SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of April, 2020

Commission File Number 1-14668

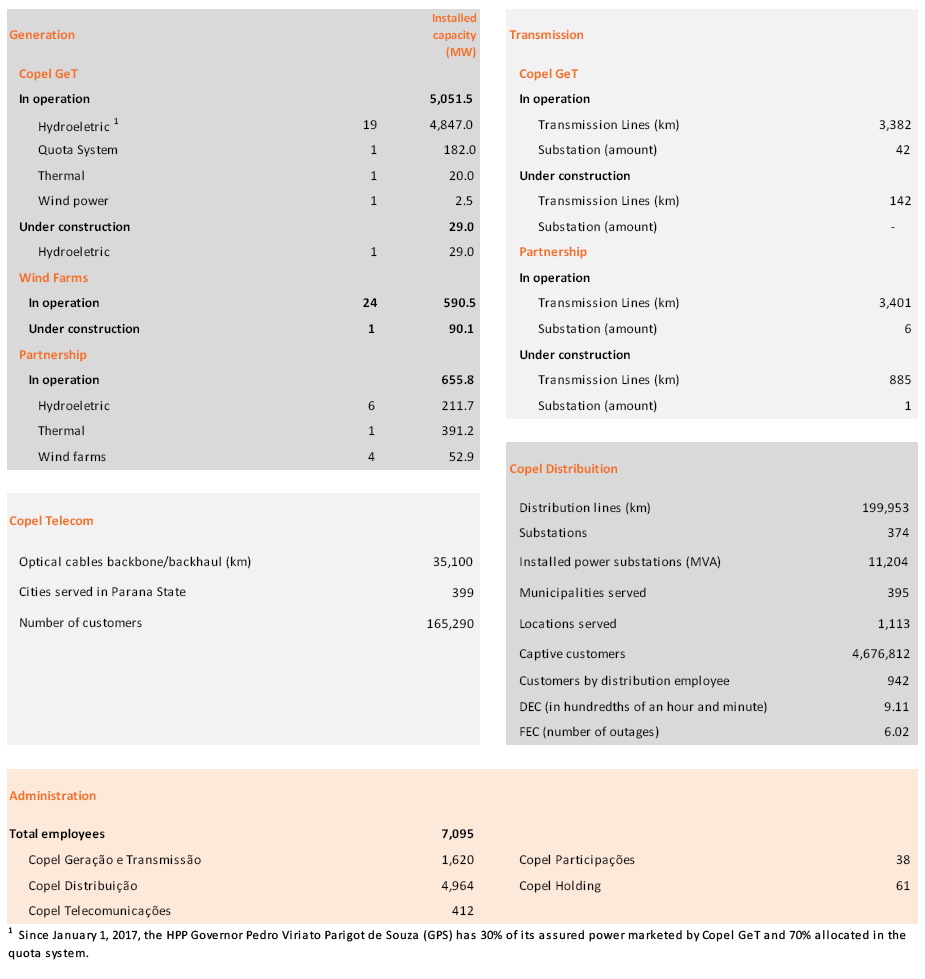

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

Rua Coronel Dulcídio, 800

80420-170 Curitiba, Paraná

Federative Republic of Brazil

+55 (41) 3331-4011

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

LIST OF CONTENTS

1. Main Events in the Period

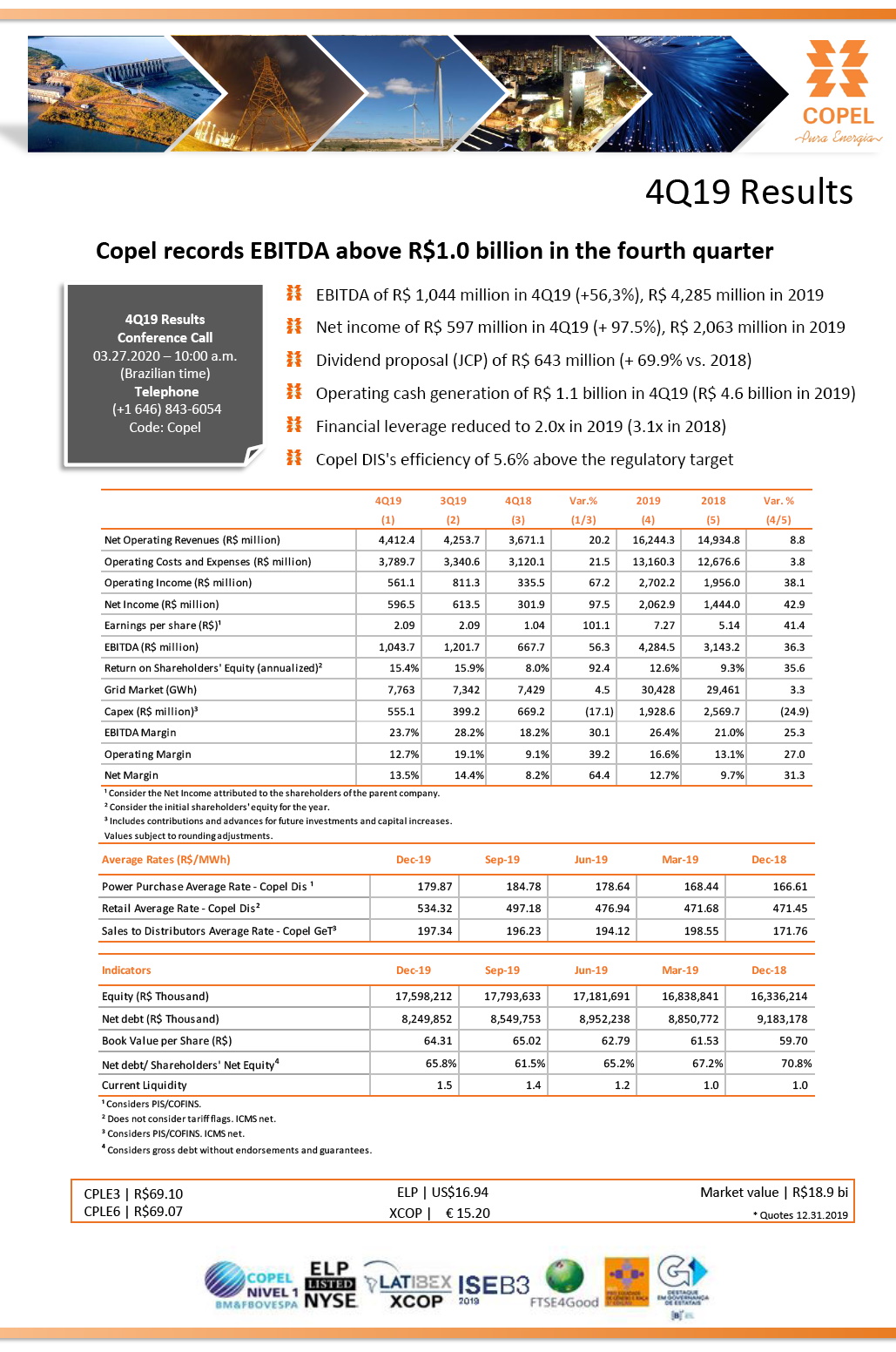

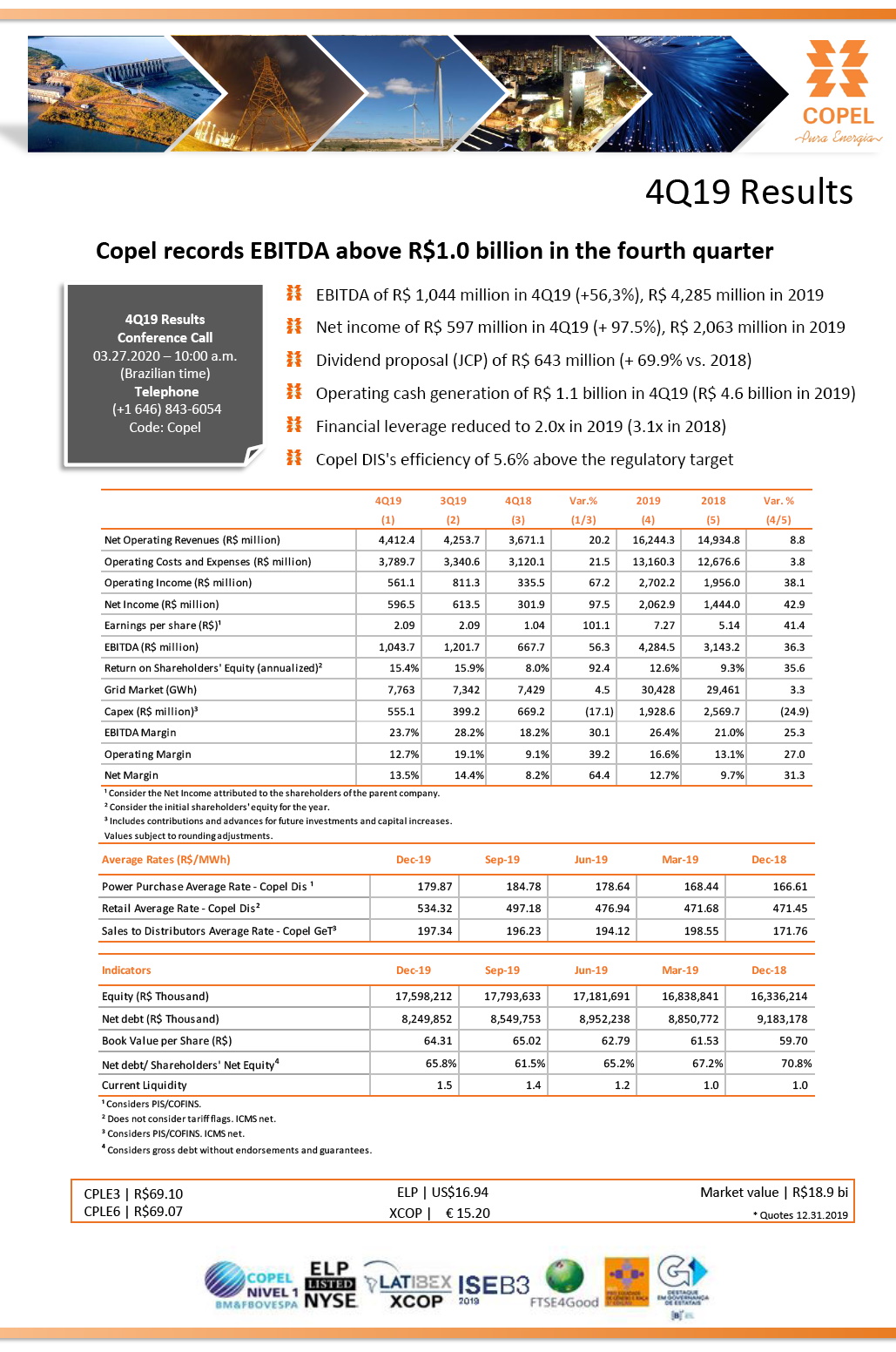

In 4Q19, earnings before interest, taxes, depreciation and amortization reached R$ 1,043.7 million, an amount 56.3% higher than the R$ 667.7 million recorded in 4Q18. This result is basically explained by (i) the 32.3% increase in revenue from “use of the main distribuition and transmission grid”, resulting from the 4.5% growth in the grid market, from Copel Dis's tariff readjustment (with an increase of 11 , 63% at TUSD as of June 24, 2019) and the start-up of transmission projects”; (ii) the 8.8% increase in the volume of energy sold in the industrial free market of Copel GeT and Copel Com, which positively impacted the “electricity sales to final costumers” revenue; and (iii) the billing of the CCEAR contracts for Baixo Iguaçu, Colíder and Cutia, generating an increase in revenue from “electricity sales to distributers”. It is also worth mentioning the positive result of R$ 66.5 million in equity income, compared to the negative effect of R$ 78.0 million in 4Q18; and the maintenance of manageable costs, which remained practically stable in nominal terms compared to the same period last year.

Coronavirus effect (COVID-19)

In accordance with Circular Letter No. 02/2020, issued on March 10, 2020 by CVM, the Company has constantly assessed the potential impacts of the Coronavirus (COVID-19) in the administrative and operations areas and has taken measures to contain the dissemination disease and minimize economic impacts. It should also be noted that, to date, there has been no material or material impact on its business that could modify the measurement of its assets and liabilities presented in the individual and consolidated financial statements as of December 31, 2019. The Company will continue to assess such impacts and risks and make the necessary disclosures when pertinent. On March 24, 2020, Aneel announced measures in the contingency period of the pandemic, suspending for 90 days, starting on March 25, 2020, the default cuts of residential consumer units, in addition to services and activities considered essential, as legislation.

Expansion of the Luz Fraterna Program

On March 24, 2020, the Government of Paraná announced the expansion of the Luz Fraterna program, with the objective of mitigating the economic and social impacts caused by the COVID-19 Pandemic, resulting from thedissemination of the new coronavirus (Sars-Cov-2). With a social package of R$ 400 million to the most vulnerable families, one of the announced financial aid measures is the extension of the limits of the Luz Fraterna Program, from 120 KWh to 150 KWh, for 90 days, increasing the program's reach by 57.5 thousand families. Thus, there will be 217.5 thousand families with their electricity bill 100% subsidized by the State of Paraná.

Copel approves Performance Incentive Program

The Board of Directors approved, within the scope of Copel Holding and its wholly-owned subsidiaries, the short-term incentive program calledPrêmio Por Desempenho- PPD (Performance Incentive Program) directed at aligning efforts throughout different organizational levels to the company's strategic objectives. Thus, Copel improves its management by goals and improves its culture of meritocracy.

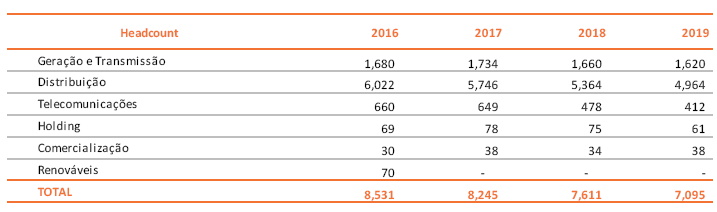

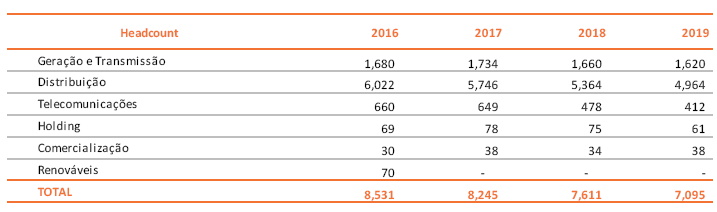

Result of the Voluntary Dismissal Program (PDI)

Copel’s Voluntary Dismissal Program(PDI) was concluded on December 15, 2019, with a total of 395 employees dismissed, of which 296 were from Copel Distribuição, 72 from Copel GeT, 17 from Copel Telecom, 4 from Copel Comercialização and 6 from Copel Holding. The amount of the respective indemnities totaled R$43.5 million and the Company expects to have annual savings of approximately R$93.7 million. With this program, a total of 1,436 employees were dismissed through PDIs over the past 3 years, reflecting the commitment by the Company's management to reduce costs and to improve the operational efficiency of the Copel group. At the end of 2019, the Company had 7,095 employees.

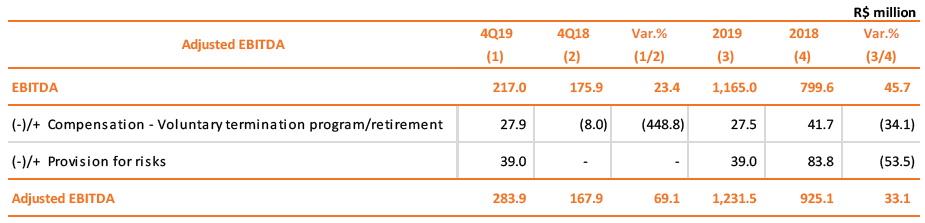

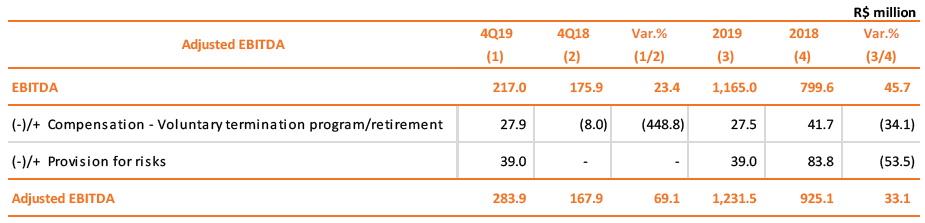

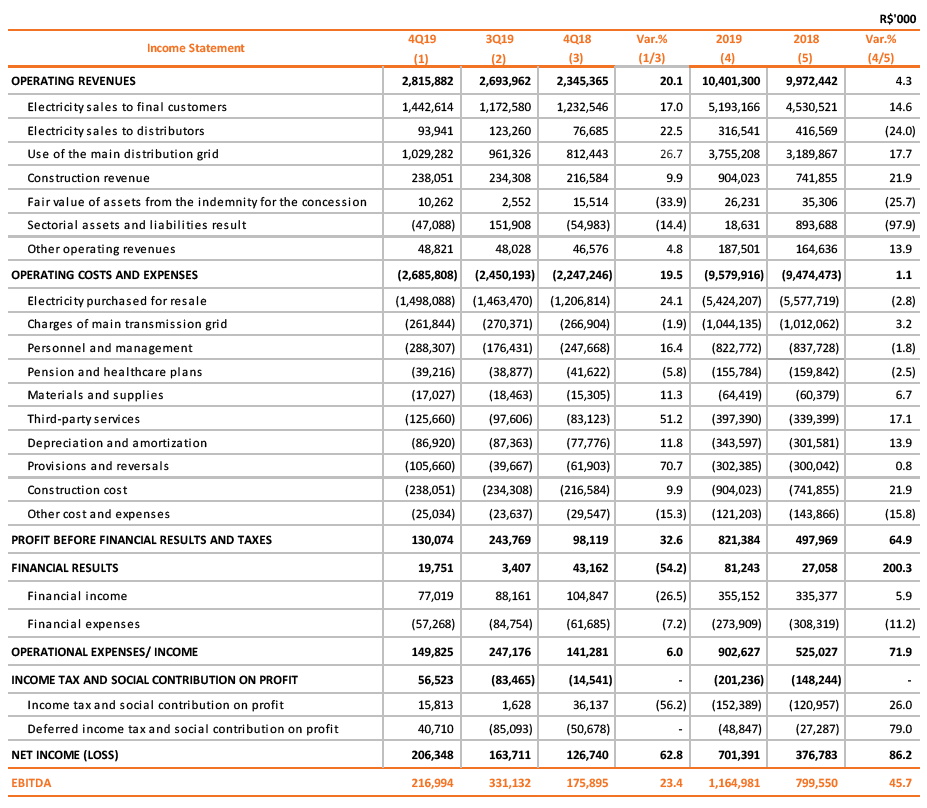

Copel Distribuição – 5.6% efficient

Copel Distribuição recorded EBITDA of R$217.0 million in 4Q19, 23.4% higher than the R$175.9 million recorded in 4Q18. In the year, the distributor accumulated an EBITDA of R$1,165 million, an amount 45.7% higher than the R $ 799.5 million recorded in 2018. With this performance, Copel Dis surpassed in 5.6% 2019 regulatory EBITDA of R $ 1,103.4, equivalent to an efficiency of R$61.6 million.

Payment of Interest on Capital – JCP

Copel’s Board of Directors approved, at the 197th Ordinary Board of Directors’ Meeting held on December 5, 2019, the payment of Interest on Capital (JCP) in the gross amount of R$ 643.0 million to shareholders part of the Company’s shareholder base on December 23, 2019. Pursuant to Law 9.249/95, JCP payments are part of the Company’s total dividends payout for the 2019 fiscal year. The ratification of this payment, as well as its payment date, will be resolved at the Annual General Meeting, to be held by April 2020, in which the Management Report, Balance Sheet and other Financial Statements will be analyzed, including the Allocation of Net Income for the 2019 fiscal year. Considering the proposed amount of Interest on Capital to replace dividends (R$ 643.0 million), the 2019 payout is equivalent to 32.3% of the adjusted net income for the year.

Copel Energia – Mark to market

Future energy purchase and sale operations are recognized at fair value through profit or loss, determined by the difference between the contracted price and the future market price estimated by the Company. At the end of December 2019, R$204.9 million was recorded under “other operating income”. More details in our ITR (Note n ° 36.2.12).

Mata de Santa Genebra

The energy start-up schedule for the Mata de Santa Genebra Transmissão S.A. project, due to successive vandalism events, which resulted in the collapse of towers and theft of aluminum cables in transmission lines that were already installed and commissioned, in different sections of the project, was postponed, with the completion of the works expected by May 2020. Mata de Santa Genebra has been receiving about 66,2 % from the total RAP, of R$ 243,5 million, as a result of the Commercial Operation regime of its electrical installations.

Dispatch of UEGA

From March 8 to 20, 2020, the Usina Termelétrica de Araucária power plant – TPP Araucaria was activated, in accordance with the operational week schedule issued by the Operador Nacional do Sistema - ONS (National System Operator). The dispatch was part of the exceptional measures adopted by the Electric Sector Monitoring Committee - CMSE (Comitê de Monitoramento do Setor Elétrico) for the recovery of hydroelectric reservoirs in the southern region of the country. The plant's remuneration, in this case, was based on the CVU approved by ANEEL, which is R$681.79/MWh. Additionally, with the signing of the addendum to the Energy Credit Assignment contract between UEG Araucária and Petróleo Brasileiro SA - Petrobras, TPP Araucária, at the request of the natural gas supplier, was again activated in the week of March 23, 2020, per generation indicated. Therefore, the remuneration is not based on the CVU, but at a value agreed between the parties, considering, among other factors, market opportunities and adequate margins for the plant's operation, which enables better conditions for recovering the fixed cost for the dispatch period.

Colíder HPP 100% operational

Since December 21, 2019, the Colíder Hydroelectric Power Plant has started to commercial operation with 100% of its generating capacity. With a total installed capacity of 300 MW and Assured Power of 178.1 average MW, the plant, whose commercial operation began in the first half of 2019, is located on the Teles Pires River, on the border between the municipalities of Nova Canaã do Norte and Itaúba, in northern region of the State of Mato Grosso, and its conclusion symbolizes a new landmark in the history of the Company, given its prominent position in closing a cycle of robust investments in the generation of clean electric energy.

Copel Distribuição's grid market grew 4.5% in the fourth quarter

Copel Distribuição's grid market, comprising the captive market, supplying concessionaires and permissionaires within the State of Paraná and all free consumers in its concession area, showed a 4.5% increase in energy consumption in 4Q19. This result is mainly due to the increase in industrial production in Paraná in the period.

Copel Energia Purchases 121.6 MWm of Incentive Energy

Copel Comercialização S.A. (Copel Energia), in the Solar and Wind Incentive Energy Purchase Auction (Public Call Notice 07/2019), held on November 13, purchased 121.6 average MW for a period of 15 years, beginning of supply in January 2023. The purchased energy was sold to Copel Energia customers.

SPC F.D.A. Electric Power Generation S.A (HPP Foz do Areia)

In order to renew the concession of HPP Gov. Bento Munhoz (or HPP Foz do Areia) for another 30 years, Copel formed the special-purpose company SPC F.D.A. Geração de Energia Elétrica S.A. and, on March 03, 2020, requested the Ministry of Mines and Energy to apply Federal Decree no. 9,271/2018 (as amended by Federal Decree no. 10,135/2019), which conditions the renewal to the sale of the concession's corporate control. On the same date, F.D.A. signed with Aneel, the Brazilian Electricity Regulatory Agency, the Concession Contract that transfers the concession of the HPP Foz do Areia from Copel GeT to the F.D.A., for the exploration of the plant until the end of the current concession, on September 17, 2023.

Copel remains in the ISE –B3 portfolio

Copel continues to be part of the select portfolio of B3's Corporate Sustainability Index (ISE), which runs from 01/06/2020 to 01/01/2021. ISE is a reference for investors who evaluate business activities from the perspective of sustainable development, considering aspects such as equity, transparency and accountability, nature of the product, and business performance in the economic, financial, social, environmental and change dimensions of the climate. ISE's 15th portfolio consists of shares of 30 companies, totaling R $ 1.64 trillion in market value, equivalent to 38% of the total traded at B3.

Water Charges Reversal

As a result of the repeal of the law that instituted the Control, Monitoring and Inspection Fee for Exploration Activities and the Use of Water Resources (TCFRH), the Company reassessed the provision for said fee and, based on the opinion of its legal advisors, concluded that the conditions to maintain the provision were not satisfied, reversing the balance of R$97.7 million against the income for the year, in Other Operating Costs and Expenses (R$ 129.4 million in 4Q19).

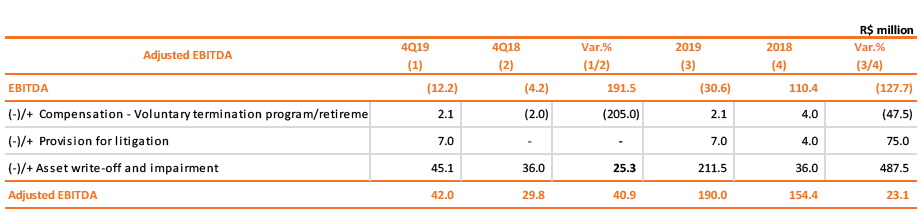

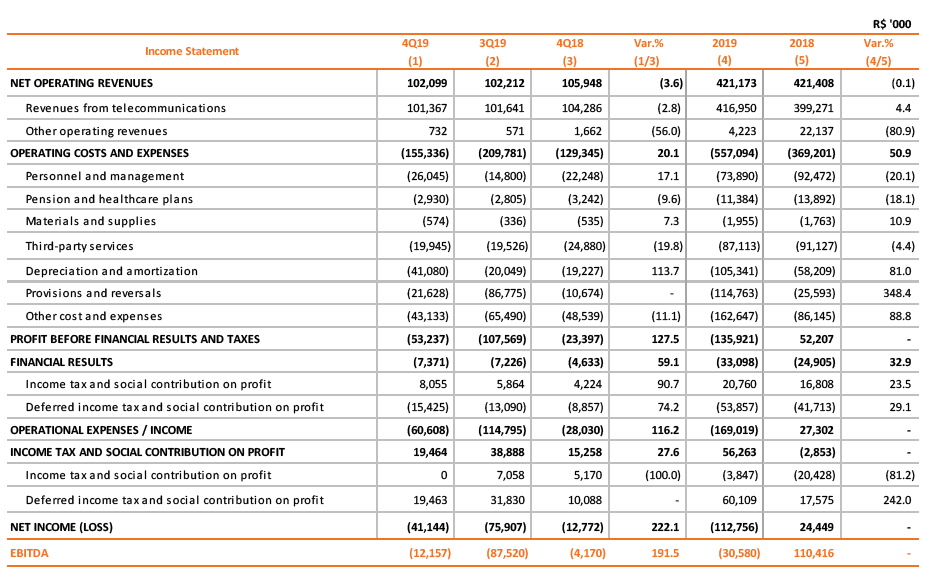

Copel Telecom - Impairment and Write-Offs of Assets

The Company's Management continuously monitors the business environment of the telecommunications segment, with special attention to certain factors such as the increased competitiveness of the industry, the high degree of investment required to preserve the customer base and the expected return of this segment. Considering that some of these factors directly affect the cash generation and the expected return outlook and, in addition to the Management’s decision to evaluate the disposal of the telecommunications segment, including the recent hiring of advisors for this purpose, the Company revalued its estimates regarding the capacity of its fixed assets, inthis segment, to continue to generate future economic benefit. In addition,given this new business environment, therefore, the Management concluded that it is necessary to include estimated losses and also recognize losses due to the decommissioning of equipment and services, specifically for some asset groups, observing new information and also the Company’s experience in managing this segment. On December 31, 2019, R$ 6.4 million were recorded as estimated impairment losses and R$ 38.6 million related to write-offs and remeasurement of assets decommissioned.

Copel Telecom - Potential Transfer of Control Studies

Studies on the potential transfer of control of Copel Telecom, under preparation by the Company and its financial and legal advisors, are at an advanced stage and, as soon as they are completed, must follow the internal governance rites for evaluation by the Board of Directors.

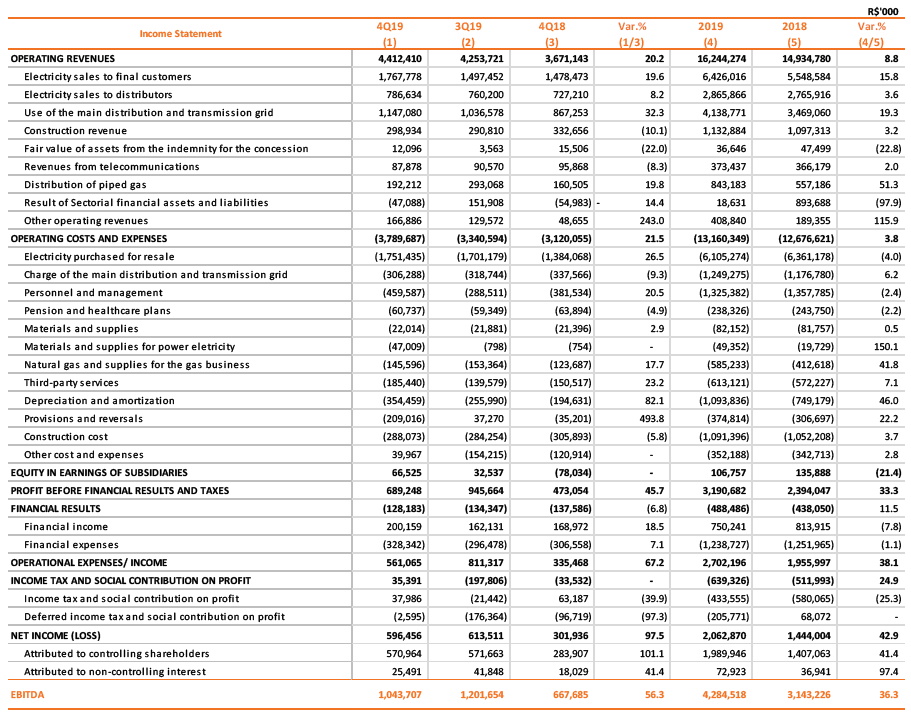

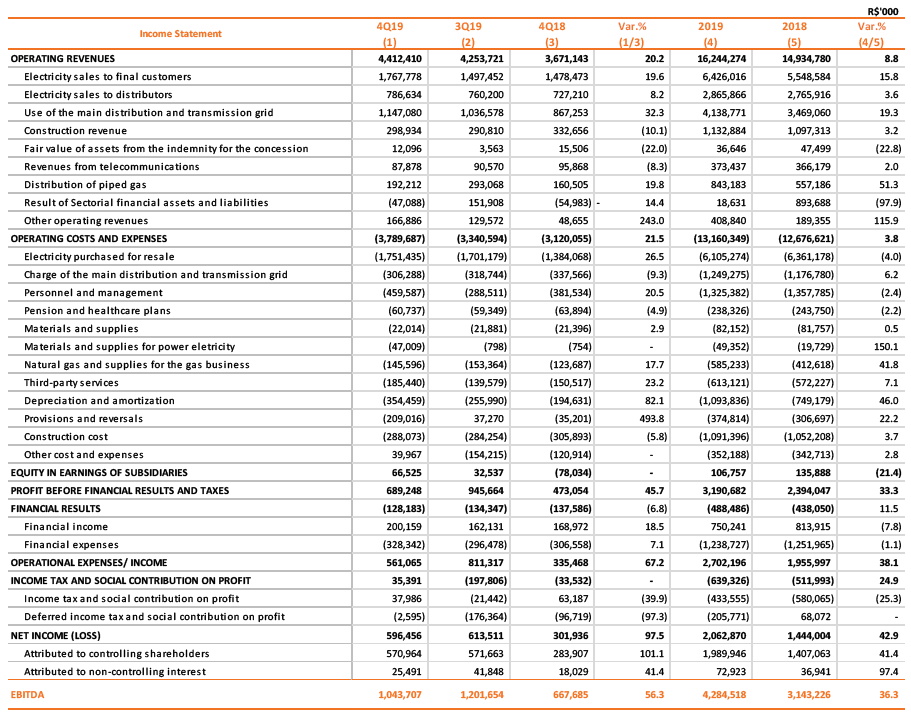

2. Financial Performance

The analyzes below refer to the fourth quarter of 2019 and the twelve months of the year, compared to the same period of 2018.

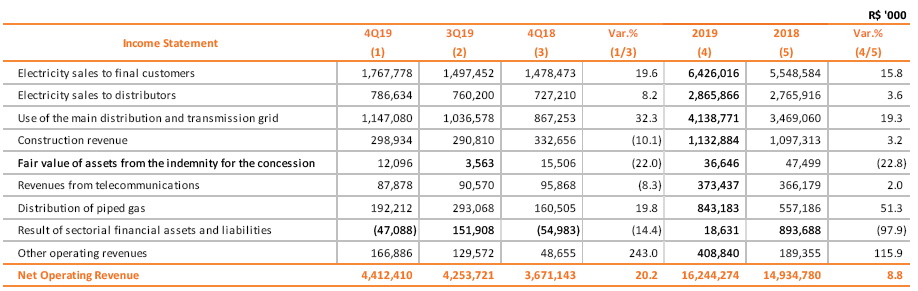

2.1 Operating Revenues

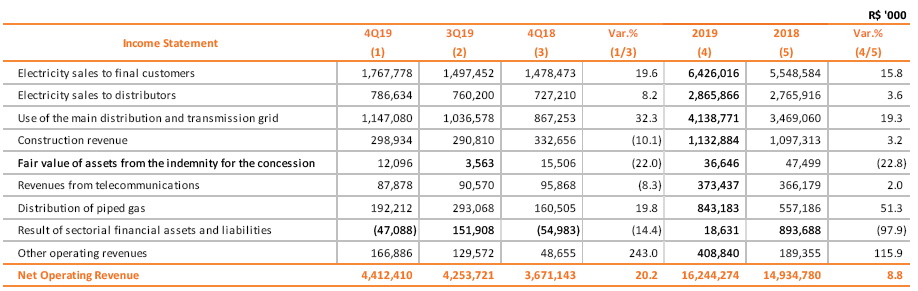

Net operating revenue totaled R$ 4,412.4 million in 4Q19, 20.2% higher than the R$ 3,671.1 million recorded in 4Q18. This result is mainly due to the (i) 19.6% increase in "electricity sales to final customers " arising from the 5.0% increase in the volume of energy sold to final consumers, in which we highlight the 8.8% increase in the industrial free market of Copel GeT and Copel Com; (ii) 32.3% increase in the “use of the main distribution and transmission grid (TUSD/TUST)” line due to the 4.5% growth in the grid market, the tariff adjustment for Copel Dis (increase of 11.63% in TUSD), the entry into operation of new transmission assets and the adjustments applied to APRs as of July 2019, with an average positive effect of 1.55% (vs. -5.5% applied in July 2018); and (iii) the positive result of R$105.7 million in the calculation of the fair value in the purchase and sale of energy from Copel Comercialização, reflecting the "other operating revenue" line.

Also noteworthy:

(i) the 8.2% increase in "electricity sales to distributors", mainly due to revenues from the agreements of CCEAR with HPP Baixo Iguaçu, HPP Colíder and Cutia Wind Complex and the dispatch of 130 GWh of TPP Araucária in 4Q19, while there were no dispatch adjustments in 4Q18;

(ii) the 19.8% increase in revenue with “distribution of piped gas”, due to the increase in the volume of sales of Compagas and the readjustment of 16.5% as of February 2019;

(iii) the 8.3% reduction in “telecommunications revenues” due to cancellation of retail customers. the 8.3% reduction in “telecommunications revenues” due to cancellation of retail customers.

In 2019, net operating revenue increased 8.8%, mainly reflecting (i) the 3.9% increase in the volume of energy sold to final consumers – highlighting the 10.9% increase of the industrial free market of Copel GeT and Copel Com – and the tariff readjustment of Copel Dis, positively impacting “electricity sales to final customers” revenue, which increased 15.8%; (ii) the 3.3% growth in the grid market and the tariff readjustment of Copel Dis (with an increase of 16.42% and 11.63% in TUSD as of June 24, 2018 and June 24, 2019, respectively), and the entry into operation of new transmission assets that increased the “use of the main distribution and transmission grid (TUSD/TUST)” revenue by 19.3%; (iii) the 51.3% increase in revenue with “distribution of piped gas”, mainly due to the final court decision on the lawsuit filed by Compagas to exclude ICMS from the PIS/Pasep and Cofins tax base, which provided R$ 105.2 million in annual operating revenue; and (iv) the positive result of R$ 204.9 million related to the fair value in the purchase and sale of energy of Copel Comercialização, reflecting the "other operating revenue" line. This growth was partially offset, in particular, by the 97.9% decrease in the “results of sectorial financial assets and liabilities” line, mainly due to the amortization of the amounts considered in the electricity sales to final customers after the tariff adjustment in June 2018 and the lower variation of balances created for the adjustment applied as of June 2019. Also, supply revenue grew by 3.6% in 2019, as a result of the higher volume of energy supplied by the Company due to the start of operations at the Colíder, Baixo Iguaçu and Cutia plants, partially offset by the reduction in the volume of energy sold in the short-term market.

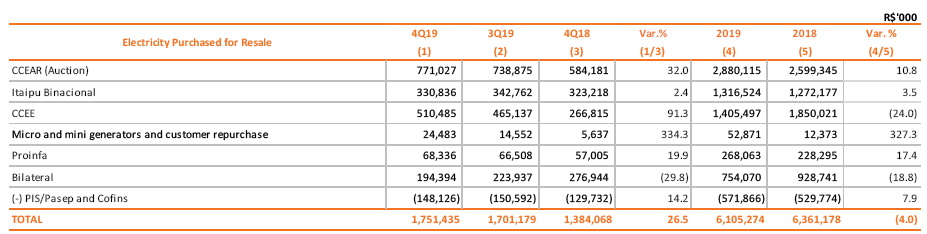

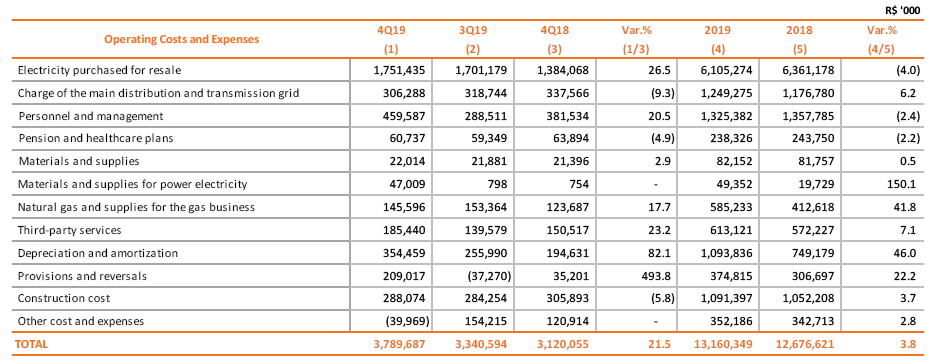

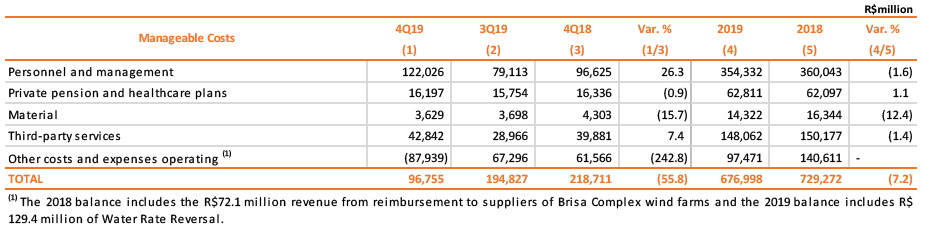

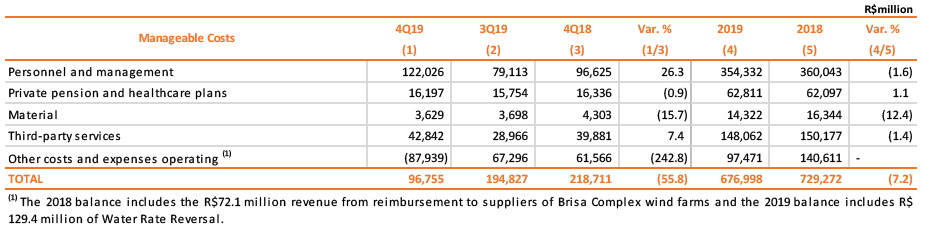

2.2 Operating Costs and Expenses

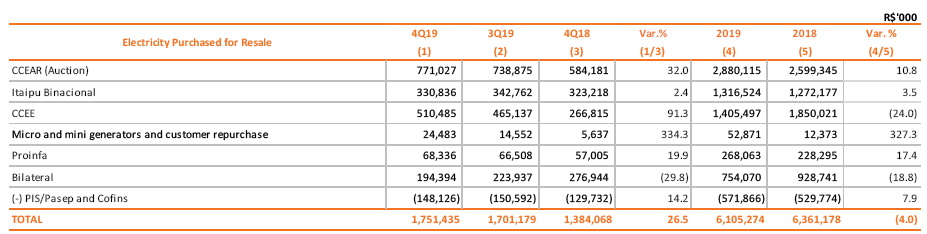

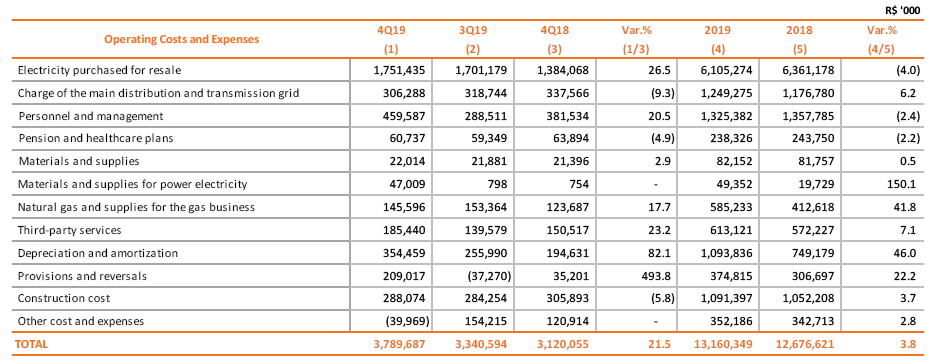

In 4Q19, operating costs and expenses increased 21.5%, totaling R$ 3,789.7 million, mainly due to (i) the 26.5% increase in “electricity purchased for resale” costs as a result of lower Average PLD (R$ 272.82 in 4Q19 versus R$ 158.24 in 4Q18) and a worsening in hydrological deficit, with GSF of 70.5% in 4Q19 versus 81.9% in 4Q18; (ii) higher amounts recorded in the “provisions and reversals” line (R$ 209.0 million in 4Q19 versus R$ 35.2 million in 4Q18), resulting from (a) the reversion, in the amount of R$ 92.7 million in 4Q18, related to a civil litigation process; (b) an increase, by approximately R$ 56.0 million, in provisions related to collective labor disputes; and (c) an increase, by R$ 15.3 million, in provisions for impairment of energy generation assets; (iii) the 82.1% increase in the “depreciation and amortization” line due to the commercialstart-up of the Colíder, Cutia and Baixo Iguaçu plants in 2019, as well as higher depreciation amounts of the telecommunications assets.

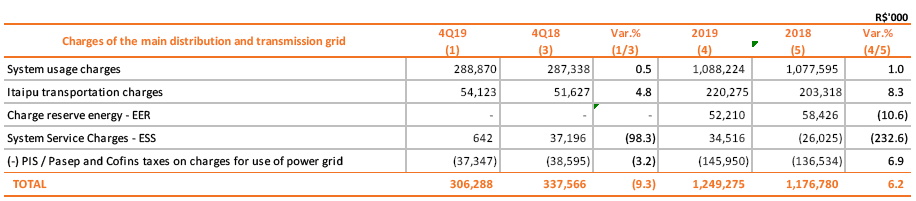

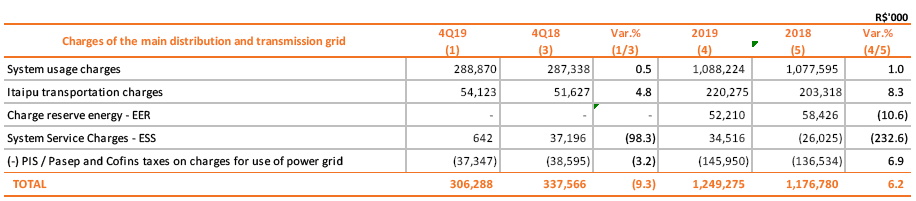

The item “charges of the main distribution and transmission grid” increased 6.2%, mainly due to the tariff increase and transmission infrastructure charges made available to new generation projects beginning in 2019 , in addition to the effect of the variation in costs related to the dispatch of thermal plants, with an impact on the System Services Charges - ESS.

PMSO costs (except estimated losses, provisions and reversals) reduced by 6.8% mainly due to the effect of the repeal of the law that instituted the Control, Monitoring and Inspection Fee for Exploration Activities and the Use of Water Resources (TCFRH), resulting in a positive effect of R$ 129.4 million in the “other costs and expenses operating”.

“Personnel and management” costs increased by 20.5%, due to (i) the R$ 43.5 million provision for indemnities related to the voluntary dismissal and retirement program (PDI) and (ii) the 125.1% increase in provisions for the profit sharing program (PLR) arising from the improvement in the Company’s results. Excluding the effects from the PDI and PLR programs, the “P” line would have reduced by 6.9% in the annual comparison period, which was impacted by a lower headcount, with 516 less employees in the last 12 months, and was partially offset by the 2.92% increase in salaries arising from a collective agreement in October 2019.

It is also worth highlighting:

(i) a 23.2% growth was also recorded in the “third party services” line, mainly related with the maintenance of the electric energy system and customer service costs.

(ii) a R$47.0 million cost recorded as “materials and supplies for power electricity” related to the dispatch of UTE Araucária in 4Q19;

(iii) the 9.3% reduction in the “charge of the main distribution and transmission grid” line, mainly reflecting the lack of Charge Reserve Energy (EER) by CCEE;

(iv) the 17.7% increase in the “natural gas and supplies for gas business” line, mainly due to the greater volume of gas purchased to meet growth in consumption and exchange rate variation.

In 2019, operating costs and expenses totaled R$ 13,160.3 million, up 3.8%. The main reasons for this variation are (i) the 46.0% increase in “depreciation and amortization” due to the start of operations of the Colíder, Baixo Iguaçu and Cutia, as well as the higher volume in the depreciation of telecommunication assets; and (ii) the 41.8% increase in “natural gas and supplies for the gas business , due to exchange variation as well as the increase, by approximately 18.0%, in consumption of natural gas.

These effects were partially offset by the 4% reduction in “electricity purchased for resale”, which reflects Copel GeT’s energy allocation strategy, the improvement in hydrological deficit during 2019, with a GSF of 91.2% (versus 83.6% in 2018) and a lower Average PLD (R$227.10 in 2019 versus R$287.62 in 2018), resulting in a lower short-term energy purchase costs; and (ii) the 2.4% reduction in personnel and management costs, mainly due to a lower headcount with 516 less employees, and was partially offset bythe 3.97% increase in salaries arising from a collective agreements in October 2018 and 2.92% in October 2019.

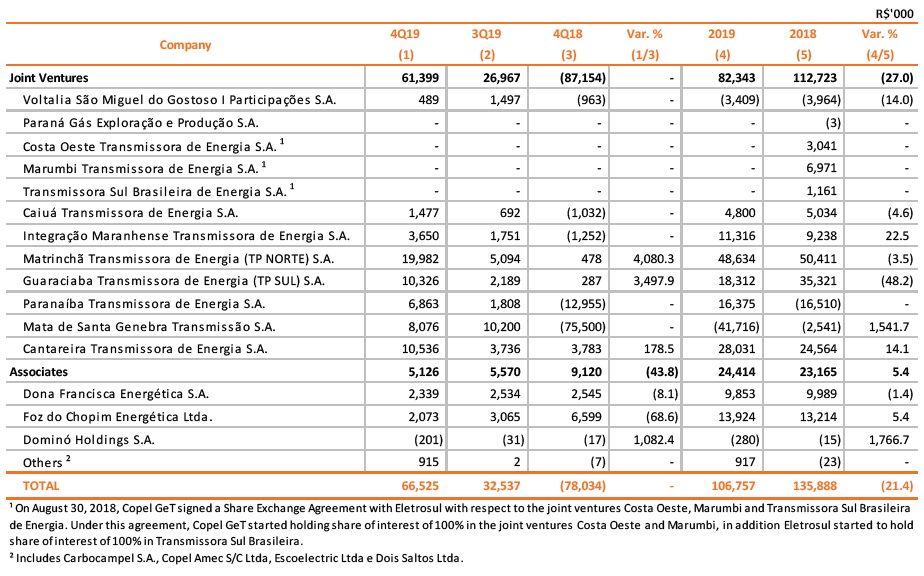

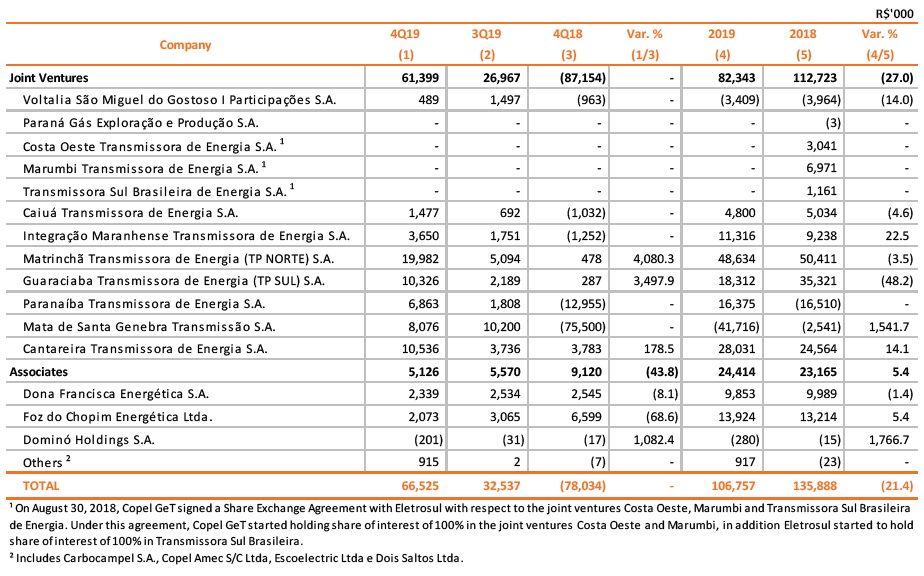

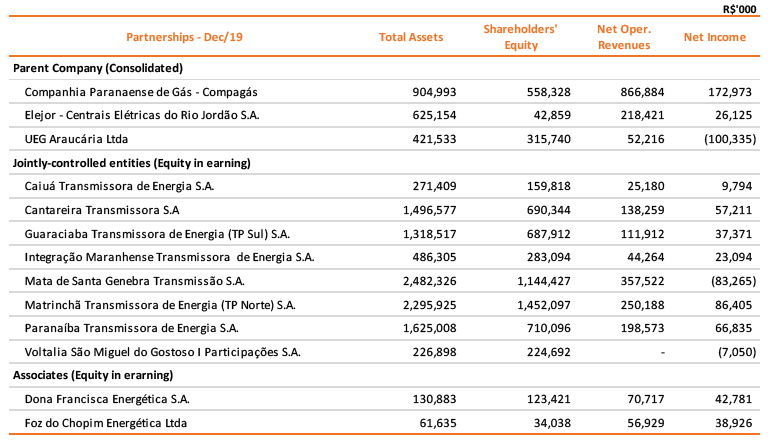

2.3 Equity in the Earnings of Subsidiaries

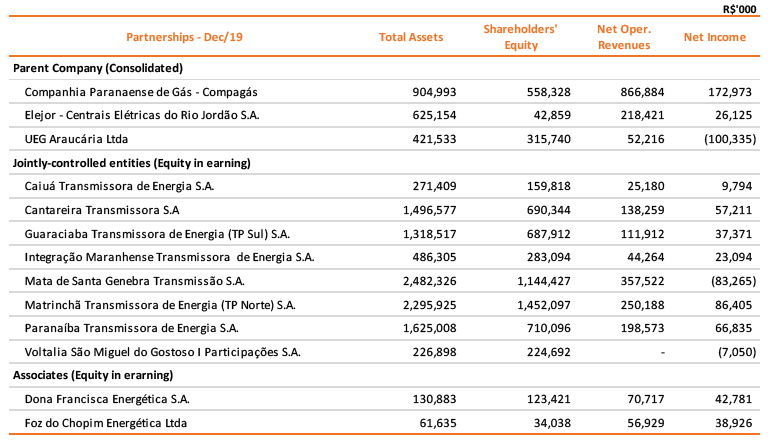

Equity in the earnings of investees reflects gains and losses from investments in Copel’s investees and jointly-controlled company, are presented in the table below.

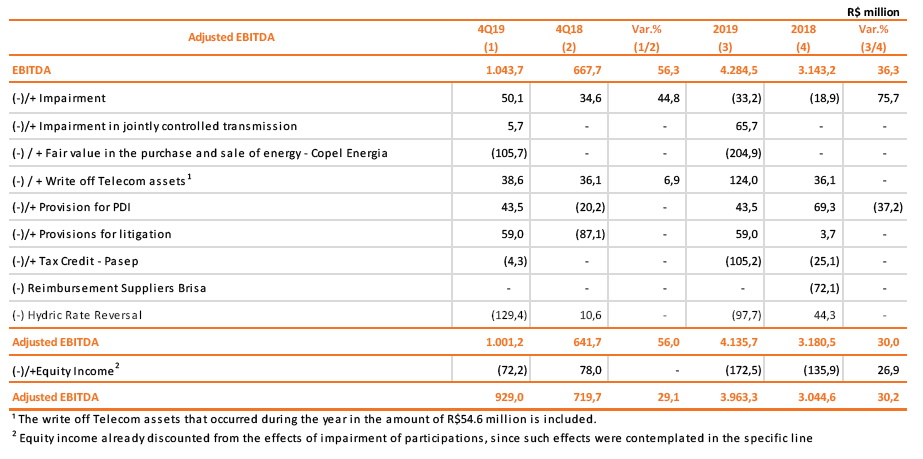

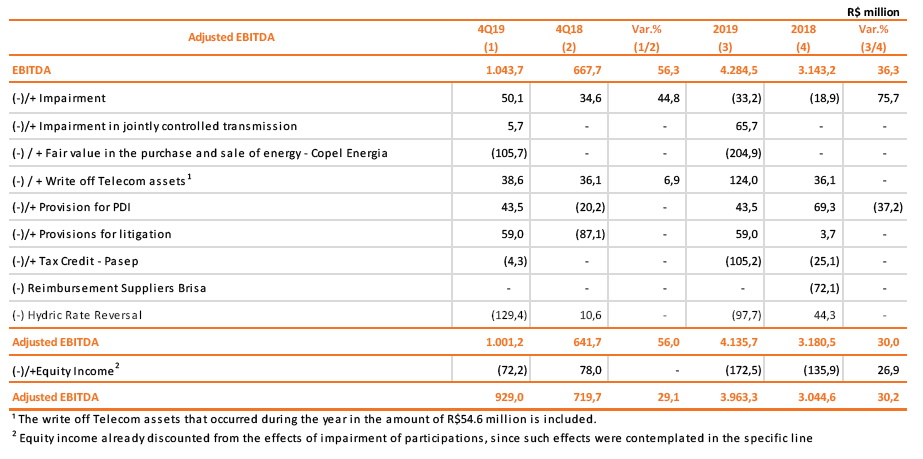

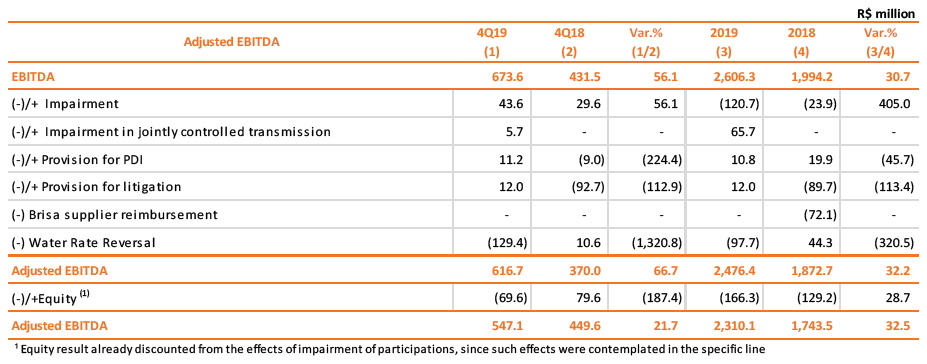

2.4 EBITDA

In 4Q19, earnings before interest, taxes, depreciation, and amortization reached R$1,043.7 million, 56.3% higher than the amount of R$667.7 million recorded in 4Q18. This result is mainly explained by (i) the 4.5% increase in the grid market, the tariff adjustment for Copel Dis (with an increase of 11.63% in TUSD as of June 24, 2019) and the entry into operation of new transmission assets that increased the “use of the main distribution and transmission grid (TUSD/TUST)” revenue by 32.3%; (ii) the 8.8% increase in the industrial free market of Copel GeT and Copel Com, positively impacting the “electricity sales to final customers” line; (iii) revenues from the agreements of CCEAR with the Baixo Iguaçu, Colíder and Cutia plants, generating an increase in “electricity sales to distributors” revenue; and, also, the positive R$66.5 million result in equity pickup in the period, versus a negative result of R$78.0 million in 4Q18; and stable manageable costs in nominal terms.This increase was partially offset by (i) the 26.5% increase in “electricity purchased for resale”, given the worsening of hydrological conditions in 4Q19 versus 4Q18 and a higher Average PLD in the period, and (ii) the increase in provisions for labor disputes.

Extraordinary events also affected the Company’s operational performance, such as (i) the positive result of R$105.7 million related to the fair value in the purchase and sale of energy from Copel Comercialização, (ii) the reversal of a water tariff for Copel GeT, in the amount of R$ 129,4 million, (iii) an impairment in the amount of R$52.9 million and (iv) provisions for the PDI program, in the amount of R$ 43.5 million. Excluding the extraordinary effects, the Adjusted EBITDA would have been R$ 1,001.2 million, 56.0 % higher than in 4Q18. Excluding the effects of equity income, adjusted EBITDA for 4Q19 would be R$ 929.0 million, 29.1% higher than the R$ 719.7 million in 4Q18.

Year to date, EBITDA grew 36.3%, while, disregarding the non-recurring effects, adjusted EBITDA increased 30.0% and, finally, eliminating the equity accounting effect, EBITDA would be 30.2% than that recorded in 2018.

2.5 Financial Result

In 4Q19, the financial result was negative by R$ 128.2 million, compared to negative R$ 137.6 million in 4Q18. Financial revenues totaled R$ 200.2 million, up 18.5 % from the R$ 169.0 million recorded in 4Q18, mainly due to higher inflation in the period (IGP-DI of 3.14% in the 4Q19 compared to – 1.33% in 4Q18) impacting the monetary variation on the CRC. Financial expenses totaled R$ 328.3 million, a balance 7.1% higher than that recorded in 4Q18, as a consequence of the Pis /Cofins due to the higher receipt of Interest on Own Capital from subsidiaries and subsidiary Compagás and greater variation with the update the concession grant charges for the Use of Public Property, incurred from the signing of the project's concession contract until the final concession date.

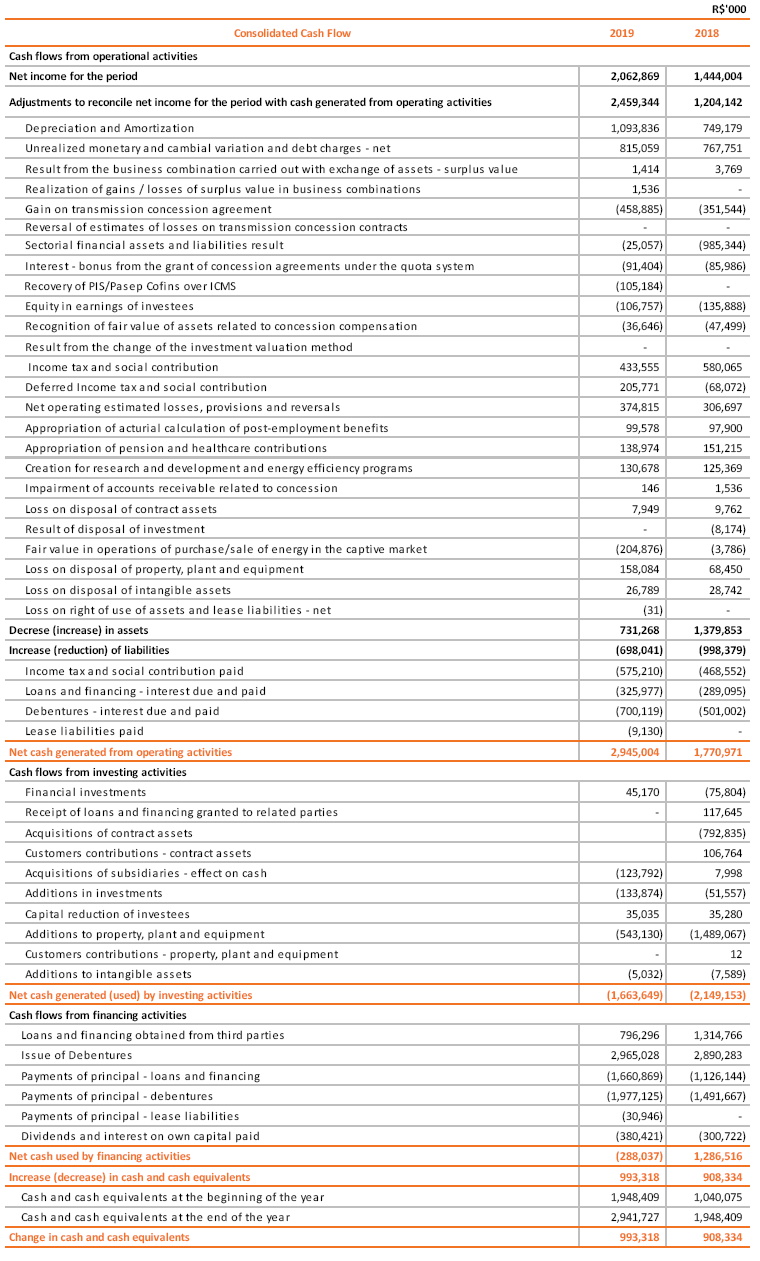

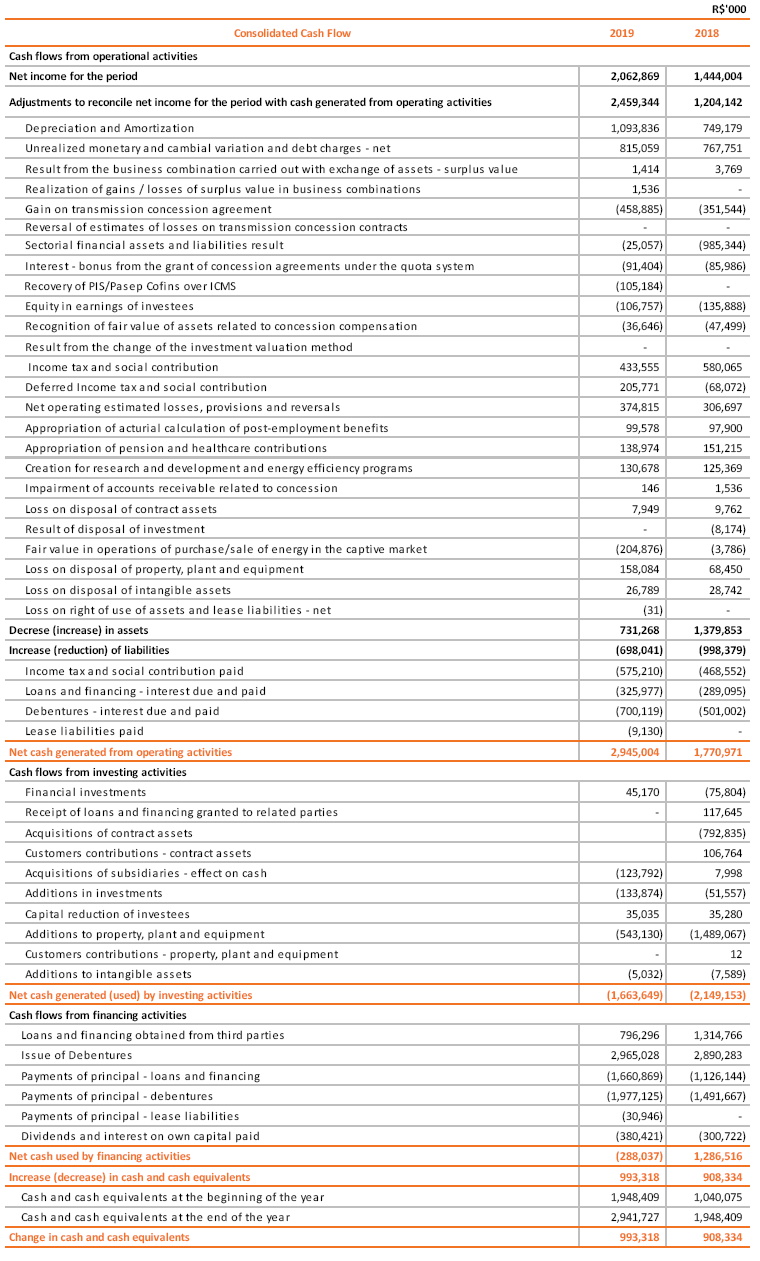

2.6 Consolidated Net Income

In 4Q19, net income was of R$ 596.5 million, 97.5% higher than the R$ 301.9 million reported in 4Q18. In 2019, net income was R$ 2,062.9 million, 42.9% higher than the R$1,444.0 million recorded in 2018.

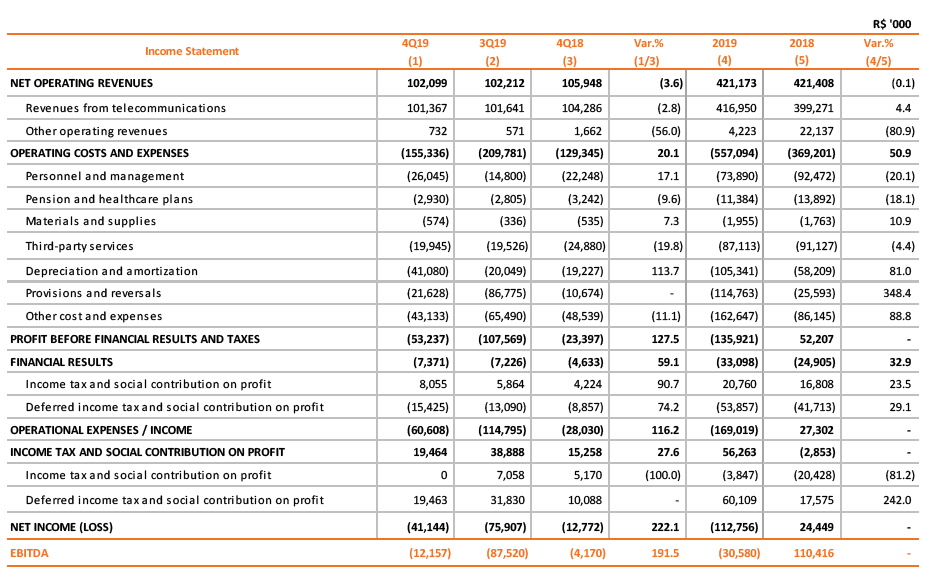

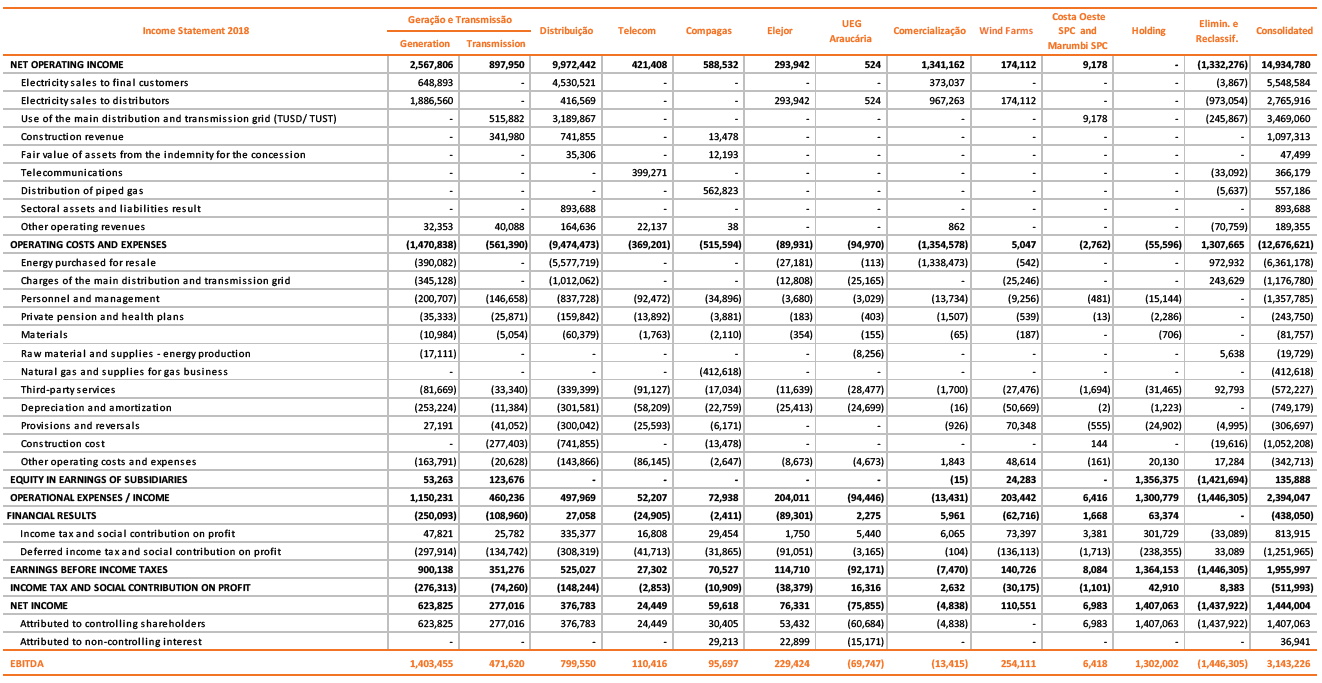

2.7 Consolidated Income Statement

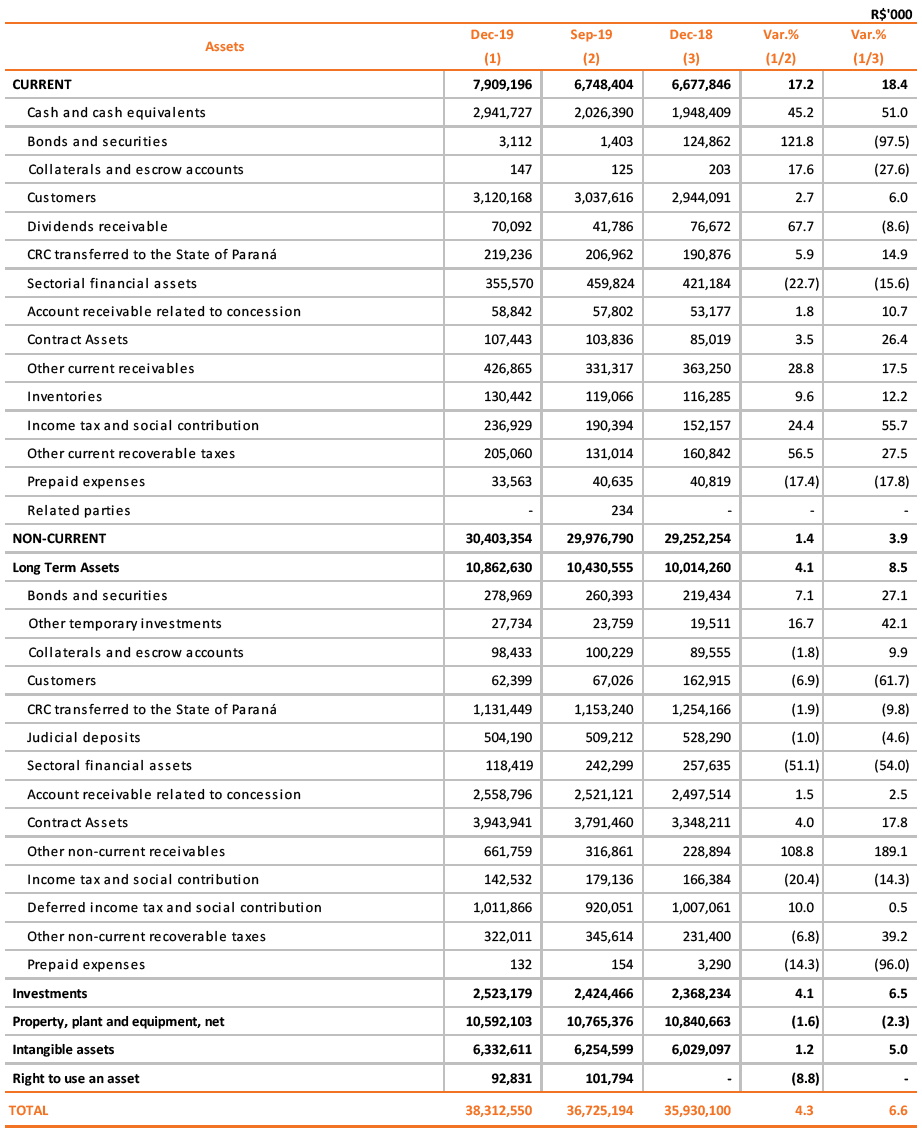

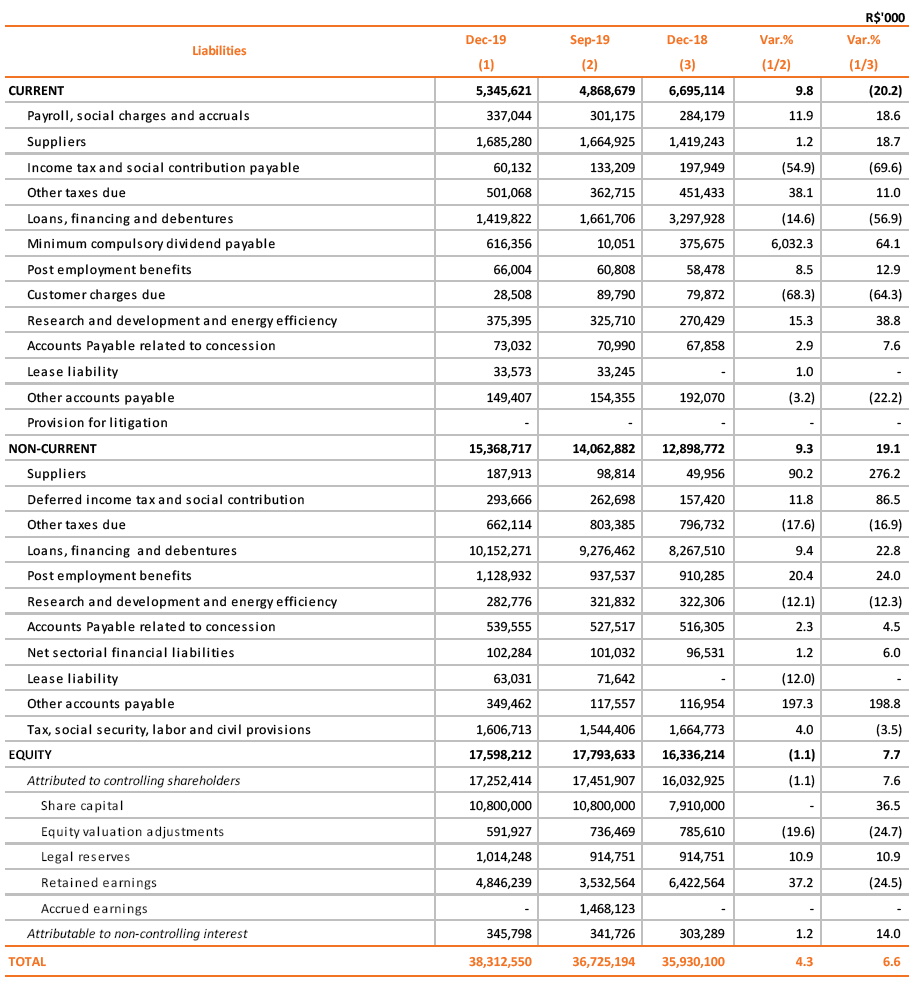

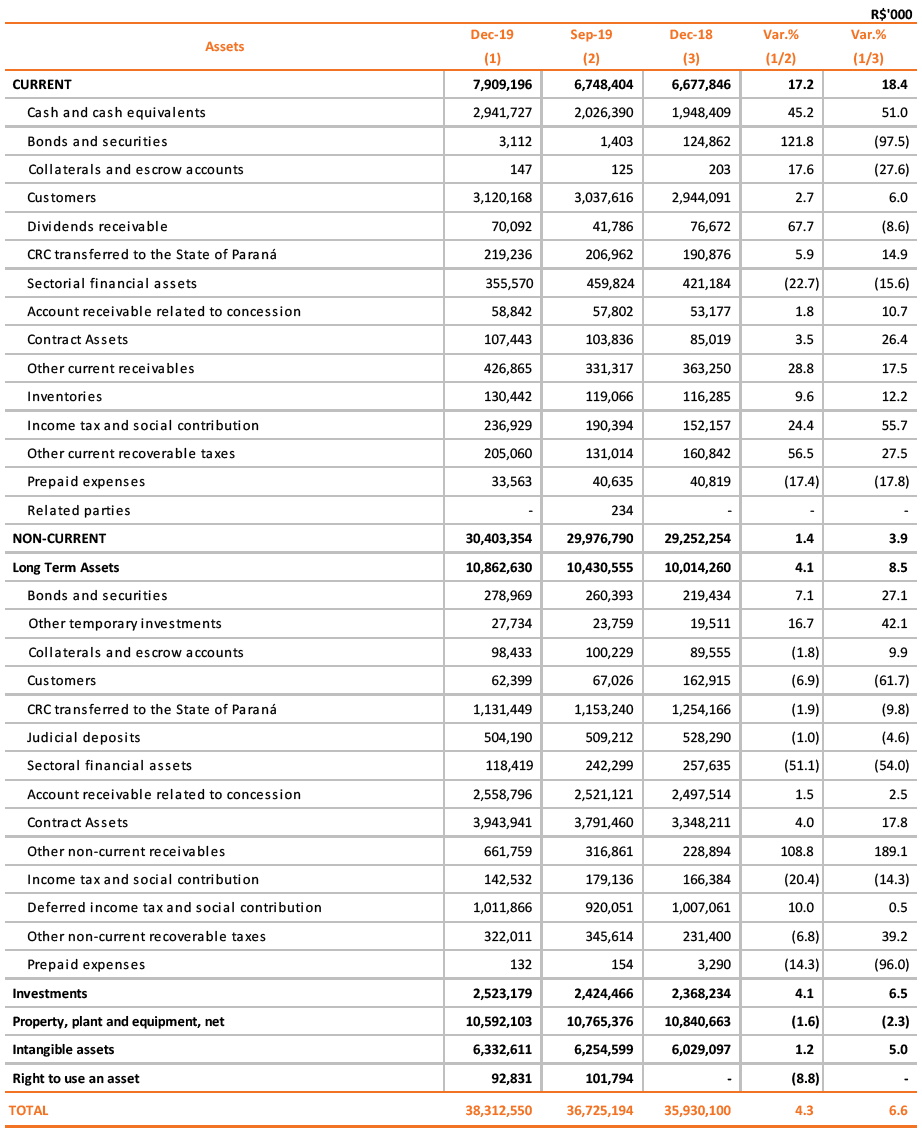

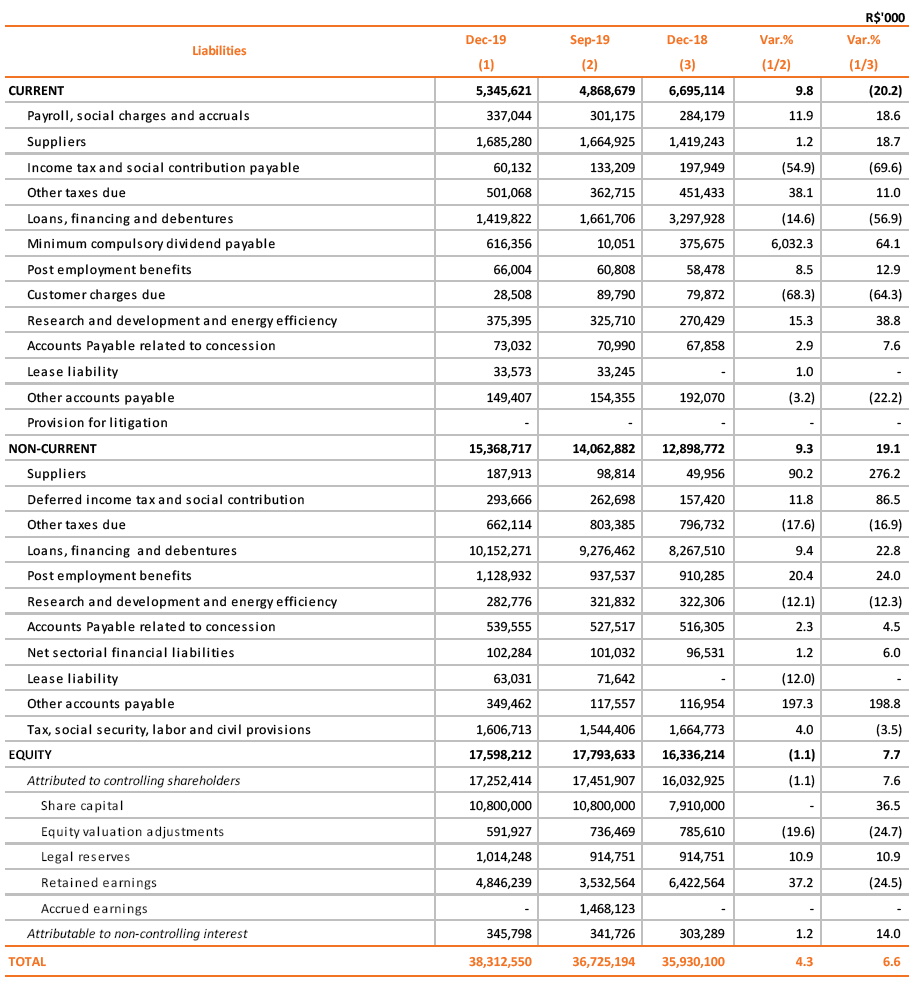

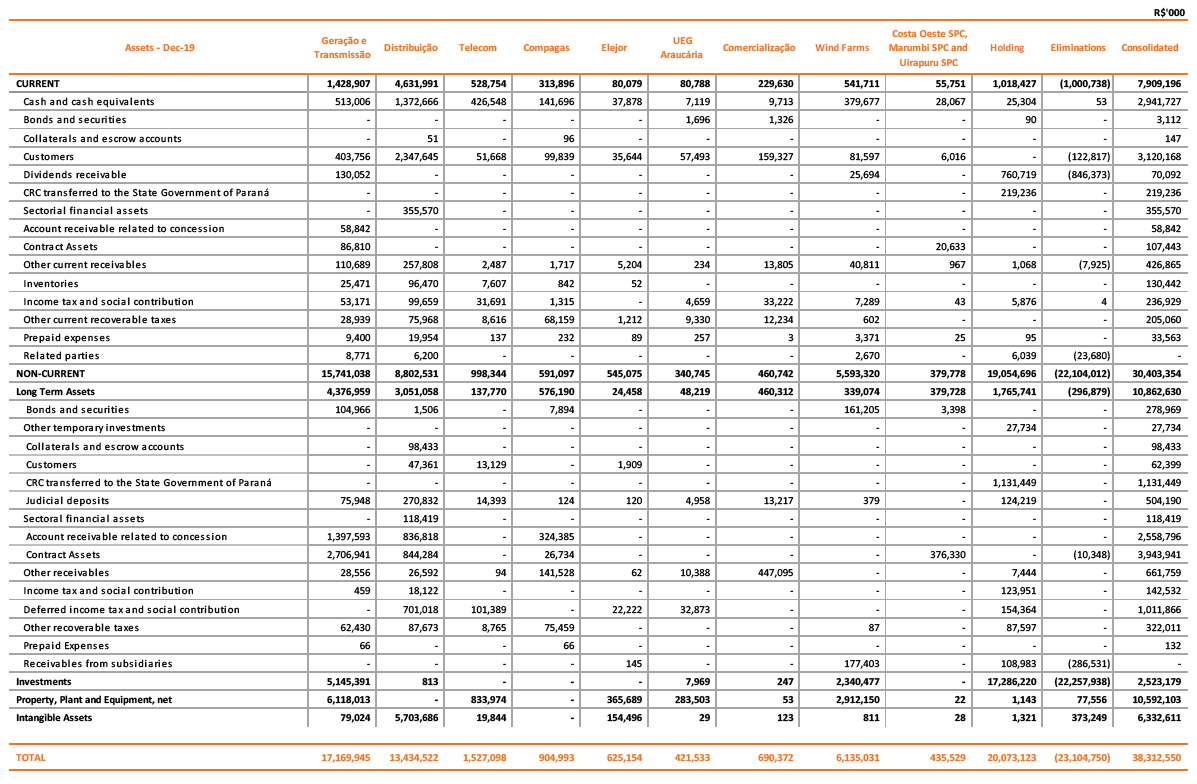

3.Main Accounts and Balance Sheet Changes

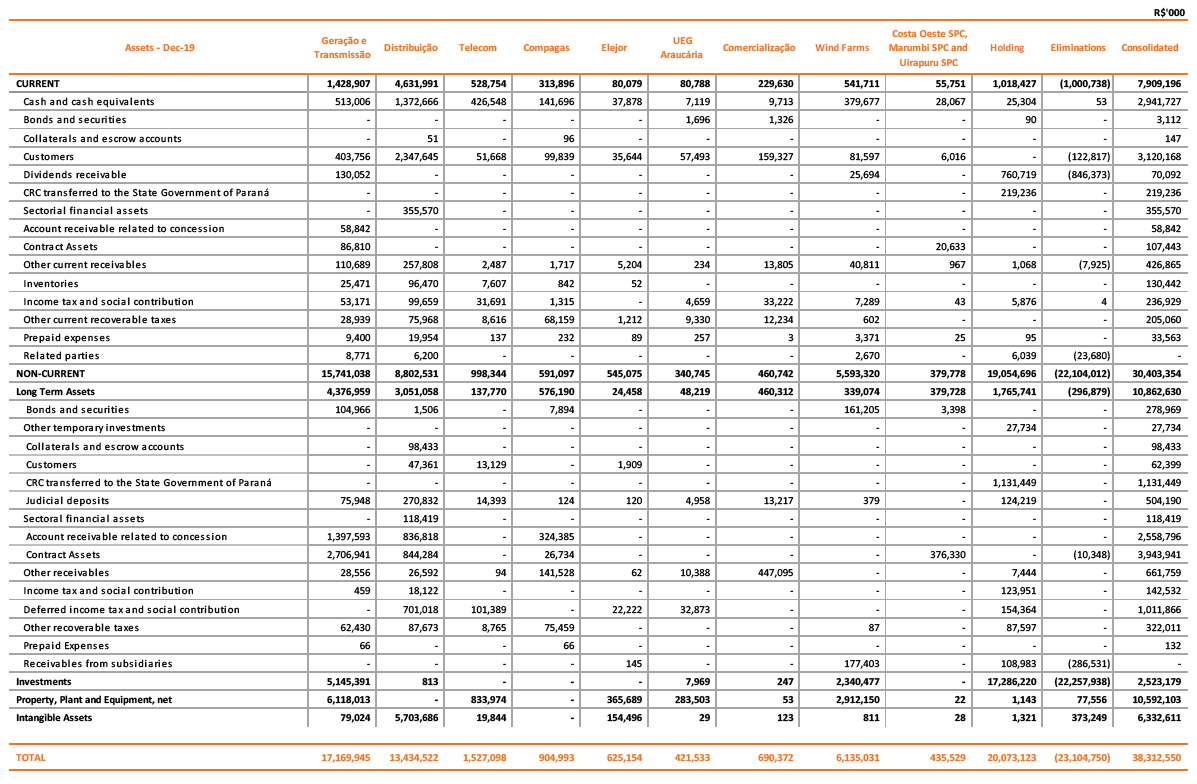

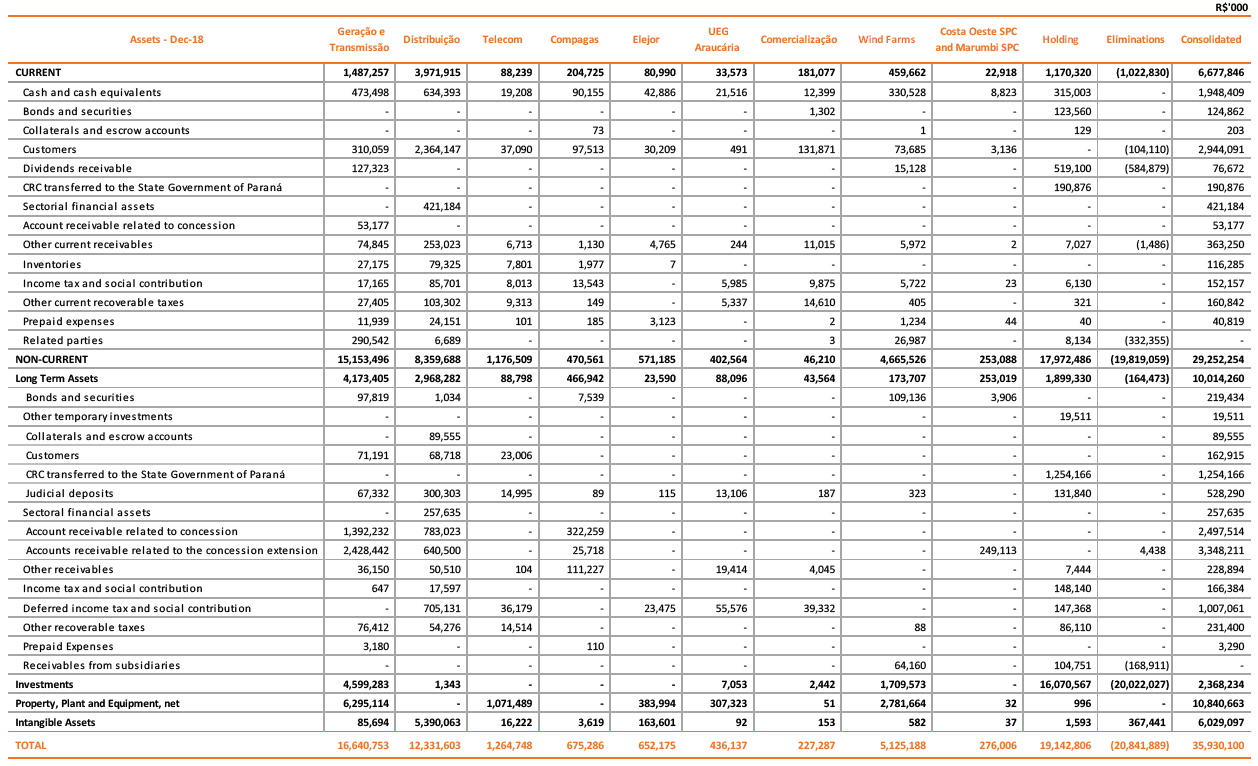

The main accounts and changes in the Balance Sheet in relation to December 2018 are described below. Additional information can be found in the Notes to our Quarterly Information.

3.1 Main Accounts

Cash, Cash Equivalents and Bonds and Securities

On December 31, 2019, the cash and cash equivalents, bonds and securities of Copel’s wholly owned subsidiaries and controlled companies totaled R$ 3,223.8 million, 4% higher than the R$ 2,292.7 million recorded in December 2018. These funds were invested, mostly in Bank Deposit Certificates (CDBs) and repo transactions. These investments are remunerated between 73% and 100.8% of the variation rate of the Interbank Deposit Certificate (CDI).

CRC Transferred to the State of Paraná

Through the fourth amendment to the CRC Account Agreement signed on January 21, 2005, the Company renegotiated the recoverable rate deficit account or CRC Account balance on December 31, 2004 with the State of Paraná at R$ 1,197.4 million, to be paid in 244 monthly installments recalculated by the “price” amortization system, adjusted for IGP-DI, plus interest at 6.65% per year. The first installment was due on January 30, 2005, with subsequent and consecutive due dates.The Company's management and the State of Paraná formalized the fifth amendment to the agreement on October 31, 2017. The State of Paraná has been strictly meeting the payments under contracted conditions, 64 monthly installments remaining. The balance of the CRC Account, on December 31, is R$ 1,350.7 million.

Sectorial Financial Assets and Liabilities

As of December 31, 2014, Copel Distribuição has recognized sectorial financial assets and/or liabilities in its financial statements as a result of an amendment to the concession agreement, that guarantees that the residual amounts of items of Portion A and other financial components not recovered or returned via tariffs will be included in, or discounted from, the calculation of the indemnification for non-amortized assets at the expiration of the concession. On December 31, 2019, the Company had a net asset of R$ 371.7 million. More detail in our Quarterly Information (Note 9).

Accounts Receivable Related to the Concession

This line refers to accounts receivable related to the contracts for the concession of electric power generation, transmission and distribution, and distribution of natural gas activities. The amounts refer to (i) the concession fee paid as a result of the auction involving the Governador Parigot de Souza Power Plant – HPP GPS, won by Copel GeT on November 25, 2015 (R$648 million), (ii) its investments in infrastructure andfinancial remuneration that have not been or will not be recovered via tariffs until the expiration of the concession (R$ 836.8 million), (iii) the amounts receivable from energy transmission assets of the Existing System Basic Network – RBSE and connection facilities and other transmission facilities - RPC, as a result of the recognition of the effects of MME Ordinance No. 120 and the approval, by Aneel, of the result of the inspection of the appraisal report of these assets (R$ 739.3 million) and (iv) the gas distribution concession agreement - Compagas (R$ 324.4 million) and (v) to the electricity generation concession contract due to the expiration of the concessions of HPP GPS and HPP Mourão I (R$ 69.2 million). On December 31, 2019, the balance of the account totaled R$ 2,617.6 million. More details in our Quarterly Information (Note 10).

Contract Assets

CPC 47/IFRS 15 came into effect on January 1, 2018 and brought the concept of “contract assets” referring to the right to consideration conditioned to the compliance with obligations to operate and maintain infrastructure, rather than passage of time only (concept of “financial asset”). Consequently, the Company changed the classification of assets related to the concession of electric power distribution and transmission, and distribution of piped gas services into contract assets. The construction works for the distribution of electric power and piped gas are now classified as contract assets during the construction period (reclassification from ongoing intangible assets into contract assets). The Company also changed the classification to contract assets of RBSE assets ratified for consideration after the first Permitted Annual Revenue - APR cycle, which started in July 2017. On December 31, 2019, the account balance totaled R$ 4,051.4 million. More details in our Quarterly Information (Note 11).

Investments, Property, Plant and Equipment and Intangible Assets

The balance in ‘investments’ increased by 6.5% by December 31, 2019, mainly due to the contributions recorded in the period. The "fixed assets" account decreased 2.3 % due to write-offs related to Copel Telecom's fixed assets. The "intangible" account, on the other hand, showed an increase of 5.0% due to the investments in new assets made in the period.

Right-of-use assets

With the adoption of CPC 06 (R2) / IFRS 16, the company recognized the right-of-use asset. The pronouncement replaces CPC 06 (R1) / IAS 17 - Leases, as well as related interpretations (ICPC 03 / IFRIC 4, SIC 15 and SIC 27). The adoption of the new standard eliminates the accounting of operating lease for the lessee, presenting a single lease model consisting of initially recognizing all leases in assets and liabilities at present value and recognizing the depreciation of the right-of-use asset and the interest of the lease separately in the result. As of December 31, 2019, the balance of the account totaled R$ 92.8 million. More details in our Quarterly Information (Note 28).

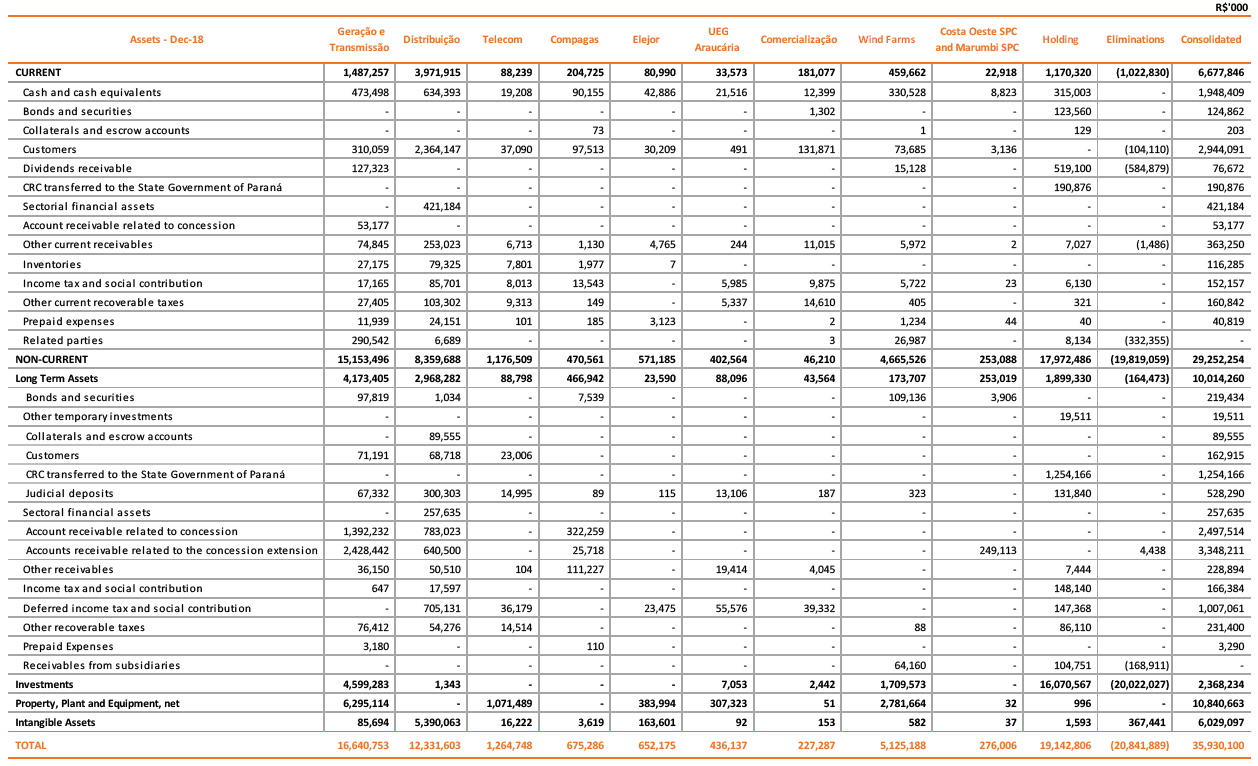

3.2 Balance Sheet – Assets

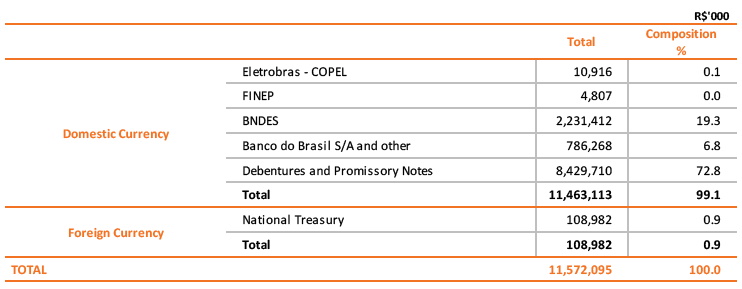

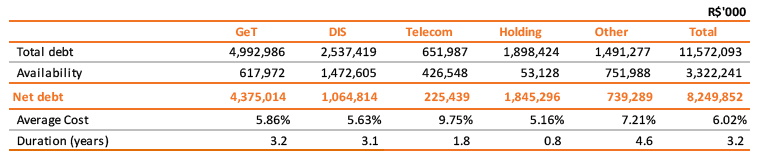

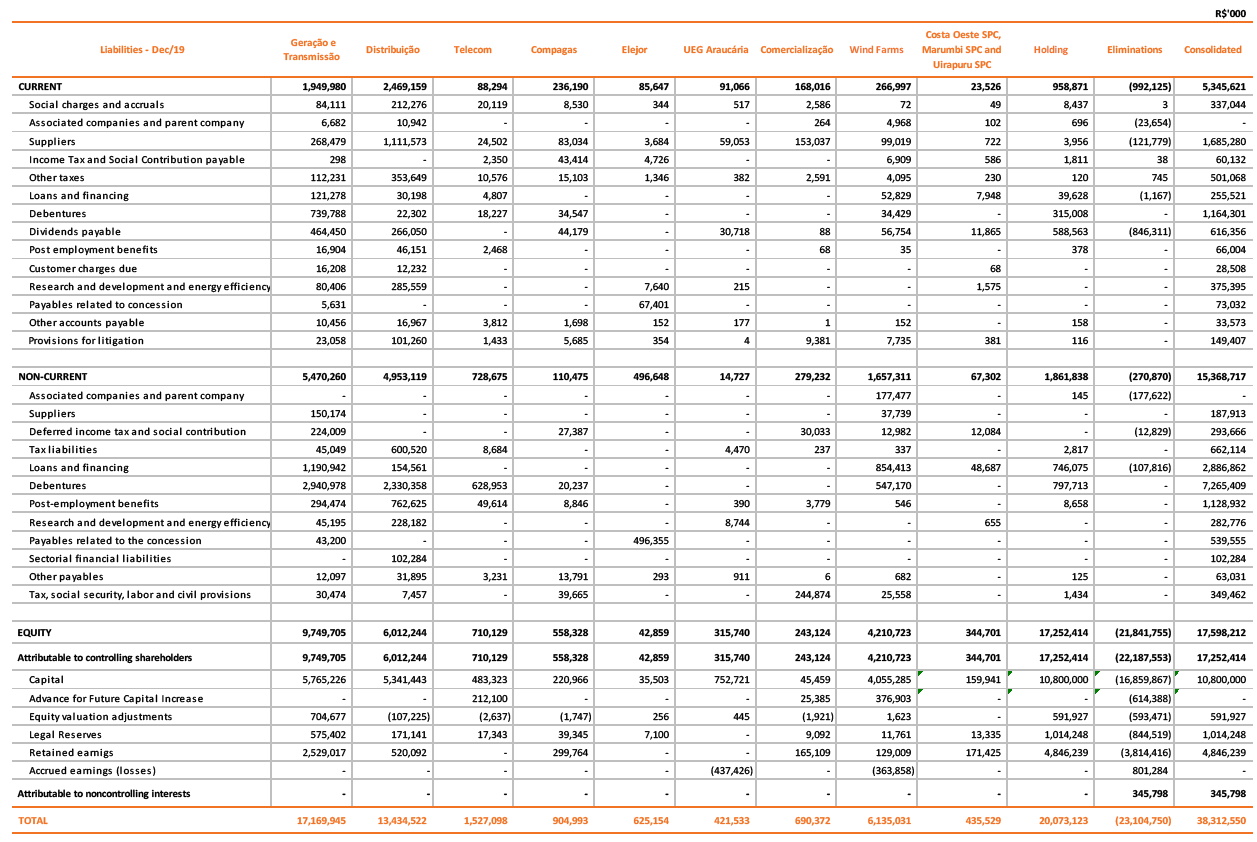

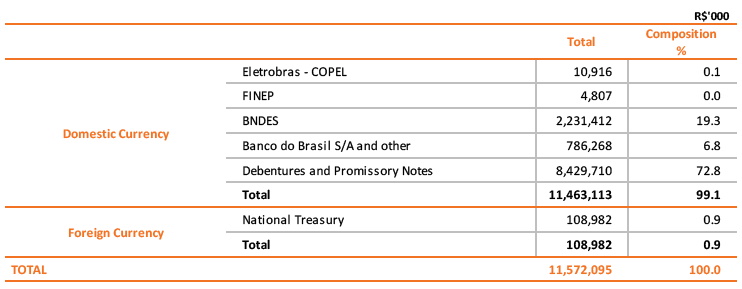

3.3 Debt

Gross Debt

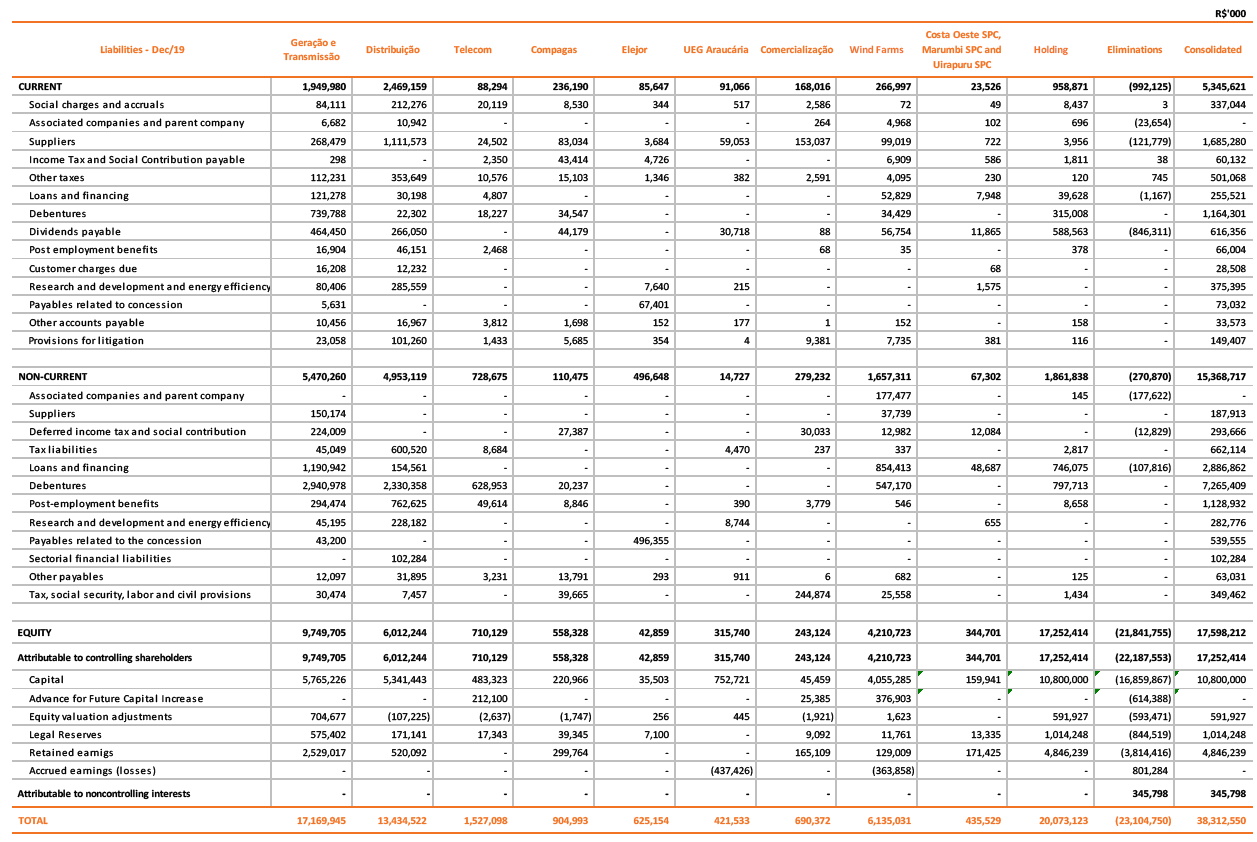

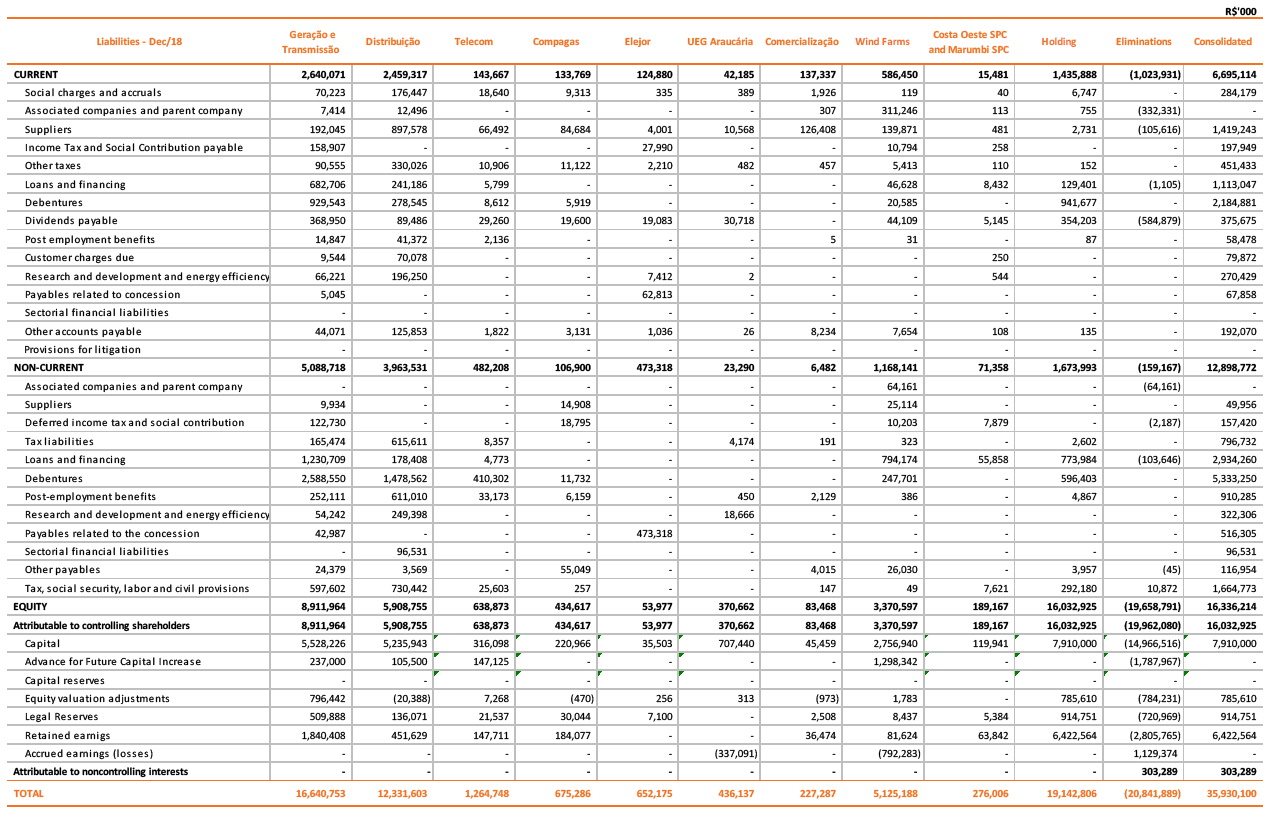

Copel's total consolidated debt amounted to R$ 11,572.1 million on December 31, 2019, quite the same amount compared to the R$ 11,565.4 million recorded on December 31, 2018. On December 31, 2019, Copel’s gross debt represented 65.8% of consolidated shareholders’ equity, which at the end of the period was R$ 17,598.2 million, equivalent to R$ 65.02 per share (book value per share). The breakdown of the balance of loans, financing and debentures is shown in the table below:

Loans, financing and debentures maturities are presented below:

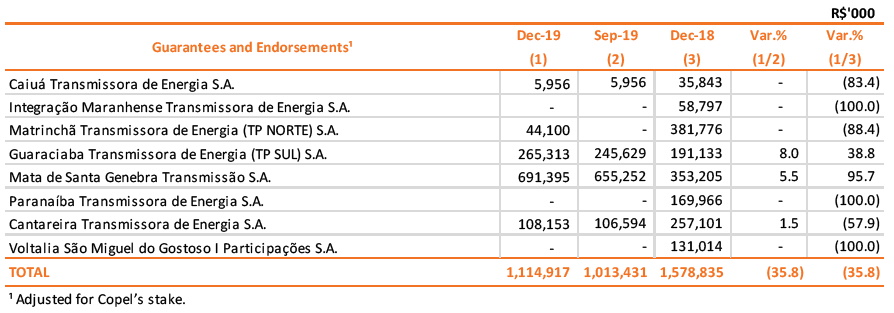

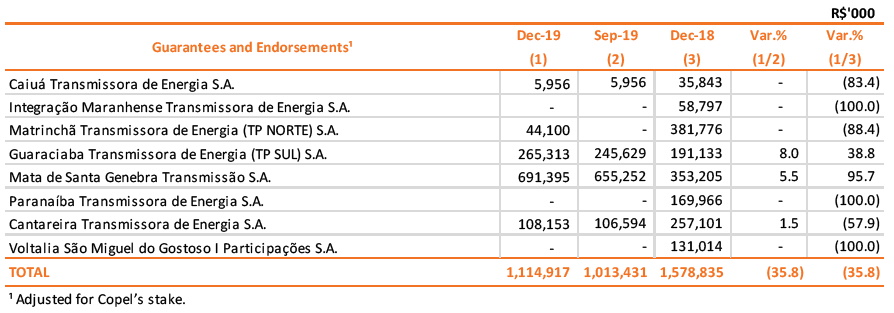

Endorsements and Guarantees

Until December 31th, 2019, the Company had R$ 1,114.9 million in guarantees and endorsements, as shown below.

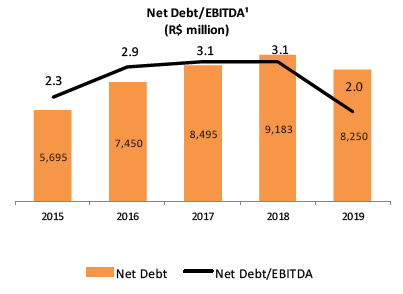

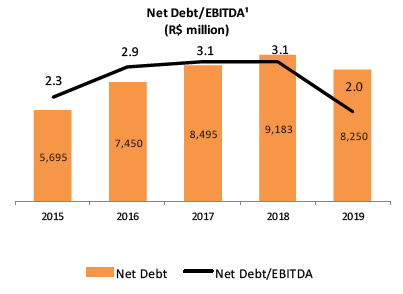

Copel’s consolidated net debt (loans, financing and debentures less cash and cash equivalents) and the net debt/EBITDA ratio are shown in the following chart:

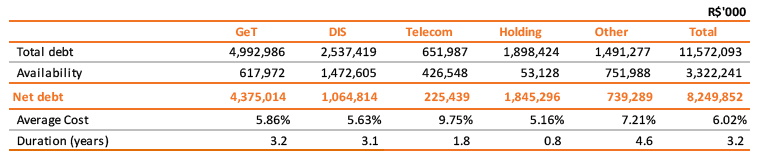

Net Debt by Subsidiary

The following table shows the gross debt and net debt of the subsidiaries:

Accounts Payable related to the Concession

Use of Public Property

It refers to the concession charges for the use of public property incurred since the execution of the project’s concession agreement until the end of the concession.

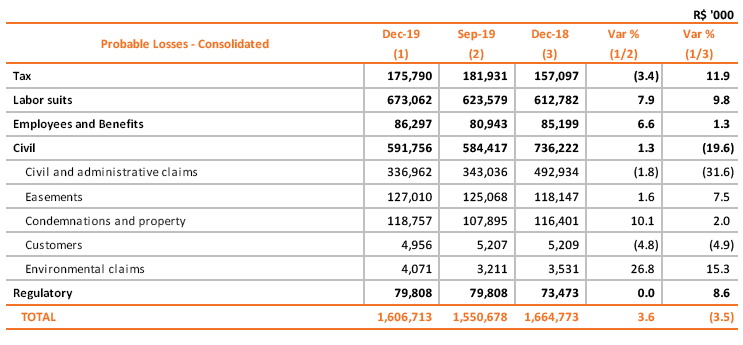

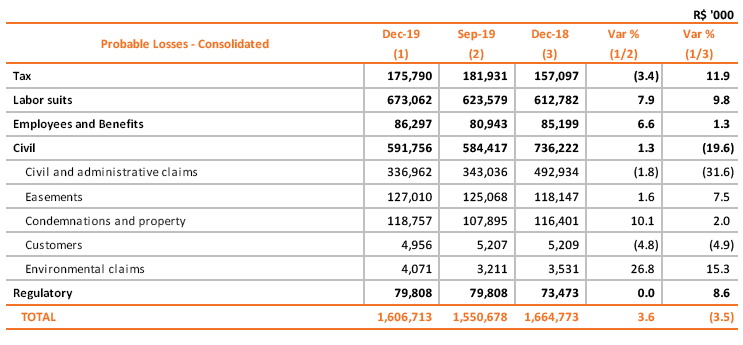

Provisions for Legal Claims

The Company is involved in a series of lawsuits in different courts and instances. Copel’s management, based on its legal advisors’ opinion, maintains a provision for legal claims for those cases assessed as probable losses. The balances of provisions for legal claims are as follows:

The lawsuits classified as possible losses (those that are not provisioned in the balance sheet), as estimated by the Company and its controlled companies at the end of December 2019, totaled R$ 3,456.9 million, 13.2% higher than amount registered in December 2018 (R$ 3,052.7 million), distributed in lawsuits of the following natures: civil (R$ 1,257.0 million), regulatory (R$ 1.141,4 million), fiscal (R$ 617.2 million), labor (R$ 419.9 million) and employee benefits (R$ 16.9 million).

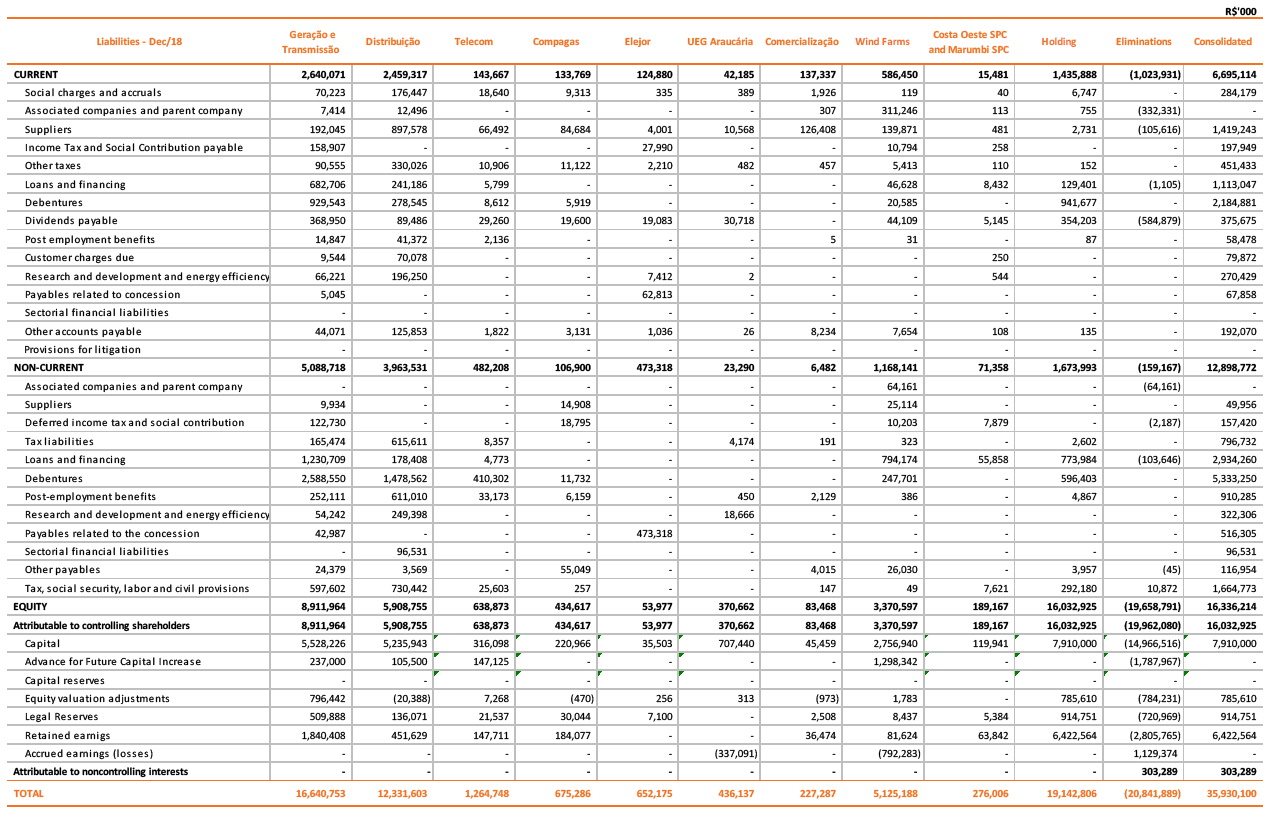

3.4 Balance Sheet – Liabilities

4. Performance of the Main Companies

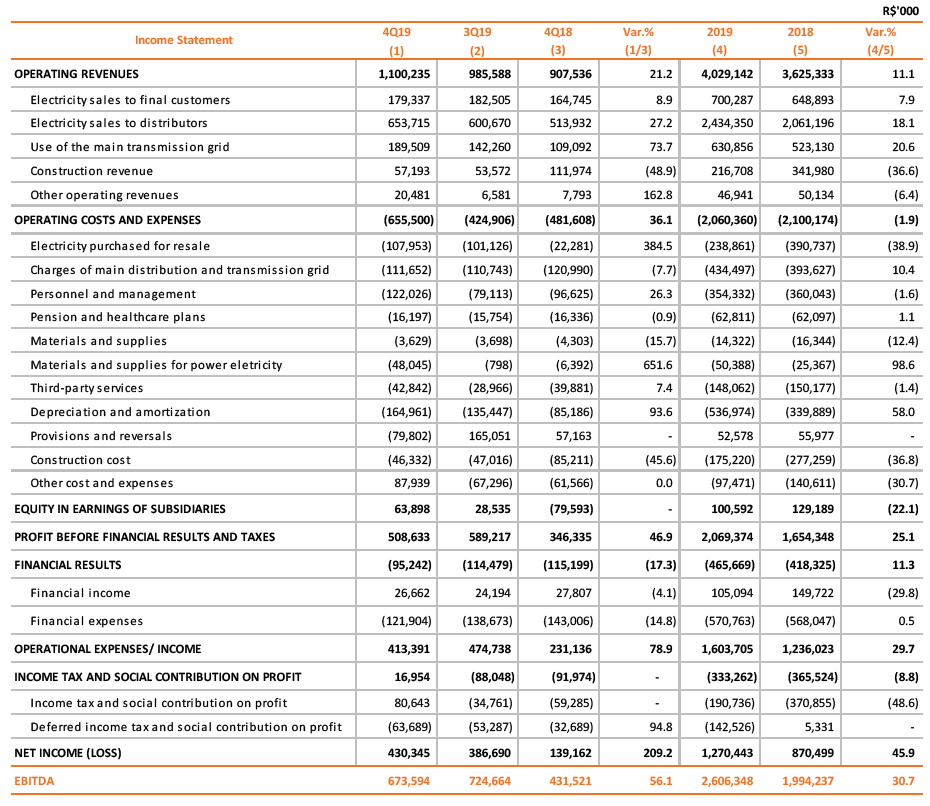

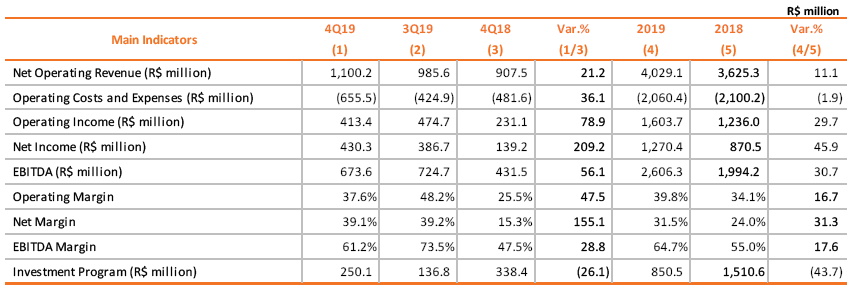

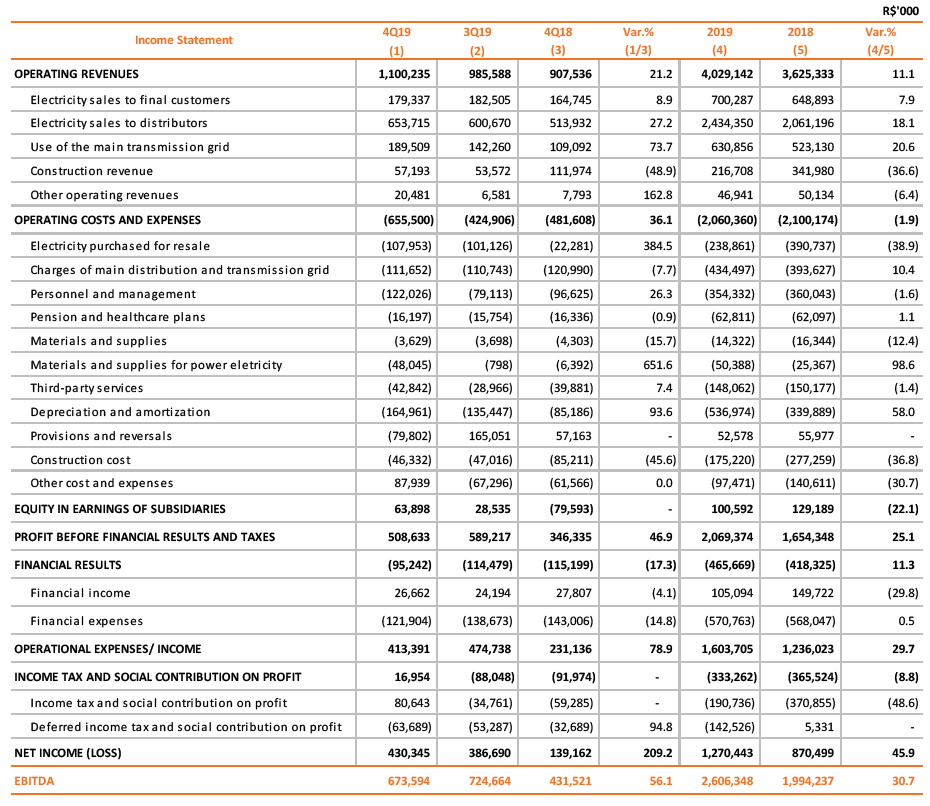

4.1 Copel Geração e Transmissão (Consolidated Result)

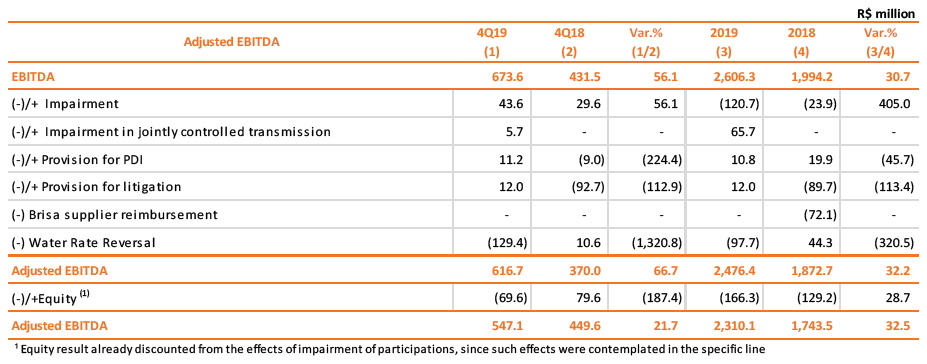

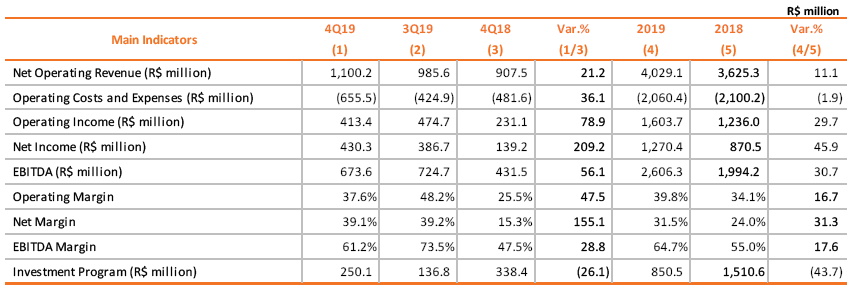

Copel GeT reported an EBITDA of R$ 673.6 million in 4Q19, up 56.1% versus the R$ 431.5 million in 4Q18. This performance mainly reflects (i) the positive result in the equity pickup in the period (R$ 63.9 million in 4Q19 versus a negative amount of R$ 79.6 million in 4Q18); (ii) the 27.2% increase in revenues with “electricity sales to distributors”, due to the revenues from CCEAR contracts of Baixo Iguaçu, Colíder and Cutia, in addition to the dispatch of UTT Araucária, whose thermoelectric plant produced a total of 130 GWh in 4Q19; (iii) the 73.7% positive variation in grid availability (TUST), influenced by the start of operations of new transmission assets (partially Lot E) and the adjustment applied to RAPs as of July 1, 2019, with an average positive effect of 1.55% (vs. -5.5% applied in July 2018); and (iv) a reversal of R$ 97.7 million in a water charges recorded in the “other operating costs and expenses” line. This growth was partially offset by (i) a provision of R$ 79.8 million in 4Q19 in the “provisions and reversals” line (against a reversal of R$ 57.2 million in 4Q18), mainly due to the increase in labor and civil provisions and the increase, by R$ 15.3 million, in impairment provisions for energy generation assets; (ii) the 85.7% increase in the cost of “electricity purchased for resale”, basically due to a worsening in the hydrological scenario, with an average GSF of 70.5% in 4Q19 (versus 81.9% in 4Q18) and a higher Average PLD (R$ 272.82/MWh in 4Q19 versus R$ 158.24/MWh in 4Q18); (iii) the 26.3% increase in the “personnel and management” line, due to the provision for the PDI program in 4Q19, in the amount of R$ 11.2 million, against a reversal of R$ 9.0 million in 4Q18; and (iv) the increase in costs with raw materials and inputs for energy production, resulting from the dispatch of UTE Araucária in 4Q19.

Also, manageable costs, except for estimated losses, provisions and reversals, decreased by 55.8%, mainly due to the effect of the revocation of the law that instituted the Control, Monitoring and Inspection Rate of Exploration Activities and the Use of Resources (TCFRH), resulting in a positive effect of R$129.4 million in the “other costs and expenses” line.

Excluding the extraordinary effects listed below, Copel GeT’s Adjusted EBITDA increased by 66.7% compared to 4Q18. Excluding the effects of the equity pickup, adjusted EBITDA would be of R$ 547.1 million in 4Q19, up 21.7% vs. R$ 446.6 million in 4Q18.

In the fourth quarter of 2019, Copel GeT posted a net income of R$ 430.4 million, up 209.2% vs. the R$ 139.2 million in 4Q18.

In 2019, Copel GeT registered an operating revenue of R$ 4,029.1 million, up 11.1% YoY, while operating costs and expenses had a 1.9% decrease, totaling R$ 2,060.4 million in the period. Net income reached R$ 1,270.4 million and EBITDA totaled R$ 2,060.4 million, an increase of 45.9% and 30.7%, respectively, year-on-year.The increase in EBITDA in 2019 was mainly due to (i) the 18.1% increase in “electricity sales to distributors” revenues resulting from revenues from the CCEAR agreements of Baixo Iguaçu, Colíder and Cutia, in addition to the dispatch of UTE Araucária during the last quarter of the year; (ii) the 38.9%reduction in “electricity purchased for resale”, mainly due to the improvement in hydrological scenario in 2019, with an average GSF of 91.2% (versus 83.6% in 2018) and an average PLD 21.0% lower than the previous year (227.10/MWh in 2019 and R$ 287.62/MWh in 2018); and (iii) a 20.6% positive variation in grid availability (TUST), influenced by the start of operations of new transmission assets (partially Lot E) and the adjustment applied to RAPs as of July 1, 2019, with an average positive effect of 1.55% (versus -5.5% applied in July 2018). We also highlight the 30.7% reduction in the “other costs and expenses” line, mainly due to the R$ 97.7 million reduction in water charges – TCFRH.

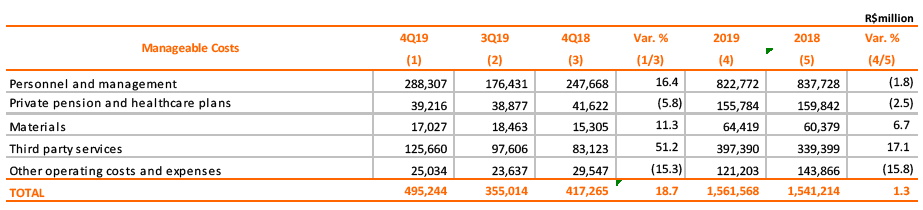

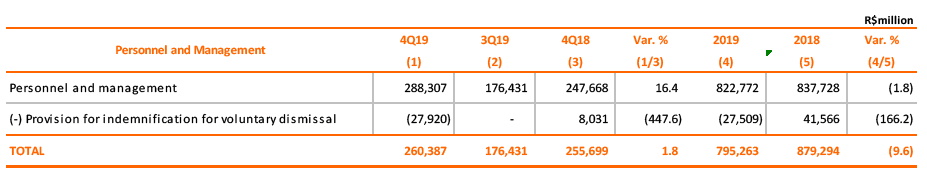

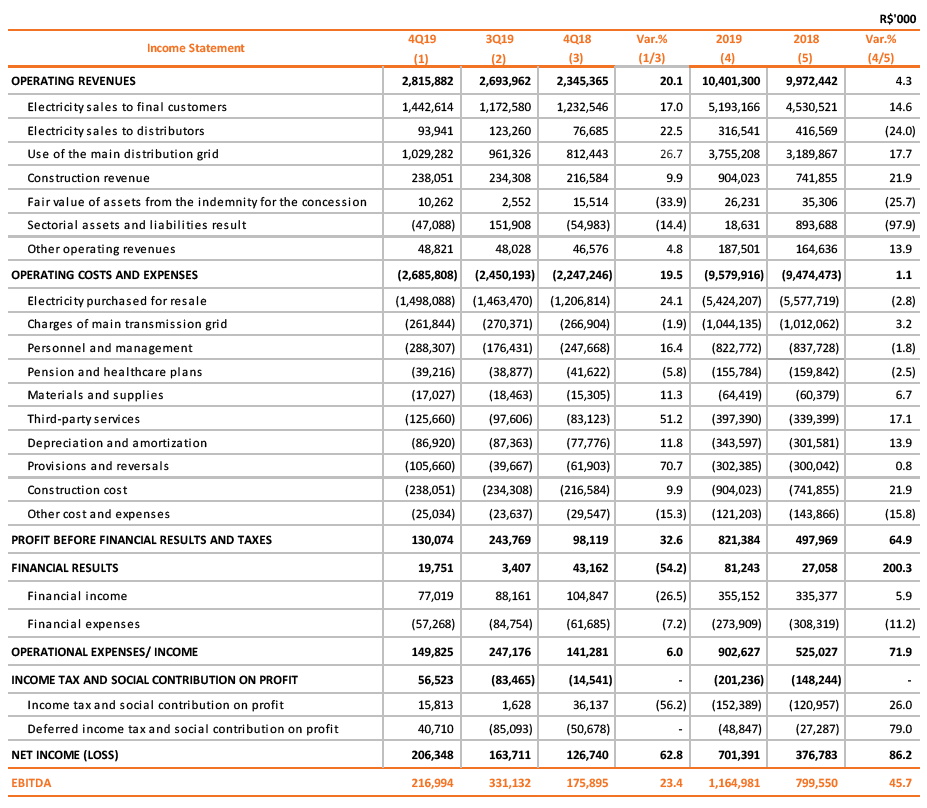

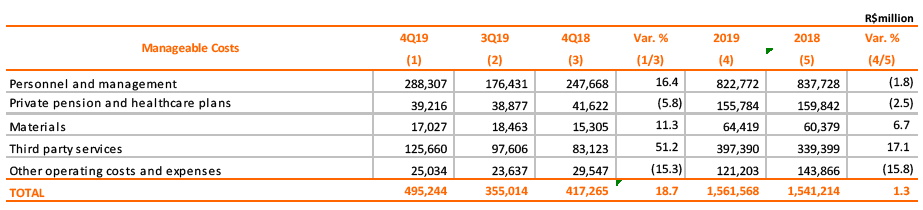

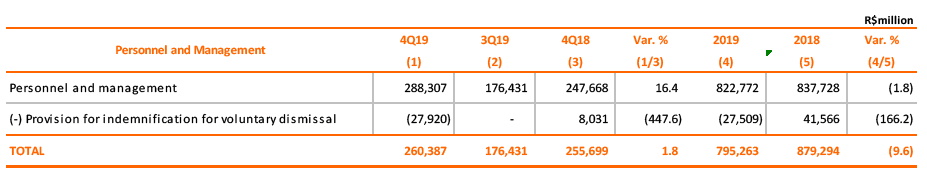

4.2 Copel Distribuição

Copel Distribuição reported an EBITDA of R$ 217.0 million in 4Q19, up 23.4% over the R$ 175.9 million in 4Q18. This result is mainly due to the 4.5% growth in grid market that, in line with the tariff adjustment as of June 24, 2019 that readjusted TUSD by 11.63%, contributed with the 26.7% increase in the “use of the main distribution and transmission grid” line. This growth was partially offset by the 18.7% increase in manageable costs, except for provisions and reversals, mainly due to (i) the 51.2% increase in “third party services” resulting from 35.6% higher maintenance costs for the electric energy system and a 77.2% increase in customer service; and (ii) the 16.4% increase in “personnel and management” costs, which was affected by (a) an increase in “profit-sharing” (PLR) due to better results, (b) a provision of R$ 27.9 million for the PDI program concluded at the end of 2019, against a reversal of R$ 8.0 million in 4Q18, and (c) the 2.92% increase in salaries in October 2019.

Excluding the provision for indemnities related to the PDI program, personnel expenses in 4Q19 increased by only 1.8% compared to the same period in 2018, a result that was lower than the 4.31% inflation (IPCA) for period and was essentially explained by the reduction in of 400 employees at Copel Distribuição.

There was also a 70.7% increase in provisions, mainly due to the updated amount for collective labor claim.

The following variations are also noteworthy:

(i) the 17.0% increase in “electricity sales to final customers” in 4Q19, which was mainly due to the energy tariff adjustment, valid since June 24, 2019, and the 2.9% increase in the captive market;

(ii) the 24.1% increase in “electricity purchased for resale", which was mainly due to a worsening in the hydrological scenario, with an average GSF of 70.5% in 4Q19 (versus 81.9% in 4Q18).

Net income was of R$ 206.3 million in 4Q19, up 62.8% vs. R$ 126.7 million YoY. In 2019, Copel Distribuição reported an EBITDA of R$ 1,165.0 million, 45.7% higher than in 2018, mainly due to (i) the 17.7% increase in “use of the main distribution and transmission grid” resulting primarily from the readjustments in TUSD (16.42% on June 24, 2018 and 11.63% valid as of June 24, 2019) and the 3.3% growth in grid market; and (ii) manageable costs, which remained stable in nominal terms compared to the previous year, increasing by only 1.3%. Except for the extraordinary effects listed below, Copel Distribuição's EBITDA would be R$ 283.9 million in 4Q19, 69.1% higher than the R$ 167.9 million reported in 4Q18. In 2019, EBITDA would be R$ 1,231.5 million, 33.1% higher than in 2018 (R $ 925.1 million).

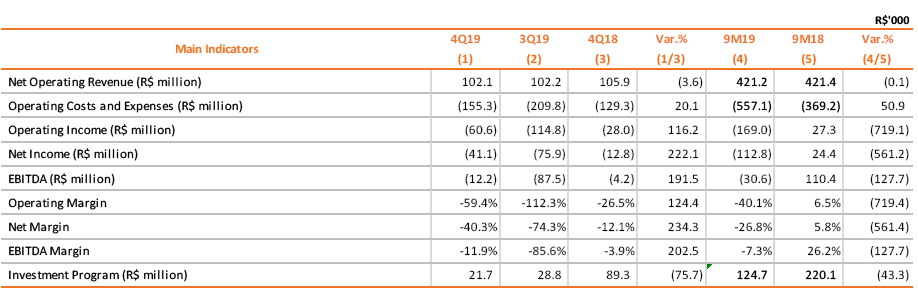

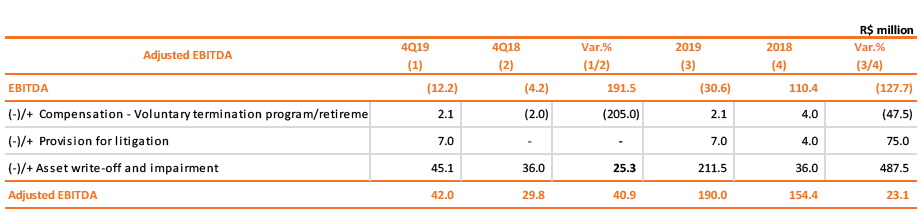

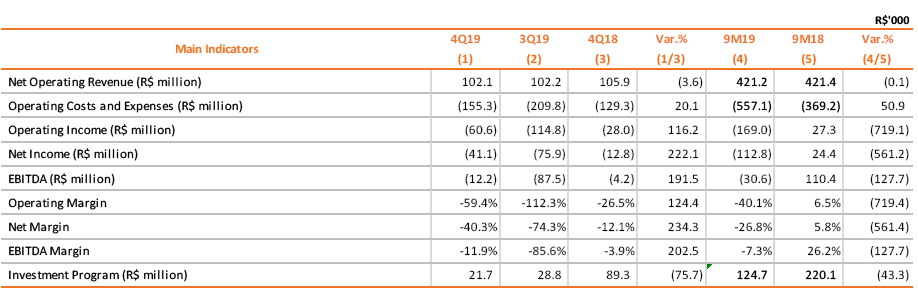

4.3 Copel Telecomunicações

Copel Telecom had a negative EBITDA of R$ 12.2 million in 4Q19, versus a negative R$ 4.2 million in 4Q18, mainly due to the recognition of impairment, in the amount of R$ 6.4 million, and write-offs and remeasurement of amounts arising from the deactivation of telecommunications assets, of R$ 38.6 million, which were recorded in “other costs and expenses” line. Excluding these extraordinary events related toinfrastructure deactivations and provision associated with the voluntary dismissal plan (PDI), the adjusted EBITDA for Copel Telecom would have been R$ 42.0 million versus a negative amount of R$ 29.8 million in 4Q18.

The personnel and management line totaled R$ 26.0 million in 4Q19, a 17.1% increase over 4Q18, due to a provision of R$ 2.1 million for the PDI program, while in 4Q18 this line was reversed by R$ 2.0 million, and an increase in provisions for profit-sharing (PLR). The number of employees was reduced by 66 people over the last 12 months, corresponding to a 13.8% reduction in total headcount.

Net income for the quarter came in as a net loss of R$ 41.1 million, versus a net loss of R$ 12.8 million in 4Q18. The following table shows the main indicators of Copel Telecom:

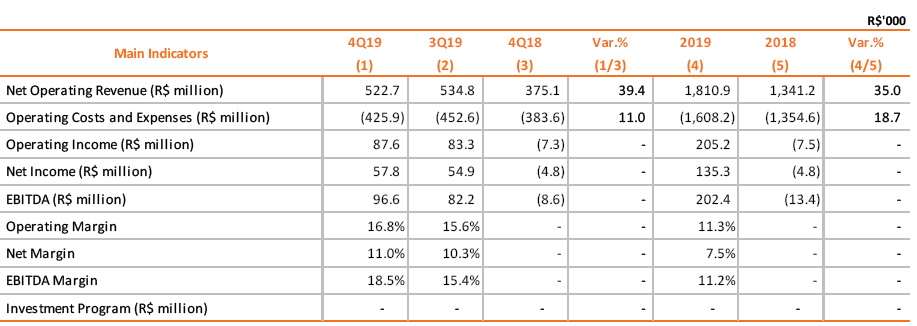

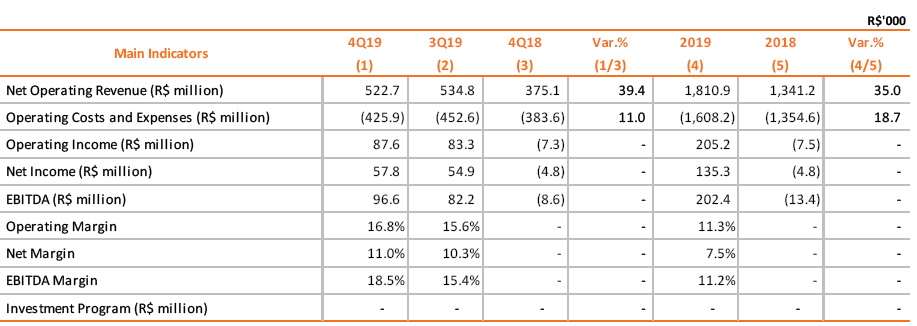

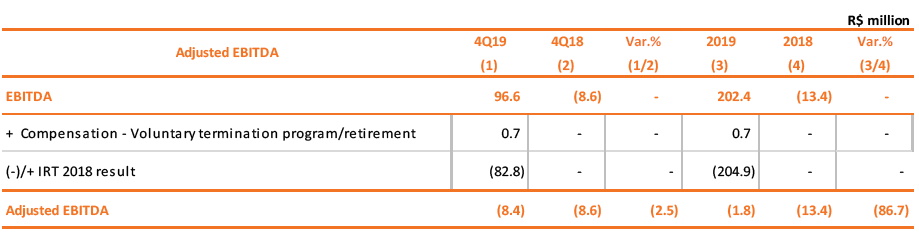

4.4 Copel Comercialização (Copel Energia)

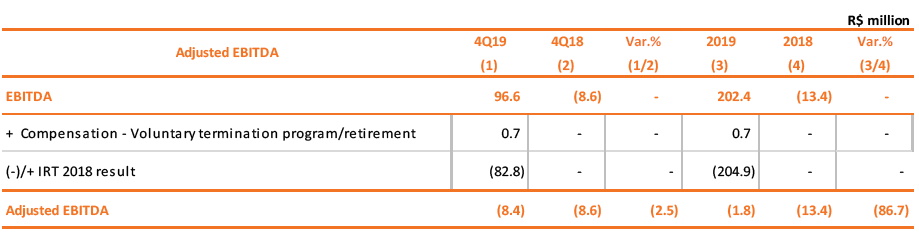

Copel Energia reported an EBITDA of R$ 96.6 million in 4Q19, which was significantly higher than the negative amount of R$ 8.6 million in 4Q18, mainly due to the positive result of R$ 105.7 million in the calculation of fair value on purchase and sale of energy (mark-to-market). We also highlight the 78.2%increase in revenues from “electricity sales to final customers”, which reflects the 20.7% increase in the volume of energy sold to free consumers and was partially offset by the 10.1% increase in “electricity purchased for resale” costs to meet demand for energy and the 7.7% reduction in revenues from “electricity sales to distributors”, due to the average lower price in energy sold in the period.

Excluding the effect of fair value on the purchase and sale of energy, EBITDA would have been negative by R$ 8.4 million, versus a negative amount of R$ 8.6 million in 4Q18.

In 2019, Copel Energia reported an EBITDA of R$ 202.4 million, versus a negative R$ 13.4 million in 2018, mainly due to the effect of R$ 204.9 million on the calculation of fair value in the purchase and sale of energy and the 30.1% increase in the volume of energy sold.

4.5 Accounting Information

Accounting information concerning Copel’s interests in other companies in 2019 is shown in the following table:

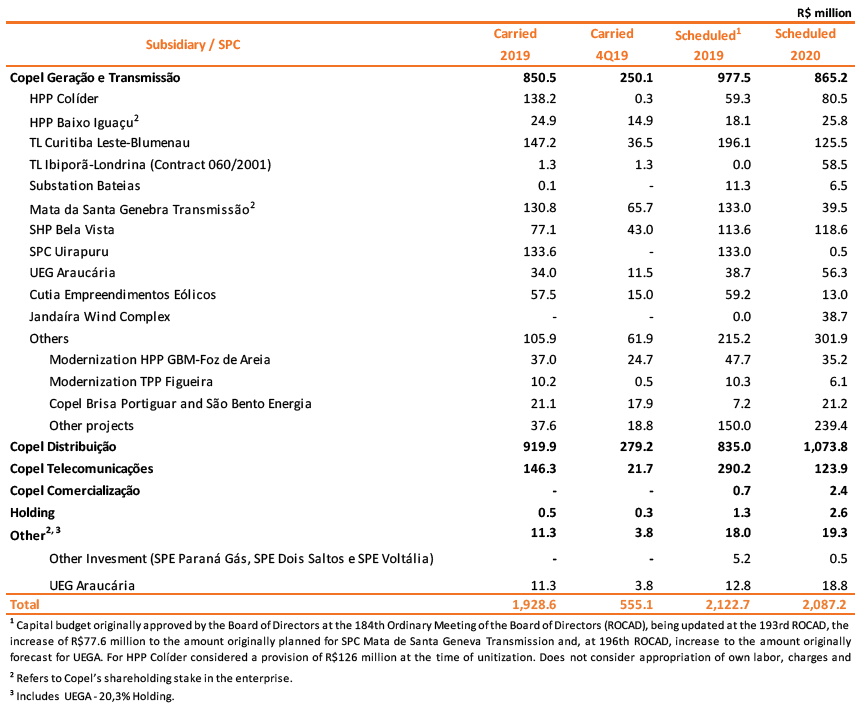

5. Investment Program

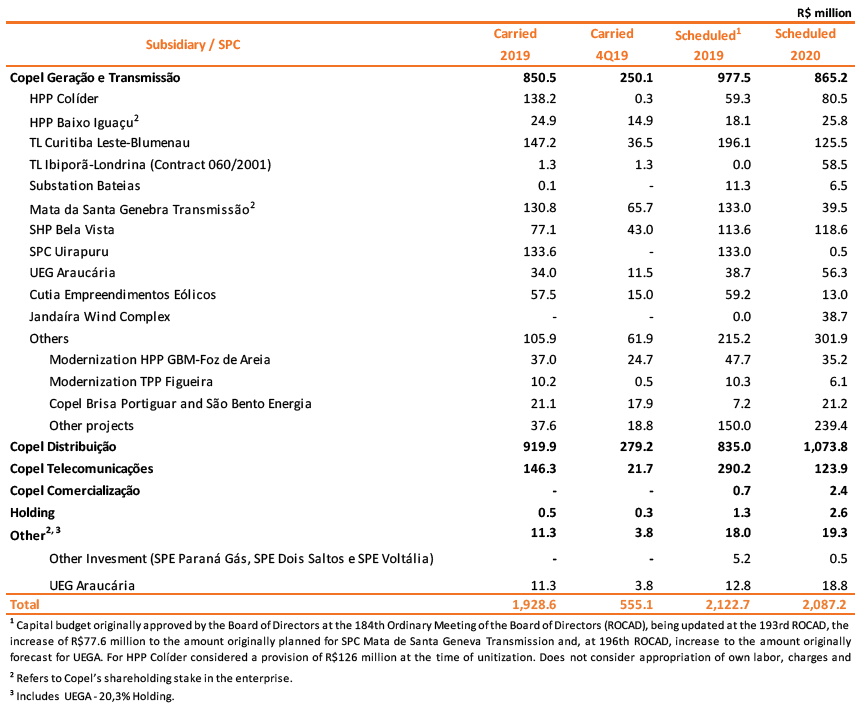

The following chart shows the investment program carried out in 4Q19 and scheduled for 2020:

6. Power Market and Tariffs

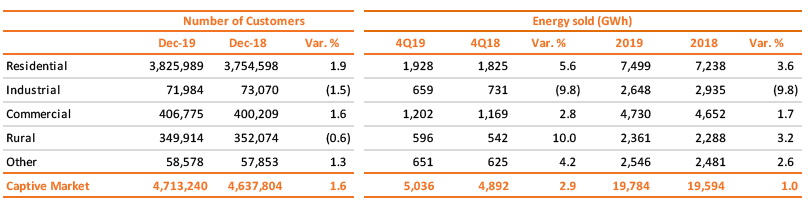

6.1 Captive Market – Copel Distribuição

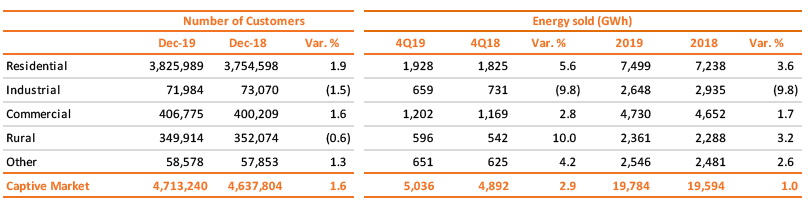

Copel Distribuição’s captive market energy sales totaled 5,036 GWh in 4Q19, an increase of 2,9%, mainly due to a higher consumption in the residential class. The following table illustrates captive market behavior according to customer segment.

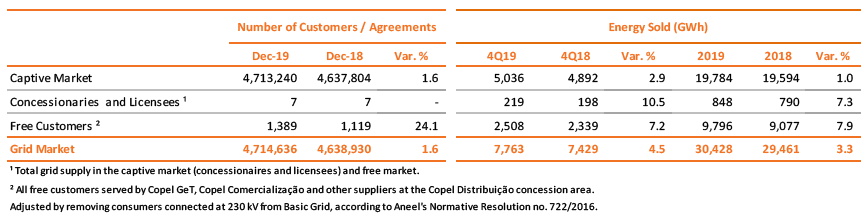

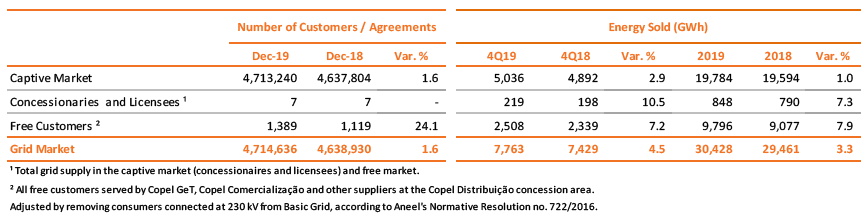

6.2 Grid Market (TUSD)

Copel Distribuição’s grid market, comprising the captive market, concessionaires and licensees in the state of Paraná, andall free consumers in the Company’s concession area, adjusted by removing consumers connected at 230 kV from the basis of comparison1, increed by 4.5 % in terms of energy consumption in 4Q19, as illustrated in the following table:

The result was mainly due to the (i) 7.2 % growth in free market consumption in 4Q19, as a result of the increase in Paraná's industrial production - growth of 8.9 % in October 2019. The sectors that contributed the most to the increase in energy consumption were food manufacturing, motor vehicles, trailers and bodywork manufacturing, and chemical manufacturing, and (ii) the 2.9% increase in the captive market, influenced by the higher average temperature recorded in the last quarter of the year.

6.3 Electricity Sales

Copel’s electricity supply —the volume of energy sold to final customers, which comprises sales in Copel Distribuição’s captive market and free market sales by Copel Geração e Transmissão and Copel Comercialização — increased by 5.0 % between October and December 2019.

The breakdown of energy sales by segment is illustrated below:

1 According to Aneel’s Normative Resolution no. 722/2016, consumers connected at 230kV voltage level must be part of the Basic Grid. The migration of these customers does not imply a reduction in revenue for the remuneration of the Distributor.

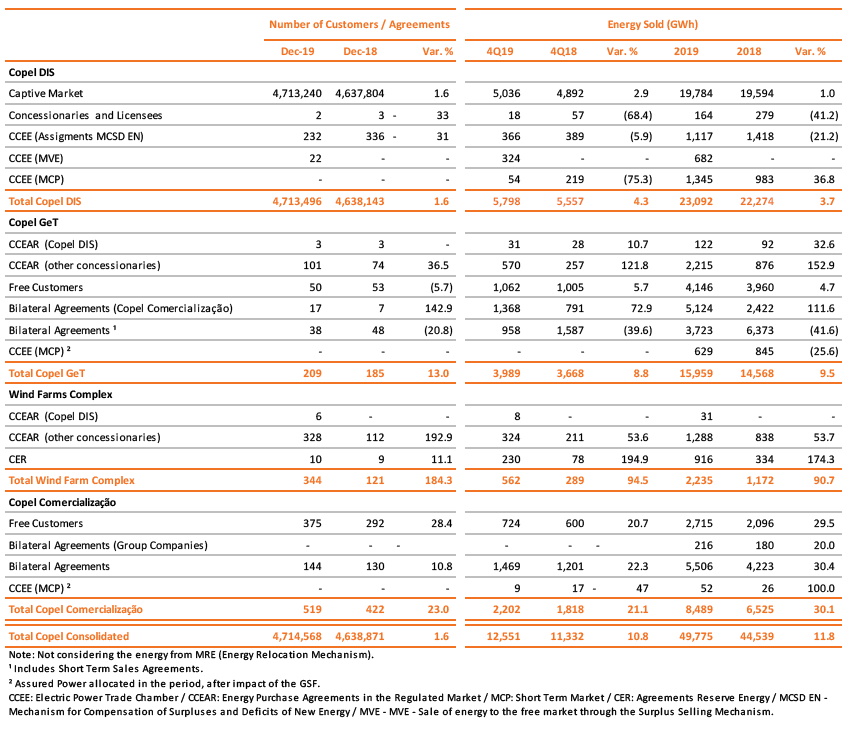

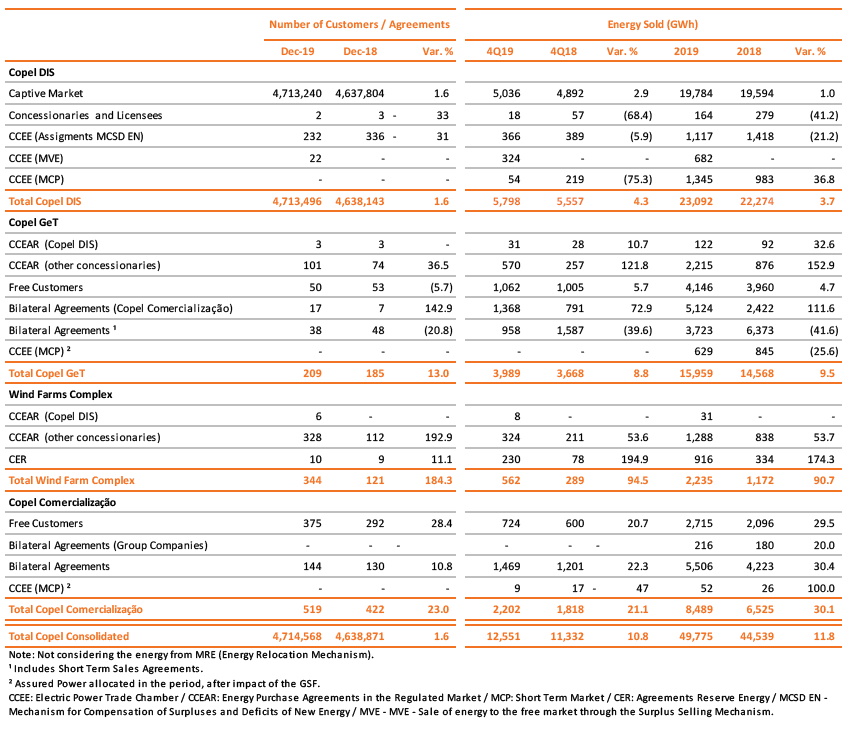

6.4 Total Energy Sold2

Total energy sold by Copel in all markets, comprising sales by Copel Distribuição, Copel Geração e Transmissão, Wind Farms and Copel Comercialização totaled 12,551 GWh in the fourth quarter of 2019, an increase of 10.8 %. The following table illustrates the total energy sales by Copel, distributed among Copel Distribuição, Copel Geração e Transmissão, Wind Farms and Copel Comercialização:

2 This item may presents a different balance to what was published in the Notice to the Market 18/19, as a result of CCEE's re-balances.

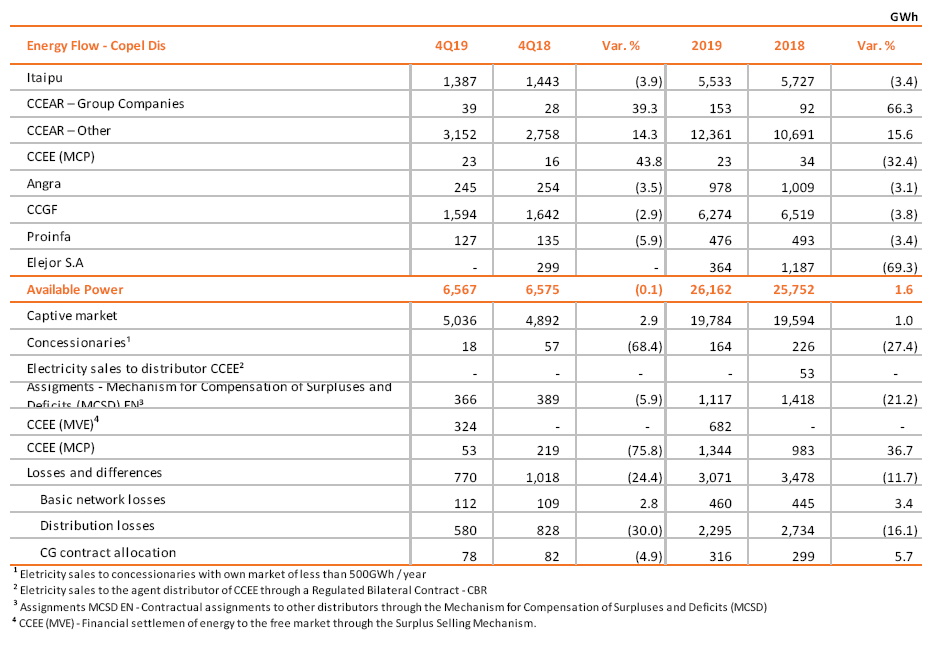

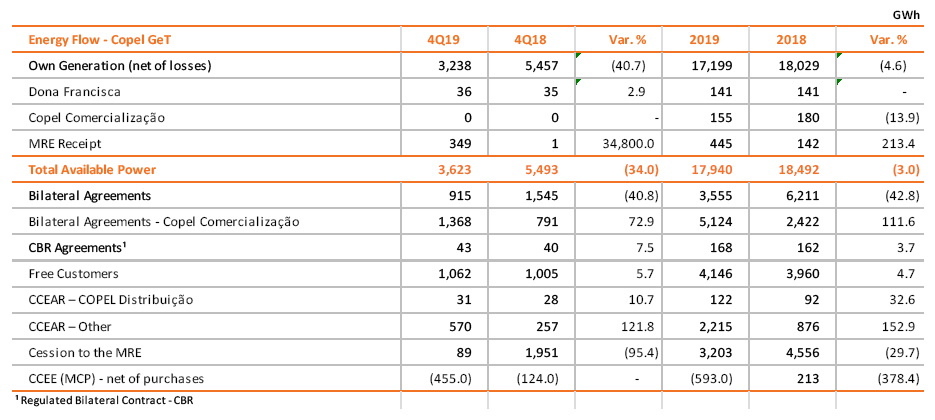

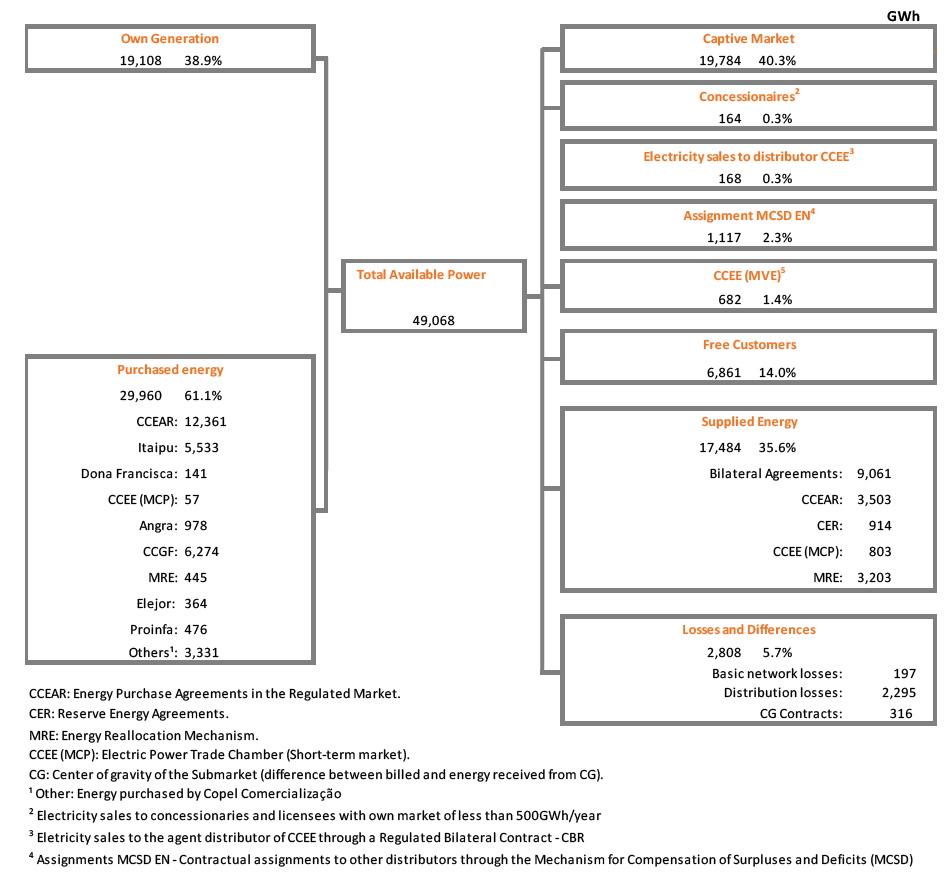

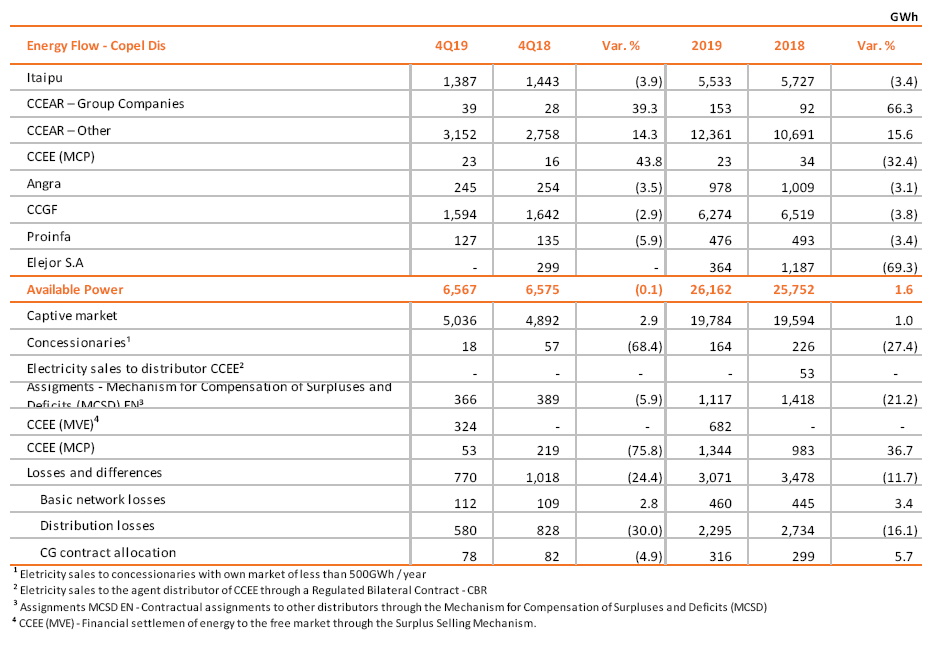

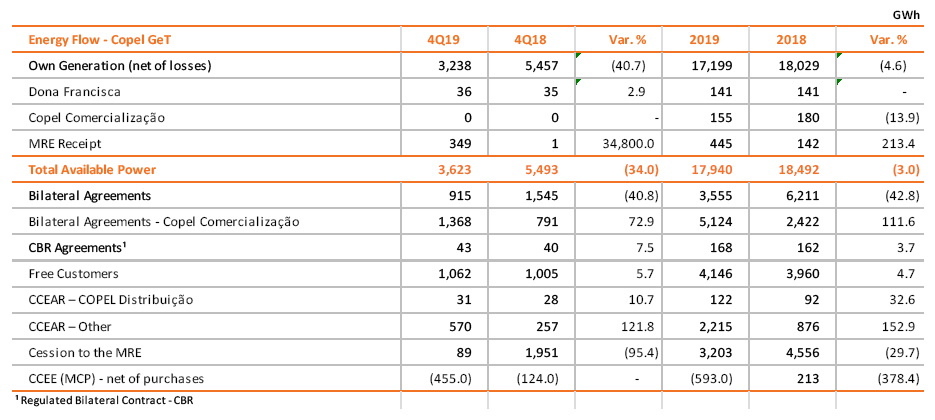

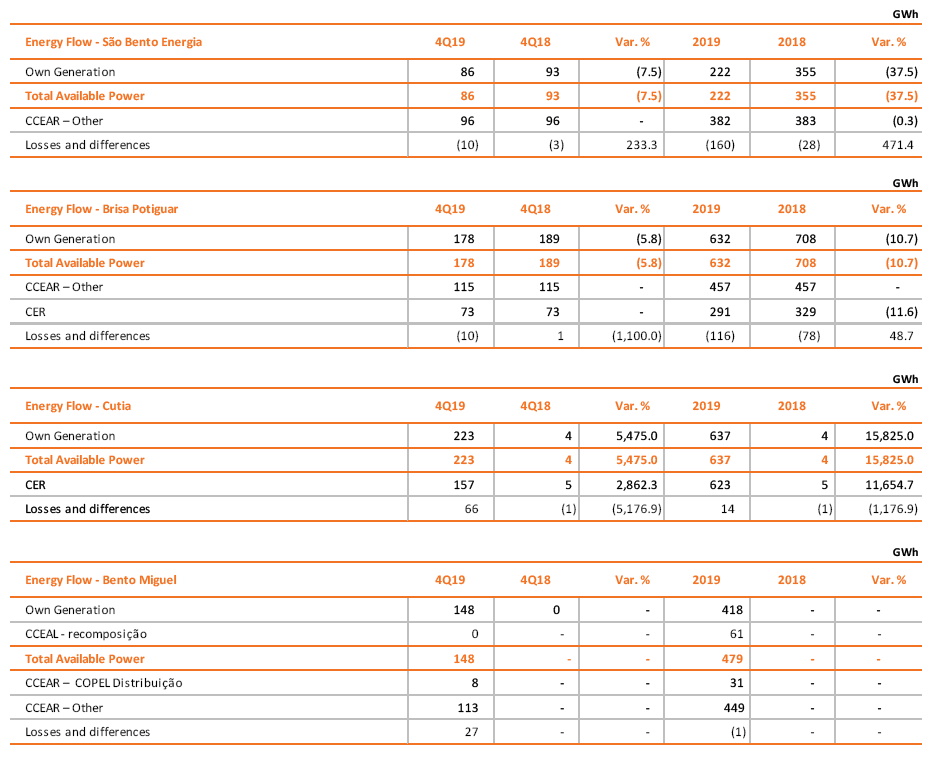

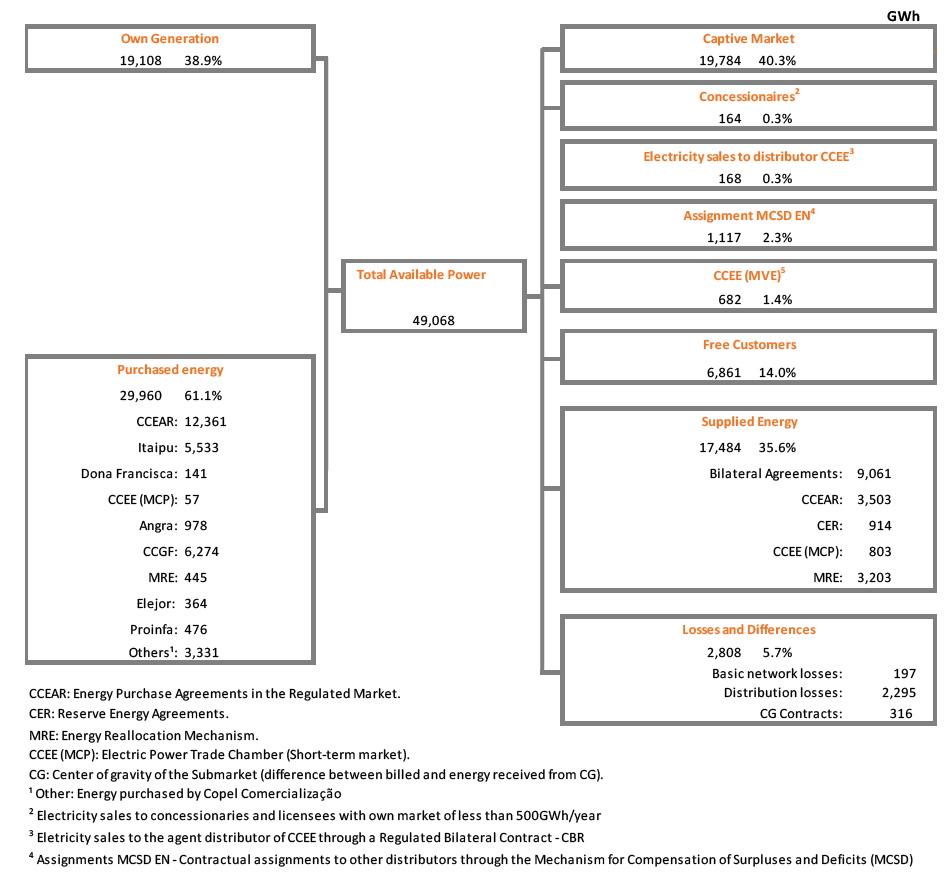

6.5 Energy Flow

Energy Flow – Copel Dis

Energy Flow – Copel GeT

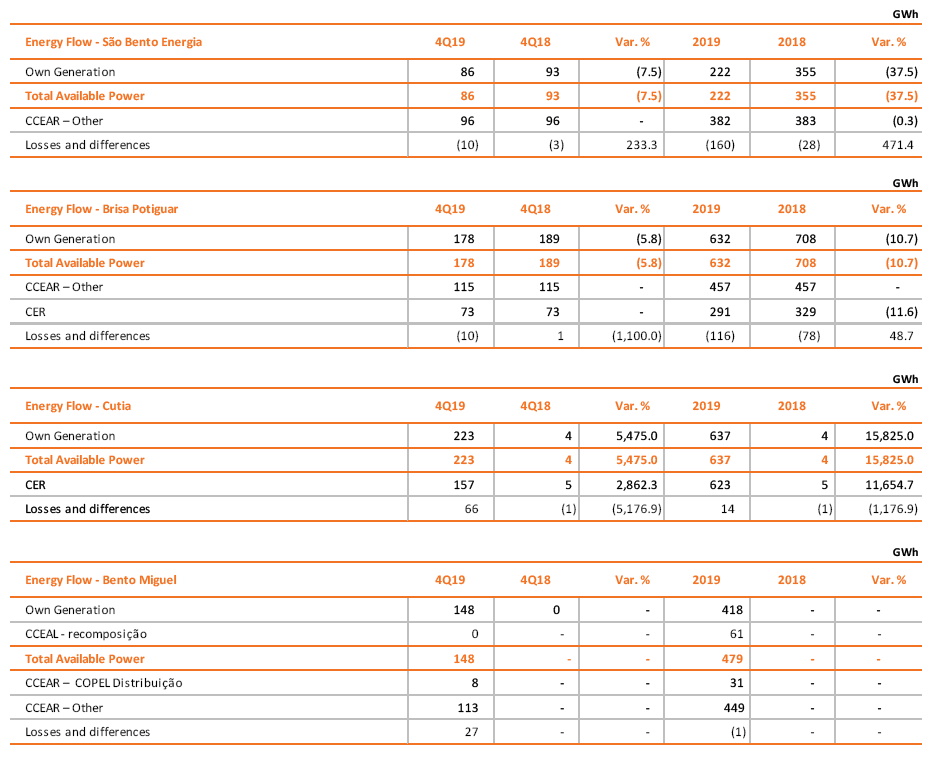

Energy Flow – Wind Farms

Energy Flow – Copel Comercialização

Consolidated Energy Flow (Jan to Dec 19)

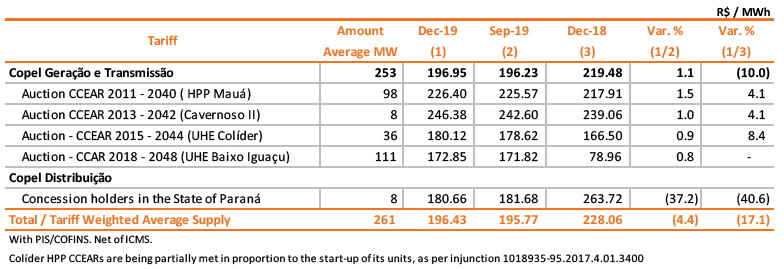

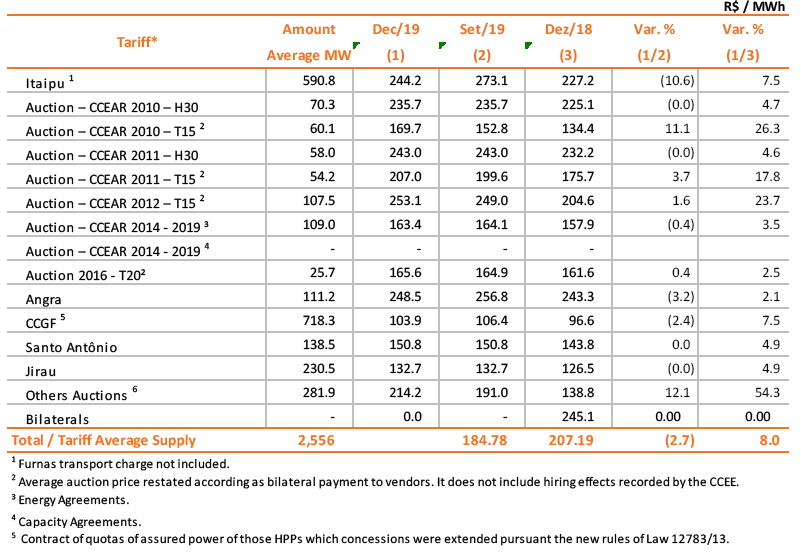

6.6 Tariffs

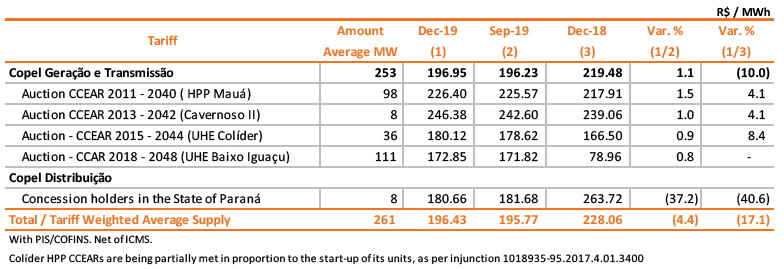

Sales to Distributors Average Tariff (CCEARs) – Copel Geração e Transmissão

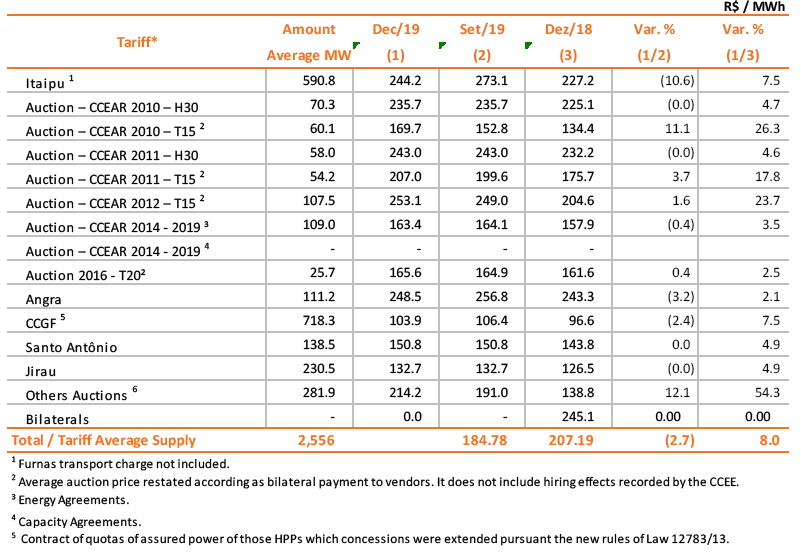

Power Purchase Average Tariff – Copel Distribuição

Sales to Final Customers Average Tariff Copel Distribuição

7. Capital Market

7.1 Capital Stock

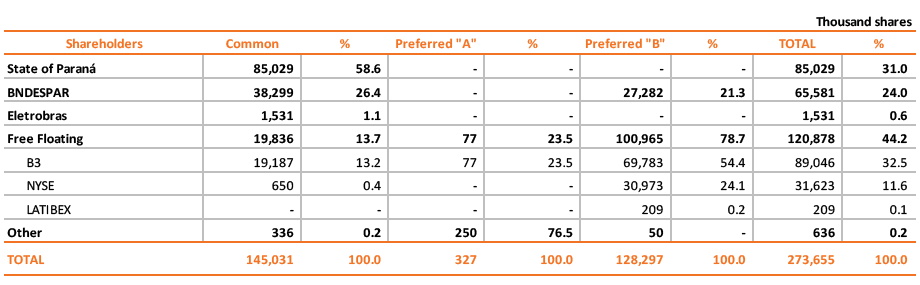

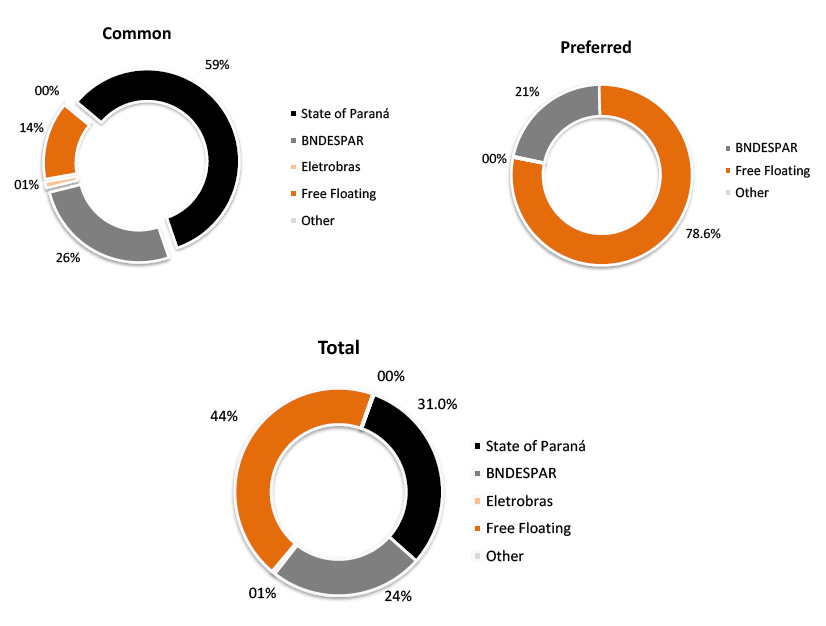

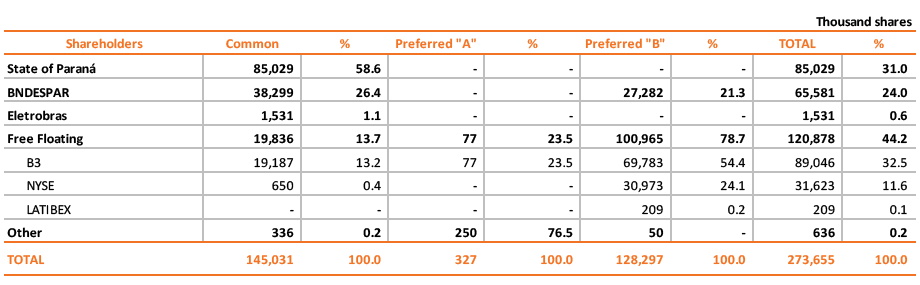

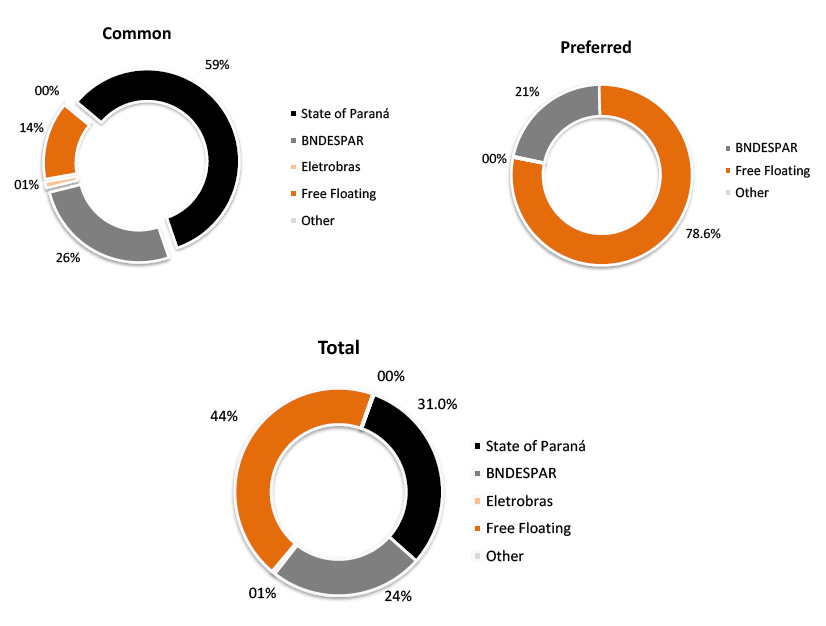

Copel’s capital amounts to R$ 10,800.0 million, consisting of 273,655 thousand shares, with no par value. In December 2019, the Company's capital was represented as follows:

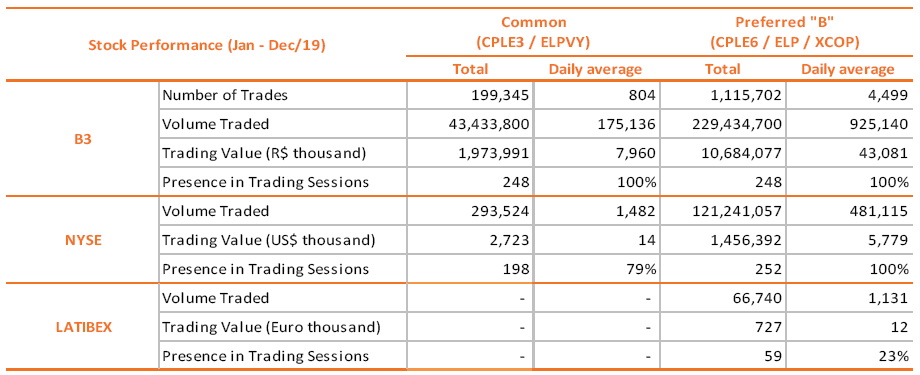

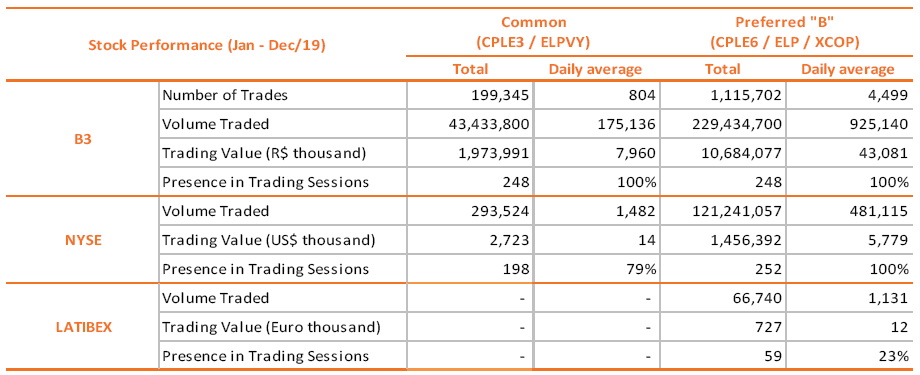

7.2 Stock Performance

From January to December 2019, Copel’s common shares (ON - CPLE3) and class B preferred shares (PNB - CPLE6) were traded in 100% of the trading sessions of the B3 S.A. - Brasil, Bolsa, Balcão (B3). The free float accounted for 68.9 % of the Company’s capital. At the end of December 2019, the market value of Copel considering the prices of all markets was R$ 18,866.7 million. Copel also accounted for 5.4 % of the B3’s Electric Power Index (IEE). In the Corporate Sustainability Index (Ise), Copel class B preferred shares accounted for 1.8 %. On the B3, Copel��s common closed the period at R$ 69.10, with a positive variation of 131.9 %. The PNB shares (CPLE6) closed the period at R$ 69.07, with a positive variation of 126.1 %. In the same period the Ibovespa had positive change of 31.6 %.

On the New York Stock Exchange (Nyse), common shares, represented by American Receipts Shares (ADRs), were traded at Level 1, under the ticker ELPVY, in 79% of the trading sessions and closed the period at US$ 17.10, with a positive variation of 121.8 %. The class B preferred shares, represented by American Depositary Shares (ADSs), were traded at Level 3, under the ticker ELP, in 100% of the trading sessions and closed the period at US$ 16.90, with a positive variation of 116.3 %. Over this period, the Dow Jones Index positive by 22.3 %.

On the Latibex (the Euro market for Latin American securities on the Madrid Stock Exchange), Copel’s class B preferred shares were traded under the ticker XCOP in 23 % of the trading sessions and closed the period at € 15.20, with a positive variation of 112,6 %. In the same period the Latibex All Shares index was positive of 16.0 %. The table below summarizes Copel’s share prices in 2019.

7.3 Dividends and Interest on Own Capital

The table below presents the payments of dividends and interest on own capital as of 2011:

8. Operating Performance

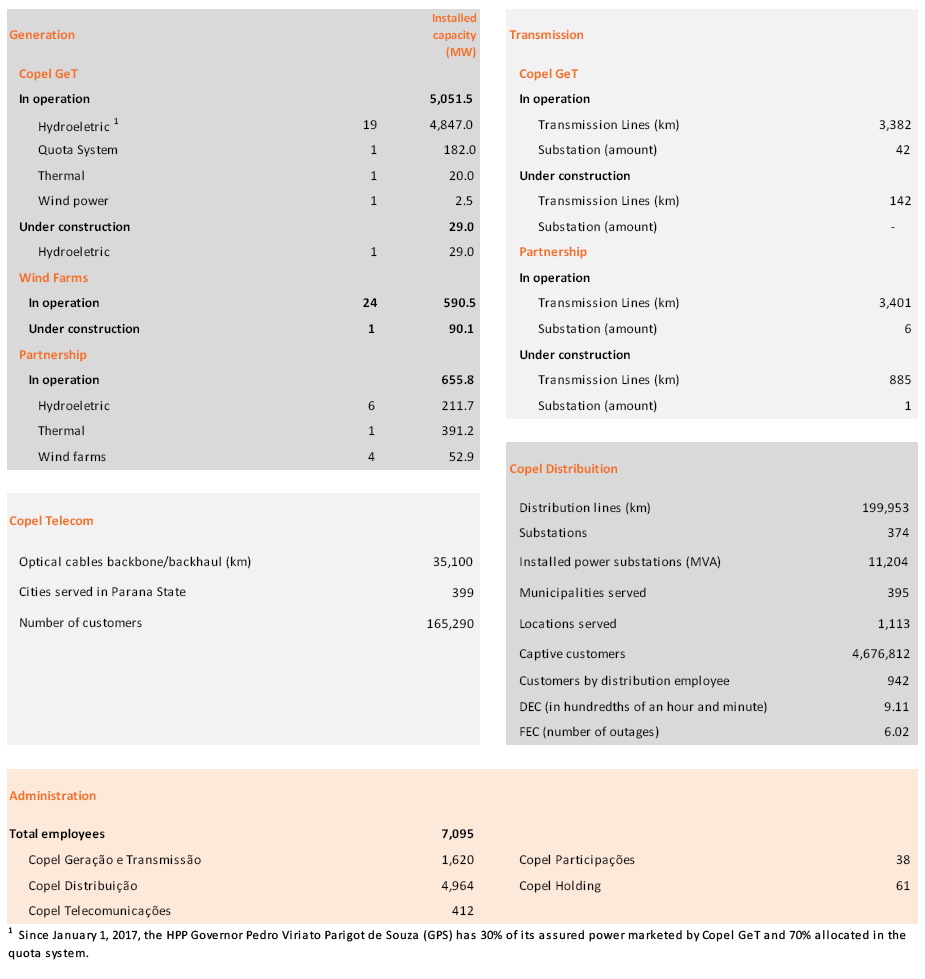

8.1 Power Generation

Assets in Operation

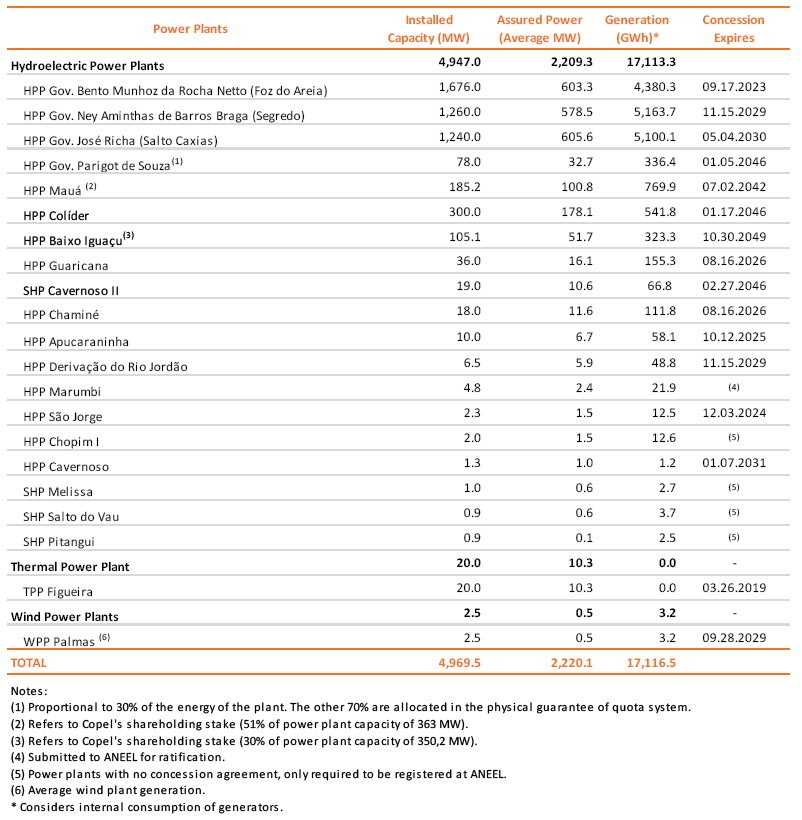

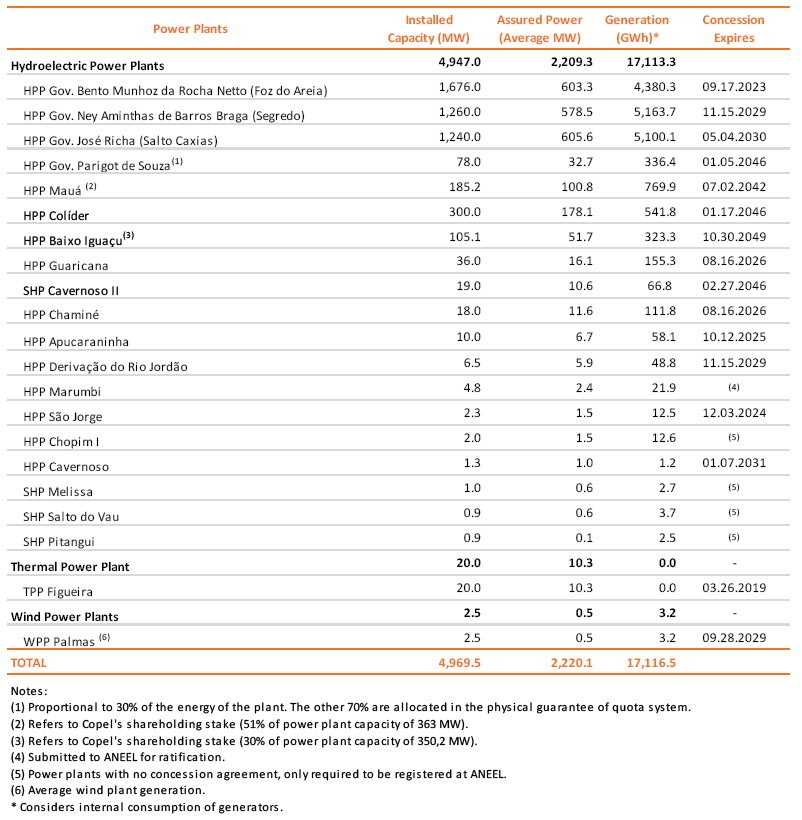

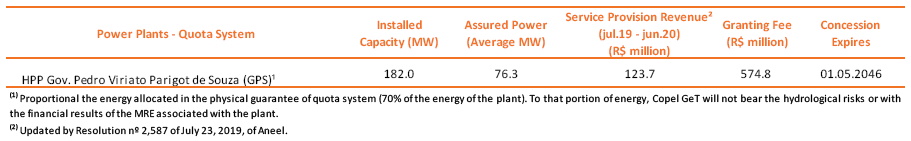

Below is the main information about Copel GeT’s power generating facilities and the power output in 2019:

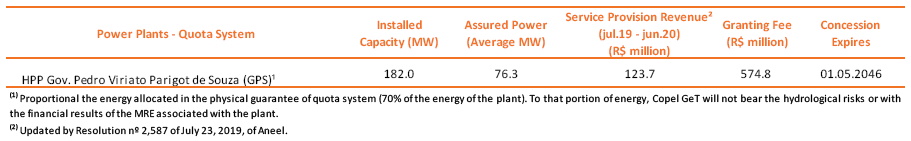

On March 24, 2017 Copel GeT filed a notice of intention with Aneel to extend the concession agreement of the TPP Figueira, noting, however, that it will only sign the necessary agreements and/or amendments after learning and accepting the terms and the rules that will govern to the extension of the grant. In addition, Copel GeT operates one plant under the quota system, as shown below:

Copel was designated as the provisional operator of the Rio dos Patos plant (1.7 MW of installed capacity and assured power of 1MW average) after the expiration of the concession. However, its operation was suspended in September 2014 due to flood damage in June of that year. On July 5, 2018, Aneel extinguished through Authorizing Resolution No. 7.050, the concession of the plant without the reversion of the assets to the granting authority, considered unfit for service, the assets were made freely available to Copel GeT, who is responsible for demobilization and occasional disposal of the assets. On December 11, 2018, the Company entered into a purchase and sale agreement with Dois Saltos Empreendimentos de Geração de Energia Elétrica Ltda. regardin the remaining assets of the extinguished Rio dos Patos plant, under the terms of Aneel’s Authorizing Resolution No. 7050 of June 5, 2018.

Wind Farms

Copel has 24 wind farms in operation divided into the São Bento Energia, Copel Brisa Potiguar and Cutia Wind Complexes. In 2019, these 24 wind farms generated 2008.5 GWh of energy, as follows:

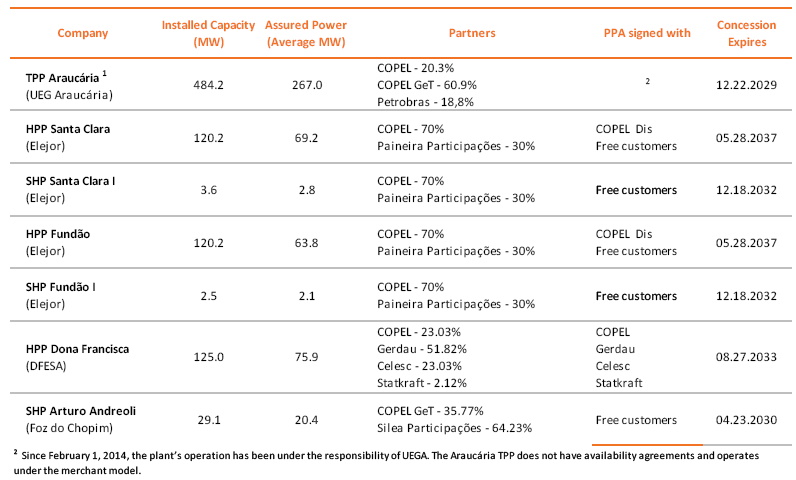

Interest in Generation Projects

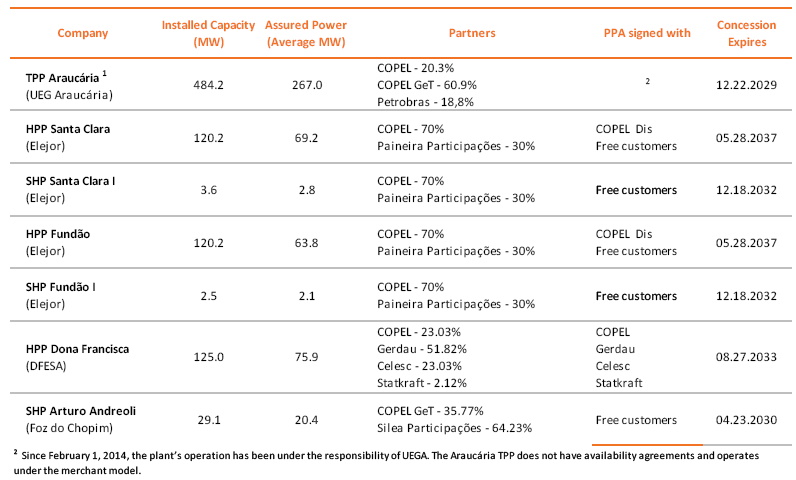

Copel holds interests in seven power generation projects at the operational stage, with a total installed capacity of 884.8 MW, out of which 599.0 MW refer to Copel´s stake, as shown below:

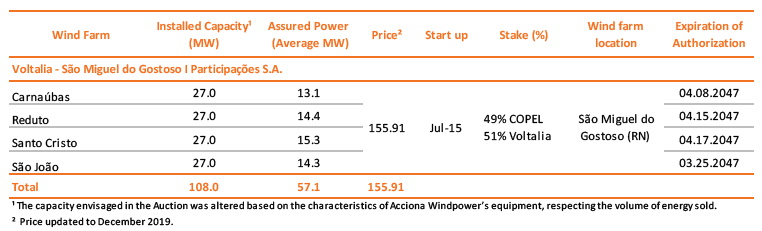

Interest in Wind Farms

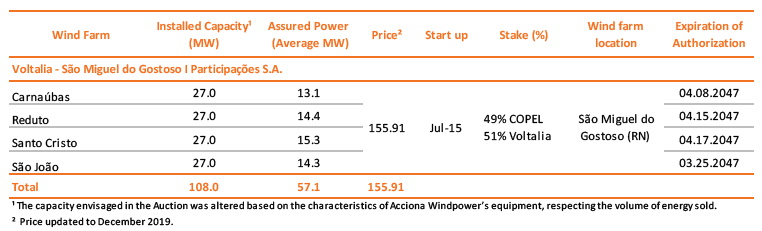

Copel has 49% interest in the Voltalia São Miguel do Gostoso I Participações S.A. wind complex, in the State of Rio Grande do Norte. The energy output of the enterprise was sold in the Fourth Reserve Energy Auction under twenty-year contracts, with supply beginning in July, 2015, according to the table below.

Under Construction

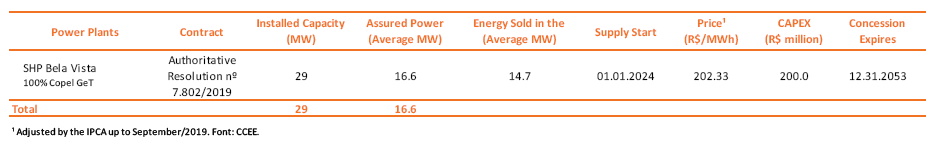

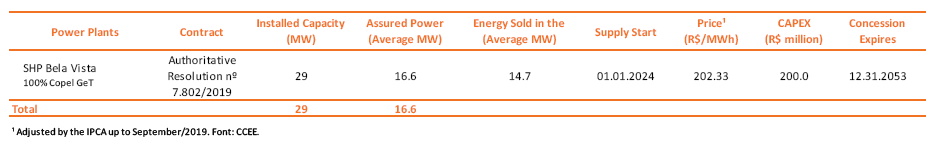

In August 2018 Copel was granted the right to build SHP Bela Vista with 29 MW of installed capacity. With an estimated investment of R$ 200.0 million, the project, which has 29.4 MW of installed capacity and assured power of 18.4 average MW, will be built on the Chopim River, close to the cities of São João and Verê, located in the southwest of the state of Paraná. At ANEEL's A-6/2018 auction, Bela vista sold the following:

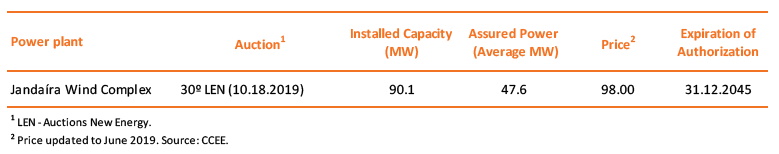

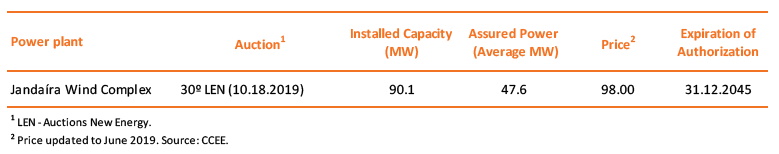

On October 18, 2019, Copel GeT in consortium with the subsidiary Cutia Empreendimentos Eólicas, participated in the A-6 new power generation auction and sold 14.4 average MW of the wind complex Jandaíra, approximately 30% of the Assured Power, at the price of R$ 98.00/MWh, as follows:

Colíder Hydroelectric Power Plant

On March 9, 2019, May 7, 2019 and December 21, 2019, respectively, the three generating units of the plant, each with an installed capacity of 100 MW, started commercial operation, according to Aneel Resolutions 673/2019, 1273/2019 and 3648/2019. Due to fortuitous and force majeure events, the plant delayed its commercial operation, initially forecast for January 2015. Copel GeT filed a request to Aneel for exclusion of liability, so that the obligation to supply the energy sold was postponed, which was denied by the agency. On December 18, 2017, Copel GeT filed an ordinary lawsuit requesting the reconsideration of such decisionand, on April 6, 2018, the Regional Federal Court of Appeals (Tribunal Regional Federal da 1ª Região). exempted Copel GeT from any liens or restrictions due to delays in the implementation schedule of HPP Colíder. After the partial start of the commercial operation in March 2019, the plant complied with its contract of sale of energy with its own generation in the amount of 41.1 average MW of a contracted total of 125 average MW. Copel GeT has been honoring energy supply agreements as follows:

- from January 2015 to May 2016: with energy surplus of its other plants that has not been contracted;

- In June 2016: partial reduction through Bilateral Agreement

- from July 2016 to December 2018: with a reduction of all Energy Commercialization Agreements in the Regulated Environment - CCEARs, through a bilateral agreement and the participation in the Mechanism for Compensation of Surpluses and Deficits of New Energy - MCSD-EN; and

- from January to March 2019, the contracts entered into in a regulated environment are now in force again, however, the energy supply remained suspended, in view of the injunction obtained by the Company’s Management.

Due to the non-judgment of the merits of the lawsuit, the contractual effects of both revenue and the cost of energy to cover its balance sheet were recognized in the quarter's results.

8.2 Transmission

Assets in Operation

The chart below shows the transmission concession agreements and the design of the substations clusters and the transmission lines in operation:

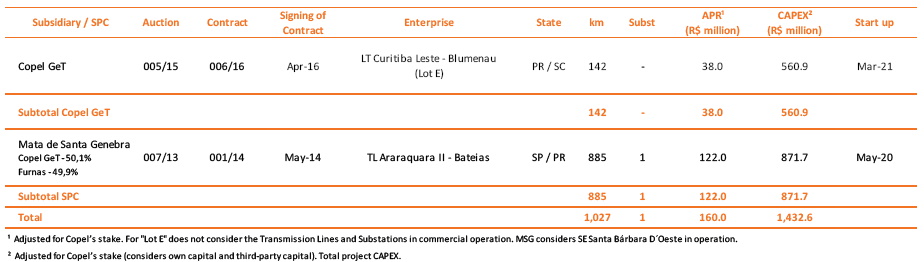

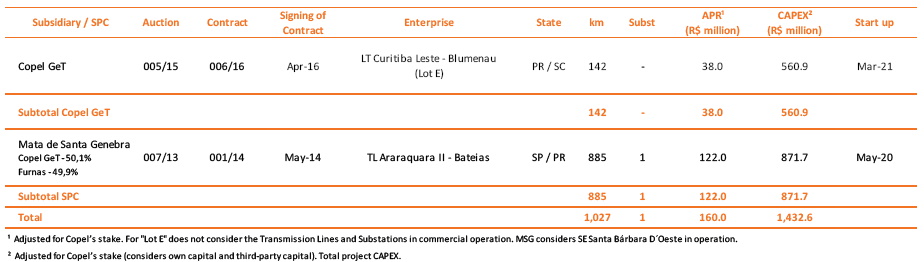

Assets under Construction

Copel GeT is substantially increasing its share of the transmission segment through its own investment and partnerships in special purpose companies - SPCs. The projects sum up a total of 1,027 km of transmission lines and one substation and will generate an APR of R$160,0 million in proportion to Copel GeT’s stake in the enterprises, as detailed in the table below.

Lot E

The commercial operation of part of the projects that compose Lot E of Transmission Auction No. 005/2015 began ahead of schedule. Fully sold to Copel GeT, Lot E is comprised of 230 km of transmission lines and 3 substations, totaling 900 MVA of power and expected ARP of R$116.9 million.

On June 18, 2019, the 230kV Medianeira Substation started its commercial operation 3 months ahead of Aneel's deadline, providing an APR of R$13.4 million. In addition, the Baixo Iguaçu - Realeza 230kV Transmission Line, which also makes up Lot E, started its commercial operation on August 5, 2019, 1 year and 7 months ahead of the schedule established by Aneel (March/21), adding about R$6.2 million to the annual revenue. On September 1, 2019, the 230 kV GIS Curitiba Centro substation and the 230 kV Uberaba - Curitiba Centro double circuit underground transmission line were first energized, providing an APR of R$44.3 million. On September7, 2019, the 230 kV Andirá Leste substation was also energized, which stands for an APR of R$15 million. As a result, R$78.9 million were added to the Company’s annual revenue, approximately 67.5% of the amount forecast for when all the projects in Lot E are 100% operational.

SPC Mata de Santa Genebra

Transmission Lines TL 500 kV Araraquara 2 - Itatiba, 207 km long, and TL 500 kV Itatiba - Bateias, 414 km long, both belonging to Mata Santa Genebra Transmissão SA, have started commercial operation. Therefore, Mata de Santa Genebra is authorized to receive an APR of R$ 161.27 million, about 66.2% of the total APR, retroactively to 03/28/2020. Due to successive vandalism events, the energy start-up schedule for the Mata de Santa Genebra Transmissão S.A. project was postponed, with the completion of the works expected by May 2020.

8.3 Distribution

Concession agreement

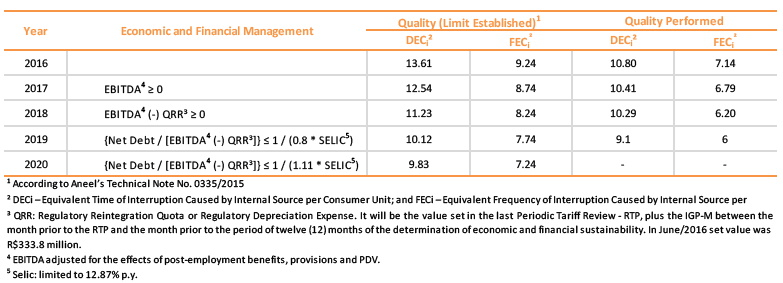

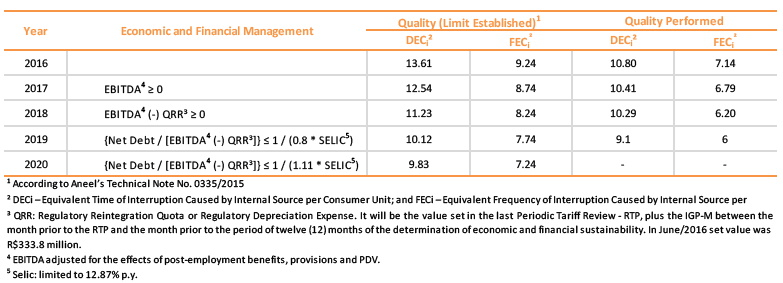

In December 2015, the Company signed the fifth amendment to the Public Electricity Distribution Concession Agreement No. 46/1999 of Copel Distribuição S.A., extending the concession term to July 7, 2045. The concession agreement imposes economic and financial efficiency and quality requirements. Failure to comply with the requirements for two consecutive years or any of the limits at the end of the first five years will result in the termination of the concession. From the sixth year following the execution of the agreement, any breach of quality criteria for three consecutive years or economic and financial management criteria for two consecutive years will result in forfeiture proceedings. The following chart shows the goals set for Copel Distribuição in the first 5 years following the renewal of the concession agreement:

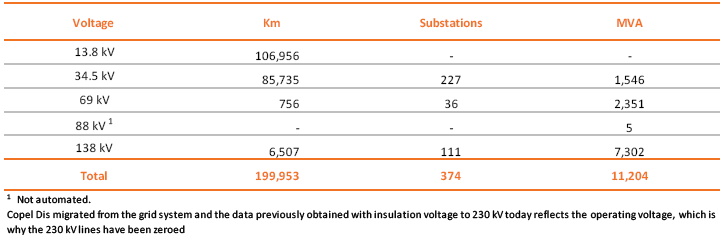

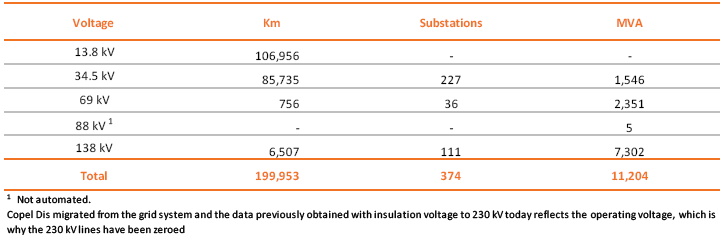

Operating Data

In the distribution business, Copel serves more than 4.6 million energy customers in 1,113 locations, belonging to 394 municipalities in State of Paraná and one in the State of Santa Catarina. Copel Distribuição operates and maintains the installations at13.8 kV, 34.5 kV, 69 kV and 138 kV voltage levels.

Compact Distribution Lines

Copel Distribuição has continued to implement compact distribution lines in urban areas with a high concentration of trees in the vicinity of the distribution grids. This technology avoids the cutting down or trimming of trees and improves the quality of power supply by reducing the number of outages. In December 2019, the total length of compact distribution lines in operation was 11,582 km.

Secondary Isolated Lines

Copel Distribuição has also invested in low-voltage (127/220V) secondary isolated lines, which offer substantial advantages over regular overhead lines, including: improvement in DEC and FEC distribution performance indicators, defense against illegal connections, improved environmental conditions, reduced areas subject to tree trimming, improved safety, reduced voltage drops throughout the grid, and increased transformer useful life, due to the reduction of short-circuits, among other advantages. The length of installed secondary isolated lines totaled 19,157 km in December 2019.

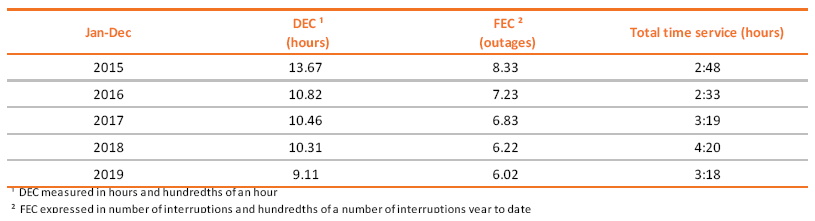

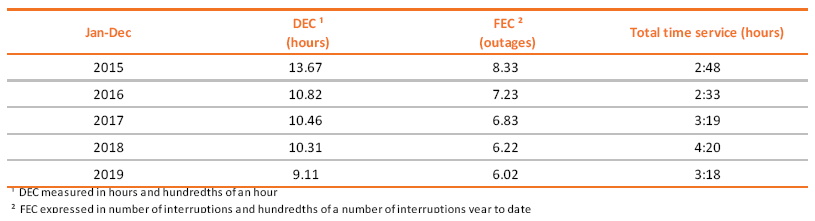

Quality of Supply

The two main indicators of power supply quality are DEC (outage duration) and FEC (outage frequency). The trends for these indicators, as well as for total time service, are shown below:

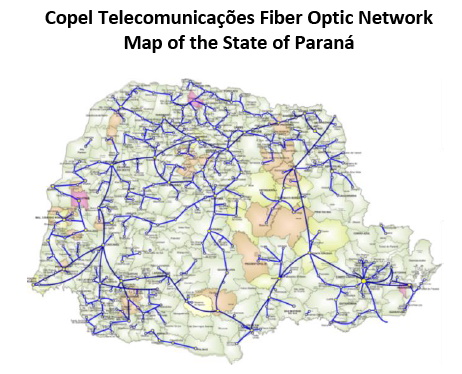

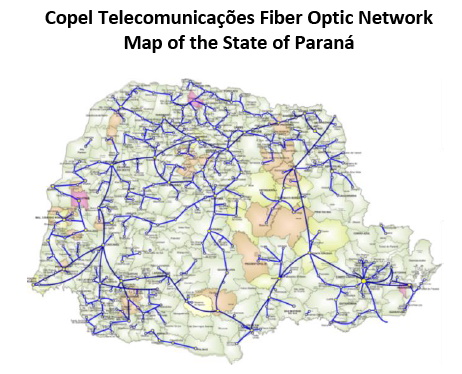

8.4 Telecommunications

Copel Telecomunicações has an optical backbone/backhaul made up of a high capacity intermunicipal transmission network and the access network. The access network can be multi-point (GPON) or point-to-point (conventional), thus connecting customers to Copel Telecom’s data transmission network and providing the contracted services, totaling 982 thousand homes passed. In December 2019, the carrier had 165,290 end customers with a 35,100 km backbone / backhaul cable network, carrying data with ultra-speed and managing an optical ring that serves the 399 municipalities of the state of Paraná, with a portfolio of data, voice and datacenter products.

8.5 Equity Interests

Other Sectors

Copel holds interests in companies in the gas, telecommunications, and service sectors, as shown below:

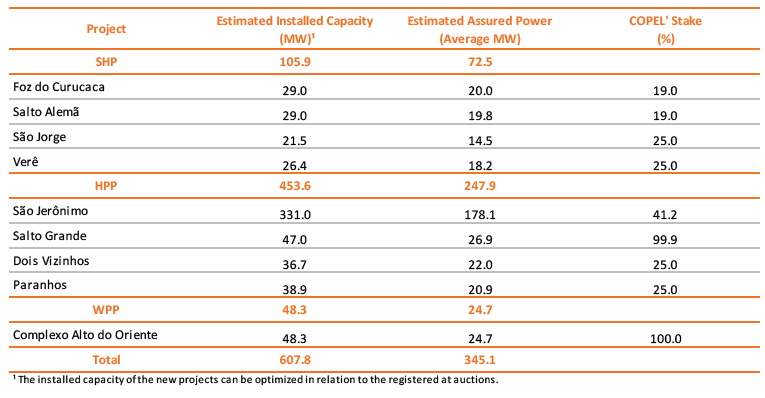

8.6 New Projects

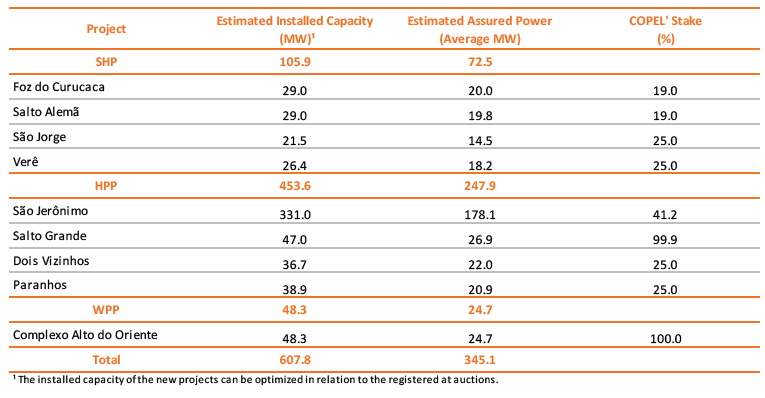

Project Portfolio

Copel holds interests in different power generation projects. When these projects go into commercial operation, they will add 273 MW of installed capacity to the Company's portfolio (in proportional to the Company’s stake in the enterprises).

Copel, in partnership with other companies, is also developing studies in the lower reaches of the Chopim river that may enable other hydroelectric projects.

As for wind power generation, there are studies for the feasibility of new wind farms in the State of Rio Grande do Norte, where Copel already has wind assets. The short-term objective is to register such projects with the Energy Research Company - EPE to enable participation in the upcoming auctions to be organized by the Federal Government. Until the effective energy commercialization of the projects, their technical characteristics may be adjusted, since Copel's engineering team is conducting optimization studies, in order to make the projects more competitive., since Copel's engineering is conducting optimization studies, in order to make the projects more competitive.

Interest in Feasibility Study

Hydroelectric Potential Surveyed Along the Piquiri River

The feasibility studies for the four hydroelectric power plants making up the hydroelectric potential of the Piquiri River, in Paraná, were submitted by Copel GeT and accepted by Aneel in 2012. The projects are in the process of environmental licensing with the Environmental Institute of Paraná. The following table features these plants, which have a joint installed capacity of 459.3 MW:

9. Other Information

9.1 Human Resources

Copel’s workforce closed 2019 at 7,095 employees distributed. The table below shows employee number trends in the Company and its subsidiaries in the last four years:

At the end of December 2019, Copel Distribuição had 4,713,240 customers, representing a consumer-to-employee ratio of 949.5. Compagas, Elejor and UEG Araucária, companies in which Copel holds a majority interest, had 148, 7 and 16 employees, respectively.

9.2 Main Operational Indicators

9.3 Conference Call 4Q19 Results

Information about 4Q19 Results Conference Call:

> Friday, March 27, 2019, at 10:00 a.m. (Brazilian time)

> Telephone: (+1 646) 843-6054

> Code: Copel

A live webcast of the conference call will be available at:ir.Copel.com

Please connect 15 minutes before the call.

Investor Relations – Copel

ri@Copel.com

Telephone: (+ 55 41) 3331-4011

The information contained in this press release may contain forward-looking statements that reflect management’s current view and estimates of future economic circumstances, industry conditions, company performance, and financial results. Any statements, expectations, capabilities, plans and assumptions contained in this press release that do not describe historical facts such as statements regarding the declaration or payment of dividends, the direction of future operations, the implementation of relevant operating and financial strategies, the investment program, factors or trends affecting the Company’s financial condition, liquidity or results of operations are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and involve a number of risks and uncertainties. There is no guarantee that these results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

Exhibit I – Consolidated Cash Flow Statement

Exhibit II – Financial Statements – Wholly Owned Subsidiaries

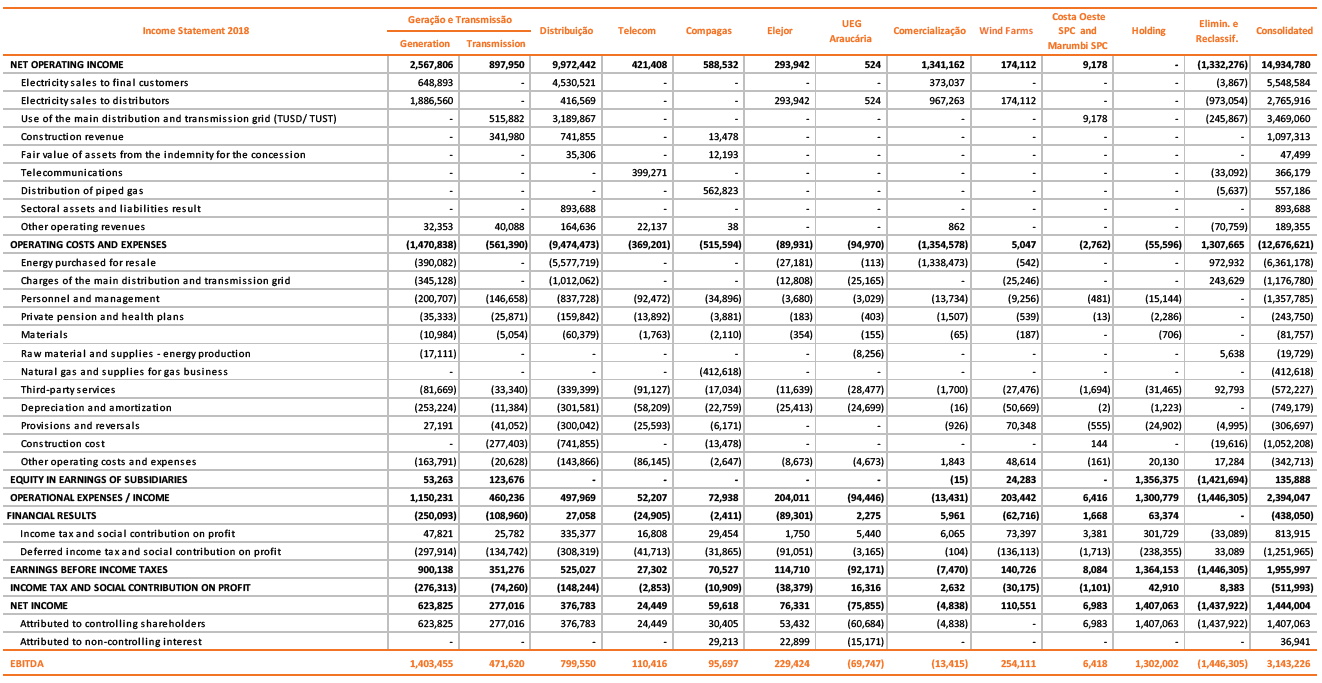

Income Statement – Copel Geração e Transmissão (Consolidated)

Income Statement – Copel Distribuição

Income Statement – Copel Telecomunicações

Income Statement – Copel Comercialização

Exhibit III – Financial Statements by Company

Balance Sheet by Company

Income Statement by Company

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| COMPANHIA PARANAENSE DE ENERGIA – COPEL |

| | |

| By: | /S/ Daniel Pimentel Slaviero

| |

| | Daniel Pimentel Slaviero

Chief Executive Officer | |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.