Exhibit 99.2Exhibit 99.2

Forward Looking Statements: The forward-looking statements in this presentation are subject to certain risks and uncertainties that could cause the Company’s actual results and financial condition to differ materially, including, but not limited to, the continued spread of COVID-19, including the speed, depth, geographic reach and duration of such spread, new information that may emerge concerning the severity of COVID-19, the actions taken to prevent or contain the spread of COVID-19 or treat its impact, the legal, regulatory and administrative developments that occur at the federal, state and local levels in response to the COVID-19 pandemic, and the frequency and magnitude of legal actions and liability claims that may arise due to COVID-19 or the Company’s response efforts; the impact of COVID-19 and the Company’s near-term debt maturities on the Company’s ability to continue as a going concern, the Company’s ability to generate sufficient cash flows from operations, additional proceeds from debt refinancings, and proceeds from the sale of assets to satisfy its short and long-term debt obligations and to fund the Company’s capital improvement projects to expand, redevelop, and/or reposition its senior living communities; the Company’s ability to obtain additional capital on terms acceptable to it; the Company’s ability to extend or refinance its existing debt as such debt matures; the Company’s compliance with its debt agreements, including certain financial covenants, and the risk of cross-default in the event such non-compliance occurs; the Company’s ability to complete acquisitions and dispositions upon favorable terms or at all, including the transfer of certain communities managed by the Company on behalf of Fannie Mae, Healthpeak, Ventas, and Welltower; the Company’s ability to improve and maintain adequate controls over financial reporting and remediate the identified material weakness; the risk of oversupply and increased competition in the markets which the Company operates; the risk of increased competition for skilled workers due to wage pressure and changes in regulatory requirements; the departure of the Company’s key officers and personnel; the cost and difficulty of complying with applicable licensure, legislative oversight, or regulatory changes; the risks associated with a decline in economic conditions generally; the adequacy and continued availability of the Company’s insurance policies and the Company’s ability to recover any losses it sustains under such policies; changes in accounting principles and interpretations; and the other risks and factors identified from time to time in the Company’s reports filed with the Securities and Exchange Commission. For information about Capital Senior Living, visit www.capitalsenior.com. The Company assumes no obligation to update or supplement forward-looking statements in this presentation that become untrue because of new information, subsequent events or otherwise. Non-GAAP Financial Measures: In this presentation, the Company utilizes certain financial valuation and performance measures of operating performance, such as Net Operating Income (‘’NOI ), that are not calculated in accordance with GAAP. Non-GAAP financial measures may have material limitations in that they do not reflect all of the costs associated with the Company's results of operations as determined in accordance with GAAP. As a result, these non-GAAP financial measures should not be considered a substitute for, nor superior to, financial results and measures determined or calculated in accordance with GAAP. NOI is calculated as revenue less operating expenses exclusive of COVID-19 relief and expenses of ($7.7M), net. The Company believes NOI is a useful performance measure in identifying trends in day-to-day operations because it excludes the costs associated with acquisitions and conversions and other items that do not ordinarily reflect the ongoing operating results of the Company's primary business. NOI is an important points of analysis when evaluating performance as it provides an indication of the effectiveness of management producing growth in operations from existing assets. NOI provides indicators to management of progress in achieving both consolidated and individual business unit operating performance and is used by research analysts and investors to evaluate the performance of companies in the senior living industry. Forward Looking Statements: The forward-looking statements in this presentation are subject to certain risks and uncertainties that could cause the Company’s actual results and financial condition to differ materially, including, but not limited to, the continued spread of COVID-19, including the speed, depth, geographic reach and duration of such spread, new information that may emerge concerning the severity of COVID-19, the actions taken to prevent or contain the spread of COVID-19 or treat its impact, the legal, regulatory and administrative developments that occur at the federal, state and local levels in response to the COVID-19 pandemic, and the frequency and magnitude of legal actions and liability claims that may arise due to COVID-19 or the Company’s response efforts; the impact of COVID-19 and the Company’s near-term debt maturities on the Company’s ability to continue as a going concern, the Company’s ability to generate sufficient cash flows from operations, additional proceeds from debt refinancings, and proceeds from the sale of assets to satisfy its short and long-term debt obligations and to fund the Company’s capital improvement projects to expand, redevelop, and/or reposition its senior living communities; the Company’s ability to obtain additional capital on terms acceptable to it; the Company’s ability to extend or refinance its existing debt as such debt matures; the Company’s compliance with its debt agreements, including certain financial covenants, and the risk of cross-default in the event such non-compliance occurs; the Company’s ability to complete acquisitions and dispositions upon favorable terms or at all, including the transfer of certain communities managed by the Company on behalf of Fannie Mae, Healthpeak, Ventas, and Welltower; the Company’s ability to improve and maintain adequate controls over financial reporting and remediate the identified material weakness; the risk of oversupply and increased competition in the markets which the Company operates; the risk of increased competition for skilled workers due to wage pressure and changes in regulatory requirements; the departure of the Company’s key officers and personnel; the cost and difficulty of complying with applicable licensure, legislative oversight, or regulatory changes; the risks associated with a decline in economic conditions generally; the adequacy and continued availability of the Company’s insurance policies and the Company’s ability to recover any losses it sustains under such policies; changes in accounting principles and interpretations; and the other risks and factors identified from time to time in the Company’s reports filed with the Securities and Exchange Commission. For information about Capital Senior Living, visit www.capitalsenior.com. The Company assumes no obligation to update or supplement forward-looking statements in this presentation that become untrue because of new information, subsequent events or otherwise. Non-GAAP Financial Measures: In this presentation, the Company utilizes certain financial valuation and performance measures of operating performance, such as Net Operating Income (‘’NOI ), that are not calculated in accordance with GAAP. Non-GAAP financial measures may have material limitations in that they do not reflect all of the costs associated with the Company's results of operations as determined in accordance with GAAP. As a result, these non-GAAP financial measures should not be considered a substitute for, nor superior to, financial results and measures determined or calculated in accordance with GAAP. NOI is calculated as revenue less operating expenses exclusive of COVID-19 relief and expenses of ($7.7M), net. The Company believes NOI is a useful performance measure in identifying trends in day-to-day operations because it excludes the costs associated with acquisitions and conversions and other items that do not ordinarily reflect the ongoing operating results of the Company's primary business. NOI is an important points of analysis when evaluating performance as it provides an indication of the effectiveness of management producing growth in operations from existing assets. NOI provides indicators to management of progress in achieving both consolidated and individual business unit operating performance and is used by research analysts and investors to evaluate the performance of companies in the senior living industry.

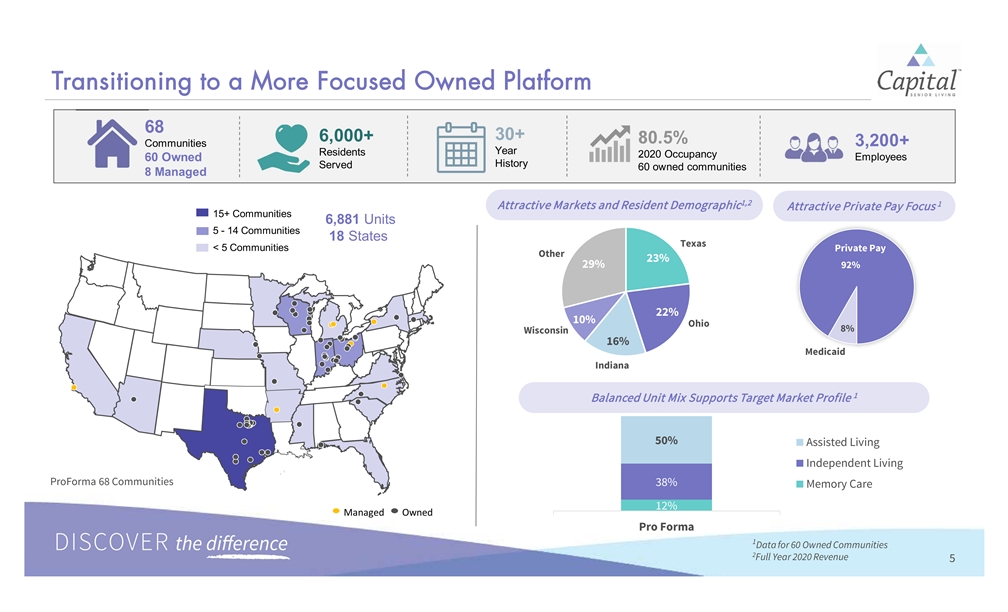

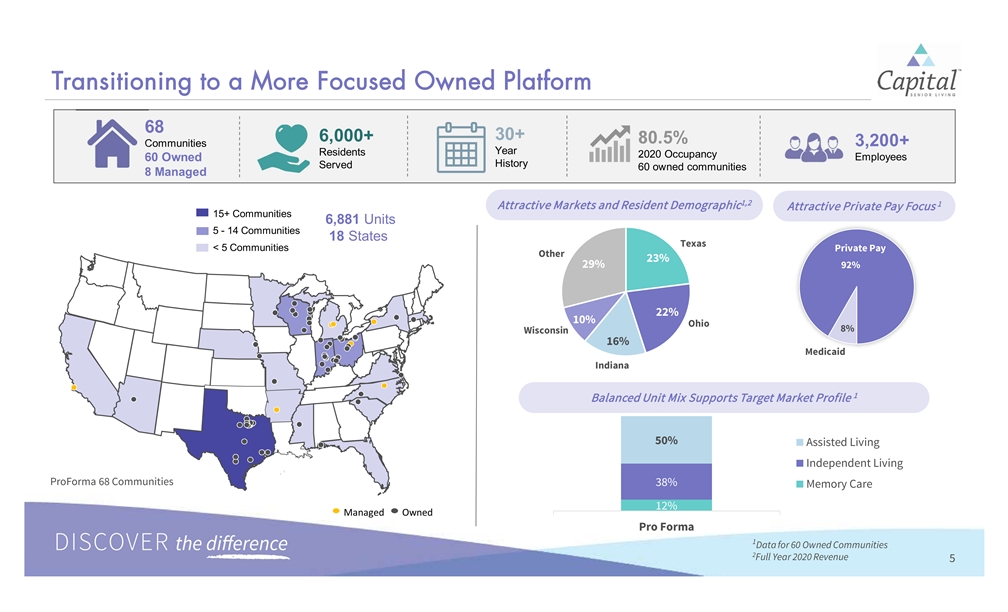

68 30+ 6,000+ 80.5% 3,200+ Communities Year Residents 2020 Occupancy Employees 60 Owned History Served 60 owned communities 8 Managed 15+ Communities 6,881 Units 5 - 14 Communities 18 States < 5 Communities Managed Owned68 30+ 6,000+ 80.5% 3,200+ Communities Year Residents 2020 Occupancy Employees 60 Owned History Served 60 owned communities 8 Managed 15+ Communities 6,881 Units 5 - 14 Communities 18 States < 5 Communities Managed Owned

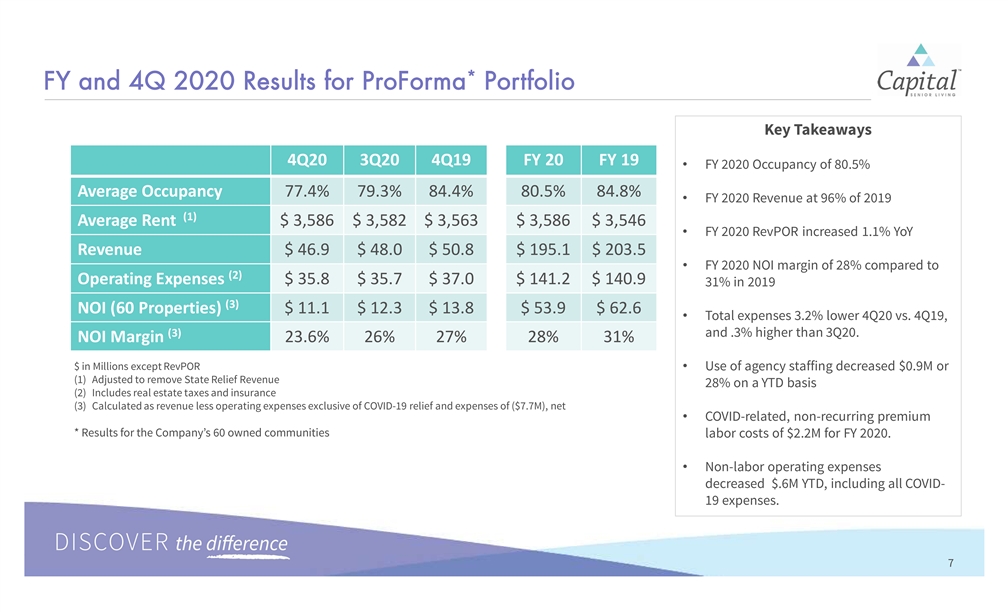

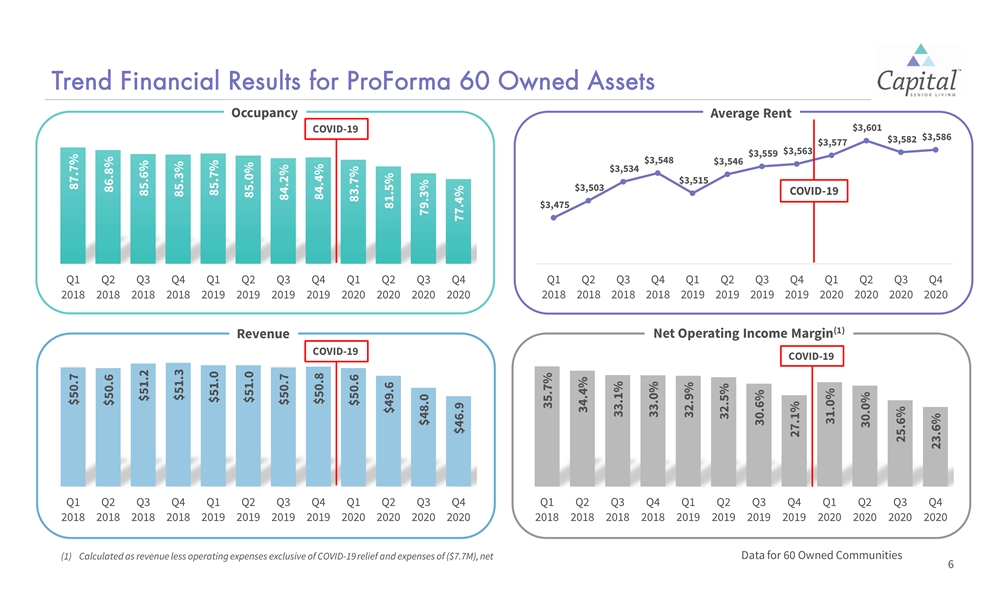

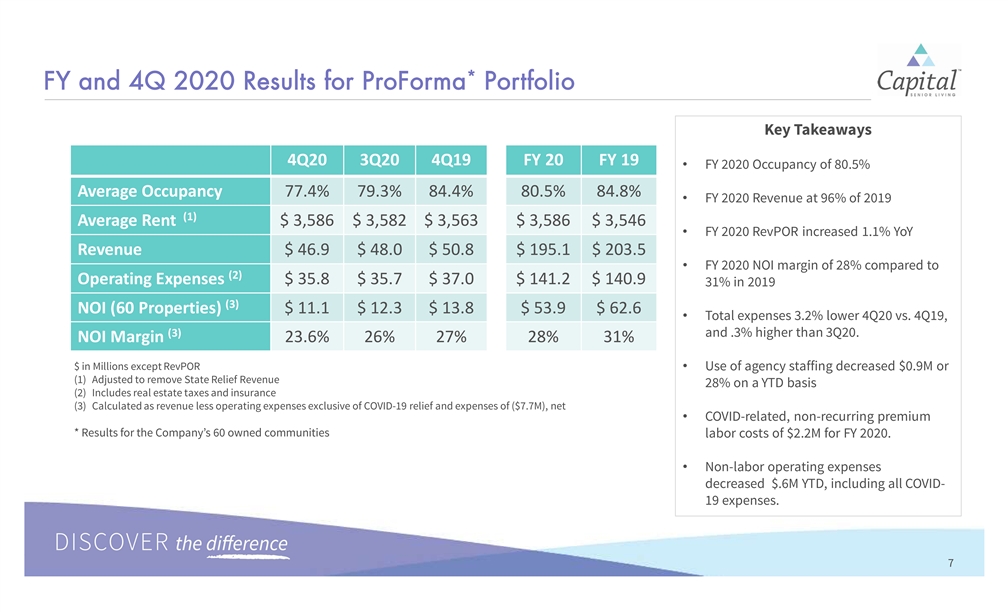

4Q20 3Q20 4Q19 FY 20 FY 19 • Average Occupancy 77.4% 79.3% 84.4% 80.5% 84.8% • (1) Average Rent $ 3,586 $ 3,582 $ 3,563 $ 3,586 $ 3,546 • Revenue $ 46.9 $ 48.0 $ 50.8 $ 195.1 $ 203.5 • (2) Operating Expenses $ 35.8 $ 35.7 $ 37.0 $ 141.2 $ 140.9 (3) NOI (60 Properties) $ 11.1 $ 12.3 $ 13.8 $ 53.9 $ 62.6 • (3) NOI Margin 23.6% 26% 27% 28% 31% • • •4Q20 3Q20 4Q19 FY 20 FY 19 • Average Occupancy 77.4% 79.3% 84.4% 80.5% 84.8% • (1) Average Rent $ 3,586 $ 3,582 $ 3,563 $ 3,586 $ 3,546 • Revenue $ 46.9 $ 48.0 $ 50.8 $ 195.1 $ 203.5 • (2) Operating Expenses $ 35.8 $ 35.7 $ 37.0 $ 141.2 $ 140.9 (3) NOI (60 Properties) $ 11.1 $ 12.3 $ 13.8 $ 53.9 $ 62.6 • (3) NOI Margin 23.6% 26% 27% 28% 31% • • •

3.46 • 5.47 5.74 9.61 2.23 3.63 4.02 6.97 • 1.23 1.84 4+ Chronic Conditions 1.73 3+ Chronic Conditions 2.64 3.46 • 5.47 5.74 9.61 2.23 3.63 4.02 6.97 • 1.23 1.84 4+ Chronic Conditions 1.73 3+ Chronic Conditions 2.64

• • •• • •

• • •• • •

• • • • • • • • • • • •• • • • • • • • • • • •