Q2 2023 Results August 3, 2023 Exhibit 99.2

2 Forward-Looking Statements Statements in this presentation that are not historical facts are forward-looking statements, which involve risks and uncertainties that could cause actual events or results to differ materially from those expressed or implied by the statements. Important factors that may cause actual results to differ materially from those in the forward-looking statements include, among other factors, the ability of our suppliers to supply us parts and components at competitive prices on a timely basis, including the impact of potential tariffs and trade considerations on their operations and output; fluctuations in the cost and availability of key materials (including semiconductors, printed circuit boards, resin, aluminum, steel and copper) and components and our ability to offset cost increases through negotiated price increases with our customers or other cost actions, as necessary; global economic trends, competition and geopolitical risks, including impacts from the ongoing conflict between Russia and Ukraine and the related sanctions and other measures, or an escalation of sanctions, tariffs or other trade tensions between the U.S. and China or other countries; our ability to achieve cost reductions that offset or exceed customer-mandated selling price reductions; the reduced purchases, loss or bankruptcy of a major customer or supplier; the costs and timing of business realignment, facility closures or similar actions; a significant change in automotive, commercial, off-highway or agricultural vehicle production; competitive market conditions and resulting effects on sales and pricing; foreign currency fluctuations and our ability to manage those impacts; customer acceptance of new products; our ability to successfully launch/produce products for awarded business; adverse changes in laws, government regulations or market conditions, including tariffs, affecting our products or our customers’ products; labor disruptions at Stoneridge’s facilities or at any of Stoneridge’s significant customers or suppliers; the ability to refinance our existing revolving Credit Facility on a timely basis to its June 5, 2024 maturity; the amount of Stoneridge’s indebtedness and the restrictive covenants contained in the agreements governing its indebtedness, including its revolving credit facility; capital availability or costs, including changes in interest rates or market perceptions; the occurrence or non-occurrence of circumstances beyond Stoneridge’s control; and the items described in “Risk Factors” and other uncertainties or risks discussed in Stoneridge’s periodic and current reports filed with the Securities and Exchange Commission. Important factors that could cause the performance of the commercial vehicle and automotive industry to differ materially from those in the forward- looking statements include factors such as (1) continued economic instability or poor economic conditions in the United States and global markets, (2) changes in economic conditions, housing prices, foreign currency exchange rates, commodity prices, including shortages of and increases or volatility in the price of oil, (3) changes in laws and regulations, (4) the state of the credit markets, (5) political stability, (6) international conflicts and (7) the occurrence of force majeure events. These factors should not be construed as exhaustive and should be considered with the other cautionary statements in Stoneridge’s filings with the Securities and Exchange Commission. Forward-looking statements are not guarantees of future performance; Stoneridge’s actual results of operations, financial condition and liquidity, and the development of the industry in which Stoneridge operates may differ materially from those described in or suggested by the forward-looking statements contained in this presentation. In addition, even if Stoneridge’s results of operations, financial condition and liquidity, and the development of the industry in which Stoneridge operates are consistent with the forward-looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. This presentation contains time-sensitive information that reflects management’s best analysis only as of the date of this presentation. Any forward-looking statements in this presentation speak only as of the date of this presentation, and Stoneridge undertakes no obligation to update such statements. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data. Stoneridge does not undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. Rounding Disclosure: There may be slight immaterial differences between figures represented in our public filings compared to what is shown in this presentation. The differences are the result of rounding due to the representation of values in millions rather than thousands in public filings.

3 2023 Guidance Reaffirmed* $960.0 – $990.0 million 20.5% - 21.25% 1.5% - 2.25% $3.0 – 4.0 million ($0.10) - $0.10 $50.9 - $58.4 million 5.3% - 5.9% Overview of Achievements Q2 adjusted sales growth of $30.2 million, or 13.0%, vs. Q1 2023 (5x+ weighted-average end market growth) Q2 margin performance significantly improved driven by strong sales growth and finalized price increases with customers Adjusted gross margin of 23.2% expanded ~470 bps vs. Q1 2023 Adjusted operating margin of 2.4% expanded by ~390 bps vs. Q1 2023 Q2 adjusted EPS of ($0.05) increased by $0.20 vs. Q1 2023 Includes unfavorable impact of non-operating FX and equity expense of ($2.7) million, or ~($0.08) Announcing Control Devices front axle disconnect actuator program extension and next generation program award Expecting operating performance (adjusted sales, gross margin and operating margin) to be at the high end of the previously provided ranges Reaffirming full-year 2023 guidance for adjusted EPS, EBITDA and tax expense as a result of year-to-date non-operating headwinds (FX and equity expense) Q2 2023 Financial Performance 2023 Full-Year Guidance AdjustedReported $262.4 million$266.8 millionSales $60.9 million 23.2% $60.5 million 22.7% Gross Profit Margin $6.2 million 2.4% $4.3 million 1.6% Operating Income Margin $1.8 million$1.5 millionTax Expense ($0.05)($0.11)EPS $11.9 million 4.5% - EBITDA Margin Guidance Summary Guiding to the high end of the previously provided range for operating metrics including adjusted revenue, gross margin and operating margin to reflect improved operating performance Maintaining guided range for adjusted EPS, EBITDA and adjusted tax expense primarily due to unfavorable non-operating expenses recognized year-to-date (FX and equity expense) offsetting improved operating performance *Full-year 2023 guidance is based on adjusted financial metrics

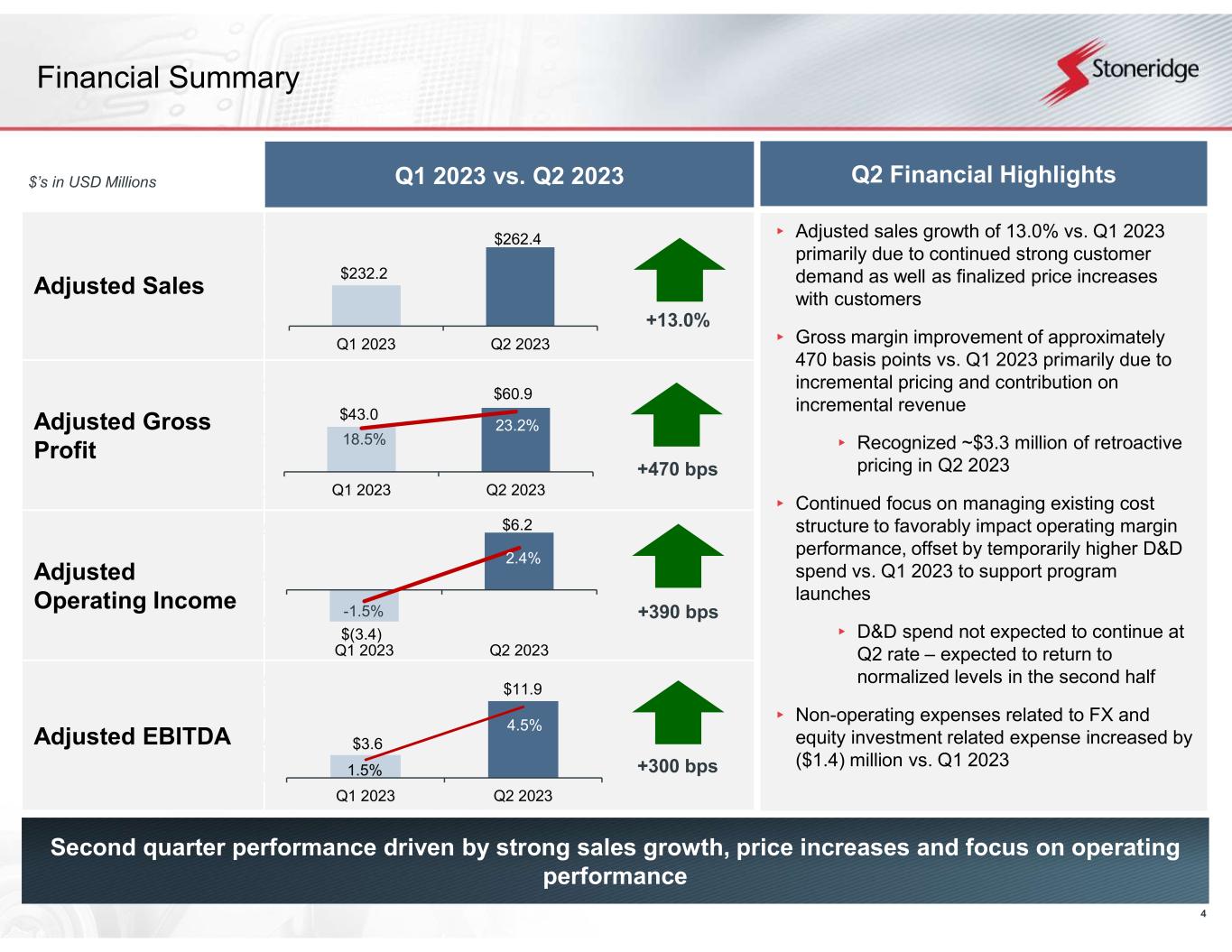

4 Financial Summary Second quarter performance driven by strong sales growth, price increases and focus on operating performance Q1 2023 vs. Q2 2023 Adjusted Sales Adjusted Gross Profit Adjusted Operating Income Adjusted EBITDA $’s in USD Millions Q2 Financial Highlights ▸ Adjusted sales growth of 13.0% vs. Q1 2023 primarily due to continued strong customer demand as well as finalized price increases with customers ▸ Gross margin improvement of approximately 470 basis points vs. Q1 2023 primarily due to incremental pricing and contribution on incremental revenue ▸ Recognized ~$3.3 million of retroactive pricing in Q2 2023 ▸ Continued focus on managing existing cost structure to favorably impact operating margin performance, offset by temporarily higher D&D spend vs. Q1 2023 to support program launches ▸ D&D spend not expected to continue at Q2 rate – expected to return to normalized levels in the second half ▸ Non-operating expenses related to FX and equity investment related expense increased by ($1.4) million vs. Q1 2023 $232.2 $262.4 200 220 240 260 280 Q1 2023 Q2 2023 $43.0 $60.9 18.5% 23.2% 0% 10% 20% 30% -20 30 80 Q1 2023 Q2 2023 $(3.4) $6.2 -1.5% 2.4% -3% 2% -3.5 1.5 6.5 Q1 2023 Q2 2023 $3.6 $11.9 1.5% 4.5% 1% 3% 5% 0 5 10 15 Q1 2023 Q2 2023 +13.0% +470 bps +390 bps +300 bps

5 ▸ MirrorEye program launched on Kenworth T680 in April 2023 and continues to ramp-up • Launching soon on Peterbilt platforms • Our existing fleet customers are inquiring about OEM availability – suggesting strong market demand ▸ MirrorEye OEM program in Europe remains consistent at ~40% take rate ▸ Existing OEM customers with future launches continue to re- evaluate estimated take rates in anticipation of strong end- customer demand based on programs currently in market MirrorEye OEM Update Business Update New business wins continue to demonstrate advanced technologies and drivetrain agnostic capabilities Continued positive momentum with MirrorEye OEM programs Control Devices - New Business Award Front Axle Disconnect Actuator ▸ Extension and next generation program awarded with major OEM customer ▸ Demonstrates versatility between vehicle platforms and product applications with drivetrain agnostic growth products ▸ Secured business and long-term strategic position on high demand light trucks and SUVs through 2032 ▸ Expecting ~$20 million of peak annual revenue for the extension and new programs MIRROREYE CAMERA MONITOR SYSTEM FRONT AXLE DISCONNECT ACTUATOR

6 Summary Summary Second quarter revenue performance driven primarily by continued strength in our automotive and commercial vehicle end markets and finalized price negotiations Second quarter operating margin performance driven by incremental pricing, including the retroactive pricing impact, contribution on incremental revenue and effective cost management, partially offset by temporarily higher D&D costs to support program launches Our first OEM program in North America launched in April on Kenworth T680 – continuing to ramp-up in 2023. Peterbilt platform launching soon. Market demand continues to be strong for first OEM MirrorEye program in Europe with ~40% take rates in 2023. Control Devices extension of existing business and new business win with OEM customer for front-axle disconnect actuator demonstrating advanced technologies and drivetrain agnostic capabilities 2023 Outlook Guiding to the high end of the previously provided operating metrics including full-year adjusted revenue, gross margin and operating margin Maintaining guidance ranges for adjusted EBITDA, EPS and tax expense driven primarily by non-operating headwinds (FX and equity expense) Driving shareholder value by executing on our long-term strategy and focusing on operational excellence

7 Financial Update

8 2023 Guidance Reaffirmed $960.0 – $990.0 millionAdjusted Sales 20.5% - 21.25%Adjusted Gross Margin 1.5% - 2.25%Adjusted Operating Margin $3.0 – $4.0 millionAdjusted Tax Expense ($0.10) - $0.10Adjusted EPS $50.9 - $58.4 million 5.3% - 5.9% Adjusted EBITDA Margin 2nd Quarter 2023 Financial Summary 2nd Quarter 2023 Financial Results Adjusted sales of $262.4 million, an increase of 13.0% over Q1 2023 • Control Devices sales of $93.1 million, an increase of 7.4% over Q1 2023 • Electronics adjusted sales of $163.9 million, an increase of 16.6% over Q1 2023 • Stoneridge Brazil sales of $14.9 million, an increase of 4.6% over Q1 2023 Adjusted operating income of $6.2 million (2.4% adjusted operating margin), an increase of 390 bps with Q1 2023 • Control Devices adjusted operating income of $5.5 million (5.9% adjusted operating margin), an increase of 420 bps over Q1 2023 • Electronics adjusted operating income of $8.8 million (5.4% adjusted operating margin), an increase of 410 bps over Q1 2023 • Stoneridge Brazil adjusted operating income of $0.9 million (6.0% adjusted operating margin), a decrease of $0.4 million over Q1 2023 2023 Full-Year Guidance Guidance Summary Guiding to the high end of the previously provided range for all operating metrics including adjusted revenue, gross margin and operating margin to reflect improved operating performance Reflects improved margin performance primarily driven by completed customer price negotiations Maintaining guided range for adjusted tax expense, EPS and EBITDA margin primarily due to unfavorable non-operating expenses recognized to date offsetting improved operating performance Includes year-to-date non-operating expense headwinds ($4.0 million or ~$0.12 adjusted EPS) related to non-operating FX expense and non-operating equity interest related expenses

9 Control Devices Financial Performance Expecting relatively stable revenue for the remainder of the year Focus on strong execution and cost control to drive margin expansion Control Devices 2023 Expectations ▸ Expecting stable revenue primarily as a result of exposure to high-demand vehicle programs with relatively higher content offsetting broader macroeconomic caution ▸ Focus on driving manufacturing performance improvement and cost control ▸ Continue to invest in and grow current capabilities targeted to electrified platforms and drivetrain architectures Q1 2023 vs. Q2 2023 Sales Adjusted Operating Income $’s in USD Millions Control Devices Q2 Summary Sales increased by 7.4% vs. Q1 2023 Higher sales in the North America passenger vehicle end market and China end markets driven by production stability relative to Q1 Adjusted operating income improved by ~420 basis points vs. Q1 2023 Primarily due to lower direct material costs primarily due to favorable sales mix driving improved gross margin Focused operational cost control resulted in improved operating margin $86.7 $93.1 $80.0 $85.0 $90.0 $95.0 Q1 2023 Q2 2023 $1.4 $5.5 1.6% 5.9% 0% 5% 0 2 4 6 Q1 2023 Q2 2023 7.4% +420 bps

10 Electronics Financial Performance Expecting significant year-over-year growth and continued margin expansion Electronics 2023 Expectations Expecting continued strength in demand in commercial vehicle end markets and the ramp-up of new and recently launched programs expected to drive continued revenue growth Expecting completed price negotiations to improve margin run-rate going forward Focused on efficient cost structure to ensure earnings potential is optimized Focus on efficient use of engineering resources to ensure strong program launches and continued advanced development activities while reducing overall cost structure Q1 2023 vs. Q2 2023 Adjusted Sales Adjusted Operating Income $’s in USD Millions Electronics Q2 Summary Adjusted sales increased by 16.6% vs. Q1 2023 Primarily due to continued strong commercial vehicle customer demand and incremental pricing recognized during the quarter Q2 adjusted operating margin improved by ~410 bps vs. Q1 2023 Primarily driven by gross margin improvement primarily as a result of incremental pricing, including retroactive pricing of ~$3.3 million Higher D&D costs vs. Q1 2023 partially offset favorable gross margin during the quarter Elevated D&D related to program launch support – expected to return to normalized levels in the second half $140.5 $163.9 Q1 2023 Q2 2023 16.6% $1.7 $8.8 1.2% 5.4% 0% 2% 4% 6% 0 5 10 Q1 2023 Q2 2023 +410 bps

11 Stoneridge Brazil Financial Performance Expecting relatively stable performance despite continued macroeconomic challenges Focus remains on supporting global Electronics business Stoneridge Brazil 2023 Expectations Expecting relative stability despite continued challenging overall macroeconomic conditions Focus remains on utilizing engineering resources to support global Electronics business Stoneridge Brazil Q2 Summary Excluding the favorable impact of foreign currency of $0.7 million, Q2 sales were approximately in line with Q1 2023 Higher sales in aftermarket products offset lower OEM sales during the quarter Operating margin decreased by $0.4 million vs. Q1 2023 Primarily due to higher SG&A and overhead costs Operating income in Q2 2023 includes favorable foreign currency impact of approximately $0.1 million vs. Q1 2023 $’s in USD Millions Q1 2023 vs. Q2 2023 Sales Operating Income $’s in USD Millions $14.3 $14.9 Q1 2023 Q2 2023 $1.3 $0.9 9.4% 6.0% 0 1 2 Q1 2023 Q2 2023

12 Q2 2023 Summary and 2023 Expectation ▸ Q2 net debt to trailing twelve month (“TTM”) adjusted EBITDA compliance ratio under 3.0x ▸ Targeting net debt to TTM adjusted EBITDA ratio under 2.5x ▸ Initiated refinancing discussions with the expectation to have debt refinanced with the appropriate capital structure in place prior to the issuance of the 2023 year-end financial statements Q2 compliance leverage ratio under 3.0x Expecting to refinance existing capital structure prior to issuance of 2023 year-end financial statements 4.75x 4.25xLeverage Ratio Compliance Requirement Capital Structure Update Waiver Period Waived 3.5x4.75x <2.5X3.37x 3.70x 2.97x Compliance Leverage Ratio (Adjusted Net Debt / TTM EBITDA*) $’s in USD Millions *Compliance Leverage Ratio calculation includes several adjustments in accordance with the Revolving Credit Facility agreement. Refer to Reconciliations to US GAAP for reconciliations. $22.5 $37.3 $24.2 $24.3 $147.7 $133.6 $146.3 $148.9 - 20.0 40.0 60.0 80.0 100.0 120.0 140.0 160.0 180.0 200.0 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Targeted Leverage Ratio Adjusted Cash (Compliance) Adjusted Net Debt (Compliance)

13 Summary 2023 Q2 Summary ▸ Control Devices – Q2 sales growth primarily due to stable customer demand and content on high-demand vehicles, as well as production normalization in our China end markets. Operating performance improved primarily due to lower material costs driven by favorable product mix and focused operational cost control ▸ Electronics – Continued strong sales growth during the quarter. Operating margin improved primarily due to gross margin expansion driven by price increases, including retroactive pricing recognized during the quarter, partially offset by temporarily higher D&D costs. ▸ Stoneridge Brazil – Stable sales and operating performance vs. Q1 2023. Focus remains on supporting global engineering initiatives and growth in OEM business to support global customers locally. 2023 Outlook and Guidance ▸ Guiding to the high end of the previously provided full-year 2023 adjusted revenue guidance range to reflect continued strong end market demand ▸ Guiding to the high end of the previously provided full-year 2023 adjusted gross and operating margin range to reflect improved operating performance expectations ▸ Reaffirming full-year 2023 adjusted EBITDA margin and EPS guidance to reflect unfavorable non- operating expenses year-to-date of approximately $4.0 million or $0.12 adjusted EPS offsetting improved operating performance Continued strong sales growth, margin expansion and focus on operational excellence providing foundation for long-term shareholder value creation

14 Appendix

15 Income Statement CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS Three months ended June 30, Six months ended June 30, (in thousands, except per share data) 2023 2022 2023 2022 Net sales $ 266,814 $ 220,936 $ 508,139 $ 441,994 Costs and expenses: Cost of goods sold 206,326 182,372 404,849 361,987 Selling, general and administrative 33,491 28,938 63,354 56,337 Design and development 22,666 15,554 39,634 32,582 Operating income (loss) 4,331 (5,928) 302 (8,912) Interest expense, net 3,120 1,217 5,866 3,003 Equity in loss of investee 329 377 500 458 Other expense (income), net 2,387 (596) 3,535 735 Loss before income taxes (1,505) (6,926) (9,599) (13,108) Provision for income taxes 1,487 413 779 1,906 Net loss $ (2,992) $ (7,339) $ (10,378) $ (15,014) Loss per share: Basic $ (0.11) $ (0.27) $ (0.38) $ (0.55) Diluted $ (0.11) $ (0.27) $ (0.38) $ (0.55) Weighted-average shares outstanding: Basic 27,452 27,269 27,400 27,234 Diluted 27,452 27,269 27,400 27,234

16 Balance Sheet CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) June 30, 2023 December 31, 2022 (Unaudited) ASSETS Current assets: Cash and cash equivalents $ 34,705 $ 54,798 Accounts receivable, less reserves of $1,132 and $962, respectively 185,296 158,155 Inventories, net 175,305 152,580 Prepaid expenses and other current assets 43,277 44,018 Total current assets 438,583 409,551 Long-term assets: Property, plant and equipment, net 106,227 104,643 Intangible assets, net 46,638 45,508 Goodwill 34,870 34,225 Operating lease right-of-use asset 12,225 13,762 Investments and other long-term assets, net 46,954 44,416 Total long-term assets 246,914 242,554 Total assets $ 685,497 $ 652,105 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Revolving credit facility $ 171,597 $ — Current portion of debt — 1,450 Accounts payable 136,457 110,202 Accrued expenses and other current liabilities 75,579 66,040 Total current liabilities 383,633 177,692 Long-term liabilities: Revolving credit facility — 167,802 Deferred income taxes 7,975 8,498 Operating lease long-term liability 8,967 10,594 Other long-term liabilities 7,284 6,577 Total long-term liabilities 24,226 193,471 Shareholders' equity: Preferred Shares, without par value, 5,000 shares authorized, none issued — — Common Shares, without par value, 60,000 shares authorized, 28,966 and 28,966 shares issued and 27,522 and 27,341 shares outstanding at June 30, 2023 and December 31, 2022, respectively, with no stated value — — Additional paid-in capital 226,713 232,758 Common Shares held in treasury, 1,444 and 1,625 shares at June 30, 2023 and December 31, 2022, respectively, at cost (44,367) (50,366) Retained earnings 191,314 201,692 Accumulated other comprehensive loss (96,022) (103,142) Total shareholders' equity 277,638 280,942 Total liabilities and shareholders' equity $ 685,497 $ 652,105

17 Statement of Cash Flows CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS Six months ended June 30, (in thousands) 2023 2022 OPERATING ACTIVITIES: Net loss $ (10,378) $ (15,014) Adjustments to reconcile net income (loss) to net cash provided by (used for) operating activities: Depreciation 13,161 13,618 Amortization, including accretion and write-off of deferred financing costs 4,004 4,323 Deferred income taxes (3,782) (1,868) Loss of equity method investee 500 458 Gain on sale of fixed assets (854) (95) Share-based compensation expense 1,271 2,834 Excess tax deficiency related to share-based compensation expense 66 259 Gain on settlement of net investment hedge — (3,716) Changes in operating assets and liabilities: Accounts receivable, net (28,100) (15,481) Inventories, net (23,142) (11,864) Prepaid expenses and other assets 3,313 (15,538) Accounts payable 27,069 16,577 Accrued expenses and other liabilities 12,184 7,689 Net cash used for operating activities (4,688) (17,818)

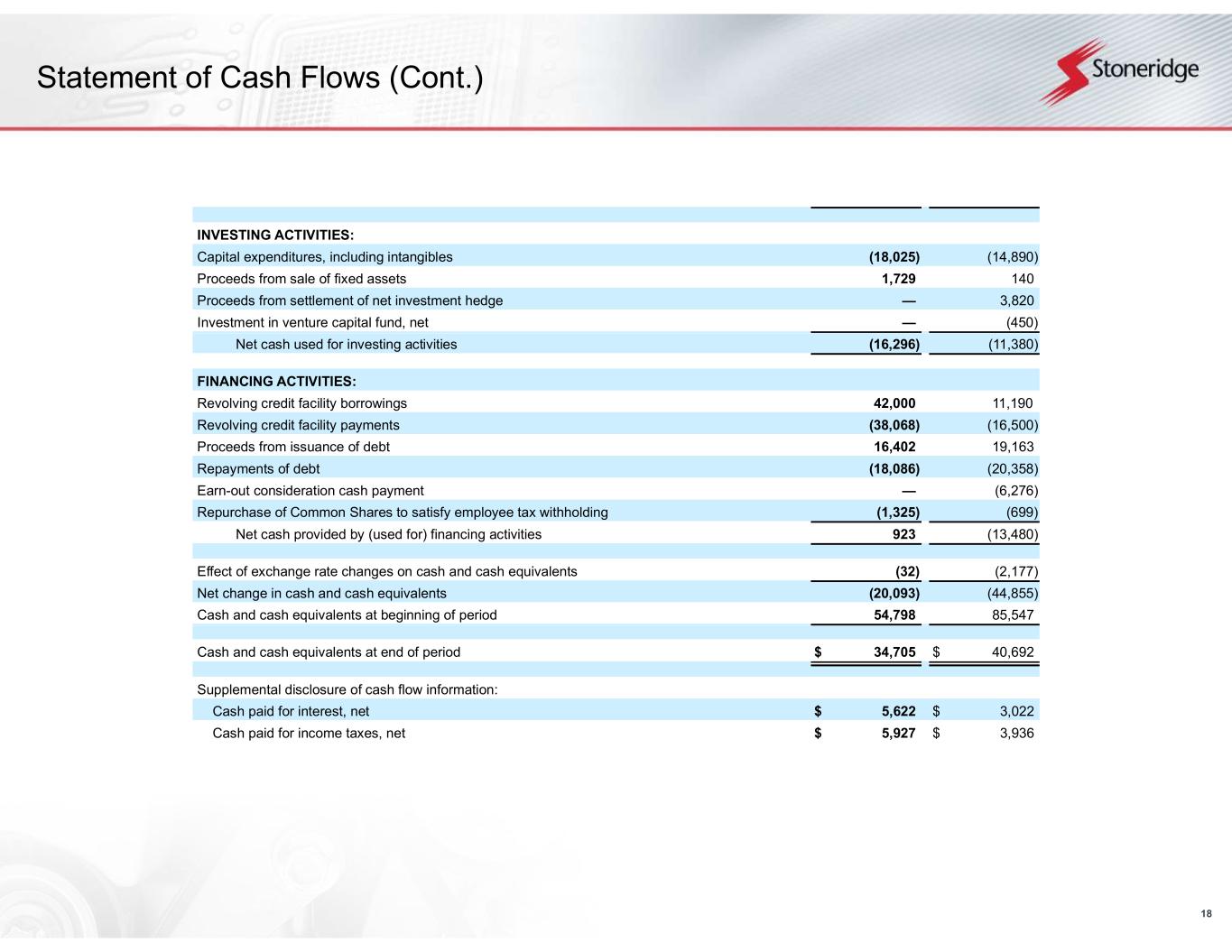

18 Statement of Cash Flows (Cont.) INVESTING ACTIVITIES: Capital expenditures, including intangibles (18,025) (14,890) Proceeds from sale of fixed assets 1,729 140 Proceeds from settlement of net investment hedge — 3,820 Investment in venture capital fund, net — (450) Net cash used for investing activities (16,296) (11,380) FINANCING ACTIVITIES: Revolving credit facility borrowings 42,000 11,190 Revolving credit facility payments (38,068) (16,500) Proceeds from issuance of debt 16,402 19,163 Repayments of debt (18,086) (20,358) Earn-out consideration cash payment — (6,276) Repurchase of Common Shares to satisfy employee tax withholding (1,325) (699) Net cash provided by (used for) financing activities 923 (13,480) Effect of exchange rate changes on cash and cash equivalents (32) (2,177) Net change in cash and cash equivalents (20,093) (44,855) Cash and cash equivalents at beginning of period 54,798 85,547 Cash and cash equivalents at end of period $ 34,705 $ 40,692 Supplemental disclosure of cash flow information: Cash paid for interest, net $ 5,622 $ 3,022 Cash paid for income taxes, net $ 5,927 $ 3,936

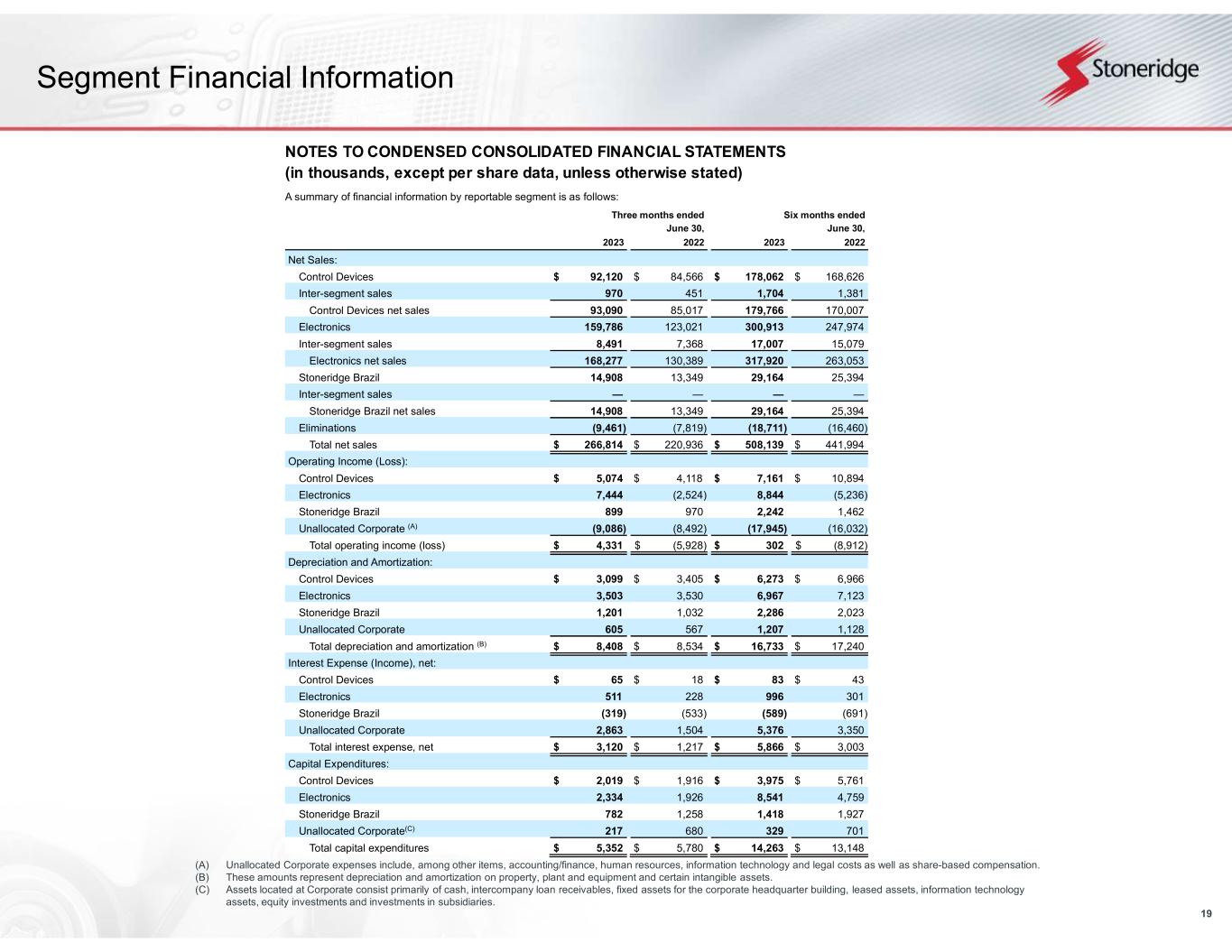

19 Segment Financial Information NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (in thousands, except per share data, unless otherwise stated) A summary of financial information by reportable segment is as follows: Three months ended June 30, Six months ended June 30, 2023 2022 2023 2022 Net Sales: Control Devices $ 92,120 $ 84,566 $ 178,062 $ 168,626 Inter-segment sales 970 451 1,704 1,381 Control Devices net sales 93,090 85,017 179,766 170,007 Electronics 159,786 123,021 300,913 247,974 Inter-segment sales 8,491 7,368 17,007 15,079 Electronics net sales 168,277 130,389 317,920 263,053 Stoneridge Brazil 14,908 13,349 29,164 25,394 Inter-segment sales — — — — Stoneridge Brazil net sales 14,908 13,349 29,164 25,394 Eliminations (9,461) (7,819) (18,711) (16,460) Total net sales $ 266,814 $ 220,936 $ 508,139 $ 441,994 Operating Income (Loss): Control Devices $ 5,074 $ 4,118 $ 7,161 $ 10,894 Electronics 7,444 (2,524) 8,844 (5,236) Stoneridge Brazil 899 970 2,242 1,462 Unallocated Corporate (A) (9,086) (8,492) (17,945) (16,032) Total operating income (loss) $ 4,331 $ (5,928) $ 302 $ (8,912) Depreciation and Amortization: Control Devices $ 3,099 $ 3,405 $ 6,273 $ 6,966 Electronics 3,503 3,530 6,967 7,123 Stoneridge Brazil 1,201 1,032 2,286 2,023 Unallocated Corporate 605 567 1,207 1,128 Total depreciation and amortization (B) $ 8,408 $ 8,534 $ 16,733 $ 17,240 Interest Expense (Income), net: Control Devices $ 65 $ 18 $ 83 $ 43 Electronics 511 228 996 301 Stoneridge Brazil (319) (533) (589) (691) Unallocated Corporate 2,863 1,504 5,376 3,350 Total interest expense, net $ 3,120 $ 1,217 $ 5,866 $ 3,003 Capital Expenditures: Control Devices $ 2,019 $ 1,916 $ 3,975 $ 5,761 Electronics 2,334 1,926 8,541 4,759 Stoneridge Brazil 782 1,258 1,418 1,927 Unallocated Corporate(C) 217 680 329 701 Total capital expenditures $ 5,352 $ 5,780 $ 14,263 $ 13,148 (A) Unallocated Corporate expenses include, among other items, accounting/finance, human resources, information technology and legal costs as well as share-based compensation. (B) These amounts represent depreciation and amortization on property, plant and equipment and certain intangible assets. (C) Assets located at Corporate consist primarily of cash, intercompany loan receivables, fixed assets for the corporate headquarter building, leased assets, information technology assets, equity investments and investments in subsidiaries.

20 Reconciliations to US GAAP

21 Reconciliations to US GAAP This document contains information about Stoneridge's financial results which is not presented in accordance with accounting principles generally accepted in the United States ("GAAP"). Such non-GAAP financial measures are reconciled to their closest GAAP financial measures in the appendix of this document. The provision of these non- GAAP financial measures is not intended to indicate that Stoneridge is explicitly or implicitly providing projections on those non-GAAP financial measures, and actual results for such measures are likely to vary from those presented. The reconciliations include all information reasonably available to the Company at the date of this document and the adjustments that management can reasonably predict.

22 Reconciliations to US GAAP (USD in millions) Q1 2023 Q1 2023 EPS Net Loss (7.4)$ (0.27)$ Add: After-Tax Business Realignment Costs 1.0 0.04 Less: After-Tax Gain on Disposal of Fixed Assets (0.6) (0.02) Add: After-Tax Environmental Remediation Costs 0.1 0.00 Adjusted Net Loss (6.9)$ (0.25)$ Reconciliation of Q1 2023 Adjusted EPS (USD in millions) Q2 2023 Q2 2023 EPS Net Loss (3.0)$ (0.11)$ Add: After-Tax Business Realignment Costs 1.6 0.06 Adjusted Net Loss (1.4)$ (0.05)$ Reconciliation of Q2 2023 Adjusted EPS

23 Reconciliations to US GAAP Reconciliation of Adjusted Gross Profit (USD in millions) Q1 2023 Q2 2023 Gross Profit 42.8$ 60.5$ Add: Pre-Tax Business Realignment Costs 0.2 0.5 Adjusted Gross Profit 43.0$ 60.9$ Reconciliation of Adjusted Operating Loss (USD in millions) Q1 2023 Q2 2023 Operating Loss (4.0)$ 4.3$ Add: Pre-Tax Business Realignment Costs 1.3 1.9 Less: Pre-Tax Gain on Disposal of Fixed Assets (0.8) - Add: Pre-Tax Environmental Remediation Costs 0.1 - Adjusted Operating Loss (3.4)$ 6.2$

24 Reconciliations to US GAAP Reconciliation of Adjusted EBITDA (USD in millions) Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Income (Loss) Before Tax (6.9)$ 1.7$ 0.7$ (8.1)$ (1.5)$ Interest expense, net 1.2 1.8 2.2 2.7 3.1 Depreciation and amortization 8.5 8.3 8.2 8.3 8.4 EBITDA 2.8$ 11.8$ 11.1$ 3.0$ 10.0$ Add: Pre-Tax Business Realignment Costs - 0.3 - 1.3 1.9 Less: Pre-Tax Gain on Disposal of Fixed Assets - - - (0.8) - Add: Pre-Tax Environmental Remediation Costs - - - 0.1 - Add: Pre-Tax Brazilian Indirect Tax Credits, Net (0.6) - - - - Adjusted EBITDA 2.3$ 12.1$ 11.1$ 3.6$ 11.9$

25 Reconciliations to US GAAP (USD in millions) Q2 2023 Tax Rate Loss Before Tax (1.5)$ Add: Pre-Tax Business Realignment Costs 1.9 Adjusted Income Before Tax 0.4$ Income Tax Expense 1.5 -98.8% Add: Tax Impact from Pre-Tax Adjustments 0.4 Adjusted Income Tax Expense 1.8$ nm nm = not meaningful Reconciliation of Q2 2023 Adjusted Tax Rate

26 Reconciliations to US GAAP Reconciliation of Electronics Adjusted Operating Income (USD in millions) Q1 2023 Q2 2023 Electronics Operating Income 1.4$ 7.4$ Add: Pre-Tax Business Realignment Costs 0.3 1.3 Electronics Adjusted Operating Income 1.7$ 8.8$ Reconciliation of Control Devices Adjusted Operating Income (USD in millions) Q1 2023 Q2 2023 Control Devices Operating Income 2.1$ 5.1$ Less: Pre-Tax Gain on Disposal of Fixed Assets (0.8) - Add: Pre-Tax Environmental Remediation Costs 0.1 - Add: Pre-Tax Business Realignment Costs - 0.4 Control Devices Adjusted Operating Income 1.4$ 5.5$

27 Reconciliations to US GAAP Reconciliation of Electronics Adjusted Sales (USD in millions) Q1 2023 Q2 2023 Electronics Sales 149.6$ 168.3$ Less: Sales from Spot Purchase Recoveries (9.1) (4.4) Electronics Adjusted Sales 140.5$ 163.9$ Reconciliation of Adjusted Sales (USD in millions) Q1 2023 Q2 2023 Sales 241.3$ 266.8$ Less: Sales from Spot Purchase Recoveries (9.1) (4.4) Adjusted Sales 232.2$ 262.4$

28 Reconciliations to US GAAP Reconciliation of Adjusted EBITDA for Compliance Calculation (USD in millions) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Income (Loss) Before Tax (6.2)$ (6.9)$ 1.7$ 0.7$ (8.1)$ (1.5)$ Interest Expense, net 1.8 1.2 1.8 2.2 2.7 3.1 Depreciation and Amortization 8.7 8.5 8.3 8.2 8.3 8.4 EBITDA 4.3$ 2.8$ 11.8$ 11.1$ 3.0$ 10.0$ Compliance adjustments: Add: Adjustments from Foreign Currency Impact 1.6 (0.4) 3.0 2.8 1.4 3.1 Add: Extraordinary, Non-recurring or Unusual items 0.1 0.4 0.0 0.1 0.2 - Add: Cash Restructuring Charges 0.1 0.0 0.6 0.2 1.4 0.5 Add: Adjustment to Autotech Investments 0.1 0.4 (0.0) 0.4 0.2 0.3 Adjusted EBITDA (Compliance) 6.2$ 3.3$ 15.5$ 14.6$ 6.1$ 13.9$ Adjusted TTM EBITDA (Compliance) 39.6$ 39.5$ 50.2$ Reconciliation of Adjusted Cash for Compliance Calculation (USD in millions) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Total Cash and Cash Equivalents 41.4$ 40.7$ 32.3$ 54.8$ 35.2$ 34.7$ Less: 35% Cash Foreign Locations (10.4) (12.9) (9.8) (17.5) (11.0) (10.4) Total Adjusted Cash (Compliance) 31.0$ 27.8$ 22.5$ 37.3$ 24.2$ 24.3$ Reconciliation of Adjusted Debt for Compliance Calculation (USD in millions) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Total Debt 152.9 162.0 168.5 169.3 168.8 171.6 Outstanding Letters of Credit 1.7 1.7 1.7 1.6 1.6 1.6 Total Adjusted Debt (Compliance) 154.6$ 163.7$ 170.2$ 170.9$ 170.5$ 173.2$ Adjusted Net Debt (Compliance) 133.6$ 146.3$ 148.9$ Compliance Leverage Ratio (Net Debt / TTM EBITDA) 3.37x 3.70x 2.97x