Second Quarter 2022 Supplemental Earnings Information Exhibit 99.2

Forward-Looking Statements The information furnished in this presentation contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements include, but are not limited to, the effects of the COVID-19 pandemic, and the effects of actions taken by third parties including, but not limited to, governmental authorities, customers, contractors and suppliers, in response to the ongoing COVID-19 pandemic, the impact of actions taken by the Organization of Petroleum Exporting Countries (OPEC) and non-OPEC nations to adjust their production levels, the general volatility of oil and natural gas prices and cyclicality of the oil and gas industry, declines in investor and lender sentiment with respect to, and new capital investments in, the oil and gas industry, project terminations, suspensions or scope adjustments to contracts, uncertainties regarding the effects of new governmental regulations, the Company’s international operations, operating risks, the impact of our customers and the global energy sector shifting some of their asset allocation from fossil-fuel production to renewable energy resources, goals, projections, estimates, expectations, market outlook, forecasts, plans and objectives, including revenue and new product revenue, capital expenditures and other projections, project bookings, bidding and service activity, acquisition opportunities, forecasted supply and demand, forecasted drilling activity and subsea investment, liquidity, cost savings, and share repurchases and are based on assumptions, estimates and risk analysis made by management of Dril-Quip, Inc. (“Dril-Quip”) in light of its experience and perception of historical trends, current conditions, expected future developments and other factors. No assurance can be given that actual future results will not differ materially from those contained in the forward-looking statements in this presentation. Although Dril-Quip believes that all such statements contained in this presentation are based on reasonable assumptions, there are numerous variables of an unpredictable nature or outside of Dril-Quip’s control that could affect Dril-Quip’s future results and the value of its shares. Each investor must assess and bear the risk of uncertainty inherent in the forward-looking statements contained in this presentation. Please refer to Dril-Quip’s filings with the Securities and Exchange Commission (“SEC”) for additional discussion of risks and uncertainties that may affect Dril-Quip’s actual future results. Dril-Quip undertakes no obligation to update the forward-looking statements contained herein. Use of Non-GAAP Financial Measures Adjusted Net Income, Adjusted Diluted EPS, Adjusted EBITDA and Free Cash Flow are non-GAAP measures. Adjusted Net Income and Adjusted Diluted EPS are defined as net income (loss) and earnings per share, respectively, excluding the impact of foreign currency gains or losses as well as other significant non-cash items and certain charges and credits. Adjusted EBITDA is defined as net income excluding income taxes, interest income and expense, depreciation and amortization expense, stock-based compensation, non-cash gains or losses from foreign currency exchange rate changes as well as other significant non-cash items and items that can be considered non-recurring. Free Cash Flow is defined as cash provided by operating activities less cash used in the purchase of property, plant and equipment. We believe that these non-GAAP measures enable us to evaluate and compare more effectively the results of our operations period over period and identify operating trends by removing the effect of our capital structure from our operating structure and certain other items including those that affect the comparability of operating results. In addition, we believe that these measures are supplemental measurement tools used by analysts and investors to help evaluate overall operating performance, ability to pursue and service possible debt opportunities and make future capital expenditures. These measures do not represent funds available for our discretionary use and are not intended to represent or to be used as a substitute for net income or net cash provided by operating activities, as measured under U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial information supplements should be read together with, and is not an alternative or substitute for, our financial results reported in accordance with GAAP. Because non-GAAP financial information is not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures. Reconciliations of these non-GAAP measures to the most directly comparable GAAP measure can be found in the appendix. Use of Website Investors should note that Dril-Quip announces material financial information in SEC filings, press releases and public conference calls. Dril-Quip may use the Investors section of its website (www.dril-quip.com) to communicate with investors. It is possible that the financial and other information posted there could be deemed to be material information. Information on Dril-Quip’s website is not part of this presentation. Disclaimer| Cautionary Statement

Leading Manufacturer of Highly Engineered Drilling & Production Equipment Technically Innovative, Environmentally Responsible Products & First-class Service Strong Financial Position Historically Superior Margins to Peers Results Driven Management Team Dril-Quip Investment Highlights

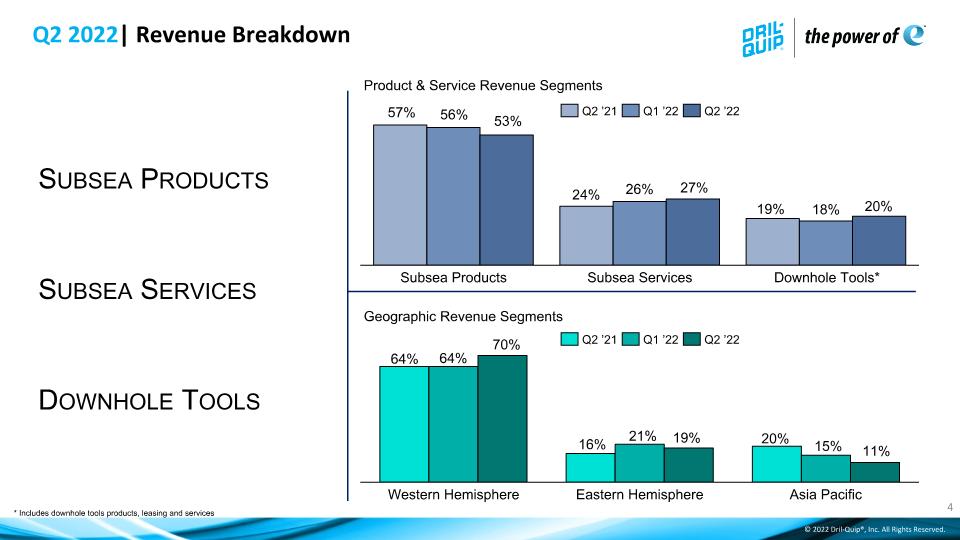

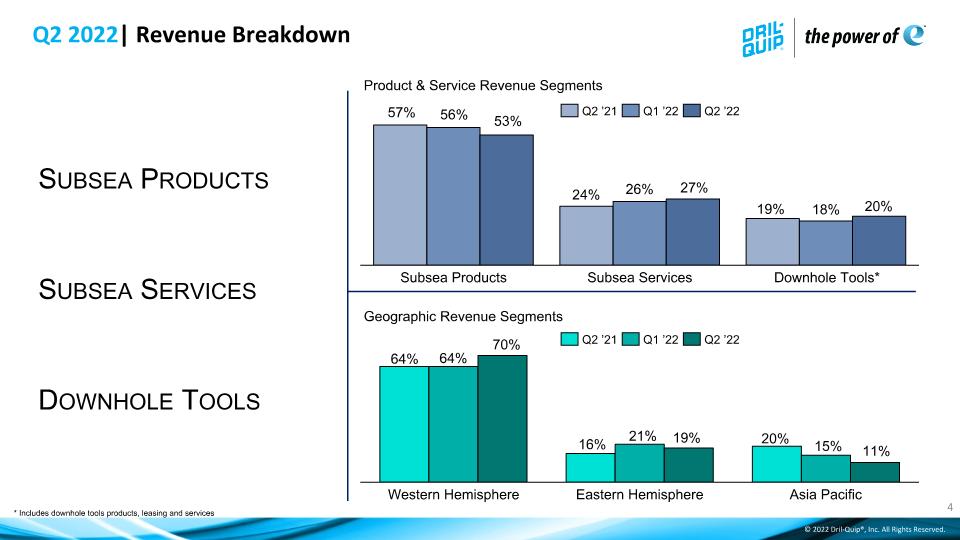

Product & Service Revenue Segments Subsea Products Subsea Services Downhole Tools Eastern Hemisphere 21% 64% Western Hemisphere 64% 70% Asia Pacific 16% 19% 20% 15% 11% 57% Downhole Tools* 20% Subsea Products 18% 53% Subsea Services 56% 24% 26% 27% 19% Q2 ’21 Q1 ’22 Q2 ’22 Q1 ’22 Q2 ’21 Q2 ’22 Geographic Revenue Segments Q2 2022| Revenue Breakdown * Includes downhole tools products, leasing and services

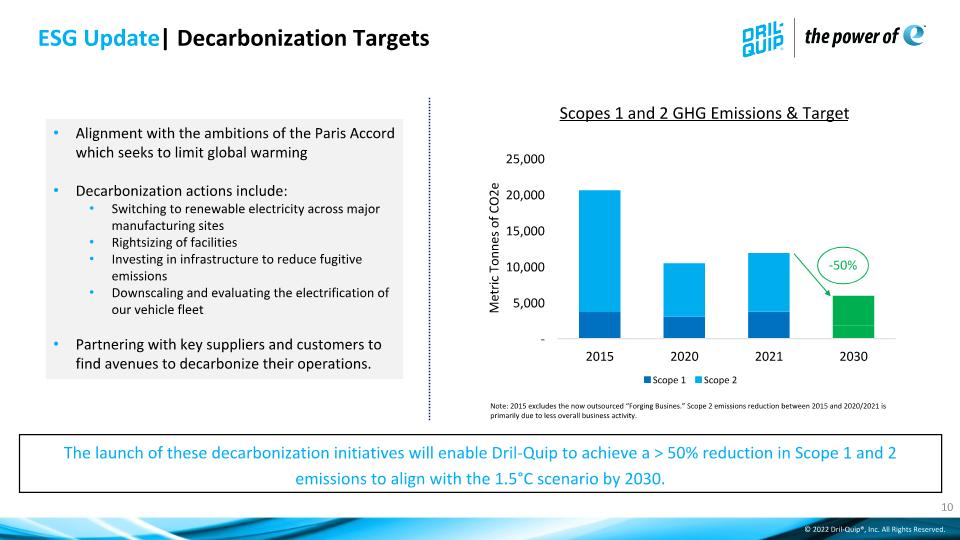

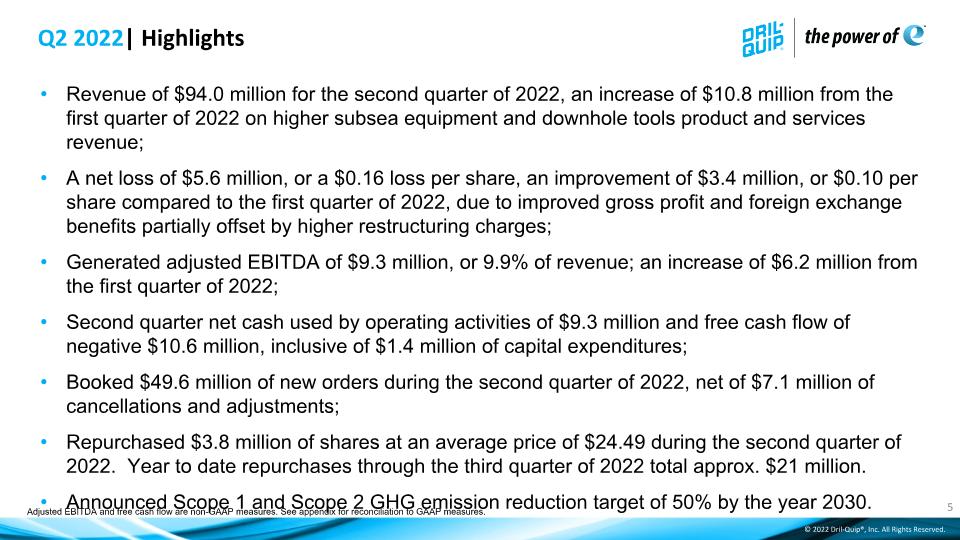

Revenue of $94.0 million for the second quarter of 2022, an increase of $10.8 million from the first quarter of 2022 on higher subsea equipment and downhole tools product and services revenue; A net loss of $5.6 million, or a $0.16 loss per share, an improvement of $3.4 million, or $0.10 per share compared to the first quarter of 2022, due to improved gross profit and foreign exchange benefits partially offset by higher restructuring charges; Generated adjusted EBITDA of $9.3 million, or 9.9% of revenue; an increase of $6.2 million from the first quarter of 2022; Second quarter net cash used by operating activities of $9.3 million and free cash flow of negative $10.6 million, inclusive of $1.4 million of capital expenditures; Booked $49.6 million of new orders during the second quarter of 2022, net of $7.1 million of cancellations and adjustments; Repurchased $3.8 million of shares at an average price of $24.49 during the second quarter of 2022. Year to date repurchases through the third quarter of 2022 total approx. $21 million. Announced Scope 1 and Scope 2 GHG emission reduction target of 50% by the year 2030. Adjusted EBITDA and free cash flow are non-GAAP measures. See appendix for reconciliation to GAAP measures. Q2 2022| Highlights

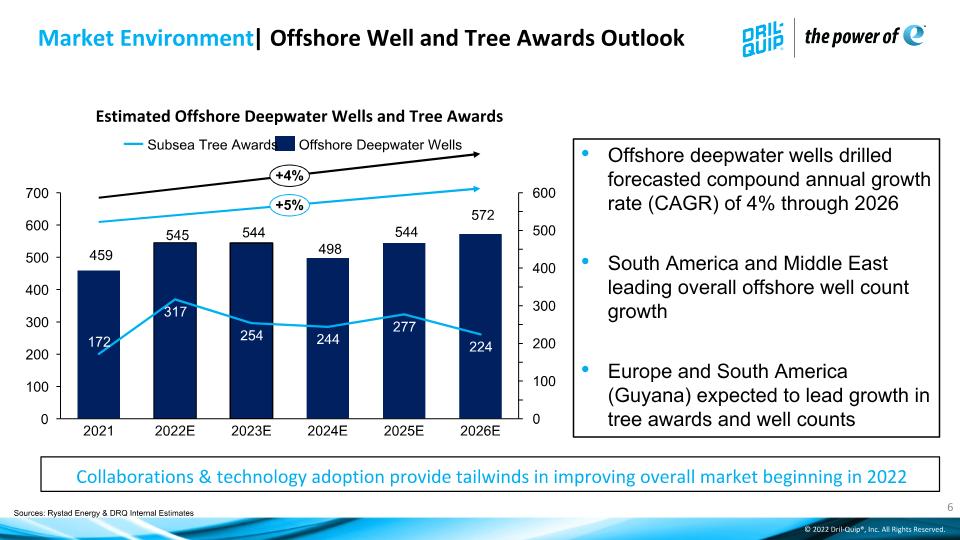

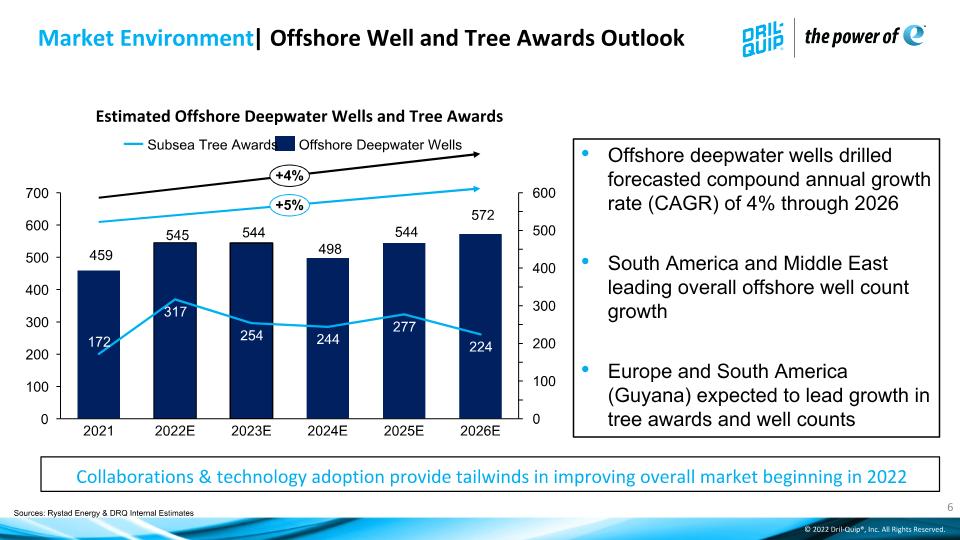

Sources: Rystad Energy & DRQ Internal Estimates Collaborations & technology adoption provide tailwinds in improving overall market beginning in 2022 Offshore deepwater wells drilled forecasted compound annual growth rate (CAGR) of 4% through 2026 South America and Middle East leading overall offshore well count growth Europe and South America (Guyana) expected to lead growth in tree awards and well counts Estimated Offshore Deepwater Wells and Tree Awards 0 500 100 200 300 600 400 2024E 2021 2022E 2026E 2023E 2025E +4% +5% Subsea Tree Awards Offshore Deepwater Wells Market Environment| Offshore Well and Tree Awards Outlook

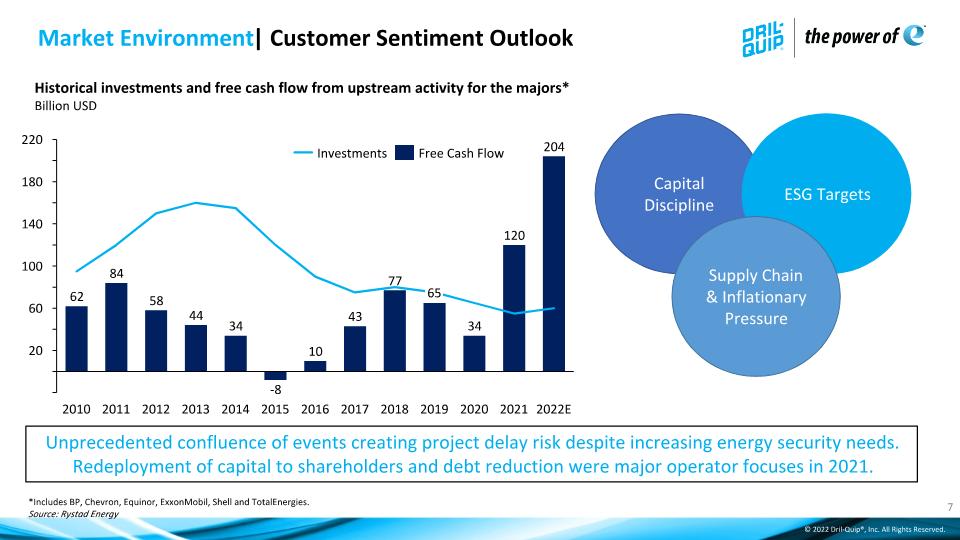

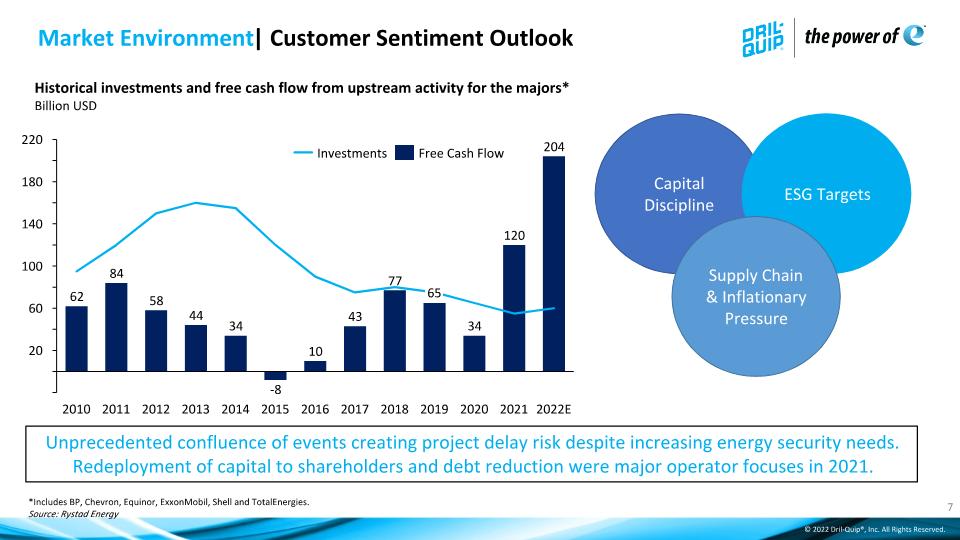

Unprecedented confluence of events creating project delay risk despite increasing energy security needs. Redeployment of capital to shareholders and debt reduction were major operator focuses in 2021. Market Environment| Customer Sentiment Outlook Capital Discipline ESG Targets Supply Chain & Inflationary Pressure Historical investments and free cash flow from upstream activity for the majors* Billion USD 20 100 60 140 180 220 2010 2011 2012 2013 2014 2015 65 2016 2018 2017 2019 2020 2021 2022E Investments Free Cash Flow *Includes BP, Chevron, Equinor, ExxonMobil, Shell and TotalEnergies. Source: Rystad Energy

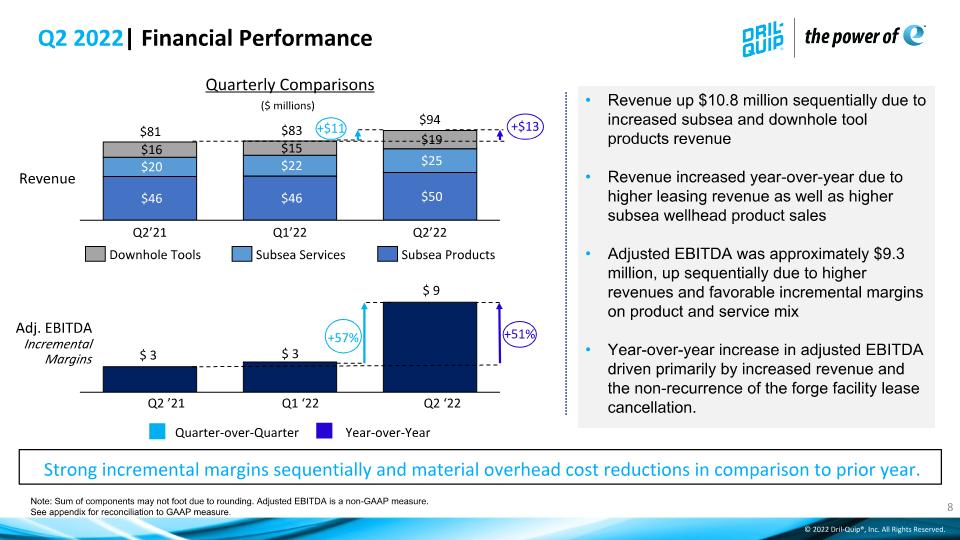

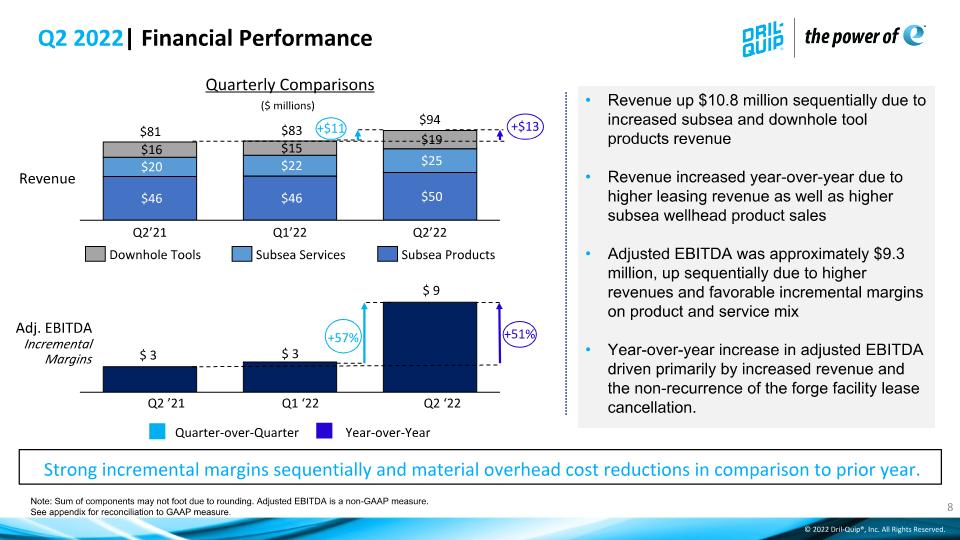

($ millions) Q2’21 Q1’22 Q2’22 $81 $83 $94 +$13 +$11 Strong incremental margins sequentially and material overhead cost reductions in comparison to prior year. Quarterly Comparisons Note: Sum of components may not foot due to rounding. Adjusted EBITDA is a non-GAAP measure. See appendix for reconciliation to GAAP measure. Revenue up $10.8 million sequentially due to increased subsea and downhole tool products revenue Revenue increased year-over-year due to higher leasing revenue as well as higher subsea wellhead product sales Adjusted EBITDA was approximately $9.3 million, up sequentially due to higher revenues and favorable incremental margins on product and service mix Year-over-year increase in adjusted EBITDA driven primarily by increased revenue and the non-recurrence of the forge facility lease cancellation. Q2 ’21 Q1 ‘22 Q2 ‘22 Adj. EBITDA Incremental Margins +57% +51% Quarter-over-Quarter Year-over-Year Q2 2022| Financial Performance Downhole Tools Subsea Services Subsea Products Revenue

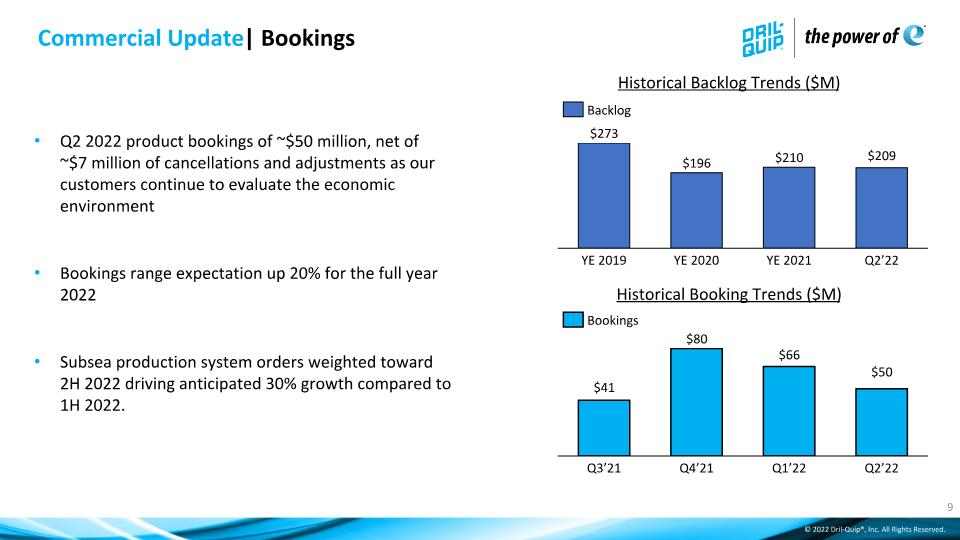

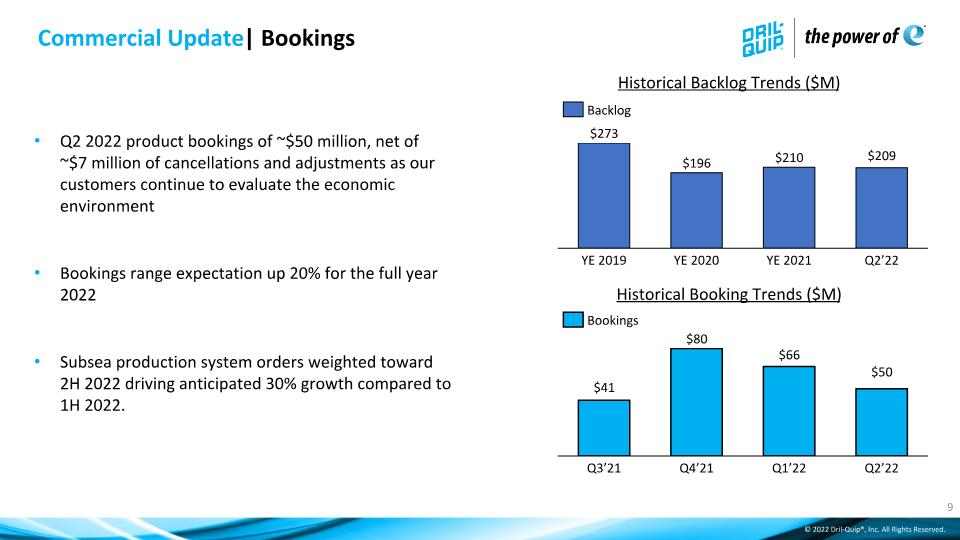

Q2 2022 product bookings of ~$50 million, net of ~$7 million of cancellations and adjustments as our customers continue to evaluate the economic environment Bookings range expectation up 20% for the full year 2022 Subsea production system orders weighted toward 2H 2022 driving anticipated 30% growth compared to 1H 2022. YE 2019 Q2’22 YE 2020 YE 2021 Historical Backlog Trends ($M) Backlog Q2’22 Q1’22 Q3’21 Q4’21 Historical Booking Trends ($M) Bookings Commercial Update| Bookings

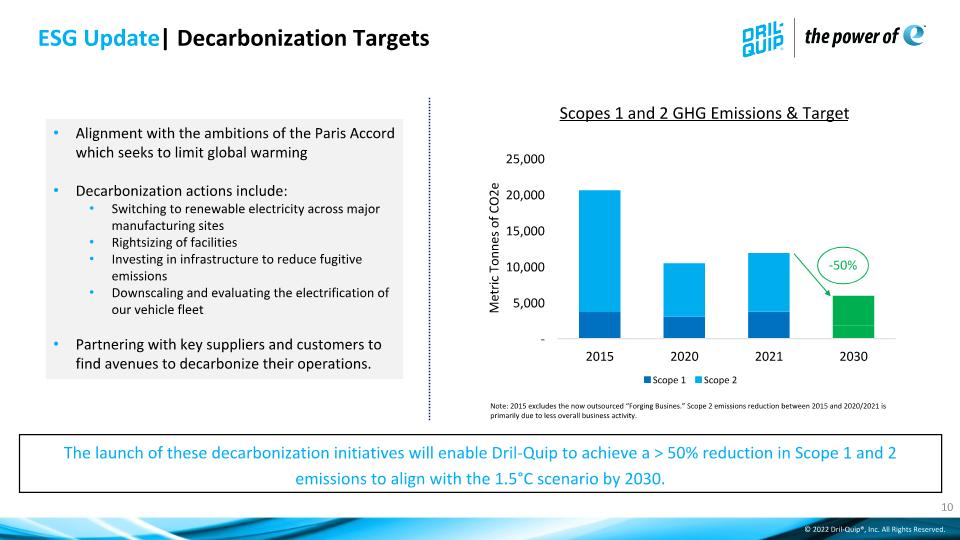

ESG Update| Decarbonization Targets Alignment with the ambitions of the Paris Accord which seeks to limit global warming Decarbonization actions include: Switching to renewable electricity across major manufacturing sites Rightsizing of facilities Investing in infrastructure to reduce fugitive emissions Downscaling and evaluating the electrification of our vehicle fleet Partnering with key suppliers and customers to find avenues to decarbonize their operations. The launch of these decarbonization initiatives will enable Dril-Quip to achieve a > 50% reduction in Scope 1 and 2 emissions to align with the 1.5°C scenario by 2030. -50% Scopes 1 and 2 GHG Emissions & Target Note: 2015 excludes the now outsourced “Forging Busines.” Scope 2 emissions reduction between 2015 and 2020/2021 is primarily due to less overall business activity.

Strategic Growth Pillars Continue to execute on collaboration agreements, downhole tools growth and e-Series technology expansion Organizational Alignment Streamlined operations and leadership around more focused and integrated product and service lines Optimized Footprint Further transformation of our operational footprint to improve efficiency and reduce excess capacity Capital Allocation Disciplined deployment of capital to generate attractive returns on capital employed Strategy| 2022 Focus Areas

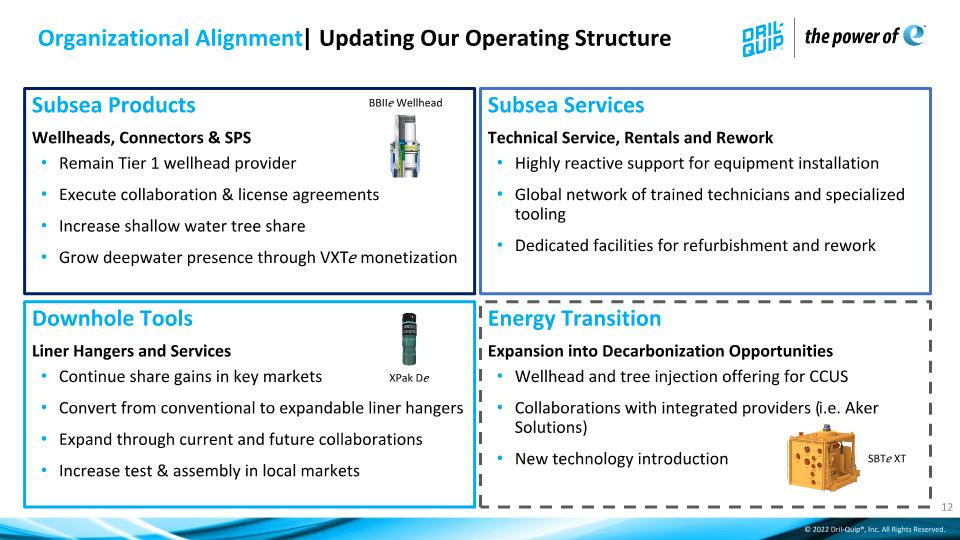

Organizational Alignment| Updating Our Operating Structure Subsea Products Wellheads, Connectors & SPS Remain Tier 1 wellhead provider Execute collaboration & license agreements Increase shallow water tree share Grow deepwater presence through VXTe monetization Downhole Tools Liner Hangers and Services Continue share gains in key markets Convert from conventional to expandable liner hangers Expand through current and future collaborations Increase test & assembly in local markets Subsea Services Technical Service, Rentals and Rework Highly reactive support for equipment installation Global network of trained technicians and specialized tooling Dedicated facilities for refurbishment and rework Energy Transition Expansion into Decarbonization Opportunities Wellhead and tree injection offering for CCUS Collaborations with integrated providers (i.e. Aker Solutions) New technology introduction SBTe XT BBIIe Wellhead XPak De

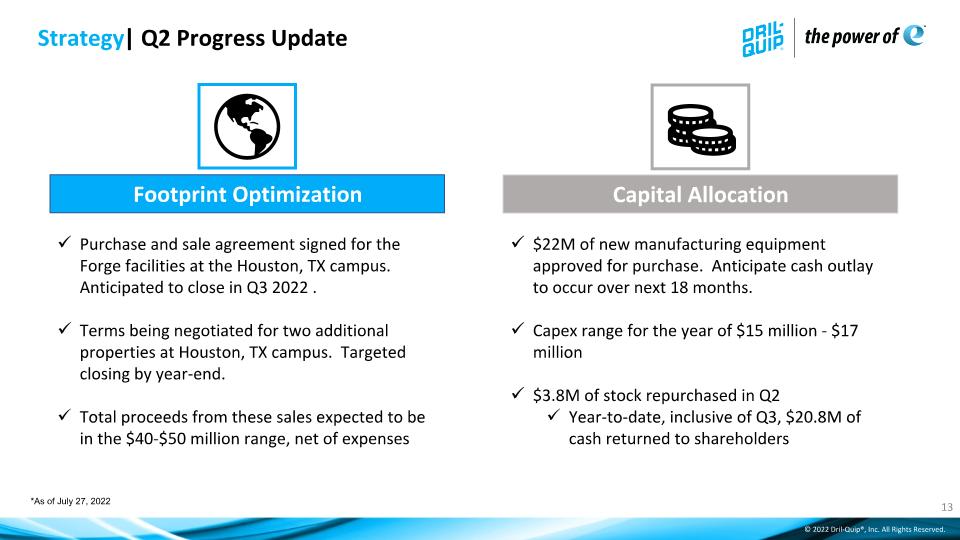

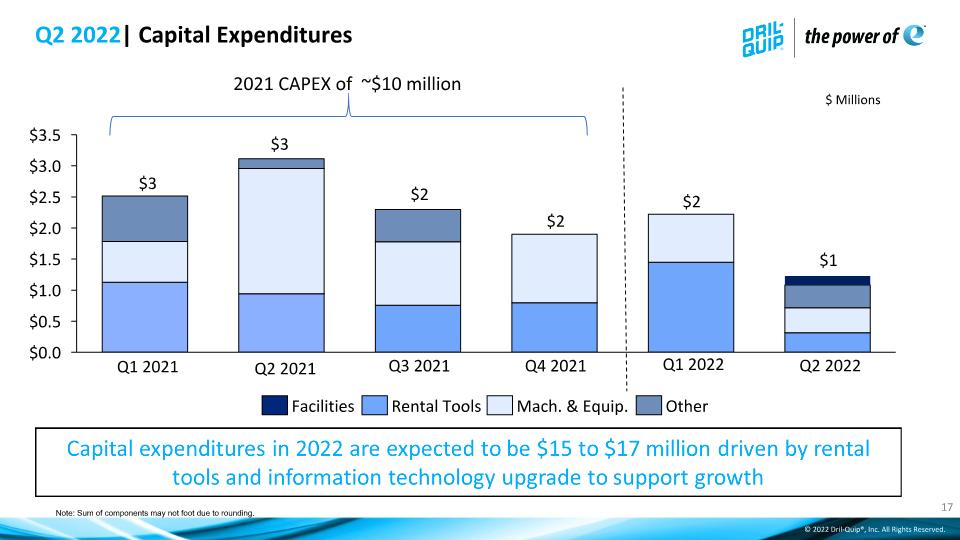

Strategy| Q2 Progress Update Footprint Optimization Capital Allocation Purchase and sale agreement signed for the Forge facilities at the Houston, TX campus. Anticipated to close in Q3 2022 . Terms being negotiated for two additional properties at Houston, TX campus. Targeted closing by year-end. Total proceeds from these sales expected to be in the $40-$50 million range, net of expenses $22M of new manufacturing equipment approved for purchase. Anticipate cash outlay to occur over next 18 months. Capex range for the year of $15 million - $17 million $3.8M of stock repurchased in Q2 Year-to-date, inclusive of Q3, $20.8M of cash returned to shareholders *As of July 27, 2022

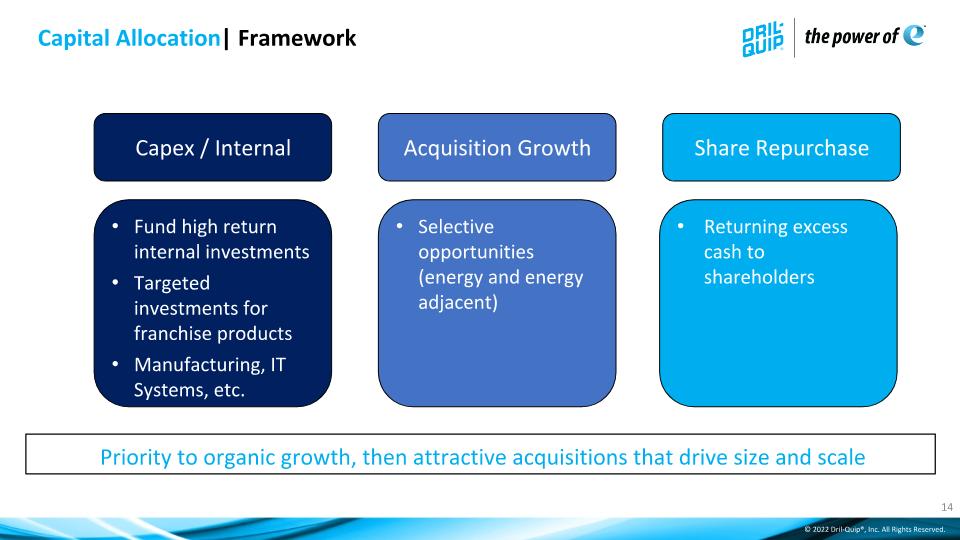

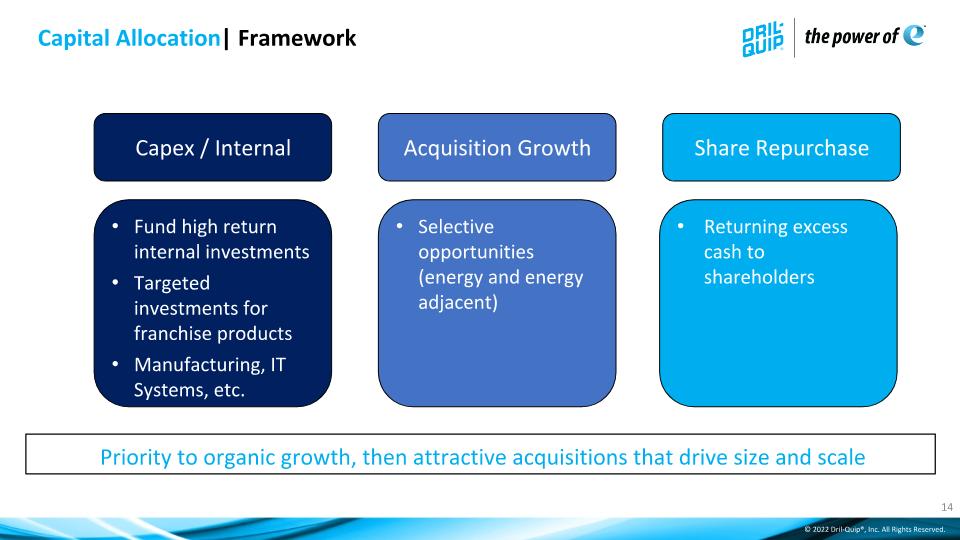

Priority to organic growth, then attractive acquisitions that drive size and scale Capex / Internal Share Repurchase Acquisition Growth Returning excess cash to shareholders Fund high return internal investments Targeted investments for franchise products Manufacturing, IT Systems, etc. Selective opportunities (energy and energy adjacent) Capital Allocation| Framework

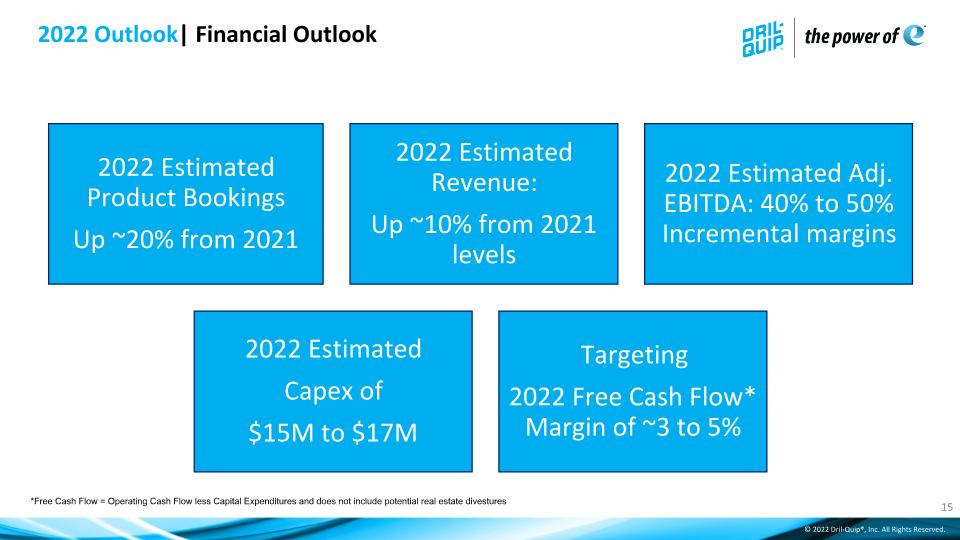

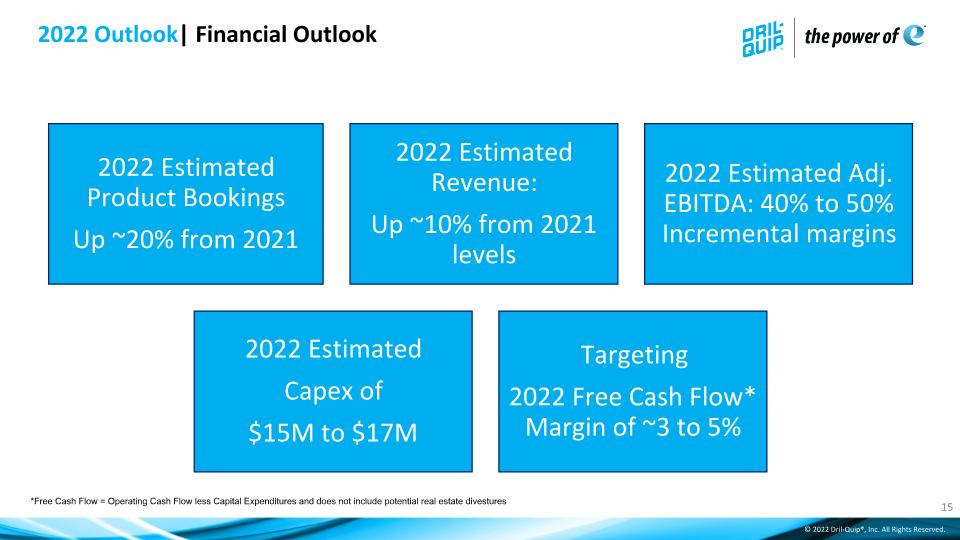

2022 Estimated Product Bookings Up ~20% from 2021 2022 Estimated Revenue: Up ~10% from 2021 levels 2022 Estimated Adj. EBITDA: 40% to 50% Incremental margins 2022 Estimated Capex of $15M to $17M Targeting 2022 Free Cash Flow* Margin of ~3 to 5% 2022 Outlook| Financial Outlook *Free Cash Flow = Operating Cash Flow less Capital Expenditures and does not include potential real estate divestures

Appendix dril-quip.com | NYSE: DRQ

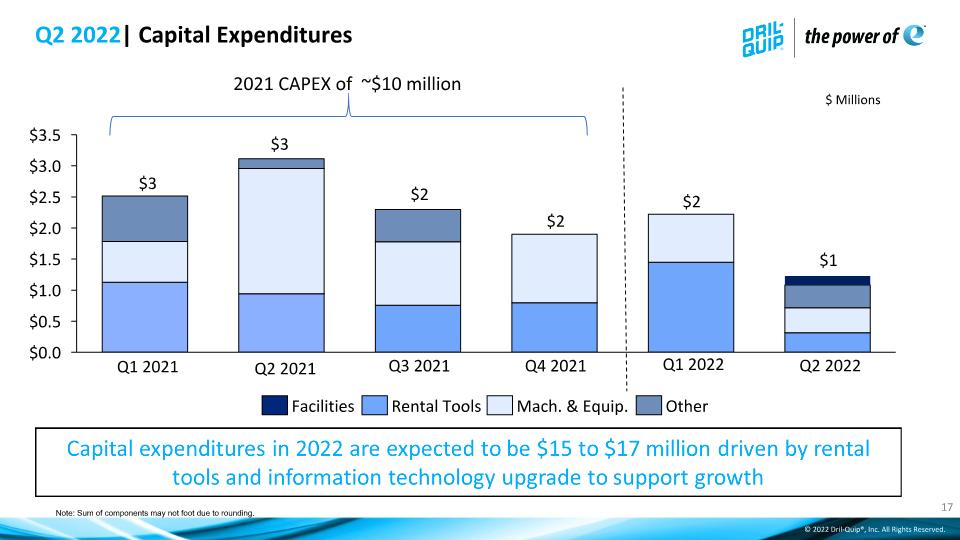

Q2 2022| Capital Expenditures $1 Q4 2021 $3 Q1 2022 Q1 2021 Q2 2021 Q3 2021 $3 $2 $2 $2 Note: Sum of components may not foot due to rounding. Other Facilities Rental Tools Mach. & Equip. $ Millions 2021 CAPEX of ~$10 million Q2 2022

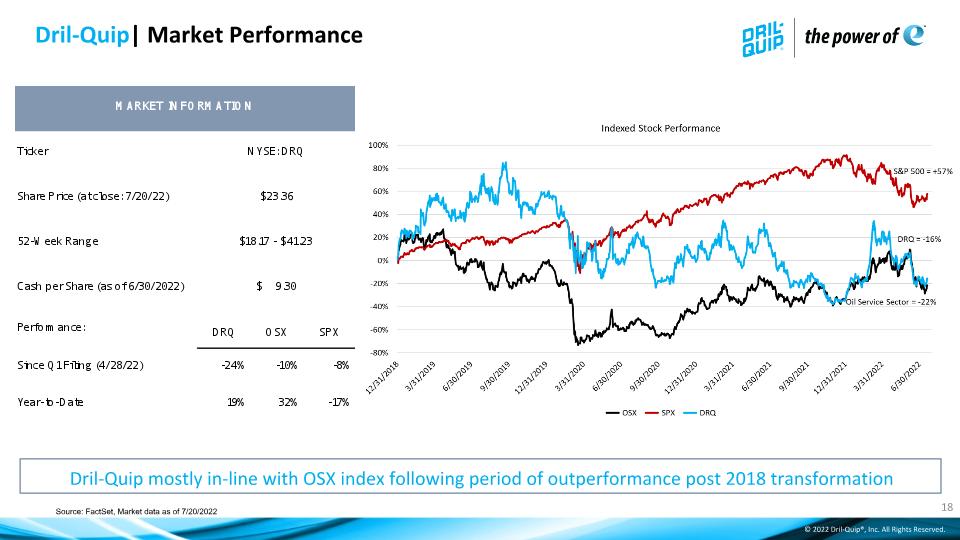

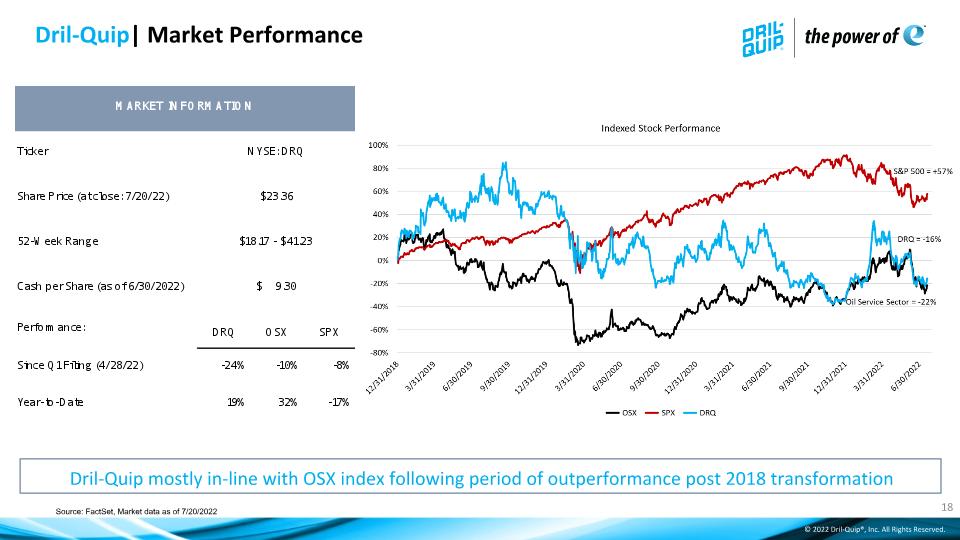

Source: FactSet, Market data as of 7/20/2022 Dril-Quip mostly in-line with OSX index following period of outperformance post 2018 transformation Dril-Quip| Market Performance

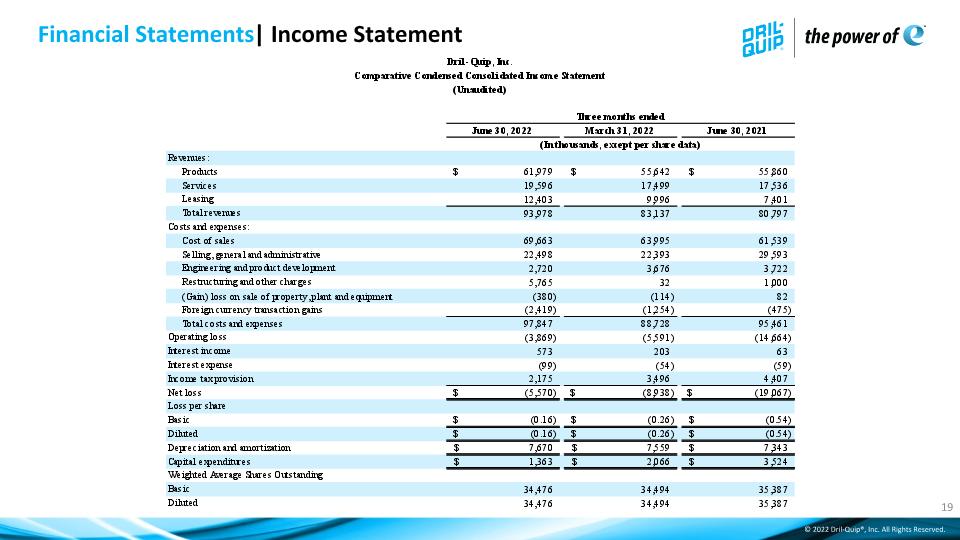

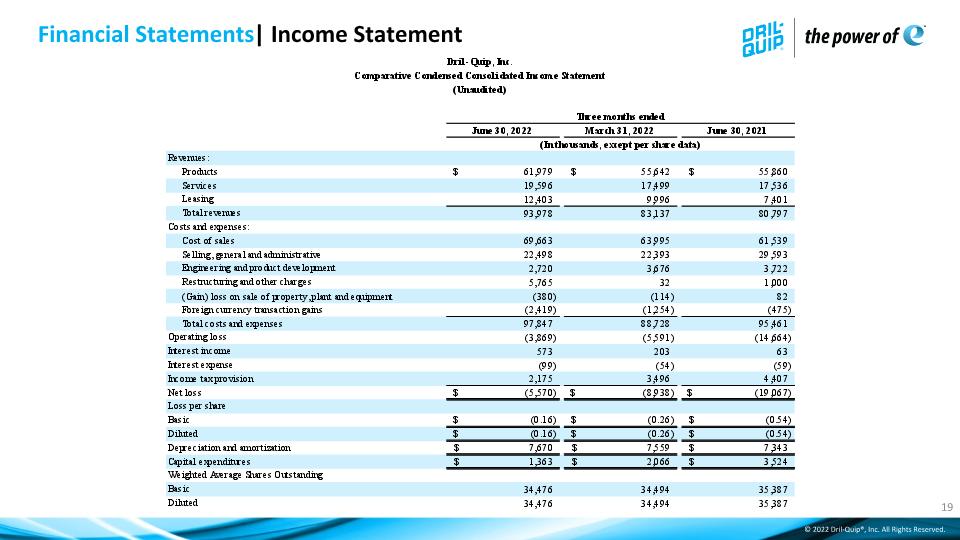

Financial Statements| Income Statement Dril-Quip, Inc. Comparative Condensed Consolidated Income Statement (Unaudited) Three months ended June 30, 2022 March 31, 2022 June 30, 2021 (In thousands, except per share data) Revenues: Products $ 61,979 $ 55,642 $ 55,860 Services 19,596 17,499 17,536 Leasing 12,403 9,996 7,401 Total revenues 93,978 83,137 80,797 Costs and expenses: Cost of sales 69,663 63,995 61,539 Selling, general and administrative 22,498 22,393 29,593 Engineering and product development 2,720 3,676 3,722 Restructuring and other charges 5,765 32 1,000 (Gain) loss on sale of property, plant and equipment (380) (114) 82 Foreign currency transaction gains (2,419) (1,254) (475) Total costs and expenses 97,847 88,728 95,461 Operating loss (3,869) (5,591) (14,664) Interest income 573 203 63 Interest expense (99) (54) (59) Income tax provision 2,175 3,496 4,407 Net loss $ (5,570) $ (8,938) $ (19,067) Loss per share Basic $ (0.16) $ (0.26) $ (0.54) Diluted $ (0.16) $ (0.26) $ (0.54) Depreciation and amortization $ 7,670 $ 7,559 $ 7,343 Capital expenditures $ 1,363 $ 2,066 $ 3,524 Weighted Average Shares Outstanding Basic 34,476 34,494 35,387 Diluted 34,476 34,494 35,387

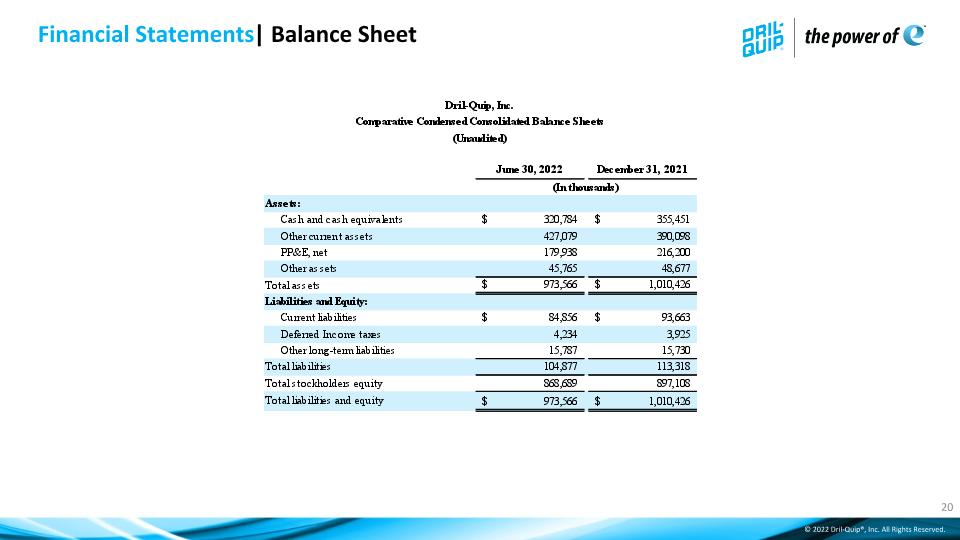

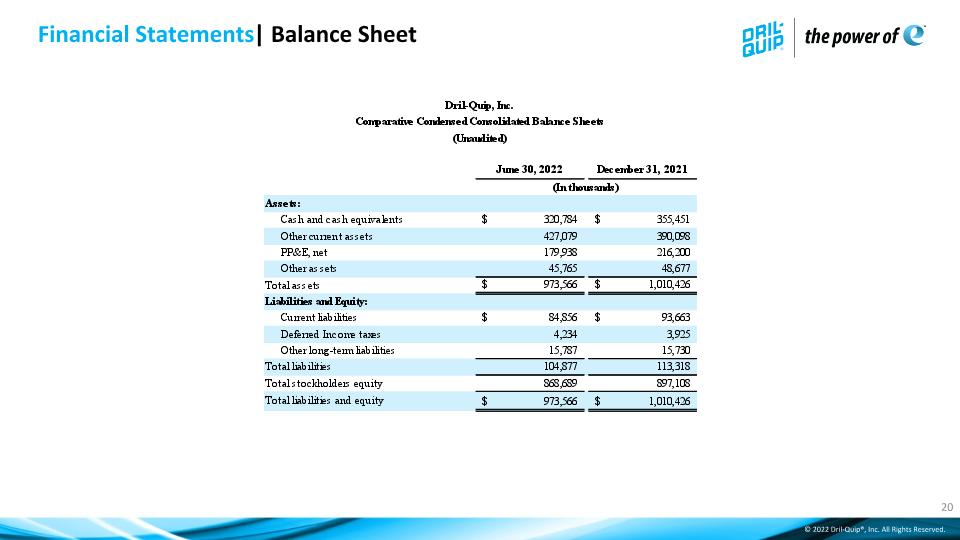

Financial Statements| Balance Sheet Dril-Quip, Inc. Comparative Condensed Consolidated Balance Sheets (Unaudited) June 30, 2022 December 31, 2021 (In thousands) Assets: Cash and cash equivalents $ 320,784 $ 355,451 Other current assets 427,079 390,098 PP&E, net 179,938 216,200 Other assets 45,765 48,677 Total assets $ 973,566 $ 1,010,426 Liabilities and Equity: Current liabilities $ 84,856 $ 93,663 Deferred Income taxes 4,234 3,925 Other long-term liabilities 15,787 15,730 Total liabilities 104,877 113,318 Total stockholders equity 868,689 897,108 Total liabilities and equity $ 973,566 $ 1,010,426

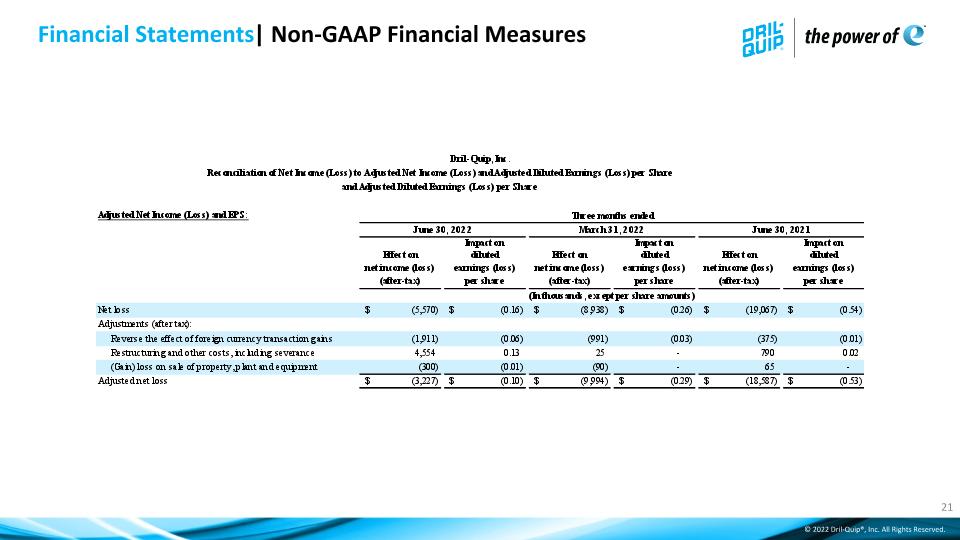

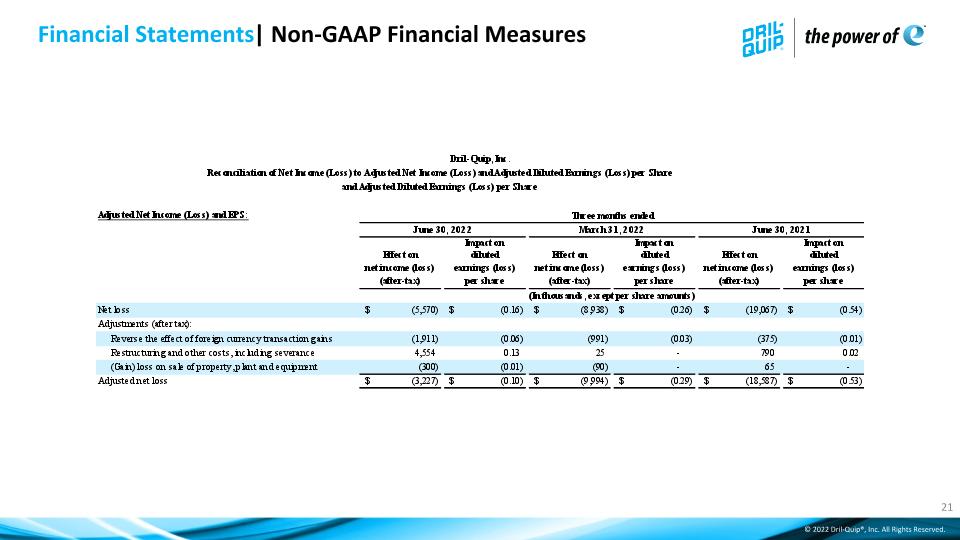

Financial Statements| Non-GAAP Financial Measures Dril-Quip, Inc. Reconciliation of Net Income (Loss) to Adjusted Net Income (Loss) and Adjusted Diluted Earnings (Loss) per Share and Adjusted Diluted Earnings (Loss) per Share Adjusted Net Income (Loss) and EPS: Three months ended June 30, 2022 March 31, 2022 June 30, 2021 Impact on Impact on Impact on Effect on diluted Effect on diluted Effect on diluted net income (loss) earnings (loss) net income (loss) earnings (loss) net income (loss) earnings (loss) (after-tax) per share (after-tax) per share (after-tax) per share (In thousands, except per share amounts) Net loss $ (5,570) $ (0.16) $ (8,938) $ (0.26) $ (19,067) $ (0.54) Adjustments (after tax): Reverse the effect of foreign currency transaction gains (1,911) (0.06) (991) (0.03) (375) (0.01) Restructuring and other costs, including severance 4,554 0.13 25 - 790 0.02 (Gain) loss on sale of property, plant and equipment (300) (0.01) (90) - 65 - Adjusted net loss $ (3,227) $ (0.10) $ (9,994) $ (0.29) $ (18,587) $ (0.53)

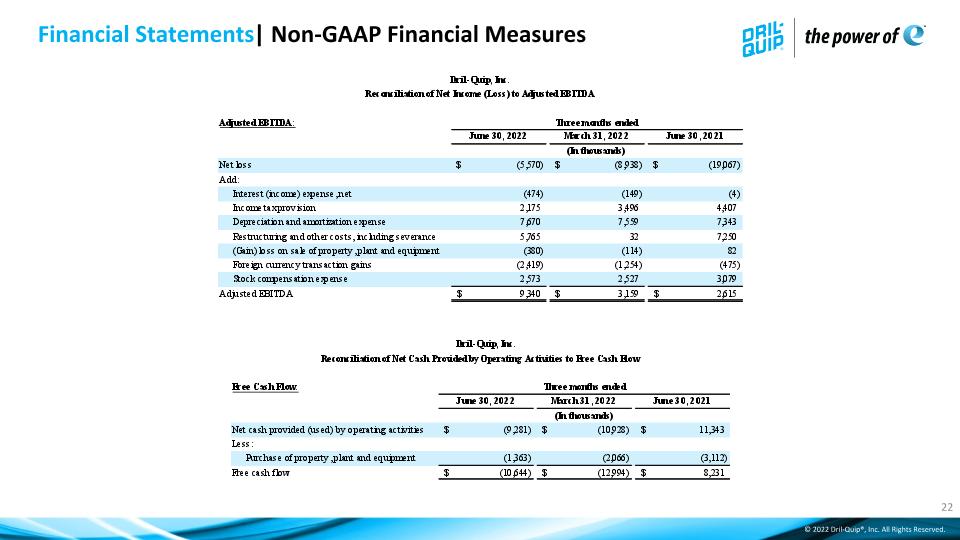

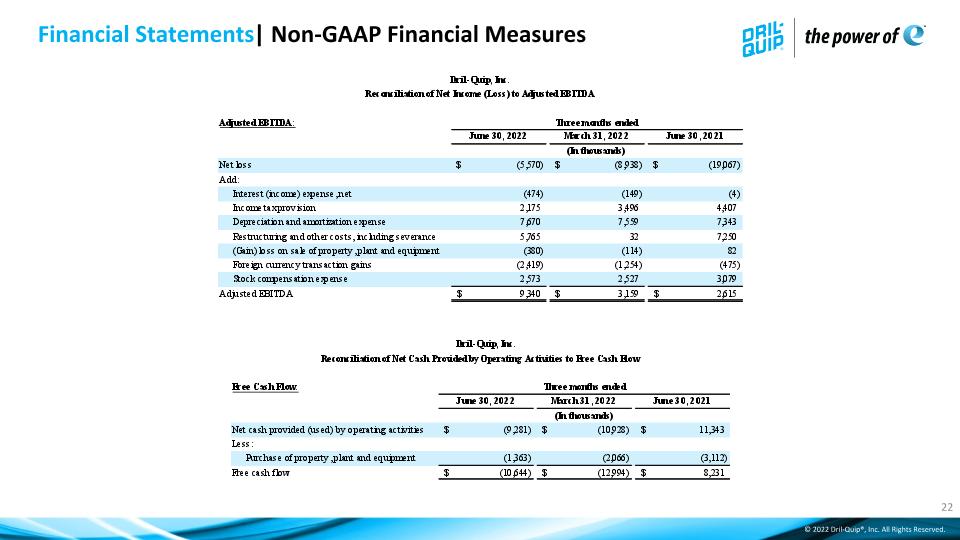

Financial Statements| Non-GAAP Financial Measures Dril-Quip, Inc. Reconciliation of Net Income (Loss) to Adjusted EBITDA Adjusted EBITDA: Three months ended June 30, 2022 March 31, 2022 June 30, 2021 (In thousands) Net loss $ (5,570) $ (8,938) $ (19,067) Add: Interest (income) expense, net (474) (149) (4) Income tax provision 2,175 3,496 4,407 Depreciation and amortization expense 7,670 7,559 7,343 Restructuring and other costs, including severance 5,765 32 7,250 (Gain) loss on sale of property, plant and equipment (380) (114) 82 Foreign currency transaction gains (2,419) (1,254) (475) Stock compensation expense 2,573 2,527 3,079 Adjusted EBITDA $ 9,340 $ 3,159 $ 2,615 Dril-Quip, Inc. Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow Free Cash Flow: Three months ended June 30, 2022 March 31, 2022 June 30, 2021 (In thousands) Net cash provided (used) by operating activities $ (9,281) $ (10,928) $ 11,343 Less: Purchase of property, plant and equipment (1,363) (2,066) (3,112) Free cash flow $ (10,644) $ (12,994) $ 8,231

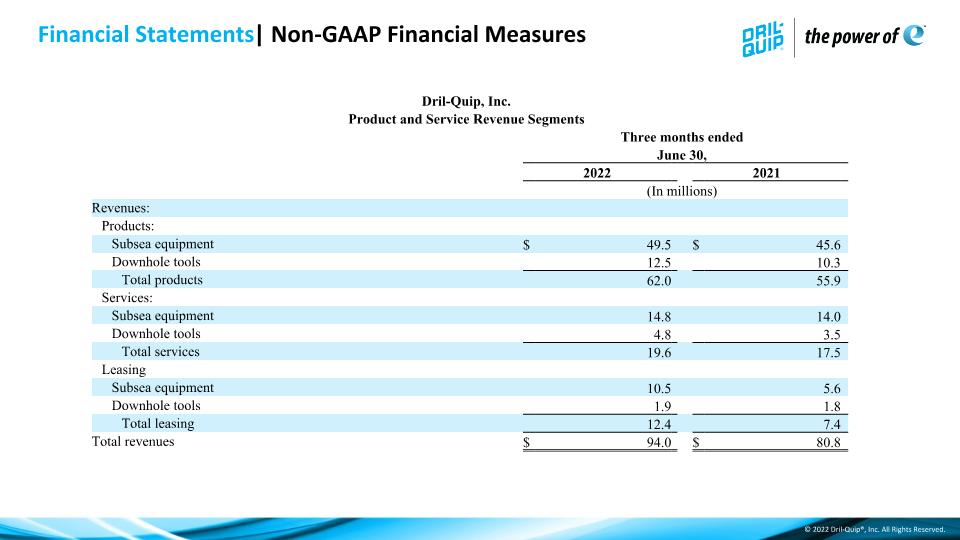

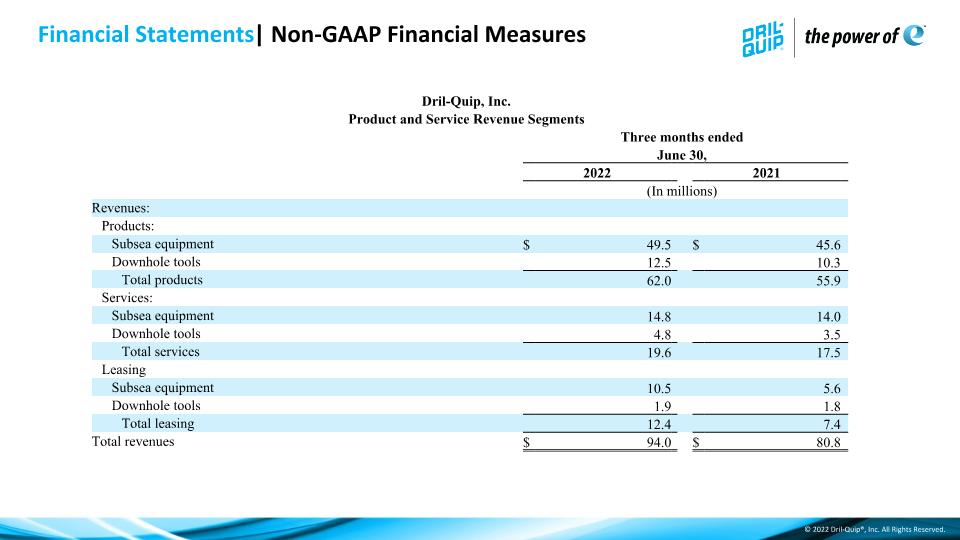

Financial Statements| Non-GAAP Financial Measures Dril-Quip, Inc. Product and Service Revenue Segments Three months ended June 30, 2022 2021 (In millions) Revenues: Products: Subsea equipment $ 49.5 $ 45.6 Downhole tools 12.5 10.3 Total products 62.0 55.9 Services: Subsea equipment 14.8 14.0 Downhole tools 4.8 3.5 Total services 19.6 17.5 Leasing Subsea equipment 10.5 5.6 Downhole tools 1.9 1.8 Total leasing 12.4 7.4 Total revenues $ 94.0 $ 80.8

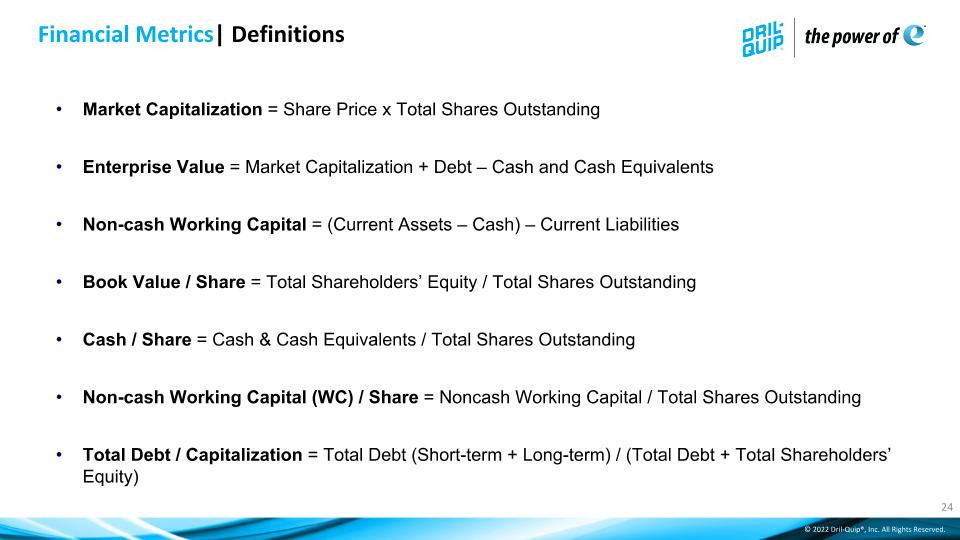

Market Capitalization = Share Price x Total Shares Outstanding Enterprise Value = Market Capitalization + Debt – Cash and Cash Equivalents Non-cash Working Capital = (Current Assets – Cash) – Current Liabilities Book Value / Share = Total Shareholders’ Equity / Total Shares Outstanding Cash / Share = Cash & Cash Equivalents / Total Shares Outstanding Non-cash Working Capital (WC) / Share = Noncash Working Capital / Total Shares Outstanding Total Debt / Capitalization = Total Debt (Short-term + Long-term) / (Total Debt + Total Shareholders’ Equity) Financial Metrics| Definitions

© 2022 Dril-Quip®, Inc. All Rights Reserved.