1 Q3 2012 Earnings Review October 23, 2012 Exhibit 99.2 Sonic Automotive, Inc. |

Sonic Automotive, Inc. 2 Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events, are not historical facts and are based on our current expectations and assumptions regarding our business, the economy and other future conditions. These statements can generally be identified by lead-in words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “foresee”, “may” , “will” and other similar words. Statements that describe our Company’s objectives, plans or goals are also forward-looking statements. Examples of such forward-looking information we may be discussing in this presentation include, without limitation, further implementation of our operational strategies and playbooks, future debt retirement, capital expenditures, operating margins and revenues, inventory levels and new vehicle industry sales volume. You are cautioned that these forward-looking statements are not guarantees of future performance, involve risks and uncertainties and actual results may differ materially from those projected in the forward-looking statements as a result of various factors. These risks and uncertainties include, among other things, (a) economic conditions in the markets in which we operate, (b) the success of our operational strategies, (c) our relationships with the automobile manufacturers and (d) new and pre-owned vehicle sales volume. These risks and uncertainties, as well as additional factors that could affect our forward-looking statements, are described in our Form 10-K for the year ending December 31, 2011 and our Form 10-Q for the quarter ended June 30, 2012. These forward-looking statements, risks, uncertainties and additional factors speak only as of the date of this presentation. We undertake no obligation to update any such statements. |

Sonic Automotive, Inc. 3 Sonic Automotive Q3 2012 o Quarter in Review o Financial Results o Operations Recap o Summary and Outlook |

Sonic Automotive, Inc. 4 Overall Results Revenue Growth – up 11.7% New retail vehicle revenue up 20.2% - volume up 25.2% - exceeds industry retail volume growth Pre-owned gross up 7.1% F&I revenue up 18.0% Fixed Operations gross up 1.3% on one less selling day (up 3.3% when adjusted for selling days) SG&A at 77.6% - improvement of 30 bps versus PY Qtr. Adjusted income from continuing operations of $23.1 million, up 14.9% Q3 2012 adjusted diluted EPS from continuing operations was $0.40 per share vs. $0.34 in prior year period – up 18% * - Adjusted results exclude a pretax charge of $18.5M (after-tax of $11.3M), or $0.19 per diluted share related to debt repurchase activity. |

Sonic Automotive, Inc. 5 B/(W) than Q3 2011 (amounts in millions, except per share data) Q3 2012 $ % Revenue $ 2,152 $ 226 12% Gross Profit $ 308 $ 14 5% Operating Profit $ 58 $ 3 5% Interest & Other ($ 19) $ 3 12% Continuing Ops: Profit (after tax) $ 23 $ 3 15% Diluted EPS $ 0.40 $ 0.06 18% SG&A as % of Gross 77.6% 30 bps Discontinued Ops Profit (after tax) ($1.8) ($1.1) * - Adjusted results exclude a pretax charge of $18.5M (after-tax of $11.3M), or $0.19 per diluted share related to debt repurchase activity. Adjusted Results * |

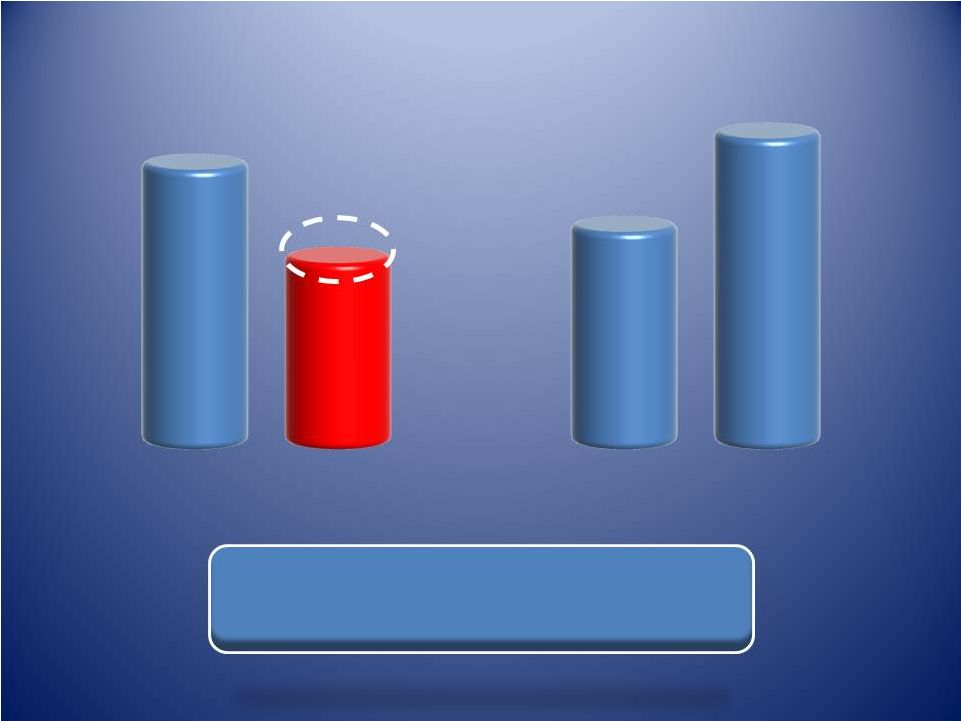

Sonic Automotive, Inc. 30 bps Improvement from PY Qtr Tracking Lower than Full Year Target 6 Q3 2011 Q3 2012 YTD Q3 2012 TARGET 77.9% 77.6% 77.7% 78.0% SG&A to Gross |

Sonic Automotive, Inc. (amounts in millions) YTD Q3 2012 Estimated 2012 Real Estate Acquisitions $ 4.8 $ 14.5 All Other Cap Ex 50.4 99.4 Subtotal $ 55.2 $ 113.9 Less: Mortgage Funding (10.7) (25.7) Total Cash Used – Cap Ex $ 44.5 $ 88.2 7 Capital Spending |

Sonic Automotive, Inc. 8 Compliant with all Covenants Covenant Actual Q3 2012 Liquidity Ratio >= 1.05 1.21 Fixed Charge Coverage Ratio >= 1.20 1.66 Total Lease Adjusted Leverage Ratio <= 5.50 4.01 Debt Covenants |

9 $172.5M Convert $210M 9% Bond $210M 9% Bond $200M 7% Bond AFTER Maturity Profile 2013 2014 2015 2016 2017 2018 2022 2013 2015 2016 2017 2018 Sonic Automotive, Inc. BEFORE |

Sonic Automotive, Inc. Share Count Changes (shares in thousands) Weighting Basic 5% Notes Other Diluted Weighted Average Shares – 6/30/2012 52,593 10,535 378 63,506 Issue 4,075 Shares 67% 2,658 - - 2,658 Redeem 5% Notes (67%) - (7,001) - (7,001) 804 Share Repurchases 30% (243) (243) Other 61 - 30 91 Weighted Average Shares – 9/30/2012 55,069 3,534 408 59,011 Net Reduction in Dilution of 4.5M Shares $116M of Share Repurchase Authorization Remaining at End of Q3 2012 |

New Vehicles 11 Includes Fleet (1) (1) Source: JD Power 25.2% 21.3% 15.1% Sonic - Retail Industry - Retail SAAR Sonic Automotive, Inc. Q3 2012 Q3 2011 B/(W) Retail Revenue $1.2 billion $1.0 billion 20.2% Retail Volume 33,737 26,955 25.2% Selling Price $ 34,741 $ 36,166 (3.9%) Gross Margin % 5.7% 6.7% (100 bps) GPU $ 1,987 $ 2,429 ($442) Retail Gross Profit $ 67 million $ 65 million 2.4% |

Sonic Automotive, Inc. Pre-Owned Retail Vehicles Q3 2012 Q3 2011 B/(W) Retail Volume 27,018 25,334 6.6% Revenue $534 million $509 million 4.8% Pre-Owned Related Gross* $ 81 million $ 76 million $ 5 million 12 * - Includes: pre-owned vehicle + reconditioning + F&I gross Continue to make progress toward our goal of 100 per store per month Q3 2012 Q3 2011 87 82 Used Retail Sales Per Store |

Sonic Automotive, Inc. 13 B/(W) than Q3 2011 (amounts in millions) Q3 2012 $ % Revenue $ 291 $ 4 1.3% Gross Profit $ 142 $ 2 1.7% Fixed Operations Gross Up 3.3% when adjusted for one less fixed ops day Sonic Automotive, Inc. Q3 YOY Gross Profit Change Breakdown: • Customer Pay Up 1.1% • Whsl. Parts - flat • Internal & Sublet Up 9.7% • Warranty Down 2.7% |

Sonic Automotive, Inc. • Grow the Base Business - Developing Predictable - Repeatable - Sustainable Business Model • Playbooks - Uniform Best Practices • People - Culture of Customer-Centric Organization • Systems - Stable, Flexible and Secure Delivery Systems • Data - Use to Drive Business Decisions Throughout the Organization - Grow Through Knowledge in Core Competencies • Own Our Properties - Create Value on the Balance Sheet - Lower Cost Option • Improve Capital Structure - Buy Back Stock Opportunistically - Manage Debt Levels - Offer Dividend to Reward Shareholders Predictable Repeatable Sustainable Predictable Repeatable Sustainable Strategic Focus Strategic Focus |

15 Summary and Outlook Double-digit overall revenue growth Anticipate Q4 retail GPU to improve from Q3 levels Luxury mix of stores contributes to higher Q4 performance Automotive retail industry outlook continues to remain positive Full year 2012 adjusted continuing operations diluted earnings per share guidance of $1.65 - $1.70 (1). (1) - Excluded from this range are costs associated with retiring outstanding 5.0% Convertible Senior Notes due 2029 (“5% Notes”) and tax benefits related to the settlement of certain tax matters in the second and third quarters of 2012 which total a net charge of $0.16 per diluted share. Sonic Automotive, Inc. |

16 Sonic Automotive, Inc. |

Sonic Automotive, Inc. Reconciliation of Non-GAAP Financial Information 17 Three Months Ended September 30, Adjusted 2012 B/(W) 2012 2011 than Adjusted 2011 ($ in millions, shares in thousands, except per share data) As Reported Adjustments As Adjusted As Reported Adjustments As Adjusted $ % Revenues 2,152.2 $ - $ 2,152.2 $ 1,926.1 $ - $ 1,926.1 $ 226.1 $ 11.7% Gross profit 307.7 - 307.7 293.4 - 293.4 14.3 4.9% Gross margin 14.3% - 15.2% - 0 bps SG&A (238.7) - (238.7) (228.6) - (228.6) (10.1) 4.4% SG&A as % of gross profit 77.6% - 77.9% - 0 bps Impairment charges - - - (0.1) - (0.1) 0.1 (100.0%) Depreciation and amortization (11.4) - (11.4) (10.1) - (10.1) (1.2) 12.2% Operating income 57.6 - 57.6 54.6 - 54.6 3.0 5.5% Operating margin 2.7% - 2.8% - 0 bps Interest expense, floor plan (4.9) - (4.9) (4.2) - (4.2) (0.7) 16.7% Interest expense, other, net (15.7) 1.2 (1) (14.5) (16.9) - (16.9) 2.4 (14.2%) Other income (expense), net (17.3) 17.3 (2) 0.0 (0.8) - (0.8) 0.9 (105.5%) Income (loss) from continuing operations 11.8 11.3 23.1 20.1 - 20.1 3.0 14.9% Income (loss) from discontinued operations (1.8) - (1.8) (0.7) - (0.7) (1.1) 153.2% Net income (loss) 10.0 $ 11.3 $ 21.3 $ 19.4 $ - $ 19.4 $ 1.9 $ 9.9% Diluted earnings (loss) per common share: Earnings (loss) per share from continuing operations 0.21 $ 0.19 $ 0.40 $ 0.34 $ - $ 0.34 $ 0.06 $ 17.6% Earnings (loss) per share from discontinued operations (0.03) - (0.03) (0.01) - (0.01) (0.02) 200.0% Earnings (loss) per common share 0.18 $ 0.19 $ 0.37 $ 0.33 $ - $ 0.33 $ 0.04 $ 12.1% Weighted average shares outstanding 59,011 59,011 65,517 65,517 (1) Represents double-carry interest in July 2012. (2) Represents debt extinguishment charges related to the 5% Convertible Notes. |

Sonic Automotive, Inc. Reconciliation of Non-GAAP Financial Information Three Months Ended September 30, 2012 Continuing Operations Discontinued Operations Total Operations ($ in millions, shares in thousands, except per share data) Net Income (Loss): Numerator Share Count: Denominator Diluted EPS Net Income (Loss): Numerator Share Count: Denominator Diluted EPS Net Income (Loss): Numerator Share Count: Denominator Diluted EPS Reported basic 11.8 $ 55,069 (1.8) $ 55,069 10.0 $ 55,069 Effect of dilutive securities: Two class method (0.2) - - - (0.2) - Contingently convertible debt 0.6 3,534 - 3,534 0.6 3,534 Stock compensation plans - 408 - 408 - 408 Reported diluted 12.2 59,011 0.21 $ (1.8) 59,011 (0.03) $ 10.4 59,011 0.18 $ Adjustments (tax-effected): Double-carry interest 0.7 - - - 0.7 - Debt extinguishment charges 10.6 - - - 10.6 - Subtotal 23.5 59,011 0.40 $ (1.8) 59,011 (0.03) $ 21.7 59,011 0.37 $ Effect of dilutive securities: Two class method (0.1) - - - (0.1) - Adjusted diluted 23.4 $ 59,011 0.40 $ (1.8) $ 59,011 (0.03) $ 21.6 $ 59,011 0.37 $ 18 |