1 Q3 2023 November 1, 2023 Earnings Presentation Dave Bozeman, President & CEO Arun Rajan, Chief Operating Officer Mike Zechmeister, Chief Financial Officer Chuck Ives, Director of Investor Relations

Safe Harbor Statement Except for the historical information contained herein, the matters set forth in this presentation and the accompanying earnings release are forward-looking statements that represent our expectations, beliefs, intentions or strategies concerning future events. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience or our present expectations, including, but not limited to factors such as changes in economic conditions, including uncertain consumer demand; changes in market demand and pressures on the pricing for our services; fuel price increases or decreases, or fuel shortages; competition and growth rates within the global logistics industry; freight levels and increasing costs and availability of truck capacity or alternative means of transporting freight; risks associated with significant disruptions in the transportation industry; changes in relationships with existing contracted truck, rail, ocean, and air carriers; changes in our customer base due to possible consolidation among our customers; risks with reliance on technology to operate our business; cyber- security related risks; risks associated with operations outside of the United States; our ability to successfully integrate the operations of acquired companies with our historic operations; climate change related risks; risks associated with our indebtedness; interest rates related risks; risks associated with litigation, including contingent auto liability and insurance coverage; risks associated with the potential impact of changes in government regulations; risks associated with the changes to income tax regulations; risks associated with the produce industry, including food safety and contamination issues; the impact of war on the economy; changes to our capital structure; changes due to catastrophic events including pandemics such as COVID-19; risks associated with the usage of artificial intelligence technologies; and other risks and uncertainties detailed in our Annual and Quarterly Reports. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update such statement to reflect events or circumstances arising after such date. 2©2023 C.H. Robinson Worldwide, Inc. All Rights Reserved.

Thoughts from President & CEO, Dave Bozeman 3 ■ Customers value the quality, stability and reliability that we provide, and they prefer partners who have the financial strength to invest through cycles and the expertise to provide innovative tech-enabled solutions ■ Focus on delivering quality and improvements to customers has been reflected in very positive customer feedback and high net promoter scores ■ We are executing on our plans to streamline our processes, remove waste and decouple volume growth from headcount growth ■ Cost reductions and productivity gains are ahead of our stated targets ■ Accelerating clock speed and driving focus on concurrent workstreams that are addressing the highest leverage areas to eliminate productivity bottlenecks ■ Utilizing generative AI, in conjunction with machine learning, to leverage our large data set as a force multiplier ■ Strength of our people, scaled network, financial model and investments in improving efficiency position us well for the eventual freight market rebound

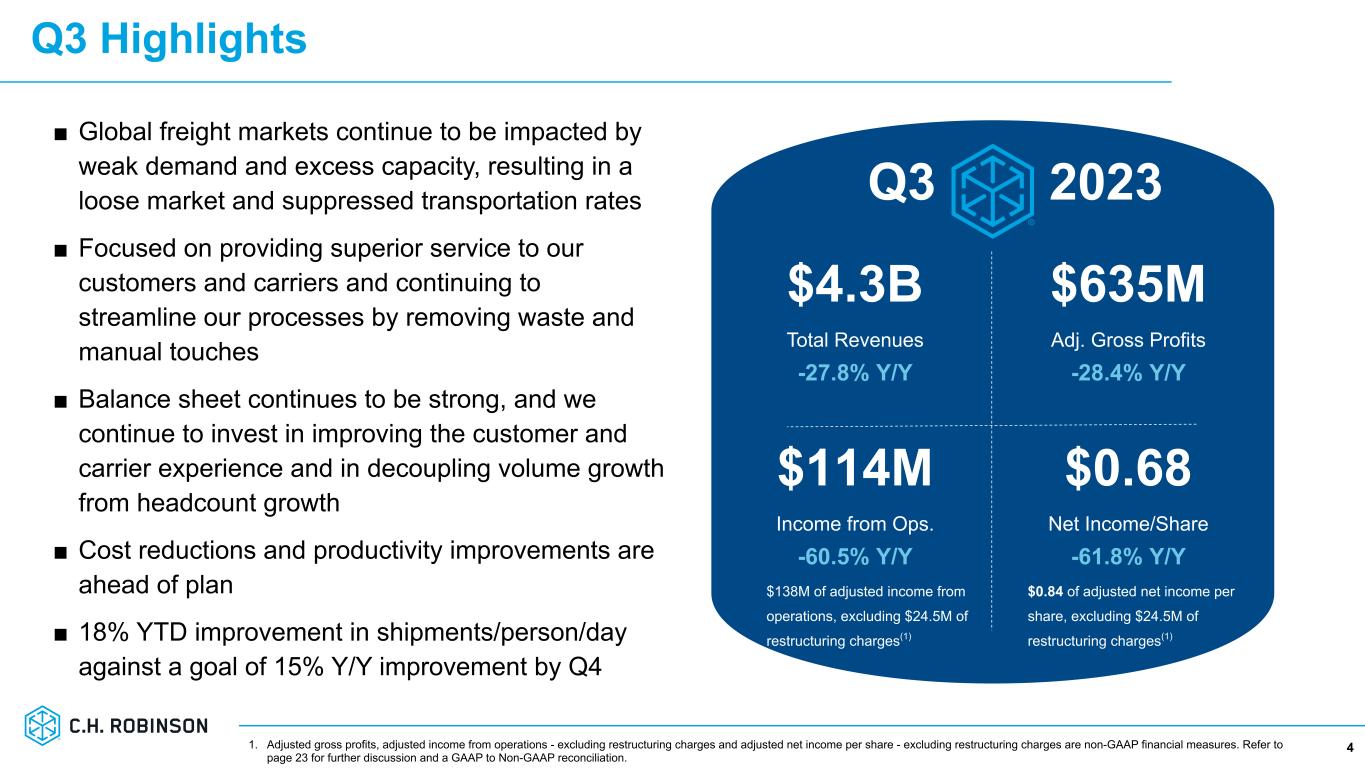

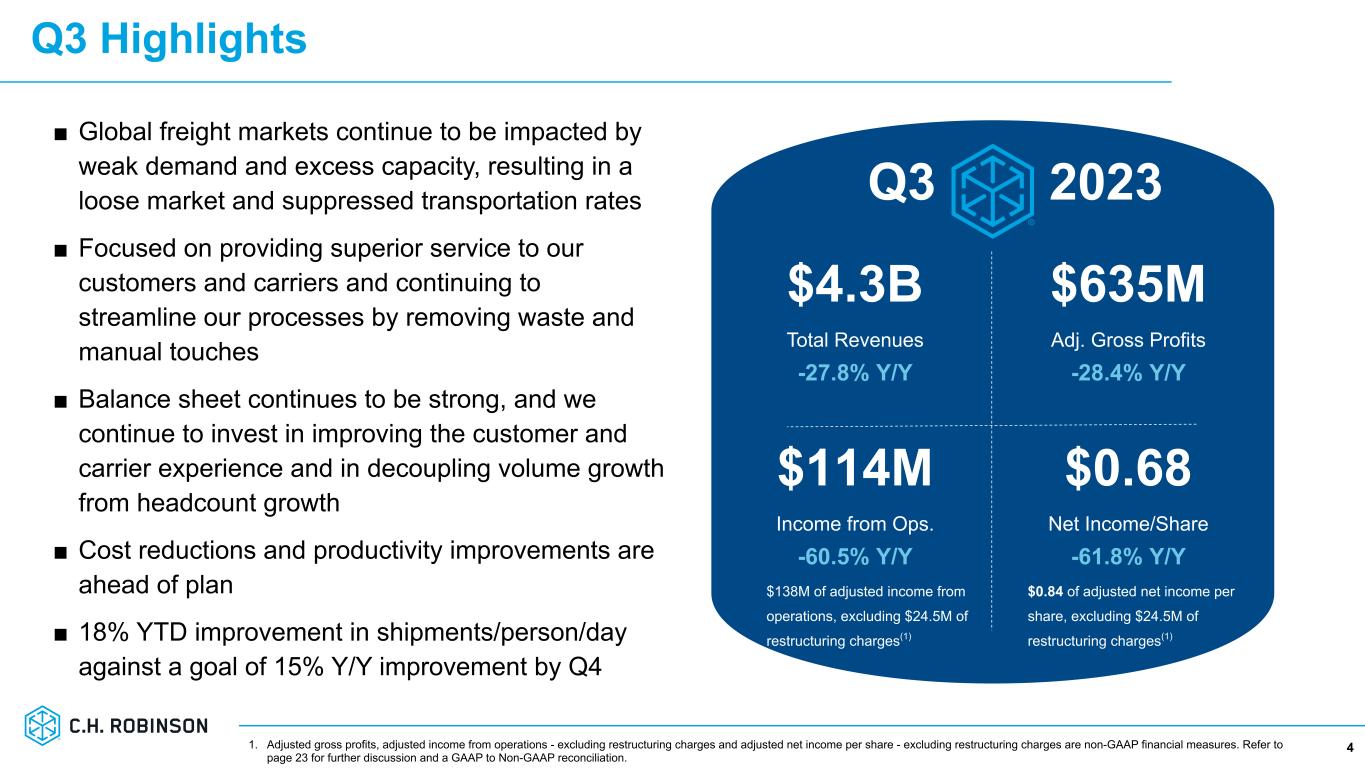

Q3 Highlights 4 ■ Global freight markets continue to be impacted by weak demand and excess capacity, resulting in a loose market and suppressed transportation rates ■ Focused on providing superior service to our customers and carriers and continuing to streamline our processes by removing waste and manual touches ■ Balance sheet continues to be strong, and we continue to invest in improving the customer and carrier experience and in decoupling volume growth from headcount growth ■ Cost reductions and productivity improvements are ahead of plan ■ 18% YTD improvement in shipments/person/day against a goal of 15% Y/Y improvement by Q4 $4.3B Total Revenues -27.8% Y/Y $635M Adj. Gross Profits -28.4% Y/Y $114M Income from Ops. -60.5% Y/Y $0.68 Net Income/Share -61.8% Y/Y Q3 2023 1. Adjusted gross profits, adjusted income from operations - excluding restructuring charges and adjusted net income per share - excluding restructuring charges are non-GAAP financial measures. Refer to page 23 for further discussion and a GAAP to Non-GAAP reconciliation. $0.84 of adjusted net income per share, excluding $24.5M of restructuring charges(1) $138M of adjusted income from operations, excluding $24.5M of restructuring charges(1)

All Other & Corporate ■ Robinson Fresh integrated supply chain solutions generating increased AGP ■ Managed Services Q3 AGP relatively flat Y/Y ■ Other Surface Transportation AGP increased 1.3% Y/Y Global Forwarding (GF) ■ Reduced global demand and excess capacity has led to declining prices for ocean and air freight ■ Sequential increase in ocean volume ■ Continuing to diversify our trade lane and industry vertical exposure North American Surface Transportation (NAST) ■ Adjusted gross profit (AGP) per load/order declined Y/Y in both TL and LTL ■ Load-to-truck ratios indicate the truckload market remains soft by historical standards ■ Significant market share opportunities remain in highly fragmented market ■ Focused on initiatives that improve the customer and carrier experience and lower our cost to serve ■ 18% YTD improvement in productivity driven by increased automation of in-transit tracking, case management and appointments Complementary Global Suite of Services 5 Q3 2023 Adjusted Gross Profits(2) -31.4% Y/Y +4.6% Y/Y -31.6% Y/Y 1. Measured over trailing twelve months. 2. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. Over half of total revenues came from customers to whom we provide both surface transportation and global forwarding services.(1)

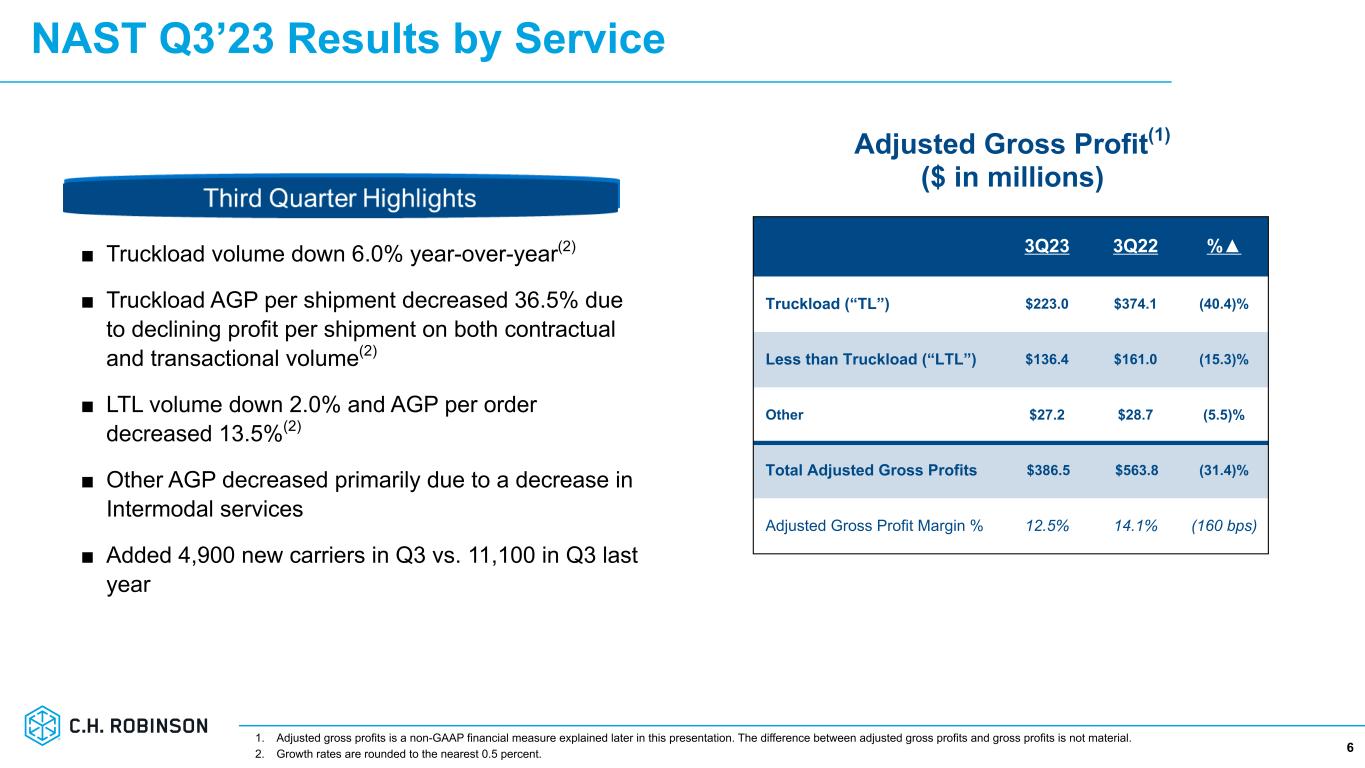

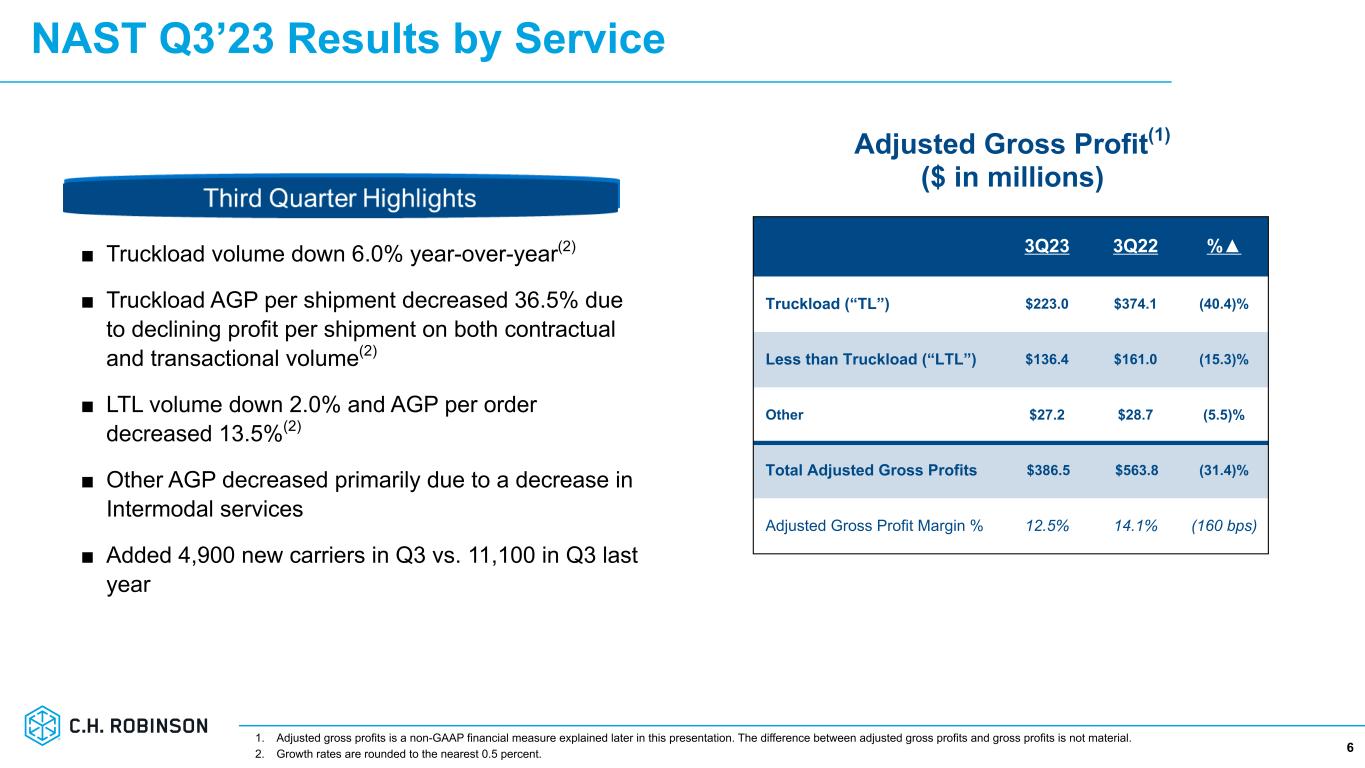

NAST Q3’23 Results by Service 6 ■ Truckload volume down 6.0% year-over-year(2) ■ Truckload AGP per shipment decreased 36.5% due to declining profit per shipment on both contractual and transactional volume(2) ■ LTL volume down 2.0% and AGP per order decreased 13.5%(2) ■ Other AGP decreased primarily due to a decrease in Intermodal services ■ Added 4,900 new carriers in Q3 vs. 11,100 in Q3 last year 3Q23 3Q22 %▲ Truckload (“TL”) $223.0 $374.1 (40.4)% Less than Truckload (“LTL”) $136.4 $161.0 (15.3)% Other $27.2 $28.7 (5.5)% Total Adjusted Gross Profits $386.5 $563.8 (31.4)% Adjusted Gross Profit Margin % 12.5% 14.1% (160 bps) Adjusted Gross Profit(1) ($ in millions) 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Growth rates are rounded to the nearest 0.5 percent.

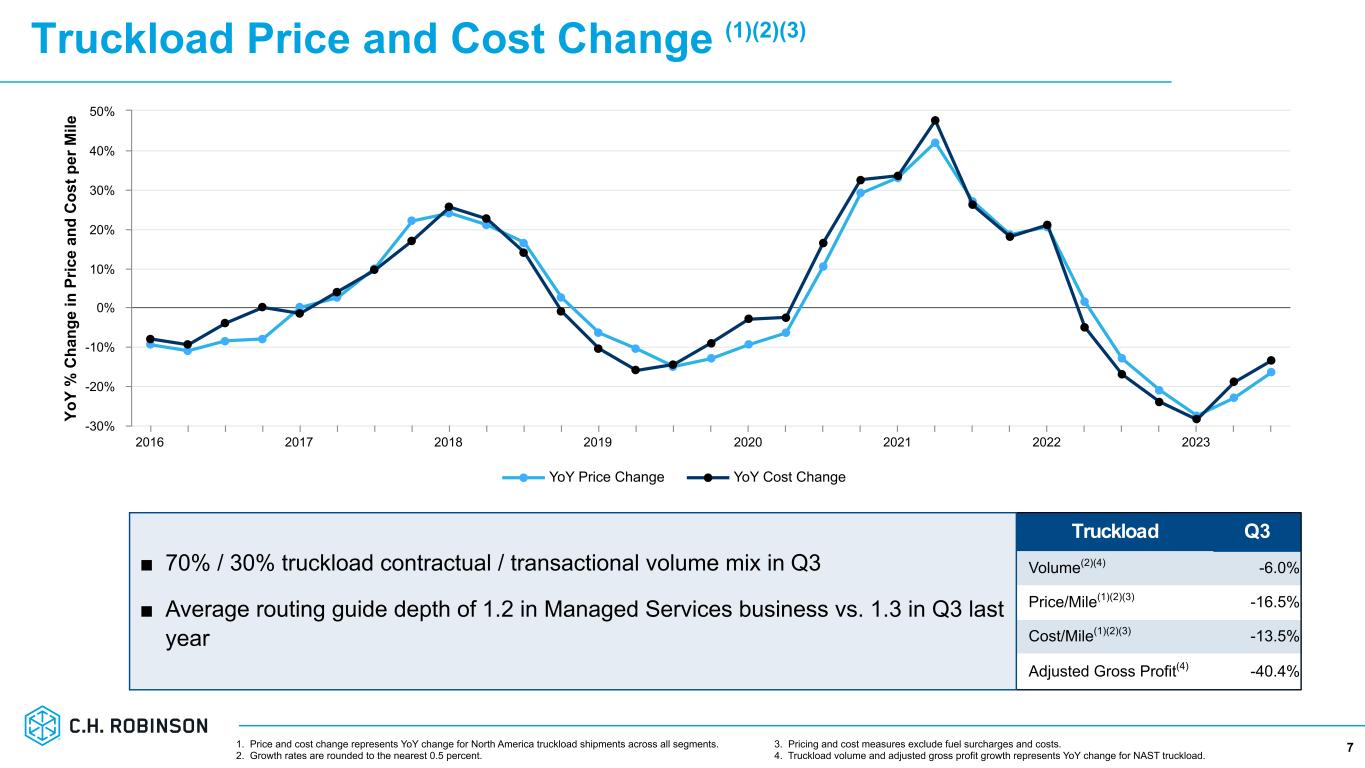

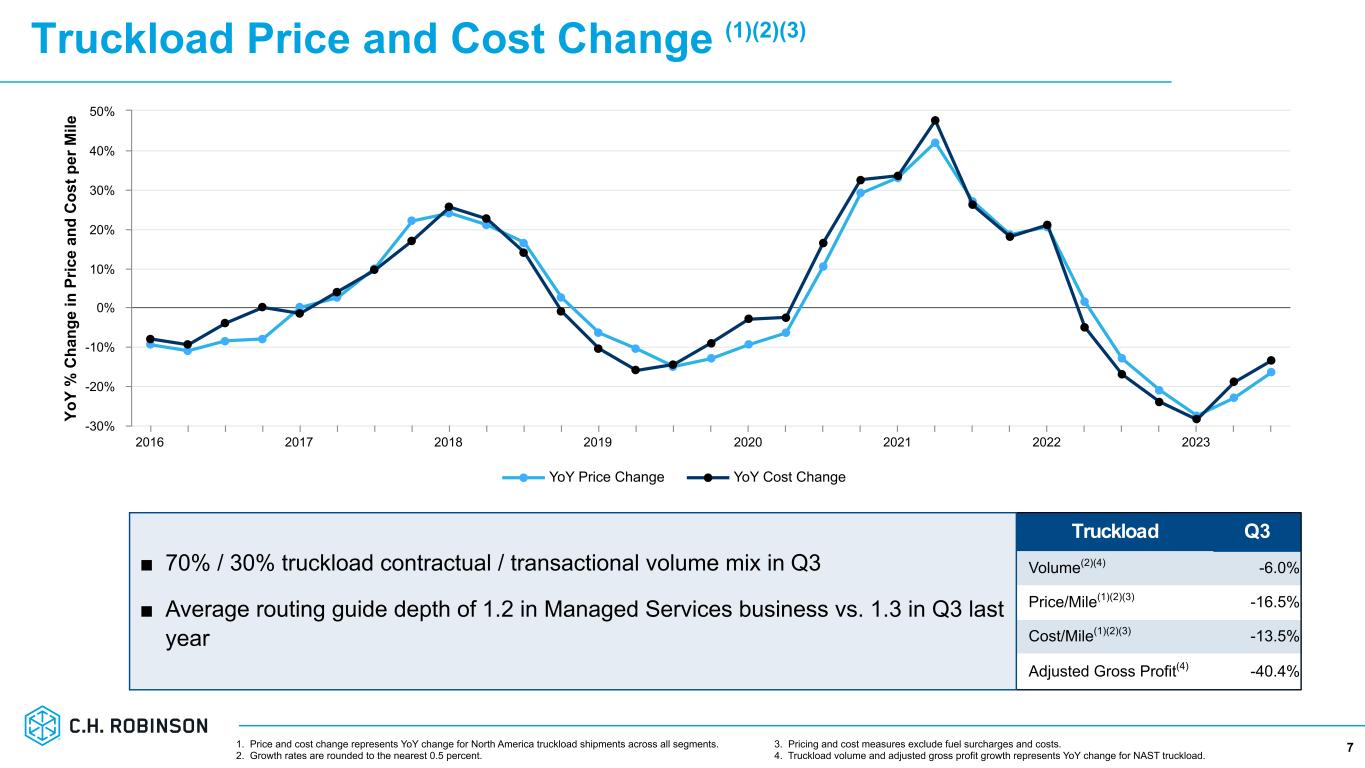

Truckload Price and Cost Change (1)(2)(3) 7 Truckload Q3 Volume(2)(4) -6.0 % Price/Mile(1)(2)(3) -16.5 % Cost/Mile(1)(2)(3) -13.5 % Adjusted Gross Profit(4) -40.4 % 1. Price and cost change represents YoY change for North America truckload shipments across all segments. 2. Growth rates are rounded to the nearest 0.5 percent. ■ 70% / 30% truckload contractual / transactional volume mix in Q3 ■ Average routing guide depth of 1.2 in Managed Services business vs. 1.3 in Q3 last year 3. Pricing and cost measures exclude fuel surcharges and costs. 4. Truckload volume and adjusted gross profit growth represents YoY change for NAST truckload. Yo Y % C ha ng e in P ric e an d C os t p er M ile YoY Price Change YoY Cost Change 2016 2017 2018 2019 2020 2021 2022 2023 -30% -20% -10% 0% 10% 20% 30% 40% 50%

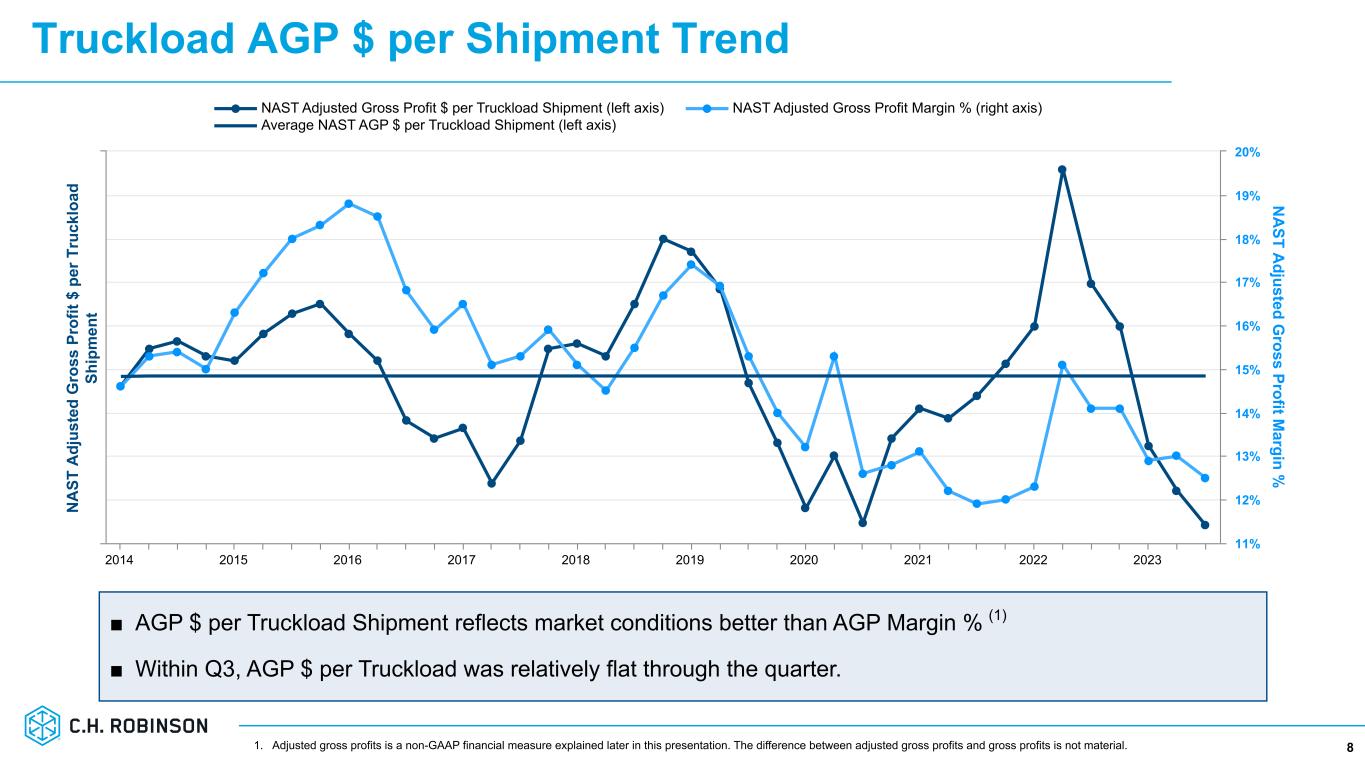

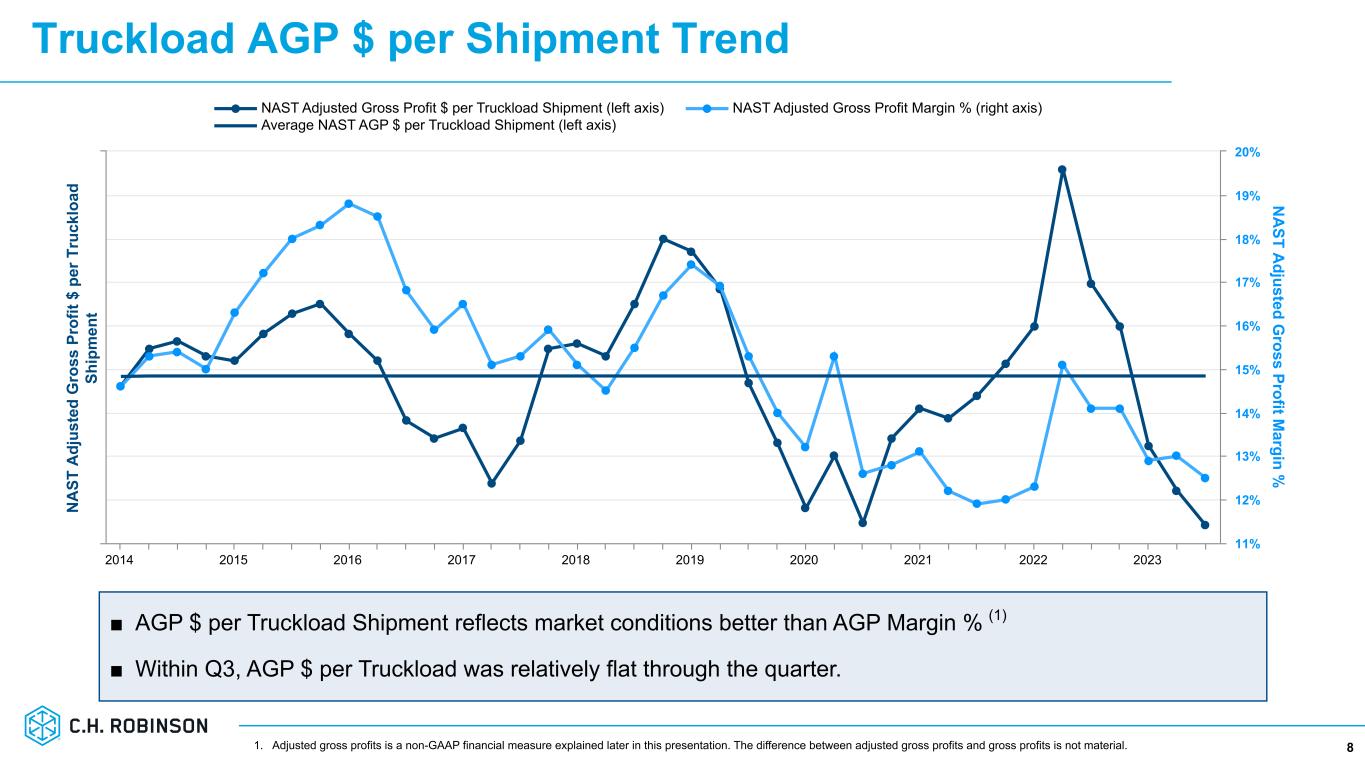

Truckload AGP $ per Shipment Trend 8 ■ AGP $ per Truckload Shipment reflects market conditions better than AGP Margin % (1) ■ Within Q3, AGP $ per Truckload was relatively flat through the quarter. N A ST A dj us te d G ro ss P ro fit $ p er T ru ck lo ad Sh ip m en t N A ST A djusted G ross Profit M argin % NAST Adjusted Gross Profit $ per Truckload Shipment (left axis) NAST Adjusted Gross Profit Margin % (right axis) Average NAST AGP $ per Truckload Shipment (left axis) 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material.

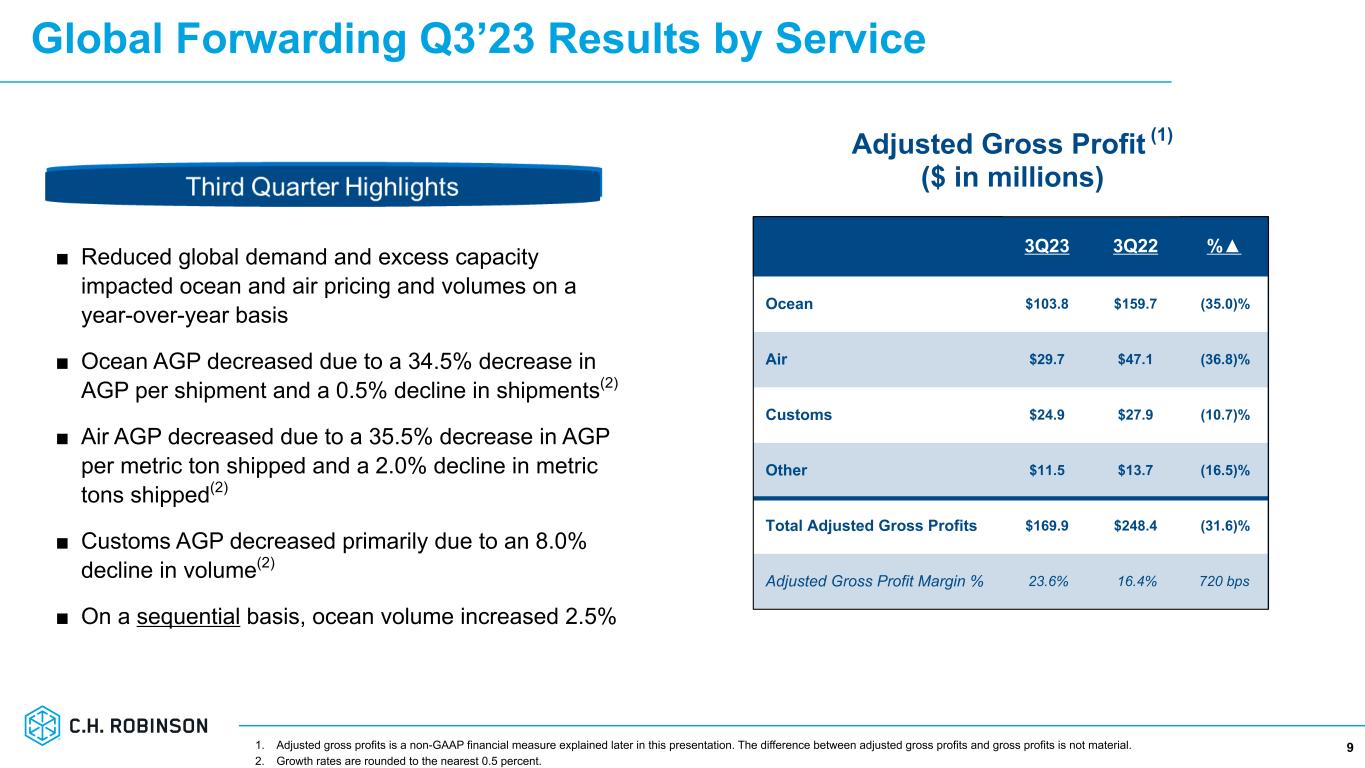

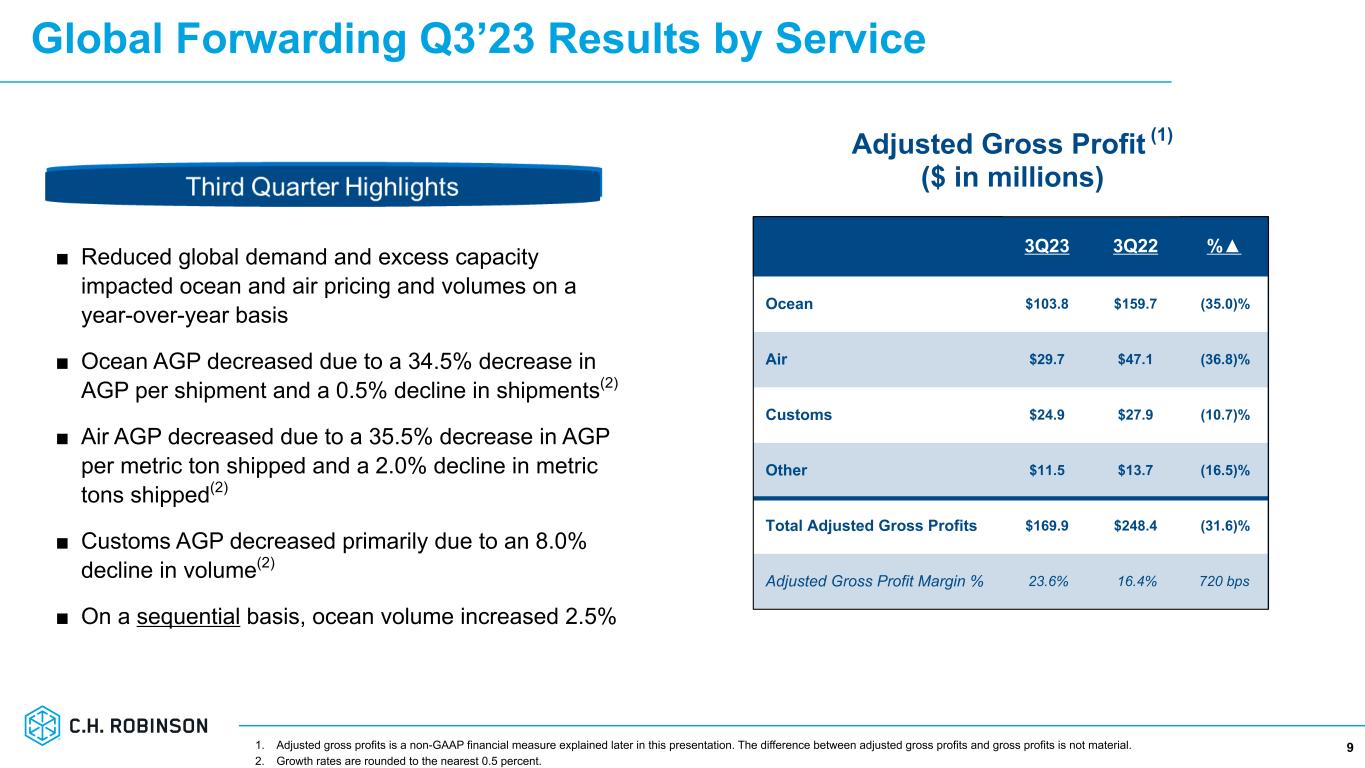

Global Forwarding Q3’23 Results by Service 9 3Q23 3Q22 %▲ Ocean $103.8 $159.7 (35.0)% Air $29.7 $47.1 (36.8)% Customs $24.9 $27.9 (10.7)% Other $11.5 $13.7 (16.5)% Total Adjusted Gross Profits $169.9 $248.4 (31.6)% Adjusted Gross Profit Margin % 23.6% 16.4% 720 bps Adjusted Gross Profit (1) ($ in millions) ■ Reduced global demand and excess capacity impacted ocean and air pricing and volumes on a year-over-year basis ■ Ocean AGP decreased due to a 34.5% decrease in AGP per shipment and a 0.5% decline in shipments(2) ■ Air AGP decreased due to a 35.5% decrease in AGP per metric ton shipped and a 2.0% decline in metric tons shipped(2) ■ Customs AGP decreased primarily due to an 8.0% decline in volume(2) ■ On a sequential basis, ocean volume increased 2.5% 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Growth rates are rounded to the nearest 0.5 percent.

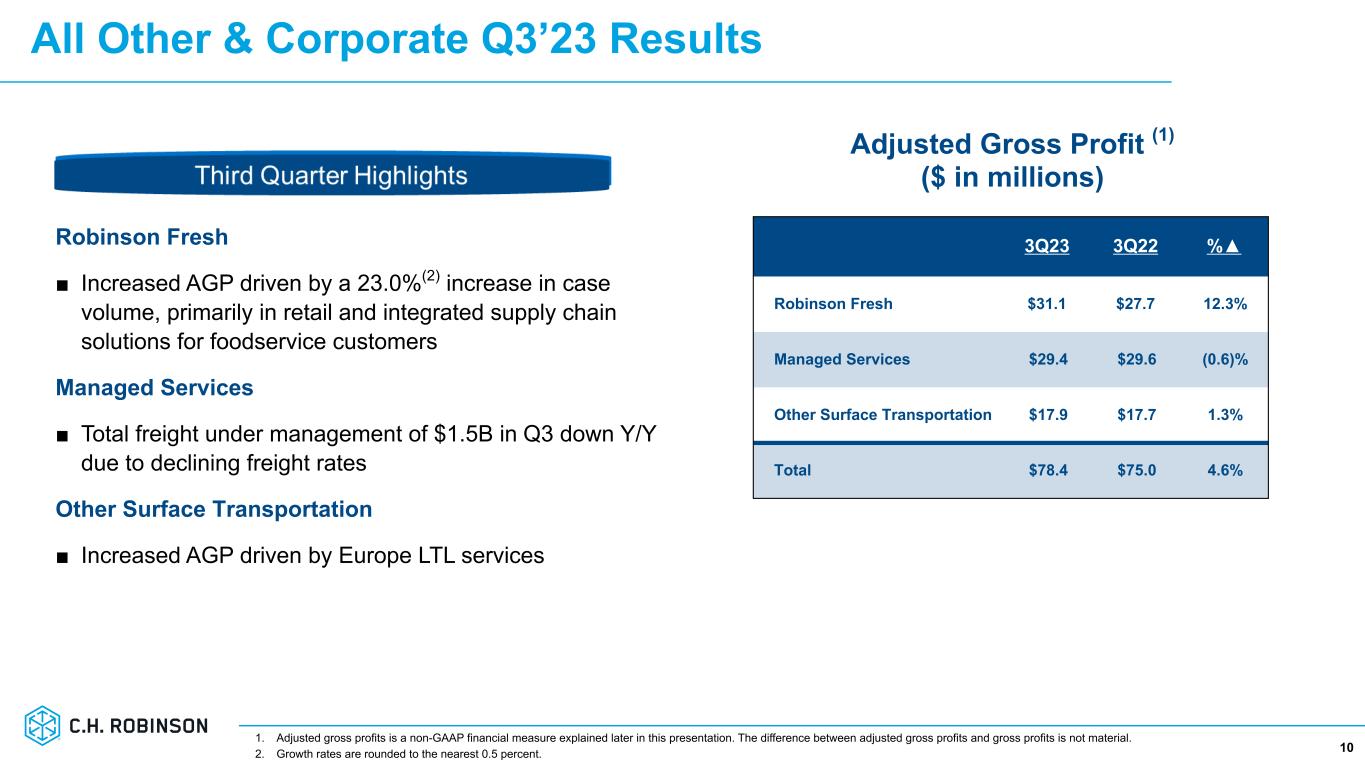

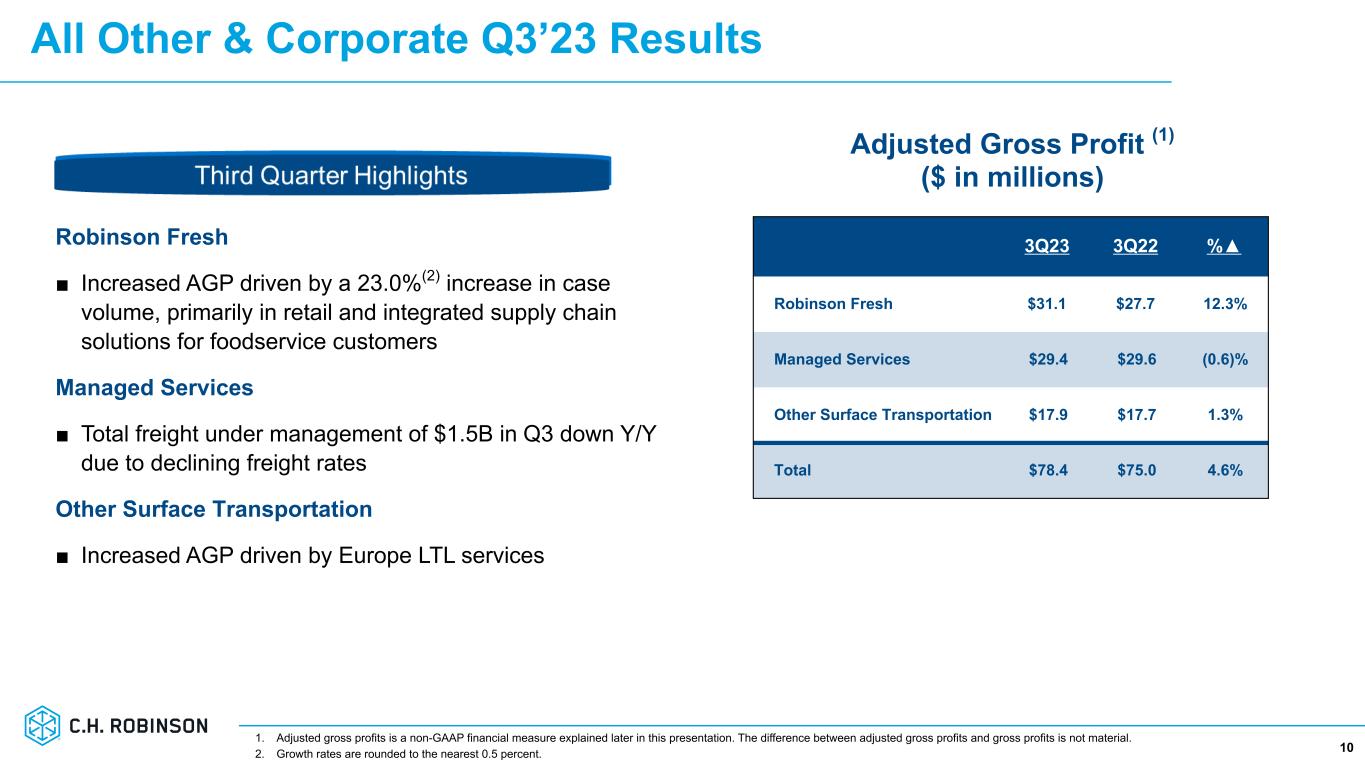

All Other & Corporate Q3’23 Results 10 Robinson Fresh ■ Increased AGP driven by a 23.0%(2) increase in case volume, primarily in retail and integrated supply chain solutions for foodservice customers Managed Services ■ Total freight under management of $1.5B in Q3 down Y/Y due to declining freight rates Other Surface Transportation ■ Increased AGP driven by Europe LTL services 3Q23 3Q22 %▲ Robinson Fresh $31.1 $27.7 12.3% Managed Services $29.4 $29.6 (0.6)% Other Surface Transportation $17.9 $17.7 1.3% Total $78.4 $75.0 4.6% Adjusted Gross Profit (1) ($ in millions) 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Growth rates are rounded to the nearest 0.5 percent.

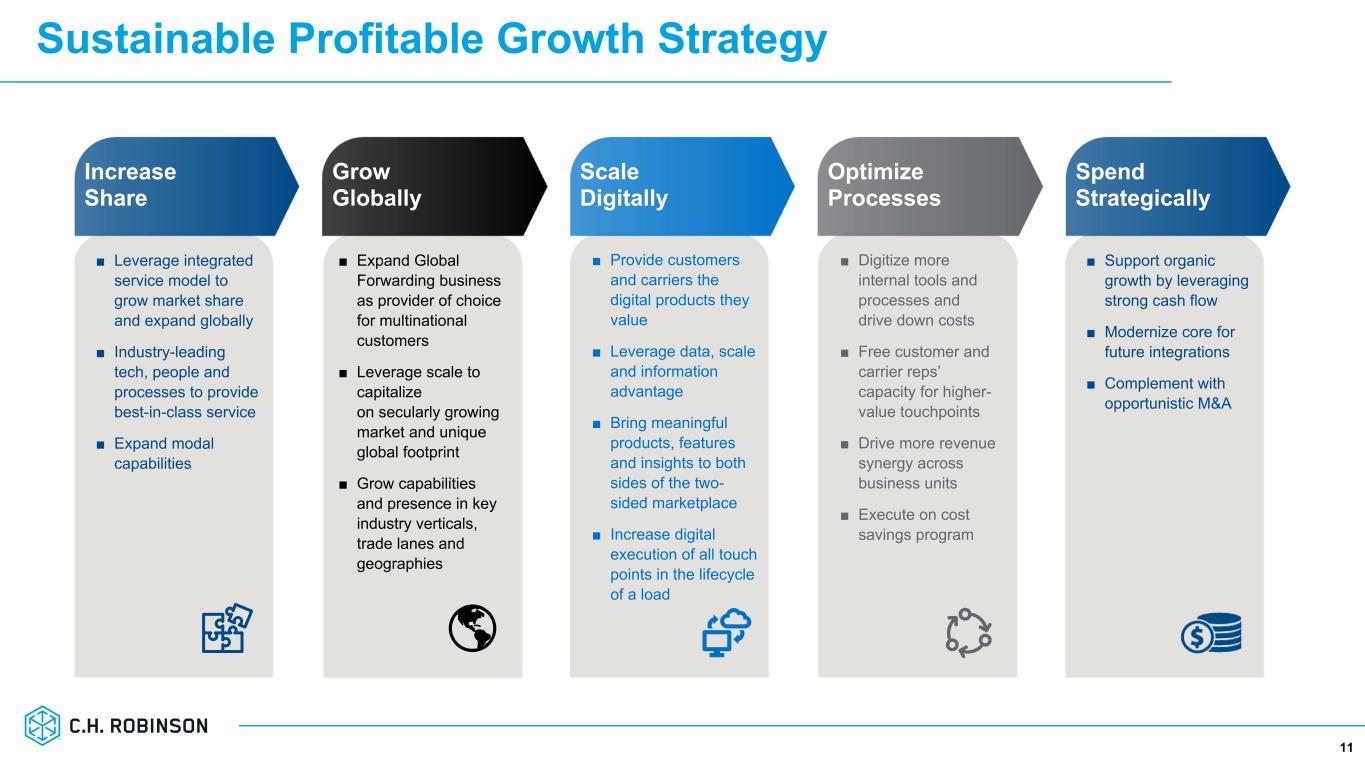

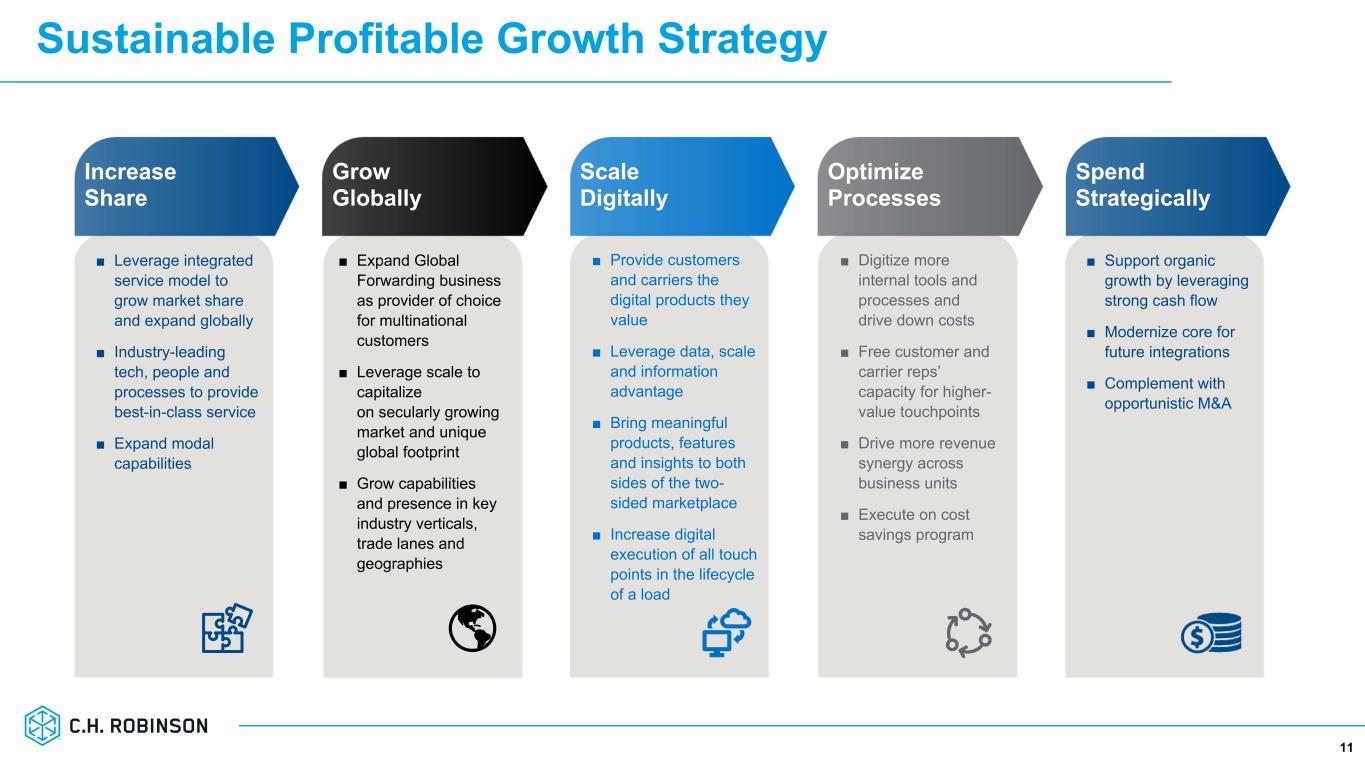

Sustainable Profitable Growth Strategy 11 Optimize Processes Spend Strategically Grow Globally Scale Digitally Increase Share ■ Leverage integrated service model to grow market share and expand globally ■ Industry-leading tech, people and processes to provide best-in-class service ■ Expand modal capabilities ■ Expand Global Forwarding business as provider of choice for multinational customers ■ Leverage scale to capitalize on secularly growing market and unique global footprint ■ Grow capabilities and presence in key industry verticals, trade lanes and geographies ■ Digitize more internal tools and processes and drive down costs ■ Free customer and carrier reps’ capacity for higher- value touchpoints ■ Drive more revenue synergy across business units ■ Execute on cost savings program ■ Provide customers and carriers the digital products they value ■ Leverage data, scale and information advantage ■ Bring meaningful products, features and insights to both sides of the two- sided marketplace ■ Increase digital execution of all touch points in the lifecycle of a load ■ Support organic growth by leveraging strong cash flow ■ Modernize core for future integrations ■ Complement with opportunistic M&A

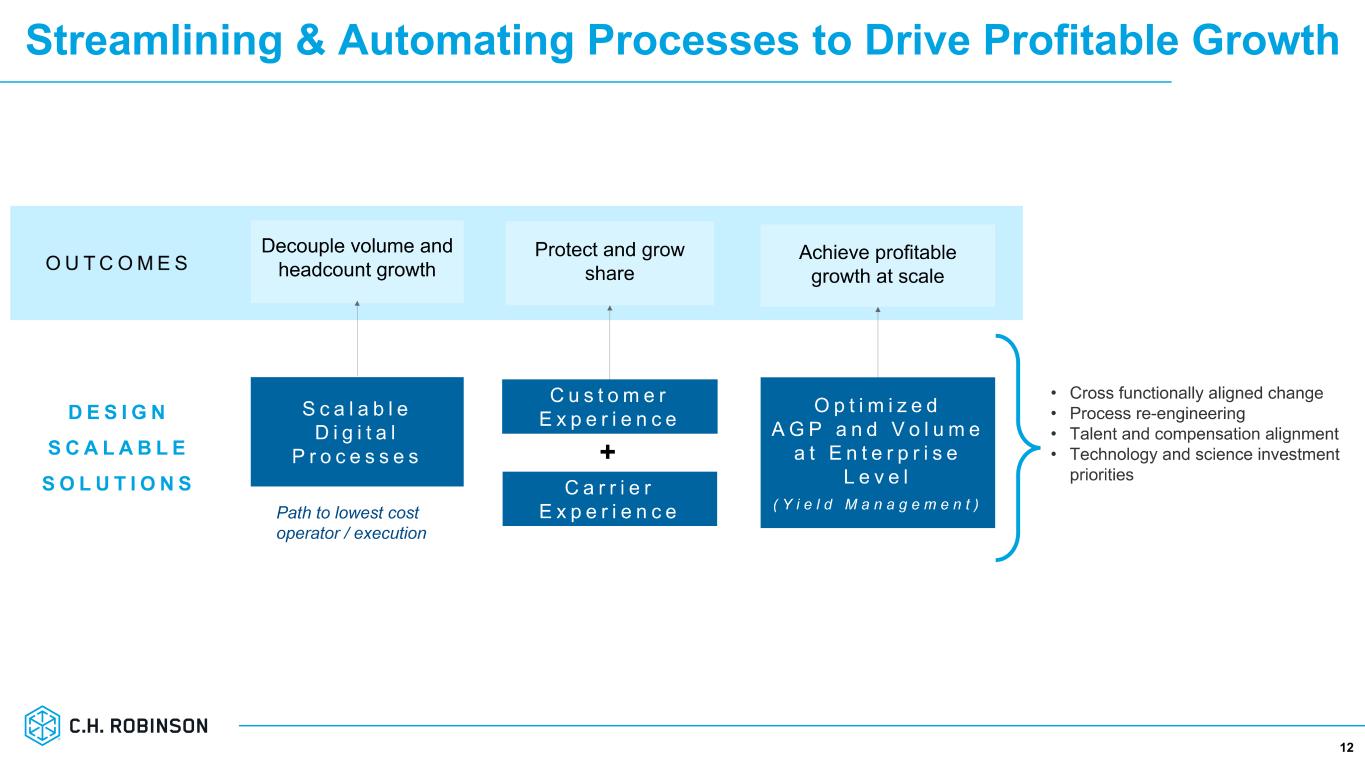

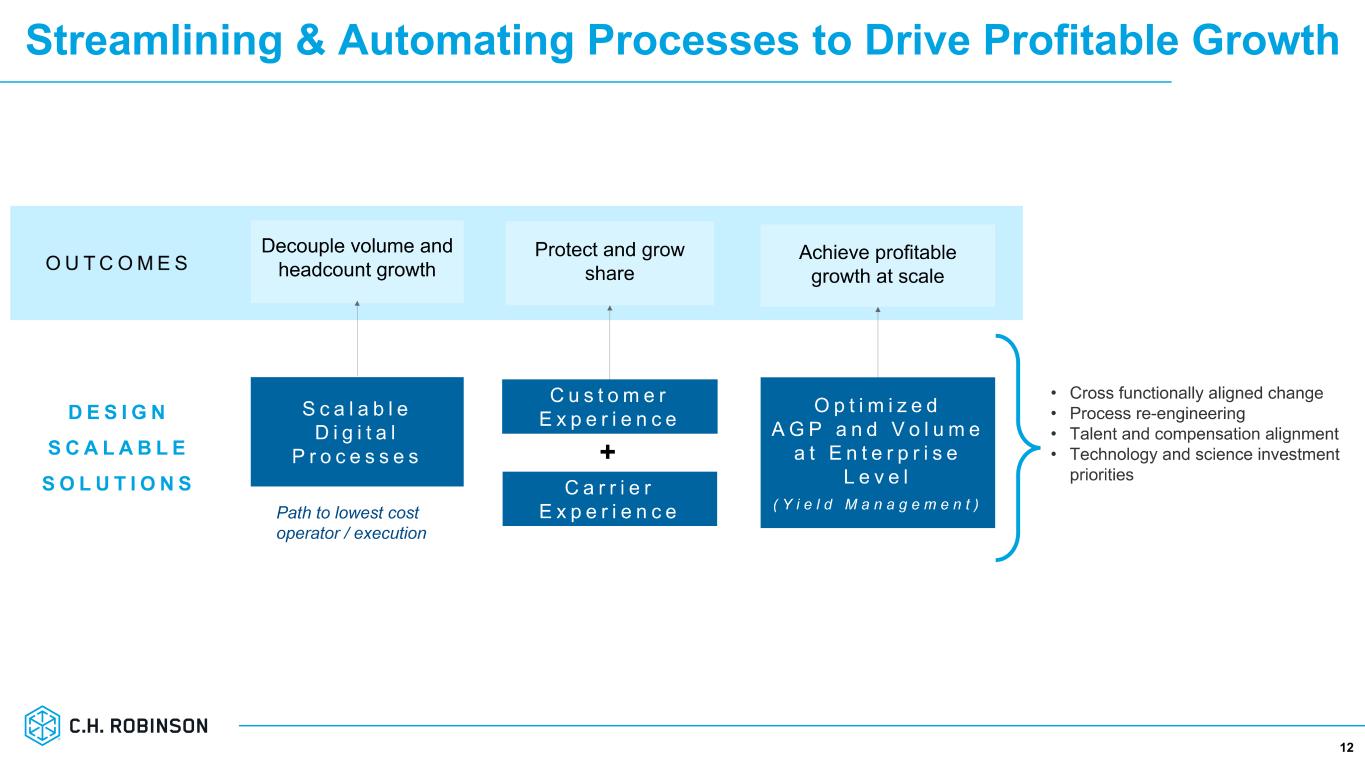

Streamlining & Automating Processes to Drive Profitable Growth 12 12

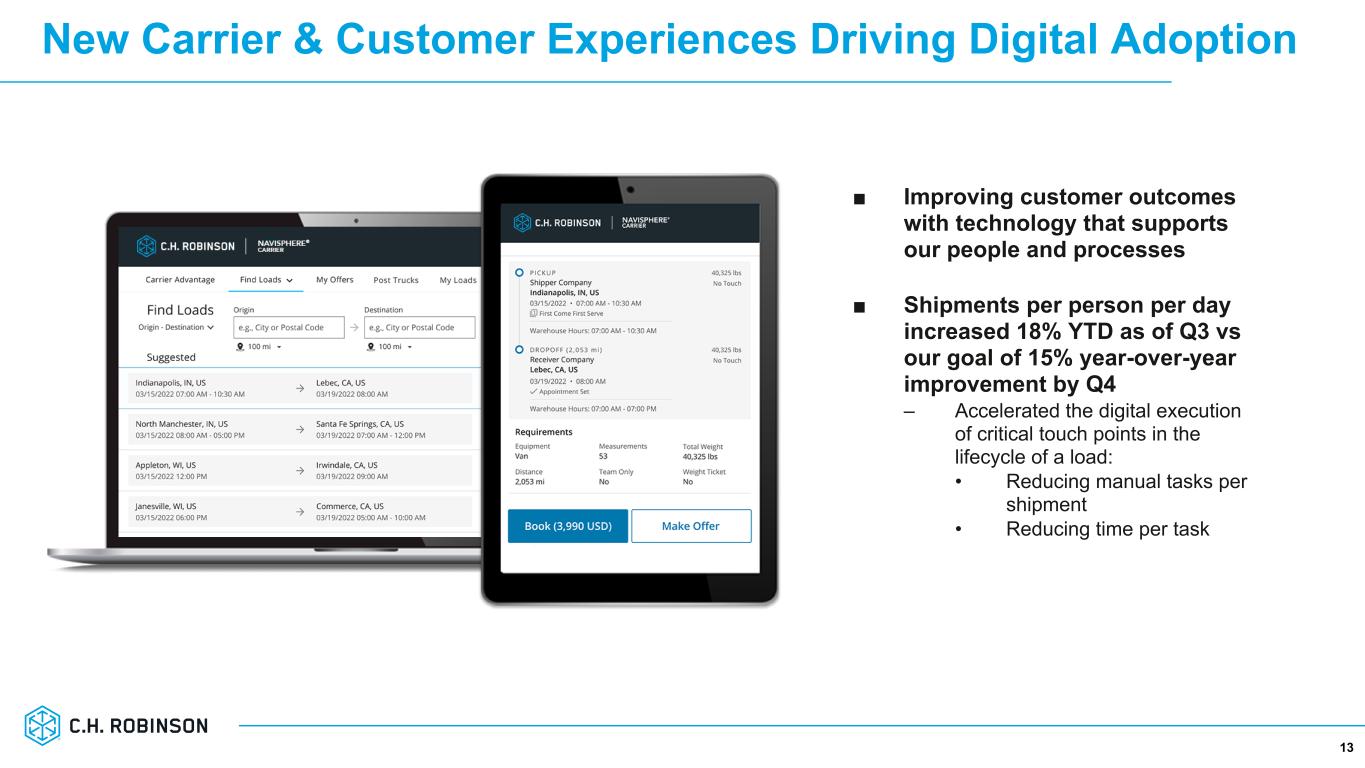

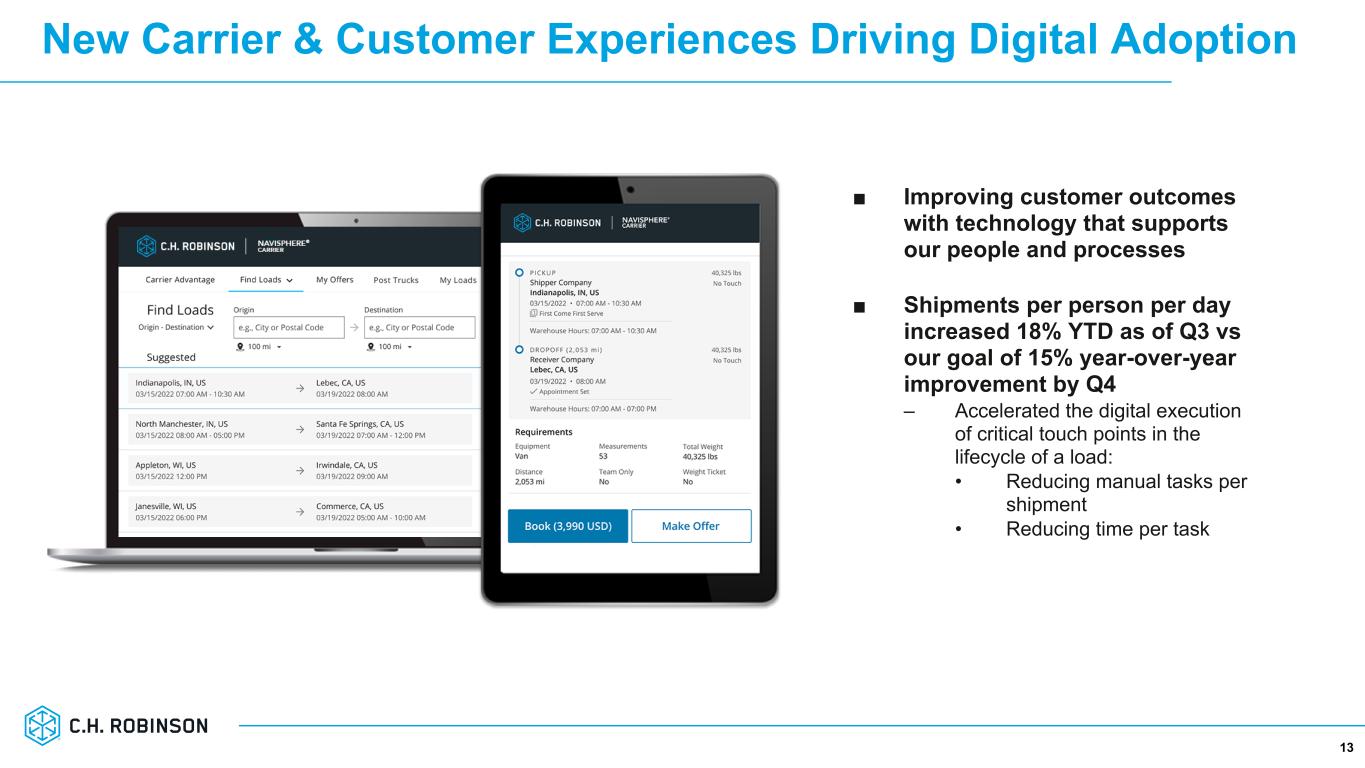

New Carrier & Customer Experiences Driving Digital Adoption 13 ■ Improving customer outcomes with technology that supports our people and processes ■ Shipments per person per day increased 18% YTD as of Q3 vs our goal of 15% year-over-year improvement by Q4 – Accelerated the digital execution of critical touch points in the lifecycle of a load: • Reducing manual tasks per shipment • Reducing time per task 13

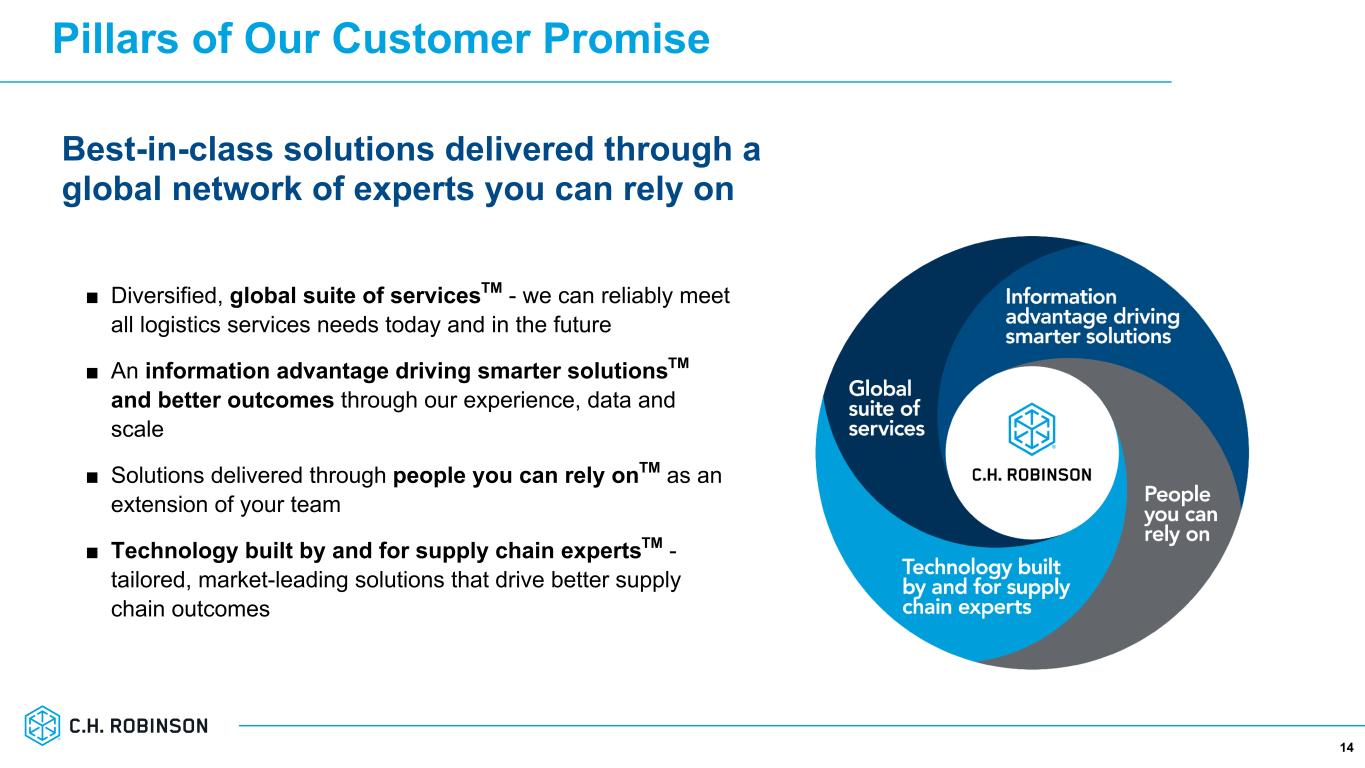

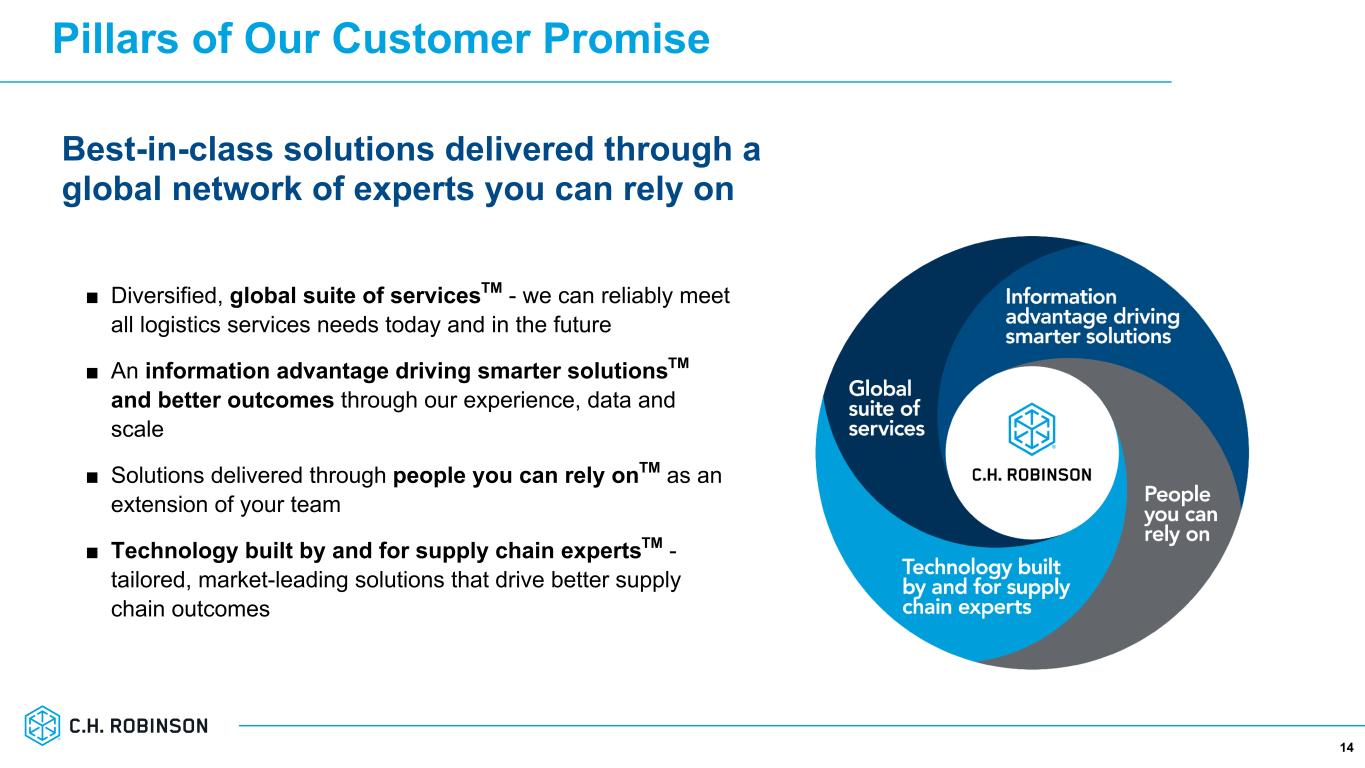

Pillars of Our Customer Promise ■ Diversified, global suite of servicesTM - we can reliably meet all logistics services needs today and in the future ■ An information advantage driving smarter solutionsTM and better outcomes through our experience, data and scale ■ Solutions delivered through people you can rely onTM as an extension of your team ■ Technology built by and for supply chain expertsTM - tailored, market-leading solutions that drive better supply chain outcomes 14 Best-in-class solutions delivered through a global network of experts you can rely on

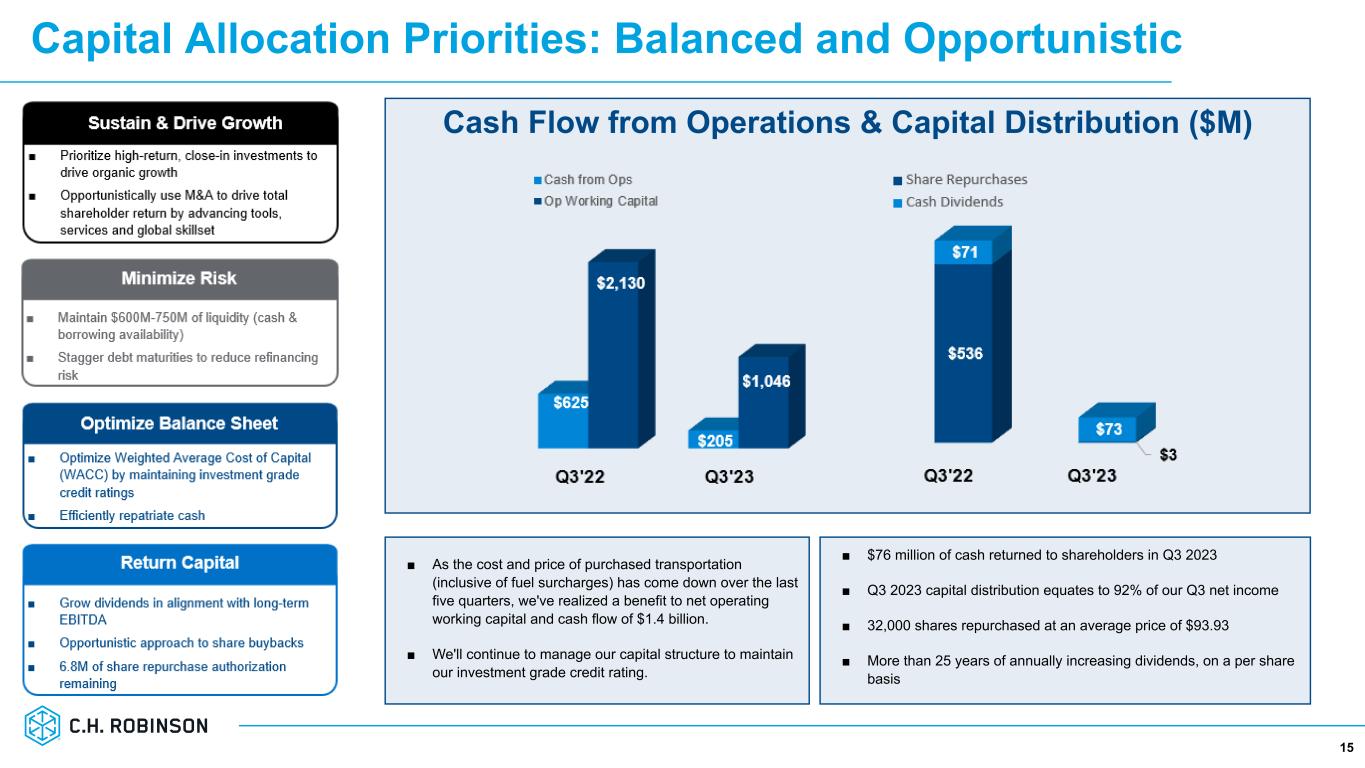

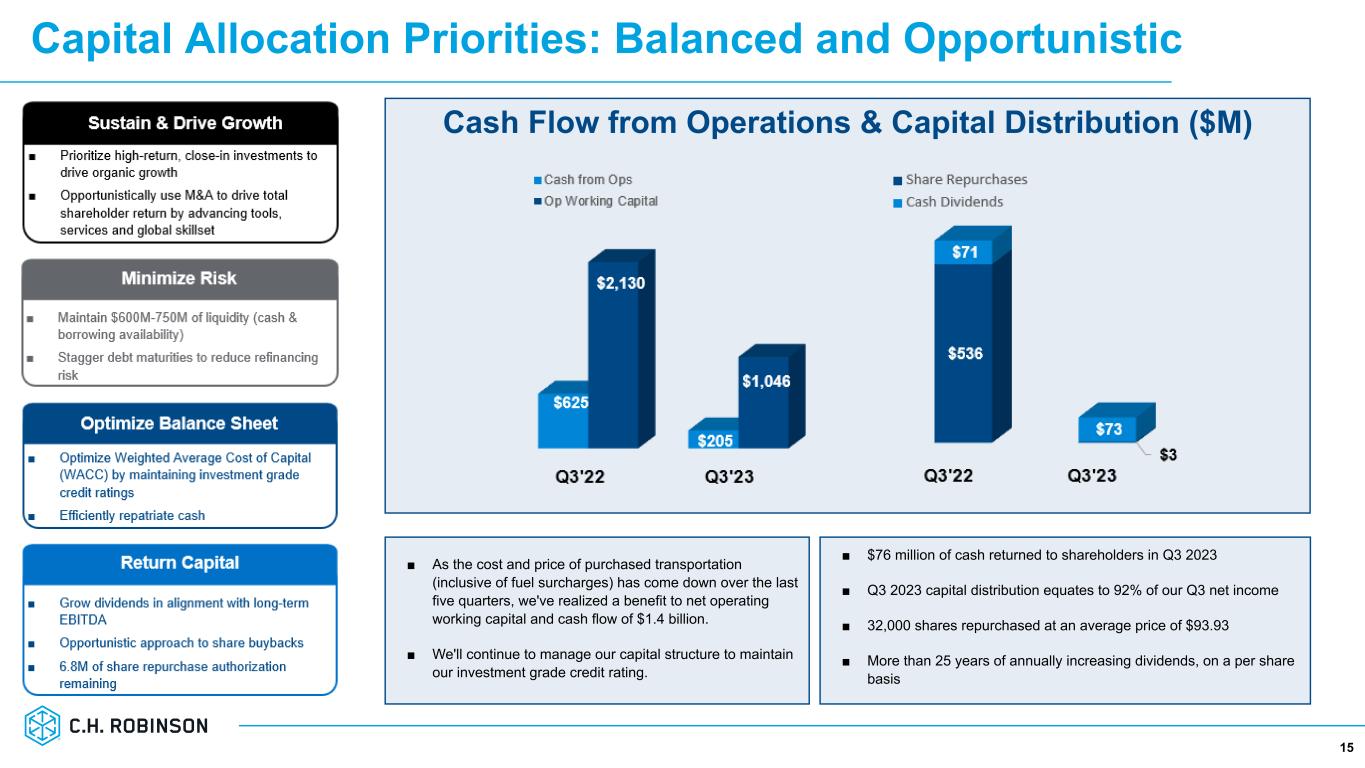

Capital Allocation Priorities: Balanced and Opportunistic 15 Cash Flow from Operations & Capital Distribution ($M) ■ $76 million of cash returned to shareholders in Q3 2023 ■ Q3 2023 capital distribution equates to 92% of our Q3 net income ■ 32,000 shares repurchased at an average price of $93.93 ■ More than 25 years of annually increasing dividends, on a per share basis ■ As the cost and price of purchased transportation (inclusive of fuel surcharges) has come down over the last five quarters, we've realized a benefit to net operating working capital and cash flow of $1.4 billion. ■ We'll continue to manage our capital structure to maintain our investment grade credit rating.

16 Appendix

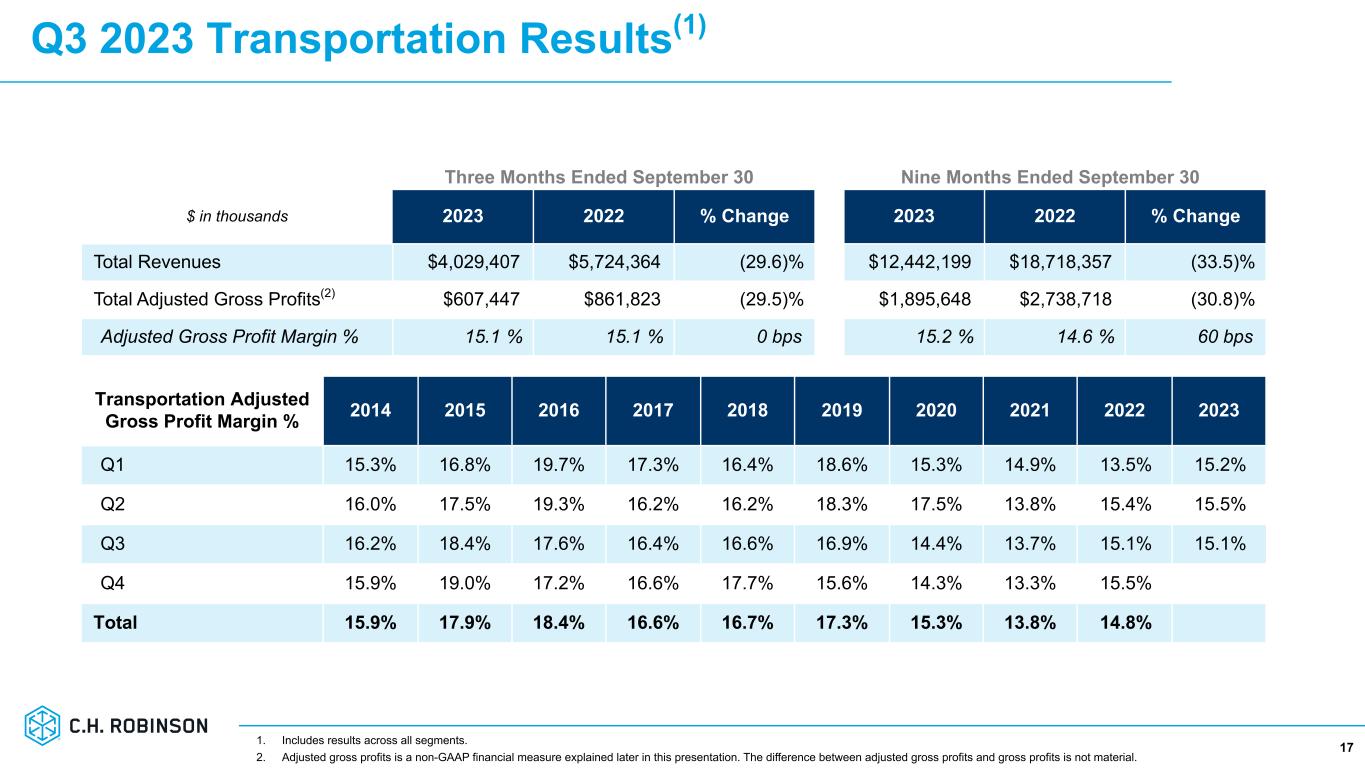

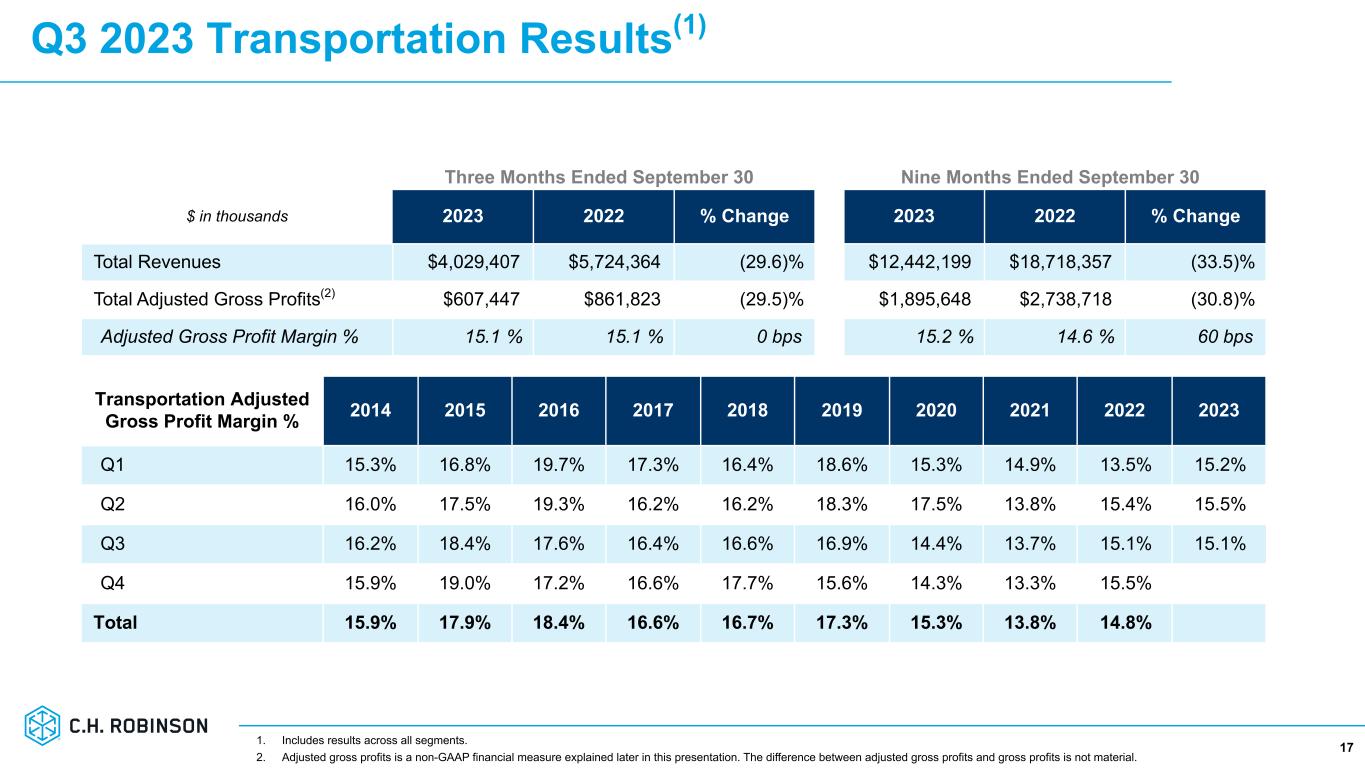

Q3 2023 Transportation Results(1) 17 Three Months Ended September 30 Nine Months Ended September 30 $ in thousands 2023 2022 % Change 2023 2022 % Change Total Revenues $4,029,407 $5,724,364 (29.6) % $12,442,199 $18,718,357 (33.5) % Total Adjusted Gross Profits(2) $607,447 $861,823 (29.5) % $1,895,648 $2,738,718 (30.8) % Adjusted Gross Profit Margin % 15.1 % 15.1 % 0 bps 15.2 % 14.6 % 60 bps Transportation Adjusted Gross Profit Margin % 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Q1 15.3% 16.8% 19.7% 17.3% 16.4% 18.6% 15.3% 14.9% 13.5% 15.2% Q2 16.0% 17.5% 19.3% 16.2% 16.2% 18.3% 17.5% 13.8% 15.4% 15.5% Q3 16.2% 18.4% 17.6% 16.4% 16.6% 16.9% 14.4% 13.7% 15.1% 15.1% Q4 15.9% 19.0% 17.2% 16.6% 17.7% 15.6% 14.3% 13.3% 15.5% Total 15.9% 17.9% 18.4% 16.6% 16.7% 17.3% 15.3% 13.8% 14.8% 1. Includes results across all segments. 2. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material.

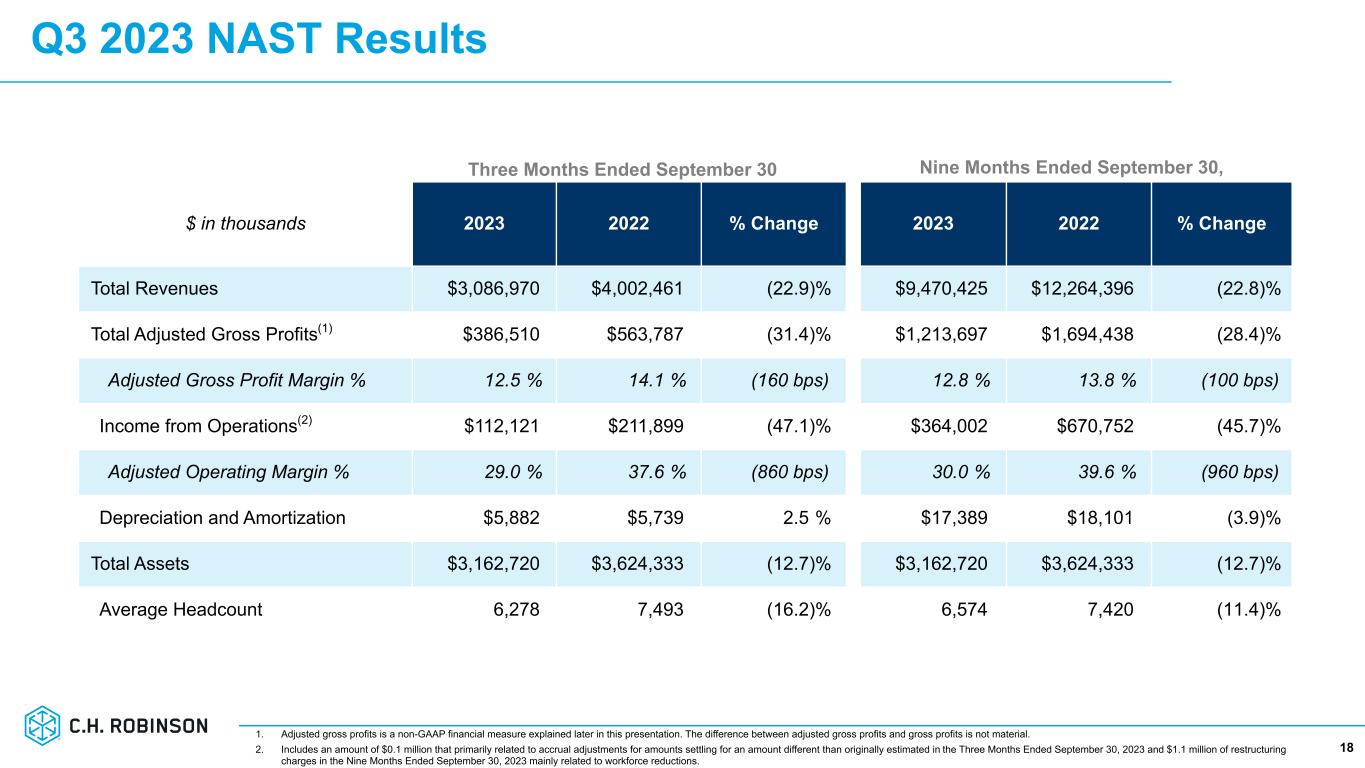

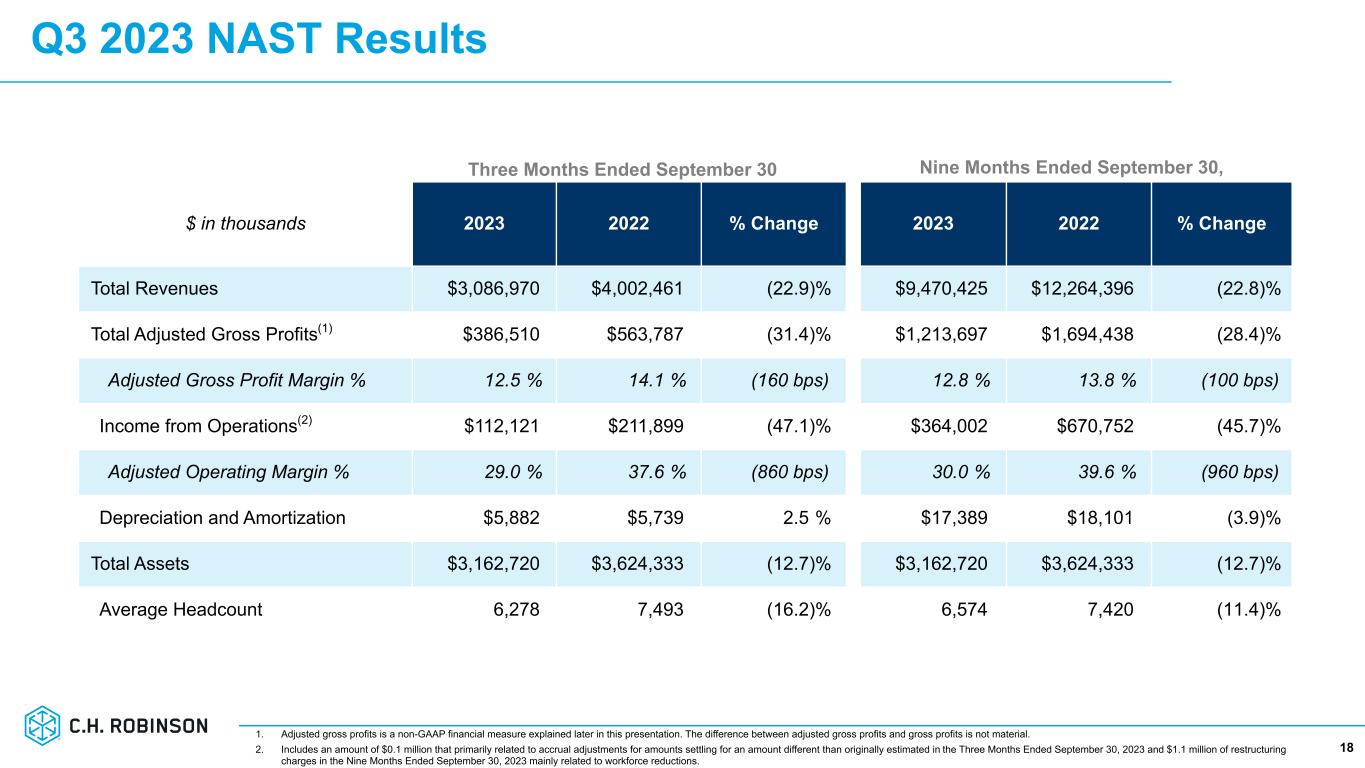

Q3 2023 NAST Results 18 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Includes an amount of $0.1 million that primarily related to accrual adjustments for amounts settling for an amount different than originally estimated in the Three Months Ended September 30, 2023 and $1.1 million of restructuring charges in the Nine Months Ended September 30, 2023 mainly related to workforce reductions. Three Months Ended September 30 Nine Months Ended September 30, $ in thousands 2023 2022 % Change 2023 2022 % Change Total Revenues $3,086,970 $4,002,461 (22.9) % $9,470,425 $12,264,396 (22.8) % Total Adjusted Gross Profits(1) $386,510 $563,787 (31.4) % $1,213,697 $1,694,438 (28.4) % Adjusted Gross Profit Margin % 12.5 % 14.1 % (160 bps) 12.8 % 13.8 % (100 bps) Income from Operations(2) $112,121 $211,899 (47.1) % $364,002 $670,752 (45.7) % Adjusted Operating Margin % 29.0 % 37.6 % (860 bps) 30.0 % 39.6 % (960 bps) Depreciation and Amortization $5,882 $5,739 2.5 % $17,389 $18,101 (3.9) % Total Assets $3,162,720 $3,624,333 (12.7) % $3,162,720 $3,624,333 (12.7) % Average Headcount 6,278 7,493 (16.2) % 6,574 7,420 (11.4) %

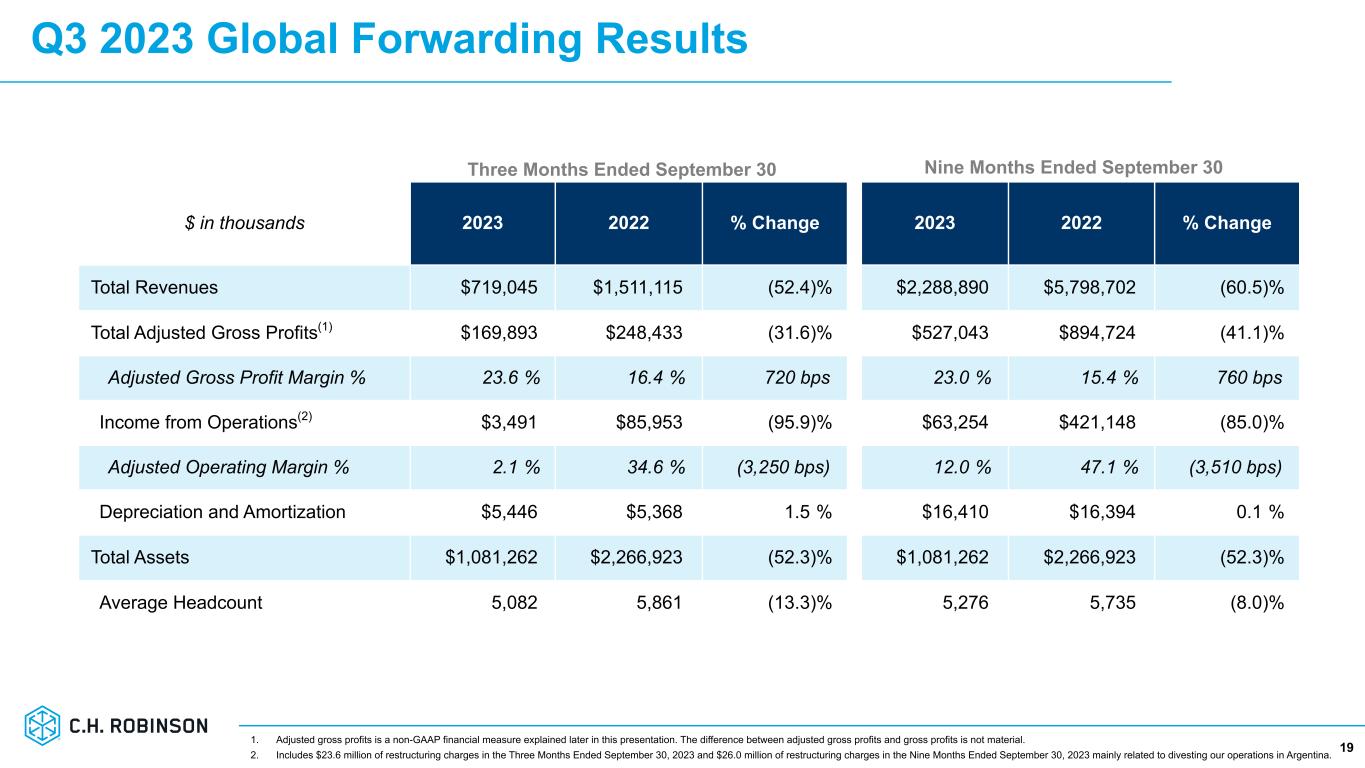

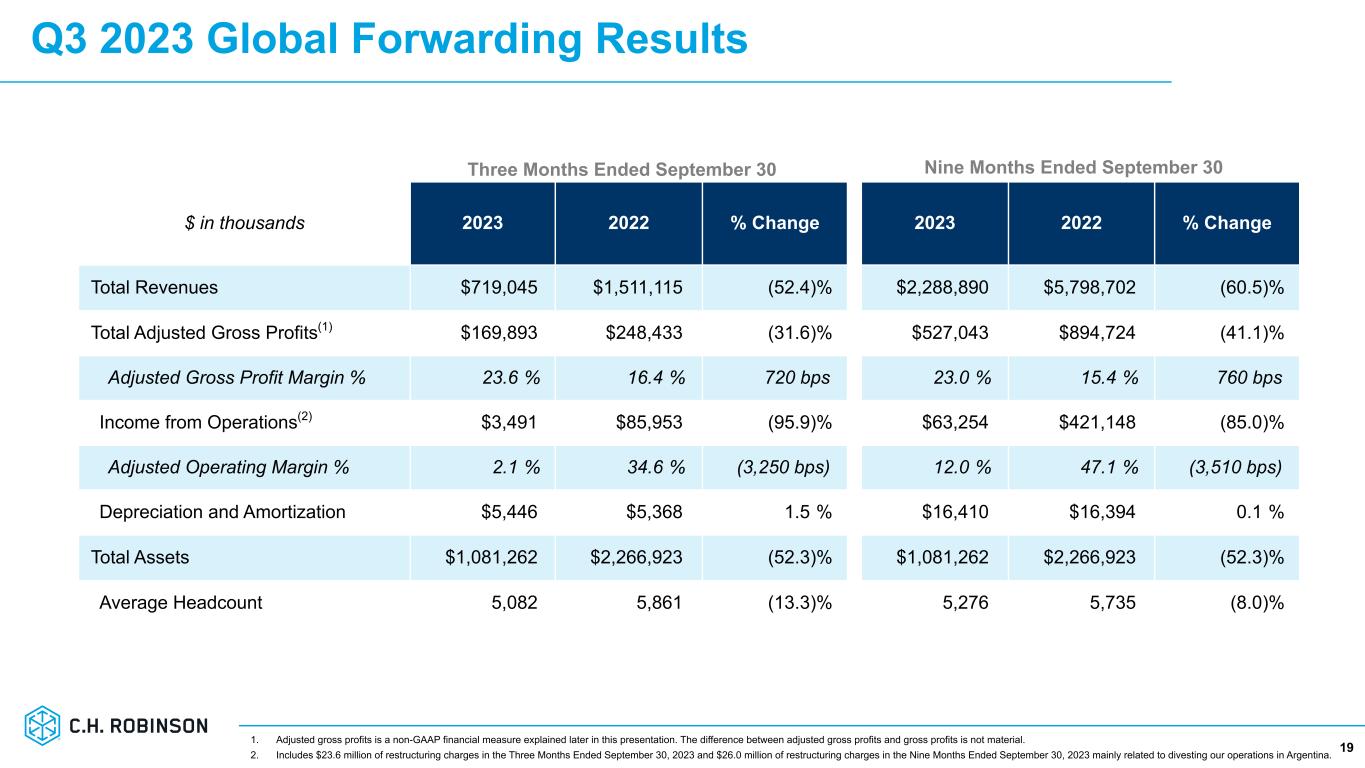

Q3 2023 Global Forwarding Results 191. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Includes $23.6 million of restructuring charges in the Three Months Ended September 30, 2023 and $26.0 million of restructuring charges in the Nine Months Ended September 30, 2023 mainly related to divesting our operations in Argentina. Three Months Ended September 30 Nine Months Ended September 30 $ in thousands 2023 2022 % Change 2023 2022 % Change Total Revenues $719,045 $1,511,115 (52.4) % $2,288,890 $5,798,702 (60.5) % Total Adjusted Gross Profits(1) $169,893 $248,433 (31.6) % $527,043 $894,724 (41.1) % Adjusted Gross Profit Margin % 23.6 % 16.4 % 720 bps 23.0 % 15.4 % 760 bps Income from Operations(2) $3,491 $85,953 (95.9) % $63,254 $421,148 (85.0) % Adjusted Operating Margin % 2.1 % 34.6 % (3,250 bps) 12.0 % 47.1 % (3,510 bps) Depreciation and Amortization $5,446 $5,368 1.5 % $16,410 $16,394 0.1 % Total Assets $1,081,262 $2,266,923 (52.3) % $1,081,262 $2,266,923 (52.3) % Average Headcount 5,082 5,861 (13.3) % 5,276 5,735 (8.0) %

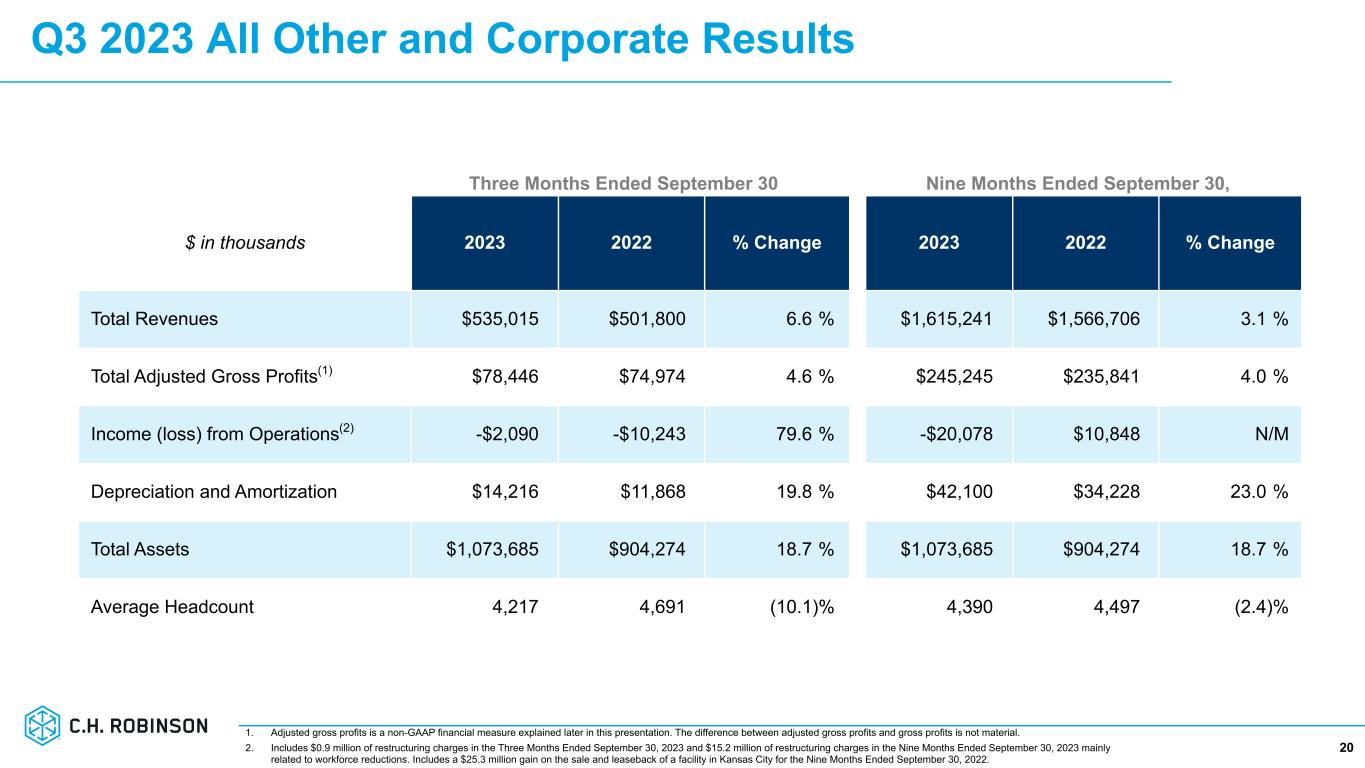

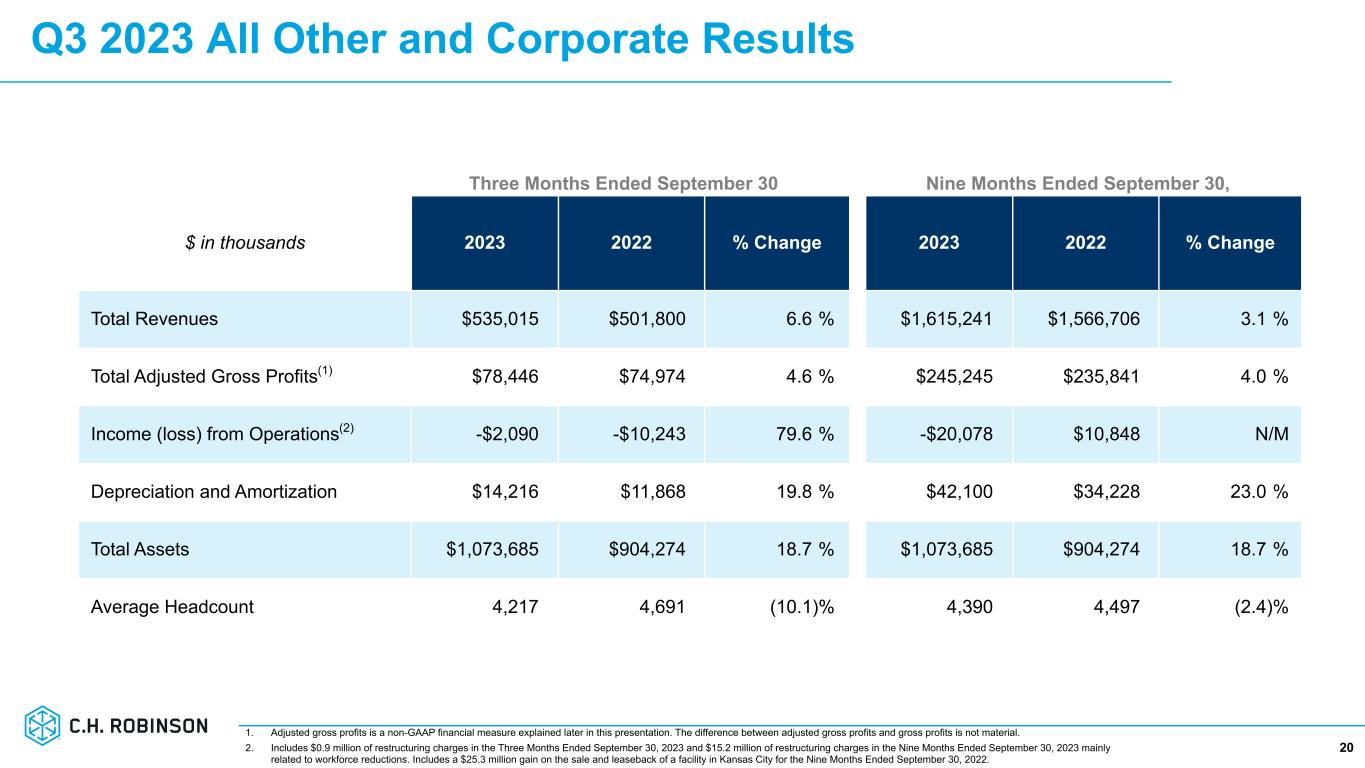

Q3 2023 All Other and Corporate Results 20 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Includes $0.9 million of restructuring charges in the Three Months Ended September 30, 2023 and $15.2 million of restructuring charges in the Nine Months Ended September 30, 2023 mainly related to workforce reductions. Includes a $25.3 million gain on the sale and leaseback of a facility in Kansas City for the Nine Months Ended September 30, 2022. Three Months Ended September 30 Nine Months Ended September 30, $ in thousands 2023 2022 % Change 2023 2022 % Change Total Revenues $535,015 $501,800 6.6 % $1,615,241 $1,566,706 3.1 % Total Adjusted Gross Profits(1) $78,446 $74,974 4.6 % $245,245 $235,841 4.0 % Income (loss) from Operations(2) -$2,090 -$10,243 79.6 % -$20,078 $10,848 N/M Depreciation and Amortization $14,216 $11,868 19.8 % $42,100 $34,228 23.0 % Total Assets $1,073,685 $904,274 18.7 % $1,073,685 $904,274 18.7 % Average Headcount 4,217 4,691 (10.1) % 4,390 4,497 (2.4) %

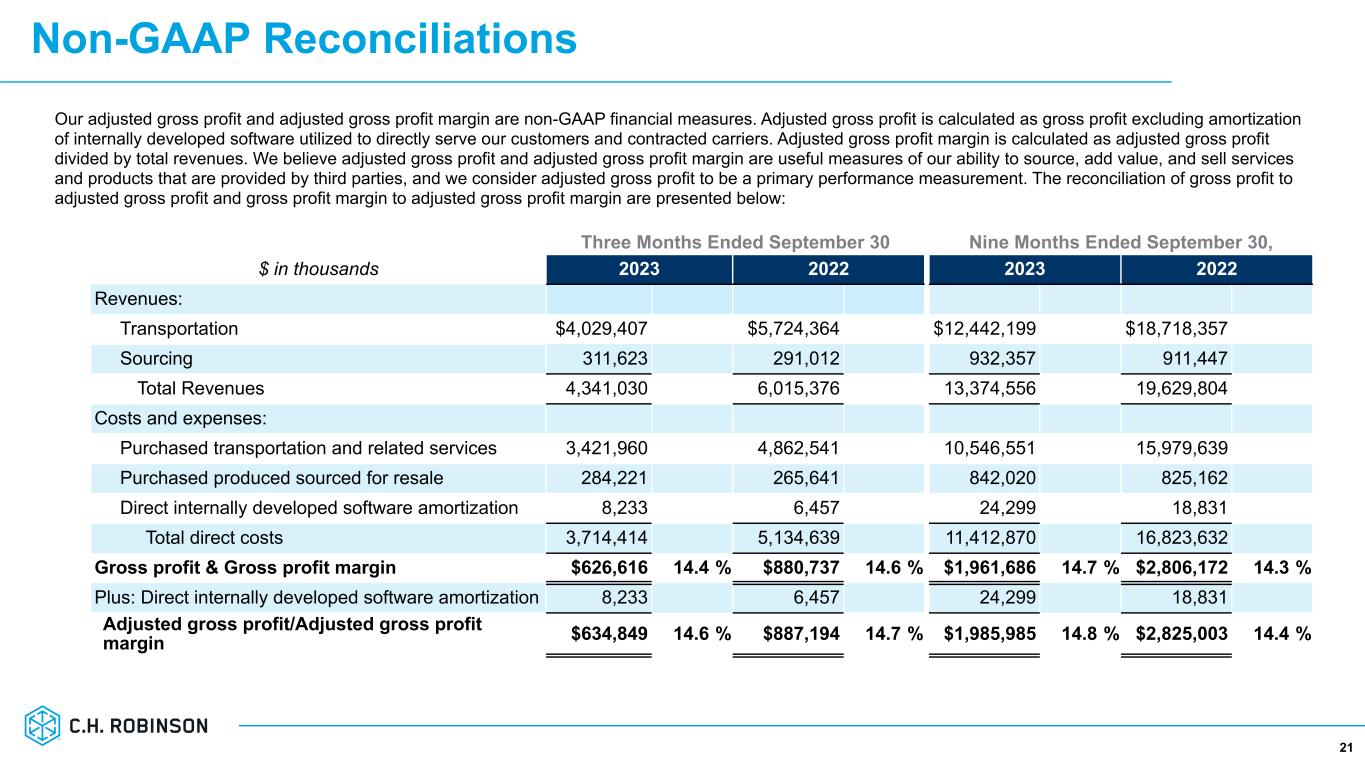

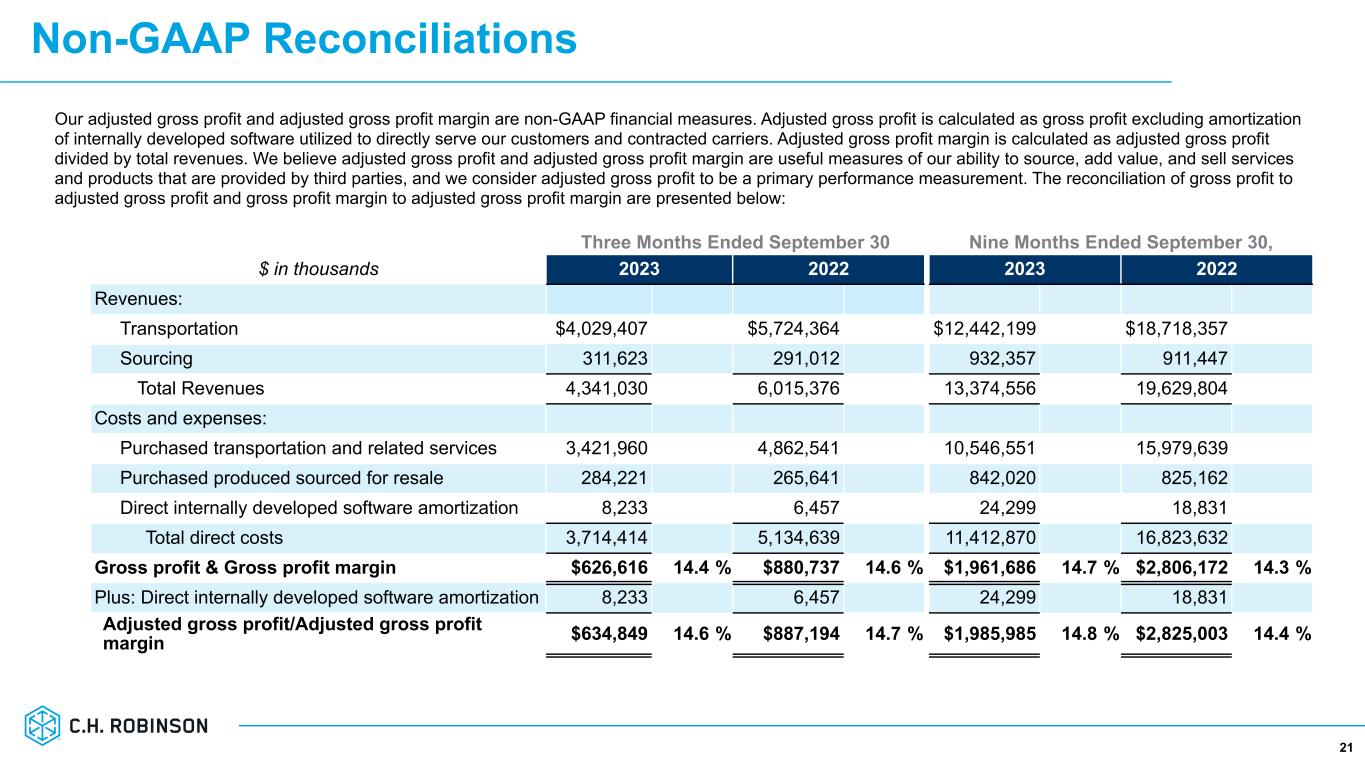

21 Our adjusted gross profit and adjusted gross profit margin are non-GAAP financial measures. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers. Adjusted gross profit margin is calculated as adjusted gross profit divided by total revenues. We believe adjusted gross profit and adjusted gross profit margin are useful measures of our ability to source, add value, and sell services and products that are provided by third parties, and we consider adjusted gross profit to be a primary performance measurement. The reconciliation of gross profit to adjusted gross profit and gross profit margin to adjusted gross profit margin are presented below: Three Months Ended September 30 Nine Months Ended September 30, $ in thousands 2023 2022 2023 2022 Revenues: Transportation $4,029,407 $5,724,364 $12,442,199 $18,718,357 Sourcing 311,623 291,012 932,357 911,447 Total Revenues 4,341,030 6,015,376 13,374,556 19,629,804 Costs and expenses: Purchased transportation and related services 3,421,960 4,862,541 10,546,551 15,979,639 Purchased produced sourced for resale 284,221 265,641 842,020 825,162 Direct internally developed software amortization 8,233 6,457 24,299 18,831 Total direct costs 3,714,414 5,134,639 11,412,870 16,823,632 Gross profit & Gross profit margin $626,616 14.4 % $880,737 14.6 % $1,961,686 14.7 % $2,806,172 14.3 % Plus: Direct internally developed software amortization 8,233 6,457 24,299 18,831 Adjusted gross profit/Adjusted gross profit margin $634,849 14.6 % $887,194 14.7 % $1,985,985 14.8 % $2,825,003 14.4 % Non-GAAP Reconciliations

Non-GAAP Reconciliations 22 Our adjusted operating margin is a non-GAAP financial measure calculated as operating income divided by adjusted gross profit. Our adjusted operating margin - excluding restructuring is a similar non-GAAP financial measure as adjusted operating margin, but also excludes the impact of restructuring and related costs. We believe adjusted operating margin and adjusted operating margin - excluding restructuring are useful measures of our profitability in comparison to our adjusted gross profit, which we consider a primary performance metric as discussed above. The comparisons of operating margin to adjusted operating margin and adjusted operating margin - excluding restructuring are presented below: Three Months Ended September 30 Nine Months Ended September 30, $ in thousands 2023 2022 2023 2022 Total Revenues $4,341,030 $6,015,376 $13,374,556 $19,629,804 Income from operations 113,522 287,609 407,178 1,102,748 Operating margin 2.6 % 4.8 % 3.0 % 5.6 % Adjusted gross profit $634,849 $887,194 $1,985,985 $2,825,003 Income from operations 113,522 287,609 407,178 1,102,748 Adjusted operating margin 17.9 % 32.4 % 20.5 % 39.0 % Adjusted gross profit $634,849 $887,194 $1,985,985 $2,825,003 Income from operations - excluding restructuring and gain on sale(1) 137,985 287,609 449,495 1,077,452 Adjusted operating margin - excluding restructuring and gain on sale 21.7 % 32.4 % 22.6 % 38.1 % 1. In the Three Months Ended September 30, 2023, we incurred restructuring expenses of $3.0 million related to workforce reductions and $21.4 million of asset impairment and other charges. In the Nine Months Ended September 30, 2023, we incurred restructuring expenses of $19.7 million related to workforce reductions and $22.6 million of asset impairment and other charges. In the Nine Months Ended September 30, 2022, we incurred a $25.3 million gain on the sale and leaseback of a facility in Kansas City.

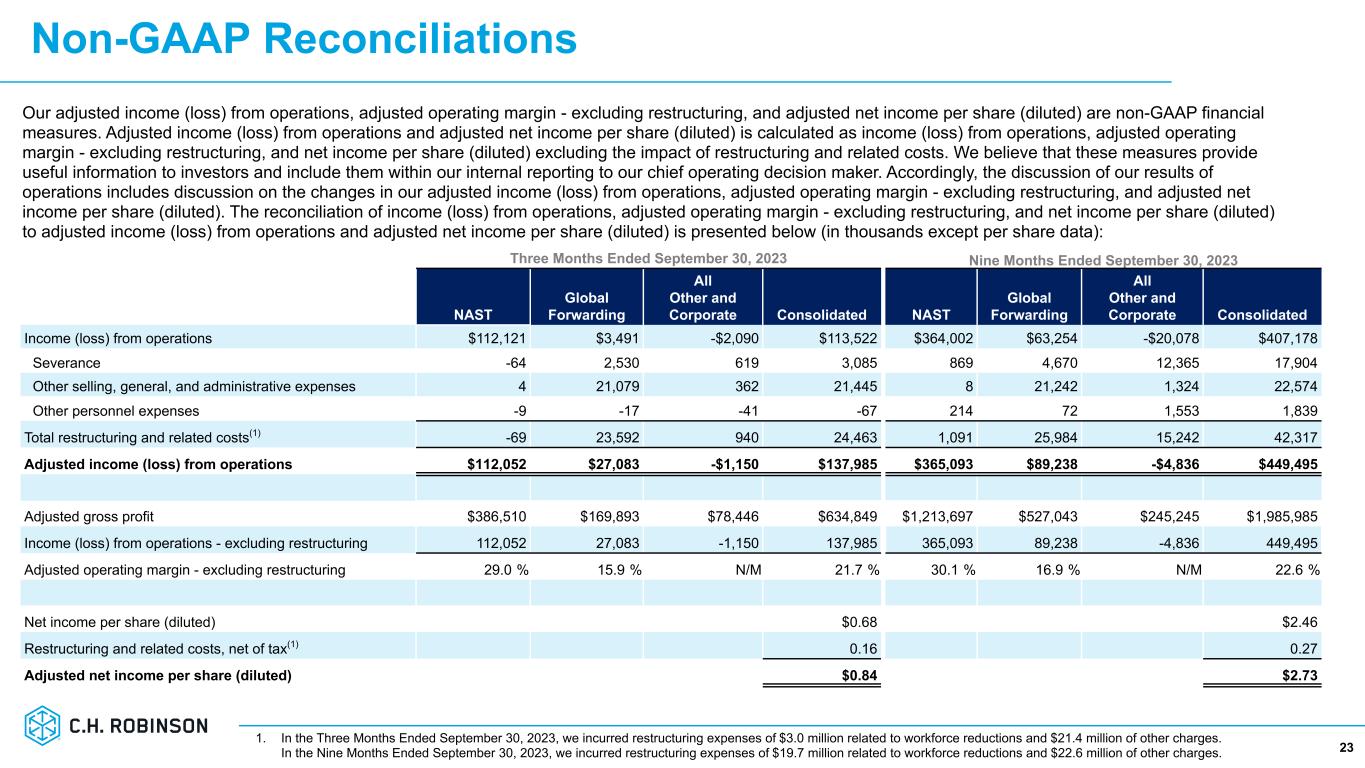

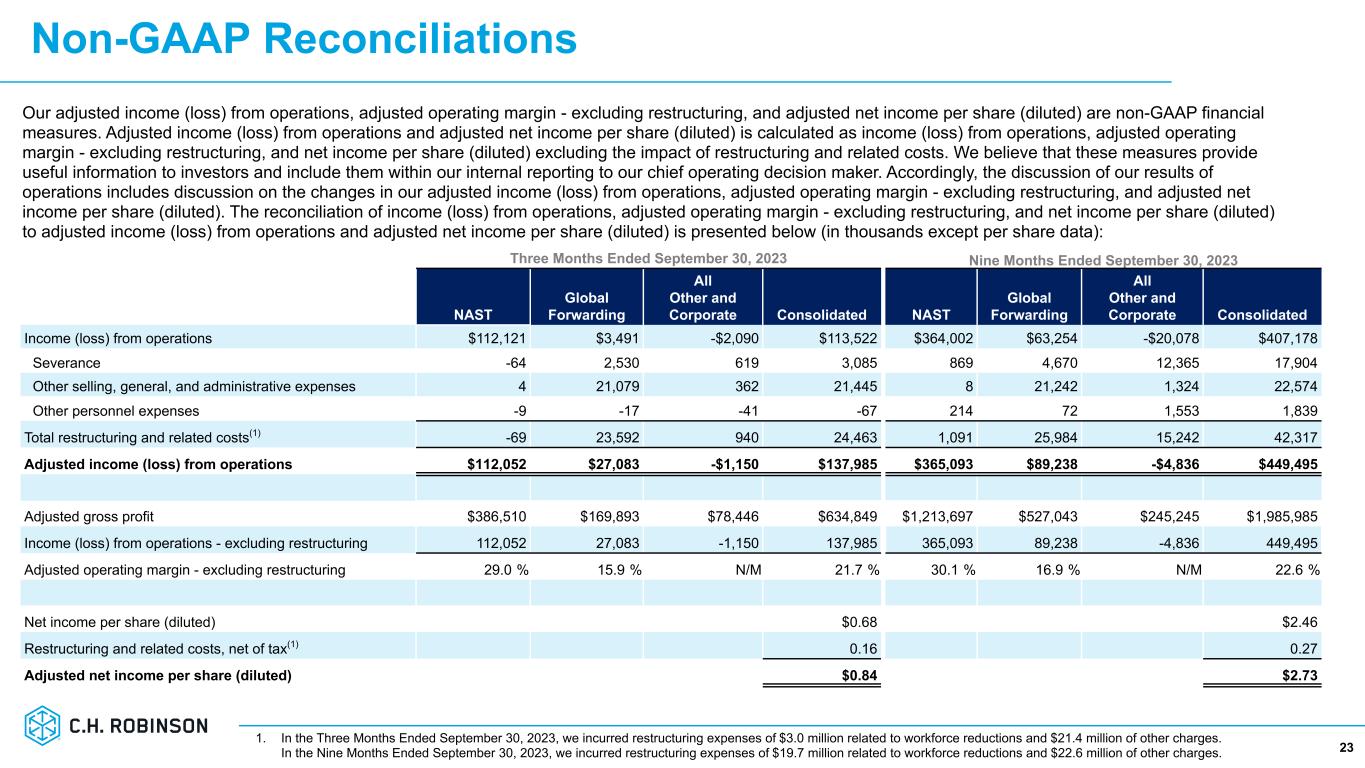

Non-GAAP Reconciliations 23 Our adjusted income (loss) from operations, adjusted operating margin - excluding restructuring, and adjusted net income per share (diluted) are non-GAAP financial measures. Adjusted income (loss) from operations and adjusted net income per share (diluted) is calculated as income (loss) from operations, adjusted operating margin - excluding restructuring, and net income per share (diluted) excluding the impact of restructuring and related costs. We believe that these measures provide useful information to investors and include them within our internal reporting to our chief operating decision maker. Accordingly, the discussion of our results of operations includes discussion on the changes in our adjusted income (loss) from operations, adjusted operating margin - excluding restructuring, and adjusted net income per share (diluted). The reconciliation of income (loss) from operations, adjusted operating margin - excluding restructuring, and net income per share (diluted) to adjusted income (loss) from operations and adjusted net income per share (diluted) is presented below (in thousands except per share data): Three Months Ended September 30, 2023 Nine Months Ended September 30, 2023 NAST Global Forwarding All Other and Corporate Consolidated NAST Global Forwarding All Other and Corporate Consolidated Income (loss) from operations $112,121 $3,491 -$2,090 $113,522 $364,002 $63,254 -$20,078 $407,178 Severance -64 2,530 619 3,085 869 4,670 12,365 17,904 Other selling, general, and administrative expenses 4 21,079 362 21,445 8 21,242 1,324 22,574 Other personnel expenses -9 -17 -41 -67 214 72 1,553 1,839 Total restructuring and related costs(1) -69 23,592 940 24,463 1,091 25,984 15,242 42,317 Adjusted income (loss) from operations $112,052 $27,083 -$1,150 $137,985 $365,093 $89,238 -$4,836 $449,495 Adjusted gross profit $386,510 $169,893 $78,446 $634,849 $1,213,697 $527,043 $245,245 $1,985,985 Income (loss) from operations - excluding restructuring 112,052 27,083 -1,150 137,985 365,093 89,238 -4,836 449,495 Adjusted operating margin - excluding restructuring 29.0 % 15.9 % N/M 21.7 % 30.1 % 16.9 % N/M 22.6 % Net income per share (diluted) $0.68 $2.46 Restructuring and related costs, net of tax(1) 0.16 0.27 Adjusted net income per share (diluted) $0.84 $2.73 1. In the Three Months Ended September 30, 2023, we incurred restructuring expenses of $3.0 million related to workforce reductions and $21.4 million of other charges. In the Nine Months Ended September 30, 2023, we incurred restructuring expenses of $19.7 million related to workforce reductions and $22.6 million of other charges.

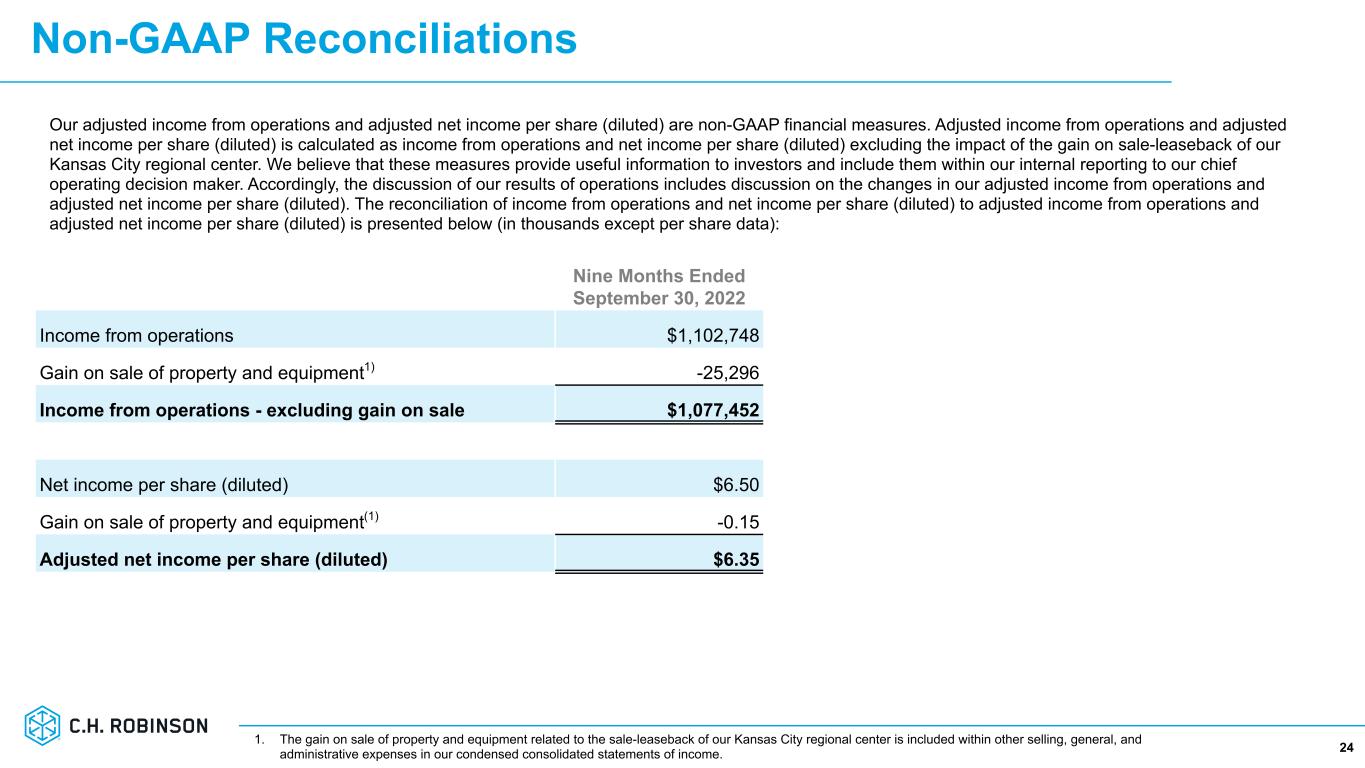

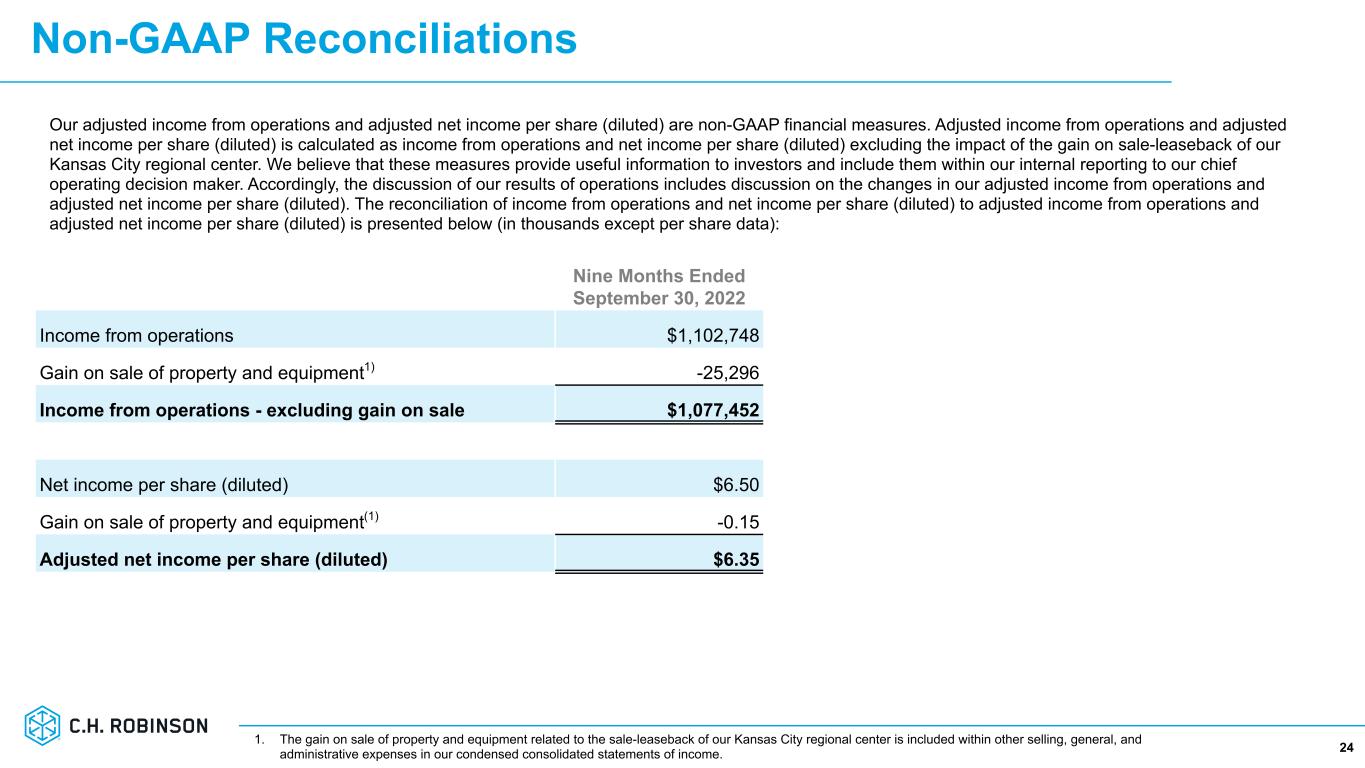

Non-GAAP Reconciliations 24 Our adjusted income from operations and adjusted net income per share (diluted) are non-GAAP financial measures. Adjusted income from operations and adjusted net income per share (diluted) is calculated as income from operations and net income per share (diluted) excluding the impact of the gain on sale-leaseback of our Kansas City regional center. We believe that these measures provide useful information to investors and include them within our internal reporting to our chief operating decision maker. Accordingly, the discussion of our results of operations includes discussion on the changes in our adjusted income from operations and adjusted net income per share (diluted). The reconciliation of income from operations and net income per share (diluted) to adjusted income from operations and adjusted net income per share (diluted) is presented below (in thousands except per share data): Nine Months Ended September 30, 2022 Income from operations $1,102,748 Gain on sale of property and equipment1) -25,296 Income from operations - excluding gain on sale $1,077,452 Net income per share (diluted) $6.50 Gain on sale of property and equipment(1) -0.15 Adjusted net income per share (diluted) $6.35 1. The gain on sale of property and equipment related to the sale-leaseback of our Kansas City regional center is included within other selling, general, and administrative expenses in our condensed consolidated statements of income.

25 Thank you INVESTOR RELATIONS: Chuck Ives 952-683-2508 chuck.ives@chrobinson.com