1 Q4 2022 February 1, 2023 Earnings Presentation Scott Anderson, Interim CEO Arun Rajan, Chief Operating Officer Mike Zechmeister, Chief Financial Officer Chuck Ives, Director of Investor Relations

Safe Harbor Statement Except for the historical information contained herein, the matters set forth in this presentation and the accompanying earnings release are forward-looking statements that represent our expectations, beliefs, intentions or strategies concerning future events. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience or our present expectations, including, but not limited to such factors such as changes in economic conditions, including uncertain consumer demand; changes in market demand and pressures on the pricing for our services; fuel price increases or decreases, or fuel shortages; competition and growth rates within the global logistics industry; freight levels and increasing costs and availability of truck capacity or alternative means of transporting freight; risks associated with significant disruptions in the transportation industry; changes in relationships with existing contracted truck, rail, ocean, and air carriers; changes in our customer base due to possible consolidation among our customers; risks with reliance on technology to operate our business; cyber-security related risks; risks associated with operations outside of the United States; our ability to successfully integrate the operations of acquired companies with our historic operations; risks related to our search for a permanent CEO and retention of key management personnel; climate change related risks; risks associated with our indebtedness, interest rates related risks; risks associated with litigation, including contingent auto liability and insurance coverage; risks associated with the potential impact of changes in government regulations; risks associated with the changes to income tax regulations; risks associated with the produce industry, including food safety and contamination issues; the impact of war on the economy; changes to our capital structure; changes due to catastrophic events including pandemics such as COVID-19; and other risks and uncertainties detailed in our Annual and Quarterly Reports. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update such statement to reflect events or circumstances arising after such date. 2©2023 C.H. Robinson Worldwide, Inc. All Rights Reserved.

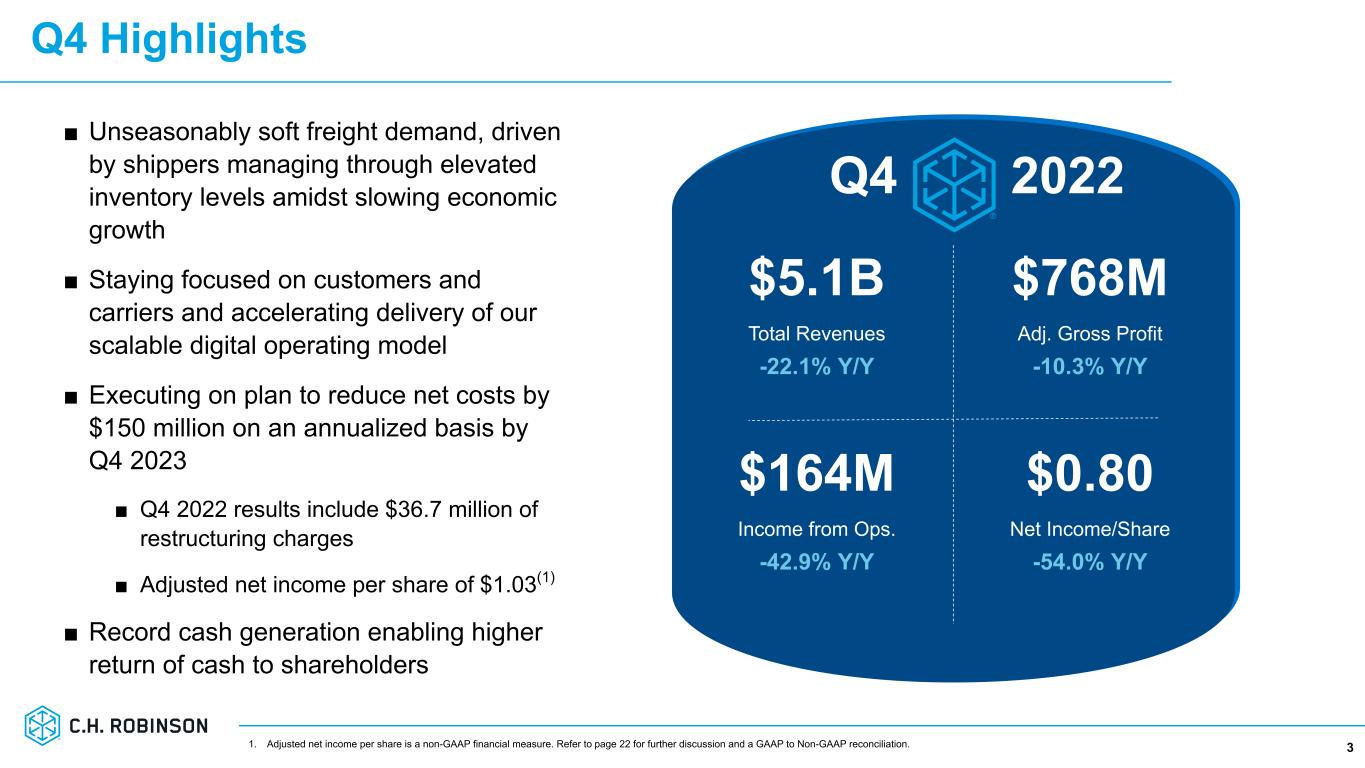

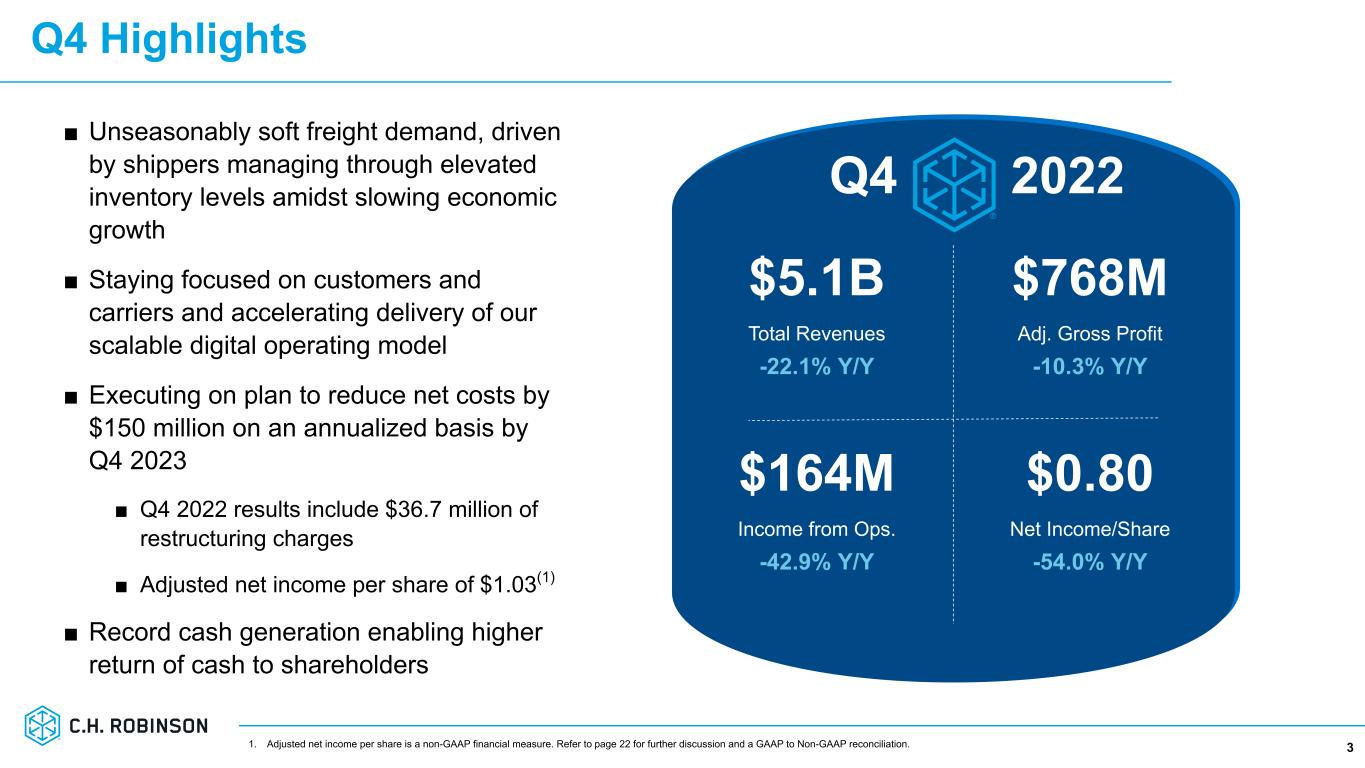

Q4 Highlights 3 ■ Unseasonably soft freight demand, driven by shippers managing through elevated inventory levels amidst slowing economic growth ■ Staying focused on customers and carriers and accelerating delivery of our scalable digital operating model ■ Executing on plan to reduce net costs by $150 million on an annualized basis by Q4 2023 ■ Q4 2022 results include $36.7 million of restructuring charges ■ Adjusted net income per share of $1.03(1) ■ Record cash generation enabling higher return of cash to shareholders $5.1B Total Revenues -22.1% Y/Y $768M Adj. Gross Profit -10.3% Y/Y $164M Income from Ops. -42.9% Y/Y $0.80 Net Income/Share -54.0% Y/Y Q4 2022 1. Adjusted net income per share is a non-GAAP financial measure. Refer to page 22 for further discussion and a GAAP to Non-GAAP reconciliation.

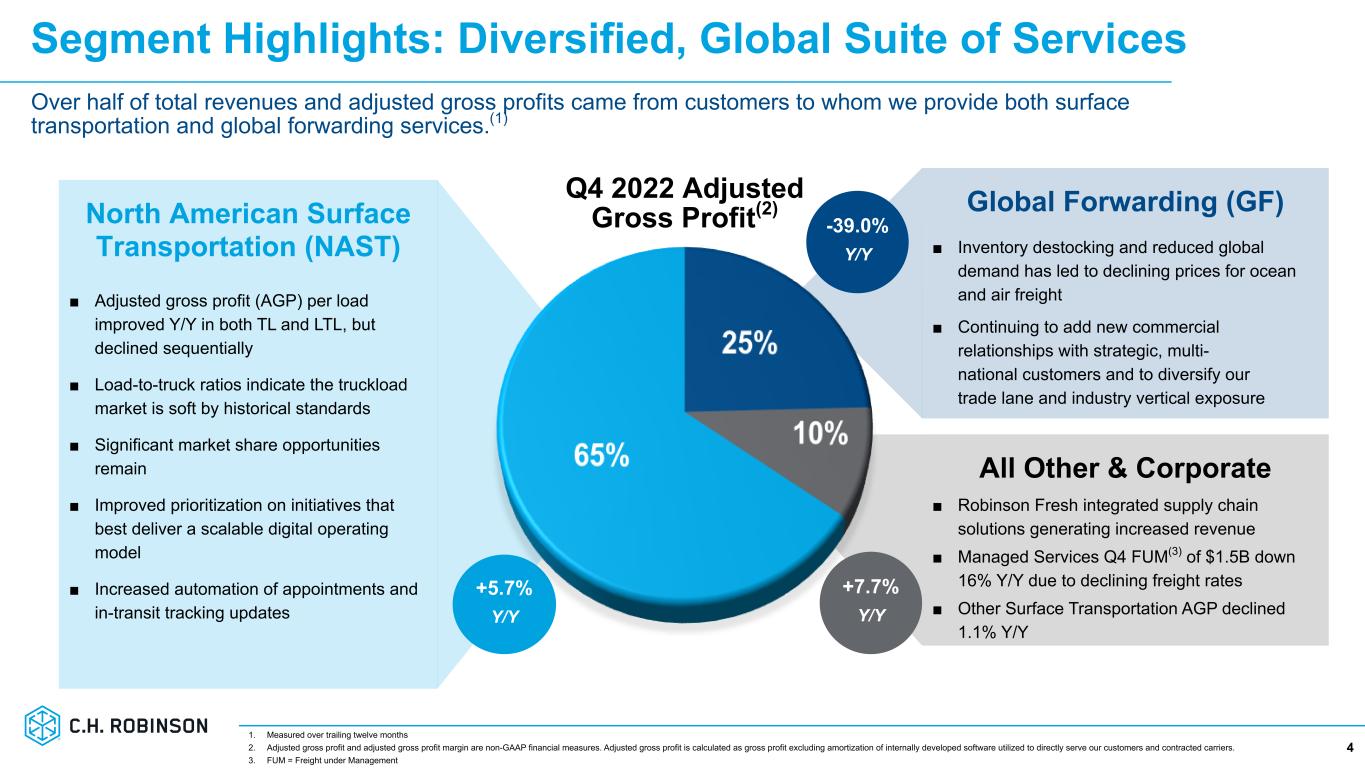

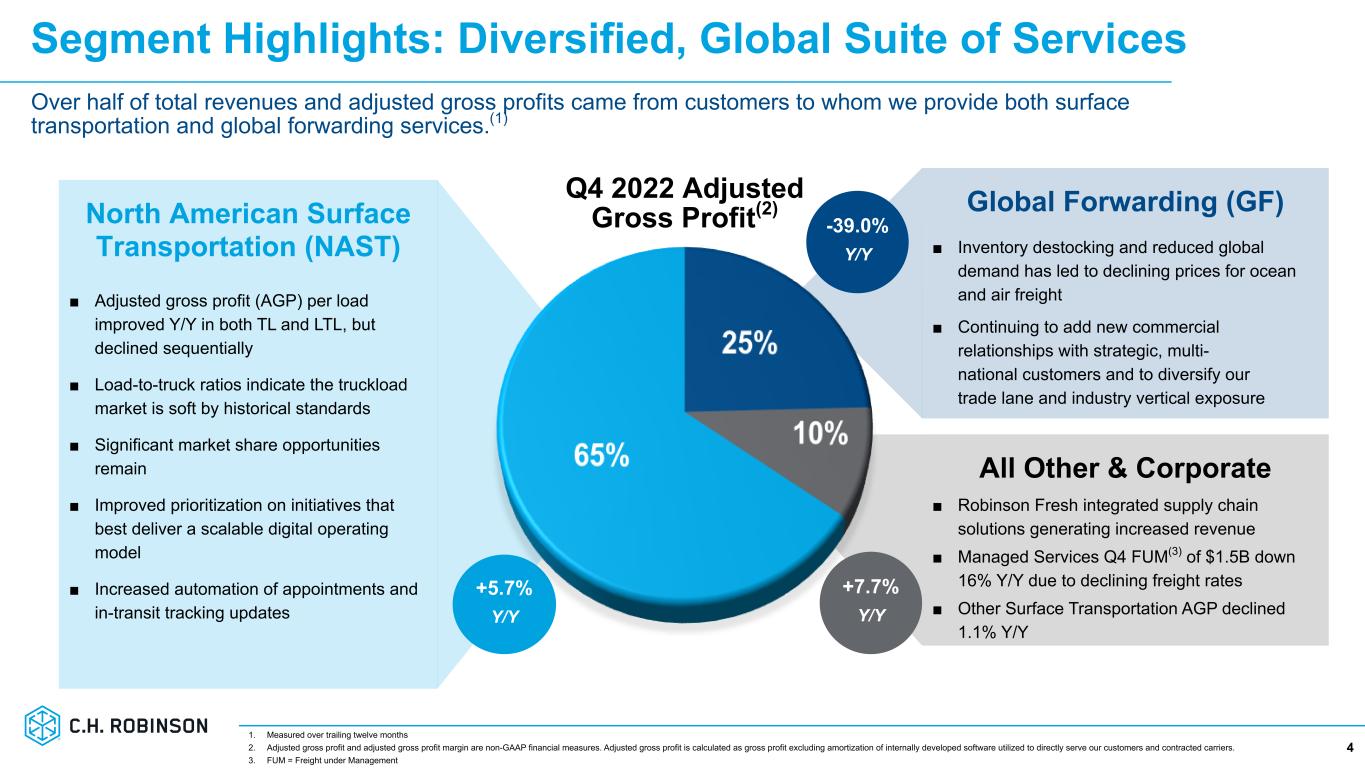

All Other & Corporate ■ Robinson Fresh integrated supply chain solutions generating increased revenue ■ Managed Services Q4 FUM(3) of $1.5B down 16% Y/Y due to declining freight rates ■ Other Surface Transportation AGP declined 1.1% Y/Y Global Forwarding (GF) ■ Inventory destocking and reduced global demand has led to declining prices for ocean and air freight ■ Continuing to add new commercial relationships with strategic, multi- national customers and to diversify our trade lane and industry vertical exposure North American Surface Transportation (NAST) ■ Adjusted gross profit (AGP) per load improved Y/Y in both TL and LTL, but declined sequentially ■ Load-to-truck ratios indicate the truckload market is soft by historical standards ■ Significant market share opportunities remain ■ Improved prioritization on initiatives that best deliver a scalable digital operating model ■ Increased automation of appointments and in-transit tracking updates Segment Highlights: Diversified, Global Suite of Services 4 Q4 2022 Adjusted Gross Profit(2) +5.7% Y/Y +7.7% Y/Y -39.0% Y/Y 1. Measured over trailing twelve months 2. Adjusted gross profit and adjusted gross profit margin are non-GAAP financial measures. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers. 3. FUM = Freight under Management Over half of total revenues and adjusted gross profits came from customers to whom we provide both surface transportation and global forwarding services.(1)

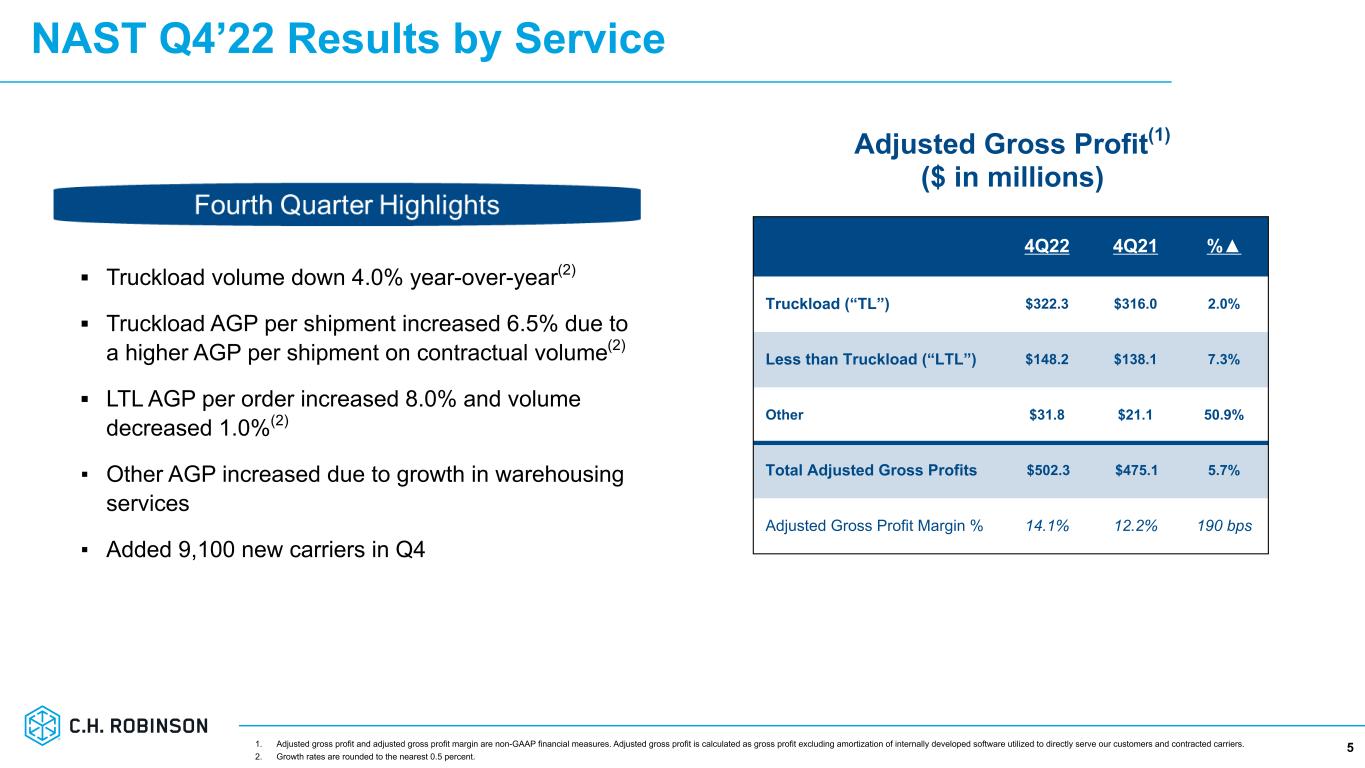

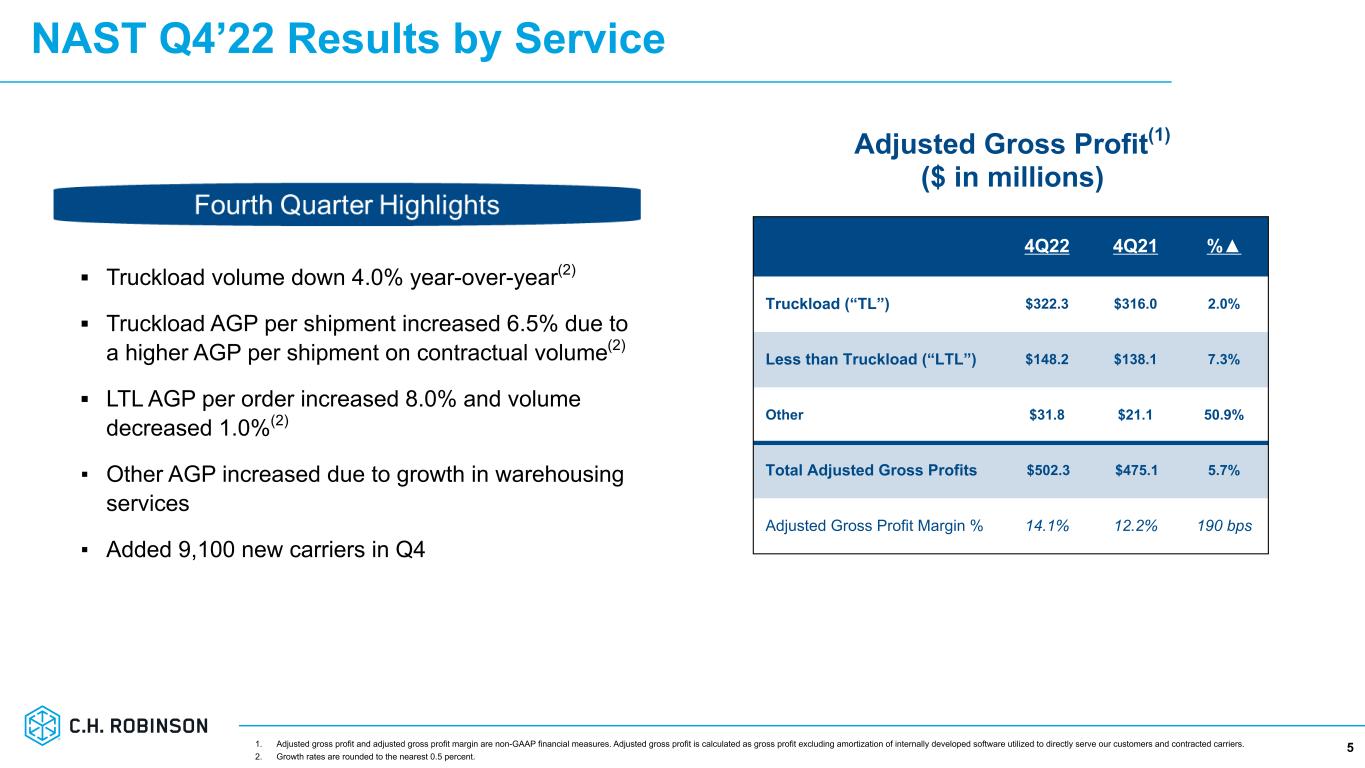

NAST Q4’22 Results by Service 5 ▪ Truckload volume down 4.0% year-over-year(2) ▪ Truckload AGP per shipment increased 6.5% due to a higher AGP per shipment on contractual volume(2) ▪ LTL AGP per order increased 8.0% and volume decreased 1.0%(2) ▪ Other AGP increased due to growth in warehousing services ▪ Added 9,100 new carriers in Q4 4Q22 4Q21 %▲ Truckload (“TL”) $322.3 $316.0 2.0% Less than Truckload (“LTL”) $148.2 $138.1 7.3% Other $31.8 $21.1 50.9% Total Adjusted Gross Profits $502.3 $475.1 5.7% Adjusted Gross Profit Margin % 14.1% 12.2% 190 bps Adjusted Gross Profit(1) ($ in millions) 1. Adjusted gross profit and adjusted gross profit margin are non-GAAP financial measures. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers. 2. Growth rates are rounded to the nearest 0.5 percent.

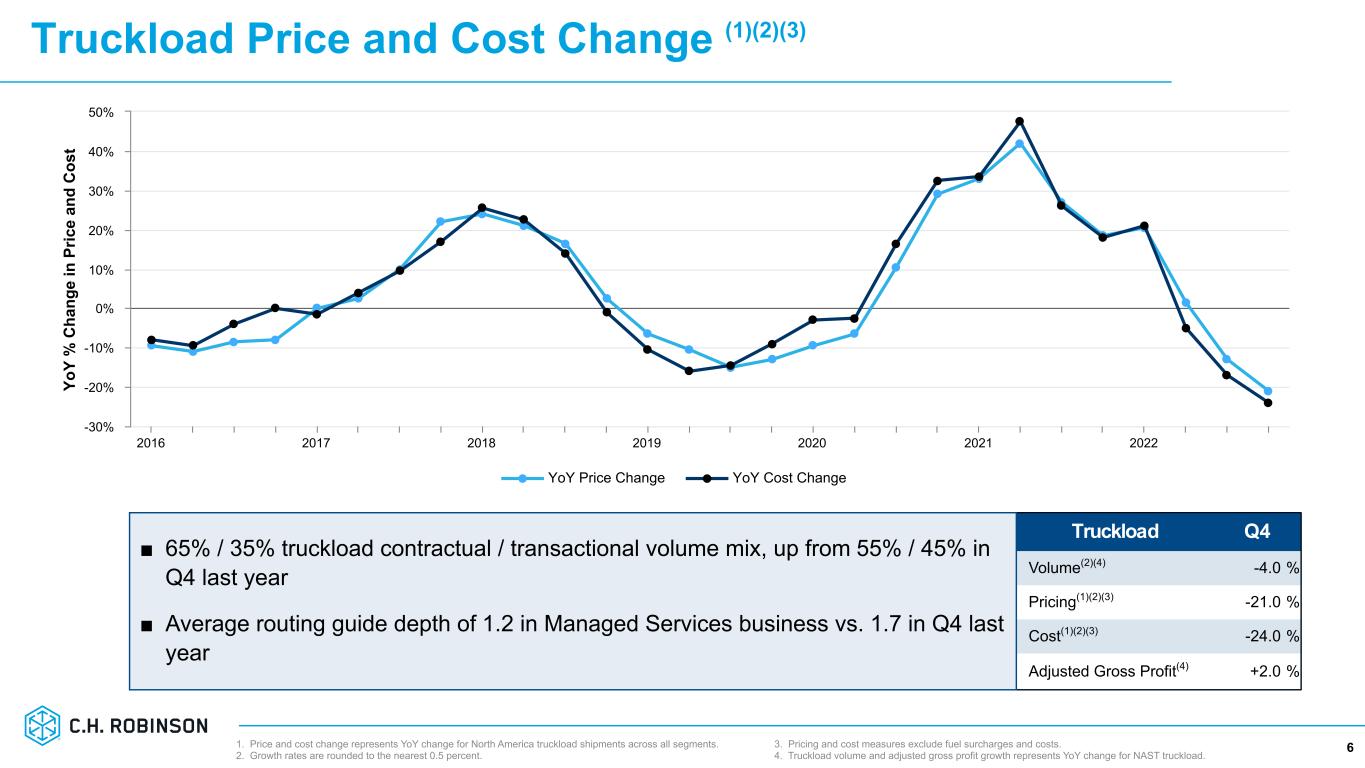

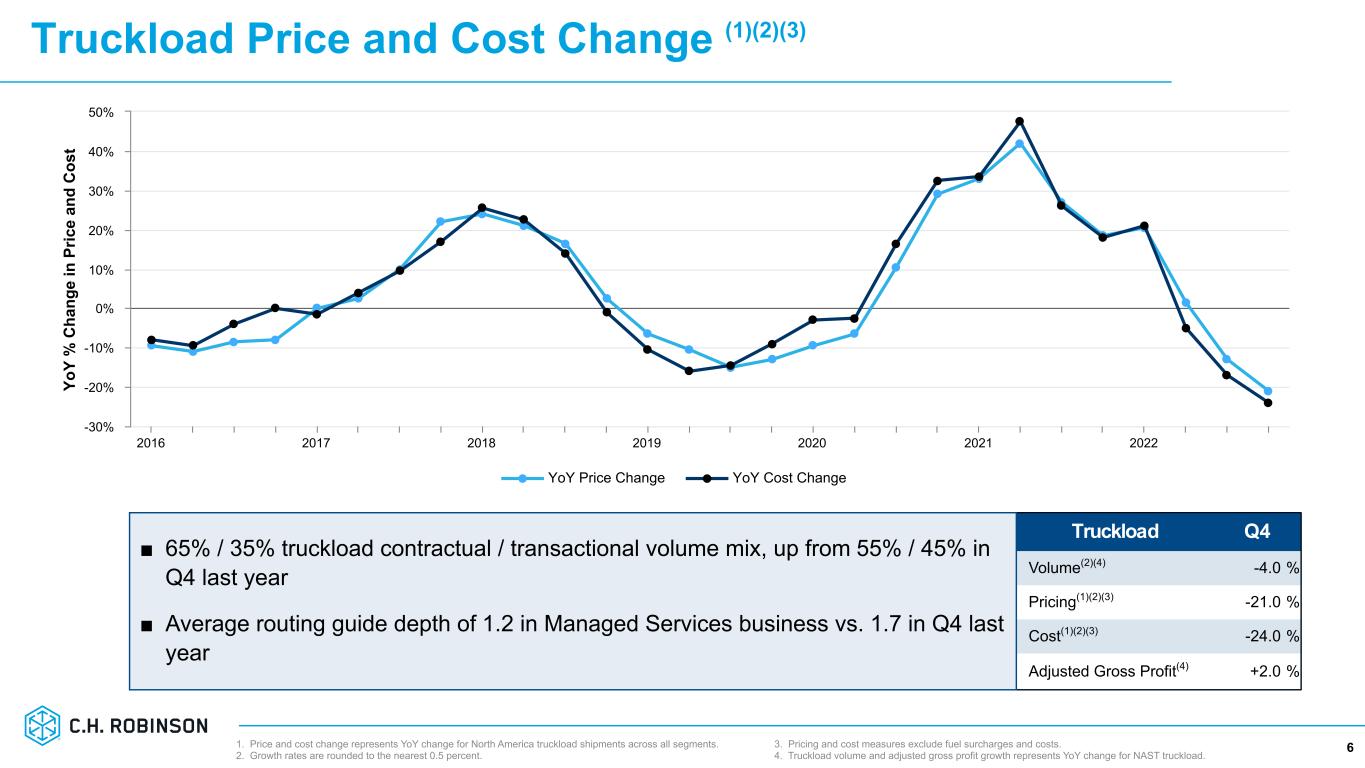

Truckload Price and Cost Change (1)(2)(3) 6 Truckload Q4 Volume(2)(4) -4.0 % Pricing(1)(2)(3) -21.0 % Cost(1)(2)(3) -24.0 % Adjusted Gross Profit(4) +2.0 % 1. Price and cost change represents YoY change for North America truckload shipments across all segments. 2. Growth rates are rounded to the nearest 0.5 percent. ■ 65% / 35% truckload contractual / transactional volume mix, up from 55% / 45% in Q4 last year ■ Average routing guide depth of 1.2 in Managed Services business vs. 1.7 in Q4 last year 3. Pricing and cost measures exclude fuel surcharges and costs. 4. Truckload volume and adjusted gross profit growth represents YoY change for NAST truckload. Yo Y % C ha ng e in P ric e an d C os t YoY Price Change YoY Cost Change 2016 2017 2018 2019 2020 2021 2022 -30% -20% -10% 0% 10% 20% 30% 40% 50%

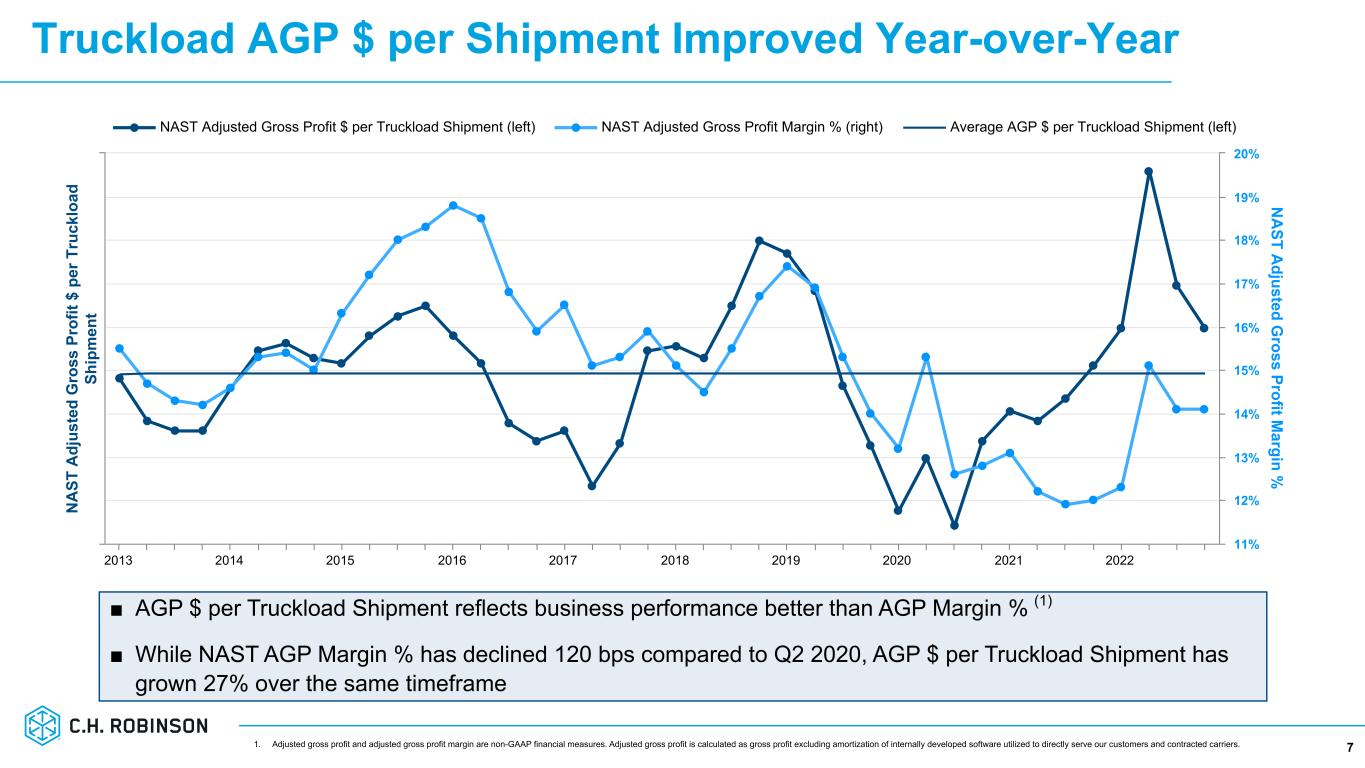

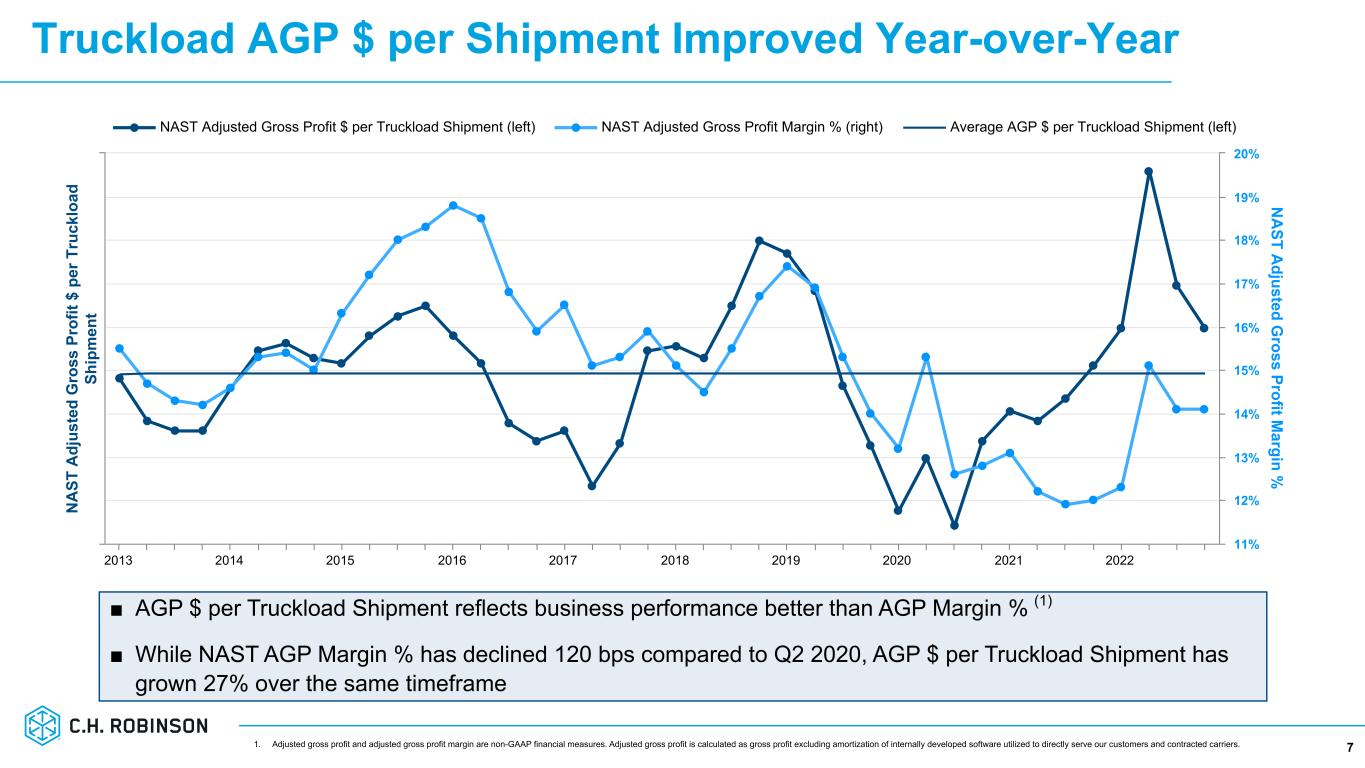

Truckload AGP $ per Shipment Improved Year-over-Year 7 ■ AGP $ per Truckload Shipment reflects business performance better than AGP Margin % (1) ■ While NAST AGP Margin % has declined 120 bps compared to Q2 2020, AGP $ per Truckload Shipment has grown 27% over the same timeframe N A ST A dj us te d G ro ss P ro fit $ p er T ru ck lo ad Sh ip m en t N A ST A djusted G ross Profit M argin % NAST Adjusted Gross Profit $ per Truckload Shipment (left) NAST Adjusted Gross Profit Margin % (right) Average AGP $ per Truckload Shipment (left) 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1. Adjusted gross profit and adjusted gross profit margin are non-GAAP financial measures. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers.

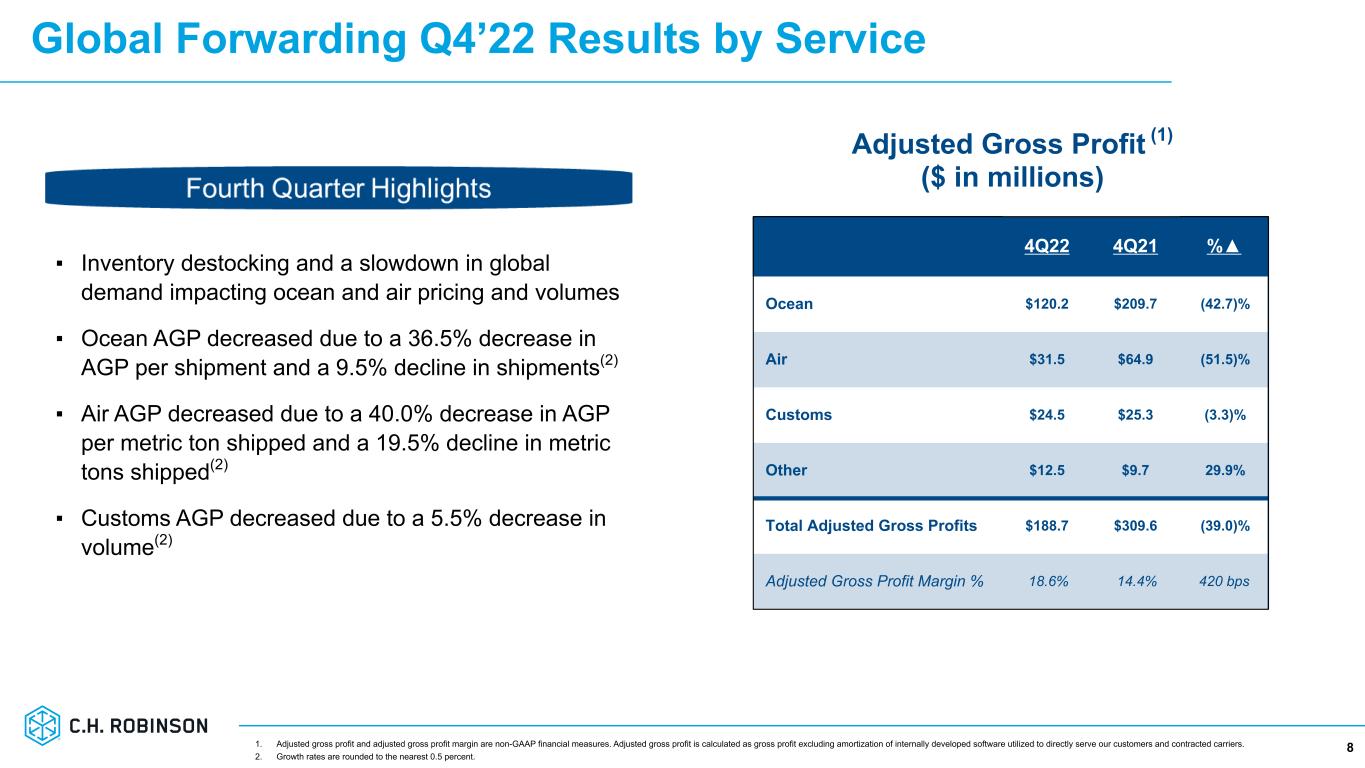

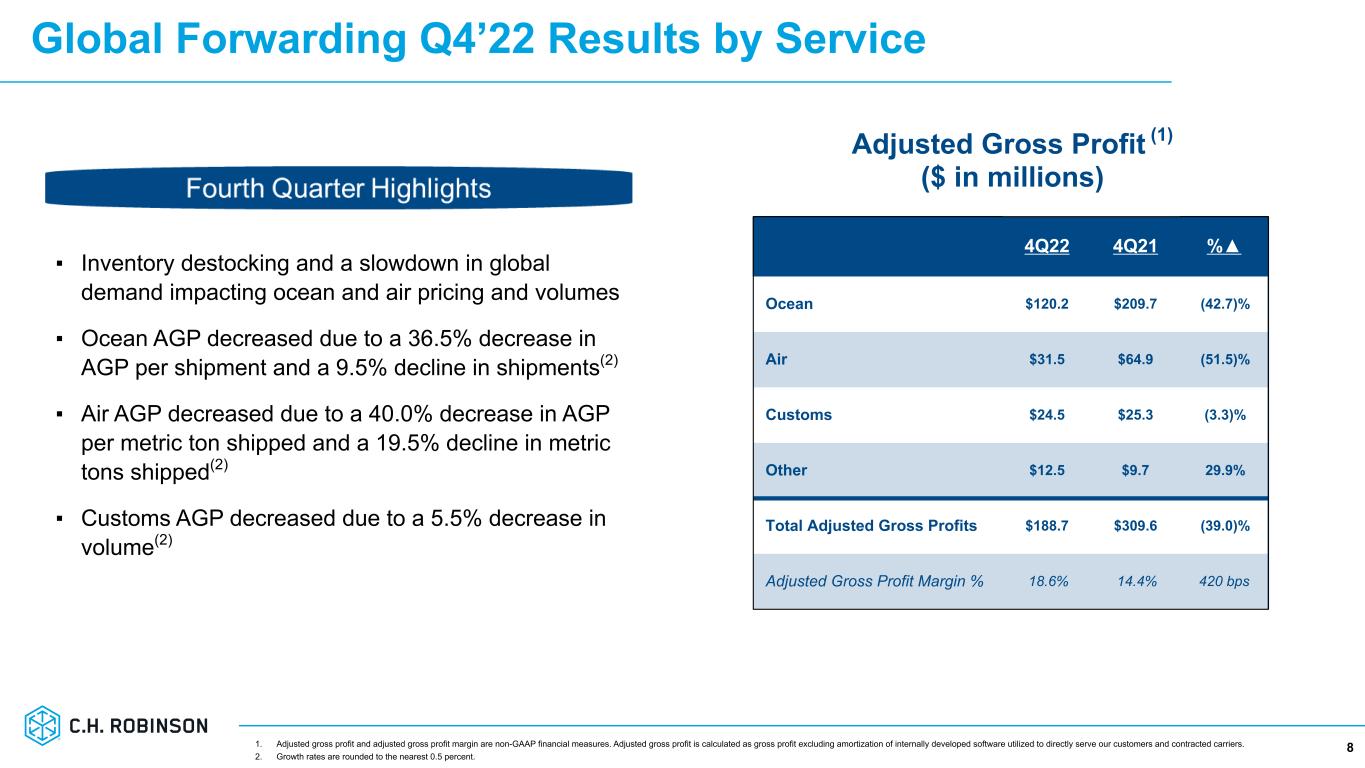

Global Forwarding Q4’22 Results by Service 8 4Q22 4Q21 %▲ Ocean $120.2 $209.7 (42.7)% Air $31.5 $64.9 (51.5)% Customs $24.5 $25.3 (3.3)% Other $12.5 $9.7 29.9% Total Adjusted Gross Profits $188.7 $309.6 (39.0)% Adjusted Gross Profit Margin % 18.6% 14.4% 420 bps Adjusted Gross Profit (1) ($ in millions) ▪ Inventory destocking and a slowdown in global demand impacting ocean and air pricing and volumes ▪ Ocean AGP decreased due to a 36.5% decrease in AGP per shipment and a 9.5% decline in shipments(2) ▪ Air AGP decreased due to a 40.0% decrease in AGP per metric ton shipped and a 19.5% decline in metric tons shipped(2) ▪ Customs AGP decreased due to a 5.5% decrease in volume(2) 1. Adjusted gross profit and adjusted gross profit margin are non-GAAP financial measures. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers. 2. Growth rates are rounded to the nearest 0.5 percent.

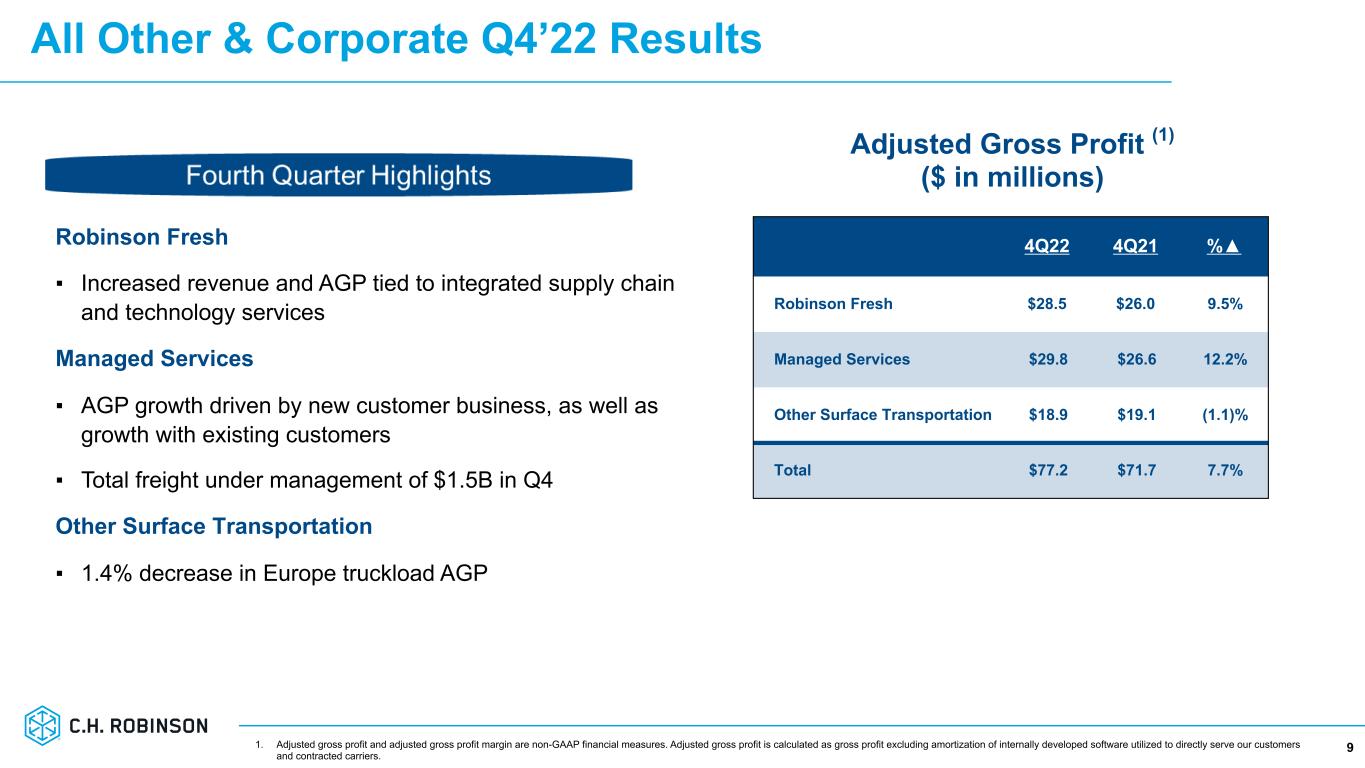

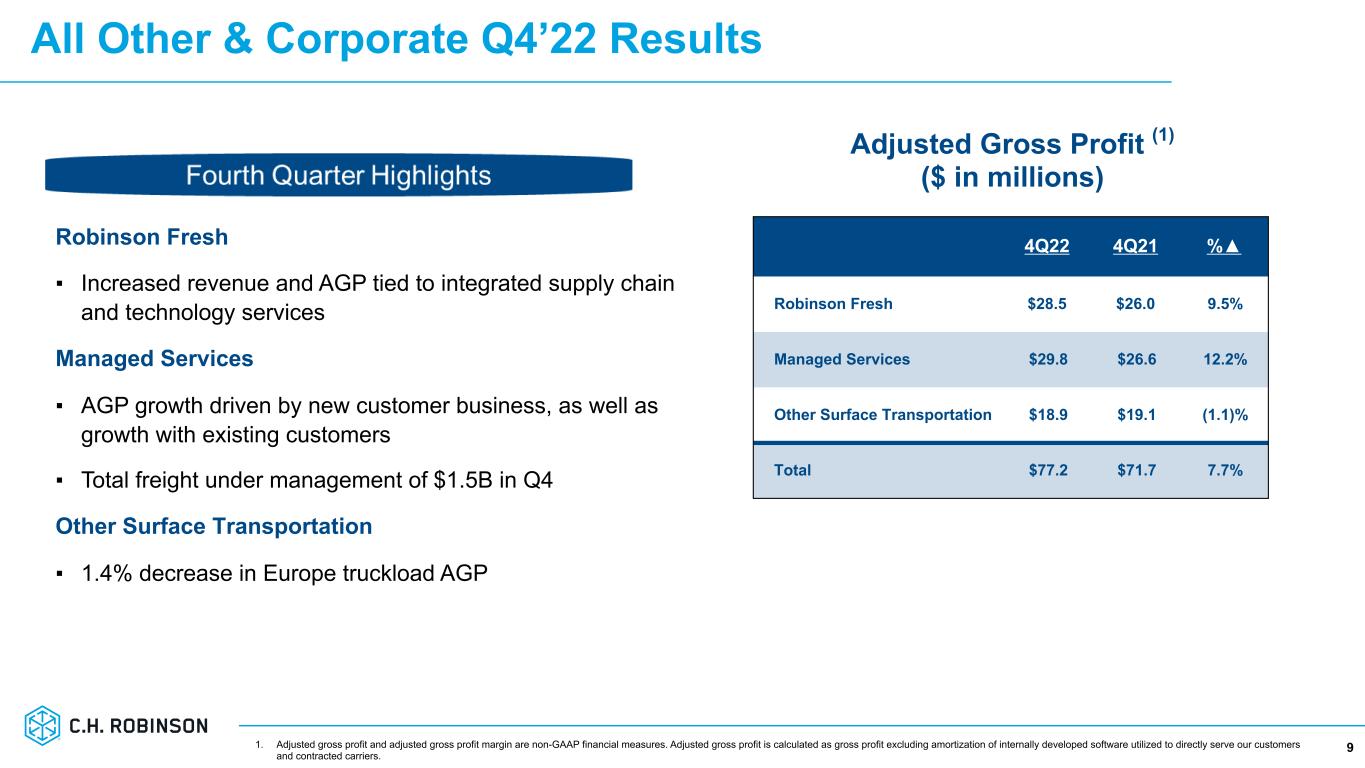

All Other & Corporate Q4’22 Results 9 Robinson Fresh ▪ Increased revenue and AGP tied to integrated supply chain and technology services Managed Services ▪ AGP growth driven by new customer business, as well as growth with existing customers ▪ Total freight under management of $1.5B in Q4 Other Surface Transportation ▪ 1.4% decrease in Europe truckload AGP 4Q22 4Q21 %▲ Robinson Fresh $28.5 $26.0 9.5% Managed Services $29.8 $26.6 12.2% Other Surface Transportation $18.9 $19.1 (1.1)% Total $77.2 $71.7 7.7% Adjusted Gross Profit (1) ($ in millions) 1. Adjusted gross profit and adjusted gross profit margin are non-GAAP financial measures. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers.

Sustainable Growth Strategy 10 Optimize Processes Spend Strategically Grow Globally Scale Digitally Increase Share ■ Leverage integrated service model to grow market share and expand globally ■ Industry-leading tech, people and processes to provide best-in-class service ■ Expand modal capabilities ■ Expand Global Forwarding business as provider of choice for multinational customers ■ Leverage scale to capitalize on secularly growing market and unique global footprint ■ Grow capabilities and presence in key industry verticals, trade lanes and geographies ■ Digitize more internal tools and processes and drive down costs ■ Free customer and carrier reps’ capacity for higher- value touchpoints ■ Drive more revenue synergy across business units ■ Provide customers and carriers the digital products they value ■ Leverage data, scale and information advantage ■ Bring meaningful products, features and insights to both sides of the two- sided marketplace ■ Increase digital execution of all touch points in the lifecycle of a load ■ Support organic growth by leveraging strong cash flow ■ Modernize core for future integrations ■ Complement with opportunistic M&A

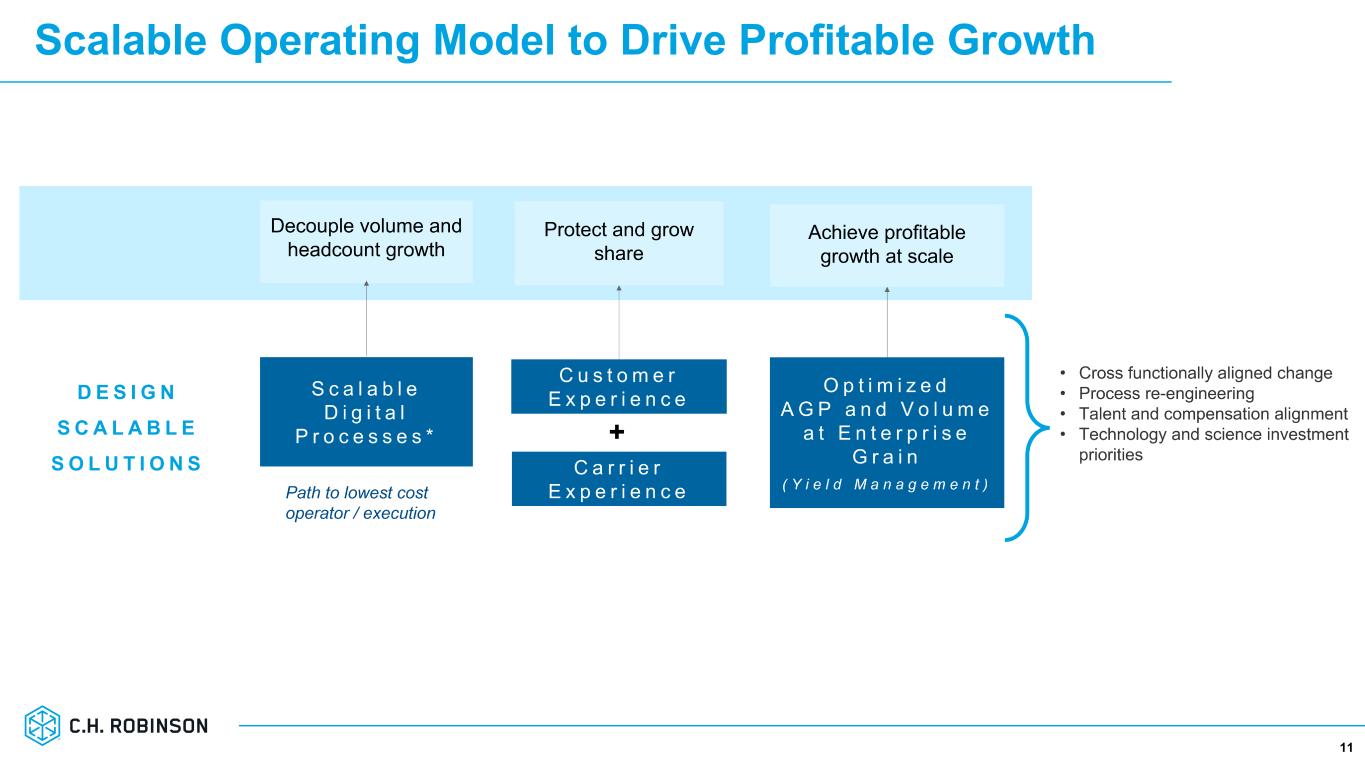

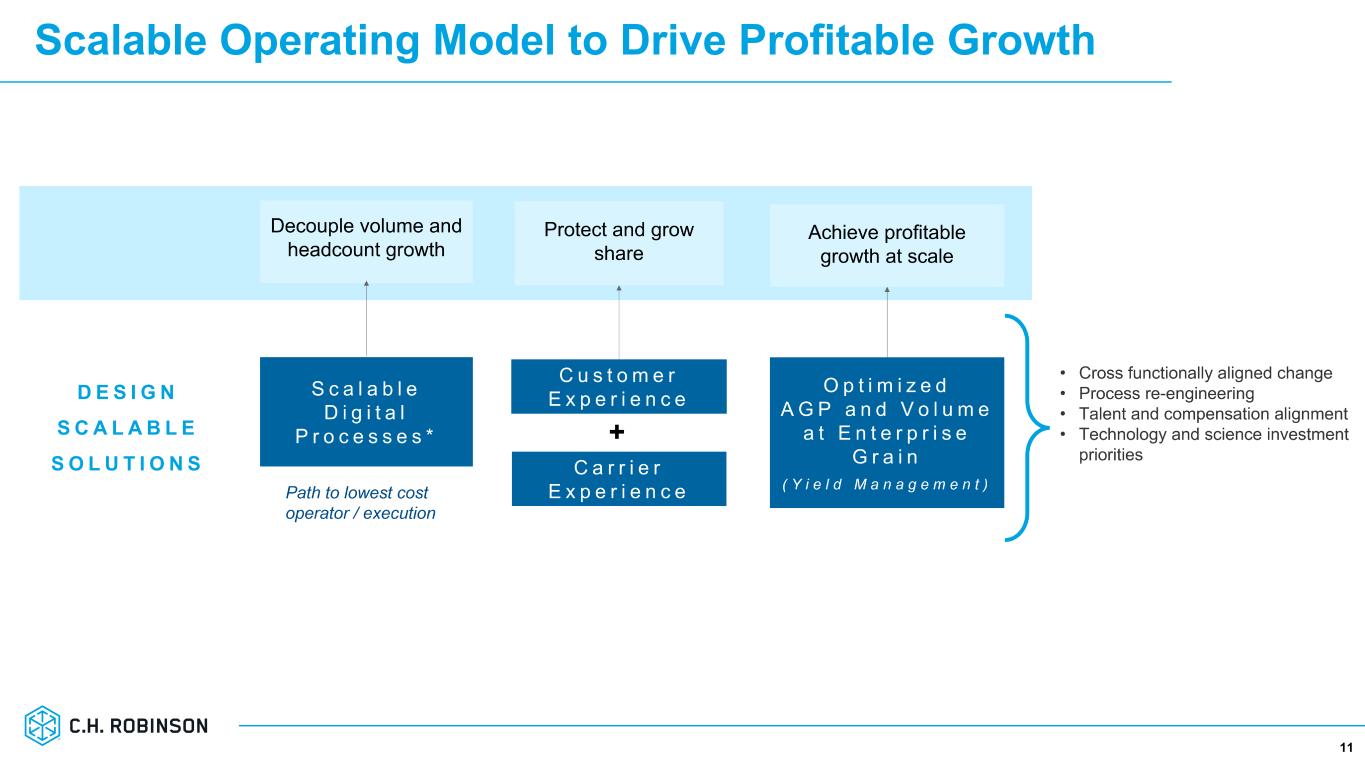

Scalable Operating Model to Drive Profitable Growth 11 11

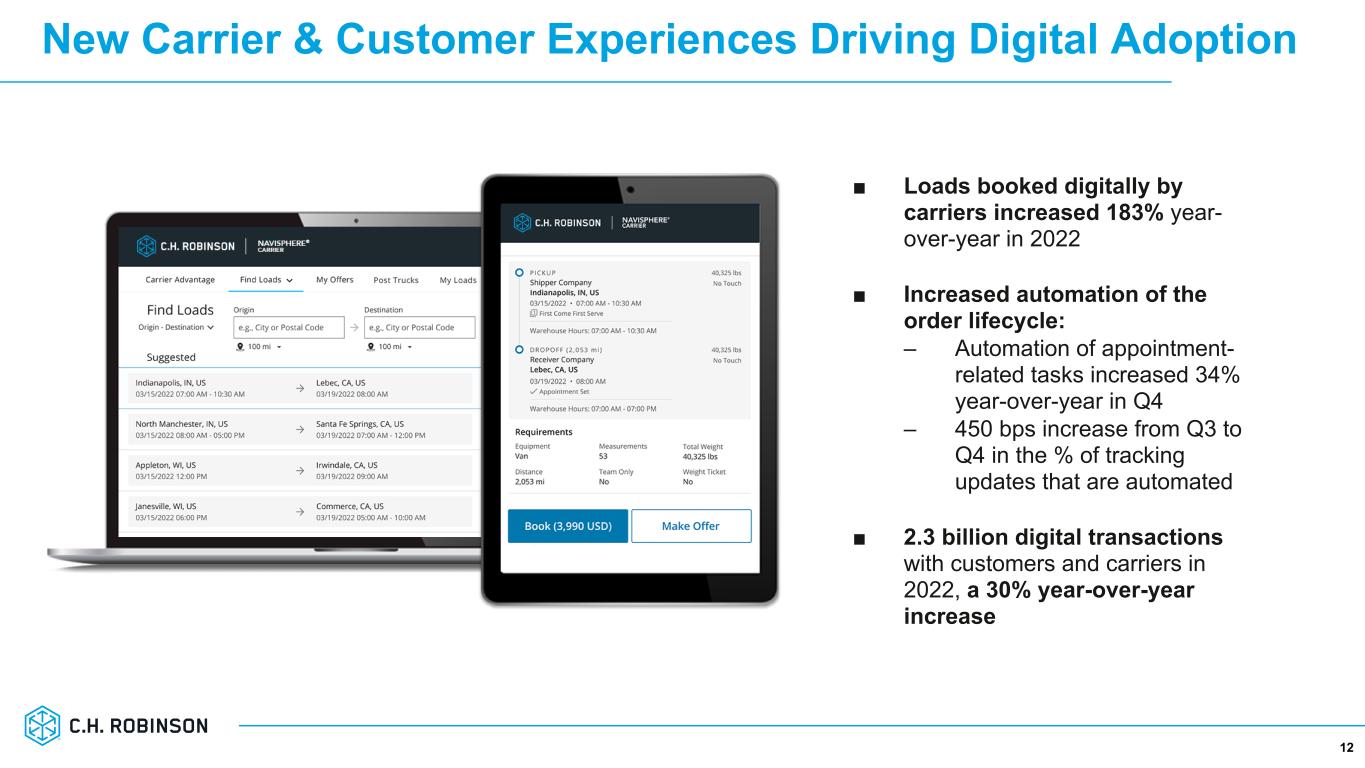

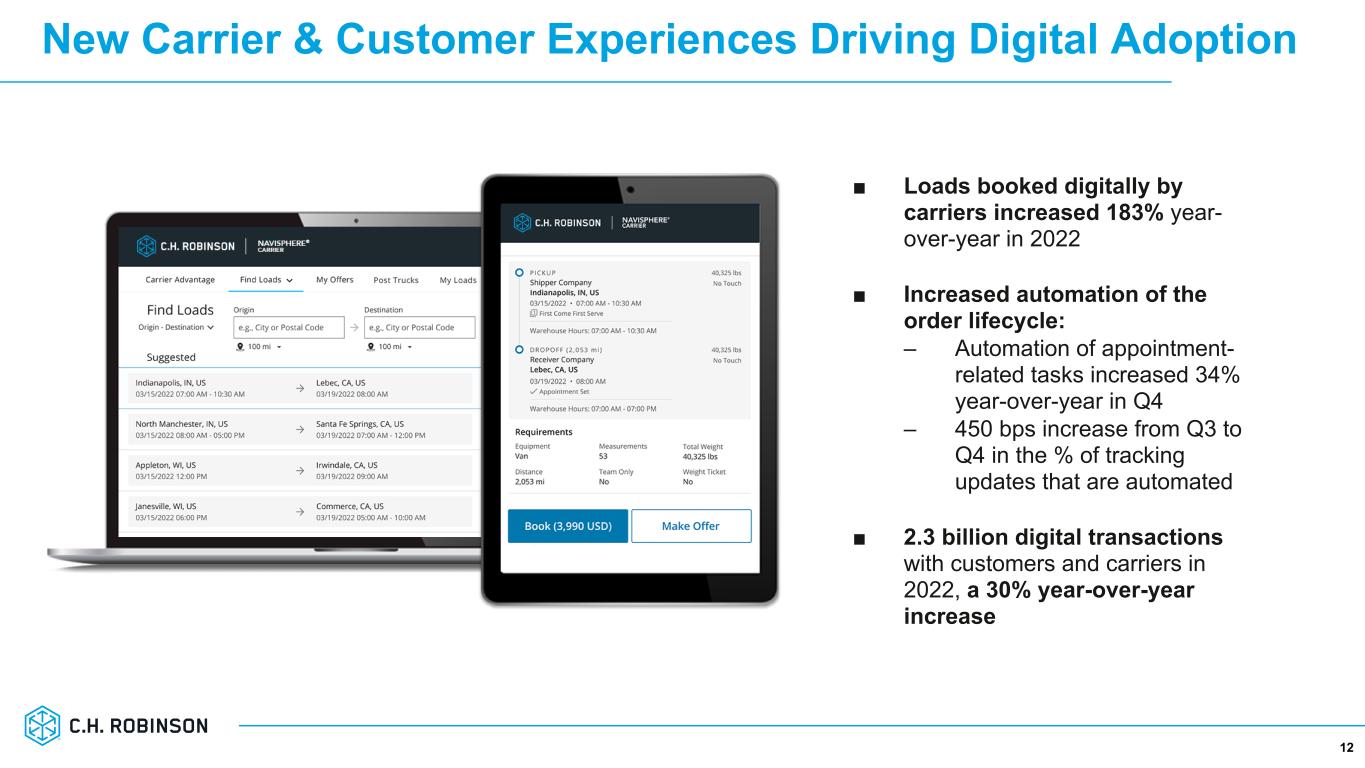

New Carrier & Customer Experiences Driving Digital Adoption 12 ■ Loads booked digitally by carriers increased 183% year- over-year in 2022 ■ Increased automation of the order lifecycle: – Automation of appointment- related tasks increased 34% year-over-year in Q4 – 450 bps increase from Q3 to Q4 in the % of tracking updates that are automated ■ 2.3 billion digital transactions with customers and carriers in 2022, a 30% year-over-year increase 12

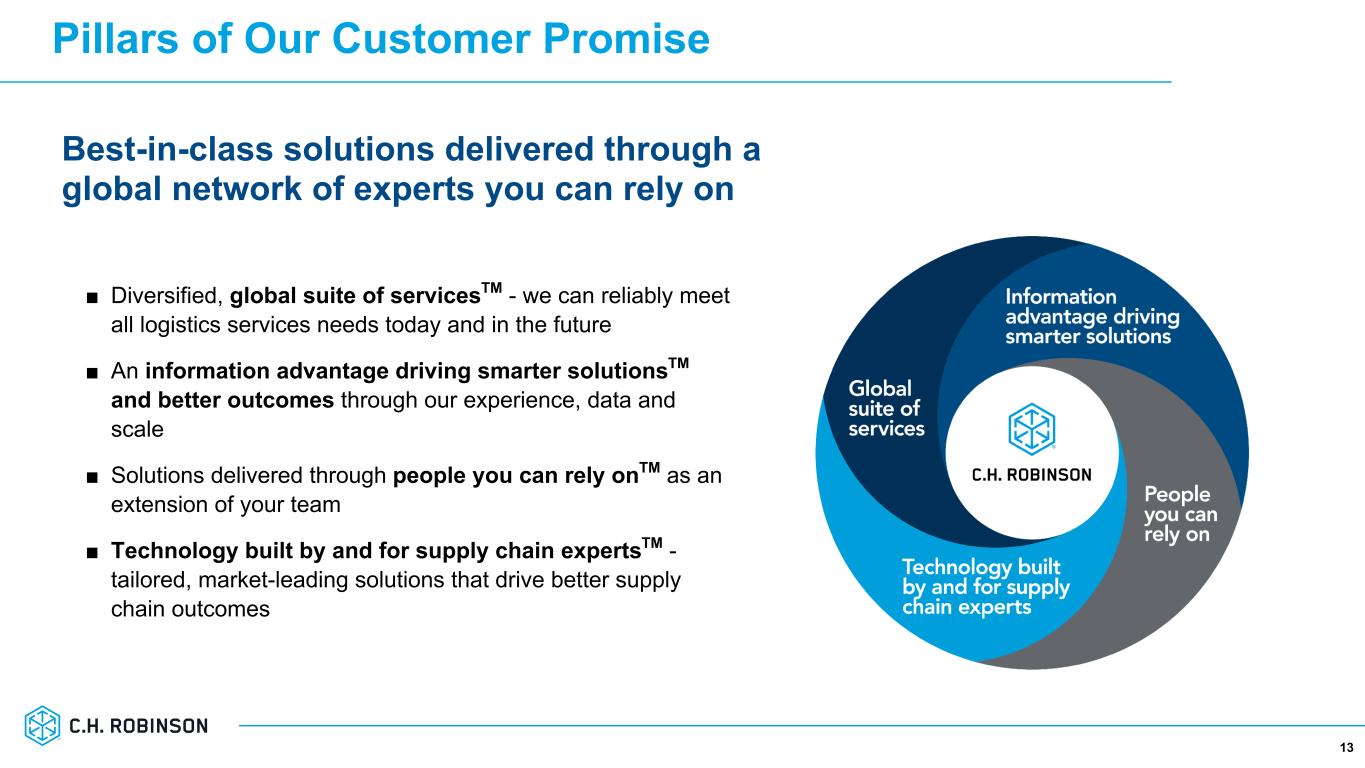

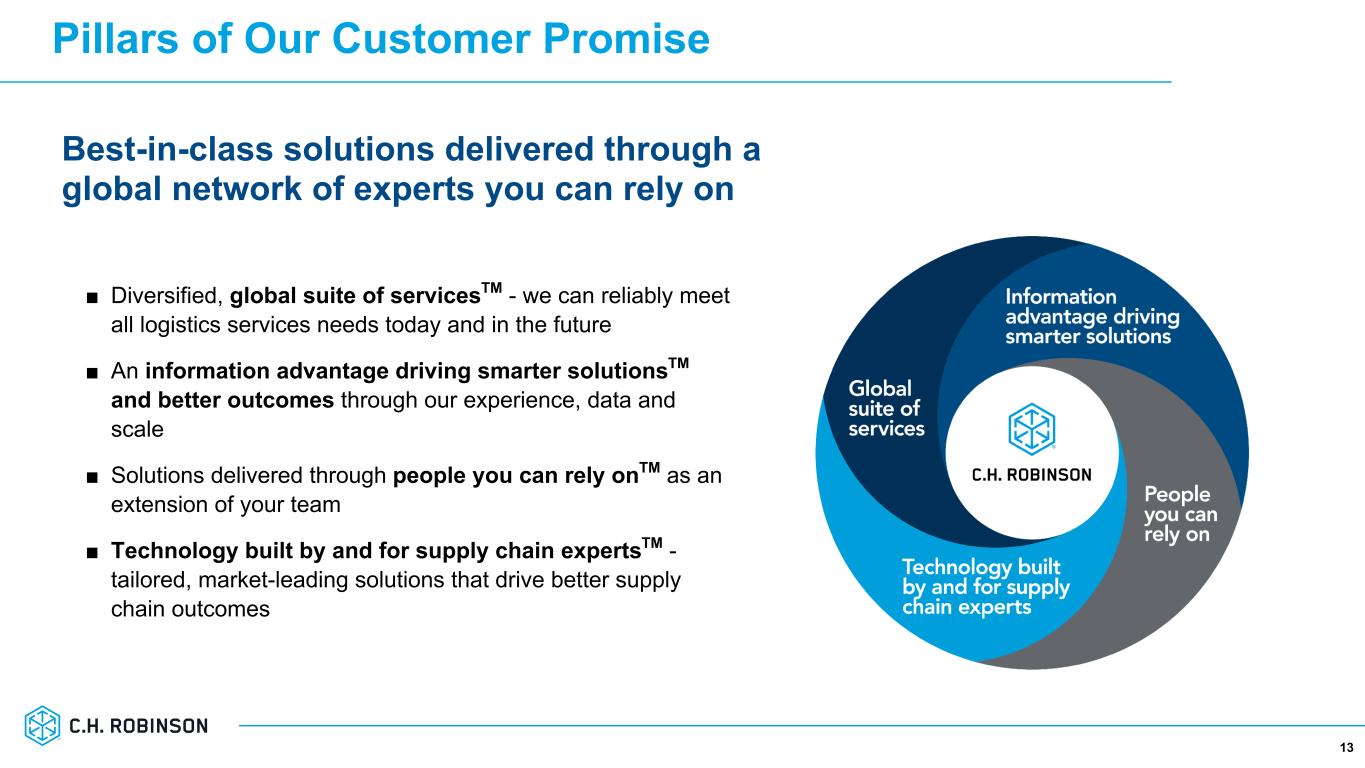

Pillars of Our Customer Promise ■ Diversified, global suite of servicesTM - we can reliably meet all logistics services needs today and in the future ■ An information advantage driving smarter solutionsTM and better outcomes through our experience, data and scale ■ Solutions delivered through people you can rely onTM as an extension of your team ■ Technology built by and for supply chain expertsTM - tailored, market-leading solutions that drive better supply chain outcomes 13 Best-in-class solutions delivered through a global network of experts you can rely on

Capital Allocation Priorities: Balanced and Opportunistic 14 Cash Flow from Operations & Capital Distribution ($M) ■ $507 million of cash returned to shareholders in Q4 2022, up 128% ■ Q4 2022 capital distribution equates to 527% of our Q4 net income ■ 4.6 million shares repurchased at an average price of $95.20 ■ Uninterrupted dividends, without decline on a per share basis, paid for more than 25 years ■ Changes in cash from operations have been driven primarily by sequential changes in operating working capital due to volatility in freight costs and prices. ■ As the cost and price of purchased transportation (inclusive of fuel surcharges) comes down, we expect a commensurate benefit to net operating working capital and operating cash flow.

15 Appendix

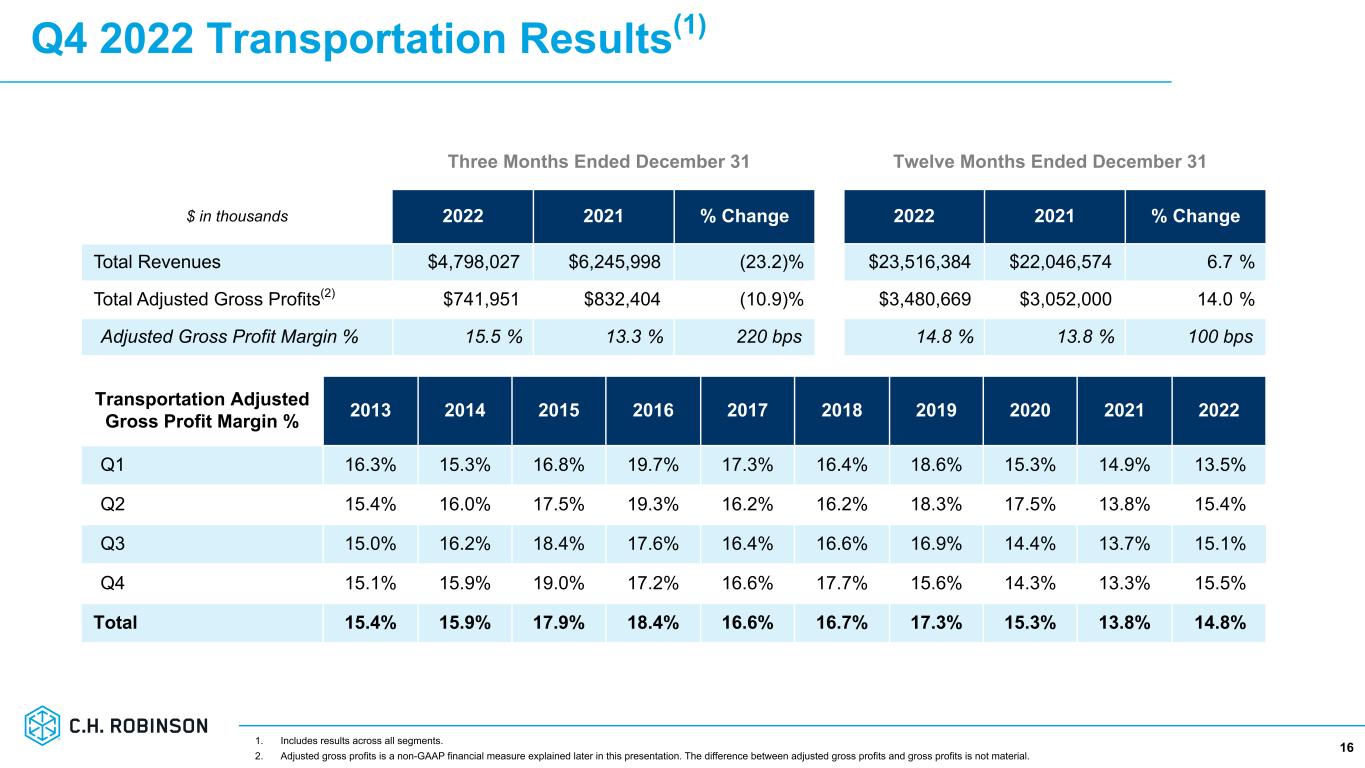

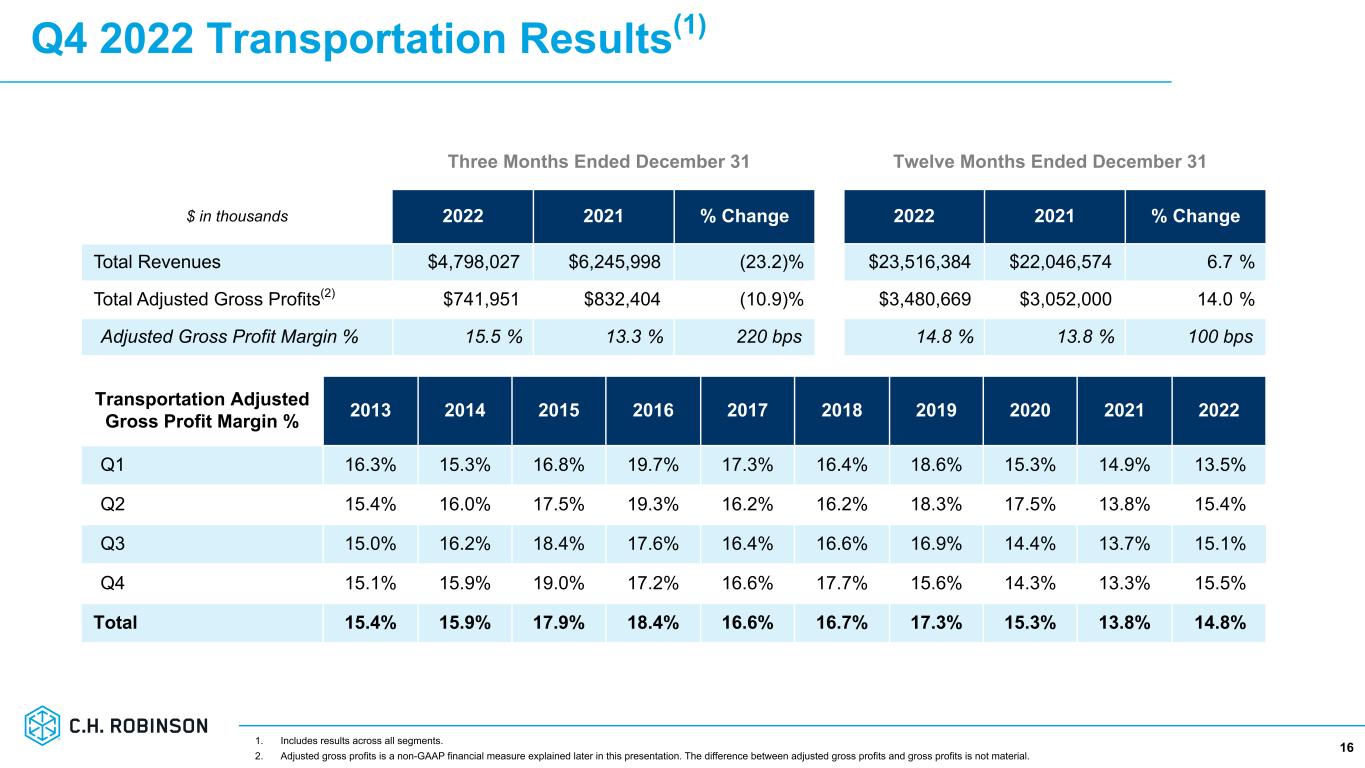

Q4 2022 Transportation Results(1) 16 Three Months Ended December 31 Twelve Months Ended December 31 $ in thousands 2022 2021 % Change 2022 2021 % Change Total Revenues $4,798,027 $6,245,998 (23.2) % $23,516,384 $22,046,574 6.7 % Total Adjusted Gross Profits(2) $741,951 $832,404 (10.9) % $3,480,669 $3,052,000 14.0 % Adjusted Gross Profit Margin % 15.5 % 13.3 % 220 bps 14.8 % 13.8 % 100 bps Transportation Adjusted Gross Profit Margin % 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Q1 16.3% 15.3% 16.8% 19.7% 17.3% 16.4% 18.6% 15.3% 14.9% 13.5% Q2 15.4% 16.0% 17.5% 19.3% 16.2% 16.2% 18.3% 17.5% 13.8% 15.4% Q3 15.0% 16.2% 18.4% 17.6% 16.4% 16.6% 16.9% 14.4% 13.7% 15.1% Q4 15.1% 15.9% 19.0% 17.2% 16.6% 17.7% 15.6% 14.3% 13.3% 15.5% Total 15.4% 15.9% 17.9% 18.4% 16.6% 16.7% 17.3% 15.3% 13.8% 14.8% 1. Includes results across all segments. 2. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material.

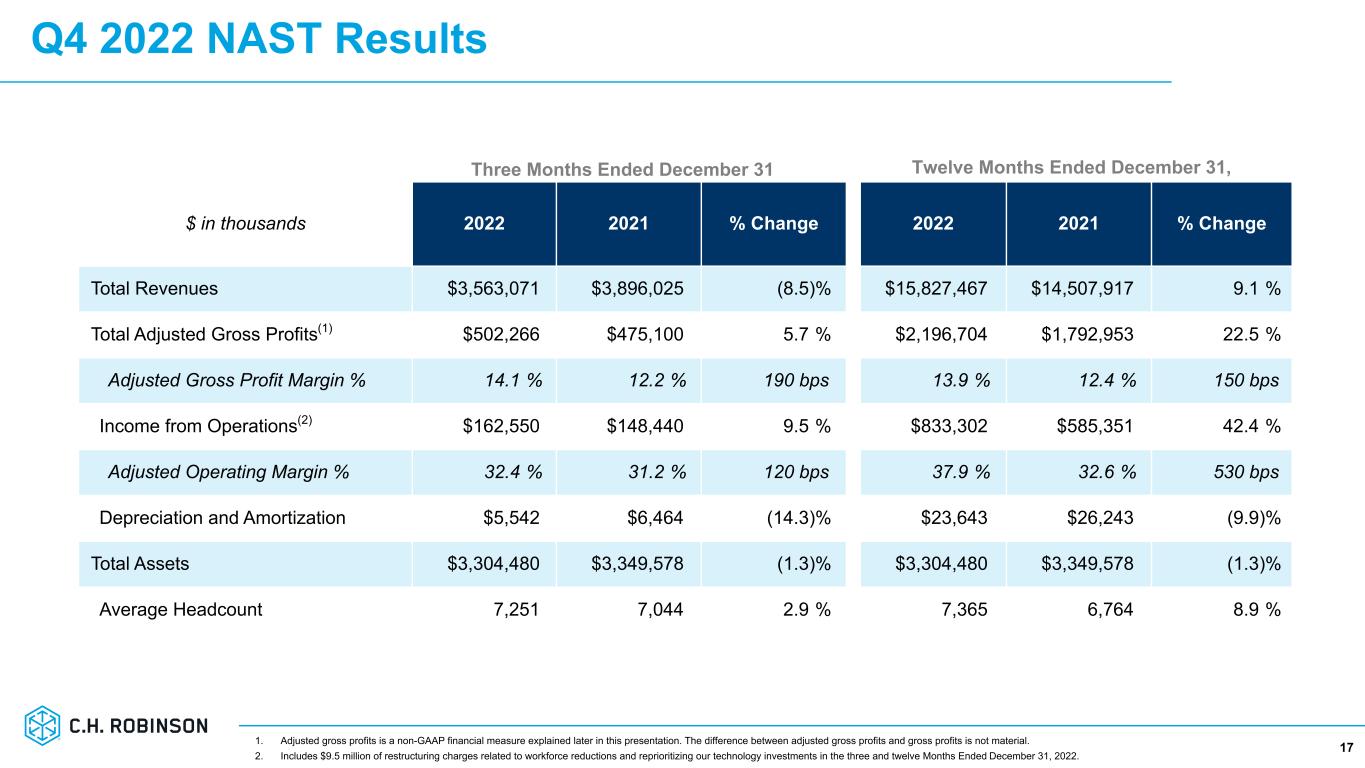

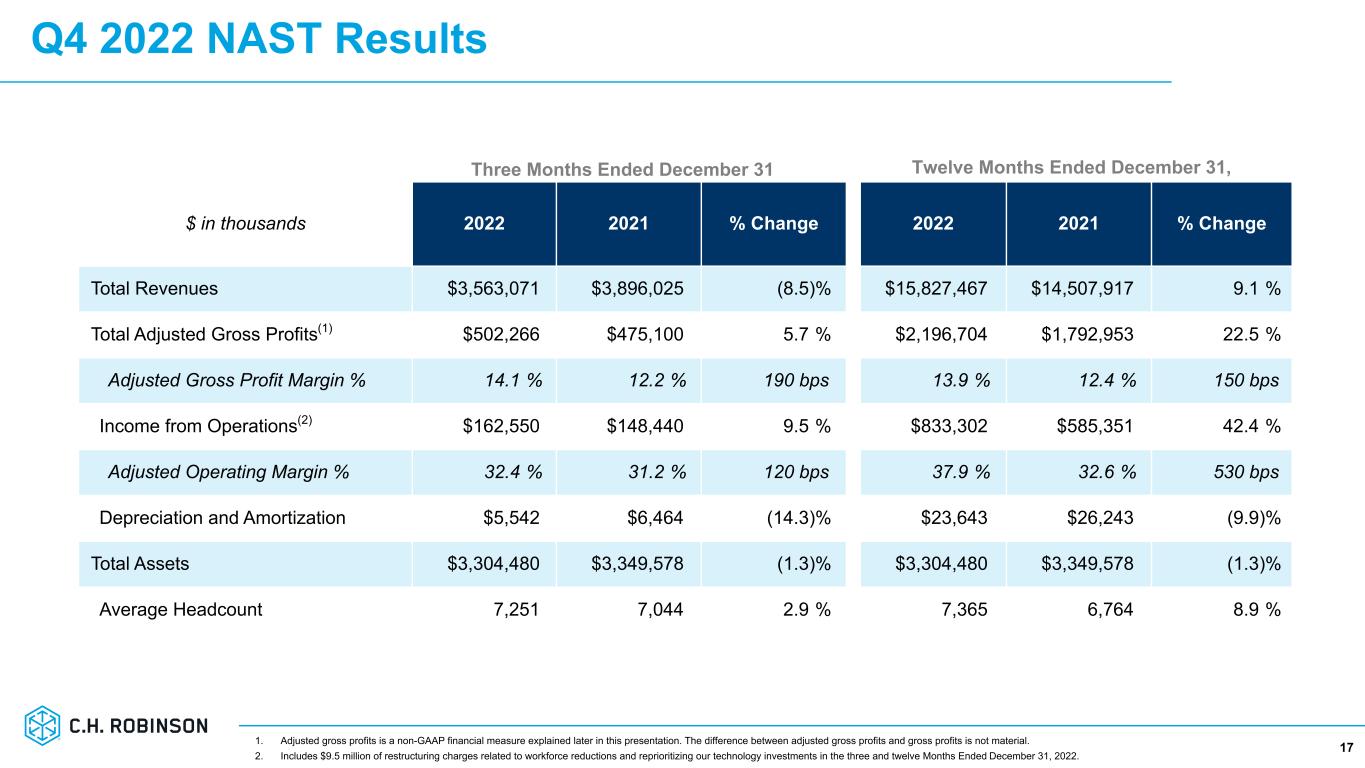

Q4 2022 NAST Results 171. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Includes $9.5 million of restructuring charges related to workforce reductions and reprioritizing our technology investments in the three and twelve Months Ended December 31, 2022. Three Months Ended December 31 Twelve Months Ended December 31, $ in thousands 2022 2021 % Change 2022 2021 % Change Total Revenues $3,563,071 $3,896,025 (8.5) % $15,827,467 $14,507,917 9.1 % Total Adjusted Gross Profits(1) $502,266 $475,100 5.7 % $2,196,704 $1,792,953 22.5 % Adjusted Gross Profit Margin % 14.1 % 12.2 % 190 bps 13.9 % 12.4 % 150 bps Income from Operations(2) $162,550 $148,440 9.5 % $833,302 $585,351 42.4 % Adjusted Operating Margin % 32.4 % 31.2 % 120 bps 37.9 % 32.6 % 530 bps Depreciation and Amortization $5,542 $6,464 (14.3) % $23,643 $26,243 (9.9) % Total Assets $3,304,480 $3,349,578 (1.3) % $3,304,480 $3,349,578 (1.3) % Average Headcount 7,251 7,044 2.9 % 7,365 6,764 8.9 %

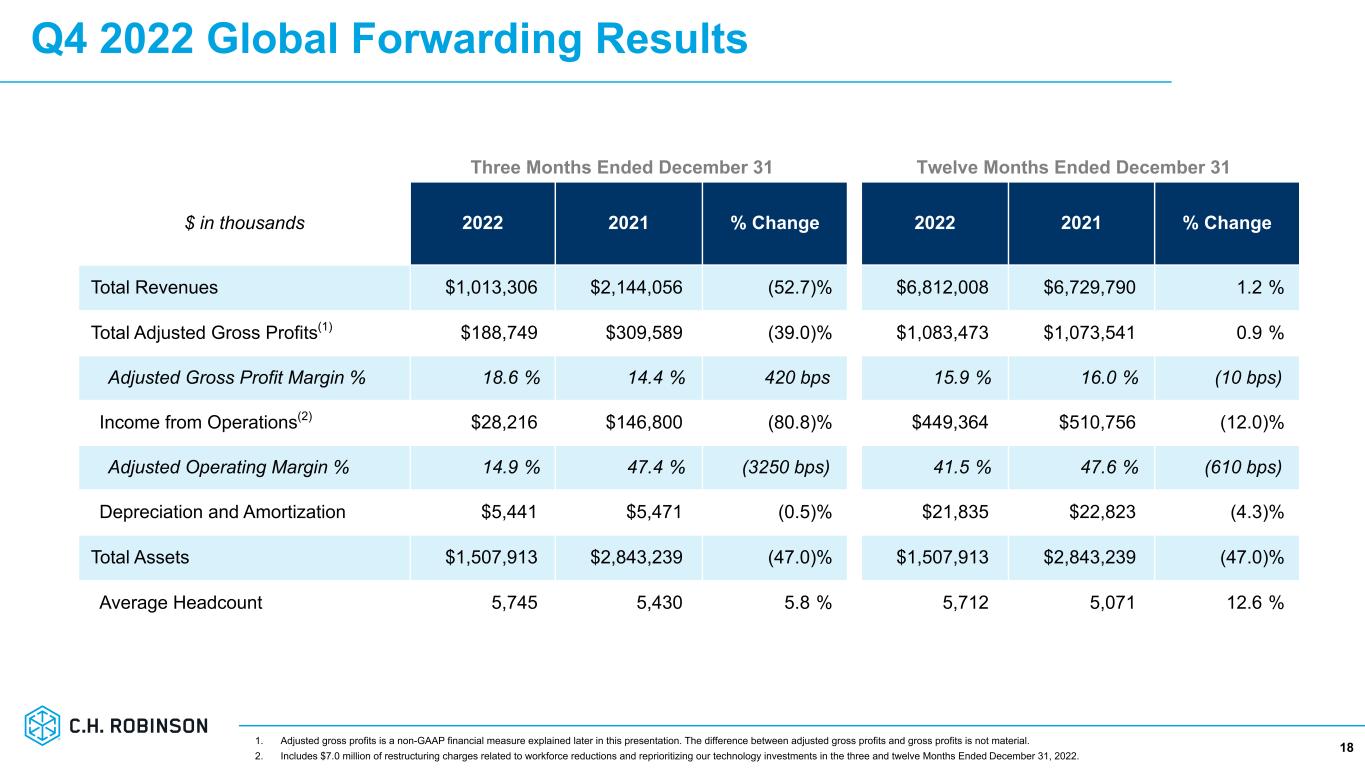

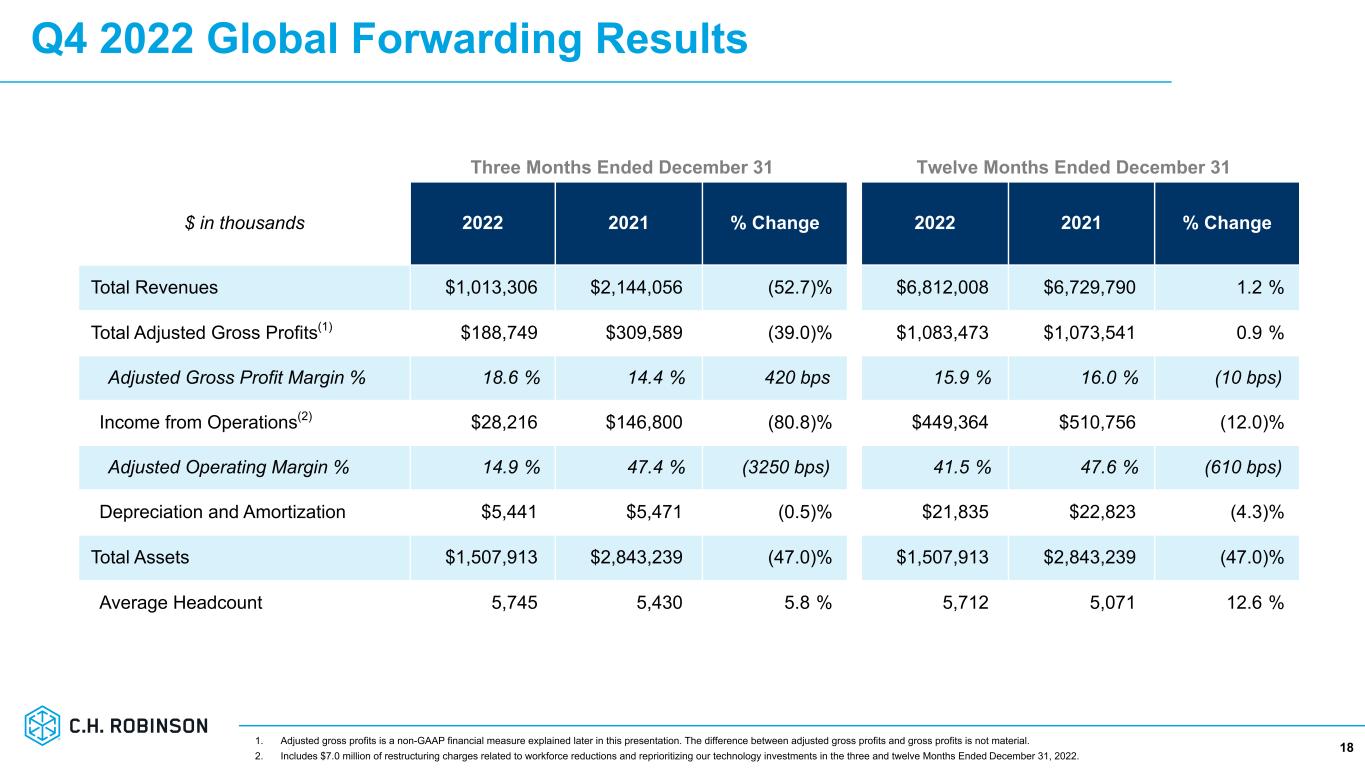

Q4 2022 Global Forwarding Results 181. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Includes $7.0 million of restructuring charges related to workforce reductions and reprioritizing our technology investments in the three and twelve Months Ended December 31, 2022. Three Months Ended December 31 Twelve Months Ended December 31 $ in thousands 2022 2021 % Change 2022 2021 % Change Total Revenues $1,013,306 $2,144,056 (52.7) % $6,812,008 $6,729,790 1.2 % Total Adjusted Gross Profits(1) $188,749 $309,589 (39.0) % $1,083,473 $1,073,541 0.9 % Adjusted Gross Profit Margin % 18.6 % 14.4 % 420 bps 15.9 % 16.0 % (10 bps) Income from Operations(2) $28,216 $146,800 (80.8) % $449,364 $510,756 (12.0) % Adjusted Operating Margin % 14.9 % 47.4 % (3250 bps) 41.5 % 47.6 % (610 bps) Depreciation and Amortization $5,441 $5,471 (0.5) % $21,835 $22,823 (4.3) % Total Assets $1,507,913 $2,843,239 (47.0) % $1,507,913 $2,843,239 (47.0) % Average Headcount 5,745 5,430 5.8 % 5,712 5,071 12.6 %

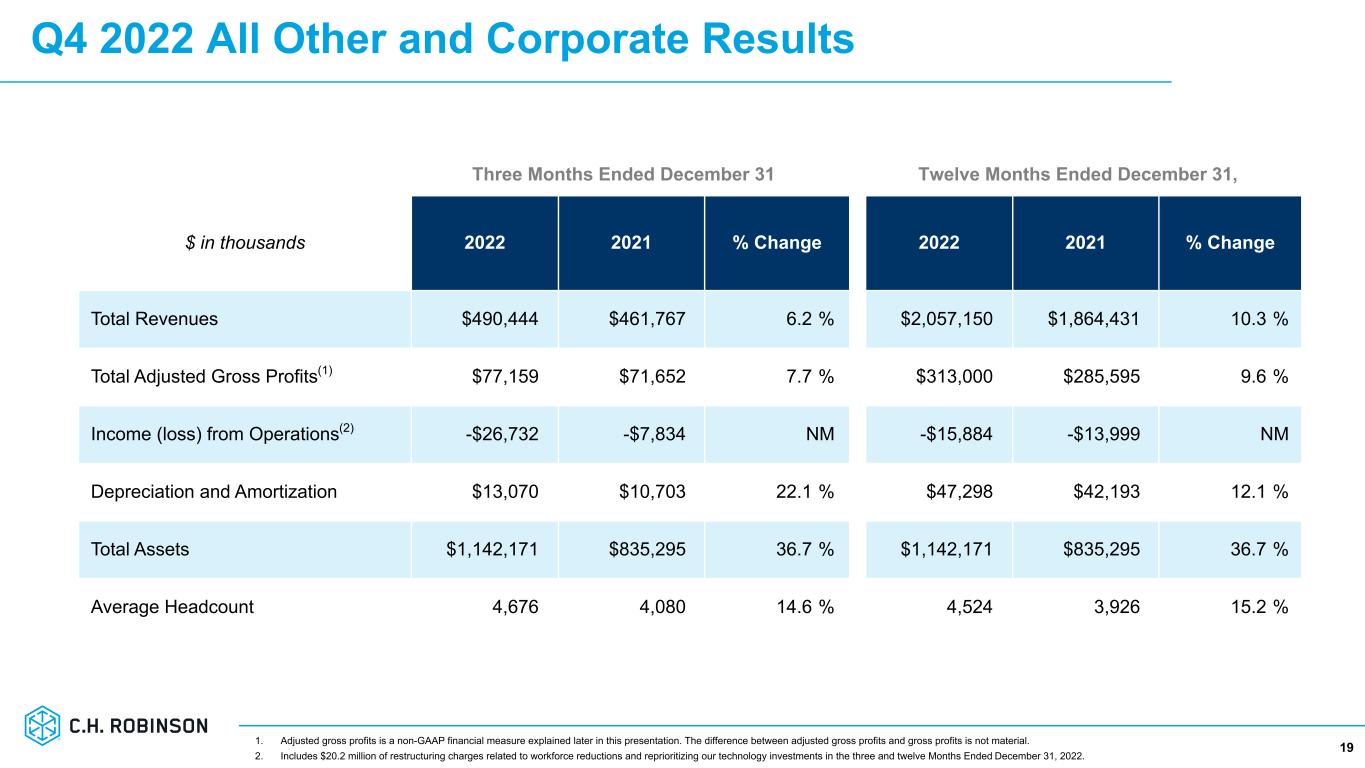

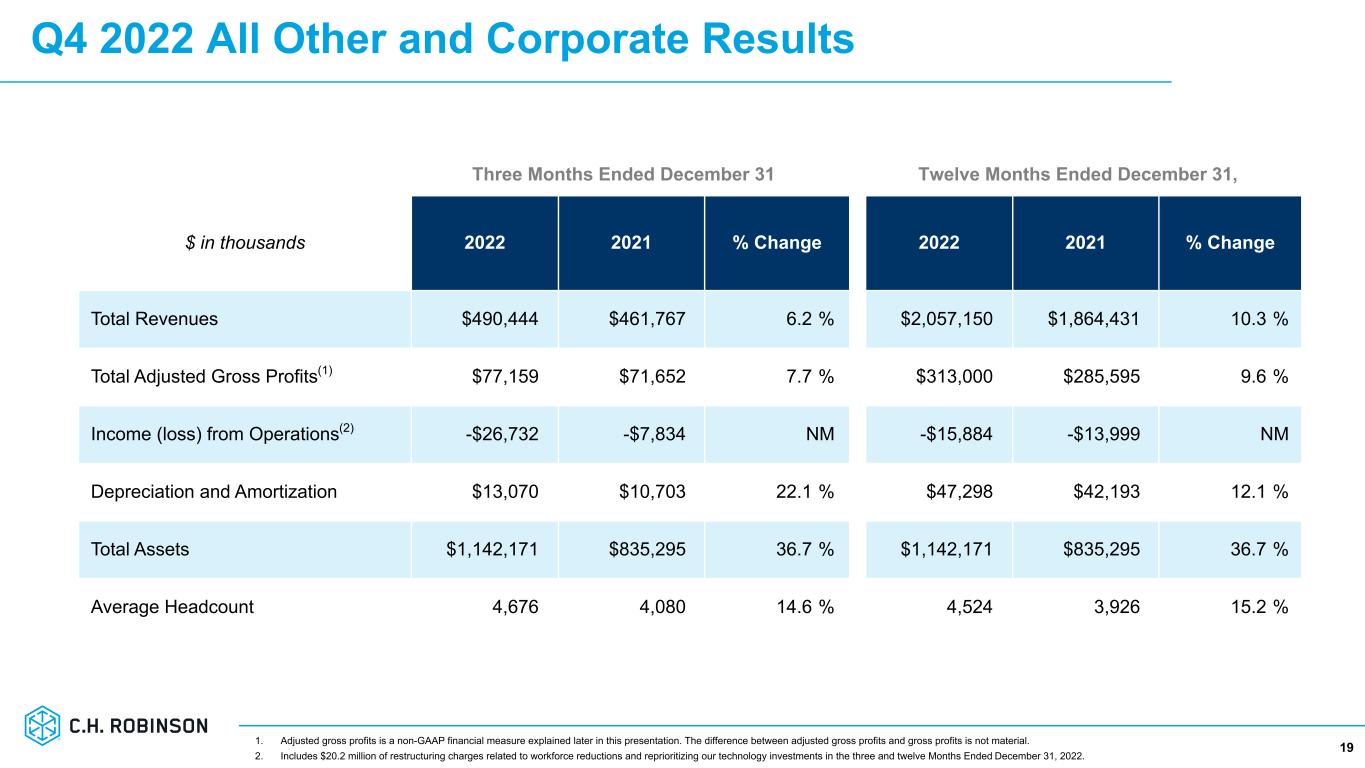

Q4 2022 All Other and Corporate Results 191. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Includes $20.2 million of restructuring charges related to workforce reductions and reprioritizing our technology investments in the three and twelve Months Ended December 31, 2022. Three Months Ended December 31 Twelve Months Ended December 31, $ in thousands 2022 2021 % Change 2022 2021 % Change Total Revenues $490,444 $461,767 6.2 % $2,057,150 $1,864,431 10.3 % Total Adjusted Gross Profits(1) $77,159 $71,652 7.7 % $313,000 $285,595 9.6 % Income (loss) from Operations(2) -$26,732 -$7,834 NM -$15,884 -$13,999 NM Depreciation and Amortization $13,070 $10,703 22.1 % $47,298 $42,193 12.1 % Total Assets $1,142,171 $835,295 36.7 % $1,142,171 $835,295 36.7 % Average Headcount 4,676 4,080 14.6 % 4,524 3,926 15.2 %

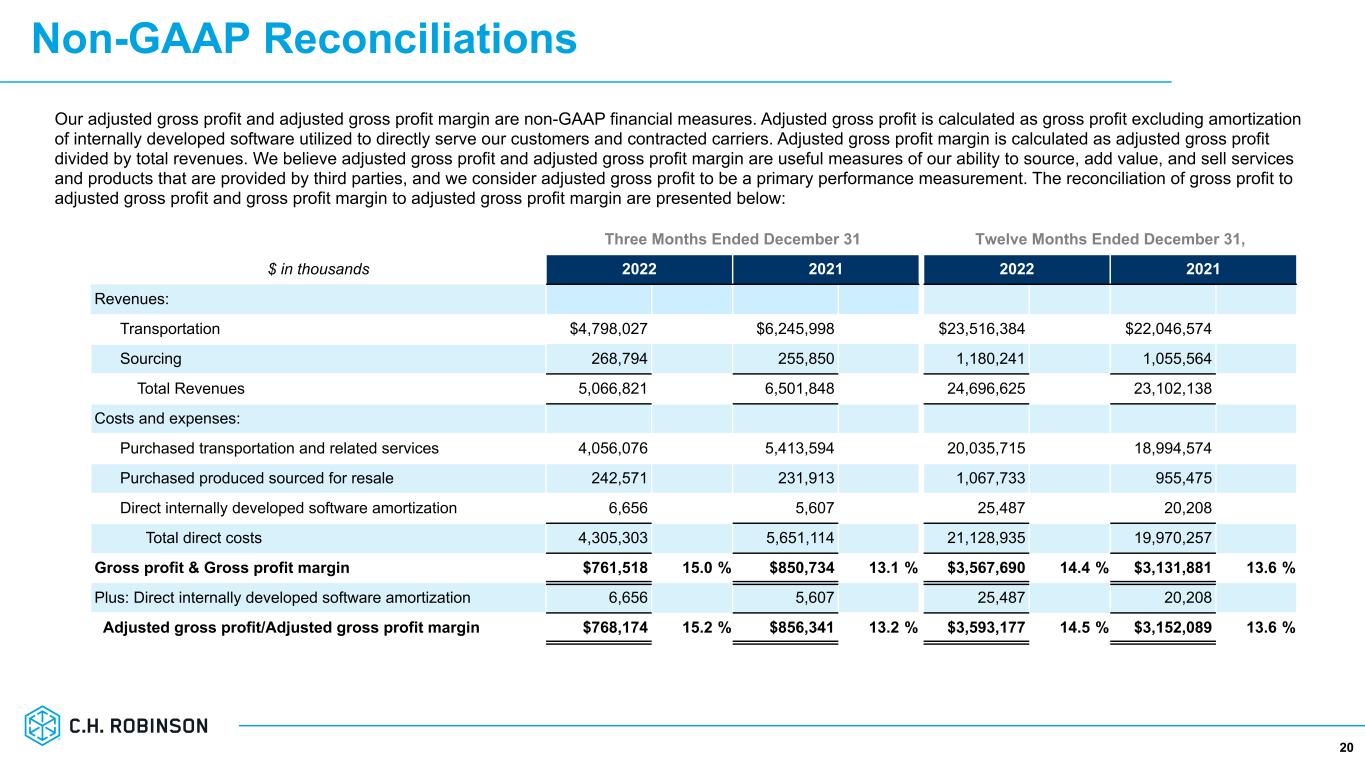

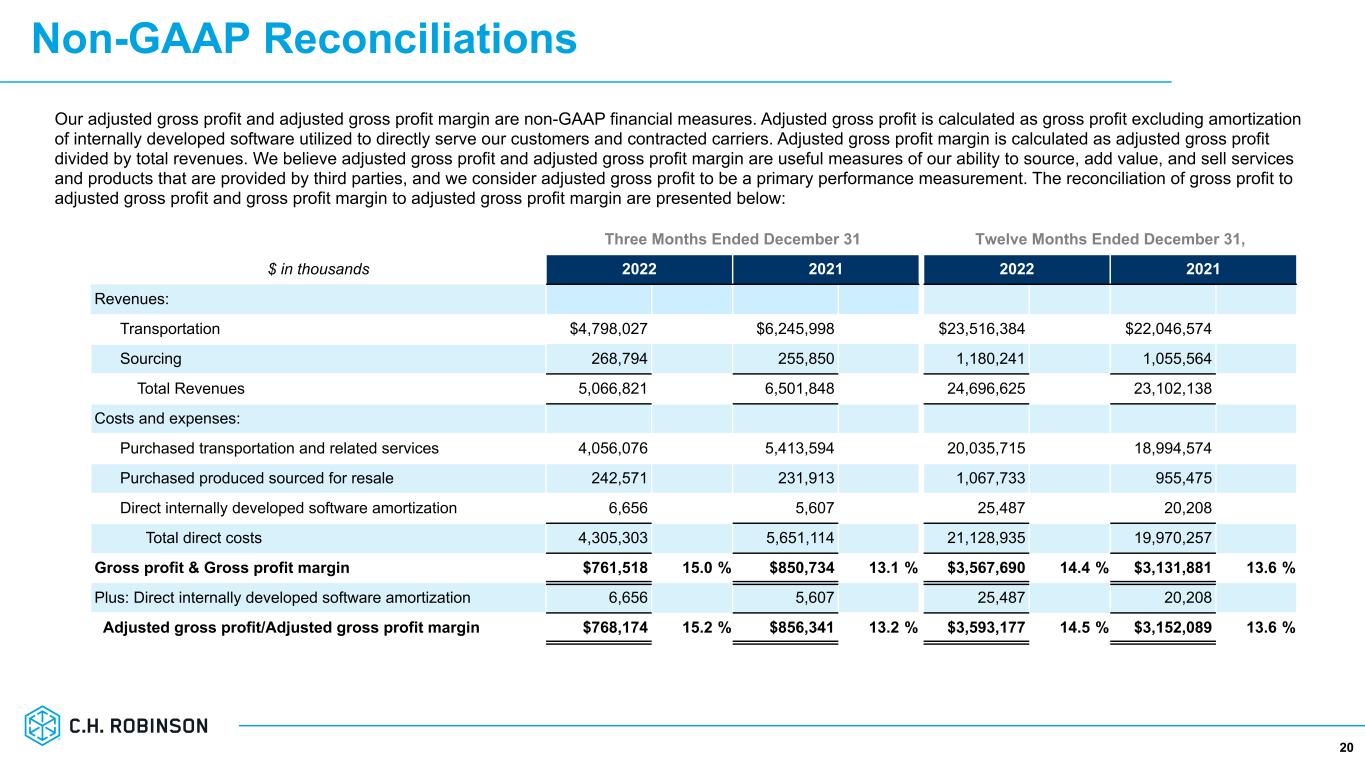

20 Our adjusted gross profit and adjusted gross profit margin are non-GAAP financial measures. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers. Adjusted gross profit margin is calculated as adjusted gross profit divided by total revenues. We believe adjusted gross profit and adjusted gross profit margin are useful measures of our ability to source, add value, and sell services and products that are provided by third parties, and we consider adjusted gross profit to be a primary performance measurement. The reconciliation of gross profit to adjusted gross profit and gross profit margin to adjusted gross profit margin are presented below: Three Months Ended December 31 Twelve Months Ended December 31, $ in thousands 2022 2021 2022 2021 Revenues: Transportation $4,798,027 $6,245,998 $23,516,384 $22,046,574 Sourcing 268,794 255,850 1,180,241 1,055,564 Total Revenues 5,066,821 6,501,848 24,696,625 23,102,138 Costs and expenses: Purchased transportation and related services 4,056,076 5,413,594 20,035,715 18,994,574 Purchased produced sourced for resale 242,571 231,913 1,067,733 955,475 Direct internally developed software amortization 6,656 5,607 25,487 20,208 Total direct costs 4,305,303 5,651,114 21,128,935 19,970,257 Gross profit & Gross profit margin $761,518 15.0 % $850,734 13.1 % $3,567,690 14.4 % $3,131,881 13.6 % Plus: Direct internally developed software amortization 6,656 5,607 25,487 20,208 Adjusted gross profit/Adjusted gross profit margin $768,174 15.2 % $856,341 13.2 % $3,593,177 14.5 % $3,152,089 13.6 % Non-GAAP Reconciliations

Non-GAAP Reconciliations 21 Our adjusted operating margin is a non-GAAP financial measure calculated as operating income divided by adjusted gross profit. We believe adjusted operating margin is a useful measure of our profitability in comparison to our adjusted gross profit which we consider a primary performance metric as discussed above. The reconciliation of operating margin to adjusted operating margin is presented below: Three Months Ended December 31 Twelve Months Ended December 31, $ in thousands 2022 2021 2022 2021 Total Revenues $ 5,066,821 $ 6,501,848 $ 24,696,625 $ 23,102,138 Income from operations 164,034 287,406 1,266,782 1,082,108 Operating margin 3.2 % 4.4 % 5.1 % 4.7 % Adjusted gross profit $ 768,174 $ 856,341 $ 3,593,177 $ 3,152,089 Income from operations 164,034 287,406 1,266,782 1,082,108 Adjusted operating margin 21.4 % 33.6 % 35.3 % 34.3 %

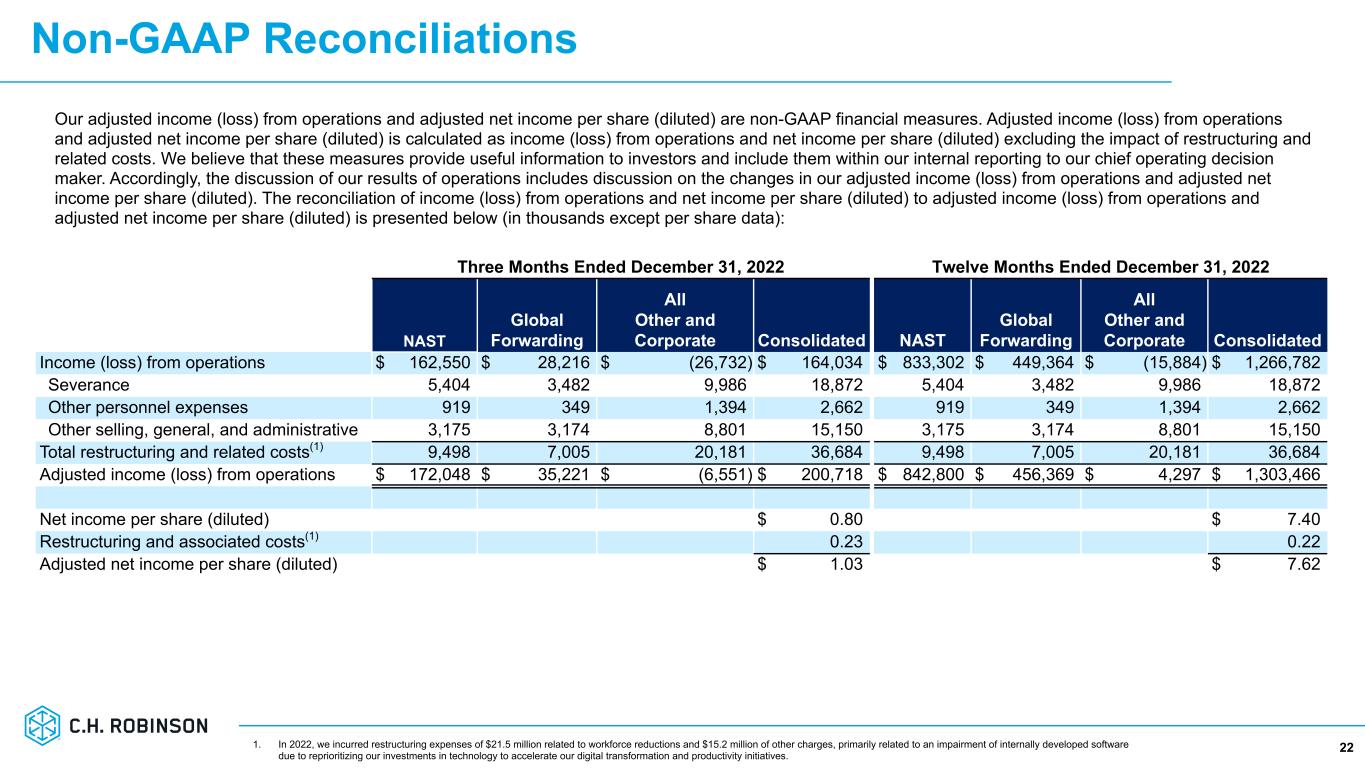

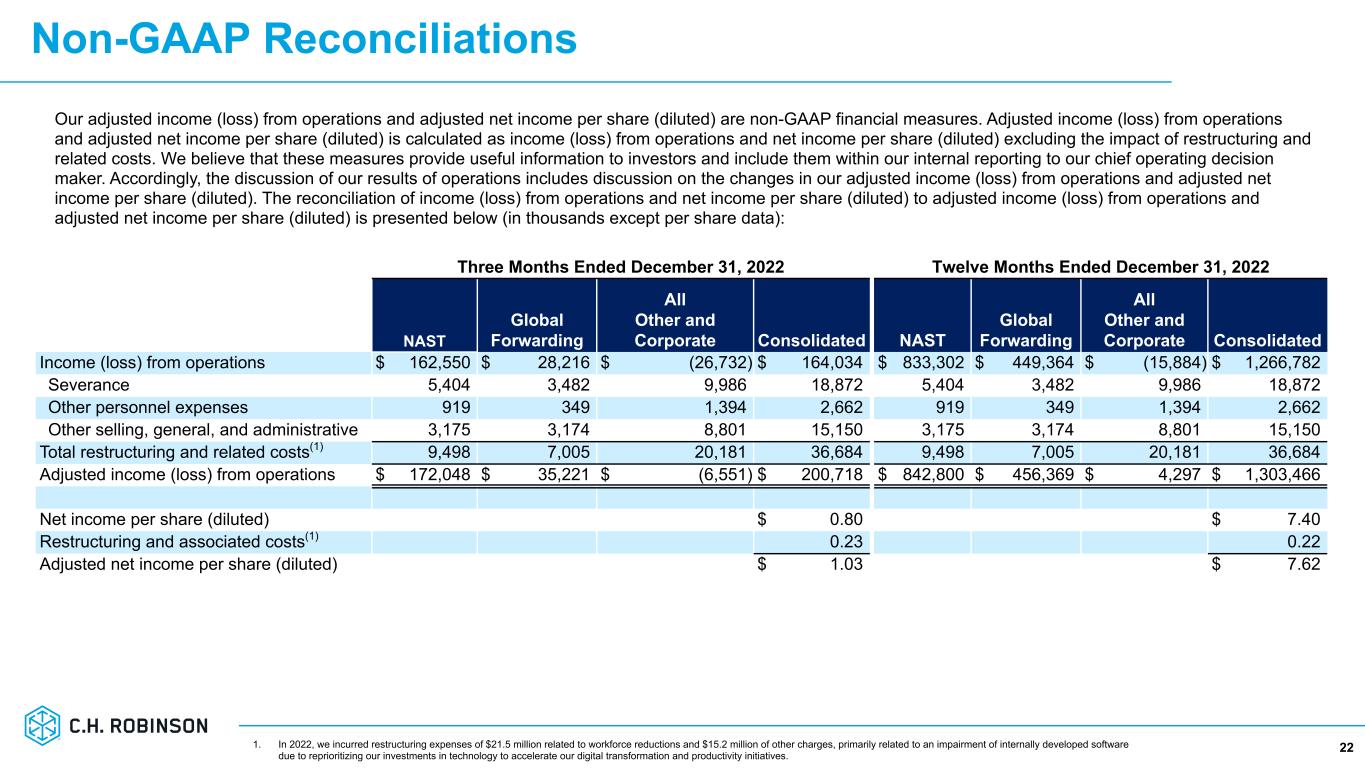

Non-GAAP Reconciliations 22 Our adjusted income (loss) from operations and adjusted net income per share (diluted) are non-GAAP financial measures. Adjusted income (loss) from operations and adjusted net income per share (diluted) is calculated as income (loss) from operations and net income per share (diluted) excluding the impact of restructuring and related costs. We believe that these measures provide useful information to investors and include them within our internal reporting to our chief operating decision maker. Accordingly, the discussion of our results of operations includes discussion on the changes in our adjusted income (loss) from operations and adjusted net income per share (diluted). The reconciliation of income (loss) from operations and net income per share (diluted) to adjusted income (loss) from operations and adjusted net income per share (diluted) is presented below (in thousands except per share data): Three Months Ended December 31, 2022 Twelve Months Ended December 31, 2022 NAST Global Forwarding All Other and Corporate Consolidated NAST Global Forwarding All Other and Corporate Consolidated Income (loss) from operations $ 162,550 $ 28,216 $ (26,732) $ 164,034 $ 833,302 $ 449,364 $ (15,884) $ 1,266,782 Severance 5,404 3,482 9,986 18,872 5,404 3,482 9,986 18,872 Other personnel expenses 919 349 1,394 2,662 919 349 1,394 2,662 Other selling, general, and administrative 3,175 3,174 8,801 15,150 3,175 3,174 8,801 15,150 Total restructuring and related costs(1) 9,498 7,005 20,181 36,684 9,498 7,005 20,181 36,684 Adjusted income (loss) from operations $ 172,048 $ 35,221 $ (6,551) $ 200,718 $ 842,800 $ 456,369 $ 4,297 $ 1,303,466 Net income per share (diluted) $ 0.80 $ 7.40 Restructuring and associated costs(1) 0.23 0.22 Adjusted net income per share (diluted) $ 1.03 $ 7.62 1. In 2022, we incurred restructuring expenses of $21.5 million related to workforce reductions and $15.2 million of other charges, primarily related to an impairment of internally developed software due to reprioritizing our investments in technology to accelerate our digital transformation and productivity initiatives.

23 Thank you INVESTOR RELATIONS: Chuck Ives 952-683-2508 chuck.ives@chrobinson.com