As Filed With The Securities And Exchange Commission On January 23, 2006

Registration No. _____

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM SB-2

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933, AS AMENDED

GOLDEN PHOENIX MINERALS, INC.

(Exact name of registrant as specified in its charter)

MINNESOTA | 1499 | 41-1878178 |

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer Identification No.) |

| incorporation or organization) | Classification Code Number) |

Kenneth S. Ripley | |

Sparks, Nevada 89434 | Interim Chief Executive Officer |

Telephone: (775) 853-4919 | Golden Phoenix Minerals, Inc. |

| (Address, including zip code, and telephone number, including area code, | 1675 East Prater Way |

| of registrant’s principal executive offices) | Suite 102 |

| Telephone No.: (775) 853-4919 | |

| Telecopier No.: (775) 853-5010 |

Copies to:

| Clayton E. Parker, Esq. | Matthew Ogurick, Esq. |

| Kirkpatrick & Lockhart Nicholson Graham LLP | Kirkpatrick & Lockhart Nicholson Graham LLP |

| 201 South Biscayne Boulevard, Suite 2000 | 201 South Biscayne Boulevard, Suite 2000 |

| Miami, FL 33131 | Miami, FL 33131 |

Telephone No.: (305) 539-3300 | Telephone No.: (305) 539-3300 |

Telecopier No.: (305) 358-7095 | Telecopier No.: (305) 358-7095 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, please check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

Title Of Each Class Of Securities To Be Registered | Amount To Be Registered | Proposed Maximum Offering Price Per Share(1) | Proposed Maximum Aggregate Offering Price(1) | Amount Of Registration Fee |

| Common stock, no par value per share | 22,191,919 | $0.18 | $3,994,545.42 | $470.16 |

| TOTAL | 22,191,919 | $0.18 | $3,994,545.42 | $470.16 |

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended. For the purposes of this table, we have used the average of the closing bid and asked prices as of January 11, 2006. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED JANUARY 23, 2006

The information in this Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission (“SEC”) is effective. This Prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS

GOLDEN PHOENIX MINERALS, INC.

22,191,919 Shares of Common Stock

This prospectus (this “Prospectus”) relates to the sale of up to 22,191,919 shares of the common stock of Golden Phoenix Minerals, Inc. (“Golden Phoenix” or the “Company”) by Fusion Capital Fund II, LLC (“Fusion Capital”). Fusion Capital, sometimes referred to in this Prospectus as the selling shareholder, is offering for sale up to 22,191,919 shares of our common stock, of which up to 20,000,000 shares may be sold by Fusion Capital pursuant to the terms of a common stock purchase agreement and 2,191,919 shares that have been previously issued to Fusion Capital as a commitment fee.

On January 20, 2006, we entered into a common stock purchase agreement (the “Purchase Agreement”) with Fusion Capital pursuant to which Fusion Capital has agreed to purchase, on each trading day, $12,500 of our common stock up to an aggregate, under certain conditions described in this Prospectus, of $6 million. The prices at which Fusion Capital may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions. We will not receive proceeds from the sale of our shares by Fusion Capital.

Our common stock is quoted on the Nasdaq Over-the-Counter Bulletin Board under the symbol “GPXM.OB”. On January 11, 2006, the last reported sale price for our common stock as reported on the Nasdaq Over-the-Counter Bulletin Board was $0.18 per share.

Investing in our common stock involves certain risks. See “Risk Factors” beginning on page 2 for a discussion of these risks.

Fusion Capital is an “underwriter” within the meaning of the Securities Act of 1933, as amended.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is _________________, 2006.

i

TABLE OF CONTENTS

| Page | |

| PROSPECTUS SUMMARY | 1 |

| RISK FACTORS | 2 |

| FORWARD-LOOKING STATEMENTS | 9 |

| USE OF PROCEEDS | 10 |

| MARKET FOR COMMON EQUITY AND RELATED SHAREHOLDER MATTERS | 11 |

| THE FUSION TRANSACTION | 12 |

| DILUTION | 16 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 17 |

| BUSINESS | 29 |

| LEGAL PROCEEDINGS | 38 |

| MANAGEMENT | 39 |

| PRINCIPAL SHAREHOLDERS | 44 |

| DESCRIPTION OF CAPITAL STOCK | 46 |

| SHARES ELIGIBLE FOR FUTURE SALE | 49 |

| SELLING SHAREHOLDER | 50 |

| PLAN OF DISTRIBUTION | 51 |

| LEGAL MATTERS | 52 |

| EXPERTS | 52 |

| WHERE YOU CAN FIND ADDITIONAL INFORMATION | 52 |

| GLOSSARY OF CERTAIN MINING TERMS | 53 |

| FINANCIAL STATEMENTS | F-1 |

| PART II | II-1 |

ii

PROSPECTUS SUMMARY

Business

Golden Phoenix is a Minnesota corporation having its principal executive offices located at 1675 East Prater Way, Suite 102, Sparks, Nevada 89434. Our telephone number is 775-853-4919. The address of our website is www.golden-phoenix.com. Information on our website is not part of this Prospectus.

We plan to produce economically valuable minerals from the mineral properties we currently control, and from mineral properties that we may acquire in the future. We intend to concentrate our exploration efforts in the Western United States.

The Offering

On January 20, 2006, we entered into a common stock purchase agreement (the “Purchase Agreement”) with Fusion Capital Fund II, LLC (“Fusion Capital”), pursuant to which Fusion Capital has agreed to purchase, on each trading day, $12,500 of our common stock up to an aggregate, under certain conditions described below, of $6 million. Fusion Capital, the selling shareholder under this Prospectus, is offering for sale up to 22,191,919 shares of our common stock. As of January 11, 2006, there were 136,030,087 shares outstanding, including the 2,191,919 initial purchase shares that we have issued to Fusion Capital as a commitment fee (the “Commitment Shares”), all of which are included in the offering pursuant to this Prospectus, but excluding the 20,000,000 shares which may be issued to Fusion Capital in the future under the Purchase Agreement. The 22,191,919 shares offered by this Prospectus represent approximately 16.3% of our total outstanding common stock as of January 11, 2006. The number of shares ultimately offered for sale by Fusion Capital is dependent upon the number of shares purchased by Fusion Capital under the Purchase Agreement

The $6 million of common stock is to be purchased over a twenty-four (24) month period, subject to a six (6) month extension or earlier termination at our discretion. The purchase price of the shares of common stock will be equal to a price based upon the future market price of our common stock. Fusion Capital does not have the right or the obligation to purchase shares of common stock in the event that the price of our common stock is less than $0.10. Fusion Capital may not purchase shares of our common stock under the Purchase Agreement if Fusion Capital, together with its affiliates, would beneficially own more than 9.9% of our common stock outstanding at the time of the purchase by Fusion Capital. Absent these circumstances, Fusion Capital would have the right to acquire additional shares in the future should its ownership subsequently become less than 9.9%. In the event our stock price is greater than the $0.10 floor price, we will issue fewer shares to Fusion Capital to draw down on the Purchase Agreement.

1

RISK FACTORS

You should carefully consider the risks described below before purchasing our common stock. The risks set forth below describe the material risks presently known by the Company. If any of the following risks actually occur, our business, financial condition, or results or operations could be materially adversely affected, the trading of our common stock could decline, and you may lose all or part of your investment. You should acquire shares of our common stock only if you can afford to lose your entire investment.

We Have A Limited Operating History With Significant Losses And Expect Losses To Continue For The Foreseeable Future

We have yet to establish any history of profitable operations. We have incurred annual operating losses of $6,470,008 and $2,966,060 during the years ended December 31, 2004 and 2003, respectively, and we incurred an operating loss of $4,228,214 during the nine (9) months ended September 30, 2005. As a result, at December 31, 2004, we had an accumulated deficit of $25,192,268 and we had an accumulated deficit of $29,420,482 at September 30, 2005. Our revenues have not been sufficient to sustain our operations. We expect that our revenues will not be sufficient to sustain our operations for the foreseeable future. Our profitability will require the successful commercialization of our mineral properties. We may not be able to successfully commercialize our mineral properties or ever become profitable.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with the financial statements for the years ended December 31, 2004 and 2003 with respect to their substantial doubt about our ability to continue as a going concern. As discussed in Note 2 to our financial statements for the fiscal year ended December 31, 2004, we have generated significant losses from operations, had an accumulated deficit of $25,192,268 and had a working capital deficit of $7,610,574 at December 31, 2004, which together raises substantial doubt about our ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2 to our financial statements for the fiscal year ended December 31, 2004. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

The Sale Of Our Common Stock To Fusion Capital May Cause Dilution And The Sale Of The Shares Of Common Stock Acquired By Fusion Capital Could Cause The Price Of Our Common Stock To Decline

The purchase price for the common stock to be issued to Fusion Capital pursuant to the Purchase Agreement will fluctuate based on the price of our common stock. Fusion Capital may sell none, some or all of the shares of common stock purchased from us at any time. The sale of shares to Fusion Capital pursuant to the Purchase Agreement will have a dilutive impact on our stockholders. For illustrative purposes, if we assume that Golden Phoenix had issued 20,000,000 shares of common stock under the Purchase Agreement (i.e., the number of shares being registered in the accompanying registration statement) at an assumed offering price of $0.18 per share, less offering expenses of $85,000, our net tangible book value as of September 30, 2005 would have been ($519,534) or $(0.0037) per share. Such an offering would represent an immediate increase in net tangible book value to existing stockholders of $0.0300 per share and an immediate dilution to new stockholders of $0.1837 per share. The 22,191,919 shares of common stock offered by this Prospectus represents approximately 16.3% of our total outstanding common stock as of January 11, 2006. As a result, our net income per share could decrease in future periods, and the market price of our common stock could decline. In addition, the lower our stock price is, the more shares of common stock we will have to issue under the Purchase Agreement to draw down the full amount. If our stock price is lower, then our existing stockholders would experience greater dilution.

There Is Substantial Doubt About Our Ability To Continue As A Going Concern Due To Significant Recurring Losses From Operations, Accumulated Deficit And Working Capital Deficit All Of Which Means That We May Not Be Able To Continue Operations Unless We Obtain Additional Funding

The report of our independent accountant on our December 31, 2004 financial statements includes an explanatory paragraph indicating that there is substantial doubt about our ability to continue as a going concern due to substantial recurring losses from operations and significant accumulated deficit and working capital deficit. Our ability to continue as a going concern will be determined by our ability to obtain additional funding and commence and maintain successful operations. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

2

We Will Require Additional Financing To Sustain Our Operations And Without It We May Not Be Able To Continue Operations

We do not currently have sufficient financial resources to fund our operations. As of September 30, 2005, we had $63,756 in cash and a working capital deficit of $9,264,725. Therefore, we need additional funds to continue these operations. Upon effectiveness of this Registration Statement which we are filing pursuant to the Purchase Agreement with Fusion Capital we have the right to receive $12,500 per trading day under such agreement unless our stock price equals or exceeds the Threshold Amount (as defined in the Purchase Agreement), in which case the daily amount may be increased under certain conditions as the price of our common stock increases. Fusion Capital does not have the right nor the obligation to purchase any shares of our common stock on any trading days that the market price of our common stock is less than $0.10. The selling price of our common stock to Fusion Capital will have to average at least $0.30 per share for us to receive the remaining $6.0 million without registering additional shares of common stock in a new registration statement. Assuming a purchase price of $0.18 per share, we would sell 33,333,333 shares of common stock to Fusion Capital in order to obtain the remaining $6.0 million. Each daily sale of our common stock to Fusion Capital pursuant to the Purchase Agreement could make a subsequent day’s sale to Fusion Capital more dilutive to existing stockholders by decreasing the price of the common stock for the subsequent day’s sale. This dilutive effect may cause us not to be able to draw down the entire $6 million under the Purchase Agreement with the 22,191,919 shares of common stock we are registering in this Registration Statement under the Purchase Agreement.

In the event we desire to draw down any available amounts remaining under the Purchase Agreement after we have issued the 22,191,919 shares being registered in this Registration Statement, we will have to file a new registration statement to cover such additional shares that we would issue for additional sales to Fusion Capital. In addition, pursuant to the terms of the Purchase Agreement, Fusion Capital may not own more than 9.9% of our outstanding shares of common stock. In the event Fusion Capital is unable to sell the shares of our common stock that are issued after we receive an advance in order to keep them below 9.9% beneficial ownership, we may not be able to draw down additional funds when needed under the Purchase Agreement and we may not be able to draw down the full $6 million under the Purchase Agreement.

The extent to which we rely on Fusion Capital as a source of funding will depend on a number of factors including, the prevailing market price of our common stock and the extent to which we are able to secure financing from other sources, such as through the sale of debt or sale of stock. If sufficient financing from Fusion Capital is not available or if we are unable to commercialize and sell our gold, we will need to secure another source of funding in order to satisfy our working capital needs. Even if we are able to access the full $6 million under the Purchase Agreement with Fusion Capital, we may still need additional financing to fully implement our business, operating and development plans. At this time, we cannot accurately predict the amount of additional financing we may need to fully implement our business, operating and development plans, as our mining operations are constantly evolving.

Existing Shareholders Will Experience Significant Dilution From Our Sale Of Shares Under The Purchase Agreement With Fusion Capital And Any Other Equity Financing

The sale of shares pursuant to the Purchase Agreement with Fusion Capital or any other future equity financing transaction will have a dilutive impact on our shareholders. As a result, our net income or loss per share could decrease in future periods, and the market price of our common stock could decline. In addition, the lower our stock price is, the more shares of common stock we will have to issue under the Purchase Agreement with Fusion Capital in order to draw down the full amount. If our stock price is lower, then our existing shareholders would experience greater dilution. We cannot predict the actual number of shares of common stock that will be issued pursuant to the Purchase Agreement with Fusion Capital or any other future equity financing transaction, in part, because the purchase price of the shares will fluctuate based on prevailing market conditions and we do not know the exact amount of funds we will need.

The Selling Shareholder’s Sale Of The Shares Of Common Stock In This Offering Could Cause The Price Of Our Common Stock To Decline And Could Make It More Difficult For Us To Sell Equity Or Equity Related Securities In The Future

The potential dilutive effects of future sales of shares of common stock by the selling shareholder pursuant to this Prospectus could have an adverse effect on the prices of our securities. All shares in this offering are freely tradable. The selling shareholder may sell none, some or all of its shares of common stock in this offering. Depending upon market liquidity at the time, a sale of shares under this offering at any given time could cause the trading price of our common stock to decline. The sale of a substantial number of shares of our common stock under this offering, or anticipation of such sales, also could make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect sales.

3

The Validity Of Our Unpatented Mining Claims Could Be Challenged, Which Could Force Us To Curtail Or Cease Our Business Operations

A majority of our properties consist of unpatented mining claims, which we own or lease. These claims are located on federal land or involve mineral rights that are subject to the claims procedures established by the General Mining Law of 1872, as amended.

We must make certain filings with the county in which the land or mineral is situated and with the Bureau of Land Management and pay an annual holding fee of $125 per claim. If we fail to make the annual holding payment or make the required filings, our mining claim would become invalid. Because mining claims are self-initiated and self-maintained rights, they are subject to unique vulnerabilities not associated with other types of property interests. It is difficult to ascertain the validity of unpatented mining claims from public property records and, therefore, it is difficult to confirm that a claimant has followed all of the requisite steps for the initiation and maintenance of a claim. The General Mining Law requires the discovery of a valuable mineral on each mining claim in order for such claim to be valid, and rival mining claimants and the United States may challenge mining claims. Under judicial interpretations of the rule of discovery, the mining claimant has the burden of proving that the mineral found is of such quality and quantity as to justify further development, and that the deposit is of such value that it can be mined, removed and disposed of at a profit. The burden of showing that there is a present profitable market applies not only to the time when the claim was located, but also to the time when such claim's validity is challenged. However, only the federal government can make such challenges; they cannot be made by other individuals with no better title rights than those of Golden Phoenix. It is therefore conceivable that, during times of falling metal prices, claims that were valid when they were located could become invalid if challenged. Title to unpatented claims and other mining properties in the western United States typically involves certain other risks due to the frequently ambiguous conveyance history of those properties, as well as the frequently ambiguous or imprecise language of mining leases, agreements and royalty obligations. No title insurance is available for mining. In the event we do not have good title to our properties, we would be forced to curtail or cease our business operations.

Estimates Of Mineral Reserves And Of Mineralized Material Are Inherently Forward-Looking Statements, Subject To Error, Which Could Force Us To Curtail Or Cease Our Business Operations

Estimates of mineral reserves and of mineralized material are inherently forward-looking statements subject to error. Although estimates of proven and probable reserves are made based on a high degree of assurance in the estimates at the time the estimates are made, unforeseen events and uncontrollable factors can have significant adverse impacts on the estimates. Actual conditions will inherently differ from estimates. The unforeseen adverse events and uncontrollable factors include: geologic uncertainties including inherent sample variability, metal price fluctuations, fuel price increases, variations in mining and processing parameters, and adverse changes in environmental or mining laws and regulations. The timing and effects of variances from estimated values cannot be predicted.

| · | Geologic Uncertainty and Inherent Variability: Although the estimated reserves and additional mineralized material have been delineated with appropriately spaced drilling to provide a high degree of assurance in the continuity of the mineralization, there is inherent variability between duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. There may also be unknown geologic details that have not been identified or correctly appreciated at the current level of delineation. This results in uncertainties that cannot be reasonably eliminated from the estimation process. Some of the resulting variances can have a positive effect and others can have a negative effect on mining operations. Acceptance of these uncertainties is part of any mining operation. |

| · | Metal Price Variability: The prices for gold, silver, and copper fluctuate in response to many factors beyond anyone's ability to predict. The prices used in making the reserve estimates are disclosed and differ from daily prices quoted in the news media. The percentage change in the price of a metal cannot be directly related to the estimated reserve quantities, which are affected by a number of additional factors. For example, a ten percent (10%) change in price may have little impact on the estimated reserve quantities and affect only the resultant positive cash flow, or it may result in a significant change in the amount of reserves. Because mining occurs over a number of years, it may be prudent to continue mining for some period during which cash flows are temporarily negative for a variety of reasons including a belief that the low price is temporary and/or the greater expense incurred in closing a property permanently. |

4

| · | Fuel Price Variability: The cost of fuel can be a major variable in the cost of mining; one that is not necessarily included in the contract mining prices obtained from mining contractors but is passed on to the overall cost of operation. Future fuel prices and their impact are difficult to predict, but could force us to curtail or cease our business operations. |

| · | Variations in Mining and Processing Parameters: The parameters used in estimating mining and processing efficiency are based on testing and experience with previous operations at the properties or on operations at similar properties. While the parameters used have a reasonable basis, various unforeseen conditions can occur that may materially affect the estimates. In particular, past operations indicate that care must be taken to ensure that proper ore grade control is employed and that proper steps are taken to ensure that the leaching operations are executed as planned. The mining contracts for the mines include clauses addressing these issues to help ensure planned requirements are met. Nevertheless, unforeseen difficulties may occur in planned operations, which would force us to curtail or cease our business operations. |

| · | Changes in Environmental and Mining Laws and Regulations: Golden Phoenix believes that it currently complies with existing environmental and mining laws and regulations affecting its operations. The reserve estimates contain cost estimates based on requirements compliance with current laws and regulations. While there are no currently known proposed changes in these laws or regulations, significant changes have affected past operations and additional changes may occur in the future. |

Environmental Controls Could Curtail Or Delay The Exploration And Development Of Our Mines And Impose Significant Costs On Us

We are required to comply with numerous environmental laws and regulations imposed by federal and state authorities. At the federal level, legislation such as the Clean Water Act, the Clean Air Act, the RCRA, CERCLA and the National Environmental Policy Act impose effluent and waste standards, performance standards, air quality and emissions standards and other design or operational requirements for various components of mining and mineral processing, including gold and copper ore mining and processing. In January 2001, the Bureau of Land Management (“BLM”) amended its surface management regulations to require bonding of all hard rock mining and exploration operations involving greater than casual use to cover the estimated cost of reclamation.

The impact of bonding has been significant. The estimated reclamation cost of the Mineral Ridge property increased from $1.64 million in 1996 to $2.7 million in 2003, an increase of approximately $1.06 million or sixty five percent (65%). The increased cost was a result of reevaluation of the required reclamation, increased manpower and equipment rates, changes in administrative costs and changes with respect to how leach pads are reclaimed. In addition, insurance companies are now requiring additional cash collateral from mining companies in order for the insurance companies to issue a surety bond. This addition of cash collateral for the bond has had a significant impact on our ability to bring the Mineral Ridge property into production and is beyond our original mining plan. We have satisfied all cash collateral requirements for the surety bond and the bond is in place. We now have annual premiums of approximately $11,300, decreasing annually as the surety limits decrease. We anticipate meeting this obligation from funds generated by future revenue. In the event we are unable to meet remaining financial obligations for the surety bond, the insurance company could force us to curtail or cease our operations.

On August 15, 2005 the Company received approval from the BLM to extract 1,000 tons of molybdenum mineralization from its Ashdown Mine for the purpose of metallurgical testing. The approval was issued by the BLM as an amendment to an existing Notice of Intent and as a result, two (2) bonds in the amounts of $45,000 and $104,000 have been posted to secure the amendment.

Proposed Legislation Affecting The Mining Industry Could Have An Adverse Effect On Us

During the past several years, the United States Congress considered a number of proposed amendments to the General Mining Law of 1872, as amended, which governs mining claims and related activities on federal lands. In 1992, a holding fee of $100 per claim was imposed upon unpatented mining claims located on federal lands. Beginning in October 1994, a moratorium on processing of new patent applications was approved. In addition, a variety of legislation over the years has been proposed by the sitting United States Congress to further amend the General Mining Law. If any of this legislation is enacted, the proposed legislation would, among other things, change the current patenting procedures, limit the rights obtained in a patent, impose royalties on unpatented claims, and enact new reclamation, environmental controls and restoration requirements.

5

The royalty proposal ranges from a two percent (2%) royalty on "net profits" from mining claims to an eight percent (8%) royalty on modified gross income/net smelter returns. The extent of any such changes that may be enacted is not presently known, and the potential impact on us as a result of future congressional action is difficult to predict. If enacted, the proposed legislation could adversely affect the economics of developing and operating our mines because many of our properties consist of unpatented mining claims on federal lands. Our financial performance could therefore be materially and adversely affected by passage of all or pertinent parts of the proposed legislation, which could force us to curtail or cease our business operations.

The Development And Operation Of Our Mining Projects Involve Numerous Uncertainties

Mine development projects, including our planned projects, typically require a number of years and significant expenditures during the development phase before production is possible.

Development projects are subject to the completion of successful feasibility studies, issuance of necessary governmental permits and receipt of adequate financing. The economic feasibility of development projects is based on many factors such as:

| · | estimation of reserves; |

| · | anticipated metallurgical recoveries; |

| · | future mineral prices; and |

| · | anticipated capital and operating costs of such projects. |

Our mine development projects may have limited relevant operating history upon which to base estimates of future operating costs and capital requirements.

Estimates of proven and probable reserves and operating costs determined in feasibility studies are based on geologic and engineering analyses.

Any of the following events, among others, could affect the profitability or economic feasibility of a project:

| · | unanticipated changes in grade and tonnage of ore to be mined and processed; |

| · | unanticipated adverse geotechnical conditions; |

| · | incorrect data on which engineering assumptions are made; |

| · | costs of constructing and operating a mine in a specific environment; |

| · | availability and cost of processing and refining facilities; |

| · | availability of economic sources of power; |

| · | adequacy of water supply; |

| · | adequate access to the site; |

| · | unanticipated transportation costs; |

| · | government regulations (including regulations relating to prices, royalties, duties, taxes, restrictions on production, quotas on exportation of minerals, as well as the costs of protection of the environment and agricultural lands); |

6

| · | fluctuations in mineral prices; and |

| · | accidents, labor actions and force majeure events. |

Any of the above referenced events may necessitate significant capital outlays or delays, may materially and adversely affect the economics of a given property, or may cause material changes or delays in our intended exploration, development and production activities. Any of these results could force us to curtail or cease our business operations.

Mineral Exploration Is Highly Speculative, Involves Substantial Expenditures, And Is Frequently Non-Productive

Mineral exploration involves a high degree of risk and exploration projects are frequently unsuccessful. Few prospects that are explored end up being ultimately developed into producing mines. To the extent that we continue to be involved in mineral exploration, the long-term success of our operations will be related to the cost and success of our exploration programs. We cannot assure you that our mineral exploration efforts will be successful. The risks associated with mineral exploration include:

| · | the identification of potential mineralization based on superficial analysis; |

| · | the quality of our management and our geological and technical expertise; and |

| · | the capital available for exploration and development. |

Substantial expenditures are required to determine if a project has economically mineable mineralization. It may take several years to establish proven and probable reserves and to develop and construct mining and processing facilities. Because of these uncertainties, our current and future exploration programs may not result in the discovery of reserves, the expansion of our existing reserves or the further development of our mines.

The Price Of Gold and Molybdenum is Highly Volatile And A Decrease In The Price of Either Mineral Can Have A Material Adverse Effect On Our Business

The profitability of gold and molybdenum mining operations is directly related to the market prices of gold and molybdenum. The market prices of gold and molybdenum can fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations of gold and molybdenum from the time development of a mine is undertaken and the time production can commence can significantly affect the profitability of a mine.

Accordingly, we may begin to develop one or more of our mines at a time when the price of gold or molybdenum makes such exploration economically feasible and, subsequently, incur losses because the price of gold or molybdenum decreases.

Adverse fluctuations of the market prices of gold and molybdenum, respectively, may force us to curtail or cease our business operations.

Mining Risks And Insurance Could Have An Adverse Effect On Our Profitability

Our operations are subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as unusual or unexpected geological formations, environmental pollution, personal injuries, flooding, cave-ins, changes in technology or mining techniques, periodic interruptions because of inclement weather and industrial accidents.

Although we currently maintain insurance to ameliorate some of these risks, more fully described in the description of our business in this Prospectus, such insurance may not continue to be available at economically feasible rates or in the future be adequate to cover the risks and potential liabilities associated with exploring, owning and operating our properties. Either of these events could cause us to curtail or cease our business operations.

7

We Are Dependent On Key Personnel, The Loss Of Either Of Them May Have An Adverse Effect

The Company is dependent on the services of our key executives, Mr. Kenneth S. Ripley, Interim Chief Executive Officer and Larry Kitchen, Principal Accounting Officer. The loss of either Mr. Ripley or Mr. Kitchen could force us to curtail our business and operations. We currently do not have key person insurance for Mssrs. Ripley and Kitchen.

The Market Price Of Our Common Stock Is Highly Volatile, Which Could Hinder Our Ability To Raise Additional Capital

The market price of our common stock has been and is expected to continue to be highly volatile. Factors, including regulatory matters, concerns about our financial condition, operating results, litigation, government regulation, developments or disputes relating to agreements, title to our properties or proprietary rights, may have a significant impact on the market price of our stock. The range of the high and low bid prices of our common stock over the last three (3) years has been between $0.08 and $0.55. In addition, potential dilutive effects of future sales of shares of common stock by shareholders and by the Company, and subsequent sale of common stock by the holders of warrants and options could have an adverse effect on the price of our securities, which could hinder our ability to raise additional capital to fully implement our business, operating and development plans.

Penny Stock Regulations Affect Our Stock Price, Which May Make It More Difficult For Investors To Sell Their Stock

Broker-dealer practices in connection with transactions in "penny stocks" are regulated by certain penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules. Our securities will be subject to the penny stock rules, and investors may find it more difficult to sell their securities.

8

FORWARD-LOOKING STATEMENTS

This Prospectus contains forward-looking statements. Such forward-looking statements include statements regarding, among other things, (a) our estimates of mineral reserves and mineralized material, (b) our projected sales and profitability, (c) our growth strategies, (d) anticipated trends in our industry, (e) our future financing plans, (f) our anticipated needs for working capital, (g) our lack of operational experience and (h) the benefits related to ownership of our common stock. Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as in this Prospectus generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this Prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Prospectus will in fact occur as projected.

9

USE OF PROCEEDS

This Prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling shareholder. We will receive no proceeds from the sale of shares of common stock in this offering. However, we may receive up to $6 million in proceeds from the sale of our common stock to Fusion Capital under the Purchase Agreement. Any proceeds from Fusion Capital we receive under the Purchase Agreement will be used for working capital and general corporate purposes.

For illustrative purposes, we have set forth below our intended use of net proceeds for the range of proceeds indicated below to be received under the Purchase Agreement.

| USE OF PROCEEDS | |||||||

PROCEEDS RECEIVED | 2005 | 2006 | |||||

Mineral Ridge Mine | |||||||

| Existing equipment rehabilitation | $ | -- | $ | 75,000 | |||

| G&A startup | -- | 150,000 | |||||

| Working capital | 300,000 | 500,000 | |||||

| Process engineering | 100,000 | 100,000 | |||||

| Metallurgical testing | -- | 25,000 | |||||

| Reclamation bond | -- | 100,000 | |||||

| Total | $ | 400,000 | $ | 950,000 | |||

Mineral Ridge Exploration | |||||||

| Drilling | $ | -- | $ | 200,000 | |||

| Assaying | -- | 75,000 | |||||

| Consultants | -- | 150,000 | |||||

| Permitting | -- | 15,000 | |||||

| Total | $ | -- | $ | 440,000 | |||

Ashdown Project | |||||||

| Lease payments | $ | 21,000 | $ | 28,000 | |||

| Drilling | -- | 200,000 | |||||

| Assaying | 8,000 | 75,000 | |||||

| Permitting | -- | 100,000 | |||||

| Metallurgical work | 50,000 | 50,000 | |||||

| Consultants | 75,000 | 50,000 | |||||

| Total | $ | 154,000 | $ | 503,000 | |||

Corporate Expenses | |||||||

| Salaries | $ | 100,000 | $ | 75,000 | |||

| Legal expenses | 22,000 | -- | |||||

| Accounting expenses | 1,500 | -- | |||||

| Consultants | 20,000 | 25,000 | |||||

| Equipment leases | 32,000 | 48,000 | |||||

| Office supplies and expenses | 4,000 | 16,000 | |||||

| Total | $ | 179,500 | $ | 164,000 | |||

| Total Proceeds Received | $ | 1,058,500 | $ | 1,732,000 | |||

10

MARKET FOR COMMON EQUITY AND RELATED SHAREHOLDER MATTERS

Our common stock has been publicly traded since August 6, 1997. The securities are traded on the over-the-counter market, and quoted on the Nasdaq Electronic Bulletin Board under the symbol “GPXM.OB”. The following table sets forth for the periods indicated the range of high and low closing bid quotations per share as reported by the over-the-counter market for the past three (3) years. These quotations represent inter-dealer prices, without retail markups, markdowns or commissions and may not necessarily represent actual transactions.

Year 2002 | High | Low |

| First Quarter | $0.20 | $0.08 |

| Second Quarter | $0.55 | $0.17 |

| Third Quarter | $0.46 | $0.21 |

| Fourth Quarter | $0.30 | $0.17 |

Year 2003 | High | Low |

| First Quarter | $0.34 | $0.17 |

| Second Quarter | $0.33 | $0.15 |

| Third Quarter | $0.44 | $0.25 |

| Fourth Quarter | $0.54 | $0.38 |

Year 2004 | High | Low |

| First Quarter | $0.40 | $0.36 |

| Second Quarter | $0.32 | $0.28 |

| Third Quarter | $0.29 | $0.26 |

| Fourth Quarter | $0.25 | $0.22 |

Year 2005 | High | Low |

| First Quarter | $0.20 | $0.10 |

| Second Quarter | $0.25 | $0.11 |

| Third Quarter | $0.24 | $0.12 |

On January 11, 2006, the closing price of our common stock as reported on the Over-the-Counter Bulletin Board was $0.18 per share. On December 31, 2004, we had in excess of 5,000 holders of common stock and 119,721,984 shares of our common stock were issued and outstanding. As of January 11, 2006, we had in excess of 5,000 holders of common stock. Many of our shares are held in brokers’ accounts, so we are unable to give an accurate statement of the number of shareholders.

Dividends

We have not paid any dividends on our common stock and do not anticipate paying any cash dividends in the foreseeable future. We intend to retain any earnings to finance the growth of the business. We cannot assure you that we will ever pay cash dividends. Whether we pay any cash dividends in the future will depend on the financial condition, results of operations and other factors that the Board of Directors will consider.

11

THE FUSION TRANSACTION

General

On July 13, 2005, we entered into a common stock purchase agreement (the “Original Purchase Agreement”) with Fusion Capital Fund II, LLC (“Fusion Capital”), pursuant to which Fusion Capital had agreed, under certain conditions, to purchase on each trading day $12,500 of our common stock up to an aggregate of $6 million over a twenty-four (24) month period. On January 19, 2006, the Company and Fusion Capital entered into a termination agreement whereby the parties terminated the Original Purchase Agreement. On January 20, 2006, Fusion Capital and the Company entered into a new common stock purchase agreement (the “Purchase Agreement”) with substantially the same terms as the Original Purchase Agreement as described above. Thus, pursuant to the Purchase Agreement, Fusion Capital has agreed, under certain conditions, to purchase on each trading day $12,500 of our common stock up to an aggregate of $6 million over a twenty-four (24) month period, subject to a six (6) month extension or earlier termination at our discretion. Furthermore, in our discretion, we may elect to sell more of our common stock to Fusion Capital than the minimum daily amount under the Purchase Agreement. The purchase price of the shares of common stock will be equal to a price based upon the future market price of the common stock without any fixed discount to the market price. Fusion Capital does not have the right or the obligation to purchase shares of our common stock in the event that the price of our common stock is less than $0.10.

Fusion Capital, the selling shareholder under this Prospectus, is offering for sale up to 22,191,919 shares of our common stock. In connection with entering into the Purchase Agreement, we authorized the sale to Fusion Capital of up to an additional 20,000,000 shares of our common stock for a maximum proceeds of $6 million. Assuming Fusion Capital purchases all $6 million of common stock, we estimate that the maximum number of shares we will sell to Fusion Capital under the Purchase Agreement will be 20,000,000 shares (exclusive of the 2,191,919 shares previously issued to Fusion Capital as a commitment fee). Subject to approval by our Board of Directors and the approval by our shareholders of an increase in our authorized common stock, we have the right but not the obligation to issue more than 20,000,000 shares to Fusion Capital. In the event we elect to issue more than 20,000,000 shares offered hereby, we will be required to file a new registration statement and have it declared effective by the SEC. The number of shares ultimately offered for sale by Fusion Capital is dependent upon the number of shares purchased by Fusion Capital under the Purchase Agreement.

Purchase Of Shares Under The Purchase Agreement

Under the Purchase Agreement, on each trading day Fusion Capital is obligated to purchase a specified dollar amount of our common stock. Subject to our right to suspend such purchases at any time, and our right to terminate the agreement with Fusion Capital at any time, each as described below, Fusion Capital shall purchase on each trading day during the term of the Purchase Agreement $12,500 of our common stock. This daily purchase amount may be decreased by us at any time. We also have the right to increase the daily purchase amount at any time, provided however, we may not increase the daily purchase amount above $12,500 unless our stock price is above $0.30 per share for five (5) consecutive trading days. The purchase price per share is equal to the lesser of:

| · | the lowest sale price of our common stock on the purchase date; or |

| · | the average of the three (3) lowest closing sale prices of our common stock during the twelve (12) consecutive trading days prior to the date of a purchase by Fusion Capital. |

The purchase price will be adjusted for any reorganization, recapitalization, non-cash dividend, stock split, or other similar transaction occurring during the trading days in which the closing bid price is used to compute the purchase price. Fusion Capital may not purchase shares of our common stock under the Purchase Agreement if Fusion Capital, together with its affiliates, would beneficially own more than 9.9% of our common stock outstanding at the time of the purchase by Fusion Capital. Fusion Capital has the right at any time to sell any shares purchased under the Purchase Agreement which would allow it to avoid the 9.9% limitation. Therefore, we do not believe that Fusion Capital will ever reach the 9.9% limitation.

12

The following table sets forth the amount of proceeds we would receive from Fusion Capital from the sale of shares of our common stock offered by this Prospectus at varying purchase prices:

Assumed Average Purchase Price | Number of Shares to be Issued if Full Purchase(1) | Percentage of Outstanding After Giving Effect to the Issuance to Fusion Capital(2) | Proceeds from the Sale of Shares to Fusion Capital Under the Purchase Agreement |

| $0.10 | 20,000,000 | 14.76% | $2,000,000 |

$0.18(3) | 20,000,000 | 14.76% | $3,600,000 |

| $0.20 | 20,000,000 | 14.76% | $4,000,000 |

| $0.25 | 20,000,000 | 14.76% | $5,000,000 |

| $0.30 | 20,000,000 | 14.76% | $6,000,000 |

| $0.50 | 12,000,000 | 8.82% | $6,000,000 |

| $1.00 | 6,000,000 | 4.41% | $6,000,000 |

| $2.00 | 3,000,000 | 2.21% | $6,000,000 |

_____________________

| (1) | We are registering 20,000,000 shares in this Registration Statement to be issued under the Purchase Agreement. |

| (2) | Based on 136,030,087 shares outstanding as of January 11, 2006 which includes the issuance of 2,191,919 shares of common stock previously issued to Fusion Capital as a commitment fee pursuant to the Purchase Agreement and the number of shares issuable at the corresponding assumed purchase price set forth in the adjacent column. |

| (3) | Closing sale price of our common stock on January 11, 2006. |

In connection with entering into the Purchase Agreement, we authorized the sale to Fusion Capital of up to 20,000,000 shares of our common stock. We estimate that we will sell no more than 20,000,000 shares to Fusion Capital under the Purchase Agreement, all of which are included in this offering. We have the right to terminate the Purchase Agreement without any payment or liability to Fusion Capital at any time, including in the event that all 20,000,000 shares are sold to Fusion Capital under the Purchase Agreement. Subject to approval by our Board of Directors and the approval by our shareholders of an increase in our authorized common stock, we have the right but not the obligation to sell more than 20,000,000 shares to Fusion Capital. In the event we elect to sell more than the 20,000,000 shares offered hereby (exclusive of the 2,191,919 shares issued to Fusion Capital as the commitment fee), we will be required to file a new registration statement and have it declared effective by the SEC.

Minimum Purchase Price

Fusion Capital shall not have the right or the obligation to purchase any shares of our common stock in the event that the purchase price would be less than $0.10.

Our Right To Suspend Purchases

We have the unconditional right to suspend purchases at any time for any reason effective upon one (1) trading day’s notice. Any suspension would remain in effect until our revocation of the suspension. To the extent we need to use the cash proceeds of the sales of common stock under the Purchase Agreement for working capital or other business purposes, we do not intend to restrict purchases under the Purchase Agreement.

Our Right To Increase and Decrease the Amount to be Purchased

Under the Purchase Agreement Fusion Capital has agreed to purchase on each trading day during the twenty-four (24) month term of the agreement, $12,500 of our common stock or an aggregate of $6 million. We have the unconditional right to decrease the daily amount to be purchased by Fusion Capital at any time for any reason effective upon one (1) trading day’s notice.

In our discretion, we may elect to sell more of our common stock to Fusion Capital than the minimum daily amount. First, in respect of the daily purchase amount, we have the right to increase the daily purchase amount as the market price of our common stock increases. Specifically, for every $0.10 increase in Threshold Price (as defined below) above $0.20, we have the right to increase the daily purchase amount by up to an additional $2,500. For example, if the Threshold Price is $0.50 we would have the right to increase the daily purchase amount to up to an aggregate of $20,000. The "Threshold Price" is the lowest sale price of our common stock during the five (5) trading days immediately preceding our notice to Fusion Capital to increase the daily purchase amount. If at any time during any trading day the sale price of our common stock is below the Threshold Price, the applicable increase in the daily purchase amount will be void.

13

In addition to the daily purchase amount, we may elect to require Fusion Capital to purchase on any single trading day our shares in an amount up to $100,000, provided that our share price is above $0.20 during the ten (10) trading days prior thereto. The price at which such shares would be purchased will be the lowest Purchase Price (as defined above) during the previous fifteen (15) trading days prior to the date that such purchase notice was received by Fusion Capital. We may increase this amount to $250,000 if our share price is above $0.35 during the ten (10) trading days prior to our delivery of the purchase notice to Fusion Capital. This amount may also be increased to up to $500,000 if our share price is above $0.60 during the ten (10) trading days prior to our delivery of the purchase notice to Fusion Capital. We may deliver multiple purchase notices; however at least ten (10) trading days must have passed since the most recent non-daily purchase was completed.

Events of Default

Generally, Fusion Capital may terminate the Purchase Agreement without any liability or payment to the Company upon the occurrence of any of the following events of default:

| · | the effectiveness of the registration statement of which this Prospectus is a part of lapses for any reason (including, without limitation, the issuance of a stop order) or is unavailable to Fusion Capital for sale of our common stock offered hereby and such lapse or unavailability continues for a period of five (5) consecutive trading days or for more than an aggregate of twenty (20) trading days in any 365-day period; |

| · | suspension by our principal market of our common stock from trading for a period of three (3) consecutive trading days; |

| · | the de-listing of our common stock from our principal market provided our common stock is not immediately thereafter trading on the Nasdaq National Market, the Nasdaq National SmallCap Market, the New York Stock Exchange or the American Stock Exchange; |

| · | the transfer agent‘s failure for five (5) trading days to issue to Fusion Capital shares of our common stock which Fusion Capital is entitled to under the Purchase Agreement; |

| · | any material breach of the representations or warranties or covenants contained in the Purchase Agreement or any related agreements which has or which could have a material adverse affect on us subject to a cure period of ten (10) trading days; |

| · | any participation or threatened participation in insolvency or bankruptcy proceedings by or against us; or |

| · | a material adverse change in our business. |

Our Termination Rights

We have the unconditional right at any time for any reason to give notice to Fusion Capital terminating the Purchase Agreement. Such notice shall be effective one (1) trading day after Fusion Capital receives such notice.

Effect of Performance of the Purchase Agreement on Our Shareholders

All shares registered in this offering will be freely tradable. It is anticipated that shares registered in this offering will be sold over a period of up to twenty-four (24) months from the date of this Prospectus. The sale of a significant amount of shares registered in this offering at any given time could cause the trading price of our common stock to decline and to be highly volatile. Fusion Capital may ultimately purchase all of the shares of common stock registered in this offering, and it may sell some, none or all of the shares of common stock it acquires upon purchase. Therefore, the purchases under the Purchase Agreement may result in substantial dilution to the interests of other holders of our common stock. However, we have the right at any time for any reason to: (a) reduce the daily purchase amount, (b) suspend purchases of the common stock by Fusion Capital and (c) terminate the Purchase Agreement.

14

No Short-Selling or Hedging by Fusion Capital

Fusion Capital has agreed that neither it nor any of its affiliates shall engage in any direct or indirect short-selling or hedging of our common stock during any time prior to the termination of the Purchase Agreement.

Commitment Shares Issued to Fusion Capital

Under the terms of the Purchase Agreement we have issued to Fusion Capital 2,191,919 shares of our common stock as a commitment fee.

No Variable Priced Financings

Until the termination of the Purchase Agreement, we have agreed not to issue, or enter into any agreement with respect to the issuance of, any variable priced equity or variable priced equity-like securities unless we have obtained Fusion Capital’s prior written consent.

15

DILUTION

The net tangible book value of Golden Phoenix as of September 30, 2005 was $(4,034,534) or $(0.0337) per share of common stock. Net tangible book value per share is determined by dividing the tangible book value of Golden Phoenix (total tangible assets less total liabilities) by the number of outstanding shares of our common stock. Since this offering is being made solely by the selling shareholder and none of the proceeds will be paid to Golden Phoenix, our net tangible book value will be unaffected by this offering. Our net tangible book value, however, will be impacted by the common stock to be issued under the Purchase Agreement. The amount of dilution will depend on the offering price and number of shares to be issued under the Purchase Agreement. The following example shows the dilution to new investors at an offering price of $0.18 per share.

If we assume that Golden Phoenix had issued 20,000,000 shares of common stock under the Purchase Agreement (i.e., the number of shares being registered in the accompanying registration statement) at an assumed offering price of $0.18 per share, less offering expenses of $85,000, our net tangible book value as of September 30, 2005 would have been $519,534 or $0.0037 per share. Such an offering would represent an immediate increase in net tangible book value to existing stockholders of $0.0300 per share and an immediate dilution to new stockholders of $0.1837 per share. The following table illustrates the per share dilution:

| Assumed public offering price per share | $ | 0.1800 | |||

| Net tangible book value per share before this offering | 0.0337 | ||||

| Increase attributable to new investors | 0.0300 | ||||

| Net tangible book value per share after this offering | (0.0037) | ||||

| Dilution per share to new stockholders | $ | 0.1837 |

The offering price of our common stock is based on the then-existing market price. In order to give prospective investors an idea of the dilution per share they may experience, we have prepared the following table showing the dilution per share at various assumed offering prices:

ASSUMED OFFERING PRICE | NO. OF SHARES TO BE ISSUED(1) | DILUTION PER SHARE TO NEW INVESTORS | ||

| $0.1800 | 20,000,000 | $0.1837 | ||

| $0.1350 | 20,000,000 | $0.1452 | ||

| $0.0900 | 20,000,000 | $0.1066 | ||

| $0.0450 | 20,000,000 | $0.0680 |

_____________________

| (1) | Golden Phoenix is registering 20,000,000 shares of common stock to be issued under the Purchase Agreement. |

16

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Except for historical information, the following Management’s Discussion and Analysis contains forward-looking statements based upon current expectations that involve certain risks and uncertainties. Our actual results could differ materially from those reflected in these forward-looking statements as a result of certain factors that include, but are not limited to, the risks discussed in the Section entitled “Risk Factors”. Please see the statements contained under the Section entitled “Forward-Looking Statements”.

Overview

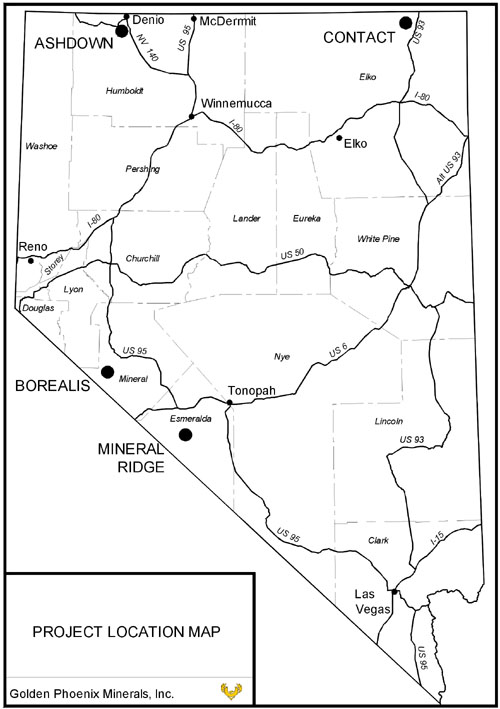

Golden Phoenix is a mineral exploration, development and production company, formed in Minnesota on June 2, 1997, specializing in acquiring and consolidating mineral properties with production potential and future growth through exploration discoveries. Acquisition emphasis is focused on properties containing gold, silver, copper, and other strategic minerals that are located in Nevada. Presently our primary mining property asset is the Mineral Ridge gold mine and the Ashdown gold-molybdenum project. The Company terminated its joint venture with International Enexco, Ltd. and its exploration license and option to purchase with F.W. Lewis, Inc. on December 23, 2004 at our Contact project. On January 31, 2005 the Company closed the sale of its Borealis project to Gryphon Gold Inc. for $1.4 million.

Mineral Ridge

Golden Phoenix purchased the Mineral Ridge mine in late 2000 out of bankruptcy for $225,000 in cash and the assumption of a $382,000 liability to Sierra Pacific Power Co. for a facility charge for the installation of a grid power line. Additional commitments were also assumed, including obligations to pay advanced royalty payments of $60,000 per year and the annual permit cost for the Nevada Department of Environmental Protection (“NDEP”) of approximately $20,000 during the time the permits were being transferred to Golden Phoenix from the previous operator. Golden Phoenix filed a $1.8 million interim reclamation bond, which allowed us to hold the Mineral Ridge property while other permitting was underway. The reclamation permit, which was in place when Golden Phoenix bought the property out of bankruptcy, was not transferable and the company holding the surety bond refused to write a new bond for a startup company. We were required to post a new bond, but this could not be completed until a new reclamation plan and permit was completed. The bond was due for a three-year review by the Bureau of Land Management (“BLM”) and NDEP. This review changed the cost of the bond from $1.64 million to $3.2 million for the same plan. The previous bonding company wanted to be released from the bond held by the BLM; however, without a replacement bond, the only method of release would have been by reclaiming the property. To avoid loss of the property value due to destruction of the infrastructure, Golden Phoenix needed to bring the property back into production. We negotiated an interim bond amount to keep the project in a status-quo status until a new plan and bond amount could be negotiated. The source for the cash bond was from the two (2) previous operators and one (1) of our shareholders.

17

On May 8, 2003, Golden Phoenix obtained a new amended operating permit and on June 23, 2003, we filed a $2.7 million reclamation bond with the BLM with respect to the Mineral Ridge mine. Now that the new permit and bond are in place the Company assumes its reclamation obligation to be $2.7 million. We began mine operations and gold production from the leach pad through the addition of new cyanide to the regular leach fluids and from initiating open pit mining and stockpile transfers to the pad. Pursuant to our internally generated feasibility study for Mineral Ridge, which was evaluated and reported by Behre Dolbear & Company, Inc. an independent mineral auditing consultant, the total value of the gold sales over the six-year mine life, at a $325 gold price, is estimated to be $59 million. The total operating cost, which includes royalty payments, refining costs, mining costs, milling costs, reclamation costs, and operating expenses, is estimated to be $36 million. Capital cost, including reclamation bonding, is estimated to be $6 million. The net income after taxes is estimated to be $12 million.

On October 27, 2004 the Company made a $16,920 deposit with Cow County Title for the purchase of approximately 1,200 acres of land and an existing 1,600-ton per day mill. The mill, know as the Lone Mountain Mill or Miller’s Mill, is held under separate title and leases the 1,200 acre land parcel. Cost to the Company for this investment at the close of escrow is estimated to be $650,000 for the land and $600,000 for the mill. The current agreement is for the landowner to have possession of both the land and mill. The current mill owner is in default of rental payments and is required by contract to deed the property to the landowner. The purchase of these properties is now delayed until the mill title has been cleared to the property owner. Concurrently with the legal working for the Lone Mountain Mill acquisition, economic feasibility studies are ongoing and may reveal that the mill is not economical to purchase due to the cost of ore transportation. If this becomes true, the deposit of $16,920 will be refunded.

On January 12, 2005 Golden Phoenix announced the inauguration of a comprehensive restructuring of all mining operations beginning with the winter idling of the Mineral Ridge gold mine. The idling is designed to redeploy manpower and resources, improve cash flow, and accelerate the development of certain high-yield mine assets. Mineral Ridge is scheduled to resume full operations pending management evaluation of an engineering study commissioned to identify techniques for improving recovery rates from existing and newly uncovered higher-grade ore deposits. The Company placed the Mineral Ridge mine into a leach-only status, due in part to the higher costs of winter operation and sub-optimal gold recovery conditions. Mining and crushing operations are suspended for the time being and employees who conducted this work have been furloughed. Winterized piping has been installed to allow uninterrupted leaching despite freezing temperatures. Employees trained to maintain the leach pad and round-the-clock circulation of leach solutions have been retained. They will also ensure site security, environmental compliance and safety protocols. To date, the Mineral Ridge gold mine and operations remain in idle status.

On August 19, 2005 the Company notified the BLM and the NDEP of its intent to modify the Mineral Ridge Plan of Operations (“POO”) to allow the addition of a full-scale milling facility at its 3,800-acre gold property located near Silver Peak, Nevada. The plan calls for building an on-site mill to process the high-grade ores, supplemented by use of the heap-leach to process lower-grade material. As part of its strategy to optimize production at the property, Golden Phoenix has placed the heap-leach operation on stand-by so as to preserve the mine's contained gold resource until it can be economically processed under the modified POO. Personnel will remain on site to monitor and maintain the facilities and assist in development of the expanded mill and mine plans. Furthermore, a comprehensive review of the past performance of selective underground mining at Mineral Ridge has caused the Company to re-evaluate the one method of extraction that has proven to be economic: milling. Metallurgical testing by the Company and performance records from historic mill operations indicates that a gold recovery rate of ninety percent (90%) or greater is achievable. The Company's new three-tiered approach is to make modifications to the POO; preserve the existing gold resource until it can be economically extracted; and actively identify and explore the zones of mill-grade gold mineralization. A project timeline will be developed after additional engineering work has been completed.

18

Ashdown

The Ashdown property near Denio, Nevada was originally held through a letter agreement with PRS Enterprises (“PRS”) with Golden Phoenix managing the project. PRS also had a letter agreement with Win-Eldridge Mines, Ltd. (“W-E”) which grants the Ashdown property to a three (3)-company venture. This agreement expired on December 15, 2003 due to the inability of PRS to fulfill their contractual obligations. Negotiations with W-E continued, which resulted in a signed letter of intent to joint venture on February 5, 2004. The terms of the agreement gives sixty percent (60%) to Golden Phoenix, as manager/operator of project, and forty percent (40%) to W-E, as owner of the property. Golden Phoenix will earn an undivided vested sixty percent (60%) interest in the project in either of two (2) ways: by placing the project into profitable production using a small pilot mill, or spending $5 million toward development of the project on or before February 4, 2008. Upon signing the letter of intent, Golden Phoenix paid W-E $50,000, and beginning three (3) months after the signing, it has paid $5,000 per month each month for seventeen (17) months and will continue to pay $5,000 per month until a cash distribution through profitable production is achieved. As of November 28, 2005 we have paid a total amount of $150,000 to W-E.

On September 8, 2004 the Company entered into a purchase agreement for a one hundred (100) ton per day mill located in Kingston, Nevada. This mill is known as the Kingston Mill. The agreement called for payment of back taxes, liens and reclamation of land on which the mill was located. The mill was disassembled and moved to the Ashdown mine area where it was held in storage awaiting permits for construction and operation. To date, we have made payments totaling $116,952 for the mill.

On April 19, 2005 Golden Phoenix announced it has secured a long-term lease on the Morris Mill site, a highly suitable twenty (20) acre parcel adjacent to its Ashdown gold/molybdenum joint venture in northwestern Nevada. The Company has increased Ashdown’s molybdenum processing capacity from 10,000 tons in a pilot mill scenario to 120,000 tons, a twelve (12)-fold increase, and to lengthen the mill’s initial operating period to five (5) years. A reclamation bond in the amount of $114,000 has been posted with the Nevada Department of Environmental Protection for the Morris Mill site.

On June 10, 2005, the Company was provided written notice that Win-Eldrich Mines Ltd. planned to remove a 1,400-ton stockpile of mineralized material mined by a previous operator and that it considered personal property not subject to the joint venture. The material had been stored on site for twenty-three (23) years and had been identified by the BLM as an item for reclamation. It is the opinion of the Company that the material is subject to the letter of intent to joint venture (“LOI”) dated February 5, 2004. The Company agreed to the removal of the material while reserving its rights under the LOI to share in the proceeds generated from the stockpile. The stockpile was removed over a five (5) week period which commenced in June 2005, and the Company intents to resolve this matter with Win-Eldrich at a later date.

On June 15, 2005, the Company and regional officials with the BLM entered into a verbal agreement to remove and to take possession of a two hundred (200) ton per day mill located near Austin, Nevada. This mill is known as the Austin Mill. The agreement constituted the removal of the mill and reclamation of the land. The Company has recognized an estimated cost of $80,000 to comply with the verbal agreement.

On June 29, 2005 the Company announced it had taken title from the BLM to take possession of the Austin Mill. The BLM acquired the Austin Mill following abandonment of an un-bonded mining project situated on public land. Golden Phoenix offered to assist the BLM in reclaiming the property, and has accepted the responsibility to remove the mill and the building in exchange for clear title to the equipment. The Austin Mill is complete with crushing, grinding and flotation gear, all in excellent condition. The mill is ideal for processing gold and molybdenum ores and provides several key components that will enhance the capability of the primary millworks. It also gives Golden Phoenix the flexibility to double its molybdenite-processing capacity or to add a separate gold circuit, as may be warranted in the future. Disassembly and relocation of the mill has been completed and parts of this facility have been incorporated into the Ashdown Mill with a design capability of one hundred (100) tons per day.

On August 15, 2005 the Company received approval from the BLM to extract 1,000 tons of molybdenum mineralization from its Ashdown mine for the purpose of metallurgical testing. The approval was issued by the BLM as an amendment to an existing Notice of Intent (“Amended NOI”). Under the Amended NOI, Golden Phoenix may access and remove molybdenite-bearing material using underground mining techniques, and then mill, metallurgically test, and trial-market the moly concentrates. The intent of the bulk sample program is to prepare Golden Phoenix for full-scale mining at Ashdown, scheduled to begin following the BLM’s final approval of the comprehensive Plan of Operations and its associated Environmental Assessment. Ashdown mine personnel have dewatered and rehabilitated the portal section of the Sylvia decline and determined that it is safer, shorter and faster to drive a new bypass from inside the portal directly to the targeted ore-shoot rather than to attempt to restore the original decline. Once full-scale mining is approved, this bypass will serve as the main haulage way for daily operations.

19

On August 26, 2005 the Ashdown Mill was deeded to an earth working company known as Retrievers LLC. The deed states that a signing fee of $30,000 shall be paid to Retrievers LLC and that when the Ashdown mill final permit is issued, an additional $30,000 shall be paid to Retrievers LLC. These monies have been paid, and the Company has agreed to an exclusive arrangement with Retrievers LLC for all earthworks over a five (5) year period. At the conclusion of the agreement period, the Pilot Mill deed shall be transferred to the Company at no cost.

On September 26, 2005, the Company entered into a Production Payment Purchase Agreement (“PPPA”) with Ashdown Milling Company, LLC, a company of which Mr. Kenneth S. Ripley and Mr. Rob Martin are both members. Under the terms of the PPPA, Ashdown Milling agreed to purchase a production payment to be paid from the production of the Company’s Ashdown Mine for a minimum of $800,000. This minimum purchase price will be paid upon the achievement of certain milestones related to the exploration and development of the Ashdown Mine. In addition, the PPPA provides that Ashdown Milling has the right to increase its investment in the production payment up to an additional $700,000 for a maximum purchase price of $1,500,000. The Company must use the funds for qualifying exploration and development expenditures on the Ashdown Mine in a sharing arrangement of its obligation to explore and develop the mine under the letter of intent to joint venture dated February 5, 2004. The amount of the production payment to be paid to Ashdown Milling is equal to a twelve percent (12%) net smelter returns royalty on the minerals produced from the mine until an amount equal to two hundred forty percent (240%) of the total purchase price has been paid. However, the production payment is paid solely from the Company’s share of production it is entitled to receive under the letter of intent to joint venture.