================================================================================

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

-----------------

FORM 20-F

Annual Report Pursuant to Section 13 or

15(d) of the Securities Exchange Act of 1934

For the Fiscal Year Ended December 31, 2002

Commission File Number 333 - 7172 - 01

-----------------

CEZ, a. s.

(Exact name of Registrant as specified in its charter)

Czech Republic

(Jurisdiction of incorporation or organization)

CEZ, a. s.

Duhova 2/1444

140 53 Prague 4

Czech Republic

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

None.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

7 1/8% Guaranteed Notes due 2007

Securities for which there is a reporting obligation pursuant to Section 15(d)

of the Act: None.

The number of outstanding shares of each of the issuer's classes of capital

or common stock as of December 31, 2002 was: 592,210,843 shares of common stock

-------------

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by check mark which financial statement item the registrant has

elected to follow. Item 17 [ ] Item 18 [x]

================================================================================

TECHNICAL TERMS AND PRESENTATION OF OTHER DATA

The technical abbreviations and expressions used herein have the following

meanings:

CO Carbon monoxide.

Demand Consumption of the final consumer not including transmission

and distribution losses and self consumption by the Company

(including electricity used in pump storage facilities) and

other electricity generators and distributors.

FBB Fluidized-bed boiler, a kind of boiler which reduces the

content of sulfur dioxide emissions in the flue gases during

the combustion process.

FGD Flue-Gas Desulfurization, a flue stack technology for

reducing sulfur dioxide content in power plant emissions.

GW; GWh One gigawatt equals 1,000 MW; one gigawatt-hour

represents one hour of electricity consumption at a constant

rate of 1 GW.

Installed Capacity The highest constant level of generation of electricity

which a power plant is designed to be capable of

maintaining.

IPP Independent Power Producer.

kV A kilovolt is a unit of electric tension; one kilovolt

equals one thousand volts.

kW; kWh A kilowatt is a unit of power, representing the rate at

which energy is produced; one kilowatt-hour represents one

hour of electricity consumption at a constant rate of 1kW.

MW; MWh One megawatt equals 1,000 kW; one megawatt-hour represents

one hour of electricity consumption at a constant rate of

1 MW.

NOx Nitrogen oxides.

PWR A type of pressurized water nuclear reactor designed in the

United States. This type of reactor uses water as both a

moderator (the medium in the reactor core which facilitates

the chain reaction) and coolant (the medium which conveys

the heat generated in the reactor to a steam generator).

SO2 Sulfur dioxide.

T/h Tons of steam per hour.

TW; TWh One terawatt equals 1,000 GW; one terawatt-hour represents

one hour of electricity consumption at a constant rate of

1 TW.

Ton Metric ton.

VVER A type of pressurized water nuclear reactor designed in the

former Soviet Union which uses water as both a moderator and

coolant.

Unless otherwise indicated, all figures in this Annual Report presenting units

of electricity generation are gross (i.e., including the electricity consumed by

the power plants themselves).

We have provided the data contained in this Annual Report as to installed

capacity, generation and other market share information with respect to the

electricity and heating industries in the Czech Republic. We compile and publish

certain of this data on a regular basis, and also supply certain of this data to

the Czech Statistical Office for use in compiling national data on the energy

sector.

We have based the data contained in this Annual Report as to end-users of

electricity (including end-user average prices and electricity demand) on data

supplied to us by eight regional distribution utilities (the "REAS") on a

voluntary basis. We have no means of independent verification of such data.

2

TABLE OF CONTENTS

Part I

Item 1. Identity of Directors, Senior Management and Advisers............ 5

Item 2. Offer Statistics and Expected Timetable.......................... 5

Item 3. Key Information.................................................. 5

Item 4. Information on the Company....................................... 13

Item 5. Operating and Financial Review and Prospects..................... 37

Item 6. Directors, Senior Management and Employees....................... 48

Item 7. Major Shareholders and Related Party Transactions................ 53

Item 8. Financial Information............................................ 54

Item 9. The Offer and Listing............................................ 54

Item 10. Additional Information........................................... 54

Item 11. Quantitative and Qualitative Disclosures about Market Risk....... 63

Item 12. Description of Securities Other Than Equity Securities........... 67

Part II

Item 13. Defaults, Dividend Arrearages and Deliquencies................... 67

Item 14. Material Modifications to the Rights of Security Holders and

Use of Proceeds.................................................. 68

Item 15. Controls and Procedures.......................................... 68

Item 16A. Audit Committee Financial Expert................................. 68

Item 16B. Code of Ethics.................................................. 68

Item 16C. Principal Accountant Fees and Services.......................... 68

Item 16D. Exemptions from the Listing Standards for Audit Committees...... 68

Part III

Item 17. Financial Statements............................................. 68

Item 18. Financial Statements............................................. 68

Item 19. Exhibits......................................................... 69

3

General Information

Forward-Looking Statements

Certain statements contained in this Annual Report are "forward-looking

statements" within the meaning of U.S. federal securities laws. We intend that

these statements be covered by the safe harbors created under these laws. Those

statements include, but are not limited to:

o statements as to expected revenues, operating results, market shares

and certain expenses, including interest expenses, in respect of

certain of our operations;

o expectations as to the operation of Temelin and its power output;

o expectations as to the anticipated privatization of our Company;

o expectations as to energy prices and the deregulation of the energy

market in the Czech Republic;

o statements as to the rate of growth of the electricity market in the

Czech Republic;

o expectations as to our relations with the regional electricity

distributors, and our integration with some of the regional

electricity distributors;

o statements about the rent we anticipate paying for certain of our

hydroelectric power plants;

o expectations as to the issuance of operations licenses, the schedule

and cost for the refurbishment of Dukovany;

o statements about the transfer of land to our Company;

o expectations as to the approval and construction of interim fuel

storage facilities;

o expectations as to the expansion of our transmission grid;

o expectations as to the future sale of regional electricity

distributors and as to the sale of our remaining shares in CEPS, a.s.;

o expectations as to the adjustment of payment schedule with respect to

our purchase of REAS from government;

o expectations as to the development of our telecommunications services;

o expectations of our future capital expenditures;

o statements as to the funding of future expenditures and investments;

o expectations of risks and liabilities of hedging transactions entered

into;

o statements as to the expected outcome of certain legal proceedings;

o estimates of future levels of employees; and

o expectations as to the legal and regulatory framework for our

industry.

These forward-looking statements are subject to risks, uncertainties and other

factors that could cause actual results to differ materially from future results

expressed or implied by the forward-looking statements. Important factors that

could cause actual results to differ materially from the information set forth

in any forward-looking statements include:

o the effect of general economic conditions and changes in interest

rates in the Czech Republic;

o difficulties encountered in the privatization of our Company;

o difficulties encountered in the integration of our Company with some

of the regional electricity distributors;

o increases in competition in the markets in which we operate and

changes in sales and marketing methods utilized by competitors;

o changes in the structure and regulation of electricity prices in the

Czech Republic;

o difficulties encountered in the initial operational testing of our

Temelin nuclear power plant and refurbishment of our Dukovany nuclear

power plant;

o the potential loss of key personnel;

o acts of war or terrorism; and

o fluctuations in exchange rates between other currencies and the Czech

crown in which our assets, liabilities and operating results are

denominated;

as well as the other factors discussed elsewhere in this Annual Report. Many of

these factors are beyond our ability to control or predict. Given these

uncertainties, readers are cautioned not to place undue reliance on the

forward-looking statements.

4

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

SELECTED CONSOLIDATED FINANCIAL DATA

The following selected consolidated financial data should be read in conjunction

with, and are qualified in their entirety by reference to, our Consolidated

Financial Statements (including the notes thereto) contained in Item 18

"Financial Statements" of this Annual Report. We prepare the Consolidated

Financial Statements in accordance with International Financial Reporting

Standards ("IFRS") which differ in certain important respects from U.S.

Generally Accepted Accounting Principles ("U.S. GAAP"). Note 26 to the

Consolidated Financial Statements provides a description of the principal

differences between IFRS and U.S. GAAP and a reconciliation to U.S. GAAP of net

earnings and total shareholders' equity for the periods and as of the dates

therein indicated.

As of or for the year ended December 31,

--------------------------------------------------------------------------

1998 1999 2000 2001 2002 2002

---- ---- ---- ---- ---- ----

(CZK millions except rates, ratios, (USD millions,

operating and per share data)(1) except per

share data)(2)

Consolidated Income Statement Data

IFRS:

Revenues...................................... 54,971 53,528 52,431 56,055 55,578 1,843.9

Operating expenses............................ 42,295 43,487 39,803 41,377 44,324 1,470.6

Income before other expense and income taxes.. 12,676 10,041 12,628 14,678 11,254 373.4

Other expenses (income)....................... (755) 4,832 2,027 1,386 (542) (18.0)

Income before income taxes.................... 13,431 5,209 10,601 13,292 11,796 391.4

Income taxes.................................. 3,460 919 3,364 4,169 3,375 112.0

Net income.................................... 9,971 4,290 7,237 9,123 8,421 279.4

Net income per share (CZK per share)

Basic....................................... 16.8 7.2 12.2 15.4 14.3 0.47

Diluted..................................... 16.8 7.2 12.2 15.4 14.2 0.47

Cash dividend per share (CZK per share)....... 0.0 0.0 0.0 2.0 2.5

Cash dividend per share (USD per share) (3)... 0.0 0.0 0.0 0.052 0.080

Weighted average number of shares (000's)

Basic....................................... 592,019 592,088 592,088 591,926 590,363

Diluted..................................... 592,019 592,088 592,088 592,088 592,150

U.S. GAAP:

Revenues...................................... 54,971 53,528 52,431 56,055 55,578 1,843.9

Net income(4)................................. 10,558 5,291 13,299 8,538 8,421 279.4

Net income per share (CZK per share) .........

Basic....................................... 17.8 8.9 22.5 14.4 14.3 0.47

Diluted..................................... 17.8 8.9 22.5 14.4 14.2 0.47

Consolidated Balance Sheet Data

IFRS:

Property, plants and equipment--net (5)........ 99,955 99,661 98,717 93,605 146,914 4,874.2

Construction work in progress................. 81,337 91,460 103,591 111,929 56,513 1,875.0

Other assets.................................. 14,913 20,368 19,952 23,493 28,038 930.2

Total assets.................................. 196,205 211,489 222,260 229,027 231,465 7,679.4

Shareholders' equity.......................... 117,915 122,205 129,442 136,726 143,675 4,766.8

Long-term debt, net of current portion........ 34,561 51,084 49,704 43,081 35,729 1,185.4

Other long-term liabilities (6)............... 17,904 18,457 20,902 21,396 23,866 791.8

Total long-term liabilities (6)............... 52,465 69,541 70,606 64,477 59,595 1,977.2

Deferred income taxes......................... 5,501 6,265 8,057 9,870 12,541 416.1

Current liabilities........................... 20,324 13,478 14,155 17,954 15,654 519.4

Stated capital (7)............................ 59,209 59,209 59,209 59,050 59,041 1,958.8

5

U.S. GAAP:

Total assets.................................. 191,473 207,059 222,260 229,027 231,465 7,679.4

Long-term liabilities (5)..................... 50,384 67,186 70,476 64,477 59,595 1,977.2

Deferred income taxes......................... 9,823 10,162 8,098 9,870 12,541 416.1

Shareholders' equity.......................... 110,941 116,232 129,531 136,726 143,675 4,766.8

Other Financial Data

IFRS:

Depreciation rate............................. 5.5 5.5 5.4 5.3 5.6

Ratio of earnings to fixed charges............ 2.78 1.30 2.35 3.13 3.42

Capital expenditures.......................... 25,812 22,726 21,621 15,318 10,330 342.7

Ratio of shareholders' equity to total

capitalization (7).......................... 0.77 0.71 0.72 0.76 0.80

U.S. GAAP:

Ratio of earnings to fixed charges............ 3.37 1.49 2.33 3.13 3.42

Capital expenditures.......................... 25,812 22,726 21,621 15,318 10,330 342.7

Ratio of shareholders' equity to total

capitalization (6).......................... 0.76 0.70 0.72 0.76 0.80

Selected Operating Data

Installed capacity (MW)....................... 10,900 10,151 10,146 10,146 11,146

Generation (GWh).............................. 47,892 45,722 50,842 52,162 54,118

Employees..................................... 10,314 9,749 9,278 8,011 7,677

- ---------------

(1) Certain prior year financial statement items have been reclassified to

conform to the current year presentation.

(2) Czech crown amounts have been translated into U.S. dollars at the rate of

CZK 30.141 per USD 1.00, the CNB Exchange Rate on December 31, 2002.

(3) Translated into USD at the Czech National Bank rate on the dividend payment

date.

(4) U.S. GAAP net income for 2000 includes the cumulated effect from prior

years of an accounting change that under IAS is recorded as an adjustment

to retained earnings (see Note 26 to the to the consolidated financial

statements included herein under Item 18).

(5) Plant in service less accumulated provision for depreciation and nuclear

fuel at amortized cost.

(6) Amounts include accumulated provision for nuclear decommissioning and

storage of spent fuel and other nuclear waste. U.S. utility companies

generally include these amounts in accumulated depreciation.

(7) Total capitalization includes stated capital, retained earnings and

long-term debt (net of current portion).

6

Exchange Rates

The following table sets forth, for the periods and dates indicated high and low

exchange rates for Czech crowns ("CZK") into U.S. dollars ("USD") as reported by

the Czech National Bank (the "CNB Exchange Rate") for each month during the

previous six months and, for the last five years, the average rate for each year

calculated as the average of the exchange rates on the last day of each month

during the period. No representation is made that the Czech crown or USD amounts

referred to herein could have been made or could be converted into USD or Czech

crowns, as the case may be, at the rates indicated or at any other rate. The

Federal Reserve Bank of New York does not report a noon buying rate for Czech

crowns. As of June 25, 2003, the CNB Exchange Rate was CZK 27.246 = USD 1.00.

CNB Exchange Rates

Month Low(1) High(1)

----- --- ----

(CZK per USD)

December 2002 31.24 30.14

January 2003 30.35 28.88

February 2003 29.71 29.08

March 2003 29.95 28.68

April 2003 29.84 28.26

May 2003 27.89 26.39

Source: Czech National Bank

------------

(1) Actual high and low, on a day-by-day basis, for each period.

CNB Exchange Rates

Year Low (1) High (1) Average (2) Period-End

----- ---- ---- ------- ----------

(CZK per USD)

1998 36.10 28.38 32.19 29.86

1999 36.35 29.65 34.87 35.98

2000 42.13 34.88 38.58 37.81

2001 40.29 34.84 38.03 36.26

2002 37.16 29.12 32.74 30.14

Source: Czech National Bank

------------

(1) Actual high and low, on a day-by-day basis, for each period.

(2) Average of the exchange rates on the last day of each month during period.

For information regarding the effects of currency fluctuations on our results,

see "Risk Factors" on page 8, "Item 5. Operating and Financial Review and

Prospects" on page 37 and "Item 11. Quantitative and Qualitative Disclosures

about Market Risk" on page 63.

7

RISK FACTORS

Factors Relating to the Company

OUR MAJORITY SHAREHOLDER MAKES DECISIONS THAT REFLECT CZECH GOVERNMENT POLICY

The Czech National Property Fund (the "NPF" or the "National Property Fund"),

which is under the direct control of the Czech Republic, holds approximately

two-thirds of all shares in CEZ. The National Property Fund also holds

significant equity interests in certain of our subcontractors, including Czech

suppliers of coal and contractors and suppliers of equipment for the Temelin

nuclear power plant. Consequently, certain of our decisions and the decisions of

our suppliers and contractors which are mandated by the National Property Fund

reflect Czech Republic government policy. We can give no assurance that these

decisions will not adversely affect our business, prospects, financial condition

or results of operations.

LIBERALIZATION OF THE ELECTRICITY MARKET COULD ADVERSELY AFFECT OUR BUSINESS

Since January 1, 2002, if an electricity end user's electricity consumption at

one supply point exceeds 40 GWh (including self-generated electricity) then such

user (eligible final customer) may choose its electricity supplier (and freely

negotiate prices). We have direct access to such eligible final customers only

and this liberalized market represents approximately 30% of the Czech

electricity market. REAS are free to choose the supplier to cover demand of the

remaining (mostly retail) customers. The wholesale market is liberalized to the

full extent and we compete on this market. As a consequence of this

liberalization we have seen our profitability per MWh produced decline. While

the REAS and eligible final customers have purchased some electricity from

producers outside the Czech Republic, which fact has reduced our revenues, we

have responded to these price and other pressures by increasing the quantity of

electricity sold for low prices while keeping fixed costs constant. We can

provide no assurance that the decisions of the REAS or other eligible final

customers will not adversely affect our business, prospects, financial condition

or results of operations.

Further, as a consequence of the liberalization of the electricity market, an

administrative procedure has been implemented which regulates the import and

transmission of electricity within the electricity transmission grid in the

Czech Republic. This system is designed to prevent imported electricity together

with our planned domestic electricity production from exceeding the transmission

capabilities of the transmission grid. As this administrative procedure is new,

it has yet to be completely tested. Consequently, we can provide no assurance

that, as a result of complications in the implementation of this procedure, the

electricity system in the Czech Republic may not suffer interruptions of

service.

Furthermore, the Energy Act (including the enforcement provisions thereof) has

just begun to be implemented by regulation, and judicially or administratively

interpreted. We can give no assurance that the specific regulatory framework and

practices that actually develop in the Czech Republic will not adversely affect

our business, prospects, financial condition or results of operations.

OUR INTEGRATION WITH REAS COULD ENCOUNTER OBSTACLES, NEGATIVELY INFLUENCING OUR

BUSINESS

On April 1, 2003, we acquired from the Czech government its shares in eight

REAS. As of then, we hold majority shares in five REAS and minority shares in

three REAS. We are required to dispose of one of the majority shares and of all

three minority shares. We intend to fully integrate the remaining four REAS into

the structure of our Company. While we believe that we will be successful in our

efforts, we can give no assurance that the integration will continue smoothly

and that minority shareholders in those REAS in which we hold a majority share

will not obstruct the integration process. Consequently, we can provide no

assurance that our business, prospects, financial condition or results of

operations will not be adversely influenced by these factors.

WE MAY BE UNABLE TO DISPOSE OF OUR SHARES IN REAS AND CEPS, A. S. AT CONDITIONS

ADVANTAGEOUS TO US

The Czech Anti-Monopoly Office resolved that we have to dispose of one of the

majority shares and of all three minority shares in REAS, and that we have to

dispose of our remaining shares in CEPS, a.s. There is only a limited number of

prospective buyers and we may encounter difficulties in trying to negotiate

conditions of such disposals that would be advantageous to us or our disposal of

the shares may be delayed. Consequently, we can provide no

8

assurance that our business, prospects, financial condition or results of

operations will not be adversely affected by the sale of the REAS and of CEPS,

a. s.

STATE SUPPORT TO SELECTED POWER GENERATION SOURCES COULD ADVERSELY AFFECT THE

PORTION OF OUR BUSINESS SUBJECT TO REGULATED PRICES

The Energy Act now requires the REAS to purchase certain amounts of electricity

from environmentally friendly "co-generation", "small hydro", "decentralized" or

"renewable" facilities and to pay subsidies to it. State support is

significantly higher for small generation sources or those that are connected

directly to the REAS grids. We, however, operate large plants and transmit a

major portion of our electricity to the transmission grid and thus cannot take

full advantage of the state support for otherwise comparable power generation

sources. While we believe that these purchases by the REAS will remain an

insignificant portion of overall REAS electricity purchases, we can provide no

assurance that this will in fact be the case and that our electricity sales to

the REAS will not decrease as a result and will not adversely affect our

business, prospects, financial condition or results of operations.

INTERRUPTIONS IN THE INITIAL TRIAL OPERATION OF THE TEMELIN NUCLEAR POWER PLANT

COULD SIGNIFICANTLY LOWER OUR CASH FLOW

We currently have a nuclear power plant in trial operation in Temelin in

Southern Bohemia which, once both of its generating units are fully operational,

is expected to account for approximately 17% of our installed capacity and an

average of 23.5% of our total production. While the construction on both units

of Temelin has been completed and the Nuclear Safety Authority has issued an

operating license for its operation, we can provide no assurance that failures

in the course of trial operation will not occur or that such interruptions will

not adversely affect our business, prospects, financial condition or results of

operations.

Further, we have experienced continuing environmental and other opposition to

the plant with demonstrations by Austrian citizens and others. As a result, the

prime ministers of Austria and the Czech Republic met on December 12, 2000. This

meeting resulted in an agreement pursuant to which we agreed to have further

studies and monitoring performed on Temelin. We can provide no assurance that,

as a result of such studies and monitoring, the initial operation of Temelin

will not be disturbed as a result of events beyond the control of management. We

can provide no assurance that any such problems will not adversely affect our

business, prospects, financial condition or results of operations.

CONTRACTUAL PENALTIES FOR A DELAY IN THE CONSTRUCTION OF UNIT 2 OF TEMELIN COULD

ADVERSELY AFFECT THE FINANCIAL CONDITION OR RESULTS OF OPERATIONS OF THE GENERAL

CONTRACTOR FOR THE CONSTRUCTION OF TEMELIN

As the general contractor for the construction of Temelin and our 29.8%

subsidiary, SKODA PRAHA, a.s., did not complete construction on Temelin's Unit 2

as scheduled, it is subject to significant contractual penalties, the imposition

of which may adversely affect its business, prospects, financial condition or

results of operations or even lead to its insolvency. While we believe that any

negative impact on SKODA PRAHA, a.s. is not likely to affect its guarantees for

trial operation of Unit 1 and 2 (and, consequently, our business generally), we

can provide no assurance that the imposition of such penalties will not, in

fact, adversely affect our business, prospects, financial condition or results

of operations. In an attempt to avoid these adverse consequences, we entered

into a settlement agreement with SKODA PRAHA, a.s. pursuant to which we would

capitalize the contractual penalties and increase our share in SKODA PRAHA, a.s.

to 68.9%. However, we can give no assurance that capitalization will eventually

take place and the above risks will be eliminated or minimized.

OUR COMMERCIAL RELATIONSHIP WITH THE REAS AND THE COMPETITIVE ENVIRONMENT FOR

THE SUPPLY OF ELECTRICITY IN THE CZECH REPUBLIC COULD CHANGE

We sell a significant portion of the electricity we produce to the eight REAS.

Except for two REAS for which we signed ten-year supply contracts in 1996, we

sign our contracts with the REAS annually. We own majority shares in five REAS,

but we will have to dispose of one of these majority shares. It is likely that

our key European competitors will control four of the REAS eventually. We can

provide no assurance that the four REAS we will not control will continue to

purchase power from us in the same quantities as they have in the past and/or

for the same or better prices or that the competitive environment for the supply

of electricity in the Czech Republic will not change.

9

BECAUSE WE LOST CONTROL OF THE TRANSMISSION GRID, ELECTRICITY TRANSMISSION

PRICES MAY INCREASE

Until April 1, 2002, we controlled the electricity transmission grid in the

Czech Republic through our wholly-owned subsidiary, CEPS, a.s. As a part of

process of the liberalization of the energy market and/or privatization in the

Czech Republic, CEZ had to sell its majority stake in CEPS, a.s. and we thereby

lost control of the transmission grid. The prices for electricity transmission

could increase as a result of our lost control of CEPS, a.s. If these

transmission prices increase and such increase is followed by increases in end

prices for electricity, we can give no assurance that the possible resulting

decrease of consumption or our increased costs would not adversely affect our

business, prospects, financial condition or results of operations. Further, we

can give no assurance that the specific regulatory or other relationship that

actually develops with respect to the transmission of electricity will not

adversely affect our business, prospects, financial condition or results of

operations.

THE COSTS WE ARE CHARGED FOR RADIOACTIVE WASTE DISPOSAL MAY INCREASE; WE MAY

BECOME LIABLE FOR INCREASED COSTS OF RADIOACTIVE WASTE DISPOSAL

Under Czech law we are required to contribute funds to a "Nuclear Account"

administrated by the Ministry of Finance based on the amount of electricity we

produce in our nuclear power plants. This fund is used by the Radioactive Waste

Repository Authority (the "Repository Authority") to centrally organize,

supervise and undertake responsibility for all final disposal facilities and

deposition of nuclear waste therein.

We can give no assurance that the government will not increase the contributions

which the Nuclear Act requires us to pay into the Nuclear Account. Additionally,

if the cash amounts accrued in the Nuclear Account are not sufficient to pay the

final disposal costs, we may be required to pay additional amounts.

THE AMOUNTS WE HAVE TO KEEP IN A SPECIAL ESCROW ACCOUNT FOR FUTURE

DECOMMISSIONING OF OUR NUCLEAR POWER PLANTS MAY INCREASE; WE MAY BECOME LIABLE

FOR INCREASED COSTS OF FUTURE DECOMMISSIONING

Under Czech law we are required to keep funds in a special escrow account based

on the expected costs of future decommissioning of our nuclear power plants.

These funds can be used only for such decommissioning and only with the

permission of the Repository Authority.

We can give no assurance that our contributions to the special escrow account

will not increase as a result of increased expected costs of decommissioning or

other factors determining the amount of our annual contributions. Additionally,

if the cash amounts accrued in the special escrow account are not sufficient to

pay the decommissioning costs, we may be required to pay additional amounts.

OUR INSURANCE DOES NOT FULLY COVER OUR RISKS AND FACILITIES

We have limited insurance (e.g., property and machinery insurance) for certain

of our significant assets, including the Dukovany and Temelin nuclear power

plant. We can give no assurance that our business will not be adversely affected

by the costs of accidents or other unexpected occurrences at such facilities.

WE COULD INCUR SIGNIFICANT LOSSES IF WE SUFFERED A NUCLEAR ACCIDENT

In accordance with the Vienna Convention, the Nuclear Act provides that the

operator of a nuclear facility is liable for any damage caused by a nuclear

accident up to CZK 6 billion per accident. The Nuclear Act also provides that

operators of nuclear facilities, such as ourselves, are obligated to acquire

insurance covering potential liabilities for nuclear damages in an amount of not

less than CZK 1.5 billion. We have concluded insurance policies for both

Dukovany and Temelin which provide coverage at these amounts. However,

notwithstanding such limitation of liability and our additional coverage, any

nuclear accident at a nuclear power station could have a material adverse effect

on our business, prospects, financial condition or results of operations due to,

inter alia, potential shut-down of the nuclear facility involved in the accident

and the resulting loss of generation capacity, remedial and replacement expenses

and negative public response. In addition, as the Nuclear Act has not been

tested in court, we can give no assurance that judicial interpretations will be

consistent with its stated limitation of liabilities.

10

DEVALUATION OF THE CZECH CROWN AGAINST THE U.S. DOLLAR AND/OR EURO WOULD

NEGATIVELY IMPACT OUR BUSINESS; WE MAY SUFFER EXCHANGE RATE LOSSES IF CZECH

CROWN BECOMES SIGNIFICANTLY WEAKER TO U.S. DOLLAR AND/OR EURO, OR LOSSES DUE TO

HEDGING IF CZECH CROWN BECOMES SIGNIFICANTLY STRONGER

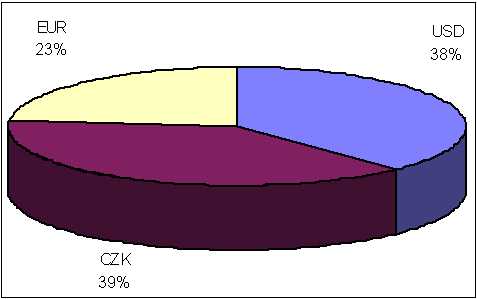

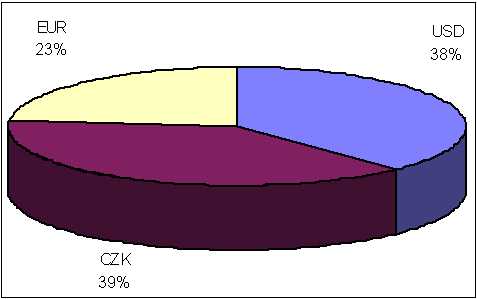

Virtually all of our revenues are denominated in Czech crowns and, after giving

effect to foreign exchange swaps, approximately one-third of our indebtedness is

effectively denominated in, and is expected to continue to be denominated in,

currencies other than the Czech crown. Consequently, we are exposed to currency

exchange risks that could impact our ability to meet our debt obligations and

finance our business. The Czech crown to euro exchange rate has been relatively

stable and there has been a trend of stronger Czech crown versus the U.S. dollar

in 2002 and the first quarter of 2003. However, we can give no assurance that

the stability against euro and the ascertainable trends with respect to the U.S.

dollar will continue. Devaluation of the Czech crown against the U.S. dollar

and/or euro would result in a larger proportion of our revenues needed to

service our indebtedness denominated in currencies other than the Czech crown,

including the 7 1/8% Notes due 2007 issued by CEZ Finance B.V. and guaranteed by

CEZ (the "Notes" and the guarantees provided by us the "Guarantees"), which

could have a material adverse effect on our ability to service the Notes or

other indebtedness denominated in currencies other that the Czech crown.

We have entered into foreign exchange swap transactions (principally U.S.

dollars and euro to Czech crowns) in order to reduce our exposure to the

exchange rate risk by adjusting our exposure to non-Czech crown denominated

liabilities. Although we intend to further reduce our exposure to exchange rate

risk by entering into other hedging transactions, we can give no assurance that

such hedging will be available or profitable.

Factors Relating to the Czech Republic

POLITICAL INSTABILITY IN THE CZECH REPUBLIC COULD NEGATIVELY IMPACT ECONOMIC

CONDITIONS IN THE CZECH REPUBLIC AND, CONSEQUENTLY, OUR BUSINESS

The next general elections for the Chamber of Deputies are scheduled for 2006.

The current political situation has remained relatively stable as a result of

the coalition among the Czech Social Democratic Party ("CSSD"), a center-left

party, which received over 30.2% of the votes in the last election in 2002, and

two other smaller center and center-right parties. The second strongest party in

the Chamber of Deputies is the Civic Democratic Party ("ODS"), a center-right

party, which received over 24.5% of the votes in the last election and is

currently in the opposition. It cannot be ruled out that the current coalition

will break up as a result of different political opinions of its members or as

result of other factors. On March 7, 2003, Vaclav Klaus became the new President

of the Czech Republic. Mr. Klaus is a former chairman of ODS and this could have

an impact on his political decisions.

With respect to the macroeconomic environment in the Czech Republic, it may be

expected that drawing up the state budget for 2004 might be connected with

difficulties, since the cabinet will have to choose between substantial

restrictions of its expenses and setting a budget with a significant deficit.

We can give no assurance that changes to the current government, the creation of

a new government or early Parliamentary elections will not occur. The factors

described above may have an adverse effect on the overall stability of the Czech

Republic and subsequently on our economic and financial situation. We can give

no assurance that any new government formed will continue the economic, fiscal,

and regulatory policies of former governments. Nor can there be any assurance

that any changes in such policies will not have a material adverse effect on our

business, prospects, financial condition or result of operations. Moreover, any

change in the government may affect the structure of the presidium of the NPF,

and/or the structure of the Supervisory Board and the Board of Directors of our

company.

IF THE CZECH ECONOMY PERFORMS POORLY, OUR BUSINESS WILL BE IMPACTED NEGATIVELY

Our revenues are sensitive to the performance of the Czech economy. Virtually

all of our assets and operations are located in the Czech Republic and we derive

the substantial majority of our electricity revenues from domestic sales.

Changes in economic, regulatory, administrative or other policies of the Czech

government, as well as political or economic developments in the Czech Republic

over which we have no control, could have a significant effect on the Czech

economy, which in turn could have a significant effect on our business,

prospects, financial conditions or results of operations or our ability to

proceed with our business plan.

11

Furthermore, the Czech Republic has undergone dramatic reform in its economy

since 1989. Public discussion continues as to the need for restructuring certain

sectors of the economy. Although the reforms already undertaken have

significantly improved economic performance, we can give no assurance that they

will continue or that the level of economic performance attained over the last

few years will be sustained. In addition, we can give no assurance that such

restructuring will not result in a decrease in the sales or production of

certain significant power consumers, which could lead to a decrease in

electricity demand.

The Czech Republic has experienced growing public finance deficits which could

potentially destabilize the Czech crown against foreign currencies, increase

inflation and increase the borrowing costs of the Czech Republic through lower

debt ratings, and for CEZ as well. While political parties in the Czech Republic

acknowledge this problem, they have not reached political accord on a solution.

Though the Czech crown is currently strong and the inflation low, we can give no

assurance that this will be the case in the future years.

WE COULD INCUR UNFORESEEN TAX PENALTIES AND/OR SANCTIONS

Changing interpretations of tax regulations by the tax authorities, extended

time periods relating to overdue liabilities and the possible imposition of high

penalties and other sanctions result in the tax risk for a Czech company being

significantly higher than in countries with more mature tax systems.

12

Item 4. Information on the Company

History and Development of the Company

CEZ, a.s. (the "Company" or "CEZ") was established on May 6, 1992 as a

joint-stock company organized under the law of the Czech Republic. We were

established through the aggregation of formerly state-owned companies into one

enterprise. The resulting company is the largest electricity generation company

in the Czech Republic in terms of installed electricity generation capacity and

one of the largest companies in the Czech Republic in terms of operating

revenues. We are governed by the provisions of Czech Civil and Commercial law

and are registered with the Commercial Register of the District Court for

Prague. Our headquarters is located in Prague, Czech Republic. Our U.S. agent's

name and address is CT Corporation System, 1633 Broadway, New York, New York

10019.

Our registered address is:

CEZ, a. s.

Duhova 2/1444

140 53 Prague 4

Czech Republic

Tel: +420 (2) 7113 1111

Internet address: www.cez.cz

All power plants that we operate are located in the Czech Republic. The total

installed capacity of our generation facilities as of December 31, 2002 amounted

to 11,146 MW. In 2002, we generated 54,118 GWh of electricity. Of this amount,

coal-fired plants accounted for 62.0%, our nuclear power plants accounted for

34.6%, and hydroelectric plants accounted for 3.4% of electricity produced. The

remaining electric power consumed in the Czech Republic comes from independent

power producers, self generators and imports. We operate twenty-five [F1] power

plants, including ten coal-fired plants, twelve hydroelectric plants and two

nuclear power plants. See "Property, Plants and Equipment" on page 28. Of the

quantity of electricity we sold in the Czech Republic in 2002, we sold

approximately 86.8% to the REAS, 1.6% to CEPS, a.s., 7.2% to traders, 3.7% to

Operator trhu s elektrinou, a.s. (Electricity Market Operator), and the

remainder directly to final customers.

We also purchased electric energy from independent producers and traders

(Sokolovska uhelna, a.s., KAUCUK, a.s., and Prvni energeticka a.s.).

The following table sets forth a breakdown of the amounts of electricity that we

supplied and which was consumed in and exported from the Czech Republic from

2000 through 2002:

2000 2001 2002

---- ---- ----

(GWh)

Supplied:

CEZ generation........................................ 50,842 52,162 54,118

Purchased from IPPs .................................. 3,483 3,274 2,018

Purchase of deviations (OTE *)........................ 0 0 882

Purchase within the framework of organized short-term

transactions (OTE *).................................. 0 0 19

Purchases to cover own consumption.................... 21 17 18

Imports............................................... 814 682 417

Transactions outside of the Czech Republic

(purchases)........................................... 0 7 921

---------- --------- ----------

Total................................................. 55,160 56,141 58,392

========== ========= ==========

- --------------

[F1] The calculation of the number of plants that we operate varies depending on

whether a plant is counted independently or as part of a larger

organizational unit. The number of plants used herein is based upon larger

organizational units than may appear elsewhere in our publications

13

Consumed:

REAS.................................................. 36,565 36,942 31,466

Sale OTE * - regulatory work - positive............... 0 847 1,356

Sale OTE * - regulatory work - negative............... 0 0 -385

Sale of deviations - (OTE *).......................... 0 0 137

Sale within the framework of organized short-term

transactions (OTE *).................................. 0 0 224

Electricity sales to eligible customers **............ 0 0 69

Electricity sales to traders ***...................... 0 0 2,593

Sales to CEPS to cover transmission losses............ 736 546 598

Other domestic sales.................................. 93 386 186

Exports............................................... 12,429 12,122 16,008

Transactions outside of the Czech Republic (sales) 0 7 921

Other consumption of CEZ.............................. 5,275 5,231 5,218

of which:

own consumption for electricity generation...... 4,102 4,218 4,245

consumption for siphoning in siphoning-type

hydro-electric power generation stations........ 749 556 479

other consumption of facilities................. 424 457 494

Losses of CEZ......................................... 62 60 0

========== ========= ==========

Total................................................. 55,160 56,141 58,392

========== ========= ==========

*) Operator trhu s elektrinou, a. s. (Electricity Market Operator)

**) Customers pursuant to Section 28 of Act No. 458/2000 Coll. (Energy Act)

***) Electricity traders pursuant to Section 28 of Act No. 458/2000 Coll.

(Energy Act)

In addition to electric power, we also generate heat, which we supply to

municipalities, district heating companies and industrial consumers via

steam/hot water pipelines that we operate with other persons. See "Heat

Generation" on page 18.

Until April 1, 2003, we also owned and operated through our subsidiary, CEPS,

a.s., approximately 2,902 kilometers (approximately 1,803 miles) of 400 kV and

1,441 kilometers (approximately 895 miles) of 220 kV high-voltage electrical

power transmission lines. These lines comprise all of the high voltage

transmission lines in the Czech Republic and transformers which reduce the

electrical voltage to 110 kV, the maximum voltage used in the distribution

networks owned by the REAS. See "Transmission of Electricity" on page 19 and

"Material Contracts" on page 57.

Breakdown of Revenue by Activity

The following table sets forth a breakdown of our principal activities together

with the revenue generated from such activities for the years 2000 through 2002:

2000 2001 2002

---- ---- ----

(CZK millions)

Electricity and Transmission Sales(1) (2) 49,675 53,300 52,938

Heat Sales.............................. 1,604 1,721 1,673

Other................................... 1,413 1,576 967

- ------------

(1) Until December 31, 2000, the Energy Regulatory Office set end-user

electricity prices and the prices at which we sell electricity to the REAS

at aggregate rates which included both the portion paid for the

electricity and transmission. Consequently, the information in this table

with respect to electricity and transmission sales represent aggregate

sales which combine the prices for transmission and electricity.

Additionally, we do not account for our electricity sales from our

nuclear, hydro-electric and coal-fired power plants separately.

(2) In 2002, our revenue from electricity sales amounted to approximately CZK

41,021 million, and our revenue from transmission sales amounted to

approximately CZK 11,917 million.

14

Electricity Generation

In 2002, we produced a total of 54,118 GWh of electricity, which represents

approximately 71% of the total electricity produced in the Czech Republic.

Revenues from electricity sales and transmission amounted to approximately CZK

52.9 million or 95.2% of our total revenue for 2002.

The following table provides information regarding our installed electricity

generating capacity at December 31, 2002 and the method of electricity

generation during the year ended December 31, 2002:

At December 31, 2002 Year Ended December 31, 2002

----------------------- ----------------------------

Installed Installed Electricity Total

Capacity Capacity Generation Production

--------- --------- ----------- ----------

(MW) (%) (GWh) (%)

Coal-Fired Plants..................................... 6,517 58.5 33,543 62.0

Nuclear Plants........................................ 2,760 24.8 18,738 34.6

Hydroelectric Plants.................................. 1,868 16.7 1,837 3.4

Wind and Solar Power Plant (1) ....................... 1 0 0 0

========= ========== =========== ==========

Total................................................. 11,146 100 54,118 100

========= ========== =========== ==========

- -----------

(1) Power plant in the locality of Mravenecnik near the Dlouhe Strane

hydroelectric power plant.

Coal-Fired Power Generation

We own and operate ten (10) coal-fired power plants which are further described

below under "Property, Plants and Equipment" on page 28. In 2002, our coal-fired

plants generated 33,543 GWh of electricity representing 62.0% of our total

electricity production.

Our coal-fired plants have a diversified age profile, and we have a planned

program of regular repairs and overhauls for the generating units. In most

cases, parts of these units have already been completely reconstructed and

modernized. As of December 31, 2002, we had installed FBB or FGD equipment on

all of our coal-fired capacity and we have installed or refurbished

electrostatic precipitators (which reduce particulate emissions) on all but two

of our coal-fired power plants. The coal-fired plants that we own and operate

are situated at various locations throughout the Czech Republic, the largest

concentration being in the lignite mining region in the northwest of the Czech

Republic. We have decommissioned the Ledvice I power plant, two units of the

Melnik II power plant and three units of the Tusimice I power plant. We decided

to decommission these plants because, in our judgment, we have sufficient

capacity to satisfy demand using our existing plants and plants under

construction.

Types and Sources of Coal. The majority of our coal-fired power plants (95.5%)

utilize lignite. Currently only one of our power plants uses hard coal. We have

four main domestic suppliers of lignite and one domestic supplier of hard coal.

Most of our coal-fired power plants are located in the vicinity of the North

Bohemian brown coal basin. Conveyor belts from nearby mines directly supply coal

to three power plants, Ledvice II, Tisova I and II and Tusimice II. In other

cases, rail is primarily used to transport coal supplies over relatively short

distances. We maintain coal stocks at a general level of 16% of our annual

consumption at plants that are not in direct proximity to coal mines.

Coal Contracts. For the purchase of lignite we have entered into a number of

annual, five-year and fifteen-year contracts with Appian Group, a.s., Sokolovska

uhelna, a.s., Severoceske doly, a.s, Lignit Hodonin, s.r.o., GEMEC-UNION, a.s.

and with OKD, a.s, for the purchase of hard coal. We have signed a long-term

contract with Severoceske doly, a.s., and short term contracts with Severoceske

doly, a.s., Appian Group, a.s., Sokolovska uhelna, a.s. and Lignit Hodonin,

s.r.o. for lignite. We have signed a short term agreement with OKD, a.s. for

hard coal. See "Equity Interests of CEZ in Other Companies as of December 31,

2002" on page 28.

We generally enter into contracts for coal deliveries on the basis of tenders.

Short-term contracts resulting from such tenders fix prices for one year.

Long-term contracts are designed to fix amounts for a period of five years.

Although long-term contracts do not set specific prices, they contain guidelines

for setting prices.

15

In October 1997, we signed a long-term contract with the largest producer of

lignite in the Czech Republic, Severoceske doly, a.s. In 1999, we increased our

stake in Severoceske doly, a.s. to more than one-third of the capital stock of

Severoceske doly, a.s. Severoceske doly, a.s. supplies more than 60% of our

total consumption of lignite. This contract covers supplies through the year

2015 and reserves certain amounts of stock through 2030. We purchase the largest

amount of coal in the Czech Republic, accounting for more than 55% of lignite

purchased in 2002 in the Czech Republic.

The following table sets forth the rate of price increases (decreases) for which

we purchased lignite and hard coal as compared to inflation rates for the years

2000 through 2002:

Year Lignite (%) Hard Coal(%) Inflation(%)

---- ----------- ------------ ------------

2000 (18) 6 3.9

2001 0.8 14.1 4.7

2002 0.0 0.7 1.8

Although we have been in a good bargaining position vis-a-vis coal suppliers and

we have generally been able to keep increases in coal prices below increases in

the annual inflation rates, there can be no assurance that we will be able to do

so in 2003 or future years. The slight increase in hard coal prices for 2002 was

due, among other things, to the low inflation rate which is relevant for the

formula for calculation of hard coal prices. The stagnation in lignite coal

prices in 2002 was influenced primarily by market conditions and increased

competitive pressures among suppliers.

For the importation of hard coal, an import license from the Ministry of

Industry and Trade of the Czech Republic is necessary. In instances in which we

were not able to obtain such an import license, we purchased hard coal supplies

from domestic sources.

We purchase limestone and lime for desulfurization facilities and fluidized-bed

boilers under long and medium-term contracts from a total of five domestic

suppliers. LOMY MORINA, spol. s r.o. supplies approximately 50% of the total

amount. We hold 51.00% of the registered capital of LOMY MORINA, spol. s r.o.

Our 64.87% owned subsidiary, KOTOUC STRAMBERK, spol. s r.o., supplies

approximately 25% of our total limestone and lime needs at prices which are

renegotiated each year. These prices do not differ significantly from market

prices.

Historically, prices for lime, limestone and other raw materials have generally

risen, but such changes have not been material.

Taking into account geographical restrictions and current estimates of

coal-fired generation needs, we estimate there are sufficient lignite reserves

in the Czech Republic for the operation of our coal-fired power plants for

approximately 30 years.

Total expenses for lignite and hard coal consumed in 2002 amounted to CZK 10,514

million or 23.7% of our total operating expenses. Total expenses for lime and

limestone consumed in 2002 amounted to approximately CZK 682 million or 1.5% of

our total operating expenses.

Final Disposal of Coal Waste. Pursuant to the 1997 Act on Wastes, effective from

January 1, 1998, and related regulations, we dispose of coal ash by depositing

it in landfills and disused shafts of existing mines. We sell some of the coal

ash residues to certain producers of building materials. In addition, we have

been selling a portion of the FGD gypsum remaining after the desulfurization

process to certain producers of construction materials. Although such sales have

not been material to our revenues, they represent an important element in our

environmental initiatives.

Sources of Working Materials. We select suppliers of caustic soda, sulfuric

acid, hydrochloric acid, technical gases, turbine and transformer oils and other

working materials on the basis of tenders. Individual power plants conclude

these supplier contracts. Our total expenditure for such supplies do not

represent a material portion of our overall expenses.

16

Nuclear Power Generation

We currently own and operate one nuclear power plant situated at Dukovany, in

the South Moravian District of Trebic and we are completing a second nuclear

power plant at Temelin, in the South Bohemian district of Ceske Budejovice. We

describe both Dukovany and Temelin in further detail below under "Property,

Plants and Equipment" on page 28 and "Capital Investments" on page 33. In 2002,

our nuclear power plants generated 18,738 GWh of electricity, including 1,786.7

GWh of electricity produced by Temelin during testing, representing 34.625% of

our total electricity production.

Both these nuclear power plants are equipped with VVER reactors. In the former

Soviet Union, two designs of nuclear reactors (with various sub-types) were

developed: the RBMK reactor, a graphite moderated water-cooled reactor and the

VVER, a pressurized water reactor in which water acts as both the moderator and

the coolant. The design of a VVER plant is generally considered identical to the

design of PWR plants based on U.S. technology (in which water also acts as the

moderator and the coolant) and which is the most common reactor type

commercially used around the world.

Unlike analogous western nuclear power plants, the units of the Dukovany nuclear

plant have no full pressure containment, the purpose of which is to prevent the

escape of radioactive steam into the atmosphere in case of any breach of the

primary circuit (the sealed circuit comprised of the steel pressure vessel

containing the reactor, the steam generator and the connecting pipe work). In

the Temelin nuclear power plant, the two units are provided with containment

buildings containing the primary circuit. The Dukovany nuclear plant is designed

to reduce the pressure and temperature of steam escaping from the primary

circuit through a venting process into semi-contained rooms within the tower.

This system is contained and without any safety-valve that would permit the

escape of radioactive gases into the atmosphere. The system is designed to

withstand the maximum projected accident caused by a breakdown of the primary

circuit.

Dukovany Nuclear Power Plant. The construction of the Dukovany nuclear power

plant began in January 1979 and its four units became operational between May

1985 and July 1987. The power plant has been in continuous operation since 1985.

The power plant uses four Soviet designed VVER 440-213 pressurized water

reactors with a total installed electricity generating capacity of 1,760 MW.

Outside the former Soviet Union, such reactors are in operation in the Czech

Republic, Finland, Hungary, Bulgaria and the Slovak Republic.

Two units of Dukovany are designed to operate until 2016 and two units until

2018. The State Nuclear Safety Authority (the "Nuclear Safety Authority") grants

operating licenses that are renewable upon application. The following table sets

forth the status of licenses at the Dukovany power plant:

Unit License Valid Until:

---- --------------------

1 December 31, 2005

2 December 31, 2006

3 December 31, 2007

4 December 31, 2007

From its initial operation to December 31, 2002, the Dukovany nuclear plant has

generated approximately 210,623 GWh of electricity at an average load factor per

year of 82.6%.

Temelin Nuclear Power Plant. Our second nuclear power plant, currently in trial

operation, is located at Temelin in South Bohemia. It employs two VVER 1000

pressurized water reactors, each with a capacity of 1000 MW. Like Dukovany, the

Temelin nuclear power plant is a base load plant (a plant that operates at a

constant level for a sustained period of time). See "Capital Investments -

Nuclear Power Plants" on page 35 for more information about the Temelin power

plant, including recent developments related to costs of completion and time

delays in the completion schedule. From its initial operation to December

31,2002, the Temelin nuclear plant has generated approximately 6,597 GWh of

electricity. As of June 10, 2002 Unit 1 of the Temelin power plant is in an

18-month pilot operation, and Unit 2 is in a similar pilot operation as of April

18, 2003.

Nuclear Fuel Materials and Fuel Procurement. Nuclear fuel materials and services

(i.e., uranium, conversion and enrichment) are supplied to us mainly on the

middle and long-term contractual basis by several primary suppliers. The main

portion of our uranium needs has been covered from domestic sources up to now.

Since Czech uranium production has been continuously decreasing in recent years

with the perspective of almost full cessation in 2006, we will seek to cover our

future needs by increased purchases on the world market. We will aim to create

and

17

maintain a diversified portfolio of uranium suppliers in a similar way as it

has already been established regarding conversion and enrichment services. One

of our important sources of uranium in the future will be Russia, as we plan to

purchase a substantial portion of nuclear fuel for the Dukovany nuclear power

plant as a package of all contained materials and services within the framework

of our long-term fuel agreement with the Russian fabricator OAO TVEL. We are

considering optimizing our current uranium stockpiles during the period of

2004-5. This should result in less urgency to seek new supplies in the near

term.

Our long-term nuclear fuel supplier for Temelin is Westinghouse Electric

Corporation which produces nuclear fuel for us at its facilities in Columbia,

South Carolina. Shipments of nuclear fuel for the Temelin nuclear power plant

from Westinghouse are performed according to the requested schedule on the basis

of our long term contract. First refuelling at Unit 1 was completed in March

2003 and fuel for the first reload for Unit 2 will be delivered in the second

half of 2003. Regarding the Dukovany nuclear power plant deliveries of nuclear

fuel designated for transition for "five-year fuel cycle" continue under very

long-term commitments concluded with Russian OAO TVEL.

Spent Nuclear Fuel Storage. Operation of an interim storage facility for spent

nuclear fuel which utilizes transport and storage containers licensed and used

in a number of countries (including the United States) at the site of the

Dukovany nuclear power plant became operational in December 1995. The capacity

of this facility is sufficient for the operation of the power plant until 2005.

A second stage of the construction of the interim storage facility for spent

nuclear fuel at the Dukovany power plant site is currently under preparation.

Upon the completion of this second stage, we expect that the capacity of the

interim storage facility will be sufficient for the planned life of the power

plant. In 1999 the State Office for Nuclear Safety issued a zoning permit for

the second stage storage facility for spent nuclear fuel and an environmental

impact assessment was completed. In 2000 we received a local zoning permit for

this interim storage facility and in 2001 we entered into an agreement for the

provision of storage containers for this facility. We have already prepared an

application for a construction permit which we expect to receive in 2003. We are

also planning the construction of an interim storage facility for spent nuclear

fuel from the Temelin power plant at the Temelin site. An underground interim

storage facility at the Skalka site in South Moravia is being considered as an

alternative for the storage of spent fuel from both power plants. We received a

local zoning permit for this site in March 2001. In 1999 we sold the repository

for disposal of nuclear waste from the operation of both Dukovany and Temelin

nuclear power plants to the Repository Authority (state agency). The Repository

Authority has engaged us to continue operating this repository located at

Dukovany site.

Hydroelectric Power Generation

We operate twelve (12) hydroelectric power plants (small storage or pump

storage), which are described in individual detail under "Property, Plants and

Equipment" on page 28. In 2002, our hydroelectric power plants generated 1,455

GWh of electricity representing 2.9% of our total electricity generation.

Eight of these plants are situated on dams on the Vltava river creating a

cascade operation controlled by a central control system. The total of 1,868 MW

of hydroelectric power capacity that we operate represents an important and

cost-effective source of peak load generation for CEZ. In recent years, the

electricity consumption pattern in the Czech Republic has exhibited increasing

intra-day peak demand. Additional development of hydropower generation in the

Czech Republic is limited by the topography of the country and we currently are

not constructing and do not have plans to construct any new hydroelectric power

plants.

Hydroelectric power plants have a high degree of flexibility in the regulation

of their output. The ability to control conventional storage hydroelectric power

plants and pump storage plants centrally permits the hydroelectric plants to

commence operating very rapidly thereby facilitating our regulation of electric

output.

Neither conventional storage nor pump storage hydroelectric power plants release

polluting emissions into the atmosphere. These plants also represent an

inexpensive source of electric energy, particularly in periods of peak demand.

In addition, pump storage power plants allow the productive use of excess

electricity generated by base load plants by operating storage pumps in periods

of low demand.

Heat Generation

In general, heat is a by-product of the generation of electricity. We sell heat

to municipalities, district heating companies and industrial consumers. At the

present time, we are supplying heat from all of our coal-fired plants and the

Dukovany nuclear power plant. We also intend to sell heat from our Temelin plant

once this plant has been

18

completed. Heat is supplied to customers via steam/hot

water pipelines operated by us and other persons. In 2002, sales of heat

amounted to CZK 1,673 billion or 3.8% of our total revenues.

Transmission of Electricity

Until April 1, 2003 we controlled the electricity transmission grid in the Czech

Republic through our wholly-owned subsidiary, CEPS, a.s. See "Risk Factors" on

page 8. We operated through CEPS, a.s. a total of approximately 4,477 km

(approximately 2,782 miles) of transmission lines, of which approximately 2,902

km operate at 400kV, 1,441 km operate at 220kV and 134 km operate at 110kV,

primarily in connecting the power plants to the transmission grid. The

efficiency of the transmission grid in the Czech Republic is comparable to

international standards. In 2002, transmission losses of the high-voltage system

that CEPS, a.s. operates amounted to 695 GWh representing approximately 1.2% of

transmitted electricity.

Currently, dispatching within the electrical power system of the Czech Republic

is carried out on a lowest cost producer basis for CEZ by a control center which

is a part of CEPS, a.s. This control center also coordinates the operations of

the transmission grid, as well as exchanges of electricity with other power

grids. This control center is allocated to CEPS, a.s.

On March 11, 2002 the Czech government decided to sell to us its shares in the

eight REAS (regional electric power distribution companies) held by the National

Property Fund and the Czech Consolidation Agency. The Czech government also

decided to purchase our 66% share in our transmission subsidiary CEPS, a. s. The

transactions were approved at our shareholder's meeting held on June 11, 2002.

On March 20, 2003, we received an affirmative opinion from the Czech

Anti-Monopoly Office approving the sale of the distribution companies to us.

After the fulfillment of this last condition precedent for the integration of

the electric power industry, we signed promissory notes on March 28, 2003, and

on April 1, 2003 the transfer of the shares of the eight distribution companies

to us was consummated. Concurrently, we transferred a 51% share in CEPS, a. s.

to OSINEK, a. s., a wholly-owned subsidiary of the National Property Fund, and a

15% share in CEPS, a. s. to the Ministry of Labor and Social Affairs. After

netting the price we should pay for the REAS against the price that we should

receive for CEPS, a.s., we are required to pay the National Property Fund

approximately CZK 15.2 billion by mid-2006. See "Material Contracts" on page 57.

In its affirmative decision on the sale of REAS to us, the Czech Anti-Monopoly

Office stated three conditions which we are required to fulfill and which were

in the opinion of the Czech Anti-Monopoly Office necessary for the protection of

economic competition in the electricity distribution market in the Czech

Republic:

o We have to dispose of our remaining 34% share in CEPS, a. s. to the

Czech government;

o We have to dispose of a majority share in one of the REAS in which we

acquired majority shares. The Anti-Monopoly Office did not specify

which REAS in particular we should sell, and therefore we can choose

to sell any of Severoceska energetika, a.s., Severomoravska

energetika, a.s., Vychodoceska energetika, a.s., Zapadoceska

energetika, a.s., or Stredoceska energeticka, a.s. Our Board of

Directors recently decided to sell Severoceska energetika, a.s.; and

o We have to dispose of all our minority shares in the three REAS in

which we hold such minority shares, namely in Jihoceska energetika,

a.s., Jihomoravska energetika, a.s., and Prazska energetika, a.s.

As regards deadlines in which we have to fulfill these conditions, the original

non-binding decision of the Anti-Monopoly Office issued on December 10, 2002

stated that we have to fulfill the conditions within one year after the decision

becomes binding and effective. We appealed this non-binding decision, and in the

final, binding and effective decision of the Anti-Monopoly Office that was

issued on March 20, 2003 the deadlines for fulfillment of the above conditions

were extended. This gives us greater latitude in finding suitable purchasers of

the relevant shares and in negotiating conditions which would be advantageous to

us. We can however give no assurance that we will actually achieve advantageous

conditions for the disposals, primarily because of the fact that the number of

potential purchasers is limited. Also, these potential purchasers know that we

are obliged to dispose of the relevant shares in REAS and they may attempt to

use this against us in the negotiation process.

After we satisfy the above conditions, out of the eight REAS, we will hold

majority shares in four of them (Severomoravska energetika, a.s., Vychodoceska

energetika, a.s., Zapadoceska energetika, a.s., or Stredoceska

19

energeticka, a.s. if we sell Severoceska energetika, a.s.), and we will have no

share interest in the remaining four. Also, we will have no ownership interest

in CEPS, a.s.

With respect to the minority shares in those REAS which we have to dispose of,

we are considering swapping these minority shares or some of them for the

minority shares in those REAS where we own majority and which we intend to keep.

We have entered into discussions with the holders of such minority shares,

namely E.ON and RWE. With E.ON we have reached a preliminary agreement on the

swap of our 35.21% in Jihomoravska energetika, a.s. and 34.01% in Jihoceska

energetika, a.s. for E.ON's 34.4% in Zapadoceska energetika, a.s. and 41.7% in

Vychoceska energetika, a.s. If the swap is consummated, we will increase our

majority share in Zapadoceska energetika, a.s. and Vychoceska energetika, a.s.,

and we may be required under Czech law to make mandatory tender offers for the

remaining minorities in these two companies. We can give no assurance that the

above discussions will be fruitful and the considered swaps will be eventually

effected.

Exports, Imports and International Exchange of Power

We imported a small portion of our purchased electricity under long-term

contracts, one of which we have assigned to CEPS, a.s. and one which expired in

2002. In 2002, we imported a total of 417 GWh. In 2002, the cost of such imports

amounted to approximately 16.5% of total expenses.

In 2002, our revenues from electricity exports amounted to CZK 9.2 billion or

approximately 20.7% of revenues from electricity sales. In 2002, we exported a

total of 16,008 GWh. Our high-voltage transmission grid is inter-connected with

the transmission grids of Germany, Poland, Austria and the Slovak Republic. We

export electricity to Germany, Slovakia, Hungary, Croatia and Serbia on the

basis of both short and long-term contracts. We consider exports to be an

important part of our revenues and we intend to seek further opportunities for

expanding and diversifying our exports in the future. However, we can give no

assurance that our efforts in this respect will be successful and that we will

be able to increase our exports or at least keep them at their current levels.

Sales of Power

We sell most of the electricity we supply (approximately 72% of total revenues

from electricity sales in 2002) to the eight REAS. Due to a change in the manner

in which electricity trading was conducted, in 2002 our direct sales of electric

power to the regional distribution companies declined by 5,476 GWh in comparison

with 2001, a fall of 14.8%. Our total sales in the domestic market, however,

declined by only 2,476 GWh, a decline of 6.4%, since in 2002 we sold some of the

electric power to domestic traders or on the electricity market organized by the

Electricity Market Operator (Operator trhu s elektrinou, a. s.).

Changing Conditions in the Electricity Market.

In accordance with the Energy Act, starting from January 1, 2002, a gradual

liberalization of the electricity market was initiated in the Czech Republic.

The electricity market is based on regulated access to the transmission grid and

the distribution systems. The participants in the electricity market include

power-generation companies, the operator of the power transmission grid, the

market operator, the commodities exchange, traders, and end customers. On

January 1, 2002, the first group of end customers (customers with an annual

consumption in excess of 40 GWh) obtained the status of eligible customers with

the right of access to the transmission grid and the right to choose their

supplier of electricity. As of January 1, 2002, government-regulated prices for

electricity apply only to protected customers (those who are not yet able to

choose their electricity supplier), to prices for the transmission and

distribution of electricity and to system-related prices (the prices of network

monopolies). The prices at which we supply electricity to the regional

distribution companies passed into the category of fully negotiated prices.

We responded to these new conditions, under which the market for domestic power

producers had been fully opened up and it became possible to secure power from

foreign competitors, by selling electricity in a completely new and

fundamentally different way. Under the brand name "Rainbow Energy", we offered

electricity in the domestic market in the form of standardized products similar

to those sold in the liberalized European markets. The structure of the offered

products consists of "building blocks" from which the customers can build the

required supply regime. The structure of this offer makes it possible for all of

the regional distribution companies to fully satisfy not only the requirements

of the protected customers, to whom the law obligates them to supply

electricity, but to also fully satisfy other requirements for delivery of

electricity from us.

20

In view of the fundamental change in the conditions for trading with electricity

in the Czech market, and the difficulty of anticipating how other participants

in the market would react (particularly eligible customers), seven "Rainbow