Third Quarter 2018 Investor Presentation October 31, 2018

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Safe Harbor Notice Forward-Looking Statements This presentation, other written or oral communications, and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions (some of which are beyond our control) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “anticipate,” “continue,” or similar terms or variations on those terms or the negative of those terms. Actual results could differ materially from those set forth in forward-looking statements due to a variety of factors, including, but not limited to, changes in interest rates; changes in the yield curve; changes in prepayment rates; the availability of mortgage-backed securities (“MBS”) and other securities for purchase; the availability of financing and, if available, the terms of any financing; changes in the market value of our assets; changes in business conditions and the general economy; our ability to grow our commercial real estate business; our ability to grow our residential mortgage credit business; our ability to grow our middle market lending business; credit risks related to our investments in credit risk transfer securities, residential mortgage-backed securities and related residential mortgage credit assets, commercial real estate assets and corporate debt; risks related to investments in mortgage servicing rights; our ability to consummate any contemplated investment opportunities; changes in government regulations and policy affecting our business; our ability to maintain our qualification as a REIT for U.S. federal income tax purposes; and our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended. For a discussion of the risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. We do not undertake, and specifically disclaim any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. We routinely post important information for investors on our website, www.annaly.com. We intend to use this webpage as a means of disclosing material, non-public information, for complying with our disclosure obligations under Regulation FD and to post and update investor presentations and similar materials on a regular basis. Annaly encourages investors, analysts, the media and others interested in Annaly to monitor the Investors section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations, webcasts and other information it posts from time to time on its website. To sign-up for email-notifications, please visit the “Email Alerts” section of our website, www.annaly.com, under the “Investors” section and enter the required information to enable notifications. The information contained on, or that may be accessed through, our webpage is not incorporated by reference into, and is not a part of, this document. Past performance is no guarantee of future results. There is no guarantee that any investment strategy referenced herein will work under all market conditions. Prior to making any investment decision, you should evaluate your ability to invest for the long-term, especially during periods of downturns in the market. You alone assume the responsibility of evaluating the merits and risks associated with any potential investment or investment strategy referenced herein. To the extent that this material contains reference to any past specific investment recommendations or strategies which were or would have been profitable to any person, it should not be assumed that recommendations made in the future will be profitable or will equal the performance of such past investment recommendations or strategies. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures, including core earnings metrics, which are presented both inclusive and exclusive of the premium amortization adjustment (“PAA”). We believe the non-GAAP financial measures are useful for management, investors, analysts, and other interested parties in evaluating our performance but should not be viewed in isolation and are not a substitute for financial measures computed in accordance with U.S. generally accepted accounting principles (“GAAP”). In addition, we may calculate non-GAAP metrics, which include core earnings, and the PAA, differently than our peers making comparative analysis difficult. Please see the section entitled “Non-GAAP Reconciliations” in the attached Appendix for a reconciliation to the most directly comparable GAAP financial measures. 2

Overview

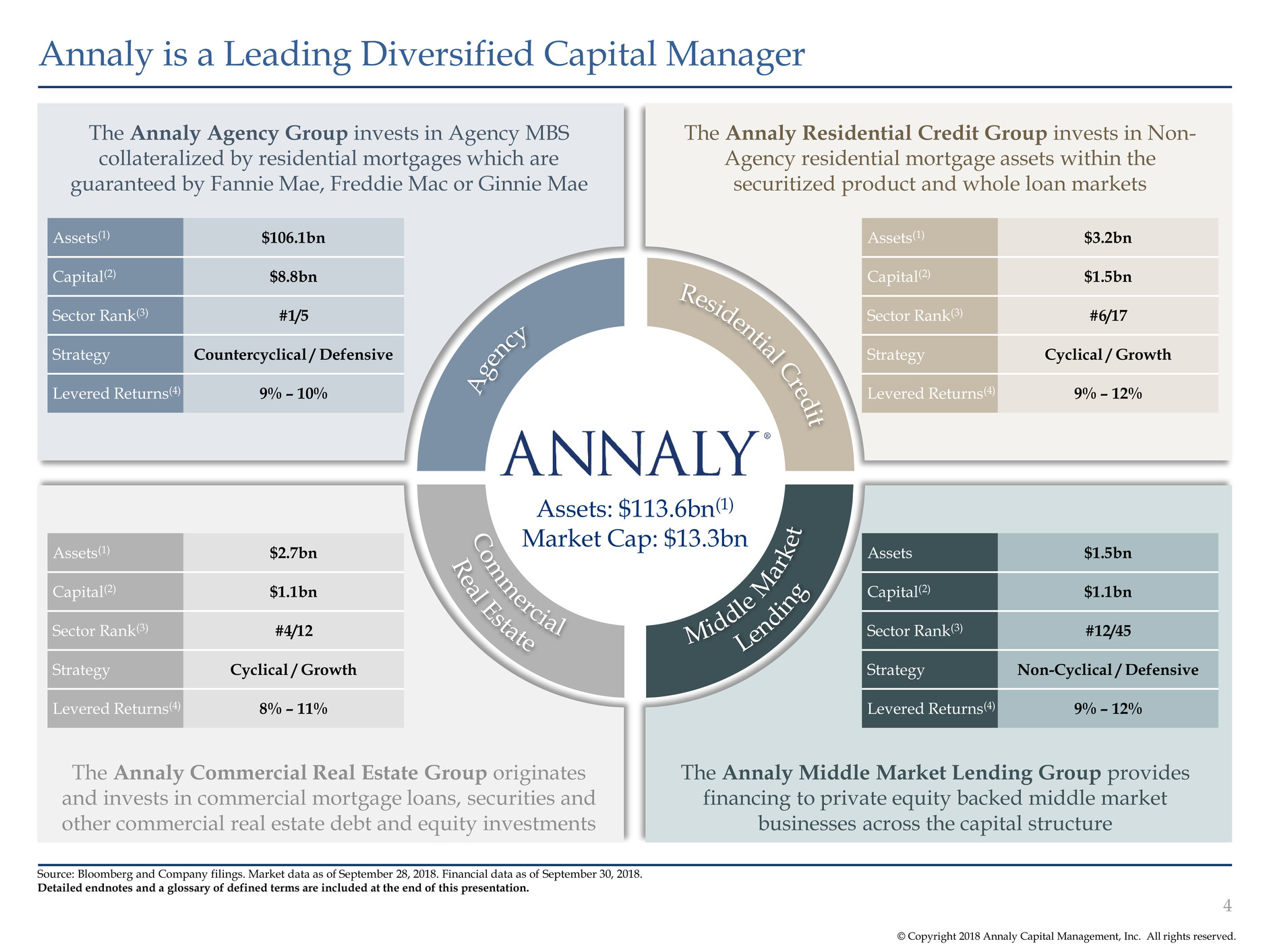

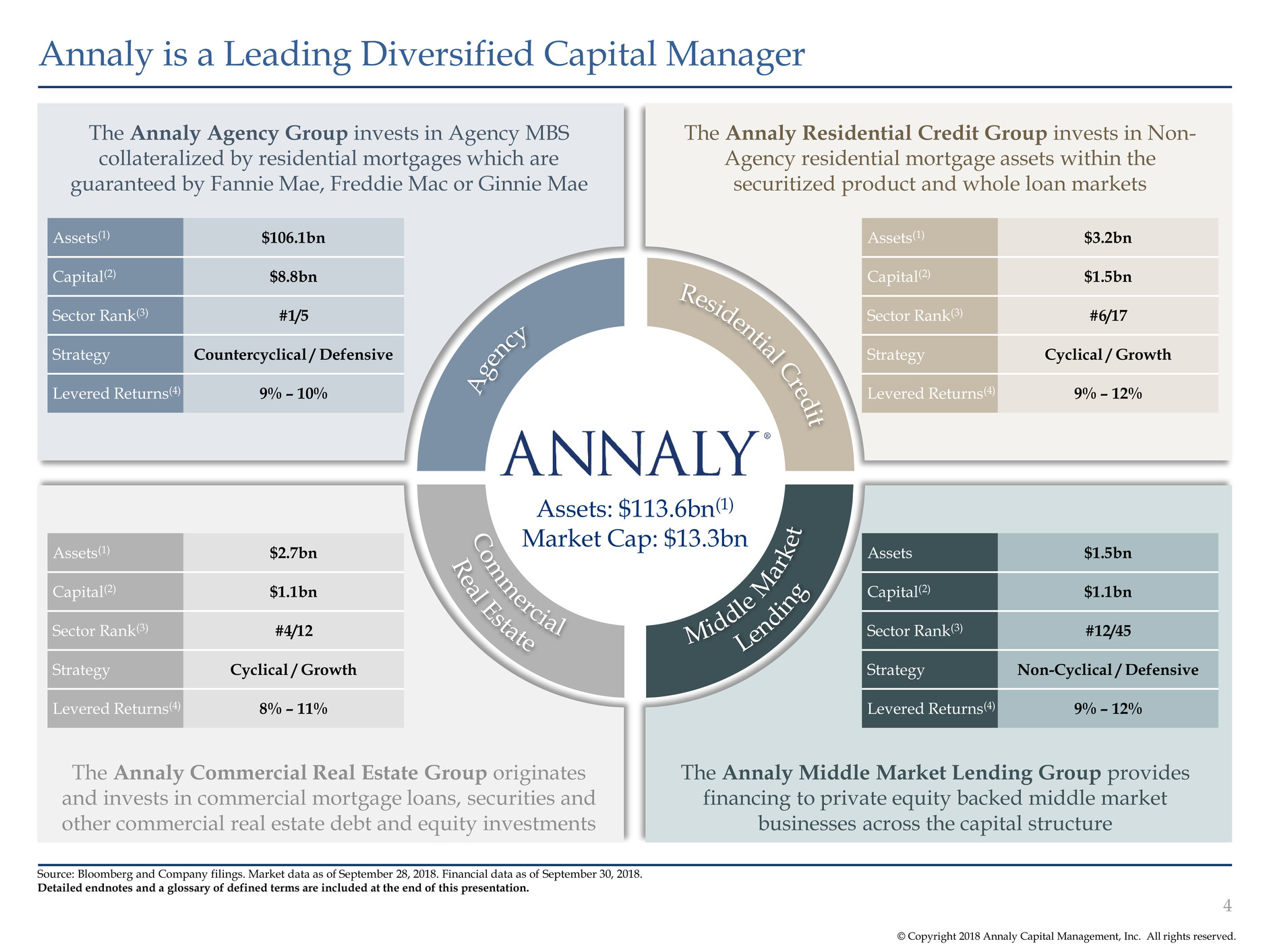

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Annaly is a Leading Diversified Capital Manager 4 Source: Bloomberg and Company filings. Market data as of September 28, 2018. Financial data as of September 30, 2018. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. The Annaly Middle Market Lending Group provides financing to private equity backed middle market businesses across the capital structure The Annaly Commercial Real Estate Group originates and invests in commercial mortgage loans, securities and other commercial real estate debt and equity investments The Annaly Residential Credit Group invests in Non- Agency residential mortgage assets within the securitized product and whole loan markets The Annaly Agency Group invests in Agency MBS collateralized by residential mortgages which are guaranteed by Fannie Mae, Freddie Mac or Ginnie Mae Assets(1) $106.1bn Capital(2) $8.8bn Sector Rank(3) #1/5 Strategy Countercyclical / Defensive Levered Returns(4) 9% – 10% Assets(1) $3.2bn Capital(2) $1.5bn Sector Rank(3) #6/17 Strategy Cyclical / Growth Levered Returns(4) 9% – 12% Assets(1) $2.7bn Capital(2) $1.1bn Sector Rank(3) #4/12 Strategy Cyclical / Growth Levered Returns(4) 8% – 11% Assets $1.5bn Capital(2) $1.1bn Sector Rank(3) #12/45 Strategy Non-Cyclical / Defensive Levered Returns(4) 9% – 12% Assets: $113.6bn(1) Market Cap: $13.3bn

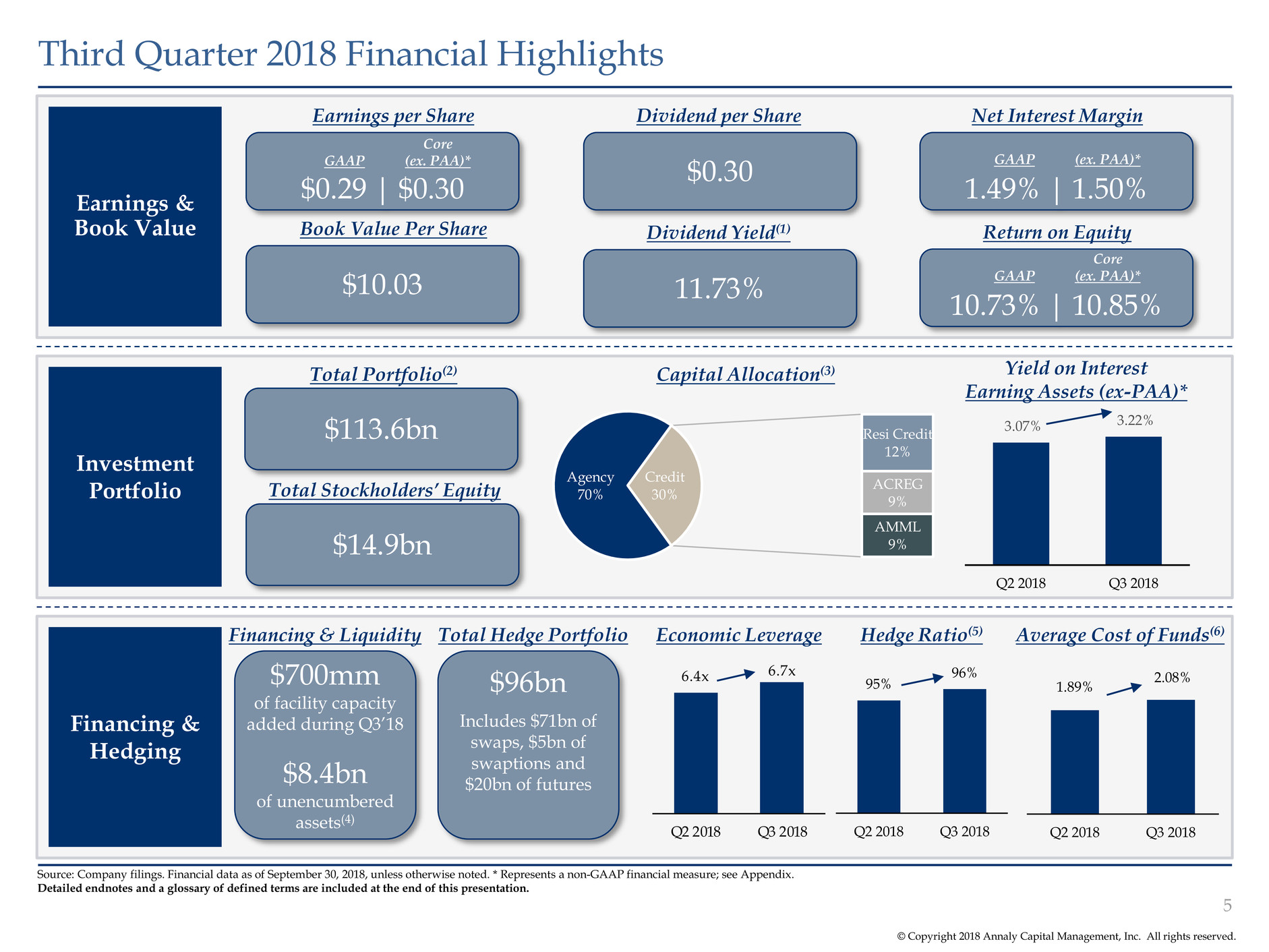

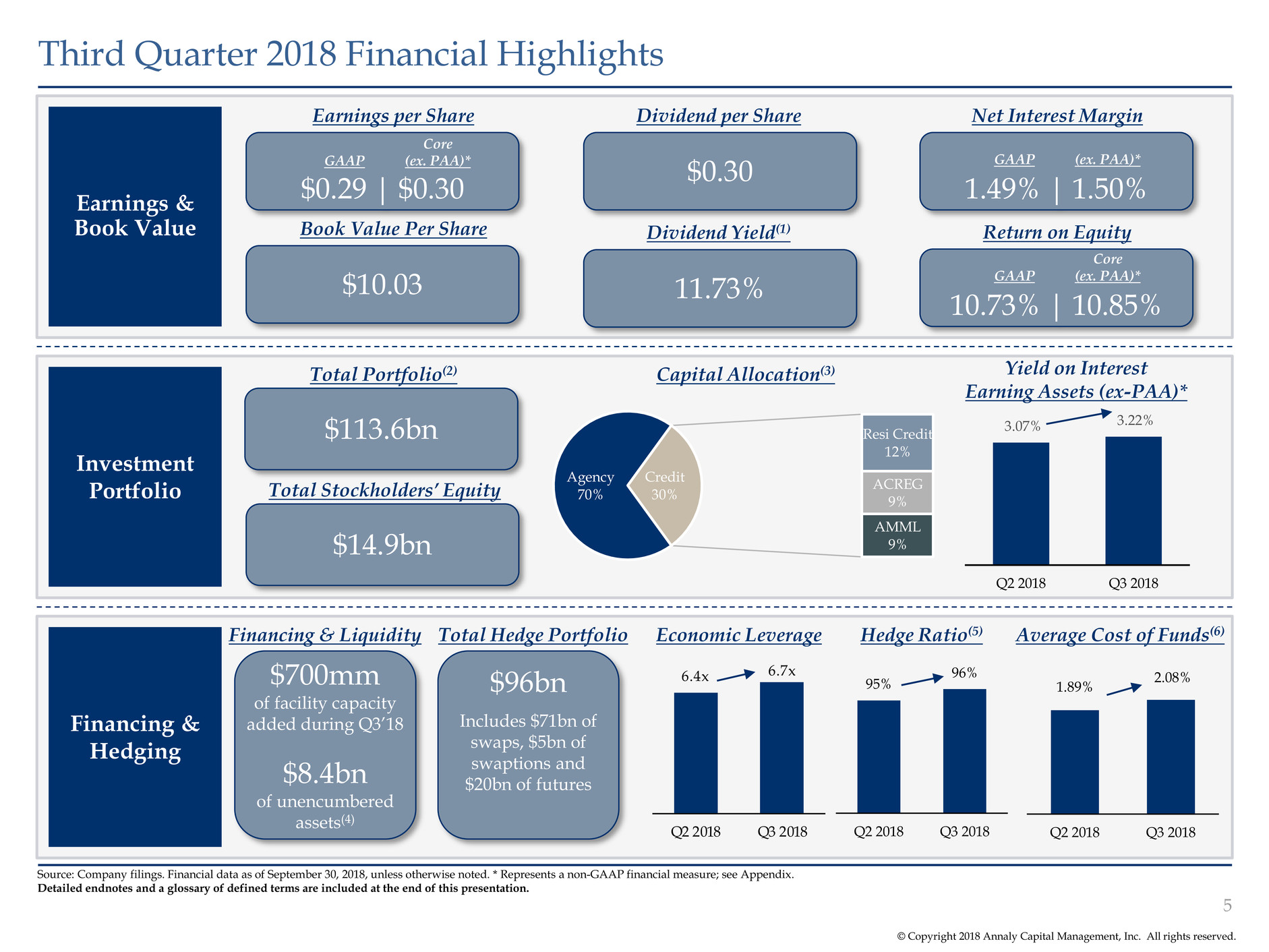

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. 95% 96% Q2 2018 Q3 2018 6.4x 6.7x Q2 2018 Q3 2018 Third Quarter 2018 Financial Highlights 5 Earnings & Book Value Investment Portfolio Financing & Hedging Earnings per Share Dividend per Share Net Interest Margin Book Value Per Share $0.29 | $0.30 $0.30 $10.03 Capital Allocation(3) Dividend Yield(1) 11.73% Core (ex. PAA)*GAAP Financing & Liquidity Average Cost of Funds(6)Economic Leverage $700mm of facility capacity added during Q3’18 $8.4bn of unencumbered assets(4) Hedge Ratio(5) $113.6bn Total Portfolio(2) $14.9bn Total Stockholders’ Equity Yield on Interest Earning Assets (ex-PAA)* Return on Equity Agency 70% Resi Credit 12% ACREG 9% AMML 9% Credit 30% Source: Company filings. Financial data as of September 30, 2018, unless otherwise noted. * Represents a non-GAAP financial measure; see Appendix. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 1.49% | 1.50% (ex. PAA)*GAAP 10.73% | 10.85% Core (ex. PAA)*GAAP Total Hedge Portfolio $96bn Includes $71bn of swaps, $5bn of swaptions and $20bn of futures 3.07% 3.22% Q2 2018 Q3 2018 1.89% 2.08% Q2 2018 Q3 2018

Investment Highlights

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Annaly’s diversification, scale and liquidity coupled with an established investment platform, provide a unique opportunity in today’s markets Annaly Advantages 7 Source: Bloomberg, SNL Financial and Company filings. Note: Market data as of September 28, 2018. Financial data as of September 30, 2018 unless otherwise noted. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Size & Scale Diversification Efficiency of the Model Liquidity & Financing Disciplined Consolidator Environmental, Social & Governance Focus Outperformance ~25x the market capitalization of the median mREIT 37 available investment options is nearly 3x more than Annaly had in 2013(1) and over 4x more than the current mREIT average Annaly operates at significantly lower expense levels than other Yield Sectors; ~2x more efficient than mREIT average(2) Annaly utilizes a multitude of funding sources and has ~$8.4bn of unencumbered assets(3) 3 transformational acquisitions since 2013, with combined deal value of ~$3.3bn(4) 2 new Independent Directors added to the Board in 2018; NEOs voluntarily increased stock ownership commitments in 2017; established broad-based employee stock purchase guidelines in 2016 Annaly’s total return of 74% since diversification strategy began(1) is 2x higher than Yield Sectors

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Since January 2016, Annaly has grown its market cap by $4.4 billion, or 50%, through 2 strategic acquisitions and 5 equity offerings(1), while declaring over $3.8 billion in dividends to shareholders Annaly Advantages | Recent Developments Enhance Size and Scale 8 Source: Bloomberg and Company filings. Market data shown from December 31, 2015 to September 28, 2018. Note: Cumulative dividends reflects common and preferred dividends. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. – $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 $5.0 $8.0 $9.0 $10.0 $11.0 $12.0 $13.0 $14.0 $15.0 Jan-16 Mar-16 Jun-16 Sep-16 Dec-16 Feb-17 May-17 Aug-17 Oct-17 Jan-18 Apr-18 Jul-18 Sep-18 Hatteras Acquisition Closed (July 2016) July 2017 Common Offering July 2017 Preferred Offering October 2017 Common Offering 2018 ATM January 2018 Preferred Offering MTGE Acquisition Closed (September 2018) September 2018 Common Offering Annaly Market Capitalization and Cumulative Dividends Declared 47% A B C D E F G H A B C D E F G H Over $3.8 billion cumulative dividends declared since 2016 M a rk et C a p ( $ b n ) Di v id en d s De cla red ($ b n ) Market Cap Cumulative Dividends Declared $13.3bn Total Return(2) Market Cap September 28, 2018

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Annaly Advantages | Diversification 9 IPO 1998–2012 2013–2015 2016–2018YTD Expanded diversification enhances flexibility to capture opportunities Source: Company filings. Financial data as of September 30, 2018 and market data as of September 28, 2018 unless otherwise noted. Note: Diagram is not representative of the size of each portfolio. Annaly may not be invested in all investment options at any one point in time. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 30Yr Fixed Pools ARMs CMO INV I.O. I.O. 15Yr Fixed Pools 30Yr Fixed Pools ARMs CMO 2nd Lien 1st Lien INV I.O. I.O. 15Yr Fixed Pools ARMs CMO 2nd Lien 1st Lien 30Yr Fixed Pools Preferred Equity 1st Mortgage TBA Contracts Mezz CRE Equity Private Label CRT Agency CRT 20Yr. Fixed Pools First Out / Last Out CMBS Unitranche Freddie B-Piece Prime Jumbo Legacy Subprime Alt-A Prime NPL RPL INV I.O. I.O. 15Yr Fixed Pools ARMs CMO 2nd Lien 1st Lien Preferred Equity 1st Mortgage TBA Contracts Mezz CRE Equity Private Label CRT Agency CRT 20Yr. Fixed Pools First Out / Last Out CMBS Unitranche Freddie B-Piece Prime Jumbo Legacy Subprime Alt-A Prime NPL RPL 30Yr Fixed Pools Expanded Whole Loans Prime Whole Loans MSR Call Rights Conduit CMBS CMBX Investor Loans Small Balance Agency DUS HECM Healthcare Equity 2014 represents the beginning of Annaly’s broad-based diversification efforts Agency Resi CRE MML Investment Options New Options(2) ($ in m illio ns ) Average IPO 1998-2012 2013-2015 2016-2018 Today Market Cap $140 $5,184 $10,894 $11,515 $13,330 Total Assets (1) $415 $40,716 $81,823 $98,968 $105,962 Beta 0.63 0.72 0.63 0.57 0.53

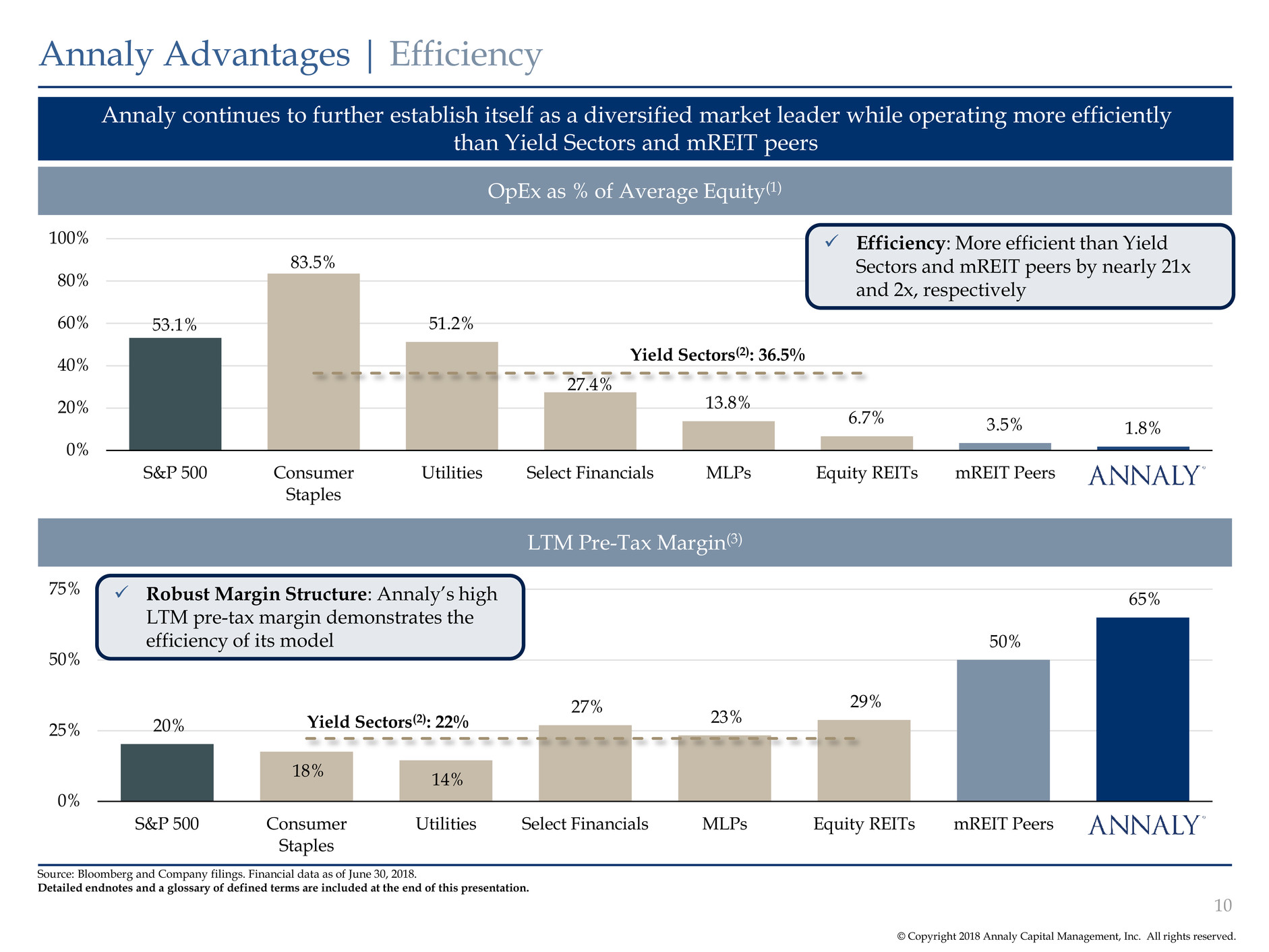

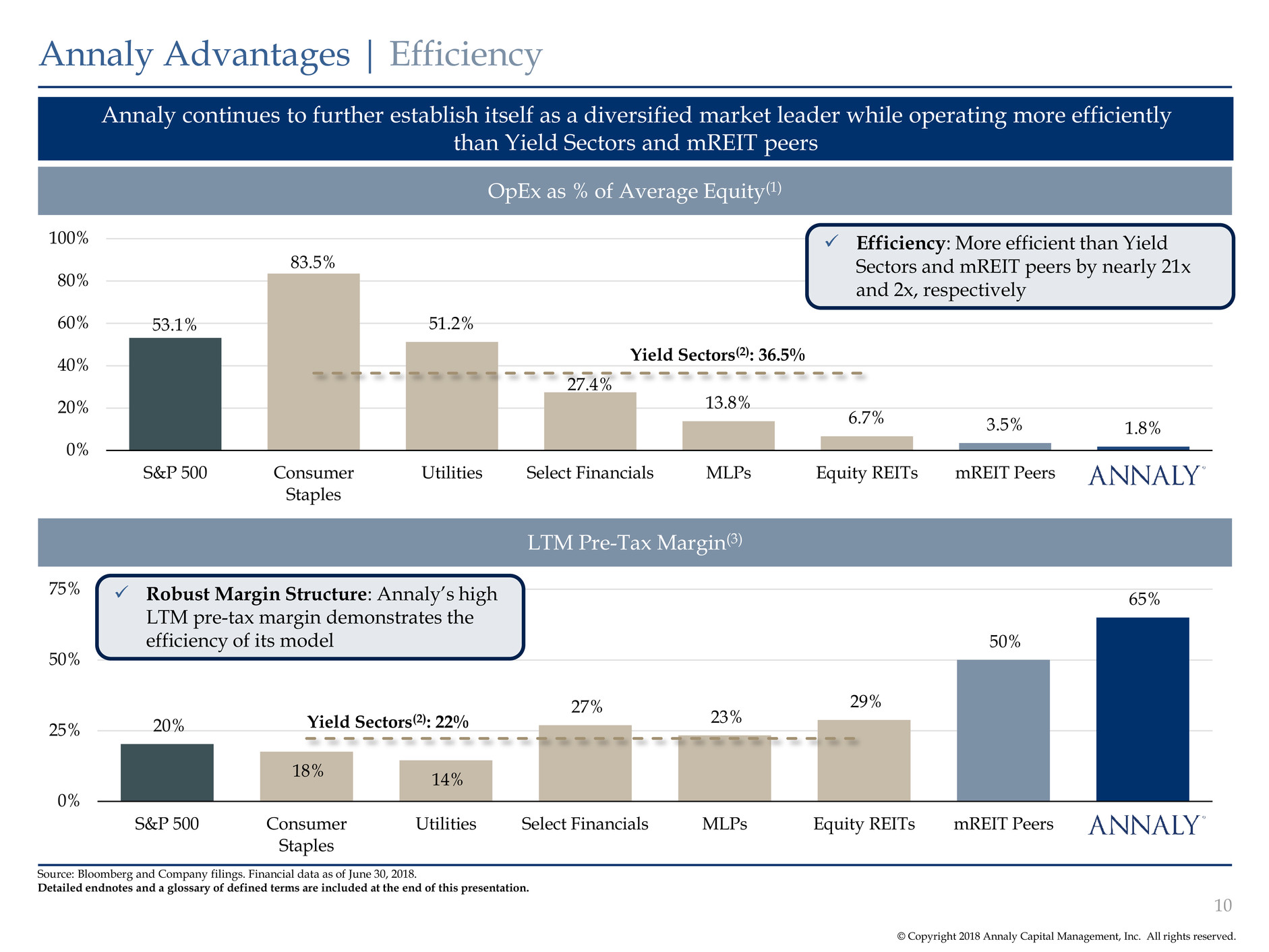

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. OpEx as % of Average Equity(1) LTM Pre-Tax Margin(3) Annaly Advantages | Efficiency 10 Source: Bloomberg and Company filings. Financial data as of June 30, 2018. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 53.1% 83.5% 51.2% 27.4% 13.8% 6.7% 3.5% 1.8% 0% 20% 40% 60% 80% 100% S&P 500 Consumer Staples Utilities Select Financials MLPs Equity REITs mREIT Peers NLY Yield Sectors(2): 36.5% Annaly continues to further establish itself as a diversified market leader while operating more efficiently than Yield Sectors and mREIT peers 20% 18% 14% 27% 23% 29% 50% 65% 0% 25% 50% 75% S&P 500 Consumer Staples Utilities Select Financials MLPs Equity REITs mREIT Peers NLY Yield Sectors(2): 22% Robust Margin Structure: Annaly’s high LTM pre-tax margin demonstrates the efficiency of its model Efficiency: More efficient than Yield Sectors and mREIT peers by nearly 21x and 2x, respectively

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Annaly’s financing flexibility and ability to raise liquidity provides the company with unique competitive advantages Annaly Advantages | Strategic Financing Alternatives 11 Source: Company filings. Financial data as of September 30, 2018. Note: Diagram is not representative of Annaly’s entire list of financing options. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Total Capitalization Common Equity $13.2 billion Preferred Equity $1.8 billion Secured Financing(3) $2.3 billion FHLB(2) $3.6 billion Agency, Non-Agency & CMBS Repo $78.3 billion 9/30/2018: $99.2 billion(1) Financing Options Available Financing Options Agency Residential Credit ACREG AMML In-House Broker-Dealer Street Repo Direct Repo FHLB Credit Facilities / Warehouse Financing Non-Recourse Financing Term(4) Syndication Mortgage Financing Preferred Equity Common Equity

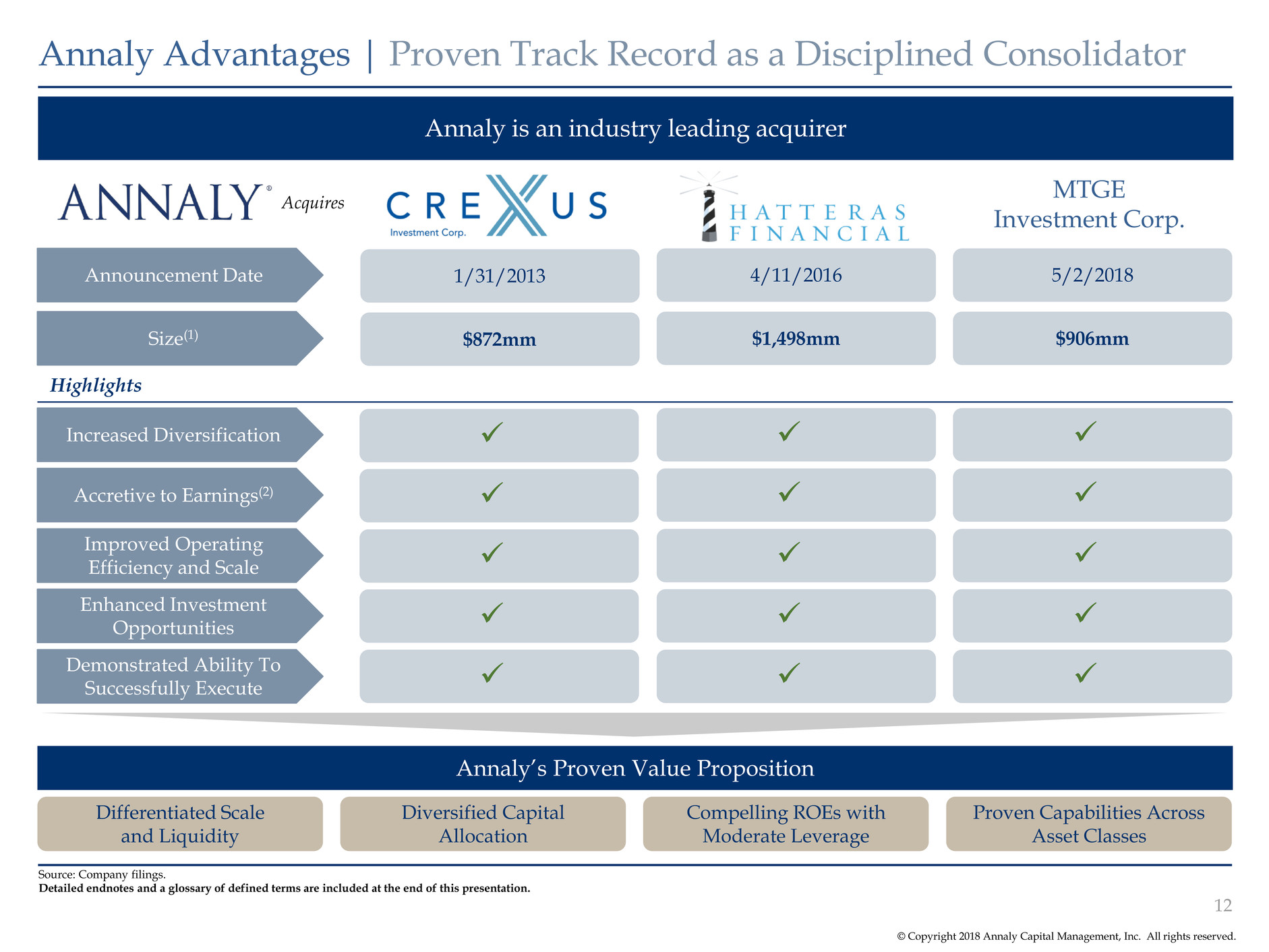

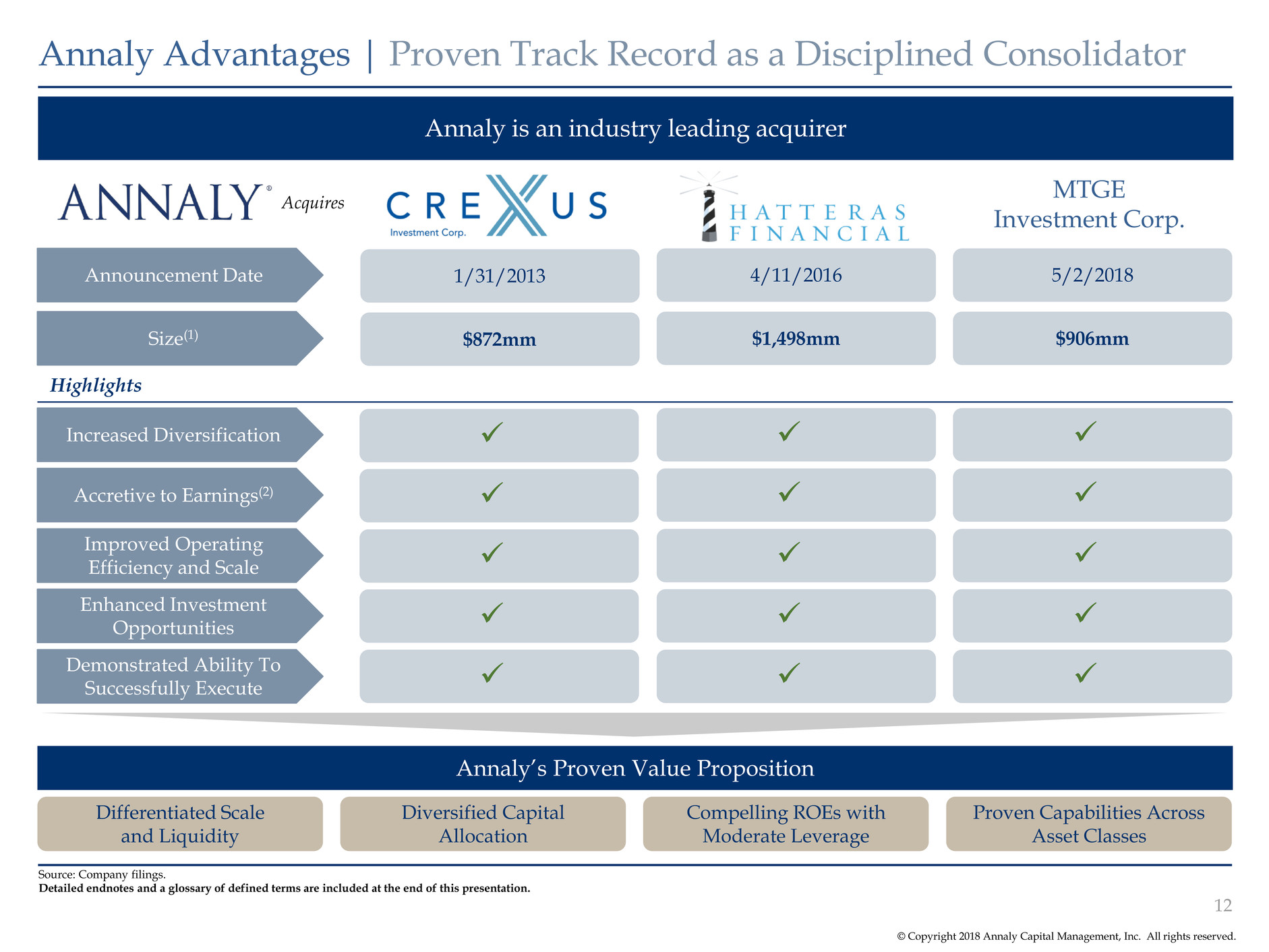

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Annaly is an industry leading acquirer Annaly Advantages | Proven Track Record as a Disciplined Consolidator 12 Source: Company filings. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Differentiated Scale and Liquidity Diversified Capital Allocation Proven Capabilities Across Asset Classes Compelling ROEs with Moderate Leverage Announcement Date Size(1) 4/11/2016 5/2/2018 $1,498mm $906mm Highlights Increased Diversification Accretive to Earnings(2) Improved Operating Efficiency and Scale Enhanced Investment Opportunities Demonstrated Ability To Successfully Execute Annaly’s Proven Value Proposition 1/31/2013 $872mm Acquires MTGE Investment Corp.

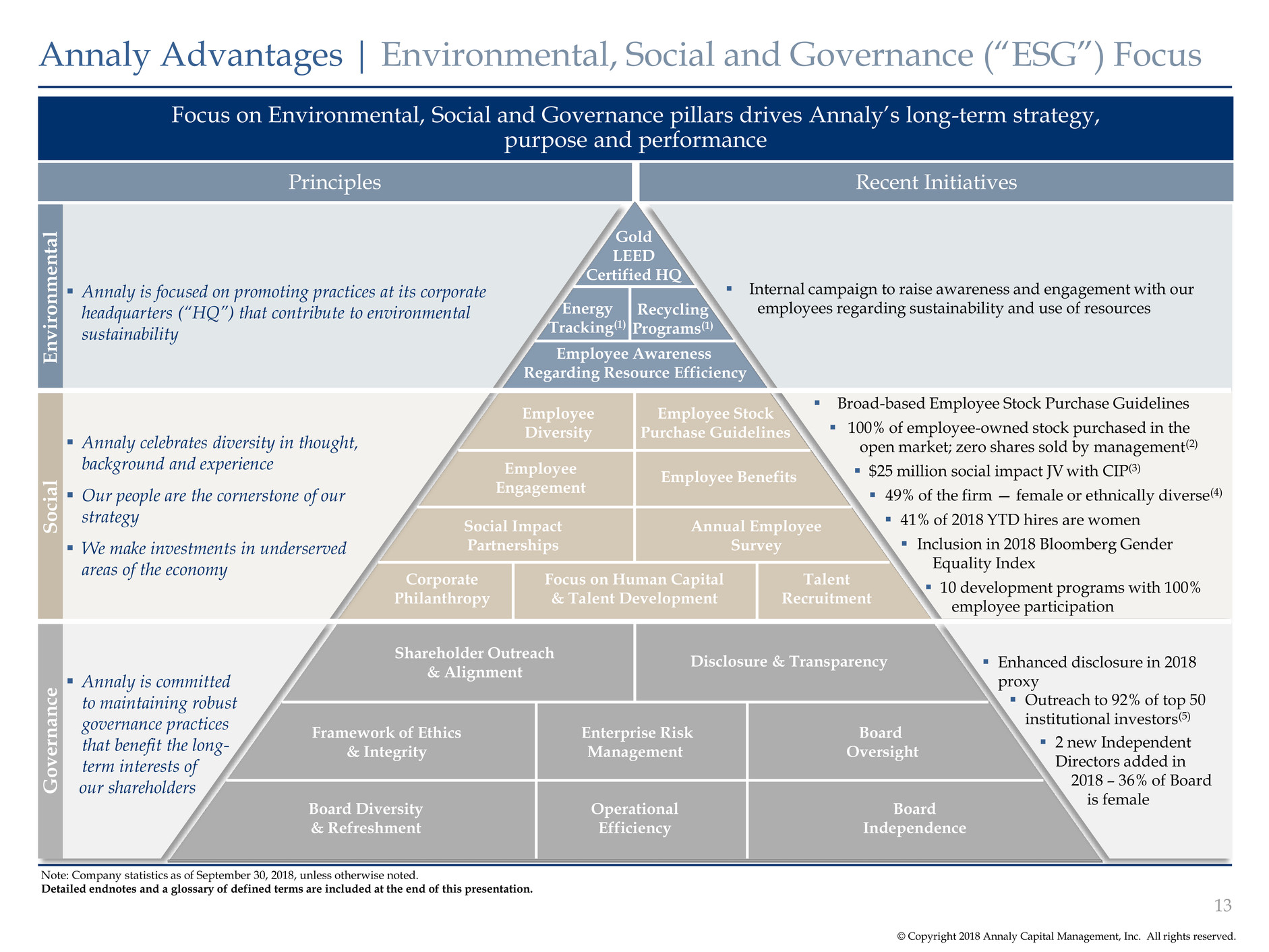

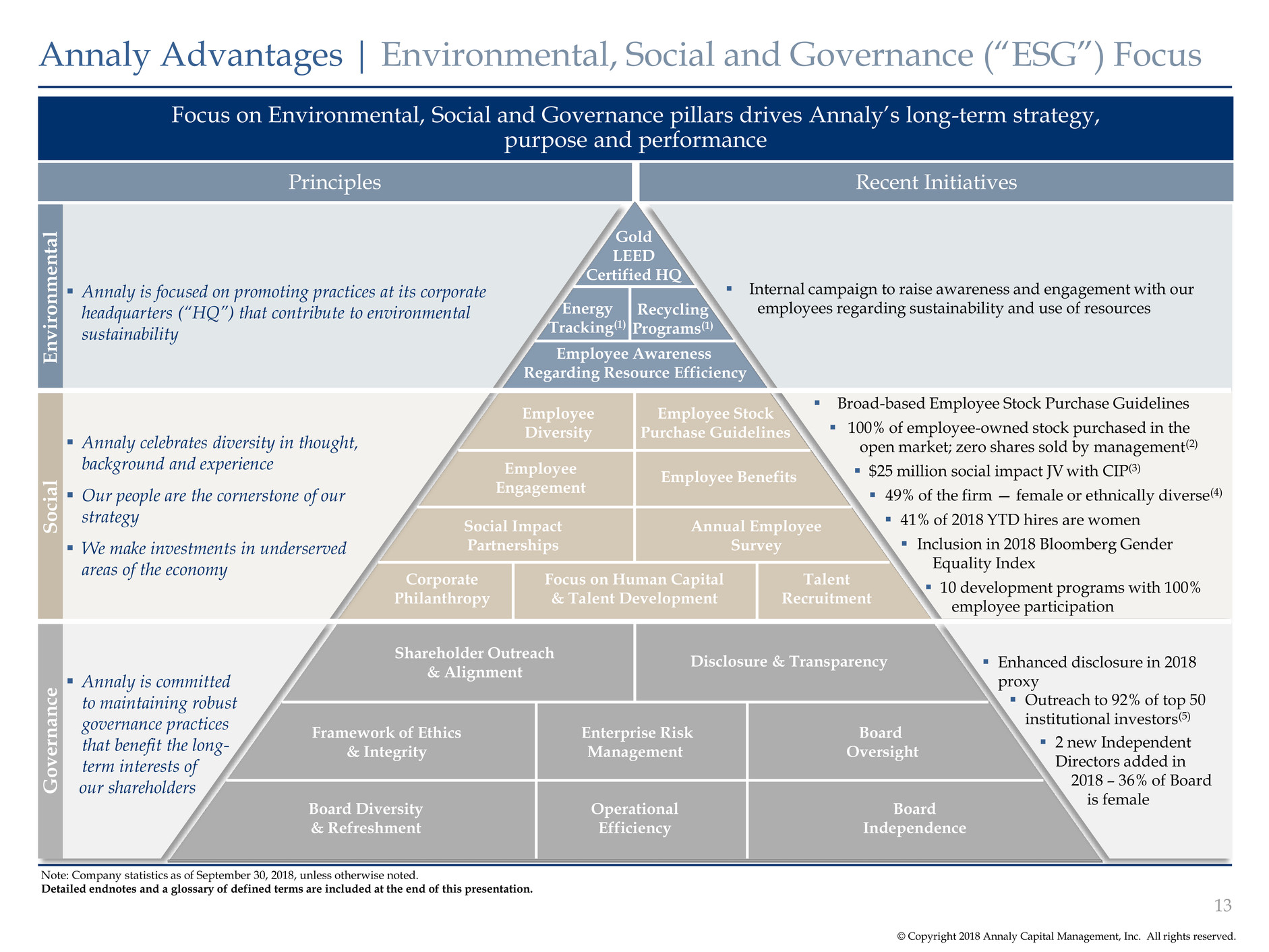

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Focus on Environmental, Social and Governance pillars drives Annaly’s long-term strategy, purpose and performance Annaly Advantages | Environmental, Social and Governance (“ESG”) Focus 13 Note: Company statistics as of September 30, 2018, unless otherwise noted. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Internal campaign to raise awareness and engagement with our employees regarding sustainability and use of resources Broad-based Employee Stock Purchase Guidelines 100% of employee-owned stock purchased in the open market; zero shares sold by management(2) $25 million social impact JV with CIP(3) 49% of the firm — female or ethnically diverse(4) 41% of 2018 YTD hires are women Inclusion in 2018 Bloomberg Gender Equality Index 10 development programs with 100% employee participation Principles Recent Initiatives E n viro n me n ta l Go v er n a n ce S ocia l Annaly celebrates diversity in thought, background and experience Our people are the cornerstone of our strategy We make investments in underserved areas of the economy Annaly is committed to maintaining robust governance practices that benefit the long- term interests of our shareholders Annaly is focused on promoting practices at its corporate headquarters (“HQ”) that contribute to environmental sustainability Employee Awareness Recycling Programs(1) Energy Tracking(1) Gold LEED Certified HQ Employee Diversity Employee Stock Purchase Guidelines Employee Benefits Talent Recruitment Employee Engagement Corporate Philanthropy Social Impact Partnerships Annual Employee Survey Focus on Human Capital & Talent Development Shareholder Outreach & Alignment Disclosure & Transparency Framework of Ethics & Integrity Enterprise Risk Management Board Oversight Board Diversity & Refreshment Operational Efficiency Board Independence Enhanced disclosure in 2018 proxy Outreach to 92% of top 50 institutional investors(5) 2 new Independent Directors added in 2018 – 36% of Board is female Regarding Resource Efficiency

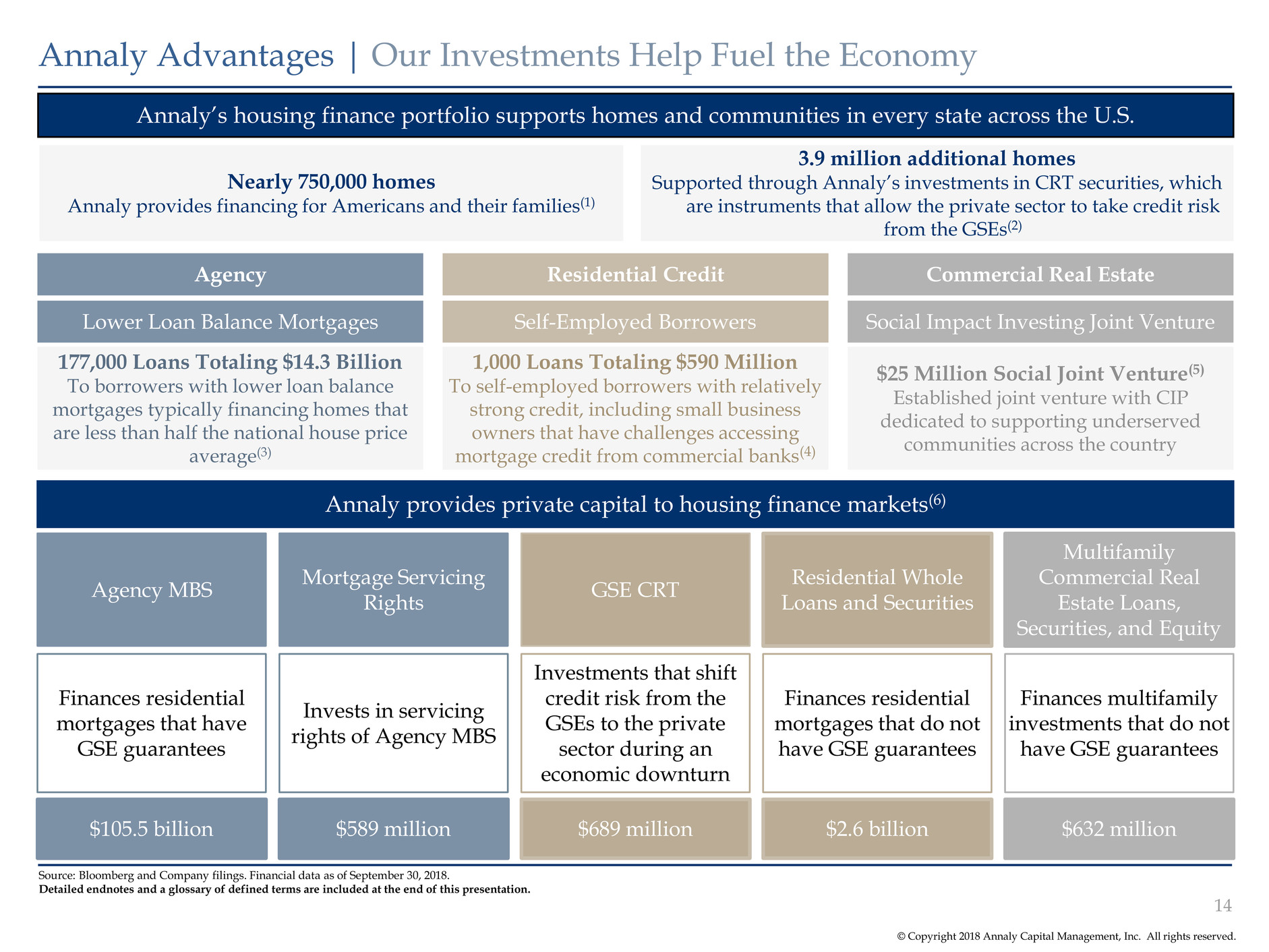

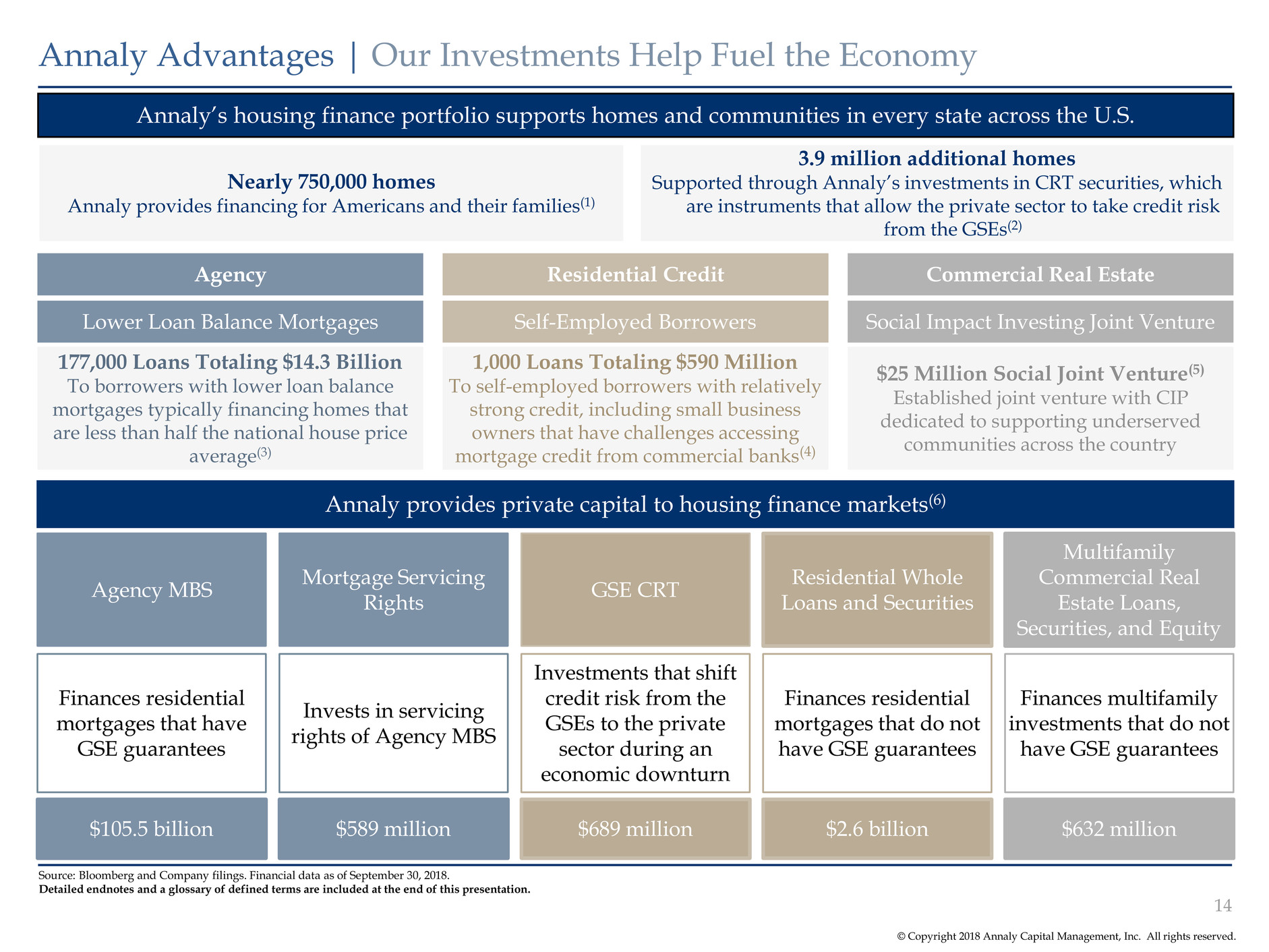

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Annaly Advantages | Our Investments Help Fuel the Economy 14 1,000 Loans Totaling $590 Million To self-employed borrowers with relatively strong credit, including small business owners that have challenges accessing mortgage credit from commercial banks(4) Annaly’s housing finance portfolio supports homes and communities in every state across the U.S. Nearly 750,000 homes Annaly provides financing for Americans and their families(1) 177,000 Loans Totaling $14.3 Billion To borrowers with lower loan balance mortgages typically financing homes that are less than half the national house price average(3) 3.9 million additional homes Supported through Annaly’s investments in CRT securities, which are instruments that allow the private sector to take credit risk from the GSEs(2) Lower Loan Balance Mortgages Self-Employed Borrowers Annaly provides private capital to housing finance markets(6) Agency MBS Mortgage Servicing Rights GSE CRT Residential Whole Loans and Securities Multifamily Commercial Real Estate Loans, Securities, and Equity Finances residential mortgages that have GSE guarantees Invests in servicing rights of Agency MBS Investments that shift credit risk from the GSEs to the private sector during an economic downturn Finances residential mortgages that do not have GSE guarantees Finances multifamily investments that do not have GSE guarantees $105.5 billion $589 million $689 million $2.6 billion $632 million Source: Bloomberg and Company filings. Financial data as of September 30, 2018. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. $25 Million Social Joint Venture(5) Established joint venture with CIP dedicated to supporting underserved communities across the country Social Impact Investing Joint Venture Agency Residential Credit Commercial Real Estate

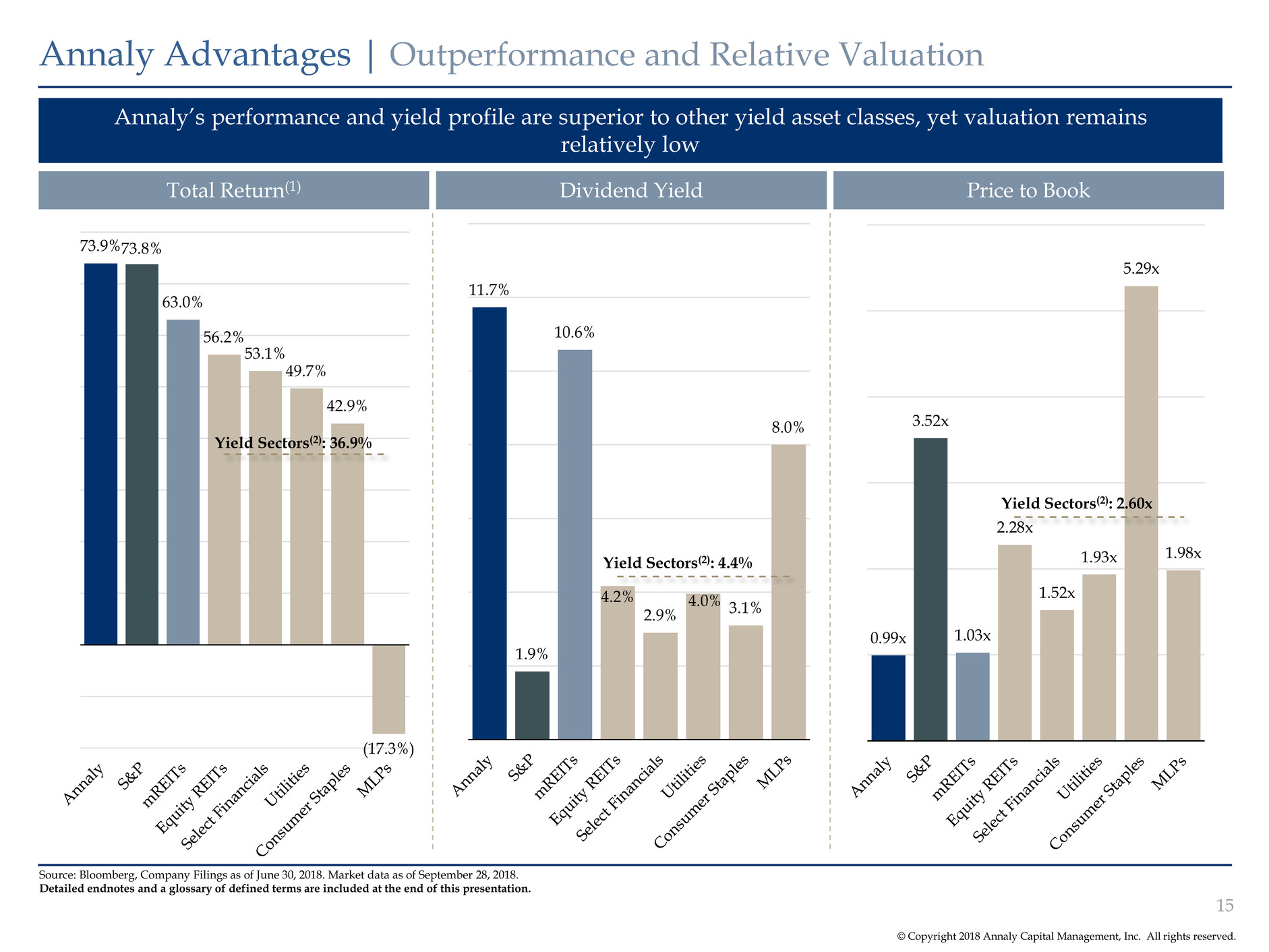

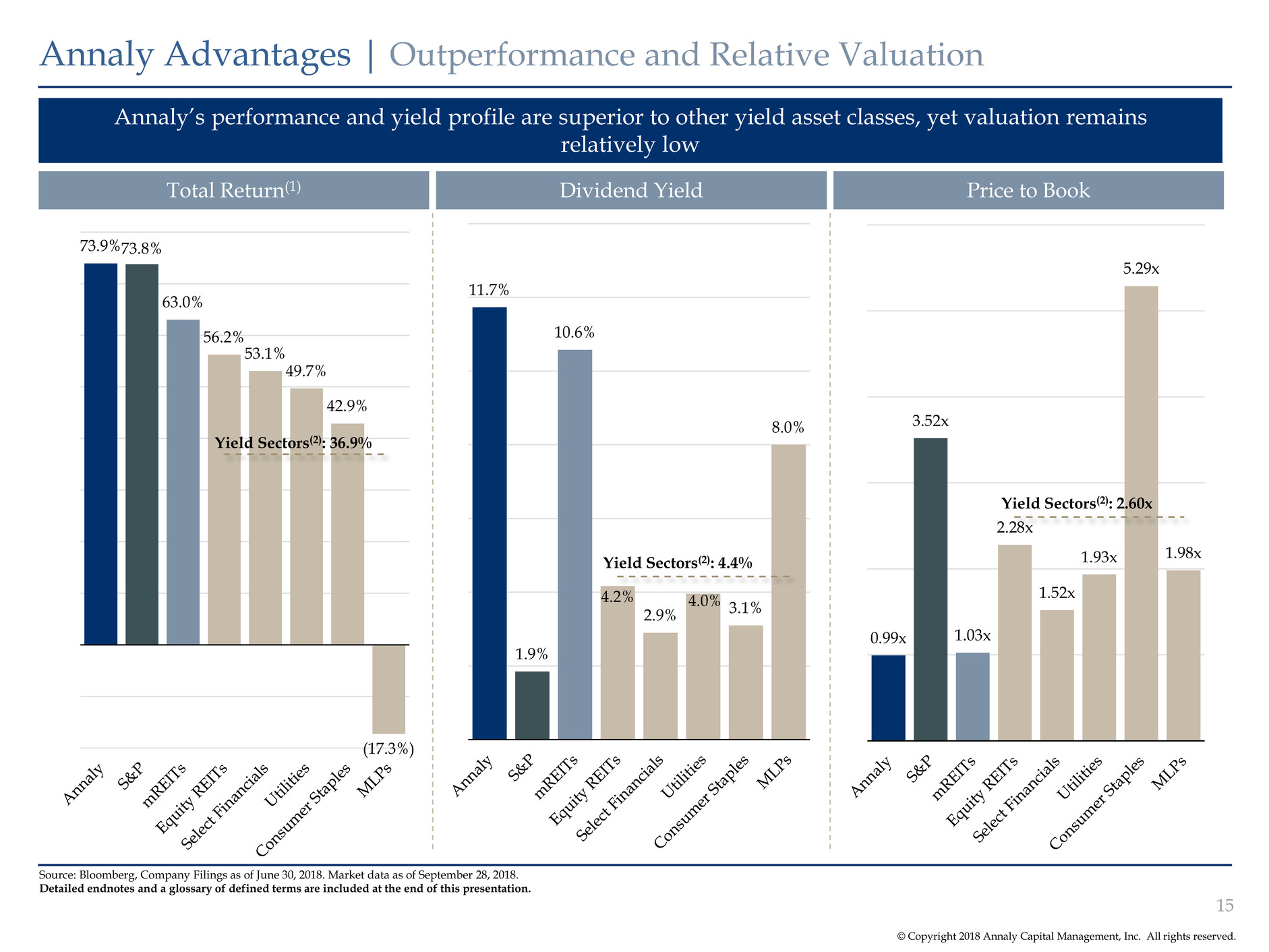

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Annaly Advantages | Outperformance and Relative Valuation Source: Bloomberg, Company Filings as of June 30, 2018. Market data as of September 28, 2018. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Annaly’s performance and yield profile are superior to other yield asset classes, yet valuation remains relatively low 15 Price to BookDividend YieldTotal Return(1) 73.9%73.8% 63.0% 56.2% 53.1% 49.7% 42.9% (17.3%) 11.7% 1.9% 10.6% 4.2% 2.9% 4.0% 3.1% 8.0% 0.99x 3.52x 1.03x 2.28x 1.52x 1.93x 5.29x 1.98x Yield Sectors(2): 36.9% Yield Sectors(2): 4.4% Yield Sectors(2): 2.60x

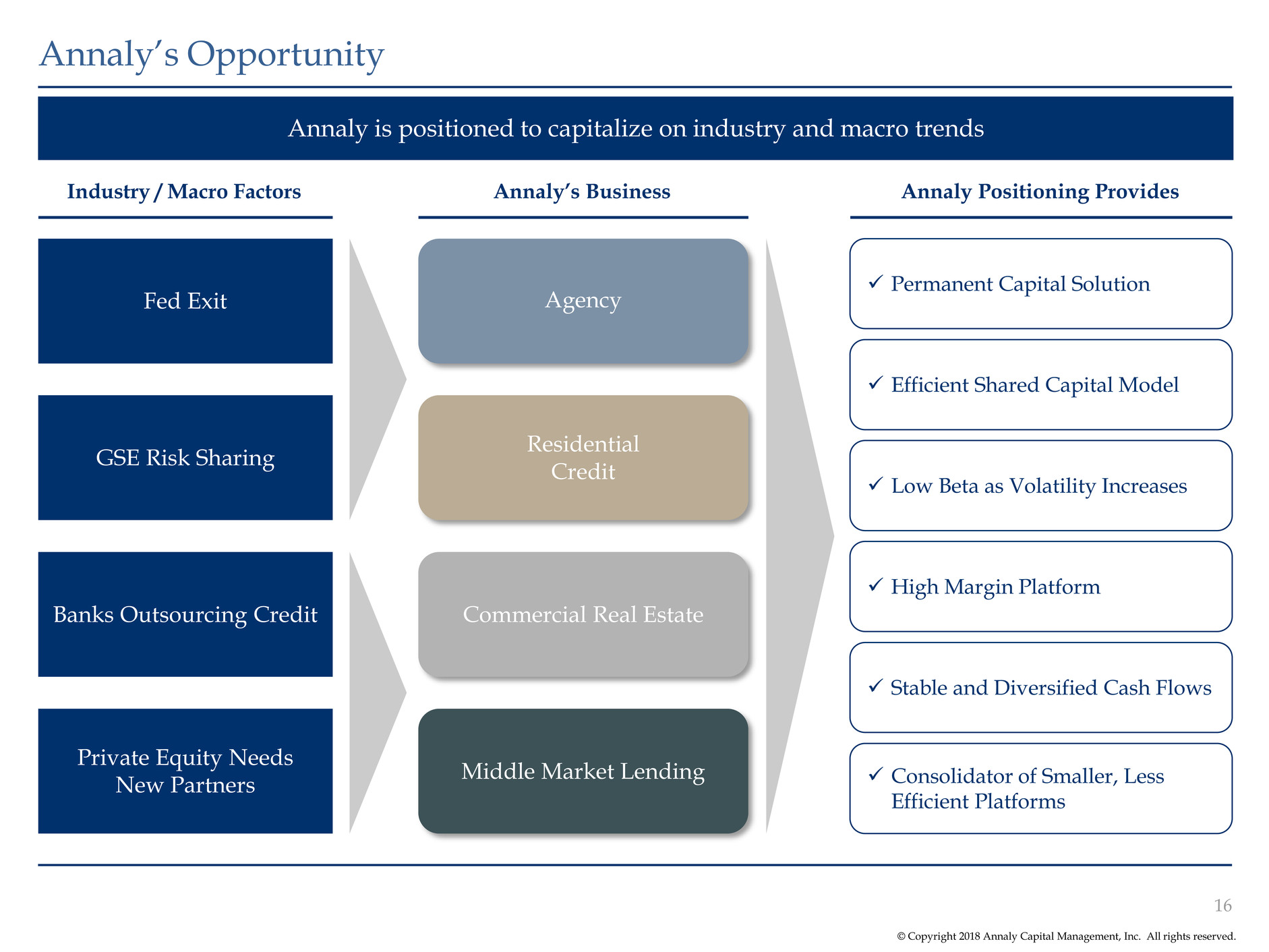

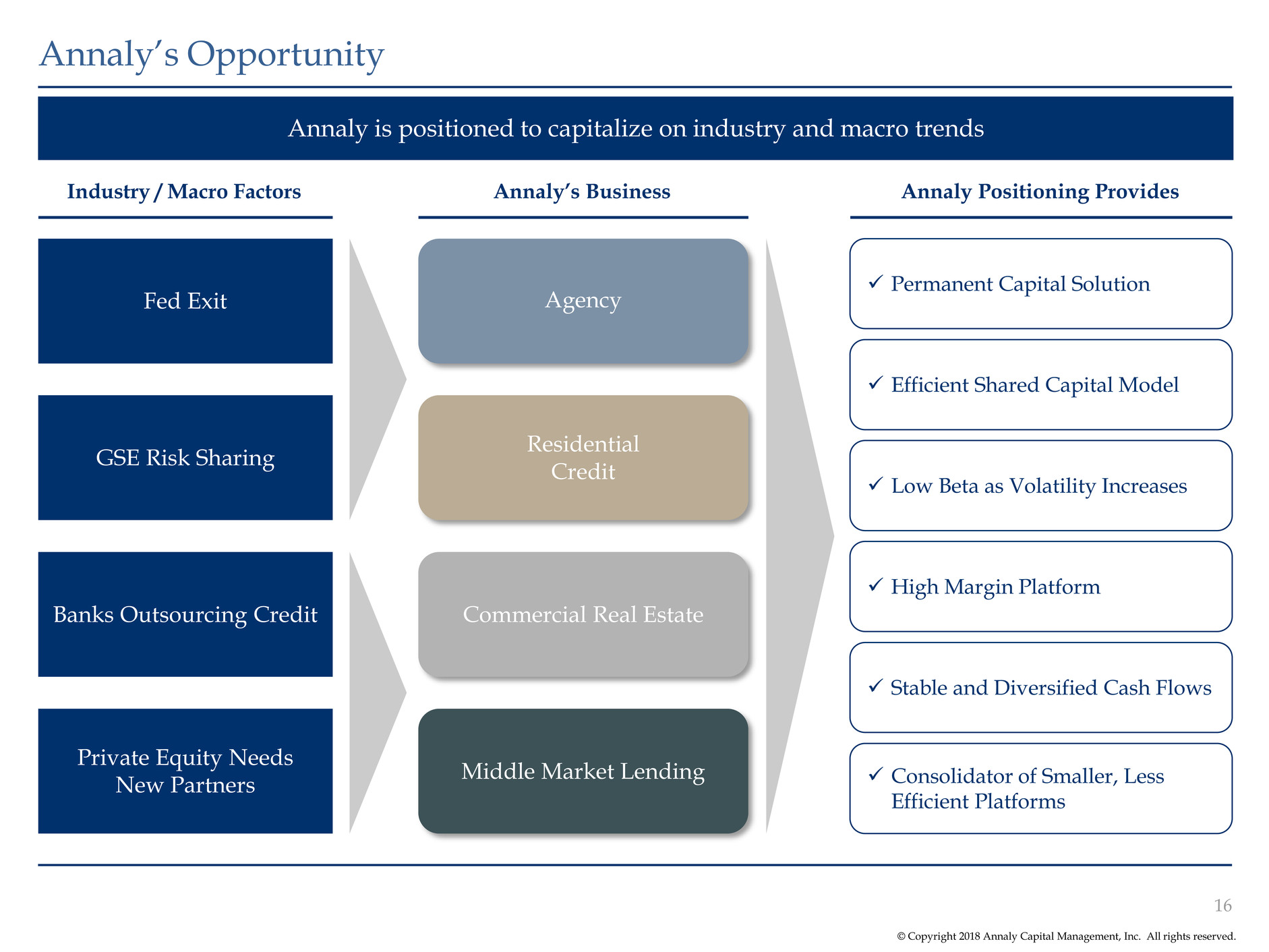

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Annaly is positioned to capitalize on industry and macro trends Annaly’s Opportunity 16 Industry / Macro Factors Fed Exit GSE Risk Sharing Banks Outsourcing Credit Private Equity Needs New Partners Agency Residential Credit Commercial Real Estate Middle Market Lending Annaly’s Business Annaly Positioning Provides Permanent Capital Solution Efficient Shared Capital Model Low Beta as Volatility Increases High Margin Platform Stable and Diversified Cash Flows Consolidator of Smaller, Less Efficient Platforms

Annaly’s Relative Value

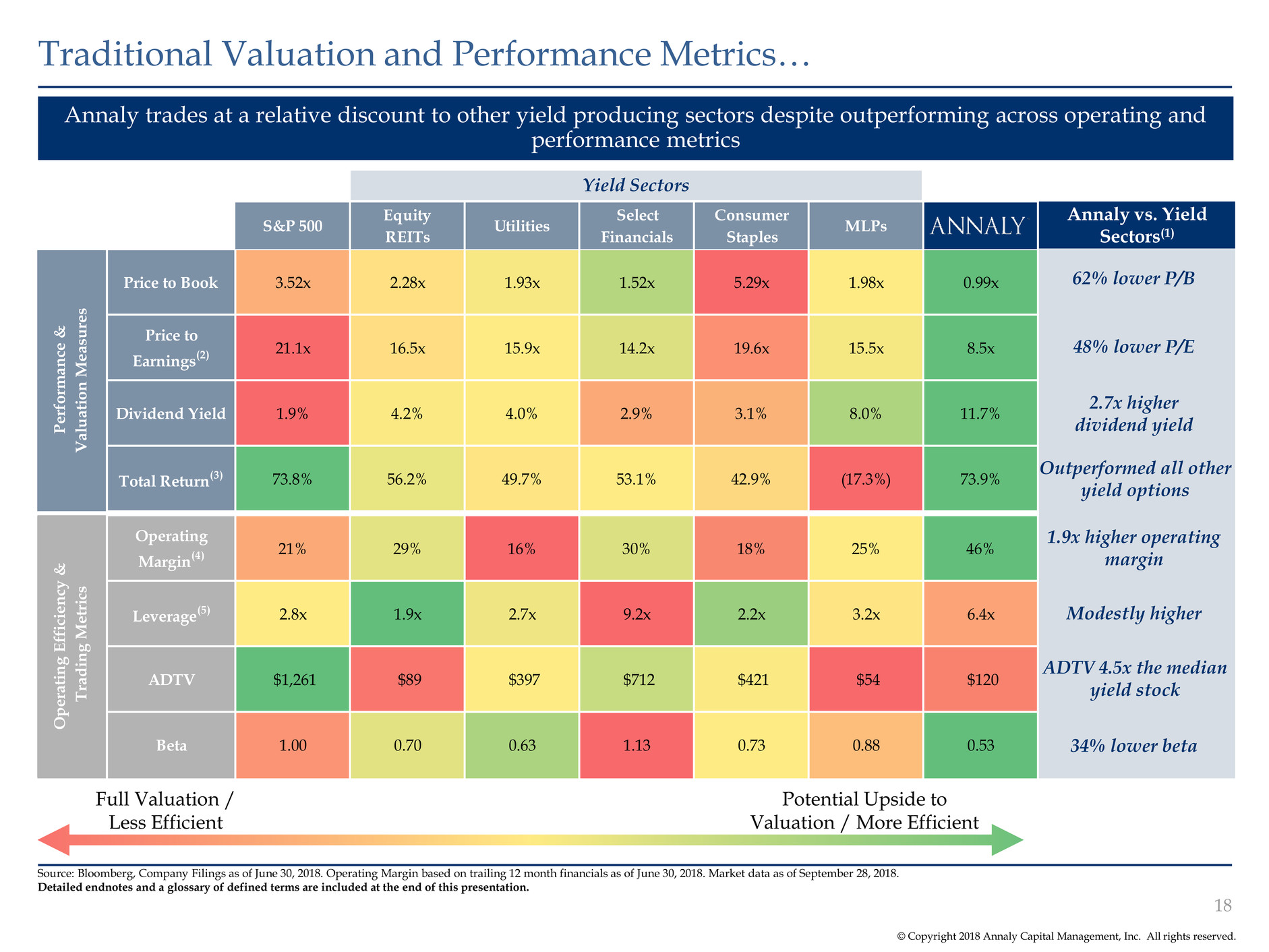

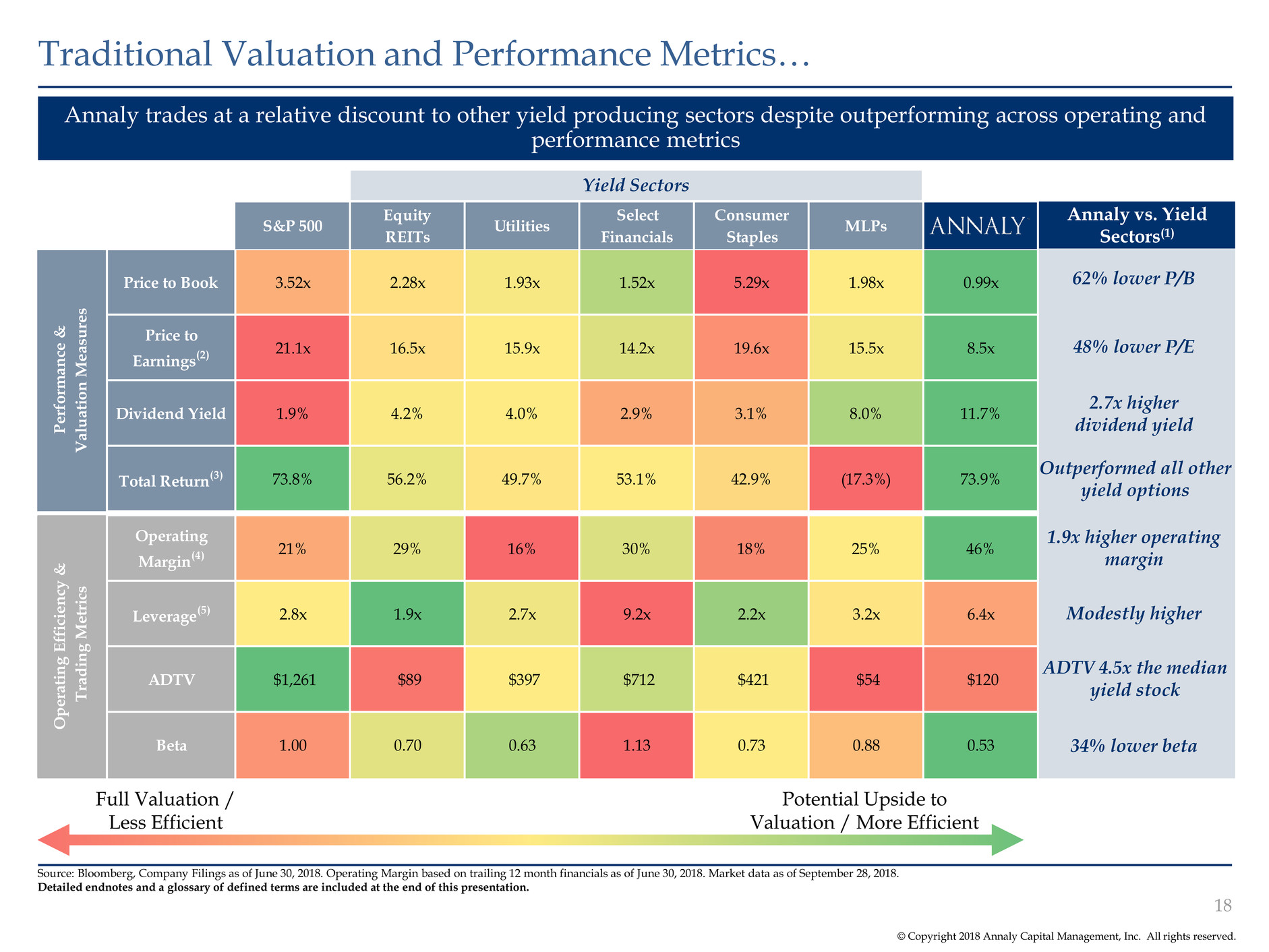

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Annaly trades at a relative discount to other yield producing sectors despite outperforming across operating and performance metrics Traditional Valuation and Performance Metrics… 18 Source: Bloomberg, Company Filings as of June 30, 2018. Operating Margin based on trailing 12 month financials as of June 30, 2018. Market data as of September 28, 2018. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Full Valuation / Less Efficient Potential Upside to Valuation / More Efficient Annaly vs. Yield Sectors(1) 62% lower P/B 48% lower P/E 2.7x higher dividend yield Outperformed all other yield options 1.9x higher operating margin ADTV 4.5x the median yield stock 34% lower beta Modestly higher S&P 500 Equity REITs Utilities Select Financials Consumer Staples MLPs Price to Book 3.52x 2.28x 1.93x 1.52x 5.29x 1.98x 0.99x Price to Earnings (2) 21.1x 16.5x 15.9x 14.2x 19.6x 15.5x 8.5x Dividend Yield 1.9% 4.2% 4.0% 2.9% 3.1% 8.0% 11.7% Total Return (3) 73.8% 56.2% 49.7% 53.1% 42.9% (17.3%) 73.9% Operating Margin (4) 21% 29% 16% 30% 18% 25% 46% Leverage (5) 2.8x 1.9x 2.7x 9.2x 2.2x 3.2x 6.4x ADTV $1,261 $89 $397 $712 $421 $54 $120 Beta 1.00 0.70 0.63 1.13 0.73 0.88 0.53 Pe rfo rm an ce & Va lu ati on Mea su re s Op er ati ng E ffi cie nc y & T ra di ng Me tri cs Yield Sectors

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. 18.9 10.0 9.3 9.7 7.1 6.9 (6.2) (10.0) (5.0) – 5.0 10.0 15.0 20.0 Annaly S&P 500 Utilities Equity REITs Consumer Staples Select Financials MLPs Treynor Ratio(1) Yield Sectors(3): 5.4 0.69 0.94 0.69 0.53 0.48 0.38 (0.37) (0.50) (0.25) – 0.25 0.50 0.75 1.00 Annaly S&P 500 Utilities Equity REITs Consumer Staples Select Financials MLPs Sharpe Ratio(2) Yield Sectors(3): 0.34 Stability, low beta and strong performance have resulted in outsized risk-adjusted returns Performance vs. Standard Deviation of ReturnsPerformance vs. Beta …Can be Supplemented by Analyzing Risk-Adjusted Returns 19 Source: Bloomberg. Market data as of September 28, 2018. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Annaly’s Sharpe Ratio(2) is 2.0x that of the average Yield Sector peer Annaly’s Treynor Ratio(1) is 3.5x that of the average Yield Sector peer

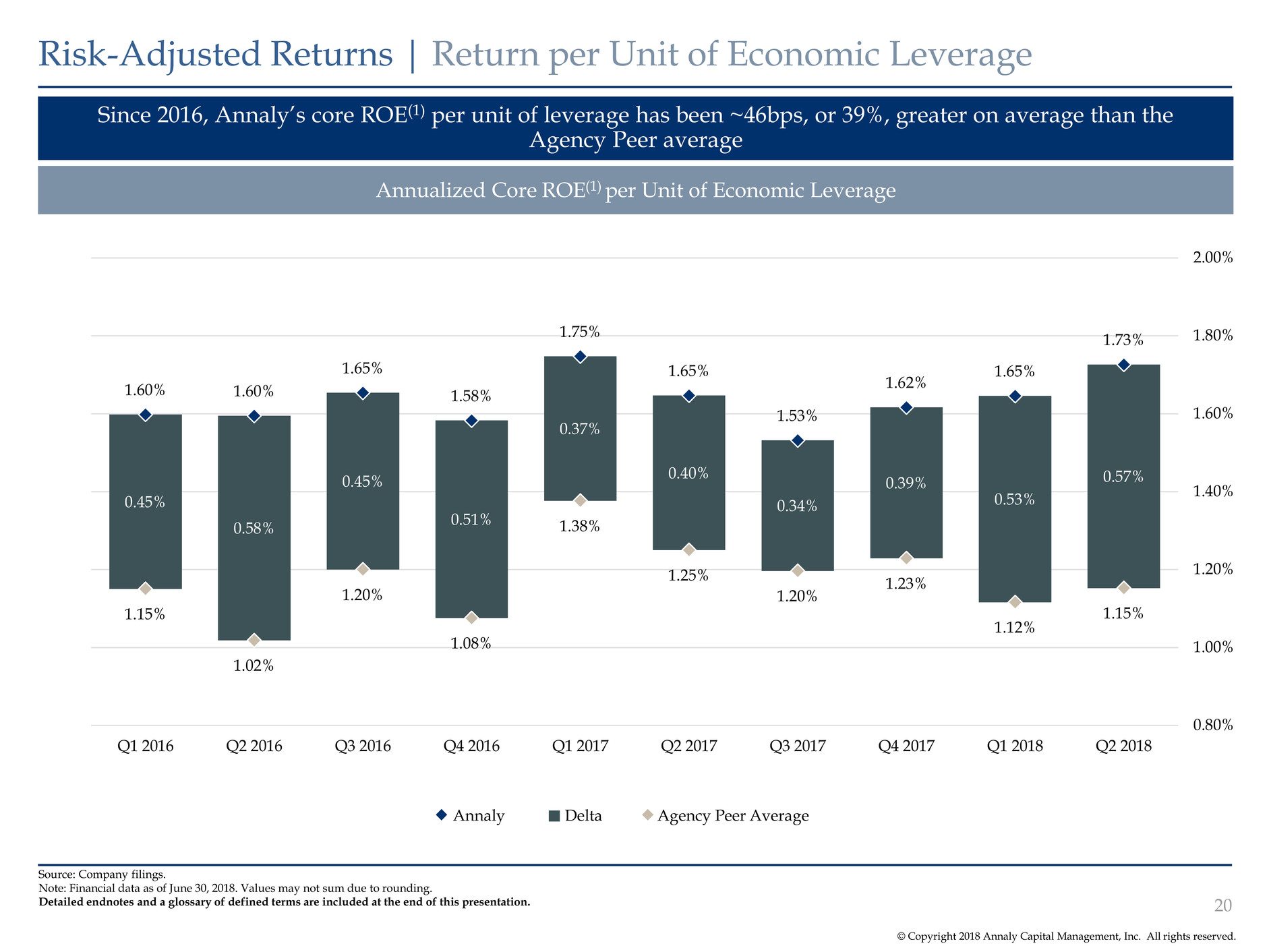

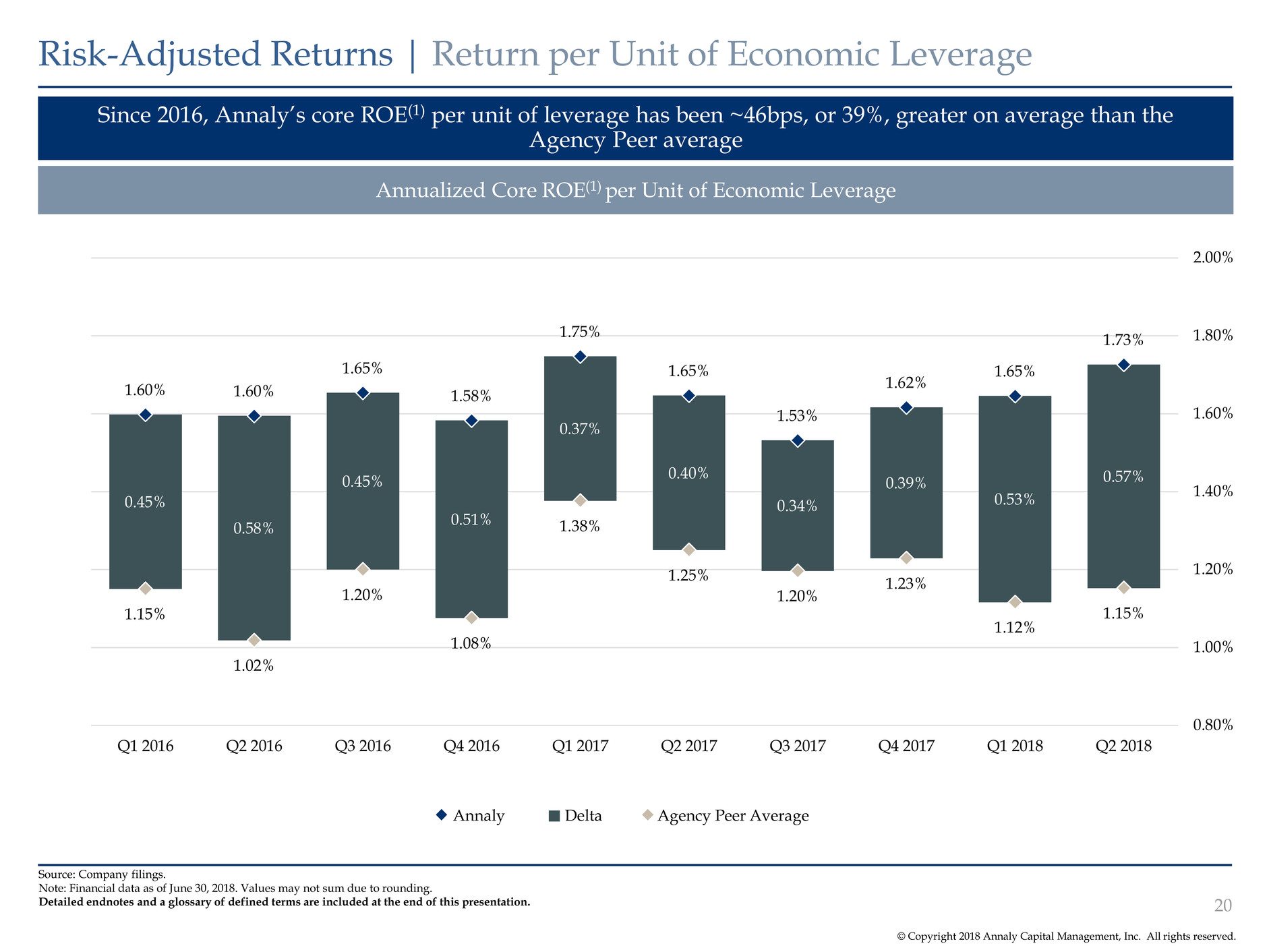

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. 0.57% 0.53% 0.39% 0.34% 0.40% 0.37% 0.51% 0.45% 0.58% 0.45% 1.73% 1.65% 1.62% 1.53% 1.65% 1.75% 1.58% 1.65% 1.60%1.60% 1.15% 1.12% 1.23% 1.20% 1.25% 1.38% 1.08% 1.20% 1.02% 1.15% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% 2.20% Q2 2018Q1 2018Q4 2017Q3 2017Q2 2017Q1 2017Q4 2016Q3 2016Q2 2016Q1 2016 Since 2016, Annaly’s core ROE(1) per unit of leverage has been ~46bps, or 39%, greater on average than the Agency Peer average Risk-Adjusted Returns | Return per Unit of Economic Leverage 20 Source: Company filings. Note: Financial data as of June 30, 2018. Values may not sum due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Annualized Core ROE(1) per Unit of Economic Leverage DeltaAnnaly Agency Peer Average

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Annaly has maintained a Net Interest Margin (“NIM”) (ex-PAA)(1) that is 11x more stable than the average mREIT since 2016 Risk-Adjusted Returns | Margin Stability 21 Source: Company filings and SNL Financial. Note: Financial data as of September 30, 2018, unless otherwise noted. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. (2) (3) 0.14% 1.52% 0.35% 1.76% 1.59% 0.04% 0.48% 0.10% 0.54% 0.52% NLY mREITs Agency Hybrid Commercial Range Standard Deviation 1.50% 1.56% 1.52% 1.51% 1.47% 1.53% 1.55% 1.53% 1.42% 1.54% 1.54% Q3'18Q2'18Q1'18Q4'17Q3'17Q2'17Q1'17Q4'16Q3'16Q2'16Q1'16 (3) (4) Annaly NIM (ex-PAA)(1) (Q1 2016 – Q3 2018) NIM Dispersion Relative to mREIT Peers(2) (Q1 2016 – Q2 2018)

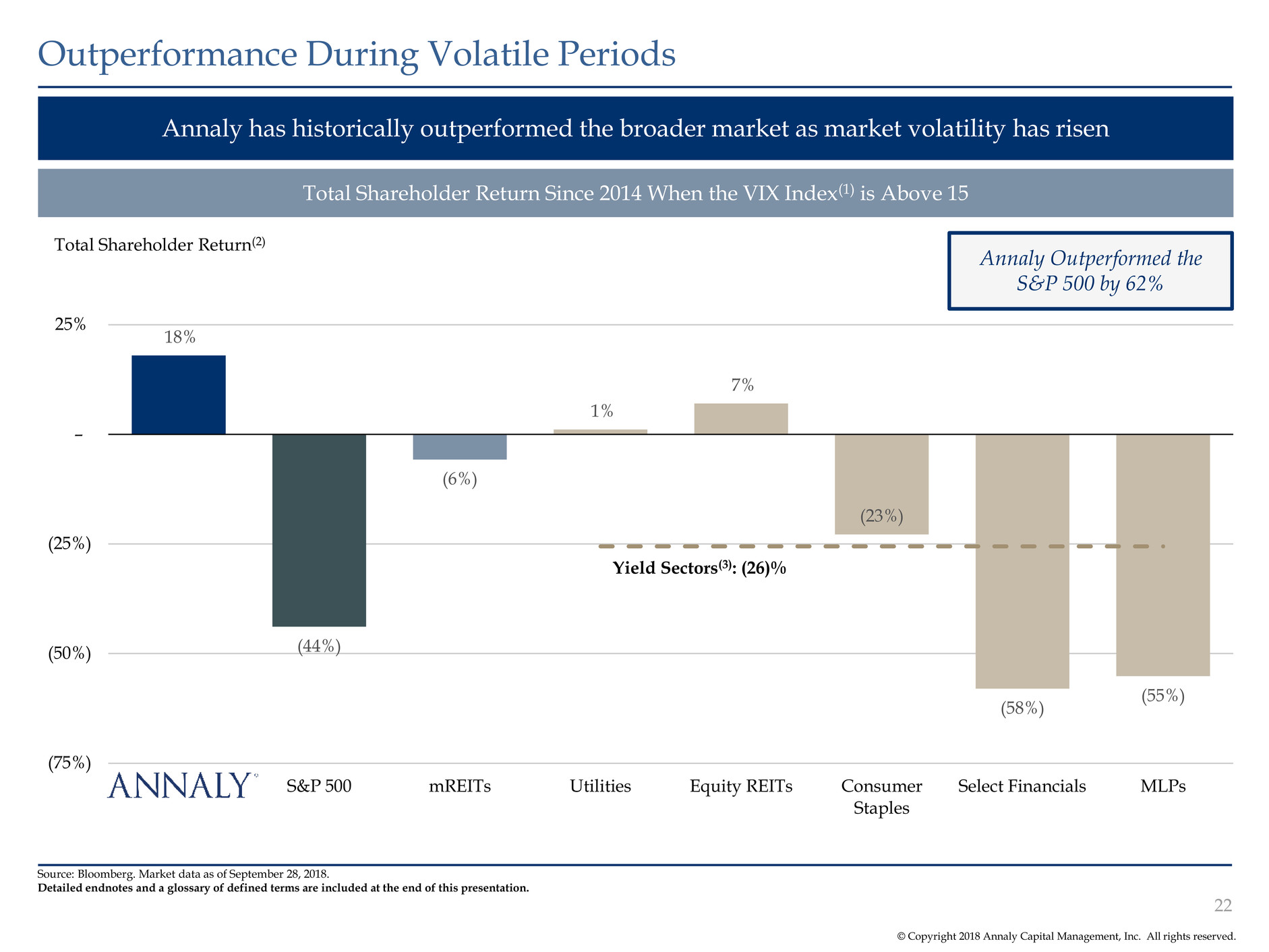

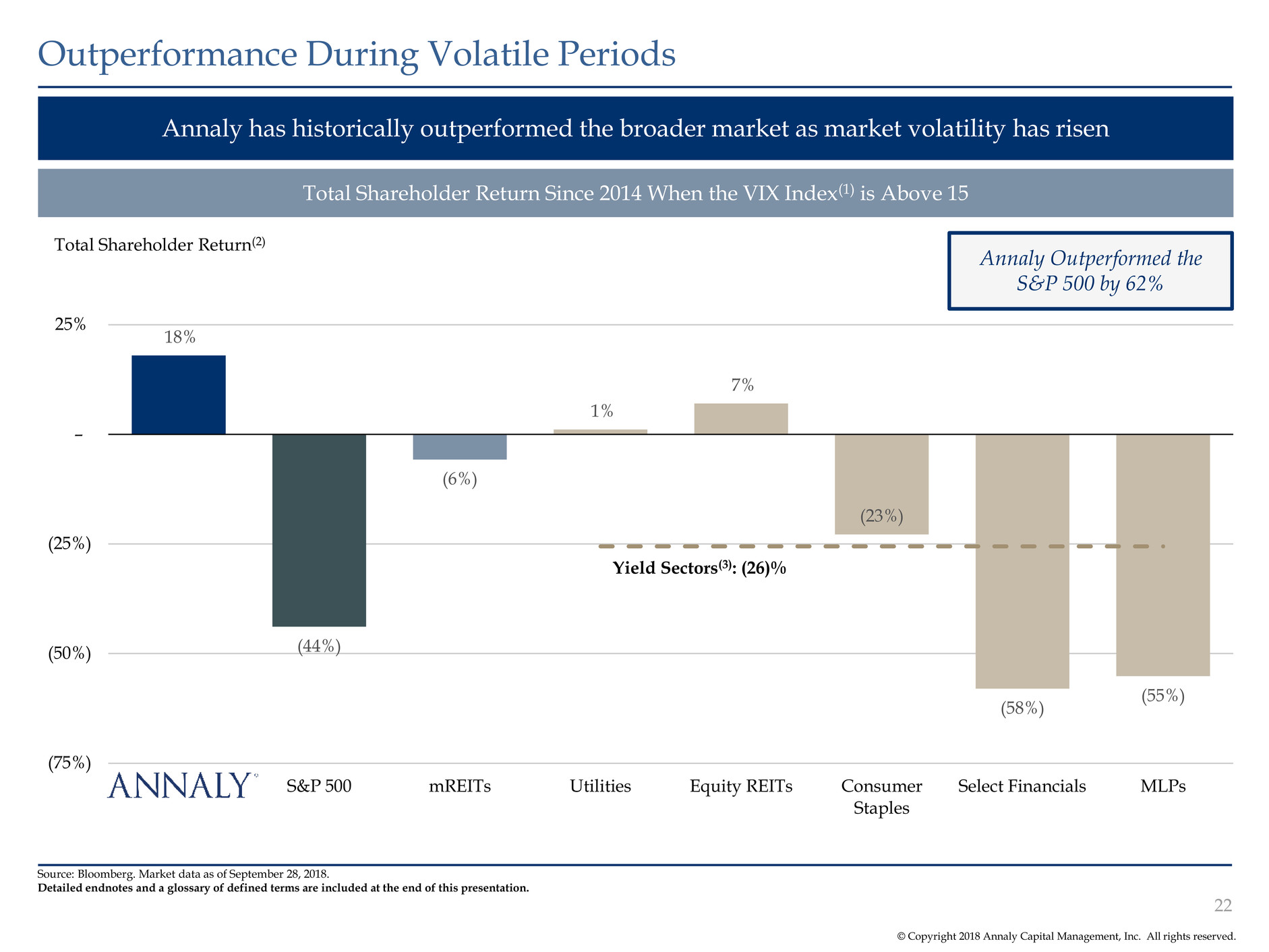

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. 18% (44%) (6%) 1% 7% (23%) (58%) (55%) (75%) (50%) (25%) – 25% Annaly S&P 500 mREITs Utilities Equity REITs Consumer Staples Select Financials MLPs Annaly has historically outperformed the broader market as market volatility has risen Outperformance During Volatile Periods Total Shareholder Return Since 2014 When the VIX Index(1) is Above 15 Source: Bloomberg. Market data as of September 28, 2018. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Annaly Outperformed the S&P 500 by 62% Yield Sectors(3): (26)% 22 Total Shareholder Return(2)

Business Update

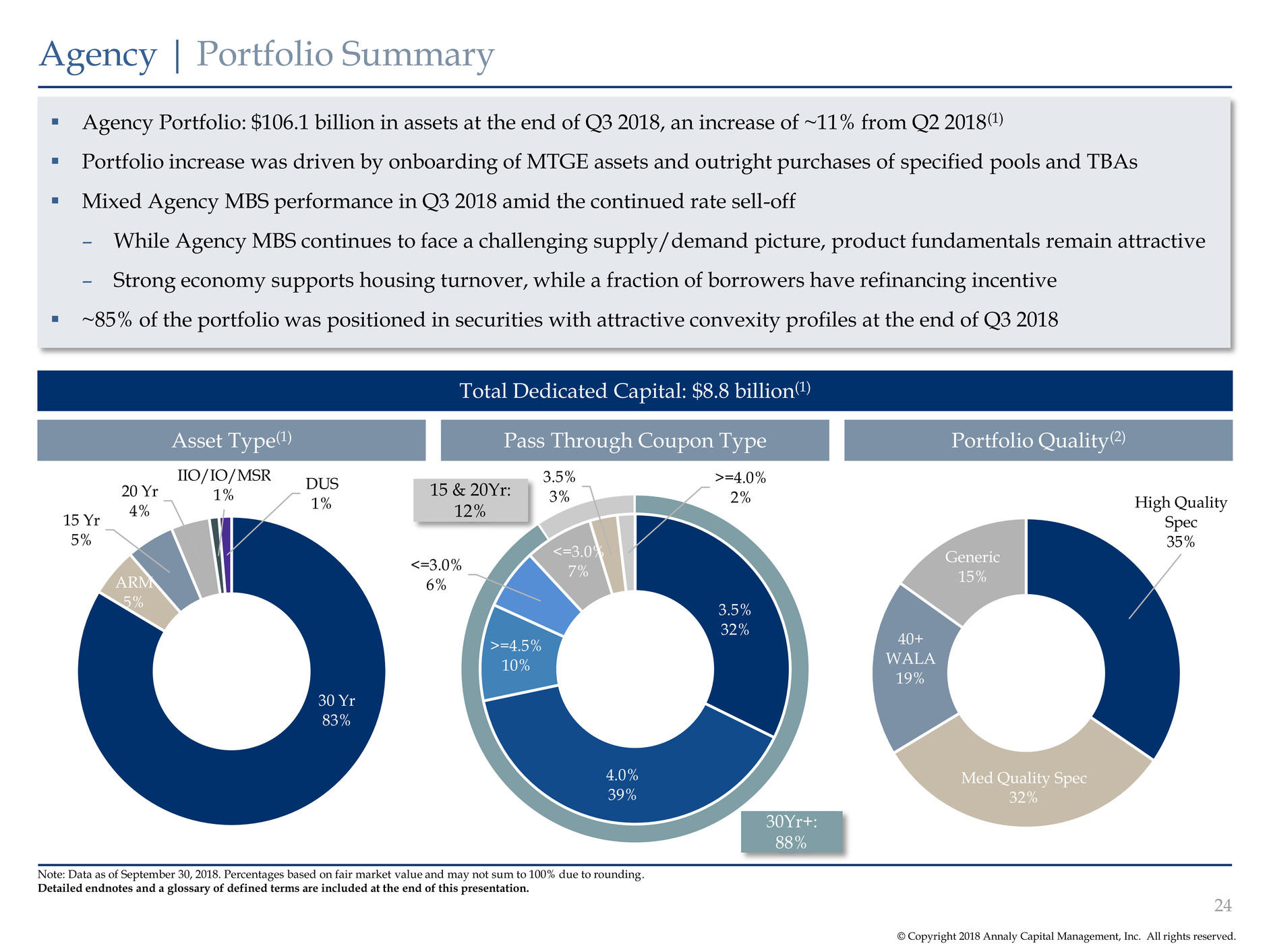

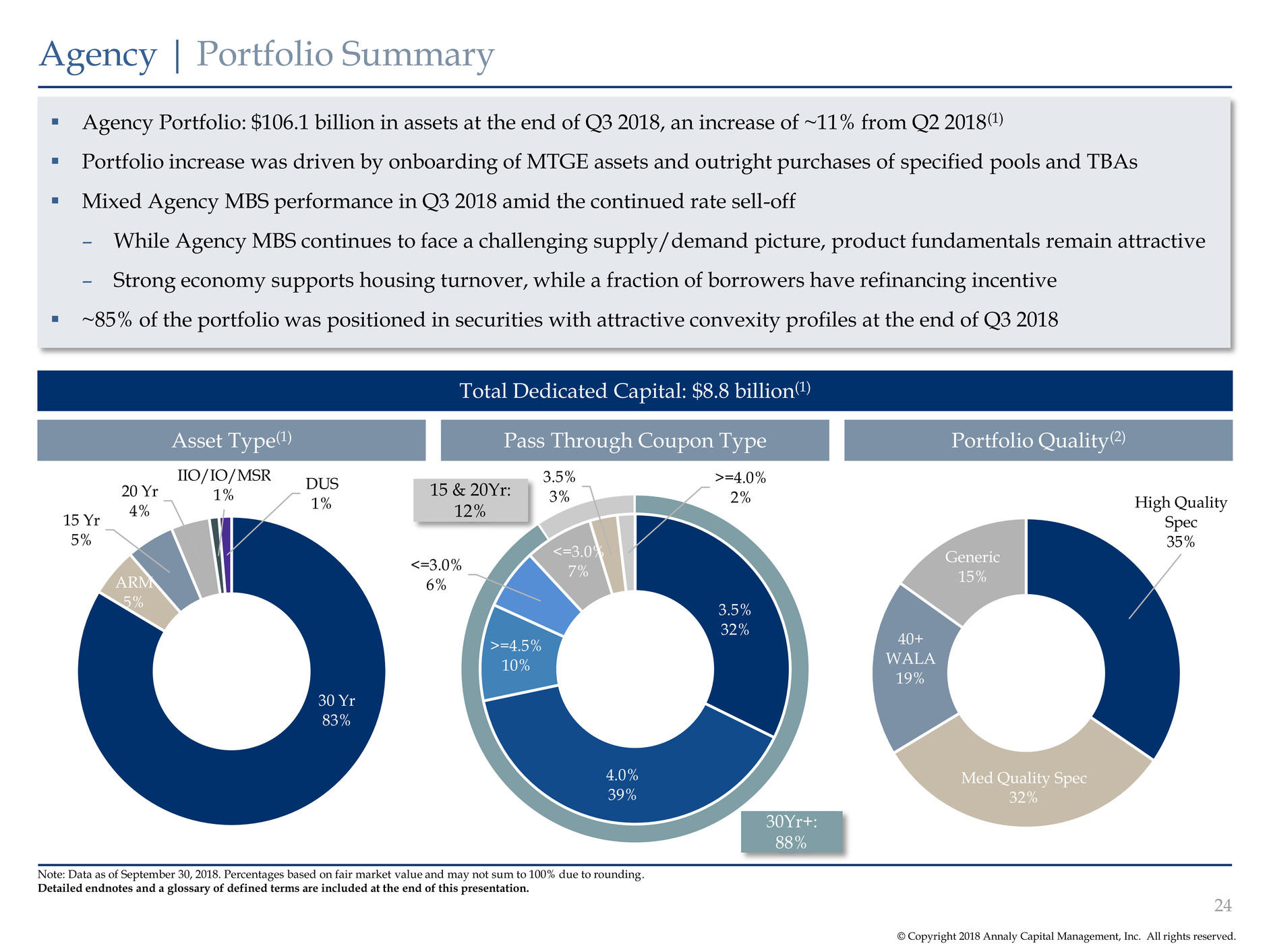

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Agency | Portfolio Summary 24 Note: Data as of September 30, 2018. Percentages based on fair market value and may not sum to 100% due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Agency Portfolio: $106.1 billion in assets at the end of Q3 2018, an increase of ~11% from Q2 2018(1) Portfolio increase was driven by onboarding of MTGE assets and outright purchases of specified pools and TBAs Mixed Agency MBS performance in Q3 2018 amid the continued rate sell-off – While Agency MBS continues to face a challenging supply/demand picture, product fundamentals remain attractive – Strong economy supports housing turnover, while a fraction of borrowers have refinancing incentive ~85% of the portfolio was positioned in securities with attractive convexity profiles at the end of Q3 2018 3.5% 32% 4.0% 39% >=4.5% 10% <=3.0% 6% <=3.0% 7% 3.5% 3% >=4.0% 2% Total Dedicated Capital: $8.8 billion(1) Asset Type(1) Pass Through Coupon Type Portfolio Quality(2) 15 & 20Yr: 12% High Quality Spec 35% Med Quality Spec 32% 40+ WALA 19% Generic 15% 30Yr+: 88% 30 Yr 83% ARM 5% 15 Yr 5% 20 Yr 4% IIO/IO/MSR 1% DUS 1%

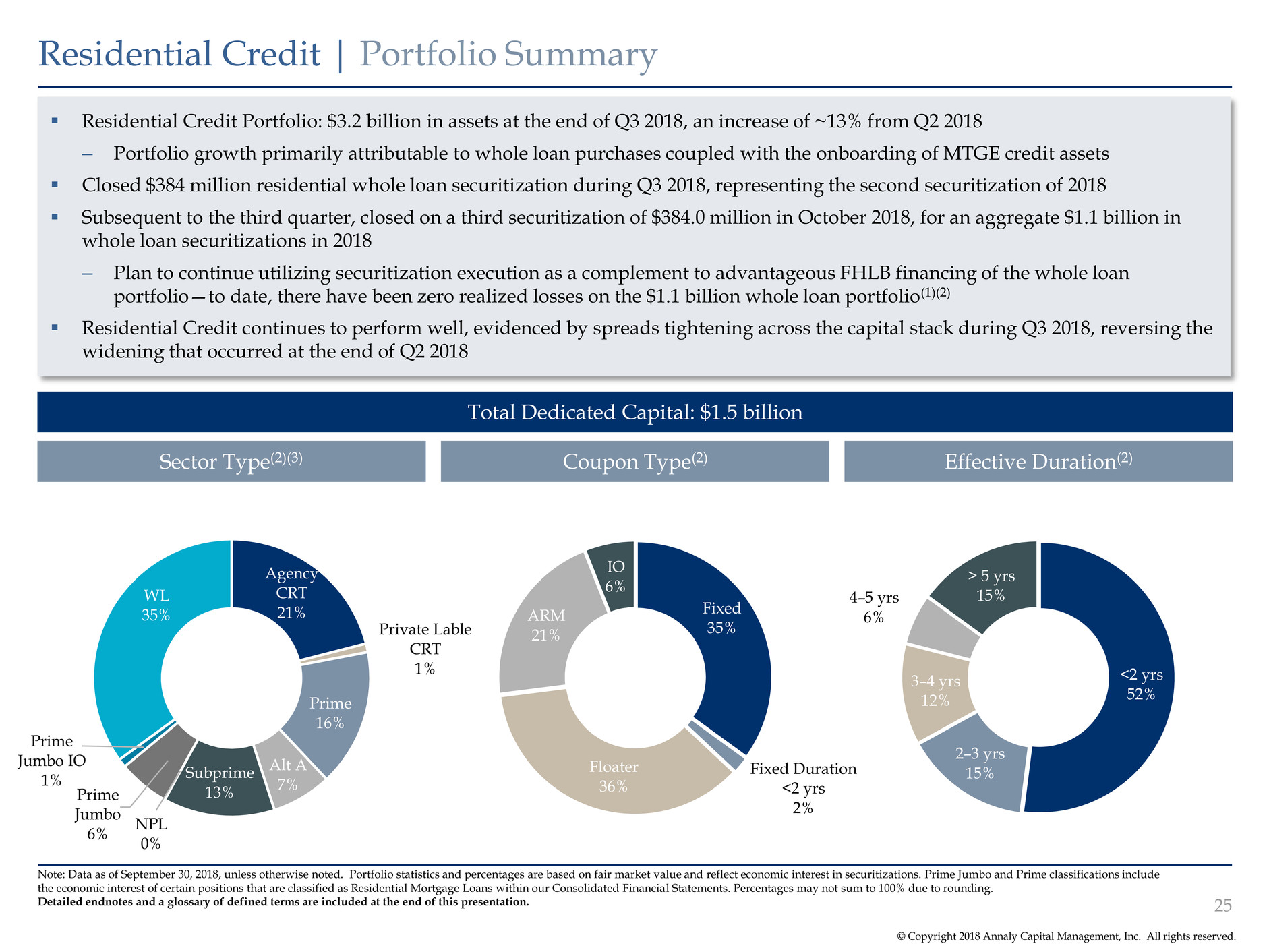

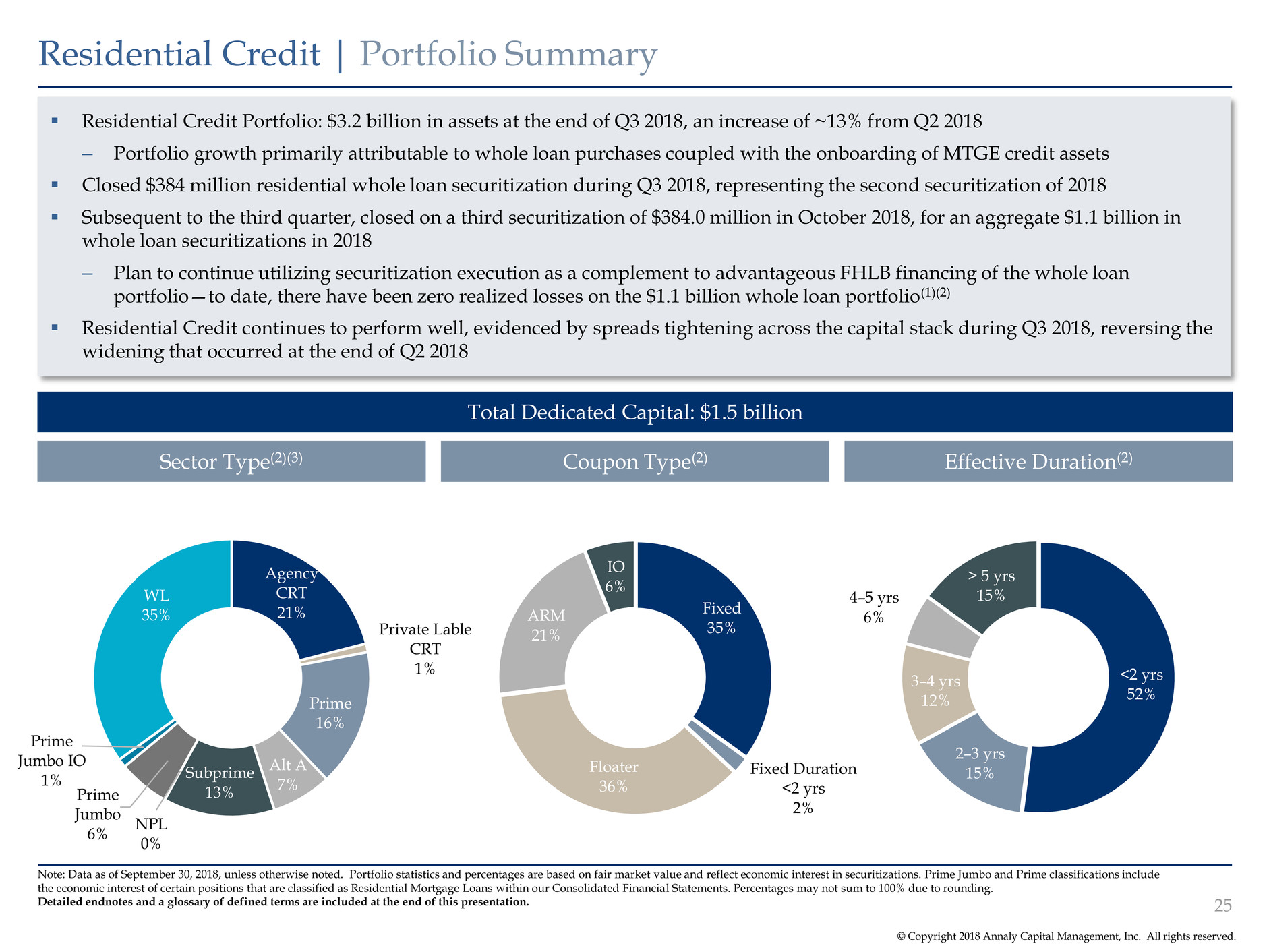

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Residential Credit | Portfolio Summary 25 Note: Data as of September 30, 2018, unless otherwise noted. Portfolio statistics and percentages are based on fair market value and reflect economic interest in securitizations. Prime Jumbo and Prime classifications include the economic interest of certain positions that are classified as Residential Mortgage Loans within our Consolidated Financial Statements. Percentages may not sum to 100% due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Residential Credit Portfolio: $3.2 billion in assets at the end of Q3 2018, an increase of ~13% from Q2 2018 – Portfolio growth primarily attributable to whole loan purchases coupled with the onboarding of MTGE credit assets Closed $384 million residential whole loan securitization during Q3 2018, representing the second securitization of 2018 Subsequent to the third quarter, closed on a third securitization of $384.0 million in October 2018, for an aggregate $1.1 billion in whole loan securitizations in 2018 – Plan to continue utilizing securitization execution as a complement to advantageous FHLB financing of the whole loan portfolio—to date, there have been zero realized losses on the $1.1 billion whole loan portfolio(1)(2) Residential Credit continues to perform well, evidenced by spreads tightening across the capital stack during Q3 2018, reversing the widening that occurred at the end of Q2 2018 Total Dedicated Capital: $1.5 billion Sector Type(2)(3) Coupon Type(2) Effective Duration(2) Agency CRT 21% Private Lable CRT 1% Prime 16% Alt A 7% Subprime 13% NPL 0% Prime Jumbo 6% Prime Jumbo IO 1% WL 35% Fixed 35% Fixed Duration <2 yrs 2% Floater 36% ARM 21% IO 6% <2 yrs 52% 2–3 yrs 15% 3–4 yrs 12% 4–5 yrs 6% > 5 yrs 15%

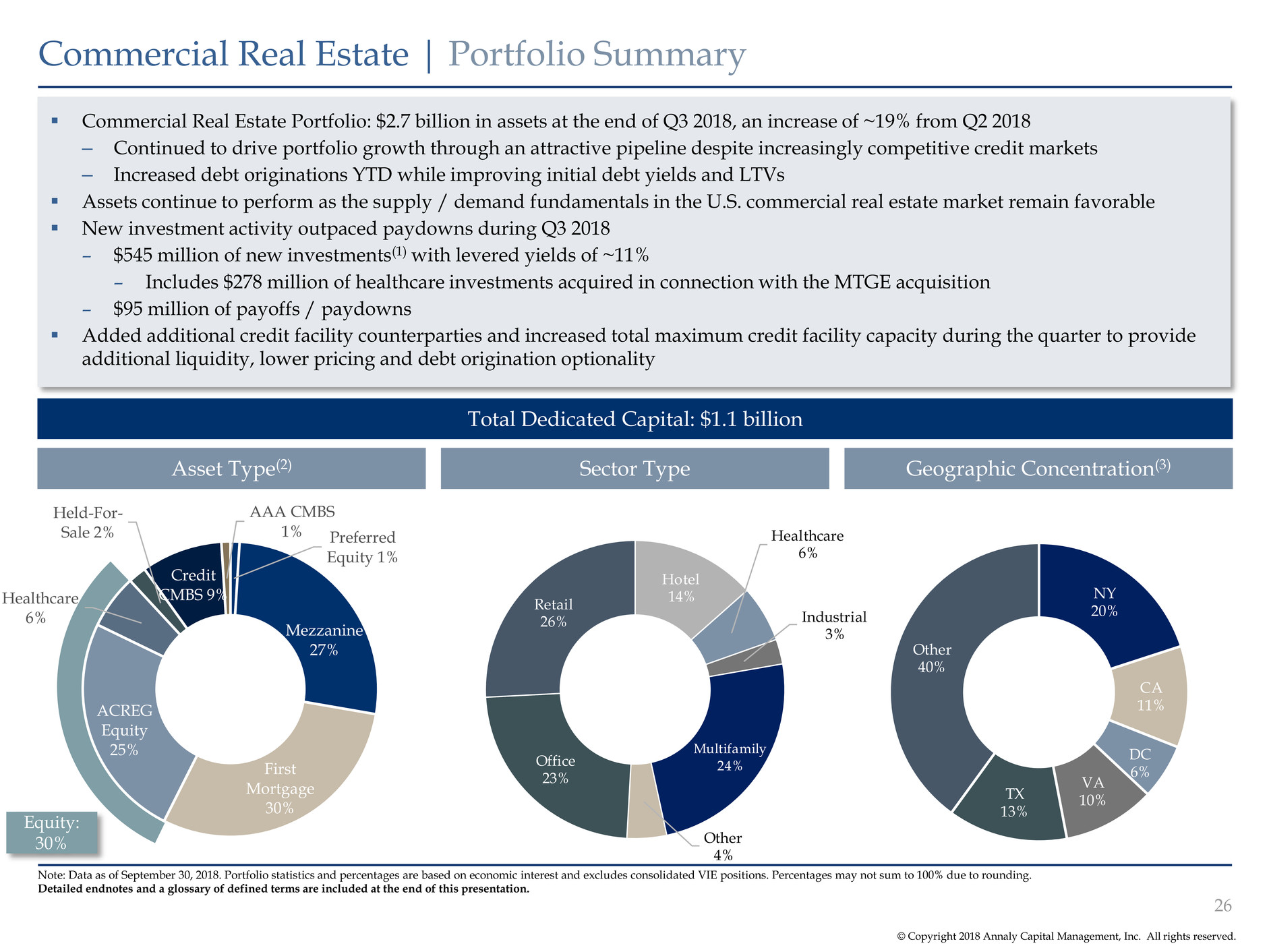

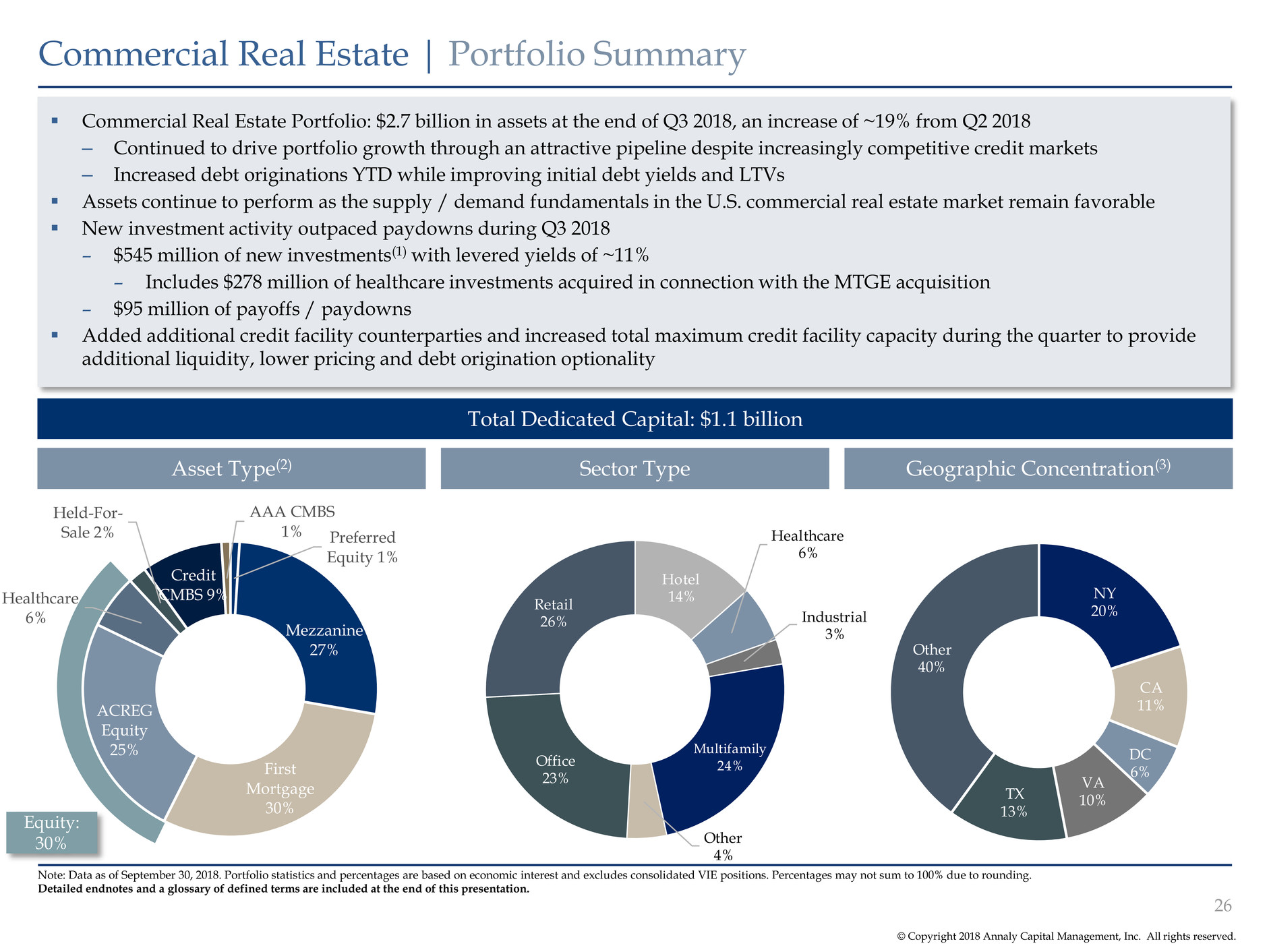

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Asset Type(2) Commercial Real Estate | Portfolio Summary Commercial Real Estate Portfolio: $2.7 billion in assets at the end of Q3 2018, an increase of ~19% from Q2 2018 – Continued to drive portfolio growth through an attractive pipeline despite increasingly competitive credit markets – Increased debt originations YTD while improving initial debt yields and LTVs Assets continue to perform as the supply / demand fundamentals in the U.S. commercial real estate market remain favorable New investment activity outpaced paydowns during Q3 2018 – $545 million of new investments(1) with levered yields of ~11% – Includes $278 million of healthcare investments acquired in connection with the MTGE acquisition – $95 million of payoffs / paydowns Added additional credit facility counterparties and increased total maximum credit facility capacity during the quarter to provide additional liquidity, lower pricing and debt origination optionality Total Dedicated Capital: $1.1 billion Sector Type Geographic Concentration(3) 26 Hotel 14% Healthcare 6% Industrial 3% Multifamily 24% Other 4% Office 23% Retail 26% NY 20% CA 11% DC 6% VA 10%TX 13% Other 40% Note: Data as of September 30, 2018. Portfolio statistics and percentages are based on economic interest and excludes consolidated VIE positions. Percentages may not sum to 100% due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Equity: 30% Preferred Equity 1% Mezzanine 27% First Mortgage 30% ACREG Equity 25% Healthcare 6% Held-For- Sale 2% Credit CMBS 9% AAA CMBS 1%

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Middle Market Lending | Portfolio Summary 27 Note: Data as of September 30, 2018. Percentages based on amortized cost and may not sum to 100% due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Middle Market Lending Portfolio: $1.5 billion in assets at the end of Q3 2018, an increase of ~22% from Q2 2018 First and second lien portfolio with increased focus on lead arranger opportunities and more concentrated positions New investment activity outpaced paydowns during Q3 2018 – $259 million of new investments with unlevered yield of ~10%(1) – $9 million of paydowns Portfolio of 45 borrowers built through long established relationships with a focus on defensive, non-discretionary, niche industries Risk rating upgrades represent 24% of portfolio due to net leverage declines Improved terms and access to financing through $100 million upsize of existing credit facility Total Dedicated Capital: $1.1 billion Lien Position Industry(2) Loan Size(3) 16% 14% 9% 5% 4%4%4% 4% 41% Management & Public Relations Services Computer Programming & Data Processing Manufacturing Engineering, Architectural, and Surveying Public Warehousing & Storage Telephone Communications Offices & Clinics of Doctors Offices & Clinics of Health Practitioners Other 1st Lien 58% 2nd Lien 42% $0mm - $20mm 21% $20mm - $40mm 18% $40mm - $60mm 26% $60mm+ 36%

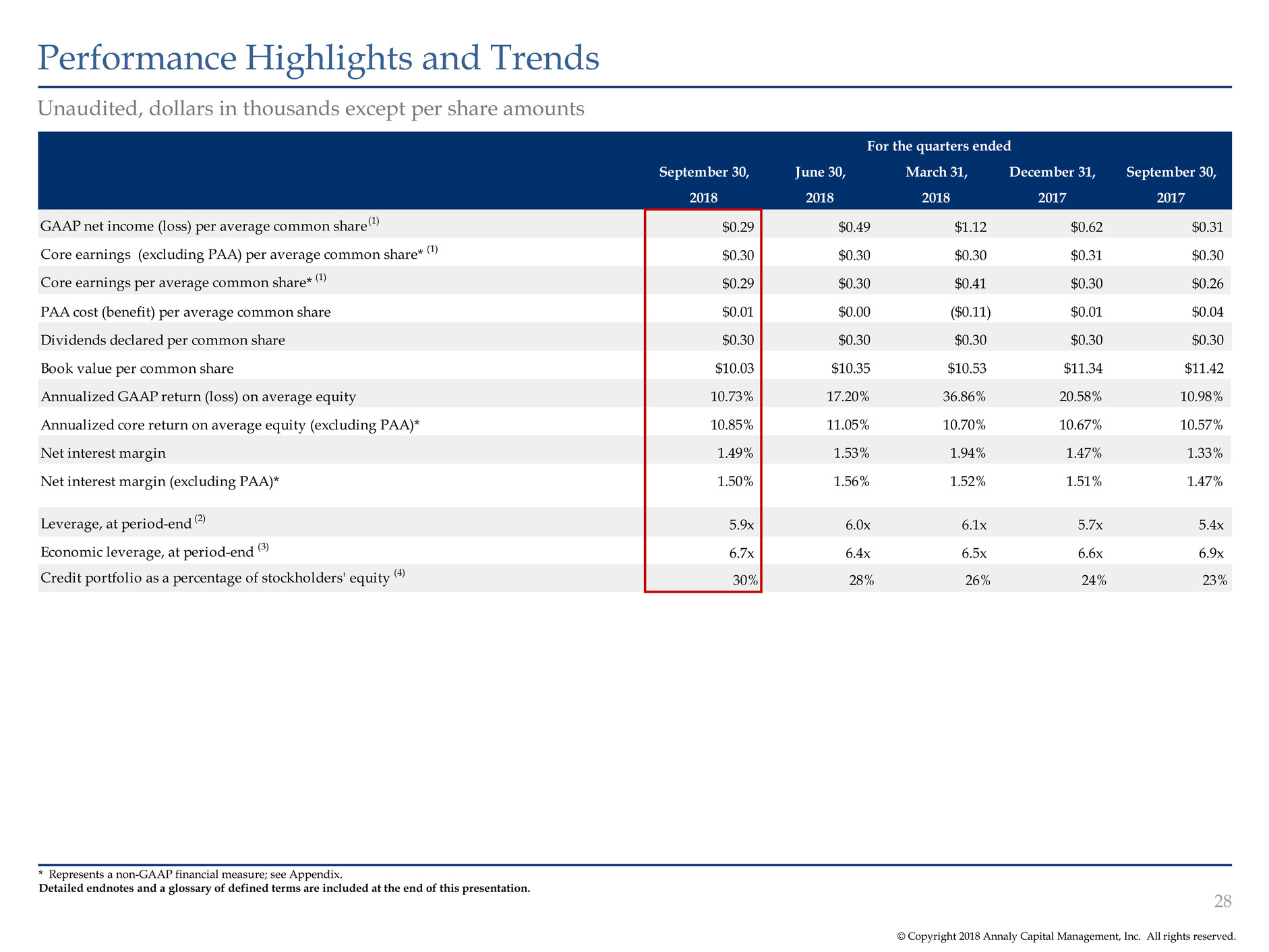

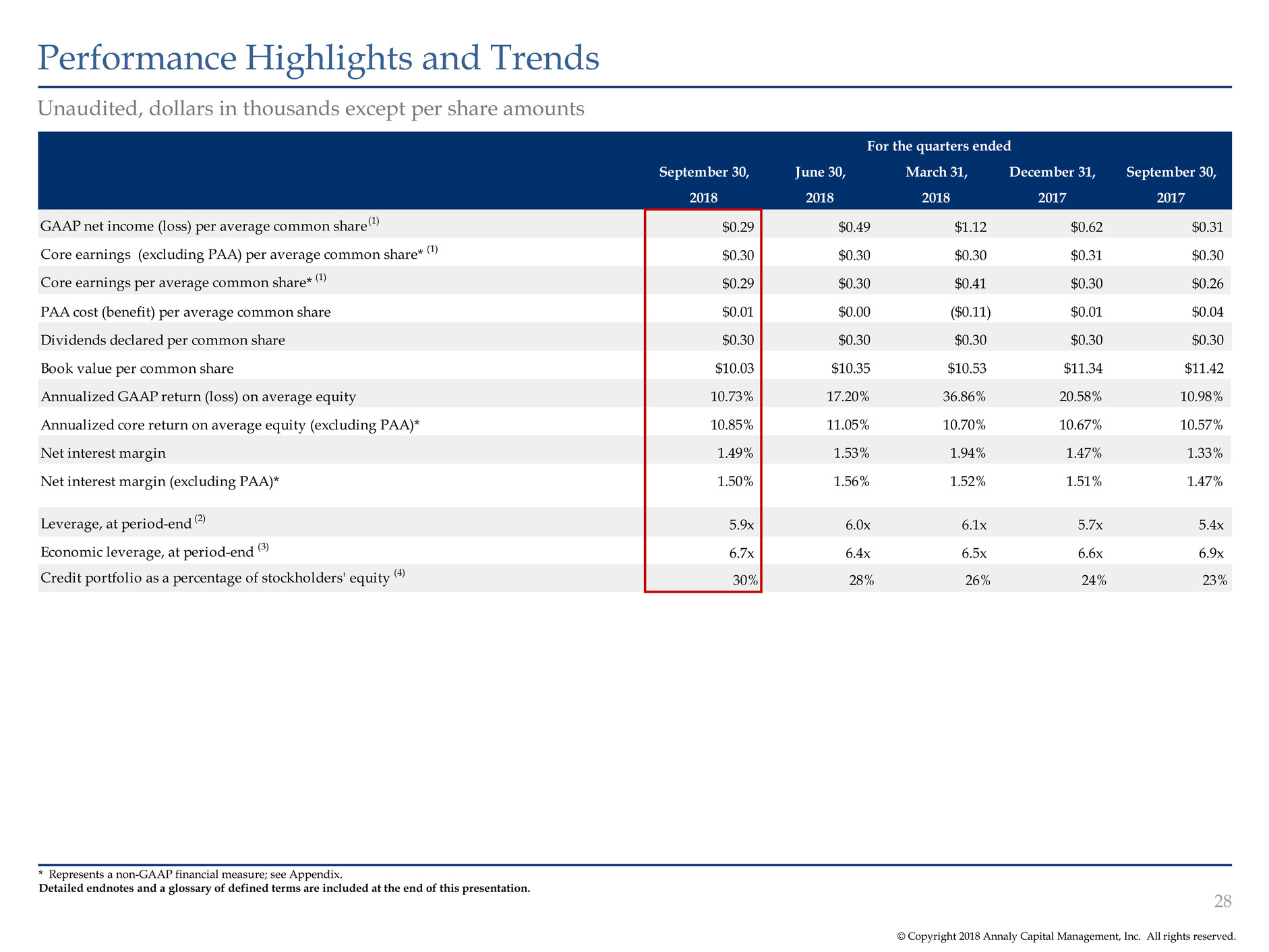

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Performance Highlights and Trends 28 Unaudited, dollars in thousands except per share amounts For the quarters ended September 30, June 30, March 31, December 31, September 30, 2018 2018 2018 2017 2017 GAAP net income (loss) per average common share (1) $0.29 $0.49 $1.12 $0.62 $0.31 Core earnings (excluding PAA) per average common share* (1) $0.30 $0.30 $0.30 $0.31 $0.30 Core earnings per average common share* (1) $0.29 $0.30 $0.41 $0.30 $0.26 PAA cost (benefit) per average common share $0.01 $0.00 ($0.11) $0.01 $0.04 Dividends declared per common share $0.30 $0.30 $0.30 $0.30 $0.30 Book value per common share $10.03 $10.35 $10.53 $11.34 $11.42 Annualized GAAP return (loss) on average equity 10.73% 17.20% 36.86% 20.58% 10.98% Annualized core return on average equity (excluding PAA)* 10.85% 11.05% 10.70% 10.67% 10.57% Net interest margin 1.49% 1.53% 1.94% 1.47% 1.33% Net interest margin (excluding PAA)* 1.50% 1.56% 1.52% 1.51% 1.47% Leverage, at period-end (2) 5.9x 6.0x 6.1x 5.7x 5.4x Economic leverage, at period-end (3) 6.7x 6.4x 6.5x 6.6x 6.9x Credit portfolio as a percentage of stockholders' equity (4) 30% 28% 26% 24% 23% * Represents a non-GAAP financial measure; see Appendix. Detailed endnotes and a glossary of defined terms are included at the end of this presentation.

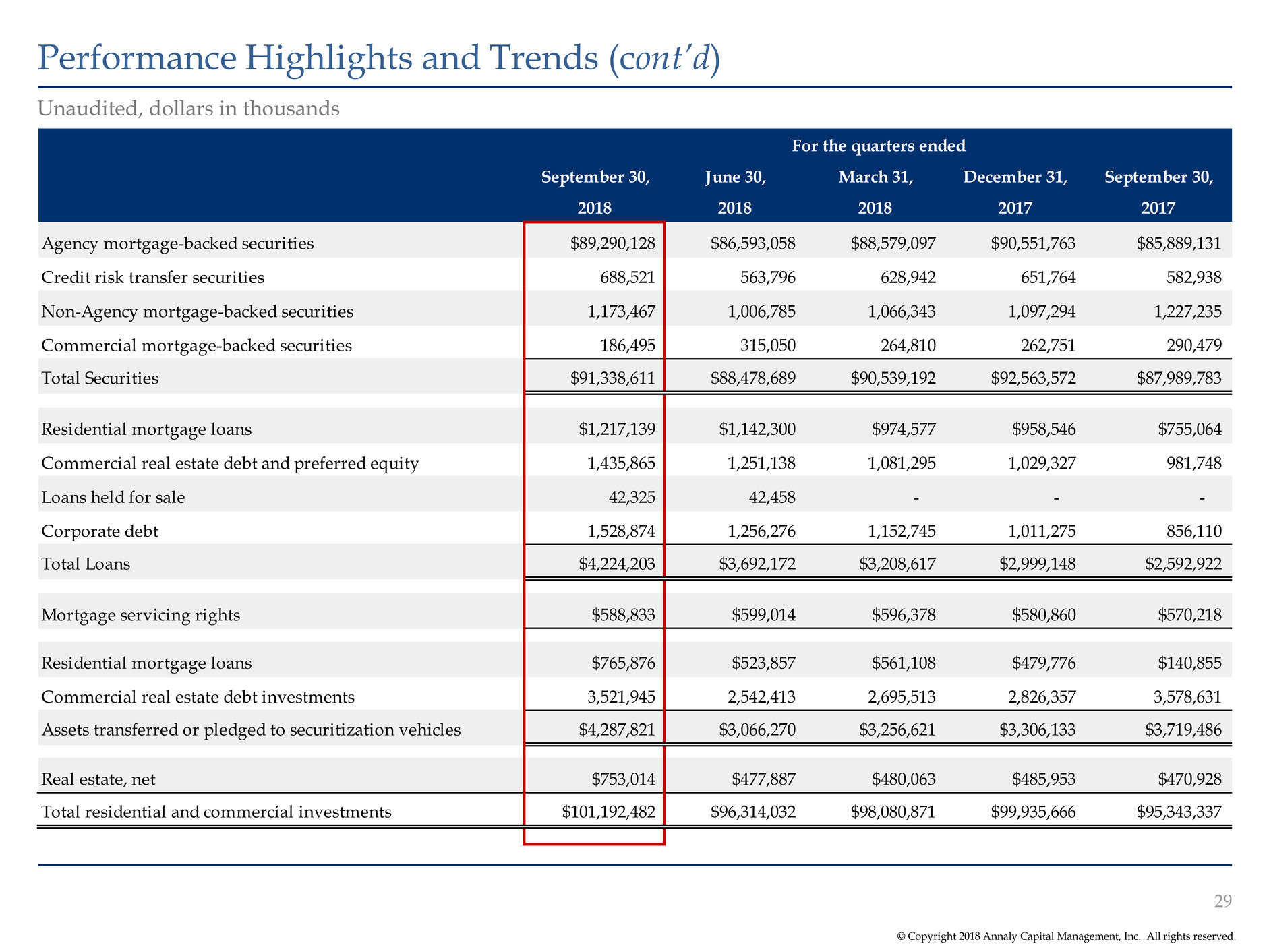

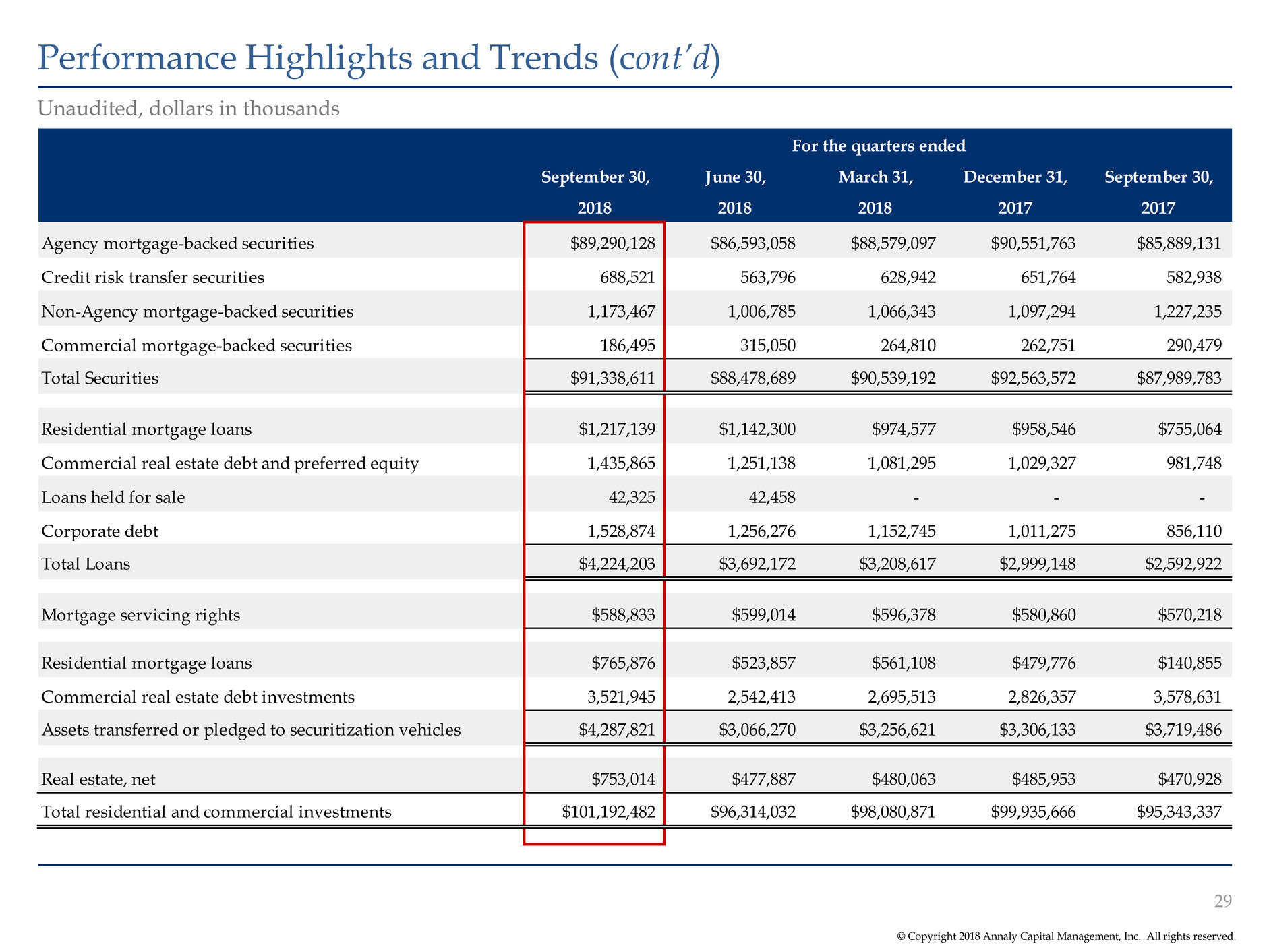

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Performance Highlights and Trends (cont’d) 29 Unaudited, dollars in thousands For the quarters ended September 30, June 30, March 31, December 31, September 30, 2018 2018 2018 2017 2017 Agency mortgage-backed securities $89,290,128 $86,593,058 $88,579,097 $90,551,763 $85,889,131 Credit risk transfer securities 688,521 563,796 628,942 651,764 582,938 Non-Agency mortgage-backed securities 1,173,467 1,006,785 1,066,343 1,097,294 1,227,235 Commercial mortgage-backed securities 186,495 315,050 264,810 262,751 290,479 Total Securities $91,338,611 $88,478,689 $90,539,192 $92,563,572 $87,989,783 Residential mortgage loans $1,217,139 $1,142,300 $974,577 $958,546 $755,064 Commercial real estate debt and preferred equity 1,435,865 1,251,138 1,081,295 1,029,327 981,748 Loans held for sale 42,325 42,458 - - - Corporate debt 1,528,874 1,256,276 1,152,745 1,011,275 856,110 Total Loans $4,224,203 $3,692,172 $3,208,617 $2,999,148 $2,592,922 Mortgage servicing rights $588,833 $599,014 $596,378 $580,860 $570,218 Residential mortgage loans $765,876 $523,857 $561,108 $479,776 $140,855 C mmercial real estate debt investments 3,521,945 2,542,413 2,695,513 2,826,357 3,578,631 Assets transferred or pledged to securitization vehicles $4,287,821 $3,066,270 $3,256,621 $3,306,133 $3,719,486 Real estate, net $753,014 $477,887 $480,063 $485,953 $470,928 Total residential and commercial investments $101,192,482 $96,314,032 $98,080,871 $99,935,666 $95,343,337

Appendix: Non-GAAP Reconciliations

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Non-GAAP Reconciliations 31 In connection with the Company's continued growth and diversification, including the recent acquisition of MTGE Investment Corp., the Company has updated its calculation of core earnings and related metrics to reflect changes to its portfolio composition and operations. Beginning with the results for the quarter ended September 30, 2018, core earnings has been refreshed to include coupon income (expense) on CMBX positions (reported in Net gains (losses) on other derivatives) and to exclude depreciation and amortization expense on real estate and related intangibles (reported in Other income (loss)), non-core income (loss) allocated to equity method investments (reported in Other income (loss)) and the income tax effect of non-core income or loss (reported in Income taxes). Prior period results will not be adjusted to conform to the revised calculation as the impact in each of those periods is not material. The Company calculates "core earnings", a non-GAAP measure, as the sum of (a) economic net interest income, (b) TBA dollar roll income and CMBX coupon income, (c) realized amortization of MSRs, (d) other income (loss) (excluding depreciation and amortization expense on real estate and related intangibles, non-core income allocated to equity method investments and other non-core components of other income (loss)), (e) general and administrative expenses (excluding transaction expenses and non-recurring items) and (f) income taxes (excluding the income tax effect of non-core (income)/loss items). Core earnings (excluding PAA) excludes the premium amortization adjustment representing the cumulative impact on prior periods, but not the current period, of quarter-over-quarter changes in estimated long-term prepayment speeds related to the Company’s Agency mortgage-backed securities.

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Non-GAAP Reconciliations (cont’d) 32 * Represents a non-GAAP financial measure. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Unaudited, dollars in thousands except per share amounts To supplement its consolidated financial statements, which are prepared and presented in accordance with GAAP, the Company provides non-GAAP financial measures. These measures should not be considered a substitute for, or superior to, financial measures computed in accordance with GAAP. These non-GAAP measures provide additional detail to enhance investor understanding of the Company’s period-over-period operating performance and business trends, as well as for assessing the Company’s performance versus that of industry peers. Reconciliations of these non-GAAP financial measures to their most directly comparable GAAP results are provided below. For the quarters ended September 30, June 30, March 31, December 31, September 30, June 30, March 31, December 31, September 30, June 30, March 31, 2018 2018 2018 2017 2017 2017 2017 2016 2016 2016 2016 GAAP to Core Reconciliation GAAP net income (loss) $385,429 $595,887 $1,327,704 $746,771 $367,315 $14,522 $440,408 $1,848,483 $730,880 ($278,497) ($868,080) Net income (loss) attributable to non-controlling interests ($149) ($32) ($96) ($151) ($232) ($102) ($103) ($87) ($336) ($385) ($162) Net income (loss) attributable to Annaly $385,578 $595,919 $1,327,800 $746,922 $367,547 $14,624 $440,511 $1,848,570 $731,216 ($278,112) ($867,918) Adjustments to excluded reported realized and unrealized (gains) losses: Realized (gains) losses on termination of interest rate swaps (575) - (834) 160,075 - 58 - 55,214 (1,337) 60,064 - Unrealized (gains) losses on interest rate swaps (417,203) (343,475) (977,285) (484,447) (56,854) 177,567 (149,184) (1,430,668) (256,462) 373,220 1,031,720 Net (gains) losses on disposal of investments 324,294 66,117 (13,468) (7,895) 11,552 5,516 (5,235) (7,782) (14,447) (12,535) 1,675 Net (gains) losses on other derivatives (94,827) (34,189) 47,145 (121,334) (154,208) 14,423 (319) 139,470 (162,981) (81,880) (125,189) Net unrealized (gains) losses on instruments measured at fair value through earnings 39,944 48,376 51,593 12,115 67,492 (16,240) (23,683) (110,742) (29,675) 54,154 (128) Bargain purchase gain - - - - - - - - (72,576) - - Adjustments to exclude components of other (income) loss: Depreciation and amortization expense related to commercial real estate 9,278 - - - - - - - - - - Non-core (income) loss allocated to equity method investments (1) (2,358) - - - - - - - - - - Non-core other (income) loss (2) 44,525 - - - - - - - - - - Adjustments to exclude components of general and administrative expenses and income taxes: Transaction expenses and non-recurring items (3) 60,081 - 1,519 - - - - - 46,724 2,163 - Income tax effect on non-core income (loss) items 886 - - - - - - - - - - Other non-recurring loss - - - - - - - - - - - Adjustments to add back components of realized and unrealized (gains) losses: TBA dollar roll income and CMBX coupon income (4) 56,570 62,491 88,353 89,479 94,326 81,051 69,968 98,896 90,174 79,519 83,189 MSR amortization (5) (19,913) (19,942) (21,156) (19,331) (16,208) (17,098) (14,030) (27,018) (21,634) - - Core earnings* $386,280 $375,297 $503,667 $375,584 $313,647 $259,901 $318,028 $565,940 $309,002 $196,593 $123,349 Less: Premium amortization adjustment (PAA) cost (benefit) 3,386 7,516 (118,395) 11,367 39,899 72,700 17,870 (238,941) 3,891 85,583 168,408 Core Earnings (excluding PAA)* 389,666 382,813 385,272 386,951 353,546 332,601 335,898 326,999 312,893 282,176 291,757 AAP net income (loss) per average common share (6) $0.29 $0.49 $1.12 $0.62 $0.31 ($0.01) $0.41 $1.79 $0.70 ($0.32) ($0.96) Core earnings per average common share (6) * $0.29 $0.30 $0.41 $0.30 $0.26 $0.23 $0.29 $0.53 $0.29 $0.19 $0.11 Core earnings (excluding PAA) per average common share (6) * $0.30 $0.30 $0.30 $0.31 $0.30 $0.30 $0.31 $0.30 $0.29 $0.29 $0.30 Annualized GAAP return (loss) on average equity 10.73% 17.20% 36.86% 20.58% 10.98% 0.46% 13.97% 57.23% 23.55% (9.60%) (29.47%) Annualized core return on average equity (excluding PAA)* 10.85% 11.05% 10.70% 10.67% 10.57% 10.54% 10.66% 10.13% 10.09% 9.73% 9.91%

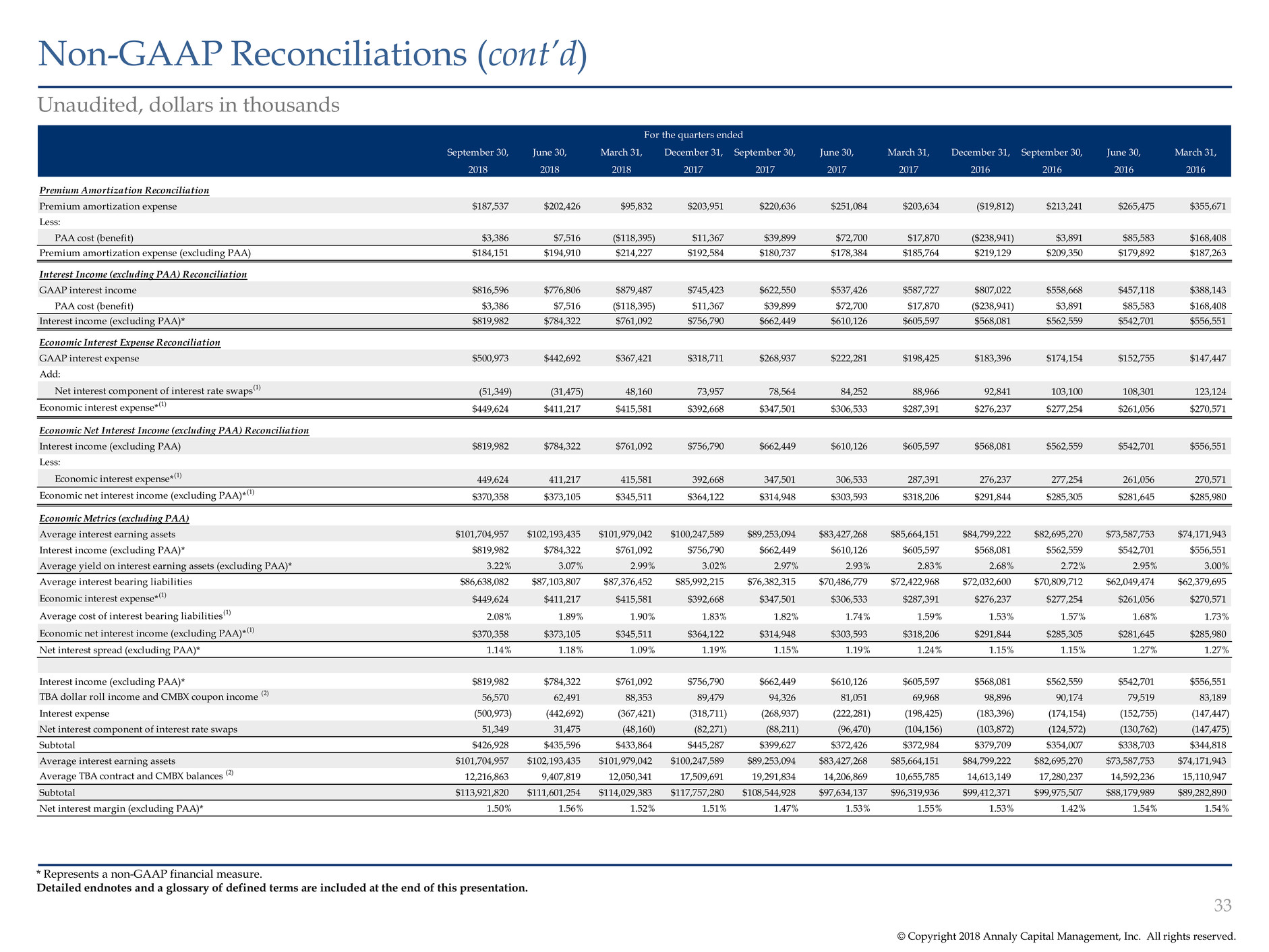

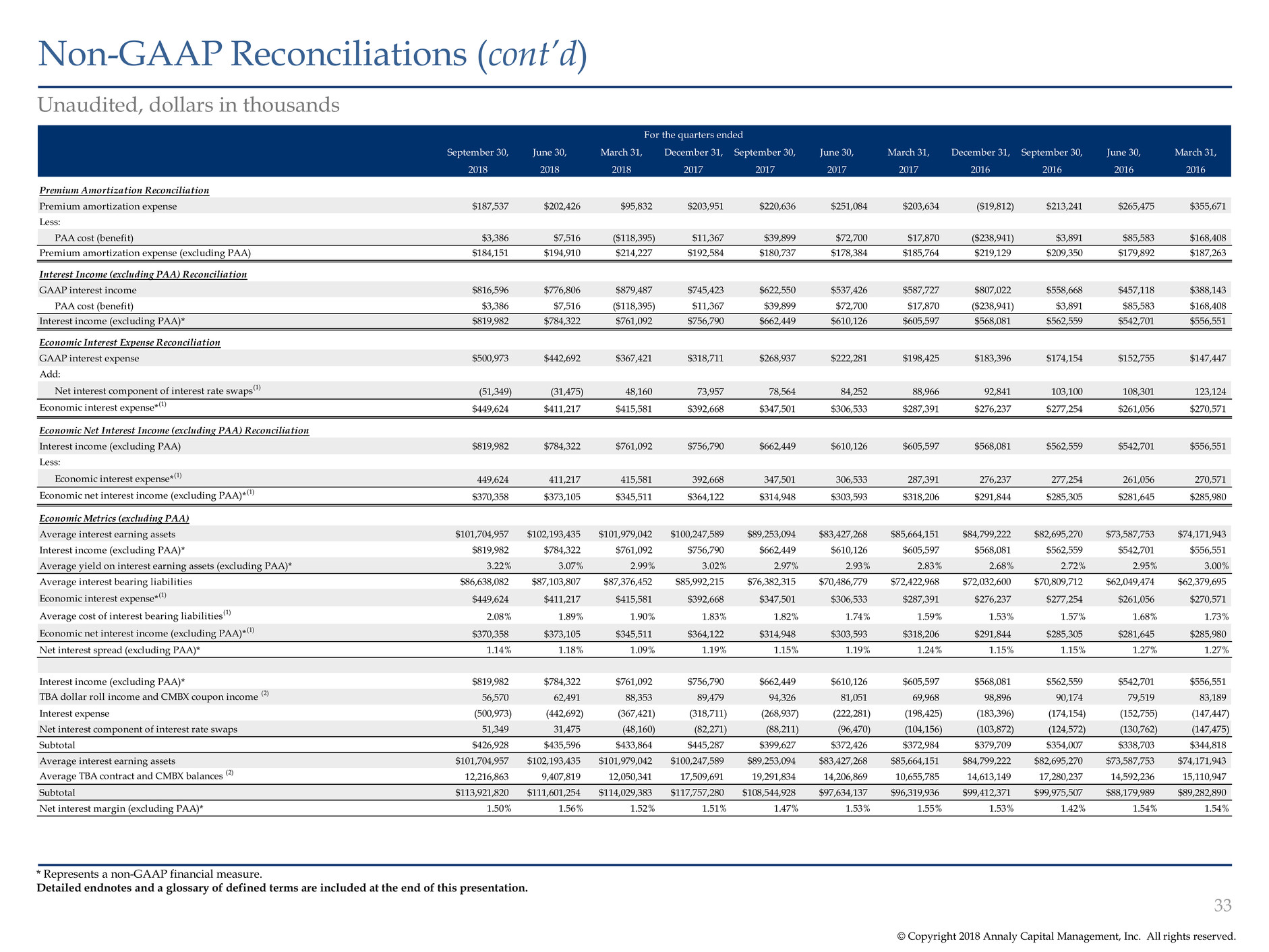

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Non-GAAP Reconciliations (cont’d) 33 * Represents a non-GAAP financial measure. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Unaudited, dollars in thousands For the quarters ended September 30, June 30, March 31, December 31, September 30, June 30, March 31, December 31, September 30, June 30, March 31, 2018 2018 2018 2017 2017 2017 2017 2016 2016 2016 2016 Premium Amortization Reconciliation Premium amortization expense $187,537 $202,426 $95,832 $203,951 $220,636 $251,084 $203,634 ($19,812) $213,241 $265,475 $355,671 Less: PAA cost (benefit) $3,386 $7,516 ($118,395) $11,367 $39,899 $72,700 $17,870 ($238,941) $3,891 $85,583 $168,408 Premium amortization expense (excluding PAA) $184,151 $194,910 $214,227 $192,584 $180,737 $178,384 $185,764 $219,129 $209,350 $179,892 $187,263 Interest Income (excluding PAA) Reconciliation GAAP interest income $816,596 $776,806 $879,487 $745,423 $622,550 $537,426 $587,727 $807,022 $558,668 $457,118 $388,143 PAA cost (benefit) $3,386 $7,516 ($118,395) $11,367 $39,899 $72,700 $17,870 ($238,941) $3,891 $85,583 $168,408 Interest income (excluding PAA)* $819,982 $784,322 $761,092 $756,790 $662,449 $610,126 $605,597 $568,081 $562,559 $542,701 $556,551 Economic Interest Expense Reconciliation GAAP interest expense $500,973 $442,692 $367,421 $318,711 $268,937 $222,281 $198,425 $183,396 $174,154 $152,755 $147,447 Add: Net interest component of interest rate swaps (1) (51,349) (31,475) 48,160 73,957 78,564 84,252 88,966 92,841 103,100 108,301 123,124 Economic interest expense* (1) $449,624 $411,217 $415,581 $392,668 $347,501 $306,533 $287,391 $276,237 $277,254 $261,056 $270,571 Economic Net Interest Income (excluding PAA) Reconciliation Interest income (excluding PAA) $819,982 $784,322 $761,092 $756,790 $662,449 $610,126 $605,597 $568,081 $562,559 $542,701 $556,551 Less: Economic interest expense* (1) 449,624 411,217 415,581 392,668 347,501 306,533 287,391 276,237 277,254 261,056 270,571 Economic net interest income (excluding PAA)* (1) $370,358 $373,105 $345,511 $364,122 $314,948 $303,593 $318,206 $291,844 $285,305 $281,645 $285,980 Economic Metrics (excluding PAA) Average interest earning assets $101,704,957 $102,193,435 $101,979,042 $100,247,589 $89,253,094 $83,427,268 $85,664,151 $84,799,222 $82,695,270 $73,587,753 $74,171,943 Interest income (excluding PAA)* $819,982 $784,322 $761,092 $756,790 $662,449 $610,126 $605,597 $568,081 $562,559 $542,701 $556,551 Average yield on interest earning assets (excluding PAA)* 3.22% 3.07% 2.99% 3.02% 2.97% 2.93% 2.83% 2.68% 2.72% 2.95% 3.00% Average interest bearing liabilities $86,638,082 $87,103,807 $87,376,452 $85,992,215 $76,382,315 $70,486,779 $72,422,968 $72,032,600 $70,809,712 $62,049,474 $62,379,695 Economic interest expense* (1) $449,624 $411,217 $415,581 $392,668 $347,501 $306,533 $287,391 $276,237 $277,254 $261,056 $270,571 Average cost of interest bearing liabilities (1) 2.08% 1.89% 1.90% 1.83% 1.82% 1.74% 1.59% 1.53% 1.57% 1.68% 1.73% Economic net interest income (excluding PAA)* (1) $370,358 $373,105 $345,511 $364,122 $314,948 $303,593 $318,206 $291,844 $285,305 $281,645 $285,980 Net interest spread (excluding PAA)* 1.14% 1.18% 1.09% 1.19% 1.15% 1.19% 1.24% 1.15% 1.15% 1.27% 1.27% Interest income (excluding PAA)* $819,982 $784,322 $761,092 $756,790 $662,449 $610,126 $605,597 $568,081 $562,559 $542,701 $556,551 TBA dollar roll income and CMBX coupon income (2) 56,570 62,491 88,353 89,479 94,326 81,051 69,968 98,896 90,174 79,519 83,189 Interest expense (500,973) (442,692) (367,421) (318,711) (268,937) (222,281) (198,425) (183,396) (174,154) (152,755) (147,447) Net nterest component of interest rate swaps 51,349 31,475 (48,160) (82,271) (88,211) (96,470) (104,156) (103,872) (124,572) (130,762) (147,475) Subtotal $426,928 $435,596 $433,864 $445,287 $399,627 $372,426 $372,984 $379,709 $354,007 $338,703 $344,818 Average interest earning assets $101,704,957 $102,193,435 $101,979,042 $100,247,589 $89,253,094 $83,427,268 $85,664,151 $84,799,222 $82,695,270 $73,587,753 $74,171,943 Average TBA contract and CMBX balances (2) 12,216,863 9,407,819 12,050,341 17,509,691 19,291,834 14,206,869 10,655,785 14,613,149 17,280,237 14,592,236 15,110,947 Subtotal $113,921,820 $111,601,254 $114,029,383 $117,757,280 $108,544,928 $97,634,137 $96,319,936 $99,412,371 $99,975,507 $88,179,989 $89,282,890 Net interest margin (excluding PAA)* 1.50% 1.56% 1.52% 1.51% 1.47% 1.53% 1.55% 1.53% 1.42% 1.54% 1.54%

Glossary and Endnotes

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Glossary 35 ACREG: Refers to Annaly Commercial Real Estate Group ADTV: Represents the average daily trading volume ($millions) for the trailing 3 months Agency Peers: Represents their respective sector within the BBREMTG Index* AMML: Refers to Annaly Middle Market Lending Group BBREMTG: Represents the Bloomberg Mortgage REIT Index* Beta: Represents Bloomberg’s ‘Overridable Adjusted Beta’ which estimates the degree to which a stock’s price will fluctuate based on a given movement in the representative market index, calculated over a two-year historical period as of the date indicated. S&P 500 is used as the relative index for the calculation Commercial Peers: Represents their respective sector within the BBREMTG Index* Consumer Staples: Represents the S5CONS Index* CRT: Refers to credit risk transfers Equity REITs: Represents the RMZ Index* FHLB: Refers to the Federal Home Loan Bank GSE: Refers to government sponsored enterprise Hybrid Peers: Represents their respective sector within the BBREMTG Index* MLPs: Represents the Alerian MLP Index* mREITs or mREIT Peers: Represents the BBREMTG Index* S&P 500: Represents the S&P 500 Index* Select Financials: Represents an average of companies in the S5FINL Index with dividend yields greater than 50 basis points higher than the S&P 500 dividend yield as of September 28, 2018 Utilities: Represents the Russell 3000 Utilities Index* Yield Sectors or Yield Sector Peers: Representative of Consumer Staples, Equity REITs, MLPs, Select Financials and Utilities *Represents constituents as of September 28, 2018.

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Endnotes 36 Page 4 1. Agency assets include to be announced (“TBA”) purchase contracts (market value) and mortgage servicing rights (“MSRs”). Residential Credit and ACREG assets include only the economic interest of consolidated variable interest entities (“VIEs”). Sum of business segment totals does not tie due to rounding. 2. Dedicated capital includes TBA purchase contracts, excludes non-portfolio related activity and varies from total stockholders’ equity. 3. Sector rank compares Annaly dedicated capital in each of its four investment groups as of September 30, 2018 (adjusted for P/B as of September 28, 2018) to the market capitalization of the companies in each respective comparative sector as of September 28, 2018. Comparative sectors used for Agency, ACREG and Residential Credit ranking are their respective sector within the BBREMTG Index as of September 28, 2018. Comparative sector used for Annaly AMML ranking is the S&P BDC Index. 4. Levered return assumptions are for illustrative purposes only and attempt to represent current market asset returns and financing terms for prospective investments of the same, or of a substantially similar, nature in each respective group. Page 5 1. Based on annualized, aggregate Q3 2018 dividend of $0.30 and a closing price of $10.23 on September 28, 2018. 2. Agency assets include TBA purchase contracts (market value) and MSRs. Residential Credit and ACREG assets include only the economic interest of consolidated VIEs. 3. Dedicated capital includes TBA purchase contracts, excludes non-portfolio related activity and varies from total stockholders’ equity. 4. “Unencumbered assets” are representative of Annaly’s excess liquidity and are defined as assets that have not been pledged or securitized (including cash and cash equivalents, Agency MBS, CRT, Non-Agency MBS, Residential mortgage loans, MSRs, reverse repo agreements, CRE debt and preferred equity and corporate debt). 5. Measures total notional balances of interest rate swaps, interest rate swaptions and futures relative to repurchase agreements, other secured financing and TBA notional outstanding; excludes MSRs and the effects of term financing, both of which serve to reduce interest rate risk. Additionally, the hedge ratio does not take into consideration differences in duration between assets and liabilities. 6. Includes GAAP interest expense and the net interest component of interest rate swaps. Page 7 1. Data shown since December 31, 2013, which marks the beginning of Annaly’s diversification efforts through September 28, 2018. 2. Represents Annaly's operating expense as a percentage of average equity compared to the BBREMTG Index as of June 30, 2018 annualized. Operating expense is defined as: (i) for internally-managed peers, the sum of compensation and benefits, G&A and other operating expenses, and (ii) for externally-managed peers, the sum of net management fees, compensation and benefits (if any), G&A and other operating expenses. 3. “Unencumbered assets” are representative of Annaly’s excess liquidity and are defined as assets that have not been pledged or securitized (including cash and cash equivalents, Agency MBS, CRT, Non-Agency MBS, Residential mortgage loans, MSRs, reverse repo agreements, CRE debt and preferred equity and corporate debt). 4. Includes Annaly’s $872mm acquisition of CreXus Investment Corp. (closed May 24, 2013), $1,498mm acquisition of Hatteras Financial Corp. (closed July 12, 2016) and $906mm acquisition of MTGE Investment Corp. (closed September 7, 2018). Page 8 1. Number of equity offerings does not include any distributions made pursuant to Annaly’s at- the-market (“ATM”) program of its common stock, which was entered into in January 2018. Offering proceeds are calculated before expenses. 2. Total return shown since December 31, 2015. Page 9 1. Reflects total balance sheet asset values. 2. Represents new options in the period. Page 10 1. Represents operating expense as a percentage of average equity as of June 30, 2018 annualized. For Annaly and mREIT Peers, operating expense is defined as: (i) for internally-managed peers, the sum of compensation and benefits, general and administrative expenses (“G&A”) and other operating expenses, and (ii) for externally-managed peers, the sum of net management fees, compensation and benefits (if any), G&A and other operating expenses. Excludes companies with negative equity or operating expenses as a percent of average equity in excess of 250%. 2. Represents the average of the Yield Sectors. 3. LTM pre-tax margin is calculated as pre-tax income divided by total revenue or total gross interest income for each company. Companies with negative pre-tax margins are excluded from the analysis. Page 11 1. Does not include synthetic financing for TBA contracts. 2. Reflects Annaly's 5-year FHLB financing, which sunsets in February 2021. 3. Excludes securitized debt of VIEs that are consolidated upon the Company's purchase of a controlling financial interest in the structure. Total does not include middle market loan syndications. 4. Includes securitization, CLOs and derivative structuring. Page 12 1. Represents total transaction value to target’s public shareholders. 2. Represents core earnings (ex-PAA), which is a non-GAAP financial measure; see Non-GAAP Reconciliations. Page 13 1. Refers to Annaly’s headquarters and any internal programs and initiatives performed at Annaly’s headquarters. This is not intended to capture any or all policies or procedures relating to Annaly’s management of assets in its portfolio. 2. Management refers to current executive management. 3. Annaly entered into a social impact investing joint venture with Capital Impact Partners (“CIP”) in November 2017, in which Annaly’s investment represents $20 million and CIP’s investment represents $5 million. 4. As permitted by the Equal Employment Opportunity Commission, diversity composition was obtained from self-identification and visual observation when employee declined to self- identify. Ethnically diverse represents all non-white ethnicities. 5. Representative of outreach during 2018 proxy season and shareholder base as of March 31, 2018. Shareholder data per Ipreo.

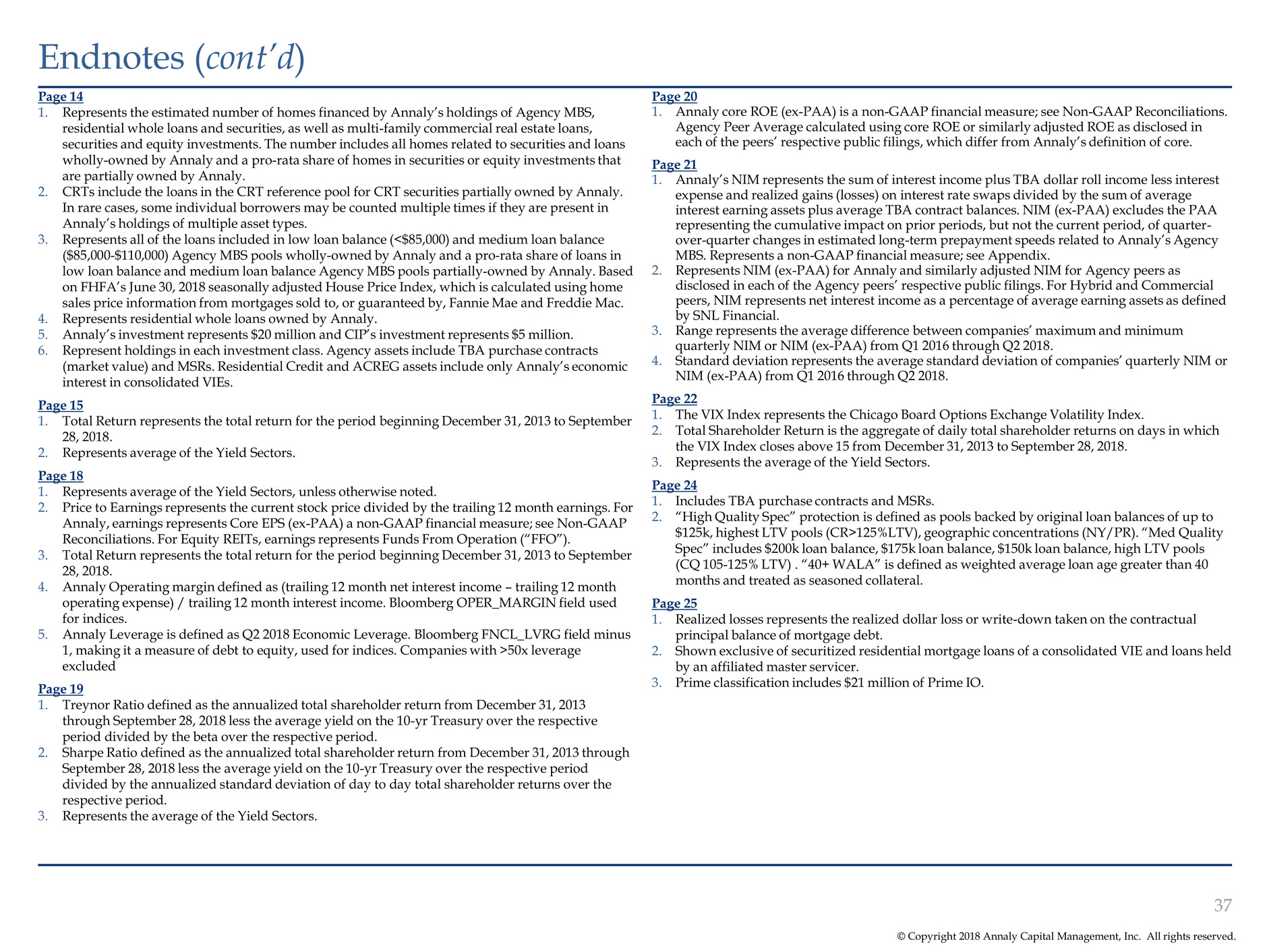

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Endnotes (cont’d) 37 Page 14 1. Represents the estimated number of homes financed by Annaly’s holdings of Agency MBS, residential whole loans and securities, as well as multi-family commercial real estate loans, securities and equity investments. The number includes all homes related to securities and loans wholly-owned by Annaly and a pro-rata share of homes in securities or equity investments that are partially owned by Annaly. 2. CRTs include the loans in the CRT reference pool for CRT securities partially owned by Annaly. In rare cases, some individual borrowers may be counted multiple times if they are present in Annaly’s holdings of multiple asset types. 3. Represents all of the loans included in low loan balance (<$85,000) and medium loan balance ($85,000-$110,000) Agency MBS pools wholly-owned by Annaly and a pro-rata share of loans in low loan balance and medium loan balance Agency MBS pools partially-owned by Annaly. Based on FHFA’s June 30, 2018 seasonally adjusted House Price Index, which is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. 4. Represents residential whole loans owned by Annaly. 5. Annaly’s investment represents $20 million and CIP’s investment represents $5 million. 6. Represent holdings in each investment class. Agency assets include TBA purchase contracts (market value) and MSRs. Residential Credit and ACREG assets include only Annaly’s economic interest in consolidated VIEs. Page 15 1. Total Return represents the total return for the period beginning December 31, 2013 to September 28, 2018. 2. Represents average of the Yield Sectors. Page 18 1. Represents average of the Yield Sectors, unless otherwise noted. 2. Price to Earnings represents the current stock price divided by the trailing 12 month earnings. For Annaly, earnings represents Core EPS (ex-PAA) a non-GAAP financial measure; see Non-GAAP Reconciliations. For Equity REITs, earnings represents Funds From Operation (“FFO”). 3. Total Return represents the total return for the period beginning December 31, 2013 to September 28, 2018. 4. Annaly Operating margin defined as (trailing 12 month net interest income – trailing 12 month operating expense) / trailing 12 month interest income. Bloomberg OPER_MARGIN field used for indices. 5. Annaly Leverage is defined as Q2 2018 Economic Leverage. Bloomberg FNCL_LVRG field minus 1, making it a measure of debt to equity, used for indices. Companies with >50x leverage excluded Page 19 1. Treynor Ratio defined as the annualized total shareholder return from December 31, 2013 through September 28, 2018 less the average yield on the 10-yr Treasury over the respective period divided by the beta over the respective period. 2. Sharpe Ratio defined as the annualized total shareholder return from December 31, 2013 through September 28, 2018 less the average yield on the 10-yr Treasury over the respective period divided by the annualized standard deviation of day to day total shareholder returns over the respective period. 3. Represents the average of the Yield Sectors. Page 20 1. Annaly core ROE (ex-PAA) is a non-GAAP financial measure; see Non-GAAP Reconciliations. Agency Peer Average calculated using core ROE or similarly adjusted ROE as disclosed in each of the peers’ respective public filings, which differ from Annaly’s definition of core. Page 21 1. Annaly’s NIM represents the sum of interest income plus TBA dollar roll income less interest expense and realized gains (losses) on interest rate swaps divided by the sum of average interest earning assets plus average TBA contract balances. NIM (ex-PAA) excludes the PAA representing the cumulative impact on prior periods, but not the current period, of quarter- over-quarter changes in estimated long-term prepayment speeds related to Annaly’s Agency MBS. Represents a non-GAAP financial measure; see Appendix. 2. Represents NIM (ex-PAA) for Annaly and similarly adjusted NIM for Agency peers as disclosed in each of the Agency peers’ respective public filings. For Hybrid and Commercial peers, NIM represents net interest income as a percentage of average earning assets as defined by SNL Financial. 3. Range represents the average difference between companies’ maximum and minimum quarterly NIM or NIM (ex-PAA) from Q1 2016 through Q2 2018. 4. Standard deviation represents the average standard deviation of companies’ quarterly NIM or NIM (ex-PAA) from Q1 2016 through Q2 2018. Page 22 1. The VIX Index represents the Chicago Board Options Exchange Volatility Index. 2. Total Shareholder Return is the aggregate of daily total shareholder returns on days in which the VIX Index closes above 15 from December 31, 2013 to September 28, 2018. 3. Represents the average of the Yield Sectors. Page 24 1. Includes TBA purchase contracts and MSRs. 2. “High Quality Spec” protection is defined as pools backed by original loan balances of up to $125k, highest LTV pools (CR>125%LTV), geographic concentrations (NY/PR). “Med Quality Spec” includes $200k loan balance, $175k loan balance, $150k loan balance, high LTV pools (CQ 105-125% LTV) . “40+ WALA” is defined as weighted average loan age greater than 40 months and treated as seasoned collateral. Page 25 1. Realized losses represents the realized dollar loss or write-down taken on the contractual principal balance of mortgage debt. 2. Shown exclusive of securitized residential mortgage loans of a consolidated VIE and loans held by an affiliated master servicer. 3. Prime classification includes $21 million of Prime IO.

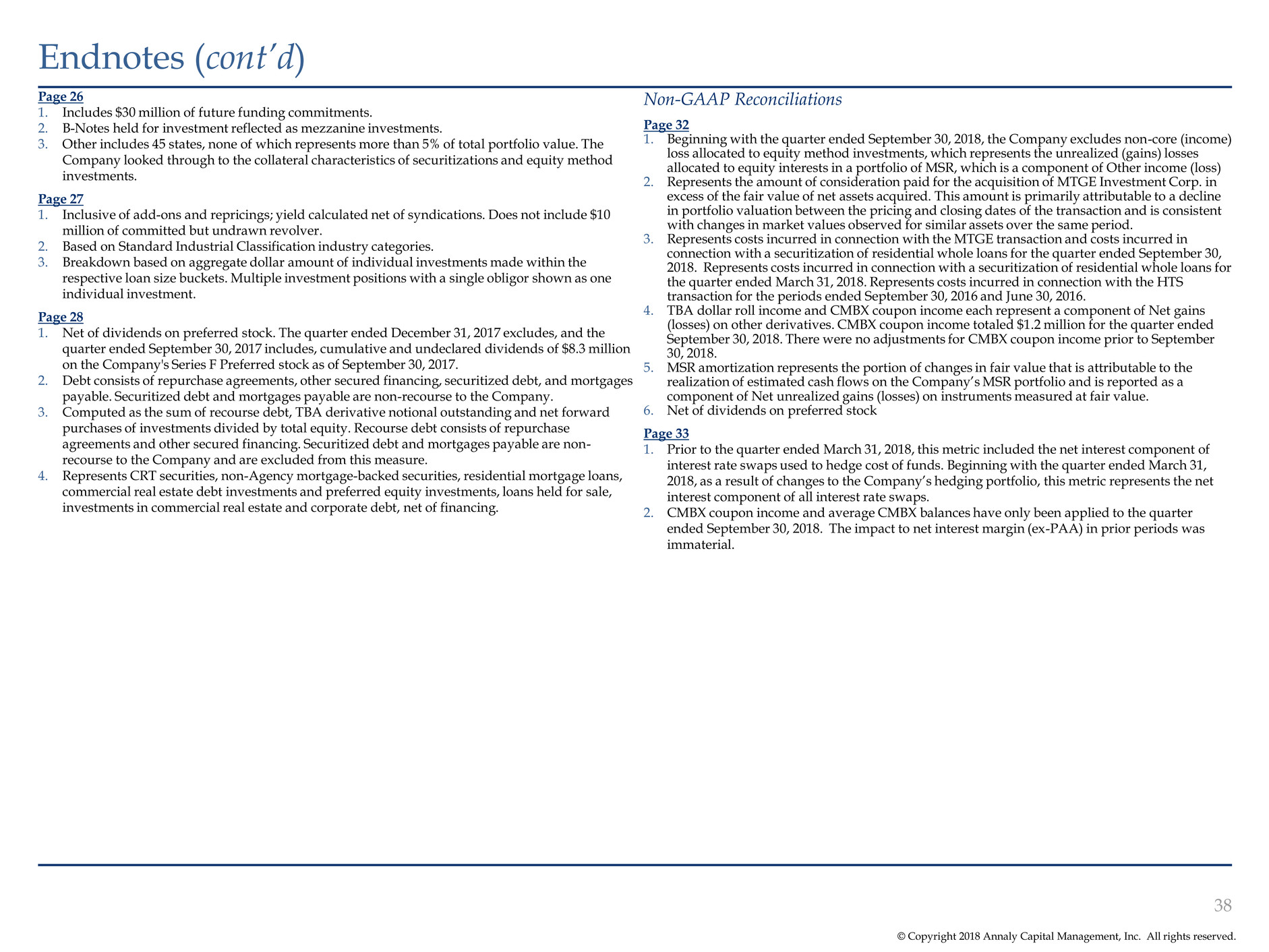

© Copyright 2018 Annaly Capital Management, Inc. All rights reserved. Endnotes (cont’d) 38 Page 26 1. Includes $30 million of future funding commitments. 2. B-Notes held for investment reflected as mezzanine investments. 3. Other includes 45 states, none of which represents more than 5% of total portfolio value. The Company looked through to the collateral characteristics of securitizations and equity method investments. Page 27 1. Inclusive of add-ons and repricings; yield calculated net of syndications. Does not include $10 million of committed but undrawn revolver. 2. Based on Standard Industrial Classification industry categories. 3. Breakdown based on aggregate dollar amount of individual investments made within the respective loan size buckets. Multiple investment positions with a single obligor shown as one individual investment. Page 28 1. Net of dividends on preferred stock. The quarter ended December 31, 2017 excludes, and the quarter ended September 30, 2017 includes, cumulative and undeclared dividends of $8.3 million on the Company's Series F Preferred stock as of September 30, 2017. 2. Debt consists of repurchase agreements, other secured financing, securitized debt, and mortgages payable. Securitized debt and mortgages payable are non-recourse to the Company. 3. Computed as the sum of recourse debt, TBA derivative notional outstanding and net forward purchases of investments divided by total equity. Recourse debt consists of repurchase agreements and other secured financing. Securitized debt and mortgages payable are non- recourse to the Company and are excluded from this measure. 4. Represents CRT securities, non-Agency mortgage-backed securities, residential mortgage loans, commercial real estate debt investments and preferred equity investments, loans held for sale, investments in commercial real estate and corporate debt, net of financing. Non-GAAP Reconciliations Page 32 1. Beginning with the quarter ended September 30, 2018, the Company excludes non-core (income) loss allocated to equity method investments, which represents the unrealized (gains) losses allocated to equity interests in a portfolio of MSR, which is a component of Other income (loss) 2. Represents the amount of consideration paid for the acquisition of MTGE Investment Corp. in excess of the fair value of net assets acquired. This amount is primarily attributable to a decline in portfolio valuation between the pricing and closing dates of the transaction and is consistent with changes in market values observed for similar assets over the same period. 3. Represents costs incurred in connection with the MTGE transaction and costs incurred in connection with a securitization of residential whole loans for the quarter ended September 30, 2018. Represents costs incurred in connection with a securitization of residential whole loans for the quarter ended March 31, 2018. Represents costs incurred in connection with the HTS transaction for the periods ended September 30, 2016 and June 30, 2016. 4. TBA dollar roll income and CMBX coupon income each represent a component of Net gains (losses) on other derivatives. CMBX coupon income totaled $1.2 million for the quarter ended September 30, 2018. There were no adjustments for CMBX coupon income prior to September 30, 2018. 5. MSR amortization represents the portion of changes in fair value that is attributable to the realization of estimated cash flows on the Company’s MSR portfolio and is reported as a component of Net unrealized gains (losses) on instruments measured at fair value. 6. Net of dividends on preferred stock Page 33 1. Prior to the quarter ended March 31, 2018, this metric included the net interest component of interest rate swaps used to hedge cost of funds. Beginning with the quarter ended March 31, 2018, as a result of changes to the Company’s hedging portfolio, this metric represents the net interest component of all interest rate swaps. 2. CMBX coupon income and average CMBX balances have only been applied to the quarter ended September 30, 2018. The impact to net interest margin (ex-PAA) in prior periods was immaterial.