UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

Commission file number: 001-13337

STONERIDGE, INC.

(Exact name of registrant as specified in its charter)

| Ohio | 34-1598949 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| 9400 East Market Street, Warren, Ohio | 44484 | |

| (Address of principal executive offices) | (Zip Code) |

| (330) 856-2443 |

| Registrant’s telephone number, including area code |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Shares, without par value | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yesx No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yesx No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

x Yeso No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filero | Accelerated filerx | Non-accelerated filero | Smaller reporting companyo |

| (Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

o Yesx No

As of June 30, 2012, the aggregate market value of the registrant’s Common Shares, without par value, held by non-affiliates of the registrant was approximately $174.0 million. The closing price of the Common Shares on June 30, 2012 as reported on the New York Stock Exchange was $6.81 per share. As of June 30, 2012, the number of Common Shares outstanding was 28,053,761.

The number of Common Shares, without par value, outstanding as of February 22, 2013 was 28,462,649.

DOCUMENTS INCORPORATED BY REFERENCE

Definitive Proxy Statement for the Annual Meeting of Shareholders to be held on May 6, 2013, into Part III, Items 10, 11, 12, 13 and 14.

INDEX

| Page | ||

| PART I | ||

| Item 1. | Business | 1 |

| Item 1A. | Risk Factors | 7 |

| Item 1B. | Unresolved Staff Comments | 14 |

| Item 2. | Properties | 15 |

| Item 3. | Legal Proceedings | 17 |

| Item 4. | Mine Safety Disclosure | 17 |

| PART II | ||

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 17 |

| Item 6. | Selected Financial Data | 19 |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 21 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 39 |

| Item 8. | Financial Statements and Supplementary Data | 40 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 77 |

| Item 9A. | Controls and Procedures | 77 |

| Item 9B. | Other Information | 79 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 79 |

| Item 11. | Executive Compensation | 79 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 79 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 80 |

| Item 14. | Principal Accounting Fees and Services | 80 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules | 80 |

| Signatures | 81 | |

| i |

PART I

Item 1. Business.

Overview

Founded in 1965, Stoneridge, Inc. (the “Company”) is a global designer and manufacturer of highly engineered electrical and electronic components, modules and systems for the commercial vehicle, automotive, agricultural, motorcycle and off-highway vehicle markets. Our products and systems are critical elements in the management of mechanical and electrical systems to improve overall vehicle performance, convenience and monitoring in areas such as emissions control, fuel efficiency, safety, security and infotainment. Our extensive footprint, including our joint ventures, encompasses more than 25 locations in 15 countries and enables us to supply global and regional commercial vehicle, automotive, agricultural and off-highway vehicle manufacturers around the world.

Our custom-engineered products and systems are used to activate equipment and accessories, monitor and display vehicle performance and control, distribute electrical power and signals and provide vehicle security and convenience. Our product offerings consist of (i) vehicle instrumentation systems, (ii) vehicle management electronics, (iii) sensors, (iv) security alarms and vehicle tracking devices and monitoring services, (v) convenience accessories, (vi) power and signal distribution products and systems, and (vii) application-specific switches and actuators. We supply the majority of our products, predominantly on a sole-source basis, to many of the world’s leading commercial vehicle and automotive original equipment manufacturers, (“OEMs”), and select non-vehicle OEMs, as well as certain commercial vehicle and automotive tier one suppliers. These OEMs are increasingly utilizing electronic technology to comply with more stringent regulations (particularly emissions and safety) and to meet end-user demand for improved vehicle performance and greater convenience. As a result, per-vehicle electronic content has been increasing. Our technology and our partnership-oriented approach to product design and development enables us to develop next-generation products and to excel in the transition from mechanical-based components and systems to electrical and electronic components, modules and systems.

On December 31, 2011, we increased our ownership in PST Eletrônica S.A. (now PST Eletrônica Ltda. (“PST”)), to 74%. As a result of the increase in ownership, PST became a consolidated subsidiary of the Company. PST is a Brazil-based electronic system provider focused on security, infotainment and convenience accessories primarily for the South American automotive and motorcycle markets. PST sells its products through the aftermarket distribution channel, to factory authorized dealer installers, also referred to as original equipment services, direct to OEMs and through mass merchandisers.

Segment and Products

We conduct our business in four reportable segments which are the same as our operating segments: Electronics, Wiring, Control Devices and PST.

Electronics. Our Electronics segment designs and manufactures electronic instrument clusters, electronic control units and driver information systems. These products collect, store and display vehicle information such as speed, pressure, maintenance data, trip information, operator performance, temperature, distance traveled and driver messages related to vehicle performance. In addition, power distribution modules and systems regulate, coordinate and direct the operation of the electrical system within a vehicle. These products use state-of-the-art hardware, software and multiplexing technology and are sold principally to the commercial vehicle market.

Wiring.Our Wiring segment designs and manufactures electrical power and signal distribution products and systems, primarily wiring harnesses and connectors. These products are sold principally to the commercial, agricultural and off-highway vehicle markets. We also assemble entire instrument panels for the commercial vehicle market that are configured specifically to the OEM customer’s specifications.

Control Devices.Our Control Devices segment designs and manufactures products that monitor, measure or activate specific functions within a vehicle. This segment includes product lines such as sensors, switches, valves, and actuators, as well as other electronic products. Sensor products are employed in major vehicle systems such as the emissions, safety, powertrain, braking, climate control, steering and suspension systems. Switches transmit signals that activate specific functions. Our switch technology is principally used in two capacities, user-activated and hidden. User-activated switches are used by a vehicle’s operator or passengers to manually activate headlights, rear defrosters and other accessories. Hidden switches are not typically visible to vehicle operators or passengers and are engaged to activate or deactivate selected functions as part of normal vehicle operations, such as brake lights. In addition, our Control Devices segment designs and manufactures electromechanical actuator products that enable OEMs to deploy power functions in a vehicle and can be designed to integrate switching and control functions. We sell these products principally to the automotive market as well as the commercial vehicle and agricultural markets.

| 1 |

PST.OurPST segment specializes in the design, manufacture and sale of electronic vehicle security alarms, convenience accessories, vehicle tracking devices and monitoring services and in-vehicle audio and video devices primarily for the automotive and motorcycle industry. This segment includes product lines such as alarms, convenience applications, vehicle monitoring and tracking devices and infotainment systems. These products improve the performance, safety and convenience features of our customers’ vehicles. PST sells its products through the aftermarket distribution channel, to factory authorized dealer installers, also referred to as original equipment services, direct to OEMs and through mass merchandisers.

The following table sets forth for the periods indicated, the percentage of net sales attributable to our product categories and reportable segments for the years ended December 31:

| Product Category | Segment | 2012 | 2011 | 2010 | ||||||||||

| Electronic instrumentation and information display products | Electronics | 17 | % | 24 | % | 22 | % | |||||||

| Vehicle electrical power and distribution products and systems | Wiring | 35 | % | 43 | % | 41 | % | |||||||

| Sensors, switches, valves and actuators | Control Devices | 29 | % | 33 | % | 37 | % | |||||||

| Security alarms, vehicle tracking devices and monitoring services and convenience accessories | PST | 19 | % | 0 | % | 0 | % | |||||||

Our products and systems are sold to numerous OEM and tier one supplier customers, in addition to aftermarket distributors and mass merchandisers, for use on many different vehicle platforms. We supply multiple parts to many of our principal OEM and tier one customers under requirements contracts for a particular vehicle model. These contracts range in duration from one year to the production life of the model, which commonly extends for three to seven years. The following table sets forth for the periods indicated, the percentage of net sales derived from our principle markets:

| Years ended December 31 | 2012 | 2011 | 2010 | |||||||||

| Commercial vehicle | 40 | % | 53 | % | 50 | % | ||||||

| Automotive | 22 | 27 | 32 | |||||||||

| Agricultural and other | 19 | 20 | 18 | |||||||||

| Aftermarket distributors and mass merchandisers | 19 | 0 | 0 | |||||||||

| Total | 100 | % | 100 | % | 100 | % | ||||||

For further information related to our reportable segments and financial information about geographic areas, see Note 12 to the consolidated financial statements included in this report.

Production Materials

The principal production materials used in the manufacturing process for our reportable segments include: copper wire and cables, electrical connectors, molded plastic components and resins, instrumentation and certain electrical components such as printed circuit boards, semiconductors, microprocessors, memory devices, resistors, capacitors, fuses, relays and infotainment devices. We purchase such materials pursuant to both annual contract and spot purchasing methods. Such materials are available from multiple sources, but we generally establish collaborative relationships with a qualified supplier for each of our key production materials in order to lower costs and enhance service and quality. As global demand for our production materials increases, we may have difficulties obtaining adequate production materials from our suppliers to satisfy our customers. Any extended period of time for which we cannot obtain adequate production material or which we experience an increase in the price of production material could materially affect our results of operations and financial condition.

| 2 |

Patents, Trademarks and Intellectual Property

We maintain and have pending various U.S. and foreign patents, trademarks and other rights to intellectual property relating to the reportable segments of our business, which we believe are appropriate to protect the Company's interests in existing products, new inventions, manufacturing processes and product developments. We do not believe any single patent is material to our business, nor would the expiration or invalidity of any patent have a material adverse effect on our business or ability to compete. We are not currently engaged in any material infringement litigation, nor are there any material infringement claims pending by or against the Company.

Industry Cyclicality and Seasonality

The markets for products in our reportable segments have been cyclical. Because these products are used principally in the production of vehicles for the commercial, automotive, agricultural, motorcycle and off-highway markets, sales, and therefore results of operations, are significantly dependent on the general state of the economy and other factors, like the impact of environmental regulations on our customers, which affect these markets. A decline in commercial, automotive, agricultural, motorcycle and off-highway vehicle production of our principal customers could adversely impact the Company. Seasonality within the markets that we serve also has some impact on our operations.

Customers

We are dependent on several customers for a significant percentage of our sales. The loss of any significant portion of our sales to these customers, or the loss of a significant customer, would have a material adverse impact on our financial condition and results of operations. We supply numerous different parts to each of our principal customers. Contracts with several of our customers provide for supplying their requirements for a particular model, rather than for manufacturing a specific quantity of products. Such contracts range from one year to the life of the model, which is generally three to seven years. These contracts are subject to renegotiation, which may affect product pricing and generally may be terminated by our customers at any time. Therefore, the loss of a contract for a major model or a significant decrease in demand for certain key models or group of related models sold by any of our major customers could have a material adverse impact on the Company. We may also enter into contracts to supply parts, the introduction of which may then be delayed or cancelled. We also compete to supply products for successor models and are therefore subject to the risk that the customer will not select the Company to produce products on any such model, which could have a material adverse impact on our financial condition and results of operations. In addition, we sell products to other customers that are ultimately sold to our principal customers. Due to the competitive nature of the markets we serve, in the ordinary course of business we face pricing pressures from our customers. In response to these pricing pressures we have been able to effectively manage our production costs by the combination of lowering certain costs and limiting the increase of others, the net impact of which has not been material. However, if we are unable to effectively manage production costs in the future to mitigate future pricing pressures, our results of operations may be adversely affected.

The following table presents our principal customers, as a percentage of net sales:

| Years ended December 31 | 2012 | 2011 | 2010 | |||||||||

| Navistar International Corporation | 18 | % | 24 | % | 24 | % | ||||||

| Deere & Company | 13 | 15 | 14 | |||||||||

| Ford Motor Company | 5 | 6 | 8 | |||||||||

| General Motors Company | 4 | 5 | 5 | |||||||||

| Scania Group | 4 | 5 | 4 | |||||||||

| Other | 56 | 45 | 45 | |||||||||

| Total | 100 | % | 100 | % | 100 | % | ||||||

Backlog

Our products are produced from readily available materials and have a relatively short manufacturing cycle; therefore our products are not on backlog status. Each of our production facilities maintains its own inventories and production schedules. Production capacity is adequate to handle current requirements and can be expanded to handle increased growth if needed.

| 3 |

Competition

The markets for our products in our reportable segments are highly competitive. The principal methods of competition are technological innovation, price, quality, performance, service and delivery. We compete for new business both at the beginning of the development of new models and upon the redesign of existing models for OEM customers. New model development generally begins two to five years before the marketing of such models to the public. Once a supplier has been selected to provide parts for a new program, an OEM customer will usually continue to purchase those parts from the selected supplier for the life of the program, although not necessarily for any model redesigns. We compete for aftermarket and mass merchandiser sales based on price, product functionality, quality and service.

Our diversity in products creates a wide range of competitors, which vary depending on both market and geographic location. We compete based on strong customer relations and a fast and flexible organization that develops technically effective solutions at or below target price. We compete against the following primary competitors:

Electronics.Our primary competitors include Actia Group, Ametek, Inc., Bosch, Commercial Vehicle Group, Continental AG, Hella KGaA Hueck & Co., Magneti Marelli S.p.A. and Yazaki Corporation.

Wiring.Our primary competitors include Commercial Vehicle Group, Delphi Automotive PLC, Leoni, Nexans SA and PKC Group.

Control Devices.Our primary competitors include Bosch, Continental AG, Delphi Automotive PLC, Denso Corporation, Hella KGaA Hueck & Co., Methode Electronics, Inc., Preh GmbH, Sensata, TRW Automotive Holdings Corp. and Visteon.

PST.Our primary competitors include Autolift, Autotrac, Brose, Car System, Graber, H-Buster, Ituran, Magneti Marelli S.p.A., Quantum, Olimpus, Sascar, Segma, Sistec, Sony, Techcar and Tragial.

Product Development

Our research and development efforts for our reportable segments are largely product design and development oriented and consist primarily of applying known technologies to customer requests. We work closely with our customers to creatively solve customer requests using innovative approaches. The majority of our development expenses are related to customer-sponsored programs where we are involved in designing custom-engineered solutions for specific applications or for next generation technology. To further our vehicle platform penetration, we have also developed collaborative relationships with the design and engineering departments of key customers. These collaborative efforts have resulted in the development of new and complimentary products and the enhancement of existing products.

Our development work is largely performed on a decentralized basis. We have engineering and product development departments organized by market. To ensure knowledge sharing among decentralized development efforts, we have instituted a number of mechanisms and practices whereby innovation and best practices are shared. The decentralized product development operations are complimented by larger technology groups in Canton, Massachusetts; Lexington, Ohio; Stockholm, Sweden; Pune, India; Manaus, Brazil; and Sao Paulo, Brazil. In addition, during 2010 we opened a product development center in Shanghai, China, to focus on the developing Chinese market.

We use efficient and quality oriented work processes to address our customers’ high standards. Our product development technical resources include a full complement of computer-aided design and engineering (“CAD/CAE”) software systems, including (i) virtual three-dimensional modeling, (ii) functional simulation and analysis capabilities and (iii) data links for rapid prototyping. These CAD/CAE systems enable us to expedite product design and the manufacturing process to shorten the development time and ultimately time to market.

We have further strengthened our electrical engineering competencies through investment in equipment such as (i) automotive electro-magnetic compliance test chambers, (ii) programmable automotive and commercial vehicle transient generators, (iii) circuit simulators and (iv) other environmental test equipment. Additional investment in product machining equipment has allowed us to fabricate new product samples in a fraction of the time required historically. Our product development and validation efforts are supported by full service, on-site test labs at most manufacturing facilities, thus enabling cross-functional engineering teams to optimize the product, process and system performance before tooling initiation.

We have invested, and will continue to invest in technology to develop new products for our customers. Product development costs incurred in connection with the development of new products and manufacturing methods, to the extent not recoverable from the customer, are charged to selling, general and administrative expenses, as incurred. Such costs amounted to approximately $44.8 million, $35.3 million and $37.6 million for 2012, 2011 and 2010, respectively, or 4.8%, 4.6% and 5.9% of net sales for these periods.

| 4 |

We will continue shifting our investment spending toward the design and development of new products rather than focusing on sustaining existing product programs for specific customers, which allows us to sell our products to multiple customers. The typical product development process takes three to five years to show tangible results. As part of our effort to shift our investment spending, we reviewed our current product portfolio and adjusted our spending to either accelerate or eliminate our investment in these products based on our position in the market and the potential of the market and product.

Environmental and Other Regulations

Our operations are subject to various federal, state, local and foreign laws and regulations governing, among other things, emissions to air, discharge to water and the generation, handling, storage, transportation, treatment and disposal of waste and other materials. We believe that our business, operations and facilities have been and are being operated in compliance, in all material respects, with applicable environmental and health and safety laws and regulations, many of which provide for substantial fines and criminal sanctions for violations.

Employees

As of December 31, 2012, we had approximately 8,700 employees, approximately 3,000 of whom were salaried and the balance of whom were paid on an hourly basis. Although we have no collective bargaining agreements covering U.S. employees, certain employees located in Brazil, Estonia, France, Mexico, Spain, Sweden, and the United Kingdom either (i) are represented by a union and are covered by a collective bargaining agreement or (ii) are covered by works council or other employment arrangements required by law. We believe that relations with our employees are good.

Joint Ventures

We form joint ventures in order to achieve several strategic objectives, including (i) diversifying our business by expanding in high-growth regions, (ii) employing complementary design processes, growth technologies and intellectual capital and (iii) realizing cost savings from combined sourcing. We have a consolidated joint venture in Brazil, PST, and a joint venture in India, Minda Stoneridge Instruments Ltd. (“Minda”), and continue to explore similar business opportunities in other global markets. We have a 74% interest in PST and a 49% interest in Minda at December 31, 2012 and 2011.

We entered into our PST joint venture in October 1997, acquiring a 50% interest. On December 31, 2011, we acquired an additional 24% interest. Prior to the acquisition of the additional interest, PST was accounted for using the equity method of accounting. Subsequent to the acquisition, PST became a consolidated subsidiary of the Company. We entered into our Minda joint venture in August 2004, this investment is accounted for using the equity method of accounting.

PST specializes in the design, manufacture and sale of electronic vehicle security alarms, convenience accessories, vehicle tracking devices and monitoring services and in-vehicle audio and video devices. PST sells its products through the aftermarket distribution channel, to factory authorized dealer installers, also referred to as original equipment services, direct to OEMs and through mass merchandisers. PST’s sales are to customers in South America. PST generated net sales of $180.4 million, $234.2 million and $182.9 million in 2012, 2011 and 2010, respectively. We received dividend payments from PST of $5.5 million in 2010.

Minda manufactures electromechanical/electronic instrumentation equipment and sensors primarily for the automotive, motorcycle and commercial vehicle markets. We leverage our investment in Minda by sharing our knowledge and expertise in electrical components and systems and expanding Minda’s product offering through the joint development of our products designed for the market in India.

| 5 |

Our joint ventures have contributed positively to our financial results in 2012, 2011 and 2010. Equity earnings by joint venture are summarized in the following table (in thousands):

| Years ended December 31 | 2012 | 2011 | 2010 | |||||||||

| PST(A) | $ | - | $ | 8,805 | $ | 9,490 | ||||||

| Minda | 760 | 1,229 | 856 | |||||||||

| Total equity earnings of investees | $ | 760 | $ | 10,034 | $ | 10,346 | ||||||

(A) We recognized no equity earnings in PST in 2012 as its financial results were consolidated based on our acquisition of controlling interest on December 31, 2011.

Executive Officers of the Company

Each executive officer of the Company serves the Board of Directors at its pleasure. The Board of Directors appoints corporate officers annually. The executive officers for reporting purposes under the Securities and Exchange Act of 1934, as amended, of the Company are as follows:

| Name | Age | Position | ||

| John C. Corey | 65 | President, Chief Executive Officer and Director | ||

| George E. Strickler | 65 | Executive Vice President, Chief Financial Officer and Treasurer | ||

| Richard P. Adante | 66 | Vice President of Operations | ||

| Thomas A. Beaver | 59 | Vice President of the Company and President of Global Sales | ||

| Sergio de Cerqueira Leite | 49 | Director President of PST Eletrônica Ltda. | ||

| Kevin B. Kramer | 53 | Vice President of the Company and President of the Wiring Division | ||

| Peter Kruk | 44 | President of the Electronics Division | ||

| Michael D. Sloan | 56 | Vice President of the Company and President of the Control Devices Division |

John C. Corey, President, Chief Executive Officer and Director.Mr. Corey has served as President and Chief Executive Officer since being appointed by the Board of Directors in January 2006. Mr. Corey has served as a Director on the Board of Directors since January 2004. Prior to his employment with the Company, Mr. Corey served from October 2000, as President and Chief Executive Officer and Director of Safety Components International, a supplier of airbags and components, with worldwide operations. Mr. Corey has served as a Director and Chairman of the Board of Haynes International, Inc., a producer of metal alloys, since 2004.

George E. Strickler, Executive Vice President, Chief Financial Officer and Treasurer.Mr. Strickler has served as Executive Vice President and Chief Financial Officer since joining the Company in January 2006. Mr. Strickler was appointed Treasurer of the Company in February 2007. Prior to his employment with the Company, Mr. Strickler served as Executive Vice President and Chief Financial Officer for Republic Engineered Products, Inc. (“Republic”), from February 2004 to January 2006. Before joining Republic, Mr. Strickler was BorgWarner, Inc.’s Executive Vice President and Chief Financial Officer from February 2001 to November 2003.

Richard P. Adante, Vice President of Operations.Mr. Adante has served as Vice President of Operations since May 2011. From November 2009 until his appointment at Stoneridge, Mr. Adante was consulting through his personal consulting firm, RMA Management Consultants. From July 2006 to November 2009, Mr. Adante served as the President of Hawthorn Manufacturing, now known as Crowne Group.

Thomas A. Beaver, Vice President of the Company and President of Global Sales.Mr. Beaver has served as Vice President of the Company and President of Global Sales since May 2012. Prior to that,Mr. Beaverserved as Vice President of the Company and Vice President of Global Sales and Systems Engineering from January 2005 to May 2012. From January 2000 to January 2005, Mr. Beaver served as Vice President of Stoneridge Sales and Marketing.

| 6 |

Sergio de Cerqueira Leite, Director President of PST Eletrônica Ltda.Mr. Leite is a founding partner of PST. He has held the Director President position since 1997. Prior to that, he worked in PST’s sales and marketing department.

Kevin B. Kramer, Vice President of the Company and President of the Wiring Division. Mr. Kramer has served as a Vice President of the Company and President of the Wiring Division since joining Stoneridge in May 2012. Prior to that, he was President of Growth Initiatives at Alcoa from 2009 to April 2012 and President of its Wheel and Transportation Products business from 2004 to 2009.

Peter Kruk, President of Stoneridge Electronics Division.Mr. Kruk has served as President of the Electronics Division since August 2012. Mr. Kruk joined the Company in October 2009 as the Managing Director of Stoneridge Electronics – Europe. Prior to that, he served as President of HEXPOL Wheels and Managing Director of Stellana AB from 2007 to 2009. From 1992-2007 Mr. Kruk served in various capacities with ABB.

Michael D. Sloan, Vice President of the Company and President of the Control Devices Division. Mr. Sloan has served as President of the Control Devices Division since July 2009 and Vice President of the Company since December 2009. Prior to that, Mr. Sloan served as Vice President and General Manager of Stoneridge Hi-Stat from February 2004 to July 2009.

Available Information

We make available, free of charge through our website (www.stoneridge.com), our Annual Report on Form 10-K (“Annual Report”), Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, all amendments to those reports, and other filings with the U.S. Securities and Exchange Commission (“SEC”), as soon as reasonably practicable after they are filed with the SEC. Our Corporate Governance Guidelines, Code of Business Conduct and Ethics, Code of Ethics for Senior Financial Officers, Whistleblower Policy and Procedures and the charters of the Board’s Audit, Compensation and Nominating and Corporate Governance Committees are posted on our website as well. Copies of these documents will be available to any shareholder upon request. Requests should be directed in writing to Investor Relations at Stoneridge, Inc., 9400 East Market Street, Warren, Ohio 44484.

The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F. Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including the Company.

Item 1A. Risk Factors.

Set forth below are the principal risks and uncertainties that may affect our business. In addition, future results could be materially affected by general industry and market conditions, changes in laws or accounting rules, general U.S. and non-U.S. economic and political conditions, including a global economic slow-down, fluctuation of interest rates or currency exchange rates, terrorism, political unrest or international conflicts, political instability or major health concerns, natural disasters, commodity prices or other disruptions of expected economic and business conditions. These risk factors should be considered in addition to our cautionary comments concerning forward-looking statements in this Annual Report, including statements related to markets for our products and trends in our business that involve a number of risks and uncertainties. Our separate section, “Forward-Looking Statements,” should be considered in addition to the following statements.

Our business is cyclical and seasonal in nature and downturns in the commercial, automotive, agricultural and off-highway vehicle markets could reduce the sales and profitability of our business.

The demand for products in our Electronics, Wiring and Control Devices segments are largely dependent on the domestic and foreign production of commercial, automotive, agricultural and off-highway vehicles. The markets for our products have been cyclical, because new vehicle demand is dependent on, among other things, consumer spending and is tied closely to the overall strength of the economy. Because the majority of our products are used principally in the production of vehicles for the commercial, automotive, agricultural and off-highway vehicle markets, our net sales, and therefore our results of operations, are significantly dependent on the general state of the economy and other factors which affect these markets. A decline in commercial, automotive, agricultural and off-highway vehicle production could adversely impact our results of operations and financial condition. Also, the demand for our PST segment products are significantly dependent on the general state of the Brazilian economy.

| 7 |

In 2012, approximately 59% of our net sales were derived from commercial, agricultural and off-highway vehicle markets, approximately 22% were derived from the automotive market and approximately 19% were derived from mass merchandisers. Seasonality experienced by our served markets also impacts our operations.

We may not realize sales represented by awarded business.

We base our growth projections, in part, on business awards made by our customers. These business awards generally renew annually during a program life cycle. Failure of actual production orders from our customers to approximate these business awards could have a material adverse effect on our business, financial condition or results of operations.

The prices that we can charge some of our customers are predetermined and we bear the risk of costs in excess of our estimates, in addition to the risk of adverse effects resulting from general customer demands for cost reductions and quality improvements.

Our supply agreements with some of our customers require us to provide our products at predetermined prices. In some cases, these prices decline over the course of the contract and may require us to meet certain productivity and cost reduction targets. In addition, our customers may require us to share productivity savings in excess of our cost reduction targets. The costs that we incur in fulfilling these contracts may vary substantially from our initial estimates. Unanticipated cost increases or the inability to meet certain cost reduction targets may occur as a result of several factors, including increases in the costs of labor, components or materials. In some cases, we are permitted to pass on to our customers the cost increases associated with specific materials. Cost overruns that we cannot pass on to our customers could adversely affect our business, financial condition or results of operations.

OEM customers have exerted considerable pressure on component suppliers to reduce costs, improve quality and provide additional design and engineering capabilities and continue to demand and receive price reductions and measurable increases in quality through their use of competitive selection processes, rating programs and various other arrangements. We may be unable to generate sufficient production cost savings in the future to offset required price reductions. Additionally, OEMs have generally required component suppliers to provide more design engineering input at earlier stages of the product development process, the costs of which have, in some cases, been absorbed by the suppliers. Future price reductions, increased quality standards and additional engineering capabilities required by OEMs may reduce our profitability and have a material adverse effect on our business, financial condition or results of operations.

Our business is very competitive and increased competition could reduce our sales.

The markets for our products are highly competitive. We compete based on quality, service, price, performance, timely delivery and technological innovation. Many of our competitors are more diversified and have greater financial and other resources than we do. In addition, with respect to certain products, some of our competitors are divisions of our OEM customers. We cannot assure that our business will not be adversely affected by competition or that we will be able to maintain our profitability if the competitive environment changes.

The loss or insolvency of any of our major customers would adversely affect our future results.

We are dependent on several principal customers for a significant percentage of our net sales. In 2012, our top three customers were Navistar International Corporation, Deere & Company and Ford Motor Company, which comprised 18%, 13% and 5% of our net sales, respectively. In 2012, our top ten customers accounted for 57% of our net sales. The loss of any significant portion of our sales to these customers or any other customers would have a material adverse effect on our results of operations and financial condition. The contracts we have entered into with many of our customers provide for supplying the customers’ requirements for a particular model, rather than for manufacturing a specific quantity of products. Such contracts range from one year to the life of the model, which is generally three to seven years. These contracts are subject to renegotiation, which may affect product pricing and generally may be terminated by our customers at any time. Therefore, the loss of a contract for a major model or a significant decrease in demand for certain key models or any group of related models sold by any of our major customers could have a material adverse effect on our results of operations and financial condition by reducing cash flows and our ability to spread costs over a larger revenue base. We also compete to supply products for successor models and are subject to the risk that the customer will not select us to produce products on any such model, which could have a material adverse impact on our business, financial condition or results of operations. In addition, we have significant receivable balances related to these customers and other major customers that would be at risk in the event of their bankruptcy.

| 8 |

Consolidation among vehicle parts customers and suppliers could make it more difficult for us to compete successfully.

The vehicle part supply industry has undergone a significant consolidation as OEM customers have sought to lower costs, improve quality and increasingly purchase complete systems and modules rather than separate components. As a result of the cost focus of these major customers, we have been, and expect to continue to be, required to reduce prices. Because of these competitive pressures, we cannot assure you that we will be able to increase or maintain gross margins on product sales to our customers. The trend toward consolidation among vehicle parts suppliers is resulting in fewer, larger suppliers who benefit from purchasing and distribution economies of scale. If we cannot achieve cost savings and operational improvements sufficient to allow us to compete successfully in the future with these larger, consolidated companies, our business, financial condition or results of operations could be adversely affected.

We rely on independent dealers and distributors to sell certain products in the aftermarket sales channel and a disruption to this channel would harm our business.

Because we sell certain products such as security accessories and driver information products to independent dealers and distributors, we are subject to many risks, including risks related to their inventory levels and support for our products. If dealers and distributors do not maintain sufficient inventory levels to meet customer demand, our sales could be negatively impacted.

Our dealer network also sells products offered by our competitors. If our competitors offer our dealers more favorable terms, those dealers may de-emphasize or decline to carry our products. In the future, we may not be able to retain or attract a sufficient number of qualified dealers and distributors. If we are unable to maintain successful relationships with dealers and distributors, or to expand our distribution channels, our business will suffer.

We are dependent on the availability and price of raw materials and other supplies.

We require substantial amounts of raw materials and other supplies, and substantially all such materials we require are purchased from outside sources. The availability and prices of raw materials and other supplies may be subject to curtailment or change due to, among other things, new laws or regulations, suppliers’ allocations to other purchasers and interruptions in production by suppliers, weather emergencies, commercial disputes, acts of terrorism or war, changes in exchange rates and worldwide price levels. As demand for raw materials and other supplies increases as a result of a recovering economy, we may have difficulties obtaining adequate raw materials and other supplies from our suppliers to satisfy our customers. At times, we have experienced difficulty obtaining adequate supplies of semiconductors and memory chips for our Electronics segment and nylon and resins for our Control Devices segment. If we cannot obtain adequate raw materials and other supplies, or if we experience an increase in the price of raw materials and other supplies, our business, financial condition or results of operations could be materially adversely affected.

We use a variety of commodities, including copper, zinc, resins and certain other commodities. Increasing commodity costs could have a negative impact on our results. We have sought to alleviate the effect of increasing costs by including a material pass-through provision in our customer contracts whenever possible, and at times by selectively hedging a portion of our copper exposure. The inability to pass-through increasing commodity costs may have a material adverse effect on our business, financial condition or results of operations.

We must implement and sustain a competitive technological advantage in producing our products to compete effectively.

Our products are subject to changing technology, which could place us at a competitive disadvantage relative to alternative products introduced by competitors. Our success will depend on our ability to continue to meet customers’ changing specifications with respect to quality, service, price, timely delivery and technological innovation by implementing and sustaining competitive technological advances. Our business may, therefore, require significant ongoing and recurring additional capital expenditures and investment in product development and manufacturing and management information systems. We cannot assure you that we will be able to achieve the technological advances or introduce new products that may be necessary to remain competitive. Our inability to continuously improve existing products, to develop new products and to achieve technological advances could have a material adverse effect on our business, financial condition or results of operations.

| 9 |

PST’s Global Positioning Systems (“GPS”) products depend upon satellites maintained by the United States Department of Defense. If a significant number of these satellites become inoperable, unavailable or are not replaced, or if the policies of the United States government for the use of the GPS without charge are changed, our business will suffer.

The GPS is a satellite-based navigation and positioning system consisting of a constellation of orbiting satellites. The satellites and their ground control and monitoring stations are maintained and operated by the United States Department of Defense. The Department of Defense does not currently charge users for access to the satellite signals. These satellites and their ground support systems are complex electronic systems subject to electronic and mechanical failures and possible sabotage. The satellites were originally designed to have lives of seven and a half years and are subject to damage by the hostile space environment in which they operate. However, of the current deployment of satellites in place, the average age is six years.

If a significant number of satellites were to become inoperable, unavailable or are not replaced, it would impair the current utility of our GPS products and the growth of market opportunities. In addition, there can be no assurance that the U.S. government will remain committed to the operation and maintenance of GPS satellites over a long period, or that the policies of the U.S. government that provide for the use of the GPS without charge and without accuracy degradation will remain unchanged. Because of the increasing commercial applications of the GPS, other U.S. government agencies may become involved in the administration or the regulation of the use of GPS signals. Any of the foregoing factors could affect the willingness of buyers of our products to select GPS-based products instead of products based on competing technologies, which could adversely affect our operational revenues and our financial condition.

We may incur material product liability costs.

We may be subject to product liability claims in the event that the failure of any of our products results in personal injury or death and we cannot assure you that we will not experience material product liability losses in the future. We cannot assure you that our product liability insurance will be adequate for liabilities ultimately incurred or that it will continue to be available on terms acceptable to us. In addition, if any of our products prove to be defective, we may be required to participate in government-imposed or customer OEM-instituted recalls involving such products. A successful claim brought against us that exceeds available insurance coverage or a requirement to participate in any product recall could have a material adverse effect on our business, financial condition or results of operations.

Increased or unexpected product warranty claims could adversely affect us.

We typically provide our customers a warranty covering workmanship, and in some cases materials, on products we manufacture. Our warranty generally provides that products will be free from defects and adhere to customer specifications. If a product fails to comply with the warranty, we may be obligated or compelled, at our expense, to correct any defect by repairing or replacing the defective product. We maintain warranty reserves in an amount based on historical trends of units sold and payment amounts, combined with our current understanding of the status of existing claims. To estimate the warranty reserves, we must forecast the resolution of existing claims, as well as expected future claims on products previously sold. The amounts estimated to be due and payable could differ materially from what we may ultimately be required to pay. An increase in the rate of warranty claims or the occurrence of unexpected warranty claims could have a material adverse effect on our customer relations and our financial condition or results of operations.

If we fail to protect our intellectual property rights or maintain our rights to use licensed intellectual property or are found liable for infringing the rights of others, our business could be adversely affected.

Our intellectual property, including our patents, trademarks, copyrights, trade secrets and license agreements, are important in the operation of our businesses, and we rely on the patent, trademark, copyright and trade secret laws of the United States and other countries, as well as nondisclosure agreements, to protect our intellectual property rights. We may not, however, be able to prevent third parties from infringing, misappropriating or otherwise violating our intellectual property, breaching any nondisclosure agreements with us, or independently developing technology that is similar or superior to ours and not covered by our intellectual property. Any of the foregoing could reduce any competitive advantage we have developed, cause us to lose sales or otherwise harm our business. We cannot assure you that any intellectual property will provide us with any competitive advantage or will not be challenged, rejected, cancelled, invalidated or declared unenforceable. In the case of pending patent applications, we may not be successful in securing issued patents, or securing patents that provide us with a competitive advantage for our businesses. In addition, our competitors may design products around our patents that avoid infringement and violation of our intellectual property rights.

| 10 |

We cannot be certain that we have rights to use all intellectual property used in the conduct of our businesses or that we have complied with the terms of agreements by which we acquire such rights, which could expose us to infringement, misappropriation or other claims alleging violations of third party intellectual property rights. Third parties have asserted and may assert or prosecute infringement claims against us in connection with the services and products that we offer, and we may or may not be able to successfully defend these claims. Litigation, either to enforce our intellectual property rights or to defend against claims regarding intellectual property rights of others, could result in substantial costs and in a diversion of our resources. Any such claims and resulting litigation could require us to enter into licensing agreements (if available on acceptable terms or at all), pay damages and cease making or selling certain products and could result in a loss of our intellectual property protection. Moreover, we may need to redesign some of our products to avoid future infringement liability. We also may be required to indemnify customers or other third parties at significant expense in connection with such claims and actions. Any of the foregoing could have a material adverse effect on our business, financial condition or results of operations.

Disruptions in the financial markets could adversely impact the availability and cost of credit which could negatively affect our business.

Our asset-based credit facility (the “Credit Facility”) has a maximum borrowing level of $100.0 million and is scheduled to expire on December 1, 2016. The available borrowing capacity on this Credit Facility is based on eligible current assets, as defined. As of December 31, 2012, we had undrawn borrowing capacity of $74.1 million, based on eligible current assets. We will need to refinance the Credit Facility prior to its expiration. Disruptions in the financial markets, including the bankruptcy, insolvency or restructuring of certain financial institutions, and the general lack of liquidity may adversely impact the availability and cost of credit. We may be required to refinance the credit facility at terms and rates that are less favorable than our current terms and rates, which could adversely affect our business, financial condition or results of operations.

Our debt obligations could limit our flexibility in managing our business and expose us to risks.

As of December 31, 2012, the principal amount of our senior secured notes was $175.0 million. In addition, we are permitted under our Credit Facility and the indenture governing our senior secured notes to incur additional debt, subject to specified limitations. Our high degree of leverage and the terms of our indebtedness may have important consequences including the following:

| · | we may have difficulty satisfying our obligations with respect to our indebtedness, and if we fail to comply with these requirements, an event of default could result; |

| · | we may be required to dedicate a substantial portion of our cash flow from operations to required payments on indebtedness, thereby reducing the availability of cash flow for working capital, capital expenditures and other general corporate activities; |

| · | covenants relating to our debt may limit our ability to obtain additional financing for working capital, capital expenditures and other general corporate activities; |

| · | covenants relating to our debt may limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| · | we may be more vulnerable than our competitors to the impact of economic downturns and adverse developments in our business; and |

| · | we may be placed at a competitive disadvantage against any less leveraged competitors. |

These and other consequences of our substantial leverage and the terms of our indebtedness could have a material adverse effect on our business, financial condition or results of operations.

Covenants in our Credit Facility and our indenture governing the senior secured notes may limit our ability to pursue our business strategies.

Our Credit Facility and the indenture governing our senior secured notes limit our ability to, among other things:

| · | incur additional debt and guarantees; |

| · | pay dividends and repurchase our shares; |

| · | make other restricted payments, including investments; |

| 11 |

| · | create liens; |

| · | sell or otherwise dispose of assets, including capital shares of subsidiaries; |

| · | enter into agreements that restrict dividends from subsidiaries; |

| · | enter into transactions with our affiliates; |

| · | consolidate, merge or sell or otherwise dispose of all or substantially all of our assets; and |

| · | substantially change the nature of our business. |

The agreement governing our Credit Facility also requires us to maintain a ratio of (i) consolidated EBITDA, as defined in the Credit Facility, less specified items to (ii) consolidated fixed charges, as defined in the Credit Facility, of at least 1.10 to 1.00 whenever undrawn availability under the Credit Facility is less than $20.0 million. Our ability to comply with this fixed charge coverage ratio requirement, as well as the restrictive covenants under the terms of our indebtedness, may be affected by events beyond our control.

The restrictions contained in the indenture governing our senior secured notes and the agreement governing our Credit Facility could:

| · | limit our ability to plan for or react to market conditions or meet capital needs or otherwise restrict our activities or business plans; and |

| · | adversely affect our ability to finance our operations, strategic acquisitions, investments or alliances or other capital needs or to engage in other business activities that would be in our interest. |

A breach of any of the restrictive covenants under our indebtedness or our inability to comply with the fixed charge coverage ratio requirement in the Credit Facility could result in a default under the agreement governing the Credit Facility and the indenture governing the senior secured notes. If a default occurs, holders of the senior secured notes could declare all principal and interest to be due and payable, the lenders under the Credit Facility could elect to declare all outstanding borrowings, together with accrued interest and other fees, to be immediately due and payable and terminate any commitments they have to provide further borrowings, and holders of the senior secured notes and the Credit Facility lenders could pursue foreclosure and other remedies against us and our assets. The covenants included in our Credit Facility to date have not and are not expected to have an impact on our financing flexibility.

We may not be able to generate sufficient cash flows to meet our debt service obligations.

Our ability to make scheduled payments on, or to refinance, our obligations with respect to our indebtedness will depend on our financial and operating performance, which in turn will be affected by general economic conditions and by financial, competitive, regulatory and other factors beyond our control. We cannot assure you that our business will generate sufficient cash flow from operations or that future sources of capital will be available to us in an amount sufficient to enable us to service our indebtedness or to fund our other liquidity needs. If we are unable to generate sufficient cash flow to satisfy our debt obligations, we may have to undertake alternative financing plans, such as refinancing or restructuring our debt, selling assets, reducing or delaying capital investments or seeking to raise additional capital. We cannot assure you that any refinancing would be possible, that any assets could be sold or, if sold, of the timing of the sales and the amount of proceeds that may be realized from those sales, or that additional financing could be obtained on acceptable terms, if at all. The Credit Facility and the indenture governing our senior secured notes restrict our ability to dispose of assets and use the proceeds from the disposition. Our inability to generate sufficient cash flows to satisfy our debt obligations, or to refinance our indebtedness on commercially reasonable terms, could materially and adversely affect our business, financial condition and results of operations.

If we cannot make scheduled payments on our debt, we will be in default and, as a result, holders of the senior secured notes could declare all outstanding principal and interest to be due and payable, the lenders under our Credit Facility could terminate their commitments to lend us money, holders of the senior secured notes and the lenders under the Credit Facility could foreclose on or exercise other remedies against the assets securing the senior secured notes and borrowings under our Credit Facility and we could be forced into bankruptcy, liquidation or other insolvency proceedings, which, in each case, could result in your losing your investment in our Common Shares.

| 12 |

Our physical properties and information systems are subject to damage as a result of disasters, outages or similar events.

Our offices and facilities, including those used for design and development, material procurement, manufacturing, logistics and sales are located throughout the world and are subject to possible destruction, temporary stoppage or disruption as a result of any number of unexpected events. If any of these facilities or offices was to experience a significant loss as a result of any of the above events, it could disrupt our operations, delay production, shipments and revenue, and result in large costs to repair or replace these facilities or offices.

In addition, network and information system shutdowns caused by unforeseen events such as power outages, disasters, hardware or software defects, computer viruses and computer security violations pose increasing risks. Such an event could also result in the disruption of our operations, delay production, shipments and revenue, and result in large expenditures necessary to repair or replace such network and information systems.

We may experience increased costs and other disruptions to our business associated with labor unions.

As of December 31, 2012, we had approximately 8,700 employees, approximately 3,000 of whom were salaried, and the balance of whom were paid on an hourly basis. Although we have no collective bargaining agreements covering U.S. employees, certain employees located in Brazil, Estonia, France, Mexico, Spain, Sweden and the United Kingdom either (i) are represented by a union and are covered by a collective bargaining agreement or (ii) are covered by works council or other employment arrangements required by law. We cannot assure you that other employees will not be represented by a labor organization in the future or that any of our facilities will not experience a work stoppage or other labor disruption. Any work stoppage or other labor disruption involving our employees, employees of our customers (many of which customers have employees who are represented by unions), or employees of our suppliers could have a material adverse effect on our business, financial condition or results of operations by disrupting our ability to manufacture our products or reducing the demand for our products.

Compliance with environmental and other governmental regulations could be costly and require us to make significant expenditures.

Our operations are subject to various federal, state, local and foreign laws and regulations governing, among other things:

| · | the discharge of pollutants into the air and water; |

| · | the generation, handling, storage, transportation, treatment, and disposal of waste and other materials; |

| · | the cleanup of contaminated properties; and |

| · | the health and safety of our employees. |

Our business, operations and facilities are subject to environmental and health and safety laws and regulations, many of which provide for substantial fines for violations. The operation of our manufacturing facilities entails risks and we cannot assure you that we will not incur material costs or liabilities in connection with these operations. In addition, potentially significant expenditures could be required in order to comply with evolving environmental, health and safety laws, regulations or requirements that may be adopted or imposed in the future. Changes in environmental, health and safety laws, regulations and requirements or other governmental regulations could increase our cost of doing business or adversely affect the demand for our products.

We also may be required to investigate or clean up contamination resulting from past or current uses of our properties. At our former Sarasota, Florida, facility, for example, groundwater and soil contamination caused by operations before we acquired the facility will require future cleanup. The costs of such remediation could have a material adverse effect on our business, financial condition or results of operations. Although no other environmental matters have been identified, other matters involving environmental contamination may also have a material adverse effect on our business, financial condition or results of operations.

We are subject to risks related to our international operations.

Approximately 34.8% of our net sales in 2012 were derived from sales outside of North America. At December 31, 2012, significant concentrations of net assets outside of North America included $179.1 million assigned to South America and $55.8 million assigned to Europe and other. Non-current assets outside of North America accounted for approximately 70.6% of our non-current assets as of December 31, 2012. International sales and operations are subject to significant risks, including, among others:

| 13 |

| · | political and economic instability; |

| · | restrictive trade policies; |

| · | economic conditions in local markets; |

| · | currency exchange controls; |

| · | labor unrest; |

| · | difficulty in obtaining distribution support and potentially adverse tax consequences; and |

| · | the imposition of product tariffs and the burden of complying with a wide variety of international and U.S. export laws. |

We have foreign currency translation and transaction risks that may materially adversely affect our operating results, financial condition and liquidity.

The financial position and results of operations of many of our international subsidiaries are initially recorded in various foreign currencies and then translated into U.S. dollars at the applicable exchange rate for inclusion in our consolidated financial statements. The strengthening of the U.S. dollar against these foreign currencies ordinarily has a negative effect on our reported sales and operating margin (and conversely, the weakening of the U.S. dollar against these foreign currencies has a positive impact). The volatility of currency exchange rates may materially adversely affect our operating results.

Our annual effective tax rate could be volatile and materially change as a result of changes in the mix of earnings and other factors.

Our overall effective tax rate is equal to our total tax expense as a percentage of our total earnings before tax. However, tax expense and benefits are not recognized on a global basis, but rather on a jurisdictional or legal entity basis. Losses in certain jurisdictions may not provide a current financial statement tax benefit. As a result, changes in the mix of earnings between jurisdictions, among other factors, could have a significant effect on our overall effective tax rate.

We may not be able to successfully integrate acquisitions into our business or may otherwise be unable to benefit from pursuing acquisitions.

Failure to successfully identify, complete and/or integrate acquisitions could have a material adverse effect on us. A portion of our growth in sales and earnings has been generated from acquisitions and subsequent improvements in the performance of the businesses acquired. We expect to continue a strategy of selectively identifying and acquiring businesses with complementary products. We cannot assure you that any business acquired by us will be successfully integrated with our operations or prove to be profitable. We could incur substantial indebtedness in connection with our acquisition strategy, which could significantly increase our interest expense. Covenant restrictions relating to such indebtedness could restrict our ability to pay dividends, fund capital expenditures and consummate additional acquisitions. We anticipate that acquisitions could occur in geographic markets, including foreign markets, in which we do not currently operate. As a result, the process of integrating acquired operations into our existing operations may result in unforeseen operating difficulties and may require significant financial resources that would otherwise be available for the ongoing development or expansion of existing operations. Any failure to successfully integrate such acquisitions could have a material adverse effect on our business, financial condition or results of operations.

Item 1B. Unresolved Staff Comments.

None.

| 14 |

Item 2. Properties.

The Company and its joint venture currently own or lease 21 manufacturing facilities that are in use, which together contain approximately 1.8 million square feet of manufacturing space. Of these manufacturing facilities, four are used by our Electronics reportable segment, eight are used by our Wiring reportable segment, six are used by our Control Devices reportable segment, two are used by our PST reportable segment and one is used by our joint venture company, Minda. The following table provides information regarding our facilities:

| 15 |

| Owned/ | Square | |||||

| Location | Leased | Use | Footage | |||

| Electronics | ||||||

| Juarez, Mexico(A) | Owned | Manufacturing | 183,854 | |||

| Tallinn, Estonia(A) | Leased | Manufacturing | 85,911 | |||

| Orebro, Sweden | Leased | Manufacturing | 77,472 | |||

| Stockholm, Sweden | Leased | Engineering Office/Division Office | 43,847 | |||

| Dundee, Scotland | Leased | Manufacturing/Sales Office/Engineering Office | 32,753 | |||

| Bayonne, France | Leased | Sales Office/Warehouse | 9,655 | |||

| Stockholm, Sweden | Owned | Sales Office/Warehouse | 2,013 | |||

| Madrid, Spain | Leased | Sales Office/Warehouse | 1,560 | |||

| Rome, Italy | Leased | Sales Office | 1,216 | |||

| Wiring | ||||||

| Portland, Indiana | Owned | Manufacturing | 182,000 | |||

| Saltillo, Mexico | Leased | Manufacturing | 144,929 | |||

| Chihuahua, Mexico | Owned | Manufacturing | 135,569 | |||

| Monclova, Mexico | Leased | Manufacturing | 114,140 | |||

| Walled Lake, Michigan | Leased | Manufacturing | 80,416 | |||

| Chihuahua, Mexico | Leased | Manufacturing | 61,619 | |||

| El Paso, Texas | Leased | Warehouse | 50,000 | |||

| Chihuahua, Mexico | Leased | Manufacturing | 49,805 | |||

| Chihuahua, Mexico | Leased | Warehouse | 17,025 | |||

| Portland, Indiana | Leased | Warehouse | 25,000 | |||

| Warren, Ohio | Leased | Engineering Office/Division Office | 24,570 | |||

| Chihuahua, Mexico | Leased | Engineering Office/Manufacturing | 10,000 | |||

| Eagle Pass, Texas | Leased | Warehouse | 6,400 | |||

| Control Devices | ||||||

| Lexington, Ohio | Owned | Manufacturing/Division Office | 219,612 | |||

| Canton, Massachusetts | Owned | Manufacturing | 132,560 | |||

| Suzhou, China(B) | Leased | Manufacturing/Warehouse | 25,737 | |||

| Lexington, Ohio | Leased | Warehouse | 15,000 | |||

| Suzhou, China | Leased | Manufacturing | 12,228 | |||

| Lexington, Ohio | Leased | Warehouse | 7,788 | |||

| Shanghai, China | Leased | Engineering Office/Sales Office | 6,345 | |||

| Suzhou, China | Leased | Manufacturing | 5,737 | |||

| Lexington, Ohio | Leased | Manufacturing | 2,700 | |||

| PST | ||||||

| Manaus, Brazil | Owned | Manufacturing | 102,247 | |||

| São Paulo, Brazil | Owned | Manufacturing/Engineering Office/Division Office | 45,467 | |||

| Buenos Aires, Argentina | Leased | Sales Office | 3,551 | |||

| Corporate | ||||||

| Novi, Michigan | Leased | Sales Office/Engineering Office | 9,400 | |||

| Warren, Ohio | Owned | Headquarters | 7,500 | |||

| Stuttgart, Germany | Leased | Sales Office/Engineering Office | 1,000 | |||

| Seoul, South Korea | Leased | Sales Office | 330 | |||

| Joint Venture | ||||||

| Pune, India | Owned | Manufacturing/Engineering Office/Sales Office | 80,000 |

| 16 |

| (A) | These facilities are also used in the Control Devices reportable segment. |

| (B) | This facility is also used in the Electronics reportable segment. |

Item 3. Legal Proceedings.

We are involved in certain legal actions and claims arising in the ordinary course of business. However, we do not believe that any of the litigation in which we are currently engaged, either individually or in the aggregate, will have a material adverse effect on our business, consolidated financial position or results of operations. We are subject to the risk of exposure to product liability claims in the event that the failure of any of our products causes personal injury or death to users of our products and there can be no assurance that we will not experience any material product liability losses in the future. We maintain insurance against such product liability claims. In addition, if any of our products prove to be defective, we may be required to participate in a government-imposed or customer OEM-instituted recall involving such products.

Item 4. Mine Safety Disclosure.

Not Applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our shares are listed on the New York Stock Exchange (“NYSE”) under the symbol “SRI.” As of February 22, 2013, we had 28,462,649 Common Shares, without par value, outstanding which were owned by approximately 300 registered holders, including Common Shares held in the names of brokers and banks (so-called “street name” holdings) who are record holders with approximately 2,500 beneficial owners.

The Company has not historically paid or declared dividends, which are restricted under both our senior secured notes and our asset-based credit facility (the “Credit Facility”), on our Common Shares. We may only pay cash dividends in the future if immediately prior to and immediately after the payment is made, no event of default shall have occurred and outstanding indebtedness under our Credit Facility is not greater than or equal to $20.0 million before and after the payment of the dividend. We currently intend to retain our earnings for acquisitions, working capital, capital expenditures, general corporate purposes and reduction in outstanding indebtedness. Accordingly, we do not expect to pay cash dividends in the foreseeable future.

High and low sales prices for our Common Shares for each quarter ended during 2012 and 2011 are as follows:

| Quarter Ended | High | Low | ||||||||

| 2012 | March 31 | $ | 10.89 | $ | 8.26 | |||||

| June 30 | $ | 10.15 | $ | 6.21 | ||||||

| September 30 | $ | 7.03 | $ | 4.45 | ||||||

| December 31 | $ | 5.36 | $ | 4.51 | ||||||

| 2011 | March 31 | $ | 17.22 | $ | 14.18 | |||||

| June 30 | $ | 15.44 | $ | 12.90 | ||||||

| September 30 | $ | 15.45 | $ | 5.17 | ||||||

| December 31 | $ | 9.17 | $ | 4.53 | ||||||

| 17 |

The following table presents information with respect to repurchases of Common Shares made by us during the three months ended December 31, 2012. These shares were delivered to us by employees as payment for the withholding taxes due upon the vesting of stock awards:

| Total number of | Maximum number | |||||||||||||||

| shares purchased | of shares that may | |||||||||||||||

| as part of publicly | yet be purchased | |||||||||||||||

| Total number of | Average price | announced plans | under the plans or | |||||||||||||

| Period | shares purchased | paid per share | or programs | programs | ||||||||||||

| 10/1/12-10/31/12 | 603 | $ | 4.93 | - | - | |||||||||||

| 11/1/12-11/30/12 | - | - | - | - | ||||||||||||

| 12/1/12-12/31/12 | - | - | - | - | ||||||||||||

| Total | 603 | $ | 4.93 | - | - | |||||||||||

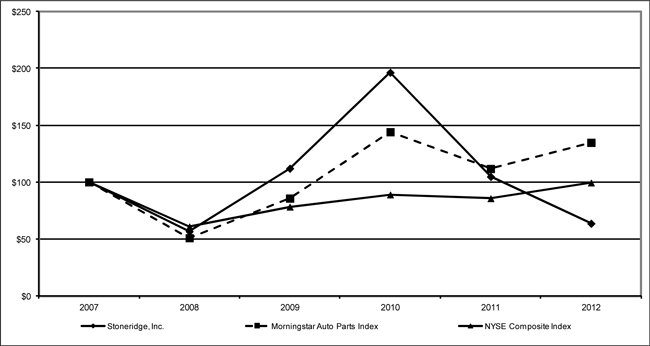

Set forth below is a line graph comparing the cumulative total return of a hypothetical investment in our Common Shares with the cumulative total return of hypothetical investments in the Morningstar Auto Parts Industry Group Index and the NYSE Composite Index based on the respective market price of each investment as of December 31, 2007, 2008, 2009, 2010, 2011 and 2012 assuming in each case an initial investment of $100 on December 31, 2007, and reinvestment of dividends.

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |||||||||||||||||||

| Stoneridge, Inc. | $ | 100 | $ | 56 | $ | 112 | $ | 196 | $ | 105 | $ | 64 | ||||||||||||

| Morningstar Auto Parts Index (A) | $ | 100 | $ | 51 | $ | 86 | $ | 144 | $ | 111 | $ | 135 | ||||||||||||

| NYSE Composite Index | $ | 100 | $ | 61 | $ | 78 | $ | 89 | $ | 86 | $ | 99 | ||||||||||||

| (A) | The Morningstar Auto Parts Group Index was formerly known as the Hemscott Group – Industry Group 333 Index. |

For information on “Related Stockholder Matters” required by Item 201(d) of Regulation S-K, refer to Item 12 of this report.

| 18 |

Item 6. Selected Financial Data.

The following table sets forth selected historical financial data and should be read in conjunction with the consolidated financial statements and notes related thereto and other financial information included elsewhere herein. The selected historical data was derived from our consolidated financial statements.

| Years ended December 31 (in thousands, except per share data) | 2012(A) | 2011(A) | 2010 | 2009 | 2008 | |||||||||||||||

| Statement of Operations Data: | ||||||||||||||||||||

| Net Sales: | ||||||||||||||||||||

| Electronics | $ | 216,053 | $ | 238,537 | $ | 179,895 | $ | 139,182 | $ | 263,697 | ||||||||||

| Wiring | 329,831 | 328,374 | 260,965 | 195,452 | 305,225 | |||||||||||||||