UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantþ

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

Dot Hill Systems Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (6) | Amount Previously Paid: |

| (7) | Form, Schedule or Registration Statement No.: |

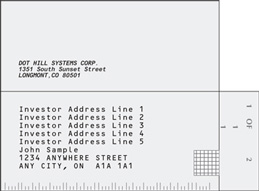

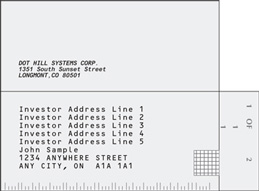

DOT HILL SYSTEMS CORP.

1351 South Sunset Street

Longmont, Colorado 80501

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 2, 2011

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Dot Hill Systems Corp., a Delaware corporation (the “Company”). The meeting will be held on May 2, 2011 at 8:30 a.m. local time at our office located at 1351 South Sunset St., Longmont, Colorado, 80501 for the following purposes:

1. To elect the two nominees for director named herein to hold office until the 2014 Annual Meeting of Stockholders.

2. To approve the Company’s 2009 Equity Incentive Plan, as amended, to increase the aggregate number of shares of common stock authorized for issuance under the plan by 8,000,000 shares.

3. To approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in this proxy statement.

4. To indicate, on an advisory basis, the preferred frequency of stockholder advisory votes on the compensation of the Company’s named executive officers.

5. To ratify the selection by the Audit Committee of our Board of Directors of Deloitte & Touche LLP, as independent registered public accounting firm of the Company for its fiscal year ending December 31, 2011.

6. To conduct any other business properly brought before the meeting.

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is March 16, 2011. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

Important Notice Regarding the Availability of Proxy Materials for the 2011 Annual Meeting of Stockholders to be held on May 2, 2011 at 8:30 a.m. local time at 1351 South Sunset St., Longmont, Colorado, 80501.

The proxy statement and annual report to stockholders are available athttp://www.proxyvote.com. The Board of Directors recommends that you vote FOR three years as the preferred frequency of non-binding advisory votes to approve executive compensation and FOR each of the other proposals identified above.

By Order of the Board of Directors

/s/ DANA W. KAMMERSGARD

Dana W. Kammersgard

President and Chief Executive Officer

Longmont, Colorado

March 25, 2011

Our 2010 Annual Report, which includes financial statements, is being mailed with the proxy statement accompanying this notice. Kindly notify Dot Hill Systems Corp., Investor Relations Department, 1351 South Sunset Street, Longmont, CO 80501, telephone (800) 704-3171, if you did not receive a report and a copy will be sent to you.

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy card as instructed in the proxy statement accompanying this notice as promptly as possible in order to ensure your representation at the meeting, or you may vote over the telephone or the internet by following the instructions in the proxy statement accompanying this notice on your proxy card. A return envelope (which is postage prepaid if mailed in the United States) has been provided for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

DOT HILL SYSTEMS CORP.

1351 South Sunset Street

Longmont, Colorado 80501

PROXY STATEMENT

FOR THE 2011 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 2, 2011

QUESTIONSAND ANSWERSABOUTTHESE PROXY MATERIALSAND VOTING

In this proxy statement, “Dot Hill,” “the Company,” “we,” “us” and “our” refer to Dot Hill Systems Corp. and its wholly-owned subsidiaries.

Why am I receiving these materials?

We have sent you these proxy materials because the Board of Directors of Dot Hill is soliciting your proxy to vote at the 2011 Annual Meeting of Stockholders, including at any adjournments or postponements of the meeting. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or through the internet.

We intend to mail these proxy materials on or about March 25, 2011 to all stockholders of record entitled to vote at the annual meeting.

How do I attend the annual meeting?

The meeting will be held on May 2, 2011 at 8:30 am local time at our office located at 1351 South Sunset St., Longmont, Colorado, 80501. Directions to the annual meeting may be found at http://www.dothill.com/company/locations/ltc_directions.htm. Information on how to vote in person at the annual meeting is discussed below.

Who can vote at the annual meeting?

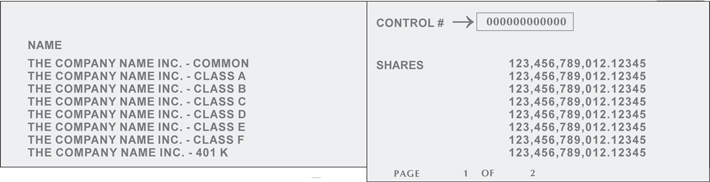

Only stockholders of record at the close of business on March 16, 2011, the record date for the annual meeting, will be entitled to vote at the annual meeting. On this record date, there were 56,404,151 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on March 16, 2011 your shares were registered directly in your name with Dot Hill’s transfer agent, American Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card, or vote by proxy over the telephone or on the internet as instructed below, to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If on March 16, 2011 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

1

What am I voting on?

There are five matters scheduled for a vote:

| | • | | Election of the Board of Directors’ nominees, Dana W. Kammersgard and Richard Mejia, Jr., to hold office until the 2014 Annual Meeting of Stockholders; |

| | • | | Approval of the proposed 8,000,000 share increase in the number of shares of common stock authorized for issuance under the Company’s 2009 Equity Incentive Plan; |

| | • | | Advisory approval of the compensation of the Company’s named executive officers, as disclosed in this proxy statement in accordance with Securities and Exchange Commission, or SEC, rules; |

| | • | | Advisory indication of the preferred frequency of stockholder advisory votes on the compensation of the Company’s named executive officers; and |

| | • | | Ratification of selection by the Audit Committee of the Board of Directors of Deloitte and Touche, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2011. |

What if another matter is properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the annual meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. With regard to your advisory vote on how frequently we should solicit stockholder advisory approval of executive compensation, you may vote for any one of the following: one year, two years or three years, or you may abstain from voting on that matter. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting.

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting or vote by proxy using the enclosed proxy card, vote by proxy over the telephone, or vote by proxy through the internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

| | • | | To vote in person, come to the annual meeting and we will give you a ballot when you arrive. |

| | • | | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

| | • | | To vote over the telephone, dial toll-free (800) 690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 11:59 p.m., Eastern Time on May 1, 2011 to be counted. |

| | • | | To vote through the internet, go tohttp://www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 11:59 p.m. Eastern Time on May 1, 2011 to be counted. |

2

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from Dot Hill. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the internet as instructed by your broker or bank. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

Internet proxy voting may be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of March 16, 2011, the record date for the annual meeting.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of the two nominees for director; “For” the approval of a share increase in the number of shares of common stock authorized for issuance under the Company’s 2009 Equity Incentive Plan; “For” the advisory approval of the compensation of our named executive officers and “For” three years as the preferred frequency of advisory votes to approve executive compensation; and “For” the ratification of the selection of Deloitte & Touche LLP as our independent auditors. If any other matter is properly presented at the meeting, one of the individuals named on your proxy card as your proxy will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the proxy cards in the proxy materials to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| | • | | You may submit another properly completed proxy card with a later date. |

| | • | | You may grant a subsequent proxy by telephone or through the internet. |

3

| | • | | You may send a timely written notice that you are revoking your proxy to the Company’s Secretary at 1351 South Sunset Street, Longmont, Colorado 80501. |

| | • | | You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or internet proxy is the one that is counted.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by November 26, 2011, to the Company’s Secretary at 1351 South Sunset Street, Longmont, Colorado 80501. If you wish to submit a proposal that is not to be included in next year’s proxy materials or nominate a director, you must do so no later than the close of business on December 26, 2011 and no earlier than November 26, 2011. You are also advised to review the Company’s Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; with respect to the proposal regarding frequency of stockholder advisory votes to approve executive compensation, votes for frequencies of one year, two years or three years, abstentions and broker non-votes; and, with respect to other proposals, votes “For” and “Against,” abstentions and, if applicable, broker non-votes. Abstentions will be counted towards the vote total for each proposal, and, except in the case of the proposal regarding frequency of stockholder advisory votes to approve executive compensation, will have the same effect as “Against” votes. Broker non-votes and, in the case of the proposal regarding frequency of stockholder advisory votes to approve executive compensation, abstentions will have no effect and will not be counted towards the vote total.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the New York Stock Exchange, or NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested) and, for the first time, under a new amendment to the NYSE rules, executive compensation, including the advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation.

How many votes are needed to approve each proposal?

| | • | | For the election of directors, the two nominees receiving the most “For” votes from the holders of shares present in person or represented by proxy and entitled to vote on the election of directors will be elected. Only votes “For” or “Withheld” will affect the outcome. |

4

| | • | | To be approved, Proposal No. 2, the proposed 8,000,000 share increase in the number of shares of common stock authorized for issuance under the Company’s 2009 Equity Incentive Plan must receive “For” votes from the holders of a majority of shares present and entitled to vote either in person or represented by proxy. If you mark your proxy to “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have the same effect as an “Against” vote. |

| | • | | Proposal No. 3, advisory approval of the compensation of the Company’s named executive officers, will be considered to be approved if it receives “For” votes from the holders of a majority of shares either present in person or represented by proxy and entitled to vote. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

| | • | | For Proposal No. 4, the advisory vote on the frequency of stockholder advisory votes on executive compensation, the frequency receiving the highest number of votes from the holders of shares present in person or represented by proxy and entitled to vote at the annual meeting will be considered the frequency preferred by the stockholders. Abstentions and Broker non-votes will have no effect. |

| | • | | To be approved, Proposal No. 5, ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal 2011, must receive “For” votes from the holders of a majority of shares present in person or by proxy and entitled to vote. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the meeting in person or represented by proxy. On the record date, there were 56,404,151 shares outstanding and entitled to vote.Thus, the holders of 28,202,076 shares must be present in person or represented by proxy at the meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

What proxy materials are available on the internet?

The proxy statement and annual report to stockholders are available atwww.proxyvote.com.

5

PROPOSAL NO. 1

ELECTIONOF DIRECTORS

Our Certificate of Incorporation provides that our Board of Directors shall be divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Vacancies on our Board may be filled only by persons elected by a majority of the remaining directors. A director elected by our Board to fill a vacancy in a class shall serve for the remainder of the full term of that class and until the director’s successor is elected and qualified. This includes vacancies created by an increase in the number of directors.

Our Board of Directors currently consists of five members. There are two directors in the class whose term of office expires at the 2011 Annual Meeting of Stockholders, Dana W. Kammersgard and Richard Mejia, Jr. Each of the nominees named above is currently a director of the Company who was previously elected by our stockholders.

Directors are elected by a plurality of the votes present at the meeting or represented by proxy and they are entitled to vote at the meeting. The two nominees receiving the most “For” votes (from the holders of votes of shares present in person or represented by proxy and entitled to vote on the election of directors) will be elected. If no contrary indication is made, shares represented by executed proxies will be voted “For” the election of the two nominees named above or, if any nominee becomes unavailable for election as a result of an unexpected occurrence, “For” the election of a substitute nominee designated by our Board of Directors. Proxies cannot be voted for a greater number of persons than the number of nominees named in this proxy statement. The two nominees have consented to be named in this proxy statement and agreed to serve as directors if elected, and our management has no reason to believe that the two nominees will be unable to serve. We invite all of our directors and nominees for director to attend our annual meeting of stockholders. All of our then directors attended our 2010 Annual Meeting of Stockholders.

THE BOARDOF DIRECTORS RECOMMENDSA VOTEFORTHE ELECTIONOF EACH NOMINEE NAMED ABOVE.

The following is biographical information as of February 1, 2011 for the nominees for director and each director whose term will continue after the 2011 Annual Meeting of Stockholders.

The Nominating and Corporate Governance Committee seeks to assemble a Board that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct the Company’s business. To that end, the Nominating and Corporate Governance Committee has identified and evaluated nominees in the broader context of the Board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that the Nominating and Corporate Governance Committee views as critical to effective functioning of the Board. The brief biographies below include information, as of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each director or nominee that led the Nominating and Corporate Governance Committee to recommend that person as a nominee. However, each of the members of the Nominating and Corporate Governance Committee may have a variety of reasons why he believes a particular person would be an appropriate nominee for the Board, and these views may differ from the views of other members.

| | | | | | |

Name | | Age | | | Position |

Charles F. Christ | | | 71 | | | Chairman of the Board |

Dana W. Kammersgard | | | 55 | | | President, Chief Executive Officer and Director |

Thomas H. Marmen | | | 67 | | | Director |

Richard Mejia, Jr. | | | 62 | | | Director |

Roderick M. Sherwood, III | | | 57 | | | Director |

6

Nominees for Election for a Three-Year Term Expiring at our 2014 Annual Meeting of Stockholders

Dana W. Kammersgard has served as our President since August 2004. In March 2006, Mr. Kammersgard was appointed as a member of our Board of Directors and our Chief Executive Officer and President. From August 1999 to August 2004, Mr. Kammersgard served as our Chief Technical Officer. Mr. Kammersgard was a founder of Artecon, Inc., our predecessor company, and served as a director from its inception in 1984 until the merger of Artecon with Box Hill Systems Corp. to become Dot Hill in August 1999. At Artecon, Mr. Kammersgard served in various positions since 1984, including Secretary and Senior Vice President of Engineering from March 1998 until August 1999 and as Vice President of Sales and Marketing from March 1997 until March 1998. Prior to co-founding Artecon, Mr. Kammersgard was the Director of Software Development at CALMA, a division of General Electric Company. Mr. Kammersgard holds a B.A. in Chemistry from the University of California, San Diego. The Nominating and Corporate Governance Committee believes Mr. Kammersgard’s experience as a founder of Artecon, his knowledge of storage technology and the storage industry, as well his experience of leading operations, sales and marketing and software and hardware development give him the breadth of knowledge and leadership capabilities to serve as the Company’s Chief Executive Officer and President and as a member of the Board of Directors.

Richard Mejia, Jr. has served as a member of our Board of Directors since September 2008. In July 2008, Mr. Mejia retired from the San Diego office of Ernst & Young, LLP, a public accounting firm, after 38 years of service where he served as partner for the last 25 years. During his 20 years in San Diego, his focus was on technology and life sciences companies and he held practice leadership positions for the Pacific Southwest area of the firm. He has extensive experience with mergers and acquisitions, securities offerings and other private and public financings. He has also worked closely with public company boards in implementing corporate governance initiatives and compliance requirements. Mr. Mejia holds a B.S. in Accounting from the University of Southern California. The Nominating and Corporate Governance Committee believes that Mr. Mejia’s vast experience in public accounting as a Certified Public Accountant and mergers and acquisitions and financings give him the financial expertise and breadth of knowledge to serve as a director of the Company and to provide direction and oversight to the Company’s financial reporting and business controls and the governance framework established within the Company.

Directors Continuing in Office Until the 2012 Annual Meeting of Stockholders

Thomas H. Marmen has served as a member of our Board of Directors since November 2008. Mr. Marmen has over 30 years of experience in the storage and semiconductor manufacturing industries. During his career, he has been involved with various start ups, global enterprises and turnaround situations. Most recently, from April 2006 to April 2007, Mr. Marmen served as the President and Chief Executive officer of TimeLab Corporation, a semiconductor company. Prior to joining TimeLab, from January 2001 to December 2005, he was vice President and General Manager for Broadcom Corporation, a broad-based semiconductor provider, where he was responsible for all aspects of the storage line of business including marketing, engineering and technical support for end-users. Mr. Marmen has also held various positions at other companies including RAIDCore Corp. where he was the company’s Chief Executive Officer, Quantum Corp. where he served as Senior Vice President and General Manager for the High End Storage Division, Adaptec Inc. as its Corporate Vice President in the Enterprise Solutions Group and Materials Research Corporation (a subsidiary of SONY Corp.) as President and Chief Executive officer. In addition he spent 18 years at Digital Equipment Corporation holding various management positions in the company’s storage, memory, disk drive and semiconductor businesses. Mr. Marmen formerly served as the Lead Director at Ciprico Inc., which voluntarily filed for Chapter 11 bankruptcy in July 2008. The Nominating and Corporate Governance Committee believes that Mr. Marmen’s storage and technology experience, including his prior Chief Executive Officer and other executive level operations experience, give him a breadth of knowledge and valuable understanding of our industry which qualify him to serve as a director.

Roderick M. Sherwood, III has served as a member of our Board of Directors since June 2006. Mr. Sherwood has served as President and Chief Financial Officer of Westwood One, Inc., a radio and TV content provider and broadcasting company, since 2008. From 2005 to 2008, Mr. Sherwood served as Chief

7

Financial Officer, Operations for The Gores Group, LLC, a private equity firm. From 2002 until 2005, Mr. Sherwood was Senior Vice President and Chief Financial Officer for Gateway, Inc. where he was responsible for corporate financial operations, processes and controls, treasury activities and cost reduction programs. He was also integrally involved in Gateway’s acquisition of eMachines. Prior to his tenure with Gateway, Mr. Sherwood was Executive Vice President and Chief Financial Officer for Opsware, Inc. (formerly Loudcloud, Inc.). Mr. Sherwood has over 25 years experience in successful financial and operations capacities for companies such as Chrysler Corporation and Hughes Electronics Corporation. Mr. Sherwood received his MBA degree from Harvard Business School and holds an Honors Bachelor of Arts Degree, with Distinction, in Economics from Stanford University. The Nominating and Corporate Governance Committee believes that Mr. Sherwood’s financial and operational experience in numerous roles including Chief Financial Officer for public companies in the technology industry, in private equity and more recently as President and Chief Financial Officer of a public company, give him the financial and operational expertise and breadth of knowledge to serve as a director of the Company and provide direction and oversight to the Company’s financial reporting and business controls environment and operating functions of the Company.

Director Continuing in Office Until the 2013 Annual Meeting of Stockholders

Charles F. Christ has served as our Chairman of the Board since July 2000. From 1997 to 1998, Mr. Christ served as President, Chief Executive Officer and a director of Symbios, Inc. (acquired by LSI Logic in 1998), a designer, manufacturer and provider of storage systems, as well as client-server integrated circuits, cell-based applications-specific integrated circuits and host adapter boards. He was Vice President and General Manager of the Components Division of Digital Equipment Corp. (DEC), where he launched and managed StorageWorks, DEC’s storage division. Mr. Christ received an M.B.A. degree from Harvard Business School, and completed his undergraduate degree earning a Bachelor in Industrial Engineering at General Motors Institute, now known as Kettering University. The Nominating and Corporate Governance Committee believes that Mr. Christ’s storage technology experience, including his prior executive level leadership and Chief Executive Officer experience, give him the operational expertise, breadth of knowledge and valuable understanding of our industry which qualify him to serve as a director and to lead the Board of Directors as Chairman.

Named Executive Officers and Key Employees

The following is biographical information as of February 1, 2011 for our executive officers and key employees not discussed above.

| | | | | | | | |

Name | | Age | | | Position | | Officer or

Key Employee Since |

Hanif I. Jamal(1) | | | 50 | | | Senior Vice President, Chief Financial Officer, Treasurer and Corporate Secretary | | July 2006 |

James Kuenzel(2) | | | 57 | | | Senior Vice President of Engineering | | February 2006 |

Ernest Hafersat(2) | | | 61 | | | Senior Vice President of Worldwide Manufacturing, Operations and Supply Base Management | | March 2008 |

| (1) | Named executive officer. |

All officers are elected by our Board of Directors and serve at the pleasure of our Board of Directors as provided in our bylaws.

Hanif I. Jamalhas served as our Senior Vice President, Chief Financial Officer, Treasurer and Corporate Secretary since July 2006. Prior to joining Dot Hill, Mr. Jamal served as Vice President and Corporate Treasurer for Gateway Inc., a provider of computer related products and services, from 2004 to 2006. Prior to joining

8

Gateway in 2002, Mr. Jamal served in a number of leadership positions over 17 years with Hewlett-Packard Company in their customer financing division, HP Technology Finance. Mr. Jamal led HP’s customer financing operations in North America, Latin America and Europe and was also Vice President and General Manager for HP’s Commercial and Consumer Financing Division. In 1998, he established Hewlett-Packard International Bank in Dublin, Ireland, and served as Managing Director through 2000. Jamal holds an MBA from Stanford Graduate School of Business and a Bachelor of Science degree, with Honors, in Management Sciences from the University of Manchester Institute of Science and Technology in the United Kingdom.

James Kuenzelhas served as our Senior Vice President of Engineering since February 2006. Mr. Kuenzel joined Dot Hill after leaving Maranti Networks Inc., a provider of storage networking products, where he began his tenure in 2002 as Vice President of Engineering and then was appointed to President and Chief Operating Officer. Mr. Kuenzel has also held Vice President of Engineering positions at McData Corporation, Cabletron Systems, Inc. and Digital Equipment Corporation. Mr. Kuenzel attended Georgetown University Extension, University of Wisconsin Extension, and holds an A.A. in Electronics from Philco Ford Technical Institute.

Ernest Hafersathas served as our Senior Vice President of Worldwide Manufacturing, Operations and Supply Base Management since November 2008 and previously served as our Vice President of Worldwide Manufacturing Operations and Supply Base Management since March 31, 2008. Mr. Hafersat joined Dot Hill after leaving Western Digital Corporation, a designer, manufacturer and provider of storage systems, where he held senior level positions in operations and engineering from 2005 to 2008. Prior to Western Digital, Mr. Hafersat was Vice President, Manufacturing Operations & Program Management for Carrier Access Corp. Previous positions include Vice President, Operations for Vari-l Corp., Vice President and General Manager at Read-Rite Corp., Philippines, Senior Director, Engineering/ NPI at Maxtor Corp. and Director of Engineering at Hyundai Semiconductor-Korea. Mr. Hafersat has overseen operations, supply base management, global supplier quality and engineering for both domestic and international multi-site facilities. His international experience includes China, Pacific Rim countries, Mexico and Costa Rica. Mr. Hafersat has a BSIE/BSEE from Waterbury State Technical University, and attended University of Hartford and Rennsslaer Polytechnic Institute with credits toward an MBA.

INFORMATIONREGARDINGTHEBOARDOFDIRECTORSANDCORPORATEGOVERNANCE

Independence of the Board of Directors

As required under the NASDAQ Stock Market, or NASDAQ, listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of the NASDAQ, as in effect from time to time.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his family members, and the Company, its senior management and its independent auditors, the Board has affirmatively determined that our directors are independent directors within the meaning of the applicable NASDAQ listing standards, except for Mr. Kammersgard, our President and Chief Executive Officer, who is not an independent director by virtue of his employment with the Company. In making this determination, the Board found that none of the directors or the nominees for director, with the exception of Mr. Kammersgard, had a material or other disqualifying relationship with the Company.

Board Leadership Structure

Our Board of Directors has an independent chair, Mr. Christ, who has authority, among other things, to call and preside over Board meetings, including meetings of the independent directors, to set meeting agendas and to determine materials to be distributed to the Board. Accordingly, the Board Chair has substantial ability to shape

9

the work of the Board. The Company believes that separation of the positions of Board Chair and Chief Executive Officer reinforces the independence of the Board in its oversight of the business and affairs of the Company. However, the Board reserves the right to modify this policy based on changes in our organization or business environment. The Board believes continued flexibility with respect to separating or combining the roles is the best approach at this time so as to provide the most appropriate leadership structure as we continue to undergo rapid growth and are required to adapt and respond to new challenges and a rapidly changing business and regulatory environment.

In addition, the Company believes that having an independent Board Chair creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the Board to monitor whether management’s actions are in the best interests of the Company and its stockholders. The Chairman of the Board also communicates with the Chief Executive Officer on a regular basis. This structure ensures a greater role of oversight for the independent directors with the Chairman of the Board serving as a key interface between the independent directors and our management. As a result, the Company believes that having an independent Board Chair can enhance the effectiveness of the Board as a whole.

Role of the Board in Risk Oversight

One of the board’s key functions is informed oversight of the Company’s risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic and operational risk exposure, our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines and the selection of prospective Board members and their qualifications. Our Compensation Committee, in conjunction with the Audit Committee, assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. The board reviews typically on a quarterly basis, the most critical risks facing the company and associated mitigation plans and meets with management and the applicable Board committees at least annually to evaluate and monitor respective areas of oversight. The board also reviews at least annually a succession plan for the companies named executive officers. Both the Board as a whole and the various standing committees receive periodic reports from individuals responsible for risk management, as well as incidental reports as matters may arise. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as quickly as possible.

Meetings of the Board of Directors and Board and Committee Member Attendance

The Board of Directors met eight times during fiscal 2010. Each Board member attended 75% or more of the aggregate number of meetings of the Board and of the committees on which he served and held during the portion of fiscal 2010 for which he was a director or committee member.

As required under applicable NASDAQ listing standards, in fiscal 2010, the Company’s independent directors met in regularly scheduled executive sessions at which only independent directors were present. All of the committees of our Board of Directors are comprised entirely of directors determined by the Board to be independent within the meaning of the applicable NASDAQ listing standards.

10

Information Regarding Committees of the Board of Directors

The Board has three regularly standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides current membership and meeting information for fiscal 2010 for each of the Board committees:

| | | | | | |

Name | | Audit | | Compensation | | Nominating and

Corporate

Governance |

Charles Christ | | X | | X | | (*) |

Thomas H. Marmen | | | | (*) | | |

Richard Mejia Jr. | | X | | | | X |

Roderick M Sherwood, III | | (*) | | X | | X |

Total meetings in fiscal 2010 | | 5 | | 7 | | 5 |

Below is a description of each committee of the Board of Directors. The Board of Directors has determined that each member of each committee meets the applicable NASDAQ rules and regulations regarding “independence” and that each member is free of any relationship that would impair his individual exercise of independent judgment with regard to the Company.

Audit Committee

The Audit Committee operates pursuant to a written charter that is available on our website athttp://www.dothill.com. The Audit Committee met five times during the fiscal year ended December 31, 2010. During fiscal 2010, the Audit Committee consisted of Joe Markee and Messrs. Mejia and Sherwood and Kimberly Alexy, with Mr. Sherwood serving as Chair. Ms. Alexy and Mr. Markee ceased serving as directors and members of the Audit Committee after the 2010 Annual Meeting of Stockholders. Mr. Christ joined the Audit Committee in March 2011.

The functions of the Audit Committee include, among other things: overseeing our corporate accounting and financial reporting process, the quality and integrity of our financial statements and reports and the qualifications, independence and performance of the registered public accountants engaged as our independent auditors; providing oversight assistance with respect to ethical compliance programs as established by management and our Board of Directors; evaluating the performance of our independent auditors; determining whether to retain or terminate our existing independent auditors or to appoint and engage new independent auditors; reviewing and approving the retention of our independent auditors to perform any proposed permissible non-audit and audit-related services; monitoring the rotation of partners of our independent auditors on our engagement team as required by law; reviewing and approving the financial statements to be included in our Annual Report on Form 10-K; discussing with our management and our independent auditors the results of our annual audit and the results of our quarterly financial statements; reviewing and approving related party transactions; and providing oversight of the internal audit and risk advisory function, establishing an internal audit plan, and reviewing the results of our internal audits, process improvements and Sarbanes-Oxley testing of our internal controls. The committee reviews and monitors risks facing Dot Hill and management’s approach to addressing these risks, including significant financial and liquidity risks and exposures and risks relating to litigation and other proceedings and regulatory matters that may have a significant impact on Dot Hill’s financial statements. The committee reviews all significant financial press releases and management’s earnings calls scripts to ensure that management is presenting a balanced perspective of the Company’s historical and potential future performance. The charter of the Audit Committee grants the Audit Committee full access to all of our books, records, facilities and personnel, as well as authority to obtain, at our expense, advice and assistance from internal and external legal, accounting, tax or other advisors and consultants and other external resources that the Audit Committee considers necessary or appropriate in the performance of its duties.

11

The Board of Directors reviews the NASDAQ listing standards definition of independence for Audit Committee members on an annual basis and has determined that all members of the Company’s Audit Committee are independent (meeting the requirements for independence currently set forth in Rule 5605(c)(2)(A)(i) of the NASDAQ Marketplace Rules). The Board of Directors has also determined that each of Messrs. Mejia and Sherwood qualifies as an “audit committee financial expert,” as defined in applicable Securities and Exchange Commission, or SEC, rules. The Board made a qualitative assessment of Messrs. Mejia’s and Sherwood’s level of knowledge and experience based on a number of factors, including their formal education and experience in financial investment firms, as a partner at Ernst & Young LLP and as a Chief Financial Officer for public reporting companies, respectively.

As part of our effort to continually improve the Company’s risk management and internal processes and controls, with the support of the Audit Committee, management engaged KPMG Advisory Services, or KPMG, in 2008 to assist us with establishing an internal risk advisory function. The risk advisory group was tasked for 2010, to assist the Company with Sarbanes-Oxley Section 404 assistance. KPMG’s appointment in 2008 was a proactive step that we took to create an internal risk advisory function, consolidate our Sarbanes-Oxley testing activities and enable us to better coordinate Sarbanes-Oxley testing with our external auditors.

REPORTOFTHE AUDIT COMMITTEEOFTHE BOARDOF DIRECTORS

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

The purpose of the Audit Committee is to assist the Board in its general oversight of our financial reporting, internal controls and audit functions. The Audit Committee charter describes in greater detail the full responsibilities of the Audit Committee. During 2010, the members of the Audit Committee were Messrs. Markee, Mejia, and Sherwood and Ms. Alexy. Ms. Alexy and Mr. Markee ceased serving as directors and members of the Audit Committee after the 2010 Annual Meeting of Stockholders. Mr. Christ joined the Audit Committee in March 2011.

The Board has determined that all members of the Audit Committee are independent (meeting the requirements for independence currently set forth in Rule 5605(c)(2)(A)(i) of the NASDAQ Marketplace Rules).

Management is responsible for the financial statements and reporting process, including the system of internal controls. Our independent auditors are responsible for performing an audit of our financial statements and expressing an opinion as to their conformity with generally accepted accounting principles. The Audit Committee oversees and reviews these processes and has reviewed and discussed the financial statements with management and our independent auditors. The Audit Committee is not, however, employed by Dot Hill, nor does it provide any expert assurance or professional certification regarding our financial statements. The Audit Committee relies, without independent verification, on the accuracy and integrity of the information provided, and representations made, by management.

In discharging its oversight responsibility as to the audit process, the Audit Committee obtained from the independent accountants a formal written statement describing all relationships between the accountants and us that might bear on the accountants’ independence consistent with applicable requirements of the Public Company Accounting Oversight Board, or PCAOB, regarding the independent accountants’ communications with the Audit Committee concerning independence. The Audit Committee discussed with the independent accountants any relationships that may impact their objectivity and independence, including fees paid relating to the audit and any non-audit services performed, and satisfied itself as to that firm’s independence.

The Audit Committee discussed and reviewed with the independent accountants all communications required by generally accepted accounting standards, including those described in Statement on Auditing Standards No. 61, as amended (AICPA,Professional Standards, Vol. 1. AU section 380), as adopted by the

12

PCAOB in Rule 3200T. In addition, the Audit Committee, with and without management present, discussed and reviewed the scope, plan and results of the independent accountants’ examination of the financial statements. Based upon the Audit Committee’s discussion with management and the independent accountants and the Audit Committee’s review of the representation of management and the report of the independent accountants to the Audit Committee, subject to the limitations on the role and responsibility of the Audit Committee referred to in the written charter of the Audit Committee, the Audit Committee recommended to the Board that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2010 for filing with the SEC. The Audit Committee also approved the selection, subject to stockholder ratification, of the independent accountants and the Board concurred in such authorization.

Audit Committee

Roderick M. Sherwood, III,Chairman

Richard Mejia, Jr.

Charles Christ

Compensation Committee

The Compensation Committee operates pursuant to a written charter that is available on our website athttp://www.dothill.com. The Compensation Committee met seven times and acted by written consent two times during the fiscal year ended December 31, 2010. During 2010, the members of the Compensation Committee were Ms. Alexy and Messrs. Christ, Markee, Marmen and Sherwood. Ms. Alexy served as Chair until she ceased serving as a director after the 2010 Annual Meeting of Stockholders, at which time Mr. Marmen began serving as Chair. Mr. Markee ceased serving as a director and a member of the Compensation Committee after the 2010 Annual Meeting of Stockholders, at which time Messrs. Christ and Sherwood joined the Compensation Committee. The functions of the Compensation Committee include, among other things: reviewing and approving our overall compensation strategy and policies; reviewing and approving corporate performance goals and objectives relevant to the compensation of our named executive officers; reviewing and approving the compensation and other terms of employment of our named executive officers; recommending the compensation of our non-employee directors; and administering our stock option and purchase plans, deferred compensation plans and other similar programs. The Compensation Committee also reviews and composes with management our Compensation Discussion and Analysis.

At minimum, the Compensation Committee meets once each quarter and with greater frequency as necessary. The agenda for each meeting is usually developed by the Chair of the Compensation Committee, in consultation with the Chief Executive Officer and the Chief Financial Officer. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, provide financial or other background information or advice or otherwise participate in Compensation Committee meetings. The Chief Executive Officer and the Chief Financial Officer may not participate in or be present during any deliberations or determinations of the Compensation Committee regarding their compensation or individual performance objectives. The charter of the Compensation Committee grants the Compensation Committee full access to all of our books, records, facilities and personnel, as well as authority to obtain, at our expense, advice and assistance from internal and external legal, accounting or other advisors and consultants and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. In particular, the Compensation Committee has the sole authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms.

During fiscal 2010, the Compensation Committee engaged Consult RJ as compensation consultants to review the compensation data for Chief Executive Officers and Chief Financial Officers of the following peer companies in the hardware industry: Adaptec Inc., Brocade Communications Systems, Inc., Emulex Corporation,

13

QLogic Corporation, Quantum Corporation, LSI Corporation, Compellent Technologies Inc., 3PAR Inc., Super Micro Computer Inc., Epicor Software Corporation, Rackable Systems Inc. (formerly Silicon Graphics Inc.) and Overland Storage Inc. In addition the compensation committee and RJ Consult reviewed compensation data from the Radford’s Global Technology Survey for the following categories: Survey Totals—Revenues of $200 million to $499.9 million, Semiconductors—Revenues of $200 million to $1.0 billion, Software—Revenues of $200 million to $1.0 billion, Northern California—Revenues of $200 million to $1.0 billion, Total US except Northern California—Revenues of $200 million to $1.0 billion and the average of these five indices.

We have adopted a stock option and grant policy pursuant to which the Compensation Committee approves all stock option grants to employees and officers to purchase shares of Dot Hill’s common stock. Pursuant to the policy, the Compensation Committee generally will meet once a quarter prior to general public release of Dot Hill’s annual or quarterly revenues and earnings for such period to approve recommended stock option grants. The effective date for the approved stock options will be the third business day after the general public release of Dot Hill’s annual or quarterly revenues and earnings, as applicable, following the applicable Compensation Committee meeting. The Compensation Committee may vary this procedure if it determines those applicable circumstances, such as public disclosure requirements or other factors, justify doing so. The exercise price for the stock option grants will be set at the fair market value of our common stock on the effective date of grant. Under our current equity incentive plan, the fair market value of our common stock on a given date is deemed to be equal to the closing sales price for such stock as reported on the NASDAQ Stock Market on the last market trading day prior to such date.

Under the 2009 Plan, the fair market value of our common stock on a given date is deemed to be equal to the closing sales price for such stock as reported on the NASDAQ Stock Market on such date, or if such date is not a trading day, the last market trading day prior to such date. All stock option grants to directors under the Directors’ Plan are made automatically in accordance with the terms of the Directors’ Plan. In addition, the Compensation Committee approves all restricted stock awards to employees, officers and directors, which are generally approved at times consistent with our stock option grant policy, provided, however, that restricted stock awards are generally effective on the date of approval by the Compensation Committee.

Historically, the Compensation Committee has made adjustments to annual compensation, determined bonus and equity awards and established new performance objectives at one or more meetings held during the fourth fiscal quarter of the prior year and the first quarter of the current year. In establishing the compensation plans for the named executive officers and their performance objectives, the Compensation Committee evaluates how these plans may incent risk taking by management. Accordingly, most of the incentive based compensation for our named executive officers is based on the financial plan for the Company for the applicable fiscal year. The plan is targeted towards incentivizing management to appropriately balance short-term and long-term objectives, but not to encourage management to take unnecessary risk in achieving their objectives. However, the Compensation Committee also considers matters related to individual compensation, such as compensation for new executive hires and promotions, as well as high-level strategic issues, such as the efficacy of our compensation strategy, potential modifications to that strategy and new trends, plans or approaches to compensation, at various meetings throughout the year. Generally, the Compensation Committee’s process comprises two related elements: the determination of compensation levels through the use of peer and industry benchmarking data as guidelines and the establishment of performance objectives for the current year. For named executives other than the Chief Executive Officer, the Compensation Committee solicits and considers evaluations and recommendations submitted to the Compensation Committee by the Chief Executive Officer. In the case of the Chief Executive Officer, the Compensation Committee considers the achievement of specific performance objectives, review of peer and industry benchmarking data and performance evaluations to determine any adjustments to compensation as well as awards to be granted. In February 2011, the board solicited feedback from all board members on the Chief Executive Officer’s performance through a standardized questionnaire. For all executives and directors, as part of its deliberations, the Compensation Committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, tax and accounting information, spreadsheets that set forth the total compensation that may become payable to executives

14

in various hypothetical scenarios, executive and director stock ownership information, company stock performance data, analyses of historical executive compensation levels and current company-wide compensation levels, and recommendations of the Compensation Committee’s compensation consultant, including analyses of executive compensation paid at other companies identified by the consultant and in conjunction with the Compensation Committee.

The specific determinations of the Compensation Committee with respect to executive compensation are described in greater detail under the heading “Compensation Discussion and Analysis.”

COMPENSATION COMMITTEEINTERLOCKSAND INSIDER PARTICIPATION

During 2010, the members of the Compensation Committee were Ms. Alexy and Messrs. Christ, Markee, Marmen and Sherwood. Ms. Alexy served as Chair until she ceased serving as a director after the 2010 Annual Meeting of Stockholders, at which time Mr. Marmen began serving as Chair. Mr. Markee ceased serving as a director and a member of the Compensation Committee after the 2010 Annual Meeting of Stockholders, at which time Messrs. Christ and Sherwood joined the Compensation Committee. No member of the Compensation Committee has ever been an officer or employee of ours. None of our executive officers currently serves, or has served during the last completed fiscal year, on the Compensation Committee or board of directors of any other entity that has one or more executive officers serving as a member of our Board of Directors or Compensation Committee.

COMPENSATION COMMITTEE REPORT

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of Dot Hill under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis contained in this proxy statement. Based on this review and discussion, the Compensation Committee has recommended to our Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement and incorporated into our Annual Report on Form 10-K for the fiscal year ended December 31, 2010.

Compensation Committee

Thomas H. Marmen,Chairman

Charles Christ

Roderick M. Sherwood III

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee operates pursuant to a written charter that is available on our website athttp://www.dothill.com. The Nominating and Corporate Governance Committee met five times during the fiscal year ended December 31, 2010. During fiscal 2010, the Nominating and Corporate Governance Committee consisted of Messrs. Christ, Mejia and Sherwood and Ms. Alexy, with Mr. Christ serving as Chair. Ms. Alexy ceased serving as a director and a member of the Nominating and Corporate Governance Committee after the 2010 Annual Meeting of Stockholders. The functions of the Nominating and Corporate Governance Committee include, among other things: overseeing all aspects of our corporate governance functions on behalf of the Board, including procedures for compliance with significant applicable legal, ethical and regulatory requirements that affect corporate governance; making recommendations to the Board regarding corporate governance issues; identifying, reviewing and evaluating candidates to serve as our directors, including

15

candidates submitted by our stockholders; serving as a focal point for communication between such candidates, non-committee directors and our management; recommending candidates to the Board; reviewing and overseeing our management succession planning; and making such other recommendations to the Board regarding affairs relating to our directors as may be needed.

The Nominating and Corporate Governance Committee believes that candidates for director should have certain qualifications, including being able to read and understand basic financial statements and having the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also intends to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to our affairs, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of our stockholders. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time.

Candidates for director nominees are reviewed in the context of the current composition of our Board of Directors, our operating requirements and the long-term interests of our stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee considers diversity, relevant business experience, skills and such other factors as it deems appropriate given the current needs of the Board of Directors and Dot Hill, to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews such directors’ overall service to us during their term, including the number of meetings attended, level of participation, quality of performance and any other relevant considerations.

The Nominating and Corporate Governance Committee seeks nominees with a broad diversity of experience, professions, skills, geographic representation and backgrounds. The Nominating and Corporate Governance Committee also focuses on issues of diversity, such as diversity of gender, race and national origin, and differences in viewpoints. The Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity and does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees; however, the Board of Directors and the Nominating and Corporate Governance Committee believe that it is essential that the members of the Board of Directors represent diverse viewpoints. In considering candidates for the Board of Directors, the Nominating and Corporate Governance Committee considers the entirety of each candidate’s credentials in the context of these standards. With respect to the nomination of continuing directors for re-election, the individual’s contributions to the Board of Directors are also considered.

When the Nominating and Corporate Governance Committee reviews a potential new candidate, the Nominating and Corporate Governance Committee looks specifically at the candidate’s qualifications in light of the needs of the Board of Directors and the Company at that time, given the then current mix of director attributes.

In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee must be independent for NASDAQ purposes, which determination is based upon applicable NASDAQ listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of our Board of Directors. The Nominating and Corporate Governance Committee meets to discuss and consider such candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote. To date, the Nominating and Corporate Governance Committee has not paid a fee to any third party to assist in the process of identifying or evaluating director candidates.

16

At this time, the Nominating and Corporate Governance Committee has not adopted a policy to consider director candidates recommended by stockholders, in part because to date, the Nominating and Corporate Governance Committee has not received a director nominee from any stockholder, including any stockholder or stockholders holding more than five percent of our voting stock. The Nominating and Corporate Governance Committee believes that it is in the best position to identify, review, evaluate and select qualified candidates for Board membership, based on the comprehensive criteria for Board membership approved by the Board.

Stockholder Communications With The Board Of Directors

Persons interested in communicating their questions, concerns or issues to our Board of Directors or our independent directors may address correspondence to the Board of Directors, a particular director or to the independent directors generally, in care of Dot Hill Systems Corp. at 1351 South Sunset Street, Longmont, Colorado 80501. If no particular director is named, letters will be forwarded, depending on the subject matter, to the Chairman of the Board or the Chair of the Audit, Compensation, or Nominating and Corporate Governance Committee.

CODEOF BUSINESS CONDUCTAND ETHICS

We have adopted a Code of Business Conduct and Ethics that applies to all of our officers, directors and employees. The Code of Business Conduct and Ethics is available on our website athttp://www.dothill.com. If we make any substantive amendments to the Code of Business Conduct and Ethics or grant any waiver from a provision of the Code of Business Conduct and Ethics to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website, as well as via any other means then required by NASDAQ listing standards or applicable law.

17

PROPOSAL NO. 2

APPROVALOF AN AMENDMENTTO OUR 2009 EQUITY INCENTIVE PLAN

Overview

Our Board of Directors is requesting stockholder approval of an amendment (the “Amendment”) to the Dot Hill Systems Corp. 2009 Equity Incentive Plan to, among other things; add an additional 8,000,000 shares to the number of shares of common stock authorized for issuance under the 2009 Plan.

On March 1, 2011, our Board of Directors unanimously approved the Amendment, subject to stockholder approval. The Board of Directors believes that the 2009 Plan is an integral part of our long-term compensation philosophy and the Amendment is necessary to continue providing the appropriate levels and types of equity compensation for our employees, consultants and directors. We refer to the 2009 Equity Incentive Plan herein as the “2009 Plan.” We also maintain the Dot Hill Systems Corp. Amended and Restated 2000 Non-Employee Directors’ Stock Option Plan (the “Director Plan”), which we use to grant stock options to our directors.

Why we are asking our stockholders to approve the Amendment

Equity awards have been historically and, we believe, will continue to be an integral component of our overall compensation program for all of our employees, consultants and directors. Approval of the Amendment will allow us to continue to grant stock options and other equity awards at levels our Compensation Committee determines to be appropriate in order to attract new employees, consultants and directors, retain our existing employees, consultants and directors and to provide incentives for such persons to exert maximum efforts for our success and ultimately increase stockholder value. The Amendment allows us to continue to utilize a broad array of equity incentives with flexibility in designing equity incentives, including traditional stock option grants, stock appreciation rights, restricted stock awards, restricted stock unit awards and performance stock awards.

We believe it is critical for our long-term success that the interests of our employees, consultants and directors are tied to our success as “owners” of our business. The equity incentive programs we have in place have worked to build stockholder value by attracting and retaining extraordinarily talented employees, consultants and directors. We believe we must continue to offer a competitive equity compensation packages in order to attract and motivate the talent necessary for our continued growth and success.

Burn Rate

Over the last three years, we have maintained an average equity award burn rate of 6.36% per year. We calculate our burn rate as shares covered by new equity awards granted during each year as a percentage of the weighted average common shares outstanding during the year. Shares underlying performance-based or market condition-based equity awards are included in our burn rate in the year in which such awards are granted and deplete the share reserve of our equity incentive plans as of the end of such year. As shown in the following chart, in our three-year average burn rate calculation we apply a multiplier of 1.5 to stock awards other than stock options and stock appreciation rights (“Full-Value Grants”) so the “Total Awards Granted” is the sum of the number of “Option Grants” plus 1.5 times the number of “Full-Value Grants” each year:

| | | | | | | | | | | | | | | | | | | | |

Year Ended December 31, | | Option

Grants | | | Full-Value Award

Grants | | | Total Awards

Granted | | | Weighted Average

Common Shares

Outstanding | | | Burn Rate | |

2010 | | | 1,103,834 | | | | 2,056,026 | | | | 4,187,873 | | | | 53,015,000 | | | | 7.9 | % |

2009 | | | 189,500 | | | | 1,522,128 | | | | 2,472,692 | | | | 47,094,000 | | | | 5.25 | % |

2008 | | | 2,240,000 | | | | 332,128 | | | | 2,738,192 | | | | 46,136,000 | | | | 5.94 | % |

Three year average burn rate | | | | | | | | | | | | | | | | | | | 6.36 | % |

18

Important Aspects of our 2009 Plan Designed to Protect our Stockholders’ Interests

The 2009 Plan was unanimously adopted by our Board of Directors on April 27, 2009 and approved by our stockholders on June 15, 2009 at our 2009 Annual Meeting. We included certain provisions in the 2009 Plan that were designed to protect our stockholders’ interests and to reflect corporate governance best practices including:

| | • | | Flexibility in designing equity compensation scheme. The 2009 Plan allows us to provide a broad array of equity incentives, including traditional stock option grants, stock appreciation rights, restricted stock awards, restricted stock unit awards, performance-based stock awards and performance-based cash awards. By providing this flexibility we can quickly and effectively react to trends in compensation practices and continue to offer competitive compensation arrangements to attract and retain the talent necessary for the success of our business. |

| | • | | Broad-based eligibility for equity awards. We grant equity awards to a significant number of our employees. By doing so, we tie our employees’ interests with stockholder interests and motivate our employees to act as owners of the business. |

| | • | | Stockholder approval is required for additional shares. The 2009 Plan does not contain an annual “evergreen” provision. Thus, stockholder approval is required each time we need to increase the share reserve allowing our stockholders the ability to have a say on our equity compensation programs. |

| | • | | Repricing is not allowed. The 2009 Plan prohibits the repricing of outstanding equity awards and the cancelation of any outstanding equity awards that have an exercise price or strike price greater than the current fair market value of our common stock in exchange for cash or other stock awards under the 2009 Plan. |

| | • | | Share counting provisions. The share reserve under the 2009 Plan is reduced one share for each share of common stock issued pursuant to a stock option or stock appreciation right and 1.2 shares (or, 1.5 shares, if this Proposal No. 2 is approved) for each share of common stock issued pursuant to restricted stock, restricted stock units, performance-based stock awards, or other stock awards. This helps to ensure that management and our Compensation Committee are using the share reserve effectively and with regard to the value of each type of equity award. |

| | • | | Seven Year Term. All equity awards granted under the 2009 Plan have a term of no more than seven years, thereby limiting the potential for unproductive overhang. |

| | • | | Submission of 2009 Plan amendments to stockholders. The 2009 Plan requires stockholder approval for material amendments to the 2009 Plan, including as noted above, any increase in the number of shares reserved for issuance under the 2009 Plan. |

| | • | | Reasonable limit on equity awards. The 2009 Plan limits the number of shares of common stock available for equity awards such that no employee may be granted an equity award covering more than to 2,000,000 shares in a calendar year. |

General 2009 Plan Information