Exhibit 99.2

Quarterly Supplemental Information

December 31, 2011

| | | | |

| Corporate Headquarters | | Institutional Analyst Contact | | Investor Relations |

| | |

| 11695 Johns Creek Parkway, Suite 350 | | Telephone: 770.418.8592 | | Telephone: 866.354.3485 |

| Johns Creek, GA 30097 | | research.analysts@piedmontreit.com | | investor.services@piedmontreit.com |

| Telephone: 770.418.8800 | | | | www.piedmontreit.com |

Piedmont Office Realty Trust, Inc.

Quarterly Supplemental Information

Index

| | |

| | | Page |

| |

Introduction | | |

Corporate Data | | 3 |

Investor Information | | 4 |

Financial Highlights | | 5-9 |

Key Performance Indicators | | 10 |

| |

Financials | | |

Balance Sheet | | 11 |

Income Statements | | 12-13 |

Funds From Operations / Adjusted Funds From Operations | | 14 |

Same Store Analysis | | 15-16 |

Capitalization Analysis | | 17 |

Debt Summary | | 18 |

Debt Detail | | 19 |

Debt Analysis | | 20 |

| |

Operational & Portfolio Information - Office Investments | | |

Tenant Diversification | | 21 |

Tenant Credit Rating & Lease Distribution Information | | 22 |

Leased Percentage Information | | 23 |

Rental Rate Roll Up / Roll Down Analysis | | 24 |

Lease Expiration Schedule | | 25 |

Annual Lease Expirations | | 26 |

Capital Expenditures & Commitments | | 27 |

Contractual Tenant Improvements & Leasing Commissions | | 28 |

Geographic Diversification | | 29 |

Geographic Diversification by Location Type | | 30 |

Industry Diversification | | 31 |

Property Investment Activity | | 32 |

Value-Add Activity | | 33 |

| |

Other Investments | | |

Other Investments Detail | | 34 |

| |

Supporting Information | | |

Definitions | | 35-36 |

Research Coverage | | 37 |

Non-GAAP Reconciliations & Other Detail | | 38-41 |

Risks, Uncertainties and Limitations | | 42 |

Please refer to page 42 for a discussion of important risks related to the business of Piedmont Office Realty Trust, as well as an investment in its securities, including risks that could cause actual results and events to differ materially from results and events referred to in the forward-looking information. Considering these risks, uncertainties, assumptions, and limitations, the forward-looking events contained in this supplemental reporting package might not occur.

Certain prior period amounts have been reclassified to conform to the current period financial statement presentation. In addition, many of the schedules herein contain rounding to the nearest thousands or millions and, therefore, the schedules may not total due to this rounding convention.

Piedmont Office Realty Trust, Inc.

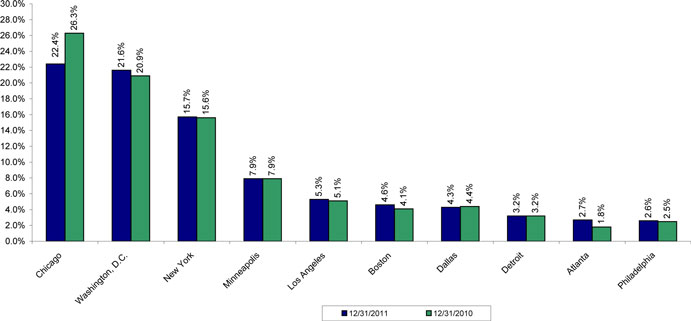

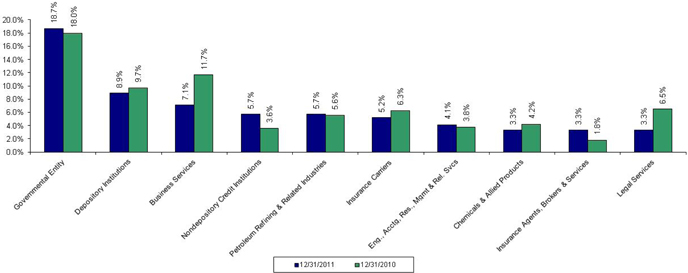

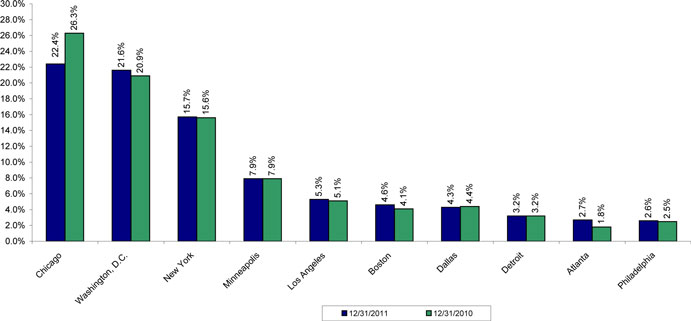

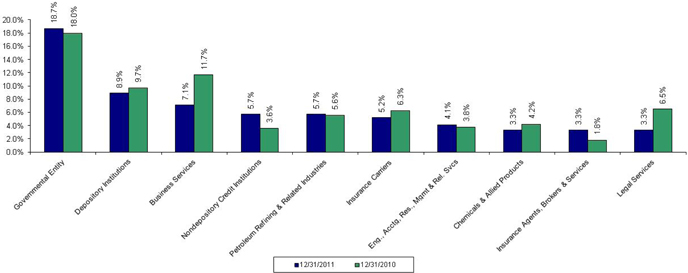

Corporate Data

Piedmont Office Realty Trust, Inc. (“Piedmont” or the “Company”) (NYSE: PDM) is a fully-integrated and self-managed real estate investment trust (“REIT”) specializing in the acquisition, ownership, management, development and disposition of primarily high-quality Class A office buildings located predominantly in large U.S. office markets and leased principally to high-credit-quality tenants. Approximately 82% of our Annualized Lease Revenue (“ALR”)(1) is derived from our office properties located within the ten largest U.S. office markets, including Chicago, Washington, D.C., the New York metropolitan area, Boston and greater Los Angeles. Since its first acquisition in 1998, the Company has acquired $5.9 billion of office and industrial properties (inclusive of joint ventures) through December 31, 2011. Rated as an investment-grade company by Standard & Poor’s and Moody’s, Piedmont has maintained a low-leverage strategy while acquiring its properties.

This data supplements the information provided in our reports filed with the Securities and Exchange Commission and should be reviewed in conjunction with such filings.

| | | | | | | | | | |

| | | As of

December 31, 2011 | | | | | As of

December 31, 2010 | |

| | | |

Number of properties(2) | | | 79 | | | | | | 75 | |

| | | |

Rentable square footage (in thousands)(2) | | | 20,942 | | | | | | 20,408 | |

| | | |

Percent leased(3) | | | 86.5% | | | | | | 89.2% | |

| | | |

Percent leased - stabilized portfolio(4) | | | 89.1% | | | | | | 89.9% | |

| | | |

Capitalization (in thousands): | | | | | | | | | | |

| | | |

Total gross debt - principal amount outstanding | | | $1,472,525 | | | | | | $1,402,525 | |

| | | |

Equity market capitalization(5) | | | $2,941,611 | | | | | | $3,477,342 | |

| | | |

Total market capitalization(5) | | | $4,414,136 | | | | | | $4,879,867 | |

| | | |

Total gross debt / Total market capitalization | | | 33.4% | | | | | | 28.7% | |

| | | |

Total gross debt / Total gross assets | | | 27.5% | | | | | | 26.6% | |

| | | |

Common stock data | | | | | | | | | | |

| | | |

High closing price during quarter | | | $17.50 | | | | | | $20.31 | |

| | | |

Low closing price during quarter | | | $15.42 | | | | | | $18.25 | |

| | | |

Closing price of common stock at period end | | | $17.04 | | | | | | $20.14 | |

| | | |

Weighted average fully diluted shares outstanding (in thousands)(6) | | | 172,981 | | | | | | 170,967 | |

| | | |

Shares of common stock issued and outstanding (in thousands) | | | 172,630 | | | | | | 172,658 | |

| | | |

Rating / outlook | | | | | | | | | | |

Standard & Poor’s | | | BBB/Stable | | | | | | BBB/Stable | |

Moody’s | | | Baa2/Stable | | | | | | Baa2/Stable | |

| | | |

Employees(7) | | | 116 | | | | | | 110 | |

| (1) | The definition for Annualized Lease Revenue can be found on page 35. |

| (2) | As of December 31, 2011, our office portfolio consisted of 79 properties (exclusive of our equity interests in five properties owned through unconsolidated joint ventures and our two industrial properties). During the fourth quarter of 2011, we sold our ownership interest in 35 West Wacker Drive, a 1,118,000 square foot property located in Chicago, IL, and we purchased 400 TownPark, a 176,000 square foot property located in Lake Mary, FL. For additional detail on asset transactions during 2011, please refer to page 32. |

| (3) | Calculated as leased square footage on December 31, 2011 plus square footage associated with executed new leases for currently vacant spaces divided by total rentable square footage, expressed as a percentage. This measure is presented for our 79 office properties and excludes industrial and unconsolidated joint venture properties. Please refer to page 23 for additional analyses regarding Piedmont’s leased percentage. |

| (4) | Please refer to page 33 for information regarding value-add properties, data for which is removed from stabilized portfolio totals. |

| (5) | Based on a share price of $17.04 as of December 31, 2011. |

| (6) | Weighted average fully diluted shares outstanding are presented on a year-to-date basis for each period. |

| (7) | During 2011, the company hired a regional manager and additional staff for its New York, NY office. The opening of this office is the primary reason for the increase in number of employees. |

3

Piedmont Office Realty Trust, Inc.

Investor Information

Corporate

11695 Johns Creek Parkway, Suite 350, Johns Creek, Georgia 30097

770.418.8800

www.piedmontreit.com

Executive and Senior Management

| | | | |

| | |

| Donald A. Miller, CFA | | Robert E. Bowers | | Laura P. Moon |

Chief Executive Officer, President and Director | | Chief Financial Officer, Executive Vice President, Secretary, and Treasurer | | Chief Accounting Officer and Senior Vice President |

| | |

| Raymond L. Owens | | Carroll A. Reddic, IV | | |

Executive Vice President - Capital Markets | | Executive Vice President - Real Estate Operations, Assistant Secretary | | |

Board of Directors

| | | | |

| | |

| W. Wayne Woody | | Donald A. Miller, CFA | | Frank C. McDowell |

Director, Chairman of the Board of Directors and Chairman of Audit Committee | | Chief Executive Officer, President and Director | | Director and Vice Chairman of the Board of Directors |

| | |

| Wesley E. Cantrell | | Michael R. Buchanan | | Donald S. Moss |

Director and Chairman of Governance Committee | | Director and Chairman of Capital Committee | | Director and Chairman of Compensation Committee |

| | |

| Jeffery L. Swope | | Raymond G. Milnes, Jr. | | William H. Keogler, Jr. |

| Director | | Director | | Director |

| | | | |

Transfer Agent | | | | Corporate Counsel |

| | |

| Bank of New York Mellon Shareowner Services | | | | King & Spalding |

P.O. Box 358010 Pittsburgh, PA 15252-8010 Phone: 866.354.3485 | | | | 1180 Peachtree Street, NE Atlanta, GA 30309 Phone: 404.572.4600 |

4

Piedmont Office Realty Trust, Inc.

Financial Highlights

As of December 31, 2011

|

| On January 22, 2010, we filed an amendment to our charter to effect a recapitalization of our common stock as described further in our Securities and Exchange Commission (“SEC”) filings. The recapitalization had the effect of a one-for-three reverse stock split. All prior period per share data has been restated to give net effect to this one-for-three reverse stock split. |

|

Financial Results(1) |

- Funds from operations (FFO) for the quarter ended December 31, 2011 was $65.9 million, or $0.38 per share (diluted), compared to $67.9 million, or $0.39 per share (diluted), for the same quarter in 2010. FFO for the twelve months ended December 31, 2011 was $271.3 million, or $1.57 per share (diluted), compared to $281.3 million, or $1.65 per share (diluted), for the same period in 2010. The decrease in FFO for the three months ended December 31, 2011 as compared to the same period in 2010 was principally related to lower termination income in the fourth quarter of 2011 and reduced tenant reimbursements due to a decrease in year-over-year leased percentage; these items were partially offset by increased rental income contributed from properties acquired during the last year and reduced general and administrative costs attributable to lower transfer agent expenses. The decrease in FFO for the twelve months ended December 31, 2011 as compared to the same period in 2010 was principally related to increased property operating costs associated with newly acquired properties and reduced termination fee income in 2011; these items were partially offset by the same transfer agent expense savings mentioned above. - Core funds from operations (Core FFO) for the quarter ended December 31, 2011 was $65.3 million, or $0.38 per share (diluted), compared to $68.2 million, or $0.39 per share (diluted), for the same quarter in 2010. Core FFO for the twelve months ended December 31, 2011 was $271.6 million, or $1.57 per share (diluted), compared to $281.9 million, or $1.65 per share (diluted), for the same period in 2010. The decrease in Core FFO for the three and the twelve months ended December 31, 2011 as compared to the same periods in 2010 was principally related to the items described for changes in FFO above. Incremental differences relate to the add back of acquisition-related expenses and the deduction of the gain on early extinguishment of debt associated with the discounted payoff of a portion of the debt related to 500 West Monroe Street in 2011. - Adjusted funds from operations (AFFO) for the quarter ended December 31, 2011 was $44.7 million, or $0.26 per share (diluted), compared to $42.0 million, or $0.24 per share (diluted), for the same quarter in 2010. AFFO for the twelve months ended December 31, 2011 was $202.6 million, or $1.17 per share (diluted), compared to $228.7 million, or $1.34 per share (diluted), for the same period in 2010. The increase in AFFO for the three months ended December 31, 2011 as compared to the same period in 2010 was primarily related to a decrease in non-incremental capital expenditures, offset somewhat by the items described for the negative FFO variance above. The decrease in AFFO for the twelve months ended December 31, 2011 as compared to the same period in 2010 was primarily due to increased capital expenditures in 2011 associated with increased leasing activity. - During the quarter ended December 31, 2011, the Company paid to shareholders a quarterly dividend in the amount of $0.315 per share for its common stock. The Company’s dividend payout percentage for the twelve months ended December 31, 2011 was 80% of Core FFO and 107% of AFFO. |

|

| Operations |

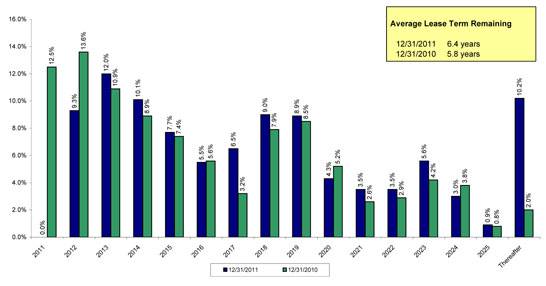

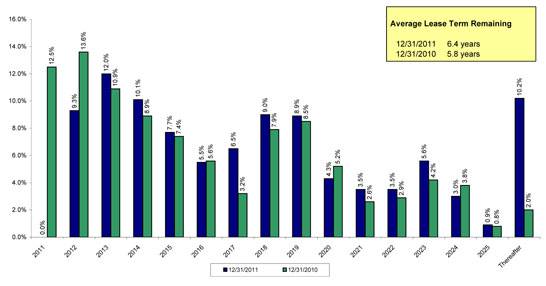

- On a same store square footage leased basis, our portfolio was 88.3% leased as of December 31, 2011 as compared to 89.1% leased as of December 31, 2010. On a square footage leased basis, our total office portfolio was 86.5% leased as of December 31, 2011, as compared to 89.2% as of December 31, 2010. The decrease in the office portfolio leased percentage during the last several quarters is primarily related to the addition to the portfolio of several properties with significant vacancies, including 500 West Monroe Street in Chicago, IL, 1200 Enclave Parkway in Houston, TX, The Medici in Atlanta, GA, Suwanee Gateway One in Suwanee, GA, and 400 TownPark in Lake Mary, FL. Removing these value-add properties from the total portfolio statistics results in an 89.1% leased rate for our stabilized assets at December 31, 2011 as compared to an 89.9% leased rate at December 31, 2010. The primary reason for the decline in the leased rate for our stabilized assets between December 31, 2010 and December 31, 2011 is the net loss of 250,000 leased square feet associated with the Zurich American Insurance Company lease expiration at Windy Point II in Schaumburg, IL. Please refer to page 23 for additional information. - The weighted average remaining lease term of our portfolio was 6.4 years(2) as of December 31, 2011 as compared to 5.8 years at December 31, 2010. - During the three months ended December 31, 2011, the Company completed 939,000 square feet of leasing at our 79 consolidated office properties. We executed renewal leases for 358,000 square feet and new tenant leases for 581,000 square feet, bringing the year-to-date total office leasing activity to 3,869,000 square feet for our wholly-owned portfolio and 3,966,000 square feet including leasing activity associated with our joint venture properties. We did not execute any new leases during the year for our two industrial properties. The average committed capital cost for our wholly-owned portfolio was $5.40 per square foot per year of lease term in 2011. Average committed capital cost per square foot per year of lease term for renewal leases signed during the twelve months ended December 31, 2011 was $5.11 and average committed capital cost per square foot per year of lease term for new leases signed during the same time period was $5.76. During the year, we completed two large, 15-year lease renewals with significant capital commitments: NASA at Two Independence Square in Washington, D.C. and GE at 500 West Monroe Street in Chicago, IL. If the costs associated with these renewals were to be removed from the average committed capital cost calculation, the average committed capital cost per square foot per year of lease term for renewal leases would be $2.80, consistent with our historical average. - During the three months ended December 31, 2011, we retained(3) tenants for 67% of the square footage associated with expiring leases. During the twelve months ended December 31, 2011, we retained tenants for 70% of the square footage associated with expiring leases. This result compares to a 72% retention rate for the year ended December 31, 2010. |

|

(1)FFO, Core FFO and AFFO are supplemental non-GAAP financial measures. See pages 35-36 for definitions of non-GAAP financial measures. See pages 14 and 38 for reconciliations of FFO, Core FFO and AFFO to Net Income. (2)Remaining lease term (after taking into account leases for vacant spaces which had been executed but not commenced as of December 31, 2011) is weighted based on Annualized Lease Revenue, as defined on page 35. (3)Piedmont defines a retained tenant to include an existing tenant/occupant signing a lease for the premises it currently occupies or a tenant whose occupancy of a space is structured in a way to eliminate downtime for the space. Excluding the Zurich American Insurance Company lease expiration at Windy Point II in Schaumburg, IL, our retention rate for the twelve months ended December 31, 2011, would have been 74%. |

5

Piedmont Office Realty Trust, Inc.

Financial Highlights

As of December 31, 2011

| | - | During the three months ended December 31, 2011, we executed six office leases greater than 20,000 square feet. Please see information on those leases listed below. |

| | | | | | | | | | | | |

| Tenant Name | | Property | | Property Location | | Square Feet

Leased | | | | Expiration Year | | Lease Type |

| General Electric Capital Corporation | | 500 West Monroe Street | | Chicago, IL | | 371,097 | | | | 2027 | | Renewal /Expansion |

US Foods, Inc. | | River Corporate Center | | Tempe, AZ | | 133,225 | | | | 2025 | | New |

Schlumberger Technology Corporation | | 1200 Enclave Parkway | | Houston, TX | | 105,432 | | | | 2024 | | New |

| Synchronoss Technologies, Inc. | | 200 Bridgewater Crossing | | Bridgewater, NJ | | 78,581 | | | | 2023 | | New |

United Healthcare Services, Inc. | | Aon Center | | Chicago, IL | | 54,634 | | | | 2023 | | New |

Crawford & Company | | Fairway Center II | | Brea, CA | | 23,035 | | | | 2017 | | New |

6

Piedmont Office Realty Trust, Inc.

Financial Highlights

As of December 31, 2011

Leasing Update

| | - | As of September 30, 2011, there were six tenants whose leases contributed greater than 1% to our Annualized Lease Revenue and were scheduled to expire during the fourth quarter of 2011 or the eighteen month period following the end of the fourth quarter of 2011. Information regarding the leasing status of the spaces associated with those tenants’ leases is presented below. |

| | | | | | | | | | | | |

| Tenant Name | | Property | | Property Location | | Square

Footage (1) | | Percentage of Current

Quarter Annualized Lease Revenue (%) | | Expiration (2) | | Current Leasing Status |

| Kirkland & Ellis | | Aon Center | | Chicago, IL | | 331,887 | | 1.8% | | Q4 2011 | | Kirkland & Ellis is vacating. KPMG has leased 69% of the space currently leased to Kirkland & Ellis beginning in August 2012. United Healthcare has leased 16% of the space currently leased to Kirkland & Ellis beginning in September 2012. The remaining 15% of the Kirkland & Ellis space is being actively marketed for lease. |

| Marsh USA | | 500 West Monroe

Street | | Chicago, IL | | 173,290 | | 1.2% | | Q4 2011 | | Piedmont acquired the property in March 2011 with the knowledge that Marsh would vacate the building at the end of their lease term. Approximately 53,000 square feet of Marsh’s current space has been leased by GE; GE has the option during the first two years of the new lease term to expand up to an additional 81,000 square feet in space formerly occupied by Marsh. The Company is actively marketing the uncommitted space for lease. Please see GE discussion below. |

| Sanofi—aventis US | | 200 Bridgewater

Crossing | | Bridgewater, NJ | | 221,491 | | 1.6% | | Q1 2012 | | The tenant will be vacating at lease expiration. The Company is in advanced negotiations with two tenants to lease a majority of the space currently leased by the tenant. The 221,000 square feet currently leased by the tenant is net of a partial lease termination to accommodate the 78,581 square foot lease with Synchronoss Technologies signed during the fourth quarter of 2011. |

| | | 400 Bridgewater

Crossing | | Bridgewater, NJ | | 77,803 | | 0.5% | | Q1 2012 | | The tenant will be vacating at lease expiration. The Company has fully leased all space currently leased by the tenant at the building. Approximately 39,000 square feet will be taken by Futurewei Technologies (“Huawei”), while the balance will be leased by Savient Pharmaceuticals under a lease that was executed subsequent to quarter end. |

United States of America (National Park Service) | | 1201 Eye Street | | Washington, D.C. | | 219,750 | | 1.8% | | Q3 2012 | | Preliminary discussions with the GSA have commenced. The Company is awaiting the release of an official solicitation for offers from the GSA, a key component of the Government’s space acquisition process. |

| GE | | 500 West Monroe

Street | | Chicago, IL | | 311,387 | | 1.9% | | Q4 2012 | | During the fourth quarter of 2011, a 371,000 square foot lease renewal and expansion was executed.(3) The tenant has rights to expand by up to 81,000 square feet during the first two years of the new lease term. |

| Comptroller of the Currency | | One

Independence

Square | | Washington, D.C. | | 333,815 | | 3.6% | | Q2 2013 | | The tenant is expected to vacate at lease expiration. The Company is actively marketing the space for lease. |

(1)Square footage represents the total square footage leased by the tenant at the building expiring during the expiration quarter.

(2)The lease expiration date presented is that of the majority of the space leased to the tenant at the building.

| | (3) | Approximately 79,000 square feet of the 371,000 square feet is must-take space; approximately 53,000 square feet must be taken a year after the renewal commencement and approximately 26,000 square feet must be taken two years after the renewal commencement. |

7

Piedmont Office Realty Trust, Inc.

Financial Highlights

As of December 31, 2011

|

| Financing and Capital Activity |

- As of December 31, 2011, our ratio of gross debt to total gross assets was 27.5%, our ratio of gross debt to gross real estate assets was 31.9%, and our ratio of gross debt to total market capitalization was 33.4%. These debt ratios are based on total principal amount outstanding for our various loans at December 31, 2011. Subsequent to quarter end, we repaid the $140 million loan secured by 500 West Monroe Street. Our pro forma leverage ratios, after adjusting for the repayment of that debt, are: 25.5% for gross debt to total gross assets, 29.8% for gross debt to gross real estate assets, and 31.2% for gross debt to total market capitalization. - On November 10, 2011, Piedmont completed the purchase of 400 TownPark, a 176,000 square foot, five-story office building in suburban Orlando, FL. The purchase price was $23.9 million, or $136 per square foot. The construction of the building was completed in 2008 with an efficient, LEED design. The building was 19% leased at acquisition and was 30% leased as of December 31, 2011. It is located within the amenity-rich, mixed-use development of TownPark, which is located adjacent to Interstate 4 in the Lake Mary suburb of Orlando. The building offers the only contiguous block of vacant space over 50,000 square feet in the market. The low cost basis and high-quality construction of the building should afford the Company a competitive advantage in securing a large corporate user as the economy recovers. - On December 15, 2011, Piedmont completed the sale of its 96.5% ownership interest in 35 West Wacker Drive, a 1,118,000 square foot, 50-story trophy office building in Chicago, IL. The ownership interest was sold for approximately $387.0 million, which equates to a gross value for the building of $401.0 million, or $359 per square foot. The operating income for the asset is presented in discontinued operations. Piedmont recorded a gain on the sale of its ownership interest in 35 West Wacker Drive of $96.1 million. Through the sale, Piedmont was able to reduce its concentration in Chicago as well as reduce the amount of the Company’s secured debt borrowings, while simultaneously securing an attractive sale price for the ownership interest. - On November 17, 2011, Piedmont repaid a $45 million mezzanine loan secured by an equity ownership interest in 500 West Monroe Street located in Chicago, IL. Piedmont was successful in negotiating a $1.1 million discount to the repayment of that obligation which is recorded in gain on early extinguishment of debt in the accompanying financial statements. - On November 22, 2011, Piedmont obtained a $300 million, five-year unsecured term loan. The loan has a stated variable interest rate based upon LIBOR and the credit rating of the Company; however, prior to closing on the loan, Piedmont entered into interest rate swap agreements with several counterparties, effectively fixing the interest rate for the loan at 2.69% for the entire five-year term, assuming no credit rating change for the Company. Proceeds from the loan were used to replace a $250 million unsecured term loan which was paid off in June 2011 and for general corporate purposes. - On November 2, 2011, the Board of Directors of Piedmont authorized the repurchase of up to $300 million of the Company’s common stock over the next two years. Any repurchases of shares of common stock will depend upon market conditions, as well as other factors, and such repurchases will be made at the discretion of the Company. During the fourth quarter of 2011, the company repurchased 199,400 shares at an average price of $16.24 per share. - During the fourth quarter of 2011, Piedmont executed a development contract to construct a 1.4 Megawatt solar canopy at 400 Bridgewater Crossing in Bridgewater, NJ. The project, once completed, will be comprised of 5,850 solar panels. The project represents a $7 million investment in clean energy and complements Piedmont’s existing environmental responsibility initiatives, including its LEED and Energy Star certification efforts. - On November 2, 2011, the Board of Directors of Piedmont declared dividends for the fourth quarter of 2011 in the amount of $0.315 per common share outstanding to stockholders of record as of the close of business on December 1, 2011. The dividends were paid on December 22, 2011. |

8

Piedmont Office Realty Trust, Inc.

Financial Highlights

As of December 31, 2011

|

Subsequent Events |

- On January 9, 2012, Piedmont repaid a $140 million loan secured by 500 West Monroe Street in Chicago, IL. The loan was open to prepayment without any yield maintenance requirements. The repayment of the loan allowed Piedmont to further it’s strategic objective of decreasing its secured debt borrowings in relation to its total borrowings. Please see Financing and Capital Activity above for pro forma leverage ratios, which take into account the repayment of this debt. |

Guidance for 2012 |

- The following financial guidance for calendar year 2012 is based on management’s expectations at this time: |

| | | | |

| | | Low High |

Core Funds from Operations | | $234 - $250 million |

Core Funds from Operations per diluted share | | $1.35 - $1.45 |

These estimates reflect management’s view of current market conditions and incorporate certain economic and operational assumptions and projections, including the disposition of 35 West Wacker Drive which contributed approximately $0.13 per share of funds from operations in 2011. Actual results could differ from these estimates. Note that individual quarters may fluctuate on both a cash and an accrual basis due to the timing of repairs and maintenance, capital expenditures, capital markets activities and one-time revenue or expense events. In addition, the Company’s guidance is based on information available to management as of the date of this supplemental report.

9

Piedmont Office Realty Trust, Inc.

Key Performance Indicators

Unaudited (in thousands except for per share data)

This section of our supplemental report includes non-GAAP financial measures, including, but not limited to, Core Earnings Before Interest, Taxes, Depreciation, and Amortization (Core EBITDA), Funds from Operations (FFO), Core Funds from Operations (Core FFO), and Adjusted Funds from Operations (AFFO). Definitions of these non-GAAP measures are provided on pages 35-36 and reconciliations are provided on pages 38-40.

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

Selected Operating Data | | 12/31/2011 | | | 9/30/2011 | | | 6/30/2011 | | | 3/31/2011 | | | 12/31/2010 | |

| | | | | |

Percent leased(1) | | | 86.5% | | | | 86.4% | | | | 86.5% | | | | 87.3% | | | | 89.2% | |

| | | | | |

Percent leased - stabilized portfolio(1) (2) | | | 89.1% | | | | 88.8% | | | | 89.0% | | | | 89.4% | | | | 89.9% | |

| | | | | |

Rental income | | | $107,381 | | | | $105,878 | | | | $104,621 | | | | $101,261 | | | | $102,137 | |

| | | | | |

Total revenues | | | $137,493 | | | | $134,414 | | | | $137,165 | | | | $132,569 | | | | $135,233 | |

| | | | | |

Total operating expenses | | | $104,221 | | | | $97,017 | | | | $100,729 | | | | $91,301 | | | | $95,874 | |

| | | | | |

Real estate operating income | | | $33,272 | | | | $37,397 | | | | $36,436 | | | | $41,268 | | | | $39,359 | |

| | | | | |

Core EBITDA | | | $82,523 | | | | $86,941 | | | | $84,729 | | | | $88,774 | | | | $85,610 | |

| | | | | |

Core FFO | | | $65,270 | | | | $69,203 | | | | $65,843 | | | | $71,281 | | | | $68,178 | |

| | | | | |

Core FFO per share - diluted | | | $0.38 | | | | $0.40 | | | | $0.38 | | | | $0.41 | | | | $0.39 | |

| | | | | |

AFFO | | | $44,728 | | | | $50,988 | | | | $50,578 | | | | $56,312 | | | | $42,046 | |

| | | | | |

AFFO per share - diluted | | | $0.26 | | | | $0.29 | | | | $0.29 | | | | $0.33 | | | | $0.24 | |

| | | | | |

Gross dividends | | | $54,441 | | | | $54,441 | | | | $54,440 | | | | $54,387 | | | | $54,388 | |

| | | | | |

Dividends per share | | | $0.315 | | | | $0.315 | | | | $0.315 | | | | $0.315 | | | | $0.315 | |

| | | | | |

Selected Balance Sheet Data | | | | | | | | | | | | | | | |

| | | | | |

Total real estate assets | | | $3,704,051 | | | | $3,926,638 | | | | $3,899,639 | | | | $3,892,087 | | | | $3,676,828 | |

| | | | | |

Total gross real estate assets | | | $4,615,812 | | | | $4,875,854 | | | | $4,828,700 | | | | $4,804,988 | | | | $4,567,326 | |

| | | | | |

Total assets | | | $4,447,834 | | | | $4,613,118 | | | | $4,560,206 | | | | $4,563,272 | | | | $4,373,480 | |

| | | | | |

Net debt(3) | | | $1,323,796 | | | | $1,600,650 | | | | $1,583,812 | | | | $1,529,603 | | | | $1,333,332 | |

| | | | | |

Total liabilities | | | $1,674,406 | | | | $1,896,195 | | | | $1,838,983 | | | | $1,809,755 | | | | $1,600,026 | |

| | | | | |

Ratios | | | | | | | | | | | | | | | |

| | | | | |

Core EBITDA margin(4) | | | 55.8% | | | | 59.8% | | | | 56.1% | | | | 60.6% | | | | 56.2% | |

| | | | | |

Fixed charge coverage ratio(5) (6) | | | 4.7 x | | | | 4.9 x | | | | 4.4 x | | | | 5.2 x | | | | 4.9 x | |

| | | | | |

Net debt to core EBITDA(6) (7) | | | 4.0 x | | | | 4.6 x | | | | 4.7 x | | | | 4.3 x | | | | 3.9 x | |

(1)Please refer to page 23 for additional leased percentage information.

(2)Please refer to page 33 for additional information on value-add properties, data for which is removed from stabilized portfolio totals.

(3)Net debt is calculated as the total principal amount of debt outstanding minus cash and cash equivalents and escrow deposits and restricted cash. As of the first quarter of 2011, net debt includes $185 million of secured debt associated with 500 West Monroe Street which was acquired March 31, 2011; $45 million of that debt was repaid during the fourth quarter of 2011. Each quarter prior to the fourth quarter of 2011 includes $120 million of debt associated with one sold asset, 35 West Wacker Drive.

(4)Core EBITDA margin is calculated as Core EBITDA divided by total revenues (including revenues associated with discontinued operations).

(5)Fixed charge coverage is calculated as Core EBITDA divided by the sum of interest expense, principal amortization, capitalized interest and preferred dividends. The Company had no capitalized interest, principal amortization or preferred dividends during any of the periods presented.

(6)The change in Piedmont’s debt coverage ratios during 2011 was primarily attributable to $185 million of additional debt assumed with the acquisition of 500 West Monroe Street in March 2011 and the related interest expense; $45 million of this debt was repaid on November 17, 2011, and the remaining $140 million was repaid subsequent to quarter end on January 9, 2012.

(7)Core EBITDA is annualized for the purposes of this calculation.

10

Piedmont Office Realty Trust, Inc.

Consolidated Balance Sheets

Unaudited (in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2011 | | | September 30, 2011 | | | June 30, 2011 | | | March 31, 2011 | | | December 31, 2010 | |

Assets: | | | | | | | | | | | | | | | | | | | | |

Real estate, at cost: | | | | | | | | | | | | | | | | | | | | |

Land assets | | $ | 640,196 | | | $ | 693,229 | | | $ | 693,962 | | | $ | 688,103 | | | $ | 647,653 | |

Buildings and improvements | | | 3,759,596 | | | | 3,930,126 | | | | 3,894,258 | | | | 3,865,239 | | | | 3,688,751 | |

Buildings and improvements, accumulated depreciation | | | (792,342) | | | | (807,917) | | | | (792,881) | | | | (770,147) | | | | (744,756) | |

Intangible lease asset | | | 198,667 | | | | 232,973 | | | | 225,182 | | | | 238,504 | | | | 219,770 | |

Intangible lease asset, accumulated amortization | | | (119,419) | | | | (141,299) | | | | (136,180) | | | | (142,754) | | | | (145,742) | |

Construction in progress | | | 17,353 | | | | 19,526 | | | | 15,298 | | | | 13,142 | | | | 11,152 | |

| | | | | | | | | | | | | | | | | | | | |

Total real estate assets | | | 3,704,051 | | | | 3,926,638 | | | | 3,899,639 | | | | 3,892,087 | | | | 3,676,828 | |

Investment in unconsolidated joint ventures | | | 38,181 | | | | 38,391 | | | | 41,271 | | | | 41,759 | | | | 42,018 | |

Cash and cash equivalents | | | 139,690 | | | | 16,128 | | | | 21,404 | | | | 42,151 | | | | 56,718 | |

Tenant receivables, net of allowance for doubtful accounts | | | 24,722 | | | | 32,066 | | | | 31,143 | | | | 29,726 | | | | 28,849 | |

Straight line rent receivable | | | 104,801 | | | | 110,818 | | | | 107,463 | | | | 103,854 | | | | 105,157 | |

Notes receivable | | | - | | | | - | | | | - | | | | - | | | | 61,144 | |

Due from unconsolidated joint ventures | | | 788 | | | | 643 | | | | 537 | | | | 594 | | | | 1,158 | |

Escrow deposits and restricted cash | | | 9,039 | | | | 47,747 | | | | 32,309 | | | | 30,771 | | | | 12,475 | |

Prepaid expenses and other assets | | | 9,911 | | | | 13,978 | | | | 14,577 | | | | 11,967 | | | | 11,249 | |

Goodwill | | | 180,097 | | | | 180,097 | | | | 180,097 | | | | 180,097 | | | | 180,097 | |

Deferred financing costs, less accumulated amortization | | | 5,977 | | | | 4,788 | | | | 4,396 | | | | 5,374 | | | | 5,306 | |

Deferred lease costs, less accumulated amortization | | | 230,577 | | | | 241,824 | | | | 227,370 | | | | 224,892 | | | | 192,481 | |

| | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 4,447,834 | | | $ | 4,613,118 | | | $ | 4,560,206 | | | $ | 4,563,272 | | | $ | 4,373,480 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Liabilities: | | | | | | | | | | | | | | | | | | | | |

Line of credit and notes payable | | $ | 1,472,525 | | | $ | 1,664,525 | | | $ | 1,637,054 | | | $ | 1,601,112 | | | $ | 1,402,525 | |

Accounts payable, accrued expenses, and accrued capital expenditures | | | 122,986 | | | | 143,106 | | | | 126,111 | | | | 122,769 | | | | 112,648 | |

Deferred income | | | 27,321 | | | | 32,514 | | | | 32,161 | | | | 38,990 | | | | 35,203 | |

Intangible lease liabilities, less accumulated amortization | | | 49,037 | | | | 56,050 | | | | 43,657 | | | | 46,517 | | | | 48,959 | |

Interest rate swap | | | 2,537 | | | | - | | | | - | | | | 367 | | | | 691 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 1,674,406 | | | | 1,896,195 | | | | 1,838,983 | | | | 1,809,755 | | | | 1,600,026 | |

| | | | | |

Stockholders’ equity(1): | | | | | | | | | | | | | | | | | | | | |

Common stock | | | 1,726 | | | | 1,728 | | | | 1,728 | | | | 1,727 | | | | 1,727 | |

Additional paid in capital | | | 3,660,420 | | | | 3,663,155 | | | | 3,662,522 | | | | 3,661,570 | | | | 3,661,308 | |

Cumulative distributions in excess of earnings | | | (887,790) | | | | (952,370) | | | | (948,956) | | | | (915,543) | | | | (895,122) | |

Other comprehensive loss | | | (2,537) | | | | - | | | | (44) | | | | (465) | | | | (691) | |

| | | | | | | | | | | | | | | | | | | | |

Piedmont stockholders’ equity | | | 2,771,819 | | | | 2,712,513 | | | | 2,715,250 | | | | 2,747,289 | | | | 2,767,222 | |

Non-controlling interest | | | 1,609 | | | | 4,410 | | | | 5,973 | | | | 6,228 | | | | 6,232 | |

| | | | | | | | | | | | | | | | | | | | |

Total stockholders’ equity | | | 2,773,428 | | | | 2,716,923 | | | | 2,721,223 | | | | 2,753,517 | | | | 2,773,454 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities, redeemable common stock and stockholders’ equity | | $ | 4,447,834 | | | $ | 4,613,118 | | | $ | 4,560,206 | | | $ | 4,563,272 | | | $ | 4,373,480 | |

| | | | | | | | | | | | | | | | | | | | |

All classes of common stock outstanding at end of period(1) | | | 172,630 | | | | 172,827 | | | | 172,827 | | | | 172,658 | | | | 172,658 | |

(1)On January 22, 2010, we filed an amendment to our charter to effect a recapitalization of our common stock as described further in our Securities and Exchange Commission (“SEC”) filings. The recapitalization had the effect of a one-for-three reverse stock split. All prior period per share data has been restated to give net effect to this one-for-three reverse stock split.

11

Piedmont Office Realty Trust, Inc.

Consolidated Statements of Income

Unaudited (in thousands except for per share data)

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | | |

| | | 12/31/2011 | | | 9/30/2011 | | | 6/30/2011 | | | 3/31/2011 | | | 12/31/2010 | |

| | | | |

| | | | | |

Revenues: | | | | | | | | | | | | | | | | | | | | |

Rental income | | $ | 107,381 | | | $ | 105,878 | | | $ | 104,621 | | | $ | 101,261 | | | $ | 102,137 | |

Tenant reimbursements | | | 29,512 | | | | 28,459 | | | | 30,834 | | | | 27,074 | | | | 30,694 | |

Property management fee revenue | | | 281 | | | | 110 | | | | 363 | | | | 830 | | | | 948 | |

Other rental income | | | 319 | | | | (33) | | | | 1,347 | | | | 3,404 | | | | 1,454 | |

| | | | |

Total revenues | | | 137,493 | | | | 134,414 | | | | 137,165 | | | | 132,569 | | | | 135,233 | |

| | | | | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | |

Property operating costs | | | 55,453 | | | | 51,062 | | | | 53,187 | | | | 49,008 | | | | 53,458 | |

Depreciation | | | 27,070 | | | | 26,375 | | | | 26,061 | | | | 25,312 | | | | 25,012 | |

Amortization | | | 15,492 | | | | 14,907 | | | | 14,137 | | | | 10,367 | | | | 9,806 | |

General and administrative | | | 6,206 | | | | 4,673 | | | | 7,344 | | | | 6,614 | | | | 7,598 | |

| | | | |

Total operating expenses | | | 104,221 | | | | 97,017 | | | | 100,729 | | | | 91,301 | | | | 95,874 | |

| |

| | | | |

Real estate operating income | | | 33,272 | | | | 37,397 | | | | 36,436 | | | | 41,268 | | | | 39,359 | |

| | | | | |

Other income (expense): | | | | | | | | | | | | | | | | | | | | |

Interest expense | | | (16,179) | | | | (16,236) | | | | (17,762) | | | | (15,640) | | | | (15,800) | |

Interest and other income (expense) | | | (357) | | | | (91) | | | | (238) | | | | 3,459 | | | | 491 | |

Equity in income of unconsolidated joint ventures | | | 587 | | | | 485 | | | | 338 | | | | 209 | | | | 630 | |

Gain / (loss) on consolidation of variable interest entity | | | - | | | | - | | | | (388) | | | | 1,920 | | | | - | |

Gain / (loss) on extinguishment of debt | | | 1,039 | | | | - | | | | - | | | | - | | | | - | |

| | | | |

Total other income (expense) | | | (14,910) | | | | (15,842) | | | | (18,050) | | | | (10,052) | | | | (14,679) | |

| |

| | | | |

Income from continuing operations | | | 18,362 | | | | 21,555 | | | | 18,386 | | | | 31,216 | | | | 24,680 | |

| | | | | |

Discontinued operations: | | | | | | | | | | | | | | | | | | | | |

Operating income, excluding impairment loss | | | 4,761 | | | | 2,719 | | | | 2,645 | | | | 2,755 | | | | 4,841 | |

Gain / (loss) on sale of properties | | | 95,901 | | | | 26,756 | | | | - | | | | - | | | | (817) | |

| | | | |

Income / (loss) from discontinued operations(1) | | | 100,662 | | | | 29,475 | | | | 2,645 | | | | 2,755 | | | | 4,024 | |

| |

| | | | |

Net income | | | 119,024 | | | | 51,030 | | | | 21,031 | | | | 33,971 | | | | 28,704 | |

| | | | | |

Less: Net income attributable to noncontrolling interest | | | (4) | | | | (4) | | | | (4) | | | | (4) | | | | (4) | |

| | | | |

| | | | | |

Net income attributable to Piedmont | | $ | 119,020 | | | $ | 51,026 | | | $ | 21,027 | | | $ | 33,967 | | | $ | 28,700 | |

| | | | |

| | | | | |

Weighted average common shares outstanding - diluted | | | 173,036 | | | | 173,045 | | | | 172,986 | | | | 172,955 | | | | 172,996 | |

| | | | | |

Net income per share available to common stockholders - diluted | | $ | 0.69 | | | $ | 0.29 | | | $ | 0.12 | | | $ | 0.20 | | | $ | 0.17 | |

| | | | |

(1) Reflects operating results for 111 Sylvan Avenue in Englewood Cliffs, NJ, which was sold on December 8, 2010, Eastpointe Corporate Center in Issaquah, WA, which was sold on July 1, 2011, 5000 Corporate Court in Holtsville, NY, which was sold on August 31, 2011, and 35 West Wacker Drive in Chicago, IL, which was sold on December 15, 2011.

12

Piedmont Office Realty Trust, Inc.

Consolidated Statements of Income

Unaudited (in thousands except for per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Twelve Months Ended | |

| | | 12/31/2011 | | | 12/31/2010 | | | Change | | | Change | | | 12/31/2011 | | | 12/31/2010 | | | Change | | | Change | |

Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Rental income | | $ | 107,381 | | | $ | 102,137 | | | $ | 5,244 | | | | 5.1% | | | $ | 419,141 | | | $ | 408,375 | | | $ | 10,766 | | | | 2.6% | |

Tenant reimbursements | | | 29,512 | | | | 30,694 | | | | (1,182) | | | | -3.9% | | | | 115,879 | | | | 114,795 | | | | 1,084 | | | | 0.9% | |

Property management fee revenue | | | 281 | | | | 948 | | | | (667) | | | | -70.4% | | | | 1,584 | | | | 3,212 | | | | (1,628) | | | | -50.7% | |

Other rental income | | | 319 | | | | 1,454 | | | | (1,135) | | | | -78.1% | | | | 5,038 | | | | 6,658 | | | | (1,620) | | | | -24.3% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenues | | | 137,493 | | | | 135,233 | | | | 2,260 | | | | 1.7% | | | | 541,642 | | | | 533,040 | | | | 8,602 | | | | 1.6% | |

| | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Property operating costs | | | 55,453 | | | | 53,458 | | | | (1,995) | | | | -3.7% | | | | 208,711 | | | | 196,875 | | | | (11,836) | | | | -6.0% | |

Depreciation | | | 27,070 | | | | 25,012 | | | | (2,058) | | | | -8.2% | | | | 104,818 | | | | 97,275 | | | | (7,543) | | | | -7.8% | |

Amortization | | | 15,492 | | | | 9,806 | | | | (5,686) | | | | -58.0% | | | | 54,903 | | | | 38,021 | | | | (16,882) | | | | -44.4% | |

General and administrative | | | 6,206 | | | | 7,598 | | | | 1,392 | | | | 18.3% | | | | 24,838 | | | | 28,388 | | | | 3,550 | | | | 12.5% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 104,221 | | | | 95,874 | | | | (8,347) | | | | -8.7% | | | | 393,270 | | | | 360,559 | | | | (32,711) | | | | -9.1% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Real estate operating income | | | 33,272 | | | | 39,359 | | | | (6,087) | | | | -15.5% | | | | 148,372 | | | | 172,481 | | | | (24,109) | | | | -14.0% | |

| | | | | | | | |

Other income (expense): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest expense | | | (16,179) | | | | (15,800) | | | | (379) | | | | -2.4% | | | | (65,817) | | | | (66,486) | | | | 669 | | | | 1.0% | |

Interest and other income (expense) | | | (357) | | | | 491 | | | | (848) | | | | -172.7% | | | | 2,774 | | | | 3,486 | | | | (712) | | | | -20.4% | |

Equity in income of unconsolidated joint ventures | | | 587 | | | | 630 | | | | (43) | | | | -6.8% | | | | 1,619 | | | | 2,633 | | | | (1,014) | | | | -38.5% | |

Gain / (loss) on consolidation of variable interest entity | | | - | | | | - | | | | - | | | | 0.0% | | | | 1,532 | | | | - | | | | 1,532 | | | | 0.0% | |

Gain / (loss) on extinguishment of debt | | | 1,039 | | | | - | | | | 1,039 | | | | 0.0% | | | | 1,039 | | | | - | | | | 1,039 | | | | 0.0% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total other income (expense) | | | (14,910) | | | | (14,679) | | | | (231) | | | | -1.6% | | | | (58,853) | | | | (60,367) | | | | 1,514 | | | | 2.5% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Income from continuing operations | | | 18,362 | | | | 24,680 | | | | (6,318) | | | | -25.6% | | | | 89,519 | | | | 112,114 | | | | (22,595) | | | | -20.2% | |

| | | | | | | | |

Discontinued operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income, excluding impairment loss | | | 4,761 | | | | 4,841 | | | | (80) | | | | -1.7% | | | | 12,880 | | | | 18,684 | | | | (5,804) | | | | -31.1% | |

Impairment loss | | | - | | | | - | | | | - | | | | 0.0% | | | | - | | | | (9,587) | | | | 9,587 | | | | 100.0% | |

Gain / (loss) on sale of properties | | | 95,901 | | | | (817) | | | | 96,718 | | | | 11838.2% | | | | 122,657 | | | | (817) | | | | 123,474 | | | | 15113.1% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income / (loss) from discontinued operations(1) | | | 100,662 | | | | 4,024 | | | | 96,638 | | | | 2401.5% | | | | 135,537 | | | | 8,280 | | | | 127,257 | | | | 1536.9% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Net income | | | 119,024 | | | | 28,704 | | | | 90,320 | | | | 314.7% | | | | 225,056 | | | | 120,394 | | | | 104,662 | | | | 86.9% | |

| | | | | | | | |

Less: Net income attributable to noncontrolling interest | | | (4) | | | | (4) | | | | - | | | | 0.0% | | | | (15) | | | | (15) | | | | - | | | | 0.0% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Net income attributable to Piedmont | | $ | 119,020 | | | $ | 28,700 | | | $ | 90,320 | | | | 314.7% | | | $ | 225,041 | | | $ | 120,379 | | | $ | 104,662 | | | | 86.9% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Weighted average common shares outstanding - diluted | | | 173,036 | | | | 172,996 | | | | | | | | | | | | 172,981 | | | | 170,967 | | | | | | | | | |

| | | | | | | | |

Net income per share available to common stockholders - diluted | | $ | 0.69 | | | $ | 0.17 | | | | | | | | | | | $ | 1.30 | | | $ | 0.70 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1)Reflects operating results for 111 Sylvan Avenue in Englewood Cliffs, NJ, which was sold on December 8, 2010, Eastpointe Corporate Center in Issaquah, WA, which was sold on July 1, 2011, 5000 Corporate Court in Holtsville, NY, which was sold on August 31, 2011, and 35 West Wacker Drive in Chicago, IL, which was sold on December 15, 2011.

13

Piedmont Office Realty Trust, Inc.

Funds From Operations, Core Funds From Operations and Adjusted Funds From Operations

Unaudited (in thousands except for per share data)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Twelve Months Ended | |

| | | 12/31/2011 | | | 12/31/2010 | | | 12/31/2011 | | | 12/31/2010 | |

Net income attributable to Piedmont | | $ | 119,020 | | | $ | 28,700 | | | $ | 225,041 | | | $ | 120,379 | |

| | | | |

Depreciation(1) (2) | | | 27,287 | | | | 26,821 | | | | 110,421 | | | | 105,107 | |

Amortization(1) | | | 15,531 | | | | 11,623 | | | | 60,132 | | | | 45,334 | |

Impairment loss(1) | | | - | | | | - | | | | - | | | | 9,640 | |

(Gain) / loss on sale of properties(1) | | | (95,901) | | | | 792 | | | | (122,773) | | | | 792 | |

(Gain) / loss on consolidation of VIE | | | - | | | | - | | | | (1,532) | | | | - | |

| | | | | | | | | | | | | | | | |

Funds from operations | | | 65,937 | | | | 67,936 | | | | 271,289 | | | | 281,252 | |

| | | | |

Acquisition costs | | | 372 | | | | 242 | | | | 1,347 | | | | 600 | |

(Gain) / loss on extinguishment of debt | | | (1,039) | | | | - | | | | (1,039) | | | | - | |

| | | | | | | | | | | | | | | | |

Core funds from operations | | | 65,270 | | | | 68,178 | | | | 271,597 | | | | 281,852 | |

| | | | |

Depreciation of non real estate assets | | | 77 | | | | 173 | | | | 499 | | | | 707 | |

Stock-based and other non-cash compensation expense | | | 1,730 | | | | 1,223 | | | | 4,705 | | | | 3,681 | |

Deferred financing cost amortization(1) | | | 649 | | | | 608 | | | | 3,195 | | | | 2,608 | |

Amortization of fair market adjustments on notes payable | | | - | | | | - | | | | 1,413 | | | | - | |

Straight-line effects of lease revenue(1) | | | (5,019) | | | | (3,456) | | | | (9,507) | | | | (6,088) | |

Amortization of lease-related intangibles(1) | | | (2,215) | | | | (1,331) | | | | (7,065) | | | | (5,793) | |

Income from amortization of discount on purchase of mezzanine loans | | | - | | | | (473) | | | | (484) | | | | (2,405) | |

Acquisition costs | | | (372) | | | | (242) | | | | (1,347) | | | | (600) | |

Non-incremental capital expenditures(3) | | | (15,392) | | | | (22,634) | | | | (60,401) | | | | (45,286) | |

| | | | | | | | | | | | | | | | |

Adjusted funds from operations | | $ | 44,728 | | | $ | 42,046 | | | $ | 202,605 | | | $ | 228,676 | |

| | | | | | | | | | | | | | | | |

| | | | |

Weighted average common shares outstanding - diluted | | | 173,036 | | | | 172,996 | | | | 172,981 | | | | 170,967 | |

| | | | |

Funds from operations per share (diluted) | | $ | 0.38 | | | $ | 0.39 | | | $ | 1.57 | | | $ | 1.65 | |

Core funds from operations per share (diluted) | | $ | 0.38 | | | $ | 0.39 | | | $ | 1.57 | | | $ | 1.65 | |

Adjusted funds from operations per share (diluted) | | $ | 0.26 | | | $ | 0.24 | | | $ | 1.17 | | | $ | 1.34 | |

| (1) | Includes adjustments for wholly-owned properties, including discontinued operations, and for our proportionate ownership in unconsolidated joint ventures. |

| (2) | Excludes depreciation of non real estate assets. |

| (3) | Non-incremental capital expenditures are defined on page 36. During the third quarter of 2011, Piedmont revised its definitions of incremental and non-incremental capital expenditures in order to conform with the more broadly accepted definitions for such terms by other office REITs. Capital expenditures have been restated for all prior periods in order to provide a consistent basis for comparison. |

14

Piedmont Office Realty Trust, Inc.

Same Store Net Operating Income (Cash Basis)

Unaudited (in thousands)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Twelve Months Ended | |

| | | 12/31/2011 | | | 12/31/2010 | | | 12/31/2011 | | | 12/31/2010 | |

Net income attributable to Piedmont | | $ | 119,020 | | | $ | 28,700 | | | $ | 225,041 | | | $ | 120,379 | |

| | | | |

Net income attributable to noncontrolling interest | | | 91 | | | | 122 | | | | 468 | | | | 531 | |

Interest expense | | | 17,457 | | | | 17,378 | | | | 71,749 | | | | 72,761 | |

(Gain) / loss on extinguishment of debt | | | (1,039) | | | | - | | | | (1,039) | | | | - | |

Depreciation(1) | | | 27,364 | | | | 26,995 | | | | 110,920 | | | | 105,814 | |

Amortization(1) | | | 15,531 | | | | 11,623 | | | | 60,132 | | | | 45,334 | |

Impairment loss(1) | | | - | | | | - | | | | - | | | | 9,640 | |

(Gain) / loss on sale of properties(1) | | | (95,901) | | | | 792 | | | | (122,773) | | | | 792 | |

(Gain) / loss on consolidation of VIE | | | - | | | | - | | | | (1,532) | | | | - | |

| | | | | | | | | | | | | | | | |

Core EBITDA | | | 82,523 | | | | 85,610 | | | | 342,966 | | | | 355,251 | |

| | | | |

General & administrative expenses(1) | | | 6,241 | | | | 7,724 | | | | 25,085 | | | | 28,853 | |

Management fee revenue | | | (281) | | | | (948) | | | | (1,584) | | | | (3,212) | |

Interest and other income(1) | | | 357 | | | | (491) | | | | (2,775) | | | | (3,489) | |

Lease termination income | | | (319) | | | | (2,589) | | | | (5,038) | | | | (7,794) | |

Lease termination expense - straight line rent & acquisition intangibles write-offs | | | 185 | | | | 461 | | | | 924 | | | | 1,338 | |

Straight-line effects of lease revenue(1) | | | (5,180) | | | | (3,791) | | | | (10,143) | | | | (7,300) | |

Net effect of amortization of above/(below) market in-place lease intangibles(1) | | | (2,239) | | | | (1,457) | | | | (7,354) | | | | (5,919) | |

| | | | | | | | | | | | | | | | |

Core net operating income | | | 81,287 | | | | 84,519 | | | | 342,081 | | | | 357,728 | |

| | | | |

Net operating income from: | | | | | | | | | | | | | | | | |

Acquisitions(2) | | | (4,855) | | | | 918 | | | | (11,298) | | | | 919 | |

Dispositions(3) | | | (5,134) | | | | (7,341) | | | | (24,306) | | | | (33,973) | |

Industrial properties | | | (242) | | | | (346) | | | | (975) | | | | (782) | |

Unconsolidated joint ventures | | | (1,013) | | | | (1,165) | | | | (3,185) | | | | (4,835) | |

| | | | | | | | | | | | | | | | |

Same Store NOI | | $ | 70,043 | | | $ | 76,585 | | | $ | 302,317 | | | $ | 319,057 | |

| | | | | | | | | | | | | | | | |

Change period over period | | | -8.5% | | | | N/A | | | | -5.2% | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Same Store Net Operating Income Top Seven Markets | | | |

| | | | | Three Months Ended | | | | | Twelve Months Ended | | | |

| | | | | 12/31/2011 | | | 12/31/2010 | | | | | 12/31/2011 | | | 12/31/2010 | | | |

| | | | | $ | | | % | | | $ | | | % | | | | | $ | | | % | | | $ | | | % | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Chicago(4) | | $ | 10,837 | | | | 15.5 | | | $ | 11,879 | | | | 15.5 | | | | | $ | 51,034 | | | | 16.9 | | | $ | 51,552 | | | | 16.2 | | | |

| | | Washington, D.C.(5) | | | 17,902 | | | | 25.6 | | | | 18,914 | | | | 24.7 | | | | | | 71,721 | | | | 23.7 | | | | 74,741 | | | | 23.4 | | | |

| | | New York(6) | | | 12,935 | | | | 18.5 | | | | 13,576 | | | | 17.7 | | | | | | 54,378 | | | | 18.0 | | | | 51,507 | | | | 16.2 | | | |

| | | Minnepolis(7) | | | 4,494 | | | | 6.4 | | | | 5,115 | | | | 6.7 | | | | | | 19,001 | | | | 6.3 | | | | 21,158 | | | | 6.6 | | | |

| | | Los Angeles(8) | | | 3,190 | | | | 4.5 | | | | 2,013 | | | | 2.6 | | | | | | 13,589 | | | | 4.5 | | | | 15,710 | | | | 4.9 | | | |

| | | Dallas | | | 3,626 | | | | 5.2 | | | | 4,348 | | | | 5.7 | | | | | | 14,625 | | | | 4.8 | | | | 16,286 | | | | 5.1 | | | |

| | | Boston(9) | | | 2,627 | | | | 3.7 | | | | 4,163 | | | | 5.4 | | | | | | 11,592 | | | | 3.8 | | | | 15,709 | | | | 4.9 | | | |

| | | Other(10) | | | 14,432 | | | | 20.6 | | | | 16,577 | | | | 21.7 | | | | | | 66,377 | | | | 22.0 | | | | 72,394 | | | | 22.7 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Total | | $ | 70,043 | | | | 100.0 | | | $ | 76,585 | | | | 100.0 | | | | | $ | 302,317 | | | | 100.0 | | | $ | 319,057 | | | | 100.0 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

(1) Includes amounts attributable to wholly-owned properties, including discontinued operations, and our proportionate share of amounts attributable to unconsolidated joint ventures.

(2)Acquisitions consist of Suwanee Gateway One in Suwanee, GA, purchased on September 28, 2010, Meridian Crossings in Richfield, MN, purchased on October 1, 2010, 1200 Enclave Parkway in Houston, TX, purchased on March 30, 2011, 500 West Monroe Street in Chicago, IL, acquired on March 31, 2011, The Dupree in Atlanta, GA, purchased on April 29, 2011, The Medici in Atlanta, GA, purchased on June 7, 2011, 225 and 235 Presidential Way in Woburn, MA, purchased on September 13, 2011, and 400 TownPark in Lake Mary, FL purchased on November 10, 2011.

(3)Dispositions consist of 111 Sylvan Avenue in Englewood Cliffs, NJ, sold on December 8, 2010, Eastpointe Corporate Center in Issaquah, WA, sold on July 1, 2011, 5000 Corporate Court in Holtsville, NY, sold on August 31, 2011, and 35 West Wacker Drive in Chicago, IL, sold on December 15, 2011.

(4)The decrease in Chicago Same Store Net Operating Income for the three months ended December 31, 2011 as compared to the same period in 2010 was primarily related to the expiration of the Zurich American Insurance Company lease at Windy Point II in Schaumburg, IL.

(5)The decrease in Washington, D.C. Same Store Net Operating Income for the three months and the twelve months ended December 31, 2011 as compared to the same periods in 2010 was primarily related to a 46,000 square foot lease termination at the beginning of the first quarter of 2011 at 1201 Eye Street in Washington, D.C. (which space is now being used as swing space for NASA) as well as the expiration of a 41,000 square foot lease during the first quarter of 2011 at 11109 Sunset Hills Road in Reston, VA. The decrease in Washington, D.C. Same Store Net Operating Income for the three and the twelve months ended December 31, 2011 was offset somewhat by increased revenue at One Independence Square in Washington, D.C. due to an increased rental rate for Comptroller of the Currency.

(6)The increase in New York Same Store Net Operating Income for the twelve months ended December 31, 2011 as compared to the same period in 2010 was primarily related to rental rate increases (offset by rental abatement concessions in 2010) associated with the lease extension/restructure with the State of New York at 60 Broad Street in New York, NY.

(7) The decrease in Minneapolis Same Store Net Operating Income for the twelve months ended December 31, 2011 as compared to the same period in 2010 was primarily related to an 80,000 square foot partial lease termination by US Bank during the second quarter of 2011 at US Bancorp Center in Minneapolis, MN, as well as the net partial lease termination for 13,000 square feet by a tenant at Crescent Ridge II in Minnetonka, MN.

(8) The increase in Los Angeles Same Store Net Operating Income for the three months ended December 31, 2011 as compared to the same period in 2010 was primarily related to a rental abatement in 2010 associated with the Nestle lease renewal at 800 North Brand Boulevard in Glendale, CA. The decrease in Los Angeles Same Store Net Operating Income for the twelve months ended December 31, 2011 as compared to the same period in 2010 was primarily due to a rental abatement concession in 2011 associated with a long-term lease renewal with Panasonic at 26200 Enterprise Way in Lake Forest, CA, and the expiration of a lease, resulting in a net decrease in leased square footage of 58,000 square feet, at 1055 East Colorado Boulevard in Pasadena, CA.

(9) The decrease in Boston Same Store Net Operating Income for the three months and the twelve months ended December 31, 2011 as compared to the same periods in 2010 was primarily due to a rental abatement concession associated with a long-term lease renewal with State Street Bank at 1200 Crown Colony Drive in Quincy, MA.

(10) The decrease in Other Same Store Net Operating Income for the three months ended December 31, 2011 as compared to the same period in 2010 was primarily attributable to two factors: 1) a rental abatement concession in 2011 associated with a new lease with Chrysler Group, LLC and the related early termination of the previous lease at 1075 West Entrance Drive in Auburn Hills, MI, and 2) a rental abatement concession in 2011 associated with a new lease at Desert Canyon 300 in Phoenix, AZ. The decrease in Other Same Store Net Operating Income for the twelve months ended December 31, 2011 as compared to the same period in 2010 was primarily attributable to the factors listed above, in addition to: 3) reduced rental rates achieved on new and renewal leases which commenced in late 2010 and early 2011 at 150 West Jefferson in Detroit, MI, and 4) a lease contraction of approximately 91,000 square feet effective third quarter 2010 at Chandler Forum in Chandler, AZ.

15

Piedmont Office Realty Trust, Inc.

Same Store Net Operating Income (Accrual Basis)

Unaudited (in thousands)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Twelve Months Ended | |

| | | 12/31/2011 | | | 12/31/2010 | | | 12/31/2011 | | | 12/31/2010 | |

Net income attributable to Piedmont | | $ | 119,020 | | | $ | 28,700 | | | $ | 225,041 | | | $ | 120,379 | |

| | | | |

Net income attributable to noncontrolling interest | | | 91 | | | | 122 | | | | 468 | | | | 531 | |

Interest expense | | | 17,457 | | | | 17,378 | | | | 71,749 | | | | 72,761 | |

(Gain) / loss on extinguishment of debt | | | (1,039) | | | | - | | | | (1,039) | | | | - | |

Depreciation(1) | | | 27,364 | | | | 26,995 | | | | 110,920 | | | | 105,814 | |

Amortization(1) | | | 15,531 | | | | 11,623 | | | | 60,132 | | | | 45,334 | |

Impairment loss(1) | | | - | | | | - | | | | - | | | | 9,640 | |

(Gain) / loss on sale of properties(1) | | | (95,901) | | | | 792 | | | | (122,773) | | | | 792 | |

(Gain) / loss on consolidation of VIE | | | - | | | | - | | | | (1,532) | | | | - | |

| | | | | | | | | | | | | | | | |

Core EBITDA | | | 82,523 | | | | 85,610 | | | | 342,966 | | | | 355,251 | |

| | | | |

General & administrative expenses(1) | | | 6,241 | | | | 7,724 | | | | 25,085 | | | | 28,853 | |

Management fee revenue | | | (281) | | | | (948) | | | | (1,584) | | | | (3,212) | |

Interest and other income(1) | | | 357 | | | | (491) | | | | (2,775) | | | | (3,489) | |

Lease termination income | | | (319) | | | | (2,589) | | | | (5,038) | | | | (7,794) | |

Lease termination expense—straight line rent & acquisition intangibles write-offs | | | 185 | | | | 461 | | | | 924 | | | | 1,338 | |

| | | | | | | | | | | | | | | | |

Core net operating income | | | 88,706 | | | | 89,767 | | | | 359,578 | | | | 370,947 | |

| | | | |

Net operating income from: | | | | | | | | | | | | | | | | |

Acquisitions(2) | | | (6,232) | | | | (270) | | | | (16,527) | | | | (269) | |

Dispositions(3) | | | (5,926) | | | | (8,622) | | | | (28,581) | | | | (38,023) | |

Industrial properties | | | (254) | | | | (366) | | | | (1,033) | | | | (843) | |

Unconsolidated joint ventures | | | (962) | | | | (1,089) | | | | (3,003) | | | | (4,605) | |

| | | | | | | | | | | | | | | | |

Same Store NOI | | $ | 75,332 | | | $ | 79,420 | | | $ | 310,434 | | | $ | 327,207 | |

| | | | | | | | | | | | | | | | |

Change period over period | | | -5.1% | | | | N/A | | | | -5.1% | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store Net Operating Income Top Seven Markets |

| | | | | Three Months Ended | | | | | Twelve Months Ended | | | |

| | | | | 12/31/2011 | | | 12/31/2010 | | | | | 12/31/2011 | | | 12/31/2010 | | | |

| | | | | $ | | | % | | | $ | | | % | | | | | $ | | | % | | | $ | | | % | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Chicago(4) | | $ | 10,589 | | | | 14.0 | | | $ | 11,541 | | | | 14.6 | | | | | $ | 49,634 | | | | 16.0 | | | $ | 53,187 | | | | 16.3 | | | |

| | | Washington, D.C. | | | 19,560 | | | | 26.0 | | | | 18,964 | | | | 23.9 | | | | | | 74,847 | | | | 24.1 | | | | 75,150 | | | | 23.0 | | | |

| | | New York(5) | | | 12,666 | | | | 16.8 | | | | 13,835 | | | | 17.4 | | | | | | 53,260 | | | | 17.2 | | | | 54,350 | | | | 16.6 | | | |

| | | Minneapolis(6) | | | 4,582 | | | | 6.1 | | | | 4,939 | | | | 6.2 | | | | | | 18,616 | | | | 6.0 | | | | 20,460 | | | | 6.3 | | | |

| | | Los Angeles(7) | | | 3,275 | | | | 4.3 | | | | 3,915 | | | | 4.9 | | | | | | 14,206 | | | | 4.6 | | | | 18,822 | | | | 5.7 | | | |

| | | Dallas | | | 3,600 | | | | 4.8 | | | | 4,227 | | | | 5.3 | | | | | | 14,965 | | | | 4.8 | | | | 15,640 | | | | 4.8 | | | |

| | | Boston(8) | | | 2,910 | | | | 3.9 | | | | 3,817 | | | | 4.8 | | | | | | 12,109 | | | | 3.9 | | | | 14,503 | | | | 4.4 | | | |

| | | Other (9) | | | 18,150 | | | | 24.1 | | | | 18,182 | | | | 22.9 | | | | | | 72,797 | | | | 23.4 | | | | 75,095 | | | | 22.9 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Total | | $ | 75,332 | | | | 100.0 | | | $ | 79,420 | | | | 100.0 | | | | | $ | 310,434 | | | | 100.0 | | | $ | 327,207 | | | | 100.0 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

(1) Includes amounts attributable to wholly-owned properties, including discontinued operations, and our proportionate share of amounts attributable to unconsolidated joint ventures.

(2) Acquisitions consist of Suwanee Gateway One in Suwanee, GA, purchased on September 28, 2010, Meridian Crossings in Richfield, MN, purchased on October 1, 2010, 1200 Enclave Parkway in Houston, TX, purchased on March 30, 2011, 500 West Monroe Street in Chicago, IL, acquired on March 31, 2011, The Dupree in Atlanta, GA, purchased on April 29, 2011, The Medici in Atlanta, GA, purchased on June 7, 2011, 225 and 235 Presidential Way in Woburn, MA, purchased on September 13, 2011, and 400 TownPark in Lake Mary, FL purchased on November 10, 2011.

(3) Dispositions consist of 111 Sylvan Avenue in Englewood Cliffs, NJ, sold on December 8, 2010, Eastpointe Corporate Center in Issaquah, WA, sold on July 1, 2011, 5000 Corporate Court in Holtsville, NY, sold on August 31, 2011, and 35 West Wacker Drive in Chicago, IL, sold on December 15, 2011.

(4) The decrease in Chicago Same Store Net Operating Income for the three months and the twelve months ended December 31, 2011 as compared to the same periods in 2010 was primarily related to the expiration of the Zurich American Insurance Company lease at Windy Point II in Schaumburg, IL.

(5) The decrease in the New York Same Store Net Operating Income for the three months and the twelve months ended December 31, 2011 as compared to the same periods in 2010 was primarily related to partial lease terminations with sanofi-aventis at 200 & 400 Bridgewater Crossing in Bridgewater, NJ in order to allow for the execution of new leases to backfill the terminated spaces in advance of the near-term sanofi-aventis lease expirations.

(6)The decrease in Minneapolis Same Store Net Operating Income for the twelve months ended December 31, 2011 as compared to the same period in 2010 was primarily related to an 80,000 square foot partial lease termination by US Bank during the second quarter of 2011 at US Bancorp Center in Minneapolis, MN, as well as the net partial lease termination for 13,000 square feet by a tenant at Crescent Ridge II in Minnetonka, MN.

(7) The decrease in Los Angeles Same Store Net Operating Income for the twelve months ended December 31, 2011 as compared to the same period in 2010 was primarily due to a space contraction associated with the Nestle lease renewal effective third quarter 2010 along with a roll down of total revenues per square foot received from that tenant at 800 North Brand Boulevard in Glendale, CA, and the expiration of a lease, resulting in a net decrease in leased square footage of 58,000 square feet, at 1055 East Colorado Boulevard in Pasadena, CA.

(8) The decrease in Boston Same Store Net Operating Income for the three months and the twelve months ended December 31, 2011 as compared to the same periods in 2010 was primarily due to a rental rate reduction associated with a long-term lease renewal with State Street Bank at 1200 Crown Colony Drive in Quincy, MA.

(9) The decrease in Other Same Store Net Operating Income for the twelve months ended December 31, 2011 as compared to the same period in 2010 was due to a number of factors, the largest four of which were: 1) a lease contraction of approximately 91,000 square feet effective third quarter 2010 at Chandler Forum in Chandler, AZ, 2) a lease expiration during late 2010 at Glenridge Highlands II in Atlanta, GA, 3) reduced rental rates achieved on new and renewal leases which commenced in late 2010 and early 2011 at 150 West Jefferson in Detroit, MI, and 4) a rental rate reduction associated with a new lease with Chrysler Group, LLC and the related early termination of the previous lease at 1075 West Entrance Drive in Auburn Hills, MI.

16

Piedmont Office Realty Trust, Inc.

Capitalization Analysis

Unaudited ($ and shares in thousands)

| | | | | | | | | | |

| | | As of

December 31, 2011 | | | As of

December 31, 2010 | | | |

Common stock price(1) | | | $17.04 | | | | $20.14 | | |

Total shares outstanding | | | 172,630 | | | | 172,658 | | |

Equity market capitalization(1) | | | $2,941,611 | | | | $3,477,342 | | |

Total gross debt - principal amount outstanding | | | $1,472,525 | | | | $1,402,525 | | |

Total market capitalization(1) | | | $4,414,136 | | | | $4,879,867 | | |

Total gross debt / Total market capitalization | | | 33.4% | | | | 28.7% | | |

Total gross real estate assets | | | $4,615,812 | | | | $4,567,326 | | |

Total gross debt / Total gross real estate assets(2) | | | 31.9% | | | | 30.7% | | |

Total gross debt / Total gross assets(2) (3) | | | 27.5% | | | | 26.6% | | |

(1) Reflects common stock closing price as of the end of the reporting period.

(2)Total gross debt to total gross real estate assets ratio is defined as total gross debt divided by gross real estate assets. Gross real estate assets is defined as total real estate assets with the add back of accumulated depreciation and accumulated amortization related to real estate assets.

(3)Total gross debt to total gross assets ratio is defined as total gross debt divided by gross assets. Gross assets is defined as total assets with the add back of accumulated depreciation and accumulated amortization related to real estate assets.

17

Piedmont Office Realty Trust, Inc.

Debt Summary

As of December 31, 2011

Unaudited ($ in thousands)

| | | | | | | | |

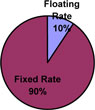

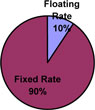

Floating Rate & Fixed Rate Debt |

| Debt (1) | | Principal Amount

Outstanding | | Weighted Average Stated Interest Rate | | Weighted Average

Maturity | |

|

| |

Floating Rate | | $140,000(2) | | 1.29%(3) | | 7.3 months | |

Fixed Rate | | 1,332,525 | | 4.61% | | 43.0 months | |

| |

Total | | $1,472,525 | | 4.29% | | 39.6 months | |

| |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Unsecured & Secured Debt |

| Debt (1) | | Principal Amount

Outstanding | | Weighted Average Stated Interest Rate | | Weighted Average

Maturity | |

|

| |

Unsecured | | $300,000 | | 2.69%(4) | | 58.8 months | |

Secured | | 1,172,525 | | 4.70% | | 34.7 months | |

| |

Total | | $1,472,525 | | 4.29% | | 39.6 months | |

| |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | |

Debt Maturities |

| Maturity Year | | Secured Debt -

Principal Amount

Outstanding(1) | | | | Unsecured Debt -

Principal Amount

Outstanding(1) | | | | Weighted Average

Stated Interest

Rate | | Percentage of

Total | | |

| |

2012 | | $185,000 | | | | $0 | | | | 2.24% | | 12.6% | |

2013 | | 0 | | | | 0 | | | | N/A | | 0.0% | |

2014 | | 575,000 | | | | 0 | | | | 4.89% | | 39.0% | |

2015 | | 105,000 | | | | 0 | | | | 5.29% | | 7.1% | |

2016 | | 167,525 | | | | 300,000 | | | | 5.55% | | 31.8% | |

2017 | | 140,000 | | | | 0 | | | | 5.76% | | 9.5% | |

| |

Total | | $1,172,525 | | | | $300,000 | | | | 4.29% | | 100.0% | |

| |

(1) All of Piedmont’s outstanding debt as of December 31, 2011 was interest-only debt.

(2)Amount represents the outstanding balance as of December 31, 2011 on a first mortgage loan secured by 500 West Monroe Street. As of December 31, 2011, there was no balance outstanding on our $500 million unsecured line of credit.

(3) The weighted average interest rate was the interest rate in effect for the loan totaling $140 million related to 500 West Monroe Street. As of December 31, 2011, there was no balance outstanding on our $500 million unsecured line of credit.

(4) The weighted average interest rate was the interest rate in effect for the $300 million unsecured term loan. The $300 million unsecured term loan has a stated variable rate; however, Piedmont entered into interest rate swap agreements which effectively fix the interest rate on this loan through its maturity date of November 22, 2016, assuming no credit rating change for the Company. As of December 31, 2011, there was no balance outstanding on our $500 million unsecured line of credit.

18

Piedmont Office Realty Trust, Inc.

Debt Detail

Unaudited ($ in thousands)

| | | | | | | | | | | | |

| Facility | | Property | | Rate(1) | | Maturity | | | Principal Amount

Outstanding as of

December 31, 2011 | |

| |

| | | | |

Secured | | | | | | | | | | | | |

$140.0 Million Floating-Rate Loan(2) | | 500 West Monroe Street | | LIBOR + 1.01% (3) | | | 8/9/2012 | | | | $140,000 | |

$45.0 Million Fixed-Rate Loan | | 4250 North Fairfax | | 5.20% | | | 6/1/2012 | | | | 45,000 | |

$200.0 Million Fixed-Rate Loan | | Aon Center | | 4.87% | | | 5/1/2014 | | | | 200,000 | |

$25.0 Million Fixed-Rate Loan | | Aon Center | | 5.70% | | | 5/1/2014 | | | | 25,000 | |

$350.0 Million Secured Pooled Facility | | Nine Property Collateralized Pool (4) | | 4.84% | | | 6/7/2014 | | | | 350,000 | |

$105.0 Million Fixed-Rate Loan | | US Bancorp Center | | 5.29% | | | 5/11/2015 | | | | 105,000 | |

$125.0 Million Fixed-Rate Loan | | Four Property Collateralized Pool (5) | | 5.50% | | | 4/1/2016 | | | | 125,000 | |

$42.5 Million Fixed-Rate Loan | | Las Colinas Corporate Center I & II | | 5.70% | | | 10/11/2016 | | | | 42,525 | |

$140.0 Million WDC Fixed-Rate Loans | | 1201 & 1225 Eye Street | | 5.76% | | | 11/1/2017 | | | | 140,000 | |

| |

| | | | |

Subtotal / Weighted Average (6) | | | | 4.70% | | | | | | | $1,172,525 | |

| | | | |

Unsecured | | | | | | | | | | | | |

$500 Million Unsecured Facility(7) (8) | | N/A | | N/A | | | 8/30/2012 | | | | $0 | |

$300 Million Unsecured Term Loan(9) | | N/A | | 2.69%(9) | | | 11/22/2016 | | | | 300,000 | |

| |

| | | | |

Subtotal / Weighted Average(6) | | | | 2.69% | | | | | | | $300,000 | |

| |

Total Gross Debt - Principal Amount Outstanding / Weighted Average Stated Rate(6) | | 4.29% | | | | | | | $1,472,525 | |

| |

(1) All of Piedmont’s outstanding debt as of December 31, 2011 was interest-only debt.

(2)On January 9, 2012, the loan was repaid in full.

(3)The LIBOR rate effective under this loan on December 31, 2011 was 0.279%. There is an interest rate cap agreement in place through August 2012 that limits Piedmont’s LIBOR exposure to 2.19%. Any increases in LIBOR above 2.19% are the responsibility of the counterparty.

(4)The nine property collateralized pool includes 1200 Crown Colony Drive, Braker Pointe III, 2 Gatehall Drive, One and Two Independence Square, 2120 West End Avenue, 200 and 400 Bridgewater Crossing, and Fairway Center II.

(5)The four property collateralized pool includes 1430 Enclave Parkway, Windy Point I and II, and 1055 East Colorado Boulevard.

(6)Weighted average is based on the total balance outstanding and interest rate at December 31, 2011.

(7)All of Piedmont’s outstanding debt as of December 31, 2011 was term debt with the exception of the $500 million unsecured line of credit.

(8) As of December 31, 2011, there was no balance outstanding on this facility. Piedmont may select from multiple interest rate options with each draw under this facility, including the prime rate and various length LIBOR locks. All LIBOR selections are subject to an additional spread (0.475% as of December 31, 2011) over the selected rate based on Piedmont’s current credit rating.

(9) On November 22, 2011, Piedmont obtained a $300 million, five-year unsecured term loan. The $300 million unsecured term loan has a stated variable rate; however, Piedmont entered into interest rate swap agreements which effectively fix the interest rate on this loan at 2.69% through its maturity date of November 22, 2016, assuming no credit rating change for the Company.

19