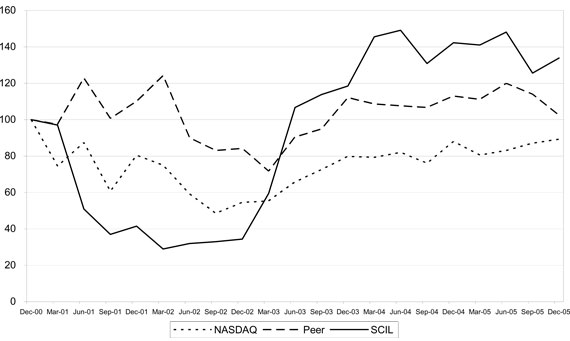

The comparison assumes $100 was invested on December 31, 2000 in Scientific Learning Common Stock and in each of the foregoing indices. It also assumes reinvestment of dividends. The stock price performance shown in the graph below should not be considered indicative of potential future stock price performance.

As noted above, the Company’s Compensation Committee consists of Mr. Holstrom, Mr. Moorhead and Mr. Smith. None of the members of the Compensation Committee has been an officer or employee of the Company, except that Mr. Holstrom served as the Company’s Chief Financial Officer from February 1996 to March 1997. No executive officer of the Company serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on the Company’s Board of Directors or Compensation Committee. Mr. Moorhead is affiliated with Warburg Pincus and its related entities, which have engaged in a number of transactions with the Company. These transactions are described below, under “Certain Transactions.”

In March 2001, the Company entered into a $15 million unsecured revolving line of credit with Fleet National Bank. WPV, Inc., an affiliate of Warburg, Pincus Ventures, the Company’s largest stockholder, provided an unlimited guaranty for the facility. In consideration of the guaranty, the Company issued WPV a warrant to purchase 1,375,000 shares of the Company’s common stock with an exercise price of $8.00, expiring March 9, 2008. The Company also agreed to reimburse WPV for any amounts it might be required to pay in satisfaction of the loan, granted WPV a security interest in substantially all of its assets, and amended the Company’s Registration

26.

Rights Agreement to include shares issuable on exercise of the warrant as Registrable Securities. The estimated value of the warrants was $3.6 million as of the date of issuance. In March 2002, the Company agreed with the Bank and the Warburg affiliate to extend the term of the line of credit from October 2002 to June 2004.

In September 2003, the Company agreed to reduce the amount available under the Fleet line of credit because the Company did not believe that it had need of the full amount of the line during its limited remaining term. As a result of the reduction in the credit facility, WPV’s guarantee obligation and its obligation to provide a standby letter of credit was reduced to $10,000,000.

In January 2004, the Company terminated the Fleet line of credit and established a new line of credit with Comerica Bank. Until July 30, 2004, that line was partially secured by a letter of credit of $3 million to $4 million provided by WPV. The Company again agreed to reimburse WPV for any amounts drawn or other payments made by WPV under the letter of credit. The Company granted a security interest in all of its assets other than intellectual property, both to Comerica and to WPV; the security interest granted to WPV terminated at the time the letter of credit terminated. The Company also agreed during the term of the letter of credit not to restrict its ability to grant a security interest on intellectual property.

Posit Science Corporation

In September 2003, we signed an agreement with Neuroscience Solutions Corporation, which has been re-named Posit Science Corporation (“PSC”), transferring technology to PSC for use in the health field. The transaction includes a license of the patents we own, a sublicense of the patents we license from others, the license of certain software we developed, and the transfer of assets related to certain research projects. All of the rights licensed to PSC are limited to the health field and most are exclusive in that field. We continue to use the licensed patents and technology in the fields of education and speech and language therapy, and retain all rights to our technology outside of the health field. We also agreed with PSC that we would license one another certain patents that may be issued in the future, on which royalties would be paid, and that we would provide PSC certain technology transfer, hosting and support services.

PSC is a start-up company located in San Francisco that develops, markets, and sells software-based products for healthcare markets based on neuroplasticity research. PSC’s first products focus on issues that commonly arise as a result of aging. Dr. Michael M. Merzenich, who is a founder, director, significant stockholder and former officer of our company, is also a founder, director, significant shareholder and officer of PSC.

The terms of the transaction were determined through arms’ length negotiations between PSC and us, in which Dr. Merzenich did not participate. We received an initial payment of $500,000 and will be entitled to a 2% to 4% royalty on future products of PSC that use the licensed technology. We were also issued 1,772,727 shares of Series A Preferred Stock in PSC. In 2004 and 2005, we received $50,000 from PSC in payment of the minimum annual royalty. Because PSC is a start-up venture the shares of which are not actively traded, in our financial statements we have assigned a value of zero to the NSC shares we received.

University Licensing

Under our license with The Regents of the University of California, we are obligated to make payments to The Regents in exchange for a license to commercially develop and sell products that make use of rights under patent applications filed by Drs. Tallal, Merzenich, Jenkins and Miller, among others, and subsequently assigned to The Regents and Rutgers, the State University of New Jersey. Eleven U.S. and three foreign patents issuing from these applications have been granted by the United States Patent and Trademark Office and additional foreign applications are pending. Drs. Tallal and Merzenich are members of our Board, and Drs. Jenkins and Miller are senior vice presidents with us. During 2005, we expensed an aggregate of approximately $1,082,000 for royalty payments under the license. Royalties are calculated based on a percentage of sales of covered products. In 2006, and for each year thereafter during the term of the license, the minimum royalty payment will be $150,000. Pursuant to the patent policies of The Regents and Rutgers, as well as understandings between inventors affiliated with each university, each university distributes to those inventors affiliated with the university, on an annual basis, a portion of the payments received from us. In 2005, the inventors received these payments from their universities in

27.

the following approximate amounts: Dr. Tallal, $87,588; Dr. Merzenich, $114,646; Dr. Jenkins, $81,208; and Dr. Miller, $29,196. The amount of any future university distributions to the inventors is indeterminable at this time because these figures are tied to our future performance; however, we estimate that less than 1% of product sales during the term of the license will be payable by the universities to each inventor. We negotiated the license on an arm’s length basis, without involvement by the inventors.

Officer Loans

In April 2001, the Company made loans in an aggregate principal amount of $3,114,383 to Dr. Miller and to Ms. Bolton, Mr. Mattson, and Mr. Mills, three former officers of the Company, for the purpose of assisting them in paying substantial income tax liabilities resulting from alternative minimum tax imposed on their exercise of Company stock options in 2000. Each loan was a full recourse loan, initially secured by a number of shares of the Company’s stock held by the officer equal to the lesser of (1) the principal amount of the loan divided by the average closing price of the Company’s stock for the 30 trading days preceding January 3, 2001, which was $4.4875, or (2) the total amount of Company stock held by the borrowing officer on the date of the note evidencing the loan. Each officer had the right to withdraw shares from the security interest to the extent that the fair market value of the collateral pledged exceeded 120% of the principal, but no officer had the obligation to pledge additional shares or to return withdrawn shares if the value of the collateral pledged fell below the loan amount. The number of shares pledged by each officer was: Dr. Miller, 323,120 shares; Ms. Bolton, 260,785 shares; Mr. Mattson, 52,591 shares, and Mr. Mills, 6,325 shares. The loans carried an annual interest rate of 4.94%. All principal and accrued interest was due December 31, 2005. At March 20, 2006 all amounts due under such loans had been paid.

Stock Transactions Involving Warburg Pincus

In November 2001, the Company completed the sale of 4,000,000 shares of our common stock to Warburg, Pincus Ventures at a purchase price of $1.25 per share, and an aggregate purchase price of $5,000,000. The transaction was completed as a private placement. In connection with the sale, the Company’s Registration Rights Agreement was further amended to include the shares sold in the transaction as Registrable Securities under that Agreement. Accordingly, the Company may be required to register such shares for resale in the future.

The former holders of our Series B, C and D preferred stock, which include Warburg, Pincus Ventures, our largest stockholder, are entitled to registration rights with respect to the common stock issued upon conversion of the Series B, C or D preferred stock.

In connection with the issuance of Series B preferred stock and warrants to purchase Series C preferred stock, we entered into an agreement that requires us, as long as Warburg, Pincus Ventures owns at least 10% of the outstanding common stock, to nominate and use our best efforts to elect one (if its percentage ownership is at or above 10% but below 20%) or two (if its percentage ownership is at or above 20%) individuals designated by Warburg, Pincus Ventures for election to the Board or Directors.

Please see the “Employment Agreement” section above for details of additional transactions with Mr. Bowen.

The Company has entered into indemnity agreements with each of its directors and executive officers. The Company’s certificate of incorporation and bylaws also contain provisions relating to limitation of liability and indemnification of directors and officers.

The Company believes that the foregoing transactions were in its best interests. As a matter of policy these transactions were, and all future transactions between the Company and any of its officers, directors or principal stockholders will be, approved by a majority of the disinterested members of the Board and/or by the Audit Committee of the Board. All future related-party transactions will be approved by the Audit Committee of the Board.

28.

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (for example, brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

This year, a number of brokers with account holders who are Scientific Learning stockholders will be “householding” our proxy materials. A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement and annual report, please notify your broker, direct your written request to Linda Carloni, Corporate Secretary, Scientific Learning Corporation, 300 Frank H. Ogawa Plaza, Suite 600, Oakland, CA 94612-2040, or contact Linda Carloni at 510-444-3500. Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request “householding” of their communications should contact their broker.

OTHER MATTERS

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

By Order of the Board of Directors

/s/ Linda L. Carloni

Linda L. Carloni

Secretary

May 3, 2006

A copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005 is being provided to shareholders with this Proxy Statement. The Company will furnish any of the Exhibits to the Report on Form 10-K free of charge to any shareholder upon request to Corporate Secretary, Scientific Learning Corporation, 300 Frank H. Ogawa Plaza, Suite 600, Oakland, CA 94612-2040.

29.

THIS PROXY IS BEING SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF SCIENTIFIC LEARNING CORPORATION

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 6, 2006.

THE BOARD OF DIRECTORS AND THE EXECUTIVE OFFICERS OF THE COMPANY

RECOMMEND A VOTE FOR ALL PROPOSALS, INCLUDING ALL NOMINEES LISTED.

PLEASE MARK, DATE, SIGN AND RETURN THIS PROXY PROMPTLY

IN THE ENCLOSED ENVELOPE.

-- FOLD AND DETACH HERE AND READ THE REVERSE SIDE --

SCIENTIFIC LEARNING CORPORATION |

THIS PROXY IS BEING SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. THIS PROXY WILL BE VOTED AS DIRECTED, OR IF NO DIRECTION IS INDICATED, WILL BE VOTED FOR ALL PROPOSALS. | Please mark

your votes

like this:

|

| |

1. ELECTION OF DIRECTORS

Nominees: Ajit M. Dalvi

Carleton A. Holstrom

Paula A. Tallal | FOR ALL WITHHOLD

authority as to ALL

| | 2. TO RATIFY THE SELECTION OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS FOR 2006 | FOR AGAINST ABSTAIN

|

| | |

To withhold authority to vote for any individual nominee, strike a line through the nominee’s name. | | 3. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting. |

| | | | |

| COMPANY ID: | |

| PROXYNUMBER: | |

| ACCOUNT NUMBER: |

| | | |

Signature: ________________________________Signature: ________________________________Date:_________

Please sign exactly as your name appears hereon. If the shares are held by joint owners, both should sign. Executors, administrators, trustees, guardians and attorneys-in-fact should add their titles. If a corporation, please give full corporate name and have a duly authorized officer sign, stating title. If a signer is a partnership, please sign in partnership name by authorized person.

-- FOLD AND DETACH HERE AND READ THE REVERSE SIDE --

Annual Meeting of Stockholders June 6, 2006 | By signing the other side, the signatory appoints Robert C. Bowen and Jane A. Freeman, and each of them, as attorneys and proxies of the signatory, with full power of substitution, to vote all of the shares of stock of Scientific Learning Corporation which the signatory is entitled to vote at the Annual Meeting of Stockholders to be held on June 6, 2006 at 10:00 a.m. local time, and at any adjournments, postponements and continuations thereof, with all power that the signatory would possess if personally present, upon the matters listed on the other side as instructed on the other side, with discretionary authority as to all other matters that may properly come before the meeting. |

TO BE MARKED, DATED AND SIGNED ON THE OTHER SIDE