| Equity One, Inc. |

| Supplemental Information Package |

March 31, 2009

Equity One, Inc.

1600 N.E. Miami Gardens Drive

North Miami Beach, Florida 33179

Tel: (305) 947-1664 Fax: (305) 947-1734

www.equityone.net

| Equity One, Inc. |

| |

| SUPPLEMENTAL INFORMATION |

| March 31, 2009 |

| (unaudited) |

| |

| TABLE OF CONTENTS |

| | Page |

| Overview | |

| Analyst Coverage | 3 |

| Disclosures | 4 |

| Summary Financial Results and Ratios | 5 |

| | |

| Assets, Liabilities, and Equity | |

| Consolidated Balance Sheets | 6 |

| Market Capitalization | 7 |

| Debt Summary | 8 |

| Debt Maturity Schedule | 9 |

| | |

| Income, EBITDA, and FFO | |

| Consolidated Statements of Operations | 10 |

| Pro Forma Financial Information for Discontinued Operations | 11-12 |

| Net Operating Income | 13 |

| EBITDA | 14 |

| Consolidated Statements of Funds from Operations | 15 |

| Additional Disclosures | 16 |

| | |

| Leasing Data | |

| Tenant Concentration - Top Twenty Tenants | 17 |

| Recent Leasing Activity | 18 |

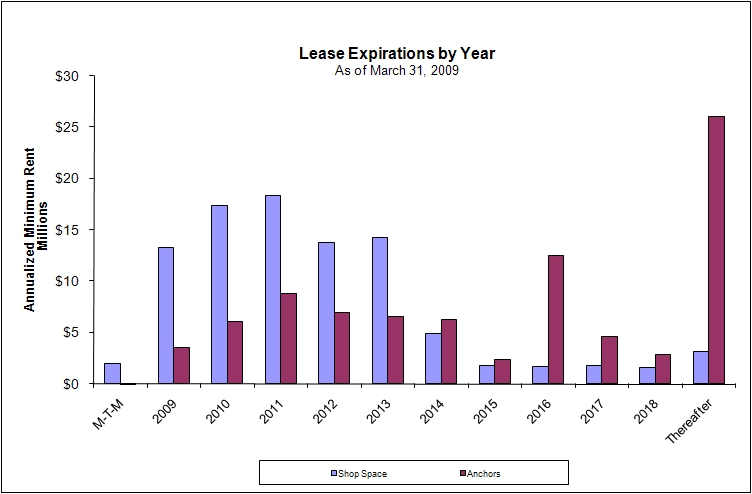

| Shopping Center Lease Expiration Schedule - All Tenants, Anchors, Shops | 19-21 |

| Shopping Center Lease Expiration by Year Graph | 22 |

| | |

| Property Data | |

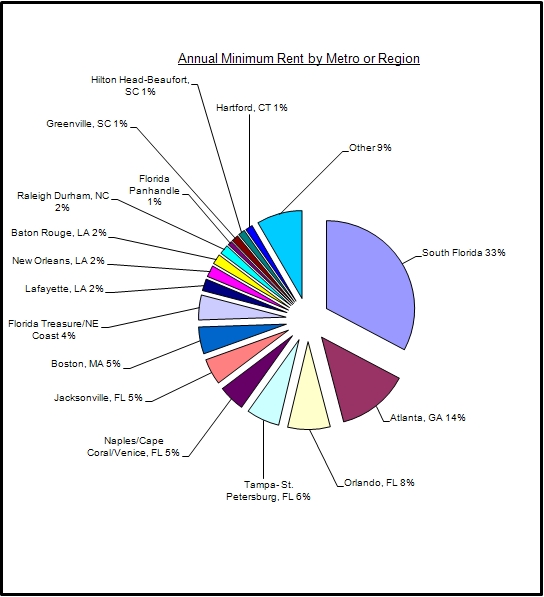

| Annual Minimum Rent of Operating Properties by Metro/Market Breakout | 23 |

| Property Status Report | 24-33 |

| Real Estate Acquisitions and Dispositions | 34 |

| Real Estate Developments and Redevelopments | 35 |

| | |

| Debt Schedule Detail | |

| Consolidated Debt Summary - Property Mortgage Detail | 36-38 |

| Consolidated Debt Summary - Unsecured Notes, Lines of Credit, and Total | 39 |

| | |

| Joint Venture Section | 40-47 |

|

| ANALYST COVERAGE |

| As of March 31, 2009 |

| |

| | | |

| Barclays Capital | Ross Smotrich | (212) 526-2306 |

| | Ryan Bennett | (212) 526-5309 |

| | | |

| BMO Capital Markets | Paul Adornato | (212) 885-4170 |

| | | |

| Credit Suisse | Andrew Rosivach | 011 612 8205 4362 |

| | | |

| Green Street Advisors | Jim Sullivan | (949) 640-8780 |

| | Nick Vedder | (949) 640-8780 |

| | | |

| JP Morgan Securities Inc. | Michael W. Mueller, CFA | (212) 622-6689 |

| | Joseph Dazio | (212) 622-6416 |

| | | |

| Macquarie Capital (USA) Inc. | David Wigginton | (212) 231-6380 |

| | | |

| Merrill Lynch | Craig Schmidt | (212) 449-1944 |

| | | |

| Raymond James & Assoc. | Paul D. Puryear | (727) 567-2253 |

| | R.J. Milligan | (727) 567-2660 |

| | | |

| Royal Bank of Canada | Richard Moore | (440) 715-2646 |

| | Wes Golladay | (440) 715-2650 |

| | | |

| Stifel, Nicolaus & Co., Inc. | David M. Fick, CPA | (410) 454-5018 |

| | Nathan Isbee | (410) 454-4143 |

| | | |

| Miller Tabak | Tom Mitchell | (212) 370-0040 x8163 |

| EQUITY ONE, INC. |

| DISCLOSURES |

| As of March 31, 2009 |

| |

Forward Looking Statements

Certain information contained in this Supplemental Information Package constitute forward-looking statements within the meaning of the federal securities laws. Although Equity One believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that these expectations will be achieved. Factors that could cause actual results to differ materially from current expectations include changes in macro-economic conditions and the demand for retail space in Florida, Georgia, Massachusetts and the other states in which Equity One owns properties; the continuing financial success of Equity One's current and prospective tenants; continuing supply constraints in its geographic markets; the availability of properties for acquisition; the success of its efforts to lease up vacant space; the effects of natural and other disasters; the ability of Equity One to successfully integrate the operations and systems of acquired companies and properties; and other risks, which are described in Equity One's filings with the Securities and Exchange Commission.

Basis of Presentation

The information contained in the Supplemental Information Package does not purport to disclose all items required by GAAP. The Company's Form 10-K for the year ended December 31, 2008 and Form 10-Q for the period ended March 31, 2009 should be read in conjunction with the above information. The results of operations of any property acquired are included in our financial statements since the date of its acquisition.

On January 14, 2009, we acquired an additional 1,237,676 ordinary shares of DIM Vastgoed, N.V. ("DIM") from Homburg Invest Inc. (“Homburg”) in a stock exchange agreement. Under the agreement, we issued 866,373 shares of our common stock in exchange for a total of 1,237,676 DIM shares or share equivalents (based on an exchange ratio of 0.7 Equity One shares for 1 DIM share).

In addition, we obtained from Homburg voting rights (the “Partex shares”) with respect to another 766,573 DIM shares that Homburg has the right to acquire on October 1, 2010 at a subsequent closing occurring no later than November 2010. Subject to certain conditions, the agreement also provides for us to acquire these DIM shares or share equivalents at the same 0.7 exchange ratio (or an aggregate of 536,601 shares of Equity One common stock) from Homburg once Homburg has acquired them. The agreement also provides for customary registration rights with respect to the Equity One common stock issued to Homburg. As a result of the initial exchange and the voting rights agreement, we now have voting control over 74.6% of DIM’s ordinary shares, including 65.2% economic ownership

Pursuant to the provisions in FASB No. 141(R), "Business Combinations", we have consolidated the results of DIM during the first quarter of 2009.

EBITDA is a widely used performance measure and is provided as a supplemental measure of operating performance. We compute EBITDA as the sum of net income before extraordinary items, depreciation and amortization, income taxes, interest expense, gain (loss) on disposal of income producing properties, and impairment of real estate. Given the nature of the Company's business as a real estate owner and operator, the Company believes that the use of EBITDA as opposed to earnings in various financial ratios is helpful to investors as a measure of our operational performance because EBITDA excludes various items included in earnings that do not relate to or are not indicative of our operating performance, such as gains and losses on sales of real estate and real estate related depreciation and amortization, and includes the results of operations of real estate properties that were sold or classified as real estate held for sale either during or subsequent to the end of a particular reporting period, which are included in earnings on a net basis. Accordingly, we believe that the use of EBITDA as opposed to earnings in various ratios provides a meaningful performance measure as it relates to our ability to meet various coverage tests for the stated periods.

EBITDA should not be considered as an alternative to earnings as an indicator of our financial performance, or as an alternative to cash flow from operating activities as a measure of our liquidity. Our computation of EBITDA may differ from the methodology utilized by other companies to calculate EBITDA. Investors are cautioned that items excluded from EBITDA are significant components in understanding and assessing the Company's financial performance.

Use of Funds from Operations as a Non-GAAP Financial Measure

We believe Funds from Operations (FFO) (combined with the primary GAAP presentations) is a useful supplemental measure of our operating performance that is a recognized metric used extensively by the real estate industry, particularly REITs. NAREIT stated in its April 2002 White Paper on FFO, "Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions many industry investors have considered presentations of operating results for real estate companies that use historical cost accounting to be insufficient by themselves." FFO, as defined by NAREIT, is "net income (computed in accordance with GAAP), excluding (gains or losses) from sales of property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect funds from operations on the same basis."

We believe that financial analysts, investors and stockholders are better served by the presentation of comparable period operating results generated from our FFO measure. Our method of calculating FFO may be different from methods used by other REITs and accordingly, may not be comparable to such other REITs. FFO is presented to assist investors in analyzing our operating performance. FFO (i) does not represent cash flow from operations as defined by GAAP, (ii) is not indicative of cash available to fund all cash flow needs, including the ability to make distributions, (iii) is not an alternative to cash flow as measure of liquidity, and (iv) should not be considered as an alternative to net income (which is determined in accordance with GAAP) for purposes of evaluating our operating performance. We believe net income is the most directly comparable GAAP measure to FFO.

| EQUITY ONE, INC. |

| SUMMARY FINANCIAL RESULTS AND RATIOS |

| As of March 31, 2009 |

| (in thousands, except per share data) |

| |

| | | For the three months ended | |

| | | Mar 31, 2009 | | | Mar 31, 2008 | |

| Summary Financial Results | | | | | | |

| Total revenues* | | $ | 69,365 | | | $ | 63,401 | |

| EBITDA | | | 43,156 | | | | 46,824 | |

| Property net operating income | | | 49,888 | | | | 47,138 | |

General & administrative expenses (G&A)* - Adjusted (1) | | | 8,056 | | | | 6,885 | |

| | | | | | | | | |

| Net income attributable to Equity One | | $ | 43,833 | | | $ | 20,855 | |

| Net income per diluted share | | | 0.57 | | | | 0.28 | |

| | | | | | | | | |

| Funds from operations (FFO) | | $ | 57,938 | | | $ | 32,651 | |

| FFO per diluted share | | | 0.75 | | | | 0.44 | |

| | | | | | | | | |

| Total dividends paid per share | | $ | 0.30 | | | $ | 0.30 | |

| | | | | | | | | |

| Weighted average diluted shares | | | 77,410 | | | | 73,499 | |

| | | | | | | | | |

| Summary Operating and Financial Ratios | | | | | | | | |

Operating shopping center portfolio occupancy (see pages 24-31) (2) | | | 91.5 | % | | | 92.7 | % |

Same-property NOI growth - cash basis (see page 13) (2) | | | -2.7 | % | | NA | |

| NOI margin (see page 13) | | | 72.5 | % | | | 74.6 | % |

| Expense recovery ratio* | | | 76.2 | % | | | 85.5 | % |

New, renewal and option rent spread - cash basis (see page 18) (2) | | | -2.1 | % | | | 9.1 | % |

| G&A expense to total revenues | | | 11.6 | % | | | 10.7 | % |

| Debt to market capitalization (see page 7) | | | 57.3 | % | | | 39.1 | % |

| EBITDA to interest expense* (see page 14) | | | 2.2 | | | | 2.9 | |

| EBITDA to fixed charges* (see page 14) | | | 1.8 | | | | 2.5 | |

| | |

* The indicated line item includes amounts reported in discontinued operations.

(1) G&A expense deducting one-time severance costs and acquisition costs associated with acquisition of controlling interest in DIM Vastgoed of $4.2 million.

(2) Excludes DIM Vastgoed.

| EQUITY ONE, INC. |

| CONSOLIDATED BALANCE SHEETS |

| As of March 31, 2009 |

| (in thousands) | |

| |

| | | | | | | | | | |

| | | Mar 31, 2009 | | | Dec 31, 2008 | | | Dec 31, 2007 | |

| Assets | | | | | | | | | |

| Properties | | | | | | | | | |

| Income producing | | $ | 2,290,026 | | | $ | 1,900,513 | | | $ | 2,047,993 | |

| Less: accumulated depreciation | | | (206,895 | ) | | | (196,151 | ) | | | (172,651 | ) |

| Income-producing property, net | | | 2,083,131 | | | | 1,704,362 | | | | 1,875,342 | |

| Construction in progress and land held for development | | | 73,677 | | | | 74,371 | | | | 81,574 | |

| Properties held for sale | | | - | | | | - | | | | 323 | |

| Properties, net | | | 2,156,808 | | | | 1,778,733 | | | | 1,957,239 | |

| | | | | | | | | | | | | |

| Cash and cash equivalents | | | 3,183 | | | | 5,355 | | | | 1,313 | |

| Cash held in escrow | | | - | | | | - | | | | 54,460 | |

| Accounts and other receivables, net | | | 8,052 | | | | 12,209 | | | | 14,148 | |

| Investments and advances in real estate joint ventures | | | 11,724 | | | | 11,745 | | | | - | |

| Marketable Securities | | | 73,990 | | | | 160,585 | | | | 72,299 | |

| Goodwill | | | 11,845 | | | | 11,845 | | | | 12,496 | |

Other assets (1) | | | 104,467 | | | | 55,791 | | | | 62,429 | |

| | | | | | | | | | | | | |

| Total Assets | | $ | 2,370,069 | | | $ | 2,036,263 | | | $ | 2,174,384 | |

| | | | | | | | | | | | | |

| Liabilities and stockholders' equity | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

| Mortgage notes payable | | $ | 629,288 | | | $ | 371,077 | | | $ | 397,112 | |

| Unsecured revolving credit facilities | | | 10,000 | | | | 35,500 | | | | 37,000 | |

| Unsecured senior notes payable | | | 627,431 | | | | 657,913 | | | | 744,685 | |

| Total debt | | | 1,266,719 | | | | 1,064,490 | | | | 1,178,797 | |

| Unamortized/unaccreted premium/(discount) on notes payable | | | (25,340 | ) | | | 5,225 | | | | 10,042 | |

| Total notes payable | | | 1,241,379 | | | | 1,069,715 | | | | 1,188,839 | |

| | | | | | | | | | | | | |

| Deferred tax payable, net | | | 54,903 | | | | 1,409 | | | | 0 | |

Accounts payable and other liabilities (1) | | | 84,515 | | | | 54,652 | | | | 68,624 | |

| Total liabilities | | | 1,380,797 | | | | 1,125,776 | | | | 1,257,463 | |

| | | | | | | | | | | | | |

| Total Stockholders' equity of Equity One | | | 963,085 | | | | 909,498 | | | | 915,932 | |

| | | | | | | | | | | | | |

| Noncontrolling interest | | | 26,187 | | | | 989 | | | | 989 | |

| | | | | | | | | | | | | |

| Total Liabilities and Stockholders' Equity | | $ | 2,370,069 | | | $ | 2,036,263 | | | $ | 2,174,384 | |

| | | | | | | | | | | | | |

| | |

| | |

Note: Amounts in 2009 include consolidation of DIM Vastgoed.

(1) Amounts have been reclassified to conform to the 2009 presentation.

| EQUITY ONE, INC. |

| MARKET CAPITALIZATION |

|

| (in thousands) |

| |

| | | | | | | | | | |

| | | Mar 31, 2009 | | | Dec 31, 2008 | | | Dec 31, 2007 | |

| | | | | | | | | | |

| Closing market price of common stock | | $ | 12.19 | | | $ | 17.70 | | | $ | 23.03 | |

| | | | | | | | | | | | | |

| Common stock shares (in thousands) | | | | | | | | | | | | |

| Basic common shares | | | 76,655.230 | | | | 76,198.420 | | | | 73,300.107 | |

| Diluted common shares | | | | | | | | | | | | |

| Unvested restricted common shares | | | 68.629 | | | | 29.360 | | | | 55.707 | |

| DownREIT units (convertible into shares) | | | 93.656 | | | | 93.656 | | | | 93.656 | |

| Common stock options (treasury method, closing price) | | | 5.846 | | | | 23.178 | | | | 60.573 | |

| Shares for DIM Vastgoed Contingent Consideration | | | 453.130 | | | | - | | | | - | |

| Diluted common shares | | | 77,276.491 | | | | 76,344.614 | | | | 73,510.043 | |

| | | | | | | | | | | | | |

| Equity market capitalization | | $ | 942,000 | | | $ | 1,351,300 | | | $ | 1,692,936 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total debt (excluding unamortized/unaccreted premium/(discount)) | | $ | 1,266,719 | | | $ | 1,064,490 | | | $ | 1,178,797 | |

| Cash and equivalents (including cash held in escrow) | | | (3,183 | ) | | | (5,355 | ) | | | (55,773 | ) |

| Net debt | | | 1,263,536 | | | | 1,059,135 | | | | 1,123,024 | |

| Equity market capitalization | | | 942,000 | | | | 1,351,300 | | | | 1,692,936 | |

| Total market capitalization | | $ | 2,205,536 | | | $ | 2,410,435 | | | $ | 2,815,961 | |

| | | | | | | | | | | | | |

| Net debt to total market capitalization | | | 57.3 | % | | | 43.9 | % | | | 39.9 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Gross real estate and securities investments | | $ | 2,437,693 | | | $ | 2,135,469 | | | $ | 2,202,189 | |

| | | | | | | | | | | | | |

| Net debt to gross real estate and securities investments | | | 51.8 | % | | | 49.6 | % | | | 51.0 | % |

| | | | | | | | | | | | | |

Note: Amounts in 2009 include consolidation of DIM Vastgoed.

| EQUITY ONE, INC. |

| DEBT SUMMARY |

| As of March 31, 2009 |

| (in thousands) |

| |

| | | | | | | | | | |

| | | Mar 31, 2009 | | | Dec 31, 2008 | | | Dec 31, 2007 | |

| | | | | | | | | | |

| Fixed rate debt | | $ | 1,155,793 | | | $ | 928,041 | | | $ | 1,042,112 | |

| Fixed rate debt - swapped to variable rate | | | 100,926 | | | | 100,949 | | | | 99,685 | |

| Variable rate debt - unhedged | | | 10,000 | | | | 35,500 | | | | 37,000 | |

| Total debt* | | $ | 1,266,719 | | | $ | 1,064,490 | | | $ | 1,178,797 | |

| | | | | | | | | | | | | |

| % Fixed rate debt | | | 91.2 | % | | | 87.2 | % | | | 88.4 | % |

| % Fixed rate debt - swapped to variable rate | | | 8.0 | % | | | 9.5 | % | | | 8.5 | % |

| % Variable rate debt - unhedged | | | 0.8 | % | | | 3.3 | % | | | 3.1 | % |

| Total | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | | |

| % Variable rate debt - total | | | 8.8 | % | | | 12.8 | % | | | 11.6 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Secured mortgage debt | | $ | 629,289 | | | $ | 371,077 | | | $ | 397,112 | |

| Unsecured debt** | | | 637,430 | | | | 693,413 | | | | 781,685 | |

| Total debt* | | $ | 1,266,719 | | | $ | 1,064,490 | | | $ | 1,178,797 | |

| | | | | | | | | | | | | |

| % Secured mortgage debt | | | 49.7 | % | | | 34.9 | % | | | 33.7 | % |

| % Unsecured debt | | | 50.3 | % | | | 65.1 | % | | | 66.3 | % |

| Total | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total market capitalization (from page 7) | | $ | 2,205,536 | | | $ | 2,410,435 | | | $ | 2,815,960 | |

| | | | | | | | | | | | | |

| % Secured mortgage debt | | | 28.5 | % | | | 15.4 | % | | | 14.1 | % |

| % Unsecured debt | | | 28.9 | % | | | 28.8 | % | | | 27.8 | % |

| Total debt : Total market capitalization | | | 57.4 | % | | | 44.2 | % | | | 41.9 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Weighted-average interest rate on secured mortgage debt* | | | 6.8 | % | | | 7.2 | % | | | 7.4 | % |

| Weighted-average interest rate on senior unsecured notes** | | | 5.4 | % | | | 5.7 | % | | | 5.7 | % |

| Interest rate on revolving credit facilities | | | 3.3 | % | | | 2.1 | % | | | 5.0 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Weighted-average maturity on mortgage debt* | | 5.0 years | | | 5.0 years | | | 4.5 years | |

| Weighted-average maturity on senior unsecured notes | | 5.6 years | | | 6.5 years | | | 6.7 years | |

| | | | | | | | | | | | | |

Note: Amounts in 2009 include consolidation of DIM Vastgoed.

| * | Excluding unamortized premium/discount. |

| ** | Including the effect of interest rate swaps. |

EQUITY ONE, INC.

CONSOLIDATED DEBT MATURITY SCHEDULE

March 31, 2009

(in thousands)

| | | Secured Debt * | | | Unsecured Debt | | | | | | | | | | |

| | | | | | | | Revolving Credit Facilities (1) | | | | | | Total | | | Weighted Average Interest Rate at Maturity | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| 2009 | | | 11,116 | | | | 52,027 | | | | 0 | | | | 171,630 | | | | 234,773 | | | | 4.79 | % | | | 18.6 | % |

| 2010 | | | 13,421 | | | | 72,076 | | | | 0 | | | | 0 | | | | 85,497 | | | | 8.23 | % | | | 6.8 | % |

| 2011 | | | 12,434 | | | | 68,570 | | | | 10,000 | | | | 0 | | | | 91,004 | | | | 6.79 | % | | | 7.2 | % |

| 2012 | | | 11,529 | | | | 44,479 | | | | 0 | | | | 10,000 | | | | 66,008 | | | | 6.97 | % | | | 5.2 | % |

| 2013 | | | 11,017 | | | | 54,126 | | | | 0 | | | | 0 | | | | 65,143 | | | | 6.25 | % | | | 5.1 | % |

| 2014 | | | 9,824 | | | | 24,950 | | | | 0 | | | | 0 | | | | 34,774 | | | | 5.77 | % | | | 2.7 | % |

| 2015 | | | 7,057 | | | | 69,092 | | | | 0 | | | | 111,570 | | | | 187,719 | | | | 5.31 | % | | | 14.8 | % |

| 2016 | | | 5,397 | | | | 51,489 | | | | 0 | | | | 106,500 | | | | 163,386 | | | | 5.96 | % | | | 12.9 | % |

| 2017 | | | 4,746 | | | | 17,241 | | | | 0 | | | | 226,805 | | | | 248,792 | | | | 6.10 | % | | | 19.7 | % |

| 2018 | | | 4,566 | | | | 56,623 | | | | 0 | | | | 0 | | | | 61,189 | | | | 6.27 | % | | | 4.8 | % |

| Thereafter | | | 19,200 | | | | 8,308 | | | | 0 | | | | 0 | | | | 27,508 | | | | 7.83 | % | | | 2.2 | % |

| Total | | $ | 110,307 | | | $ | 518,981 | | | $ | 10,000 | | | $ | 626,505 | | | $ | 1,265,793 | | | | 5.95 | % | | | 100.0 | % |

| (1) | Represents the entire principal balance of a maturing loan on the maturity date. Credit facilities are shown as due on the initial maturity dates, though certain extension options may be available. |

| (2) | Excludes the adjustment attributable to the fair value of the associated interest rate swap. |

| * | Includes 22 loans related to DIM Vastgoed properties. |

| EQUITY ONE, INC. |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| For the quarter ended March 31, 2009 |

| (in thousands, except per share data) |

| |

| | | Three months ended | | | Percent | |

| | | Mar 31, 2009 | | | Mar 31, 2008 | | | Change | |

| REVENUE: | | | | | | | | | |

| Minimum rent | | $ | 53,215 | | | $ | 47,975 | | | | |

| Expense recoveries | | | 14,423 | | | | 13,664 | | | | |

| Percentage rent | | | 1,140 | | | | 1,449 | | | | |

| Management and leasing services | | | 550 | | | | 183 | | | | |

| Total revenue | | | 69,328 | | | | 63,271 | | | | 9.6 | % |

| | | | | | | | | | | | | |

| COSTS AND EXPENSES: | | | | | | | | | | | | |

| Property operating | | | 18,922 | | | | 16,067 | | | | | |

| Rental property depreciation and amortization | | | 15,291 | | | | 11,764 | | | | | |

| General and administrative | | | 12,256 | | | | 6,885 | | | | | |

| Total costs and expenses | | | 46,469 | | | | 34,716 | | | | 33.9 | % |

| | | | | | | | | | | | | |

INCOME BEFORE OTHER INCOME AND EXPENSE AND DISCONTINUED OPERATIONS | | | 22,859 | | | | 28,555 | | | | | |

| | | | | | | | | | | | | |

| OTHER INCOME AND EXPENSE: | | | | | | | | | | | | |

| Investment income | | | 2,057 | | | | 6,162 | | | | | |

| Equity in real estate joint ventures | | | (7 | ) | | | - | | | | | |

| Other income | | | 1,050 | | | | 43 | | | | | |

| Interest expense | | | (19,563 | ) | | | (15,982 | ) | | | | |

| Amortization of deferred financing fees | | | (444 | ) | | | (429 | ) | | | | |

| Gain on acquisition of controlling interest in subsidiary | | | 26,866 | | | | - | | | | | |

| (Loss) on sale of real estate | | | - | | | | (42 | ) | | | | |

| Gain on extinguishment of debt | | | 8,691 | | | | 2,380 | | | | | |

INCOME FROM CONTINUING OPERATIONS BEFORE TAXES AND DISCONTINUED OPERATIONS | | | 41,509 | | | | 20,687 | | | | | |

| Income tax benefit of taxable REIT subsidiaries | | | 639 | | | | 83 | | | | | |

| INCOME FROM CONTINUING OPERATIONS | | | 42,148 | | | | 20,770 | | | | 102.9 | % |

| | | | | | | | | | | | | |

| DISCONTINUED OPERATIONS: | | | | | | | | | | | | |

| Operations of income-producing properties sold or held for sale | | | 31 | | | | 85 | | | | | |

| Gain on disposal of income-producing properties | | | 1,178 | | | | - | | | | | |

| INCOME FROM DISCONTINUED OPERATIONS | | | 1,209 | | | | 85 | | | | | |

| | | | | | | | | | | | | |

| NET INCOME | | $ | 43,357 | | | $ | 20,855 | | | | 107.9 | % |

| Net loss attributable to noncontrolling interest | | | 476 | | | | - | | | | | |

| NET INCOME ATTRIBUTABLE TO EQUITY ONE | | $ | 43,833 | | | $ | 20,855 | | | | | |

| | | | | | | | | | | | | |

| EARNINGS PER COMMON SHARE - BASIC: | | | | | | | | | | | | |

| Continuing operations | | | 0.55 | | | | 0.28 | | | | | |

| Discontinued operations | | | 0.02 | | | | - | | | | | |

| NET INCOME | | $ | 0.57 | | | $ | 0.28 | | | | 104.6 | % |

| | | | | | | | | | | | | |

| EARNINGS PER COMMON SHARE - DILUTED: | | | | | | | | | | | | |

| Continuing operations | | | 0.54 | | | | 0.28 | | | | | |

| Discontinued operations | | | 0.02 | | | | 0 | | | | | |

| NET INCOME | | $ | 0.56 | | | $ | 0.28 | | | | 100.0 | % |

| | | | | | | | | | | | | |

| Weighted average shares outstanding | | | | | | | | | | | | |

| Basic | | | 76,764 | | | | 73,324 | | | | | |

| Diluted | | | 77,410 | | | | 73,499 | | | | | |

| | |

Note: Amounts in 2009 include consolidation of DIM Vastgoed.

| EQUITY ONE, INC. |

| PRO FORMA FINANCIAL INFORMATION FOR DISCONTINUED OPERATIONS |

| For the quarter ended March 31, 2009 |

| (in thousands) |

| |

| | | Three months ended | |

| | | Mar 31, 2009 | |

| | | As | | | Disc. Ops | | | Pre Disc | |

| | | Reported | | | Total | | | Ops | |

| REVENUE: | | | | | | | | | |

| Minimum rent | | $ | 53,215 | | | $ | 30 | | | $ | 53,245 | |

| Expense recoveries | | | 14,423 | | | | 7 | | | | 14,430 | |

| Percentage rent | | | 1,140 | | | | - | | | | 1,140 | |

| Management and leasing services | | | 550 | | | | - | | | | 550 | |

| Total revenue | | | 69,328 | | | | 37 | | | | 69,365 | |

| | | | | | | | | | | | | |

| COSTS AND EXPENSES: | | | | | | | | | | | | |

| Property operating | | | 18,922 | | | | 5 | | | | 18,927 | |

| Rental property depreciation and amortization | | | 15,291 | | | | 1 | | | | 15,292 | |

| General and administrative | | | 12,256 | | | | - | | | | 12,256 | |

| Total costs and expenses | | | 46,469 | | | | 6 | | | | 46,475 | |

| | | | | | | | | | | | | |

| INCOME BEFORE OTHER INCOME AND EXPENSE AND DISCONTINUED OPERATIONS | | | 22,859 | | | | 31 | | | | 22,890 | |

| | | | | | | | | | | | | |

| OTHER INCOME AND EXPENSE: | | | | | | | | | | | | |

| Investment income | | | 2,057 | | | | - | | | | 2,057 | |

| Equity in real estate joint ventures | | | (7 | ) | | | - | | | | (7 | ) |

| Other income | | | 1,050 | | | | - | | | | 1,050 | |

| Interest expense | | | (19,563 | ) | | | - | | | | (19,563 | ) |

| Amortization of deferred financing fees | | | (444 | ) | | | - | | | | (444 | ) |

| Gain on acquisition of controlling interest in subsidiary | | | 26,866 | | | | - | | | | 26,866 | |

| Gain on disposal of income-producing properties | | | - | | | | 1,178 | | | | 1,178 | |

| Gain on extinguishment of debt | | | 8,691 | | | | - | | | | 8,691 | |

| INCOME FROM CONTINUING OPERATIONS BEFORE TAXES AND DISCONTINUED OPERATIONS | | | 41,509 | | | | 1,209 | | | | 42,718 | |

Income tax benefit of taxable REIT subsidiaries | | | 639 | | | | | | | | 639 | |

| INCOME FROM CONTINUING OPERATIONS | | | 42,148 | | | | 1,209 | | | | 43,357 | |

| | | | | | | | | | | | | |

| DISCONTINUED OPERATIONS: | | | | | | | | | | | | |

| Operations of income-producing properties sold | | | 31 | | | | (31 | ) | | | - | |

| Gain on disposal of income-producing properties | | | 1,178 | | | | (1,178 | ) | | | - | |

| Income (loss) from discontinued operations | | | 1,209 | | | | (1,209 | ) | | | - | |

| | | | | | | | | | | | | |

| Net loss attributable to noncontrolling interest | | | 476 | | | | - | | | | 476 | |

| | | | | | | | | | | | | |

| NET INCOME ATTRIBUTABLE TO EQUITY ONE | | $ | 43,833 | | | $ | - | | | $ | 43,833 | |

| | | | | | | | | | | | | |

| | |

| Note: | The Company adopted SFAS No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets" ("SFAS No. 144"), effective January 1, 2002. This standard requires that operating results of income producing real estate assets that are sold or held for sale be included in discontinued operations in the statement of earnings for all periods presented. The above table presents the results as reported pursuant to SFAS No. 144, results of the assets sold or held for sale and the results before the impact of SFAS No. 144. |

Amounts in 2009 include consolidation of DIM Vastgoed.

| EQUITY ONE, INC. |

| PRO FORMA FINANCIAL INFORMATION FOR DISCONTINUED OPERATIONS |

| For the quarter ended March 31, 2009 |

| (in thousands) |

| |

| | | Three months ended | |

| | | Mar 31, 2008 | |

| | | As | | | Disc. Ops | | | Pre Disc | |

| | | Reported | | | Total | | | Ops | |

| REVENUE: | | | | | | | | | |

| Minimum rent | | $ | 47,975 | | | $ | 50 | | | $ | 48,025 | |

| Expense recoveries | | | 13,664 | | | | 80 | | | | 13,744 | |

| Percentage rent | | | 1,449 | | | | - | | | | 1,449 | |

| Management and leasing services | | | 183 | | | | - | | | | 183 | |

| Total revenue | | | 63,271 | | | | 130 | | | | 63,401 | |

| | | | | | | | | | | | | |

| COSTS AND EXPENSES: | | | | | | | | | | | | |

| Property operating | | | 16,067 | | | | 13 | | | | 16,080 | |

| Rental property depreciation and amortization | | | 11,764 | | | | 32 | | | | 11,796 | |

| General and administrative | | | 6,885 | | | | - | | | | 6,885 | |

| Total costs and expenses | | | 34,716 | | | | 45 | | | | 34,761 | |

| | | | | | | | | | | | | |

| INCOME BEFORE OTHER INCOME AND EXPENSE AND DISCONTINUED OPERATIONS | | | 28,555 | | | | 85 | | | | 28,640 | |

| | | | | | | | | | | | | |

| OTHER INCOME AND EXPENSE: | | | | | | | | | | | | |

| Investment income | | | 6,162 | | | | - | | | | 6,162 | |

| Other income | | | 43 | | | | - | | | | 43 | |

| Interest expense | | | (15,982 | ) | | | - | | | | (15,982 | ) |

| Amortization of deferred financing fees | | | (429 | ) | | | - | | | | (429 | ) |

| (Loss) on sale of real estate | | | (42 | ) | | | - | | | | (42 | ) |

| Gain on extinguishment of debt | | | 2,380 | | | | - | | | | 2,380 | |

| INCOME FROM CONTINUING OPERATIONS BEFORE TAXES AND DISCONTINUED OPERATIONS | | | 20,687 | | | | 113 | | | | 20,800 | |

Income tax benefit of taxable REIT subsidiaries | | | 83 | | | | - | | | | 83 | |

| INCOME FROM CONTINUING OPERATIONS | | | 20,770 | | | | 85 | | | | 20,855 | |

| | | | | | | | | | | | | |

| DISCONTINUED OPERATIONS: | | | | | | | | | | | | |

| Operations of income-producing properties sold or held for sale | | | 85 | | | | (85 | ) | | | - | |

| Gain on disposal of income-producing properties | | | - | | | | - | | | | - | |

| Income from discontinued operations | | | 85 | | | | (85 | ) | | | - | |

| | | | | | | | | | | | | |

| NET INCOME ATTRIBUTABLE TO EQUITY ONE | | $ | 20,855 | | | $ | - | | | $ | 20,855 | |

| Note: | The Company adopted SFAS No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets" ("SFAS No. 144"), effective January 1, 2002. This standard requires that operating results of income producing real estate assets that are sold or held for sale be included in discontinued operations in the statement of earnings for all periods presented. The above table presents the results as reported pursuant to SFAS No. 144, results of the assets sold or held for sale and the results before the impact of SFAS No. 144. |

Amounts in 2009 include consolidation of DIM Vastgoed.

| EQUITY ONE, INC. |

| NET OPERATING INCOME |

| For the quarter ended March 31, 2009 |

| (in thousands) |

| |

| | | Three months ended | | | Percent | |

| | | Mar 31, 2009 | | | Mar 31, 2008 | | | Change | |

| | | | | | | | | | |

| | | | | | | | | | |

Total net operating income (1) | | | | | | | | | |

| Total rental revenue | | $ | 68,815 | | | $ | 63,218 | | | | 8.9 | % |

| Property operating expenses | | | 18,927 | | | | 16,080 | | | | 17.7 | % |

| Net operating income | | $ | 49,888 | | | $ | 47,138 | | | | 5.8 | % |

| | | | | | | | | | | | | |

| NOI margin (NOI / Total rental revenue) | | | 72.5 | % | | | 74.6 | % | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Same-property NOI (2) | | | | | | | | | | | | |

| Total rental revenue | | $ | 55,807 | | | $ | 55,688 | | | | 0.2 | % |

Property operating expenses (3) | | | 17,309 | | | | 16,137 | | | | 7.3 | % |

| Net operating income | | $ | 38,498 | | | $ | 39,551 | | | | (2.7 | %) |

| | | | | | | | | | | | | |

| Growth in same property NOI | | | (2.7 | %) | | | | | | | | |

| | | | | | | | | | | | | |

| Number of properties included in analysis | | | 150 | | | | | | | | | |

| Same-property occupancy | | | 91.4 | % | | | 92.3 | % | | | | |

| | |

Note: Amounts in 2009 include consolidation of DIM Vastgoed.

| | (1) | Amounts included in discontinued operations have been included for purposes of this presentation of net operating income. |

| | (2) | Retail centers only. Excludes the effects of straight-line rent, SFAS 141 / 142, lease termination fees, and prior year expense recoveries and adjustments, if any. |

| | (3) | Property operating expenses include intercompany management fee expense. |

| EQUITY ONE, INC. |

| EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION and AMORTIZATION (EBITDA) |

| For the quarter ended March 31, 2009 |

| (in thousands) |

| |

| | | Three months ended | |

| | | Mar 31, 2009 | | | Mar 31, 2008 | |

| | | | | | | |

| Net income | | $ | 43,357 | | | $ | 20,855 | |

| Net loss attributable to noncontrolling interest | | | 476 | | | | - | |

| Rental property depreciation and amortization* | | | 15,292 | | | | 11,796 | |

| Other depreciation and amortization | | | 213 | | | | 183 | |

| Interest expense* | | | 19,563 | | | | 15,982 | |

| Amortization of deferred financing fees* | | | 444 | | | | 429 | |

| (Loss) on sale of real estate | | | - | | | | 42 | |

| Gain on extinguishment of debt | | | (8,691 | ) | | | (2,380 | ) |

| Gain on acquisition of controlling interest in subsidiary | | | (26,866 | ) | | | - | |

| Benefit for income taxes | | | (639 | ) | | | (83 | ) |

| Equity in real estate joint ventures | | | 7 | | | | - | |

| EBITDA* | | $ | 43,156 | | | $ | 46,824 | |

| | | | | | | | | |

| | $ | 19,563 | | | $ | 15,982 | |

| | | | | | | | | |

| EBITDA to interest expense* | | | 2.2 | | | | 2.9 | |

| | | | | | | | | |

| Fixed charges | | | | | | | | |

| | $ | 19,563 | | | $ | 15,982 | |

Scheduled principal amortization (2) | | | 3,986 | | | | 2,743 | |

| Total fixed charges | | $ | 23,549 | | | $ | 18,725 | |

| | | | | | | | | |

| EBITDA to fixed charges* | | | 1.8 | | | | 2.5 | |

| | | | | | | | | |

| Total market capitalization (see page 7) | | $ | 2,205,536 | | | $ | 2,410,435 | |

| | |

Note: Amounts in 2009 include consolidation of DIM Vastgoed.

* The indicated line item includes amounts reported in discontinued operations.

(1) Interest expense for March 31, 2009 includes $918K of debt (discount) attributable to DIM.

(2) Excludes balloon payments upon maturity.

| EQUITY ONE, INC. |

| CONSOLIDATED STATEMENTS OF FUNDS FROM OPERATIONS |

| For the quarter ended March 31, 2009 |

| (in thousands, except per share data) |

| |

| | | Three months ended | |

| | | Mar 31, 2009 | | | Mar 31, 2008 | |

| | | | | | | |

| Net income attributable to Equity One | | $ | 43,833 | | | $ | 20,855 | |

| Adjustments: | | | | | | | | |

| Rental property depreciation and amortization, net of noncontrolling interest, including discontinued operations | | | 13,744 | | | | 11,796 | |

| Pro rata share of real estate depreciation from unconsolidated JV | | | 361 | | | | - | |

| Funds from operations | | $ | 57,938 | | | $ | 32,651 | |

| Change | | | 77.4 | % | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Earnings per diluted share attributable to Equity One | | $ | 0.56 | | | $ | 0.28 | |

| Adjustments: | | | | | | | | |

| Rental property depreciation and amortization, net of noncontrolling interest, including discontinued operations | | | 0.18 | | | | 0.16 | |

| Pro rata share of real estate depreciation from unconsolidated joint ventures | | | - | | | | - | |

Net adjustment for unvested shares and noncontrolling interest (1) | | | 0.01 | | | | - | |

| Funds from operations per diluted share | | $ | 0.75 | | | $ | 0.44 | |

| Change | | | 69.9 | % | | | | |

| | |

| Weighted average diluted shares | | | 77,410 | | | | 73,499 | |

| | |

| | |

Note: Amounts in 2009 include consolidation of DIM Vastgoed.

| (1) | Includes net effect of (a) an adjustment for unvested awards of share-based payments with rights to receive dividends or dividend equivalents and (b) an adjustment related to the possible share issuance in the fourth quarter of 2010 pursuant to the DIM stock exchange agreement. |

| EQUITY ONE, INC. |

| ADDITIONAL DISCLOSURES |

| For the quarter ended March 31, 2009 |

| (in thousands) |

| |

| | | | | | Three months ended | |

| | | | | | Mar 31, 2009 | | | Mar 31, 2008 | |

| | | | | | | | | | |

| Certain non-cash items: | | | | | | | | | |

| Amortization of deferred financing fees | | | | | $ | 444 | | | $ | 429 | |

| Amortization of above/below market rent intangibles | | | | | | (1,525 | ) | | | (1,109 | ) |

| Amortization of restricted stock and stock option expense | | | | | | 3,195 | | | | 1,634 | |

| Straight line rents | | | | | | (516 | ) | | | (271 | ) |

| Capitalized interest | | | | | | (315 | ) | | | (790 | ) |

| Amortization of debt premium/discount | | | | | | 591 | | | | (538 | ) |

| Total non-cash items | | | | | $ | 1,874 | | | $ | (645 | ) |

| | | | | | | | | | | | |

| Certain capital expenditures: | | | | | | | | | | | |

| Tenant improvements | | | | | $ | 3,538 | | | $ | 1,672 | |

| Leasing commissions and costs | | | | | | 972 | | | | 2,222 | |

| Total tenant improvements and leasing costs | | | | | $ | 4,510 | | | $ | 3,894 | |

| | | | | | | | | | | | |

| Certain balance sheet accounts at 03/31/09: | | | | | | | | | | | |

| Straight-line rent receivable | | $ | 14,626 | | | | | | | | | |

| Lease intangible asset, net | | | 42,679 | | | | | | | | | |

| Lease intangibles liability, net | | | (43,579 | ) | | | | | | | | |

| Deferred expenses, net | | | 26,035 | | | | | | | | | |

| Total balance sheet accounts | | $ | 39,761 | | | | | | | | | |

| | |

Note: Amounts in 2009 include consolidation of DIM Vastgoed.

| EQUITY ONE, INC. |

| TENANT CONCENTRATION SCHEDULE |

| CONSOLIDATED PROPERTIES |

| As of March 31, 2009 |

| |

| Tenant | | Number of stores | | | Square feet | | | % of total square feet | | | Annualized minimum rent | | | % of total annualized minimum rent | | | Average annual minimum rent per square foot | |

| | | | | | | | | | | | | | | | | | | |

| Top twenty tenants | | | | | | | | | | | | | | | | | | |

| Publix | | | 52 | | | | 2,303,366 | | | | 14.4 | % | | $ | 18,097,419 | | | | 10.5 | % | | $ | 7.86 | |

| Supervalu | | | 7 | | | | 458,273 | | | | 2.9 | % | | | 8,302,236 | | | | 4.8 | % | | | 18.12 | |

| Kroger | | | 12 | | | | 679,082 | | | | 4.2 | % | | | 5,379,703 | | | | 3.1 | % | | | 7.92 | |

| Bed Bath & Beyond | | | 8 | | | | 261,332 | | | | 1.6 | % | | | 3,079,214 | | | | 1.8 | % | | | 11.78 | |

| Winn Dixie | | | 9 | | | | 398,128 | | | | 2.5 | % | | | 2,940,815 | | | | 1.7 | % | | | 7.39 | |

| LA Fitness | | | 3 | | | | 144,307 | | | | 0.9 | % | | | 2,517,941 | | | | 1.5 | % | | | 17.45 | |

| CVS Pharmacy | | | 13 | | | | 143,460 | | | | 0.9 | % | | | 2,315,237 | | | | 1.4 | % | | | 16.14 | |

| TJ Maxx Companies | | | 8 | | | | 248,658 | | | | 1.6 | % | | | 2,239,515 | | | | 1.3 | % | | | 9.01 | |

| Blockbuster | | | 21 | | | | 110,669 | | | | 0.7 | % | | | 2,220,755 | | | | 1.3 | % | | | 20.07 | |

| Office Depot | | | 7 | | | | 179,837 | | | | 1.1 | % | | | 2,062,123 | | | | 1.2 | % | | | 11.47 | |

| Kmart Corp. | | | 5 | | | | 439,558 | | | | 2.8 | % | | | 1,939,705 | | | | 1.1 | % | | | 4.41 | |

| Food Lion | | | 6 | | | | 241,934 | | | | 1.5 | % | | | 1,850,161 | | | | 1.1 | % | | | 7.65 | |

| Bi-Lo | | | 4 | | | | 149,016 | | | | 0.9 | % | | | 1,372,730 | | | | 0.8 | % | | | 9.21 | |

| Dollar Tree | | | 17 | | | | 184,420 | | | | 1.2 | % | | | 1,299,092 | | | | 0.8 | % | | | 7.04 | |

| Stein Mart | | | 4 | | | | 158,472 | | | | 1.0 | % | | | 1,207,286 | | | | 0.7 | % | | | 7.62 | |

| Walgreens | | | 5 | | | | 78,699 | | | | 0.5 | % | | | 1,167,746 | | | | 0.7 | % | | | 14.84 | |

| H&R Block | | | 31 | | | | 49,764 | | | | 0.3 | % | | | 1,043,920 | | | | 0.6 | % | | | 20.98 | |

| Albertsons | | | 3 | | | | 175,470 | | | | 1.1 | % | | | 991,390 | | | | 0.6 | % | | | 5.65 | |

| Big Lots | | | 5 | | | | 169,741 | | | | 1.1 | % | | | 978,213 | | | | 0.6 | % | | | 5.76 | |

| Memorial Healthcare Group | | | 1 | | | | 61,000 | | | | 0.4 | % | | | 925,836 | | | | 0.5 | % | | | 15.18 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Sub-total top ten tenants | | | 221 | | | | 6,635,186 | | | | 41.6 | % | | $ | 61,931,037 | | | | 36.1 | % | | $ | 9.33 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Remaining tenants | | | 2,299 | | | | 7,948,674 | | | | 49.9 | % | | | 109,671,569 | | | | 63.9 | % | | | 13.80 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Sub-total all tenants | | | 2,520 | | | | 14,583,860 | | | | 91.5 | % | | $ | 171,602,606 | | | | 100.0 | % | | $ | 11.93 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Vacant | | | 512 | | | | 1,358,948 | | | | 8.5 | % | | NA | | | NA | | | NA | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total including vacant | | | 3,032 | | | | 15,942,808 | | | | 100.0 | % | | $ | 171,602,606 | | | | 100.0 | % | | NA | |

Note: Excludes developments, non-retail properties, and DIM properties.

| EQUITY ONE, INC. |

| RECENT LEASING ACTIVITY |

| For the three months ended March 31, 2009 |

| |

| Category | | Total Leases | | | Total Sq. Ft. | | | Same Space Sq. Ft. | | | Prior Rent PSF | | | New Rent PSF | | | Rent Spread PSF | | | Same Space TIs PSF | |

New Leases (1) | | | 30 | | | | 100,068 | | | | 82,184 | | | $ | 15.55 | | | $ | 14.20 | | | | -8.7 | % | | $ | 5.38 | |

| Renewals | | | 79 | | | | 188,453 | | | | 188,453 | | | | 14.85 | | | | 14.89 | | | | 0.3 | % | | | 0.45 | |

| Options | | | 7 | | | | 10,242 | | | | 10,242 | | | | 18.19 | | | | 19.40 | | | | 6.6 | % | | | - | |

| Total New, Renewals & Options | | | 116 | | | | 298,763 | | | | 280,879 | | | $ | 15.18 | | | $ | 14.85 | | | | -2.1 | % | | $ | 1.88 | |

| | |

| Note: | Prior rent and new rent are presented on a "cash basis", not on a straight-line basis. |

| Note: | Excludes developments, non-retail properties, and DIM properties. |

| (1) | Rent spreads for new leases reflect same-space leasing where amount of rent paid by prior tenant is available. |

| EQUITY ONE, INC. |

| SHOPPING CENTER LEASE EXPIRATION SCHEDULE |

| CONSOLIDATED PROPERTIES |

| As of March 31, 2009 |

| |

ALLTENANTS

| Date | | | Number of leases | | | Square feet | | | Percent of total square feet | | | Annualized minimum rent at expiration | | | Percent of total annualized minimum rent | | | Average annual minimum rent per square foot | |

| | | | | | | | | | | | | | | | | | | | |

| M-T-M | | | | 74 | | | | 152,679 | | | | 1.0 | % | | $ | 2,006,520 | | | | 1.1 | % | | $ | 13.14 | |

| 2009 | | | | 435 | | | | 1,330,268 | | | | 8.3 | % | | | 16,796,101 | | | | 9.3 | % | | | 12.63 | |

| 2010 | | | | 533 | | | | 2,023,846 | | | | 12.7 | % | | | 23,407,672 | | | | 13.0 | % | | | 11.57 | |

| 2011 | | | | 498 | | | | 2,144,255 | | | | 13.4 | % | | | 27,098,414 | | | | 15.0 | % | | | 12.64 | |

| 2012 | | | | 336 | | | | 1,746,504 | | | | 11.0 | % | | | 20,691,345 | | | | 11.5 | % | | | 11.85 | |

| 2013 | | | | 300 | | | | 1,533,114 | | | | 9.6 | % | | | 20,736,266 | | | | 11.5 | % | | | 13.53 | |

| 2014 | | | | 125 | | | | 1,155,358 | | | | 7.3 | % | | | 11,155,657 | | | | 6.2 | % | | | 9.66 | |

| 2015 | | | | 32 | | | | 353,140 | | | | 2.2 | % | | | 4,115,870 | | | | 2.3 | % | | | 11.66 | |

| 2016 | | | | 37 | | | | 927,869 | | | | 5.8 | % | | | 14,132,221 | | | | 7.9 | % | | | 15.23 | |

| 2017 | | | | 27 | | | | 495,943 | | | | 3.1 | % | | | 6,332,535 | | | | 3.5 | % | | | 12.77 | |

| 2018 | | | | 29 | | | | 378,600 | | | | 2.4 | % | | | 4,454,504 | | | | 2.5 | % | | | 11.77 | |

| Thereafter | | | | 94 | | | | 2,342,284 | | | | 14.7 | % | | | 29,166,732 | | | | 16.2 | % | | | 12.45 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sub-total / average | | | | 2,520 | | | | 14,583,860 | | | | 91.5 | % | | $ | 180,093,837 | | | | 100.0 | % | | $ | 12.35 | |

| | | | | | | | | | | | | | | | | | . | | | | | | | | | |

| Vacant | | | | 512 | | | | 1,358,948 | | | | 8.5 | % | | NA | | | NA | | | NA | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total / average | | | | 3,032 | | | | 15,942,808 | | | | 100.0 | % | | $ | 180,093,837 | | | | 100.0 | % | | NA | |

Note: Excludes developments, non-retail properties, and DIM properties.

| EQUITY ONE, INC. |

| SHOPPING CENTER LEASE EXPIRATION SCHEDULE |

| CONSOLIDATED PROPERTIES |

| As of March 31, 2009 |

| |

ANCHOR TENANTS (SF >= 10,000)

| Date | | | Number of leases | | | Square feet | | | Percent of total square feet | | | Annualized minimum rent at expiration | | | Percent of total annualized minimum rent | | | Average annual minimum rent per square foot | |

| | | | | | | | | | | | | | | | | | | | |

| M-T-M | | | | 1 | | | | 12,000 | | | | 0.1 | % | | $ | 30,960 | | | | 0.0 | % | | $ | 2.58 | |

| 2009 | | | | 15 | | | | 487,233 | | | | 4.9 | % | | | 3,526,360 | | | | 4.1 | % | | $ | 7.24 | |

| 2010 | | | | 36 | | | | 1,014,604 | | | | 10.1 | % | | | 6,066,441 | | | | 7.0 | % | | $ | 5.98 | |

| 2011 | | | | 41 | | | | 1,162,463 | | | | 11.6 | % | | | 8,804,526 | | | | 10.2 | % | | $ | 7.57 | |

| 2012 | | | | 31 | | | | 1,054,728 | | | | 10.5 | % | | | 6,949,072 | | | | 8.1 | % | | $ | 6.59 | |

| 2013 | | | | 27 | | | | 870,263 | | | | 8.7 | % | | | 6,504,645 | | | | 7.5 | % | | $ | 7.47 | |

| 2014 | | | | 29 | | | | 898,121 | | | | 9.0 | % | | | 6,279,946 | | | | 7.3 | % | | $ | 6.99 | |

| 2015 | | | | 9 | | | | 277,831 | | | | 2.8 | % | | | 2,328,013 | | | | 2.7 | % | | $ | 8.38 | |

| 2016 | | | | 17 | | | | 853,255 | | | | 8.5 | % | | | 12,483,738 | | | | 14.4 | % | | $ | 14.63 | |

| 2017 | | | | 11 | | | | 413,474 | | | | 4.1 | % | | | 4,591,709 | | | | 5.3 | % | | $ | 11.11 | |

| 2018 | | | | 10 | | | | 317,861 | | | | 3.2 | % | | | 2,891,047 | | | | 3.3 | % | | $ | 9.10 | |

| Thereafter | | | | 55 | | | | 2,209,344 | | | | 22.1 | % | | | 26,045,614 | | | | 30.1 | % | | $ | 11.79 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sub-total / average | | | | 282 | | | | 9,571,177 | | | | 95.6 | % | | $ | 86,502,071 | | | | 100.0 | % | | $ | 9.04 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Vacant | | | | 18 | | | | 436,140 | | | | 4.4 | % | | NA | | | NA | | | NA | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total / average | | | | 300 | | | | 10,007,317 | | | | 100.0 | % | | $ | 86,502,071 | | | | 100.0 | % | | NA | |

Note: Excludes developments, non-retail properties, and DIM properties.

| EQUITY ONE, INC. |

| SHOPPING CENTER LEASE EXPIRATION SCHEDULE |

| CONSOLIDATED PROPERTIES |

| As of March 31, 2009 |

| |

SHOP TENANTS (SF < 10,000)

| Date | | | Number of leases | | | Square feet | | | Percent of total square feet | | | Annualized minimum rent at expiration | | | Percent of total annualized minimum rent | | | Average annual minimum rent per square foot | |

| | | | | | | | | | | | | | | | | | | | |

| M-T-M | | | | 73 | | | | 140,679 | | | | 2.4 | % | | $ | 1,975,560 | | | | 2.1 | % | | $ | 14.04 | |

| 2009 | | | | 420 | | | | 843,035 | | | | 14.2 | % | | | 13,269,741 | | | | 14.2 | % | | | 15.74 | |

| 2010 | | | | 497 | | | | 1,009,242 | | | | 17.0 | % | | | 17,341,231 | | | | 18.5 | % | | | 17.18 | |

| 2011 | | | | 457 | | | | 981,792 | | | | 16.5 | % | | | 18,293,888 | | | | 19.5 | % | | | 18.63 | |

| 2012 | | | | 305 | | | | 691,776 | | | | 11.7 | % | | | 13,742,273 | | | | 14.7 | % | | | 19.87 | |

| 2013 | | | | 273 | | | | 662,851 | | | | 11.2 | % | | | 14,231,621 | | | | 15.2 | % | | | 21.47 | |

| 2014 | | | | 96 | | | | 257,237 | | | | 4.3 | % | | | 4,875,711 | | | | 5.2 | % | | | 18.95 | |

| 2015 | | | | 23 | | | | 75,309 | | | | 1.3 | % | | | 1,787,857 | | | | 1.9 | % | | | 23.74 | |

| 2016 | | | | 20 | | | | 74,614 | | | | 1.3 | % | | | 1,648,483 | | | | 1.8 | % | | | 22.09 | |

| 2017 | | | | 16 | | | | 82,469 | | | | 1.4 | % | | | 1,740,826 | | | | 1.9 | % | | | 21.11 | |

| 2018 | | | | 19 | | | | 60,739 | | | | 1.0 | % | | | 1,563,457 | | | | 1.7 | % | | | 25.74 | |

| Thereafter | | | | 39 | | | | 132,940 | | | | 2.2 | % | | | 3,121,118 | | | | 3.3 | % | | | 23.48 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sub-total / average | | | | 2,238 | | | | 5,012,683 | | | | 84.5 | % | | $ | 93,591,766 | | | | 100.0 | % | | $ | 18.67 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Vacant | | | | 494 | | | | 922,808 | | | | 15.5 | % | | NA | | | NA | | | NA | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total / average | | | | 2,732 | | | | 5,935,491 | | | | 100.0 | % | | $ | 93,591,766 | | | | 100.0 | % | | NA | |

Note: Excludes developments, non-retail properties, and DIM properties.

| EQUITY ONE, INC. |

| SHOPPING CENTER LEASE EXPIRATION GRAPH |

| CONSOLIDATED PROPERTIES |

| As of March 31, 2009 |

Note: Excludes developments, non-retail properties, and DIM properties.

| EQUITY ONE, INC. |

| ANNUAL MINIMUM RENT OF OPERATING PROPERTIES BY METRO/REGION |

| As of March 31, 2009 |

| |

| Metro or Region | | # Properties | | | Total SF | | | AMR | | | % of AMR | |

| Broward County, FL | | | 13 | | | | 1,933,454 | | | | 25,230,354 | | | | 14.7 | % |

| Miami Dade County, FL | | | 11 | | | | 1,236,895 | | | | 17,430,817 | | | | 10.1 | % |

| Palm Beach County, FL | | | 10 | | | | 1,090,884 | | | | 13,515,406 | | | | 7.9 | % |

| South Florida | | | 34 | | | | 4,261,233 | | | | 56,176,577 | | | | 32.7 | % |

| Atlanta, GA | | | 19 | | | | 1,933,631 | | | | 22,658,646 | | | | 13.2 | % |

| Orlando, FL | | | 10 | | | | 1,129,335 | | | | 13,376,337 | | | | 7.8 | % |

| Tampa- St. Petersburg, FL | | | 12 | | | | 1,094,802 | | | | 10,486,351 | | | | 6.1 | % |

| Naples/Cape Coral/Venice, FL | | | 8 | | | | 885,156 | | | | 8,362,249 | | | | 4.9 | % |

| Jacksonville, FL | | | 6 | | | | 781,644 | | | | 8,249,245 | | | | 4.8 | % |

| Boston, MA | | | 6 | | | | 401,454 | | | | 8,511,791 | | | | 5.0 | % |

| Florida Treasure/Northeast Coast | | | 8 | | | | 711,278 | | | | 7,864,499 | | | | 4.6 | % |

| Lafayette, LA | | | 5 | | | | 714,691 | | | | 3,756,927 | | | | 2.2 | % |

| New Orleans, LA | | | 4 | | | | 458,125 | | | | 3,639,820 | | | | 2.1 | % |

| Baton Rouge, LA | | | 3 | | | | 349,146 | | | | 3,157,475 | | | | 1.8 | % |

| Raleigh Durham, NC | | | 3 | | | | 357,701 | | | | 2,963,374 | | | | 1.7 | % |

| Florida Panhandle | | | 2 | | | | 140,803 | | | | 1,337,876 | | | | 0.8 | % |

| Greenville, SC | | | 2 | | | | 164,176 | | | | 2,194,887 | | | | 1.3 | % |

| Hilton Head-Beaufort, SC | | | 1 | | | | 166,639 | | | | 2,141,658 | | | | 1.2 | % |

| Hartford, CT | | | 1 | | | | 213,323 | | | | 2,320,704 | | | | 1.4 | % |

| Other | | | 22 | | | | 2,179,671 | | | | 14,404,190 | | | | 8.4 | % |

| | | | | | | | | | | | | | | | | |

| Total | | | 146 | | | | 15,942,808 | | | $ | 171,602,606 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | |

Note: Excludes developments, non-retail properties, and DIM properties.

| EQUITY ONE, INC. |

| PROPERTY STATUS REPORT |

| As of March 31, 2009 |

| | | | | Year | | Total | | | | Number | | Supermarket anchor | | Other | | Average |

| | | | | Built / | | Sq. Ft. | | Percent | | of tenants | | Owned | | | | Expiration | | anchor | | base rent |

Property | | City | | Renovated | | Owned | | Leased | | Leased | | Vacant | | sq. ft. | | Name | | Date | | tenants | | per leased SF |

| | | | | | | | | | | | | | | | | | | | | | | |

| ALABAMA (2) | | | | | | | | | | | | | | | | | | | | | | |

| Madison Centre | | Madison | | 1997 | | 64,837 | | 97.5% | | 12 | | 1 | | 37,912 | | Publix | | 06/01/17 | | Rite Aid | | $ 9.83 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Winchester Plaza | | Huntsville | | 2006 | | 75,700 | | 90.2% | | 14 | | 5 | | 45,600 | | Publix | | 08/31/26 | | | | 11.57 |

| | | | | | | | | | | | | | | | | | | | | | | |

| TOTAL SHOPPING CENTERS ALABAMA (2) | | 140,537 | | 93.6% | | 26 | | 6 | | 83,512 | | | | | | | | $ 10.73 |

| | | | | | | | | | | | | | | | | | | | | | | |

| CONNECTICUT (1) | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Brookside Plaza** | | Enfield | | 1985 / 2006 | | 213,323 | | 92.6% | | 25 | | 3 | | 59,648 | | Shaw's | | 08/31/10 | | Bed Bath & Beyond / Walgreens / Staples / Petsmart | | $ 11.74 |

| | | | | | | | | | | | | | | | | | | | | | | |

| TOTAL SHOPPING CENTERS CONNECTICUT (1) | | 213,323 | | 92.6% | | 25 | | 3 | | 59,648 | | | | | | | | $ 11.74 |

| | | | | | | | | | | | | | | | | | | | | | | |

| FLORIDA (80) | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Orlando / Central Florida (10) | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Alafaya Commons | | Orlando | | 1987 | | 126,333 | | 97.2% | | 28 | | 2 | | 54,230 | | Publix | | 11/30/10 | | | | $ 14.24 |

| | | | | | | | | | | | | | | | | | | | | | | |

Alafaya Village | | Orlando | | 1986 | | 38,118 | | 72.5% | | 10 | | 7 | | | | | | | | Metro Fitness (shadow) | | 21.19 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Conway Crossing | | Orlando | | 2002 | | 76,321 | | 81.6% | | 12 | | 6 | | 44,271 | | Publix | | 04/30/22 | | | | 11.39 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Eastwood, Shoppes of | | Orlando | | 1997 | | 69,037 | | 100.0% | | 13 | | - | | 51,512 | | Publix | | 11/01/17 | | | | 12.37 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Hunter's Creek | | Orlando | | 1998 | | 73,204 | | 100.0% | | 10 | | - | | | | | | | | Office Depot / Lifestyle Family Fitness | | 13.90 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Kirkman Shoppes | | Orlando | | 1973 | | 88,820 | | 98.6% | | 29 | | 1 | | | | | | | | Party America | | 18.67 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Lake Mary Centre | | Orlando | | 1988 / 2001 | | 339,084 | | 94.0% | | 64 | | 23 | | 63,139 | | Albertsons | | 06/30/12 | | Kmart / Lifestyle Fitness Center / Office Depot | | 13.16 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Park Promenade | | Orlando | | 1987 / 2000 | | 128,848 | | 82.0% | | 19 | | 7 | | | | | | | | Beauty Depot / Orange County Library | | 7.82 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Town & Country | | Kissimmee | | 1993 | | 72,043 | | 95.6% | | 12 | | 2 | | 52,883 | | Albertsons* | | 10/31/18 | | | | 8.41 |

| | | | | | | | | | | | | | | | | (Ross Dress For Less) | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Unigold Shopping Center | | Winter Park | | 1987 | | 117,527 | | 86.2% | | 21 | | 4 | | 52,500 | | Winn-Dixie | | 04/30/12 | | Lifestyle Family Fitness | | 12.09 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Jacksonville / North Florida (8) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Atlantic Village | | Atlantic Beach, FL | | 1984 | | 100,559 | | 89.9% | | 20 | | 5 | | 39,795 | | Publix | | 10/31/13 | | Jo-Ann Fabric & Crafts | | 11.28 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Beauclerc Village | | Jacksonville | | 1962 / 1988 | | 68,846 | | 93.9% | | 7 | | 4 | | | | | | | | Big Lots / Goodwill / Bealls Outlet | | 8.92 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Forest Village | | Tallahassee | | 2000 | | 71,526 | | 86.7% | | 13 | | 3 | | 37,866 | | Publix | | 04/30/20 | | | | 10.79 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Ft. Caroline | | Jacksonville | | 1985 / 1995 | | 74,546 | | 87.0% | | 7 | | 6 | | 45,500 | | Winn-Dixie | | 05/31/15 | | Citi Trends | | 7.28 |

| EQUITY ONE, INC. |

| PROPERTY STATUS REPORT |

| As of March 31, 2009 |

| | | | | Year | | Total | | | | Number | | Supermarket anchor | | Other | | Average |

| | | | | Built / | | Sq. Ft. | | Percent | | of tenants | | Owned | | | | Expiration | | anchor | | base rent |

Property | | City | | Renovated | | Owned | | Leased | | Leased | | Vacant | | sq. ft. | | Name | | Date | | tenants | | per leased SF |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Medical & Merchants | | Jacksonville | | 1993 | | 156,153 | | 91.6% | | 13 | | 4 | | 55,999 | | Publix | | 02/10/13 | | Memorial Hospital | | $ 13.21 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Middle Beach | | Panama City Beach | | 1994 | | 69,277 | | 98.7% | | 8 | | 1 | | 56,077 | | Publix | | 09/30/14 | | | | 9.78 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Oak Hill | | Jacksonville | | 1985 / 1997 | | 78,492 | | 94.3% | | 17 | | 3 | | 39,795 | | Publix | | 03/11/15 | | Beall's | | 7.80 |

| | | | | | | | | | | | | | | | | | | | | | | |

| South Beach** | | Jacksonville Beach | | 1990 / 1991 | | 303,048 | | 96.7% | | 43 | | 5 | | | | | | | | Beall's / Bed Bath & Beyond / Home Depot / Stein Mart / Staples | | 12.67 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Miami-Dade / Broward / Palm Beach (34) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Bird Ludlum | | Miami | | 1988 / 1998 | | 192,282 | | 96.3% | | 40 | | 3 | | 44,400 | | Winn-Dixie | | 12/31/12 | | CVS Pharmacy / Bird Executive / Goodwill | | 17.15 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Boca Village | | Boca Raton | | 1978 | | 93,428 | | 92.2% | | 18 | | 3 | | 36,000 | | Publix Greenwise | | 03/31/12 | | CVS Pharmacy | | 16.23 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Boynton Plaza | | Boynton Beach | | 1978 / 1999 | | 99,324 | | 91.9% | | 23 | | 6 | | 37,664 | | Publix | | 08/31/13 | | CVS Pharmacy | | 13.07 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Bluffs Square | | Jupiter | | 1986 | | 132,395 | | 90.6% | | 39 | | 5 | | 39,795 | | Publix | | 10/22/11 | | Walgreens | | 13.74 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Chapel Trail | | Pembroke Pines | | 2007 | | 56,378 | | 97.2% | | 3 | | 1 | | | | | | | | LA Fitness | | 22.05 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Coral Reef Shopping Center | | Palmetto Bay | | 1968 / 1990 | | 74,680 | | 100.0% | | 16 | | - | | | | | | | | Office Depot / Walgreen's | | 19.47 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Countryside Shops | | Cooper City | | 1986 / 1988 / 1991 | | 179,561 | | 96.8% | | 40 | | 5 | | 39,795 | | Publix | | 12/04/10 | | CVS Pharmacy / Stein Mart | | 13.87 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Crossroads Square | | Pembroke Pines | | 1973 | | 84,387 | | 73.6% | | 20 | | 6 | | | | | | | | CVS Pharmacy | | 17.96 |

| | | | | | | | | | | | | | | | | | | | | | | |

| CVS Plaza | | Miami | | 2004 | | 29,204 | | 91.1% | | 7 | | 1 | | | | | | | | CVS Pharmacy | | 17.35 |

| | | | | | | | | | | | | | | | | | | | | | | |

| El Novillo | | Miami Beach | | 1970 / 2000 | | 10,000 | | 100.0% | | 1 | | - | | | | | | | | Jumbo Buffet | | 22.05 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Greenwood | | Palm Springs | | 1982 / 1994 | | 132,325 | | 87.7% | | 30 | | 6 | | 50,032 | | Publix | | 12/05/14 | | Bealls Outlet | | 12.74 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Jonathan's Landing | | Jupiter | | 1997 | | 26,820 | | 68.3% | | 10 | | 2 | | | | Publix | | | | | | 23.19 |

| | | | | | | | | | | | | | | | | (shadow) | | | | | | |

| Lago Mar | | Miami | | 1995 | | 82,613 | | 92.4% | | 18 | | 4 | | 42,323 | | Publix | | 09/13/15 | | | | 13.94 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Lantana Village | | Lantana | | 1976 / 1999 | | 181,780 | | 96.1% | | 23 | | 2 | | 39,473 | | Winn-Dixie | | 02/15/11 | | Kmart / Rite Aid* (Family Dollar) | | 7.28 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Meadows | | Miami | | 1997 | | 75,524 | | 97.4% | | 18 | | 2 | | 47,955 | | Publix | | 07/09/17 | | | | 13.83 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Oakbrook Square | | Palm Beach Gardens | | 1974 / 2000 / 2003 | | 199,633 | | 95.4% | | 26 | | 4 | | 44,400 | | Publix | | 11/30/20 | | Stein Mart / Home Goods / CVS / Basset Furniture / Duffy's | | 14.33 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Oaktree Plaza | | North Palm Beach | | 1985 | | 23,745 | | 82.0% | | 16 | | 4 | | | | | | | | | | 16.50 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Pine Island | | Davie | | 1983 / 1999 | | 254,907 | | 94.5% | | 40 | | 6 | | 39,943 | | Publix | | 11/30/13 | | Home Depot Expo* / Staples | | 12.00 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Pine Ridge Square | | Coral Springs | | 1986 / 1998 / 1999 | | 117,399 | | 89.6% | | 27 | | 8 | | 17,441 | | Fresh Market | | 07/31/09 | | Bed Bath & Beyond / Nordic Interiors | | 14.55 |

| EQUITY ONE, INC. |

| PROPERTY STATUS REPORT |

| As of March 31, 2009 |

| | | | | Year | | Total | | | | Number | | Supermarket anchor | | Other | | Average |

| | | | | Built / | | Sq. Ft. | | Percent | | of tenants | | Owned | | | | Expiration | | anchor | | base rent |

Property | | City | | Renovated | | Owned | | Leased | | Leased | | Vacant | | sq. ft. | | Name | | Date | | tenants | | per leased SF |

| | | | | | | | | | | | | | | | | | | | | | | |

| Plaza Alegre | | Miami | | 2003 | | 91,611 | | 96.1% | | 19 | | 2 | | 44,271 | | Publix | | 03/14/23 | | Goodwill | | $ 16.15 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Point Royale | | Miami | | 1970 / 2000 | | 216,760 | | 96.9% | | 24 | | 2 | | 45,350 | | Winn-Dixie | | 02/15/10 | | Best Buy | | 7.56 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Prosperity Centre | | Palm Beach Gardens | | 1993 | | 122,014 | | 96.6% | | 9 | | 1 | | | | | | | | Office Depot / CVS / Bed Bath & Beyond / TJ Maxx | | 17.98 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Ridge Plaza | | Davie | | 1984 / 1999 | | 155,204 | | 99.0% | | 28 | | 1 | | | | | | | | AMC Theater / Kabooms / Wachovia* (United Collection) / Round Up / Goodwill | | 11.77 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Riverside Square | | Coral Springs | | 1987 | | 104,241 | | 84.3% | | 26 | | 8 | | 39,795 | | Publix | | 02/18/12 | | | | 13.44 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Sawgrass Promenade | | Deerfield Beach | | 1982 / 1998 | | 107,092 | | 86.6% | | 22 | | 7 | | 36,464 | | Publix | | 12/15/14 | | Walgreens | | 11.62 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Sheridan Plaza | | Hollywood | | 1973 / 1991 | | 504,495 | | 94.8% | | 54 | | 9 | | 65,537 | | Publix | | 10/09/11 | | Kohl's / Ross / Bed Bath & Beyond / Office Depot / LA Fitness / USA Baby & Child Space / Assoc. in Neurology | | 14.18 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Shoppes of Andros Isles | | West Palm Beach | | 2000 | | 79,420 | | 91.2% | | 14 | | 3 | | 51,420 | | Publix | | 02/29/20 | | | | 12.84 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Shoppes of Silverlakes | | Pembroke Pines | | 1995 / 1997 | | 126,788 | | 95.9% | | 37 | | 3 | | 47,813 | | Publix | | 06/14/15 | | | | 17.77 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Shops at Skylake | | North Miami Beach | | 1999 / 2005 / 2006 | | 283,943 | | 100.0% | | 49 | | - | | 51,420 | | Publix | | 07/31/19 | | TJMaxx / LA Fitness / Goodwill | | 16.18 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Tamarac Town Square | | Tamarac | | 1987 | | 127,635 | | 80.7% | | 27 | | 12 | | 37,764 | | Publix | | 12/15/14 | | Dollar Tree | | 11.50 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Waterstone | | Homestead | | 2005 | | 79,531 | | 97.8% | | 11 | | 1 | | 45,600 | | Publix | | 07/31/25 | | Walgreens | | 14.94 |

| | | | | | | | | | | | | | | | | | | | | | | |

| West Lakes Plaza | | Miami | | 1984 / 2000 | | 100,747 | | 100.0% | | 27 | | - | | 46,216 | | Winn-Dixie | | 05/22/16 | | Navarro Pharmacy | | 12.63 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Westport Plaza | | Davie | | 2002 | | 49,533 | | 100.0% | | 8 | | - | | 27,887 | | Publix | | 11/30/22 | | | | 17.89 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Young Circle | | Hollywood | | 1962 / 1997 | | 65,834 | | 98.1% | | 9 | | 1 | | 23,124 | | Publix | | 11/30/16 | | Walgreens | | 15.45 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Florida Treasure / Northeast Coast (8) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Cashmere Corners | | Port St. Lucie | | 2001 | | 92,734 | | 96.0% | | 16 | | 2 | | 59,448 | | Albertsons | | 04/30/25 | | | | 9.58 |

| | | | | | | | | | | | | | | | | | | | | | | |

| New Smyrna Beach | | New Smyrna Beach | | 1987 | | 118,451 | | 100.0% | | 34 | | - | | 42,112 | | Publix | | 09/30/12 | | Bealls Outlet | | 11.68 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Old King Commons | | Palm Coast | | 1988 | | 84,759 | | 94.7% | | 16 | | 3 | | | | | | | | Wal-Mart / Staples / Bealls Outlet | | 8.70 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Ryanwood | | Vero Beach | | 1987 | | 114,925 | | 96.3% | | 30 | | 2 | | 39,795 | | Publix | | 03/23/17 | | Bealls Outlet / Books-A-Million | | 11.39 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Salerno Village | | Stuart | | 1987 | | 82,477 | | 92.8% | | 16 | | 4 | | 45,802 | | Winn-Dixie | | 03/23/24 | | CVS Pharmacy | | 10.76 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Shops at St. Lucie | | Port St. Lucie | | 2006 | | 19,361 | | 100.0% | | 10 | | - | | | | | | | | | | 22.96 |

| | | | | | | | | | | | | | | | | | | | | | | |

| South Point Center | | Vero Beach | | 2003 | | 64,790 | | 88.1% | | 10 | | 6 | | 44,840 | | Publix | | 11/30/23 | | | | 15.67 |

| EQUITY ONE, INC. |

| PROPERTY STATUS REPORT |

| As of March 31, 2009 |

| | | | | Year | | Total | | | | Number | | Supermarket anchor | | Other | | Average |

| | | | | Built / | | Sq. Ft. | | Percent | | of tenants | | Owned | | | | Expiration | | anchor | | base rent |

Property | | City | | Renovated | | Owned | | Leased | | Leased | | Vacant | | sq. ft. | | Name | | Date | | tenants | | per leased SF |

| | | | | | | | | | | | | | | | | | | | | | | |

| Treasure Coast | | Vero Beach | | 1983 | | 133,781 | | 96.6% | | 21 | | 3 | | 59,450 | | Publix | | 07/31/26 | | TJ Maxx | | $ 11.66 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Tampa / St. Petersburg / Venice / Cape Coral / Naples (20) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Bay Pointe Plaza | | St. Petersburg | | 1984 / 2002 | | 103,986 | | 95.6% | | 20 | | 4 | | 52,610 | | Publix | | 11/30/21 | | Bealls Outlet | | 10.22 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Carrollwood | | Tampa | | 1970 / 2002 | | 94,203 | | 92.9% | | 29 | | 7 | | 27,887 | | Publix | | 11/30/22 | | Golf Locker | | 13.43 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Charlotte Square | | Port Charlotte | | 1980 | | 96,188 | | 78.2% | | 15 | | 9 | | 44,024 | | Publix* | | 01/31/11 | | Seafood Buffet | | 7.83 |

| | | | | | | | | | | | | | | | | (American Signature Furniture) | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Chelsea Place | | New Port Richey | | 1992 | | 81,144 | | 96.5% | | 16 | | 2 | | 48,890 | | Publix | | 05/27/12 | | | | 11.76 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Dolphin Village | | St. Petersburg | | 1967/1990 | | 138,129 | | 75.2% | | 27 | | 20 | | 33,238 | | Publix | | 11/07/13 | | Dollar Tree, CVS | | 12.01 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Lake St. Charles | | Tampa | | 1999 | | 57,015 | | 100.0% | | 8 | | - | | 46,295 | | Sweet Bay | | 06/30/19 | | | | 10.22 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Lutz Lake | | Lutz | | 2002 | | 64,985 | | 95.8% | | 13 | | 2 | | 44,270 | | Publix | | 05/31/22 | | | | 13.95 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Marco Town Center | | Marco Island | | 2001 | | 109,830 | | 86.8% | | 35 | | 7 | | 27,887 | | Publix | | 01/31/18 | | | | 18.06 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Mariners Crossing | | Spring Hill | | 1989 / 1999 | | 97,812 | | 91.9% | | 16 | | 2 | | 48,315 | | Sweet Bay | | 08/15/20 | | | | 10.57 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Midpoint Center | | Cape Coral | | 2002 | | 75,386 | | 100.0% | | 10 | �� | - | | 60,667 | | Publix | | 10/31/22 | | | | 12.29 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Pavilion | | Naples | | 1982 | | 167,745 | | 90.3% | | 32 | | 8 | | 50,795 | | Publix | | 02/28/13 | | Pavilion 6 Theatre | | 13.65 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Regency Crossing | | Port Richey | | 1986 / 2001 | | 85,864 | | 81.6% | | 15 | | 10 | | 44,270 | | Publix | | 02/28/21 | | | | 10.27 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Ross Plaza | | Tampa | | 1984 / 1996 | | 90,826 | | 95.3% | | 20 | | 2 | | | | | | | | Ross Dress for Less / Deals | | 12.18 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Seven Hills | | Spring Hill | | 1991 | | 72,590 | | 87.8% | | 12 | | 6 | | 48,890 | | Publix | | 09/25/11 | | | | 10.48 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Shoppes of North Port | | North Port | | 1991 | | 84,705 | | 94.7% | | 18 | | 3 | | 48,890 | | Publix | | 12/11/11 | | Bealls Outlet | | 10.11 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Summerlin Square | | Fort Myers | | 1986 / 1998 | | 109,156 | | 77.0% | | 13 | | 15 | | 45,500 | | Winn-Dixie | | 06/04/11 | | Lee County Sheriff's Office | | 10.93 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Sunpoint Shopping Center | | Ruskin | | 1984 | | 132,374 | | 60.0% | | 17 | | 7 | | | | | | | | Goodwill / Ozzie's Buffet / Big Lots | | 9.14 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Venice Plaza | | Venice | | 1971 / 1979 / 1999 | | 132,345 | | 97.5% | | 13 | | 2 | | 42,582 | | Sweet Bay | | 09/30/18 | | TJ Maxx / Blockbuster | | 6.00 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Venice Shopping Center | | Venice | | 1968 / 2000 | | 109,801 | | 92.7% | | 13 | | 1 | | 44,271 | | Publix | | 12/31/26 | | Beall's Outlet | | 5.45 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Walden Woods | | Plant City | | 1985 / 1998 / 2003 | | 75,874 | | 91.8% | | 12 | | 3 | | | | | | | | Dollar Tree / Aaron Rents / Dollar General | | 7.97 |

| | | | | | | | | | | | | | | | | | | | | | | |

| TOTAL SHOPPING CENTERS FLORIDA (80) | | 9,004,251 | | 92.4% | | 1,632 | | 331 | | 2,686,177 | | | | | | | | $ 12.72 |

| EQUITY ONE, INC. |

| PROPERTY STATUS REPORT |

| As of March 31, 2009 |

| | | | | Year | | Total | | | | Number | | Supermarket anchor | | Other | | Average |

| | | | | Built / | | Sq. Ft. | | Percent | | of tenants | | Owned | | | | Expiration | | anchor | | base rent |

| Property | | City | | Renovated | | Owned | | Leased | | Leased | | Vacant | | sq. ft. | | Name | | Date | | tenants | | per leased SF |

| | | | | | | | | | | | | | | | | | | | | | | |

| GEORGIA (24) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Atlanta (20) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| BridgeMill | | Canton | | 2000 | | 89,102 | | 91.0% | | 26 | | 4 | | 37,888 | | Publix | | 01/31/20 | | | | $ 15.49 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Buckhead Station | | Atlanta | | 1996 | | 233,930 | | 89.7% | | 15 | | 4 | | | | | | | | Bed Bath & Beyond / TJ Maxx / Old Navy / Toys R Us / DSW / Golfsmith / Ulta 3 | | 19.84 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Butler Creek | | Acworth | | 1990 | | 95,597 | | 91.9% | | 17 | | 3 | | 59,997 | | Kroger | | 01/31/18 | | | | 10.82 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Chastain Square | | Atlanta | | 1981 / 2001 | | 91,637 | | 97.4% | | 25 | | 3 | | 37,366 | | Publix | | 05/31/24 | | | | 17.92 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Commerce Crossing | | Commerce | | 1988 | | 100,668 | | 62.4% | | 8 | | 3 | | 32,000 | | Ingles | | 09/26/09 | | Fred's Store | | 4.80 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Douglas Commons | | Douglasville | | 1988 | | 97,027 | | 97.5% | | 16 | | 2 | | 59,431 | | Kroger | | 08/31/13 | | | | 10.68 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Fairview Oaks | | Ellenwood | | 1997 | | 77,052 | | 93.9% | | 11 | | 3 | | 54,498 | | Kroger | | 09/30/16 | | | | 11.29 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Grassland Crossing | | Alpharetta | | 1996 | | 90,906 | | 97.3% | | 12 | | 2 | | 70,086 | | Kroger | | 06/30/16 | | | | 11.44 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Hairston Center | | Decatur | | 2000 | | 13,000 | | 38.5% | | 3 | | 6 | | | | | | | | | | 13.62 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Hamilton Ridge | | Buford | | 2002 | | 90,996 | | 81.6% | | 12 | | 9 | | 54,166 | | Kroger | | 11/30/22 | | | | 11.68 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Mableton Crossing | | Mableton | | 1997 | | 86,819 | | 97.1% | | 15 | | 2 | | 63,419 | | Kroger | | 08/31/17 | | | | 10.66 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Macland Pointe | | Marietta | | 1992-93 | | 79,699 | | 98.5% | | 16 | | 1 | | 55,999 | | Publix | | 12/29/12 | | | | 10.19 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Market Place | | Norcross | | 1976 | | 77,706 | | 89.4% | | 19 | | 4 | | | | | | | | Galaxy Cinema | | 12.33 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Paulding Commons | | Hiram | | 1991 | | 192,391 | | 94.9% | | 25 | | 5 | | 49,700 | | Kroger | | 02/28/11 | | Kmart | | 8.03 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Piedmont Peachtree Crossing | | Buckhead | | 1978 / 1998 | | 152,239 | | 100.0% | | 28 | | - | | 55,520 | | Kroger | | 05/31/10 | | Cost Plus Store / Binders Art Supplies | | 17.16 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Powers Ferry Plaza | | Marietta | | 1979 / 1987 / 1998 | | 86,473 | | 91.3% | | 20 | | 5 | | | | | | | | Micro Center | | 9.84 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Shops of Huntcrest | | Lawrenceville | | 2003 | | 97,040 | | 91.2% | | 21 | | 5 | | 54,340 | | Publix | | 01/31/23 | | | | 13.64 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Shops of Westridge | | McDonough | | 2006 | | 66,297 | | 83.1% | | 11 | | 7 | | 38,997 | | Publix | | 04/30/26 | | | | 13.75 |

| | �� | | | | | | | | | | | | | | | | | | | | | |

| Wesley Chapel | | Decatur | | 1989 | | 170,792 | | 61.9% | | 13 | | 13 | | 32,000 | | Ingles* | | 09/25/09 | | CVS Pharmacy / Corinthian College | | 6.21 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Williamsburg @ Dunwoody | | Dunwoody | | 1983 | | 44,928 | | 97.4% | | 25 | | 1 | | | | | | | | | | 20.18 |

| EQUITY ONE, INC. |

| PROPERTY STATUS REPORT |

| As of March 31, 2009 |