1 Q3 2024 October 30, 2024 Earnings Presentation Dave Bozeman, President & CEO Arun Rajan, Chief Strategy & Innovation Officer Damon Lee, Chief Financial Officer Michael Castagnetto, President of NAST Chuck Ives, Senior Director of Investor Relations

Safe Harbor Statement Except for the historical information contained herein, the matters set forth in this presentation and the accompanying earnings release are forward-looking statements that represent our expectations, beliefs, intentions or strategies concerning future events. These forward- looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience or our present expectations, including, but not limited to factors such as changes in economic conditions, including uncertain consumer demand; changes in market demand and pressures on the pricing for our services; fuel price increases or decreases, or fuel shortages; competition and growth rates within the global logistics industry that could adversely impact our profitability; freight levels and increasing costs and availability of truck capacity or alternative means of transporting freight; risks associated with seasonal changes or significant disruptions in the transportation industry; risks associated with identifying and completing suitable acquisitions; our dependence on and changes in relationships with existing contracted truck, rail, ocean, and air carriers; risks associated with the loss of significant customers; risks associated with reliance on technology to operate our business; cyber-security related risks; our ability to staff and retain employees; risks associated with operations outside of the U.S.; our ability to successfully integrate the operations of acquired companies with our historic operations; climate change related risks; risks associated with our indebtedness; risks associated with interest rates; risks associated with litigation, including contingent auto liability and insurance coverage; risks associated with the potential impact of changes in government regulations including environmental-related regulations; risks associated with the changes to income tax regulations; risks associated with the produce industry, including food safety and contamination issues; the impact of changes in political and governmental conditions; changes to our capital structure; changes due to catastrophic events; risks associated with the usage of artificial intelligence technologies; and other risks and uncertainties detailed in our Annual and Quarterly Reports. Any forward- looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update such statement to reflect events or circumstances arising after such date. 2©2024 C.H. Robinson Worldwide, Inc. All Rights Reserved.

Thoughts from President & CEO, Dave Bozeman 3 ■ Our Q3 results reflect continued improvement in our execution, as we continue to deploy our new operating model. We are raising the bar, even in a historically prolonged freight recession, with strong execution and disciplined volume growth across divisions while delivering exceptional service for our customers and carriers. ■ Due to a focus on constantly testing market conditions and optimizing yield, we improved the quality of our volume in Q3 and continued to expand our NAST gross profit margin. ■ We also continued to push our efficiency to higher levels in both NAST and Global Forwarding, and we remain on track to deliver greater than 30% compound growth in productivity over the two-year period from the end of 2022 to the end of 2024. ■ Improvements in gross profit margin, productivity, and operating leverage resulted in a 75% increase in our enterprise’s Q3 adjusted income from operations.

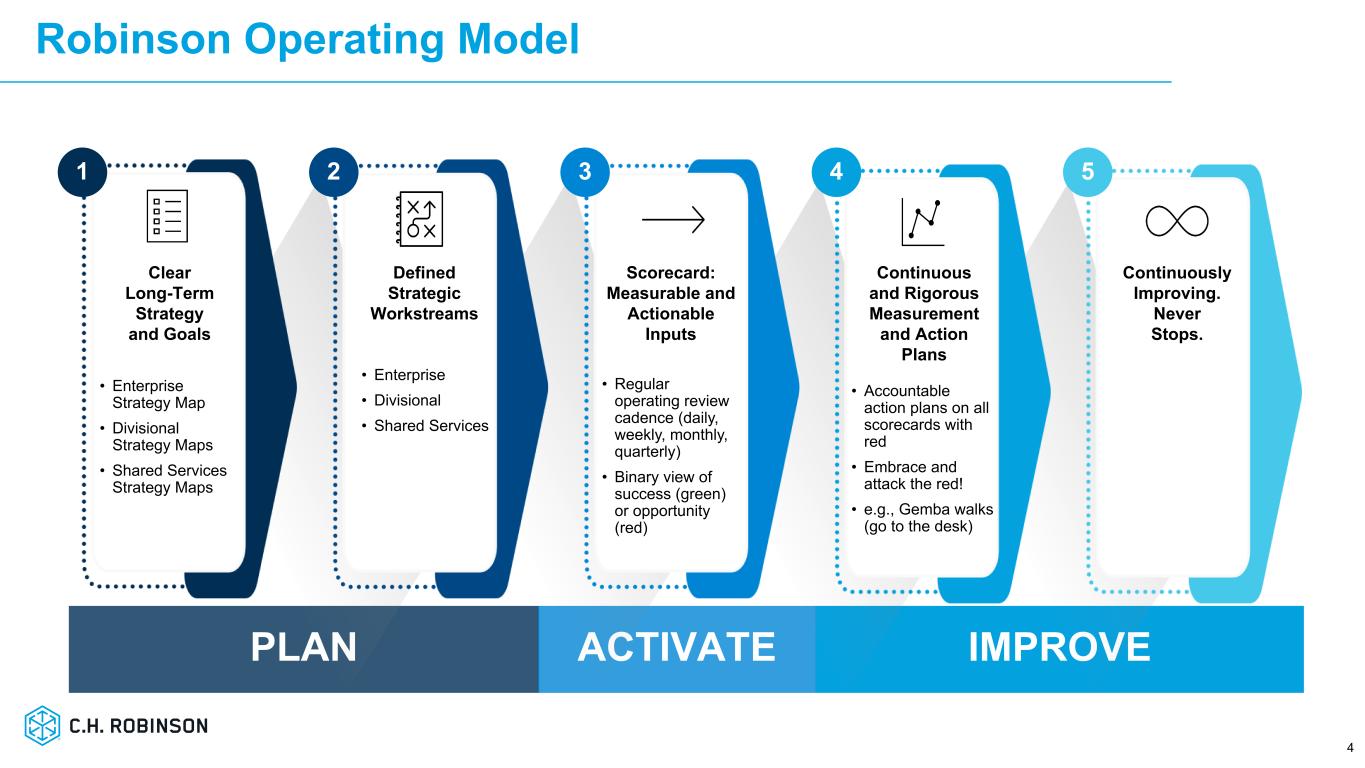

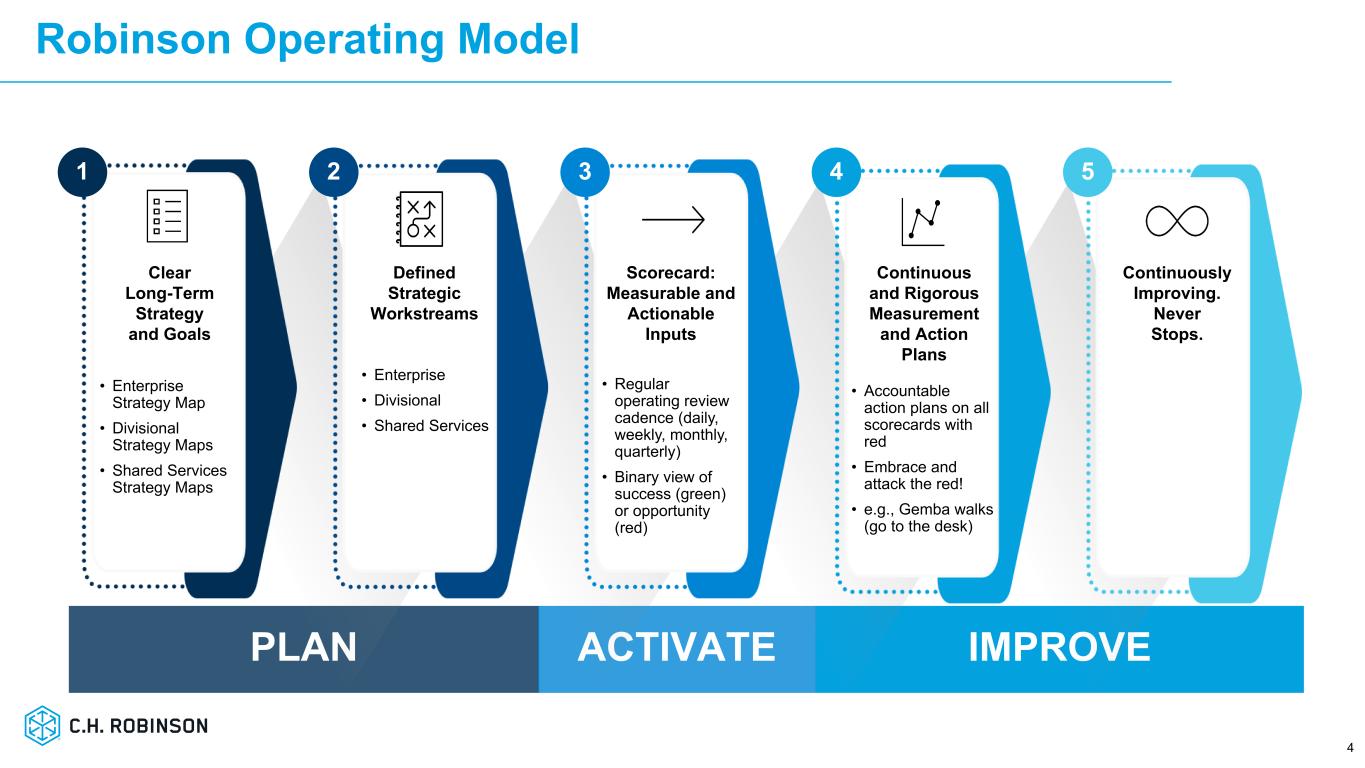

IMPROVEPLAN ACTIVATE • Enterprise Strategy Map • Divisional Strategy Maps • Shared Services Strategy Maps • Regular operating review cadence (daily, weekly, monthly, quarterly) • Binary view of success (green) or opportunity (red) • Enterprise • Divisional • Shared Services • Accountable action plans on all scorecards with red • Embrace and attack the red! • e.g., Gemba walks (go to the desk) Scorecard: Measurable and Actionable Inputs Defined Strategic Workstreams Clear Long-Term Strategy and Goals Continuous and Rigorous Measurement and Action Plans Continuously Improving. Never Stops. 1 2 3 4 5 Robinson Operating Model 4

Q3 Highlights 5 ■ Q3 NAST volume increased modestly Y/Y, which outpaced the market indices for the sixth consecutive quarter. Truckload AGP/ load improved Y/Y and sequentially, driving NAST adjusted income from operations up 34% Y/Y ■ Q3 ocean and air volume grew Y/Y, ocean AGP/shipment increased 47% Y/Y and Global Forwarding adjusted income from operations increased 230% Y/Y ■ Focused on deploying our new operating model, providing best- in-class service to our customers and carriers, gaining profitable share in targeted market segments, streamlining our processes, applying Lean principles, leveraging generative AI to drive out waste and optimize our costs, and ensuring readiness for the eventual freight market rebound, with a disciplined operating model that responsibly grows market share, decouples headcount growth from volume growth and drives operating leverage $4.6B Total Revenues +7.0% Y/Y $735M Adj. Gross Profits(1) +15.8% Y/Y $180M Income from Operations +58.7% Y/Y $0.80 Net Income/Share +17.6% Y/Y Q3 2024 1. Adjusted gross profits, adjusted income from operations and adjusted net income per share are non-GAAP financial measures. Refer to pages 21 through 24 for further discussion and a GAAP to Non-GAAP reconciliation. $1.28 of Adj. Net Income per Share(1) $242M of Adj. Income from Operations(1)

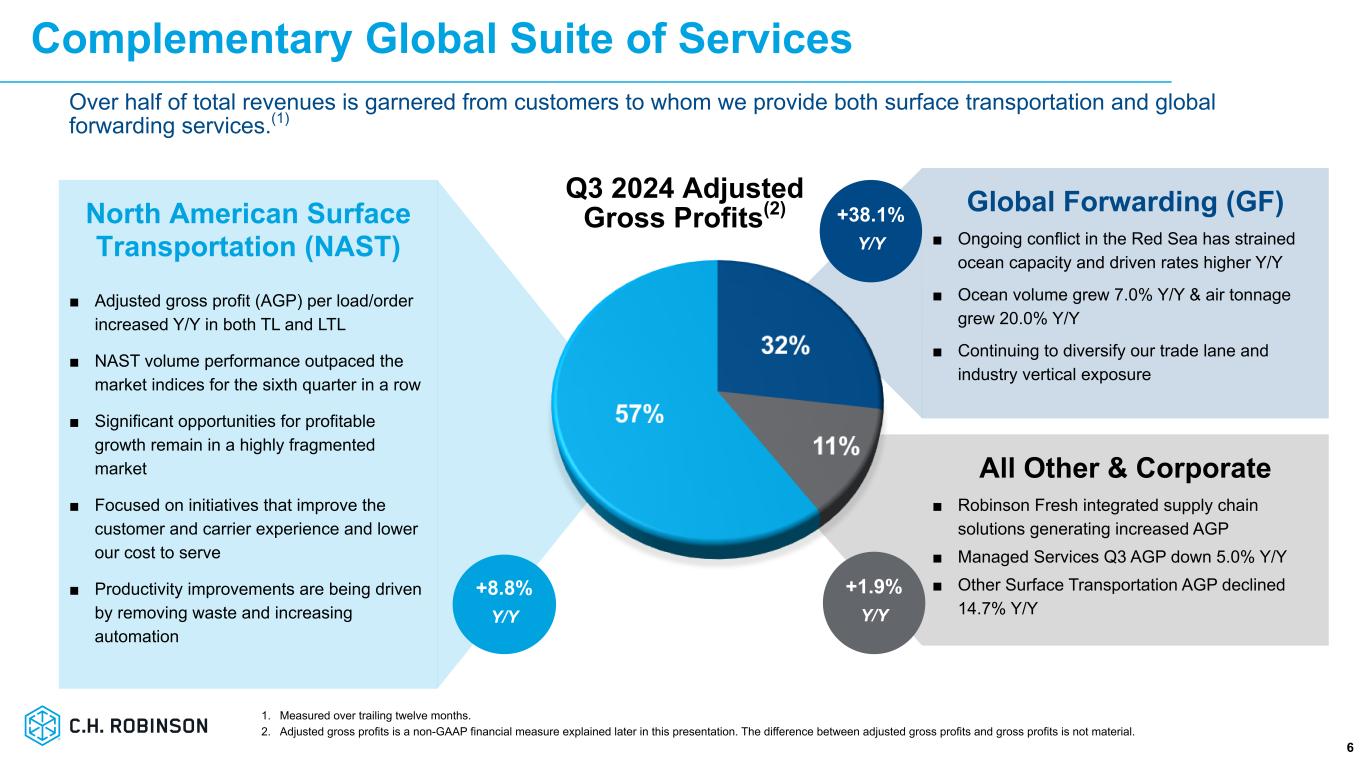

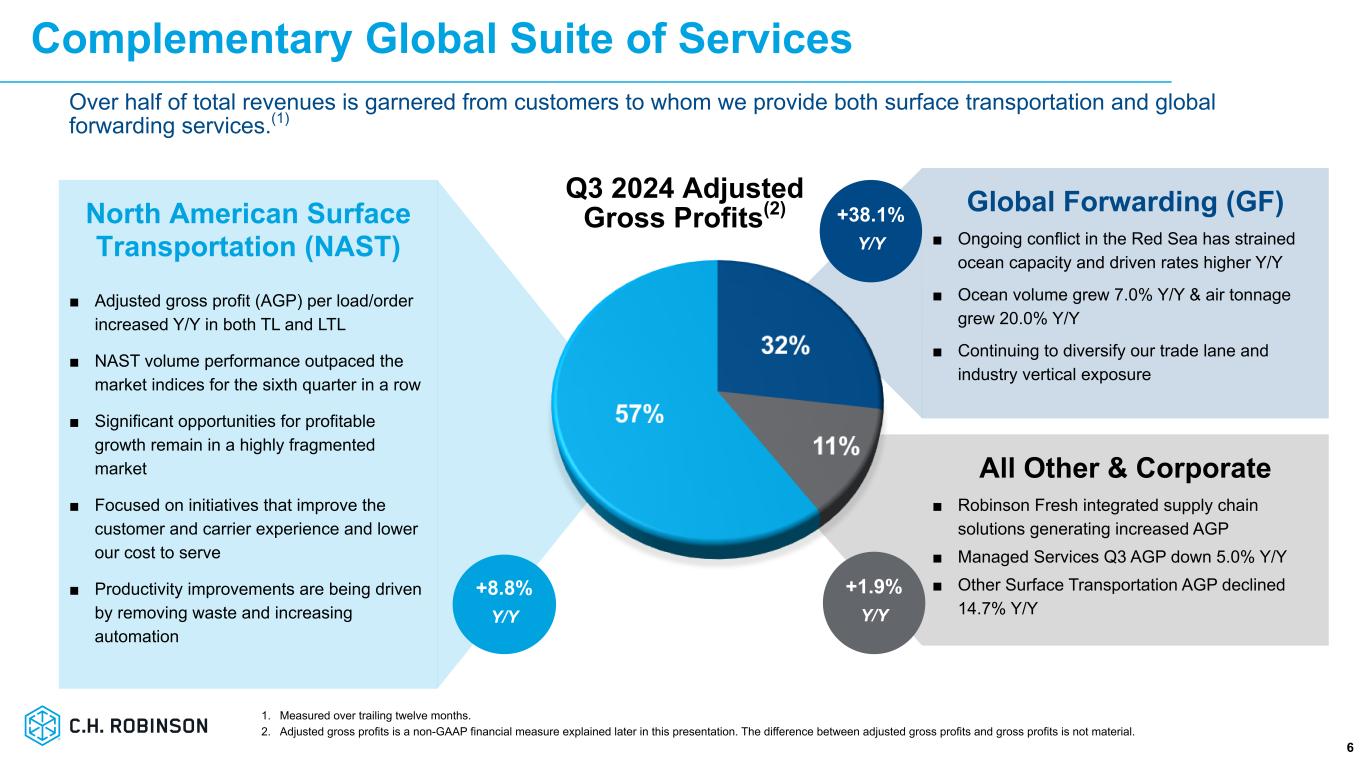

All Other & Corporate ■ Robinson Fresh integrated supply chain solutions generating increased AGP ■ Managed Services Q3 AGP down 5.0% Y/Y ■ Other Surface Transportation AGP declined 14.7% Y/Y Global Forwarding (GF) ■ Ongoing conflict in the Red Sea has strained ocean capacity and driven rates higher Y/Y ■ Ocean volume grew 7.0% Y/Y & air tonnage grew 20.0% Y/Y ■ Continuing to diversify our trade lane and industry vertical exposure North American Surface Transportation (NAST) ■ Adjusted gross profit (AGP) per load/order increased Y/Y in both TL and LTL ■ NAST volume performance outpaced the market indices for the sixth quarter in a row ■ Significant opportunities for profitable growth remain in a highly fragmented market ■ Focused on initiatives that improve the customer and carrier experience and lower our cost to serve ■ Productivity improvements are being driven by removing waste and increasing automation Complementary Global Suite of Services 6 Q3 2024 Adjusted Gross Profits(2) +8.8% Y/Y +1.9% Y/Y +38.1% Y/Y 1. Measured over trailing twelve months. 2. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. Over half of total revenues is garnered from customers to whom we provide both surface transportation and global forwarding services.(1)

NAST Q3’24 Results by Service 7 ■ Truckload AGP per shipment increased 21.0% due to disciplined pricing and procurement efforts, resulting in higher profit per shipment on transactional volume and a 180 bps improvement in adjusted gross profit margin(2) ■ Total NAST volume increased modestly year-over- year ■ Truckload volume down 3.5% year-over-year(2) ■ LTL volume up 2.5% and AGP per order increased 1.0%(2) ■ Other AGP decreased primarily due to a decrease in warehousing and intermodal services 3Q24 3Q23 %▲ Truckload (“TL”) $260.0 $223.0 16.6% Less than Truckload (“LTL”) $141.4 $136.4 3.7% Other $19.3 $27.2 (29.0)% Total Adjusted Gross Profits $420.7 $386.5 8.8% Adjusted Gross Profit Margin % 14.3% 12.5% 180 bps Adjusted Gross Profits(1) ($ in millions) 1. Adjusted gross profits and adjusted gross profit margin % are non-GAAP financial measures explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Growth rates are rounded to the nearest 0.5 percent. Third Quarter Highlights

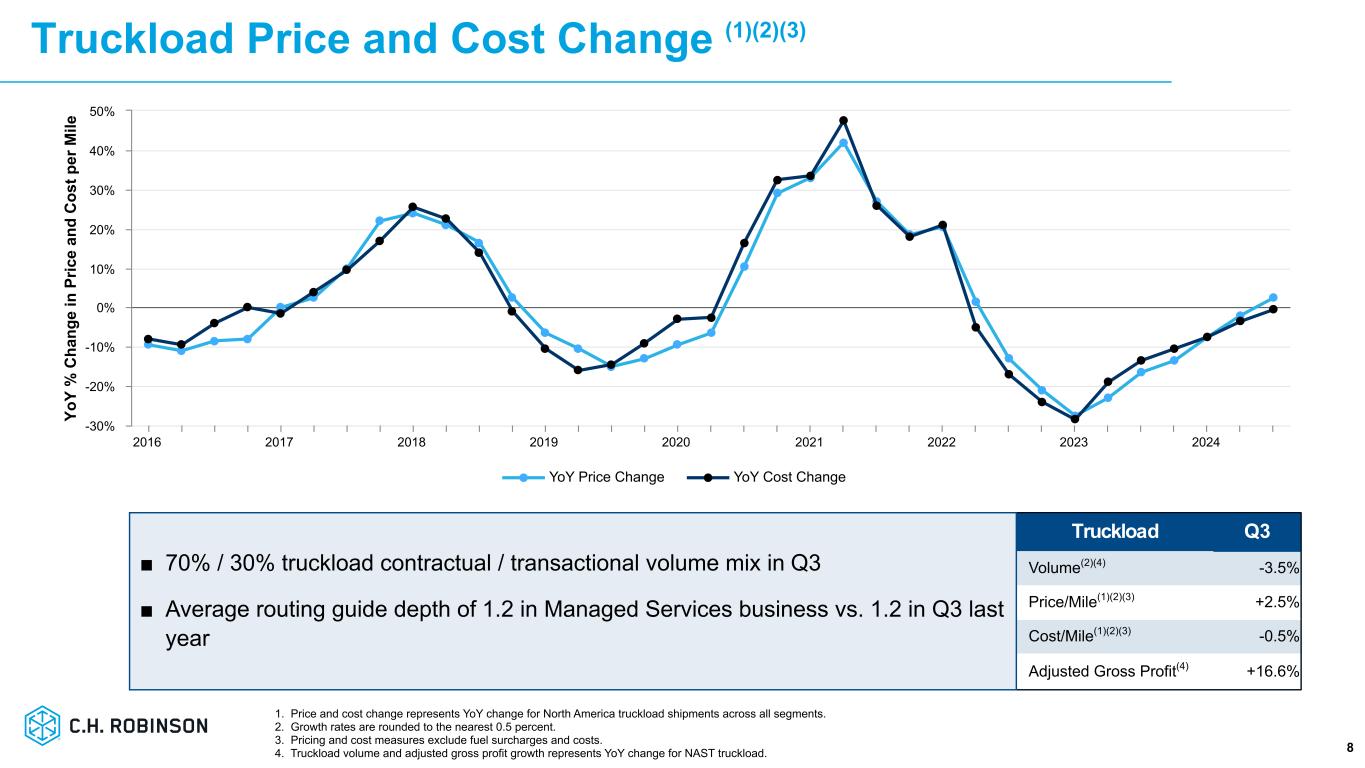

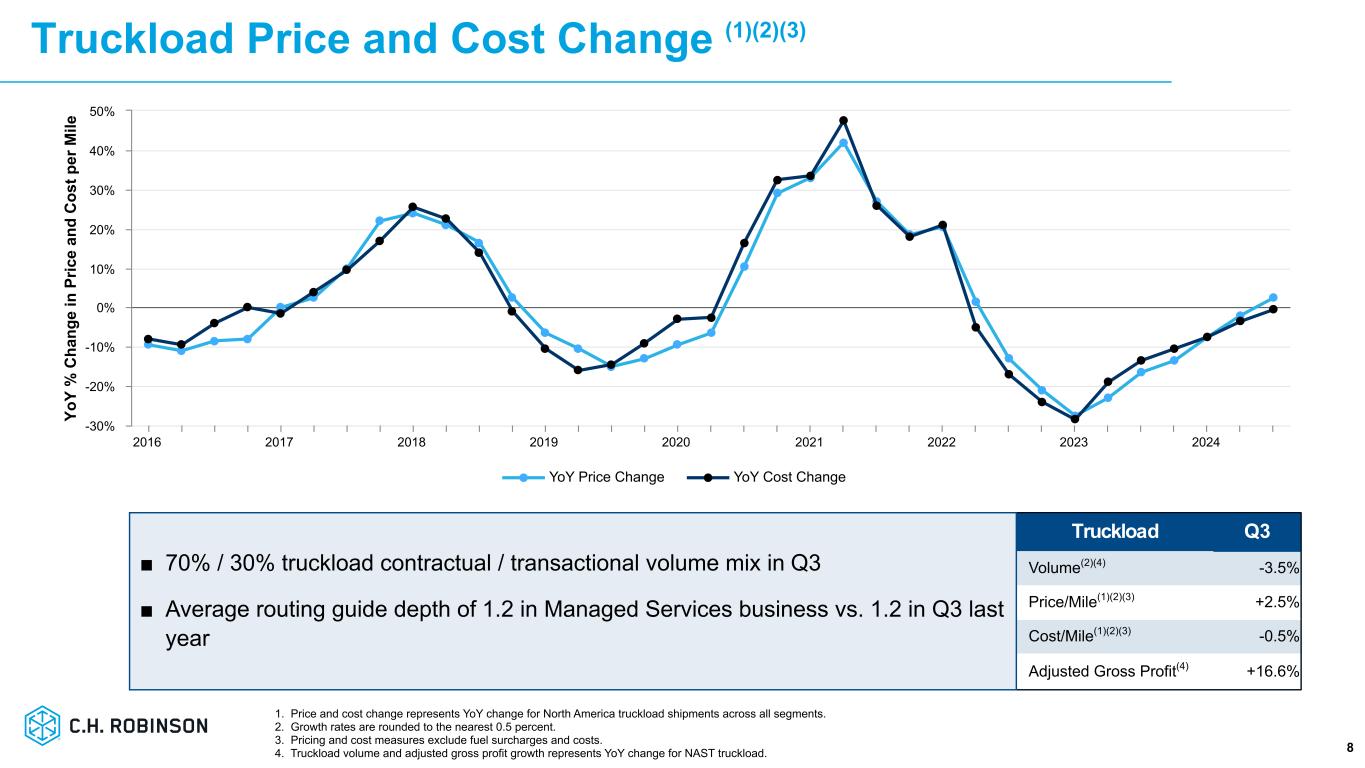

Truckload Price and Cost Change (1)(2)(3) 8 Truckload Q3 Volume(2)(4) -3.5 % Price/Mile(1)(2)(3) +2.5 % Cost/Mile(1)(2)(3) -0.5 % Adjusted Gross Profit(4) +16.6 % 1. Price and cost change represents YoY change for North America truckload shipments across all segments. 2. Growth rates are rounded to the nearest 0.5 percent. 3. Pricing and cost measures exclude fuel surcharges and costs. 4. Truckload volume and adjusted gross profit growth represents YoY change for NAST truckload. ■ 70% / 30% truckload contractual / transactional volume mix in Q3 ■ Average routing guide depth of 1.2 in Managed Services business vs. 1.2 in Q3 last year Yo Y % C ha ng e in P ric e an d C os t p er M ile YoY Price Change YoY Cost Change 2016 2017 2018 2019 2020 2021 2022 2023 2024 -30% -20% -10% 0% 10% 20% 30% 40% 50%

Truckload AGP $ per Shipment Trend 9 ■ Disciplined pricing and capacity procurement efforts resulted in improved optimization of volume and AGP per truckload, primarily in our transactional business.(1) ■ Increasing adoption of digital brokerage offering is improving our cost of hire. N A ST A dj us te d G ro ss P ro fit $ p er T ru ck lo ad Sh ip m en t N A ST A djusted G ross Profit M argin % NAST Adjusted Gross Profit $ per Truckload Shipment (left axis) NAST Adjusted Gross Profit Margin % (right axis) Average NAST AGP $ per Truckload Shipment (left axis) 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material.

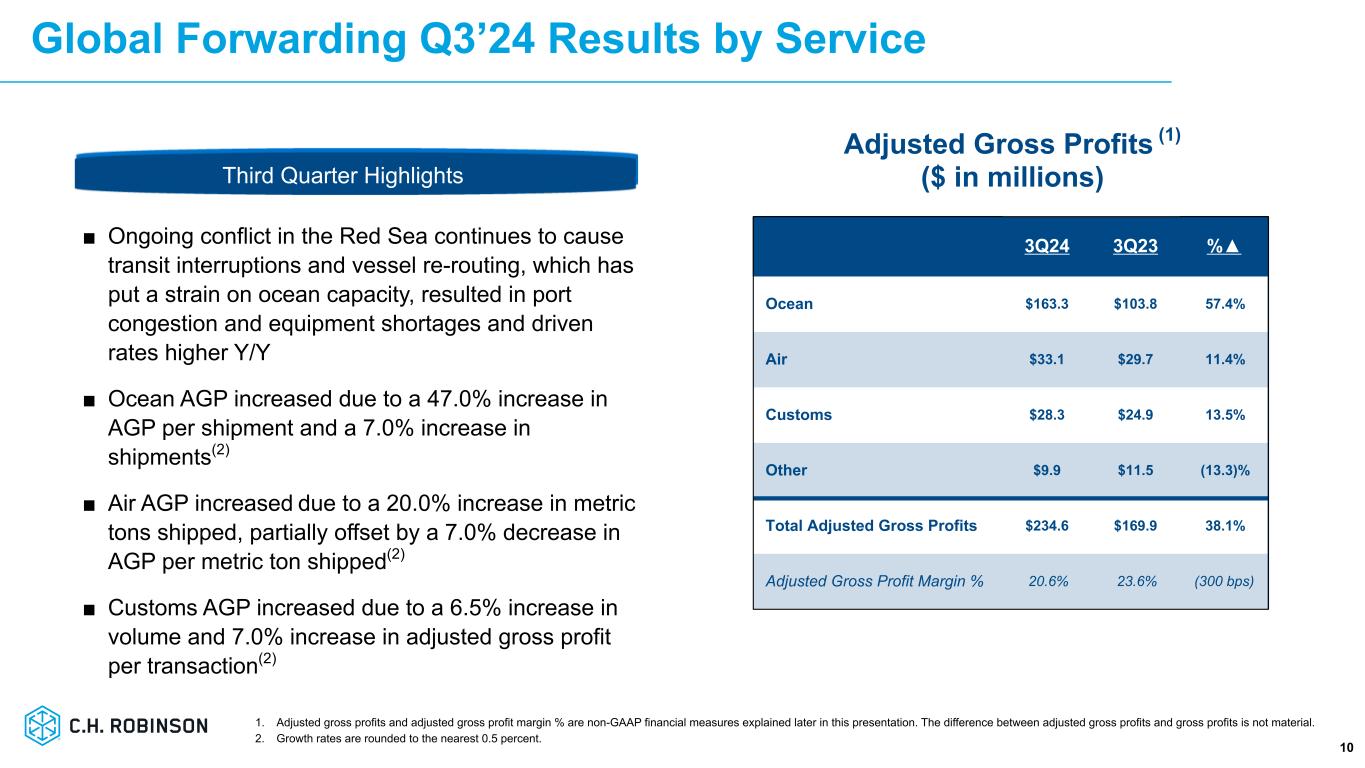

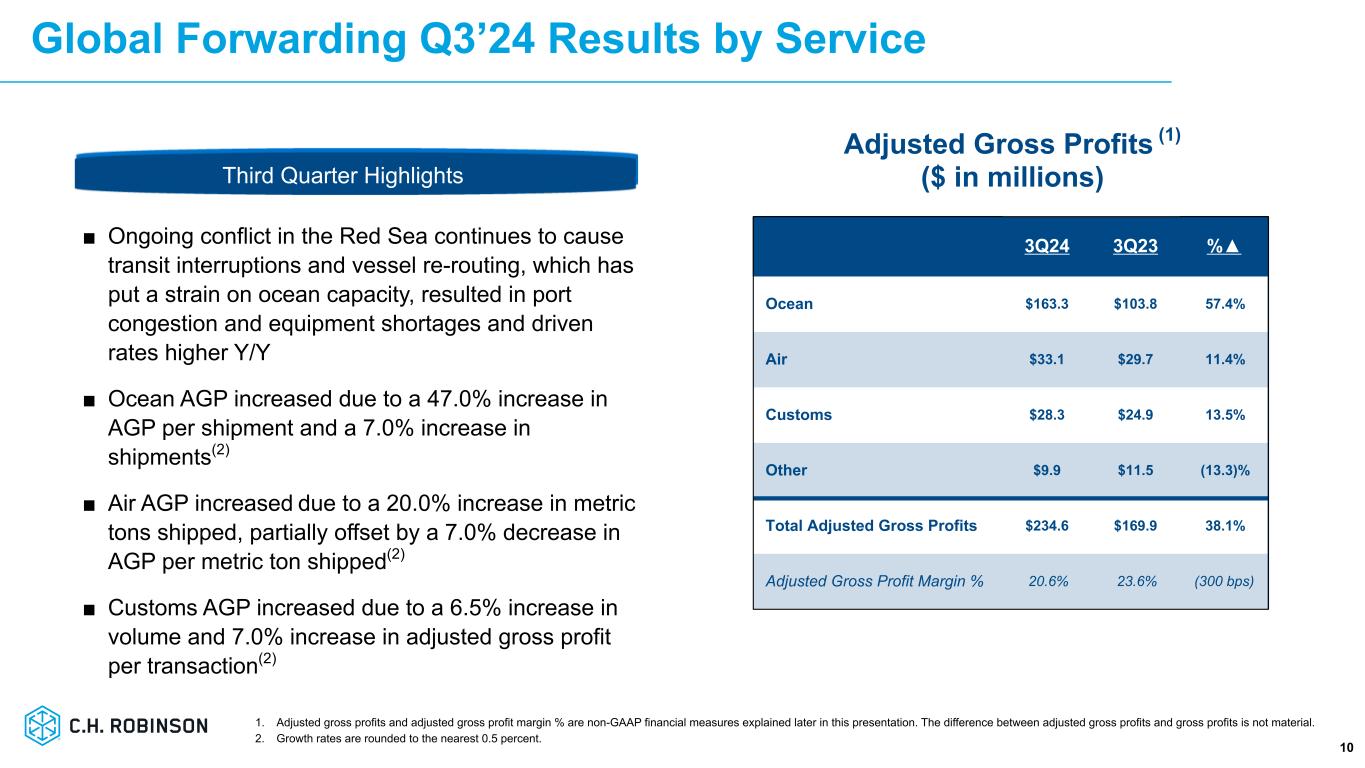

Global Forwarding Q3’24 Results by Service 10 3Q24 3Q23 %▲ Ocean $163.3 $103.8 57.4% Air $33.1 $29.7 11.4% Customs $28.3 $24.9 13.5% Other $9.9 $11.5 (13.3)% Total Adjusted Gross Profits $234.6 $169.9 38.1% Adjusted Gross Profit Margin % 20.6% 23.6% (300 bps) Adjusted Gross Profits (1) ($ in millions) ■ Ongoing conflict in the Red Sea continues to cause transit interruptions and vessel re-routing, which has put a strain on ocean capacity, resulted in port congestion and equipment shortages and driven rates higher Y/Y ■ Ocean AGP increased due to a 47.0% increase in AGP per shipment and a 7.0% increase in shipments(2) ■ Air AGP increased due to a 20.0% increase in metric tons shipped, partially offset by a 7.0% decrease in AGP per metric ton shipped(2) ■ Customs AGP increased due to a 6.5% increase in volume and 7.0% increase in adjusted gross profit per transaction(2) 1. Adjusted gross profits and adjusted gross profit margin % are non-GAAP financial measures explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Growth rates are rounded to the nearest 0.5 percent. Third Quarter Highlights

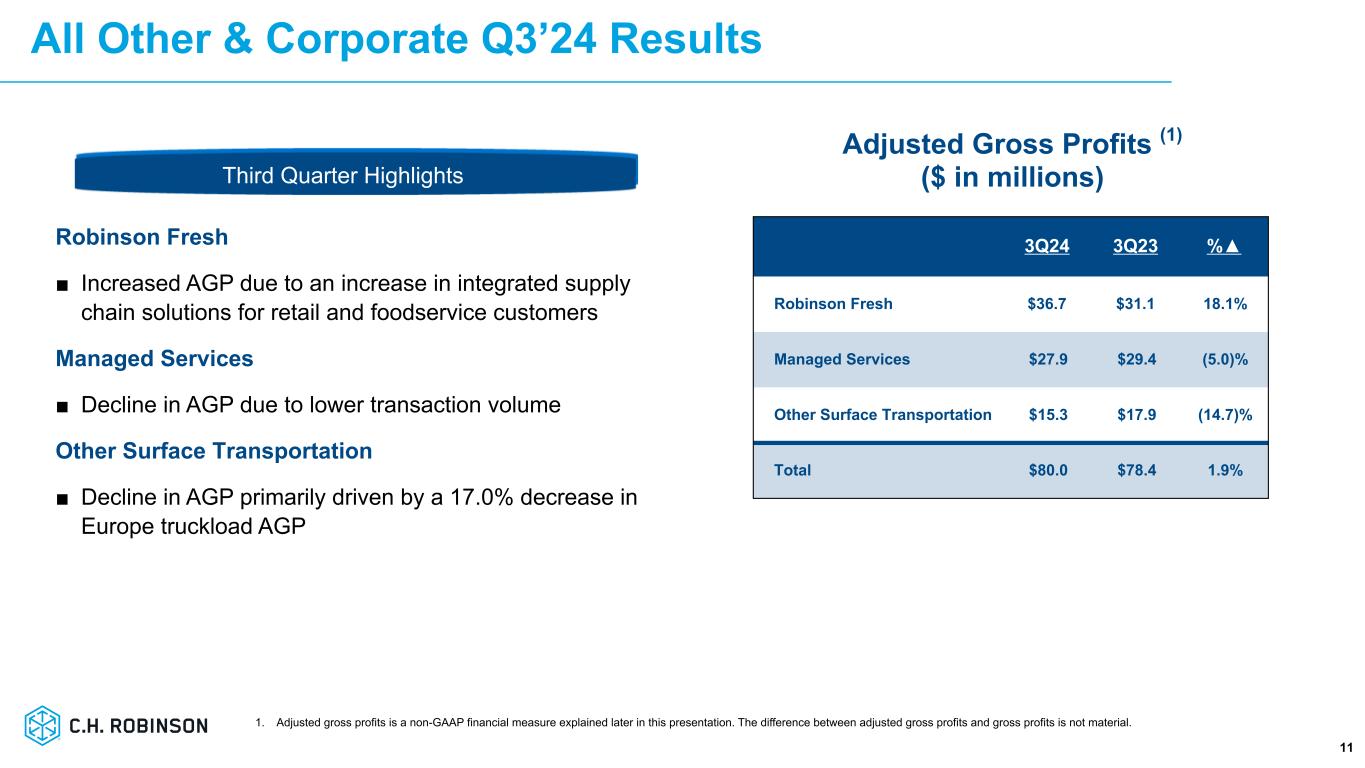

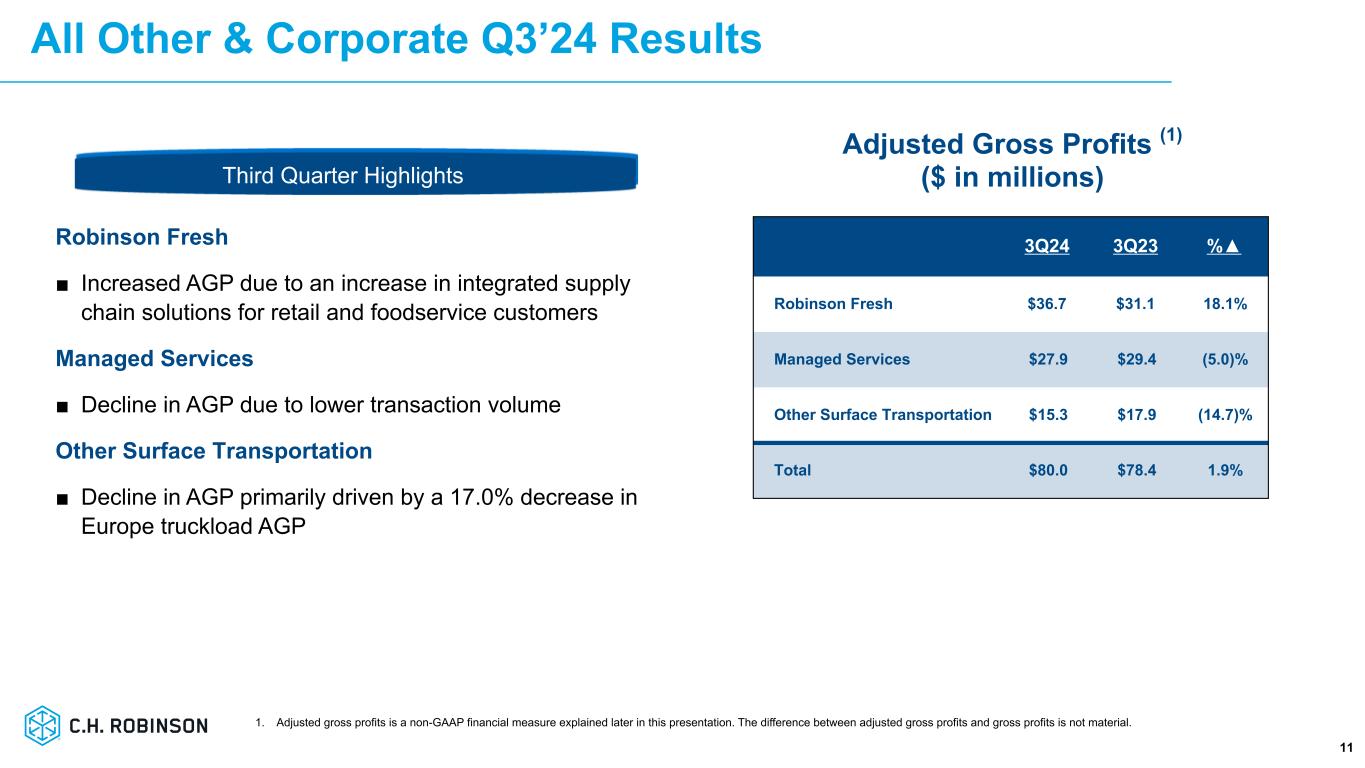

All Other & Corporate Q3’24 Results 11 Robinson Fresh ■ Increased AGP due to an increase in integrated supply chain solutions for retail and foodservice customers Managed Services ■ Decline in AGP due to lower transaction volume Other Surface Transportation ■ Decline in AGP primarily driven by a 17.0% decrease in Europe truckload AGP 3Q24 3Q23 %▲ Robinson Fresh $36.7 $31.1 18.1% Managed Services $27.9 $29.4 (5.0)% Other Surface Transportation $15.3 $17.9 (14.7)% Total $80.0 $78.4 1.9% Adjusted Gross Profits (1) ($ in millions) 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. Third Quarter Highlights

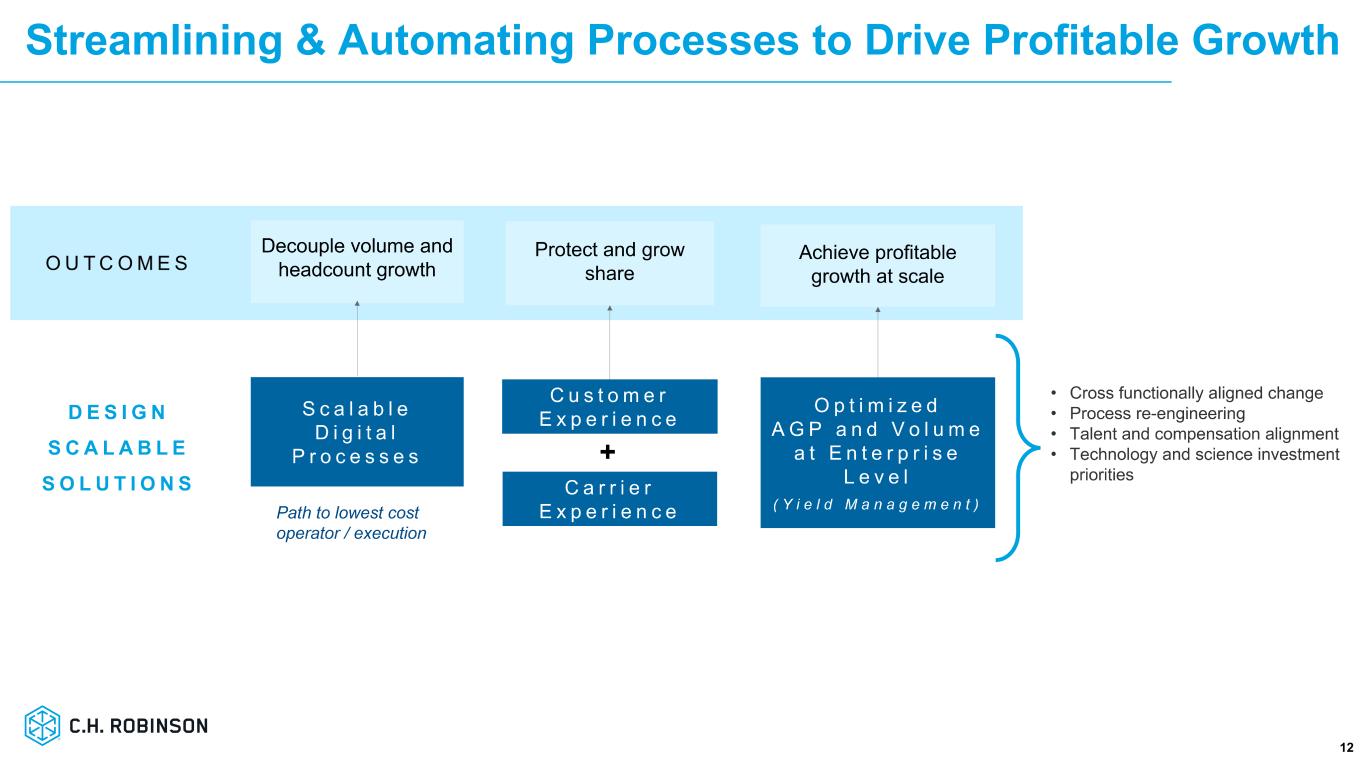

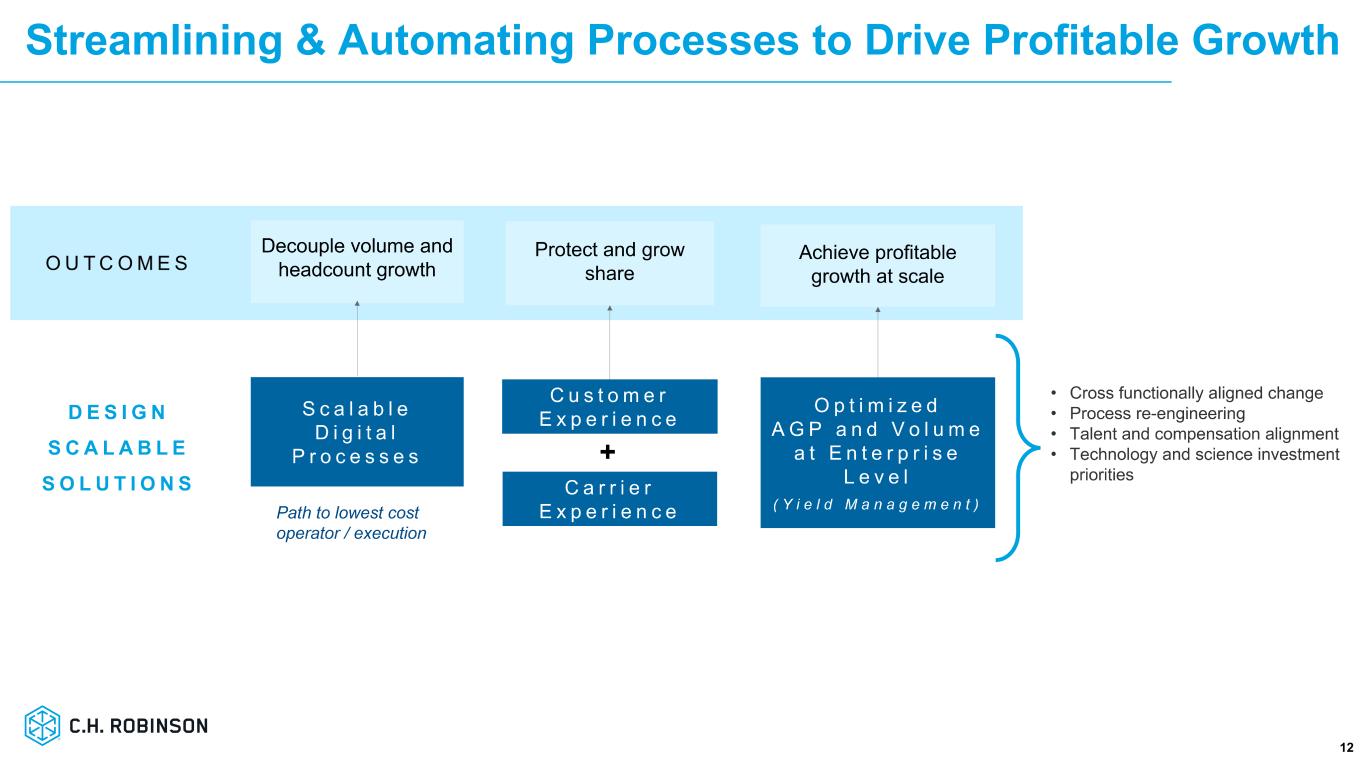

Streamlining & Automating Processes to Drive Profitable Growth 12 12

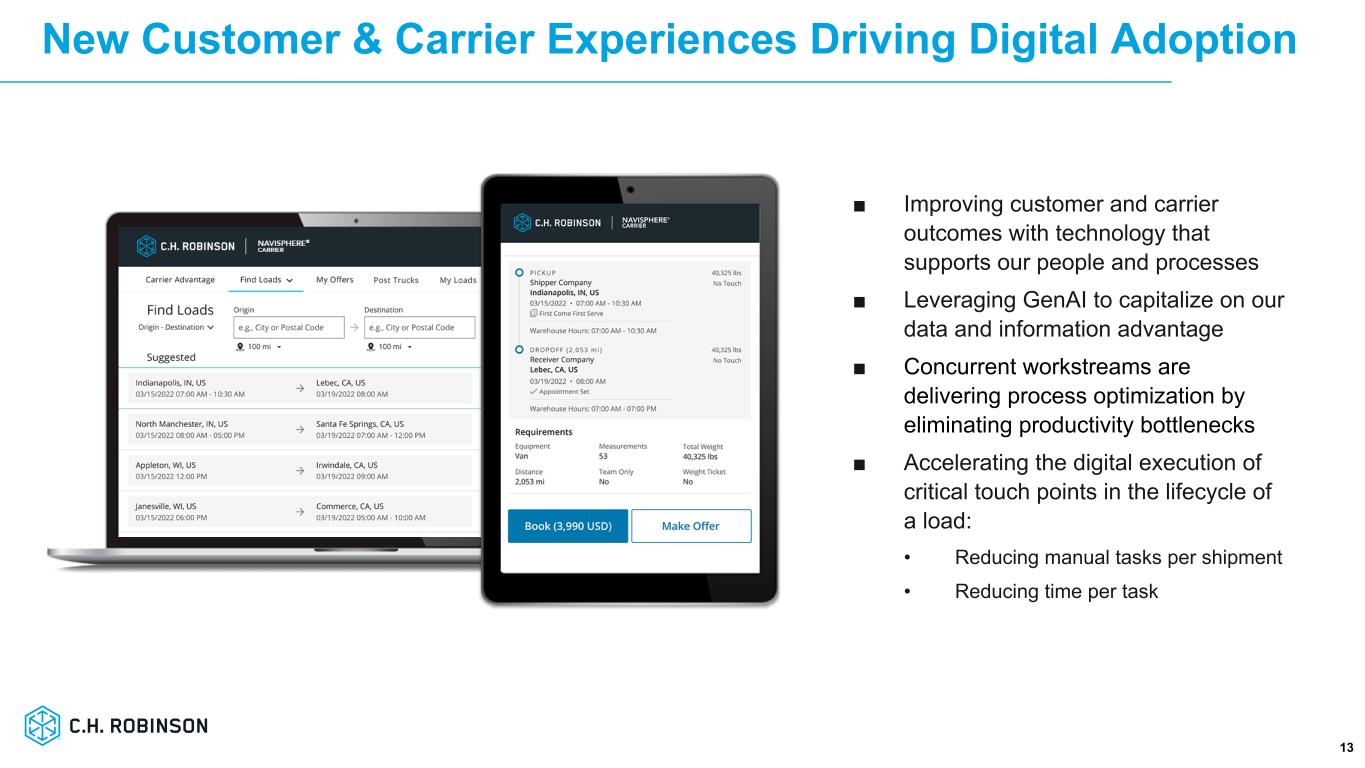

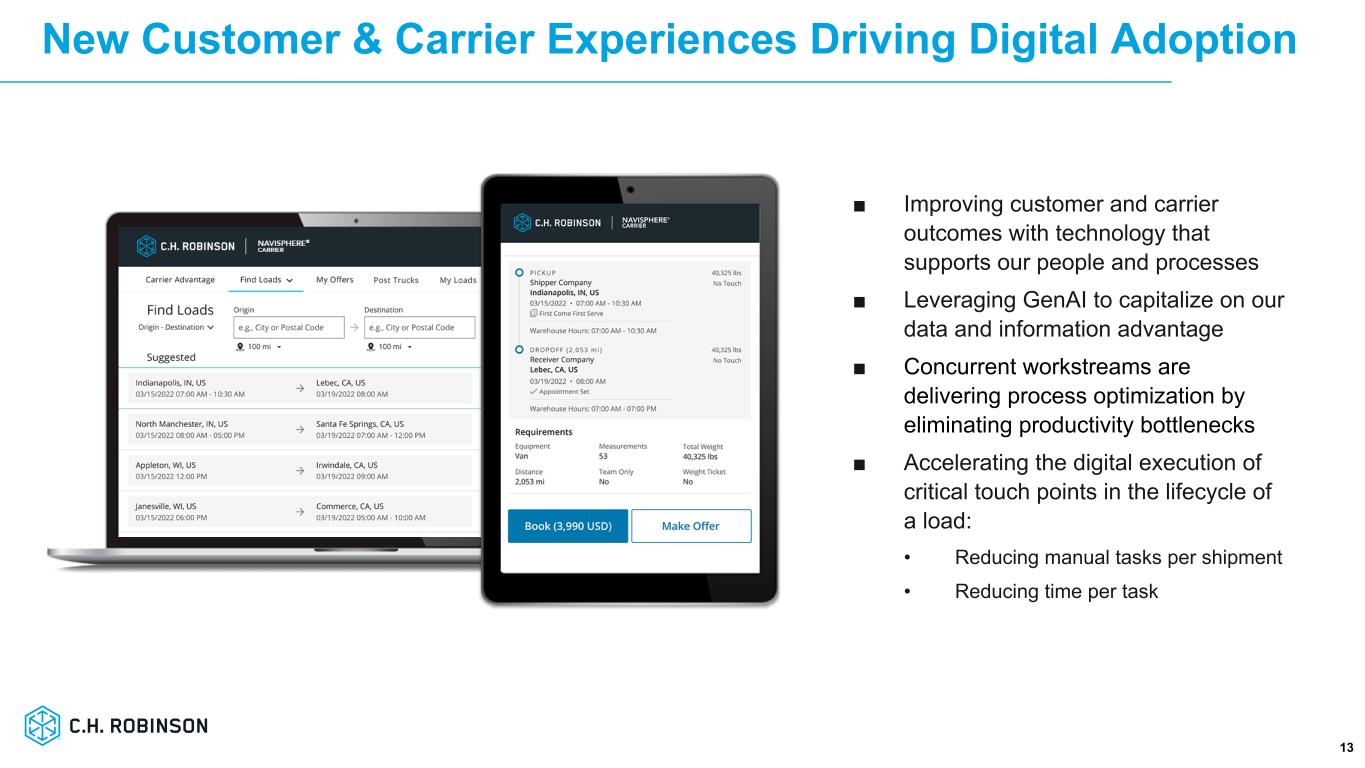

New Customer & Carrier Experiences Driving Digital Adoption 13 ■ Improving customer and carrier outcomes with technology that supports our people and processes ■ Leveraging GenAI to capitalize on our data and information advantage ■ Concurrent workstreams are delivering process optimization by eliminating productivity bottlenecks ■ Accelerating the digital execution of critical touch points in the lifecycle of a load: • Reducing manual tasks per shipment • Reducing time per task 13

© C.H. Robinson Worldwide, Inc. All rights reserved. © C.H. Robinson Worldwide, Inc. All rights reserved. 14 Our Customer Promise

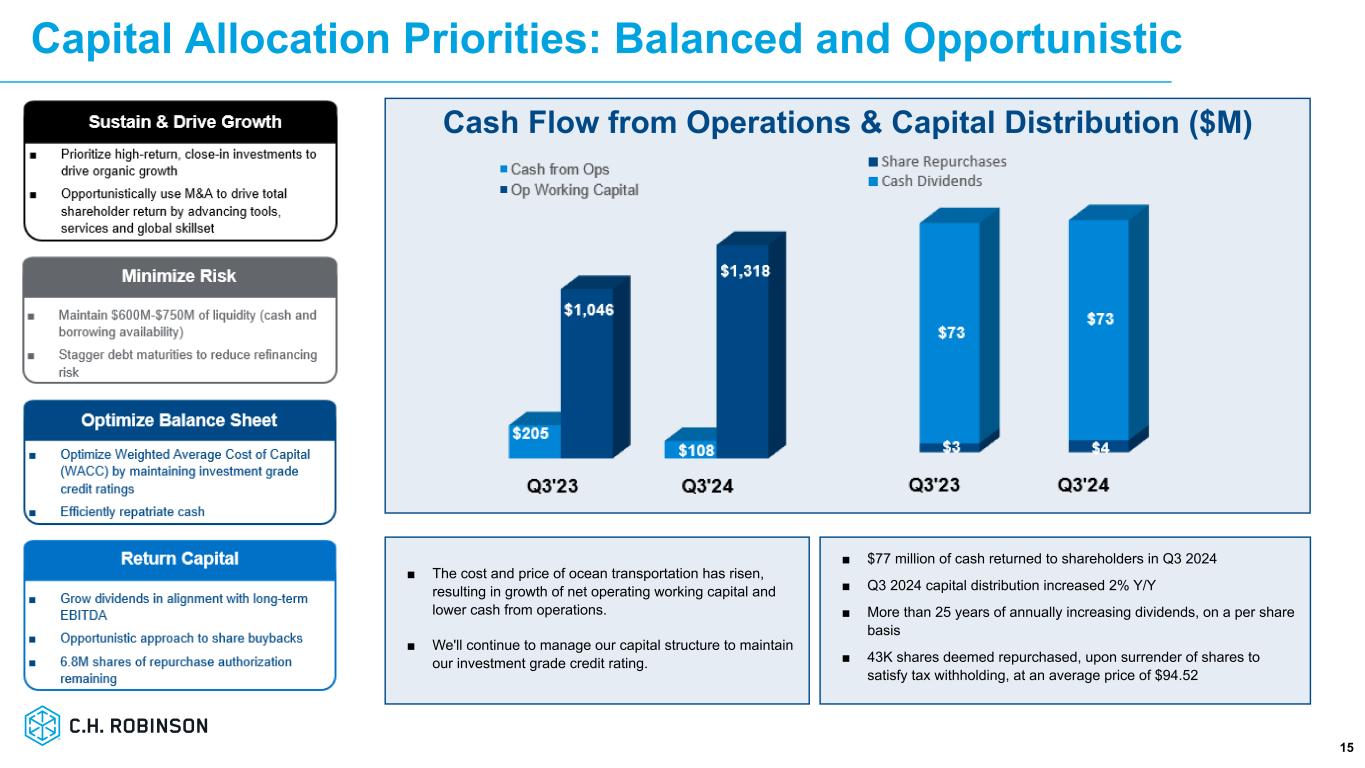

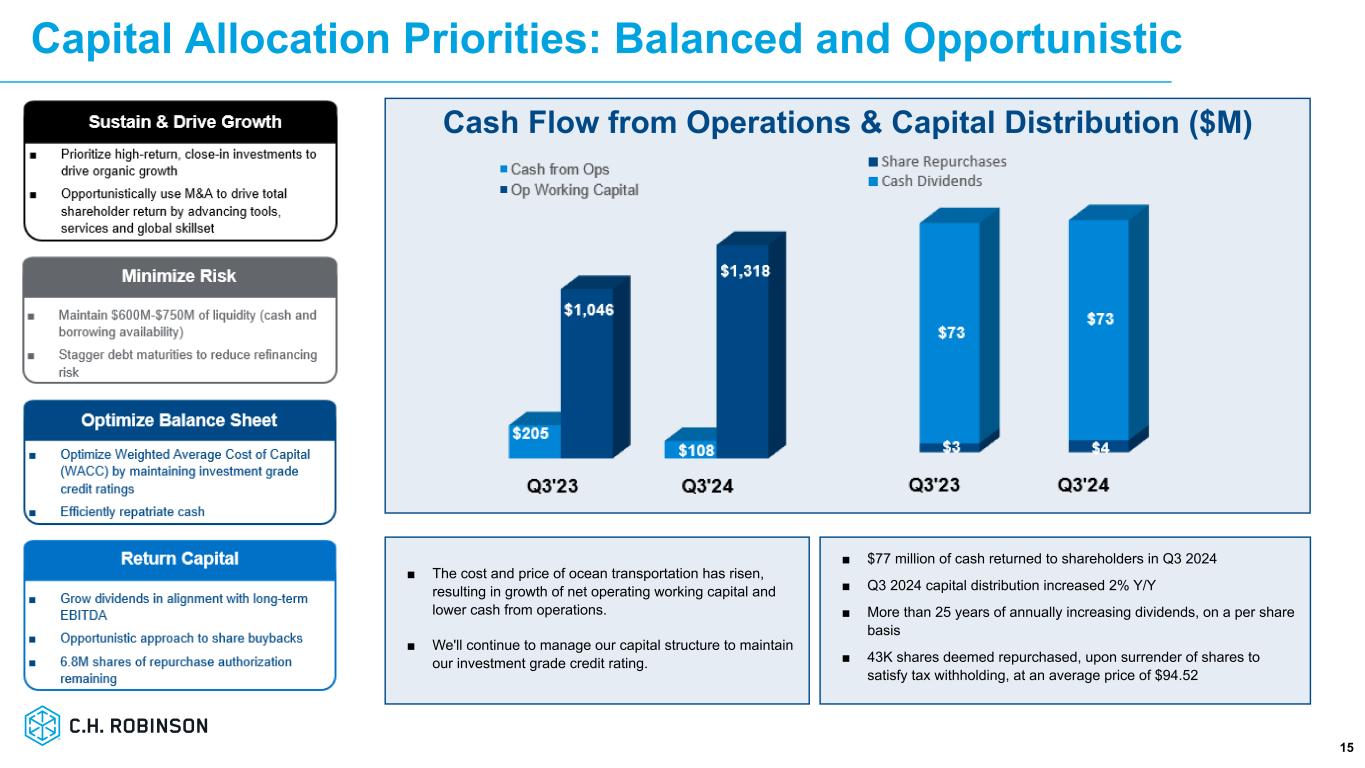

Capital Allocation Priorities: Balanced and Opportunistic 15 Cash Flow from Operations & Capital Distribution ($M) ■ $77 million of cash returned to shareholders in Q3 2024 ■ Q3 2024 capital distribution increased 2% Y/Y ■ More than 25 years of annually increasing dividends, on a per share basis ■ 43K shares deemed repurchased, upon surrender of shares to satisfy tax withholding, at an average price of $94.52 ■ The cost and price of ocean transportation has risen, resulting in growth of net operating working capital and lower cash from operations. ■ We'll continue to manage our capital structure to maintain our investment grade credit rating.

16 Appendix

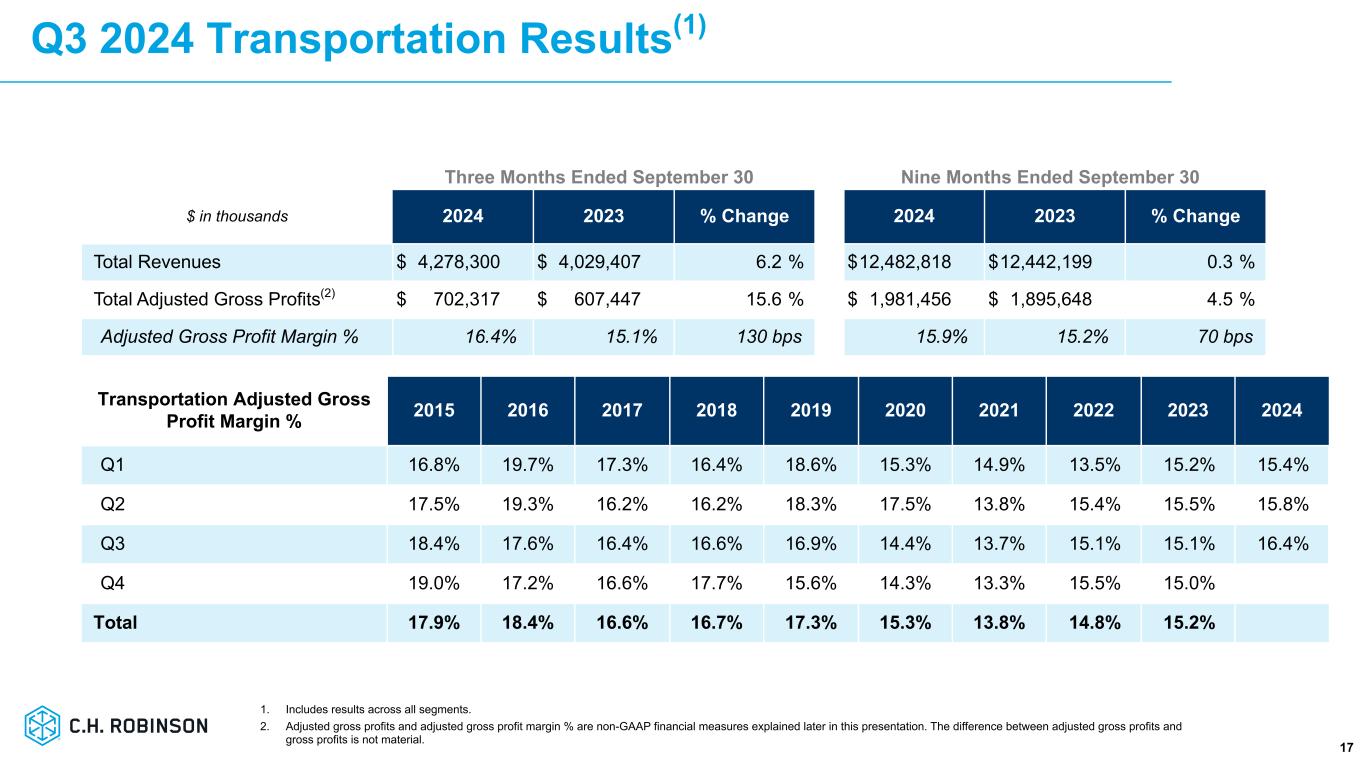

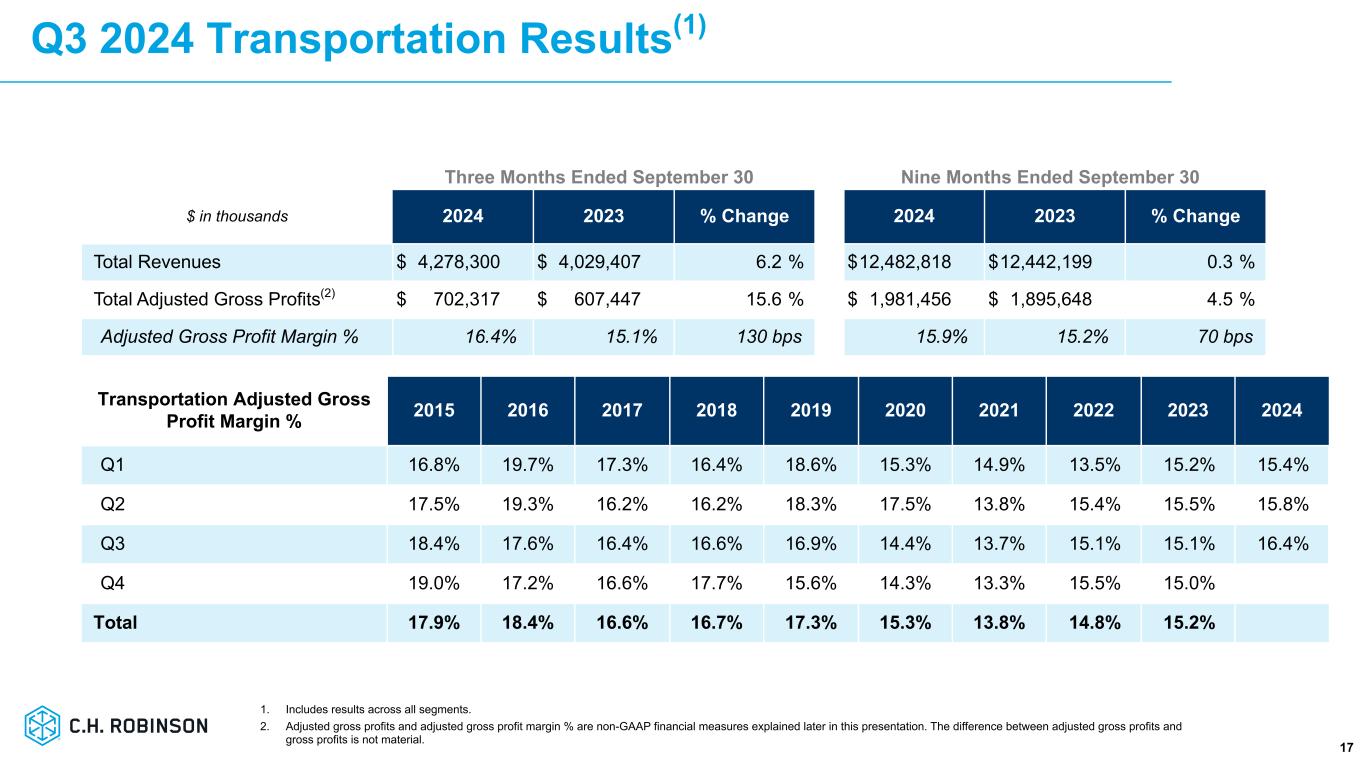

Q3 2024 Transportation Results(1) 17 Three Months Ended September 30 Nine Months Ended September 30 $ in thousands 2024 2023 % Change 2024 2023 % Change Total Revenues $ 4,278,300 $ 4,029,407 6.2 % $ 12,482,818 $ 12,442,199 0.3 % Total Adjusted Gross Profits(2) $ 702,317 $ 607,447 15.6 % $ 1,981,456 $ 1,895,648 4.5 % Adjusted Gross Profit Margin % 16.4% 15.1% 130 bps 15.9% 15.2% 70 bps Transportation Adjusted Gross Profit Margin % 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Q1 16.8% 19.7% 17.3% 16.4% 18.6% 15.3% 14.9% 13.5% 15.2% 15.4% Q2 17.5% 19.3% 16.2% 16.2% 18.3% 17.5% 13.8% 15.4% 15.5% 15.8% Q3 18.4% 17.6% 16.4% 16.6% 16.9% 14.4% 13.7% 15.1% 15.1% 16.4% Q4 19.0% 17.2% 16.6% 17.7% 15.6% 14.3% 13.3% 15.5% 15.0% Total 17.9% 18.4% 16.6% 16.7% 17.3% 15.3% 13.8% 14.8% 15.2% 1. Includes results across all segments. 2. Adjusted gross profits and adjusted gross profit margin % are non-GAAP financial measures explained later in this presentation. The difference between adjusted gross profits and gross profits is not material.

Q3 2024 NAST Results 18 1. Adjusted gross profits and adjusted gross profit margin % are non-GAAP financial measures explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Includes $1.8 million of restructuring charges in the Three Months Ended September 30, 2024 mainly related to workforce reductions and $15.2 million of restructuring charges in the Nine Months Ended September 30, 2024 related to workforce reductions, impairment of internally developed software, and charges to reduce our facilities footprint. Includes an amount of $0.1 million that primarily related to accrual adjustments for amounts settling for an amount different than originally estimated in in the Three Months Ended September 30, 2023 and $1.1 million in the Nine Months Ended September 30, 2023 mainly related to workforce reductions. Three Months Ended September 30 Nine Months Ended September 30, $ in thousands 2024 2023 % Change 2024 2023 % Change Total Revenues $ 2,934,617 $ 3,086,970 (4.9) % $ 8,924,839 $ 9,470,425 (5.8) % Total Adjusted Gross Profits(1) $ 420,664 $ 386,510 8.8 % $ 1,237,431 $ 1,213,697 2.0 % Adjusted Gross Profit Margin % 14.3% 12.5% 180 bps 13.9% 12.8% 110 bps Income from Operations(2) $ 148,767 $ 112,121 32.7 % $ 398,764 $ 364,002 9.5 % Adjusted Operating Margin % 35.4% 29.0% 640 bps 32.2% 30.0% 220 bps Depreciation and Amortization $ 4,904 $ 5,882 (16.6) % $ 15,779 $ 17,389 (9.3) % Total Assets $ 3,026,031 $ 3,162,720 (4.3) % $ 3,026,031 $ 3,162,720 (4.3) % Average Headcount 5,595 6,278 (10.9) % 5,800 6,574 (11.8) %

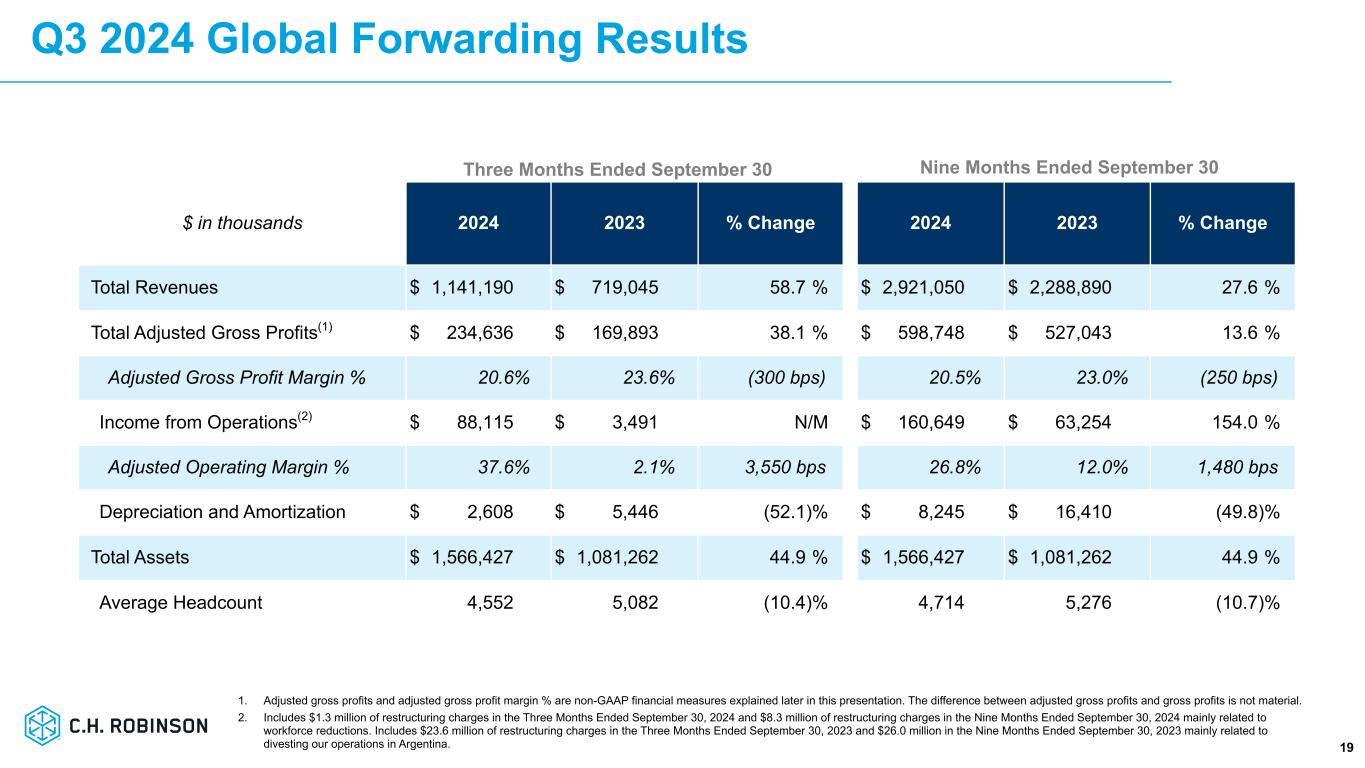

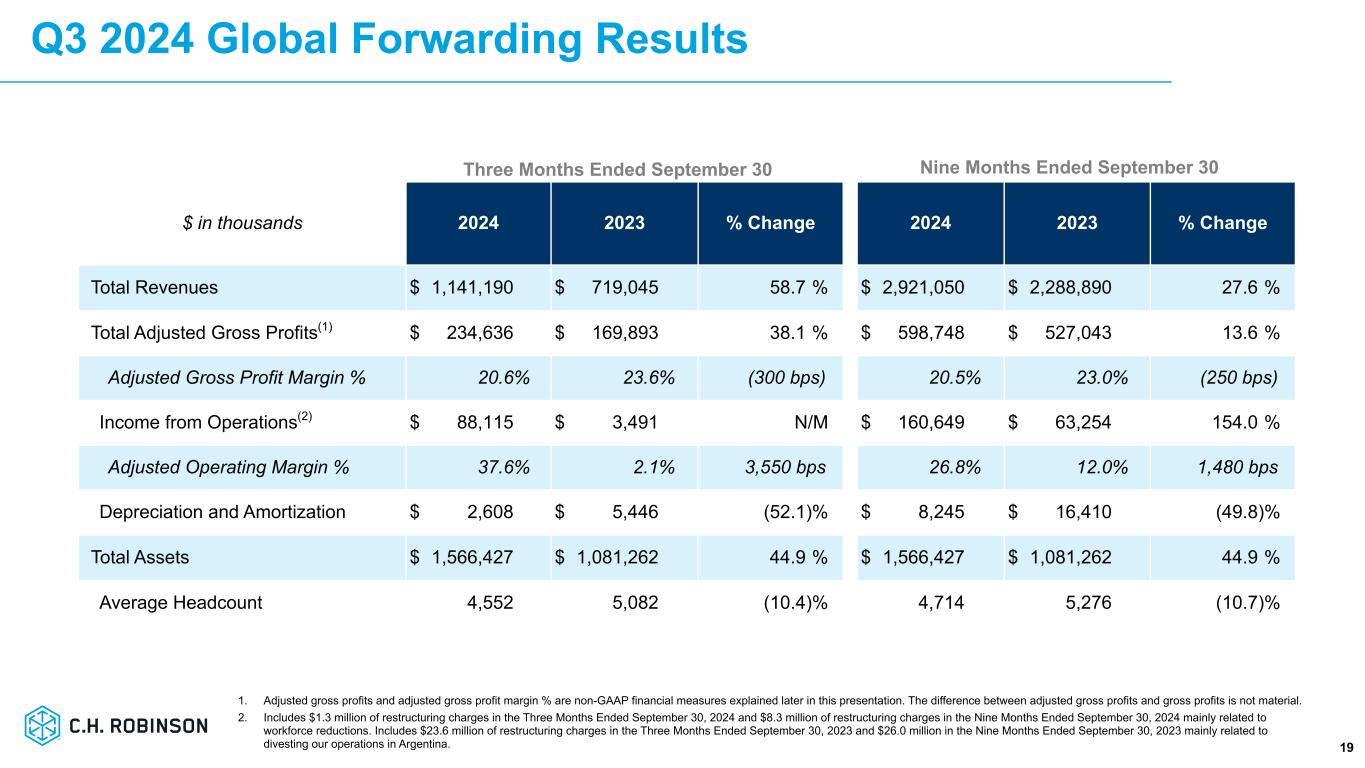

Q3 2024 Global Forwarding Results 19 1. Adjusted gross profits and adjusted gross profit margin % are non-GAAP financial measures explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Includes $1.3 million of restructuring charges in the Three Months Ended September 30, 2024 and $8.3 million of restructuring charges in the Nine Months Ended September 30, 2024 mainly related to workforce reductions. Includes $23.6 million of restructuring charges in the Three Months Ended September 30, 2023 and $26.0 million in the Nine Months Ended September 30, 2023 mainly related to divesting our operations in Argentina. Three Months Ended September 30 Nine Months Ended September 30 $ in thousands 2024 2023 % Change 2024 2023 % Change Total Revenues $ 1,141,190 $ 719,045 58.7 % $ 2,921,050 $ 2,288,890 27.6 % Total Adjusted Gross Profits(1) $ 234,636 $ 169,893 38.1 % $ 598,748 $ 527,043 13.6 % Adjusted Gross Profit Margin % 20.6% 23.6% (300 bps) 20.5% 23.0% (250 bps) Income from Operations(2) $ 88,115 $ 3,491 N/M $ 160,649 $ 63,254 154.0 % Adjusted Operating Margin % 37.6% 2.1% 3,550 bps 26.8% 12.0% 1,480 bps Depreciation and Amortization $ 2,608 $ 5,446 (52.1) % $ 8,245 $ 16,410 (49.8) % Total Assets $ 1,566,427 $ 1,081,262 44.9 % $ 1,566,427 $ 1,081,262 44.9 % Average Headcount 4,552 5,082 (10.4) % 4,714 5,276 (10.7) %

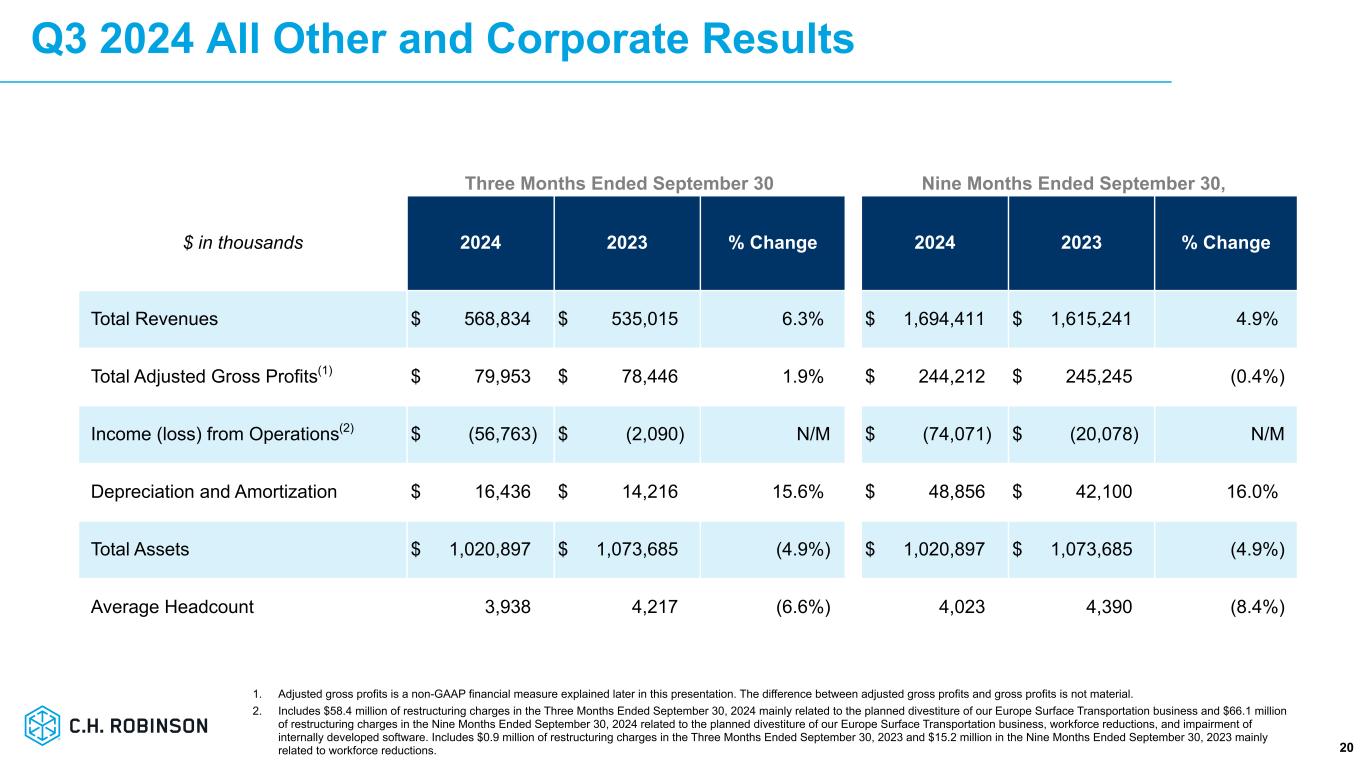

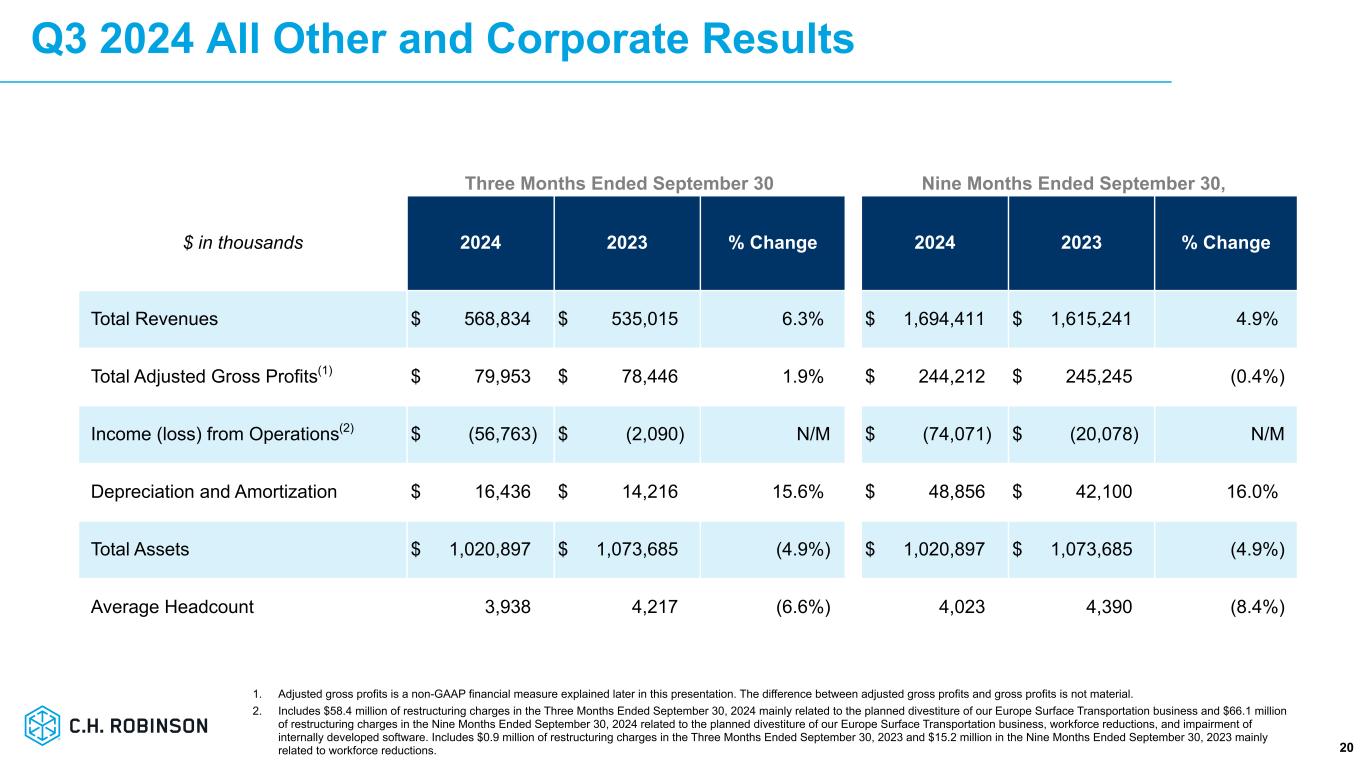

Q3 2024 All Other and Corporate Results 20 1. Adjusted gross profits is a non-GAAP financial measure explained later in this presentation. The difference between adjusted gross profits and gross profits is not material. 2. Includes $58.4 million of restructuring charges in the Three Months Ended September 30, 2024 mainly related to the planned divestiture of our Europe Surface Transportation business and $66.1 million of restructuring charges in the Nine Months Ended September 30, 2024 related to the planned divestiture of our Europe Surface Transportation business, workforce reductions, and impairment of internally developed software. Includes $0.9 million of restructuring charges in the Three Months Ended September 30, 2023 and $15.2 million in the Nine Months Ended September 30, 2023 mainly related to workforce reductions. Three Months Ended September 30 Nine Months Ended September 30, $ in thousands 2024 2023 % Change 2024 2023 % Change Total Revenues $ 568,834 $ 535,015 6.3% $ 1,694,411 $ 1,615,241 4.9% Total Adjusted Gross Profits(1) $ 79,953 $ 78,446 1.9% $ 244,212 $ 245,245 (0.4%) Income (loss) from Operations(2) $ (56,763) $ (2,090) N/M $ (74,071) $ (20,078) N/M Depreciation and Amortization $ 16,436 $ 14,216 15.6% $ 48,856 $ 42,100 16.0% Total Assets $ 1,020,897 $ 1,073,685 (4.9%) $ 1,020,897 $ 1,073,685 (4.9%) Average Headcount 3,938 4,217 (6.6%) 4,023 4,390 (8.4%)

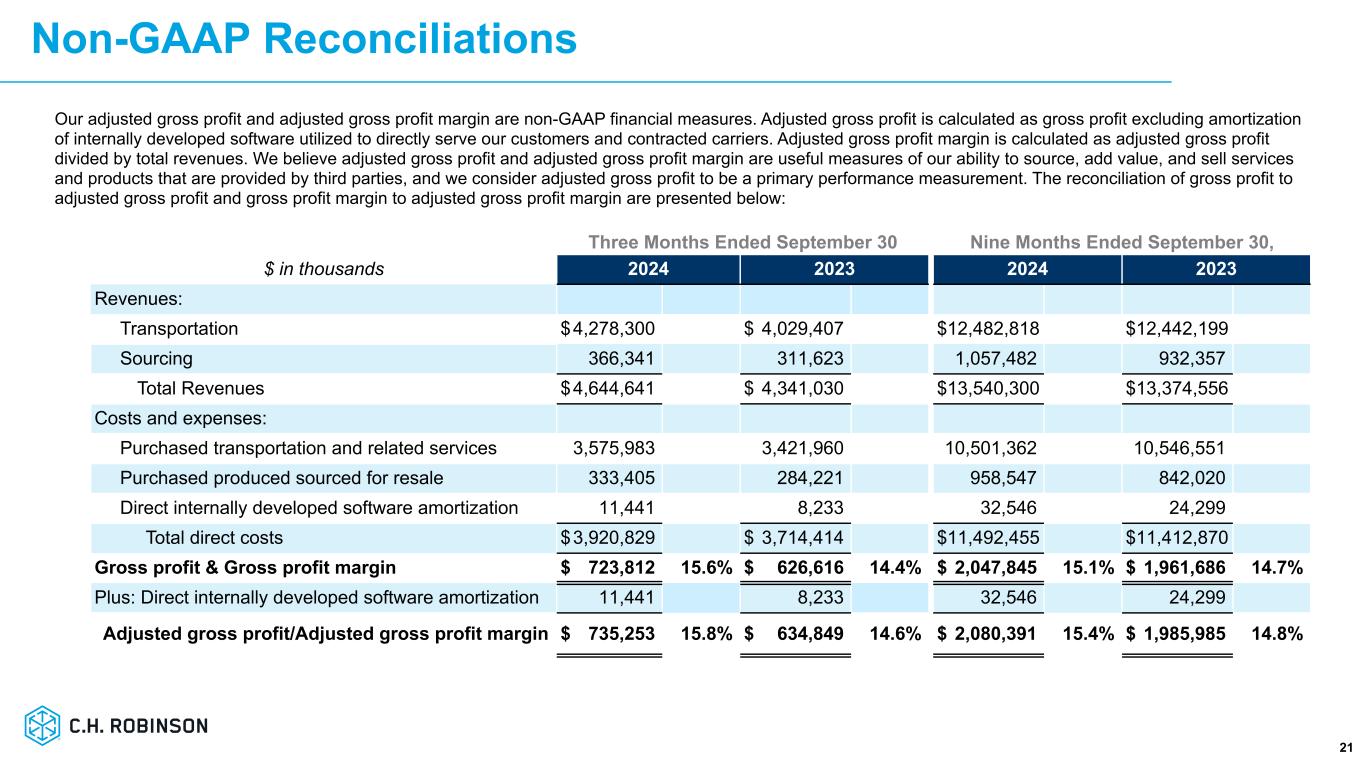

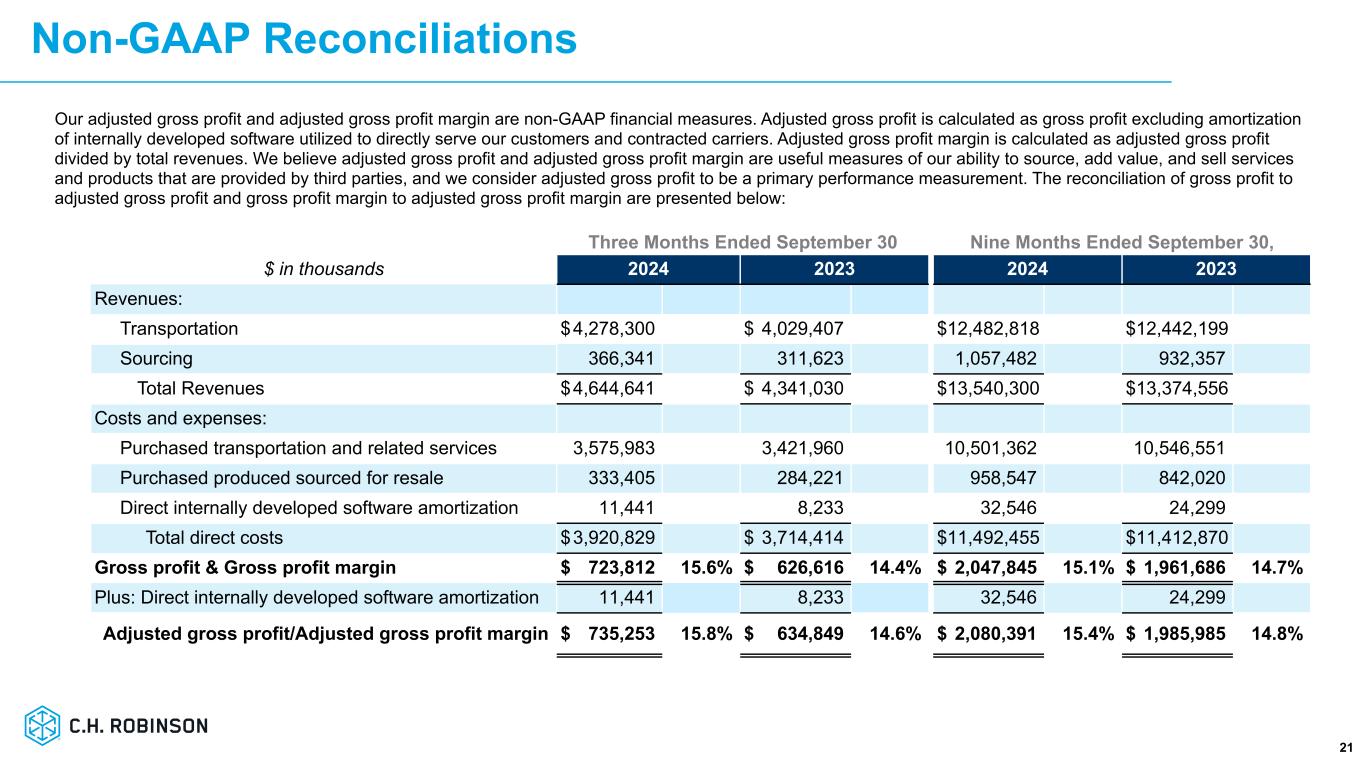

21 Our adjusted gross profit and adjusted gross profit margin are non-GAAP financial measures. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers. Adjusted gross profit margin is calculated as adjusted gross profit divided by total revenues. We believe adjusted gross profit and adjusted gross profit margin are useful measures of our ability to source, add value, and sell services and products that are provided by third parties, and we consider adjusted gross profit to be a primary performance measurement. The reconciliation of gross profit to adjusted gross profit and gross profit margin to adjusted gross profit margin are presented below: Three Months Ended September 30 Nine Months Ended September 30, $ in thousands 2024 2023 2024 2023 Revenues: Transportation $ 4,278,300 $ 4,029,407 $ 12,482,818 $ 12,442,199 Sourcing 366,341 311,623 1,057,482 932,357 Total Revenues $ 4,644,641 $ 4,341,030 $ 13,540,300 $ 13,374,556 Costs and expenses: Purchased transportation and related services 3,575,983 3,421,960 10,501,362 10,546,551 Purchased produced sourced for resale 333,405 284,221 958,547 842,020 Direct internally developed software amortization 11,441 8,233 32,546 24,299 Total direct costs $ 3,920,829 $ 3,714,414 $ 11,492,455 $ 11,412,870 Gross profit & Gross profit margin $ 723,812 15.6% $ 626,616 14.4% $ 2,047,845 15.1% $ 1,961,686 14.7% Plus: Direct internally developed software amortization 11,441 8,233 32,546 24,299 Adjusted gross profit/Adjusted gross profit margin $ 735,253 15.8% $ 634,849 14.6% $ 2,080,391 15.4% $ 1,985,985 14.8% Non-GAAP Reconciliations

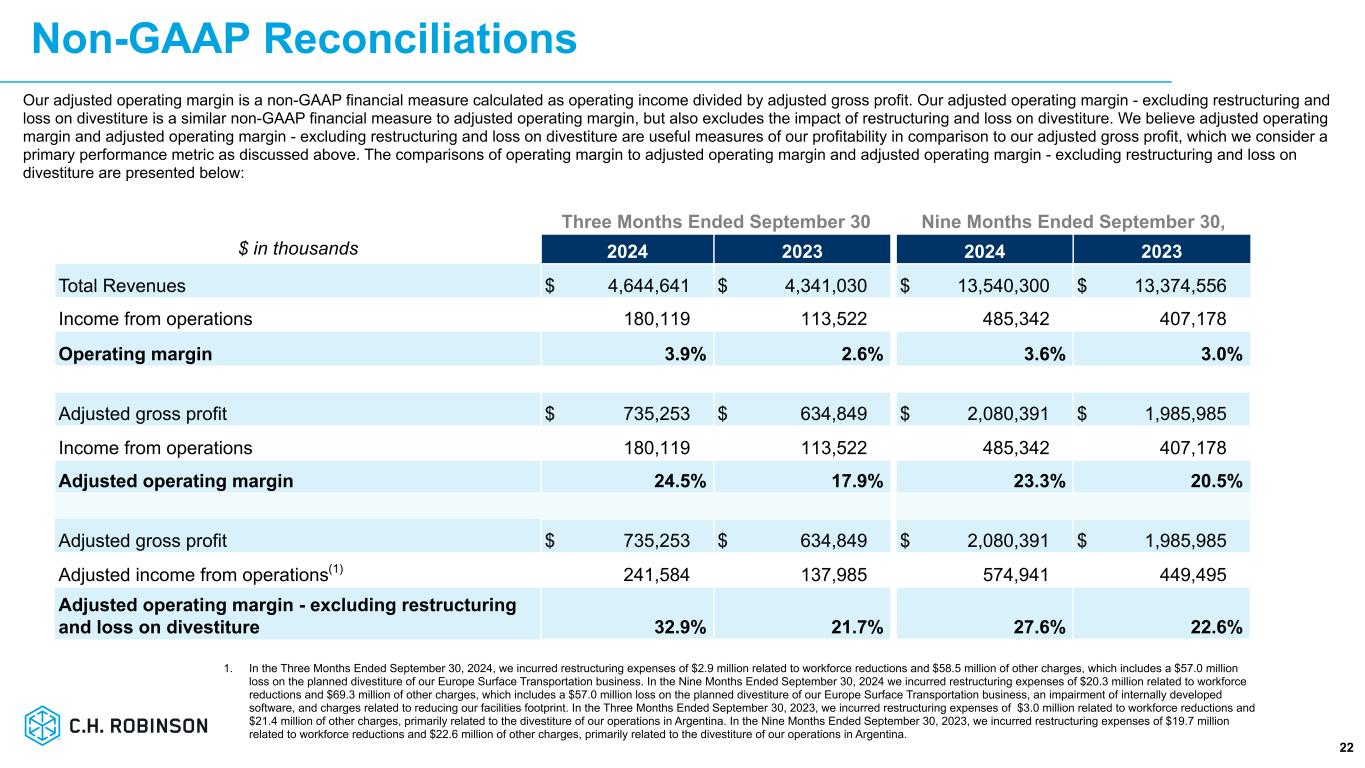

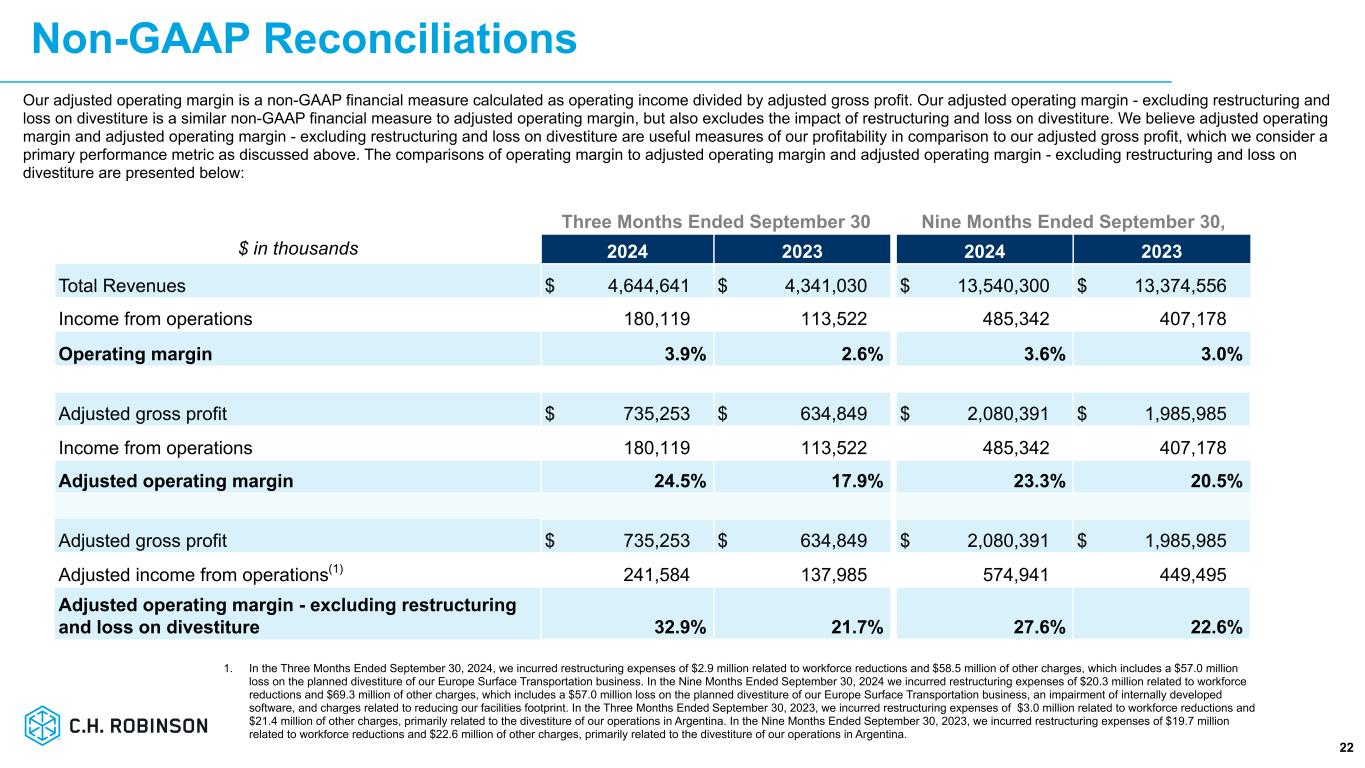

Non-GAAP Reconciliations 22 Our adjusted operating margin is a non-GAAP financial measure calculated as operating income divided by adjusted gross profit. Our adjusted operating margin - excluding restructuring and loss on divestiture is a similar non-GAAP financial measure to adjusted operating margin, but also excludes the impact of restructuring and loss on divestiture. We believe adjusted operating margin and adjusted operating margin - excluding restructuring and loss on divestiture are useful measures of our profitability in comparison to our adjusted gross profit, which we consider a primary performance metric as discussed above. The comparisons of operating margin to adjusted operating margin and adjusted operating margin - excluding restructuring and loss on divestiture are presented below: Three Months Ended September 30 Nine Months Ended September 30, $ in thousands 2024 2023 2024 2023 Total Revenues $ 4,644,641 $ 4,341,030 $ 13,540,300 $ 13,374,556 Income from operations 180,119 113,522 485,342 407,178 Operating margin 3.9% 2.6% 3.6% 3.0% Adjusted gross profit $ 735,253 $ 634,849 $ 2,080,391 $ 1,985,985 Income from operations 180,119 113,522 485,342 407,178 Adjusted operating margin 24.5% 17.9% 23.3% 20.5% Adjusted gross profit $ 735,253 $ 634,849 $ 2,080,391 $ 1,985,985 Adjusted income from operations(1) 241,584 137,985 574,941 449,495 Adjusted operating margin - excluding restructuring and loss on divestiture 32.9% 21.7% 27.6% 22.6% 1. In the Three Months Ended September 30, 2024, we incurred restructuring expenses of $2.9 million related to workforce reductions and $58.5 million of other charges, which includes a $57.0 million loss on the planned divestiture of our Europe Surface Transportation business. In the Nine Months Ended September 30, 2024 we incurred restructuring expenses of $20.3 million related to workforce reductions and $69.3 million of other charges, which includes a $57.0 million loss on the planned divestiture of our Europe Surface Transportation business, an impairment of internally developed software, and charges related to reducing our facilities footprint. In the Three Months Ended September 30, 2023, we incurred restructuring expenses of $3.0 million related to workforce reductions and $21.4 million of other charges, primarily related to the divestiture of our operations in Argentina. In the Nine Months Ended September 30, 2023, we incurred restructuring expenses of $19.7 million related to workforce reductions and $22.6 million of other charges, primarily related to the divestiture of our operations in Argentina.

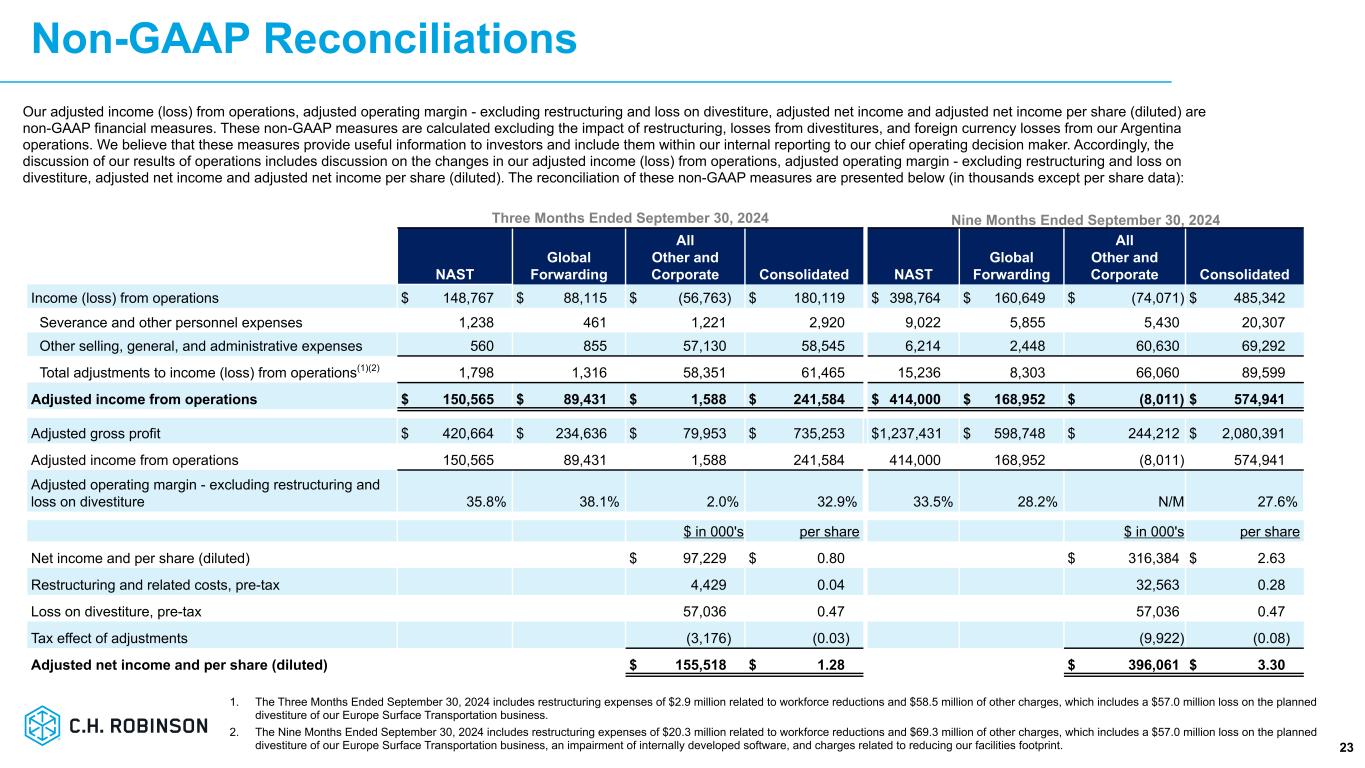

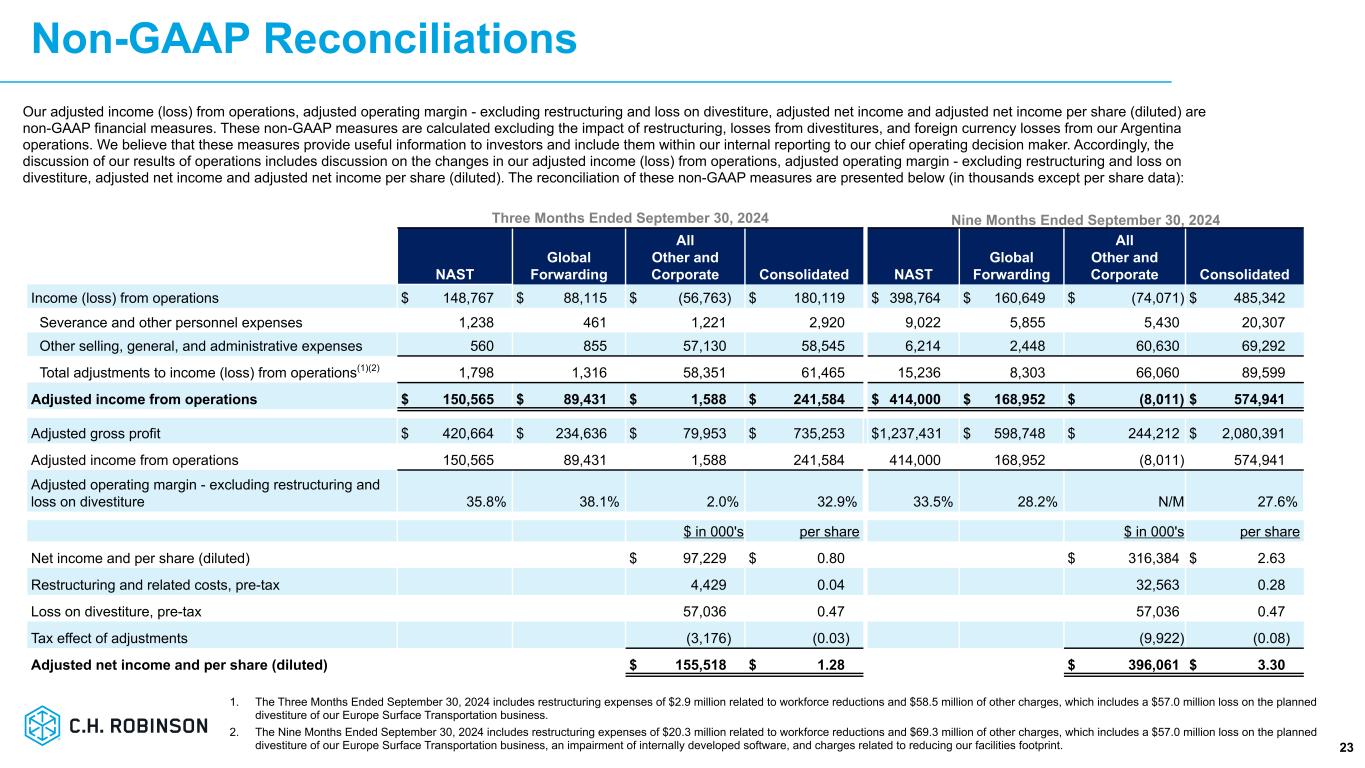

Non-GAAP Reconciliations 23 Our adjusted income (loss) from operations, adjusted operating margin - excluding restructuring and loss on divestiture, adjusted net income and adjusted net income per share (diluted) are non-GAAP financial measures. These non-GAAP measures are calculated excluding the impact of restructuring, losses from divestitures, and foreign currency losses from our Argentina operations. We believe that these measures provide useful information to investors and include them within our internal reporting to our chief operating decision maker. Accordingly, the discussion of our results of operations includes discussion on the changes in our adjusted income (loss) from operations, adjusted operating margin - excluding restructuring and loss on divestiture, adjusted net income and adjusted net income per share (diluted). The reconciliation of these non-GAAP measures are presented below (in thousands except per share data): Three Months Ended September 30, 2024 Nine Months Ended September 30, 2024 NAST Global Forwarding All Other and Corporate Consolidated NAST Global Forwarding All Other and Corporate Consolidated Income (loss) from operations $ 148,767 $ 88,115 $ (56,763) $ 180,119 $ 398,764 $ 160,649 $ (74,071) $ 485,342 Severance and other personnel expenses 1,238 461 1,221 2,920 9,022 5,855 5,430 20,307 Other selling, general, and administrative expenses 560 855 57,130 58,545 6,214 2,448 60,630 69,292 Total adjustments to income (loss) from operations(1)(2) 1,798 1,316 58,351 61,465 15,236 8,303 66,060 89,599 Adjusted income from operations $ 150,565 $ 89,431 $ 1,588 $ 241,584 $ 414,000 $ 168,952 $ (8,011) $ 574,941 Adjusted gross profit $ 420,664 $ 234,636 $ 79,953 $ 735,253 $ 1,237,431 $ 598,748 $ 244,212 $ 2,080,391 Adjusted income from operations 150,565 89,431 1,588 241,584 414,000 168,952 (8,011) 574,941 Adjusted operating margin - excluding restructuring and loss on divestiture 35.8% 38.1% 2.0% 32.9% 33.5% 28.2% N/M 27.6% $ in 000's per share $ in 000's per share Net income and per share (diluted) $ 97,229 $ 0.80 $ 316,384 $ 2.63 Restructuring and related costs, pre-tax 4,429 0.04 32,563 0.28 Loss on divestiture, pre-tax 57,036 0.47 57,036 0.47 Tax effect of adjustments (3,176) (0.03) (9,922) (0.08) Adjusted net income and per share (diluted) $ 155,518 $ 1.28 $ 396,061 $ 3.30 1. The Three Months Ended September 30, 2024 includes restructuring expenses of $2.9 million related to workforce reductions and $58.5 million of other charges, which includes a $57.0 million loss on the planned divestiture of our Europe Surface Transportation business. 2. The Nine Months Ended September 30, 2024 includes restructuring expenses of $20.3 million related to workforce reductions and $69.3 million of other charges, which includes a $57.0 million loss on the planned divestiture of our Europe Surface Transportation business, an impairment of internally developed software, and charges related to reducing our facilities footprint.

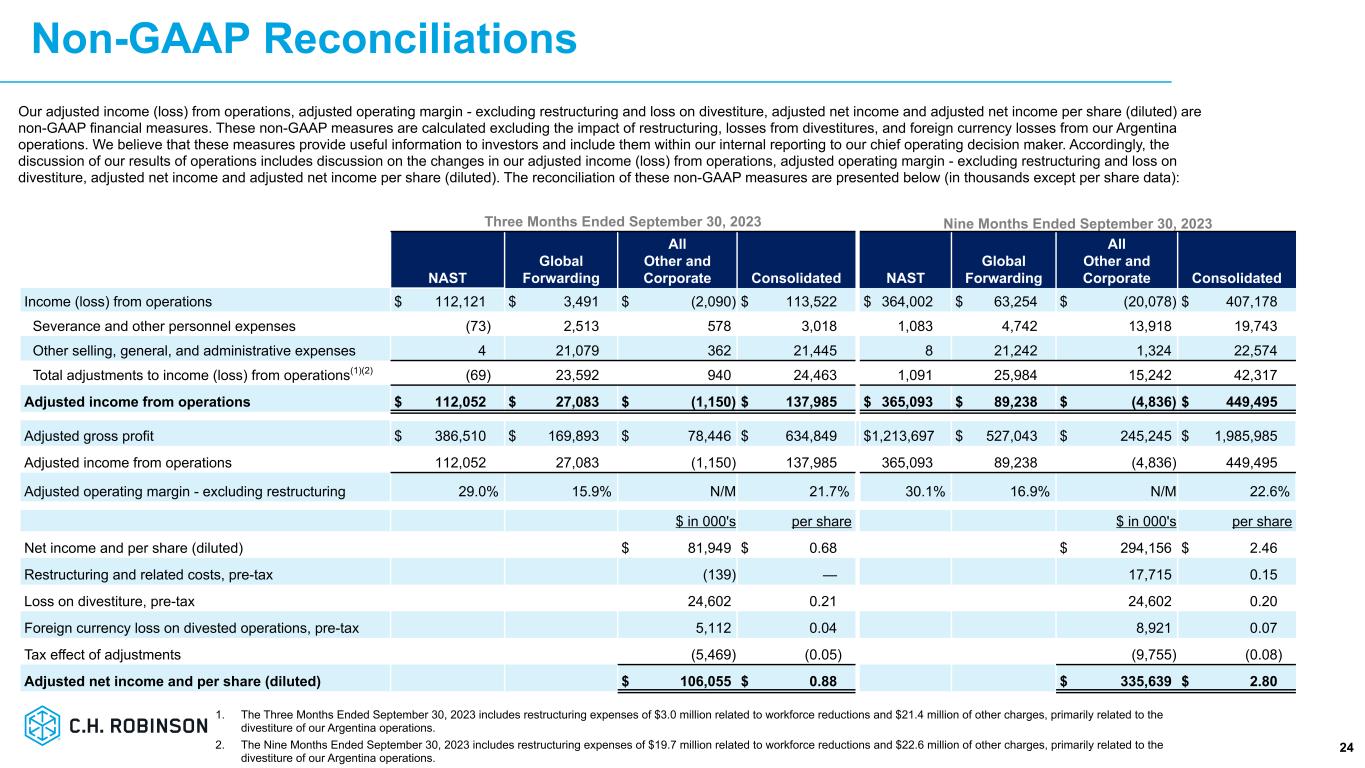

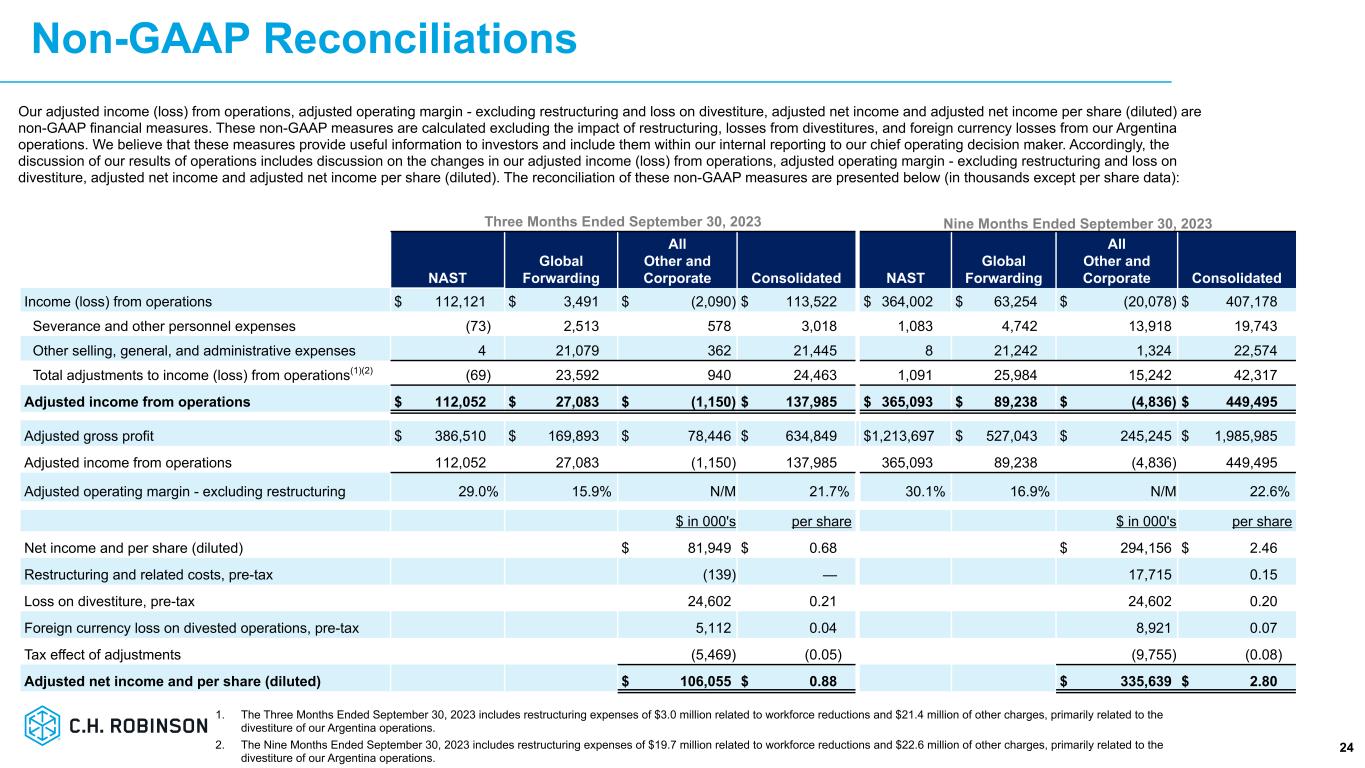

Non-GAAP Reconciliations 24 Our adjusted income (loss) from operations, adjusted operating margin - excluding restructuring and loss on divestiture, adjusted net income and adjusted net income per share (diluted) are non-GAAP financial measures. These non-GAAP measures are calculated excluding the impact of restructuring, losses from divestitures, and foreign currency losses from our Argentina operations. We believe that these measures provide useful information to investors and include them within our internal reporting to our chief operating decision maker. Accordingly, the discussion of our results of operations includes discussion on the changes in our adjusted income (loss) from operations, adjusted operating margin - excluding restructuring and loss on divestiture, adjusted net income and adjusted net income per share (diluted). The reconciliation of these non-GAAP measures are presented below (in thousands except per share data): Three Months Ended September 30, 2023 Nine Months Ended September 30, 2023 NAST Global Forwarding All Other and Corporate Consolidated NAST Global Forwarding All Other and Corporate Consolidated Income (loss) from operations $ 112,121 $ 3,491 $ (2,090) $ 113,522 $ 364,002 $ 63,254 $ (20,078) $ 407,178 Severance and other personnel expenses (73) 2,513 578 3,018 1,083 4,742 13,918 19,743 Other selling, general, and administrative expenses 4 21,079 362 21,445 8 21,242 1,324 22,574 Total adjustments to income (loss) from operations(1)(2) (69) 23,592 940 24,463 1,091 25,984 15,242 42,317 Adjusted income from operations $ 112,052 $ 27,083 $ (1,150) $ 137,985 $ 365,093 $ 89,238 $ (4,836) $ 449,495 Adjusted gross profit $ 386,510 $ 169,893 $ 78,446 $ 634,849 $ 1,213,697 $ 527,043 $ 245,245 $ 1,985,985 Adjusted income from operations 112,052 27,083 (1,150) 137,985 365,093 89,238 (4,836) 449,495 Adjusted operating margin - excluding restructuring 29.0% 15.9% N/M 21.7% 30.1% 16.9% N/M 22.6% $ in 000's per share $ in 000's per share Net income and per share (diluted) $ 81,949 $ 0.68 $ 294,156 $ 2.46 Restructuring and related costs, pre-tax (139) — 17,715 0.15 Loss on divestiture, pre-tax 24,602 0.21 24,602 0.20 Foreign currency loss on divested operations, pre-tax 5,112 0.04 8,921 0.07 Tax effect of adjustments (5,469) (0.05) (9,755) (0.08) Adjusted net income and per share (diluted) $ 106,055 $ 0.88 $ 335,639 $ 2.80 1. The Three Months Ended September 30, 2023 includes restructuring expenses of $3.0 million related to workforce reductions and $21.4 million of other charges, primarily related to the divestiture of our Argentina operations. 2. The Nine Months Ended September 30, 2023 includes restructuring expenses of $19.7 million related to workforce reductions and $22.6 million of other charges, primarily related to the divestiture of our Argentina operations.

25 Thank you INVESTOR RELATIONS: Chuck Ives 952-683-2508 chuck.ives@chrobinson.com