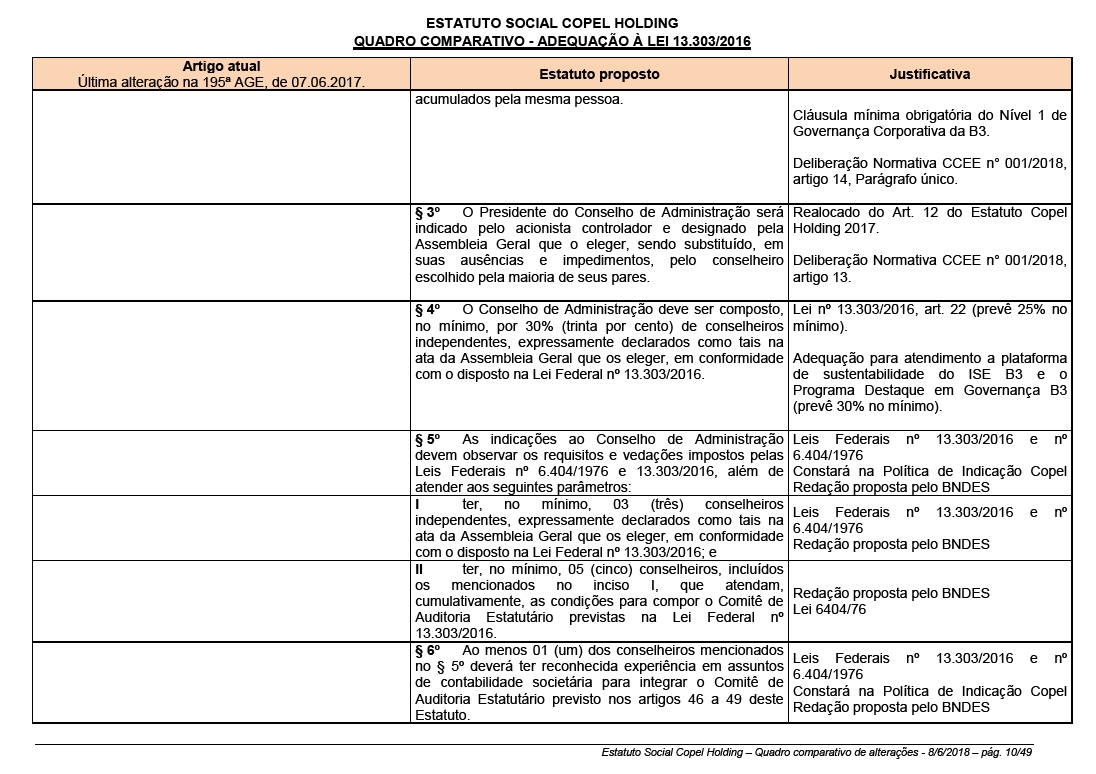

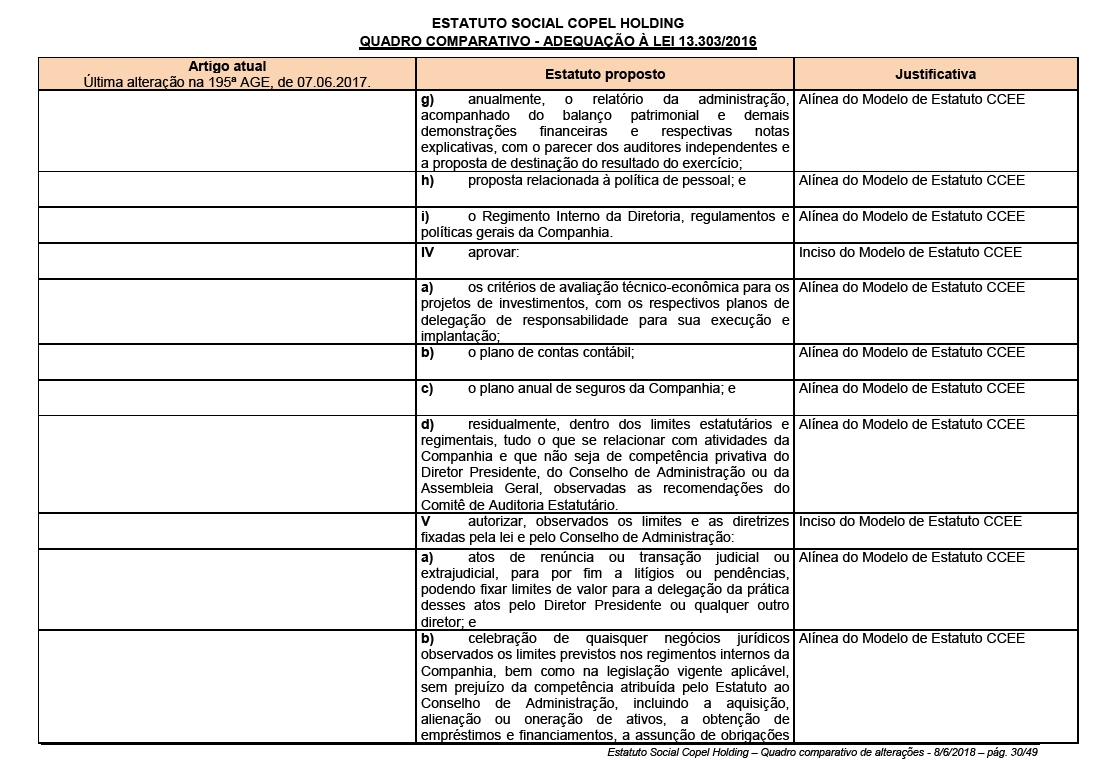

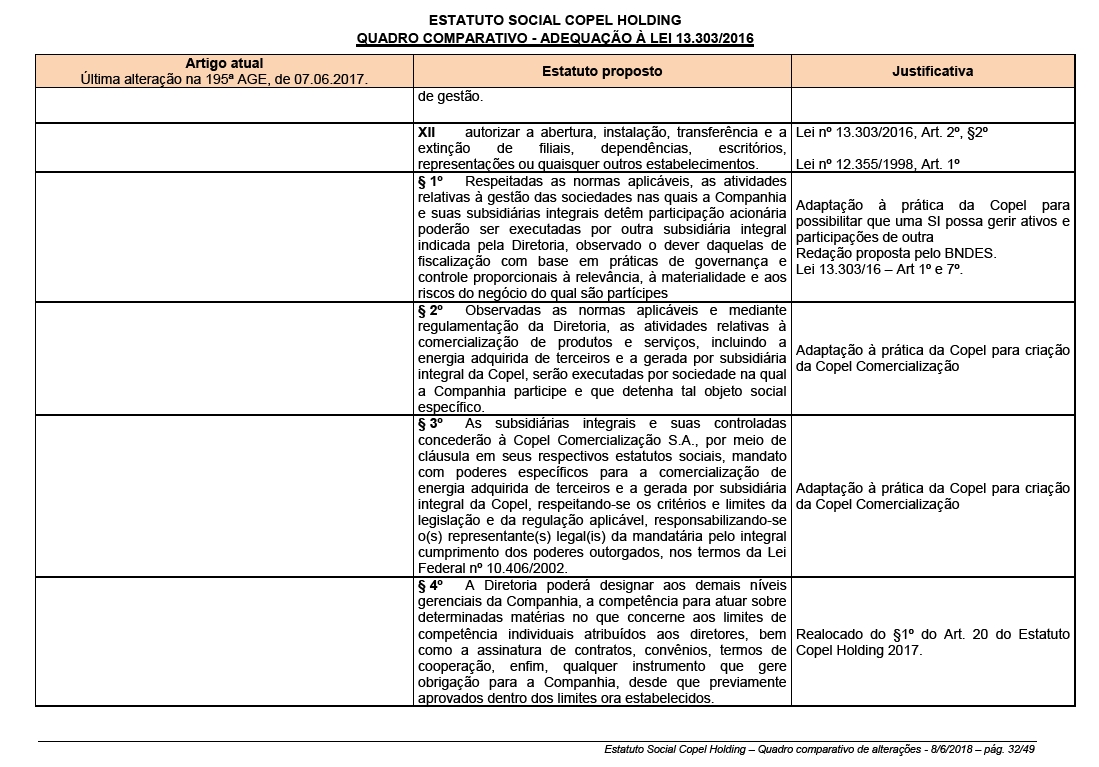

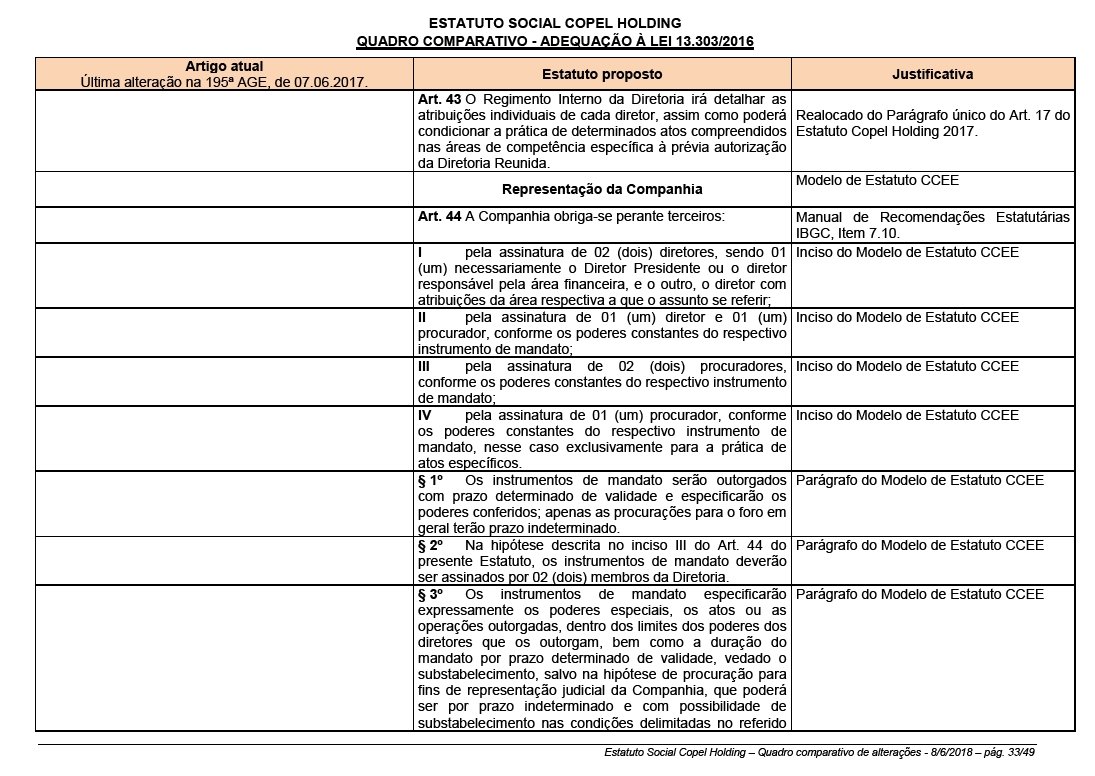

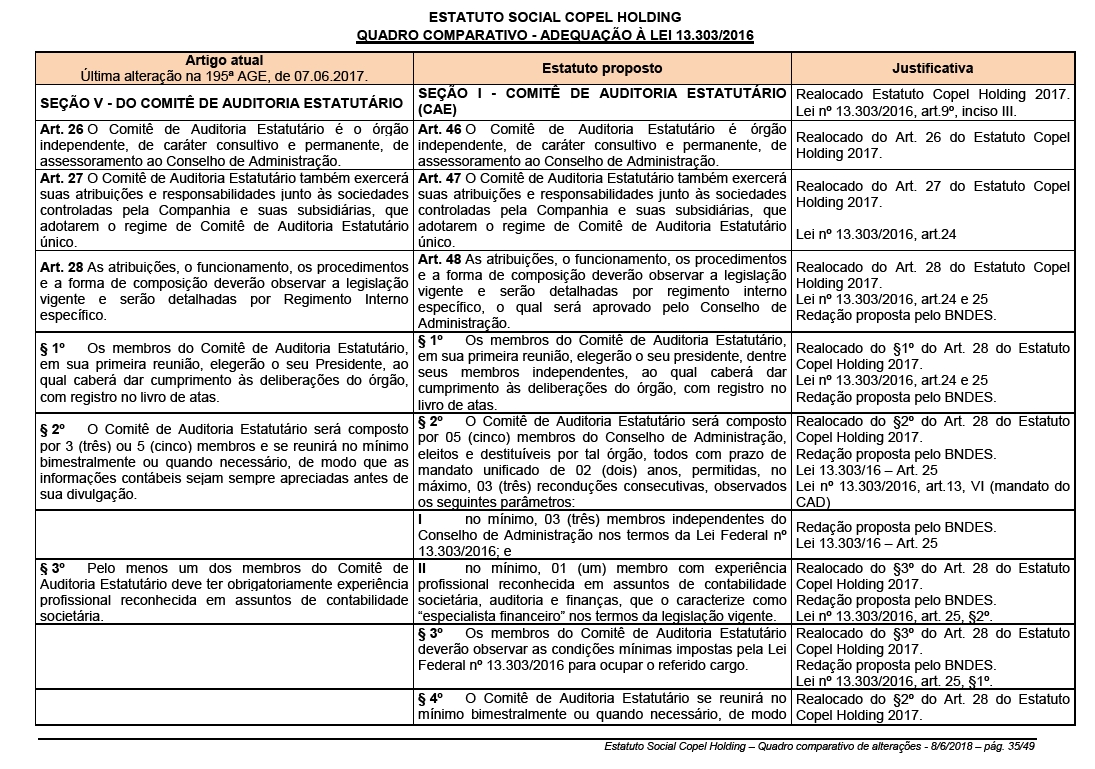

1. Analysis, discussion and voting on the proposal for alteration of the Company’s Bylaws, in order to adjust it to the dispositions of the Federal Law no. 13,303/2016, to CVM Rule no. 586/2017, to B3’s State Owned Enterprises Governance Program and other necessary adjustments considering the format proposed by the Control Council for State-Owned Companies of the State of Paraná - CCEE, according to good practices of corporate governance.Considering the extent of the reform, the description is found in a “From - To” table, as an annex to the Manual for Participation on General Meetings; and

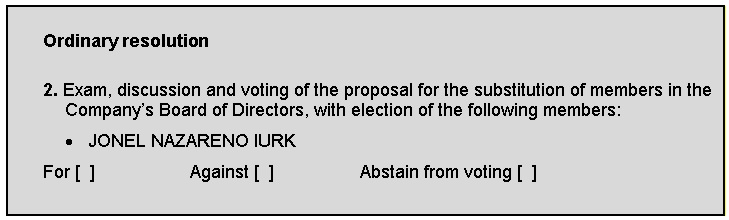

2. Substitution of members in the Company’s Board of Directors.

Notes: a) Documents referring to the matters to be discussed at the Extraordinary General Meeting, in addition to the Manual for Attendance in Meetings, are available for shareholders’ consultation at the Company’s headquarters as well as on its website (ri.copel.com);b) The Company’s shareholders shall take part in the Extraordinary General Meeting by attending it and casting his/her vote on the meeting’s agenda items or by appointing a proxy with powers to represent him/her; andc) Powers-of-attorney for the Extraordinary General Meeting shall be filed at the Company’s head office, at the Chief Financial and Investor Relations Office, at the Shareholders and Custody Department of the Chief Financial and Investors’ Relations Office, at Rua Coronel Dulcídio nº 800 - 3º andar, Curitiba, at leastforty-eight hours prior to the meeting.

Curitiba, June 13, 2018

Mauricio Schulman

Chairman of the Board of Directors

5/10

Publication

This Call Notice will be published on the proper websites ofComissão de Valores Mobiliários - CVM and B3 S.A. -Brasil, Bolsa, Balcão, being also available on the Company’s website (ir.copel.com) as from June 13, 2018, as well as, pursuant to the Brazilian Corporation Law, in the Official Gazette of the State of Paraná and in the newspaperFolha de Londrinaas from June 14, 2018.

6/10

IV. Information on the matters to be examined and discussed at the 197th Extraordinary General Meeting

Below the Company’s Management presents some clarifications related to the items for resolution at the Extraordinary General Meeting for the exercise of a conscious vote:

è Analysis, discussion and voting on the proposal foralteration of the Company’s Bylaws, in order to adjust it to the dispositions of the Federal Law no. 13,303/2016, to CVM Rule no. 586/2017, to B3’s State Owned Enterprises Governance Program and other necessary adjustments considering the format proposed by the Control Council for State-Owned Companies of the State of Paraná - CCEE, according to good practices of corporate governance.

Clarifications

The Government of the State of Paraná published, in January 2015, the State Decree no. 34/2015 (revoked by Decree no. 6.262/2017) and State Law no. 18.875/2016, which established the Control Council for State-Owned Companies of the State of Paraná - CCEE, directly subordinated to the State Finance Secretary, with the duty of advising the Governor in the creation, sale, merge, spin-off, liquidation and extinction of companies directly or indirectly controlled by the State.

On September 21, 2015, CCEE published the Normative Deliberation no. 001/2015, which provides for general rules to be observed by companies in which the State of Paraná is a controlling shareholder in matters related to the Executive Board, Board of Directors, Fiscal Council, among others. In addition, CCEE sent the companies a "model" of corporate bylaws, recommending the adequacy to it. Copel (Holding), its wholly-owned subsidiaries and controlled companies are among the ones included in this resolution.

In view of the scenario that was unfolding in the electricity sector, within the state government and the legislative field, regarding integrity, compliance and good governance practices, Copel (Holding), in September 2015, established a working group with the goal of promoting studies and assessments aiming at adapting to the new laws, as well as verifying possible synergy gains, cost reduction, among other improvements.

While Copel (Holding) carried out these studies, on April 15, 2016, CCEE revoked Normative Deliberation no. 001/2015 with the publication of Normative Deliberation no. 001/2016 (revoked by Normative Deliberation no. 001/2018) on the regulation of certain topics that should be present in the bylaws of companies controlled by the State of Paraná.

Thus, in addition to the legislative changes at the federal and state levels, changes in the governance programs of state companies, changes in the organizational structure and reorganization of corporate duties of Copel (Holding), in order to improve its performance in the market, Copel (Holding) was obliged to carry out an evaluation of the impacts and effects of these changes for a reformulation of its bylaws.

While this evaluation was carried out, on June 30, 2016, Federal Law no. 13,303, publicly known as the State-Owned Company Responsibility Law, was promulgated, which established new standards of governance, control and transparency for companies under state control, resulting in a new challenge for the Company's technical team to organize its activities.

The scenario described above, together with the expansion and diversification of Copel (Holding) and its wholly-owned subsidiaries' businesses, the increase in control by oversight and regulatory bodies, the need to improve corporate governance bestpractices to safeguard the interests of the shareholders, justified the need for Copel (Holding) to propose new statutory changes.

Copel (Holding) also considered the rules defined by the Brazilian Securities and Exchange Commission - CVM in the preparation of the proposal for the adequacy of the bylaws, as of the publication of CVM Instruction no. 586/2017. The main change brought by CVM Instruction no. 586 is related to the incorporation in CVM Instruction no. 480/2009 of the companies' duty to disclose information on the application of the governance practices set forth in the Brazilian Corporate Governance Code. The rule applies to issuers registered in category A, whose shares or share certificates are admitted to trading on stock exchanges.

Accordingly, in order to adapt Copel's bylaws to the objectives set forth in Federal Law no. 13,303/2016, CVM Instruction no. 586/2017, B3's State-Owned Enterprises Governance Program and other necessary adjustments, and based on the model of bylaws proposed by CCEE and good corporate governance practices, Copel proposed a version of its bylaws comprising the changes that seek to broaden transparency and compliance, strengthening the Company's corporate governance.

Considering the conclusion of the adjustments in the text by the parties, in order to improve their content, the resubmission of this Manual presentsthe proposal for alteration of the Company’s Bylaws, specially concerning the adjustments to the dispositions of Federal Law no. 13,303/2016, to CVM Rule no. 586/2017, as well as the compliance and validation of governance and integrity programs and sustainability platforms incorporated and required by national and international bodies and institutions such asAgência Nacional de Energia Elétrica - Aneel, ISE-BOVESPA,Câmara de Comercialização de Energia Elétrica - CCEE, Dow Jones Sustainability Index - DJSI, The Committee of Sponsoring Organizations of the Treadway Commission - COSO, Sustainability Disclosure Search - CERES-SEC, State Owned Enterprises Governance Program from B3 S.A. - Brasil, Bolsa, Balcão, Securities and Exchange Comission of Brazil - CVM, Control Council for State-Owned Companies of the State of Paraná - CCEE of the Secretariat of Finance of the State of Paraná, among others, as well as its compatibility with current national and state regulations.(added paragraph)

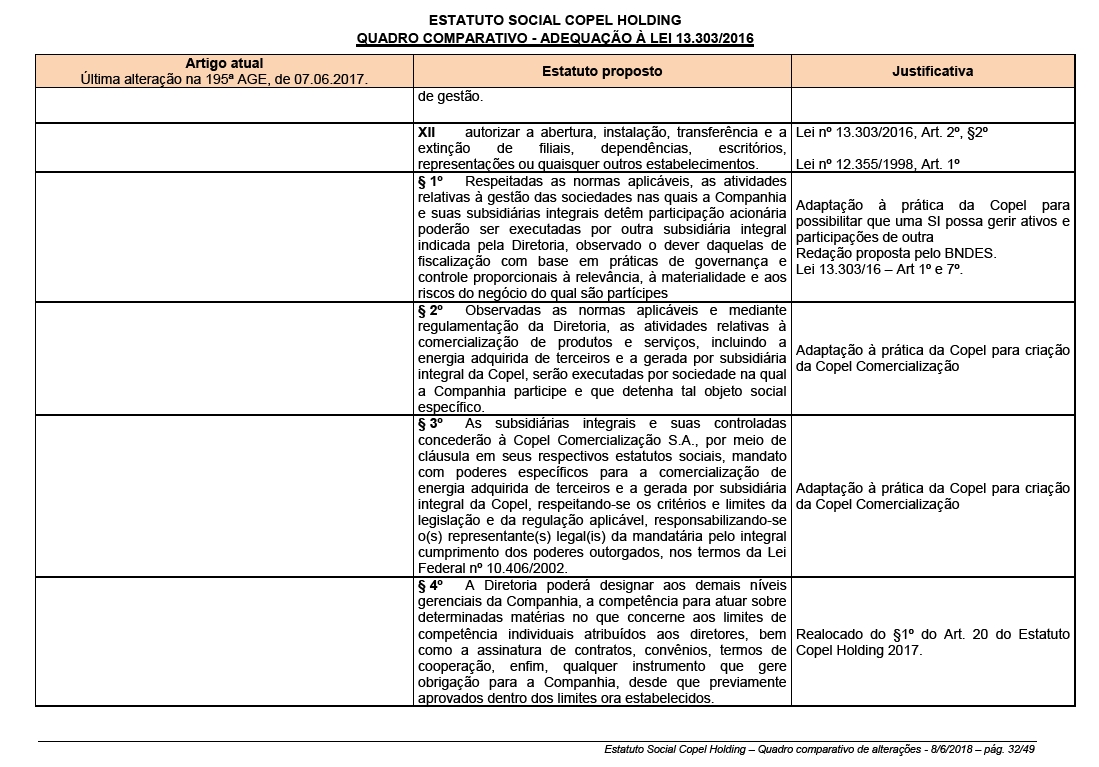

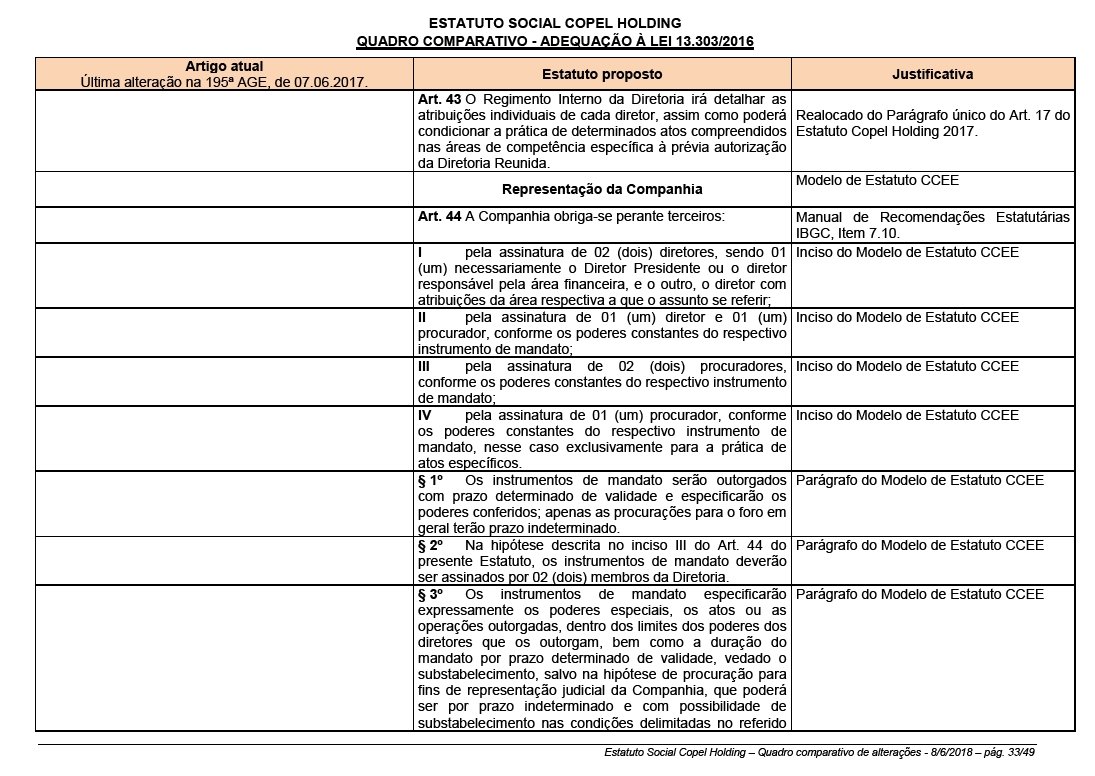

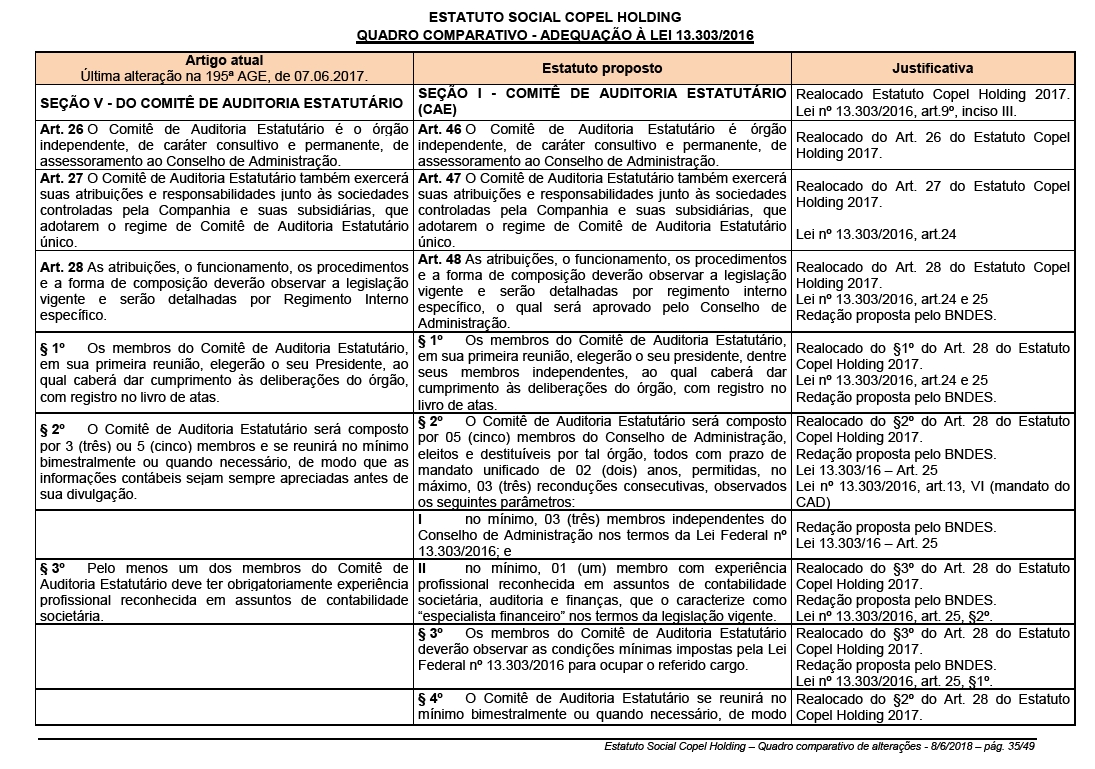

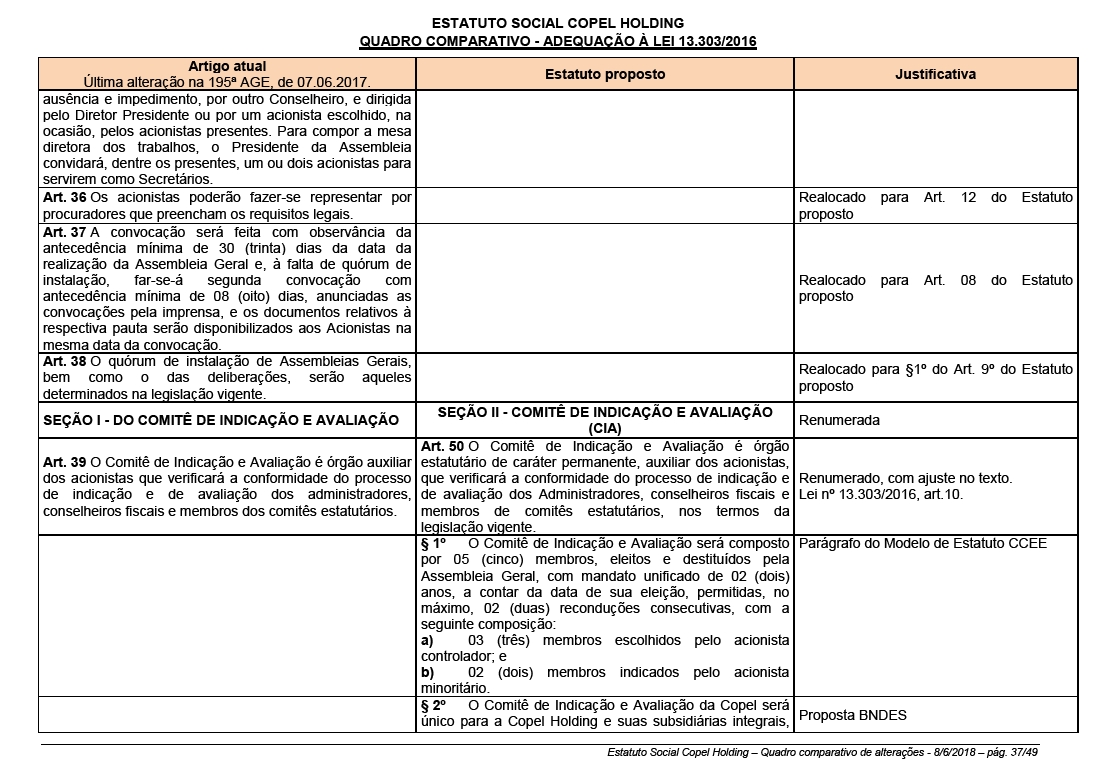

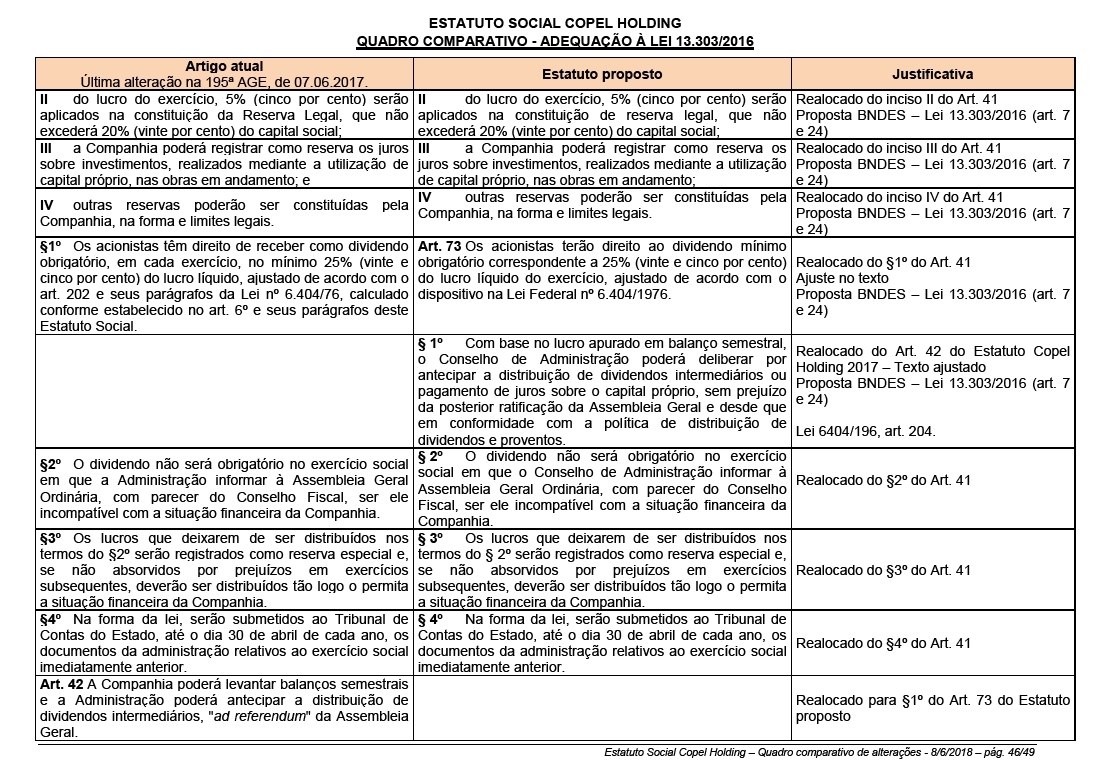

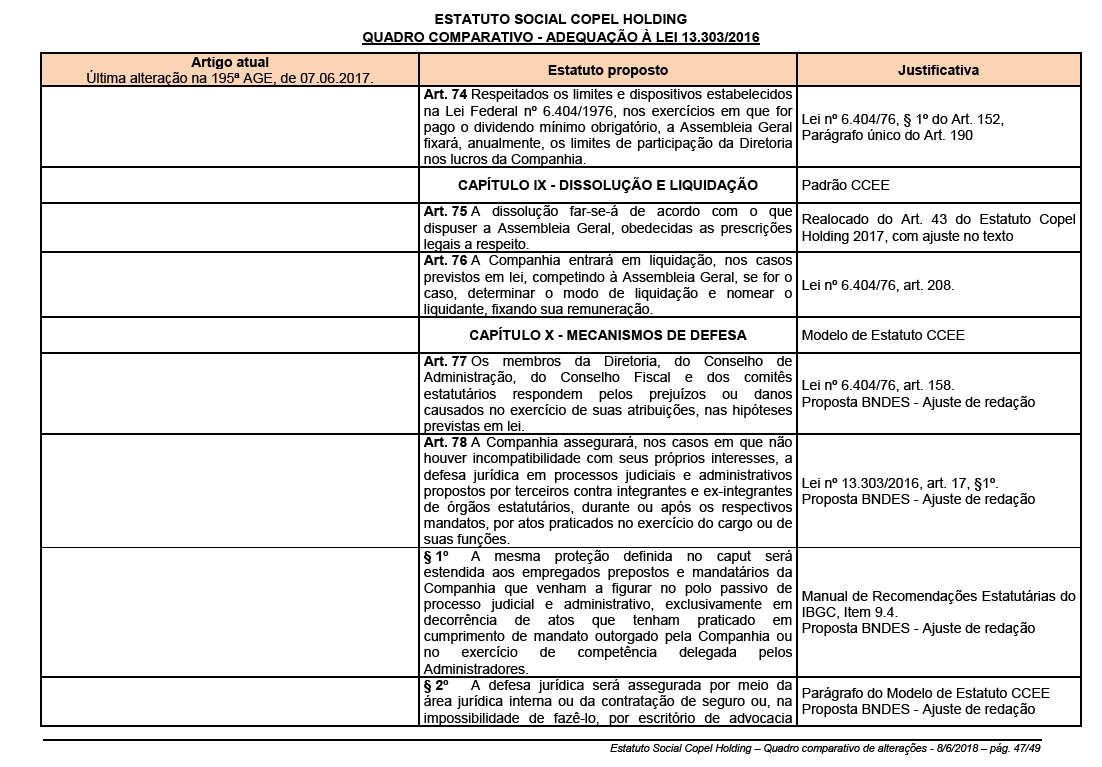

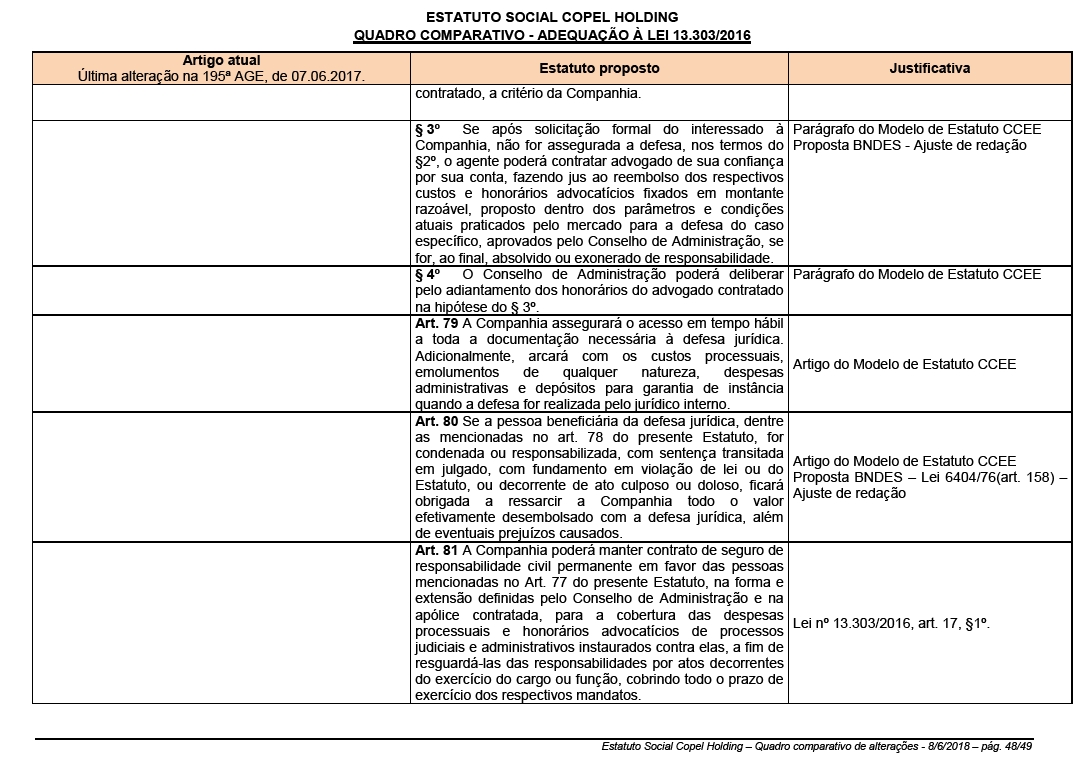

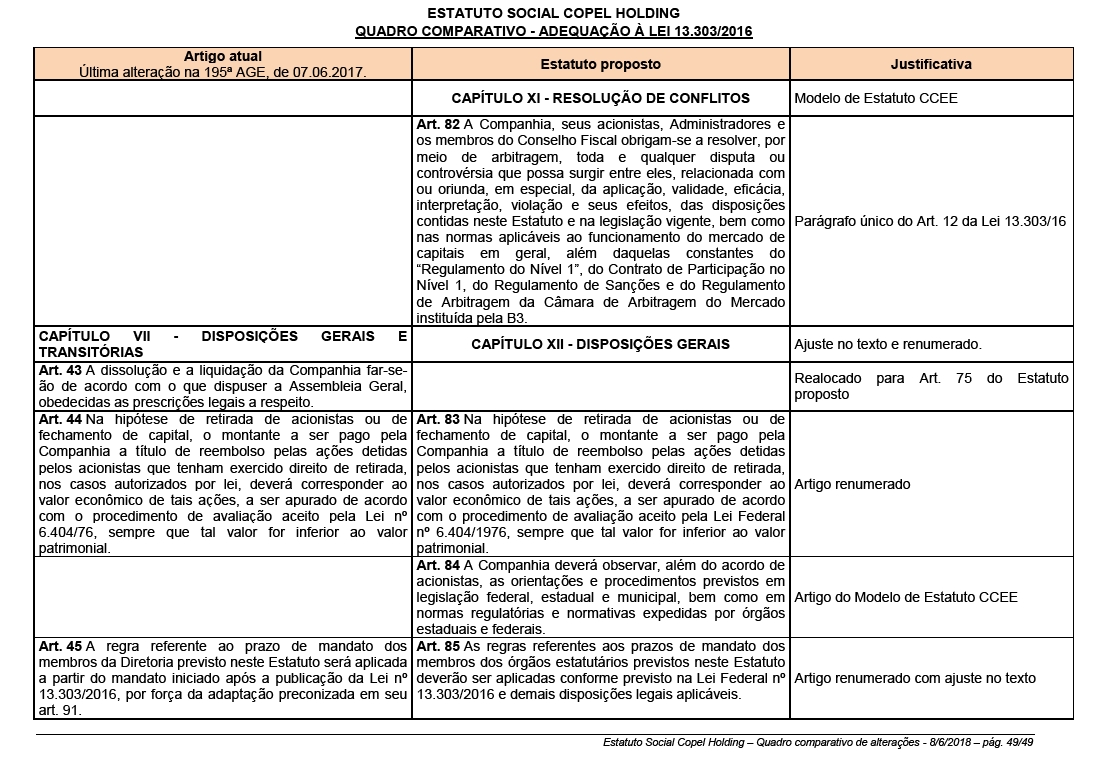

The current proposal, which replaces the one previously filed at CVM on May 29, 2018, provides on itsAnnex I ba comparative chart containing all the justifications, item by item, to the presented propositions.(added paragraph)

Enclosure I a. THE COMPANY’S BYLAWS HIGHLIGHTING THE ALTERATION PROPOSALS, IN COMPLIANCE WITH ARTICLE 11 OF CVM RULE NO. 481/09

I b. THE COMPANY’S BYLAWS ALTERATION PROPOSALS WITH DESCRIPTION OF THE CURRENT ARTICLES AND THE NEW PROPOSED ARTICLES AND THE DUE JUSTIFICATIONS FOR THE ALTERATIONS, IN COMPLIANCE WITH ARTICLE 11 OF CVM RULE NO. 481/09

Approvals

This matter was analyzed by the Company’s Board of Directors in its 172th Extraordinary Meeting, held on May 28, 2018, and on its 179th Ordinary Meeting, held on June 13, 2018.

Voting right

In this item of the agenda, onlyholdersofcommon sharesareentitled to vote.

è Analysis, discussion and voting on the proposal forsubstitution of members in the Company’s Board of Directors

Clarifications

Copel’s Board of Directors is a decision-making body, composed of 7 (seven) or 9 (nine) members, Brazilian, shareholders, residing in the country and elected by the General Assembly, pursuant to the Brazilian Corporation Law (Law no. 6,404/1976).

The Board of Directos has as its main duty the laying down of the overall strategy for the Company business.

In accordance with Law no. 6,404/1976 (Brazilian Corporation Law), in order to take office, all Board members shall sign a clearance certificate declaring that they are not impeded by any crimes provided for by law from performing business activities, and they shall also execute the Investiture Instrument and the Instruments of Adhesion to the Policies for Disclosure of Material Information and Maintenance of Confidentiality and for Trading of Securities issued by Copel itself, set forth by CVM Rule no. 358/2002, through which they undertake to comply with the rules therein.

Additionally, the members of the Board of Directors, inorder to take office, shall sign a Management Consent Form as referred in the Corporate Governance Practices of Level 1 Regulation ("Level 1 Regulation") ofB3 S.A. - Brasil, Bolsa, Balcão, and in compliance with article 25 of the Company’s Bylaws.

Voting right

Copel’sBoardofDirectorsis currentlycomposed of9(nine)members and the board vacancies are filled as follows:

a) five are appointed by the State of Paraná, the Company’s main shareholder (only holders of common shares have voting rights);

b) two are appointed by BNDES Participações S.A. - BNDESPAR, as established in the Shareholders’ Agreement signed with the State of Paraná (only holders of common shares have voting rights);

c) one is appointed by the Company’s employees as established in State Law no. 8,096/1985, regulated by the Decree no. 6,343/1985 and by the State Law no. 8,681/1987 (only holders of common shares have voting rights); and

d) one is appointed by the minority of shareholders in compliance with article 239 of Law no. 6,404/1976 (Brazilian Corporation Law), being the election held separately(the controlling shareholders are not entitled to vote).Only holders of common and preferred shares have voting rights. The candidate elected is theone that obtains the highest representation percentage of the Company’s capital stock, with no minimum limit.

Nomination

Thus, considering the recent substitution of the Company’s Chief Executive Office, which is a statutory member of the Board of Directors (on vacancies provided on item “a)” above), the Company presents for consideration and vote of Shareholders, to join the Board of Directors to complete the 2017-2019 term of office:

· JONEL NAZARENO IURK - to fill the vacant position due to substitution of the member Antonio Sergio de Souza Guetter, according to OF CEE/G 108/18, of April 16, 2018.

Enclosure:II -ITEMS 12.5 TO 12.10 OF THEREFERENCE FORM

Voting right

In this item of the agenda, only holders of common shares are entitled to vote.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| COMPANHIA PARANAENSE DE ENERGIA – COPEL |

| | |

| By: | /S/ Jonel Nazareno Iurk

| |

| | Jonel Nazareno Iurk

Chief Executive Officer | |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.