Fourth Quarter 2018 Investor Presentation February 13, 2019

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Safe Harbor Notice Forward-Looking Statements This presentation, other written or oral communications, and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions (some of which are beyond our control) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “anticipate,” “continue,” or similar terms or variations on those terms or the negative of those terms. Actual results could differ materially from those set forth in forward-looking statements due to a variety of factors, including, but not limited to, changes in interest rates; changes in the yield curve; changes in prepayment rates; the availability of mortgage-backed securities (“MBS”) and other securities for purchase; the availability of financing and, if available, the terms of any financing; changes in the market value of our assets; changes in business conditions and the general economy; our ability to grow our commercial real estate business; our ability to grow our residential credit business; our ability to grow our middle market lending business; credit risks related to our investments in credit risk transfer securities, residential mortgage-backed securities and related residential mortgage credit assets, commercial real estate assets and corporate debt; risks related to investments in mortgage servicing rights; our ability to consummate any contemplated investment opportunities; changes in government regulations or policy affecting our business; our ability to maintain our qualification as a REIT for U.S. federal income tax purposes; and our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended. For a discussion of the risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. We do not undertake, and specifically disclaim any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. We routinely post important information for investors on our website, www.annaly.com. We intend to use this webpage as a means of disclosing material, non-public information, for complying with our disclosure obligations under Regulation FD and to post and update investor presentations and similar materials on a regular basis. Annaly encourages investors, analysts, the media and others interested in Annaly to monitor the Investors section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations, webcasts and other information we post from time to time on our website. To sign-up for email-notifications, please visit the “Email Alerts” section of our website, www.annaly.com, under the “Investors” section and enter the required information to enable notifications. The information contained on, or that may be accessed through, our webpage is not incorporated by reference into, and is not a part of, this document. Past performance is no guarantee of future results. There is no guarantee that any investment strategy referenced herein will work under all market conditions. Prior to making any investment decision, you should evaluate your ability to invest for the long-term, especially during periods of downturns in the market. You alone assume the responsibility of evaluating the merits and risks associated with any potential investment or investment strategy referenced herein. To the extent that this material contains reference to any past specific investment recommendations or strategies which were or would have been profitable to any person, it should not be assumed that recommendations made in the future will be profitable or will equal the performance of such past investment recommendations or strategies. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures, including core earnings metrics, which are presented both inclusive and exclusive of the premium amortization adjustment (“PAA”). We believe the non-GAAP financial measures are useful for management, investors, analysts, and other interested parties in evaluating our performance but should not be viewed in isolation and are not a substitute for financial measures computed in accordance with U.S. generally accepted accounting principles (“GAAP”). In addition, we may calculate non-GAAP metrics, which include core earnings, and the PAA, differently than our peers making comparative analysis difficult. Please see the section entitled “Non-GAAP Reconciliations” in the attached Appendix for a reconciliation to the most directly comparable GAAP financial measures. 2

Overview

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Annaly is a Leading Diversified Capital Manager 4 Source: Bloomberg and Company filings. Market data as of January 31, 2019. Financial data as of December 31, 2018. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. The Annaly Middle Market Lending Group provides financing to private equity backed middle market businesses across the capital structure The Annaly Commercial Real Estate Group originates and invests in commercial mortgage loans, securities and other commercial real estate debt and equity investments The Annaly Residential Credit Group invests in Non- Agency residential mortgage assets within the securitized product and whole loan markets The Annaly Agency Group invests in Agency MBS collateralized by residential mortgages which are guaranteed by Fannie Mae, Freddie Mac or Ginnie Mae Assets(1) $105.3bn Capital(2) $9.3bn Sector Rank(3) #1/5 Strategy Countercyclical / Defensive Levered Returns(4) 10% – 12% Assets(1) $3.3bn Capital(2) $1.3bn Sector Rank(3) #7/17 Strategy Cyclical / Growth Levered Returns(4) 9% – 12% Assets(1) $2.5bn Capital(2) $0.9bn Sector Rank(3) #5/12 Strategy Cyclical / Growth Levered Returns(4) 9% – 12% Assets $1.9bn Capital(2) $1.4bn Sector Rank(3) #7/44 Strategy Non-Cyclical / Defensive Levered Returns(4) 10% – 13% Represents credit business Assets: $113.0bn(1) Market Cap: $14.6bn

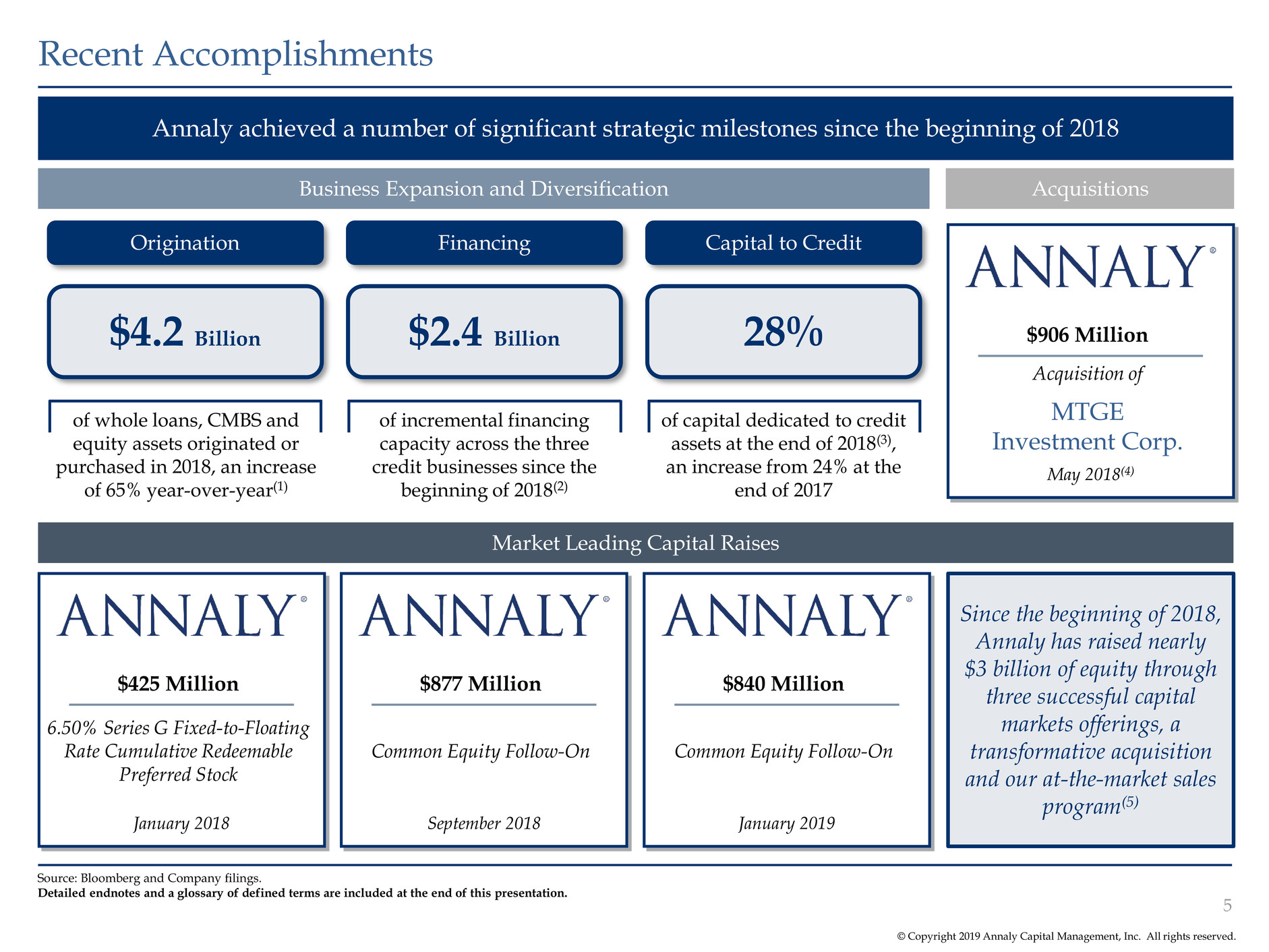

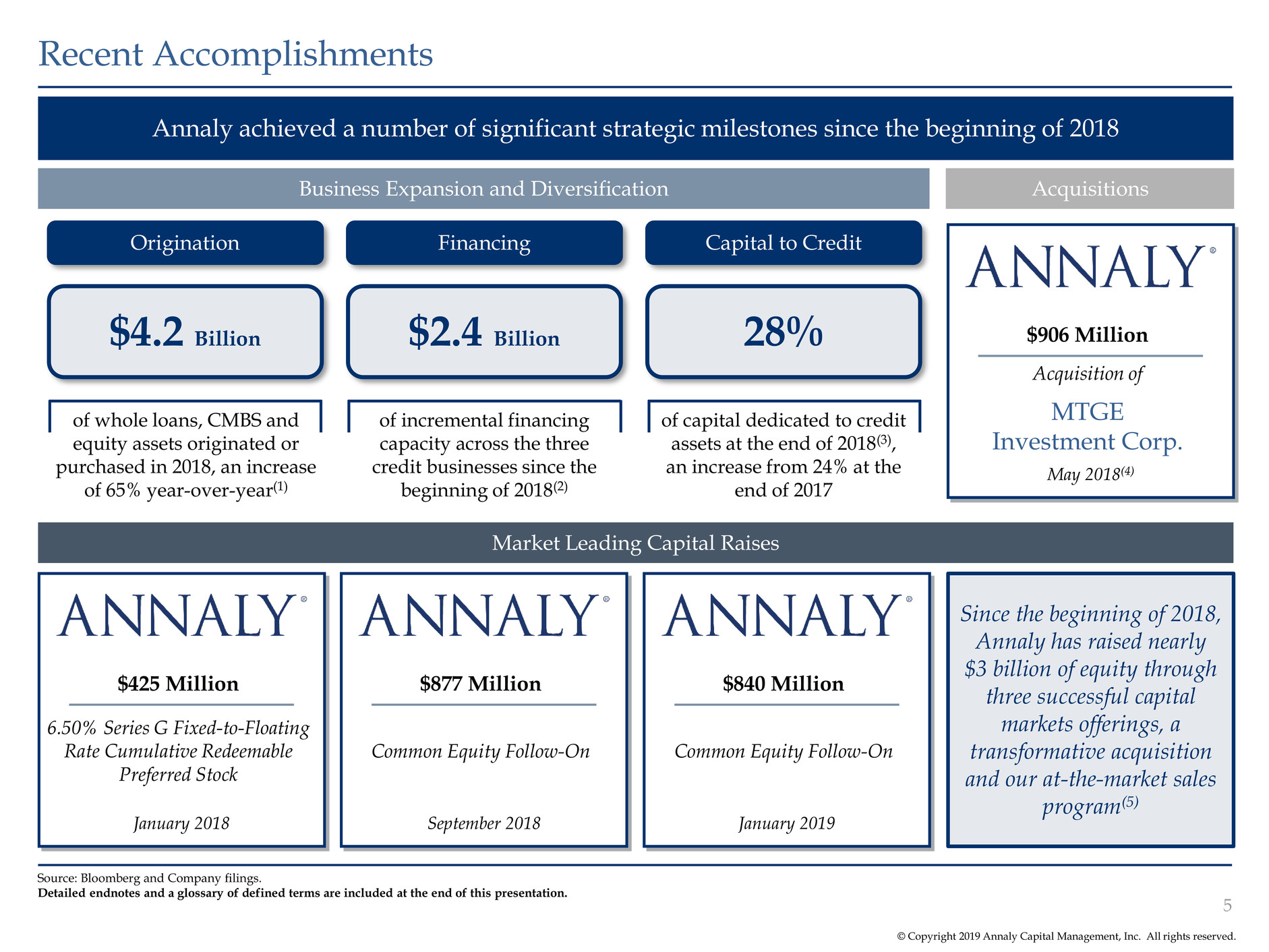

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Annaly achieved a number of significant strategic milestones since the beginning of 2018 Recent Accomplishments 5 Source: Bloomberg and Company filings. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. AcquisitionsBusiness Expansion and Diversification of whole loans, CMBS and equity assets originated or purchased in 2018, an increase of 65% year-over-year(1) of incremental financing capacity across the three credit businesses since the beginning of 2018(2) May 2018(4) $906 Million Acquisition of MTGE Investment Corp. $4.2 Billion $2.4 Billion of capital dedicated to credit assets at the end of 2018(3), an increase from 24% at the end of 2017 28% Origination Financing Capital to Credit Market Leading Capital Raises January 2018 $425 Million 6.50% Series G Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock September 2018 $877 Million Common Equity Follow-On January 2019 $840 Million Common Equity Follow-On Since the beginning of 2018, Annaly has raised nearly $3 billion of equity through three successful capital markets offerings, a transformative acquisition and our at-the-market sales program(5)

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Recent initiatives and acknowledgements demonstrate Annaly’s continued focus on Corporate Responsibility Recent Corporate Responsibility Enhancements 6 Note: For more information and to review the complete Press Releases referenced above, please visit www.annaly.com/investors. Corporate Governance Corporate Governance Enhancements Related to Board Declassification and Refreshment December 13, 2018 “We believe that continually refreshing the framework of our governance practices and oversight ensures fairness and transparency and will contribute to increased value to our shareholders over the long term…enhancing our Board refreshment policy increases the accountability of our Board, and reflects management’s and the Board’s efforts to proactively respond to the input of our global investor base and address important initiatives relating to the best practices of corporate governance.” – Kevin Keyes Chairman, CEO & President Responsible Investments “We are excited to announce our second social impact venture with Capital Impact Partners. Our commitment is aimed at improving economic opportunity while helping to preserve and protect affordable housing and foster education in Washington, D.C…Housing and educational opportunity are fundamental to the economic health of individuals and communities. We are proud of this Venture and look forward to continuing to deliver long- term benefits and diversified returns to our shareholders through our social impact investment strategies.” – Kevin Keyes Chairman, CEO & President & Announce Launch of Second Social Impact Investing Joint Venture January 16, 2019 Gender Diversity Recognized in Bloomberg Gender-Equality Index for Second Consecutive Year January 16, 2019 “Annaly is honored to again be recognized in the Bloomberg Gender- Equality Index for our commitment to balanced representation across our Firm…Diversity and inclusion continue to be core values at Annaly, reflected in our culture, policies and practices, and we know that all dimensions of diversity enhance our overall performance, creating incremental value for our shareholders. This recognition…is further acknowledgement of the broad efforts that Annaly continues to make across our Environmental, Social and Governance practices.” – Kevin Keyes Chairman, CEO & President Expands Board with Election of Kathy Hopinkah Hannan February 13, 2019 “We are excited to welcome Kathy to our Board of Directors and look forward to benefiting from her significant experience in tax and accounting, financial reporting and controls, Board effectiveness and corporate governance…Kathy is a proven thought leader with a track record of success and valued financial, governance and corporate advisory experience that will be a tremendous benefit to Annaly’s Management and shareholders. In addition, Kathy’s leadership on topics of gender equality, ethics and mentorship align with Annaly’s broader ESG initiatives.” – Kevin Keyes Chairman, CEO & President

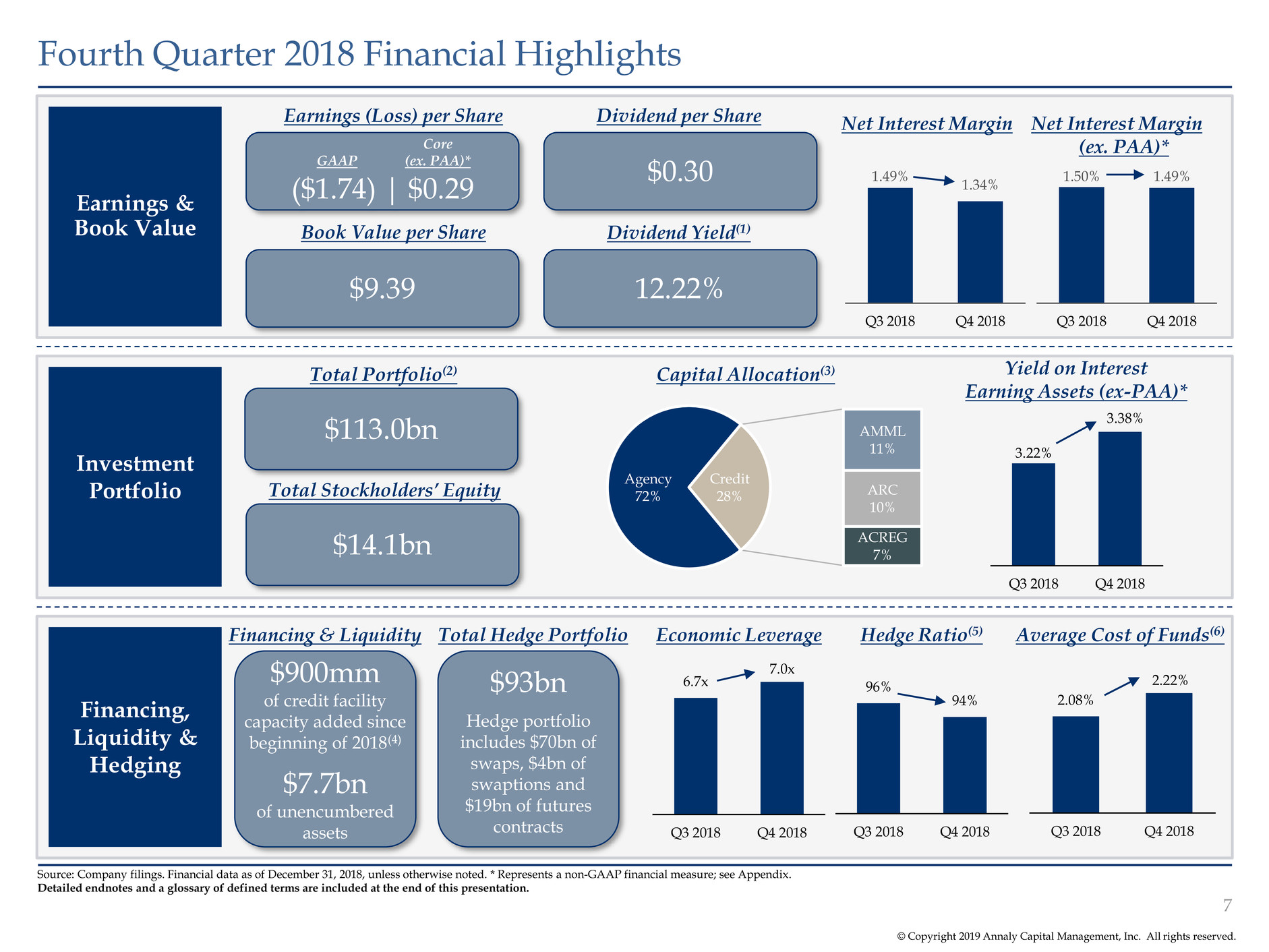

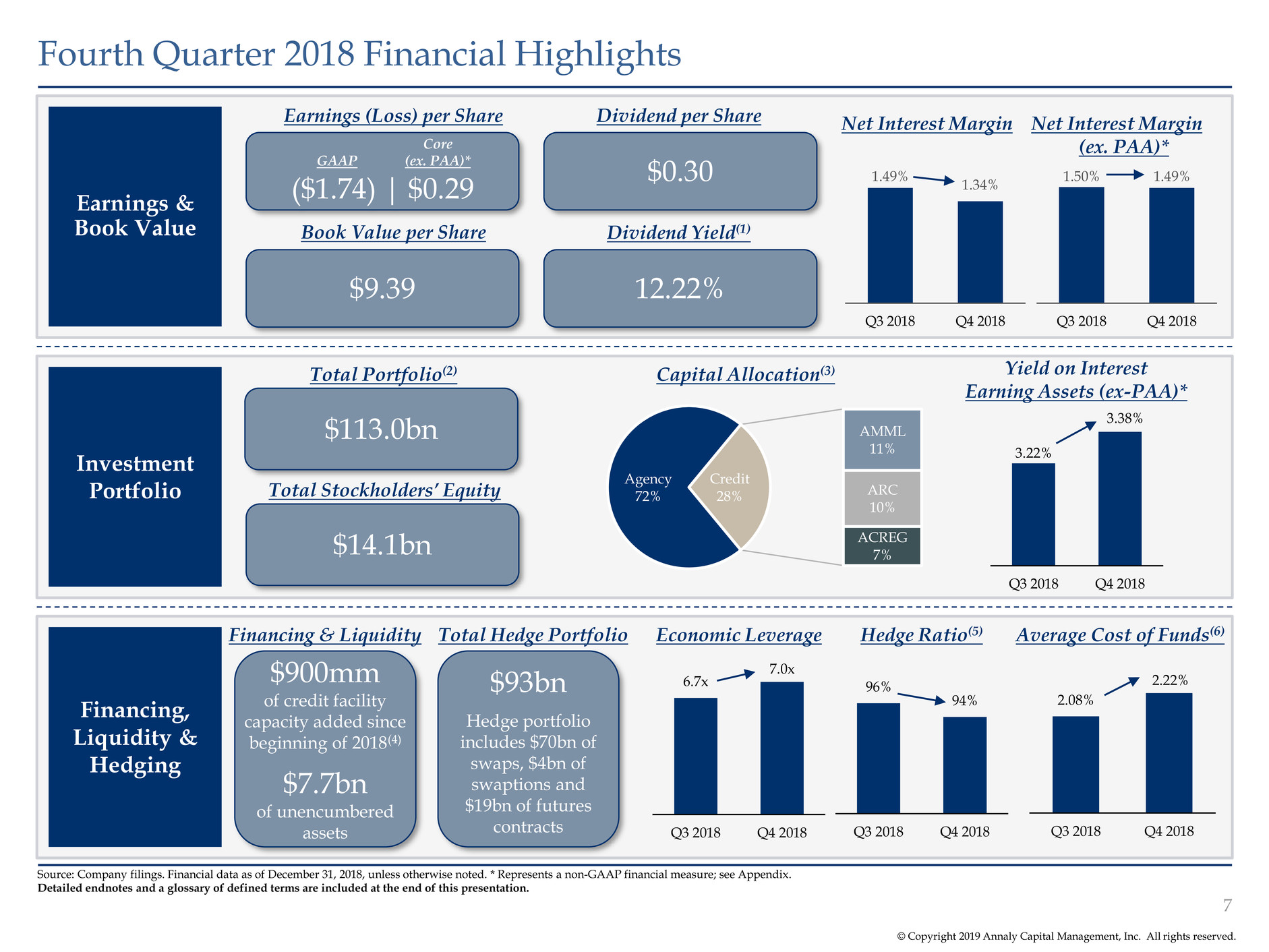

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. 2.08% 2.22% Q3 2018 Q4 2018 96% 94% Q3 2018 Q4 2018 Fourth Quarter 2018 Financial Highlights 7 Earnings & Book Value Investment Portfolio Financing, Liquidity & Hedging Earnings (Loss) per Share Dividend per Share Net Interest Margin (ex. PAA)* Book Value per Share ($1.74) | $0.29 $0.30 $9.39 Capital Allocation(3) Dividend Yield(1) 12.22% Core (ex. PAA)*GAAP Financing & Liquidity Average Cost of Funds(6)Economic Leverage $900mm of credit facility capacity added since beginning of 2018(4) $7.7bn of unencumbered assets Hedge Ratio(5) $113.0bn Total Portfolio(2) $14.1bn Total Stockholders’ Equity Yield on Interest Earning Assets (ex-PAA)* Source: Company filings. Financial data as of December 31, 2018, unless otherwise noted. * Represents a non-GAAP financial measure; see Appendix. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Total Hedge Portfolio $93bn Hedge portfolio includes $70bn of swaps, $4bn of swaptions and $19bn of futures contracts 6.7x 7.0x Q3 2018 Q4 2018 3.22% 3.38% Q3 2018 Q4 2018 Net Interest Margin Agency 72% AMML 11% ARC 10% ACREG 7% Credit 28% 1.49% 1.34% Q3 2018 Q4 2018 1.50% 1.49% Q3 2018 Q4 2018

Investment Highlights

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. The diversification, scale and liquidity of Annaly’s established investment platform provide a unique opportunity in today’s markets Annaly Advantages 9 Source: Bloomberg, SNL Financial and Company filings. Note: Market data as of January 31, 2019. Financial data as of December 31, 2018 unless otherwise noted. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Size & Scale Diversification Efficiency of the Model Liquidity & Financing Disciplined Consolidator ESG Focus Outperformance ~28x the market capitalization of the median mREIT 37 available investment options is nearly 3x more than Annaly had in 2013(1) and over 4x more than the current mREIT average Annaly operates at significantly lower expense levels than other Yield Sectors; 2x more efficient than mREIT average(2) Annaly utilizes a multitude of funding sources and has $7.7bn of unencumbered assets 3 transformational acquisitions, with combined deal value of ~$3.3bn(3) 3 new Independent Directors added since the beginning of 2018; Adopted Declassified Board structure(4); Board Refreshment Policy; 2nd Social Impact Venture launched Annaly’s total return of 83% since diversification strategy began(1) is 1.3x higher than the S&P 500 and 2.3x higher than Yield Sectors

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. – $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 8 9 10 11 12 13 14 15 Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Feb-17 May-17 Aug-17 Nov-17 Feb-18 Apr-18 Jul-18 Oct-18 Jan-19 Since January 2016, Annaly has grown its market cap by $5.7 billion, or 64%, and declared over $4.2 billion in dividends to shareholders amidst a market backdrop where the Fed has raised rates 8 times and the 2s-10s curve has flattened by 86% Annaly Advantages | Size & Scale Drive Performance Even in Challenging Markets 10 Source: Bloomberg and Company filings. Market data shown from December 31, 2015 to January 31, 2019. Note: Cumulative dividends reflects common and preferred dividends. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Market Cap Cumulative Dividends Declared(2)2s-10s Federal Funds Rate(3) 121.8 bps $8.9bn $4.2bn 0.25%-0.50% 0.75%-1.00% 1.00%-1.25% 1.75%-2.00% 2.00%-2.25% 2.25%-2.50% 0.50%-0.75% 1.25%-1.50% 1.50%-1.75% 17.0 bps $14.6bn 55% $14.6bn Total Return(1) Market Cap January 31, 2019

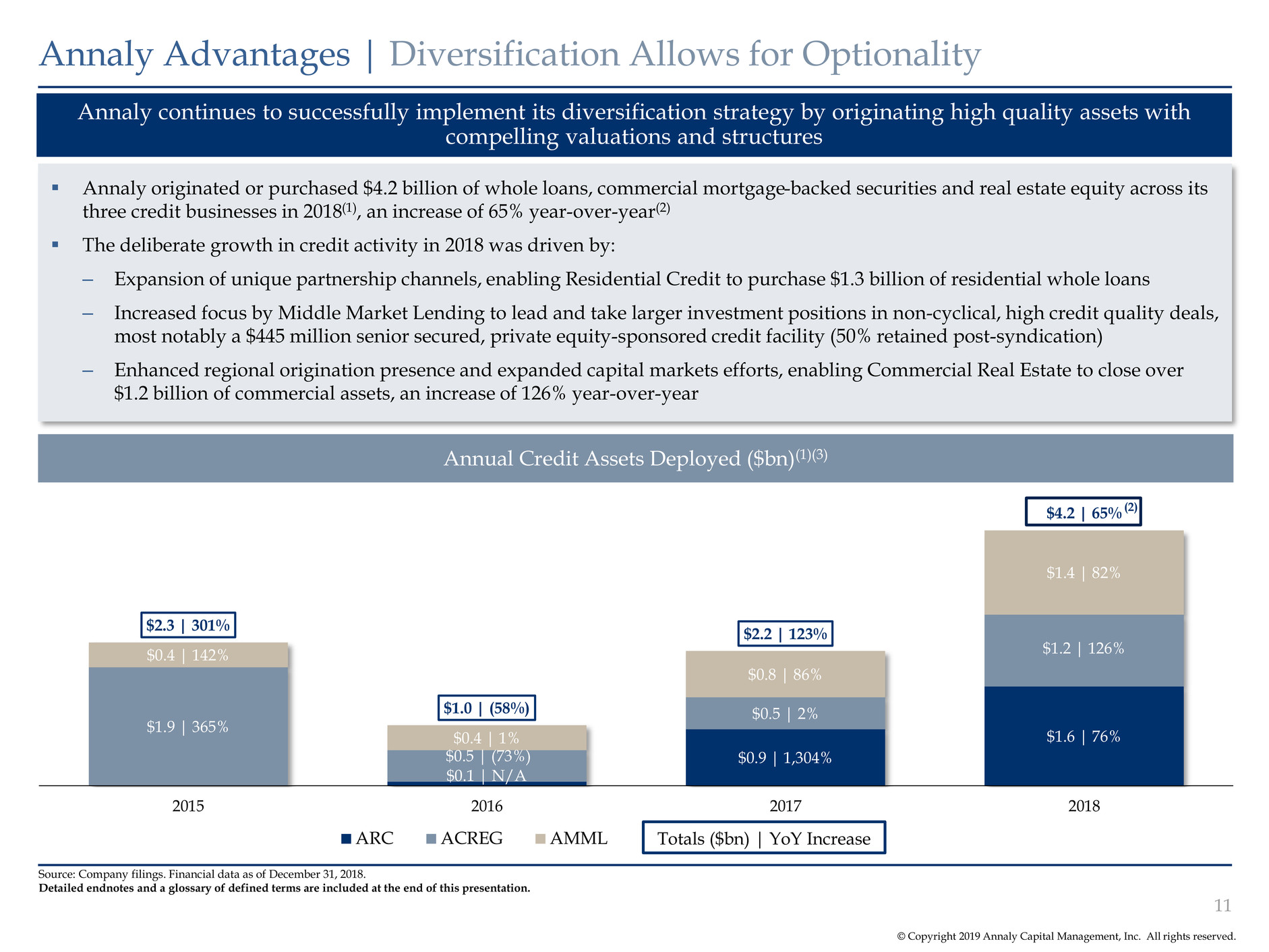

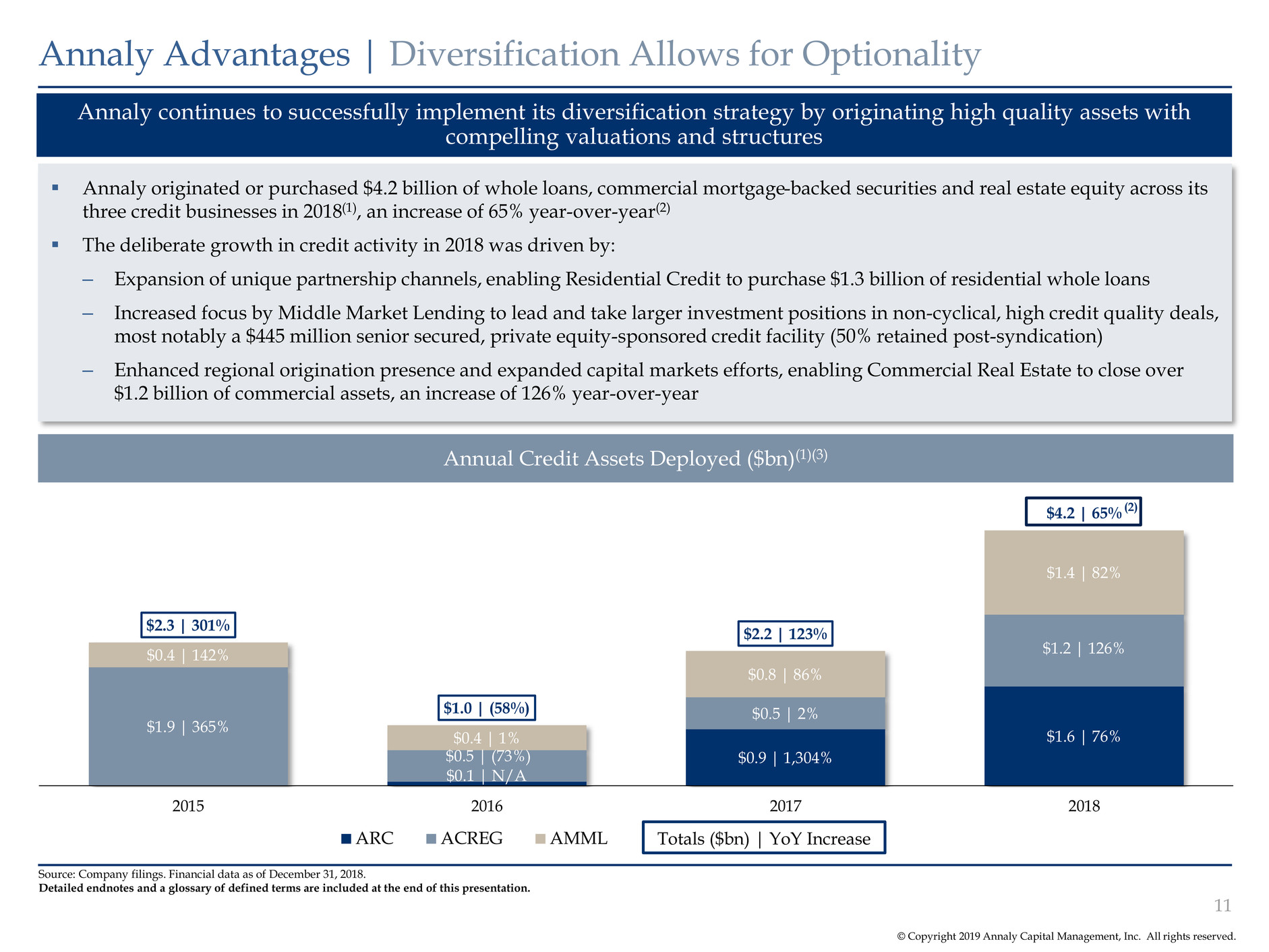

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. $0.1 | N/A $0.9 | 1,304% $1.6 | 76% $1.9 | 365% $0.5 | (73%) $0.5 | 2% $1.2 | 126%$0.4 | 142% $0.4 | 1% $0.8 | 86% $1.4 | 82% $2.3 | 301% $1.0 | (58%) $2.2 | 123% $4.2 | 65% 2015 2016 2017 2018 ARC ACREG AMML Annaly Advantages | Diversification Allows for Optionality 11 Annaly continues to successfully implement its diversification strategy by originating high quality assets with compelling valuations and structures Source: Company filings. Financial data as of December 31, 2018. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Annaly originated or purchased $4.2 billion of whole loans, commercial mortgage-backed securities and real estate equity across its three credit businesses in 2018(1), an increase of 65% year-over-year(2) The deliberate growth in credit activity in 2018 was driven by: – Expansion of unique partnership channels, enabling Residential Credit to purchase $1.3 billion of residential whole loans – Increased focus by Middle Market Lending to lead and take larger investment positions in non-cyclical, high credit quality deals, most notably a $445 million senior secured, private equity-sponsored credit facility (50% retained post-syndication) – Enhanced regional origination presence and expanded capital markets efforts, enabling Commercial Real Estate to close over $1.2 billion of commercial assets, an increase of 126% year-over-year Annual Credit Assets Deployed ($bn)(1)(3) Totals ($bn) | YoY Increase (2)

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. 53.9% 84.8% 50.1% 27.4% 12.0% 6.2% 3.6% 1.8% S&P 500 Consumer Staples Utilities Select Financials MLPs Equity REITs mREIT Peers NLY Yield Sectors(2): 36.1% 20.7% 17.6% 14.5% 27.6% 16.5% 30.1% 47.9% 61.2% S&P 500 Consumer Staples Utilities Select Financials MLPs Equity REITs mREIT Peers NLY Yield Sectors(2): 21.3% Annaly continues to further scale its diversified platform while operating more efficiently than Yield Sectors and mREIT peers OpEx as % of Average Equity(1) Annaly Advantages | Efficiency of Annaly’s Model Helps Drive Performance LTM Pre-Tax Margin(3) 12 Source: Bloomberg and Company filings. Financial data as of September 30, 2018. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Robust Margin Structure: Annaly’s high LTM pre-tax margin demonstrates the efficiency of its model Efficiency: More efficient than the S&P 500, Yield Sectors and mREIT peers by 30x, 20x and 2x, respectively

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Annaly’s diversified financing sources and liquidity provide the Company with unique competitive advantages Annaly Advantages | Diversified Financing Enhances Liquidity 13 Source: Company filings. Financial data as of December 31, 2018. Note: Diagram is not representative of Annaly’s entire list of financing options. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Achieved financing diversification through four residential whole loan securitizations for an aggregate $1.5 billion since the beginning of 2018(1) Expanded direct repo relationships with key counterparties $3.6 billion line with FHLB(2) provides attractive terms Added $900 million of credit financing capacity through three new facilities and upsizing of existing facilities since the beginning of 2018(3) Remain ~75% less levered across our credit businesses than peers(4) Total Capitalization Financing Options Common Equity $12.3bn Preferred Equity $1.8bn Secured Financing(6) $2.6bn FHLB(2) $3.6bn Agency, Non-Agency & CMBS Repo $80.4bn 12/31/2018: $100.7bn(5) Available Financing Options Agency Residential Credit Commercial Real Estate Middle Market Lending In-House Broker-Dealer Street Repo Direct Repo FHLB Credit Facilities / Warehouse Financing Non-Recourse Term Financing(7) Syndication Mortgage Financing Preferred Equity Common Equity

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. 0.84x 0.82x 0.98x 0.92x 0.91x 0.94x 1.19x 1.04x Agency Peers Hybrid Peers Commercial Peers mREIT Total 4/8/2016 1/31/2019 Since Annaly announced the acquisition of Hatteras Financial Corp. in April 2016, the number of mREITs has decreased by 23% while the sector market capitalization has grown ~$19 billion(1), or 41%, and P/TBV multiples expanded by 13% Annaly Advantages | Proven Track Record as a Disciplined Consolidator 14 Source: Bloomberg and company filings as of September 30, 2018. Market data as of January 31, 2019. Note: Excludes commercial mREITs SACH and RASF as SACH was not publicly traded in April 2016 and RASF currently has negative common equity. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Price to Tangible Book Value (“P/TBV”) Multiple Expansion (April 2016 vs. January 2019) Annaly has announced two acquisitions since April 2016, representing 20% of mREIT M&A activity(2) Number of companies acquired within each mREIT sector since April 2016(3) 3 1 6 10 MTGE Investment Corp.

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Annaly takes into account Environmental, Social and Governance factors that contribute to our ability to drive positive impacts and deliver attractive risk-adjusted returns over the long term Annaly Advantages | ESG Focus Embedded in Annaly’s Culture 15 Annaly promotes practices at our corporate headquarters that contribute to environmental sustainability Environmental Social Governance Our people are our greatest asset We are committed to a culture of ownership, inclusion and excellence that promotes our employees’ engagement, development and full potential Our investments finance housing across the country and support the vitality of local communities and the economy Annaly is committed to maintaining robust governance practices that benefit the long- term interests of our shareholders Internal campaign to raise awareness and engagement with our employees regarding sustainability and use of resources Initiated an extensive energy audit to more thoroughly track and monitor our impact and energy use Invested nearly $430 million in environmentally friendly buildings and businesses(1) Inclusion in 2018 and 2019 Bloomberg Gender-Equality Index 40% of Managing Director promotions and 50% of additions to Annaly’s Operating Committee since 2015 were women Expanded parental leave and dependent support programs Since 2015, we have delivered 10 different learning and development programs that are available to 100% of our employees Two social impact JVs totaling $50 million of commitments with Capital Impact Partners(2) ~750,000 homes financed by Annaly for Americans and their families(3) Added three new Independent Board members since 2018: 83% of the Board is independent; 42% of the Board are women(4), which compares to 25% on average for the S&P 500(5) Enhanced disclosure in 2018 proxy; ~94% approval on Say-on-Pay Adopted Board Refreshment policy requiring that an Independent Director may not stand for re-election following the earlier of the Director’s 12th anniversary of service or 73rd birthday Amended bylaws to declassify the Board of Directors beginning at the annual meeting in 2019(6) Principles Recent Initiatives Note: Company statistics as of December 31, 2018, unless otherwise noted. Detailed endnotes and a glossary of defined terms are included at the end of this presentation.

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. 83% 68% 62% 63% 52% 42% 43% (23%) Total Return(1) Annaly Advantages | Outperformance and Relative Valuation Source: Bloomberg, Company Filings as of September 30, 2018. Market data as of January 31, 2019. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Annaly’s low beta and strong performance have resulted in outsized risk-adjusted returns since the beginning of 2014 Yield Sectors(2): 36% BetaTreynor Ratio(3): Performance vs. Beta 19.6 12.9 7.6 10.2 9.2 6.4 5.4 (7.4) Yield Sectors(2): 4.8 0.52 0.65 1.00 0.75 0.68 0.76 1.11 0.99 Yield Sectors(2): 0.86 16

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Annaly is positioned to capitalize on industry and macro trends Annaly’s Opportunity 17 Industry / Macro Factors Fed Exit GSE Risk Sharing Banks Outsourcing Credit Private Equity Needs Partners Agency Residential Credit Commercial Real Estate Middle Market Lending Annaly’s Business Annaly Positioning Provides Permanent Capital Solution Efficient Shared Capital Model Low Beta as Volatility Increases High Margin Platform Stable and Diversified Cash Flows Consolidator of Smaller, Less Efficient Platforms

Business Update

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. High Quality Spec 34% Med Quality Spec 33% 40+ WALA 17% Generic 16% Agency | Portfolio Summary 19 Note: Data as of December 31, 2018. Percentages based on fair market value and may not sum to 100% due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Annaly Agency Portfolio: $105.3 billion in assets at the end of Q4 2018, a decrease of 2% from Q4 2017 The portfolio mix was comprised of over 90% 30-year fixed rate securities, as we believe these offer the most attractive risk-adjusted returns in the Agency MBS market – Steadily shifted the portfolio towards higher coupons in Q4 2018 Levered returns improved as a result of runoff and turnover at more attractive spreads – Diversified into Agency CMBS, which were attractive relative to the single-family sector for much of the year ~84% of the portfolio was positioned in securities with attractive convexity profiles at the end of Q4 2018 Total Dedicated Capital: $9.3 billion(1) Asset Type(1) Pass Through Coupon Type Portfolio Quality(2) 30Yr+: 92% 15 & 20Yr: 8% <=3.0% 2% 3.5% 24% 4.0% 43% >=4.5% 23% <=3.0% 4% 3.5% 2% >=4.0% 2% ARM/HECM 5% DUS 2% IO/IIO/CMO/ MSR 1% 15yr 5% 20yr 3% 30yr 84%

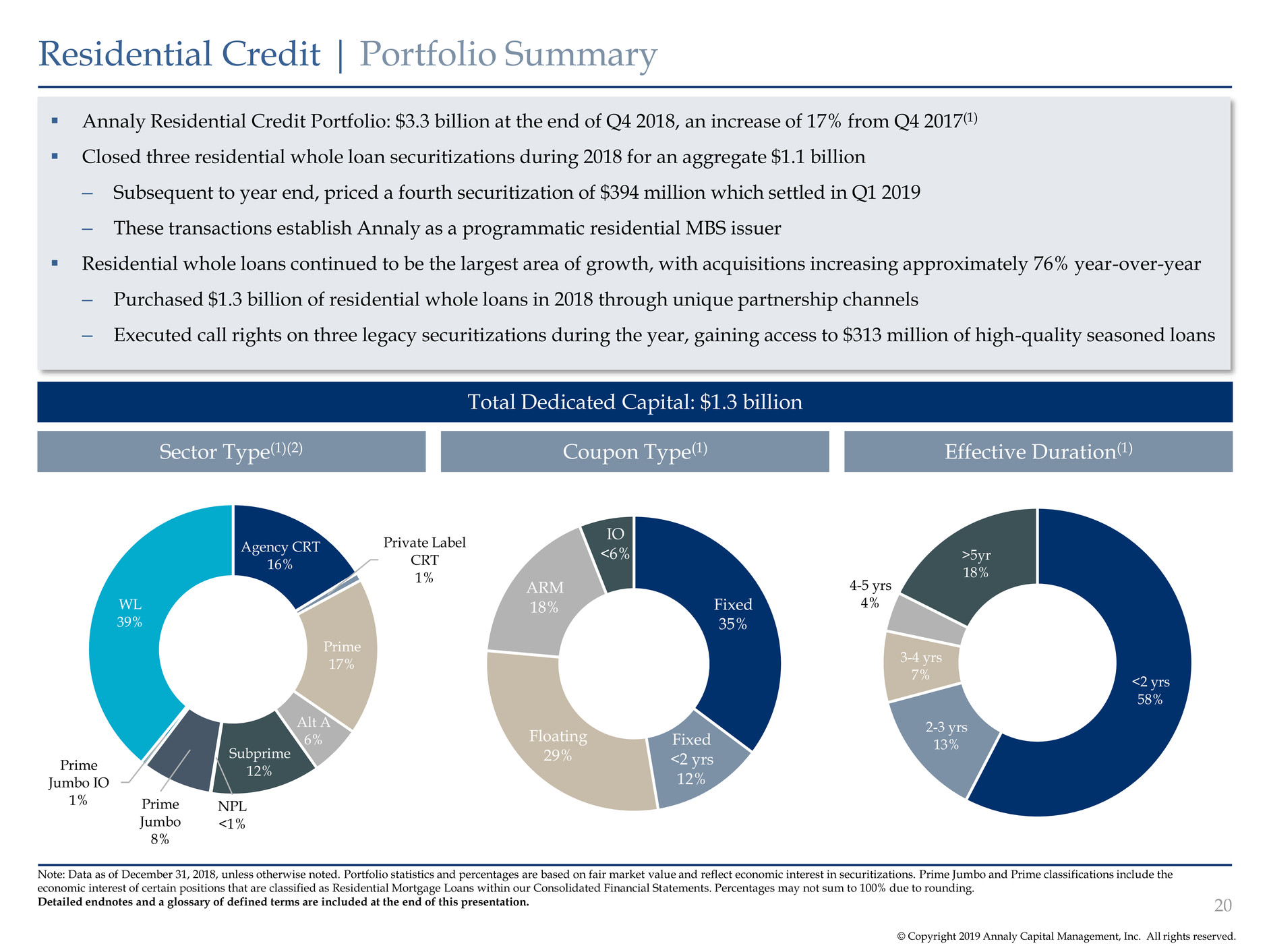

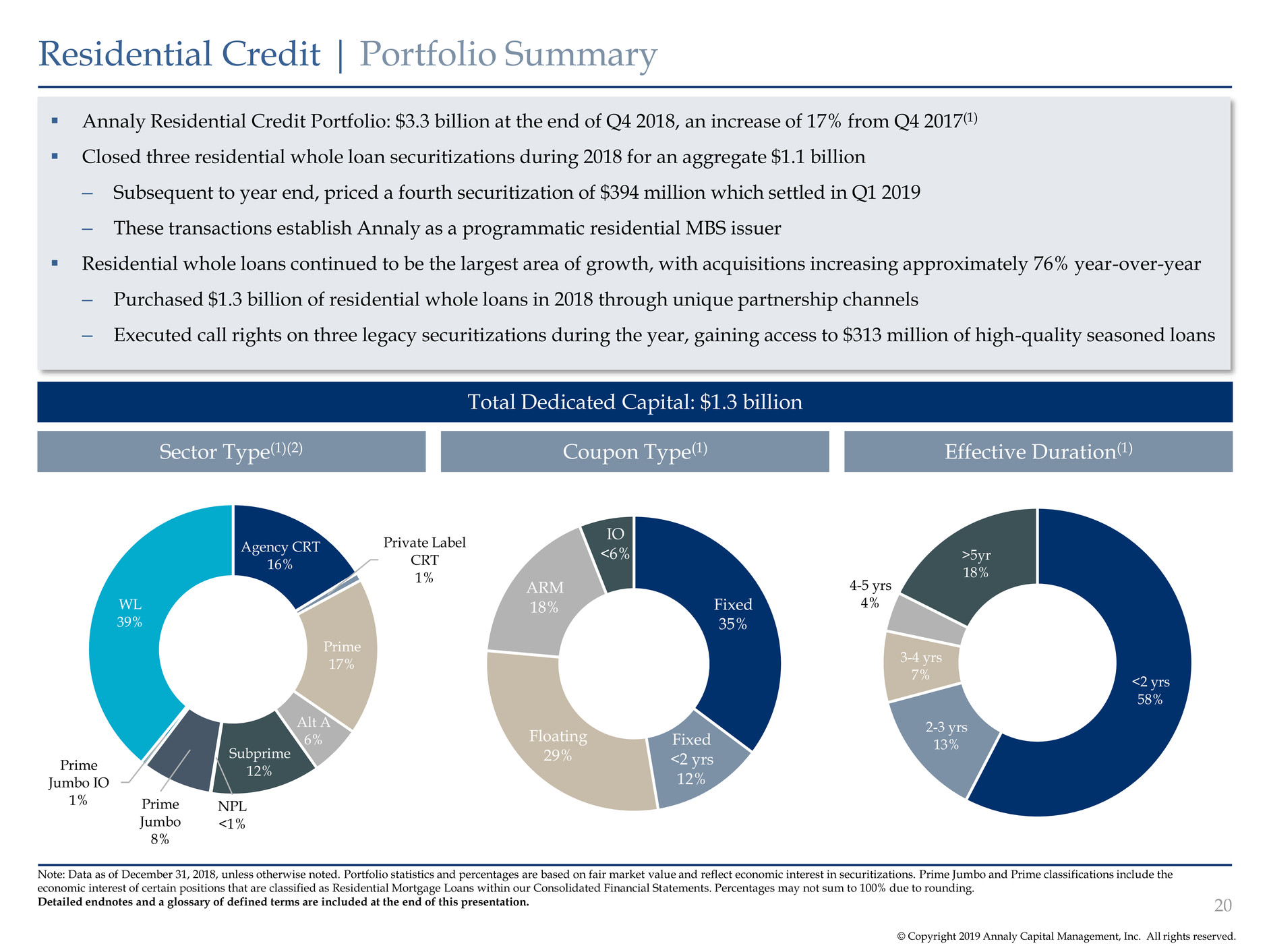

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Residential Credit | Portfolio Summary 20 Note: Data as of December 31, 2018, unless otherwise noted. Portfolio statistics and percentages are based on fair market value and reflect economic interest in securitizations. Prime Jumbo and Prime classifications include the economic interest of certain positions that are classified as Residential Mortgage Loans within our Consolidated Financial Statements. Percentages may not sum to 100% due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Annaly Residential Credit Portfolio: $3.3 billion at the end of Q4 2018, an increase of 17% from Q4 2017(1) Closed three residential whole loan securitizations during 2018 for an aggregate $1.1 billion – Subsequent to year end, priced a fourth securitization of $394 million which settled in Q1 2019 – These transactions establish Annaly as a programmatic residential MBS issuer Residential whole loans continued to be the largest area of growth, with acquisitions increasing approximately 76% year-over-year – Purchased $1.3 billion of residential whole loans in 2018 through unique partnership channels – Executed call rights on three legacy securitizations during the year, gaining access to $313 million of high-quality seasoned loans Total Dedicated Capital: $1.3 billion Sector Type(1)(2) Coupon Type(1) Effective Duration(1) Agency CRT 16% Private Label CRT 1% Prime 17% Alt A 6% Subprime 12% NPL <1% Prime Jumbo 8% Prime Jumbo IO 1% WL 39% <2 yrs 58% 2-3 yrs 13% 3-4 yrs 7% 4-5 yrs 4% >5yr 18% Fixed 35% Fixed <2 yrs 12% Floating 29% ARM 18% IO <6%

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. AAA CMBS 1% Mezzanine 26% Whole Loan(4) 32% Equity(3) 26% ESG(1) 3% Other(2) 3% Credit CMBS 9% Commercial Real Estate | Portfolio Summary Annaly Commercial Real Estate Portfolio: $2.5 billion in assets at the end of Q4 2018, an increase of 24% from Q4 2017 Enhanced regional origination presence and expanded capital markets efforts enabled Commercial Real Estate to close over $1.2 billion of commercial assets in 2018, an increase of ~126% from Q4 2017 across the portfolio Noteworthy deals closed in 2018 include: Originated a $185 million floating-rate whole loan secured by a Class-A office tower in Dallas, Texas Acquired a ~$100 million controlling interest in a CMBS trust secured by a pool of full service hotels across 16 states Extended an existing credit facility and further reduced facility pricing during Q4 2018 to maintain competitiveness in debt origination secured by high quality assets Total Dedicated Capital: $0.9 billion Asset Type Sector Type Geographic Concentration(5) Note: Data as of December 31, 2018. Portfolio statistics and percentages are based on economic interest and excludes consolidated VIE positions. Percentages may not sum to 100% due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Hotel 5% Healthcare 7% Industrial 2% Multifamily 22% Other 6% Office 26% Retail 32% CA 13% Other 37% DC 8% VA 9% TX 13% NY 20% 21

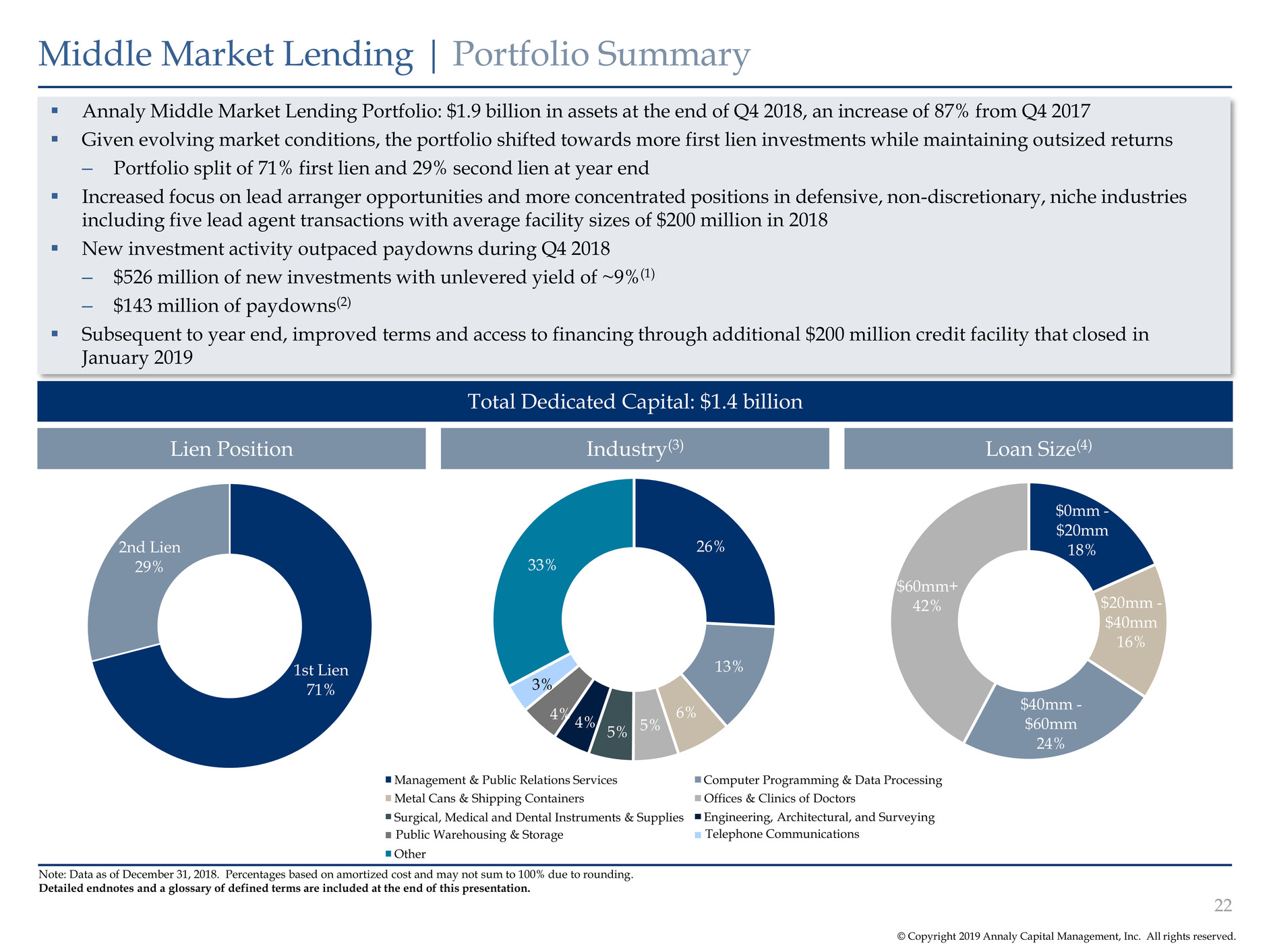

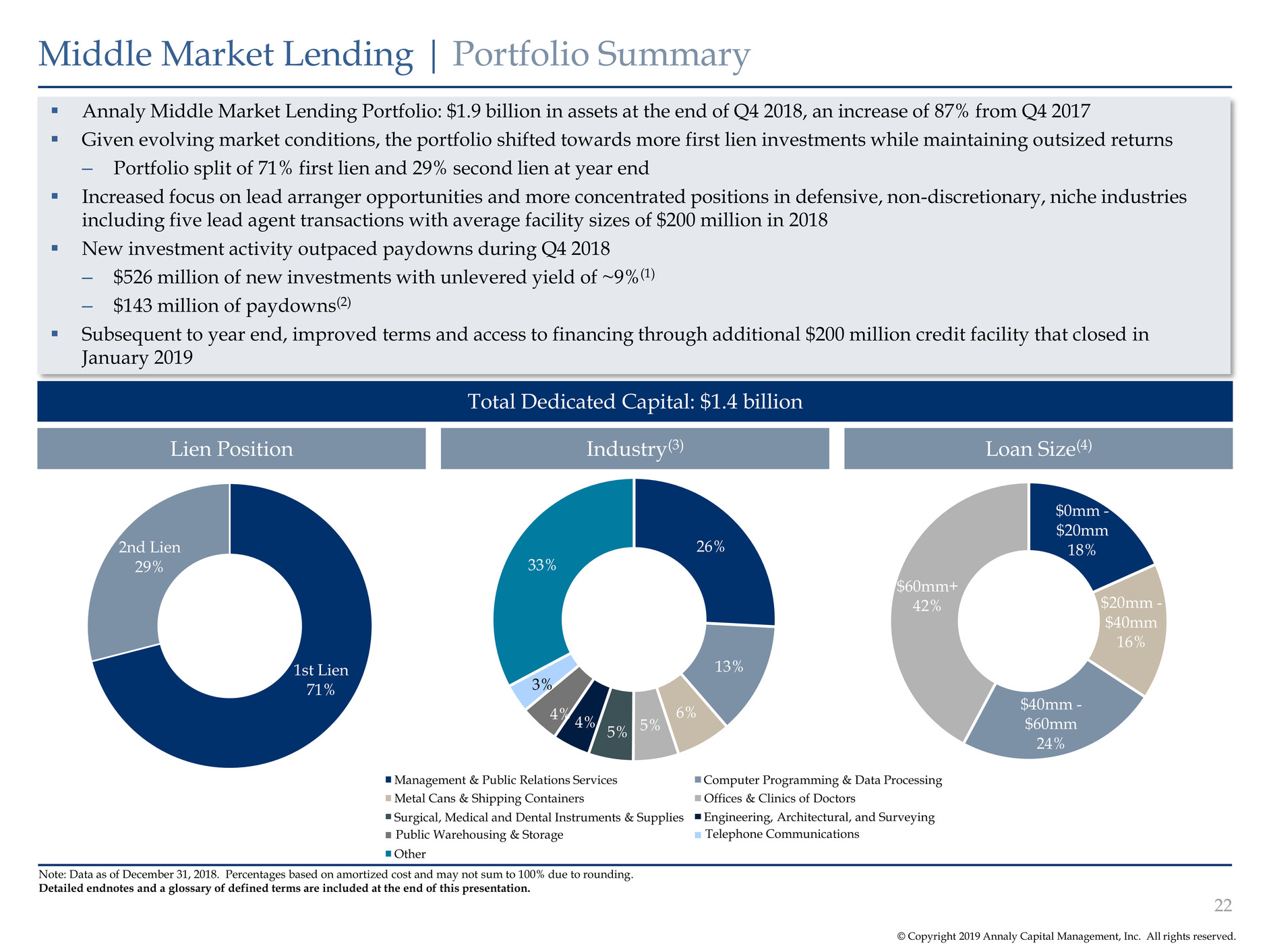

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. 26% 13% 6% 5%5% 4% 4% 3% 33% Middle Market Lending | Portfolio Summary Note: Data as of December 31, 2018. Percentages based on amortized cost and may not sum to 100% due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Annaly Middle Market Lending Portfolio: $1.9 billion in assets at the end of Q4 2018, an increase of 87% from Q4 2017 Given evolving market conditions, the portfolio shifted towards more first lien investments while maintaining outsized returns – Portfolio split of 71% first lien and 29% second lien at year end Increased focus on lead arranger opportunities and more concentrated positions in defensive, non-discretionary, niche industries including five lead agent transactions with average facility sizes of $200 million in 2018 New investment activity outpaced paydowns during Q4 2018 – $526 million of new investments with unlevered yield of ~9%(1) – $143 million of paydowns(2) Subsequent to year end, improved terms and access to financing through additional $200 million credit facility that closed in January 2019 Total Dedicated Capital: $1.4 billion Lien Position Industry(3) Loan Size(4) $0mm - $20mm 18% $20mm - $40mm 16% $40mm - $60mm 24% $60mm+ 42% Management & Public Relations Services Computer Programming & Data Processing Metal Cans & Shipping Containers Engineering, Architectural, and Surveying Public Warehousing & Storage Telephone Communications Offices & Clinics of Doctors Surgical, Medical and Dental Instruments & Supplies Other 1st Lien 71% 2nd Lien 29% 22

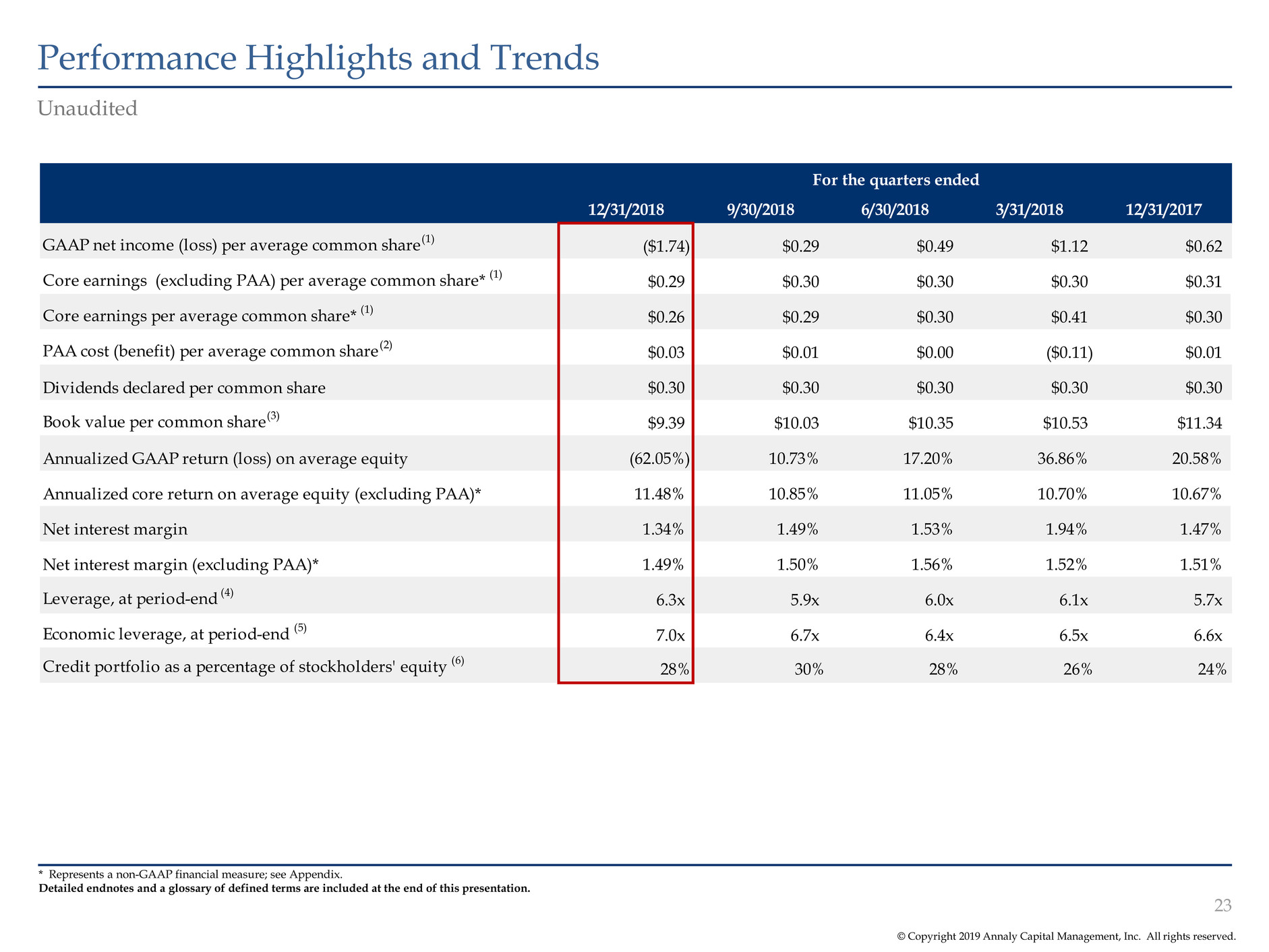

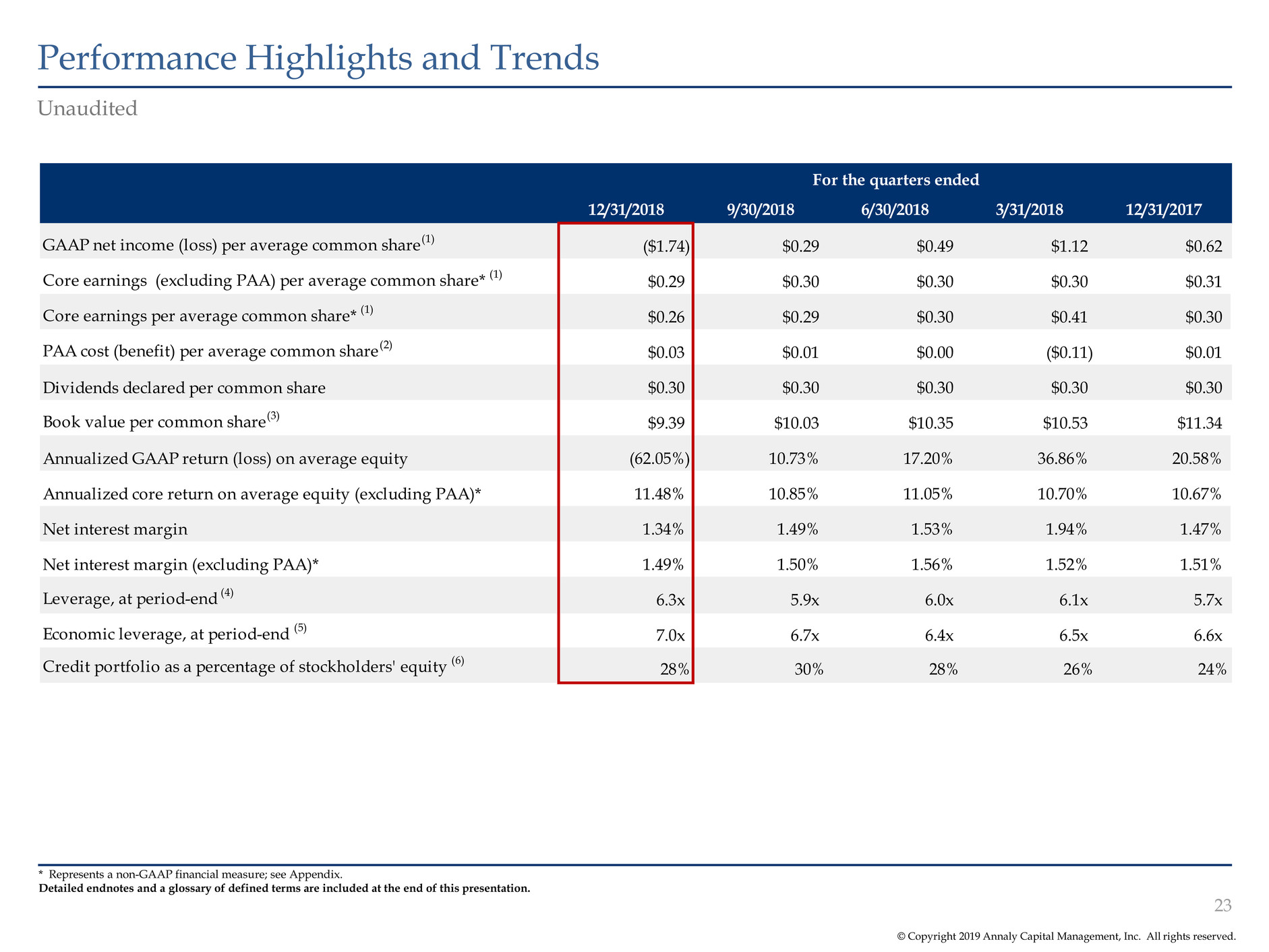

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Performance Highlights and Trends 23 Unaudited * Represents a non-GAAP financial measure; see Appendix. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. For the quarters ended 12/31/2018 9/30/2018 6/30/2018 3/31/2018 12/31/2017 GAAP net income (loss) per average common share (1) ($1.74) $0.29 $0.49 $1.12 $0.62 Core earnings (excluding PAA) per average common share* (1) $0.29 $0.30 $0.30 $0.30 $0.31 Core earnings per average common share* (1) $0.26 $0.29 $0.30 $0.41 $0.30 PAA cost (benefit) per average common share (2) $0.03 $0.01 $0.00 ($0.11) $0.01 Dividends declared per common share $0.30 $0.30 $0.30 $0.30 $0.30 Book value per common share (3) $9.39 $10.03 $10.35 $10.53 $11.34 Annualized GAAP return (loss) on average equity (62.05%) 10.73% 17.20% 36.86% 20.58% Annualized core return on average equity (excluding PAA)* 11.48% 10.85% 11.05% 10.70% 10.67% Net interest margin 1.34% 1.49% 1.53% 1.94% 1.47% Net interest margin (excluding PAA)* 1.49% 1.50% 1.56% 1.52% 1.51% Leverage, at period-end (4) 6.3x 5.9x 6.0x 6.1x 5.7x Economic leverage, at period-end (5) 7.0x 6.7x 6.4x 6.5x 6.6x Credit portfolio as a percentage of stockholders' equity (6) 28% 30% 28% 26% 24%

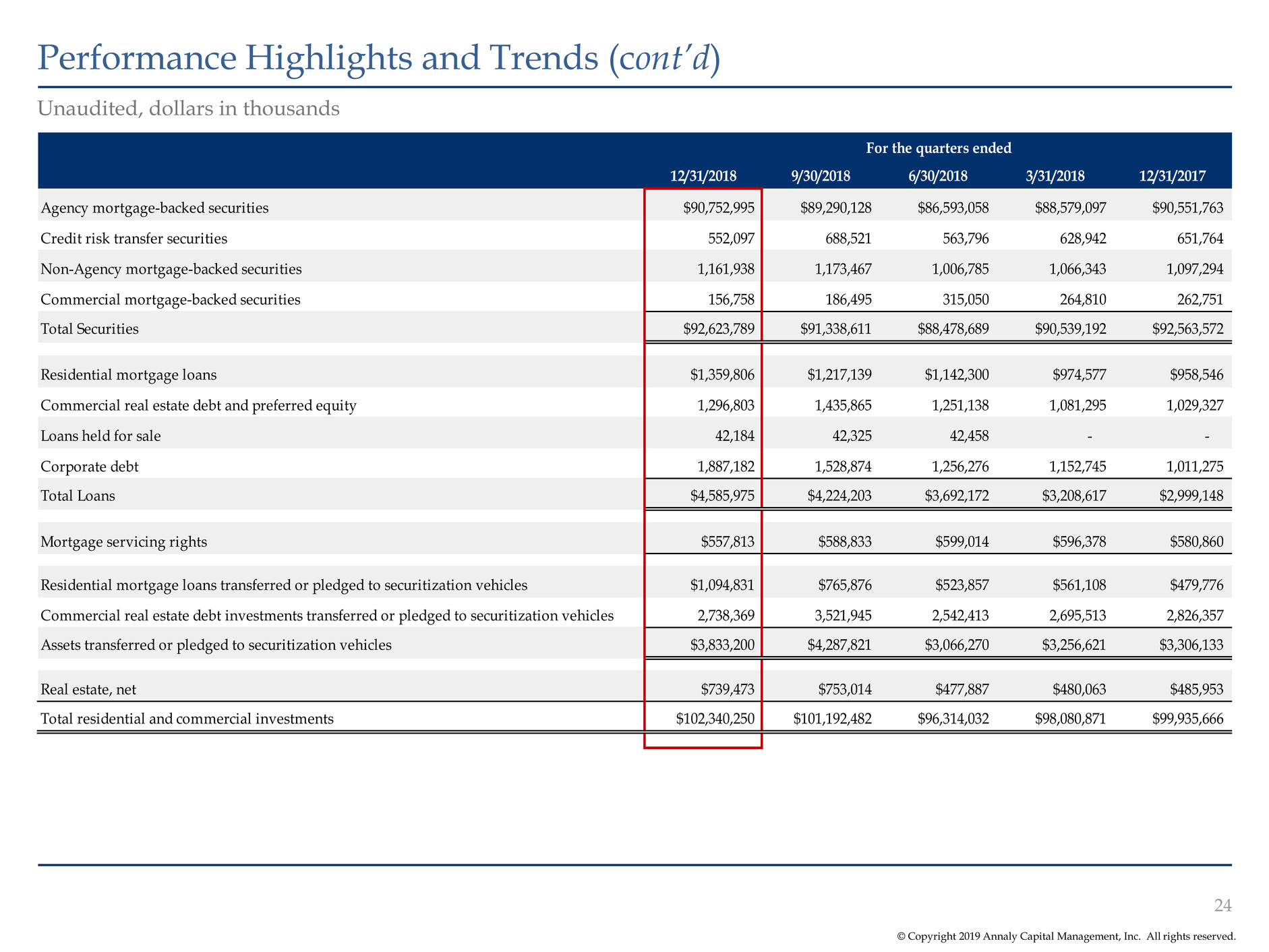

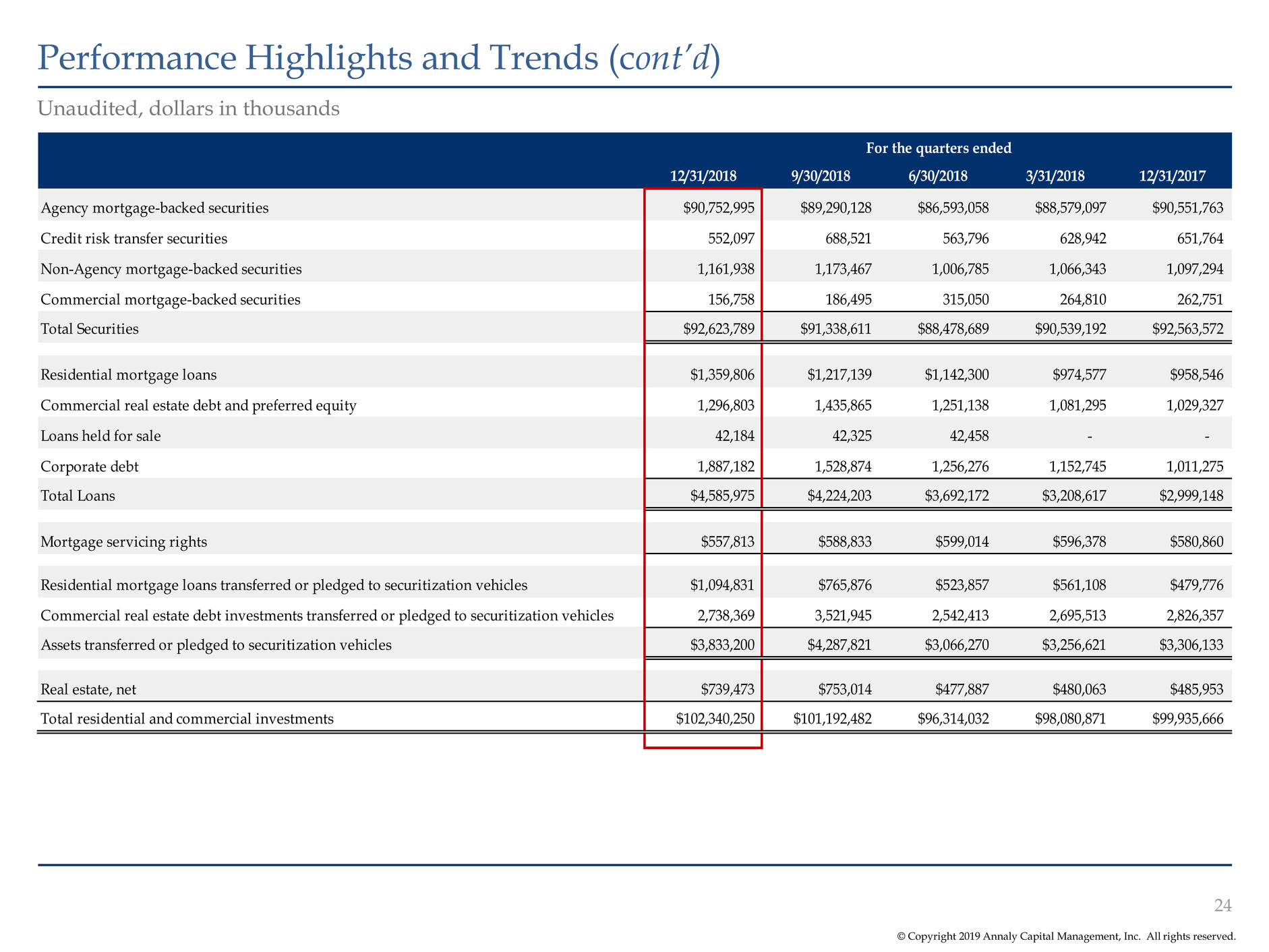

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Performance Highlights and Trends (cont’d) 24 Unaudited, dollars in thousands For the quarters ended 12/31/2018 9/30/2018 6/30/2018 3/31/2018 12/31/2017 Agency mortgage-backed securities $90,752,995 $89,290,128 $86,593,058 $88,579,097 $90,551,763 Credit risk transfer securities 552,097 688,521 563,796 628,942 651,764 Non-Agency mortgage-backed securities 1,161,938 1,173,467 1,006,785 1,066,343 1,097,294 Commercial mortgage-backed securities 156,758 186,495 315,050 264,810 262,751 Total Securities $92,623,789 $91,338,611 $88,478,689 $90,539,192 $92,563,572 Residential mortgage loans $1,359,806 $1,217,139 $1,142,300 $974,577 $958,546 Commercial real estate debt and preferred equity 1,296,803 1,435,865 1,251,138 1,081,295 1,029,327 Loans held for sale 42,184 42,325 42,458 - - Corporate debt 1,887,182 1,528,874 1,256,276 1,152,745 1,011,275 Total Loans $4,585,975 $4,224,203 $3,692,172 $3,208,617 $2,999,148 Mortgage servicing rights $557,813 $588,833 $599,014 $596,378 $580,860 Residential mortgage loans transferred or pledged to securitization vehicles $1,094,831 $765,876 $523,857 $561,108 $479,776 C mmercial real estate debt investments transferred or pledged to securitization vehicles 2,738,369 3,521,945 2,542,413 2,695,513 2,826,357 Assets transferred or pledged to securitization vehicles $3,833,200 $4,287,821 $3,066,270 $3,256,621 $3,306,133 Real estate, net $739,473 $753,014 $477,887 $480,063 $485,953 Total residential and commercial investments $102,340,250 $101,192,482 $96,314,032 $98,080,871 $99,935,666

Appendix: Non-GAAP Reconciliations

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Non-GAAP Reconciliations 26 Beginning with the quarter ended September 30, 2018, the Company updated its calculation of core earnings and related metrics to reflect changes to its portfolio composition and operations, including the acquisition of MTGE in September 2018. Compared to prior periods, the revised definition of core earnings includes coupon income (expense) on CMBX positions (reported in Net gains (losses) on other derivatives) and excludes depreciation and amortization expense on real estate and related intangibles (reported in Other income (loss)), non-core income (loss) allocated to equity method investments (reported in Other income (loss)) and the income tax effect of non-core income (loss) (reported in Income taxes). Prior period results have not been adjusted to conform to the revised calculation as the impact in each of those periods is not material. The Company calculates “core earnings”, a non-GAAP measure, as the sum of (a) economic net interest income, (b) TBA dollar roll income and CMBX coupon income, (c) realized amortization of MSRs, (d) other income (loss) (excluding depreciation and amortization expense on real estate and related intangibles, non-core income allocated to equity method investments and other non-core components of other income (loss)), (e) general and administrative expenses (excluding transaction expenses and non-recurring items) and (f) income taxes (excluding the income tax effect of non-core income (loss) items), and core earnings (excluding PAA), which is defined as core earnings excluding the premium amortization adjustment representing the cumulative impact on prior periods, but not the current period, of quarter-over-quarter changes in estimated long-term prepayment speeds related to the Company’s Agency mortgage-backed securities.

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Non-GAAP Reconciliations (cont’d) 27 * Represents a non-GAAP financial measure. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Unaudited, dollars in thousands except per share amounts For the quarters ended 12/31/2018 9/30/2018 6/30/2018 3/31/2018 12/31/2017 GAAP to Core Reconciliation GAAP net income (loss) ($2,254,872) $385,429 $595,887 $1,327,704 $746,771 Net income (loss) attributable to non-controlling interests 17 (149) (32) (96) (151) Net income (loss) attributable to Annaly ($2,254,889) $385,578 $595,919 $1,327,800 $746,922 Adjustments to excluded reported realized and unrealized (gains) losses: Realized (gains) losses on termination of interest rate swaps - (575) - (834) 160,075 Unrealized (gains) losses on interest rate swaps 1,313,882 (417,203) (343,475) (977,285) (484,447) Net (gains) losses on disposal of investments 747,505 324,294 66,117 (13,468) (7,895) Net (gains) losses on other derivatives 484,872 (94,827) (34,189) 47,145 (121,334) Net unrealized (gains) losses on instruments measured at fair value through earnings 18,169 39,944 48,376 51,593 12,115 Loan loss provision 3,496 - - - - Adjustments to exclude components of other (income) loss: Depreciation and amortization expense related to commercial real estate (1) 11,000 9,278 - - - Non-core (income) loss allocated to equity method investments (2) (10,307) (2,358) - - - Non-core other (income) loss (3) - 44,525 - - - Adjustments to exclude components of general and administrative expenses and income taxes: Transaction expenses and non-recurring items (4) 3,816 60,081 - 1,519 - Income tax effect on non-core income (loss) items 3,334 886 - - - Adjustments to add back components of realized and unrealized (gains) losses: TBA dollar roll income and CMBX coupon income (5) 69,572 56,570 62,491 88,353 89,479 MSR amortization (6) (18,753) (19,913) (19,942) (21,156) (19,331) Core earnings* 371,697 386,280 375,297 503,667 375,584 Less: Premium amortization adjustment (PAA) cost (benefit) 45,472 3,386 7,516 (118,395) 11,367 Core Earnings (excluding PAA)* $417,169 $389,666 $382,813 $385,272 $386,951 Dividends on preferred stock 32,494 31,675 31,377 33,766 32,334 Core Earnings attributable to common shareholders * $339,203 $354,605 $343,920 $469,901 $343,250 Core Earnings (excluding PAA) attributable to common shareholders * $384,675 $357,991 $351,436 $351,506 $354,617 AAP net income (loss) per average common share (7) ($1.74) $0.29 $0.49 $1.12 $0.62 Core earnings per average common share (7) * $0.26 $0.29 $0.30 $0.41 $0.30 Core earnings (excluding PAA) per average common share (7) * $0.29 $0.30 $0.30 $0.30 $0.31 Annualized GAAP return (loss) on average equity (62.05%) 10.73% 17.20% 36.86% 20.58% Annualized core return on average equity (excluding PAA)* 11.48% 10.85% 11.05% 10.70% 10.67% To supplement its consolidated financial statements, which are prepared and presented in accordance with GAAP, the Company provides non-GAAP financial measures. These measures should not be considered a substitute for, or superior to, financial measures computed in accordance with GAAP. These non-GAAP measures provide additional detail to enhance investor understanding of the Company’s period-over-period operating performance and business trends, as well as for assessing the Company’s performance versus that of industry peers. Reconciliations of these non-GAAP financial measures to their most directly comparable GAAP results are provided below and on the next page.

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Non-GAAP Reconciliations (cont’d) 28 * Represents a non-GAAP financial measure. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Unaudited, dollars in thousands For the quarters ended 12/31/2018 9/30/2018 6/30/2018 3/31/2018 12/31/2017 Premium Amortization Reconciliation Premium amortization expense $220,131 $187,537 $202,426 $95,832 $203,951 Less: PAA cost (benefit) $45,472 $3,386 $7,516 ($118,395) $11,367 Premium amortization expense (excluding PAA) $174,659 $184,151 $194,910 $214,227 $192,584 Interest Income (excluding PAA) Reconciliation GAAP interest income $859,674 $816,596 $776,806 $879,487 $745,423 PAA cost (benefit) $45,472 $3,386 $7,516 ($118,395) $11,367 Interest income (excluding PAA)* $905,146 $819,982 $784,322 $761,092 $756,790 Economic Interest Expense Reconciliation GAAP interest expense $586,774 $500,973 $442,692 $367,421 $318,711 Add: Net interest component of interest rate swaps (1) (65,889) (51,349) (31,475) 48,160 73,957 Economic interest expense* (1) $520,885 $449,624 $411,217 $415,581 $392,668 Economic Net Interest Income (excluding PAA) Reconciliation Interest income (excluding PAA) $905,146 $819,982 $784,322 $761,092 $756,790 Less: Economic interest expense* (1) 520,885 449,624 411,217 415,581 392,668 Economic net interest income (excluding PAA)* (1) $384,261 $370,358 $373,105 $345,511 $364,122 Economic Metrics (excluding PAA) Average interest earning assets $107,232,861 $101,704,957 $102,193,435 $101,979,042 $100,247,589 Interest income (excluding PAA)* $905,146 $819,982 $784,322 $761,092 $756,790 Average yield on interest earning assets (excluding PAA)* 3.38% 3.22% 3.07% 2.99% 3.02% Average interest bearing liabilities $91,746,160 $86,638,082 $87,103,807 $87,376,452 $85,992,215 Economic interest expense* (1) $520,885 $449,624 $411,217 $415,581 $392,668 Average cost of interest bearing liabilities (1) 2.22% 2.08% 1.89% 1.90% 1.83% Economic net interest income (excluding PAA)* (1) $384,261 $370,358 $373,105 $345,511 $364,122 Net interest spread (excluding PAA)* 1.16% 1.14% 1.18% 1.09% 1.19% Interest income (excluding PAA)* $905,146 $819,982 $784,322 $761,092 $756,790 TBA dollar roll income and CMBX coupon income (2) 69,572 56,570 62,491 88,353 89,479 Interest expense (586,774) (500,973) (442,692) (367,421) (318,711) Net interest component of interest rate swaps 65,889 51,349 31,475 (48,160) (82,271) Subtotal $453,833 $426,928 $435,596 $433,864 $445,287 Average interest earning assets $107,232,861 $101,704,957 $102,193,435 $101,979,042 $100,247,589 Average TBA contract and CMBX balances (2) 14,788,453 12,216,863 9,407,819 12,050,341 17,509,691 Subtotal $122,021,314 $113,921,820 $111,601,254 $114,029,383 $117,757,280 Net interest margin (excluding PAA)* 1.49% 1.50% 1.56% 1.52% 1.51%

Glossary and Endnotes

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Glossary 30 *Represents constituents as of January 31, 2019. ACREG: Refers to Annaly Commercial Real Estate Group Agency Peers: Represents companies comprising the Agency sector within the BBREMTG Index* AMML: Refers to Annaly Middle Market Lending Group ARC: Refers to Annaly Residential Credit Group BBREMTG: Represents the Bloomberg Mortgage REIT Index* Beta: Represents Bloomberg’s ‘Overridable Adjusted Beta’ which estimates the degree to which a stock’s price will fluctuate based on a given movement in the representative market index, calculated over a two-year historical period as of the date indicated. S&P 500 is used as the relative index for the calculation Commercial Peers: Represents companies comprising the commercial sector within the BBREMTG Index* Consumer Staples: Represents the S5CONS Index* CRT: Refers to credit risk transfer securities Equity REITs: Represents the RMZ Index* ESG: Refers to Environmental, Social and Governance FHLB: Refers to the Federal Home Loan Bank GSE: Refers to government sponsored enterprise Hybrid Peers: Represents companies comprising the hybrid sector within the BBREMTG Index* MLPs: Represents the Alerian MLP Index* mREITs or mREIT Peers: Represents the BBREMTG Index* S&P 500: Represents the S&P 500 Index* Select Financials: Represents an average of companies in the S5FINL Index with dividend yields greater than 50 basis points higher than the S&P 500 dividend yield as of January 31, 2019 Unencumbered Assets: Representative of Annaly’s excess liquidity and are defined as assets that have not been pledged or securitized (generally including cash and cash equivalents, Agency MBS, CRT, Non-Agency MBS, residential mortgage loans, MSRs, reverse repurchase agreements, CRE debt and preferred equity, corporate debt, other unencumbered financial assets and capital stock) Utilities: Represents the Russell 3000 Utilities Index* Yield Sectors or Yield Sector Peers: Representative of Consumer Staples, Equity REITs, MLPs, Select Financials and Utilities

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Endnotes 31 Page 4 1. Agency assets include to be announced (“TBA”) purchase contracts (market value) and mortgage servicing rights (“MSRs”). Residential Credit and Commercial Real Estate assets exclude securitized debt of consolidated variable interest entities (“VIEs”). 2. Represents the capital allocation for each of the four investment groups and is calculated as the difference between assets and related financing. Includes TBA purchase contracts, excludes non- portfolio related activity and varies from total stockholders’ equity. 3. Sector rank compares Annaly dedicated capital in each of its four investment groups as of December 31, 2018 (adjusted for P/B as of January 31, 2019) to the market capitalization of the companies in each respective comparative sector as of January 31, 2019. Comparative sectors used for Agency, Commercial Real Estate and Residential Credit ranking are their respective sector within the BBREMTG Index as of January 31, 2019. Comparative sector used for Middle Market Lending ranking is the S&P BDC Index as of January 31, 2019. 4. Levered return assumptions are for illustrative purposes only and attempt to represent current market asset returns and financing terms for prospective investments of the same, or of a substantially similar, nature in each respective group. Page 5 1. Includes unfunded commitments of $161mm. Year-over-year increase excludes loans acquired through securitization call rights and assets onboarded in connection with the MTGE acquisition. 2. $2.4bn of financing capacity includes $1.5bn in residential whole loan securitizations ($1.1bn closed in 2018 and $394mm closed subsequent to year end in January 2019) and $900mm in additional credit facility capacity ($700mm closed in 2018 and $200mm closed subsequent to year end in January 2019). 3. Dedicated capital includes TBA purchase contracts, excludes non-portfolio related activity and varies from total stockholders’ equity. 4. Reflects announcement date of the MTGE acquisition, which closed in September 2018. 5. ~$3bn of equity includes: (1) $425mm raised through a preferred equity offering in January 2018; (2) $877mm raised through a common equity offering in September 2018; (3) $840mm raised through a common equity offering in January 2019; (4) $456mm of equity issued as partial merger consideration and $55mm of preferred equity assumed in connection with the MTGE acquisition in September 2018; and (5) $251mm raised through the Company’s at-the-market sales program for its common stock, which was entered into in January 2018. These amounts exclude any applicable underwriting discounts and other estimated offering expenses. The September 2018 and January 2019 common equity offerings include the underwriters’ full exercise of their overallotment option to purchase additional shares of stock. Page 7 1. Based on annualized Q4 2018 dividend of $0.30 and a closing price of $9.82 on December 31, 2018. 2. Total portfolio excludes securitized debt of consolidated VIEs. 3. Capital allocation includes TBA purchase contracts, excludes non-portfolio related activity and varies from total stockholders’ equity. 4. Includes $700mm closed in 2018 and $200mm closed subsequent to year end in January 2019. 5. Measures total notional balances of interest rate swaps, interest rate swaptions and futures relative to repurchase agreements, other secured financing and TBA derivative and CMBX notional outstanding; excludes MSRs and the effects of term financing, both of which serve to reduce interest rate risk. Additionally, the hedge ratio does not take into consideration differences in duration between assets and liabilities. 6. Includes GAAP interest expense and the net interest component of interest rate swaps. Page 9 1. Data shown since December 31, 2013, which marks the beginning of Annaly’s diversification efforts, through January 31, 2019. 2. Represents Annaly's operating expense as a percentage of average equity compared to the BBREMTG Index as of September 30, 2018 annualized. Operating expense is defined as: (i) for internally-managed peers, the sum of compensation and benefits, G&A and other operating expenses, and (ii) for externally-managed peers, the sum of net management fees, compensation and benefits (if any), G&A and other operating expenses. 3. Includes Annaly’s $876mm acquisition of CreXus Investment Corp. (closed May 2013), $1,519mm acquisition of Hatteras Financial Corp. (closed July 2016) and $906mm acquisition of MTGE Investment Corp. (closed September 2018). 4. On December 13 2018, the Board unanimously approved and amended its bylaws to declassify the Board. The amendment provides that Directors will be nominated for election for one-year terms beginning with the Company’s annual meeting of stockholders in 2019 as their terms expire. For more information, see the Form 8-K filed December 13, 2018. Page 10 1. Total return shown since December 31, 2015. 2. The third quarter 2018 common stock dividend is represented as the aggregate $0.30 common stock dividend comprised of (i) the $0.22174 short period dividend paid on September 6, 2018 in connection with the MTGE acquisition and (ii) the $0.07826 remaining dividend paid on September 28, 2018. 3. Line represents the lower bound of the target Fed Funds range. Page 11 1. Includes unfunded commitments in the year of origination. 2. Year-over-year increase excludes loans acquired through securitization call rights and assets onboarded in connection with the MTGE acquisition. 3. Represents originated or purchased whole loans, commercial mortgage-backed securities and equity assets across the credit businesses in each year. Page 12 1. Represents operating expense as a percentage of average equity for the quarter ended September 30, 2018 annualized. For Annaly and mREIT Peers, operating expense is defined as: (i) for internally-managed peers, the sum of compensation and benefits, general and administrative expenses (“G&A”) and other operating expenses, and (ii) for externally-managed peers, the sum of net management fees, compensation and benefits (if any), G&A and other operating expenses. Excludes companies with negative equity or operating expenses as a percent of average equity in excess of 250%. 2. Represents the average of the Yield Sectors. 3. LTM pre-tax margin is calculated as pre-tax income divided by total revenue or total gross interest income for each company. Companies with negative pre-tax margins are excluded from the analysis. Page 13 1. Includes $1.1bn closed in 2018 (three securitizations) and $394mm closed subsequent to year end in January 2019 (one securitization). 2. Reflects Annaly's 5-year FHLB financing, which sunsets in February 2021. 3. Includes $700mm closed in 2018 and $200mm closed subsequent to year end in January 2019. 4. Does not include structural leverage. 5. Does not include synthetic financing for TBA contracts. 6. Excludes securitized debt of consolidated VIEs. Total does not include middle market loan syndications. 7. Includes securitizations.

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Endnotes (cont’d) 32 Page 14 1. Representative of BBREMTG Index as of January 31, 2019 pro forma for pending acquisition of ORM by RC (announced on November 7, 2018). 2. Reflects the number of Annaly’s acquisitions as a percentage of the number of total acquisitions in the mREIT sector. 3. Includes M&A transactions that were either announced or closed after April 8, 2016. Page 15 1. Includes commercial real estate loans or equity investments in buildings with U.S. Green Building Council’s LEED certification or that have been designated as energy efficient by EnergyStar. $429mm represents the cumulative commitment value at investment date of Annaly’s commercial investments, including current and prior investments. 2. Annaly entered into its first social impact investing joint venture with Capital Impact Partners (“CIP”) in November 2017, in which Annaly’s investment represents $20mm and CIP’s investment represents $5mm. Annaly entered into its second social impact investing joint venture with CIP in December 2018, in which Annaly’s commitment represents $20mm and CIP’s commitment represents $5mm. 3. Represents the estimated number of homes financed by Annaly’s holdings of Agency MBS, residential whole loans and securities, as well as multi-family commercial real estate loans, securities and equity investments. The number includes all homes related to securities and loans wholly-owned by Annaly and a pro-rata share of homes in securities or equity investments that are partially owned by Annaly. 4. Includes appointment of new Board member Kathy Hopinkah Hannan, PhD, CPA, effective February 13, 2019. 5. S&P 500 board composition per ISS Corporate Solutions as of January 2019. 6. On December 13, 2018, the Board unanimously approved and amended its bylaws to declassify the Board. The amendment provides that Directors will be nominated for election for one-year terms beginning with the Company’s annual meeting of stockholders in 2019 as their terms expire. For more information, see our public filings, including Form 8-K filed December 13, 2018. Page 16 1. Total Return represents the total shareholder return for the period beginning December 31, 2013 to January 31, 2019. 2. Represents average of the Yield Sectors. 3. Treynor Ratio defined as the annualized total shareholder return from December 31, 2013 through January 31, 2019 less the average yield on the 10-yr Treasury over the respective period divided by the beta over the respective period. Page 19 1. Includes TBA purchase contracts and MSRs. 2. “High Quality Spec” protection is defined as pools backed by original loan balances of up to $125k, highest LTV pools (CR>125%LTV), geographic concentrations (NY/PR). “Med Quality Spec” includes $200k loan balance, $175k loan balance, $150k loan balance, high LTV pools (CQ 105-125% LTV) . “40+ WALA” is defined as weighted average loan age greater than 40 months and treated as seasoned collateral. Page 20 1. Shown exclusive of securitized residential mortgage loans of a consolidated VIE and loans held by an affiliated master servicer. 2. Prime classification includes $22.1mm of Prime IO. Page 21 1. Reflects joint venture interests in a social impact loan investment fund that is accounted for under the equity method for GAAP. 2. Reflects limited and general partnership interests in a commercial loan investment fund that is accounted for under the equity method for GAAP. 3. Includes equity investment in health care assets. 4. Includes mezzanine loans for which Commercial Real Estate is also the corresponding first mortgage lender, B-Notes held for investment and a B-Note held for sale. 5. Other includes 46 states, none of which represents more than 5% of total portfolio value. The Company looked through to the collateral characteristics of securitizations and equity method investments. Page 22 1. Excludes unfunded commitments. Yield calculated net of syndications. 2. Paydowns reflect $115mm in complete payoffs and $29mm in principal amortization. 3. Based on Standard Industrial Classification industry categories. 4. Breakdown based on aggregate dollar amount of individual investments made within the respective loan size buckets. Multiple investment positions with a single obligor shown as one individual investment. Page 23 1. Net of dividends on preferred stock. The quarter ended December 31, 2017 excludes cumulative and undeclared dividends of $8.3mm on the Company's Series F Preferred stock as of September 30, 2017. 2. The Company separately calculates core earnings per average common share and core earnings (ex-PAA) per average common share, with the difference between these two per share amounts attributed to the PAA cost (benefit) per average common share. As such, the reported value of the PAA cost (benefit) per average common share may not reflect the result of dividing the PAA cost (benefit) by the weighted average number of common shares outstanding due to rounding. 3. Book value per common share includes 10.6mm shares of the Company’s common stock that were pending issuance to shareholders of MTGE Investment Corp. (“MTGE”) at September 30, 2018 in connection with the MTGE acquisition. 4. Debt consists of repurchase agreements, other secured financing, securitized debt and mortgages payable. Certain credit facilities (included within other secured financing), securitized debt and mortgages payable are non-recourse to the Company. 5. Computed as the sum of recourse debt, TBA derivative and CMBX notional outstanding and net forward purchases (sales) of investments divided by total equity. Recourse debt consists of repurchase agreements and other secured financing (excluding certain non-recourse credit facilities). Securitized debt, certain credit facilities (included within other secured financing) and mortgages payable are non-recourse to the Company and are excluded from this measure. 6. Represents CRT securities, non-Agency mortgage-backed securities, residential mortgage loans, commercial real estate debt investments and preferred equity investments, loans held for sale, investments in commercial real estate and corporate debt, net of financing.

© Copyright 2019 Annaly Capital Management, Inc. All rights reserved. Endnotes (cont’d) 33 Non-GAAP Reconciliations Page 27 1. Includes depreciation and amortization expense related to equity method investments. 2. Beginning with the quarter ended September 30, 2018, the Company excludes non-core (income) loss allocated to equity method investments, which represents the unrealized (gains) losses allocated to equity interests in a portfolio of MSR, which is a component of Other income (loss). The quarter ended December 31, 2018 also includes a realized gain on sale within an unconsolidated joint venture, which is a component of Other income (loss). 3. The quarter ended September 30, 2018 reflects the amount of consideration paid for the acquisition of MTGE in excess of the fair value of net assets acquired. This amount is primarily attributable to a decline in portfolio valuation between the pricing and closing dates of the transaction and is consistent with changes in market values observed for similar instruments over the same period. 4. Represents costs incurred in connection with the MTGE transaction and costs incurred in connection with a securitization of residential whole loans for the quarters ended September 30, 2018 and December 31, 2018. Represents costs incurred in connection with a securitization of residential whole loans for the quarter ended March 31, 2018. 5. TBA dollar roll income and CMBX coupon income each represent a component of Net gains (losses) on other derivatives. CMBX coupon income totaled $1.2mm for each of the quarters ended December 31, 2018 and September 30, 2018. There were no adjustments for CMBX coupon income prior to September 30, 2018. 6. MSR amortization represents the portion of changes in fair value that is attributable to the realization of estimated cash flows on the Company’s MSR portfolio and is reported as a component of Net unrealized gains (losses) on instruments measured at fair value. 7. Net of dividends on preferred stock. Page 28 1. Average cost of interest bearing liabilities represents annualized economic interest expense divided by average interest bearing liabilities. Average interest bearing liabilities reflects the average amortized cost during the period. Economic interest expense is comprised of GAAP interest expense and the net interest component of interest rate swaps. Prior to the quarter ended March 31, 2018, this metric included the net interest component of interest rate swaps used to hedge cost of funds. Beginning with the quarter ended March 31, 2018, as a result of changes to the Company’s hedging portfolio, this metric reflects the net interest component of all interest rate swaps. 2. CMBX coupon income and average CMBX balances have only been applied to the quarters ended December 31, 2018 and September 30, 2018. The impact to net interest margin (ex-PAA) in prior periods was immaterial.