Exhibit 99.1

ANNALY® Investor Day November 16, 2017

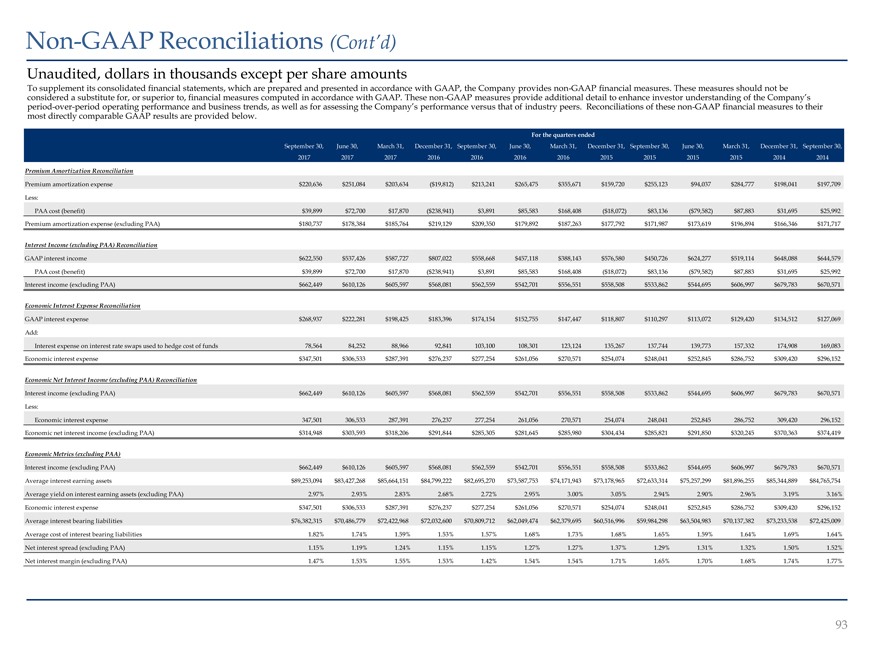

Safe Harbor Notice This presentation, other written or oral communications, and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions (some of which are beyond our control) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “should,” “expect,” “anticipate,” “continue,” or similar terms or variations on those terms or the negative of those terms. Actual results could differ materially from those set forth in forward-looking statements due to a variety of factors, including, but not limited to, changes in interest rates; changes in the yield curve; changes in prepayment rates; the availability of mortgage-backed securities (“MBS”) and other securities for purchase; the availability of financing and, if available, the terms of any financing; changes in the market value of our assets; changes in business conditions and the general economy; our ability to grow our commercial business; our ability to grow our residential mortgage credit business; our ability to grow our middle market lending business; credit risks related to our investments in credit risk transfer securities, residential mortgage-backed securities and related residential mortgage credit assets, commercial real estate assets and corporate debt; risks related to investments in mortgage servicing rights (“MSRs”); our ability to consummate any contemplated investment opportunities; changes in government regulations and policy affecting our business; our ability to maintain our qualification as a REIT for U.S. federal income tax purposes; and our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended. For a discussion of the risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in our most recent Annual Report on Form10-K and any subsequent Quarterly Reports on Form10-Q filed with the Securities and Exchange Commission. We do not undertake, and specifically disclaim any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. Past performance is no guarantee of future results. There is no guarantee that any investment strategy referenced herein will work under all market conditions. Prior to making any investment decision, you should evaluate your ability to invest for the long-term, especially during periods of downturns in the market. You alone assume the responsibility of evaluating the merits and risks associated with any potential investment or investment strategy referenced herein. To the extent that this material contains reference to any past specific investment recommendations or strategies which were or would have been profitable to any person, it should not be assumed that recommendations made in the future will be profitable or will equal the performance of such past investment recommendations or strategies.Non-GAAP Financial Measures This presentation includes certainnon-GAAP financial measures, including core earnings metrics, which are presented both inclusive and exclusive of the premium amortization adjustment (“PAA”). The Company believes itsnon-GAAP financial measures are useful for management, investors, analysts, and other interested parties in evaluating the Company’s performance but should not be viewed in isolation and are not a substitute for financial measures computed in accordance with U.S generally accepted accounting principles (“GAAP”). In addition, the Company may calculate itsnon-GAAP metrics, which include core earnings and the PAA, differently than its peers making comparative analysis difficult. Please see the section entitled“Non-GAAP Reconciliations” in the attached Appendix for a reconciliation to the most directly comparable GAAP financial measures. 1

Agenda Session 1—Introduction Special Guest Speaker Tom Brokaw Kevin Keyes CEO Overview Chief Executive Officer and President Session 2 – Overview of Annaly Businesses David Finkelstein Chief Investment Officer Agency Ilker Ertas Head of Residential Mortgage-Backed Securities David Finkelstein Chief Investment Officer Residential Credit Michael Fania Head of Residential Credit Break Michael Quinn Head of Annaly Commercial Real Estate Group, Inc. Commercial Real Estate Steve Campbell Chief Operating Officer of Annaly Commercial Real Estate Group, Inc. Tim Coffey Chief Credit Officer Middle Market Lending Peter Dancy Head of Annaly Middle Market Lending LLC Session 3 – Capital Allocation and Financial Performance Brooke Carillo Head of Corporate Development and Strategy Capital Allocation V.S. Srinivasan Managing Director, Agency and Residential Credit Glenn Votek Chief Financial Officer Financial Performance Souren Ouzounian Deputy Chief Financial Officer and Treasurer 2

ANNALTY® CEO Overview

CEO Overview 1 The Yield-Less World 2 Three Major Questions Answered 3 Annaly Advantages 4 Performance & Relative Value 5 Annaly’s Opportunity 4

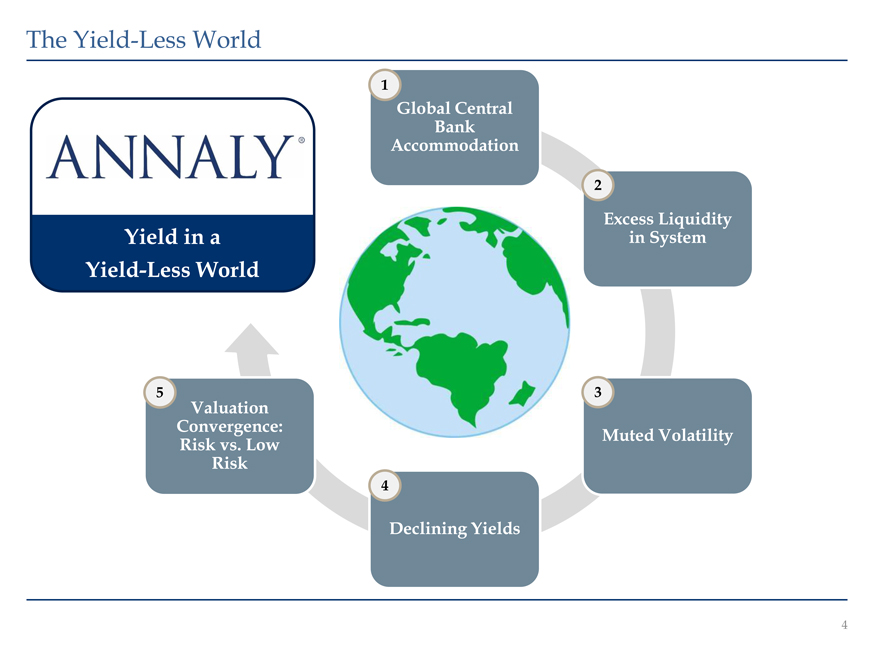

The Yield-Less World ANNALY® Yield in a Yield-Less World 1 Global Central Bank Accommodation 2 Excess Liquidity in System 3 Muted Volatility 4 Declining Yields 5 Valuation Convergence: Risk vs. Low Risk 5

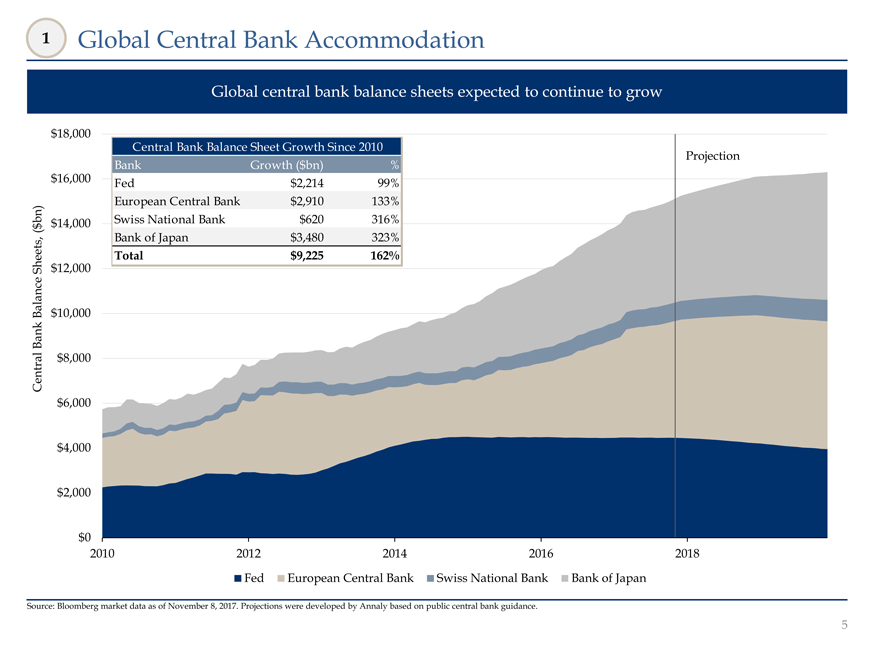

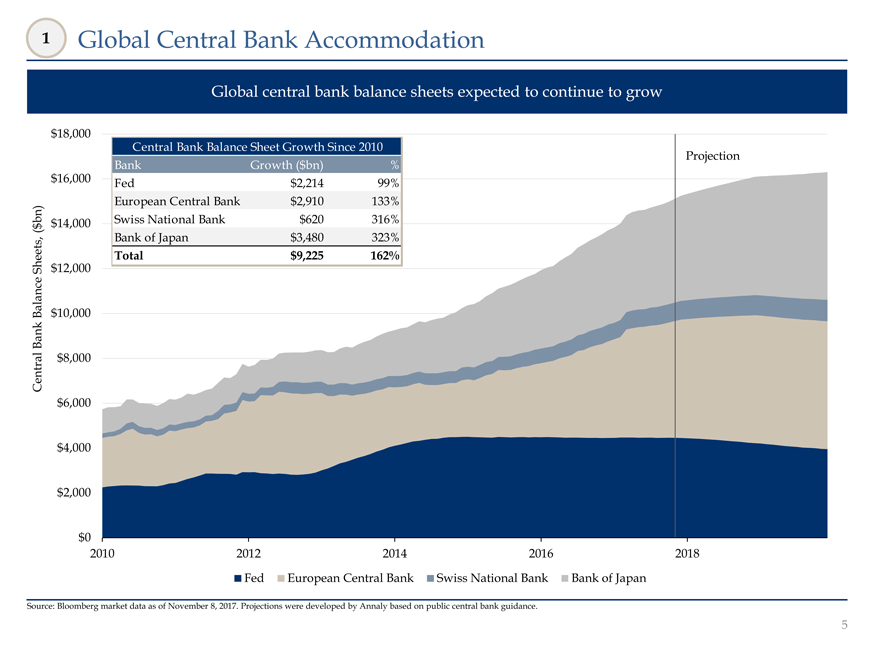

1 Global Central Bank Accommodation Global central bank balance sheets expected to continue to grow $18,000 Central Bank Balance Sheet Growth Since 2010 Projection Bank Growth ($bn) % $16,000 Fed $2,214 99% European Central Bank $2,910 133% $ bn) $14,000 Swiss National Bank $620 316% ( Bank of Japan $3,480 323% heets, Total $9,225 162% S $12,000 Balance $10,000 Bank $8,000 Central $6,000 $4,000 $2,000 $0 2010 2012 2014 2016 2018 Fed European Central Bank Swiss National Bank Bank of Japan Source: Bloomberg market data as of November 8, 2017. Projections were developed by Annaly based on public central bank guidance. 5

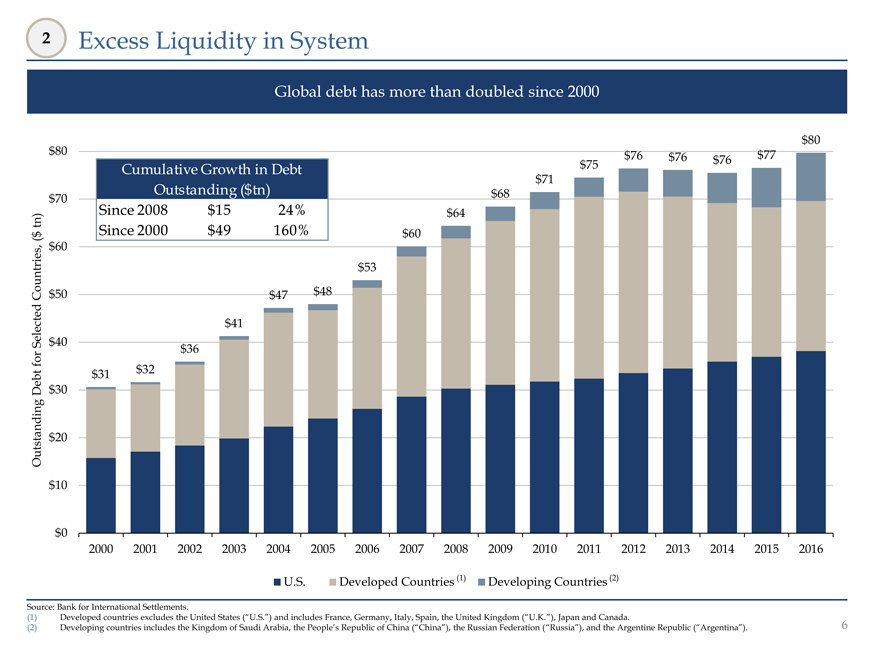

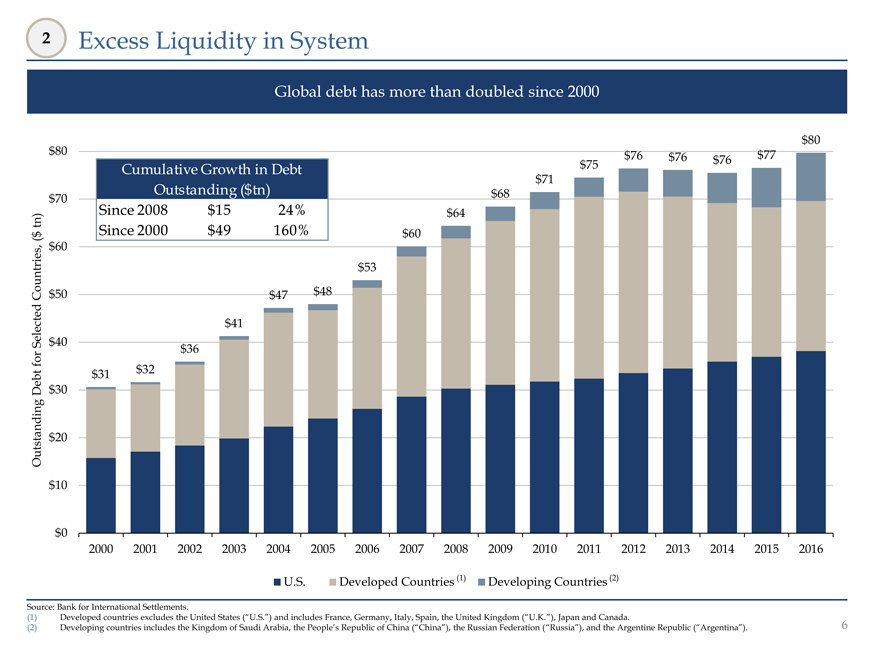

2 Excess Liquidity in System Sovereign debt has more than doubled since 2000 $80 $76 $77 $76 $76 Cumulative Growth in Debt $75 $71 Outstanding ($tn) $68 $70 Since 2008 $15 24% $64 tn) $ Since 2000 $49 160% $60 ( $60 $53 Countries, $50 $47 $48 $41 Selected $40 for $36 $31 $32 Debt $30 Outstanding $20 $10 $0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 U.S. Developed Countries (1) Developing Countries (2) Source: Bank for International Settlements. (1) Developed countries excludes the United States (“U.S.”) and includes France, Germany, Italy, Spain, the United Kingdom (“U.K.”), Japan and Canada. (2) Developing countries includes the Kingdom of Saudi Arabia, the People’s Republic of China (“China”), the Russian Federation (“Russia”), and the Argentine Republic (“Argentina”). 7

Global debt has more than doubled since 2000

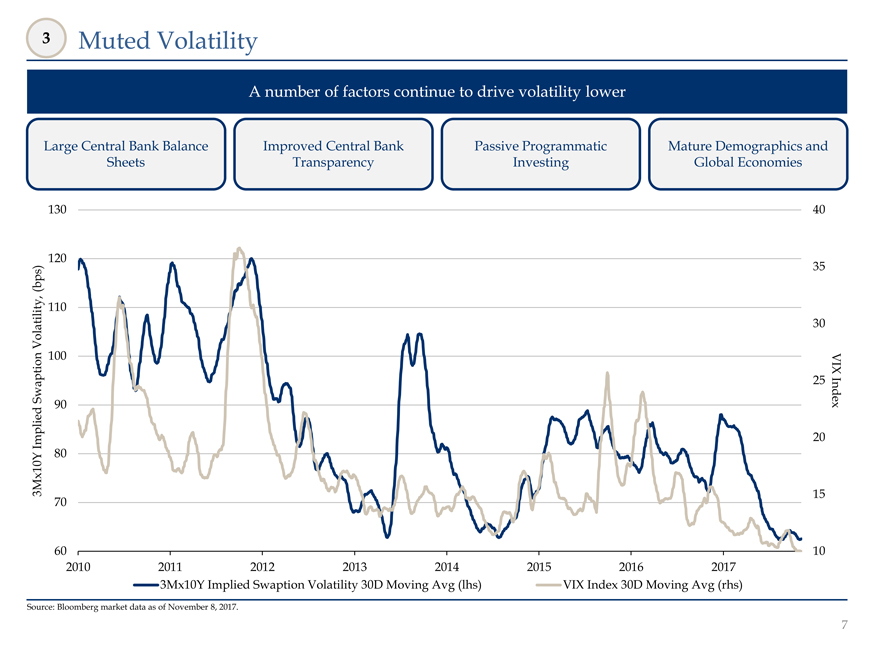

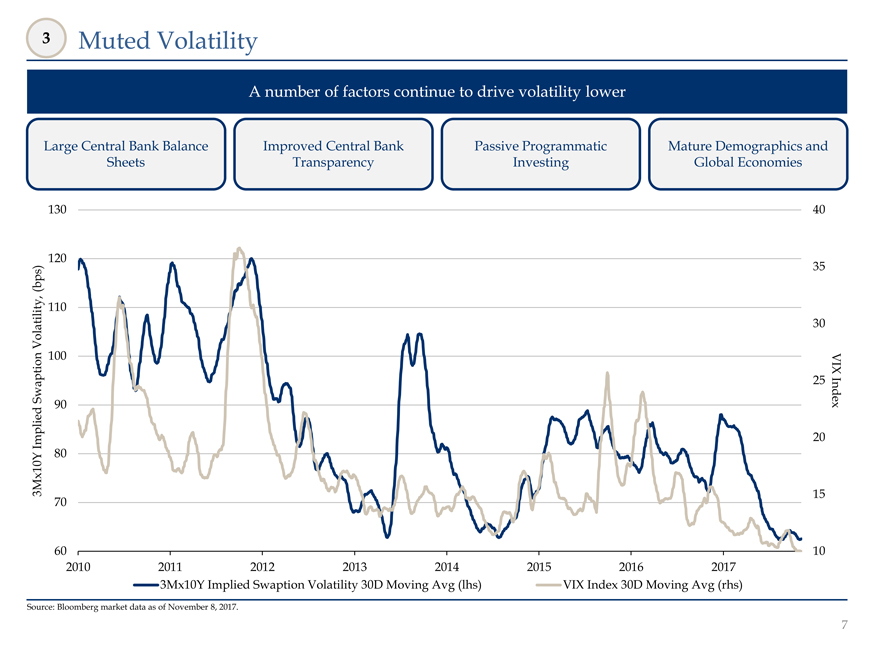

3 Muted Volatility A number of factors continue to drive volatility lower Large Central Bank Balance Sheets Improved Central Bank Transparency Passive Programmatic Investing Mature Demographics and Global Economies 130 40 120 35 (bps) , 110 Volatility 30 n 100 VIX Swaptio 25 90 Index Implied 20 3Mx10Y 80 15 70 60 10 2010 2011 2012 2013 2014 2015 2016 2017 3Mx10Y Implied Swaption Volatility 30D Moving Avg (lhs) VIX Index 30D Moving Avg (rhs) Source: Bloomberg market data as of November 8, 2017. 8

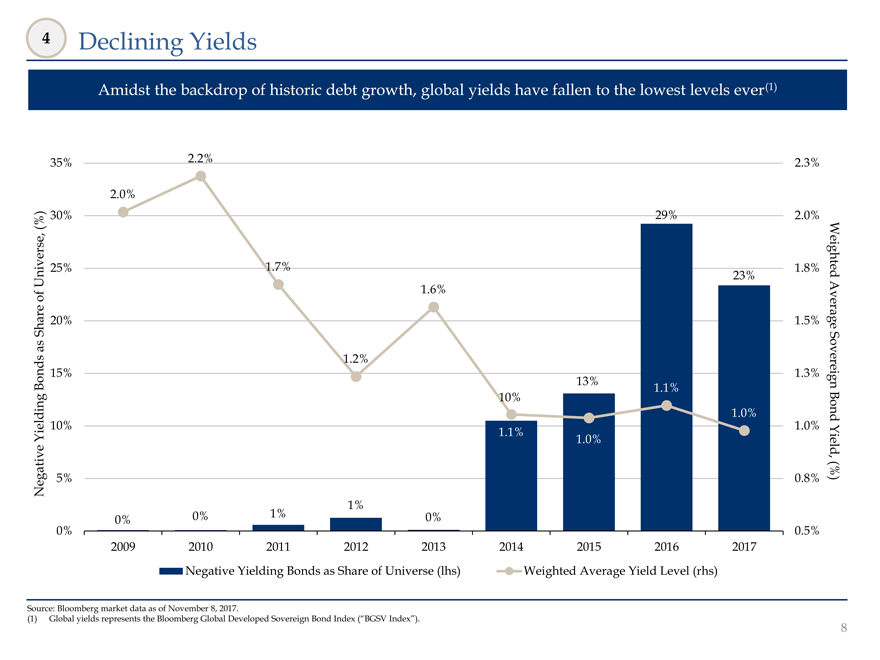

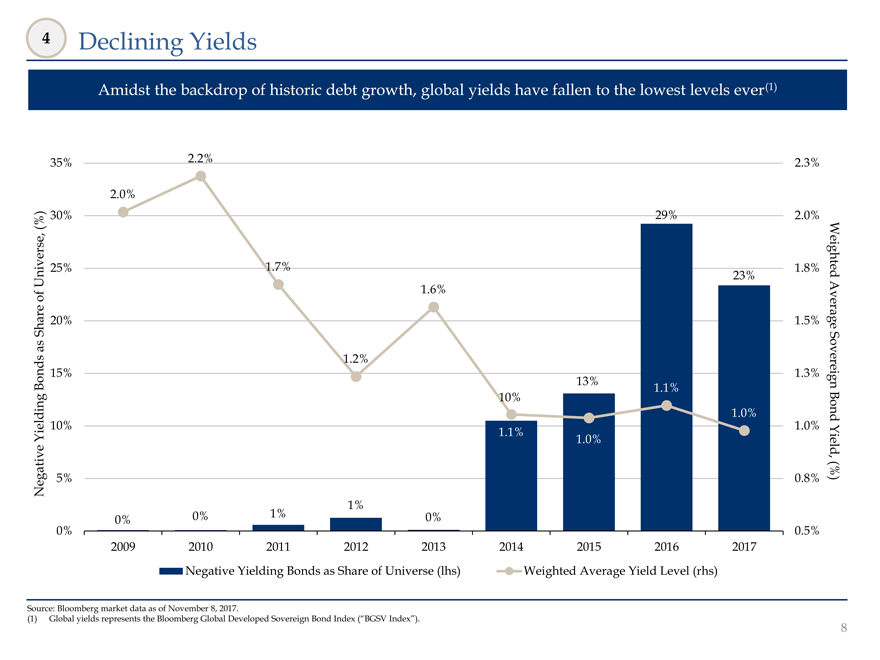

4 Declining Yields Amidst the backdrop of historic debt growth, global yields have fallen to the lowest levels ever(1) 35% 2.2% 2.3% 2.0% (%) 30% 29% 2.0% 25% 1.7% 1.8% Weighted Universe, 23% of 1.6% 20% 1.5% Average Share as 1.2% 15% 1.3% Bonds 13% Sovereign 1.1% 10% 1.0% Bond Yielding 10% 1.1% 1.0% 1.0% Yield, (%) Negative 5% 0.8% 1% 0% 1% 0% 0% 0% 0.5% 2009 2010 2011 2012 2013 2014 2015 2016 2017 Negative Yielding Bonds as Share of Universe (lhs) Weighted Average Yield Level (rhs) Source: Bloomberg market data as of November 8, 2017. (1) Global yields represents the Bloomberg Global Developed Sovereign Bond Index (“BGSV Index”). 9

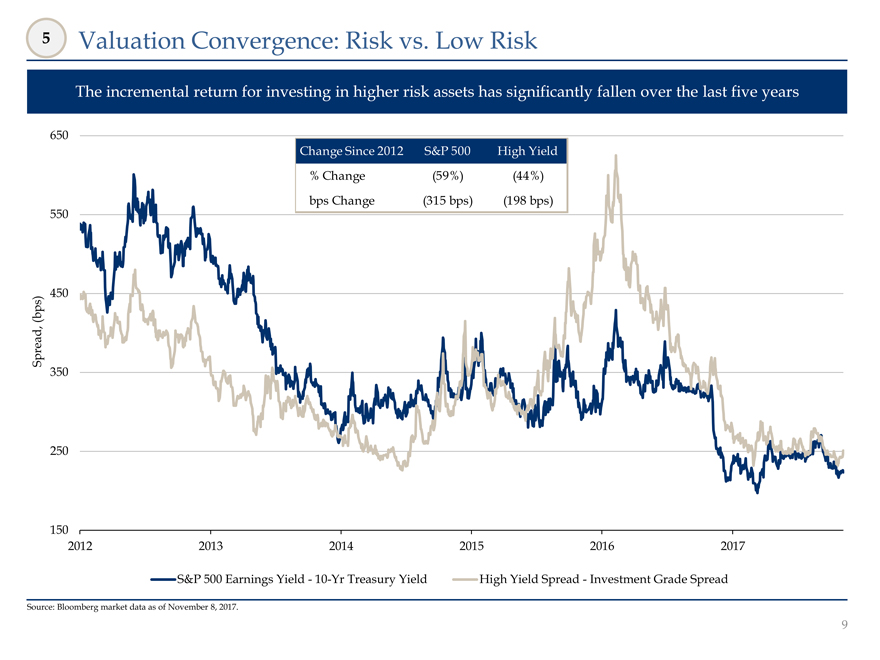

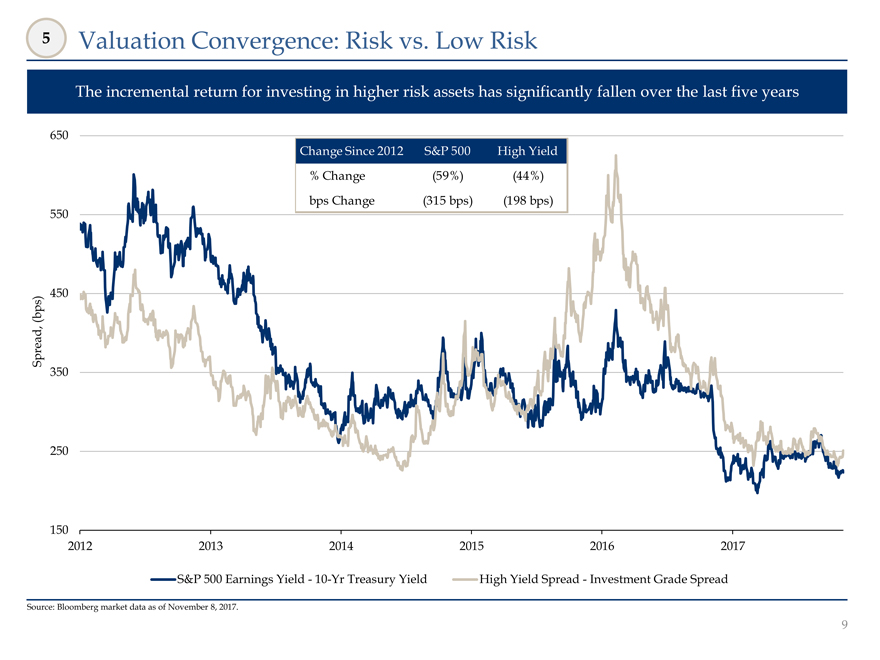

5 Valuation Convergence: Risk vs. Low Risk

The incremental return for investing in higher risk assets has significantly fallen over the last five years

650Change Since 2012 S&P 500 High Yield% Change (59%) (44%) bps Change (315 bps) (198 bps)550450 (bps) Spread, 3502501502012 2013 2014 2015 2016 2017S&P 500 EarningsYield—10-Yr Treasury Yield High Yield Spread—Investment Grade Spread

Source: Bloomberg market data as of November 8, 2017.

10

CEO Overview

1 The Yield-Less World

2 Three Major Questions Answered

3 Annaly Advantages

4 Performance & Relative Value

5 Annaly’s Opportunity

11

Three Major Questions Answered

Against the current macroeconomic backdrop, there are three questions consistently raised by nearly all of our investors

1

How Will Annaly Be Impacted By Central Bank Policy?

2

What Happens In A Rising Rate Environment?

3

How Stable And Resilient Is The Annaly Model Over Time?

12

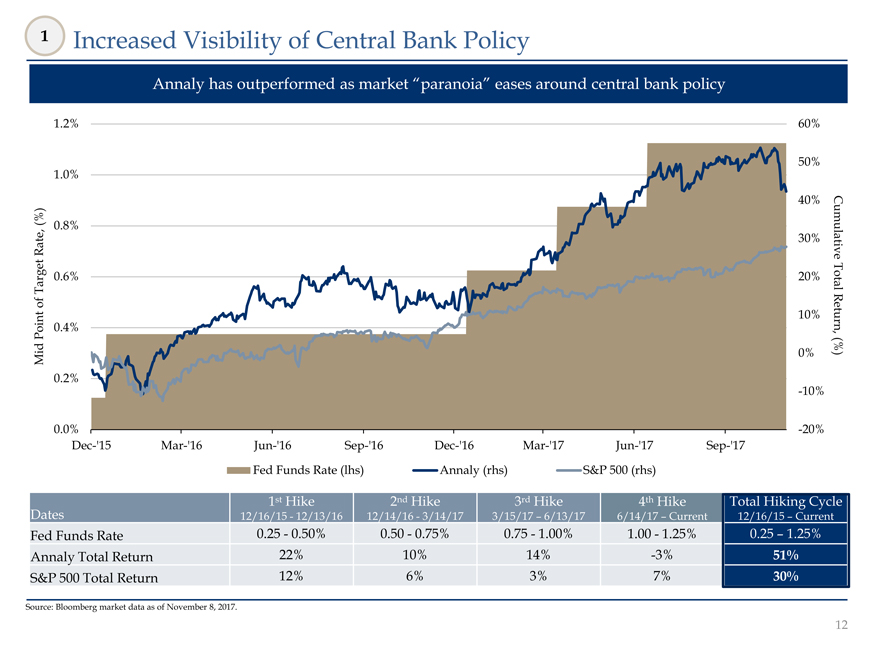

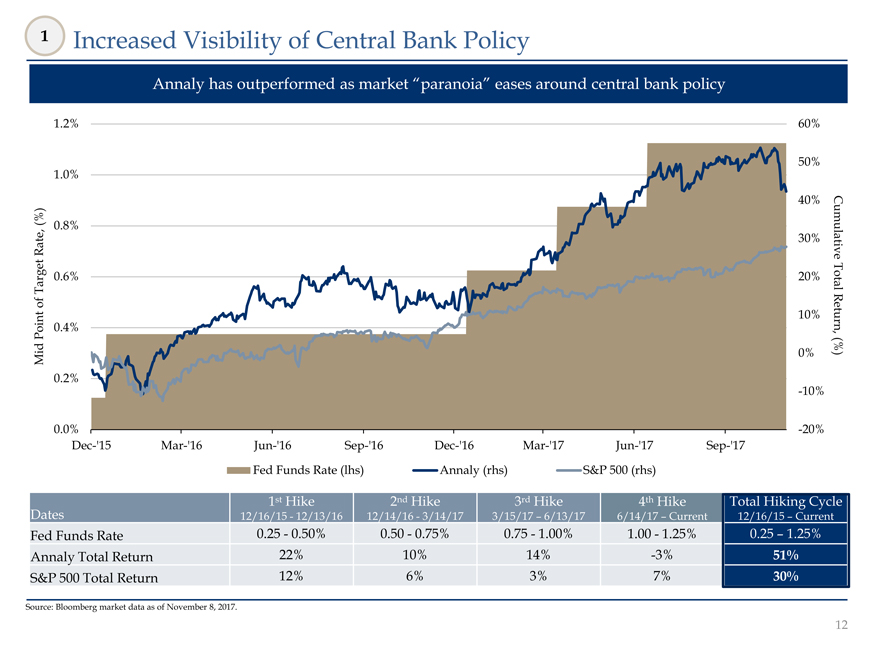

1 Increased Visibility of Central Bank Policy

Annaly has outperformed as market “paranoia” eases around central bank policy

1.2% 60%50%1.0%40% (%) 0.8% Rate, 30% Cumulative0.6% 20% Total Target of 10%0.4% Return, Point (%) Mid0%0.2%-10%0.0%-20%Dec-‘15Mar-‘16Jun-‘16Sep-‘16Dec-‘16Mar-‘17Jun-‘17Sep-‘17 Fed Funds Rate (lhs) Annaly (rhs) S&P 500 (rhs)

1st Hike 2nd Hike 3rd Hike 4th Hike Total Hiking Cycle

Dates 12/16/15—12/13/16 12/14/16—3/14/17 3/15/17 – 6/13/17 6/14/17 – Current 12/16/15 – Current

Fed Funds Rate 0.25—0.50% 0.50—0.75% 0.75—1.00% 1.00—1.25% 0.25 – 1.25% Annaly Total Return 22% 10% 14%-3% 51% S&P 500 Total Return 12% 6% 3% 7% 30%

Source: Bloomberg market data as of November 8, 2017.

13

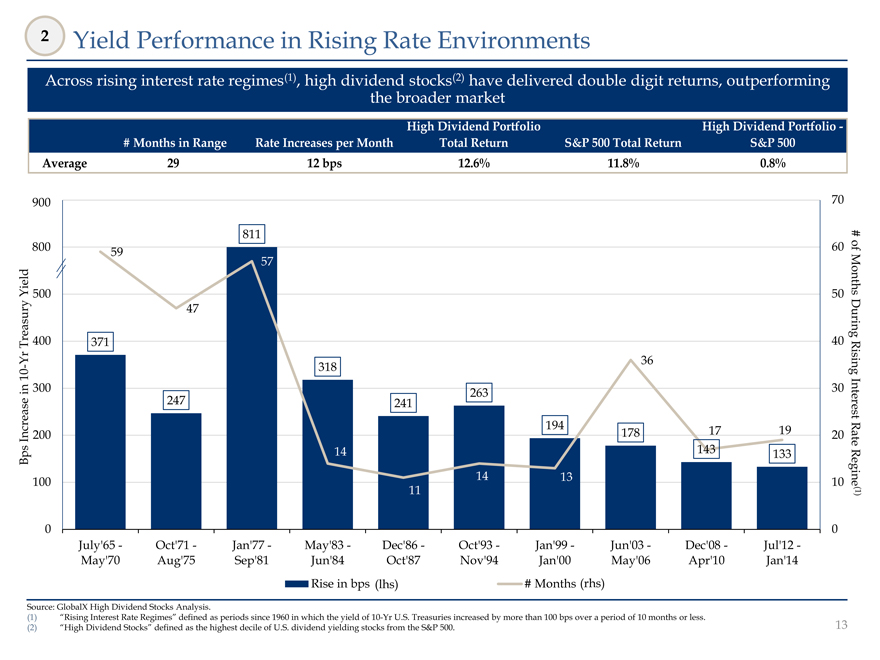

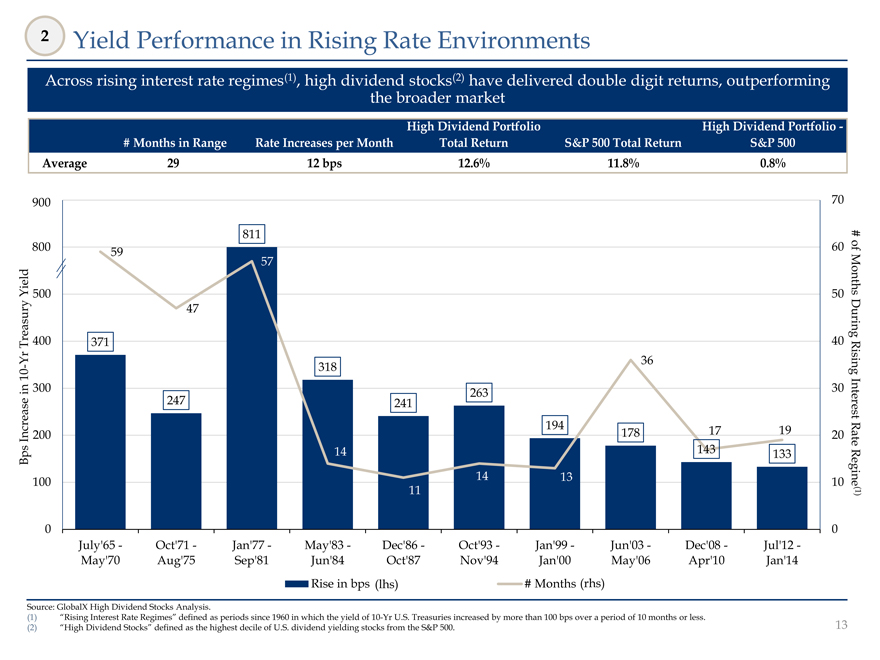

2 Yield Performance in Rising Rate Environments

Across rising interest rate regimes(1), high dividend stocks(2) have delivered double digit returns, outperforming the broader market

High Dividend Portfolio High Dividend Portfolio—# Months in Range Rate Increases per Month Total Return S&P 500 Total Return S&P 500 Average 29 12 bps 12.6% 11.8% 0.8%900 70811# 800 59 60of57 Months Yield 500 50 47 During Treasury 400 371 40 Yr—36 318 Rising 10 in 300 30 263 247 241 Interest 194 Increase 200 178 17 19 20 Rate Bps 14 143 133 14 13100 10 Regine11 (1)0 0 July’65—Oct’71—Jan’77—May’83—Dec’86—Oct’93—Jan’99—Jun’03—Dec’08—Jul’12-May’70 Aug’75 Sep’81 Jun’84 Oct’87 Nov’94 Jan’00 May’06 Apr’10 Jan’14 Rise in bps (lhs) # Months (rhs)

Source: GlobalX High Dividend Stocks Analysis.

(1) “Rising Interest Rate Regimes” defined as periods since 1960 in which the yield of10-Yr U.S. Treasuries increased by more than 100 bps over a period of 10 months or less. (2) “High Dividend Stocks” defined as the highest decile of U.S. dividend yielding stocks from the S&P 500.

14

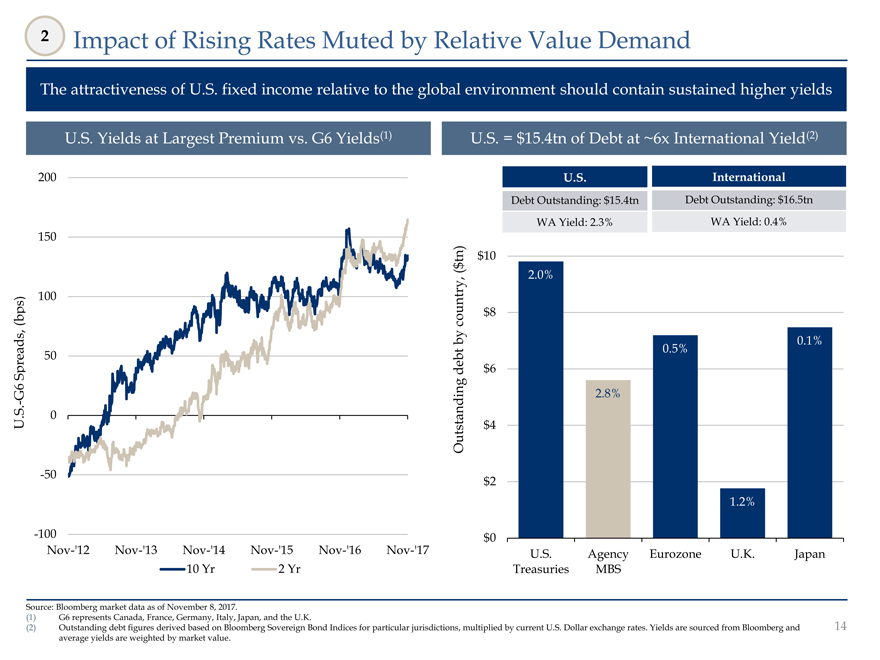

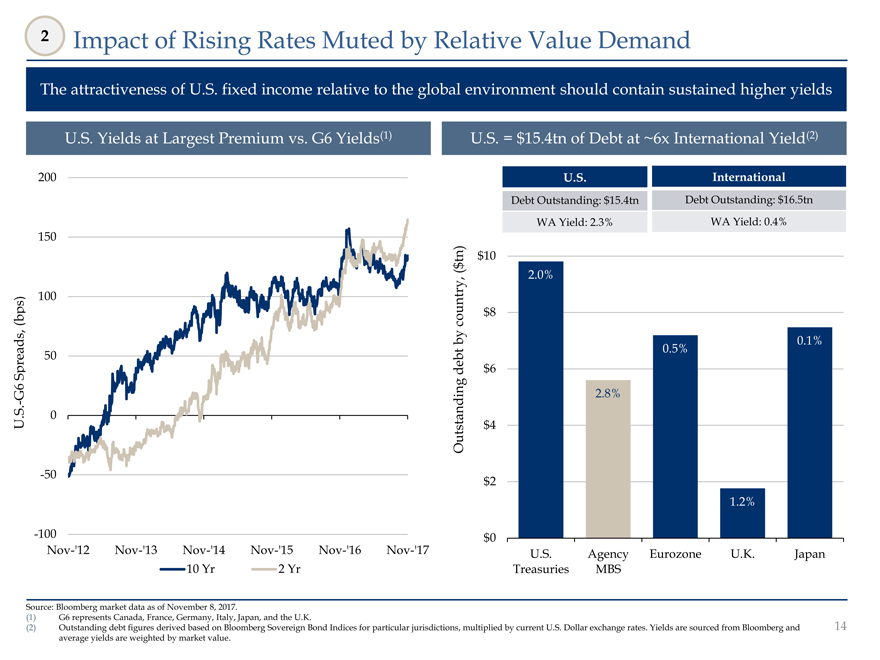

2 Impact of Rising Rates Muted by Relative Value Demand The attractiveness of U.S. fixed income relative to the global environment should contain sustained higher yields U.S. Yields at Largest Premium vs. G6 Yields(1) U.S. = $15.4tn of Debt at ~6x International Yield(2) 200 U.S. International Debt Outstanding: $15.4tn Debt Outstanding: $16.5tn WA Yield: 2.3% WA Yield: 0.4% 150 tn) $10 $ ( 2.0% (bps) 100 country, $8 by 0.1% 50 0.5% Spreads, debt $6 G6 2.8% - . . S 0 U Outstanding $4 -50 $2 1.2% -100 $0 Nov-’12 Nov-’13 Nov-’14 Nov-’15 Nov-’16 Nov-’17 U.S. Agency Eurozone U.K. Japan 10 Yr 2 Yr Treasuries MBS Source: Bloomberg market data as of November 8, 2017. (1) G6 represents Canada, France, Germany, Italy, Japan, and the U.K. (2) Outstanding debt figures derived based on Bloomberg Sovereign Bond Indices for particular jurisdictions, multiplied by current U.S. Dollar exchange rates. Yields are sourced from Bloomberg and 14 average yields are weighted by market value.

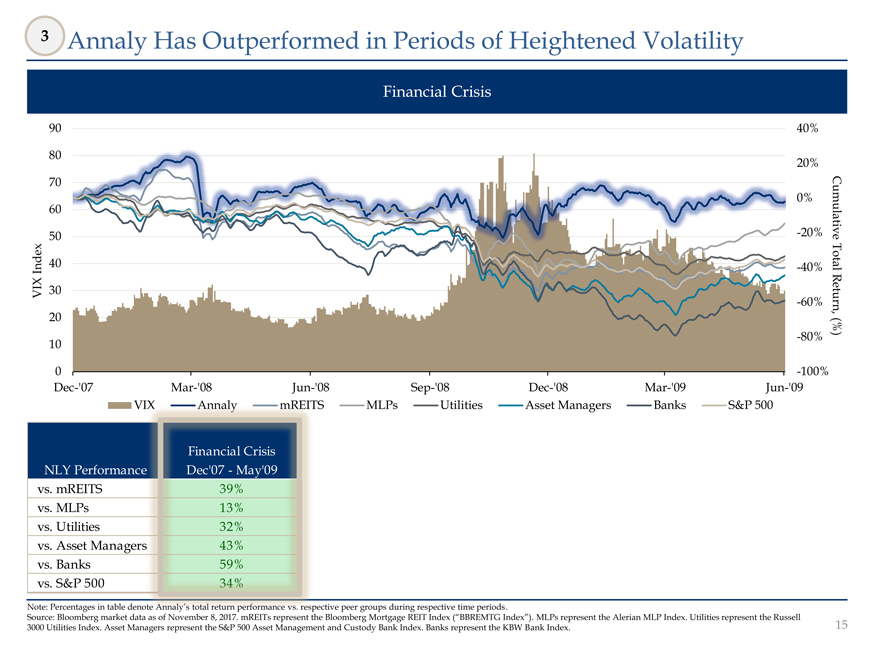

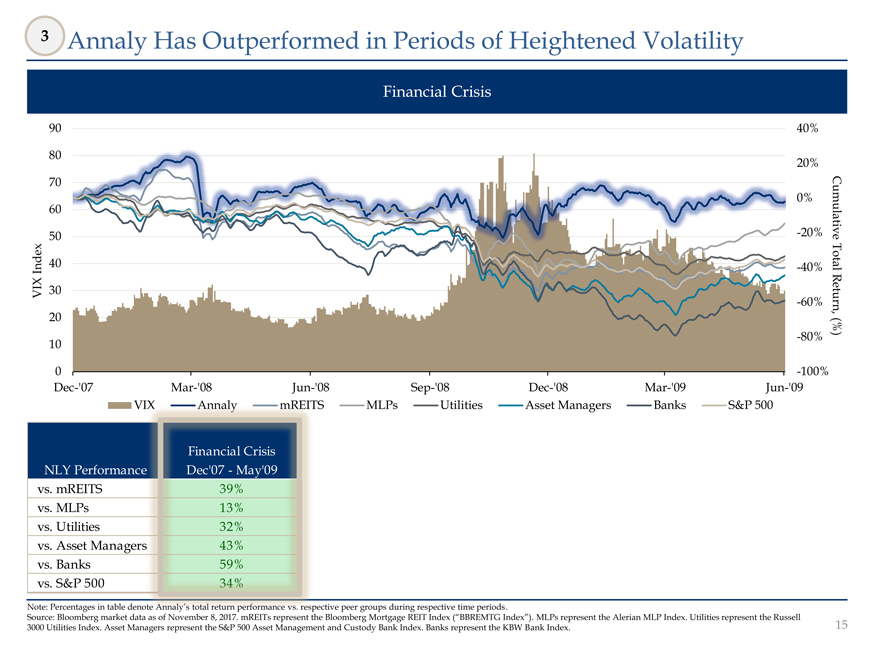

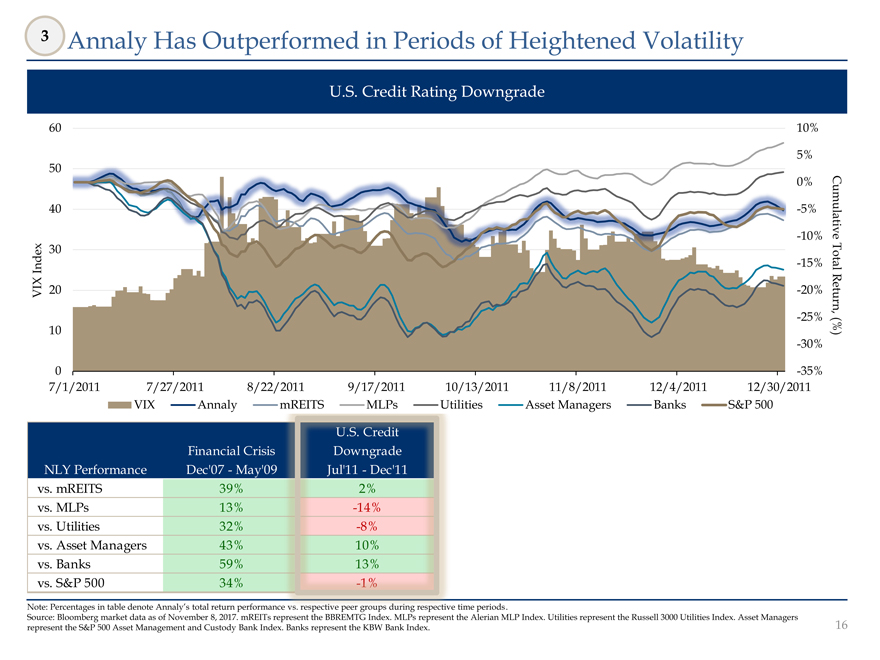

3 Annaly Has Outperformed in Periods of Heightened Volatility

Financial Crisis

90 40%

80

20%

70

60 0%

50-20% Cumulative

40-40% Total Index VIX 30-60% Return,

20 (%)-80% 10

0-100%Dec-‘07Mar-‘08Jun-‘08Sep-‘08Dec-‘08Mar-‘09Jun-‘09 VIX Annaly mREITS MLPs Utilities Asset Managers Banks S&P 500

NLY Performance vs. mREITS vs. MLPs vs. Utilities vs. Asset Manager vs. Banks vs. S&P 500

Note: Percentages in table denote Annaly’s total return performance vs. respective peer groups during respective time periods.

Source: Bloomberg market data as of November 8, 2017. mREITs represent the Bloomberg Mortgage REIT Index (“BBREMTG Index”). MLPs represent the Alerian MLP Index. Utilities represent the Russell 3000 Utilities Index. Asset Managers represent the S&P 500 Asset Management and Custody Bank Index. Banks represent the KBW Bank Index.

16

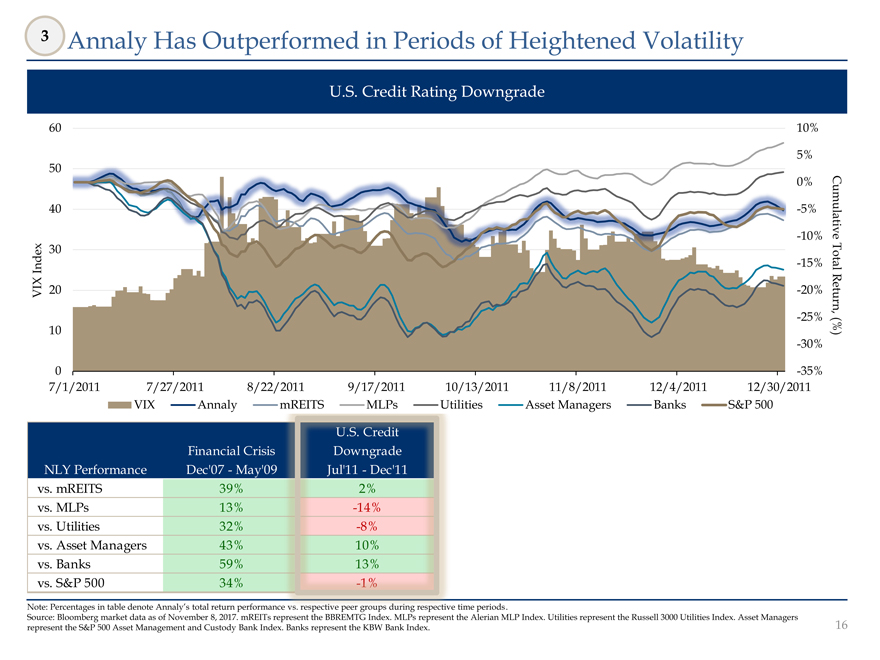

3 Annaly Has Outperformed in Periods of Heightened Volatility

U.S. Credit Rating Downgrade

60 10%

5% 50 0%

40-5% Cumulative-10% 30-15% Total Index VIX 20-20% Return,-25%

10 (%)-30%

0-35% 7/1/2011 7/27/2011 8/22/2011 9/17/2011 10/13/2011 11/8/2011 12/4/2011 12/30/2011

VIX Annaly mREITS MLPs Utilities Asset Managers Banks S&P 500

Financial Crisis U.S. Credit Downgrade NLY Performance Dec’07—May’09 Jul’11—Dec’11 vs. mREITS 39% 2% vs. MLPs 13%-14% vs. Utilities 32%-8% vs. Asset Managers 43% 10% vs. Banks 59% 13% vs. S&P 500 34%-1%

Note: Percentages in table denote Annaly’s total return performance vs. respective peer groups during respective time periods.

Source: Bloomberg market data as of November 8, 2017. mREITs represent the BBREMTG Index. MLPs represent the Alerian MLP Index. Utilities represent the Russell 3000 Utilities Index. Asset Managers represent the S&P 500 Asset Management and Custody Bank Index. Banks represent the KBW Bank Index.

17

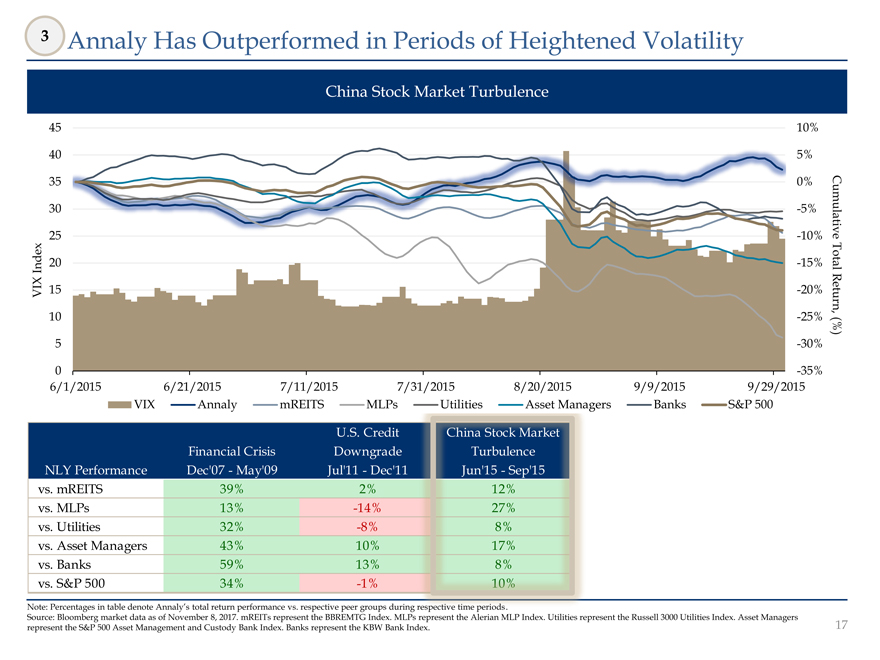

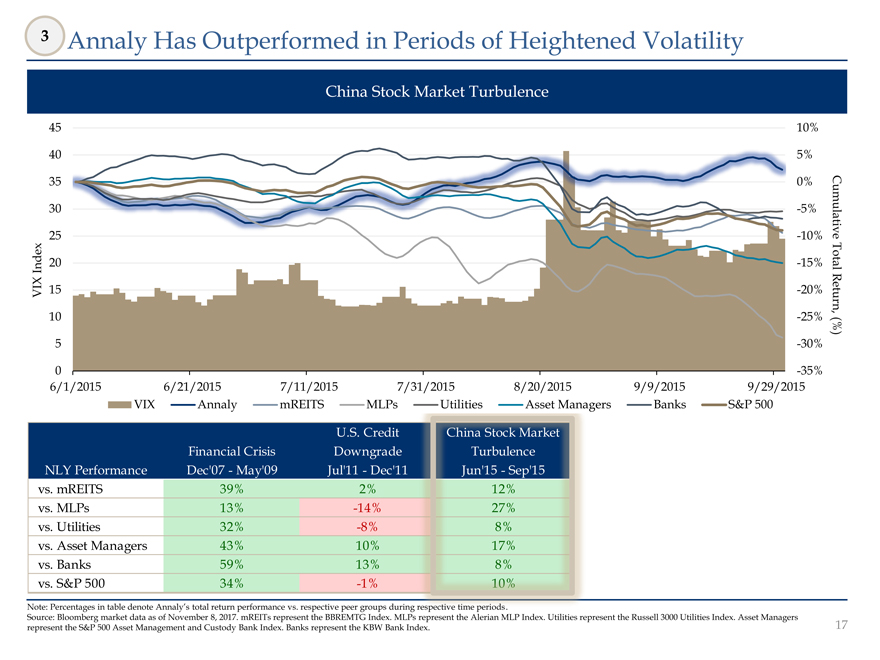

3 Annaly Has Outperformed in Periods of Heightened Volatility China Stock Market Turbulence 45 10% 40 5% 35 0% 30-5% Cumulative 25-10% 20-15% Total Index VIX 15-20% Return, 10-25% (%) 5-30% 0-35% 6/1/2015 6/21/2015 7/11/2015 7/31/2015 8/20/2015 9/9/2015 9/29/2015 VIX Annaly mREITS MLPs Utilities Asset Managers Banks S&P 500 Financial Crisis U.S. Credit Downgrade China Stock Market Turbulence NLY Performance Dec’07—May’09 Jul’11—Dec’11 Jun’15—Sep’15 vs. mREITS 39% 2% 12% vs. MLPs 13%-14% 27% vs. Utilities 32%-8% 8% vs. Asset Managers 43% 10% 17% vs. Banks 59% 13% 8% vs. S&P 500 34%-1% 10% Note: Percentages in table denote Annaly’s total return performance vs. respective peer groups during respective time periods. Source: Bloomberg market data as of November 8, 2017. mREITs represent the BBREMTG Index. MLPs represent the Alerian MLP Index. Utilities represent the Russell 3000 Utilities Index. Asset Managers represent the S&P 500 Asset Management and Custody Bank Index. Banks represent the KBW Bank Index. 18

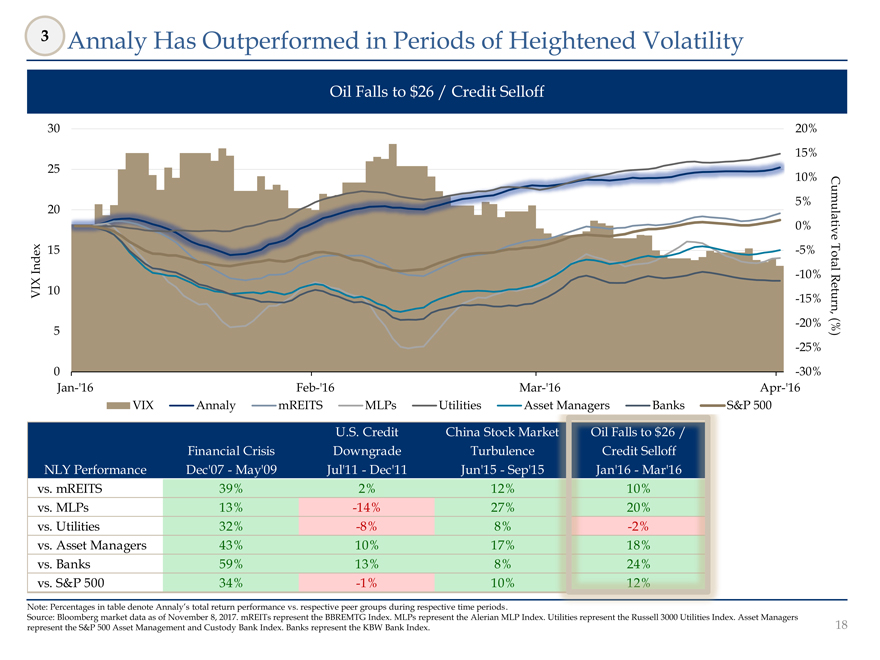

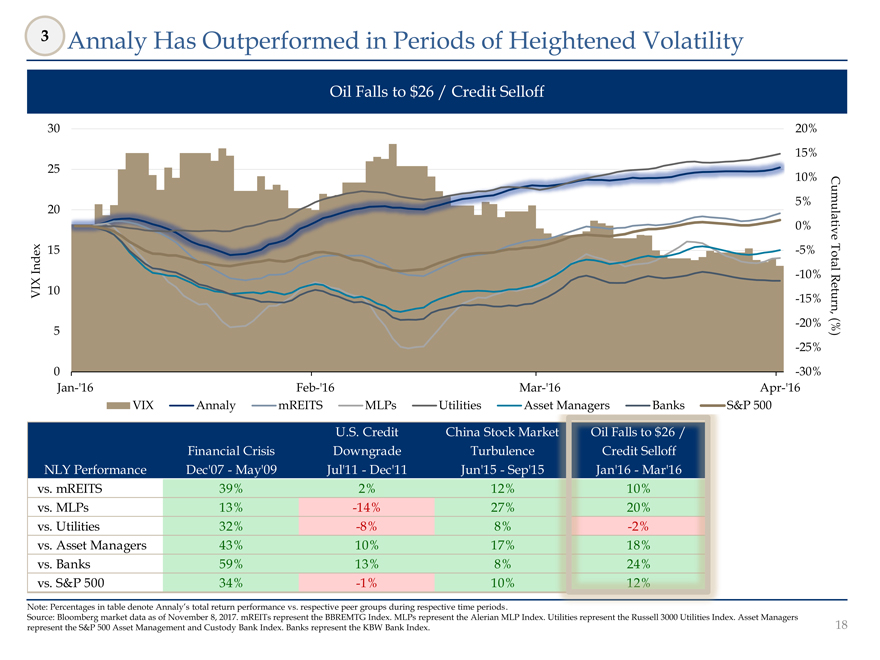

3 Annaly Has Outperformed in Periods of Heightened Volatility Oil Falls to $26 / Credit Selloff 30 20% 15% 25 10% 5% 200% Cumulative15-5% Total Index-10% VIX 10-15% Return,-20% 5 (%)-25% 0-30%Jan-‘16Feb-‘16Mar-‘16Apr-‘16 VIX Annaly mREITS MLPs Utilities Asset Managers Banks S&P 500 Financial Crisis U.S. Credit Downgrade China Stock Market Turbulence Oil Falls to $26 / Credit Selloff NLY Performance Dec’07—May’09 Jul’11—Dec’11 Jun’15—Sep’15 Jan’16—Mar’16 vs. mREITS 39% 2% 12% 10% vs. MLPs 13%-14% 27% 20% vs. Utilities 32%-8% 8%-2% vs. Asset Managers 43% 10% 17% 18% vs. Banks 59% 13% 8% 24% vs. S&P 500 34%-1% 10% 12% Note: Percentages in table denote Annaly’s total return performance vs. respective peer groups during respective time periods. Source: Bloomberg market data as of November 8, 2017. mREITs represent the BBREMTG Index. MLPs represent the Alerian MLP Index. Utilities represent the Russell 3000 Utilities Index. Asset Managers represent the S&P 500 Asset Management and Custody Bank Index. Banks represent the KBW Bank Index. 19

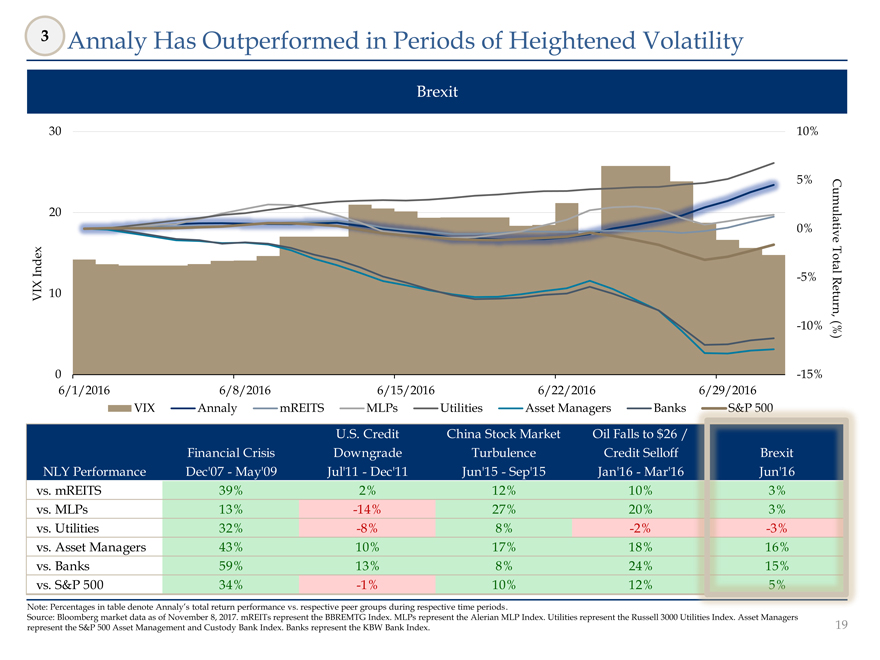

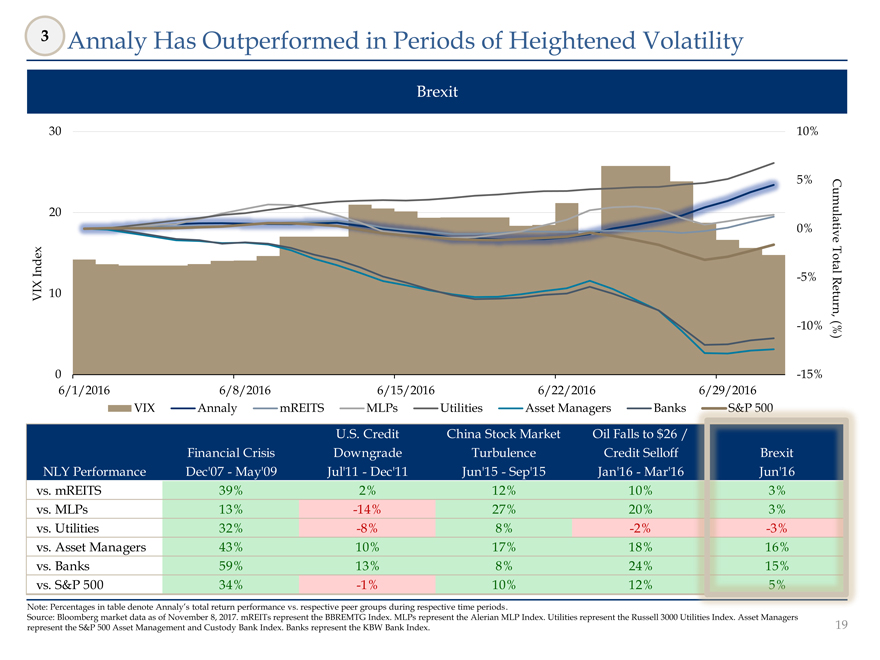

3 Annaly Has Outperformed in Periods of Heightened Volatility

Brexit

30 10%5%200% Cumulative Total Index-5%VIX 10 Return,-10% (%) 0-15% 6/1/2016 6/8/2016 6/15/2016 6/22/2016 6/29/2016 VIX Annaly mREITS MLPs Utilities Asset Managers BanksS&P 500

Financial Crisis U.S. Credit Downgrade China Stock Market Turbulence Oil Falls to $26 / Credit Selloff Brexit NLY Performance Dec’07—May’09 Jul’11—Dec’11 Jun’15—Sep’15 Jan’16—Mar’16 Jun’16 vs. mREITS 39% 2% 12% 10% 3% vs. MLPs 13%-14% 27% 20% 3% vs. Utilities 32%-8% 8%-2%-3% vs. Asset Managers 43% 10% 17% 18% 16% vs. Banks 59% 13% 8% 24% 15% vs. S&P 500 34%-1% 10% 12% 5%

Note: Percentages in table denote Annaly’s total return performance vs. respective peer groups during respective time periods.

Source: Bloomberg market data as of November 8, 2017. mREITs represent the BBREMTG Index. MLPs represent the Alerian MLP Index. Utilities represent the Russell 3000 Utilities Index. Asset Managers represent the S&P 500 Asset Management and Custody Bank Index. Banks represent the KBW Bank Index.

20

CEO Overview

1 The Yield-Less World

2 Three Major Questions Answered

3 Annaly Advantages

4 Performance & Relative Value

5 Annaly’s Opportunity

21

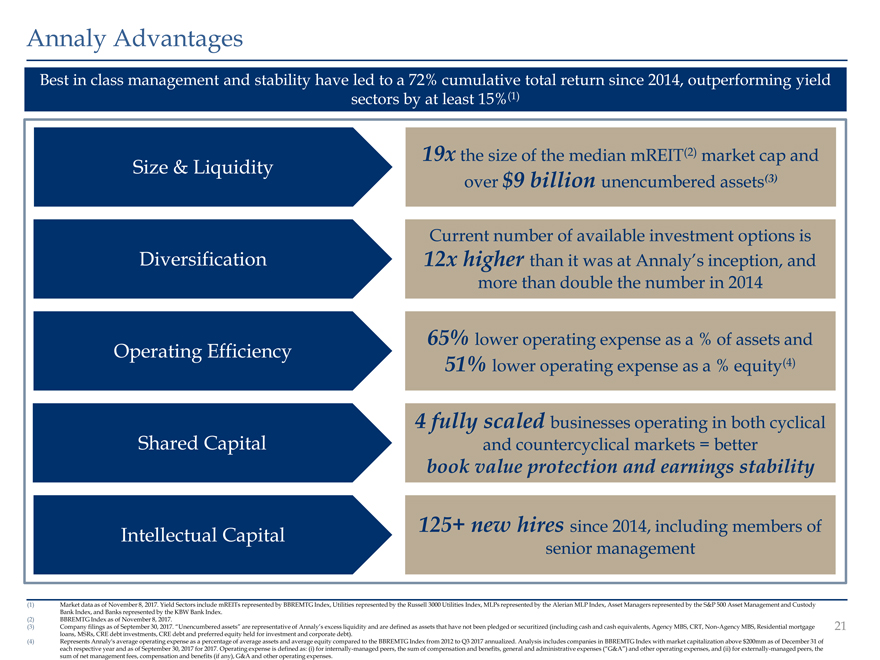

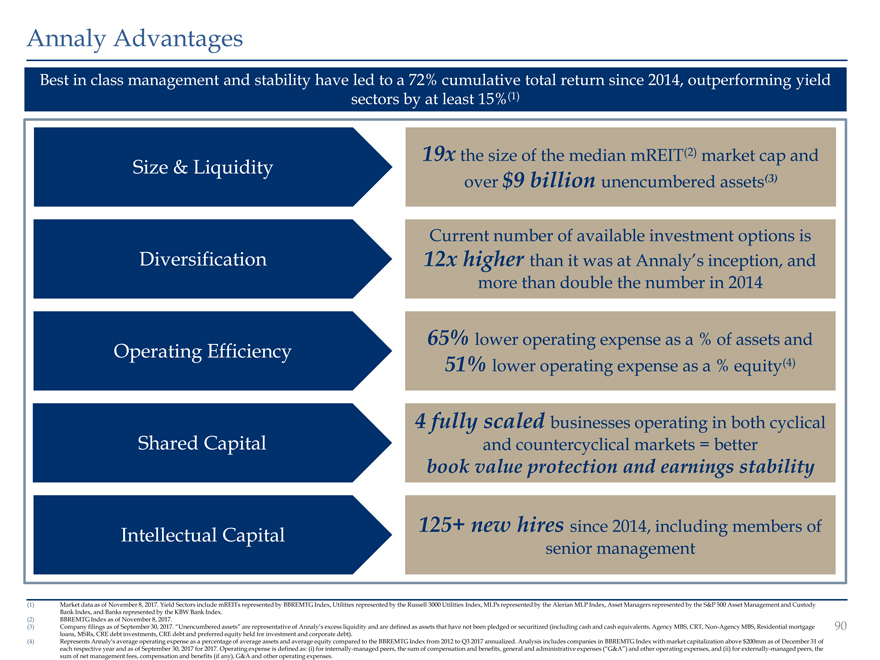

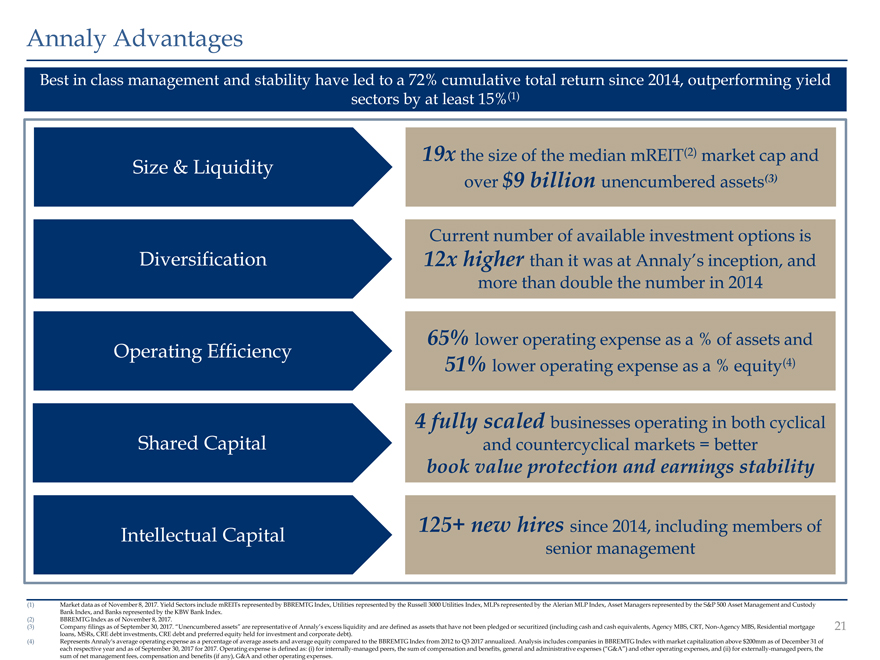

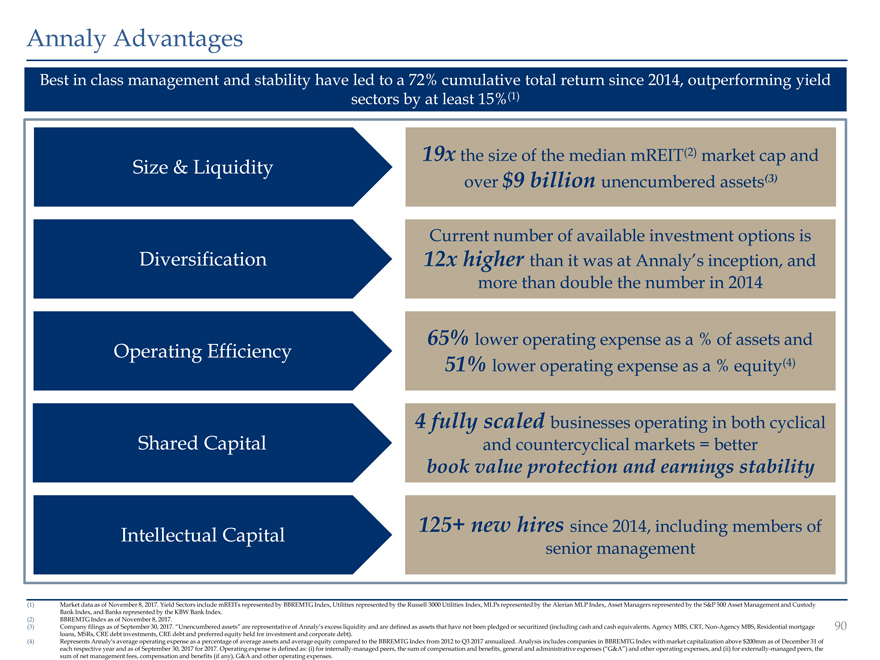

Annaly Advantages Best in class management and stability have led to a 72% cumulative total return since 2014, outperforming yield sectors by at least 15%(1) 19x the size of the median mREIT(2) market cap and Size & Liquidity over $9 billion unencumbered assets(3) Current number of available investment options is Diversification 12x higher than it was at Annaly’s inception, and more than double the number in 2014 65% lower operating expense as a % of assets and Operating Efficiency 51% lower operating expense as a % equity(4) 4 fully scaled businesses operating in both cyclical Shared Capital and countercyclical markets = better book value protection and earnings stability Intellectual Capital 125+ new hires since 2014, including members of senior management (1) Market data as of November 8, 2017. Yield Sectors include mREITs represented by BBREMTG Index, Utilities represented by the Russell 3000 Utilities Index, MLPs represented by the Alerian MLP Index, Asset Managers represented by the S&P 500 Asset Management and Custody Bank Index, and Banks represented by the KBW Bank Index. (2) BBREMTG Index as of November 8, 2017. (3) Company filings as of September 30, 2017. “Unencumbered assets” are representative of Annaly’s excess liquidity and are defined as assets that have not been pledged or securitized (including cash and cash equivalents, Agency MBS, CRT, Non-Agency MBS, Residential mortgage 21 loans, MSRs, CRE debt investments, CRE debt and preferred equity held for investment and corporate debt). (4) Represents Annaly’s average operating expense as a percentage of average assets and average equity compared to the BBREMTG Index from 2012 to Q3 2017 annualized. Analysis includes companies in BBREMTG Index with market capitalization above $200mm as of December 31 of each respective year and as of September 30, 2017 for 2017. Operating expense is defined as: (i) for internally-managed peers, the sum of compensation and benefits, general and administrative expenses (“G&A”) and other operating expenses, and (ii) for externally-managed peers, the sum of net management fees, compensation and benefits (if any), G&A and other operating expenses.

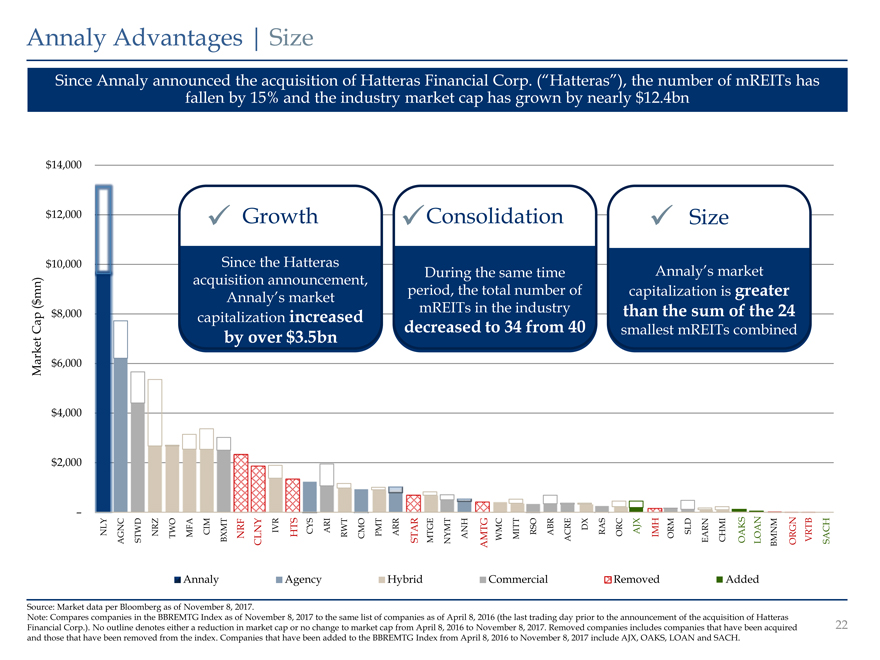

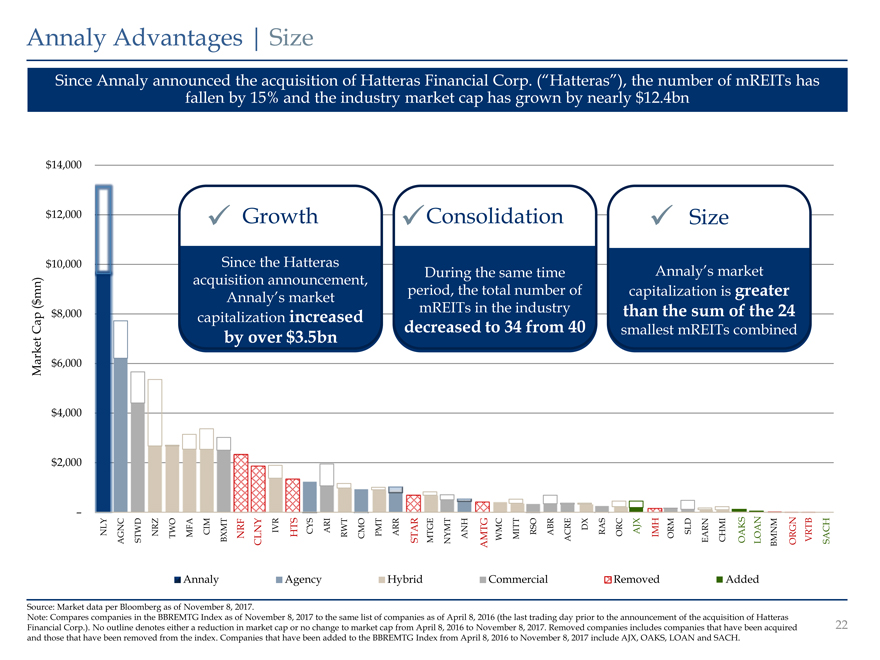

Annaly Advantages | Size Since Annaly announced the acquisition of Hatteras Financial Corp. (“Hatteras”), the number of mREITs has fallen by 15% and the industry market cap has grown by nearly $12.4bn $14,000 $12,000 Growth Consolidation Size $10,000 Since the Hatteras mn) acquisition Annaly’s announcement, market period, During the the total same number time of capitalization Annaly’s market is greater $ ( $8,000 increased mREITs in the industry than the sum of the 24 Cap capitalization decreased to 34 from 40 smallest mREITs combined by over $3.5bn Market $6,000 $4,000 $2,000 RF R G DX X S GN NLY AGNC STWD NRZ TWO MFA CIM BXMT NRF CLNYCLN IVR HTS CYS ARI RWT CMO PMT ARR TSTAR MTGE NYMT ANH AMAMTG WMC MITT RSO ABR ACRE RAS ORC AJX IMHIMH ORM SLD EARN CHMI OAKS LOAN BMNM ORGN VRTBVR ACSACH Annaly Agency Hybrid Commercial Removed Added Source: Market data per Bloomberg as of November 8, 2017. Note: Compares companies in the BBREMTG Index as of November 8, 2017 to the same list of companies as of April 8, 2016 (the last trading day prior to the announcement of the acquisition of Hatteras Financial Corp.). No outline denotes either a reduction in market cap or no change to market cap from April 8, 2016 to November 8, 2017. Removed companies includes companies that have been acquired 22 and those that have been removed from the index. Companies that have been added to the BBREMTG Index from April 8, 2016 to November 8, 2017 include AJX, OAKS, LOAN and SACH.

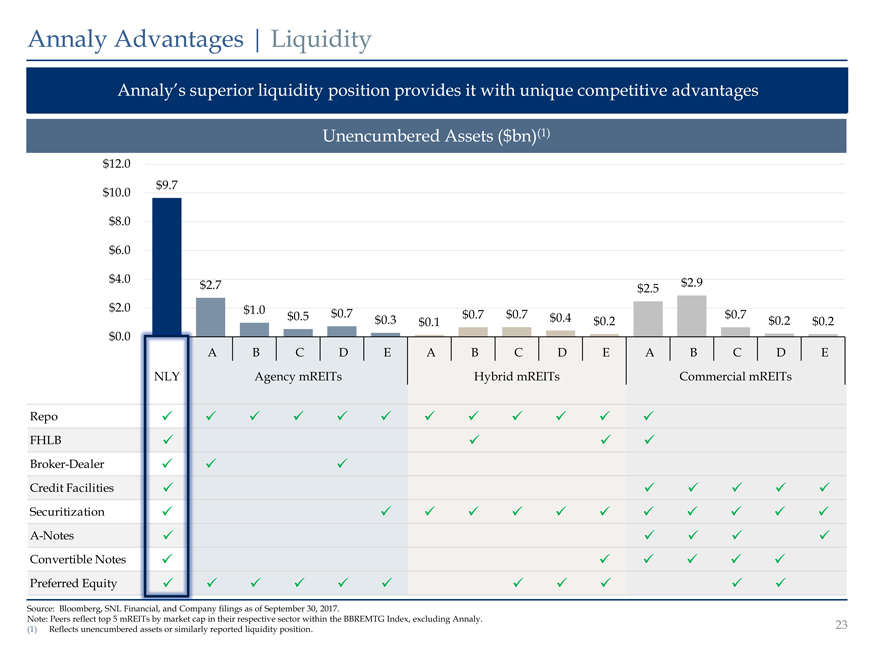

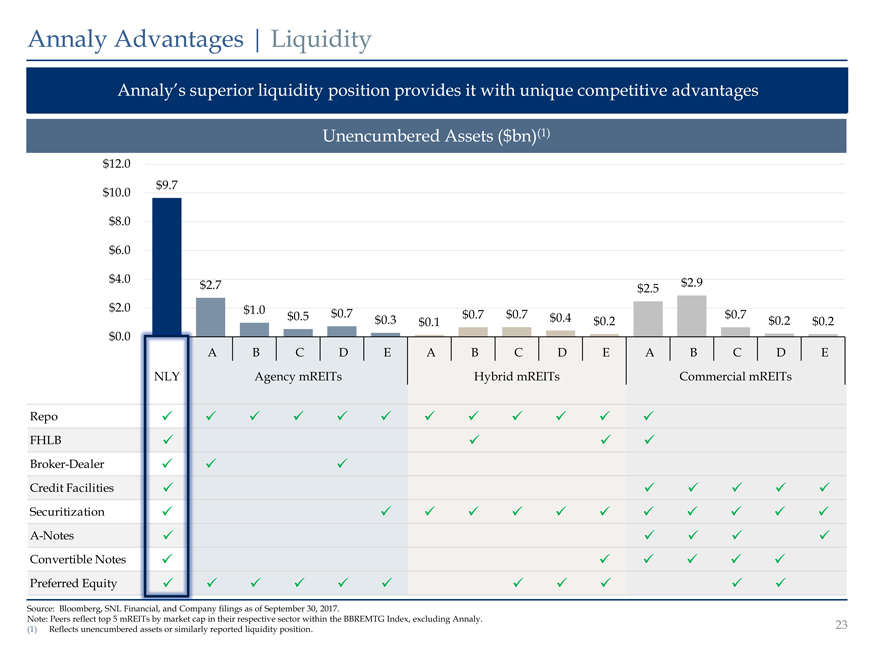

Annaly Advantages | Liquidity

Annaly’s superior liquidity position provides it with unique competitive advantages

Unencumbered Assets ($bn)(1)

$12.0

$9.7

$10.0

$8.0

$6.0

$4.0 $2.9

$2.7 $2.5

$2.0 $1.0

$0.5 $0.7 $0.7 $0.7 $0.4 $0.7

$0.3 $0.1 $0.2 $0.2 $0.2

$0.0

A B C D E A B C D E A B C D E Agency mREITs Hybrid mREITs Commercial mREITs

Repo

FHLB Broker-Dealer

Credit Facilities SecuritizationA-Notes Convertible Notes Preferred Equity

Source: Bloomberg, SNL Financial, and Company filings as of September 30, 2017.

Note: Peers reflect top 5 mREITs by market cap in their respective sector within the BBREMTG Index, excluding Annaly. (1) Reflects unencumbered assets or similarly reported liquidity position.

24

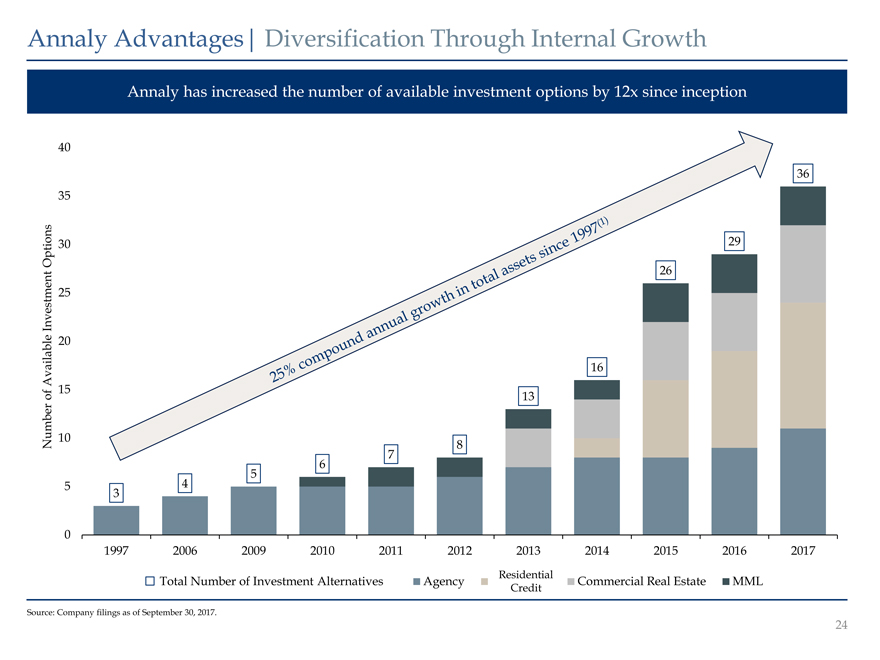

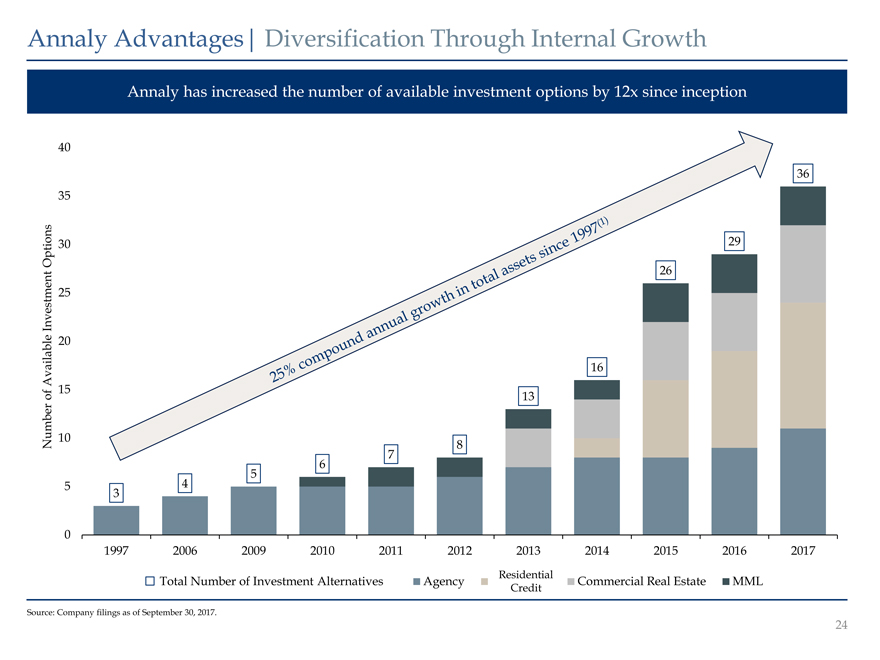

Annaly Advantages| Diversification Through Internal Growth Annaly has increased the number of available investment options by 12x since inception 40 36 35 ons 30 29 Opti 26 Investment 25 20 Available 16 of 15 13 Number 10 8 7 6 5 5 4 3 0 1997 2006 2009 2010 2011 2012 2013 2014 2015 2016 2017 Residential Total Number of Investment Alternatives Agency Commercial Real Estate MML Credit Source: Company filings as of September 30, 2017. 24

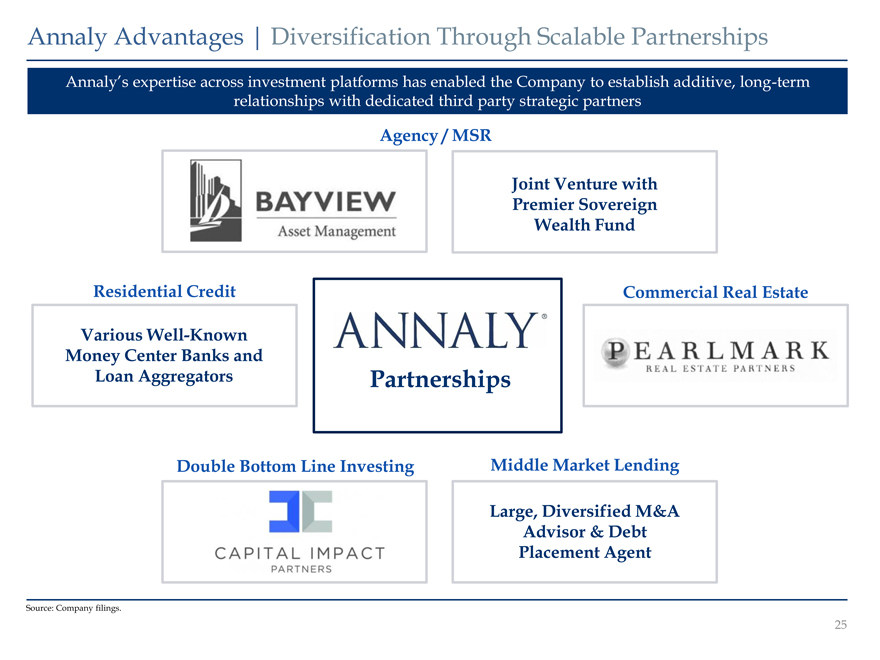

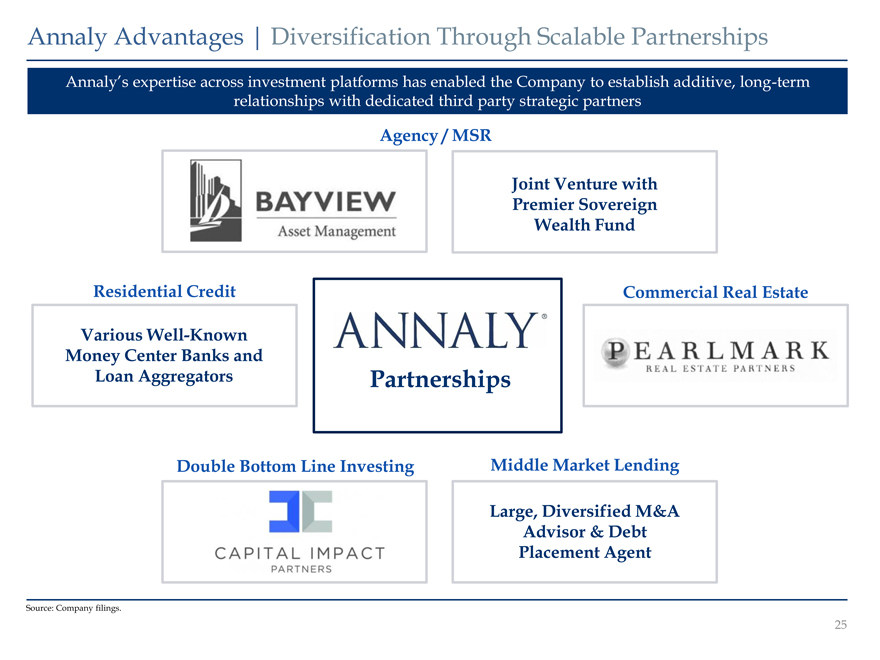

Annaly Advantages | Diversification Through Scalable Partnerships Annaly’s expertise across investment platforms has enabled the Company to establish additive, long-term relationships with dedicated third party strategic partners Agency / MSR Joint Venture with Premier Sovereign Wealth Fund Residential Credit Commercial Real Estate Various Well-Known Money Center Banks and Loan Aggregators Partnerships Double Bottom Line Investing Middle Market Lending Large, Diversified M&A Advisor & Debt Placement Agent Source: Company filings. 25

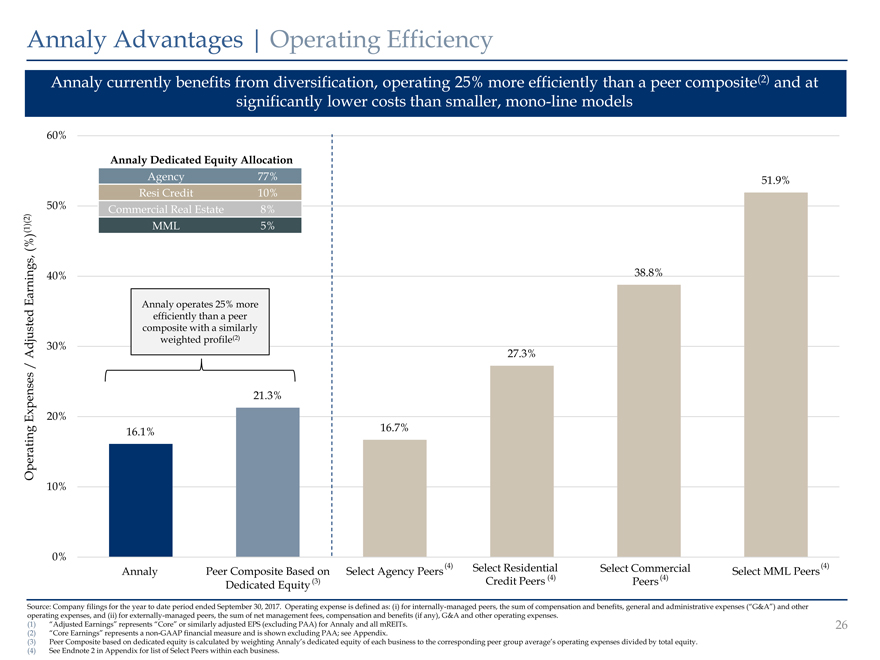

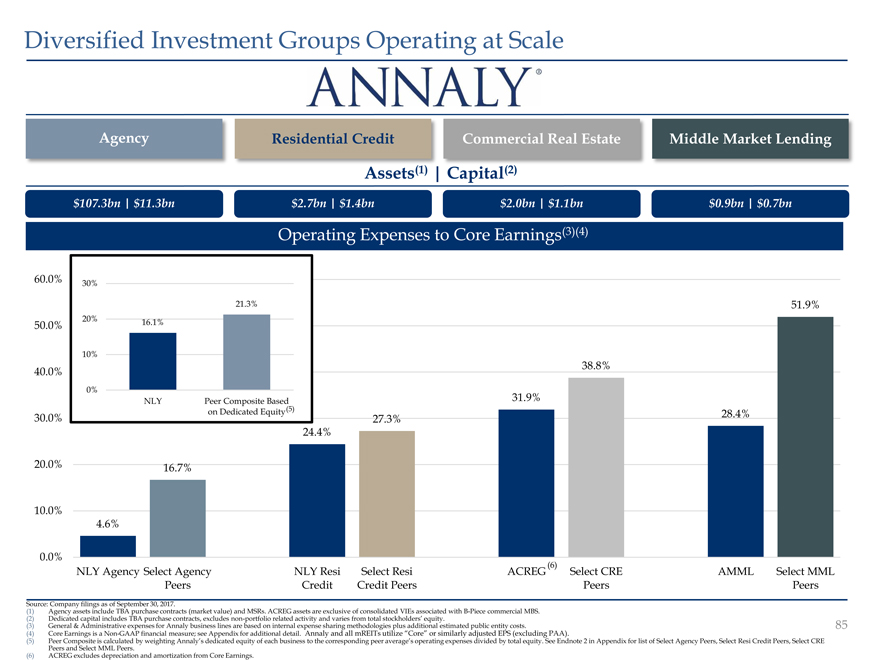

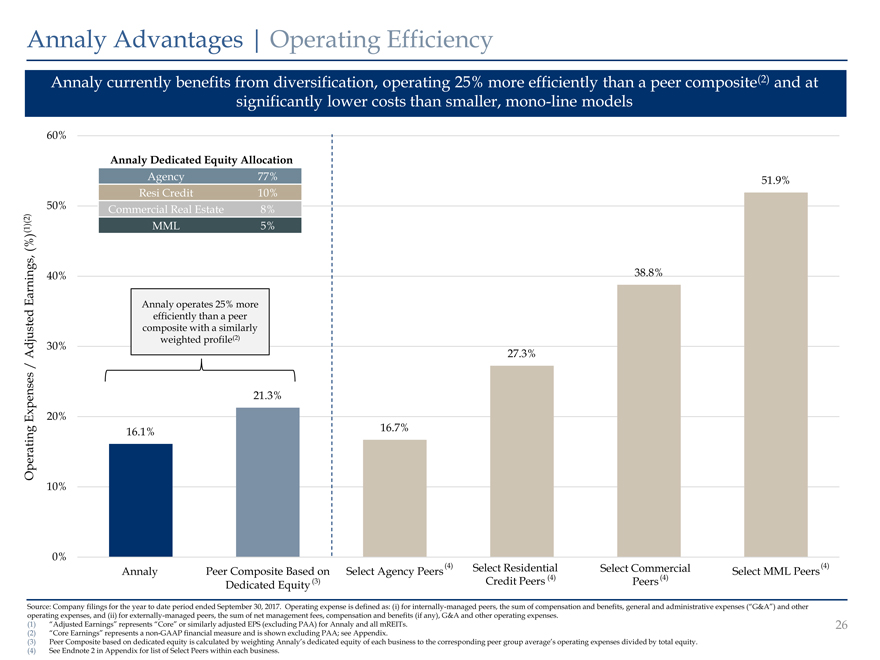

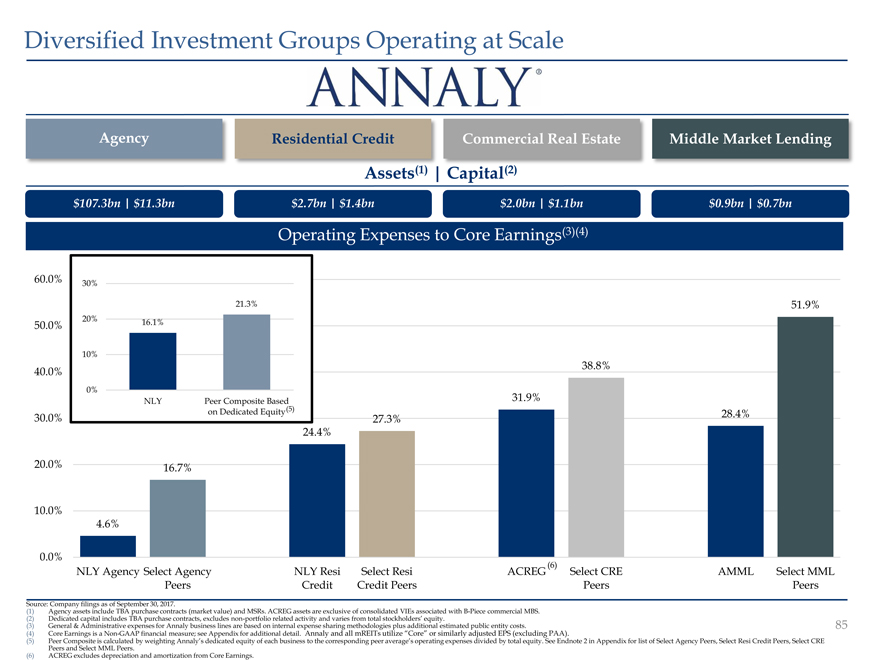

Annaly Advantages | Operating Efficiency

Annaly currently benefits from diversification, operating 25% more efficiently than a peer composite(2) and at significantly lower costs than smaller, mono-line models

60%

Annaly Dedicated Equity Allocation

Agency 77% 51.9% Resi Credit 10% 50% Commercial Real Estate 8%

(1)(2) MML 5%

(%)

Earnings, 40% 38.8%

Annaly operates 25% more efficiently than a peer composite with a similarly 30% weighted profile(2)

Adjusted 27.3% /

21.3%

Expenses 20% g 16.1% 16.7%

Operatin

10%

0%

(4) Select Residential Select Commercial (4) Annaly Peer Composite Based on Select Agency Peers Select MML Peers

(4) (4)

Dedicated Equity (3) Credit Peers Peers

Source: Company filings for the year to date period ended September 30, 2017. Operating expense is defined as: (i) for internally-managed peers, the sum of compensation and benefits, general and administrative expenses (“G&A”) and other operating expenses, and (ii) for externally-managed peers, the sum of net management fees, compensation and benefits (if any), G&A and other operating expenses.

(1) “Adjusted Earnings” represents “Core” or similarly adjusted EPS (excluding PAA) for Annaly and all mREITs. (2) “Core Earnings” represents anon-GAAP financial measure and is shown excluding PAA; see Appendix.

(3) Peer Composite based on dedicated equity is calculated by weighting Annaly’s dedicated equity of each business to the corresponding peer group average’s operating expenses divided by total equity.

(4) See Endnote 2 in Appendix for list of Select Peers within each business.

27

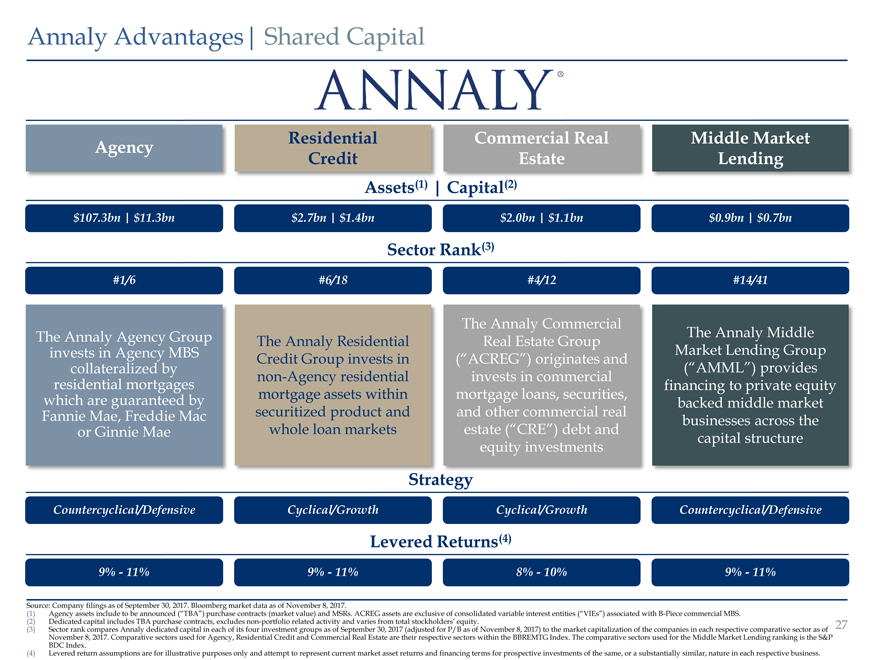

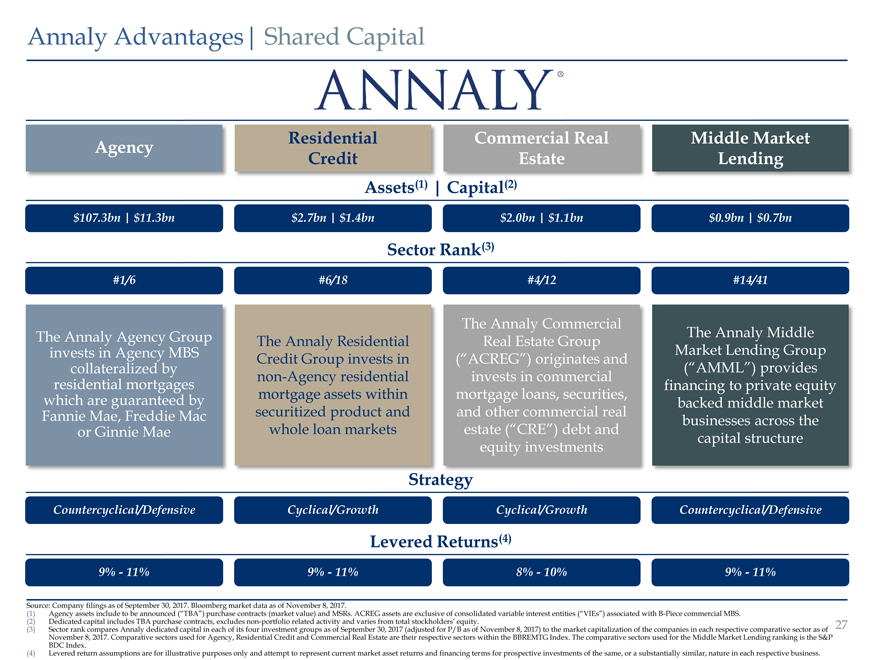

Annaly Advantages| Shared Capital Agency Residential Commercial Real Middle Market Credit Estate Lending Assets(1) | Capital(2) $107.3bn | $11.3bn $2.7bn | $1.4bn $2.0bn | $1.1bn $0.9bn | $0.7bn Sector Rank(3) #1/6 #6/18 #4/12 #14/41 The Annaly Commercial The Annaly Agency Group The Annaly Residential Real Estate Group The Annaly Middle invests in Agency MBS Credit Group invests in (“ACREG”) originates and Market Lending Group collateralized by (“AMML”) provides non-Agency residential invests in commercial residential mortgages financing to private equity which are guaranteed by mortgage assets within mortgage loans, securities, backed middle market Fannie Mae, Freddie Mac securitized product and and other commercial real businesses across the or Ginnie Mae whole loan markets estate (“CRE”) debt and capital structure equity investments Strategy Countercyclical/Defensive Cyclical/Growth Cyclical/Growth Countercyclical/Defensive Levered Returns(4) 9% - 11% 9% - 11% 8% - 10% 9% - 11% Source: Company filings as of September 30, 2017. Bloomberg market data as of November 8, 2017. (1) Agency assets include to be announced (“TBA”) purchase contracts (market value) and MSRs. ACREG assets are exclusive of consolidated variable interest entities (“VIEs”) associated with B-Piece commercial MBS. (2) Dedicated capital includes TBA purchase contracts, excludes non-portfolio related activity and varies from total stockholders’ equity. 27 (3) Sector rank compares Annaly dedicated capital in each of its four investment groups as of September 30, 2017 (adjusted for P/B as of November 8, 2017) to the market capitalization of the companies in each respective comparative sector as of November 8, 2017. Comparative sectors used for Agency, Residential Credit and Commercial Real Estate are their respective sectors within the BBREMTG Index. The comparative sectors used for the Middle Market Lending ranking is the S&P BDC Index. (4) Levered return assumptions are for illustrative purposes only and attempt to represent current market asset returns and financing terms for prospective investments of the same, or a substantially similar, nature in each respective business.

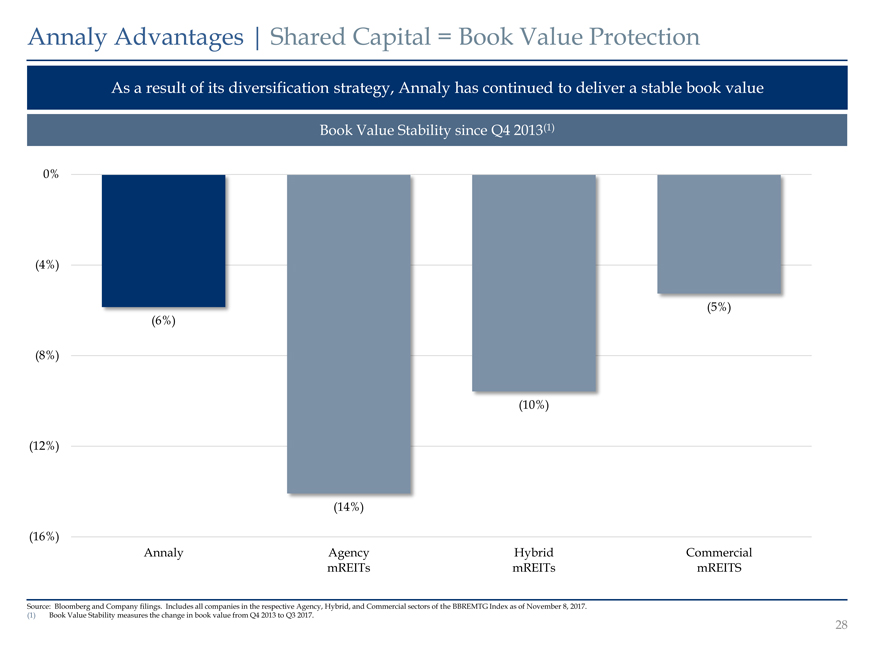

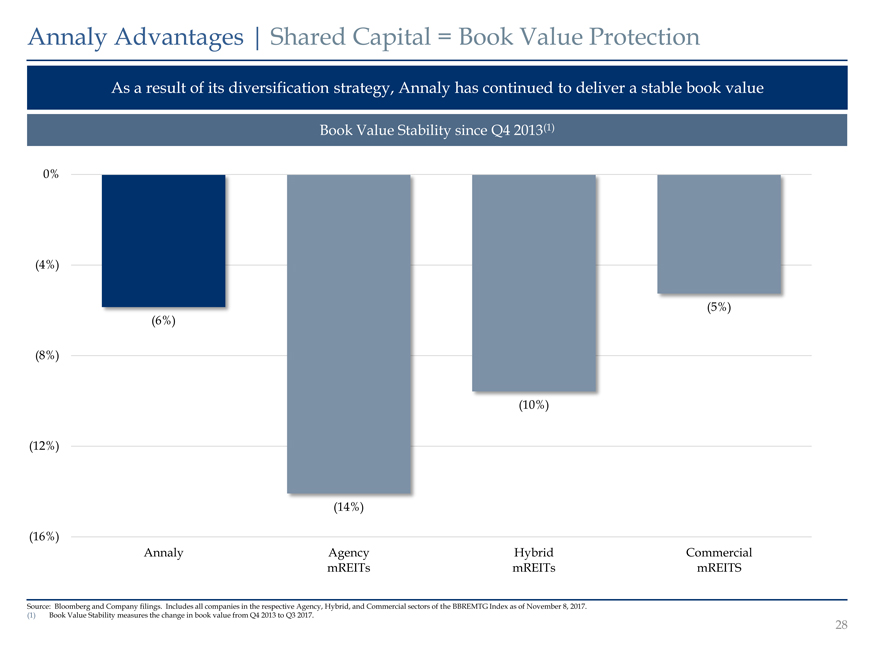

Annaly Advantages | Shared Capital = Book Value Protection

As a result of its diversification strategy, Annaly has continued to deliver a stable book value

Book Value Stability since Q4 2013(1)

0%

(4%)

(5%)

(6%)

(8%)

(10%)

(12%)

(14%)

(16%)

Annaly Agency Hybrid Commercial mREITs mREITs mREITS

Source: Bloomberg and Company filings. Includes all companies in the respective Agency, Hybrid, and Commercial sectors of the BBREMTG Index as of November 8, 2017. (1) Book Value Stability measures the change in book value from Q4 2013 to Q3 2017.

29

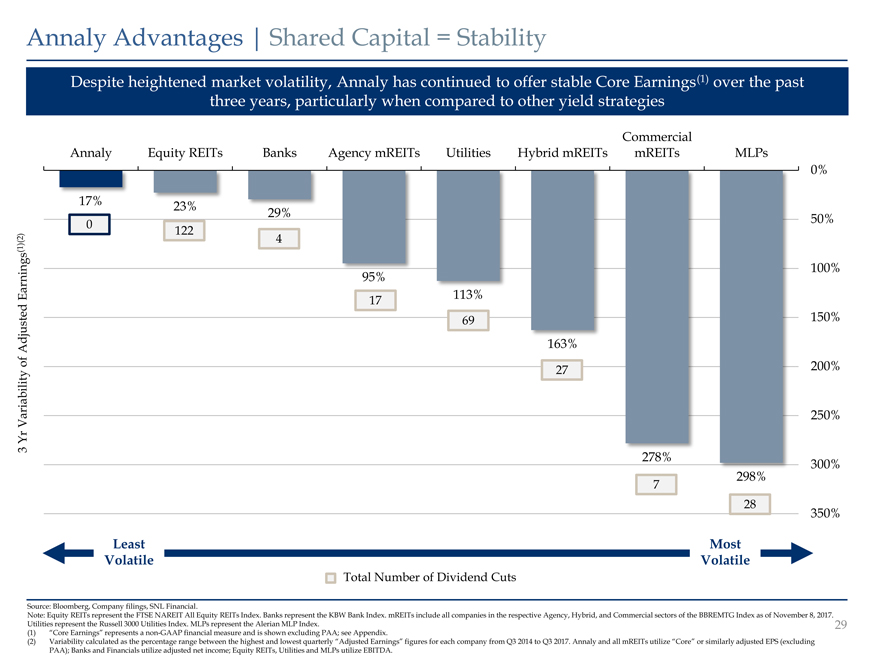

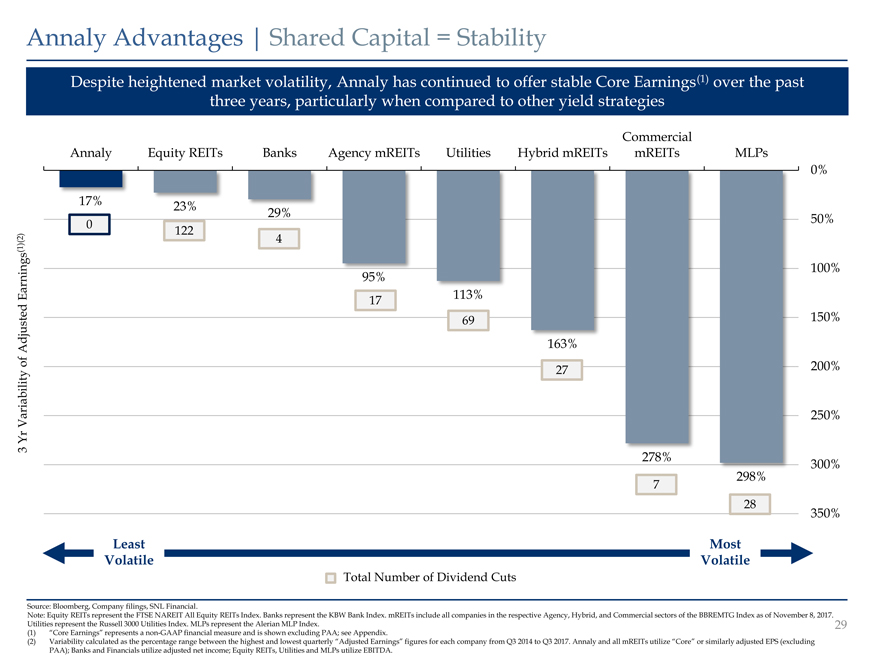

Annaly Advantages | Shared Capital = Stability Despite heightened market volatility, Annaly has continued to offer stable Core Earnings(1) over the past three years, particularly when compared to other yield strategies Commercial Annaly Equity REITs Banks Agency mREITs Utilities Hybrid mREITs mREITs MLPs 0% 17% 23% 29% 0 122 50% (1)(2) 4 100% 95% Earnings 113% 17 69 150% Adjusted 163% of 27 200% Variability 250% Yr 3 278% 298% 300% 7 28 350% Least Most Volatile Volatile Total Number of Dividend Cuts Source: Bloomberg, Company filings, SNL Financial. Note: Equity REITs represent the FTSE NAREIT All Equity REITs Index. Banks represent the KBW Bank Index. mREITs include all companies in the respective Agency, Hybrid, and Commercial sectors of the BBREMTG Index as of November 8, 2017. Utilities represent the Russell 3000 Utilities Index. MLPs represent the Alerian MLP Index. (1) “Core Earnings” represents a non-GAAP financial measure and is shown excluding PAA; see Appendix. (2) Variability calculated as the percentage range between the highest and lowest quarterly “Adjusted Earnings” figures for each company from Q3 2014 to Q3 2017. Annaly and all mREITs utilize “Core” or similarly adjusted EPS (excluding PAA); Banks and Financials utilize adjusted net income; Equity REITs, Utilities and MLPs utilize EBITDA. 30

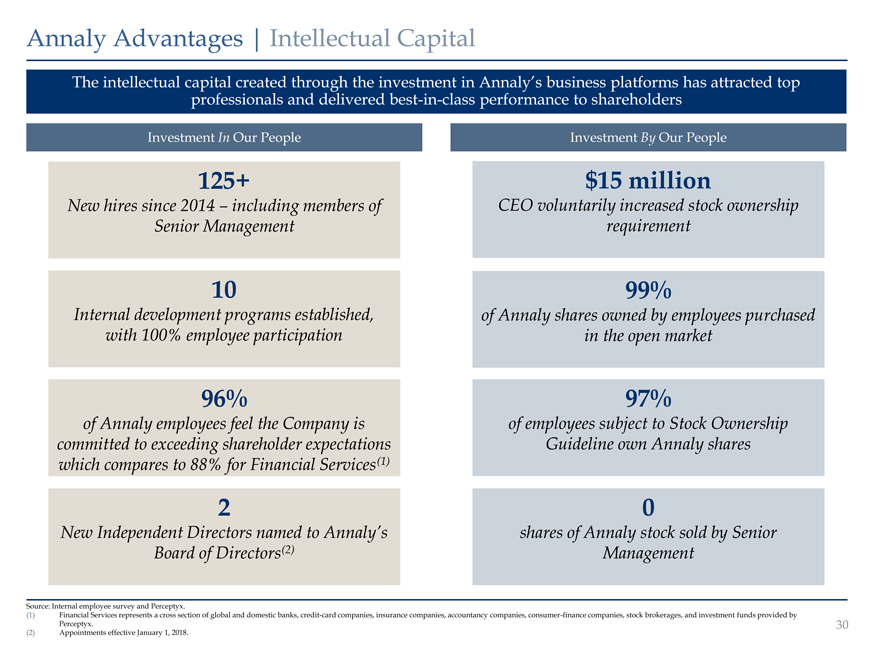

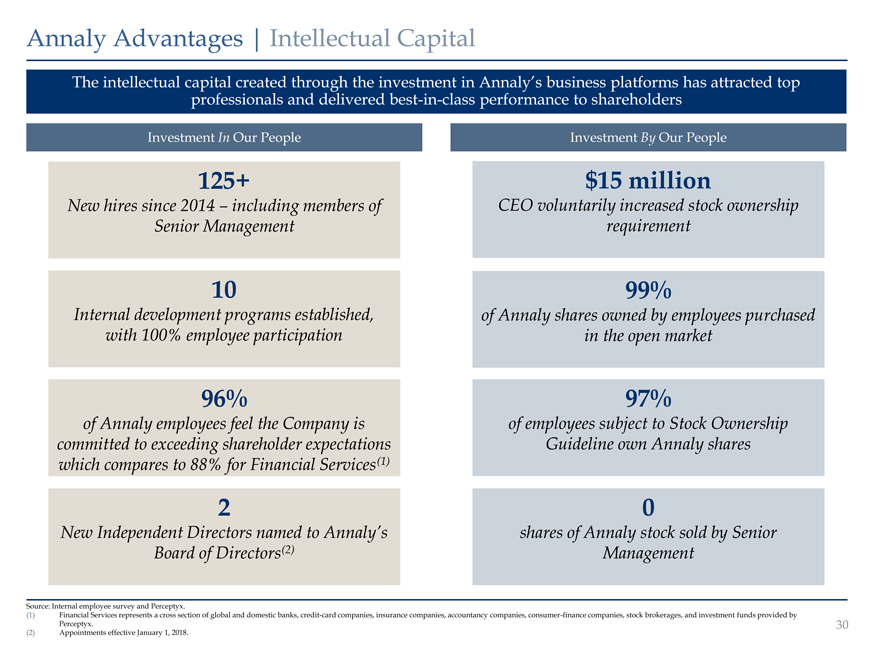

Annaly Advantages | Intellectual Capital The intellectual capital created through the investment in Annaly’s business platforms has attracted top professionals and delivered best-in-class performance to shareholders Investment In Our People Investment By Our People 125+ $15 million New hires since 2014 including members of CEO voluntarily increased stock ownership Senior Management requirement 10 99% Internal development programs established, of Annaly shares owned by employees purchased with 100% employee participation in the open market 96% 97% of Annaly employees feel the Company is of employees subject to Stock Ownership committed to exceeding shareholder expectations Guideline own Annaly shares which compares to 88% for Financial Services(1) 2 0 New Independent Directors named to Annaly’s shares of Annaly stock sold by Senior Board of Directors(2) Management Source: Internal employee survey and Perceptyx. (1) Financial Services represents a cross section of global and domestic banks, credit-card companies, insurance companies, accountancy companies, consumer-finance companies, stock brokerages, and investment funds provided by Perceptyx. 30 (2) Appointments effective January 1, 2018.

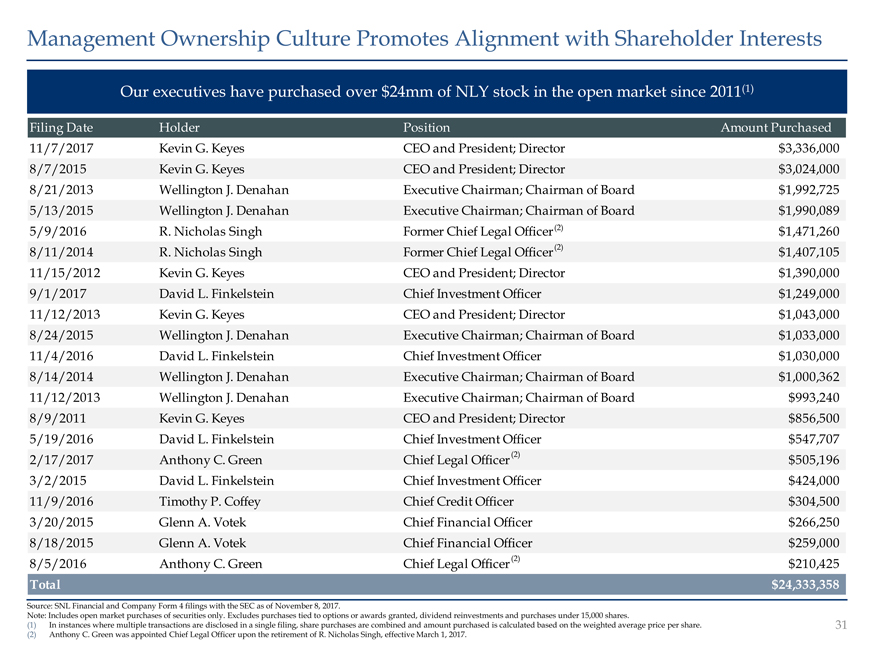

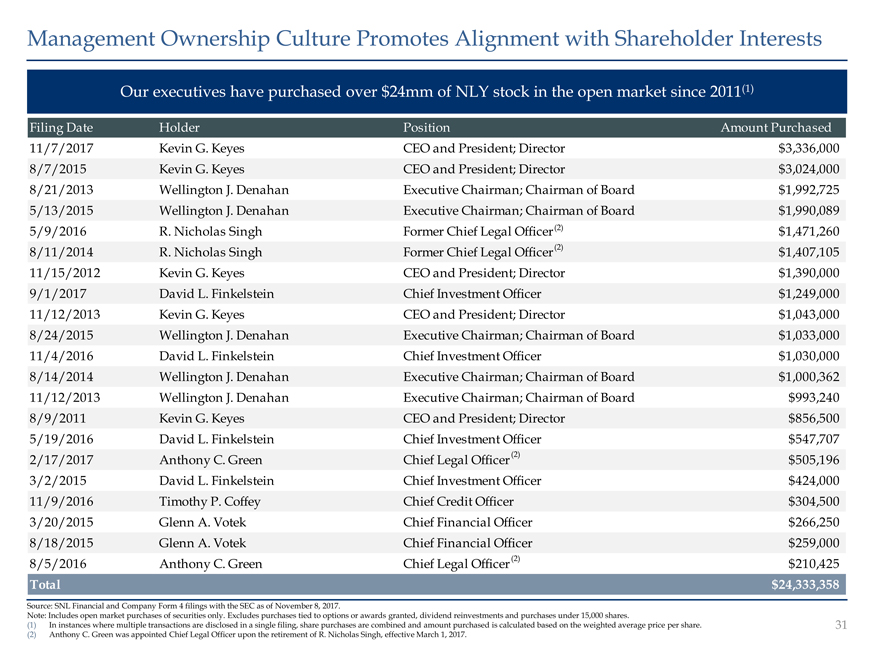

Management Ownership Culture Promotes Alignment with Shareholder Interests Our executives have purchased over $24mm of NLY stock in the open market since 2011(1) Filing Date Holder Position Amount Purchased 11/7/2017 Kevin G. Keyes CEO and President; Director $3,336,000 8/7/2015 Kevin G. Keyes CEO and President; Director $3,024,000 8/21/2013 Wellington J. Denahan Executive Chairman; Chairman of Board $1,992,725 5/13/2015 Wellington J. Denahan Executive Chairman; Chairman of Board $1,990,089 5/9/2016 R. Nicholas Singh Former Chief Legal Officer(2) $1,471,260 8/11/2014 R. Nicholas Singh Former Chief Legal Officer(2) $1,407,105 11/15/2012 Kevin G. Keyes CEO and President; Director $1,390,000 9/1/2017 David L. Finkelstein Chief Investment Officer $1,249,000 11/12/2013 Kevin G. Keyes CEO and President; Director $1,043,000 8/24/2015 Wellington J. Denahan Executive Chairman; Chairman of Board $1,033,000 11/4/2016 David L. Finkelstein Chief Investment Officer $1,030,000 8/14/2014 Wellington J. Denahan Executive Chairman; Chairman of Board $1,000,362 11/12/2013 Wellington J. Denahan Executive Chairman; Chairman of Board $993,240 8/9/2011 Kevin G. Keyes CEO and President; Director $856,500 5/19/2016 David L. Finkelstein Chief Investment Officer $547,707 2/17/2017 Anthony C. Green Chief Legal Officer(2) $505,196 3/2/2015 David L. Finkelstein Chief Investment Officer $424,000 11/9/2016 Timothy P. Coffey Chief Credit Officer $304,500 3/20/2015 Glenn A. Votek Chief Financial Officer $266,250 8/18/2015 Glenn A. Votek Chief Financial Officer $259,000 8/5/2016 Anthony C. Green Chief Legal Officer(2) $210,425 Total $24,333,358 Source: SNL Financial and Company Form 4 filings with the SEC as of November 8, 2017. Note: Includes open market purchases of securities only. Excludes purchases tied to options or awards granted, dividend reinvestments and purchases under 15,000 shares. (1) In instances where multiple transactions are disclosed in a single filing, share purchases are combined and amount purchased is calculated based on the weighted average price per share. (2) Anthony C. Green was appointed Chief Legal Officer upon the retirement of R. Nicholas Singh, effective March 1, 2017. 32

CEO Overview 1 The Yield-Less World 2 Three Major Questions Answered 3 Annaly Advantages 4 Performance & Relative Value 5 Annaly’s Opportunity 33

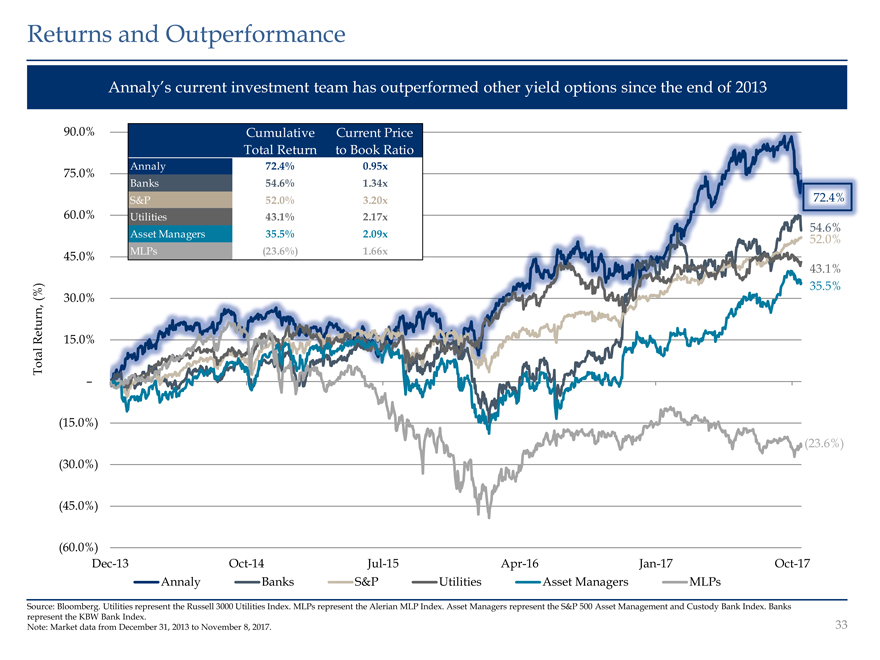

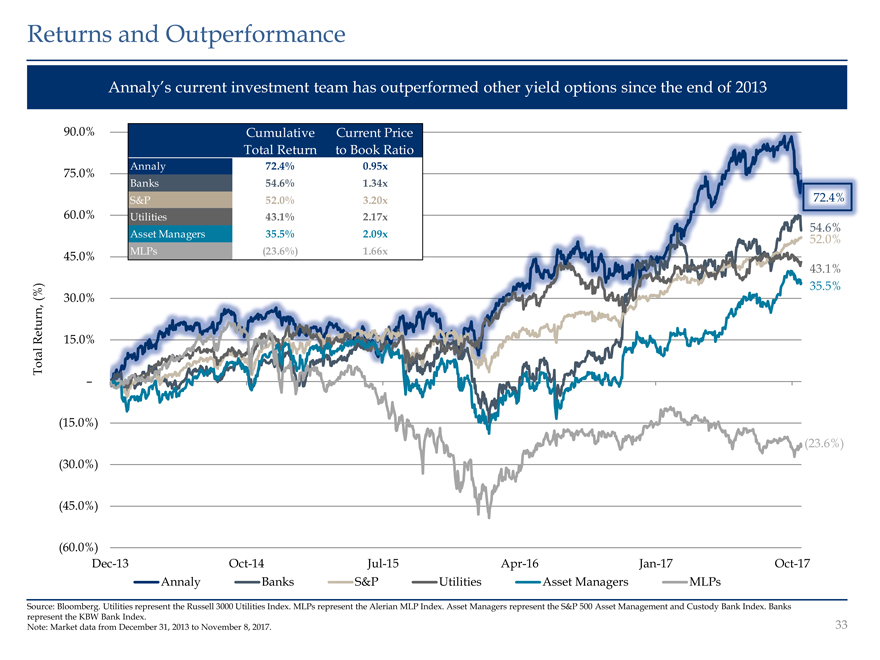

Returns and Outperformance Annaly’s current investment team has outperformed other yield options since the end of 2013 Cumulative Current Price 90.0% Total Cumulative Return to Current Book Ratio Price Annaly Total 72. Return 4% to Book 0.95x Ratio Annaly Banks 72 54.4 6% 0 1.95 34x 75.0% 52.0% Banks S&P 4 6 1 3.34 20x mREITs 51.3% 0.99x 72.4% 60.0% Utilities 43.1% 2.17x 54.6% Asset Managers 35.5% 2.09x 52.0% 45.0% MLPs (23.6%) 1.66x MLPs (23.6%) 1.66x 43.1% (%) 35.5% 30.0% Return, 15.0% Total – (15.0%) (23.6%) (30.0%) (45.0%) (60.0%) Dec-13 Oct-14 Jul-15 Apr-16 Jan-17 Oct-17 Annaly Banks S&P Utilities Asset Managers MLPs Source: Bloomberg. Utilities represent the Russell 3000 Utilities Index. MLPs represent the Alerian MLP Index. Asset Managers represent the S&P 500 Asset Management and Custody Bank Index. Banks represent the KBW Bank Index. Note: Market data from December 31, 2013 to November 8, 2017. 34

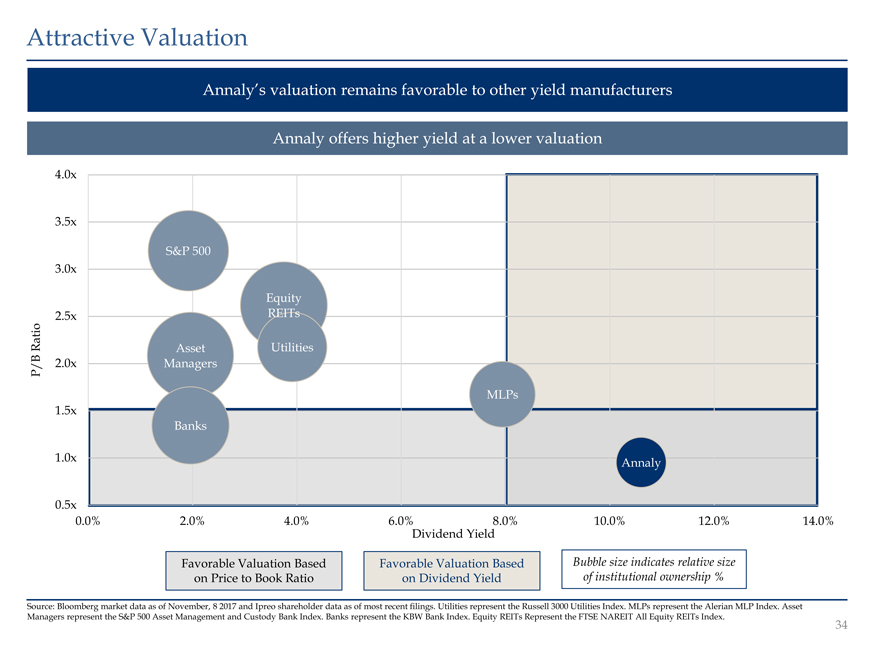

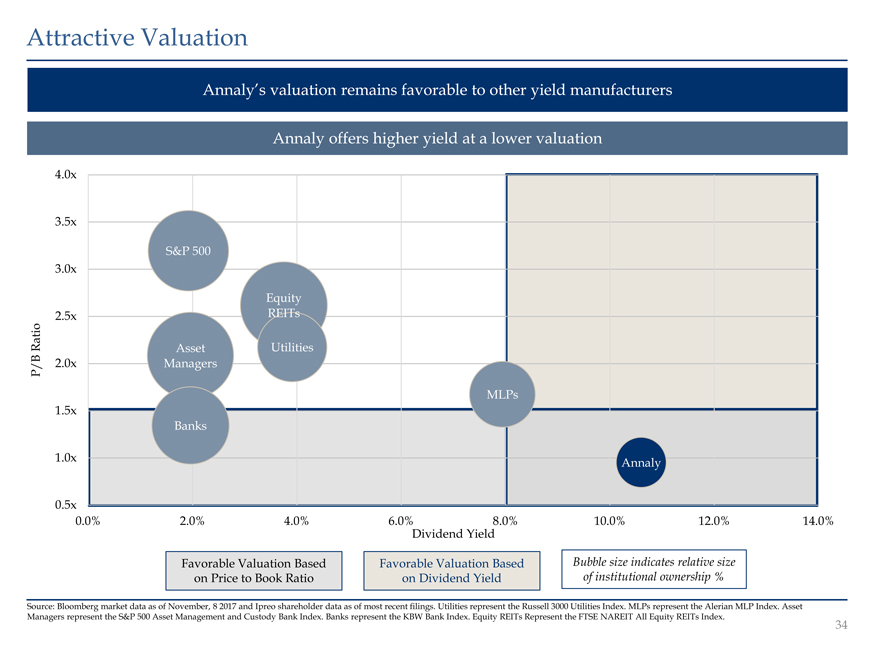

Attractive Valuation Annaly’s valuation remains favorable to other yield manufacturers Annaly offers higher yield at a lower valuation 4.0x 3.5x S&P 500 3.0x Equity 2.5x REITs Ratio Asset Utilities P/B 2.0x Managers MLPs 1.5x Banks 1.0x Annaly 0.5x 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% Dividend Yield Favorable Valuation Based Favorable Valuation Based Bubble size indicates relative size on Price to Book Ratio on Dividend Yield of institutional ownership % Source: Bloomberg market data as of November, 8 2017 and Ipreo shareholder data as of most recent filings. Utilities represent the Russell 3000 Utilities Index. MLPs represent the Alerian MLP Index. Asset Managers represent the S&P 500 Asset Management and Custody Bank Index. Banks represent the KBW Bank Index. Equity REITs Represent the FTSE NAREIT All Equity REITs Index. 34

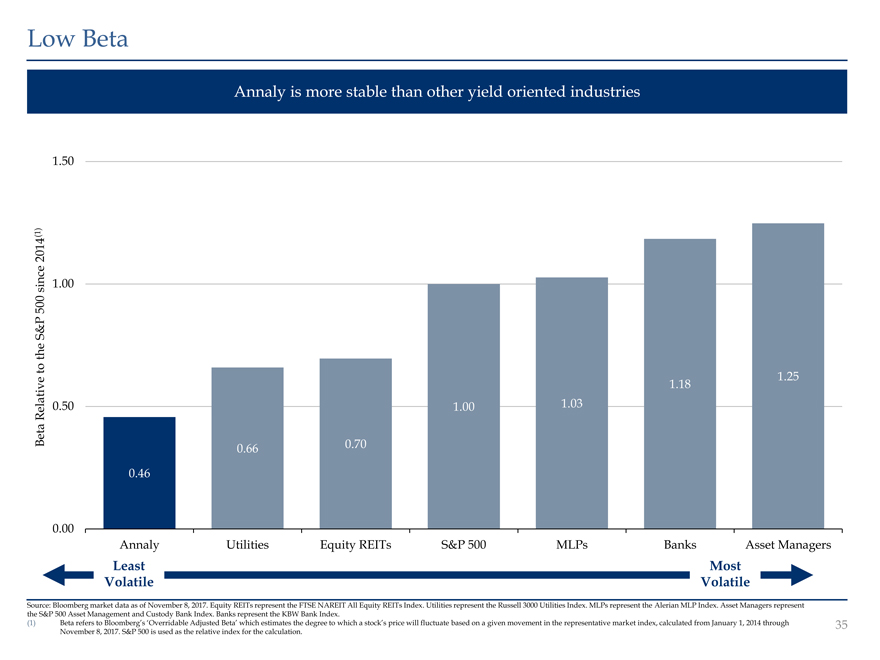

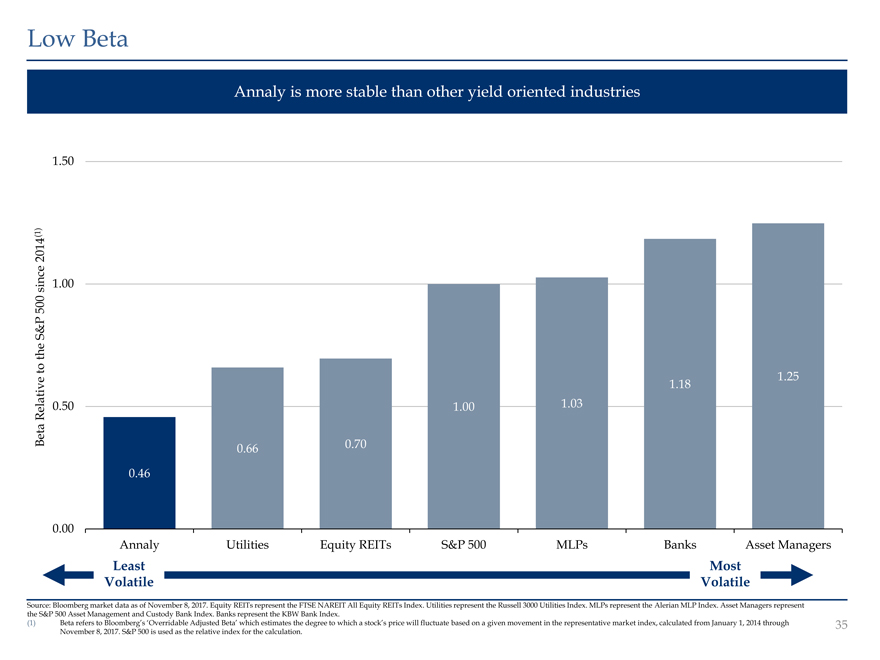

Low Beta Annaly is more stable than other yield oriented industries 1.50 (1) 2014 since 1.00 500 S&P the to 1.18 1.25 Relative 0.50 1.00 1.03 Beta 0.66 0.70 0.46 0.00 Annaly Utilities Equity REITs S&P 500 MLPs Banks Asset Managers Least Most Volatile Volatile Source: Bloomberg market data as of November 8, 2017. Equity REITs represent the FTSE NAREIT All Equity REITs Index. Utilities represent the Russell 3000 Utilities Index. MLPs represent the Alerian MLP Index. Asset Managers represent the S&P 500 Asset Management and Custody Bank Index. Banks represent the KBW Bank Index. (1) Beta refers to Bloomberg’s ‘Overridable Adjusted Beta’ which estimates the degree to which a stock’s price will fluctuate based on a given movement in the representative market index, calculated from January 1, 2014 through November 8, 2017. S&P 500 is used as the relative index for the calculation. 36

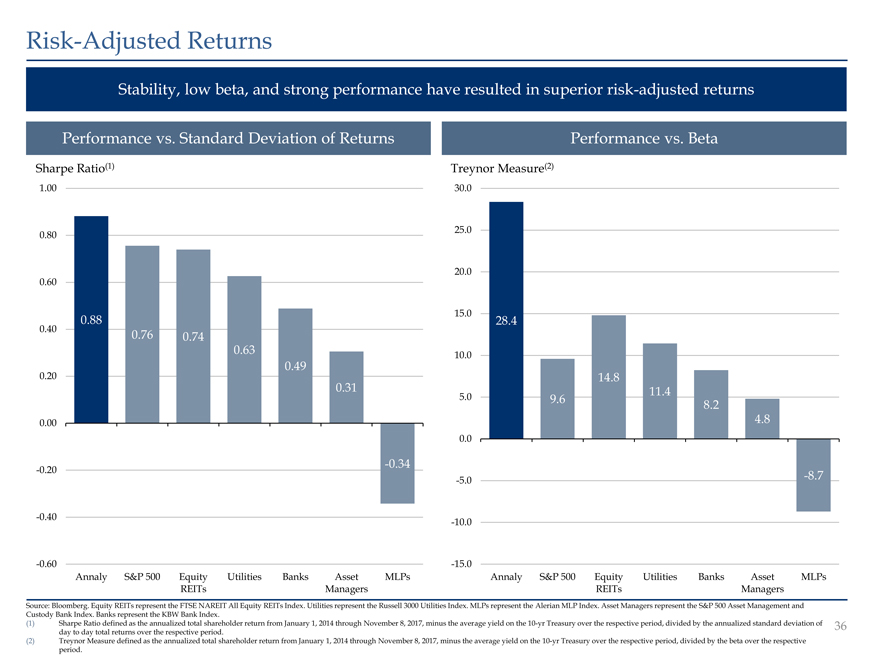

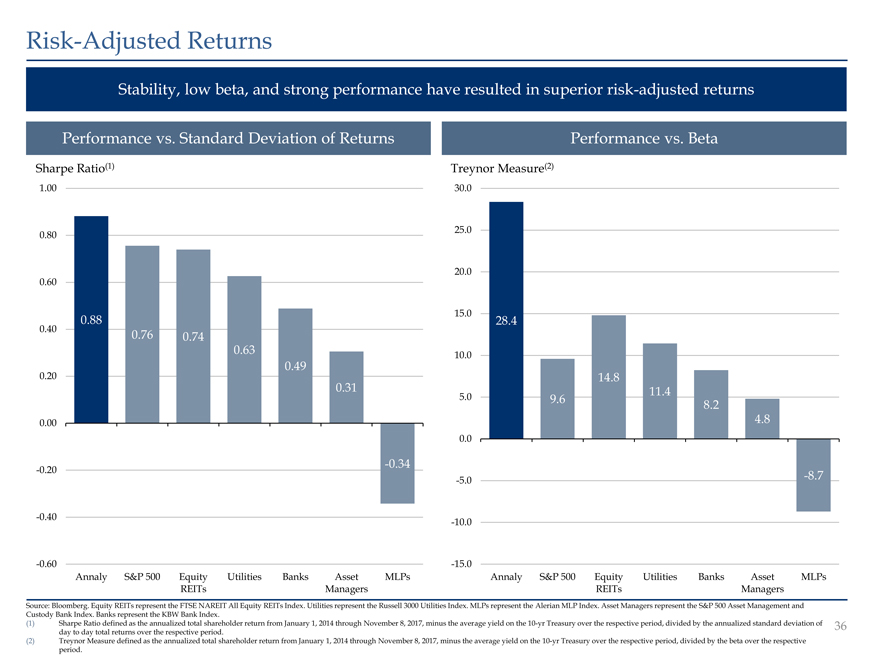

Risk-Adjusted Returns Stability, low beta, and strong performance have resulted in superior risk-adjusted returns Performance vs. Standard Deviation of Returns Performance vs. Beta Sharpe Ratio(1) Treynor Measure(2) 1.00 30.0 25.0 0.80 20.0 0.60 15.0 0.88 28.4 0.40 0.76 0.74 0.63 10.0 0.20 0.49 14.8 0.31 11.4 5.0 9.6 8.2 0.00 4.8 0.0 -0.34 -0.20 -8.7 -5.0 -0.40 -10.0 -0.60 -15.0 Annaly S&P 500 Equity Utilities Banks Asset MLPs Annaly S&P 500 Equity Utilities Banks Asset MLPs REITs Managers REITs Managers Source: Bloomberg. Equity REITs represent the FTSE NAREIT All Equity REITs Index. Utilities represent the Russell 3000 Utilities Index. MLPs represent the Alerian MLP Index. Asset Managers represent the S&P 500 Asset Management and Custody Bank Index. Banks represent the KBW Bank Index. (1) Sharpe Ratio defined as the annualized total shareholder return from January 1, 2014 through November 8, 2017, minus the average yield on the 10-yr Treasury over the respective period, divided by the annualized standard deviation of day to day total returns over the respective period. (2) Treynor Measure defined as the annualized total shareholder return from January 1, 2014 through November 8, 2017, minus the average yield on the 10-yr Treasury over the respective period, divided by the beta over the respective period. 37

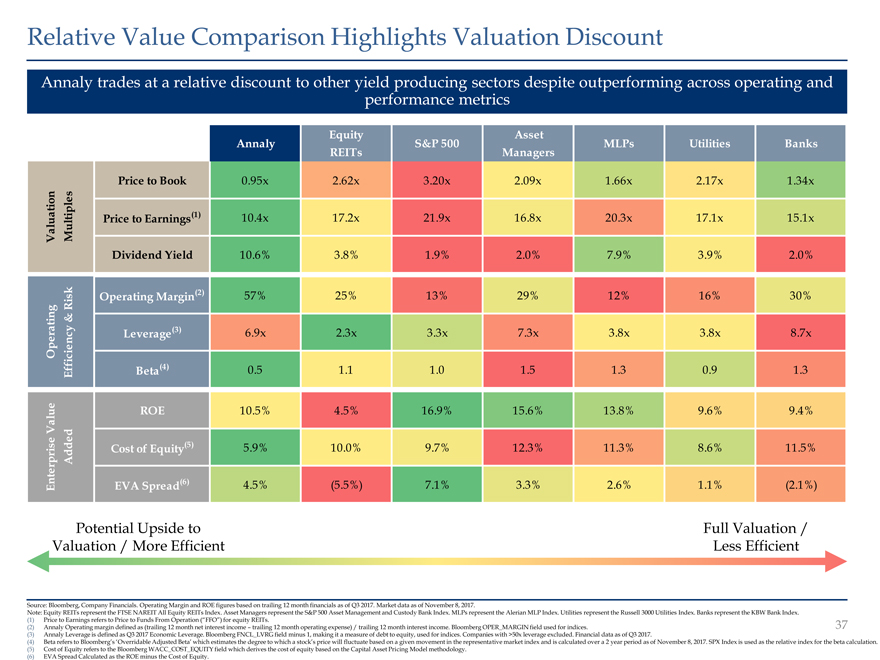

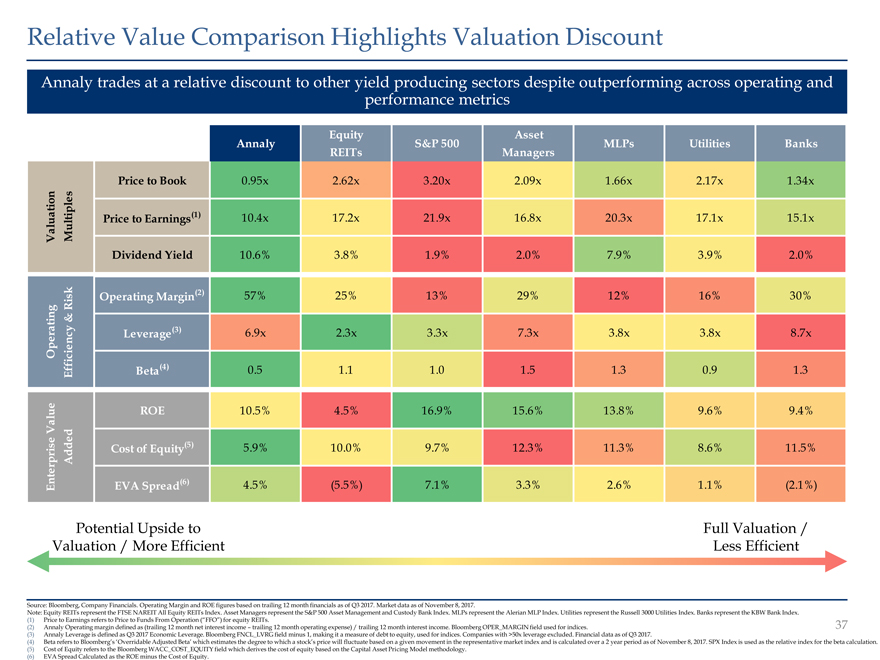

Relative Value Comparison Highlights Valuation Discount Annaly trades at a relative discount to other yield producing sectors despite outperforming across operating and performance metrics Equity Asset Annaly S&P 500 MLPs Utilities Banks REITs Managers Price to Book 0.95x 2.62x 3.20x 2.09x 1.66x 2.17x 1.34x n t io iples ua Price to Earnings(1) 10.4x 17.2x 21.9x 16.8x 20.3x 17.1x 15.1x Val Mult Dividend Yield 10.6% 3.8% 1.9% 2.0% 7.9% 3.9% 2.0% s k Operating Margin(2) 57% 25% 13% 29% 12% 16% 30% Ri ing & at (3) r pe ncy Leverage 6.9x 2.3x 3.3x 7.3x 3.8x 3.8x 8.7x ie O c Effi Beta(4) 0.5 1.1 1.0 1.5 1.3 0.9 1.3 ue ROE 10.5% 4.5% 16.9% 15.6% 13.8% 9.6% 9.4% a l V prise Added Cost of Equity(5) 5.9% 10.0% 9.7% 12.3% 11.3% 8.6% 11.5% Enter EVA Spread(6) 4.5% (5.5%) 7.1% 3.3% 2.6% 1.1% (2.1%) Potential Upside to Full Valuation / Valuation / More Efficient Less Efficient Source: Bloomberg, Company Financials. Operating Margin and ROE figures based on trailing 12 month financials as of Q3 2017. Market data as of November 8, 2017. Note: Equity REITs represent the FTSE NAREIT All Equity REITs Index. Asset Managers represent the S&P 500 Asset Management and Custody Bank Index. MLPs represent the Alerian MLP Index. Utilities represent the Russell 3000 Utilities Index. Banks represent the KBW Bank Index. (1) Price to Earnings refers to Price to Funds From Operation (“FFO”) for equity REITs. (2) Annaly Operating margin defined as (trailing 12 month net interest income – trailing 12 month operating expense) / trailing 12 month interest income. Bloomberg OPER_MARGIN field used for indices. (3) Annaly Leverage is defined as Q3 2017 Economic Leverage. Bloomberg FNCL_LVRG field minus 1, making it a measure of debt to equity, used for indices. Companies with >50x leverage excluded. Financial data as of Q3 2017. (4) Beta refers to Bloomberg’s ‘Overridable Adjusted Beta’ which estimates the degree to which a stock’s price will fluctuate based on a given movement in the representative market index and is calculated over a 2 year period as of November 8, 2017. SPX Index is used as the relative index for the beta calculation. (5) Cost of Equity refers to the Bloomberg WACC_COST_EQUITY field which derives the cost of equity based on the Capital Asset Pricing Model methodology. (6) EVA Spread Calculated as the ROE minus the Cost of Equity. 38

CEO Overview 1 The Yield-Less World 2 Three Major Questions Answered 3 Annaly Advantages 4 Performance & Relative Value 5 Annaly’s Opportunity 39

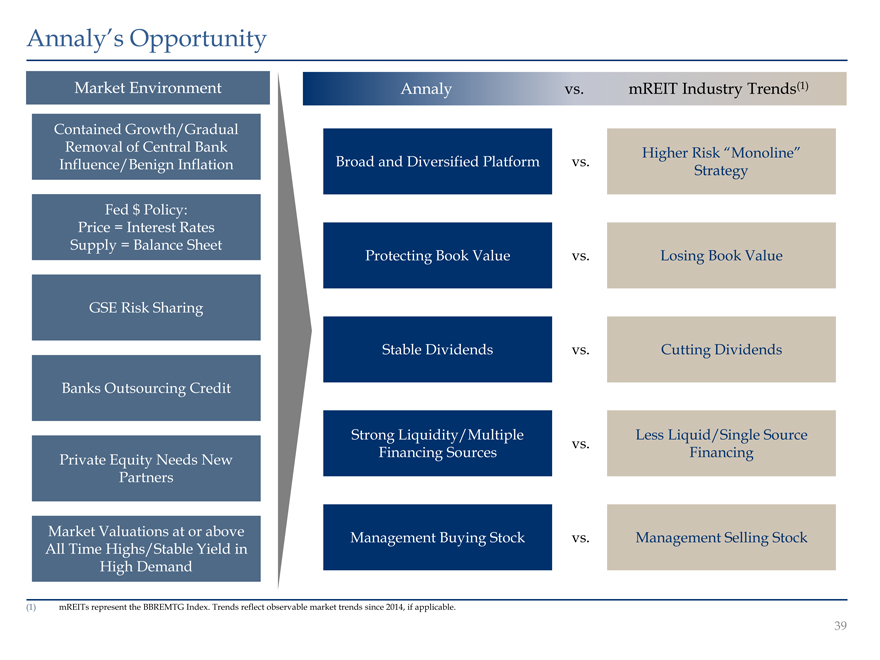

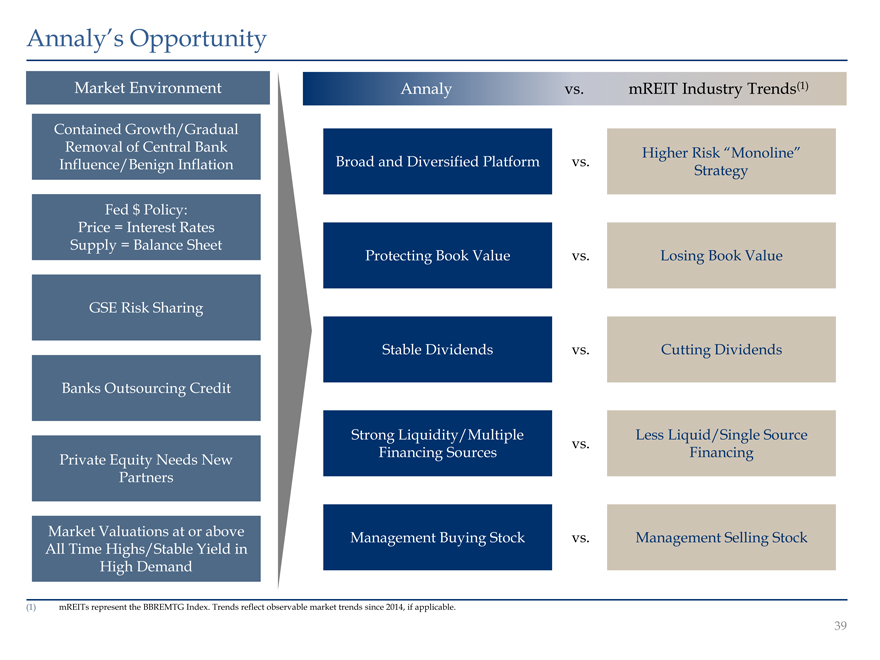

Annaly’s Opportunity Market Environment Annaly vs. mREIT Industry Trends(1) Contained Growth/Gradual Removal of Central Bank Higher Risk “Monoline” Influence/Benign Inflation Broad and Diversified Platform vs. Strategy Fed $ Policy: Price = Interest Rates Supply = Balance Sheet Protecting Book Value vs. Losing Book Value GSE Risk Sharing Stable Dividends vs. Cutting Dividends Banks Outsourcing Credit Strong Liquidity/Multiple Less Liquid/Single Source vs. Private Equity Needs New Financing Sources Financing Partners Market Valuations at or above Management Buying Stock vs. Management Selling Stock All Time Highs/Stable Yield in High Demand (1) mREITs represent the BBREMTG Index. Trends reflect observable market trends since 2014, if applicable. 39

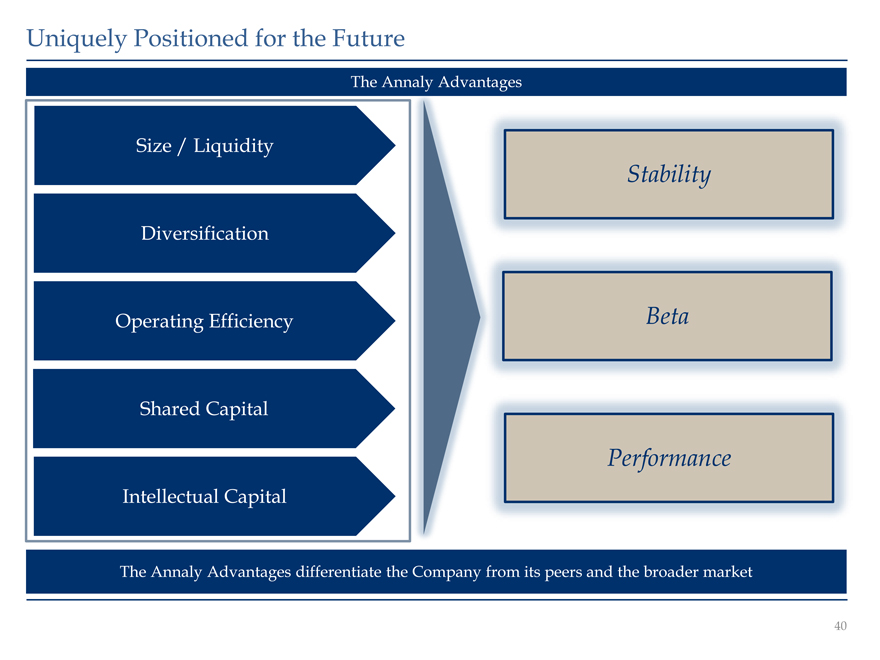

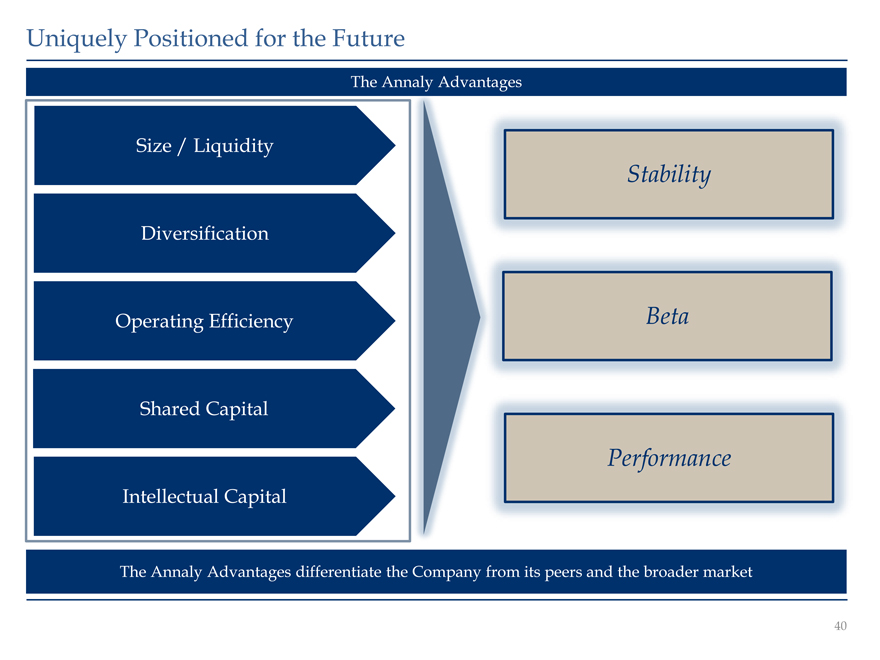

Uniquely Positioned for the Future The Annaly Advantages Size / Liquidity Stability Diversification Operating Efficiency Beta Shared Capital Performance Intellectual Capital The Annaly Advantages differentiate the Company from its peers and the broader market 40

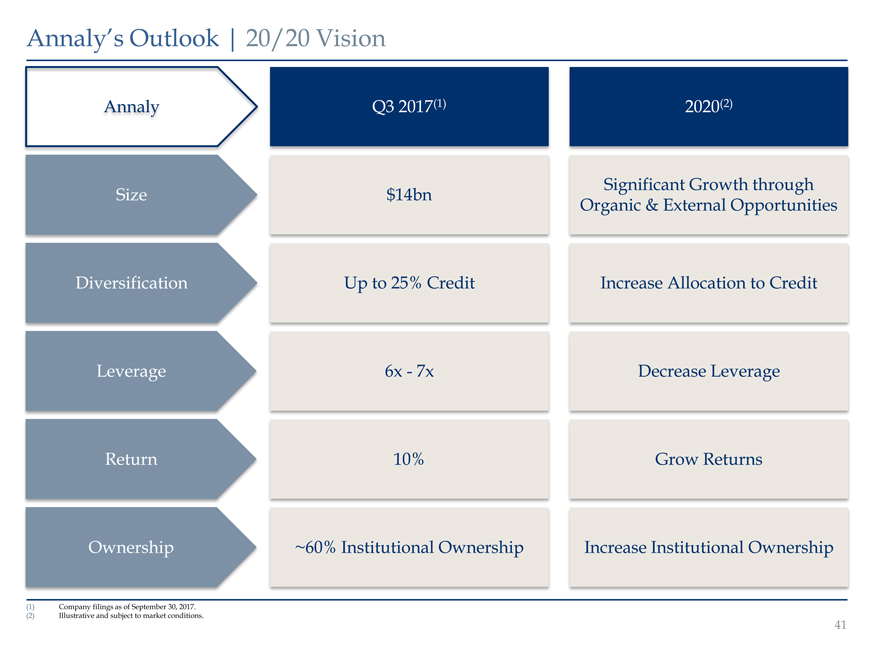

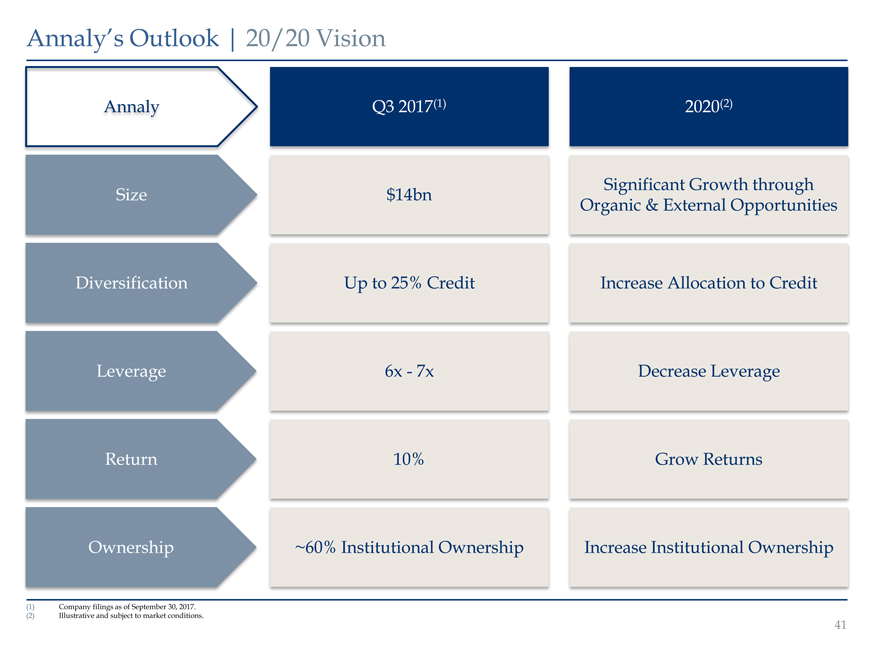

Annaly’s Outlook | 20/20 Vision Annaly Q3 2017(1) 2020(2) Size $14bn Significant Growth through Organic & External Opportunities Diversification Up to 25% Credit Increase Allocation to Credit Leverage 6x - 7x Decrease Leverage Return 10% Grow Returns Ownership ~60% Institutional Ownership Increase Institutional Ownership (1) Company filings as of September 30, 2017. (2) Illustrative and subject to market conditions. 41

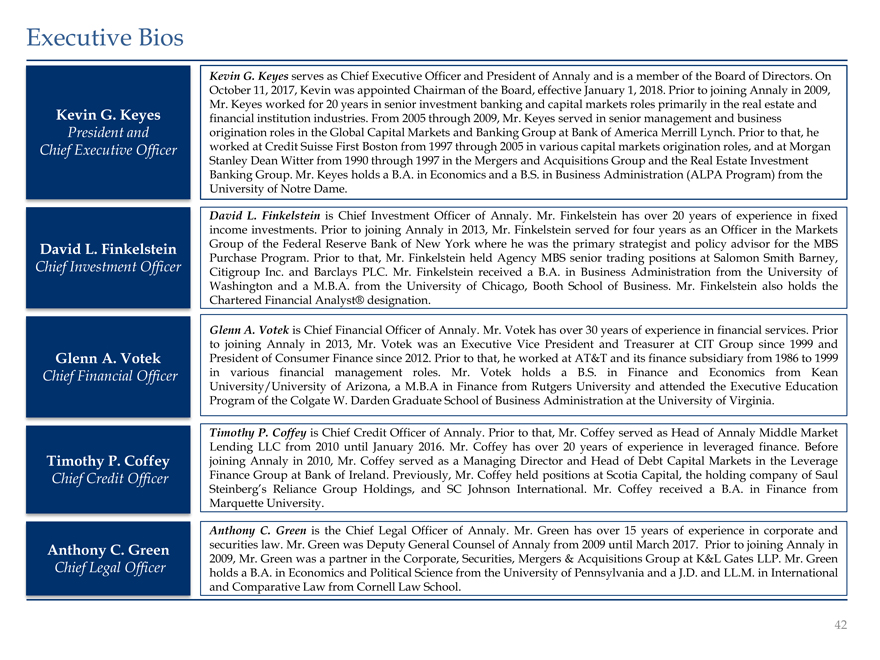

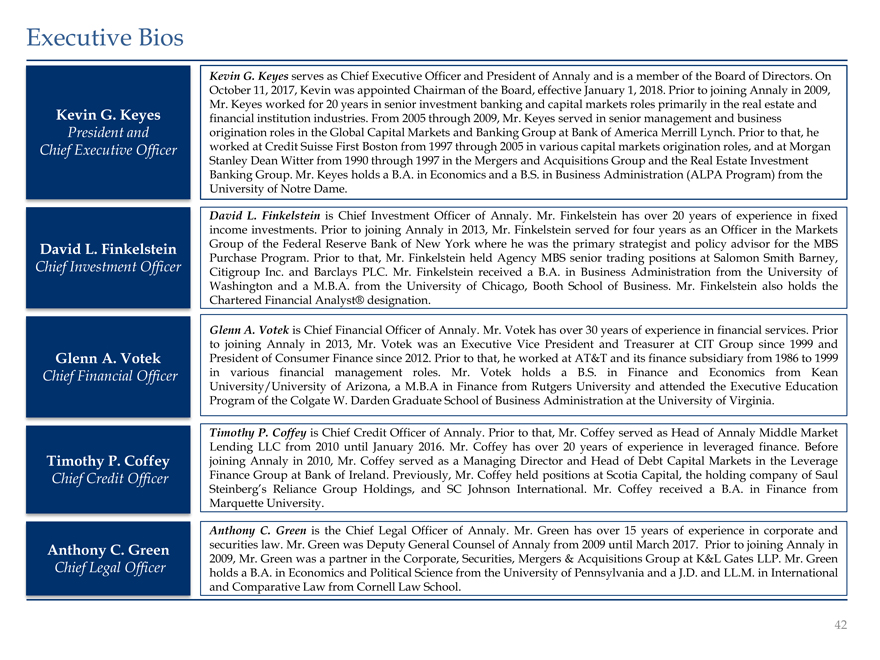

Executive Bios Kevin G. Keyes serves as Chief Executive Officer and President of Annaly and is a member of the Board of Directors. On October 11, 2017, Kevin was appointed Chairman of the Board, effective January 1, 2018. Prior to joining Annaly in 2009, Mr. Keyes worked for 20 years in senior investment banking and capital markets roles primarily in the real estate and Kevin G. Keyes financial institution industries. From 2005 through 2009, Mr. Keyes served in senior management and business President and origination roles in the Global Capital Markets and Banking Group at Bank of America Merrill Lynch. Prior to that, he Chief Executive Officer worked at Credit Suisse First Boston from 1997 through 2005 in various capital markets origination roles, and at Morgan Stanley Dean Witter from 1990 through 1997 in the Mergers and Acquisitions Group and the Real Estate Investment Banking Group. Mr. Keyes holds a B.A. in Economics and a B.S. in Business Administration (ALPA Program) from the University of Notre Dame. David L. Finkelstein is Chief Investment Officer of Annaly. Mr. Finkelstein has over 20 years of experience in fixed income investments. Prior to joining Annaly in 2013, Mr. Finkelstein served for four years as an Officer in the Markets David L. Finkelstein Group of the Federal Reserve Bank of New York where he was the primary strategist and policy advisor for the MBS Purchase Program. Prior to that, Mr. Finkelstein held Agency MBS senior trading positions at Salomon Smith Barney, Chief Investment Officer Citigroup Inc. and Barclays PLC. Mr. Finkelstein received a B.A. in Business Administration from the University of Washington and a M.B.A. from the University of Chicago, Booth School of Business. Mr. Finkelstein also holds the Chartered Financial Analyst® designation. Glenn A. Votek is Chief Financial Officer of Annaly. Mr. Votek has over 30 years of experience in financial services. Prior to joining Annaly in 2013, Mr. Votek was an Executive Vice President and Treasurer at CIT Group since 1999 and Glenn A. Votek President of Consumer Finance since 2012. Prior to that, he worked at AT&T and its finance subsidiary from 1986 to 1999 Chief Financial Officer in various financial management roles. Mr. Votek holds a B.S. in Finance and Economics from Kean University/University of Arizona, a M.B.A in Finance from Rutgers University and attended the Executive Education Program of the Colgate W. Darden Graduate School of Business Administration at the University of Virginia. Timothy P. Coffey is Chief Credit Officer of Annaly. Prior to that, Mr. Coffey served as Head of Annaly Middle Market Lending LLC from 2010 until January 2016. Mr. Coffey has over 20 years of experience in leveraged finance. Before Timothy P. Coffey joining Annaly in 2010, Mr. Coffey served as a Managing Director and Head of Debt Capital Markets in the Leverage Chief Credit Officer Finance Group at Bank of Ireland. Previously, Mr. Coffey held positions at Scotia Capital, the holding company of Saul Steinberg’s Reliance Group Holdings, and SC Johnson International. Mr. Coffey received a B.A. in Finance from Marquette University. Anthony C. Green is the Chief Legal Officer of Annaly. Mr. Green has over 15 years of experience in corporate and Anthony C. Green securities law. Mr. Green was Deputy General Counsel of Annaly from 2009 until March 2017. Prior to joining Annaly in 2009, Mr. Green was a partner in the Corporate, Securities, Mergers & Acquisitions Group at K&L Gates LLP. Mr. Green Chief Legal Officer holds a B.A. in Economics and Political Science from the University of Pennsylvania and a J.D. and LL.M. in International and Comparative Law from Cornell Law School. 42

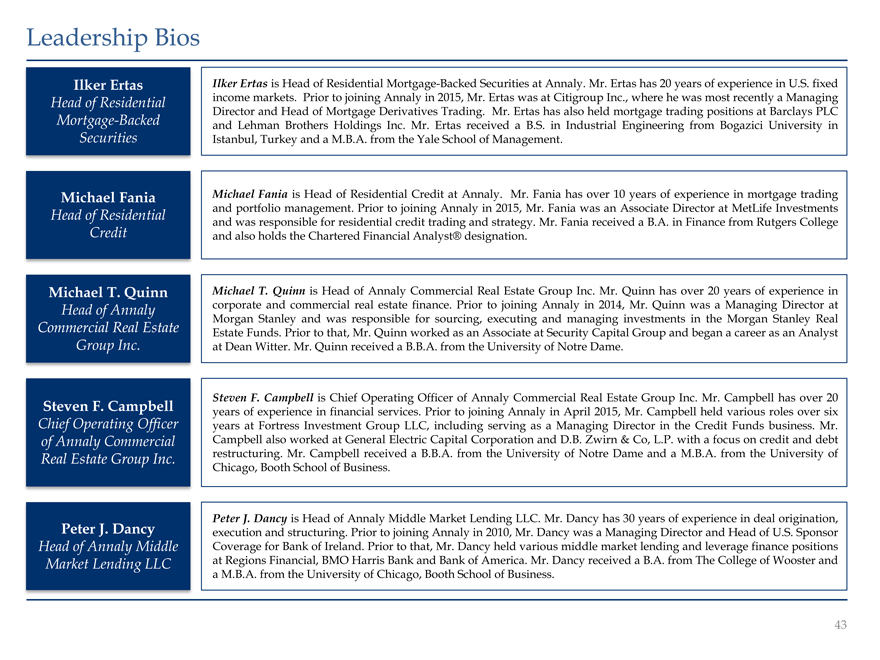

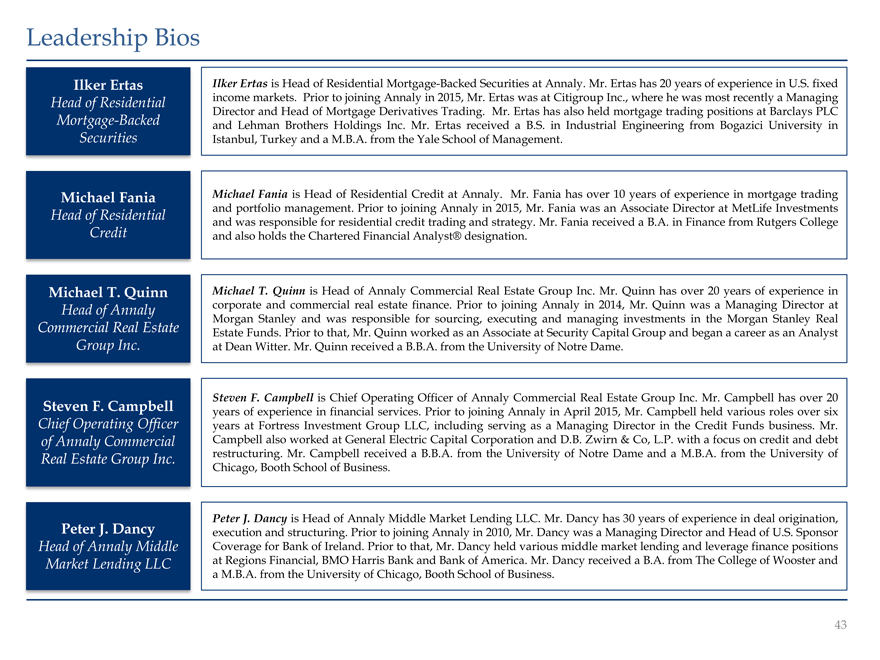

Leadership Bios Ilker Ertas Ilker Ertas is Head of Residential Mortgage-Backed Securities at Annaly. Mr. Ertas has 20 years of experience in U.S. fixed Head of Residential income markets. Prior to joining Annaly in 2015, Mr. Ertas was at Citigroup Inc., where he was most recently a Managing Director and Head of Mortgage Derivatives Trading. Mr. Ertas has also held mortgage trading positions at Barclays PLC Mortgage-Backed and Lehman Brothers Holdings Inc. Mr. Ertas received a B.S. in Industrial Engineering from Bogazici University in Securities Istanbul, Turkey and a M.B.A. from the Yale School of Management. Michael Fania Michael Fania is Head of Residential Credit at Annaly. Mr. Fania has over 10 years of experience in mortgage trading Head of Residential and portfolio management. Prior to joining Annaly in 2015, Mr. Fania was an Associate Director at MetLife Investments and was responsible for residential credit trading and strategy. Mr. Fania received a B.A. in Finance from Rutgers College Credit and also holds the Chartered Financial Analyst® designation. Michael T. Quinn Michael T. Quinn is Head of Annaly Commercial Real Estate Group Inc. Mr. Quinn has over 20 years of experience in Head of Annaly corporate and commercial real estate finance. Prior to joining Annaly in 2014, Mr. Quinn was a Managing Director at Morgan Stanley and was responsible for sourcing, executing and managing investments in the Morgan Stanley Real Commercial Real Estate Estate Funds. Prior to that, Mr. Quinn worked as an Associate at Security Capital Group and began a career as an Analyst Group Inc. at Dean Witter. Mr. Quinn received a B.B.A. from the University of Notre Dame. Steven F. Campbell is Chief Operating Officer of Annaly Commercial Real Estate Group Inc. Mr. Campbell has over 20 Steven F. Campbell years of experience in financial services. Prior to joining Annaly in April 2015, Mr. Campbell held various roles over six Chief Operating Officer years at Fortress Investment Group LLC, including serving as a Managing Director in the Credit Funds business. Mr. of Annaly Commercial Campbell also worked at General Electric Capital Corporation and D.B. Zwirn & Co, L.P. with a focus on credit and debt Real Estate Group Inc. restructuring. Mr. Campbell received a B.B.A. from the University of Notre Dame and a M.B.A. from the University of Chicago, Booth School of Business. Peter J. Dancy is Head of Annaly Middle Market Lending LLC. Mr. Dancy has 30 years of experience in deal origination, Peter J. Dancy execution and structuring. Prior to joining Annaly in 2010, Mr. Dancy was a Managing Director and Head of U.S. Sponsor Head of Annaly Middle Coverage for Bank of Ireland. Prior to that, Mr. Dancy held various middle market lending and leverage finance positions Market Lending LLC at Regions Financial, BMO Harris Bank and Bank of America. Mr. Dancy received a B.A. from The College of Wooster and a M.B.A. from the University of Chicago, Booth School of Business. 43

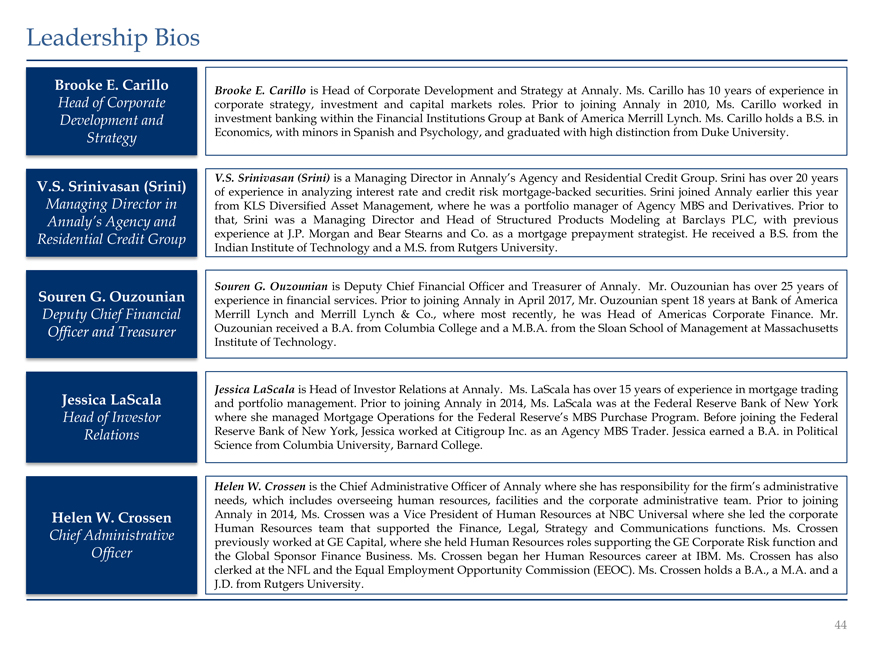

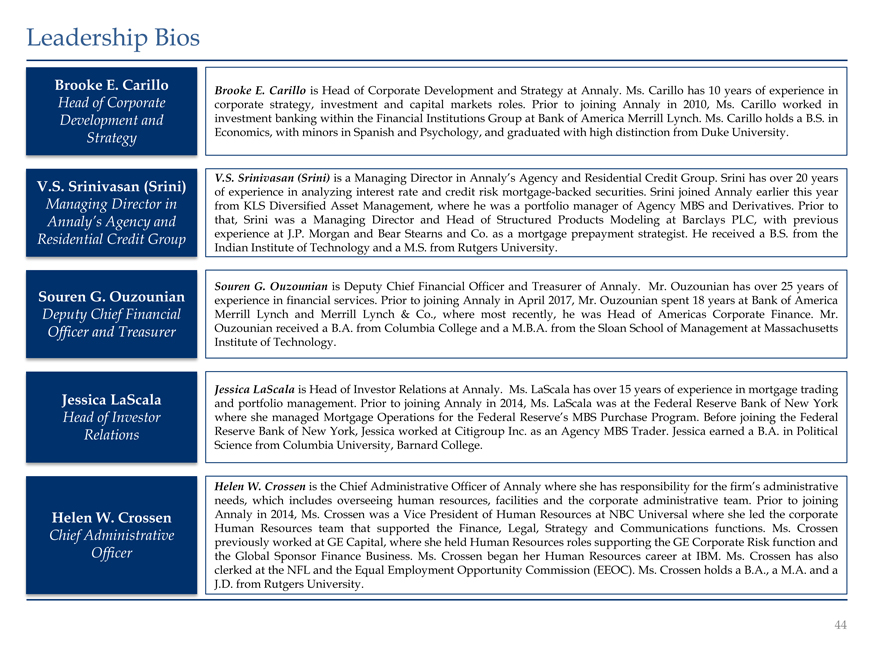

Leadership Bios Brooke E. Carillo Brooke E. Carillo is Head of Corporate Development and Strategy at Annaly. Ms. Carillo has 10 years of experience in Head of Corporate corporate strategy, investment and capital markets roles. Prior to joining Annaly in 2010, Ms. Carillo worked in Development and investment banking within the Financial Institutions Group at Bank of America Merrill Lynch. Ms. Carillo holds a B.S. in Strategy Economics, with minors in Spanish and Psychology, and graduated with high distinction from Duke University. V.S. Srinivasan (Srini) is a Managing Director in Annaly’s Agency and Residential Credit Group. Srini has over 20 years V.S. Srinivasan (Srini) of experience in analyzing interest rate and credit risk mortgage-backed securities. Srini joined Annaly earlier this year Managing Director in from KLS Diversified Asset Management, where he was a portfolio manager of Agency MBS and Derivatives. Prior to Annaly’s Agency and that, Srini was a Managing Director and Head of Structured Products Modeling at Barclays PLC, with previous Residential Credit Group experience at J.P. Morgan and Bear Stearns and Co. as a mortgage prepayment strategist. He received a B.S. from the Indian Institute of Technology and a M.S. from Rutgers University. Souren G. Ouzounian is Deputy Chief Financial Officer and Treasurer of Annaly. Mr. Ouzounian has over 25 years of Souren G. Ouzounian experience in financial services. Prior to joining Annaly in April 2017, Mr. Ouzounian spent 18 years at Bank of America Deputy Chief Financial Merrill Lynch and Merrill Lynch & Co., where most recently, he was Head of Americas Corporate Finance. Mr. Officer and Treasurer Ouzounian received a B.A. from Columbia College and a M.B.A. from the Sloan School of Management at Massachusetts Institute of Technology. Jessica LaScala is Head of Investor Relations at Annaly. Ms. LaScala has over 15 years of experience in mortgage trading Jessica LaScala and portfolio management. Prior to joining Annaly in 2014, Ms. LaScala was at the Federal Reserve Bank of New York Head of Investor where she managed Mortgage Operations for the Federal Reserve’s MBS Purchase Program. Before joining the Federal Relations Reserve Bank of New York, Jessica worked at Citigroup Inc. as an Agency MBS Trader. Jessica earned a B.A. in Political Science from Columbia University, Barnard College. Helen W. Crossen is the Chief Administrative Officer of Annaly where she has responsibility for the firm’s administrative needs, which includes overseeing human resources, facilities and the corporate administrative team. Prior to joining Helen W. Crossen Annaly in 2014, Ms. Crossen was a Vice President of Human Resources at NBC Universal where she led the corporate Chief Administrative Human Resources team that supported the Finance, Legal, Strategy and Communications functions. Ms. Crossen previously worked at GE Capital, where she held Human Resources roles supporting the GE Corporate Risk function and Officer the Global Sponsor Finance Business. Ms. Crossen began her Human Resources career at IBM. Ms. Crossen has also clerked at the NFL and the Equal Employment Opportunity Commission (EEOC). Ms. Crossen holds a B.A., a M.A. and a J.D. from Rutgers University. 44

Overview of Annaly Businesses

Overview of Annaly Businesses 1 Agency 2 Residential Credit & Future of Housing Finance 3 Commercial Real Estate 4 Middle Market Lending 47

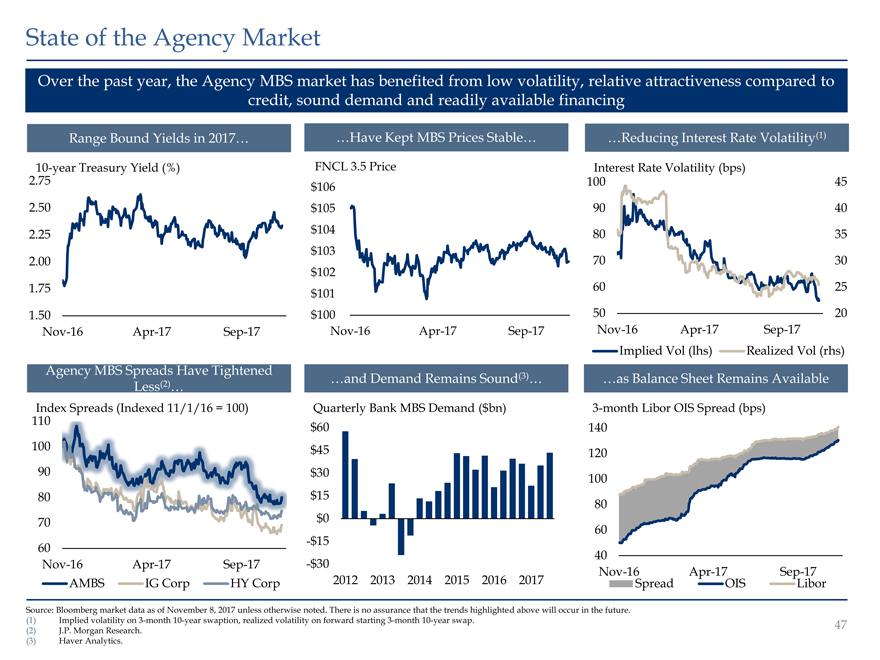

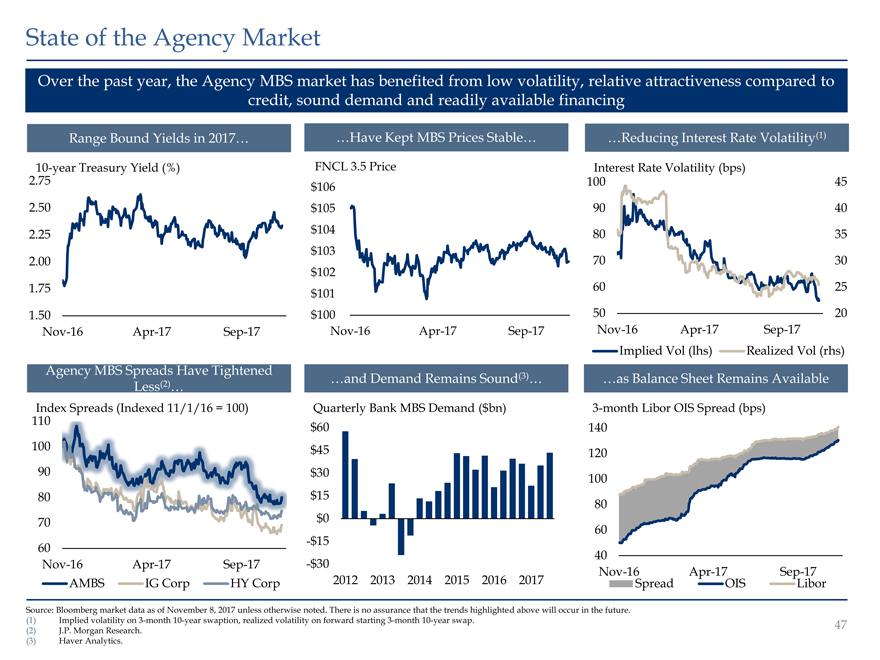

State of the Agency Market Over the past year, the Agency MBS market has benefited from low volatility, relative attractiveness compared to credit, sound demand and readily available financing Range Bound Yields in 2017… …Have Kept MBS Prices Stable… …Reducing Interest Rate Volatility(1) 10-year Treasury Yield (%) FNCL 3.5 Price Interest Rate Volatility (bps) 2.75 100 45 $106 2.50 $105 90 40 2.25 $104 80 35 $103 2.00 $102 70 30 1.75 60 25 $101 1.50 $100 50 20 Nov-16 Apr-17 Sep-17 Nov-16 Apr-17 Sep-17 Nov-16 Apr-17 Sep-17 Implied Vol (lhs) Realized Vol (rhs) Agency MBS Spreads Have Tightened (3) (2) …and Demand Remains Sound … …as Balance Sheet Remains Available Less … Index Spreads (Indexed 11/1/16 = 100) Quarterly Bank MBS Demand ($bn) 3-month Libor OIS Spread (bps) 110 $60 140 100 $45 120 90 $30 100 80 $15 80 70 $0 60 -$15 60 40 Nov-16 Apr-17 Sep-17 -$30 Nov-16 Apr-17 Sep-17 AMBS IG Corp HY Corp 2012 2013 2014 2015 2016 2017 Spread OIS Libor Source: Bloomberg market data as of November 8, 2017 unless otherwise noted. There is no assurance that the trends highlighted above will occur in the future. (1) Implied volatility on 3-month 10-year swaption, realized volatility on forward starting 3-month 10-year swap. (2) J.P. Morgan Research. (3) Haver Analytics. 48

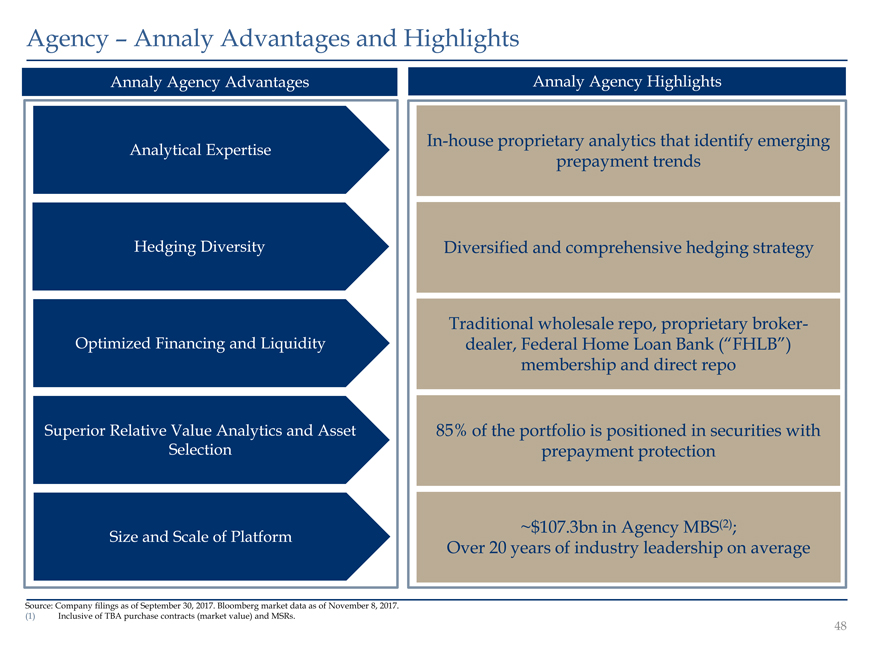

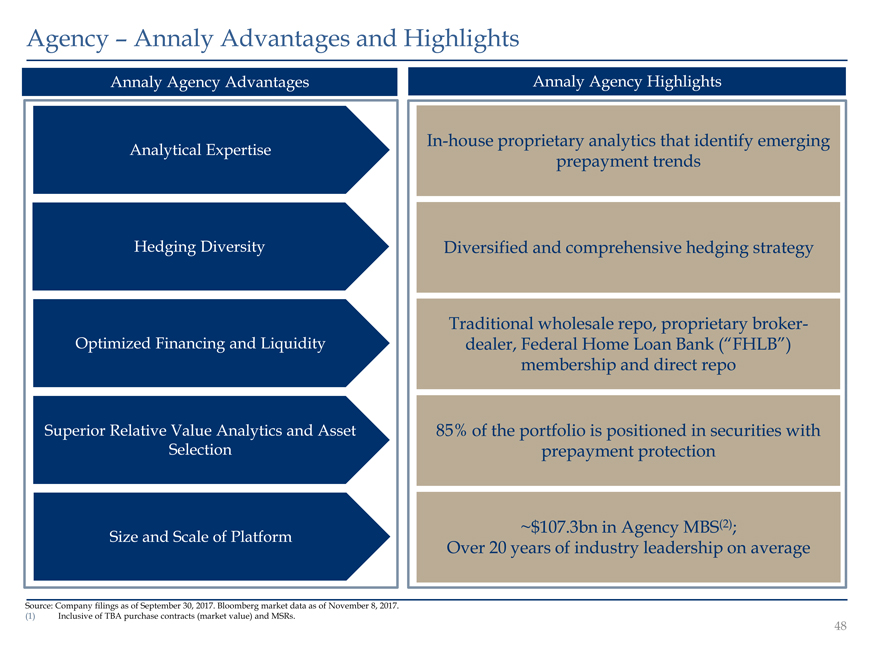

Agency Annaly Advantages and Highlights Annaly Agency Advantages Annaly Agency Highlights Analytical Expertise In-house proprietary analytics that identify emerging prepayment trends Hedging Diversity Diversified and comprehensive hedging strategy Traditional wholesale repo, proprietary broker- Optimized Financing and Liquidity dealer, Federal Home Loan Bank (“FHLB”) membership and direct repo Superior Relative Value Analytics and Asset 85% of the portfolio is positioned in securities with Selection prepayment protection Size and Scale of Platform ~$107.3bn in Agency MBS(2); Over 20 years of industry leadership on average Source: Company filings as of September 30, 2017. Bloomberg market data as of November 8, 2017. (1) Inclusive of TBA purchase contracts (market value) and MSRs. 48

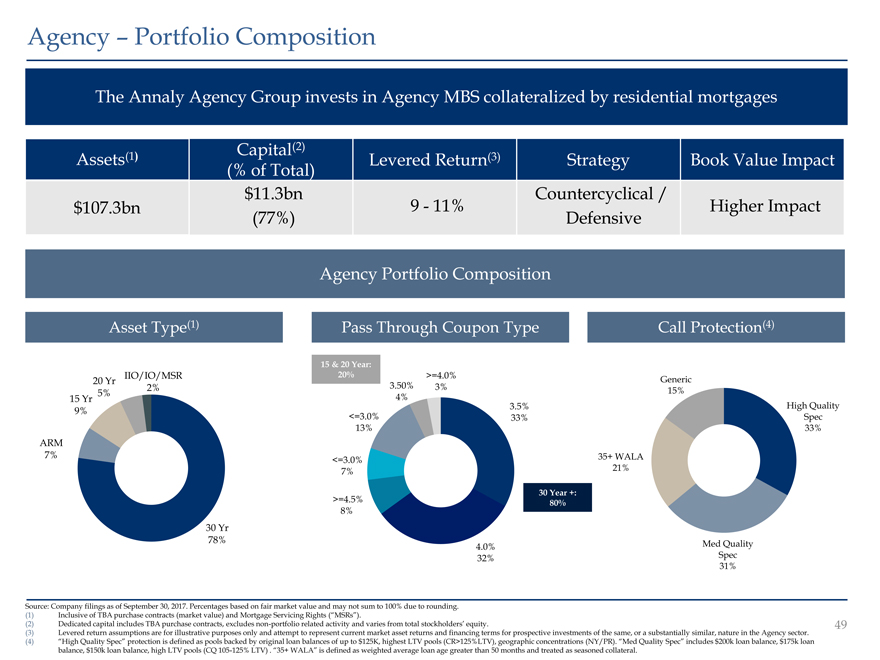

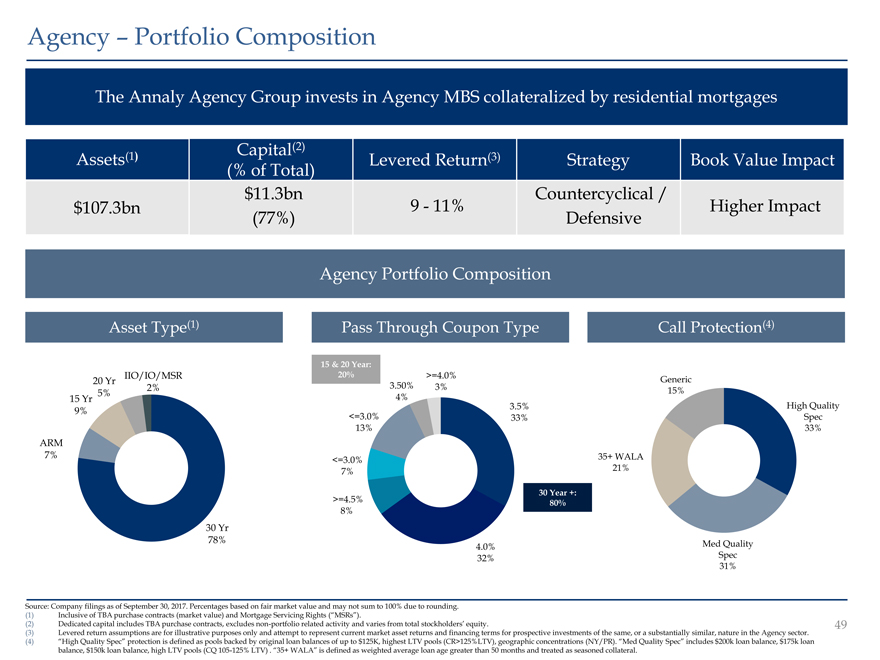

Agency – Portfolio Composition The Annaly Agency Group invests in Agency MBS collateralized by residential mortgages Capital(2) Assets(1) (% of Total) Levered Return(3) Strategy Book Value Impact $11.3bn Countercyclical / $107.3bn 9—11% Higher Impact (77%) Defensive Agency Portfolio Composition Asset Type(1) Pass Through Coupon Type Call Protection(4) 15 & 20 Year: IIO/IO/MSR 20% >=4.0% 20 Yr Generic 2% 3.50% 3% 5% 15% 15 Yr 4% High Quality 3.5% 9% <=3.0% 33% Spec 13% 33% ARM 7% 35+ WALA <=3.0% 21% 7% 30 Year +: >=4.5% 80% 8% 30 Yr 78% Med Quality 4.0% Spec 32% 31% Source: Company filings as of September 30, 2017. Percentages based on fair market value and may not sum to 100% due to rounding. (1) Inclusive of TBA purchase contracts (market value) and Mortgage Servicing Rights (“MSRs”). (2) Dedicated capital includes TBA purchase contracts, excludes non-portfolio related activity and varies from total stockholders’ equity. 50 (3) Levered return assumptions are for illustrative purposes only and attempt to represent current market asset returns and financing terms for prospective investments of the same, or a substantially similar, nature in the Agency sector. (4) “High Quality Spec” protection is defined as pools backed by original loan balances of up to $125K, highest LTV pools (CR>125%LTV), geographic concentrations (NY/PR). “Med Quality Spec” includes $200k loan balance, $175k loan balance, $150k loan balance, high LTV pools (CQ 105-125% LTV) . “35+ WALA” is defined as weighted average loan age greater than months and treated as seasoned collateral. 50

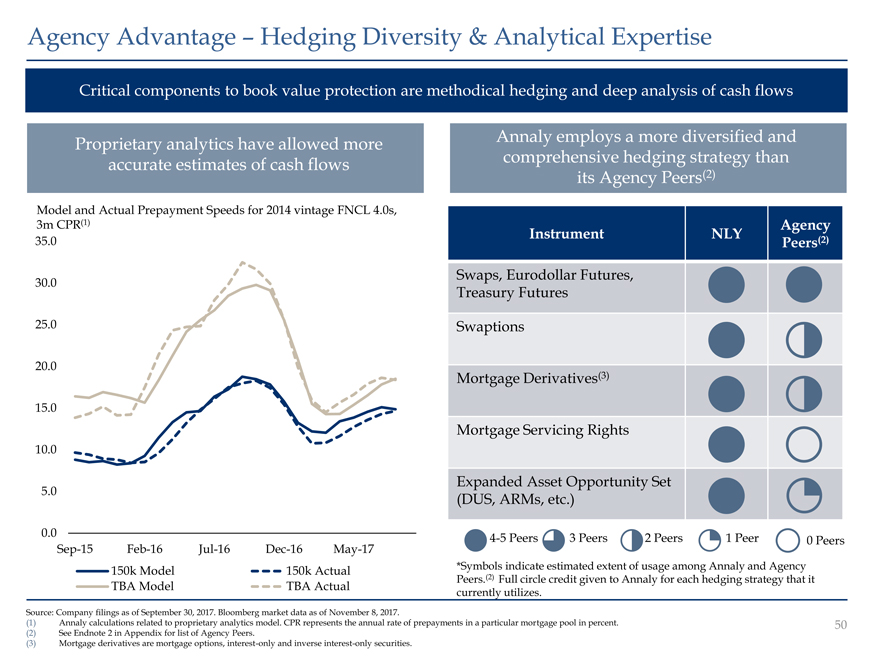

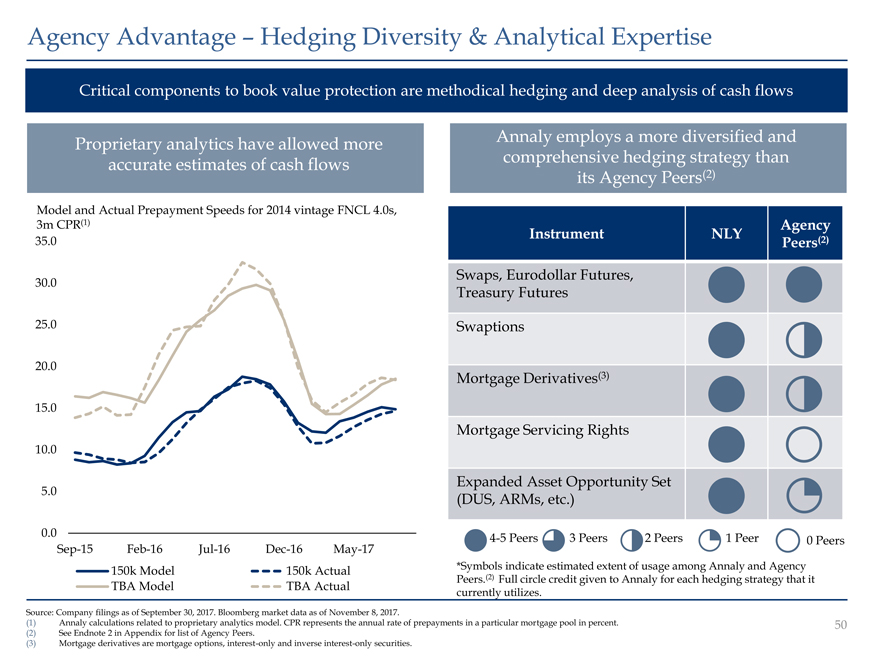

Agency Advantage Hedging Diversity & Analytical Expertise Critical components to book value protection are methodical hedging and deep analysis of cash flows Proprietary analytics have allowed more Annaly employs a more diversified and accurate estimates of cash flows comprehensive hedging strategy than its Agency Peers(2) Model and Actual Prepayment Speeds for 2014 vintage FNCL 4.0s, 3m CPR(1) Agency Instrument NLY 35.0 Peers(2) 30.0 Swaps, Eurodollar Futures, Treasury Futures 25.0 Swaptions 20.0 Mortgage Derivatives(3) 15.0 Mortgage Servicing Rights 10.0 Expanded Asset Opportunity Set 5.0 (DUS, ARMs, etc.) 0.0 4-5 Peers 3 Peers 2 Peers 1 Peer 0 Peers Sep-15 Feb-16 Jul-16 Dec-16 May-17 150k Model 150k Actual *Symbols indicate estimated extent of usage among Annaly and Agency Peers.(2) Full circle credit given to Annaly for each hedging strategy that it TBA Model TBA Actual currently utilizes. Source: Company filings as of September 30, 2017. Bloomberg market data as of November 8, 2017. (1) Annaly calculations related to proprietary analytics model. CPR represents the annual rate of prepayments in a particular mortgage pool in percent. 50 (2) See Endnote 2 in Appendix for list of Agency Peers. (3) Mortgage derivatives are mortgage options, interest-only and inverse interest-only securities.

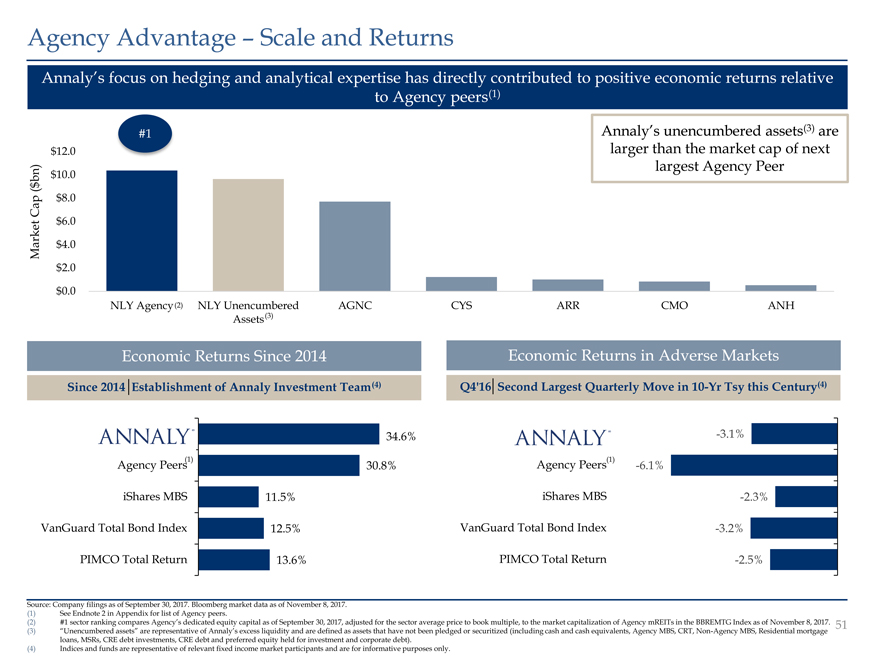

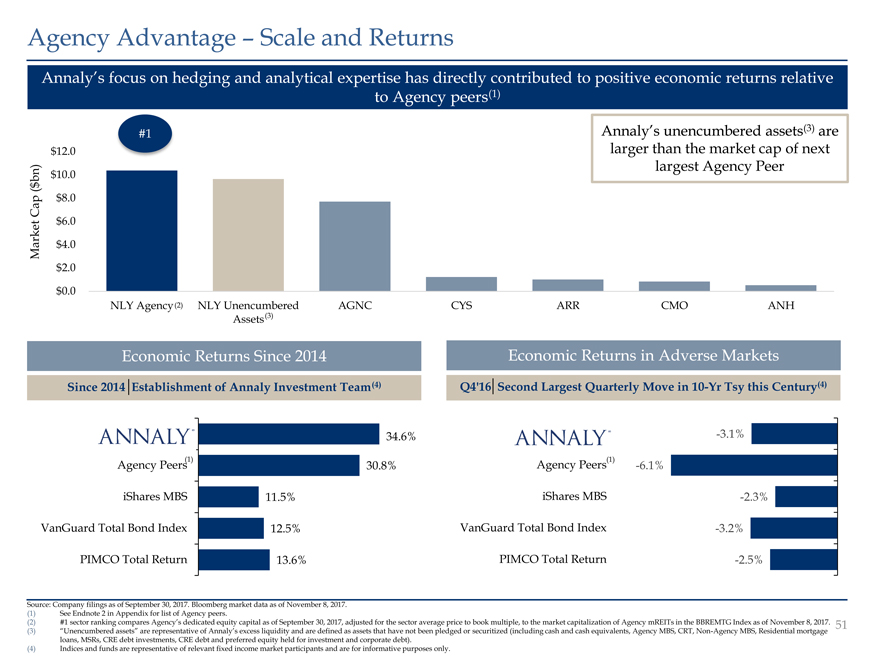

Agency Advantage Scale and Returns Annaly’s focus on hedging and analytical expertise has directly contributed to positive economic returns relative to Agency peers(1) #1 Annaly’s unencumbered assets(3) are $12.0 larger than the market cap of next bn) $10.0 largest Agency Peer $ ( Cap $8.0 $6.0 Market $4.0 $2.0 $0.0 NLY Agency (2) NLY Unencumbered AGNC CYS ARR CMO ANH Assets(3) Economic Returns Since 2014 Economic Returns in Adverse Markets Since 2014 Establishment of Annaly Investment Team(4) Q4’16 Second Largest Quarterly Move in 10-Yr Tsy this Century(4) 34.6% -3.1% Agency Peers(1) 30.8% Agency Peers(1) -6.1% iShares MBS 11.5% iShares MBS -2.3% VanGuard Total Bond Index 12.5% VanGuard Total Bond Index -3.2% PIMCO Total Return 13.6% PIMCO Total Return -2.5% Source: Company filings as of September 30, 2017. Bloomberg market data as of November 8, 2017. (1) See Endnote 2 in Appendix for list of Agency peers. (2) #1 sector ranking compares Agency’s dedicated equity capital as of September 30, 2017, adjusted for the sector average price to book multiple, to the market capitalization of Agency mREITs in the BBREMTG Index as of November 8, 2017. 51 (3) “Unencumbered assets” are representative of Annaly’s excess liquidity and are defined as assets that have not been pledged or securitized (including cash and cash equivalents, Agency MBS, CRT, Non-Agency MBS, Residential mortgage loans, MSRs, CRE debt investments, CRE debt and preferred equity held for investment and corporate debt). (4) Indices and funds are representative of relevant fixed income market participants and are for informative purposes only.

Overview of Annaly Businesses 1 Agency 2 Residential Credit & Future of Housing Finance 3 Commercial Real Estate 4 Middle Market Lending 53

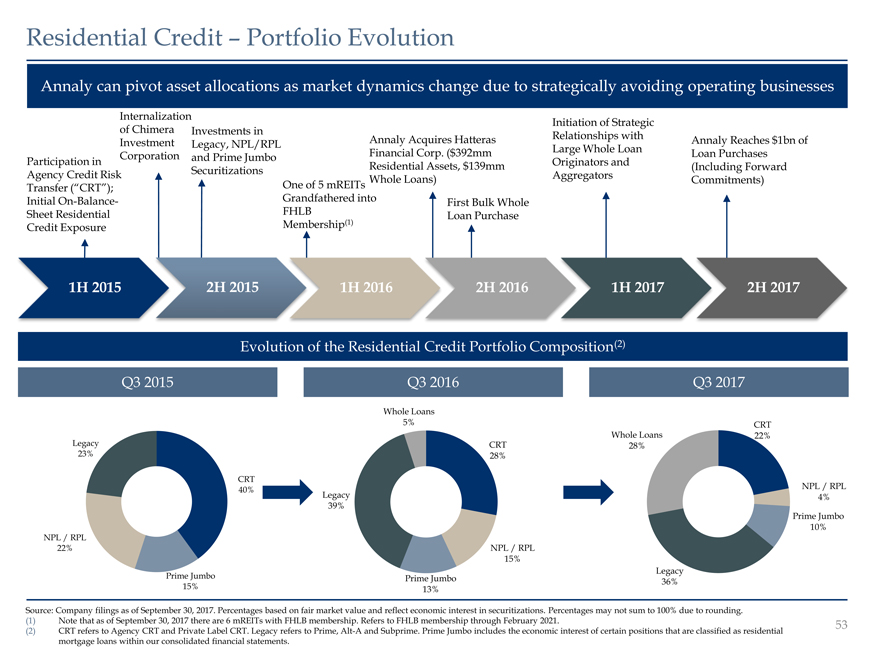

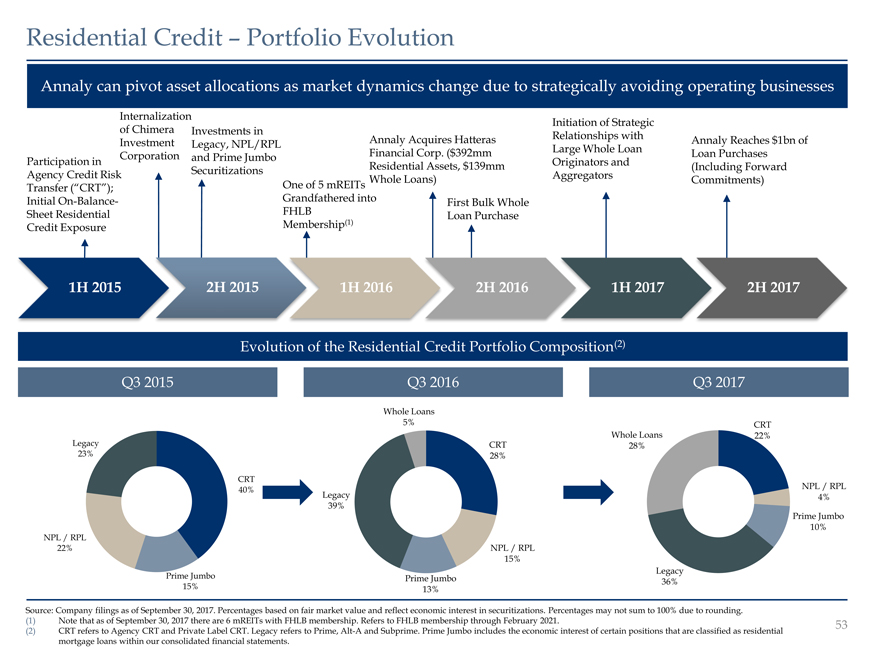

Residential Credit Portfolio Evolution Annaly can pivot asset allocations as market dynamics change due to strategically avoiding operating businesses Internalization Initiation of Strategic of Chimera Investments in Relationships with Investment Legacy, NPL/RPL Annaly Acquires Hatteras Large Whole Loan Annaly Reaches $1bn of Participation in Corporation and Prime Jumbo Financial Corp. ($392mm Originators and Loan Purchases Securitizations Residential Assets, $139mm (Including Forward Agency Credit Risk Whole Loans) Aggregators Commitments) Transfer (“CRT”); One of 5 mREITs Initial On-Balance- Grandfathered into First Bulk Whole Sheet Residential FHLB Loan Purchase Credit Exposure Membership(1) 1H 2015 2H 2015 1H 2016 2H 2016 1H 2017 2H 2017 Evolution of the Residential Credit Portfolio Composition(2) Q3 2015 Q3 2016 Q3 2017 Whole Loans 5% CRT Whole Loans 22% Legacy CRT 28% 23% 28% CRT 40% NPL / RPL Legacy 4% 39% Prime Jumbo 10% NPL / RPL 22% NPL / RPL 15% Legacy Prime Jumbo Prime Jumbo 36% 15% 13% Source: Company filings as of September 30, 2017. Percentages based on fair market value and reflect economic interest in securitizations. Percentages may not sum to 100% due to rounding. (1) Note that as of September 30, 2017 there are 6 mREITs with FHLB membership. Refers to FHLB membership through February 2021. 53 (2) CRT refers to Agency CRT and Private Label CRT. Legacy refers to Prime, Alt-A and Subprime. Prime Jumbo includes the economic interest of certain positions that are classified as residential mortgage loans within our consolidated financial statements.

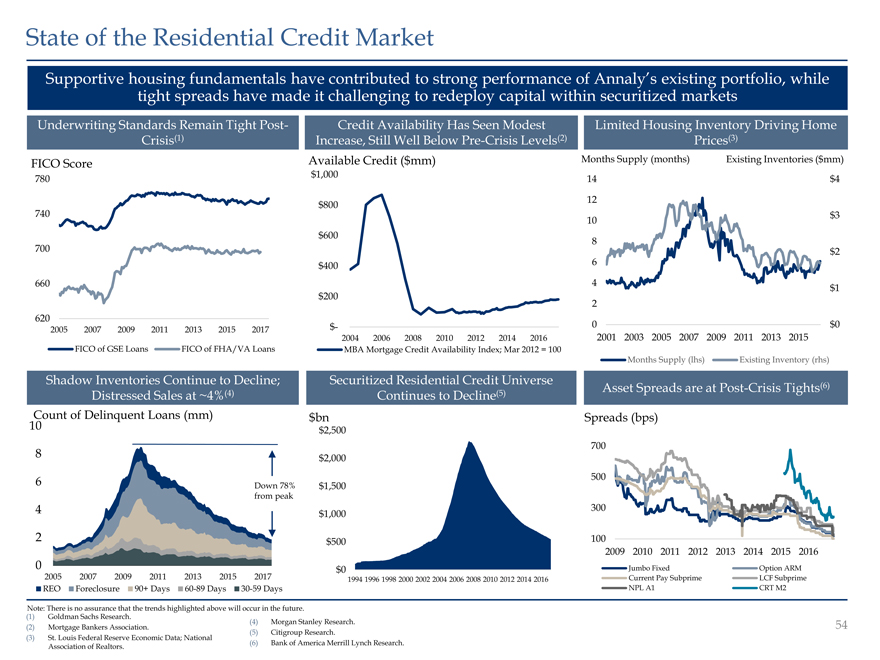

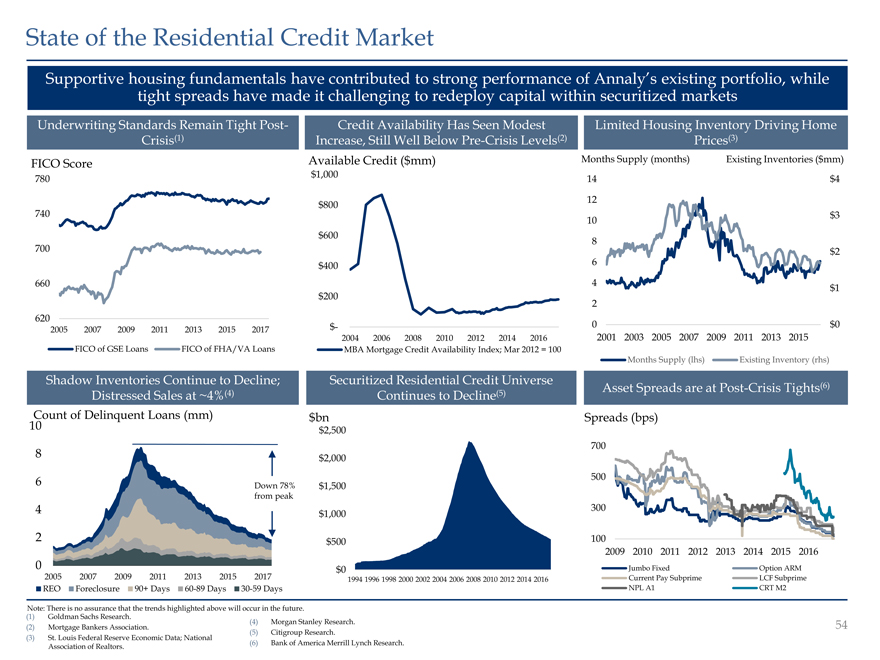

State of the Residential Credit Market Supportive housing fundamentals have contributed to strong performance of Annaly’s existing portfolio, while tight spreads have made it challenging to redeploy capital within securitized markets Underwriting Standards Remain Tight Post- Credit Availability Has Seen Modest Limited Housing Inventory Driving Home Crisis(1) Increase, Still Well Below Pre-Crisis Levels(2) Prices(3) FICO Score Available Credit ($mm) Months Supply (months) Existing Inventories ($mm) 780 $1,000 14 $4 12 740 $800 $3 10 $600 8 700 $2 $400 6 660 4 $1 $200 2 620 $- 0 $0 2005 2007 2009 2011 2013 2015 2017 2004 2006 2008 2010 2012 2014 2016 2001 2003 2005 2007 2009 2011 2013 2015 FICO of GSE Loans FICO of FHA/VA Loans MBA Mortgage Credit Availability Index; Mar 2012 = 100 Months Supply (lhs) Existing Inventory (rhs) Shadow Inventories Continue to Decline; Securitized Residential Credit Universe (6) (4) (5) Asset Spreads are at Post-Crisis Tights Distressed Sales at ~4% Continues to Decline 10 Count of Delinquent Loans (mm) $bn Spreads (bps) $2,500 700 8 $2,000 6 500 Down 78% $1,500 from peak 4 300 $1,000 2 $500 100 2009 2010 2011 2012 2013 2014 2015 2016 0 $0 Jumbo Fixed Option ARM 2005 2007 2009 2011 2013 2015 2017 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 Current Pay Subprime LCF Subprime REO Foreclosure 90+ Days 60-89 Days 30-59 Days NPL A1 CRT M2 Note: There is no assurance that the trends highlighted above will occur in the future. (1) Goldman Sachs Research. (4) Morgan Stanley Research. (2) Mortgage Bankers Association. (5) Citigroup Research. (3) St. Louis Federal Reserve Economic Data; National (6) Bank of America Merrill Lynch Research. Association of Realtors. 55

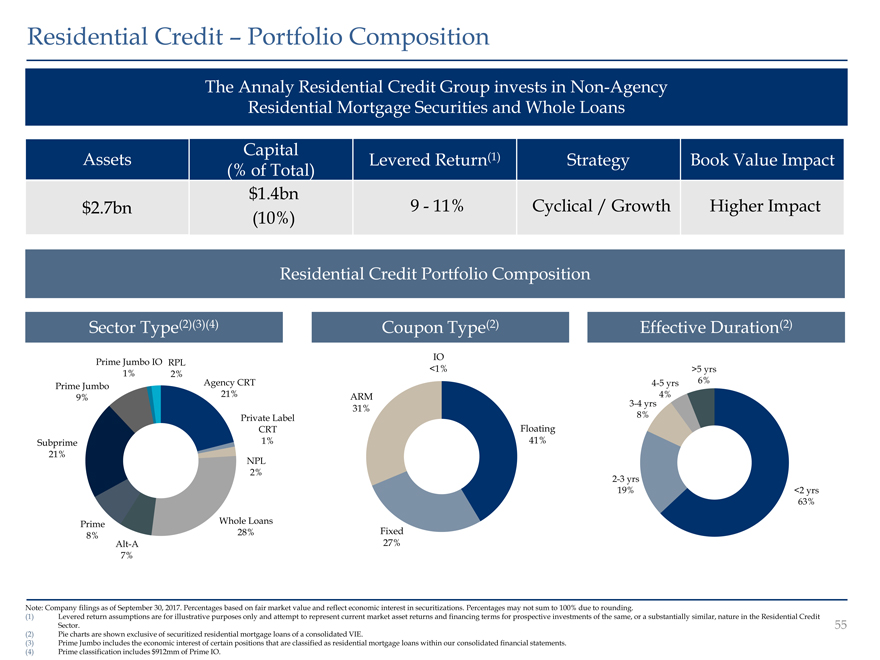

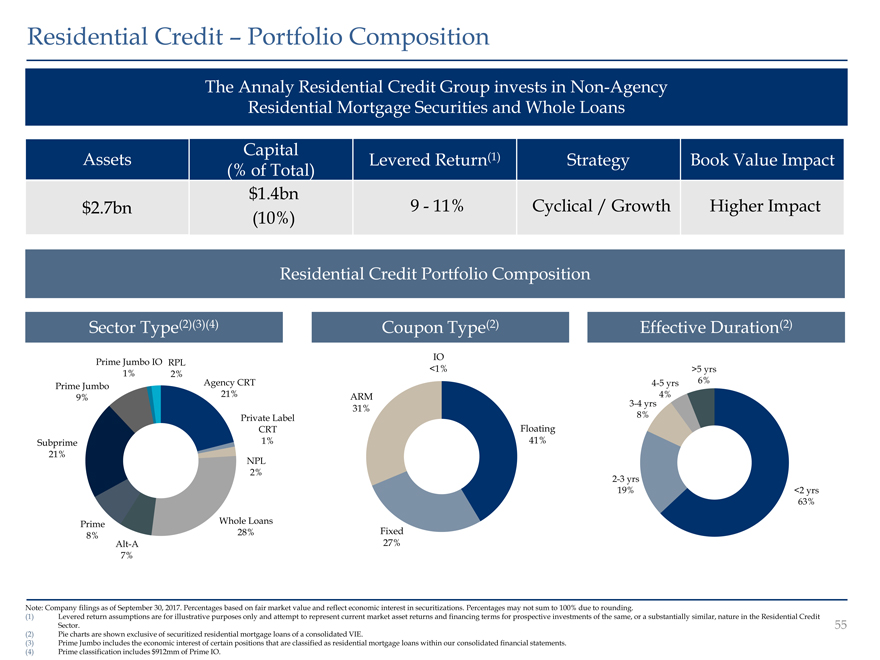

Residential Credit – Portfolio Composition The Annaly Residential Credit Group invests in Non-Agency Residential Mortgage Securities and Whole Loans Capital (1) Assets Levered Return Strategy Book Value Impact (% of Total) $1.4bn $2.7bn 9—11% Cyclical / Growth Higher Impact (10%) Residential Credit Portfolio Composition Sector Type(2)(3)(4) Coupon Type(2) Effective Duration(2) IO Prime Jumbo IO RPL <1% >5 yrs 1% 2% Agency CRT 4-5 yrs 6% Prime Jumbo 9% 21% ARM 4% 3-4 yrs 31% Private Label 8% CRT Floating Subprime 1% 41% 21% NPL 2% 2-3 yrs 19% <2 yrs 63% Prime Whole Loans 28% Fixed 8% Alt-A 27% 7% Note: Company filings as of September 30, 2017. Percentages based on fair market value and reflect economic interest in securitizations. Percentages may not sum to 100% due to rounding. (1) Levered return assumptions are for illustrative purposes only and attempt to represent current market asset returns and financing terms for prospective investments of the same, or a substantially similar, nature in the Residential Credit Sector. (2) Pie charts are shown exclusive of securitized residential mortgage loans of a consolidated VIE. (3) Prime Jumbo includes the economic interest of certain positions that are classified as residential mortgage loans within our consolidated financial statements. (4) Prime classification includes $912mm of Prime IO. 56

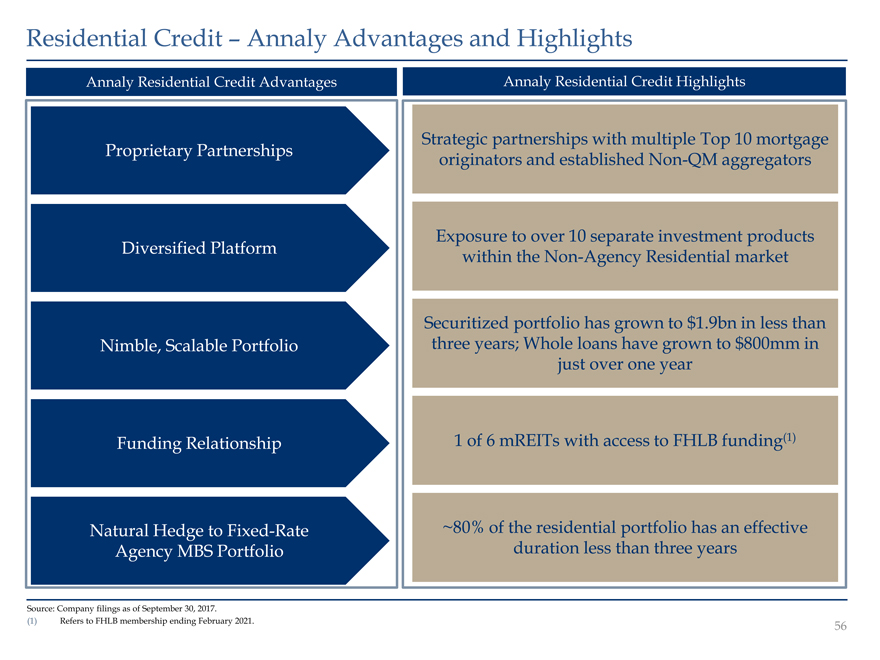

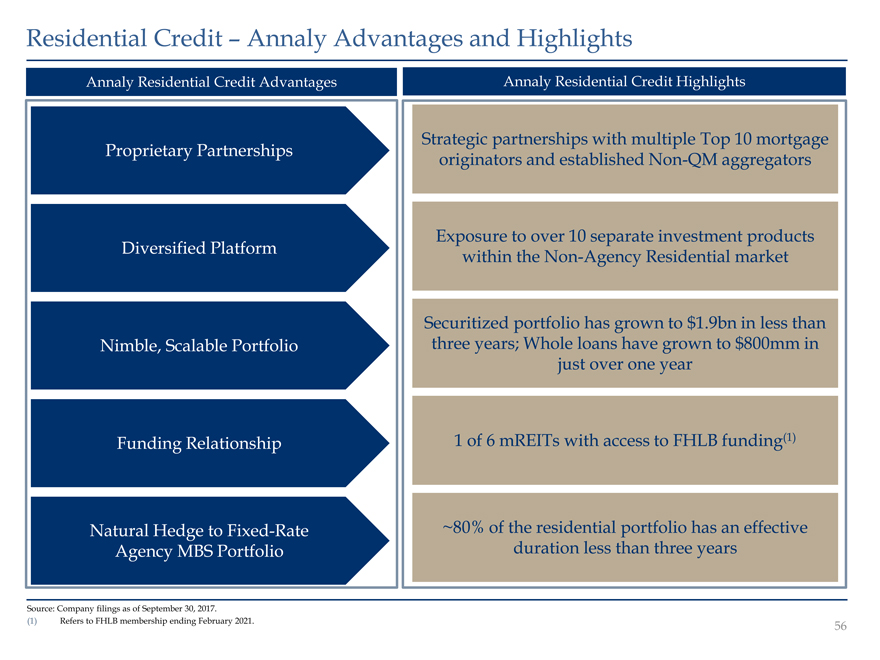

Residential Credit Annaly Advantages and Highlights Annaly Residential Credit Advantages Annaly Residential Credit Highlights Strategic partnerships with multiple Top 10 mortgage Proprietary Partnerships originators and established Non-QM aggregators Exposure to over 10 separate investment products Diversified Platform within the Non-Agency Residential market Securitized portfolio has grown to $1.9bn in less than Nimble, Scalable Portfolio three years; Whole loans have grown to $800mm in just over one year Funding Relationship 1 of 6 mREITs with access to FHLB funding(1) Natural Hedge to Fixed-Rate ~80% of the residential portfolio has an effective Agency MBS Portfolio duration less than three years Source: Company filings as of September 30, 2017. (1) Refers to FHLB membership ending February 2021. 56

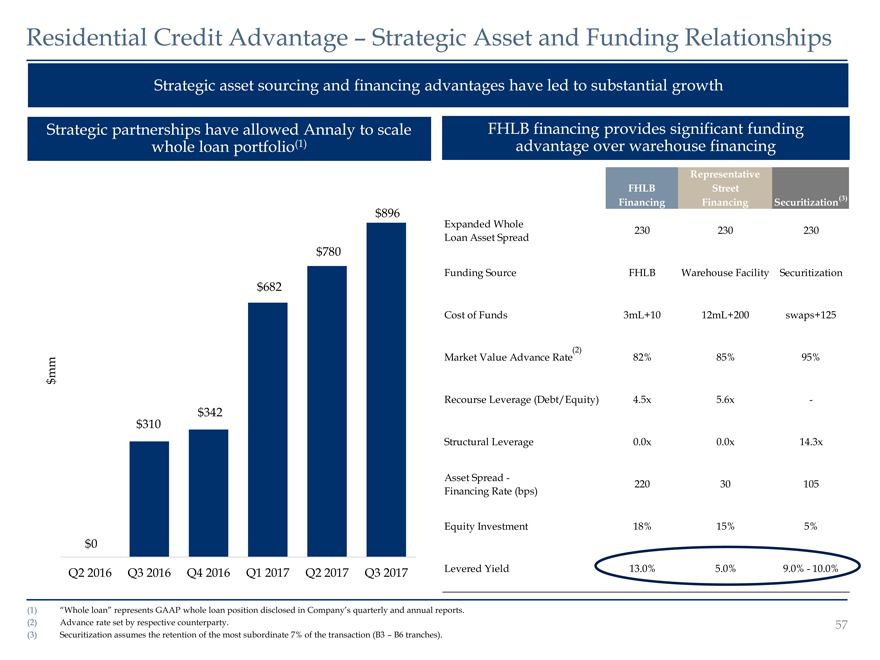

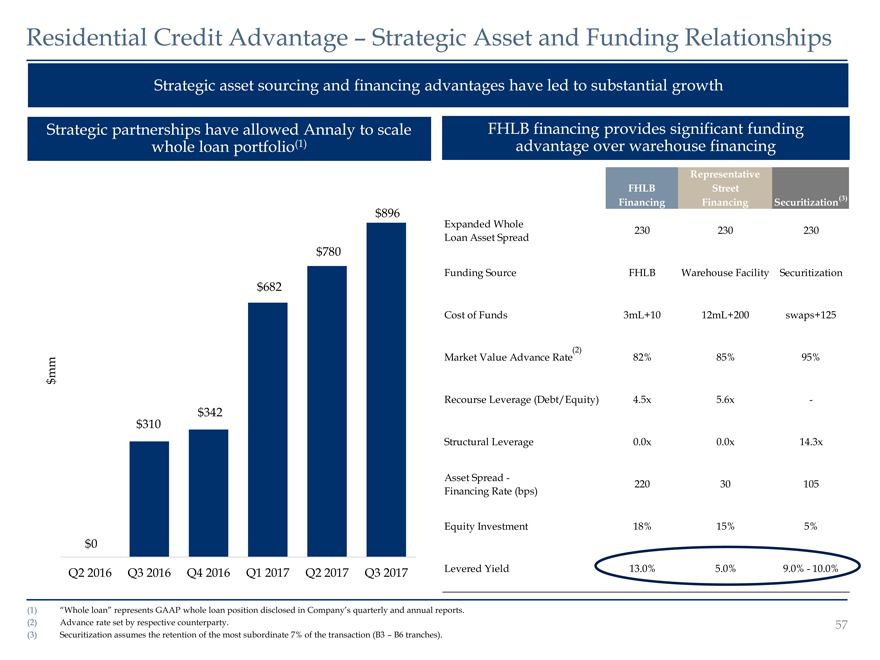

Residential Credit Advantage Strategic Asset and Funding Relationships Strategic asset sourcing and financing advantages have led to substantial growth Strategic partnerships have allowed Annaly to scale FHLB financing provides significant funding whole loan portfolio(1) advantage over warehouse financing Representative FHLB Street Financing Financing Securitization(3) $896 Expanded Whole 230 230 230 Loan Asset Spread $780 Funding Source FHLB Warehouse Facility Securitization $682 Cost of Funds 3mL+10 12mL+200 swaps+125 Market Value Advance Rate(2) 82% 85% 95% mm $ Recourse Leverage (Debt/Equity) 4.5x 5.6x - $342 $310 Structural Leverage 0.0x 0.0x 14.3x Asset Spread - 220 30 105 Financing Rate (bps) Equity Investment 18% 15% 5% $0 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Levered Yield 13.0% 5.0% 9.0% - 10.0% (1) “Whole loan” represents GAAP whole loan position disclosed in Company’s quarterly and annual reports. (2) Advance rate set by respective counterparty. 57 (3) Securitization assumes the retention of the most subordinate 7% of the transaction (B3 B6 tranches).

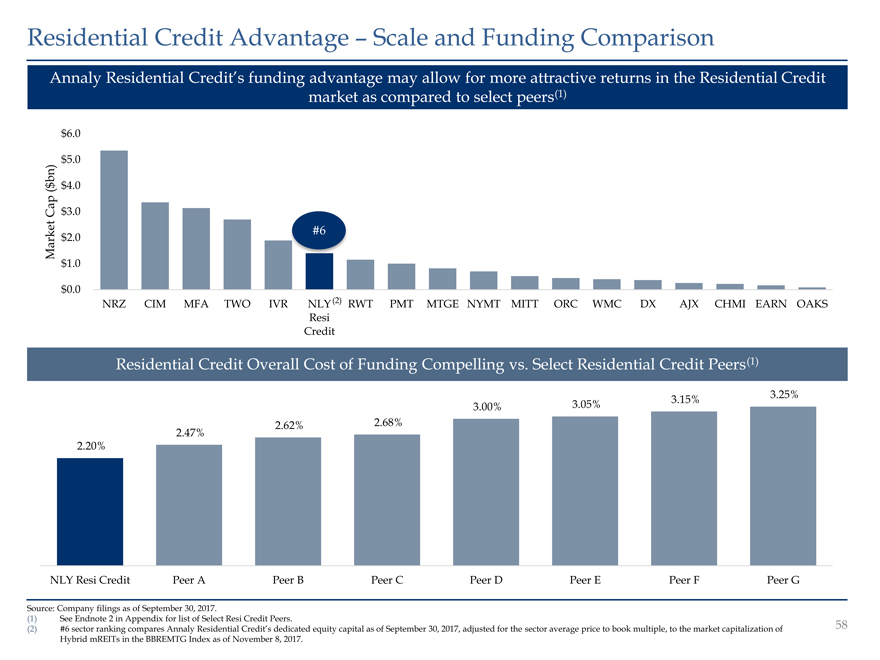

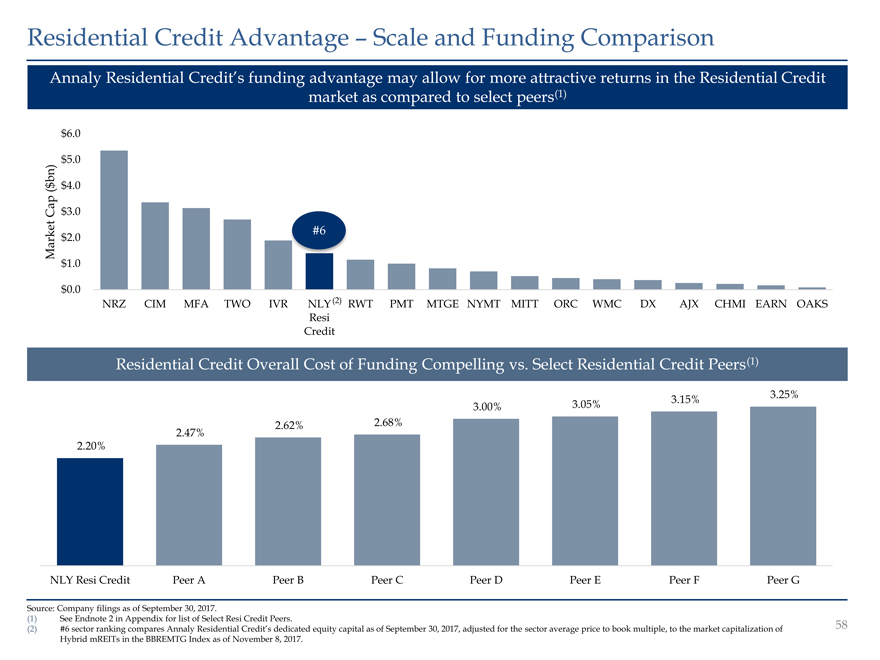

Residential Credit Advantage – Scale and Funding Comparison Annaly Residential Credit’s funding advantage may allow for more attractive returns in the Residential Credit market as compared to select peers(1) $6.0 $5.0 $ bn) $4.0 ( Cap $3.0 #6 Market $2.0 $1.0 $0.0 NRZ CIM MFA TWO IVR NLY(2) RWT PMT MTGE NYMT MITT ORC WMC DX AJX CHMI EARN OAKS Resi Credit Residential Credit Overall Cost of Funding Compelling vs. Select Residential Credit Peers(1) 3.05% 3.15% 3.25% 3.00% 2.47% 2.62% 2.68% 2.20% NLY Resi Credit Peer A Peer B Peer C Peer D Peer E Peer F Peer G Source: Company filings as of September 30, 2017. (1) See Endnote 2 in Appendix for list of Select Resi Credit Peers. (2) #6 sector ranking compares Annaly Residential Credit’s dedicated equity capital as of September 30, 2017, adjusted for the sector average price to book multiple, to the market capitalization of Hybrid mREITs in the BBREMTG Index as of November 8, 2017. 59

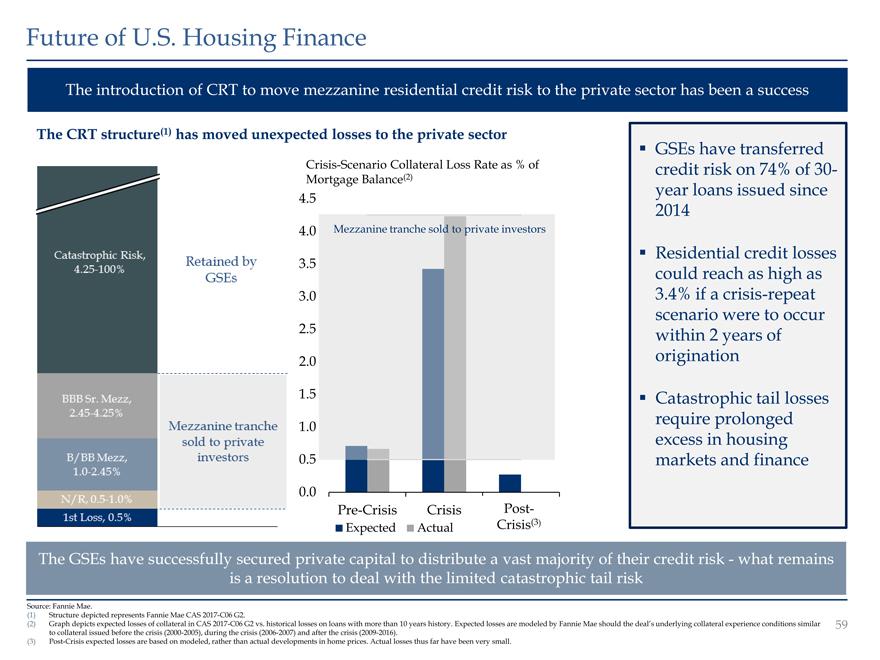

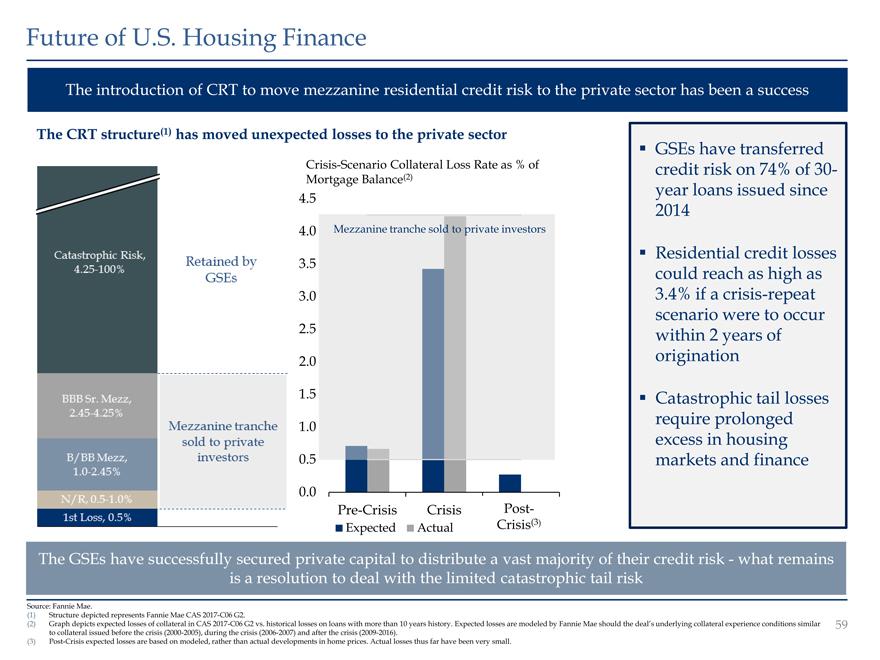

Future of U.S. Housing Finance The introduction of CRT to move mezzanine residential credit risk to the private sector has been a success The CRT structure(1) has moved unexpected losses to the private sector GSEs have transferred Crisis-Scenario Collateral Loss Rate as % of credit risk on 74% of 30- Mortgage Balance(2) 4.5 year loans issued since 2014 4.0 Mezzanine tranche sold to private investors Residential credit losses 3.5 could reach as high as 3.0 3.4% if a crisis-repeat scenario were to occur 2.5 within 2 years of 2.0 origination 1.5 Catastrophic tail losses 1.0 require prolonged excess in housing 0.5 markets and finance 0.0 Pre-Crisis Crisis Post- Expected Actual Crisis(3) The GSEs have successfully secured private capital to distribute a vast majority of their credit risk - what remains is a resolution to deal with the limited catastrophic tail risk Source: Fannie Mae. (1) Structure depicted represents Fannie Mae CAS 2017-C06 G2. (2) Graph depicts expected losses of collateral in CAS 2017-C06 G2 vs. historical losses on loans with more than 10 years history. Expected losses are modeled by Fannie Mae should the deal’s underlying collateral experience conditions similar 59 to collateral issued before the crisis (2000-2005), during the crisis (2006-2007) and after the crisis (2009-2016). (3) Post-Crisis expected losses are based on modeled, rather than actual developments in home prices. Actual losses thus far have been very small.

Overview of Annaly Businesses 1 Agency 2 Residential Credit & Future of Housing Finance 3 Commercial Real Estate 4 Middle Market Lending 61

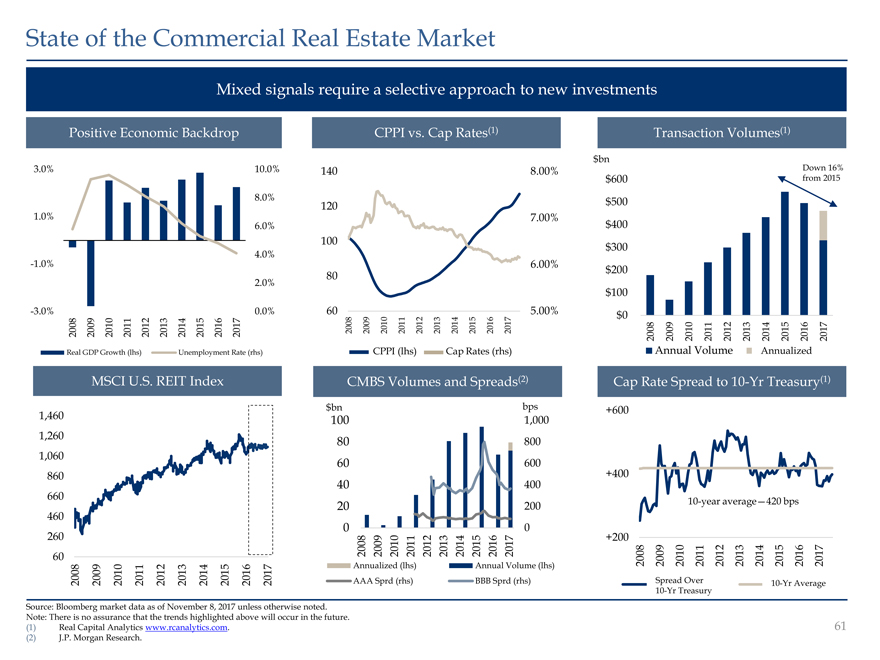

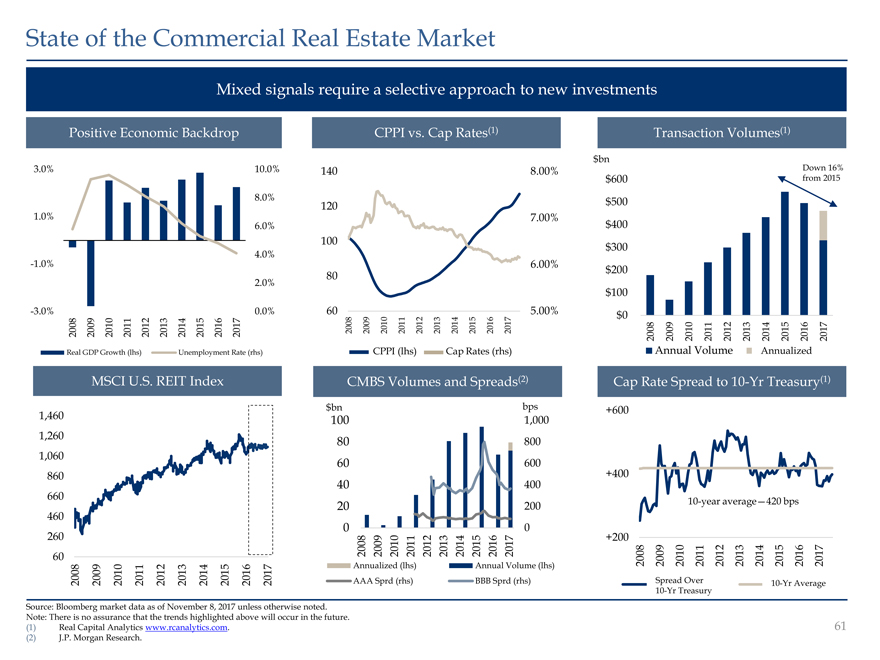

State of the Commercial Real Estate Market Mixed signals require a selective approach to new investments Positive Economic Backdrop CPPI vs. Cap Rates(1) Transaction Volumes(1) $bn 3.0% 10.0% 140 8.00% Down 16% $600 from 2015 8.0% 120 $500 1.0% 7.00% 6.0% $400 100 $300 4.0% -1.0% 6.00% $200 2.0% 80 $100 -3.0% 0.0% 60 5.00% $0 2008 2009 2010 2011 2012 2013 2014 15 2016 2017 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 20 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Real GDP Growth (lhs) Unemployment Rate (rhs) CPPI (lhs) Cap Rates (rhs) Annual Volume Annualized MSCI U.S. REIT Index CMBS Volumes and Spreads(2) Cap Rate Spread to 10-Yr Treasury(1) $bn bps +600 1,460 100 1,000 1,260 80 800 1,060 60 600 860 +400 40 400 660 20 200 10-year average 420 bps 460 0 0 260 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 +200 60 Annualized (lhs) Annual Volume (lhs) 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 AAA Sprd (rhs) BBB Sprd (rhs) Spread Over 10-Yr Average 10-Yr Treasury Source: Bloomberg market data as of November 8, 2017 unless otherwise noted. Note: There is no assurance that the trends highlighted above will occur in the future. (1) Real Capital Analytics www.rcanalytics.com. 61 (2) J.P. Morgan Research.

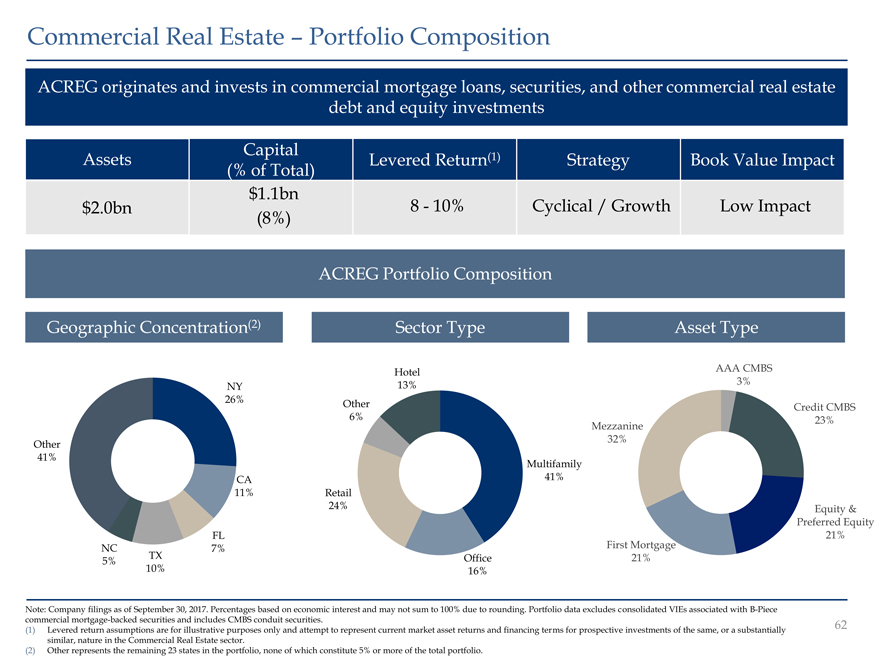

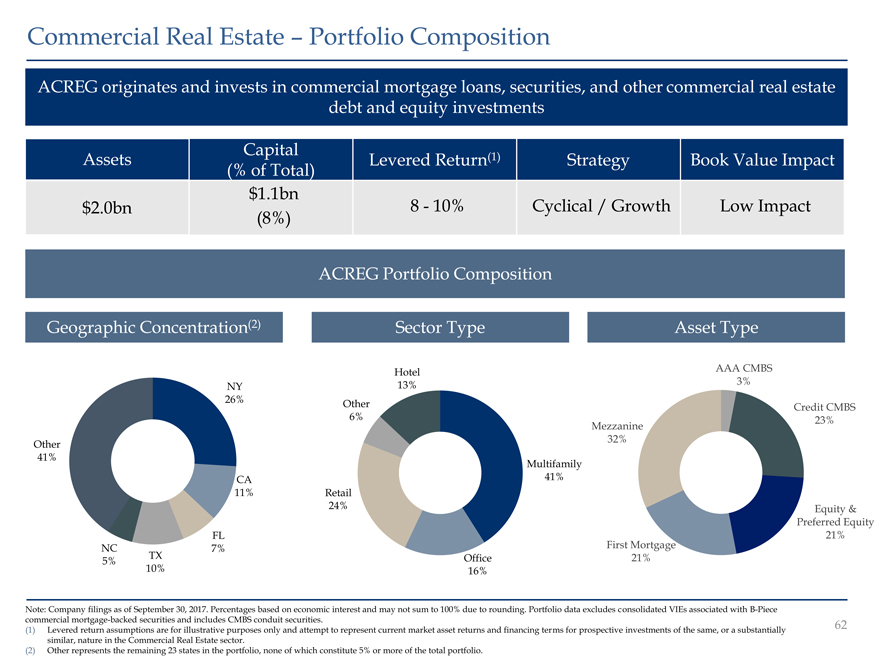

Commercial Real Estate – Portfolio Composition ACREG originates and invests in commercial mortgage loans, securities, and other commercial real estate debt and equity investments Capital (1) Assets Levered Return Strategy Book Value Impact (% of Total) $1.1bn $2.0bn 8—10% Cyclical / Growth Low Impact (8%) ACREG Portfolio Composition Geographic Concentration(2) Sector Type Asset Type Hotel AAA CMBS 13% 3% NY 26% Other 6% Credit CMBS 23% Mezzanine 32% Other 41% Multifamily CA 41% 11% Retail 24% Equity & Preferred Equity FL First Mortgage 21% NC 7% TX Office 21% 5% 10% 16% Note: Company filings as of September 30, 2017. Percentages based on economic interest and may not sum to 100% due to rounding. Portfolio data excludes consolidated VIEs associated with B-Piece commercial mortgage-backed securities and includes CMBS conduit securities. (1) Levered return assumptions are for illustrative purposes only and attempt to represent current market asset returns and financing terms for prospective investments of the same, or a substantially similar, nature in the Commercial Real Estate sector. (2) Other represents the remaining 23 states in the portfolio, none of which constitute 5% or more of the total portfolio. 63

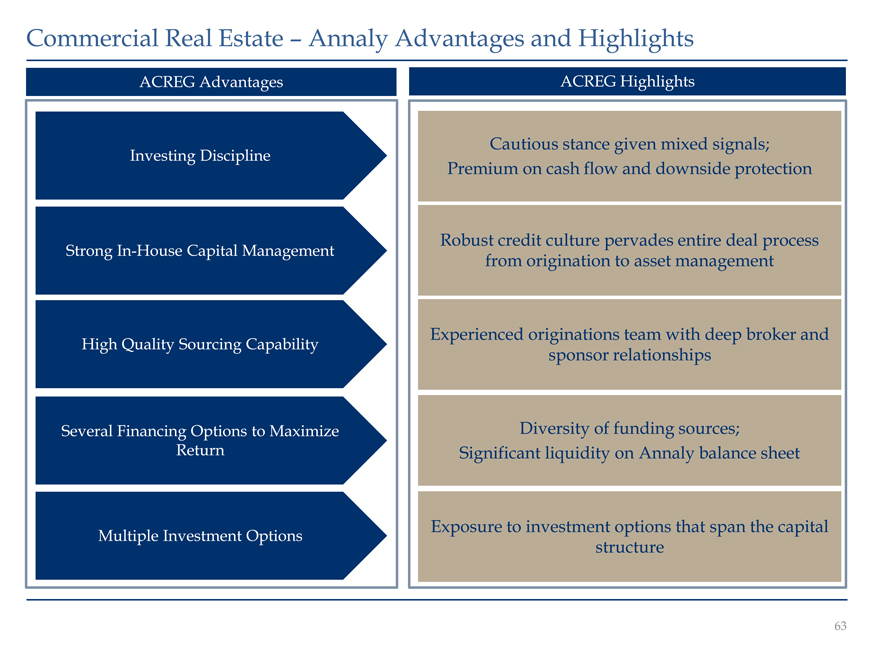

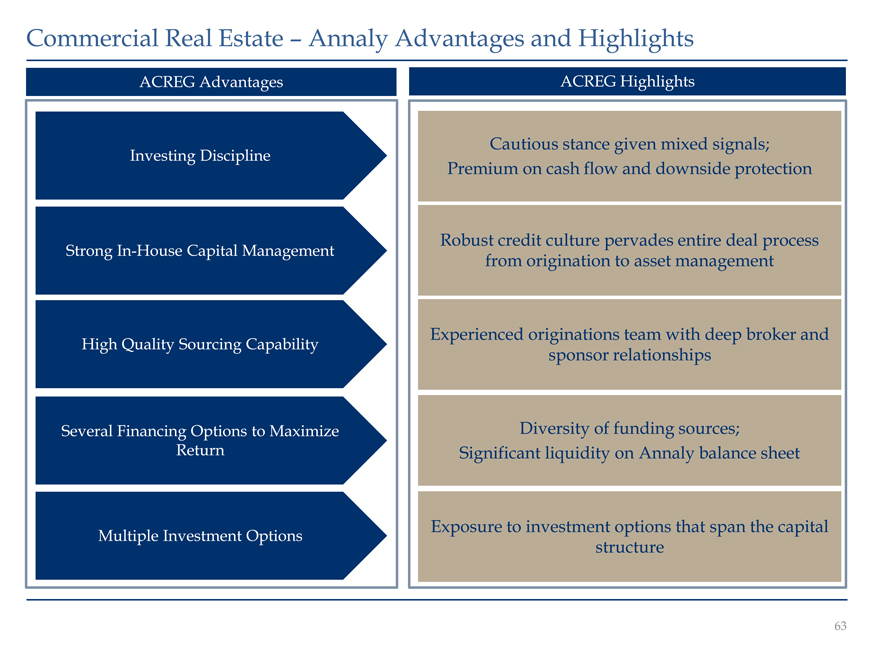

Commercial Real Estate Annaly Advantages and Highlights ACREG Advantages ACREG Highlights Cautious stance given mixed signals; Investing Discipline Premium on cash flow and downside protection Robust credit culture pervades entire deal process Strong In-House Capital Management from origination to asset management High Quality Sourcing Capability Experienced originations team with deep broker and sponsor relationships Several Financing Options to Maximize Diversity of funding sources; Return Significant liquidity on Annaly balance sheet Multiple Investment Options Exposure to investment options that span the capital structure 63

Commercial Real Estate Advantage – Multiple Investment Options ACREG’s multiple investment options provide flexibility across investment sizes, geographies and structures Investment Options and Recent Illustrative Examples Floating Rate First Mortgage CMBS Denver West Freddie Mac 2015 KLSF ? $112mm floating rate loan to a ? $102mm B-Piece of Freddie private equity sponsor for a Mac floating rate securitization portfolio of office properties? Acquisition financing for private equity sponsor ? 1.5mm square foot office park? 18.2k unit multi-family ? Denver, CO portfolio? Concentrated in nine states Mezzanine Equity Westin New Orleans Ellicott House ? $15mm floating rate ? $75mm joint venture mezzanine loan to a private acquisition with strong, equity sponsor for the national owner-operator acquisition of an ? 327 unit apartment building institutional quality hotel? Washington, DC ? 437 room hotel? New Orleans, LA Note: Above select transactions are shown for illustrative purposes only and there is no assurance that similar investment options will be available in the future or are indicative of future transactions in the ACREG portfolio. All transactions have closed as of September 30, 2017. 65

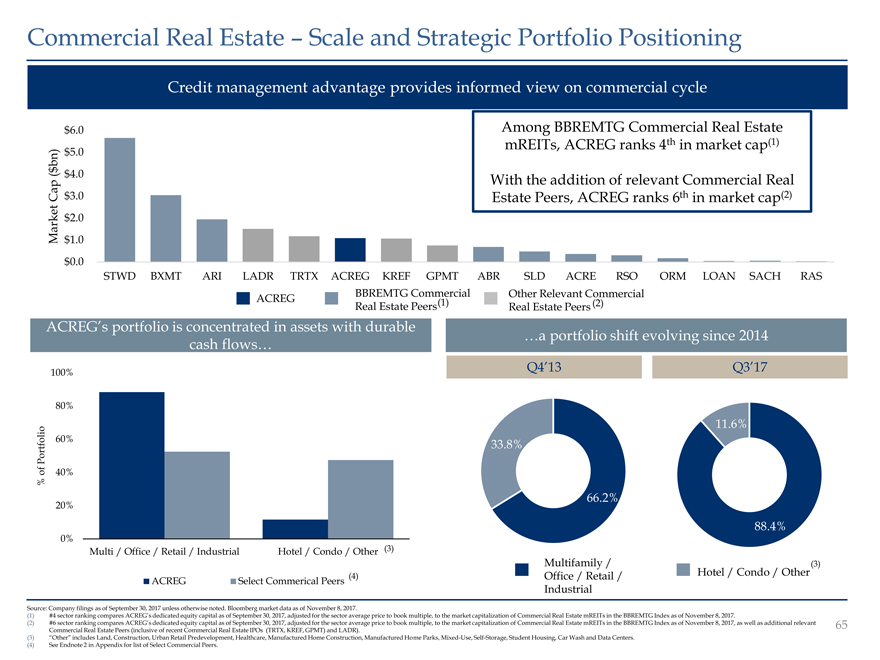

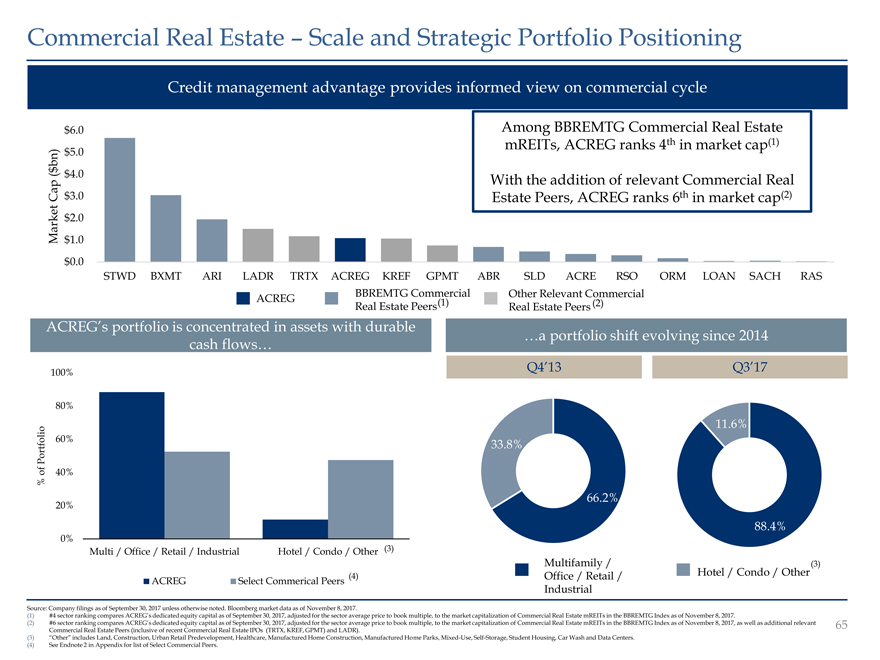

Commercial Real Estate Scale and Strategic Portfolio Positioning Credit management advantage provides informed view on commercial cycle $ 6.0 Among BBREMTG Commercial Real Estate mREITs, ACREG ranks 4th in market cap(1) bn) $ 5.0 ( $ $ 4.0 With the addition of relevant Commercial Real Cap $ 3.0 Estate Peers, ACREG ranks 6th in market cap(2) $ 2.0 Market $ 1.0 $ 0.0 STWD BXMT ARI LADR TRTX ACREG KREF GPMT ABR SLD ACRE RSO ORM LOAN SACH RAS BBREMTG Commercial Other Relevant Commercial ACREG Real Estate Peers(1) Real Estate Peers (2) ACREG’s portfolio is concentrated in assets with durable …a portfolio shift evolving since 2014 cash flows… 100% Q4’13 Q3’17 80% 11.6% Portfolio 60% 33.8% of 40% % 20% 66.2% 88.4% 0% Multi / Office / Retail / Industrial Hotel / Condo / Other (3) Multifamily / (3) (4) Office / Retail / Hotel / Condo / Other ACREG Select Commerical Peers Industrial Source: Company filings as of September 30, 2017 unless otherwise noted. Bloomberg market data as of November 8, 2017. (1) #4 sector ranking compares ACREG’s dedicated equity capital as of September 30, 2017, adjusted for the sector average price to book multiple, to the market capitalization of Commercial Real Estate mREITs in the BBREMTG Index as of November 8, 2017. (2) #6 sector ranking compares ACREG’s dedicated equity capital as of September 30, 2017, adjusted for the sector average price to book multiple, to the market capitalization of Commercial Real Estate mREITs in the BBREMTG Index as of November 8, 2017, as well as additional relevant 65 Commercial Real Estate Peers (inclusive of recent Commercial Real Estate IPOs (TRTX, KREF, GPMT) and LADR). (3) “Other” includes Land, Construction, Urban Retail Predevelopment, Healthcare, Manufactured Home Construction, Manufactured Home Parks, Mixed-Use, Self-Storage, Student Housing, Car Wash and Data Centers. (4) See Endnote 2 in Appendix for list of Select Commercial Peers.

Overview of Annaly Businesses 1 Agency 2 Residential Credit & Future of Housing Finance 3 Commercial Real Estate 4 Middle Market Lending 67

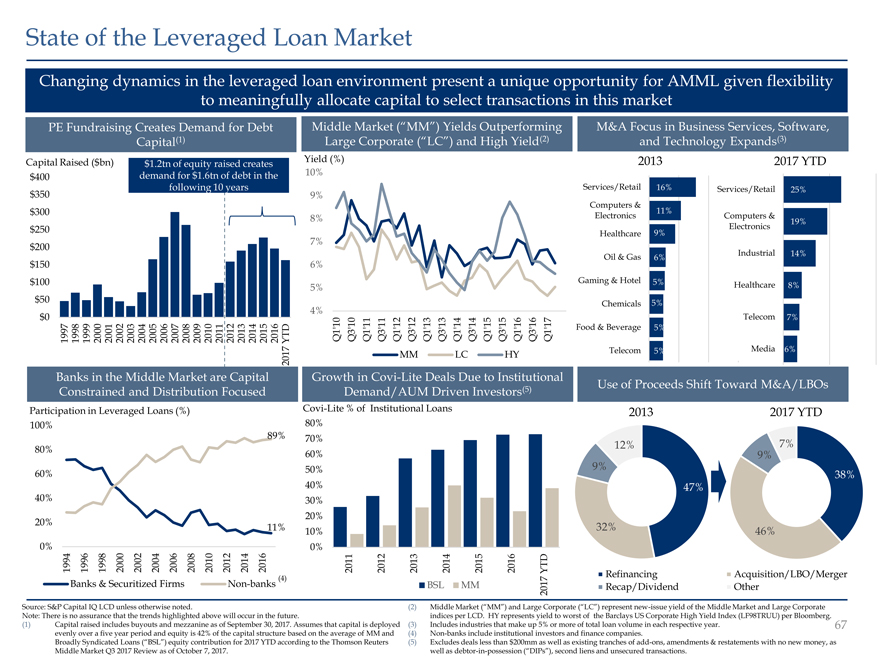

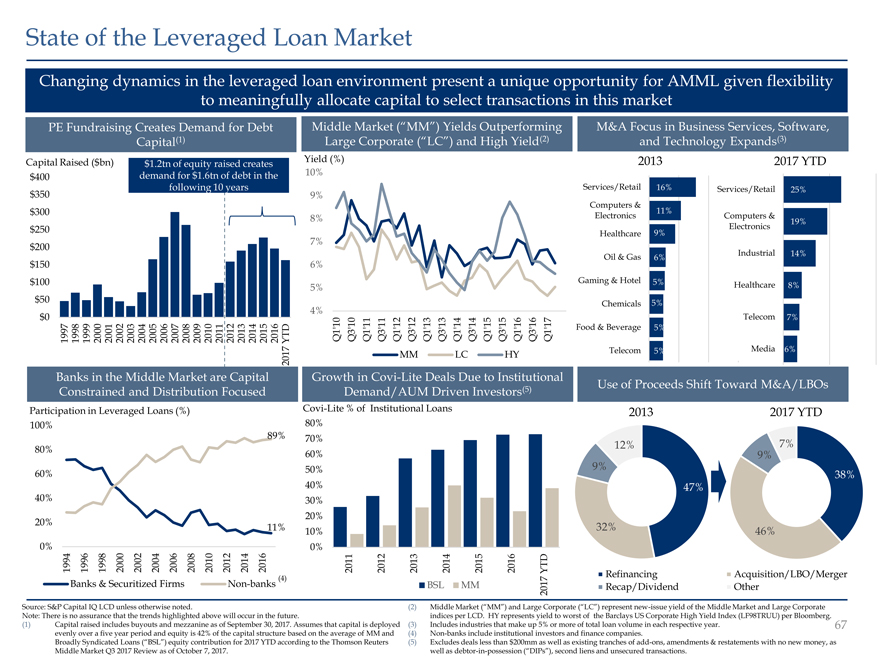

State of the Leveraged Loan Market Changing dynamics in the leveraged loan environment present a unique opportunity for AMML given flexibility to meaningfully allocate capital to select transactions in this market PE Fundraising Creates Demand for Debt Middle Market (“MM”) Yields Outperforming M&A Focus in Business Services, Software, Capital(1) Large Corporate (“LC”) and High Yield(2) and Technology Expands(3) Capital Raised ($bn) $1.2tn of equity raised creates Yield (%) 2013 2017 YTD $400 demand for $1.6tn of debt in the 10% following 10 years Services/Retail 16% Services/Retail 25% $350 9% Computers & $300 11% 8% Electronics Computers & 19% $250 Healthcare 9% Electronics $200 7% Oil & Gas 6% Industrial 14% $150 6% $100 5% Gaming & Hotel 5% Healthcare 8% $50 Chemicals 5% 4% $0 Telecom 7% 1997 98 19 1999 2000 2001 2002 2003 2004 2005 2006 2007 08 20 2009 2010 2011 2012 2013 2014 2015 2016 YTD Q1’10 Q3’10 Q1’11 Q3’11 Q1’12 Q3’12 Q1’13 Q3’13 Q1’14 Q3’14 Q1’15 Q3’15 Q1’16 Q3’16 Q1’17 Food & Beverage 5% 2017 MM LC HY Telecom 5% Media 6% Banks in the Middle Market are Capital Growth in Covi-Lite Deals Due to Institutional Use of Proceeds Shift Toward M&A/LBOs Constrained and Distribution Focused Demand/AUM Driven Investors(5) Participation in Leveraged Loans (%) Covi-Lite % of Institutional Loans 2013 2017 YTD 100% 80% 89% 70% 80% 12% 7% 60% 9% 50% 9% 60% 38% 40% 47% 40% 30% 20% 20% 11% 10% 32% 46% 0% 0% 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2011 2012 2013 2014 2015 2016 YTD Refinancing Acquisition/LBO/Merger Banks & Securitized Firms Non-banks (4) BSL MM 2017 Recap/Dividend Other Source: S&P Capital IQ LCD unless otherwise noted. (2) Middle Market (“MM”) and Large Corporate (“LC”) represent new-issue yield of the Middle Market and Large Corporate Note: There is no assurance that the trends highlighted above will occur in the future. indices per LCD. HY represents yield to worst of the Barclays US Corporate High Yield Index (LF98TRUU) per Bloomberg. (1) Capital raised includes buyouts and mezzanine as of September 30, 2017. Assumes that capital is deployed (3) Includes industries that make up 5% or more of total loan volume in each respective year. 67 evenly over a five year period and equity is 42% of the capital structure based on the average of MM and (4) Non-banks include institutional investors and finance companies. Broadly Syndicated Loans (“BSL”) equity contribution for 2017 YTD according to the Thomson Reuters (5) Excludes deals less than $200mm as well as existing tranches of add-ons, amendments & restatements with no new money, as Middle Market Q3 2017 Review as of October 7, 2017. well as debtor-in-possession (“DIPs”), second liens and unsecured transactions.

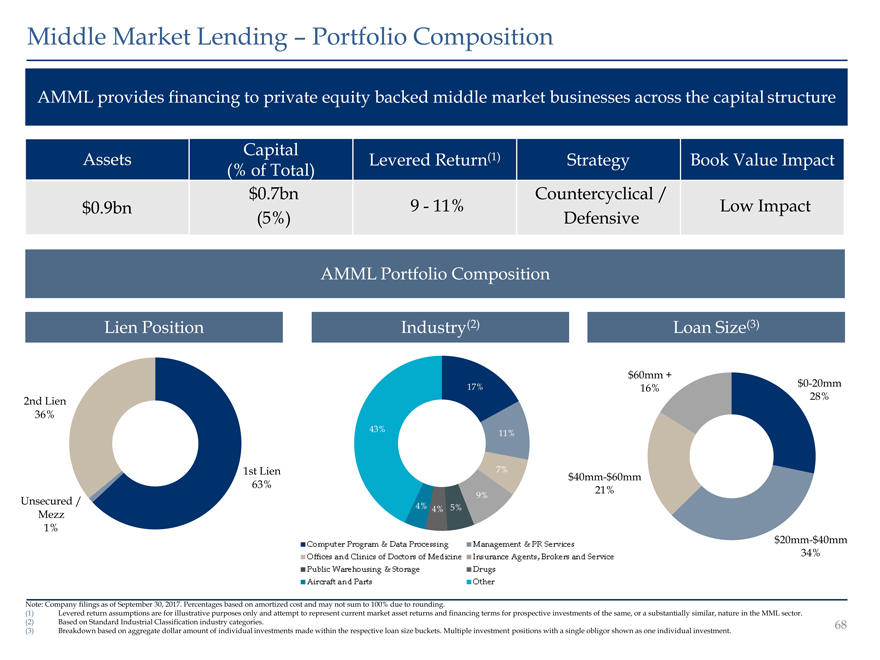

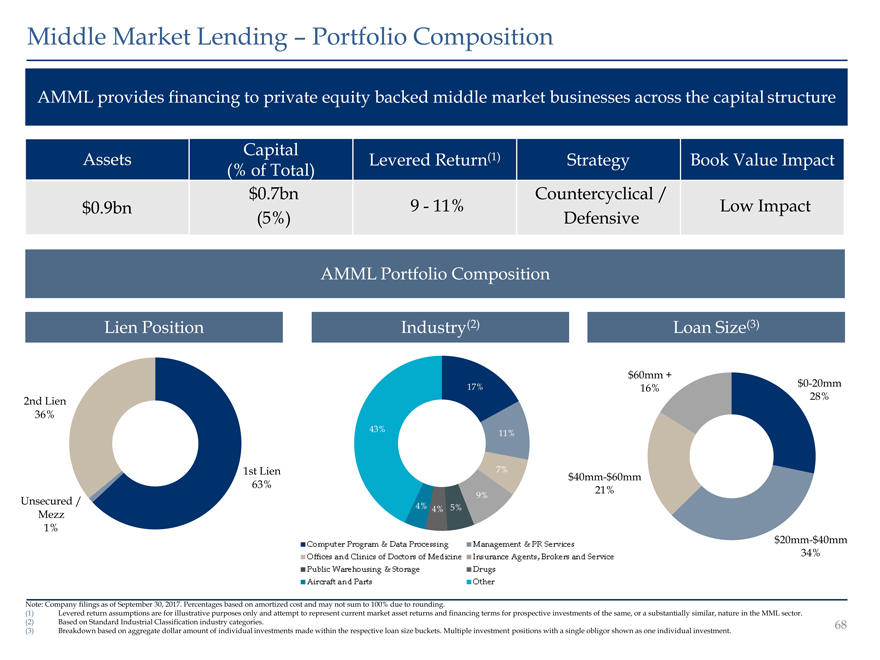

Middle Market Lending – Portfolio Composition AMML provides financing to private equity backed middle market businesses across the capital structure Capital (1) Assets Levered Return Strategy Book Value Impact (% of Total) $0.7bn Countercyclical / $0.9bn 9—11% Low Impact (5%) Defensive AMML Portfolio Composition Lien Position Industry(2) Loan Size(3) $60mm + 17% $0-20mm 16% 2nd Lien 28% 36% 43% 11% 1st Lien 7% $40mm-$60mm 63% 21% 9% Unsecured / 4% 4% 5% Mezz 1% $20mm-$40mm 34% Note: Company filings as of September 30, 2017. Percentages based on amortized cost and may not sum to 100% due to rounding. (1) Levered return assumptions are for illustrative purposes only and attempt to represent current market asset returns and financing terms for prospective investments of the same, or a substantially similar, nature in the MML sector. (2) Based on Standard Industrial Classification industry categories. (3) Breakdown based on aggregate dollar amount of individual investments made within the respective loan size buckets. Multiple investment positions with a single obligor shown as one individual investment. 69

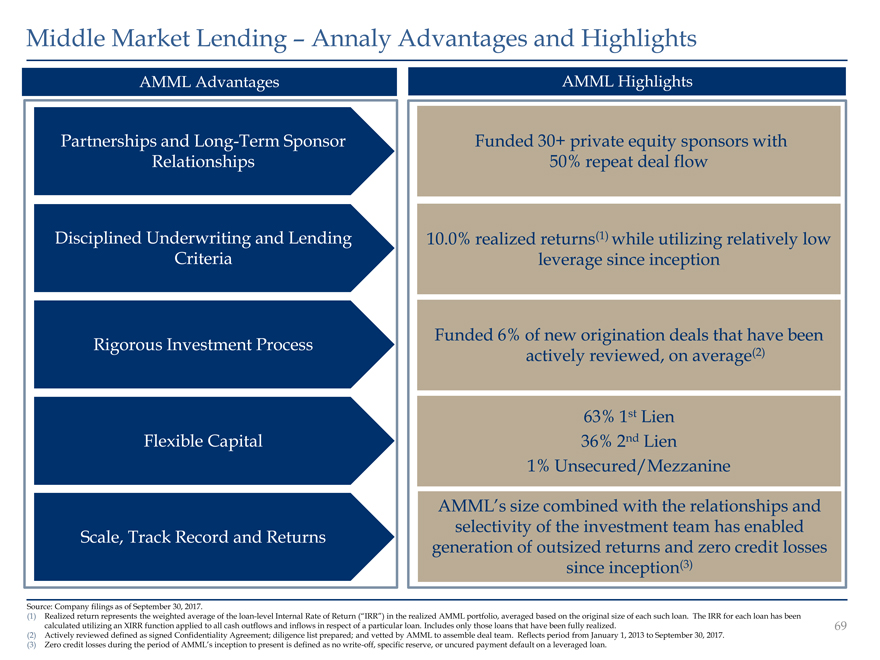

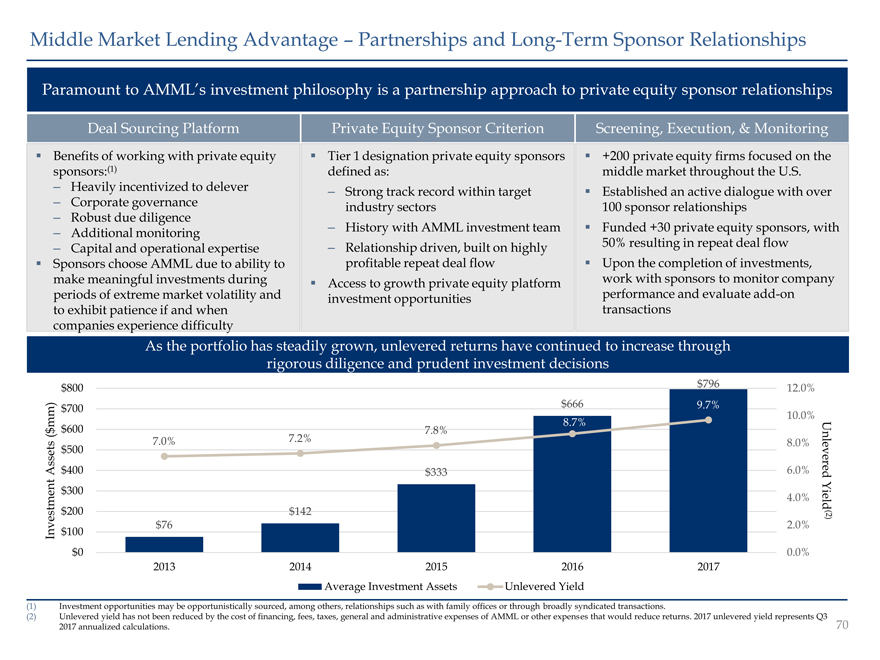

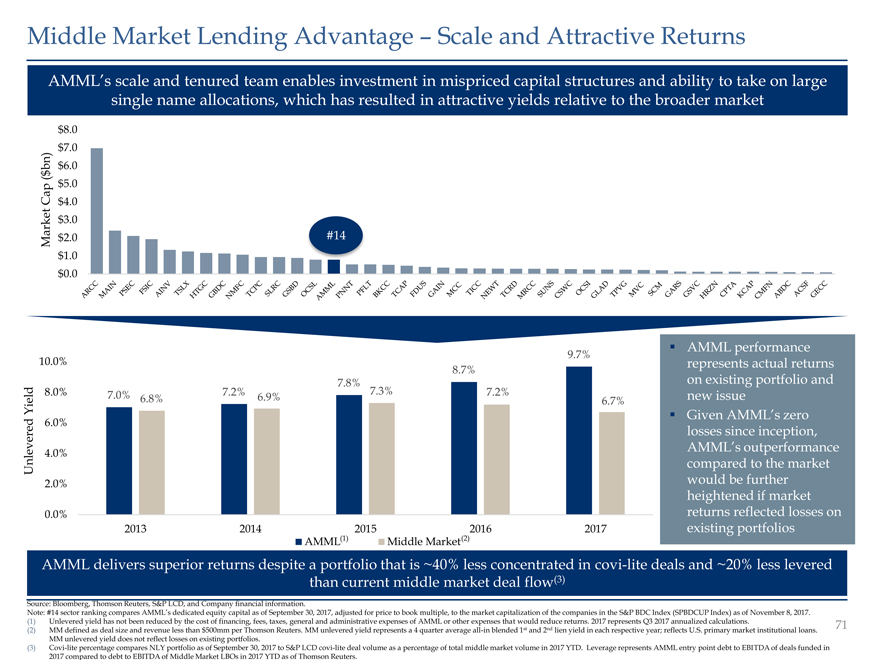

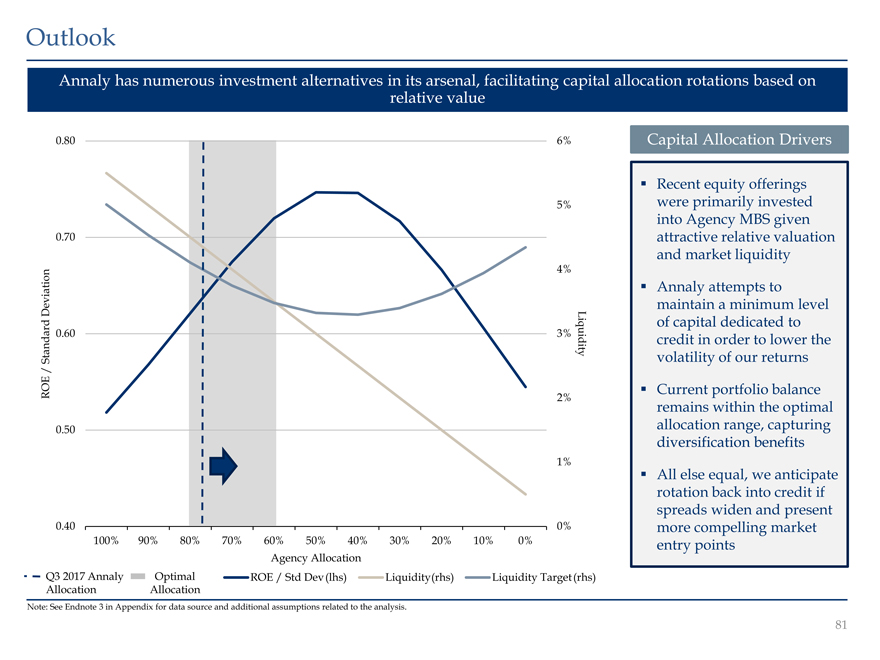

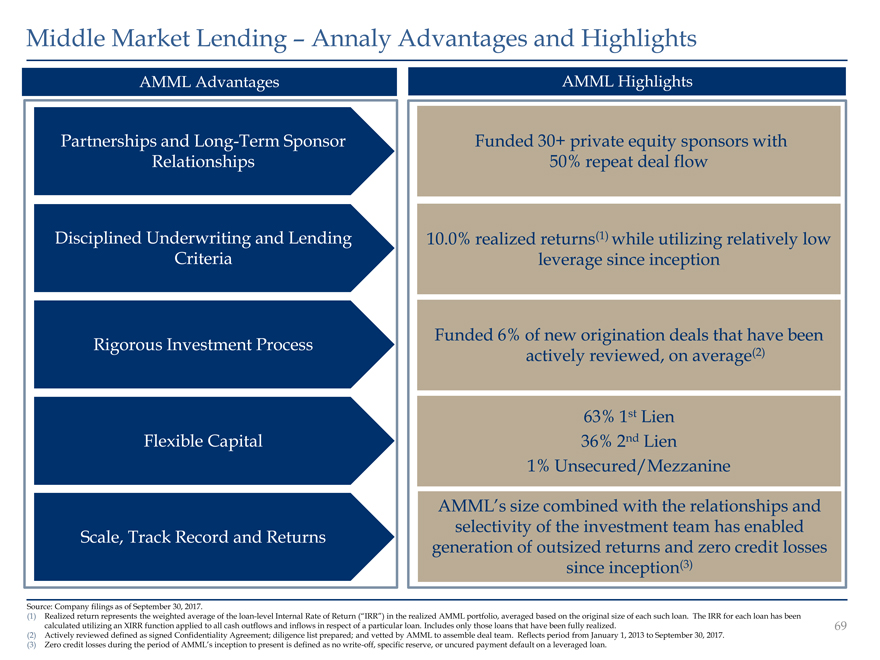

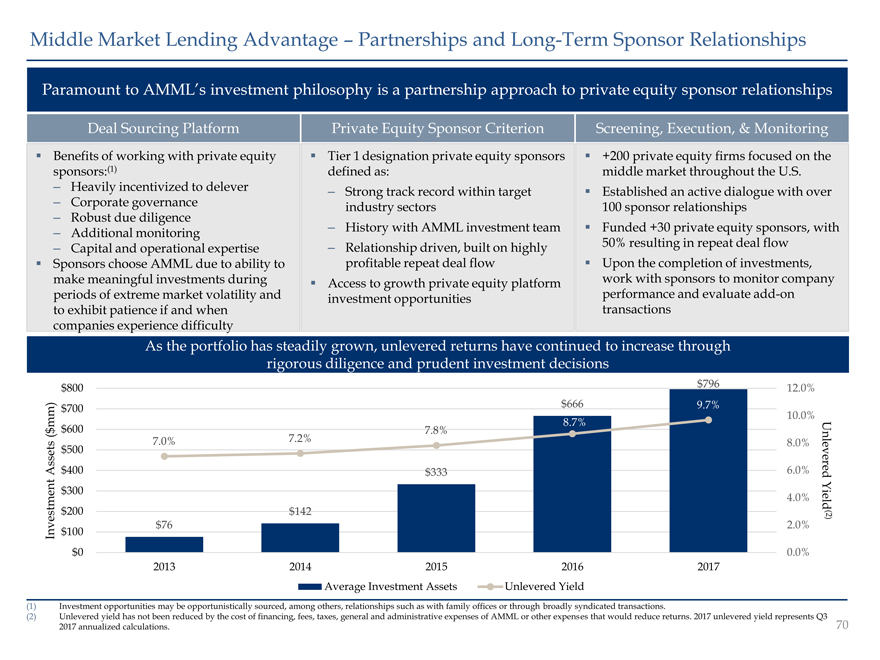

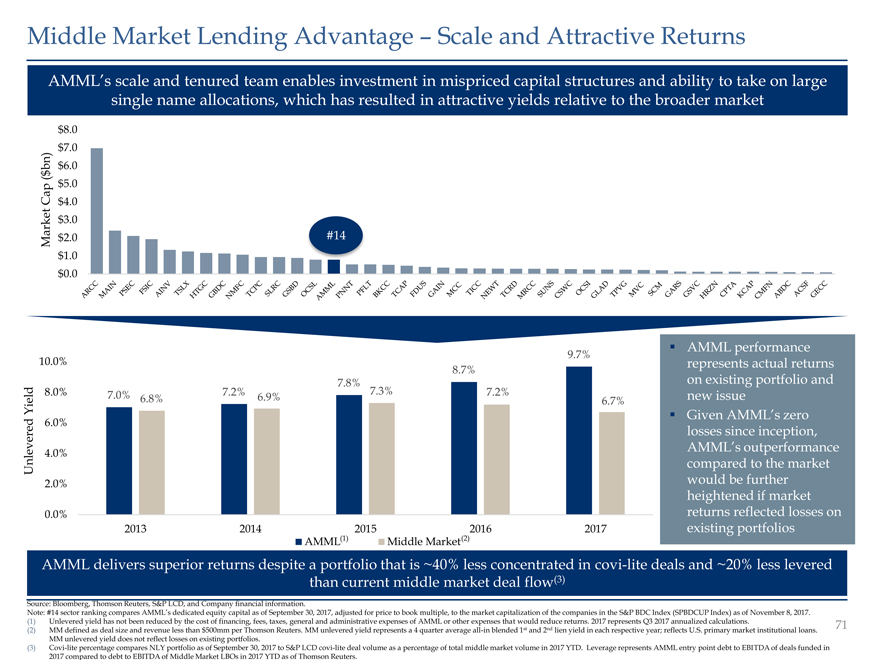

Middle Market Lending Annaly Advantages and Highlights AMML Advantages AMML Highlights Partnerships and Long-Term Sponsor Funded 30+ private equity sponsors with Relationships 50% repeat deal flow Disciplined Underwriting and Lending 10.0% realized returns(1) while utilizing relatively low Criteria leverage since inception Rigorous Investment Process Funded 6% of new origination deals that have been actively reviewed, on average(2) 63% 1st Lien Flexible Capital 36% 2nd Lien 1% Unsecured/Mezzanine AMML’s size combined with the relationships and selectivity of the investment team has enabled Scale, Track Record and Returns generation of outsized returns and zero credit losses since inception(3) Source: Company filings as of September 30, 2017. (1) Realized return represents the weighted average of the loan-level Internal Rate of Return (“IRR”) in the realized AMML portfolio, averaged based on the original size of each such loan. The IRR for each loan has been calculated utilizing an XIRR function applied to all cash outflows and inflows in respect of a particular loan. Includes only those loans that have been fully realized. 69 (2) Actively reviewed defined as signed Confidentiality Agreement; diligence list prepared; and vetted by AMML to assemble deal team. Reflects period from January 1, 2013 to September 30, 2017. (3) Zero credit losses during the period of AMML’s inception to present is defined as no write-off, specific reserve, or uncured payment default on a leveraged loan.