SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Materials Pursuant to Rule 14a-12 |

EQUITY ONE, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration No.: |

1600 N.E. Miami Gardens Drive

North Miami Beach, Florida 33179

(305) 947-1664

April 4, 2012

Dear stockholder:

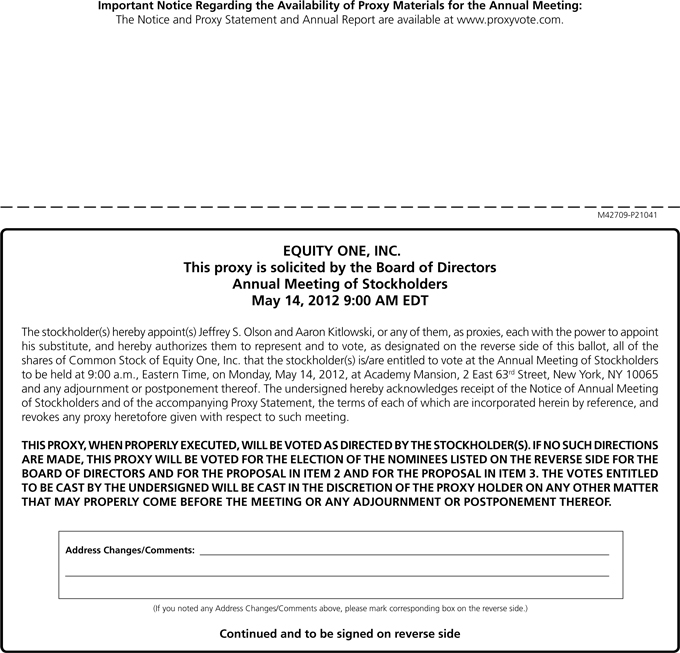

The board of directors and officers of Equity One, Inc., a Maryland corporation, join us in extending to you a cordial invitation to attend the 2012 annual meeting of our stockholders. This meeting will be held on Monday, May 14, 2012, at 9:00 a.m., local time, at the Academy Mansion, 2 East 63rd Street, New York, New York 10065.

As permitted by the rules of the Securities and Exchange Commission, we have provided access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials, or E-proxy notice, on or about April 4, 2012 to our stockholders of record as of the close of business on March 5, 2012. The E-proxy notice contains instructions for your use of this process, including how to access our proxy statement and annual report and how to authorize your proxy to vote online. In addition, the E-proxy notice contains instructions on how you may receive a paper copy of the proxy statement and annual report or elect to receive your proxy statement and annual report over the Internet.

If you are unable to attend the annual meeting in person, it is very important that your shares be represented and voted at the meeting. You may authorize your proxy to vote your shares over the Internet as described in the E-proxy notice. Alternatively, if you received a paper copy of the proxy card by mail, please complete, date, sign and promptly return the proxy card in the self-addressed stamped envelope provided. You may also authorize your proxy to vote your shares by telephone as described in your proxy card. If you authorize your proxy to vote your shares over the Internet, return your proxy card by mail or vote by telephone prior to the annual meeting, you may nevertheless revoke your proxy and cast your vote personally at the meeting.

We look forward to seeing you on May 14, 2012.

Sincerely,

| | | | |

| | | |

|

| | |

| CHAIM KATZMAN | | | | JEFFREY S. OLSON |

| Chairman of the Board | | | | Chief Executive Officer |

EQUITY ONE, INC.

1600 N.E. Miami Gardens Drive

North Miami Beach, Florida 33179

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on May 14, 2012

To our stockholders:

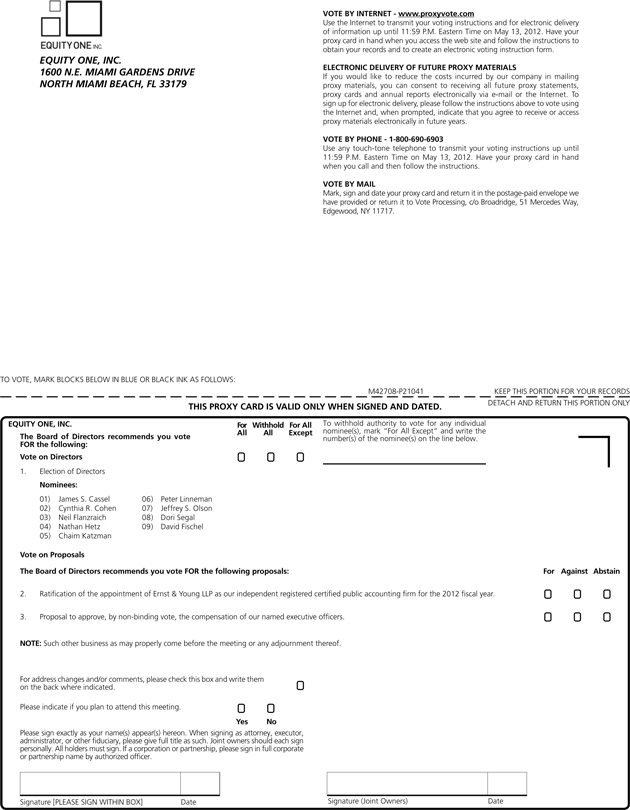

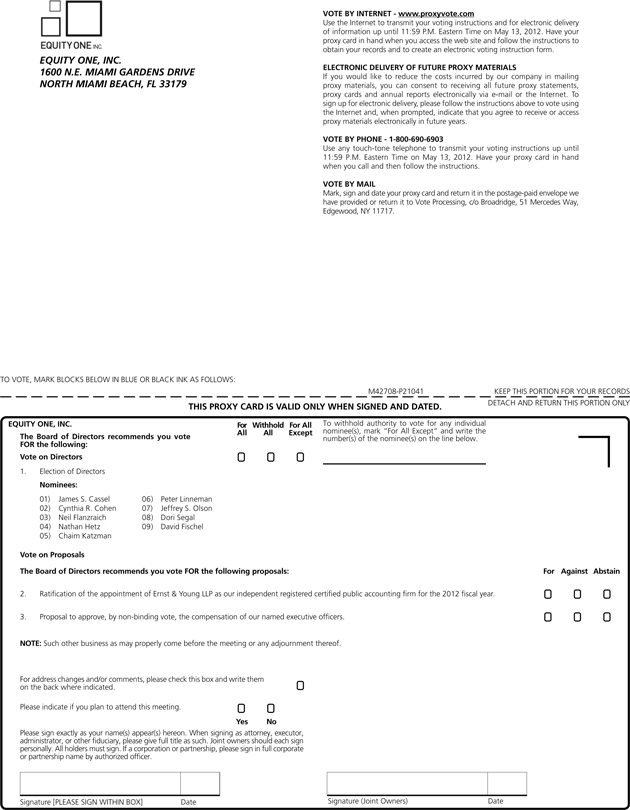

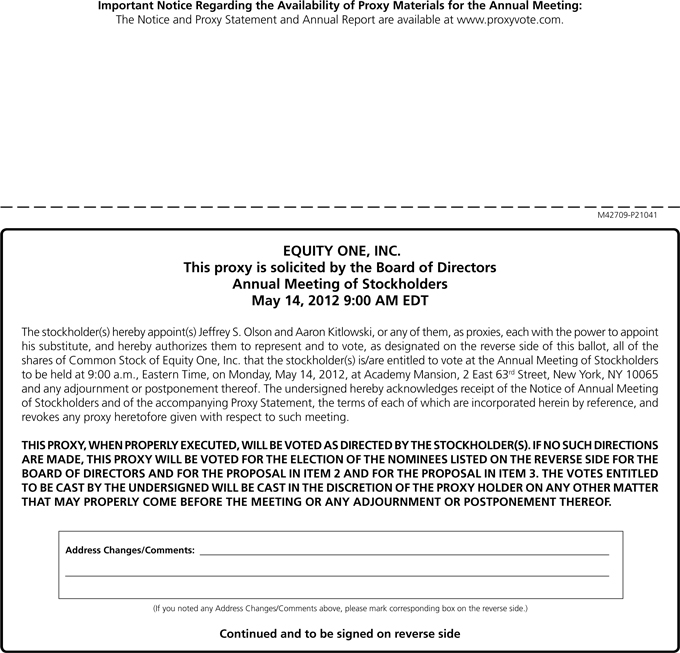

You are cordially invited to attend the 2012 annual meeting of the stockholders of Equity One, Inc., a Maryland corporation, which will be held at the Academy Mansion, 2 East 63rd Street, New York, New York 10065, on Monday, May 14, 2012 at 9:00 a.m., local time. At the meeting, stockholders will consider and vote on the following matters:

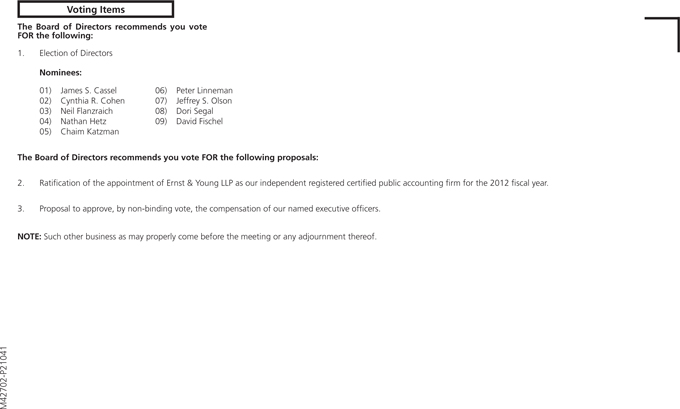

| | 1. | The election of James S. Cassel, Cynthia R. Cohen, David Fischel, Neil Flanzraich, Nathan Hetz, Chaim Katzman, Peter Linneman, Jeffrey S. Olson and Dori Segal as directors, each to hold office until our 2013 annual meeting of stockholders and until his or her successor has been duly elected and qualifies; |

| | 2. | The ratification of the appointment of Ernst & Young LLP as our independent registered certified public accounting firm for the 2012 fiscal year; |

| | 3. | The approval, on a non-binding, advisory basis, of the compensation of our named executive officers; and |

| | 4. | Such other business as may properly come before the annual meeting, including any postponements or adjournments of the meeting. |

If you own shares of our common stock as of the close of business on March 5, 2012, you can vote those shares by proxy or at the meeting.

Whether or not you plan to attend the meeting in person, please authorize your proxy to vote your shares over the Internet, as described in the Notice of Internet Availability of Proxy Materials, or E-proxy notice. Alternatively, if you received a paper copy of the proxy card by mail, please mark, sign, date and promptly return the proxy card in the self-addressed stamped envelope provided. You may also authorize your proxy to vote your shares by telephone as described in your proxy card. Stockholders who authorize a proxy to vote over the Internet, who return proxy cards by mail or vote by telephone prior to the meeting may nevertheless attend the meeting, revoke their proxies and vote their shares in person.

|

By Order of the Board of Directors |

|

|

|

AARON M. KITLOWSKI |

Vice President, General Counsel and Secretary |

North Miami Beach, Florida

April 4, 2012

TABLE OF CONTENTS

(i)

(ii)

2012 ANNUAL MEETING

OF

STOCKHOLDERS OF EQUITY ONE, INC.

PROXY STATEMENT

QUESTIONS AND ANSWERS

| Q: | Why did I receive a Notice of Internet Availability of Proxy Materials? |

| A: | Our board of directors is soliciting proxies to be voted at our annual meeting. The annual meeting will be held at the Academy Mansion, 2 East 63rd Street, New York, New York 10065 on Monday, May 14, 2012, at 9:00 a.m., local time. Pursuant to the rules of the Securities and Exchange Commission, or SEC, we have provided access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials, which we refer to as the “E-proxy notice,” on or about April 4, 2012 to our stockholders of record as of the close of business on March 5, 2012. The E-proxy notice and this proxy statement summarize the information that you need to know to vote by proxy or in person at the annual meeting. You do not need to attend the annual meeting in person in order to vote. |

| Q: | When was the E-proxy notice mailed? |

| A: | The E-proxy notice was mailed to stockholders beginning on or about April 4, 2012. |

| Q: | Who is entitled to vote? |

| A: | All stockholders of record as of the close of business on March 5, 2012, the record date, are entitled to vote at the annual meeting. |

| Q: | How many votes do I have? |

| A: | Each share of our common stock outstanding on the record date is entitled to one vote on each item submitted to you for consideration. Our stockholders do not have the right to cumulate their votes for directors. |

| Q: | What is the quorum for the meeting? |

| A: | A quorum at the annual meeting will consist of a majority of the votes entitled to be cast by the |

| | holders of all shares of common stock outstanding. No business may be conducted at the meeting if a quorum is not present. As of the record date, 113,960,966 shares of common stock were issued and outstanding, which number excludes 800,000 shares of unvested restricted stock held by three of our named executive officers, which shares are not entitled to vote. If less than a majority of votes entitled to be cast are represented at the annual meeting, the chairman of the meeting or a majority of the shares so represented may adjourn the annual meeting to another date, time or place, not later than 120 days after the original record date of March 5, 2012. Notice need not be given of the new date, time or place if announced at the meeting before an adjournment is taken. |

| A: | Whether or not you plan to attend the annual meeting, we urge you to authorize your proxy to vote your shares over the Internet as described in the E-proxy notice. Alternatively, if you received a paper copy of the proxy card by mail please complete, date, sign and promptly return the proxy card in the self-addressed stamped envelope provided. You may also authorize your proxy to vote your shares by telephone as described in your proxy card. Authorizing your proxy over the Internet, by mailing a proxy card or by telephone will not limit your right to attend the annual meeting and vote your shares in person. Your proxy (one of the individuals named in your proxy card) will vote your shares per your instructions. If you fail to provide instructions on a proxy properly submitted via the Internet, mail or telephone, your proxy will vote, to elect (FOR) the director nominees listed in “Proposal 1 – Election of Directors,” in favor of (FOR) “Proposal 2 – Ratification of the Appointment of Independent Registered Certified Public Accounting Firm,” in favor of (FOR) “Proposal 3 – Advisory Vote On |

| | Executive Compensation,” and in accordance with the recommendation of the board of directors as to all other matters that may properly come before the annual meeting and at any postponement or adjournment thereof. |

| Q: | How do I vote my shares that are held by my broker? |

| A: | If you have shares held by a broker, you should instruct your broker to vote your shares by following the instructions that the broker provides to you. Most brokers allow you to authorize your proxy by mail, telephone and the Internet. |

| | • | | The election of nine directors to hold office until our 2013 annual meeting of stockholders and until his or her successor has been elected and qualifies; |

| | • | | The ratification of the appointment of Ernst & Young LLP to act as our independent registered certified public accounting firm for 2012; and |

| | • | | The approval, on a non-binding, advisory basis, of the compensation of our named executive officers. |

In addition, your proxies will have the authority to vote in their discretion as to such other business as may properly come before the annual meeting, including any adjournments or postponements thereof.

| Q: | What vote is required to approve the proposals assuming that a quorum is present at the annual meeting? |

| | | | |

A: | | Proposal 1: Election of Directors | | The election of the director nominees must be approved by a plurality of the votes cast. |

| | |

| | Proposal 2: Ratification of Independent Accounting Firm | | Ratification of the appointment of the independent registered certified public accounting firm requires a majority of the votes cast. |

| | | | |

| | Proposal 3: Advisory Vote On Executive Compensation | | The approval of the compensation of our named executive officers requires a majority of the votes cast. |

| Q: | How are abstentions and broker non-votes treated? |

| A: | Pursuant to Maryland law, abstentions and broker non-votes are counted as present for purposes of determining the presence of a quorum. For purposes of the election of directors, the ratification of the independent registered certified public accounting firm and the advisory vote on executive compensation, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote. |

Under the rules of the New York Stock Exchange, or NYSE, brokerage firms may have the authority to vote their customers’ shares on certain routine matters for which they do not receive voting instructions, including the ratification of the independent registered certified public accounting firm. Therefore, brokerage firms may vote such shares with respect to Proposal 2. The election of directors and the advisory vote on executive compensation are considered “non-routine” matters under the rules of the NYSE. In addition, other matters may properly be brought before the meeting that may be considered “non-routine” under the applicable NYSE rules. Shares held by a brokerage firm will not be voted on such non-routine matters by a brokerage firm unless it has received voting instructions from the stockholder and, accordingly, any such shares without voting instruction will be “broker non-votes.”

| Q: | Will there be any other items of business on the agenda? |

| A: | The board of directors does not know of any other matters that may be brought before the annual meeting nor does it foresee or have reason to believe that proxy holders will have to vote for substitute or alternate nominees for election to the board of directors. In the event that any other matter should come before the annual meeting or any nominee is not available for election, the persons named in the enclosed proxy will have discretionary authority to vote all proxies with respect to such matters in accordance with their discretion. |

2

| Q: | What happens if I submit my proxy without providing voting instructions on all proposals? |

| A: | Proxies properly submitted via the Internet, mail or telephone will be voted at the annual meeting in accordance with your directions. If the properly-submitted proxy does not provide voting instructions on a proposal,the proxy will be voted: |

| | • | | to elect (FOR) the director nominees listed in “Proposal 1 – Election of Directors;” |

| | • | | in favor of (FOR) “Proposal 2 – Ratification of the Appointment of Independent Registered Certified Public Accounting Firm;” |

| | • | | in favor of (FOR) “Proposal 3 – Advisory Vote on Approval of Named Executive Officer Compensation;” and |

| | • | | in accordance with the recommendation of the board of directors as to all other matters that may properly come before the annual meeting. |

| Q: | Will anyone contact me regarding this vote? |

| A: | No arrangements or contracts have been made with any solicitors as of the date of this proxy statement, although we reserve the right to engage solicitors if we deem them necessary. Such solicitations may be made by mail, telephone, facsimile, e-mail or personal interviews. |

| Q: | Who has paid for this proxy solicitation? |

| A: | We have paid the entire expense of preparing, printing and mailing the E-proxy notice and, to the extent requested by our stockholders, this proxy statement and any additional materials furnished to stockholders. |

| Q: | May stockholders ask questions at the annual meeting? |

| A: | Yes. There will be time allotted at the end of the meeting when our representatives will answer questions from the floor. |

| Q: | How do I submit a proposal for the 2013 annual meeting? |

| A: | Our bylaws currently provide that in order for a stockholder to nominate a candidate for election |

| | as a director at an annual meeting of stockholders or propose business for consideration at such meeting, written notice generally must be delivered to our corporate secretary not later than the close of business on the 60th day, and not earlier than the close of business on the 90th day, prior to the first anniversary of the preceding year’s annual meeting. Accordingly, a stockholder nomination or proposal intended to be considered at the 2013 annual meeting, but not included in our proxy statement, generally must be received by our corporate secretary after the close of business on February 13, 2013 and prior to the close of business on March 15, 2013. Proposals should be mailed to the attention of our corporate secretary at 1600 N.E. Miami Gardens Drive, North Miami Beach, Florida 33179. A copy of the bylaws may be obtained from our corporate secretary by written request to the same address. |

Our board of directors will review any stockholder proposals that are timely submitted and will determine whether such proposals meet the criteria for inclusion in the proxy solicitation materials or for consideration at the 2013 annual meeting. In addition, the persons named in the proxies retain the discretion to vote proxies on matters of which we are not properly notified at our principal executive offices on or before 60 days prior to the annual meeting and also retain such authority under certain other circumstances.

| Q: | What does it mean if I receive more than one E-proxy notice? |

| A: | It means that you have multiple accounts at the transfer agent or with stockbrokers. Please submit all of your proxies over the Internet, following the instructions provided in the E-proxy notice, by mail or by telephone to ensure that all of your shares are voted. |

| Q: | Can I change my vote after I have voted? |

| A: | Yes. Proxies properly submitted over the Internet, by mail or by telephone do not preclude a stockholder from voting in person at the meeting. A stockholder may revoke a proxy at any time prior to its exercise by filing with our corporate secretary a duly executed revocation of proxy, by properly submitting, either by Internet, mail or telephone, a proxy to our corporate secretary bearing a later date or by appearing at the meeting and voting in person. Attendance at |

3

| | the meeting will not by itself constitute revocation of a proxy. |

| Q: | Can I find additional information on the Company’s website? |

| A: | Yes. Our website is located atwww.equityone.net. Although the information contained on our website is not part of this proxy statement, you can view additional information on the website, such as our corporate governance guidelines, our code of conduct and ethics, charters of our board committees and reports that we file with the SEC. A copy of our corporate governance guidelines, our code of conduct and ethics and each of the charters of our board committees may be obtained free of charge by writing to Equity One, Inc., 1600 N.E. Miami Gardens Drive, North Miami Beach, Florida 33179, Attention: Investor Relations. |

4

CORPORATE GOVERNANCE AND RELATED MATTERS

Our business, property and affairs are managed under the direction of our board of directors, except with respect to those matters reserved for our stockholders. Our board of directors establishes our overall corporate policies, reviews the performance of our senior management in executing our business strategy and managing our day-to-day operations and acts as an advisor to our senior management. Our board’s mission is to further the long-term interests of our stockholders. Members of the board of directors are kept informed of our business through discussions with our management, primarily at meetings of the board of directors and its committees, and through reports and analyses presented to them. Significant communications between our directors and senior management occur apart from such meetings. The board and each of its committees – audit, compensation, executive and nominating and corporate governance – also have the authority to retain, at our expense, outside counsel, consultants or other advisors in the performance of their duties.

Charters for the audit, compensation and nominating and corporate governance committees, our corporate governance guidelines and our code of conduct and ethics may be viewed on our website atwww.equityone.net under the “About Us” tab. These documents are also available without charge to stockholders who request them by contacting Equity One, Inc. — Investor Relations, at 1600 N.E. Miami Gardens Drive, North Miami Beach, Florida 33179.

Independent Directors

Under the corporate governance standards of the NYSE, at least a majority of our directors and all of the members of our audit committee, compensation committee and nominating and corporate governance committee must meet the test of “independence” as defined by the NYSE. The NYSE standards provide that to qualify as an “independent” director, in addition to satisfying certain bright-line criteria, the board of directors must affirmatively determine that a director has no material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us). In making this determination, the board of directors considered transactions and relationships between each director or any member of his or her immediate family and us and our subsidiaries and affiliates, including those transactions reported below under “Certain Transactions.” The board of directors has determined that each of Messrs. Cassel, Flanzraich, Hetz and Linneman and Ms. Cohen satisfy the bright-line criteria and that none has a relationship with us that would interfere with such person’s ability to exercise independent judgment as a member of our board. Therefore, following the election of the director candidates at the annual meeting, we believe that 56% of our board members will be independent under those rules.

Nominations for Directors

The nominating and corporate governance committee, or nominating committee, will consider nominees for director suggested by stockholders in written submissions to our corporate secretary. In evaluating nominees for director, the nominating committee does not differentiate between nominees recommended by stockholders and others. In identifying and evaluating candidates to be nominated for director, the nominating committee reviews the desired experience, mix of skills and other qualities required for appropriate board composition, taking into account the current board members and our specific needs as well as those of the board. This process is designed so that the board of directors includes members with diverse backgrounds, skills and experience, and represents appropriate financial and other expertise relevant to our business. In addition to the personal qualifications of each candidate, the nominating committee will consider, among other things, the following:

| | • | | if the nominee will consent to being named in the proxy and serving, if elected, on the board; |

| | • | | whether the candidate qualifies as “independent” under the NYSE rules; |

| | • | | the nominee’s biographical data (including other boards on which the nominee serves), business experience and involvement in certain legal proceedings, including any involving our company; |

| | • | | transactions and relationships between the nominee and the recommending stockholder, on the one hand, and us or our management, on the other hand; |

| | • | | the nominee’s trading history in our stock and his or her current stock ownership information; |

5

| | • | | any material proceedings to which the nominee or his or her associates is a party that are adverse to our company; |

| | • | | information regarding whether the recommending stockholder or nominee (or their affiliates) have any plans or proposals for us; and |

| | • | | whether the nominating stockholder and nominee seek to use the nomination to redress personal claims or grievances against us or others, or to further personal interests or special interests not shared by our stockholders at large. |

The nominating committee also reserves the right to request such additional information as it deems appropriate.

Although the nominating committee’s charter permits it to engage a search firm to identify director candidates, we did not pay fees to any third parties to assist in the process of identifying or evaluating director candidates to stand for election at the annual meeting.

Executive Sessions

Pursuant to our corporate governance guidelines, our non-management directors meet in separate executive sessions at least four times a year and as otherwise determined by the lead director (discussed below). The lead director may invite our chief executive officer or others, as he deems appropriate, to attend a portion of these sessions. The non-management directors met four times in executive sessions in 2011.

Board Leadership Structure

At least annually, our nominating and corporate governance committee evaluates the structure and composition of our board of directors, including the current leadership structure. This evaluation is discussed with the full board annually to ensure that our leadership structure is appropriate given the specific characteristics and circumstances of our business.

Our board does not have a policy with respect to the separation of the offices of chairman of the board and chief executive officer. Rather, our board believes that this issue is part of the succession planning process and that it is in the best interests of the company for the board to make a determination when it elects a chief executive officer. Since December 2006, Chaim Katzman has served as our chairman of the board and Jeffrey S. Olson has served as our chief executive officer.

In May 2006, Neil Flanzraich was elected to serve as our lead director and has served in that capacity since that time. The lead director is an independent director who acts in a lead capacity to coordinate the other independent directors, consult with the chairman on board agendas, chair the executive sessions of the non-management directors and perform such other functions as the board may direct. The lead director would also preside over meetings of our board of directors to the extent there were matters involving conflicts with our majority stockholders, with whom our chairman is affiliated.

Stockholder Communications

Our board has implemented a process by which our stockholders and other interested parties may communicate with one or more members of our board, its committees, the lead director or the non-management directors or independent directors as a group in a writing addressed to Equity One, Inc., Board of Directors, c/o Corporate Secretary, 1600 N.E. Miami Gardens Drive, North Miami Beach, Florida 33179. Such communications may be made on an anonymous or confidential basis. The board has instructed our corporate secretary to promptly forward all such communications to the specified addressees thereof.

Risk Oversight

Our board provides oversight of the company’s risk exposure by receiving periodic reports from senior management regarding matters relating to financial, operational, legal and strategic risks and mitigation strategies for such risks. Our board believes that the current separation of the roles of chairman of the board and chief

6

executive officer facilitates communication between senior management and the full board of directors about risk oversight and therefore strengthens the board’s risk oversight activities. In addition, as reflected in the audit committee charter, our board has delegated to the audit committee responsibility to oversee, discuss and evaluate the company’s policies and guidelines with respect to risk assessment and risk management, including internal control over financial reporting. As appropriate, the audit committee provides reports to and receives direction from the full board regarding the company’s risk management policies and guidelines, as well as the audit committee’s risk oversight activities.

Code of Conduct and Ethics

Our board of directors has adopted a code of conduct and ethics that applies to all of our directors, officers, employees and independent contractors. The code also has specific provisions applicable to all employees with access to, and responsibility for, matters of finance and financial management, including our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The full text of the code of conduct and ethics is available at, and we intend to disclose any amendments to, or waivers from, any provision of the code that applies to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions or any other executive officers or directors by posting such information within four business days of such amendment or waiver on our website atwww.equityone.net.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

Meetings

During the fiscal year ended December 31, 2011, our board of directors held a total of 14 meetings. Each of our directors attended at least 75% of the aggregate of (i) the number of the meetings of the board of directors which were held during the period that such person served on the board of directors and (ii) the number of meetings of committees of the board of directors held during the period that such person served on such committee. Although we have no specific requirement regarding the attendance at the annual meeting of stockholders by our directors, our bylaws require that a meeting of our directors be held following the annual meeting of stockholders. In 2011, all but three of our directors attended the annual meeting in person.

Committee Membership

We have four standing committees: the executive committee, the audit committee, the compensation committee and the nominating and corporate governance committee.

The current members of our committees are as follows:

| | | | | | | | |

Name | | Audit | | Compensation | | Nominating and

Corporate

Governance | | Executive |

Noam Ben-Ozer | | X | | | | X* | | |

James Cassel | | X | | X | | | | |

Cynthia Cohen | | X* | | | | X | | |

David Fischel | | | | | | | | |

Neil Flanzraich** | | | | X | | X | | |

Nathan Hetz | | X | | | | | | |

Chaim Katzman | | | | | | | | X* |

Peter Linneman | | | | X * | | X | | X |

Jeffrey S. Olson | | | | | | | | X |

Dori Segal | | | | | | | | X |

7

Executive Committee. The executive committee is authorized to perform all functions which may be lawfully delegated by the board of directors; provided, however, that the executive committee may only approve the sale or acquisition of properties with a purchase price of no more than $60 million, the sale or acquisition of undeveloped land with a purchase price of no more than $30 million and budgets for the development or redevelopment of properties of no more than $50 million. The executive committee met or took action by consent six times during the year ended December 31, 2011.

Audit Committee. The members of the audit committee are “independent,” as defined under the NYSE listing standards and the rules and regulations of the SEC. The board has determined that each of Ms. Cohen and Messrs. Ben-Ozer and Hetz qualifies as an “audit committee financial expert” as defined by the rules and regulations of the SEC. The audit committee’s functions include reviewing and discussing our financial statements, including reviewing our specific disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” with our management and independent registered certified public accounting firm, retaining and terminating the engagement of our independent registered certified public accounting firm, determining the independence of such firm and discussing with management and the independent registered certified public accounting firm the quality and adequacy of our disclosure controls and procedures and internal controls. The audit committee is also responsible for overseeing, discussing and evaluating our guidelines, policies and processes with respect to risk assessment and risk management and the steps management has taken to monitor and control risk exposure, and advises the board of directors with respect to such matters, as appropriate. The audit committee met 10 times during the year ended December 31, 2011.

Please refer to the audit committee report, which is set forth on page 16 of this proxy statement, for a further description of our audit committee’s responsibilities and its recommendation with respect to our audited consolidated financial statements for the year ended December 31, 2011.

Compensation Committee. The members of the compensation committee are “independent,” as defined under the NYSE listing standards. The compensation committee’s functions consist of administering our 2000 Executive Incentive Compensation Plan, which we refer to as the 2000 plan, and our 2004 Employee Stock Purchase Plan, recommending, reviewing and approving our salary, bonus and fringe benefits policies, including compensation of our executive officers, and discussing with management the Compensation Discussion and Analysis and, if appropriate, recommending its inclusion in our annual report on Form 10-K and proxy statement. The compensation committee has the power to create subcommittees with such powers as the compensation committee may from time to time confer to such subcommittees. For a description of the role performed by executive officers and compensation consultants in determining or recommending the amount or form of executive and director compensation, see “Compensation Discussion and Analysis – Management’s and Advisor’s Role in Compensation Decisions.” The compensation committee met or took action by consent 12 times during the year ended December 31, 2011.

Please refer to the compensation committee report, which is set forth on page 17 of this proxy statement, for a further description of our compensation committee’s responsibilities.

Nominating and Corporate Governance Committee. The members of the nominating and corporate governance committee are “independent,” as defined under the NYSE listing standards. The committee’s duties include establishing criteria for recommending candidates for election or reelection to the board, considering issues and making recommendations concerning the size, composition, organization and effectiveness of the board, including committee assignments, establishing and overseeing procedures for annual assessment of board and director performance, evaluating issues of corporate governance and making recommendations to the board regarding our governance policies and practices. The nominating and corporate governance committee met four times during the year ended December 31, 2011.

8

|

PROPOSAL 1 – ELECTION OF DIRECTORS |

The board of directors proposes that the nominees described below be elected for a one-year term and until their successors are duly elected and qualify. All of the nominees are currently serving as our directors.

| | |

Nominee | | Principal Occupation, Business Experience, Other Directorships Held and Age |

| |

| James S. Cassel | | Mr. Cassel was elected as a director in April 2005. Since 2010, Mr. Cassel has served as Co-founder and Chairman of Cassel Salpeter & Co., LLC, a middle market investment banking firm. From 2006 until December 2009, Mr. Cassel served as Vice Chairman and Head of Investment Banking of Ladenburg Thalmann & Co. Inc., an investment banking company that in 2006 purchased Capitalink, L.C., a South Florida based investment banking company founded by Mr. Cassel in 1998 and where he served as its president from 1998 to 2006. From 1996 to 1998, he served as president of Catalyst Financial, an investment banking company. Mr. Cassel received a B.S. from American University and a Juris Doctorate from the University of Miami. Mr. Cassel is 56 years old. Our board of directors has concluded that Mr. Cassel’s qualifications to serve on our board include his background as an investment banker and as a real estate and corporate securities attorney and his experience and familiarity with capital market activities in general. |

| |

| Cynthia R. Cohen | | Ms. Cohen was elected as a director in 2006. She founded Strategic Mindshare, a strategic management consulting firm serving retailers and consumer product manufacturers, in 1990 and, since that time, has served as its president. Ms. Cohen is a director of bebe stores, inc., a specialty apparel retailer, and Steiner Leisure Limited, a spa operator, both of which are public companies. Ms. Cohen also serves on the executive advisory board for the Center for Retailing Education and Research at the University of Florida. Ms. Cohen previously served as a director of Hot Topic, Inc. and The Sports Authority. She is a graduate of Boston University. Ms. Cohen is 59 years old. Our board of directors has concluded that Ms. Cohen’s qualifications to serve on our board include her extensive experience in the retail industry, as a retail consultant and as a board member of several public retail companies. |

| |

| David Fischel | | Mr. Fischel was appointed as a director in January 2011 in connection with our joint venture acquisition of Capital & Counties USA, Inc. from Liberty International Holdings Limited (“LIH”). We and several of our stockholders have agreed, pursuant to a stockholders agreement, that until January 4, 2020 (or until such agreement is earlier terminated), as long as LIH or its affiliates beneficially own (including shares issuable upon redemption of joint venture units), in the aggregate, (i) prior to February 3, 2015, 50% of the shares of our common stock held by LIH at the closing of the transaction and (ii) thereafter, three percent or more of the total outstanding shares of our common stock, it may designate one nominee for election to our board of directors. LIH has chosen Mr. Fischel as its nominee pursuant to this agreement. Since 2001, Mr. Fischel has served as the chief executive officer of Capital Shopping Centres Group PLC (“CSC”), a FTSE 100 listed UK REIT and the parent company of LIH. Mr. Fischel joined CSC in 1985 and previously served as its finance director and managing director. He has served as a director of CSC since 1998 and served as a director of Capital & Counties Properties PLC, a UK listed REIT that demergered from CSC in 2010, from February 2010 to February 2011. Mr. Fischel is a chartered accountant in the United Kingdom and is 53 years old. Mr. Fischel’s qualifications to serve on our board include his experience as a real estate executive, having served as an executive of CSC for many years, and his experience as a chartered accountant. |

9

| | |

Nominee | | Principal Occupation, Business Experience, Other Directorships Held and Age |

| |

| Neil Flanzraich | | Mr. Flanzraich was elected as a director in April 2005. Mr. Flanzraich is currently the Executive Chairman of Tigris Pharmaceuticals, Inc. and the Executive Chairman of ParinGenix, Inc., both privately-owned biotech companies. Mr. Flanzraich is also a founder and principal of Leviathan Biopharma Group, LLC, a venture capital firm. From May 1998 to 2006, he served as a director, vice chairman and president of IVAX Corporation, a company specializing in the discovery, development, manufacturing and marketing of branded and generic pharmaceuticals and veterinary products, and as a director of IVAX Diagnostics, Inc. IVAX was acquired by Teva Pharmaceuticals in January 2006. From 1995 to 1998, Mr. Flanzraich was a shareholder and served as chairman of the life sciences legal practice group of Heller Ehrman White & McAuliffe, formerly a San Francisco-based law firm. From 1981 to 1995, he served in various capacities at Syntex Corporation, a pharmaceutical company, most recently as its senior vice president, general counsel and a member of the corporate executive committee. In addition to our board of directors, he is also a director of BELLUS Health Inc. (formerly known as Neurochem Inc.), a biotechnology company, and Chipotle Mexican Grill, Inc., a chain of Mexican restaurants. Both of these are public companies. Mr. Flanzraich served as a director of Rae Systems, Inc. from December 2000 until March 2009, of Javelin Pharmaceuticals, Inc. from June 2006 until its merger with Hospira, Inc. in July 2010, and of Continucare Corporation from March 2002 until its acquisition by Metropolitan Health Network in October 2011. Additionally, he was a member of the Board of Directors of privately-owned Outcomes Health Information Solutions, LLC, a provider of healthcare data retrieval, analytics and management services, until his resignation in January 2012. Mr. Flanzraich is also a member of the Advisory Board of The Wolfsonian-FIU, a museum of art, design and communication. Mr. Flanzraich received an A.B. degree from Harvard College (phi beta kappa, magna cum laude) and a Juris Doctorate from Harvard Law School (magna cum laude). Mr. Flanzraich is 68 years old. Our board of directors has concluded that Mr. Flanzraich’s qualifications to serve on our board include his experience as a senior corporate executive for public companies for over 25 years and his experience as an investor in, and member of the boards of directors of, numerous publicly-traded companies. |

| |

| Nathan Hetz | | Mr. Hetz was elected as a director in November 2000. Since November 1990, Mr. Hetz has served as the chief executive officer, director and principal shareholder of Alony Hetz Properties & Investments, Ltd., an Israeli corporation that specializes in real estate investments in Israel, Switzerland, Great Britain, Canada and the United States, the shares of which are publicly traded on the Tel-Aviv Stock Exchange. Mr. Hetz currently serves as a director of First Capital Realty Inc., an Ontario-based real estate company, the common stock of which is listed on the Toronto Stock Exchange and which may be deemed to be controlled by Gazit-Globe, Ltd., one of our principal, indirect stockholders, Amot Investments Ltd., a real estate company, the shares of which are publicly traded on the Tel-Aviv Stock Exchange, and PSP Swiss Property, a real estate company, the shares of which are publicly traded on the Swiss Stock Exchange. Mr. Hetz received a B.A. in accounting from Tel-Aviv University in Israel and is a certified public accountant in Israel. Mr. Hetz is 59 years old. Our board of directors has concluded that Mr. Hetz’ qualifications to serve on our board include his experience as an international real estate executive, board member and investor, having investments in, and serving as an executive and board member of, numerous publicly-traded real estate companies. |

| |

| Chaim Katzman | | Mr. Katzman has served as the chairman of our board since he founded Equity One in 1992. He also served as our chief executive officer until December 2006 and president until November 2000. Mr. Katzman has been involved in the purchase, development and management of commercial and residential real estate in the United States since 1980. |

10

| | |

Nominee | | Principal Occupation, Business Experience, Other Directorships Held and Age |

| |

| | Mr. Katzman purchased the controlling interest of Norstar Holdings Inc. (formerly known as Gazit Inc.), a publicly-traded company listed on the Tel-Aviv Stock Exchange, and one of our principal, indirect stockholders, in May 1991, has served as the chairman of its board and chief executive officer since that time, and remains its largest stockholder. Shulamit Katzman, Mr. Katzman’s wife, is the vice chairman of the board of directors of Norstar Holdings Inc. Mr. Katzman has served as a director of Gazit-Globe Ltd., a publicly-traded real estate investment company listed on the Tel-Aviv Stock Exchange and New York Stock Exchange and one of our principal, indirect stockholders, since 1994 and as its chairman since 1995. Mr. Katzman also serves as non-executive chairman of the board of First Capital Realty Inc. In 2008, Mr. Katzman was named chairman of the board of Atrium European Real Estate Ltd., a leading real estate company that owns, operates and develops shopping centers in Central and Eastern Europe, the shares of which are listed on the Vienna Stock Exchange, and which is an affiliate of Gazit-Globe, Ltd., one of our principal, indirect stockholders, and in 2010 he was elected to the board of Citycon Oyj, a Finnish real estate company, the shares of which are traded on the Helsinki Stock Exchange, and currently serves as its chairman of the board. Mr. Katzman received an LL.B. from Tel Aviv University Law School in 1973. Mr. Katzman is 62 years old. Our board of directors has concluded that Mr. Katzman’s qualifications to serve on our board include his experience as our chairman and founder, his real estate and financial expertise as well as his experience as an investor, owner and executive of multiple international real estate companies. |

| |

| Peter Linneman, Ph.D. | | Dr. Linneman was elected as a director in November 2000. From 1979 to 2011, Dr. Linneman was a Professor of Real Estate, Finance and Public Policy at the University of Pennsylvania, Wharton School of Business and is currently an Emeritus Albert Sussman Professor of Real Estate there. Dr. Linneman is currently a principal of Linneman Associates, a real estate advisory firm, and a principal of American Land Funds, a private equity firm. Dr. Linneman is currently serving as a director of Atrium European Real Estate Ltd., an affiliate of Gazit-Globe, Ltd., one of our principal, indirect stockholders, by reason of Gazit-Globe’s more than 10% ownership interest in Atrium, and AG Mortgage Investment Trust, Inc. Dr. Linneman previously served as a director of Bedford Property Investors, Inc. and JER Investors Trust, Inc., a finance company that acquires real estate debt securities and loans. Dr. Linneman holds both a masters and a doctorate degree in economics from the University of Chicago. Dr. Linneman is 61 years old. Our board of directors has concluded that Mr. Linneman’s qualifications to serve on our board include his experience over many years in financial and business advisory services and investment activity and his experience as a member of numerous public and private boards, including many real estate companies. |

| |

| Jeffrey S. Olson | | Mr. Olson was elected to our board of directors in November 2006. Mr. Olson has served as chief executive officer of Equity One since 2006 and served as our president from 2006 to March 2008. Prior to joining Equity One, he served as president of the Eastern and Western Regions of Kimco Realty Corporation from 2002 to 2006. Mr. Olson worked on Wall Street from 1996 to 2001 as a REIT analyst with Salomon Brothers, CIBC and UBS. Spanning the five year period from 1991 to 1996, he held a variety of financial and accounting positions at The Mills Corporation. Mr. Olson also practiced public accounting at Reznick, Fedder and Silverman, CPA’s, where he worked from 1986 to 1990. Mr. Olson has a Masters of Science in Real Estate from The Johns Hopkins University, a Bachelor of Science in Accounting from the University of Maryland and was previously a Certified Public Accountant. Mr. Olson is on the board of NAREIT and also serves as a member of The Browning School’s Board of Trustees. Mr. Olson is 44 years old. Our board of directors has concluded that Mr. Olson’s qualifications to serve on our board include his experience as our chief executive officer and general expertise in real estate |

11

| | |

Nominee | | Principal Occupation, Business Experience, Other Directorships Held and Age |

| | operations, as well as his knowledge of the REIT industry developed as an analyst covering many U.S. REITs. |

| |

| Dori Segal | | Mr. Segal was elected as a director in November 2000 and our vice chairman in May 2006. Mr. Segal also serves as executive vice chairman of Gazit-Globe, Ltd., one of our principal, indirect stockholders, and previously served as its president. Since November 2000, Mr. Segal has served as chief executive officer, president and as vice chairman of the board of First Capital Realty Inc. Since 2010, he has served as Chairman of RealPac, the Real Property Association of Canada. Mr. Segal has also served since 2004 as a Director of Citycon Oyj and, since June 2009, as chairman of the board of Gazit America Inc., an Ontario-based real estate company, the shares of which are traded on the Toronto Stock Exchange, and one of our principal, indirect stockholders. Since 1995, Mr. Segal has served as the president of Gazit Israel Ltd., a real estate investment holding company. Mr. Segal is 50 years old. Our board of directors has concluded that Mr. Segal’s qualifications to serve on our board include his experience as a director and executive of a large, publicly traded real estate company and his expertise in operating, owning and managing shopping center assets in North America, in addition to his management activities in numerous international real estate companies. |

Vote Required

The vote of a plurality of all votes cast at the meeting at which a quorum is present is necessary for the election of a director. For purposes of the election of directors, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

|

RECOMMENDATION – The board of directors recommends a vote FOR each named nominee. |

12

EXECUTIVE OFFICERS

As of the date of this proxy statement, our executive officers are as follows:

| | | | |

Name | | Age | | Position |

Jeffrey S. Olson | | 44 | | Chief Executive Officer |

Thomas A. Caputo | | 65 | | President |

Mark Langer | | 45 | | Executive Vice President, Chief Financial Officer and Treasurer |

Arthur L. Gallagher | | 41 | | Executive Vice President and President of Florida |

Aaron M. Kitlowski | | 39 | | Vice President, General Counsel and Corporate Secretary |

Mr. Olson also serves as a director. His biographical information can be found in the section entitled “Proposal 1 – Election of Directors” on page 9.

Thomas A. Caputo has served as our president since March 2008. Prior to joining us, from December 2000 to March 2008, Mr. Caputo was executive vice president and head of the portfolio management and acquisition groups at Kimco Realty Corporation, a publicly-traded real estate investment trust. From January 2000 to December 2000, he was a principal of H&R Retail, a private real estate company specializing in development and redevelopment of real estate and located in Baltimore, Maryland. From April 1983 to December 1999, Mr. Caputo was a principal with RREEF, a pension fund advisor, where he was in charge of nationwide retail acquisitions and dispositions and a member of its investment committee. Prior to joining RREEF, from February 1976 to March 1983, Mr. Caputo was the principal in charge of retail leasing with Collier Pinkard in Baltimore, Maryland. He has a B.A. from Randolph Macon College.

Mark Langer has served as our executive vice president and chief financial officer since April 2009 and served as our chief administrative officer from January 2008 until January 2011. Prior to joining us, Mr. Langer served as Chief Operating Officer of Johnson Capital Management, Inc., an investment advisory firm, from January 2000 to December 2007. From July 1988 to January 2000, he worked in the assurance practice in the Washington D.C. office of KPMG, LLP, where he was elected partner in 1998. Mr. Langer has a Bachelors of Business Administration from James Madison University.

Arthur L. Gallagherhas served as our executive vice president since February 2008, as senior vice president from December 2006 to February 2008 and as our general counsel and corporate secretary from March 2003 to February 2012. In August 2010, he also assumed the role of president of our South Florida region and, in March of 2012, expanded his operating role to the president of our operations in the State of Florida. Prior to joining us, Mr. Gallagher was with the law firms of Greenberg Traurig P.A., Miami, Florida, from 1999 to 2003, and Simpson Thacher & Bartlett, New York, New York, from 1997 to 1999. Mr. Gallagher received a B.A. from the University of North Carolina – Chapel Hill and a Juris Doctorate from Duke University School of Law.

Aaron M. Kitlowski has served as our general counsel and corporate secretary since February 2012, our deputy general counsel and assistant corporate secretary from March 2011 to January 2012 and a vice president since joining us in March 2011. Prior to joining us, Mr. Kitlowski served as a Chief Counsel of CIT Group Inc., a finance company, from September 2005 to March 2011. From 1997 to 2000 and again from 2001 to 2005, Mr. Kitlowski was an associate with the law firm of Simpson Thacher & Bartlett, New York, New York. From 2000 to 2001, Mr. Kitlowski served as Assistant General Counsel for Sphera Optical Networks, a fiber optic telecommunications company. Mr. Kitlowski received a B.A. from Duke University and a Juris Doctorate from Duke University School of Law.

13

|

PROPOSAL 2 – RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED CERTIFIED PUBLIC ACCOUNTING FIRM |

The audit committee has selected and appointed the firm of Ernst & Young LLP to act as our independent registered certified public accounting firm for 2012. Ernst & Young LLP was first engaged to audit our books for the fiscal year ended December 31, 2005 and has served as our independent registered certified public accounting firm since that time. Ratification of the appointment of the registered certified public accounting firm requires a majority of the votes cast at the meeting. Any shares not voted, whether by abstention, broker non-vote, or otherwise, have no impact on the vote.

|

RECOMMENDATION: The board of directors recommends that the stockholders vote FOR ratification of the appointment of Ernst & Young LLP. |

Although stockholder ratification of the appointment of our independent registered certified public accounting firm is not required by our bylaws or otherwise, we are submitting the selection of Ernst & Young LLP to our stockholders for ratification as a matter of good corporate governance practice. Even if the selection is ratified, the audit committee in its discretion may select a different independent registered certified public accounting firm at any time if it determines that such a change would be in our best interest and the best interests of our stockholders. If our stockholders do not ratify the audit committee’s selection, the audit committee will take that fact into consideration, together with such other factors it deems relevant, in determining its next selection of independent registered certified public accounting firm.

In choosing our independent registered certified public accounting firm, our audit committee conducts a comprehensive review of the qualifications of those individuals who will lead and serve on the engagement team, the quality control procedures the firm has established, and any issue raised by the most recent quality control review of the firm. The review also includes matters required to be considered under the SEC rules on “Auditor Independence,” including the nature and extent of non-audit services to ensure that they will not impair the independence of any such firm.

Representatives of Ernst & Young LLP are expected to be present at the annual meeting. These representatives will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Fees Paid to Independent Registered Certified Public Accounting Firm

The following table provides information of fees billed by Ernst & Young LLP to us during or in connection with the years ended December 31, 2010 and 2011 for services provided:

| | | | | | | | |

| | | 2010 | | | 2011 | |

Audit Fees | | $ | 1,087,157 | | | $ | 1,398,286 | |

Audit-Related Fees | | | — | | | | — | |

Tax Fees | | | 94,110 | | | | 135,730 | |

All Other Fees | | | — | | | | 185,847 | |

All audit and non-audit services were pre-approved by the audit committee, either pursuant to the audit committee’s pre-approval policy described below or through a separate pre-approval by the audit committee, which concluded that the provision of such services by the independent auditors was compatible with the maintenance of that firm’s independence from us.

14

Audit Fees

Audit fees for 2010 and 2011 were incurred for professional services in connection with the audit of our consolidated financial statements and internal control over financial reporting for the years ended December 31, 2010 and 2011, reviews of our interim consolidated financial statements which are included in each of our quarterly reports on Form 10-Q for the years ended December 31, 2010 and 2011, preparation of “comfort letters” for the issuance of our securities in both years, statutory audits of a partially-owned subsidiary and certain accounting consultations.

Audit-Related Fees

We did not incur any audit-related fees in 2010 or 2011.

Tax Fees

In 2011, we engaged our independent registered certified public accounting firm with respect to certain tax matters arising from the preparation of our tax returns.

In 2010, we engaged our independent registered certified public accounting firm with respect to (i) tax diligence services in connection with our acquisition of C&C (US) No. 1, Inc. (“CapCo”) and formation of a joint venture with its parent company and (ii) certain tax matters arising from the preparation of our tax returns.

All Other Fees

In 2011, we engaged our independent registered certified public accounting firm to conduct a risk assessment of our information systems strategy.

Pre-Approval Policies and Procedures

The audit committee’s policy is to review and pre-approve any engagement of our independent registered certified public accounting firm to provide any audit or permissible non-audit service to us. The audit committee has adopted an audit and non-audit services pre-approval policy, which is reviewed and reassessed by the audit committee annually. This policy includes a list of specific services within certain categories of services, including audit, audit-related, tax and other services, which will be specifically pre-approved for the upcoming or current fiscal year, subject to an aggregate maximum annual fee payable by us for each category of pre-approved services. Any service that is not included in the list of pre-approved services must be separately approved by the audit committee.

15

REPORT OF THE AUDIT COMMITTEE

The following report of the audit committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any of our other filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

In accordance with its written charter adopted by our board of directors, the audit committee’s role is to act on behalf of the board of directors in the oversight of our accounting, auditing and financial reporting practices. The audit committee currently consists of four members, each of whom is “independent” as that term is defined by the New York Stock Exchange listing standards and the rules and regulations of the Securities and Exchange Commission (the “SEC”).

Management is responsible for our financial reporting process including our system of internal controls, and for the preparation of our consolidated financial statements in accordance with generally accepted accounting principles in the United States. Our independent accountants are responsible for auditing those financial statements. It is the audit committee’s responsibility to monitor and review these processes. It is not the audit committee’s duty or responsibility to conduct auditing or accounting reviews or procedures. The audit committee does not consist of our employees and it may not be, and may not represent itself to be or to serve as, accountants or accountants by profession or experts in the fields of accounting or auditing. Therefore, the audit committee has relied on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States and on the representations of our independent accountants included in their reports on our financial statements. The audit committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the audit committee’s considerations and discussions with management and with our independent accountants do not assure that our financial statements are presented in accordance with generally accepted accounting principles, that the audit of our financial statements has been carried out in accordance with generally accepted auditing standards or that our independent accountants are in fact “independent.”

In fulfilling its oversight responsibilities, the audit committee reviewed the audited financial statements for the fiscal year ended December 31, 2011 with management, including a discussion of the quality of the accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and the effectiveness of our disclosure controls and procedures and internal controls over financial reporting. The audit committee reviewed the financial statements for the fiscal year ended December 31, 2011 with our independent accountants and discussed with them all of the matters required to be discussed by Statement of Auditing Standards No. 61 (Communications with Audit Committees), as amended and as adopted by the Public Company Accounting Oversight Board, including their judgments as to the quality, not just the acceptability, of our accounting principles. In addition, the audit committee has received the written disclosures and the letter from our independent accountants required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountants’ communications with the audit committee concerning independence and has discussed with our independent accountants their independence from our management and from us. Upon its review, the audit committee has satisfied itself as to our independent accountants’ independence.

Based on the review and discussions with management and the independent accountants, and subject to the limitations on its role and responsibilities described above, the audit committee recommended to our board of directors, and the board of directors has approved, that the audited financial statements be included in our annual report on Form 10-K for the year ended December 31, 2011, as filed with the SEC on February 29, 2012. The undersigned members of the audit committee have submitted this report to us.

Members of the Audit Committee

Cynthia Cohen, Chair

Noam Ben-Ozer

James S. Cassel

Nathan Hetz

16

COMPENSATION COMMITTEE REPORT

The compensation committee consists of the three directors named below, each of whom is “independent” under the New York Stock Exchange listing standards. The compensation committee has overall responsibility for:

| | • | | determining the compensation of the executive officers, including setting and determining achievement of established performance goals; |

| | • | | designing, with the active assistance of management and the committee’s consultants, the company’s executive compensation program; |

| | • | | administering the company’s stock-based compensation plans and programs; |

| | • | | recommending any new elements of executive compensation or programs for consideration to the full board of directors; |

| | • | | overseeing the review of the company’s incentive compensation arrangements to determine whether they encourage excessive risk-taking, discussing at least annually the relationship between risk management policies and practices and compensation, and, as appropriate, considering compensation policies and practices that could mitigate any such risk; and |

| | • | | discussing the Compensation Discussion and Analysis required by Securities and Exchange Commission regulations with management and, if appropriate, recommending its inclusion in the company’s annual report on Form 10-K and proxy statement. |

The compensation committee reviewed and discussed with management the Compensation Discussion and Analysis that begins on page 19 of this proxy statement. Based on our review and these discussions with management, the compensation committee has recommended its inclusion in the company’s annual report on Form 10-K for the fiscal year ended December 31, 2011 and proxy statement for the company’s 2012 annual meeting of stockholders.

Members of the Compensation Committee

Peter Linneman, Chairman

James S. Cassel

Neil Flanzraich

Risk Considerations in our Compensation Programs

Our management, in consultation and discussion with our compensation committee, has reviewed our compensation structures and policies as they pertain to risk and has determined that our compensation programs do not create or encourage the taking of risks that are reasonably likely to have a material adverse effect on the company. In making such determination, our management assessed compensation policies and practices at various levels and in different parts of the company and reviewed the design and operation of our compensation policies and practices, including incentive compensation arrangements for our named executive officers and for all employees. For example, management took into consideration that for our named executive officers who have the largest potential bonuses, a significant portion of total pay is composed of shares of restricted stock that vest over three to four years and, in the past, has included stock options that vest over similar periods and have a ten-year life. Furthermore, performance-based compensation to named executive officers is primarily in the form of equity awards with performance measures based on total stockholder return, both on a relative and absolute basis, over a multiyear period. We believe that the equity award structures and the corresponding vesting conditions and periods applicable to such awards encourage actions for long-term stockholder value rather than short-term risk taking that could materially and adversely affect the company’s business. Additionally, management considered the fact that employees, other than our named executive officers who participate in the executive compensation program described in this proxy statement, receive only a small percentage of their total compensation in the form of variable, performance-based compensation, other than in the case of leasing agents who receive market-based leasing commissions. Management also considered the active role played by the compensation committee and the

17

overall design of the executive compensation program, which management believes encourages an appropriate level of risk taking, creates long-term stockholder value and avoids unnecessary or excessive levels of enterprise risk.

Compensation Committee Interlocks and Insider Participation

No member of the compensation committee during 2011 was an officer, employee or former officer of ours or any of our subsidiaries or had any relationship that would be considered a compensation committee interlock and would require disclosure in this proxy statement pursuant to SEC regulations. None of our executive officers served as a member of a compensation committee or a director of another entity under the circumstances requiring disclosure in this proxy statement pursuant to SEC regulations.

18

COMPENSATION DISCUSSION AND ANALYSIS

Overview

The following discussion is intended to supplement the more detailed information concerning executive compensation that appears in the tables and the accompanying narrative that follow. It is also intended to provide both a review of our compensation policies for 2011 and to describe our compensation policies with respect to our executive officers. Our goal is to provide a better understanding, both in absolute terms and relative to our performance, of our compensation practices and the decisions made concerning the compensation payable to our executive officers, including the chief executive officer, or CEO, and the other executive officers named in the “Summary Compensation Table” below. We refer to these officers as the “named executive officers.��

The compensation committee of our board of directors, referred to in this section as the “committee,” designs and administers our executive compensation program. All principal elements of compensation paid to our named executive officers are subject to approval by the committee. The Compensation Committee Report appears on page 17 of this proxy statement.

Executive Summary

Despite continued economic challenges facing retailers and consumers, we delivered a strong performance in 2011 and made significant progress on many of the strategic objectives established at the beginning of the year. For the year ended December 31, 2011, we generated funds from operations, or FFO1, of $146.8 million, or $1.21 per diluted share, as compared to $92.0 million, or $1.00 per diluted share, for 2010. Our core shopping center occupancy rate increased to 90.7% at December 31, 2011 from 90.3% at December 31, 2010. Consistent with our strategic plan, we continued to increase the quality and geographic diversity of our portfolio through the acquisition of CapCo and other properties primarily located in California, the Northeast and South Florida and through the disposition of non-strategic shopping centers, outparcels and non-retail properties. Finally, we strengthened our balance sheet by raising $115.7 million in net proceeds from a public equity offering and concurrent private placement, repaying or defeasing $146.8 million of mortgage debt (excluding the mortgage on Serramonte Shopping Center that was repaid at the closing of the CapCo transaction) and entering into an expanded $575.0 million, four-year unsecured revolving credit facility.

As a result of this performance, and in accordance with the individual performance measures established by the committee in early 2011 described below, the committee awarded bonuses to our named executive officers in an amount equal to 140% of the target bonus amounts set forth in each of their employment agreements.

During 2011, the committee also completed the negotiation and execution of new employment agreements with Messrs. Caputo, Langer and Gallagher. Similar to the employment agreement executed with Mr. Olson in late 2010, these new employment agreements seek to strengthen the relationship between pay and performance by placing a greater portion of our named executive officers’ compensation “at risk”. Unlike the previous employment agreements with our executives, the new agreements do not provide minimum or guaranteed bonus payments and instead give the committee the discretion to pay bonuses above, at or below specified bonus targets based on each executive’s individual performance. Additionally, the new agreements include one-time, performance based awards of restricted stock that vest on December 31, 2014, the conclusion of the current employment period, only if the return on our common stock over the employment period exceeds both a fixed return threshold and the average total stockholder return of the common stock of a group of our peer companies. Therefore, our executives will receive the benefit of these shares only if our performance during the current employment period exceeds both a predetermined level and compares favorably to the average total stockholder return of our peers.

In part due to these multi-year awards, year-to-year and executive-to-executive comparisons of total compensation for our named executive officers are difficult to make. Notwithstanding the multi-year nature of these awards, the full compensation expense is required, under applicable disclosure requirements, to be shown solely in the year of grant. For instance, each of Mr. Olson’s 2010 compensation and Mr. Caputo’s 2011 compensation

1 We believe FFO (when combined with the presentations in our financial statements under accounting principles generally accepted in the United States, or GAAP) is a useful supplemental measure of our operating performance that is a recognized metric used extensively by the real estate industry and, in particular, REITs. For a discussion of FFO and reconciliations of FFO and FFO per share to net income and earnings per diluted share, respectively, please see pages 31 and 32 of our Annual Report on Form 10-K for the year ended December 31, 2011.

19

includes both an award of restricted stock with a four-year performance period and a separate award of restricted stock subject to a four-year vesting schedule. Similarly, 2011 compensation for Messrs. Langer and Gallagher includes an award of restricted stock with a four-year performance period. It is not anticipated that the named executive officers will receive additional equity awards of similar size during the duration of their current four year employment periods. On the other hand, because they relate only to one-year periods, the base salaries and annual bonus or incentive compensation of our named executive officers are relatively more stable. The terms of the employment agreements for our named executive officers are described below in the section of this proxy statement entitled “Payments Upon Termination of Employment and Change of Control — Employment Agreements with Named Executive Officers.”

Compensation Objectives

The principal objectives of our executive compensation program are to:

| | • | | attract and retain the most talented executives in our industry; |

| | • | | motivate executives to achieve corporate performance objectives as well as individual goals; and |

| | • | | align the interests of our executives with those of our stockholders. |

Management’s and Advisor’s Role in Compensation Decisions

The committee evaluates, in consultation with the full board, the performance of our CEO, Mr. Olson, and determines his compensation based on this evaluation. Mr. Olson provides significant input in setting the compensation for our other named executive officers by providing the committee with an evaluation of their performances and recommendations for their compensation, including recommendations for any adjustments to annual bonuses. He also makes recommendations for equity awards to other employees throughout the company. The committee can accept, reject or modify Mr. Olson’s recommendations as it sees fit, subject to the terms of any applicable employment agreement.

Under its charter, the committee has the authority to engage independent compensation consultants or other advisors. The committee has on occasion relied upon outside advisors to ascertain competitive pay levels, evaluate pay program design, and assess evolving compensation trends. In December 2009, the committee engaged FPL Associates L.P., or FPL, to review our executive compensation programs with our named executive officers in connection with the renewal, amendment and restatement of employment agreements with these executives. In addition, in 2010, the committee also engaged FPL to review our compensation arrangement with our chairman of the board. FPL worked closely with the committee throughout 2010 and early 2011 in connection with the execution of amended and restated compensation and employment agreements with these executives. Finally, the committee engaged FPL in 2011 to analyze the director fees and other compensation paid to our directors. In addition, the committee engaged the law firm of Reed Smith LLP in 2010 and 2011 to advise it with respect to the new employment agreements and other ongoing committee matters.

Principal Elements of Compensation and Total Direct Compensation

We have designed our executive compensation program to include three major elements - base salary, annual bonus incentives and long-term equity incentives, such as stock options, restricted stock awards and performance-based equity awards. Historically, the principal elements of our executive compensation program are agreed to and determined at the time of our entry into the applicable employment agreement with each executive officer. The current employment agreements specify levels and types of compensation, including, base salaries and certain cash and equity bonus targets. Unlike the prior employment agreements with our named executive officers, the current employment agreements do not guarantee any minimum bonus compensation levels. The current employment agreements are described below under the heading entitled “Payments upon Termination of Employment and Change of Control – Employment Agreements with Named Executive Officers.”

Although all three of these elements are integrated into our compensation program, the elements are intended to achieve different objectives:

20

| | • | | base salaries are intended to provide an appropriate level of fixed compensation that will assist in employee retention and recruitment; |

| | • | | annual bonus incentives provide additional motivation for the achievement of specified objectives at the corporate or individual levels; and |

| | • | | long-term equity incentives align the interests of our executives more closely with the interests of our stockholders because they are tied to our financial and stock performance and vest or accrue over a number of years, encouraging executives to remain our employees. |