Companhia Paranaense de Energia

Corporate Taxpayer's ID (CNPJ/MF) 76.483.817/0001-20

State Registration 10146326-50

Publicly-Held Company - CVM 1431-1

www.copel.com copel@copel.com

Rua Coronel Dulcídio, 800, Batel - Curitiba - PR

CEP 80420-170

MANAGEMENT’S REPORT

2017

| | | | |

TABLE OF CONTENTS |

| |

| |

| MESSAGE FROM THE CEO | | | 3 |

| 1. | ORGANIZATIONAL PROFILE | | | 5 |

| 2. | GOVERNANCE AND SUSTAINABILITY | | | 10 |

| | 2.1.Governance, Risk and Compliance Management | | 10 | |

| | 2.2.Governance Structure | | 11 | |

| | 2.3.Integrity Practices | | 13 | |

| | 2.4.Sustainability Management | | 15 | |

| 3. | OPERATING PERFORMANCE | | | 17 |

| | 3.1.Macroeconomic analysis | | 17 | |

| | 3.2.Regulatory environment | | 18 | |

| | 3.3.Business Segments | | 24 | |

| 4. | ECONOMIC-FINANCIAL PERFORMANCE | | | 42 |

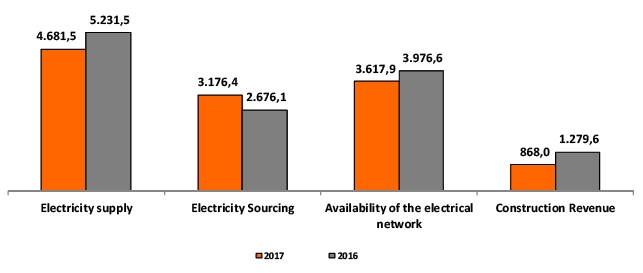

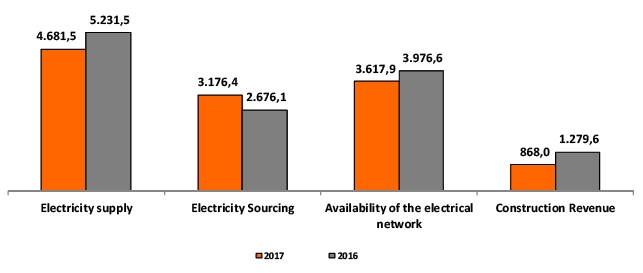

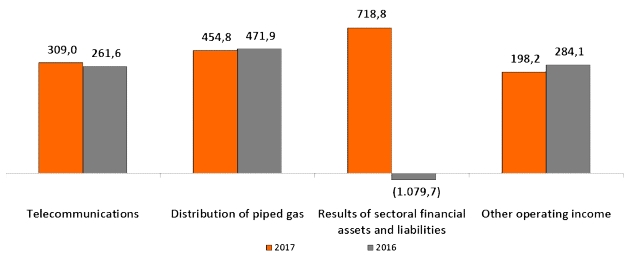

| | 4.1.Net Operating Revenue | | 42 | |

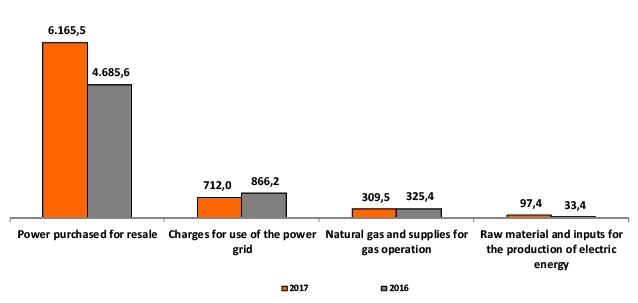

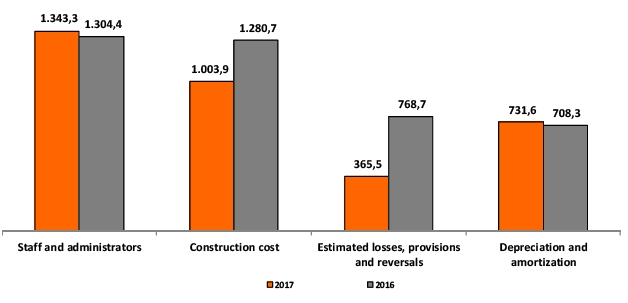

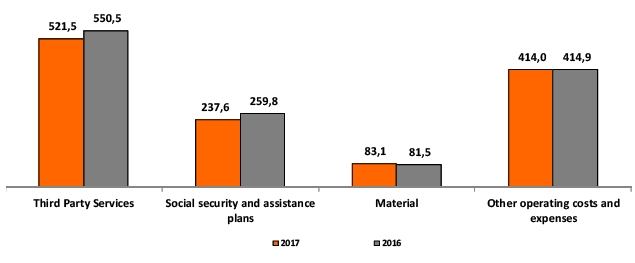

| | 4.2.Operating Costs and Expenses | | 44 | |

| | 4.3.EBITDA | | 46 | |

| | 4.4.Financial Result | | 47 | |

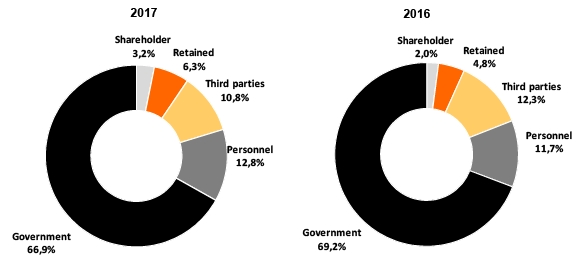

| | 4.5.Added Value | | 47 | |

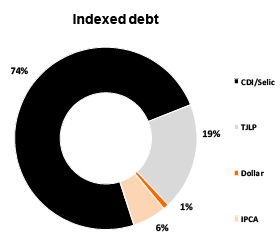

| | 4.6.Debt | | 48 | |

| | 4.7.Net income | | 49 | |

| | 4.8.Non-Paying Consumers | | 50 | |

| | 4.9.Investment Program | | 51 | |

| | 4.10.Research & Development - R&D | | 51 | |

| | 4.11.Energy Efficiency Program – PEE | | 52 | |

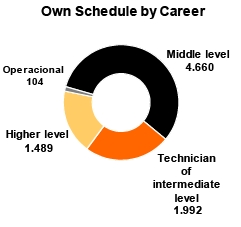

| 5. | HUMAN RESOURCES | | | 53 |

| | 5.1.People Management | | 53 | |

| 6. | SOCIAL AND ENVIRONMENTAL PERFORMANCE | | | 57 |

| | 6.1.Suppliers | | 57 | |

| | 6.2.Customers | | 57 | |

| | 6.3.Community and Environment | | 58 | |

| 7. | COMPOSITION OF GROUPS RESPONSIBLE FOR GOVERNANCE | | | 67 |

| 8. | COMPOSITION OF GROUPS RESPONSIBLE FOR GOVERNANCE | | | 70 |

2

MESSAGE FROM THE CEO

The year 2017 proved once again the enormous resilience of the Brazilian electric sector to the conjuncture crisis. The opening of the discussion of a new regulatory framework and the incipient economic recovery fuel the expectation of the end of a long winter – both in the electric sector and in macroeconomics.

Copel responded to the challenges of the period in line with market expectations: with financial discipline, aggressive cost reduction program and commitment to consolidate its governance. These are the pillars of a management that has already begun to bear fruit, either through the institutional armor that will guarantee the continuity of its business, or by the positive results in all the areas in which it operates.

Our governance and compliance area, structured a year ago as an executive board, had enormous merit in the recent recognition by Transparency International of our practices to prevent corruption and in favor of transparency, benchmarks among Brazilian state-owned companies.

The recognition of one year of important achievements in the name of our long-term commitments, the most significant being the invitation from the United Nations Organization (UNO) in October to host the first regional center of the Global Compact Cities Program, an outpost of articulation of programs that will contribute to the global challenge of the Sustainable Development Objectives (SDO), in line with the Paraná Government's strategy to promote Agenda 2030 in all the 399 municipalities of the State.

In the same month of October, we joined the list of the 150 best companies to work for in Brazil, Guia Você S/A, a survey that testifies to the dedication and professionalism of each of our more than eight thousand employees, which is a result of their perception of the improvements implemented in recent years in people management.

Achievements like these once again guaranteed our presence in the exclusive B3's sustainability indexes, in ISE of FTSE4Good, of the London Stock Exchange, and in Morgan Stanley's MSCI ESG - ratings that place us among the most committed companies in the global utilities sector.

In economic and financial terms, we have been successful through the renegotiation of short-term debt and the strong investments made, even in a crisis scenario, to complete construction and start generating revenue from a series of major projects already in 2018: the hydroelectric power plants of Baixo Iguaçu and Colíder, as well as the Cutia Wind Complex, totaling 720 MW of installed capacity and more than 1,200 km of the Araraquara II-Taubaté transmission line between São Paulo and Bateias.

In 2017, a work program was also started between Paraná and Santa Catarina in the amount of R$ 500 million, and the Londrina - Assis and Figueira - Ponta Grossa Norte lines, important for energy exchange between the South and Southeast regions of Brazil, were completed. Our transmission assets currently exceed 4,400 km of lines throughout Brazil.

3

In the distribution segment, we have been successful in the research and application of new technologies for monitoring and automation of networks, mainly in the interior of Paraná. Even in a scenario of crisis and reduction of consumption, innovation has allowed us to reduce costs and promote indices of quality of supply at unprecedented levels in the State.

Parallel to the immediate implementation of smart grid solutions - which are bringing the quality of energy supplied to rural and urban areas within the scope of the Plus Clic Rural program - stand out the launching of a public call for partnerships with startups and ongoing research in the areas of energy storage and electric mobility, which already anticipate Copel's vision of acting, in the near future, as operator of a state system of distributed generation.

Reason for being of our distribution concessionaire, the satisfaction of the customers with the services of Copel led, for the sixth time in seven years, the survey of perception of the Abradee (Brazilian Association of Electric Energy Distributors) Award. In the same way, for the fifth time in seven years, we won the title of best distributor in Latin America in consumer opinion.

In addition to the significant and ongoing investment in distribution in recent years - more than R$ 4 billion since 2011 - the performance of our telecommunications subsidiary contributes to the strength of our brand. Customer satisfaction with Copel Telecomunicações, conquered by a fiber optic retail internet network that is the fastest in the country, reflects the management excellence we have been able to bring to bear recently at Copel, the results of which are disclosed in the accompanying report.

Curitiba, May 14, 2018.

Have a good reading.

Jonel Nazareno Iurk

4

1. ORGANIZATIONAL PROFILE

Copel was created in October 1954 and is the largest company in Paraná. It operates with state-of-the-art technology in the areas of generation, transmission, commercialization and distribution of energy, as well as telecommunications and natural gas.

It operates a comprehensive and effective electrical system with its own generator unit of power plants, transmission lines, substations, electric lines and networks of the distribution system and a modern optical telecommunications system that integrates all the cities of the State.

Although the Company is headquartered in Curitiba, Paraná, Copel is present in ten Brazilian states, according to the following map:

5

· Participation in the Market

| | | |

| Main products (%) | Brazil | South Region | Paraná |

| Electricity generation(1) | 3,7 | (2) (3)23,8 | (2) (3)52,7 |

| Electricity transmission(4) | 2.2 | 10,9 | 22,3 |

| Electricity distribution(5) | (6)6,2 | (6)33,8 | (7)97,6 |

| Gas distribution(7) | 3,2 | 25,3 | 100,0 |

| (1)Installed capacity. Equity interest of Copel and w ind farms are not included. | | | |

| (2)Itaipu Pow er Plant not included | | | |

| (3)Paranapanema river pow er plants not included | | | |

| (4)The market refers to Permitted Annual Revenues - RAP | | | |

| (5)Distribution w ire market | | | |

| (6)Source: Empresa de Pesquisa Energética - EPE | | | |

| (7)Estimated | | | |

· Awards and Certifications in 2017

| |

| Awards/Certifications | Certifier |

| | |

| Abradee Award -Social Responsibility | Brazilian Association of Electric Energy Distributors |

| Abradee Award for Customer Evaluation -Best distributor in Brazil | Brazilian Association of Electric Energy Distributors |

| Award -Best Distributor (gold category) | Regional Energy Integration Committee - CIER (Comisíon de Integración Energética Regional) Latin America |

| Selo Weather Parana Ouro | Government of the State of Paraná |

| |

| Award -150 Best Companies to Work For | Você S/A |

| Citizen Company Certificate -information presented in the Social Report | Regional Accounting Council of Rio de Janeiro, Sistema Firjan and Fecomercio |

| |

| 500 Largest Southern Award -Largest Paraná Company | Revista Amanhã |

| |

| 500 Largest Southern Prize -Highest Net Energy Sector Revenue | Revista Amanhã |

| Sesi Seal ODS -Recognition of practices in support of sustainable development objectives | Sesi Paraná |

| Recognition of good practice regarding the objectives of sustainable development | United Nations - UN |

| IASC Brazil Award- Concessionaires above 400 thousand consumer units | Aneel |

| IASC Sul Award -Concessionaires above 400 thousand consumer units | Aneel |

| |

| Award -Best companies to work for (9th place in Paraná) | Great Place to Work |

| |

| Award -Best in management | FNQ - National Quality Foundation |

6

· Strategic Reference

The guidelines expressed in the Company's strategic reference guide its management and all internal and external actions and decisions. They include:

Mission: Provide energy and sustainable development solutions.

Vision: To be a reference in the businesses in which it operates generating value in a sustainable way.

Values:

· Ethics: Result of a collective agreement that defines individual behaviors in line with a common goal.

· Respect for people: Taking others into account.

· Dedication: Ability to engage intensely and completely in the work contributing to the achievement of the organization's goals.

· Transparency: Accountability of the decisions and achievements of the company to report their positive or negative aspects to all stakeholders.

· Safety and Health: Healthy working environment in which workers and managers collaborate to use a process of continuous improvement of the protection and promotion of safety, health and well-being for all.

· Responsibility: Conduct the life of the company in a sustainable manner, respecting the rights of all stakeholders, including future generations and the commitment to support all life forms.

· Innovation: Applying ideas in processes, products or services in order to improve something that already exists or to build something different and better.

Organizational structure

The following chart shows the Company's shareholding structure on December 31, 2017:

7

8

· Copel in Numbers

| | | |

| In R$ thousands (except w hen stated otherwise) | 2017 | 2016 | Change % |

| Accounting Indicators | | | |

| Total assets | 33.162.377 | 30.288.900 | 9,5 |

| Cash and cash equivalents | 1.040.075 | 982.073 | 5,9 |

| Securities | 219.663 | 331.745 | (33,8) |

| Total debt | 9.830.483 | 8.837.102 | 11,2 |

| Net debt | 8.570.745 | 7.523.284 | 13,9 |

| Gross operating revenues | 21.574.289 | 21.061.792 | 2,4 |

| Deductions from revenues | 7.549.716 | 7.960.039 | (5,2) |

| Net operating revenues | 14.024.573 | 13.101.753 | 7,0 |

| Operating costs and expenses | 11.984.931 | 11.279.346 | 6,3 |

| Equity pick-up | 101.739 | 166.411 | (38,9) |

| Income from activities | 2.039.642 | 1.822.407 | 11,9 |

| EBITDA | 2.872.980 | 2.697.114 | 6,5 |

| Financial result | (748.440) | (594.656) | 25,9 |

| IRPJ/CSLL | 274.686 | 519.690 | (47,1) |

| Operating profit | 1.392.941 | 1.394.162 | (0,1) |

| Net income for the year | 1.118.255 | 874.472 | 27,9 |

| Shareholders' Equity | 15.510.503 | 14.978.142 | 3,6 |

| Interest on shareholders equity | 266.000 | 282.947 | (6,0) |

| Dividends | 23.401 | - | - |

| Economic and Financial Indicators | | | |

| Current liquidity (index) | 0,9 | 0,7 | 28,6 |

| Overall liquidity (index) | 0,8 | 0,8 | - |

| EBITDA Margin (%) | 20,5 | 20,6 | (0,5) |

| Earnings per share - Common shares | 3,60754 | 3,12641 | 15,4 |

| Earnings per share - Class "A" preferred shares | 3,96830 | 3,43906 | 15,4 |

| Earnings per share - Class "B" preferred shares | 3,96830 | 3,43906 | 15,4 |

| Equity value per share R$ (shareholders equity/number of shares) | 56,7 | 54,7 | 3,7 |

| Debt on shareholders' equity (%) | 63,4 | 59,0 | 7,5 |

| Operating margin (operating profit / net operating revenue) (%) | 9,9 | 10,6 | (6,6) |

| Net margin (net income/net operating revenues) (%) | 8,0 | 6,7 | 19,4 |

| Participation of third-party capital (%) | 53,2 | 50,5 | 5,3 |

| Return on shareholders' equity (%)(1) | 7,5 | 6,0 | 25,0 |

| (1)LL ÷ (initial PL) | | | |

9

2. GOVERNANCE AND SUSTAINABILITY

Copel's governance model is guided by principles of transparency, equity, accountability and corporate responsibility, according to the best market practices and seeking the best results for the stakeholders. The Company’s corporate governance practices comply with the requirements set for companies listed at B3’s governance level 1, with reference to the Code of Best Practices of Corporate Governance of the Brazilian Institute of Corporate Governance - IBGC.

Copel is guided by values described in its strategic reference, in its Corporate Governance Policy and in its Code of Conduct – all approved by senior management -, in addition to respecting the Global Pact Principles.

2.1. Governance, Risk and Compliance Management

Copel’s Governance, Risk and Compliance Board - DRC, created at the end of 2016, performed with all the Company areas in order to improve governance practices in seeking the best results for stakeholders.

In association with Copel University - Unicopel, the DRC held training sessions that educated senior management and employees to perform according to the legislation in force, the best practices and the rules of the Company itself.

10

2.2. Governance Structure

The Company's governance structure on December 31, 2017 is as follows:

General shareholders’ meeting

It is the forum in which the shareholders decide business guidelines and make strategic decisions.

Fiscal Council

Permanent body that examines the financial statements, gives opinions on the management's report, capital modification, capital budget, dividends distribution and oversees the work of the management. It has five sitting members and five alternates with a one-year term.

11

Board of Directors - BOD

The Board of Directors resolves and sets the overall guidance on business, is responsible for submitting the articles of incorporation to be approved by the General Meeting of Shareholders and for approving the bylaws of the Board of Directors, which set out the matters concerning the economic, environmental and corporate topics for senior executives and other employees of the Company.

The BOD members are selected and appointed in accordance with the rules set forth by Copel’s Corporate Governance Policy and with the legislation in force, made up of nine members, with a two-year term.

Executive Board gathered

The Board fulfills executive duties and applies the Company strategy, including topics involving economic, corporate and environmental issues, pursuant to the articles of incorporation. The Board meets fortnightly, and minutes are drawn up in an own book, reporting to the Board of Directors in accordance with the bylaws. Members are as follows: the chairman, five officers and a deputy officer, with two-year term, after the meeting to elect the Board of Directors, three consecutive reelections being allowed.

Audit Committee

Independent, advisory and standing committee that assists the Board of Directors, engaged mainly in the inspection, review, supervision, monitoring and, where applicable, presentation of recommendations on the Company’s activities. It is also responsible for monitoring the Confidential Communication Channel.

The Committee holds ordinary meeting at least six times a year, according to a preset schedule. Special meetings may also be held, if necessary, with a member of the Boards, of the Independent Audit, of the Internal Audit or of the Fiscal Council.

It is made up of five independent members of the board of directors, as set forth by Rule 10A-3 of the Securities Exchange Act, with a two-year term.

Board of Ethical Guidance - BEG

An administrative board connected to the Presidency, with the duty to contribute with the Company's performance to be permanently driven by ethical principles in the development of its business. It has eleven officers, of whom ten are Copel's employees and one is a representative of the civil society.

Committee of disclosure of material acts and facts

It has thirteen members and supports the Finance and Investor Relations Office in the practice of the Policy for Disclosure of Relevant Information and the Policy for Trading Company's Shares, pursuant to CVM Instruction 358/2002.

12

2.3. Integrity Practices

Copel is committed to the integrity practices and acts for all stakeholders to keep abreast of their ethical principles and the legislation in force. The Company’s integrity practices aim to guarantee that its business is done with transparency and legality, relying on a number of structures and adopting internal tools, made available in the Portal Compliance.

· Integrity Program

The Integrity Program is a platform for disseminating the Company's commitments to transparency and the fight against corruption. In 2017, Copel’s revised Integrity Program was published. The disclosure and dissemination of contents are digitally made from time to time across the Company, and the contents can be accessed through Copel’s internal and external online channels.

In the period under analysis, 8,200 employees took part in the training sessions for dissemination of the Integrity Program. The matters of courses were General Aspects of the Law and of the Anticorruption Decree, Code of Conduct, Risk Management based on ISO 31000 and Risk Management – GRC Methodology and Tool.

The Company’s senior management was given an in-person training on the Anticorruption Law, State-run Companies Law, Corporate Governance, Corporate Strategy, Internal Control and Strategic Management of Corporate Risks.

· Code of Conduct

The Code of Conduct is a key instrument in the fight against corporate corruption, setting the corporate and individual responsibilities. Copel implemented its Code of Conduct in 2003 and keeps it updated through periodic revisions reported to all the Company areas by emails and in the Portal Compliance.

· Corruption Risk Assessment

As part of its Policy of Integrated Management of Corporate Risk, Copel seeks to ensure a constant monitoring of the threat of corruption within the Company and of fraud in the internal control environment.

Due to these safety criteria, all operational processes are annually submitted to the evaluation of risks related to errors or fraud, which may interfere with the results of the financial statements. In this respect, established controls are submitted to tests by the Internal Audit and by the Independent Audit, the results of which are reported to senior management.

13

· Reporting channels

In order to receive opinions, criticisms, complaints, claims and personal inquiries, Copel provides communication channels that, in addition to contributing to the fight against fraud and corruption, also expand the organization's relationship with its stakeholders. They are:

· Confidential Communication Channel: intended to receive complaints and communications of noncompliance with laws and regulations, especially of fraud or irregularities involving issues on the area of finance, auditing or accounting. The channel guarantees protection, preservation of the identity of the person making the claim and an answer to the complaint. It is available 24 hours a day, seven days a week, toll-free call. Phone Number: 0800 643 5665 .

· Ombudsman: There are two channels open to all stakeholders, internal and external, for suggestions, claims and complaints, and are available on weekdays, from 8am to 6pm, with toll-free call. The Copel Distribuição Ombudsman is available through the phone number 0800 647 0606 and also through the email ouvidoria@copel.com. In addition, it can receive the complaints in person or through correspondence sent to its address at Rua Professor Brasílio Ovidio da Costa, 1703, in the Santa Quitéria Neighborhood, CEP: 80310-130, in Curitiba - PR. The Copel Telecomunicações Ombudsman is available through the phone number 0800 649 3949 and through the email ouvidoriatelecom@copel.com., able to receive the complaints in person or through correspondence sent to its address, at Rua Emiliano Perneta, 756, Batel Neighborhood, CEP: 80420-080, in Curitiba - PR.

· Commission for analysis of complaints of harassment - CADAM: assists and supports every employee who is a victim of bullying in his or her work environment. The information is confidential and both the complainant and the respondent have a guarantee of identity preservation. Email:cadam@copel.com

· Ethics Guidance Board – EGB assesses and issues guidance on processes related to ethical conduct in the Company and has a maximum deadline of 90 days to provide a final answer. Email:conselho.etica@copel.com

· External Audit

Under the terms of Instruction 381/2003 of the Brazilian Securities and Exchange Commission, in an internal Corporate Governance standard and under the review and supervision of the Audit Committee, the Company and its wholly-owned subsidiaries have a contract with Deloitte Touche Tohmatsu Auditores Independentes since March 21, 2016, to provide audit services of the financial statements,being that the work necessary for the evaluation of the fiscal year will extend until June 30, 2018, date that will correspond to its final term, and may be formally extended in up to 36 months.

14

Every five years, following the criterion of rotation of the independent auditors according to CVM Instruction 308/99, the Company changes the company responsible for auditing its financial statements.

The amount contracted for the 2017-2018 period was of R$2.6 millionand the total gross amount paid for external audit services rendered in 2017 was R$1.7 million.

When hiring other services from its external auditors, the Company's practice of action foresees the prior review by the Audit Committee of the Board of Directors, which should take into account in this evaluation if the relationship or a service rendered by an independent auditor:(a) creates conflicting interests with its audit client; (b) puts them in a position to audit their own work; (c) results in working as manager or as employee of the audit client; or (d) puts them in a position of being an advocate to the audit client.

The Audit Committee also considers in this type of assessment if any service rendered by the independent audit firm may impair, in fact or apparently, the firm's independence.Whenever necessary, the Audit Committee can count on the technical support of the Internal Audit or also of an independent advisory service for a technical evaluation that may be required in each specific case, with this hiring of an independent advisory service being recorded in the minutes of the meetings of these boards.

2.4. Sustainability Management

The challenges of sustainability are part of Copel's strategic reference contained in the mission and vision of business. The permanent search for improving the performance of the area of sustainability, as well as its communication with stakeholders and the management of matters and indicators are steps of this strategy.

All of this work involves some of the main market practices to direct and assess their performance, as well as compare their practices with world and national references: RobecoSAM questionnaire (Dow Jones Sustainability Index - DJSI), Ethos Indicators for Sustainable and Responsible Business Models, and Corporate Sustainability Index (ISE – B3). To report their performance and engage their stakeholders, the Sustainability Management also adopts references such as Global Reporting Initiative - GRI, Integrated Reporting – IR, Carbon Disclosure Project - CDP and Global Greenhouse Gas Protocol – GHG.

One of the results of Copel's actions was the Company remaining in the group of the most sustainable companies of the São Paulo Stock Exchange (B3). The Company has been part of the ISE portfolio since its creation in 2005. Copel was included in twelve of the thirteen editions of the index.

The Company also continued in the sustainability index of the Morgan Stanley Capital International MSCI, the world leader in the composition of financial indices that work as a reference for investors. The MSCI ESG seal is awarded to companies with excellent performance in the corporate, environmental and corporate governance areas.

15

In 2017, Copel started being listed by FTSE 4Good Emerging Index, a tool for investors, prepared by FTSE, an independent provider of stock market indices comprising the Financial Times and the London Stock Exchange, which gauges the performance of companies in the environmental, corporate and governance realms.

· Southern Brazil UN Global Compact – Cities Program

Since November 2017 Copel has been hosting and coordinating the Southern Brazil UN Global Compact – Cities Program. It performs in association with the State Council for Economic and Social Development of Paraná – CEDES and the Autonomous Social Service Paranacidade. The office duties include: develop actions and projects of multiple associates that promote the Sustainable Development Objectives - ODS of Agenda 2030 of the United Nations Organization; and work in alignment with other UNO agencies that operate in Brazil and in Latin America to advance ODS, including the Local Networks of the Global Pact.

· Voluntary Commitments

Copel — committed to the sustainable development — has made several voluntary commitments throughout its history, namely:

· Global Pact

· National Movement ODS We Can

· Business Contribution for the Promotion of the Green and Inclusive Economy

· Statement Call to Action for Governments in the Fight against Corruption

· Business Pact for Integrity and Against Corruption

· Eradication of Child Labor, Forced Labor or Compulsory Labor

· Fighting Sexual Exploitation of Children and Teenagers

· Fighting the Practice of Discrimination and Valuing Diversity

· Preventing Moral Harassment and Sexual Harassment

· Respecting the Right of Free Association and the Right of Collective Bargaining

· Principles for Sustainable Business Education - PRME

16

3. OPERATIONAL PERFORMANCE

3.1. Macroeconomic analysis

The world economy kept the pace of growth seen in the first months of the year, and it is expected to grow by nearly 3.7%1 by the end of 2017. The fear of an accelerated slowdown in China’s economy turned out to be exaggerated and, together with the behavior of developed economies, set up a situation of synchronized expansion in the world that was not seen since before the international financial crisis. This has been reflected on the expansion of foreign trade and on the increase in capital flows towards emerging countries. The United States of America led the growth among developed countries, securing a robust recovery relying on the increase in consumption and on the strong pace of growth of non-household investments, even taking into consideration the trail of destruction by the hurricanes that hit the U.S. states of Texas and Florida in late August and early September 2017. In the euro zone, the growth seems to be consolidated, with a highlight for the economies of Germany and France. In China, the data of the level of the economic activity also show that the pace of growth is still strong, with a projected growth of 6.9% for 2017.

In the domestic market, the year was marked by the end of recession, but the economy still recorded effects of the crisis, with interruption of public services due to the lack of resources and the critical situation of public accounts of some states. After accumulating a GDP decrease by 7.0% between 2015 and 2016, the Brazilian economy showed signs of recovery since the last quarter of 2016, and consolidated in the first half of 2017. Despite the various indices for longer and still unfavorable periods, it is undeniable the accumulation of positive production indicators in the very short term. While the industry migrates from a strong negative to a positive performance, trading attempts a similar move. The Company also witnesses positive effects of the inflicted crisis,as the strong reduction in negative balances in current transactions of the balance of payments, and others relating to the drop in inflation and easing in nominal interest rates, with the SELIC rate dropping from 14% to 7.0%. By the way, the last two moves allowed a certain recovery of average output of work and of the real income mass, the extension of which for a longer period should represent a significant part of the prospective growth of consumption levels. In this scenario, the national economy recorded an expansion of 1.0% in 2017.

The Paraná has been recording a more vigorous recovery, especially in its transformation industry, including exports. This recovery is partially linked to foreign trade, since exports by the State accumulated expansion of 19.2%, repositioning as the fourth biggest exporter in Brazil in 2017. These trends include the agribusiness performance, which grew by 11.5% versus 2016, thanks to the bumper crop and high productions of soybean, corn, coffee, beans and tobacco. Another positive factor was the industry, which expanded by 1.8%, thanks to the results of machinery and equipment, transportation material and spare parts. Accordingly, the state GDP more than doubled the Brazilian average, recording a 2.5% growth, consolidating the upturn in the economy.

1 International Monetary Fund - World Economic Outlook - WEO

17

3.2. Regulatory environment

Since 2013, the Brazilian electricity sector faces a major crisis that can be divided into three distinct moments: (a) from 2013 onwards, a period of hydrological restrictions, which hindered the production of electricity in the National Interconnected System (SIN); (b) the financial de-restructuring of generation and distribution agents due to the exposure to the short-term market, followed by a strong judicialization, practically halting operations in the national energy market from the end of 2014; (c) renegotiation of the liabilities hired by the agents in this period and attempt to unlock the segment.

In this context, 2015 was a year in which the Brazilian electricity sector had its regulatory environment strongly influenced by the search for solutions to equation this third phase of the crisis.

Following these changes, in 2017 Public Hearing No. 33/2017 was opened in order to improve the legal framework of the Brazilian electricity sector. After the time period for comments from agents, the Ministry of Mines and Energy - MME prepared a document together with a set of proposals to be submitted to the National Congress. The MME comments include: improvements in pricing and market operation, insourcing of environmental external factors regarding emissions, separation of indirect guarantee of assured power and energy, expansion of the free market and changes in the assignment of risks arising from decisions on power delivery on regulated contracting.

· Rationing Risk

Approximately 64%2 of Brazil's capacity currently comes from hydroelectric generation, which makes Brazil and the geographic region in which we operate to be subject to hydrological conditions that are unpredictable due to non-cyclical deviations from average rainfall. Among other things, unfavorable hydrological conditions may lead to comprehensive electricity saving programs such as a rationalization or even mandatory reduction of consumption, which is the case of rationing.

Since 2016, the major water basins of Brazil, where the reservoirs of the Southeast/Midwest and Northeast regions are located, experienced adverse weather situations. Beginning 2017, however, the Southeast/Midwest subsystem recorded a relative improvement, with a slight uptick in the levels of reservoirs. In view of this, the Electricity Sector Monitoring Committee – CMSE highlighted that for 2018 the SIN electroenergetic supply is guaranteed, and the thermal power stations deliver energy in order of merit of cost, within the risk of rationing ranging between 0.0% and 0.6%.

2 Generation Information Bank - Aneel

18

Although the stocks stored in reservoirs are not ideal, from the point of view of regulators, when combined with other variables, they are enough to maintain the risk of deficit within the safety margin established by the National Council for Energy Policy - CNPE (maximum risk of 5.0%) in all subsystems.

· Extension of Concessions

Concerning the extension of the concessions delegated to Copel, it is important to note that, in 2012, a new regulation was established for concessions in the electric energy sector, in which the concession wasextended, provided that several concessions are accepted by the Concessionaire Grantor. At that time, MP 579/2012 was published, later converted into Law 12,783/2013, which provided, among others, for the treatment to be given to the generation, transmission and distribution concessions under articles 17, 19 and 22 of Law 9,074/1995, whose maturity would initially be between 2015 and 2017 and which had already undergone a single extension. This rule also remains valid for the concessions that will expire as of this date.

Generation Concessions

For the concessions of generation, an extension of up to 30 years was established. The extension was granted to the concessionaire and its adoption depended, in addition to the acceptance of anticipation of the original term of its concession, also the express acceptance of the following conditions: (a) remuneration per rate calculated by Aneel for each hydroelectric plant; (b) allocation of quotas of physical guarantee of energy and power of the hydroelectric plant to the concessionaires and permissionaires of the public electricity distribution service of the SIN, to be established by the regulatory agency, according to the regulation of the granting authority; and (c) compliance with the quality of service standards established by Aneel.

Copel Geração e Transmissão, after learning the conditions for the extension, carried out the possible analyses, concluded that it was not feasible to adopt the extension at that moment of the concessions of generation of its four plants due between 2014 and 2015: Rio dos Patos with 1.8 MW of installed capacity, Governador Pedro Viriato Parigot de Souza Plant with 260.0 MW, Mourão with 8.2 MW and Chopim I with 1.8 MW.

Subsequently, MP 688/2015, among other matters, changed the conditions for the renewal of the concession of these plants, which became subject to an auction, being disputed through the highest grant bonus to be offered by the concessionaire in comparison with the lower revenue required. Thus, on November 25, 2015, Auction 12/2015 was held, in which the plants of Mourão and Governador Pedro Viriato Parigot de Souza were offered. After the event, Copel Geração e Transmissão was the winner in Lot B1, in which the HPP Governador Pedro Viriato Parigot de Souza was tendered, thus renewing the concession of the plant for another 30 years. For the Mourão plant, Copel Geração e Transmissão did not present a proposal, being taken over by another concessionaire.

19

As for the Chopim I plant, after the concession was terminated, it became recorded by Copel Geração e Transmissão, pursuant to Law 12,783/2013. Rio dos Patos, in turn, is subject to the quota system introduced by the same law.

The next plant to have its concession expired is TPP Figueira, which has its contractual term scheduled for March 26, 2019. On March 24, 2017, Copel already filed with Aneel its intention to extend the granting of the generation concession of the TPP; however, it highlighted that it will sign the necessary agreements and/or amendments only after knowing and accepting the contractual terms and rules that will guide all process related to the extension of the grant. TPP Figueira has an installed capacity of 20 MW and is currently undergoing a modernization process.

Decree 9,271, recently published on January 25, 2018, opened up the possibility of renewing the concession for up to 30 years for projects with an agreement for concession of public generation service that have been privatized up to 60 months of the inception of the agreement or of the act of grant. In exchange, a grant bonus shall be paid to the federal government, to be calculated with basis on the value of the benefit obtained from the new agreement, with payments proportional to this additional period.

Transmission Concessions

For the concessions of transmission, an extension of up to 30 years was established. The extension was granted to the concessionaire and its adoption depended, in addition to the acceptance of anticipation of the original term of its concession, also the express acceptance of the following conditions: (i) fixed revenues determined in accordance with criteria set by ANEEL; and (ii) submission to levels of service quality set by Aneel.

Having been informed of the conditions for extension, and analyzed and evaluated them, Copel Geração e Transmissão opted for extending its transmission agreement. However, the extension failed to take into account several investments made by concessionaires that were not reimbursed by the concession granting authority. Normative Resolution 589 issued in 2013 set rules for indemnifying investments not yet amortized and/or depreciated existing on May 31, 2000, which were designated as Basic Network of the Existing System - RBSE and RPC (connection and other transmission facilities).

On April 20, 2016, the MME published Ordinance 120/2016 which presented the guidelines for the payment of the indemnities related to the appraisal report on the assets of RBSE and RPC of Copel Geração e Transmissão, which should be recognized from the 2017 tariff cycle.

20

Aneel Resolution 1,272, published on May 9, 2017, validated the appraisal report for R$ 667.6 million, at amounts ruling in December 2012, corresponding to the portion of reversible assets not yet amortized for purposes of compensation to Copel Geração e Transmissão. This amount will be received through two means: in 8 years for the period between 2013 and June 2017, and from July 2017 to the end of the useful life of the assets, limited to the end of the concession agreement. These updated amounts incorporated into the Annual Revenue Allowed – RAP of the transmission concession agreement 060/2001 as of July 2017.

Distribution Concessions

Another matter that called attention in the regulatory environment and that strongly affects the business was the renewal of electricity distribution concessions. A Ministry of Mines and Energy order issued on November 9, 2015 granted the request for extension of Copel Distribuição concession and in early December 2015 the fifth amendment was entered into, formalizing the extension of the Agreement for Public Service Concession for Distribution of Electricity No. 46/1999 until July 7, 2045.

The fifth amendment imposes conditions related to indicators of quality of service and economic and financial sustainability, which will be supported by an investment program focusing automation and new technologies, full implementation of tariff adjustments approved by ANEEL, and the implementation of corporate governance structure defined by Aneel Normative Resolution 787, of October 24, 2017, effective as from January 1, 2018, ensuring the protection and individualization of Copel Distribuição.

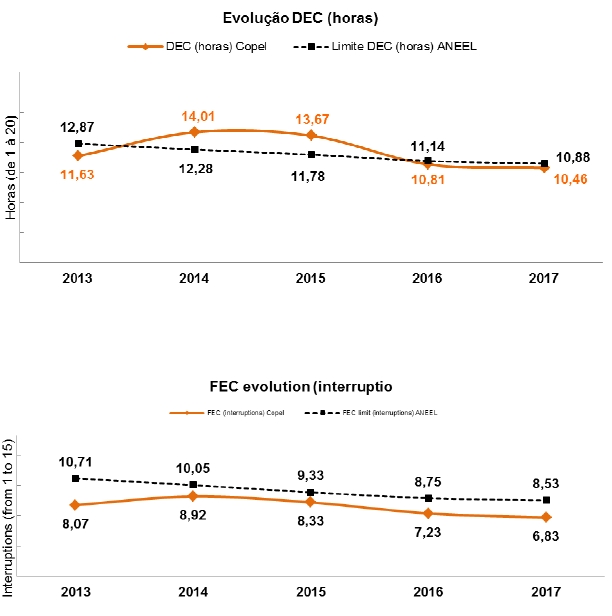

The following chart shows the goals set for Copel Distribuição in the first five years of renewal:

| | | | | |

| Year | Economic and Financial Management | Quality - limits(a) | Quality - accomplished |

| | | DECi(b) | FECi(b) | DECi | FECi |

| 2016 | - | 13,61 | 9,24 | 10,80 | 7,14 |

| 2017 | EBITDAe0(d) | 12,54 | 8,74 | 10,41(c) | 6,79(c) |

| 2018 | EBITDA (-) QRRe0(e) | 11,23 | 8,24 | - | - |

| 2019 | {Net Debt / [EBITDA (-) QRRe0]}d1 / (0,8 * Selic)(e) (f) | 10,12 | 7,74 | - | - |

| 2020 | {Net Debt / [EBITDA (-) QRRe0]}d1 / (1,11 * Selic)(e) (f) | 9,83 | 7,24 | - | - |

| (a)According to NT 0335/2015 Aneel. | | | | |

| (b)DECi - Equivalent Duration of Interruption of Internal Origin per Consumer Unit; and FECi - Equivalent Frequency of Interruption of Internal Origin per Consumer Unit. |

| (c)Preliminary data. | | | | |

| (d)Amount w ill be presented in the Regulatory Accounting Statement. | | | | |

| (e)QRR: Regulatory Reintegration Quota or Regulatory Depreciation Expenses. It w ill be the value defined in the last Periodic Tariff Review - RTP, plus the IPCA betw een the month prior to RTP and the month prior to the 12-month period of the economic-financial sustainability measurement. |

| (f)Selic: limited to 12.87% a.a. | | | | |

The Company reiterates its commitment to the economic sustainability of the concession and continued investments backed by management's efforts to cut costs, maximize productivity and improve operational efficiency.

21

Gas Concessions

Companhia Paranaense de Gás - Compagas is a party to an agreement that grants and regulates the concession for public services of piped gas in the State of Paraná, with an effective period of 30 years, which may be extended for the same period through a request by the Concessionaire.

The subject matter of the concession is the exploitation of services for distribution of piped gas and other related activities, to be used by all consuming market segments, whether as a raw material or for generation of energy or other purposes allowed by technological advances.

The gas concession agreement falls within the bifurcated model, in which a portion of investments made by the concessionaire is compensated by the public service users, while the other part is compensated by the Granting Power, i.e. the State of Paraná, at the end of the concession.This model establishes the recognition of a financial asset and of an intangible asset.

As presented in Note 2.1.1, the expiration date of the gas distribution concession of the subsidiary Compagás is under discussion with the granting authority.

In the event of non-extension of the concession, Compagás will be entitled to indemnification for investments made in the last 10 years prior to the end of the concession at its depreciated replacement value, according to the contractual forecast.

22

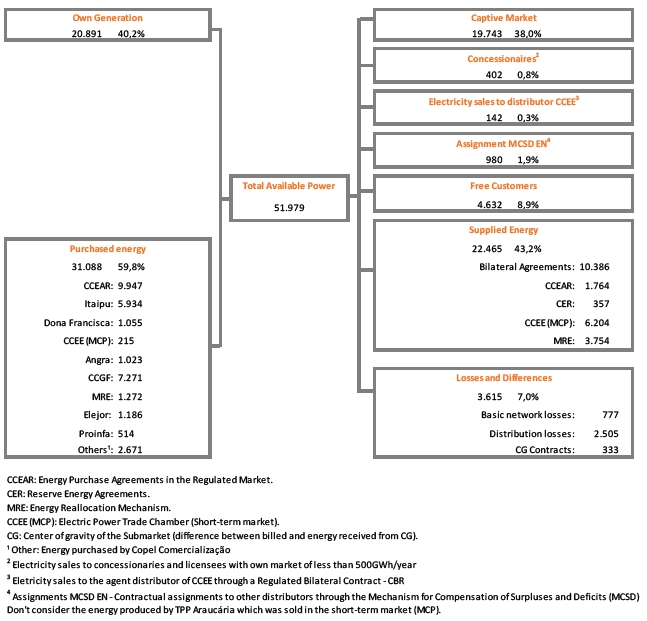

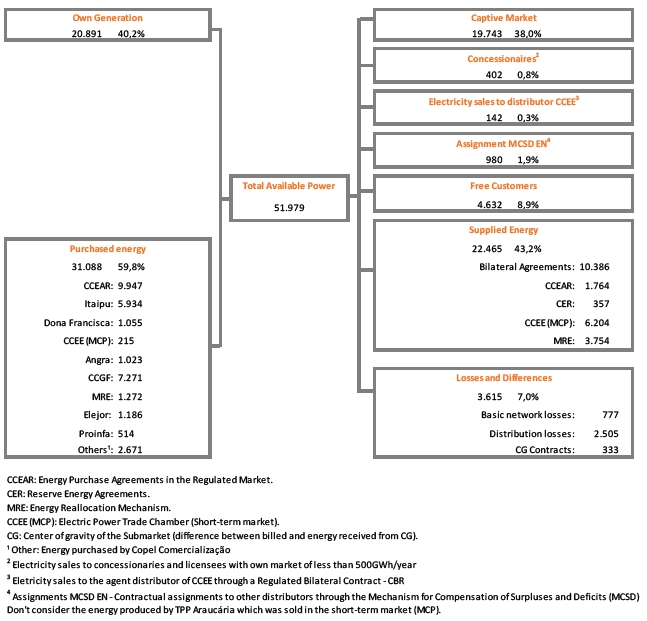

· Energy Flow (% and GW/hour)

23

3.3. Business Segments

3.3.1. Generation

Copel operates 28 plants of its own and has ownership interests in another 3. Of the total, 17 are hydroelectric, 12 wind powered and 2 thermoelectric plants, with total capacity of 5,313.4 MW and physical guarantee of 2,430.3 MW on average, as shown below:

Plants in Operation - Physical Characteristics

| | | | | | | |

| Developments | Installed

Capacity

(MW) | Physical

Assurance

(Average MW) | Ownership % | Proportional

Installed

Capacity

(MW) | Proportional

Physical

Assurance

(Average MW) | Start of

Commercial

Operations | Concession

expires on |

| Hydroelectric Power Plants | | | | | | | |

| UHE Gov. José Richa (Salto Caxias)(1) | 1.240,0 | 605,6 | 100% | 1.240,0 | 605,6 | 18.02.1999 | 04.05.2030 |

| UHE Gov. Ney Aminthas de Barros Braga (Segredo)(1) | 1.260,0 | 578,5 | 100% | 1.260,0 | 578,5 | 29.09.1992 | 15.11.2029 |

| UHE Gov. Bento Munhos da Rocha Netto (Foz do Areia)(1) | 1.676,0 | 603,3 | 100% | 1.676,0 | 603,3 | 01.10.1980 | 17.09.2023 |

| UHE Gov. Pedro Viriato Parigot de Souza (GPS) | 260,0 | 109,0 | 100% | 260,0 | 109,0 | 03.09.1971 | 05.01.2046 |

| UHE Gov. Jayme Canet Júnior (Mauá) | 361,0 | 197,7 | 51% | 184,1 | 100,8 | 23.11.2012 | 02.07.2042 |

| UHE Guaricana | 36,0 | 16,1 | 100% | 36,0 | 16,1 | 26.09.1957 | 16.08.2026 |

| UHE Chaminé | 18,0 | 11,6 | 100% | 18,0 | 11,6 | 15.03.1931 | 16.08.2026 |

| PCH Cavernoso II | 19,0 | 10,5 | 100% | 19,0 | 10,5 | 15.05.2013 | 27.02.2046 |

| UHE Apucaraninha | 10,0 | 6,7 | 100% | 10,0 | 6,7 | 06.04.1949 | 12.10.2025 |

| UHE Derivação do Rio Jordão | 6,5 | 5,9 | 100% | 6,5 | 5,9 | 02.12.1997 | 15.11.2029 |

| UHE Marumbi | 4,8 | 2,4 | 100% | 4,8 | 2,4 | 05.04.1961 | (2) |

| UHE São Jorge | 2,3 | 1,5 | 100% | 2,3 | 1,5 | 01.01.1945 | 03.12.2024 |

| CGH Chopim I | 2,0 | 1,5 | 100% | 2,0 | 1,5 | 28.05.1963 | (3) |

| UHE Cavernoso | 1,3 | 1,0 | 100% | 1,3 | 1,0 | 08.12.1965 | 07.01.2031 |

| CGH Melissa | 1,0 | 0,6 | 100% | 1,0 | 0,6 | 31.01.1966 | (3) |

| CGH Salto do Vau | 0,9 | 0,6 | 100% | 0,9 | 0,6 | 03.12.1959 | (3) |

| CGH Pitangui | 0,9 | 0,1 | 100% | 0,9 | 0,1 | 09.07.1911 | (3) |

| Total Hydroelectric Power Plants | 4.899,7 | 2.152,6 | | 4.722,8 | 2.055,7 | | |

| Wind Energy Plants | | | | | | | |

| Santa Maria | 29,7 | 15,7 | 100% | 29,70 | 15,7 | 23.04.2015 | 07.05.2047 |

| Santa Helena | 29,7 | 16,0 | 100% | 29,70 | 16,0 | 06.05.2015 | 08.04.2047 |

| Olho d'Água | 30,0 | 15,3 | 100% | 30,00 | 15,3 | 25.02.2015 | 31.05.2046 |

| São Bento do Norte | 30,0 | 14,6 | 100% | 30,00 | 14,6 | 25.02.2015 | 18.05.2046 |

| Eurus IV | 27,0 | 14,7 | 100% | 27,00 | 14,7 | 20.08.2015 | 26.04.2046 |

| Asa Branca I | 27,0 | 14,2 | 100% | 27,00 | 14,2 | 05.08.2015 | 24.04.2046 |

| Asa Branca II | 27,0 | 14,3 | 100% | 27,00 | 14,3 | 15.09.2015 | 30.05.2046 |

| Asa Branca III | 27,0 | 14,5 | 100% | 27,00 | 14,5 | 04.09.2015 | 30.05.2046 |

| Farol | 20,0 | 10,1 | 100% | 20,00 | 10,1 | 25.02.2015 | 19.04.2046 |

| Ventos de Santo Uriel | 16,2 | 9,0 | 100% | 16,20 | 9,0 | 22.05.2015 | 08.04.2047 |

| Boa Vista | 14,0 | 6,3 | 100% | 14,00 | 6,3 | 25.02.2015 | 27.04.2046 |

| Palmas | 2,5 | 0,5 | 100% | 2,50 | 0,5 | 12.11.1999 | 28.09.2029 |

| Total Wind Energy Plants | 280,1 | 145,2 | | 280,1 | 145,2 | | |

| Thermal Power Plants | | | | | | | |

| UTE Figueira | 20,0 | 10,3 | 100% | 20,0 | 10,3 | 08.04.1963 | 26.03.2019 |

| UTE Araucária | 484,1 | 365,2 | 60% | 290,5 | 219,1 | 27.09.2002 | 22.12.2029 |

| Total Thermal Power Plants | 504,1 | 375,5 | | 310,5 | 229,4 | | |

| |

| Total Sources | 5.683,9 | 2.673,3 | | 5.313,4 | 2.430,3 | | |

| (1)Physical Guarantee as a result of the new amounts established by Ordinance MME nº 178 of 03.05.2017, w ith effect from 01.01.2018 | |

| (2)In the process of homologation at ANEEL. | | | | | | | |

| (3)Registration according to Aneel Order n° 182/2002 and Aneel Resolution n° 5373/2015. | | | | |

24

To fulfill important strategic and sustainability guidelines established for the generation business, the Company's main purpose is to profitably and sustainably boost the share of renewable alternative sources in the energy mix.

The composition of the generating park by source is as follows:

Currently, the Company is focusing its efforts on the construction of 15 plants, which will add 716.8 MW of installed capacity and 355.3 MW on average of physical guarantee to the generator park, with 80% of this physical guarantee expected to start the commercial operation during 2018, according to the table:

25

Power Plant Projects under Construction - Physical Characteristics

| | | | | | | | |

| Development | Installed

Capacity

(MW) | Physical

Assurance

(average MW) | | Ownership % | Proportional

Installed

Capacity (MW) | Proportional

Physical

Assurance

(Average MW) | Commercial

Operations

expected toÂ

start on | Concession

expires on |

| Hydroelectric Power Plants | | | | | | | | |

| UHE Colíder | 300,0 | 178,1 | (1) | 100% | 300,0 | 178,1 | jun/2018 | 16.01.2046 |

| UHE Baixo Iguaçu | 350,0 | 171,3 | (2) | 30% | 105,0 | 51,4 | nov/2018 | 13.09.2049(3) |

| Total Hydroelectric Power Plants | 650,0 | 349,4 | | | 405,0 | 229,5 | | |

| Wind Energy Plants | | | | | | | | |

| GE Maria Helena | 27,3 | 12,0 | | 100% | 27,3 | 12,0 | jul/2018 | 04.01.2042 |

| Potiguar | 27,3 | 11,5 | | 100% | 27,3 | 11,5 | jul/2018 | 10.05.2050 |

| Paraíso dos Ventos do Nordeste | 27,3 | 10,6 | | 100% | 27,3 | 10,6 | jul/2018 | 10.05.2050 |

| GE Jangada | 27,3 | 10,3 | | 100% | 27,3 | 10,3 | jul/2018 | 04.01.2042 |

| Cutia | 23,1 | 9,2 | | 100% | 23,1 | 9,2 | jul/2018 | 04.01.2042 |

| Esperança do Nordeste | 27,3 | 9,1 | | 100% | 27,3 | 9,1 | jul/2018 | 10.05.2050 |

| Guajiru | 21,0 | 8,3 | | 100% | 21,0 | 8,3 | jul/2018 | 04.01.2042 |

| São Bento do Norte I | 23,1 | 9,7 | | 100% | 23,1 | 9,7 | jan/2019 | 03.08.2050 |

| São Bento do Norte II | 23,1 | 10,0 | | 100% | 23,1 | 10,0 | jan/2019 | 03.08.2050 |

| São Bento do Norte III | 22,0 | 9,6 | | 100% | 22,0 | 9,6 | jan/2019 | 03.08.2050 |

| São Miguel I | 21,0 | 8,7 | | 100% | 21,0 | 8,7 | jan/2019 | 03.08.2050 |

| São Miguel II | 21,0 | 8,4 | | 100% | 21,0 | 8,4 | jan/2019 | 03.08.2050 |

| São Miguel III | 21,0 | 8,4 | | 100% | 21,0 | 8,4 | jan/2019 | 03.08.2050 |

| Total Wind Energy Plants | 311,8 | 125,8 | | | 311,8 | 125,8 | | |

| |

| Total Sources | 961,8 | 475,2 | | | 716,8 | 355,3 | | |

| (1)Physical guarantee revised by virtue of the new amounts established by the Ordinance of the Secretariat Planej. and Develop. Energetic nº 258/2016. |

| (2)Physical guarantee revised by virtue of the new amounts established by the Ordinance of the Secretary Planej. and Develop. Energetic nº 11/2017. | |

| (3)According to the 2nd Addendum to the Concession Agreement, w hich considers the exclusion of responsibility for 756 days. | | |

R$4.1 billion were invested in these generation projects up to December 31, 2017, of which R$3.2 billion were until December 31, 2016. Of the total, R$2.9 billion refer to the improvement in fixed assets in progress of our own and consortium plants, and the remainder refers to nvestment in wind farms.

In the segment of electric energy generation, we also highlight:

· | Colíder Hydroelectric Power Plant:The plant located in the Teles Pires River, between the cities of Nova Canaã do Norte and Itaúba, in Mato Grosso, had the construction works started in 2011 and should absorb R$2.4 billion in investments. In 2016, the work of suppression of vegetation around the future reservoir was completed and 94% of the construction works have already been completed. Copel Geração e Transmissão won the concession for the implementation and operation of the plant for 35 years in the energy auction held by Aneel on July 30, 2010. The project, which was expected to be commercially operating in December 2017, will have an installed capacity of 300 MW. Due to acts of God or force majeure, such as fire at the construction site, acts of the public power, which resulted in difficulties involving environmental licenses, among other setbacks such as delays in the delivery of equipment, in electromechanical assembly services in the construction of the transmission line associated to the power station, the project experienced adverse effects on its schedule, so that the commercial generation of the power plant was postponed, and the first generating unit is expected to be operational in June 2018, while the third and last line is expected to be operational in November 2018. |

26

· | Baixo Iguaçu Hydroelectric Power Plant:With a 30% interest in the project, the Company estimates to invest R$720,0 million. After the Baixo Iguaçu Entrepreneurial Consortium (CEBI) having carried out actions to meet the additional requirements of the environmental licensing imposed by the Chico Mendes Institute of Biodiversity Conservation (ICMBio – Instituto Chico Mendes de Conservação da Biodiversidade), in February 2016 the construction work resumed fully. Also in August 2016, Aneelformalized the publication of the 2nd Amendment to the Concession Agreement, in order to formalize the redefinition of the schedule of the HPP Baixo Iguaçu, as well as its final closing date, acknowledging in favor of CEBI an exclusion of liability for the delay in the implementation of the project for a period corresponding to 756 days, recommending to the MME the extension of the term of the grant and establishing that the CCEE must promote the postponement of the beginning of the supply period of the CCEARs for the period of the recognized exclusion of liability. The plant will have an installed capacity of 350.2 MW in partnership with Geração Céu Azul S.A., the forecast of the beginning of the commercial generation of the three generating units is currently expected to occur in the middle of the 4th quarter of 2018. |

· | Modernization of the Figueira Thermoelectric Power Plant: The Company started the modernization work in 2015, in order to increase its efficiency and reduce the emission of gases and particles resulting from the burning of coal. Until the first quarter of 2016, the work developed as it should, but after the second quarter of the same year, as a result of financial difficulties, the company hired to carry out the services showed signs of difficulty to maintain the execution of the activities of the agreement, culminating in the near paralysis of the work. In view of this situation, the Company replaced the company engaged to continue the work, and expects that the project be completed by the end of the last half of 2018. |

· | Cutia and Bento Miguel Wind Farm Complex: Copel’s largest wind farm project is under construction. The project named Cutia is divided into two large complexes, namely: (a) Cutia Complex, comprised of seven wind farms (Guajiru, Jangada, Potiguar, Cutia, Maria Helena, Esperança do Nordeste and Paraíso dos Ventos do Nordeste), with an installed capacity of 180.6 MW, 71.4 MW average physical guarantee, all located in the State of Rio Grande do Norte. Energy to be generated by the parks was traded at the 6th Reserve Auction, held on October 31, 2014, at the average historical price of R$144.00/MWh, adjusted by the variation of the IPCA to R$ 176.64 at December 31, 2017. These parks are expected to be commercially operational in July 2018; and (b) Bento Miguel Complex: comprised of six wind farms (São Bento do Norte I, São Bento do Norte II, São Bento do Norte III, São Miguel I, São Miguel II and São Miguel III) with 132.3 MW of total installed capacity, 54.8 MW average physical guarantee, all located in the State of Rio Grande do Norte. The energy to be generated by wind farms was traded at the 20th Auction of New Energy held on November 28, 2014, at the average historical price of R$ 136.97/MWh, adjusted by the variation of the IPCA to R$ 167.16 at December 31, 2017. These parks are initially expected to become operational in January 2019. Following are the significant highlights of completion of works from January 2016 to December 2017. In January 2016, environmental licenses were obtained, with the construction of access routes, bases and platform of assembly of the generating set. In April 2016, the construction of the Cutia Substation was started, with an installed power of three transformers of 120 MVA and 26 circuits of 34.0 kV, two circuits for each wind farm. In October 2016, with the advanced stage of the civil services in some farms the first generating sets started to be delivered, and the Torres Production Center became operational, structure in which pre-cast elements are being prepared, which will consist of the supporting towers of air generators. In January 2017, the process of assembly of air generator towers began. |

27

3.3.2. Transmission

The main responsibility of the segment is to provide electric energy transportation and transformation services, and is responsible for the construction, operation and maintenance of substations, as well as lines for the transmission of energy.

The Company owns and participates in transmission concessions in operation, corresponding to 7,025 km of transmission lines and 45 substations of the basic network with a processing power of 14,752 MVA. Below is the breakdown of transmission lines and substations in operation.

28

Transmission Lines and Substations in Operation

| | | | | | | | |

| Linhas e Subestações de Transmissão | | Propriedade | Circuito | Tensão (kV) | Extensão

(km) | Capacidade

Trans-

formação

(MVA) | Previsão

de Operação

Comercial | Vencimento da

Outorga |

| Linhas e Subestações próprias | | | | | 2.658 | 13.152 | | |

| Contrato nº 060/2001 | Instalações de transmissão diversas(1) | | AmbosDiversas | 2.024 | 12.202 | Diversos | 31.12.2042 |

| Contrato nº 075/2001 | LT Bateias - Jaguariaíva | | CS | 230 kV | 137 | - | 01.11.2003 | 16.08.2031 |

| Contrato nº 006/2008 | LT Bateias - Pilarzinho | | CS | 230 kV | 32 | - | 14.09.2009 | 16.03.2038 |

| Contrato nº 027/2009 | LT Foz do Iguaçu - Cascavel Oeste | | CS | 525 kV | 116 | - | 06.12.2012 | 18.11.2039 |

| Contrato nº 015/2010 | SE Cerquilho III | | - | 230/138 kV | - | 300 | 01.06.2014 | 05.10.2040 |

| Contrato nº 022/2012 | LT Londrina - Figueira C2 | | CS | 230 kV | 92 | - | 30.06.2015 | 26.08.2042 |

| | LT Foz do Chopim - Salto Osório C2 | | CS | 230 kV | 10 | - | | |

| Contrato nº 002/2013 | LT Assis - Paraguaçu Paulista II | | CD | 230 kV | 42 | - | 25.01.2016 | 24.02.2043 |

| | SE Paraguaçu Paulista II | | - | 230 kV | - | 200 | | |

| Contrato nº 005/2014 | LT Bateias - Curitiba Norte | | CS | 230 kV | 31 | - | 29.07.2016 | 28.01.2044 |

| | SE Curitiba Norte | | - | 230/138 kV | - | 300 | | |

| Contrato nº 021/2014 | LT Foz do Chopim - Realeza | | CS | 230 kV | 52 | - | 05.03.2017 | 04.09.2044 |

| | SE Realeza | | - | 230/138 kV | - | 150 | | |

| Contrato nº 022/2014 | LT Assis - Londrina C2 | | CS | 500 kV | 122 | - | 05.09.2017 | 04.09.2044 |

| Sociedades de Propósito Específico | | | | | 4.373 | 1.838 | | |

| Costa Oeste Transmissora de Energia S.A. | | 0,51 | | | | | | |

| Contrato nº 001/2012 | LT Cascavel Oeste - Umuarama Sul | | CS | 230 kV | 152 | - | 31.08.2014 | 11.01.2042 |

| | SE Umuarama | | - | 230/138 kV | - | 300 | 27.07.2014 | |

| TSBE Transmissora Sul Brasileira de Energia S.A. | | 0,2 | | | | | | |

| Contrato nº 004/2012 | LT Nova Santa Rita - Camaquã 3 | | CS | 230 kV | 121 | - | 09.12.2014 | 09.05.2042 |

| | LT Camaquã 3 - Quinta | | CS | 230 kV | 167 | - | 09.12.2014 | |

| | LT Salto Santiago - Itá C2 | | CS | 525 kV | 188 | - | 04.02.2014 | |

| | LT Itá - Nova Santa Rita C2 | | CS | 525 kV | 307 | - | 06.08.2014 | |

| | Secc Guaiba 2-Pelotas3-SE Camaquã 3 | | - | - | 2 | - | 09.12.2014 | |

| | SE Camaquã 3 | | - | 230/69/13,8 kV | - | 166 | 09.12.2014 | |

| Caiuá Transmissora de Energia S.A. | | 0,49 | | | | | | |

| Contrato nº 007/2012 | LT Umuarama - Guaíra | | CS | 230 kV | 105 | - | 12.05.2014 | 09.05.2042 |

| | LT Cascavel Oeste - Cascavel Norte | | CS | 230 kV | 37 | - | 02.07.2014 | |

| | SE Santa Quitéria - SF6 | | - | 230/138/13,8 kV | - | 400 | 01.06.2014 | |

| | SE Cascavel Norte | | - | 230/138/13,8 kV | - | 300 | 02.07.2014 | |

| Marumbi Transmissora de Energia S.A. | | 0,8 | | | | | | |

| Contrato nº 008/2012 | LT Curitiba - Curitiba Leste | | CS | 525 kV | 29 | - | 28.06.2015 | 09.05.2042 |

| | SE Curitiba Leste | | - | 525/230 kV | - | 672 | | |

| Integração Maranhense e Transmissora de Energia S.A. | 0,49 | | | | | | |

| Contrato nº 011/2012 | LT Açailândia - Miranda II | | CS | 500 kV | 365 | - | 02.12.2014 | 09.05.2042 |

| Matrinchã Transmissora de Energia (TP NORTE) S.A. | | 0,49 | | | | | | |

| Contrato nº 012/2012 | LT Paranatinga - Ribeirãozinho | | CD | 500 Kv | 355 | - | 29.07.2016 | |

| | LT Paranaíta - Cláudia | | CD | 500 Kv | 300 | - | | |

| | LT Cláudia - Paranatinga | | CD | 500 Kv | 350 | - | | 09.05.2042 |

| | SE Paranaíta (a) | | - | 500 Kv | - | - | | |

| | SE Cláudia (a) | | - | 500 Kv | - | - | | |

| | SE Paranatinga (a) | | - | 500 Kv | - | - | | |

| Guaraciaba Transmissora de Energia S.A. | | 0,49 | | | | | | |

| Contrato nº 013/2012 | LT Ribeirãozinho - Rio Verde Norte C3 | | CS | 500 Kv | 250 | - | 30.08.2016 | |

| | LT Rio Verde Norte - Marimbondo II | | CD | 500 Kv | 350 | - | | 09.05.2042 |

| | SE Marimbondo II (a) | | - | 500 Kv | - | - | | |

| Paranaíba Transmissora de Energia S.A | | 0,245 | | | | | | |

| Contrato nº 007/2013 | LT Barreiras II - Rio das Éguas | | CS | 500 Kv | 239 | - | 30.01.2017 | 02.05.2043 |

| | LT Rio das Éguas - Luziânia | | CS | 500 Kv | 368 | - | | |

| | LT Luziânia - Pirapora 2 | | CS | 500 Kv | 346 | - | | |

| Cantareira Transmissora de Energia S.A. | | 0,49 | | | | | | |

| Contrato nº 019/2014 | LT Estreito - Fernão Dias | | CD | 500 kV | 342 | - | 05.03.2018 | 04.09.2044 |

| Total | | | | | 7.031 | 14.990 | | |

| (1)Concessão prorrogada nos termos da MP nº 579/2012. | | | | | | | | |

The transmission concessions in operation on December 31, 2017 currently generate RAP to Copel Geração e Transmissão of R$777.4 million, proportional to its share in the projects.

Currently, the Company is focusing its efforts on the construction of 3 projects, which will add 1,408 kilometers of range and 4,000 MVA of transformation capacity to the set of own and in partnership transmission lines and substations, as follows:

29

Transmission Lines and Substations Projects - Physical Characteristics

| | | | | | | |

| Transmission Lines and Substations | Property | Circuit | Tension(kV) | Extension

(km) | Transformation

capacity (MVA) | Commercial

Operations

expected to

start on | Concession

expires on |

| | | | | | | | |

| Own lines and Substations | | | | 544,5 | 900 | | |

| Contract No.010/2010 LT Araraquara 2 - Taubaté | | CS | 500 kV | 356,0 | - | 30.06.2017 | 05.10.2040 |

| Contract No.006/2016 LT Curitiba leste - Blumenau | | CS | 525 KV | 142,0 | - | 04.03.2021 | 06.04.2046 |

| LT Baixo Iguaçu - Realeza | | CS | 230 KV | 38,0 | - | | |

| LT Curitiba centro | | Subterrâneo | 230 KV | 8,5 | - | | |

| SE Medianeira | | - | 230/138 KV | - | 300 | 04.09.2019 | 06.04.2046 |

| SE Curitiba centro | | - | 230/138 KV | - | 300 | | |

| SE Andira leste | | - | 230/138 KV | - | 300 | | |

| Special Purpose Entity | | | | 885,0 | 3.600 | | |

| Mata de Santa Genebra Transmissão S.A. | 50,1% | | | | | | |

| Contract No.001/2014 LT Itatiba - Bateias | | CS | 500 Kv | 414,0 | - | | |

| LT Araraquara 2 - Itatiba | | CS | 500 Kv | 222,0 | - | | |

| LT Araraquara 2 - Fernão Dias | | CS | 500 Kv | 249,0 | - | 14.11.2017 | 13.05.2044 |

| SE Santa Bárbara d'Oeste(1) | | - | 440 kV | - | - | | |

| SE Itatiba (a) | | - | 500 kV | - | - | | |

| SE Fernão Dias | | - | 500/440 kV | - | 3.600 | 14.05.2018 | 13.05.2044 |

| Total | | | | 1.430 | 4.500 | | |

| (1) Exclusive for reactive control of transmission lines of the Na tional Interconnected System, improving the quality of the transmitted energy. | |

· Transmission works:

· LT Araraquara — Taubaté: including the implementation of the Transmission Facilities of Lot A - Auction 01/2010. The construction and operation of 334 km of 500 kV Transmission Line, starting at the Araraquara 2 SE porch to the vicinity of SE Taubaté and the respective line entrances, bar interconnections and other equipment, will enable an increase of the RAP to Copel of R$29.0 million. The project is under construction and forecasted to start operating in 2018.

· Lot E - Auction Aneel 005/2015:includes a series of projects that are expected to start operating in September 2019 and March 2021. The project will enable an increase of the RAP to Copel Geração e Transmissão of R$108.6 million. Lot E has been divided into several projects that are in progress.

In addition to the works won in the auctions promoted by Aneel, Copel has the works coming from the authorizing resolutions in order to expand and improve existing facilities.

· Authorization Resolution 5,711/2016:implementation at the 230 kV Figueira substation - of the first 138 kV - 15 Mvar capacitor bank, with an investment of R$4.8 million and RAP of approximately R$0.8 million from the commercial start-up, scheduled for December 2018.

· Authorization Resolution 5,776/2016:implementation at the 230 kV Sarandi substation - of the second 230/138kV - 150 MVA autotransformer, with an investment of approximately R$14.8 million and RAP of approximately R$2.3 million from the commercial start-up scheduled for October 2018.

30

· Authorization Resolution 5,834/2016:implementation at the 230 kV Apucarana substation - of the 138 kV - 30 Mvar capacitor bank, with an investment of approximately R$5.5 million and RAP of approximately R$0.9 million from the commercial start-up scheduled for 2018.

· Authorization Resolution 5,930/2016:implementation at the 500 kV Bateias substation - of a 500 kV - 200 Mvar bank of bar reactor, with an investment of approximately R$30.0 million and a RAP of approximately R$4.3 million from the start-up scheduled for September 2018.

· Other highlights

On March 05, 2017, the operation of the new power substation in Realeza, in the southwest region of Paraná, began. The substation operates at 230 kV and has 150 MVA of total transformation power. The installation also has a backup transformer for emergency situations. The project includes a 52 km long transmission line that connects Realeza Sul to substation Foz do Chopim, already in operation. The set has the function of improving the flow of energy from thermal plants to the biomass existing in the region, given the increase in the electricity demand registered mainly in the cities of Presidente Prudente, Assis and Salto Grande. This venture adds RAP to the Company of R $ 7.2 million.

With the start-up of commercial operations in September 2017, the transmission line 525 kV Londrina – Assis with a 123 km extension will connect the substations located in the municipality of Londrina, in the North of Paraná, and Assis, in the Southwest of São Paulo. This project will add to the Company a RAP of approximately R$18.9 million.

Also completed in 2017 were the projects authorized for Copel Geração e Transmissão by Aneel Authorization Resolution 4,890/2014. Transmission line 230 kV Figueira – Ponta Grossa Norte, with 142 km of extension, which was reconstructed, and the capacitor banks at 230 kV, with 300 Mvar of reactive power, at the Bateias substation, located in the municipality of Campo Largo, in the metropolitan area of Curitiba, started up in July. The projects add to the Company a RAP of approximately R$ 6.6 million.

3.3.3. Distribution

In the scope of the electric energy distribution, Copel Distribuição's main activities are to provide, operate and maintain the infrastructure, as well as to provide related services, described in the Concession Agreement 046/1999, signed on June 24, 1999, extended until July 7, 2045 by means of the Fifth Amendment Term.

Copel Distribuição's activities are aimed at serving more than 4.6 million energy consumers in 1,113 locations in 394 cities in Paraná and one in Santa Catarina (Porto União). The cities of Guarapuava and Coronel Vivida are partially served. In addition to operating and maintaining the installations at voltage levels up to 34.5 kV, it also operates in installations with voltage levels of 69 and 138 kV.

31

In 2017, new substations and high voltage lines were connected to reinforce the electrical distribution system, improving the quality and increasing the availability of electric energy to consumers. The works of the new substations completed are:

| | | |

| Substation | Power (MVA) | | Location |

| Implantations | | | |

| SE Cafelândia do Oeste 138 kV | 41,66 | | Cafelândia |

| SE Cambé 138 kV | 41,66 | | Cambé |

| SE Catanduvas do Sul 34,5 kV | 7,00 | | Contenda |

| SE Colombo 138 kV | 30,00 | | Colombo |

| SE São Pedro do Ivaí 138 kV | 20,83 | | São Pedro Do Ivaí |

| SE São Valentim 34,5 kV | 7,00 | | Dois Vizinhos |

| SE Sítio Cercado 69 kV | 41,67 | | Curitiba |

| SE Santa Maria 34,5 kV | 0,00 | | Santa Maria Do Oeste |

| Expansions | | | |

| SE Apucarana 230 kV | 83,34 | | Apucarana |

| SE Concórdia 138 kV | 30,00 | | Toledo |

| SE Astorga 138 kV | 83,34 | | Astorga |

| SE Palotina 138 kV | 41,67 | | Palotina |

| SE Maringá 230 kV | 41,67 | | Maringá |

| SE Califórnia 34,5 kV | 7,00 | | Califórnia |

| SE Passo do Iguaçu 138 kV | 20,83 | | União Da Vitória |

| SE Cianorte 138 kV | 41,67 | | Cianorte |

| SE Douradina 34,5 kV | 7,00 | | Douradina |

| SE Xisto 34,5 kV | 7,00 | | São Mateus Do Sul |

32

New 69 kV and 138 kV high voltage lines have been completed:

| | |

| Location | Tension | Extension |

| Sitio Cercado - Seccionamento (CIC-NMU) | 69 kV | 15,4 km |

| Santa Mônica - Guaraituba 2 | 69 kV | 6,21 km |

| Almirante Tamandaré - Rio Branco do Sul | 138 kV | 5,0 km |

| Colombo - Seccionamento (ATM-RBS) | 138 kV | 14,98 km |

| Bateias - Rio Branco do Sul | 138 kV | 0,26 km |

| Rio Branco do Sul - Tunas | 138 kV | 0,26 km |

| Barbosa Ferraz - São Pedro do Ivaí | 138 kV | 28,2 km |

| Cafelândia - Seccionamento (PHS-AND) | 138 kV | 5,5 km |

| Fazenda Rio Grande - Tafisa | 138 kV | 56,4 km |

| Joaquim Távora - Seccionamento (SPL-SQC) | 138 kV | 8,2 km |

| São Cristovão - Coopavel | 138 kV | 2,3 km |

| Umuarama Sul - Douradina | 138 kV | 50,1 km |

| Total | | 192,8 km |

In all, in 2017, these projects have added approximately 553.34 MVA to the distribution system and 192.81 km of new transmission lines.

· Distribution Lines

The following table shows the distribution lines of Copel Distribuição:

| | |

| Distribution Lines - Length in km | dez/17 | dez/16 |

| |

| 13,8 kV | 105.510,6 | 104.556,0 |

| 34,5 kV | 84.639,2 | 84.071,3 |

| 69,0 kV | 866,4 | 695,4 |

| 138,0 kV | 5.935,0 | 5.970,3 |

| 230,0 kV | 0,0 | 165,5 |

| Total | 196.951,2 | 195.458,5 |

33

· Substations

The following table presents the Copel Distribuição substation park, open for voltage:

| | | | |

| Power | Automated substations | MVA |

| | dez/17 | dez/16 | dez/17 | dez/16 |

| 34,5 kV | 225 | 223 | 1.537,9 | 1.488,5 |

| 69 kV | 35 | 35 | 2.406,3 | 2.395,8 |

| 88 kV | - | - | 5,0 | 5,0 |

| 138 kV | 109 | 106 | 7.286,0 | 7.132,6 |

| Total | 369 | 364 | 11.235,2 | 11.021,9 |

· Quality of Supply

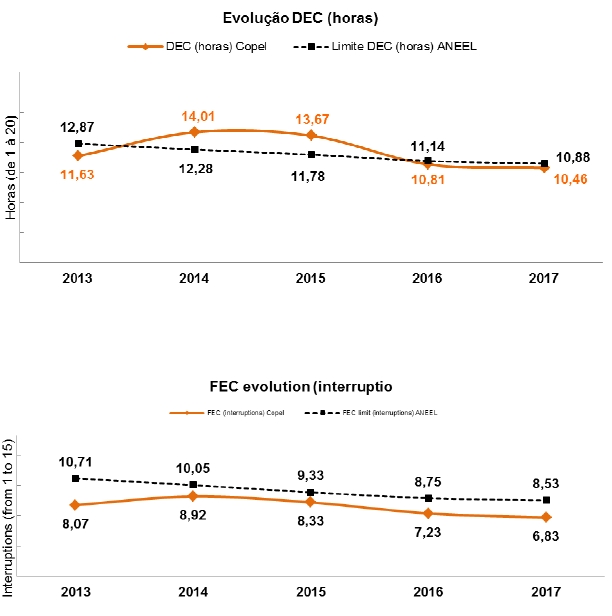

Supply quality is measured by indicators that monitor distributors' performance in terms of continuity of service. The Outage Duration Equivalent per Consumer Unit (DEC) measures the number of hours on average that consumers remain without power during a certain period. The Outage Frequency Equivalent per Consumer Unit (FEC) indicates the average number of outages per consumer unit. Based on DEC and FEC, ANEEL establishes individual continuity parameters (DIC, FIC and DMIC) which are itemized in electricity consumers’ monthly bills.

These indicators are reviewed in the Periodic Tariff Review (RTP), and are increasingly becoming stricter in order to improve the quality of customer service. The indicator is established in concession agreements and failing to fulfill the efficiency criterion for quality of service for two consecutive years during the period assessed or in the year 2020, will lead to the concession being canceled.

Copel Distribution's DEC and FEC indicators showed improvement in the number and duration of outages for the year 2017 compared to the previous year, due to investments in performance and expansion work, increase in periodic maintenance, and preventive inspections, as shown below:

34

· Management of energy losses

Energy losses are inherent to the nature of the process of transforming, transmission and distribution of electricity. An analysis of the electricity required to serve consumers must bear in mind that not all electricity generated is delivered to end consumers.

In this context, distributor losses may be segmented between losses in the Basic Grid, which are external to the concessionaire's distribution system and are imminently technical in their origin, and distribution losses that may be of a technical or non-technical nature.

35

In 2017, overall distribution losses - technical, non-technical and basic network - accounted for 9.2% of the energy injected into the distribution system. This percentage decreased by nearly 0.4% versus 2016 and kept below the levels seen over the last few years. The Program for Fight against Non-technical Losses held by Copel Distribuição contributed to that decrease.

· Captive market

From January to December the captive market consumption was of 19,743 GWh, with a negative variation of 11.6% in relation to the prior year due to the migration of consumers to the free market.The number of captive consumers billed by Copel Distribuição was 1.8% larger than that in December 2016, totaling 4,560,493 consumers.In 2017, 81,726 captive consumers were added to the system.

The tables show the energy sold and the consumption class in number of consumers:

| | | |

| Captive Market - Copel Distribuição |

| No. of consumers |

| | Dec/17 | Dec/16 | % |

| Residential | 3.682.009 | 3.597.105 | 2,4 |

| Industrial | 76.328 | 82.021 | (6,9) |

| Commercial | 389.844 | 382.121 | 2,0 |

| Rural | 354.829 | 360.066 | (1,5) |

| Others | 57.483 | 57.454 | 0,1 |

| Total | 4.560.493 | 4.478.767 | 1,8 |

| |

| Energy sold (GWh) |

| | Dec/17 | Dec/16 | % |

| Residential | 7.126 | 6.932 | 2,8 |

| Industrial | 3.254 | 5.753 | (43,4) |

| Commercial | 4.651 | 5.059 | (8,1) |

| Rural | 2.257 | 2.179 | 3,6 |

| Others | 2.455 | 2.405 | 2,1 |

| Total | 19.743 | 22.328 | (11,6) |

36

· Wire Market (TUSD)

In 2017, the wire load, which takes into account all consumers who accessed the network of the Distributor, presented an increase of 3.4% when compared to 2016.

The industrial wire market increased by 4.9% in 2017, with the most significant branches of the industrial class being the production of food, pulp, paper and paper products and manufacture of wood products.

| | | |

| Number of consumers |

| | Dec/17 | Dec/16 | % |

| Captive Market | 4.560.493 | 4.478.767 | 1,8 |

| Real Estate Agents | 3 | 4 | (25,0) |

| Free Consumers | 991 | 620 | 59,8 |

| Dealerships Fio | 3 | 2 | 50,0 |

| Wire Market | 4.561.490 | 4.479.393 | 1,8 |

| |

| Distributed energy (GWh) |

| | 2017 | 2016 | % |

| Captive Market | 19.743 | 22.328 | (11,6) |

| Real Estate Agents | 521 | 614 | (15,1) |

| Free Consumers | 8.873 | 5.273 | 68,3 |

| Dealerships Fio | 78 | 52 | 50,0 |

| Wire Market | 29.215 | 28.267 | 3,4 |

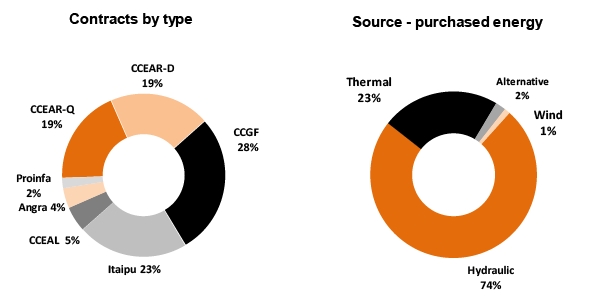

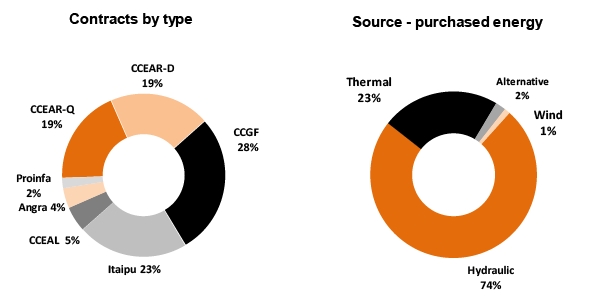

· Purchase of Energy

Under the current regulatory reference, the contracting of energy by the distributors mainly occurs through an auction regulated by Aneel. To supply the market in the following years, in 2017 Copel Distribuição participated in the 25th Auction of New Energy (A-4), which took place on December 18, 2017, with a 35 MWmed acquisition and a start-up from January 1, 2021, and in the 26th New Energy Auction (A-6) on December 20, 2017, with the acquisition of 239.5 MWmed and start of supply beginning January 1, 2023.

To serve the market in 2017, the agreements negotiated in prior years started being supplied: 3rd Auction of Structuring Projects, contracted in 2010; 15th New Energy Auction (A-5), contracted in 2012; 19th New Energy Auction (A-3), contracted in 2014, and 3rd Alternative Sources Action, contracted in 2015.

In addition to these events, Copel Distribuição received the compulsory allocation of new physical guarantee quotas from HPP Volta Grande, Miranda, Jaguara and Pery, which started operating under the quotas system in connection with Law 12,783/2013.

The charts show the composition of the Distributor’s energy purchase agreements portfolio by type of agreement and source, respectively:

37

CCEAR – Energy Trading Agreements in the Regulated Environment – By Quantity and Availability

CCGF – Physical Guarantee Quota Agreement

CBR – Bilateral Regulated Agreement

Proinfa – Incentive Program for Alternative Energy Sources

· Overcontracting

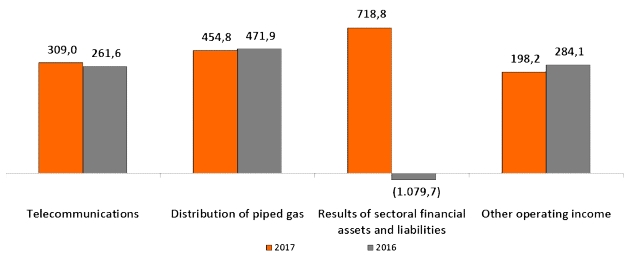

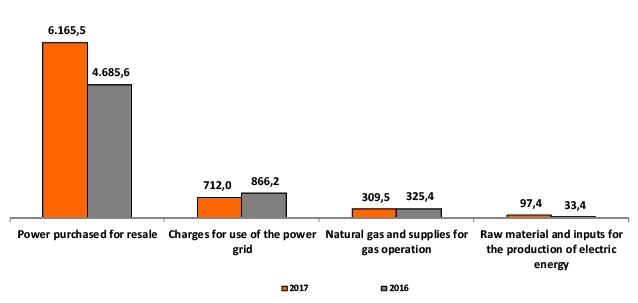

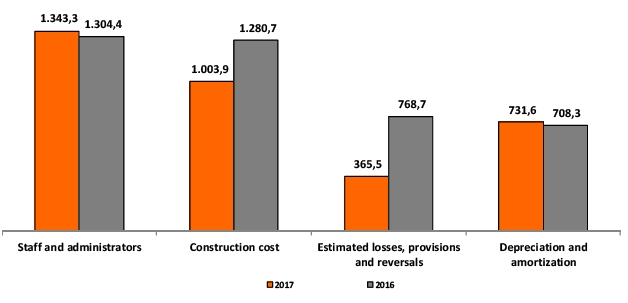

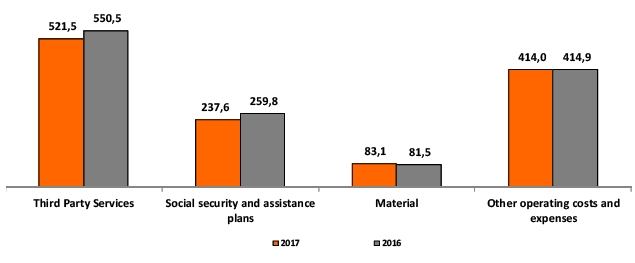

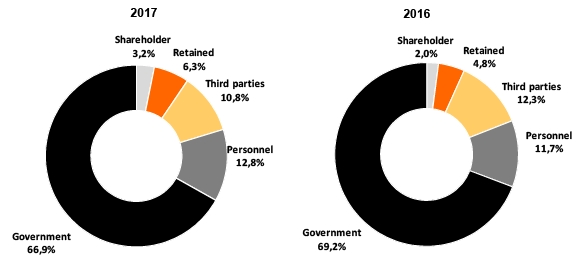

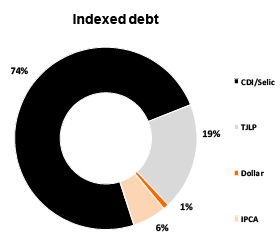

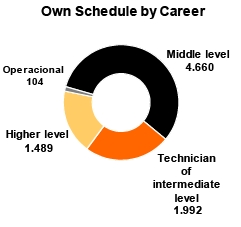

In the current regulatory model, the purchase of energy by distributors is regulated by Law 10,484/2014 and by Decree 5,163/2004, which determine that these shall acquire the volume required to serve 100% of market, through auctions of the Regulated Contracting Environment – ACR.