Exhibit 99.1

ITEM 1. Business.

Sonic Automotive, Inc. was incorporated in Delaware in 1997. We are one of the largest automotive retailers in the United States. As of March 11, 2003, we operated 186 dealership franchises at 139 dealership locations, representing 34 different brands of cars and light trucks, and 45 collision repair centers in 15 states. Each of our dealerships provides comprehensive services including (1) sales of both new and used cars and light trucks, (2) sales of replacement parts and performance of vehicle maintenance, warranty, paint and repair services and (3) arrangement of extended warranty contracts and financing and insurance (“F&I”) for our automotive customers.

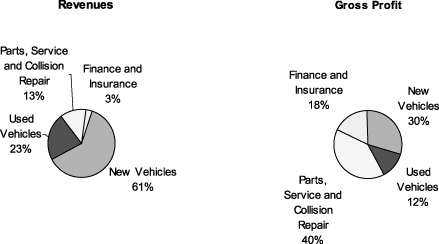

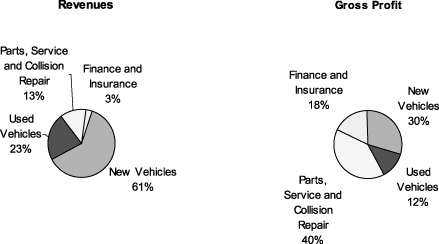

As compared to automotive manufacturers, we and other automotive retailers exhibit relatively low earnings volatility. This is primarily due to a higher ratio of variable or semi-variable costs that allows us to manage the majority of our expenses, such as advertising, sales commissions and vehicle carrying costs, as demand patterns change. We also have a greater diversity in our sources of revenue compared to automobile manufacturers. In addition to new vehicle sales, our revenues include used vehicle sales and parts, service and collision repair, which carry higher gross margins and are less sensitive to economic cycles and seasonal influences than are new vehicle sales. The following charts depict the diversity of our sources of revenues and gross profit for the year ended December 31, 2002:

BUSINESS STRATEGY

Further Develop Strategic Markets and Brands. Our growth strategy is focused on metropolitan markets, predominantly in the Southeast, Southwest, Midwest and California, that on average are experiencing population growth that exceeds the national average. Where practicable, we also seek to acquire franchises that we believe have above average sales prospects. We have a dealership portfolio of 34 American, European and Asian brands. A majority of our dealerships are either luxury or mid-line import brands. Our dealership network is organized into divisional and regional dealership groups. As of December 31, 2002, we operated dealerships in the following geographic areas:

Region

| | Number of

Dealerships

| | Number of

Franchises

| | Percent

of 2002

Total

Revenue

| |

Carolinas | | 11 | | 16 | | 6.6 | % |

South Carolina/ Georgia | | 11 | | 17 | | 6.4 | % |

West Florida | | 8 | | 8 | | 7.9 | % |

East Florida | | 6 | | 11 | | 1.0 | % |

Birmingham/Tennessee | | 10 | | 13 | | 5.3 | % |

Alabama | | 9 | | 15 | | 4.5 | % |

| | |

| |

| |

|

|

Southeastern Division | | 55 | | 80 | | 31.6 | % |

Ohio | | 6 | | 10 | | 3.2 | % |

Michigan | | 3 | | 4 | | 2.7 | % |

Mid-Atlantic | | 4 | | 5 | | 3.3 | % |

| | |

| |

| |

|

|

Northern Division | | 13 | | 19 | | 9.2 | % |

Houston | | 9 | | 11 | | 10.9 | % |

Dallas | | 9 | | 10 | | 9.3 | % |

Oklahoma | | 7 | | 7 | | 4.6 | % |

Colorado | | 4 | | 6 | | 1.9 | % |

| | |

| |

| |

|

|

Central Division | | 29 | | 34 | | 26.7 | % |

Northern California | | 19 | | 25 | | 16.5 | % |

Los Angeles | | 15 | | 20 | | 10.7 | % |

San Diego/Nevada | | 8 | | 8 | | 5.2 | % |

| | |

| |

| |

|

|

Western Division | | 42 | | 53 | | 32.5 | % |

| | |

| |

| |

|

|

| | | 139 | | 186 | | 100.0 | % |

| | |

| |

| |

|

|

During 2002, we acquired 31 dealerships representing 44 franchises, and we disposed of nine dealerships representing 16 franchises.

We generally seek to acquire larger, well managed dealerships or multiple franchise dealership groups located in metropolitan or high growth suburban markets (“hub” acquisitions). We also look to acquire single franchise dealerships that will allow us to capitalize upon professional management practices and provide greater breadth of products and services in our existing markets (“spoke” acquisitions).

The automotive retailing industry remains highly fragmented. We believe that further consolidation in the auto retailing industry is likely and we intend to seek acquisitions consistent with our business strategy. We believe that attractive acquisition opportunities continue to exist for dealership groups with the capital and experience to identify, acquire, and professionally manage dealerships. We believe our “hub and spoke” acquisition strategy allows us to realize economies of scale, offer a greater breadth of products and services and increase brand diversity. We also intend to acquire dealerships that have under performed the industry average but represent attractive franchises or have attractive locations that would immediately benefit from our professional management practices.

2

Increase Sales of Higher Margin Products and Services. We continue to pursue opportunities to increase our sales of higher-margin products and services by expanding the following:

Finance and Insurance (“F&I”): Each sale of a new or used vehicle provides us with an opportunity to earn financing fees and to sell extended warranty service contracts. We currently offer a wide range of nonrecourse financing, leasing and insurance products to our customers. We believe there are opportunities at acquired dealerships to increase earnings from the sale of finance, insurance and warranty products. As a result of our size and scale, we have also negotiated higher commissions on the origination of customer vehicle financing, insurance policies and extended warranty contracts.

Parts, Service & Repair (“Fixed Operations”): Each of our dealerships offers a fully integrated service and parts department. Manufacturers permit warranty work to be performed only at franchised dealerships. As a result, our dealerships are uniquely qualified to perform work covered by manufacturer warranties on increasingly complex vehicles. We believe we can continue to grow our profitable parts and service business by using variable rate pricing structures, focusing on customer service and efficiently managing our parts inventory.

In addition, we operated collision repair centers at 45 locations at March 11, 2003 and are in the process of constructing additional collision repair centers in order to increase capacity. We believe we can improve these operations by capitalizing on the synergies between our franchised dealerships and our collision repair centers. These synergies include access to customer networks, ready access to parts and the ability to share employees.

Emphasize Expense Control. We continually focus on controlling expenses and expanding margins at the dealerships we acquire and integrate into our organization. Approximately 60.7% of our selling, general and administrative expenses for the year ended December 31, 2002 were variable. We are able to adjust these expenses as the operating or economic environment impacting our dealerships changes. We manage variable and semi-variable costs, such as advertising and non-salaried compensation expenses, so that they are generally related to vehicle sales and can be adjusted in response to changes in vehicle sales volume. Salespersons, sales managers, service managers, parts managers, service advisors, service technicians and all other non-clerical dealership personnel are paid either a commission or a modest salary plus commissions. In addition, dealership management compensation is tied to individual dealership profitability.

Effectively Manage Inventory Levels. Maintaining appropriate levels of both vehicle and parts inventories has a direct impact on profitability. We believe that vehicle gross margins decline as inventory levels increase and more pressure is exerted on the sales staff to close deals. In addition, net profitability is negatively affected by the higher costs (floor plan interest and insurance) of carrying that inventory. We have implemented financial reporting systems that give us the ability to analyze our vehicle inventory on a consolidated basis.

Train, Develop and Motivate Qualified Management. We believe that our well-trained dealership personnel are key to our long-term prospects. We require all of our employees, from service technicians to regional vice presidents, to participate in our in-house training programs each year. We have expanded our Sonic Dealer Academy to include modules not only for our dealer operators but also for general sales managers and fixed operations managers. We believe that our comprehensive training of all employees and professional, multi-tiered management structure provide us with a competitive advantage over other dealership groups. This training and organizational structure provides high-level supervision over the dealerships, accurate financial reporting and the ability to maintain effective controls as we expand. In order to motivate management, we employ an incentive compensation program for each officer, vice president and dealer operator, a portion of which is provided in the form of Sonic stock options with additional incentives based on the performance of individual profit centers. We believe that this organizational structure, together with the opportunity for promotion within our large organization and for equity participation, serve as a strong motivation for our employees.

Achieve High Levels of Customer Satisfaction. We focus on maintaining high levels of customer satisfaction. Our personalized sales process is designed to satisfy customers by providing high-quality

3

vehicles in a positive, “consumer friendly” buying environment. Some manufacturers offer specific financial incentives on a per vehicle basis if certain Customer Satisfaction Index (“CSI”) levels (which vary by manufacturer) are achieved by a dealer. In addition, all manufacturers consider CSI scores in approving acquisitions. In order to keep management focused on customer satisfaction, we include CSI results as a component of our incentive compensation programs. Our success in this area is evident by the number of manufacturer awards our dealerships have received. In 2002, a number of our dealerships received BMW’s Center of Excellence award, Chrysler’s Five Star Certification, the Lexus Elite Award, Toyota’s President’s Award, Honda’s President’s Award and Infiniti’s Reward of Excellence.

Dealership Management

Our dealership operations are overseen by regional or divisional vice presidents for a particular geographic area. These vice presidents are geographically aligned with regional and divisional controllers who are responsible for maintaining effective internal controls and accurate financial reporting at each dealership. Our divisional and regional management teams use our computer-based information systems to monitor each dealership’s sales, profitability, inventory and other financial and operating data. We believe this management structure gives us a competitive advantage over many individually-owned dealerships. It allows us to effectively oversee our operations, recruit new employees and implement best practices using employees that have a thorough understanding of the local market. In addition, it gives us the ability to quickly field an experienced team of professionals to lead our acquisition due diligence and integration efforts thereby increasing the speed with which we deploy our operating strategy at acquired dealerships.

Each of our dealerships is managed by a dealer operator who is responsible for the operations of the dealership and the dealership’s financial and customer satisfaction performance. The dealer operator is responsible for selecting, training and retaining dealership personnel. All dealer operators report to Sonic’s regional vice presidents.

Each dealer operator is complemented by a team that generally includes two senior managers who aid in the operation of the dealership. The general sales manager is primarily responsible for the operations, personnel, financial performance and customer satisfaction performance of the new vehicle sales, used vehicle sales, and finance and insurance departments. The parts and service director is primarily responsible for the operations, personnel, financial and customer satisfaction performance of the service, parts and collision repair departments (if applicable). Each of the departments of the dealership typically has a manager or managers who reports to the general sales manager or parts and service director.

Sonic’s dealer operators are also supported by national directors of finance and insurance, fixed operations, field operations and sales, respectively. Each of these national directors assist the dealer operators in implementing organizational best practices. Regional directors of finance and insurance, fixed operations and collision repair centers support the national directors.

Sales and Marketing

Sonic’s marketing and advertising activities vary among our dealerships and among our markets. We advertise primarily through television, newspapers, radio and direct mail and regularly conduct special promotions designed to focus vehicle buyers on our product offerings. We also utilize computer technology to aid sales people in prospecting for customers.

Relationships with Manufacturers

Each of Sonic’s dealerships operates under a separate franchise or dealer agreement that governs the relationship between the dealership and the manufacturer. In general, each dealer agreement specifies the location of the dealership for the sale of vehicles and for the performance of certain approved services in a

4

specified market area. The designation of such areas generally does not guarantee exclusivity within a specified territory. In addition, most manufacturers allocate vehicles on a “turn and earn” basis that rewards high volume. A dealer agreement requires the dealer to meet specified standards regarding showrooms, the facilities and equipment for servicing vehicles, inventories, minimum net working capital, personnel training and other aspects of the business. The dealer agreement with each dealership also gives the related manufacturer the right to approve the dealership’s general manager and any material change in management or ownership of the dealership. Each manufacturer may terminate a dealer agreement under certain circumstances, such as a change in control of the dealership without manufacturer approval, the impairment of the reputation or financial condition of the dealership, the death, removal or withdrawal of the dealership’s general manager, the conviction of the dealership or the dealership’s owner or general manager of certain crimes, the failure to adequately operate the dealership or maintain wholesale financing arrangements, insolvency or bankruptcy of the dealership or a material breach of other provisions of the dealer agreement.

Many automobile manufacturers have developed policies regarding public ownership of dealerships. To the extent that new or amended manufacturer policies restrict the number of dealerships which may be owned by a dealership group, or the transferability of Sonic’s common stock, such policies could have a material adverse effect on us. Sonic believes that it will be able to renew at expiration all of its existing franchise and dealer agreements. Policies implemented by manufacturers include the following restrictions:

| | • | | The ability to force the sale of their respective franchises upon a change in control or a material change in the composition of Sonic’s Board of Directors |

| | • | | The ability to force the sale of their respective franchises if an automobile manufacturer or distributor acquires more than 5% of the voting power of Sonic’s securities. |

| | • | | The ability to force the sale of their respective franchises if an individual or entity acquires more than 20% of the voting power of Sonic’s securities, and the manufacturer disapproves of such individual’s or entity’s ownership interest. |

Many states have placed limitations upon manufacturers’ and distributors’ ability to sell new motor vehicles directly to customers in their respective states in an effort to protect dealers from practices they believe constitute unfair competition. In general, these statutes make it unlawful for a manufacturer or distributor to compete with a new motor vehicle dealer in the same brand operating under an agreement or franchise from the manufacturer or distributor in the relevant market area.

Certain states, such as Florida, Georgia, Oklahoma, South Carolina, North Carolina and Virginia, limit the amount of time that a manufacturer may temporarily operate a dealership. Further, certain states require a person who is attempting to acquire a dealership from a manufacturer or distributor to invest a specified amount of money in the dealership.

In addition, all of the states in which Sonic dealerships currently do business require manufacturers to show “good cause” for terminating or failing to renew a dealer’s franchise agreement. Further, each of the states provides some method for dealers to challenge manufacturers’ attempts to establish dealerships of the same line-make in their relevant market area.

Competition

The retail automotive industry is highly competitive. Depending on the geographic market, we compete both with dealers offering the same brands and product lines as ours and dealers offering other manufacturers’ vehicles. We also compete for vehicle sales with auto brokers and leasing companies, and with internet companies that provide customer referrals to other dealerships or who broker vehicle sales between customers and other dealerships. We compete with small, local dealerships and with large multi-franchise auto dealerships. Some of our competitors also may utilize marketing techniques, such as “no negotiation” sales methods, not extensively used by us.

5

We believe that the principal competitive factors in vehicle sales are the marketing campaigns conducted by manufacturers, the ability of dealerships to offer a wide selection of the most popular vehicles, the location of dealerships and the quality of customer service. Other competitive factors include customer preference for makes of automobiles, pricing (including manufacturer rebates and other special offers) and warranties.

In addition to competition for vehicle sales, we also compete with other auto dealers, service stores, auto parts retailers and independent mechanics in providing parts and service. We believe that the principal competitive factors in parts and service sales are price, the use of factory-approved replacement parts, the familiarity with a dealer’s makes and models and the quality of customer service. A number of regional and national chains offer selected parts and service at prices that may be lower than our prices.

In arranging or providing financing for our customers’ vehicle purchases, we compete with a broad range of financial institutions. In addition, financial institutions are now offering F&I products through the internet, which may reduce our profits on these items. We believe that the principal competitive factors in providing financing are convenience, interest rates and contract terms.

Our success depends, in part, on national and regional automobile-buying trends, local and regional economic factors and other regional competitive pressures. Conditions and competitive pressures affecting the markets in which we operate, such as price-cutting by dealers in these areas, or in any new markets we enter, could adversely affect us, although the retail automobile industry as a whole might not be affected.

Governmental Regulations and Environmental Matters

Numerous federal and state regulations govern Sonic’s business of marketing, selling, financing and servicing automobiles. Sonic also is subject to laws and regulations relating to business corporations generally.

Under the laws of the states in which we currently operate as well as the laws of other states into which we may expand, we must obtain a license in order to establish, operate or relocate a dealership or operate an automotive repair service. These laws also regulate our conduct of business, including our sales, operating, advertising, financing and employment practices. These laws also include federal and state wage-hour, anti-discrimination and other employment practices laws.

Our operations are also subject to certain consumer protection laws known as “Lemon Laws.” These laws typically require a manufacturer or dealer to replace a new vehicle or accept it for a full refund within one year after initial purchase if the vehicle does not conform to the manufacturer’s express warranties and the dealer or manufacturer, after a reasonable number of attempts, is unable to correct or repair the defect. Federal laws require certain written disclosures to be provided on new vehicles, including mileage and pricing information.

The imported automobiles purchased by us are subject to United States customs duties and, in the ordinary course of our business, we may, from time to time, be subject to claims for duties, penalties, liquidated damages, or other charges.

Our financing activities with customers are subject to federal truth-in-lending, consumer privacy, consumer leasing and equal credit opportunity regulations as well as state and local motor vehicle finance laws, installment finance laws, usury laws and other installment sales laws. Some states regulate finance fees that may be paid as a result of vehicle sales.

Federal, state and local environmental regulations, including regulations governing air and water quality, the clean-up of contaminated property and the use, storage, handling, recycling and disposal of gasoline, oil and other materials, also apply to us and our dealership properties.

6

We believe that we comply in all material respects with the laws affecting our business. However, claims arising out of actual or alleged violations of laws may be asserted against us or our dealerships by individuals or governmental entities, and may expose us to significant damages or other penalties, including possible suspension or revocation of our licenses to conduct dealership operations and fines.

As with automobile dealerships generally, and service, parts and body shop operations in particular, our business involves the use, storage, handling and contracting for recycling or disposal of hazardous or toxic substances or wastes and other environmentally sensitive materials. Our business also involves the past and current operation and/or removal of above ground and underground storage tanks containing such substances or wastes. Accordingly, we are subject to regulation by federal, state and local authorities that establish health and environmental quality standards, provide for liability related to those standards, and in certain circumstances provide penalties for violations of those standards. We are also subject to laws, ordinances and regulations governing remediation of contamination at facilities we own or operate or to which we send hazardous or toxic substances or wastes for treatment, recycling or disposal.

We believe that we do not have any material environmental liabilities and that compliance with environmental laws and regulations will not, individually or in the aggregate, have a material adverse effect on our results of operations or financial condition. However, soil and groundwater contamination is known to exist at certain properties used by us. Further, environmental laws and regulations are complex and subject to frequent change. In addition, in connection with our acquisitions, it is possible that we will assume or become subject to new or unforeseen environmental costs or liabilities, some of which may be material. We cannot assure you that compliance with current or amended, or new or more stringent, laws or regulations, stricter interpretations of existing laws or the future discovery of environmental conditions will not require additional expenditures by Sonic, or that such expenditures will not be material.

Employees

As of March 11, 2003, Sonic employed 12,133 people. We believe that many dealerships in the retail automobile industry have difficulty in attracting and retaining qualified personnel for a number of reasons, including the historical inability of dealerships to provide employees with an equity interest in the profitability of the dealership. We provide certain executive officers, managers and other employees with stock options and all employees with a stock purchase plan. We believe this type of equity incentive is attractive to our existing and prospective employees.

We believe that our relationships with our employees are good. Approximately 310 of our employees, primarily service technicians in our Northern California markets, are represented by a labor union. We may be affected by labor strikes, work slowdowns and walkouts at our dealerships or the manufacturer’s manufacturing facilities.

Company Information

Our website is located at www.sonicautomotive.com. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports, as well as proxy statements and other information we file with the Securities and Exchange Commission (“SEC”) are available free of charge on our website. We make these documents available as soon as reasonably practicable after we file them with, or furnished them to, the SEC. Except as otherwise stated in these documents, the information contained on our website or available by hyperlink from our website is not incorporated into this Current Report on Form 8-K or other documents we file with, or furnish to, the SEC.

7

Item 6: Selected Financial Data.

In accordance with accounting principles generally accepted in the United States of America, the selected consolidated financial data have been retroactively restated to reflect Sonic’s two-for-one common stock split that occurred on January 25, 1999. This selected consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes included elsewhere in this Form 8-K.

We have accounted for all of our dealership acquisitions using the purchase method of accounting and, as a result, we do not include in our financial statements the results of operations of these dealerships prior to the date they were acquired by us. The selected consolidated financial data of Sonic discussed on the following page reflect the results of operations and financial positions of each of our dealerships acquired prior to December 31, 2002. As a result of the effects of our acquisitions and other potential factors in the future, the historical consolidated financial information described in selected consolidated financial data is not necessarily indicative of the results of operations and financial position of Sonic in the future or the results of operations and financial position that would have resulted had such acquisitions occurred at the beginning of the periods presented in the selected consolidated financial data.

| | | Year Ended December 31,

|

| | | 2000

| | 2001

| | 2002 (2)

|

| | | (dollars and shares in thousands except per

share amounts) |

Income Statement Data (1): | | | | | | | | | |

Total revenues | | $ | 5,207,220 | | $ | 5,687,640 | | $ | 6,933,948 |

Operating income | | $ | 192,776 | | $ | 195,295 | | $ | 235,791 |

Income from continuing operations before income taxes | | $ | 113,161 | | $ | 130,098 | | $ | 176,775 |

Net income from continuing operations | | $ | 70,216 | | $ | 79,416 | | $ | 109,433 |

Basic net income per share from continuing operations | | $ | 1.65 | | $ | 1.96 | | $ | 2.62 |

Diluted net income per share from continuing operations | | $ | 1.60 | | $ | 1.91 | | $ | 2.54 |

| | | |

Consolidated Balance Sheet Data (3): | | | | | | | | | |

Total assets | | $ | 1,782,993 | | $ | 1,810,369 | | $ | 2,375,308 |

Long-term debt (4) | | | 493,309 | | | 519,963 | | | 645,809 |

Total liabilities | | | 1,332,071 | | | 1,293,108 | | | 1,738,130 |

Stockholders’ equity (5) | | | 450,922 | | | 517,261 | | | 637,178 |

| (1) | | In accordance with the provisions of Statement of Financial Accounting Standards (SFAS) No. 144:Accounting for the Impairment or Disposal of Long-Lived Assets, (“SFAS 144”) adopted January 1, 2002, income statement data in prior years reflect the reclassification of the results of operations of all dealerships sold during 2002 and in the first quarter of 2003 and held for sale as of March 31, 2003 to income from discontinued operations. |

| (2) | | In accordance with the provisions of SFAS No. 142:Goodwill and Other Intangible Assets, effective January 1, 2002, goodwill is no longer amortized. See Note 1 to the accompanying consolidated financial statements contained herein. |

| (3) | | Certain prior year amounts have been reclassified to conform with the current year presentation. See Note 1 to our Consolidated Financial Statements. |

| (4) | | Long-term debt includes current maturities of long-term debt and the note payable to Sonic’s Chairman. See Sonic’s Consolidated Financial Statements and related notes included elsewhere in this Form 8-K. |

| (5) | | No cash dividends were paid in the three years presented. |

8

Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of the results of operations and financial condition should be read in conjunction with the Sonic Automotive, Inc. and Subsidiaries Consolidated Financial Statements and the related notes thereto appearing elsewhere in this report. The financial data contained in the following discussion for all periods presented reflects our March 31, 2003 classification of dealerships between continuing operations and discontinued operations in accordance with SFAS 144.

Overview

We are one of the largest automotive retailers in the United States. As of March 11, 2003 we operated 186 dealership franchises, representing 34 different brands of cars and light trucks, at 139 locations and 45 collision repair centers in 15 states. Our dealerships provide comprehensive services including sales of both new and used cars and light trucks, sales of replacement parts, performance of vehicle maintenance, warranty, paint and collision repair services, and arrangement of extended warranty contracts, financing and insurance for our customers. Our brand diversity allows us to offer a broad range of products at a wide range of prices from lower priced, or economy vehicles, to luxury vehicles. We believe that this diversity reduces the risk of changes in customer preferences, product supply shortages and aging products. In addition, although vehicle sales are cyclical and are affected by many factors, including general economic conditions, consumer confidence, levels of discretionary personal income, interest rates and available credit, our parts, service and collision repair services are not closely tied to vehicle sales and are not dependent upon near-term sales volume. As a result, we believe the diversity of these products and services reduces the risk of periodic economic downturns.

The following table depicts the breakdown of our new vehicle revenues by brand for each of the past three years:

| | | Percentage of New Vehicle Revenues Year Ended December 31,

| |

| | | 2000

| | | 2001

| | | 2002

| |

Brand (1) | | | | | | | | | |

General Motors (2) | | 11.4 | % | | 12.3 | % | | 22.0 | % |

Ford | | 13.9 | % | | 19.0 | % | | 17.1 | % |

Honda | | 16.3 | % | | 14.3 | % | | 14.0 | % |

Toyota | | 9.5 | % | | 12.4 | % | | 10.9 | % |

BMW | | 11.8 | % | | 11.8 | % | | 10.4 | % |

Chrysler (3) | | 8.1 | % | | 5.4 | % | | 4.6 | % |

Lexus | | 6.0 | % | | 5.9 | % | | 4.5 | % |

Nissan | | 5.1 | % | | 4.4 | % | | 2.7 | % |

Other Luxury (4) | | 11.6 | % | | 9.5 | % | | 8.9 | % |

Other (5) | | 6.3 | % | | 5.0 | % | | 4.9 | % |

| | |

|

| |

|

| |

|

|

Total | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | |

|

| |

|

| |

|

|

| (1) | | In accordance with the provisions of SFAS No. 144, adopted January 1, 2002, revenue data in prior years reflect the reclassification of the results of operations of all dealerships sold during 2002 and in the first quarter of 2003 and held for sale as of March 31, 2003 to income from discontinued operations. |

| (2) | | Includes Buick, Cadillac, Chevrolet, GMC, Oldsmobile, and Pontiac. |

| (3) | | Includes Chrysler, Dodge, Jeep, and Plymouth . |

| (4) | | Includes Acura, Audi, Hummer, Infiniti, Land Rover, Mercedes, Porsche, Saab, and Volvo. |

| (5) | | Includes Hyundai, Isuzu, KIA, Lincoln, Mazda, Mercury, Mitsubishi, Subaru, and Volkswagen. |

We sell similar products and services, use similar processes in selling our products and services and sell our products and services to similar classes of customers. As a result of this and the way we manage our business, we have aggregated our results into a single segment for purposes of reporting financial condition and results of operations.

9

We have accounted for all of our dealership acquisitions using the purchase method of accounting and, as a result, we do not include in our consolidated financial statements the results of operations of these dealerships prior to the date they were acquired. Our consolidated financial statements discussed below reflect the results of operations, financial position and cash flows of each of our dealerships acquired prior to December 31, 2002. As a result of the effects of our acquisitions and other potential factors in the future, the historical consolidated financial information described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” is not necessarily indicative of the results of operations, financial position and cash flows which would have resulted had such acquisitions occurred at the beginning of the periods presented, nor is it indicative of future results of operations, financial position and cash flows.

Use of Estimates and Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Critical accounting policies are those that are both most important to the portrayal of our financial position and results of operations and require the most subjective and complex judgments. Following is a discussion of what we believe are our critical accounting policies and estimates. See Note 1 to our consolidated financial statements for additional discussion regarding our accounting policies.

Finance and Service Contracts—We arrange financing for customers through various financial institutions and receive a commission from the lender equal to the difference between the actual interest rates charged to customers and the predetermined base rates set by the financing institution. We also receive commissions from the sale of various insurance contracts and non-recourse third party extended service contracts to customers. Under these contracts, the applicable manufacturer or third party warranty company is directly liable for all warranties provided within the contract.

In the event a customer terminates a financing, insurance or warranty contract prior to the original termination date, we may be required to return a portion of the commission revenue originally recorded to the third party provider (“chargebacks”). The commission revenue for the sale of these products and services is recorded net of estimated chargebacks at the time of sale. Our estimate of future chargebacks is established based on our historical chargeback rates and the termination provisions of the applicable contracts. While chargeback rates vary depending on the type of contract sold, a 100 basis point increase in the estimated chargeback rates used in determining our estimates of future chargebacks would have resulted in an additional $0.6 million in recorded chargebacks.

Goodwill—Goodwill and other intangible assets having indefinite useful lives are tested for impairment at least annually, or more frequently when events or circumstances indicate that impairment might have occurred. In evaluating goodwill for impairment, we compare the carrying value to the fair value of the underlying businesses. We use various assumptions in determining fair value, including estimates of future earnings, future growth rates, earnings multiples and discount factors. We are subject to financial statement risk to the extent goodwill balances are impaired due to decreases in the fair market value of the related underlying businesses.

Insurance Reserves—We have various self-insured and high deductible insurance programs which require us to make estimates in determining the ultimate liability we may incur for claims arising under these programs. These insurance reserves are estimated by management using actuarial evaluations based on historical claims experience, claims processing procedures, medical cost trends and, in the case of reserves for workers’ compensation claims, a discount factor. At December 31, 2002, we had $10.6 million reserved for such programs. For each one percentage point increase in the assumed medical trend rate, the reserve for our medical insurance program would increase by $52,000. Each one day increase in the average claim lag would cause the reserve to increase by $87,000. We used an experience modification factor in estimating reserves for workers’ compensation claims of 0.73. A change of five basis points in this factor would change the reserve by $300,000.

10

We also used a discount rate of 5.0% to calculate the present value of our estimated workers’ compensation claims. A change of 100 basis points in the discount rate would change the reserve by $150,000.

Legal Proceedings—Sonic is involved, and will continue to be involved, in numerous legal proceedings arising in the ordinary course of business, including litigation with customers, employment related lawsuits, contractual disputes and actions brought about by governmental authorities. Currently, no legal proceedings are pending against or involve Sonic that, in the opinion of management, could reasonably be expected have a material adverse effect on our business, financial condition or results of operations. However, the results of these proceedings cannot be predicted with certainty, and an unfavorable resolution of one or more if these proceedings could have a material adverse effect on our business, financial condition, results of operations, cash flows and prospects.

Recent Accounting Pronouncements

The Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards (“SFAS”) No. 142,Goodwill and Other Intangible Assets in June 2001. Among other things, SFAS 142 no longer permits the amortization of goodwill, but requires that the carrying amount of goodwill be reviewed and reduced with a charge against operations if it is found to be impaired. SFAS 142 also requires the amortization of intangible assets other than goodwill over their useful economic lives, unless the useful economic life is determined to be indefinite. Intangible assets determined to have a finite life are required to be reviewed for impairment in accordance with SFAS 144:Accounting for Impairment or Disposal of Long-Lived Assets.Intangible assets that are determined to have an indefinite economic life are not amortized and must be reviewed for impairment in accordance with the terms of SFAS 142. We have not recognized any impairment related to the goodwill or other intangible assets recorded on our balance sheet.

The provisions of SFAS 142 applied immediately to all acquisitions completed after June 30, 2001. Goodwill and intangible assets with indefinite lives existing at June 30, 2001 were amortized until December 31, 2001. Effective January 1, 2002, such amortization ceased, as all of the provisions became effective on that date.

We also adopted the provisions of SFAS 144 as of January 1, 2002. SFAS 144 establishes a single accounting model for assets to be disposed of by sale whether previously held and used or newly acquired. SFAS 144 requires certain long-lived assets to be reported at the lower of carrying amount or fair value, less cost to sell, and provides guidance in asset valuation and measuring impairment. The results of operations of those dealerships disposed of and those dealerships held for sale are now required to be reflected in discontinued operations as shown in the accompanying consolidated statements of income.

In April 2002, the FASB issued SFAS No. 145: Rescission of FASB Statements No. 4, 44 and 64, Amendment of FASB Statement No. 13, and Technical Corrections. Prior to adoption, gains or losses resulting from extinguishment of debt were required to be classified as extraordinary items, net of related tax effects. Upon adoption of SFAS 145, however, the classification of such gains or losses as extraordinary must be evaluated based on the criteria established in APB Opinion No. 30. Gains and losses not meeting that criterion, including gains and losses classified as extraordinary in prior periods, must be classified in income from operations. We adopted the provisions of SFAS 145 effective July 1, 2002. Accordingly, gains or losses incurred on the early extinguishment of debt (debt repurchases) have been included in other income in the accompanying consolidated statements of income.

In June 2002, the FASB issued SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal Activities.” SFAS 146 requires the recognition of a liability for costs associated with an exit or disposal activity at the time the liability is incurred, rather than at the date of the entity’s commitment to the exit or disposal plan. The provisions of SFAS 146 are effective for exit or disposal activities initiated after December 31, 2002. We do not expect the adoption of SFAS 146 to have a material effect on our consolidated operating results, financial position, or cash flows.

In November 2002, the FASB issued FASB Interpretation (“FIN”) No. 45, “Guarantor’s Accounting and Disclosure Requirements for Guarantees of Indebtedness of Others.” FIN 45 requires the recognition of a liability for certain guarantees, issued guarantees, after December 31, 2002, or for modifications made after

11

December 31, 2002 to previously issued guarantees, and clarifies disclosure requirements for certain guarantees. The disclosure provisions of FIN 45 are effective for fiscal years ended after December 15, 2002. We have adopted the disclosure provisions of FIN 45 as of December 31, 2002.

In January 2003, the FASB issued FIN 46, “Consolidation of Variable Interest Entities, an Interpretation of APB No.51.” FIN 46 requires the consolidation of certain variable interest entities by the primary beneficiary if the equity investors do not have a controlling financial interest or sufficient equity at risk to finance the entities’ activities without additional subordinated financial support of other parties. The provisions of FIN 46 are effective for all variable interest entities created or acquired after January 31, 2003. For variable interest entities created or acquired prior to that date, the provisions of FIN 46 must be applied for the first interim or annual period beginning after June 15, 2003. The adoption of FIN 46 is not expected to have a material impact on our consolidated results of operations, financial position or cash flows.

In April 2003, the FASB issued SFAS No. 149, “Amendment of Statement 133 on Derivative Instruments and Hedging Activities.” SFAS No. 149 amends and clarifies financial accounting and reporting for derivative instruments, including certain derivative instruments embedded in other contracts and for hedging activities under SFAS No. 133 generally entered into or modified after June 30, 2003 and hedging relationships designated after June 30, 2003. We do not expect SFAS No. 149 to have a material effect on our consolidated operating results, financial position, or cash flows.

In May 2003, the FASB issued SFAS No. 150, “Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity.” SFAS No. 150 establishes standards for the classification and measurement of certain financial instruments with characteristics of both liabilities and equity and is effective for financial instruments entered into or modified after May 31, 2003, and otherwise is effective at the beginning of the first interim period beginning after June 15, 2003. We do not expect SFAS No. 150 to have a material effect on our consolidated operating results, financial position, or cash flows.

Results of Operations

The following table summarizes the percentages of total revenues represented by certain items reflected in our Consolidated Statements of Income.

| | | Percentage of Total Revenues for the Year Ended December 31,

| |

| | | 2000

| | | 2001

| | | 2002

| |

Revenues(1): | | | | | | | | | |

New vehicles | | 59.5 | % | | 60.5 | % | | 60.9 | % |

Used vehicles | | 18.9 | % | | 17.7 | % | | 16.8 | % |

Wholesale vehicles | | 7.0 | % | | 6.4 | % | | 6.6 | % |

Parts, service and collision repair | | 11.8 | % | | 12.4 | % | | 12.9 | % |

Finance and insurance and other | | 2.8 | % | | 3.0 | % | | 2.8 | % |

| | |

|

| |

|

| |

|

|

Total revenues | | 100.0 | % | | 100.0 | % | | 100.0 | % |

Cost of sales | | 84.9 | % | | 84.5 | % | | 84.5 | % |

| | |

|

| |

|

| |

|

|

Gross profit | | 15.1 | % | | 15.5 | % | | 15.5 | % |

Selling, general and administrative | | 11.0 | % | | 11.7 | % | | 12.0 | % |

Depreciation | | 0.1 | % | | 0.1 | % | | 0.1 | % |

Goodwill amortization | | 0.3 | % | | 0.3 | % | | 0.0 | % |

| | |

|

| |

|

| |

|

|

Operating income | | 3.7 | % | | 3.4 | % | | 3.4 | % |

Interest expense, floor plan | | 0.8 | % | | 0.5 | % | | 0.3 | % |

Interest expense, other | | 0.8 | % | | 0.6 | % | | 0.6 | % |

| | |

|

| |

|

| |

|

|

Income from continuing operations before income taxes | | 2.1 | % | | 2.3 | % | | 2.5 | % |

Income tax expense | | 0.8 | % | | 0.9 | % | | 0.9 | % |

| | |

|

| |

|

| |

|

|

Net income from continuing operations | | 1.3 | % | | 1.4 | % | | 1.6 | % |

| | |

|

| |

|

| |

|

|

| (1) | | In accordance with the provisions of SFAS 144, income statement data in prior years reflect the reclassification of the results of operations of all dealerships sold during 2002 and in the first quarter of 2003 and held for sale as of March 31, 2003 to income from discontinued operations. |

12

During the year ended December 31, 2002, we disposed of 16 franchises and had approved, but not completed, the disposition of ten additional franchises. In accordance with the provisions of SFAS 144, the results of operations of these dealerships, including gains or losses on disposition, have been included in net income from discontinued operations in the accompanying Consolidated Statements of Income for all periods presented. In addition to these dispositions, during the year ended December 31, 2001 and 2000, we disposed of 15 and 8 franchises, respectively. However, because the provisions of SFAS 144 do not permit retroactive application to dispositions occurring before January 1, 2002, the results of operations of these dealerships have been included in net income from continuing operations in the accompanying Consolidated Statements of Income. As a result, the results of operations based on the information presented in the accompanying Consolidated Statements of Income is not comparative since the information presented for 2001 and 2000 includes results of operations for dealerships disposed in those years that were not in existence in 2002. Therefore, in order to provide a more meaningful comparison, the tables included within the discussion below disaggregate the impact of the dealerships disposed in prior years in order to arrive at a comparison of only the results of operations of “ongoing” operations.

Annual “same store” results of operations represent the aggregate of the same store results for each quarter. Same store results for each quarter include dealerships that were owned and operated for the entire quarter in both periods.

Revenues

| | | For the Year Ended

| | $ Change

| | | %

Change

| | | For the Year Ended

| | $ Change

| | | %

Change

| |

| | | 12/31/2002

| | 12/31/2001

| | | | 12/31/2001

| | 12/31/2000

| | |

Total Revenues (in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store | | $ | 5,316,967 | | $ | 5,444,091 | | (127,124 | ) | | (2.3 | )% | | $ | 4,755,445 | | $ | 4,957,212 | | $ | (201,767 | ) | | (4.1 | )% |

Acquisitions | | | 1,616,981 | | | 158,549 | | 1,458,432 | | | 919.9 | % | | | 847,195 | | | 66,659 | | | 780,536 | | | 1170.9 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total Ongoing Dealerships | | | 6,933,948 | | | 5,602,640 | | 1,331,308 | | | 23.8 | % | | | 5,602,640 | | | 5,023,871 | | | 578,769 | | | 11.5 | % |

Disposed prior to 2002 | | | — | | | 85,000 | | (85,000 | ) | | (100.0 | )% | | | 85,000 | | | 183,349 | | | 98,349 | | | (53.6 | )% |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total As Reported | | $ | 6,933,948 | | $ | 5,687,640 | | 1,246,308 | | | 21.9 | % | | $ | 5,687,640 | | $ | 5,207,220 | | $ | 480,420 | | | 9.2 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Revenues from ongoing dealerships increased in 2002 as a result of acquired dealerships, while same store revenues declined compared to 2001, which was the second best year in history for sales of light vehicles in the United States. The primary factor causing this decline was reduced consumer spending resulting from a downturn in economic conditions (as described in more detail below). Reduced consumer spending may continue to affect future revenues as economic conditions remain uncertain. In addition, uncertainty associated with U.S. military action in the Middle East may also affect future revenues.

Revenues from ongoing dealerships increased in 2001 as a result of acquired dealerships, while same store revenues declined compared to 2000, driven by lower vehicle revenues primarily in our Northern California and Carolina regions.

13

New Vehicles

| | | For the Year Ended

| | Units or $

Change

| | | %

Change

| | | For the Year Ended

| | Units or $

Change

| | | %

Change

| |

| | | 12/31/2002

| | 12/31/2001

| | | | 12/31/2001

| | 12/31/2000

| | |

Total New Vehicle Units | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store | | | 119,986 | | | 124,607 | | (4,621 | ) | | (3.7 | )% | | | 106,255 | | | 115,436 | | | (9,181 | ) | | (8.0 | )% |

Acquisitions | | | 31,007 | | | 2,964 | | 28,043 | | | 946.1 | % | | | 21,316 | | | 904 | | | 20,412 | | | 2258.0 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total Ongoing Dealerships | | | 150,993 | | | 127,571 | | 23,422 | | | 18.4 | % | | | 127,571 | | | 116,340 | | | 11,231 | | | 9.7 | % |

Disposed prior to 2002 | | | — | | | 1,902 | | (1,902 | ) | | (100.0 | )% | | | 1,902 | | | 3,447 | | | (1,545 | ) | | (44.8 | )% |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total As Reported | | | 150,993 | | | 129,473 | | 21,520 | | | 16.6 | % | | | 129,473 | | | 119,787 | | | 9,686 | | | 8.1 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total New Vehicle Revenues (in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store | | $ | 3,277,714 | | $ | 3,319,751 | | (42,037 | ) | | (1.3 | )% | | $ | 2,864,123 | | $ | 2,981,110 | | $ | (116,987 | ) | | (3.9 | )% |

Acquisitions | | | 941,654 | | | 76,971 | | 864,683 | | | 1123.4 | % | | | 532,599 | | | 24,966 | | | 507,633 | | | 2033.3 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total Ongoing Dealerships | | | 4,219,368 | | | 3,396,722 | | 822,646 | | | 24.2 | % | | | 3,396,722 | | | 3,006,076 | | | 390,646 | | | 13.0 | % |

Disposed prior to 2002 | | | — | | | 43,680 | | (43,680 | ) | | (100.0 | )% | | | 43,680 | | | 92,359 | | | (48,679 | ) | | (52.7 | )% |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total As Reported | | $ | 4,219,368 | | $ | 3,440,402 | | 778,966 | | | 22.6 | % | | $ | 3,440,402 | | $ | 3,098,435 | | $ | 341,967 | | | 11.0 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total New Vehicle Unit Price | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store | | $ | 27,317 | | $ | 26,642 | | 675 | | | 2.5 | % | | $ | 26,955 | | $ | 25,825 | | $ | 1,130 | | | 4.4 | % |

Total Ongoing Dealerships | | $ | 27,944 | | $ | 26,626 | | 1,318 | | | 5.0 | % | | $ | 26,626 | | $ | 25,839 | | $ | 787 | | | 3.0 | % |

The decline in same store unit sales during the year ended December 31, 2002 was consistent with an industry-wide decline in new vehicle sales. This decline was particularly evident in domestic brands, which are generally more sensitive to economic conditions than import and luxury brands. Sales of domestic non-luxury brands declined approximately 5.6% for the year ended December 31, 2002 and accounted for approximately 63.2% of the total decline in same store unit sales. Regional performance continued to be negatively affected by weaker economic conditions in our Northern California region, evidenced by significantly higher unemployment rates compared to the rest of the country. Same store unit sales in that region declined by 3,475 units, or 12.1%. Similar economic conditions in the Dallas market resulted in same store unit sales declines of 2,309 units or 15.7%. Our Ohio region experienced same store declines of 21.2%, due primarily to a predominance of domestic brand stores in that region. These decreases were partially offset by increases in unit sales in regions whose portfolios are dominated by import and luxury brands, primarily San Diego/Nevada, where units sales increased 1,048 units, or 15.2%, and South Carolina/Georgia, where units sales increased 710 units, or 11.9%, compared to the same period last year. We expect declines in same store new vehicle sales when comparing to the prior year’s quarter to continue during 2003.

In 2001, the decline in same store unit sales was primarily isolated to domestic brands. Sales of domestic brands on a same store basis declined by 6,903 units, or 15.1%, and accounted for 75.2% of the total decline in same store unit sales. As such, our regions dominated by domestic brands, such as Northern California and Carolinas, were particularly affected. Same store unit sales declined by 4,445 units or, 13.7%, and by 1,925 units, or 19.7%, in those two regions respectively, compared to 2000. Sales of import brands on a same store basis declined by only 2,278 units, or 3.3%, in 2001.

14

Used Vehicles

| | | For the Year Ended

| | Units or $

Change

| | | %

Change

| | | For the Year Ended

| | Units or $

Change

| | | %

Change

| |

| | | 12/31/2002

| | 12/31/2001

| | | | 12/31/2001

| | 12/31/2000

| | |

Total Used Vehicle Units | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store | | | 56,758 | | | 64,731 | | (7,973 | ) | | (12.3 | )% | | | 57,264 | | | 62,093 | | | (4,829 | ) | | (7.8 | )% |

Acquisitions | | | 17,406 | | | 2,348 | | 15,058 | | | 641.3 | % | | | 9,815 | | | 812 | | | 9,003 | | | 1108.7 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total Ongoing Dealerships | | | 74,164 | | | 67,079 | | 7,085 | | | 10.6 | % | | | 67,079 | | | 62,905 | | | 4,174 | | | 6.6 | % |

Disposed prior to 2002 | | | — | | | 1,366 | | (1,366 | ) | | (100.0 | )% | | | 1,366 | | | 3,022 | | | (1,656 | ) | | (54.8 | )% |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total As Reported | | | 74,164 | | | 68,445 | | 5,719 | | | 8.4 | % | | | 68,445 | | | 65,927 | | | 2,518 | | | 3.8 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total Used Vehicle Revenues (in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store | | $ | 867,692 | | $ | 955,611 | | (87,919 | ) | | (9.2 | )% | | $ | 853,314 | | $ | 931,760 | | $ | (78,446 | ) | | (8.4 | )% |

Acquisitions | | | 295,783 | | | 32,161 | | 263,622 | | | 819.7 | % | | | 134,458 | | | 11,484 | | | 122,974 | | | 1070.8 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total Ongoing Dealerships | | | 1,163,475 | | | 987,772 | | 175,703 | | | 17.8 | % | | | 987,772 | | | 943,244 | | | 44,528 | | | 4.7 | % |

Disposed prior to 2002 | | | — | | | 18,679 | | (18,679 | ) | | (100.0 | )% | | | 18,679 | | | 42,764 | | | (24,085 | ) | | (56.3 | )% |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total As Reported | | $ | 1,163,475 | | $ | 1,006,451 | | 157,024 | | | 15.6 | % | | $ | 1,006,451 | | $ | 986,008 | | $ | 20,443 | | | 2.1 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total Used Vehicle Unit Price | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store | | $ | 15,288 | | $ | 14,763 | | 525 | | | 3.6 | % | | $ | 14,901 | | $ | 15,006 | | $ | (105 | ) | | (0.7 | )% |

Total Ongoing Dealerships | | $ | 15,688 | | $ | 14,726 | | 962 | | | 6.5 | % | | $ | 14,726 | | $ | 14,995 | | $ | (269 | ) | | (1.8 | )% |

During 2002, used vehicle unit sales were negatively affected by a lack of adequate consumer credit availability. This was caused by many of the manufacturers’ captive finance companies focusing their financing of new vehicle sales and, to a lesser extent, used vehicle sales only at those dealerships selling their brands and tightening of credit standards by other finance companies. These factors have adversely affected consumers’ ability to finance used vehicle purchases, which reduces retail activity. Also contributing to the decline in used vehicle sales were competitive pressures from strong manufacturer incentives and interest rate subsidies on new vehicles. Our Oklahoma region, which has historically been heavily dependent on used vehicle sales, especially the sub-prime market, was particularly affected by these trends. Same store unit sales declined 1,533 units, or 23.8%. Unit sales in our Southeast division declined 2,720 units, or 13.8%. These regions accounted for 53.3% of the total decline in same store unit sales for 2002.

During 2001, 60.1% of the decline in same store unit sales was the Southeast Division, primarily the Carolinas region which declined 1,077 units, or 17.4%, the South Carolina/Georgia region which declined 1,264 units, or 21.8%, and the Birmingham/Tennessee region which declined 845 units, or 18.3%, compared to 2000.

Wholesale Vehicles

| | | For the Year Ended

| | Units or $

Change

| | | %

Change

| | | For the Year Ended

| | Units or $

Change

| | | %

Change

| |

| | | 12/31/2002

| | 12/31/2001

| | | | 12/31/2001

| | 12/31/2000

| | |

Total Wholesale Vehicle Units | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store | | | 47,778 | | | 51,334 | | (3,556 | ) | | (6.9 | )% | | | 44,684 | | | 48,133 | | | (3,449 | ) | | (7.2 | )% |

Acquisitions | | | 14,465 | | | 2,185 | | 12,280 | | | 562.0 | % | | | 8,835 | | | 3,891 | | | 4,944 | | | 127.1 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total Ongoing Dealerships | | | 62,243 | | | 53,519 | | 8,724 | | | 16.3 | % | | | 53,519 | | | 52,024 | | | 1,495 | | | 2.9 | % |

Disposed prior to 2002 | | | — | | | 1,663 | | (1,663 | ) | | (100.0 | )% | | | 1,663 | | | 3,381 | | | (1,718 | ) | | (50.8 | )% |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total As Reported | | | 62,243 | | | 55,182 | | 7,061 | | | 12.8 | % | | | 55,182 | | | 55,405 | | | (223 | ) | | (0.4 | )% |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total Wholesale Vehicle Revenues (in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store | | $ | 325,589 | | $ | 327,114 | | (1,525 | ) | | (0.5 | )% | | $ | 288,611 | | $ | 327,898 | | $ | (39,287 | ) | | (12.0 | )% |

Acquisitions | | | 130,110 | | | 25,399 | | 104,711 | | | 412.3 | % | | | 63,902 | | | 17,656 | | | 46,246 | | | 261.9 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total Ongoing Dealerships | | | 455,699 | | | 352,513 | | 103,186 | | | 29.3 | % | | | 352,513 | | | 345,554 | | | 6,959 | | | 2.0 | % |

Disposed prior to 2002 | | | — | | | 9,251 | | (9,251 | ) | | (100.0 | )% | | | 9,251 | | | 17,638 | | | (8,387 | ) | | (47.6 | )% |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total As Reported | | $ | 455,699 | | $ | 361,764 | | 93,935 | | | 26.0 | % | | $ | 361,764 | | $ | 363,192 | | $ | (1,428 | ) | | (0.4 | )% |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total Wholesale Unit Price | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store | | $ | 6,815 | | $ | 6,372 | | 443 | | | 7.0 | % | | $ | 6,459 | | $ | 6,812 | | $ | (353 | ) | | (5.2 | )% |

Total Ongoing Dealerships | | $ | 7,321 | | $ | 6,587 | | 734 | | | 11.1 | % | | $ | 6,587 | | $ | 6,642 | | $ | (55 | ) | | (0.8 | )% |

15

During 2002, the decrease in same store wholesale vehicle revenues is due to a decrease in units sold, offset by an increase in average price per unit, primarily resulting from wholesaling higher end models in order to liquidate aged units and maintain appropriate inventory levels.

During 2001, the majority of the decline in same store sales resulted from a decline in units sold, coupled with a lower selling price caused by the declines in values of used units at the wholesale level, especially in the fourth quarter.

Fixed Operations

| | | For the Year Ended

| | $

Change

| | | %

Change

| | | For the Year Ended

| | $

Change

| | | %

Change

| |

| | | 12/31/2002

| | 12/31/2001

| | | | 12/31/2001

| | 12/31/2000

| | |

Total Parts, Service and Collision Repair (in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store | | $ | 691,568 | | $ | 681,845 | | 9,723 | | | 1.4 | % | | $ | 606,190 | | $ | 581,231 | | $ | 24,959 | | | 4.3 | % |

Acquisitions | | | 206,661 | | | 15,134 | | 191,527 | | | 1265.5 | % | | | 90,789 | | | 8,008 | | | 82,781 | | | 1033.7 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total Ongoing Dealerships | | | 898,229 | | | 696,979 | | 201,250 | | | 28.9 | % | | | 696,979 | | | 589,239 | | | 107,740 | | | 18.3 | % |

Disposed prior to 2002 | | | — | | | 11,737 | | (11,737 | ) | | (100.0 | )% | | | 11,737 | | | 26,928 | | | (15,191 | ) | | (56.4 | )% |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total As Reported | | $ | 898,229 | | $ | 708,716 | | 189,513 | | | 26.7 | % | | $ | 708,716 | | $ | 616,167 | | $ | 92,549 | | | 15.0 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Same store parts, service and collision repair revenues increased during 2002, resulting primarily from increases in warranty sales arising in part from BMW expanding their warranty to cover all new vehicle maintenance and Honda extending its warranty on two models due to problems with its V6 engines. In addition, we continued implementation of our best practices and investments in real estate and construction projects on collision facilities, which allowed us to increase our overall service and parts capacity. These increases were partially offset by significant declines in our Ford stores of $9.3 million, or 8.2%, resulting from unusually high parts and service sales generated in 2001 by the Firestone tire recall and other recalls. In addition, collision revenues were adversely affected by rising insurance premiums that have caused consumers to obtain higher deductible policies. Lower collision revenues in 2002 are a result of customers choosing not to perform minor repair work that historically would have been covered by lower deductible policies, as well as a change in insurance company trends whereby vehicles are being declared totaled rather than repaired at a greater percentage than in prior years.

Same store revenues increased during 2001, resulting in part from investments in real estate and construction projects on collision facilities, which allowed us to increase our overall service and parts capacity, as well as an increase at our Ford stores of $4.0 million or 5.4%, resulting in part from unusually high parts and service sales generated in 2001 by the Firestone tire recall and other recalls.

Finance and Insurance

| | | For the Year Ended

| | $

Change

| | | %

Change

| | | For the Year Ended

| | $

Change

| | | %

Change

| |

| | | 12/31/2002

| | 12/31/2001

| | | | 12/31/2001

| | 12/31/2000

| | |

Total Finance & Insurance Revenue (in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store | | $ | 154,405 | | $ | 159,770 | | $ | (5,365 | ) | | (3.4 | )% | | $ | 143,208 | | $ | 135,213 | | $ | 7,995 | | | 5.9 | % |

Acquisitions | | | 42,772 | | | 8,884 | | | 33,888 | | | 381.4 | % | | | 25,446 | | | 4,544 | | | 20,902 | | | 460.0 | % |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total Ongoing Dealerships | | | 197,177 | | | 168,654 | | | 28,523 | | | 16.9 | % | | | 168,654 | | | 139,757 | | | 28,897 | | | 20.7 | % |

Disposed prior to 2002 | | | — | | | 1,653 | | | (1,653 | ) | | (100.0 | )% | | | 1,653 | | | 3,661 | | | (2,008 | ) | | (54.8 | )% |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total As Reported | | $ | 197,177 | | $ | 170,307 | | $ | 26,870 | | | 15.8 | % | | $ | 170,307 | | $ | 143,418 | | $ | 26,889 | | | 18.7 | % |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total F&I per Unit | | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store | | $ | 874 | | $ | 844 | | $ | 30 | | | 3.5 | % | | $ | 876 | | $ | 762 | | $ | 114 | | | 15.0 | % |

Total Ongoing Dealerships | | $ | 876 | | $ | 866 | | $ | 10 | | | 1.1 | % | | $ | 866 | | $ | 780 | | $ | 86 | | | 11.1 | % |

16

Same store finance and insurance revenues decreased during 2002 primarily due to lower retail vehicle unit sales. Unit sales were negatively impacted by the decline in retail vehicle unit sales in our Northern California market, and our Ohio, Carolinas and Dallas regions. Finance and insurance revenues in these markets declined $2.7 million or 7.2%, $1.8 million or 17.1%, $0.7 million or 7.2% and $1.7 million or 9.4%, respectively, compared to 2001.These declines were offset by strong performance in our San Diego/Nevada region, driven by a higher import and luxury brand mix, where revenues increased $2.3 million or 23.3% compared to 2001.

During 2001, the increase in same store finance and insurance revenues was primarily due to an increase in per unit revenue, which reflected our continued focus on training programs for finance and insurance sales people along with our ability to negotiate higher commissions on the origination of customer vehicle financing, insurance polices and extended warranty contracts.

Gross Profit and Gross Margins

| | | For the Year Ended

| | $

Change

| | | %

Change

| | | For the Year Ended

| | $

Change

| | | %

Change

| |

| | | 12/31/2002

| | 12/31/2001

| | | | 12/31/2001

| | 12/31/2000

| | |

Total Gross Profit (in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store | | $ | 831,407 | | $ | 842,318 | | $ | (10,911 | ) | | (1.3 | )% | | $ | 749,631 | | $ | 744,515 | | $ | 5,116 | | | 0.7 | % |

Acquisitions | | | 242,767 | | | 27,516 | | | 215,251 | | | 782.3 | % | | | 120,203 | | | 15,564 | | | 104,639 | | | 672.3 | % |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total Ongoing Dealerships | | | 1,074,174 | | | 869,834 | | | 204,340 | | | 23.5 | % | | | 869,834 | | | 760,079 | | | 109,755 | | | 14.4 | % |

Disposed prior to 2002 | | | — | | | 10,504 | | | (10,504 | ) | | (100.0 | )% | | | 10,504 | | | 26,585 | | | (16,081 | ) | | (60.5 | )% |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total As Reported | | $ | 1,074,174 | | $ | 880,338 | | $ | 193,836 | | | 22.0 | % | | $ | 880,338 | | $ | 786,664 | | $ | 93,674 | | | 11.9 | % |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Our overall gross profit and gross profit as a percentage of revenues (“gross margins”) generally vary depending on changes in our revenue mix. Although sales of new vehicles comprise the majority of our total revenues, new vehicles generally carry the lowest margin of any product or service we offer, generally averaging between 7.5% and 8.5%. As a result, sales of new vehicles comprise a relatively small portion of total gross profits. Retail sales of used vehicles generally carry a slightly higher gross margin than new vehicles, averaging between 11% and 11.5%. Parts, service, and collision repair carry the next highest margins, averaging between 45% and 47%. Commission revenues from the sale of finance, insurance and extended warranty products carry the highest margin at 100%. As a result, as our mix of revenues shifts between lower margin products and services to higher margin products and services, overall gross margins fluctuate accordingly.

During 2002, gross margins from ongoing dealerships remained stable at 15.5%. We experienced an increase during 2002 in the percentage of revenues contributed by parts, service and collision repair services. In addition, the gross profit percentage earned on our parts, service, and collision repair services increased to 47.6% in 2002 from 46.0% in 2001. This was offset by a slight decrease in the percentage of revenues contributed by our finance and insurance products to 2.8% in 2002 from 3.0% in 2001, and an increase in the percentage of revenues contributed by new vehicle sales to 60.9% in 2002 from 60.6% in 2001.

Ongoing dealership gross margin during 2001 increased to 15.5% from 15.1% due primarily to an increase in the percentage of revenues contributed by parts, service, collision repair services and finance and insurance products. Parts, service and collision repair revenues as a percentage of total revenues increased to 12.4% in 2001 from 11.7% in 2000. Finance and insurance revenues as a percentage of total revenues increased to 3.0% in 2001 from 2.8% in 2000. In addition, the gross profit percentage earned on our parts, service, and collision repair and finance and insurance products increased to 56.5% in 2001 from 55.0% in 2000.

17

Selling, General & Administrative Expenses

| | | For the Year Ended

| | $

Change

| | | %

Change

| | | For the Year Ended

| | $

Change

| | | %

Change

| |

| | | 12/31/2002

| | 12/31/2001

| | | | 12/31/2001

| | 12/31/2000

| | |

Total SG&A (in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Same Store | | $ | 614,949 | | $ | 601,374 | | $ | 13,575 | | | 2.3 | % | | $ | 537,496 | | $ | 518,587 | | $ | 18,909 | | | 3.6 | % |

Acquisitions | | | 214,992 | | | 46,364 | | | 168,628 | | | 363.7 | % | | | 110,242 | | | 28,253 | | | 81,989 | | | 290.2 | % |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total Ongoing Dealerships | | | 829,941 | | | 647,738 | | | 182,203 | | | 28.1 | % | | | 647,738 | | | 546,840 | | | 100,898 | | | 18.5 | % |

Disposed prior to 2002 | | | — | | | 13,892 | | | (13,892 | ) | | (100.0 | )% | | | 13,892 | | | 26,718 | | | (12,826 | ) | | (48.0 | )% |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total As Reported | | $ | 829,941 | | $ | 661,630 | | $ | 168,311 | | | 25.4 | % | | $ | 661,630 | | $ | 573,558 | | $ | 88,072 | | | 15.4 | % |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Of our total selling, general and administrative expenses from ongoing dealerships in 2002, approximately 60.7% were variable or semi-variable, comprised primarily of non-salaried sales compensation and advertising, and approximately 39.3% were fixed, comprised primarily of fixed compensation and rent expense.We manage these variable and semi-variable expenses so that they are generally related to vehicle sales gross profit and can be adjusted in response to changes in vehicle sales gross profit. Salespersons, sales managers, service managers, parts managers, service advisors, service technicians and all other non-clerical dealership personnel are paid either a commission or a modest salary plus commissions. In addition, dealership management compensation is tied to individual dealership profitability.