A Leading Owner-Operator of Senior Living Communities and Services Investor Presentation - March 30, 2023

Forward-Looking Statements 2 This presentation contains forward-looking statements which are subject to certain risks and uncertainties that could cause our actual results and financial condition of Sonida Senior Living, Inc. (the “Company,” “we,” “our” or “us”) to differ materially from those indicated in the forward-looking statements, including, among others, the risks, uncertainties and factors set forth under “Item. 1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on March 30, 2023, and also include the following: contains forward-looking statements which are subject to certain risks and uncertainties that could cause the actual results and financial condition of Sonida Senior Living, Inc. (the “Company,” “we,” “our” or “us”) to differ materially from those indicated in the forward-looking statements, including, among others, the risks, uncertainties and factors set forth under “Item. 1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on March 30, 2023, and also include the following: The impact of COVID-19, including the actions taken to prevent or contain the spread of COVID-19, the transmission of its highly contagious variants and sub-lineages and the development and availability of vaccinations and other related treatments, or another epidemic, pandemic or other health crisis; the Company’s ability to generate sufficient cash flows from operations, additional proceeds from debt financings or refinancings, and proceeds from the sale of assets to satisfy its short and long-term debt obligations and to fund the Company’s capital improvement projects to expand, redevelop, and/or reposition its senior living communities; increases in market interest rates that increase the cost of certain of our debt obligations; increased competition for, or a shortage of, skilled workers, including due to the COVID-19 pandemic or general labor market conditions, along with wage pressures resulting from such increased competition, low unemployment levels, use of contract labor, minimum wage increases and/or changes in overtime laws; the Company’s ability to obtain additional capital on terms acceptable to it; the Company’s ability to extend or refinance its existing debt as such debt matures; the Company’s compliance with its debt agreements, including certain financial covenants, and the risk of cross-default in the event such non-compliance occurs; the Company’s ability to complete acquisitions and dispositions upon favorable terms or at all; the risk of oversupply and increased competition in the markets which the Company operates; the Company’s ability to improve and maintain controls over financial reporting and remediate the identified material weakness discussed in Item 9 of the Annual Report on Form 10-K; the departure of certain of the Company’s key officers and personnel; the cost and difficulty of complying with applicable licensure, legislative oversight, or regulatory changes; risks associated with current global economic conditions and general economic factors such as inflation, the consumer price index, commodity costs, fuel and other energy costs, competition in the labor market, costs of salaries, wages, benefits, and insurance, interest rates, and tax rates; and changes in accounting principles and interpretations. We caution you that the risks, uncertainties and other factors referenced above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits or outcomes that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. For information about the Company, visit www.sonidaseniorliving.com.

Non-GAAP Financial Measures 3 This presentation contains financial measures (1) same-store Resident Revenue, (2) same-store Adjusted Operating Expenses, (3) same-store Community Net Operating Income, (4) same-store Community Net Operating Income Margin, (5) Revenue per Occupied Unit (RevPOR) and (6) Revenue per Available Unit (RevPAR) which are not calculated in accordance with U.S. Generally Accepted Accounting Principles ("GAAP"). Presentations of these non-GAAP financial measures are intended to aid investors in better understanding the factors and trends affecting the Company’s performance and liquidity. However, investors should not consider these non-GAAP financial measures as a substitute for financial measures determined in accordance with GAAP, including net income (loss), income (loss) from operations, or net cash provided by (used in) operating activities. Investors are cautioned that amounts presented in accordance with the Company’s definitions of these non-GAAP financial measures may not be comparable to similar measures disclosed by other companies because not all companies calculate non-GAAP measures in the same manner. Investors are urged to review the reconciliations of these non-GAAP financial measures from the most comparable financial measures determined in accordance with GAAP contained in the Company’smost recent earnings release issued on March 30, 2023. Same-store Resident Revenue is a non-GAAP performance measure for the Company’s portfolio of 60 continuing communities that excludes revenue from non-same-store communities acquired or divested in the presented periods. Same-store Adjusted Operating Expenses, Net Operating Income and Same-store Community Net Operating Income Margin are non-GAAP performance measures for the Company’s portfolio of 60 continuing communities that the Company defines as net income (loss) excluding: general and administrative expenses, interest income, interest expense, other income/expense, provision for income taxes, settlement fees and expenses, revenue and operating expenses from the Company’s disposed properties; and further adjusted to exclude income/expense associated with non-cash, non- operational, transactional, or organizational restructuring items that management does not consider as part of the Company’s underlying core operating performance and that management believes impact the comparability of performance between periods. For the periods presented herein, such other items include depreciation and amortization expense, gain(loss) on extinguishment of debt, gain(loss) on disposition of assets, long-lived asset impairment, and loss on non-recurring settlements with third parties. RevPAR, or average monthly revenue per available unit, is defined by the Company as resident revenue for the period, divided by the weighted average number of available units in the corresponding portfolio for the period, divided by the number of months in the period. RevPOR, or average monthly revenue per occupied unit, is defined by the Company as resident revenue for the period, divided by the weighted average number of occupied units in the corresponding portfolio for the period, divided by the number of months in the period. The Company believes that presentation of same-store Resident Revenue, Adjusted Operating Expenses, Community Net Operating Income and Community Net Operating Income Margin as performance measures are useful to investors because (i) they are some of the metrics used by the Company’s management to evaluate the performance of our core portfolio of 60 continuing communities, to review the Company’s comparable historic and prospective core operating performance of the 60 continuing communities, and to make day-to-day operating decisions; (ii) they provide an assessment of operational factors that management can impact in the short-term, namely revenues and the controllable cost structure of the organization, by eliminating items related to the Company’s financing and capital structure and other items that management does not consider as part of the Company’s underlying core operating performance and that management believes impact the comparability of performance between periods. Same-store Adjusted Operating Expenses, Net Operating Income and Same-store Community Net Operating Income Margin have material limitations as a performance measure, including: (i) excluded interest is necessary to operate the Company’s business under its current financing and capital structure; (ii) excluded depreciation, amortization and impairment charges may represent the wear and tear and/or reduction in value of the Company’s communities, and other assets and may be indicative of future needs for capital expenditures; and (iii) the Company may incur income/expense similar to those for which adjustments are made, such as gain/loss on sale of assets, facility lease termination, or debt extinguishment, non-cash stock-based compensation expense, and transaction and other costs, and such income/expense may significantly affect the Company’soperating results.

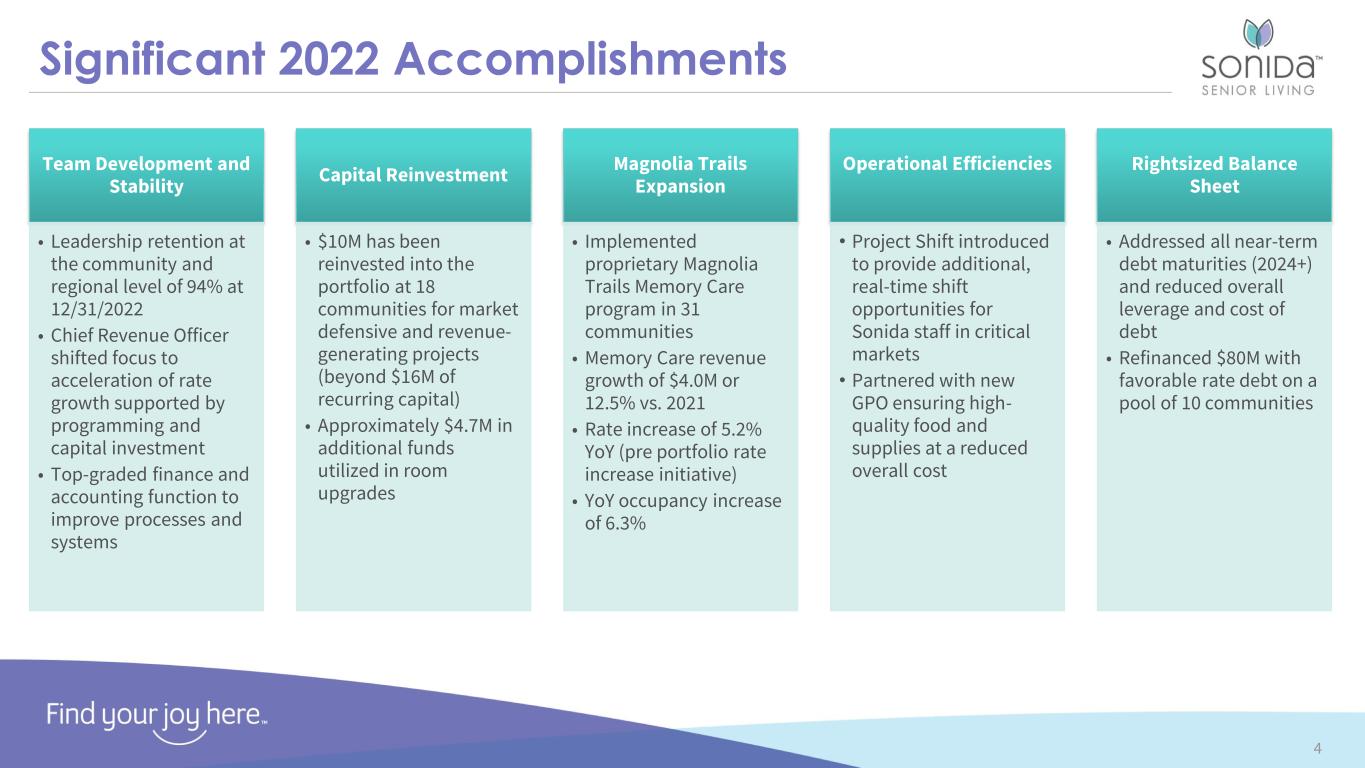

Significant 2022 Accomplishments Team Development and Stability • Leadership retention at the community and regional level of 94% at 12/31/2022 • Chief Revenue Officer shifted focus to acceleration of rate growth supported by programming and capital investment • Top-graded finance and accounting function to improve processes and systems Capital Reinvestment • $10M has been reinvested into the portfolio at 18 communities for market defensive and revenue- generating projects (beyond $16M of recurring capital) • Approximately $4.7M in additional funds utilized in room upgrades Magnolia Trails Expansion • Implemented proprietary Magnolia Trails Memory Care program in 31 communities • Memory Care revenue growth of $4.0M or 12.5% vs. 2021 • Rate increase of 5.2% YoY (pre portfolio rate increase initiative) • YoY occupancy increase of 6.3% Operational Efficiencies • Project Shift introduced to provide additional, real-time shift opportunities for Sonida staff in critical markets • Partnered with new GPO ensuring high- quality food and supplies at a reduced overall cost Rightsized Balance Sheet • Addressed all near-term debt maturities (2024+) and reduced overall leverage and cost of debt • Refinanced $80M with favorable rate debt on a pool of 10 communities 4

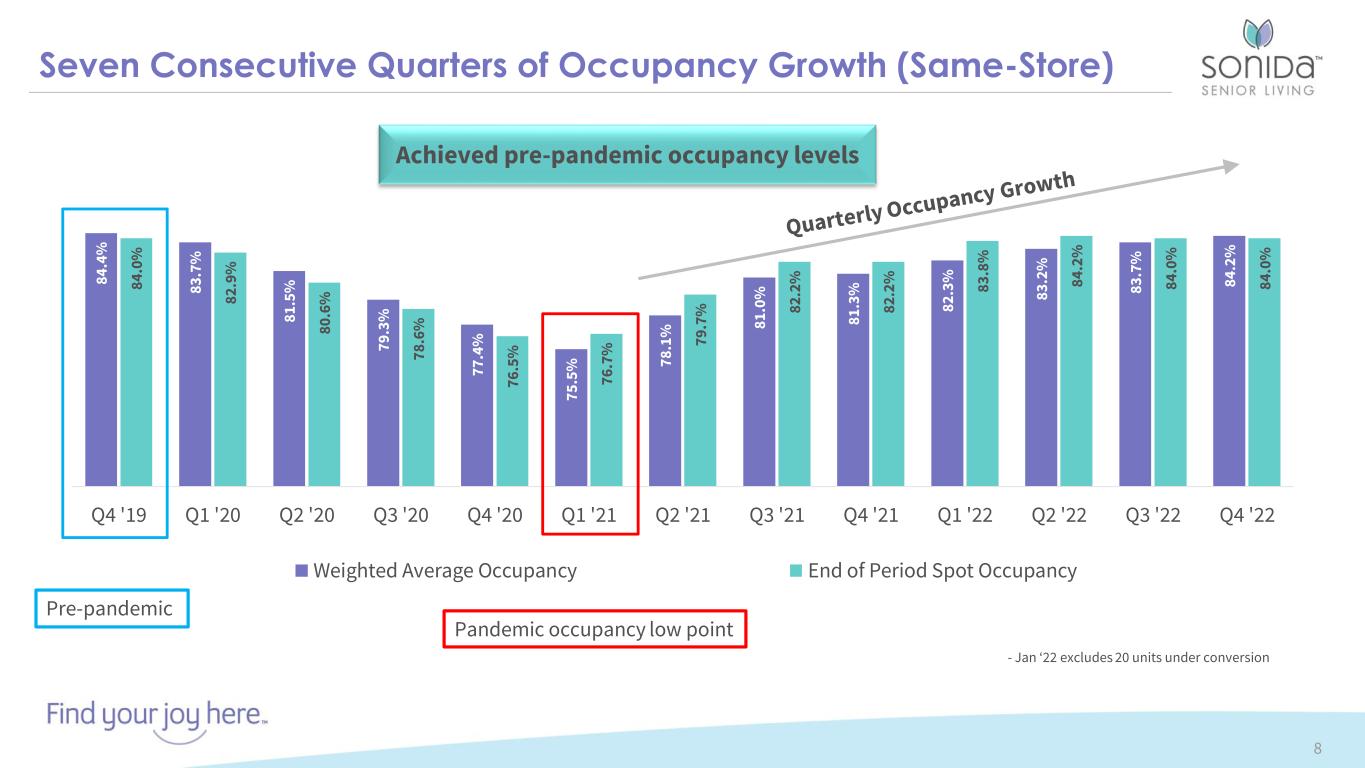

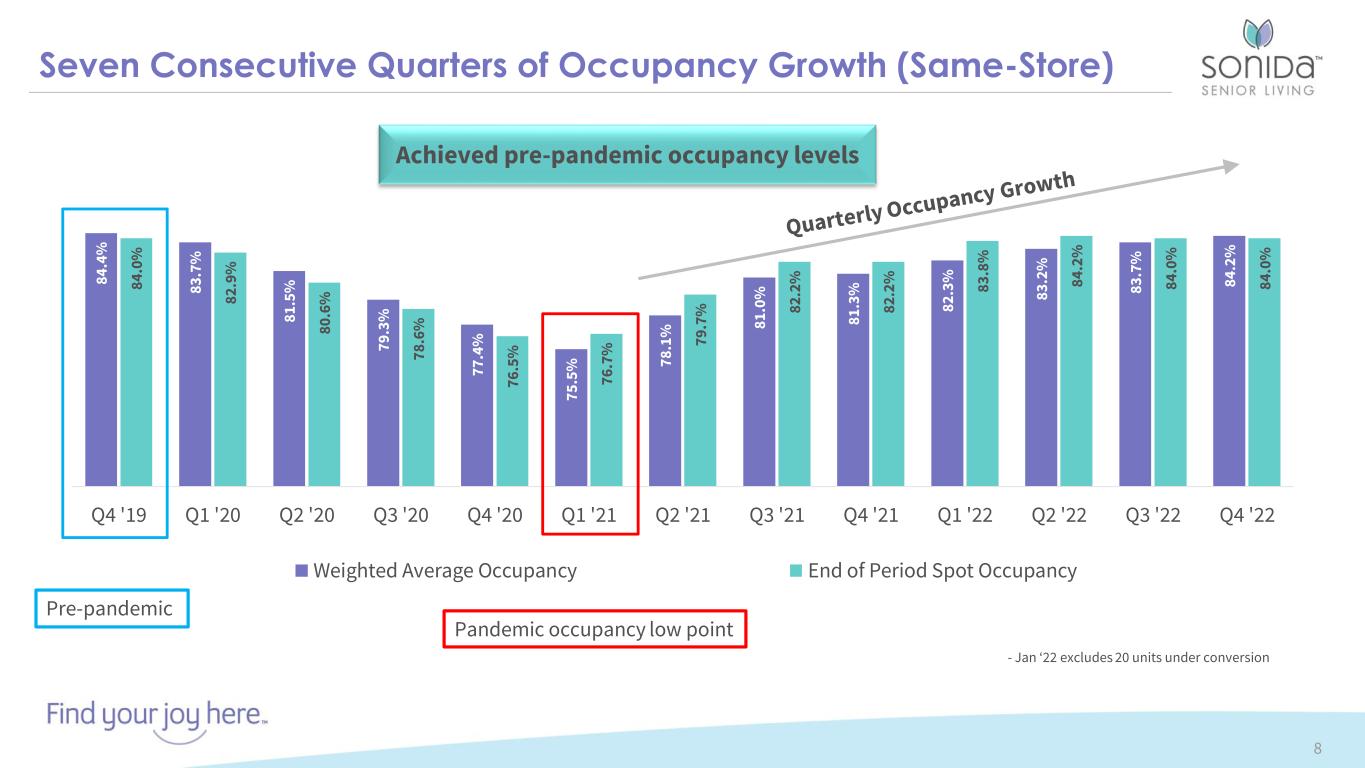

Q4 2022 Same-Store Highlights – 60 Communities Occupancy up 280 bps YoY to 84.2% Seven consecutive quarters of occupancy and revenue growth RevPOR up 3.6% YoY and 1.1% from Q3 ‘22 YTD Resident Revenue and RevPAR increased 8.9% and 9.2%, respectively Community Net Operating Income (NOI) up 5.5% from Q3 ’22 RevPAR up 7.2% YoY and 1.7% from Q3 ‘22 5See Forward Looking Statements on Page 2

2022 Financial Comparisons – 62 Owned Communities 6See Forward Looking Statements on Page 2 $ in Millions except RevPAR and RevPOR (1) Amounts are not calculated in accordance with GAAP. See page 3 for the Company’s disclosure regarding non-GAAP financial measures. (2) Adjusted operating expense is calculated as operating expense excluding professional fees, settlement expense, non-income tax, non-property tax, casualty gains and losses, operating expense for non-continuing communities and other expenses. Other expenses include corporate operating expenses not allocated to the 62 continuing communities. 2022 2021 Y-O-Y Change (%) Q4 2022 Weighted Average Occupancy 82.9% 79.0% 3.9% 83.9% RevPAR (1) $3,019 $2,810 7.4% $3,081 RevPOR (1) $3,640 $3,557 2.3% $3,674 Resident Revenue (1) $208.7 $189.8 9.9% $53.4 Adjusted Operating Expenses (1,2) $167.1 $151.5 10.2% $42.8 NOI (62 Properties) (1) $41.6 $38.3 8.7% $10.6 NOI Margin (1) 19.9% 20.2% (0.3%) 19.9%

24% 20% 18% 10% 28% Texas Ohio Wisconsin Indiana Other 10% 90% Medicaid Private Pay 72 Communities 62 Owned 10 Managed ~8,000 Resident Capacity 3,600+ Employees 83.9% 2022 Q4 Weighted Avg Occupancy 62 owned communities 30+ Year History Leading Operator of Senior Housing and Services 7 72 Communities 11% - 792 Units 41% - 2,920 Units 48% - 3,347 Units Assisted Living Independent Living Memory Care Attractive Markets and Resident Demographics 1 Balanced Unit Mix Supports Target Market Profile Attractive Private Pay Focus 1 15+ Communities 5 - 14 Communities < 5 Communities Primary Metro MSA 7,059 Units 18 States OwnedManaged Data through December 31, 2022. 1 Q4 2022 data for the Company’s 62 owned and managed communities. See Forward Looking Statements on Page 2

8 4 .4 % 8 3 .7 % 8 1 .5 % 7 9 .3 % 7 7 .4 % 7 5 .5 % 7 8 .1 % 8 1 .0 % 8 1 .3 % 8 2 .3 % 8 3 .2 % 8 3 .7 % 8 4 .2 % 8 4 .0 % 8 2 .9 % 8 0 .6 % 7 8 .6 % 7 6 .5 % 7 6 .7 % 7 9 .7 % 8 2 .2 % 8 2 .2 % 8 3 .8 % 8 4 .2 % 8 4 .0 % 8 4 .0 % Q4 '19 Q1 '20 Q2 '20 Q3 '20 Q4 '20 Q1 '21 Q2 '21 Q3 '21 Q4 '21 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Weighted Average Occupancy End of Period Spot Occupancy Seven Consecutive Quarters of Occupancy Growth (Same-Store) 8 - Jan ‘22 excludes 20 units under conversion Pandemic occupancy low point Pre-pandemic Achieved pre-pandemic occupancy levels

Revenue and Rate Initiatives 9 Single lease renewal date initiative has begun • Shift all residents to a single lease renewal date of March each year • Target 1,500 leases updated March 1, 2023 • Remaining resident lease renewal dates will continue to move to March following year at their anniversary or lease renewal date Unit market rate reviews are underway • Leverage industry data by key Designated Market Areas (DMA) • Utilize localized, competitive data collection for comparable analysis • Consideration of apartment and hospitality specific characteristics including exterior views and proximity to high- value communal spaces • Ongoing local competitive rate checks along with quarterly leadership reviews to ensure market rate maximization New level of care (“LoC”) program implementation is in progress • Simplified to 4 levels of care with clear requirements; Implementation complete by Q2 2023 • New monitoring tools reinforce timely LoC reviews based on company and state-specific requirements • Leveraging new monitoring technology to aid in more accurate resident assessments

Select Operating Expenses 10 $8,953,269 $8,568,772 $8,783,442 $9,129,417 $8,790,989 $8,918,232 Total Labor Breakdown Food Costs per Occupied Unit $646K $558K $679K $626K $339K $385K

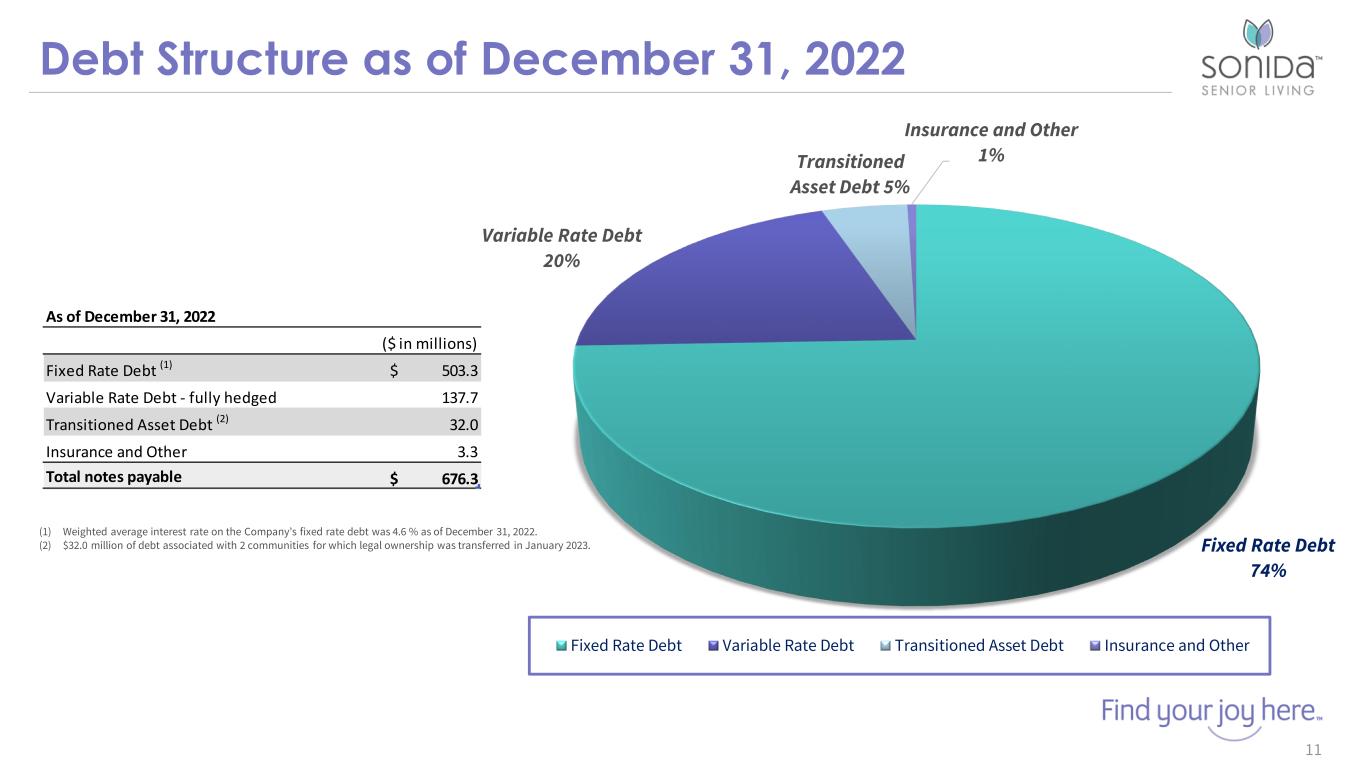

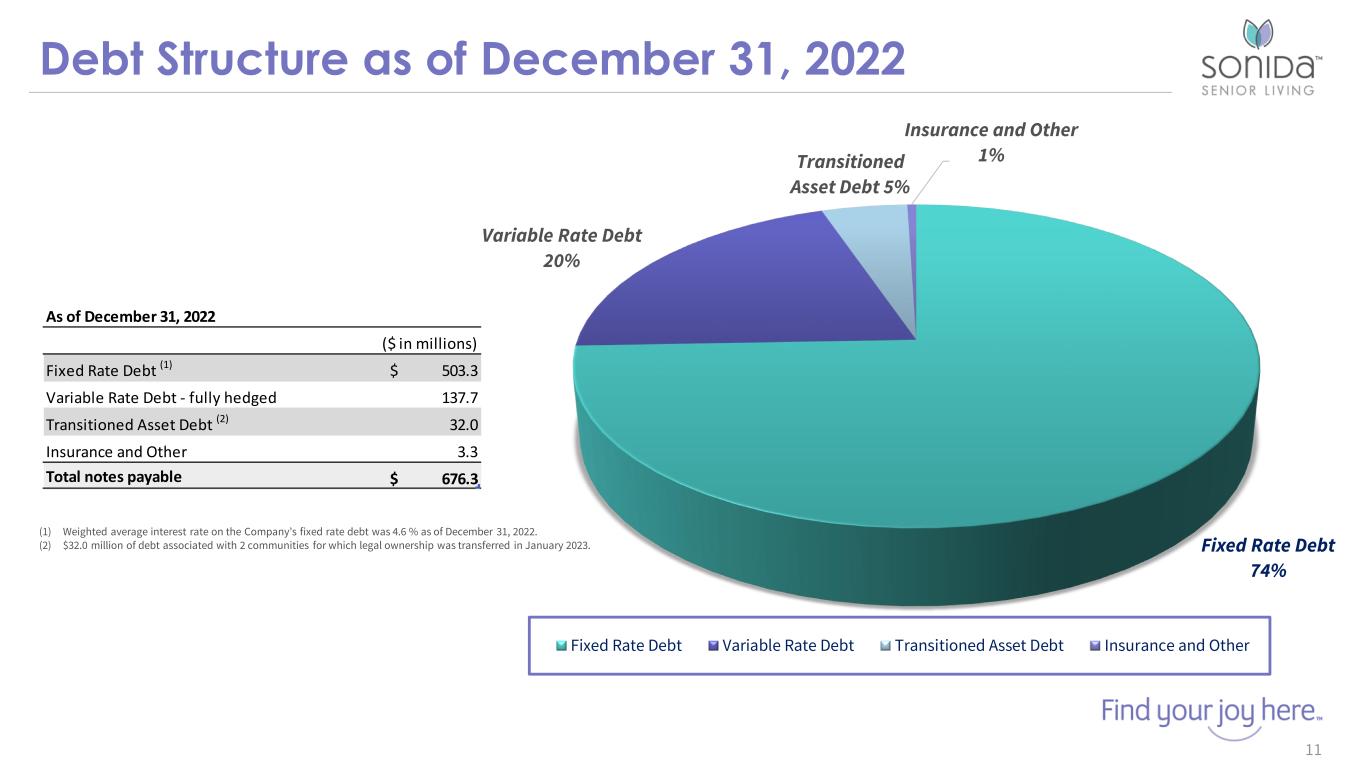

Debt Structure as of December 31, 2022 11 Fixed Rate Debt 74% Variable Rate Debt 20% Transitioned Asset Debt 5% Insurance and Other 1% Fixed Rate Debt Variable Rate Debt Transitioned Asset Debt Insurance and Other (1) Weighted average interest rate on the Company’s fixed rate debt was 4.6 % as of December 31, 2022. (2) $32.0 million of debt associated with 2 communities for which legal ownership was transferred in January 2023. As of December 31, 2022 ($ in millions) Fixed Rate Debt (1) $ 503.3 Variable Rate Debt - fully hedged 137.7 Transitioned Asset Debt (2) 32.0 Insurance and Other 3.3 Total notes payable $ 676.3

Liquidity and Capital Resources: Cash Preservation Initiatives 12 New Strategic and Operational Plans • Comprehensive resident rate review program • Accelerated rent increases in 2023 • Increased compliance in GPO spend • Other OpEx mitigants Loan Modification Discussions Proposed restructure of current terms to maximize current liquidity and create long-term equity value Lower G&A Profile • Leaner management team • Support staff reductions based on improved technologies Recurring Capex Recent ERP implementation provides for tighter controls around capital approvals and more return-based capital spending Relief Funds Company continues to access funds available in certain states to offset inflationary labor costs Asset Sales Sale of unencumbered land parcels in select markets

13