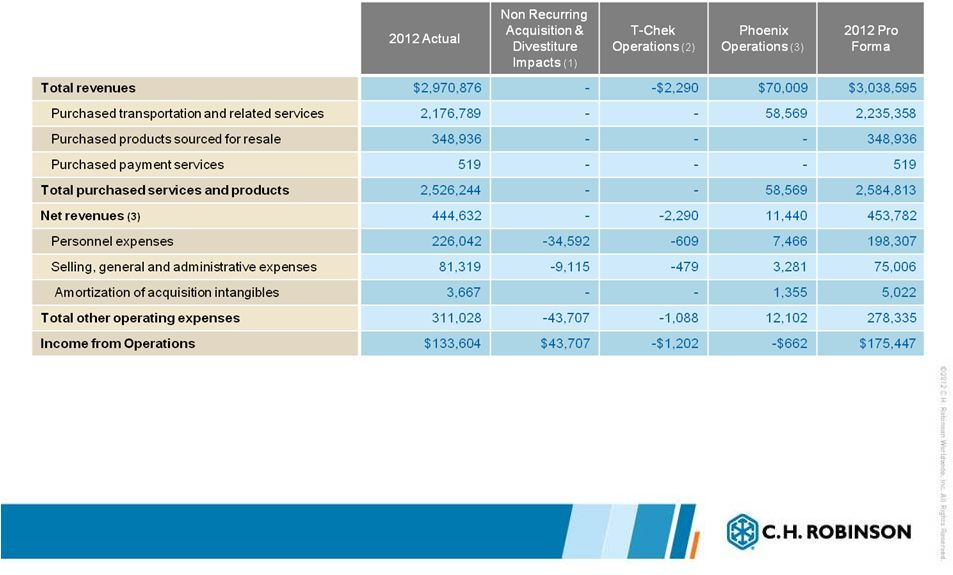

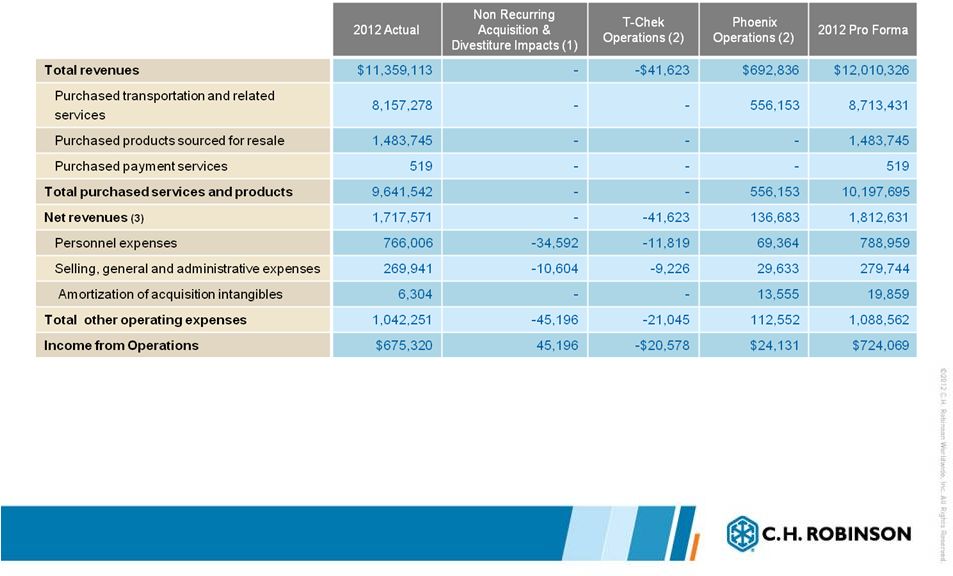

19 Appendix B: Twelve Month 2012 Actual to Pro Forma Reconciliation 1. The adjustment to personnel consists of $33 million of incremental vesting expense of our equity awards triggered by the gain on the divestiture of T-Chek. The balance consists of transaction-related bonuses. The adjustments to other operating expenses reflect fees paid to third parties for investment banking fees related to the acquisition of Phoenix and external legal and accounting fees related to the acquisitions of Apreo and Phoenix and the divestiture of T-Chek. The adjustment to investment and other income reflects the gain from the divestiture of T-Chek. The adjustment to diluted weighted average shares outstanding relates to the shares of C.H. Robinson stock issued as consideration paid to the sellers in the acquisition of Phoenix and the additional vesting of performance-based restricted stock as a result of the gain on sale recognized from the divestiture of T-Chek. 2. Adjustments have been made to historical Phoenix operations for addition of amortization expense of finite-lived intangible assets recorded in connection with the acquisition ($13.6 million), rent expense for lease agreements entered into in connection with the acquisition ($280 thousand), depreciation on a building acquired in the acquisition ($123 thousand), and incremental interest expense on the borrowings associated with the acquisition ($2.1 million). Adjustments have been made for the elimination of contractual changes in compensation ($5.1 million), and additional bonuses ($1.4 million) and third party advisory fees ($582 thousand) paid by Phoenix. An adjustment has also been made to reduce purchased transportation and related services ($24.4 million) and other selling, general, and administrative expenses ($50.1 million) and to increase personnel expenses ($74.5 million) to conform to C.H. Robinson’s historical financial reporting presentation. The adjustment to diluted weighted average shares outstanding relates to the shares of C.H. Robinson stock issued as consideration paid to the sellers in the acquisition of Phoenix. There were no pro forma adjustments to the T-Chek historical results. 3. Net revenues are our total revenues less purchased transportation and related services, including contracted motor carrier, rail, ocean, air, and other costs, and the purchased price and services related to the products we source. |