UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2018

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 1-13395

SONIC AUTOMOTIVE, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 56-2010790 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

4401 Colwick Road | | |

| Charlotte, North Carolina | | 28211 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (704) 566-2400

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | | Name of each exchange on which registered |

| Class A common stock, $0.01 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

______________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large Accelerated Filer | ☒ | | Accelerated filer ☐ |

| Non-accelerated filer ☐ | | | Smaller Reporting Company ☐ Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

The aggregate market value of the voting common stock held by non-affiliates of the registrant was approximately $599.3 million based upon the closing sales price of the registrant’s Class A Common Stock on June 30, 2018 of $20.60 per share.

As of February 20, 2019, there were 30,916,226 shares of Class A Common Stock, par value $0.01 per share, and 12,029,375 shares of Class B Common Stock, par value $0.01 per share, outstanding.

Documents incorporated by reference. Portions of the registrant’s definitive Proxy Statement for the 2019 Annual Meeting of Stockholders to be held April 24, 2019 are incorporated by reference into Part III of this Form 10-K.

UNCERTAINTY OF FORWARD-LOOKING STATEMENTS AND INFORMATION

This Annual Report on Form 10-K contains, and written or oral statements made from time to time by us or by our authorized officers may contain, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements address our future objectives, plans and goals, as well as our intent, beliefs and current expectations regarding future operating performance, results and events, and can generally be identified by words such as “may,” “will,” “should,” “believe,” “expect,” “estimate,” “anticipate,” “intend,” “plan,” “foresee” and other similar words or phrases.

These forward-looking statements are based on our current estimates and assumptions and involve various risks and uncertainties. As a result, you are cautioned that these forward-looking statements are not guarantees of future performance, and that actual results could differ materially from those projected in these forward-looking statements. Factors which may cause actual results to differ materially from our projections include those risks described in “Item 1A. Risk Factors” of this Annual Report on Form 10-K and elsewhere herein, as well as:

•the number of new and used vehicles sold in the United States as compared to our expectations and the expectations of the market;

•our ability to generate sufficient cash flows or to obtain additional financing to fund our EchoPark expansion, capital expenditures, our share repurchase program, dividends on our common stock, acquisitions and general operating activities;

•our business and growth strategies, including, but not limited to, our EchoPark store operations;

•the reputation and financial condition of vehicle manufacturers whose brands we represent, the financial incentives vehicle manufacturers offer and their ability to design, manufacture, deliver and market their vehicles successfully;

•our relationships with manufacturers, which may affect our ability to obtain desirable new vehicle models in inventory or to complete additional acquisitions;

•the adverse resolution of one or more significant legal proceedings against us or our franchised dealerships or EchoPark stores;

•changes in laws and regulations governing the operation of automobile franchises, accounting standards, taxation requirements and environmental laws;

•changes in vehicle and parts import quotas, duties, tariffs or other restrictions;

•general economic conditions in the markets in which we operate, including fluctuations in interest rates, employment levels, the level of consumer spending and consumer credit availability;

•high competition in the retail automotive industry, which not only creates pricing pressures on the products and services we offer, but also on businesses we may seek to acquire;

•our ability to successfully integrate potential future acquisitions; and

•the rate and timing of overall economic recovery or decline.

These forward-looking statements speak only as of the date of this Annual Report on Form 10-K or when made, and we undertake no obligation to revise or update these statements to reflect subsequent events or circumstances, except as required under the federal securities laws and the rules and regulations of the Securities and Exchange Commission.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2018

TABLE OF CONTENTS

| | | | | | | | |

| | PAGE |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | |

| | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| | |

| Item 15. | | |

| Item 16. | | |

| | |

| | |

| | |

PART I

Item 1. Business.

Sonic Automotive, Inc. was incorporated in Delaware in 1997. We are one of the largest automotive retailers in the United States (as measured by total revenue). As a result of the way we manage our business, we had two operating segments as of December 31, 2018: (1) the Franchised Dealerships Segment and (2) the EchoPark Segment. For management and operational reporting purposes, we group certain businesses together that share management and inventory (principally used vehicles) into “stores.” As of December 31, 2018, we operated 96 stores in the Franchised Dealerships Segment and eight stores in the EchoPark Segment. The Franchised Dealerships Segment consists of 108 new vehicle franchises (representing 23 different brands of cars and light trucks) and 15 collision repair centers in 13 states.

The Franchised Dealerships Segment provides comprehensive services, including (1) sales of both new and used cars and light trucks; (2) sales of replacement parts and performance of vehicle maintenance, manufacturer warranty repairs, and paint and collision repair services (collectively, “Fixed Operations”); and (3) arrangement of extended warranties, service contracts, financing, insurance and other aftermarket products (collectively, “finance and insurance” or “F&I”) for our customers. The EchoPark Segment sells used cars and light trucks and arranges F&I product sales for our customers in pre-owned vehicle specialty retail locations. Our EchoPark business operates independently from our franchised dealerships business. Sales operations in our first EchoPark market in Denver, Colorado began in the fourth quarter of 2014. As of December 31, 2018, we had three EchoPark stores in operation in Colorado, four in Texas and one in North Carolina. By the end of 2019, we expect to open one additional EchoPark store in Texas. We believe that the expansion of our EchoPark business will provide long-term benefits to the Company, our stockholders and our guests. However, in the short term, this strategic initiative may negatively impact our overall operating results as we allocate management and capital resources to this business.

References to “Sonic,” the “Company,” “we,” “us” and “our” used throughout this Annual Report on Form 10-K refer to Sonic Automotive, Inc. and its subsidiaries.

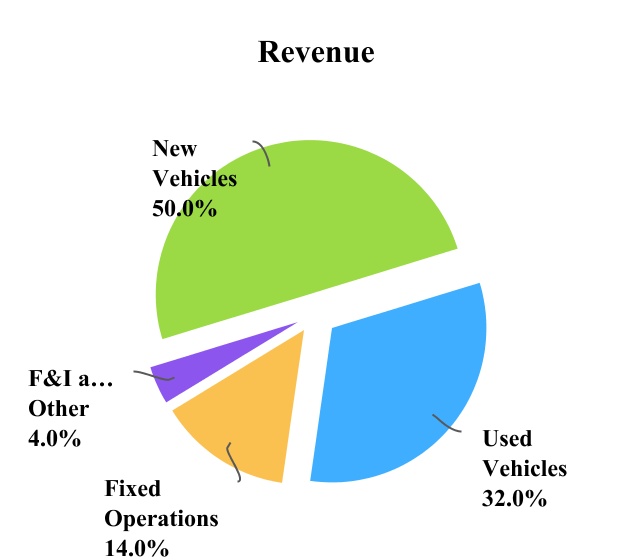

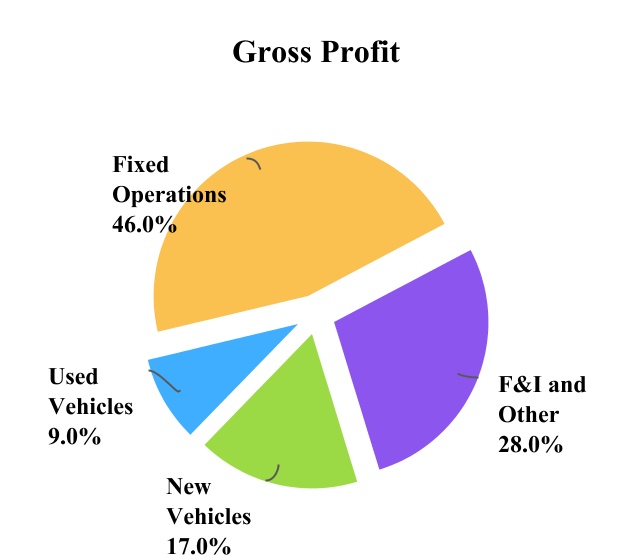

The following charts depict the multiple sources of continuing operations revenue and gross profit for the year ended December 31, 2018 (“2018”):

As of December 31, 2018, we operated in the following states:

| | | | | | | | | | | | | | | | | | | | |

| Market | | Number of Franchised Stores | | Number of EchoPark Stores | | Percent of 2018 Total Revenue |

| California | | 23 | | — | | 28.2 | % |

| Texas | | 20 | | 4 | | 26.8 | % |

| Colorado | | 2 | | 3 | | 7.8 | % |

| Tennessee | | 11 | | — | | 6.8 | % |

| Florida | | 9 | | — | | 5.6 | % |

| Alabama | | 10 | | — | | 5.2 | % |

| North Carolina | | 4 | | 1 | | 3.4 | % |

| Ohio | | 5 | | — | | 3.1 | % |

| Maryland | | 2 | | — | | 3.0 | % |

| Georgia | | 4 | | — | | 2.8 | % |

| Virginia | | 2 | | — | | 2.8 | % |

| Nevada | | 2 | | — | | 1.7 | % |

| South Carolina | | 2 | | — | | 1.5 | % |

| Disposed stores and holding companies | | — | | — | | 1.3 | % |

| Total | | 96 | | 8 | | 100.0 | % |

In the future, we may acquire dealerships and open new stores that we believe will enrich our portfolio and divest dealerships or close stores that we believe will not yield acceptable returns over the long term. The automotive retailing industry remains highly fragmented, and we believe that further consolidation may occur. We believe that attractive acquisition opportunities continue to exist for dealership groups with the capital and experience to identify, acquire and professionally manage dealerships. Our ability to complete acquisitions and open new stores in the future will depend on many factors, including the availability of financing and the existence of any contractual provisions that may restrict our acquisition activity.

See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources” for a discussion of our plans for the use of capital generated from operations.

Operating Segments

As of December 31, 2018, we had two operating segments: (1) the Franchised Dealerships Segment and (2) the EchoPark Segment. The Franchised Dealerships Segment is comprised of retail automotive franchises that sell new vehicles and buy and sell used vehicles, sell replacement parts, perform vehicle maintenance, warranty and repair services, and arrange finance and insurance products. The EchoPark Segment is comprised of pre-owned vehicle specialty retail locations that buy and sell used vehicles and arrange finance and insurance products.

For 2018, EchoPark Segment revenue represented approximately 7.0% of total revenue. See Note 14, “Segment Information,” to the accompanying consolidated financial statements for additional financial information regarding our two operating segments.

Unless otherwise noted, the following discussion of our business is presented on a consolidated basis.

Business Strategy

Execute our EchoPark Store Initiative. We have augmented our manufacturer-franchised dealership operations with our EchoPark pre-owned vehicle specialty retail locations. Our EchoPark business operates independently from our franchised dealerships business. Sales operations for EchoPark began in Denver, Colorado in the fourth quarter of 2014. As of December 31, 2018, we had three EchoPark stores in operation in Colorado, four in Texas and one in North Carolina. We expect to open one additional EchoPark store in Texas during 2019.

Achieve High Levels of Customer Satisfaction. We focus on maintaining high levels of customer satisfaction. Our personalized sales process is designed to satisfy customers by providing high-quality vehicles and service in a positive, “consumer friendly” buying environment. Several manufacturers offer specific financial incentives on a per vehicle basis if certain Customer Satisfaction Index (“CSI”) levels (which vary by manufacturer) are achieved by a dealership. In addition, all

manufacturers consider CSI scores in approving acquisitions or awarding new dealership open points. To keep dealership and executive management focused on customer satisfaction, we include CSI results as a component of our incentive-based compensation programs for certain groups of associates and executive management.

Invest in Dealership Properties. Historically, we have operated our dealerships primarily on property financed through long-term operating leases. As these leases mature, or as we have an opportunity to purchase the underlying real estate prior to renewal, we take actions to own more of our dealership properties when the effect is financially or operationally favorable to us. We remain opportunistic in purchasing existing properties or relocating dealership operations to owned real estate where the returns are favorable. We believe owning our properties where feasible and financially and strategically advantageous will, over the long term, strengthen our balance sheet and reduce our overall cost of operating and financing our facilities.

Improve Capital Structure. As we generate cash through operations, we may opportunistically repurchase our Class A Common Stock or our outstanding subordinated notes in open-market or structured transactions and may sell our Class A Common Stock to reduce debt.

Maximize Asset Returns Through Process Execution. We have developed standardized operating processes that are documented in operating playbooks for our stores. Through the continued implementation of our operating playbooks, we believe organic growth opportunities exist by offering a more favorable buying experience to our customers and creating efficiencies in our business processes. We believe the development, refinement and implementation of these operating processes will enhance the customer experience, make us more competitive in the markets we serve and drive profit growth across each of our revenue streams.

Maintain Diverse Revenue Streams. We have multiple revenue streams. In addition to new vehicle sales, our revenue sources include used vehicle sales, which we believe are less sensitive to economic cycles and seasonal influences that exist with new vehicle sales. Our Fixed Operations sales carry a higher gross margin than new and used vehicle sales and, in the past, have not been as economically sensitive as new vehicle sales. We also offer customers assistance in obtaining financing and a range of automobile-related warranty, aftermarket and insurance products.

Manage Portfolio. Our long-term growth and acquisition strategy is focused on large metropolitan markets, predominantly in the Southeast, Texas and California. We seek to add like-branded dealerships to our portfolio that exist in regions in which we already operate; however, we may look outside of our existing geographic footprint when considering the location of new EchoPark stores. A majority of our franchised dealerships are either luxury or mid-line import brands. For 2018, approximately 89.4% of our total new vehicle revenue was generated by luxury and mid-line import dealerships, which usually have higher operating margins, more stable Fixed Operations departments, lower associate turnover and lower inventory levels.

The following table depicts the breakdown of our new vehicle revenues from continuing operations by brand:

| | | | | | | | | | | | | | | | | |

| Percentage of New Vehicle Revenues | | | | |

| Year Ended December 31, | | | | |

| Brand | 2018 | | 2017 | | 2016 |

| Luxury: | | | | | |

| BMW | 19.8 | % | | 19.6 | % | | 20.2 | % |

| Mercedes | 10.7 | % | | 10.7 | % | | 10.6 | % |

| Audi | 6.5 | % | | 6.0 | % | | 5.3 | % |

| Lexus | 6.1 | % | | 5.8 | % | | 5.9 | % |

| Land Rover | 4.4 | % | | 3.2 | % | | 3.3 | % |

| Porsche | 2.7 | % | | 2.4 | % | | 2.3 | % |

| Cadillac | 2.3 | % | | 2.7 | % | | 3.3 | % |

| MINI | 1.3 | % | | 1.3 | % | | 1.6 | % |

| Other luxury (1) | 2.8 | % | | 2.9 | % | | 3.0 | % |

| Total Luxury | 56.6 | % | | 54.6 | % | | 55.5 | % |

| Mid-line Import: | | | | | |

| Honda | 17.2 | % | | 17.3 | % | | 16.8 | % |

| Toyota | 10.2 | % | | 11.9 | % | | 11.4 | % |

| Volkswagen | 2.0 | % | | 1.8 | % | | 1.5 | % |

| Hyundai | 1.6 | % | | 1.5 | % | | 1.2 | % |

| Other imports (2) | 1.8 | % | | 1.7 | % | | 1.7 | % |

| Total Mid-line Import | 32.8 | % | | 34.2 | % | | 32.6 | % |

| Domestic: | | | | | |

| Ford | 5.7 | % | | 6.8 | % | | 6.8 | % |

| General Motors (3) | 4.9 | % | | 4.4 | % | | 5.1 | % |

| Total Domestic | 10.6 | % | | 11.2 | % | | 11.9 | % |

| Total | 100.0 | % | | 100.0 | % | | 100.0 | % |

(1) Includes Acura, Infiniti, Jaguar, Smart and Volvo.

(2) Includes Kia, Nissan, Scion and Subaru.

(3) Includes Buick, Chevrolet and GMC.

Expand our eCommerce Capabilities. Automotive customers have become increasingly more comfortable using technology to research their vehicle buying alternatives and communicate with store personnel. The internet presents a marketing, advertising and automotive sales channel that we will continue to utilize to drive value for our stores and enhance the customer experience. Our technology platforms give us the ability to leverage technology to efficiently integrate systems, customize our dealership websites and use our data to improve the effectiveness of our advertising and interaction with our customers. These platforms also allow us to market all of our products and services to a national audience and, at the same time, support the local market penetration of our individual stores.

Train, Develop and Retain Associates. We believe our associates are the cornerstone of our business and crucial to our financial success. Our goal is to develop our associates and foster an environment where our associates can contribute and grow with the Company. Associate satisfaction is very important to us, and we believe a high level of associate satisfaction reduces associate turnover and enhances our customers’ experience at our stores by pairing our customers with well-trained associates. We believe that our comprehensive training of all employees provides us with a competitive advantage over other dealership groups.

Increase Sales of Higher-Margin Products and Services. We continue to pursue opportunities to increase our sales of higher-margin products and services by expanding the following:

Finance, Insurance and Other Aftermarket Products. Each sale of a new or used vehicle gives us an opportunity to provide our customers with financing and insurance options and earn financing fees and insurance and other aftermarket product commissions. We also offer our customers the opportunity to purchase extended warranties, service contracts and other aftermarket products from third-party providers whereby we earn a commission for arranging the contract sale. We currently offer a wide range of non-recourse financing, leasing, other aftermarket products, extended warranties, service contracts and

insurance products to our customers. We emphasize menu-selling techniques and other best practices to increase our sales of F&I products at our franchised dealerships and EchoPark stores.

Parts, Service and Collision Repair. Each of our franchised dealerships offers a fully integrated service and parts department. Manufacturers permit warranty work to be performed only at franchised dealerships such as ours. As a result, our franchised dealerships are uniquely qualified and positioned to perform work covered by manufacturer warranties on increasingly complex vehicles. We believe we can continue to grow our profitable parts and service business over the long term by increasing service capacity, investing in sophisticated equipment and well-trained technicians, using variable rate pricing structures, focusing on customer service and efficiently managing our parts inventory. In addition, we believe our emphasis on selling extended service contracts and maintenance associated with new and used vehicle retail sales will drive further service and parts business in our franchised dealerships as we increase the potential to retain current customers beyond the term of the standard manufacturer warranty period.

Certified Pre-Owned Vehicles. Various manufacturers provide franchised dealers the opportunity to sell certified pre-owned (“CPO”) vehicles. This certification process extends the standard manufacturer warranty on the CPO vehicle, which we believe increases our potential to retain the pre-owned purchaser as a future parts and service customer. As CPO vehicles can only be sold by franchised dealerships and CPO warranty work can only be performed at franchised dealerships, we believe CPO vehicles add additional sales volume and will increase our Fixed Operations business.

Relationships with Manufacturers

Each of our dealerships operates under a separate franchise or dealer agreement that governs the relationship between the dealership and the manufacturer. Each franchise or dealer agreement specifies the location of the dealership for the sale of vehicles and for the performance of certain approved services in a specified market area. The designation of such areas generally does not guarantee exclusivity within a specified territory. In addition, most manufacturers allocate vehicles on a “turn and earn” basis that rewards high unit sales volume. A franchise or dealer agreement incentivizes the dealer to meet specified standards regarding showrooms, facilities and equipment for servicing vehicles, inventories, minimum net working capital, personnel training and other aspects of the business. Each franchise or dealer agreement also gives the related manufacturer the right to approve the dealer operator and any material change in management or ownership of the dealership. Each manufacturer may terminate a franchise or dealer agreement under certain circumstances, such as a change in control of the dealership without manufacturer approval, the impairment of the reputation or financial condition of the dealership, the death, removal or withdrawal of the dealer operator, the conviction of the dealership or the dealership’s owner or dealer operator of certain crimes, the failure to adequately operate the dealership or maintain new vehicle financing arrangements, insolvency or bankruptcy of the dealership or a material breach of other provisions of the applicable franchise or dealer agreement.

Many automobile manufacturers have developed and implemented policies regarding public ownership of dealerships, which include the ability to force the sale of their respective franchises:

•upon a change in control of the Company or a material change in the composition of our Board of Directors;

•if an automobile manufacturer or distributor acquires more than 5% of the voting power of our securities; or

•if an individual or entity (other than an automobile manufacturer or distributor) acquires more than 20% of the voting power of our securities, and the manufacturer disapproves of such individual’s or entity’s ownership interest.

To the extent that new or amended manufacturer policies restrict the number of dealerships that may be owned by a dealership group or the transferability of our common stock, such policies could have a material adverse effect on us. We believe that we will be able to renew at expiration all of our existing franchise and dealer agreements.

Many states have placed limitations upon manufacturers’ and distributors’ ability to sell new motor vehicles directly to customers in their respective states in an effort to protect dealers from practices they believe constitute unfair competition. In general, these statutes make it unlawful for a manufacturer or distributor to compete with a new motor vehicle dealer in the same brand operating under an agreement or franchise from the manufacturer or distributor in the relevant market area. Certain states, including Florida, Georgia, North Carolina, South Carolina and Virginia, limit the amount of time that a manufacturer or distributor may temporarily operate a dealership. These statutes have been increasingly challenged by new entrants into the automotive industry and, to the extent that these statutes are repealed or weakened, such changes could have a material adverse effect on our business.

In addition, all of the states in which our dealerships currently do business require manufacturers or distributors to show “good cause” for terminating or failing to renew a dealer’s franchise or dealer agreement. Further, each of these states provides

some method for dealers to challenge manufacturer attempts to establish dealerships of the same brand in their relevant market area.

Competition

The retail automotive industry is highly competitive. Depending on the geographic market, we compete both with dealers offering the same brands and product lines as ours and dealers offering other manufacturers’ vehicles. We also compete for vehicle sales with auto brokers, leasing companies and services offered on the internet that provide customer referrals to other dealerships or who broker vehicle sales between customers and other dealerships. We compete with small, local dealerships and with large multi-franchise and pre-owned automotive dealership groups.

We believe that the principal competitive factors in vehicle sales are the customer experience provided, the location of dealerships, the marketing campaigns conducted by manufacturers, the ability of dealerships to offer an attractive selection of the most popular vehicles, the quality of services and pricing (including manufacturer rebates and other special offers). In particular, pricing has become more important as a result of well-informed customers using sources available on the internet to determine current market retail prices. Other competitive factors include customer preference for makes of automobiles and coverage under manufacturer warranties.

In addition to competition for vehicle sales, we also compete with other auto dealers, service stores, auto parts retailers and independent mechanics in providing parts and service. We believe that the principal competitive factors in parts and service sales are price, the use of factory-approved replacement parts, factory-trained technicians, the familiarity with a manufacturer’s makes and models and the quality of customer service. A number of regional and national chains offer selected parts and services at prices that may be lower than our prices.

In arranging or providing financing for our customers’ vehicle purchases, we compete with a broad range of financial institutions. In addition, financial institutions are now offering F&I products through the internet. We believe the principal competitive factors in providing financing are convenience, interest rates and contract terms.

Our success depends, in part, on national and regional automobile-buying trends, local and regional economic factors and other regional competitive pressures. Conditions and competitive pressures affecting the markets in which we operate, such as price-cutting by dealers in these areas, or in any new markets we enter, could adversely affect us, even though the retail automobile industry as a whole might not be affected.

Governmental Regulations and Environmental Matters

Numerous federal and state regulations govern our business of marketing, selling, financing and servicing automobiles. We are also subject to laws and regulations relating to business corporations.

Under the laws of the states in which we currently operate, as well as the laws of other states into which we may expand, we must obtain a license in order to establish, operate or relocate a franchised dealership or EchoPark store or operate an automotive repair service. These laws also regulate our conduct of business, including our sales, operating, advertising, financing and employment practices, including federal and state wage-hour, anti-discrimination and other employment practices laws.

Our financing activities with customers are subject to federal truth-in-lending, consumer privacy, consumer leasing and equal credit opportunity regulations as well as state and local motor vehicle finance laws, installment finance laws, usury laws and other installment sales laws. Some states regulate finance fees that may be paid as a result of vehicle sales.

Federal, state and local environmental regulations, including regulations governing air and water quality, the clean-up of contaminated property and the use, storage, handling, recycling and disposal of gasoline, oil and other materials, also apply to us and our franchised dealership and EchoPark properties.

As with automobile dealerships generally, and service, parts and body shop operations in particular, our business involves the use, storage, handling and contracting for recycling or disposal of hazardous or toxic substances or wastes and other environmentally sensitive materials. Our business also involves the past and current operation and/or removal of above ground and underground storage tanks containing such substances, wastes or materials. Accordingly, we are subject to regulation by federal, state and local authorities that establish health and environmental quality standards, provide for liability related to those standards and provide penalties for violations of those standards. We are also subject to laws, ordinances and regulations governing remediation of contamination at facilities we own or operate or to which we send hazardous or toxic substances or wastes and other environmentally sensitive materials for treatment, recycling or disposal.

We do not have any known material environmental liabilities, and we believe that compliance with environmental laws and regulations will not, individually or in the aggregate, have a material adverse effect on our results of operations, financial condition and cash flows. However, soil and groundwater contamination is known to exist at certain properties owned and used by us. Further, environmental laws and regulations are complex and subject to frequent change. In addition, in connection with our past or future acquisitions, it is possible that we will assume or become subject to new or unforeseen environmental costs or liabilities, some of which may be material.

Executive Officers of the Registrant

Our executive officers as of the date of this Annual Report on Form 10-K are as follows:

| | | | | | | | | | | | | | |

| Name | | Age | | Position(s) with Sonic |

| O. Bruton Smith | | 91 | | Executive Chairman and Director |

| David Bruton Smith | | 44 | | Chief Executive Officer and Director |

| Jeff Dyke | | 51 | | President |

| Heath R. Byrd | | 52 | | Executive Vice President and Chief Financial Officer |

O. Bruton Smith is the Founder of Sonic and has served as its Executive Chairman since July 2015. Prior to his election as Executive Chairman, Mr. Smith had served as Chairman and Chief Executive Officer of the Company since its organization in January 1997. Mr. Smith has also served as a director of Sonic since its organization in January 1997. Mr. Smith is also a director of many of Sonic’s subsidiaries. Mr. Smith has worked in the retail automobile industry since 1966. Mr. Smith is also the Executive Chairman and a director of Speedway Motorsports, Inc. (“SMI”), which is controlled by Mr. Smith and his family. SMI is a public company whose shares are traded on the New York Stock Exchange (the “NYSE”). Among other things, SMI owns and operates the following speedways: Atlanta Motor Speedway, Bristol Motor Speedway, Charlotte Motor Speedway, Kentucky Speedway, Las Vegas Motor Speedway, New Hampshire Motor Speedway, Sonoma Raceway and Texas Motor Speedway. He is also a director of most of SMI’s operating subsidiaries. He is the father of Mr. David Bruton Smith.

David Bruton Smith was elected as Chief Executive Officer of Sonic in September 2018. Prior to his election as Chief Executive Officer, Mr. Smith served as Sonic’s Executive Vice Chairman and Chief Strategic Officer from March 2018 to September 2018, Sonic’s Vice Chairman from March 2013 to March 2018 and as an Executive Vice President of Sonic from October 2008 to March 2013. He has served as a director of Sonic since October 2008 and has served in Sonic’s organization since 1998. Prior to being named an Executive Vice President and a director in October 2008, Mr. Smith had served as Sonic’s Senior Vice President of Corporate Development since March 2007. Mr. Smith served as Sonic’s Vice President of Corporate Strategy from October 2005 to March 2007, and also served prior to that time as Dealer Operator and General Manager of several Sonic dealerships. He is the son of Mr. O. Bruton Smith.

Jeff Dyke was elected as President of Sonic in September 2018 and is responsible for direct oversight for all of Sonic’s retail automotive operations. Prior to his election as President, Mr. Dyke served as Sonic’s Executive Vice President of Operations from October 2008 to September 2018. From March 2007 to October 2008, Mr. Dyke served as our Division Chief Operating Officer – Southeast Division, where he oversaw retail automotive operations for the states of Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee and Texas. Mr. Dyke first joined Sonic in October 2005 as our Vice President of Retail Strategy, a position that he held until April 2006, when he was promoted to Division Vice President – Eastern Division, a position he held from April 2006 to March 2007. Prior to joining Sonic, Mr. Dyke worked in the automotive retail industry at AutoNation, Inc., an American automotive retailer, which provides new and pre-owned vehicles and associated services in the United States, from 1996 to 2005, where he held several positions in divisional, regional and dealership management with that company.

Heath R. Byrd has served as Sonic’s Executive Vice President and Chief Financial Officer since April 2013. Mr. Byrd was previously a Vice President and Sonic’s Chief Information Officer from December 2007 to March 2013, and has served our organization since 2007. Prior to joining Sonic, Mr. Byrd served in a variety of management positions at HR America, Inc., a workforce management firm that provided customized human resource and workforce development through co-sourcing arrangements, including as a director, as President and Chief Operating Officer and as Chief Financial Officer and Chief Information Officer. Prior to HR America, Mr. Byrd served as a Manager in the Management Consulting Division of Ernst & Young LLP.

Employees

As of December 31, 2018, we employed approximately 9,700 associates. We believe that our relationships with our associates are good. Approximately 260 of our associates, primarily service technicians in northern California, are represented

by a labor union. Although only a small percentage of our associates is represented by a labor union, we may be affected by labor strikes, work slowdowns and walkouts at automobile manufacturers’ manufacturing facilities.

Company Information

Our website can be accessed at www.sonicautomotive.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as well as proxy statements and other information we file with, or furnish to, the Securities and Exchange Commission (the “SEC”) are available free of charge on our website. We make these documents available as soon as reasonably practicable after we electronically transmit them to the SEC. Except as otherwise stated in these documents, the information contained on our website or available by hyperlink from our website is not incorporated into this Annual Report on Form 10-K or other documents we transmit to the SEC.

SONIC AUTOMOTIVE, INC.

RISK FACTORS

Item 1A. Risk Factors.

Our business, financial condition, results of operations, cash flows and prospects and the prevailing market price and performance of our Class A Common Stock may be adversely affected by a number of factors, including the material risks noted below. Our stockholders and prospective investors should consider these risks, uncertainties and other factors prior to making an investment decision.

Risks Related to Our Sources of Financing and Liquidity

Our significant indebtedness could materially adversely affect our financial health, limit our ability to finance future acquisitions, expansion plans and capital expenditures and prevent us from fulfilling our financial obligations.

As of December 31, 2018, our total outstanding indebtedness was approximately $2.5 billion, which includes floor plan notes payable, long-term debt and short-term debt.

We have up to $250.0 million of maximum borrowing availability under a syndicated revolving credit facility (the “2016 Revolving Credit Facility”) and up to $1.0 billion of maximum borrowing availability for combined syndicated new and used vehicle inventory floor plan financing (the “2016 Floor Plan Facilities”). We refer to the 2016 Revolving Credit Facility and the 2016 Floor Plan Facilities collectively as the “2016 Credit Facilities.” As of December 31, 2018, we had approximately $223.9 million available for additional borrowings under the 2016 Revolving Credit Facility based on the borrowing base calculation, which is affected by numerous factors, including eligible asset balances. We are able to borrow under the 2016 Revolving Credit Facility only if, at the time of the borrowing, we have met all representations and warranties and are in compliance with all financial and other covenants contained therein. We also have capacity to finance new and used vehicle inventory purchases under floor plan agreements with various manufacturer-affiliated finance companies and other lending institutions (the “Silo Floor Plan Facilities”) as well as the 2016 Floor Plan Facilities. In addition, the indentures relating to our 5.0% Senior Subordinated Notes due 2023 (the “5.0% Notes”) and our 6.125% Senior Subordinated Notes due 2027 (the “6.125% Notes”) and our other debt instruments allow us to incur additional indebtedness, including secured indebtedness, as long as we comply with the terms thereunder.

In addition, the majority of our dealership properties are subject to long-term operating lease arrangements that commonly have initial terms of 15 to 20 years with renewal options generally ranging from five to 10 years. These operating leases require compliance with financial and operating covenants similar to those under the 2016 Credit Facilities, and monthly payments of rent that may fluctuate based on interest rates and local consumer price indices. The total future minimum lease payments related to these operating leases and certain equipment leases are significant and are disclosed in Note 12, “Commitments and Contingencies,” to the accompanying consolidated financial statements.

Our failure to comply with certain covenants in these agreements or indentures could materially adversely affect our ability to access our borrowing capacity, subject us to acceleration of our outstanding debt, result in a cross default on other indebtedness and could have a material adverse effect on our ability to continue our business.

An acceleration of our obligation to repay all or a substantial portion of our outstanding indebtedness or lease obligations would have a material adverse effect on our business, financial condition or results of operations.

The 2016 Credit Facilities, the indentures governing the 5.0% Notes and the 6.125% Notes and many of our operating leases contain numerous financial and operating covenants. A breach of any of these covenants could result in a default under the applicable agreement or indenture. In addition, a default under one agreement or indenture could result in a cross default and acceleration of our repayment obligations under the other agreements or indentures, including the indentures governing the 5.0% Notes and the 6.125% Notes. If a default or cross default were to occur, we may not be able to pay our debts or borrow sufficient funds to refinance them. Even if new financing were available, it may not be on terms acceptable to us. If a default were to occur, we may be unable to adequately finance our operations and the value of our common stock would be materially adversely affected because of acceleration and cross-default provisions. As a result of this risk, we could be forced to take actions that we otherwise would not take, or not take actions that we otherwise might take, in order to comply with the covenants in these agreements and indentures.

Our ability to make interest and principal payments when due to holders of our debt securities depends upon our future performance and our receipt of sufficient funds from our subsidiaries.

Our ability to meet our debt obligations and other expenses will depend on our future performance, which will be affected by financial, business, domestic and foreign economic conditions, the regulatory environment and other factors, many of which we are unable to control. Substantially all of our consolidated assets are held by our subsidiaries and substantially all

SONIC AUTOMOTIVE, INC.

RISK FACTORS

of our consolidated cash flow and net income are generated by our subsidiaries. Accordingly, our cash flow and ability to service debt depend to a substantial degree on the results of operations of our subsidiaries and upon the ability of our subsidiaries to provide us with cash. We may receive cash from our subsidiaries in the form of dividends, loans or distributions. We may use this cash to service our debt obligations or for working capital. Our subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to distribute cash to us or to make funds available to service debt.

If our cash flow is not sufficient to service our debt as it becomes due, we may be required to refinance the debt, sell assets or sell shares of our common stock on terms that we do not find attractive. Further, our failure to comply with the financial and other restrictive covenants relating to the 2016 Credit Facilities and the indentures pertaining to our outstanding notes could result in a default under these agreements and indentures that would prevent us from borrowing under the 2016 Credit Facilities, which could materially adversely affect our business, financial condition and results of operations. If a default and acceleration of repayment were to occur, we may be unable to adequately finance our operations and the value of our Class A Common Stock could be materially adversely affected.

We have financed the purchase and improvement of certain dealership properties with mortgage notes that require balloon payments at the end of the notes’ terms.

Many of our mortgage notes’ principal and interest payments are based on an amortization period longer than the actual terms (maturity dates) of the notes. We will be required to repay or refinance the remaining principal balances for certain of our mortgages with balloon payments at the notes’ maturity dates, which range from 2019 to 2033. The amounts to be repaid or refinanced at the maturity dates could be significant. We may not have sufficient liquidity to make such payments at the notes’ maturity dates. In the event we do not have sufficient liquidity to completely repay the remaining principal balances at maturity, we may not be able to refinance the notes at interest rates that are acceptable to us or, depending on market conditions, refinance the notes at all. Our inability to repay or refinance these notes could have a material adverse effect on our business, financial condition and results of operations.

We depend on the performance of subleases to offset costs related to certain of our lease agreements.

In many cases, when we sell a dealership, the buyer of the dealership will sublease the dealership property from us, but we are not released from the underlying lease obligation to the primary landlord. We rely on the sublease income from the buyer to offset the expense incurred related to our obligation to pay the primary landlord. We also rely on the buyer to maintain the property in accordance with the terms of the sublease (which in most cases mirror the terms of the lease we have with the primary landlord). Although we assess the financial condition of a buyer at the time we sell the dealership, and seek to obtain guarantees of the buyer’s sublease obligation from the stockholders or affiliates of the buyer, the financial condition of the buyer and/or the sublease guarantors may deteriorate over time. In the event the buyer does not perform under the terms of the sublease agreement (due to the buyer’s financial condition or other factors), we may not be able to recover amounts owed to us under the terms of the sublease agreement or the related guarantees. Our operating results, financial condition and cash flows may be materially adversely affected if sublessees do not perform their obligations under the terms of the sublease agreements.

Our use of hedging transactions could limit our financial gains or result in financial losses.

To reduce our exposure to fluctuations in cash flow due to interest rate fluctuations, we have entered into, and in the future expect to enter into, certain derivative instruments (or hedging agreements). No hedging activity can completely insulate us from the risks associated with changes in interest rates. As of December 31, 2018, we had interest rate cap agreements related to a portion of our LIBOR-based variable rate debt to limit our exposure to rising interest rates. See the heading “Derivative Instruments and Hedging Activities” under Note 6, “Long-Term Debt,” to the accompanying consolidated financial statements. We intend to hedge as much of our interest rate risk as management determines is in our best interests given the cost of such hedging transactions.

Our hedging transactions expose us to certain risks and financial losses, including, among other things:

•counterparty credit risk;

•available interest rate hedging may not correspond directly with the interest rate risk for which we seek protection;

•the duration or the amount of the hedge may not match the duration or the amount of the related liability;

•the value of derivatives used for hedging may be adjusted from time to time in accordance with accounting rules to reflect changes in fair value, downward adjustments or “mark-to-market losses,” which would affect our recorded stockholders’ equity amounts; and

SONIC AUTOMOTIVE, INC.

RISK FACTORS

•all of our hedging instruments contain terms and conditions with which we are required to meet. In the event those terms and conditions are not met, we may be required to settle the instruments prior to the instruments’ maturity with cash payments, which could significantly affect our liquidity.

A failure on our part to effectively hedge against interest rate changes may adversely affect our financial condition and results of operations.

We may not be able to satisfy our debt obligations upon the occurrence of a change of control.

Upon the occurrence of a change of control, as defined in the 5.0% Notes and the 6.125% Notes, holders of these instruments will have the right to require us to purchase all or any part of such holders’ notes at a price equal to 101% of the principal amount thereof, plus accrued and unpaid interest, if any. The events that constitute a change of control under these indentures may also constitute a default under the 2016 Credit Facilities. The agreements or instruments governing any future debt that we may incur may contain similar provisions regarding repurchases in the event of a change of control triggering event. There can be no assurance that we would have sufficient resources available to satisfy all of our obligations under these debt instruments in the event of a change of control. In the event we were unable to satisfy these obligations, it could have a material adverse impact on our business and our stockholders.

Risks Related to Our Relationships with Vehicle Manufacturers

Our operations may be adversely affected if one or more of our manufacturer franchise or dealer agreements is terminated or not renewed.

Each of our dealerships operates under a separate franchise or dealer agreement with the applicable automobile manufacturer. Without a franchise or dealer agreement, we cannot obtain new vehicles from a manufacturer or advertise as an authorized factory service center. As a result, we are significantly dependent on our relationships with the manufacturers.

Moreover, manufacturers exercise a great degree of control over the operations of our dealerships through the franchise and dealer agreements. The franchise and dealer agreements govern, among other things, our ability to purchase vehicles from the manufacturer and to sell vehicles to customers. Each of our franchise or dealer agreements provides for termination or non-renewal for a variety of causes, including certain changes in the financial condition of the dealerships and any unapproved change of ownership or management. Manufacturers may also have a right of first refusal if we seek to sell dealerships.

We cannot guarantee that any of our existing franchise and dealer agreements will be renewed or that the terms and conditions of such renewals will be favorable to us. Actions taken by manufacturers to exploit their superior bargaining position in negotiating the terms of franchise and dealer agreements or renewals of these agreements or otherwise could also have a material adverse effect on our business, results of operations, financial condition and cash flows.

Our failure to meet a manufacturer’s customer satisfaction, financial and sales performance, and facility requirements may adversely affect our profitability and our ability to acquire new dealerships.

A manufacturer may condition its allotment of vehicles, participation in bonus programs or acquisition of additional franchises upon our compliance with its brand and facility standards. These standards may require investments in technology and facilities that we otherwise would not make. This may put us in a competitive disadvantage with other competing dealerships and may ultimately result in our decision to sell a franchise when we believe it may be difficult to recover the cost of the required investment to reach the manufacturer’s brand and facility standards.

In addition, many manufacturers attempt to measure customers’ satisfaction with their sales and warranty service experiences through manufacturer-determined CSI scores. The components of CSI vary by manufacturer and are modified periodically. Franchise and dealer agreements may also impose financial and sales performance standards. Under our agreements with certain manufacturers, a dealership’s CSI scores and financial and sales performance standards may be considered as factors in evaluating applications for additional dealership acquisitions. From time to time, some of our dealerships have had difficulty meeting various manufacturers’ CSI requirements or performance standards. We cannot assure you that our dealerships will be able to comply with these requirements or performance standards in the future. A manufacturer may refuse to consent to an acquisition of one of its franchises if it determines our dealerships do not comply with its CSI requirements or performance standards, which could impair the execution of our acquisition strategy. In addition, we receive incentive payments from the manufacturers based, in part, on CSI scores, which could be materially adversely affected if our CSI scores decline.

SONIC AUTOMOTIVE, INC.

RISK FACTORS

If state dealer laws are repealed or weakened, our dealerships will be more susceptible to termination, non-renewal or renegotiation of their franchise and dealer agreements.

State dealer laws generally provide that a manufacturer may not terminate or refuse to renew a franchise or dealer agreement unless it has first provided the dealer with written notice setting forth good cause and stating the grounds for termination or non-renewal. Some state dealer laws allow dealers to file protests or petitions or to attempt to comply with the manufacturer’s criteria within the notice period to avoid the termination or non-renewal. Manufacturers’ lobbying efforts may lead to the repeal or revision of state dealer laws. If dealer laws are repealed or weakened in the states in which we operate, manufacturers may be able to terminate our franchises without providing advance notice, an opportunity to cure or a showing of good cause. Without the protection of state dealer laws, it may also be more difficult for our dealerships to renew their franchise or dealer agreements upon expiration.

The ability of a manufacturer to grant additional franchises is based on several factors which are not within our control. If manufacturers grant new franchises in areas near or within our existing markets, this could significantly impact our revenues and/or profitability. In addition, current state dealer laws generally restrict the ability of automobile manufacturers to enter the retail market and sell directly to consumers. However, if manufacturers obtain the ability to directly retail vehicles and do so in our markets, such competition could have a material adverse effect on us.

Our sales volume and profit margin on each sale may be materially adversely affected if manufacturers discontinue or change their incentive programs.

Our dealerships depend on the manufacturers for certain sales incentives, warranties and other programs that are intended to promote and support dealership new vehicle sales. Manufacturers routinely modify their incentive programs in response to changing market conditions. Some of the key incentive programs include:

•customer rebates or below market financing on new and used vehicles;

•employee pricing;

•dealer incentives on new vehicles;

•manufacturer floor plan interest and advertising assistance;

•warranties on new and used vehicles; and

•sponsorship of CPO vehicle sales by authorized new vehicle dealers.

Manufacturers frequently offer incentives to potential customers. A reduction or discontinuation of a manufacturer’s incentive programs may materially adversely impact vehicle demand and affect our results of operations.

Our sales volume may be materially adversely affected if manufacturer captives change their customer financing programs or are unable to provide floor plan financing.

One of the primary finance sources used by consumers in connection with the purchase of a new or used vehicle is the manufacturer captive finance companies. These captive finance companies rely, to a certain extent, on the public debt markets to provide the capital necessary to support their financing programs. In addition, the captive finance companies will occasionally change their loan underwriting criteria to alter the risk profile of their loan portfolio. A limitation or reduction of available consumer financing for these or other reasons could affect consumers’ ability to purchase a vehicle and, thus, could have a material adverse effect on our sales volume.

Our parts and service sales volume and margins are dependent on manufacturer warranty programs.

Franchised automotive retailers perform factory authorized service work and sell original replacement parts on vehicles covered by warranties issued by the automotive manufacturer. Dealerships which perform work covered by a manufacturer warranty are reimbursed at rates established by the manufacturer. For 2018, approximately 19.5% of our parts, service and collision repair revenues was for work covered by manufacturer warranties. To the extent a manufacturer reduces the labor rates or markup of replacement parts for such warranty work, our parts and service sales volume and margins could be adversely affected.

SONIC AUTOMOTIVE, INC.

RISK FACTORS

Adverse conditions affecting one or more key manufacturers or lenders may negatively impact our results of operations.

Our results of operations depend on the products, services, and financing and incentive programs offered by major automobile manufacturers, and could be negatively impacted by any significant changes to these manufacturers’ financial condition, marketing strategy, vehicle design, publicity concerning a particular manufacturer or vehicle model, production capabilities, management, reputation and labor relations.

Events such as labor strikes or other disruptions in production, including those caused by natural disasters, that may adversely affect a manufacturer may also adversely affect us. In particular, labor strikes at a manufacturer that continue for a substantial period of time could have a material adverse effect on our business. Similarly, the delivery of vehicles from manufacturers at a time later than scheduled, which may occur during critical periods of new product introductions, could limit sales of those vehicles during those periods. This has been experienced at some of our dealerships from time to time. Adverse conditions affecting these and other important aspects of manufacturers’ operations and public relations may adversely affect our ability to sell their automobiles and, as a result, significantly and detrimentally affect our business and results of operations.

Moreover, our business could be materially adversely impacted by the bankruptcy of a major vehicle manufacturer or related lender. For example:

•a manufacturer in bankruptcy could attempt to terminate all or certain of our franchises, in which case we may not receive adequate compensation for our franchises;

•consumer demand for such manufacturer’s products could be substantially reduced;

•a lender in bankruptcy could attempt to terminate our floor plan financing and demand repayment of any amounts outstanding;

•we may be unable to arrange financing for our customers for their vehicle purchases and leases through such lender, in which case we would be required to seek financing with alternate financing sources, which may be difficult to obtain on similar terms, if at all;

•we may be unable to collect some or all of our significant receivables that are due from such manufacturer or lender, and we may be subject to preference claims relating to payments made by such manufacturer or lender prior to bankruptcy; and

•such manufacturer may be relieved of its indemnification obligations with respect to product liability claims.

Additionally, any such bankruptcy may result in us being required to incur impairment charges with respect to the inventory, fixed assets and intangible assets related to certain dealerships, which could adversely impact our results of operations and financial condition and our ability to remain in compliance with the financial ratios contained in our debt agreements.

Manufacturer stock ownership restrictions may impair our ability to maintain or renew franchise or dealer agreements or issue additional equity.

Some of our franchise and dealer agreements prohibit transfers of any ownership interests of a dealership and, in some cases, its parent, without prior approval of the applicable manufacturer. Our existing franchise and dealer agreements could be terminated if a person or entity acquires a substantial ownership interest in us or acquires voting power above certain levels without the applicable manufacturer’s approval. While the holders of our Class B Common Stock currently maintain voting control of Sonic, their future investment decisions as well as those of holders of our Class A Common Stock are generally outside of our control and could result in the termination or non-renewal of existing franchise or dealer agreements or impair our ability to negotiate new franchise or dealer agreements for dealerships we acquire in the future. In addition, if we cannot obtain any requisite approvals on a timely basis, we may not be able to issue additional equity or otherwise raise capital on terms acceptable to us. These restrictions may also prevent or deter a prospective acquirer from acquiring control of us.

We depend on manufacturers to supply us with sufficient numbers of popular new models.

Manufacturers typically allocate their vehicles among dealerships based on the sales history of each dealership. Supplies of popular new vehicles may be limited by the applicable manufacturer’s production capabilities. Popular new vehicles that are in limited supply typically produce the highest profit margins. We depend on manufacturers to provide us with a desirable mix of popular new vehicles. Our operating results may be materially adversely affected if we do not obtain a sufficient supply of these vehicles on a timely basis.

SONIC AUTOMOTIVE, INC.

RISK FACTORS

A decline in the quality of vehicles we sell, or consumers’ perception of the quality of those vehicles, may adversely affect our business.

Our business is highly dependent on consumer demand and preferences. Events such as manufacturer recalls and negative publicity or legal proceedings related to these events may have a negative impact on the products we sell. If such events are significant, the profitability of our dealerships related to those manufacturers could be adversely affected and we could experience a material adverse effect on our overall results of operations, financial position and cash flows.

Risks Related to Our Growth Strategy

Our investment in new business strategies, services and technologies is inherently risky, and could disrupt our ongoing business or have a material adverse effect on our overall business and results of operations.

We have invested and expect to continue to invest in new business strategies, services and technologies, including our EchoPark stores. Such endeavors may involve significant risks and uncertainties, including allocating management resources away from current operations, insufficient revenues to offset expenses associated with these new investments, inadequate return of capital on our investments and unidentified issues not discovered in our due diligence of such strategies and offerings. Because these ventures are inherently risky, no assurance can be given that such strategies and offerings will be successful and will not have a material adverse effect on our reputation, financial condition and operating results.

Our ability to make acquisitions, execute our growth strategy for our EchoPark business and grow organically may be restricted by the terms and limits of the 2016 Credit Facilities and the indentures which govern our outstanding notes.

The amount of capital available to us is limited to the liquidity available under the 2016 Credit Facilities and capital generated through operating activities. Pursuant to the 2016 Credit Facilities, we are restricted from making dealership acquisitions in any fiscal year if the aggregate cost of all such acquisitions is in excess of certain amounts, without the written consent of the Required Lenders (as that term is defined in the 2016 Credit Facilities). Our pace and scale of growing our EchoPark business may be limited in the event other sources of capital are unavailable. These restrictions may limit our growth strategy.

We may not be able to capitalize on future real estate and dealership acquisition opportunities because our ability to obtain capital to fund these acquisitions is limited.

We intend to finance future real estate and dealership acquisitions with cash generated from operations, through issuances of our stock or debt securities and through borrowings under credit arrangements. We may not be able to obtain additional financing by issuing stock or debt securities due to the market price of our Class A Common Stock, overall market conditions or covenants under the 2016 Credit Facilities that restrict our ability to issue additional indebtedness, or the need for manufacturer consent to the issuance of equity securities. Using cash to complete acquisitions could substantially limit our operating or financial flexibility.

In addition, we are dependent to a significant extent on our ability to finance our new and certain of our used vehicle inventory under the 2016 Floor Plan Facilities or the Silo Floor Plan Facilities (collectively, “Floor Plan Financing”). Floor Plan Financing arrangements allow us to borrow money to buy a particular new vehicle from the manufacturer or a used vehicle on trade-in or at auction and pay off the loan when we sell that particular vehicle. We must obtain Floor Plan Financing or obtain consents to assume existing floor plan notes payable in connection with our acquisition of dealerships. In the event that we are unable to obtain such financing, our ability to complete dealership acquisitions could be limited.

Substantially all of the assets of our dealerships are pledged to secure the indebtedness under the 2016 Credit Facilities and the Silo Floor Plan Facilities. These pledges may impede our ability to borrow from other sources. Moreover, because certain lending institutions are either owned by or affiliated with an automobile manufacturer, any deterioration of our relationship with the particular manufacturer-affiliated finance subsidiary could adversely affect our relationship with the affiliated manufacturer, and vice versa.

Manufacturers’ restrictions on acquisitions could limit our future growth.

We are required to obtain the approval of the applicable manufacturer before we can acquire an additional franchise of that manufacturer. In determining whether to approve an acquisition, manufacturers may consider many factors, such as our financial condition and CSI scores.

Certain manufacturers also limit the number of its dealerships that we may own in total, the number of dealerships we may own in a particular geographic area, or our national market share of that manufacturer’s sales of new vehicles. In addition,

SONIC AUTOMOTIVE, INC.

RISK FACTORS

under an applicable franchise or dealer agreement or under state law, a manufacturer may have a right of first refusal to acquire a dealership that we seek to acquire.

A manufacturer may condition approval of an acquisition on the implementation of material changes in our operations or extraordinary corporate transactions, facilities improvements or other capital expenditures. If we are unable or unwilling to comply with these conditions, we may be required to sell the assets of that manufacturer’s dealerships or terminate our franchise or dealer agreement. We cannot assure you that manufacturers will approve future acquisitions or do so on a timely basis, which could impair the execution of our acquisition strategy.

Failure to effectively integrate acquired dealerships with our existing operations could adversely affect our future operating results.

Our future operating results depend on our ability to integrate the operations of acquired dealerships with our existing operations. In particular, we need to integrate our management information systems, procedures and organizational structures, which can be difficult. Our growth strategy has focused on the pursuit of strategic acquisitions or brand development that either expand or complement our business.

We cannot assure you that we will effectively and profitably integrate the operations of these dealerships without substantial costs, delays or operational or financial problems, due to:

•the difficulties of managing operations located in geographic areas where we have not previously operated;

•the management time and attention required to integrate and manage newly acquired dealerships;

•the difficulties of assimilating and retaining employees;

•the challenges of keeping customers; and

•the challenge of retaining or attracting appropriate dealership management personnel.

These factors could have a material adverse effect on our financial condition and results of operations.

We may not adequately anticipate all of the demands that growth through acquisitions or brand development will impose.

We face risks growing through acquisitions or expansion. These risks include, but are not limited to:

•incurring significantly higher capital expenditures and operating expenses;

•failing to assimilate the operations and personnel of acquired dealerships;

•entering new markets with which we are unfamiliar;

•incurring potential undiscovered liabilities and operational difficulties at acquired dealerships;

•disrupting our ongoing business;

•diverting our management resources;

•failing to maintain uniform standards, controls and policies;

•impairing relationships with employees, manufacturers and customers as a result of changes in management;

•incurring increased expenses for accounting and computer systems, as well as integration difficulties;

•failing to obtain a manufacturer’s consent to the acquisition of one or more of its franchises or to renew the franchise or dealer agreement on terms acceptable to us; and

•incorrectly valuing entities to be acquired or assessing markets entered.

We may not adequately anticipate all of the demands that growth will impose on our business.

SONIC AUTOMOTIVE, INC.

RISK FACTORS

We may not be able to execute our growth strategy without the costs escalating.

We have grown our business primarily through acquisitions in the past. We may not be able to consummate any future acquisitions at acceptable prices and terms or identify suitable candidates. In addition, increased competition for acquisition candidates could result in fewer acquisition opportunities for us and higher acquisition prices. The magnitude, timing, pricing and nature of future acquisitions or growth opportunities will depend upon various factors, including:

•the availability of suitable acquisition candidates;

•competition with other dealer groups or institutional investors for suitable acquisitions;

•the negotiation of acceptable terms with the seller and with the manufacturer;

•our financial capabilities and ability to obtain financing on acceptable terms;

•our stock price; and

•the availability of skilled employees to manage the acquired companies.

We may not be able to determine the actual financial condition of dealerships we acquire until after we complete the acquisition and take control of the dealerships.

The operating and financial condition of acquired businesses cannot be determined accurately until we assume control. Although we conduct what we believe to be a prudent level of due diligence regarding the operating and financial condition of the businesses we purchase, in light of the circumstances of each transaction, an unavoidable level of risk remains regarding the actual operating condition of these businesses. Similarly, many of the dealerships we acquire, including some of our largest acquisitions, do not have financial statements audited or prepared in accordance with U.S. generally accepted accounting principles ("U.S. GAAP"). We may not have an accurate understanding of the historical financial condition and performance of our acquired entities. Until we actually assume control of business assets and their operations, we may not be able to ascertain the actual value or understand the potential liabilities of the acquired entities and their operations.

Risks Related to the Automotive Retail Industry

Our facilities and operations are subject to extensive governmental laws and regulations. If we are found to be in violation of, or subject to liabilities under, any of these laws or regulations or if new laws or regulations are enacted that adversely affect our operations, then our business, operating results, financial condition, cash flows and prospects could suffer.

The automotive retail industry, including our facilities and operations, is subject to a wide range of federal, state, and local laws and regulations, such as those relating to motor vehicle sales, retail installment sales, leasing, sales of finance, insurance and vehicle protection products, licensing, consumer protection, consumer privacy, employment practices, escheatment, anti-money laundering, environmental, vehicle emissions and fuel economy, and health and safety. With respect to motor vehicle sales, retail installment sales, leasing, and sales of finance, insurance and vehicle protection products at our dealerships and stores, we are subject to various laws and regulations, the violation of which could subject us to consumer class action or other lawsuits or governmental investigations and adverse publicity, in addition to administrative, civil or criminal sanctions. With respect to employment practices, we are subject to various laws and regulations, including complex federal, state, and local wage and hour and anti-discrimination laws. We are also subject to lawsuits and governmental investigations alleging violations of these laws and regulations, including purported class action lawsuits, which could result in significant liability, fines and penalties. The violation of other laws and regulations to which we are subject also can result in administrative, civil or criminal sanctions against us, which may include a cease and desist order against the subject operations or even revocation or suspension of our license to operate the subject business, as well as significant liability, fines and penalties. We currently devote significant resources to comply with applicable federal, state and local regulation of health, safety, environmental, zoning and land use regulations, and we may need to spend additional time, effort and money to keep our operations and existing or acquired facilities in compliance. In addition, we may be subject to broad liabilities arising out of contamination at our currently and formerly owned or operated facilities, at locations to which hazardous substances were transported from such facilities, and at such locations related to entities formerly affiliated with us. Although for some such liabilities we believe we are entitled to indemnification from other entities, we cannot assure you that such entities will view their obligations as we do or will be able to satisfy them. Failure to comply with applicable laws and regulations may have an adverse effect on our business, operating results, financial condition, cash flows and prospects.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), which was signed into law on July 21, 2010, established the Consumer Financial Protection Bureau (the “CFPB”), a new independent federal agency

SONIC AUTOMOTIVE, INC.

RISK FACTORS