Table of Contents

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JUNE 26, 2002 REGISTRATION NO. 333-____

SECURITIES AND EXCHANGE COMMISSION

FORM S-4

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

EchoStar DBS Corporation*

(Exact name of registrant as specified in its charter)

| Colorado (State or other jurisdiction of incorporation or organization) | 5064 (Primary Standard Industrial Classification Number) | 84-1328967 (IRS Employer Identification No.) |

5701 South Santa Fe Drive

Littleton, Colorado 80120

(303) 723-1000

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive office)

Senior Vice President, General Counsel and Secretary

EchoStar DBS Corporation

5701 South Santa Fe Drive

Littleton, Colorado 80120

(303) 723-1000

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

With copies to:

Raymond L. Friedlob, Esq.

John W. Kellogg, Esq.

RaLea Sluga, Esq.

Friedlob Sanderson Paulson & Tourtillott, LLC

1775 Sherman Street, Twenty-First Floor

Denver, Colorado 80203

(303) 571-1400

* The companies listed on the next page are also included in this Form S-4 Registration Statement as additional Registrants.

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following Box.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Table of Contents

| CALCULATION OF REGISTRATION FEE | ||||||||||||||||

| Title of each class of | Proposed Maximum | Proposed Maximum | ||||||||||||||

| securities to be | Amount to be | Offering Price Per | Aggregate Offering | Amount of | ||||||||||||

| registered | Registered | Note(1) | Price (1) | Registration Fee | ||||||||||||

| 9 1/8% Senior Notes due 2009 | $ | 700,000,000 | 100 | % | $ | 700,000,000 | $ | 64,400 | ||||||||

| Guarantees of 9 1/8% Senior Notes due 2009 by subsidiaries of us | (2 | ) | (2 | ) | $ | 0 | None(2) | |||||||||

| (1) | Pursuant to Rule 457(f)(2), the fee is calculated based upon the book value of the 9 1/8% Senior Notes due 2009 as of June 25, 2002. | |

| (2) | Pursuant to Rule 457(n) under the Securities Act of 1933, no registration fee is required with respect to the guarantees. |

The registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

| IRS Employer | ||||||||

| Exact Name of Additional Registrants* | Jurisdiction of Formation | Identification No. | ||||||

| EchoStar Satellite Corporation | Colorado | 84-1114039 | ||||||

| EchoStar Technologies Corporation | Texas | 76-0033570 | ||||||

| Echo Acceptance Corporation | Colorado | 84-1082359 | ||||||

| Echosphere Corporation | Colorado | 84-0833457 | ||||||

| Dish Network Service Corporation | Colorado | 84-1195952 | ||||||

| EchoStar International Corporation | Colorado | 84-1258859 | ||||||

| EchoStar North America Corporation | Colorado | 84-1282886 | ||||||

| EchoStar Indonesia, Inc. | Colorado | 84-1253832 | ||||||

| EchoStar Space Corporation | Colorado | 84-1307367 | ||||||

| EchoStar 110 Corporation | Colorado | 84-1480897 | ||||||

| * | The address for each of the additional Registrants is c/o EchoStar DBS Corporation, 5701 South Santa Fe Drive, Littleton, Colorado 80120. The primary standard industrial classification number for each of the additional Registrants is 5064. |

Table of Contents

| The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

SUBJECT TO COMPLETION DATED JUNE 25, 2002

| Prospectus _________________ , 2002 |

EchoStar DBS Corporation

Offer to Exchange $700,000,000 of its 9 1/8% Senior Notes due 2009 which have been registered under

the Securities Act for all of its outstanding 9 1/8% Senior Notes due 2009.

The Exchange Offer will expire at 5:00 p.m. Eastern Daylight Time on ___, 2002,

unless extended

The Exchange Notes

The exchange notes are substantially identical to the old notes that we issued on December 28, 2001, except for certain transfer restrictions and registration rights provisions relating to the old notes.

Material Terms of The Exchange Offer

| • | You will receive an equal principal amount of exchange notes for all old notes that you validly tender and do not validly withdraw. | ||

| • | The exchange will not be a taxable exchange for United States federal income tax purposes. | ||

| • | There has been no public market for the old notes and we cannot assure you that any public market for the exchange notes will develop. We do not intend to list the exchange notes on any national securities exchange or any automated quotation system. |

Consider carefully the “Risk Factors” beginning on page 18 of this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED THE EXCHANGE NOTES TO BE DISTRIBUTED IN THE EXCHANGE OFFER, NOR HAVE ANY OF THESE ORGANIZATIONS DETERMINED THAT THIS PROSPECTUS IS ACCURATE OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is _______________, 2002.

Table of Contents

TABLE OF CONTENTS

| WHERE YOU CAN FIND MORE INFORMATION | 2 | |||

| FORWARD-LOOKING STATEMENTS | 2 | |||

| SUMMARY | 3 | |||

| THE ECHOSTAR ORGANIZATION | 17 | |||

| RISK FACTORS | 18 | |||

| USE OF PROCEEDS | 40 | |||

| THE EXCHANGE OFFER | 41 | |||

| SELECTED FINANCIAL DATA | 49 | |||

| MANAGEMENT'S NARRATIVE ANALYSIS OF RESULTS OF OPERATIONS | 53 | |||

| QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 67 | |||

| THE PROPOSED MERGER AND RELATED TRANSACTIONS | 69 | |||

| BUSINESS | 77 | |||

| MANAGEMENT | 101 | |||

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 107 | |||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 107 | |||

| DESCRIPTION OF THE NOTES | 110 | |||

| DESCRIPTION OF OTHER INDEBTEDNESS | 144 | |||

| REGISTRATION RIGHTS | 145 | |||

| SUMMARY OF CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS | 146 | |||

| UNITED STATES ERISA CONSIDERATIONS | 151 | |||

| BOOK-ENTRY, DELIVERY AND FORM | 151 | |||

| PLAN OF DISTRIBUTION | 154 | |||

| LEGAL MATTERS | 155 | |||

| INDEPENDENT ACCOUNTANTS | 155 | |||

| INDEX TO FINANCIAL STATEMENTS | F-1 |

1

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

This prospectus contains summaries and other information that we believe are accurate as of the date hereof with respect to specific terms of specific documents, but we refer to the actual documents (copies of which will be made available to prospective purchaser upon request to us) for complete information with respect to those documents. Statements contained in this prospectus as to the contents of any contract or other documents referred to in this prospectus do not purport to be complete. Where reference is made to the particular provisions of a contract or other document, the provisions are qualified in all respects by reference to all of the provisions of the contract or other document. Industry and company data is approximate and reflect rounding in certain cases

We, our ultimate parent, EchoStar Communications Corporation, or ECC, and our direct parent, EchoStar Broadband Corporation, or EBC, are each subject to the informational requirements of the Exchange Act and accordingly file reports, proxy statements and other information with the SEC. These reports, proxy statements and other information may be inspected and copied at the offices of the SEC at 450 Fifth Street, N.W., Washington, D.C. 20549, 500 West Madison Street, Suite 1400, Chicago, Illinois 60661 and the Woolworth Building, 233 Broadway, New York, New York 10013. The SEC also maintains a website that contains reports and other information regarding registrants such as us that file electronically with the SEC. The address of that site is http://www.sec.gov.

The class A common stock of our ultimate parent company, ECC, is traded as “DISH” on the NASDAQ National Market. Materials filed by ECC can be inspected at the offices of the National Association of Securities Dealers, Inc., Reports Section, 1735 K Street, N.W., Washington, D.C. 20006. ECC has not guaranteed and is not otherwise responsible for the notes.

FORWARD-LOOKING STATEMENTS

All statements contained in this prospectus, as well as statements made in press releases and oral statements that may be made by us or by officers, directors or employees acting on our behalf, that are not statements of historical fact constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known or unknown risks, uncertainties and other factors that could cause our actual results to be materially different from historical results or from any future results expressed or implied by such forward-looking statements. The “Risk Factors” section of this prospectus, commencing on page 19, summarizes certain of the material risks and uncertainties that could cause our actual results to differ materially. In addition to statements that explicitly describe such risks and uncertainties, readers are urged to consider statements that include the terms “believes,” “belief,” “expects,” “plans,” “anticipates,” “intends” or the like to be uncertain and forward-looking. All cautionary statements made herein should be read as being applicable to all forward-looking statements wherever they appear. In this connection, investors should consider the risks described herein and should not place undue reliance on any forward-looking statements.

2

Table of Contents

SUMMARY

In this prospectus, the words “we,” “our,” “us” and “EDBS” refer to EchoStar DBS Corporation, a Colorado corporation, together with our subsidiaries, unless the context otherwise requires. “ECC” refers to our ultimate parent, EchoStar Communications Corporation, a Nevada corporation, “EBC” refers to EchoStar Broadband Corporation, a Colorado corporation, our direct parent and a wholly-owned subsidiary of ECC and “EchoStar” refers to ECC and its subsidiaries, including EBC and us. You should refer to the section entitled “The EchoStar Organization” for a simplified chart depicting EchoStar’s organizational structure. “Hughes” refers to Hughes Electronics Corporation, or a holding company that is expected to be formed to hold all of the stock of Hughes Electronics Corporation, and “PanAmSat” refers to PanAmSat Corporation, in each case including their respective subsidiaries, unless the context otherwise requires. This summary highlights selected information contained in greater detail elsewhere in this prospectus. This summary may not contain all of the information that you should consider before investing in our notes. You should carefully read the entire prospectus, including “Risk Factors” and “Disclosure Regarding Forward-Looking Statements” and the consolidated financial statements and the notes thereto appearing elsewhere in this prospectus.

ECHOSTAR DBS CORPORATION

Our Business

We are a leading provider of direct broadcast satellite television services in the United States through our DISH Network business unit. We are also an international supplier of digital satellite receiver systems and a provider of other satellite services.

Our Business Strategy

Our primary objective is to continue to expand our DISH Network subscriber base and to develop our interactive services. To achieve these objectives, we plan to:

| • | leverage our significant share of direct broadcast satellite spectrum capacity to offer more channels than any other video provider in the United States, and to offer unique programming services that will differentiate us from our competition, including niche and foreign language services; | ||

| • | offer marketing promotions that will enhance our position as a leading provider of value-oriented programming services and receiver systems; | ||

| • | expand and improve DISH Network distribution channels; | ||

| • | emphasize one-stop shopping for direct broadcast satellite services and equipment and superior customer service; and | ||

| • | develop EchoStar Technologies Corporation and our other businesses. |

Our DISH Network

We started offering subscription television services on the DISH Network in March 1996. As of March 31, 2002, the Dish Network had approximately 7.16 million subscribers. We now have seven direct broadcast satellite satellites in operation that enable us to offer over 500 video and audio channels, together with data services and high definition and interactive TV services, to consumers across the continental United States. We believe that the DISH Network offers programming packages that have a better “price-to-value” relationship than packages currently offered by most other subscription television providers. As of March 31, 2002, there were approximately 18.4 million subscribers to direct broadcast satellite and other direct-to-home satellite services in the United States. We believe that there are more than 88 million total pay television subscribers in the United States, and that there continues to be significant unsatisfied demand for high quality, reasonably priced television programming services.

3

Table of Contents

Interactive Services

We are continuing to expand our offerings to include interactive services. During 2001, we began offering DISH Network customers an interactive digital receiver with a built-in hard disk drive that permits viewers to pause and record live programs without the need for videotape. We now offer receivers capable of storing up to 35 hours of programming, and expect to increase storage capacity on future models to over 100 hours. We are also offering set-top boxes that can provide a wide variety of innovative interactive television services and applications.

EchoStar Technologies Corporation

In addition to supplying EchoStar satellite receiver systems for the DISH Network, our EchoStar Technologies Corporation subsidiary supplies similar digital satellite receivers to international satellite TV service operations. In addition to the DISH Network, our two major customers are Via Digital, a subsidiary of Telefonica, Spain’s national telephone company, and Bell ExpressVu, a subsidiary of Bell Canada, Canada’s national telephone company.

Our Executive Offices

Our principal executive offices are located at 5701 South Santa Fe Drive, Littleton, Colorado 80120 and our telephone number is (303) 723-1000.

The Proposed Merger of ECC with Hughes

On October 28, 2001, our parent company ECC, Hughes and General Motors, which is Hughes’ parent company, signed definitive agreements relating to ECC’s merger with Hughes in a stock-for-stock transaction to occur after the separation of HEC Holdings Inc., a newly formed company that will hold all of the outstanding capital stock of Hughes, from GM by means of a split-off. Hughes is a leading provider of satellite-based entertainment, information and communication services for the home and business markets, including video, data, voice, multimedia and Internet services. Through its DIRECTV subsidiary, Hughes is the largest provider of direct broadcast satellite services in the United States. Hughes also owns an approximately 81% equity interest in PanAmSat, a leading global provider of video and data broadcasting services through 21 satellites it owns and operates.

We will not be a direct party to the proposed merger or the acquisition of Hughes’ interest in PanAmSat. Although none of the parties is under any obligation to contribute any assets to us if ECC completes either of these transactions, we expect these transactions to have a significant impact on us.

We used the net proceeds from the offering of the old notes to repay amounts we owed to ECC. ECC intends to use these amounts for one or more of the following: (1) to provide a portion of the financing required for its merger with Hughes, (2) if ECC does not consummate the merger, to provide a portion of the financing for the acquisition by ECC of Hughes’ interest in PanAmSat, and (3) the construction, launch and insurance of additional satellites, strategic investments and acquisitions and other general corporate purposes. See “The Proposed Merger and Related Transactions – Merger Financing” for more information.

The surviving corporation in the merger will carry the EchoStar name and will provide direct broadcast satellite services in the United States and Latin America, primarily under the DIRECTV brand name, global fixed satellite services and other broadband communication services. The merger is subject to the prior separation of the business of Hughes from GM by way of a recapitalization of Hughes and split-off of HEC Holdings from GM and other conditions and risks. We expect the merger with Hughes and related transactions to require at least $7.025 billion of cash. We expect that ECC will provide approximately $1.5 billion of this amount from available cash at the time of signing the merger agreement. In addition, ECC and Hughes obtained $5.525 billion in bridge financing commitments for the Hughes merger and related transactions, which commitments have been reduced to $3.325 billion as a result of the sale of $700 million of the old notes and a $1.5 billion of investment by Vivendi Universal in ECC, which resulted in the issuance of 5,760,479 shares of ECC’s series D convertible preferred stock to a

4

Table of Contents

subsidiary of Vivendi. The remaining $3.325 billion of required cash will come from new cash raised by ECC, Hughes or a subsidiary of Hughes on or prior to the closing of the Hughes merger through public or private debt or equity offerings, bank debt or a combination thereof. The amount of such cash that could be raised by ECC prior to the completion of the Hughes merger is severely restricted. ECC’s agreements with GM and Hughes prohibit it from raising any additional equity capital beyond the $1.5 billion Vivendi investment, which prohibition will likely continue for two years following completion of the Hughes merger, absent possible favorable IRS rulings or termination of the Hughes merger. Any other financing we, EchoStar or Hughes complete prior to these transactions will further reduce the financing commitments on a dollar-for-dollar basis. We discuss this commitment under “The Proposed Merger and Related Transactions – Merger Financing.”

If the Hughes merger is terminated, ECC may be required to purchase Hughes’ interest in PanAmSat, merge with PanAmSat or make a tender offer for all of PanAmSat’s shares and may also be required to pay a $600 million termination fee to Hughes. If ECC purchases the Hughes interest in PanAmSat rather than undertaking the merger or the tender offer, it must make offers for all PanAmSat shares that remain outstanding. We expect that ECC’s acquisition of Hughes’ interest in PanAmSat, which would be at a price of $22.47 per share, together with its assumed purchase of the remaining outstanding PanAmSat shares and its payment of the termination fee to GM would require at least $3.4 billion of cash and approximately $600 million of ECC’s class A common stock. We expect that ECC would meet this cash requirement by utilizing a portion of its cash on hand.

ECC currently expects the Hughes merger to occur in the second half of 2002, subject, among other things, to receiving FCC approval and antitrust clearance. The section of this summary entitled “Effects of the Hughes Merger or the PanAmSat Acquisition on EDBS” briefly explains some of the immediate consequences we expect the transactions to have on us, and the section of this prospectus entitled “The Proposed Merger and Related Transactions” contains a more complete description of these transactions.

Information in this prospectus relating to potential business combinations with Hughes and/or PanAmSat is relevant only if ECC completes the Hughes merger or acquires Hughes’ interest in PanAmSat. For a discussion of the uncertainties surrounding the completion of the Hughes merger or the acquisition by ECC and the potential resulting impact on us, see “Risk Factors – Risks Related to the Proposed Merger and Related Transactions.” None of GM, HEC Holdings, Hughes or PanAmSat is offering the notes or any other securities hereby, and none of GM, HEC Holdings, Hughes or PanAmSat has guaranteed or is otherwise responsible in any way for the notes, our offering of the notes or any other securities that we may issue, or for the information contained in this prospectus. The completion of these transactions is not certain. You should consider all the alternative outcomes in connection with your investment in the notes, including the possibility that ECC completes neither the Hughes merger nor the acquisition of Hughes’ interest in PanAmSat.

EchoStar’s Reasons for the Merger

At its meeting on October 27, 2001, the EchoStar board of directors approved the Hughes merger and related transactions. In the course of making its decision to approve the Hughes merger and related transactions, the EchoStar board of directors consulted with EchoStar’s management, as well as its outside legal counsel and its financial advisors. The EchoStar board of directors considered, among other things, the following material factors at its October 27, 2001 meeting and certain prior meetings:

Strengthened Strategic Position.The combination of EchoStar and Hughes would create one of the nation’s largest multi-channel subscription television platforms, having a scale that would permit the surviving company to compete more effectively with cable television providers, deliver more program and service offerings to subscribers and better position the surviving company to exploit the growth opportunity represented by 100 million available United States television households.

Cost Savings and Revenue Synergies.The integration of the two companies would create substantial potential cost savings and revenue synergies, which were estimated at up to $5 billion annually by 2005, based on various assumptions and the expected contributions of these savings and synergies to the EBITDA of the combined

5

Table of Contents

companies. Based on further analysis and discussions that have taken place between EchoStar and Hughes since October 2001, EchoStar management is currently estimating that the integration of the two companies would create substantial potential cost savings and revenue synergies of up to $5 billion annually by 2007, based on various assumptions and the expected contributions of these savings and synergies to the EBITDA of the combined companies. The principal elements of the expected costs savings and synergies include the following:

Cost Savings:

| • | the reduction of subscriber acquisition costs through, among other things, standardization and reduction in the cost of set-top boxes; | ||

| • | reductions in churn through the offering of increased services to subscribers, the enhancement of customer loyalty and the reduction of signal piracy through new technology; | ||

| • | reductions in programming costs as a result of a significantly larger subscriber base; and | ||

| • | reductions in general and administrative expenses through the elimination of duplicative overhead. |

Revenue Synergies:

| • | increased advertising and interactive services revenue as a result of the larger subscriber base and a broader, national reach; | ||

| • | increased subscriber revenue as a result of the increase in the number of local markets that would have satellite access to local programming; | ||

| • | the provision of broadband Internet access to consumers and businesses in less densely populated areas; | ||

| • | increased revenue per subscriber through the addition of new product offerings, such as specialty content channels, video-on-demand and pay-per-view; and | ||

| • | additional revenues from the expansion in high definition television capabilities. |

You should understand that these estimated potential synergies are forward-looking statements subject to the risks and uncertainties described at “Forward-Looking Statements.” These estimated of synergies are based on numerous estimates, assumptions, and judgments and are subject to significant uncertainties. We cannot assure you that any particular amount of synergies will be realized by the surviving company in connection with the Hughes merger. See also “Risk Factors–Risks Related to the Proposed Merger and Related Transactions.”

Technological Strength.The surviving company would be able to leverage the combined research and development efforts and the engineering capabilities of the combined companies to expand the features and functionality of their satellite receiver systems. These features would include a wide variety of innovative interactive television services and applications. In addition, EchoStar believes that the surviving company would be better positioned to enhance its satellite-based broadband communications platform.

Effects of the Hughes Merger or the PanAmSat Acquisition on EDBS

The proceeds from the offering of the old notes may be used by ECC, among other things, to provide a portion of the new financing required for the merger of ECC with Hughes, or if ECC does not consummate the Hughes merger, to provide a portion of the cash financing required for ECC’s acquisition of Hughes’ interest in PanAmSat. See “The Proposed Merger and Related Transaction.” The Hughes merger or the acquisition of PanAmSat could have effects on us that are important to you.

6

Table of Contents

If ECC completes the Hughes merger, we will become a subsidiary of the combined company. Although we are not directly a party to the Hughes merger, the merger will affect us significantly in ways that are difficult to predict. See “Risk Factors – Risks Related to the Proposed Merger and Related Transactions” for a discussion of some of the possible direct and indirect effects of the merger on us.

The indenture governing the notes allows us to incur additional secured debt to provide additional financing for the merger. If ECC completes the Hughes merger, the amount of this additional secured debt would be limited to $2.7 billion plus the greater of $500 million or up to 1.25 times our 12-month trailing cash flow, depending on our credit rating. See “Description of the Notes – Limitation on Liens” and “– Limitation on Incurrence of Indebtedness.” To incur this debt, we would need consents from holders of our and EBC’s outstanding senior notes.

If ECC does not consummate the merger, ECC may purchase Hughes’ interest in PanAmSat, merge with PanAmSat or make a tender offer for all of PanAmSat’s shares. In this event, we will continue to be a subsidiary of ECC.

Finally, if neither the Hughes merger nor the acquisition of Hughes’ interest in PanAmSat occurs, we will remain a subsidiary of ECC.

Recent Developments

EchoStar VII Satellite

During April 2002, EchoStar VII, which was successfully launched on February 21, 2002 from Cape Canaveral, Florida, reached its final orbital location at the 119 degree orbital location and commenced commercial operation. To date, all systems on the satellite are operating normally.

EBC Exchange Offer

We are required by the terms of the indenture for EBC’s 10 3/8% senior notes due 2007 to make an offer to exchange all of EBC’s outstanding 10 3/8% senior notes for substantially identical notes of us as soon as practical following March 22, 2002, the date on which we filed our annual report on Form 10-K with the SEC and were permitted to incur indebtedness in an amount equal to $1,000,000,000 under the indebtedness to cash flow ratio test contained in Section 4.09 of the indentures for our 9 3/8% senior notes due 2009 and our 9 1/4% senior notes due 2006, each issued on January 25, 1999, and such incurrence of indebtedness would not otherwise cause any breach or violation of, or result in a default under the terms of our 1999 note indentures. Our subsidiaries will guarantee these exchange notes to the same extent that those subsidiaries guaranteed our 1999 notes. We anticipate making this offer to exchange EBC’s notes shortly after the exchange contemplated by this prospectus is made.

Changes to our Certifying Public Accountants

Effective June 1, 2002, ECC determined not to renew the engagement of its independent accountants, Arthur Andersen LLP and appointed KPMG LLP as its independent accountants, effective immediately for ECC and all of its consolidated subsidiaries including, but not limited to EBC and us. This determination followed ECC’s decision to seek proposals from independent accountants to audit its and our financial statements for the fiscal year ending December 31, 2002. The decision not to renew the engagement of Arthur Andersen LLP and to retain KPMG LLP was approved by ECC’s Board of Directors upon the recommendation of its Audit Committee.

Arthur Andersen’s report on ECC’s and our 2001 financial statements was issued on February 27, 2002 in conjunction with the filing of ECC’s and our Annual Report on Form 10-K for the year ended December 31, 2001.

During ECC’s and our two most recent fiscal years ended December 31, 2001, and the subsequent interim period through June 1, 2002, there were no disagreements between ECC or us and Arthur Andersen on any matter of accounting principles, or practices, financial statement disclosure, or auditing scope or procedure, which disagreements if not resolved to Arthur Andersen’s satisfaction would have caused them to make reference to the subject matter of the disagreement in connection with their reports.

None of the reportable events described under Item 304(a)(1)(v) of Regulation S-K occurred within ECC’s and our two most recent fiscal years and the subsequent interim period through June 1, 2002. The audit reports of Arthur Andersen on the consolidated financial statements of ECC and us as of and for the fiscal years ended December 31, 2001 and 2000 do not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

ECC provided Arthur Andersen with a copy of the foregoing disclosures.

During ECC’s and our two most recent fiscal years ended December 31, 2001, and the subsequent interim period through June 1, 2002, ECC and us did not consult with KPMG LLP regarding any of the matters or events set forth in Item 304(a)(2)(i) and (ii) or Regulation S-K.

7

Table of Contents

THE EXCHANGE OFFER

The exchange offer relates to the exchange of up to $700,000,000 aggregate principal amount of outstanding 9 1/8% senior notes due 2009 for an equal aggregate principal amount of exchange notes. The form and terms of the exchange notes are identical in all material respects to the form and terms of the corresponding outstanding old notes, except that we registered the exchange notes under the Securities Act, and therefore they will not bear legends restricting their transfer.

| The exchange offer | We are offering to exchange $700,000,000 principal amount of our exchange notes which we have registered under the Securities Act for each $1,000 principal amount of outstanding old notes. In order for us to exchange your old notes, you must properly tender them to us and we must accept them. We will exchange all outstanding old notes that are validly tendered and not validly withdrawn. | |

| Resale of the exchange notes | Based on an interpretation by the staff of the SEC set forth in no-action letters issued to third parties, we believe that you may offer for resale, resell and otherwise transfer your exchange notes without compliance with the registration and prospectus delivery provisions of the Securities Act if you are not our affiliate and you acquire the exchange notes issued in the exchange offer in the ordinary course of your business. | |

| You must also represent to us that you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate in the distribution of the exchange notes we issue to you in the exchange offer. | ||

| Each broker-dealer that receives exchange notes in the exchange offer for its own account in exchange for old notes that it acquired as a result of market-making or other trading activities must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act, in connection with any resale of the exchange notes issued in the exchange offer. You may not participate in the exchange offer if you are a broker-dealer who purchased such outstanding old notes directly from us for resale pursuant to Rule 144A or any other available exemption under the Securities Act. | ||

| Expiration date | The exchange offer will expire at 5:00 p.m., Eastern Daylight Time, , 2002, unless we decide to extend the expiration date. You will have certain rights against us under the registration rights agreements executed as part of the offering of the outstanding old notes if we fail to consummate the exchange offer. | |

| Special procedures for beneficial owners | If you are the beneficial owner of old notes and you registered your notes in the name of a broker or other institution, and you wish to participate in the exchange, you should promptly contact the person in whose name you registered your old notes and instruct such person to tender on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your outstanding old notes, either make appropriate arrangements to register ownership of the outstanding old notes in your name or obtain a properly completed bond power from the registered holder. The transfer of record ownership may take considerable time. |

8

Table of Contents

| Guaranteed delivery procedure | If you wish to tender your old notes and time will not permit your required documents to reach the exchange agent by the expiration date, or you cannot complete the procedure for book-entry transfer on time or you cannot deliver your certificates for registered old notes on time, you may tender you old notes pursuant to the procedures described in this prospectus under the heading “The exchange offer–How to use the guaranteed delivery procedures if you will not have enough time to send all documents to us.” | |

| Withdrawal rights | You may withdraw the tender of your old notes at any time before 5:00 p.m., Eastern Daylight Time, on , 2002, the business day before the expiration date. | |

| Certain United States federal income tax consequences | An exchange of old notes for exchange notes will not be taxable to you. See “Summary of Certain United States Federal Income Tax Considerations–The Exchange Offer.” | |

| Use of proceeds | We will not receive any proceeds from the issuance of exchange notes pursuant to the exchange offer. We will pay all expenses incident to the exchange offer. | |

| Exchange agent | You can reach U.S. Bank National Association at Specialized Finance Group, 180 East 5th Street, St. Paul, Minnesota 55101. For more information with respect to the exchange offer, the telephone number for the exchange agent is (800) 934-6802 and the fax number for the exchange agent is (651) 244-1537. |

9

Table of Contents

THE NOTES

The exchange offer applies to $700,000,000 aggregate principal amount of 9 1/8% senior notes due 2009. Form and terms of the exchange notes are substantially identical to the form and terms of the old notes, except that we registered the exchange notes under the Securities Act, and therefore, the exchange notes will not bear legends restricting their transfer. The exchange notes will evidence the same debt as the old notes and will be entitled to the benefits of the indenture. See “Description of the Notes.” As used in this summary of the notes, “subsidiaries” refers to our direct and indirect subsidiaries.

| Issuer | EchoStar DBS Corporation | |

| Securities offered | $700,000,000 aggregate principal amount of 9 1/8% senior notes due January 15, 2009. | |

| Maturity | January 15, 2009. | |

| Interest rate | 9 1/8% per year (calculated using a 360-day year) | |

| Interest payment dates | January 15 and July 15 of each year, commencing July 15, 2002. Interest will accrue from the issue date of the notes. | |

| Ranking | The notes are our unsecured senior obligations and rank senior to all of our future subordinated debt. The notes effectively rank junior to any of our secured debt to the extent of the value of the assets securing such debt. As of December 31, 2001, with the completion of the offering of the old notes, the notes ranked equal to approximately $2.0 billion of debt. In addition, shortly after the exchange offer contemplated by this prospectus is made, we expect to make an offer to exchange approximately $1.0 billion of EBC’s 10 3/8% senior notes due 2007 for substantially identical notes issued by us, which will also rank equally to the notes. | |

| Guarantees by our subsidiaries | The notes are guaranteed by substantially all of our subsidiaries on a senior basis. The guarantees are unsecured obligations of the guarantors and rank senior to all future subordinated debt of the guarantors. The guarantees effectively rank junior to any secured debt of the guarantors to the extent of the value of the assets securing such debt. Neither ECC nor any of its subsidiaries, other than us and substantially all our subsidiaries, are obligated under the notes or any guarantee of the notes. See “Description of the Notes – Guarantees.” | |

| Optional redemption | We may redeem some or all the notes at any time on or after January 15, 2006 at stated redemption prices and subject to certain limitations explained under “Description of the Notes – Optional Redemption.” | |

| At any time before January 15, 2005, we may redeem up to 35% of the outstanding notes with the net proceeds of one or more equity offerings, at a redemption price equal to 109.125% of the principal amount, plus accrued and unpaid interest. We may exercise this right more than once, so long as after the redemption at least 65% |

10

Table of Contents

| of the aggregate principal mount of the notes originally issued remains outstanding. | ||

| Repurchase right of holders upon a change of control | If a “change of control” occurs, as that term is defined in the “Description of the Notes — Change of Control Offer,” holders of the notes have the right, subject to certain conditions, to require us to repurchase their notes at a purchase price equal to 101% of the aggregate principal amount of notes repurchased plus accrued and unpaid interest, if any, as of the date of repurchase. See “Description of the Notes – Change of Control Offer” for further information regarding the conditions that would apply if we must offer holders this repurchase right. Neither consummation of the Hughes merger and related transactions nor the purchase of Hughes’ interest in PanAmSat would constitute a change of control giving rise to this repurchase right with respect to the notes. | |

| Certain Other Covenants | The indenture governing the notes contains covenants limiting our and our restricted subsidiaries’ ability to: | |

| • incur additional debt or enter into sale and leaseback transactions; | ||

| • pay dividends or make distributions on our capital stock or repurchase our capital stock; | ||

| • make certain investments; | ||

| • create liens; | ||

| • enter into transactions with affiliates; | ||

| • merge or consolidate with another company; and | ||

| • transfer and sell assets. | ||

| These covenants are subject to a number of important limitations and exceptions. | ||

| Registration rights | Pursuant to a registration rights agreement among us and the initial purchasers, we agreed: | |

| • to file an exchange offer registration statement on or prior to June 26, 2002, relating to an exchange offer for the notes; and | ||

| • to use our best efforts to cause the exchange offer registration statement to be declared effective by the SEC on or prior to September 24, 2002. | ||

| We intend that the registration statement relating to this prospectus satisfies these obligations. In certain circumstances, we will be required to file a shelf registration statement to cover resales of the notes. If we do not comply with our obligations under the registration rights agreement, we will be required to pay additional interest on the notes. See “Registration Rights.” | ||

| Risk factors | Investing in the notes involves substantial risks. See “Risk Factors” for a description of certain risks you should consider before investing in the notes. |

11

Table of Contents

SUMMARY FINANCIAL DATA

(in millions, except subscriber and per subscriber data)

We derived the following summary statements of operations, balance sheet and other data for the five years ended December 31, 2001 from our audited consolidated financial statements. The following tables also present summary unaudited financial data for the three months ended March 31, 2001 and 2002. In our opinion, this interim data reflects all adjustments, consisting of normal recurring adjustments necessary to fairly present the data for such interim periods. Operating results for interim periods are not necessarily indicative of the results that may be expected for a full year.

You should read the data in conjunction with, and it is qualified by reference to, the sections entitled “Management’s Narrative Analysis of Results of Operations,” our consolidated financial statements and the notes thereto, and other financial information for the year ended December 31, 2001 and for the three months ended March 31, 2002, which appear elsewhere in this prospectus.

| Three Months Ended | ||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | March 31, | |||||||||||||||||||||||||||||||||||||||

| 1997 | 1998 | 1999 | 2000 | 2001 | 2001 | 2002 | ||||||||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||||||||||||||

| Total revenue | $ | 476 | $ | 986 | $ | 1,606 | $ | 2,709 | $ | 3,987 | $ | 858 | $ | 1,101 | ||||||||||||||||||||||||||

| Operating income (loss) | (224 | ) | (131 | ) | (354 | ) | (425 | ) | 216 | (12 | ) | 102 | ||||||||||||||||||||||||||||

| Net income (loss) | (323 | ) | (294 | ) | (791 | ) | (608 | ) | 32 | (58 | ) | 19 | ||||||||||||||||||||||||||||

| As of | ||||

| March 31, | ||||

| 2002 | ||||

| (unaudited) | ||||

| Cash, cash equivalents and marketable investment securities(1) | $ | 235 | ||

| Total assets | 3,491 | |||

| Total long-term obligations, net of current portion (2) | 3,810 | |||

| Total stockholder’s deficit | (1,766 | ) | ||

12

Table of Contents

| Three Months Ended | ||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | March 31, | |||||||||||||||||||||||||||||||||||||||

| 1997 | 1998 | 1999 | 2000 | 2001 | 2001 | 2002 | ||||||||||||||||||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||||||||||||||||||

| DISH Network subscribers (000) | 1,040 | 1,940 | 3,410 | 5,260 | 6,830 | 5,720 | 7,160 | |||||||||||||||||||||||||||||||||

| Average monthly revenue per subscriber | $ | 38.50 | $ | 39.25 | $ | 42.71 | $ | 45.33 | $ | 49.32 | $ | 48.23 | $ | 48.36 | ||||||||||||||||||||||||||

| EBITDA, as adjusted to exclude non-cash stock-based compensation (3) | (52 | ) | (29 | ) | (182 | ) | (199 | ) | 502 | 50 | 181 | |||||||||||||||||||||||||||||

| Less amortization of subscriber acquisition costs | (121 | ) | (19 | ) | — | — | — | — | — | |||||||||||||||||||||||||||||||

| EBITDA, as adjusted to exclude non-cash stock-based compensation and to include amortization of subscriber acquisition costs | (173 | ) | (48 | ) | (182 | ) | (199 | ) | 502 | 50 | 181 | |||||||||||||||||||||||||||||

| Net cash flows from: | ||||||||||||||||||||||||||||||||||||||||

| Operating activities | (8 | ) | (54 | ) | (85 | ) | (250 | ) | 602 | 19 | 252 | |||||||||||||||||||||||||||||

| Investing activities | (306 | ) | (43 | ) | 39 | (287 | ) | (575 | ) | (73 | ) | (231 | ) | |||||||||||||||||||||||||||

| Financing activities | 337 | 61 | 181 | 469 | (80 | ) | (30 | ) | — | |||||||||||||||||||||||||||||||

| Ratio of earnings to fixed charges (4) | — | — | — | — | 1.22 | — | 1.15 | |||||||||||||||||||||||||||||||||

| Deficiency of earnings to fixed charges (4) | $ | (358 | ) | $ | (306 | ) | $ | (552 | ) | $ | (597 | ) | $ | — | $ | (55 | ) | $ | — | |||||||||||||||||||||

| (1) | Excludes approximately $176 million that we have reclassified from cash and cash equivalents to cash reserved for satellite insurance on our balance sheet to satisfy insurance covenants related to our and EBC’s outstanding senior notes. The reclassification will continue at least until such time, if ever, as insurers are again willing to insure our satellites on commercially reasonable terms. | |

| (2) | Accounting rules required that at December 31, 2001, we record indebtedness of $1.0 billion for EBC’s 10 3/8% senior notes due 2007, which we will offer to exchange for substantially identical notes issued by us shortly after the exchange contemplated by this prospectus is made. Following this exchange, the EBC notes will become our obligations. | |

| (3) | We believe it is common practice in the telecommunications industry for investment bankers and others to use various multiples of current or projected EBITDA (operating income (loss) plus depreciation and amortization, and non-cash, stock-based compensation) for purposes of estimating current or prospective enterprise value and as one of many measures of operating performance. Conceptually, EBITDA measures the amount of income generated each period that could be used to service debt, because EBITDA is independent of the actual leverage employed by the business, but EBITDA ignores funds needed for capital expenditures and expansion. Some investment analysts track the relationship of EBITDA to total debt as one measure of financial strength. However, EBITDA does not purport to represent cash provided or used by operating activities and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with generally accepted accounting principles. | |

| EBITDA differs significantly from cash flows from operating activities reflected in the consolidated statement of cash flows. Cash flows from operating activities is net of interest and taxes paid and is a more comprehensive determination of periodic income on a cash (vs. accrual) basis, exclusive of non-cash items of income and expenses such as depreciation and amortization. In contrast, EBITDA is derived from accrual basis income and is not reduced for cash invested in working capital. Consequently, EBITDA is not affected by the timing of receivable collections or when accrued expenses are paid. We are aware of no uniform standards for determining EBITDA and we believe presentations of EBITDA may not be calculated consistently by different entities in the same or similar businesses. We have shown EBITDA with the add back for amortization of subscriber acquisition costs, which we deferred through September 1997 and amortized over one year. EBITDA for the years ended December 31, 1999, 2000 and 2001 and for the three months ended March 31, 2001 and 2002 also excludes approximately $61 million, $51 million, $20 million, $7 million |

13

Table of Contents

| and $2 million in non-cash, stock-based compensation expense resulting from significant post-grant appreciation of stock options granted to employees, respectively. In addition, EBITDA does not include the impact of amounts capitalized under EchoStar’s Digital Home Plan of approximately $65.4 million, $338 million, $63 million and $77 million during the years ended December 31, 2000 and 2001 and for the three months ended March 31, 2001 and 2002, respectively. | ||

| (4) | For purposes of computing the deficiency of earnings to fixed charges, earnings consist of earnings from continuing operations before income taxes, plus fixed charges. Fixed charges consist of interest incurred on all indebtedness and the imputed interest component of rental expense under non-cancelable operating leases. For each of the four years ended December 31, 2000 and the three months ended March 31, 2001, earnings were insufficient to cover fixed charges. |

14

Table of Contents

SUMMARY SATELLITE DATA

The following table provides information about EchoStar’s satellites. Our subsidiary, EchoStar Satellite Corporation, owns EchoStar I through EchoStar VII, and our affiliate, EchoStar Orbital Corporation, has contracted for the construction and launch of EchoStar VIII and EchoStar IX.

| EchoStar I | EchoStar II | EchoStar III | EchoStar IV | EchoStar V | EchoStar VI | EchoStar VII(1) | EchoStar VIII(2) | EchoStar IX(2) | ||||||||||

| Orbital slot | 148 degree | 148 degree | 61.5 degree | 119 degree | 110 degree | 119 degree | 119 degree | 110 degree | 121 degree | |||||||||

| Transponders(3) | 16 @ 24 MHZ | 16 @ 24 MHZ | 16/32 @ 24 MHZ | 7/14 @ 24 MHZ | 16/32 @ 24 MHZ | 16/32 @ 24 MHZ | (4) | (4) | (5) | |||||||||

| Approximate channel capacity(6) | 160 | 160 | 160/320 | 70/140 | 160/320 | 160/320 | (4) | (4) | (5) | |||||||||

| Output power | 130 watts | 130 watts | 230/120 watts | 230/120 watts | 220/110 watts | 240/120 watts | 240/120 watts | 240/120 watts | (5) | |||||||||

| Expected end of commercial life(7) | 2011 | 2011 | 2012 | 2004(8) | 2014 | 2014 | 2015 | 2017 | 2015 | |||||||||

| Coverage area | Western and Central United States | Western and Central United States | Eastern and Central United States | Western and Central United States, Continental United States, Alaska, Hawaii, Puerto Rico and certain regions of Canada and Mexico | ||||||||||||||

| (1) | During April 2002, EchoStar VII, which was successfully launched on February 21, 2002 from Cape Canaveral, Florida, reached its final location at the 119 degree orbital location and commenced commercial operation. To date, all systems on the satellite are operating normally. | |

| (2) | We have completed construction of EchoStar VIII, which is expected to launch later this summer, and EchoStar IX is currently under construction and, subject to FCC approval (which we have received for EchoStar VIII), are expected to commence operations within the next year, subject to potential construction and launch delays, at the orbital locations listed above. The launch of EchoStar VIII on June 21, 2002 was delayed because the complete functionality of a command receiver could not be confirmed. The launch will be rescheduled following the completion of further satellite testing and the availability of the launch base. | |

| (3) | The transponders on each of EchoStar III, EchoStar IV, EchoStar V and EchoStar VI can be independently switched to provide up to 16 transponders operating at 220 or 230 watts of power each (240 watts in the case of EchoStar VI) or up to 32 transponders operating at 110 or 120 watts of power each. During January 2002 a transponder pair on EchoStar III failed, resulting in a temporary interruption of service. The operation of EchoStar III was quickly restored. Including the five transponders pairs that malfunctioned in prior years, these anomalies have resulted in the failure of a total of 12 transponders on EchoStar III to date. While a maximum of 32 transponders can be operated at any time, EchoStar III was equipped with a total of 44 transponders to provide redundancy. EchoStar IV is equipped with a total of 44 transponders including 12 spares. As a result of the failure of the solar arrays on EchoStar IV to properly deploy and the failure of 30 transponders to date, a maximum of approximately 14 of the 44 transponders are currently usable. EchoStar IV’s capacity will further decrease over time. Propulsion system and other anomalies have further reduced the anticipated useful life of the entire satellite. See “Risk Factors — We currently have no traditional commercial insurance coverage on our satellites and we may be unable to settle outstanding claims with insurers,” and “–Our satellites have minimum design lives of 12 years, but could fail or suffer reduced capacity before then.” | |

| (4) | EchoStar VII and EchoStar VIII are equipped with 32 CONUS beam transponders operating at 120 watts each switchable to 16 CONUS transponders operating at 240 watts each. If used in that manner, these satellites are capable of approximately the same channel capacity as EchoStar V and EchoStar VI. EchoStar VII and EchoStar VIII are equipped with spot beam technology utilizing up to 25 effective transponders spread across 15 and 16 spot beams, respectively. If used in that manner, these satellites are also capable of operating up to 16 CONUS transponders at 240 watts each simultaneously with the spot beam transponders. The use of spot beams may enable us to provide satellite delivered local broadcast channels to more than 30 major markets across the United States, but will reduce the number of video channels that could otherwise be offered ubiquitously across the United States. | |

| (5) | EchoStar IX, a hybrid Ku/Ka-band satellite, is currently expected to be used for expanded DISH Network service such as video and other services. The portion of the satellite expected to be used for video and other |

15

Table of Contents

| services has not yet been finally determined. A C-band payload owned by Loral Skynet, will also be included on EchoStar IX. | ||

| (6) | With digital compression, each direct broadcast satellite transponder or frequency can yield as many as ten video channels. In practice, we currently operate approximately eight to ten video channels per transponder, on average. | |

| Our direct broadcast satellite licenses do not allow full use of the channel capacity on our satellites. They specifically cover the following: | ||

| • 29 transponders at the 110 degree orbital location, a maximum of approximately 290 video channels; | ||

| • 21 transponders at the 119 degree orbital location, a maximum of approximately 210 video channels; | ||

| • 24 transponders at the 148 degree orbital location, a maximum of approximately 240 video channels; and | ||

| • 11 transponders at the 61.5 degree orbital location, a maximum of approximately 110 video channels. | ||

| (7) | We have estimated the expected end of commercial life of each satellite based on each satellite’s actual or expected launch date and the terms of the construction and launch contracts. The minimum design life is 12 years. See “Risk Factors – Our satellites have minimum design lives of 12 years, but could fail or suffer reduced capacity before then.” The FCC issued the licenses for ten year periods, and such licenses would, unless renewed by the FCC, expire prior to the end of the minimum design life. See “Risk factors — Our business depends substantially on FCC licenses that can expire or be revoked or modified and applications that may not be granted.” | |

| (8) | There can be no assurance that a total loss of use of EchoStar IV will not occur in the near future. See “Risk Factors – Our satellites have minimum design lives of 12 years, but could fail or suffer reduced capacity before then.” |

16

Table of Contents

THE ECHOSTAR ORGANIZATION

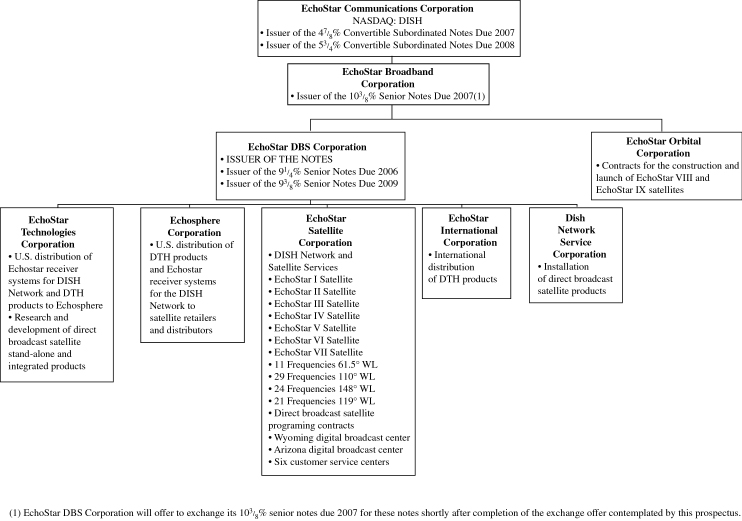

The following chart illustrates the EchoStar corporate structure.

17

Table of Contents

RISK FACTORS

Investing in the notes involves a high degree of risk. You should carefully consider the following risk factors and all other information contained in this prospectus before deciding whether to invest in the notes. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties that we are unaware of, or that we currently believe to be immaterial, also may become important factors that affect us.

If any of the following events occur, our business, financial condition or results of operations could be materially and adversely affected. In that case, the value of the notes could decline and you may lose some or all of your investment.

Risks Primarily Related to Our Business

We have substantial debt outstanding after the offering of the old notes and may incur additional debt, so we may be unable to pay interest or principal on the notes.

As of March 31, 2002, our total debt, including the debt of our subsidiaries, was approximately $3.7 billion, which includes approximately $1.0 billion of EBC’s 10 3/8% senior notes due 2007, which we will exchange for substantially identical notes issued by us shortly after the exchange contemplated by this prospectus is made. See “Description of Other Indebtedness.” The indebtedness represented by the notes exchanged for EBC notes will rank equal to the notes.

The indenture governing the notes allows us to incur additional secured debt to provide additional financing for the Hughes merger. If ECC completes its merger with Hughes, the amount of this additional secured debt would be limited to $2.7 billion plus the greater of $500 million or up to 1.25 times our 12-month trailing cash flow, depending on our credit rating. See “Description of the Notes – Limitation on Liens” and “–Limitation on Incurrence of Indebtedness.” If we incur this secured debt, it would effectively rank senior to the notes to the extent of the value of the assets securing it.

Our substantial debt could have significant consequences to you, including:

| • | making it more difficult to satisfy our obligations with respect to the notes; | ||

| • | increasing our vulnerability to general adverse economic conditions, including changes in interest rates; | ||

| • | limiting our ability to obtain additional financing, including financing to satisfy our obligations with respect to the notes; | ||

| • | requiring us to devote a substantial portion of our available cash and cash flow to make interest and principal payments on our debt, thereby reducing the amount of available cash for other purposes; | ||

| • | limiting our financial flexibility in responding to changing economic and competitive conditions; and | ||

| • | placing us at a disadvantage compared to our competitors that have less debt. |

Increased subscriber turnover could affect our financial performance.

Historically, we have had significant levels of churn. Any development which, among other things, increases costs to our existing customers, materially adversely impacts the quality of the product of service, increases the desirability of competing products or increases uncertainty about whether the Hughes merger will be completed may increase churn. Thus, any of the risks described in this prospectus which potentially have a material adverse impact on cost or quality could also result in an increase in churn which would harm our financial performance. Churn can also increase due to factors beyond our control, including a slowing economy, significant signal compromise, a maturing subscriber base and competitive offers. We cannot assure you that we will be able to manage our churn rates to achieve a reasonable level of financial performance.

18

Table of Contents

While our percentage of churn for the three months ended March 31, 2002 was consistent with our percentage churn compared to the same period during 2001, impacts from our litigation with the networks in Miami, new FCC rules governing the delivery of superstations and other factors could cause us to terminate delivery of distant network channels and superstations to a material portion of our subscriber base, which could cause many of those customers to cancel their subscriptions to our other services. Any such terminations could result in a small reduction in average monthly revenue per subscriber and could result in an increase in our percentage churn.

Increased subscriber acquisition costs could affect our financial performance.

We generally subsidize the cost and installation of EchoStar receiver systems in order to attract new DISH Network subscribers. Our average subscriber acquisition costs were approximately $430 per new subscriber activation during the three months ended March 31, 2002. While there can be no assurance, we currently expect per subscriber acquisition costs for the year ended December 31, 2002 to be consistent with costs for the three months ended March 31, 2002. We also believe, while there can be no assurance, that heightened credit procedures we implemented during the first quarter of 2002, together with promotions tailored towards subscribers with multiple receivers, will attract better long-term subscribers than could be obtained through less costly promotions. Our subscriber acquisition costs, both in the aggregate and on a per new subscriber activation basis, may materially increase to the extent that we introduce other more aggressive promotions if we determine that they are necessary to respond to competition, or for other reasons.

Since we retain ownership of the equipment, amounts capitalized under our Digital Home Plan, totaling approximately $77 million for the three months ended March 31, 2002, are not included in our calculation of these subscriber acquisitions costs. Cash and returned equipment received as a result of Digital Home Plan customer disconnects totaling approximately $12 million during the three months ended March 31, 2002, also is not included in our calculation of subscriber acquisition costs.

We may be unable to manage rapidly expanding operations.

If we are unable to manage our growth effectively, our business and results of operations could be materially adversely affected. To manage our growth effectively, we must continue to:

| • | develop our internal and external sales forces; | ||

| • | develop installation capability; | ||

| • | develop customer service operations and information systems; | ||

| • | maintain our relationships with third party vendors; and | ||

| • | expand, train and manage our employee base. |

Furthermore, our management personnel must assume even greater levels of responsibility. If we are unable to effectively manage our growth, we may experience a decrease in subscriber growth, an increase in churn, an increase in expenses or other adverse results, any one of, which could have a material adverse effect on our business.

We may need additional capital, which may not be available, in order to continue growing and to increase earnings and to make payments on the notes.

Our ability to increase earnings, and to make interest and principal payments on the notes will depend, in part, on our ability to continue growing our business by maintaining and increasing our subscriber base. This may require significant additional capital that may not be available to us.

Funds necessary to meet subscriber maintenance and acquisition costs will be satisfied from existing cash and investment balances to the extent available. We may, however, be required to raise additional capital in the future to meet these requirements. There can be no assurance that additional financing will be available on acceptable terms, or at all, if needed in the future.

19

Table of Contents

In addition to our direct broadcast satellite business plan, EchoStar has conditional licenses and pending FCC applications for a two satellite FSS Ku-band satellite system and a two satellite FSS Ka-band satellite system. EchoStar will need to raise additional capital to construct, launch and insure satellites and complete these systems. We may need to raise additional capital to construct, launch and insure additional satellites. There can be no assurance that additional financing will be available on acceptable terms, or at all.

We cannot be certain that we will sustain profitability.

Due to the substantial expenditures necessary to complete construction, launch and deployment of our direct broadcast satellite system and to obtain and service DISH Network customers, we have in the past sustained significant losses. If we do not have sufficient income or other sources of cash, our ability to service our debt and pay our other obligations could be affected. While we had net income of $32 million and $19 million for the year ended December 31, 2001 and the three months ended March 31, 2002, respectively, we can provide no assurance that we will be able to sustain this profitability. Improvements in our results of operations will depend largely upon our ability to increase our customer base while maintaining our price structure, effectively managing our costs and controlling churn. We cannot assure you that we will be effective with regard to these matters. Acquisition costs to obtain DISH Network subscribers are responsible for a substantial portion of the negative effects of churn and may otherwise have a material adverse effect on our revenues and earnings.

Our satellites are subject to risks related to launch.

Satellite launches are subject to significant risks, including launch failure, incorrect orbital placement or improper commercial operation. About 15% of all commercial geostationary satellite launches have resulted in a total or constructive total loss. Certain launch vehicles that may be used by us have either unproven track records or have experienced launch failures in the past. The risks of launch delay and failure are usually greater when the launch vehicle does not have a track record of previous successful flights. Launch failures result in significant delays in the deployment of satellites because of the need both to construct replacement satellites, which can take up to 24 months, and obtain other launch opportunities. Such significant delays could materially adversely affect our ability to generate revenues. If we were unable to obtain launch insurance, or obtain launch insurance at rates we deem commercially reasonable, and a significant launch failure were to occur, its could have a material adverse effect on our ability to generate revenues and fund future satellite acquisitions and launch opportunities. In addition, the occurrence of future launch failures may materially adversely affect our ability to insure the launch of our satellites at commercially reasonable premiums, if at all. See “–We currently have no traditional commercial insurance coverage on our satellites and we may be unable to settle outstanding claims with insurers.”

EchoStar VIII is currently expected to launch later this summer on a Russian Proton K/Block DM launch vehicle from the Baikonur Cosmodrome in Kazakhstan. The launch of EchoStar VIII on June 21, 2002 was delayed because the complete functionality of a command receiver could not be confirmed. The launch will be rescheduled following the completion of further satellite testing and the availability of the launch base.

Our satellites are subject to significant operational risks.

Satellites are subject to significant operational risks while in orbit. These risks include malfunctions, commonly referred to as anomalies, that have occurred in our satellites and the satellites of other operators as a result of various factors, such as satellite manufacturer’s error, problems with the power systems or control systems of the satellites and general failures resulting from operating satellites in the harsh space environment.

Although we work closely with the satellite manufacturers to determine and eliminate the cause of anomalies in new satellites and provide for redundancies of critical components in the satellites, we cannot assure you that we will not experience anomalies in the future, whether of the types described above or arising from the failure of other systems or components.

Any single anomaly or series of anomalies could materially adversely affect the operations and revenues of us and our relationship with current customers, as well as our ability to attract new customers for our direct broadcast satellites and other satellite services. In particular, future anomalies may result in the loss of individual transponders

20

Table of Contents

on a satellite, a group of transponders on that satellite or the entire satellite, depending on the nature of the anomaly. Anomalies may also reduce the expected useful life of a satellite, thereby reducing the revenue that could be generated by that satellite, or create additional expenses due to the need to provide replacement or back-up satellites. Finally, the occurrence of anomalies may materially adversely affect our ability to insure our satellites at commercially reasonable premiums, if at all. While some anomalies are currently covered by existing insurance policies, others are not now covered or may not be covered in the future. The initial capitalized cost of a satellite ranges from about $175 million to about $350 million, depending upon the design. Most of the satellites used by us cost in the range of about $200 million to about $250 million. Typically, direct broadcast satellites have from 24 to 72 transponders on -board, and we expect that most of our satellites will have from 30 to 48 transponders.

Meteoroid events pose a potential threat to all in-orbit geosynchronous satellites. The probability that meteoroids will damage those satellites increases significantly when the Earth passes through the particulate stream left behind by various comets. Due to the current peak in the 11-year solar cycle, increased solar activity is likely for the next year. Occasionally, increased solar activity poses a potential threat to all in-orbit satellites. The probability that the effects from this activity will damage our satellites or cause service interruptions is generally very small.

Some decommissioned spacecraft are in uncontrolled orbits which pass through the geostationary belt at various points, and present hazards to operational spacecraft, including our direct broadcast satellites. We may be required to perform maneuvers to avoid collisions and these maneuvers may prove unsuccessful or could reduce the useful life of the satellite through the expenditure of fuel to perform these maneuvers. The loss, damage or destruction of any of our satellites as a result of an electrostatic storm, collision with space debris, malfunction or other event would have a material adverse effect on our business. As is common in the industry, our in-orbit insurance, if any, will not cover damage to satellites that occurs as a result of collisions with meteoroids, decommissioned spacecraft or other space debris.

Our satellites have minimum design lives of 12 years, but could fail or suffer reduced capacity before then.

Our ability to earn revenue depends on the usefulness of our satellites. Each satellite has a limited useful life. A number of factors affect the useful lives of the satellites, including, among other things:

| • | the quality of their construction; | ||

| • | the durability of their component parts; | ||

| • | the ability to continue to maintain proper orbit and control over the satellites’s functions; | ||

| • | the efficiency of the launch vehicle used; and | ||

| • | the remaining on -board fuel following orbit insertion. |

Generally, the minimum design life of each of our satellites is 12 years. We can provide no assurance, however, as to the actual useful lives of the satellites.

In the event of a failure or loss of any of our satellites, we may relocate another satellite and use it as a replacement for the failed or lost satellite. Such a relocation would require prior FCC approval and, among other things, a showing to the FCC that the replacement satellite would not cause additional interference compared to the failed or lost satellite. We cannot be certain that we could obtain such FCC approval. If we choose to use a satellite in this manner, we cannot assure you that this use would not adversely affect our ability to meet the operation deadlines associated with our authorizations. Failure to meet those deadlines could result in the loss of such authorizations, which would have an adverse effect on our ability to generate revenues.

We currently have no traditional commercial insurance coverage on our satellites and we may be unable to settle outstanding claims with insurers.

The price, terms and availability of insurance fluctuate significantly. In the last several years, the cost of obtaining launch and in-orbit policies on satellites reached historic lows but the cost has recently begun to return to the

21

Table of Contents

higher levels for such policies that were common in the early 1990s. We currently expect the cost of obtaining insurance to continue to rise and the availability to be limited as result of recent satellite failures and general conditions in the insurance industry, including the effects of the September 11, 2001 terrorist attacks. Launch and in-orbit policies on satellites may not continue to be available on commercially reasonable terms or at all. In addition to higher premiums, insurance policies may provide for higher deductibles, shorter coverage periods and additional satellite health-related policy exclusions.

The indentures related to certain of EBC’s and our outstanding notes contain restrictive covenants that require EchoStar and us to maintain satellite insurance with respect to specified numbers of the satellites we own or lease. To date, we have been unable to obtain insurance on many of our satellites on terms acceptable to us. As a result, we are currently self-insuring all of our satellites. To satisfy insurance covenants related to our and EBC’s outstanding notes, we have reclassified an amount equal to the depreciated cost of four of our satellites from cash and cash equivalents to cash reserved for satellite insurance on our balance sheet. As of March 31, 2002 cash reserved for satellite insurance totaled about $176 million, which could be increased upon the occurrence of certain events as described in our 2001 Form 10-K, which is incorporated into this document by reference and attached hereto. The reclassifications will continue until such time, if ever, as we can again insure our satellites on acceptable terms and for acceptable amounts. We believe that we have in-orbit capacity sufficient to expeditiously recover transmission of most programming in the event one of our satellites fails. However, the cash reserved for satellite insurance is not adequate to fund the construction, launch and insurance for a replacement satellite in the event of a complete loss of a satellite. Programming continuity cannot be assured in the event of multiple satellite losses.

While we have secured $125 million in commercial insurance for the launch of EchoStar VIII, we may not be able to obtain additional commercial insurance covering the launch and/or commercial insurance for the in-orbit operation of EchoStar VIII at rates acceptable to us and for the full amount necessary to construct, launch and insure a replacement satellite. In that event, we will be forced to self-insure all or a portion of the launch and/or in-orbit operation of EchoStar VIII. The manufacturer of EchoStar VIII is contractually obligated to use its reasonable best efforts to obtain commercial insurance for the launch and in-orbit operation of EchoStar VIII for a period of in-orbit operation to be determined and in an amount up to $225 million. There is no guarantee that it or we will be able to obtain additional commercial insurance for the launch and in-orbit operation of EchoStar VIII at reasonable rates and for the full replacement cost of the satellite. Any launch vehicle failure, or loss or destruction of EchoStar VIII for which we do not have commercial insurance for the full replacement cost of such satellite could have a material adverse effect on our ability to comply with “must carry” and other regulatory obligations and on our financial condition. See “– We need to increase satellite capacity to avoid potential disruptions in our service caused by “must carry” requirements.”

Our business depends substantially on FCC licenses that can expire or be revoked or modified and applications that may not be granted.