SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of May, 2019

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

Rua Coronel Dulcídio, 800

80420-170 Curitiba, Paraná

Federative Republic of Brazil

+55 (41) 3331-4011

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

Companhia Paranaense de Energia

Corporate Taxpayer's ID (CNPJ/MF) 76.483.817/0001-20

State registration 10146326-50

Publicly-Held Company- CVM 1431-1

copel@copel.com

Rua Coronel Dulcídio, 800, Batel – Curitiba - PR

CEP 80420-170

MANAGEMENTS’ REPORT

AND

FINANCIAL STATEMENTS

2018

SUMÁRIO

MESSAGE FROM THE CEO

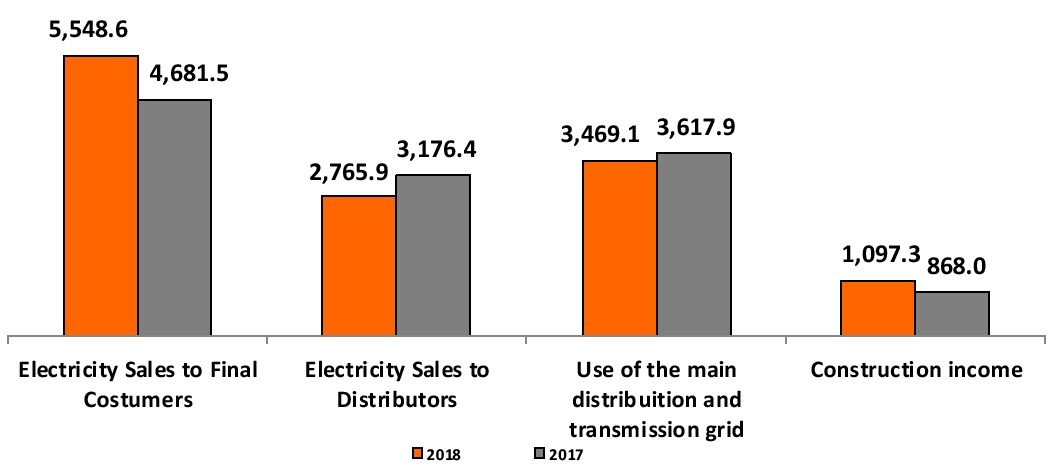

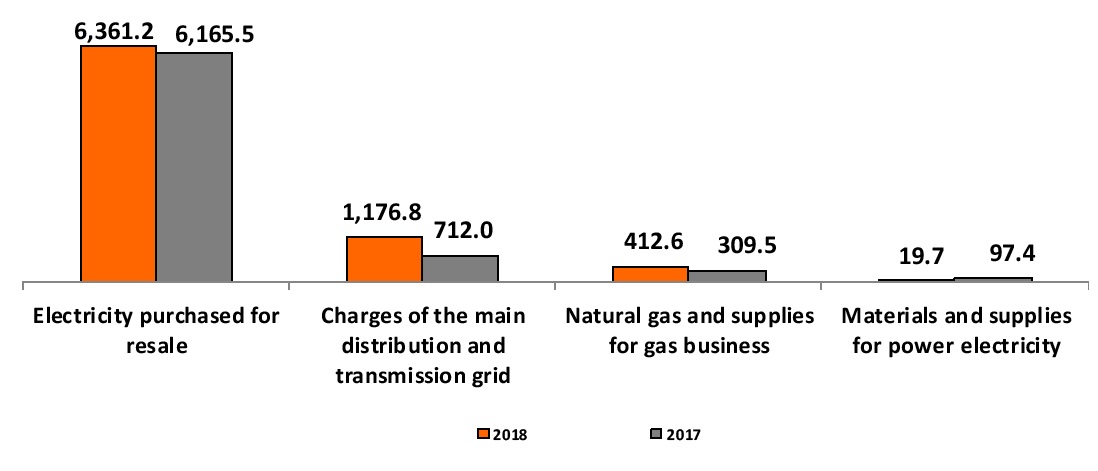

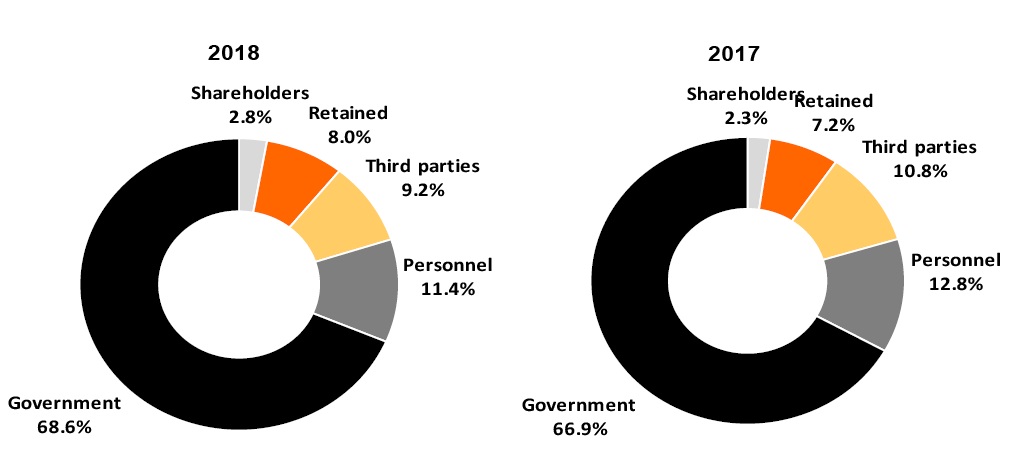

Copel presented in 2018 solid financial results and expanded its business. In a year of political transition and with a macroeconomic scenario of an ongoing recovering, Copel recorded an EBITDA of 3.143.3 million, 9,4% above than what was recorded last year, and a net profit of R$1,444.0 million, and has experienced a growth of 29.1%.

The figures reflect a consistentcost reduction program, improvements in efficiency and a strict discipline in the allocation of capital.Concurrently, concluded a long cycle of investments in its generation and transmission facilities in the ten States in which the Company operates.Highlights of this process include the conclusion of the hydroelectric power plants of Colíder (300 MW of installed capacity and an investment of R$2.4 billion), and Baixo Iguaçu (350 MW and R$2.5 billion), with Copel holding a 30% ownership interest, as well as Cutia and Bento Miguel wind farm complexes (312 MW and R$2.1 billion), with the production beginning in 2019.

More than the expansion of Copel’s generator park, we will begin to reap the benefits of our investmentswith an incremental revenue of approximately R$450 million henceforth the current year, when we project an investment of approximately R$2 billion in the Company business.Those investments include the start of work of SHP Bela Vista, acquired in an auction last year, and of the transmission lines concentrated in the State of Paraná.

Copel Energia, our trading subsidiary also made a significant step forward in 2018.Having been established less than two years ago, it showed a 102% increase in its revenues, and already ranks as one of the largest traders in Brazil in terms of traded volume.The objective is to expand the market share even more with the Copel brand reputation as its driving force.

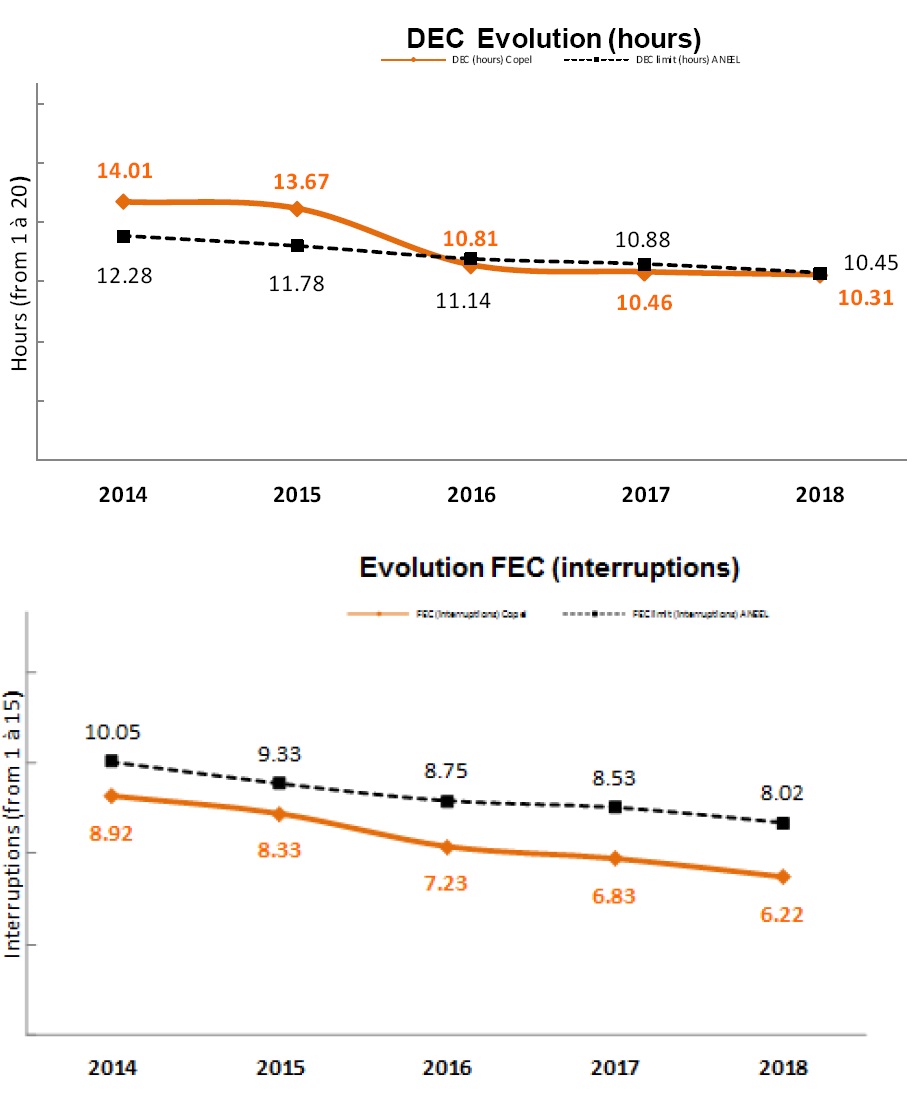

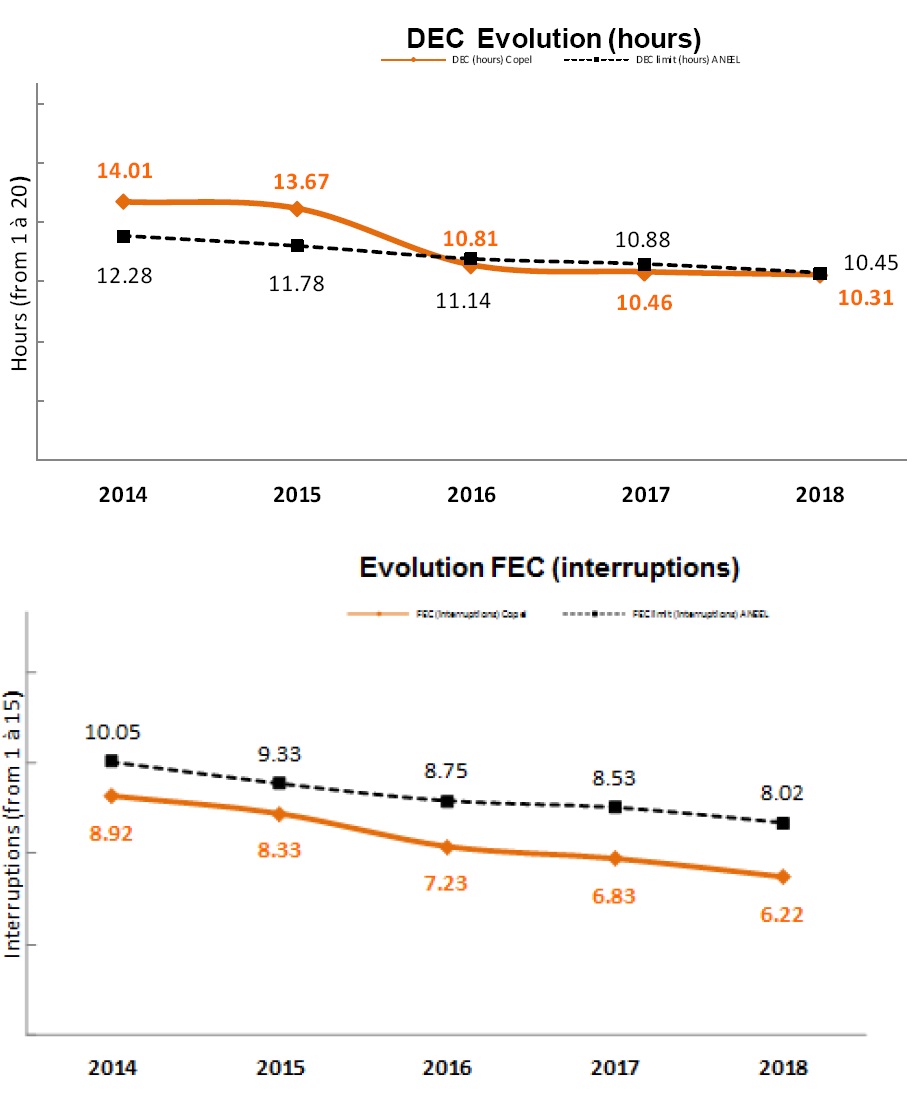

In the distribution segment, Copel improved, in the last two years, in 73% the efficiency of the EBITDA achieved in relation to the estimated regulatory EBITDA. There is also a realistic expectation that it will be achieved in 2019, when the investment in the segment shall amount to R$835 million.Currently Copel Distribuição presents its main supply quality indices — System Average Interruption Duration Index (SAIDI) and the Customer Average Interruption Duration Index (CAIDI) which are below the regulatory limits, a factor that contributed to the Company being recognized as the best distributor in Brazil, in the opinion of its customers, as well as by the Brazilian Electricity Regulatory Agency (Aneel).

We launched Smart Copel, the most modern distribution operations center in Brazil, in the district of Novo Mundo in Curitiba.The unit will gradually centralize the system management—undertaking the function that was originally performed in five regions of the State— , and already allows to remote control the electrical system, identifying problems quickly and controlling the quality of supply in real time, among other features.

Considering the transformation that the distribution segment is currently undergoing, innovation in investment is vital, and it is focusing on the construction of infrastructure for the future smart cities. Our grids modernization program shall continue with the implementation of innovations that are the result of more thana decade of working with smart grids operation.These include smart grid automation and remote-control technologies, installation of smart meters and pioneering research and development projects in Brazil.

In 2018, Ipiranga, in the interior of Paraná State, became the first city in Brazil to be entirely covered by smart meters and reclosers integrated into a single communication system.The second project to utilize this concept shall fully cover the cities of São José dos Pinhais and Tijucas do Sul, serving 126,000 consumers.Copel set of innovations also includes the largest research on current energy storage in Brazil. And microgeneration tests from the biomass of agribusiness, which holds enormous potential for exploration in Paraná.

Electrical mobility is another important innovation investment, with the 2018 inauguration of the largest networking of charging stations in Brazil. This includes 11 electric car charging stations that connect Paraná from East to West, along more than 700 kilometers between Paranaguá Harbor and the city of Foz do Iguaçu.

The basis for all these investments and results stands in our corporate governance.In December 2018, Copel have received a certification for Governance by B3 Stock Exchange, being the only state-owned enterprise to have receive such recognition.Furthermore, seeking to become a reference in sustainability we consolidated last year our role as protagonists through the articulation of key figures in the Southern Region of Brazil in pursuit of Sustainable Development Objectives (SDO).For this purpose, the Company, which leads the regional front of the Global Pact Cities Program since 2017, started to host, at its facilities in Curitiba, in 2018, the `Local Hub 2030’, event which is directly linked to the United Nations (UN).

The achieved results reflect Copel’s largest asset, more than 7,600 employees which spare no efforts to provide a service of excellence, and whom in 2018 have ranked us among the 150 Best Companies to Work For, in a survey by Você S/A Magazine.

It is with great courage and confidence that we face the challenges of 2019. We have started a new cycle for the Company with limitless energy to collaborate as an indispensable driver of economic growth and, accordingly, serve our customers, partners and society in general.

Daniel Pimentel Slaviero

Copel CEO

1. ORGANIZAtIONAL profile

Copel was created in October 1954 and is the largest company in Paraná State in equity and net revenue.It operates with cutting-edge technology in the areas of generation, transmission, commercialization and distribution of energy, as well as in telecommunications and natural gas.

It operates a comprehensive and effective electrical system with its own generating plants, transmission lines, substations, electrical lines and grids of the distribution system, and a modern telecommunications system that integrates all the cities of the State.

Although the Company is headquartered in Curitiba, Copel is present in ten other Brazilian states as follows:

· Participation in the Market

| | | | | |

Main Products(%) | | Brazil | Southern Region | Paraná |

Electricity generation(1) | | 3,1 | (2) (3) 21,1 | (2) (3) 49,3 |

Electricity transmission(4) | | 2.4 | 11,6 | 21,6 |

Electricity distribution(5) | | (6) 6,2 | (6) 33,8 | (7)97,3 |

Gas distribution(7) | | 3,0 | 23,4 | 100,0 |

Telecommunications(8) | | 0,6 | 3,4 | 8,8 |

(1) Installed capacity. Equity interest of Copel and wind farms are not included. |

(2) Itaipu Power Plant not included |

(3) Paranapanema river power plants not included |

(4) The market refers to Permitted Annual Revenues - RAP |

(5) Distribution wire market |

(6) Source: Empresa de Pesquisa Energética - EPE |

(7)Estimated |

(8)Number of hits |

· Awards and Certifications in 2018

| |

Awards / Certifications | Certification Body |

Abradee Award - Management Quality | Associação Brasileira de Distribuidores de Energia Elétrica - Abradee |

Award - Best Distribuition Company (Bronze Category) | Comisíon de Integración Energética Regional - CIER América Latina |

Clima Paraná Ouro Seal | Governo do Estado do Paraná |

Award -150 Great to Work | Você S/A Magazine |

Certificado Empresa Cidadã - information presetend at Social Report | Conselho Regional de Contabilidade do Rio de Janeiro, Sistema Firjan e Fecomércio |

Award - 500 Largest Companies in the South -Large company in Paraná State | Amanhã Magazine |

Award - 500 Largest Companies in the South - Highest Net Revenue in the Energy Sector | Amanhã Magazine |

Award - 500 Largest Companies in the South - Highest Net Revenue and Highest Net Equity among the 100 Largest Companies in Paraná | Amanhã Magazine |

Sesi ODS Award- Recognition of practices in support of sustainable development objectives - industry category | Sesi Paraná |

ODS Sesi Seal -Optical fiber recycling | SESI - Serviço Social da Indústria |

Data center Merit | Anuário telecom |

IASC Brazil Award - Concessionaries with more than 400.000 Consumer Units | Aneel |

IASC South Award - Concessionaries with more than 400.000 Consumer Units | Aneel |

Award - Best in Management | FNQ - Fundação Nacional da Qualidade |

Better Social and Environmental Practices | Benchmarking Brasil |

Viva Voluntário (Voluntary Work) | Governo Federal |

Best Fleet Management in Latin America | Instituto Parar |

Professionals of the Year award | Organizações Globo |

Carbon-Zero Certificate | Biofílica |

Best Fleet Management in Latin America | Anuário telecom |

Abraconee Award Best 2017 Financial Statement Disclosure - 1st place in the Holding Category of the electric energy sector. | Associação Brasileira dos Contadores do Setor de Energia Elétrica - Abraconee |

Abraconee Award Best 2017 Financial Statement Disclosure - 3td place in the category large companies of the electric energy sector. | Associação Brasileira dos Contadores do Setor de Energia Elétrica - Abraconee |

Leading State-Owned Company in Governance | B3 S.A. - Brasil, Bolsa, Balcão |

Business Sustainability Index | B3 S.A. - Brasil, Bolsa, Balcão |

The more transparent public company in Brazil | Transparência Internacional - Trac Brasil |

10 years issuing the greehouse gas emission | GHG Protocol |

Recognition for the implantation of the nursing support rooms | Ministry of Health |

Broadband operator with highest overall satisfaction score | Anatel |

· Strategic Reference

Copel's actions and management decisions are directed by the guidelines established in its Mission, Vision and Values, as follows:

Mission:Provide energy and sustainable development solutions.

Vision:To be a reference in the businesses in which it operates generating value in a sustainable way.

Values:

· Ethics:Result of a collective agreement that defines individual behaviors in line with a common goal.

· Respect for people:Taking others into account.

· Commitment:Ability to engage intensely and completely in the work, contributing to the achievement of the organization’s goals.

· Transparency:Accountability of the decisions and achievements of the company to report its positive or negative aspects to all stakeholders.

· Safety and Health:Healthy working environment in which workers and managers collaborate to use a process of continuous improvement of the protection and promotion of safety, health and well-being for all.

· Responsibility:Conducting the company's life in a sustainable manner, respecting the rights of all stakeholders, including the future generations, and the commitment to sustaining all life forms.

· Innovation:Applying ideas in processes, products or services in order to improve something that already exists or to build something different and better.

Organizational structure

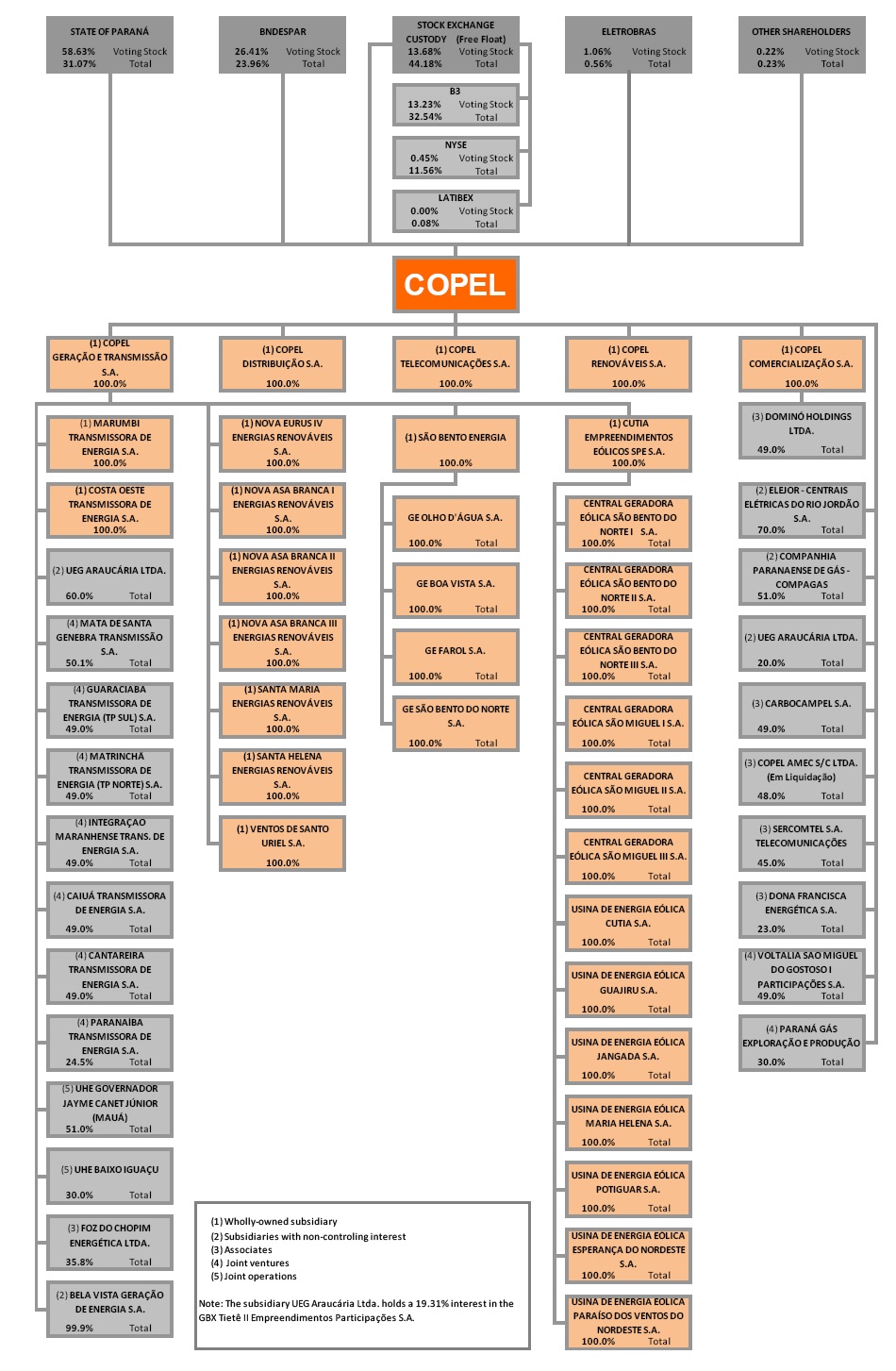

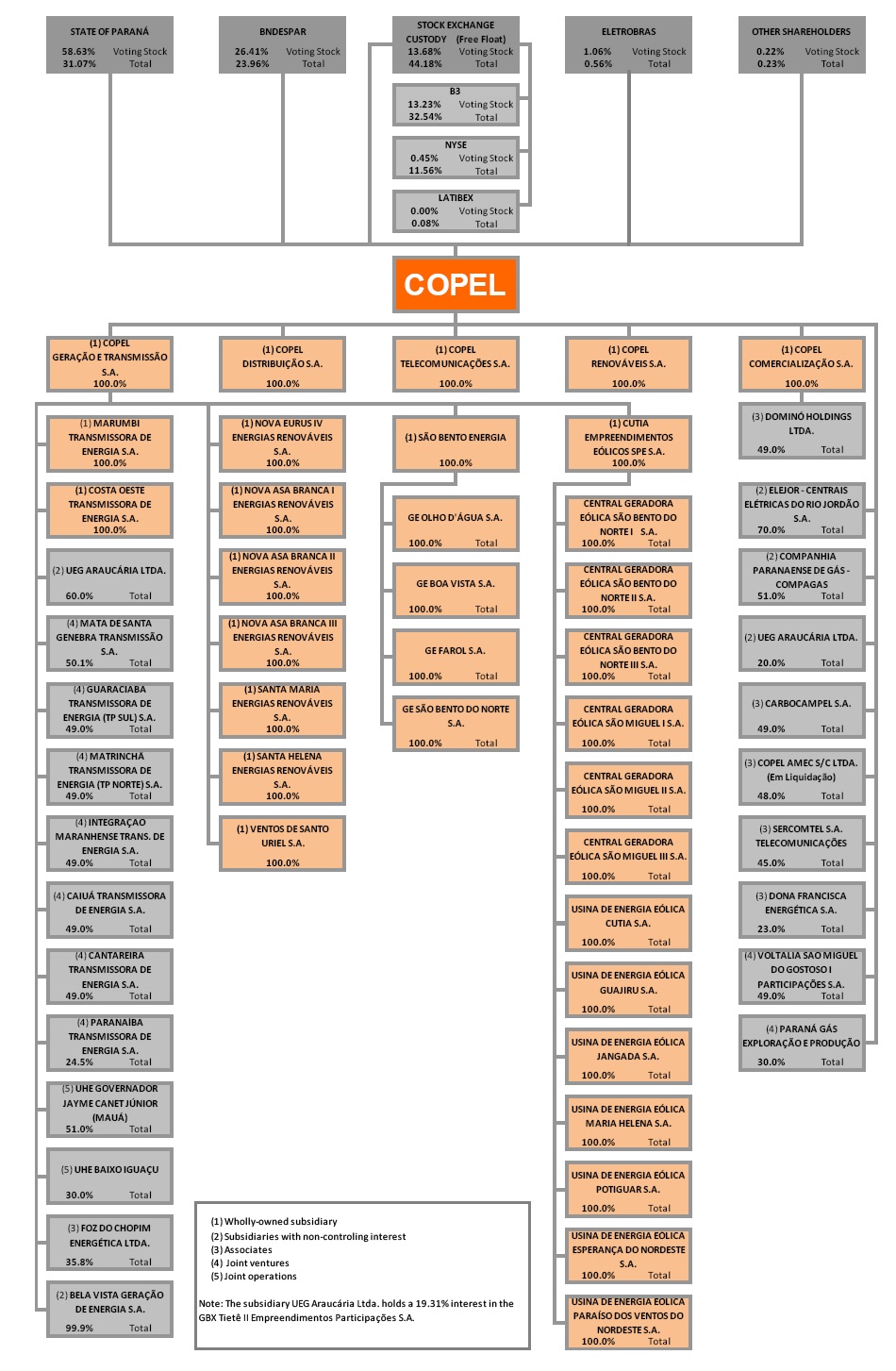

The following chart shows the Copel's shareholding structure on December 31, 2018:

· Copel in Numbers

| | | | |

| 2018 | 2017 | variation % |

Accounting Indicators | | | |

Total assets | 35,930,100 | 33,162,377 | 8.3 |

Cash and cash equivalents | 1,948,409 | 1,040,075 | 87.3 |

Bonds and securities | 344,296 | 219,663 | 56.7 |

Total debt | 11,565,438 | 9,830,483 | 17.6 |

Net debt | 9,272,733 | 8,570,745 | 8.2 |

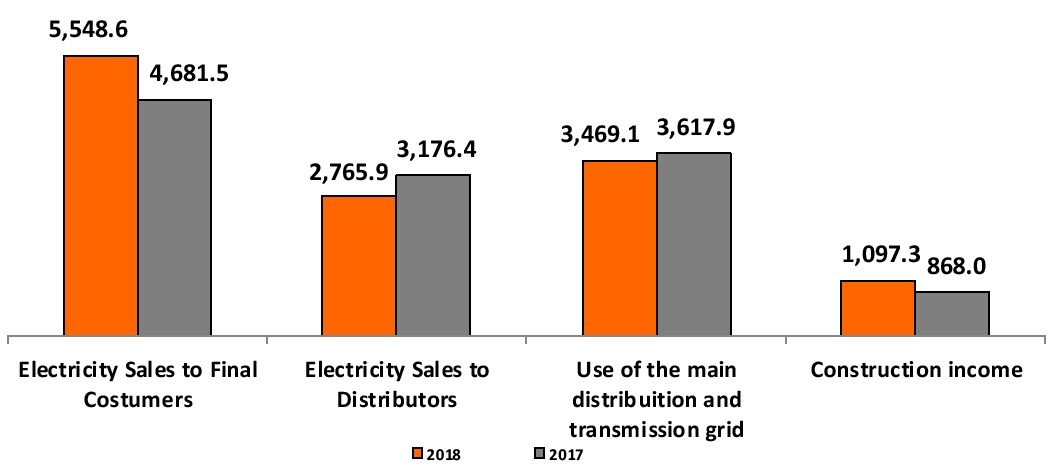

Gross operating revenues | 23,725,810 | 21,574,289 | 10.0 |

Deductions from revenues | 8,791,030 | 7,549,716 | 16.4 |

Net operating revenues | 14,934,780 | 14,024,573 | 6.5 |

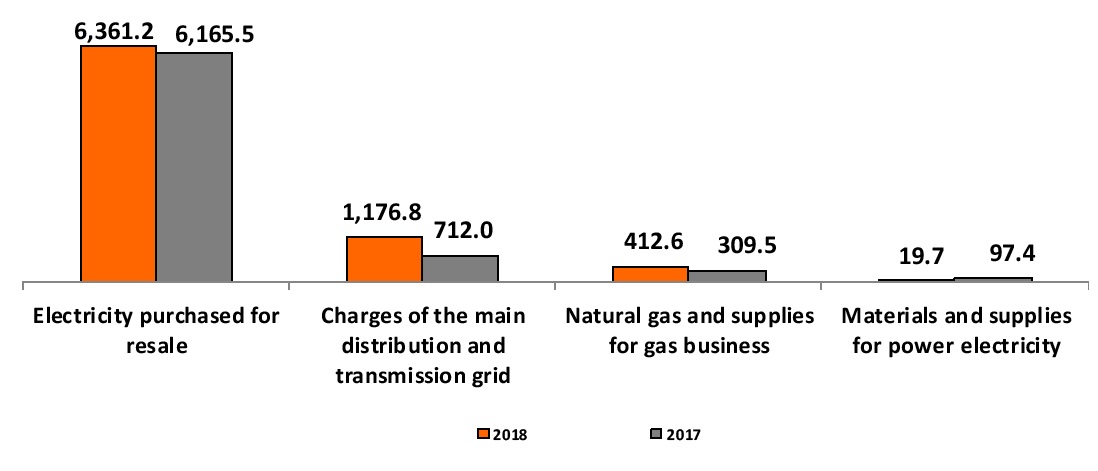

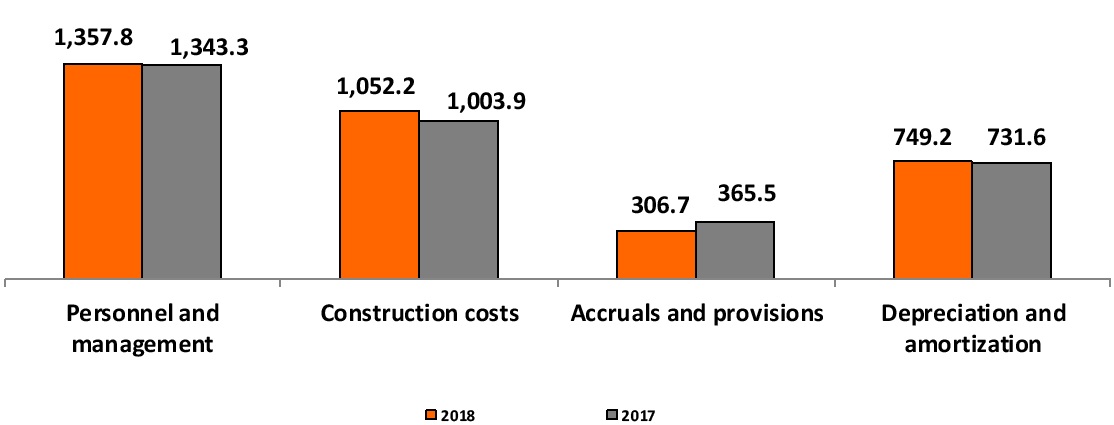

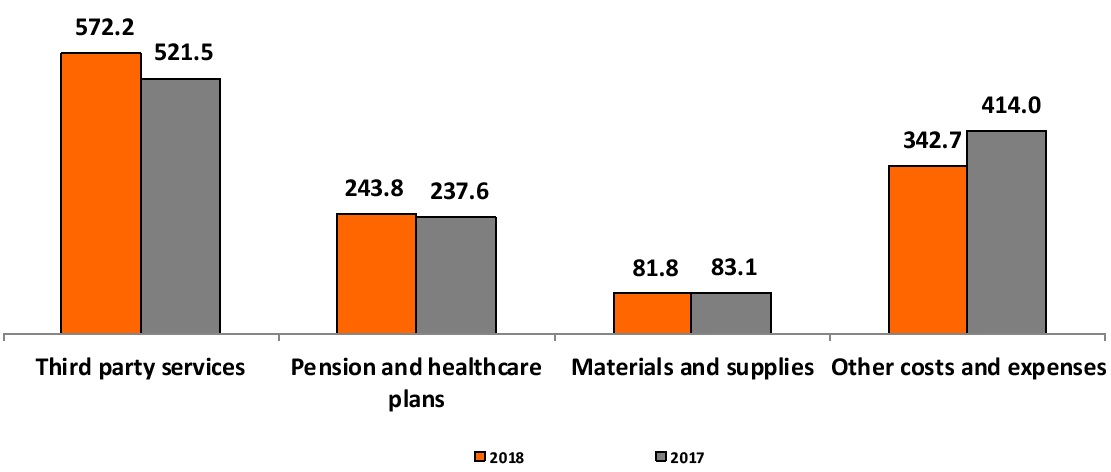

Operating costs and expenses | 12,676,621 | 11,984,931 | 5.8 |

Equity in earnings of investees | 135,888 | 101,739 | 33.6 |

Equity pick-up | 2,258,159 | 2,039,642 | 10.7 |

EBTIDA or LAJIDA | 3,143,226 | 2,872,980 | 9.4 |

Financial result | (438,050) | (748,440) | (41.5) |

IRPJ/CSLL | 511,993 | 274,686 | 86.4 |

Operating profit | 1,955,997 | 1,392,941 | 40.4 |

Net income for the year | 1,444,004 | 1,118,255 | 29.1 |

Shareholder's Equity | 16,336,214 | 15,510,503 | 5.3 |

Interest on shareholder's equity | 280,000 | 266,000 | 5.3 |

Dividends | 98,542 | 23,401 | 321.1 |

Economic and Financial Indicators | | | |

Current liquidity (index) | 1.0 | 0.9 | 11.1 |

Overall liquidity (index) | 0.9 | 0.8 | 12.5 |

EBTIDA Margin (%) | 21.0 | 20.5 | 2.4 |

Earnings per share - Common Shares | 4.91091 | 3.60754 | 36.1 |

Earnings per share - Class "A" preferred shares | 5.40201 | 3.96830 | 36.1 |

Earnings per share - Class "B" preferred shares | 5.40201 | 3.96830 | 36.1 |

Equity value per share – R$ (shareholders’ equity/number of shares) | 59.7 | 56.7 | 5.3 |

Debt on shareholders' equity (%) | 70.8 | 63.4 | 11.7 |

Operating margin (operating profit / net operating revenue) (%) | 13.1 | 9.9 | 32.3 |

Net margin (net income/net operating revenues) (%) | 9.7 | 8.0 | 21.3 |

Participation of third-party capital (%) | 54.5 | 53.2 | 2.4 |

Return on shareholders' equity (%)(1) | 9.3 | 7.5 | 24.0 |

(1) LL ÷ (initial PL) | | | |

2. corporate governance

In addition to Law 13,303/2016, Copel's management has as a reference the Code of Best Corporate Governance Practices, from the Brazilian Corporate Governance Institute (IBGC), CVM Instruction 586/2017, the decisions of the Securities and Exchange Commission - SEC, and the Sarbanes-Oxley Act - SOX.The Company has a Corporate Governance Policy, in which establishes its responsibility, objectives and commitments, based on the principles of transparency, equity, accountability and corporate responsibility.

COPEL has improved its corporate governance practices to fully comply with legal requirements, the Brazilian Securities and Exchange Commission (CVM) regulations, the B3 Issuer Regulations and the strict practices imposed by the US legislation for companies listed on the New York Stock Exchange, aligned with the best corporate governance practices.

It was the first company in the Brazilian electric sector to be listed on the New York Stock Exchange, in 1997.Its brand is also present in the European Economic Community since June 2002 due to its entry into Latibex - the Latin American arm of the Madrid Stock Exchange (Spain).In Brazil, Copel is a member of B3's Corporate Governance at Level 1.In December 2018, the Company received the certification in the Governance of State-Owned Enterprises Program of the Brazilian stock exchange.

Among the advances made in 2018, we highlight:

· the revision of the Bylaws of Copel (Holding) and its wholly-owned subsidiaries (SIs), which have incorporated improvements beyond the provisions of the State-Owned Enterprises Law, strengthening the Company's corporate governance;

· the establishment of guidelines and rules for the nomination of members to the boards of Copel (Holding) and SIs, and to the boards of their direct or indirect ownership interests in line with the relevant legislation and with the agreements with the CVM; and

· the establishment of guidelines and rules for the management of the Company's ownership interests, seeking to maximize the efficiency, efficacy and effectiveness of its business, contribute to Copel’s sustainability and ownership interests, reduce exposure to risks and strengthen the internal control environment with the objective of avoiding fraud and reducing the financial losses generated by the process’s inefficiency.

In addition to these advances, other corporate governance measures that deserve special mention are the management of fraud and corruption risks in the operations; of conflicts of interest; damage to reputation; and the adoption of anticompetitive practices.

2.1.Governance Structure

The Company's governance structure is as follows:

General meeting of shareholders

It is the Company’s highest authority, with powers to decide on all businesses related to its corporate purpose.It is governed by relevant legislation.

Nomination and evaluation committee

Committee with the authority to support the shareholder in the verification of the compliance of the nomination and evaluation process of the board members, members of the supervisory board and members of the statutory committees of Copel (Holding) and its wholly-owned subsidiaries, such authority may be extended to its direct and indirect ownership interests, pursuant to relevant legislation.

Fiscal Council

A body that is independent from Management, which purpose is to inspect the actions undertaken by officers and members of the board of directors and provide an opinion on the Company's accounts.

Board of Directors - BOD

Strategic and collegiate decision-making body, responsible for defining the Company's highest level of guidance, protecting its assets, verifying compliance with its corporate purpose, and being responsible for guiding the executive board in order to maximize return on investment, adding value to the business in a sustainable manner.

Executive Board

Executive management and representation body of Copel (Holding), with responsibility for ensuring the regular operation of the Company, in line with the general strategy outlined by the Board of Directors.It is composed of a CEO, a Chief Executive Officer, a Chief Financial and Investor Relations Officer, a Chief Legal and Institutional Relations Officer, a Chief Business Development Officer, and a Chief Governance, Risk and Compliance Officer.The Company also has a Deputy Officer.

The Chief Financial and Investor Relations Officer of Copel (Holding) is responsible for performing the unpaid function of Chief Financial Officer of the wholly-owned subsidiaries, unless specific legislation determines nomination of an exclusive officer.

It is incumbent upon the Company's Chief Legal and Institutional Relations Officer to perform the unpaid function of Chief Legal and Institutional Relations Officer for Copel GeT, Copel DIS, Copel Energia and Copel REN.

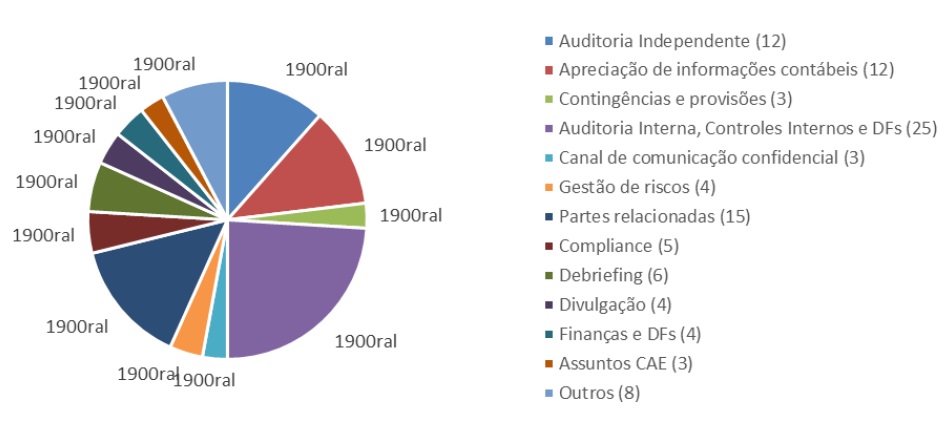

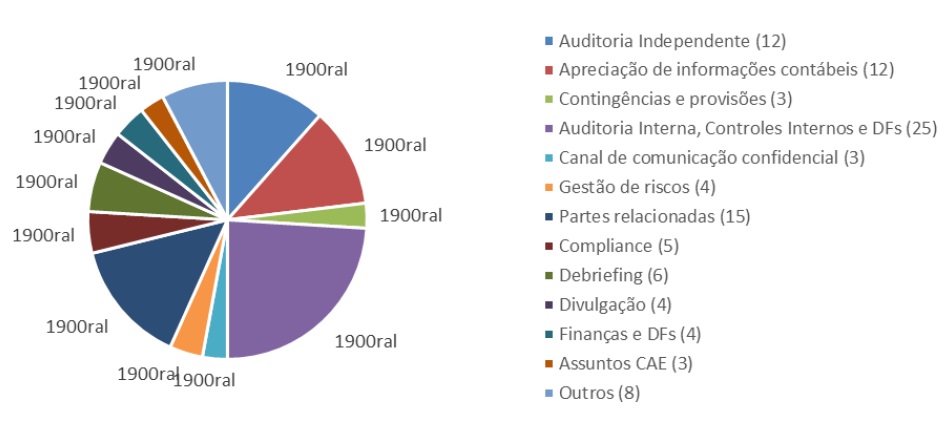

Statutory Audit Committee

Advisory body to the Board of Directors, composed mostly of independent members, chosen from among the members of the Board of Directors and in accordance with relevant legislation.This body is intended to protect the interests of shareholders and other stakeholders by monitoring the quality of financial statements and internal controls, as well as the organization's compliance, integrity, and risk management.

Board of Ethical Guidance

A body linked to the Chief Executive Officer, whose purpose is to ensure that Copel's ethical and moral position remains at elevated levels with respect to civil society.

Committee of disclosure of material acts and relevant facts

A body linked to the Financial and Investor Relations Office whose purpose is to manage the Company's Information Disclosure and Preservation of Confidentiality Policy, responsible for approving the information to be disclosed to the market and for monitoring and providing privileged information to the area responsible for communicating with regulatory agencies and other capital market agents.

Financial Committee (ad hoc)

A committee intended to advise the Board of Directors of Copel (Holding), with competencies related to economic and financial matters of the Company, and its wholly-owned subsidiaries, subsidiaries and associates.

Standing Compensation Committee

A body linked to the Enterprise Management Office/ Business Management Board responsible for preparing and proposing a policy to establish compensation of managers and members of the supervisory board of Copel's wholly-owned subsidiaries, subsidiaries and associates.

Internal Audit

An independent, non-statutory body linked to the CEO, responsible for assessing the effectiveness of the risk management process and the adequacy of actions for handling and internal control mechanisms, as well as providing advice to the Supervisory Board, Board of Directors, Statutory Audit Committee, Executive Board and other business areas.

2.2.Integrity

· Integrity Program

In accordance with Federal Law 12,846/2013, Federal Decree 8,420/2015 and Federal Law 13,303/2016, Copel published in 2017 its Integrity Program, a set of internal mechanisms for integrity, ethics, transparency, risk management, internal controls, compliance, internal audit and application of the Code of Conduct, which must be observed by all employees, managers and members of the supervisory board.The purpose of the Program is to prevent, detect and remedy any acts that may have an impact on the Company.The initiative is coordinated by the Governance, Risk and Compliance Office, monitored by internal and external audit, and submitted to Copel’s Statutory Audit Committee.

The disclosure and dissemination of the Integrity Program and other compliance initiatives are digitally made from time to time across the Company. The content in its entirety can be accessed through Copel’s online internal and external channels, through the Compliance Portal.

· Anti-corruption practices

The operational processes are annually assessed for risks related to errors or fraud that may interfere with the results of the financial statements, and internal controls are established, submitted to tests by the Internal Audit and to the Independent Auditor, with results reported to Management.The tests occur annually beginning in October and are finalized with an assessment of the severity and magnitude of the weaknesses at the time of filing Form 20-F with the SEC in April of each year.

Taking into account the number of processes mapped to comply with the Sarbanes Oxley Act, 100% of Copel's operations were subject to risk assessments related to corruption.

The Company also carries out activities intended to safeguard the internal control environment and to comply with legal and regulatory requirements in force, particularly of SOX.The internal control structure complies with COSO standards, which is an internationally recognized reference framework. Copel uses tools provided by the ERP-SAP system.

· Reporting channels

In order to receive opinions, criticisms, complaints, claims and personal inquiries, Copel provides communication channels that, in addition to contributing to the fight against fraud and corruption, also expand the organization's relationship with its stakeholders.These are:

· Confidential Communication Channel: intended to receive complaints and communications regarding noncompliance with laws and regulations, particularly of fraud or irregularities involving finance, auditing or accounting matters.The channel guarantees protection, preservation of the identity of the person making the claim and an answer to the complaint.It is available 24 hours a day, seven days a week, toll-free call: 0800 643 5665. 0800 643 5665.

· Ombudsman: There are two channels open to all stakeholders, internal and external, for suggestions, claims and complaints, and are available on weekdays, from 8 am to 6 pm, with toll-free call.The Copel Distribuição Ombudsman is available through the phone number 0800 647 0606 and also through the email ouvidoria@copel.com.In addition, it can receive the complaints in person or through correspondence sent to its address at Rua Professor Brasilio Ovidio da Costa, 1703, Santa Quitéria, CEP: 80310-130, Curitiba - Paraná. 80310-130 Curitiba – PR.The Copel Telecomunicações Ombudsman is available through phone number 0800 649 3949 and through the email ouvidoriatelecom@copel.com, able to receive complaints in person or through correspondence sent to its address at Rua Comendador Araújo, 614, Batel, CEP: 80420-000, Curitiba - Paraná. 80420-000 Curitiba - PR.

· Commission for Analysis of Complaints of Harassment - CADAM: assists and supports every employee who is a victim of bullying in his or her work environment.The information is confidential, and both the complainant and the respondent have a guarantee of identity preservation. Email: cadam@copel.com. Email: cadam@copel.com

· Ethical Guidance Board - EGB: assesses and issues guidance on processes related to ethical conduct in the Company and has a maximum deadline of 90 days to offer a final answer. Email: conselho.etica@copel.com

· External Audit

Under the terms of Instruction 381/2003, of the Brazilian Securities and Exchange Commission, in an internal Corporate Governance standard and under the review and supervision of the Audit Committee, the Company and its wholly-owned subsidiaries have a contract with Deloitte Touche Tohmatsu AuditoresIndependentes since March 21, 2016, to provide audit services of the financial statements.The work necessary for the evaluation of the fiscal year will extend until June 30, 2019, date that will correspond to its final term, and may be formally extended by up to 24 months.

The Company changes the firm responsible for auditing its financial statements in accordance with the independent auditor's rotation criterion, in accordance with CVM Instruction 308/1999, and/or Law 8,666 /1993 - "Bid to Tender Law".

The contracted value for the period 2019-2020 is R$3.2 million. The amount paid for external audit services rendered in 2018 was R$3.8 million.

When hiring other services from its external auditors, the Company's practice foresees the prior analysis by the Audit Committee of the Board of Directors, which should take into account in this evaluation whether a relationship or service rendered by an independent auditor:(a) creates conflicting interests with its audit client; (b) puts them in a position to audit their own work; (c) results in working as manager or as employee of the audit client; or (d) puts them in a position of being an advocate to the audit client.

The Audit Committee also considers in this type of assessment if any service rendered by the independent audit firm may impair in fact or apparently the firm’s independence.Whenever necessary, the Audit Committee can count on the technical support of the Internal Audit, or independent advisory service for a technical evaluation that may be required in each specific case, the discussions on the hiring of other independent auditor services are recorded in the minutes of meeting of these boards.

2.3.Sustainability Management

The challenges of sustainability are part of Copel’s strategic reference contained in the mission and vision of business.The permanent search for improving the performance of the area of sustainability, as well as its communication with stakeholders and the management of matters and indicators are steps of this strategy.

Throughout its history, the Company has undertaken voluntary commitments that are recognized worldwide as best practices:

· Agenda 2030

· Global Compact

· Global Compact Cities Program

· National Movement ODS We Can

· Statement:Call to Action for Governments in the Fight against Corruption

· Business Pact for Integrity and Against Corruption

· Principles for Sustainable Business Education

3. OPERATING PERFORMANCE

3.1.Macroeconomic analysis

In 2018 the Brazilian economy was shaped by several economic, political and institutional elements that were reflected in the slow recovery and the low economic growth of the country.At the end of May 2018, Brazil recorded the largest strike of recent times, when truck drivers, dissatisfied with diesel prices, blocked highways which caused significant shortages of food and fuel throughout the country. The external uncertainties provoked by a possible trade war between the United States and China, corroborated by the United Kingdom's exit from the European Union, caused great fluctuations in the UD Dollar and the stock market, which coupled with the internal tensions of the Brazilian electoral process contributed to lower economic growth estimates for 2018 still further. This perception was consolidated in the fall in market expectations for the national GDP as surveyed by the Focus Bulletin of the Central Bank, which, from a peak of 2.9% at the end of February, fell to 1.3% at the end of December. On the other hand, a fall in inflation rates and with the Central Bank of Brazil Overnight Interest Rate (SELIC) at its lowest level since 1998, aligned with a modest recovery in the labor market, contributed to the 1.3% expansion of Brazilian gross domestic product, as reported by the Brazilian Institute of Geography and Statistics - IBGE.

At the regional level, Paraná had already anticipated recovery from the crisis as from the second six-month period of 2016, reaping the excellent results of the performance in rural areas, when a record harvest of 41.5 million tons of grain was recorded in 2017.The estimate for 2018 was below the previous year, but with production levels higher than those observed in 2016, so that the positive effects of agricultural earnings were reflected in the industrial segments, directly linked to agriculture, as well as other sectors such as trade and services.In addition, the state’s manufacturing sector has been progressively recovering its production levels from the second six-month period of 2017, with especial focus on the automobile and pulp and paper industries, supported in part by the international market.Improvements in trade and service sector indices for the state of Paraná also posted significant growth, associated with several sectors of expanded retail trade.Given this scenario, the economy of Paraná recorded growth of 1.5% in 2018, according to data from the Paraná Institute of Economic and Social Development (IPARDES).

3.2.Regulatory background

On July 5, 2017, the Ministry of Mines and Energy (MME) published a public inquiry containing a proposal for legal measures that will enable the future of the electric energy sector with long-term sustainability, titled "Enhancement of the Legal Framework of the Electric Sector."The public inquiry was held from July 5, 2017 to August 17, 2017 and received more than 209 contributions from a wide variety of segments.

On February 9, 2018, a document concluding the public inquiry and containing a compiled proposal for improvements to be made to the energy regulatory framework, driven in particular by technological, socialand environmental phenomena and by frictions in existing business models, was published on the website of that government ministry. These themes included discussions on the following:

· An end to the quota regime for hydroelectric power plants, either extended or under tender, established by Law 12,783/2013 and allocation of part of the economic benefit of grants to the Energy Development Account - CDE, with a view to reducing said charge to civil society;

· Reduction of access limits to the free energy market;

· Alignment of the short-term price setting to the operating cost of the system;

· Possibility of separation of guarantee and energy, currently sold in aggregate form;

· Effect of migrating consumers to the free market;

· Environmental attributes market;

· Attracting foreign capital to investments in the Brazilian electric energy sector;

· Rationalization of tariff discounts;

· Allocation of funds from the global reversion reserve to the transmission segment;

· Guidelines for the use of resources in research and development;

· Modernization of the regulated market; and

· Reduction of judicial involvement over hydrological risk.

In May 2018, most of the aforementioned improvements were added to the Bill drawn up by the Chamber of Deputies, Law 1,917 /2015, called Portabilidade da Conta da Luz - (electric energy bill portability law), as a substitute.The Bill is awaiting approval of that Chamber for subsequent submission and approval in the Senate and then the Presidential sanction.

If the project is converted into Law, there will also be a need for the supervenient regulation of these issues.For this reason, there are many uncertainties related to the future proposal of the energy sector.However, Copel monitors and works together to build a new regulatory framework, including, through intermediation of the associations that represent it, public hearings and inquiries instituted by the Concession Grantor and Aneel, with a view to mitigating risks and anticipating new opportunities for Company business.

· Extension of Concessions

Concessions of the generation, transmission and distribution segments are governed by Law 12,783 of January 11, 2013.

In the hydroelectric generation segment, for the concessions of plants covered by article 19 of Law 9,074 /1995 - which encompasses most Copel plants - the possibility of extending the physical guarantee quotas for up to a single 30-year period, through acceptance of express conditions as: regulated tariffs, energy allocation to the regulated market, and submission to quality standards.The thermoelectric power plant generation concession establishes the possibility of a single 20-year extension at the discretion of theconcession grantor provided that they ensure continuity, efficiency in the provision of the service and the security of the system are ensured.

In the transmission segment, to the electric energy transmission concessions covered by paragraph 5 of article 17 of Law 9,074 /1995, allow for the possibility of a single 30-year extension, one time, at the discretion of the concession grantor, in order to ensure continuity, efficiency in the provision of the service and low tariffs.

In the distribution segment, the electric energy distribution concessions covered by article 22 of Law 9,074 dated 1995, allow for the possibility of a single 30-year extension, one time, at the discretion of the concession grantor, in order to ensure continuity, efficiency in the provision of the service, low tariffs and compliance with operational and economic rationality criteria.

Generation Concessions

In 2014 and 2015, four Copel generation concessions expired:Rio dos Patos, with 1.8 MW; Governador Pedro Viriato Parigot de Souza Plant - GPS, with 260 MW; Mourão, with 8.2 MW; and Chopim I, with 1.8 MW of installed capacity.Once the extension conditions were known, analysis was carried out, which concluded that the extension of the concession for these plants was not feasible.The HPP Rios dos Patos had its concession expired, without further rebidding, due to lack of operational conditions.The Company signed an instrument committing to buy or sell the remaining assets. The amount negotiated was R$9.1 million.

The HPPs GPS and Mourão were resubmitted to tender by the concession grantor, for another 30 years, and the former one was obtained by Copel.The HPP Chopim 1 had its operating regime changed, as a result of the law, having the condition of registration passed in favor of the Company.

The Figueira Thermoelectric Power Plant concession expired on March 26, 2019. On May 24, 2017, the Company filed its intention to extend this concession, emphasizing, however, that it will sign the necessary contracts and/or amendments, only after knowing and accepting the contractual terms and the rules that will govern all process related to the extension of the grant.

Transmission Concessions

In 2015, COPEL's largest transmission concession, known as the Concession of Existing Installations or Contract No. 060/2001, was won. After being aware of the conditions for extension, analyzes and evaluations were made, opting for an extension of the transmission contract, for a further 30 years, in accordance with Law 12.783 / 2013, detailed in Note 10.4 to the Financial Statements.

Distribution Concessions

In 2015, Copel won the distribution concession agreement No. 046/1999.

In November 2015, by the Order of the Minister of Mines and Energy, Copel's request for extension of the concession was granted.In December of the same year, the fifth (5th) contractual addendum was entered into, which formalized the extension of Concession Agreement No. 46/1999 for another 30 years, subject to acceptance of new indicators of service quality and economic and financial sustainability.

The following table sets out the minimum economic-financial sustainability parameters defined for Copel Distribuição in the first five years of renewal:

Economic and Financial Management | Realizado | Quality - limits (a) | Quality - accomplished |

Ano | Gestão Econômico-Financeira | SAIDIi(b) | CAIDIi(b) | SAIDIi | CAIDIi |

2016 | - | | - | 13.61 | 9.24 | 10.80 | 7.14 |

2017 | Lajida ≥ 0(d) | | 661.4 | 12.54 | 8.74 | 10.41 | 6.79 |

2018 | Lajida (-) QRR ≥ 0(e) (f) | | | 11.23 | 8.24 | 10,29(c) | 6,20(c) |

2019 | {Net Debt / [Lajida (-) QRR ≥ 0]} ≤ 1 / (0,8 * Selic)(e)(g) | 10.12 | 7.74 | - | - |

2020 | {Net Debt / [Lajida (-) QRR ≥ 0]} ≤ 1 / (1,11 * Selic)(e)(g) | 9.83 | 7.24 | - | - |

| | | | | | | | |

(a) According to NT 0335/2015 Aneel. |

(b) DECi - Equivalent Duration of Interruption of Internal Origin per Consumer Unit; and FECi - Equivalent Frequency of Interruption of Internal Origin per Consumer Unit. |

(c)Preliminary data. |

(d)Amount will be presented in the Regulatory Accounting Statement. |

(e) QRR: Regulatory Reintegration Quota or Regulatory Depreciation Expenses. It will be the value defined in the last Periodic Tariff Review - RTP, plus the IPCA between the month prior to RTP and the month prior to the 12-month period of the economic-financial sustainability measurement. |

(f)Selic: limited to 12.87% a.a. |

The Company has achieved the annual indicators and reiterates its commitment to the economic sustainability of the concession and the continuity of the investments supported by cost control management, maximization of productivity and improvement of operational efficiency.

Gas Concessions

Companhia Paranaense de Gas - Compagas is the concessionaire responsible for the distribution of piped natural gas in the State of Paraná, whose concession was granted on July 6, 1994 for 30 years.On December 7, 2017, the State of Paraná has published the Supplementary Law No. 205, introducing a new interpretation of the expiry of the concession, understanding that the expiry will be on January 20, 2019.

The management of Compagas, its parent company and other shareholders questioned the effects of the aforesaid law since they understand that these conflict with the provisions of the concession agreement currently in force.Compagas filed a lawsuit challenging the early termination of the concession, obtaining on October 30, 2018 a preliminary injunction, which can be subject to an appeal by the State of Paraná.

· Energy Flow (% and GW /hour)

3.3. Business Segments

3.3.1. Generation

Copel operates 35 plants of its own and has ownership interest in another 10. Of this total 21 are hydroelectric, 22 wind powered and two thermoelectric plants with a total installed capacity of 5,828 MW and a physical guarantee of 2,715.7 MW on average, as shown below:

Plants in Operation at December 31, 2018 - Physical Characteristics

Developments | Installed Capacity (MW) | Physical Assurance (Average MW) | Ownership % | Proportional Installed Capacity (MW) | Proportional Physical Assurance (Average MW) | Start of Commercial Operations | Concession expires on |

Hydroelectric Power Plants | | | | | | | |

UHE Gov. José Richa (Salto Caxias)(1) | 1,240.0 | 605.6 | 100% | 1,240.0 | 605.6 | 18.02.1999 | 04.05.2030 |

UHE Gov. Ney Aminthas de Barros Braga (Segredo)(1) | 1,260.0 | 578.5 | 100% | 1,260.0 | 578.5 | 29.09.1992 | 15.11.2029 |

UHE Gov. Bento Munhoz da Rocha Netto (Foz do Areia)(1) | 1,676.0 | 603.3 | 100% | 1,676.0 | 603.3 | 01.10.1980 | 17.09.2023 |

UHE Gov. Pedro Viriato Parigot de Souza (GPS) | 260.0 | 109.0 | 100% | 260.0 | 109.0 | 03.09.1971 | 04.01.2046 |

UHE Gov. Jayme Canet Júnior (Mauá) | 361.0 | 197.7 | 51% | 184.1 | 100.8 | 23.11.2012 | 02.07.2042 |

UHE Guaricana | 36.0 | 16.1 | 100% | 36.0 | 16.1 | 01.01.1957 | 15.08.2026 |

UHE Chaminé | 18.0 | 11.6 | 100% | 18.0 | 11.6 | 01.01.1930 | 16.08.2026 |

PCH Cavernoso II | 19.0 | 10.5 | 100% | 19.0 | 10.5 | 15.05.2013 | 27.02.2046 |

UHE Apucaraninha | 10.0 | 6.7 | 100% | 10.0 | 6.7 | 06.04.1949 | 12.10.2025 |

UHE Derivação do Rio Jordão | 6.5 | 5.9 | 100% | 6.5 | 5.9 | 02.12.1997 | 15.11.2029 |

CGH Marumbi | 4.8 | 2.4 | 100% | 4.8 | 2.4 | 05.04.1961 | (2) |

UHE São Jorge | 2.3 | 1.5 | 100% | 2.3 | 1.5 | 01.01.1945 | 03.12.2024 |

CGH Chopim I | 2.0 | 1.5 | 100% | 2.0 | 1.5 | 28.05.1963 | (3) |

UHE Cavernoso | 1.3 | 1.0 | 100% | 1.3 | 1.0 | 07.12.1965 | 07.01.2031 |

CGH Melissa | 1.0 | 0.6 | 100% | 1.0 | 0.6 | 31.01.1966 | (4) |

CGH Salto do Vau | 0.9 | 0.6 | 100% | 0.9 | 0.6 | 01.01.1959 | (4) |

CGH Pitangui | 0.9 | 0.1 | 100% | 0.9 | 0.1 | 01.01.1911 | (4) |

UHE Santa Clara e Fundão | 240.3 | 135.4 | 70% | 168.2 | 94.8 | 31.07.2005 | 28.05.2037 |

UHE Dona Francisca | 125.0 | 78.0 | 23% | 28.8 | 18.0 | 05.02.2001 | 27.08.2033 |

PCH Arturo Andreoli | 29.1 | 20.4 | 36% | 10.4 | 7.3 | 25.10.2001 | 23.04.2030 |

UHE Santa Clara I e Fundão I | 6.0 | 4.9 | 70% | 4.2 | 3.4 | 13.08.2005 | 18.12.2032 |

Total Hydroelectric Power Plants | 5,300.1 | 2,391.3 | | 4,934.4 | 2,179.2 | 85% | |

Eólicas | | | | | | | |

Santa Maria | 29.7 | 15.7 | 100% | 29.7 | 15.7 | 23.04.2015 | 07.05.2047 |

Santa Helena | 29.7 | 16.0 | 100% | 29.7 | 16.0 | 06.05.2015 | 08.04.2047 |

Olho d'Água | 30.0 | 15.3 | 100% | 30.0 | 15.3 | 25.02.2015 | 31.05.2046 |

São Bento do Norte | 30.0 | 14.6 | 100% | 30.0 | 14.6 | 25.02.2015 | 18.05.2046 |

Eurus IV | 27.0 | 14.7 | 100% | 27.0 | 14.7 | 20.08.2015 | 26.04.2046 |

Asa Branca I | 27.0 | 14.2 | 100% | 27.0 | 14.2 | 05.08.2015 | 24.04.2046 |

Asa Branca II | 27.0 | 14.3 | 100% | 27.0 | 14.3 | 15.09.2015 | 30.05.2046 |

Asa Branca III | 27.0 | 14.5 | 100% | 27.0 | 14.5 | 04.09.2015 | 30.05.2046 |

Farol | 20.0 | 10.1 | 100% | 20.0 | 10.1 | 25.02.2015 | 19.04.2046 |

Ventos de Santo Uriel | 16.2 | 9.0 | 100% | 16.2 | 9.0 | 22.05.2015 | 08.04.2047 |

Boa Vista | 14.0 | 6.3 | 100% | 14.0 | 6.3 | 25.02.2015 | 27.04.2046 |

Cutia | 23.1 | 9.6 | 100% | 23.1 | 9.6 | 22.12.2018 | 04.01.2042 |

Esperança do Nordeste | 27.3 | 9.1 | 100% | 27.3 | 9.1 | 29.12.2018 | 10.05.2050 |

Guajiru | 21.0 | 8.3 | 100% | 21.0 | 8.3 | 29.12.2018 | 04.01.2042 |

Jangada | 27.3 | 10.3 | 100% | 27.3 | 10.3 | 29.12.2018 | 04.01.2042 |

Maria Helena | 27.3 | 12.0 | 100% | 27.3 | 12.0 | 29.12.2018 | 04.01.2042 |

Potiguar | 27.3 | 11.5 | 100% | 27.3 | 11.5 | 29.12.2018 | 10.05.2050 |

Palmas(5) | 2.5 | 0.5 | 100% | 2.5 | 0.5 | 12.11.1999 | 28.09.2029 |

Santo Cristo | 27.0 | 15.3 | 49% | 13.23 | 7.5 | 30.06.2015 | 17.04.2047 |

Reduto | 27.0 | 14.4 | 49% | 13.23 | 7.1 | 26.06.2015 | 15.04.2047 |

São João | 27.0 | 14.3 | 49% | 13.23 | 7.0 | 30.06.2015 | 25.03.2047 |

Carnaúbas | 27.0 | 13.1 | 49% | 13.23 | 6.4 | 30.06.2015 | 08.04.2047 |

Total Wind Energy Plants | 541.4 | 263.1 | | 486.3 | 234.0 | 6% | |

Termelétricas | | | | | | | |

UTE Figueira | 20.0 | 10.3 | 100% | 20.0 | 10.3 | 08.04.1963 | 26.03.2019 |

UTE Araucária(6) | 484.1 | 365.2 | 80% | 387.3 | 292.2 | 27.09.2002 | 22.12.2029 |

Total Thermal Power Plants | 504.1 | 375.5 | | 407.3 | 302.5 | 9% | |

| | | | | | | | |

Total Sources | 6,345.6 | 3,029.9 | | 5,828.0 | 2,715.7 | #DIV/0! | |

(1) Physical Guarantee as a result of the new amounts established by Ordinance MME nº 178 of 03.05.2017, with effect from 01.01.2018 |

(2) In the process of homologation at ANEEL. |

(3) Registration according to Aneel Order n° 182/2002 and Aneel Resolution n° 5373/2015. |

(4) Registration according to Aneel Order n° 182/2002 and Aneel Resolution n° 5373/2015. |

(5) Whithout physical guarantee set by the MME, estimated value based on generation average. |

(6) The Company still holds a 20% interest in the Holding and 60% in Copel GeT. |

To fulfill important strategic and sustainability guidelines established for the generation business, the Company’s main purpose is to profitably and sustainably boost the share of renewable alternative sources in the energy mix.

The composition of the generating park by source is as follows:

Currently, the Company is focusing its efforts on the construction of 9 plants, which will add 537.4 MW of installed capacity and 288.5 MW on average of physical guarantee to the generating park:

Power Plant Projects under Construction - Physical Characteristics

| | | | | | | | | | | |

Development | Installed Capacity (MW) | Physical Assurance (average MW) | | Ownership % | Proportional Installed Capacity (MW) | Proportional Physical Assurance (Average MW) | Commercial Operations expected to start on | | Concession expires on | |

Hydroelectric Power Plants | | | | | | | | | | |

UHE Colíder | 300.0 | 178.1 | (1) | 100% | 300.0 | 178.1 | 09.03.2019 | (3) | 16.01.2046 | |

UHE Baixo Iguaçu | 350.2 | 172.4 | (2) | 30% | 105.1 | 51.7 | 08.02.2019 | (3) | 14.09.2049 | (4) |

Total das Hidrelétricas | 650.2 | 350.5 | | | 405.1 | 229.8 | | | | |

Wind Energy Plants | | | | | | | | | | |

Paraíso dos Ventos do Nordeste | 27.3 | 10.6 | | 100% | 27.3 | 10.6 | 05.01.2019 | | 03.08.2050 | |

São Bento do Norte I | 23.1 | 10.1 | | 100% | 23.1 | 10.1 | 31.01.2019 | | 03.08.2050 | |

São Bento do Norte II | 23.1 | 10.8 | | 100% | 23.1 | 10.8 | 29.01.2019 | | 03.08.2050 | |

São Bento do Norte III | 23.1 | 10.2 | | 100% | 23.1 | 10.2 | 15.05.2019 | | 03.08.2050 | |

São Miguel I | 21.0 | 9.3 | | 100% | 21.0 | 9.3 | 14.02.2019 | | 03.08.2050 | |

São Miguel II | 21.0 | 9.1 | | 100% | 21.0 | 9.1 | 02.02.2019 | | 03.08.2050 | |

São Miguel III | 21.0 | 9.2 | | 100% | 21.0 | 9.2 | 14.02.2019 | | 03.08.2050 | |

| | | | | | | | | | |

Total Wind Energy Plants | 132.3 | 58.7 | | | 132.3 | 58.7 | 20% | | | |

| | | | | | | | | | |

Total Sources | 782.5 | 409.2 | | | 537.4 | 288.5 | | | | |

(1)Physical guarantee revised by virtue of the new amounts established by the Ordinance of the Planning and Energetic Development Secretary 213/2017. |

(2) Physical guarantee revised by virtue of the new amounts established by the Ordinance of the Planning and Energetic Development Secretary 11/2017. |

(3)Entry of the first generating unit (Note 40.2). |

(4)According to the 2nd Addendum to the Concession Agreement, which considers the exclusion of responsibility for 756 days. |

Were invested R$4 billion in these generation projects still under construction up to December 31, 2018. From this total, R$3.1 billion refers to the increase in fixed assets in progress, of our own plants, and of the consortium plants, and the remainder refers to investment in wind farms.

In the segment of electric energy generation, we also give emphasis to:

· Colíder Hydroelectric Power Plant:Copel Geração e Transmissão won the concession for the implementation and operation of the plant for 35 years in the energy auction held by Aneel on July 30, 2010, with 300 MW of installed capacity.The construction of the plant, located in the Teles Pires River, between the cities of Nova Canaã do Norte and Itaúba, in Mato Grosso, was started in 2011 and shall absorb R$2.4 billion in investments.Projection for the start of commercial operation was in June 2018, however, due tounforeseeable circumstances or force majeure, such as fire at the construction site, acts of public power, delays in the delivery of equipment, in electromechanical assembly services and in the construction of the transmission line associated with the plant, in addition to the fact that an Operating License was not issued by the Environment Department for the State of Mato Grosso - SEMA /MT - the project experienced adverse effects on its schedule, so that the commercial generation of the plant was postponed.See Note 18.4 to the Financial Statements for more information.

· Baixo Iguaçu Hydroelectric Power Plant: With a 30% ownership interest in the project, where the remaining 70% is held by Neoenergia, the total investment is estimated at R$2.5 billion.Commercial operation began in February 2019. See Note 18.5.1 of the Financial Statements.

· Modernization of the Figueira Thermoelectric Power Plant:The Company started the modernization work in 2015, in order to increase its efficiency and reduce the emission of gases and particles resulting from the coal burning.Until the first quarter of 2016, the work developed as it should, but after the second quarter of the same year, as a result of financial difficulties, the company that was hired to carry out the services showed signs of difficulty to maintain the execution of the activities agreed, culminating in the near paralysis of the work. In view of this situation, the Company replaced the engaged company to continue the work, restarting the work at the beginning of the second half of 2017, with the completion expected in 2019.

· Cutia and Bento Miguel Wind Farm Complex:Copel Geração e Transmissão’s largest wind farm project is at the conclusion stage and at the beginning of entry into commercial operation.Named Cutia Empreendimentos Eólicas - CEE SA, it is divided into two large complexes:(a) Cutia Complex, comprised of seven wind farms (Guajiru, Jangada, Potiguar, Cutia, Maria Helena, Esperança do Nordeste and Paraíso do Ventos do Nordeste), with a total installed capacity of 180.6 MW, physical guarantee of 71.4 MW on average, all located in the State of Rio Grande do Norte, and (b) Bento Miguel Complex: comprised of six wind farms (São Bento do Norte I, São Bento do Norte II, São Bento do Norte III, São Miguel I, São Miguel II and São Miguel III) with 132.3 MW of total installed capacity, 58.7 MW on average of physical guarantee, all located in the State of Rio Grande do Norte. See Note 18.6 to the Financial Statements for more information.

3.3.2. Transmission

The main responsibility of the segment is to provide electric energy transportation and transformation services, and is responsible for the construction, operation and maintenance of substations, as well as for the lines for the transmission of energy.

The Company owns and participates in transmission concessions in operation, corresponding to 6,628 kilometers of transmission lines, with a processing power of its substations in the order of 14,974 MVA. Below is the breakdown of transmission lines and substations in operation:

Transmission Lines and Substations in Operation on December 31, 2018

| | | | | | | | | | |

Transmission Lines and Substations | Property | Circuit | Tension (kV) | Extension (km) | Transformation capacity (MVA) | Commercial Operations expected to start on | Concession expires on |

| | | | | | | | | | |

Own lines and Substations | | | | 3,032 | 13,302 | | |

| Contract No. 060/2001 | Miscellaneous transmission installations (1) | Both | Varied | 2,064 | 12,352 | Multiple | 31.12.2042 |

| | Contract No. 075/2001 | LT Bateias - Jaguariaíva | | CS | 230 kV | 137 | - | 01.11.2003 | 16.08.2031 |

| Contract No. 006/2008 | LT Bateias - Pilarzinho | | CS | 230 kV | 32 | - | 14.09.2009 | 16.03.2038 |

| | Contract No. 027/2009 | LT Foz do Iguaçu - Cascavel Oeste | | CS | 525 kV | 116 | - | 06.12.2012 | 18.11.2039 |

| Contract No. 010/2010 | LT Araraquara 2 - Taubaté | | CS | 500 kV | 334 | - | 27.07.2018 | 05.10.2040 |

| | Contract No. 015/2010 | SE Cerquilho III | | - | 230/138 kV | - | 300 | 01.06.2014 | 05.10.2040 |

| Contract No. 022/2012 | LT Londrina - Figueira C2 | | CS | 230 kV | 92 | - | 30.06.2015 | 26.08.2042 |

| | LT Foz do Chopim - Salto Osório C2 | | CS | 230 kV | 10 | - | | |

| | Contract No. 002/2013 | LT Assis - Paraguaçu Paulista II | | CD | 230 kV | 42 | - | 25.01.2016 | 24.02.2043 |

| | | SE Paraguaçu Paulista II | | - | 230 kV | - | 200 | | |

| Contract No. 005/2014 | LT Bateias - Curitiba Norte | | CS | 230 kV | 31 | - | 29.07.2016 | 28.01.2044 |

| | SE Curitiba Norte | | - | 230/138 kV | - | 300 | | |

| | Contract No. 021/2014 | LT Foz do Chopim - Realeza | | CS | 230 kV | 52 | - | 05.03.2017 | 04.09.2044 |

| | | SE Realeza | | - | 230/138 kV | - | 150 | | |

| Contract No. 022/2014 | LT Assis - Londrina C2 | | CS | 500 kV | 122 | - | 05.09.2017 | 04.09.2044 |

| | | | | | | | | | |

Special Purpose Entity | | | | 3,596 | 1,672 | | |

| Costa Oeste Transmissora de Energia S.A. | 100.0% | | | | | | |

| Contract No. 001/2011 | LT Cascavel Norte - Cascavel Oeste | | CS | 230kV | 30 | | | |

| Contract No. 001/2012 | LT Cascavel Norte - Umuarama Sul | | CS | 230 kV | 130 | - | 31.08.2014 | 11.01.2042 |

| | SE Umuarama | | - | 230/138 kV | - | 300 | 27.07.2014 | |

| | Caiuá Transmissora de Energia S.A. | 49.0% | | | | | | |

| | Contract No. 007/2012 | LT Umuarama - Guaíra | | CS | 230 kV | 105 | - | 12.05.2014 | 09.05.2042 |

| | | LT Cascavel Oeste - Cascavel Norte | | CS | 230 kV | 37 | - | 02.07.2014 | |

| | | SE Santa Quitéria - SF6 | | - | 230/138/13,8 kV | - | 400 | 01.06.2014 | |

| | | SE Cascavel Norte | | - | 230/138/13,8 kV | - | 300 | 02.07.2014 | |

| Marumbi Transmissora de Energia S.A. | 100.0% | | | | | | |

| Contract No. 008/2012 | LT Curitiba - Curitiba Leste | | CS | 525 kV | 29 | - | 28.06.2015 | 09.05.2042 |

| | SE Curitiba Leste | | - | 525/230 kV | - | 672 | | |

| | Integração Maranhense e Transmissora de Energia S.A. | 49.0% | | | | | | |

| | Contract No. 011/2012 | LT Açailândia - Miranda II | | CS | 500 kV | 365 | - | 02.12.2014 | 09.05.2042 |

| Matrinchã Transmissora de Energia (TP NORTE) S.A. | 49.0% | | | | | | |

| Contract No. 012/2012 | LT Paranatinga - Ribeirãozinho | | CD | 500 Kv | 355 | - | 29.07.2016 | 09.05.2042 |

| | LT Paranaíta - Cláudia | | CD | 500 Kv | 300 | - | | |

| | LT Cláudia - Paranatinga | | CD | 500 Kv | 350 | - | | |

| | SE Paranaíta(2) | | - | 500 Kv | - | - | | |

| | SE Cláudia(2) | | - | 500 Kv | - | - | | |

| | SE Paranatinga(2) | | - | 500 Kv | - | - | | |

| Guaraciaba Transmissora de Energia S.A. | 49.0% | | | | | | |

| | Contract No. 013/2012 | LT Ribeirãozinho - Rio Verde Norte C3 | | CS | 500 Kv | 250 | - | 30.08.2016 | 09.05.2042 |

| | | LT Rio Verde Norte - Marimbondo II | | CD | 500 Kv | 350 | - | | |

| | | SE Marimbondo II (2) | | - | 500 Kv | - | - | | |

| Paranaíba Transmissora de Energia S.A | 24.5% | | | | | | |

| Contract No. 007/2013 | LT Barreiras II - Rio das Éguas | | CS | 500 Kv | 239 | - | 30.01.2017 | 02.05.2043 |

| | LT Rio das Éguas - Luziânia | | CS | 500 Kv | 368 | - | | |

| | LT Luziânia - Pirapora 2 | | CS | 500 Kv | 346 | - | | |

| | Cantareira Transmissora de Energia S.A. | 49.0% | | | | | | |

| | Contract No. 019/2014 | LT Estreito - Fernão Dias | | CD | 500 kV | 342 | - | 05.03.2018 | 04.09.2044 |

| | | | | | | | | |

Total | | | | | 6,628 | 14,974 | | |

(1) Concession extended under the terms of Provisional Measure No. 579/2012. |

(2) Exclusive for reactive control of the transmission lines of the National Interconnected System, improving the quality of the transmitted energy. |

The transmission concessions in operation at December 31, 2018 currently generate RAP to Copel Geração e Transmissão of R$807.4 million, proportional to its share in the projects.

Currently, the Company is focusing its efforts on the following projects, which will add 1,408 kilometers in extension and 4,500 MVA of transformation capacity to the set of own and partnership transmission lines and substations, as follows:

Transmission Lines and Substations Projects - Physical Characteristics

Transmission Lines and Substations | Property | Circuit | Tension (kV) | Extension (km) | Transformation capacity (MVA) | Commercial Operations expected to start on | Concession expires on |

| | | | | | | | | | |

Own lines and Substations | | | | 522.8 | 900 | | |

Contract No. 006/2016 | LT Curitiba leste - Blumenau | | CS | 525 KV | 142.0 | - | 04.04.2021 | 06.04.2046 |

| | | LT Baixo Iguaçu - Realeza | | CS | 230 KV | 38.0 | - |

| | | LT Curitiba centro | | Subterrâneo | 230 KV | 8.5 | - | 04.09.2019 | 06.04.2046 |

| | | SE Medianeira | | - | 230/138 KV | - | 300 |

| | | SE Curitiba centro | | - | 230/138 KV | - | 300 |

| | | SE Andira leste | | - | 230/138 KV | - | 300 |

Special Purpose Entity | | | | | 885.0 | 3,600 | | |

Mata de Santa Genebra Transmissão S.A. | 50.1% | | | | | | |

Contract No. 001/2014 | LT Itatiba - Bateias | | CS | 500 Kv | 414.0 | - | 31.08.2019 | 13.05.2044 |

| | | LT Araraquara 2 - Itatiba | | CS | 500 Kv | 222.0 | - |

| | | LT Araraquara 2 - Fernão Dias | | CS | 500 Kv | 249.0 | - |

| | | SE Santa Bárbara d'Oeste (1) | | - | 440 kV | - | - |

| | | SE Itatiba (1) | | - | 500 kV | - | - |

| | | SE Fernão Dias | | - | 500/440 kV | - | 3,600 | 01.06.2019 | 13.05.2044 |

| | | | | | | | | |

Total | | | | | 1,408 | 4,500 | | |

(1) | Exclusive for reactive control of the transmission lines of the National Interconnected System, improving the quality of the transmitted energy. |

· Transmission works:

· Lot E - Auction ANEEL 05/2015:Through transmission service concession agreement 06/2016 that includes a series of projects that are expected to start operating in September 2019 and other works, such as the 500 kV Blumenau - Curitiba Leste transmission line with commercial operation projected for March 2021.The project will enable an increase of the RAP to Copel GeT in the order of R$118 million, when all the projects are completed.Lot E was divided into several projects that are in different stages. Some works are in the commissioning phase of the facilities while others are already in operation.

In addition to the works won in the auctions promoted by Aneel, Copel GeT has works stemming from the authorization resolutions in order to expand and improve existing facilities, such as:

· Authorization Resolution 5,711 /2016: implementation at the 230 kV Figueira substation, of the first 138 kV - 15 Mvar capacitor bank, with an investment of R$4,8 million and RAP of approximately R$0.8 million, from the commercial start-up scheduled for March 2020.

· Authorization Resolution 5,834 /2016:implementation at the 230 kV Apucarana substation of the 138 kV – 30 Mvar capacitor bank, with an investment of R$5,5 million and RAP of approximately R$0.9 million from the commercial start-up scheduled for March 2020.

· Other highlights

· LT 500 kV Araraquara - Taubaté:On July 27, 2018, the ONS issued the Definitive Release Term (TLD) for the project consisting of the implementation of the Transmission Facilities pursuant to Aneel Auction 01/2010. Lot A - which includes the construction and operation of 334.3 km, 500 kV Transmission Line, from the SE Araraquara 2 gateway to the vicinity of SE Taubaté and the respective line entries, barinterconnections and other equipment, which enabled an increase of RAP to Copel GeT in the order of R$30 million.

· Authorization Resolution 5,776 /2016: On July 29, 2018, ONS issued a TLD for the 230 kV Sarandi substation, of the second 230 /138 kV - 150 MVA autotransformer, with an investment of around R$14.8 million, allowing an increase of RAP in the range of R$2.5 million, from the commercial start-up.

· Authorization Resolution 5,930 /2016:On October 14, 2018, the ONS issued a TLD referring to the implementation of the 500 kV Bateias substation, a bar reactor bank of 500 kV - 200 Mvar, with an investment of approximately R$30 million and RAP of approximately R$4.3 million.

3.3.3. Distribution

In the scope of electric energy distribution, Copel Distribuição's main activities are to provide, operate and maintain the infrastructure, as well as to provide related services, described in the Concession Agreement 046/1999, signed on June 24, 1999, the Fifth Amendment Term of which was entered into on December 9, 2015, extending the concession until July 7, 2045. Decree 8,461, dated 2 June 2015, regulated the extension of the electric energy distribution concessions referred to in article 7, of Law 12,783, of January 11, 2013, establishing, as a condition for the concession extension, efficiency indicators that shall be observed by the concessionaire for a period of five years counted from January 1, 2016.

Copel Distribuição's activities are intended to serve approximately 4.6 million energy consumers in 1,113 locations in 394 cities in Paraná and one in Santa Catarina (Porto União). The cities of Guarapuava and Coronel Vivida are partially served. It also operates and maintains installations with voltage levels up to 138kV.

In 2018, substations were connected to reinforce the electrical distribution system, improving quality and increasing the availability of electric energy to consumers.The works of new substations and completed expansions are as follows:

| | | |

Substation | Power (MVA) | Location |

Implantations | | |

SE Queimados 34,5 kV | 7.00 | Palmeira |

SE Rio Branco do Sul 138 kV | 30.00 | Rio Branco Do Sul |

Expansions | | |

SE Cambira 34,5 kV | 7.00 | Cambira |

SE Matelândia 34,5 kV | 7.00 | Matelândia |

SE Novo Mundo 69 kV | 41.67 | Curitiba |

· Distribution lines

The following table shows the extension of the distribution lines of Copel Distribuição:

Distribution Lines | Lenght in km |

13,8 kV | 106,732 |

34,5 kV | 87,090 |

69,0 kV | 751 |

138,0 kV | 6,265 |

Total | 200,838 |

· Substations

The following table presents the Copel Distribuição substation park, open for voltage:

| | | |

Power | Automated Substations | MVA |

34,5 kV | 225 | 1,502 |

69,0 kV | 35 | 2,393 |

88,0 kV | - | 5 |

138,0 kV | 109 | 7,125 |

Total | 369 | 11,025 |

· Quality of Supply

Supply quality is measured by indicators that monitor distributors’ performance in terms of continuity of the service provided.The System Average Interruption Duration Index (SAIDI) measures the number of hours on average that consumers remain without power during a certain period of time.The Customer Average Interruption Duration Index (CAIDI) indicates the average number of outages per consumer unit.Based on SAIDI and CAIDI, Aneel establishes individual continuity parameters (Individual interruption duration per consumer unit, Individual interruption frequency per consumer unit, and Maximum continuous interruption duration per consumer unit or connection point) which are itemized in electric energy consumers’ monthly bills.

These indicators are reviewed in the Periodic Tariff Review and are increasingly becoming stricter in order to improve the quality of customer service.The indicator is established in the Concession Agreement, being that the non-compliance with the efficiency criterion for the quality of the service provided, for two consecutive years during the period assessed, or in the year 2020, will result in the extinction of the concession.

Copel Distribuição’s results of SAIDI and CAIDI indicators showed an improvement in the number and duration of outages for 2018 compared to the previous year, due to investments in performance and expansion work, increase in periodic maintenance and preventive inspections, presented, as shown below:

· Management of energy losses

Energy losses are inherent to the nature of the process of transforming, transmission and distribution of electric energy.An analysis of the electric energy required to serve customers must consider that not all the electric energy generated is delivered to the end consumers.

In this context, losses may be segmented between Losses in the Basic Grid, which are external to the concessionaire’s distribution system and are imminently technical in their origin, and Distribution Losses that may be of a technical or non-technical nature.

The technical losses refer to the portion of losses in the distribution inherent to the transmission process, voltage transformation and energy measurement in the concessionaire’s grid.Non-technical losses, in turn, represent all other losses associated with the distribution of electric energy, such as energy theft, measurement errors, errors in the billing process, consumer units that do not have measuring equipment, among others.

In 2018, overall distribution losses - technical, non-technical and basic network - accounted 9.7% of the energy injected into the distribution system, representing a 5.4% year-on-year increase.

Copel Distribuição maintains a Non-Technical Loss Combatting Program that consists of several activities that intend to reduce or maintain the current level of non-technical losses through the following activities:

· Constant mapping of the situation regarding clandestine connections, by identifying the areas and the number of families with clandestine connections;

· Improvement of actions to combat irregular procedures, improving the performance of targeted inspections;

· Investments for the provision and /or acquisition of equipment for inspection;

· Preparation and execution of specific training and recycling related to commercial losses;

· Conducting inspections, both in Medium and Low Voltage;

· Educational notes in the press and messages on electric bills.

· Joint operations with the Civil Police and Prosecution Office;

· Opening of the police investigation in regions where significant numbers of irregular procedures are identified.

· Captive market

The following table shows the behavior of the captive market by consumption class in number of consumers and the behavior of energy sold in the last four years:

| | | | | | | |

Captive Market - Copel Distribuição |

| Number of Consumers | Sold Energy |

| Dez/18 | Dez/17 | % | Dez/18 | Dez/17 | % |

Residential | 3,754,598 | 3,682,009 | 2.0 | 7,238 | 7,126 | 1.6 |

Industrial | 73,070 | 76,328 | (4.3) | 2,935 | 3,254 | (9.8) |

Commercial | 400,209 | 389,844 | 2.7 | 4,653 | 4,651 | - |

Rural | 352,074 | 354,829 | (0.8) | 2,288 | 2,257 | 1.4 |

Others | 57,853 | 57,483 | 0.6 | 2,480 | 2,455 | 1.0 |

Total | 4,637,804 | 4,560,493 | 1.7 | 19,594 | 19,743 | (0.8) |

· Grid Market (TUSD)

In 2018, the wire load, which takes into account all consumers who accessed the grid of the Distributor, grew by 1.9%, strongly influenced by the industrial class. In this segment, "Food”, “Pulp & Paper” and “Wood” where the industrial branches that have contributed more to this result, together they represent more than 50% of the industrial use and have registered an average variation of 4,8% in 2018.

The wire Market have reached in 2018 the pre-crisis levels seen four years ago. The industrial class had already regained these consumption levels in 2017, and the residential and commercial classes continue to show positive growth, however, have not yet recovered the levels of 2014.

Market Power Wire - Copel Distribuição |

| Number of Consumers | Distributed Energy (GWh) |

| Dez/18 | Dez/17 | % | Dez/18 | Dez/17 | % |

Captive Market | 4,637,804 | 4,560,493 | 1.7 | 19,594 | 19,743 | (0.8) |

Concessionaires and Permissionaires | 3 | 3 | - | 279 | 521 | (46.4) |

Free Consumers | 1,121 | 991 | 13.1 | 9,568 | 8,873 | 7.8 |

Wire Dealerships | 4 | 3 | 33.3 | 511 | 263 | 94.3 |

Wire Market | 4,638,932 | 4,561,490 | 1.7 | 29,952 | 29,400 | 1.9 |

· Purchase of energy

Under the current regulatory framework, the energy contracting by the distributors mainly occurs through auctions overseen by Aneel. To supply the market in the coming years, in 2018 Copel Distribuição participated in the following auctions: 28th New Energy Auction (A-4), hold on September 9, 2018, with a 39 MW average acquired and shall begin the supply on January 1, 2024.

To serve the market in 2018, the agreements negotiated in prior years started being supplied: 16th New Energy Auction (A-5) and 18th New Energy Auction (A-5), both contracted in 2013 and the 22nd New Energy Auction (A-3), contracted in 2015.

· Overcontracting

In the current regulatory model, the purchase of energy by distributors is regulated by Law No. 10,484/1914 and by Decree No. 5,163 /2004, which determine that these shall acquire the volume required to serve 100% of their market.

The verification that the whole market is being served takes into account the period comprised by the calendar year, being the difference between the costs paid by the tariff and the costs actually realized with the purchase of energy, entirely passed on to the captive consumers, provided that the distributor records a contracting level between 100 % and 105% of its market. However, if distributors reach contracting levels below or above the regulatory limits, these will still be able to maintain a guarantee of neutrality, if it isidentified that such violation arises from extraordinary or unforeseeable events, that do not allow management by the buyer.

In recent years, the distribution segment has been exposed to a scenario of widespread overcontracting, as most companies have reached a contracting level of more than 105%.

Understanding that several of the factors that contributed to this situation are extraordinary and unavoidable by the distributors, such as the compulsory allocation of physical guarantee quotas and the mass migration of consumers to the free market, the Regulatory Agency and the Ministry of Mines and Energy implemented a series of measures intended to mitigate overcontracting, highlighting:

· Normative Resolution 706/2016, which regulated the recognition of involuntary overcontracting resulting from the reallocation of physical guarantee quotas for plants renewed in accordance with Law No. 12,783 /2013;

· Normative Resolution 693/2015 which regulated the Mechanism for Compensation of New Energy Surpluses and Deficits - MCSD-EN, focused on the contracts stemming from new generation projects, through which the reallocation of energy between distributors and generators was permitted;

· Normative Resolution 711/2016 which established the criteria and conditions for the signing of bilateral agreements between distributors and generators, which included: temporary reduction, total or partial contracted energy, permanent but partial reduction of the agreement or termination of agreement.

· Decree 9,143/2017 which, among other measures, amended Decree 5,163 /2004, recognizing: i) the involuntary contractual exposures stemming from the migration of special consumers to the free market, provided that Aneel observes an evaluation of maximum effort by the distributors; and (ii) the right to contractual reduction of existing energy auctions, of amounts related to the migration of special consumers to the free market. The eligible agreements are those resulting from the auctions of existing energy made after June 2016, pursuant to Normative Resolution 726/2016; and

· Normative Resolution 824/2018, which established the criteria for the processing of the Mechanism for Sale of Energy Surplus by the distributors.

In relation to contracting, preliminarily, yet in 2017 and throughout 2018, Copel Distribuição's indicators often identified overcontracting scenarios. During this period, the monitoring of indicators of contracting levels prevailed, and mitigating actions were required.

All available tools were used for contracting management by the Distributor, in order to meet the requirement to make the maximum effort to adjust its contracting level to the regulatory limits. In this context, we can highlight the following actions:

a) Surplus Statement in the MCSDs of New Energy and Free Exchanges, related to the amounts of energy in surpluses of physical guarantee quotas and not included in agreements for special consumers;

b) Full return on MCSD 4%, referring to market variations of up to 4% of existing contracted energy amounts;

c) Full return in the monthly MCSDs, of the available amounts of energy in the Distributor portfolio, related to the termination of agreements for potentially free consumers; and

d) Establishing of negotiations with generators to reduce contracts, entering into bilateral agreements pursuant to Normative Resolution 711/2016.

Copel Distribuição ended 2018 within the regulatory contracting limits from 100% to 105%, thus guaranteeing the neutrality of the costs associated with the purchase of energy.

· Tariff Flags

The purpose of the tariff flag system is for consumer prices to reflect conditions under which electric energy is generated in the SIN, by the charging of additional amounts in the Energy Tariff (TE), thus enabling consumers to adapt their consumption to the actual price of electric energy. Green, yellow and red flags show higher or lower electric energy costs depending on conditions for electric energy generation. Tariff flag amounts are set in a specific document published by Aneel each calendar year, in approval resolution.

The table below shows the history of tariff flags and the amounts charged:

| | | | | |

| 2018 | 2017 |

Month | Flag | Value applied in the tariff (every 100kwh) | Flag | Value applied in the tariff (every 100kwh) |

January | green | - | yellow | 2.00 |

February | green | - | yellow | 2.00 |

March | green | - | yellow | 2.00 |

April | green | - | red | 3.00 |

May | yellow | 1.00 | red | 3.00 |

June | red | 5.00 | green | - |

July | red | 5.00 | yellow | 2.00 |

August | red | 5.00 | red | 3.00 |

September | red | 5.00 | yellow | 2.00 |

October | red | 5.00 | red | 3.50 |

November | yellow | 1.00 | red | 5.00 |

December | green | - | red | 3.00 |

· White Tariff

Since January 1, 2018, the White Tariff has been in effect, a tariff type that presents a change in the energy value according to the day and time of consumption.

The white tariff is to enable the consumer to rationalize the energy consumption at the peak times (5:30 p.m. to 8:29 p.m.) and encourage the use in periods when demand is low. This type is offered for the low voltage consumer units (127, 220, 380 or 440 Volts), called group B.

The conditions for application of the white tariff are set forth in the Normative Resolutions of Aneel 414/2010 and 733/2016.

· Annual Tariff Adjustment - RTA

The Tariff Adjustment process is intended to pass on: non-manageable costs (Portion A), which covers costs related to the acquisition of electric energy, use of transmission systems, sectorial charges, unrecoverable revenues, and monetarily restate the manageable costs (Portion B), inherent in the activity of energy distribution, i.e., operational costs and capital remuneration.

In June 2018, through Homologation Resolution No. 2,402/2018, Aneel approved the last annual tariff adjustment for Copel Distribuição, which corresponded to the average tariff effect to be charged to consumers of 15.99%, which was 17.55%, on average for high voltage consumers and 15.13% on average for low voltage consumers.

3.3.4. Trading

Copel Comercialização S.A. (Copel Energia) operates with purchase and sale of energy and provision of services in the Free Energy Market. In 2018, it was heavily involved in its consolidation and began its activities as a retailer, being the first Brazilian seller to represent a generator in the Electric Energy Trading Chamber (CCEE).

With only two years of operation, Copel Energia is already one of the largest companies in the market, with a portfolio of more than 520 customers in 14 Brazilian states.

In addition, it offered management services, consulting for migration, modeling for generators and consumers, demand management, among other products, which allow customers to operate with security in the Free Market.

Having as a value proposition the Company's security and its good relationship with its customers, in 2018 Copel Energia reached the milestone of 740 MWm traded on the CCEE, preparing for the imminent opening of the free energy market and the new challenges of the market.

3.3.5. Telecommunications

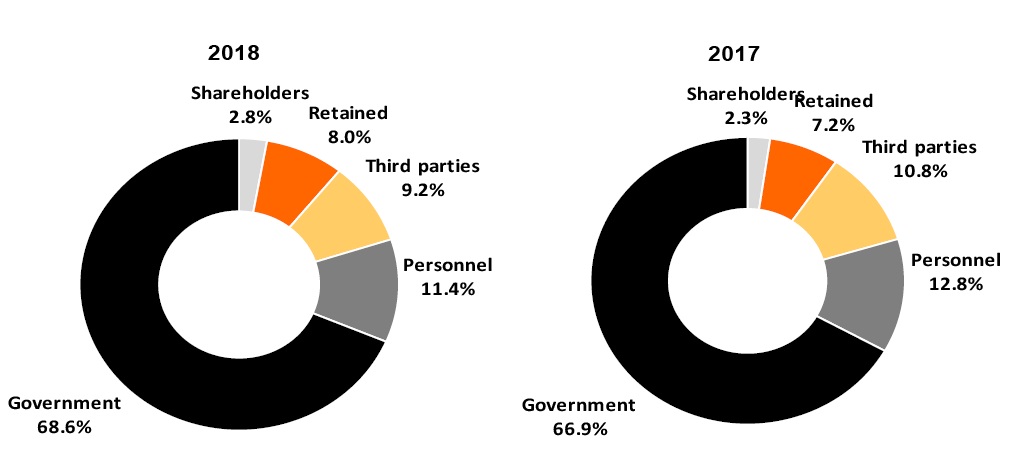

Copel Telecomunicações is responsible for the provision of telecommunications and communications services in general, in the form of the Multimedia Communication Service - SCM, in Paraná. Since 1998, the subsidiary has been licensed to operate these services and offer the highest technology to companies, public authority, and in the retail sector, for residential customers in 85 cities.