SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by a Party other than the Registrant | ¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

Scientific Learning Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 6. | Amount Previously Paid: |

| 7. | Form, Schedule or Registration Statement No.: |

SCIENTIFIC LEARNING CORPORATION

300 Frank H. Ogawa Plaza, Suite 600

Oakland, CA 94612-2040

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 1, 2011

TO THE STOCKHOLDERS OF SCIENTIFIC LEARNING CORPORATION:

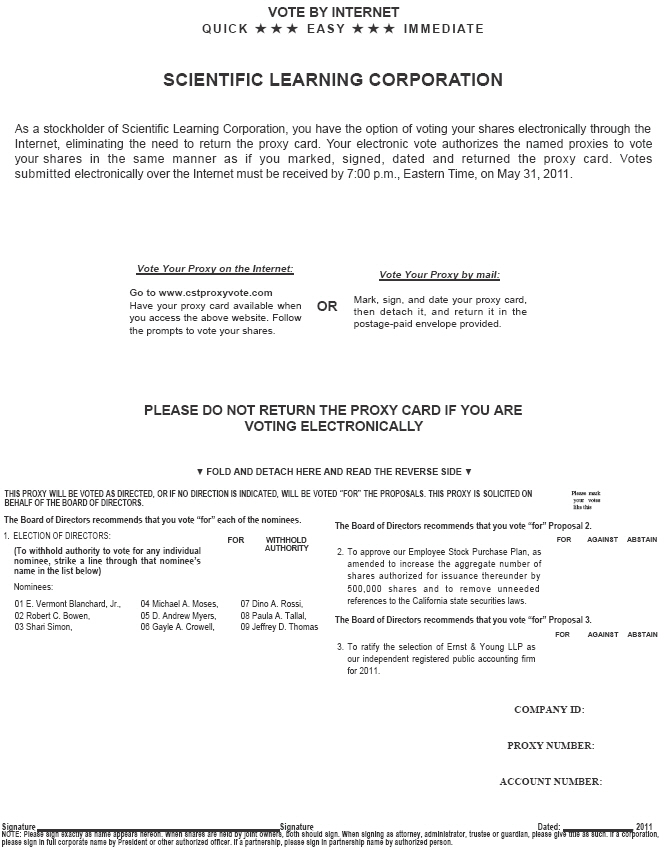

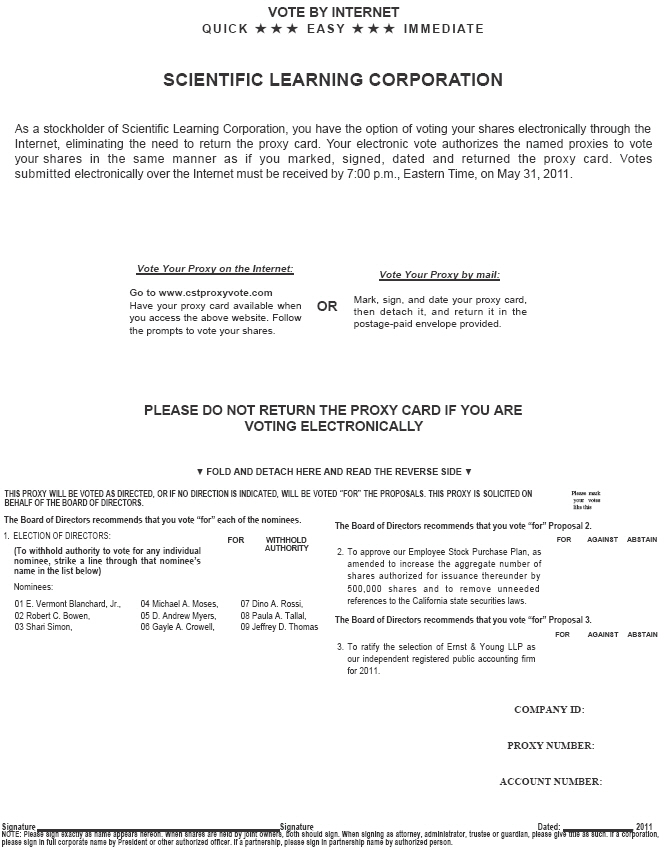

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of SCIENTIFIC LEARNING CORPORATION, a Delaware corporation, will be held on Wednesday, June 1, 2011, at 10:00 a.m. local time at our principal executive office at 300 Frank H. Ogawa Plaza, Suite 600, Oakland, CA 94612-2040 for the following purposes:

| 1. | To elect nine directors. |

| 2. | To approve our Employee Stock Purchase Plan, as amended to increase the aggregate number of shares authorized for issuance thereunder by 500,000 shares and to remove unneeded references to the California state securities laws. |

| 3. | To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2011. |

| 4. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on April 6, 2011 as the record date for the determination of stockholders entitled to notice of and to vote at this Annual Meeting and at any adjournment or postponement thereof.

| | By Order of the Board of Directors |

| | |

| | LINDA L. CARLONI |

| | Secretary |

Oakland, California

April 13, 2011

| All stockholders are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please vote by Internet, telephone, or if you received paper copies of the proxy materials by mail, you can also vote by mail by following the instructions on the proxy card or voting instruction card. If you vote by Internet or telephone, please do not mail a proxy or voting instruction card. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder. |

SCIENTIFIC LEARNING CORPORATION

300 Frank H. Ogawa Plaza, Suite 600

Oakland, CA 94612-2040

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

June 1, 2011

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We made these proxy materials available to you on the Internet or, upon your request, we have delivered printed versions of these materials to you by mail or email, because the Board of Directors of Scientific Learning Corporation is soliciting your proxy to vote at the 2011 Annual Meeting of Stockholders. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may vote by Internet or telephone or, if you requested printed versions of these materials, you may complete, sign and return the enclosed proxy card.

We intend to provide this proxy statement and accompanying proxy card on or about April 14, 2011 to all stockholders of record entitled to vote at the annual meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 6, 2011 will be entitled to vote at the annual meeting. On this record date, there were 18,736,620 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on April 6, 2011 your shares were registered directly in your name with Scientific Learning’s transfer agent, Continental Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 6, 2011, your shares were held not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

Because of a change in the rules applicable to brokers, your broker will not be able to vote your shares with respect to the election of directors if you have not given your broker specific instructions with respect to that vote.

What am I voting on?

There are three matters scheduled for a vote:

| · | Election of nine directors. |

| · | Approval of our Employee Stock Purchase Plan, as amended to increase the aggregate number of shares authorized for issuance thereunder by 500,000 shares and to make other changes described below. |

| · | Ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2011. |

Why did I receive a two-page notice in the mail regarding the Internet availability of proxy materials this year instead of a full set of proxy materials?

As required by the Securities and Exchange Commission, we have provided access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record and beneficial owners. All stockholders will have the ability to access the proxy materials on a website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found on the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

How do I vote?

You may either vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote from any nominee you specify. For the other matter to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting or vote by Internet, telephone or by using the enclosed proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

| · | To vote by Internet or touchtone telephone, please follow the instructions in the Notice. |

| · | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

| · | To vote in person, come to the annual meeting and we will give you a ballot when you arrive. |

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from Scientific Learning. Simply complete and mail the voting instruction card to ensure that your vote is counted. Alternatively, if your broker or bank offers this, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of April 6, 2011.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections and you are a stockholder of record, your shares will be voted “For” the election of all nine nominees for director and “For” the other proposals listed above. If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his or her best judgment, subject to compliance with applicable rules. If you are a beneficial holder and do not provide specific voting instructions to your broker, the organization that holds your shares will not be authorized to vote on the election of directors or the approval of the Employee Stock Purchase Plan. Accordingly, we encourage you to vote promptly, even if you plan to attend the annual meeting.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We will also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. We have not engaged a third-party proxy solicitor.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please vote the shares held in each different name or account by Internet, telephone or by returning each proxy card to ensure that all of your shares are voted.

Can I change my vote?

Yes. You can revoke your proxy. If you are not a stockholder of record, you should follow the instructions of your broker or bank. If you are a stockholder of record, you may revoke your proxy at any time before the final vote at the meeting in any one of three ways:

| · | You may submit a later Internet or telephone vote or a properly completed proxy card with a later date. |

| · | You may, prior to the date of the annual meeting, send a written notice that you are revoking your proxy to Scientific Learning’s Secretary at 300 Frank H. Ogawa Plaza, Suite 600, Oakland, CA 94612-2040. |

| · | You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

When are stockholder proposals due for next year’s annual meeting?

If you wish to suggest a candidate to be nominated by the Board of Directors at next year’s annual meeting, you must contact the Board’s Nominating and Corporate Governance Committee no later than December 23, 2011. If you wish to submit a proposal for the annual meeting, your proposal must be submitted in writing to Scientific Learning’s Secretary at 300 Frank H. Ogawa Plaza, Suite 600, Oakland, CA 94612-2040. To be considered for inclusion in next year’s proxy materials, the proposal must be submitted by December 23, 2011. Nominations for directors and proposals not to be included in the proxy materials must be submitted between February 1 and March 2, 2012. You are also advised to review our Bylaws and the Board’s Director Nominations process, which contain additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count “For,” “Withhold” and, with respect to proposals other than the election of directors, “Against” votes, abstentions and broker non-votes. Abstentions will be counted for purposes of determining the presence or absence of a quorum, but will have no effect on the outcome of the voting. Broker non-votes will be counted for purposes of determining the presence or absence of a quorum, but will have no effect on the outcome of the voting.

If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain voting instructions from the institution that holds your shares and follow those instructions regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange (“NYSE”) on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes. We believe that Proposal 3 will be considered a discretionary item.

How many votes are needed to approve each proposal?

| · | For the election of directors, the nine nominees receiving the most “For” votes (among votes properly cast in person or by proxy) will be elected. Only votes “For” or “Withheld” will affect the outcome. Abstentions and broker non-votes will have no effect on the outcome of the voting. |

| · | To be approved, Proposals No. 2 and 3 (approval of the amended Employee Stock Purchase Plan and ratification of the selection of Ernst & Young as our independent registered public accountants for 2010) must receive a “For” vote from the majority of the votes cast either in person or by proxy. Abstentions and broker non-votes will have no effect on the outcome of the voting. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares are represented by stockholders present at the meeting or by proxy. On the record date, there were 18,736,620 shares outstanding and entitled to vote.

Your shares will be counted for purposes of determining the presence or absence of a quorum only if you submit a valid proxy vote (or one is submitted for you) or if you vote in person at the meeting. Abstentions and broker non-votes will also be counted towards determining whether a quorum exists. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. We plan to publish final voting results in a Form 8-K within four business days after the end of the annual meeting.

Proposal 1

ELECTION OF DIRECTORS

Our Board of Directors is presently composed of eleven members. The term of office of all directors expires at the June 2011 meeting.

Of the nominees for election at this meeting, all are currently directors. Our Board elected Gayle A. Crowell and Shari Simon as members of the Board in November 2011 to fill vacancies on our Board. The other seven directors nominated for election were previously elected by the stockholders. If elected at the Annual Meeting, each of the nominees will serve until the 2012 annual meeting and until his or her successor is elected and qualified, or until such director’s earlier death, resignation or removal.

Except as otherwise required by applicable law, vacancies on the Board may be filled only by a majority of the remaining directors. A director elected by the Board to fill a vacancy (including a vacancy created by an increase in the number of directors) shall serve until the next annual meeting and until such director’s successor is elected and qualified.

Our policy is to invite all directors to attend the Annual Meetings of the stockholders, but their attendance is not required. Mr. Andy Myers was the only director who attended the 2010 Annual Meeting. Historically, few if any stockholders other than employees have attended the Annual Meeting in person.

Set forth below is biographical information for each person nominated and each person whose term of office as a director will continue after the Annual Meeting, with ages shown as of March 31, 2011.

Nominees for Election at the 2011 Annual Meeting

Edward Vermont Blanchard, Jr., age 59, joined us as a director in November 2002. Mr. Blanchard is presently a Managing Director at Aon Benfield Securities, Inc., the capital markets and strategic advisory investment banking subsidiary of Aon Corporation, which he joined in June 2009. From December 2004 through September 2008, Mr. Blanchard was a Senior Advisor to Irving Place Capital (formerly known as Bear Stearns Merchant Banking), a private equity investment firm. From 1986 through 1999, Mr. Blanchard worked in investment banking for Merrill Lynch & Co., from 1990 through 1999 as a Managing Director specializing in mergers and acquisitions for financial institutions. From January 2007 through July 2009, Mr. Blanchard was a member of the Board of Directors of Ironshore Inc., a Bermuda-based specialty property/casualty insurance company. He is also a Trustee of the American Folk Art Museum and the Yorkville Common Pantry. Mr. Blanchard holds a BA from Harvard College and an MBA from the University of North Carolina at Chapel Hill. Mr. Blanchard’s extensive experience in investment banking, mergers and acquisitions and private equity investments provides us valuable perspective and expertise in evaluating potential strategic opportunities, as well as financial and analytical expertise important in exercising oversight over our financial and accounting issues.

Robert C. Bowen, age 69, is the Chairman of our Board. He was our Executive Chairman during 2009 and served as our CEO from June 2002 through December 2008. From 1989 to 2001, Mr. Bowen served as a senior executive of National Computer Systems, a provider of educational assessment and administrative software and services acquired by Pearson PLC in 2000. His last assignment there, from 1995 to 2001, was as President of NCS Education, a provider of enterprise software for K-12 school districts. Earlier in his career, Mr. Bowen held senior executive positions with other education and publishing companies. Mr. Bowen has been a high school math teacher, a coach, and a school district administrator. Mr. Bowen received his bachelor’s and master’s degrees from the University of Tennessee, Chattanooga. Mr. Bowen’s deep experience in education technology provides us with invaluable expertise and knowledge in our particular industry, and his long history with the Company affords continuity in leadership.

Gayle A. Crowell, age 60, joined us as a director in November 2010. Since 2001, Ms. Crowell has served as an operational business consultant for Warburg Pincus, LLC, in its technology software and Internet services group. From 1998 to 2001 she was the CEO and Chairman of RightPoint Corporation, which offered real-time personalization for Internet and call center markets. Prior to RightPoint, she served as an executive at other leading software companies, including Oracle Corporation, View Star, Mosaix, Recognition International, DSC and Cubix Corporation. She currently also serves as a board member of Yodlee, Inc., Service Repair Solutions, Inc. and TradeCard. Ms. Crowell is also the co-founder of ConservingNow.com, an online community focused on environmental protection. Ms. Crowell began her career as an educator in the state of Nevada, and holds a Bachelor of Science degree from the University of Nevada at Reno. Ms. Crowell has broad experience in operations, sales, and marketing in a variety of large and small technology enterprises across multiple industries. This experience offers us a valuable and unique perspective, particularly with respect to our initiatives to improve the ease of use and accessibility of our offerings and to increase our social media presence.

Michael A. Moses, age 59, joined us as a member and Vice Chairman of the board in July 2007. Dr. Moses has been an educator for over 30 years. He currently serves as a senior advisor to the Center for the Reform of School Systems, a nonprofit organization focusing on the promotion of urban school reform. From November 2004 until July 2006, Dr. Moses served as Vice Chairman of the board at Higher Ed Holdings, the owner of the American College of Education. Dr. Moses served as the general superintendent of the Dallas Independent School District from 2001 through 2004. From 1999 through 2001, he served as the deputy chancellor for System Operations for the Texas Tech University system. Dr. Moses was the Commissioner of Education for the State of Texas from 1995 through 1999. Prior to that service, Dr. Moses was the superintendent of three Texas school districts, including Lubbock, LaMarque and Tatum and served as a teacher and school administrator in the Duncanville and Garland school districts. Dr. Moses holds bachelor’s and master’s degrees from Stephen F. Austin State University and a Doctor of Education degree from Texas A&M University - Commerce. Dr. Moses is a member of the board of directors of Southwest Securities Services Group, a holding company whose subsidiaries provide financial and investment services. He serves as special advisor and consultant to several corporations and entities that interface with elementary, secondary and higher education. Dr. Moses’ long service as an educator provides us with insight into the needs, organization and issues of our customers. His extensive contacts at all levels of education assist us in sales, marketing and business development.

D. Andrew Myers, age 39, joined us as President and Chief Operating Officer in January 2008 and became our Chief Executive Officer in January 2009. Prior to joining us, Mr. Myers worked at Pearson Education since 1996. His last position was as Senior Vice President, Digital Product Development for Pearson Curriculum, where he was responsible for integrating the technology teams from six preceding business units into a digital development group of 275 employees. From August 2004 to March 2007, Mr. Myers was the Chief Operations Officer for Pearson Digital Learning, where he was responsible for setting product, financial, technical and operational strategies for that 580-employee business unit. From 2002 to 2004, Mr. Myers served as Vice President Sales for Pearson Digital Learning. Mr. Myers started with Pearson as a sales representative in 1996. Pearson Education is the education division of Pearson PLC, an international media company. Mr. Myers holds an MBA from the Haas School of Business at the University of California Berkeley and a BS in finance from the University of Utah. Mr. Myers was elected to our Board because of his position as CEO, as well as his extensive experience in our K-12 market and in sales, operations and strategy.

Dino Rossi, age 56, joined our Board in February 2010. Mr. Rossi has been President, Chief Executive Officer and a director of Balchem Corporation since 1997. He became the Chair of Balchem’s Board in 2007. Balchem develops, manufactures and markets specialty performance ingredients and products for the food, nutritional, feed, pharmaceutical and medical sterilization industries. Mr. Rossi was also Chief Financial Officer of Balchem from April 1996 to January 2004, and earlier in his career served as principal accounting and/or financial officer at Norit Americas Inc., a wholly-owned subsidiary of Norit N.V., a Dutch chemicals company, and Oakite Products Inc., a specialty chemicals company, from 1987 to 1993. Mr. Rossi holds a B.S. in Accounting from West Virginia University. As the CEO of Balchem, Mr. Rossi has the experience of leading a small public company through a series of strategic moves that contributed significantly to company growth. Mr. Rossi’s extensive accounting and finance experience adds financial and accounting expertise important in exercising oversight over our financial and accounting issues.

Shari Simon, age 48, joined our Board in November 2010. Since 2006, Ms. Simon has served as President, Vice President, and a Board member of the Moraga Education Foundation, a nonprofit organization that funds programs in Moraga, California public schools. From 1993 to 2006 Ms. Simon was at Oracle Corporation, serving in positions of steadily increasing responsibility. From 2001 to 2006, she served as Senior Vice President, Strategy, Oracle Services; from 1999 to 2000 as Senior Vice President, E-business Strategy and Online Sales and prior to that as Senior Vice President, World-wide Alliances and Americas marketing. Earlier in her career, Ms. Simon served in sales management roles at Oracle, ReportSmith and Macromedia. She holds a BA and a Masters degree from the University of Connecticut. Ms. Simon is a technology leader with extensive experience in leading teams through the transition from a traditional software business to a web-based SaaS enterprise. As we make the transition from premises-based software to a SaaS mode, she offers us broad and deep experience in this area, as well as significant expertise in process simplification, sales, and marketing.

Dr. Paula A. Tallal, age 63, is one of our founders and has served as a director since inception. Since 1988, Dr. Tallal has served as co-director of the Center for Molecular and Behavioral Neuroscience at Rutgers, the State University of New Jersey. In 2001, Dr. Tallal was named a Board of Governors Professor in Neuroscience by Rutgers University. Dr. Tallal is an active participant in many scientific advisory boards and governmental committees for both developmental language disorders and learning disabilities. Dr. Tallal holds a BA in Art History from New York University and a PhD in Experimental Psychology from Cambridge University with additional training from The Johns Hopkins University. Dr. Tallal has a broad and deep understanding of the science behind our products, and therefore is particularly well-suited to provide guidance on scientific issues relating to our offerings. Dr. Tallal also has significant experience in working with children with language problems and the speech and language professionals who serve them, so she is able to provide us a valuable perspective about this important customer segment.

Jeffrey D. Thomas, age 44, joined us as a director in November 2008. Since February 2002, Mr. Thomas has been President and Chief Executive Officer of Ambassadors Group, Inc., an educational travel company that organizes and promotes international and domestic educational travel and sports programs for youth, athletes and professionals. Thomas has served in executive positions of increasing responsibility at Ambassadors Group and its predecessors since 1995, as President and Chief Executive Officer of Ambassador Programs, Inc. from 1996 to 2002; President of Ambassadors Education Group, Inc. from 1997 to 2002; and Chief Financial Officer to Ambassadors International from 1995 to 2002. Mr. Thomas serves as a member of the board of directors of Ambassadors Group, Inc. He holds a BA from Dartmouth College. Mr. Thomas offers us valuable perspective as an operating company executive and experience in guiding a small pubic company through rapid growth. His background also adds financial expertise to our Board to provide oversight over our financial and accounting issues.

The Board Of Directors Recommends

A Vote In Favor Of Each Named Nominee.

Independence of the Board of Directors

The Nasdaq Stock Market (“Nasdaq”) listing standards require that a majority of the members of a listed company’s Board of Directors qualify as “independent,” as affirmatively determined by the Board of Directors. After review of all relevant transactions and relationships between each director, or certain of his or her family members, and us, our senior management and our independent auditors, the Board affirmatively has determined that Mr. Blanchard, Ms. Crowell, Dr. Moses, Mr. Rossi, Ms. Simon, Dr. Tallal and Mr. Thomas are independent directors within the meaning of the applicable Nasdaq listing standards. In connection with the independence determination, the following relationships between the Company and the directors determined to be independent were considered:

| · | Starting in 2011, Ms. Simon is serving as a consultant to us. Her contract provides that her fees will not exceed $90,000. |

| · | Dr. Moses has served as a consultant to us in sales and marketing since 2007. His fee is approximately $40,000 per year. In addition, in 2007, Dr. Moses was granted stock options for 180,000 shares. Of these, 80,000 shares are vesting ratably over four years. The remaining 100,000 shares vest if our stock price reaches and maintains certain levels, starting at $15 per share. None of the performance-vesting shares have yet vested. |

| · | Dr. Tallal is one of our founders. Dr. Tallal served as our Executive Vice President from January 1996 until December 2000 and as Chairman of the Board of Directors from January 1996 until November 2000. During 1997, Dr. Tallal worked full-time with us during a sabbatical from her faculty position at Rutgers; she continues to consult with us pursuant to a consulting agreement. Under that consulting agreement, Dr. Tallal received compensation from us in the amounts of $87,516 in 2008 and $43,776 in each of 2009 and2010, respectively. Dr. Tallal has also consulted for Posit Science Corporation, which has licensed certain technology from us. Dr. Tallal also receives inventor share payments from Rutgers resulting from the license to us of the technology developed by the University of California and Rutgers. |

Information Regarding the Board of Directors and its Committees

The Board of Directors met eight times during the last fiscal year. All incumbent directors attended at least 75% of the meetings of the Board and the committees on which he or she served, held during the period for which he or she was a director or committee member, respectively.

Board Leadership Structure

Presently, our positions of Chairman of the Board and Chief Executive Officer are separate: Our CEO is D. Andrew Myers and our Chairman is Robert C. Bowen. Jeffrey D. Thomas serves as our Lead Director, and chairs the meetings of the independent directors. We believe that at this point in our development, separating the positions of Chairman and CEO improves our corporate governance by facilitating oversight through a non-employee chairman. Because of Mr. Bowen’s long history with the Company, we believe that in his role as Chairman, he provides particularly valuable continuity in our leadership, at a time when several of our executive officers have relatively short tenures with the Company.

Board’s Role in Risk Oversight

Board-level risk oversight is performed both by the Board itself and by our Board committees. The Audit Committee oversees our internal controls and monitors risks associated with our financial statements, accounting policies, fraud, information technology and disaster recovery. Our Nominating and Corporate Governance Committee addresses issues related to risks posed by related party transactions, corporate governance and non-financial regulatory issues. Our Compensation Committee oversees risks related to our compensation programs and policies. The full Board has responsibility for operational, strategic and technology risk and other areas of risk not assigned to a committee. We believe that allocating risk oversight to several committees and the Board itself provides for “checks and balances” and avoids the concentration of responsibility in only a few Board members. This same philosophy is reflected in our diversified leadership structure, which includes a non-Chair CEO, a non-employee Chairman and an independent Lead Director.

Board Committees

Our Board has three standing committees: an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The following table lists for each of these committees its members during 2010 and currently and the number of committee meetings held during 2010:

| Director | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee |

| Edward Vermont Blanchard, Jr. | Chair | | |

| Gayle A. Crowell | Member (starting Nov. 2010) | | |

| Michael A. Moses | | | Member (starting Feb. 2011) |

| Rodman W. Moorhead III | | Member (until Feb 2011) | Member (until Feb 2011) |

| Lance R. Odden | Member (until Feb 2011) | Member (until Feb 2011) | |

| Dino A. Rossi | Member | Chair (starting Nov. 2010) | |

| Shari Simon | Member (starting Nov. 2010) | Member (starting Nov. 2010) | |

| Paula A. Tallal | | | Member |

| Jeffrey D. Thomas | | Member | Chair |

| Total meetings in 2010 | 6 | 4 | 4 |

Below is a description of each standing committee of the Board of Directors. The charter of each committee can be found at our corporate website, on the World Wide Web, at scientificlearning.com/corporategovernance.

Audit Committee

The Audit Committee of the Board of Directors oversees our corporate accounting and financial reporting process. To achieve this, the Audit Committee evaluates the performance and assesses the qualifications of the independent registered public accounting firm (the “Auditors”); determines and approves the engagement of the Auditors; determines whether to retain or terminate the existing Auditors or to appoint and engage new Auditors; reviews and approves the retention of the Auditors to perform any proposed permissible non-audit services; pre-approves all compensation to be paid to the Auditors; confers with management and the Auditors regarding the scope, quality and effectiveness of internal controls over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; reviews the financial statements to be included in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q; and discusses with management and the Auditors the results of the annual audit and review of our quarterly financial statements.

The Board of Directors annually reviews the Nasdaq listing standards definition of independence for Audit Committee members and has determined that all members of our Audit Committee are independent (as independence is currently defined in Rule 4350(d)(2)(A) of the Nasdaq listing standards). The Board of Directors has determined that Mr. Blanchard and Mr. Rossi each qualify as an “audit committee financial expert,” as defined in applicable SEC rules, based on a qualitative assessment of their knowledge and experience.

Compensation Committee

The Compensation Committee of the Board of Directors oversees our compensation policies, plans and programs. The Compensation Committee reviews and approves our overall compensation strategy, including corporate performance goals and objectives relevant to the compensation of our executive officers and other senior management. The Committee also reviews and approves the compensation and other terms of employment of our Chief Executive Officer; considers the recommendation of our Chief Executive Officer and makes all determinations with respect to the compensation and other terms of employment of the other executive officers; makes recommendations to the full Board with respect to compensation of the members of the Board of Directors; and administers our employee equity plans. The Board of Directors has determined that all members of our Compensation Committee are independent, as independence is currently defined in Rule 4200(a) (15) of the Nasdaq listing standards.

The Compensation Committee periodically retains a compensation consulting firm, Compensia, as described in the Compensation Discussion and Analysis. In 2010, the compensation consultant retained by the Committee did not provide any additional consulting services to the Company where the fees for such services exceeded $120,000.

The Company has a two-person Non-Officer Equity Grant Committee composed of Andy Myers, our CEO, and Jeffrey D. Thomas. This Committee met four times in 2010. The Non-Officer Equity Grant Committee is authorized to award equity grants to non-officer employees and consultants, subject to numerical limits and other parameters established by the Compensation Committee from time to time.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of the Board of Directors oversees the director nomination process and our corporate governance functions. The Committee has the primary responsibility for identifying, reviewing and evaluating candidates to serve as directors, consistent with criteria approved by the Board. The Committee recommends to the Board candidates for election to the Board of Directors, makes recommendations to the Board regarding the membership of the committees of the Board, and assesses the independence of directors. The Board has determined that all members of the Committee are independent, as independence is currently defined in Rule 4200(a)(15) of the Nasdaq listing standards.

The Board has established guidelines for evaluating nominees for director. The qualifications that the Board seeks include: the highest standards of personal and professional ethics and integrity; demonstrated excellence and leadership in the candidate’s field of endeavor; commitment to, and experience and expertise in, strategic and independent thinking; and a demonstrated ability to ask critical questions and to exercise sound business judgment. The Board seeks to include a diverse spectrum of expertise and experience, with each director bringing to the Board experience or knowledge in one or more fields that contributes to the effectiveness of the Board. Examples of such fields are: neuroscience, research, marketing and sales, strategy development & execution, operations, education, public policy, finance and financial reporting, entrepreneurship, and strategic transactions.

The Board also considers the candidate’s commitment to staunchly representing the long-term interests of our stockholders, as well as the candidate’s willingness and ability to devote sufficient time to carrying out his or her duties and responsibilities and to serve on the Board for at least five years. The Board may modify these guidelines from time to time and will consider other factors as appropriate.

The Nominating and Corporate Governance Committee seeks nominees through a variety of sources, including suggestions by directors and management, business contacts of Committee members and other directors, recommendations from the Company’s stockholders (as further described below), and such other sources as the Committee believes appropriate. During 2010, the Company engaged a search firm to identify director candidates with diverse backgrounds, which resulted in the selection of Ms. Crowell and Ms. Simon as directors. The Committee may retain search firms in other circumstances if the Committee believes that to be appropriate. The Committee will consider the general guidelines summarized above, the current composition of the Board, which areas of qualification and expertise would best enhance the composition of the Board, the experience, expertise and other qualifications of candidates, the number of other commitments of candidates, whether the candidate would qualify as independent under applicable rules, and such other considerations as the Committee believes to be appropriate. The Committee has the flexibility to determine the most appropriate interviewing and referencing process. The Committee recommends nominees to the full Board, which then selects the nominees.

The Nominating and Corporate Governance Committee will also consider director candidates recommended by stockholders. The Committee evaluates all recommended candidates, in the same manner and using the same minimum criteria (set forth above), whether the candidate was recommended by a stockholder, the board or otherwise. The Committee will also evaluate whether candidates recommended by stockholders are identified with any particular issue to such an extent that the candidate’s ability to effectively represent all of the stockholders on a broad variety of issues might be compromised. Stockholders who wish to recommend individuals for consideration by the Committee to become nominees for election to the Board may do so by delivering a written recommendation to the Corporate Secretary at our principal executive office at least six months before the next annual meeting. Submissions must include the candidate’s name, contact information and biographical information; a description of any relationships between the stockholder making the suggestion and the candidate; any information that would be required to be disclosed about the candidate in the proxy statement if the candidate is nominated by the Board; the candidate’s consent to a background review by the Committee and to being included in the proxy statement if nominated; and the name and contact information of the stockholders who recommended the nominee, and the number of shares of our stock held by those stockholders.

Diversity

Our Board selection guidelines state that the Board should represent a diverse spectrum of expertise and experience. In considering changes in Board composition, the Nominating and Corporate Governance Committee considers what experience or knowledge contributes to the effectiveness of the Board, what experience or knowledge is already represented on the Board, what may be missing, and what fields may be over-represented. In 2010, the Committee emphasized the identification of more diverse candidates for the Board, which resulted in the Committee’s recommendation of Ms. Crowell and Ms. Simon as directors

Stockholder Communications with the Board of Directors

Our Board has adopted a formal process by which stockholders may communicate with the Board or any director. This information is available on our website on the World Wide Web at scientificlearning.com/corporategovernance.

Code of Ethics

We have adopted the Scientific Learning Corporation Policies on Business Ethics, which apply to all officers, directors and employees. The Policies are available on our website at the address stated above. If we make any substantive amendments to these Policies or grant any waiver from the Policies to any executive officer or director, the Board must approve such waivers or amendments. As required by law, within four business days of any amendment to or waiver of these policies that applies to a director or executive officer, we will disclose the nature of the amendment or waiver on our website or in a Form 8-K.

Report of the Audit Committee of the Board of Directors

This Report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

The Audit Committee oversees the financial reporting process on behalf of the Board. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal and disclosure controls. In fulfilling its oversight responsibilities, the Audit Committee reviews the financial statements with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee has reviewed and discussed our audited financial statements for the year ended December 31, 2010 with management. In addition, the Audit Committee discussed with Ernst & Young LLP, our independent registered public accounting firm, the matters required to be discussed by Statement on Auditing Standards No. 61, as amended by Statement on Auditing Standards No. 90 (Communication with Audit Committees).

The Audit Committee has also received and reviewed the written disclosure letter from Ernst & Young LLP regarding the auditors’ independence, as required by Rule 3526 of the Public Accounting Oversight Board (Communication with Audit Committees Concerning Independence) ) and has discussed the independence of Ernst & Young LLP with them.

Based upon this review and discussion, the Audit Committee has recommended to the Board of Directors that our audited financial statements for the year ended December 31, 2010 be included in our Annual Report on Form 10-K for the year, to be filed with the SEC.

From the members of the Audit Committee of Scientific Learning Corporation.

Edward Vermont Blanchard, Jr., Chair

Gayle A. Crowell

Dino A. Rossi

Proposal 2

APPROVAL OF THE EMPLOYEE STOCK PURCHASE PLAN, AS AMENDED

Since 1999, we have had in place our 1999 Employee Stock Purchase Plan (“Purchase Plan”). The Purchase Plan is intended to be a tax-qualified plan under Section 423 of the Code. There are presently 1,200,000 shares of Common Stock reserved for issuance under the Purchase Plan. As of March 15, 2011 an aggregate of 1,056,472 shares of our Common Stock had been purchased under the Purchase Plan and 143,528 shares of Common Stock (plus any shares that might in the future be returned to the Purchase Plan as a result of cancellations or expiration of purchase rights) remained available for future grant under the Purchase Plan.

In February 2011, subject to stockholder approval, the Board of Directors adopted an amendment to the Purchase Plan increasing the number of shares authorized under the Purchase Plan by 500,000 shares, for a total of 1,700,000 shares. Most of the shares that remain available under the Purchase Plan are expected to be purchased in the next scheduled purchase in June 2011. The Board believes that the Purchase Plan helps align the interests of employees with those of the stockholders by giving employees the ability to purchase shares in a convenient manner and at a modest discount. The Board further believes that the Purchase Plan helps us recruit, maintain and motivate a broad group of our employees.

In March 2011, subject to stockholder approval, the Board of Directors adopted further amendments to the Purchase Plan to:

| · | Change the name of the Purchase Plan to the Employee Stock Purchase Plan. |

| · | Remove certain references to provisions of the California Code of Regulations. These provisions were intended to make the Purchase Plan eligible for a permit under California state securities laws in the event that one was needed. A permit is not now needed because the Company is listed on the NASDAQ Global Market, and the Company does not expect to need a permit in the future. These references to the California regulations: |

| | o | Prevented issuance of rights under the Purchase Plan if a California permit was required and the shares covered by certain options and equity rights amounted to more than 30% of the Company’s outstanding stock without requisite stockholder approval; |

| | o | Limited the Purchase Plan life to ten years after stockholder approval if rights under thePurchase Plan were issued when a California permit was required. |

| | o | Required the delivery of certain financial information to participants if awards were issued when a California permit was required. |

Stockholders are requested in this Proposal 2 to approve the Purchase Plan, as amended. The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the meeting will be required to approve the Purchase Plan.

The Board Of Directors Recommends

A Vote In Favor Of Proposal 2.

A copy of the Purchase Plan, as Amended, is attached as Appendix 1 to these Proxy materials. The essential features of the Purchase Plan, as amended, are outlined below:

Purpose

The purpose of the Purchase Plan is to provide a means by which our employees (and employees of any parent or subsidiary of us designated by the Board to participate in the Purchase Plan) may be given an opportunity to purchase our Common Stock through payroll deductions, to assist us in retaining the services of our employees, to secure and retain the services of new employees, and to provide incentives for such persons to exert maximum efforts for the success of the our success. As of March 15, 2010, all of our approximately 200 employees in the United States were eligible to participate in the Purchase Plan, or would be eligible at the next entry date.

Administration

The Board has delegated administration of the Purchase Plan to the Compensation Committee of the Board. The Compensation Committee has the power to construe and interpret the Purchase Plan and the rights granted under it and, subject to the provisions of the Purchase Plan, to determine when and how rights to purchase our Common Stock will be granted, the provisions of each offering of such rights (which need not be identical), and whether any parent or subsidiary shall be eligible to participate in such plan. As used herein with respect to the Purchase Plan, the “Board” refers to any committee the Board appoints as well as to the Board itself.

Stock Subject to Purchase Plan

Subject to approval of this Proposal 4, 1,200,000 shares of Common Stock are reserved for issuance under the Purchase Plan. If rights granted under the Purchase Plan terminate without being exercised, the Common Stock not purchased under such rights again becomes available for issuance under the Purchase Plan.

Offerings

The Purchase Plan is implemented by offerings of rights to all eligible employees. The maximum length for an offering under the Purchase Plan is 27 months. Under the Purchase Plan, each offering is typically one year in duration and is divided into two “purchase periods” of six months in duration.

Eligibility

Any person who is customarily employed by us at least 20 hours per week and five months per calendar year (or by any or our parents or subsidiaries designated from time to time by the Board) on the first day of an offering period is eligible to participate in that offering under the Purchase Plan, provided such employee has been our employee for at least 10 days preceding the first day of the offering period.

Notwithstanding the foregoing, no employee is eligible to participate in the Purchase Plan if, immediately after the grant of purchase rights, the employee would own, directly or indirectly, stock possessing 5% or more of the total combined voting power or value of all classes of our stock or stock of our affiliates (including any stock which such employee may purchase under all outstanding rights and options), nor will any employee be granted rights that would permit him to buy more than $25,000 worth of stock (determined at the fair market value of the shares at the time such rights are granted) under all of our employee stock purchase plans in any calendar year.

Participation in the Plan

An eligible employee becomes a participant in the Purchase Plan by delivering to us, prior to the date selected by the Board as the offering date for the offering, an agreement authorizing payroll deductions of up to 15% of the employee’s total compensation during the purchase period.

Purchase Price and Payment

The purchase price per share at which shares are sold in an offering under the Purchase Plan is the lower of (a) 85% of the fair market value of a share of Common Stock on first day of the offering, or (b) 85% of the fair market value of a share of Common Stock on any purchase date.

The purchase price of the shares is accumulated by payroll deductions (without any increase for interest) over the offering period. Under the current offering, a participant may increase or decrease his or her participation level only as of the beginning of the next purchase period. In addition, a participant may, during a purchase period, reduce his contributions to zero, or withdraw from the offering, as described below, and receive the accumulated payroll deductions. All payroll deductions made for a participant are credited to his or her account under the Purchase Plan and deposited with our general funds. A participant may not make any additional payments into such account.

Purchase of Stock

By executing an agreement to participate in the Purchase Plan, an employee is entitled to purchase shares under the Purchase Plan. In connection with offerings made under the Purchase Plan, the Board shall specify a maximum number of shares any employee may be granted the right to purchase and may specify the maximum aggregate number of shares that may be purchased pursuant to such offering by all participants. If the aggregate number of shares to be purchased upon exercise of rights granted in the offering would exceed the maximum aggregate number, the Board would make a pro rata allocation of shares available in a uniform and equitable manner. Unless the employee’s participation is discontinued, his right to purchase shares is exercised automatically at the end of the purchase period at the applicable purchase price. See “Withdrawal” below.

Withdrawal; Termination of Employment

While each participant in the Purchase Plan is required to sign an agreement authorizing payroll deductions, the participant may withdraw from a given offering by terminating his or her payroll deductions and by delivering to us a notice of withdrawal from the Purchase Plan. Such withdrawal may be elected at any time prior to the end of the applicable offering period.

Upon any withdrawal from an offering by an employee, we distribute to the employee his or her accumulated payroll deductions without interest, less any accumulated deductions previously applied to the purchase of stock on the employee’s behalf during such offering, and such employee’s interest in the offering is automatically terminated. The employee is not entitled to again participate in such offering. An employee’s withdrawal from an offering does not have any effect upon such employee’s eligibility to participate in subsequent offerings under the Purchase Plan.

Rights granted pursuant to any offering under the Purchase Plan terminate immediately upon cessation of an employee’s employment for any reason, and we distribute to such employee all of his or her accumulated payroll deductions, without interest.

Restrictions on Transfer

Rights granted under the Purchase Plan are not transferable and may be exercised only by the person to whom such rights are granted.

Duration, Amendment and Termination

The Board may amend, suspend or terminate the Purchase Plan at any time. Any amendment of the Purchase Plan must be approved by the stockholders if such approval is necessary for the Purchase Plan to satisfy applicable laws and regulations, including a change in who is eligible to participate in the Purchase Plan or an increase in the number of shares available for awards under the Purchase Plan. Rights granted before amendment or termination of the Purchase Plan will not be altered or impaired by any amendment or termination of such plan without consent of the person to whom such rights were granted.

Adjustment Provisions

Transactions not involving our receipt of consideration, such as a merger, consolidation, reorganization, stock dividend or stock split will result in a change in the class and number of shares of Common Stock subject to the Purchase Plan and outstanding rights. In that event, the Purchase Plan will be appropriately adjusted as to the class and the maximum number of shares of Common Stock subject to the Purchase Plan, and outstanding rights will be adjusted as to the class, number of shares and price per share of Common Stock subject to such rights.

Effect of Certain Corporate Events

In the event of our dissolution, liquidation or specified type of merger then, as determined by the Board in its sole discretion; (i) the surviving corporation may assume the rights under the Purchase Plan or substitute similar rights; (ii) the rights under the Purchase Plan may continue in full force and effect; or (iii) the participants’ accumulated payroll deductions may be used to purchase stock immediately prior to the transaction and the participants’ rights in the ongoing offering terminated. The acceleration of purchase rights in the event of an acquisition or similar corporate event may be viewed as an anti-takeover provision, which may have the effect of discouraging a proposal to acquire or otherwise obtain control of us.

Federal Income Tax Information

The following is a summary of the effect of U.S. federal income taxation on the Purchase Plan participants and us. This summary does not discuss the income tax laws of any other jurisdiction in which the participant may reside.

The rights to purchase Common Stock granted under the Purchase Plan are intended to qualify as rights granted under an “employee stock purchase plan” as that term is defined in Section 423(b) of the Code.

A participant will be taxed on amounts withheld for the purchase of shares as if such amounts were actually received. A participant will recognize no taxable income until disposition of the acquired shares, and the method of taxation will depend upon the holding period of the purchased shares.

If the stock is disposed of at least two years after the beginning of the offering period and more than one year after the stock is transferred to the participant, then the lesser of (a) the excess of the fair market value of the stock at the time of such disposition over the exercise price or (b) the excess of the fair market value of the stock as of the beginning of the offering period over the exercise price will be treated as ordinary income. Any further gain will be taxed as a capital gain. Capital gains currently are generally subject to lower tax rates than ordinary income.

If the stock is sold or disposed of before the expiration of either of the holding periods described above, then the excess of the fair market value of the stock on the exercise date over the exercise price will be treated as ordinary income at the time of such disposition. The balance of any gain will be treated as capital gain. Even if the stock is later disposed of for less than its fair market value on the exercise date, the participant recognizes the same amount of ordinary income, and a capital loss is recognized equal to the difference between the sales price and the fair market value of the stock on such exercise date. Any capital gain or loss will be short-term or long-term, depending on how long the stock was held.

There are no federal income tax consequences to us by reason of the grant or exercise of rights under the Purchase Plan. We are entitled to a deduction to the extent amounts are taxed as ordinary income to a participant (subject to the requirement of reasonableness and the satisfaction of a tax reporting obligations).

Proposal 3

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Ernst & Young, LLP (“Ernst & Young”) as our independent registered public accounting firm for the fiscal year ending December 31, 2011 and the Board of Directors has directed that management submit the selection of the firm for ratification by the stockholders at the Annual Meeting. Ernst & Young has audited our financial statements since our inception in 1996. Representatives of Ernst & Young are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Stockholder ratification of the selection of Ernst & Young as our independent registered public accounting firm is not required. However, the Board is submitting the selection of Ernst & Young for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain the firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent registered public accountants at any time if the Audit Committee determines that such a change would be in the best interests of our company and our stockholders.

The Board Of Directors Recommends A Vote In Favor Of Proposal 3

Principal Accountant Fees and Services

The following table represents aggregate fees billed to us for the fiscal years ended December 31, 2010 and 2009 by Ernst & Young.

| | | Fiscal Year Ended | |

| | | 2010 | | | 2009 | |

| Audit Fees (annual audit, reviews of quarterly financial statements, reviews of SEC filings) | | $ | 638,000 | | | $ | 706,329 | |

| Audit-related Fees (consultations on accounting matters, internal controls and compliance with accounting and reporting standards) | | | ---- | | | | ---- | |

| Tax Fees (preparation of federal, state and local returns, assistance with audits, consultations with respect to tax planning and compliance issues and international transfer pricing) | | $ | 13,805 | | | | ---- | |

| All Other Fees (For 2010, support for potential corporate transaction; for 2009, subscription to Ernst & Young’s accounting research tool.) | | $ | 7,500 | | | $ | 1,995 | |

| Total Fees | | $ | 659,305 | | | $ | 706,329 | |

Pre-Approval Policies and Procedures

All fees described above were approved by the Audit Committee or its Chair prior to engagement of the auditor to perform the service, as is required by our policy. Under its policies, the full Audit Committee generally considers proposed engagements of the independent auditors as a committee. However, to ensure prompt handling of unexpected matters between meetings of the Committee, the Chair is authorized to approve services to be provided by Ernst & Young so long as the expected fees for each such service does not exceed $25,000 and the aggregate expected fees for all such services between one meeting of the Audit Committee to the next does not exceed $50,000. If the Chair pre-approves fees, that pre-approval is reported to the full Committee at its next meeting.

Generally, the Committee pre-approves particular services in the defined categories of audit services, audit-related services, tax services and other non-audit services, specifying the maximum fee payable with respect to that service. Pre-approval may be given as part of the Audit Committee’s approval of the scope of the engagement or on an individual explicit case-by-case basis before the independent auditor is engaged to provide each service. The Audit Committee has determined that the rendering of the services other than audit services specified above by Ernst & Young is compatible with maintaining the auditor’s independence.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of the our Common Stock as of March 11, 2011 by: (i) each director and nominee for director; (ii) each executive officer named in the Summary Compensation Table below (“Named Officer”); (iii) all executive officers and directors as a group; and (iv) all those known by us to be beneficial owners of more than five percent of our Common Stock.

| | | Shares Beneficially Owned (1) | |

| Beneficial Owner | | Number | | | Percent | |

| Trigran Investments, Inc. (2) | | | 5,178,910 | | | | 27.7 | % |

630 Dundee Road, Suite 230 Northbrook, IL 60062 | | | | | | | | |

Noel G. Moore 200 West Monroe Ave, Suite 1440 Chicago, IL 60606 | | | 1,573,492 | | | | 8.4 | % |

| Osmium Partners, LLC (3) | | | 1,300,081 | | | | 6.9 | % |

388 Market Street, Suite 920 San Francisco, CA 94111 | | | | | | | | |

| Segall Bryant & Hamill (4 | | | 1,250,477 | | | | 6.7 | % |

10 South Wacker, Drive, Suite 3500 Chicago, IL 60606 | | | | | | | | |

| Edward Vermont Blanchard, Jr. (5) | | | 222,443 | | | | 1.2 | % |

| Robert C. Bowen (6) | | | 1,881,981 | | | | 9.5 | % |

| Linda L. Carloni (7) | | | 149,038 | | | | * | |

| Gayle A. Crowell (8) | | | 1,000 | | | | * | |

| Robert E. Feller (9) | | | 47,558 | | | | * | |

| Jessica J. Lindl (10) | | | 49,622 | | | | * | |

| Rodman W. Moorhead III (11) | | | 157,561 | | | | * | |

| Michael A. Moses (12) | | | 98,142 | | | | * | |

| D. Andrew Myers (13) | | | 203,079 | | | | 1.1 | % |

| David C. Myers (14) | | | 41,765 | | | | * | |

| Lance R. Odden (15) | | | 72,578 | | | | * | |

| Dino A. Rossi (16) | | | 16,313 | | | | * | |

| Shari Simon (17) | | | 1,000 | | | | * | |

| Dr. Paula A. Tallal (18) | | | 595,107 | | | | 3.2 | % |

| Jeffrey D. Thomas(19) | | | 27,346 | | | | * | |

| | | | | | | | | |

| All directors and executive officers as a group | | | 3,833,643 | | | | 18.8 | % |

| (17 persons) (20) | | | | | | | | |

________________

| (1) | This table is based upon information supplied by officers and directors and Schedules 13D and 13G filed with the SEC. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, we believe that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 18,712,184 shares outstanding on March 11, 2011, adjusted as required by rules promulgated by the SEC. |

| (2) | Includes 3,320,763 shares held by Trigran Investments, L.P., 1,811,792 shares held by Trigran Investments, L.P. II, and 46,355 shares held by accounts (“Accounts”) managed by Trigran Investments, Inc. on a discretionary basis. Trigran Investments, Inc. is the investment manager to and general partner of both the partnerships. Trigran Investments, Inc. shares voting and investment power with respect to the shares held by Accounts. Douglas Granat, Lawrence A. Oberman and Steven G. Simon are the controlling shareholders and sole directors of Trigran Investments, Inc. and thus may be considered the beneficial owners of the Common Stock beneficially owned by Trigran Investments Inc. Each of these persons disclaims beneficial ownership of the Common Stock except to the extent of his or its pecuniary interest therein. |

| (3) | Includes 271,436 shares held by Osmium Capital, LP (“Fund 1”), 817,177 shares held by Osmium Capital II, LP (“Fund 2”), 116,365 shares held by Osmium Spartan, LP (“Fund 3”), 94,003 shares held by accounts (“Accounts”) managed by Osmium Partners, LLC (“Osmium Partners”) on a discretionary basis, and 1,100 shares held by John H. Lewis. Mr. Lewis is the controlling member of Osmium Partners, which serves as the general Partner of Funds 1, 2 and 3 (the “Funds”). Mr. Lewis and Osmium Partners may be deemed to share with the Funds and the Accounts voting and dispositive power with respect to such shares. Each of Mr. Lewis, Osmium Partners and the Funds disclaims beneficial ownership with respect to any shares other than the shares owned directly by such person. |

| (4) | Segall, Bryant & Hamill is a registered investment advisor. Their filings indicate that they have sole investment discretion over all these shares, sole voting authority over 525,339 of the shares and no voting authority over 725,138 of the shares. |

| (5) | Includes 185,777 shares held by Mr. Blanchard and 15,000 shares held by the Edward V. Blanchard Insurance Trust UAD 12/20/93, of which Mr. Blanchard’s children are beneficiaries. Also includes 21,666 shares subject to stock options that are or will be exercisable by May 10, 2011. |

| (6) | Includes 830,315 shares held by Mr. Bowen and 1,051,666 shares subject to stock options that are or will be exercisable by May 10, 2011. |

| (7) | Includes 46,851 shares held by Ms. Carloni. Also includes 102,187 shares subject to stock options that are or will be exercisable as of May 10, 2011. |

| (8) | Includes 1,000 shares subject to stock options that are or will be exercisable as of May 10, 2011. |

| (9) | Includes 18,809 shares held by Mr. Feller. Also includes 28,749 shares subject to stock options that are or will be exercisable by May 10, 2011. |

| (10) | Includes 31,538 shares held by Ms. Lindl. Also includes 18,084 shares subject to stock options that are or will be exercisable as of May 10, 2011. |

| (11) | Includes 150,895 shares held by Mr. Moorhead. Also includes 6,666 shares subject to stock options that are or will be exercisable as of May 10, 2011. |

| (12) | Includes 16,476 shares held by Mr. Moses. Also includes 81,666 shares subject to stock options that are or will be exercisable as of May 10, 2011. |

| (13) | Includes 65,788 shares held by D. Andrew Myers and 137,291 shares subject to stock options that are or will be exercisable as of May 10, 2011. |

| (14) | David C. Myers and D. Andrew Myers are not related. Includes 13,016 shares held by David C. Myers and 28,749 shares subject to stock options that are or will be exercisable as of May 10, 2011. |

| (15) | Includes 20,912 shares held by Mr. Odden. Also includes 51,666 shares subject to stock options that are or will be exercisable as of May 10, 2011. |

| (16) | Includes 13,980 shares held by Mr. Rossi. Also includes 2,333 shares subject to stock options that are or will be exercisable as of May 10, 2011. |

| (17) | Includes 1,000 shares subject to stock options that are or will be exercisable as of May 10, 2011. |

| (18) | Includes 440,108 shares held directly by Dr. Tallal and 133,333 shares held by the Colleen Osburn Trust, for which Dr. Tallal serves as trustee. Also includes 21,666 shares subject to stock options that are or will be exercisable as of May 10, 2011. Dr. Tallal disclaims beneficial ownership of the shares held by the trust. |

| (19) | Includes 25,680 shares held by Mr. Thomas. Also includes 1,666 shares subject to stock options that are or will be exercisable as of May 10, 2011. |

| (20) | Includes the information in notes (1) and (5) through (19), as applicable. Also includes for two other executive officers included in the group: 139,111 shares held by such officers and 129,999 shares subject to stock options that are or will be exercisable as of May 10, 2011. |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our Common Stock and other equity securities. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on our review of the copies of such reports furnished to us, during the fiscal year ended December 31, 2010, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were met.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

2010 Summary

| · | We faced a difficult funding and selling environment in 2010, particularly in the US K-12 market, and our 2010 revenue decreased 22% compared to 2009, reflecting a 30% decrease in booked sales. Under our 2010 Management Incentive Plan (“MIP”), 70% of the target bonus potential is based on shared financial goals. We did not achieve the 2010 financial goals and no payouts under the MIP were made for those goals, leading to an average 77% decline in MIP bonuses to the Named Officers for 2010 compared to 2009. |

| · | In 2010, the non-equity compensation of our CEO decreased 40% compared to 2009, to $388,247, reflecting the MIP bonus decrease. In March 2010, the Compensation Committee granted restricted stock units for 150,000 shares to the CEO, to reward his 2009 performance, improve his retention incentives, further align the CEO’s interests with those of the stockholders, and provide an additional long-term incentive to balance the short-term incentive provided by the MIP. While the restricted stock units vest over four years, the full grant date value is reflected as required in the summary compensation table below. This resulted in a $495,000 increase in the CEO’s equity compensation to $697,500 and a 28% increase in total compensation year over year. |

| · | In May 2010, the Board made two changes in compensation related to change in control. The Board adopted a Change of Control Benefit Plan, which provides for severance payments of 12 months base salary for executive officers other than the CEO if we experience a change of control and the officer’s employment terminates under certain circumstances. Our CEO has continued under his earlier change of control provisions. The Board also amended the Company’s employee option plan for new grants, to better align the option program with best practice. The plan previously provided that in the event of certain change in control transactions, all unvested equity grants would accelerate. The change requires that, in addition to the change in control occurring, the grantee must also be terminated. More detail on these provisions can be found below in the section titled Change of Control; Termination. |

Philosophy

Like all of our compensation programs, our executive compensation programs are designed to attract and retain key employees, to motivate our employees to achieve our operating and strategic goals and to bring value to our stockholders and customers, and to reward our employees for achieving those objectives.

Our executive compensation programs specifically seek to:

| · | Focus our executives on our most significant strategic and operating objectives – increasing market acceptance of our products and growing our sales and revenue in an increasingly profitable manner; |

| · | Provide incentives for our executives to build long-term stockholder value; |

| · | Align compensation with company and individual achievement of specified goals; |

| · | Enable us to attract and retain superior executives in key positions by providing a competitive level of compensation; and |

| · | Provide appropriate levels of risk and reward. |

Compensation Process

The Compensation Committee of our Board determines the compensation of the Named Officers. The Committee reviews executive compensation in the first quarter of each year, making decisions with respect to the discretionary portion of the officers’ incentive compensation for the prior year and decisions for the coming year with respect to base salary and incentive compensation plan structure and content. In past years, equity grants to officers were made at the same time; the Committee decided that starting in 2011, it would consider equity grants for the Named Officers in the third quarter, in connection with the mid-year performance reviews.

Compensation Consultant / Benchmarking

The Compensation Committee periodically retains Compensia, a compensation consulting firm, to assist it. Compensia provided executive compensation reviews to the Committee in 2008 and 2010, as well as providing periodic assistance to the Committee in connection with Board compensation, executive hiring, executive promotions and other compensation disclosure and policy issues.