QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantý

|

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

DOT HILL SYSTEMS CORP. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

DOT HILL SYSTEMS CORP.

6305 EL CAMINO REAL

CARLSBAD, CALIFORNIA 92009

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 14, 2002

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders ofDOT HILL SYSTEMS CORP., a Delaware corporation (the "Company"). The meeting will be held on Tuesday, May 14, 2002, at 9:00 a.m. Pacific time at the Grand Pacific Palisades Resort, located at 5805 Armada Drive, Carlsbad, California 92008, for the following purposes:

- 1.

- To elect three directors to hold office until the 2005 Annual Meeting of Stockholders.

- 2.

- To ratify the selection of Deloitte & Touche LLP as independent auditors of the Company for its fiscal year ending December 31, 2002.

- 3.

- To conduct any other business properly brought before the meeting.

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is March 29, 2002. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

| | | By Order of the Board of Directors |

|

|

|

|

|

James L. Lambert

President and Chief Executive Officer |

| | | |

Carlsbad, California

April 5, 2002 |

|

|

The Dot Hill Systems Corp. 2001 Annual Report, which includes financial statements, is being mailed with this Proxy Statement. Kindly notify American Stock Transfer & Trust Company, 59 Maiden Lane, New York, NY 10038, telephone (877) 777-0800, if you did not receive a report, and a copy will be sent to you.

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

DOT HILL SYSTEMS CORP.

6305 EL CAMINO REAL

CARLSBAD, CALIFORNIA 92009

PROXY STATEMENT

FOR THE 2002 ANNUAL MEETING OF STOCKHOLDERS

MAY 14, 2002

INFORMATION CONCERNING SOLICITATION AND VOTING

GENERAL

The enclosed proxy is solicited on behalf of the Board of Directors ofDOT HILL SYSTEMS CORP., a Delaware corporation ("Dot Hill" or the "Company"), for use at the Annual Meeting of Stockholders to be held on May 14, 2002, at 9:00 a.m. Pacific time (the "Annual Meeting"), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at the Grand Pacific Palisades Resort, 5805 Armada Drive, Carlsbad, California 92008. The Company intends to mail this proxy statement and accompanying proxy card on or about April 5, 2002 to all stockholders entitled to vote at the Annual Meeting.

SOLICITATION

The Company will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of common stock beneficially owned by others to forward to such beneficial owners. The Company may reimburse persons representing beneficial owners of common stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other regular employees of the Company. No additional compensation will be paid to directors, officers or other regular employees for such services.

VOTING RIGHTS AND OUTSTANDING SHARES

Only holders of record of common stock at the close of business on March 29, 2002 will be entitled to notice of and to vote at the Annual Meeting. At the close of business on March 29, 2002, the Company had outstanding and entitled to vote 24,790,549 shares of common stock.

Each holder of record of common stock on such date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting.

All votes will be tabulated and certified by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions will be counted towards the vote total on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted toward a quorum, but are not counted for any purpose in determining whether a matter has been approved.

1

REVOCABILITY OF PROXIES

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of the Company at the Company's principal executive office, 6305 El Camino Real, Carlsbad, California 92009, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

STOCKHOLDER PROPOSALS

The deadline for submitting a stockholder proposal for inclusion in the Company's proxy statement and form of proxy for the Company's 2003 annual meeting of stockholders pursuant to Rule 14a-8 of the Securities and Exchange Commission is 5:00 p.m., PST, on December 6, 2002. Stockholders wishing to submit proposals or director nominations that are not to be included in such proxy statement and proxy must do so no earlier than December 6, 2002 nor later than the close of business on January 5, 2003.

QUORUM

A quorum is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares are represented by votes at the meeting or by proxy.

PROPOSAL 1

ELECTION OF DIRECTORS

The Company's Certificate of Incorporation provides that the Board of Directors shall be divided into three classes, each class consisting, as nearly as possible, of one-third of the total number of directors, with each class having a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy (including a vacancy created by an increase in the number of directors) shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director's successor is elected and has qualified, or until such director's earlier death, resignation or removal.

The Board of Directors is presently composed of eight members. There are three directors in the class whose term of office expires in 2002. Each of the nominees for election to this class is currently a director of the Company who was previously elected by the stockholders. If elected at the Annual Meeting, each of the nominees would serve until the 2005 annual meeting and until his or her successor is elected and is qualified, or until such director's earlier death, resignation or removal.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the three nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as management may propose. Each person nominated for election has notified the Company that he or she intends to serve if elected, and management has no reason to believe that any nominee will be unable to serve.

Set forth below is biographical information for each person nominated and each person whose term of office as a director will continue after the Annual Meeting.

2

NOMINEES FOR ELECTION FOR A THREE-YEAR TERM EXPIRING AT THE 2005 ANNUAL MEETING

JAMES L. LAMBERT

James L. Lambert, age 48, has served as a Director and the President, Chief Operating Officer and Chief Executive Officer of the Company since August 2000. From the date of the merger of Artecon, Inc. ("Artecon") and Box Hill Systems Corp. ("Box Hill") in August 1999 (the "Merger") to August 2000, Mr. Lambert served as President, Chief Operating Officer and Co-Chief Executive Officer. A founder of Artecon, Mr. Lambert served as President, Chief Executive Officer and director of Artecon from its inception in 1984 until the Merger. From 1979 to 1984, Mr. Lambert served in various positions at CALMA, a division of General Electric Company, most recently from 1981 to 1984 as Vice President of Research and Development. Mr. Lambert currently serves as a director of the Nordic Group of Companies, a group of privately held companies. He holds a B.S. and an M.S. in Civil and Environmental Engineering from University of Wisconsin, Madison. Mr. Lambert is W.R. Sauey's son-in-law.

W.R. SAUEY

W.R. Sauey, age 74, has served as a Director of the Company since the Merger. From the date of the Merger until July 2000, Mr. Sauey served as Chairman of the Board of the Company. Mr. Sauey was a founder of Artecon and served as its Chairman of the Board from Artecon's inception in 1984 until the Merger. From 1984 to 1997, Mr. Sauey also served as Treasurer of Artecon. Mr. Sauey founded and serves as Chairman of the Board of a number of manufacturing companies in the Nordic Group of Companies, a group of privately-held independent companies of which Mr. Sauey is the principal stockholder. Mr. Sauey is an advisory board member of the Liberty Mutual Insurance Company, a publicly-traded insurance company, and also serves as a Trustee to the State of Wisconsin Investment Board and trustee and member of the executive committee of Finlandia University. Mr. Sauey holds an M.B.A. from the University of Chicago. Mr. Sauey is James Lambert's father-in-law.

CAROL TURCHIN

Carol Turchin, age 40, has served as a Director of the Company since the Merger and as Vice Chairman of the Board since October 1999. A founder of Box Hill, Ms. Turchin was an executive officer and a director of Box Hill from its incorporation in 1988 until the Merger and served as Executive Vice President Strategic Planning, Executive Vice President of Sales and Executive Vice President of Marketing for Box Hill. Ms. Turchin is currently President and CEO of Alphagenome Inc., a venture capital firm focusing on biotechnology, a member of the Advisory Board of Carrot Capital, LLC, a venture capital firm, Chairman of the Board of Standing Tall, a school for Special Needs Children and a Director of the ML4 Foundation. Ms. Turchin holds a Bachelor of Arts degree from Vassar College. Ms. Turchin is married to Benjamin Monderer.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2003 ANNUAL MEETING

CHARLES CHRIST

Mr. Charles Christ, age 63, joined the Company as Chairman of the Board in July 2000. Mr. Christ also serves as a director of Maxtor Corporation and Pioneer Standard Electronics. Maxtor is a supplier of hard disk drives for desktop computer systems. Pioneer Standard Electronics is a broad-line distributor of electronic components and computer products. From 1997 to 1998, Mr. Christ served as President, Chief Executive Officer and a director of Symbios, Inc. (acquired by LSI Logic in 1998), a

3

designer, manufacturer and provider of storage systems, as well as client-server integrated circuits, cell-based applications-specific integrated circuits and host adapter boards. He was Vice President and General Manager of the Components Division of Digital Equipment Corp. (DEC), where he launched and managed StorageWorks, DEC's storage division. Mr. Christ received an M.B.A. from Harvard Business School and completed his undergraduate studies at General Motors Institute, now known as Kettering University.

NORMAN R. FARQUHAR

Norman R. Farquhar, age 55, has served as a Director of the Company since the Merger. From April 1998 until the Merger, Mr. Farquhar was a director of Artecon. Mr. Farquhar has served as Chief Financial Officer for Airprime, Inc., a leading provider of high-speed CDMA wireless data and voice products for the original equipment manufacturing market since December 2001. From November 1999 to October 2001, Mr. Farquhar was Executive Vice President and Chief Financial Officer of medibuy.com, a company that provides medical/surgical products, commodity items, capital equipment and facility-related products exclusively over the Internet. From December 1998 to November 1999, Mr. Farquhar was Executive Vice President and Chief Financial Officer of Epicor Software Corporation (formerly known as Platinum Software Corporation), a publicly-traded developer of client/server enterprise resource planning software. Mr. Farquhar also served as Executive Vice President and Chief Financial Officer of DataWorks Corporation, a publicly traded supplier of information systems to manufacturing companies (which was acquired by Platinum Software Corporation in December 1998), from February 1996 to December 1998 and as a director of DataWorks from August 1995 to December 1998. Mr. Farquhar is also a member of the board of directors of Alteer Corporation, a privately held medical software company. Mr. Farquhar holds a B.S. from California State University, Fullerton and an M.B.A. from California State University, Long Beach.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2004 ANNUAL MEETING

BENJAMIN BRUSSELL

Benjamin Brussell, age 41, has served as a Director of the Company since the Merger. Since March 1998, Mr. Brussell has served as Vice President of Corporate Development for Plantronics (NYSE:PLT), a worldwide provider of communications products. From 1990 to 1998, Mr. Brussell was responsible for corporate development at Storage Technology Corporation, a manufacturer of storage systems, most recently serving as Vice President of Corporate Development. From 1985 to 1990, Mr. Brussell worked for Salomon Brothers in various capacities, including Vice President of a technology industry group within Salomon's Corporate Finance Department. Mr. Brussell earned a Bachelor of Arts degree from Wesleyan University, where he majored in Math and Economics, and a Masters degree in Management, with a concentration in Finance, from the M.I.T. Sloan School of Management.

DR. BENJAMIN MONDERER

Dr. Benjamin Monderer, Eng.Sc.D., age 43, has been a Director of the Company since the Merger and served as Executive Vice President of Strategic Development from August 2000 until March 2001. From the time of the Merger until August 2000, Dr. Monderer served as the Company's Executive Vice President of Applications Engineering/Professional Services. A founder of Box Hill, Dr. Monderer was President and a director from its incorporation in 1988 until the Merger, and served as Chairman of the Board of Box Hill from July 1997 until the Merger. Dr. Monderer was a member of the technical staff at Hewlett-Packard Company in 1980 and 1981, and was a Research Scientist at Columbia University from 1986 to 1989. Dr. Monderer is currently Chairman of the Board of Alphagenome Inc. a venture capital firm focusing on biotechnology and a Director of the ML4 Foundation. Dr. Monderer holds a Bachelor of Science in Electrical Engineering from Princeton University and a Master of

4

Science degree in Electrical Engineering and a Doctor of Engineering Science from Columbia University. Dr. Monderer is married to Carol Turchin.

CHONG SUP PARK

Chong Sup Park, age 54, has served as a Director of the Company since the Merger, and was a director of Artecon from 1996 until the Merger. Dr. Park has served as Chairman and CEO of Hynix Semiconductor Inc. (formerly Hyundai Electronics Industries, Co, Ltd.), since April 2000, and as Chairman of Hynix Semiconductor America, Inc. (formerly Hyundai Electronics America), an electronics company, and Chairman of Maxtor Corporation, a disk drive manufacturer, since 1996. Dr. Park was the President of Hyundai Electronics America from September 1996 to March 2000 and was the president of Maxtor Corporation from 1995 to 1996. Dr. Park holds a B.A. in Management from Yonsei University, an M.A. in Management from Seoul National University, an M.B.A. from the University of Chicago and a Doctorate in Business Administration from Nova Southeastern University.

BOARD COMMITTEES AND MEETINGS

During the fiscal year ended December 31, 2001, the Board of Directors held eight meetings and acted by unanimous written consent four times. The Board has an Audit Committee and a Compensation Committee.

The Audit Committee or its Chairman meets with the Company's independent auditors after each quarter to review quarterly results. The entire Committee meets at least annually with management and the independent auditors to discuss the results of the annual audit and discuss the financial statements. The Committee also recommends to the Board the independent auditors to be retained; oversees the independence of the independent auditors; evaluates the independent auditors' performance; and receives and considers the independent auditors' comments as to controls, adequacy of staff and management performance and procedures in connection with audit and financial controls. The Audit Committee is composed of three non-employee directors: Messrs. Farquhar, Christ and Brussell. The Audit Committee met twice during 2001 and did not act by unanimous written consent. In addition, the Chairman of the Audit Committee met two times with the Company's independent auditors on behalf of the Audit Committee to discuss the Company's financial results. All members of the Company's Audit Committee are independent (as independence is defined in Sections 303.01(B)(2)(a) and (3) of the NYSE listing standards). The Audit Committee adopted a written Audit Committee Charter which was filed as an exhibit to the proxy statement for our 2001 Annual Meeting of Stockholders.

The Compensation Committee is responsible for administering and approving all elements of compensation for executive officers and certain other senior management positions. It also approves, by direct action or delegation, participation in and all awards, grants and related actions under the Company's 2000 Amended and Restated Equity Incentive Plan (the "Equity Incentive Plan") and 2000 Amended and Restated Employee Stock Purchase Plan (the "Purchase Plan"). The Compensation Committee is also responsible for reviewing the Company's management resources programs and for recommending qualified candidates to the Board for election as officers. The Compensation Committee is composed of three outside directors: Messrs. Brussell, Farquhar and Christ. In the opinion of the Board, the Compensation Committee members are independent of management and free of any relationship that would interfere with their exercise of independent judgment as members of this committee. The Compensation Committee held four meetings during 2001 and acted by unanimous written consent one time.

During the fiscal year ended December 31, 2001, each director attended 75% or more of all meetings of the Board and of the committees on which he or she served during the period for which he or she was a director or committee member, respectively.

5

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS(1)

The Audit Committee oversees the Company's financial reporting process on behalf of the Board. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report with management and discussed with management the quality, in addition to the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States of America, their judgments as to the quality, not just the acceptability, of the Company's accounting principles and such other matters as are required to be discussed with the Audit Committee under auditing standards generally accepted in the United States of America including the matters required to be discussed by SAS 61. In addition, the Audit Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 and has discussed with the independent auditors the auditors' independence from management and the Company, including the matters in the written disclosures required by the Independence Standards Board.

The Audit Committee discussed with the Company's independent auditors the overall scope and plans for their respective audits. The Audit Committee meets with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company's internal controls, and the overall quality of the Company's financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board (and the Board has approved) that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2001 for filing with the Securities and Exchange Commission. The Audit Committee and the Board have also recommended, subject to stockholder ratification, the selection of the Company's independent auditors.

AUDIT COMMITTEE

| Norman R. Farquhar, Chairman | | Charles Christ | | Benjamin Brussell |

March 29, 2002 |

|

|

|

|

- (1)

- The material in this report is not "soliciting material," is not deemed filed with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

6

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Board of Directors has selected Deloitte & Touche LLP ("Deloitte & Touche") as the Company's independent auditors for the fiscal year ending December 31, 2002 and has further directed that management submit the selection of independent auditors for ratification by the stockholders at the Annual Meeting. Deloitte & Touche has audited the Company's financial statements since 1999. Representatives of Deloitte & Touche are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Stockholder ratification of the selection of Deloitte & Touche as the Company's independent auditors is not required by the Company's Bylaws or otherwise. However, the Board is submitting the selection of Deloitte & Touche to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee and the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee and the Board in their discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the selection of Deloitte & Touche. Abstentions will be counted toward the tabulation of votes cast on Proposal 2 and will have the same effect as votes cast against the ratification of the selection of Deloitte & Touche. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

AUDIT FEES.

During the fiscal year ended December 31, 2001, the aggregate fees billed by Deloitte & Touche for the audit of the Company's financial statements for such fiscal year and for the reviews of the Company's interim financial statements was $232,063.

FINANCIAL INFORMATION SYSTEMS DESIGN AND IMPLEMENTATION FEES.

During the fiscal year ended December 31, 2001, Deloitte & Touche did not bill any amounts to the Company for information technology consulting services.

ALL OTHER FEES.

During fiscal year ended December 31, 2001, all other fees billed by Deloitte and Touche were $291,315, including audit related services of $42,930 and non-audit related services of $248,385. Audit related services included fees for employee benefit plan audits and SEC registration statement review. Non-audit services included tax consultation and tax preparation.

The Audit Committee has determined that the rendering of the information technology consulting fees and all other non-audit services by Deloitte & Touche is compatible with maintaining the auditor's independence.

During the fiscal year ended December 31, 2001, none of the hours expended on the Company's financial audit by Deloitte & Touche were provided by persons other than Deloitte & Touche's full-time permanent employees.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of the Company's common stock as of January 31, 2002 by:

- •

- all those known by the Company to be beneficial owners of more than five percent of its common stock;

- •

- each director and nominee for director;

- •

- each of the executive officers named in the Summary Compensation Table; and

- •

- all executive officers and directors of the Company as a group.

| | Beneficial Ownership(1)

| |

|---|

Beneficial Owner

| | Number of Shares

| | Percent of

Total

| |

|---|

| 5% Stockholders | | | | | |

| Mark Mays | | 2,751,653 | | 11.1 | % |

| Royce & Associates, Inc. | | 1,448,900 | | 5.8 | % |

Officers & Directors |

|

|

|

|

|

| Dr. Benjamin Monderer(2) | | 5,000,696 | | 20.1 | % |

| Carol Turchin(2) | | 5,000,696 | | 20.1 | % |

| W.R. Sauey(3) | | 2,466,944 | | 9.9 | % |

| James L. Lambert(4) | | 1,455,076 | | 5.9 | % |

| Dana W. Kammersgard(5) | | 589,297 | | 2.4 | % |

| Preston Romm(6) | | 88,294 | | * | |

| Norman R. Farquhar(7) | | 49,999 | | * | |

| Chong Sup Park(8) | | 49,999 | | * | |

| Benjamin Brussell(9) | | 44,791 | | * | |

| Charles Christ(10) | | 28,124 | | * | |

| All executive officers and directors as a group (10 persons) | | 9,773,220 | | 38.7 | % |

- *

- Less than one percent.

- (1)

- This table is based upon information supplied by officers, directors and principal stockholders and Schedules 13D and 13G filed with the Securities and Exchange Commission (the "SEC"). Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 24,790,549 shares outstanding on January 31, 2002, adjusted as required by rules promulgated by the SEC.

- (2)

- Dr. Monderer and Ms. Turchin are married. Includes (i) 2,476,753 shares held by Dr. Monderer, as to which shares Ms. Turchin disclaims beneficial ownership, (ii) 1,812,914 shares held by the Monderer 1999 GRAT u/a/d March 1999 Trust, as to which Dr. Monderer is the trustee and Ms. Turchin is the grantor, (iii) 663,739 shares held by Ms. Turchin, as to which Dr. Monderer disclaims beneficial ownership, (iv) options to purchase 5,208 shares exercisable within 60 days of January 31, 2002 held by Dr. Monderer, as to which shares Mr. Turchin disclaims beneficial ownership, and (v) options to purchase 42,082 shares exercisable within 60 days of January 31, 2002 held by Ms. Turchin, as to which shares Dr. Monderer disclaims beneficial ownership.

- (3)

- Includes (i) 655,876 shares held by Flambeau Corp., (ii) 393,618 shares held by Flambeau Products Corp., and (iii) 64,075 shares held by Seats, Inc. Mr. Sauey is Chairman of the Board and the principal stockholder of each of Flambeau Corp., Flambeau Products Corp. and Seats, Inc.

8

Mr. Sauey disclaims beneficial ownership of all the above-listed shares, except to the extent of his pecuniary or pro rata interest in such shares. Also includes options to purchase 49,999 shares exercisable within 60 days of January 31, 2002.

- (4)

- Includes (i) 1,407,072 shares held jointly with Pamela Lambert, the spouse of Mr. Lambert, (ii) 1,440 shares held by Pamela Lambert, (iii) 66 shares held by Mr. Lambert's daughter, (iv) 1,332 shares held by the James Lambert IRA, and (v) options to purchase 45,166 shares exercisable within 60 days of January 31, 2002.

- (5)

- Includes (i) 218 shares held by Lisa Kammersgard, the spouse of Mr. Kammersgard, as to which shares Mr. Kammersgard disclaims beneficial ownership, and (ii) options to purchase 36,563 shares exercisable within 60 days of January 31, 2002.

- (6)

- Includes options to purchase 84,894 shares exercisable within 60 days of January 31, 2002.

- (7)

- Includes options to purchase 49,999 shares exercisable within 60 days of January 31, 2002.

- (8)

- Includes options to purchase 49,999 shares exercisable within 60 days of January 31, 2002. Does not include 640,000 shares held by Maxtor Corporation, of which Dr. Park is a director.

- (9)

- Includes options to purchase 44,791 shares exercisable within 60 days of January 31, 2002.

- (10)

- Includes options to purchase 28,124 shares exercisable within 60 days of January 31, 2002. Does not include 640,000 shares held by Maxtor Corporation, of which Mr. Christ is a director.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company's directors and executive officers, and persons who own more than ten percent of a registered class of the Company's equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company's knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended December 31, 2001, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with.

EXECUTIVE COMPENSATION

COMPENSATION OF DIRECTORS

Each non-employee director of the Company excluding the Chairman receives an annual fee of $16,000 (plus an additional $2,000 for each scheduled regular meeting of the Board attended in person or an additional $1,000 for each scheduled regular meeting of the Board attended via telephone). The Chairman receives an annual fee of $48,000 (plus an additional $2,000 for each scheduled regular meeting of the Board attended in person or an additional $1,000 for each scheduled regular meeting of the Board attended via telephone). During the fiscal year ended December 31, 2001, the total compensation paid to non-employee directors was $192,667. All members of the Board of Directors are also eligible for reimbursement for their expenses incurred in connection with attendance at Board and committee meetings in accordance with Company policy.

Each non-employee director of the Company also receives stock option grants under the 2000 Non-Employee Directors' Stock Option Plan (the "Directors' Plan"). Only non-employee directors of the Company or an affiliate of such directors (as defined in the Internal Revenue Code) are eligible to

9

receive options under the Directors' Plan. Options granted under the Directors' Plan are intended by the Company not to qualify as incentive stock options under the Internal Revenue Code.

Option grants under the Directors' Plan are non-discretionary. Each person who, after the Company's 2000 Annual Meeting, is elected or appointed as a director and who, for at least one year preceding such election or appointment, has at no time served as a non-employee director, is automatically granted under the Directors' Plan, without further action by the Company, the Board of Directors or the stockholders of the Company, an option to purchase 50,000 shares of common stock of the Company as of the date of such election or appointment. In addition, as of the date of the annual meeting each year, each member of the Company's Board of Directors who is not an employee of the Company and has served as a non-employee director for at least four months is automatically granted under the Directors' Plan, without further action by the Company, the Board of Directors or the stockholders of the Company, an option to purchase 10,000 shares of common stock of the Company. No other options may be granted at any time under the Directors' Plan. The exercise price of options granted under the Directors' Plan may not be less than 100% of the fair market value of the common stock subject to the option on the date of the option grant. Options granted under the Directors' Plan become exercisable (or "vest") as set out in the Directors' Plan during the optionholder's service as a director of the Company and any subsequent employment of the optionholder by, and/or service by the optionholder as a consultant to, the Company or an affiliate (collectively, "service"). Options granted under the Directors' Plan permit exercise prior to vesting, but in such event, the optionholder is required to enter into an early exercise stock purchase agreement that allows the Company to repurchase unvested shares, generally at their exercise price, should the optionholder's service terminate. The term of options granted under the Directors' Plan is ten years. In the event of a merger of the Company with or into another corporation or a consolidation, acquisition of assets or other change-in-control transaction involving the Company, the vesting of each option will accelerate and the option will terminate if not exercised prior to the consummation of the transaction.

During 2001, the Company granted options under the Directors' Plan covering 10,000 shares to each of the six non-employee directors of the Company as of the 2001 Annual Meeting, at an exercise price of $2.34 per share. The fair market value of the Company's common stock on the date of grant was $2.34 per share (based on the closing sales price reported on the New York Stock Exchange on the date of grant). As of January 31, 2002, no options had been exercised under the Directors' Plan.

In addition, during 2001 the Company granted options under the Equity Incentive Plan to purchase 50,000 shares to each of the seven non-employee directors of the Company as of the date of grant at an exercise price of $1.55 per share. The fair market value of the Company's common stock on the date of grant was $1.55 per share (based on the closing sales price reported on the New York Stock Exchange for October 29, 2001, the date of grant).

The Company had an arrangement with Ms. Turchin and Dr. Monderer whereby the Company paid two of Ms. Turchin's and Dr. Monderer's household employees and Ms. Turchin and Dr. Monderer reimbursed the Company for the expenses related to such payment. Effective June 30, 2001, this arrangement was terminated. During the first six months of 2001, the Company paid a total of $28,710 to, and received a total of $28,710 from, Dr. Monderer and/or Ms. Turchin under this arrangement.

10

COMPENSATION OF EXECUTIVE OFFICERS

SUMMARY OF COMPENSATION

The following table shows for the fiscal years ended December 31, 1999, 2000 and 2001, compensation awarded or paid to, or earned by, the Company's Chief Executive Officer during 2001, its other two most highly compensated executive officers at December 31, 2001 and one former executive officer who ceased serving as an executive officer of the Company during fiscal year 2001 (the "Named Executive Officers"):

SUMMARY COMPENSATION TABLE

| |

| |

| |

| |

| | Long-Term

Compensation

| |

| |

|---|

| |

| | Annual Compensation

| | Awards

| |

| |

|---|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Other Annual

Compensation

($)

| | Securities

Underlying

Options (#)

| | All Other

Compensation

($)

| |

|---|

James L. Lambert

Chief Executive Officer, President and Chief Operating Officer | | 2001

2000

1999 | | 350,000

350,000

272,633 | | 48,125

74,144

134,500 | | —

—

33,606 |

(1) | 250,000

—

— | | —

—

906 |

(2) |

Dana W. Kammersgard

Chief Technical Officer |

|

2001

2000

1999 |

|

250,000

250,000

201,870 |

|

56,250

52,960

98,500 |

(3)

|

—

—

33,606 |

(4) |

100,000

75,000

— |

|

—

—

— |

|

Preston Romm

Chief Financial Officer,

Treasurer and Secretary |

|

2001

2000

1999 |

|

185,971

174,832

8,750 |

(5) |

23,188

25,950

25,493 |

|

—

—

— |

|

100,000

75,000

100,000 |

|

—

—

— |

|

Benjamin Monderer

Former Executive

Vice President,

Strategic Development |

|

2001

2000

1999 |

|

115,385

288,462

416,667 |

|

—

63,552

75,000 |

|

—

—

36,558 |

(7) |

—

— |

|

300,000

— |

(6)

|

- (1)

- Represents tax gross-up paid to Mr. Lambert.

- (2)

- Represents term life insurance premium paid on behalf of Mr. Lambert.

- (3)

- Includes forgiveness of indebtedness of Mr. Kammersgard to the Company in the amount of $25,625. See "—Employment, Severance and Change of Control Agreements."

- (4)

- Represents tax gross-ups paid to Mr. Kammersgard.

- (5)

- Mr. Romm joined the Company in November 1999.

- (6)

- Represents severance payment paid to Dr. Monderer.

- (7)

- Represents tax gross-up paid to Dr. Monderer.

STOCK OPTION GRANTS AND EXERCISES

The Company grants options to its executive officers under its Equity Incentive Plan. As of January 31, 2002, options to purchase a total of 3,277,459 shares were outstanding under the Equity Incentive Plan and options to purchase 532,033 shares remained available for grant thereunder.

11

The following tables show for the fiscal year ended December 31, 2001, certain information regarding options granted to, exercised by, and held as of December 31, 2001 by, the Named Executive Officers.

OPTION GRANTS IN LAST FISCAL YEAR

| | Individual Grants

| |

| |

| |

| |

|

|---|

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock

Price Appreciation for Option Term

|

|---|

| |

| | % of Total Options

Granted to

Employees in

Fiscal Year(2)

| |

| |

|

|---|

Name

| | Number of Securities

Underlying Options

Granted (#)(1)

| | Exercise or

Base Price

($/Sh)

| | Expiration

Date

|

|---|

| | 5%($)(3)

| | 10%($)(3)

|

|---|

| James L. Lambert | | 100,000

150,000 | | 8.5

12.8 | %

% | 6.00

1.89 | | 1/22/11

7/23/11 | | 178,292

377,336 | | 451,826

956,245 |

| Dana W. Kammersgard | | 100,000 | | 8.5 | % | 1.89 | | 7/23/11 | | 118,861 | | 301,217 |

| Preston Romm | | 100,000 | | 8.5 | % | 1.89 | | 7/23/11 | | 118,861 | | 301,217 |

| Benjamin Monderer | | 50,000 | | 4.3 | % | 1.55 | | 10/29/11 | | 48,739 | | 123,515 |

- (1)

- Options generally vest over a four-year period, 25% after one year and in equal monthly installments during the following three years.

- (2)

- Based on options to purchase 1,170,200 shares of common stock granted to employees, including Messrs. Lambert, Kammersgard and Romm but not including Dr. Monderer who was not an employee at the time of his option grant, under the Equity Incentive Plan during the fiscal year ended December 31, 2001. Does not included 350,000 shares of common stock granted to outside directors, including Dr. Monderer under the Equity Incentive Plan.

- (3)

- Calculated on the assumption that the market value of the underlying stock increases at the stated values, compounded annually. The total appreciation of the options over their 10-year terms at 5% and 10% is 63% and 159%, respectively.

AGGREGATED OPTION EXERCISES IN FISCAL 2001

AND VALUE OF OPTIONS AT END OF FISCAL 2001

| |

| |

| | Number of Securities

Underlying Unexercised

Options at Fiscal Year-End

(#)(2)(3)

| | Value of Unexercised

In-the-Money

Options at Fiscal Year-End

($)(2)(4)

|

|---|

Name

| | Shares Acquired

on Exercise (#)

| | Value

Realized

($)(1)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| James L. Lambert | | — | | — | | 16,000 | | 250,000 | | — | | — |

| Dana W. Kammersgard | | — | | — | | 31,875 | | 153,125 | | — | | — |

| Preston Romm | | — | | — | | 73,957 | | 201,043 | | — | | — |

| Benjamin Monderer | | — | | — | | 2,083 | | 47,917 | | 271 | | 6,229 |

- (1)

- Value realized is based on the fair market value of the Company's common stock on the date of exercise minus the exercise price (or the actual sales price if the shares were sold by the optionee simultaneously with the exercise) without taking into account any taxes that may be payable in connection with the transaction.

- (2)

- Reflects shares vested and unvested at December 31, 2001. Certain options granted under the Equity Incentive Plan and the Directors' Plan are immediately exercisable, but are subject to the Company's right to repurchase unvested shares on termination of employment.

- (3)

- Includes both in-the-money and out-of-the-money options.

- (4)

- Calculated based on the fair market value of the Company's common stock on December 31, 2001 ($1.68) less the exercise or base price. Excludes out-of-the-money options.

12

EMPLOYMENT, SEVERANCE AND CHANGE OF CONTROL AGREEMENTS

In August 1999, the Company entered into employment contracts with James Lambert and Dana Kammersgard that currently provide for base salaries in the amounts of $350,000 and $250,000, respectively. These employment contracts may be terminated at the option of either the Company or the employee "for cause" or, upon 30 days written notice, for convenience and "without cause." If the Company terminates for convenience, the employee is entitled to a severance payment equal to the employee's then-current annual base salary. In addition, following termination of employment other than due to death or disability, the Company may hire the employee as a consultant for a period of one year at a cost of 25% of the employee's then-current annual base salary, during which period the employee may not engage in any business activities that directly compete with the business of the Company. The agreements also provide for indemnification of the employees, non-disclosure of confidential or proprietary Company information and health and dental insurance for the employee, his spouse and his children under the age of 21.

In November 1999, the Company and Preston Romm executed an employment offer letter pursuant to which Mr. Romm became the Chief Financial Officer of the Company. Mr. Romm's employment agreement currently provides for a base salary of $185,500. Mr. Romm's employment agreement may be terminated by the Company or Mr. Romm at will. The agreement also provides for non-disclosure of confidential or proprietary Company information and health and dental insurance for Mr. Romm, his spouse and his children under the age of 21.

Effective January 1, 2001, the Company entered into Executive Compensation Plans 2001 (the "2001 Plan") with James Lambert, Dana Kammersgard and Preston Romm that provide for base salaries in the amounts of $350,000, $250,000 and $185,500, respectively. Except with respect to base salaries, the terms of the 2001 Plan are in addition to the terms of such officers' employment agreements. The 2001 Plan provides for an annual performance bonus target of 55% of base salary for Mr. Lambert and 50% of base salary for Messrs. Kammersgard and Romm.

The formula for the annual bonus calculation for Messrs. Lambert and Kammersgard under the 2001 Plan is as follows: Half of the annual performance bonus is based on meeting revenue goals and half of the annual bonus is based on net income goals. If the Company attains less than 85% of the revenue goals and net income goals for the year, no bonus is payable for the year. For each 1% increase above 85% of the revenue goal and, separately, the net income goal, a bonus equal to 3.33% of the annual performance bonus potential will be paid, with no cap.

The formula for the annual bonus calculation for Mr. Romm under the 2001 Plan is as follows: Seventy-five percent of the annual performance bonus potential is based on meeting revenue and net income goals. If the Company attains less than 85% of the revenue goals and net income goals for the year, no bonus is payable for the year. For each 1% increase above 85% of the revenue goal and, separately, the net income goal, a bonus equal to 3.33% of the annual performance bonus potential will be paid, with no cap. Twenty-five percent of the annual performance bonus potential is subjective and may be tied to individual departmental goals and performance to be determined by the Chief Executive Officer.

Effective July 2001, the Board of Directors amended the 2001 Plan for Messrs. Lambert, Romm and Kammersgard as follows: 75% of the bonus is subjective based on achieving net income; the remaining 25% of the bonus is subjective and may be tied to individual goals and performance. The Board of Directors will determine this 25% portion. Of the 75% bonus potential, 50% is tied to achieving a cumulative positive operating income for the second half of 2001.

In August 1999, the Company entered into an employment contract with Benjamin Monderer that provided for a base salary in the amount of $300,000 for 2001. In addition, effective January 1, 2001, the Company entered into the 2001 Plan with Dr. Monderer, except with respect to base salaries, the

13

terms of which were in addition to the terms of Dr. Monderer's employment agreement. The 2001 Plan provided for an annual performance bonus target of 50% of base salary for Dr. Monderer.

In March 2001, Dr. Monderer's employment with the Company was terminated. In connection with this termination, Dr. Monderer signed a release and waiver of claims. Pursuant to the terms of his employment agreement, the Company paid Dr. Monderer $334,615, of which $300,000 was a severance payment equal to his then current annual base salary and $34,615 was in payment of his accrued and unused vacation as of his termination.

Effective January 1, 2002, the Company entered into Executive Compensation Plan 2002 (the "2002 Plan") with Messrs. Lambert, Kammersgard and Romm that provides for base salary in the amount of $350,000, $250,000 and $185,500, respectively. Except with respect to base salaries, the terms of the 2002 Plan are in addition to the terms of such officer's employment agreements. The 2002 Plan provides for annual performance bonus potential of 55% of base salary for Mr. Lambert and 50% of base salary for Messrs. Kammersgard and Romm. The formula for the annual bonus calculation is as follows: 75% of the annual performance bonus potential is based on meeting revenue and net income goals. If the Company attains less than 85% of the revenue goals and net income goals for the year, no bonus is payable for the year. For each 1% increase above 85% of the revenue goal and, separately, the net income goal, a bonus equal to 3.33% of the annual performance bonus potential will be paid, with no cap. 25% of the annual performance bonus potential is subjective and may be tied to individual departmental goals and performance as determined by the Chief Executive Officer for Messrs. Kammersgard and Romm and the Board of Directors for Mr. Lambert.

Effective August 23, 2001, the Company entered into change of control agreements with Messrs. Lambert, Kammersgard and Romm. Under Mr. Lambert's change of control agreement, in the event of an acquisition of the Company or similar corporate event, Mr. Lambert's then remaining unvested stock and options will become fully vested and he will be entitled to a lump sum cash payment equal to 150% of his annual base salary then in effect, reduced by any severance payments payable under his employment agreement. Mr. Kammersgard's change of control agreement provides that if Mr. Kammersgard's employment with the Company is terminated, other than for cause, in connection with an acquisition of the Company or similar corporate event, Mr. Kammersgard's then remaining unvested stock and options will become fully vested and he will be entitled to a lump sum cash payment equal to 125% of his annual base salary then in effect, reduced by any severance payments payable under his employment agreement. Mr. Romm's change of control agreement provides that, in the event of an acquisition of the Company or similar corporate event, Mr. Romm's then remaining unvested stock and options will become fully vested and he will be entitled to a lump sum cash payment equal to 125% of his annual base salary then in effect.

In June 2001, the Company loaned $25,000 to Dana Kammersgard pursuant to a full recourse promissory note issued by Mr. Kammersgard to the Company. The note was secured by shares of the Company's common stock held by Mr. Kammersgard valued at twice the principal balance of the loan, and the principal amount of the note accrued interest at the rate of 5% per year. In October 2001, the Compensation Committee of the Board of Directors approved the cancellation of the note and the forgiveness by the Company of the principal amount of the note and accrued interest thereon effective in 2002 as a bonus to Mr. Kammersgard for his performance in 2001. At December 31, 2001, the total principal and accrued interest outstanding under the note was $25,625.

REPORT OF THE COMPENSATION COMMITTEE

OF THE BOARD OF DIRECTORS ON EXECUTIVE COMPENSATION(2)

The Compensation Committee of the Board of Directors (the "Committee") is composed of directors who are not employees of the Company. The Committee is responsible for establishing and administering compensation arrangements with the Company's executive officers.

- (2)

- The material in this report is not "soliciting material," is not deemed filed with the SEC, and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

14

COMPENSATION OBJECTIVES AND IMPLEMENTATION

The objectives of the Company's executive compensation arrangements are to attract and retain the services of key management and to align the interests of its executives with those of the Company's stockholders. The Committee endeavors to accomplish these by:

- •

- Establishing compensation arrangements that are adequate to attract and retain the services of key management personnel and that deliver compensation commensurate with the Company's performance, as measured against the achievement of operating, financial and strategic objectives and taking into account competitive compensation practices in the industry.

- •

- Providing significant equity-based incentives for executives to ensure that they are motivated over the long term to respond to the Company's business challenges and opportunities as owners rather than solely as employees.

- •

- Rewarding executives if stockholders receive an above-average return on their investment over the long term.

COMPENSATION MIX AND MEASUREMENT

A significant portion of the Company's annual executive compensation program is determined on the basis of corporate performance. The Company's current executive compensation mix generally consists of an annual base salary, which in the Committee's opinion is adequate under the circumstances to retain the services of the executive, a cash bonus based on Company and individual performance and, for certain executive officers, stock options that are intended to provide long-term incentives tied to increases in the value of the Company's common stock and bonuses based on individual performance.

SALARY

The Committee establishes the annual base salary for the executive officers in line with their responsibilities and with external market practices. In determining base salary, the Committee reviews information about similar companies from third party, nationally recognized surveys.

The 2001 compensation of the Company's executive officers was set by the Committee after consideration of the factors discussed above. When setting each officer's compensation, the Committee considers nationally recognized surveys and the level of responsibility, experience and contributions of each executive officer. In addition, the Committee takes into account recent corporate and individual performance. During 2000, the Committee also commissioned an outside, independent research firm to create a Compensation Report reviewing the Company's compensation packages and comparing such compensation to the compensation received by executives of other companies in the industry. The Committee considers this Report when setting base salary levels for members of senior and executive management.

ANNUAL BONUSES

Annual bonuses are awarded to the Company's executives in accordance with the executive compensation plan for the year as established by the Committee. The plan provides for an annual performance bonus target ranging from 50% to 55% of base salary. 75% of the target performance bonus is calculated based on the level to which certain revenue and net income goals are exceeded during the course of the year, and the remaining 25% is based on a subjective evaluation of performance. In 2001, no bonuses were paid under the Executive Compensation Plan on the basis of revenue and net income goals, and bonuses in the aggregate amount of $102,563 were paid.

15

LONG-TERM INCENTIVES

Long-term incentives are provided to executives through the Company's 2000 Amended and Restated Equity Incentive Plan (the "Equity Incentive Plan"). Grants under the Equity Incentive Plan generally have a term of 10 years and are tied to the market valuation of the Company's common stock, thereby providing an additional incentive for executives to build stockholder value. In addition, grants are generally subject to vesting over four years, with vesting tied to continued employment. Executives receive value from this plan only if the Company's common stock appreciates accordingly. This component is intended to retain and motivate executives to improve long-term stock market performance. Additional long-term incentives are provided through the Company's 2000 Amended and Restated Employee Stock Purchase Plan in which all eligible employees may participate up to 15% of their annual compensation.

The Committee subjectively determines option grant levels to executive officers after considering the practices of other, similar companies, and the commissioned Compensation Report, as well as the level of responsibility, experience and contributions of each executive officer. The Committee may grant options to executive officers annually as part of the performance review process for each officer. In determining the size of individual grants, the Committee also considers the number of shares held by, and options previously granted to, each executive officer.

LIMITATION ON DEDUCTION OF COMPENSATION PAID TO CERTAIN EXECUTIVE OFFICERS

Section 162(m) of the Internal Revenue Code limits the Company to a deduction for federal income tax purposes of no more than $1 million of compensation paid to certain Named Executive Officers in a taxable year. Compensation above $1 million may be deducted if it is "performance-based compensation" within the meaning of the Internal Revenue Code. The Committee has determined that stock options granted under the Equity Incentive Plan with an exercise price at least equal to the fair market value of the Company's common stock on the date of grant shall be treated as "performance-based compensation."

CHIEF EXECUTIVE OFFICER COMPENSATION

The Committee uses the same procedures described above for all executive officers in setting the annual salary, annual performance bonus and long-term incentives awards for the Chief Executive Officer. The Chief Executive Officer's salary is determined based on comparisons with similar companies and nationally recognized surveys. The Chief Executive Officer's annual bonus is awarded in accordance with the Company's executive compensation plan based primarily on the Company's corporate performance where certain revenue and income goals for the year are achieved. In awarding stock options under the Equity Incentive Plan as a long-term incentive, the Committee considers the practices of other, similar companies; the level of responsibility, experience and contribution of the Chief Executive Officer; the number of shares held; and options previously granted.

COMPENSATION COMMITTEE

| Benjamin Brussell, Chairman | | Norman R. Farquhar | | Charles Christ |

March 29, 2002 |

|

|

|

|

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

As noted above, the Company's Compensation Committee consists of three outside directors, Messrs. Brussell, Farquhar and Christ, none of whom has ever been an officer or employee of the Company or any of its subsidiaries.

16

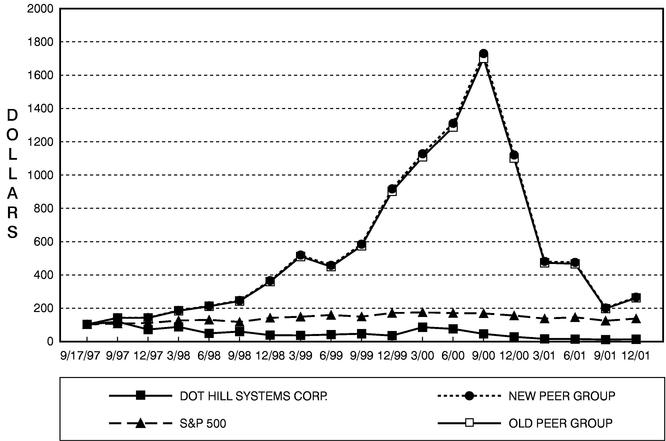

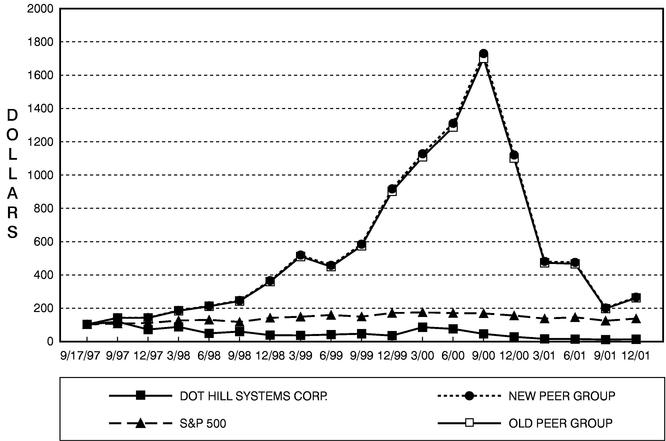

PERFORMANCE MEASUREMENT COMPARISON(3)

The following graph shows the total stockholder return of an investment of $100 in cash on September 17, 1997, the date of Box Hill's initial public offering, for (i) the Company's common stock, (ii) the Standards & Poor's 500 Index (the "S&P 500") and (iii) the common stock of a group of peer issuers. The group of peer issuers consists of eleven companies with common stock that is publicly traded and which operate in the computer data storage industry: Advanced Digital Info Corp., Auspex Sys Inc., Ciprico, Inc., EMC Corp., MTI Technology Corp., Network Appliance, Inc., nStor, Overland Data, Inc., Procom Technology Inc., Storage Computer Corp. and Storage Technology. During 1997, the Company compared itself to fourteen companies—those listed above, plus Artecon, Andataco, Inc., Exabyte and ATL Corporation and did not include nStor as part of the peer group. However, ATL Corporation was acquired by Quantum Corporation in 1998, and no longer trades separately. In 1998, the Company compared itself to thirteen companies—those listed above, plus Artecon, Andataco, Inc. and Exabyte and did not include nStor as part of the peer group. In 1999, Artecon, Inc. merged with Box Hill to form Dot Hill, and no longer trades separately. Likewise, Andataco, Inc. merged with nStor Technologies during 1999, and no longer trades separately. In 2000, the Company compared itself to eleven companies, those listed above plus Exabyte and less nStor. All values assume reinvestment of the full amount of all dividends and are calculated as of December 31 of each year:

COMPARISON OF 51 MONTH CUMULATIVE TOTAL RETURN*

AMONG DOT HILL SYSTEMS CORP., THE S & P 500 INDEX,

A NEW PEER GROUP AND AN OLD PEER GROUP

*$100 invested on 9/17/97 in stock or on 8/31/97 in index-including reinvestment of dividends. Fiscal year ending December 31.

Copyright @ 2002, Standard & Poor's, a division of The McGraw-Hill Companies, Inc. All rights reserved. www.researchdatagroup.com/S&P.htm

- (3)

- This Section is not "soliciting material," is not deemed "filed" with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

17

CERTAIN TRANSACTIONS

On July 31, 1997, Dr. Monderer, Ms. Turchin and Mark A. Mays entered into a voting agreement with respect to the shares of Company stock each owns which became effective upon the consummation of Box Hill's initial public offering. Pursuant to the agreement, the three stockholders agreed to vote their respective shares for the election of each other as a director of the Company and to vote their shares in accordance with the determination of the holders of a majority of their shares as to any proposal to merge, consolidate, liquidate or sell substantially all the assets of the Company. This agreement was terminated by Dr. Monderer, Ms. Turchin and Mr. Mays as of July 18, 2001.

In August 1999, the Company entered into an employment contract with Mr. Mays that provided for a base salary in the amount of $230,000 for 2001. In addition, effective January 1, 2001, the Company entered into the 2001 Plan with Mr. Mays, the terms of which were in addition to the terms of Mr. Mays' employment agreement. The 2001 Plan provided for an annual performance bonus target of 50% of base salary for Mr. Mays.

In March 2001, Mr. Mays' employment with the Company was terminated. In connection with this termination, Mr. Mays signed a termination letter and a release and waiver of claims. Pursuant to his termination letter and release and waiver of claims, the Company paid Mr. Mays $261,779, of which $230,000 was a severance payment equal to his then current annual base salary and $31,779 was in payment of his accrued and unused vacation as of his termination.

The Company maintains directors' and officers' insurance coverage. These insurance policies cover directors and officers individually where exposure exists and run from September 16, 2001 through September 16, 2002 at a total cost of $872,000. The Company also purchased a discovery period extension for the former Artecon directors and officers insurance at a total cost of $124,540, which runs from August 2, 1999 through August 2, 2005.

In addition, the Company has entered into certain transactions with its directors, as described under the captions "Executive Compensation—Compensation of Directors."

The Company has also entered into certain agreements with its Chief Executive Officer and other executive officers, as described under the caption "Executive Compensation—Employment, Severance and Change of Control Agreements."

The Company's Certificate of Incorporation and Bylaws provide that the Company will indemnify its directors and executive officers to the fullest extent permitted by Delaware law.

During 2000, the Company entered into a settlement of a class action lawsuit filed against Box Hill Systems Corp., certain of its officers and directors, and the underwriters of the Company's September 16, 1997 initial public offering. On January 5, 2001, the settlement was approved and the action dismissed with prejudice by the United States District Court for the Southern District of New York. There were no plaintiff objections or opt-outs to the settlement agreement.

There is no pending litigation or proceeding involving a director, officer, employee or other agent of the Company as to which indemnification is being sought.

18

OTHER MATTERS

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

| | | By Order of the Board of Directors |

|

|

|

|

|

Preston Romm

Secretary |

| April 5, 2002 | | |

19

DOT HILL SYSTEMS CORP.

PROXY SOLICITED BY THE BOARD OF DIRECTORS

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 14, 2002

The undersigned hereby appoints JAMES L. LAMBERT and PRESTON ROMM, and each of them, as attorneys and proxies of the undersigned, with full power of substitution, to vote all of the shares of stock of Dot Hill Systems Corp. which the undersigned may be entitled to vote at the Annual Meeting of Stockholders of Dot Hill Systems Corp. to be held at the Grand Pacific Palisades Resort, located at 5805 Armada Drive, Carlsbad, California, on Tuesday, May 14, 2002 at 9:00 a.m. local time, and at any and all postponements, continuations and adjournments thereof, with all powers that the undersigned would possess if personally present, upon and in respect of the following matters and in accordance with the following instructions, with discretionary authority as to any and all other matters that may properly come before the meeting.

UNLESS A CONTRARY DIRECTION IS INDICATED, THIS PROXY WILL BE VOTED FOR ALL NOMINEES LISTED IN PROPOSAL 1 AND FOR PROPOSAL 2, AS MORE SPECIFICALLY DESCRIBED IN THE PROXY STATEMENT. IF SPECIFIC INSTRUCTIONS ARE INDICATED, THIS PROXY WILL BE VOTED IN ACCORDANCE THEREWITH.

------------------------------------detach here------------------------------------

MANAGEMENT RECOMMENDS A VOTE FOR THE NOMINEES FOR DIRECTOR LISTED BELOW.

PROPOSAL 1: To elect three (3) directors to hold office until the 2005 Annual Meeting of Stockholders, and until their successors are elected.

| o | | FOR all nominees listed below (except as marked to the contrary below). | | o | | WITHHOLD AUTHORITY to vote for all nominees listed below. |

Nominees:James L. Lambert, W.R. Sauey, Carol Turchin |

To withhold authority to vote for any nominee(s) write such nominee(s)' name(s) below: |

|

|

(Continued and to be signed on other side)

MANAGEMENT RECOMMENDS A VOTE FOR PROPOSAL 2.

PROPOSAL 2:To ratify the selection of Deloitte & Touche LLP as independent auditors of the Company for its fiscal year ending December 31, 2002.

| o | | FOR | | o | | AGAINST | | o | | ABSTAIN |

| Dated | | | | |

| | |

| |

|

|

|

|

|

|

| | | | | SIGNATURE(S) |

|

|

|

|

Please sign exactly as your name appears herein. If the stock is registered in the names of two or more persons, each person should sign. Executors, administrators, trustees, guardians and attorneys-in-fact should add their titles. If signer is a corporation, please give full corporate name and have a duly authorized officer sign, stating title. If signer is a partnership, please sign in partnership name by authorized person. |

Please vote, date and promptly return this proxy in the enclosed return envelope which is postage prepaid if mailed in the United States. |

QuickLinks

PROPOSAL 1 ELECTION OF DIRECTORSPROPOSAL 2 RATIFICATION OF SELECTION OF INDEPENDENT AUDITORSSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTEXECUTIVE COMPENSATIONCOMPENSATION OF EXECUTIVE OFFICERSSUMMARY COMPENSATION TABLESTOCK OPTION GRANTS AND EXERCISESOPTION GRANTS IN LAST FISCAL YEARAGGREGATED OPTION EXERCISES IN FISCAL 2001 AND VALUE OF OPTIONS AT END OF FISCAL 2001EMPLOYMENT, SEVERANCE AND CHANGE OF CONTROL AGREEMENTSREPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS ON EXECUTIVE COMPENSATION(2)COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATIONPERFORMANCE MEASUREMENT COMPARISON(3)COMPARISON OF 51 MONTH CUMULATIVE TOTAL RETURN* AMONG DOT HILL SYSTEMS CORP., THE S & P 500 INDEX, A NEW PEER GROUP AND AN OLD PEER GROUPCERTAIN TRANSACTIONSOTHER MATTERSDOT HILL SYSTEMS CORP. PROXY SOLICITED BY THE BOARD OF DIRECTORS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 14, 2002