- INVX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Innovex Downhole Solutions (INVX) DEF 14ADefinitive proxy

Filed: 30 Mar 21, 4:54pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | |

DRIL-QUIP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Price per unit or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing party:

| |||

| (4) | Date filed:

| |||

Notes:

Reg. § 240.14a-101.

SEC 1913 (3-99)

Notice of 2021 Annual Meeting and Proxy Statement

May 12, 2021 at 10:00 a.m.

LETTER TO OUR STOCKHOLDERS |

| Dril-Quip, Inc. 6401 N. Eldridge Parkway Houston, Texas 77041 |

March 30, 2021

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders to be held at the Company’s worldwide headquarters, 6401 N. Eldridge Parkway, Houston, Texas, on May 12, 2021 at 10:00 a.m. For those of you who cannot be present at this annual meeting, we urge that you participate by voting your proxy over the Internet, by telephone or mail at your earliest convenience.

This booklet includes the notice of the meeting and the proxy statement, which contains information about the Board of Directors and its committees and personal information about the nominees for the Board. Other matters on which action is expected to be taken during the meeting are also described.

It is important that your shares are represented at the meeting, whether or not you are able to attend personally. Accordingly, please vote your proxy over the Internet, by telephone or, if printed proxy materials are mailed to you, by signing, dating and mailing promptly the enclosed proxy in the envelope provided.

On behalf of the Board of Directors, thank you for your continued support.

Blake T. DeBerry

Chief Executive Officer

Notice of Annual Meeting of Stockholders

DATE: May 12, 2021

TIME: 10:00 a.m., Houston time

PLACE: Company’s worldwide headquarters 6401 N. Eldridge Parkway Houston, Texas 77041

RECORD DATE: March 18, 2021

|

AGENDA:

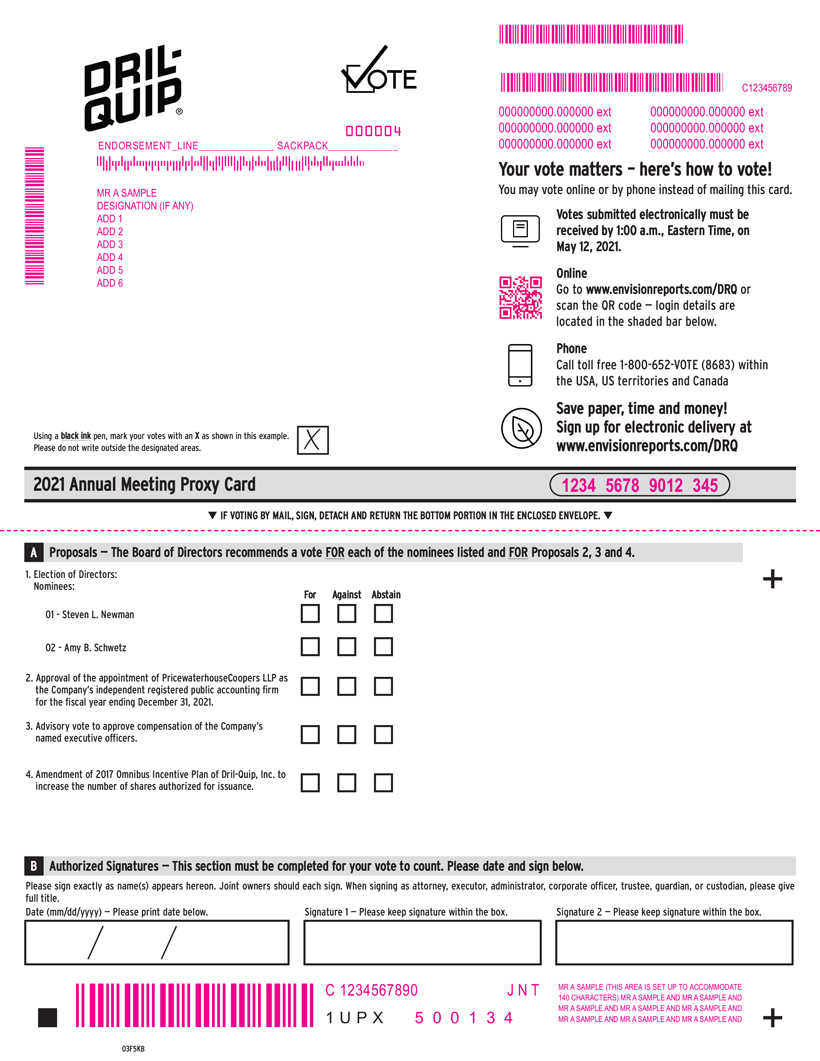

1. To elect the two nominees named in the Proxy Statement as directors to serve for

2. To approve the appointment of PricewaterhouseCoopers LLP as independent registered public accounting firm for 2021 (Proposal 2).

3. To conduct a non-binding advisory vote to approve the Company’s compensation of its named executive officers (Proposal 3).

4. To amend the 2017 Omnibus Incentive Plan of Dril-Quip, Inc. to increase the number of shares authorized for issuance by 1,900,000 shares (Proposal 4).

5. To transact such other business as may properly come before the meeting or any reconvened meeting after an adjournment thereof.

|

The Board of Directors has fixed March 18, 2021 as the record date for determining stockholders entitled to notice of, and to vote at, the meeting or any reconvened meeting after an adjournment thereof, and only holders of common stock of record at the close of business on that date will be entitled to notice of, and to vote at, the meeting or any reconvened meeting after an adjournment.

You are cordially invited to attend the meeting in person. Even if you plan to attend the meeting, however, you are requested to vote your proxy over the Internet, by telephone or, if printed proxy materials are mailed to you, by marking, signing, dating and returning the accompanying proxy in the envelope provided as soon as possible.

We continue to monitor developments regarding COVID-19. We would like to emphasize that the health of our stockholders, employees and other attendees remains a top priority. We strongly urge you to appoint a proxy to vote at the Annual Meeting on your behalf, as this is the preferred means of fully and safely exercising your right to vote. In the event that our meeting venue has restricted access due to the COVID-19 pandemic, we will communicate this information to our stockholders by way of announcement, which will be published on the investor relations page of our website at https://drilquip.gcs-web.com/ and, if required, included in our filings with the SEC. We recommend that stockholders keep apprised of public official guidance regarding travel, self-isolation and other health and safety precautions.

By Order of the Board of Directors

Blake T. DeBerry

Chief Executive Officer

March 30, 2021

PROXY VOTING

Your vote is important. Please vote promptly so your shares can be represented, even if you plan to attend the annual meeting. You can vote by Internet at http://www.envisionreports.com/DRQ.com, by telephone at 1-800-652-8683 or by requesting a printed copy of the proxy materials and using the proxy card enclosed with the printed materials.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 12, 2021.

The Proxy Statement, our annual report and other proxy materials

are available at http://www.edocumentview.com/DRQ.

| 1 | ||||

| 1 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 3 | |||

| 5 | ||||

| 5 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 40 | ||||

PROPOSAL 2 Approval of Appointment of Independent Registered Public Accounting Firm | 41 | |||

| 41 | ||||

Audit Committee Pre-Approval Policy for Audit and Non-Audit Services | 41 | |||

| 42 | ||||

PROXY STATEMENT INTRODUCTION |

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation by the Board of Directors of Dril-Quip, Inc., a Delaware corporation, of proxies from the holders of our common stock, par value $0.01 per share, for use at the 2021 Annual Meeting of Stockholders to be held at the time and place and for the purposes set forth in the accompanying notice. We are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies of those materials to each stockholder. We expect to provide notice and electronic delivery of this proxy statement and the accompanying proxy to stockholders on or about March 30, 2021. If you would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the notice.

In addition to the solicitation of proxies by mail, proxies may also be solicited by telephone or personal interview by our regular employees. We will pay all costs of soliciting proxies. We will also reimburse brokers or other persons holding stock in their names or in the names of their nominees for their reasonable expenses in forwarding proxy materials to beneficial owners of such stock.

RECORD DATE AND VOTING SECURITIES

As of the close of business on March 18, 2021, the record date for determining stockholders entitled to notice of and to vote at the annual meeting, we had outstanding and entitled to vote 35,428,778 shares of common stock. Each share entitles the holder to one vote on each matter submitted to a vote of stockholders.

The requirement for a quorum at the annual meeting is the presence in person or by proxy of holders of a majority of the outstanding shares of our common stock. Proxies indicating stockholder abstentions and shares represented by “broker non-votes” (i.e., shares held by brokers or nominees for which instructions have not been received from the beneficial owners or persons entitled to vote and for which the broker or nominee does not have discretionary power to vote on a particular matter) will be counted for purposes of determining whether there is a quorum at the annual meeting. Votes cast by proxy or in person at the annual meeting will be counted by the persons appointed as election inspectors for the annual meeting.

Brokers holding shares must vote according to specific instructions they receive from the beneficial owners of those shares. If brokers do not receive specific instructions, brokers may in some cases vote the shares in their discretion. However, the New York Stock Exchange, or NYSE, precludes brokers from exercising voting discretion on certain proposals without specific instructions from the beneficial owner. Importantly, NYSE rules expressly prohibit brokers holding shares in “street name” for their beneficial holder clients from voting on behalf of those clients in uncontested director elections or on matters that relate to executive compensation without receiving specific voting instructions from those clients. Under NYSE rules, brokers will have discretion to vote only on Proposal 2 (approval of the appointment of independent registered public accounting firm). Brokers cannot vote on Proposal 1 (election of directors), Proposal 3 (advisory vote to approve executive compensation) or Proposal 4 (approval of amendment to the Company’s 2017 Omnibus Incentive Plan) without instructions from the beneficial owners. If you do not instruct your broker how to vote on these matters, your broker will not vote for you.

All duly executed proxies received prior to the annual meeting will be voted in accordance with the choices specified thereon and, in connection with any other business that may properly come before the meeting, in the discretion of the persons named in the proxy. As to any matter for which no choice has been specified in a duly executed proxy, the shares represented thereby will be voted FOR the election as director of the nominees listed herein, FOR approval of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm, FOR approval, on an advisory basis, of the compensation of our named executive officers, FOR approval of the amendment to the Company’s 2017 Omnibus Incentive Plan and in the discretion of the persons named in the proxy in connection with any other business that may properly come before the annual meeting.

2021 Proxy Statement 1

RECORD DATE AND VOTING SECURITIES |

A stockholder giving a proxy may revoke it at any time before it is voted at the annual meeting by filing with the Corporate Secretary at our executive offices a written instrument revoking it, by delivering a duly executed proxy bearing a later date or by appearing at the annual meeting and voting in person. Our executive offices are located at 6401 N. Eldridge Parkway, Houston, Texas 77041. For a period of ten days prior to the annual meeting, a complete list of stockholders entitled to vote at the annual meeting will be available for inspection by stockholders of record during ordinary business hours for proper purposes at our executive offices.

2 2021 Proxy Statement

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the number of shares of our common stock beneficially owned directly or indirectly as of March 18, 2021 or as otherwise indicated below by (i) each person who is known to us to own beneficially more than 5% of our common stock, (ii) each of our directors, director nominees and executive officers and (iii) all directors, director nominees and executive officers as a group.

| Amount of Beneficial Ownership | ||||||||

Name of Beneficial Owner (1) | Number of Shares | Percent of Stock | ||||||

Blake T. DeBerry (2) |

| 275,882 |

| * | ||||

Jeffrey J. Bird (3) |

| 95,927 |

|

| * |

| ||

James C. Webster (4) |

| 74,622 |

|

| * |

| ||

John V. Lovoi (6) |

| 52,846 |

|

| * |

| ||

Terence B. Jupp (6) |

| 37,843 |

|

| * |

| ||

Raj Kumar (5) |

| 30,942 |

|

| * |

| ||

Steven L. Newman (6) |

| 30,476 |

|

| * |

| ||

Alexander P. Shukis (6) |

| 24,815 |

|

| * |

| ||

Amy B. Schwetz (6) |

| 12,301 |

|

| * |

| ||

All current directors and executive officers as a group (9 persons) (7) |

| 635,654 |

|

| 1.79% |

| ||

BlackRock, Inc. (8) |

| 5,506,666 |

|

| 15.7% |

| ||

55 East 52nd Street | ||||||||

New York, NY 10055 | ||||||||

Kayne Anderson Rudnick Investment Management LLC (9) |

| 3,817,314 |

|

| 10.88% |

| ||

1800 Avenue of the Stars, 2nd Floor | ||||||||

Los Angeles, CA 90067 | ||||||||

The Vanguard Group (10) | 3,769,595 | 10.74% | ||||||

100 Vanguard Boulevard | ||||||||

Malvern, PA 19355 | ||||||||

AllianceBernstein L.P. (11) |

| 2,767,244 |

|

| 7.9% |

| ||

1345 Avenue of the Americas | ||||||||

New York, NY 10105 | ||||||||

Dimensional Fund Advisors LP (12) |

| 1,954,666 |

|

| 5.6% |

| ||

Building One | ||||||||

6300 Bee Cave Road | ||||||||

T. Rowe Price Associates, Inc. (13) |

| 1,394,045 |

|

| 3.9% |

| ||

100 E. Pratt Street | ||||||||

Baltimore, MD 21202 | ||||||||

| * | Less than 1%. |

| (1) | Except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock. The address of each such person, unless otherwise provided, is 6401 N. Eldridge Parkway, Houston, Texas 77041. |

| (2) | Includes (a) 89,690 shares of restricted stock held directly by Mr. DeBerry and (b) 15,000 shares of common stock that may be acquired pursuant to options that are currently exercisable. |

| (3) | Includes 59,846 shares of restricted stock held directly by Mr. Bird. |

| (4) | Includes (a) 29,078 shares of restricted stock held directly by Mr. Webster and (b) 8,000 shares of common stock that may be acquired pursuant to options that are currently exercisable. |

2021 Proxy Statement 3

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| (5) | Includes 27,346 shares of restricted stock held directly by Mr. Kumar. Mr. Kumar was appointed Vice President-Chief Financial Officer of the Company effective May 14, 2020, and previously served as Vice President — Finance and Chief Accounting Officer of the Company effective February 26, 2019. |

| (6) | Includes restricted stock held directly in the amount of 15,925 shares by Mr. Lovoi, 11,305 shares by Mr. Jupp, 10,580 shares by Mr. Newman, 9,145 shares by Mr. Shukis, and 9,158 shares by Ms. Schwetz. |

| (7) | Includes Blake T. DeBerry, Jeffrey J. Bird, James C. Webster, Raj Kumar, John V. Lovoi, Terence B. Jupp, Steven L. Newman Alexander P. Shukis and Amy B. Schwetz. |

| (8) | Number of shares based on a Schedule 13G/A filed with the Securities and Exchange Commission (“SEC”) on January 25, 2021. Such filing indicates that BlackRock, Inc. has sole voting power with respect to 5,443,453 shares and sole dispositive power with respect to 5,506,666 shares. |

| (9) | Number of shares based on a Schedule 13G/A filed with the SEC on February 11, 2021. Such filing indicates that Kayne Anderson Rudnick Investment Management LLC has sole voting power with respect to 2,627,566 shares, shared voting power with respect to 1,189,748 shares, sole dispositive power with respect to 2,627,566 shares and shared dispositive power with respect to 1,189,748 shares. |

| (10) | Number of shares based on a Schedule 13G/A filed with the SEC on February 10, 2021. Such filing indicates that The Vanguard Group has sole voting power with respect to 0 shares, shared voting power with respect to 32,700 shares, sole dispositive power with respect to 3,710,134 shares and shared dispositive power with respect to 59,461 shares. |

| (11) | Number of shares based on a Schedule 13G filed with the SEC on February 8, 2021. Such filing indicates that AllianceBernstein L.P. has sole voting power with respect to 2,322,659 shares, sole dispositive power with respect to 2,767,244 shares. |

| (12) | Number of shares based on a Schedule 13G/A filed with the SEC on February 12, 2021. Such filing indicates that Dimensional Fund Advisors LP has sole voting power with respect to 1,867,843 shares and sole dispositive power with respect to 1,954,666 shares. |

| (13) | Number of shares based on a Schedule 13G/A filed with the SEC on February 16, 2021. Such filing indicates that T. Rowe Price Associates, Inc. has sole voting power with respect to 377,324 shares and sole dispositive power with respect to 1,394,045 shares. |

4 2021 Proxy Statement

PROPOSAL 1 ELECTION OF DIRECTORS |

PROPOSAL 1 Election of Directors

Our Board of Directors is divided into three classes, Class I, Class II and Class III, with staggered terms of office ending in 2022, 2023 and 2021, respectively. The term for each class expires on the date of the third annual stockholders’ meeting for the election of directors following the most recent election of directors for such class. Each director holds office until the next annual meeting of stockholders for the election of directors of his or her class or until his or her successor has been duly appointed or elected and qualified.

Our Board of Directors has nominated each of Mr. Newman and Ms. Schwetz for election as a director to serve a three-year term expiring on the date of the annual meeting of stockholders to be held in 2024 (or until a successor is duly appointed or elected and qualified). Mr. Newman and Ms. Schwetz currently serve as members of our Board of Directors. In accordance with our bylaws, directors are elected by a majority of the votes cast at the meeting. This means that the number of shares voted “for” a director must exceed the number of votes cast “against” that director. Abstentions and broker non-votes will not affect the outcome of the vote. For additional information on the election of directors, see “Corporate Governance Matters — Majority Voting in Director Elections.”

Our Board of Directors has no reason to believe that Mr. Newman and Ms. Schwetz will not be candidates for director at the time of the annual meeting or will be unable to serve as directors. If Mr. Newman or Ms. Schwetz becomes unavailable for election, our Board of Directors can name a substitute nominee, and proxies will be voted for the substitute nominee pursuant to discretionary authority, unless withheld.

2021 Proxy Statement 5

PROPOSAL 1 ELECTION OF DIRECTORS |

The Board of Directors recommends that you vote FOR the election of the nominees listed below. Properly dated and signed proxies will be so voted unless authority to vote in the election of directors is withheld.

Nominees for Class III Director for Three-Year Term to Expire in 2024

The following sets forth information concerning the nominees for election as a director at the annual meeting, including each nominee’s age as of March 18, 2021, position with us, business experience during the past five years and the experiences, qualifications, attributes or skills that caused our Nominating and Governance Committee and the Board to determine that the nominees should serve as directors of the Company.

STEVEN L. NEWMAN | ||

Age: 56

Director Since: 2015

Board Committees: • Audit • Nominating and Governance • Compensation |

Mr. Newman has been a Class III director since August 2015. Previously, he was President and Chief Executive Officer and a member of the Board of Directors of Transocean Ltd., a global offshore drilling company, from March 2010 until February 2015. From 1994 to 2010, Mr. Newman was employed by Transocean Ltd. in various management and operational positions. Mr. Newman is a director, and a member of the audit committee, the safety, workplace and project risk committee, and chair of the governance and ethics committee of SNC-Lavalin Group Inc., a worldwide engineering and construction company based in Montreal that also provides operations and maintenance services and invests in infrastructure projects. Mr. Newman is a former director of Rubicon Oilfield International Holdings GP, Ltd., a Houston-based company engaged in the manufacture and sale of drilling and completion tools for the worldwide oil and gas industry, Tidewater, Inc., a leading provider of offshore service vessels to the global energy industry, and Bumi Armada Bhd, a Malaysian-based company that provides offshore production and support vessels to the oil and gas industry worldwide. Mr. Newman holds a Bachelor of Science degree in petroleum engineering from the Colorado School of Mines and an MBA from the Harvard University Graduate School of Business.

| |

Qualifications: Mr. Newman was selected to serve as a director due to his executive experience within the oil and gas industry, his international experience and his public company experience.

| ||

AMY B. SCHWETZ | ||

Age: 46

Director Since: 2019

Board Committees: • Audit • Nominating and Governance • Compensation |

Ms. Schwetz has been a Class III director of the Company since September 2019. She has been Senior Vice President and Chief Financial Officer of Flowserve Corporation, a leading provider of flow control products and services for the global infrastructure markets, since February 2020. From July 2015 to February 2020, she was Executive Vice President and Chief Financial Officer of Peabody Energy Corporation, a global coal company. From June 2013 to July 2015, Ms. Schwetz was Senior Vice President of Finance and Administration – Australia at Peabody. From August 2005 to June 2013, she served in various other financial management positions at Peabody, including as Senior Vice President of Finance and Administration – Americas, Vice President of Investor Relations and Vice President of Capital and Financial Planning. From 1997 to 2005, Ms. Schwetz was employed by Ernst & Young LLP, an international accounting firm, in its audit practice. Ms. Schwetz holds a Bachelor of Science degree in Accounting from Indiana University.

| |

Qualifications: Ms. Schwetz was selected to serve as a director due to her executive experience with a publicly-traded company in the energy industry, her international experience and her extensive financial and accounting background.

| ||

6 2021 Proxy Statement

PROPOSAL 1 ELECTION OF DIRECTORS |

Information Concerning Class I and Class II Directors

The following sets forth information concerning the Class I and Class II directors whose present terms of office will expire at the 2022 and 2023 annual meetings of stockholders, respectively, including each director’s age as of March 18, 2021, position with us, if any, business experience during the past five years and the experiences, qualifications, attributes or skills that caused our Nominating and Governance Committee and the Board to determine that the nominees should serve as directors of the Company.

Class I

ALEXANDER P. SHUKIS | ||

Age: 76

Director Since: 2003

Board Committees: • Audit (Chair) • Nominating and Governance • Compensation

|

Mr. Shukis has been a Class I director since February 2003. From July 2001 until his retirement in December 2007, Mr. Shukis was the Controller of Corporate Strategies, Inc., a merchant bank. From 1997 to July 2001, Mr. Shukis was self-employed, working as a business consultant. From 1995 to 1997, he was Chief Financial Officer and Director of Great Western Resources, Inc., an exploration and production company. He served as Vice President and Controller of Great Western Resources, Inc. from 1986 to 1995. Mr. Shukis holds a BBA in accounting from the University of Houston.

| |

Qualifications: Mr. Shukis was selected to serve as a director due to his extensive financial and accounting background and his knowledge of the energy industry.

| ||

TERENCE B. JUPP | ||

Age: 61

Director Since: 2012

Board Committees: • Compensation (Chair) • Audit • Nominating and Governance |

Mr. Jupp has been a Class I director since November 2012. Since April 2015, Mr. Jupp has been Chief Operating Officer of Harbour Energy, Ltd., a company that owns and operates upstream and midstream energy assets globally, and Managing Director of EIG Global Energy Partners, a private energy investment company that is an owner of Harbour Energy. From January 2012 to April 2015, Mr. Jupp served as Chief Operating Officer of CASA Exploration, an oil and gas exploration company. Mr. Jupp was previously employed by Anadarko Petroleum as Vice President International Operations — Americas/Far East and in various management positions for Kerr McGee Oil and Gas domestically and internationally for over 20 years, including as Vice President — International Exploration and Production. Mr. Jupp is a director of Maverick Natural Resources, LLC, a privately held oil and gas company, and Chrysaor Holdings Limited, a privately-held oil and gas company focused on North Sea, both of which are controlled by EIG Global Energy Partners but his position as a director of Chrysaor Holdings Limited is scheduled to end on March 31, 2021. Mr. Jupp holds a Bachelor of Science degree in petroleum engineering from Texas A&M University.

| |

Qualifications: Mr. Jupp was selected to serve as a director due to his executive experience with oil and gas exploration companies, including his international experience in the energy industry.

| ||

2021 Proxy Statement 7

PROPOSAL 1 ELECTION OF DIRECTORS |

Class II

BLAKE T. DEBERRY | ||

Chief Executive Officer

Age: 61

Director Since: 2011 |

Mr. DeBerry has been a Class II director and the Chief Executive Officer of the Company since October 2011. Mr. DeBerry was also President from October 2011 to May 2020, was Senior Vice President — Sales and Engineering from July 2011 until October 2011, and was Vice President — Dril-Quip Asia-Pacific (which covers the Pacific Rim, Asia, Australia, India and the Middle East) from March 2007 to July 2011. He has been an employee of the Company since 1988 and has held a number of management and engineering positions in the Company’s domestic and international offices. Mr. DeBerry holds a Bachelor of Science degree in mechanical engineering from Texas Tech University.

| |

Qualifications: Mr. DeBerry was selected to serve as a director because he is our Chief Executive Officer, he has extensive knowledge of the Company and its operations and people gained over 30 years and he has demonstrated engineering knowledge and technical expertise.

| ||

JOHN V. LOVOI | ||

Chairman of the Board

Age: 60

Director Since: 2005

Board Committees: • Nominating and Governance (Chair) • Audit • Compensation |

Mr. Lovoi has been a Class II director since May 2005 and Chairman of the Board since October 2011. He is the Managing Partner of JVL Advisors LLC, a private energy investment company established in 2002. From January 2000 to August 2002, Mr. Lovoi was a Managing Director at Morgan Stanley Incorporated, and during this period served as head of the firm’s Global Oil and Gas Research practice and then as head of the firm’s Global Oil and Gas Investment Banking practice. From 1995 to 2000, he was a leading oilfield services and equipment research analyst for Morgan Stanley. Prior to joining Morgan Stanley, he spent two years as a senior financial executive at Baker Hughes and four years as an energy investment banker with Credit Suisse First Boston. Mr. Lovoi is a director of Helix Energy Solutions Group, an energy services company, and Chairman of the Board of Directors of Epsilon Energy, Ltd., an oil and gas company based in Canada. Mr. Lovoi holds a Bachelor of Science degree in chemical engineering from Texas A&M University and an MBA degree from the University of Texas at Austin.

| |

Qualifications: Mr. Lovoi was selected to serve as a director due to his financial expertise and industry insight, as well as his experience as a director of other public companies.

| ||

8 2021 Proxy Statement

CORPORATE GOVERNANCE MATTERS |

The offices of Chair of the Board and Chief Executive Officer are currently separate and have been separate since October 2011. At that time, the Board of Directors appointed Mr. Lovoi as Chairman of the Board and Blake T. DeBerry as President and Chief Executive Officer.

The Board does not have a policy requiring either that the positions of the Chair of the Board and the Chief Executive Officer should be separate or that they should be occupied by the same individual. The Board believes that this issue is properly addressed as part of the succession planning process and that it is in the best interests of the Company for the Board to make a determination on the matter when it elects a new chief executive officer or at other times consideration is warranted by circumstances. The Board believes that this structure enables it to fulfill its oversight role in determining the manner in which its leadership is configured with a view toward flexibility and maintaining a structure that best serves our Company and its stockholders.

The Board believes that the current separation of these two important roles is in the best interest of the Company and its stockholders at this time. This structure permits the Chair to direct board operations and lead the Board in its oversight of management and the Chief Executive Officer to develop and implement the Company’s board-approved strategic vision and manage its day-to-day business. The separation of duties also allows Mr. Lovoi and Mr. DeBerry to focus on their responsibilities as Chairman and Chief Executive Officer, respectively. The Board believes that the independent board chair helps provide an opportunity for Board members to provide more direct input to management in shaping our organization and strategy and strengthens the Board’s independent oversight of management. To that end, at each regularly scheduled Board meeting, our non-management directors hold executive sessions at which our management is not in attendance. Mr. Lovoi, as Chairman, presides at these sessions.

Board’s Role in the Oversight of Risk Management

The Board of Directors has ultimate oversight responsibility for our system of enterprise risk management. Management is responsible for developing and implementing our program of enterprise risk management. Pursuant to the Audit Committee charter, the Audit Committee has been designated to take the lead in overseeing our risk management process and overall risk management system at the Board level. Accordingly, the Audit Committee meets periodically with management to review our major risk exposures, including risks associated with information technology, cybersecurity and data privacy and protection, and the steps management has taken to monitor and control those exposures. The Audit Committee also monitors our risk management policies and guidelines concerning risk assessment and risk management. In this role, the Audit Committee receives reports from management and other advisors and analyzes our risk management process and system, the nature of the material risks we face and the adequacy of our policies and procedures designed to respond to and mitigate these risks.

In addition to the formal compliance program, the Board and the Audit Committee encourage management to promote a corporate culture that understands risk management and incorporates it into our overall corporate strategy and day-to-day business operations. Our risk management structure also includes an ongoing effort to assess and analyze the most likely areas of future risk for the Company. As a result, the Board and Audit Committee periodically ask our executives to discuss the most likely sources of material future risks and how the Company is addressing any significant potential vulnerability.

The Board believes that the administration of its risk oversight function has not affected its leadership structure. In reviewing our compensation program, the Compensation Committee has made an assessment of whether compensation policies and practices create risks that are reasonably likely to have a material adverse effect on us and has concluded that they do not create such risks as presently constituted.

2021 Proxy Statement 9

CORPORATE GOVERNANCE MATTERS |

Determinations of Director Independence

Under rules adopted by the NYSE, no board member qualifies as independent unless the Board of Directors affirmatively determines that the director has no material relationship with us. In evaluating each director’s independence, the Board considers all relevant facts and circumstances in making a determination of independence. In particular, when assessing the materiality of a director’s relationship with us, the Board considers the issue not merely from the standpoint of the director, but also from the standpoint of persons or organizations with which the director has an affiliation.

As contemplated by the rules of the NYSE then in effect, the Board adopted categorical standards in 2004 to assist the Board of Directors in making independence determinations. Under the NYSE rules then in effect, immaterial relationships that fall within the guidelines were not required to be disclosed separately in proxy statements. As set forth in our Corporate Governance Guidelines, a relationship falls within the categorical standard if it:

| • | is not a type of relationship that would preclude a determination of independence under Section 303A.02(b) of the New York Stock Exchange Listed Company Manual; |

| • | consists of charitable contributions by us to an organization where a director is an executive officer and does not exceed the greater of $1 million or 2% of the organization’s gross revenue in any of the last three years; or |

| • | is not a type of relationship that would require disclosure in the proxy statement under Item 404 of Regulation S-K of the SEC. |

In its determination of independence, the Board of Directors reviewed and considered all relationships and transactions between each director, his or her family members or any business, charity or other entity in which the director has an interest, on the one hand, and we, our affiliates, or our senior management has an interest, on the other. The Board considered the relationships and transactions in the context of the NYSE’s objective listing standards, the categorical standards noted above and the additional standards established for members of audit, compensation and governance committees. As part of its review, the Board considered ordinary course transactions between the Company and Chrysaor Holdings Limited (“Chrysaor”). In particular, the Board considered that Mr. Jupp served as a member of the Board of Directors of Chrysaor during 2020 and that Chrysaor made payments for products purchased from the Company of approximately $911,882 in 2020. These payments represent approximately 0.013% of the Company’s consolidated gross revenues in 2020, and approximately 0.04% of Chrysaor’s consolidated gross revenues in 2020. The Board also considered that Chrysaor may order additional products from the Company in the future. The Board has concluded that these transactions and relationships do not adversely affect Mr. Jupp’s ability or willingness to act in the best interests of the Company and its shareholders or otherwise compromise his independence, nor are similar transactions in the future expected to adversely affect Mr. Jupp’s independence. The Board took note of the fact that these transactions were on standard terms and conditions and that neither company was afforded any special benefits. The Board further noted that Mr. Jupp had no involvement in negotiating the terms of the purchases or interest in the transactions.

As a result of this review, the Board of Directors affirmatively determined that Messrs. Jupp, Lovoi, Newman and Shukis and Ms. Schwetz are independent from us and our management. In addition, the Board of Directors affirmatively determined that Messrs. Jupp, Lovoi, Newman and Shukis and Ms. Schwetz are independent under the additional standards for audit committee membership and compensation committee membership under rules of the SEC. The remaining director, Mr. DeBerry, is not independent because of his current service as a member of our senior management.

You can access our Independence Guidelines in our Corporate Governance Guidelines on the Investors section of our website at www.dril-quip.com.

10 2021 Proxy Statement

CORPORATE GOVERNANCE MATTERS |

Code of Business Conduct and Ethical Practices

Pursuant to NYSE rules, we have adopted the Dril-Quip, Inc. Code of Business Conduct and Ethical Practices for our directors, officers and employees. The Code of Business Conduct and Ethical Practices, which also meets the requirements of a code of ethics under Item 406 of Regulation S-K, is posted on the Investors section of our website at www.dril-quip.com. Changes in and waivers to the Code of Business Conduct and Ethical Practices for our directors and executive officers will also be posted on our website.

Majority Voting in Director Elections

Our amended and restated bylaws include a majority voting standard in uncontested director elections. This standard applies to the election of directors at this meeting. To be elected in an uncontested election, a nominee must receive more votes cast “for” that nominee’s election than votes cast “against” that nominee’s election. In contested elections, the voting standard will be a plurality of votes cast. Under our bylaws, a contested election is one at which the number of candidates for election as directors exceeds the number of directors to be elected, as determined by our Corporate Secretary as of the tenth day preceding the date we mail or deliver a notice of meeting to stockholders.

Our Corporate Governance Guidelines include director resignation procedures. In brief, these procedures provide that:

| • | As a condition to being nominated to continue to serve as a director, an incumbent director nominee must submit an irrevocable letter of resignation that becomes effective upon and only in the event that (1) the nominee fails to receive the required vote for election to the Board at the next meeting of stockholders at which such nominee faces re-election and (2) the Board accepts such resignation; |

| • | As a condition to being nominated, each director candidate who is not an incumbent director must agree to submit such an irrevocable resignation upon election as a director; |

| • | Upon the failure of any nominee to receive the required vote, the Nominating and Governance Committee makes a recommendation to the Board on whether to accept or reject the resignation; |

| • | The Board takes action with respect to the resignation and publicly discloses its decision and the reasons therefor within 90 days from the date of the certification of the election results; and |

| • | The resignation, if accepted, will be effective at the time specified by the Board when it determines to accept the resignation, which effective time may be deferred until a replacement director is identified and appointed to the Board. |

Our Corporate Governance Guidelines can be found on the Investors section of our website at www.dril-quip.com.

Committees of the Board of Directors

The Board of Directors has appointed three committees: the Audit Committee, the Nominating and Governance Committee and the Compensation Committee.

Audit Committee

The current members of the Audit Committee are Mr. Shukis, who serves as Chairman, Messrs. Jupp, Lovoi and Newman and Ms. Schwetz. The Board of Directors has determined that Mr. Shukis is an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K promulgated by the SEC. In addition, the Company believes that certain other members of the Audit Committee could also qualify as “audit committee financial experts” if needed in the future.

The Board of Directors has approved the Audit Committee Charter, which contains a detailed description of the Audit Committee’s duties and responsibilities. Under the charter, the Audit Committee has been appointed by the Board of Directors to assist the Board in overseeing (i) the integrity of our financial statements, (ii) our compliance with legal and

2021 Proxy Statement 11

CORPORATE GOVERNANCE MATTERS |

regulatory requirements, (iii) the independent auditor’s independence, qualifications and performance and (iv) the performance of our internal audit function. The Audit Committee also has direct responsibility for the appointment, compensation and retention of our independent auditors.

Compensation Committee

The current members of the Compensation Committee are Mr. Jupp, who serves as Chairman, Messrs. Lovoi, Newman and Shukis and Ms. Schwetz.

The Board of Directors has approved the Compensation Committee Charter, which contains a detailed description of the Compensation Committee’s responsibilities. Under the charter, the Compensation Committee assists the Board in establishing the compensation of our directors and executive officers in a manner consistent with our stated compensation strategy, internal equity considerations, competitive practice and the requirements of applicable law and regulations and rules of applicable regulatory bodies.

Nominating and Governance Committee

The current members of the Nominating and Governance Committee are Mr. Lovoi, who serves as Chairman, and Messrs. Jupp, Newman and Shukis and Ms. Schwetz.

The Board of Directors has approved the Nominating and Governance Committee Charter, which contains a detailed description of the Nominating and Governance Committee’s responsibilities. Under the charter, the Nominating and Governance Committee identifies and recommends individuals qualified to become Board members, consistent with criteria approved by the Board, and assists the Board in determining the composition of the Board and its committees, in monitoring a process to assess Board and committee effectiveness and in developing and implementing our corporate governance guidelines, practices and procedures. The Nominating and Governance Committee has the authority to engage a third-party consultant at any time.

Selection of Nominees for the Board of Directors

Identifying Candidates

The Nominating and Governance Committee solicits ideas for potential Board candidates from a number of sources, including members of the Board of Directors, our executive officers, individuals personally known to the members of the Nominating and Governance Committee and research. In addition, the Nominating and Governance Committee will consider candidates submitted by stockholders. Any such submissions should include the candidate’s name and qualifications for Board membership and should be directed to our Corporate Secretary at the address indicated on the first page of this proxy statement. Although the Board does not require the stockholder to submit any particular information regarding the qualifications of the stockholder’s candidate, the level of consideration that the Nominating and Governance Committee will give to the stockholder’s candidate will be commensurate with the quality and quantity of information about the candidate that the nominating stockholder makes available to the Nominating and Governance Committee. The Nominating and Governance Committee did not receive any candidate submissions from stockholders during 2019. The Nominating and Governance Committee will consider all candidates identified through the processes described above and will evaluate each of them on the same basis.

In addition, our bylaws permit stockholders to nominate directors for election at an annual stockholders meeting whether or not such nominee is submitted to and evaluated by the Nominating and Governance Committee. To nominate a director using this process, the stockholder must follow certain procedures required by the Bylaws which are described under “Additional Information — Advance Notice Required for Stockholder Nominations and Proposals” below.

12 2021 Proxy Statement

CORPORATE GOVERNANCE MATTERS |

Evaluating Candidates

The members of the Nominating and Governance Committee are responsible for assessing the skills and characteristics that candidates for election to the Board should possess, as well as the composition of the Board as a whole. This assessment will include the qualifications under applicable independence standards and other standards applicable to the Board and its committees, as well as consideration of skills and experience in the context of the needs of the Board. The charter of the Nominating and Governance Committee requires the committee to evaluate each candidate for election to the Board in the context of the Board as a whole, with the objective of recommending individuals that can best perpetuate the success of our business and represent stockholder interests through the exercise of sound business judgment using their diversity of experience in a number of areas. Each candidate must meet certain minimum qualifications, including:

| • | independence of thought and judgment; |

| • | the ability to dedicate sufficient time, energy and attention to the performance of her or his duties, taking into consideration the nominee’s service on other public company boards; and |

| • | skills and expertise complementary to the existing Board members’ skills; in this regard, the Nominating and Governance Committee will consider the Board’s need for operational, sales, management, financial or other relevant expertise. |

The Nominating and Governance Committee may also consider the ability of the prospective candidate to work with the then-existing interpersonal dynamics of the Board and her or his ability to contribute to the collaborative culture among Board members.

Based on this initial evaluation, the Nominating and Governance Committee will determine whether to interview the candidate, and, if warranted, will recommend that one or more of its members and senior management, as appropriate, interview the candidate in person or by telephone. After completing this evaluation and interview process, the Nominating and Governance Committee recommends to the Board a slate of director nominees for election at the next annual meeting of stockholders or for appointment to fill vacancies on the Board.

Board Diversity

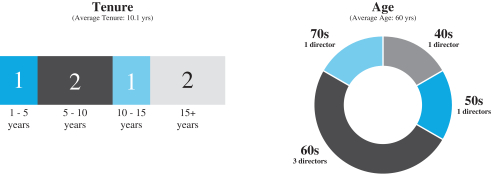

The charter of the Nominating and Governance Committee was amended in October 2017 to specifically ensure that qualified women and minority candidates are included in director searches. At the request of the Nominating and Governance Committee, the Company recently engaged a national recruiting firm to assist the Company in its efforts to add a board member, with racial diversity being a primary focus.

Information Regarding Meetings

During 2020, the Board of Directors held five meetings. The Audit Committee met four times, the Nominating and Governance Committee met twice and the Compensation Committee met three times. During 2020, all current directors attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings of the committees of the Board of Directors held during the period of such director’s service.

We expect, but do not require, Board members to attend the annual meeting. Last year, all of our Board members attended the annual meeting.

Stockholders and other interested parties may communicate directly with our independent directors by sending a written communication in an envelope addressed to “Board of Directors (Independent Members)” in care of the Corporate Secretary at the address indicated on the first page of this proxy statement.

2021 Proxy Statement 13

CORPORATE GOVERNANCE MATTERS |

Stockholders and other interested parties may communicate directly with the Board of Directors by sending a written communication in an envelope addressed to “Board of Directors” in care of the Corporate Secretary at the address indicated on the first page of this proxy statement.

Website Availability of Governance Documents

You can access our Corporate Governance Guidelines, Code of Business Conduct and Ethical Practices, Audit Committee Charter, Nominating and Governance Committee Charter and Compensation Committee Charter on the Investors section of our website at www.dril-quip.com. Information contained on our website or any other website is not incorporated into this proxy statement and does not constitute a part of this proxy statement. Additionally, any stockholder who so requests may obtain a printed copy of the governance documents from the Corporate Secretary at the address indicated on the first page of this proxy statement.

In order to seek continued alignment with our stockholders, our executive officers meet with our stockholders from time to time to obtain their views on our performance. The feedback received from our stockholders is also shared with our Board of Directors. Part of the recent feedback from our stockholders focuses on our ability to generate free cash flow on decreased revenues following the industry downturn and the ability to increase bookings. In response, we included a Free Cash Flow element and a Bookings element to our annual cash incentives program for 2021 to increase focus on both improving free cash flow and bookings. We also added a reduced payout schedule to our 2020 performance units such that no more than 150% of 2020 performance shares will be earned in the event our relative total stockholder return is negative. We will continue to regularly engage with our stockholders and consider their feedback on all aspects of our performance.

14 2021 Proxy Statement

RELATED PERSON TRANSACTIONS |

The Board has adopted a written policy implementing procedures for the review, approval or ratification of related person transactions. Under the policy, a “related person” is any director, executive officer or more than 5% stockholder. The policy applies to any transaction in which (1) we are a participant, (2) any related person has a direct or indirect material interest and (3) the amount involved exceeds $120,000, but excludes any transaction that does not require disclosure under Item 404(a) of Regulation S-K. The Nominating and Governance Committee is responsible for reviewing, approving and ratifying any related person transaction. The Nominating and Governance Committee intends to approve only those related person transactions that are in, or are not inconsistent with, the best interests of us and our stockholders.

2021 Proxy Statement 15

DIRECTOR COMPENSATION |

For the year ended December 31, 2020, the non-employee Chairman of the Board received an annual fee of $175,000 and the Company’s other non-employee directors received an annual fee of $75,000. In addition, each of the non-employee chairmen of the Nominating and Governance Committee, Compensation Committee and Audit Committee of the Board received a supplemental annual fee of $10,000, $15,000 and $20,000, respectively. All directors are reimbursed for their out-of-pocket expenses and other expenses incurred in attending meetings of the Board or its committees and for other expenses incurred in their capacity as directors. Such fees are consistent with the modified director service fees provided by the Company commencing on January 1, 2020.

Under the Company’s 2017 Omnibus Incentive Plan (the “2017 Incentive Plan”), non-employee directors may be granted awards in the form of stock options, stock appreciation rights, stock awards, cash awards or performance awards. Upon the recommendation of the Compensation Committee, the Board granted 5,867 shares of restricted stock to each of Messrs. Lovoi, Shukis, Jupp and Newman and Ms. Schwetz in October 2020 under the 2017 Incentive Plan. Such shares of restricted stock vest on the first anniversary of the date of grant subject to such director’s continued service through such date.

We maintain stock ownership guidelines applicable to our directors under which each non-employee director is expected to own Dril-Quip common stock valued at five times the then current annual cash retainer paid to such director. If, however, at any time the Chair of the Board is a non-employee and is receiving a retainer greater than that paid to the non-employee directors who are not Chair of the Board, the Chair of the Board is generally expected to own common stock valued at five times the then current annual cash retainer paid to non-employee directors who are not Chair of the Board. New directors are expected to attain the specified level of ownership within five years of becoming a director. At its most recent meeting, the Nominating and Governance Committee confirmed that all directors are in compliance with our stock ownership guidelines.

The following table sets forth a summary of the compensation paid to our non-employee directors in relation to 2020:

Name | Fees Earned or Paid in Cash(1) | Stock Awards (2) (3) | Total | ||||||||||||

John V. Lovoi | $ | 185,000 | $ | 194,590 | $ | 379,590 | |||||||||

Alexander P. Shukis | $ | 95,000 | $ | 153,935 | $ | 248,935 | |||||||||

Terence B. Jupp | $ | 90,000 | $ | 167,514 | $ | 257,514 | |||||||||

Steven L. Newman | $ | 75,000 | $ | 163,292 | $ | 238,292 | |||||||||

Amy B. Schwetz | $ | 75,000 | $ | 156,772 | $ | 231,772 | |||||||||

| (1) | Amounts include fees that each director elected to take in the form of restricted stock. Each director taking fees in the form of restricted stock receives his or her award in an amount equal to 125% of the cash equivalent of his or her fees. This 25% incremental value for awards granted in 2020 has been reflected in the column entitled “Stock Awards”. |

| (2) | Amounts reflect the aggregate grant date fair value of restricted stock awarded to each of the directors in 2020 with respect to their annual grants pursuant to the 2017 Incentive Plan as well as the portion of the restricted stock issued in 2020 in lieu of cash fees representing a 25% incremental value over the foregone cash fees. If a non-employee director elects to receive restricted stock for his or her fees relating to the fourth quarter of the fiscal year, such shares of restricted stock are granted during the first quarter of the subsequent fiscal year. As such, this column includes restricted stock issued in lieu of fees pertaining to the fourth quarter of 2019 but excludes restricted stock issued in January of 2021 pertaining to foregone fees for the fourth quarter of 2020. |

16 2021 Proxy Statement

DIRECTOR COMPENSATION |

The aggregate grant date fair values are computed in accordance with FASB ASC 718, “Share-Based Payment” (“ASC 718”), in the following total amounts:

Name | Restricted Stock Awards | ||||

John V. Lovoi |

| 13,108 | |||

Alexander P. Shukis |

| 7,778 | |||

Terence B. Jupp |

| 9,490 | |||

Steven L. Newman |

| 8,923 | |||

Amy B. Schwetz |

| 8,367 | |||

Assumptions used in the calculation of this amount are included in footnote 18 to our audited consolidated financial statements for the fiscal year ended December 31, 2020, included in our Annual Report on Form 10-K filed with the SEC on February 25, 2021.

| (3) | The aggregate number of shares of restricted stock outstanding at December 31, 2020, including restricted stock issued in lieu of cash fees pursuant to the director stock compensation program, held by each director is as follows: |

Name | Total Restricted Stock | ||||

John V. Lovoi |

| 18,652 | |||

Alexander P. Shukis |

| 10,045 | |||

Terence B. Jupp |

| 12,986 | |||

Steven L. Newman |

| 12,146 | |||

Amy B. Schwetz |

| 8,367 | |||

Director Stock Compensation Program

We maintain a stock compensation program for non-employee directors under the 2017 Incentive Plan. Under this program, non-employee directors have the option to receive all or a portion of their board and committee fees (but not expenses) in the form of restricted stock awards in an amount equal to 125% of such fees in lieu of cash. Each director may elect to take fees in the form of restricted stock prior to the beginning of the subject calendar year. Each director taking fees in the form of restricted stock receives his or her award attributable to a calendar quarter on or about the first business day of the next calendar quarter in an amount equal to 125% of the cash equivalent of his or her fees, with the number of shares determined by the closing stock price on the last trading day of the calendar quarter for which the fees are being determined. These awards fully vest on the first day of the second calendar year following issuance. The director stock compensation program is intended to encourage non-employee directors to acquire and hold common stock of the Company to align the interests of directors and the Company’s other stockholders. Each of the non-employee directors elected to take all or a portion of their Board fees in the form of restricted stock during 2020, and each of them has elected to take all or a portion of their Board fees in the form of restricted stock during 2021.

2021 Proxy Statement 17

EXECUTIVE COMPENSATION |

Compensation Discussion and Analysis

The primary objectives of our compensation programs are to attract and retain talented executive officers and to deliver rewards for superior corporate performance. We had four named executive officers in 2020:

Named Executive Officer | Title | |

Blake T. DeBerry (1) | Chief Executive Officer | |

Jeffrey J. Bird (2) | President and Chief Operating Officer | |

Raj Kumar (3) | Vice President and Chief Financial Officer | |

James C. Webster | Vice President — General Counsel and Secretary | |

| (1) | Mr. DeBerry served as our President and Chief Executive Officer until May 14, 2020 when he ceased to serve as President. |

| (2) | Mr. Bird served as our Senior Vice President — Production Operations and Chief Financial Officer until May 14, 2020 when he was promoted to President and Chief Operating Officer. |

| (3) | Mr. Kumar served as our Vice President — Finance and Chief Accounting Officer until May 14, 2020 when he was promoted to Vice President and Chief Financial Officer. |

The compensation of our named executive officers was determined at the discretion of the Compensation Committee (the “Committee”) and was governed in part by employment agreements entered into with those executives. The employment agreements are described below under “— Employment Agreements with Executive Officers” and “— Potential Payments Upon Termination or Change-in-Control.”

Purposes of the Executive Compensation Program

Our executive compensation program has been designed to accomplish the following objectives:

| • | align executive compensation with Company and individual performance and appropriate peer group comparisons; |

| • | produce long-term, positive results for our stockholders; |

| • | create a proper balance between building stockholder wealth and executive wealth while maintaining good corporate governance; and |

| • | provide market-competitive compensation and benefits that will enable us to attract, motivate and retain a talented workforce. |

Administration of Executive Compensation Program

Our executive compensation program is administered by the Committee. The specific duties and responsibilities of the Committee are described in this proxy statement under “Corporate Governance Matters — Committees of the Board of Directors — Compensation Committee.” The Committee normally meets each February to determine annual incentive compensation earned during the prior year and to establish performance targets for the current year annual incentive compensation plan. The Committee also normally meets in October to determine any adjustments to base salaries for our executive officers and to award equity-based compensation. The Committee also meets at other times during the year and acts by written consent when necessary or appropriate.

Our Chief Executive Officer provides recommendations on any adjustments to the base salaries of our other executive officers. Our Chief Executive Officer also periodically reviews and recommends specific performance metrics to be used

18 2021 Proxy Statement

EXECUTIVE COMPENSATION |

under our annual cash incentive program. These recommendations are then presented to the Committee for its consideration and approval. Our Chief Executive Officer bases his recommendations on a variety of factors such as his appraisal of the executive’s job performance and contribution to the Company, improvement in organizational and employee development and accomplishment of strategic priorities. Our Chief Executive Officer does not make any recommendations regarding his own compensation.

Compensation determinations made for 2020 reflect our pay-for-performance philosophy and the Company’s intent to align compensation paid to our named executive officers with the interests of our stockholders. The key compensation determinations made with respect to our named executive officers for 2020 are summarized as follows:

| • | Management Changes and Related Compensation Decisions. In connection with their respective promotions in May of 2020, the Board granted a promotional equity award with a grant date fair market value of $750,000 to Mr. Bird and a promotional equity award with a grant date fair market value of $450,000 to Mr. Kumar. In addition, the Board approved an increase in Mr. Kumar’s annual cash incentive target for 2020 from 50% to 75% of his base salary, which increase was prorated from May 14, 2020, the date that Mr. Kumar began serving in his new position. The Board also approved an increase in the annual base salary of Mr. Kumar from $300,000 to $350,000, effective May 14, 2020. |

| • | No Annual Base Salary Changes. The Compensation Committee normally reviews and approves base salary increases for the executive officers at its October meeting. Except for the promotional increase for Mr. Kumar described above, no changes were made to the base salaries of the executive officers in 2020. |

| • | Termination of Annual Cash Incentive Compensation; No Bonuses Paid. The Company’s annual incentive compensation plan for 2020 was terminated by the Compensation Committee based in part on the recommendation of the Company’s chief executive officer. In May of 2020, the Company’s chief executive officer recommended to the Compensation Committee that no annual incentive compensation should be paid for 2020 due to the significant negative impact of the COVID-19 pandemic on both the Company’s industry and its financial performance, and as part of the Company’s cost cutting efforts in response to the pandemic. |

| • | Changes to 2020 Performance Unit Award Structure. Performance units awarded in October of 2020 may be earned at 0% to 200% of the target number of units granted based on the Company’s relative total stockholder return over the three year performance period from October 1, 2020 through September 30, 2023, as measured against the constituent companies in the Philadelphia Oil Service Sector Index and, new for this year, the S&P 500 Index. In addition, a negative adjustment factor will be applied to the 2020 Performance Units such that if the Company’s absolute total stockholder return over the three-year performance period is negative, no more than 150% of the target units granted may be earned. |

| • | 2017 Performance Units paid at 183.33% of target. The Company’s total stockholder return ranked in the 83rd percentile of the 12 remaining component companies of the Philadelphia Oil Service Index over the three-year period from October 1, 2017 through September 30, 2020, which resulted in 183.33% of the 2017 performance units vesting in accordance with the award agreements. Despite paying out at 183.33% of target, the actual value of shares delivered to each named executive officer upon settlement of these awards was only 1.054% of the original target grant date value due to declines in our stock price. This further illustrates our shareholder and executive alignment. |

| • | 401(k) Match Suspended. As part of our cost cutting efforts in response to the significant negative impact of the COVID-19 pandemic on both the Company’s industry and its financial performance, the Company suspended matching contributions to the 401(k) retirement accounts of all employees effective July 1, 2020. |

2021 Proxy Statement 19

EXECUTIVE COMPENSATION |

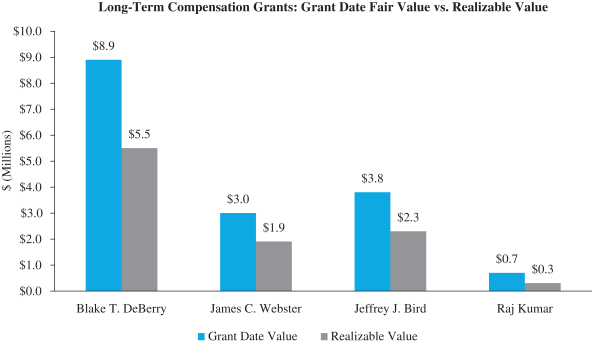

The ultimate value realized by our long-term compensation grants is heavily influenced by the performance of our stock, both on an absolute basis and relative to the Philadelphia Oil Service Index. The following chart compares the realizable value (as defined below) of long-term compensation grants made during the three-year period beginning on October 1, 2017 and ending on September 30, 2020 to the original grant date fair market value of such grants for each named executive officer.

| • | Realizable value is defined as the pre-tax value as of September 30, 2020 of all shares of restricted stock and performance units granted between October 1, 2017 and ending on September 30, 2020 with certain assumptions regarding performance units as discussed below. |

| • | For the 2017 performance unit grant, the 183.33% vesting level, discussed above, is reflected in the chart. |

| • | For performance unit awards for which the performance period is not yet complete (2018 grants and 2019 grants), the value is based on our period-to-date results through September 2020. |

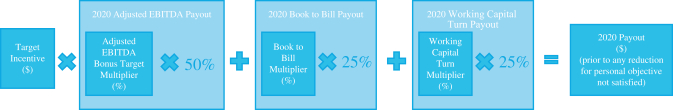

The Committee made adjustments to the annual cash incentives program for 2021 to better align compensation with the Company’s objectives for 2021. The main changes are as follows:

| • | The metrics were changed to focus on Free Cash Flow (70% weighting) and Bookings (30% weighting) to focus management on improving free cash flow and bookings in a challenging industry environment. |

| • | The bonus payout at target performance was reduced from 100% to 75% of each named executive’s target bonus and the maximum payout was reduced from 200% to 150% of target bonus. |

The Committee has the authority to engage a third-party consultant at any time, and has continued to engage Meridian Compensation Partners, LLC (“Meridian”), to provide independent advice on executive compensation and evaluate and recommend appropriate modifications to our compensation program consistent with our program’s objectives. Meridian reports directly to the Committee, which pre-approves the scope of work and the fees charged. The Committee reviewed and

20 2021 Proxy Statement

EXECUTIVE COMPENSATION |

assessed Meridian’s independence and performance in order to confirm that it was independent and met all applicable regulatory requirements.

In October 2020, at the direction of the Committee, Meridian evaluated the base salary and annual and long-term incentive compensation of our named executive officers. As it had done in prior years for the Committee, Meridian used publicly available data from a peer group of oilfield service companies to assist in that analysis.

The peer group data used in October 2020 in relation to compensation for the Company’s named executive officers for 2020 was the same peer group used by Meridian in its October 2019 report to the Committee, except that Hornbeck Offshore Services, Inc. was removed as a result of its bankruptcy and Apergy Corporation is now ChampionX Corp. following its merger with the ChampionX subsidiary of Ecolab. With those changes, the peer group consisted of the following 12 publicly traded oilfield services and equipment companies:

ChamptionX Corp. | Core Laboratories N.V. | Forum Energy Technologies, Inc. | ||

Frank’s International N.V. | Gulf Island Fabrication, Inc. | Helix Energy Solutions Group, Inc. | ||

Newpark Resources, Inc. | Oceaneering International, Inc. | Oil States International, Inc. | ||

SEACOR Marine Holdings Inc. | TETRA Technologies, Inc. | Tidewater Inc. |

This peer group represents a group of companies in the oilfield services industry of comparable size to Dril-Quip based on measures such as enterprise value, revenues, market capitalization and assets. We believe that the use of this group as a reference for evaluating our compensation policies helps align us with our peers and competitors and ensure our compensation program remains competitive when compared to our competition for executive talent. We also believe this group of companies provides a sufficiently large data set that is generally not subject to wide changes in compensation data.

Pursuant to Meridian’s recommendations and its own analysis, the Committee has implemented the compensation program for our named executive officers as further described below.

In fulfilling its role, the Compensation Committee is authorized to:

| • | review and approve corporate goals and objectives relevant to the Chief Executive Officer’s compensation; evaluate the Chief Executive Officer’s performance in light of those goals and objectives; and either as a committee or together with other independent directors (as directed by the Board), determine and approve the Chief Executive Officer’s compensation based on that evaluation, including administering, negotiating any changes to and determining amounts due under the Chief Executive Officer’s employment agreement; |

| • | review and approve, or make recommendations to the Board with respect to, the compensation of other executive officers, and oversee the periodic assessment of the performance of such officers; |

| • | from time to time consider and take action on the establishment of and changes to incentive compensation plans, equity-based compensation plans and other benefit plans, including making recommendations to the Board on plans, goals or amendments to be submitted for action by our stockholders; |

| • | administer our compensation plans, including authorizing the issuance of our common stock and taking other action on grants and awards, determinations with respect to achievement of performance goals, and other matters provided in the respective plans; and |

| • | review from time to time when and as the Compensation Committee deems appropriate the compensation and benefits of non-employee directors, including compensation pursuant to equity-based plans, and approve, or make recommendations to the Board with respect to, any changes in such compensation and benefits. |

2021 Proxy Statement 21

EXECUTIVE COMPENSATION |

General

Our executive compensation program generally consists of the following elements:

| • | base salary; |

| • | annual incentive compensation in the form of cash bonuses; |

| • | long-term stock-based incentive compensation consisting of restricted stock and performance unit awards; and |

| • | benefits such as medical and dental insurance and participation in our 401(k) retirement plan. |

We primarily seek to reward achievement of our short-term goals with base salary and annual cash incentive compensation, while long-term interests are rewarded through long-term equity awards. We believe that base salaries should be at levels competitive with peer companies that compete with us for business opportunities and executive talent, and annual cash incentive compensation and long-term stock-based incentive awards should be at levels which reflect progress made toward our corporate goals and individual performance. In general, salary level and the target level of annual and long-term incentive compensation for each named executive officer are based on market data for the officer’s position. Compensation levels can vary compared to the market due to a variety of factors such as experience, scope of responsibilities, tenure and individual performance.

Relative Size of Major Compensation Elements

The relative sizes of the components of an executive’s compensation are determined in the sole discretion of the Committee, often with reference to recommendations by Meridian. Pursuant to their employment agreements, however, the Committee may not reduce the salary of our named executive officers without their consent.

Factors taken into account in determining compensation for all executive officers are our performance and the executive’s responsibilities, experience, leadership, potential future contributions and demonstrated individual performance. The Committee seeks to achieve the appropriate balance between immediate cash rewards for the achievement of performance objectives and long-term incentives that align the interests of our executive officers with those of our stockholders. In setting the target executive compensation levels, the Committee considers the aggregate compensation payable to an executive officer and the form of the compensation. The Committee also considered the results of the 2020 advisory vote on executive compensation and, based upon the strong stockholder support of over 97% of votes cast in favor of our program, believes that its approach to executive compensation is appropriate.

22 2021 Proxy Statement

EXECUTIVE COMPENSATION |

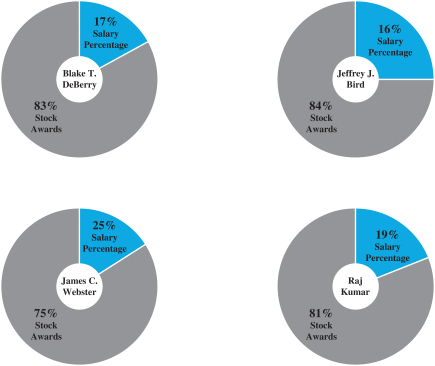

The following charts summarize the relative size of base salary and target incentive compensation opportunities for 2020 for each of our named executive officers (excluding bonuses under the annual incentive compensation plan, which were cancelled for 2020).

| (1) | Stock Awards calculated using the aggregate grant date fair value of the restricted stock awards and performance unit awards at target award level. |

Base Salary

We evaluate base salaries for our named executive officers annually or as warranted by circumstances, including changes in positions. The base salaries for our Chief Executive Officer and our other executive officers are reviewed and approved by the Committee. Our Chief Executive Officer provides recommendations on adjustments to the base salary of our other executive officers. Base salary recognizes the job being performed and the value of that job in the competitive market. Base salary must be sufficient to attract and retain the executive talent necessary for our continued success and provide an element of compensation that is not at risk in order to avoid fluctuations in compensation that could distract our executives from the performance of their responsibilities.

Base salaries for our named executive officers are based on a review of numerous factors, including our financial and operating performance during the relevant period and the executive officer’s experience level and contribution to our success. Salary determinations are subjective and are not based on any formula. As in years past, the Committee and the Chief Executive Officer, as applicable, make an assessment of our actual financial results compared to our overall annual budget based on the financial statements as a whole, taking into account market and economic conditions unknown during the preparation of the relevant annual budgets. In addition, annual adjustments to base salaries also reflect changes or responses to changes in market data.

Mr. Kumar’s annual base salary was increased from $300,000 to $350,000, effective May 14, 2020, in connection with his promotion to the Chief Financial Officer role. In October 2020, the Committee met to review the overall compensation of the named executive officers based on their positions and performance, and in relation to the compensation provided to

2021 Proxy Statement 23

EXECUTIVE COMPENSATION |

executives at the Company’s peers. In connection with that review, the Committee decided to maintain the salaries of Messrs. DeBerry, Webster and Kumar at the same levels based on a review of competitive market data and as a result of the decline in the industry environment following the COVID-19 pandemic.