NASDAQ: HILL DRIVING GROWTH NASDAQ: HILL May 2014 15th Annual B. Riley Investor Conference

NASDAQ: HILL 2 May 2014 Statements contained in this presentation regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Such statements include statements regarding future opportunities for additional business and the stage of such opportunities relative to a final binding agreement, prospects for Dot Hill’s continued growth, and Dot Hill’s projected financial results for the second quarter and full year of 2014. The risks that contribute to the uncertain nature of the forward-looking statements include, among other things: the risk that actual financial results for the second quarter and full year of 2014 may be different from the financial guidance provided in the press release; the risks associated with macroeconomic factors that are outside of Dot Hill’s control; the risk that projected future opportunities may never fully develop into ongoing business relationships and/or binding contractual agreements; the fact that no Dot Hill customer agreements provide for mandatory minimum purchase requirements; the risk that one or more of Dot Hill’s OEM or other customers may cancel or reduce orders, not order as forecasted or terminate their agreements with Dot Hill; the risk that Dot Hill’s new products may not prove to be popular; the risk that one or more of Dot Hill’s suppliers or subcontractors may fail to perform or may terminate their agreements with Dot Hill; the risk that Vertical Markets’ sales may not ramp as expected; unforeseen product quality, technological, intellectual property, personnel or engineering issues and any costs that may result from such issues; and the additional risks set forth in Dot Hill’s most recent Form 10-Q and Form10-K filings with the Securities and Exchange Commission. All forward-looking statements contained in this presentation speak only as of the date on which they were made. Dot Hill undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made. Safe Harbor

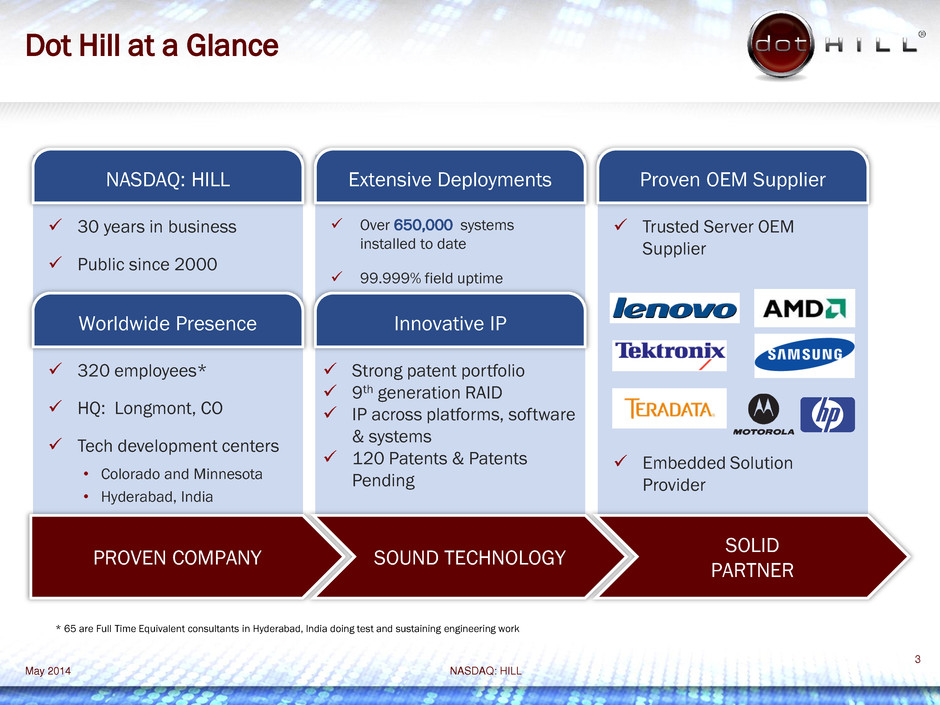

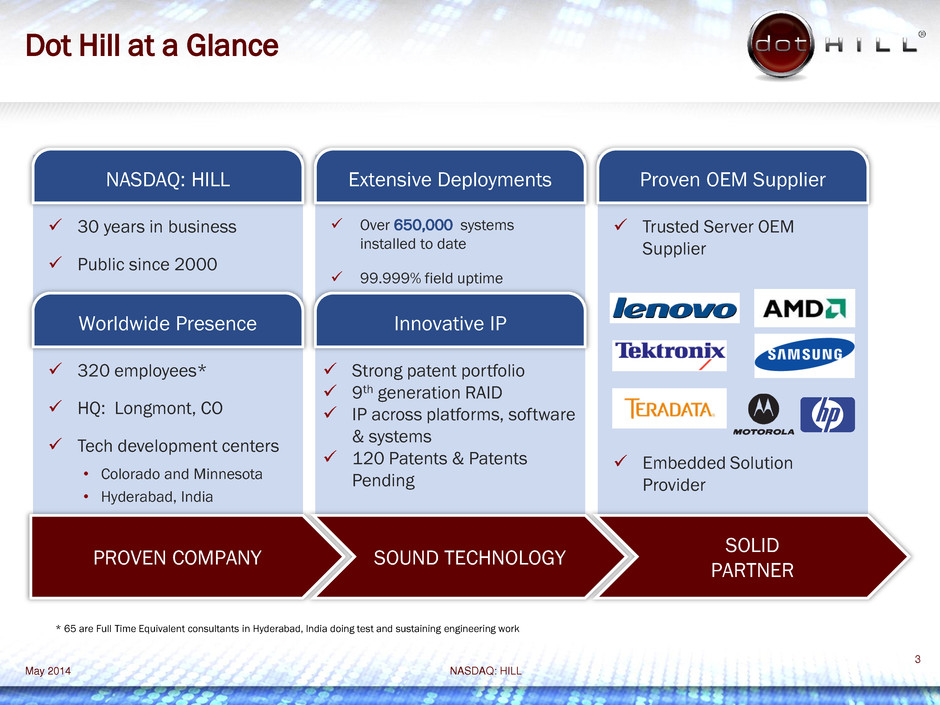

NASDAQ: HILL 3 Dot Hill at a Glance * 65 are Full Time Equivalent consultants in Hyderabad, India doing test and sustaining engineering work Extensive Deployments SOUND TECHNOLOGY Over 650,000 systems installed to date 99.999% field uptime Innovative IP Strong patent portfolio 9th generation RAID IP across platforms, software & systems 120 Patents & Patents Pending NASDAQ: HILL PROVEN COMPANY 30 years in business Public since 2000 Worldwide Presence 320 employees* HQ: Longmont, CO Tech development centers • Colorado and Minnesota • Hyderabad, India Proven OEM Supplier SOLID PARTNER Trusted Server OEM Supplier Embedded Solution Provider May 2014

NASDAQ: HILL 4 Selected Financial Information May 2014 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 2011 2012 2013 2014 Stock Information (NASDAQ: HILL) Closing Price @ 5/15/14 $3.71 52 Week High $6.06 52 Week Low $1.64 Market Cap $214.84M Avg Volume (3m) 922,526 Fully Diluted Shares Outstanding 63.9M Non-GAAP Income Statement (TTM) Revenue ($M) $212.7 Gross Margin % 33.2% Opex $58.6 Operating Income (%) 5.3% EPS $0.20 Balance Sheet as of 3/31/14 Cash & Cash Equivalents $40.3M Accounts Receivable $33.7M Inventories $7.7M Accounts Payable $26.3M Net Working Capital $45.0M Net Working Capital = Current Assets – Current Liabilities YTD 2014 13 Wks 26 Wks 52 Wks 14% -33% 40% 111% 3-Year Stock Price: HILL

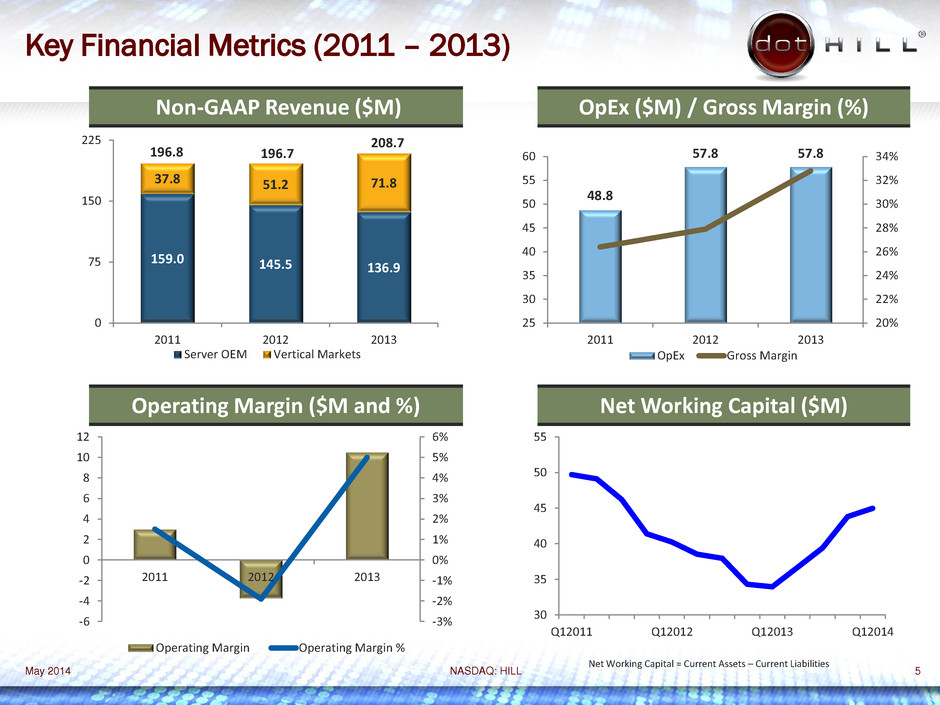

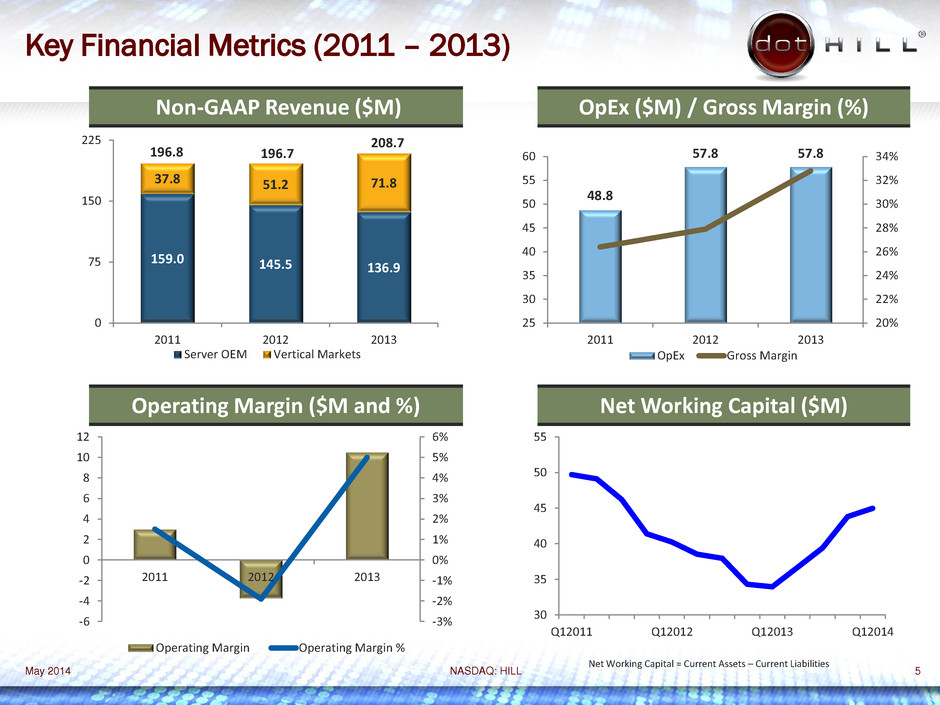

NASDAQ: HILL 5 Key Financial Metrics (2011 – 2013) May 2014 159.0 145.5 136.9 37.8 51.2 71.8 0 75 150 225 2011 2012 2013 Server OEM Vertical Markets 48.8 57.8 57.8 20% 22% 24% 26% 28% 30% 32% 34% 25 30 35 40 45 50 55 60 2011 2012 2013 OpEx Gross Margin -3% -2% -1% 0% 1% 2% 3% 4% 5% 6% -6 -4 -2 0 2 4 6 8 10 12 2011 2012 2013 Operating Margin Operating Margin % 30 35 40 45 50 55 Q12011 Q12012 Q12013 Q12014 Net Working Capital = Current Assets – Current Liabilities OpEx ($M) / Gross Margin (%) 196.8 196.7 208.7 Non-GAAP Revenue ($M) Net Working Capital ($M) Operating Margin ($M and %)

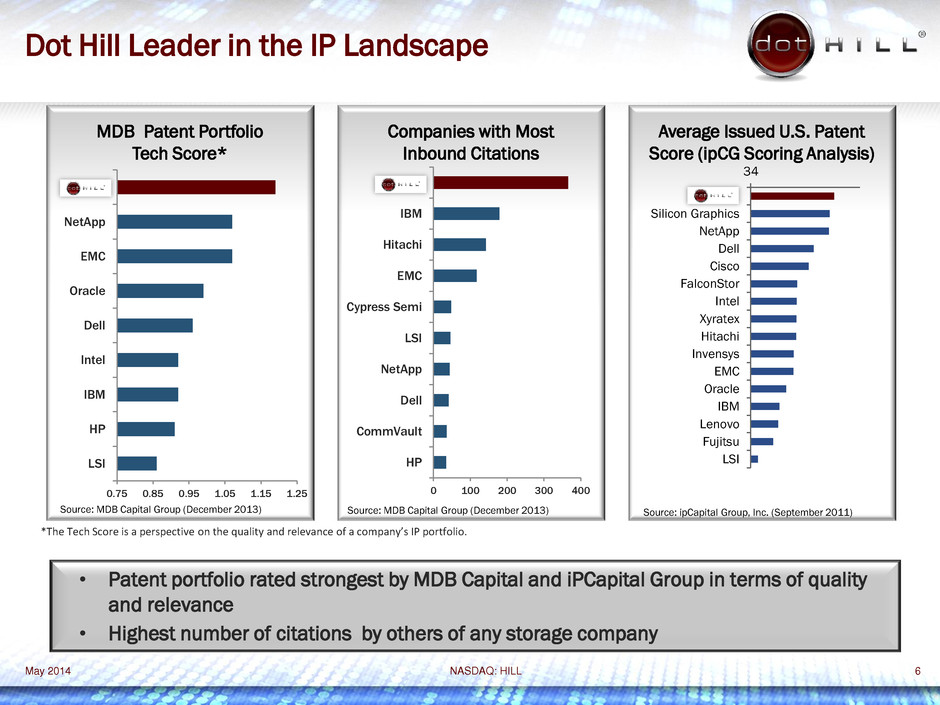

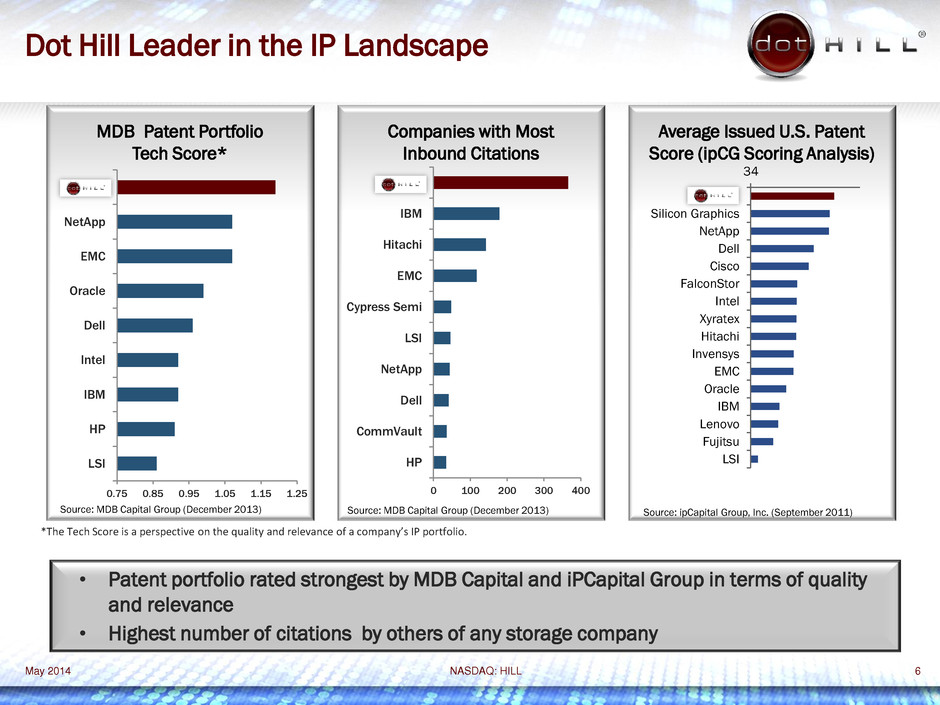

NASDAQ: HILL 6 Dot Hill Leader in the IP Landscape • Patent portfolio rated strongest by MDB Capital and iPCapital Group in terms of quality and relevance • Highest number of citations by others of any storage company MDB Patent Portfolio Tech Score* Companies with Most Inbound Citations Average Issued U.S. Patent Score (ipCG Scoring Analysis) 34 Dot Hill Silicon Graphics NetApp Dell Cisco FalconStor Intel Xyratex Hitachi Invensys EMC Oracle IBM Lenovo Fujitsu LSI May 2014 Source: ipCapital Group, Inc. (September 2011) 0.75 0.85 0.95 1.05 1.15 1.25 LSI HP IBM Intel Dell Oracle EMC NetApp *The Tech Score is a perspective on the quality and relevance of a company’s IP portfolio. Source: MDB Capital Group (December 2013) 0 100 200 300 400 HP CommVault Dell NetApp LSI Cypress Semi EMC Hitachi IBM Source: MDB Capital Group (December 2013)

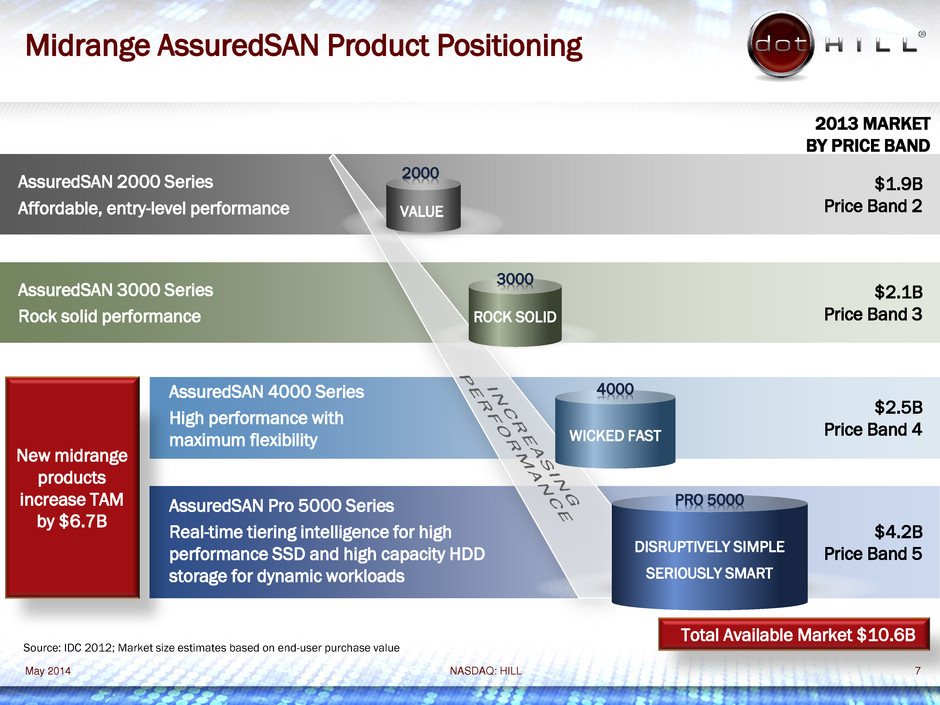

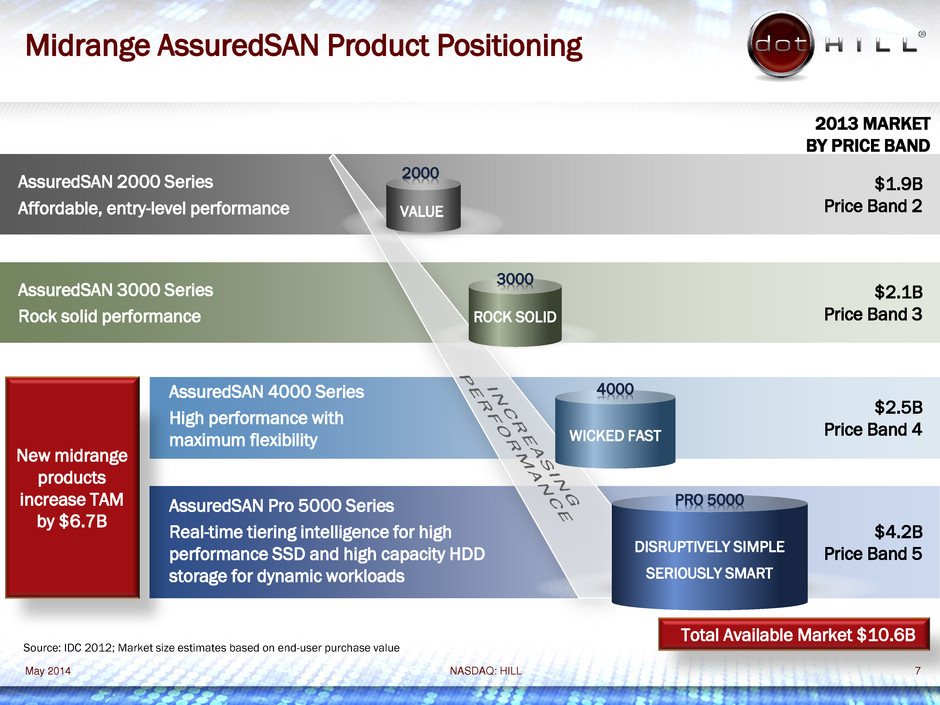

NASDAQ: HILL 7 Midrange AssuredSAN Product Positioning AssuredSAN Pro 5000 Series Real-time tiering intelligence for high performance SSD and high capacity HDD storage for dynamic workloads $4.2B Price Band 5 AssuredSAN 4000 Series High performance with maximum flexibility $2.5B Price Band 4 AssuredSAN 3000 Series Rock solid performance $2.1B Price Band 3 AssuredSAN 2000 Series Affordable, entry-level performance $1.9B Price Band 2 DISRUPTIVELY SIMPLE SERIOUSLY SMART PRO 5000 ROCK SOLID 3000 WICKED FAST 4000 VALUE 2000 2013 MARKET BY PRICE BAND New midrange products increase TAM by $6.7B Total Available Market $10.6B Source: IDC 2012; Market size estimates based on end-user purchase value May 2014

NASDAQ: HILL 8 Data Growth Facts • The "Digital Universe“ will continue to explode Each day, our society creates 2.5 quintillion bytes of data1 growing to 20 20ZB by 20202 Driven by the explosion in mobile devices, apps, social media, and the Internet of Things • New Data Intensive Applications Over the next three years, 80% of the new "killer apps" emerging on the 3rd Platform will be "data intensive“2 • Hybrid Storage Poised for Rapid Growth Market to reach $14.3 billion by 2017, representing 45% of the overall external enterprise storage systems market3 Hybrid external storage system capacity will grow at a 64.1% CAGR for 2012– 20173 1Source: Datanami 2014 2Source: IDC "Predictions 2014: Battles for Dominance — and Survival — on the 3rd Platform" Doc # 244606 Dec 2013 3Source: IDC "Worldwide Hybrid External Enterprise Storage Systems 2013–2017 Forecast" Doc # 245117 Dec 2013 Source: Data Center Journal, 2013 May 2014

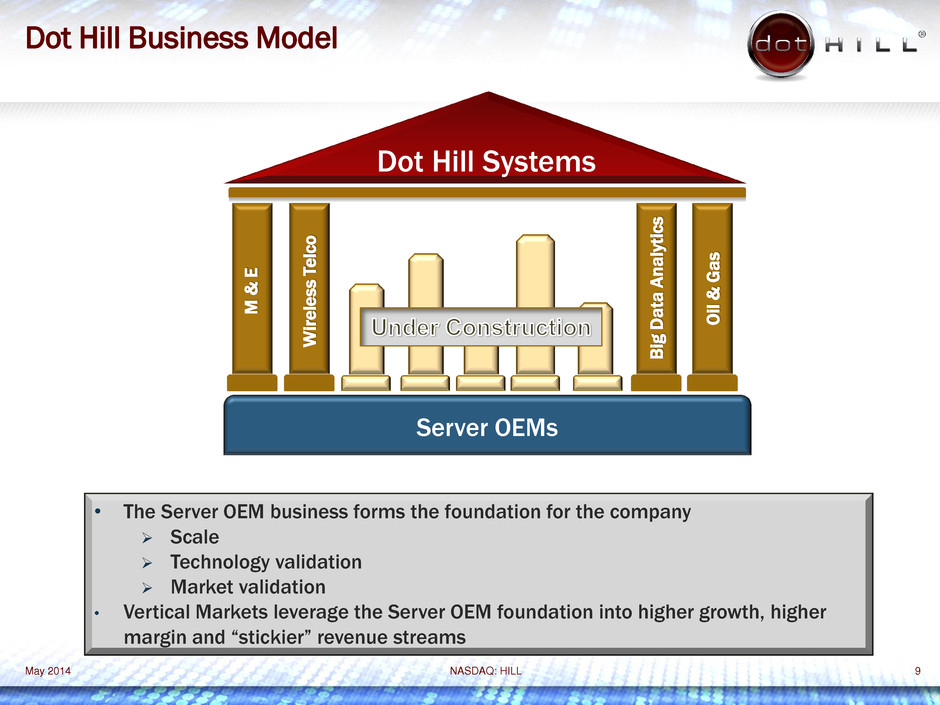

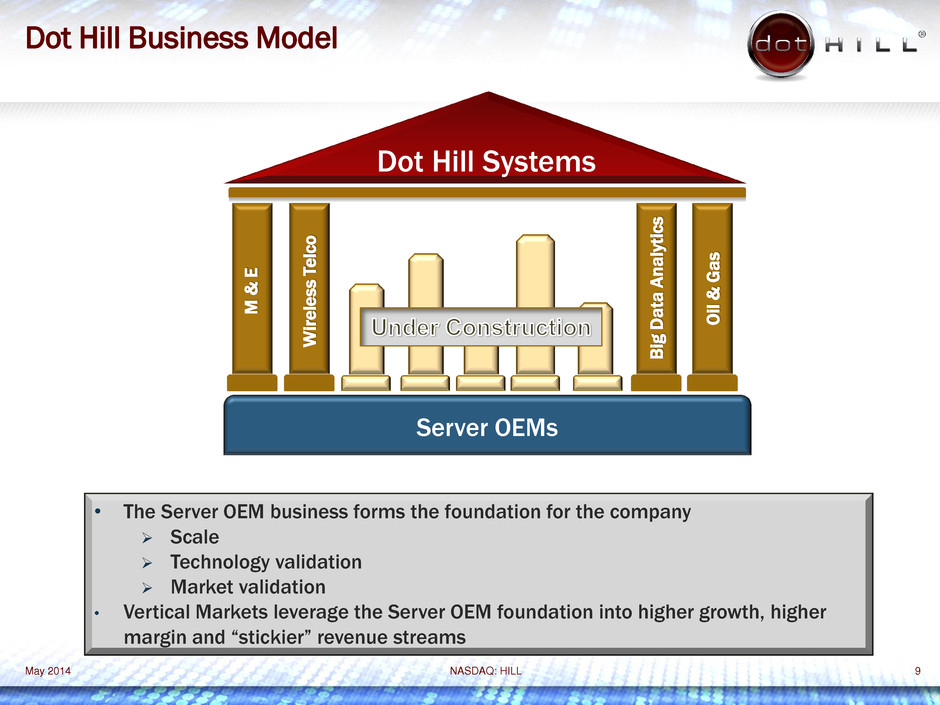

NASDAQ: HILL Server OEMs Dot Hill Systems M & E W ir e le ss T e lc o B ig D a ta A n a ly ti cs O il & G a s 9 May 2014 Dot Hill Business Model • The Server OEM business forms the foundation for the company Scale Technology validation Market validation • Vertical Markets leverage the Server OEM foundation into higher growth, higher margin and “stickier” revenue streams

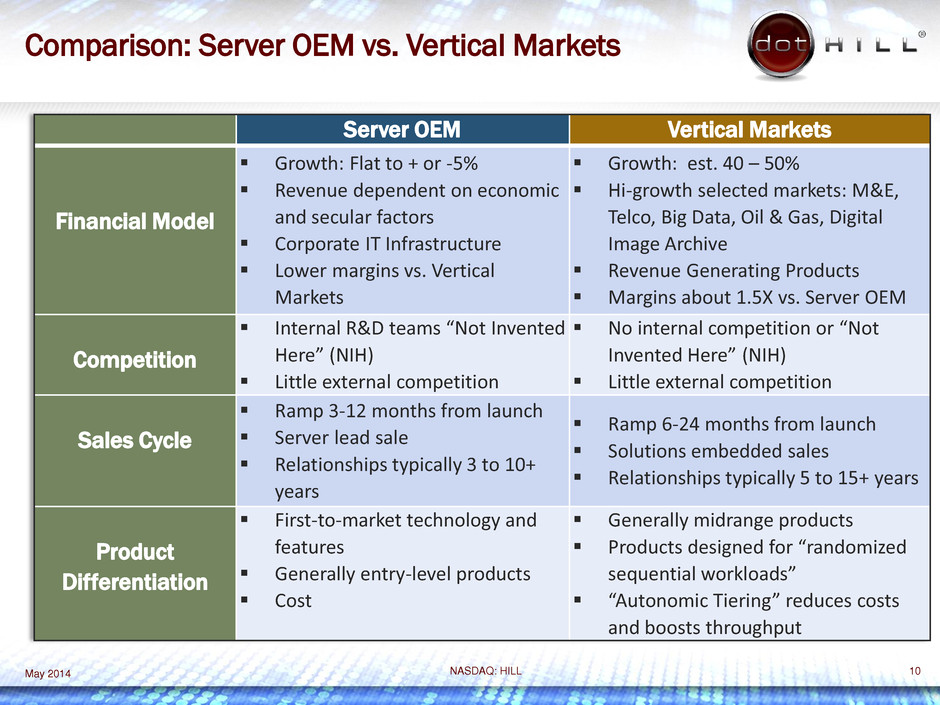

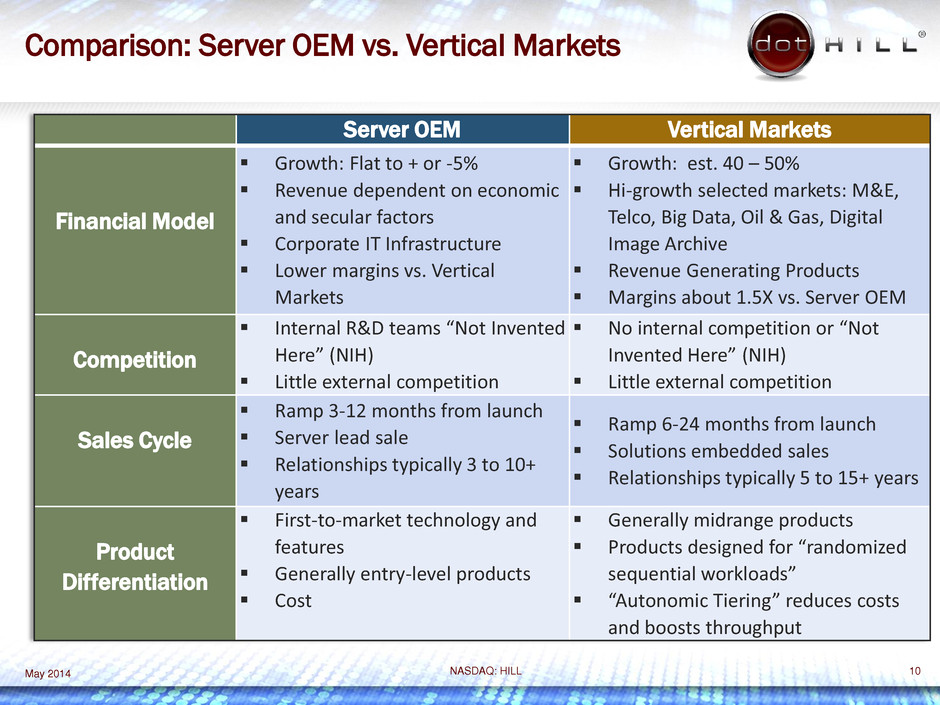

NASDAQ: HILL 10 Comparison: Server OEM vs. Vertical Markets May 2014 Server OEM Vertical Markets Financial Model Growth: Flat to + or -5% Revenue dependent on economic and secular factors Corporate IT Infrastructure Lower margins vs. Vertical Markets Growth: est. 40 – 50% Hi-growth selected markets: M&E, Telco, Big Data, Oil & Gas, Digital Image Archive Revenue Generating Products Margins about 1.5X vs. Server OEM Competition Internal R&D teams “Not Invented Here” (NIH) Little external competition No internal competition or “Not Invented Here” (NIH) Little external competition Sales Cycle Ramp 3-12 months from launch Server lead sale Relationships typically 3 to 10+ years Ramp 6-24 months from launch Solutions embedded sales Relationships typically 5 to 15+ years Product Differentiation First-to-market technology and features Generally entry-level products Cost Generally midrange products Products designed for “randomized sequential workloads” “Autonomic Tiering” reduces costs and boosts throughput

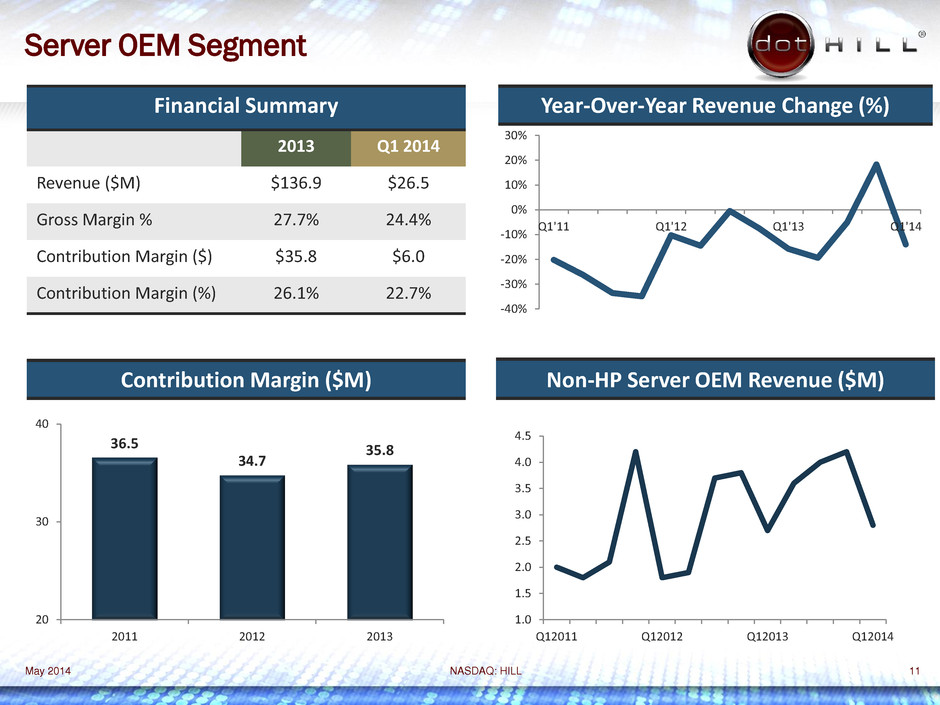

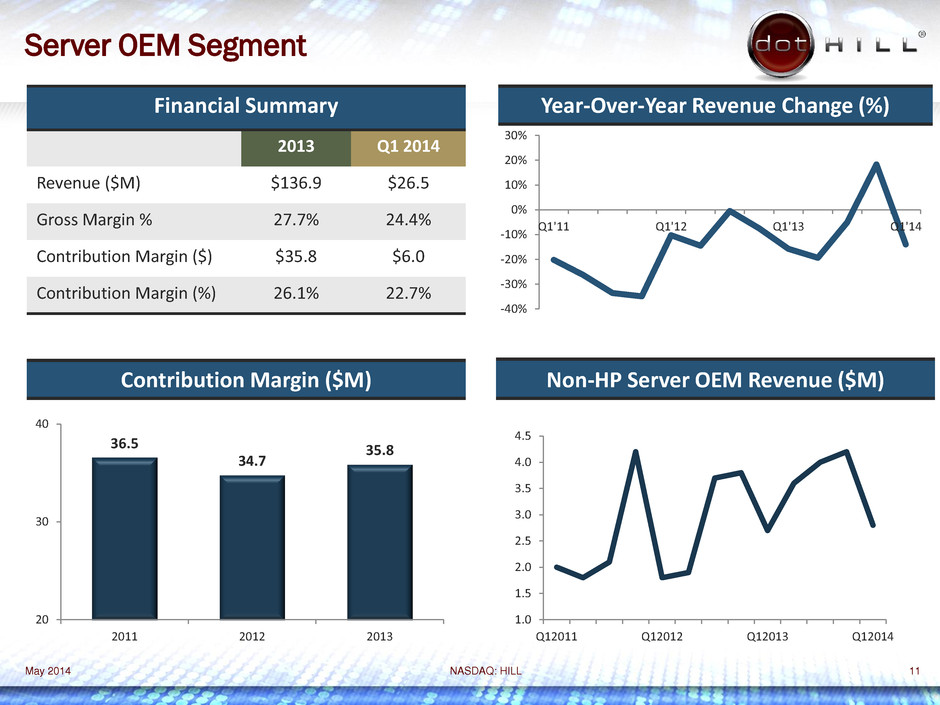

NASDAQ: HILL 11 Server OEM Segment May 2014 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 Q12011 Q12012 Q12013 Q12014 -40% -30% -20% -10% 0% 10% 20% 30% Q1'11 Q1'12 Q1'13 Q1'14 Financial Summary 2013 Q1 2014 Revenue ($M) $136.9 $26.5 Gross Margin % 27.7% 24.4% Contribution Margin ($) $35.8 $6.0 Contribution Margin (%) 26.1% 22.7% Year-Over-Year Revenue Change (%) 36.5 34.7 35.8 20 30 40 2011 2012 2013 Contribution Margin ($M) Non-HP Server OEM Revenue ($M)

NASDAQ: HILL 12 Server OEM Segment: Hewlett Packard May 2014 • Entry level market share leader, shipping 4th generation of Dot Hill based products • 250,000 systems shipped • First- to-market advantage with 16Gb Fibre Channel products • Complete refresh of entry- level offerings with three product launches over the past three quarters • Could benefit from the Lenovo- IBM transaction

NASDAQ: HILL 13 Vertical Markets Segment May 2014 4.9 8.8 22.0 1.0 6.0 11.0 16.0 21.0 26.0 2011 2012 2013 Financial Summary 2013 Q1 2014 Revenue $71.8 $22.4 Gross Margin % 42.7% 43.4% Contribution Margin ($) $22.0 $7.5 Contribution Margin (%) 30.7% 33.6% -30% -10% 10% 30% 50% 70% 90% 110% 130% 150% Q1'11 Q1'12 Q1'13 Q1'14 Year-Over-Year Revenue Change (%) 2011 2012 2013 2014E 37.8 51.2 71.8 102.5 Growth in Vertical Markets ($M) Contribution Margin ($M) 2014 based on midpoint of guidance as of Mar. 6, 2014

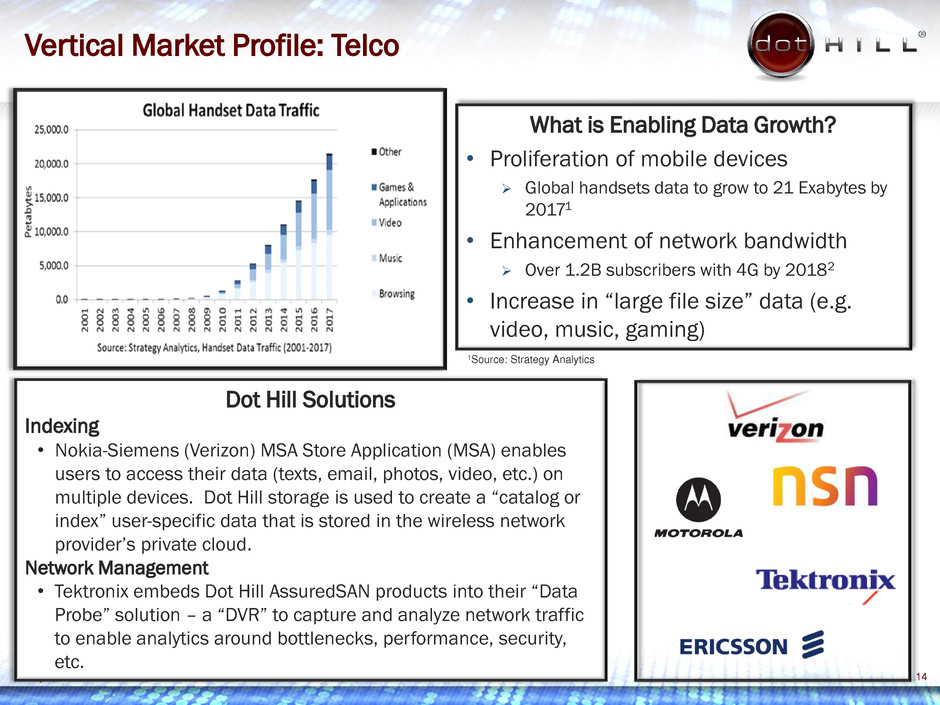

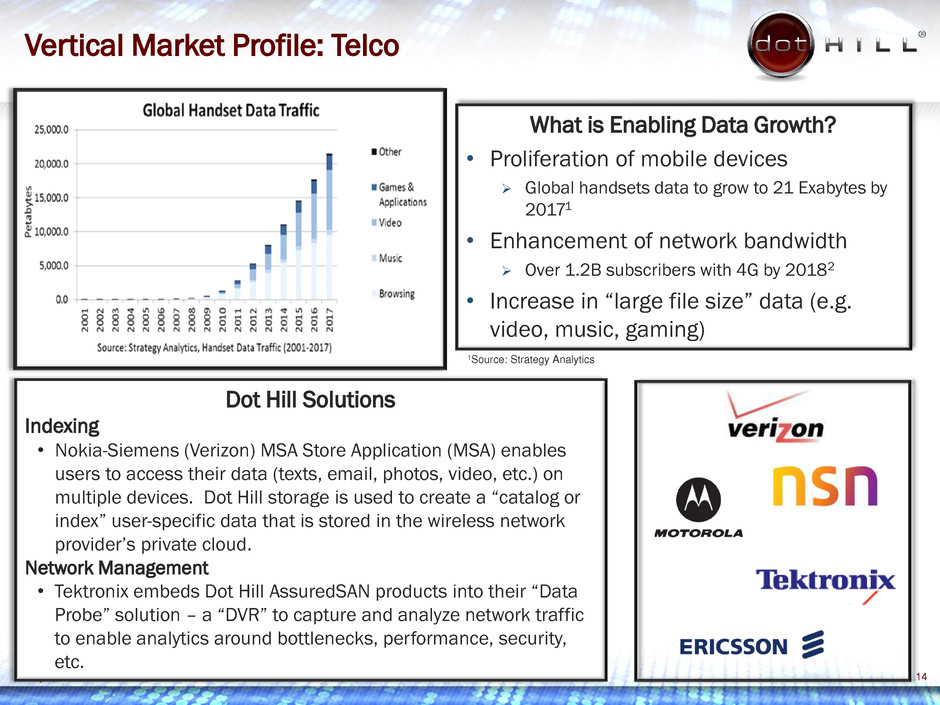

NASDAQ: HILL 14 Vertical Market Profile: Telco May 2014 1Source: Strategy Analytics What is Enabling Data Growth? • Proliferation of mobile devices Global handsets data to grow to 21 Exabytes by 20171 • Enhancement of network bandwidth Over 1.2B subscribers with 4G by 20182 • Increase in “large file size” data (e.g. video, music, gaming) Dot Hill Solutions Indexing • Nokia-Siemens (Verizon) MSA Store Application (MSA) enables users to access their data (texts, email, photos, video, etc.) on multiple devices. Dot Hill storage is used to create a “catalog or index” user-specific data that is stored in the wireless network provider’s private cloud. Network Management • Tektronix embeds Dot Hill AssuredSAN products into their “Data Probe” solution – a “DVR” to capture and analyze network traffic to enable analytics around bottlenecks, performance, security, etc.

NASDAQ: HILL 15 Vertical Market Profile: Big Data Analytics May 2014 What is Enabling Big Data Analytics growth? • Explosion of unstructured by “rich” social media • Security, including biometrics, correlation of log data for real-time malicious activity monitoring • Predictive analytics using facial recognition and wearable internet devices (e.g. enables retailer to greet incoming customers) Dot Hill Solutions Teradata Integrated Big Data Platform 1700 • Business analytics on large, deep detailed data that leverages Teradata’s leading-edge technologies • Dot Hill AssuredSAN 4000 provides 229TB per cabinet Scalable to 117 petabytes across multiple cabinets Powerful and purpose-built for analytics on extremely large data Cost-effective storage with the lowest cost/capacity in Teradata Platform Family

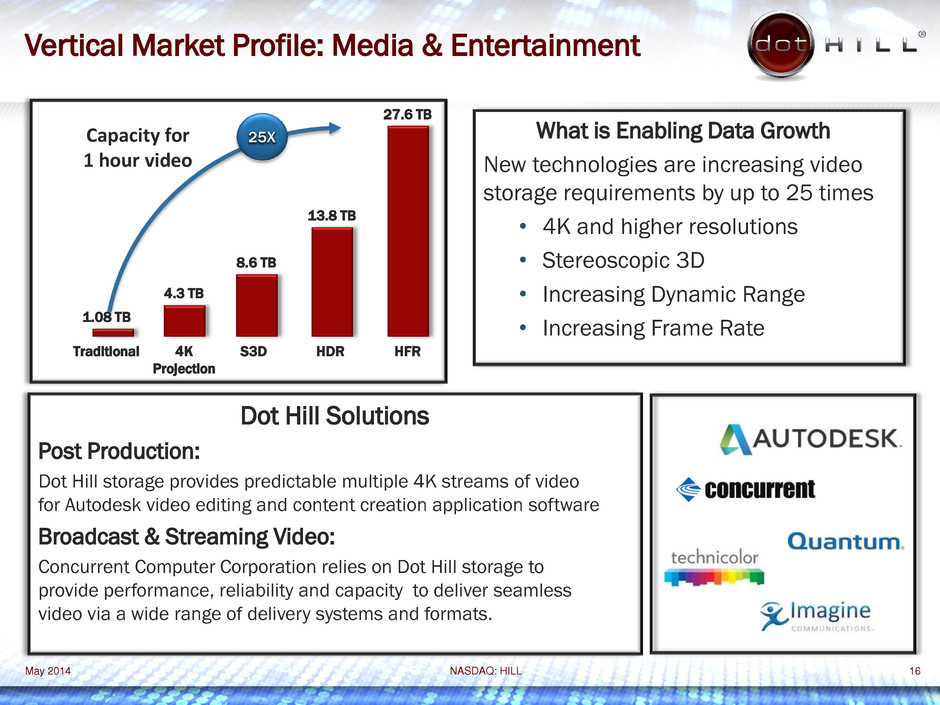

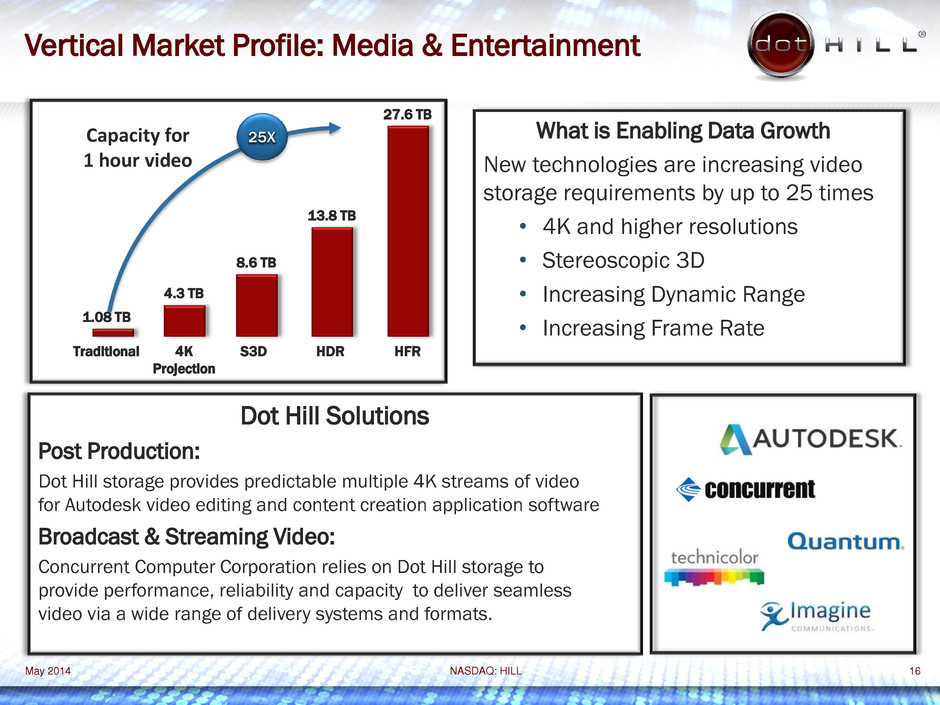

NASDAQ: HILL 16 Vertical Market Profile: Media & Entertainment What is Enabling Data Growth New technologies are increasing video storage requirements by up to 25 times • 4K and higher resolutions • Stereoscopic 3D • Increasing Dynamic Range • Increasing Frame Rate May 2014 1.08 TB Traditional 4.3 TB 4K Projection 8.6 TB S3D 13.8 TB HDR 27.6 TB HFR 25X Capacity for 1 hour video Dot Hill Solutions Post Production: Dot Hill storage provides predictable multiple 4K streams of video for Autodesk video editing and content creation application software Broadcast & Streaming Video: Concurrent Computer Corporation relies on Dot Hill storage to provide performance, reliability and capacity to deliver seamless video via a wide range of delivery systems and formats.

NASDAQ: HILL 17 Expansion to Other Growth Markets May 2014 Health Care Video Surveillance Oil & Gas Geospatial High Performance Computing Federal System Integrators

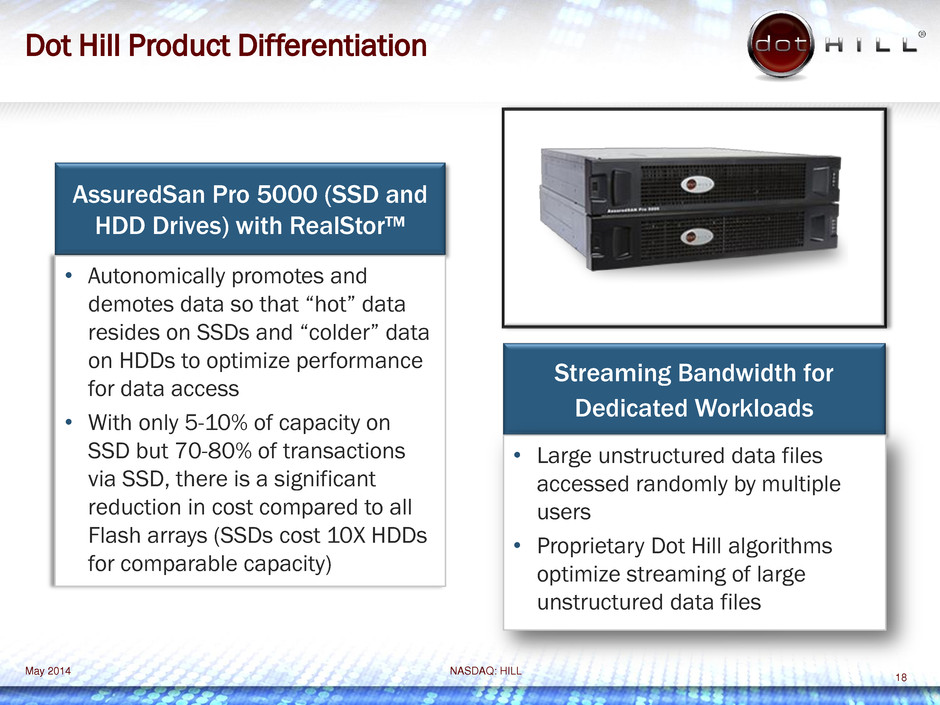

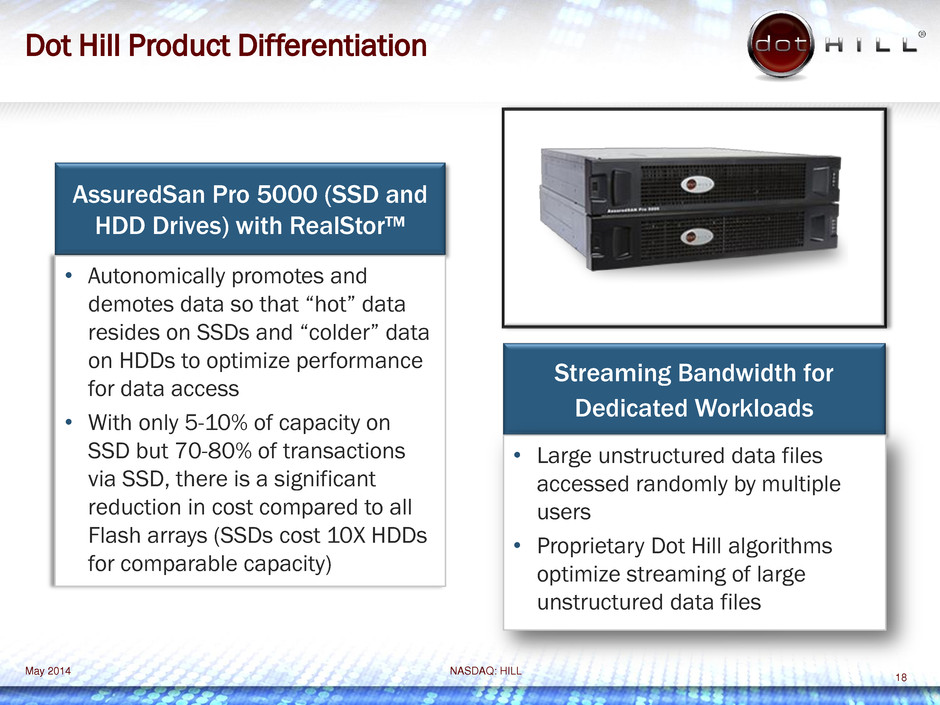

NASDAQ: HILL 18 Dot Hill Product Differentiation May 2014 AssuredSan Pro 5000 (SSD and HDD Drives) with RealStor™ Streaming Bandwidth for Dedicated Workloads • Autonomically promotes and demotes data so that “hot” data resides on SSDs and “colder” data on HDDs to optimize performance for data access • With only 5-10% of capacity on SSD but 70-80% of transactions via SSD, there is a significant reduction in cost compared to all Flash arrays (SSDs cost 10X HDDs for comparable capacity) • Large unstructured data files accessed randomly by multiple users • Proprietary Dot Hill algorithms optimize streaming of large unstructured data files

NASDAQ: HILL DRIVING GROWTH NASDAQ: HILL Financials and Business Model

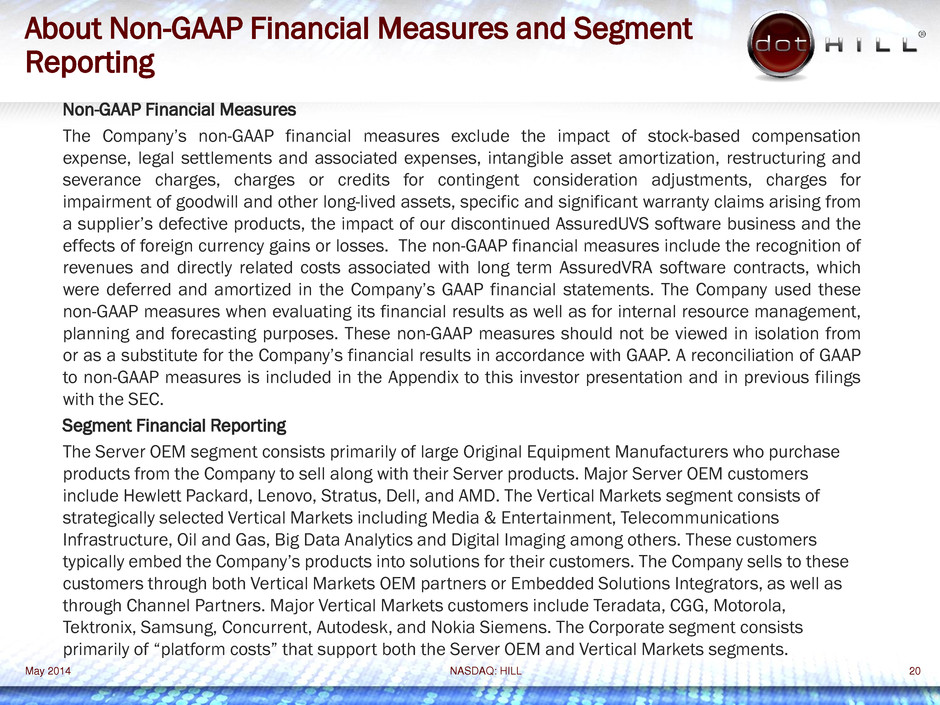

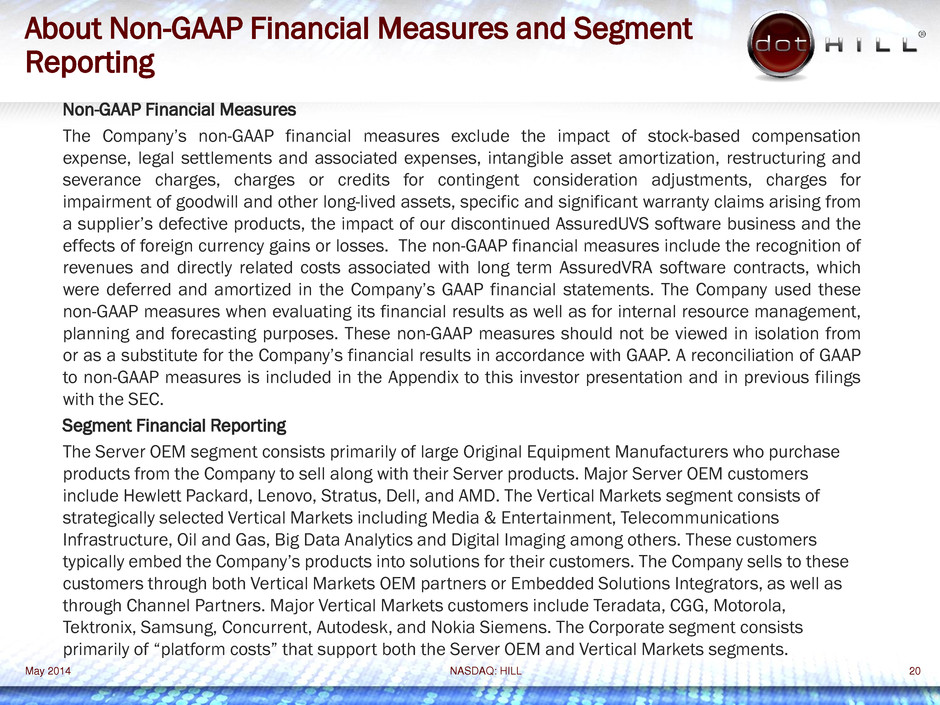

NASDAQ: HILL 20 About Non-GAAP Financial Measures and Segment Reporting May 2014 Non-GAAP Financial Measures The Company’s non-GAAP financial measures exclude the impact of stock-based compensation expense, legal settlements and associated expenses, intangible asset amortization, restructuring and severance charges, charges or credits for contingent consideration adjustments, charges for impairment of goodwill and other long-lived assets, specific and significant warranty claims arising from a supplier’s defective products, the impact of our discontinued AssuredUVS software business and the effects of foreign currency gains or losses. The non-GAAP financial measures include the recognition of revenues and directly related costs associated with long term AssuredVRA software contracts, which were deferred and amortized in the Company’s GAAP financial statements. The Company used these non-GAAP measures when evaluating its financial results as well as for internal resource management, planning and forecasting purposes. These non-GAAP measures should not be viewed in isolation from or as a substitute for the Company’s financial results in accordance with GAAP. A reconciliation of GAAP to non-GAAP measures is included in the Appendix to this investor presentation and in previous filings with the SEC. Segment Financial Reporting The Server OEM segment consists primarily of large Original Equipment Manufacturers who purchase products from the Company to sell along with their Server products. Major Server OEM customers include Hewlett Packard, Lenovo, Stratus, Dell, and AMD. The Vertical Markets segment consists of strategically selected Vertical Markets including Media & Entertainment, Telecommunications Infrastructure, Oil and Gas, Big Data Analytics and Digital Imaging among others. These customers typically embed the Company’s products into solutions for their customers. The Company sells to these customers through both Vertical Markets OEM partners or Embedded Solutions Integrators, as well as through Channel Partners. Major Vertical Markets customers include Teradata, CGG, Motorola, Tektronix, Samsung, Concurrent, Autodesk, and Nokia Siemens. The Corporate segment consists primarily of “platform costs” that support both the Server OEM and Vertical Markets segments.

NASDAQ: HILL 21 Q1’14 Non-GAAP Segment Financial Results May 2014 REVENUE ($M): Total Server OEM 26.5$ $ 30.8 $ 40.8 -13.9% -35.1% Total Vertical Markets 22.4$ $ 14.1 $ 18.9 58.6% 18.2% Total net revenue 48.9$ 44.9$ 59.7$ 8.9% -18.2% GROSS PROFIT ($M): Total Server OEM 6.5$ $ 8.2 $ 11.6 -21.4% -44.3% Total Vertical Markets 9.7$ $ 6.2 $ 7.3 57.0% 32.5% Total gross profit 16.2$ 14.4$ 18.9$ 12.3% -14.6% GROSS MARGIN (%): Total Server OEM 24.4% 26.7% 28.4% -230 bps -400 bps Total Vertical Markets 43.4% 43.9% 38.7% -50 bps -470 bps Gross margin % 33.1% 32.1% 31.7% +100 bps +140 bps SALES & MARKETING: Total Server OEM 0.5$ $ 0.4 $ 0.6 9.6% -17.6% Total Vertical Markets 2.2$ $ 2.0 $ 2.3 7.8% -3.2% Corporate 0.5$ $ 0.6 $ 0.8 -8.0% -30.6% Total sales & marketing 3.2$ 3.0$ 3.7$ 5.1% -11.2% Q1’14 Q4’13 Q1’13 YoY Change QoQ Change

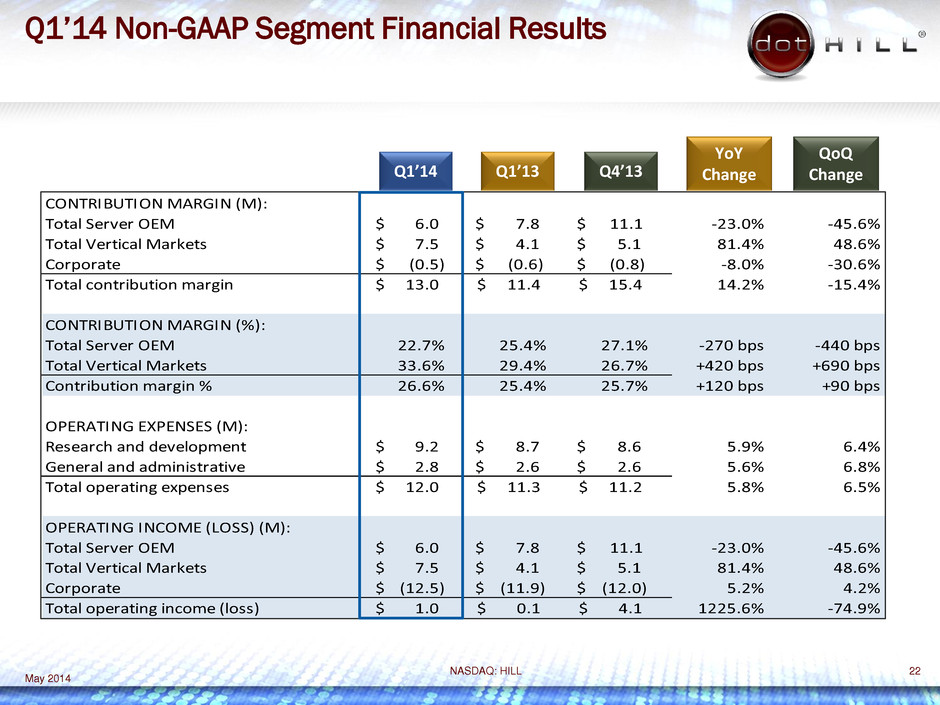

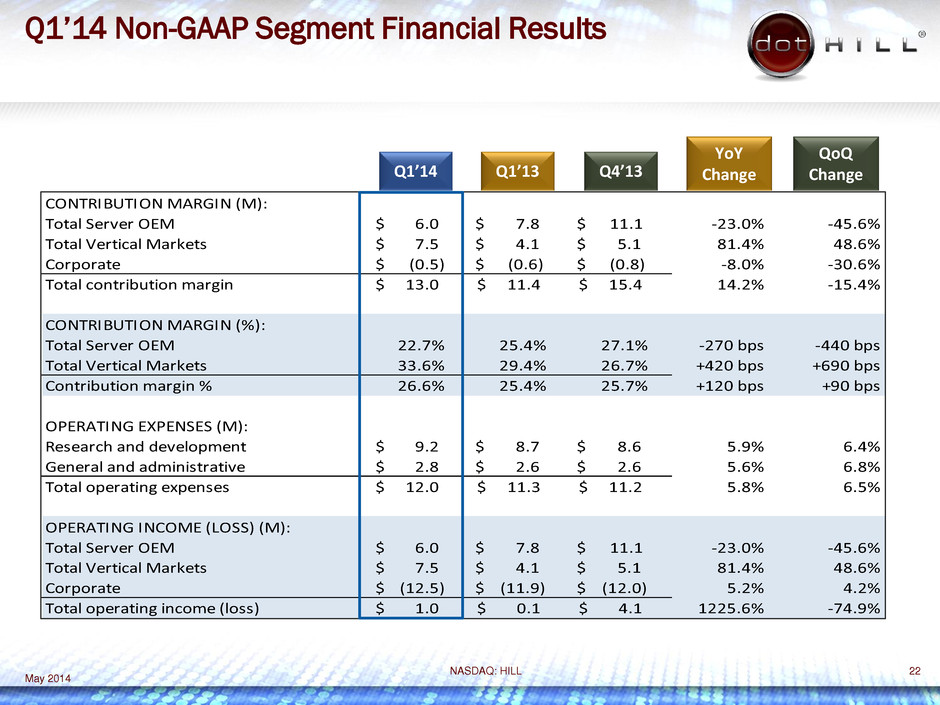

NASDAQ: HILL 22 Q1’14 Non-GAAP Segment Financial Results May 2014 CONTRIBUTION MARGIN (M): Total Server OEM 6.0$ $ 7.8 $ 11.1 -23.0% -45.6% Total Vertical Markets 7.5$ $ 4.1 $ 5.1 81.4% 48.6% Corporate (0.5)$ $ (0.6) $ (0.8) -8.0% -30.6% Total contribution margin 13.0$ 11.4$ 15.4$ 14.2% -15.4% CONTRIBUTION MARGIN (%): Total Server OEM 22.7% 25.4% 27.1% -270 bps -440 bps Total Vertical Markets 33.6% 29.4% 26.7% +420 bps +690 bps Contribution margin % 26.6% 25.4% 25.7% +120 bps +90 bps OPERATING EXPENSES (M): Research and development 9.2$ $ 8.7 $ 8.6 5.9% 6.4% General and administrative 2.8$ $ 2.6 $ 2.6 5.6% 6.8% Total operating expenses 12.0$ 11.3$ 11.2$ 5.8% 6.5% OPERATING INCOME (LOSS) (M): Total Server OEM 6.0$ $ 7.8 $ 11.1 -23.0% -45.6% Total Vertical Markets 7.5$ $ 4.1 $ 5.1 81.4% 48.6% Corporate (12.5)$ $ (11.9) $ (12.0) 5.2% 4.2% Total operating income (loss) 1.0$ 0.1$ 4.1$ 1225.6% -74.9% Q1’14 Q4’13 Q1’13 YoY Change QoQ Change

NASDAQ: HILL 23 Q2’14 and Full Year 2014 Guidance Revenue ($M) $49 - 54 +0.6% EPS $ $0.01 - $0.04 -0.035 2nd Quarter 2014 YoY Change at midpoints Revenue (M) $220 - $255M +13.7% Project greater back half growth Gross Margin 32% - 33% Flat Operating Expenses (M) $61 - $63M +4.2M Invest in R&D and Sales EPS $ $0.18 - $0.29 +0.055 Full Year 2014 Annual Change at midpoints May 2014

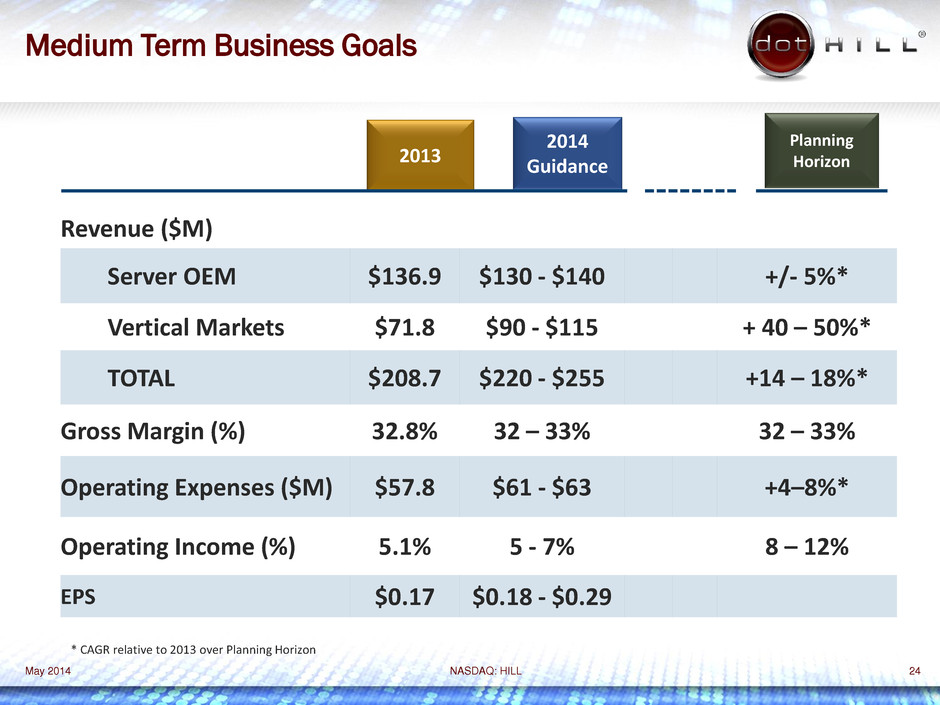

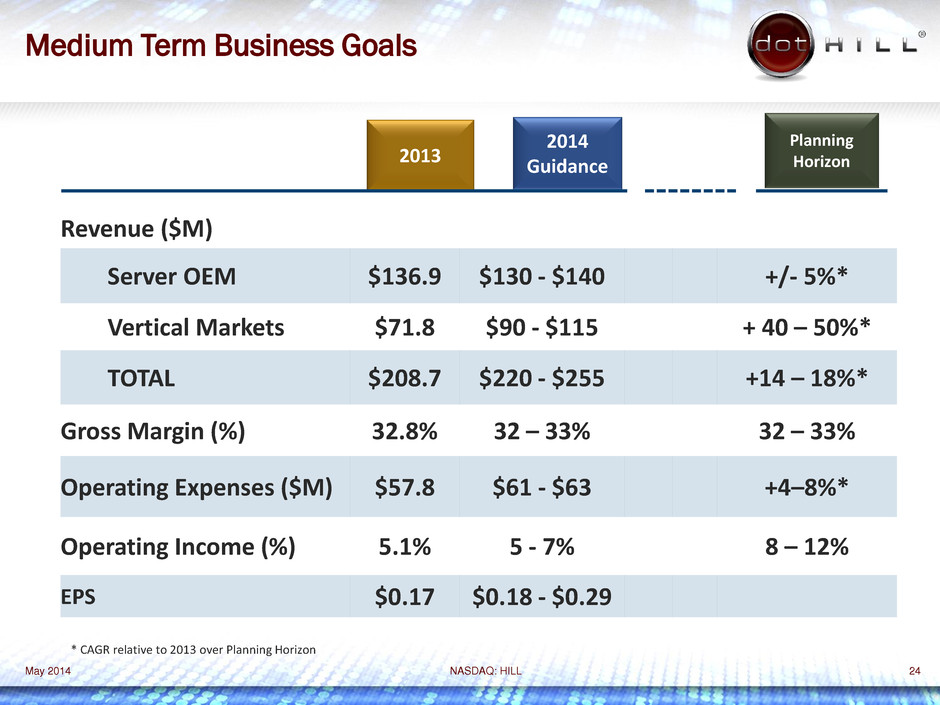

NASDAQ: HILL 24 Medium Term Business Goals Revenue ($M) Server OEM $136.9 $130 - $140 +/- 5%* Vertical Markets $71.8 $90 - $115 + 40 – 50%* TOTAL $208.7 $220 - $255 +14 – 18%* Gross Margin (%) 32.8% 32 – 33% 32 – 33% Operating Expenses ($M) $57.8 $61 - $63 +4–8%* Operating Income (%) 5.1% 5 - 7% 8 – 12% EPS $0.17 $0.18 - $0.29 2013 2014 Guidance Planning Horizon May 2014 * CAGR relative to 2013 over Planning Horizon

NASDAQ: HILL DRIVING GROWTH NASDAQ: HILL Appendix I: Reconciliation of GAAP to Non-GAAP Financial Measures

NASDAQ: HILL 26 Q1’14 GAAP to Non-GAAP Revenue Reconciliation ($K) Q1’13 Q4’13 Q1’14 May 2014 GAAP net revenue from continuing operations 44,480$ 58,799$ 48,207$ Revenue from discontinued operations 20 10 - Net revenue, from continuing and discontinued operations 44,500$ 58,809$ 48,207$ AssuredUVS revenue (20) (10) - Long-term software contract royalties 401 942 653 Non-GAAP net revenue 44,881$ 59,741$ 48,860$

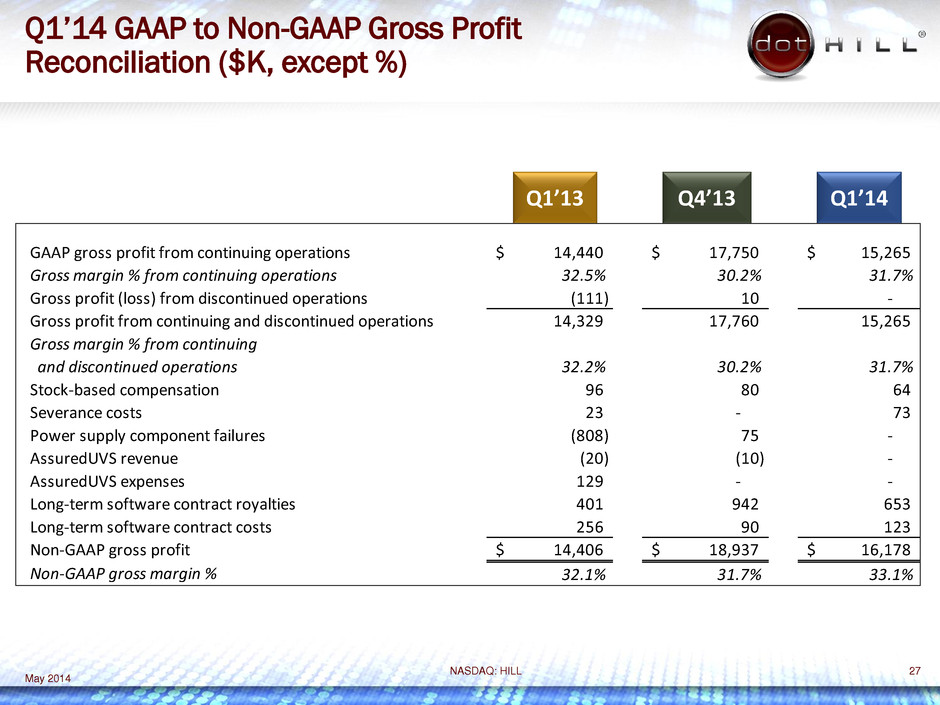

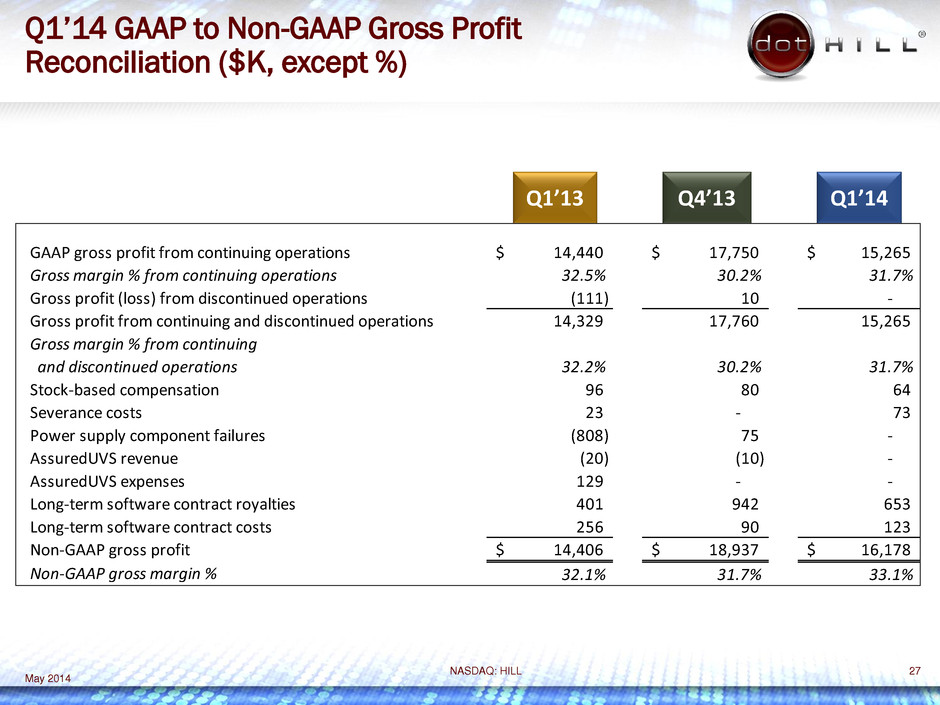

NASDAQ: HILL 27 Q1’14 GAAP to Non-GAAP Gross Profit Reconciliation ($K, except %) Q1’13 Q4’13 Q1’14 May 2014 GAAP gross profit from continuing operations 14,440$ 17,750$ 15,265$ Gross margin % from continuing operations 32.5% 30.2% 31.7% Gross profit (loss) from discontinued operations (111) 10 - Gross profit from continuing and discontinued operations 14,329 17,760 15,265 Gross margin % from continuing and discontinued operations 32.2% 30.2% 31.7% Stock-based compensation 96 80 64 Severance costs 23 - 73 Power supply component failures (808) 75 - AssuredUVS revenue (20) (10) - AssuredUVS expenses 129 - - Long-term software contract royalties 401 942 653 Long-term software contract costs 256 90 123 Non-GAAP gross profit 14,406$ 18,937$ 16,178$ Non-GAAP gross margin % 32.1% 31.7% 33.1%

NASDAQ: HILL 28 Q1’14 GAAP to Non-GAAP Operating Expenses Reconciliation ($K) Q1’13 Q4’13 Q1’14 May 8, 2014 GAAP operating expenses from continuing operations 14,958$ 15,624$ 15,668$ Operating expenses from discontinued operations 310 33 - Operating expenses from continuing and discontinued operations 15,268$ 15,657$ 15,668$ Currency (loss) gain (343) (152) 73 Stock-based compensation (572) (693) (514) Assu edUVS expenses (353) (8) - Long-term software contract deferred costs 400 29 - Restructuring (charge) recoveries 10 (11) - Legal fees related to power supply component failure (1) - - Severance costs (82) (7) (83) Non-GAAP operating expenses 14,327$ 14,815$ 15,144$

NASDAQ: HILL 29 Q1’14 GAAP to Non-GAAP Net Income (Loss) Reconciliation ($K) Q1’13 Q4’13 Q1’14 May 2014 GAAP net income (loss) from continuing operations (560)$ 2,236$ (412)$ Net loss from discontinued operations (421) (24) - Net income (loss) from continuing and discontinued operations (981)$ 2,212$ (412)$ Currency loss (gain) 343 152 (73) Stock-based compensation 668 773 578 Restructuring charge (recoveries) (10) 11 - Power supply component failures (807) 75 - AssuredUVS expenses 482 8 - AssuredUVS revenue (20) (10) - Other income - - (10) Long-term software contract royalties 401 942 653 Long-term software contract costs 256 90 123 Long-term software contract deferred costs (400) (29) - Severance costs 105 7 156 Non-GAAP net income 37$ 4,231$ 1,015$

NASDAQ: HILL 30 Q1’14 GAAP to Non-GAAP EPS (LPS) Reconciliation Q1’13 Q4’13 Q1’14 * Per share data may not always add to the total for the period because each figure is independently calculated. May 2014 GAAP earnings (loss) per share from continuing operations (0.01)$ 0.04$ (0.01)$ Loss per share from discontinued operations (0.01) 0.00 - Income (loss) per share from continuing and discontinued operations* (0.02)$ 0.04$ (0.01)$ Currency loss 0.01 0.00 (0.00) Stock-based compensation 0.01 0.01 0.01 AssuredUVS expenses 0.01 0.00 - Long-term software contract royalties 0.01 0.02 0.01 Long-term software contract costs 0.00 0.00 0.00 Long-term software contract deferred costs (0.01) (0.00) - Other adjustments (0.01) 0.00 0.01 Non-GAAP earnings per share* 0.00$ 0.07$ 0.02$ Weighted average shares used to calculate earnings per share: Basic 58,001 58,948 59,678 Diluted 58,473 60,867 63,912

NASDAQ: HILL 31 Q1’14 Cash Reconciliation ($K) Q1’13 Q4’13 Q1’14 Cash 40,297$ 40,406$ 40,322$ redit facility borrowings 2,800 2,0 0 - Cash net of credit facility borrrowings 37,497$ 38,406$ 40,322$ May 2014

NASDAQ: HILL 32 Q1’14 GAAP to Non-GAAP Server OEM Reconciliation ($K) Q1’13 May 2014 Q4’13 Q1’14 Server OEM net revenue from continuing operations 30,383$ 39,889$ 25,854$ Long-term software contract royalties 401 942 653 Server OEM Non-GAAP net revenue 30,784$ 40,831$ 26,507$ Server OEM gross profit from continuing operations 8,283$ 10,445$ 5,604$ Server OEM gross margin % from continuing operations 27.3% 26.2% 21.7% Server OEM gross profit from discontinued operations - - - Server OEM gross profit from continuing and discontinued operations 8,283 10,445 5,604 Server OEM gross margin % from continuing and discontinued operations 27.3% 26.2% 21.7% Stock-based compensation 78 59 41 Severance costs 14 - 47 Power supply component failures (808) 75 - Long-term software contract royalties 401 942 653 Long-term software contract costs 256 90 123 Server OEM non-GAAP gross profit 8,224$ 11,611$ 6,468$ Server OEM Non-GAAP gross margin % 26.7% 28.4% 24.4% Server OEM selling and marketing expenses from continuing operations 435$ 569$ 482$ Server OEM contribution margin from continuing operations 7,848$ 9,876$ 5,122$ Server OEM contribution % from continuing operations 25.8% 24.8% 19.8% Stock-based compensation (16) (13) (15) Severance costs (1) - (9) Server OEM non-GAAP selling and marketing expenses 418$ 556$ 458$ Server OEM non-GAAP contribution margin 7,806$ 11,055$ 6,010$ Server OEM Non-GAAP contribution margin % 25.4% 27.1% 22.7% Server OEM operating income for continuing operations 7,848$ 9,876$ 5,122$ Server OEM operating income (loss) for discontinued continuing operations - - - Server OEM operating income for continuing and discontinued operations 7,848$ 9,876$ 5,122$ Stock-based compensation 94 72 56 Severance costs 15 - 56 Power supply component failures (808) 75 - Long-term software contract royalties 401 942 653 Long-term software contract costs 256 90 123 Server OEM non-GAAP operating income 7,806$ 11,055$ 6,010$

NASDAQ: HILL 33 Q1’14 GAAP to Non-GAAP Vertical Markets Reconciliation ($K) Q1’13 May 2014 Q4’13 Q1’14 Vertical Markets net revenue from continuing operations 14,097$ 18,910$ 22,353$ Revenue from discontinued operations 20 10 - Vertical Markets net revenue, from continuing and discontinued operations 14,117$ 18,920$ 22,353$ AssuredUVS revenue (20) (10) - Vertical Markets Non-GAAP net revenue 14,097$ 18,910$ 22,353$ Vertical Markets gross profit from continuing operations 6,157$ 7,305$ 9,661$ Vertical Markets gross margin % from continuing operations 43.7% 38.6% 43.2% Vertical Markets gross profit from discontinued operations (111) 10 - Vertical Markets gross profit from continuing and discontinued operations 6,046 7,315 9,661 Vertical Markets gross margin % from continuing and discontinued operations 42.8% 38.7% 43.2% Stock-based compensation 18 21 23 Severance costs 9 - 26 AssuredUVS revenue (20) (10) - AssuredUVS expenses 129 - - Vertical Markets non-GAAP gross profit 6,182$ 7,326$ 9,710$ Vertical Markets Non-GAAP gross margin % 43.9% 38.7% 43.4% Vertical Markets selling and marketing expenses from continuing operations 2,080$ 2,302$ 2,254$ Vertical Markets contribution margin from continuing operations 4,077$ 5,003$ 7,407$ Vertical Markets contribution % from continuing operations 28.9% 26.5% 33.1% Stock-based compensation (35) (28) (33) Severance costs (2) - (19) Vertical Markets non-GAAP selling and marketing expenses 2,043$ 2,274$ 2,202$ Vertical Markets non-GAAP contribution margin 4,139$ 5,052$ 7,508$ Vertical Markets Non-GAAP contribution margin % 29.4% 26.7% 33.6% Vertical Markets operating income for continuing operations 4,077$ 5,003$ 7,407$ Vertical Markets operating income (loss) for discontinued continuing operations (111) 10 - Vertical Markets operating income for continuing and discontinued operations 3,966$ 5,013$ 7,407$ Stock-based compensation 53 49 56 Severance costs 11 - 45 AssuredUVS revenue (20) (10) - AssuredUVS expenses 129 - - Vertical Markets non-GAAP operating income 4,139$ 5,052$ 7,508$

NASDAQ: HILL 34 Q1’14 GAAP to Non-GAAP Corporate Segment Reconciliation ($K) Q1’13 May 2014 Q4’13 Q1’14 Corporate selling and marketing expenses from continuing operations 593$ 772$ 558$ Corporate contribution margin from continuing operations (593)$ (772)$ (558)$ Stock-based compensation (25) (21) (24) Severance costs (2) - (14) Corporate non-GAAP selling and marketing expenses 566$ 751$ 520$ Corporate non-GAAP contribution margin (566)$ (751)$ (520)$ Corporate expenses from continuing operations (Research & Development and General & Administrative) 11,850$ 11,981$ 12,374$ Corporate expenses from discontinued operations 310 33 - Corporate expenses from continuing and discontinued operations 12,160$ 12,014$ 12,374$ Currency loss (gain) (343) (152) 73 Stock-based compensation (496) (631) (442) AssuredUVS expenses (353) (8) - Long-term software contract deferred costs 400 29 - Restructuring (charge) recoveries 10 (11) - Legal fees related to power supply component failure (1) - - Severance costs (77) (7) (41) Non-GAAP corporate expenses 11,300$ 11,234$ 11,964$ Corporate operating loss for continuing operations (12,443)$ (12,753)$ (12,932)$ Corporate operating loss from discontinued operations (310) (33) - Corporate operating loss from continuing and discontinued operations (12,753)$ (12,786)$ (12,932)$ Currency loss (gain) 343 152 (73) Stock-based compensation 521 652 466 AssuredUVS expenses 353 8 - Long-term software contract deferred costs (400) (29) - Restructuring (charge) recoveries (10) 11 - Legal fees related to power supply component failure 1 - - Severance costs 79 7 55 Corporate non-GAAP operating loss (11,866)$ (11,985)$ (12,484)$

NASDAQ: HILL 35 March 2014