Exhibit 99.2

Exhibit 99.2

Cautionary Notice Regarding Forward-Looking Statements

This presentation contains statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

These forward-looking statements are not historical facts, but only predictions by our company and/or our company’s management.

These statements generally can be identified by lead-in words such as “believe,” “expect” “anticipate,” “intend,” “plan,” “foresee” and other similar words. Similarly, statements that describe our company’s objectives, plans or goals are also forward-looking statements.

You are cautioned that these forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Among others, factors that could materially adversely affect actual results and performance include those risk factors that are listed in Sonic Automotive’s Form 10-K for the year ended December 31, 2008.

First Quarter 2009 Earnings Review May 8, 2009

Sonic Automotive Q1 2009

Conference Call Topics

Quarterly Overview

Financial Review

Operations Review

Closing Comments

Quarter in Review

Strong performance in a tough environment

Gained new vehicle market share

Used vehicle performance solid – CPO again outperformed industry

Expanded service customer pay

Cost optimization

Made money

Successfully restructured debt

Strategic initiatives continue to gain traction

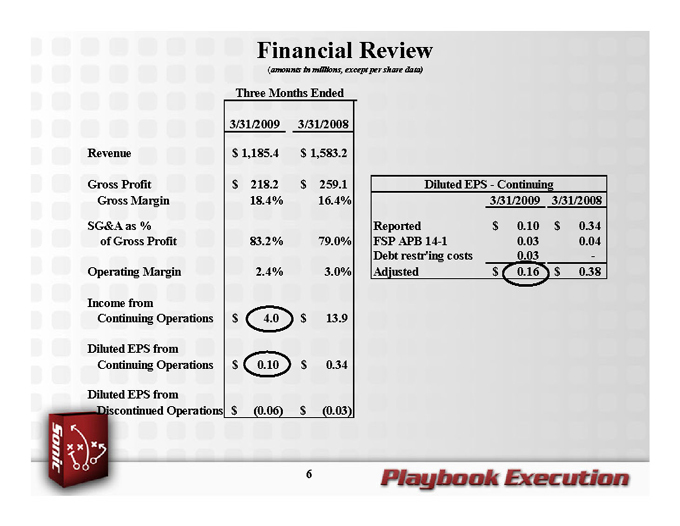

Financial Review

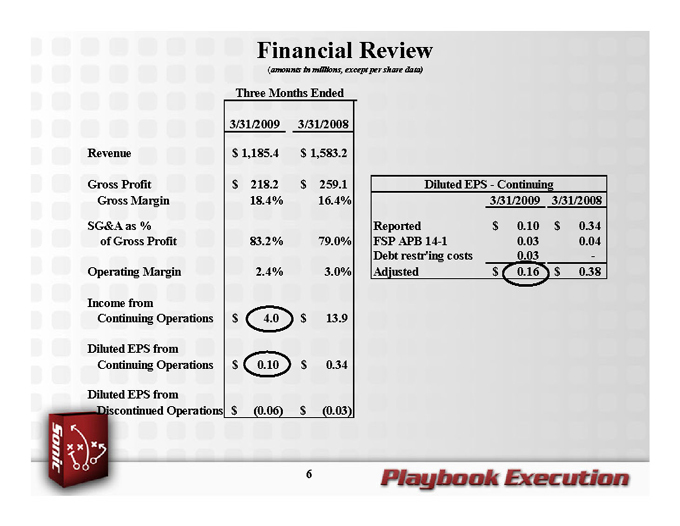

(amounts in millions, except per share data)

Three Months Ended

3/31/2009 3/31/2008

Revenue $ 1,185.4 $ 1,583.2

Gross Profit $ 218.2 $ 259.1

Gross Margin 18.4% 16.4%

SG&A as %

of Gross Profit 83.2% 79.0%

Operating Margin 2.4% 3.0%

Income from

Continuing Operations $ 4.0 $ 13.9

Diluted EPS from

Continuing Operations $ 0.10 $ 0.34

Diluted EPS from

Discontinued Operations $ (0.06) $ (0.03)

Diluted EPS - Continuing

3/31/2009 3/31/2008

Reported $ 0.10 $ 0.34

FSP APB 14-1 0.03 0.04

Debt restr’ing costs 0.03 -

Adjusted $ 0.16 $ 0.38

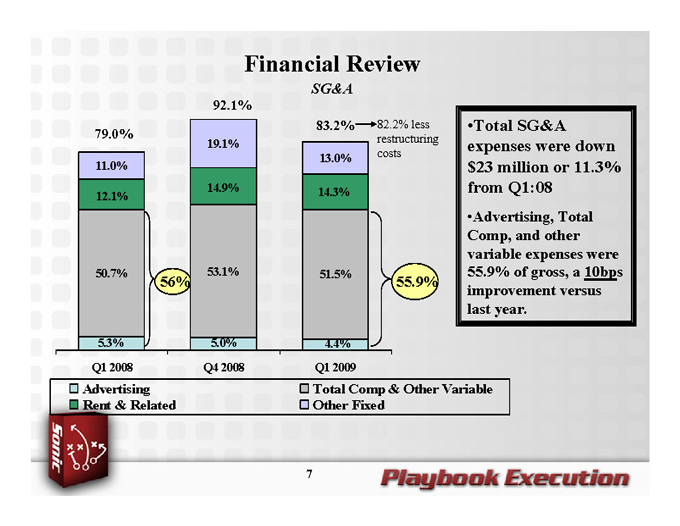

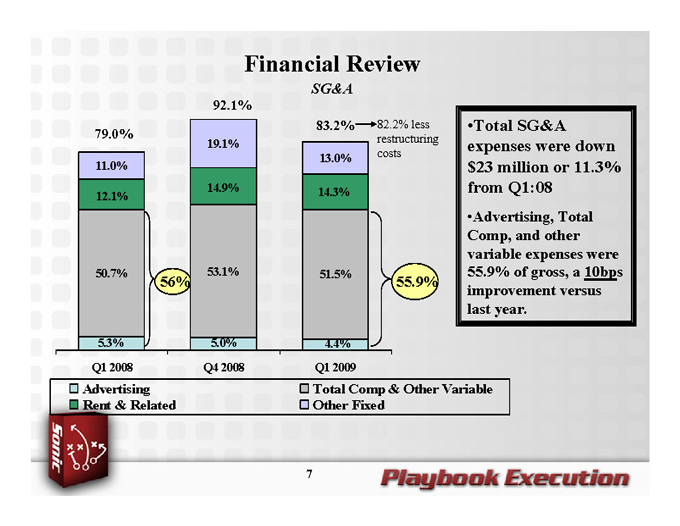

Financial Review

SG&A

92.1%

83.2% 82.2% less

79.0% 19.1% restructuring

13.0% costs

11.0%

14.9%

12.1% 14.3%

50.7% 53.1% 51.5%

56% 55.9%

5.3% 5.0% 4.4%

Q1 2008 Q4 2008 Q1 2009

Advertising

Total Comp & Other Variable

Rent & Related

Other Fixed

Total SG&A expenses were down $23 million or 11.3% from Q1:08

Advertising, Total Comp, and other variable expenses were 55.9% of gross, a 10bps improvement versus last year.

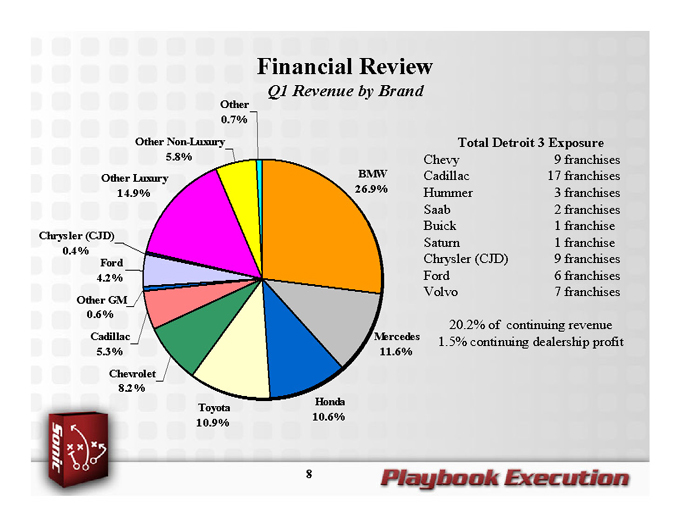

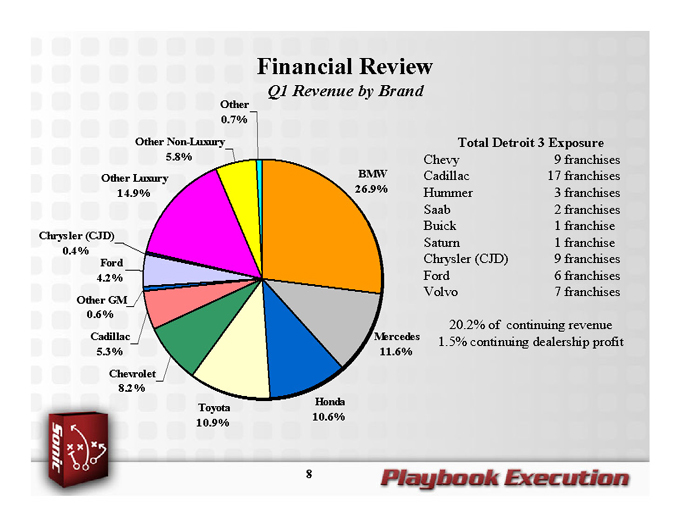

Financial Review

Q1 Revenue by Brand

Other

0.7%

Other Non-Luxury

5.8%

Other Luxury BMW

14.9% 26.9%

Chrysler (CJD)

0.4%

Ford

4.2%

Other GM

0.6%

Cadillac Mercedes

5.3% 11.6%

Chevrolet

8.2%

Toyota Honda

10.9% 10.6%

Total Detroit 3 Exposure

Chevy 9 franchises

Cadillac 17 franchises

Hummer 3 franchises

Saab 2 franchises

Buick 1 franchise

Saturn 1 franchise

Chrysler (CJD) 9 franchises

Ford 6 franchises

Volvo 7 franchises

20.2% of continuing revenue

1.5% continuing dealership profit

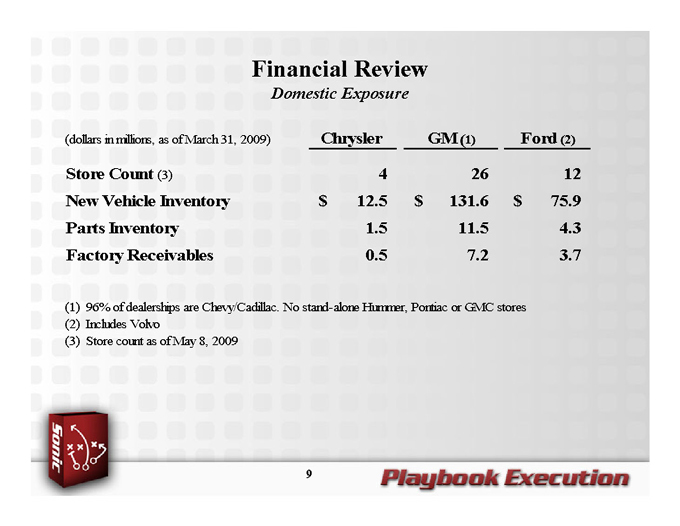

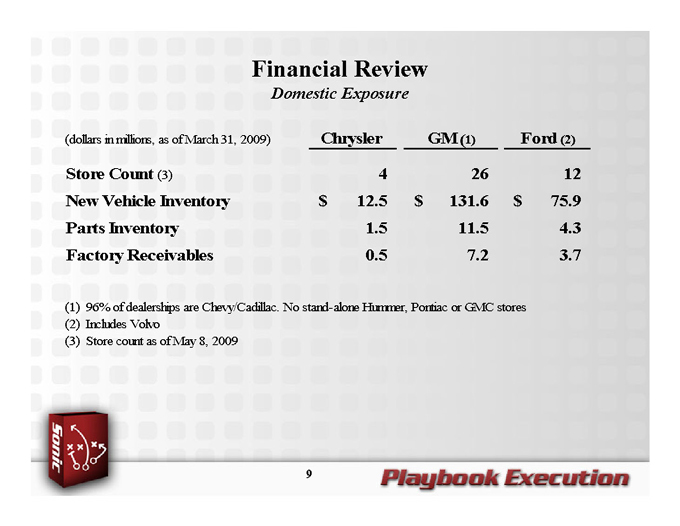

Financial Review

Domestic Exposure

(dollars in millions, as of March 31, 2009) Chrysler GM (1) Ford (2)

Store Count (3) 4 26 12

New Vehicle Inventory $ 12.5 $ 131.6 $ 75.9

Parts Inventory 1.5 11.5 4.3

Factory Receivables 0.5 7.2 3.7

(1) | | 96% of dealerships are Chevy/Cadillac. No stand-alone Hummer, Pontiac or GMC stores |

(3) | | Store count as of May 8, 2009 |

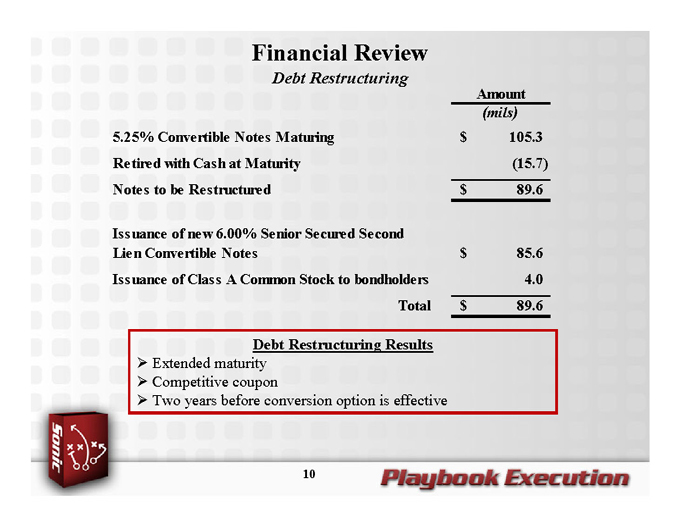

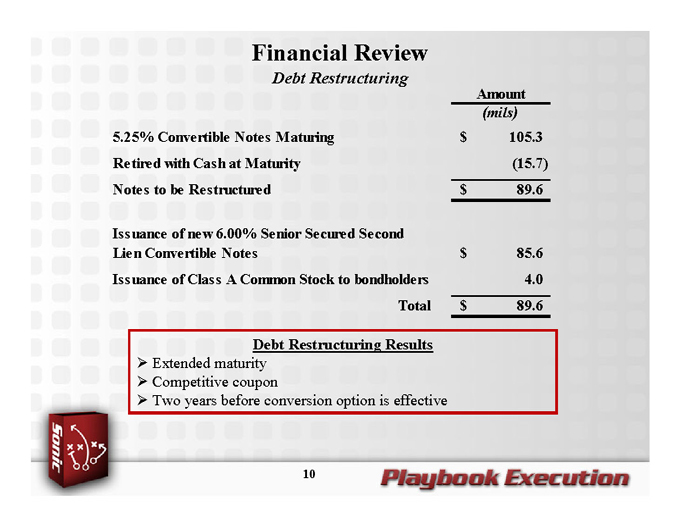

Financial Review

Debt Restructuring

Amount

(mils)

5.25% Convertible Notes Maturing $ 105.3

Retired with Cash at Maturity (15.7)

Notes to be Restructured $ 89.6

Issuance of new 6.00% Senior Secured Second

Lien Convertible Notes $ 85.6

Issuance of Class A Common Stock to bondholders 4.0

Total $ 89.6

Debt Restructuring Results

Extended maturity

Competitive coupon

Two years before conversion option is effective

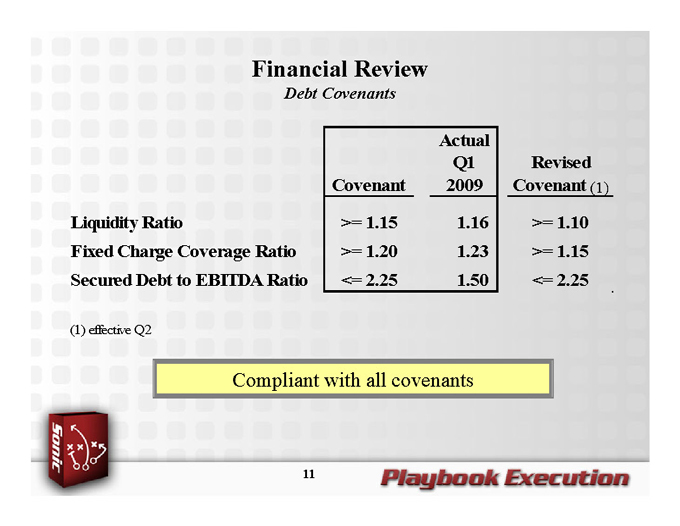

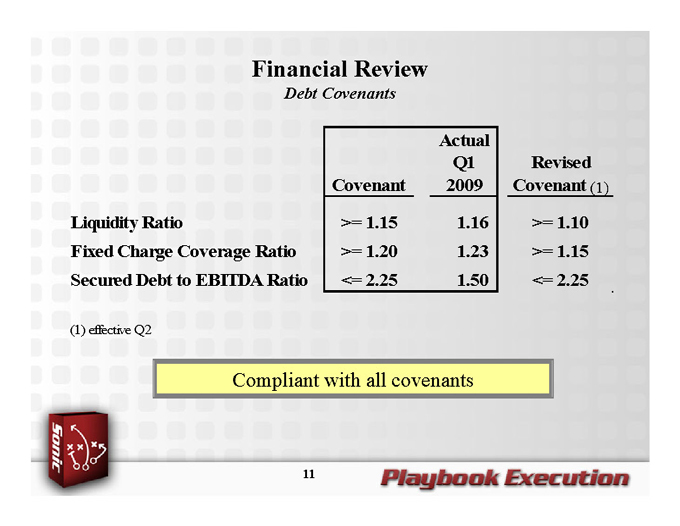

Financial Review

Debt Covenants

Actual

Q1 Revised

Covenant 2009 Covenant (1)

Liquidity Ratio >= 1.15 1.16 >= 1.10

Fixed Charge Coverage Ratio >= 1.20 1.23 >= 1.15

Secured Debt to EBITDA Ratio <= 2.25 1.50 <= 2.25

(1) effective Q2

Compliant with all covenants

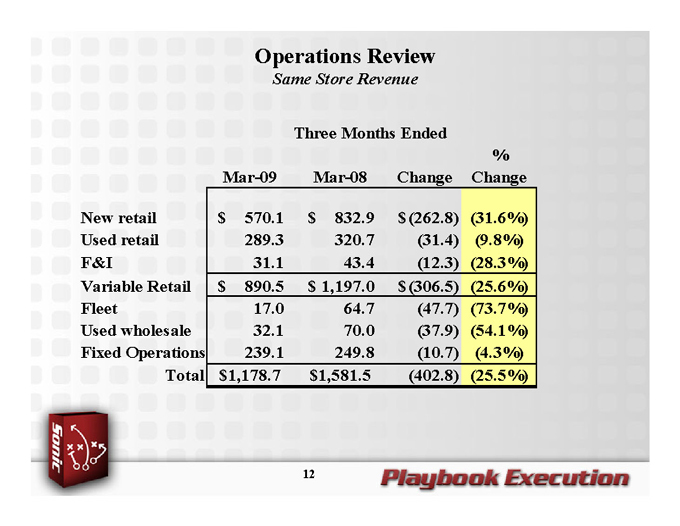

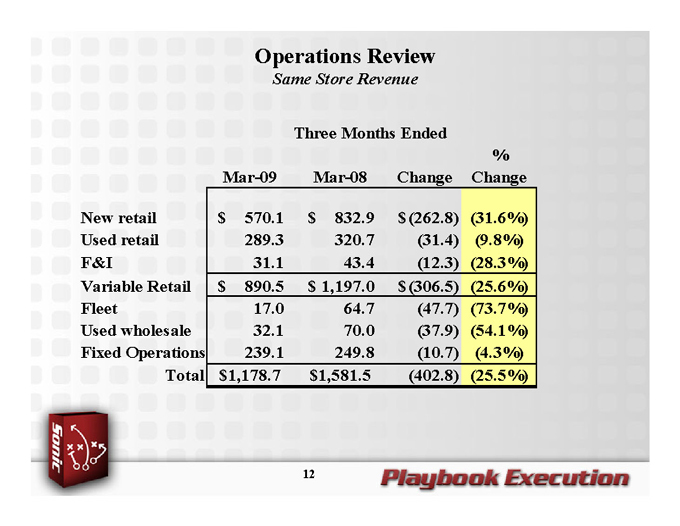

Operations Review

Same Store Revenue

Three Months Ended

%

Mar-09 Mar-08 Change Change

New retail $ 570.1 $ 832.9 $ (262.8) (31.6%)

Used retail 289.3 320.7 (31.4) (9.8%)

F&I 31.1 43.4 (12.3) (28.3%)

Variable Retail $ 890.5 $ 1,197.0 $ (306.5) (25.6%)

Fleet 17.0 64.7 (47.7) (73.7%)

Used wholesale 32.1 70.0 (37.9) (54.1%)

Fixed Operations 239.1 249.8 (10.7) (4.3%)

Total $1,178.7 $1,581.5 (402.8) (25.5%)

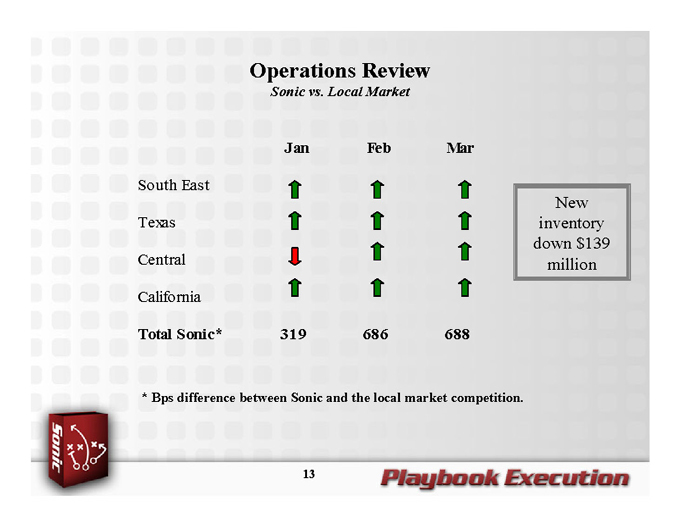

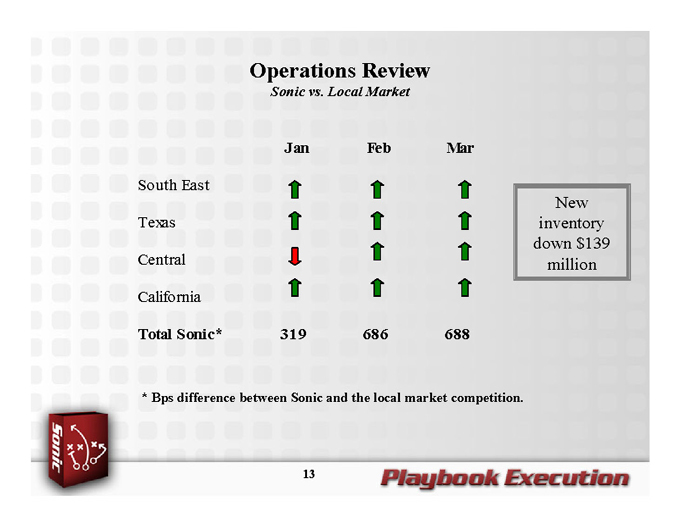

Operations Review

Sonic vs. Local Market

Jan Feb Mar

South East

Texas

Central

California

Total Sonic* 319 686 688

New inventory down $139 million

* | | Bps difference between Sonic and the local market competition. |

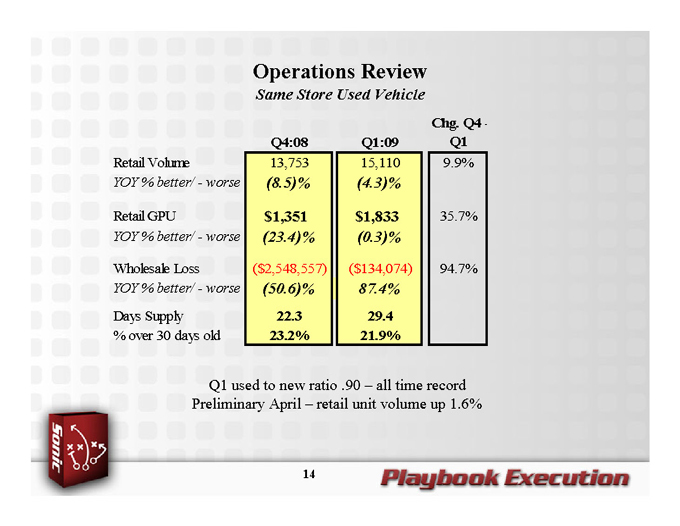

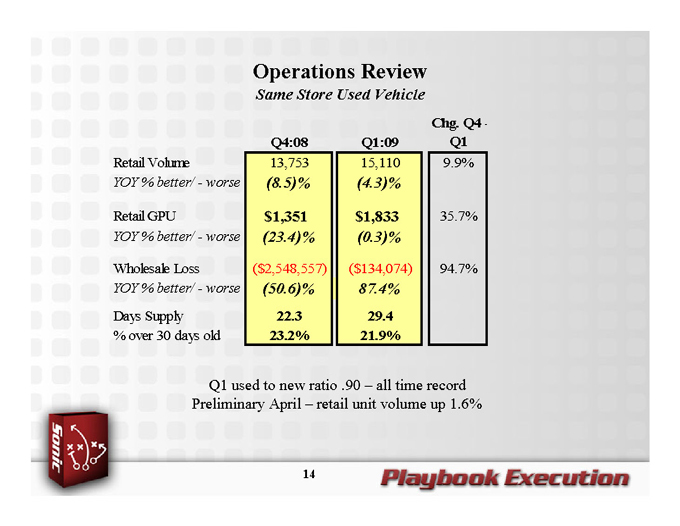

Operations Review

Same Store Used Vehicle

Chg. Q4 -

Q4:08 Q1:09 Q1

Retail Volume 13,753 15,110 9.9%

YOY % better/ - worse (8.5)% (4.3)%

Retail GPU $1,351 $1,833 35.7%

YOY % better/ - worse (23.4)% (0.3)%

Wholesale Loss ($2,548,557) ($134,074) 94.7%

YOY % better/ - worse (50.6)% 87.4%

Days Supply 22.3 29.4

% over 30 days old 23.2% 21.9%

Q1 used to new ratio .90 – all time record

Preliminary April – retail unit volume up 1.6%

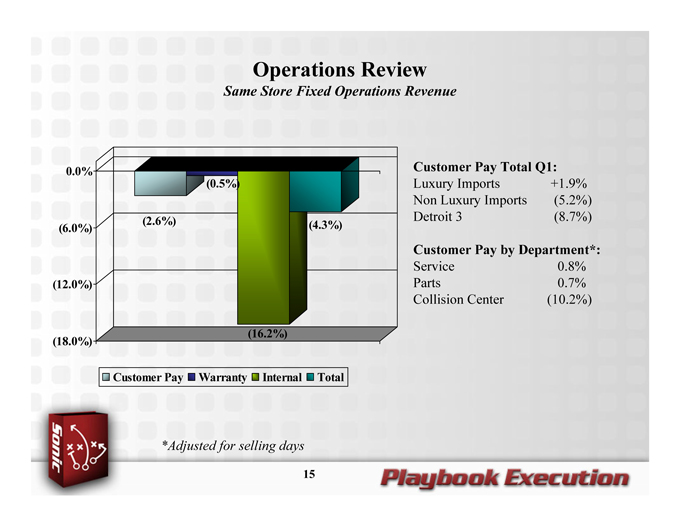

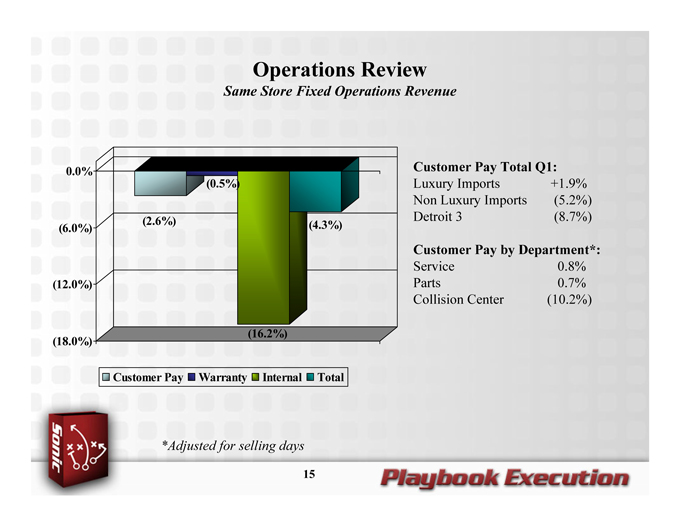

Operations Review

Same Store Fixed Operations Revenue

0.0%

(0.5%)

(6.0%) (2.6%) (4.3%)

(12.0%)

(18.0%) (16.2%)

Customer Pay Warranty Internal Total

Customer Pay Total Q1:

Luxury Imports +1.9%

Non Luxury Imports (5.2%)

Detroit 3 (8.7%)

Customer Pay by Department*:

Service 0.8%

Parts 0.7%

Collision Center (10.2%)

*Adjusted for selling days

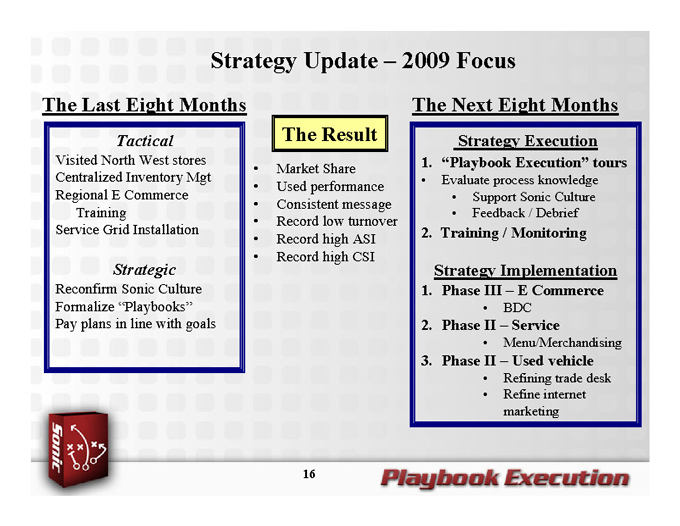

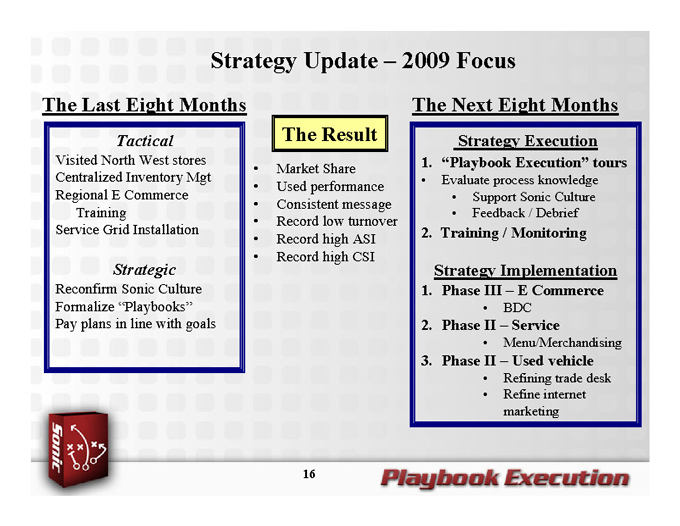

Strategy Update – 2009 Focus

The Last Eight Months

Tactical

Visited North West stores Centralized Inventory Mgt Regional E Commerce Training Service Grid Installation

Strategic

Reconfirm Sonic Culture Formalize “Playbooks” Pay plans in line with goals

The Result

Market Share Used performance Consistent message Record low turnover Record high ASI Record high CSI

The Next Eight Months

Strategy Execution

1. “Playbook Execution” tours

Evaluate process knowledge

Support Sonic Culture

Feedback / Debrief

2. Training / Monitoring

Strategy Implementation

1. Phase III – E Commerce

BDC

2. Phase II – Service

Menu/Merchandising

3. Phase II – Used vehicle

Refining trade desk

Refine internet marketing

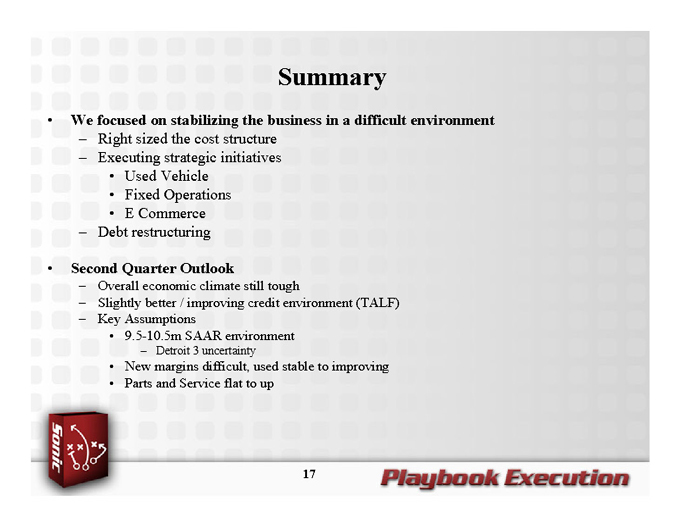

Summary

We focused on stabilizing the business in a difficult environment

Right sized the cost structure

Executing strategic initiatives

Used Vehicle

Fixed Operations

E Commerce

Debt restructuring

Second Quarter Outlook

Overall economic climate still tough

Slightly better / improving credit environment (TALF)

Key Assumptions

9.5-10.5m SAAR environment

Detroit 3 uncertainty

New margins difficult, used stable to improving

Parts and Service flat to up