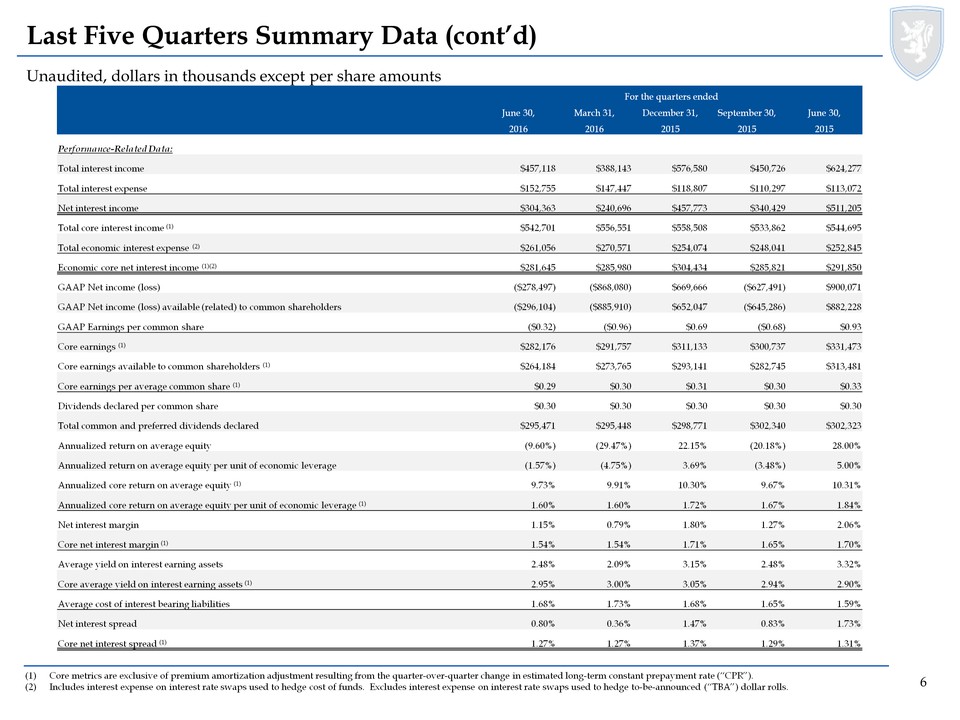

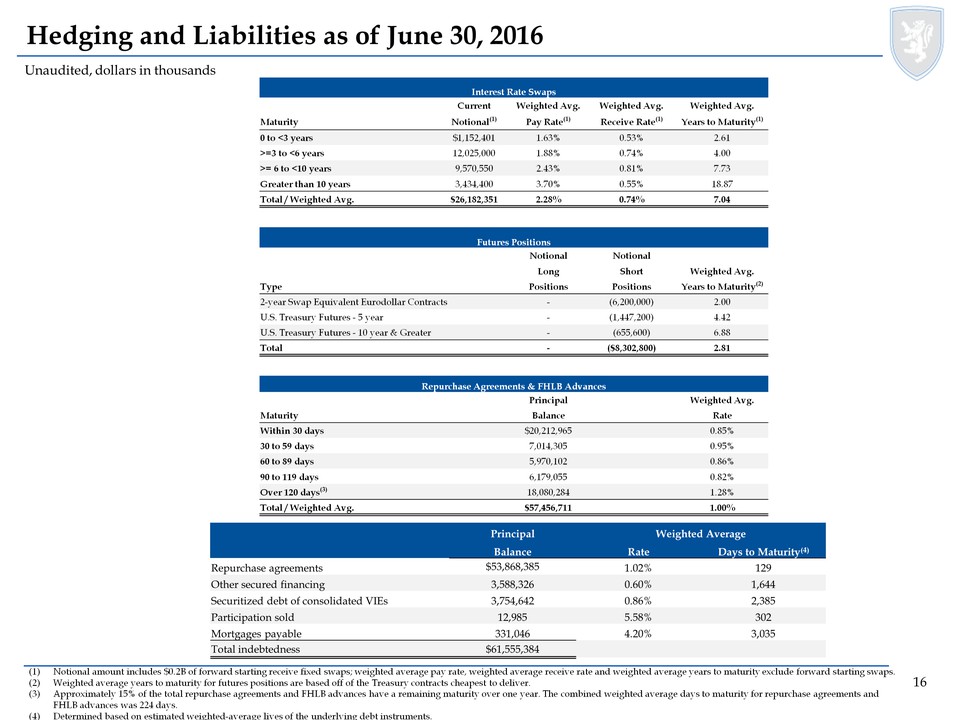

Unaudited, dollars in thousands except per share amounts Last Five Quarters Summary Data (cont’d) Consists of common stock, additional paid in capital, accumulated other comprehensive income (loss) and accumulated deficit.Measures total notional balances of interest rate swaps, interest rate swaptions and futures relative to repurchase agreements and TBA notional outstanding.Excludes forward starting swaps; weighted average fixed rate on forward starting pay fixed swaps was 1.44%, 2.04% and 1.77% as of December 31, 2015, September 30, 2015 and June 30, 2015, respectively; weighted average fixed rate on forward starting receive fixed swaps was 1.38% as of June 30, 2016. There were no forward starting swaps as of March 31, 2016. For the quarters ended June 30, March 31, December 31, September 30, June 30, 2016 2016 2015 2015 2015 Liabilities, Capital and Hedging Data: Repurchase agreements $53,868,385 $54,448,141 $56,230,860 $56,449,364 $57,459,552 Other secured financing $3,588,326 $3,588,326 $1,845,048 $359,970 $203,200 Securitized debt of consolidated VIEs $3,748,289 $3,802,682 $2,540,711 $2,553,398 $2,610,974 Participation sold $13,079 $13,182 $13,286 $13,389 $13,490 Mortgages payable $327,643 $334,765 $334,707 $166,697 $146,359 Total debt $61,545,722 $62,187,096 $60,964,612 $59,542,818 $60,433,575 Total liabilities $66,154,597 $65,785,958 $63,284,971 $63,054,354 $62,950,875 Cumulative redeemable preferred stock $913,059 $913,059 $913,059 $913,059 $913,059 Common equity(1) $10,640,156 $10,735,393 $10,982,915 $11,365,769 $11,676,940 Total Annaly stockholders' equity $11,553,215 $11,648,452 $11,895,974 $12,278,828 $12,589,999 Non-controlling interests $8,658 $9,555 $9,948 $5,505 $4,806 Total equity $11,561,873 $11,658,007 $11,905,922 $12,284,333 $12,594,805 Weighted average days to maturity of repurchase agreements 129 136 151 147 149 Weighted average rate on repurchase agreements, at period end 1.02% 0.99% 0.90% 0.78% 0.76% Weighted average rate on repurchase agreements, average during period 1.00% 0.95% 0.78% 0.73% 0.67% Leverage, at period end 5.3x 5.3x 5.1x 4.8x 4.8x Economic leverage, at period end 6.1x 6.2x 6.0x 5.8x 5.6x Capital ratio 13.2% 13.2% 13.7% 14.0% 14.6% Common stock book value per share $11.50 $11.61 $11.73 $11.99 $12.32 Total common stock shares outstanding 924,930 924,853 935,930 947,826 947,768 Interest rate swaps: Hedge ratio(2) 49% 51% 55% 57% 53% Weighted average pay rate on interest rate swaps(3) 2.28% 2.26% 2.26% 2.26% 2.29% Weighted average receive rate on interest rate swaps(3) 0.74% 0.69% 0.53% 0.42% 0.40% Weighted average net rate on interest rate swaps 1.54% 1.57% 1.73% 1.84% 1.89%