UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

| X | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the fiscal year ended December 31, 2011 |

| |

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the transition period from __________ to __________ Commission file number 001-13255 |

SOLUTIA INC. (Exact name of registrant as specified in its charter) |

Delaware (State or other jurisdiction of incorporation or organization) | 43-1781797 (I.R.S. Employer Identification No.) |

| |

575 Maryville Centre Drive, P.O. Box 66760, St. Louis, Missouri 63166-6760 (Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including area code: (314) 674-1000

Securities registered pursuant to Section 12(b) of the Act:

Registrant’s telephone number, including area code: (314) 674-1000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| $.01 par value Common Stock | New York Stock Exchange |

| Preferred Stock Purchase Rights | New York Stock Exchange |

| Warrants, each exercisable for one share of Common Stock | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act:

Title of each class

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ X ] Yes [ ] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. [ ] Yes [ X ] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [ X ] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ X ] Accelerated filer [ ] Non-accelerated filer [ ] (Do not check if smaller reporting company)

Smaller Reporting Company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). [ ] Yes [X] No

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. [ X] Yes [ ] No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2011): approximately $2.3 billion.

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date: 122,412,740 shares of common stock, $.01 par value, outstanding as of the close of business on January 31, 2012.

EXPLANATORY NOTE

This amendment No. 1 on Form 10-KA (“Amendment No. 1) is being filed to (i) remove the section for Documents Incorporated by Reference on the cover page; (ii) replace Part III, Items 10 through 14 and (iii) add 2 exhibits to Item 15 and update Item 15 of the Company’s Annual Report on Form 10-K for the period ending December 31, 2011 as filed on February 24, 2012 (the “Original Filing”). Except as otherwise stated herein, no other information contained in the Original Filing has been updated by this Amendment No. 1.

This amendment No. 1 should be read in conjunction with our periodic filings made with the Securities and Exchange Commission (“SEC”) subsequent to the date of the Original Filing, including any amendments to those filings, as well as any Current Reports filed on Form 8-K subsequent to the date of the Original Filing.

Exhibits 31.1 (a) and 31.2 (a) hereto have been provided with respect to and in light of the disclosures being amended.

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements which can be identified by the use of words such as “believes,” “expects,” “may,” “will,” “intends,” “plans,” “estimates,” “estimated,” or “anticipates,” or other comparable terminology, or by discussions of strategy, plans or intentions. These statements are based on management’s current beliefs, expectations, and assumptions about the industries in which we operate. Forward-looking statements are not guarantees of future performance and are subject to significant risks and uncertainties that may cause actual results or achievements to be materially different from the future results or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, those risks and uncertainties described in the Item 1A. Risk Factors section of this report. We disclaim any intent or obligation to update or revise any forward-looking statements in response to new information, unforeseen events, changed circumstances or any other occurrence.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors

The following table shows information about Solutia’s directors on April 30, 2012:

Name and Age of Director | Director Biographical Information |

| Jeffry N. Quinn, age 53 | Mr. Quinn serves as our President, Chief Executive Officer and Chairman of the Board. Mr. Quinn joined Solutia in January 2003 as Senior Vice President, General Counsel and Secretary. Mr. Quinn became Chief Restructuring Officer in June 2003. Mr. Quinn became our President and CEO and a director in May 2004 and was elected Chairman of the Board in February 2006. Prior to joining Solutia, Mr. Quinn was Executive Vice President of Premcor, Inc., one of the nation’s largest independent oil refiners in the United States, which prior to its going public, was in the portfolio of companies held by The Blackstone Group. (Premcor was subsequently acquired by Valero Energy Corporation.) Mr. Quinn’s responsibilities included legal, human resources, governmental and public affairs and strategic planning functions and he was instrumental in taking the company public in April 2002. Before joining Premcor, Mr. Quinn served as Senior Vice President, General Counsel and Secretary of Arch Coal, Inc., the nation’s second largest coal producer. There he was a member of the management team that grew the company through acquisitions from a small privately held entity to a publicly traded company. Mr. Quinn is imminently qualified to serve as director with senior level executive leadership experience in diverse industries and broad experience in a wide range of functional areas, including strategic planning, mergers and acquisitions, human resources, and legal and governmental affairs. He also has extensive experience in board process and governance. Under Mr. Quinn’s guidance and direction, our Company was restructured through the bankruptcy process and transformed into a premier specialty chemical company. Mr. Quinn joined the board of directors of Tronox Incorporated upon its emergence from Chapter 11 bankruptcy proceedings on February 14, 2011, and is Chairman of its Compensation Committee. Tronox Incorporated is the world’s third largest producer and marketer of titanium dioxide pigment. Mr. Quinn also served as a director of Tecumseh Products Company from August 2007 until August 2009. |

William T. Monahan, age 64 | Mr. Monahan is the retired Chairman and Chief Executive Officer of Imation Corporation, a developer, manufacturer and marketer of data storage and imaging products and a spin off from 3M Company, where he served in that capacity from 1996 to 2004. Mr. Monahan served as a director from January 2005 and Chairman of the Board and interim CEO from August 2006 to 2007 of Novelis Inc., a manufacturer of aluminum and a spin off of Alcan Aluminum. Mr. Monahan is a director of Hutchinson Technology, Inc., where he serves as the Chairman of the Compensation Committee and a member of the Nominating and Governance Committee, Mosaic Company, where he serves as the Chairman of the Compensation Committee and a member of the Audit and Executive Committees and Pentair, Inc. where he serves as lead director and a member of the Compensation and Nominating and Governance Committees. Our Governance Committee believes Mr. Monahan’s diverse and far-ranging executive and operational experience as a CEO of turnaround companies well prepares and qualifies him to serve as Solutia’s lead director and member of our Executive Compensation and Development Committee and Governance Committee. Mr. Monahan joined our Board in 2008. |

Robert K. deVeer, Jr., age 65 | Mr. deVeer serves as President of deVeer Capital LLC, a private investment company which he founded in 1996. From May 1995 until December 1996, Mr. deVeer served as Head of Industrial Group at New York-based Lehman Brothers. From 1973 to 1995, he held positions of increasing responsibility at New York-based CS First Boston, including Head of Project Finance, Head of Industrials and Head of Natural Resources. He was a managing director, member of the investment banking committee and a trustee of the First Boston Foundation. Mr. deVeer brings to our Board over twenty-five years of extensive experience and knowledge of international banking and finance and complex mergers and acquisitions. The Governance Committee believes Mr. deVeer’s long-term experience with and understanding of the credit markets, analyzing risk and performing financial strategic planning are particularly helpful as the Company works to restructure its post-emergence capital structure and to explore growth opportunities. Mr. deVeer has also served since 1998 as a director of Palatin Technologies, Inc. where he is the Chairman of its Audit Committee. This experience also provides valuable insights for his service as a member of our Audit and Executive Compensation and Disclosure Committees. Mr. deVeer joined our Board in 2008. |

James P. Heffernan, age 66 | Mr. Heffernan brings decades of significant business experience to our board. Currently, he serves as a member of the board of directors of United Natural Foods, Inc., a leading distributor of natural and organic foods and of Command Security Corporation, a provider of uniformed security officers, aviation security services and support security services to commercial, financial, industrial, aviation and governmental customers throughout the United States. Mr. Heffernan also serves as Vice Chairman and as a Trustee of the New York Racing Association, which is the governing body for thoroughbred racing at Belmont, Aqueduct and Saratoga. Previously, Mr. Heffernan served as President of WHR Management Corp. and as General Partner and President of Whitman Heffernan & Rhein Workout Funds, an investment banking firm specializing in corporate reorganizations. From 1993 to 2000, Mr. Heffernan served as Chief Financial Officer, Chief Operating Officer and as a Director of Danielson Holding Corporation, which had ownership interests in a number of insurance and trust operations. From 1993 until 2000, Mr. Heffernan served as a Director and as Chairman of the Finance Committee of Columbia Energy Group, a vertically integrated gas company with several billion dollars of annual revenues and assets (which was acquired by NiSource in November 2000). The totality of his professional experience, together with his other board service has provided him with the background and experience of board processes, function, compensation practices and oversight of management which is valuable to the Board, the Audit Committee and in his role as Chairman of the Executive Compensation and Development Committee. Mr. Heffernan has been a director since 2008. |

Edgar G. Hotard, age 68 | Mr. Hotard has been an independent consultant/investor since 1999 when he retired as President and Chief Operating Officer of Praxair, Inc., a leading producer and distributor of specialty gases. Under his leadership, Praxair’s global sales more than doubled to $5 billion, and the company executed a successful expansion into the Asia Pacific region. In 1992, Mr. Hotard co-led the spin-off of Praxair from Union Carbide Corporation, where he served as Corporate Vice President. Since September 2004, he has served as a Venture Partner of ARCH Venture Partners and, since October 2010, as a Partner at Hao Capital, a private equity firm based in Hong Kong and Beijing, China, investing growth capital in Chinese firms. Since March 2000, he has served as an advisor to the Monitor Group, a global strategy consulting firm, for their Asian practice and as the Chairman of the Monitor Group (China). Mr. Hotard is the Monitor Group’s representative to the China Business Council for Sustainable Development. Mr. Hotard also serves as a director of Albany International Corporation, the world’s leading maker of paper machine clothing, where he serves as Chairman of its Audit Committee and member of its Nominating and Governance Committee. He also serves as a director of Shona Energy Company, an international oil an gas exploration, development and acquisition company, where he serves as chairman of the Audit Committee. Prior to its merger into Technip, Mr. Hotard served as lead director, of Global Industries, Ltd., where he also served as a member of its Nominating & Governance and Technical, Safety, Health & Environment Committees. The merger was effective December 1, 2011. Mr. Hotard was a founding sponsor of the China Economic and Technology Alliance and of a joint MBA program between Renmin University, Beijing and the School of Management, State University of Buffalo, New York. Mr. Hotard has extensive experience in assisting non-Chinese companies to develop their businesses and business relationships in China. His extensive background and first hand experience in China is valuable to the board as the board oversees our efforts to develop our growing presence in China and the surrounding region. Additionally, his executive and operational experience provide insights that are valuable to the board and to the Governance and Risk Committees on which he serves. Mr. Hotard has been a director since 2011. |

W. Thomas Jagodinski, age 55 | Mr. Jagodinski retired as President, Chief Executive Officer and director of Delta and Pine Land Company, a multi-national cotton and soybean planting seed company. Mr. Jagodinski spent sixteen years with Delta and Pine Land Company, working his way through increasing levels of responsibility, from Corporate Controller and Treasurer to Vice President, Finance, Treasurer, and then Senior Vice President and Chief Financial Officer prior to becoming President and CEO. Before joining Delta Pine and Land Company, Mr. Jagodinski held senior positions in public accounting firms. Mr. Jagodinski serves as a director of Lindsay Corporation, where he is also Chairman of the Audit Committee and a director of Phosphate Holdings Inc., where he is Chairman of the Board. The Governance Committee finds Mr. Jagodinski’s financial and auditing background to be extremely helpful to the board and suited to his role as Chairman of our Audit Committee. Mr. Jagodinski brings to us previous experience as a Chief Financial Officer, and Audit Committee chair of a public company, uniquely qualifying him to serve as our Audit Committee Chairman and as a member of the Risk Committee. Mr. Jagodinski has been a director since 2008. |

Robert A. Peiser, age 64 | Mr. Peiser is involved in active service on corporate and not-for-profit boards. Mr. Peiser serves as a director of USA Truck Inc., where he serves as a member of the Compensation and Governance Committees and Team Inc., where he serves as a member of the Compensation and Executive Committees. During the last five years, but not currently, he also served as a director of Omniflight Helicopters, Inc., Imperial Sugar and the Signature Group Holdings, Inc. Our Governance Committee believes Mr. Peiser’s diverse executive and board experience provides him with key skills in working with directors, and understanding board processes and functions. Furthermore, Mr. Peiser is the immediate past Chairman of the Board and continues to serve on the board of the Texas TriCities Chapter of the National Association of Corporate Directors (“NACD”). His work with the NACD contributes to his being a valuable resource to our Board and our Governance Committee where he serves as Chairman, in the area of corporate governance best practices. Mr. Peiser is also a member of our Risk Committee. Mr. Peiser has been a director since 2008. |

| William C. Rusnack, age 67 | Mr. Rusnack is a private investor. Our Governance Committee believes Mr. Rusnack’s varied executive experiences, including his diversified background in managing and directing companies gives him superior qualifications and skills to serve as a Director. Mr. Rusnack served as President and Chief Executive Officer and a director of Premcor, Inc., one of the largest independent oil refiners in the United States. (Premcor was subsequently acquired by Valero Energy Corporation.) Prior to joining Premcor, Mr. Rusnack was President of ARCO Products Company, the refining and marketing division of Atlantic Richfield Company. During his 31-year career with ARCO, he was also President of ARCO Transportation Company and Vice President of Corporate Planning and Senior Vice President, Marketing and Employee Relations. In addition to Mr. Rusnack’s broad-based executive experience, he has gained significant experience with other companies through his board service as a director of three public companies. Mr. Rusnack has served since 2001 as a director of Sempra Energy, an energy services holding company. He currently serves as its Lead Director and as a member of its Corporate Governance and Executive Committee and Chairman of its Compensation Committee. Mr. Rusnack has also been a director since 2002 of Peabody Energy Corporation where he serves as Chairman of the Audit Committee and a member of the Executive Committee. Additionally, since 1997, Mr. Rusnack has served as a director of Flowserve Corporation, one of the world’s leading providers of fluid motion and control products and services, where he currently serves as Chairman of the Organization and Compensation Committee and a member of the Corporate Governance and Nominating Committee. He is a member of the American Petroleum Institute, the Dean’s Advisory Council of the Graduate School of Business at the University of Chicago and the National Council of the Olin School of Business at Washington University in St. Louis. His extensive board service with key leadership positions, provides him with substantial insights that are valuable to our Board. Mr. Rusnack is a member of our Executive Compensation and Development Committee and Audit Committee and has been a director since 2010. |

Gregory C. Smith, age 60 | Mr. Smith is Principal of Greg C. Smith LLC, a consulting firm focused on financial service, automotive and environmental markets. Previously, Mr. Smith was employed by Ford Motor Company for over 30 years until his retirement in 2006. Mr. Smith held various executive-level management positions at Ford Motor Company, most recently serving as Vice Chairman from 2005 until 2006, Executive Vice President and President — Americas from 2004 until 2005, Group Vice President — Ford Motor Company and Chairman and Chief Executive Officer — Ford Motor Credit Company from 2002 to 2004, Vice President, Ford Motor Company, and President and Chief Operating Officer, Ford Motor Credit Company, from 2001 to 2002. Mr. Smith serves as a director of Lear Corporation, where he chairs the Audit Committee and is a member of the Compensation Committee. He is also a director of Penske Corporation, where he serves as a member of the Audit and Compensation Committees and previously served as a director of Fannie Mae from 2005 until 2008. Mr. Smith also serves as a director of Challenge Aspen, a non-profit organization that provides recreational opportunities for people with disabilities. Mr. Smith brings a wealth of experience in operations, engineering, product development, marketing, sales, strategy and financial services. His extensive experience with the automotive sector uniquely qualifies him to serve as a director where his insight in operational and manufacturing excellence and deep knowledge of the automotive industry provides great value. Mr. Smith serves as Chairman of our Risk Committee and a member of our Governance Committee and has been a director since 2008. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires our directors, executive officers and any persons beneficially holding more than ten percent of our common stock to report their ownership of common stock and any changes in that ownership to the SEC and the New York Stock Exchange. The SEC has established specific due dates for these reports, and we are required to report in this annual report on Form 10-K any failure to file by these dates. Based solely on a review of the copies of the reports furnished to us and written representations that no other such statements were required, we believe that all such reports of our directors, executive officers and persons beneficially holding more than ten percent of our common stock were filed on a timely basis.

Code of Ethics for Senior Financial Officers

Our Board of Directors has adopted a Code of Ethics for Senior Financial Officers. This code applies to our CEO and the other senior officers who have financial responsibilities, including our chief financial officer, treasurer, controller and general counsel. This code is filed as an exhibit to this Annual Report on Form 10-K. Any person who wishes to obtain a copy of our Code of Ethics may do so by writing to Investor Relations, Solutia Inc., 575 Maryville Centre Drive, St. Louis, Missouri 63141.

Audit Committee

The members of the Audit Committee of our Board of Directors are: W. Thomas Jagodinski, Chairman of the Committee, Robert K. deVeer, Jr., James P. Heffernan and William C. Rusnack. The Board has also determined, in its judgment, that all members of the Audit Committee are “audit committee financial experts” and that each member of the Audit Committee is “financially literate.” The Board of Directors has determined that none of the members of the Audit Committee currently serves on the audit committees of more than three public companies.

ITEM 11. EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

We seek to closely align the interests of our named executive officers with the interests of our shareholders. Our Executive Compensation and Development Committee (the “ECDC”) has designed compensation programs to reward our named executive officers for the achievement of short-term and long-term operational and strategic goals and the achievement of increased total shareholder return, while at the same time avoiding the encouragement of unnecessary or excessive risk-taking. Our named executive officers’ total compensation is comprised of a mix of base salary, annual cash incentive awards and long-term incentive awards that include both cash and performance-based equity awards.

Our Performance for 2011

The Company achieved strong financial performance in 2011 and we believe our employees, including our named executive officers were instrumental in helping us achieve these results. Certain highlights of our 2011 performance include the following:

| · | We achieved annual revenue growth of 8% over 2010 actual results. |

| · | Our Earnings Per Share, a performance measure defined and used in our annual incentive plan, grew 27% over 2010 actual results, significantly ahead of our revenue performance. |

| · | Our adjusted EBITDA1 margin was 24.7%; and continues to rank us in the top tier of the specialty chemical industry. |

| · | We completed two highly synergistic acquisitions that significantly expand our technology capabilities. |

| · | Strong cash generation allowed us to pay down our debt and improved our leverage profile from 2.9 in the prior year to 2.5 as of year end. |

Our Pay Decisions for 2011

| · | Increased base salaries 3.3% for Messrs. Quinn, Sullivan DeBolt and Voss; 6.3% for Mr. Berra and set Mr. Donnelly’s at $425,000 upon his promotion to Executive Vice President and Chief Operating Officer. |

| · | Determined to pay out annual incentives at 0.88 times target, reflecting above target performance on revenue growth and strategic measures and below target performance on EPS and cash flow from continuing operations. |

| · | Granted long-term incentives above each named executive office’s guidelines in recognition of each of their leadership in executing on our key strategic initiatives and achieving our strong financial results. |

Our Named Executive Officers

For 2011, our named executive officers are the following individuals:

| · | Jeffry N. Quinn, President, Chief Executive Officer, and Chairman of the Board |

| · | James M. Sullivan, Executive Vice President and Chief Financial Officer |

| · | D. Michael Donnelly, Executive Vice President and Chief Operating Officer |

| · | Robert T. DeBolt, Senior Vice President – Business Operations |

| · | Paul J. Berra, III, Senior Vice President, Legal and Governmental Affairs and General Counsel |

1 We define Adjusted EBITDA as income from continuing operations attributable to Solutia before interest expense, loss on debt extinguishment or modification, income taxes, depreciation and amortization, certain gains and losses that affect comparability, cost overhang associated with discontinued operations and non-cash share-based stock compensation expense.

Additionally, Mr. James R. Voss, our former Executive Vice President and Chief Operating Officer, was terminated in August 2011. Under applicable SEC rules, Mr. Voss is deemed a named executive officer for whom certain information must be disclosed in this Item.

In determining 2012 compensation for our named executive officers, the ECDC reviewed the results of our shareholder advisory vote on executive compensation (“Say on Pay”) in 2011. At the 2011 annual meeting of stockholders over 93% of the shares present and entitled to vote were voted in support of our Say on Pay proposal. Based on the 2011 Say on Pay results, the Committee concluded that our overall compensation program as it relates to our named executive officers enjoys our shareholders’ support and does not require revision to address any broad shareholder concerns.

Compensation Philosophy and Objectives

Our philosophy for compensating executives is to motivate and reward exceptional performance on a company and individual basis. Our program is designed to capture many aspects of performance, including annual financial and strategic results, relative performance against our industry and longer-term shareholder value creation. We provide a competitive level of total compensation at target that can vary substantially for performance above and below target to attract and retain executives qualified to execute our business objectives and our strategy and to motivate them to contribute to our short-term and long-term success.

In addition to company performance, compensation levels for our named executive officers reflect factors such as each named executive officer’s leadership ability, overall knowledge and experience in his particular segment of our business, the competitive compensation environment for such individual, that person’s unique skills and his expected future contribution to the success of the Company. Our ECDC’s approach to compensation includes efforts to ensure that compensation policies and practices are consistent with effective risk management. We believe our compensation philosophy reflects a responsible balance of competitive compensation, sound risk management and accountability to stockholders.

The Role of our ECDC, our Compensation Consultant and our Management

The Role of our ECDC. The ECDC oversees the development and administration of our executive compensation program, including the design of its underlying compensation philosophy and related policies. The ECDC determines all compensation for our executive officers, including our named executive officers. The ECDC’s responsibilities include reviewing and establishing the overall compensation program, including base salaries, annual incentive opportunities, equity compensation, executive perquisites and any other form of executive compensation for our named executive officers including our CEO.

The ECDC reviews management’s risk assessment of the Company’s performance-based compensation programs. The ECDC also oversees the performance evaluation of our CEO and makes its decisions relating to our CEO’s compensation after discussion and analysis from the independent members of our Board.

The Role of our Compensation Consultant. Under the ECDC’s charter, the ECDC has the authority to select, retain and compensate one or more executive compensation consultants and/or other experts as it deems necessary to carry out its responsibilities. Since 2009, the ECDC has retained Semler Brossy Consulting Group (“Semler Brossy”) as its independent compensation consultant to ensure that it would receive independent advice on its compensation programs and decisions.

At the ECDC’s request, Semler Brossy provides research and market data regarding executive compensation and advises the ECDC on all principal aspects of executive compensation, including market practices, compensation program design and related subjects. Semler Brossy reports directly to the ECDC, although its personnel may meet with management from time to time to gather information or to obtain management’s perspective on executive compensation matters. A consultant from Semler Brossy attends relevant parts of the ECDC meetings in person or by phone. Semler Brossy does not provide any other services to us.

The Role of Management. Our CEO participates in ECDC meetings at the ECDC’s request to provide:

| · | Background information regarding our operating and financial objectives; |

| · | His evaluation of the performance of the senior executive officers, including all of our other named executive officers; and |

| · | Compensation and professional development recommendations for senior executive officers, including all of our other named executive officers. |

Our CEO has no role in determining his own compensation.

Our human resources department is responsible for managing and implementing the day-to-day aspects of our executive compensation program established by the ECDC. Our Senior Vice President and Chief Human Resources Officer serves as the primary management liaison to the ECDC.

Compensation At Risk

We believe that there should be a strong relationship between pay and performance (both financial results and stock price), and our executive compensation program reflects this belief. Additionally, a higher percentage of pay is at-risk at more senior levels in the organization. In particular, the annual incentive program and equity awards represent a significant portion of our executive compensation program and this variable compensation is considered at-risk as it is directly dependent upon the achievement of pre-established performance measures and/or stock price.

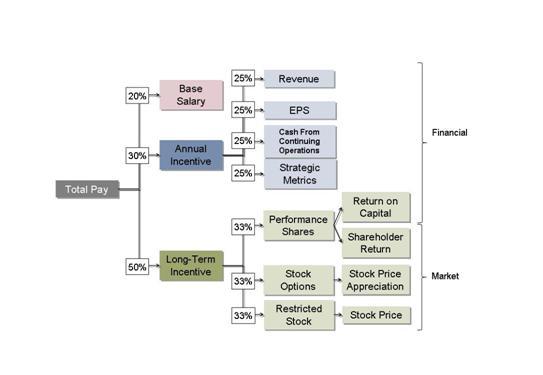

The following chart illustrates the general framework for the elements of compensation and the weighting by our ECDC of such elements for 2011 compensation at target for our CEO and the interplay of the performance measurements for at–risk compensation

Determining Compensation

To make decisions regarding the compensation of each executive, the ECDC reviews the executive’s performance and accomplishments over the prior year with our CEO. The CEO makes recommendations to the ECDC about base salary increases and any variations for senior executives in the applicable annual bonus or equity grant value guidelines adopted by the ECDC, except with respect to his own compensation. The ECDC takes into account the competitive compensation environment, our Company performance and each executive’s performance, as well as internal equity considerations within the Company.

For the CEO, the ECDC reviews the factors described above as well as reviews evaluations from all of the independent directors and a self assessment by the CEO. This information is reviewed by the full Board in executive session without the CEO’s participation to provide a basis for determining CEO compensation as well as to provide constructive feedback to our CEO.

Role of Peer Companies and Use of Market Data:

With the assistance of Semler Brossy, our ECDC identifies a group of peer companies (the “Peer Group”) to use for comparison purposes for our executive compensation and reviews compensation pay levels and practices at the Peer Group companies to inform the Committee’s decision making process so it can set total compensation levels that it believes are reasonably competitive. The ECDC does not target or benchmark any specific percentage or range of total compensation or any individual compensation element for our named executive officers relative to the Peer Group. Rather, the ECDC uses the Peer Group information merely as a guide to determine whether we are generally competitive in the market. The ECDC also reviews the Aon Hewitt general industry survey data from companies of similar size to us as another reference point to determine competitiveness with the market.

Below follows the companies that comprise the Peer Group for 2011.

| Albemarle Corporation | FMC Corporation | Rockwood Holdings, Inc. |

| Arch Chemicals Inc. | International Flavors & Fragrances, Inc. | RPM International Inc. |

| Cabot Corporation | The Lubrizol Corporation | Sigma-Aldrich Corporation |

| Cytec Industries Inc. | OM Group | Valspar Corporation |

| Eastman Chemical Company | PolyOne Corporation | |

With the announcement in the first quarter of 2011 of the acquisition of The Lubrizol Corporation by Berkshire Hathaway Inc., which closed in the third quarter of 2011, the ECDC removed The Lubrizol Corporation from the Peer Group.

Additionally, in December of 2011, our ECDC reviewed the composition of the Peer Group. Based on its review, our ECDC approved the inclusion of three additional companies in the Peer Group for 2012: Ferro Corporation, H.B. Fuller Company and Sensient Technologies. Our ECDC determined that, with the inclusion of these three companies into the Peer Group, the Peer Group would be closer aligned to us based on revenue and EBITDA margin as well as market value to revenue comparisons.

Internal Pay Equity Review

The ECDC carefully considers the relative compensation levels among all members of the executive team for internal pay equity. Accordingly, the Company’s executive compensation program is designed to take into account each executive’s performance, role, responsibilities, tenure and experience relative to our other executives.

Tally Sheets

The ECDC, as part of its evaluation of the overall compensation of each named executive officer, reviews these elements individually and total compensation as a whole in the form of tally sheets and compares each against competitive compensation data. The purpose of the tally sheet is to provide a view of the combined effects of each compensation component in a summary format. The tally sheets include the total dollar value of each named executive officers’ annual compensation, including base salary, annual incentive pay, equity-based compensation, perquisites, pension benefit accruals and other compensation as well as the total compensation to be paid upon termination of employment under various circumstances under the named executive officer’s employment agreement or under our Executive Separation Pay Plan, whichever is applicable.

Elements of Executive Compensation Program

The direct compensation of our executives is comprised of three principal elements: (1) base salary, (2) annual cash incentives and (3) long-term incentives in the form of equity awards. We also provide perquisites of relatively limited value for the convenience of our executives so that their time can be most effectively directed toward Company matters.

Our ECDC approves the components of executive compensation at its regular February meeting in connection with the Company’s annual performance review cycle. At the February meeting, the ECDC reviews and takes all necessary action to approve: 1) payouts under the prior year’s annual incentive plan; 2) the financial and strategic performance measures, target performance goal and the minimum corporate threshold required to fund the plan for the current year’s annual incentive bonus plan; 3) base salary increases, if any; and 4) equity compensation awards under Company’s long-term incentive plan.

Base Salaries:

Base salary is a critical element of executive compensation as it is the only element of compensation that is fixed and provides our executives with a monthly income. Base salaries are designed to comprise a lesser portion of our executives’ total direct compensation than targeted at-risk compensation (i.e., cash incentive and equity pay). The effective date of any increase in executives’ base salaries is January 1st of each year.

Our ECDC reviews the base salaries of our executive officers, including our named executive officers, each year. Base salary for our CEO is determined by our ECDC and, for our named executive officers other than the CEO, by our ECDC with input from our CEO. The amount of any change is then based primarily on the executive officer’s performance, the level of his responsibilities, an assessment of the executive officer’s long-term potential with Solutia, internal equity considerations and the competitiveness of base salary and total target compensation based on market conditions. Our ECDC’s review of these factors is subjective and the importance of each factor in the ECDC’s decision-making varies based on the individual.

For 2011, Messrs. Quinn, Sullivan, DeBolt and Voss each received a 3.3% increase, and Mr. Berra received a 6.3% increase, in base salary over 2010. Base salaries reflecting such increase are reported in the “Salary” column of the Summary Compensation Table.

Mr. Donnelly was appointed Executive Vice President and Chief Operating Officer on August 19, 2011 with a base salary of $425,000.

Annual Cash Incentives:

The annual incentive plan (the “AIP”) provides short-term performance-based cash incentives to reward virtually all of our employees for the achievement of corporate and, if applicable, specific business unit financial and strategic measures. The AIP is based on a bonus pool concept meaning that the annual cash bonuses are funded based on the results of corporate (enterprise) and business unit performance. Each participant in the AIP has a target bonus level expressed as a percentage of the participant’s base pay. The sum of all the target bonuses constitutes the total pool available for bonuses at a target level of performance. The actual bonus pool is determined based upon our performance against the specific financial and strategic goals established by our ECDC. The maximum funding factor is 2x target meaning that the maximum bonus pool cannot exceed two times the sum of all target bonuses.

Every participant’s AIP award is comprised of an objective portion and a discretionary portion. The objective portion, expressed as a percentage of the participant’s target bonus opportunity, is based solely on Company performance. Accordingly, under any specific performance scenario, assuming a minimum threshold pool funding level of performance is achieved, the fixed portion serves as a minimum bonus the participant is entitled to receive if the other eligibility criteria set forth in the AIP are satisfied. Due to the 2x funding factor limitation discussed above, the maximum objective portion an individual can receive is 2x the objective portion at a target performance level.

The discretionary portion is based upon an assessment of the participant’s performance and can range from 0% upwards. Since the maximum bonus a participant can receive under the plan is 300% of their target bonus depending upon company performance, this serves as a limitation on the discretionary portion of a participant’s bonus.

Our named executive officers have the following target bonus opportunities, expressed as a percentage of base salary: Mr. Quinn: 150%, Messrs. Sullivan, Donnelly and Voss: 100% and Messrs. DeBolt and Berra: 75%. The maximum bonus our named executive officers can be awarded under the plan is three times their target bonus. Our named executive officers participate at the enterprise level as the goals applicable to them are Company measures and not business unit specific measures. The objective portion of our named executive officers’ target bonus is 75% and the discretionary portion is 25%.

Based upon company performance, the actual objective portion of our named executive officer’s bonus can range from zero (if minimum thresholds are not met) to 150% of their target bonus provided the maximum pool funding level of 2x is reached. In other words, at 2x performance level, our named executive officers will receive, at a minimum, a bonus of 150% of their target bonuses, assuming all other eligibility criteria are met.

The discretionary portion of the NEO’s bonus can range from zero up to an amount equal to the objective portion which would be 150% of a named executive officer’s target bonus if maximum funding of the bonus pool is achieved.

The 2011 AIP Program

In designing the annual incentive plan for 2011 (the “2011 AIP”), the ECDC established a comprehensive measurement framework using financial results, quality of results and strategic initiatives as performance goals and established a minimum level of corporate performance that must be met in order to award payouts under the 2011 AIP.

Our ECDC established the following financial performance measures, each weighted at 25%: Revenue from Consolidated Continuing Operations; Earnings per Share, and Cash From Continuing Operations (excluding excess funding into our U.S. pension plans).

Our ECDC established the level of performance for these financial measures at which a threshold payout would be earned at 0.5x of target and the level of performance at which a maximum payout would be earned at 2.5x of target.

In addition to the financial measures, our ECDC also established specific strategic initiatives as performance measures under the 2011 AIP, also weighted at 25%. The following are the enterprise strategic measures approved by our ECDC:

| | ● | Environmental, Safety and Health (“ESH”) personal safety |

| | ● | ESH process safety |

| | ● | M&A and other Strategic Transactions |

Our ECDC established the level of performance for these financial measures at which a threshold payout would be earned at 0.5x of target and the level of performance at which a maximum payout would be earned at 1.5x of target. Performance against these targets is assessed by the ECDC and is a subjective determination.

The minimum, target and maximum amounts for each of our named executive officers can be found in the table entitled “Grants of Plan-Based Awards for the Year Ended December 31, 2011” in the columns under “Estimated Possible Payouts Under Non-Equity Incentive Plan Awards.”

2011 Performance and 2011 AIP awards

The minimum, target and maximum levels of achievement for each of the performance measures for the enterprise level (the level at which all named executive officers participate), together with our actual performance against these measures is shown below:

| Performance Measures - | Type/Weighting | | Minimum | | | Target | | | Maximum | | | 2011 Actual Results | | | Funding Factor | |

| Revenue from Consolidated Continuing Operations | Financial- 25% | | $ | 1,834 | | | $ | 2,015 | | | $ | 2,350 | | | $ | 2,097 | | | | 1.24 | |

| Earnings Per Share - Continuing Operations | Financial- 25% | | $ | 1.81 | | | $ | 2.05 | | | $ | 2.76 | | | $ | 2.00 | | | | 0.90 | |

| Cash From Continuing Operations (excluding excess funding into U.S. pension plans) | Financial- 25% | | $ | 240 | | | $ | 280 | | | $ | 390 | | | $ | 235 | | | | 0 | |

| Strategic- Safety and Portfolio Management | Strategic- 25% | | NA | | | NA | | | NA | | | Above Target | | | | 1.40 | |

| Overall Performance | | | | | | | | | | | | | | | | | | | | 0.88 | |

On February 14, 2012, our ECDC approved awards under our 2011 AIP to our named executive officers based on the 0.88x target funding factor. No adjustments were made for individuals from the funded amount and each executive received a bonus payment equal to 0.88x of his target. The 2011 AIP payouts for each named executive officer are reported in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table.

Long-term Equity Awards: Equity-based awards are provided to our executives under the Amended and Restated Solutia Inc. 2007 Management Long Term Incentive Plan (the “Equity Incentive Plan”) which was approved by our stockholders in 2010. Such long-term incentive awards are designed to reward the creation of stockholder value, align executives’ interests with those of our stockholders and retain outstanding talent, all at a reasonable cost to stockholders.

The 2011 Equity Grants

In 2010, our ECDC established equity grant guidelines under which annual equity grants will be valued. Under the guidelines, the equity grant value for each plan participant is expressed as a percentage of the participant’s base salary. The equity grant values for our named executive officers at guideline are as follows: Mr. Quinn: 225%; Messrs. Sullivan, Donnelly and Voss: 150% and Messrs. DeBolt and Berra: 120%. The ECDC retains discretion to adjust an equity grant value 30% above or below a participant’s guideline. Additionally, the ECDC adopted a share granting approach that includes: (1) determining the number of time-vested restricted stock and performance shares to grant based on the average closing price of our common stock for the 90 calendar days preceding the grant; (2) determining the aggregate number of options to grant in any given year based on a pre-defined range of 0.6% and 0.8% of our outstanding common shares; and (3) providing the ECDC with discretion to adjust the pre-defined option range in any given year if our stock price changes significantly. We believe this approach balances providing appropriate grant date value to the participant and dilution to the stockholders.

On February 23, 2011 in accordance with the equity grant guidelines adopted by the ECDC, the ECDC approved grants of stock options, restricted stock awards and performance shares under the Equity Incentive Plan to certain executives, including our named executive officers as shown below:

| Named Executive Officer | | Stock Options | | | Restricted Stock | | | Performance Shares | |

| Jeffry N. Quinn | | | 141,031 | | | | 34,188 | | | | 34,188 | |

| James M. Sullivan | | | 52,342 | | | | 12,688 | | | | 12,688 | |

| D. Michael Donnelly (1) | | | 20,355 | | | | 4,934 | | | | 4,934 | |

| Robert T. DeBolt | | | 29,079 | | | | 7,049 | | | | 7,050 | |

| Paul J. Berra, III | | | 23,263 | | | | 5,639 | | | | 5,640 | |

| James R. Voss | | | 58,157 | | | | 14,098 | | | | 14,098 | |

(1) Mr. Donnelly was appointed Executive Vice President and Chief Operating Officer on August 19, 2011. In recognition of his increased job responsibilities and duties, our ECDC approved an interim equity award representing the pro-rated difference between his prior equity grant value and his new equity grant value of 150%. Accordingly, on August 19, 2011, Mr. Donnelly received 8,360 stock options (with an exercise price of $14.98, the closing price of our stock on the date of the grant), 2,245 shares of time-based restricted stock and 2,246 shares of performance-based restricted stock. Other than the exercise price of the stock options, the stock options and restricted stock awards were on the same terms as those applicable to the February 23, 2011 grant.

The ECDC exercised its discretion to increase the equity grant value to Messrs. Quinn, Sullivan, Donnelly, DeBolt and Voss by 14%, 25%, 11%, 19% and 20%, respectively in recognition of each of their leadership in executing on the Company’s key strategic initiatives and achieving the Company’s strong financial results in 2010.

The terms of the grants are as follows:

| Stock Options: | | The stock options vest over a four year period at a rate of 25% per year on the anniversary date of the grant. |

| Restricted Stock: | | The time-based restricted stock vest over a four year period at a rate of 25% per year on the anniversary of the date of the grant. |

| Performance Shares: | | The performance-based restricted stock vest on the third year anniversary of the date of the grant subject to the achievement of performance goals, described below, during the Performance Period. The Performance Period runs from January 1, 2011 up to and including December 31, 2013. |

Total Shareholder Return: Fifty percent of the Performance Shares shall vest 100% at target if the total shareholder return (“TSR”) equals the 55th percentile of a group of companies listed below, for the Performance Period. A threshold level of 25% of the target shares shall vest if the TSR equals the 40th percentile. A maximum of 175% shall vest if TSR equals the 75th percentile or higher. Vested performance-based restricted stock will be interpolated for the percentile achieved at the end of the Performance Period. The TSR shall include reinvested dividends over the Performance Period and shall be calculated using the average closing price of the Company’s common stock and the average closing price of the common stock of the companies in the group listed below within a ninety calendar day period, which would include all trading days within that ninety day calendar period, immediately preceding the beginning date of the Performance Period and the ending date of the Performance Period.

Relative Return on Capital: Fifty percent of the Performance Shares shall vest 100% at target if the three year average return on capital (“ROC”) equals the 55th percentile of the group of companies listed below for the Performance Period. A threshold level of 25% of the target shares shall vest if the three year average ROC equals the 40th percentile. A maximum of 175% shall vest if the three year average ROC equals the 75th percentile or higher. Vested Performance Shares will be interpolated for the percentile achieved at the end of the Performance Period. ROC is subject to a $1 billion cumulative EBITDA threshold before any payouts occur.

The group of companies (a subset of the S&P Chemical Index) means: Dow Chemical Company, E.I. du Pont de Nemours and Company, PPG Industries Inc., Ashland Inc., Ecolab Inc., Eastman Chemical Company, The Lubrizol Corporation, RPM International Inc., Cytec Industries Inc., Valspar Corporation, Rockwood Holdings, Inc., Cabot Corporation, FMC Corporation, PolyOne Corporation, Albemarle Corporation, International Flavors & Fragrances, Inc., Sigma-Aldrich Corporation, OM Group, Inc. Olin Corporation, NewMarket Corporation, Stepan Company, A. Schulman Inc., H.B. Fuller Company, Sensient Technologies Corporation, Minerals Technologies Inc., Zep Inc., Quaker Chemical Corporation, The Sherwin-Williams Company, LSB Industries Inc., STR Holdings, Inc, Calgon Carbon Corporation, Balchem Corporation, and Arch Chemicals Inc. The ECDC may adjust the group of companies if, during the Performance Period, a company in this group is acquired or ceases to be publicly traded. As discussed above, The Lubrizol Corporation was acquired by Berkshire Hathaway and as a result, the ECDC removed them from the group of companies.

Other Compensation and Perquisites:

Our use of perquisites is limited. We believe that the perquisites we provide generally allow our executives to work more efficiently and, in the case of tax, financial and estate planning services, help them optimize the value received from our compensation and benefits programs. Additionally, our CEO is allowed personal use of aircraft in which we own fractional interests for domestic travel, which allows him maximum flexibility to manage his work schedule. These perquisites are not subject to tax gross-up.

Our executives also participate in compensation and benefit programs generally available to all U.S. employees, such as our 401(k) Retirement Program and our medical, dental, vision, supplemental life and disability insurance programs. Our executives are also eligible to participate in our Solutia Inc. Savings and Investment Restoration Plan (the “Restoration Plan”). Under the Restoration Plan, an eligible employee can elect to defer up to 35% of eligible pay. The Company matches deferrals under the Restoration Plan in the same fashion as it matches contributions under our Savings and Investment Plan above the IRS maximum recognizable compensation under a qualified plan, i.e. $245,000 for 2011.

We froze our U.S. pension plan in 2004. As a result, only interest credits are being applied to the accounts. See “Pension Benefits” for more information about our retirement plan and the benefits that our named executive officers would be entitled to receive thereunder.

The 2011 Company Match for the Savings and Investment Plan and the Restoration Plan

We contribute matching contributions to our Savings and Investment Plan as well as our Restoration Plan. We contribute both a Basic Match and a Performance Match. Under the Basic Match, we match in cash 50% of the first 7% of eligible pay contributed by an employee to the Savings and Investment Plan, for a maximum Basic Match of 3.5% of the employee’s eligible pay. Thereafter, under the Performance Match, we may match up to 6.5% of an employee’s eligible pay contributed to the Savings and Investment Plan, depending on how we perform. We match deferrals under the Restoration Plan in the same fashion as we match contributions under our Savings and Investment Plan. The enterprise financial performance measures established by the ECDC under our AIP are used to determine the Performance Match. At the Company’s discretion, the Performance Match may be made in cash or in Company common stock. For 2011, the Performance Match was made at 2.49% and contributed to the Savings and Investment Plan and the Restoration Plan in cash.

Compensation Decisions for 2012

Please refer to Item 9B of the Original Filing for information relating to our ECDC’s approvals relating to the 2012 annual incentive plan, the award of phantom stock units to our named executive officers and amendments to our Executive Separation Pay Plan. In addition to the approvals described therein, our ECDC at its meeting on February 21, 2012 approved a 3.5% increase in base salary for each of the current named executive officers, except Mr. Donnelly. In recognition of Mr. Donnelly’s job performance and the competitive market data provided by Semler Brossy, our ECDC approved a base salary for Mr. Donnelly of $475,000, reflecting an increase of 11.8% over his previous base salary.

Other Compensation Policies

Employment Agreements:

Messrs. Quinn, Sullivan and DeBolt are parties to employment agreements with us which specify payments upon termination for various causes. In the event of a “not for cause” termination (as defined in the respective employment agreements), these executives are entitled to receive various amounts based on multiples of their base salary and annual bonuses and to receive executive outplacement services. The employment agreements provide for four months continuation of health coverage at active employee contribution rates. See the sections entitled “Employment Agreements with Named Executive Officers” and “Potential Payments Upon Termination of Employment or Change-in-Control” for a description of the material terms of the employment agreements and an estimate of the benefits that our Messrs. Quinn, Sullivan and DeBolt would be entitled to receive pursuant to their respective employment agreements under various employment termination scenarios.

Executive Separation Pay Plan:

Messrs. Donnelly and Berra participate in the Company’s Executive Separation Pay Plan, each as modified under their respective letter agreements, under which each is entitled to receive separation pay upon an involuntary termination. See the section entitled “Executive Separation Pay Plan” for a description of the Plan and “Potential Payments upon Termination of Employment or Change-in-Control” for a description of the material terms of the Plan and an estimate of the benefits Messrs. Donnelly and Berra would be entitled to receive pursuant to the Plan and their respective letter agreements under various termination scenarios.

Stock Ownership Guidelines: In October 2008, stock ownership guidelines that require our named executive officers to own shares of our common stock took effect. The ECDC adopted these guidelines on the belief that our executive officers should have a meaningful ownership stake in the Company that will align their interests with our stockholders and encourage a long-term perspective in managing our Company. The stock ownership requirements for the following Named executive officers are:

| Position | | Multiple of Base Salary |

| Chief Executive Officer | | 5x |

| Executive and Senior Vice Presidents | | 3.5x |

Executives, including our named executive officers have five years to achieve these ownership requirements. Shares owned outright, as well as restricted stock and options for which the executive officer has beneficial ownership, count towards meeting the ownership requirement. As of December 31, 2011, the value of the stock owned by our current named executive officers met or exceeded the guidelines.

Our Policies With Respect to the Granting of Stock Options and Restricted Stock

Timing of Grants. Stock options and restricted stock are granted to executives on the day the grants are approved by our ECDC as part of its regularly scheduled Committee meetings. Beginning in 2011, our ECDC made equity grants at its regular Committee meeting in February to align the grants with our annual performance management process. For our newly hired executives, stock options are generally granted as of the date of hire.

Option Exercise Price. The exercise price of a newly granted option (that is, not an option assumed in, or granted in connection with, an acquisition) is the closing price on the NYSE on the date of grant.

Re-Pricing of Options. Under the terms of the Equity Incentive Plan, the ECDC is precluded from amending or replacing any previously granted option in a transaction that constitutes a “re-pricing” under NYSE rules without stockholder approval.

Tax Deductibility of Compensation and Section 409A

Under Section 162(m) of the Internal Revenue Code, publicly-held corporations generally may not take a tax deduction for compensation in excess of $1 million paid to the chief executive officer, the chief financial officer and the three most highly compensated executive officers during any fiscal year. There is an exception to the $1 million limitation for performance-based compensation meeting certain requirements. To maintain flexibility in compensating executive officers in a manner designed to promote varying corporate goals, our ECDC has not adopted a policy requiring all compensation to be deductible. However, the ECDC considers deductibility under Section 162(m) with respect to compensation arrangements for executive officers. In 2011, none of our named executive officers received taxable cash compensation that we could not deduct by reason of Section 162(m). Section 409A of the U.S. tax code generally changes the tax rules that affect most forms of deferred compensation that were not earned and vested prior to 2005. The ECDC takes Section 409A into account in determining the form and timing of compensation paid to our executive officers.

Compensation Clawbacks

The New York Stock Exchange is expected to revise its listing standards in accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act to require listed issuers to adopt and disclose clawback policies. Under such policies, an accounting restatement due to material noncompliance with any financial reporting requirements under the securities laws will trigger a clawback. The Company will be required to recover any erroneously awarded compensation payments that would not have been made had the restated accounting numbers been used. Any payments made to current or former executive officers during the three-year period preceding the date of a restatement will be subject to the policy. Our existing incentive compensation plans will be reviewed and updated for consistency with the clawback policy when it is adopted.

Compensation Committee Interlocks

The Executive Compensation and Development Committee is comprised of four directors: Mr. Heffernan, Chairman, and Messrs. deVeer, Monahan and Rusnack. None of these individuals is a current or former officer or employee of ours or any of our subsidiaries, nor did any of these individuals have any reportable transactions with us or any of our subsidiaries during 2011. During 2011, none of our executive officers served as a director or member of the compensation committee (or equivalent thereof) of another entity, any of whose executive officers served as our director.

Executive Compensation and Development Committee Report

The ECDC has reviewed and discussed the Compensation Discussion and Analysis with management and based on the review and discussions, the ECDC recommended to the board of directors that the Compensation Discussion and Analysis be included in this annual report on Form 10-K.

James P. Heffernan, Chairman

Robert K. deVeer, Jr.

William T. Monahan

William C. Rusnack

Compensation Tables

The following summary compensation table sets forth information concerning compensation of individuals serving as our chief executive officer and chief financial officer and of the Company’s three other most highly compensated executive officers who were serving as executive officers at December 31, 2011. Consistent with the requirements of Item 402 of Regulation S-K, Mr. Voss, who was terminated in August 2011 is also considered a named executive officer at December 31, 2011.

Summary Compensation Table

| Name and Principal Position | Year | Salary ($) | Stock Awards ($) (1) | Option Awards ($) (2) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) (3) | All Other Compensation ($) | Total ($) |

J. N. Quinn President, Chief Executive Officer and Chairman of the Board | 2011 2010 2009 | 947,000 917,000 865,000 | 1,735,896 2,242,613 4,807,711 | 1,375,052 1,362,562 0 | 1,250,040 4,126,500 0 | 3,756 2,640 5,425 | 220,684 (4) 332,573 32,870 | 5,532,428 8,983,888 5,711,007 |

J. M. Sullivan Executive Vice President and Chief Financial Officer | 2011 2010 2009 | 481,600 466,400 440,000 | 644,233 836,107 1,194,361 | 510,335 507,995 0 | 423,808 1,399,200 0 | 42,574 29,147 61,001 | 15,573 (5) 27,877 634 | 2,118,123 3,266,726 1,695,996 |

D. M. Donnelly Executive Vice President and Chief Operating Officer | 2011 | 358,281 | 325,638 | 261,830 | 327,230 | 0 | 43,529 (6) | 1,316,508 |

R. T. DeBolt Senior Vice President – Business Operations | 2011 2010 2009 | 351,400 340,260 318,000 | 357,941 392,580 827,375 | 283,520 238,535 0 | 231,924 765,586 0 | 36,055 24,611 51,611 | 44,633 (7) 72,934 7,860 | 1,305,473 1,834,506 1,204,846 |

P.J. Berra, III Senior Vice President, Legal and Governmental Affairs and General Counsel | 2011 2010 2009 | 340,000 320,000 300,000 | 286,348 353,199 748,456 | 226,814 214,578 0 | 224,400 600,000 0 | 1,493 905 2,024 | 16,900(8) 68,453 1,143 | 1,095,955 1,557,135 1,051,623 |

J. R. Voss former Executive Vice President and Chief Operating Officer | 2011 2010 2009 | 335,827 540,000 496,458 | 715,826 880,391 1,677,108 | 567,031 534,924 0 | 0 1,620,000 0 | 0 0 0 | 3,314,397 (9) 131,940 5,146 | 4,933,081 3,707,255 2,178,712 |

(1) | The amounts reported in this column reflect the aggregate grant date fair value for time-based and performance-based restricted stock shares computed in accordance with FASB ASC Topic 718, excluding the effect of estimated forfeitures. The grant date fair value per share is equal to the closing price of our common stock on the date of grant. The performance-shares have been calculated based on the probable outcome of the performance conditions at target. The value of the performance-based restricted stock awards (based on the closing price of our common stock on the date of the grant) assuming the highest level of performance conditions is achieved for Messrs. Quinn, Sullivan, Donnelly, DeBolt, Berra and Voss is $1,383,845, $513,579, $258,595, $285,366, $228,293 and 0, respectively. |

(2) | The amounts reported in this column reflect the aggregate grant date fair value of stock option awards computed in accordance with FASB ASC Topic 718, excluding the effect of estimated forfeitures, based on the Black-Scholes option-pricing model. The assumptions used to calculate the grant date fair value of option awards under the Black-Scholes model are set forth in Note 13 to our Consolidated Financial Statements filed with our Annual Report on Form 10-K for year 2011. |

(3) | The amounts reported in this column reflect the actuarial increase in the present value of such participant’s benefit under the pension plan. We froze our pension plan as of June 30, 2004; consequently, Messrs. Donnelly and Voss are not participants in the plan. |

(4) | This amount includes (i) the Company’s contributions to Mr. Quinn’s accounts under our Savings and Investment Plan and under our Savings and Investment Restoration Plan in the amount of $180,314; (ii) Company paid life insurance premiums in the amount of $1,761; (iii) financial, tax or estate planning services in the amount of $4,000; and (iv) the incremental cost to the Company of Mr. Quinn’s personal use of the aircraft in which we own fractional interests in the amount of $34,609. See “Elements of Executive Compensation Program” “Other Compensation and Perquisites” for a discussion regarding our aircraft usage policy. |

(5) | This amount includes (i) the Company’s contributions to Mr. Sullivan’s account under our Savings and Investment Plan in the amount of $14,676 and (ii) the Company paid life insurance premiums in the amount of $897. |

(6) | This amount includes (i) the Company’s contributions to Mr. Donnelly’s accounts under our Savings and Investment Plan and under our Savings and Investment Restoration Plan in the amount of $41,830; and (ii) Company paid life insurance premiums in the amount of $1,699. |

(7) | This amount includes (i) the Company’s contributions to Mr. DeBolt’s accounts under our Savings and Investment Plan and under our Savings and Investment Restoration Plan in the amount of $43,978; and (ii) Company paid life insurance premiums in the amount of $655. |

(8) | This amount includes (i) the Company’s contributions to Mr. Berra’s account under our Savings and Investment Plan in the amount of $14,676; (ii) financial, tax or estate planning services in the amount of $1,955; and (iii) Company paid life insurance premiums in the amount of $269. |

(9) | This amount includes (i) the Company’s contributions to Mr. Voss’ accounts under our Savings and Investment Plan and under our Savings and Investment Restoration Plan in the amount of $41,005; (ii) financial, tax or estate planning services in the amount of $8,845; and (iii) Company paid life insurance premiums in the amount of $475. Additionally, this amount includes payments made to Mr. Voss in accordance with his employment agreement in connection with his termination of employment of the following: (i) accrued vacation in the amount of $38,603 and severance in the amount of $3,225,469. Please see “Employment Agreements with Certain Named Executive Officers” for a discussion regarding termination payments to which Mr. Voss became entitled. |

The following table sets forth certain information regarding the grants of non-equity awards and equity incentive awards made in 2011 to the individuals named in the summary compensation table.

Grants of Plan-Based Awards for the Year Ended December 31, 2011

| Name | Grant Date | | Estimated Possible Payouts Under Non-Equity Incentive Plan Awards (1) | | Estimated Future Payouts Under Equity Incentive Plan Awards (2) | All Other Stock Awards: Number of Shares of Stock or Units (#)(3) | All Other Option Awards: Number of Securities Underlying Options (#) | Exercise or Base Price of Option Awards ($/Share) | Grant Date FV of Stock and Option Awards ($)(4) |

| Threshold ($) | Target ($) | Maximum ($) | | Threshold # | Target # | Maximum # |

| J. N. Quinn | 2/23/11 | | 710,250 | 1,420,500 | 4,261,500 | | | | | | | | |

| | 2/23/11 | | | | | | | | | | 141,031 | 23.13 | 1,375,052 |

| | 2/23/11 | | | | | | | | | 34,188 | | | 790,768 |

| | 2/23/11 | | | | | | 4,274 | 17,094 | 29,915 | | | | 395,384 |

| | 2/23/11 | | | | | | 4,274 | 17,094 | 29,915 | | | | 549,743 |

| J. M. Sullivan | 2/23/11 | | 240,800 | 481,600 | 1,444,800 | | | | | | | | |

| | 2/23/11 | | | | | | | | | | 52,342 | 23.13 | 510,335 |

| | 2/23/11 | | | | | | | | | 12,688 | | | 293,473 |

| | 2/23/11 | | | | | | 1,586 | 6,344 | 11,102 | | | | 146,737 |

| | 2/23/11 | | | | | | 1,586 | 6,344 | 11,102 | | | | 204,023 |

| D. M. Donnelly | 2/23/11 | | 179,141 | 358,281 | 1,074,843 | | | | | | | | |

| | 2/23/11 | | | | | | | | | | 20,355 | 23.13 | 198,461 |

| | 2/23/11 | | | | | | | | | 4,934 | | | 114,123 |

| | 2/23/11 | | | | | | 617 | 2,467 | 4,317 | | | | 57,062 |

| | 2/23/11 | | | | | | 617 | 2,467 | 4,317 | | | | 79,339 |

| | 8/19/11 | | | | | | | | | | 8,360 | 14.98 | 63,369 |

| | 8/19/11 | | | | | | | | | 2,245 | | | 33,630 |

| | 8/19/11 | | | | | | 281 | 1,123 | 1,965 | | | | 16,823 |

| | 8/19/11 | | | | | | 281 | 1,123 | 1,965 | | | | 24,661 |

| R. T. DeBolt | 2/23/11 | | 131,775 | 263,550 | 790,650 | | | | | | | | |

| | 2/23/11 | | | | | | | | | | 29,079 | 23.13 | 283,520 |

| | 2/23/11 | | | | | | | | | 7,049 | | | 163,043 |

| | 2/23/11 | | | | | | 881 | 3,525 | 6,169 | | | | 81,533 |

| | 2/23/11 | | | | | | 881 | 3,525 | 6,169 | | | | 113,364 |

| P. J. Berra, III | 2/23/11 | | 127,500 | 255,000 | 765,000 | | | | | | | | |

| | 2/23/11 | | | | | | | | | | 23,263 | 23.13 | 226,814 |

| | 2/23/11 | | | | | | | | | 5,639 | | | 130,430 |

| | 2/23/11 | | | | | | 705 | 2,820 | 4,935 | | | | 65,227 |

| | 2/23/11 | | | | | | 705 | 2,820 | 4,935 | | | | 90,691 |

| J.R. Voss (5) | 2/23/11 | | 0 | 0 | 0 | | | | | | | | |

| | 2/23/11 | | | | | | | | | | 58,157 | 23.13 | 567,031 |

| | 2/23/11 | | | | | | | | | 14,098 | | | 326,087 |

| | 2/23/11 | | | | | | 1,762 | 7,049 | 12,336 | | | | 163,043 |

| | 2/23/11 | | | | | | 1,762 | 7,049 | 12,336 | | | | 226,696 |

(1) | Represents possible annual incentive cash awards that could have been earned in 2011 under the AIP at “threshold”, “target” and “maximum” levels of performance. Amounts actually received by the named executive officers under the 2011 AIP are set forth in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table. For further information about the 2011 AIP, please see the discussion under the heading “The 2011 AIP Program.” |

(2) | The shares listed represent estimated future share payouts at threshold, target and mazimum levels for performance-based restricted stock for the January 1, 2011 through December 31, 2013 performance period, assuming performance conditions are satisfied. See “The 2011 Equity Grants” for more information regarding the 2011 grant of performance-based restricted stock. |

(3) | The shares listed in this column represent time-based restricted stock that vest over a four year period at a rate of 25% per year on the anniversary date of the grant. |

(4) | The dollar amounts in this column include the aggregate grant date fair value of the time-based restricted stock and performance-based restricted stock granted in 2011. For the time-based restricted stock, the aggregate grant date fair value used in the calculation is $23.13. For performance-based restricted stock, the amounts in this column assume that the shares vest at target. For performance-based restricted stock that vest based on our total shareholder return performance, the aggregate grant date fair value used in the calculation is $32.16 and for the performance-based restricted stock that vest based on our return on capital, the aggregate grant date fair value used in the calculation is $23.13. Please refer to Note 13 to our Consolidated Financial Statements filed with our Annual Report on Form 10-K for 2011 for the relevant assumptions used to determine grant date fair value of time-based restricted stock, performance-based restricted stock and option awards. |

(5) | Mr. Voss was terminated effective August 5, 2011, which termination was deemed to be other than “for cause” as such term is defined in his amended and restated employment agreement dated November 1, 2008. In accordance with the terms of his employment agreement, the Equity Incentive Plan and his award agreements, of the amounts shown above as granted 49,575 options, 8,518 shares of time-based restricted stock vested as of the date of his termination. Also, of the amount shown above, Mr. Voss became entitled to receive at target 11,357 shares of performance-based restricted stock, which represent a pro-rata portion of the grant but the number of shares that vest will be determined based on if and to what extent the Company meets the performance goals attributable to the performance-based restricted stock. The remaining 8,582 options, 5,580 shares of time-based restricted stock and 2,741 shares of performance-based restricted stock awarded Mr. Voss on February 23, 2011 were cancelled as of the date of his termination. The options remained exercisable until February 1, 2012. |

The following table sets forth information regarding outstanding option and equity awards as of December 31, 2011 held by individuals named in the summary compensation table.

Outstanding Equity Awards at December 31, 2011

| | | Option Awards | Stock Awards |

| Name | Grant Date | Number of Securities Underlying Unexercised Options # Exercisable (1) | Number of Securities Underlying Unexercised Options # Unexercisable (1) | Option Exercise Price ($) | Option Expiration Date | Equity Incentive Plan Awards: # of Unearned Shares, units or other rights that have not Vested # | | Equity Incentive Plan Awards: Market or payout value of unearned Shares, units or other rights that have Not Vested $ (2) |

| J. N. Quinn | 2/28/08 | 500,000 | | 17.33 | 2/28/2018 | | | |

| | 7/23/09 | | | | | 79,672 | (3) | 1,376,732 |

| | 7/23/09 | | | | | 196,207 | (4) | 3,390,457 |

| | 4/21/10 | 47,575 | 142,727 | 16.95 | 4/21/2020 | 59,250 | (5) | 1,023,840 |

| | 4/21/10 | | | | | 59,250 | (6) | 1,023,840 |

| | 2/23/11 | | 141,031 | 23.13 | 2/23/2021 | 34,188 | (7) | 590,769 |

| | 2/23/11 | | | | | 34,188 | (8) | 590,769 |

| J. M. Sullivan | 2/28/08 | 150,000 | | 17.33 | 2/28/2018 | | | |

| | 7/23/09 | | | | | 19,793 | (3) | 342,023 |

| | 7/23/09 | | | | | 48,743 | (4) | 842,279 |

| | 4/21/10 | 17,737 | 53,212 | 16.95 | 4/21/2020 | 22,090 | (5) | 381,715 |

| | 4/21/10 | | | | | 22,090 | (6) | 381,715 |

| | 2/23/11 | | 52,342 | 23.13 | 2/23/2021 | 12,688 | (7) | 219,249 |

| | 2/23/11 | | | | | 12,688 | (8) | 219,249 |

| D. M. Donnelly | 2/28/08 | 20,000 | | 17.33 | 2/28/2018 | | | |

| | 7/23/09 | | | | | 8,829 | (3) | 152,565 |

| | 7/23/09 | | | | | 21,741 | (4) | 375,684 |

| | 4/21/10 | 6,524 | 19,572 | 16.95 | 4/21/2020 | 8,125 | (5) | 140,400 |

| | 4/21/10 | | | | | 8,126 | (6) | 140,417 |

| | 2/23/11 | | 20,355 | 23.13 | 2/23/2021 | 4,934 | (7) | 85,260 |

| | 2/23/11 | | | | | 4,934 | (8) | 85,260 |

| | 8/19/11 | | 8,360 | 14.98 | 2/23/2021 | 2,245 | (7) | 38,794 |

| | 8/19/11 | | | | | 2,246 | (8) | 38,811 |

| R. T. DeBolt | 2/28/08 | 70,000 | | 17.33 | 2/28/2018 | | | |

| | 7/23/09 | | | | | 13,711 | (3) | 236,926 |

| | 7/23/09 | | | | | 33,766 | (4) | 583,476 |

| | 4/21/10 | 8,328 | 24,987 | 16.95 | 4/21/2020 | 10,372 | (5) | 179,228 |

| | 4/21/10 | | | | | 10,372 | (6) | 179,228 |

| | 2/23/11 | | 29,079 | 23.13 | 2/23/2021 | 7,049 | (7) | 121,807 |

| | 2/23/11 | | | | | 7,050 | (8) | 121,824 |

| P. J. Berra, III | 2/28/08 | 45,000 | �� | 17.33 | 2/28/2018 | | | |