SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of February, 2025

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

José Izidoro Biazetto, 158

81200-240 Curitiba, Paraná

Federative Republic of Brazil

+55 (41) 3331-4011

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

COMPANHIA PARANAENSE DE ENERGIA – COPEL

Corporate Taxpayer ID (CNPJ/ME) 76.483.817/0001-20 –

Company Registry (NIRE) 41300036535 - CVM Registration

B3 (CPLE3, CPLE5, CPLE6)

NYSE (ELP, ELPC)

LATIBEX (XCOP, XCOPO)

Copel Distribuição's Grid Market grows 4.7% in 4Q24 and 7.3% year-to-date

COPEL (“Company”) informs its shareholders and the market in general the performance of the energy market in the fourth quarter of 2024.

Distribution

Grid Market

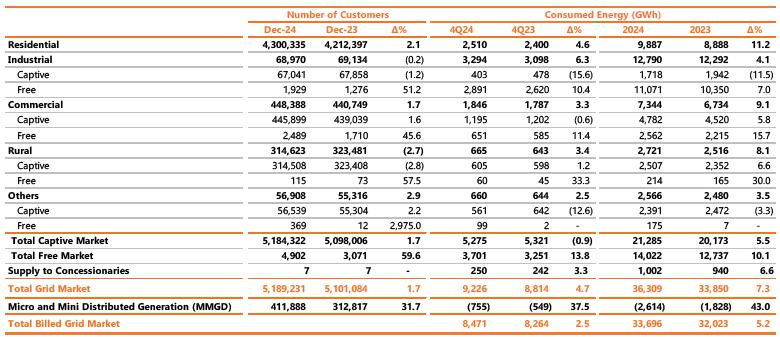

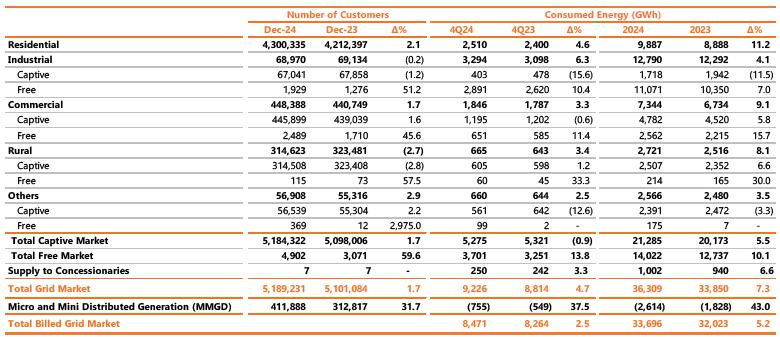

Copel Distribuição's grid market saw a 4.7% increase in electricity consumption in 4Q24 compared to the same period last year, mainly explained by the increase in economic activity and the higher consumption pattern of the customer base. The billed grid market, which considers the compensated energy from Mini and Micro Distributed Generation - MMGD, increased 2.5% in the quarter.

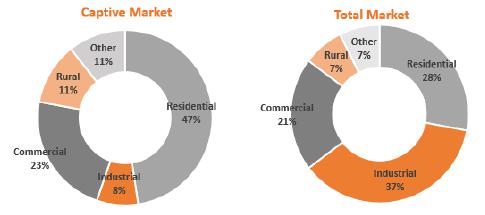

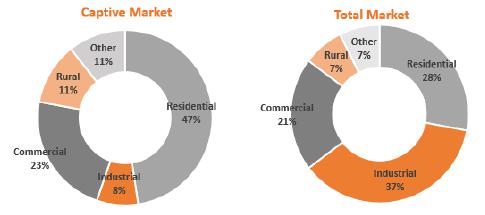

The following graphs show the electricity consumed by class in 4Q24:

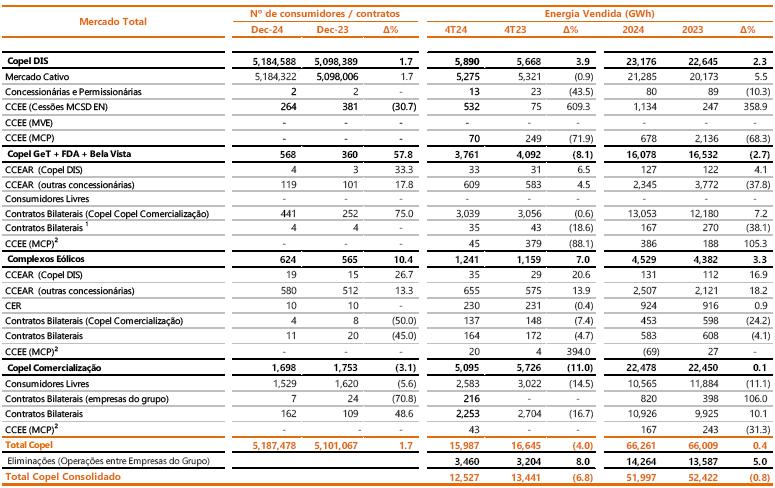

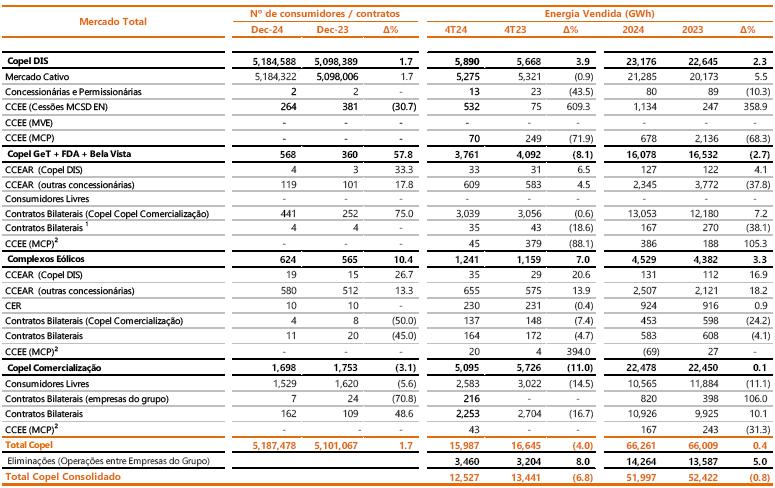

The following table shows Copel's total energy sales, segmented between Copel Distribuição, Copel Geração e Transmissão, Wind Farms and Copel Comercialização:

Note: Does not consider the energy made available through the MRE (Energy Reallocation Mechanism).

1 Includes Short-Term Sales Contracts and CBR.

2 Negative values mean that there were more purchases than sales.

CCEE: Electric Energy Trading Chamber / CCEAR: Energy Trading Contracts in the Regulated Environment / MCP: Short-Term Market / CER: Reserve Energy Contract / MCSD EN - Compensation Mechanism for New Energy Surpluses and Deficits / MVE - Sale of energy to the free market through the Surplus Sale Mechanism.

Curitiba, February 03, 2025

Felipe Gutterres

Vice-President of Financial and Investor Relations

For further information, please contact the Investor Relations team:

ri@copel.com or (41) 3331-4011

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date February 3, 2025

| COMPANHIA PARANAENSE DE ENERGIA – COPEL |

| | | |

| By: | /S/ Daniel Pimentel Slaviero

| |

| | Daniel Pimentel Slaviero

Chief Executive Officer | |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.