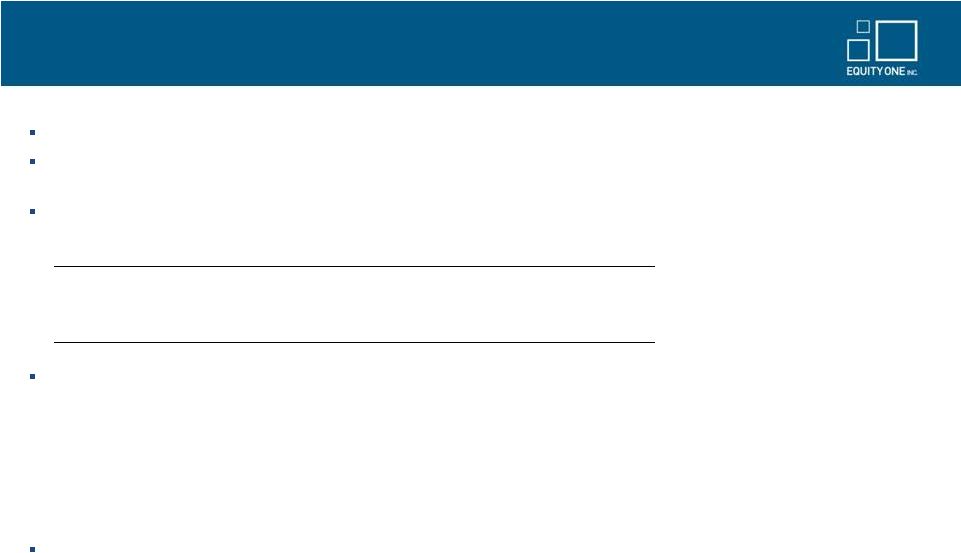

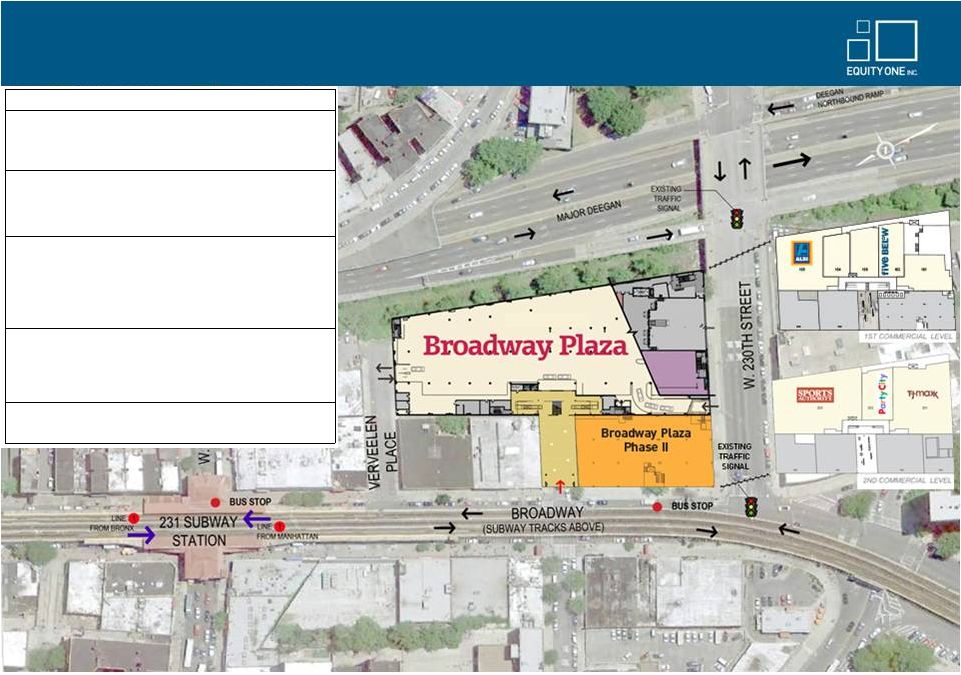

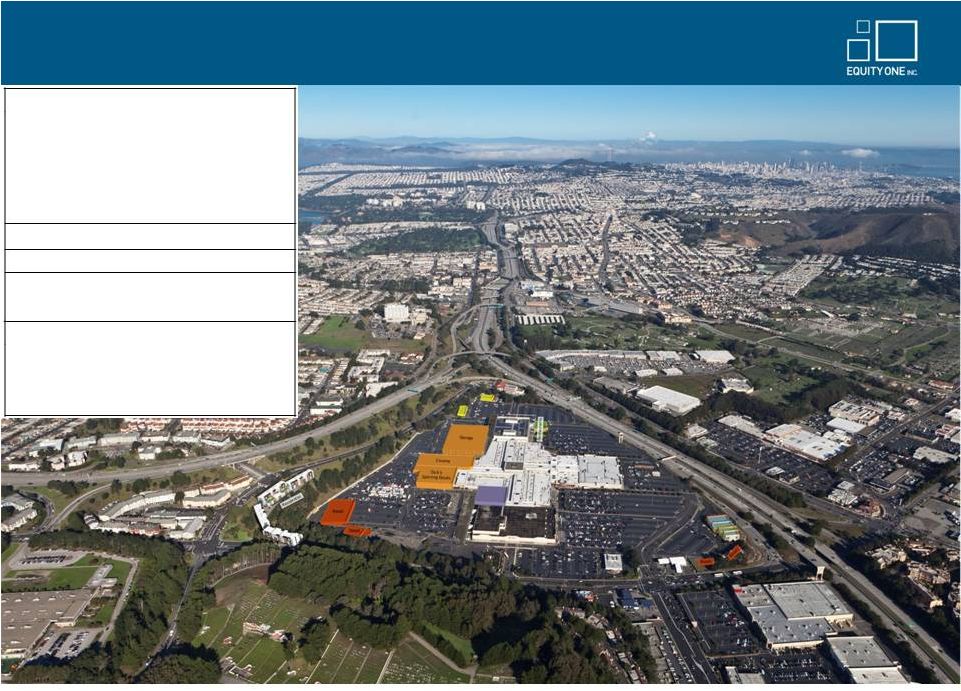

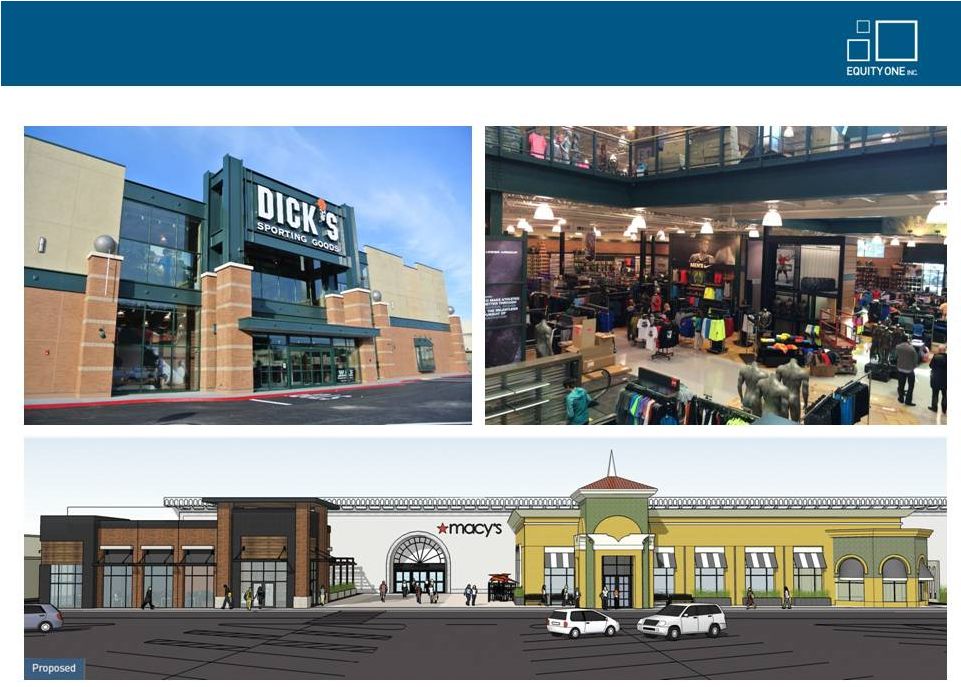

9/30/14 Occupancy In-Place Debt (9/30/14) No. of Centers 3Q14 Fair Value ($000) Value per Property ($000) GLA Total Anchor Shop Base Rent PSF Avg 3-mi Population Avg 3-mi HH Income Grocer Sales PSF Balance ($000) Interest Rate Years to Maturity CONSOLIDATED PORTFOLIO Florida South Florida 33 973,607 $ 29,503 $ 4,331,675 94.1% 99.6% 85.4% 16.02 $ 133,146 77,481 $ 626 $ 95,326 $ 6.33% 4.9 Jacksonville 7 130,067 $ 18,581 $ 929,403 91.0% 100.0% 72.7% 12.63 $ 42,854 87,826 $ 336 $ - $ - - Orlando 7 118,619 $ 16,946 $ 926,265 85.4% 95.3% 74.3% 13.81 $ 78,356 77,913 $ 207 $ - $ - - Tampa 4 86,325 $ 21,581 $ 454,761 87.3% 100.0% 70.4% 17.29 $ 45,514 96,273 $ 519 $ 15,595 $ 5.75% 1.7 Sun Coast 6 68,400 $ 11,400 $ 426,891 92.1% 100.0% 79.8% 12.43 $ 40,357 65,077 $ 756 $ 4,378 $ 6.50% 9.4 Florida Total 57 1,377,018 $ 24,158 $ 7,068,995 92.0% 99.2% 80.9% 15.17 $ 109,795 79,057 $ 609 $ 115,299 $ 6.26% 4.7 California San Francisco 6 680,946 $ 113,491 $ 1,790,587 97.1% 100.0% 90.8% 22.86 $ 214,319 98,936 $ 800 $ 73,713 $ 5.74% 1.7 Los Angeles 5 214,467 $ 42,893 $ 593,939 98.1% 100.0% 95.0% 22.38 $ 240,280 95,327 $ 513 $ 85,138 $ 5.46% 4.5 California Total 11 895,413 $ 81,401 $ 2,384,526 97.3% 100.0% 92.1% 22.74 $ 220,537 98,071 $ 619 $ 158,850 $ 5.59% 3.2 New York 8 698,322 $ 87,290 $ 1,092,227 97.8% 100.0% 85.3% 39.05 $ 570,823 107,919 $ 1,550 $ 22,877 $ 6.52% 2.5 Connecticut 8 330,067 $ 41,258 $ 983,845 96.4% 98.5% 92.1% 20.27 $ 37,399 154,164 $ 912 $ 95,972 $ 5.72% 3.7 Georgia 9 200,871 $ 22,319 $ 983,592 93.3% 100.0% 82.8% 15.83 $ 99,107 114,596 $ 536 $ 6,937 $ 7.94% 6.6 Maryland 1 142,131 $ 142,131 $ 466,173 97.0% 100.0% 86.2% 19.35 $ 142,569 216,130 $ 832 $ - $ - - Massachusetts 7 135,230 $ 19,319 $ 602,929 98.1% 100.0% 84.3% 18.71 $ 187,219 91,408 $ 348 $ 6,654 $ 8.07% 9.9 Louisiana 7 74,098 $ 10,585 $ 883,066 93.9% 93.3% 95.1% 9.90 $ 65,310 82,217 $ 218 $ - $ - - North Carolina 3 23,200 $ 7,733 $ 436,511 95.1% 100.0% 80.9% 6.71 $ 28,591 52,509 $ 367 $ - $ - - Pro Forma Consolidated Portfolio 111 3,876,349 $ 34,922 $ 14,901,864 94.2% 99.1% 84.6% 18.26 $ 214,278 102,244 $ 626 $ 406,589 $ 5.94% 3.9 (1) Fair value of Broadway Plaza is based on the budgeted construction cost, as it is currently in development. (2) New York occupancy rates exclude Broadway Plaza (in development). (3) Pro forma for dispositions completed and under contract as of 10/29/2014. Includes development and redevelopment properties. Excludes land, non-retail assets (with exception of Westwood in Bethesda, MD), and unconsolidated JV properties. Maryland base rent is retail only. Summary of Pro Forma Portfolio Metrics 41 (1) (2) (3) |