Exhibit 99.1

PART I

Sonic Automotive, Inc. was incorporated in Delaware in 1997. We are one of the largest automotive retailers in the United States. As of June 30, 2009, we operated 154 dealership franchises at 131 dealership locations, representing 31 different brands of cars and light trucks, and 30 collision repair centers in 15 states. Each of our dealerships provides comprehensive services including (1) sales of both new and used cars and light trucks; (2) sales of replacement parts and performance of vehicle maintenance, warranty, paint and repair services (collectively, “Fixed Operations”); and (3) arrangement of extended service contracts, financing and insurance and other aftermarket products (collectively, “F&I”) for our automotive customers.

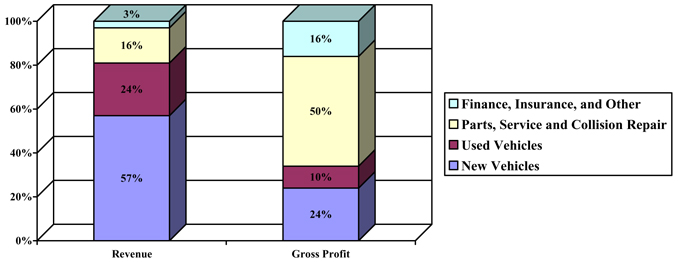

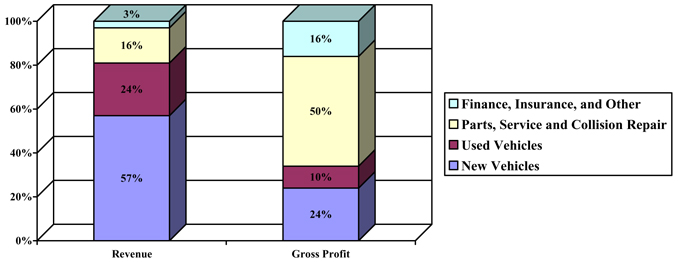

The following chart depicts the multiple sources of revenue and gross profit for the year ended December 31, 2008:

As of December 31, 2008, we operated dealerships (classified in our financial statements as continuing operations or discontinued operations) in the following markets:

| | | | | | | |

Market | | Number of

Dealerships | | Number of

Franchises | | Percent of

2008 Total

Revenue | |

Houston | | 19 | | 25 | | 18.0 | % |

North/South Carolina/Georgia | | 16 | | 17 | | 11.4 | % |

Alabama/Tennessee | | 17 | | 24 | | 9.6 | % |

Dallas | | 7 | | 9 | | 9.4 | % |

South Bay (San Francisco) | | 10 | | 11 | | 7.3 | % |

North Bay (San Francisco) | | 10 | | 12 | | 7.0 | % |

Los Angeles North | | 8 | | 10 | | 6.8 | % |

Florida | | 13 | | 17 | | 6.4 | % |

Los Angeles South / San Diego | | 7 | | 8 | | 6.4 | % |

Oklahoma | | 7 | | 7 | | 5.3 | % |

Mid-Atlantic | | 5 | | 6 | | 4.4 | % |

Ohio | | 4 | | 6 | | 2.5 | % |

Colorado | | 2 | | 2 | | 2.4 | % |

Las Vegas | | 4 | | 4 | | 2.1 | % |

Michigan | | 6 | | 6 | | 1.0 | % |

| | | | | | | |

Total | | 135 | | 164 | | 100.0 | % |

| | | | | | | |

During 2008, we acquired, or were awarded by manufacturers, five franchises and disposed of ten franchises. Over the long-term, we plan to continue to purchase franchises that enrich our franchise portfolio and divest franchises which we believe will not yield acceptable returns over the long-term. Currently, we are not pursuing new acquisition opportunities and are in the process of

10

marketing a number of our stores for divestiture, including some profitable stores, in order to generate liquidity. There are no assurances that we will be able to sell these franchises on favorable terms, if at all. In the most recent amendment to the 2006 Credit Facility, we are prohibited from making any acquisitions and we agreed that net proceeds from asset sales until May 4, 2009 would be used to permanently reduce the amount available under the 2006 Revolving Credit Sub-Facility (as defined below). See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources.” Our ability to resume acquisition activity in the future will depend on many factors, including the availability of financing and the existence of any contractual provisions that restrict our acquisition activity, including any restrictions under the 2006 Credit Facility.

The automotive retailing industry remains highly fragmented, and we believe that further consolidation may occur over the long-term. We believe that attractive acquisition opportunities continue to exist for dealership groups with the capital and experience to identify, acquire and professionally manage dealerships. We also believe manufacturers may begin to take steps to reduce the number of dealership franchisees as a result of declines in demand and in order to operate more efficiently.

Also, during 2008, domestic manufacturers (General Motors (GM), Ford and Chrysler) experienced substantial declines in demand due to challenging economic conditions, including the tightening of consumer credit and declines in consumer confidence. This has forced these domestic manufacturers to seek alternative sources of capital and/or government financing to maintain sufficient liquidity in order to operate. Our business will be materially and adversely impacted if any of these manufacturers cannot remain solvent or continue to further limit their lending and financing practices. Import manufacturers have also experienced declines in demand. Although we currently believe most of the import manufacturers that we represent are sufficiently capitalized and possess sufficient liquidity in order to efficiently operate, in the event the import manufacturers are severely affected by the current economic environment, our business may also be materially and adversely impacted.

Recent Developments

On June 1, 2009, General Motors Corp. and certain of its subsidiaries (“General Motors”) filed for Chapter 11 bankruptcy protection. As of June 30, 2009, we operated 33 General Motors franchises (under the Cadillac, Chevrolet, Hummer, Saab, Buick and Saturn nameplates) at 26 physical dealerships. Six of our General Motors dealerships, representing twelve franchises, including three Hummer franchises at multi-franchise dealerships, two Saab franchises at multi-franchise dealerships and one additional General Motors franchise at a multi-franchise dealership received letters stating that the franchise agreements between General Motors and us will not be continued by General Motors on a long-term basis. Subject to bankruptcy approval, General Motors has offered assistance with winding down the operations of these franchises in exchange for our execution of termination agreements. We executed all of the termination agreements. Assistance expected to be received from General Motors totals $3.3 million. The termination agreements provide for the following:

| | • | | The termination of the franchise agreement no earlier than January 1, 2010 and no later than October 31, 2010; |

| | • | | The assignment and assumption of the franchise agreement by the purchaser of General Motors’ assets; |

| | • | | The payment of financial assistance to the franchisee in installments in connection with the orderly winding down of the franchise operations; |

| | • | | The waiver of any other termination assistance of any kind that may have been required under the franchise agreement; |

| | • | | The release of claims against General Motors or the purchaser of General Motors’ assets and their related parties; |

| | • | | The continuation of franchise operations pursuant to the franchise agreement, as supplemented by the termination agreement, through the effective date of termination of the franchise agreement, except that Sonic shall not be entitled to order any new vehicles from General Motors or the purchaser of General Motors’ assets; and |

| | • | | A restriction on our ability to transfer the franchise agreement to another party. |

For the remaining General Motors franchises, we executed “continuation agreements” which require, among other things, that existing franchise agreements will expire no later than October 31, 2010. In consideration of the execution of the “continuation

11

agreements” General Motors will recommend to the bankruptcy court the continuation or assumption of our existing franchise agreements, as amended by the “continuation agreements”. We expect our franchises which executed “continuation agreements” to be renewed on or before October 31, 2010. We cannot be assured that General Motors will renew our franchise agreements when they expire on October 31, 2010.

With the exception of product liability indemnifications, amounts owed to us through incentive programs, amounts currently owed to our franchises under their open accounts with General Motors and warranty claims occurring within 90 days prior to June 1, 2009, all amounts owed to us from General Motors were extinguished as a result of the execution of the termination and continuation agreements. A motion was made by General Motors to the bankruptcy court and the motion was granted by the bankruptcy court allowing General Motors to pay the claims noted above. As a result, we have been receiving payments related to pre-bankruptcy claims and the effect of General Motor’s bankruptcy filing has not had a material effect on our recorded receivable balances as of June 30, 2009.

As our operations at the affected franchises that will not be renewed wind down, we may be required to accelerate depreciation expenses and record impairment charges related to, but not limited to, lease obligations, fixed assets, franchise assets, accounts receivable and inventory.

On June 2, 2009, General Motors announced that Chinese equipment manufacturer Sichuan Tengzhong Heavy Industrial Machinery Co. (“STHIMC”) will buy its Hummer brand. As of June 30, 2009, we operated three Hummer franchises at three dealership locations. It is uncertain whether STHIMC will continue supporting the Hummer brand or whether STHIMC’s ownership of the Hummer brand will have a positive or negative impact on our Hummer franchises’ operations.

On June 5, 2009, General Motors announced that Penske Automotive Group (PAG) will buy its Saturn brand. As of June 5, 2009, we operated one Saturn franchise at one dealership location. It is uncertain whether PAG will continue supporting the Saturn brand or whether PAG’s ownership of the Saturn brand will have a positive or negative impact on our Saturn franchise’s operations.

On July 10, 2009, General Motors emerged from bankruptcy as the new General Motors Company, with the former General Motors Corp. henceforth known as Motors Liquidation Company. With the exception of the sale of the Hummer and Saturn brands discussed above, the new General Motors expects to continue its current brand portfolio going forward, however, discontinuation or sale of additional brands in the future could have an uncertain impact on our operations.

On April 30, 2009, Chrysler LLC filed for bankruptcy protection and submitted a plan of reorganization. On June 10, 2009, Fiat SpA purchased a substantial portion of Chrysler’s assets which include rights related to our franchise agreements. As of June 30, 2009, we owned six Chrysler franchises at two dealership locations. It is uncertain whether Fiat will continue supporting the Chrysler brand or whether Fiat’s ownership of the Chrysler brand will have a positive or negative impact on our Chrysler franchises’ operations. In conjunction with Chrysler’s reorganization efforts in the second quarter of 2009, three franchise agreements associated with one of our dealership locations were terminated. The result of these franchise terminations was not material to our results of operations, balance sheet or cash flows for the second quarter ended June 30, 2009.

Our independent registered public accounting firm included an explanatory paragraph in its audit report on our 2008 Consolidated Financial Statements that indicated there is an uncertainty that we will remain in compliance with certain covenants in its debt agreements and that this uncertainty raises substantial doubt about our ability to continue as a going concern. The issuance of a “going concern” explanatory paragraph by our independent registered public accounting firm would, by itself, violate a separate covenant of our revolving credit facility with Bank of America, NA, as administrative agent, and a syndicate of commercial banks and commercial finance entities (the “2006 Credit Facility”). On March 31, 2009, we executed an amendment to the 2006 Credit Facility which resulted in no default arising by virtue of the “going concern” explanatory paragraph through May 4, 2009. On May 7, 2009, we completed a restructuring of our 5.25% convertible senior subordinated notes that were scheduled to mature on May 7, 2009 (the “5.25% Convertible Notes”). In conjunction with this restructuring, we paid cash of approximately $15.7 million, issued $85.6 million in 6.00% senior secured second lien convertible notes due 2012 in two series (Series A and Series B) (the “6.00% Convertible Notes”) and issued 860,723 shares of Class A common stock to satisfy our obligations under the 5.25% Convertible Notes. In addition, we executed an amendment effective May 4, 2009 to its 2006 Credit Facility which, among other things, removes the requirement for us to deliver to the administrative agent under the 2006 Credit Facility and the lenders thereto an opinion of our independent registered public accounting firm with respect to our fiscal year ended December 31, 2008 without any “going concern” or like qualification. The amendment to the 2006 Credit Facility and a description of the 6.00% Convertible Notes are discussed further in Note 6 in the accompanying financial statements. Also in conjunction with the restructuring, we sold, in a private placement primarily to certain of our officers, directors and management employees, 487,796 shares of our Class A common stock at a price of $5.74 per share. We have agreed to register the shares issued primarily to certain of our directors and management employees upon request.

In addition, on March 12, 2009, we amended a guaranty and subordination agreement with the landlord of many of our facility leases. This amendment adjusted the calculation of the consolidated fixed charge coverage ratio contained in the original guaranty

12

and subordination agreement and added two additional financial covenants: a consolidated liquidity ratio covenant and a consolidated total senior secured debt to EBITDA ratio covenant.

We continue to explore options related to our other debt obligations with the assistance of a financial advisor. We are evaluating refinancing options for $160.0 million principal amount outstanding of 4.25% Convertible Notes that we may be required to repurchase at the option of the holders on November 30, 2010 and our 2006 Credit Facility that matures February 17, 2010. Although we believe we will be successful in refinancing these debt obligations to avoid events of default under one or more of these arrangements, we cannot assure our investors that we will succeed in these efforts. A default under one or more of our debt arrangements, including the 2006 Credit Facility, could cause cross defaults of other debt, lease facilities and operating agreements, any of which could have a material adverse effect on our business, financial condition, liquidity, operations and ability to continue as a going concern. If we are unable to restructure these upcoming debt maturities, we may not be able to continue our operations, and we may be unable to avoid filing for bankruptcy protection and/or have an involuntary bankruptcy case filed against us.

Business Strategy

Portfolio Management.We continue to evaluate our portfolio of franchises. Efforts are made to divest franchises that do not yield, or are not expected to yield, adequate long-term returns, although we may be unable to divest franchises as quickly as we would like, if at all, given current market conditions. We may also divest profitable franchises to fund our capital needs. There are no assurances that we will be able to sell these franchises on favorable terms, if at all. In the most recent amendment to the 2006 Credit Facility, we are prohibited from making any acquisitions and we agreed that net proceeds from certain asset sales until May 4, 2009 would be used to permanently reduce the amount available under the 2006 Revolving Credit Sub-Facility (as defined below) and, under certain conditions, repurchase portions of the 6.00% Convertible Notes. See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.” Although we are not currently pursuing acquisition opportunities, our long-term growth strategy is focused on large metropolitan markets, predominantly in the Southeast, Southwest, Midwest and California. We also seek to acquire stable franchises that we believe have above average sales prospects. A majority of our dealerships are either luxury or mid-line import brands. For the year ended December 31, 2008, 81.8% of our total revenue was generated by import and luxury dealerships, which generally have higher operating margins, more stable fixed operations departments, lower associate turnover and lower inventory levels. We expect this trend toward acquiring more luxury and mid-line import dealerships to continue over the long-term.

The following table depicts the breakdown of our new vehicle revenues by brand:

13

| | | | | | | | | |

| | | Percentage of New Vehicle Revenue

Year Ended December 31, | |

| | | 2006 | | | 2007 | | | 2008 | |

Brand (1) | | | | | | | | | |

| | | |

BMW | | 15.9 | % | | 18.5 | % | | 20.0 | % |

Honda | | 13.9 | % | | 12.5 | % | | 12.4 | % |

Toyota | | 12.2 | % | | 12.4 | % | | 12.2 | % |

Ford | | 8.9 | % | | 7.9 | % | | 9.1 | % |

General Motors (2) | | 9.3 | % | | 9.1 | % | | 8.6 | % |

Mercedes | | 6.8 | % | | 7.7 | % | | 8.2 | % |

Lexus | �� | 8.1 | % | | 7.7 | % | | 6.4 | % |

Cadillac | | 7.5 | % | | 6.8 | % | | 5.3 | % |

Other (3) | | 2.4 | % | | 2.6 | % | | 3.9 | % |

Audi | | 1.3 | % | | 1.5 | % | | 1.9 | % |

Volkswagen | | 1.8 | % | | 1.5 | % | | 1.9 | % |

Porsche | | 1.5 | % | | 1.5 | % | | 1.5 | % |

Land Rover | | 1.1 | % | | 1.9 | % | | 1.5 | % |

Hyundai | | 1.8 | % | | 1.6 | % | | 1.5 | % |

Volvo | | 2.7 | % | | 2.3 | % | | 1.5 | % |

Other Luxury (4) | | 1.2 | % | | 1.2 | % | | 1.2 | % |

Acura | | 1.4 | % | | 1.3 | % | | 1.1 | % |

Nissan | | 1.0 | % | | 0.8 | % | | 0.7 | % |

Infiniti | | 0.6 | % | | 0.6 | % | | 0.6 | % |

Chrysler (5) | | 0.6 | % | | 0.6 | % | | 0.5 | % |

| | | | | | | | | |

Total | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | | |

(1) In accordance with the provisions of SFAS No. 144, prior years’ income statement data reflect reclassifications to exclude franchises sold, identified for sale, or terminated subsequent to December 31, 2007 which had not been previously included in discontinued operations. See Notes 1 and 2 to our accompanying Consolidated Financial Statements which discusses these and other factors that affect the comparability of the information for the periods presented. (2) Includes Buick, Chevrolet, GMC, Pontiac and Saturn (3) Includes Isuzu, KIA, Mini, Mitsubishi, Scion and Subaru (4) Includes Hummer, Jaguar and Saab (5) Includes Chrysler, Dodge and Jeep | |

Increase Sales of Higher Margin Products and Services. We continue to pursue opportunities to increase our sales of higher-margin products and services by expanding the following:

Finance, Insurance and Other Aftermarket Products (“F&I”): Each sale of a new or used vehicle provides us with an opportunity to earn financing fees and insurance commissions and to sell extended service contracts and other aftermarket products. We currently offer a wide range of nonrecourse financing, leasing, other aftermarket products, service contracts and insurance products to our customers. We emphasize menu-selling techniques and other best practices to increase our sales of F&I products at both newly acquired and existing dealerships.

Parts, Service & Repair: Each of our dealerships offers a fully integrated service and parts department. Manufacturers permit warranty work to be performed only at franchised dealerships such as ours. As a result, our franchised dealerships are uniquely qualified and positioned to perform work covered by manufacturer warranties on increasingly complex vehicles. We believe we can continue to grow our profitable parts and service business over the long-term by increasing service capacity, investing in sophisticated equipment and well trained technicians, using variable rate pricing structures, focusing on customer service and efficiently managing our parts inventory. In addition, we believe our emphasis on selling extended service contracts associated with new and used vehicle retail sales will drive further service and parts business in our dealerships as we increase the potential to retain current customers beyond the term of the standard manufacturer warranty period.

Certified Pre-Owned Vehicles. Various manufacturers provide franchised dealers the opportunity to sell certified pre-owned (“CPO”) vehicles. This certification process extends the standard manufacturer warranty on the CPO vehicle. We typically earn

14

higher revenues and gross profits on CPO vehicles compared to non-certified pre-owned vehicles. We also believe the extended manufacturer warranty increases our potential to retain the pre-owned purchaser as a future parts and service customer. Since CPO warranty work can only be performed at franchised dealerships, we believe the used vehicle business will become more clearly segmented and CPO sales and similar products will increase in volume.

“Value” Used Vehicle. Due to our favorable luxury and import brand mix, our used vehicle strategy has historically been focused on CPO vehicles and other higher cost of sale vehicles. A market segment that drives used vehicle volume that we historically participated in on only a limited basis is vehicles with retail prices below $10,000. Until recent years, if we received a trade-in which did not meet our then existing internal criteria for used vehicles (in many instances these would be “value” vehicles), we would wholesale the vehicle. We believe the market for these “value” vehicles is deeper today, and not as sensitive to market fluctuations as higher priced used vehicles. As a result, we have shifted our strategy to more aggressively market and retail these vehicles.

Emphasize Expense Control. We continually focus on controlling expenses and expanding margins at the dealerships we acquire and integrate into our organization. We manage these costs, such as advertising and variable compensation expenses, so that they are generally related to vehicle sales and can be adjusted in response to changes in vehicle sales volume. The majority of our non-clerical dealership personnel are paid either a commission or a modest salary plus commissions. In addition, dealership management compensation is tied to individual dealership profitability. We believe we can further manage these types of costs through best practices, standardization of compensation plans, controlled oversight and accountability, reducing associate turnover and centralizing and standardizing processes and systems such as accounting office consolidation, payroll system consolidation and inventory management technology.

Expand our eCommerce Capabilities. Automotive customers have become increasingly more comfortable using technology to research their vehicle buying alternatives and communicate with dealership personnel. Our conversion to a single dealer management system has given us the ability to leverage technology to more efficiently integrate systems, customize our dealership websites and use our customer data to improve the effectiveness of our advertising and interaction with our customers.

Achieve High Levels of Customer Satisfaction. We focus on maintaining high levels of customer satisfaction. Our personalized sales process is designed to satisfy customers by providing high-quality vehicles in a positive, “consumer friendly” buying environment. Several manufacturers offer specific financial incentives on a per vehicle basis if certain Customer Satisfaction Index (“CSI”) levels (which vary by manufacturer) are achieved by a dealership. In addition, all manufacturers consider CSI scores in approving acquisitions. In order to keep management focused on customer satisfaction, we include CSI results as a component of our incentive-based compensation programs.

Train and Develop Associates. We believe that our well-trained dealership personnel are key to our long-term prospects. Our employees, from service technicians to regional vice presidents, participate in our in-house training programs each year. We believe that our comprehensive training of all employees provide us with a competitive advantage over other dealership groups.

Relationships with Manufacturers

Each of our dealerships operates under a separate franchise or dealer agreement that governs the relationship between the dealership and the manufacturer. In general, each dealer agreement specifies the location of the dealership for the sale of vehicles and for the performance of certain approved services in a specified market area. The designation of such areas generally does not guarantee exclusivity within a specified territory. In addition, most manufacturers allocate vehicles on a “turn and earn” basis that rewards high volume. A dealer agreement requires the dealer to meet specified standards regarding showrooms, facilities and equipment for servicing vehicles, inventories, minimum net working capital, personnel training and other aspects of the business. Each dealer agreement also gives the related manufacturer the right to approve the dealer operator and any material change in management or ownership of the dealership. Each manufacturer may terminate a dealer agreement under certain circumstances, such as a change in control of the dealership without manufacturer approval, the impairment of the reputation or financial condition of the dealership, the death, removal or withdrawal of the dealer operator, the conviction of the dealership or the dealership’s owner or dealer operator of certain crimes, the failure to adequately operate the dealership or maintain new vehicle financing arrangements, insolvency or bankruptcy of the dealership or a material breach of other provisions of the dealer agreement.

Many automobile manufacturers have developed policies regarding public ownership of dealerships. Policies implemented by manufacturers include the following restrictions:

| | • | | The ability to force the sale of their respective franchises upon a change in control of our company or a material change in the composition of our Board of Directors; |

15

| | • | | The ability to force the sale of their respective franchises if an automobile manufacturer or distributor acquires more than 5% of the voting power of our securities; and |

| | • | | The ability to force the sale of their respective franchises if an individual or entity (other than an automobile manufacturer or distributor) acquires more than 20% of the voting power of our securities, and the manufacturer disapproves of such individual’s or entity’s ownership interest. |

To the extent that new or amended manufacturer policies restrict the number of dealerships which may be owned by a dealership group, or the transferability of our common stock, such policies could have a material adverse effect on us. We believe that we will be able to renew at expiration all of our existing franchise and dealer agreements.

Many states have placed limitations upon manufacturers’ and distributors’ ability to sell new motor vehicles directly to customers in their respective states in an effort to protect dealers from practices they believe constitute unfair competition. In general, these statutes make it unlawful for a manufacturer or distributor to compete with a new motor vehicle dealer in the same brand operating under an agreement or franchise from the manufacturer or distributor in the relevant market area. Certain states, such as Florida, Georgia, Oklahoma, South Carolina, North Carolina and Virginia, limit the amount of time that a manufacturer may temporarily operate a dealership.

In addition, all of the states in which our dealerships currently do business require manufacturers to show “good cause” for terminating or failing to renew a dealer’s franchise agreement. Further, each of the states provides some method for dealers to challenge manufacturer attempts to establish dealerships of the same brand in their relevant market area.

Competition

The retail automotive industry is highly competitive. Depending on the geographic market, we compete both with dealers offering the same brands and product lines as ours and dealers offering other manufacturers’ vehicles. We also compete for vehicle sales with auto brokers, leasing companies and services offered on the Internet that provide customer referrals to other dealerships or who broker vehicle sales between customers and other dealerships. We compete with small, local dealerships and with large multi-franchise auto dealerships.

We believe that the principal competitive factors in vehicle sales are the location of dealerships, the marketing campaigns conducted by manufacturers, the ability of dealerships to offer an attractive selection of the most popular vehicles, pricing (including manufacturer rebates and other special offers) and the quality of customer service. Other competitive factors include customer preference for makes of automobiles and manufacturer warranties.

In addition to competition for vehicle sales, we also compete with other auto dealers, service stores, auto parts retailers and independent mechanics in providing parts and service. We believe that the principal competitive factors in parts and service sales are price, the use of factory-approved replacement parts, factory-trained technicians, the familiarity with a dealer’s makes and models and the quality of customer service. A number of regional and national chains offer selected parts and services at prices that may be lower than our prices.

In arranging or providing financing for our customers’ vehicle purchases, we compete with a broad range of financial institutions. In addition, financial institutions are now offering F&I products through the Internet, which may reduce our profits on these items. We believe that the principal competitive factors in providing financing are convenience, interest rates and contract terms.

Our success depends, in part, on national and regional automobile-buying trends, local and regional economic factors and other regional competitive pressures. Conditions and competitive pressures affecting the markets in which we operate, such as price-cutting by dealers in these areas, or in any new markets we enter, could adversely affect us, even though the retail automobile industry as a whole might not be affected.

Governmental Regulations and Environmental Matters

Numerous federal and state regulations govern our business of marketing, selling, financing and servicing automobiles. We are also subject to laws and regulations relating to business corporations generally.

Under the laws of the states in which we currently operate as well as the laws of other states into which we may expand, we must obtain a license in order to establish, operate or relocate a dealership or operate an automotive repair service. These laws also regulate our conduct of business, including our sales, operating, advertising, financing and employment practices. These laws also include federal and state wage-hour, anti-discrimination and other employment practices laws.

16

Our financing activities with customers are subject to federal truth-in-lending, consumer privacy, consumer leasing and equal credit opportunity regulations as well as state and local motor vehicle finance laws, installment finance laws, usury laws and other installment sales laws. Some states regulate finance fees that may be paid as a result of vehicle sales.

Federal, state and local environmental regulations, including regulations governing air and water quality, the clean-up of contaminated property and the use, storage, handling, recycling and disposal of gasoline, oil and other materials, also apply to us and our dealership properties.

We believe that we comply in all material respects with the laws affecting our business. However, claims arising out of actual or alleged violations of laws may be asserted against us or our dealerships by individuals or governmental entities, and may expose us to significant damages or other penalties, including possible suspension or revocation of our licenses to conduct dealership operations and fines.

As with automobile dealerships generally, and service, parts and body shop operations in particular, our business involves the use, storage, handling and contracting for recycling or disposal of hazardous or toxic substances or wastes and other environmentally sensitive materials. Our business also involves the past and current operation and/or removal of above ground and underground storage tanks containing such substances or wastes. Accordingly, we are subject to regulation by federal, state and local authorities that establish health and environmental quality standards, provide for liability related to those standards, and in certain circumstances provide penalties for violations of those standards. We are also subject to laws, ordinances and regulations governing remediation of contamination at facilities we own or operate or to which we send hazardous or toxic substances or wastes for treatment, recycling or disposal.

We do not have any known material environmental liabilities and we believe that compliance with environmental laws and regulations will not, individually or in the aggregate, have a material adverse effect on our results of operations, financial condition and cash flows. However, soil and groundwater contamination is known to exist at certain properties used by us. Further, environmental laws and regulations are complex and subject to frequent change. In addition, in connection with our acquisitions, it is possible that we will assume or become subject to new or unforeseen environmental costs or liabilities, some of which may be material. We cannot assure you that compliance with current or amended, or new or more stringent, laws or regulations, stricter interpretations of existing laws or the future discovery of environmental conditions will not require additional expenditures by us, or that such expenditures will not be material.

Executive Officers of the Registrant

Our executive officers as of the date of this Form 8-K, are as follows:

| | | | |

Name | | Age | | Position(s) with Sonic |

O. Bruton Smith | | 83 | | Chairman, Chief Executive Officer and Director |

B. Scott Smith | | 41 | | President, Chief Strategic Officer and Director |

David P. Cosper | | 55 | | Vice Chairman and Chief Financial Officer |

David B. Smith | | 34 | | Executive Vice President and Director |

Jeff Dyke | | 42 | | Executive Vice President of Operations |

O. Bruton Smith, 83, is our Founder, Chairman, Chief Executive Officer and a director and has served as such since our formation in January 1997, and he currently is a director and executive officer of many of our subsidiaries. Mr. Smith has worked in the retail automobile industry since 1966. Mr. Smith is also the Chairman and Chief Executive Officer, a director and controlling stockholder of Speedway Motorsports, Inc. (“SMI”). SMI is a public company traded on the New York Stock Exchange (the “NYSE”). Among other things, SMI owns and operates the following NASCAR racetracks: Atlanta Motor Speedway, Bristol Motor Speedway, Lowe’s Motor Speedway, Infineon Raceway, Las Vegas Motor Speedway, New Hampshire Motor Speedway, Texas Motor Speedway, and Kentucky Speedway. He is also an executive officer or a director of most of SMI’s operating subsidiaries.

B. Scott Smith, 41, is our Co-Founder, President, Chief Strategic Officer and a director. Prior to his appointment as President in March 2007, Mr. Smith served as our Vice Chairman and Chief Strategic Officer since October 2002. He held the position of President and Chief Operating Officer from April 1997 to October 2002. Mr. Smith has been a director of our company since our organization was formed in January 1997. Mr. Smith also serves as a director and executive officer of many of our subsidiaries. Mr. Smith, who is the son of O. Bruton Smith, has been an executive officer of Town & Country Ford since 1993, and was a minority owner of both Town & Country Ford and Fort Mill Ford before our acquisition of these dealerships in 1997. Mr. Smith became the General Manager of Town & Country Ford in November 1992 where he remained until his appointment as President and Chief Operating Officer in April 1997. Mr. Smith has over twenty years experience in the automobile dealership industry.

17

David P. Cosper, 55, is our Vice Chairman and Chief Financial Officer. In March 2007, Mr. Cosper was appointed to Vice Chairman after serving as Executive Vice President since March 2006. He joined Sonic Automotive on March 1, 2006 as an Executive Vice President and became our Chief Financial Officer and Treasurer on March 16, 2006. Mr. Cosper served as Treasurer through the end of 2006 and relinquished the position in February 2007. Prior to joining Sonic, he was Vice Chairman and Chief Financial Officer of Ford Motor Credit Company, a position held since 2003. From 1979, when he joined Ford Motor Company, Mr. Cosper served in a variety of positions in Ford Motor Company and Ford Motor Credit Company, including Vice President and Treasurer of Ford Motor Credit Company and Executive Director of Corporate Finance at Ford Motor Company. In such positions, he was responsible for worldwide profit analysis and treasury matters, risk management, business planning, and competitive and strategic analysis.

David B. Smith, 34, is our Executive Vice President and a director and has served our organization beginning in October 2000. Prior to being named a director and Executive Vice President of Sonic in October 2008, Mr. Smith, also a son of O. Bruton Smith, has served as our Senior Vice President of Corporate Development since March 2007. Prior to that appointment, Mr. Smith served as our Vice President of Corporate Strategy from October 2005 to March 2007, and also served us prior to that time as Dealer Operator of our Arnold Palmer Cadillac dealership from January 2004 to October 2005, our Fort Mill Ford dealership from January 2003 to January 2004, and our Town and Country Ford dealership from October 2000 to December 2002.

Jeff Dyke, 42, is our Executive Vice President of Operations and is responsible for direct oversight for all retail automotive operations of Sonic. From March 2007 to October 2008, Mr. Dyke served as our Division Chief Operating Officer—South East Division, where he oversaw retail automotive operations for the states of Alabama, Georgia, Florida, North Carolina, Tennessee, Texas and South Carolina. Mr. Dyke first joined Sonic in October 2005 as its Vice President of Retail Strategy, a position that he held until April 2006, when he was promoted to Division Vice President—Eastern Division, a position he held from April 2006 to March 2007. Prior to joining Sonic, Mr. Dyke worked in the automotive retail industry at AutoNation from 1996 to 2005, where he held several positions in divisional, regional and dealership management with that company.

Employees

As of July 20, 2009, we employed approximately 9,500 people. We believe that our relationships with our employees are good. Approximately 180 of our employees, primarily service technicians in our Northern California markets and certain sales associates in Michigan, are represented by a labor union. Because of our dependence on the manufacturers, however, we may be affected by labor strikes, work slowdowns and walkouts at the manufacturers’ manufacturing facilities.

Company Information

Our website is located at www.sonicautomotive.com. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as well as proxy statements and other information we file with, or furnish to, the Securities and Exchange Commission (“SEC”) are available free of charge on our website. We make these documents available as soon as reasonably practicable after we electronically file them with, or furnish them to, the SEC. Except as otherwise stated in these documents, the information contained on our website or available by hyperlink from our website is not incorporated into this Current Report on Form 8-K or other documents we file with, or furnish to, the SEC.

18

Risks Related to Our Sources of Financing and Liquidity

If we do not restructure or obtain additional financing to satisfy our substantial debt obligations, we may not be able to continue as a going concern or we may be unable to avoid filing for bankruptcy protection.

On May 7, 2009, we completed a restructuring of our 5.25% convertible senior subordinated notes that matured on May 7, 2009 (the “5.25% Convertible Notes”). In conjunction with this restructuring, we paid cash of approximately $15.7 million, issued $85.6 million in 6.00% senior secured second lien convertible notes due 2012 in two series (Series A and Series B) (the “6.00% Convertible Notes”) and issued 860,723 shares of Class A common stock to holders of our 5.25% Convertible Notes to satisfy in full our obligations under the 5.25% Convertible Notes. In addition, we executed an amendment to our revolving credit facility with Bank of America, NA, as administrative agent, and a syndicate of commercial banks and commercial finance entities (the “2006 Credit Facility”) which, among other things, permanently removes the requirement for us to deliver to the administrative agent under the 2006 Credit Facility an opinion of our independent registered public accounting firm with respect to our fiscal year ended December 31, 2008 without any “going concern�� or like qualification. The amendment to the 2006 Credit Facility and a description of the 6.00% Convertible Notes are discussed further in Note 6 of the notes to the accompanying financial statements. Also in conjunction with the restructuring, we sold, in a private placement primarily to certain of our officers, directors and management employees to fund a portion of the repayment of our 5.25% Convertible Notes, 487,796 shares of our Class A common stock at a price of $5.74 per share.

We continue to explore options related to our other debt obligations with the assistance of a financial advisor. We are evaluating restructuring options for $160.0 million principal amount outstanding of 4.25% Convertible Notes that we may be required to repurchase at the option of the holders on November 30, 2010, our $85.6 million principal outstanding of 6.00% Convertible Notes that we may be required to repurchase on August 25, 2010 if we have not refinanced at least 85% of our 4.25% Convertible Notes as of August 25, 2010 and our 2006 Credit Facility that matures February 17, 2010. Although we will attempt to restructure these debt obligations to avoid events of default under one or more of these arrangements, we cannot assure our investors that we will succeed in these efforts. A default under one or more of our debt arrangements, including the 2006 Credit Facility, could cause cross defaults of other debt, lease facilities and operating agreements, any of which could have a material adverse effect on our business, financial condition, liquidity and operations and raise substantial doubt about our ability to continue as a going concern. If we are unable to restructure these upcoming debt obligations, we may not be able to continue our operations, may be unable to avoid filing for bankruptcy protection and/or may have an involuntary bankruptcy case filed against us.

Our significant indebtedness and near-term debt maturities could materially adversely affect our financial health, limit our ability to finance future acquisitions and capital expenditures and prevent us from fulfilling our financial obligations.

As of December 31, 2008, our total outstanding indebtedness was approximately $1.9 billion, including the following:

| | • | | $70.8 million under the 2006 Revolving Credit Sub-Facility (as defined below), classified as current; |

| | • | | $1,120.5 million under the secured new and used inventory floor plan facilities, including $199.5 million classified as liabilities associated with assets held for sale; |

| | • | | $103.0 million in 5.25% Convertible Notes representing $105.3 million in aggregate principal amount outstanding less unamortized discount of approximately $2.3 million; |

| | • | | $147.5 million in 4.25% Convertible Notes, classified as current, representing $160.0 million in aggregate principal amount outstanding less unamortized discount of approximately $12.5 million; |

| | • | | $273.1 million in 8.625% Notes, classified as current, representing $275.0 million in aggregate principal amount outstanding less unamortized net discount of approximately $1.9 million; |

| | • | | $114.4 million of mortgage notes, representing $114.1 million in aggregate principal amount plus unamortized premium of approximately $0.3 million, due from June, 2013 to September, 2028, classified as current, with a weighted average interest rate of 5.3%; and |

| | • | | $29.6 million of other secured debt, classified as current, representing $26.4 million in aggregate principal amount plus unamortized premium of approximately $3.2 million. |

As of December 31, 2008, we had $141.0 million available for additional borrowings under the 2006 Revolving Credit Sub-Facility (as defined below) based on the borrowing base calculation on that date, which is affected by numerous factors including eligible asset balances, the market value of certain collateral and historical consolidated EBITDA (as defined). We are also able to borrow under our 2006 Revolving Credit Sub-Facility only if we are in compliance with our financial and other covenants and all of our representations and warranties contained in the 2006 Revolving Credit Sub-Facility are true on the date of borrowing. Based on the most recent amendment to the 2006 Credit Facility, we can only use proceeds from borrowings for ordinary course of business

19

expenditures. We also have additional capacity under new and used inventory floor plan facilities. In addition, the indentures relating to our 8.625% Notes, 6.00% Convertible Notes issued in May 2009, 4.25% Convertible Notes and our other debt instruments allow us to incur additional indebtedness, including secured indebtedness, as long as we are in compliance with the terms thereunder. We refer to the $141.0 million of availability under a revolving credit facility (“2006 Revolving Credit Sub-Facility”), up to $775.6 million in borrowing availability for new vehicle inventory floor plan financing and up to $193.9 million in borrowing availability for used vehicle inventory floor plan financing collectively as our “2006 Credit Facility”.

In addition, the majority of our dealership properties are leased under long-term operating lease arrangements that generally have initial terms of fifteen to twenty years with one or two ten-year renewal options. These operating leases require compliance of financial and operating covenants similar to those under our 2006 Credit Facility, monthly payments of rent that may fluctuate based on interest rates and local consumer price indices. The total future minimum lease payments related to these operating leases and certain equipment leases are significant and are disclosed in the notes to our financial statements under the heading “Commitments and Contingencies” in this Current Report on Form 8-K dated August 21, 2009.

As of December 31, 2008, we had approximately $1.4 billion of debt that matures or which holders may force us to repay in 2009 and 2010. This leverage could have important consequences to the holders of our securities, including the following:

| | • | | we may be forced to sell certain assets at prices below where we might otherwise consider selling such assets in order to repay current maturities of debt; |

| | • | | our ability to obtain additional financing for acquisitions, capital expenditures, working capital or general corporate purposes or to refinance existing indebtedness may be impaired in the future; |

| | • | | a substantial portion of our current cash flow from operations must be dedicated to the payment of principal and interest on our indebtedness and rents under long-term operating leases, thereby reducing the funds available to us for our operations and other purposes; |

| | • | | some of our borrowings and facility leases are and will continue to be at variable rates of interest, which exposes us to the risk of increasing interest rates; |

| | • | | significant additional equity could be issued in connection with restructuring our 2010 debt obligations; |

| | • | | future interest rates may be higher than those currently applicable to our outstanding debt; |

| | • | | the indebtedness outstanding under our 2006 Credit Facility and other floor plan facilities and the indenture governing our 6.00% Convertible Notes are secured by a pledge of substantially all the assets of our dealerships, which may limit our ability to borrow money from other sources; and |

| | • | | we may be substantially more leveraged than some of our competitors, which may place us at a relative competitive disadvantage and make us more vulnerable to changing market conditions and regulations. |

In addition, our debt agreements contain numerous covenants that limit our discretion with respect to certain business matters, including mergers or acquisitions, paying dividends, incurring additional debt, making capital expenditures or disposing of assets. These covenants may become more restrictive as a result of refinancing in the current environment. It is possible that, in connection with restructuring our 2006 Credit Facility, the covenants relevant to these matters will be significantly more restrictive to our business.

An acceleration of our obligation to repay all or a substantial portion of our outstanding indebtedness or lease obligations would have a material adverse effect on our business, financial condition or results of operations.

Our 2006 Credit Facility, the indenture governing our 8.625% Notes and many of our facility operating leases contain numerous financial and operating covenants. A breach of any of these covenants could result in a default under the applicable agreement or indenture. If a default were to occur, we may be unable to adequately finance our operations and the value of our common stock would be materially adversely affected because of acceleration and cross default. In addition, a default under one agreement or indenture could result in a default and acceleration of our repayment obligations under the other agreements or indentures, including the indentures governing our outstanding 6.00% Convertible Notes, 4.25% Convertible Notes and the 8.625% Notes, under the cross default provisions in those agreements or indentures. If a cross default were to occur, we may not be able to pay our debts or borrow sufficient funds to refinance them. Even if new financing were available, it may not be on terms acceptable to us. As a result of this risk, we could be forced to take actions that we otherwise would not take, or not take actions that we otherwise might take, in order to comply with the covenants in these agreements and indentures.

Our ability to make interest and principal payments when due to holders of our debt securities depends upon our future performance.

Our ability to meet our debt obligations and other expenses will depend on our future performance, which will be affected by financial, business, domestic and foreign economic conditions, the regulatory environment and other factors, many of which we

20

are unable to control. If our cash flow is not sufficient to service our debt as it becomes due, we may be required to refinance the debt, sell assets or sell shares of our stock on terms that we do not find attractive, if it can be done at all. Further, our failure to comply with the financial and other restrictive covenants relating to the 2006 Credit Facility and the indentures pertaining to our outstanding notes could result in a default under these agreements that would prevent us from borrowing under the 2006 Revolving Credit Sub-Facility, which could adversely affect our business, financial condition and results of operations.

Our ability to make interest and principal payments when due to holders of our debt securities depends upon the receipt of sufficient funds from our subsidiaries.

Substantially all of our consolidated assets are held by our subsidiaries and substantially all of our consolidated cash flow and net income are generated by our subsidiaries. Accordingly, our cash flow and ability to service debt depends to a substantial degree on the results of operations of our subsidiaries and upon the ability of our subsidiaries to provide us with cash. We may receive cash from our subsidiaries in the form of dividends, loans or otherwise. We may use this cash to service our debt obligations or for working capital. Our subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to distribute cash to us or to make funds available to service debt. In addition, the ability of our subsidiaries to pay dividends or make loans to us are subject to contractual limitations under the floor plan facilities, minimum net capital requirements under manufacturer franchise agreements and laws of the state in which a subsidiary is organized and depend to a significant degree on the results of operations of our subsidiaries and other business considerations. In addition, if we sell a dealership subsidiary, our cash flows will decline and consequently, the sale of a significant portion of our dealership subsidiaries could have a material adverse effect on our cash flows.

We may need to sell certain assets to raise capital in connection with restructuring our 2010 obligations.

We may need to sell certain assets including dealerships and subsidiaries in order to satisfy our 2010 debt obligations. We may determine to sell profitable dealerships that we may otherwise want to retain. There are no assurances that we will be able to sell such assets on favorable terms, if at all. In addition, in the most recent amendment to the 2006 Credit Facility, we agreed that net proceeds from certain assets sales would be used to repay loans made under the 2006 Credit Facility. The sale of profitable assets will reduce our profitability in future periods.

We depend on the performance of sublessees to offset costs related to certain of our lease agreements.

In most cases when we sell a dealership franchise, the buyer of the franchise will sublease the dealership property from us, but we are not released from the underlying lease obligation to the primary landlord. We rely on the sublease income from the buyer to offset the expense incurred related to our obligation to pay the primary landlord. We also rely on the buyer to maintain the property in accordance with the terms of the sublease (which in most cases mirror the terms of the lease we have with the primary landlord). Although we assess the financial condition of a buyer at the time we sell the franchise, and seek to obtain guarantees of the buyer’s sublease obligation from the stockholders or affiliates of the buyer, the financial condition of the buyer and/or the sublease guarantors may deteriorate over time. In the event the buyer does not perform under the terms of the sublease agreement (due to the buyer’s financial condition or other factors), we may not be able to recover amounts owed to us under the terms of the sublease agreement or the related guarantees. Our operating results, financial condition and cash flows may be materially adversely affected if sublessees do not perform their obligations under the terms of the sublease agreements.

Our use of hedging transactions could limit our gains and result in financial losses.

To reduce our exposure to fluctuations in cash flow due to interest rate fluctuations, we have entered into, and in the future expect to enter into, derivative instruments (or hedging agreements). No hedging activity can completely insulate us from the risks associated with changes in interest rates. As of December 31, 2008 Sonic had interest rate swap agreements to effectively convert a portion of its LIBOR-based variable rate debt to a fixed rate. See“Derivative Instruments and Hedging Activities” under Note 1 to our Consolidated Financial Statements. Subsequent to December 31, 2008, we settled our $100 million notional, pay 5.002% and $100 million notional, pay 5.319% swaps with a payment to the counterparty of $16.5 million. We generally intend to hedge as much of the interest rate risk as management determines is in our best interests given the cost of such hedging transactions.

Our hedging transactions expose us to certain risks and financial losses, including, among other things:

| | • | | counterparty credit risk; |

| | • | | available interest rate hedging may not correspond directly with the interest rate risk for which we seek protection; |

| | • | | the duration of the amount of the hedge may not match the duration or amount of the related liability; |

21

| | • | | the credit quality of the party owing money on the hedge may be downgraded to such an extent that it impairs our ability to sell or assign our side of the hedging transaction; and |

| | • | | the value of derivatives used for hedging may be adjusted from time to time in accordance with accounting rules to reflect changes in fair-value. Downward adjustments, or “mark-to-market losses,” would reduce our stockholders’ equity. |

A failure on our part to effectively hedge against interest rate changes may adversely affect our financial condition and results of operations.

We may require additional capital in the future, which may not be available on favorable terms, if at all. Such issuances may dilute the value of our common stock and adversely affect the market price of our common stock.

We believe we will require additional capital in 2009 and/or 2010 to (i) address the 2010 debt obligations discussed above; (ii) expand our business and increase revenues; (iii) add liquidity in response to continued negative economic conditions; and (iv) meet unexpected liquidity needs caused by industry volatility and/or uncertainty. To the extent that our existing capital and borrowing capabilities are insufficient to meet these requirements and cover any losses, we will need to raise additional funds through debt or equity financings, including offerings of our common stock, securities convertible into our common stock or rights to acquire our common stock or curtail our growth and reduce our assets or restructure arrangements with existing security holders. Any equity or debt financing, or additional borrowings, if available at all, may be on terms that are not favorable to us. Equity financings could result in dilution to our stockholders, and the securities issued in future financings may have rights, preferences and privileges that are senior to those of our common stock. If our need for capital arises because of significant losses, the occurrence of these losses may make it more difficult for us to raise the necessary capital. If we cannot raise funds on acceptable terms if and when needed, we may not be able to take advantage of future opportunities, grow our business or respond to competitive pressures or unanticipated requirements. We may need to issue significant amounts of equity to the holders of our 2010 debt obligations in connection with any debt restructuring.

Because of the current low price of our common stock, if we raise funds through an equity offering, we would need to issue a large amount of common stock to raise a significant amount of cash, which will be dilutive, will decrease the ownership percentage of current outstanding stockholders and may result in a decrease in the market price of our common stock. Any large issuance may also result in a change in control of the Company which could result in a default under our debt instruments or make such debt instruments effectively due and payable.

Our depressed stock price could jeopardize our listing on the New York Stock Exchange (NYSE), affect our ability to raise equity in the future and enable the holders of our 4.25% Convertible Notes to require us to redeem their 4.25% Convertible Notes.

Current conditions in both the capital markets as well as in the automotive retailing industry have depressed the value of our common stock. At December 31, 2008, our common stock closed at $3.98 per share and we had a market capitalization of $159.6 million, representing a 79% and 80% decline in our stock price and market capitalization, respectively, from December 31, 2007. As of August 14, 2009, our common stock closed at $13.29 per share and we had a market capitalization of approximately $551.8 million. NYSE rules require, among other things, that the average closing price of our Class A common stock be not less than $1.00 over a consecutive 30-day period or the average global market capitalization over a consecutive 30-day trading period be more than $25.0 million. During two consecutive days during the month of March 2009, our stock traded at levels below $1 per share. Although the NYSE has temporarily suspended or modified these listing standards, we cannot assure you that we will comply with these and other listing standards in the future. If we do not satisfy such listing standards our Class A common stock could be delisted from the NYSE and traded only in the over–the-counter market. This could limit our ability to raise new equity capital in the future and cause our existing equity securities to trade at lower values, and would give holders of our 4.25% Convertible Notes the right to require us to repurchase the 4.25% Convertible Notes. Such a repayment event could have a material adverse effect on our business and our liquidity.

Risks Related to Our Relationships with Vehicle Manufacturers

Our operations may be adversely affected if one or more of our manufacturer franchise agreements is terminated or not renewed.

Each of our dealerships operates under a franchise agreement with the applicable automobile manufacturer or distributor. Without a franchise agreement, we cannot obtain new vehicles from a manufacturer. As a result, we are significantly dependent on our relationships with these manufacturers.

Manufacturers exercise a great degree of control over the operations of our dealerships through the franchise agreements. The franchise agreements govern, among other things, our ability to purchase vehicles from the manufacturer and to sell vehicles to customers. Each of our franchise agreements provides for termination or non-renewal for a variety of causes, including certain

22

changes in the financial condition of the dealerships and any unapproved change of ownership or management. Manufacturers may also have a right of first refusal if we seek to sell dealerships.

Actions taken by manufacturers to exploit their superior bargaining position in negotiating the terms of franchise agreements or renewals of these agreements or otherwise could also have a material adverse effect on our results of operations, financial condition and cash flows. We cannot guarantee you that any of our existing franchise agreements will be renewed or that the terms and conditions of such renewals will be favorable to us.

Our sales volume and profit margin on each sale may be materially adversely affected if manufacturers discontinue or change their incentive programs.

Our dealerships depend on the manufacturers for certain sales incentives, warranties and other programs that are intended to promote and support dealership new vehicle sales. Manufacturers routinely modify their incentive programs in response to changing market conditions. Some of the key incentive programs include:

| | • | | customer rebates or below market financing on new vehicles; |

| | • | | dealer incentives on new vehicles; |

| | • | | manufacturer floor plan interest and advertising assistance; |

| | • | | warranties on new and used vehicles; and |

| | • | | sponsorship of used vehicle sales by authorized new vehicle dealers. |

Manufacturers frequently offer incentives to potential customers. A reduction or discontinuation of a manufacturer’s incentive programs may materially adversely impact vehicle demand and affect our profitability. For example, in the fourth quarter of 2008, General Motors delayed payments related to certain incentive programs. In the event this delay was longer or of greater scale, the effect on our overall liquidity could have been material.

Our sales volume may be materially adversely affected if manufacturer captives change their customer financing programs or are unable to provide floor plan financing.

One of the primary finance sources used by consumers in connection with the purchase of a new or used vehicle is the manufacturer captive finance companies. These captive finance companies rely, to a certain extent, on the public debt markets to provide the capital necessary to support their financing programs. In addition, the captive finance companies will occasionally change their loan underwriting criteria to alter the risk profile of their loan portfolio. A limitation or reduction of available consumer financing for these or other reasons could affect a consumer’s ability to purchase a vehicle, and thus, could have a material adverse effect on our sales volume. For example, for a period of time in the fourth quarter, GMAC stated they would not make loans to customers with FICO credit scores below 700. If this continues or if consumer credit is further restricted, the adverse effect on our overall liquidity could be material.

Our parts and service sales volume and profitability are dependent on manufacturer warranty programs.

Franchised automotive retailers perform service work and sell replacement parts on vehicles covered by warranties issued by the automotive manufacturer. Dealerships which perform work covered by a manufacturer warranty are reimbursed at rates established by the manufacturer. For the year ended December 31, 2008, approximately 18.1% of our parts and service revenue was for work covered by manufacturer warranties. To the extent a manufacturer reduces the labor rates or markup of replacement parts for such warranty work, our fixed operations sales volume and profitability could be adversely affected.

We depend on manufacturers to supply us with sufficient numbers of popular and profitable new models.

Manufacturers typically allocate their vehicles among dealerships based on the sales history of each dealership. Supplies of popular new vehicles may be limited by the applicable manufacturer’s production capabilities. Popular new vehicles that are in limited supply typically produce the highest profit margins. We depend on manufacturers to provide us with a desirable mix of popular new vehicles. Our operating results may be materially adversely affected if we do not obtain a sufficient supply of these vehicles.

Adverse conditions affecting one or more key manufacturers may negatively impact our profitability.

On June 1, 2009, General Motors Corp. and certain of its subsidiaries (“General Motors”) filed for Chapter 11 bankruptcy protection. As of June 30, 2009, we operated 33 General Motors franchises (under the Cadillac, Chevrolet, Hummer, Saab, Buick

23

and Saturn nameplates) at 26 physical dealerships. Six of our General Motors dealerships, representing twelve franchises, including three Hummer franchises at multi-franchise dealerships, two Saab franchises at multi-franchise dealerships and one additional General Motors franchise at a multi-franchise dealership received letters stating that the franchise agreements between General Motors and us will not be continued by General Motors on a long-term basis. Subject to bankruptcy approval, General Motors has offered assistance with winding down the operations of these franchises in exchange for our execution of termination agreements. We executed all of the termination agreements. Assistance expected to be received from General Motors totals $3.3 million, none of which was recorded as a receivable from General Motors as of June 30, 2009 due to the uncertainty of bankruptcy court approval and certain conditions required for the payments to occur had not yet been satisfied. The termination agreements provide for the following:

| | • | | The termination of the franchise agreement no earlier than January 1, 2010 and no later than October 31, 2010; |

| | • | | The assignment and assumption of the franchise agreement by the purchaser of General Motors’ assets; |

| | • | | The payment of financial assistance to the franchisee in installments in connection with the orderly winding down of the franchise operations; |

| | • | | The waiver of any other termination assistance of any kind that may have been required under the franchise agreement; |

| | • | | The release of claims against General Motors or the purchaser of General Motors’ assets and their related parties; |

| | • | | The continuation of franchise operations pursuant to the franchise agreement, as supplemented by the termination agreement, through the effective date of termination of the franchise agreement, except that we shall not be entitled to order any new vehicles from General Motors or the purchaser of General Motors’ assets; and |

| | • | | A restriction on our ability to transfer the franchise agreement to another party. |

For the remaining General Motors franchises we executed “continuation agreements” which require, among other things, that existing franchise agreements will expire no later than October 31, 2010. In consideration of the execution of the “continuation agreements” General Motors will recommend to the bankruptcy court the continuation or assumption of our existing franchise agreements, as amended by the “continuation agreements”. We cannot be assured that General Motors will renew our franchise agreements when they expire on October 31, 2010.

With the exception of product liability indemnifications, amounts owed to us through incentive programs, amounts currently owed to our franchises under their open accounts with General Motors and warranty claims occurring within 90 days prior to June 1, 2009, all amounts owed to us from General Motors were extinguished as a result of the execution of the termination and continuation agreements. A motion was made by General Motors to the bankruptcy court and the motion was granted by the bankruptcy court allowing General Motors to pay the claims noted above. As a result, we have been receiving payments related to pre-bankruptcy claims. However, we cannot give assurances that General Motors will continue to pay our pre-bankruptcy claims or that it will not encounter financial difficulties in the future that may affect us.

As our operations at the affected franchises that will not be renewed wind down, we may be required to accelerate depreciation expenses and record impairment charges related to, but not limited to, lease obligations, fixed assets, franchise assets, accounts receivable and inventory. These charges could have a material adverse impact on our results, financial position and cash flows.

On June 2, 2009, General Motors announced that Chinese equipment manufacturer Sichuan Tengzhong Heavy Industrial Machinery Co. (“STHIMC”) will buy its Hummer brand. As of June 30, 2009, we operated three Hummer franchises at three dealership locations. It is uncertain whether STHIMC will continue supporting the Hummer brand or whether STHIMC’s ownership of the Hummer brand will have a positive or negative impact on our Hummer franchises’ operations.

On June 5, 2009, General Motors announced that Penske Automotive Group (PAG), will buy its Saturn brand. As of June 5, 2009, we operated one Saturn franchise at one dealership location. It is uncertain whether PAG will continue supporting the Saturn brand or whether PAG’s ownership of the Saturn brand will have a positive or negative impact on our Saturn franchise’s operations.

24

On April 30, 2009, Chrysler LLC filed for bankruptcy protection and submitted a plan of reorganization. On June 10, 2009, Fiat SpA purchased a substantial portion of Chrysler’s assets which include rights related to our franchise agreements. As of June 30, 2009, we owned six Chrysler franchises at two dealership locations. It is uncertain whether Fiat will continue supporting the Chrysler brand or whether Fiat’s ownership of the Chrysler brand will have a positive or negative impact on our Chrysler franchises’ operations.

At June 30, 2009 we had the following balances recorded related to domestic manufacturers:

| | | |

| | | (dollars in millions)

June 30, 2009 |

General Motors | | | |

New Vehicle Inventory | | $ | 100.1 |

Parts Inventory | | | 10.7 |

Factory Receivables | | | 6.0 |

Property and Equipment, net | | | 21.0 |

Franchise Assets | | | 16.7 |

Ford (including Volvo) | | | |

New Vehicle Inventory | | | 55.8 |

Parts Inventory | | | 3.9 |

Factory Receivables | | | 3.4 |

Property and Equipment, net | | | 9.3 |

Franchise Assets | | | 2.2 |

Chrysler | | | |

New Vehicle Inventory | | | 7.9 |

Parts Inventory | | | 1.2 |

Factory Receivables | | | 0.1 |

Property and Equipment, net | | | 1.5 |

Franchise Assets | | | — |

The manner in which these manufactures maintain relations with their franchisees may change as a result of the bankruptcy filings and subsequent emergence from bankruptcy. We can give no assurances that future practices of these manufactures will be consistent with the way they have historically operated.

In addition, we rely on the manufacturer captive finance companies associated with these domestic manufacturers for new vehicle floor plan financing. The changes in circumstances related to any of these domestic manufacturers could result in an attempt by the related captive finance company to terminate our floor plan financing, which would have a material adverse impact on our operations and liquidity.

Manufacturer stock ownership restrictions may impair our ability to maintain or renew franchise agreements or issue additional equity.

Some of our franchise agreements prohibit transfers of any ownership interests of a dealership and, in some cases, its parent, without prior approval of the applicable manufacturer. A number of manufacturers impose restrictions on the transferability of our Class A common stock and our ability to maintain franchises if a person acquires a significant percentage of the voting power of our common stock. Our existing franchise agreements could be terminated if a person or entity acquires a substantial ownership interest in us or acquires voting power above certain levels without the applicable manufacturer’s approval. Violations of these levels by an investor are generally outside of our control and may result in the termination or non-renewal of existing franchise agreements or impair our ability to negotiate new franchise agreements for dealerships we acquire in the future. In addition, if we cannot obtain any requisite approvals on a timely basis, we may not be able to issue additional equity or otherwise raise capital on terms acceptable to us. These restrictions may also prevent or deter a prospective acquirer from acquiring control of us. This could adversely affect the market price of our Class A common stock and also may limit our ability to restructure our debt obligations.

The current holders of our Class B common stock maintain voting control over us. However, we are unable to prevent our stockholders from transferring shares of our common stock, including transfers by holders of the Class B common stock. If such transfer results in a change in control, it could result in the termination or non-renewal of one or more of our existing franchise agreements, the triggering of provisions in our agreements with certain manufacturers requiring us to sell our dealerships franchised with such manufacturers and/or a default under our credit arrangements.

Our dealers depend upon vehicle sales and, therefore, their success depends in large part upon customer demand for the particular vehicles they carry.

25

The success of our dealerships depends in large part on the overall success of the vehicle lines they carry. New vehicle sales generate the majority of our total revenue and lead to sales of higher-margin products and services such as finance, insurance, vehicle protection products and other aftermarket products, and parts and service operations. Although we have sought to limit our dependence on any one vehicle brand and our parts and service operations and used vehicle sales may serve to offset some of this risk, we have focused our new vehicle sales operations in mid-line import and luxury brands.

Our failure to meet a manufacturer’s customer satisfaction, financial and sales performance and facility requirements may adversely affect our ability to acquire new dealerships and our profitability.

Many manufacturers attempt to measure customers’ satisfaction with their sales and warranty service experiences through manufacturer-determined CSI scores. The components of CSI vary from manufacturer to manufacturer and are modified periodically. Franchise agreements also may impose financial and sales performance standards. Under our agreements with certain manufacturers, a dealership’s CSI scores, sales and financial performance may be considered a factor in evaluating applications for additional dealership acquisitions. From time to time, some of our dealerships have had difficulty meeting various manufacturers’ CSI requirements or performance standards. We cannot assure you that our dealerships will be able to comply with these requirements in the future. A manufacturer may refuse to consent to an acquisition of one of its franchises if it determines our dealerships do not comply with its CSI requirements or performance standards, which could impair the execution of our acquisition strategy. In addition, we receive incentive payments from the manufacturers based, in part, on CSI scores, which could be materially adversely affected if our CSI scores decline.