Washington, D.C. 20549

Commission File No. 000-22905

GOLDEN PHOENIX MINERALS, INC.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

The aggregate market value of common stock held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter, June 30, 2014, was $1,883,844.

The number of shares of registrant’s common stock outstanding as of March 27, 2015 was 456,773,907.

This Annual Report on Form 10-K contains “forward-looking statements” as such term is defined by the Securities and Exchange Commission in its rules, regulations and releases, which represent our expectations or beliefs, including but not limited to, statements concerning our operations, economic performance, financial condition, growth and acquisition strategies, investments, and future operational plans. Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “hope,” “intend,” “could,” “might,” “plan,” “predict” or “project” or the negative of these words or other variations on these words or comparable terminology.

The Report of Independent Registered Accounting Firm on our 2014 consolidated financial statements addresses an uncertainty, indicating that our operating losses and lack of working capital raise substantial doubt about our ability to continue as a going concern. We have a history of operating losses since our inception in 1997, and have an accumulated deficit of $60,626,496 and a total stockholders’ deficit of $1,379,437 at December 31, 2014. We currently have no operating revenues, and will require additional capital to fund our operations and to pursue mineral property opportunities with our existing properties and other prospects.

We completed the sale of our 10% ownership interest in the Santa Rosa, Panama gold project for $US 2.6 million. In February 2014, we received $260,000 of the sales proceeds and received the balance of $2,340,000 on April 23, 2014, net of certain fees and taxes. This funding has helped capitalize the Company, extinguish certain liabilities and will provide working capital to commence planned exploration activities on our joint-ventured Nevada properties.

We have entered into options and agreements for the acquisition of our Nevada mineral properties. None of these mineral properties currently have proven or probable reserves. We believe we will be required to raise significant additional capital to fund our operations and to complete the acquisition of the interests in and further the exploration, evaluation and development of our existing mineral properties and other prospects. There can be no assurance that we will be successful in raising the required capital at favorable rates or at all, or that any of these mineral properties will ultimately attain a successful level of operations. If we are unable to raise sufficient capital to meet our current obligations, we may be forced to further reduce or terminate operations and file for reorganization or liquidation under the bankruptcy laws. These factors and our negative working capital position together raise substantial doubt about our ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We are a mineral exploration and development company, formed in Minnesota on June 2, 1997 and reincorporated in the State of Nevada in May 2008.

Our business includes acquiring mineral properties with potential production and future growth through exploration discoveries. Our current growth strategy is focused on the expansion of our operations through the development of mineral properties into joint ventures or royalty mining projects. Our current efforts are focused on our properties in Nevada.

As more fully described in the Notes to Consolidated Financial Statements and elsewhere in this annual report, we have entered into an agreement to acquire an 80% interest in the Vanderbilt Silver and Gold Project, the Coyote Fault Gold and Silver Project, and claims that are an extension to the Coyote Fault property, all located adjacent to the producing Mineral Ridge property near Silver Peak, Nevada (the “Mhakari Properties”). In addition, we entered into an agreement to acquire the rights to 16 unpatented lode mining claims on BLM lands in Esmeralda County, Nevada, also located near the Mineral Ridge property (the “North Springs Properties”).

We have contracted the professional mining services of Cardno MM&A (“Cardno”) to perform the technical evaluation of our Nevada mineral properties. We began first round evaluation on the Vanderbilt property, which we believe is a viable gold and silver exploration project. With the assistance of Cardno, we are currently permitting an exploration drilling program including up to 20 exploration drill holes using reverse circulation (“RC”). Other highlights include establishing survey control of the property’s three patent claims from 1876, contracting heavy equipment for access road improvement and drill pad construction, and establishing a strong, positive relationship with the local lead regulator office. We have also spent time evaluating the North Springs Properties, and have decided to defer future work on them.

Because of lack of funds and scaling back our operations, we allowed the remainder of our mineral property claims interests to lapse in 2013, and we have abandoned such other projects to focus on our Nevada properties, which in the opinion of management have the best potential for success.

As funding permits, we intend to continue to strategically acquire, explore and develop mineral properties. We plan to provide joint venture opportunities for mining companies to conduct exploration or development on mineral properties we own or control. We, together with any future joint venture partners, intend to explore and develop selected properties to a stage of proven and probable reserves, at which time we would then decide whether to sell our interest in a property or take the property into production alone or with our future partner(s). By joint venturing our properties, we may be able to reduce our costs for further work on those properties, while continuing to maintain and acquire interests in a portfolio of gold and base strategic metals properties in various stages of mineral exploration and development. We expect that this corporate strategy will minimize the financial risk that we would incur by assuming all the exploration costs associated with developing any one property, while maximizing the potential for success and growth.

We have completed the sale of our 10% ownership interest in the Santa Rosa, Panama gold project for $US 2.6 million. In February 2014, we received $260,000 of the sales proceeds and received the balance of $2,340,000 in April 2014, net of certain fees and taxes. As a result, we recognized a gain on disposition of assets of $2,515,654 in our consolidated financial statements for the year ended December 31, 2014.

In September 2011, the Company and its partner formed a Panamanian corporation, subsequently renamed Vera Gold Corporation (“Vera Gold”), for the purpose of developing and operating mining concessions pertaining to the Santa Rosa Gold Mine located in the Province of Veraguas, Panama. Pursuant to an agreement entered into in July 2012, the Company and its partner agreed to terminate the original agreement to develop the Santa Rosa Gold Mine, and the Company retained a 10% interest in Vera Gold. On February 12, 2014, the Company completed negotiations for a Share Purchase Agreement, whereby it sold its 10% ownership in Vera Gold to certain foreign investors for US$2.6 million.

Ximen Mining Corp. Investment

In October 2014, we participated in a private placement in Ximen Mining Corp. (“Ximen”), a Canadian publicly listed mineral exploration company, with an investment of $124,000. We purchased 450,000 units consisting of one common share and one non-transferable warrant entitling us to purchase one further common share of Ximen at an exercise price of $0.40 per warrant share for a period of two years. Ximen is focused on the exploration and development of gold projects in southern British Columbia and currently has a 100% interest in two properties: the Gold Drop Project and the Brett Gold Project.

On August 20, 2014, we announced that Thomas Klein had resigned from the Company’s Board of Directors. Mr. Klein had been a Director since December 2008 and previously served as Chief Executive Officer of the Company from February 2010 until that position was absorbed by the creation of the IGB.

Our corporate directors and officers have prior management experience with large and small mining companies. We believe that we have created the basis for a competitive mineral exploration, development and operational company through assembling a group of individuals with experience in target generation, ore discovery, resource evaluation, mine development and mine operations.

We expect to retain up to a 30% interest in each project, and we anticipate our cash flow will be leveraged to the price of gold or the underlying strategic metal. Ultimately, we intend to convert some of our interests into royalty agreements.

In connection with exploration, mining and milling activities, we are subject to extensive federal, state and local laws and regulations, domestic and international, governing the protection of the environment, including laws and regulations relating to protection of air and water quality, hazardous waste management and mine reclamation as well as the protection of endangered or threatened species.

We are required to comply with numerous environmental laws and regulations imposed by federal and state authorities within the United States. At the federal level, legislation such as the Clean Water Act, the Clean Air Act, the Resource Conservation and Recovery Act, the Comprehensive Environmental Response Compensation Liability Act and the National Environmental Policy Act impose effluent and waste standards, performance standards, air quality and emissions standards and other design or operational requirements for various components of mining and mineral processing, including molybdenum, gold and silver mining and processing.

At present, we do not employ any individuals at our mining properties; we utilize the services of consultants and independent contractors, which are regulated by the Mine Safety and Health Administration (MSHA), a federal agency within the United States.

Our planned exploration activities at the Mhakari and North Springs properties do not require permits or bonding, but will be necessary for proposed future work programs.

The mining industry has historically been intensely competitive and the increasing price of gold since 2002 has led a number of companies to begin once again to aggressively acquire claims and properties.

As of the date of this filing, we currently have no full-time employees. We have contracts with various independent contractors and consultants to fulfill our personnel needs, including management, accounting, investor relations, exploration, development, permitting, and other administrative functions, and may staff further with employees as funding permits and as we bring new projects on line.

We operate in a dynamic and rapidly changing environment that involves numerous risks and uncertainties. The risks described below should be considered carefully when assessing an investment in our common stock. The occurrence of any of the following events could harm us and these risks are not the only ones that we face. If these events occur, our business, operating results or financial condition could suffer and stockholders may lose part or even all of their investment.

We Have Incurred Significant Losses Since our Inception in 1997 And May Never Be Profitable.

We have yet to establish any history of profitable operations. At December 31, 2014 we had an accumulated deficit of $60,626,496. We currently have no operating revenues and our only source of operating revenues for the past few years has been minimal rental income from our drilling equipment. We have sold the assets of our drilling division, and will have no more revenues from this source. Our profitability will require the successful commercialization of our mineral interests.

We may not be able to successfully commercialize our mineral interests or ever become profitable.

We Have Limited Cash and Current Liabilities That Significantly Exceed Our Current Assets.

We Will Require Significant Additional Capital to Continue our Exploration Activities, and, if Warranted, to Develop Mining Operations.

We will require significant additional funding for geological and geochemical analysis, metallurgical testing, and, if warranted, feasibility studies with regard to the results of our exploration. We may not benefit from such investments if we are unable to identify a commercial ore deposit. If we are successful in identifying reserves, we will require significant additional capital to establish a mine and construct a mill and other facilities necessary to mine those reserves. That funding, in turn, will depend upon a number of factors, including the state of the national and worldwide economy and the price of gold and other metals. We may not be successful in obtaining the required financing for these or other purposes, which would adversely affect our ability to continue operating. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration and the possible, partial or total loss of our potential interest in certain properties.

There Is Doubt About Our Ability To Continue As A Going Concern Due To Recurring Losses From Operations, And Accumulated Deficit, All Of Which Mean That We May Not Be Able To Continue Operations.

The Report of Independent Registered Accounting Firm on our 2014 consolidated financial statements addresses an uncertainty, indicating that our operating losses and lack of working capital raise substantial doubt about our ability to continue as a going concern. We have a history of operating losses since our inception in 1997, and have an accumulated deficit of $60,626,496 and a total stockholders’ deficit of $1,379,437 at December 31, 2014. We currently have no operating revenues. We will require additional capital to fund our operations and to pursue mineral property development opportunities with our existing properties and other prospects.

Fluctuating Gold and Silver Prices Could Negatively Impact our Business Plan.

The potential for profitability of gold and silver mining operations at our joint ventured properties and properties that we are actively exploring with an option to acquire, is directly related to the market prices of gold and silver. The prices of gold and silver may also have a significant influence on the market price of our common stock. In the event that we obtain positive feasibility results and progress to a point where a commercial production decision can be made, our decision to put a mine into production and to commit the funds necessary for that purpose must be made long before any revenue from production would be received. A decrease in the price of gold or silver at any time during future exploration, development or mining may prevent our properties from being economically mined or result in the impairment of assets as a result of lower gold or silver prices. The prices of gold and silver are affected by numerous factors beyond our control, including inflation, fluctuation of the United States dollar and foreign currencies, global and regional demand, the purchase or sale of gold by central banks, and the political and economic conditions of major gold producing countries throughout the world.

Although it may be possible for us to protect against future gold and silver price fluctuations through hedging programs, the volatility of metal prices represents a substantial risk that is impossible to completely eliminate by planning or technical expertise.

We May Be at Risk of Losing an Interest in or Failing to Consummate Option and Acquisition Transactions With Respect to our Nevada Property Interests if we Fail to Perform Our Obligations.

Under the terms of our Amended and Restated Option Agreement with Mhakari, we are required to meet certain obligations in order to attain an 80% interest in the Vanderbilt, Coyote Fault and Coyote Extension properties. In addition, under the terms of an Exploration and Mining Lease with Options to Purchase Agreement for our North Springs Properties, we have significant future cash and equity payment obligations. If we fail to make the required cash and equity payments and make the minimum exploration and development expenditures in a timely manner or to perform our other obligations as required under the agreements, we are at risk that the interests in our Nevada properties will be lost.

Our ability to access capital or credit necessary to continue operations may be hindered by the continuing difficulties in the capital and credit markets both in the U.S. and internationally. Moreover, longer term volatility and continued disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation of financial institutions, reduced alternatives or failures of significant financial institutions could affect adversely our access to the liquidity needed for our business in the longer term. Such disruptions could require us to take measures to conserve cash until the markets stabilize or until alternative credit arrangements or other funding for our business needs can be arranged. The disruptions in the capital and credit markets have also resulted in higher interest rates on publicly issued debt securities and increased costs under credit facilities. The continuation of these disruptions could increase our interest expense and capital costs and could affect adversely our results of operations and financial position including our ability to grow our business through joint ventures, sales or acquisitions.

We May Not Be Able To Secure Additional Financing To Meet Our Future Capital Needs Due To Changes In General Economic Conditions.

We anticipate needing significant capital to conduct further exploration and development needed to fulfill our outstanding obligations under our option and acquisition agreements to acquire property interests, repay outstanding debt obligations, bring our existing mining properties into production, and meet ongoing operating expenses. We may use capital more rapidly than currently anticipated and incur higher operating expenses than currently expected, and we will be required to depend on external financing to satisfy our operating and capital needs. We will need new or additional financing in the future to conduct our operations or expand our business. Any sustained weakness in the general economic conditions and/or financial markets in the United States or globally could affect adversely our ability to raise capital on favorable terms or at all. From time to time we have relied, and may also rely in the future, on access to financial markets as a source of liquidity to satisfy working capital requirements and for general corporate purposes. We may be unable to secure additional debt or equity financing on terms acceptable to us, or at all, at the time when we need such funding. If we do raise funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders would be reduced, and the securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock or may be issued at a discount to the market price of our common stock which would result in dilution to our existing stockholders. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

The Development and Completion of Our Properties Entail Significant Risks.

The development of mineral deposits involves significant risks that even the best evaluation, experience and knowledge cannot eliminate. The economic feasibility of our mining properties is based upon a number of factors, including estimations of reserves and mineralized material, extraction and process recoveries, engineering, capital and operating costs, future production rates and future prices of precious metals.

The Validity Of Our Unpatented Mining Claims Could Be Challenged, Which Could Force Us To Curtail Or Cease Our Business Operations.

A significant portion of our properties consist of unpatented mining claims, which we own or lease. These claims are located on federal land or involve mineral rights that are subject to the claims procedures established by the General Mining Law of 1872. We must make certain filings with the county in which the land or mineral is situated and with the Bureau of Land Management and pay annual holding fees of $133.50 per claim. If we fail to make the annual holding payment or make the required filings, our mining claim could be void or voidable. Because mining claims are self-initiated and self-maintained rights, they are subject to unique vulnerabilities not associated with other types of property interests. It is difficult to ascertain the validity of unpatented mining claims from public property records and, therefore, it is difficult to confirm that a claimant has followed all of the requisite steps for the initiation and maintenance of a claim. The General Mining Law requires the discovery of a valuable mineral on each mining claim in order for such claim to be valid, and rival mining claimants and the United States may challenge mining claims. Under judicial interpretations of the rule of discovery, the mining claimant has the burden of proving that the mineral found is of such quality and quantity as to justify further development, and that the deposit is of such value that it can be mined, removed and disposed of at a profit. The burden of showing that there is a present profitable market applies not only to the time when the claim was located, but also to the time when such claim’s validity is challenged. However, only the federal government can make such challenges; they cannot be made by other individuals with no better title rights than us. It is therefore conceivable that, during times of falling metal prices, claims that were valid when they were located could become invalid if challenged. Title to unpatented claims and other mining properties in the western United States typically involves certain other risks due to the frequently ambiguous conveyance history of those properties, as well as the frequently ambiguous or imprecise language of mining leases, agreements and royalty obligations. No title insurance is available for mining. In the event we do not have good title to our properties, we would be forced to curtail or cease our business operations.

Environmental Controls Could Curtail Or Delay Exploration And Development Of Our Mines And Impose Significant Costs On Us.

We are required to comply with numerous environmental laws and regulations imposed by federal and state authorities. At the federal level, legislation such as the Clean Water Act, the Clean Air Act, the Resource Conservation and Recovery Act, the Comprehensive Environmental Response Compensation Liability Act and the National Environmental Policy Act impose effluent and waste standards, performance standards, air quality and emissions standards and other design or operational requirements for various components of mining and mineral processing, including molybdenum, gold and silver mining and processing. In addition, insurance companies are now requiring additional cash collateral from mining companies in order for the insurance companies to issue a surety bond. This addition of cash collateral for a bond could have a significant impact on our ability to bring properties into production.

Many states, including the State of Nevada (where current mineral property interests are located), have also adopted regulations that establish design, operation, monitoring, and closing requirements for mining operations. Under these regulations, mining companies are required to provide a reclamation plan and financial assurance to ensure that the reclamation plan is implemented upon completion of mining operations. Additionally, Nevada and other states require mining operations to obtain and comply with environmental permits, including permits regarding air emissions and the protection of surface water and groundwater. Although we believe that we are currently in compliance with applicable federal and state environmental laws, changes in those laws and regulations may necessitate significant capital outlays or delays, may materially and adversely affect the economics of a given property, or may cause material changes or delays in our intended exploration, development and production activities. Any of these results could force us to curtail or cease our business operations.

Our Exploration Activities and Operations in the U.S. and Abroad Are Subject to the Risks of Doing Business.

Exploration, development, production and mine closure activities are subject to political, economic and other risks of doing business, including, but not limited to:

As a result, our exploration, development and potential production activities may be affected by these and other factors, many of which are beyond our control, and some of which, individually or in the aggregate, could materially adversely affect our financial position or results of operations.

Proposed Legislation Affecting The Mining Industry Could Have An Adverse Effect On Us.

During the past several years, the United States Congress considered a number of proposed amendments to the General Mining Law of 1872, which governs mining claims and related activities on federal lands. For example, a broad based bill to reform the General Mining Law of 1872, the Hardrock Mining and Reclamation Act of 2007 (H.R. 2262) was introduced in the U.S. House of Representatives on May 10, 2007 and was passed by the U.S. House of Representatives on November 1, 2007, and has been submitted to the U.S. Senate where no action has been taken to date.

In 1992, a federal holding fee of $100 per claim was imposed upon unpatented mining claims located on federal lands. This fee was increased to $125 per claim in 2005 ($133.50 total with the accompanying County fees included). Beginning in October 1994, a moratorium on processing of new patent applications was approved. In addition, a variety of legislation over the years has been proposed by the United States Congress to further amend the General Mining Law. If any of this legislation is enacted, the proposed legislation would, among other things, change the current patenting procedures, limit the rights obtained in a patent, impose royalties on unpatented claims, and enact new reclamation, environmental controls and restoration requirements.

For example, the Hardrock Mining and Reclamation Act of 2007 (H.R. 2262), if enacted, would have several negative impacts on us, including but not limited to: requiring royalty payments of 8% of gross income from mining a claim on Federal land, or 4% of claims on Federal land that existed prior to the passage of this act; and prohibition of certain areas from being open to the location of mining claims, including wilderness study areas, areas of critical environmental concern, areas included in the National Wild and Scenic Rivers System, and any area included in maps made for the Forest Service Roadless Area Conservation Final Environmental Impact Statement.

The extent of any such changes to the General Mining Law of 1872 that may be enacted is not presently known, and the potential impact on us as a result of future congressional action is difficult to predict. If enacted, the proposed legislation could adversely affect the economics of developing and operating our mines because many of our properties consist of unpatented mining claims on federal lands. Our financial performance could therefore be materially and adversely affected by passage of all or pertinent parts of the proposed legislation, which could force us to curtail or cease our business operations.

The Development And Operation Of Our Mining Projects Involve Numerous Uncertainties.

Mine development projects, including our planned projects, typically require a number of years and significant expenditures during the development phase before production is possible.

Development projects are subject to the completion of successful feasibility studies, issuance of necessary governmental permits and receipt of adequate financing. The economic feasibility of development projects is based on many factors such as:

Our mine development projects may have limited relevant operating history upon which to base estimates of future operating costs and capital requirements. Estimates of proven and probable reserves and operating costs determined in feasibility studies are based on geologic and engineering analyses.

Any of the following events, among others, could affect the profitability or economic feasibility of a project:

Any of the above referenced events may necessitate significant capital outlays or delays, may materially and adversely affect the economics of a given property, or may cause material changes or delays in our intended exploration, development and production activities. Any of these results could force us to curtail or cease our business operations.

Mineral Exploration Is Highly Speculative, Involves Substantial Expenditures, And Is Frequently Non-Productive.

Mineral exploration involves a high degree of risk and exploration projects are frequently unsuccessful. Few prospects that are explored end up being ultimately developed into producing mines. To the extent that we continue to be involved in mineral exploration, the long-term success of our operations will be related to the cost and success of our exploration programs. We cannot assure you that our mineral exploration efforts will be successful. The risks associated with mineral exploration include:

Substantial expenditures are required to determine if a project has economically mineable mineralization. It may take several years to establish proven and probable reserves and to develop and construct mining and processing facilities. Because of these uncertainties, our current and future exploration programs may not result in the discovery of reserves, the expansion of our existing reserves or the further development of our mines.

Mining Risks And Insurance Could Have An Adverse Effect On Potential Future Profitability.

Our operations are subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as unusual or unexpected geological formations, environmental pollution, personal injuries, flooding, cave-ins, changes in technology or mining techniques, periodic interruptions because of inclement weather and industrial accidents. Although we plan to maintain insurance when needed to ameliorate some of these risks, such insurance may not continue to be available at economically feasible rates or in the future be adequate to cover the risks and potential liabilities associated with exploring, owning and operating our properties. Either of these events could cause us to curtail or cease our business operations.

The Market Price Of Our Common Stock Is Highly Volatile, Which Could Hinder Our Ability To Raise Additional Capital.

The market price of our common stock has been and is expected to continue to be highly volatile. Several factors, including regulatory matters, concerns about our financial condition, operating results, litigation, government regulation, the price of gold, silver and other precious metals, developments or disputes relating to agreements, title to our properties or proprietary rights, may have a significant impact on the market price of our stock. The range of the high and low bid prices of our common stock over the last three years has been between $0.10 and $0.0009. In addition, potential dilutive effects of future sales of shares of common stock by shareholders and by us, and subsequent sale of common stock by the holders of warrants and options could have an adverse effect on the price of our securities, which could hinder our ability to raise additional capital to fully implement our business, operating and development plans.

Penny Stock Regulations Affect Our Stock Price, Which May Make It More Difficult For Investors To Sell Their Stock.

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the SEC. Penny stocks generally are equity securities with a price per share of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ Stock Market, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules. Our securities are subject to the penny stock rules, and investors may find it more difficult to sell their securities.

We Have Never Paid Dividends on Our Common Stock and We Do Not Anticipate Paying Any in the Foreseeable Future.

We have not paid dividends on our common stock to date, and we may not be in a position to pay dividends in the foreseeable future. Our ability to pay dividends will depend on our ability to successfully develop one or more properties and generate revenue from operations. Further, our initial earnings, if any, will likely be retained to finance our growth. Any future dividends will depend upon our earnings, our then-existing financial requirements and other factors and will be at the discretion of our Board of Directors.

Completion of One or More New Acquisitions Could Result in the Issuance of a Significant Amount of Additional Common Stock, Which May Depress the Trading Price of Our Common Stock.

Not applicable.

Our business includes acquiring mineral properties with potential production and future growth through exploration discoveries. Pending requisite funding, our current growth strategy is focused on the expansion of our operations through the development of mineral properties into joint ventures or royalty mining projects. Our current efforts are focused on our properties in Nevada. These properties are early exploration stage and we have not developed any future exploration plans due to the lack of funding.

We have entered into an agreement to acquire an 80% interest in the “Mhakari Properties”, which include the Vanderbilt Silver and Gold Project, the Coyote Fault Gold and Silver Project, and Galena Flat Gold Project, and claims that are an extension to the Coyote Fault property, all located adjacent to the producing Mineral Ridge property near Silver Peak, Nevada In addition, we entered into an agreement to acquire the rights to the “North Springs” properties consisting of 16 unpatented lode mining claims in three claim blocks on BLM lands in Esmeralda County, Nevada, also located near the Mineral Ridge property .

On February 26, 2013, we entered into an Amended and Restated Option Agreement with Mhakari Gold (Nevada) Inc. (“Mhakari”) with respect to the Mhakari Properties, which terminated all rights and obligations under prior agreements and restated the parties’ agreement with respect to each of the Mhakari Properties.

Mhakari granted us an option to acquire up to an undivided 80% interest in the Mhakari Properties, which consist of three separate unpatented mining claims blocks, for the following consideration to be paid by us to Mhakari:

Cash payments: $25,500, payable $20,000 upon execution of the agreement and $5,500 within 60 days thereafter; $20,000 payable on the 3 month anniversary of the agreement; $15,000 on the 6 month and 9 month anniversary of the agreement; and $50,000 on the 15 month anniversary of the agreement.

Equity payments: 8,000,000 shares of our common stock upon the execution of the agreement; an additional 7,000,000 shares of our common stock on the 4 month anniversary of the agreement; and an additional 5,000,000 shares on the 12 month anniversary of the agreement.

Work commitment: $500,000 in exploration and development expenditures on the Mhakari Properties within 18 months of the date of the agreement; an additional $500,000 in exploration and development expenditures between 18 months and 30 months from the date of the agreement; with no less than $2,000,000 in exploration and development expenditures in the aggregate within 48 months from the date of the agreement. Inclusive in this work commitment, we are to earmark no less than $10,000 per contract year for 4 years to enhancing safety on the Mhakari Properties.

Under the terms of an Exploration and Mining Lease with Options to Purchase Agreement effective June 17, 2013 (the “North Springs Agreement”), we acquired the rights to 16 unpatented lode mining claims, which consists of three separate unpatented lode mining claims, on BLM lands in Esmeralda County, Nevada, located near the operating Mineral Ridge gold project (the “North Springs Properties”). As required by the North Springs Agreement, we made advance royalty payments of $5,000 cash in June 2013 and issued 1,000,000 shares of our common stock in July 2013. We are further obligated to make the following payments under the terms of the North Springs Agreement:

We made the Second Anniversary cash payment and common share payment during the year ended December 31, 2014, and are current on our obligations under the North Springs Agreement.

Subject to prior termination, the term of the North Springs Agreement shall be for a period of twenty years commencing on the effective date. The Company is obligated to pay a production royalty equal to three percent of the Net Smelter Returns (“NSR”) from the production or sale of minerals from the North Springs Properties and meet defined minimum annual work commitments ranging from $10,000 in the first year to $100,000 beginning in the fifth year and thereafter

Because of lack of funds and scaling back our operations, we allowed the remainder of our mineral property claims interests to lapse in 2013, and we have abandoned the projects to focus on our Nevada properties, which in the opinion of management have the best potential for success.

Total costs incurred on the Mhakari Properties through December 31, 2014 were $1,466,530. Current lack of funding has precluded us from developing any future plans for exploration activities; therefore, we are currently unable to estimate future exploration costs. Absent an exploration plan, we anticipate that future costs for the Mhakari properties will consist of annual minimum claim maintenance costs estimated at approximately $26,000 per year.

The Vanderbilt property is located within 4 miles of the town of Silver Peak, Nevada and highway 265 via Coyote Road. It is comprised of 44 claims, plus 3 patented claims for a total of 900 acres and is located on the southern flank of Mineral Ridge within the Silver Peak Range. The Vanderbilt property is within the middle of the Walker Lane tectonic belt with the Sierra uplift to the west and the Basin and Range to the east. The claim name designations include the 5 Van, 39 Dock unpatented lode mining claims and the patented claims called the Vanderbilt Extension, Pocotillo and Vanderbilt. Access is achieved by four wheel drive trucks over steep rocky roads. The Company controls the subsurface mineral rights, but the surface is controlled by the Bureau of Land Management (BLM). There are currently no formal permits with the BLM, but access and work is allowed on a casual basis.

The underlying rocks found at Vanderbilt are part of the Mineral Ridge Metamorphic Core Complex (MRMCC) and include granite, Wyman Formation slates and phyllites, and Reed Formation marble. Gold and silver mineralization is found in flat lying fault zones in the Wyman associated with quartz veins and stockworks.

The Vanderbilt property was first developed around 1860 by prospectors looking for gold. They developed a number of small tunnels and shafts where the quartz veins contained high values of gold and silver. This material was transported to Silver Peak and milled where access to water was possible. There are no hazardous materials on the property, and the old mine workings have been fenced for public safety. The Company has not to this date conducted any road building or other surface disturbance. Future drilling work will require an approved BLM Notice of Exploration (NOI) and a posted reclamation bond before such work is conducted.

Phase I geologic mapping and outcrop sampling (above ground) was completed in October 2010, resulting in average grades of 2.1 g/t gold and 58.6 g/t silver. A Phase II exploration program (below ground) in the old mine workings was commenced during the first quarter of 2011 to help identify drill targets. The average assay value of the channel samples collected from the old mine tunnels was 9.04 g/t gold and 140 g/t silver, utilizing a 1.0 g/t cutoff value. These sample assay results were obtained from ALS Global Laboratories using fire assay/atomic absorption assay techniques. ALS is an international analytical laboratory used by numerous mining companies globally. An exploratory drill program is expected to begin as funding is obtained and the Company receives permits from the BLM.

The Coyote Fault/Coyote Fault Extension claim block is within nine miles of Silver Peak, Nevada and Hwy 265 via Coyote Road. This property is considered to be an early stage exploration project. The property consists of 110 contiguous unpatented mining claims having a total of 2,200 acres. The claim block is represented with claims labeled CF 1 to CF 37 and SP 1 to SP71. The property is on the northern flank of Mineral Ridge and is along the eastern edge of the Silver Peak Range. Access is achieved by four-wheel drive truck over graded roads followed by steep rocky roads

The underlying rocks found at Coyote Fault are part of the Mineral Ridge Metamorphic Core Complex (MRMCC) and include granite, Wyman Formation slates and phyllites, and Reed Formation marble. Gold and silver mineralization is found in flat lying fault and shear zones in the Wyman associated with quartz veins and stockworks.

Phase I geologic mapping and outcrop sampling (above ground) was completed on the Coyote Fault claim group in December 2010, which identified a new potential gold exploration target. These sample results were obtained from ALS Global Laboratories using fire assay/atomic absorption assay techniques.

Currently, the Company has not conducted any surface work such as road building and no exploration plans have been developed at this time.

The Galena Flat claims are found about 4 miles from Silver Peak, Nevada and can be accessed by dirt road from the historic town site of Blair off of State Highway 265. The project is in early stage exploration and consists of 24 unpatented lode mining claims for a total of 480 acres. The claim block is identified with claim names GF 1 to GF 24. Access is achieved by four wheel drive trucks over steep rocky roads

The underlying rocks found at Galena Flat are part of the Mineral Ridge Metamorphic Core Complex (MRMCC) and include granite, Wyman Formation slates and phyllites, and Reed Formation marble. Gold and silver mineralization is found in flat lying fault zones in the Wyman associated with quartz veins and stockworks.

Very little exploration work has been conducted on the Galena Flat Project. No sampling or mapping or any surface work such as road building has been conducted and no exploration plans have been developed at this time.

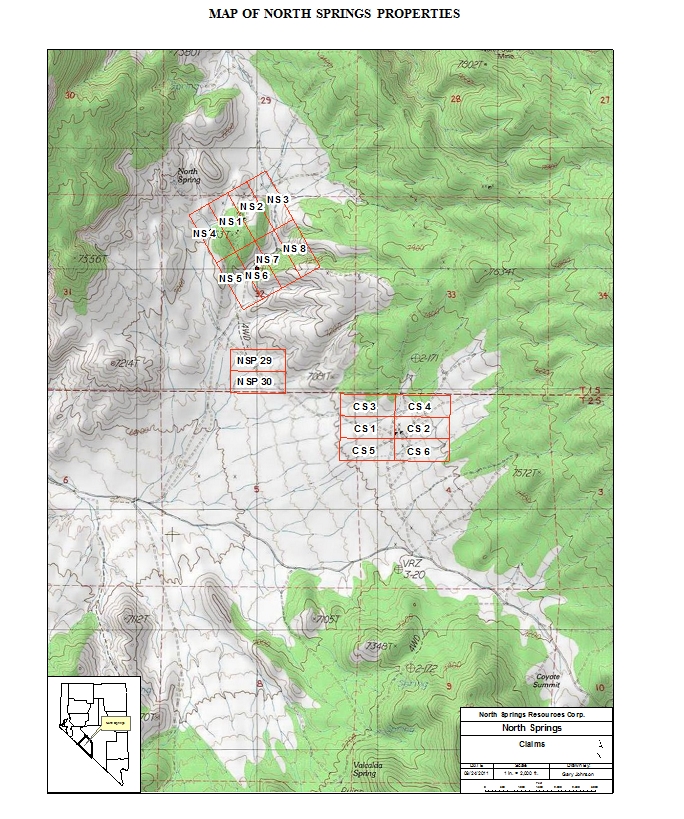

The North Springs Properties are located along the western margin of the Mineral Ridge Mining District, approximately 8 miles west of the town of Silver Peak and 3 miles west of the Mineral Ridge open pit and underground mines. This property consists of 16 unpatented lode mining claims in three separate blocks totaling 320 acres.

The North Springs Properties, Mhakari Properties and the Mineral Ridge gold mine deposits are situated along a regional northwest trending, large anticline known as the Mineral Ridge Metamorphic Core Complex. This geologic complex hosts extensive high-grade gold and stacked, low angle, shear zones, which has been open pit mined in several deposits at the Mineral Ridge mine. The North Springs Properties occupies similar geological environment to the Mineral Ridge deposits.

The North Springs Properties consist of three separate claim blocks and are identified as NS 1 through NS 8 (Roadrunner or North Springs prospect), NSP 29 and 30 (North Springs Pediment prospect) and CS 1 through CS 6 (Coyote Summit prospect) for a total of 16 claims or 320 acres. The claims are located on BLM administered lands. Access is from Silver Peak about 10 miles west along the Coyote dirt road by four wheel drive truck. Each claim block is easily reached by following good secondary dirt roads to each area.

The three North Springs claim blocks are all underlain by granite and a minor veneer of Wyman phyllite. Considerable rock chip sampling has been conducted to determine if anomalous gold and silver values exist on the properties. Only one of the three properties has returned chip samples with gold values that are of interest. This area, called North Springs, contains anomalous gold mineralization over an area approximately 75 feet wide by 300 feet long. Inspection of the some of the exposed shafts and cuttings from a rotary hole suggests the mineralized zone is too small to host a gold deposit that could be mined at a profit. The other two blocks contain very low values of gold and do not contain a gold target.

There is no infrastructure available in the area. Water would need to be hauled in from Silver Peak to conduct an exploration drilling program. Certain hazards exist including open shafts and adits in all three claim blocks. The Company has previously not completed any surface disturbance such as road building on any one of the claim blocks.

There are no plans at this time to conduct exploration activities. The properties will be maintained until a decision on what to do with them is made.

Total costs incurred on the North Springs Properties through December 31, 2013 were $54,264. Should we elect to continue to hold and conduct exploration activities on the properties, our costs will include the advance royalty cash and share payments required in year two and thereafter as described above under North Springs Legal Agreement. In addition we estimate our annual obligation for minimum claim maintenance costs will approximate $3,000.

Other Related Disclosures

Any physical work conducted on any of the Company’s properties requires a Bureau of Land Management permit and reclamation bond. For less than 5 acres of proposed disturbance, a Notice of Intent Permit is required. A reclamation bond amount is calculated, and money is provided to an account that the BLM controls before work can begin. Depending upon the surface disturbance provided, the amount of bond money may range from $5,000 to $30,000. For work over 5 acres of disturbance, an Exploration Plan of Operations is required and would add a considerable amount of field study including cultural resource studies, biological studies and other concerns that are important for the public. Because the amount of work proposed for a POO is considerable, the bond amount may range from $20,000 to $100,000 depending on the size of the exploration program.

Any mining company engaged in exploration, development or mining activities face considerable risk due to the large number of state and federal regulation that require compliance. These regulations include surface degradation, air quality, water quality, chemical controls, mercury controls, and others. The Company would need to address socio-economic impacts of a large operation and understand those impacts. Any one of these issues may delay a project until specific compliance measures are addressed.

ITEM 3. LEGAL PROCEEDINGS

On May 22, 2013, Pinnacle Minerals Corporation, a Florida corporation (“Pinnacle”), sued the Company, seeking payments allegedly due on the two promissory notes issued in connection with a membership interest purchase agreement entered into as of March 7, 2011, relating to a Peruvian mining venture. The case was filed in the United States District Court for the District of Nevada, as “Pinnacle Minerals Corporation v. Golden Phoenix Minerals, Inc., Case number 2:13 – CV – 00915 – MMD – NJK. We filed a motion to stay the litigation and compel arbitration, pursuant to a provision of the subject purchase agreement. Based on negotiations, and agreement and stipulation between the parties, this case was dismissed on July 22, 2013. The parties have submitted the dispute to binding arbitration in Reno, Nevada. While denying the allegations of the complaint, we have also asserted counterclaims against Pinnacle and intend to vigorously defend the claims, all of which will be pursued through the arbitration proceedings. The arbitration was originally set to be heard on September 8, 2014, but the new dates set for the arbitration are April 27-29, 2015.

On October 24, 2013, we filed a lawsuit in the Second Judicial District Court for the State of Nevada (Golden Phoenix Minerals, Inc. vs. David A. Caldwell, Tom Klein, et al., case number CV 13-02332) alleging breaches by the defendants of various contracts and duties owed by the defendants to the Company, together with claims for fraud and breach of contract, conspiracy and other claims, relating primarily to the facts and circumstances surrounding the transaction we entered into with Pinnacle as discussed above, and related business and financial transactions among the parties. Mr. Caldwell is a former Chief Executive Officer and former member of the Board of Directors of the Company. Mr. Klein is a former Chief Executive Officer and a former member of the Board of Directors of the Company. We subsequently entered into a settlement agreement with Mr. Klein and have removed him from this case. We intend to vigorously prosecute the case involving Mr. Caldwell to protect our legal and property rights and interests. Answers and counterclaims have been filed by the remaining defendants, alleging breach of contracts and related claims, all of which have been denied by the Company. The Company has filed an answer to the counterclaim. Formal discovery has commenced, and a trial date has been set for September 28, 2015.

ITEM 4. MINE SAFETY DISCLOSURES

None.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock has been publicly traded since August 6, 1997. The securities are quoted on the OTC Bulletin Board under the symbol “GPXM.OB.” The following table sets forth for the periods indicated the range of high and low bid quotations per share as reported by the OTC Bulletin Board for our past two fiscal years. These quotations represent inter-dealer prices, without retail markups, markdowns or commissions and may not necessarily represent actual transactions.

| Fiscal Year 2013 | | High | | | Low | |

| First Quarter | | $ | 0.0075 | | | $ | 0.0045 | |

| Second Quarter | | $ | 0.0089 | | | $ | 0.0024 | |

| Third Quarter | | $ | 0.0064 | | | $ | 0.0035 | |

| Fourth Quarter | | $ | 0.0050 | | | $ | 0.0009 | |

| | | | | | | | | |

| Fiscal Year 2014 | | High | | | Low | |

| First Quarter | | $ | 0.0080 | | | $ | 0.0006 | |

| Second Quarter | | $ | 0.0075 | | | $ | 0.0020 | |

| Third Quarter | | $ | 0.0050 | | | $ | 0.0023 | |

| Fourth Quarter | | $ | 0.0050 | | | $ | 0.0012 | |

Holders

On March 27, 2015, the closing price of our common stock as reported on the OTC Bulletin Board was $0.0022 per share. On March 27, 2015, we had approximately 301 holders of record of our common stock, 456,773,907 shares of our common stock were issued and outstanding, and an additional 19,650,000 shares issuable upon the exercise of outstanding options and warrants.

Dividend Policy

We have not paid any dividends on our common stock and do not anticipate paying any cash dividends in the foreseeable future. We intend to retain any earnings to finance the growth of the business. We cannot assure you that we will ever pay cash dividends. Whether we pay any cash dividends in the future will depend on the financial condition, results of operations and other factors that our Board of Directors (the “Board”) will consider.

Securities Authorized for Issuance under Equity Compensation Plans

On September 21, 2007, our shareholders approved the 2007 Equity Incentive Plan (the “2007 Plan”) providing 9% of the total number of our outstanding shares of common stock to be reserved and available for grant and issuance at the effective date of the 2007 Plan, with an increase at the beginning of each year if additional shares of common stock were issued in the preceding year so that the total number of shares reserved and available for grant and issuance, not including shares that are subject to outstanding awards, will be 9% of the total number of our outstanding shares of common stock on that date. No more than 2,000,000 shares of common stock shall be granted in the form of Incentive Stock Options. Under the 2007 Plan, grants may be made to any director, officer or employee of the Company or other person who, in the opinion of the Board, is rendering valuable services to the Company, including without limitation, an independent contractor, outside consultant, or advisor.

We have also issued stock options on a stand-alone basis under no specific plan, which have been approved by the Board.

The following table presents information concerning outstanding stock options and warrants issued by us as of December 31, 2014.

Equity Compensation Plan Information

| Plan Category | | Number of securities to be issued upon exercise of of outstanding options, warrants and rights (a) | | | Weighted-average exercise price of outstanding options warrants and rights (b) | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |

| | | | | | | | | | |

| Equity compensation plans approved by security holders (1) | | | 3,300,000 | | | $ | 0.08 | | | | 39,578,152 | |

| Equity compensation plans not approved by security holders (2) | | | 19,650,000 | | | $ | 0.043 | | | | N/A | |

| Total: | | | 22,950,000 | | | $ | 0.05 | | | | 39,578,152 | |

____________

| | (1) Includes shares issuable upon exercise of stock options to employees, consultants and directors under the 2007 Plan. |

| | (2) Includes 19,650,000 shares issuable upon exercise of warrants. |

Recent Sales of Unregistered Securities

During the fourth quarter ended December 31, 2014, we did not have any sales of unregistered securities.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

None

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

We are a mineral exploration and development company, formed in Minnesota on June 2, 1997 and reincorporated in the State of Nevada in May 2008.

Our business includes acquiring mineral properties with potential production and future growth through exploration discoveries. Our current growth strategy is focused on the expansion of our operations through the development of mineral properties into joint ventures or royalty mining projects. Our current efforts are focused on our properties in Nevada.

We have entered into an agreement to acquire an 80% interest in the Vanderbilt Silver and Gold Project, the Coyote Fault Gold and Silver Project, and claims that are an extension to the Coyote Fault property, all located adjacent to the producing Mineral Ridge property near Silver Peak, Nevada (the “Mhakari Properties”). In addition, we entered into an agreement to acquire the rights to 16 unpatented lode mining claims on BLM lands in Esmeralda County, Nevada, also located near the Mineral Ridge property (the “North Springs Properties”).

We have contracted the professional mining services of Cardno MM&A (“Cardno”) to perform the technical evaluation of our Nevada mineral properties. We began first round evaluation on the Vanderbilt property, which we believe is a viable gold and silver exploration project. With the assistance of Cardno, we are currently permitting an exploration drilling program including up to 20 exploration drill holes using reverse circulation (“RC”). Other highlights include establishing survey control of the property’s three patent claims from 1876, contracting heavy equipment for access road improvement and drill pad construction, and establishing a strong, positive relationship with the local lead regulator office. We have also spent time evaluating the North Springs Properties, and have decided to defer future work on them.

Because of lack of funds and scaling back our operations, we allowed the remainder of our mineral property claims interests to lapse in 2013, and we have abandoned such other projects to focus on our Nevada properties, which in the opinion of management have the best potential for success.

In October 2014, we participated in a private placement in Ximen Mining Corp. (“Ximen”), a Canadian publicly listed mineral exploration company, with an investment of $124,000. We purchased 450,000 units consisting of one common share and one non-transferable warrant entitling us to purchase one further common share of Ximen at an exercise price of $0.40 per warrant share for a period of two years. Ximen is focused on the exploration and development of gold projects in southern British Columbia and currently has a 100% interest in two properties: the Gold Drop Project and the Brett Gold Project.

As funding permits, we intend to continue to strategically acquire, explore and develop mineral properties. We plan to provide joint venture opportunities for mining companies to conduct exploration or development on mineral properties we own or control. We, together with any future joint venture partners, intend to explore and develop selected properties to a stage of proven and probable reserves, at which time we would then decide whether to sell our interest in a property or take the property into production alone or with our future partner(s). By joint venturing our properties, we may be able to reduce our costs for further work on those properties, while continuing to maintain and acquire interests in a portfolio of gold and base strategic metals properties in various stages of mineral exploration and development. We expect that this corporate strategy will minimize the financial risk that we would incur by assuming all the exploration costs associated with developing any one property, while maximizing the potential for success and growth.

Going Concern Uncertainty

Our consolidated financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, we have a history of operating losses since our inception in 1997, and have an accumulated deficit of $60,626,496 and a total stockholders’ deficit of $1,379,437 at December 31, 2014. We currently have no operating revenues.

We completed the sale of our 10% ownership interest in the Santa Rosa, Panama gold project for $US 2.6 million. In February 2014, we received $260,000 of the sales proceeds and received the balance of $2,340,000 on April 23, 2014, net of certain fees and taxes. This funding has helped capitalize the Company, extinguish certain liabilities and will provide working capital to commence planned exploration activities on our joint-ventured Nevada properties.

We have entered into options and agreements for the acquisition of our Nevada mineral properties. None of these mineral properties currently have reserves. We believe we will be required to raise significant additional capital to fund our operations and to complete the acquisition of the interests in and further the exploration, evaluation and development of our existing mineral properties and other prospects. There can be no assurance that we will be successful in raising the required capital at favorable rates or at all, or that any of these mineral properties will ultimately attain a successful level of operations. If we are unable to raise sufficient capital to meet our current obligations, we may be forced to further reduce or terminate operations and file for reorganization or liquidation under the bankruptcy laws. These factors and our negative working capital position together raise substantial doubt about our ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make a variety of estimates and assumptions that affect: (1) the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements, and (2) the reported amounts of revenues and expenses during the reporting periods covered by the financial statements. Our management routinely makes judgments and estimates about the effect of matters that are inherently uncertain. As the number of variables and assumptions affecting the future resolution of the uncertainties increases, these judgments become even more subjective and complex. We have identified certain accounting policies that are most important to the portrayal of our current financial condition and results of operations. Our significant accounting policies are disclosed in Note 1 of the Notes to Consolidated Financial Statements, and several of these critical accounting policies are as follows:

Marketable Securities

Marketable securities consist of investments in common stock of two publicly held mining companies. The marketable securities are stated at market value, with market value based on market quotes. Unrealized gains and losses resulting from changes in market value are recorded as other comprehensive income, a component of stockholders’ equity in our consolidated balance sheet. Realized gains and losses resulting from the sale or disposition of marketable securities are reflected in net income or loss for the period. Estimated impairment losses that are determined to be other-than-temporary are included in net income or loss for the period.

Property and Equipment

Mine development costs are capitalized after proven and probable reserves have been identified. Amortization of mine development costs will be calculated using the units-of-production method over the expected life of the operation based on the estimated proven and probable reserves. As of December 31, 2014 and 2013, we had no mineral properties with proven or probable reserves and no amortizable mine development costs.

Mineral Property Acquisition Costs

Mineral property acquisition costs are recorded at cost and capitalized where an evaluation of market conditions and other factors imply the acquisition costs are recoverable. Such factors may include the existence or indication of economically mineable reserves, a market for the subsequent sale of the mineral property, the stage of exploration and evaluation of the property, historical exploration or production data, and the geographic location of the property. Once a determination has been made that a mineral property has proven or probable reserves that can be produced profitably, depletion of the capitalized acquisition costs will be computed at the commencement of commercial production on the units-of-production basis using estimated proven and probable reserves. As of December 31, 2014 and 2013, we had no capitalized mineral property acquisition costs.

Where an evaluation of market conditions and other factors results in uncertainty as to the recoverability of exploration mineral property acquisition costs, the costs are expensed as incurred and included in exploration and evaluation expenses.

Exploration and Evaluation Expenses

Exploration expenses relating to the search for resources suitable for commercial production, including researching and analyzing historic exploration data, conducting topographical, geological, geochemical and geophysical studies, exploratory drilling, trenching and sampling are expensed as incurred.

Evaluation expenses relating to the determination of the technical feasibility and commercial viability of a mineral resource, including determining volume and grade of deposits, examining and testing extraction methods, metallurgical or treatment processes, surveying transportation and infrastructure requirements and conducting market and finance studies are expensed as incurred.

Mineral Property Development Costs

Mineral property development costs relate to establishing access to an identified mineral reserve and other preparations for commercial production, including infrastructure development, sinking shafts and underground drifts, permanent excavations, and advance removal of overburden and waste rock.

When it is determined that commercially recoverable reserves exist and a decision is made by management to develop the mineral property, mineral property development costs are capitalized and carried forward until production begins. The capitalized mineral property development costs are then amortized using the units-of-production method using proven and probable reserves as the mineral resource is mined.

Proven and Probable Ore Reserves

We currently have no proven or probable ore reserves.

On a periodic basis, if warranted based on our property portfolio and the stage of development of each property, management would review the reserves that reflect estimates of the quantities and grades of metals at our mineral properties which management believes can be recovered and sold at prices in excess of the total cost associated with mining and processing the mineralized material. Management’s calculations of proven and probable ore reserves would be based on, along with independent consultant evaluations, in-house engineering and geological estimates using current operating costs, metals prices and demand for the metals. Periodically, management may obtain external determinations of reserves.

Closure, Reclamation and Remediation Costs

Current laws and regulations require certain closure, reclamation and remediation work to be done on mineral properties as a result of exploration, development and operating activities. We periodically review the activities performed on our mineral properties and make estimates of closure, reclamation and remediation work that will need to be performed as required by those laws and regulations and make estimates of amounts that are expected to be incurred when the closure, reclamation and remediation work is expected to be performed. Future closure, reclamation and environmental related expenditures are difficult to estimate in many circumstances due to the early stages of investigation, uncertainties associated with defining the nature and extent of environmental contamination, the uncertainties relating to specific reclamation and remediation methods and costs, application and changing of environmental laws, regulations and interpretation by regulatory authorities, the country where the project is located, and the possible participation of other potentially responsible parties.

At December 31, 2014 and 2013, we had no mining projects that had advanced to the stage where closure, reclamation and remediation costs were required to be accrued.

Property Evaluations and Impairment of Long-Lived Assets

We review and evaluate the carrying amounts of our mineral properties, capitalized mineral property development costs and related buildings and equipment, and other long-lived assets when events or changes in circumstances indicate that the carrying amount may not be recoverable. Estimated future net cash flows, on an undiscounted basis, from a property or asset are calculated using estimated recoverable minerals (considering current proven and probable reserves and mineralization expected to be classified as reserves where applicable); estimated future mineral price realization (considering historical and current prices, price trends and related factors); operating, capital and reclamation costs; , and other factors beyond proven and probable reserves such as estimated market value for the property in an arms-length sale. Reduction in the carrying value of property, plant and equipment, or other long-lived assets, with a corresponding charge to earnings, are recorded to the extent that the estimated future net cash flows are less than the carrying value.

Estimates of future cash flows are subject to risks and uncertainties. It is reasonably possible that changes in circumstances could occur which may affect the recoverability of our properties and long-lived assets.

Debt Issuance Costs

Costs incurred with the issuance of notes payable are capitalized and amortized to interest expense through the earlier of the maturity date or repayment of the notes payable.

Derivative for Conversion Feature

We estimate the fair value of the derivative for the conversion feature of our convertible debt using the Black-Scholes pricing model at the inception of the debt and at each reporting date, recording a derivative liability, debt discount and a gain or loss on derivative liability as applicable.

Fair Value of Financial Instruments

Disclosures about fair value of financial instruments require disclosure of the fair value information, whether or not recognized in our consolidated balance sheet, where it is practicable to estimate that value. As of December 31, 2014 and 2013, the amounts reported for cash, accrued liabilities, accrued interest payable, certain notes payable and amounts due to related party fair value because of their short maturities.

In accordance with Accounting Standards Codification (“ASC”) Topic 820, “Fair Value Measurements and Disclosures,” we measure certain financial instruments at fair value on a recurring basis. ASC Topic 820 defines fair value, established a framework for measuring fair value in accordance with accounting principles generally accepted in the United States, and expands disclosures about fair value measurements.

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC Topic 820 established a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1measurements) and the lowest priority to unobservable inputs (level 3 measurements). These tiers include:

| · | Level 1, defined as observable inputs such as quoted prices for identical instruments in active markets; |

| | |

| · | Level 2, defined as inputs other than quoted prices in active markets that are either directly or indirectly observable such as quoted prices for similar instruments in active markets or quoted prices for identical or similar instruments in markets that are not active; and |

| | |

| · | Level 3, defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions, such as valuations derived from valuation techniques in which one or more significant inputs or significant value drivers are unobservable. |

Liabilities measured at fair value on a recurring basis are as follows at December 31, 2013:

| | | Total | | | Level 1 | | | Level 2 | | | Level 3 | |

| | | | | | | | | | | | | |

| Derivative liability | | $ | 136,765 | | | $ | - | | | $ | - | | | $ | 136,765 | |

| Convertible notes payable | | | 32,444 | | | | - | | | | - | | | | 32,444 | |

| | | | | | | | | | | | | | | | | |

| Total liabilities measured at fair value | | $ | 169,209 | | | $ | - | | | $ | - | | | $ | 169,209 | |

We had no liabilities measured at fair value at December 31, 2014.

Revenue Recognition

Revenue from the sale of precious metals is recognized when title and risk of ownership passes to the buyer and the collection of sales proceeds is assured.

Revenue from the rental of drilling equipment is recognized when the agreed upon rental period is completed and the collection of rental proceeds is assured.

Income Taxes

We recognize a liability or asset for deferred tax consequences of all temporary differences between the tax bases of assets and liabilities and their reported amounts in the financial statements that will result in taxable or deductible amounts in future years when the reported amounts of the assets and liabilities are recovered or settled. Deferred tax items mainly relate to net operating loss carry forwards and accrued expenses. These deferred tax assets or liabilities are measured using the enacted tax rates that will be in effect when the differences are expected to reverse. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. Deferred tax assets are reviewed periodically for recoverability, and valuation allowances are provided when it is more likely than not that some or all of the deferred tax assets may not be realized. As of December 31, 2014 and 2013, we had fully reduced our net deferred tax assets by recording a 100% valuation allowance.

Stock-Based Compensation and Equity Transactions

In accordance with ASC Topic 718, Compensation – Stock Compensation, we measure the compensation cost of stock options and other stock-based awards issued to employees and directors pursuant to stock-based compensation plans at fair value at the grant date and recognize compensation expense over the requisite service period for awards expected to vest.

Except for transactions with employees and directors that are within the scope of ASC Topic 718, all transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instruments issued, whichever is more reliably measurable. Additionally, in accordance with ASC Topic 505-50, Equity-Based Payments to Non-Employees, we have determined that the dates used to value the transaction are either: (1) the date at which a commitment for performance by the counter party to earn the equity instruments is established; or (2) the date at which the counter party’s performance is complete.

Foreign Currency Transactions

At times, certain of our cash accounts may be deposited in a foreign bank. Gains and losses resulting from translation of such account balances are included in operating results, as are gains and losses from foreign currency transactions.

Comprehensive Income (Loss)

We present the components of other comprehensive income (loss) in a single continuous consolidated statement of comprehensive income (loss). For the year ended December 31, 2014, other comprehensive loss consists of unrealized losses on our marketable securities.

Earnings per Common Share

The computation of basic earnings per common share is based on the weighted average number of shares outstanding during the period. The computation of diluted earnings per common share is based on the weighted average number of shares outstanding during the period plus the weighted average outstanding common stock equivalents which would arise from the exercise of stock options and warrants using the treasury stock method and the average market price per share during the period.

For the years ended December 31, 2014 and 2013, there were no common stock equivalents outstanding and, therefore, the computation of basic and diluted earnings per share were the same. At December 31, 2014, we had outstanding options and warrants to purchase a total of 22,950,000 common shares that could have a future dilutive effect on the calculation of earnings per share.

RECENT ACCOUNTING PRONOUNCEMENTS