1

Vote Against Approval of Issuance of Shares (Item 2)

to CompleteAcquisition of Alliance Boots

at December 29, 2014 Special Meeting

of Walgreen Shareholders

3

CEO Wasson out, AB’s Pessina in! What Just Happened?

- 2 weeks before vote Wasson suddenly announces intent to stepdown, with no successor in place and no clear succession planannounced.

- AB’s Pessina will assume interim-CEO position.

- Two chief architects of this deal from WAG’s side now gone:CFO Miquelon and CEO Wasson.

- After 2.5 years of partnership and promises of smooth merger,shareholders are to vote with no idea who will lead thechallenging integration.

- Where was the board during this coup? It has remained silent, asit did during this deal’s other twists and turns.

4

Paying for the privilege of being taken over.

- An original deal, not even billed as a ‘merger of equals,’ but anacquisition with a control premium, now grants AB control overWAG’s operations plus a takeover premium.

- The “blended management team” is now dominated by AllianceBoots executives.

- If WAG’s management needed overhauling, there are cheaperways to do this than a $24 billion deal.

- History has repeated itself. Pessina used the 2005 mergerbetween his company, Alliance UniChem, and the Boots Groupto gain control of the combined company.

- Sets up specter of competing power bases - Nottingham,Chicago

5

Why vote AGAINST the full takeover of AB?

- Unnecessary –The existing partnership and joint venturealready achieve most, if not all, realizable synergies. There islittle need for the $24 billion second step.

- Overvalued –The premium is exceedingly rich and providesvaluation multiples far above comparables.

- Strategically risky –Shareholders face heightened exposure tounderperforming AB business amid weak Euro markets.

- Poorly negotiated –The cost of the acquisition has risen 28%since announced, investor vote delayed 2+ years.

- Lacks credible execution –Management has reducedcombined FY2016 EBIT 20% and has failed to give shareholdersneeded disclosure.

6

Alliance Boots:Looking under the hood shows sand in its growth engine

- Majority owned by Stefano Pessina and KKR

- AB is primarily a European drug wholesaler

–Source of revenue:

Europe > 90% of total

Wholesaling = 67% of total

- Limited organic growth potential:Retail pharmacy chains are prohibitedin most of Europe, making vertical integration impossible.

- Flat sales for the foreseeable future:The firm faces shrinking drugspends in many of its primary wholesaling markets, and increased retailcompetition in the UK. In 2013, wholesale profits were down and retailsales were flat.

- Global growth platform untested:AB’s investments in China and LatinAmerican are new, small and risky.

7

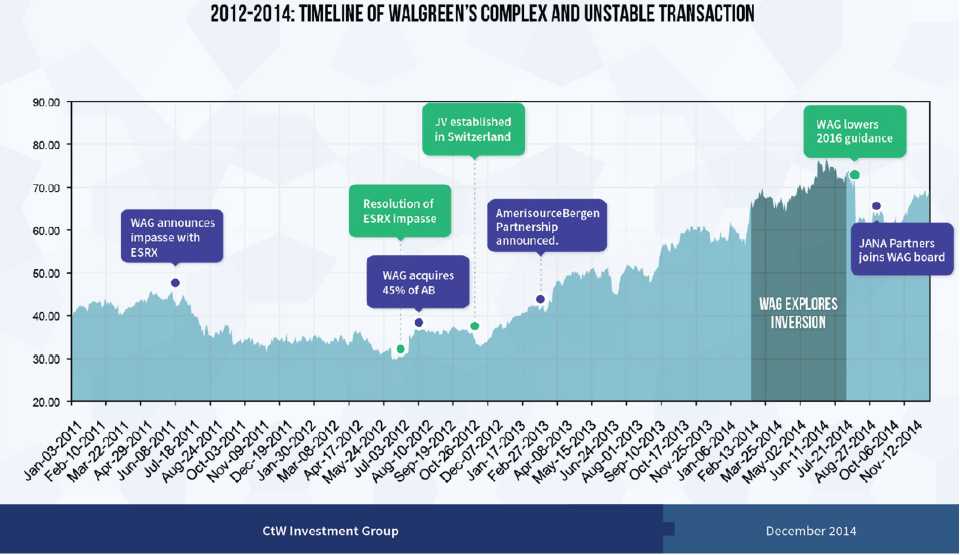

Deal Overview:Selected Timeline of Walgreen’s Complex and Unstable Transaction

8

Deal Overview:The unusual two-step business combination failed to give investors timely vote

| | | | |

| Transaction | Date | Deal Term | Consideration | Governance |

| |

| |

| Joint venture, | Aug 2012 | “Step 1” | $4.0B cash | Pessina & Murphy |

| equity swap | | | 83.4 M shares | (KKR) join WAG’s |

| (45% stake in | | | | board; hold 7.7% and |

| AB) | | | | ~0.7% respectively |

| |

| Full Acquisition | Pending | “Step 2” | $4.9B cash | ~16 to 20% ownership |

| | | | 144 M shares | Pessina Exec Vice |

| | | | (AB’s Debt) | Chair |

| | | | | | |

| | | 2012 Projections | | | 2014 Realities | |

| 2016 operating profit | $ | 9 - $9.5B | | $ | 7.2 | B |

| |

| Combined debt | $ | 11 | B | $ | 17.9 | B |

| Total cost of deal | $ | 28.9 | B | $ | 35.7 | B |

| EV/EBITDA (2015) | | 11.5 | x | | 14.8 | x |

| AB’s annual operating | | 9 | % | | 4.4 | % |

| income growth | | | | | | |

| |

| | 10 |

| Deal Overview: | |

| Market reaction to deal ambivalent | |

Walgreen’s share price has benefitted from a bull market, and has tracked a similar trajectory to close competitor CVS since the transaction was announced.

11

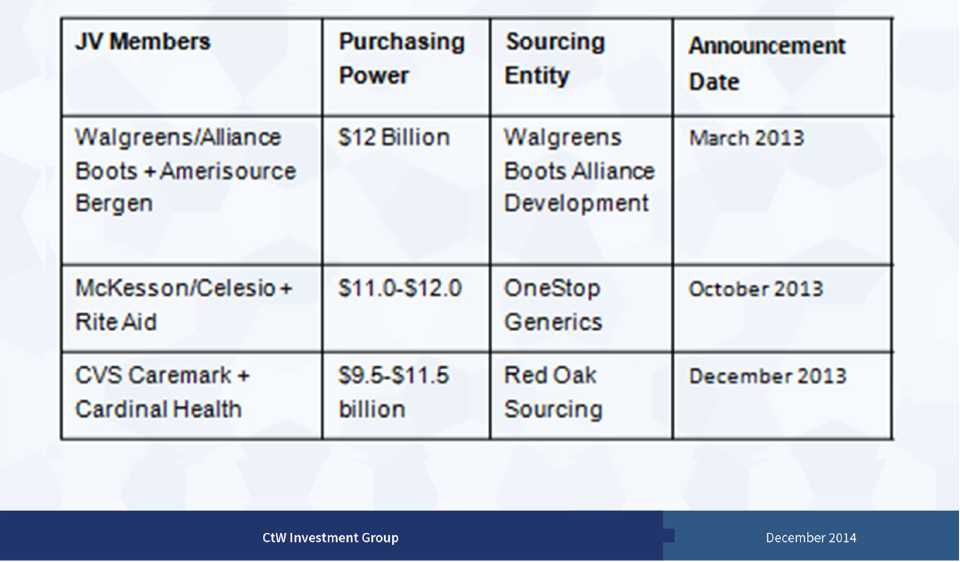

Acquisition Unnecessary: Paying for Pessina’s Empire Building, not for Synergies

| Synergies to date are procurement from purchasing JV. |

| | o | Probably a “majority” of procurement synergies can occur without second-step, according to Walgreen CFO. |

| Top two competitors have opted for the capital lightapproach of procurement joint ventures. |

| o | CVS JV with Cardinal |

| o | Rite Aid JV with McKesson |

- WAG has similar deal with AmerisourceBergen & AB- a betterway to test the waters of global consolidation.

12

Acquisition Overvalued: Excessive premium the road to buyer’s remorse

- Debt plus equity of second step ~$24 bn

- Consideration offers up to a 93% premium above fair value of AB’sequity under second step.

- Buffett’s first law of capital allocation: “what is smart at one price isdumb at another”

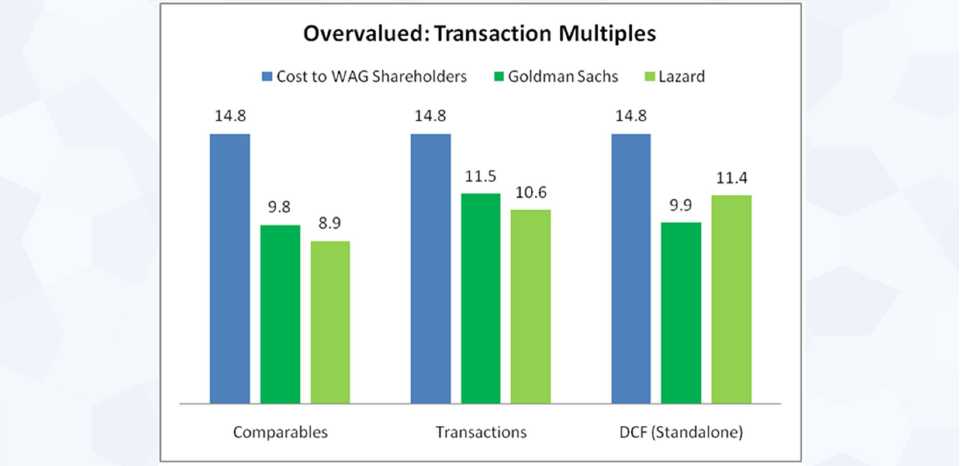

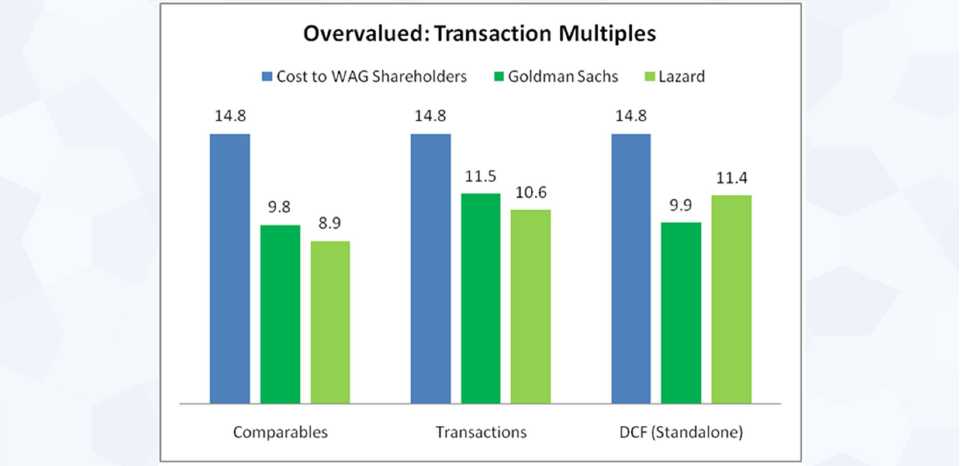

WAG is Paying EV/EBITDA Forward Multiple for13

Step 2 Far in Excess ofComparables

Mid-point valuations of fairness opinions provided by Goldman Sachs and Lazard compared to second step transaction cost based on consideration valued at $13.96 billion (based on Aug. 11. 2014) and expected debt.

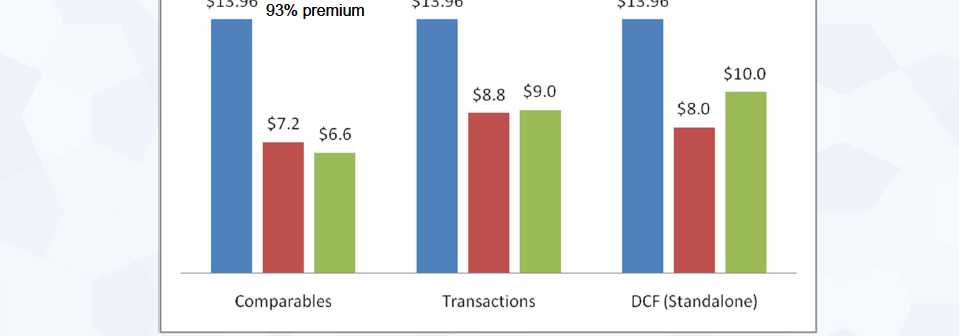

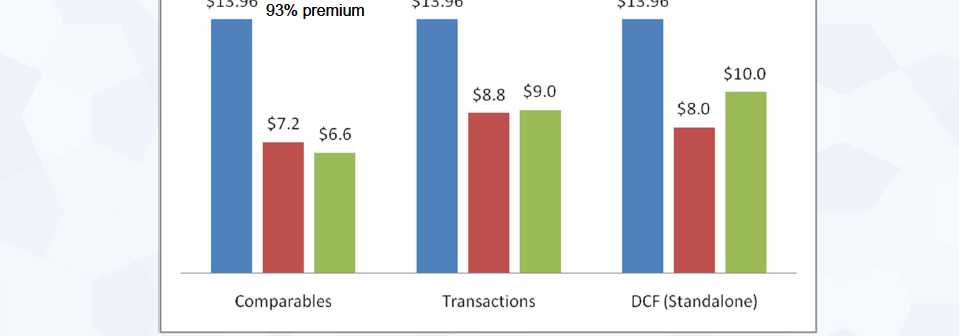

WAG is Paying up to a 93% Premium for Remaining Equity of AB 14

OVERVALUED: COST OF STEP 2 EQUITY

Blue = Cost to WAG shareholders Red = Goldman Sachs Green = Lazard

Due to AB’s privately-held status, the premium over and above market value is not available from per-share data. Using the midpoint valuations performed by Lazard andGoldman Sachs pursuant to the three valuation methodologies, we illustrate the takeout premiums using a second-step consideration value of $13.96 billion (based on Aug. 11. 2014 valuation date).

15

The Deal is Risky:Threats to Alliance Boots Performance and Synergies

| Continuing Headwinds from Europe |

| | | Austerity policies driving down drug prices, set to remain in place. |

| Timing, Likelihood of Synergies Uncertain |

| | | Procurement synergies are back-loaded. |

| | | Top-line synergies promised but appear unlikely. |

16

The Deal is Risky:Doubtful beauty synergies make deal look even uglier

| Boots’ beauty strategy faces challenges in US |

| | | Differences in US and UK markets make importing Boots’ beauty success unlikely. |

| | | US customers resist drugstores for beauty, favor high-end specialty retailers. |

| Margins are slashed for Boots products in US |

| | | Boots products cost up to 55 percent less at Walgreen. |

17

The Deal is Risky:The long line of British failure in America

18

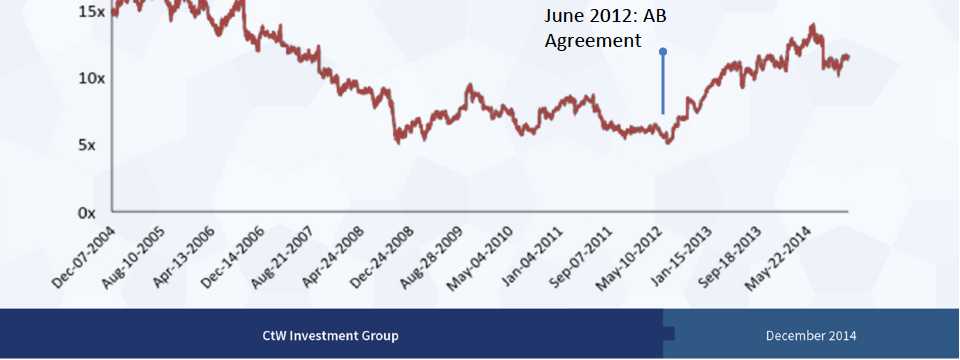

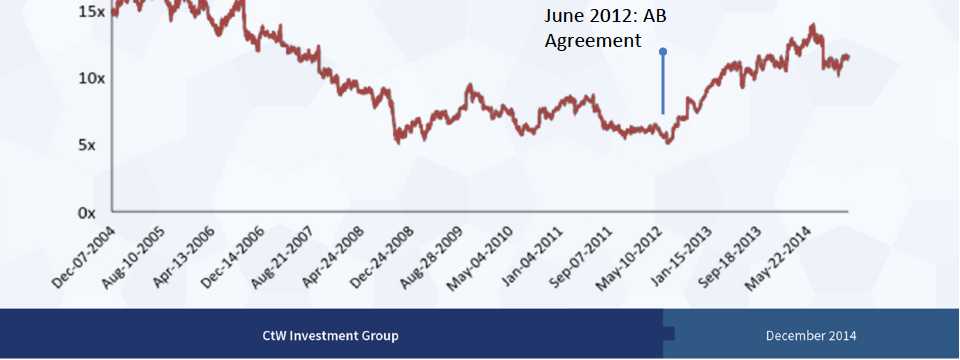

Acquisition poorly negotiated:Benefits AB’s Sellers

- Issue up to 25% in undervalued stock currencywithout“ceiling”protection for WAG shareholders on two-year option;

- Yetconcede downside “floor” protection for AB holders.

WAG Historical EV/EBITDA Trading

19Acquisition poorly negotiated:Long-term

shareholdervoices effectively silenced

| Failed to protect shareholder franchise by: |

| | o | Avoiding shareholder vote for 2 years: |

| | | o | Shareholders should have more say…“The way WAG has structured [this deal] treats shareholders very poorly…Shareholders have no real say… since the minimum purchase price ...is essentially set now even though there is no shareholder vote” - Barclays Equity Research, 20 June 2012 |

| |

| o | No provision for a vote of the disinterested shares in Second Step, when Pessina already holds 7% of voting shares |

- Failure to establish independent committee to renegotiate priceas AB’s performance slips and risk increases.

20

Lacks Credible Execution:Acquisition comes at time of strategic missteps and internal acrimony.

| WAG shocked market with $2 billion forecast reduction in August; 20% reduction in FY2016 EBIT goal for AB/WAG, stemming from: |

| | | Internal miscalculation of generic pricing and Medicare Part D reimbursement rates |

| | | Underperformance in both AB and WAG’s core businessÏAB growing at half the rate expected in 2012 |

| Controversy over the departure of CFO and other top-ranking executives |

| Increasing pressure from hedge funds to prop up stock: |

| | | Undertake a tax inversion |

| | | Pursue share buybacks |

21

Lacks Credible Execution:Disclosure leaves shareholders in dark on critical issues

- How well the board negotiated, oversaw original 2012agreement and its decision to proceed without key dealprovisions, shareholder vote.

- The basis of the original financial fairness opinions in 2012 andthe extent to which they would have supported what is now amore expensive deal for a weaker performing business.

- The degree to which hedge funds engaged and influenced theboard and/or key management, and the board’s decision toacquiesce to short-term activist demands.

22

Jana settlement further clouds interests of long-term shareholders

23

Summary: Why vote AGAINST this deal?

- Unnecessary

- Overvalued

- Strategically Risky

- Poorly negotiated

- Lacks credible execution

Appendix

Trend to Procurement Joint Ventures