SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December, 2018

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

Rua Coronel Dulcídio, 800

80420-170 Curitiba, Paraná

Federative Republic of Brazil

+55 (41) 3331-4011

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

PROPOSAL FOR AMENDMENT OF THE BYLAWS

COMPANHIA PARANAENSE DE ENERGIA - COPEL

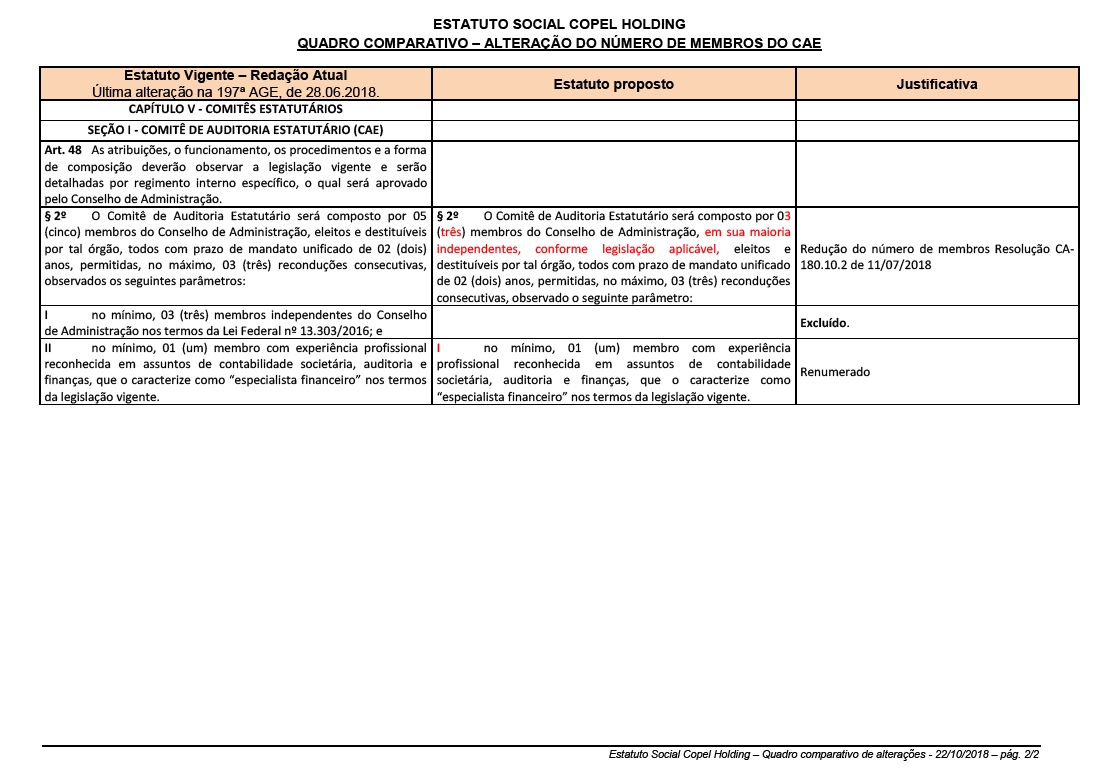

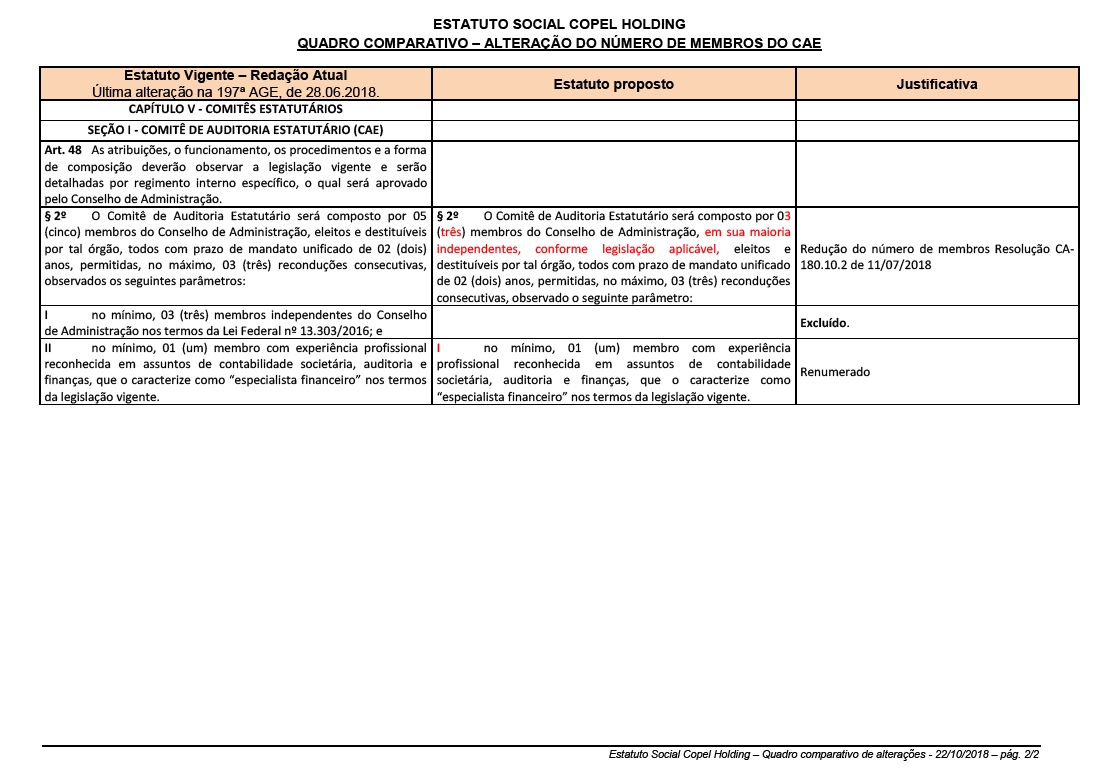

The Statutory Audit Committee - SAC is an independent, permanent advisory committee to the Board of Directors. Its duties, procedures and the number of the members shall comply with current legislation and are laid down in the Rules of Procedure specific for such Committee, duly approved by the Board of Directors

The SAC is composed of five members of the Board of Directors, elected and dismissed by such Board, whose unified term of office shall be of two years, reelection being permitted for no more than three consecutive times, subject to the following requirements:i. having a minimum of three independent members of the Board of Directors, pursuant to Federal Law no.13,303/2016; andii. at least one member of the Statutory Audit Committee shall have recognized professional experience in matters of corporate accounting, auditing and finance, allowing such member to be considered a financial expert according to the current legislation.

In order to sit on the Statutory Audit Committee, members shall comply with the minimum requirements of Federal Law no. 13,303/2016.

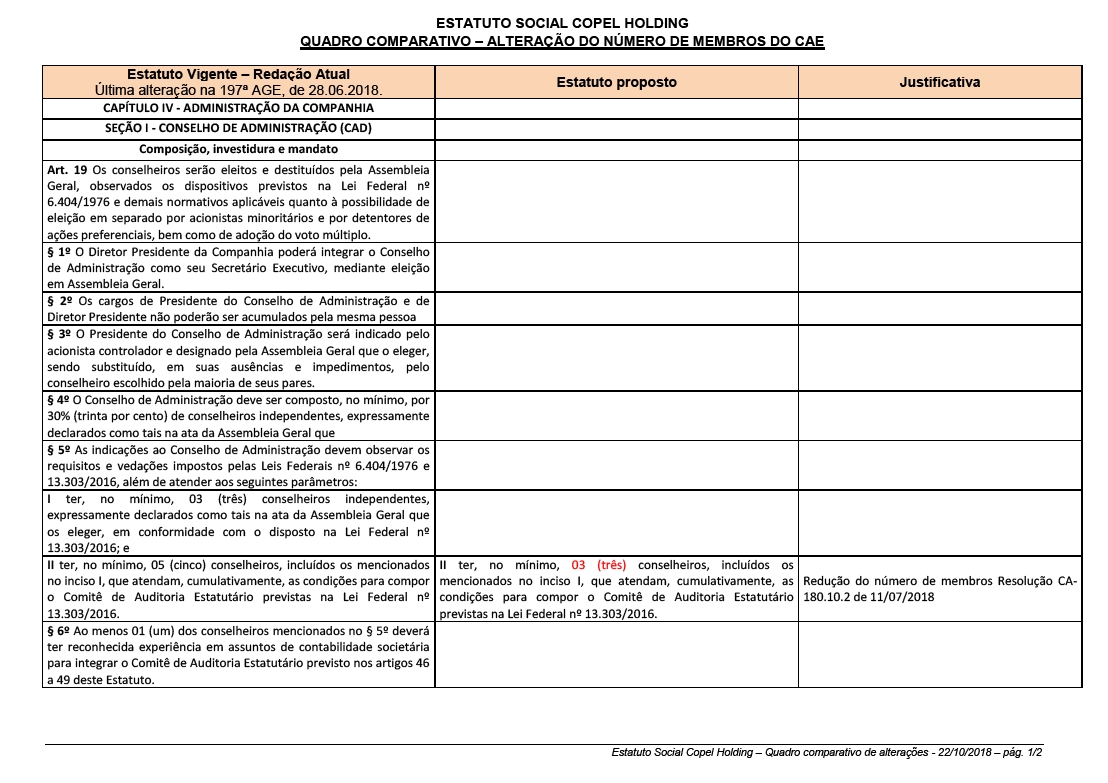

Considering SAC’s current structure and aiming at adjusting it in order to fulfill the Company’s needs,and observing good corporate governance practices, the members of the Board of Directors, in their 180th Ordinary Meeting, of July 11, 2018, proposed to alter the Company’s Bylaws to adequate the number of members of the Statutory Audit Committee, reducing it from 05 (five) to 03 (three) members.

Thus, we present, in the terms ofAnnex I a and of the comparative table with the appropriate justifications (Anexo I b), adjusted proposal for the Corporate Bylaws of Copel (Holding).

PROPOSAL FOR SUBSTITUTION OF MEMBER IN

THE COMPANY’S BOARD OF DIRECTORS

(Item already deliberated in the meeting held on November 30, 2018)

Copel’s Board of Directors is a decision-making body, composed of 9 (nine) members, Brazilian, shareholders, residing in the country and elected by the General Assembly, pursuant to the Brazilian Corporation Law (Law no. 6,404/1976).

The Board of Directos has as its main duty the laying down of the overall strategy for the Company business.

In accordance with Law no. 6,404/1976 (Brazilian Corporation Law), in order to take office, all Board members shall sign a clearance certificate declaring that they are not impeded by any crimes provided for by law from performing business activities, and they shall also execute the Investiture Instrument and the Instruments of Adhesion to the Policies for Disclosure of Material Information and Maintenance of Confidentiality and for Trading of Securities issued by Copel itself, set forth by CVM Rule no. 358/2002, through which they undertake to comply with the rules therein.

Additionally, the members of the Board of Directors, in order to take office, shall sign a Management Consent Form as referred in the Corporate Governance Practices of Level 1 Regulation ("Level 1 Regulation") ofB3 S.A. - Brasil, Bolsa, Balcão, and in compliance with article 25 of the Company’s Bylaws.

Voting right

Copel’sBoardofDirectorsis currentlycomposed of9(nine)members and the board vacancies are filled as follows:

a) five are appointed by the State of Paraná, the Company’s controlling shareholder (only holders of common shares have voting rights);

b) two are appointed by BNDES Participações S.A. - BNDESPAR, as established in the Shareholders’ Agreement signed with the State of Paraná (only holders of common shares have voting rights);

c) one is appointed by the Company’s employees as established in State Law no. 8,096/1985, regulated by the Decree no. 6,343/1985 and by the State Law no. 8,681/1987 (only holders of common shares have voting rights); and

d) one is appointed by the minority of shareholders in compliance with article 239 of Law no. 6,404/1976 (Brazilian Corporation Law), being the election held separately(the controlling shareholders are not entitled to vote).Only holders of common and preferred shares have voting rights. The candidate elected is the one that obtains the highest representation percentage of the Company’s capital stock, with no minimum limit.

Nomination

Thus, considering the vacancy in the Company’s Board of Directors, due to the resignation of member George Hermann Rodolfo Tormin for his election to the Company’s Fiscal Council, in the General Meeting of June 15, 2018, the Company presents for consideration and vote of Shareholders, to fill the vacant position of the Board of Directors, to complete the 2017-2019 term of office:

MAURO RICARDO MACHADO COSTA - to fill the vacant position due to resignation of the member George Hermann Rodolfo Tormin, according to OF CEE/G 109/18, of April 16, 2018, and due to the ending of Mr. Mauro Ricardo’s term in the Company’s Fiscal Council.

MANUAL FOR PARTICIPATION

IN GENERAL MEETINGS

198th Extraordinary General Meeting

Second call

December 17, 2018

TABLE OF CONTENTS

| |

| I. | Message from the Chairman of the Board of Directors | 3 |

| |

| II. Guidance for Participation in the GeneralShareholders’Meeting | 4 |

| | Attending Shareholder | 4 |

| | Shareholder Represented by Proxy | 4 |

| | Holders of ADRs | 4 |

| |

| III. Call Notice | 5 |

| |

| IV. Information on the matters to be examined and discussed at the 198thExtraordinary General Meeting - Second call | 6 |

| | | |

| | Analysis, discussion and voting on the proposal for alteration ofthe Company’sBylaws | 6 |

| |

| | Analysis, discussion and voting on the proposal to fill vacancyin the Company’s Board of Directors (Item already deliberated in the meeting held on November 30, 2018) | 7 |

| | |

Annexes (Only in Portuguese)

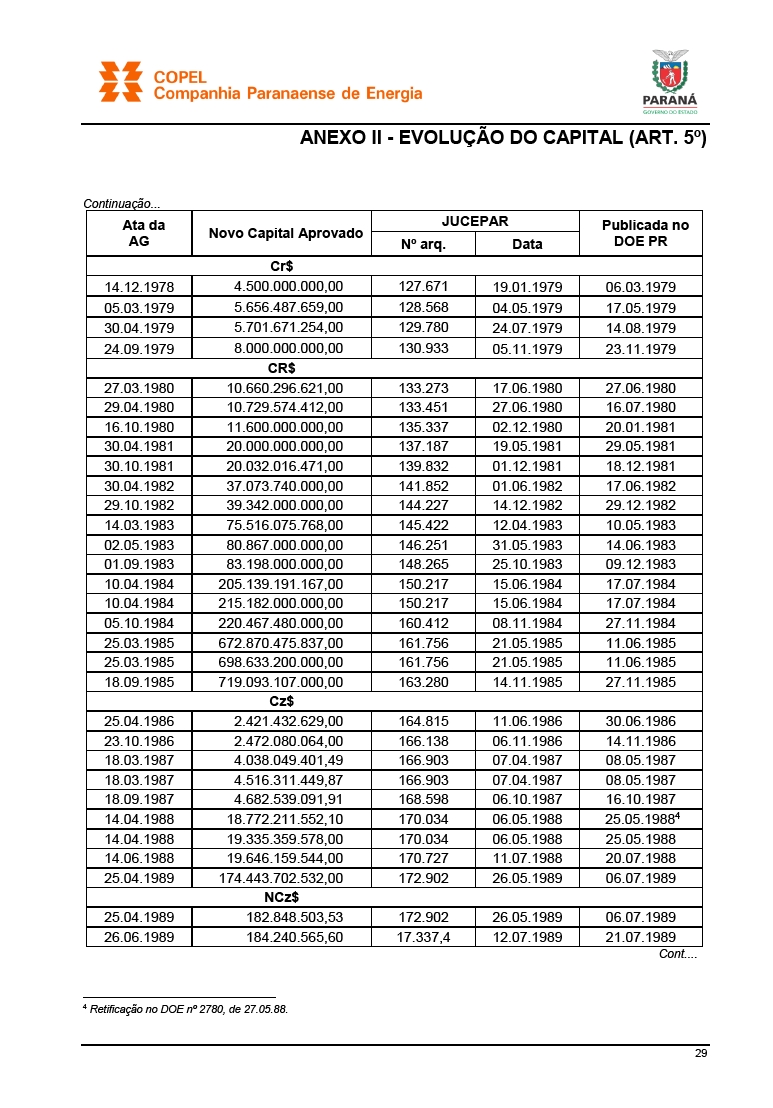

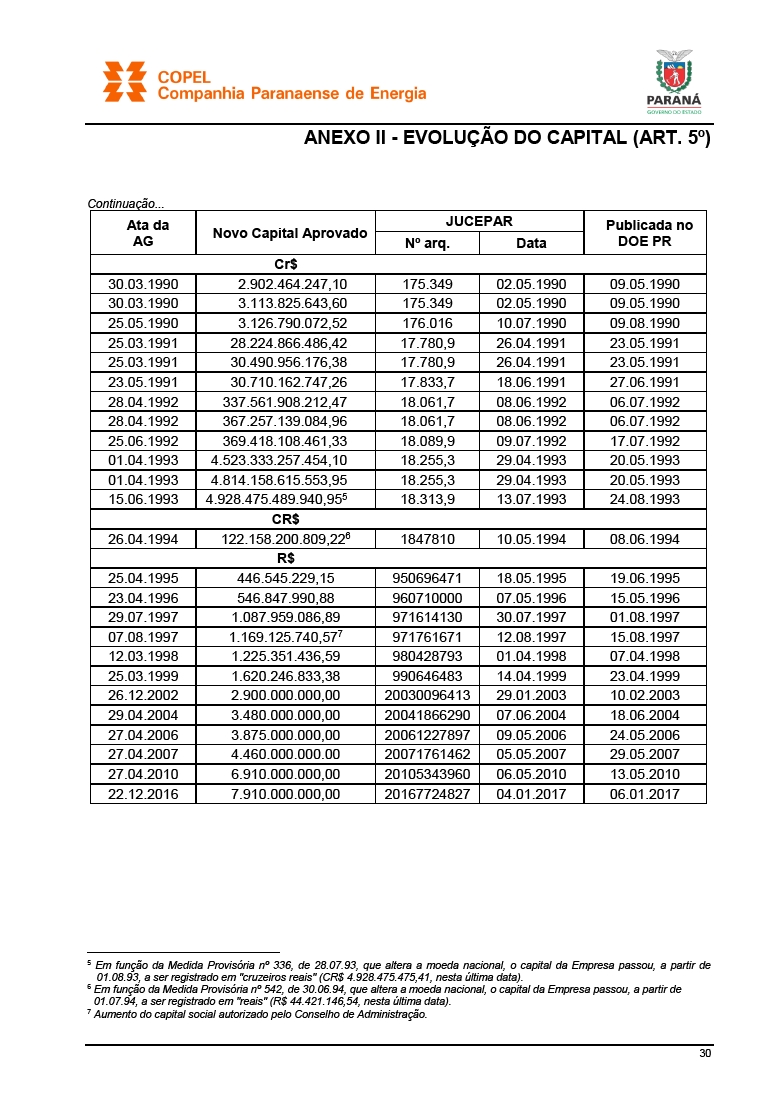

I a. THE COMPANY’S BYLAWS HIGHLIGHTING THE ALTERATION PROPOSALS, IN COMPLIANCE WITH ARTICLE 11 OF CVM RULE NO. 481/09

I b. THE COMPANY’S BYLAWS ALTERATION PROPOSALS WITH DESCRIPTION OF THE CURRENT ARTICLES AND THE NEW PROPOSED ARTICLES AND THE DUE JUSTIFICATIONS FOR THE ALTERATIONS, IN COMPLIANCE WITH ARTICLE 11 OF CVM RULE NO. 481/09

II a. ITEMS 12.5 TO 12.10 OF THE REFERENCE FORM

II b. ENCLOSURE I OF CCEE NORMATIVE DELIBERATION NO. 002/2017 FORM

II c. CCEE INFORMATION NO. 112/2018 – APPOINTMENT ANALYSIS

2/9

I. Message from the Chairman of the Board of Directors

Dear Shareholder:

ItiswithimmensepleasurethatIpresenttoyouthisManualforParticipation inthe General Shareholders’MeetingoftheCompanhiaParanaensedeEnergia -Copel,with generalguidanceforaneffectiveparticipationandexerciseofthevote.

ThismanualhasbeenpreparedbasedonCopel'sCorporateGovernancepolicy, whichisfoundedontransparencyandequity.

Themanualaimstopresent,inaclearandbriefway,theinformation relatedtothe Company’s General Shareholders’Meeting,seekingtherebytocontributeforthe understandingoftheproposalsforresolutionandtoencouragetheparticipationof shareholdersintheeventsoftheannualcorporateagendaoftheCompany.

Copel’s 198thExtraordinary General Meeting was called, at second call, for December 17, 2018, at 10:30 a.m., at the Company’s headquarters located at Rua Coronel Dulcídio nº 800, in the city of Curitiba.

ThematterstobepresentedintheExtraordinary General Meeting for theresolutionof theshareholders aredescribed intheCallNoticeandinthismanual as well as thetypes ofsharesgrantingtherighttovoteontheitemoftheagenda.Giventhecurrent numberofCompanyshareholders, thismanualseekstoencourageandenable participationintheGeneralMeeting.

Yourparticipation isveryimportant,considering thatissuesrelevanttotheCompany and its shareholders aredealtwithinthe General Shareholders’ Meetings.

Yours sincerely,

Mauricio Schulman

Chairman of the Board of Directors

3/9

II. Guidance for Participation in the General Shareholders’ Meeting

Copel’sshareholdersmaytakepartintheGeneralMeetingbyattendingthemeeting attheCompany’sheadquartersandvoting orby appointing a proxy with powers to represent him/her,asdescribedbelow.

Attending Shareholder

Theshareholder wishingtotakepartin the Extraordinary General Meeting shallarrivea few minutesbeforethetimeindicated intheCallNoticeandbearthefollowing documents:

· Identity card (RG), Alien’s Identity Card (RNE), Brazilian Driver’s License (CNH) or an accreditation card issued by an official professional organization; and

· Proof as Company shareholder issued by a depositary financial institution or a custodian agent or through the shareholding position issued by Copel.

Shareholder Represented by Proxy

Theshareholderwhoisnotabletoattendthemeetingandwishestotakepartin the Extraordinary General Meetingmayappointaproxywithpowerstorepresenthim/her.

Pursuant toArticle126,paragraph1,oftheBrazilianCorporationLaw no.6,404/1976, theproxyshallbeashareholder,lawyerormanageroftheCompanyorofa financialinstitution/investmentfund.Theproxyshallhavebeenappointednot morethanoneyearbeforethedateofthe Annual General Meeting.

The documents required are the following:

· Power of attorney with special powers for representation at Copel’s General Meeting, bearing a notarized signature of the grantee (shareholder);

· Bylaws or Article of Incorporation and the instrument of election/appointment of the managers in the event of the grantee being a legal entity; and

· Proof of ownership of the shares issued by the Company, conferred by the depositary financial institution and/or custodian.

Note:thedocumentsmentionedaboveshallbe forwardedtoCopel’sheadquarters,DiretoriadeFinanças e deRelaçõescom Investidores,Departamento de Acionistas e Custódia,atRuaCoronelDulcídionº800 -3º andar,preferably48hourspriortotheMeeting.

Holders of ADRs

ThefinancialdepositaryinstitutionofAmericanDepositaryReceipts(ADRs)in theUnitedStates,TheBankof NewYorkMellon,willsendthepowersof attorney totheholders ofADRs,sothattheyexercise theirvotingrightatthe Extraordinary General Meeting.

TheparticipationshalltakeplacethroughBancoItaú,representativeofThe BankofNewYorkMelloninBrazil.

Shouldtherebeanydoubtconcerning the Extraordinary General Meeting procedures anddeadlines, pleasecontacttheShareholdersandCustodyDepartment(Departamento de AcionistaseCustódia)atthetelephonenumber(5541)3331-4269orthrough thee-mailaddressacionistas@copel.com.

4/9

III. Call Notice

EXTRAORDINARY GENERAL MEETING

CALL NOTICE - SECOND CALL

The Shareholders of Companhia Paranaense de Energia - Copel are invited to attend the Extraordinary General Meeting, at second call, to be held onDecember 17, 2018, at10:30 a.m.at the Company’s head office located at Rua Coronel Dulcídio nº 800, Curitiba, to decide on the following agenda:

EXTRAORDINARY GENERAL MEETING

1. Analysis, discussion and voting on the proposal for alteration of the Company’s Bylaws.

Notes: a) Documents referring to the matters to be discussed at the Extraordinary General Meeting, in addition to the Manual for Attendance in Meetings, are available for shareholders’ consultation at the Company’s headquarters as well as on its website (ri.copel.com);b) The Company’s shareholders shall take part in the Extraordinary General Meeting by attending it and casting his/her vote on the meeting’s agenda items or by appointing a proxy with powers to represent him/her; andc) Powers-of-attorney for the Extraordinary General Meeting shall be filed at the Company’s head office, at the Chief Financial and Investor Relations Office, at the Shareholders and Custody Department of the Chief Financial and Investors’ Relations Office, at Rua Coronel Dulcídio nº 800 - 3º andar, Curitiba, at leastforty-eight hours prior to the meeting.

Curitiba, December 04, 2018

Mauricio Schulman

Chairman of the Board of Directors

Publication

This Call Notice - Second Call will be published, pursuant to the Brazilian Corporation Law, in the Official Gazette of the State of Paraná and in the newspaperFolha de Londrinaas from December 5th, 2018, being also available on the Company’s website (ir.copel.com) and on the proper websites both ofComissão de Valores Mobiliários - CVM andBrasil, Bolsa, Balcão - [B]³ on December 4th, 2018.

5/9

IV. Information on the matter to be examined and discussed at the second call of the 198th Extraordinary General Meeting

Below the Company’s Management presents some clarifications related to the item for resolution at the Extraordinary General Meeting for the exercise of a conscious vote:

èAnalysis, discussion and voting on the proposal foralteration of the Company’s Bylaws.

Clarifications

The Statutory Audit Committee - SAC is an independent, permanent advisory committee to the Board of Directors. Its duties, procedures and the number of the members shall comply with current legislation and are laid down in the Rules of Procedure specific for such Committee, duly approved by the Board of Directors

The SAC is composed of five members of the Board of Directors, elected and dismissed by such Board, whose unified term of office shall be of two years, reelection being permitted for no more than three consecutive times, subject to the following requirements: i. having a minimum of three independent members of the Board of Directors, pursuant to Federal Law no.13,303/2016; and ii. at least one member of the Statutory Audit Committee shall have recognized professional experience in matters of corporate accounting, auditing and finance, allowing such member to be considered a financial expert according to the current legislation.

In order to sit on the Statutory Audit Committee, members shall comply with the minimum requirements of Federal Law no. 13,303/2016.

Considering SAC’s current structure and aiming at adjusting it in order to fulfill the Company’s needs,and observing good corporate governance practices, the members of the Board of Directors, in their 180th Ordinary Meeting, of July 11, 2018, proposed to alter the Company’s Bylaws to adequate the number of members of the Statutory Audit Committee, reducing it from 05 (five) to 03 (three) members.

Thus, we present, in the terms ofAnnex I a and of the comparative table with the appropriate justifications (Anexo I b), adjusted proposal for the Corporate Bylaws of Copel (Holding).

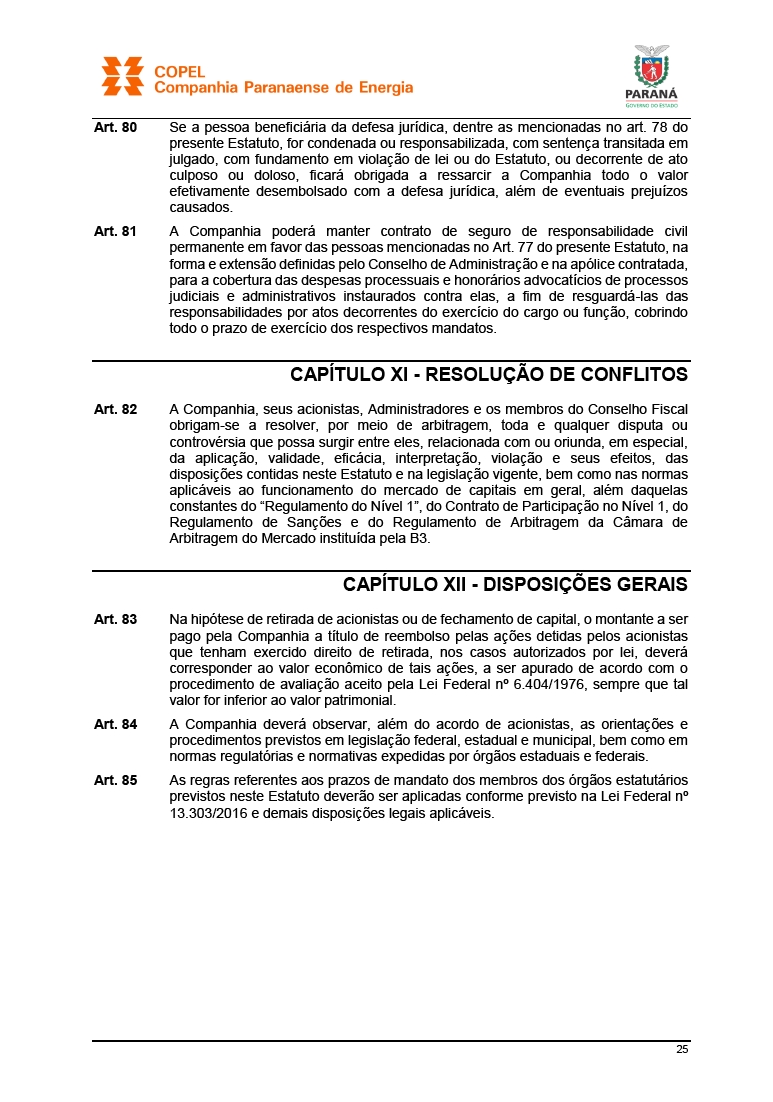

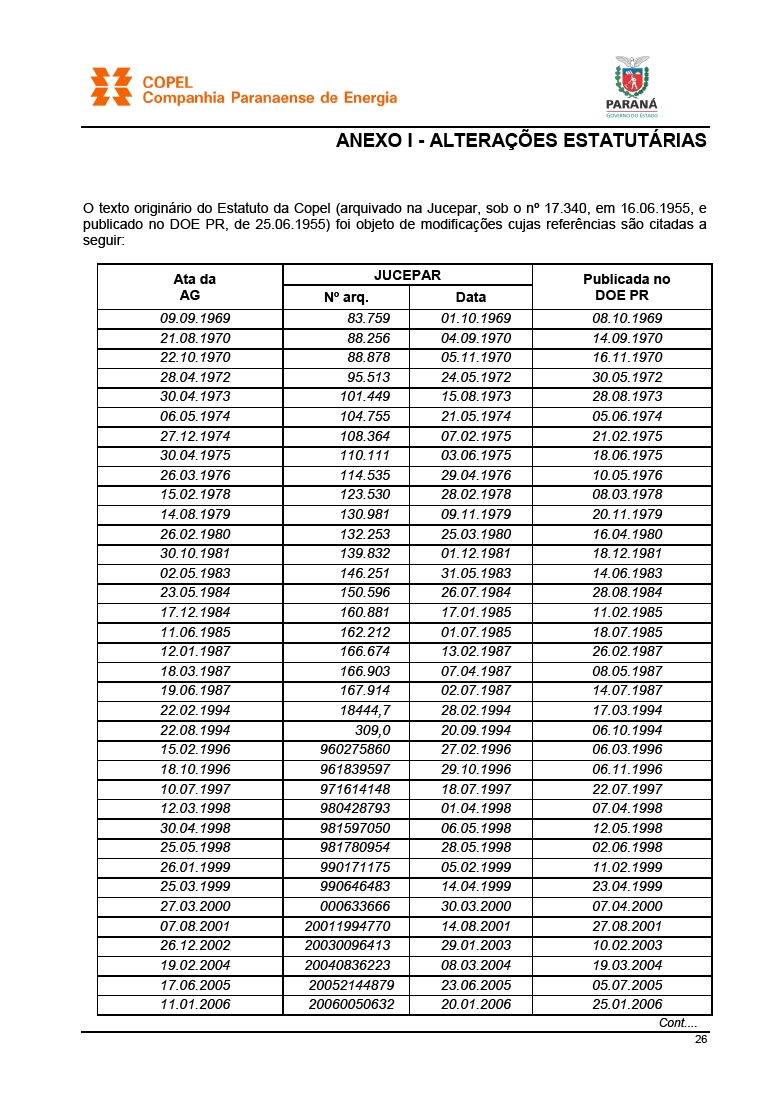

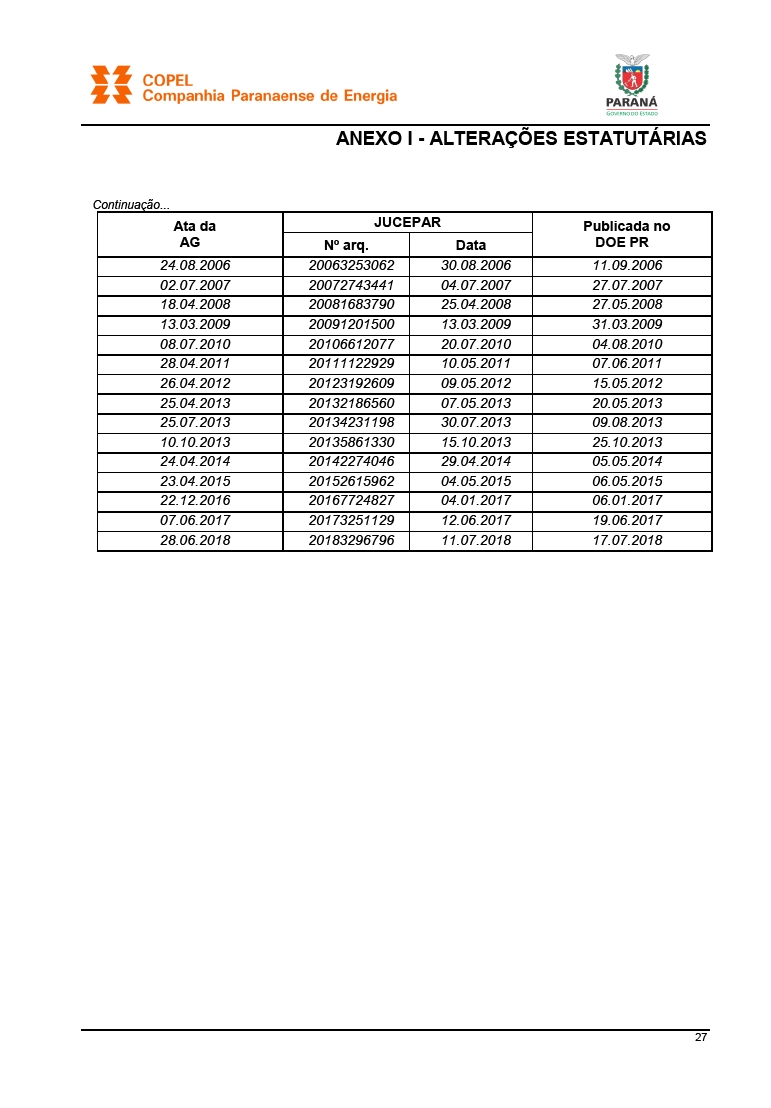

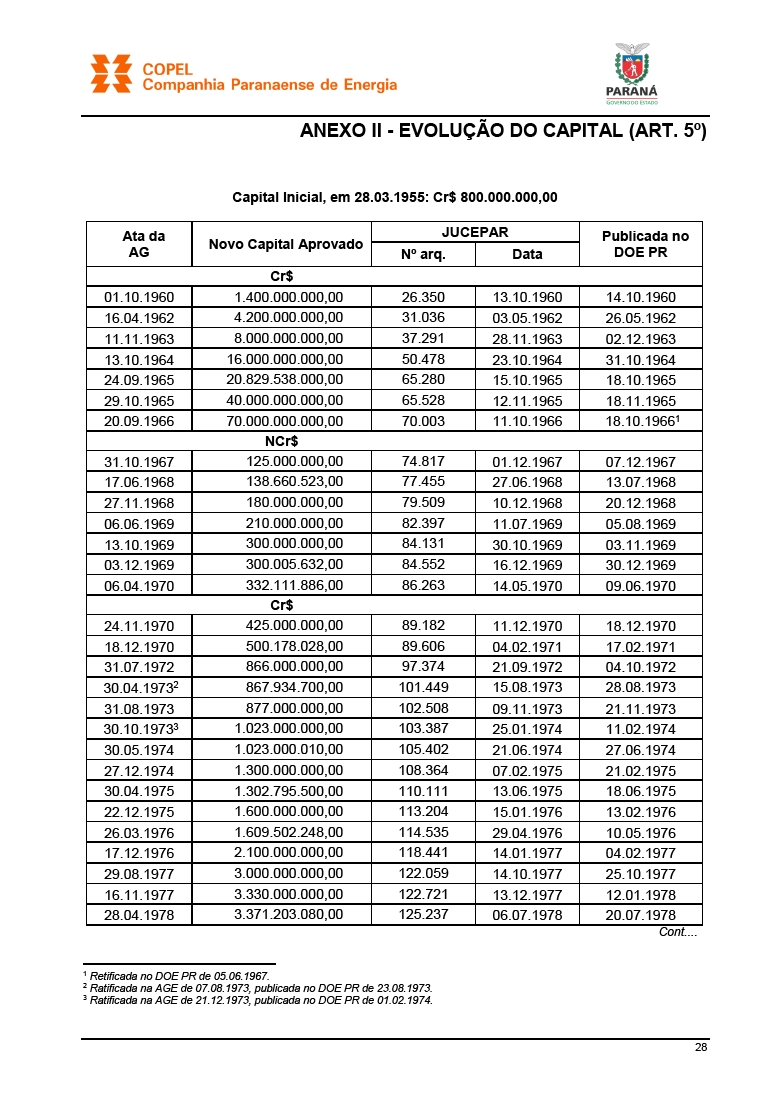

Enclosure I a.THE COMPANY’S BYLAWS HIGHLIGHTING THE ALTERATION PROPOSALS, IN COMPLIANCE WITH ARTICLE 11 OF CVM RULE NO. 481/09

I b.THE COMPANY’S BYLAWS ALTERATION PROPOSALS WITH DESCRIPTION OF THE CURRENT ARTICLES AND THE NEW PROPOSED ARTICLES AND THE DUE JUSTIFICATIONS FOR THE ALTERATIONS, IN COMPLIANCE WITH ARTICLE 11 OF CVM RULE NO. 481/09

Compliance

As provided for in clause 3 - “Exercising Voting Rights”, 3.1.b, of the Shareholders’ Agreement ( http://ri.copel.com/ptb/4109/acordo_port.pdf ) entered into byBNDES Participações S.A. - BNDESPAR and the Government of the State of Paraná on December 22, 1998, with the intervention of Copel and Paraná Investimentos:3.1TheSTATE, as theCOMPANY’s controlling shareholder, hereby commits, during the term of this Agreement, to exercise its voting rights so as: (…) b) not to approve, without previous written authorization by BNDESPAR, any of the following matters: I. amendment of COMPANY’s Bylaws; (…).

6/9

Approvals

This matter was analyzed by the Company’s Board of Directors in its 180thOrdinary Meeting, held on July 11, 2018, and it was approved by BNDES Participações S.A. – BNDESPAR through letter DIR4 no. 41/2018 – Previous Statement regarding Amendment of Bylaws.

Voting right

In this item of the agenda, onlyholdersofcommon sharesareentitled to vote.

èAnalysis, discussion and voting on the proposalto fill vacant positions in the Company’s Board of Directors

Clarifications

Copel’s Board of Directors is a decision-making body, composed of 9 (nine) members, Brazilian, shareholders, residing in the country and elected by the General Assembly, pursuant to the Brazilian Corporation Law (Law no. 6,404/1976).

The Board of Directos has as its main duty the laying down of the overall strategy for the Company business.

In accordance with Law no. 6,404/1976 (Brazilian Corporation Law), in order to take office, all Board members shall sign a clearance certificate declaring that they are not impeded by any crimes provided for by law from performing business activities, and they shall also execute the Investiture Instrument and the Instruments of Adhesion to the Policies for Disclosure of Material Information and Maintenance of Confidentiality and for Trading of Securities issued by Copel itself, set forth by CVM Rule no. 358/2002, through which they undertake to comply with the rules therein.

Additionally, the members of the Board of Directors, in order to take office, shall sign a Management Consent Form as referred in the Corporate Governance Practices of Level 1 Regulation ("Level 1 Regulation") ofB3 S.A. - Brasil, Bolsa, Balcão, and in compliance with articles 57 to 59 of the Company’s Bylaws.

Voting right

Copel’sBoardofDirectorsis currentlycomposed of9(nine)members and the board vacancies are filled as follows:

a) five are appointed by the State of Paraná, the Company’s controlling shareholder (only holders of common shares have voting rights);

b) two are appointed by BNDES Participações S.A. - BNDESPAR, as established in the Shareholders’ Agreement signed with the State of Paraná (only holders of common shares have voting rights);

7/9

c) one is appointed by the Company’s employees as established in State Law no. 8,096/1985, regulated by the Decree no. 6,343/1985 and by the State Law no. 8,681/1987 (only holders of common shares have voting rights); and

d) one is appointed by the minority of shareholders in compliance with article 239 of Law no. 6,404/1976 (Brazilian Corporation Law), being the election held separately(the controlling shareholders are not entitled to vote).Only holders of common and preferred shares have voting rights. The candidate elected is the one that obtains the highest representation percentage of the Company’s capital stock, with no minimum limit.

Nomination

Thus, considering the vacancy in the Company’s Board of Directors, due to the resignation of member George Hermann Rodolfo Tormin for his election to the Company’s Fiscal Council, in the General Meeting of June 15, 2018, the Company presents for consideration and vote of Shareholders, to fill the vacant position of the Board of Directors, to complete the 2017-2019 term of office:

· MAURO RICARDO MACHADO COSTA - to fill the vacant position due to resignation of the member George Hermann Rodolfo Tormin, according to OF CEE/G 109/18, of April 16, 2018, and due to the ending of Mr. Mauro Ricardo’s term in the Company’s Fiscal Council.

Note: The Board of Directors, pursuant to Federal Law no. 6.404/1976 and the Company’s Bylaws, assigned Mr. Mauro Ricardo Machado Costa as member of the Board of Directors of Copel (Holding) in its 173rd Extraordinary Meeting, of June 18, 2018. As of that date, Mr. Mauro Ricardo was allowed to participate of the Board’s meetings until the Extraordinary General Meeting to homologate the proposed nomination.

Compliance

Pursuant to paragraph 5 of article 19 of the Company’s Bylaws, the appointment of members of the Board of Directors shall meet the requirements and prohibitions set forth in Federal Laws no. 6,404/1976 and no.13,303/2016, in addition to the following criteria:i. having a minimum of three independent members, expressly declared as such on the minutes of the Shareholders’ Meeting at which they were elected, pursuant to Federal Law no.13,303/2016; andii. having a minimum of five members, including those mentioned ini above, who meet the requirements for members of the Statutory Audit Committee, pursuant to Federal Law no.13,303/2016.

In accordance with item 5.4 of the Company’s Nomination Policy

( http://ri.copel.com/ptb/10501/647013.pdf ), appointees shall also comply with the requirements and prohibitions provided for in applicable regulations and internal rules, as follows:

a) Federal Law no. 6,404/1976 - Brazilian Corporation Law;b) Federal Law no. 12,846/2013 - Anti-corruption Law;c) Federal Law no. 13,303/2016 - State-Owned Company Responsibility Law; State Decree no. 6,263/2017 - Regulation of Federal Law no. 13,303/2016;f) Corporate Bylaws of Copel (Holding) and its wholly-owned subsidiaries;g) CCEE Normative Deliberation no. 001/2017 and amendments;h) CCEE Normative Deliberation no. 001/2018 and amendments;i) CCEE Normative Deliberation no. 003/2018 and amendments;j) Copel’s Code of Conduct;k) State Decree no. 38/2015 - Senior

8/9

Management of the State Code of Ethics;l) Manager Nomination Policy Model - CCEE; andm) Code of Best Practice of Corporate Governance -Instituto Brasileiro de Governança Corporativa (IBGC),5th Edition, 2015.

The presentation of the following documents is required in the act of submitting a candidacy:

i.Brief curriculum vitae;

ii.Copies of graduation and post-graduation diplomas;

iii.Legible copy of identification document and tax payer registration;

iv.Proof of address, updated;

v.Declaration of Income and Assets; and

vi.Registration Form (Enclosure I of CCEE Normative Deliberation no. 002/2017 - http://www.fazenda.pr.gov.br/arquivos/File/CCEE/Anexo1CCEE.pdf ) filled in and signed.

Appointees are submitted to a background check in order to secure compliance.

Enclosure MAURO RICARDO MACHADO COSTA

II a.ITEMS 12.5 TO 12.10 OF REFERENCE FORM

II b.ENCLOSURE I OF CCEE NORMATIVE DELIBERATION NO. 002/2017 FORM

II c.CCEE Information no. 112/2018 - Appointment analysis

Voting right

In this item of the agenda, only holders of common shares are entitled to vote.

9/9

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| COMPANHIA PARANAENSE DE ENERGIA – COPEL |

| | |

| By: | /S/ Jonel Nazareno Iurk

| |

| | Jonel Nazareno Iurk

Chief Executive Officer | |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.