| Forward-Looking Statements The forward-looking statements in this presentation are subject to certain risks and uncertainties that could cause results to differ materially, including, but not without limitation to, the Company's ability to find suitable acquisition properties at favorable terms, financing, licensing, business conditions, risks of downturns in economic conditions generally, satisfaction of closing conditions such as those pertaining to licensures, availability of insurance at commercially reasonable rates and changes in accounting principles and interpretations. These and other risks are detailed in the Company's reports filed with the Securities and Exchange Commission. The Company assumes no obligation to update or supplement forward- looking statements in this presentation that become untrue because of new information, subsequent events or otherwise. |

| Investment Highlights Strong demographic trends Highly fragmented industry with acquisition opportunities Established national platform High quality communities at affordable rates Predominately private pay with minimal federal regulation Financial leverage through Blackstone joint venture Experienced management team with demonstrated ability to operate and develop |

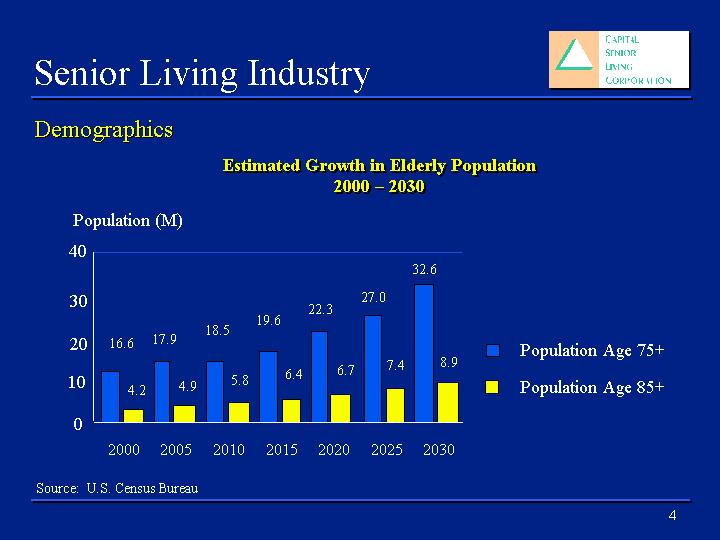

| Source: U.S. Census Bureau Senior Living Industry Demographics Estimated Growth in Elderly Population 2000 - 2030 17.9 18.5 19.6 22.3 27.0 32.6 16.6 8.9 7.4 6.7 6.4 5.8 4.9 4.2 0 10 20 30 40 2000 2005 2010 2015 2020 2025 2030 Population Age 75+ Population Age 85+ Population (M) |

| Senior Living Industry 1997 1998 1999 2000 2001 2002 2003 2004 Total Units 45483 50667 65879 35305 28964 21495 28696 32184 IL Avg. Occ. 0.975 0.95 0.95 0.945 0.93 0.885 0.89 0.895 AL Avg. Occ. 0.919 0.937 0.9 0.938 0.94 0.835 0.84 0.855 Total Units Constructed and Industry Occupancy Percentages Source: American Seniors Housing Association Seniors Housing Construction Report, 2004 |

| Senior Housing Construction Total Units by Property Type: Source: American Seniors Housing Association Seniors Housing Construction Report, 2004 1997 1998 1999 2000 2001 2002 2003 2004 IL 9671 10206 13042 12415 9274 5077 6028 7216 AL 22380 32666 31273 14096 8005 3627 6147 6034 CCRC 10709 4991 17749 6244 5408 8225 7732 10302 Srs. Apt. 2823 2804 3815 2550 6277 4566 8789 8632 |

| Senior Living Industry Barriers to Entry Significant equity required Substantial industry operating expertise needed Constraint of capital Long lead-times -- average of four to five years from initial planning to final lease-up |

| Senior Living Industry Seniors Housing Property Supply(20,920 properties) (1) Source: American Seniors Housing Association Seniors Housing Construction Report, 2004 Source: American Seniors Housing Association Seniors Housing Statistical Handbook Assisted Living - 35% Independent Living - 30% Seniors Apartments - 25% CCRC - 10% East 35 30 25 10 Seniors Housing Capitalized Market Value ($176,425,190,000) (2) AL IL Srs Apart. CCRC 39.6 57.3 15.9 63.6 $ in Billions AL IL Srs. Apart. CCRC |

| Source: Price Waterhouse LLP/National Investment Conference Effective Demand for Senior Living Senior Living Industry Beds (000s) Elderly Population With Income Over $15,000 2000 2005 2010 2015 2020 2025 2030 Independent Living 640 695 750 870 990 1190 1390 Skilled Nursing 670 720 770 865 960 1135 1310 Assisted Living 510 550 590 655 720 860 1000 |

| Benefits of Independent Living Communities A Comparative Analysis of Residents and Non-residents 42.1% of residents feel healthier than they did before 92.3% of residents would recommend independent living to their friends 94.0% of residents are satisfied or very satisfied with their quality of life Source: American Seniors Housing Association, 2003 |

| Company History 1990 - Began senior living operations October 1997 - Completed IPO April 1998 - Formed Triad venture to develop communities January 2000 - Announced no new development of communities January 2002 - Announced joint venture with Blackstone May 2002 - Completed development of Triad communities July 2003 - Acquired Triads II - V January 2004 - Completed $34.5 million equity offering August 2004 - Completed acquisition of CGI Management |

| Overview of Communities Owns and/or operates 56 communities in 20 states Total resident capacity of approximately 8,700 residents Average resident capacity of 155 per community 85% of residents live independently and 15% require assistance with activities of daily living 95% of revenue from private pay sources |

| Status of Communities As of September 30, 2004 Stabilized 41 In lease-up 12 Renovations/re-leasing 3 Total 56 communities |

| Community Occupancy |

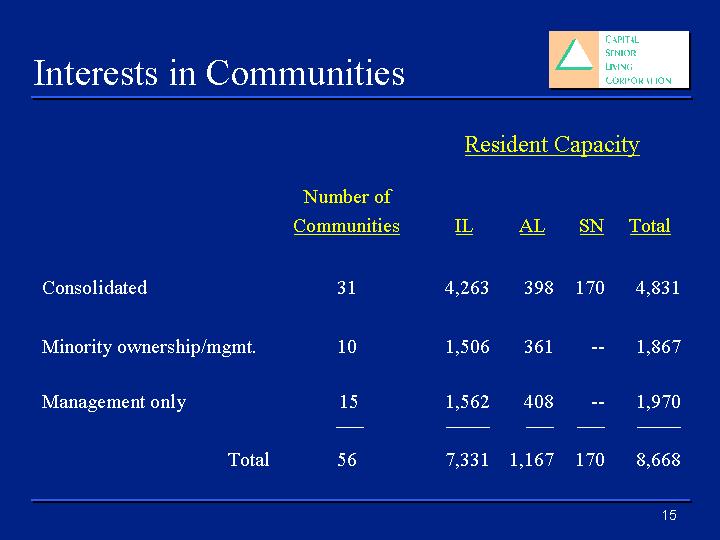

| Interests in Communities Resident Capacity Resident Capacity Resident Capacity Resident Capacity Number of Communities IL AL SN Total Consolidated 31 4,263 398 170 4,831 Minority ownership/mgmt. 10 1,506 361 -- 1,867 Management only 15 1,562 408 -- 1,970 _______ ___________ _______ _______ ___________ Total 56 7,331 1,167 170 8,668 |

| The Capital Advantage: Independent Lifestyles |

| Resident Demographics at CSU Communities Average age of resident: 84 years Average age of resident moving in: 81 years Average stay period: 3-4 years Resident turnover is primarily attributed to death or need for higher care 80% of residents are women |

| The Capital Advantage: High-Quality Communities |

| The Capital Advantage: Established National Platform Consolidated (31) Minority Ownership/Managed (10) Management Only (15) ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Dallas Region David Beathard (30) Sally Vann (22) Midwest Region Gary Fernandez (7) Western Region Lesley Tejada (26) Rob Goodpaster (27) Eastern Region Gary Vasquez (24) Sharon Wortsman (11) ? ? ? ? ? ? ? ? SW Region Greg Boemer (8) Lynda Warren (23) ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Parenthetical indicates years of experience in industry ? ? ? ? ? ? ? ? ? |

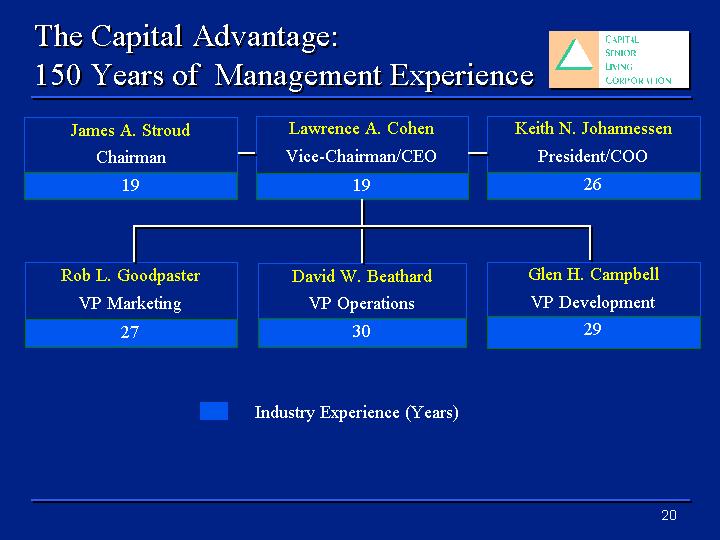

| The Capital Advantage: 150 Years of Management Experience James A. Stroud Chairman 19 Keith N. Johannessen President/COO 26 Glen H. Campbell VP Development 29 Industry Experience (Years) David W. Beathard VP Operations 30 Rob L. Goodpaster VP Marketing 27 Lawrence A. Cohen Vice-Chairman/CEO 19 |

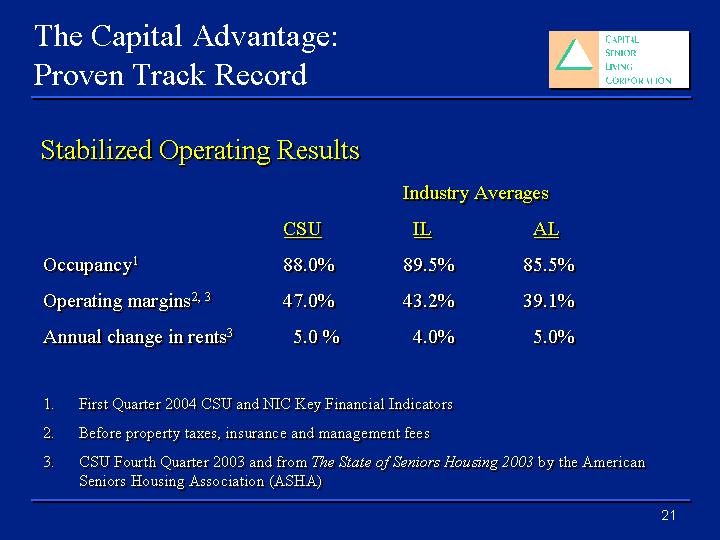

| The Capital Advantage: Proven Track Record Industry Averages CSU IL AL Occupancy1 88.0% 89.5% 85.5% Operating margins2, 3 47.0% 43.2% 39.1% Annual change in rents3 5.0 % 4.0% 5.0% 1. First Quarter 2004 CSU and NIC Key Financial Indicators 2. Before property taxes, insurance and management fees 3. CSU Fourth Quarter 2003 and from The State of Seniors Housing 2003 by the American Seniors Housing Association (ASHA) Stabilized Operating Results |

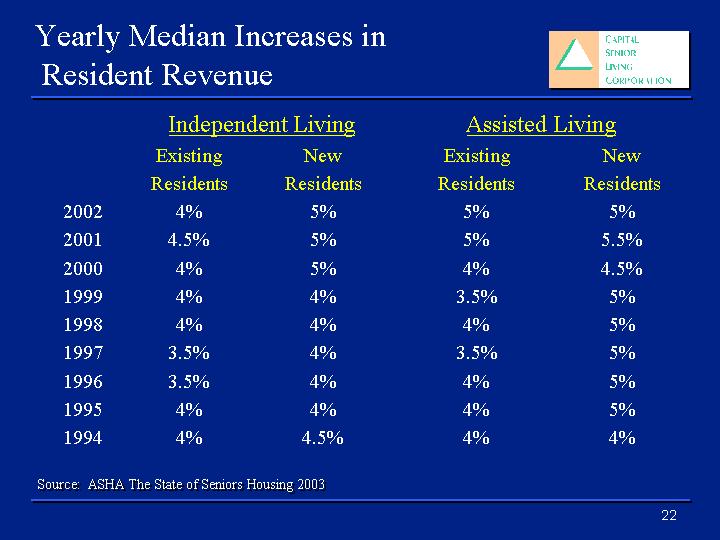

| Yearly Median Increases in Resident Revenue Source: ASHA The State of Seniors Housing 2003 Independent Living Independent Living Assisted Living Assisted Living Existing New Existing New Residents Residents Residents Residents 2002 4% 5% 5% 5% 2001 4.5% 5% 5% 5.5% 2000 4% 5% 4% 4.5% 1999 4% 4% 3.5% 5% 1998 4% 4% 4% 5% 1997 3.5% 4% 3.5% 5% 1996 3.5% 4% 4% 5% 1995 4% 4% 4% 5% 1994 4% 4.5% 4% 4% |

| Triad Consolidation The Company acquired the remaining interests in 12 Triad communities in lease-up Resident capacity of 1,670 residents is 95% IL and 5% AL All revenues are private pay PP&E increased $183.6 million Bank debt increased $109.6 million Triad I (7 communities) consolidated 12/31/03 with fixed purchase option |

| 2004 Public Offering Raised $34.5 million of additional equity Retired $13.7 million of debt with proceeds Remaining proceeds to be used: to invest directly or indirectly in senior housing communities for working capital and other general corporate purposes to acquire or invest in properties, joint ventures or companies if opportunity arises |

| CGIM Transaction Transaction closed August 2004 increasing resident capacity by approximately 1,800, 78% IL and 22% AL Capital assumed management of 14 operating communities, with 15-year management agreements on seven properties owned by The Covenant Group Capital has the exclusive right and option to purchase the seven owned communities for $41 million through February 2007 and thereafter for $42 million through August 2009 Capital also has rights of first refusal for 15 years, through August 2019. |

| CGIM Transaction Capital paid $2.0 million in cash at closing in addition to the first of four installment payments of $250k. Additional installments of $300k, $400k and $650k are potentially due on the first, third and fifth anniversaries respectively, if third party management fees increase Currently estimate the transaction to be accretive to earnings - anticipate initial management fees of $1.4 million and incremental annual expenses of $0.5 million |

| Company Strategy Focus on lease-up of non-stabilized communities Improve occupancy and operating margins of stabilized communities Co-invest with Blackstone to acquire communities Manage acquired and other communities Develop communities for third parties Operating Strategy Growth Strategy |

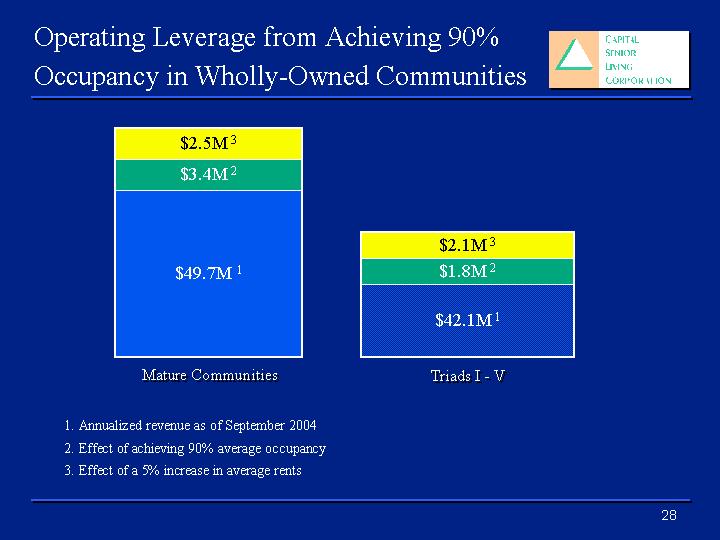

| Operating Leverage from Achieving 90% Occupancy in Wholly-Owned Communities $2.1M 3 $1.8M 2 $42.1M 1 $2.5M 3 $3.4M 2 $49.7M 1 1. Annualized revenue as of September 2004 2. Effect of achieving 90% average occupancy 3. Effect of a 5% increase in average rents Mature Communities Triads I - V |

| Growth Strategies: Blackstone Joint Venture Venture has acquired six senior housing communities with combined resident capacity of 1,200 Seeking additional acquisitions of senior housing communities Co-invest with Blackstone to participate in economics: 10% CSU 90% Blackstone Earn management fees under long-term contracts and potential additional incentive payments |

| Blackstone Joint Venture Benefits of Financial Leverage 75% Debt / 25% Equity 75% Debt / 25% Equity 70% Debt / 30% Equity 70% Debt / 30% Equity Cap Rate 10% 11% 10% 11% Interest Rate 6.25% 6.25% 6.25% 6.25% ROE 21.2% 25.2% 18.8% 22.1% ROE w/25 year amortization 16.3% 20.3% 14.9% 18.2% |

| Example of Joint Venture Economics Venture CSU Partner NOI $ 1,000,000 Cap Rate 10% Purchase Price $10,000,000 Debt $ 7,500,000 Equity $ 2,500,000 $250,000 $2,250,000 Revenues $ 3,000,000 Mgt. Fees (5%) $150,000 ROE (20%) $ 50,000 $ 450,000 Total First Year Return $200,000 $ 450,000 Total Return % 80% 20% |

| Income Statement Q3 Comparison (in millions, except per share) 2004 2003 Resident & Health Care Revenue $23.0 $18.0 Other Revenue 0.7 0.7 Total Revenues $23.7 $18.7 Operating Expenses 14.4 12.0 General & Administrative Expenses 4.2 3.5 Depreciation & Amortization 3.0 2.6 Total Expenses $21.6 $18.1 Income from Operations 2.1 0.6 Other Income/(Expense) (3.8) (0.1) Taxes & Minority Interests 0.3 (0.2) Net Income Earnings Per Share ($1.4) ($0.05) $0.3 $0.01 |

| Balance Sheet As of September 30, 2004 (in millions) Cash and Securities $ 23.3 Current Liabilities $ 55.4 Other Current Assets 13.8 Long-Term Debt 217.3 Total Current Assets $ 37.1 Other Liabilities 8.7 Fixed Assets 373.0 Total Liabilities $281.4 Assets Held for Sale 2.0 Stockholders' Equity 151.3 Other Assets 20.6 Total Assets $432.7 Total Liabilities & Equity $432.7 |