Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

HILL similar filings

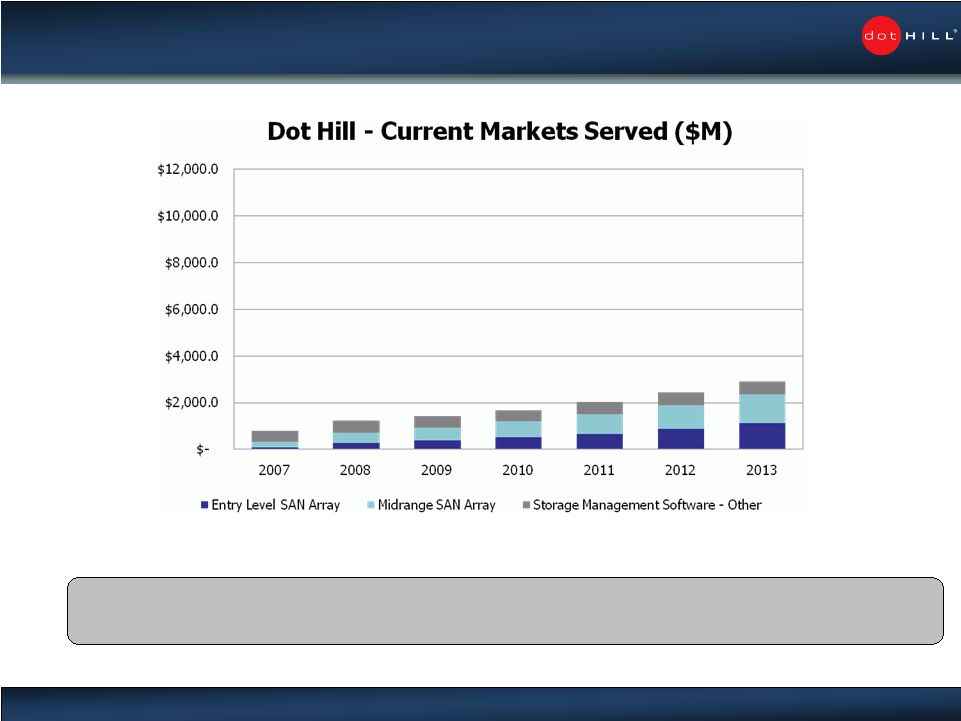

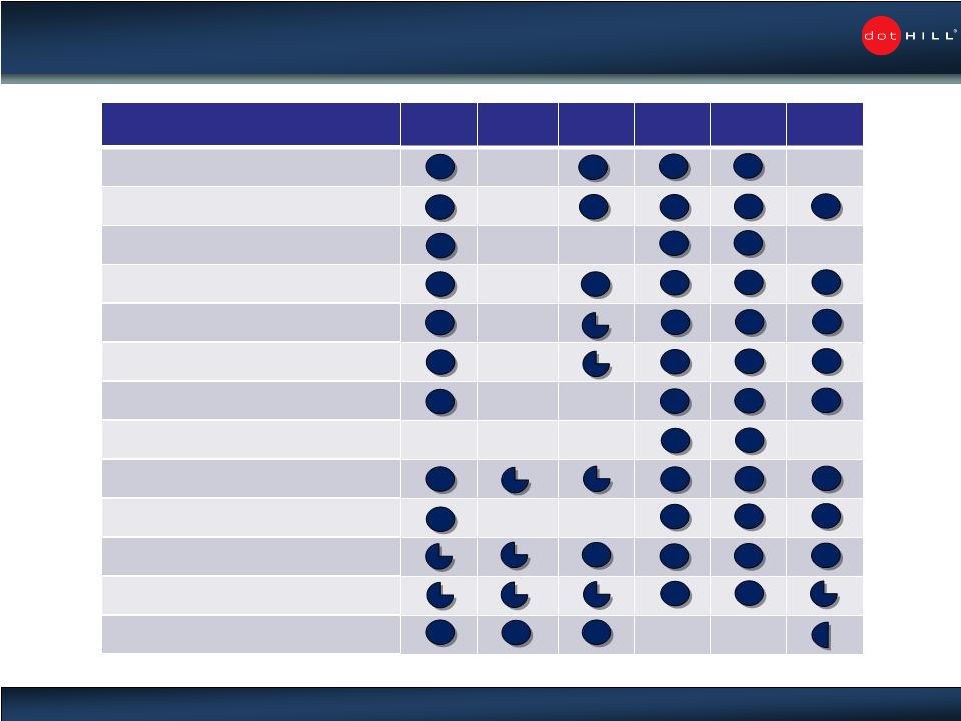

- 25 Feb 10 20+ Years In The Storage Business

- 28 Jan 10 Dot Hill Completes Acquisition of Cloverleaf Communications

- 26 Jan 10 Departure of Directors or Certain Officers

- 7 Jan 10 Other Events

- 5 Jan 10 Dot Hill Announces Acquisition of Cloverleaf Communications

- 5 Nov 09 Dot Hill Reports Third Quarter 2009 Results

- 8 Sep 09 Dot Hill Updates Third Quarter 2009 Guidance

Filing view

External links