High-Bandwidth Connectivity Solutions

AboveNet, Inc.

Fourth Quarter 2009

Earnings Conference Call

March 10, 2010

Bill LaPerch, President & CEO

Joe Ciavarella, SVP & CFO

2

Statements made in this presentation that are not historical in nature constitute forward-looking statements

within the meaning of the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.

We cannot assure you that the future results expressed or implied by the forward-looking statements will

be achieved. Such statements are based on the current expectations and beliefs of the management of

AboveNet, Inc. and are subject to a number of risks and uncertainties that could cause actual results to

differ materially from the future results expressed or implied by such forward-looking statements. These

risks and uncertainties include, but are not limited to, the Company's financial and operating prospects,

current economic trends and recessionary pressures, future opportunities, the Company's exposure to the

financial services industry and strength of competition and pricing. The Company's business could be

materially adversely affected and the trading price of the Company's common stock could decline if these

risks and uncertainties develop into actual events. The Company cautions you not to place undue reliance

on these forward-looking statements, which speak only as of their respective dates. The Company

undertakes no obligation to publicly update or revise forward-looking statements to reflect events or

circumstances after the date of this presentation or to reflect the occurrence of unanticipated events. A

more detailed discussion of factors that may affect the Company's business or future financial results is

included in the Company's SEC filings, including, but not limited to, those described in "Risk Factors" and

"Management's Discussion and Analysis of Financial Condition and Results of Operations" in the

Company's Annual Report on Form 10-K for the year ended December 31, 2008 and in the Company's

Quarterly Report on Form 10-Q for the quarter ended September 30, 2009. We discuss certain non-GAAP

financial measures in this presentation and provide the GAAP financial measures that correspond to such

non-GAAP measures, as well as the reconciliation between the two.

Safe Harbor Statement

3

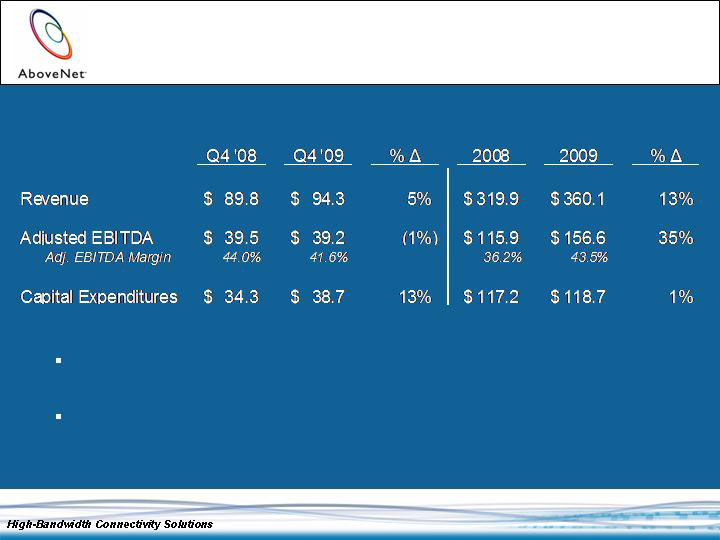

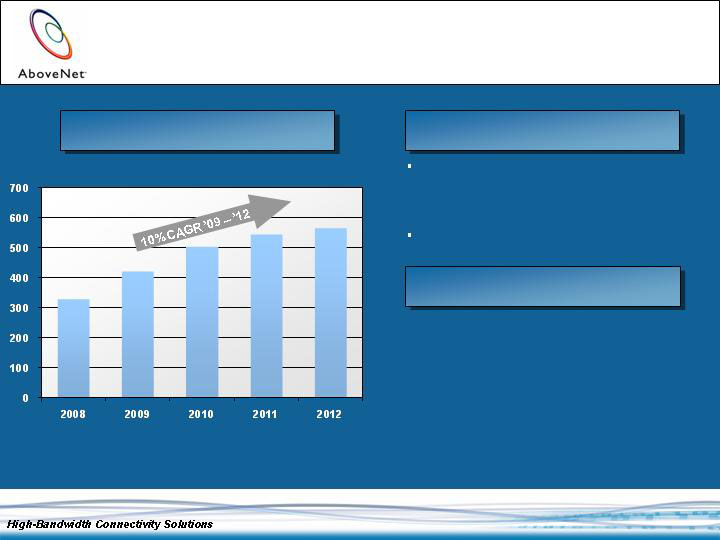

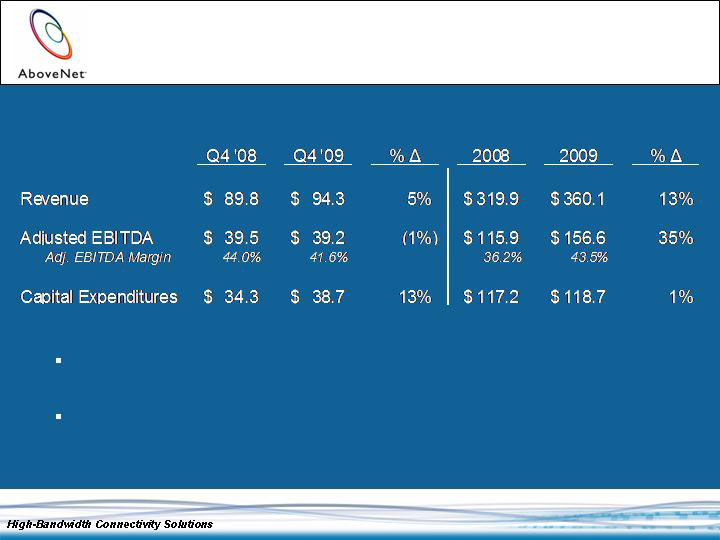

Q4 2009 Highlights

Excluding termination revenue of $8.7M in Q4 2008

and $0.9M in Q4 2009, growth was 15%

Excluding termination revenue of $15.4M in 2008 and

$3.9M in 2009, growth was 17%

$/M

4

Q4 2009 Highlights

Revenue from new customers during the quarter came primarily

from the financial, energy, and healthcare sectors

Continue to see trend of smaller deals ($10k MRC and under)

Grew our team of sales professionals by approximately 15% from

the end of September 2009 through January 2010

Q4 net contract activity (in $’s) improved over Q3, but 2009

remained lower than 2008

2009 new order activity roughly in line with last year

2009 terminations and downgrades are up over last year, but Q4

returned to levels experienced in first half of 2009, following a

particularly challenging Q3, which included large customer

network optimizations

5

Includes Contract Termination Revenue of $8.7, $0.3, $0.9, respectively

Q4 2009 Highlights

$/M

All periods adjusted for two-for-one stock split delivered 09/03/09

$/M

Q4 ’09 includes $183.0M of non-cash tax benefits

6

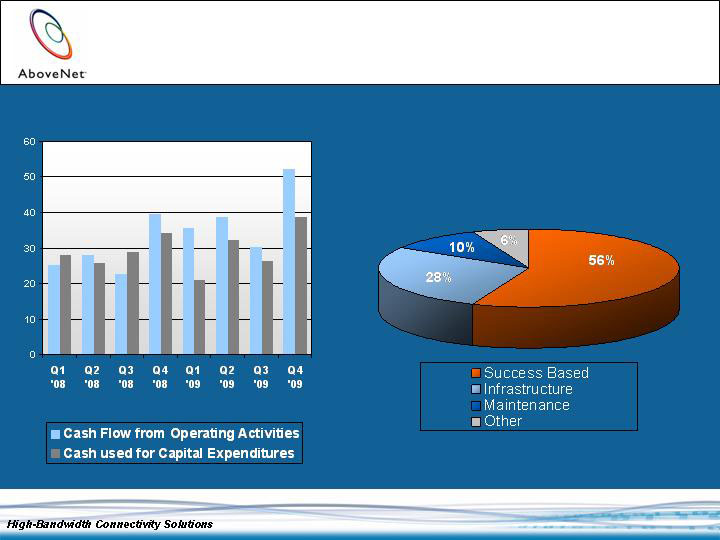

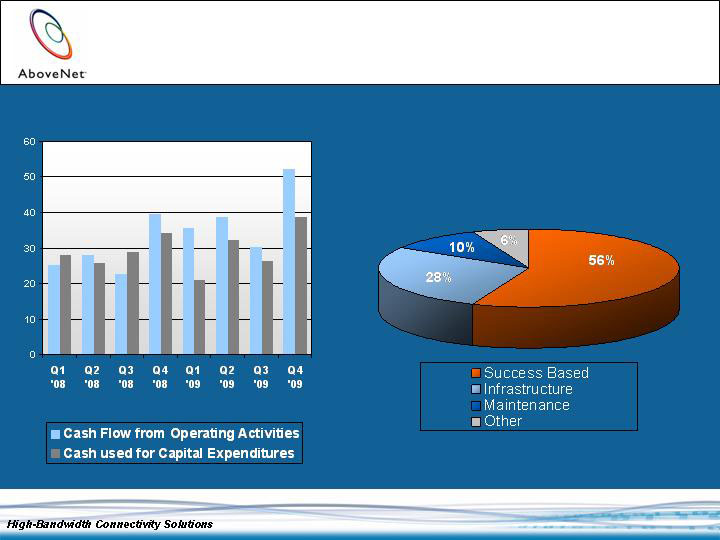

Cash Flow from Operating Activities and Capex

$/M

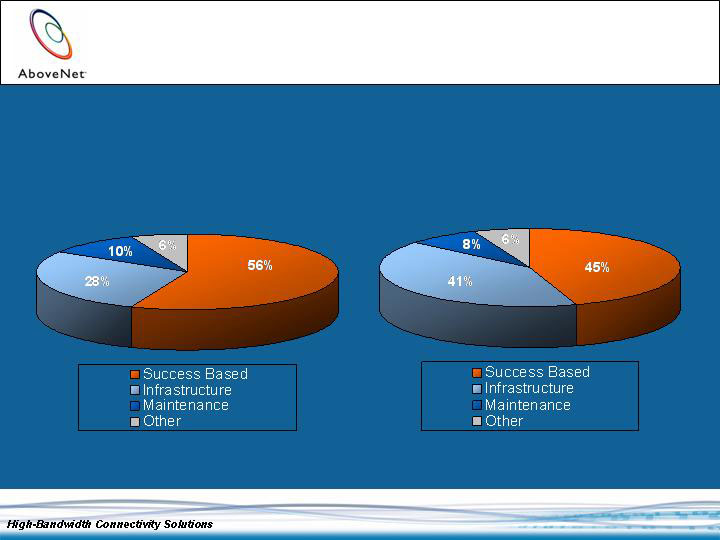

Capital Expenditure Components

December 31, 2009 YTD

High-Bandwidth Connectivity Solutions

Financial Review

8

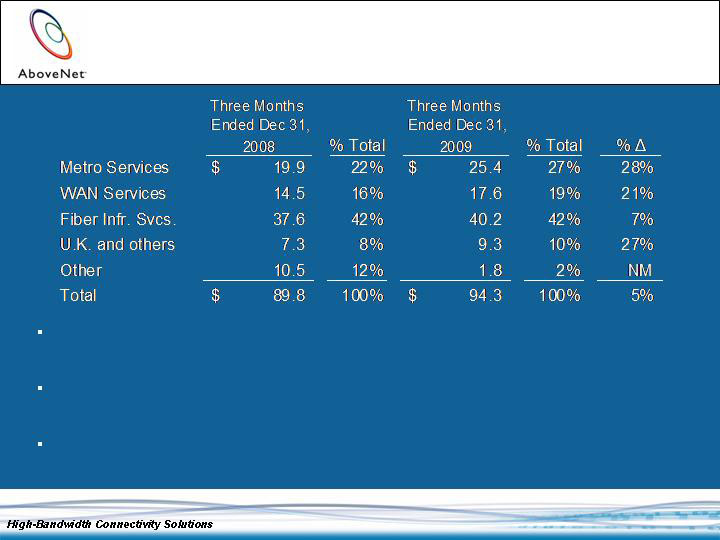

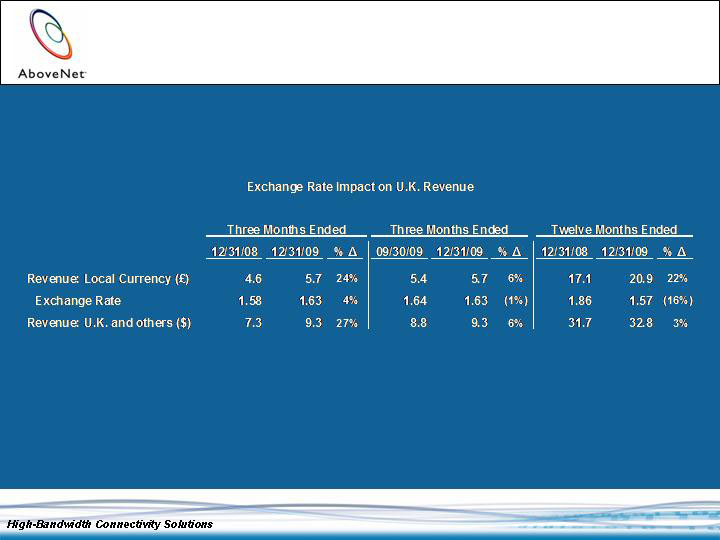

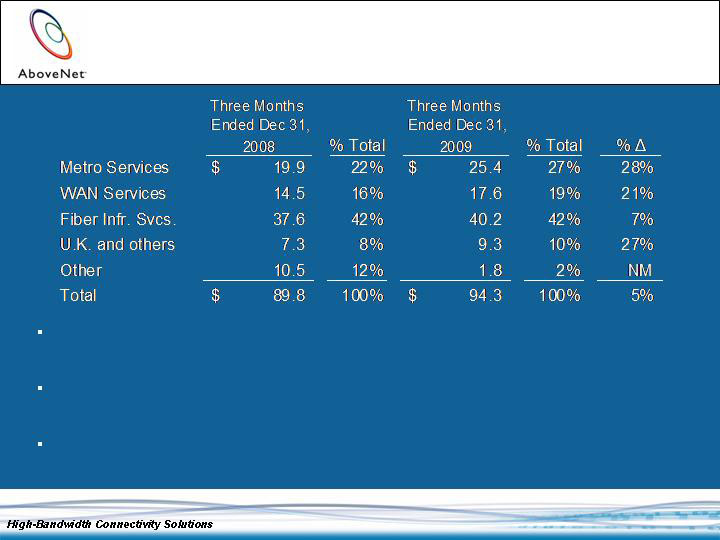

Q4 2009 Revenue –

Year-over-Year Comparison

$/M

Domestic Metro and WAN revenue increased from 38% to 46% of total

revenue between Q4 2008 and Q4 2009

Revenue from U.K. operations grew 24% in local currency and was aided by a

4% strengthening of the British Pound

Other includes Contract Termination Revenue of $8.7M in Q4 2008 vs. $0.9M

in Q4 2009. Adjusting for Contract Termination Revenue, growth was 15%

9

$/M

Revenue from Fiber Infrastructure Services decreased primarily as a result

of terminations and downgrades

Modification of accounting for installation fees negatively impacted Q4

revenue by approximately $1M, or 1%

Revenue from U.K. operations grew 6% in local currency

Q4 2009 Revenue –

Sequential Quarter Comparison

10

Q4 2009 Highlights

Costs of Revenue increased over Q4 2008 primarily a result of increased co-location and third party

network costs

Q4 2009 includes $183.0M of non-cash tax benefits

13% increase in Capex over Q4 2008 primarily a result of sparing program initiated in Q4 2009

* Diluted EPS adjusted for two-for-one stock split delivered 09/03/09

$/M, except EPS

11

Future Scheduled Secured Credit

Facility Repayments

$57.3 million term loan outstanding

$27 million revolver ($26 million available)

2007 2008 2009

Cash/cash equivalents $45.8 $87.1 $165.3

Debt $ 1.8 $37.6 $ 58.6

(1)

$/M (for period ended)

$/M (at period ended)

$/M

(1)

Includes capital lease obligation and senior secured credit

facility in 2008 and 2009

Financial Strength

Secured Credit Facility

Cash Flow

Balance Sheet

2010 2011 2012 2013

$ 7.6 $ 7.6 $ 9.4 $32.7

2007 2008 2009

CF from Operating Act. $69.7 $116.1 $157.2

Capital Expenditures $90.8 $117.2 $118.7

CF from Financing Act. ($5.4) $42.6 $38.9

(2)

(2)

Per Consolidated Statements of Cash Flows

December 31,

December 31,

12

Strong financial results in 2009, particularly given economic conditions

Business conditions remain challenging

Well positioned product suite

Annualized 2009 terminations and downgrades impact 2010 growth

Net new MRR down approximately 20% from 2008 to 2009

2010 Revenue forecast at $395M to $400M

Forecast excludes Contract Termination Revenue

Forecast includes modification of accounting for installation payments

Expect FY 2010 Adjusted EBITDA Margin roughly in line with 2009

actual Adjusted EBITDA margin

2010 Capital Expenditures forecast of $150M to $160M

Includes growth opportunities under analysis

Small impact to 2010 margin

2010 Outlook

13

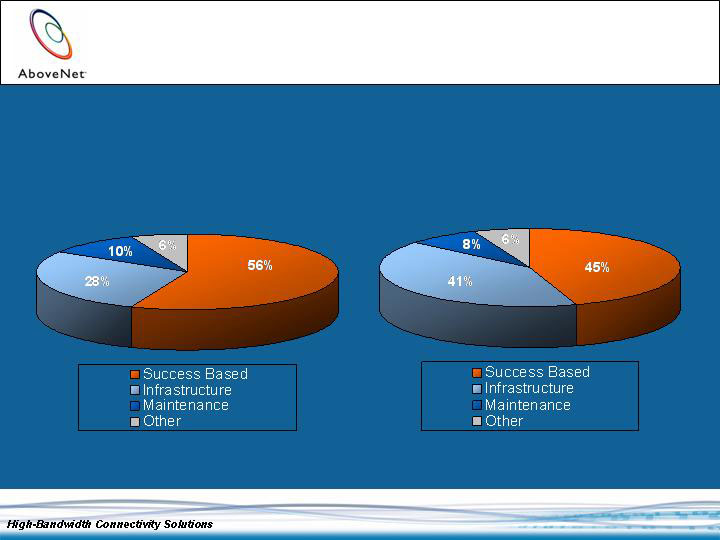

Capital Expenditure Components

2010 Forecast

2009 Actual

14

Delivery of high-bandwidth

solutions is a core

competency

Dimensions define

elements necessary for

success

High-bandwidth markets

are key to future growth

Existing markets will

continue to expand

New markets offer

significant opportunity in

the long term

Strategic Direction

Internet

Hub Cities

Presence of Data

Intensive Verticals

Large Concentration

of Enterprise

Customers

High Density

of Data Centers

Dimensions

Overview

15

Top 25 Global Markets

1.

New York

2.

Tokyo

3.

London

4.

Washington D.C.

5.

Los Angeles

6.

Chicago

7.

San Francisco

8.

Paris

9.

Toronto

10.

Seoul

11.

Philadelphia

12.

Madrid

13.

Frankfurt

14.

Boston

15.

Hong Kong

16.

Dallas

17.

Amsterdam

18.

Singapore

19.

Atlanta

20.

Miami

21.

Sydney

22.

Milan

23.

Dublin

24.

Houston

25.

Osaka

Commissioned by AboveNet

Analyze global market data

Rank top cities using

AboveNet’s four dimensions

for success

AboveNet has metro

networks in 11 of the top 25

markets

Target markets based on

alignment with capabilities

Source: Ovum, 2010

Top 25 Global Markets

Ovum Study

Existing Market

Potential Market

16

Proactive approach

Extend networks

Build past high value

enterprises

Optimize network paths

Bring new data centers

on-net

Existing Market Growth Initiatives

Investment Approach

Approved investments

in the following cities

Chicago

New York

Washington D.C.

Los Angeles

Boston

Seattle

San Francisco

Markets

17

New Market Growth Initiatives

Markets

Under assessment

Toronto

Miami

Amsterdam

Paris

Frankfurt

Measured approach

Establish initial market

presence

Additional investment

predicated on success

Feedback from existing

customers is important

Investment Approach

High-Bandwidth Connectivity Solutions

Thank You

High-Bandwidth Connectivity Solutions

Appendix

20

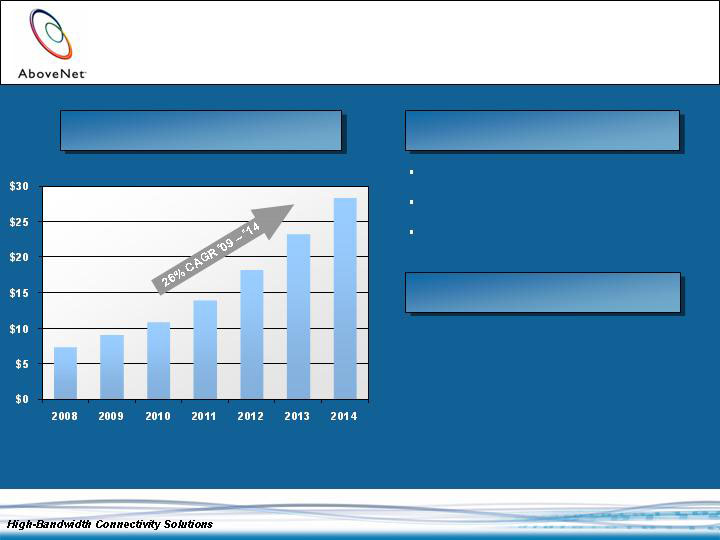

$/B

Source: Hoovers (D&B), 2010

Enterprise Market Trends

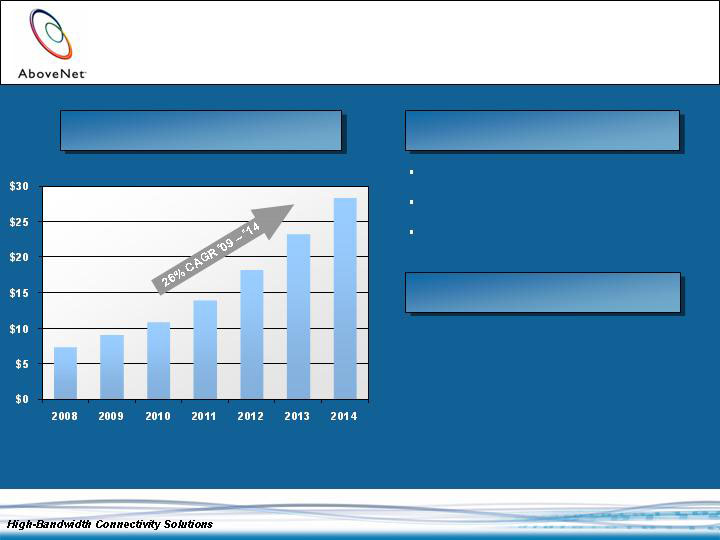

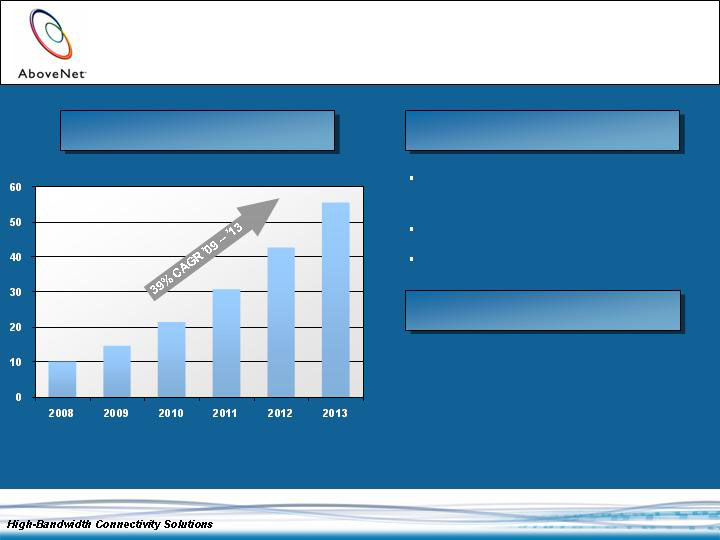

Global 100+ Mbps Ethernet

Services

Key Points

Key Enterprise Markets*

1.

New York

2.

Paris

3.

Tokyo

4.

Los Angeles

5.

Chicago

6.

London

7.

Washington D.C.

8.

Dallas

9.

Philadelphia

10.

San Francisco

Source: Ovum data, 2009

* Concentration of enterprises with 300+

employees; excludes China

Enterprise bandwidth growing

Ethernet services are the focus

100+ Mbps Ethernet services is a

proxy for addressable market

21

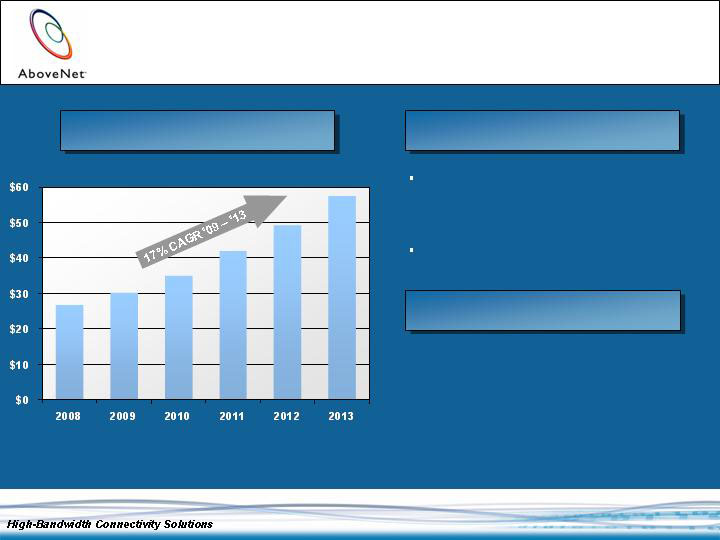

Source: Jefferies, 2009

Data Center Trends

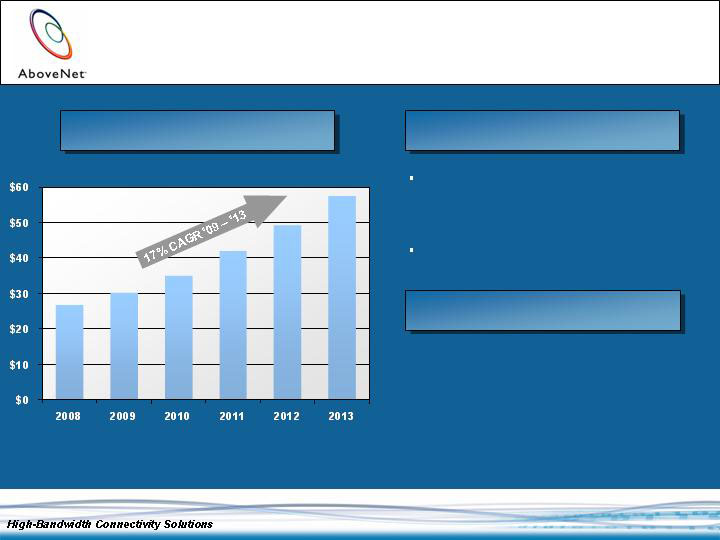

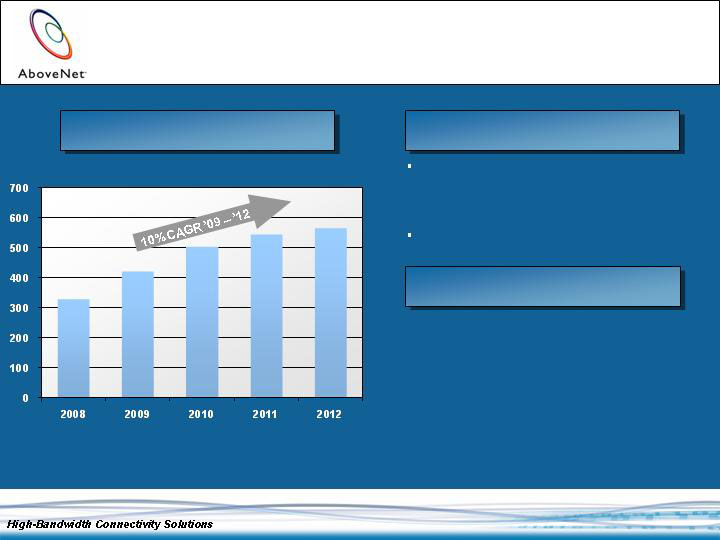

Global Data Center Services

Growth

Key Points

Largest Data Center Markets

Source: Telegeography, 2009

1.

New York

2.

San Francisco

3.

Los Angeles

4.

Dallas

5.

Tokyo

6.

Washington D.C.

7.

London

8.

Atlanta

9.

Chicago

10.

Frankfurt

$/B

Carrier neutral data centers are

very important bandwidth

locations

Private data centers also provide

opportunity

22

Source: Cisco, 2009

Internet Trends

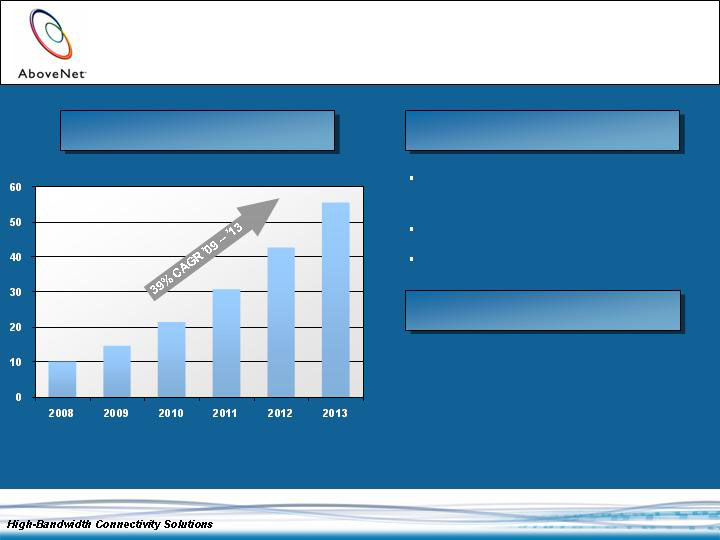

Global IP Traffic Growth

Key Points

Internet Hub Cities

Source: Telegeography, 2008

US

1.

New York

2.

Washington D.C.

3.

Los Angeles

4.

San Francisco

5.

Miami

Europe

1.

London

2.

Paris

3.

Frankfurt

4.

Amsterdam

5.

Stockholm

PB/Mo

Internet hub cities drive significant

bandwidth need

IP traffic growth is strong

Pricing remains under pressure

23

Source: Ovum, 2008

Data Intensive Verticals

Social Networking Growth

Key Points

Markets with Important

Verticals*

Source: Hoovers (D&B), 2010

1.

New York

2.

Tokyo

3.

Los Angeles

4.

Washington D.C.

5.

Chicago

6.

London

7.

San Francisco

8.

Boston

9.

Dallas

10.

Philadelphia

* Concentration of enterprises with 100+ employees in

key verticals (e.g. finance, media and social networking)

Millions of Users

Verticals such as Finance, Media

and social networking tend to have

specialized needs

Flexibility of AboveNet solutions

cater to these needs

24

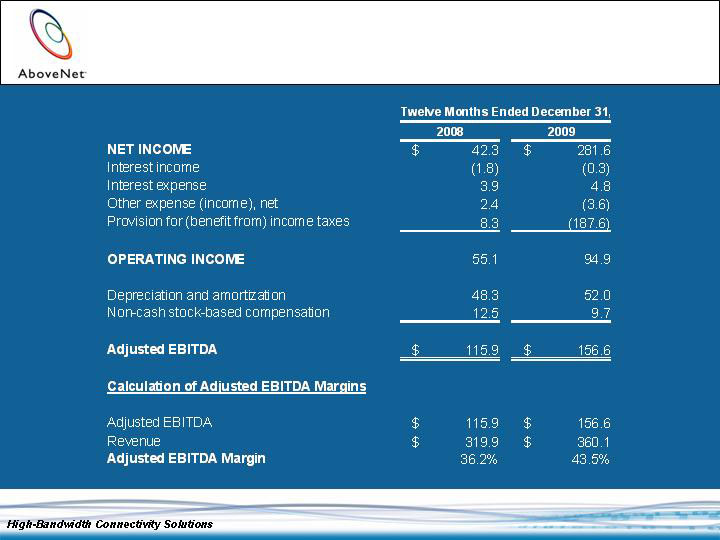

Adjusted EBITDA is defined as net income before provision for

(benefit from) income taxes, other income/expense, interest

income/expense, gain on reversal of foreign currency translation

adjustments from liquidation of subsidiaries, income/loss from

discontinued operations, gain/loss on asset dispositions,

depreciation and amortization, and non-cash stock-based

compensation

Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by

revenue

Revenue, Net of Contract Termination Revenue is defined as

Revenue minus Contract Termination Revenue

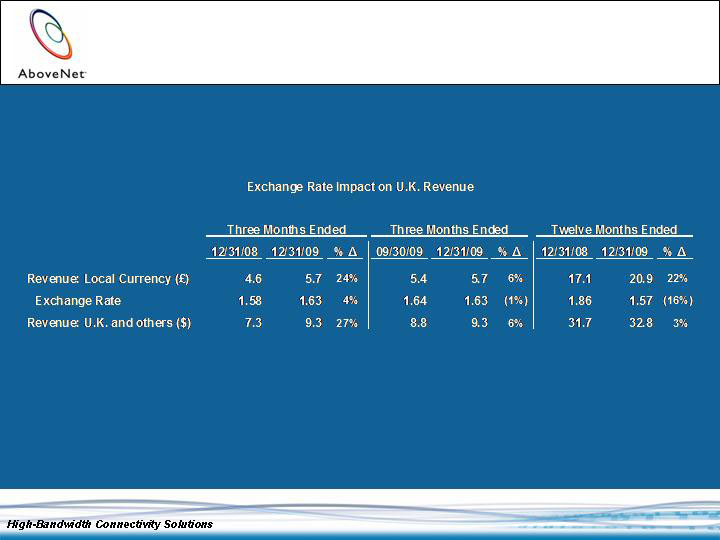

Revenue: Local Currency is defined as Revenue from U.K. and

others multiplied by the period average exchange rate between the

functional currency of the foreign subsidiaries and our functional

currency, the U.S. dollar

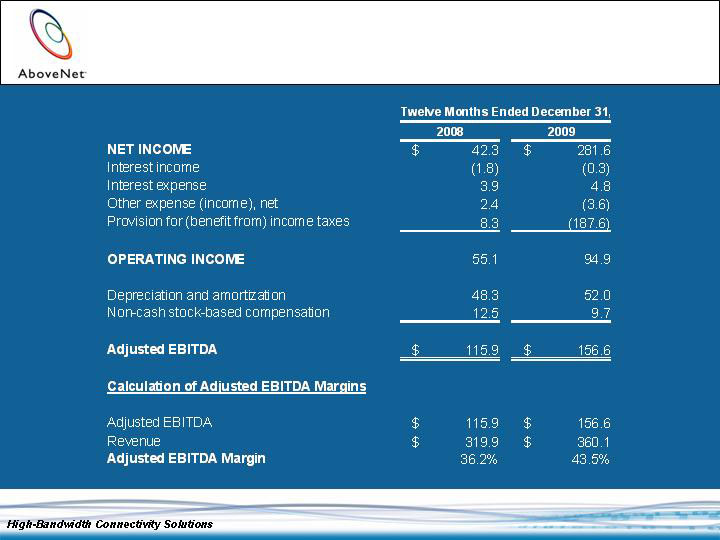

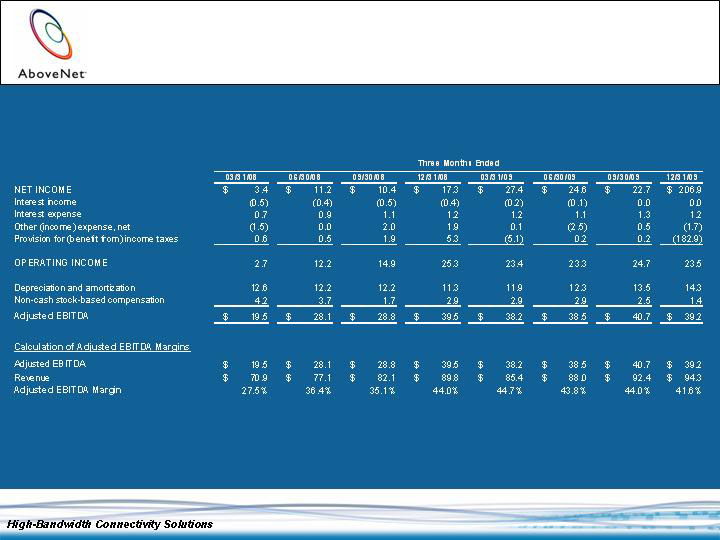

Reconciliation of Non-GAAP

Financial Measures

25

Reconciliation of Non-GAAP

Financial Measures (Cont’d)

$/M

26

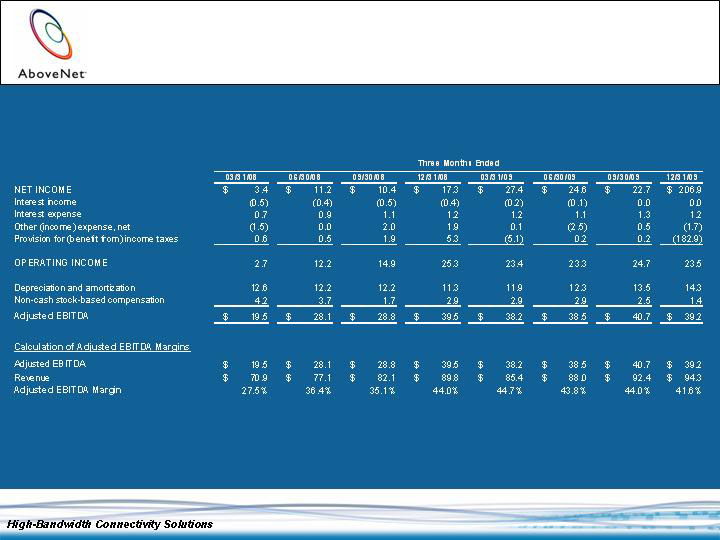

Reconciliation of Non-GAAP

Financial Measures (Cont’d)

$/M

27

Reconciliation of Non-GAAP

Financial Measures (Cont’d)

$/M

28

Reconciliation of Non-GAAP

Financial Measures (Cont’d)

(in millions)

Note: The percentage changes are calculated based on the detailed amounts and may differ slightly from

percentages calculated based on rounded amounts in the table above.