Fourth Quarter and Full Year 2019 Supplemental Earnings Information dril-quip.com | NYSE: DRQ Exhibit 99.2

Forward-Looking Statements The information furnished in this presentation contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements include goals, projections, estimates, expectations, market outlook, forecasts, plans and objectives, including revenue and new product revenue and other projections, project bookings, bidding and service activity, acquisition opportunities, forecasted supply and demand, forecasted drilling activity and subsea investment, liquidity, cost savings, and share repurchases and are based on assumptions, estimates and risk analysis made by management of Dril-Quip, Inc. (“Dril-Quip”) in light of its experience and perception of historical trends, current conditions, expected future developments and other factors. No assurance can be given that actual future results will not differ materially from those contained in the forward-looking statements in this presentation. Although Dril-Quip believes that all such statements contained in this presentation are based on reasonable assumptions, there are numerous variables of an unpredictable nature or outside of Dril-Quip’s control that could affect Dril-Quip’s future results and the value of its shares. Each investor must assess and bear the risk of uncertainty inherent in the forward-looking statements contained in this presentation. Please refer to Dril-Quip’s filings with the Securities and Exchange Commission (“SEC”) for additional discussion of risks and uncertainties that may affect Dril-Quip’s actual future results. Dril-Quip undertakes no obligation to update the forward-looking statements contained herein. Use of Non-GAAP Financial Measures EBITDA, Adjusted Net Income, Adjusted Diluted EPS, Adjusted EBITDA and Free Cash Flow are non-GAAP measures. Adjusted Net Income and Adjusted Diluted EPS are defined as net income (loss) and earnings per share, respectively, excluding the impact of foreign currency gains or losses as well as other significant non-cash items and certain charges and credits. EBITDA is defined as net income excluding income taxes, interest income and expense, and depreciation and amortization expense. Adjusted EBITDA is defined as net income excluding income taxes, interest income and expense, depreciation and amortization expense, non-cash gains or losses from foreign currency exchange rate changes as well as other significant non-cash items and items that can be considered non-recurring. Free Cash Flow is defined as net cash provided by operating activities less net cash used in the purchase of property, plant and equipment. We believe that these non-GAAP measures enable us to evaluate and compare more effectively the results of our operations period over period and identify operating trends by removing the effect of our capital structure from our operating structure and certain other items including those that affect the comparability of operating results. In addition, we believe that these measures are supplemental measurement tools used by analysts and investors to help evaluate overall operating performance, ability to pursue and service possible debt opportunities and make future capital expenditures. These measures do not represent funds available for our discretionary use and are not intended to represent or to be used as a substitute for net income or net cash provided by operating activities, as measured under U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial information supplements and should be read together with, and is not an alternative or substitute for, our financial results reported in accordance with GAAP. Because non-GAAP financial information is not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures. Reconciliations of these non-GAAP measures to the most directly comparable GAAP measure can be found in the appendix. Use of Website Investors should note that Dril-Quip announces material financial information in SEC filings, press releases and public conference calls. Dril-Quip may use the Investors section of its website (www.dril-quip.com) to communicate with investors. It is possible that the financial and other information posted there could be deemed to be material information. Information on Dril-Quip’s website is not part of this presentation. Cautionary Statement

Dril-Quip Investment Highlights Leading Manufacturer of Highly Engineered Drilling & Production Equipment Technically Innovative Products & First-class Service Strong Financial Position Historically Superior Margins to Peers Results Driven Management Team

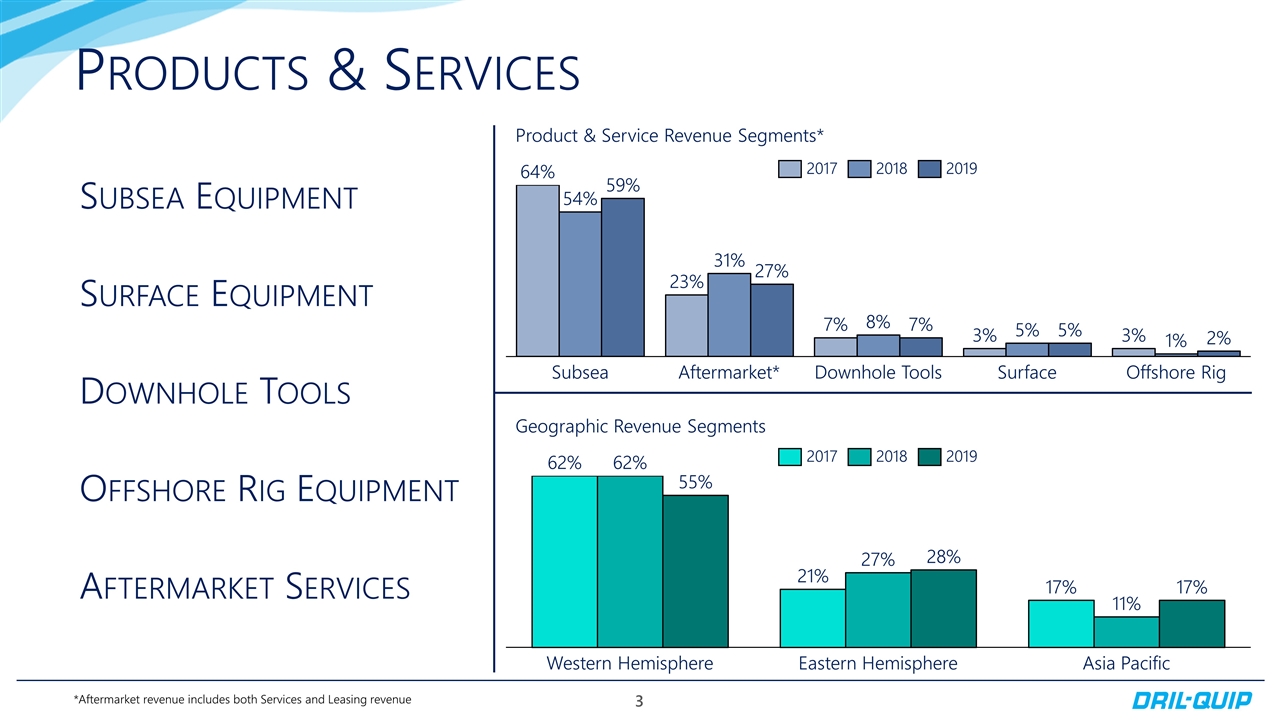

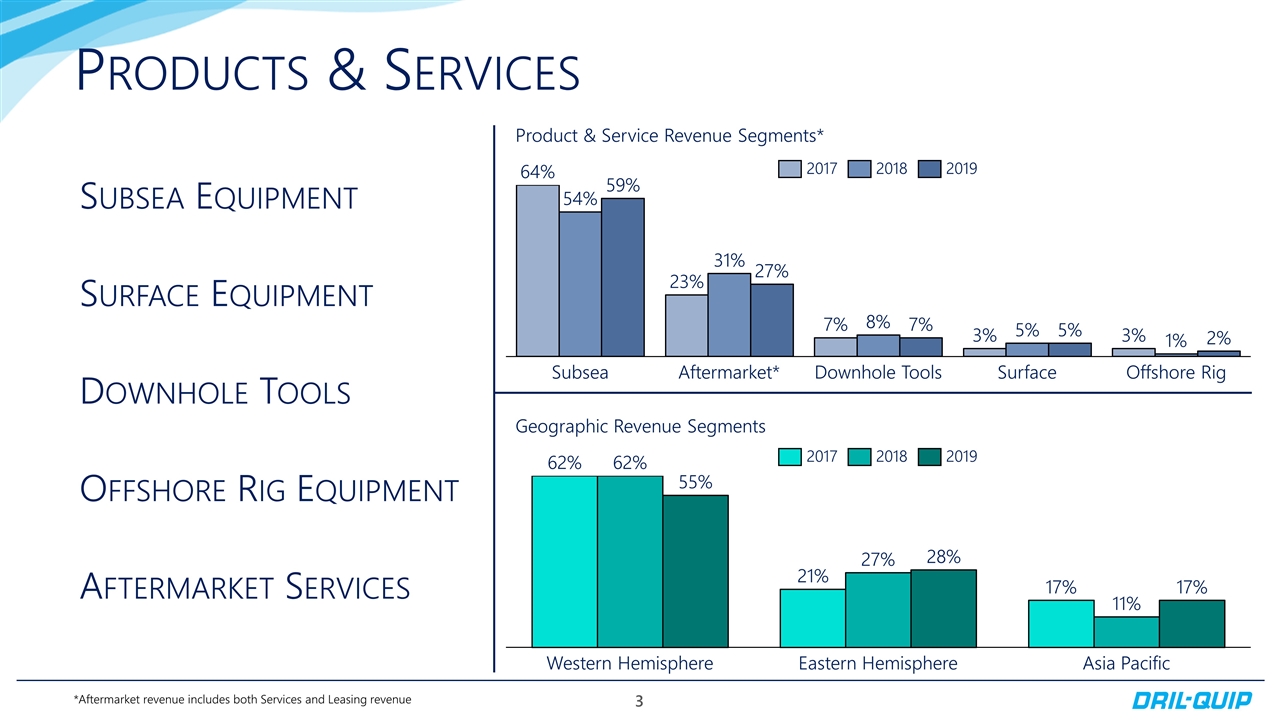

Products & Services Product & Service Revenue Segments* Geographic Revenue Segments *Aftermarket revenue includes both Services and Leasing revenue Subsea Equipment Surface Equipment Downhole Tools Offshore Rig Equipment Aftermarket Services

Q4 2019 Highlights Continued revenue growth to $109 million at the high end of guidance range Increased product bookings to $101 million, 1st time since Q4 2014 with non-project product bookings above $100 million Reported net income of $7 million, or $0.21 per diluted share Grew Adjusted EBITDA to $16 million Generated net cash provided by operating activities of $8 million and free cash flow of $5 million Captured additional annualized cost savings of ~$8 million, mostly from supply chain Free cash flow is a non-GAAP measure. See appendix for reconciliation to a GAAP measure.

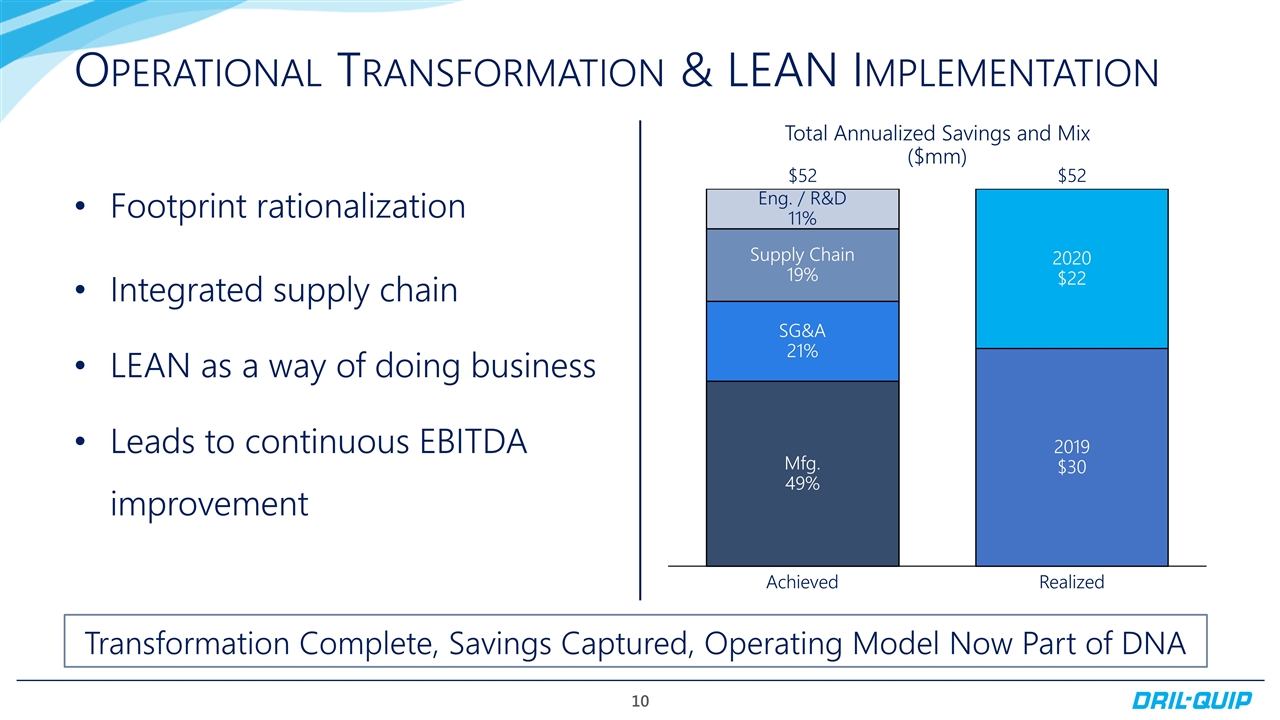

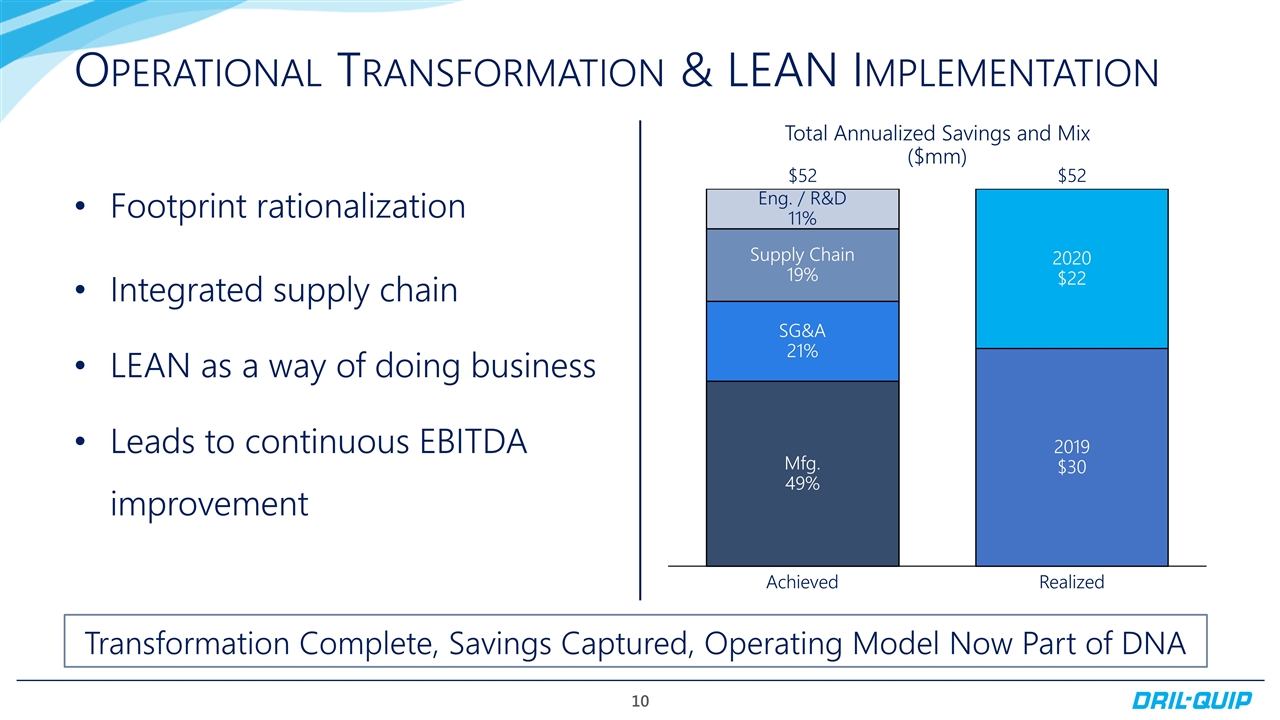

2019 Accomplishments Grew revenue to $415 million, an increase of 8% YoY, and at the high end of guidance Increased product bookings to $388 million, up 59% YoY, driven by sales transformation which resulted in additional growth in new technology product orders Grew Adjusted EBITDA to $54 million, more than double compared to 2018 Generated net cash provided by operating activities of $15 million and free cash flow of $3 million Completed cost saving initiatives, resulting in total annualized cost savings of $52 million, exceeding the initial target of $40 to $50 million Maintained clean balance sheet with no debt and cash on hand of $399 million as of 12/31/2019 Repurchased over 615,000 common shares at an average price of $43.12 for a total of $26.6 million

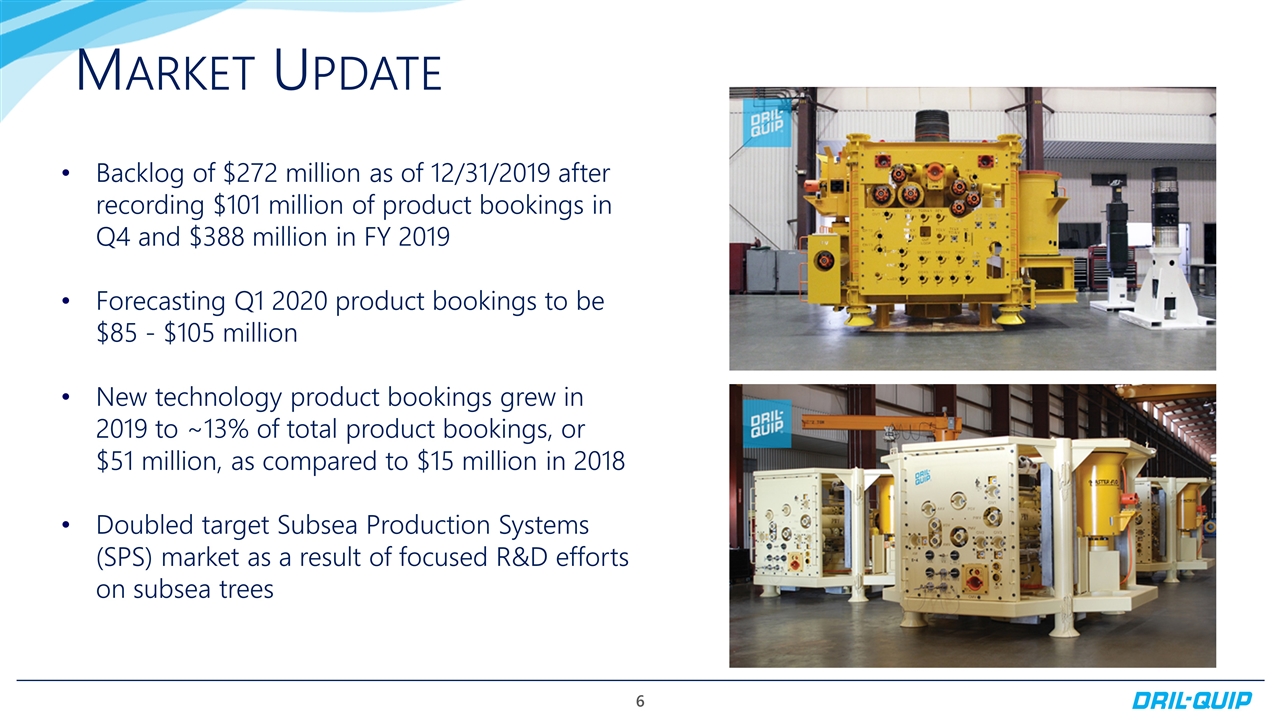

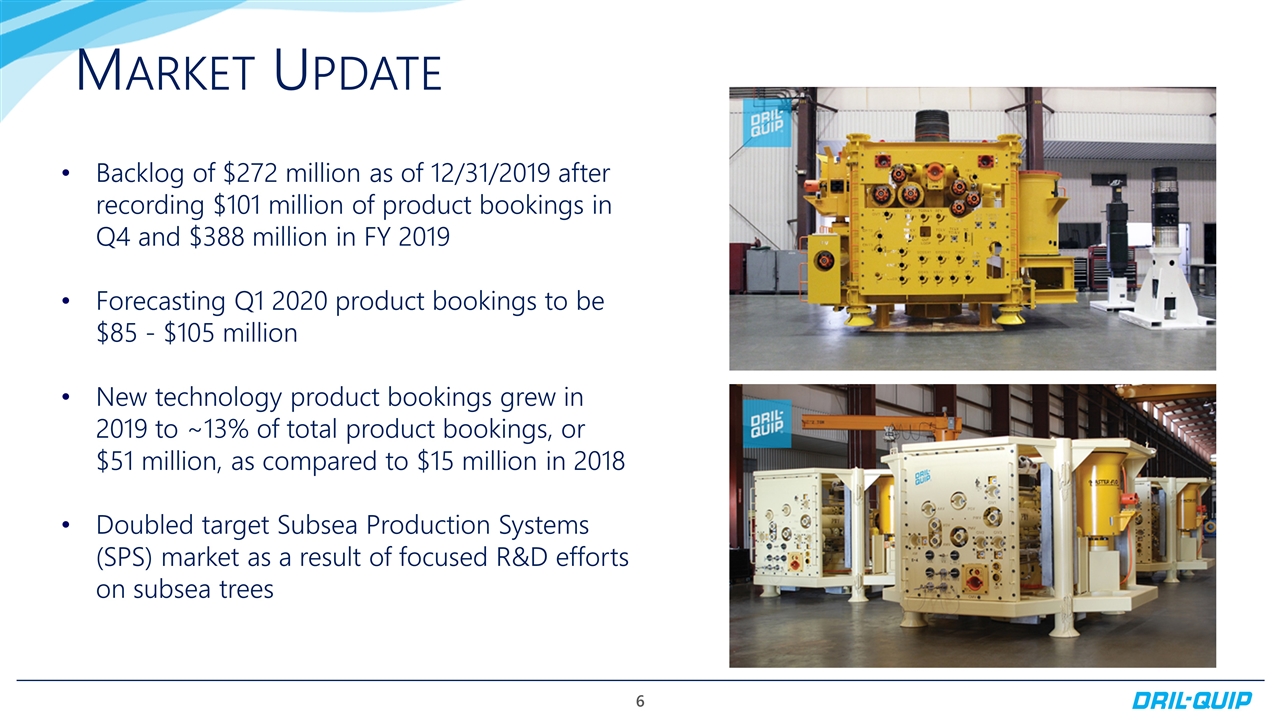

Market Update Backlog of $272 million as of 12/31/2019 after recording $101 million of product bookings in Q4 and $388 million in FY 2019 Forecasting Q1 2020 product bookings to be $85 - $105 million New technology product bookings grew in 2019 to ~13% of total product bookings, or $51 million, as compared to $15 million in 2018 Doubled target Subsea Production Systems (SPS) market as a result of focused R&D efforts on subsea trees

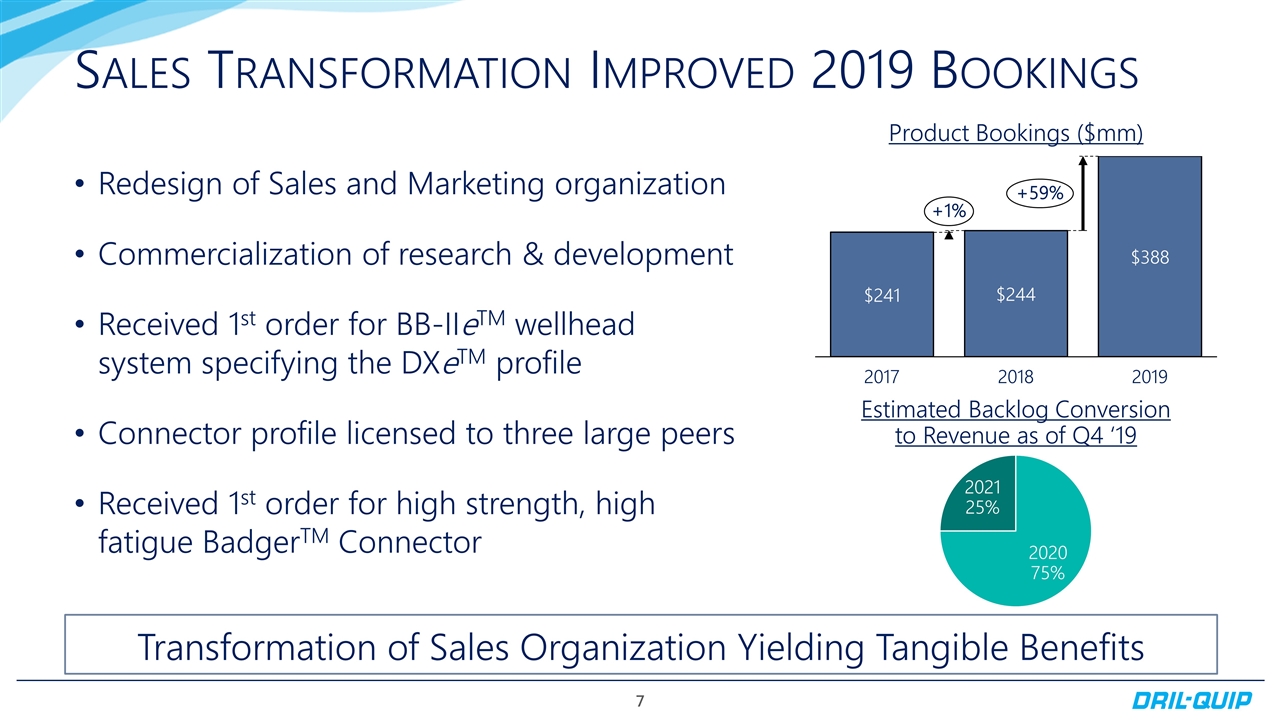

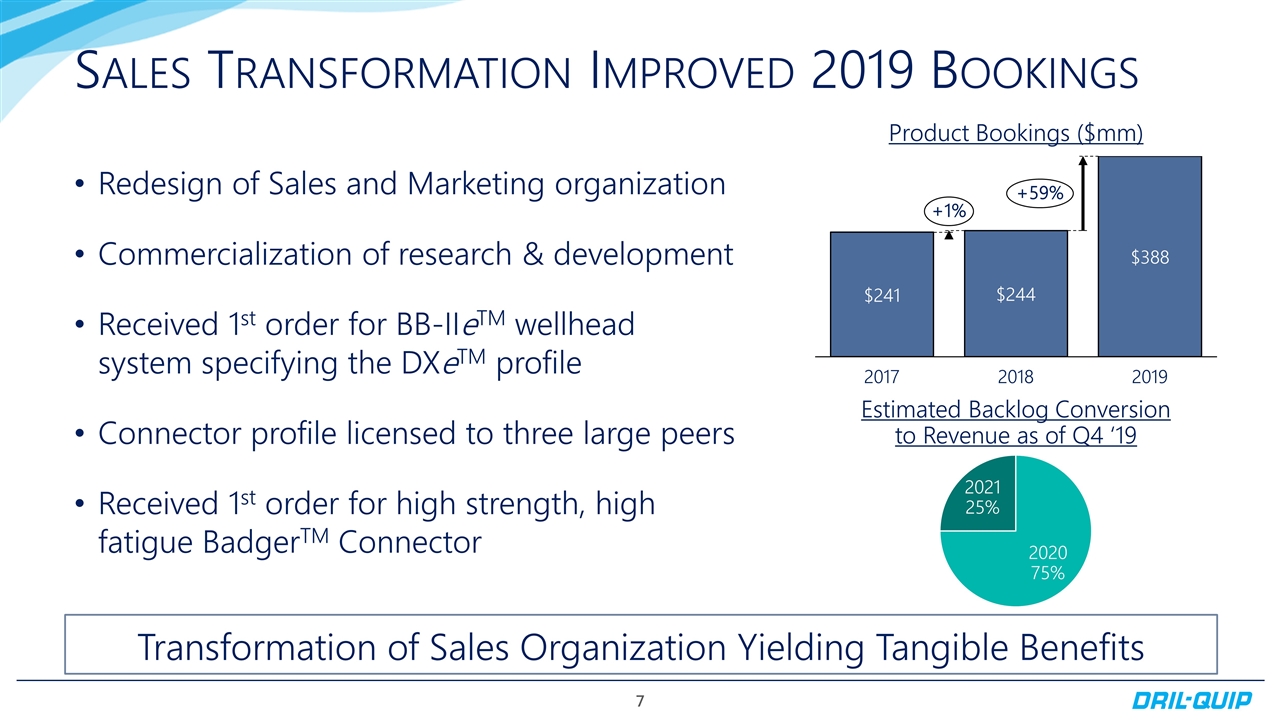

Sales Transformation Improved 2019 Bookings Product Bookings ($mm) Redesign of Sales and Marketing organization Commercialization of research & development Received 1st order for BB-IIeTM wellhead system specifying the DXeTM profile Connector profile licensed to three large peers Received 1st order for high strength, high fatigue BadgerTM Connector Transformation of Sales Organization Yielding Tangible Benefits Estimated Backlog Conversion to Revenue as of Q4 ‘19

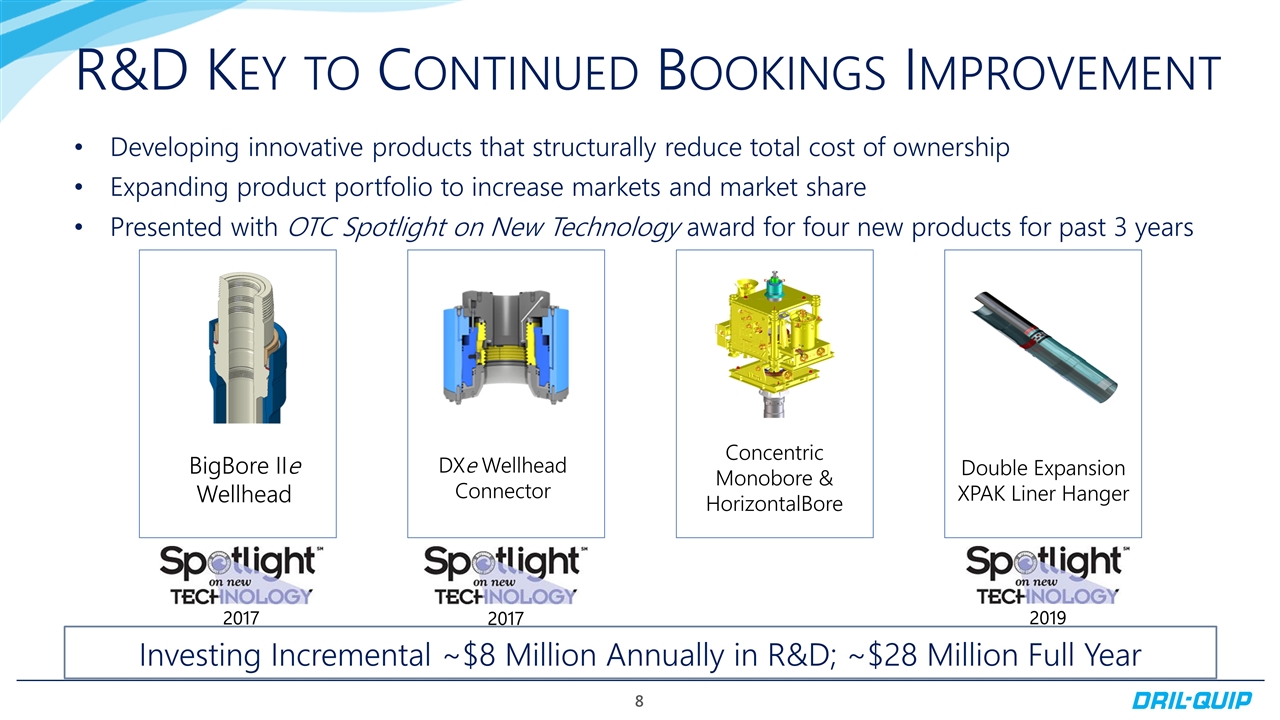

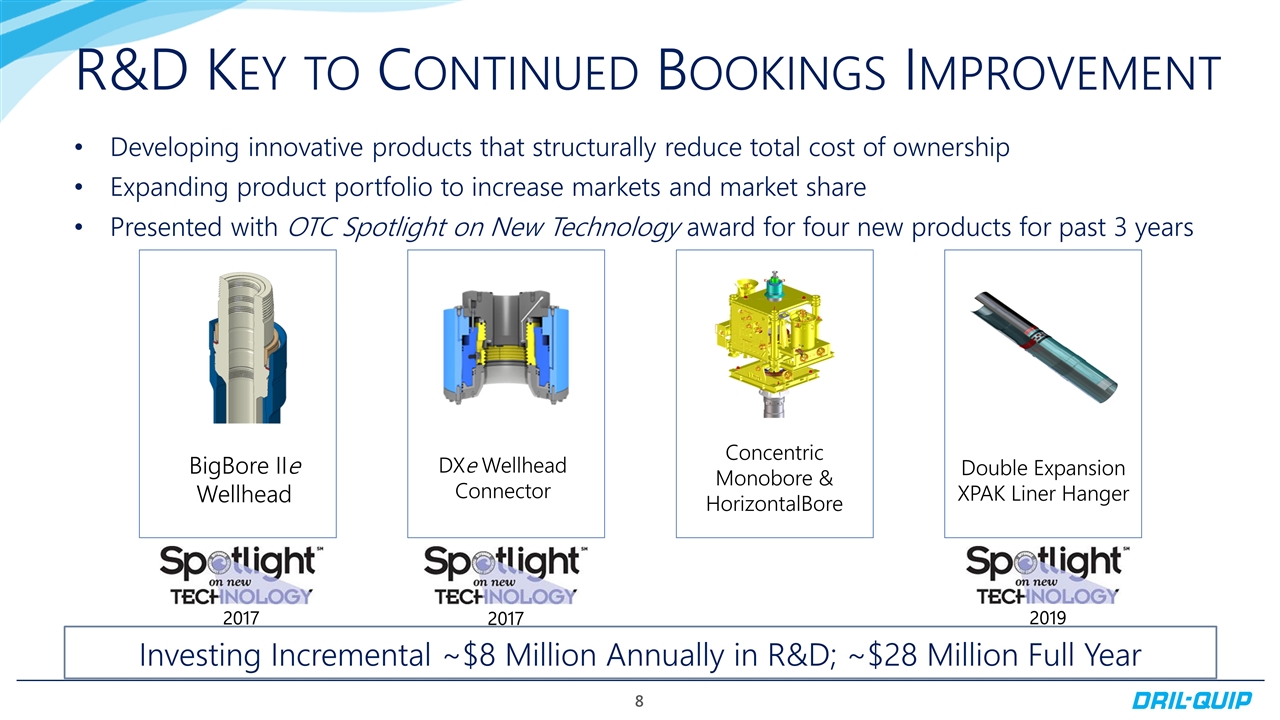

R&D Key to Continued Bookings Improvement Developing innovative products that structurally reduce total cost of ownership Expanding product portfolio to increase markets and market share Presented with OTC Spotlight on New Technology award for four new products for past 3 years 2017 2017 2019 Investing Incremental ~$8 Million Annually in R&D; ~$28 Million Full Year BigBore II e Wellhead DX e Wellhead Connector Concentric Monobore & HorizontalBore Double Expansion XPAK Liner Hanger

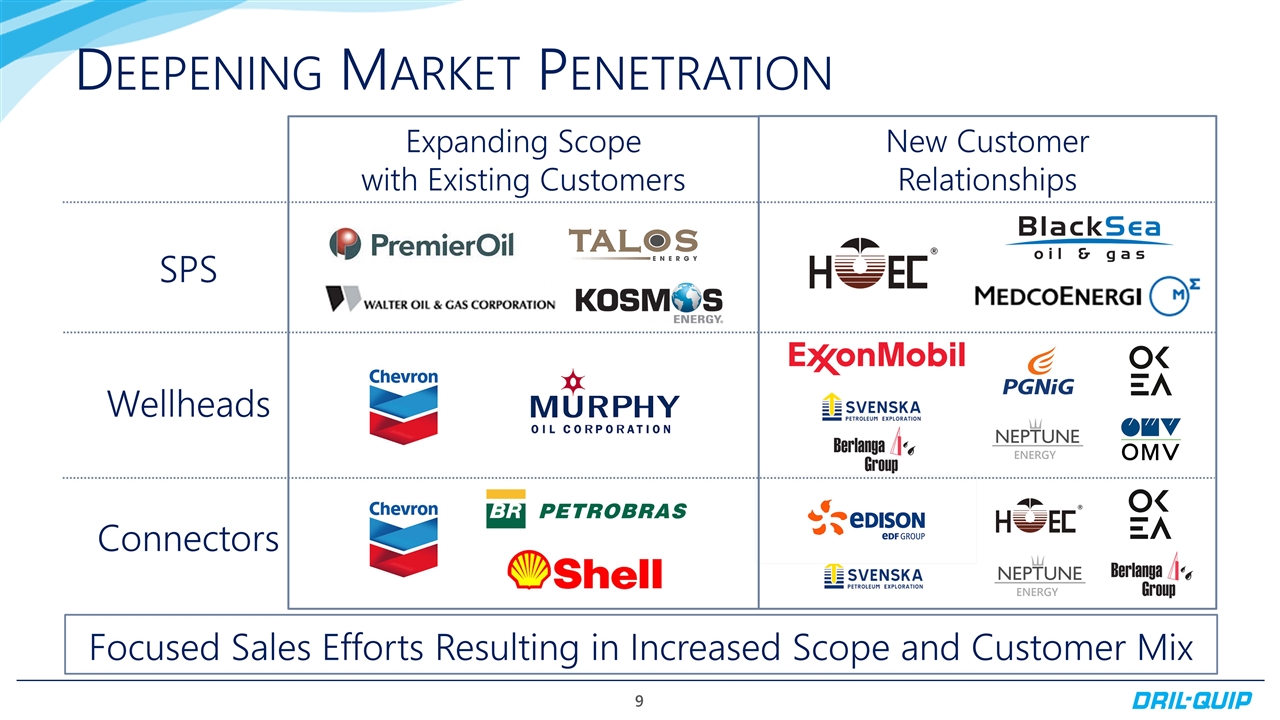

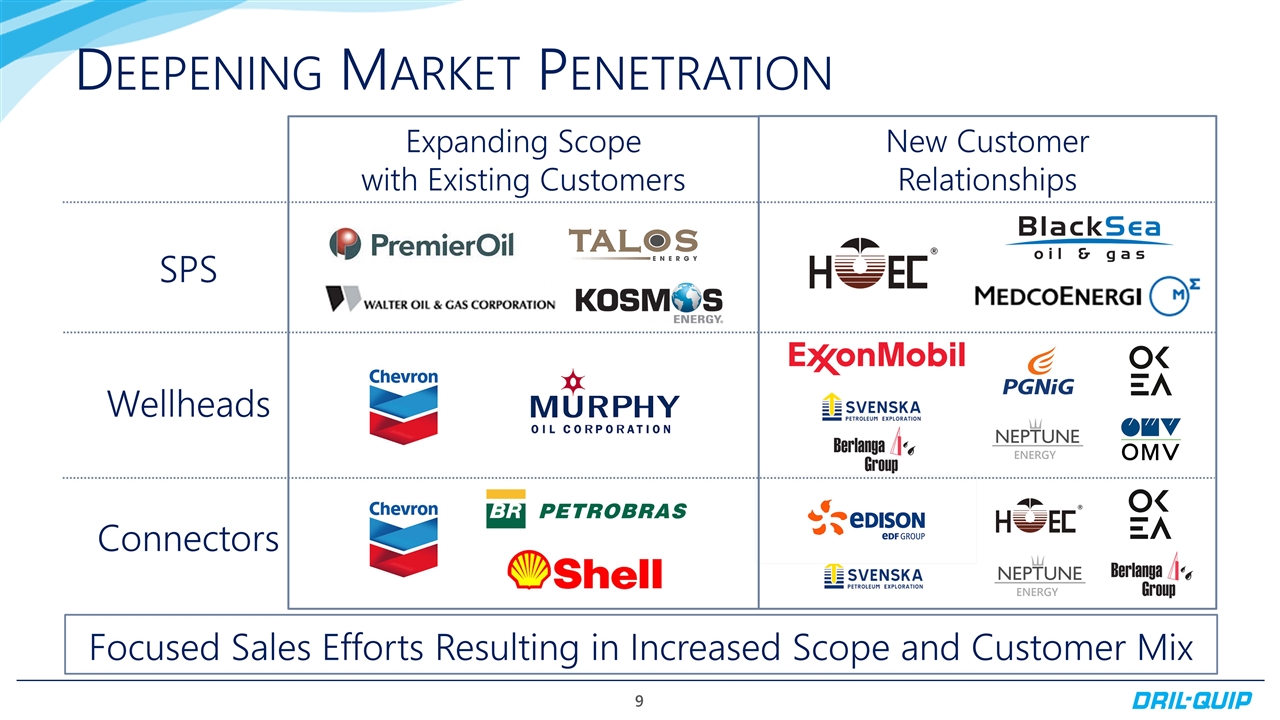

New Customer Relationships Expanding Scope with Existing Customers Deepening Market Penetration Focused Sales Efforts Resulting in Increased Scope and Customer Mix SPS Wellheads Connectors

Operational Transformation & LEAN Implementation Transformation Complete, Savings Captured, Operating Model Now Part of DNA Total Annualized Savings and Mix ($mm) Realized $ Footprint rationalization Integrated supply chain LEAN as a way of doing business Leads to continuous EBITDA improvement

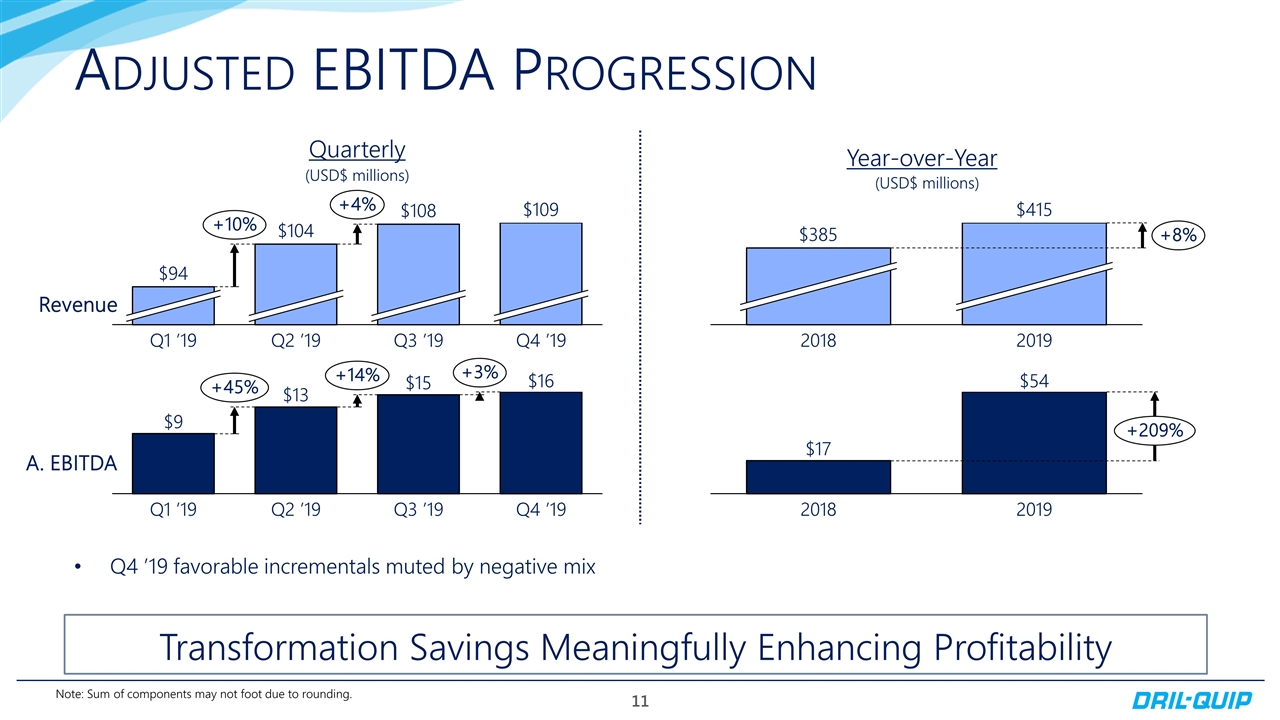

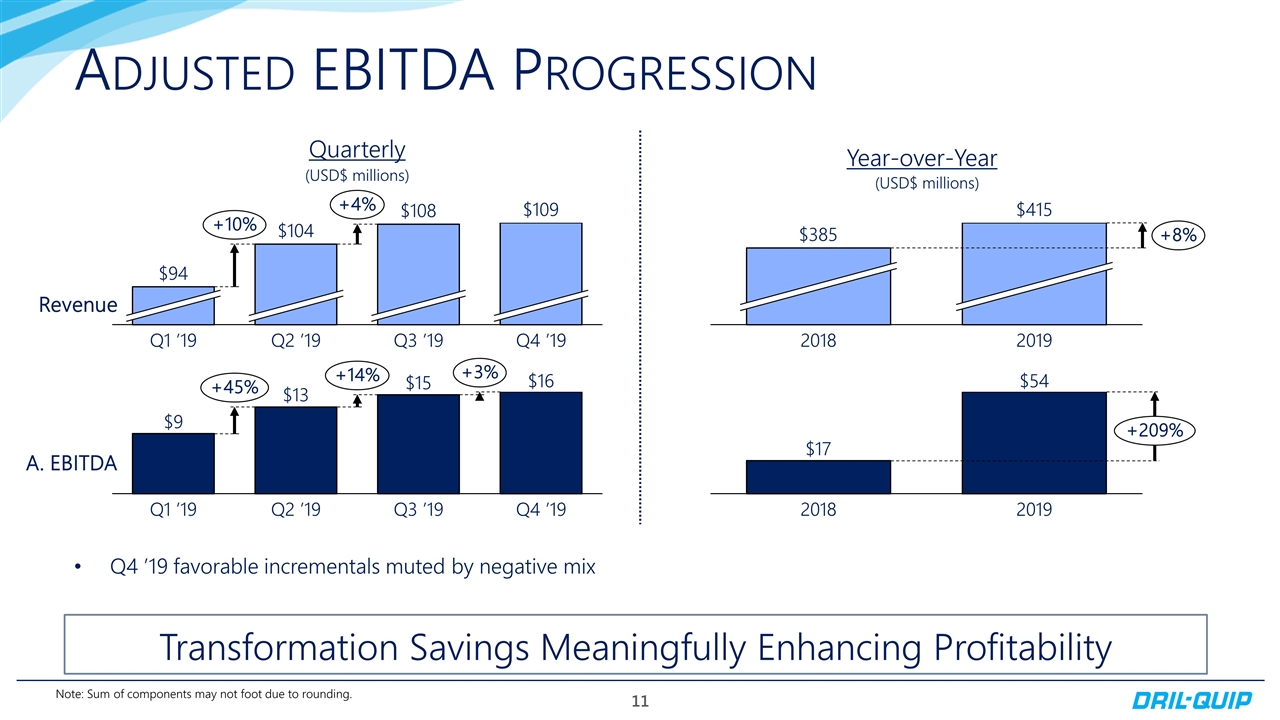

Adjusted EBITDA Progression Q4 ’19 favorable incrementals muted by negative mix (USD$ millions) Transformation Savings Meaningfully Enhancing Profitability Quarterly Year-over-Year (USD$ millions) Note: Sum of components may not foot due to rounding.

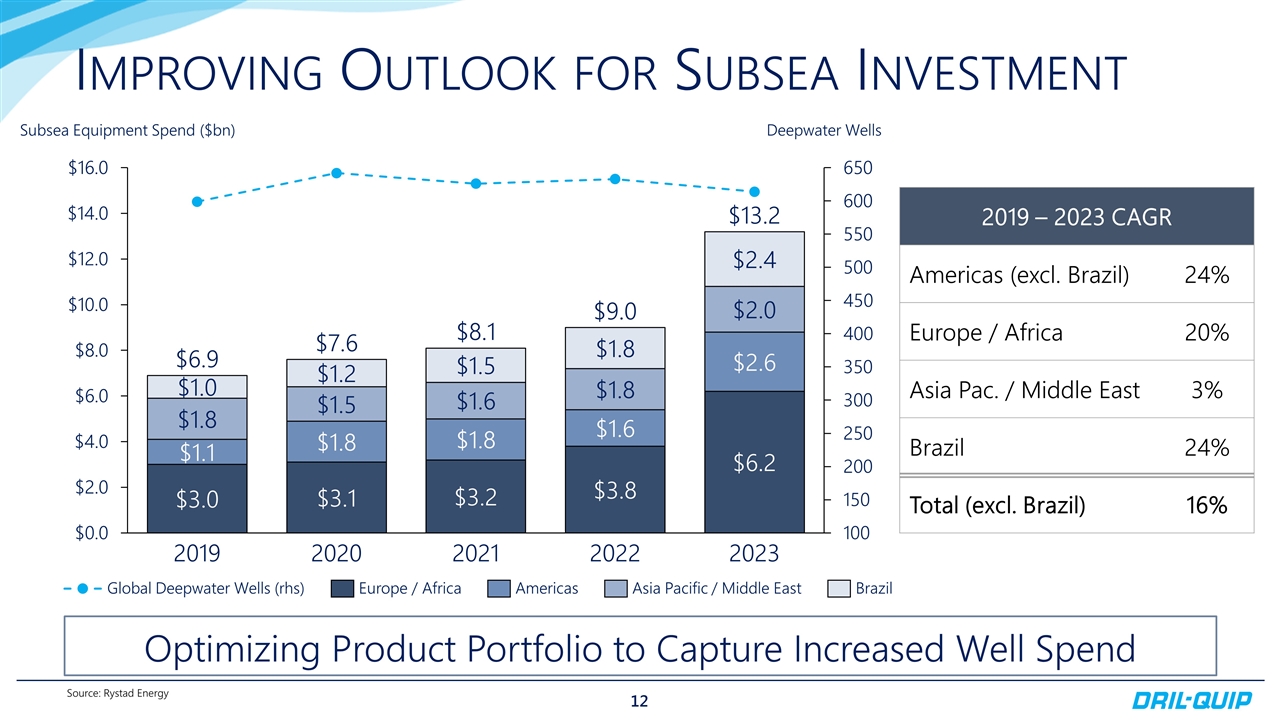

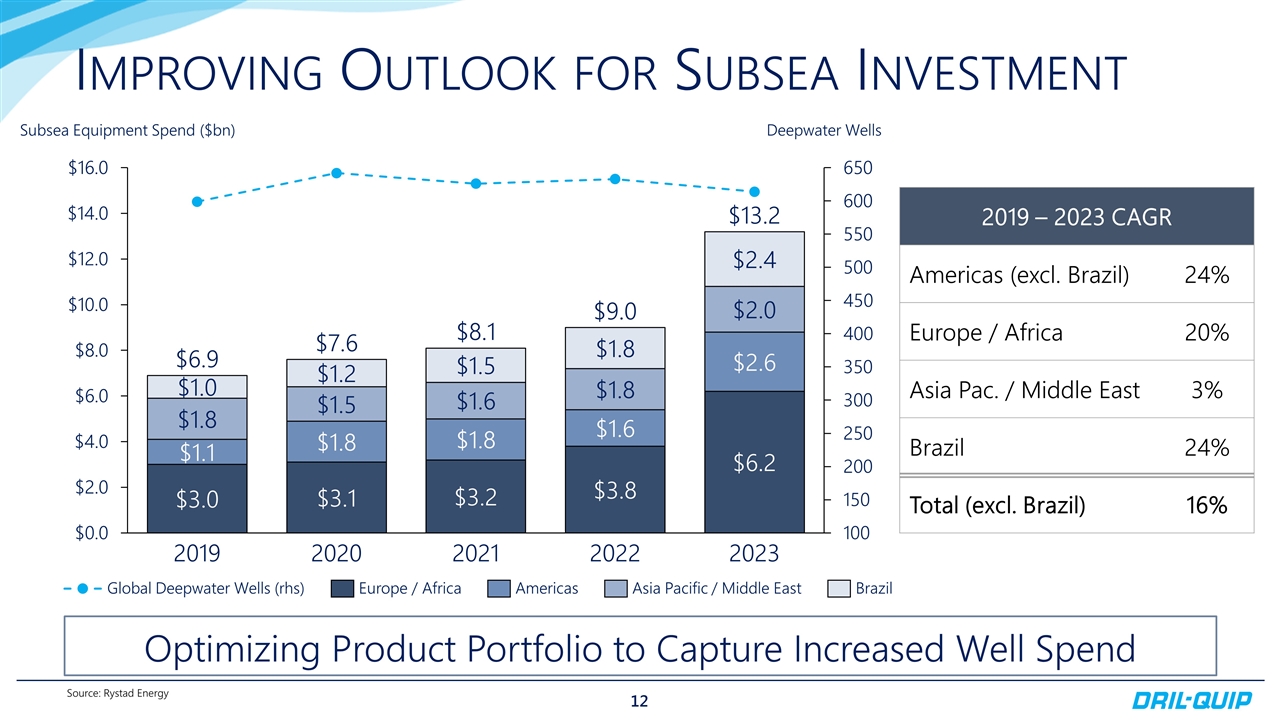

Improving Outlook for Subsea Investment Source: Rystad Energy Subsea Equipment Spend ($bn) Deepwater Wells Optimizing Product Portfolio to Capture Increased Well Spend 2019 – 2023 CAGR Americas (excl. Brazil) 24% Europe / Africa 20% Asia Pac. / Middle East 3% Brazil 24% Total (excl. Brazil) 16%

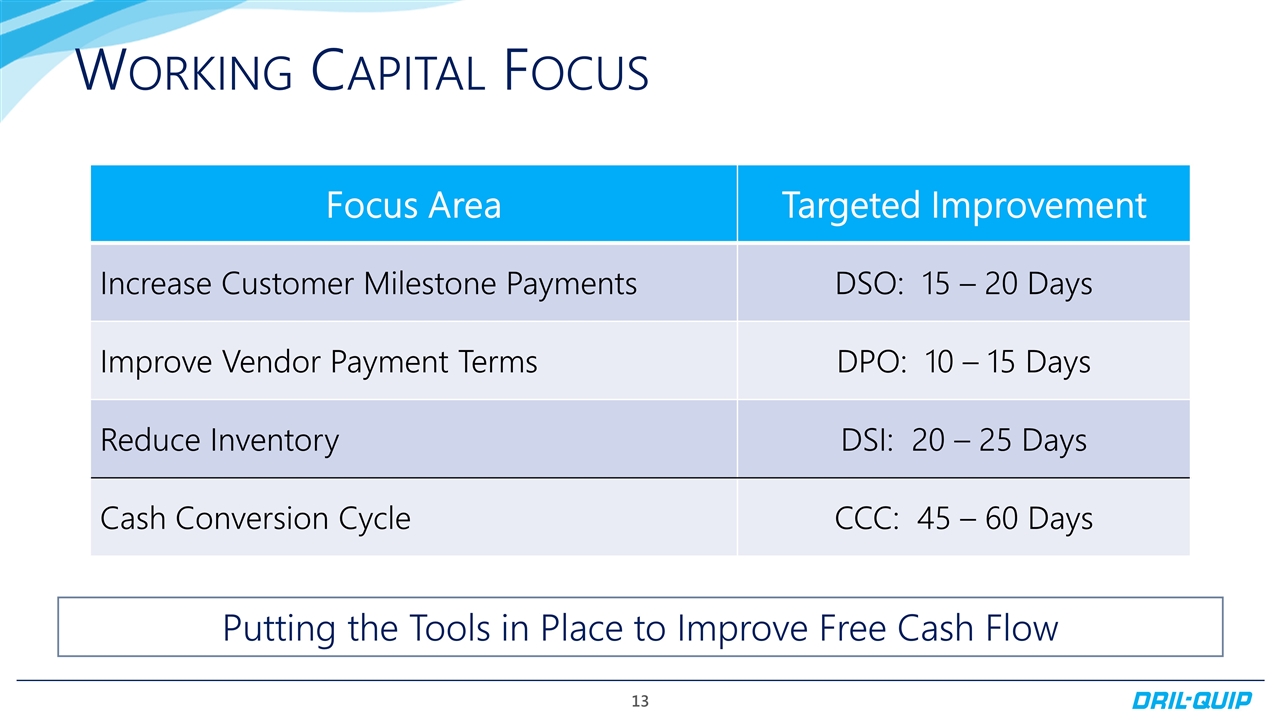

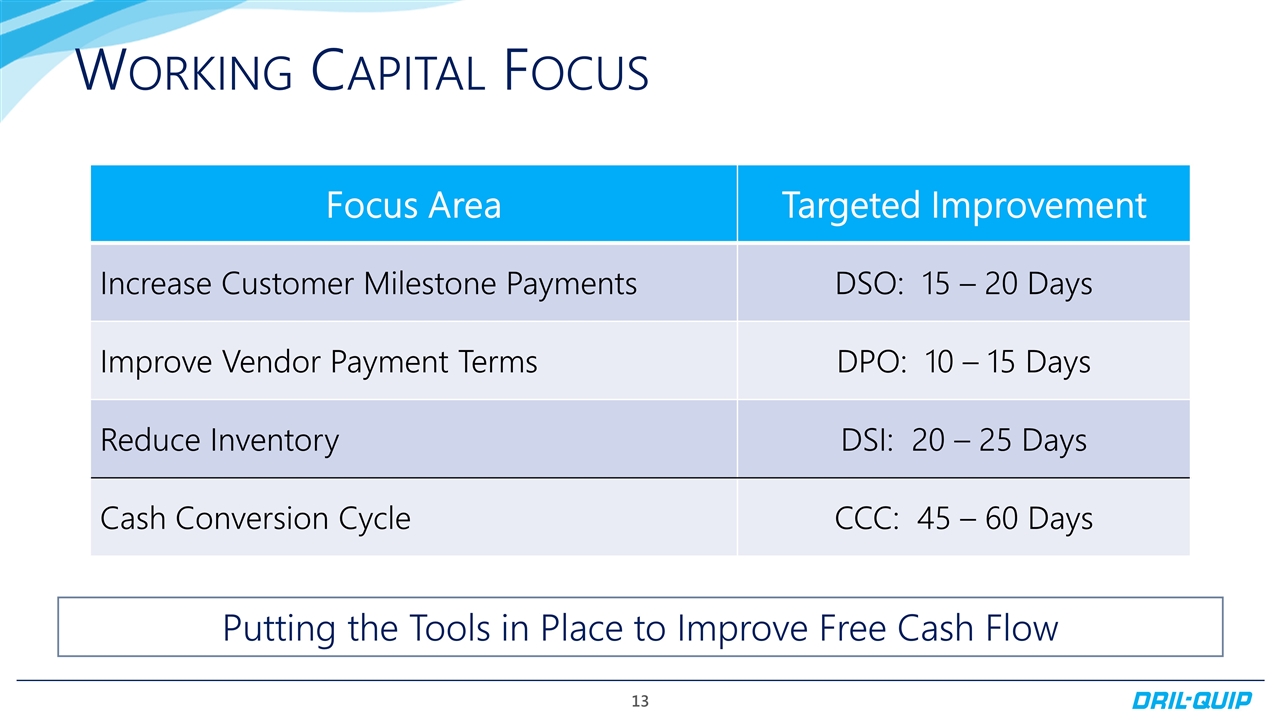

Working Capital Focus Putting the Tools in Place to Improve Free Cash Flow Focus Area Targeted Improvement Increase Customer Milestone Payments DSO: 15 – 20 Days Improve Vendor Payment Terms DPO: 10 – 15 Days Reduce Inventory DSI: 20 – 25 Days Cash Conversion Cycle CCC: 45 – 60 Days

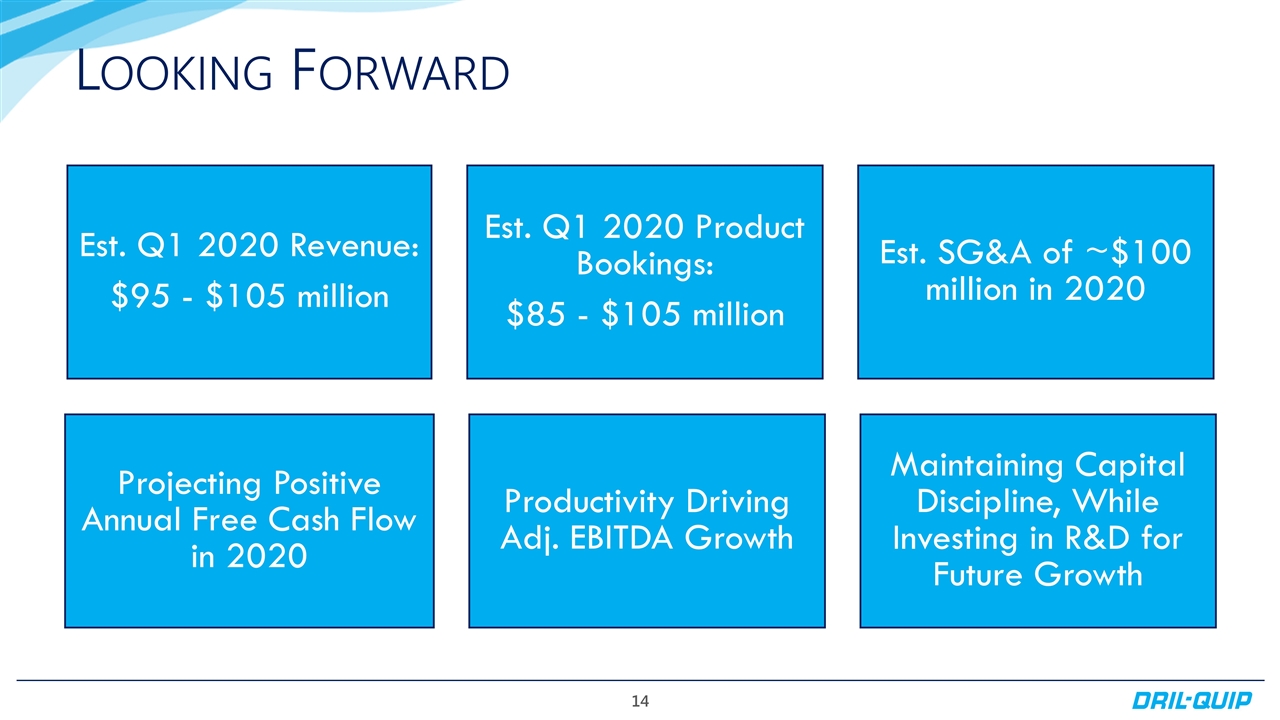

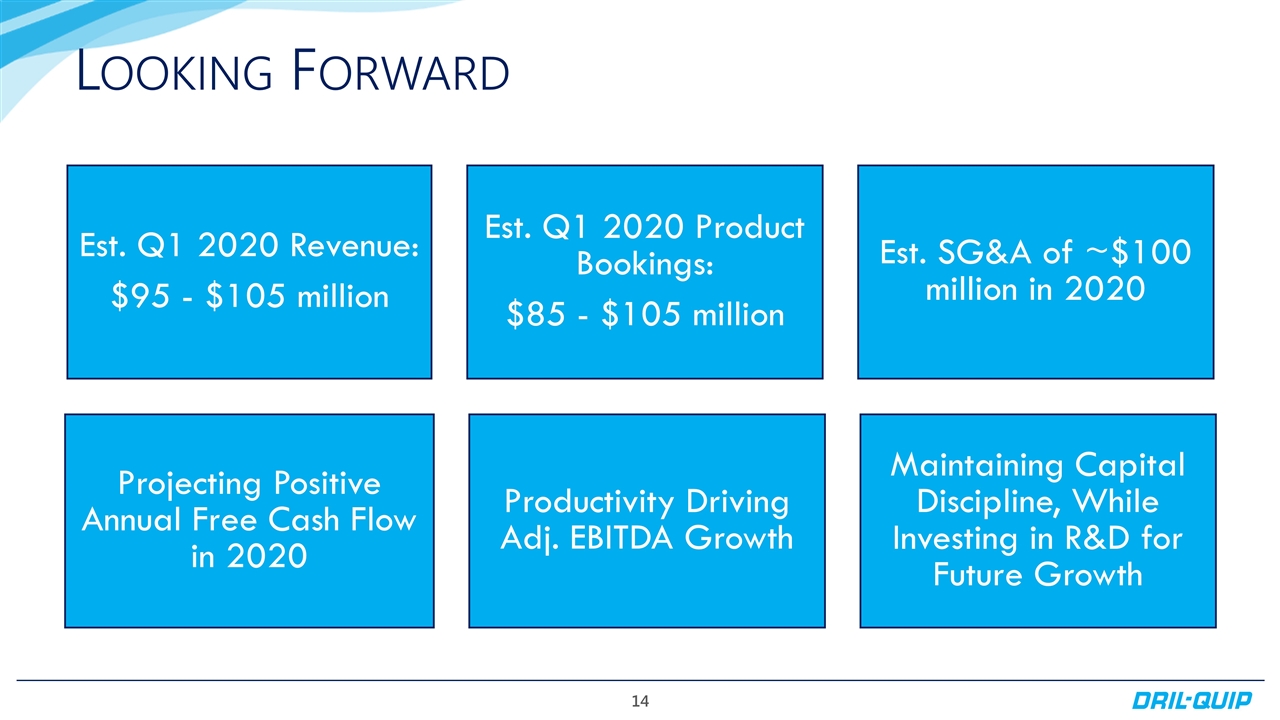

Looking Forward Est. Q1 2020 Revenue: $95 - $105 million Est. Q1 2020 Product Bookings: $85 - $105 million Est. SG&A of ~$100 million in 2020 Projecting Positive Annual Free Cash Flow in 2020 Productivity Driving Adj. EBITDA Growth Maintaining Capital Discipline, While Investing in R&D for Future Growth

dril-quip.com | NYSE: DRQ APPENDIX

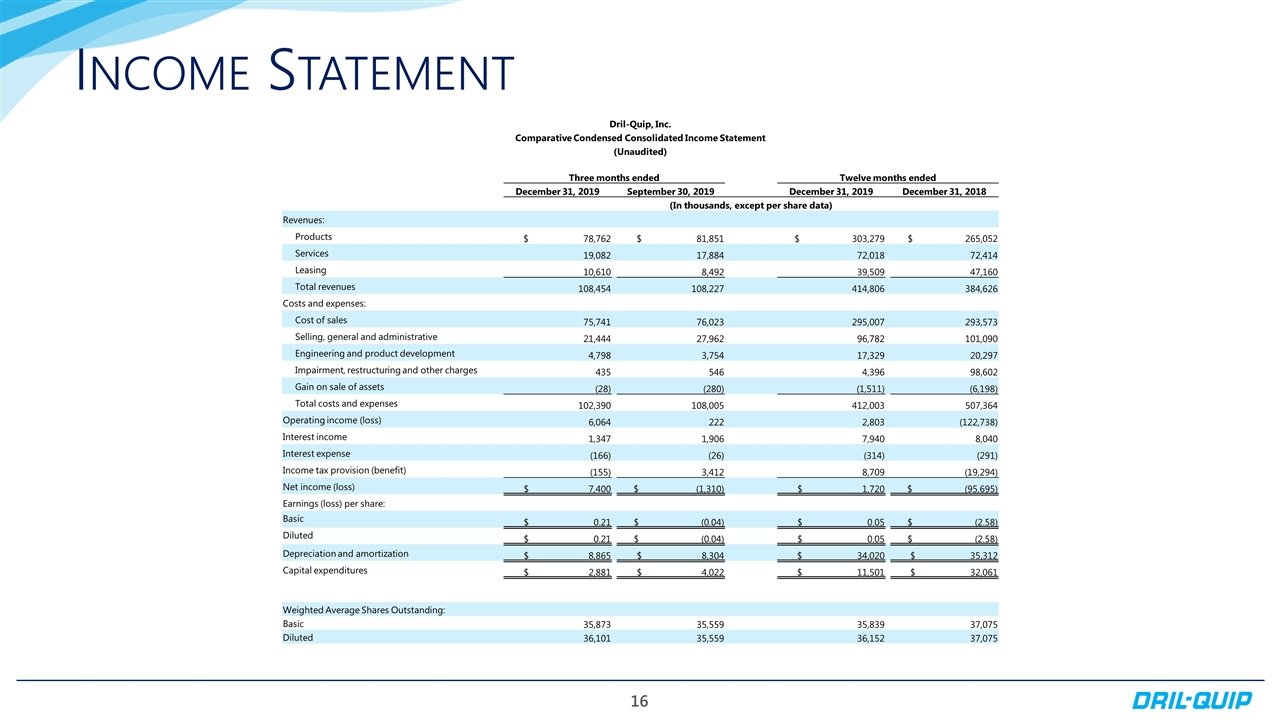

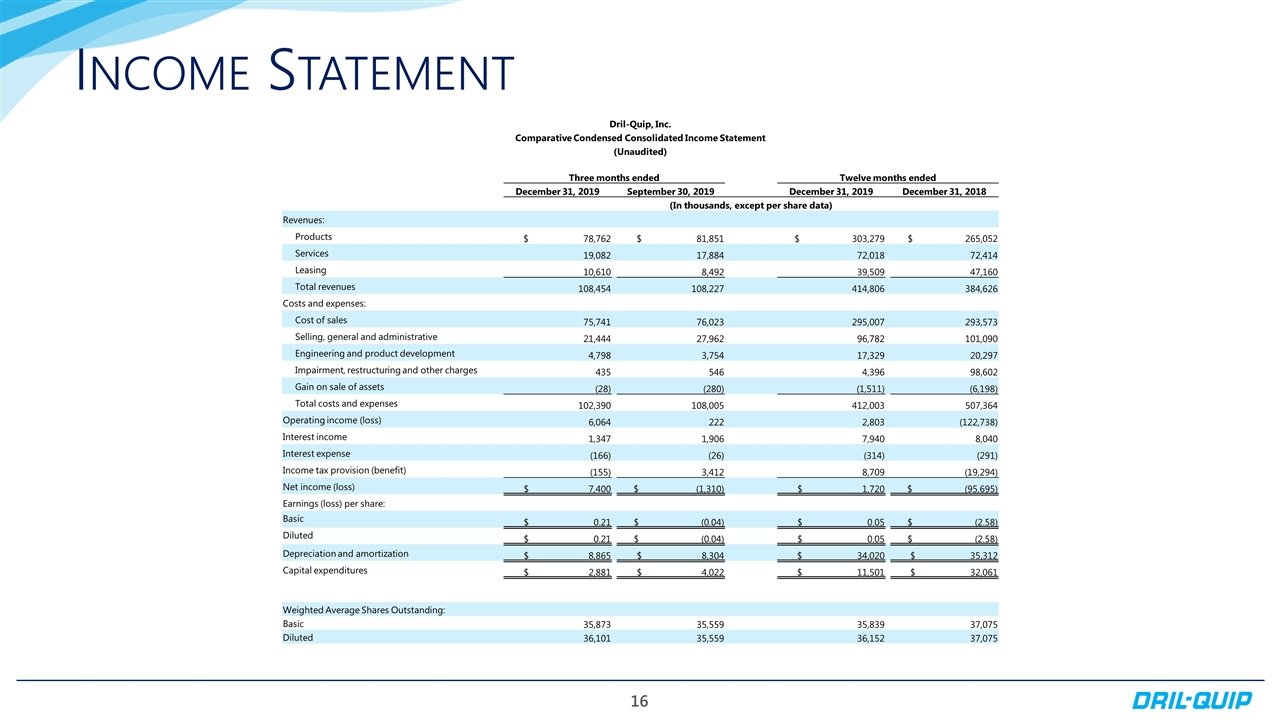

Income Statement Dril-Quip, Inc. Comparative Condensed Consolidated Income Statement (Unaudited) Three months ended Twelve months ended December 31, 2019 September 30, 2019 December 31, 2019 December 31, 2018 (In thousands, except per share data) Revenues: Products $ 78,762 $ 81,851 $ 303,279 $ 265,052 Services 19,082 17,884 72,018 72,414 Leasing 10,610 8,492 39,509 47,160 Total revenues 108,454 108,227 414,806 384,626 Costs and expenses: Cost of sales 75,741 76,023 295,007 293,573 Selling, general and administrative 21,444 27,962 96,782 101,090 Engineering and product development 4,798 3,754 17,329 20,297 Impairment, restructuring and other charges 435 546 4,396 98,602 Gain on sale of assets (28) (280) (1,511) (6,198) Total costs and expenses 102,390 108,005 412,003 507,364 Operating income (loss) 6,064 222 2,803 (122,738) Interest income 1,347 1,906 7,940 8,040 Interest expense (166) (26) (314) (291) Income tax provision (benefit) (155) 3,412 8,709 (19,294) Net income (loss) $ 7,400 $ (1,310) $ 1,720 $ (95,695) Earnings (loss) per share: Basic $ 0.21 $ (0.04) $ 0.05 $ (2.58) Diluted $ 0.21 $ (0.04) $ 0.05 $ (2.58) Depreciation and amortization $ 8,865 $ 8,304 $ 34,020 $ 35,312 Capital expenditures $ 2,881 $ 4,022 $ 11,501 $ 32,061 Weighted Average Shares Outstanding: Basic 35,873 35,559 35,839 37,075 Diluted 36,101 35,559 36,152 37,075

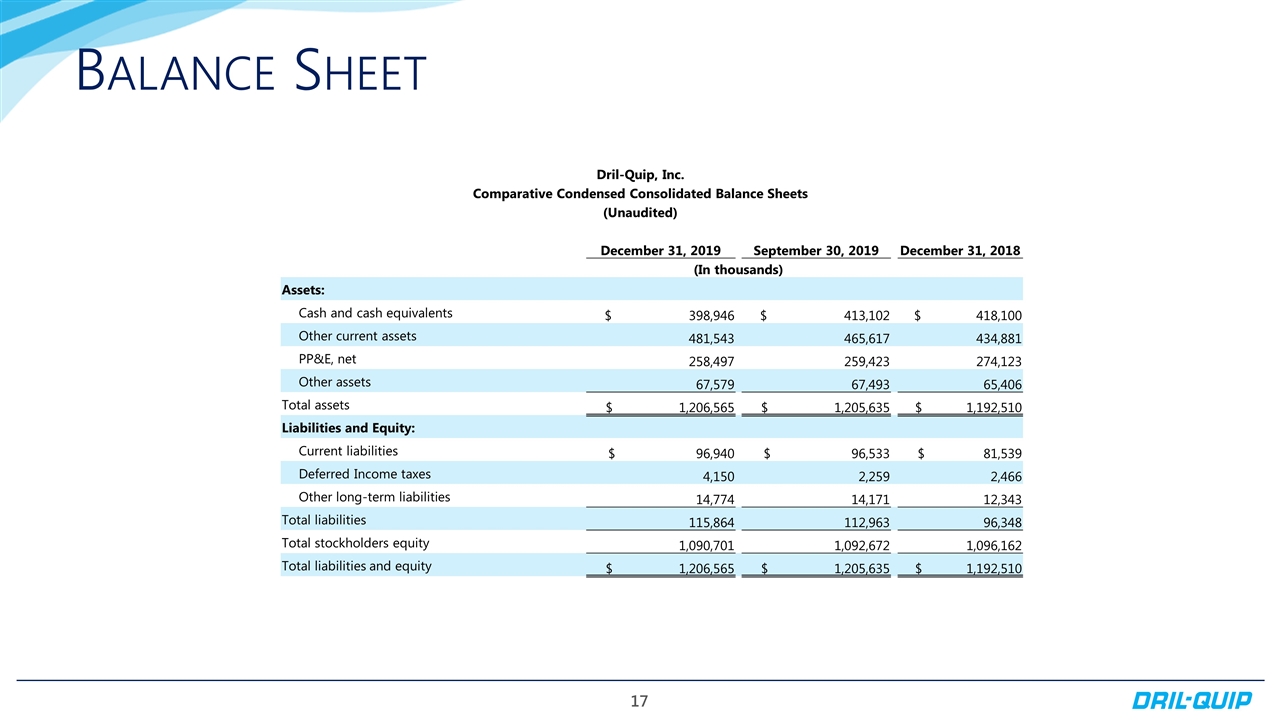

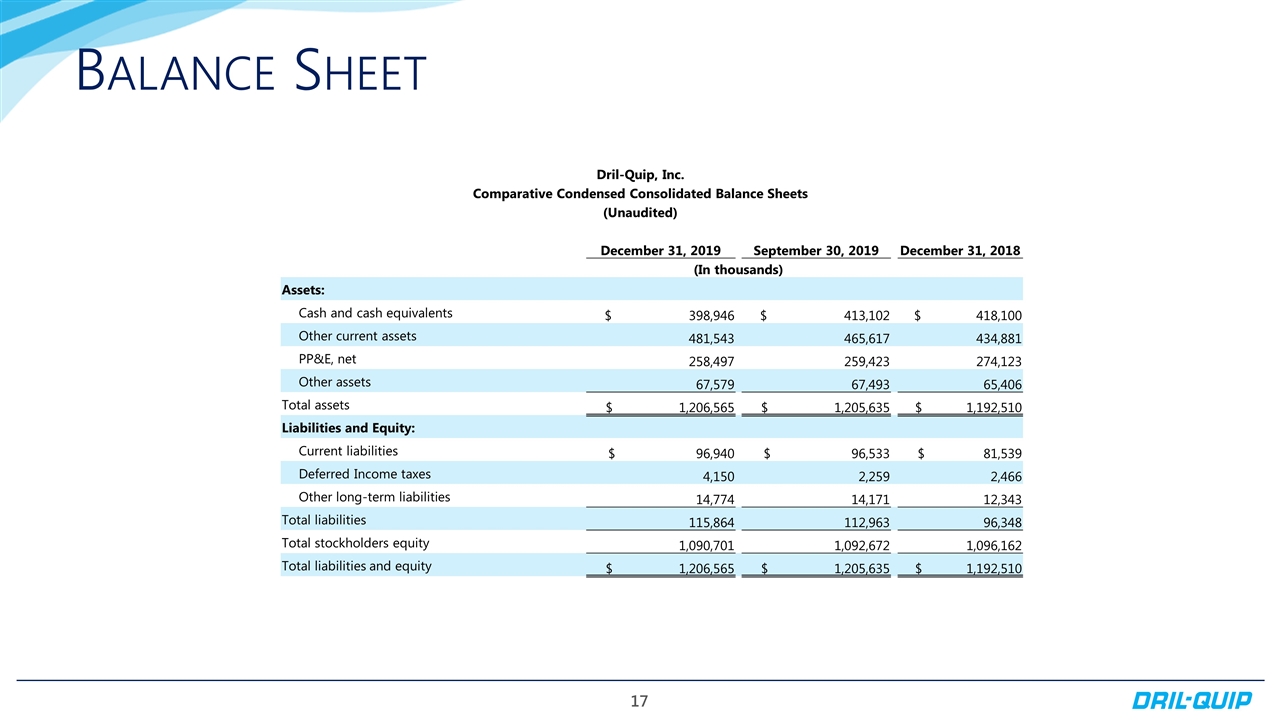

Balance Sheet Dril-Quip, Inc. Comparative Condensed Consolidated Balance Sheets (Unaudited) December 31, 2019 September 30, 2019 December 31, 2018 (In thousands) Assets: Cash and cash equivalents $ 398,946 $ 413,102 $ 418,100 Other current assets 481,543 465,617 434,881 PP&E, net 258,497 259,423 274,123 Other assets 67,579 67,493 65,406 Total assets $ 1,206,565 $ 1,205,635 $ 1,192,510 Liabilities and Equity: Current liabilities $ 96,940 $ 96,533 $ 81,539 Deferred Income taxes 4,150 2,259 2,466 Other long-term liabilities 14,774 14,171 12,343 Total liabilities 115,864 112,963 96,348 Total stockholders equity 1,090,701 1,092,672 1,096,162 Total liabilities and equity $ 1,206,565 $ 1,205,635 $ 1,192,510

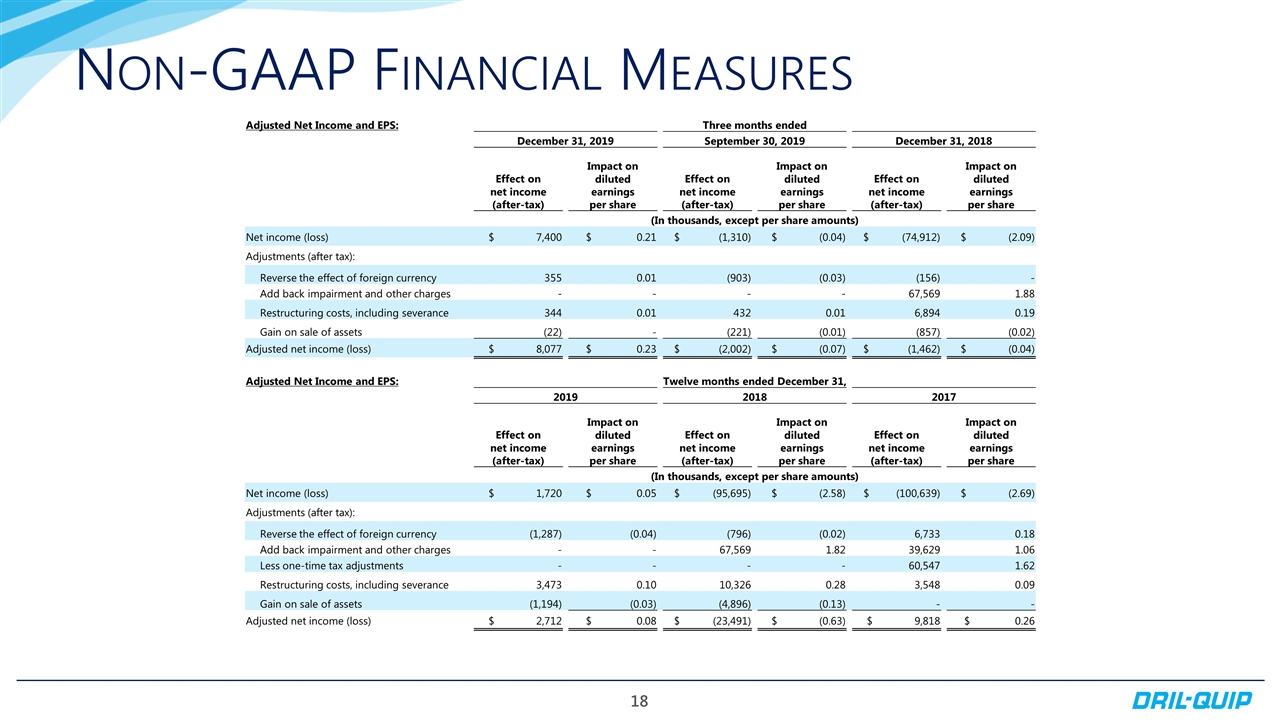

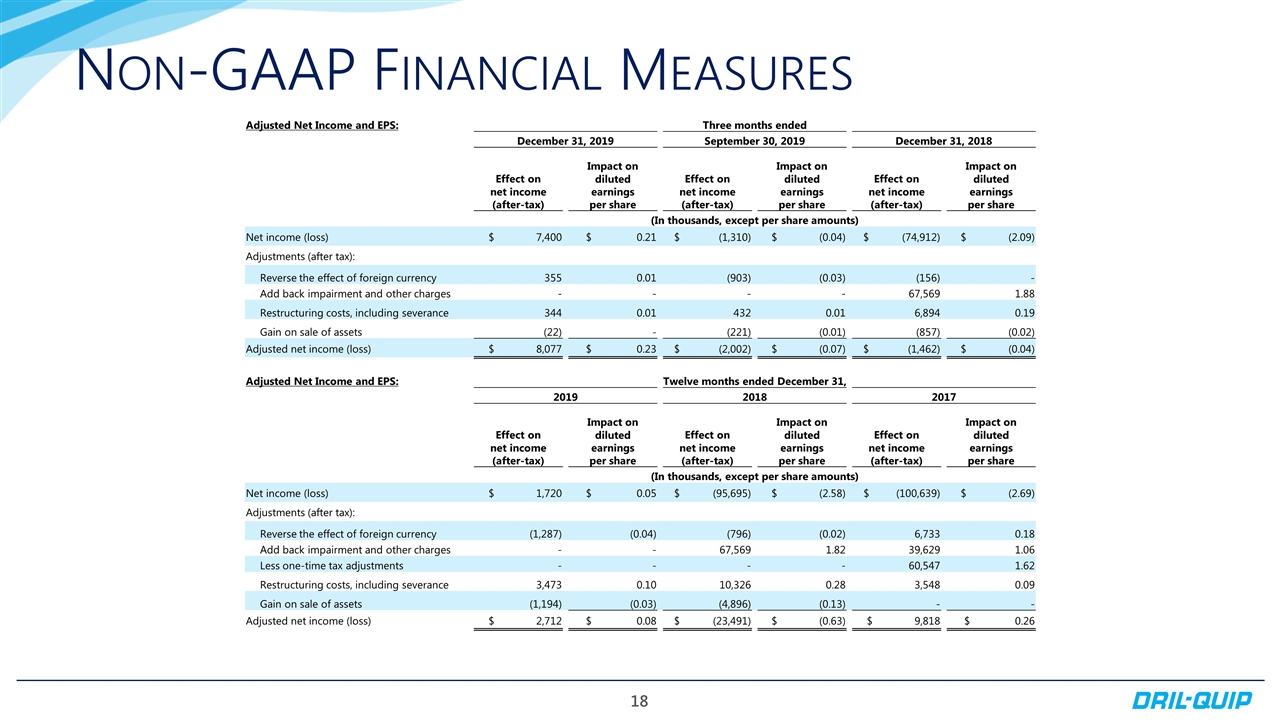

Non-GAAP Financial Measures Adjusted Net Income and EPS: Three months ended December 31, 2019 September 30, 2019 December 31, 2018 Effect on net income (after-tax) Impact on diluted earnings per share Effect on net income (after-tax) Impact on diluted earnings per share Effect on net income (after-tax) Impact on diluted earnings per share (In thousands, except per share amounts) Net income (loss) $ 7,400 $ 0.21 $ (1,310) $ (0.04) $ (74,912) $ (2.09) Adjustments (after tax): Reverse the effect of foreign currency 355 0.01 (903) (0.03) (156) - Add back impairment and other charges - - - - 67,569 1.88 Restructuring costs, including severance 344 0.01 432 0.01 6,894 0.19 Gain on sale of assets (22) - (221) (0.01) (857) (0.02) Adjusted net income (loss) $ 8,077 $ 0.23 $ (2,002) $ (0.07) $ (1,462) $ (0.04) Adjusted Net Income and EPS: Twelve months ended December 31, 2019 2018 2017 Effect on net income (after-tax) Impact on diluted earnings per share Effect on net income (after-tax) Impact on diluted earnings per share Effect on net income (after-tax) Impact on diluted earnings per share (In thousands, except per share amounts) Net income (loss) $ 1,720 $ 0.05 $ (95,695) $ (2.58) $ (100,639) $ (2.69) Adjustments (after tax): Reverse the effect of foreign currency (1,287) (0.04) (796) (0.02) 6,733 0.18 Add back impairment and other charges - - 67,569 1.82 39,629 1.06 Less one-time tax adjustments - - - - 60,547 1.62 Restructuring costs, including severance 3,473 0.10 10,326 0.28 3,548 0.09 Gain on sale of assets (1,194) (0.03) (4,896) (0.13) - - Adjusted net income (loss) $ 2,712 $ 0.08 $ (23,491) $ (0.63) $ 9,818 $ 0.26

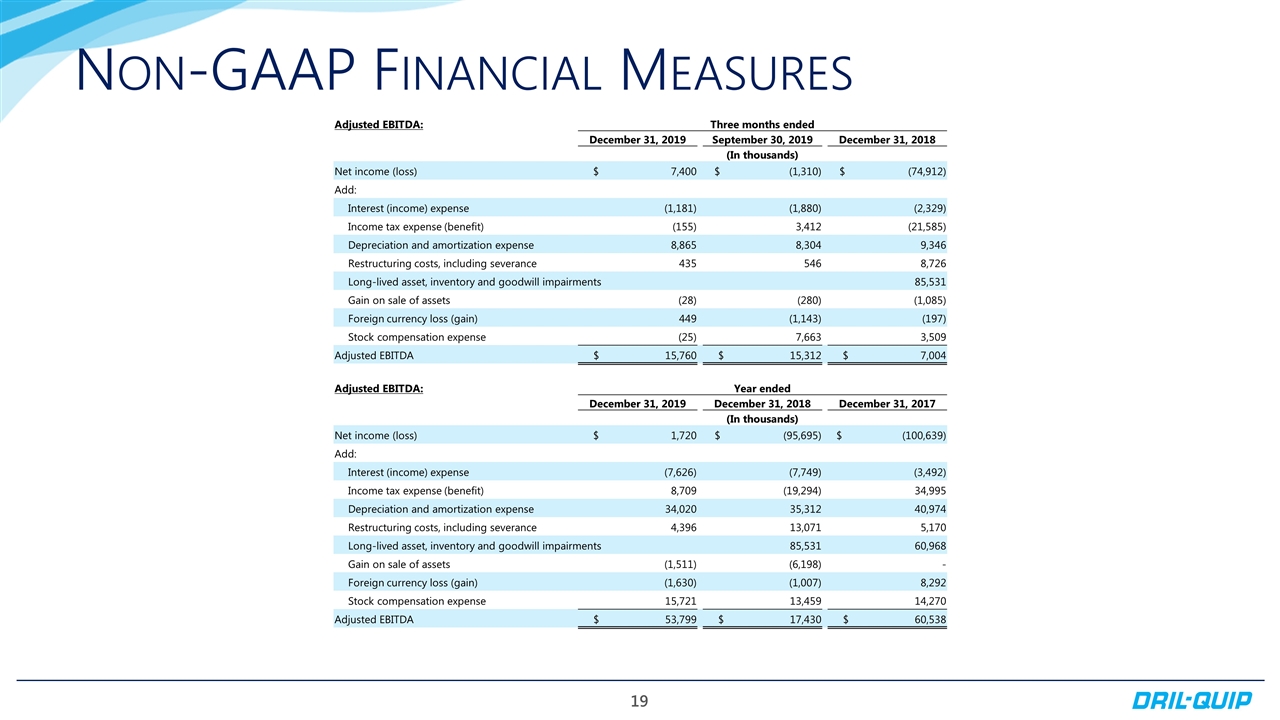

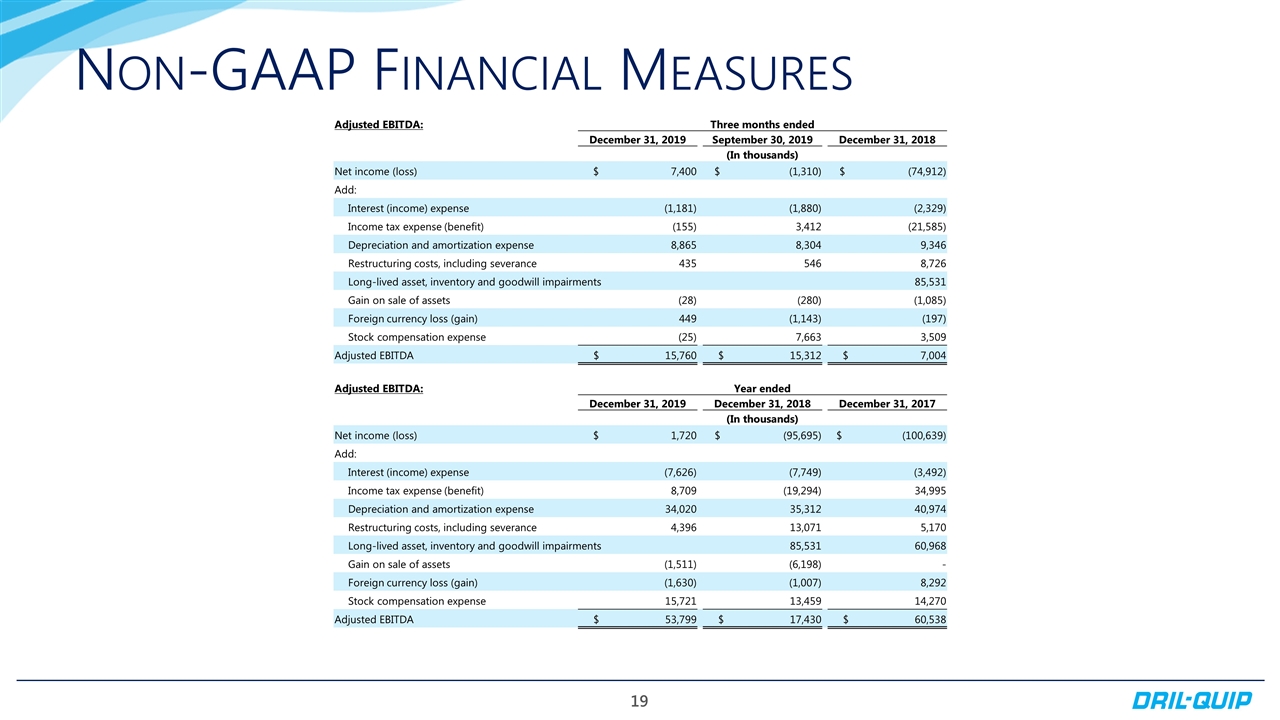

Non-GAAP Financial Measures Adjusted EBITDA: Three months ended December 31, 2019 September 30, 2019 December 31, 2018 (In thousands) Net income (loss) $ 7,400 $ (1,310) $ (74,912) Add: Interest (income) expense (1,181) (1,880) (2,329) Income tax expense (benefit) (155) 3,412 (21,585) Depreciation and amortization expense 8,865 8,304 9,346 Restructuring costs, including severance 435 546 8,726 Long-lived asset, inventory and goodwill impairments 85,531 Gain on sale of assets (28) (280) (1,085) Foreign currency loss (gain) 449 (1,143) (197) Stock compensation expense (25) 7,663 3,509 Adjusted EBITDA $ 15,760 $ 15,312 $ 7,004 Adjusted EBITDA: Year ended December 31, 2019 December 31, 2018 December 31, 2017 (In thousands) Net income (loss) $ 1,720 $ (95,695) $ (100,639) Add: Interest (income) expense (7,626) (7,749) (3,492) Income tax expense (benefit) 8,709 (19,294) 34,995 Depreciation and amortization expense 34,020 35,312 40,974 Restructuring costs, including severance 4,396 13,071 5,170 Long-lived asset, inventory and goodwill impairments 85,531 60,968 Gain on sale of assets (1,511) (6,198) - Foreign currency loss (gain) (1,630) (1,007) 8,292 Stock compensation expense 15,721 13,459 14,270 Adjusted EBITDA $ 53,799 $ 17,430 $ 60,538

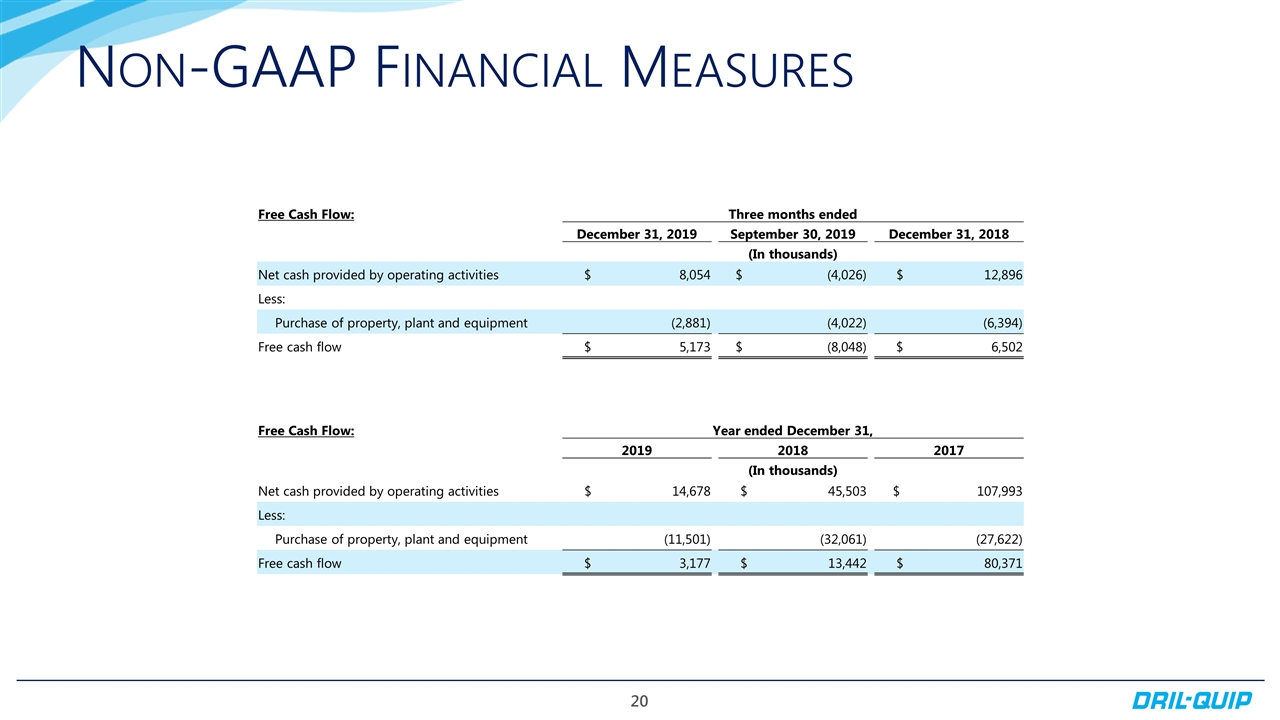

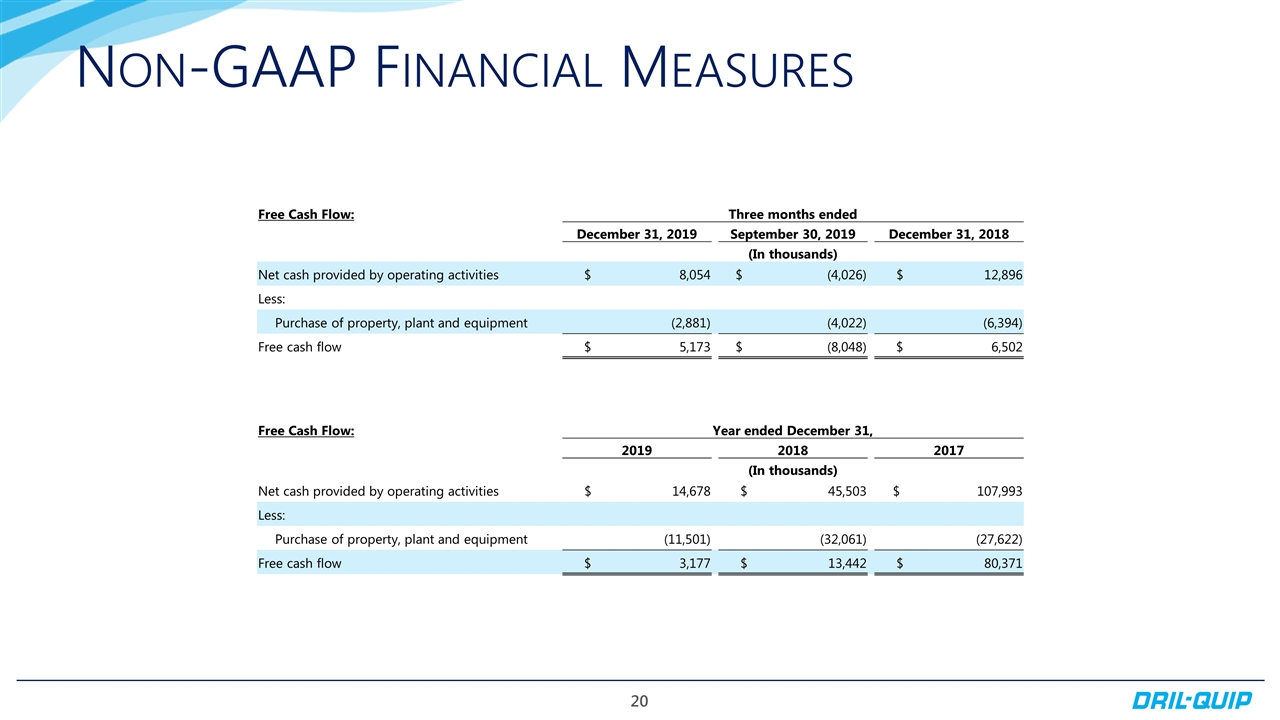

Free Cash Flow: Three months ended December 31, 2019 September 30, 2019 December 31, 2018 (In thousands) Net cash provided by operating activities $ 8,054 $ (4,026) $ 12,896 Less: Purchase of property, plant and equipment (2,881) (4,022) (6,394) Free cash flow $ 5,173 $ (8,048) $ 6,502 Free Cash Flow: Year ended December 31, 2019 2018 2017 (In thousands) Net cash provided by operating activities $ 14,678 $ 45,503 $ 107,993 Less: Purchase of property, plant and equipment (11,501) (32,061) (27,622) Free cash flow $ 3,177 $ 13,442 $ 80,371 Non-GAAP Financial Measures

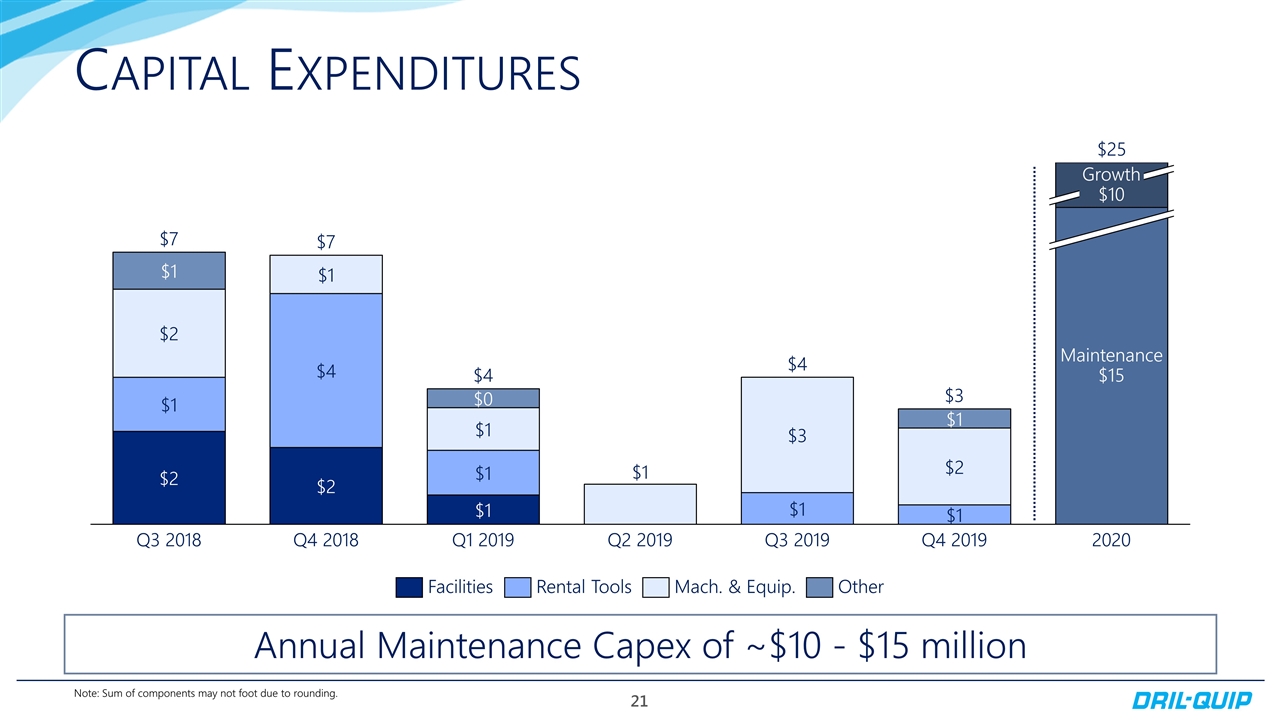

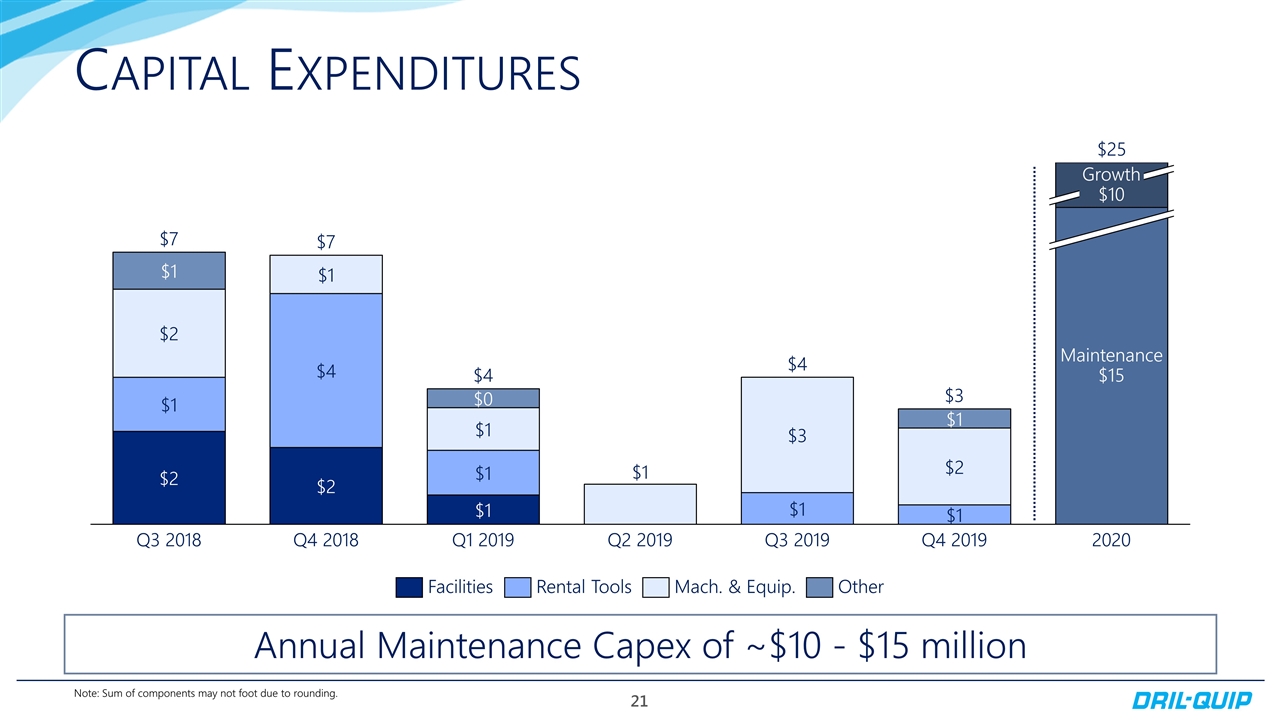

Capital Expenditures Annual Maintenance Capex of ~$10 - $15 million Note: Sum of components may not foot due to rounding.

NYSE: DRQ

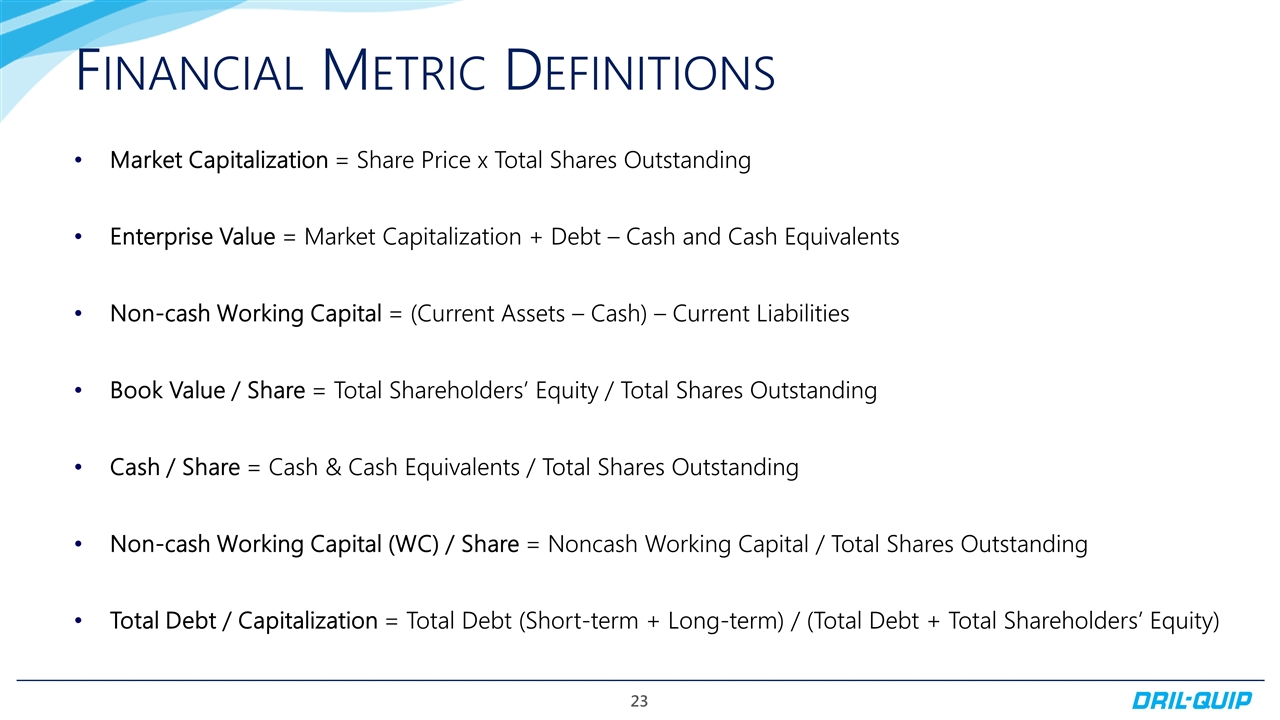

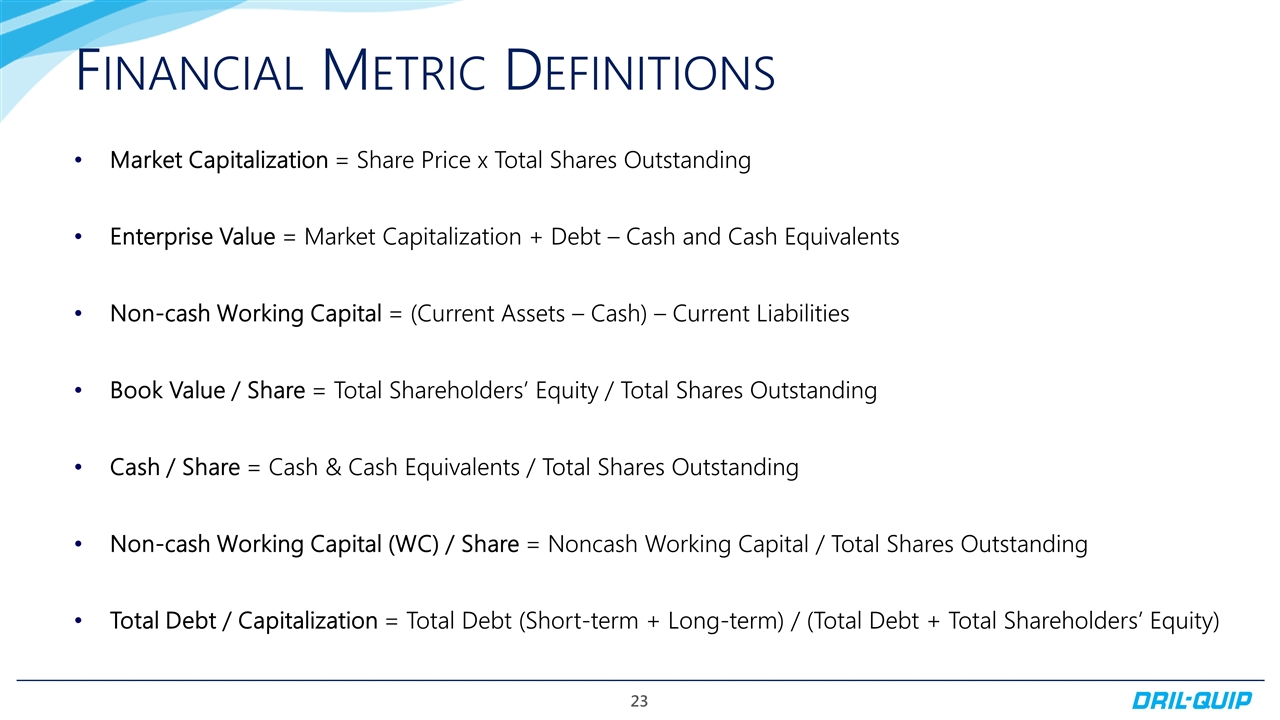

Financial Metric Definitions Market Capitalization = Share Price x Total Shares Outstanding Enterprise Value = Market Capitalization + Debt – Cash and Cash Equivalents Non-cash Working Capital = (Current Assets – Cash) – Current Liabilities Book Value / Share = Total Shareholders’ Equity / Total Shares Outstanding Cash / Share = Cash & Cash Equivalents / Total Shares Outstanding Non-cash Working Capital (WC) / Share = Noncash Working Capital / Total Shares Outstanding Total Debt / Capitalization = Total Debt (Short-term + Long-term) / (Total Debt + Total Shareholders’ Equity)