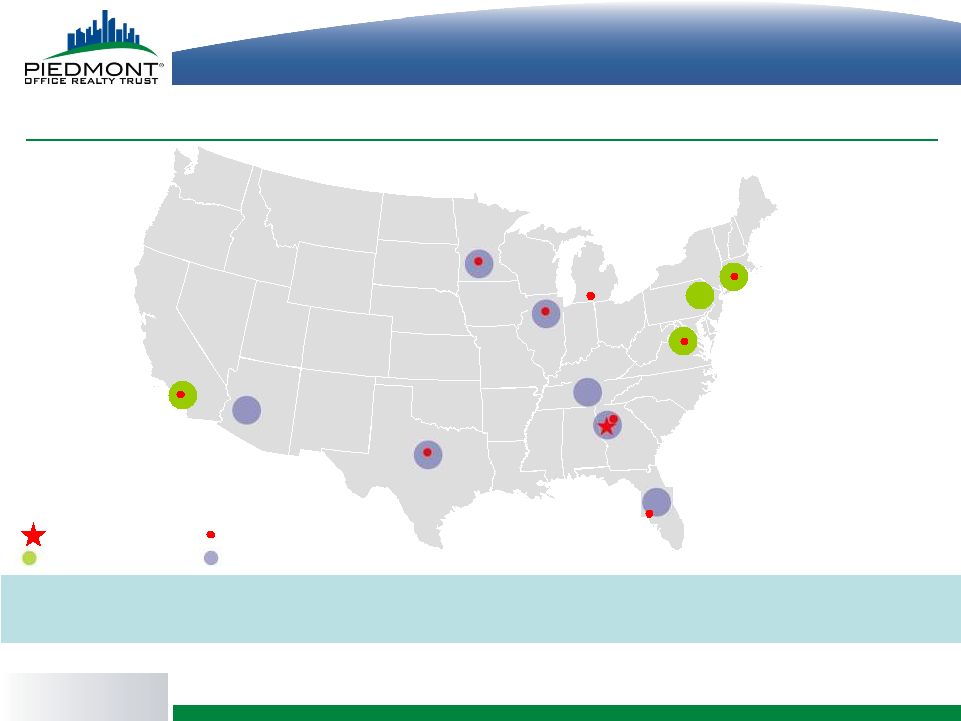

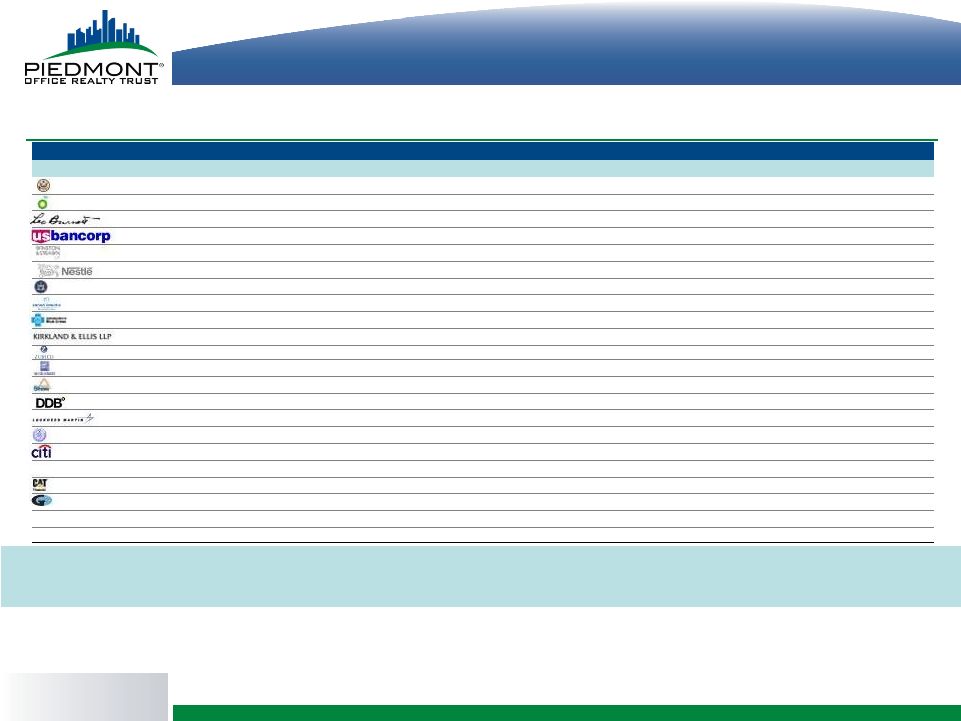

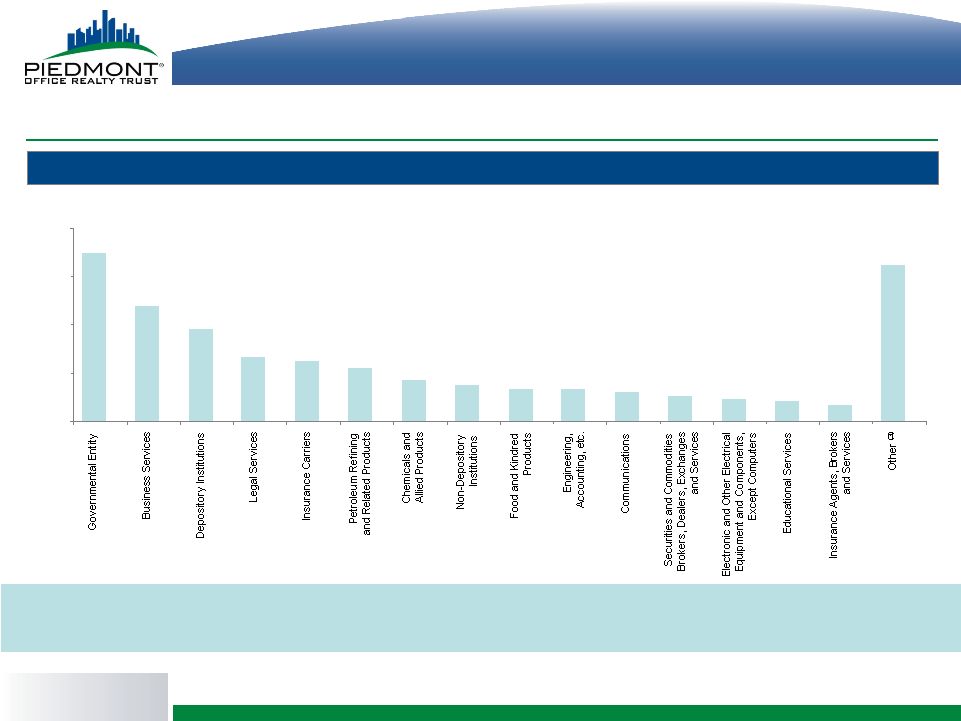

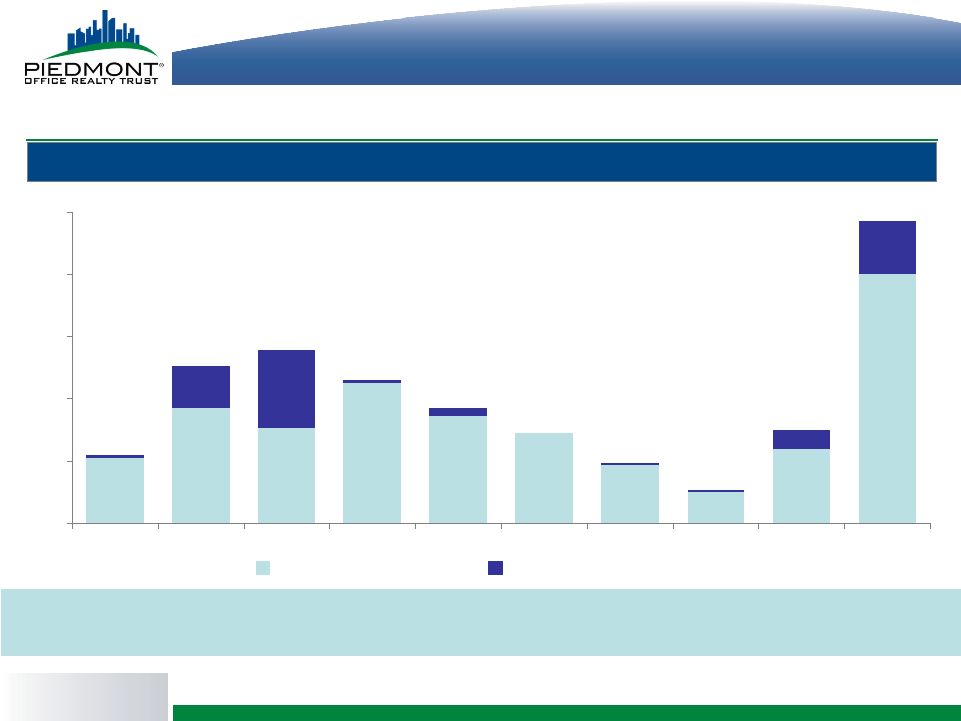

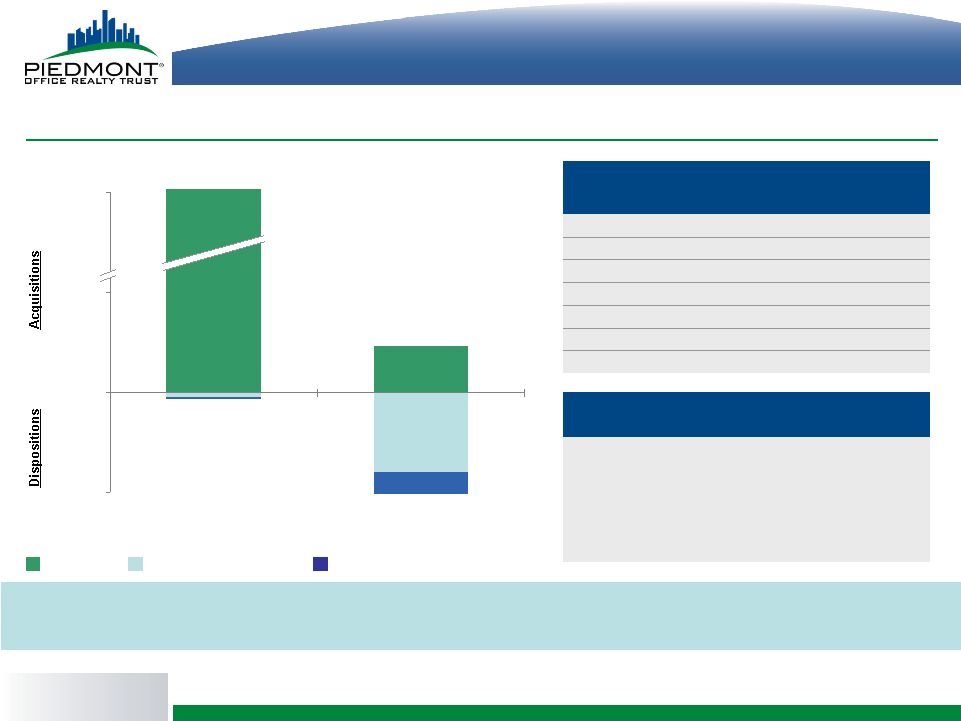

1 1 Piedmont Office Realty Trust, Inc. (NYSE: PDM) is a fully-integrated and self-managed real estate investment trust (“REIT”) specializing in the acquisition, ownership, management, development and disposition of primarily high-quality Class A office buildings located predominately in large U.S. office markets and leased principally to high-credit-quality tenants. Since its first acquisition in 1998, the Company has acquired over $5.5 billion of office and industrial properties (inclusive of joint ventures). Rated as an investment-grade company by Standard & Poor’s and Moody’s, Piedmont has maintained a low-leverage strategy while acquiring its properties. Over 87% of our Annualized Lease Revenue ("ALR") is derived from our office properties located within the ten largest U.S. office markets, including Chicago, Washington, D.C., the New York metropolitan area, Boston and greater Los Angeles. We use market data and industry forecasts and projections throughout this presentation. We have obtained certain market and industry data from publicly available industry publications. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on industry surveys and the preparers’ experience in the industry, and there is no assurance that any of the projected amounts will be achieved. We believe that the surveys and market research others have performed are reliable, but we have not independently verified this information. Unless otherwise noted herein, all the information contained in this presentation is presented as of March 31, 2010. Unless the context indicates otherwise, the term “properties” as used in this document and the statistical information presented in this document regarding our properties includes our wholly owned office properties and our office properties owned through our consolidated joint ventures, but excludes our interest in eight properties owned through our equity interests in our unconsolidated joint ventures and our two industrial properties. Unless otherwise indicated, all information in this document gives effect to, and all share and per share amounts have been retroactively adjusted to give effect to, the Recapitalization. The information contained in this presentation does not contain all of the information that may be important to you and should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2009 and our quarterly report on Form 10-Q for the period ended March 31, 2010 and our other filings with the Securities and Exchange Commission. Such documents are available at www.sec.gov and under the heading Investor Relations on our website at www.piedmontreit.com. 1 Introduction © 2010 Piedmont Office Realty Trust, Inc. |