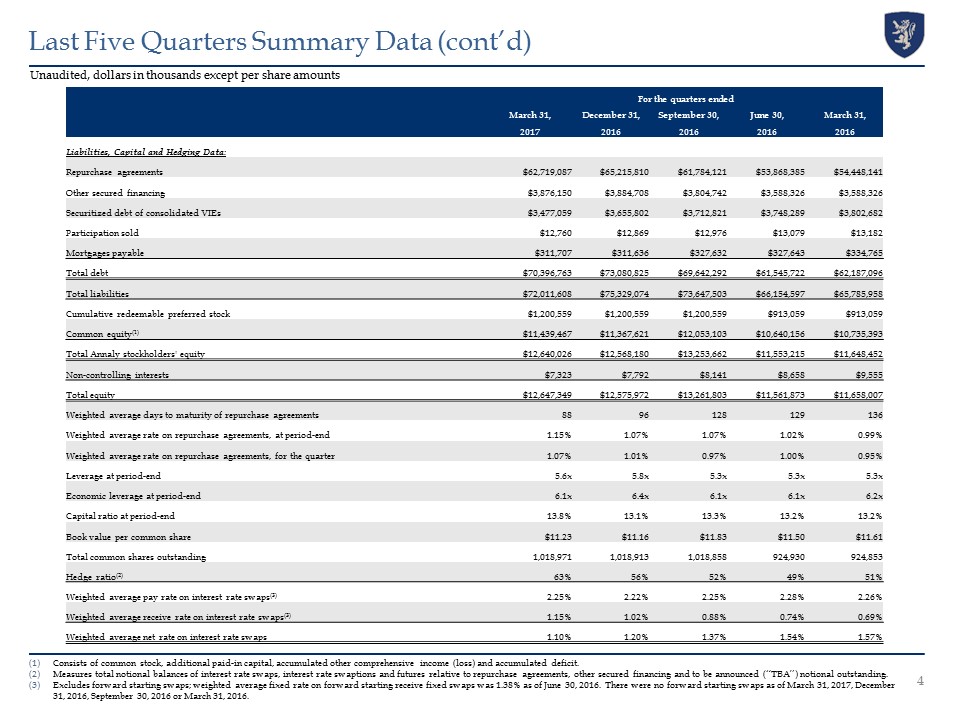

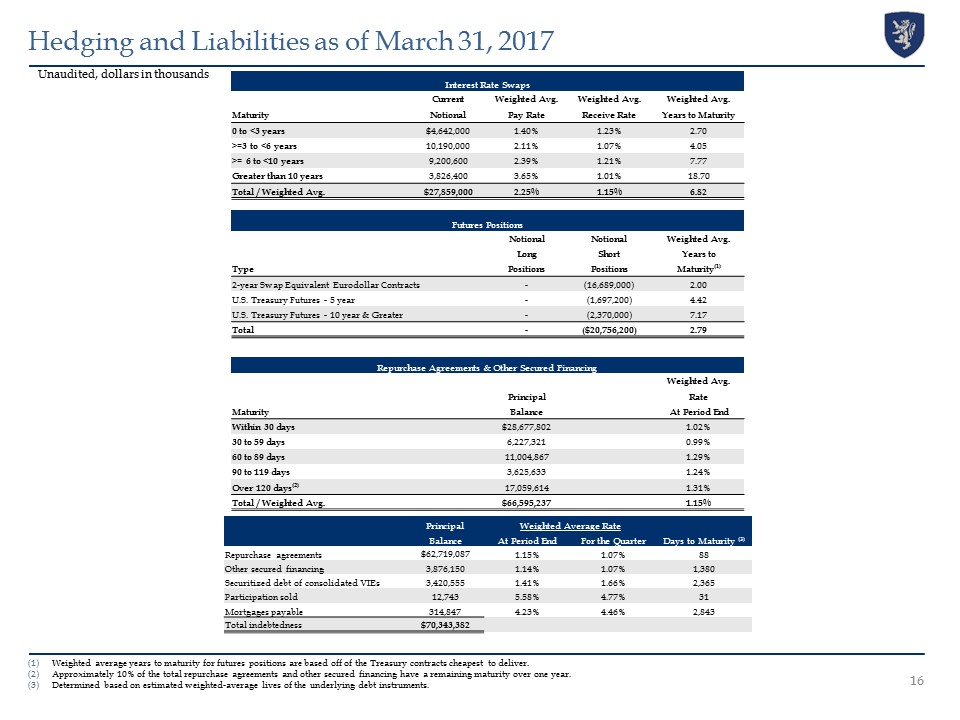

Consists of common stock, additional paid-in capital, accumulated other comprehensive income (loss) and accumulated deficit.Measures total notional balances of interest rate swaps, interest rate swaptions and futures relative to repurchase agreements, other secured financing and to be announced (“TBA”) notional outstanding.Excludes forward starting swaps; weighted average fixed rate on forward starting receive fixed swaps was 1.38% as of June 30, 2016. There were no forward starting swaps as of March 31, 2017, December 31, 2016, September 30, 2016 or March 31, 2016. Unaudited, dollars in thousands except per share amounts Last Five Quarters Summary Data (cont’d) 4 For the quarters ended March 31, December 31, September 30, June 30, March 31, 2017 2016 2016 2016 2016 Liabilities, Capital and Hedging Data: Repurchase agreements $62,719,087 $65,215,810 $61,784,121 $53,868,385 $54,448,141 Other secured financing $3,876,150 $3,884,708 $3,804,742 $3,588,326 $3,588,326 Securitized debt of consolidated VIEs $3,477,059 $3,655,802 $3,712,821 $3,748,289 $3,802,682 Participation sold $12,760 $12,869 $12,976 $13,079 $13,182 Mortgages payable $311,707 $311,636 $327,632 $327,643 $334,765 Total debt $70,396,763 $73,080,825 $69,642,292 $61,545,722 $62,187,096 Total liabilities $72,011,608 $75,329,074 $73,647,503 $66,154,597 $65,785,958 Cumulative redeemable preferred stock $1,200,559 $1,200,559 $1,200,559 $913,059 $913,059 Common equity(1) $11,439,467 $11,367,621 $12,053,103 $10,640,156 $10,735,393 Total Annaly stockholders' equity $12,640,026 $12,568,180 $13,253,662 $11,553,215 $11,648,452 Non-controlling interests $7,323 $7,792 $8,141 $8,658 $9,555 Total equity $12,647,349 $12,575,972 $13,261,803 $11,561,873 $11,658,007 Weighted average days to maturity of repurchase agreements 88 96 128 129 136 Weighted average rate on repurchase agreements, at period-end 1.15% 1.07% 1.07% 1.02% 0.99% Weighted average rate on repurchase agreements, for the quarter 1.07% 1.01% 0.97% 1.00% 0.95% Leverage at period-end 5.6x 5.8x 5.3x 5.3x 5.3x Economic leverage at period-end 6.1x 6.4x 6.1x 6.1x 6.2x Capital ratio at period-end 13.8% 13.1% 13.3% 13.2% 13.2% Book value per common share $11.23 $11.16 $11.83 $11.50 $11.61 Total common shares outstanding 1,018,971 1,018,913 1,018,858 924,930 924,853 Hedge ratio(2) 63% 56% 52% 49% 51% Weighted average pay rate on interest rate swaps(3) 2.25% 2.22% 2.25% 2.28% 2.26% Weighted average receive rate on interest rate swaps(3) 1.15% 1.02% 0.88% 0.74% 0.69% Weighted average net rate on interest rate swaps 1.10% 1.20% 1.37% 1.54% 1.57%