Investor Presentation December 2019

Cautionary Statement Regarding Forward‐Looking Statements This presentation contains “forward‐looking statements” which express our expectations concerning future events, plans, results and objectives. All statements based on future expectations rather than on historical facts are forward‐looking statements that involve a number of risks and uncertainties, and the Company cannot give assurance that such statements will prove to be correct. While the Company believes that such forward‐looking statements are based on reasonable assumptions, there can be no assurance that such future events, plans, results and objectives will be achieved or achieved on the schedule or in the amounts indicated. The factors which could affect the Company’s future results include, but are not limited to, general economic conditions, our ability to execute our business strategy; our limited operating history; our ability to obtain additional financing to affect our strategy; loss of one or more of our customers; cyclical or other changes in the demand for and price of LNG and natural gas; operational, regulatory, environmental, political, legal and economic risks pertaining to the construction and operation of our facilities; hurricanes or other natural or manmade disasters; dependence on contractors for successful completions of our energy related infrastructure; reliance on third party engineers; inability to contract with suppliers and tankers to facilitate the delivery of LNG on their chartered LNG tankers; competition from third parties in our business; failure of LNG to be a competitive source of energy in the markets in which we operate, and seek to operate; increased labor costs, and the unavailability of skilled workers or our failure to attract and retain qualified personnel; a major health and safety incident relating to our business; failure to obtain and maintain approvals and permits from governmental and regulatory agencies including with respect to our planned operational expansion in Mexico; changes to health and safety, environmental and similar laws and governmental regulations that are adverse to our operations; volatility of the market price of our common stock; and our ability to integrate successfully the businesses of Stabilis Energy, LLC and American Electric and additional acquisitions in the expected timeframe. In addition to the factors described above, you should carefully read and consider the Risk Factors set forth in our Prospectus filed with the Securities and Exchange Commission on November 8, 2019 and “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part I of our most recent quarterly report on Form 10‐Q, as updated in our subsequent quarterly reports on Form 10‐Q and annual reports on Form 10‐K, which are available on the SEC’s website at www.sec.gov or on the Investors section of our website at www.stabilisenergy.com. Each forward‐looking statement speaks only as of the date of the particular statement, and we undertake no obligation to publicly update or revise any forward‐looking statements herein even if experience or future events make it clear that any of the future events, plans, results and objectives expressed or implied herein will not be realized, except as required by law. 2

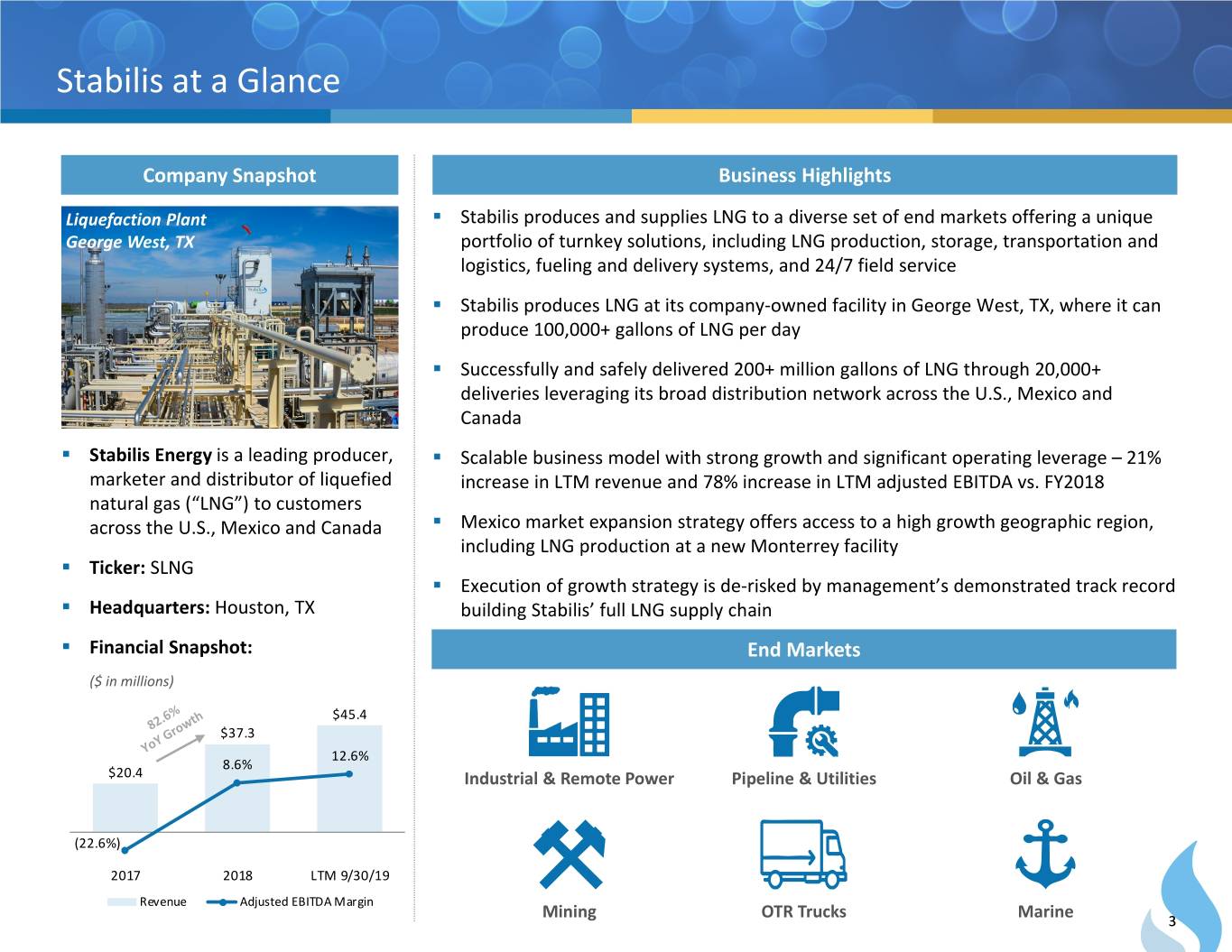

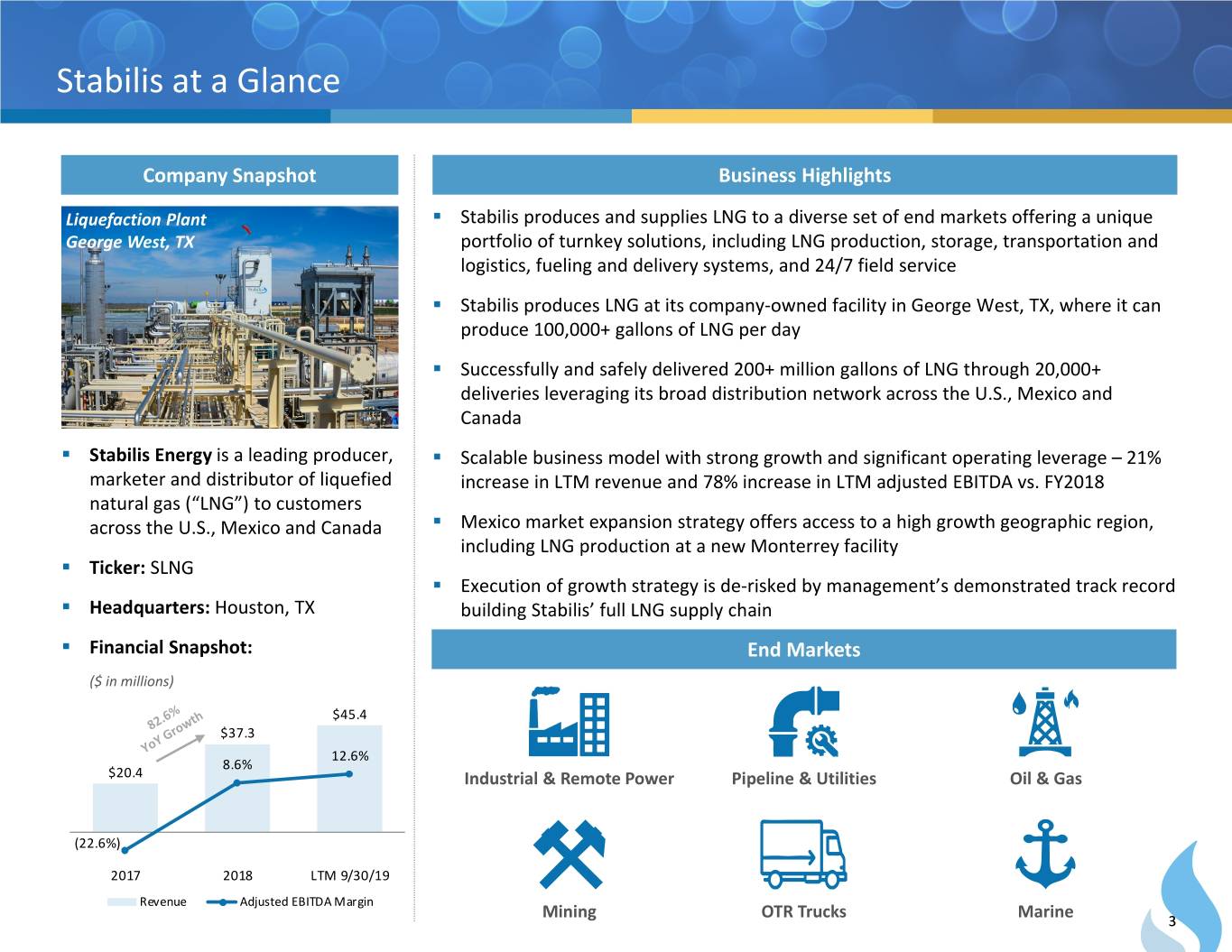

Stabilis at a Glance Company Snapshot Business Highlights Liquefaction Plant . Stabilis produces and supplies LNG to a diverse set of end markets offering a unique George West, TX portfolio of turnkey solutions, including LNG production, storage, transportation and logistics, fueling and delivery systems, and 24/7 field service . Stabilis produces LNG at its company‐owned facility in George West, TX, where it can produce 100,000+ gallons of LNG per day . Successfully and safely delivered 200+ million gallons of LNG through 20,000+ deliveries leveraging its broad distribution network across the U.S., Mexico and Canada . Stabilis Energy is a leading producer, . Scalable business model with strong growth and significant operating leverage – 21% marketer and distributor of liquefied increase in LTM revenue and 78% increase in LTM adjusted EBITDA vs. FY2018 natural gas (“LNG”) to customers across the U.S., Mexico and Canada . Mexico market expansion strategy offers access to a high growth geographic region, including LNG production at a new Monterrey facility . Ticker: SLNG . Execution of growth strategy is de‐risked by management’s demonstrated track record . Headquarters: Houston, TX building Stabilis’ full LNG supply chain . Financial Snapshot: End Markets ($ in millions) $45.4 35.0% $37.3 25.0% 12.6% 8.6% 15.0% $20.4 Industrial & Remote Power Pipeline & Utilities Oil & Gas 5.0% (5.0%) (15.0%) (22.6%) ‐$10.0 (25.0%) 2017 2018 LTM 9/30/19 Revenue Adjusted EBITDA Margin Mining OTR Trucks Marine 3

Investment Highlights 1 Large and growing market opportunity as the global economy transitions away from traditional energy sources to cleaner and cheaper natural gas 2 Largest and most experienced small‐scale LNG operator in North America 3 Complete North American footprint offers customers a full suite of LNG solutions and services 4 Large, attractive growth opportunity in Mexico driven by need for clean and inexpensive fuel sources 5 Scalable business model with strong growth and significant operating leverage 6 Strategic investment and validation from Chart Industries (ticker: GTLS), a global leader in the LNG space 7 Highly‐experienced management and operating team with demonstrated ability to execute Stabilis’ business plan 4

Natural Gas and Liquefied Natural Gas Basics LNG Enables Customers to Access Natural Gas Without Direct Pipeline Infrastructure . Natural gas is abundant in North America and is used for utility, industrial, residential, commercial and transportation applications LNG is natural gas chilled LNG is not flammable as a liquid . Natural gas is primarily to ‐260 degrees Fahrenheit and quickly dissipates if released transported via pipeline where there is sufficient LNG infrastructure 101 . To reach remote areas, natural gas is liquefied (LNG), stored, and transported to end users via truck or marine vessel LNG shrinks to 1/600th Natural gas releases significantly lower the volume of natural gas emissions than other fossil fuels Source: U.S. Energy Information Administration, industry research. 5

Small‐Scale Production Offers Large Opportunity for LNG Small‐Scale LNG offers a scalable method for replacing energy sources such as petroleum and coal What is Small‐Scale LNG Production? How Does Small‐Scale LNG Reach End‐Users? Small‐scale liquefaction plants are developed to service specific markets and generally have a production capacity of less than one million gallons per day Pipeline Gas Small‐Scale LNG Plant Why Do Customers Use Small‐Scale LNG? 1 Virtual pipeline for markets that do not have access to LNG Transport traditional pipeline infrastructure or to supplement pipeline natural gas during service interruptions 2 Lower fuel and operating costs compared to competing fuels such as diesel and propane Industrial & Pipeline & Oil & Gas Mining OTR Trucks Marine Remote Power Utilities Source: Engie; Strategy & Research, GEA Group Aktiengesellschaft. 6

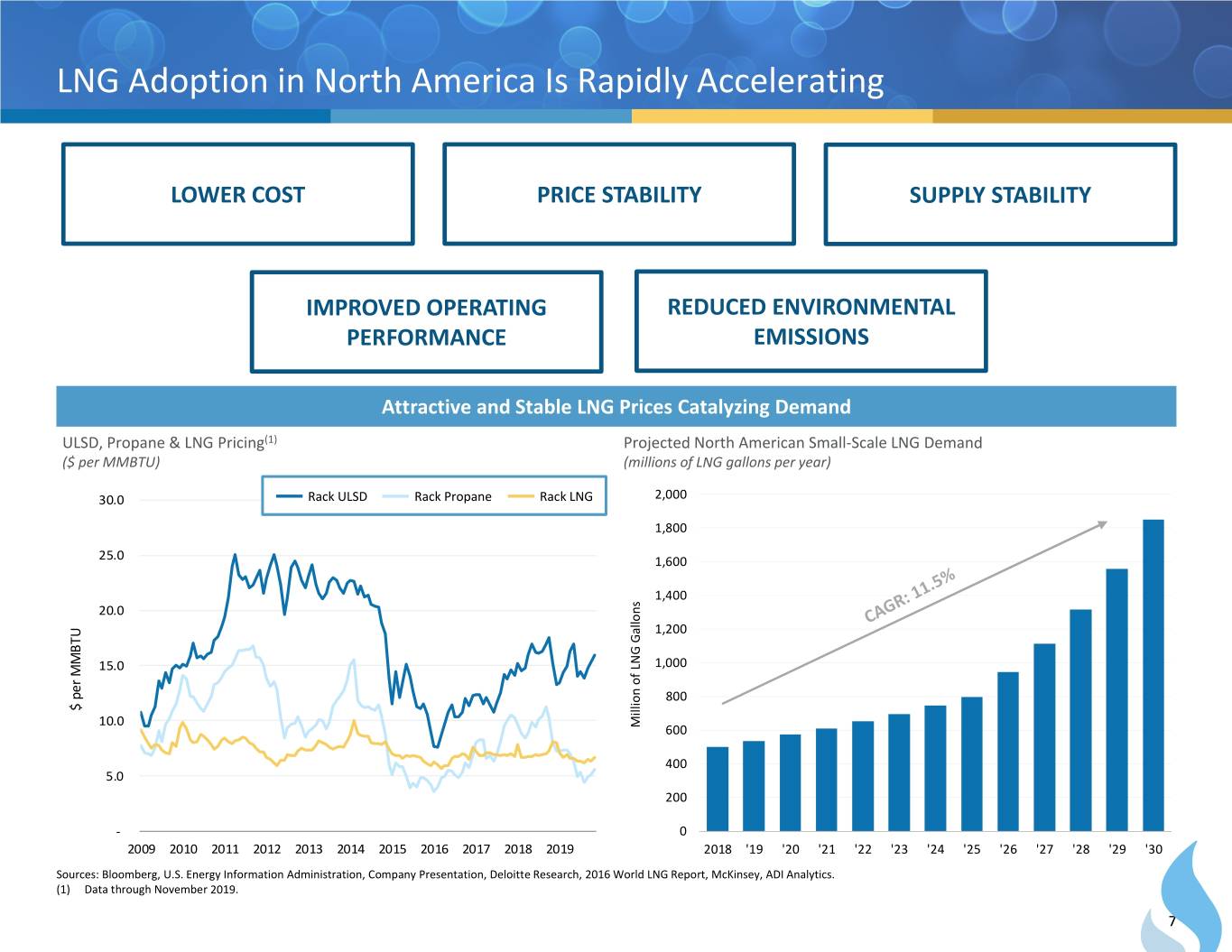

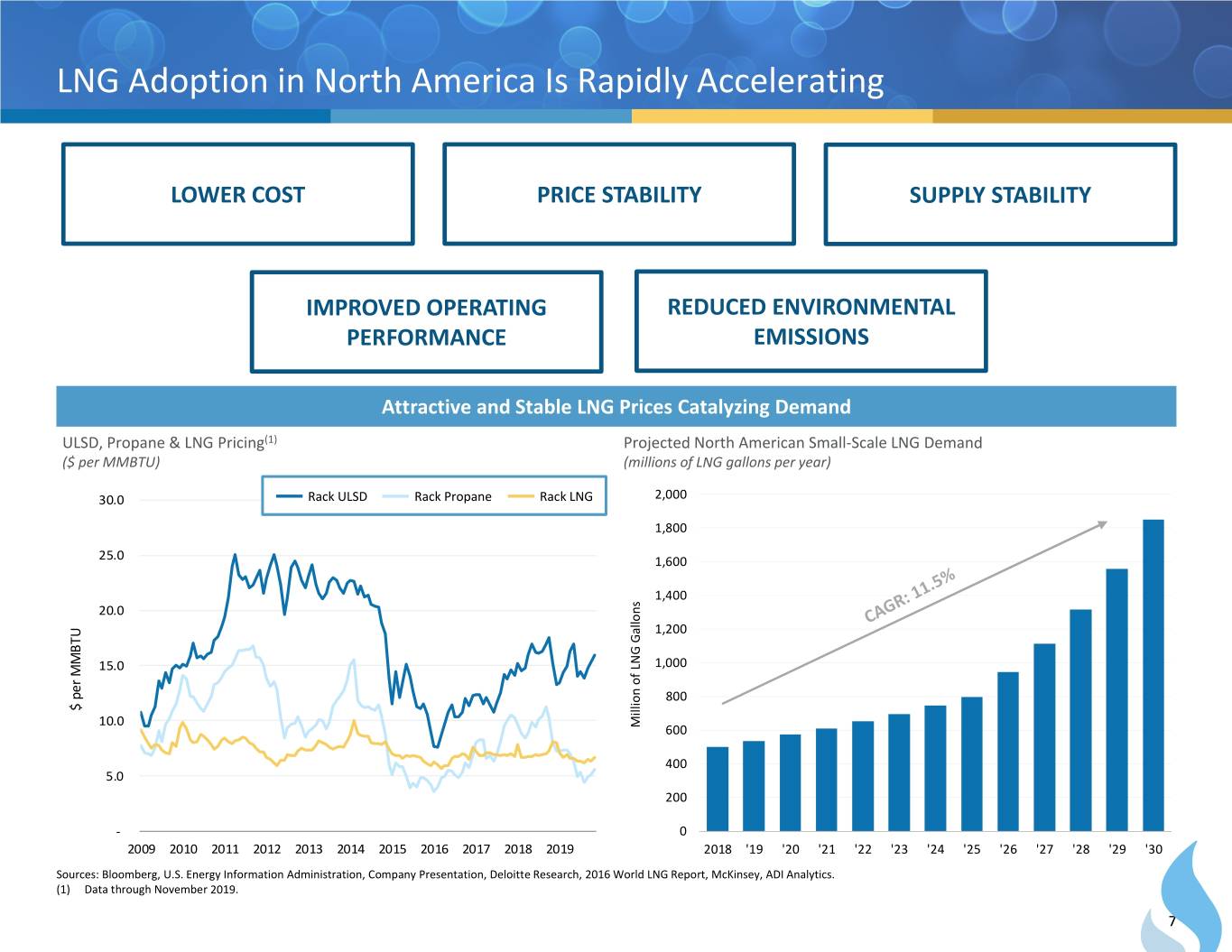

LNG Adoption in North America Is Rapidly Accelerating LOWER COST PRICE STABILITY SUPPLY STABILITY IMPROVED OPERATING REDUCED ENVIRONMENTAL PERFORMANCE EMISSIONS Attractive and Stable LNG Prices Catalyzing Demand ULSD, Propane & LNG Pricing(1) Projected North American Small‐Scale LNG Demand ($ per MMBTU) (millions of LNG gallons per year) 30.0 Rack ULSD Rack Propane` Rack LNG 2,000 1,800 25.0 1,600 1,400 20.0 1,200 15.0 1,000 800 $ per MMBTU 10.0 Million of LNG Gallons 600 400 5.0 200 ‐ 0 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2018 '19 '20 '21 '22 '23 '24 '25 '26 '27 '28 '29 '30 Sources: Bloomberg, U.S. Energy Information Administration, Company Presentation, Deloitte Research, 2016 World LNG Report, McKinsey, ADI Analytics. (1) Data through November 2019. 7

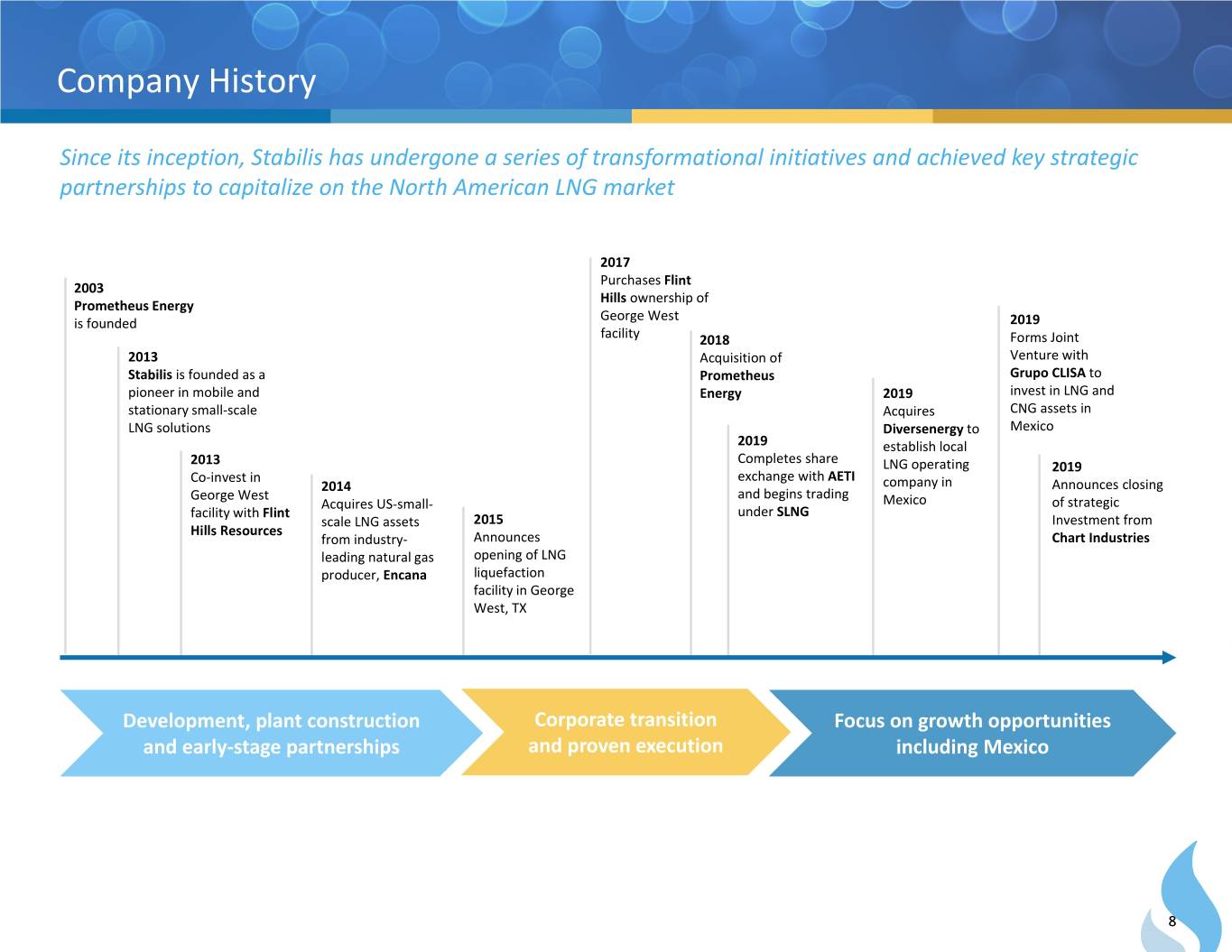

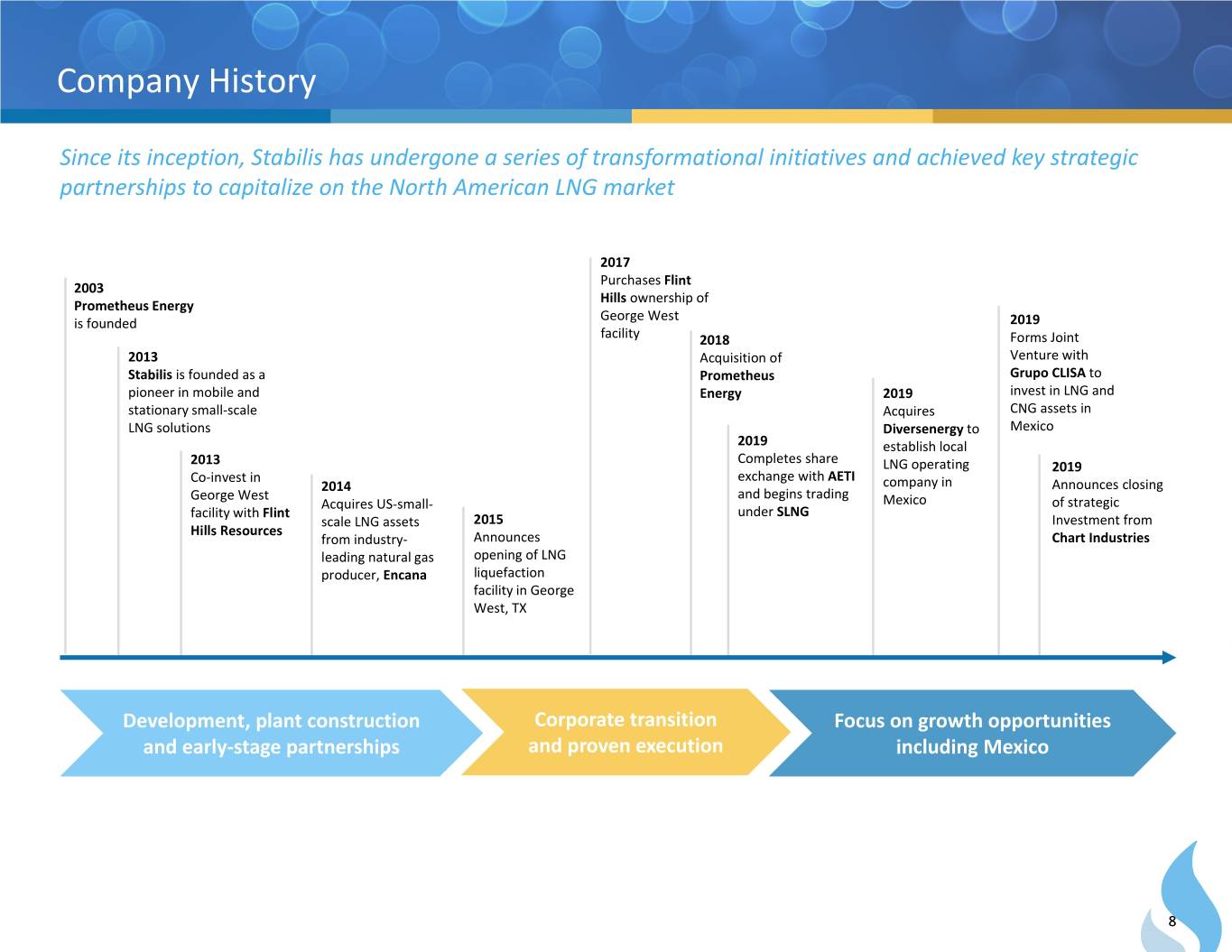

Company History Since its inception, Stabilis has undergone a series of transformational initiatives and achieved key strategic partnerships to capitalize on the North American LNG market 2017 Purchases Flint 2003 Hills ownership of Prometheus Energy George West is founded 2019 facility 2018 Forms Joint 2013 Acquisition of Venture with Stabilis is founded as a Prometheus Grupo CLISA to pioneer in mobile and Energy 2019 invest in LNG and stationary small‐scale Acquires CNG assets in LNG solutions Diversenergy to Mexico 2019 establish local Completes share 2013 LNG operating 2019 Co‐invest in exchange with AETI 2014 company in Announces closing George West and begins trading Acquires US‐small‐ Mexico of strategic facility with Flint under SLNG scale LNG assets 2015 Investment from Hills Resources from industry‐ Announces Chart Industries leading natural gas opening of LNG producer, Encana liquefaction facility in George West, TX Development, plant construction Corporate transition Focus on growth opportunities and early‐stage partnerships and proven execution including Mexico 8

Stabilis Offers Industry‐Leading Fuel Programs and Reach Production Distribution LNG LNG Transportation & Equipment Rental & Production Supply Network Logistics Field Service Support Agreements with carriers Comprehensive Lease, install and Build and operate for national distribution Overview North American LNG operate cryogenic liquefaction plants and tailor made logistics supply network equipment software 100,000+ LNG gallon per day Supply contracts with 200+ million LNG gallons 150+ piece fleet of Scale plant in George 25+ LNG producers delivered since inception mobile equipment West, TX Opportunity to build new Can deliver LNG 24/7 field service plants, with 2nd liquefier Proven track record of safe Highlights anytime throughout and remote already owned and targeted and on‐time deliveries North America monitoring for the Mexican market 9

Production Facility | George West, TX Our Small‐Scale Liquefier in George West, TX . State‐of‐the‐art liquefaction facility with nameplate production capacity of 100,000+ LNG gallons per day . Construction completed on time and on budget – incorporated over 500 changes from standard design during construction that increased production and reliability Stabilis . LNG Plant Austin 99% operating uptime exceeds design specifications Houston San Antonio . Industry‐leading team with extensive know‐how in operating the plant under various conditions Corpus Christi Facility George West, TX (270,000 gallons) LNG Storage Tanks Truck Loading Racks Rolling Stock Equipment 10

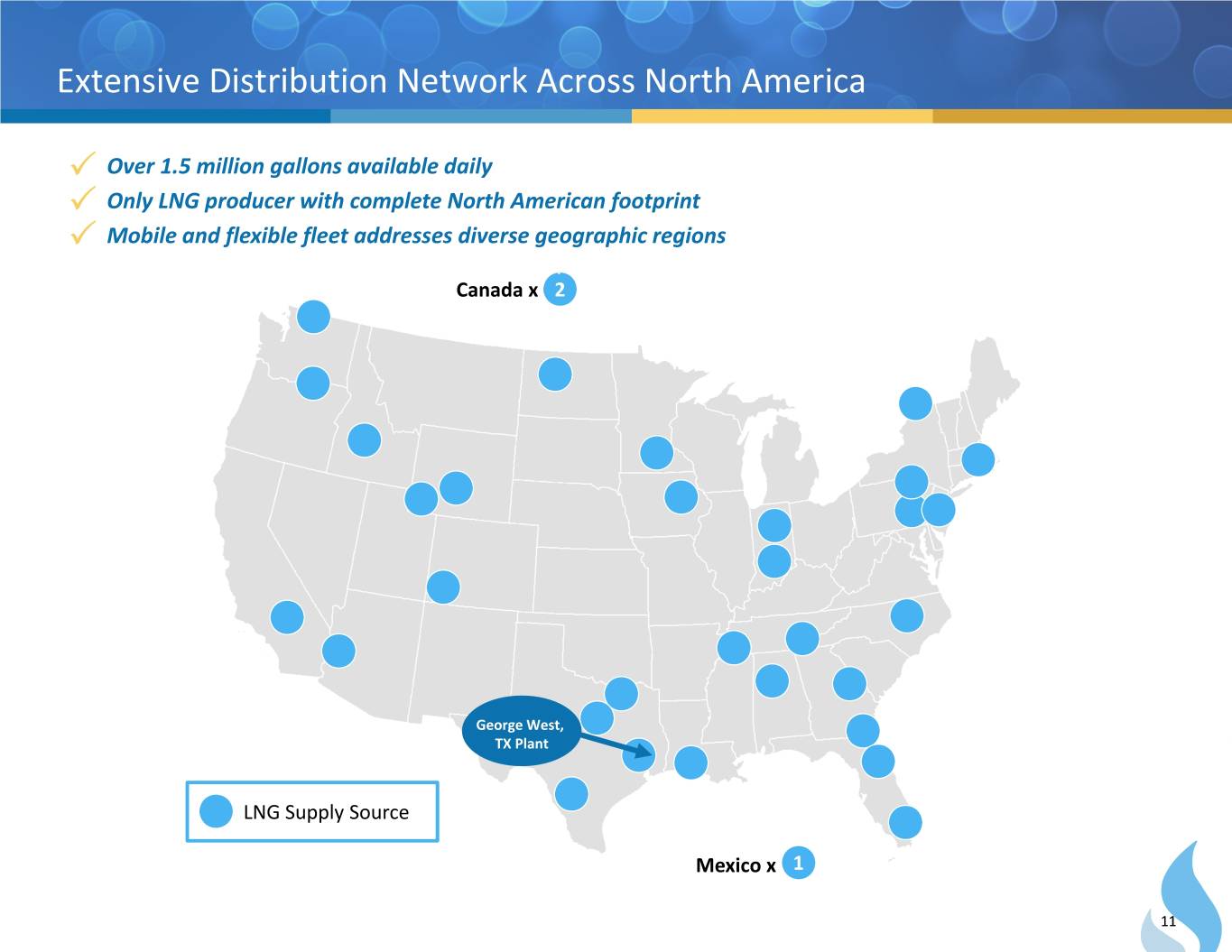

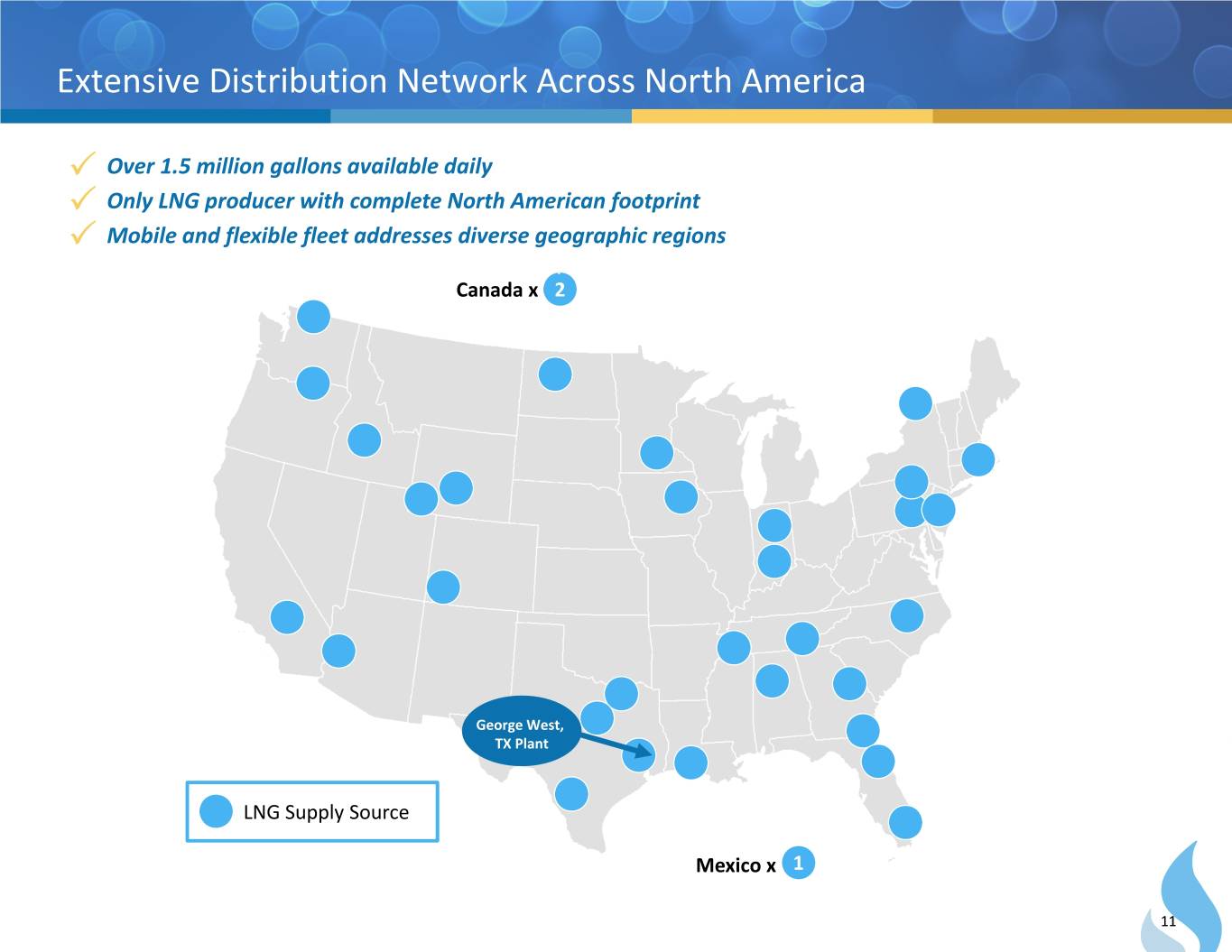

Extensive Distribution Network Across North America Over 1.5 million gallons available daily Only LNG producer with complete North American footprint Mobile and flexible fleet addresses diverse geographic regions ( Canada x 2 ) George West, TX Plant LNG Supply Source Mexico x 1 11

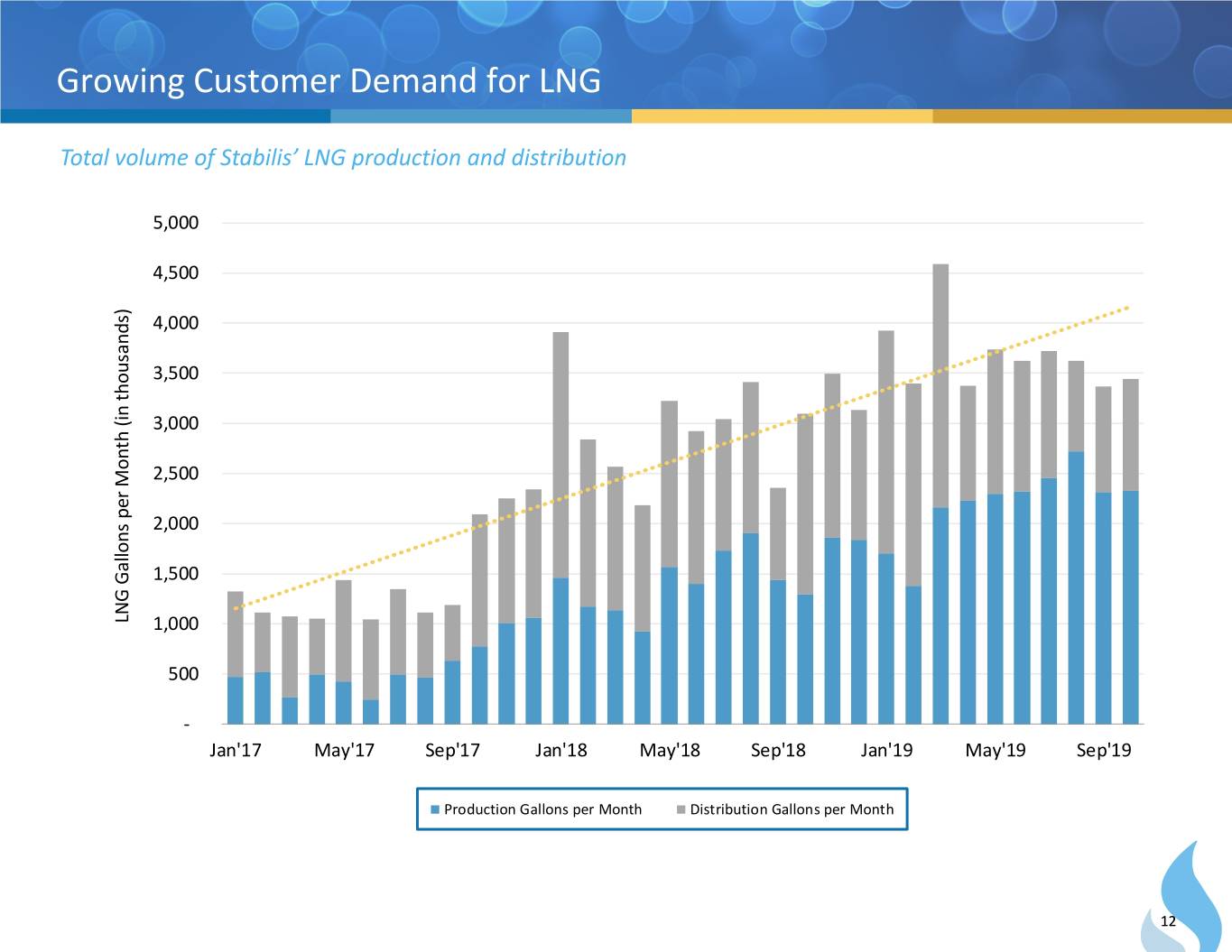

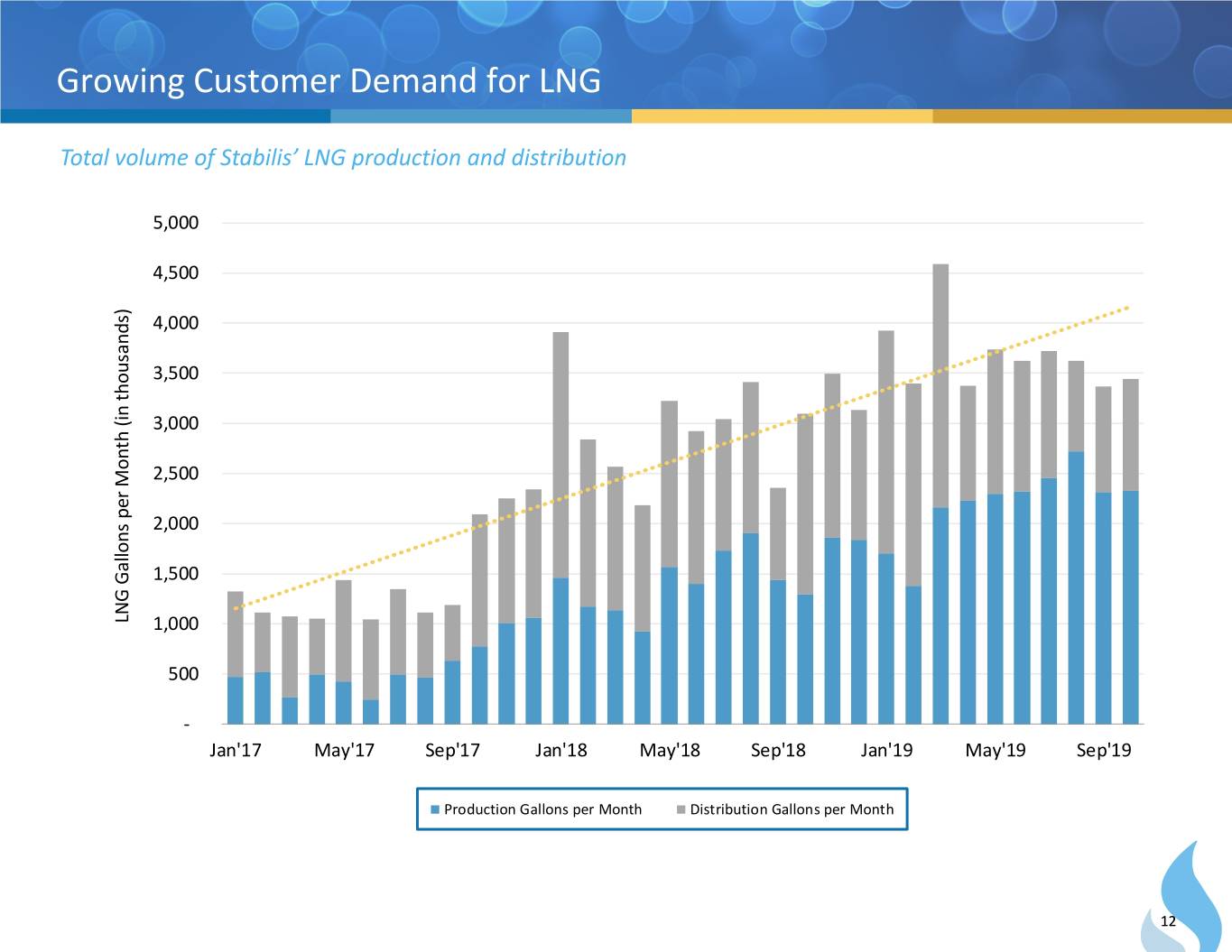

Growing Customer Demand for LNG Total volume of Stabilis’ LNG production and distribution 5,000 5 ,0 0 0 4,500 4 ,5 0 0 4,000 4 ,0 0 0 3,500 3 ,5 0 0 3,000 3 ,0 0 0 2,500 2 ,5 0 0 2,000 2 ,0 0 0 1,500 1 ,5 0 0 LNG Gallons per Month (in thousands) 1,000 1 ,0 0 0 500 5 0 0 ‐ ‐ Jan'17 May'17 Sep'17 Jan'18 May'18 Sep'18 Jan'19 May'19 Sep'19 Production Gallons per Month ` Distribution Gallons per Month 12

Proven Ability to Serve Customers Across Diverse End Markets Revenue Composition % by End Market 54% 33% 8% 3%2% Industrial & Oil & Gas Pipeline & Mining OTR Trucks Remote Power Utilities Key Metrics Since Inception 20,000+ 200M+ 200+ gallons deliveries made projects served delivered 13

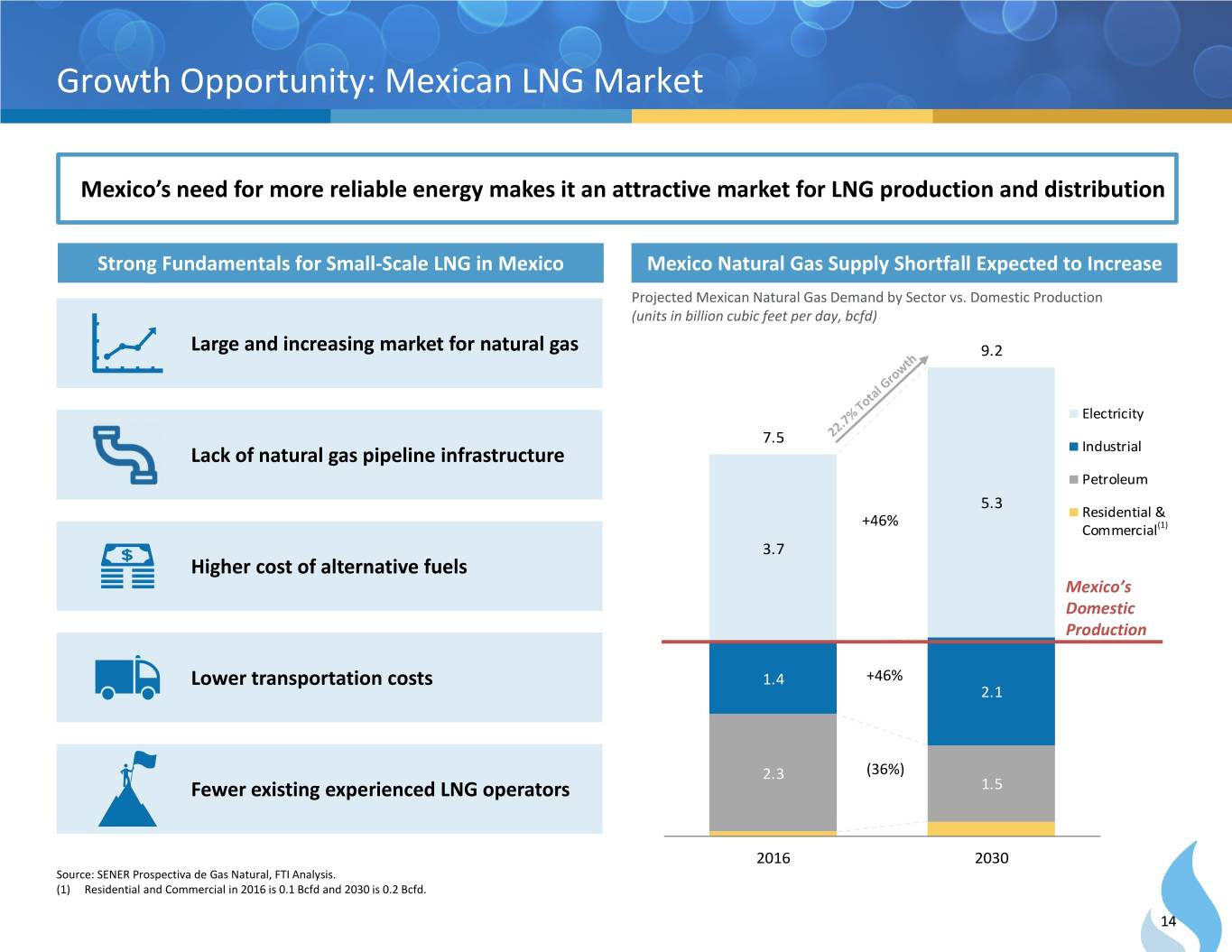

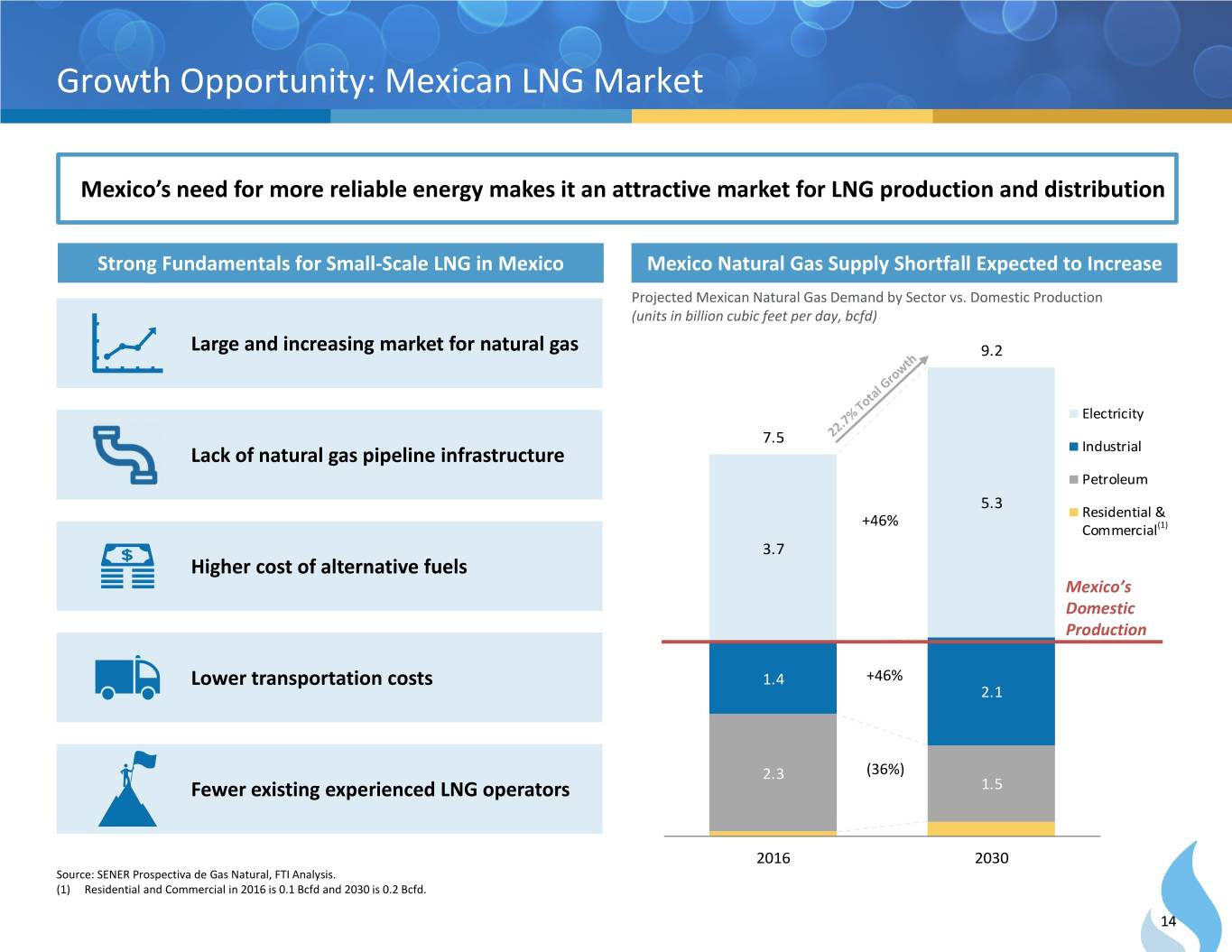

Growth Opportunity: Mexican LNG Market Mexico’s need for more reliable energy makes it an attractive market for LNG production and distribution Strong Fundamentals for Small‐Scale LNG in Mexico Mexico Natural Gas Supply Shortfall Expected to Increase Projected Mexican Natural Gas Demand by Sector vs. Domestic Production (units in billion cubic feet per day, bcfd)10 Large and increasing market for natural gas 9.2 9 8 Electricity 7.5 Lack of natural gas pipeline infrastructure Industrial 7 Petroleum 5.3 Residential & 6 +46% Commercial (1) 3.7 Higher cost of alternative fuels 5 Mexico’s Domestic 4 Production 3 1.4 +46% Lower transportation costs 2.1 2 2.3 (36%) Fewer existing experienced LNG operators 1 1.5 0 2016 2030 Source: SENER Prospectiva de Gas Natural, FTI Analysis. (1) Residential and Commercial in 2016 is 0.1 Bcfd and 2030 is 0.2 Bcfd. 14

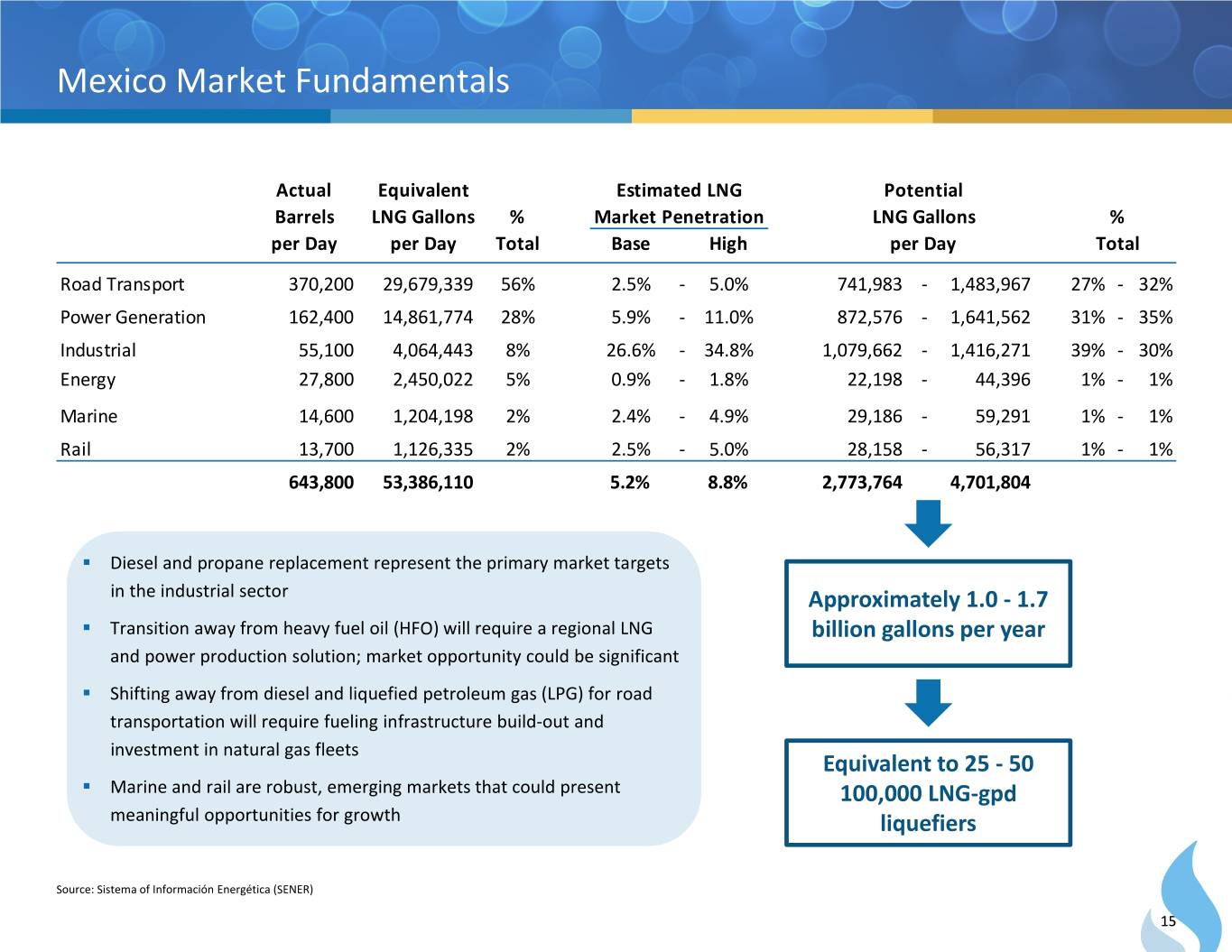

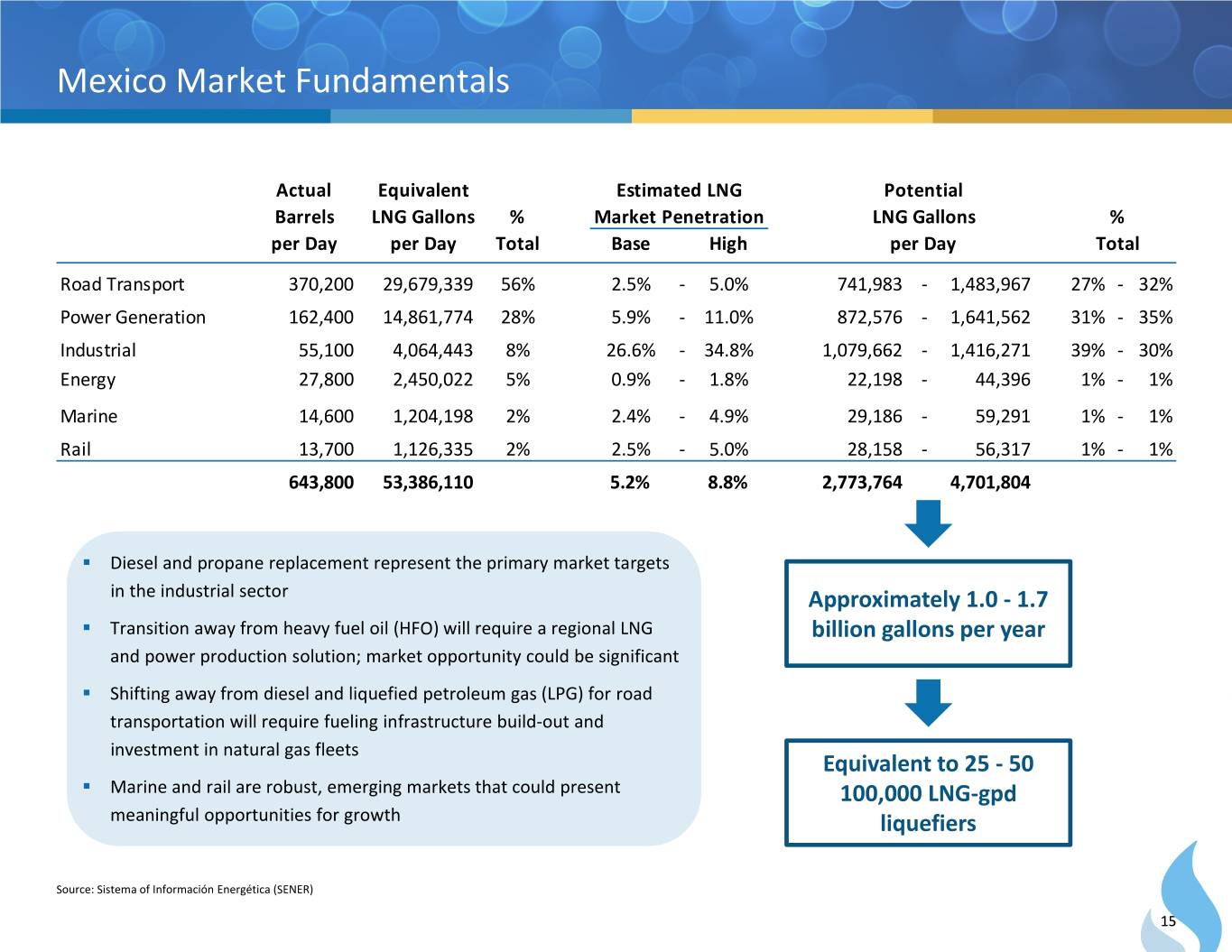

Mexico Market Fundamentals Actual Equivalent Estimated LNG Potential Barrels LNG Gallons % Market Penetration LNG Gallons % per Day per Day Total Base High per Day Total Road Transport 370,200 29,679,339 56% 2.5% ‐ 5.0% 741,983 ‐ 1,483,967 27% ‐ 32% Power Generation 162,400 14,861,774 28% 5.9% ‐ 11.0% 872,576 ‐ 1,641,562 31% ‐ 35% Industrial 55,100 4,064,443 8% 26.6% ‐ 34.8% 1,079,662 ‐ 1,416,271 39% ‐ 30% Energy 27,800 2,450,022 5% 0.9% ‐ 1.8% 22,198 ‐ 44,396 1% ‐ 1% Marine 14,600 1,204,198 2% 2.4% ‐ 4.9% 29,186 ‐ 59,291 1% ‐ 1% Rail 13,700 1,126,335 2% 2.5% ‐ 5.0% 28,158 ‐ 56,317 1% ‐ 1% 643,800 53,386,110 5.2% 8.8% 2,773,764 4,701,804 . Diesel and propane replacement represent the primary market targets in the industrial sector Approximately 1.0 ‐ 1.7 . Transition away from heavy fuel oil (HFO) will require a regional LNG billion gallons per year and power production solution; market opportunity could be significant . Shifting away from diesel and liquefied petroleum gas (LPG) for road transportation will require fueling infrastructure build‐out and investment in natural gas fleets Equivalent to 25 ‐ 50 . Marine and rail are robust, emerging markets that could present 100,000 LNG‐gpd meaningful opportunities for growth liquefiers Source: Sistema of Información Energética (SENER) 15

Our Go‐To Market Strategy in Mexico Joint Venture with Grupo CLISA Diversenergy Acquisition August 2019 August 2019 Pursue investments in small‐scale LNG Enables Stabilis to rapidly expand LNG market development in Mexico with a distribution in Mexico locally established player Leading Position in Mexico . Partnership provides local capabilities and access to the broader Mexico market . Direct access to U.S. pipelines . Less mature market enables Stabilis to secure attractive contracts Stabilis . Limited investment remaining to j Monterrey install existing liquefaction plant in Monterrey . Distribution range covers a critical Guadalajara geography of the Mexico market Mexico City . Additional LNG production and distribution projects under development . Marine and other distribution assets under development 16

Target 2020 Milestones Complete construction of Monterrey liquefaction plant and commence operations Secure one additional LNG supply source in Mexico Increase utilization of existing plant (90%+) and rolling stock assets (60%+) Execute initial marine bunkering project 17

Industry‐Leading Senior Management Team Jim Reddinger, Chief Executive Officer • Multiple leadership positions with Stabilis since co‐founding in 2013, including CFO, COO and CEO • Led construction of the George West facility as well as several acquisitions and partnerships Jim Aivalis, Chief Operating Officer • 38+ years’ experience in the energy industry; formerly CEO of Prometheus Energy and ThruBit, both Shell Ventures companies • Held senior roles at Tenaris where he led global commercialization through R&D, licensee support and technical sales Andy Puhala, Chief Financial Officer • 25 years’ experience in the energy industry, including multiple global assignments for Baker Hughes • Formerly CFO of ERA Group, AETI and AccessESP; held other senior finance roles in the energy sector Koby Knight, Senior Vice President – Operations, Engineering and Construction • Energy executive specializing in LNG, CNG, and renewable gas, built large‐scale production facilities and 300+ fueling stations • Formerly Assistant Vice President of CLNE’s LNG Operations; managed LNG production, supply, fueling and logistics operations Matt Barclay, Senior Vice President – Business Development • 20+ years’ experience in LNG production and distribution, as well as the renewable natural gas markets • Founding partner of Prometheus where he held various senior operations, business development and executive roles Steve Stump, Senior Vice President – Sales • 45+ years’ sales experience in the cryogenic and compressed gas industries and introduced Stabilis’ LNG sales into Mexico • Held senior roles at Chart, Worthington and others; has supplied over 60 countries with intermodal gas and equipment Stage Marroquin, President of CyroMex Joint Venture • Currently VP of International Business Development at Groupo CLISA and formerly Director of Mexico Operations of Diversenergy • Responsible for developing new business ventures with leading international partners for Grupo CLISA 18

Financial Overview 19

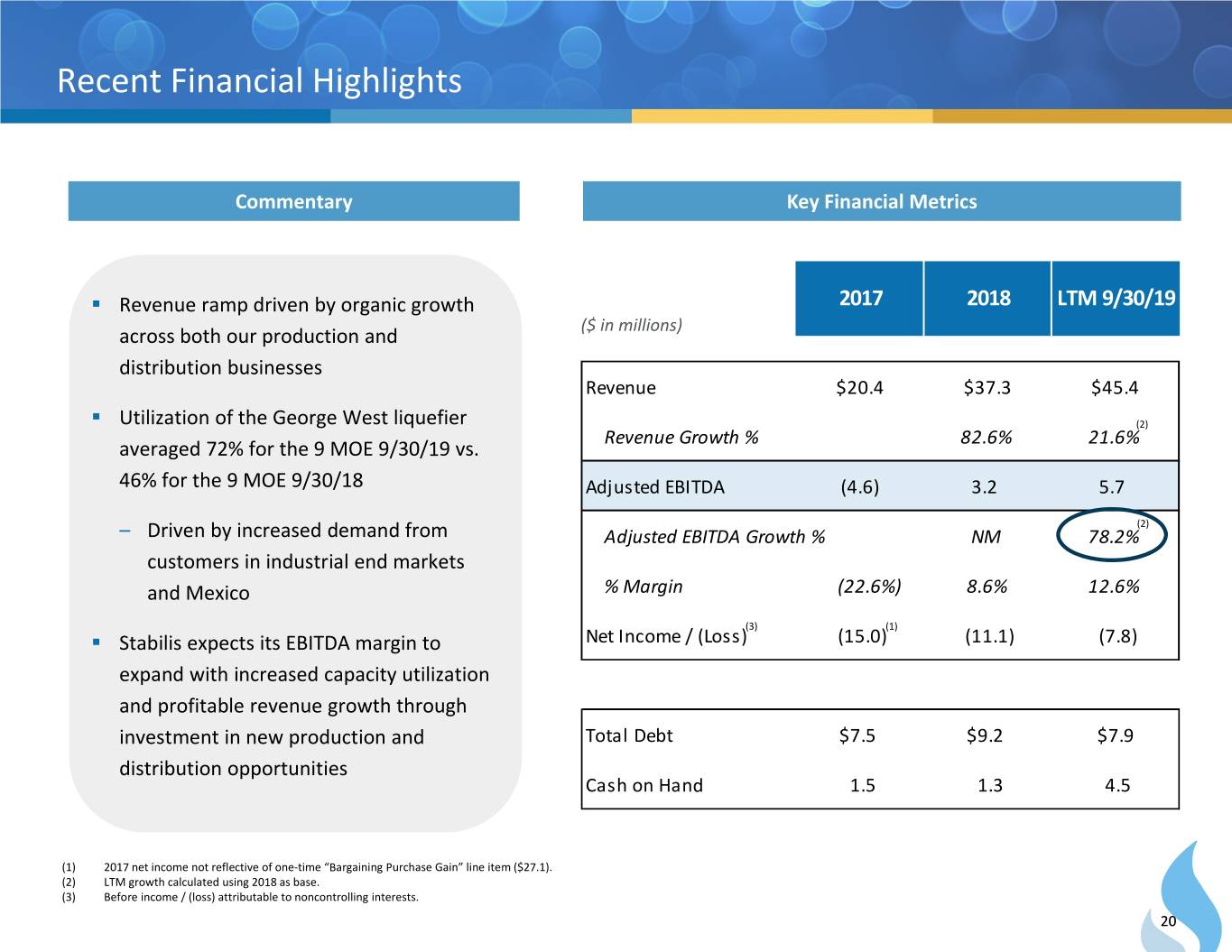

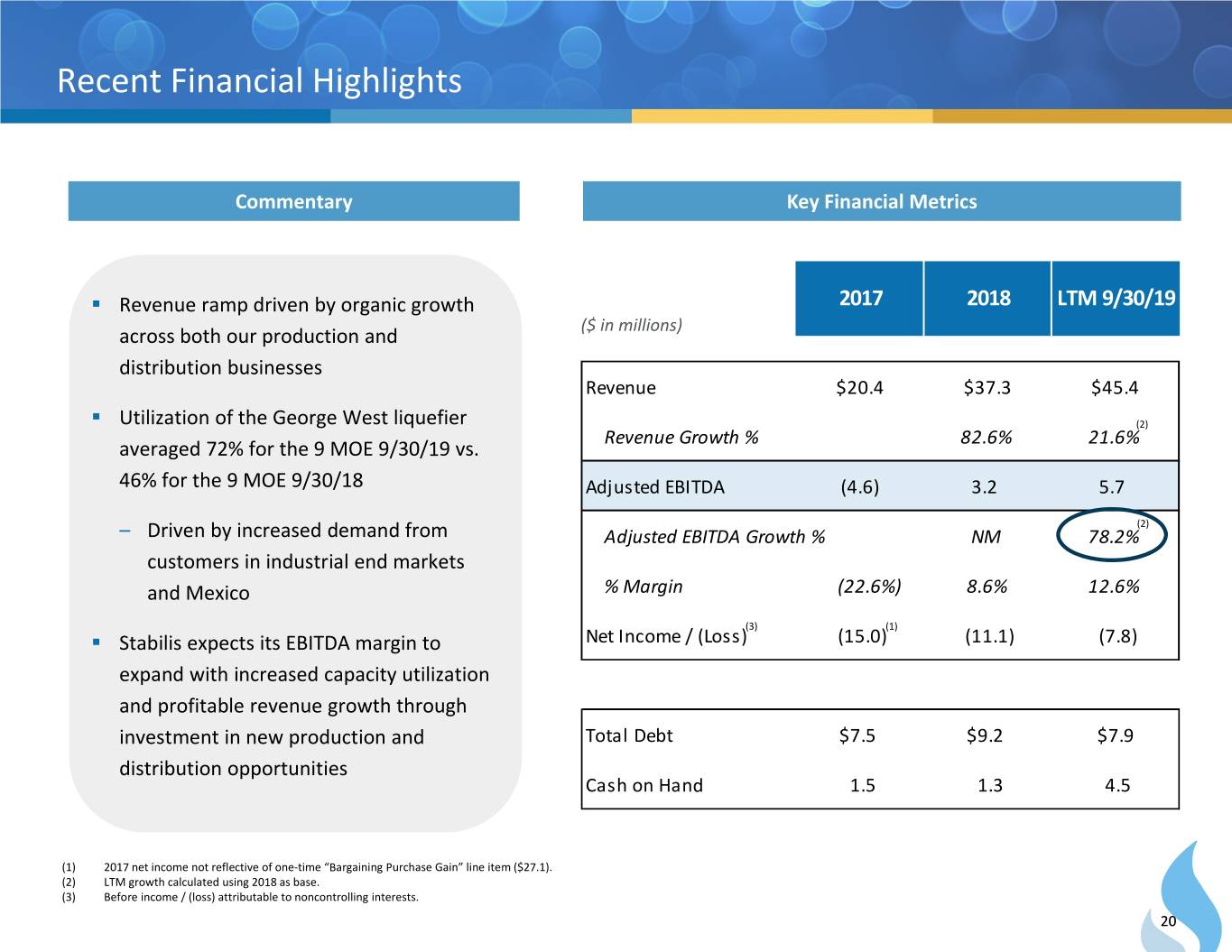

Recent Financial Highlights Commentary Key Financial Metrics . Revenue ramp driven by organic growth 2017 2018 LTM 9/30/19 ($ in millions) across both our production and distribution businesses Revenue $20.4 $37.3 $45.4 . Utilization of the George West liquefier (2) Revenue Growth % 82.6% 21.6% averaged 72% for the 9 MOE 9/30/19 vs. 46% for the 9 MOE 9/30/18 Adjusted EBITDA (4.6) 3.2 5.7 (2) – Driven by increased demand from Adjusted EBITDA Growth % NM 78.2% customers in industrial end markets and Mexico % Margin (22.6%) 8.6% 12.6% (3) (1) . Stabilis expects its EBITDA margin to Net Income / (Loss) (15.0) (11.1) (7.8) expand with increased capacity utilization and profitable revenue growth through investment in new production and Total Debt $7.5 $9.2 $7.9 distribution opportunities Cash on Hand 1.5 1.3 4.5 (1) 2017 net income not reflective of one‐time “Bargaining Purchase Gain” line item ($27.1). (2) LTM growth calculated using 2018 as base. (3) Before income / (loss) attributable to noncontrolling interests. 20

Attractive Business Model Pathway to Sustainable and Profitable Growth . Increase utilization of George West facility – Demonstrated ability to produce above nameplate – Minimal maintenance expense/capex . Improve asset utilization of transportation and logistics operations to enhance distribution Revenue Growth offering . Secure additional 1‐2 LNG liquefaction facilities – Launch production of Monterrey, Mexico plant with minimal additional capex – Leverage engineering and expertise from existing plants to efficiently build new facilities Cost Structure . Minimal SG&A and operating expense increases required to support revenue growth Inorganic Growth . Selective acquisition of distribution assets and field equipment 21

Appendix 22

Income Statement ($ in thousands, except per share data) Three Months Ended Nine Months Ended September 30, September 30, 2019 2018 2019 2018 Revenue LNG product $7,919 $6,914 $26,872 $21,812 Rental, service and other 2,595 1,087 7,712 4,754 Total Revenue $10,514 $8,001 $34,584 $26,566 Operating Expenses: Cost of LNG product $5,191 $5,098 $18,289 $17,046 Cost of rental, service and other 2,436 1,121 5,546 3,476 Selling, general and administrative expenses 3,834 1,607 8,037 4,667 Depreciation expense 2,307 2,190 6,892 6,573 Total Operating Expenses $13,768 $10,016 $38,764 $31,762 Loss From Operations Before Equity Income ($3,254) ($2,015) ($4,180) ($5,196) Net Equity Income From Foreign Joint Ventures' Operations: Income from equity investments in foreign joint ventures $187 ‐ $187 ‐ Foreign joint ventures' operations related expenses (52) ‐ (52) ‐ Net Equity Income From Foreign Joint Ventures' Operations $135 ‐ $135 ‐ Loss From Operations ($3,119) ($2,015) ($4,045) ($5,196) Other Income (Expense): Interest expense, net ($339) ($1,202) ($947) ($3,482) Other income 124 ‐ 61 352 Gain from disposal of fixed assets 17 ‐ 17 162 Total Other Income (Expense) ($198) ($1,202) ($869) ($2,968) Loss before income tax expense ($3,317) ($3,217) ($4,914) ($8,164) Income tax expense 38 ‐ 38 ‐ Net Loss ($3,355) ($3,217) ($4,952) ($8,164) Net income (loss) attributable to noncontrolling interests ‐ (130) 207 (84) Net Loss Attributable to Controlling Interests ($3,355) ($3,087) ($5,159) ($8,080) Basic and Diluted Net Loss per Share ($0.22) ($0.82) ($0.37) ($2.14) Source: SEC filings. 23

Balance Sheet ($ in thousands) September 30, December 31, September 30, December 31, 2019 2018 2019 2018 ASSETS LIABILITES Current Assets: Current Liabilities: Cash and cash equivalents $4,516 $1,247 Current portion of long‐term notes payable $1,000 $2,500 Accounts receivable, net 4,707 4,359 Current portion of finance lease obligation ‐ related parties 4,662 3,879 Inventories, net 107 106 Current portion of operating lease obligations 340 ‐ Prepaid expenses and other current assets 3,868 2,115 Short‐term notes payable 831 121 Due from related parties 1 22 Accrued liabilities 5,395 2,913 Total Current Assets $13,199 $7,849 Accounts payable and other accrued expenses 4,298 2,684 Total Current Liabilities $16,526 $12,097 Non‐Current Assets: Property, plant and equipment, net $62,617 $66,606 Non‐Current Liabilities: Right‐of‐use assets 1,002 ‐ Long‐term notes payable, net of current portion $1,077 $6,577 Goodwill 4,960 ‐ Long‐term notes payable, net of current portion ‐ related parties 5,000 ‐ Investments in foreign joint ventures 9,268 ‐ Finance lease obligations, net of current portion ‐ related parties 3 3,367 Other noncurrent assets 402 250 Long‐term portion of operating lease obligations 682 ‐ Total Assets $91,448 $74,705 Total Liabilities $23,288 $22,041 EQUITY Preferred Stock ‐ ‐ Stockholders' equity: Common stock 17 13 Additional paid‐in capital 90,748 68,244 Accumulated other comprehensive loss (530) ‐ Accumulated deficit (22,075) (16,916) Total Stockholders' Equity $68,160 $51,341 Noncontrolling interest ‐ 1,323 Total Equity $68,160 $52,664 Total Liabilities and Equity $91,448 $74,705 Source: SEC filings. 24

Cash Flow Statement ($ in thousands) Nine Months Ended Nine Months Ended September 30, September 30, 2019 2018 2019 2018 Cash Flow from Operating Activities: Cash Flow from Financing Activities: Net loss ($4,952) ($8,164) Proceeds on long‐term borrowings from related parties $5,000 $4,603 Adjustments to reconcile net loss to net cash used in operating activities ‐ ‐ Payments on long‐term borrowings from related parties (2,582) (1,233) Depreciation and amortization 6,892 6,573 Payments on long‐term borrowings ‐ (2,420) Gain on disposal of fixed assets (17) (162) Proceeds from short‐term notes payable 767 408 Bad debt expense 147 ‐ Payments on short‐term notes payable (394) (452) Gain on extinguishment of debt (116) ‐ Net cash provided by financing activities $2,791 $906 Income from equity investment in joint venture (187) ‐ Interest expense restructured to debt ‐ 3,258 Net increase (decrease) in cash and cash equivalents $3,269 ($583) Changes in operating assets and liabilities, net of acquisitions: Cash and cash equivalents, beginning of period $1,247 $1,488 Accounts receivable 1,823 (55) Cash and cash equivalents, end of period $4,516 $905 Due to/(from) related parties 113 (2,148) Inventories 67 (28) Supplemental disclosure of cash flow information: Prepaid expenses and other current assets (1,184) (590) Interest paid $1,108 $1,121 Accounts payable and accrued liabilities 1,117 (199) Income taxes paid ‐ ‐ Other 18 45 Non‐cash investing and financing activities: Net cash provided by (used in) operating activities $3,721 ($1,470) Extinguishment of long‐term debt $7,000 ‐ Cash Flow from Investing Activities: Equipment acquired under capital leases ‐ 1,335 Acquisition of fixed assets ($2,103) ($819) Proceeds on sales of fixed assets 125 800 Acquisition of American Electric, net of cash received (1,876) ‐ Acquisition of Diversenergy, net of cash received 611 ‐ Net cash used in investing activities ($3,243) ($19) Source: SEC filings. 25

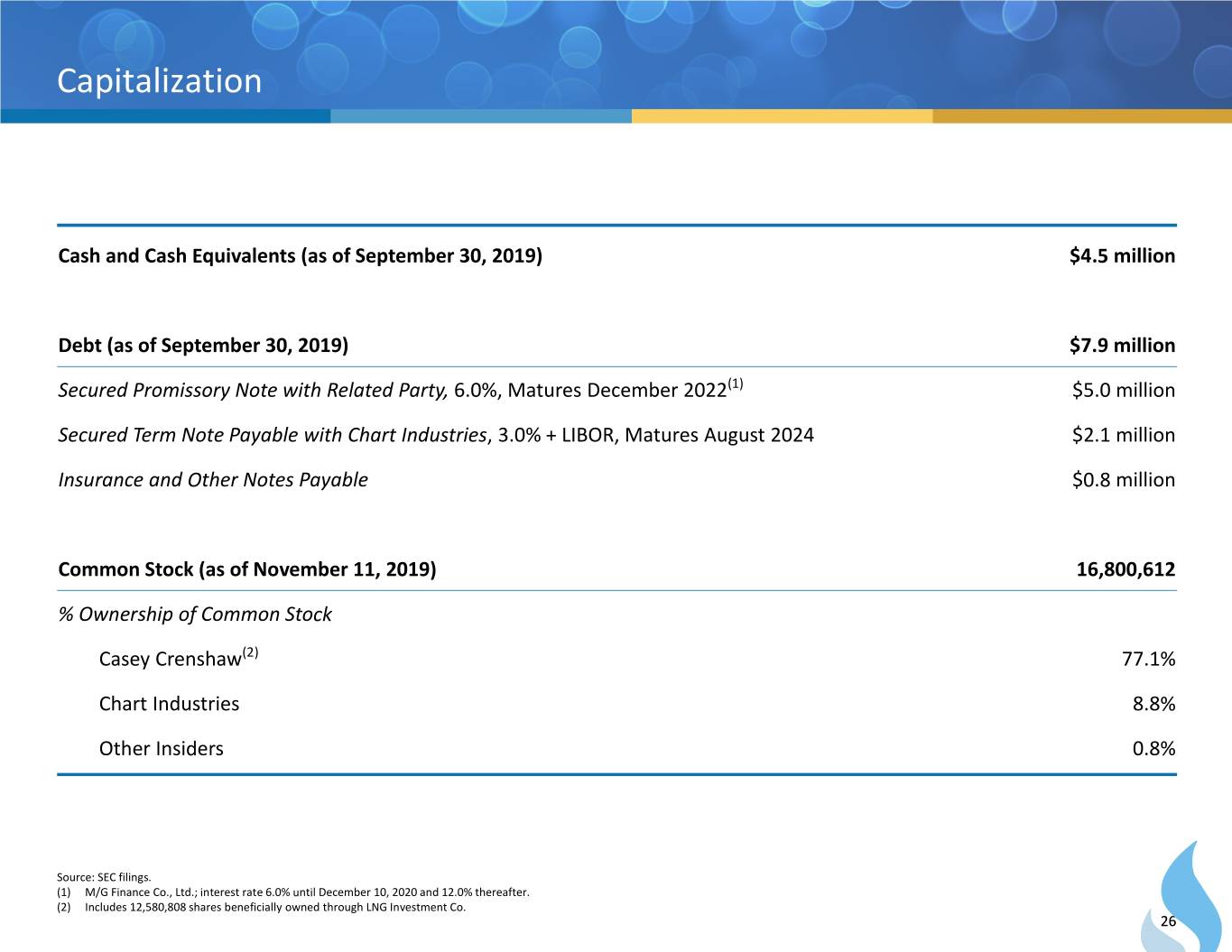

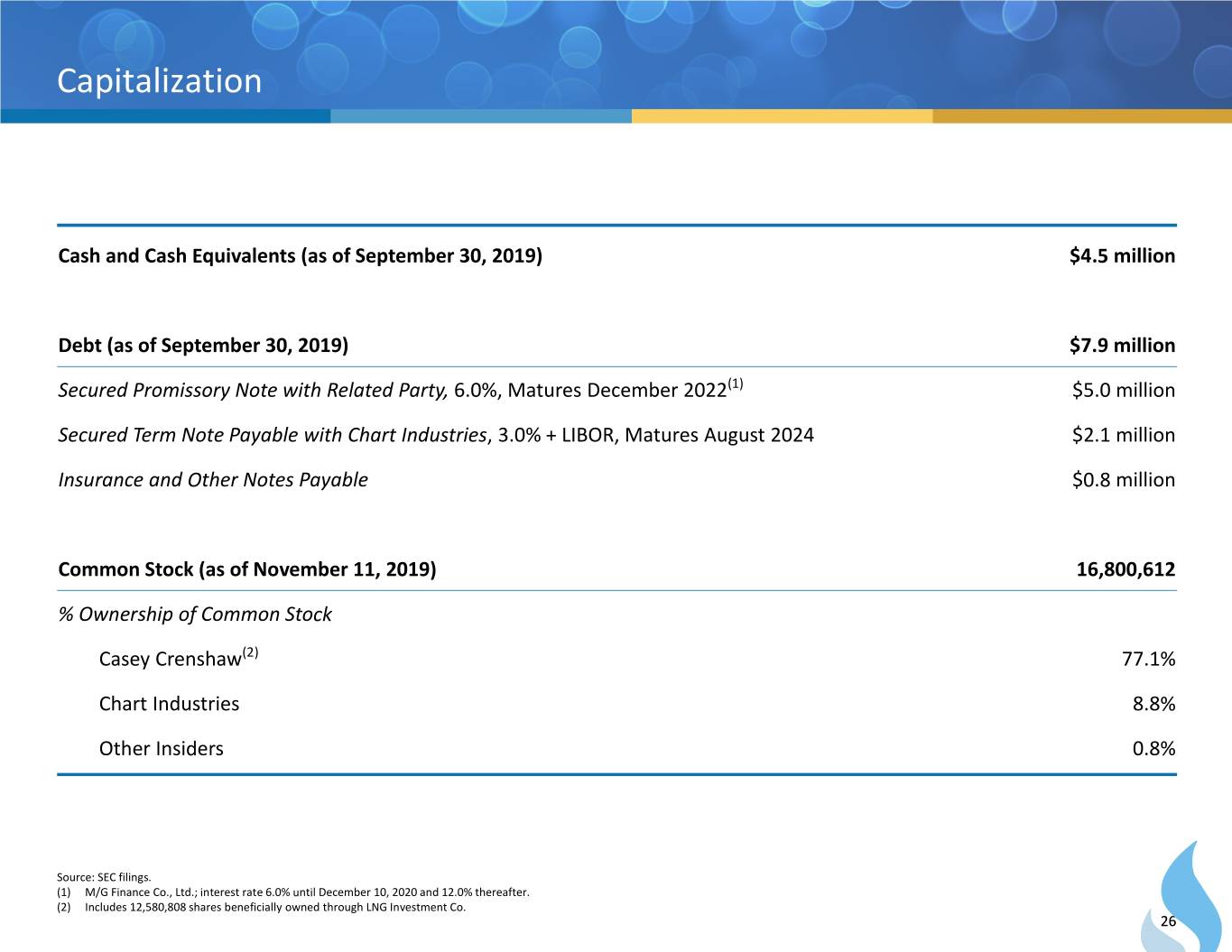

Capitalization Cash and Cash Equivalents (as of September 30, 2019) $4.5 million Debt (as of September 30, 2019) $7.9 million Secured Promissory Note with Related Party, 6.0%, Matures December 2022(1) $5.0 million Secured Term Note Payable with Chart Industries, 3.0% + LIBOR, Matures August 2024 $2.1 million Insurance and Other Notes Payable $0.8 million Common Stock (as of November 11, 2019) 16,800,612 % Ownership of Common Stock Casey Crenshaw(2) 77.1% Chart Industries 8.8% Other Insiders 0.8% Source: SEC filings. (1) M/G Finance Co., Ltd.; interest rate 6.0% until December 10, 2020 and 12.0% thereafter. (2) Includes 12,580,808 shares beneficially owned through LNG Investment Co. 26

Thank you. www.stabilisenergy.com